Use these links to rapidly review the document

Table of Contents

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS

As filed with the Securities and Exchange Commission on June 15, 2010

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-4

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

VIRGIN MEDIA INC.*

(Exact name of registrant as specified in its charter)

* And the additional registrants listed below

| Delaware | 4813 | 59-3778247 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

909 Third Avenue, Suite 2863

New York, New York 10022

(212) 906-8440

(Address, including zip code, and telephone number,

including area code, of registrant's principal executive offices)

Bryan H. Hall

Secretary and General Counsel

Virgin Media Inc.

909 Third Avenue, Suite 2863

New York, New York 10022

(212) 906-8440

(Name, address, including zip code, and telephone number,

including area code, of agent for service)

Copy to:

Timothy E. Peterson

Fried, Frank, Harris, Shriver & Jacobson (London) LLP

99 City Road

London, EC1Y 1AX

United Kingdom

Tel: +44 (0) 20 7972 9600

Approximate Date of Commencement of Proposed Sale of the Securities to the Public: As soon as practicable after this registration statement becomes effective.

If the securities being registered on this Form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box. o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ý | Accelerated filer o | Non-accelerated filer o (Do not check if a smaller reporting company) |

Smaller reporting company o |

If applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

| Exchange Act Rule 13e-4(i) (Cross-Border Issuer Tender Offer) | o | |

| Exchange Act Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) | o |

CALCULATION OF REGISTRATION FEE

|

||||||||

| Title of each class of securities to be registered |

Amount to be registered |

Proposed maximum offering price per unit |

Proposed maximum aggregate offering price |

Amount of registration fee |

||||

|---|---|---|---|---|---|---|---|---|

6.50% Senior Secured Notes due 2018 |

$1,000,000,000 | 100% | $1,000,000,000 | $71,300.00(1) | ||||

7.00% Senior Secured Notes due 2018 |

£875,000,000 | 100% | £875,000,000 | $90,418.20(1)(2) | ||||

Guarantees of 6.50% Senior Secured Notes due 2018 and 7.00% Senior Secured Notes due 2018 |

(3) | (3) | (3) | $0(3) | ||||

|

||||||||

The registrants hereby amend this registration statement on such date or dates as may be necessary to delay its effective date until the registrants shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

TABLE OF ADDITIONAL REGISTRANTS

Name of Additional Registrants

|

Jurisdiction of Incorporation or Organization |

I.R.S. Employee Identification Number |

||

|---|---|---|---|---|

| Avon Cable Limited Partnership | Colorado | Not applicable | ||

| Cotswolds Cable Limited Partnership | Colorado | Not applicable | ||

| Edinburgh Cable Limited Partnership | Colorado | Not applicable | ||

| Estuaries Cable Limited Partnership | Colorado | Not applicable | ||

| London South Cable Partnership | Colorado | Not applicable | ||

| TCI/US West Cable Communications Group | Colorado | Not applicable | ||

| Tyneside Cable Limited Partnership | Colorado | Not applicable | ||

| United Cable (London South) Limited Partnership | Colorado | Not applicable | ||

| Chartwell Investors L.P. | Delaware | 51-0352359 | ||

| NNS UK Holdings 1 LLC | Delaware | 13-3819696 | ||

| NNS UK Holdings 2, Inc. | Delaware | 13-3819694 | ||

| North CableComms Holdings, Inc. | Delaware | 13-3734757 | ||

| North CableComms L.L.C. | Delaware | 13-3827338 | ||

| North CableComms Management, Inc. | Delaware | 13-3734751 | ||

| NTL (Triangle) LLC | Delaware | 13-4086747 | ||

| NTL Bromley Company | Delaware | 98-0123978 | ||

| NTL CableComms Group, Inc. | Delaware | 98-0151139 | ||

| NTL Chartwell Holdings 2, Inc. | Delaware | 13-3827334 | ||

| NTL Chartwell Holdings, Inc. | Delaware | 13-3756572 | ||

| NTL North CableComms Holdings, Inc. | Delaware | 13-3756575 | ||

| NTL North CableComms Management, Inc. | Delaware | 13-3756576 | ||

| NTL Programming Subsidiary Company | Delaware | 13-3718517 | ||

| NTL Solent Company | Delaware | 98-0123982 | ||

| NTL South CableComms Holdings, Inc. | Delaware | 13-3756573 | ||

| NTL South CableComms Management, Inc. | Delaware | 13-3756574 | ||

| NTL Surrey Company | Delaware | 98-0123983 | ||

| NTL Sussex Company | Delaware | 98-0123984 | ||

| NTL UK CableComms Holdings, Inc. | Delaware | 98-0157233 | ||

| NTL Wessex Company | Delaware | 98-0123986 | ||

| NTL Winston Holdings, Inc. | Delaware | 13-3734766 | ||

| NTL Wirral Company | Delaware | 98-0123988 | ||

| South CableComms Holdings, Inc. | Delaware | 13-3827336 | ||

| South CableComms L.L.C. | Delaware | 13-3827337 | ||

| South CableComms Management, Inc. | Delaware | 13-3827330 | ||

| Winston Investors L.L.C. | Delaware | 51-0363339 | ||

| Andover Cablevision Limited | England and Wales | 98-0193306 | ||

| Anglia Cable Communications Limited | England and Wales | Not applicable | ||

| Avon Cable Joint Venture | England and Wales | Not applicable | ||

| Barnsley Cable Communications Limited | England and Wales | Not applicable | ||

| BCMV Limited | England and Wales | Not applicable | ||

| Berkhamsted Properties & Building Contractors Limited | England and Wales | 98-0197759 | ||

| Birmingham Cable Corporation Limited | England and Wales | Not applicable | ||

| Birmingham Cable Limited | England and Wales | Not applicable | ||

| Cable Camden Limited | England and Wales | Not applicable | ||

| Cable Enfield Limited | England and Wales | Not applicable | ||

| Cable Hackney & Islington Limited | England and Wales | Not applicable | ||

| Cable Haringey Limited | England and Wales | Not applicable | ||

| Cable London Limited | England and Wales | Not applicable | ||

| Cable Television Limited | England and Wales | 98-0197761 |

Name of Additional Registrants

|

Jurisdiction of Incorporation or Organization |

I.R.S. Employee Identification Number |

||

|---|---|---|---|---|

| Cable Thames Valley Limited | England and Wales | 98-0197760 | ||

| Cabletel (UK) Limited | England and Wales | Not applicable | ||

| CableTel Cardiff Limited | England and Wales | Not applicable | ||

| CableTel Central Hertfordshire Limited | England and Wales | Not applicable | ||

| CableTel Hertfordshire Limited | England and Wales | Not applicable | ||

| CableTel Herts and Beds Limited | England and Wales | Not applicable | ||

| CableTel Investments Limited | England and Wales | Not applicable | ||

| CableTel Newport | England and Wales | Not applicable | ||

| CableTel North Bedfordshire Limited | England and Wales | Not applicable | ||

| CableTel Surrey and Hampshire Limited | England and Wales | Not applicable | ||

| CableTel Telecom Supplies Limited | England and Wales | Not applicable | ||

| CableTel West Glamorgan Limited | England and Wales | Not applicable | ||

| CableTel West Riding Limited | England and Wales | Not applicable | ||

| Cambridge Cable Services Limited | England and Wales | 98-0199438 | ||

| Cambridge Holding Company Limited | England and Wales | 98-0199439 | ||

| CCL Corporate Communication Services Limited | England and Wales | 98-0199441 | ||

