UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2013

OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ______ to _______

Commission file number 1-5684

W.W. Grainger, Inc.

(Exact name of registrant as specified in its charter)

|

| | |

Illinois | | 36-1150280 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

100 Grainger Parkway, Lake Forest, Illinois | | 60045-5201 |

(Address of principal executive offices) | | (Zip Code) |

(847) 535-1000 |

(Registrant’s telephone number including area code) |

Securities registered pursuant to Section 12(b) of the Act: |

Title of each class | | Name of each exchange on which registered |

Common Stock $0.50 par value | | New York Stock Exchange |

| | Chicago Stock Exchange |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [X] No [ ]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [X] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [X]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

| | | |

Large accelerated filer [X] | Accelerated filer [ ] | Non-accelerated filer [ ] | Smaller reporting company [ ] |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes [ ] No [X]

The aggregate market value of the voting common equity held by nonaffiliates of the registrant was $16,677,711,460 as of the close of trading as reported on the New York Stock Exchange on June 30, 2013. The Company does not have nonvoting common equity.

The registrant had 68,797,706 shares of the Company’s Common Stock outstanding as of January 31, 2014.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the proxy statement relating to the annual meeting of shareholders of the registrant to be held on April 30, 2014, are incorporated by reference into Part III hereof.

|

| | | | | | |

| TABLE OF CONTENTS | Page(s) |

|

| PART I | |

Item 1: | BUSINESS | |

Item 1A: | RISK FACTORS | |

Item 1B: | UNRESOLVED STAFF COMMENTS | |

Item 2: | PROPERTIES | |

Item 3: | LEGAL PROCEEDINGS | |

Item 4: | MINE SAFETY DISCLOSURES | |

| PART II | |

Item 5: | MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED SHAREHOLDER | |

| | MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES | |

Item 6: | SELECTED FINANCIAL DATA | |

Item 7: | MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL | |

| | CONDITION AND RESULTS OF OPERATIONS | |

Item 7A: | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | |

Item 8: | FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA | |

Item 9: | CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS | |

| | ON ACCOUNTING AND FINANCIAL DISCLOSURE | |

Item 9A: | CONTROLS AND PROCEDURES | |

Item 9B: | OTHER INFORMATION | |

| PART III | |

Item 10: | DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE | |

Item 11: | EXECUTIVE COMPENSATION | |

Item 12: | SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND | |

| | MANAGEMENT AND RELATED STOCKHOLDER MATTERS | |

Item 13: | CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND | |

| | DIRECTOR INDEPENDENCE | |

Item 14: | PRINCIPAL ACCOUNTING FEES AND SERVICES | |

| PART IV | |

Item 15: | EXHIBITS AND FINANCIAL STATEMENT SCHEDULES | |

Signatures | | | | | |

| | | | | |

PART I

Item 1: Business

The Company

W.W. Grainger, Inc., incorporated in the State of Illinois in 1928, is a broad-line distributor of maintenance, repair and operating (MRO) supplies and other related products and services used by businesses and institutions primarily in the United States and Canada, with a presence in Europe, Asia and Latin America. In this report, the words “Grainger” or “Company” mean W.W. Grainger, Inc. and its subsidiaries.

Grainger uses a multichannel business model to provide customers with a range of options for finding and purchasing products, utilizing sales representatives, direct marketing materials, catalogs and eCommerce. Grainger serves more than 2 million customers worldwide through a network of highly integrated branches, distribution centers, websites and export services.

In 2013, Grainger acquired two businesses in the United States. E&R Industrial Sales, Inc., acquired in the third quarter, is a distributor of metalworking, production supplies and MRO materials to manufacturers and industrial customers. Safety Solutions, Inc., acquired in the fourth quarter, is a distributor of safety footwear, supplies and services with a strong focus on the manufacturing sector.

In 2013, Grainger divested four direct marketing brands at the end of the fourth quarter, which included Gempler's, Ben Meadows, AW Direct and McFeely's.

Grainger has centralized business support functions that provide coordination and guidance in the areas of accounting and finance, business development, communications and investor relations, compensation and benefits, information systems, health and safety, global supply chain functions, human resources, risk management, internal audit, legal, real estate, security, tax and treasury. These services are provided in varying degrees to all business units.

Items are regularly added to and deleted from Grainger’s product lines on the basis of customer demand, market research, recommendations of suppliers, sales volumes and other factors.

Grainger’s two reportable segments are the United States and Canada and they are described further below. Other businesses include operations in Europe, Asia, Latin America and other U.S. operations. These businesses generate revenue through the distribution of maintenance, repair and operating supplies and products and provide related services. For segment and geographical information and consolidated net sales and operating earnings, see “Item 7: Management’s Discussion and Analysis of Financial Condition and Results of Operations” and Note 16 to the Consolidated Financial Statements.

United States

The United States business offers a broad selection of maintenance, repair and operating supplies and other related products and services through local branches, sales representatives, catalogs and eCommerce. A combination of product breadth, local availability, speed of delivery, detailed product information and competitively priced products and services is provided by this business. Products offered include material handling equipment, safety and security supplies, lighting and electrical products, power and hand tools, pumps and plumbing supplies, cleaning and maintenance supplies, building and home inspection supplies, vehicle and fleet components and many other items primarily focused on the facilities maintenance market. Services offered primarily include inventory management and energy efficiency solutions.

The United States business operates in all 50 states through a network of 390 branches and sales representatives. The branches are located in close proximity to the majority of U.S. businesses and serve the immediate needs of customers in their local markets by allowing them to pick up items directly from the branches. The branch network has approximately 4,800 employees who primarily fulfill counter and will-call product purchases and provide customer service. An average branch is 22,000 square feet in size, has 12 employees and handles about 150 transactions per day. In the normal course of business, Grainger continually reviews the effectiveness of its branch network. In 2013, Grainger added 21 branches to its portfolio through the recent acquisitions as noted above.

The logistics network in the United States is comprised of 18 distribution centers (DCs) of various sizes. Automated equipment and processes in the larger DCs allow them to handle the majority of the customer shipping for next-day product availability and replenish the branches that provide same-day availability. In 2013, Grainger opened a 1 million square-foot and highly automated DC in the Chicago area.

Customers range from small and medium-sized businesses to large corporations, government entities and other institutions. They are primarily represented by purchasing managers or workers in facilities maintenance departments and service shops across a wide range of industries such as manufacturing, hospitality, transportation, government, retail, healthcare and education. Sales in 2013 were made to approximately 1.4 million customers averaging 109,000 daily transactions. No single customer accounted for more than 3% of total sales.

The business has a sales force of almost 3,100 professionals who help businesses and institutions select the right products to find immediate solutions to maintenance problems and to reduce operating expenses and improve cash flows. In 2013, Grainger continued to expand its sales force to facilitate growth with targeted segments and provide more specialized support.

Another area in which the United States business helps customers be more productive is through inventory management services. A comprehensive program called KeepStock® is an offering that includes vendor managed inventory, customer managed inventory and on-site vending machines. Grainger's KeepStock program currently provides services to more than 21,000 customers at approximately 55,000 unique customer installations.

Customers can also purchase products through Grainger.com®. Customers continue to migrate to online and electronic purchasing. eCommerce revenues were $2.5 billion in 2013, an increase of 16% versus 2012. Grainger.com provides access to approximately 1.2 million products and serves as a prominent channel for the United States business. Grainger.com provides real-time price and product availability and detailed product information, and offers advanced features such as product search and compare capabilities. For customers with sophisticated electronic purchasing platforms, Grainger utilizes technology that allows these systems to communicate directly with Grainger.com. In 2013, Grainger transitioned Grainger.com to a new web platform, launched a Spanish language website and introduced new applications for mobile devices. Customers can also purchase products through other branded websites.

The majority of the products sold by the United States business are well recognized national branded products. In addition, 22% of 2013 sales were private label items bearing Grainger’s registered trademarks, such as DAYTON® motors, power transmission, HVAC and material handling, SPEEDAIRE® air compressors, AIR HANDLER® air filtration equipment, TOUGH GUY® cleaning products, WESTWARD® tools, CONDOR® safety products and LUMAPRO® lighting products. Grainger has taken steps to protect these trademarks against infringement and believes that they will remain available for future use in its business. The United States business purchases products for sale from more than 2,700 key suppliers, most of which are manufacturers. Through a global sourcing operation, the business procures competitively priced, high-quality products produced outside the United States from approximately 400 suppliers. Grainger sells these items primarily under the private label brands listed above. No single supplier comprised more than 5% of total purchases and no significant difficulty has been encountered with respect to sources of supply.

