false 2023-05-03 2023-05-03 2022-11-30 497 0000719423 VALIC Co I N-1A 41.19 38.81 9.14 11.04 0.85 36.21 1.97 29.84 34.37 16.38 0000719423 2023-05-01 2023-05-01 0000719423 valic:S000008005Member 2023-05-01 2023-05-01 0000719423 valic:S000008005Member valic:C000021774Member 2023-05-01 2023-05-01 0000719423 valic:S000008005Member valic:Russell1000GrowthIndexMember 2023-05-01 2023-05-01 0000719423 valic:S000008005Member valic:Sandp500IndexMember 2023-05-01 2023-05-01 xbrli:pure iso4217:USD

|

| VALIC Company I Prospectus, May 1, 2023 |

|

| SAVING : INVESTING : PLANNING |

VALIC Company I (“VC I”) is a mutual fund complex made up of 36 separate funds, one of which is described in this Prospectus. The investment objective of the Systematic Growth Fund (formerly, the Blue Chip Growth Fund) (the “Fund”) is to seek total return. The Fund is explained in more detail in its Fund Summary contained herein.

|

|

|

| |

|

Ticker Symbol: |

| Systematic Growth Fund (formerly, Blue Chip Growth Fund) |

|

VCBCX |

This Prospectus contains information you should know before investing, including information about risks. Please read it before you invest and keep it for future reference.

The Securities and Exchange Commission has not approved or disapproved these securities, nor has it determined that this Prospectus is accurate or complete. It is a criminal offense to state otherwise.

TABLE OF CONTENTS

|

|

|

|

|

| |

|

|

1 |

|

| |

|

|

1 |

|

| |

|

|

1 |

|

| |

|

|

1 |

|

| |

|

|

2 |

|

| |

|

|

4 |

|

| |

|

|

4 |

|

| |

|

|

5 |

|

| |

|

|

5 |

|

| |

|

|

5 |

|

| |

|

|

6 |

|

| |

|

|

8 |

|

| |

|

|

8 |

|

| |

|

|

12 |

|

| |

|

|

14 |

|

| |

|

|

17 |

|

| |

|

|

17 |

|

| |

|

|

17 |

|

| |

|

|

19 |

|

| |

|

|

19 |

|

| |

|

|

20 |

|

| |

|

|

21 |

|

FUND SUMMARY: SYSTEMATIC GROWTH FUND (FORMERLY, BLUE CHIP GROWTH FUND)

Investment Objective

The Fund seeks total return.

Fees and Expenses of the Fund

This table describes the fees and expenses that you may pay if you buy, hold and sell shares of the Fund. The table and the example below do not reflect the separate account fees charged in the variable annuity or variable life insurance policy (“Variable Contracts”) in which the Fund is offered. If separate account fees were shown, the Fund’s annual operating expenses would be higher. Please see your Variable Contract prospectus for more details on the separate account fees.

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment)

|

|

|

|

|

| Management Fees |

|

|

0.72 |

% |

| Other Expenses |

|

|

0.10 |

% |

| Total Annual Fund Operating Expenses |

|

|

0.82 |

% |

| Fee Waivers and/or Expense Reimbursements1 |

|

|

0.17 |

% |

| Total Annual Fund Operating Expenses After Fee Waivers and/or Expense Reimbursements1 |

|

|

0.65 |

% |

| 1 |

The Fund’s investment adviser, The Variable Annuity Life Insurance Company (“VALIC”), has contractually agreed to waive its advisory fee until September 30, 2024, so that the advisory fee payable by the Fund to VALIC equals 0.580% on the first $250 million of the Fund’s average daily net assets, 0.555% on the next $250 million of the Fund’s average daily net assets, 0.530% on the next 300 million of the Fund’s average daily net assets, 0.505% on the next $200 million of the Fund’s average daily net assets and 0.450% on the Fund’s average daily net assets over $1 billion. This agreement may be modified or discontinued prior to such time only with the approval of the Board of Directors of VALIC Company I (“VC I”), including a majority of the directors who are not “interested persons” of VC I as defined in the Investment Company Act of 1940, as amended. |

Expense Example

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem or hold all of your shares at the end of those periods. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses include fee waivers for year

one. The Example does not reflect charges imposed by the Variable Contract. If the Variable Contract fees were reflected, the expenses would be higher. See the Variable Contract prospectus for information on such charges. Although your actual costs may be higher or lower, based on these assumptions and the net expenses shown in the fee table, your costs would be:

|

|

|

|

|

|

|

| 1 Year |

|

3 Years |

|

5 Years |

|

10 Years |

| $66 |

|

$245 |

|

$438 |

|

$998 |

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). These costs, which are not reflected in annual fund operating expenses or in the Example, affect the Fund’s performance.

During the most recent fiscal year, the Fund’s portfolio turnover rate was 25% of the average value of its portfolio.

Principal Investment Strategies of the Fund

The Fund invests primarily in equity securities of issuers included in the Russell 1000® Growth Index (the “Index”) at the time of purchase. The Index is comprised of U.S. large- and mid‑cap companies that exhibit certain growth characteristics, as defined by the index provider. As of December 31, 2022, the market capitalization range of the companies in the Index was approximately $656.70 million to $2.10 trillion. The size of the companies in the Index changes with market conditions and the composition of the Index.

The equity securities in which the Fund invests include common stock, preferred stock, convertible securities, rights, and warrants. The Fund may at times have significant exposure to one or more industries or sectors and may be overweight with respect to certain securities (i.e., the Fund will hold a greater percentage of those securities than the Index) and underweight with respect to others (i.e., the Fund will hold a lesser percentage of those securities than the Index). Such weightings may change over time.

Each of the Fund’s subadvisers manages a portion of the Fund’s assets using different investment strategies and techniques.

One subadviser employs a proprietary, dynamic multifactor approach to managing the Fund’s assets that is based on quantitative and qualitative research and analysis. In selecting securities, the subadviser seeks to allocate its portion of the Fund’s assets to equity securities the subadviser believes share complementary

1

FUND SUMMARY: SYSTEMATIC GROWTH FUND (FORMERLY, BLUE CHIP GROWTH FUND)

factor exposures. Factors are characteristics that are important in explaining the returns and risks of a group of securities. Among the factors that the subadviser uses to select equity securities for the Fund are: (1) mean reversion (e.g., stocks that are inexpensive relative to their historical fundamentals); (2) trend following (e.g., strong momentum and higher growth potential); and (3) risk aversion (e.g., financially healthy, stable, and lower volatility companies). In exceptional circumstances, the subadviser may exclude, remove or include an issuer or security in the Fund’s portfolio where it believes the data available does not accurately reflect current events, or to adjust the risk profile of the Fund appropriately. The subadviser may engage in frequent and active trading of portfolio securities with respect to its portion of the Fund’s assets.

The other subadviser uses a rules-based methodology that emphasizes quantitatively-based stock selection, portfolio construction, and efficient implementation to seek to capture common sources of active equity returns among factors. Among the factors that the subadviser’s methodology employs are: (1) value (i.e., how attractively a stock is priced relative to its “fundamentals,” such as book value and free cash flow); (2) momentum (i.e., whether a company’s share price is trending up or down); (3) quality (i.e., profitability) and (4) low volatility (i.e., a relatively low degree of fluctuation in a company’s share price over time). The subadviser seeks to capitalize on the low correlations in returns across these factors by diversifying exposure to securities selected based on such factors. The subadviser may, in its discretion, make changes to its quantitative techniques, or use other quantitative techniques that are based on the subadviser’s proprietary research.