| Central Cable Holdings Limited | England and Wales | Not applicable | ||

| Columbia Management Limited | England and Wales | Not applicable | ||

| ComTel Cable Services Limited | England and Wales | 98-0193313 | ||

| ComTel Coventry Limited | England and Wales | 98-0193311 | ||

| Continental Shelf 16 Limited | England and Wales | Not applicable | ||

| Credit-Track Debt Recovery Limited | England and Wales | 98-0199442 | ||

| Crystal Palace Radio Limited | England and Wales | Not applicable | ||

| Diamond Cable Communications Limited | England and Wales | Not applicable | ||

| Digital Television Network Limited | England and Wales | Not applicable | ||

| Doncaster Cable Communications Limited | England and Wales | 98-0197755 | ||

| DTELS Limited | England and Wales | Not applicable | ||

| East Coast Cable Limited | England and Wales | Not applicable | ||

| Ed Stone Limited | England and Wales | Not applicable | ||

| EMS Investments Limited | England and Wales | Not applicable | ||

| Enablis Limited | England and Wales | Not applicable | ||

| EuroBell (Holdings) Limited | England and Wales | Not applicable | ||

| EuroBell (IDA) Limited | England and Wales | Not applicable | ||

| EuroBell (No. 2) Limited | England and Wales | Not applicable | ||

| EuroBell (No. 3) Limited | England and Wales | Not applicable | ||

| EuroBell (No. 4) Limited | England and Wales | Not applicable | ||

| EuroBell (South West) Limited | England and Wales | Not applicable | ||

| EuroBell (Sussex) Limited | England and Wales | Not applicable | ||

| EuroBell (West Kent) Limited | England and Wales | Not applicable | ||

| EuroBell CPE Limited | England and Wales | Not applicable | ||

| EuroBell Internet Services Limited | England and Wales | Not applicable | ||

| EuroBell Limited | England and Wales | Not applicable | ||

| Filegale Limited | England and Wales | Not applicable | ||

| Fleximedia Limited | England and Wales | Not applicable | ||

| Flextech (1992) Limited | England and Wales | Not applicable | ||

| Flextech (Kindernet Investment) Limited | England and Wales | Not applicable | ||

| Flextech (Travel Channel) Limited | England and Wales | Not applicable | ||

| Flextech Broadband Limited | England and Wales | Not applicable | ||

| Flextech Broadcasting Limited | England and Wales | Not applicable | ||

| Flextech Business News Limited | England and Wales | Not applicable | ||

| Flextech Childrens Channel Limited | England and Wales | Not applicable |

Name of Additional Registrants

|

Jurisdiction of Incorporation or Organization |

I.R.S. Employee Identification Number |

||

|---|---|---|---|---|

| Flextech Communications Limited | England and Wales | Not applicable | ||

| Flextech Digital Broadcasting Limited | England and Wales | Not applicable | ||

| Flextech Distribution Limited | England and Wales | Not applicable | ||

| Flextech Family Channel Limited | England and Wales | Not applicable | ||

| Flextech IVS Limited | England and Wales | Not applicable | ||

| Flextech Limited | England and Wales | Not applicable | ||

| Flextech Media Holdings Limited | England and Wales | Not applicable | ||

| Flextech Music Publishing Limited | England and Wales | Not applicable | ||

| Flextech Video Games Limited | England and Wales | Not applicable | ||

| Flextech-Flexinvest Limited | England and Wales | Not applicable | ||

| General Cable Group Limited | England and Wales | Not applicable | ||

| General Cable Holdings Limited | England and Wales | Not applicable | ||

| General Cable Investments Limited | England and Wales | Not applicable | ||

| General Cable Limited | England and Wales | Not applicable | ||

| Halifax Cable Communications Limited | England and Wales | Not applicable | ||

| Heartland Cablevision (UK) Limited | England and Wales | Not applicable | ||

| Heartland Cablevision II (UK) Limited | England and Wales | Not applicable | ||

| Herts Cable Limited | England and Wales | Not applicable | ||

| Interactive Digital Sales Limited | England and Wales | 98-0597080 | ||

| Jewel Holdings | England and Wales | Not applicable | ||

| Lanbase European Holdings Limited | England and Wales | Not applicable | ||

| Lanbase Limited | England and Wales | Not applicable | ||

| Lichfield Cable Communications Limited | England and Wales | 98-0193315 | ||

| M&NW Network II Limited | England and Wales | 98-0606718 | ||

| M&NW Network Limited | England and Wales | 98-0606716 | ||

| Maza Limited | England and Wales | 98-0197757 | ||

| Metro Hertfordshire Limited | England and Wales | Not applicable | ||

| Metro South Wales Limited | England and Wales | Not applicable | ||

| Middlesex Cable Limited | England and Wales | Not applicable | ||

| Northampton Cable Television Limited | England and Wales | Not applicable | ||

| NTL (Aylesbury and Chiltern) Limited | England and Wales | Not applicable | ||

| NTL (B) Limited | England and Wales | Not applicable | ||

| NTL (Broadland) Limited | England and Wales | Not applicable | ||

| NTL (City & Westminster) Limited | England and Wales | Not applicable | ||

| NTL (County Durham) Limited | England and Wales | Not applicable | ||

| NTL (CRUK) | England and Wales | Not applicable | ||

| NTL (CWC Holdings) | England and Wales | Not applicable | ||

| NTL (CWC) Corporation Limited | England and Wales | Not applicable | ||

| NTL (CWC) Limited | England and Wales | Not applicable | ||

| NTL (CWC) Management Limited | England and Wales | Not applicable | ||

| NTL (CWC) No. 2 Limited | England and Wales | Not applicable | ||

| NTL (CWC) No. 3 Limited | England and Wales | Not applicable | ||

| NTL (CWC) No. 4 Limited | England and Wales | Not applicable | ||

| NTL (CWC) Programming Limited | England and Wales | Not applicable | ||

| NTL (CWC) UK | England and Wales | Not applicable | ||

| NTL (Ealing) Limited | England and Wales | Not applicable | ||

| NTL (Fenland) Limited | England and Wales | Not applicable | ||

| NTL (Greenwich and Lewisham) Limited | England and Wales | Not applicable | ||

| NTL (Hampshire) Limited | England and Wales | Not applicable | ||

| NTL (Harrogate) Limited | England and Wales | Not applicable | ||

| NTL (Harrow) Limited | England and Wales | Not applicable |

Name of Additional Registrants

|

Jurisdiction of Incorporation or Organization |

I.R.S. Employee Identification Number |

||

|---|---|---|---|---|

| NTL (Kent) Limited | England and Wales | Not applicable | ||

| NTL (Lambeth and Southwark) Limited | England and Wales | Not applicable | ||

| NTL (Leeds) Limited | England and Wales | 98-0223823 | ||

| NTL (Norwich) Limited | England and Wales | Not applicable | ||

| NTL (Peterborough) Limited | England and Wales | Not applicable | ||

| NTL (South East) Limited | England and Wales | Not applicable | ||

| NTL (South London) Limited | England and Wales | Not applicable | ||

| NTL (Southampton and Eastleigh) Limited | England and Wales | Not applicable | ||

