Subject to completion, as filed with the Securities and Exchange Commission on December 29, 2006

Registration No. 333-137916

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Amendment No. 2 to

FORM S-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Burlington Coat Factory Warehouse Corporation

(Exact Name of Registrant as Specified in Its Charter)

| Delaware | 5311 | 22-1970303 | ||

| (State of Incorporation) | (Primary Standard Industrial Classification Code Number) | (I.R.S. employer identification number) |

1830 Route 130 North

Burlington, New Jersey 08016

(609) 387-7800

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Paul C. Tang, Esq.

Burlington Coat Factory Warehouse Corporation

Executive Vice President and General Counsel

1830 Route 130 North

Burlington, New Jersey 08016

(609) 387-7800

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent for Service)

Copy to:

Joshua N. Korff, Esq.

Kirkland & Ellis LLP

Citicorp Center

153 East 53rd Street

New York, New York 10022

(212) 446-4800

APPROXIMATE DATE OF COMMENCEMENT OF PROPOSED SALE TO THE PUBLIC: The exchange will occur as soon as practicable.

If the securities being registered on this form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box. ¨

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities to Be Registered(1) |

Proposed Maximum Aggregate Offering Price(1) |

Amount of Registration Fee |

|||||

| 11 1/8% Senior Notes due 2014 |

$ | 305,000,000 | $ | 32,635 | (3) | ||

| Guarantees(2) |

N/A | N/A | |||||

| (1) | Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(o) promulgated under the Securities Act of 1933, as amended (the “Securities Act”). |

| (2) | No separate consideration will be received for the guarantees, and no separate fee is payable, pursuant to Rule 457(n) under the Securities Act. |

| (3) | Previously paid. |

THE REGISTRANTS HEREBY AMEND THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANTS SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(a) OF THE SECURITIES ACT OF 1933, AS AMENDED, OR UNTIL THIS REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE COMMISSION, ACTING PURSUANT TO SAID SECTION 8(a), MAY DETERMINE.

ADDITIONAL REGISTRANTS

| Exact Name of Registrant as Specified in its Charter |

State or Other Jurisdiction of Incorporation or Organization |

Primary Standard Industrial Classification Code Number |

I.R.S. Employer Identification No. |

Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices | ||||

| Burlington Coat Factory of Alabama, LLC |

Alabama | 5311 | 20-4632712 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Burlington Coat Factory Realty of Huntsville LLC |

Alabama | 5311 | 22-1970303 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Burlington Coat Factory Warehouse of Anchorage, Inc. |

Alaska | 5311 | 93-1046485 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Burlington Coat Factory of Arizona, LLC |

Arizona | 5311 | 20-4632763 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Burlington Coat Factory Realty of Desert Sky, Inc. |

Arizona | 5311 | 86-1031005 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Burlington Coat Factory Realty of Mesa, Inc. |

Arizona | 5311 | 86-1031006 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Burlington Coat Factory of Arkansas, LLC |

Arkansas | 5311 | 20-4632817 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Baby Depot of California, LLC |

California | 5311 | 20-4633089 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Burlington Coat Factory of California, LLC |

California | 5311 | 20-4632887 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Burlington Coat Factory Realty of Dublin, Inc. |

California | 5311 | 94-3399808 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Burlington Coat Factory Realty of Florin, Inc. |

California | 5311 | 94-3399809 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Burlington Coat Factory Realty of Ventura, Inc. |

California | 5311 | 77-0518590 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Burlington Coat Factory Warehouse of San Bernadino, LLC |

California | 5311 | 20-4633016 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| MJM Designer Shoes of California, LLC |

California | 5311 | 20-4632945 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Burlington Coat Factory of Colorado, LLC |

Colorado | 5311 | 20-4633153 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Burlington Coat Factory of Connecticut, LLC |

Connecticut | 5311 | 20-4633202 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Burlington Coat Realty of East Windsor, Inc. |

Connecticut | 5311 | 06-1391139 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Exact Name of Registrant as Specified in its Charter |

State or Other Jurisdiction of Incorporation or Organization |

Primary Standard Industrial Classification Code Number |

I.R.S. Employer Identification No. |

Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices | ||||

| Cohoes Fashions of Connecticut, LLC |

Connecticut | 5311 | 20-4633634 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Burlington Coat Factory of Delaware, LLC |

Delaware | 5311 | 20-4633728 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Burlington Coat Factory of Texas, Inc. |

Delaware | 5311 | 20-4633830 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Burlington Coat Factory of Texas, L.P. |

Delaware | 5311 | 20-4633782 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Burlington Coat Factory Investments Holdings, Inc. |

Delaware | 5311 | 20-4663833 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Burlington Coat Factory Purchasing, Inc. |

Delaware | 5311 | 20-4633884 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Burlington Coat Factory Realty Corp. |

Delaware | 5311 | 22-3246670 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| C.F.I.C. Corporation |

Delaware | 5311 | 51-0282085 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| C.F.B., Inc. |

Delaware | 5311 | 51-0282080 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| C.L.B., Inc. |

Delaware | 5311 | 51-0282081 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| MJM Designer Shoes of Delaware, LLC |

Delaware | 5311 | 20-2681523 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Bee Ridge Plaza, LLC |

Florida | 5311 | 02-0693864 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Burlington Coat Factory of Florida, LLC |

Florida | 5311 | 58-1975714 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Burlington Coat Factory Realty of Coral Springs, Inc. |

Florida | 5311 | 03-0387530 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Burlington Coat Factory Realty of Orlando, Inc. |

Florida | 5311 | 59-3558218 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Burlington Coat Factory Realty of Sarasota, Inc. |

Florida | 5311 | 22-3869014 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Exact Name of Registrant as Specified in its Charter |

State or Other Jurisdiction of Incorporation or Organization |

Primary Standard Industrial Classification Code Number |

I.R.S. Employer Identification No. |

Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices | ||||

| Burlington Coat Factory Realty of University Square, Inc. |

Florida | 5311 | 59-3724802 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Burlington Coat Factory Realty of West Colonial, Inc. |

Florida | 5311 | 05-0550581 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| K&T Acquisition Corp. |

Florida | 5311 | 57-1176343 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| MJM Designer Shoes of Florida, LLC |

Florida | 5311 | 58-2553674 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Burlington Coat Factory of Georgia, LLC |

Georgia | 5311 | 22-2310204 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Burlington Coat Factory Realty of Morrow, Inc. |

Georgia | 5311 | 58-2331013 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Burlington Coat Factory Warehouse of Atlanta, Inc. |

Georgia | 5311 | 22-2310222 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Burlington Coat Factory of Idaho, LLC |

Idaho | 5311 | 20-4633933 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Burlington Coat Factory of Illinois, LLC |

Illinois | 5311 | 20-4634340 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Burlington Coat Factory Realty of Bloomingdale, Inc. |

Illinois | 5311 | 36-4446838 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Burlington Coat Factory Realty of River Oaks, Inc. |

Illinois | 5311 | 36-4171851 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Burlington Coat Factory Warehouse of East St. Louis, Inc. |

Illinois | 5311 | 36-3384100 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Burlington Coat Realty of Gurnee, Inc. |

Illinois | 5311 | 36-3898953 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Burlington Coat Factory of Indiana, LLC |

Indiana | 5311 | 35-2086329 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Burlington Coat Factory Realty of Greenwood, Inc. |

Indiana | 5311 | 36-4494986 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Burlington Coat Factory of Iowa, LLC |

Iowa | 5311 | 42-1204776 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Burlington Coat Factory of Kansas, LLC |

Kansas | 5311 | 20-4634554 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Exact Name of Registrant as Specified in its Charter |

