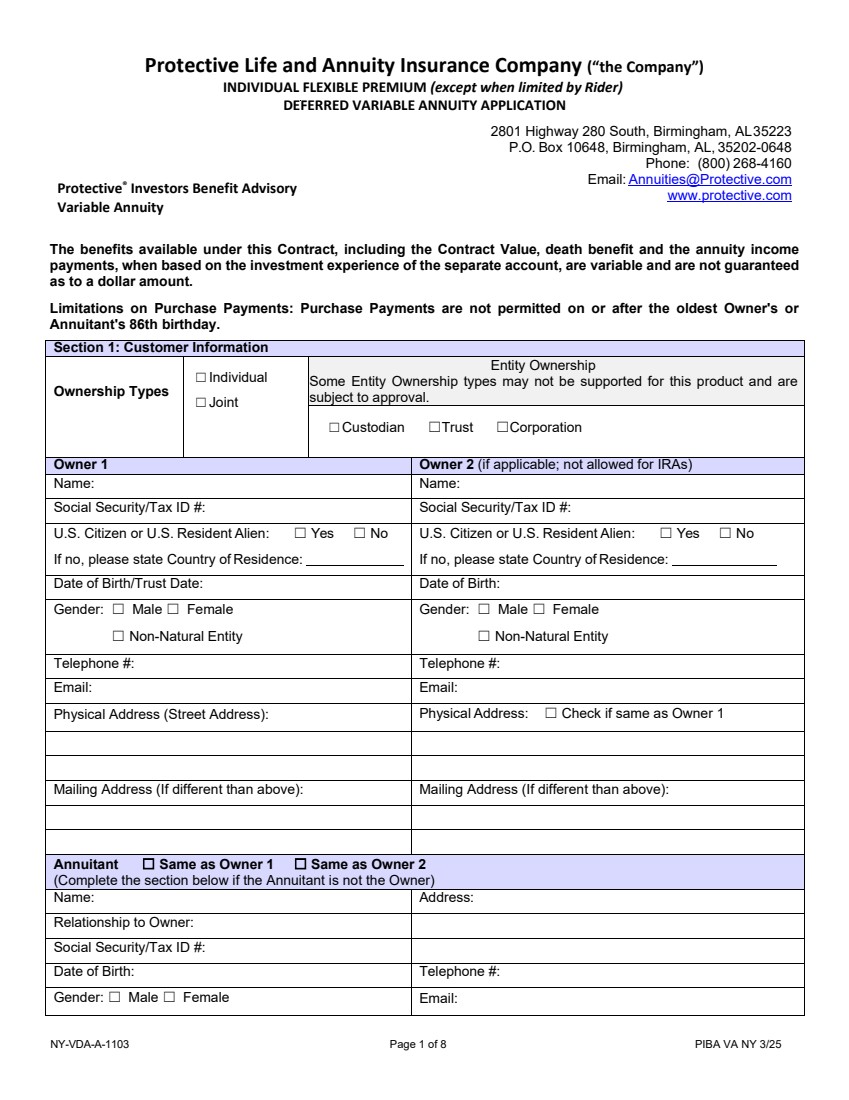

| NY-VDA-A-1103 Page 1 of 8 PIBA VA NY 3/25Protective Life and Annuity Insurance Company (“the Company”) INDIVIDUAL FLEXIBLE PREMIUM (except when limited by Rider) DEFERRED VARIABLE ANNUITY APPLICATION 2801 Highway 280 South, Birmingham, AL35223 P.O. Box 10648, Birmingham, AL, 35202-0648 Phone: (800) 268-4160 Protective® Investors Benefit Advisory Variable Annuity Email: Annuities@Protective.com www.protective.com The benefits available under this Contract, including the Contract Value, death benefit and the annuity income payments, when based on the investment experience of the separate account, are variable and are not guaranteed as to a dollar amount. Limitations on Purchase Payments: Purchase Payments are not permitted on or after the oldest Owner's or Annuitant's 86th birthday. Section 1: Customer Information Ownership Types ☐Individual ☐Joint Entity Ownership Some Entity Ownership types may not be supported for this product and are subject to approval. ☐Custodian ☐Trust ☐Corporation Owner 1 Owner 2 (if applicable; not allowed for IRAs) Name: Name: Social Security/Tax ID #: Social Security/Tax ID #: U.S. Citizen or U.S. Resident Alien: ☐ Yes ☐ No If no, please state Country of Residence: U.S. Citizen or U.S. Resident Alien: ☐ Yes ☐ No If no, please state Country of Residence: Date of Birth/Trust Date: Date of Birth: Gender: ☐ Male ☐ Female ☐ Non-Natural Entity Gender: ☐ Male ☐ Female ☐ Non-Natural Entity Telephone #: Telephone #: Email: Email: Physical Address (Street Address): Physical Address: ☐ Check if same as Owner 1 Mailing Address (If different than above): Mailing Address (If different than above): Annuitant ☐ Same as Owner 1 ☐ Same as Owner 2 (Complete the section below if the Annuitant is not the Owner) Name: Address: Relationship to Owner: Social Security/Tax ID #: Date of Birth: Telephone #: Gender: ☐ Male ☐ Female Email: |

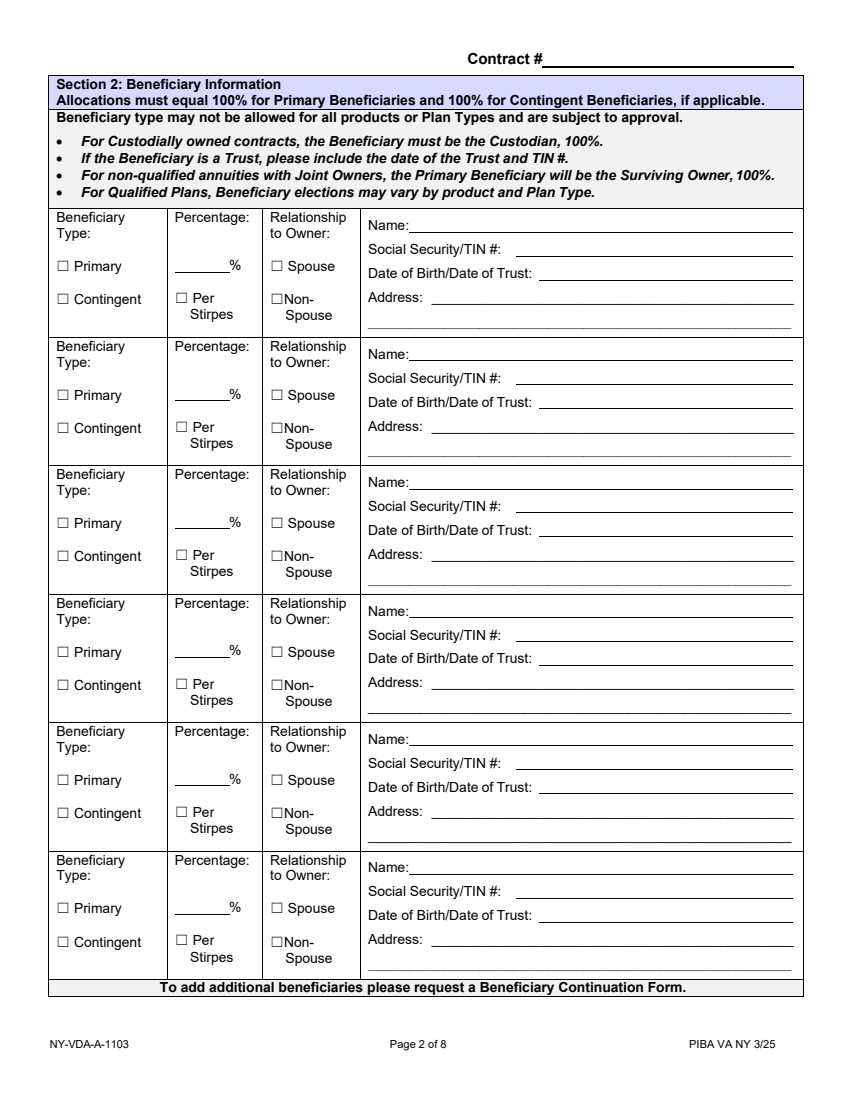

| Contract # NY-VDA-A-1103 Page 2 of 8 PIBA VA NY 3/25 Section 2: Beneficiary Information Allocations must equal 100% for Primary Beneficiaries and 100% for Contingent Beneficiaries, if applicable. Beneficiary type may not be allowed for all products or Plan Types and are subject to approval. • For Custodially owned contracts, the Beneficiary must be the Custodian, 100%. • If the Beneficiary is a Trust, please include the date of the Trust and TIN #. • For non-qualified annuities with Joint Owners, the Primary Beneficiary will be the Surviving Owner, 