| NTL (Sunderland) Limited | England and Wales | Not applicable | ||

| NTL (Thamesmead) Limited | England and Wales | Not applicable | ||

| NTL (V) | England and Wales | 98-0494768 | ||

| NTL (Wandsworth) Limited | England and Wales | Not applicable | ||

| NTL (Wearside) Limited | England and Wales | 98-0180429 | ||

| NTL (West London) Limited | England and Wales | Not applicable | ||

| NTL (Yorcan) Limited | England and Wales | Not applicable | ||

| NTL (York) Limited | England and Wales | Not applicable | ||

| NTL Acquisition Company Limited | England and Wales | 98-0180421 | ||

| NTL Bolton Cablevision Holding Company | England and Wales | 52-1872194 | ||

| NTL Business (Ireland) Limited | England and Wales | Not applicable | ||

| NTL Business Limited | England and Wales | Not applicable | ||

| NTL Cablecomms Bolton | England and Wales | 98-0139992 | ||

| NTL Cablecomms Bromley | England and Wales | 98-0123989 | ||

| NTL Cablecomms Bury and Rochdale | England and Wales | 98-0139995 | ||

| NTL Cablecomms Cheshire | England and Wales | 98-0139994 | ||

| NTL Cablecomms Derby | England and Wales | 98-0139996 | ||

| NTL Cablecomms East Lancashire | England and Wales | 98-0139997 | ||

| NTL Cablecomms Greater Manchester | England and Wales | 98-0139998 | ||

| NTL Cablecomms Group Limited | England and Wales | 98-0151138 | ||

| NTL Cablecomms Holdings No. 1 Limited | England and Wales | 98-0140169 | ||

| NTL Cablecomms Holdings No. 2 Limited | England and Wales | 98-0140168 | ||

| NTL Cablecomms Lancashire No. 1 | England and Wales | Not applicable | ||

| NTL Cablecomms Lancashire No. 2 | England and Wales | Not applicable | ||

| NTL Cablecomms Limited | England and Wales | Not applicable | ||

| NTL Cablecomms Macclesfield | England and Wales | 98-0139999 | ||

| NTL Cablecomms Manchester Limited | England and Wales | 98-0346426 | ||

| NTL Cablecomms Oldham and Tameside | England and Wales | 98-0140000 | ||

| NTL Cablecomms Solent | England and Wales | 98-0123998 | ||

| NTL Cablecomms Staffordshire | England and Wales | 98-0140001 | ||

| NTL Cablecomms Stockport | England and Wales | 98-0140002 | ||

| NTL Cablecomms Surrey | England and Wales | 98-0123999 | ||

| NTL Cablecomms Sussex | England and Wales | 98-0123990 | ||

| NTL Cablecomms Wessex | England and Wales | 98-0123991 | ||

| NTL Cablecomms West Surrey Limited | England and Wales | 98-0346435 | ||

| NTL Cablecomms Wirral | England and Wales | 98-0124001 | ||

| NTL Cambridge Limited | England and Wales | Not applicable | ||

| NTL Chartwell Holdings Limited | England and Wales | Not applicable | ||

| NTL Communications Services Limited | England and Wales | Not applicable | ||

| NTL Darlington Limited | England and Wales | Not applicable | ||

| NTL Derby Cablevision Holding Company | England and Wales | 52-1872196 | ||

| NTL Equipment No. 1 Limited | England and Wales | Not applicable | ||

| NTL Equipment No. 2 Limited | England and Wales | Not applicable |

Name of Additional Registrants

|

Jurisdiction of Incorporation or Organization |

I.R.S. Employee Identification Number |

||

|---|---|---|---|---|

| NTL Finance Limited | England and Wales | Not applicable | ||

| NTL Funding Limited | England and Wales | Not applicable | ||

| NTL Glasgow Holdings Limited | England and Wales | Not applicable | ||

| NTL Holdings (Broadland) Limited | England and Wales | 98-0180422 | ||

| NTL Holdings (East London) Limited | England and Wales | 98-0180423 | ||

| NTL Holdings (Fenland) Limited | England and Wales | 98-0180424 | ||

| NTL Holdings (Leeds) Limited | England and Wales | 98-0180425 | ||

| NTL Holdings (Norwich) Limited | England and Wales | 98-0180426 | ||

| NTL Holdings (Peterborough) Limited | England and Wales | 98-0180427 | ||

| NTL Internet Limited | England and Wales | Not applicable | ||

| NTL Internet Services Limited | England and Wales | 98-0232442 | ||

| NTL Irish Holdings Limited | England and Wales | Not applicable | ||

| NTL Kirklees | England and Wales | 52-1872166 | ||

| NTL Kirklees Holdings Limited | England and Wales | Not applicable | ||

| NTL Limited | England and Wales | 98-0225423 | ||

| NTL Manchester Cablevision Holding Company | England and Wales | 52-1872197 | ||

| NTL Microclock Services Limited | England and Wales | Not applicable | ||

| NTL Midlands Limited | England and Wales | Not applicable | ||

| NTL Milton Keynes Limited | England and Wales | Not applicable | ||

| NTL National Networks Limited | England and Wales | 98-0439626 | ||

| NTL Networks Limited | England and Wales | Not applicable | ||

| NTL Partcheer Company Limited | England and Wales | Not applicable | ||

| NTL Rectangle Limited | England and Wales | 98-0582025 | ||

| NTL Sideoffer Limited | England and Wales | Not applicable | ||

| NTL Solent Telephone and Cable TV Company Limited | England and Wales | Not applicable | ||

| NTL South Central Limited | England and Wales | 98-0197758 | ||

| NTL South Wales Limited | England and Wales | Not applicable | ||

| NTL Streetunique Projects Limited | England and Wales | Not applicable | ||

| NTL Streetunit Projects Limited | England and Wales | Not applicable | ||

| NTL Streetusual Services Limited | England and Wales | Not applicable | ||

| NTL Streetvision Services Limited | England and Wales | Not applicable | ||

| NTL Streetvital Services Limited | England and Wales | Not applicable | ||

| NTL Streetwarm Services Limited | England and Wales | Not applicable | ||

| NTL Streetwide Services Limited | England and Wales | Not applicable | ||

| NTL Strikeagent Trading Limited | England and Wales | Not applicable | ||

| NTL Strikeamount Trading Limited | England and Wales | Not applicable | ||

| NTL Strikeapart Trading Limited | England and Wales | Not applicable | ||

| NTL Systems Limited | England and Wales | Not applicable | ||

| NTL Technical Support Company Limited | England and Wales | Not applicable | ||

| NTL Teesside Limited | England and Wales | Not applicable | ||

| NTL Telecom Services Limited | England and Wales | Not applicable | ||

| NTL UK Telephone and Cable TV Holding Company Limited | England and Wales | Not applicable | ||

| NTL Victoria II Limited | England and Wales | 98-0558061 | ||

| NTL Victoria Limited | England and Wales | Not applicable | ||

| NTL Westminster Limited | England and Wales | Not applicable | ||

| NTL Winston Holdings Limited | England and Wales | Not applicable | ||

| NTL Wirral Telephone and Cable TV Company | England and Wales | 98-0141469 | ||

| Oxford Cable Limited | England and Wales | 98-0193307 | ||

| Screenshop Limited | England and Wales | 98-0568474 | ||

| Secure Backup Systems Limited | England and Wales | Not applicable | ||

| Sheffield Cable Communications Limited | England and Wales | Not applicable |

Name of Additional Registrants

|

Jurisdiction of Incorporation or Organization |

I.R.S. Employee Identification Number |

||

|---|---|---|---|---|

| Southern East Anglia Cable Limited | England and Wales | 98-0199443 | ||

| Southwestern Bell International Holdings Limited | England and Wales | Not applicable | ||

| Stafford Communications Limited | England and Wales | 98-0193308 | ||

| Swindon Cable Limited | England and Wales | Not applicable | ||

| Tamworth Cable Communications Limited | England and Wales | 98-0193319 | ||

| Telewest Communications (Central Lancashire) Limited | England and Wales | Not applicable | ||

| Telewest Communications (Cotswolds) Limited | England and Wales | Not applicable | ||

| Telewest Communications (Cotswolds) Venture | England and Wales | Not applicable | ||

| Telewest Communications (Liverpool) Limited | England and Wales | Not applicable | ||

| Telewest Communications (London South) Joint Venture | England and Wales | Not applicable | ||

| Telewest Communications (London South) Limited | England and Wales | Not applicable | ||

| Telewest Communications (Midlands and North West) Limited | England and Wales | Not applicable | ||

| Telewest Communications (Midlands) Limited | England and Wales | Not applicable | ||

| Telewest Communications (Nominees) Limited | England and Wales | Not applicable | ||

| Telewest Communications (North East) Limited | England and Wales | Not applicable | ||

| Telewest Communications (North East) Partnership | England and Wales | Not applicable | ||

| Telewest Communications (North West) Limited | England and Wales | Not applicable | ||

| Telewest Communications (Scotland) Venture | England and Wales | Not applicable | ||

| Telewest Communications (South East) Limited | England and Wales | Not applicable | ||

| Telewest Communications (South East) Partnership | England and Wales | Not applicable | ||

| Telewest Communications (South Thames Estuary) Limited | England and Wales | Not applicable | ||

| Telewest Communications (South West) Limited | England and Wales | Not applicable | ||

| Telewest Communications (St. Helens & Knowsley) Limited | England and Wales | Not applicable | ||

| Telewest Communications (Tyneside) Limited | England and Wales | Not applicable | ||

| Telewest Communications (Wigan) Limited | England and Wales | Not applicable | ||

| Telewest Communications Cable Limited | England and Wales | Not applicable | ||

| Telewest Communications Holdco Limited | England and Wales | Not applicable | ||

| Telewest Communications Holdings Limited | England and Wales | Not applicable | ||

| Telewest Communications Networks Limited | England and Wales | Not applicable | ||

| Telewest Limited | England and Wales | Not applicable | ||

| Telewest Parliamentary Holdings Limited | England and Wales | Not applicable | ||

| Telewest UK Limited | England and Wales | 98-0416238 | ||

| Telso Communications Limited | England and Wales | Not applicable | ||

| The Cable Corporation Limited | England and Wales | Not applicable | ||

| The Yorkshire Cable Group Limited | England and Wales | Not applicable | ||

| Theseus No. 1 Limited | England and Wales | Not applicable | ||

| Theseus No. 2 Limited | England and Wales | Not applicable | ||

| TVS Pension Fund Trustees Limited | England and Wales | Not applicable | ||

| TVS Television Limited | England and Wales | Not applicable | ||

| United Artists Investments Limited | England and Wales | Not applicable | ||

| Virgin Media Business Limited | England and Wales | Not applicable | ||

| Virgin Media Finance PLC | England and Wales | 98-0425095 | ||

| Virgin Media Investment Holdings Limited | England and Wales | Not applicable | ||