The Grainger catalog, most recently issued in February 2014, offers approximately 590,000 facilities maintenance and other products, an increase of 20,000 from the prior year, and is used by customers to assist in product selection. Approximately 1.6 million copies of the catalog were produced. In addition, Grainger’s United States business issues targeted catalogs for its multiple branded products, as well as other marketing materials.

Grainger estimates the United States market for facilities maintenance and related products to be approximately $122 billion, of which Grainger’s share is approximately 6%.

Canada

Acklands – Grainger is Canada’s leading broad-line distributor of industrial and safety supplies. A combination of product breadth, local availability, speed of delivery, detailed product information and competitively priced products and services is provided by this business.

The Canadian business serves customers through 171 branches, sales and service representatives and 6 DCs across Canada. Acklands – Grainger distributes tools, fasteners, safety supplies, instruments, welding and shop equipment, and many other items. During 2013, approximately 15,200 sales transactions were completed daily. A comprehensive catalog, printed in both English and French, was most recently issued in February 2014. The catalog has more than 139,000 products and is used by customers to assist in product selection. In addition, customers can purchase products through Acklandsgrainger.com, a fully bilingual website. In 2013, Acklands – Grainger announced a large product expansion, adding 200,000 new products to its online offering and also began construction on a 500,000 square-foot distribution center in the Toronto area. Grainger estimates the Canadian market for facilities maintenance and related products to be approximately $14 billion, of which Acklands – Grainger’s share is approximately 8%.

Other Businesses

Included in other businesses are the operations in Europe, Asia, Latin America and other U.S. operations. The more significant businesses in this group, those with anticipated revenues of more than $100 million in 2014, are described below.

Fabory

Fabory is a European distributor of fasteners, tools and industrial supplies. Fabory is headquartered in Tilburg, the Netherlands, and has more than 100 locations in 14 countries. Customers have access to more than 100,000 products through a catalog and through Fabory.com. Grainger estimates the European market (in which Fabory has its primary operations) for facilities maintenance and related products to be approximately $39 billion, of which Grainger’s share is approximately 1%.

Japan

Grainger operates in Japan through its 51% interest in MonotaRO Co. MonotaRO provides small and mid-sized domestic businesses with products that help them operate and maintain their facilities. MonotaRO is a catalog and web-based direct marketer with approximately 84% of orders being conducted through Monotaro.com. MonotaRO has no branches or sales force and fulfills all orders from two DCs, which have approximately 120,000 stocked products. Grainger estimates the Japanese market for facilities maintenance and related products to be approximately $45 billion, of which Grainger’s share is approximately 1%.

Mexico

Grainger’s operations in Mexico provide local businesses with maintenance, repair and operating supplies and other related products primarily from Mexico and the United States. The business in Mexico distributes products through a network of branches and two DCs where customers have access to approximately 119,000 products through a Spanish-language catalog and through Grainger.com.mx. Grainger estimates the Mexican market for facilities maintenance and related products to be approximately $11 billion, of which Grainger’s share is approximately 1%.

Zoro Tools

Zoro Tools is an online distributor of MRO products serving U.S. businesses and consumers through its website Zorotools.com. Zoro Tools offers a broad selection of approximately 400,000 items at single, competitive prices. Zoro Tools has no branches or sales force, and product is delivered through the Grainger U.S. supply chain.

Seasonality

Grainger’s business in general is not seasonal, however, there are some products that typically sell more often during the winter or summer season. In any given month, unusual weather patterns, i.e., unusually hot or cold weather, could impact the sales volumes of these products, either positively or negatively.

Competition

Grainger faces competition in all markets it serves, from manufacturers (including some of its own suppliers) that sell directly to certain segments of the market, wholesale distributors, catalog houses, retail enterprises and Internet-based businesses. Grainger provides local product availability, a broad product line, sales representatives, competitive pricing, catalogs (which include product descriptions and, in certain cases, extensive technical and application data), and electronic and Internet commerce technology. Other services, such as inventory management and energy efficiency solutions to assist customers in lowering their total facilities maintenance costs, are also offered. Grainger believes that it can effectively compete with manufacturers on small orders, but manufacturers may have an advantage in filling large orders. There are several large competitors, although the majority of the market is served by small local and regional competitors.

Employees

As of December 31, 2013, Grainger had approximately 23,700 employees, of whom approximately 22,500 were full-time and 1,200 were part-time or temporary. Grainger has never had a major work stoppage and considers employee relations to be good.

Website Access to Company Reports

Grainger makes available, through its website, free of charge, its Annual Report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, proxy statements and amendments to those reports, as soon as reasonably practicable after this material is electronically filed with or furnished to the Securities and Exchange Commission. This material may be accessed by visiting www.grainger.com/investor.

Item 1A: Risk Factors

The following is a discussion of significant risk factors relevant to Grainger's business that could adversely affect its financial position or results of operations.

Weakness in the economy could negatively impact Grainger's sales growth. Economic and industry trends affect Grainger's business environments. Economic downturns can cause customers, both domestic and international, to idle or close facilities, delay purchases and otherwise reduce their ability to purchase Grainger's products and services as well as their ability to make full and timely payments. Thus, a significant or prolonged slowdown in economic activity in the United States, Canada or any other major world economy could negatively impact Grainger's sales growth and results of operations.

The facilities maintenance industry is highly fragmented, and changes in competition could result in a decreased demand for Grainger's products and services. There are several large competitors in the industry, although most of the market is served by small local and regional competitors. Grainger faces competition in all markets it serves, from manufacturers (including some of its own suppliers) that sell directly to certain segments of the market, wholesale distributors, catalog houses, retail enterprises and Internet-based businesses. Competitive pressures could adversely affect Grainger's sales and profitability.

Volatility in commodity prices may adversely affect operating margins. Some of Grainger's products contain significant amounts of commodity-priced materials, such as steel, copper, petroleum derivatives or rare earth minerals, and are subject to price changes based upon fluctuations in the commodities market. Increases in the price of fuel could also drive up transportation costs. Grainger's ability to pass on increases in costs depends on market conditions. The inability to pass along cost increases could result in lower operating margins. In addition, higher prices could impact demand for these products, resulting in lower sales volumes.

Unexpected product shortages could negatively impact customer relationships, resulting in an adverse impact on results of operations. Grainger's competitive strengths include product selection and availability. Products are purchased from approximately 5,000 key suppliers located in various countries around the world, no one of which accounted for more than 5% of total purchases. Historically, no significant difficulty has been encountered with respect to sources of supply; however, disruptions could occur due to factors beyond Grainger's control, such as economic downturns, political unrest, trade issues, etc., any of which could adversely affect a supplier's ability to manufacture or deliver products. If Grainger were to experience difficulty in obtaining products, there could be a short-term adverse effect on results of operations and a longer-term adverse effect on customer relationships and Grainger's reputation. In addition, Grainger has strategic relationships with key vendors. In the event Grainger were unable to maintain those relations, there might be a loss of competitive pricing advantages which could, in turn, adversely affect results of operations.

Changes in customer or product mix could cause the gross margin percentage to decline. From time to time, Grainger experiences changes in customer and product mix that effect gross margin. Changes in customer and product mix result primarily from business acquisitions, changes in customer demand, customer acquisitions, selling and marketing activities and competition. If rapid growth with large customers continues, Grainger will face pressure to maintain current gross margins, as this customer segment receives discounted pricing due to their higher sales volume. There can be no assurance that Grainger will be able to maintain historical gross margins in the future.

Disruptions in Grainger's supply chain could result in an adverse impact on results of operations. A disruption within Grainger's logistics or supply chain network, including damage, destruction and other events which would cause one or more of the distribution centers to become non-operational, could adversely affect Grainger's ability to deliver inventory in a timely manner, impair Grainger's ability to meet customer demand for products and result in lost sales or damage to Grainger's reputation. Such a disruption could adversely impact the results of operations.

Interruptions in the proper functioning of information systems could disrupt operations and cause unanticipated increases in costs and/or decreases in revenues. The proper functioning of Grainger's information systems, including its websites, is critical to the successful operation of its business. Grainger continues to invest in software, hardware and network infrastructures in order to effectively manage its information systems and websites. Although Grainger's information systems are protected with robust backup and security systems, including physical and software safeguards and remote processing capabilities, information systems are still vulnerable to natural disasters, power losses, computer viruses, telecommunication failures and other problems. If critical information systems fail or otherwise become unavailable, among other things, Grainger's ability to process orders, maintain proper levels of inventories, collect accounts receivable and disburse funds could be adversely affected. Any such interruption of Grainger's information systems could also subject Grainger to additional costs.