100%. • For Qualified Plans, Beneficiary elections may vary by product and Plan Type. Beneficiary Type: ☐ Primary ☐ Contingent Percentage: % ☐ Per Stirpes Relationship to Owner: ☐ Spouse ☐Non-Spouse Name: Social Security/TIN #: Date of Birth/Date of Trust: Address: _______________________________________________ _____________________________________________________________ Beneficiary Type: ☐ Primary ☐ Contingent Percentage: % ☐ Per Stirpes Relationship to Owner: ☐ Spouse ☐Non-Spouse Name: Social Security/TIN #: Date of Birth/Date of Trust: Address: _______________________________________________ _____________________________________________________________ Beneficiary Type: ☐ Primary ☐ Contingent Percentage: % ☐ Per Stirpes Relationship to Owner: ☐ Spouse ☐Non-Spouse Name: Social Security/TIN #: Date of Birth/Date of Trust: Address: _______________________________________________ _____________________________________________________________ Beneficiary Type: ☐ Primary ☐ Contingent Percentage: % ☐ Per Stirpes Relationship to Owner: ☐ Spouse ☐Non-Spouse Name: Social Security/TIN #: Date of Birth/Date of Trust: Address: _______________________________________________ _____________________________________________________________ Beneficiary Type: ☐ Primary ☐ Contingent Percentage: % ☐ Per Stirpes Relationship to Owner: ☐ Spouse ☐Non-Spouse Name: Social Security/TIN #: Date of Birth/Date of Trust: Address: _______________________________________________ _____________________________________________________________ Beneficiary Type: ☐ Primary ☐ Contingent Percentage: % ☐ Per Stirpes Relationship to Owner: ☐ Spouse ☐Non-Spouse Name: Social Security/TIN #: Date of Birth/Date of Trust: Address: _______________________________________________ _____________________________________________________________ To add additional beneficiaries please request a Beneficiary Continuation Form. |

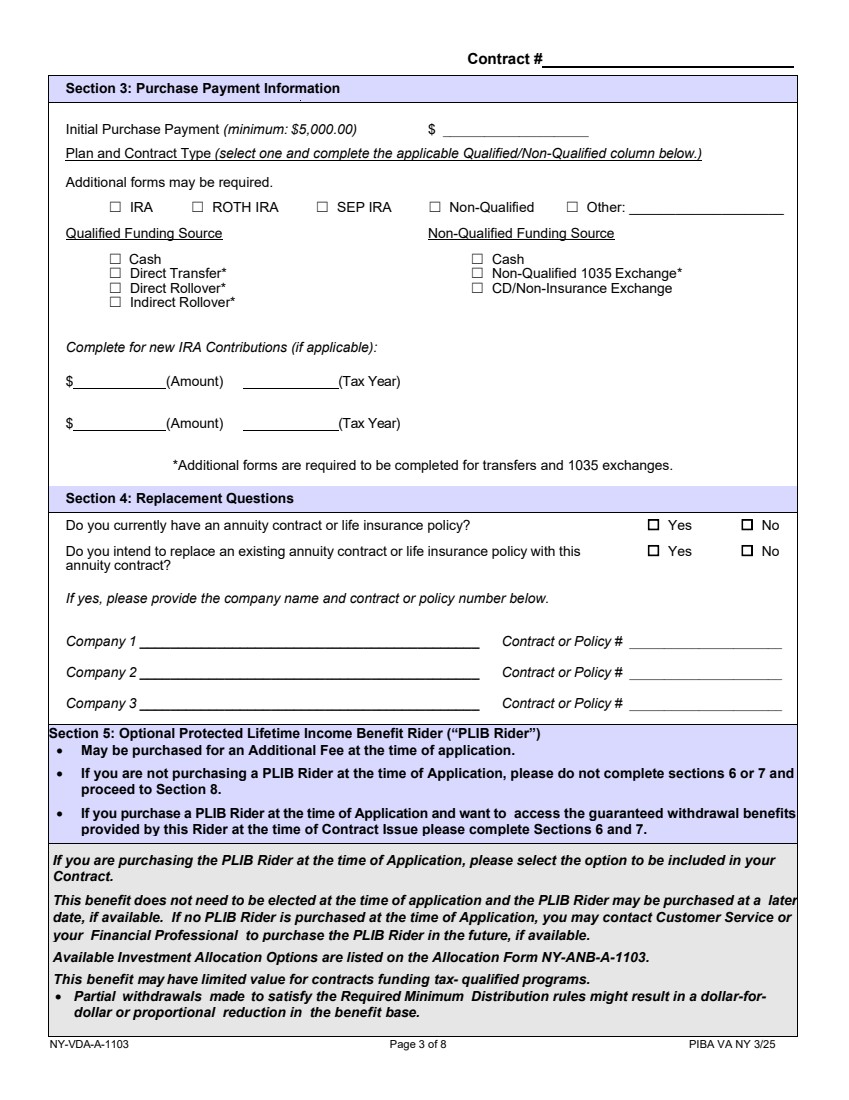

| Contract # NY-VDA-A-1103 Page 3 of 8 PIBA VA NY 3/25 Section 3: Purchase Payment Information Initial Purchase Payment (minimum: $5,000.00) $ _____________________ Plan and Contract Type (select one and complete the applicable Qualified/Non-Qualified column below.) Additional forms may be required. ☐ IRA ☐ ROTH IRA ☐ SEP IRA ☐ Non-Qualified ☐ Other: ____________________ Qualified Funding Source Non-Qualified Funding Source ☐ Cash ☐ Direct Transfer* ☐ Direct Rollover* ☐ Indirect Rollover* ☐ Cash ☐ Non-Qualified 1035 Exchange* ☐ CD/Non-Insurance Exchange Complete