State or Other Jurisdiction of Incorporation or Organization |

Primary Standard Industrial Classification Code Number |

I.R.S. Employer Identification No. |

Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices | ||||

| Burlington Coat Factory of Kentucky, Inc. |

Kentucky | 5311 | 62-1247906 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Burlington Coat Factory of Louisiana, LLC |

Louisiana | 5311 | 20-4634617 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Burlington Coat Factory of Maine, LLC |

Maine | 5311 | 20-4634794 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Burlington Coat Factory of Maryland, LLC |

Maryland | 5311 | 20-4634824 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Burlington Coat Factory of Massachusetts, LLC |

Massachusetts | 5311 | 58-2669608 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Burlington Coat Factory Realty of North Attleboro, Inc. |

Massachusetts | 5311 | 04-3344507 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Cohoes Fashions of Massachusetts, LLC |

Massachusetts | 5311 | 20-4634868 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Burlington Coat Factory of Michigan, LLC |

Michigan | 5311 | 20-4635333 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Burlington Coat Factory Warehouse of Detroit, Inc. |

Michigan | 5311 | 38-2424219 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Burlington Coat Factory Warehouse of Grand Rapids, Inc. |

Michigan | 5311 | 31-1045013 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Burlington Coat Factory Warehouse of Redford, Inc. |

Michigan | 5311 | 36-3251099 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Burlington Coat Factory of Minnesota, LLC |

Minnesota | 5311 | 20-4635381 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Burlington Coat Factory of Mississippi, LLC |

Mississippi | 5311 | 20-4804503 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Burlington Coat Factory of Missouri, LLC |

Missouri | 5311 | 20-4635447 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Burlington Coat Factory Realty of Des Peres, Inc. |

Missouri | 5311 | 43-1842990 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Burlington Coat Factory of Nebraska, LLC |

Nebraska | 5311 | 20-4635566 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Burlington Coat Factory of Nevada, LLC |

Nevada | 5311 | 20-4635612 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Exact Name of Registrant as Specified in its Charter |

State or Other Jurisdiction of Incorporation or Organization |

Primary Standard Industrial Classification Code Number |

I.R.S. Employer Identification No. |

Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices | ||||

| Burlington Coat Realty of Las Vegas, Inc. |

Nevada | 5311 | 88-0314073 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Burlington Coat Factory of New Hampshire, LLC |

New Hampshire |

5311 | 20-4635690 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Burlington Coat Factory Direct Corporation |

New Jersey |

5311 | 22-3531725 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Burlington Coat Factory of New Jersey, LLC |

New Jersey |

5311 | 20-4635873 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Burlington Coat Factory Realty of Edgewater Park, Inc. |

New Jersey |

5311 | 22-3815140 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Burlington Coat Factory Realty of Paramus, Inc. |

New Jersey |

5311 | 22-3823189 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Burlington Coat Factory Realty of Pinebrook, Inc. |

New Jersey |

5311 | 48-1266066 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Burlington Coat Factory Warehouse of Edgewater Park Urban Renewal Corp. |

New Jersey |

5311 | 22-3843958 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Burlington Coat Factory Warehouse of New Jersey, Inc. |

New Jersey |

5311 | 22-2667705 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Cohoes Fashions of New Jersey, LLC |

New Jersey |

5311 | 20-4635964 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| MJM Designer Shoes of Moorestown, Inc. |

New Jersey |

5311 | 20-0156497 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| MJM Designer Shoes of New Jersey, LLC |

New Jersey |

5311 | 20-4635926 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Super Baby Depot of Moorestown, Inc. |

New Jersey |

5311 | 20-0828544 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Burlington Coat Factory of New Mexico, LLC |

New Mexico |

5311 | 20-4771747 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Burlington Coat Factory of New York, LLC |

New York | 5311 | 20-4636047 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Burlington Coat Factory Realty of Yonkers, Inc. |

New York | 5311 | 13-4199049 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Exact Name of Registrant as Specified in its Charter |

State or Other Jurisdiction of Incorporation or Organization |

Primary Standard Industrial Classification Code Number |

I.R.S. Employer Identification No. |

Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices | ||||

| Cohoes Fashions of New York, LLC |

New York | 5311 | 20-4636764 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Cohoes of Fayetteville, Inc. |

New York | 5311 | 22-3213890 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Georgetown Fashions Inc. |

New York | 5311 | 11-2463441 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| LC Acquisition Corp. |

New York | 5311 | 22-2913067 | 1830 Route 130 Burlington, New Jersey 08016 (609) 387-7800 | ||||

| MJM Designer Shoes of New York, LLC |

New York | 5311 | 20-4636419 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Monroe G. Milstein, Inc. |

New York | 5311 | 13-3150740 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Burlington Coat Factory of North Carolina, LLC |

North Carolina |

5311 | 20-4636810 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Burlington Coat Factory of North Dakota, LLC |

North Dakota |

5311 | 20-4680654 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Burlington Coat Factory of Ohio, LLC |

Ohio | 5311 | 20-4636839 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Burlington Coat Factory Warehouse of Cleveland, Inc. |

Ohio | 5311 | 34-1402739 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Burlington Coat Factory of Oklahoma, LLC |

Oklahoma | 5311 | 20-4636882 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Burlington Coat Factory Realty of Tulsa, Inc. |

Oklahoma | 5311 | 20-1593400 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Burlington Coat Factory of Oregon, LLC |

Oregon | 5311 | 93-1113593 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Burlington Coat Factory of Pennsylvania, LLC |

Pennsylvania | 5311 | 20-4636915 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Burlington Coat Factory Realty of Langhorne, Inc. |

Pennsylvania | 5311 | 51-0420881 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Burlington Coat Factory Realty of West Mifflin, Inc. |

Pennsylvania | 5311 | 25-1900644 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Burlington Coat Factory Realty of Whitehall, Inc. |

Pennsylvania | 5311 | 52-2367723 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Exact Name of Registrant as Specified in its Charter |

State or Other Jurisdiction of Incorporation or Organization |

Primary Standard Industrial Classification Code Number |

I.R.S. Employer Identification No. |

Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices | ||||

| Burlington Coat Factory Warehouse Inc. |

Pennsylvania | 5311 | 52-1097225 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Burlington Coat Factory Warehouse of Bristol, LLC |

Pennsylvania | 5311 | 20-4637002 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Burlington Coat Factory Warehouse of Cheltenham, Inc. |

Pennsylvania | 5311 | 52-2004601 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Burlington Coat Factory Warehouse of Langhorne, Inc. |

Pennsylvania | 5311 | 22-3737338 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Burlington Coat Factory Warehouse of Montgomeryville, Inc. |

Pennsylvania | 5311 | 23-2777799 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Burlington Factory Warehouse of Reading, Inc. |

Pennsylvania | 5311 | 22-2263811 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Burlington Coat Factory Warehouse of Wilkes-Barre, Inc. |

Pennsylvania | 5311 | 23-2857838 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| MJM Designer Shoes of Pennsylvania, LLC |

Pennsylvania | 5311 | 20-4636967 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Burlington Coat Factory of Rhode Island, LLC |

Rhode Island |

5311 | 20-4637038 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Cohoes Fashions of Cranston, Inc. |

Rhode Island |

5311 | 05-0478167 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Burlington Coat Factory of South Carolina, LLC |

South Carolina |

5311 | 20-4637069 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Burlington Coat Factory Warehouse of Charleston, Inc. |

South Carolina |

5311 | 57-0903026 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Burlington Coat Factory Realty of Memphis, Inc. |

Tennessee | 5311 | 71-0911391 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Burlington Coat Factory Warehouse of Hickory Commons, Inc. |