Breaches of information systems security could damage Grainger's reputation, disrupt operations, increase costs and/or decrease revenues. Through Grainger's sales and eCommerce channels, Grainger collects and stores confidential information that customers provide to, among other things, purchase products or services, enroll in promotional programs and register on the website. Grainger also acquires and retains information about suppliers and employees in the normal course of business. Despite instituted safeguards for the protection of such information, computer hackers may attempt to penetrate Grainger's or its vendors' information systems and, if successful, misappropriate confidential customer, supplier, employee or other business information. In addition, a Grainger employee, contractor or other third party with whom Grainger does business may attempt to circumvent security measures in order to obtain such information or inadvertently cause a breach involving such information. Loss of customer, supplier, employee or other business information could disrupt operations, damage Grainger's reputation and expose Grainger to claims from customers, suppliers, financial institutions, regulators, payment card associations, employees and other persons, any of which could have an adverse effect on Grainger, its financial condition and results of operations. In addition, compliance with tougher privacy and information security laws and standards may result in significant additional expense due to increased investment in technology and the development of new operational processes.

Fluctuations in foreign currency have an effect on reported results of operations. Foreign currency exchange rates and fluctuations have an impact on sales, costs and cash flows from international operations, and could affect reported financial performance.

Acquisitions involve a number of inherent risks, any of which could result in the benefits anticipated not being realized and could have an adverse effect on results of operations. Acquisitions, both foreign and domestic, involve various inherent risks, such as uncertainties in assessing the value, strengths, weaknesses, liabilities and potential profitability of acquired companies. There is a risk of potential losses of key employees of an acquired business and of an inability to achieve identified operating and financial synergies anticipated to result from an acquisition. Additionally, problems could arise from the integration of the acquired business including unanticipated changes in the business or industry, or general economic conditions that affect the assumptions underlying the acquisition. Any one or more of these factors could cause Grainger to not realize the benefits anticipated to result from the acquisitions or have a negative impact on the fair value of the reporting units. Accordingly, goodwill and intangible assets recorded as a result of acquisitions could become impaired.

In order to compete, Grainger must attract, retain and motivate key employees, and the failure to do so could have an adverse effect on results of operations. In order to compete and have continued growth, Grainger must attract, retain and motivate executives and other key employees, including those in managerial, technical, sales, marketing and support positions. Grainger competes to hire employees and then must train them and develop their skills and competencies. Grainger's operating results could be adversely affected by increased costs due to increased competition for employees, higher employee turnover or increased employee benefit costs.

Grainger's continued success is substantially dependent on positive perceptions of Grainger's reputation. One of the reasons why customers choose to do business with Grainger and why employees choose Grainger as a place of employment is the reputation that Grainger has built over many years. To be successful in the future, Grainger must continue to preserve, grow and leverage the value of Grainger's brand. Reputational value is based in large part on perceptions of subjective qualities. Even an isolated incident, or the aggregate effect of individually insignificant incidents, can erode trust and confidence, particularly if they result in adverse publicity, governmental investigations or litigation, and as a result, could tarnish Grainger's brand and lead to adverse effects on Grainger's business.

Grainger's business is subject to various government regulations. Grainger's business is subject to a wide array of laws and regulations in every jurisdiction where it operates, and compliance with these laws and regulations increases the cost of doing business. Grainger is subject to a variety of laws and regulations, including without limitation import and export requirements, the Foreign Corrupt Practices Act, tax laws (including U.S. taxes on foreign subsidiaries), foreign exchange controls and cash repatriation restrictions, data privacy requirements, regulations and potential expansion of regulations on suppliers regarding the sources of supplies or products, labor laws and anti-competition regulations, and is also subject to audits and inquiries in the ordinary course of business. As a government contractor selling to federal, state and local government entities, Grainger is also subject to a wide variety of additional laws and regulations. Changes to the legal and regulatory environments could increase the cost of doing business, and such costs may increase in the future as a result of changes in these laws and regulations or in their interpretation. Furthermore, Grainger has implemented policies and procedures designed to facilitate compliance with these laws and regulations, but there can be no assurance that employees, contractors or agents will not violate such laws and regulations or Grainger's policies. Any such violations could individually or in the aggregate materially adversely affect Grainger's financial condition or operating results.

Item 1B: Unresolved Staff Comments

None.

Item 2: Properties

As of December 31, 2013, Grainger’s owned and leased facilities totaled approximately 27 million square feet. The United States business and Acklands – Grainger accounted for the majority of the total square footage. Grainger believes that its properties are generally in excellent condition, well maintained and suitable for the conduct of business.

A brief description of significant facilities follows:

|

| | | | | |

Location | | Facility and Use (6) | | Size in Square Feet (in 000's) |

United States (1) | | 390 United States branch locations | | 8,554 |

|

United States (2) | | 18 Distribution Centers | | 6,793 |

|

United States (3) | | Other facilities | | 3,344 |

|

Canada (4) | | 182 Acklands – Grainger facilities | | 2,872 |

|

Other Businesses (5) | | Other facilities | | 4,205 |

|

Chicago Area (2) | | Headquarters and General Offices | | 1,595 |

|

| | Total Square Feet | | 27,363 |

|

|

| |

(1) | United States branches consist of 273 owned and 117 leased properties located throughout the U.S. Branches range in size from approximately 1,000 to 109,000 square feet. Most leases expire between 2014 and 2020. |

(2) | These facilities are primarily owned. |

(3) | These facilities include both owned and leased locations, consisting of storage facilities, office space and idle properties. |

(4) | Acklands – Grainger facilities consist of general offices, distribution centers and branches located throughout Canada, of which 64 are owned and 118 leased. |

(5) | These facilities include owned and leased locations in Europe, Asia, Latin America and other U.S. operations. |

(6) | Owned facilities are not subject to any mortgages. |

Item 3: Legal Proceedings

Information on specific and significant legal proceedings is set forth in Note 18 to the Consolidated Financial Statements included under Item 8.

Item 4: Mine Safety Disclosures

Not applicable.

PART II

Item 5: Market for Registrant’s Common Equity, Related Shareholder Matters and Issuer Purchases of Equity Securities

Market Information and Dividends

Grainger's common stock is listed on the New York Stock Exchange and the Chicago Stock Exchange, with the ticker symbol GWW. The high and low sales prices for the common stock and the dividends declared and paid for each calendar quarter during 2013 and 2012 are shown below.

|

| | | | | | | | | | | | |

| | Prices | | |

| Quarters | High | | Low | | Dividends |

2013 | First | $ | 233.95 |

|

| $ | 201.49 |

| | $ | 0.80 |

|

| Second | 269.17 |

|

| 216.64 |

| | 0.93 |

|

| Third | 276.38 |

|

| 245.01 |

| | 0.93 |

|

| Fourth | 274.37 |

|

| 246.86 |

| | 0.93 |

|

| Year | $ | 276.38 |

|

| $ | 201.49 |

| | $ | 3.59 |

|

2012 | First | $ | 221.84 |

|

| $ | 184.37 |

| | $ | 0.66 |

|

| Second | 221.00 |

|

| 172.50 |

| | 0.80 |

|

| Third | 211.36 |

|

| 176.50 |

| | 0.80 |

|

| Fourth | 218.23 |

|

| 184.78 |

| | 0.80 |

|

| Year | $ | 221.84 |

|

| $ | 172.50 |

| | $ | 3.06 |

|

Grainger expects that its practice of paying quarterly dividends on its common stock will continue, although the payment of future dividends is at the discretion of Grainger’s Board of Directors and will depend upon Grainger’s earnings, capital requirements, financial condition and other factors.

Holders

The approximate number of shareholders of record of Grainger’s common stock as of January 31, 2014, was 790 with approximately 198,500 additional shareholders holding stock through nominees.