for new IRA Contributions (if applicable): $ (Amount) (Tax Year) $ (Amount) (Tax Year) *Additional forms are required to be completed for transfers and 1035 exchanges. Section 4: Replacement Questions Do you currently have an annuity contract or life insurance policy? ☐ Yes ☐ No Do you intend to replace an existing annuity contract or life insurance policy with this annuity contract? ☐ Yes ☐ No If yes, please provide the company name and contract or policy number below. Company 1 ____________________________________________ Company 2 ____________________________________________ Company 3 ____________________________________________ Contract or Policy # ______________________ Contract or Policy # ______________________ Contract or Policy # ______________________ Section 5: Optional Protected Lifetime Income Benefit Rider (“PLIB Rider”) • May be purchased for an Additional Fee at the time of application. • If you are not purchasing a PLIB Rider at the time of Application, please do not complete sections 6 or 7 and proceed to Section 8. • If you purchase a PLIB Rider at the time of Application and want to access the guaranteed withdrawal benefits provided by this Rider at the time of Contract Issue please complete Sections 6 and 7. If you are purchasing the PLIB Rider at the time of Application, please select the option to be included in your Contract. This benefit does not need to be elected at the time of application and the PLIB Rider may be purchased at a later date, if available. If no PLIB Rider is purchased at the time of Application, you may contact Customer Service or your Financial Professional to purchase the PLIB Rider in the future, if available. Available Investment Allocation Options are listed on the Allocation Form NY-ANB-A-1103. This benefit may have limited value for contracts funding tax- qualified programs. • Partial withdrawals made to satisfy the Required Minimum Distribution rules might result in a dollar-for-dollar or proportional reduction in the benefit base. |

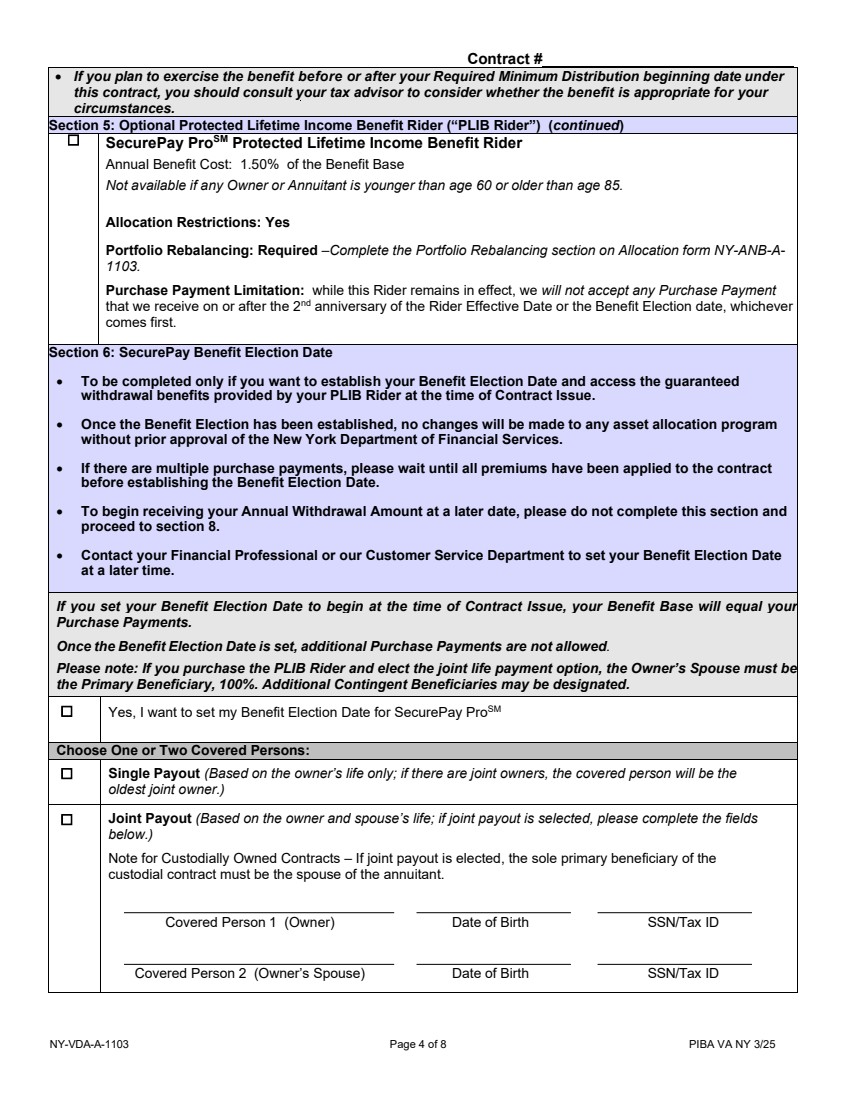

| Contract # NY-VDA-A-1103 Page 4 of 8 PIBA VA NY 3/25 • If you plan to exercise the benefit before or after your Required Minimum Distribution beginning date under this contract, you should consult your tax advisor to consider whether the benefit is appropriate for your circumstances. Section 5: Optional Protected Lifetime Income Benefit Rider (“PLIB Rider”) (continued) ☐ SecurePay ProSM Protected Lifetime Income Benefit Rider Annual Benefit Cost: 