Tennessee | 5311 | 62-1664387 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Burlington Coat Factory Warehouse of Memphis, Inc. |

Tennessee | 5311 | 62-1142888 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Burlington Coat Factory Warehouse of Shelby, Inc. |

Tennessee | 5311 | 62-1283132 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Burlington Coat Factory Realty of Bellaire, Inc. |

Texas | 5311 | 76-0682036 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Burlington Coat Factory Realty of El Paso, Inc. |

Texas | 5311 | 20-1985900 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Exact Name of Registrant as Specified in its Charter |

State or Other Jurisdiction of Incorporation or Organization |

Primary Standard Industrial Classification Code Number |

I.R.S. Employer Identification No. |

Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices | ||||

| Burlington Coat Factory Realty of Westmoreland, Inc. |

Texas | 5311 | 75-2940553 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Burlington Coat Factory Warehouse of Baytown, Inc. |

Texas | 5311 | 76-0682033 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Burlington Coat Realty of Houston, Inc. |

Texas | 5311 | 76-0442092 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Burlington Coat Realty of Plano, Inc. |

Texas | 5311 | 75-2491335 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| MJM Designer Shoes of Texas, Inc. |

Texas | 5311 | 74-2579897 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Burlington Coat Factory of Utah, LLC |

Utah | 5311 | 20-4637069 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Burlington Coat Factory of Virginia, LLC |

Virginia | 5311 | 22-2377376 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Burlington Coat Factory of Pocono Crossing, LLC |

Virginia | 5311 | 46-0492681 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Burlington Coat Factory Reality of Coliseum, Inc. |

Virginia | 5311 | 54-2040601 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Burlington Coat Factory Realty of Fairfax, Inc. |

Virginia | 5311 | 54-2011140 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Burlington Coat Factory Warehouse of Coliseum, Inc. |

Virginia | 5311 | 54-2040603 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Burlington Coat Realty of Potomac, Inc. |

Virginia | 5311 | 52-1848892 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Burlington Coat Factory of Washington, LLC |

Washington | 5311 | 20-4637093 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Burlington Coat Factory Realty of Franklin, Inc. |

Washington | 5311 | 91-2131354 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Burlington Coat Factory of West Virginia, LLC |

West Virginia |

5311 | 20-4637153 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

| Burlington Coat Factory of Wisconsin, LLC |

Wisconsin | 5311 | 20-4637125 | 1830 Route 130 North Burlington, New Jersey 08016 (609) 387-7800 | ||||

Name, address, including zip code, and telephone number, including area code, of agent for service

Paul C. Tang, Esq.

Burlington Coat Factory Warehouse Corporation

Executive Vice President and General Counsel

1830 Route 130 North

Burlington, New Jersey 08016

(609) 387-7800

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. The prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

| Prospectus |

Subject to Completion, Dated December 29, 2006 |

$305,000,000

Burlington Coat Factory Warehouse Corporation

Exchange Offer for

11 1/8% Senior Notes due 2014

Set forth below is a summary of the terms of the notes offered hereby. For more details, see “Description of Exchange Notes.”

Offer for outstanding 11 1/8% Senior Notes due 2014, in the aggregate principal amount of $305,000,000 (which we refer to as the “Old Notes”) in exchange for up to $305,000,000 in aggregate principal amount of 11 1/8% Senior Notes due 2014 which have been registered under the Securities Act of 1933, as amended (which we refer to as the “Exchange Notes” and, together with the Old Notes, the “notes”).

Terms of the Exchange Offer:

| • | Expires 5:00 p.m., New York City time, , 2006, unless extended. |

| • | Not subject to any condition other than that the exchange offer does not violate applicable law or any interpretation of the staff of the Securities and Exchange Commission. |

| • | We can amend or terminate the exchange offer. |

| • | We will exchange all 11 1/8% Senior Notes due 2014 that are validly tendered and not validly withdrawn. |

| • | We will not receive any proceeds from the exchange offer. |

| • | The exchange of notes should not be a taxable exchange for U.S. federal income tax purposes. |

| • | You may withdraw tendered outstanding Old Notes any time before the expiration of the exchange offer. |

Terms of the Exchange Notes:

| • | The Exchange Notes will be general unsecured obligations and will rank equally in right of payment with all existing and future unsecured senior debt, senior in right of payment to all existing and future senior subordinated debt and effectively subordinated in right of payment to secured indebtedness to the extent of the value of the assets securing such indebtedness, including all borrowings under senior secured credit facilities. |

| • | The Exchange Notes will be fully and unconditionally guaranteed on a senior unsecured basis by Burlington Coat Factory Investment Holdings, Inc. and each of our existing and future domestic restricted subsidiaries. |

| • | The Exchange Notes mature on April 15, 2014. The Exchange Notes will accrue interest at a rate of 11 1/8% per year, payable semi-annually in cash in arrears on April 15 and October 15 of each year, commencing on April 15, 2007. Interest on the Exchange Notes will accrue from the last interest date on which interest was paid on your Old Notes, October 15, 2006, if you effectively tender your Old Notes for Exchange Notes. |

| • | We may redeem the Exchange Notes in whole or in part from time to time. See “Description of Exchange Notes.” |

| • | We may also redeem up to 35% of the Exchange Notes using the proceeds of certain equity offerings completed before April 15, 2009. See “Description of Exchange Notes.” |

| • | The terms of the Exchange Notes are identical to our outstanding Old Notes except for transfer restrictions and registration rights. |

For a discussion of specific risks that you should consider before tendering your outstanding 11 1/8% Senior Notes due 2014 in the exchange offer, see “ Risk Factors” beginning on page 12.

There is no public market for the Old Notes.

Each broker-dealer that receives Exchange Notes pursuant to the exchange offer must acknowledge that it will deliver a prospectus in connection with any resale of the Exchange Notes. A broker dealer who acquired Old Notes as a result of market making or other trading activities may use this exchange offer prospectus, as supplemented or amended, in connection with any resales of the Exchange Notes.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the Exchange Notes or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is [ ], 2006

You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with information different from that contained in this prospectus. The selling noteholders are offering to sell, and seeking offers to buy, 11 1/8% Senior Notes due 2014 only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of our 11 1/8% Senior Notes due 2014.

| 1 | ||

| 12 | ||

| 23 | ||

| 25 | ||

| 26 | ||

| 27 | ||

| 34 | ||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

38 | |

| 66 | ||

| 77 | ||

| Security Ownership of Certain Beneficial Owners and Management |

83 | |

| 85 | ||

| 88 | ||

| 90 | ||

| United States Federal Income Tax Consequences |

139 | |

| 140 | ||

| 142 | ||

| 142 | ||

| 142 | ||

| F-1 |

i

This summary highlights all material information contained elsewhere in this prospectus. It does not contain all the information that you may consider in making your investment decision. Therefore, you should read the entire prospectus carefully, including, in particular, the section entitled “Risk Factors” and the financial statements and the related notes to those statements. In this prospectus, unless we indicate otherwise or the context requires, “we,” “us,” “our,” “Company,” “BCFWC” and “Burlington Coat Factory” refers to Burlington Coat Factory Warehouse Corporation and its consolidated subsidiaries. We maintain our records on the basis of a 52 or 53 week fiscal year ending on the Saturday closest to May 31. We define our “comparative store sales” as sales of those stores (net of sales discounts) that have been open at least 425 days for the entire comparative period.