| Virgin Media Investments Limited | England and Wales | 98-0644845 | ||

| Virgin Media Limited | England and Wales | 98-0397314 | ||

| Virgin Media Payments Ltd | England and Wales | 98-0521160 | ||

| Virgin Media SFA Finance Limited | England and Wales | Not applicable | ||

| Virgin Media Secured Finance PLC | England and Wales | Not applicable | ||

| Virgin Media Wholesale Limited | England and Wales | Not applicable | ||

| Virgin Mobile Group (UK) Limited | England and Wales | 98-0521554 | ||

| Virgin Mobile Holdings (UK) Limited | England and Wales | Not applicable |

Name of Additional Registrants

|

Jurisdiction of Incorporation or Organization |

I.R.S. Employee Identification Number |

||

|---|---|---|---|---|

| Virgin Mobile Telecoms Limited | England and Wales | 98-0513715 | ||

| Virgin Net Limited | England and Wales | Not applicable | ||

| Vision Networks Services UK Limited | England and Wales | Not applicable | ||

| VMIH Sub Limited | England and Wales | Not applicable | ||

| VM Sundial Limited | England and Wales | 98-00662210 | ||

| Wakefield Cable Communications Limited | England and Wales | Not applicable | ||

| Wessex Cable Limited | England and Wales | 98-0193309 | ||

| Windsor Television Limited | England and Wales | Not applicable | ||

| XL Debt Recovery Agency Limited | England and Wales | Not applicable | ||

| X-Tant Limited | England and Wales | Not applicable | ||

| Yorkshire Cable Communications Limited | England and Wales | Not applicable | ||

| Birmingham Cable Finance Limited | Jersey | Not applicable | ||

| Future Entertainment S.à r.l. | Luxembourg | 98-0620181 | ||

| CableTel Scotland Limited | Scotland | Not applicable | ||

| NTL Glasgow | Scotland | 13-3610666 | ||

| Prospectre Limited | Scotland | Not applicable | ||

| Telewest Communications (Cumbernauld) Limited | Scotland | Not applicable | ||

| Telewest Communications (Dumbarton) Limited | Scotland | Not applicable | ||

| Telewest Communications (Dundee & Perth) Limited | Scotland | Not applicable | ||

| Telewest Communications (Falkirk) Limited | Scotland | Not applicable | ||

| Telewest Communications (Glenrothes) Limited | Scotland | Not applicable | ||

| Telewest Communications (Motherwell) Limited | Scotland | Not applicable | ||

| Telewest Communications (Scotland) Limited | Scotland | Not applicable | ||

| Telewest Communications (Scotland Holdings) Limited | Scotland | Not applicable |

The Primary Standard Industrial Classification Code Number for each additional registrant is 4813.

The address, including zip code, and telephone number, including area code, of the principal executive offices of each additional registrant (other than Future Entertainment S.à r.l.) is 160 Great Portland Street, London, W1W 5QA, England; Tel: +44 (0) 1256 752000.

The address, including zip code, and telephone number, including area code, of the principal executive offices of Future Entertainment S.à r.l. is Media Center Betzdorf, 11 rue Pierre Werner, L-6832 Betzdorf, Luxembourg; Tel: +352 27178 425.

The information in this prospectus is not complete and may be changed. We may not complete the exchange offer until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion, dated June 15, 2010

Preliminary Prospectus

Virgin Media Secured Finance PLC

Exchange Offer for

$1,000,000,000 6.50% Senior Secured Notes due 2018

£875,000,000 7.00% Senior Secured Notes due 2018

We are offering to exchange any and all of our outstanding $1,000,000,000 aggregate principal amount of 6.50% Senior Secured Notes due 2018 and £875,000,000 aggregate principal amount of 7.00% Senior Secured Notes due 2018, or the "outstanding notes," for a like amount of our new 6.50% Senior Secured Notes due 2018 and 7.00% Senior Secured Notes due 2018, respectively, or the "exchange notes," which have been registered under the U.S. Securities Act of 1933, as amended, or the Securities Act. The exchange notes have substantially the same terms as the outstanding notes, except that the transfer restrictions and registration rights applicable to the outstanding notes will not apply to the exchange notes. The exchange notes will be issued under the same indenture as the outstanding notes.

The exchange notes will be issued by Virgin Media Secured Finance PLC and fully and unconditionally guaranteed on a senior basis by Virgin Media Inc., Virgin Media Finance PLC, Virgin Media Investment Holdings Limited and most of its subsidiaries, and certain other companies which are subsidiaries of Virgin Media Inc. but not of Virgin Media Investment Holdings Limited.

The principal features of the exchange offer are as follows:

All untendered outstanding notes will continue to be subject to the transfer restrictions set forth in the outstanding notes and in the related indenture.

Each broker-dealer that receives exchange notes for its own account pursuant to the exchange offer must acknowledge that it will deliver a prospectus in connection with any resale of such exchange notes. The letter of transmittal states that by so acknowledging and delivering a prospectus, a broker-dealer will not be deemed to admit that it is an "underwriter" within the meaning of the Securities Act. This prospectus, as it may be amended or supplemented from time to time, may be used by a broker-dealer in connection with resales of exchange notes received in exchange for outstanding notes where such outstanding notes were acquired by such broker-dealer as a result of market-making activities or other trading activities. In addition, all dealers effecting transactions in the exchange notes may be required to deliver a prospectus. See "Plan of Distribution."

See "Risk Factors" beginning on page 14 for a discussion of certain risks that you should consider before you decide to participate in the exchange offer.

We will make an application to list the exchange notes on the Official List of the Luxembourg Stock Exchange and for the admission of the exchange notes to trading on the Euro MTF market of the Luxembourg Stock Exchange.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2010.

This prospectus incorporates important business and financial information about the company that is not included in or delivered with the prospectus. This information is available without charge to note holders upon written or oral request to Virgin Media Inc., 909 Third Avenue, Suite 2863, New York, New York 10022, United States (Attention: Investor Relations), telephone: +1 (212) 906-8440 or +44 (0) 2072 995479. To obtain timely delivery, note holders must request the information no later than five business days before the expiration date of the exchange offer.

You should read this prospectus together with the documents incorporated by reference herein. See "Where You Can Find More Information."

You should rely only on the information contained in or incorporated by reference into this prospectus. We have not authorized any other person to provide you with different or additional information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus is accurate only as of the date on the front cover of this prospectus. Our business, financial condition, results of operations and prospects may have changed since that date.

If you are our affiliate or are engaged in, or intend to engage in, or have an agreement or understanding to participate in, a distribution of the exchange notes, you cannot rely on the applicable interpretations of the staff of the Securities and Exchange Commission, or the SEC, and you must comply with the registration requirements of the Securities Act in connection with any resale transaction.

References to the "company," the "group," "Virgin Media," "we," "us" and "our" and all similar references are to Virgin Media Inc. and all of its consolidated subsidiaries, unless otherwise stated or the context otherwise requires.

i

Currency Presentation and Exchange Rate Information

In this prospectus: (i) £, sterling, or pound sterling refer to the lawful currency of the United Kingdom; (ii) $, dollar or U.S. dollar refer to the lawful currency of the United States; and (iii) € or euro refer to the lawful currency of participating member states of the European Union.

The following table sets forth, for the periods indicated, certain information regarding the noon buying rate in New York City for cable transfers in pound sterling as certified for customs purposes by the Federal Reserve Bank of New York, expressed in U.S. dollars per pound sterling. The rates below may differ from the actual rates used in the preparation of our consolidated financial statements and other financial information appearing in this prospectus. Our inclusion of the exchange rates is not meant to suggest that the pound sterling amounts actually represent such U.S. dollar amounts or that such amounts could have been converted into U.S. dollars at any particular rate, if at all.