1.50% of the Benefit Base Not available if any Owner or Annuitant is younger than age 60 or older than age 85. Allocation Restrictions: Yes Portfolio Rebalancing: Required –Complete the Portfolio Rebalancing section on Allocation form NY-ANB-A-1103. Purchase Payment Limitation: while this Rider remains in effect, we will not accept any Purchase Payment that we receive on or after the 2nd anniversary of the Rider Effective Date or the Benefit Election date, whichever comes first. Section 6: SecurePay Benefit Election Date • To be completed only if you want to establish your Benefit Election Date and access the guaranteed withdrawal benefits provided by your PLIB Rider at the time of Contract Issue. • Once the Benefit Election has been established, no changes will be made to any asset allocation program without prior approval of the New York Department of Financial Services. • If there are multiple purchase payments, please wait until all premiums have been applied to the contract before establishing the Benefit Election Date. • To begin receiving your Annual Withdrawal Amount at a later date, please do not complete this section and proceed to section 8. • Contact your Financial Professional or our Customer Service Department to set your Benefit Election Date at a later time. If you set your Benefit Election Date to begin at the time of Contract Issue, your Benefit Base will equal your Purchase Payments. Once the Benefit Election Date is set, additional Purchase Payments are not allowed. Please note: If you purchase the PLIB Rider and elect the joint life payment option, the Owner’s Spouse must be the Primary Beneficiary, 100%. Additional Contingent Beneficiaries may be designated. ☐ Yes, I want to set my Benefit Election Date for SecurePay ProSM Choose One or Two Covered Persons: ☐ Single Payout (Based on the owner’s life only; if there are joint owners, the covered person will be the oldest joint owner.) ☐ Joint Payout (Based on the owner and spouse’s life; if joint payout is selected, please complete the fields below.) Note for Custodially Owned Contracts – If joint payout is elected, the sole primary beneficiary of the custodial contract must be the spouse of the annuitant. Covered Person 1 (Owner) Date of Birth SSN/Tax ID Covered Person 2 (Owner’s Spouse) Date of Birth SSN/Tax ID |