Burlington Coat Factory Warehouse Corporation

We are a nationally recognized retailer of high-quality, branded apparel at every day low prices (“EDLP”). We opened our first store in Burlington, New Jersey in 1972, selling primarily coats and outerwear. Since then, we have expanded our store base to 367 stores in 42 states (exclusive of one store closed due to hurricane damage), and diversified our product categories by offering an extensive selection of in-season better and moderate brands, fashion-focused merchandise, including: ladies sportswear, menswear, coats, family footwear, baby furniture and accessories, as well as home décor and gifts. We employ a hybrid business model which enables us to offer the low prices of off-price retailers and the branded merchandise, product breadth and product diversity of department stores. We acquire desirable, first-quality, labeled merchandise directly from nationally-recognized manufacturers such as Ralph Lauren, Jones New York, Calvin Klein, Nine West, and Nautica. For the three months ended September 2, 2006, we generated total revenues of approximately $664.3 million and experienced a net loss in the amount of $51.8 million due in part to increased quarterly expenses resulting from the Merger. As a result of the Merger and related transactions, we expect to continue to incur these increased quarterly expenses primarily related to interest, amortization, depreciation and advisory fees. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

As of September 2, 2006, we operated stores under the names “Burlington Coat Factory Warehouse” (“BCFW”) (342 stores exclusive of one store closed due to hurricane damage), “MJM Designer Shoes” (17 stores), “Cohoes Fashions” (7 stores), and “Super Baby Depot” (1 store). The average BCFW store is approximately 81,500 square feet, generally twice the size of most competitive off-price formats. We also offer merchandise for sale through our wholly-owned internet subsidiary, Burlington Coat Factory Direct Corporation, at www.burlingtoncoatfactory.com, www.coat.com and www.babydepot.com.

We purchase a majority of our merchandise pre-season, when department stores make a large portion of their purchases, and the balance of our merchandise in-season (replenishment, re-orders and opportunistic purchases), when off-price retailers make a large portion of their purchases. This unique buying strategy, along with a “no-frills” merchandising approach enables us to offer merchandise at prices substantially below full retail prices. Our strategy of up-front purchasing allows us to acquire a product line with depth of style, size and color more extensive than the product lines of our off-price competitors. Merchandise is displayed on easy-access racks, and sales assistance is provided in specialty departments on a store-by-store basis.

We offer products in two primary categories, Apparel and Other Products, as follows:

| • | Apparel includes departments that offer clothing items for men, women and children, and apparel accessories such as shoes, jewelry, perfumes and watches. Net sales from continuing operations of Apparel products were approximately 80% of total net sales for fiscal 2006. |

| • | Other Products includes departments that offer baby furniture and accessories, linens and home furnishings. Net sales from continuing operations of Other Products were approximately 20% of total net sales for fiscal 2006. |

1

Holding Company Structures

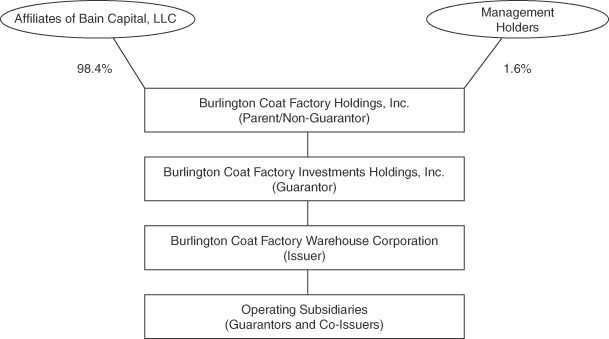

Burlington Coat Factory Investments Holdings, Inc. (“Holdings”) is a newly-created wholly-owned subsidiary of Parent that has no material assets or operations other than its ownership of our Company, BCFWC. BCFWC is a wholly-owned subsidiary of Holdings, and is primarily a holding company with few material assets (including one store location and related inventory and the equity interests of its subsidiaries).

The Transactions

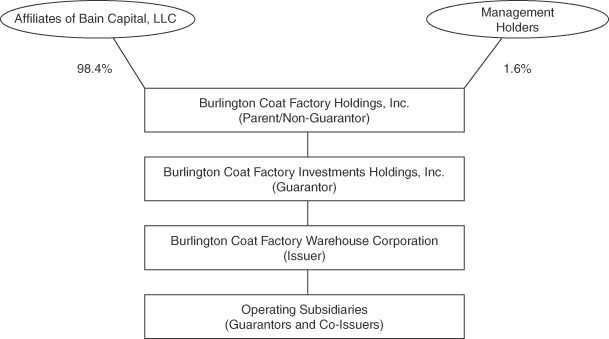

On January 18, 2006, we entered into a merger agreement (the “Merger Agreement”) with Burlington Coat Factory Holdings, Inc. (“Parent”) and BCFWC Mergersub, Inc. (“Merger Sub”), each a newly formed holding company owned by affiliates of Bain Capital Partners, LLC (“Bain Capital”), pursuant to which Merger Sub, a wholly-owned subsidiary of Parent, merged with and into our Company (the “Merger”). As consideration for the Merger, each former holder of our common stock was entitled to receive a cash amount equal to $45.50 per common share. Funds associated with Bain Capital own approximately 98.4% of Parent’s basic common stock, with the remainder held by existing members of management. Additionally, management holds options to purchase 7.5% of the basic shares outstanding.

As a result of the Transactions (as defined below), our shares are no longer listed on the New York Stock Exchange, and we continue our operations as a privately held company. We financed the Merger and paid related costs and expenses with the following:

| • | Approximately $225.0 million of drawings (excluding a seasonal working capital adjustment) under $800.0 million of an ABL senior secured revolving credit facility, referred to herein as the ABL Credit Facility; |

| • | $900.0 million senior secured term loan facility, referred to herein as the term loan facility and, together with the ABL Credit Facility, the senior secured credit facilities; |

| • | $305.0 million aggregate principal amount 11 1/8% Senior Notes due 2014 issued at a discount which generated $299 million in proceeds and offered to be exchanged hereby; |

| • | $99.3 million aggregate principal amount at maturity of senior unsecured discount notes of Holdings, which were offered at a substantial discount and generated gross proceeds of approximately $75.0 million at issuance, referred to herein as the Holdings Senior Discount Notes; |

| • | Existing cash estimated at $192.5 million; and |

| • | $445.0 million of invested equity from funds associated with Bain Capital and $0.8 million in cash from members of management (collectively all of the transactions described in this paragraph, the “Transactions”). |

We retained approximately $32.9 million in capital leases and other existing debt in an amount that was adjusted based on balances at the time of closing of the Merger.

2

Burlington Coat Factory Warehouse Corporation Corporate Structure

The chart below summarizes our corporate structure prior to the Merger and related transactions.

The chart below summarizes our corporate structure following the consummation of the Merger and related transactions.

3

Executive Offices

Our principal offices are located at 1830 Route 130 North, Burlington, New Jersey 08016. Our telephone number is (609) 387-7800. Our web site address is www.burlingtoncoatfactory.com. The information on our website is not deemed to be part of this prospectus.

Purpose of the Exchange Offer

On April 13, 2006, we sold, through a private placement exempt from the registration requirements of the Securities Act, $305,000,000 of our 11 1/8% Senior Notes due 2014, all of which are eligible to be exchanged for Exchange Notes. We refer to these notes as “Old Notes” in this prospectus.

Simultaneously with the private placement, we entered into a registration rights agreement with the initial purchasers of the Old Notes. Under the registration rights agreement, we are required to use our reasonable best efforts to cause a registration statement for substantially identical Notes, which will be issued in exchange for the Old Notes, to be filed within 180 days of issuance of the Old Notes and to become effective within 120 days after the filing of the registration statement. We refer to the Notes to be registered under this exchange offer registration statement as “Exchange Notes” and collectively with the Old Notes, we refer to them as the “Notes” in this prospectus. You may exchange your Old Notes for Exchange Notes in this exchange offer. You should read the discussion under the headings “—Summary of the Exchange Offer,” “The Exchange Offer” and “Description of Exchange Notes” for further information regarding the Exchange Notes.