The subadviser constructs its portion of the Fund’s portfolio by investing assets in the securities comprising the Index and adjusting the relative weight of each security based on the security’s attractiveness when evaluated based on the factors as described above, subject to the Fund being constrained to long-only positions. The subadviser will rebalance its portion of the Fund’s portfolio according to the process set forth above on a quarterly basis. The subadviser generally employs a strategy to continue to hold securities between quarterly rebalancings, even if there are adverse developments concerning a particular security, an industry, the economy, or the stock market generally. The subadviser may reduce the position size of a security or sell a security during quarterly rebalancings if the security no longer has favorable scores in one or more of the four factors.

In order to generate additional income, the Fund may lend portfolio securities to broker-dealers and other financial institutions provided that the value of the loaned

securities does not exceed 30% of the Fund’s total assets. These loans earn income for the Fund and are collateralized by cash and securities issued or guaranteed by the U.S. Government or its agencies or instrumentalities.

The Fund is a non‑diversified fund, which means that it may invest in a smaller number of issuers than a diversified fund.

Principal Risks of Investing in the Fund

As with any mutual fund, there can be no assurance that the Fund’s investment objective will be met or that the net return on an investment in the Fund will exceed what could have been obtained through other investment or savings vehicles. Shares of the Fund are not bank deposits and are not guaranteed or insured by any bank, government entity or the Federal Deposit Insurance Corporation. If the value of the assets of the Fund goes down, you could lose money.

The following is a summary of the principal risks of investing in the Fund.

Management Risk. The investment style or strategy used by the subadviser may fail to produce the intended result. The subadviser’s assessment of a particular security or company may prove incorrect, resulting in losses or underperformance.

Equity Securities Risk. The Fund invests principally in equity securities and is therefore subject to the risk that stock prices will fall and may underperform other asset classes. Individual stock prices fluctuate from day‑to‑day and may decline significantly. The prices of individual stocks may be negatively affected by poor company results or other factors affecting individual prices, as well as industry and/or economic trends and developments affecting industries or the securities market as a whole.

Growth Style Risk. Generally, “growth” stocks are stocks of companies that a subadviser believes have anticipated earnings ranging from steady to accelerated growth. Many investors buy growth stocks because of anticipated superior earnings growth, but earnings disappointments often result in sharp price declines. Growth companies usually invest a high portion of earnings in their own businesses so their stocks may lack the dividends that can cushion share prices in a down market. In addition, the value of growth stocks may be more sensitive to changes in current or expected earnings than the value of other stocks, because growth stocks trade at higher prices relative to current earnings.

2

FUND SUMMARY: SYSTEMATIC GROWTH FUND (FORMERLY, BLUE CHIP GROWTH FUND)

Factor-Based Investing Risk. There can be no assurance that the multi-factor selection process employed by a subadviser will enhance performance. Exposure to investment style factors may detract from performance in some market environments, which may continue for prolonged periods.

Large- and Mid‑Cap Company Risk. Investing in large- and mid‑cap companies carries the risk that due to current market conditions these companies may be out of favor with investors. Large‑cap companies may be unable to respond quickly to new competitive challenges or attain the high growth rate of successful smaller companies. Stocks of mid‑cap companies may be more volatile than those of larger companies due to, among other reasons, narrower product lines, more limited financial resources and fewer experienced managers.

Preferred Stock Risk. Unlike common stock, preferred stock generally pays a fixed dividend from a company’s earnings and may have a preference over common stock on the distribution of a company’s assets in the event of bankruptcy or liquidation. Preferred stockholders’ liquidation rights are subordinate to the company’s debt holders and creditors. If interest rates rise, the fixed dividend on preferred stocks may be less attractive and the price of preferred stocks may decline. Preferred stockholders typically do not have voting rights.

Convertible Securities Risk. Convertible security values may be affected by market interest rates, issuer defaults and underlying common stock values; security values may fall if market interest rates rise and rise if market interest rates fall. Additionally, an issuer may have the right to buy back the securities at a time unfavorable to the Fund.

Warrants and Rights Risk. Warrants and rights can provide a greater potential for profit or loss than an equivalent investment in the underlying security. Prices of warrants and rights do not necessarily move in tandem with the prices of the underlying securities and therefore are highly volatile and speculative investments. They have no voting rights, pay no dividends and have no rights with respect to the assets of the issuer other than a purchase option. If a warrant or right held by the Fund is not exercised by the date of its expiration, the Fund would lose the entire purchase price of the warrant or right.

Quantitative Investing Risk. The value of securities selected using quantitative analysis can react differently to issuer, political, market, and economic developments from the market as a whole or securities selected using only fundamental analysis. This may be the result of the

factors used in building the quantitative analytical framework, the weights placed on each factor, and the accuracy of historical data supplied by third parties. In addition, factors that affect a security’s value can change over time and these changes may not be reflected in the quantitative model.

Sector Risk. Companies with similar characteristics may be grouped together in broad categories called sectors. Sector risk is the risk that securities of companies within specific sectors of the economy can perform differently than the overall market. This may be due to changes in such things as the regulatory or competitive environment or to changes in investor perceptions regarding a sector. Because the Fund may allocate relatively more assets to certain sectors than others, the Fund’s performance may be more susceptible to any developments which affect those sectors emphasized by the Fund.

Market Risk. The Fund’s share price can fall because of weakness in the broad market, a particular industry, or specific holdings or due to adverse political or economic developments here or abroad, changes in investor psychology, or heavy institutional selling and other conditions or events (including, for example, military confrontations, war, terrorism, sanctions, disease/virus, outbreaks and epidemics). The prices of individual securities may fluctuate, sometimes dramatically, from day to day. The prices of stocks and other equity securities tend to be more volatile than those of fixed-income securities.

The coronavirus (COVID-19) pandemic and the related governmental and public responses have had and may continue to have an impact on the Fund’s investments and net asset value and have led and may continue to lead to increased market volatility and the potential for illiquidity in certain classes of securities and sectors of the market. Preventative or protective actions that governments may take in respect of pandemic or epidemic diseases may result in periods of business disruption, business closures, inability to obtain raw materials, supplies and component parts, and reduced or disrupted operations for the issuers in which the Fund invests. Government intervention in markets may impact interest rates, market volatility and security pricing. The occurrence, reoccurrence and pendency of such diseases could adversely affect the economies (including through changes in business activity and increased unemployment) and financial markets either in specific countries or worldwide.

Non‑Diversification Risk. Because the Fund may invest in a smaller number of issuers, its value may be affected to a greater extent by the performance of any one of those issuers or by any single economic, political,

3

FUND SUMMARY: SYSTEMATIC GROWTH FUND (FORMERLY, BLUE CHIP GROWTH FUND)

market or regulatory event affecting any one of those issues than a fund that invests in a larger number of issuers.

Securities Lending Risk. Engaging in securities lending could increase the market and credit risk

for Fund investments. The Fund may lose money if it does not recover borrowed securities, the value of the collateral falls, or the value of investments made with cash collateral declines. The Fund’s loans will be collateralized by securities issued or guaranteed by the U.S. Government or its agencies and instrumentalities, which subjects the Fund to the credit risk of the U.S. Government or the issuing federal agency or instrumentality. If the value of either the cash collateral or the Fund’s investments of the cash collateral falls below the amount owed to a borrower, the Fund also may incur losses that exceed the amount it earned on lending the security. Securities lending also involves the risks of delay in receiving additional collateral or possible loss of rights in the collateral if the borrower fails. Another risk of securities lending is the risk that the loaned portfolio securities may not be available to the Fund on a timely basis and the Fund may therefore lose the opportunity to sell the securities at a desirable price.