| Contract # NY-VDA-A-1103 Page 5 of 8 PIBA VA NY 3/25 Section 7: Optional – SecurePay Benefit Withdrawals • To be completed only if you want to begin receiving the guaranteed withdrawal benefit provided by your PLIB Rider at the time of application. • If you choose to receive your Annual Withdrawal Amount (AWA) at a later date, please do not complete this section and proceed to section 8. We will calculate your Annual Withdrawal Amount by multiplying the applicable Withdrawal Percentage shown on your Rider Schedule by the Benefit Base as of the date the Annual Withdrawal amount is calculated. You may take your entire AWA or a portion of your AWA each Contract Year. The AWA is not cumulative. If you do not take the entire AWA during a Contract Year, the remaining portion will not carry forward to future Contract Years. How much do you want? Choose one: ☐ The entire AWA allowed based on my current Benefit Base. ☐ A portion of the AWA allowed based on my current Benefit Base. Send me only $ Additional options for Qualified Plans, such as IRAs: ☐ Only the amount to satisfy my Required Minimum Distribution (RMD) for this contract. I understand that the RMD will be processed as an annual withdrawal every December 20th. If this date falls on a weekend or holiday, the RMD will be processed the next business day. Please note: If the annuity was issued after January 1st of the current calendar year, please contact the former carrier to verify the RMD amount. The RMD amount for this year is $______________________ _____ ☐ The greater of the AWA or RMD. I understand that this withdrawal will be paid out over the frequency selected below and any remaining RMD amount will be processed on December 20th. If this date falls on a weekend or holiday, the remaining RMD will be processed the next business day. You may take your Annual Withdrawal Amount as a one-time lump sum payment or as a series of automatic payments. Choose one: ☐ One Time Withdrawal - The Annual Withdrawal Amount as a one-time lump sum. You may take the entire Annual Withdrawal Amount or a portion of the Annual Withdrawal Amount. Please allow 2-3 business days to process the withdrawal. For future withdrawal requests, please contact Customer Service. ☐ Partial Automatic Withdrawal - The Annual Withdrawal Amount as a series of automatic payments paid out over the frequency selected below. ☐ Monthly ☐ Quarterly ☐ Semi-Annually ☐ Annually Beginning on: (MM/DD - select a date between the 1st – 28th) The date selected will be the date the withdrawal is processed. Please allow 3-5 business days for the EFT to be received by your bank. Electronic Funds Transfer ☐ I want my funds sent electronically to my bank (EFT). PLEASE ATTACH A VOIDED CHECK. Routing Number: Bank Account Number: _______________________________ |