Issuer Purchases of Equity Securities - Fourth Quarter

|

| | | | | | |

Period | Total Number of Shares Purchased (A) | Average Price Paid per Share (B) | Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs (C) | Maximum Number of

Shares That May Yet be Purchased Under the

Plans or Programs |

Oct. 1 – Oct. 31 | 112,330 | 267.18 | 112,330 | 4,115,080 |

| shares |

Nov. 1 – Nov. 30 | 386,491 | 262.46 | 386,491 | 3,728,589 |

| shares |

Dec. 1 – Dec. 31 | 106,921 | 256.19 | 106,921 | 3,621,668 |

| shares |

Total | 605,742 | 262.23 | 605,742 | | |

| |

(A) | There were no shares withheld to satisfy tax withholding obligations. |

| |

(B) | Average price paid per share includes any commissions paid and includes only those amounts related to purchases as part of publicly announced plans or programs. |

| |

(C) | Purchases were made pursuant to a share repurchase program approved by Grainger's Board of Directors on July 28, 2010. The program has no specified expiration date. Activity is reported on a trade date basis. |

Company Performance

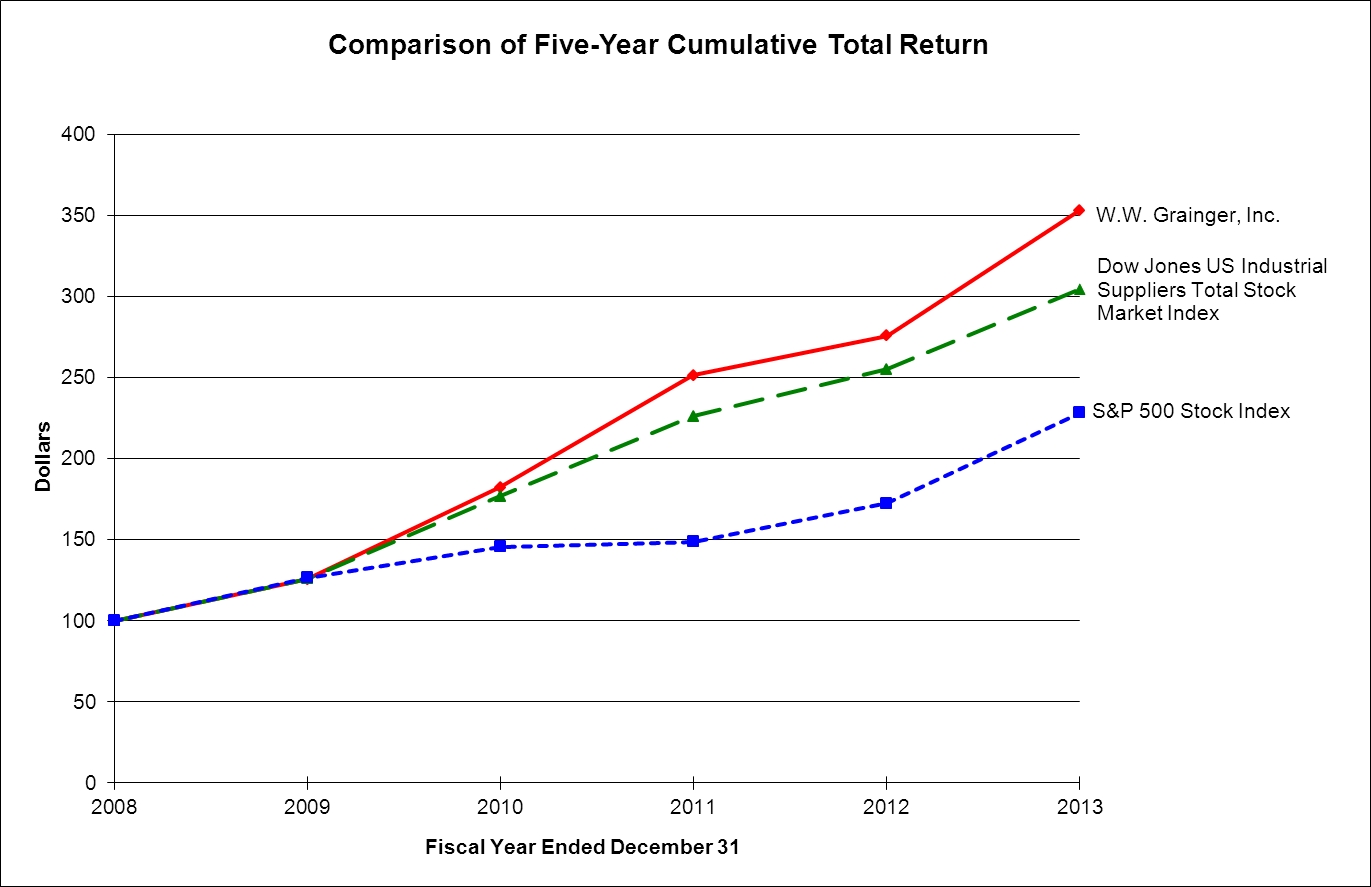

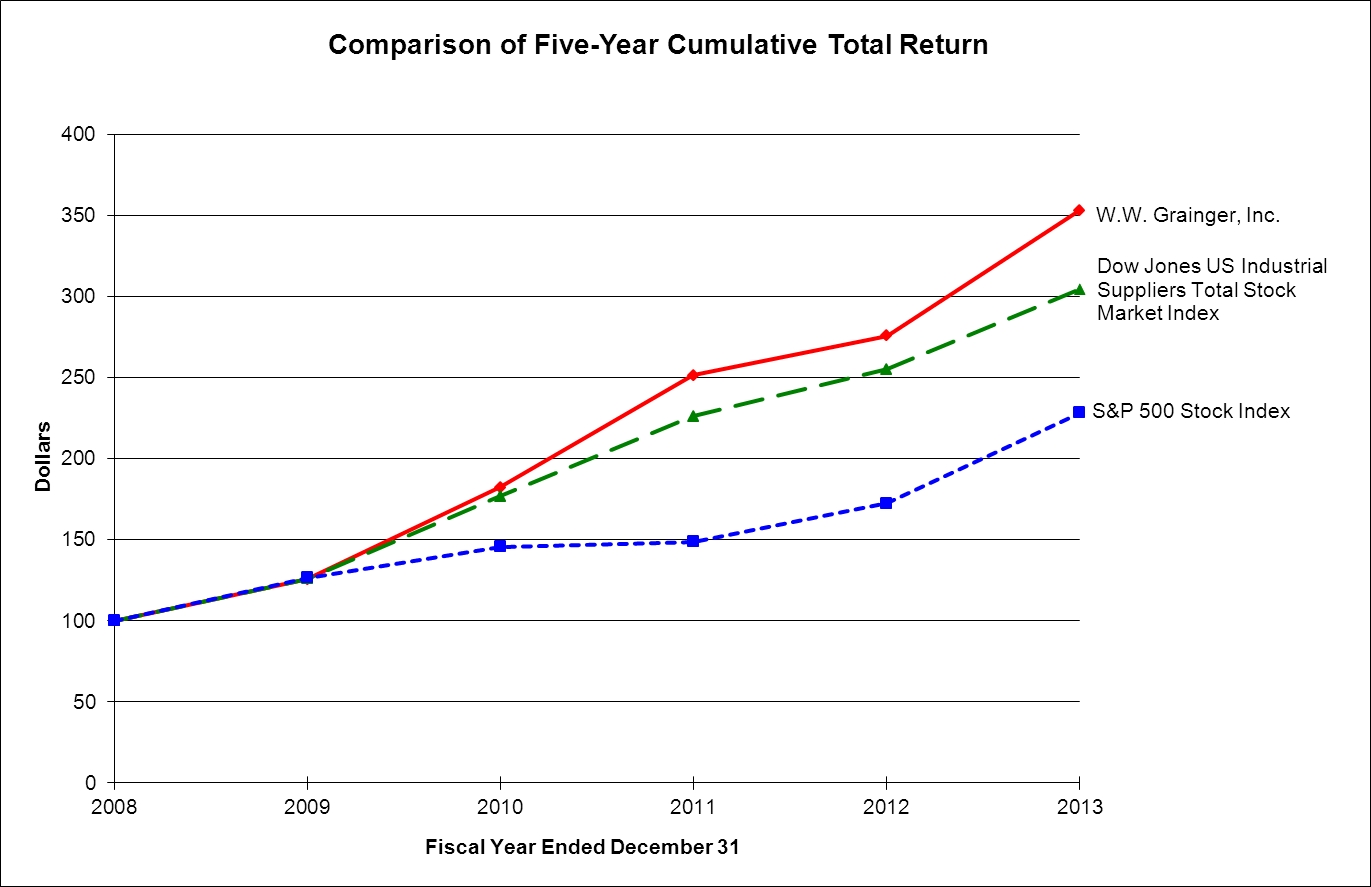

The following stock price performance graph compares the cumulative total return on an investment in Grainger common stock with the cumulative total return of an investment in each of the Dow Jones US Industrial Suppliers Total Stock Market Index and the S&P 500 Stock Index. It covers the period commencing December 31, 2008, and ending December 31, 2013. The graph assumes that the value for the investment in Grainger common stock and in each index was $100 on December 31, 2008, and that all dividends were reinvested.