Year ended December 31,

|

Exchange rate at end of period |

Average exchange rate during period(1) |

Highest exchange rate during period |

Lowest exchange rate during period |

|||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

(U.S. dollars per pound sterling) |

||||||||||||

2007 |

1.9843 | 2.0073 | 2.1104 | 1.9235 | |||||||||

2008 |

1.4619 | 1.8424 | 2.0311 | 1.4395 | |||||||||

2009 |

1.6167 | 1.5707 | 1.6977 | 1.3658 | |||||||||

Month and Year

|

Highest exchange rate during the month |

Lowest exchange rate during the month |

|||||

|---|---|---|---|---|---|---|---|

| |

(U.S. dollars per pound sterling) |

||||||

January 2010 |

1.6370 | 1.5912 | |||||

February 2010 |

1.5968 | 1.5201 | |||||

March 2010 |

1.5296 | 1.4884 | |||||

April 2010 |

1.5484 | 1.5160 | |||||

May 2010 |

1.5242 | 1.4344 | |||||

June 2010 (through June 11, 2010) |

1.4674 | 1.4422 | |||||

On June 11, 2010, the noon buying rate in New York City for cable transfers as certified for customs purposes by the Federal Reserve Bank of New York was $1.4545 per £1.00.

Where You Can Find More Information

Virgin Media Inc. is subject to the information and reporting requirements of the U.S. Securities Exchange Act of 1934, as amended, or the Exchange Act, and, in accordance with the Exchange Act, it files annual, quarterly and current reports, proxy statements and other information with the SEC. You may read and copy any document that Virgin Media Inc. files at the Public Reference Room of the SEC at 100 F Street, NE, Washington, D.C. 20549. You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. You may inspect such filings on the internet website maintained by the SEC at www.sec.gov. You may also consult reports and other information about us that we file pursuant to the rules of the London Stock Exchange.

Documents Incorporated by Reference

We are incorporating by reference certain documents that we file with the SEC. This means that we can disclose important business, financial and other information to you by referring you to other

ii

documents separately filed with the SEC. The information in the documents incorporated by reference is considered to be part of this prospectus. Information in documents that we file with the SEC after the date of this prospectus and that are incorporated or deemed to be incorporated by reference into this prospectus will automatically update and, where applicable, supersede information in this prospectus. We incorporate by reference the documents listed below and any future filings Virgin Media Inc. may make with the SEC under Section 13(a), 13(c), 14 or 15(d) of the Exchange Act after the date of the initial registration statement and prior to the effectiveness of the registration statement or prior to the termination of this offering.

Virgin Media Inc. Filings

|

Period and Date Filed | |

|---|---|---|

| Annual Report on Form 10-K | Year ended December 31, 2009, as filed on February 26, 2010. | |

Quarterly Report on Form 10-Q |

Quarterly period ended March 31, 2010, as filed on May 6, 2010. |

|

Current Reports on Form 8-K |

Filed on January 13, 2010, January 20, 2010, February 1, 2010, March 3, 2010, March 18, 2010, April 12, 2010, April 29, 2010, May 28, 2010, June 4, 2010 and June 15, 2010. |

We are not incorporating by reference any documents or information deemed to have been furnished and not filed in accordance with SEC rules.

You may request a copy of the information incorporated in this prospectus by reference, at no cost, by writing or telephoning Virgin Media's office of Investor Relations:

Virgin

Media Inc.

909 Third Avenue, Suite 2863

New York, New York 10022

United States

Attention: Investor Relations

Telephone: +1 (212) 906-8440 or +44 (0) 2072 995479

For

general inquiries concerning us please call:

+1 (212) 906-8440

To obtain timely delivery of any copies of filings requested, please write or call us no later than five business days before the expiration date of the exchange offer.

You may also obtain a copy of these filings from our website at www.virginmedia.com. The investor relations section of our website can be accessed under the heading "About Virgin Media—Investors Information." The information on our website or any other website referenced in this prospectus is not intended to be incorporated by reference and should not be considered a part of this prospectus.

You should rely only upon the information provided in this prospectus or incorporated by reference herein. We have not authorized anyone to provide you with different information. You should not assume that the information in this prospectus or any document incorporated by reference is accurate as of any date other than that on the front cover of the document.

Various statements contained in this document or incorporated by reference herein constitute "forward-looking statements" as that term is defined under the Private Securities Litigation Reform Act of 1995. Words like "believe," "anticipate," "should," "intend," "plan," "will," "expects," "estimates,"

iii

"projects," "positioned," "strategy," and similar expressions identify these forward-looking statements, which involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements or industry results to be materially different from those contemplated, projected, forecasted, estimated or budgeted, whether expressed or implied, by these forward-looking statements. These factors, among others, include:

These and other factors are discussed in more detail under "Risk Factors" and elsewhere in this prospectus and under Item 1A "Risk Factors" and elsewhere in our Annual Report on Form 10-K for the year ended December 31, 2009, as filed with the SEC on February 26, 2010. That report is incorporated by reference in this prospectus. We assume no obligation to update our forward-looking statements to reflect actual results, changes in assumptions or changes in factors affecting these statements.

iv

This summary highlights information contained elsewhere, or incorporated by reference, in this prospectus. Because it is a summary, it does not contain all of the information that you should consider before participating in the exchange offer. You should read this entire prospectus and the documents incorporated by reference herein carefully, including the section entitled "Risk Factors," and the financial statements and related notes to those financial statements, before making a decision on whether to tender your outstanding notes in the exchange offer. In this prospectus, references to the "issuer" are to Virgin Media Secured Finance PLC; references to the "guarantors" are to the guarantors in respect of the exchange notes, which are listed beginning on page 154 of this prospectus; and references to the "company," the "group," "Virgin Media," "we," "us" and "our," and all similar references, are to Virgin Media Inc. and all of its consolidated subsidiaries, unless otherwise stated or the context otherwise requires.

Our Company

We are a leading provider of entertainment and communications services in the U.K., offering "quad-play" broadband internet, television, mobile telephony and fixed line telephony services. We are one of the U.K.'s largest providers of residential broadband internet, pay television and fixed line telephony services by number of customers. We believe our advanced, deep fiber access network enables us to offer faster and higher quality broadband services than our digital subscriber line, or DSL, competitors. As a result, we provide our customers with a leading next generation broadband service and one of the most advanced TV on-demand services available in the U.K. market. We are also one of the U.K.'s largest mobile virtual network operators by number of customers, providing mobile telephone service to prepay and contract mobile customers over third party networks.

In addition, we provide a complete portfolio of voice, data and internet solutions to leading businesses, public sector organizations and service providers in the U.K. through Virgin Media Business (formerly ntl:Telewest Business). We also provide programming through Virgin Media Television, or Virgin Media TV, and through UKTV, our joint ventures with BBC Worldwide.

Our operating segments are as follows:

1

Our revenue by segment for the three months ended March 31, 2010 and 2009 and the years ended December 31, 2009, 2008 and 2007 was as follows (in millions):

| |

Three months ended March 31, | Year ended December 31, | |||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2010 | 2009 | 2009 | 2008 | 2007 | ||||||||||||||||||||||||||

| |

(unaudited) |

(unaudited) |

|

|

|

|

|

|

|||||||||||||||||||||||

Consumer |

£ | 789.5 | 82.0 | % | £ | 753.3 | 80.5 | % | £ | 3,083.1 | 81.0 | % | £ | 3,029.0 | 80.2 | % | £ | 3,087.3 | 80.4 | % | |||||||||||

Business |

139.9 | 14.5 | 149.8 | 16.0 | 580.8 | 15.3 | 626.0 | 16.6 | 641.8 | 16.7 | |||||||||||||||||||||

Content |

33.8 | 3.5 | 32.6 | 3.5 | 140.5 | 3.7 | 121.8 | 3.2 | 109.5 | 2.9 | |||||||||||||||||||||

|

£ | 963.2 | 100.0 | % | £ | 935.7 | 100.0 | % | £ | 3,804.4 | 100.0 | % | £ | 3,776.8 | 100.0 | % | £ | 3,838.6 | 100.0 | % | |||||||||||

Recent Developments

New Senior Credit Facility

On March 16, 2010, Virgin Media Inc. and certain of its subsidiaries entered into a new senior facilities agreement, including a term loan A facility in an aggregate principal amount of £1.0 billion and a revolving credit facility in an aggregate principal amount of £250 million. On April 12, 2010, a term loan B facility in an aggregate principal amount of £675 million was added to the senior facilities agreement. On April 19, 2010, the term loan A facility and the term loan B facility were drawn down in full and all amounts outstanding under our previous senior facilities agreement, dated March 3, 2006, were repaid in full. See "Description of Other Debt—Senior Credit Facility."

On May 12, 2010, we redeemed the full outstanding principal amount of our senior notes due 2014. See "Description of Other Debt—Existing Senior Notes."