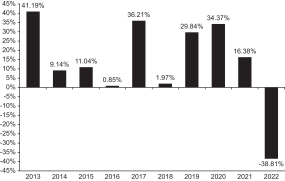

Performance Information

The following Risk/Return Bar Chart and Table illustrate the risks of investing in the Fund by showing changes in the Fund’s performance from calendar year to calendar year and comparing the Fund’s average annual returns to those of the Russell 1000® Growth Index and the S&P 500® Index. Effective May 1, 2023, the Fund changed its benchmark index against which the Fund measures its performance from the S&P 500® Index to the Russell 1000® Growth Index. Fund management believes that the Russell 1000® Growth Index is more representative of the securities in which the Fund invests. The Fund’s returns prior to May 1, 2023, as reflected in the bar chart and table, are the returns of the Fund when it followed different investment strategies under the name “Blue Chip Growth Fund.” Fees and expenses incurred at the contract level are not reflected in the bar chart or table. If these amounts were reflected, returns would be less than those shown. Of course, past performance of the Fund is not necessarily an indication of how the Fund will perform in the future.

Effective May 1, 2023, Goldman Sachs Asset Management, L.P. (“GSAM”) and Wellington Management Company LLP (“Wellington Management”) assumed subadvisory responsibilities for the Fund. Prior to May 1, 2023, T. Rowe Price Associates, Inc. served as subadviser to the Fund.

During the period shown in the bar chart:

Highest Quarterly Return: June 30, 2020 27.59%

Lowest Quarterly Return: June 30, 2022 ‑25.46%

Year to Date Most Recent Quarter: March 31, 2023 16.40%

Average Annual Total Returns (For the periods ended December 31, 2022)

|

|

|

|

|

|

|

| |

|

1

Year |

|

5

Years |

|

10

Years |

| Fund |

|

-38.81% |

|

4.84% |

|

11.53% |

| Russell 1000®

Growth Index (reflects no deduction for fees, expenses or taxes) |

|

-29.14% |

|

10.96% |

|

14.10% |

| S&P 500®

Index (reflects no deduction for fees, expenses or taxes) |

|

-18.11% |

|

9.42% |

|

12.56% |

Investment Adviser

The Fund’s investment adviser is VALIC.

The Fund is subadvised by GSAM and Wellington Management.

4

FUND SUMMARY: SYSTEMATIC GROWTH FUND (FORMERLY, BLUE CHIP GROWTH FUND)

Portfolio Managers

|

|

|

|

|

| Name and Title |

|

Portfolio

Manager of

the

Fund Since |

|

| GSAM |

|

|

|

|

|

|

| Andrew Alford,

Managing Director and Portfolio Manager |

|

|

2023 |

|

| Karhan E. Akcoglu, PhD

Vice President and Portfolio Manager |

|

|

2023 |

|

| Wellington Management |

|

|

|

|

|

|

| Thomas S. Simon, CFA,

FRM Senior Managing Director and Portfolio Manager |

|

|

2023 |

|

| Matthew J. Kyller,

CFA Managing Director and Portfolio Manager |

|

|

2023 |

|

Purchases and Sales of Fund Shares

Shares of the Fund may only be purchased or redeemed through Variable Contracts offered by the separate accounts of VALIC or other participating life insurance companies and through qualifying retirement plans (“Plans”) and individual retirement accounts (“IRAs”). Shares of the Fund may be purchased and redeemed each day the New York Stock Exchange is open, at the Fund’s net asset value determined after receipt of a request in good order.

The Fund does not have any initial or subsequent investment minimums. However, your insurance company may impose investment or account value minimums. The prospectus (or other offering document) for your Variable Contract contains additional information about purchases and redemptions of the Fund’s shares.

Tax Information

The Fund will not be subject to U.S. federal income tax so long as it qualifies as a regulated investment company and distributes its income and gains each year to its shareholders. However, contractholders may be subject to federal income tax (and a federal Medicare tax of 3.8% that applies to net income, including taxable annuity payments, if applicable) upon withdrawal from a Variable Contract. Contractholders should consult the prospectus (or other offering document) for the Variable Contract for additional information regarding taxation.

Payments to Broker-Dealers and Other Financial Intermediaries

The Fund is not sold directly to the general public but instead is offered to registered and unregistered separate accounts of VALIC and its affiliates and to Plans and IRAs. The Fund and its related companies may make payments to the sponsoring insurance company or its affiliates for recordkeeping and distribution. These payments may create a conflict of interest as they may be a factor that the insurance company considers in including the Fund as an underlying investment option in a variable contract. Visit your sponsoring insurance company’s website for more information.

5

ADDITIONAL INFORMATION ABOUT THE FUND’S INVESTMENT OBJECTIVE, STRATEGIES AND RISKS

The Fund’s investment objective, principal investment strategies and principal risks are summarized in the Fund Summary and a full description of the Fund’s principal investment strategies and principal risks is included below. In addition to the Fund’s principal investment strategies, the Fund may from time‑to‑time invest in other securities and use other investment techniques. The risks of these non‑principal securities and other investment techniques are included in the section “Investment Risks” below. In addition to the securities and investment techniques described in this Prospectus, there are other securities and investment techniques in which the Fund may invest in limited instances. These other securities and investment techniques are listed in the Statement of Additional Information (“SAI”), which you may obtain free of charge (see back cover).

From time to time, the Fund may take temporary defensive positions that are inconsistent with its principal investment strategies, in attempting to respond to adverse market, economic, political, or other conditions. There is no limit on the Fund’s investments in money market securities for temporary defensive purposes. If the Fund takes such a temporary defensive position, it may not achieve its investment objective.

The investment objective and principal strategies for the Fund in this Prospectus are non‑fundamental and may be changed by the Board of Directors of VALIC Company I (“VC I”) without investor approval. References to “net assets” in the Prospectus take into account any borrowings for investment purposes by the Fund. Unless stated otherwise, all percentages are calculated as of the time of purchase.

The Fund enters into contractual arrangements with various parties, including, among others, the Fund’s investment adviser, The Variable Annuity Life Insurance Company (“VALIC” or the “Adviser”), which provide services to the Fund. Shareholders are not parties to, or intended (or “third-party”) beneficiaries, of those contractual arrangements and those contractual arrangements cannot be enforced by shareholders.

This Prospectus and SAI provide information concerning the Fund that you should consider in determining whether to purchase shares of the Fund. The Fund may make changes to this information from time to time. Neither this Prospectus nor the SAI is intended to give rise to any contract rights or other rights in any shareholder, other than any rights conferred by federal or state securities laws.

Systematic Growth Fund

The Fund seeks total return. The Fund invests primarily in equity securities of issuers included in the Russell 1000® Growth Index (the “Index”) at the time of purchase. The Index is comprised of U.S. large- and mid‑cap companies that exhibit certain growth characteristics, as defined by the index provider. As of December 31, 2022, the market capitalization range of the companies in the Index was approximately $656.70 million to $2.10 trillion. The size of the companies in the Index changes with market conditions and the composition of the Index.