|

| | | | | | | | | | | | | | | | | | |

| December 31, |

| 2008 | 2009 | 2010 | 2011 | 2012 | 2013 |

W.W. Grainger, Inc. | $ | 100 |

| $ | 125 |

| $ | 182 |

| $ | 251 |

| $ | 276 |

| $ | 353 |

|

Dow Jones US Industrial Suppliers Total Stock Market Index | 100 |

| 126 |

| 177 |

| 226 |

| 255 |

| 305 |

|

S&P 500 Stock Index | 100 |

| 126 |

| 146 |

| 149 |

| 172 |

| 228 |

|

Item 6: Selected Financial Data

|

| | | | | | | | | | | | | | | | | | | |

| 2013 | | 2012 | | 2011 | | 2010 | | 2009 |

| (In thousands of dollars, except for per share amounts) |

Net sales | $ | 9,437,758 |

|

| $ | 8,950,045 |

| | $ | 8,078,185 |

| | $ | 7,182,158 |

| | $ | 6,221,991 |

|

Net earnings attributable to W.W. Grainger, Inc. | 797,036 |

|

| 689,881 |

| | 658,423 |

| | 510,865 |

| | 430,466 |

|

Net earnings per basic share | 11.31 |

|

| 9.71 |

| | 9.26 |

| | 7.05 |

| | 5.70 |

|

Net earnings per diluted share | 11.13 |

|

| 9.52 |

| | 9.07 |

| | 6.93 |

| | 5.62 |

|

Total assets | 5,266,328 |

|

| 5,014,598 |

| | 4,716,062 |

| | 3,904,377 |

| | 3,726,332 |

|

Long-term debt (less current maturities) and other long-term liabilities | 743,702 |

| | 817,229 |

| | 603,858 |

| | 747,404 |

| | 722,334 |

|

Cash dividends paid per share | $ | 3.59 |

|

| $ | 3.06 |

| | $ | 2.52 |

| | $ | 2.08 |

| | $ | 1.78 |

|

Net earnings for 2013 included a $0.29 per share expense related to non-cash impairment charges, primarily for goodwill. Results also included a $0.10 per share expense due to restructuring charges primarily related to improving the long-term performance of the businesses in Europe and China. When combined, these items had a net expense effect of $0.39 per share.

Net earnings for 2012 included a $0.66 per share expense related to the settlement of disputes involving the General Services Administration (GSA) and United States Postal Service (USPS) contracts. Results also included a $0.18 per share expense due to restructuring charges primarily related to improving the long-term performance of the businesses in Europe, India and China, a $0.04 per share expense due to an impairment charge and a $0.03 per share expense related to U.S. branch closures. When combined, these items had a net expense effect of $0.91 per share.

Net earnings for 2011 included a $0.16 per share expense for U.S. branch closures, a $0.12 per share benefit related to the settlement of prior year tax reviews and a $0.07 per share benefit from a gain on the sale of the MRO Korea Co., Ltd. joint venture, which when combined, resulted in a net benefit of $0.03 per share.

There were two non-cash items included in 2010 earnings, a $0.28 per share benefit from a change to the paid time off policy and a $0.15 per share tax expense related to the tax treatment of retiree healthcare benefits following the passage of the Patient Protection and Affordable Care Act, which when combined, resulted in a net benefit of $0.13 per share. Results for 2009 included a $0.37 per share non-cash gain from the MonotaRO transaction in September 2009.

Grainger completed several acquisitions for the years presented above, all of which were immaterial individually and in the aggregate. Operating results have included the results of each business acquired since the respective acquisition dates.

For further information see “Item 7: Management's Discussion and Analysis of Financial Condition and Results of Operations.”

Item 7: Management’s Discussion and Analysis of Financial Condition and Results of Operations

Overview

General. Grainger is a broad-line distributor of maintenance, repair and operating supplies, and other related products and services used by businesses and institutions. Grainger’s operations are primarily in the United States and Canada, with a presence in Europe, Asia and Latin America. Grainger uses a multichannel business model to provide customers with a range of options for finding and purchasing products utilizing sales representatives, catalogs, direct marketing materials and eCommerce. Grainger serves more than 2 million customers worldwide through a network of highly integrated branches, distribution centers, multiple websites and export services.

Grainger’s two reportable segments are the United States and Canada. The United States segment reflects the results of Grainger’s U.S. operating segment. The Canada segment reflects the results for Acklands – Grainger Inc., Grainger’s Canadian operating segment. Other Businesses include operations in Europe, Asia, Latin America and other U.S. operations, which are not material individually.

Business Environment. Given Grainger's large number of customers and the diverse industries it serves, several economic factors and industry trends tend to shape Grainger’s business environment. The overall economy and leading economic indicators provide general insight into projecting Grainger’s growth. Grainger’s sales in the United States and Canada tend to positively correlate with Gross Domestic Product (GDP), Industrial Production, Exports and Business Investment. In the United States, sales also tend to positively correlate with Business Inventory. The table below provides these estimated indicators for 2013 and 2014:

|

| | | | | | | |

| United States | | Canada |

| Estimated 2013 | | Forecasted 2014 | | Estimated 2013 | | Forecasted 2014 |

GDP | 1.9% | | 2.7% | | 1.8% | | 2.4% |

Industrial Production | 2.6% | | 3.2% | | 1.3% | | 2.5% |

Exports | 2.8% | | 4.9% | | 1.2% | | 2.9% |

Business Investment | 2.9% | | 6.3% | | 1.2% | | 6.6% |

Business Inventory | 4.2% | | 3.0% | | — | | — |

Source: Global Insight (February 2014) | | | | | | | |

The light and heavy manufacturing customer sectors, which comprised approximately 30% of Grainger’s total 2013 sales, have historically correlated with manufacturing employment levels and manufacturing production. Manufacturing employment levels in the United States increased approximately 0.6% from December 2012 to December 2013, while manufacturing output increased 2.6%. These increases contributed to a high single-digit percent sales increase in the light manufacturing customer sector and a mid single-digit percent sales increase in the heavy manufacturing customer sector for Grainger in 2013.

As oil production represents a large segment of the Canadian economy, fluctuations in crude oil prices can have a significant impact on the sales and business conditions in Grainger's Canadian business. According to the U.S. Energy Information Administration, crude oil prices increased from $88 to $98 per barrel, or an 11% increase from December 2012 to December 2013.

Outlook. In 2014, Grainger plans to continue to make investments in its supply chain, eCommerce, sales force and inventory management services. These investments are expected to accelerate market share growth and increase Grainger's size and scale. Grainger is also taking appropriate steps to strengthen areas of the business that are not performing to expectations.

On January 24, 2014, Grainger revised its 2014 earnings per share guidance from a range of $12.25 to $13.00 to a range of $12.10 to $12.85 and also revised its 2014 sales guidance from a range of 6 to 10 percent to a range of 5 to 9 percent. This change is primarily driven by unfavorable foreign exchange and the divestiture of the four direct marketing brands, which were sold on December 31, 2013.

Matters Affecting Comparability.

Grainger completed several acquisitions throughout 2013, 2012 and 2011, all of which were immaterial individually and in the aggregate. Grainger’s operating results have included the results of each business acquired since the respective acquisition dates.

Results of Operations

The following table is included as an aid to understanding changes in Grainger's Consolidated Statements of Earnings:

|

| | | | | | | | | | | | | | |

| For the Years Ended December 31, |

| As a Percent of Net Sales | | Percent Increase/(Decrease) from Prior Year |

| 2013 | | 2012 | | 2011 | | 2013 | | 2012 |

Net sales | 100.0 | % | | 100.0 | % | | 100.0 | % | | 5.4 | % | | 10.8 | % |

Cost of merchandise sold | 56.2 |

| | 56.2 |

| | 56.5 |

| | 5.3 |

| | 10.2 |

|

Gross profit | 43.8 |

| | 43.8 |

| | 43.5 |

| | 5.6 |

| | 11.5 |

|

Operating expenses | 30.1 |

| | 31.2 |

| | 30.5 |

| | 2.0 |

| | 13.3 |

|

Operating earnings | 13.7 |

| | 12.6 |

| | 13.0 |

| | 14.7 |

| | 7.5 |

|

Other income (expense) | (0.1 | ) | | (0.1 | ) | | — |

| | (30.6 | ) | | — |

|

Income taxes | 5.1 |

| | 4.7 |

| | 4.8 |

| | 14.5 |

| | 8.8 |

|

Noncontrolling interest | 0.1 |

| | 0.1 |

| | 0.1 |

| | 19.5 |

| | 12.3 |

|

Net earnings attributable to W.W. Grainger, Inc. | 8.4 | % | | 7.7 | % | | 8.1 | % | | 15.5 | % | | 4.8 | % |

2013 Compared to 2012

Grainger's net sales of $9,438 million for 2013 increased 5% when compared with net sales of $8,950 million for 2012. The 5% increase for the year consisted of the following contributors:

|

| |

| Percent Increase/ (Decrease) |

Volume | 3 |

Business acquisitions | 2 |

Price | 1 |

Foreign exchange | (1) |

Total | 5% |

Net sales to most customer end markets increased for 2013. The increase in net sales was led by growth in sales to heavy and light manufacturing customers, followed by diversified commercial services customers. Refer to the Segment Analysis below for further details.