| Contract # NY-VDA-A-1103 Page 6 of 8 PIBA VA NY 3/25 Section 7: Optional – SecurePay Benefit Withdrawals (continued) Tax Withholding I understand that I am responsible for payment of federal income tax on the taxable portion of each withdrawal I receive, even if I choose not to have federal income tax withheld from my withdrawal. I also understand that if I don’t specify the tax withholding I want before my payment date, 10% federal income tax and applicable state income tax will be withheld from the taxable portion of my withdrawals until I make a different election. 1) Tax Withholding for IRA's and Non-Qualified Annuities Only Federal income taxes ☐ Withhold 10% ☐ Withhold $ or % ☐ Do not withhold State income taxes ☐ Withhold 10% ☐ Withhold as required by my state ☐ Do not withhold 2) Tax Withholding for 401k, 403(b), or 457 Annuities Only Federal income taxes (cannot be less than 20%) ☐ Withhold 20% ☐ Withhold $ or % State income taxes ☐ Withhold 10% ☐ Withhold as required by my state ☐ Do not withhold Certification of Taxpayer IDs (Substitute Form W-9) To be completed only by U.S. persons (including U.S. citizens and resident aliens). If not a U.S. person, you are required to submit the applicable IRS For W-8 series. By their signatures on the last page of this application, under penalty of perjury, the owner, annuitant and joint annuitant (if applicable) certify that: 1. The number shown on this form is my correct taxpayer identification number (or I am waiting for a number to be issued to me); and 2. I am not subject to backup withholding because: (a) I am exempt from backup withholding, or (b) I have not been notified by the Internal Revenue Service (IRS) that I am subject to backup withholding as a result of a failure to report all interest or dividends, or (c) the IRS has notified me that I am no longer subject to backup withholding; and 3. I am a U.S. citizen or U.S. resident alien; and 4. The FATCA code(s) entered on this form (if any) indicating that I am exempt from FATCA reporting is correct. Exemption from FATCA reporting code (if any) | | Are you subject to backup withholding under section 3406(a)(1)(c) of the Internal Revenue Code? □ Yes □ No Section 8: Optional - Automatic Purchase Plan-this is not available if the Benefit Election Date is set. ☐ Allowable Purchase Payments may be restricted based on Plan Type (Qualified or Non-Qualified) and the