The equity securities in which the Fund invests include common stock, preferred stock, convertible securities, rights, and warrants. The Fund may at times have significant exposure to one or more industries or sectors and may be overweight with respect to certain securities (i.e., the Fund will hold a greater percentage of those securities than the Index) and underweight with respect to others (i.e., the Fund will hold a lesser percentage of those securities than the Index). Such weightings may change over time.

Each of the Fund’s subadvisers manages a portion of the Fund’s assets using different investment strategies and techniques.

One subadviser employs a proprietary, dynamic multifactor approach to managing the Fund’s assets that is based on quantitative and qualitative research and analysis. In selecting securities, the subadviser seeks to allocate its portion of the Fund’s assets to equity securities the subadviser believes share complementary factor exposures. Factors are characteristics that are important in explaining the returns and risks of a group of securities. Among the factors that the subadviser uses to select equity securities for the Fund are: (1) mean reversion (e.g., stocks that are inexpensive relative to their historical fundamentals); (2) trend following (e.g., strong momentum and higher growth potential); and (3) risk aversion (e.g., financially healthy, stable, and lower volatility companies). In exceptional circumstances, the subadviser may exclude, remove or include an issuer or security in the Fund’s portfolio where it believes the data available does not accurately reflect current events, or to adjust the risk profile of the Fund appropriately. The subadviser may engage in frequent and active trading of portfolio securities with respect to its portion of the Fund’s assets.

6

ADDITIONAL INFORMATION ABOUT THE FUND’S INVESTMENT OBJECTIVE, STRATEGIES AND RISKS

The other subadviser uses a rules-based methodology that emphasizes quantitatively-based stock selection, portfolio construction, and efficient implementation to seek to capture common sources of active equity returns among factors. The rules-based methodology involves two steps:

Step One

In the first step, individual factor portfolios are constructed at the same level of targeted tracking error to the Index. The subadviser assigns all securities in the Index a “factor score” that is derived from the measurements described below to create four factor portfolios.

| |

• |

|

Value: The value measurement is a composite of three valuation measures, which consist of book value‑to‑price, sales‑to‑price and free cash flow‑to‑price (earnings‑to‑price ratios are used for financial stocks or where free cash flow data are not available). |

| |

• |

|

Momentum: The momentum measurement is based on beta- and volatility-adjusted daily returns over an 11‑month period ending one month prior to the rebalance date. |

| |

• |

|

Quality: The quality measurement is gross profit divided by total assets or return on equity for financial stocks or when gross profit is not available. |

| |

• |

|

Low Volatility: The volatility measurement is defined as the inverse of the standard deviation of past 12‑month daily total stock returns. |

The securities are ranked and scored on each factor measurement independently. Based on these scores, securities with a favorable factor score will be generally overweight in the factor portfolio relative to the Index and securities with an unfavorable factor score will be generally underweight in the factor portfolio relative to the Index. Securities in each factor portfolio are also subject to minimum and maximum weights, depending on the securities’ relative weight in the Index. The portion of the Fund’s portfolio managed by the subadviser only includes long positions (i.e., short positions are impermissible).

Step Two

In the second step, the subadviser combines the factor portfolios in equal weights to create its portion of the Fund’s portfolio. As part of this combination, offsetting security positions are calculated and netted across the factor portfolios. As part of this netting process, trades are generally reduced across factor portfolios by offsetting trades in one factor portfolio against weights in another factor portfolio, subject to all security weights remaining within the upper and lower bounds around the target weight.

The subadviser will rebalance its portion of the Fund’s portfolio according to the process set forth above on a quarterly basis. The subadviser generally employs a strategy to continue to hold securities between quarterly rebalancings, even if there are adverse developments concerning a particular security, an industry, the economy, or the stock market generally. The subadviser may reduce the position size of a security or sell a security during quarterly rebalancings if the security no longer has favorable scores in one or more of the four factors. The subadviser may, in its discretion, make changes to its quantitative techniques or investment approach, including with respect to intra-quarter actions, from time‑to‑time.

In order to generate additional income, the Fund may lend portfolio securities to broker-dealers and other financial institutions provided that the value of the loaned securities does not exceed 30% of the Fund’s total assets. These loans earn income for the Fund and are collateralized by cash and securities issued or guaranteed by the U.S. Government or its agencies or instrumentalities.

The Fund is a non‑diversified fund, which means that it may invest in a smaller number of issuers than a diversified fund.

In addition to the Fund’s principal investment strategies described above, the Fund may also invest in equity securities of U.S. small cap companies. It may also invest in futures contracts and exchange-traded funds to manage the Fund’s cash position and real estate investment trusts. The Fund may hold a portion of its assets in cash or cash equivalents. The Fund is also subject to the following non-principal investment risks: Cybersecurity Risk, Derivatives Risk, Investment Company Risk, Privately Placed Securities Risk, REITs Risk and Small‑Cap Company Risk.

7

Investment Risks

Cybersecurity Risk. Intentional cybersecurity breaches include: unauthorized access to systems, networks, or devices (such as through “hacking” activity); infection from computer viruses or other malicious software code; and attacks that shut down, disable, slow, or otherwise disrupt operations, business processes, or website access or functionality. In addition, unintentional incidents can occur, such as the inadvertent release of confidential information (possibly resulting in the violation of applicable privacy laws).

A cybersecurity breach could result in the loss or theft of customer data or funds, the inability to access electronic systems (“denial of services”), loss or theft of proprietary information or corporate data, physical damage to a computer or network system, or costs associated with system repairs. Such incidents could cause the Fund, the Adviser, a subadviser, or other service providers to incur regulatory penalties, reputational damage, additional compliance costs, or financial loss. In addition, such incidents could affect issuers in which the Fund invests, and thereby cause the Fund’s investments to lose value

Derivatives Risk. Unlike stocks and bonds that represent actual ownership of a stock or bond, derivatives are instruments that “derive” their value from securities issued by a company, government, or government agency, such as futures and options. The use of derivatives involves risks different from, or possibly greater than, the risks associated with investing directly in the underlying assets. Derivatives can significantly increase the Fund’s exposure to market and credit risk. Derivatives can be highly volatile, illiquid and difficult to value, and there is the risk that changes in the value of a derivative held by the Fund will not correlate with the underlying instruments or the Fund’s other investments. A small investment in derivatives can have a potentially large impact on the Fund’s performance. Derivative instruments also involve the risk that a loss may be sustained as a result of the failure of the counterparty to the derivative instruments to make required payments or otherwise comply with the derivative instruments’ terms. Certain types of derivatives involve greater risks than the underlying obligations because, in addition to general market risks, they are subject to illiquidity risk, counterparty risk and credit risk.

Additionally, some derivatives involve economic leverage, which could increase the volatility of these investments as they may fluctuate in value more than the underlying instrument. Leveraging also may expose

the Fund to losses in excess of the amount invested. Due to their complexity, derivatives may not perform as intended. As a result, the Fund may not realize the anticipated benefits from a derivative it holds or it may realize losses. The Fund may not be able to terminate or sell a derivative under some market conditions, which could result in substantial losses.