Gross profit of $4,136 million for 2013 increased 6%. The gross profit margin for 2013 was 43.8%, flat versus 2012, primarily driven by price increases exceeding product cost increases, offset by lower margins from the acquired businesses and faster growth with lower margin customers.

Operating expenses of $2,840 million for 2013 increased 2% from $2,785 million for 2012. Operating expenses in 2013 included a $26 million expense related to the impairment charges for the business in Brazil and Grainger Lighting Services in the United States. Also included was $10 million of expense related to restructuring charges for improving the long-term performance of the businesses in Europe and China. Operating expenses in 2012 included a $76 million expense related to the settlement of disputes involving the GSA and USPS contracts. Also included in 2012 was $24 million of expense related to branch closure costs, restructuring charges related to improving the long-term performance of the businesses in Europe, India and China and an impairment charge for Grainger Lighting Services. Excluding these expenses from both years, operating expenses increased 4%, primarily driven by the acquisitions and an incremental $132 million in growth-related spending on new sales representatives, eCommerce and inventory management solutions, primarily in the United States.

Operating earnings of $1,297 million for 2013 increased 15% from $1,131 million for 2012. Excluding the expenses mentioned above for both years, operating earnings increased 8%, primarily due to higher sales and operating expenses increasing at a slower rate than sales.

Net earnings attributable to Grainger for 2013 increased by 16% to $797 million from $690 million in 2012. The increase in net earnings primarily resulted from an increase in operating earnings. Diluted earnings per share of $11.13 in 2013 were 17% higher than $9.52 for 2012, due to increased net earnings and lower average shares outstanding.

The table below reconciles reported diluted earnings per share determined in accordance with generally accepted accounting principles in the United States to adjusted diluted earnings per share, a non-GAAP measure. Management believes adjusted diluted earnings per share is an important indicator of operations because it excludes items that may not be indicative of core operating results. Because non-GAAP financial measures are not standardized, it may not be possible to compare this financial measure with other companies' non-GAAP financial measures having the same or similar names.

|

| | | | | |

| Twelve Months Ended December 31, | |

| 2013 | | 2012 | % |

Diluted earnings per share reported | $11.13 | | $9.52 | 17 | % |

GSA/USPS settlement | — | | 0.66 | |

Goodwill impairment | 0.29 | | 0.04 | |

Restructuring | 0.10 | | 0.18 | |

Charge for U.S. branch closures | — | | 0.03 | |

Subtotal | 0.39 | | 0.91 | |

Diluted earnings per share adjusted | $11.52 | | $10.43 | 10 | % |

Segment Analysis

The following comments at the reportable segment and other business unit level include external and intersegment net sales and operating earnings. See Note 16 to the Consolidated Financial Statements.

United States

Net sales were $7,414 million for 2013, an increase of $488 million, or 7%, when compared with net sales of $6,926 million for 2012. The 7% increase for the year consisted of the following contributors:

|

| |

| Percent Increase |

Volume | 4 |

Business acquisitions | 2 |

Price | 1 |

Total | 7% |

Net sales to most customer end markets increased for 2013. The increase was led by high single digit growth to light manufacturing customers, followed by mid-single digit growth to heavy manufacturing, commercial services, contractors and natural resources customers. Government was up in the low single digits and net sales to resellers were down in the low single digits.

The segment gross profit margin decreased 0.3 percentage point in 2013 compared to 2012, primarily driven by lower margins from the acquired businesses and faster growth with lower margin customers, partially offset by price increases exceeding product cost increases.

Operating expenses were up 1% for 2013 versus 2012. Operating expenses in 2013 included a $13 million expense related to goodwill impairment charges for Grainger Lighting Services. The 2012 year included a $76 million expense related to the settlement of disputes involving the GSA and USPS contracts. Also included in 2012 was $10 million of expense primarily related to branch closure costs and a goodwill impairment charge for Grainger Lighting Services. Excluding these expenses from both years, operating expenses increased 5%, primarily driven by an incremental $118 million in growth-related spending on new sales representatives, eCommerce and inventory management solutions.

For the segment, operating earnings of $1,304 million for 2013 increased 15% over $1,133 million in 2012. Excluding the expenses mentioned above in both years, operating earnings were up 8%. The improvement in operating earnings for 2013 was due to an increase in net sales and operating expenses increasing at a slower rate than sales.

Canada

Net sales were $1,114 million for 2013, an increase of $8 million, or 1%, when compared with $1,106 million for 2012. In local currency, sales increased 4% for 2013. The 1% increase for the year consisted of the following contributors:

|

| |

| Percent Increase/ (Decrease) |

Volume | 4 |

Foreign exchange | (3) |

Total | 1% |

Sales performance in Canada was driven by double digit growth in the forestry market, followed by high single digit growth to the light manufacturing, commercial services and oil and gas end markets. Net sales to heavy manufacturing customers were down in the mid-single digits and the government end market was down in the low single digits.

The segment gross profit margin increased 0.4 percentage point in 2013 over 2012, primarily driven by price increases exceeding product cost increases and favorable freight rates, partially offset by the unfavorable effect of foreign exchange on purchases.

Operating expenses increased 2% in 2013. In local currency, operating expenses increased 5%, primarily due to higher volume-related payroll, occupancy and technology investments, partially offset by lower warehouse expenses.

Operating earnings of $129 million for 2013 were up $1 million, or 1%, versus 2012. In local currency, operating earnings increased 4%. The increase in earnings was due to sales growth and improved gross profit margins, partially offset by operating expenses increasing at a faster rate than sales.

Other Businesses

Net sales were $1,040 million for 2013, an increase of $33 million, or 3%, when compared with $1,007 million for 2012. The net sales increase was primarily due to incremental sales from Zoro Tools, Brazil and Mexico, partially offset by lower sales in India due to a change in its business model. Higher sales in Japan were offset by unfavorable foreign exchange. The 3% increase for the year consisted of the following contributors:

|

| |

| Percent Increase/ (Decrease) |

Volume/Price | 10 |

Foreign exchange | (7) |

Total | 3% |

Operating earnings for other businesses were $8 million for 2013 compared to $20 million for 2012. The year 2013 included $13 million of expense related to impairment charges for the business in Brazil and $10 million of expense in structural changes to the businesses in Europe and China. The year 2012 included $14 million of charges related to restructuring the businesses in Europe, India and China. Excluding these charges, operating earnings decreased $4 million, or 11%, primarily driven by lower earnings from the businesses in Latin America, partially offset by higher earnings at Zoro Tools and Japan.

Other Income and Expense

Other income and expense was $9 million of expense in 2013 compared with $13 million of expense in 2012. The following table summarizes the components of other income and expense (in thousands of dollars):

|

| | | | | | | |

| For the Years Ended December 31, |

| 2013 | | 2012 |

Interest income (expense) - net | $ | (9,991 | ) | | $ | (13,418 | ) |

Other non-operating income | 2,732 |

| | 1,866 |

|

Other non-operating expense | (1,996 | ) | | (1,784 | ) |

Total | $ | (9,255 | ) | | $ | (13,336 | ) |

Net interest expense decreased in 2013 due to lower average interest rates, partially offset by higher average outstanding debt.

Income Taxes

Income taxes of $480 million in 2013 increased 15% as compared with $419 million in 2012. Grainger's effective tax rates were 37.3% and 37.5% in 2013 and 2012, respectively.

2012 Compared to 2011

Grainger's net sales of $8,950 million for 2012 increased 11% when compared with net sales of $8,078 million for 2011. The 11% increase for the year consisted of the following contributors:

|

| |

| Percent Increase/ (Decrease) |

Volume | 6 |

Business acquisitions | 3 |

Price | 3 |

Foreign exchange | (1) |

Total | 11% |

Sales to all customer end markets increased for 2012. The increase in net sales was led by growth in sales to heavy and light manufacturing customers, followed by diversified commercial services customers. Refer to the Segment Analysis below for further details.

Gross profit of $3,916 million for 2012 increased 12%. The gross profit margin for 2012 was 43.8%, up 0.3 percentage point versus 2011, primarily driven by price increases exceeding product cost increases, partially offset by customer mix.