election of a Protected Lifetime Income Benefit. Not available if Partial Automatic Withdrawals are selected. Draft $ per month -or- quarter from my account on the day (1st – 28th ) of the month and apply to my Contract. Section 9: Optional Enhanced Death Benefit – May be added for an Additional Fee. The option to elect an Enhanced Death Benefit is only available at time of application. If you do not elect an optional Enhanced Death Benefit, the Death Benefit will be equal to the Contract Value of the Contract at date of death. ☐ Return of Purchase Payments Death Benefit - Annual Benefit Cost: 0.20% of the Death Benefit Not available if any Owner or Annuitant is age 86 or older. ☐ Maximum Anniversary Value Death Benefit – Annual Benefit Cost: 0.35% of the Death Benefit Not available if any Owner or Annuitant is age 78 or older. |

| Contract # NY-VDA-A-1103 Page 7 of 8 PIBA VA NY 3/25 Section 10: Remarks/Notes Section 11: Disclosures and Applicant Signatures Did you receive an Annuity Buyers Guide forthis annuity? ☐ Yes ☐ No Please read the disclosures below and acknowledge the following: I am applying for an Individual Flexible Premium (except when limited by Rider) Deferred Variable Annuity. No representative is authorized to modify this Contract or waive any of the Company’s rights or requirements. Only the President and the Secretary of the Company are authorized, in writing, to change or waive any terms of this application or any contract of insurance issued. I understand this application will attach to and be made a part of the annuity contract. I have read the completed application and confirm that the information it contains is true and correct to the best of my knowledge and belief. However, these statements are representations and not warranties. I understand that federal law requires the Company to obtain sufficient information to identify the parties to the purchase of an annuity, and that failure to provide such information could result in processing delays or in the contract not being issued. For non-tax qualified annuities only: I understand that if I purchase another such annuity from the Company or its affiliates, in the same calendar year, both annuities will be considered as one for tax purposes. I understand that the Contract is not a bank or credit union deposit or obligation and is not FDIC or NCUA insured. I also understand that the Contract is not insured by any federal government agency and is not guaranteed by any bank or credit union. If one of the