Disposal of Virgin Media TV

On June 4, 2010, we entered into a sale and purchase agreement with British Sky Broadcasting Limited, or BSkyB, pursuant to which we have agreed to sell Virgin Media TV to BSkyB. The transaction is subject to certain regulatory approvals. The total consideration for the sale of Virgin Media TV is £160 million in cash, with £105 million payable at closing. A further amount of up to £55 million is conditional upon certain regulatory approvals. On June 4, 2010, we also entered into a number of agreements providing for the carriage by us of certain of BSkyB's standard and high-definition channels.

Virgin Media Secured Finance PLC is a public limited company organized under the laws of England and Wales which was incorporated on December 18, 2009. Virgin Media Inc. is a Delaware corporation. Our group's principal executive offices are located at 909 Third Avenue, Suite 2863, New York, New York 10022, and our telephone number at that address is +1 (212) 906-8440. Our website is located at www.virginmedia.com. The information on our website is not part of this prospectus.

2

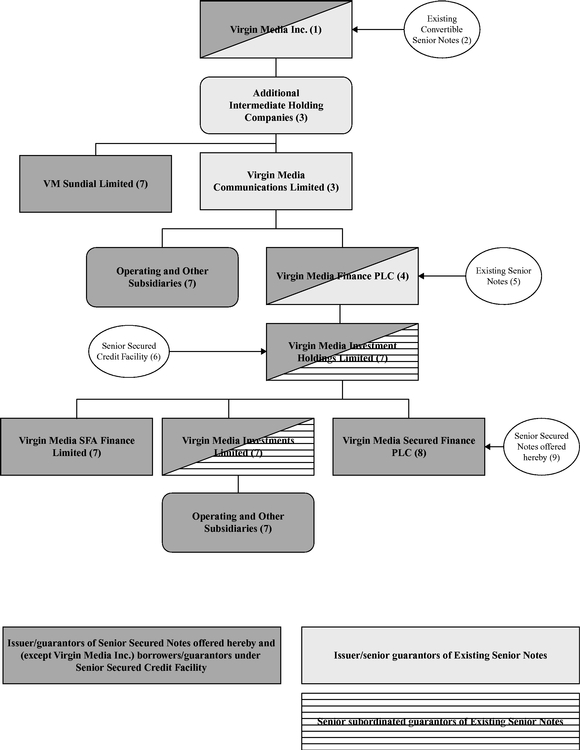

Corporate Structure Chart

The following diagram sets forth our simplified corporate structure following the offering of the outstanding notes. This is a condensed chart and it does not show all of our operating and holding companies.

3

investments in its subsidiaries. Virgin Media Inc. is not subject to the restrictive covenants under the indenture governing the exchange notes.

4

Background |

On January 19, 2010, we issued the outstanding notes, which comprise $1,000,000,000 aggregate principal amount of 6.50% Senior Secured Notes due 2018 and £875,000,000 aggregate principal amount of 7.00% Senior Secured Notes due 2018. In connection with that issuance, we entered into a registration rights agreement, dated as of January 19, 2010, in which we agreed, among other things, to use our reasonable best efforts to complete this exchange offer. Under the terms of the exchange offer, you are entitled to exchange outstanding notes for exchange notes evidencing the same indebtedness and with substantially similar terms. You should read the discussion under the heading "Description of the Exchange Notes" for further information regarding the exchange notes. | |

The Exchange Offer |

We are offering to exchange, for each $1,000 aggregate principal amount of our dollar denominated outstanding notes validly tendered and accepted, $1,000 aggregate principal amount of our dollar denominated exchange notes and, for each £1,000 aggregate principal amount of our sterling denominated outstanding notes validly tendered and accepted, £1,000 aggregate principal amount of our sterling denominated exchange notes. |

|

|

We will not pay any accrued and unpaid interest on the outstanding notes that we acquire in the exchange offer. Instead, interest on the exchange notes will accrue from the most recent date on which interest has been paid on the outstanding notes. |

|

|

As of the date of this prospectus, $1,000,000,000 aggregate principal amount of the dollar denominated outstanding notes and £875,000,000 aggregate principal amount of the sterling denominated outstanding notes were outstanding. |

|

Denominations of Exchange Notes |

Tendering holders of dollar denominated outstanding notes must tender outstanding notes in minimum denominations of $100,000 and integral multiples of $1,000 in excess thereof and tendering holders of sterling denominated outstanding notes must tender outstanding notes in minimum denominations of £50,000 and integral multiples of £1,000 in excess thereof. Dollar denominated exchange notes will be issued in minimum denominations of $100,000 and integral multiples of $1,000 in excess thereof and sterling denominated exchange notes will be issued in minimum denominations of £50,000 and integral multiples of £1,000 in excess thereof. |

|

Expiration Date |

The exchange offer will expire at 5:00 p.m., New York City time, on , 2010, unless we extend or terminate the exchange offer, in which case the "expiration date" will mean the latest date and time to which we extend the exchange offer. |

5

Tenders |

By tendering your outstanding notes, you represent to us that: |

|

|

• you are acquiring the exchange notes in the ordinary course of business; |

|

|

• you have no arrangement or understanding with any person to participate in a distribution of the exchange notes in violation of the Securities Act; |

|

|

• you are not an "affiliate" of ours within the meaning of Rule 405 of the Securities Act; |

|

|

• if you are not a broker-dealer, you are not engaged in, and do not intend to engage in, the distribution of the exchange notes; and |

|

|

• if you are a broker-dealer that will receive exchange notes for your own account in exchange for outstanding notes that were acquired as a result of market-making or other trading activities, you will deliver a copy of this prospectus (or, to the extent permitted by law, make a copy of this prospectus available) to purchasers in connection with any resale of such exchange notes. |

|

Settlement Date |

The settlement date of the exchange offer will be as soon as practicable after the expiration date. |

|

Withdrawal of Tenders |

Tenders of outstanding notes may be withdrawn at any time prior to the expiration date. |

|

Conditions to the Exchange Offer |

Our obligation to consummate the exchange offer is subject to certain customary conditions, which we may assert or waive. See "Description of the Exchange Offer—Conditions to the Exchange Offer." |

|

Procedures for Tendering |

To participate in the exchange offer, you should transmit your acceptance to DTC, Euroclear or Clearstream, as the case may be, on or prior to the expiration date. |

|

|

For sterling denominated notes, your letter of transmittal, or an agent's message that you have received and agreed to be bound by the letter of transmittal, together with any required signature guarantees and any other required documents, must be transmitted to and received by the exchange agent at the address set forth below under "The Exchange Offer—Exchange Agent" on or prior to the expiration date. |

|

|

For dollar denominated notes, you must follow the automatic tender offer program, or ATOP, procedures established by The Depository Trust Company, or DTC, for tendering outstanding notes held in book-entry form. The ATOP procedures require that the exchange agent receive, prior to the expiration date of the exchange offer, a computer-generated message known as an "agent's message" that is transmitted through ATOP and that DTC confirm that: |

|

|

• DTC has received instructions to exchange your outstanding notes; and |

6

|

• you agree to be bound by the terms of the letter of transmittal. |

|

|

For more details, please read "Description of the Exchange Offer—Terms of the exchange offer" and "Description of the Exchange Offer—Procedures for tendering." If you elect to have outstanding notes exchanged pursuant to this exchange offer, you must properly tender your outstanding notes prior to 5:00 p.m., New York City time, on the expiration date. All outstanding notes validly tendered and not properly withdrawn will be accepted for exchange. Outstanding notes may be exchanged only in minimum denominations of $100,000 and integral multiples of $1,000 in excess thereof (in the case of the dollar denominated outstanding notes) and minimum denominations of £50,000 and integral multiples of £1,000 in excess thereof (in the case of the sterling denominated outstanding notes). |

|

Consequences of Failure to Exchange |

If we complete the exchange offer and you do not participate in it, then: |

|

|

• your outstanding notes will continue to be subject to the existing restrictions upon their transfer; |

|

|

• we will have no further obligation to provide for the registration under the Securities Act of those outstanding notes except under certain limited circumstances; and |

|

|

• the liquidity of the market for your outstanding notes could be adversely affected. |

|

Taxation |

The exchange pursuant to the exchange offer generally will not be a taxable exchange for U.S. federal income tax purposes. See "Material United States Federal Income Tax Considerations." |

|

Use of Proceeds |

We will not receive any cash proceeds from the issuance of the exchange notes in the exchange offer. |

|

Exchange Agent |

The Bank of New York Mellon is the exchange agent for the exchange offer. |

7

The terms of the exchange notes are identical in all material respects to the terms of the outstanding notes, except that the exchange notes will be issued in a transaction registered under the Securities Act, and the transfer restrictions and registration rights relating to the outstanding notes will not apply to the exchange notes. We refer to the outstanding notes and the exchange notes collectively as the "notes."