We did not register the Old Notes under the Securities Act or any state securities law, nor do we intend to after the exchange offer. As a result, the Old Notes may only be transferred in limited circumstances under the securities laws. If the holders of the Old Notes do not exchange their Old Notes in the exchange offer, they lose their right to have the Old Notes registered under the Securities Act, subject to certain limitations. Anyone who still holds Old Notes after the exchange offer may be unable to resell their Old Notes.

Summary of the Exchange Offer

The Exchange Offer

| Securities Offered |

$305,000,000 principal amount of 11 1/8% Senior Notes due 2014. |

| The Exchange Offer |

We are offering to exchange the Old Notes for a like principal amount at maturity of the Exchange Notes. Old Notes may be exchanged only in integral principal at maturity multiples of $1,000. This exchange offer is being made pursuant to a registration rights agreement dated as of April 13, 2006 which granted the initial purchasers and any subsequent holders of the Old Notes certain exchange and registration rights. This exchange offer is intended to satisfy those exchange and registration rights with respect to the Old Notes. After the exchange offer is complete, you will no longer be entitled to any exchange or registration rights with respect to your Old Notes. |

4

| Expiration Date; Withdrawal of Tender |

The exchange offer will expire 5:00 p.m., New York City time, on , 2006, or a later time if we choose to extend this exchange offer. You may withdraw your tender of Old Notes at any time prior to the expiration date. All outstanding Old Notes that are validly tendered and not validly withdrawn will be exchanged promptly. Any Old Notes not accepted by us for exchange for any reason will be returned to you at our expense promptly after the expiration or termination of the exchange offer. |

| Resales |

We believe that you can offer for resale, resell and otherwise transfer the Exchange Notes without complying with the registration and prospectus delivery requirements of the Securities Act if: |

| • | you acquire the Exchange Notes in the ordinary course of business: |

| • | you are not participating, do not intend to participate, and have no arrangement or understanding with any person to participate, in the distribution of the Exchange Notes; |

| • | you are not an “affiliate” of ours, as defined in Rule 405 of the Securities Act; and |

| • | you are not a broker-dealer. |

| If any of these conditions is not satisfied and you transfer any Exchange Notes without delivering a proper prospectus or without qualifying for a registration exemption, you may incur liability under the Securities Act. We do not assume, or indemnify you against, this liability. |

| Each broker-dealer acquiring Exchange Notes issued for its own account in exchange for Old Notes, which it acquired through market-making activities or other trading activities, must acknowledge that it will deliver a proper prospectus when any Exchange Notes issued in the exchange offer are transferred. A broker-dealer may use this prospectus for an offer to resell, a resale or other retransfer of the Exchange Notes issued in the exchange offer. |

| Conditions to the Exchange Offer |

Our obligation to accept for exchange, or to issue the Exchange Notes in exchange for, any Old Notes is subject to certain customary conditions relating to compliance with any applicable law, or any applicable interpretation by any staff of the Securities and Exchange Commission, or any order of any governmental agency or court of law. We currently expect that each of the conditions will be satisfied and that no waivers will be necessary. See “The Exchange Offer—Conditions to the Exchange Offer.” |

| Procedures for Tendering Notes Held in the Form of Book-Entry Interests |

|

5

| which represent a 100% interest in those Old Notes, to The Depositary Trust Company. |

| Beneficial interests in the outstanding Old Notes, which are held by direct or indirect participants in the Depository Trust Company, are shown on, and transfers of the Old Notes can only be made through, records maintained in book-entry form by The Depository Trust Company. |

| You may tender your outstanding Old Notes by instructing your broker or bank where you keep the Old Notes to tender them for you. In some cases you may be asked to submit the BLUE-colored “Letter of Transmittal” that may accompany this prospectus. By tendering your Old Notes you will be deemed to have acknowledged and agreed to be bound by the terms set forth under “The Exchange Offer.” Your outstanding Old Notes will be tendered in multiples of $1,000. |

| A timely confirmation of book-entry transfer of your outstanding Old Notes into the exchange agent’s account at The Depository Trust Company, under the procedure described in this prospectus under the heading “The Exchange Offer” must be received by the exchange agent on or before 5:00 p.m., New York City time, on the expiration date. |

| United States Federal Income Tax Consequences |

The exchange offer should not result in any income, gain or loss to the holders of old notes or to us for United States Federal Income Tax Purposes. See “U.S. Federal Income Tax Consequences.” |

| Use of Proceeds |

We will not receive any proceeds from the issuance of the Exchange Notes in the exchange offer. |

| Exchange Agent |

Wells Fargo Bank, N.A. is serving as the exchange agent for the exchange offer. |

| Shelf Registration Statement |

In limited circumstances, holders of Old Notes may require us to register their Old Notes under a shelf registration statement. |

6

Terms of the Exchange Notes

| Issuer |

Burlington Coat Factory Warehouse Corporation. |

| Notes Offered |

$305,000,000 million aggregate principal amount of Exchange Notes due 2014 of BCFWC. |

| Maturity Date |

April 15, 2014. |

| Interest |

Interest on the Exchange Notes will accrue at a rate of 11 1/8% per year, payable semi-annually in cash in arrears on April 15 and October 15 of each year, commencing on April 15, 2007. Interest on the Exchange Notes will accrue from the last interest date on which interest was paid on your Old Notes if you effectively tender your Old Notes for Exchange Notes. |

| Guarantees |

Holdings and each of our current and future restricted subsidiaries jointly, severally, fully and unconditionally guarantee the Exchange Notes. The Exchange Notes will be guaranteed on a senior unsecured basis. If we create or acquire a new domestic subsidiary, then that subsidiary will fully and unconditionally guarantee the Exchange Notes on a senior unsecured basis, unless we designate the subsidiary as an “unrestricted subsidiary” under the indenture governing the Exchange Notes. Holders of the Exchange Notes should not attribute significant value to the Holdings guarantee, as Holdings does not have any assets other than the capital stock of BCFWC. |

| Ranking |

The Exchange Notes and any guarantees will be general unsecured obligations of us and the guarantors, and will rank equally in right of payment to all of our and the guarantors’ indebtedness and other obligations that are not, by their terms, expressly subordinated in right of payment to the Exchange Notes and the guarantees. The Exchange Notes and any guarantees will be senior in right of payment to any future indebtedness and other obligations of us or the guarantors that are, by their terms, expressly subordinated in right of payment to the Exchange Notes and the guarantees. The Exchange Notes and any guarantees will be effectively subordinated to all senior secured indebtedness and other obligations of us and the guarantors (including our senior secured revolving credit facility) to the extent of the value of the assets securing such obligations. |

| Optional Redemption |

Prior to April 15, 2010, we may redeem some or all of the Exchange Notes at any time at a price of 100% of the principal amount of the Exchange Notes redeemed plus a “make-whole” premium. On or after April 15, 2010, we may redeem some or all of the Exchange Notes at any time at the redemption prices described under “Description of Exchange Notes—Optional Redemption,” plus accrued and unpaid interest. In addition, at any time prior to April 15, 2009, we may also redeem up to 35% of the aggregate principal amount of the Exchange Notes with the net cash proceeds of certain equity offerings at the redemption price specified under “Description of Exchange Notes—Optional Redemption,” plus accrued and unpaid interest. |

7

| Mandatory Offer to Repurchase Following Certain Asset Sales |

|

| Change of Control |

If we experience certain kinds of changes of control, we must offer to purchase the Exchange Notes at 101% of their principal amount, plus accrued and unpaid interest (if any). There can be no assurance that we will have sufficient funds to purchase notes tendered. See “Risk Factors—Related to the Offering—We may not have the funds to purchase the notes upon the changes of control offer as required by the indentures governing the notes.” |

| Certain Covenants |

The indenture contains covenants that limit, among other things, our ability and the ability of our restricted subsidiaries to: |

| • | incur additional indebtedness; |

| • | pay dividends on our capital stock or repurchase our capital stock; |

| • | make investments; |

| • | use assets as security in other transactions; and |

| • | sell certain assets or merge with or into other companies. |

| Use of Proceeds |

We will not receive any proceeds from the issues of the Exchange Notes in the Exchange Offer. We used the proceeds from the sale of the Old Notes and borrowings under our senior secured credit facilities and the equity contribution to fund the acquisition of Burlington Coat Factory Warehouse Corporation and pay related fees and expenses. See “Use of Proceeds.” |

Risk Factors

Investment in the Exchange Notes involves substantial risks. See “Risk Factors” for a discussion of certain risks relating to an investment in the Exchange Notes.