Protected Lifetime Income Benefit Riders is purchased at the time of completing this application, I understand that it is subject to an additional fee and other contract and allocation restrictions. I understand that Variable annuities involve risk, including the possible loss of principal, and that contract values, death benefits, annuity payments and termination values, when based upon the investment experience of the separate account, are variable and are not guaranteed as to any fixed dollar amount. An agent or employee of the Company cannot waive, modify, change or interpret any questions asked of me on this application, the answers to which shall be deemed solely mine. I represent that all statements, answers, or selections made in this application are full, complete, and true, to the best of my knowledge and belief. Application signed at: on (City and State) (Date) The Internal Revenue Service does not require your consent to any provision of this document other than the certifications required to avoid backup withholding. Owner’s Signature Joint Owner’s Signature (if applicable) Annuitant’s Signature (if not an Owner) |

| Contract # NY-VDA-A-1103 Page 8 of 8 PIBA VA NY 3/25 For administrative use only Section 12: Registered Financial Professional Information This section must be completed and signed by the Registered Financial Professional for the Contract to be issued. To the best of your knowledge and belief… Does the applicant have any existing annuity contract or life insurance policy? ☐ Yes ☐ No Does this annuity change or replace any existing annuity contract or life insurance policy? ☐ Yes ☐ No Type of unexpired government issued photo I.D. used to verify applicant’s identity: Owner 1: # Owner 2: # I certify that only the Company approved sales materials were used and that copies of such materials were (as applicable) left with the client and/or retained in my files. Registered Financial Professional 1 Signature Firm Name Printed Name Phone Number Email Address: Protective Assigned # State License Commission % Registered Financial Professional 2 (if applicable) Printed Name Phone Number Protective Assigned # State License Commission % Registered Financial Professional 3 (if applicable) Printed Name Phone Number Protective Assigned # State License Commission % If more than three Registered Financial Professionals, please provide additional names, details, and commission percentages. Total commission for all Registered Financial Professionals must equal 100%. |