Issuer |

Virgin Media Secured Finance PLC | |

Notes Offered |

$1,000,000,000 aggregate principal amount of 6.50% Senior Secured Notes due 2018. |

|

|

£875,000,000 aggregate principal amount of 7.00% Senior Secured Notes due 2018. |

|

Maturity Date |

January 15, 2018. |

|

Interest |

6.50% per year on the principal amount of the dollar denominated notes. |

|

|

7.00% per year on the principal amount of the sterling denominated notes. |

|

|

Interest on the notes will be payable semi-annually in arrears in cash on June 15 and December 15 of each year, beginning June 15, 2010. Interest will accrue from the most recent date on which interest has been paid on the outstanding notes. |

|

Ranking |

The notes will be senior secured indebtedness of the issuer, will rank equally in right of payment with all existing and future senior indebtedness of the issuer, including its guarantee of our senior credit facility, and will be senior in right of payment to all existing and future subordinated indebtedness of the issuer. The notes will, subject to certain exceptions, be secured over the same assets that secure our senior credit facility and will share in any enforcement proceeds on a pari passu basis, and will be effectively senior to existing and future senior unsecured indebtedness of the issuer to the extent of the value of the assets securing the notes. |

|

Guarantors |

The notes will benefit from full and unconditional senior guarantees granted by Virgin Media Inc., Virgin Media Finance PLC, VMIH and most of its subsidiaries, VM Sundial Limited, CableTel West Riding Limited, NTL Glasgow Holdings Limited, NTL Kirklees Holdings Limited, NTL Kirklees, CableTel Scotland Limited and NTL Glasgow. A complete list of the guarantors of the notes begins on page 154 of this prospectus. See "Description of the Exchange Notes—Note Guarantees." |

8

Security |

Subject to certain exceptions, the notes are secured over the same assets that secure our senior credit facility and will share in any enforcement proceeds on a pari passu basis. Our senior credit facility requires that members of the bank group (which comprises VMIH and most of its subsidiaries, and certain other companies which are subsidiaries of Virgin Media Inc. but not of VMIH) which generate not less than 80% of the consolidated operating cash flow of the bank group in any financial year guarantee the payment of all sums payable under our senior credit facility and grant security over all or substantially all of their assets, subject to permitted liens, to secure the payment of all sums payable under our senior credit facility. Assets that are included in the collateral package for our senior credit facility, but which would be excluded from the collateral package for the notes, would include the capital stock and other securities of a subsidiary (other than Virgin Media Investments Limited and VMIH), to the extent that the inclusion of these assets in the collateral would require the provision of separate financial statements under Rule 3-16 of Regulation S-X under the Securities Act. This exclusion may affect many of our subsidiaries from time to time, depending upon the book value or fair market value of these assets. The security trustee, pursuant to the terms of our group intercreditor deed, controls the security and any enforcement actions in respect thereof and will generally take its instructions from the lenders under our senior credit facility or, upon repayment in full of that facility, any refinancing facility designated by us. If, for a 60 day period, the aggregate outstanding principal amount and undrawn uncancelled commitments under our senior credit facility (or, upon repayment in full of that facility, any refinancing facility designated by us) is (i) less than £1 billion and (ii) less than 60% of aggregate outstanding principal amount and undrawn uncancelled commitments under all senior secured debt, then control of any enforcement actions with respect to the security will pass to the holders of the majority of all outstanding pari passu senior secured debt. See "Description of the Exchange Notes—Security for the Notes" and "Description of the |

9

Additional Amounts |

Subject to limited exceptions, the issuer and each guarantor of the notes will make all payments in respect of the notes, including principal and interest payments, without deduction or withholding for or on account of any present or future taxes or other governmental charges in the United Kingdom, the United States or any other relevant taxing jurisdiction, unless it is obligated by law to deduct or withhold taxes or governmental charges. If the issuer or any guarantor is obligated by law to deduct or withhold taxes or government charges in respect of the notes or the guarantees, subject to various exceptions, the issuer or the relevant guarantor, as applicable, will pay to the holders of the notes additional amounts so that the net amount received by the holders after any deduction or withholding will not be less than the amount the holders would have received if these taxes or government charges had not been withheld or deducted. |

|

Optional Redemption for Tax Reasons |

If the issuer becomes obligated to pay any additional amounts as a result of any change in law of any relevant taxing jurisdiction which becomes effective after the date on which the notes are issued, the issuer may redeem the notes at its option in whole, but not in part, at any time at a price equal to 100% of the principal amount of the notes, plus any accrued and unpaid interest and additional amounts to the date of redemption. |

|

Optional Redemption |

The issuer may redeem each series of the notes in whole or in part at any time before January 15, 2014, at a redemption price equal to the principal amount of the notes to be redeemed, plus the applicable "make-whole" premium described in this prospectus, plus any accrued and unpaid interest and additional amounts to the date of redemption. |

|

|

The issuer may redeem each series of the notes in whole or in part at any time on or after January 15, 2014, at the redemption prices described under the heading "Description of the Exchange Notes—Optional Redemption," plus any accrued and unpaid interest and additional amounts to the date of redemption. |

|

|

At any time on or before January 15, 2013, the issuer may, on one or more occasions, redeem up to 40% of the aggregate principal amount of each series of the notes using the net cash proceeds from specified equity offerings at a redemption price equal to 106.50% of the principal amount of the dollar denominated notes and 107.00% of the principal amount of the sterling denominated notes plus any accrued and unpaid interest and additional amounts to the date of redemption, so long as at least 60% of the original aggregate principal amount of such series of the notes remains outstanding after the redemption. For more details, see "Description of the Exchange Notes—Optional Redemption." |

10

Change of Control |

If a change of control occurs, as defined in the indenture governing the notes, the issuer will be required to make an offer to repurchase the notes at 101% of their principal amount, plus any accrued and unpaid interest and additional amounts to the date of repurchase. For more details, see "Description of the Exchange Notes—Repurchase at the Option of the Holders—Change of Control." |

|

Certain Covenants |

The indenture governing the notes and the guarantees of the notes restricts the ability of VMIH and its subsidiaries and certain other guarantors to: |

|

|

• incur or guarantee additional indebtedness; |

|

|

• pay dividends or make other distributions, or redeem or repurchase equity interests or subordinated obligations; |

|

|

• make investments; |

|

|

• sell assets, including the capital stock of subsidiaries; |

|

|

• create liens; |

|

|

• enter into agreements that restrict the restricted subsidiaries' ability to pay dividends, transfer assets or make intercompany loans; |

|

|

• merge or consolidate or transfer all or substantially all of its assets; |

|

|

• enter into transactions with affiliates; |

|

|

• enter into sale/leaseback transactions; and |

|

|

• materially adversely impair the liens granted with respect to the collateral. |

|

|

All of these covenants are subject to a number of important qualifications and limitations. Many of the covenants in the indenture will be suspended for as long as the notes are rated investment grade by any two of Fitch, Moody's or Standard & Poor's provided that at such time no default or event of default has occurred and is continuing. For more details, see "Description of the Exchange Notes—Certain Covenants." |

|

Governing Law for the Notes and Guarantees |

The notes and the guarantees of the notes will be governed by the laws of the State of New York. |

|

Trustee |

The Bank of New York Mellon. |

|

Principal Paying Agent and Registrar |

The Bank of New York Mellon. |

|

Security Trustee |

Deutsche Bank AG, London Branch. |

|

Luxembourg Listing Agent, Paying Agent and Transfer Agent |

The Bank of New York Mellon (Luxembourg), S.A. |

11

Form of Notes |

The exchange notes will be issued initially in the form of one or more dollar global exchange notes and one or more sterling global exchange notes, which will represent the aggregate principal amount of exchange notes being offered under this prospectus. The exchange notes will be deposited with the applicable custodians for the book-entry depositaries. The book-entry depositaries will issue depositary interests in respect of the dollar global exchange notes to DTC and in respect of the sterling global exchange notes to Clearstream Banking S.A., or Clearstream, and/or Euroclear Bank S.A./N.V., or Euroclear, and will then record such interests in their books and records in the name of DTC's, Clearstream's or Euroclear's nominee, as the case may be. Ownership of book-entry interests in the depositary interests will be limited to persons who have accounts with DTC, Clearstream and/or Euroclear or persons who hold interests through these persons. Book-entry interests in the depositary interests will be shown on, and transfers will be effected only through, records maintained in book-entry form by DTC, Clearstream and/or Euroclear and their participants. See "Book-Entry Settlement and Clearance." |