Derivatives are often used to hedge against positions in a fund. A hedge is an investment made in order to reduce the risk of adverse price movements in a security, by taking an offsetting position in a related security (often a derivative, such as an option or a short sale). While hedging strategies can be very useful and inexpensive ways of reducing risk, they are sometimes ineffective due to unexpected changes in the market or exchange rates. Hedging also involves the risk that changes in the value of the related security will not match those of the instruments being hedged as expected, in which case any losses on the instruments being hedged may not be reduced. For gross currency hedges, there is an additional risk, to the extent that these transactions create exposure to currencies in which a fund’s securities are not denominated. Moreover, while hedging can reduce or eliminate losses, it can also reduce or eliminate gains. There are some investors who take higher risk (“speculate”) and buy derivatives to profit from a change in price of the underlying security. The Fund may purchase derivatives to hedge its investment portfolio and to earn additional income in order to help achieve its objective. Generally, the Fund does not buy derivatives to speculate.

Regulatory Risk. Over‑the‑counter derivatives are subject to regulation under the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) in the United States and under comparable regimes in Europe, Asia and other non‑U.S. jurisdictions. Under the Dodd-Frank Act, with respect to uncleared swaps, swap dealers are required to collect variation margin from a fund and may be required by applicable regulations to collect initial margin from a fund. Both initial and variation margin may be comprised of cash and/or securities, subject to applicable regulatory haircuts. Shares of investment companies (other than money market funds) may not be posted as collateral under these regulations. In addition, regulations adopted by global prudential regulators require certain bank-regulated counterparties and certain of their affiliates to include in certain financial contracts, including many derivatives contracts, terms that delay or restrict the rights of counterparties, such as the Fund, to terminate such contracts, foreclose upon collateral, exercise other default rights or restrict transfers of credit support in the event that the counterparty and/or its affiliates are

8

subject to certain types of resolution or insolvency proceedings.

The implementation of these requirements with respect to derivatives, along with additional regulations under the Dodd-Frank Act regarding clearing and mandatory trading and trade reporting of derivatives, generally have increased the costs of trading in these instruments and, as a result, may affect returns to investors in the Fund.

Futures Risk. A futures contract is considered a derivative because it derives its value from the price of the underlying currency, security or financial index. The prices of futures contracts can be volatile and futures contracts may lack liquidity. In addition, there may be imperfect or even negative correlation between the price of a futures contract and the price of the underlying currency, security or financial index.

Equity Securities Risk. Equity securities represent an ownership position in a company. The prices of equity securities fluctuate based on changes in the financial condition of the issuing company and on market and economic conditions. If you own an equity security, you own a part of the company that issued it. Companies sell equity securities to get the money they need to grow.

Stocks are one type of equity security. Generally, there are three types of stocks:

| |

• |

|

Common stock — Each share of common stock represents a part of the ownership of the company. The holder of common stock participates in the growth of the company through increasing stock price and receipt of dividends. If the company runs into difficulty, the stock price can decline and dividends may not be paid. |

| |

• |

|

Preferred stock — Each share of preferred stock usually allows the holder to get a set dividend before the common stock shareholders receive any dividends on their shares. |

| |

• |

|

Convertible preferred stock — A stock with a set dividend which the holder may exchange for a certain amount of common stock. |

Stocks are not the only type of equity security. Other equity securities include but are not limited to convertible securities, depositary receipts, warrants, rights and partially paid shares, investment company securities, real estate securities, convertible bonds and American Depositary Receipts, European Depositary Receipts and Global Depositary Receipts. More information about

these equity securities is included elsewhere in this Prospectus or contained in the SAI.

Equity securities are subject to the risk that stock prices will fall over short or extended periods of time. Although the stock market has historically outperformed other asset classes over the long term, the stock market tends to move in cycles. Individual stock prices fluctuate from day‑to‑day and may underperform other asset classes over an extended period of time. Individual companies may report poor results or be negatively affected by industry and/or economic trends and developments. The prices of securities issued by such companies may suffer a decline in response. These price movements may result from factors affecting individual companies, industries or the securities market as a whole. In addition, the performance of different types of equity securities may rise or decline under varying market conditions — for example, “value” stocks may perform well under circumstances in which the prices of “growth” stocks in general have fallen, or vice versa.

Convertible Securities Risk. The values of the convertible securities in which the Fund may invest also will be affected by market interest rates, the risk that the issuer may default on interest or principal payments and the value of the underlying common stock into which these securities may be converted. Specifically, since these types of convertible securities pay fixed interest and dividends, their values may fall if market interest rates rise and rise if market interest rates fall. At times a convertible security may be more susceptible to fixed-income security related risks, while at other times such a security may be more susceptible to equity security related risks. Additionally, an issuer may have the right to buy back certain of the convertible securities at a time and a price that is unfavorable to the Fund.

Preferred Stock Risk. Unlike common stock, preferred stock generally pays a fixed dividend from a company’s earnings and may have a preference over common stock on the distribution of a company’s assets in the event of bankruptcy or liquidation. Preferred stockholders’ liquidation rights are subordinate to the company’s debt holders and creditors. If interest rates rise, the fixed dividend on preferred stocks may be less attractive and the price of preferred stocks may decline. Preferred stock usually does not require the issuer to pay dividends and may permit the issuer to defer dividend payments. Deferred dividend payments could have adverse tax consequences for the Fund and may cause the preferred stock to lose substantial value. Preferred stock usually does not require the issuer to pay dividends and may permit the issuer to defer dividend payments.

9

Factor-Based Investing Risk. There can be no assurance that the multi-factor selection process employed by a subadviser will enhance performance. Exposure to investment style factors may detract from performance in some market environments, which may continue for prolonged periods.

Investment Company Risk. An exchange-traded fund (“ETF”) or investment company may not achieve its investment objective or execute its investment strategy effectively, which may adversely affect the performance of a Fund investing in these instruments. Investments in ETFs and investment companies involve substantially the same risks as investing directly in the instruments held by these entities. However, the total return from such investments will be reduced by the operating expenses and fees of the ETF or investment company. In addition, the Fund that invests in shares of an ETF or another investment company bears a proportionate share of the ETF or other investment company’s expenses. In addition, an ETF may fail to accurately track the market segment or index that underlies its investment objective. The price of an ETF can fluctuate, and the Fund could lose money investing in an ETF.

Disruptions in the markets for the securities held by the other investment companies purchased or sold by the Fund could result in losses on the Fund’s investment in such securities. Other investment companies also have fees that increase their costs versus owning the underlying securities directly.

ETF Risk. ETFs are a type of investment company bought and sold on a securities exchange. An ETF trades like common stock. While some ETFs are passively-managed and seek to replicate the performance of a particular market index or segment, other ETFs are actively-managed and do not track a particular market index or segment, thereby subjecting investors to active management risk. The Fund could purchase an ETF to gain exposure to a portion of the U.S. or a foreign market while awaiting purchase of underlying securities. The risks of owning an ETF generally reflect the risks of owning the securities underlying the ETF, although an ETF has management fees which increase its cost. The Fund’s ability to invest in ETFs is limited by the Investment Company Act of 1940, as amended (the “1940 Act”).