For more complete information about the notes, see “Description of Exchange Notes” section of this prospectus.

8

SUMMARY HISTORICAL AND PRO FORMA FINANCIAL AND OPERATING DATA

We maintain our records on the basis of a 52 or 53 week fiscal year ending on the Saturday closest to May 31. Results for fiscal 2005 and fiscal 2004 represent the operating results of BCFWC and its subsidiaries as reflected in the consolidated financial statements of Burlington Coat Factory Investments Holdings, Inc. (collectively referred to as the “Predecessor Company”). Results for 2006 are represented by (i) the results of Holdings (the “Successor Company”) for the period from April 13, 2006 through June 3, 2006, subsequent to the acquisition of our Company by Bain Capital and other investors and (ii) results of the Predecessor Company for the period from May 29, 2005 through April 12, 2006, prior to the acquisition of our Company by Bain Capital and other investors. Set forth below is summary historical consolidated financial data and summary pro forma consolidated financial data for the Predecessor Company and the Successor Company at the dates and for the periods indicated.

The following table sets forth selected historical consolidated financial information for Predecessor Company for the periods presented prior to the acquisition of our Company by Bain Capital and other investors and selected historical financial data and summary pro forma consolidated financial data for the Successor Company for periods presented after such acquisition. The statement of operations data and cash flow data for the fiscal years ended May 28, 2005 and May 29, 2004 and the period from May 29, 2005 through April 12, 2006, and the balance sheet data as of May 28, 2005 and May 29, 2004 have been derived from the audited financial statements of the Predecessor Company. The statement of operations data and cash flow for the period from April 13, 2006 through June 3, 2006, and the balance sheet date as of June 3, 2006 have been derived from the audited financial statements of the Successor Company. The statement of operations data for the thirteen weeks ended September 2, 2006 and for the thirteen weeks ended August 27, 2005, and the balance sheet data as of September 2, 2006 have been derived from our unaudited condensed consolidated financial statements included in this prospectus, which, in our opinion, contain adjustments which are of a normal recurring nature, which we consider necessary to present fairly our financial position and results of operations at such dates and for such periods. The balance sheet data as of August 27, 2005 has been derived from our unaudited condensed consolidated financial statements which are not included in this prospectus. Results of the thirteen weeks ended September 2, 2006 are not necessarily indicative of the results that may be expected for the entire fiscal year.

The unaudited pro forma consolidated statement of operations for the twelve months ended June 3, 2006 gives effect to the Transactions, as if the Transactions had occurred as of May 29, 2005. The summary pro forma financial data for the twelve months ended June 3, 2006 were derived by adding our financial data for the period from May 29, 2005 to April 12, 2006 to our financial data for the period from April 13, 2006 to June 3, 2006 and by applying pro forma adjustments to those numbers. The pro forma adjustments are based upon available information and certain assumptions that we believe are reasonable. The summary unaudited pro forma consolidated financial data are for informational purposes only and do not purport to represent what our results of operations or financial position actually would be if the Transactions had occurred at any date, nor do such data purport to project the results of operations for any future period. Unless otherwise stated, the pro forma amounts presented below represent those of Holdings and its subsidiaries.

The summary historical and pro forma consolidated financial data and operating data should be read in conjunction with “Selected Historical Consolidated Financial and Other Data,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and related notes appearing elsewhere in this prospectus.

9

| Predecessor | Successor | Three Months Ended |

||||||||||||||||||||||||||

| Fiscal Year Ended | Predecessor |

Successor | ||||||||||||||||||||||||||

| May 29, 2004 |

May 28, 2005 |

May 29, 2005 through April 12, 2006 |

April 13, through June 3, 2006 |

Pro Forma Twelve Months Ended June 3, 2006 |

August 27, 2005 |

September 2, 2006 |

||||||||||||||||||||||

| (dollars in thousands) | ||||||||||||||||||||||||||||

| Consolidated Statements of Operations: |

||||||||||||||||||||||||||||

| Revenues: |

||||||||||||||||||||||||||||

| Net Sales |

$ | 2,833,484 | $ | 3,171,242 | $ | 3,017,633 | $ | 421,180 | $ | 3,438,813 | $ | 650,848 | $ | 656,846 | ||||||||||||||

| Other Revenue |

26,476 | 28,598 | 27,675 | 4,066 | 31,533 | 7,324 | 7,420 | |||||||||||||||||||||

| 2,859,960 | 3,199,840 | 3,045,308 | 425,246 | 3,470,346 | 658,172 | 664,266 | ||||||||||||||||||||||

| Costs and Expenses: |

||||||||||||||||||||||||||||

| Cost of Sales (Exclusive of Depreciation and Amortization) |

1,765,478 | 1,987,159 | 1,916,798 | 266,465 | 2,183,263 | 425,335 | 426,914 | |||||||||||||||||||||

| Selling and Administrative Expenses |

899,984 | 957,759 | 897,231 | 154,691 | 1,078,193 | 234,440 | 247,060 | |||||||||||||||||||||

| Depreciation |

83,915 | 89,858 | 78,804 | 18,097 | 136,213 | 22,628 | 34,984 | |||||||||||||||||||||

| Amortization |

75 | 98 | 494 | 9,758 | 48,267 | 24 | 10,933 | |||||||||||||||||||||

| Interest Expense |

5,863 | 7,334 | 4,609 | 18,093 | 135,870 | 1,813 | 35,414 | |||||||||||||||||||||

| Other (Income) Loss, Net |

(10,335 | ) | (14,619 | ) | (3,572 | ) | (4,876 | ) | (1,395 | ) | (119 | ) | (981 | ) | ||||||||||||||

| 2,744,980 | 3,027,589 | 2,894,364 | 462,228 | 3,580,411 | 684,121 | 754,324 | ||||||||||||||||||||||

| Income (Loss) from Continuing Operations Before Provision (Benefit) for Income Tax |