|

No Prior Market |

The exchange notes will be new securities for which there is currently no market. Accordingly, we cannot assure you that a liquid market for the exchange notes will develop or be maintained. |

|

Listing |

The issuer will make an application to list the exchange notes on the Official List of the Luxembourg Stock Exchange and for admission of the notes to trading on the Euro MTF market of the Luxembourg Stock Exchange. The outstanding notes are listed on the Official List of the Luxembourg Stock Exchange and admitted to trading on the Euro MTF market of the Luxembourg Stock Exchange. |

|

Tax Considerations |

You are urged to consult your own tax advisors with respect to the U.S. federal, state, local and non-U.S. tax consequences of purchasing, owning and disposing of the exchange notes. See "Material United States Federal Income Tax Considerations" and "Material United Kingdom Tax Considerations." |

|

Clearing Information |

The CUSIP number assigned to the dollar denominated exchange notes is and the ISIN number is . |

|

|

The ISIN number assigned to the sterling denominated exchange notes is and the common code is . |

Risk Factors

An investment in the exchange notes involves a high degree of risk. You should carefully consider the information set forth under "Risk Factors" beginning on page 14 and all of the information included in, or incorporated by reference into, this prospectus before deciding to tender your outstanding notes in the exchange offer.

12

Summary Consolidated Financial Data

The following tables summarize our consolidated financial data for the periods presented. The summary consolidated financial data as of December 31, 2009 and 2008 and for each of the years ended December 31, 2009, 2008, and 2007 are derived from our audited consolidated financial statements included in our Annual Report on Form 10-K for the year ended December 31, 2009 The summary consolidated financial data as of March 31, 2010 and for the three months ended March 31, 2010 and 2009 are derived from our unaudited condensed consolidated financial statements included in our Quarterly Report on Form 10-Q for the three months ended March 31, 2010. Our unaudited condensed consolidated financial statements contain all adjustments, consisting only of normal recurring adjustments necessary for a fair presentation of our financial position, results of operations and cash flows. The financial results for the three months ended March 31, 2010 are not necessarily indicative of results for the full year ending December 31, 2010. Our financial statements are prepared in accordance with generally accepted accounting principles in the United States. The reporting currency of our financial statements is U.K. pounds sterling. See "Currency Presentation and Exchange Rate Information." You should read the following financial information together with the information under "Management's Discussion and Analysis of Financial Condition and Results of Operations" and our consolidated financial statements and the notes to those consolidated financial statements included in our Annual Report on Form 10-K filed with the SEC on February 26, 2010, which is incorporated by reference into this prospectus.

| |

Three months ended March 31, | Year ended December 31, | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

2010 | 2009 | 2009 | 2008 | 2007 | |||||||||||

| |

(unaudited) |

(unaudited) |

|

|

|

|||||||||||

| |

|

|

(in millions) |

|

|

|||||||||||

Statement of Operations Data: |

||||||||||||||||

Revenue |

£ | 963.2 | £ | 935.7 | £ | 3,804.4 | £ | 3,776.8 | £ | 3,838.6 | ||||||

Operating income (loss)(1) |

76.0 | 13.0 | 142.0 | (271.8 | ) | 28.4 | ||||||||||

Loss from continuing operations(1) |

(160.4 | ) | (132.9 | ) | (335.0 | ) | (853.4 | ) | (452.8 | ) | ||||||

| |

As of March 31, | As of December 31, | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| |

2010 | 2009 | 2008 | |||||||

| |

(unaudited) |

|

|

|||||||

| |

(in millions) |

|||||||||

Balance Sheet Data: |

||||||||||

Cash, cash equivalents and marketable securities |

£ | 420.7 | £ | 430.5 | £ | 181.6 | ||||

Working capital |

(266.5 | ) | (348.4 | ) | (460.1 | ) | ||||

Fixed assets |

4,982.6 | 5,049.2 | 5,342.1 | |||||||

Total assets |

9,136.2 | 9,187.4 | 9,933.3 | |||||||

Long term obligations |

6,146.9 | 5,974.7 | 6,170.1 | |||||||

Shareholders' equity |

1,340.0 | 1,491.3 | 2,016.2 | |||||||

13

An investment in the exchange notes involves a high degree of risk. You should carefully consider the risks described below before deciding to exchange your outstanding notes for exchange notes. In assessing these risks, you should also refer to the other information included in, or incorporated by reference into, this prospectus, including the financial statements and related notes incorporated by reference. We also incorporate by reference the risk factors listed under Item 1A "Risk Factors" in our Annual Report on Form 10-K for the year ended December 31, 2009, as filed with the SEC on February 26, 2010. These risks and uncertainties are not the only ones we face. Additional risks and uncertainties that are not currently known to us or that we currently consider immaterial could also impair our business, financial condition, results of operations and our ability to make payments on the exchange notes. Various statements in this prospectus, including the following risk factors, constitute forward-looking statements.

Risks relating to the exchange notes and our capital structure

Our current leverage is substantial, which may have an adverse effect on our available cash flow, our ability to obtain additional financing if necessary in the future, our flexibility in reacting to competitive and technological changes and our operations.

We had consolidated total long term debt, including current portion, of £6,146.9 million as of March 31, 2010. This high degree of leverage could have important consequences, including the following:

Most of our debt becomes due prior to the repayment at final maturity of the notes offered hereby. We may not be able to repay such debt when it becomes due and, to the extent we cannot repay such debt, we may not be able to refinance these debt obligations or may be able to refinance only on terms that will increase our cost of borrowing.

Most of our long term debt, including the amounts outstanding under our senior credit facility, our convertible senior notes due 2016 and our existing senior notes due 2016, is scheduled to come due prior to the stated maturity of the notes offered hereby. We also have significant amounts due under other instruments, including our existing senior notes due 2019 which, while not maturing before the notes, may require refinancing at the same time as, or before, the maturity of the notes or any refinancing of the notes.

While we expect to be able to repay a portion of our debt obligations through cash flow from operations, we may not be able to repay or refinance all outstanding amounts as or before they become due, or may be able to refinance such amounts only on terms that will increase our cost of borrowing or on terms that may be more onerous. Our ability to implement any future refinancing successfully will also depend on a variety of factors, many of which may be beyond our control, such as then

14

prevailing conditions in the debt markets, including the availability of sufficient bank debt to meet our needs. We may also need to raise additional capital by doing one or more of the following:

We cannot assure you that any of, or any combination of, the above actions would be available or sufficient to fund our debt obligations, that we will be able to refinance our debt obligations as or before they come due, or that we will be able to obtain additional financing on favorable terms or at all, should the need arise.

The issuer is a finance company and some of the guarantors are holding companies, or finance companies, and are dependent upon cash flow from group subsidiaries to meet their obligations.

Each of the issuer, Virgin Media Finance PLC, Virgin Media Investments Limited, VMIH, Virgin Media Inc. and certain other guarantors has no revenue-generating operations of its own. To make payment on the exchange notes or the respective guarantees, as applicable, each will depend on cash flows received from its subsidiaries and payments under intercompany loans, including convertible unsecured loan stock.

The terms of our senior credit facility and other indebtedness limit the payment of dividends, loan repayments and other distributions to or from these companies under many circumstances. Various agreements governing our debt may restrict and, in some cases, may also prohibit the ability of these subsidiaries to move cash within their restricted group. Applicable tax laws may also subject such payments to further taxation.

Applicable law may also limit the amounts that some of our subsidiaries will be permitted to pay as dividends or distributions on their equity interests, or even prevent such payments.

The inability to transfer cash among entities within their respective consolidated groups may mean that even though the entities, in aggregate, may have sufficient resources to meet their obligations, they may not be permitted to make the necessary transfers from one entity in their restricted group to another entity in their restricted group in order to make payments to the entity owing the obligations.

The value of the security securing our senior secured indebtedness, including the exchange notes, may not be sufficient to satisfy our obligations under the exchange notes.