Lending Portfolio Securities Risk. The Fund may make secured loans of its portfolio securities for purposes of realizing additional income. No lending may be made with any companies affiliated with VALIC. The Fund will only make loans to broker-dealers and other financial institutions deemed by State Street Bank and Trust Company (the “securities lending agent”) to be

creditworthy. The securities lending agent also holds the cash and the portfolio securities of VC I. Each loan of portfolio securities will be continuously secured by collateral in an amount at least equal to the market value of the securities loaned. Such collateral will be cash and securities issued or guaranteed by the U.S. Government or its agencies or instrumentalities, which subjects the Fund to the credit risk of the U.S. Government or the issuing federal agency or instrumentality. As with other extensions of credit, securities lending involves the risk that the borrower may fail to return the securities in a timely manner or at all. The Fund may lose money if the Fund does not recover the securities and/or the value of the collateral or the value of investments made with cash collateral falls. Such events may also trigger adverse tax consequences for the Fund. To the extent that either the value of the cash collateral or the Fund’s investments of the cash collateral declines below the amount owed to a borrower, the Fund also may incur losses that exceed the amount it earned on lending the security. Securities lending also involves the risks of delay in receiving additional collateral or possible loss of rights in the collateral should the borrower fail financially. Another risk of securities lending is the risk that the loaned portfolio securities may not be available to the Fund on a timely basis and the Fund may therefore lose the opportunity to sell the securities at a desirable price. Engaging in securities lending could also have a leveraging effect, which may intensify the market risk, credit risk and other risks associated with investments in the Fund.

Management Risk. Different investment styles and strategies tend to shift in and out of favor depending upon market and economic conditions, as well as investor sentiment. The investment style or strategy used by the Fund may fail to produce the intended result. Moreover, the Fund may outperform or underperform funds that employ a different investment style or strategy. A subadviser’s assessment of a particular security or company may prove incorrect, resulting in losses or underperformance.

Generally, stocks with growth characteristics can have relatively wide price swings as a result of their potentially high valuations. The share price of the Fund may be negatively affected by holding stocks with growth characteristics, as discussed in more detail below.

| |

• |

|

Growth Style Risk. Generally, “growth” stocks are stocks of companies that a subadviser believes have anticipated earnings ranging from steady to accelerated growth. They may be volatile for several reasons. Many investors buy growth stocks because of anticipated superior earnings growth, but earnings |

10

| |

|

disappointments often result in sharp price declines. Growth companies usually invest a high portion of earnings in their own businesses so their stocks may lack the dividends that can cushion share prices in a down market. In addition, the value of growth stocks may be more sensitive to changes in current or expected earnings than the value of other stocks, because growth stocks trade at higher prices relative to current earnings. Consequently, if earnings expectations are not met, the market price of growth stocks will often decline more than other stocks. |

Market Capitalization Risk. Companies are determined to be large‑cap companies, mid‑cap companies, or small‑cap companies based upon the total market value of the outstanding common stock (or similar securities) of the company at the time of purchase. The market capitalization of the companies in which the Fund invests and in the Index change over time. The Fund will not automatically sell or cease to purchase stock of a company that it already owns just because the company’s market capitalization grows or falls outside a range.

Large‑Cap Company Risk. Large‑cap companies tend to go in and out of favor based on market and economic conditions. Large‑cap companies tend to be less volatile than companies with smaller market capitalizations. In exchange for this potentially lower risk, the Fund’s value may not rise as much as the value of funds that emphasize smaller capitalization companies. Larger, more established companies may be unable to respond quickly to new competitive challenges, such as changes in technology and consumer tastes. Larger companies also may not be able to attain the high growth rate of successful smaller companies, particularly during extended periods of economic expansion.

Mid‑Cap Company Risk. The risk that mid‑cap companies, which usually do not have as much financial strength as very large companies, may not be able to do as well in difficult times. Investing in mid‑cap companies may be subject to special risks associated with narrower product lines, more limited financial resources, fewer experienced managers, dependence on a few key employees, and a more limited trading market for their stocks, as compared with larger companies.

Small‑Cap Company Risk. Investing in small companies involves greater risk than is customarily associated with larger companies. Stocks of small companies are subject to more abrupt or erratic price movements than larger company stocks. Small

companies often are in the early stages of development and have limited product lines, markets, or financial resources. Their managements may lack depth and experience. Such companies seldom pay significant dividends that could cushion returns in a falling market. In addition, these companies may be more affected by intense competition from larger companies, and the trading markets for their securities may be less liquid and more volatile than securities of larger companies. This means that the Fund could have greater difficulty selling a security of a small‑cap issuer at an acceptable price, especially in periods of market volatility. Also, it may take a substantial period of time before the Fund realizes a gain on an investment in a small‑cap company, if it realizes any gain at all.

Market Risk. The Fund’s share price can fall because of weakness in the broad market, a particular industry, or specific holdings. The market as a whole can decline for many reasons, including adverse political or economic developments here or abroad, changes in investor psychology, or heavy institutional selling and other conditions or events (including, for example, military confrontations, war, terrorism, sanctions, disease/virus, outbreaks and epidemics). The prospects for an industry or company may deteriorate because of a variety of factors, including disappointing earnings or changes in the competitive environment. In addition, a subadviser’s assessment of companies held in the Fund may prove incorrect, resulting in losses or poor performance even in a rising market. Markets tend to move in cycles with periods of rising prices and periods of falling prices. Like markets generally, the investment performance of the Fund will fluctuate, so an investor may lose money over short or even long periods.

The coronavirus (COVID‑19) pandemic and the related governmental and public responses have had and may continue to have an impact on the Fund’s investments and net asset value and have led and may continue to lead to increased market volatility and the potential for illiquidity in certain classes of securities and sectors of the market. Preventative or protective actions that governments may take in respect of pandemic or epidemic diseases may result in periods of business disruption, business closures, inability to obtain raw materials, supplies and component parts, and reduced or disrupted operations for the issuers in which the Fund invests. Government intervention in markets may impact interest rates, market volatility and security pricing. The occurrence, reoccurrence and pendency of such diseases could adversely affect the economies (including through changes in business activity and increased unemployment) and financial markets either in specific countries or worldwide.

11

Non‑Diversification Risk. The Fund is non‑diversified under the 1940 Act. A fund that is considered a non‑diversified investment company may invest a larger portion of its assets in the stock of a single company than a diversified investment company, and thus can invest in a smaller number of securities. As a result, the Fund’s value will be affected to a greater extent by the performance of any one company than would be a diversified investment company.

Privately Placed Securities Risk. The Fund’s investments may also include privately placed securities, which are subject to resale restrictions. These securities will have the effect of increasing the level of Fund illiquidity to the extent the Fund may be unable to sell or transfer these securities due to restrictions on transfers or on the ability to find buyers interested in purchasing the securities. The illiquidity of the market, as well as the lack of publicly available information regarding these securities, may also adversely affect the ability to arrive at a fair value for certain securities at certain times and could make it difficult for the Fund to sell certain securities.

Quantitative Investing Risk. The value of securities selected using quantitative analysis can react differently to issuer, political, market, and economic developments from the market as a whole or securities selected using only fundamental analysis. The factors used in quantitative analysis and the weight placed on those factors may not be predictive of a security’s value. In addition, factors that affect a security’s value can change over time and these changes may not be reflected in the quantitative model.

REITs Risk. Real Estate Investment Trusts (“REITs”) pool investors’ funds for investments primarily in commercial real estate properties. Like mutual funds, REITs have expenses, including advisory and administration fees that are paid by their shareholders. As a result, shareholders will absorb an additional layer of fees when the Fund invests in REITs. The performance of any Fund’s REITs holdings ultimately depends on the types of real property in which the REITs invest and how well the property is managed. A general downturn in real estate values also can hurt REITs performance. When a REIT focuses its investments in particular sub‑sectors of the real estate industry or particular geographic regions, the REIT’s performance would be especially sensitive to developments that significantly affected those particular sub‑sectors or geographic regions. Due to their dependence on the management skills of their managers, REITs may underperform if their managers are incorrect in their assessment of particular real estate investments. In

addition, REITs are subject to certain provisions under federal tax law. The failure of a company to qualify as a REIT could have adverse consequences for the Fund, including significantly reducing the return to the Fund on its investment in such company.