Operating expenses of $2,785 million for 2012 increased 13% from $2,458 million for 2011. Operating expenses in 2012 included a $76 million expense related to the settlement of disputes involving the GSA and USPS contracts. Also included was $24 million of expense related to branch closure costs, restructuring charges related to improving the long-term performance of the businesses in Europe, India and China and an impairment charge for Grainger Lighting Services. The year 2011 included $18 million of branch closure costs. Excluding these expenses from both years, operating expenses increased 10%, primarily driven by the Fabory and AnFreixo acquisitions and incremental growth-related spending on new sales representatives, eCommerce and advertising, primarily in the United States.

Operating earnings of $1,131 million for 2012 increased 7% from $1,052 million for 2011. Excluding the expenses mentioned above for both years, operating earnings increased 15%, primarily due to higher sales and gross profit margins, and operating expenses increasing at a slightly slower rate than sales.

Net earnings attributable to Grainger for 2012 increased by 5% to $690 million from $658 million in 2011. The increase in net earnings primarily resulted from an increase in operating earnings. Diluted earnings per share of $9.52 in 2012 were 5% higher than $9.07 for 2011, due to increased net earnings.

The table below reconciles reported diluted earnings per share determined in accordance with generally accepted accounting principles in the United States to adjusted diluted earnings per share, a non-GAAP measure. Management believes adjusted diluted earnings per share is an important indicator of operations because it excludes items that may not be indicative of core operating results. Because non-GAAP financial measures are not standardized, it may not be possible to compare this financial measure with other companies' non-GAAP financial measures having the same or similar names.

|

| | | | | |

| Twelve Months Ended December 31, | |

| 2012 | | 2011 | % |

Diluted earnings per share reported | $9.52 | | $9.07 | 5 | % |

GSA/USPS settlement | 0.66 | | — | |

Restructuring | 0.18 | | — | |

Goodwill impairment | 0.04 | | — | |

Charge for U.S. branch closures | 0.03 | | 0.16 | |

Settlement of prior year tax reviews | — | | (0.12) | |

Gain on sale of joint venture | — | | (0.07) | |

Subtotal | 0.91 | | (0.03) | |

Diluted earnings per share adjusted | $10.43 | | $9.04 | 15 | % |

Segment Analysis

The following comments at the reportable segment and other business unit level include external and intersegment net sales and operating earnings. See Note 16 to the Consolidated Financial Statements.

United States

Net sales were $6,926 million for 2012, an increase of $425 million, or 7%, when compared with net sales of $6,501 million for 2011. The 7% increase for the year consisted of the following contributors:

|

| |

| Percent Increase |

Volume | 4 |

Price | 3 |

Total | 7% |

Sales to all customer end markets increased for 2012. The increase was led by growth in sales to heavy and light manufacturing customers, followed by diversified commercial services customers.

The segment gross profit margin increased 0.3 percentage point in 2012 over 2011, primarily driven by price increases exceeding product cost increases, partially offset by customer mix.

Operating expenses were up 8% for 2012 versus 2011. The 2012 year included a $76 million expense related to the settlement of disputes involving the GSA and USPS contracts. Also included was $10 million of expense primarily related to branch closure costs and an impairment charge for Grainger Lighting Services. The 2011 year included costs for the closure of 35 branches of $18 million. Excluding these expenses from both years, operating expenses increased 4%, primarily driven by an incremental $70 million in growth-related spending on new sales representatives, eCommerce and advertising.

For the segment, operating earnings of $1,133 million for 2012 increased 6% over $1,066 million in 2011. Excluding the expenses mentioned above in both years, operating earnings were up 12%. The improvement in operating earnings for 2012 was due to an increase in net sales and gross profit margin, and operating expenses increasing at a slower rate than sales.

Canada

Net sales were $1,106 million for 2012, an increase of $113 million, or 11%, when compared with $993 million for 2011. In local currency, sales increased 12% for 2012. The 11% increase for the year consisted of the following contributors:

|

| |

| Percent Increase/ (Decrease) |

Volume | 11 |

Price | 1 |

Foreign exchange | (1) |

Total | 11% |

The increase in net sales was led by growth to oil and gas, commercial and construction customers.

The segment gross profit margin increased 0.2 percentage point in 2012 over 2011, primarily driven by price increases exceeding product cost increases, partially offset by unfavorable customer and product mix.

Operating expenses increased 9% in 2012. In local currency, operating expenses increased 10% primarily due to higher volume-related payroll and travel costs, and higher advertising and depreciation expense, partially offset by lower occupancy costs.

Operating earnings of $127 million for 2012 were up $20 million, or 18%, versus 2011. In local currency, operating earnings increased 19%. The increase in earnings was due to strong sales growth, an improved gross profit margin and expense leverage.

Other Businesses

Net sales for other businesses, which include operations in Europe, Asia, Latin America and other U.S. operations were up 55% for 2012. The sales increase was due primarily to a full year of sales from Fabory, acquired in August 2011, and incremental sales from AnFreixo, acquired in April 2012, as well as strong growth from the businesses in Japan and Mexico.

Operating earnings for other businesses were $20 million for 2012 compared to $31 million for 2011. The decrease was primarily due to restructuring charges related to improving the long-term performance of the businesses in Europe, India and China. Excluding these charges, operating earnings were up $3 million, primarily driven by improved performance in Japan and Mexico, partially offset by losses from the acquired businesses in Europe and Brazil, along with losses in some start-up businesses in developing markets.

Other Income and Expense

Other income and expense was $13 million of expense in 2012 compared with $1 million of expense in 2011. The following table summarizes the components of other income and expense (in thousands of dollars):

|

| | | | | | | |

| For the Years Ended December 31, |

| 2012 | | 2011 |

Interest income (expense) - net | $ | (13,418 | ) | | $ | (7,023 | ) |

Equity in net income of unconsolidated entity | — |

| | 314 |

|

Gain on sale of investment in unconsolidated entity | — |

| | 7,639 |

|

Other non-operating income | 1,866 |

| | 709 |

|

Other non-operating expense | (1,784 | ) | | (2,541 | ) |

Total | $ | (13,336 | ) | | $ | (902 | ) |

Net interest expense increased in 2012 due to higher average outstanding debt, higher average interest rates and interest expense related to capital leases for the acquired business in Europe.

In 2011, Grainger divested its 49% ownership in the MRO Korea Co., Ltd. joint venture, resulting in a gain of approximately $8 million.

Income Taxes

Income taxes of $419 million in 2012 increased 9% as compared with $385 million in 2011. Grainger's effective tax rates were 37.5% and 36.6% in 2012 and 2011, respectively. The 2011 rate benefited from a tax law change in Japan and the settlement of various tax reviews. Excluding these benefits in 2011, the effective tax rate was 38.1%. The effective tax rate in 2012 benefited primarily from a lower blended state tax rate.

Financial Condition

Grainger expects its strong working capital position, cash flows from operations and borrowing capacity to continue, allowing it to fund its operations, including growth initiatives, capital expenditures, acquisitions and repurchase of shares, as well as to pay cash dividends.

Cash Flow

Fiscal year 2013 compared with fiscal year 2012

Cash from operating activities continues to serve as Grainger's primary source of liquidity. Net cash flows from operations in 2013 were $986 million and increased $170 million from $816 million in 2012. The primary driver of the improvement was an increase in net earnings of $109 million. In addition, changes in operating assets and liabilities resulted in a net use of cash of $58 million for 2013 compared to $129 million for 2012. The lower use of cash for operating assets and liabilities was driven primarily by higher trade accounts payable due to higher inventory purchases at year-end in 2013 compared to 2012, partially offset by higher accounts receivable from increased sales.

Net cash used in investing activities was $399 million and $306 million in 2013 and 2012, respectively. The higher use of cash in 2013 compared to 2012 was primarily driven by the increased cash paid for acquisitions and cash expended for property, buildings, equipment and software.

Net cash used in financing activities of $591 million in 2013 increased $197 million from $394 million in 2012. The increase was primarily due to higher treasury share repurchases. Cash paid for treasury share purchases was $438 million in 2013 versus $341 million in 2012, an increase of $97 million. The prior year also included $300 million in proceeds from the issuance of long-term debt.

Fiscal year 2012 compared with fiscal year 2011

Cash from operating activities served as Grainger's primary source of liquidity. Net cash flows from operations in 2012 were $816 million and increased $70 million from $746 million in 2011. The primary driver of the improvement was an increase in net earnings of $32 million as well as an increase of $34 million in net non-cash expenses.

Net cash used in investing activities of $306 million in 2012 was driven by net cash expended for property, buildings, equipment and software of $241 million and net cash paid for business acquisitions of $65 million. Additional information regarding capital spending is detailed in the Capital Expenditures section below. Net cash used in investing activities was $229 million less than in 2011 due primarily to a decrease in net cash paid for business acquisitions of $294 million versus 2011.