114,980 | 172,251 | 150,944 | (36,982 | ) | (110,065 | ) | (25,949 | ) | (90,058 | ) | |||||||||||||||||

| Provision (Benefit) for Income Tax |

42,641 | 66,204 | 56,605 | (9,816 | ) | (41,285 | ) | (10,042 | ) | (38,250 | ) | |||||||||||||||||

| Income (Loss) from Continuing Operations |

$ | 72,339 | $ | 106,047 | $ | 94,339 | $ | (27,166 | ) | $ | (68,780 | ) | (15,907 | ) | (51,808 | ) | ||||||||||||

| Balance Sheet Data: |

||||||||||||||||||||||||||||

| Total Assets |

$ | 1,579,178 | $ | 1,673,268 | $ | * | $ | 3,200,549 | 1,680,537 | $ | 3,329,458 | |||||||||||||||||

| Working Capital(1) |

330,007 | 407,240 | * | 233,165 | 391,046 | 354,438 | ||||||||||||||||||||||

| Total Debt |

134,585 | 133,537 | * | 1,518,479 | 133,426 | 1,668,179 | ||||||||||||||||||||||

| Stockholders’ Equity |

845,432 | 926,153 | * | 419,512 | 910,249 | 370,158 | ||||||||||||||||||||||

| Statement of Cash Flow Data: |

||||||||||||||||||||||||||||

| Net Cash Provided By (Used In) Continuing Operations: |

||||||||||||||||||||||||||||

| Operating Activities(2) |

$ | 23,336 | $ | 142,024 | $ | 430,979 | $ | (52,893 | ) | $ | 33,654 | $ | (91,005 | ) | ||||||||||||||

| Investing Activities(2) |

(118,330 | ) | (98,493 | ) | (63,920 | ) | (2,057,669 | ) | (24,860 | ) | (17,413 | ) | ||||||||||||||||

| Financing Activities(2) |

98,784 | (25,384 | ) | (102,063 | ) | 1,855,989 | (111 | ) | 147,077 | |||||||||||||||||||

| Capital Expenditures(3) |

125,775 | 97,340 | 69,558 | 6,275 | 25,488 | 21,223 | ||||||||||||||||||||||

| Other Financial Data: |

||||||||||||||||||||||||||||

| Rent Expense(4) |

$ | 115,900 | $ | 125,300 | $ | 113,317 | $ | 19,327 | 30,811 | 35,127 | ||||||||||||||||||

| Cash Rent Expense(5) |

114,294 | 123,149 | 113,214 | 17,996 | 31,738 | 32,625 | ||||||||||||||||||||||

| Number of Stores (at end of period) |

349 | 362 | 367 | 367 | 362 | 367 | ||||||||||||||||||||||

| Comparative Store Sales Growth (Decline)(6) |

(0.3 | )% | 6.3 | % | * | * | 8.9 | % | (0.7 | )% | ||||||||||||||||||

| Cash Interest Expense(7) |

$ | 5,160 | $ | 9,363 | $ | 5,538 | $ | 6,223 | 564 | 23,114 | ||||||||||||||||||

| Ratio of Earnings to Fixed Charges(8) |

3.6x | 4.6x | 4.6x | ** | 0.4x | * | * | * | * | |||||||||||||||||||

| * | Information not available for interim periods. |

| ** | Due to losses for the period, the coverage ratio was less than 1:1. BCFWC would have to generate additional pretax earnings of $37.0 million, $25.9 million and $90.1 million to achieve a ratio of 1:1 for the periods April 13, 2006 through June 3, 2006, three months ended August 27, 2005 and the three months ended September 2, 2006, respectively. |

10

| (1) | We define working capital as current assets (excluding assets from discontinued operations) minus current liabilities (including the current portion of long-term debt and accrued interest thereon). |

| (2) | Excludes cash provided by or used in discontinued operations. |

| (3) | Includes cash paid for property and equipment and lease acquisition costs. |

| (4) | Rent expense represents (i) basic rent expense on a straight-line basis; (ii) contingent rent expense; (iii) amortization of leasehold purchases; and (iv) amortization of leasehold incentives received from landlords. |

| (5) | Includes cash paid for rent expense, including minimum rent payments and contingent rental payments. |

| (6) | Since fiscal 2004, we have defined comparative store sales to include sales (net of sales discounts) of those stores that have operated at least 425 days for the entire comparative period. Existing stores whose square footage has been changed by more than 20% and relocated stores are classified as new stores for comparative store sales purposes. Prior to fiscal 2004: (i) comparative store sales included sales of those stores that have operated at least 365 days for the entire comparative period; (ii) comparative store sales did not include sales discounts; (iii) comparative store sales included sales of all expanded stores; and (iv) relocated stores were treated as new stores for comparative store sales purposes. |

| (7) | Includes cash paid for interest expense excluding the non cash interest related to Holdings Senior Discount Notes. |

| (8) | For purposes of calculating the ratio of earnings to fixed charges, earnings consist of income from continuing operations before provision for income taxes plus fixed charges. Fixed charges include: interest expense; amortization of capitalized finance costs; and a one-third portion of operating lease expenses (primarily rent) that our management believes is representative of the interest component of operating leases. |

11

You should carefully consider the following risks, which we believe are all of the material risks related to the Exchange Notes and our business, as well as the other information contained in this prospectus, before investing in the notes. Any of the following risks could materially adversely affect our business, financial condition or results of operations. In such case, you may lose all or part of your original investment. We may become subject to additional risks in the future.

Risk Factors Relating to the Exchange Notes

Because there is no public market for the Exchange Notes, you may not be able to sell your Exchange Notes.

The Exchange Notes will be registered under the Securities Act of 1933, as amended, or the Securities Act, but will constitute a new issue of securities, and uncertainty exists with regard to:

| • | the liquidity of any trading market that may develop; |

| • | the ability of holders to sell their Exchange Notes; or |

| • | the price at which the holders would be able to sell their Exchange Notes. |

The Exchange Notes might trade at higher or lower prices than their principal amount or purchase price, depending on many factors, including prevailing interest rates, the market for similar securities and our financial performance.

Any market-making activity will be subject to the limits imposed by the Securities Act and the Exchange Act, and may be limited during the exchange offer or the pendency of an applicable shelf registration statement. An active trading market might not exist for the Exchange Notes and any trading market that does develop might not be liquid.

In addition, any holder of Old Notes who tenders in the exchange offer for the purpose of participating in a distribution of the Exchange Notes may be deemed to have received restricted securities, and if so, will be required to comply with the registration and prospectus delivery requirements of the Securities Act in connection with any resale transaction.

Your Old Notes will not be accepted for exchange if you fail to follow the exchange offer procedures.

We will issue Exchange Notes pursuant to this exchange offer only after a timely receipt of your Old Notes (including timely notation in book-entry form). Therefore, if you want to tender your Old Notes, please allow sufficient time to ensure timely delivery. If we do not receive your Old Notes by the expiration date of the exchange offer, we will not accept your Old Notes for exchange. We are under no duty to give notification of defects or irregularities with respect to the tenders of Old Notes for exchange. If there are defects or irregularities with respect to your tender of Old Notes, we will not accept your Old Notes for exchange.

If you do not exchange your Old Notes, your Old Notes will continue to be subject to the existing transfer restrictions and you may be unable to sell your Old Notes.

We did not register the Old Notes, nor do we intend to do so following the exchange offer. The Old Notes that are not tendered will, therefore, continue to be subject to the existing transfer restrictions and may be transferred only in limited circumstances under the securities laws. If you do not exchange your Old Notes, you will be subject to existing transfer restrictions. As a result, if you hold Old Notes after the exchange offer, you may be unable to sell your Old Notes. If a large number of outstanding Old Notes are exchanged for Exchange Notes issued in the exchange offer, it may be difficult for holders of outstanding Old Notes that are not exchanged in the exchange offer to sell their Old Notes, since those Old Notes may not be offered or sold unless

12

they are registered or there are exemptions from registration requirements under the Securities Act or state laws that apply to them. In addition, if there are only a small number of Old Notes outstanding, there may not be a very liquid market in those Old Notes. There may be few investors that will purchase unregistered securities in which there is not a liquid market.

If you exchange your Old Notes, you may not be able to resell the Exchange Notes you receive in the exchange offer without registering them and delivering a prospectus.