Sector Risk. Companies with similar characteristics may be grouped together in broad categories called sectors. Sector risk is the risk that securities of companies within specific sectors of the economy can perform differently than the overall market. This may be due to changes in such things as the regulatory or competitive environment or to changes in investor perceptions regarding a sector. Because the Fund may allocate relatively more assets to certain sectors than others, the Fund’s performance may be more susceptible to any developments which affect those sectors emphasized by the Fund.

At times, the Fund may have a significant portion of its assets invested in securities of companies conducting business in a broadly related group of industries within an economic sector. Companies in the same economic sector may be similarly affected by economic or market events, making the Fund more vulnerable to unfavorable developments in that economic sector than funds that invest more broadly.

Substantial investments in a particular market, industry, group of industries, country, region, group of countries, asset class or sector make the Fund’s performance more susceptible to any single economic, market, political or regulatory occurrence affecting that particular market, industry, group of industries, country, region, group of countries, asset class or sector than a fund that invests more broadly.

Warrants and Rights Risk. Warrants and rights can provide a greater potential for profit or loss than an equivalent investment in the underlying security. Prices of warrants and rights do not necessarily move in tandem with the prices of the underlying securities and therefore are highly volatile and speculative investments. They have no voting rights, pay no dividends and have no rights with respect to the assets of the issuer other than a purchase option. If a warrant or right held by the Fund is not exercised by the date of its expiration, the Fund would lose the entire purchase price of the warrant or right.

About the Indices

Unlike mutual funds, the indices do not incur expenses. If expenses were deducted, the actual returns of the indices would be lower.

12

The Russell 1000® Growth Index measures the performance of those Russell 1000® companies with higher price‑to‑book ratios and higher forecasted growth values.

The S&P 500® Index is an index of the stocks of 500 major large‑cap U.S. corporations, chosen for market

size, liquidity, and industry group representation. It is a market-value weighted index, with each stock’s percentage in the Index in proportion to its market value.

Additional Information About the S&P Index. “S&P 500®” is a trademark of S&P.

13

VC I Shares

VC I is an open‑end management investment company and may offer shares of the Fund for sale at any time. However, VC I offers shares of the Fund only to registered and unregistered separate accounts of VALIC and its affiliates and to qualifying retirement plans (previously defined as the “Plans”) and IRAs.

Buying and Selling Shares

As a participant in a Variable Contract, Plan, or IRA, you do not directly buy shares of the funds that make up VC I. Instead, you buy units in either a registered or unregistered separate account of VALIC or of its affiliates or through a trust or custodial account under a Plan or an IRA. When you buy these units, you specify the funds in which you want the separate account, trustee or custodian to invest your money. The separate account, trustee or custodian in turn, buys the shares of the funds according to your instructions. After you invest in a fund, you participate in fund earnings or losses in proportion to the amount of money you invest. When you provide instructions to buy, sell, or transfer shares of a fund, the separate account, trustee or custodian does not pay any sales or redemption charges related to these transactions. The value of such transactions is based on the next calculation of net asset value after the orders are placed with the fund.

For certain investors, there may be rules or procedures regarding the following:

| |

• |

|

any minimum initial investment amount and/or limitations on periodic investments; |

| |

• |

|

how to purchase, redeem or exchange your interest in the Fund; |

| |

• |

|

how to obtain information about your account, including account statements; and |

| |

• |

|

any fees applicable to your account. |

For more information on such rules or procedures, you should review your Variable Contract prospectus, Plan document or custodial agreement. The Fund does not currently foresee any disadvantages to participants arising out of the fact that it may offer its shares to separate accounts of various insurance companies to serve as the investment medium for their variable annuity and variable life insurance contracts. Nevertheless, the Board of Directors intends to monitor events in order to identify any material irreconcilable conflicts which may possibly arise and to determine what action, if any, should be taken in response to such conflicts. If such a conflict were to occur, one or more insurance companies’ separate accounts might be required to withdraw their investments in the Fund and

shares of another fund may be substituted. This might force the Fund to sell portfolio securities at disadvantageous prices. In addition, VC I reserves the right to refuse to sell shares of the Fund to any separate account, plan sponsor, trustee or custodian, or financial intermediary, or may suspend or terminate the offering of shares of the Fund if such action is required by law or regulatory authority or is in the best interests of the shareholders of the Fund.

Execution of requests. VC I is open on those days when the New York Stock Exchange is open for regular trading. Buy and sell requests are executed at the next net asset value (“NAV”) to be calculated after the request is accepted by VC I. If the order is received by VC I, or the insurance company as its authorized agent, before VC I’s close of business (generally 4:00 p.m., Eastern time), the order will receive that day’s closing price. If the order is received after that time, it will receive the next business day’s closing price.

Normally, VC I redeems Fund shares within seven days when the request is received in good order, but may postpone redemptions beyond seven days when: (i) the New York Stock Exchange is closed for other than weekends and customary holidays, or trading on the New York Stock Exchange becomes restricted; (ii) an emergency exists making disposal or valuation of the Fund’s assets not reasonably practicable; or (iii) the SEC has so permitted by order for the protection of VC I’s shareholders. For these purposes, the SEC determines the conditions under which trading shall be deemed to be restricted and an emergency shall be deemed to exist. The New York Stock Exchange is closed on the following holidays: New Year’s Day, Martin Luther King, Jr. Day, Washington’s Birthday (observed), Good Friday, Memorial Day, Juneteenth, Independence Day, Labor Day, Thanksgiving Day and Christmas.

Your redemption proceeds typically will be sent within three business days after your request is submitted, but in any event, within seven days. Under normal circumstances, VC I expects to meet redemption requests by using cash or cash equivalents in the Fund’s portfolio or by selling portfolio assets to generate cash. During periods of stressed market conditions, the Fund may be more likely to limit cash redemptions and may determine to pay redemption proceeds by borrowing under a line of credit.

Frequent or Short-term Trading

The Fund, which is offered only through Variable Contracts, Plans or IRAs, is intended for long-term investment and not as a frequent short-term trading (“market timing”) vehicle. Accordingly, organizations or

14

individuals that use market timing investment strategies and make frequent transfers or redemptions should not purchase shares of the Fund. The Board of Directors has adopted policies and procedures with respect to market timing activity as discussed below. VC I believes that market timing activity is not in the best interest of the participants of the Fund. Due to the disruptive nature of this activity, it can adversely impact the ability of the Subadvisers to invest assets in an orderly, long-term manner. In addition, market timing can disrupt the management of the Fund and raise its expenses through: increased trading and transaction costs; forced and unplanned portfolio turnover; and large asset swings that decrease the Fund’s ability to provide maximum investment return to all participants. This in turn can have an adverse effect on Fund performance.