Net cash used in financing activities of $394 million in 2012 increased $217 million from $177 million in 2011. The increase was primarily due to higher treasury shares repurchases and higher dividends paid in 2012 versus 2011. Cash paid for treasury share purchases was $341 million in 2012 versus $151 million in 2011, an increase of $190 million. Cash dividends paid were $220 million in 2012, an increase of $39 million versus 2011.

Working Capital

Internally generated funds are the primary source of working capital and funds used in business expansion, supplemented by debt. In addition, funds are expended to support growth initiatives, as well as for business and systems development and other infrastructure improvements.

Working capital consists of current assets (less non-operating cash) and current liabilities (less short-term debt and current maturities of long-term debt). Working capital was $1,621 million at December 31, 2013, compared with $1,604 million at December 31, 2012. At these dates, the ratio of current assets to current liabilities was 2.5 and 2.6, respectively.

Capital Expenditures

In each of the past three years, a portion of operating cash has been used for additions to property, buildings, equipment and capitalized software as summarized in the following table (in thousands of dollars):

|

| | | | | | | | | | | |

| For the Years Ended December 31, |

| 2013 | | 2012 | | 2011 |

Land, buildings, structures and improvements | $ | 60,419 |

| | $ | 57,929 |

| | $ | 51,249 |

|

Furniture, fixtures, machinery and equipment | 152,328 |

| | 145,483 |

| | 118,228 |

|

Subtotal | 212,747 |

| | 203,412 |

| | 169,477 |

|

Capitalized software | 59,398 |

| | 46,448 |

| | 27,465 |

|

Total | $ | 272,145 |

| | $ | 249,860 |

| | $ | 196,942 |

|

In 2013 and 2012, Grainger made significant capital investments to build new distribution centers in the United States and Canada. In the United States, Grainger opened a new 1 million square-foot and highly automated Chicago-area distribution center in 2013. In Canada, Grainger began construction of a 500,000 square-foot distribution center in the Toronto area. Grainger also invested in vending machines for KeepStock, as this program continues to grow. Other significant investments in 2013 and 2012 included investing in a new eCommerce platform, sustaining capital investments for Grainger's branches and distribution centers and other technology infrastructure.

In 2011, significant expenditures were made to build new distribution centers in the United States and for distribution center expansion in Canada. Also, a large investment was made to update and improve the eCommerce platform in the United States business. Finally, Grainger continued to invest in new and existing international businesses, as well as for normal recurring replacement of equipment.

In 2014, capital expenditures are expected to range from $375 million to $425 million. Projected spending includes continued investments in the supply chain, technology infrastructure, eCommerce and in support of sales initiatives. Grainger expects to fund 2014 capital spending from operating cash.

Debt

Grainger maintains a debt ratio and liquidity position that provides flexibility in funding working capital needs and long-term cash requirements. In addition to internally generated funds, Grainger has various sources of financing available, including bank borrowings under lines of credit. Refer to Note 6 and Note 7 to the Consolidated Financial Statements included in Item 8. Total debt as a percent of total capitalization was 14.0% and 15.3% as of December 31, 2013 and 2012, respectively. The reduction in total debt as a percent of total capitalization was primarily due to increased retained earnings associated with higher earnings in 2013. Grainger believes any circumstances that would trigger early payment or acceleration with respect to any outstanding debt obligations would not have a material impact on its results of operations or financial position.

Commitments and Other Contractual Obligations

At December 31, 2013, Grainger's contractual obligations, including estimated payments due by period, are as follows (in thousands of dollars):

|

| | | | | | | | | | | | | | | | | | | |

| Payments Due by Period |

| Total Amounts Committed | | Less than 1 Year | | 1 - 3 Years | | 4 - 5 Years | | More than 5 Years |

Debt obligations | $ | 542,799 |

| | $ | 97,286 |

| | $ | 429,010 |

| | $ | 2,498 |

| | $ | 14,005 |

|

Interest on debt | 28,367 |

| | 9,992 |

| | 13,574 |

| | 4,771 |

| | 30 |

|

Operating lease obligations | 230,644 |

| | 67,993 |

| | 97,929 |

| | 44,785 |

| | 19,937 |

|

Purchase obligations: | | | | | | | | | |

Uncompleted additions to property, buildings and equipment | 65,536 |

| | 65,536 |

| | — |

| | — |

| | — |

|

Commitments to purchase inventory | 402,935 |

| | 402,935 |

| | — |

| | — |

| | — |

|

Other purchase obligations | 261,773 |

| | 176,651 |

| | 63,233 |

| | 21,833 |

| | 56 |

|

Other liabilities | 303,324 |

| | 185,272 |

| | 23,862 |

| | 24,554 |

| | 69,636 |

|

Total | $ | 1,835,378 |

| | $ | 1,005,665 |

| | $ | 627,608 |

| | $ | 98,441 |

| | $ | 103,664 |

|

Purchase obligations for inventory are made in the normal course of business to meet operating needs. While purchase orders for both inventory purchases and non-inventory purchases are generally cancelable without penalty, certain vendor agreements provide for cancellation fees or penalties depending on the terms of the contract.

Other liabilities represent future payments for profit sharing and employee benefits plans as determined by actuarial projections, and other employee benefit plans. Other employment-related benefits costs of $50 million have not been included in this table as the timing of benefit payments is not predictable. See Note 9 to the Consolidated Financial Statements.

See also Note 7 and Note 10 to the Consolidated Financial Statements for further detail related to the interest on long-term debt and operating lease obligations, respectively.

Grainger has recorded a noncurrent liability of approximately $44 million for tax uncertainties and interest at December 31, 2013. This amount is excluded from the table above, as Grainger cannot make reliable estimates of these cash flows by period. See Note 14 to the Consolidated Financial Statements.

Off-Balance Sheet Arrangements

Grainger does not have any material exposures to off-balance sheet arrangements. Grainger does not have any variable interest entities or activities that include non-exchange-traded contracts accounted for at fair value.

Critical Accounting Estimates

The preparation of financial statements, in conformity with accounting principles generally accepted in the United States of America, requires management to make judgments, estimates and assumptions that affect the reported amounts of assets, liabilities, revenues and expenses in the financial statements. Management bases its estimates on historical experience and other assumptions, which it believes are reasonable. If actual amounts are ultimately different from these estimates, the revisions are included in Grainger's results of operations for the period in which the actual amounts become known.

Accounting policies are considered critical when they require management to make assumptions about matters that are highly uncertain at the time the estimates are made and when there are different estimates that management reasonably could have made, which would have a material impact on the presentation of Grainger's financial condition, changes in financial condition or results of operations.

Note 1 to the Consolidated Financial Statements describes the significant accounting policies used in the preparation of the Consolidated Financial Statements. The most significant areas involving management judgments and estimates follow. Actual results in these areas could differ materially from management's estimates under different assumptions or conditions.

Allowance for Doubtful Accounts. Grainger considers several factors to estimate the allowance for uncollectible accounts receivable including the age of the receivables, the percent past due and the historical ratio of actual write-offs to the age of the receivables. The analyses performed also take into consideration economic conditions that may have an impact on a specific industry, group of customers or a specific customer. Based on analysis of actual historical write-offs of uncollectible accounts receivable, Grainger's estimates and assumptions have been materially accurate in regards to the valuation of its allowance for doubtful accounts. However, write-offs could be materially different than the reserves established if business or economic conditions change or actual results deviate from historical trends, and Grainger's estimates and assumptions may be revised as appropriate to reflect these changes. For fiscal years 2013, 2012 and 2011, actual results did not vary materially from estimated amounts.

Inventory Reserves. Grainger establishes inventory reserves for obsolete inventory. Grainger regularly reviews inventory to evaluate continued demand and identify any obsolete or excess quantities. Grainger records provisions for the difference between excess and obsolete inventory and its estimated realizable value. Estimated realizable value is based on anticipated future product demand, market conditions and liquidation values. As Grainger's inventory consists of approximately 1.4 million stocked products, it is not practical to quantify the actual disposition of excess and obsolete inventory against estimated amounts at a stock keeping unit (SKU) level and no individual SKU is material. There were no material differences noted between reserve levels compared to the level of write-offs historically. Grainger's methodology for estimating reserves is continually evaluated based on current experience and the methodology provides for a materially accurate level of reserves at any reporting date. Actual results could differ materially from projections and require changes to reserves which could have a material effect on Grainger's results of operations based on significant changes in product demand, market conditions or liquidation value. If business or economic conditions change, Grainger's estimates and assumptions may be revised as appropriate. For fiscal years 2013, 2012 and 2011, actual results did not vary materially from estimated amounts.