You may not be able to resell Exchange Notes you receive in the exchange offer without registering those Exchange Notes or delivering a prospectus. Based on interpretations by the Commission in no-action letters, we believe, with respect to Exchange Notes issued in the exchange offer, that:

| • | holders who are not “affiliates” of ours within the meaning of Rule 405 of the Securities Act; |

| • | holders who acquire their Exchange Notes in the ordinary course of business; |

| • | holders who do not engage in, intend to engage in, or have arrangements to participate in a distribution (within the meaning of the Securities Act) of the Exchange Notes; and |

| • | are not broker-dealers |

do not have to comply with the registration and prospectus delivery requirements of the Securities Act.

Holders described in the preceding sentence must tell us in writing at our request that they meet these criteria. Holders that do not meet these criteria could not rely on interpretations of the SEC in no-action letters, and will have to register the Exchange Notes they receive in the exchange offer and deliver a prospectus for them. In addition, holders that are broker-dealers may be deemed “underwriters” within the meaning of the Securities Act in connection with any resale of Exchange Notes acquired in the exchange offer. Holders that are broker-dealers must acknowledge that they acquired their outstanding Exchange Notes in market-making activities or other trading activities and must deliver a prospectus when they resell Exchange Notes they acquire in the exchange offer in order not to be deemed an underwriter.

The Taxability of the Exchange Offer Under Federal Income Tax Rules and Regulations is Uncertain.

The exchange offer should be tax-free for U.S. federal income tax purposes; however, the ultimate determination of whether the exchange offer is tax-free is highly fact dependent. While we are not aware of the existence of any facts that would cause the exchange to be taxable, the specific facts and circumstances related to each holder of Old Notes have not been analyzed.

Risk Factors Related to the Offering

Servicing our debt will require a significant amount of cash. Our ability to generate sufficient cash depends on numerous factors beyond our control, and we may be unable to generate sufficient cash flow to service our debt obligations, including making payments on the notes.

Our ability to make payments on and to refinance our debt, including the notes, and to fund planned capital expenditures will depend on our ability to generate cash in the future. To some extent, this is subject to general economic, financial, competitive, legislative, regulatory and other factors that are beyond our control. If we are unable to generate sufficient cash flow to service our debt and meet our other commitments, we will be required to adopt one or more alternatives, such as refinancing all or a portion of our debt, including the notes, selling material assets or operations or raising additional debt or equity capital. We may not be able to effect any of these actions on a timely basis, on commercially reasonable terms or at all, or that these actions would be sufficient to meet our capital requirements. In addition, the terms of our existing or future debt agreements, including the credit agreement governing our senior secured credit facilities and each indenture governing the notes, may restrict us from effecting any of these alternatives.

13

If we fail to make scheduled payments on our debt or otherwise fail to comply with our covenants, we will be in default and, as a result:

| • | our debt holders could declare all outstanding principal and interest to be due and payable, |

| • | our secured debt lenders could terminate their commitments and commence foreclosure proceedings against our assets, and |

| • | we could be forced into bankruptcy or liquidation. |

As of September 2, 2006, our total indebtedness was $1.668 billion including $299.3 million of senior notes due 2014, $79.2 million of senior unsecured notes, $895.5 million under the Term Loan, and $362.3 million under the ABL Credit Facility. As of November 4, 2006, the total amount of our outstanding indebtedness for borrowed money was $1.573 billion. Estimated cash required to make minimum debt service payments (including principal and interest) for these debt obligations amounts to $78.6 million for the fiscal year ending June 2, 2007, exclusive of the the ABL Credit Facility. The ABL Credit Facility has no annual minimum principal payment requirement. For the fiscal year ending June 2, 2007, cash required to pay interest due under the ABL Credit Facility is estimated to be $9.2 million assuming an average outstanding balance under the ABL Credit Facility of $215.7 million.

Our substantial debt could adversely affect our financial condition and prevent us from fulfilling our obligations under the notes.

After giving effect to the offering of the Old Notes and related use of proceeds we have a substantial amount of debt, which requires significant interest and principal payments. Specifically, our high level of debt could have important consequences to the holders of the notes, including the following:

| • | making it more difficult for us to satisfy our obligations with respect to the notes and our other debt; |

| • | limiting our ability to obtain additional financing to fund future working capital, capital expenditures, acquisitions or other general corporate requirements; |

| • | requiring a substantial portion of our cash flows to be dedicated to debt service payments instead of other purposes; |

| • | increasing our vulnerability to general adverse economic and industry conditions; |

| • | limiting our flexibility in planning for and reacting to changes in the industry in which we compete; |

| • | placing us at a disadvantage compared to other, less leveraged competitors; and |

| • | increasing our cost of borrowing. |

Repayment of our debt, including the notes, is dependent upon a significant amount of cash flow, most of which is generated by our subsidiaries. Our ability to generate cash depends on many factors beyond our control, and any failure to meet our debt service obligations could harm our business, financial condition and results of operations.

We are primarily a holding company with few material assets, other than one store location and related inventory, and the equity interests of our subsidiaries. Our subsidiaries conduct substantially all of our operations and own substantially all of our assets. Therefore, repayment of our indebtedness, including the notes, is dependent on the generation of cash flow by our subsidiaries and their ability to make such cash available to us , by dividend, debt repayment or otherwise. Our subsidiaries may not be able to, or be permitted to, make distributions to enable us to make payments in respect of our indebtedness, including the notes. Under certain circumstances, legal and contractual restrictions may limit our ability to obtain cash from our subsidiaries. In the event that we do not receive distributions from our subsidiaries, we may be unable to make required principal and interest payments on our indebtedness, including the notes.

14

Our ability to pay interest on and principal of the notes offered hereunder and satisfy our other debt obligations will primarily depend upon our future operating performance. As a result, prevailing economic conditions and financial business and other factors, many of which are beyond our control, will affect our ability to make these payments.

If we do not generate sufficient cash flow from operations to satisfy our debt service obligations, including payments on the notes, we may have to undertake alternative financing plans, such as refinancing or restructuring our indebtedness. Our ability to restructure or refinance our debt will depend on the condition of the capital markets and our financial condition at such time.

Contractual limitations on our ability to execute any necessary alternative financing plans could exacerbate the effects of any failure to generate sufficient cash flow to satisfy our debt service obligations. Our ABL Credit Facility permits us to borrow up to $800 million (of which $225 million was drawn at closing of the Merger, excluding a seasonal working capital adjustment); however, our ability to borrow thereunder is limited by a borrowing base which is calculated periodically based on specified percentages of the value of eligible inventory and eligible credit card receivables, subject to certain reserves and other adjustments. See “Description of Other Indebtedness—ABL Credit Facility.” The value of our eligible inventory and credit card receivables, which in turn affect our ability to borrow under the ABL Credit Facility, can be affected by events beyond our control, and the value of these items may decline materially.

The notes will be unsecured and will be effectively subordinated to our secured indebtedness.

The notes will not be secured by any of our or our subsidiaries’ assets. The indenture governing the notes permits us and our subsidiaries to incur secured indebtedness, including pursuant to our senior secured credit facilities, purchase money instruments and other forms of secured indebtedness. As a result, the notes and the guarantees will be effectively subordinated to all of our and the guarantors’ secured indebtedness and other obligations to the extent of the value of the assets securing such obligations. If we and the guarantors were to become insolvent or otherwise fail to make payment on the notes, holders of any of our and the subsidiary guarantors’ secured obligations would be paid first and would receive payments from the assets securing such obligations before the holders of the notes would receive any payments. You may therefore not be fully repaid if we or the guarantors become insolvent or otherwise fail to make payment on the notes.