The Fund may invest in foreign securities and/or high yield fixed income securities (often referred to as “junk bonds”), so it may be particularly vulnerable to market timing. Market timing may occur because of time zone differences between the foreign markets on which the Fund’s international portfolio securities trade and the time as of which the Fund’s net asset value is calculated. Market timing may also occur if market prices are not readily available for the Fund’s junk bond holdings. Market timers might try to purchase shares of the Fund based on events occurring after foreign market closing prices are established but before calculation of the Fund’s net asset value, or if they believe market prices for junk bonds are not accurately reflected by the Fund. One of the objectives of VC I’s fair value pricing procedures is to minimize the possibilities of this type of market timing (see “How Shares are Valued”).

Shares of the Fund are generally held through insurance company separate accounts, Plans or through a trust or custodial account (“Financial Intermediaries”). The ability of VC I to monitor transfers made by the participants in separate accounts or Plans maintained by Financial Intermediaries is limited by the institutional nature of Financial Intermediaries’ omnibus accounts. VC I’s policy is that the Fund will rely on the Financial Intermediaries to monitor market timing within the Fund to the extent that VC I believes that each Financial Intermediary’s practices are reasonably designed to detect and deter transactions that are not in the best interest of the Fund.

There is no guarantee that VC I will be able to detect market timing activity or the participants engaged in such activity, or, if it is detected, to prevent its recurrence. Whether or not VC I detects it, if market timing occurs, then you should anticipate that you will be subject to the disruptions and increased expenses discussed above. In situations in which VC I becomes aware of possible

market timing activity, it will notify the Financial Intermediary in order to help facilitate the enforcement of such entity’s market timing policies and procedures. VC I has entered into agreements with various Financial Intermediaries that require such intermediaries to provide certain information to help identify frequent trading activity and to prohibit further purchases or exchanges by a participant identified as having engaged in frequent trades. VC I reserves the right, in its sole discretion and without prior notice, to reject, restrict or refuse purchase orders received from a Financial Intermediary, whether directly or by transfer, including orders that have been accepted by a Financial Intermediary, that VC I determines not to be in the best interest of the Fund. Such rejections, restrictions or refusals will be applied uniformly without exception.

You should review your Variable Contract prospectus, Plan document or custodial agreement for more information regarding market timing, including any restrictions, limitations or fees that may be charged on trades made through a Variable Contract, Plan or IRA. Any restrictions or limitations imposed by the Variable Contract, Plan or IRA may differ from those imposed by VC I.

Payments in Connection with Distribution

VALIC and its affiliates may receive revenue sharing payments from the Subadvisers to the Fund in connection with certain administrative, marketing and other servicing activities, which payments help offset costs for education, marketing activities and training to support sales of the Fund, as well as occasional gifts, entertainment or other compensation as incentives. Payments may be derived from investment management fees received by the subadvisers.

Selective Disclosure of Portfolio Holdings

VC I’s policies and procedures with respect to the disclosure of the Fund’s portfolio securities are described in the SAI.

How Shares are Valued

The NAV for the Fund is determined each business day at the close of regular trading on the New York Stock Exchange (generally 4:00 p.m., Eastern Time) by dividing the net assets of the Fund by the number of outstanding shares. The NAV for the Fund also may be calculated on any other day in which there is sufficient liquidity in the securities held by the Fund. As a result, the value of the Fund’s shares may change on days when you will not be able to purchase or redeem your shares. The value of the investments held by the Fund are determined by VALIC, as the “valuation designee,”

15

pursuant to its valuation procedures. The Board of Directors oversees the valuation designee and at least annually reviews its valuation policies and procedures. Investments for which market quotations are readily available are valued at their market price as of the close of regular trading on the New York Stock Exchange for the day, unless the market quotations are determined to be unreliable. Securities and other assets for which market quotations are unavailable or unreliable are valued by the valuation designee at fair value in accordance with valuation procedures. There is no single standard for making fair value determinations, which may result in prices that vary from those of other funds. In addition, there can be no assurance that fair value pricing will reflect actual market value and it is possible that the fair value determined for a security may differ materially from the value that could be realized upon the sale of the security.

Investments in registered investment companies that do not trade on an exchange are valued at the end of the day net asset value per share. Investments in registered investment companies that trade on an exchange are valued at the last sales price or official closing price as of the close of the customary trading session on the exchange where the security principally traded. The prospectus for any such open‑end funds should explain the circumstances under which these funds use fair value pricing and the effect of using fair value pricing.

As of the close of regular trading on the New York Stock Exchange, securities traded primarily on security exchanges outside the United States are valued at the last sale price on such exchanges on the day of valuation or if there is no sale on the day of valuation, at the last reported bid price. If a security’s price is available from more than one exchange, the Fund uses the exchange that is the primary market for the security. However, depending on the foreign market, closing prices may be up to 15 hours old when they are used to price the Fund’s shares, and the Fund may determine that certain closing prices do not reflect the fair value of a security. This determination will be based on review of a number of factors, including developments in foreign markets, the performance of U.S. securities markets, and the performance of instruments trading in U.S. markets that represent foreign securities and baskets of foreign securities. If the valuation designee determines that closing prices do not reflect the fair value of the securities, the valuation designee will adjust the previous closing prices in accordance with pricing procedures to reflect what it believes to be the fair value of the securities as of the close of regular trading on the New York Stock Exchange. The Fund may also fair value securities in other situations, for example, when a

particular foreign market is closed but the Fund is open.

For foreign equity securities and foreign equity futures contracts, the Fund uses an outside pricing service to provide it with closing market prices and information used for adjusting those prices.

The Fund may invest in securities that are primarily listed on foreign exchanges that trade on weekends or other days when the Fund does not price its shares. As a result, the value of such foreign securities may change on days when the Fund is not open to purchases or redemptions.

During periods of extreme volatility or market crisis, the Fund may temporarily suspend the processing of sell requests or may postpone payment of proceeds for up to seven business days or longer, or as allowed by federal securities laws.

Dividends and Capital Gains

Dividends from Net Investment Income

Dividends from net investment income are declared and paid annually. Dividends from net investment income are automatically reinvested for you into additional shares of the Fund.

Distributions from Capital Gains

When the Fund sells a security for more than it paid for that security, a capital gain results. Distributions from capital gains, if any, are normally declared and paid annually. Distributions from capital gains are automatically reinvested for you into additional shares of the Fund.

Tax Consequences

As the owner of a Variable Contract, a participant under your employer’s Variable Contract or Plan or as an IRA account owner, you will not be directly affected by the federal income tax consequences of distributions, sales or redemptions of Fund shares. You should consult your Variable Contract prospectus, Plan document, custodial agreement or your tax professional for further information concerning the federal income tax consequences to you of investing in the Fund.

The Fund will annually designate certain amounts of its dividends paid as eligible for the dividend received deduction. If the Fund incurs foreign taxes, it will elect to pass-through allowable foreign tax credits. These designations and elections will benefit VALIC, in potentially material amounts, and will not beneficially or adversely affect you or the Fund. The benefits to VALIC will not be passed to you or the Fund.

16

Investment Adviser

VALIC is a stock life insurance company which has been in the investment advisory business since 1960 and is the investment adviser for the Fund. VALIC is an indirect wholly-owned subsidiary of Corebridge Financial, Inc. (“Corebridge”). VALIC is located at 2929 Allen Parkway, Houston, Texas 77019.

VALIC serves as investment adviser through an Investment Advisory Agreement with VC I. As investment adviser, VALIC oversees the day‑to‑day operations of the Fund and supervises the purchase and sale of Fund investments. VALIC employs investment subadvisers that make investment decisions for the Fund.