DEF 14AfalseEMCOR Group, Inc.000010563400001056342022-01-012022-12-3100001056342020-01-012020-12-3100001056342021-01-012021-12-310000105634ecd:PeoMembereme:ChangeInFairValueOfAwardsGrantedInPriorYearsThatVestedInTheCurrentYearMember2022-01-012022-12-310000105634ecd:PeoMembereme:ChangeInFairValueOfAwardsGrantedInPriorYearsThatVestedInTheCurrentYearMember2020-01-012020-12-310000105634ecd:PeoMembereme:ChangeInFairValueOfAwardsGrantedInPriorYearsThatVestedInTheCurrentYearMember2021-01-012021-12-310000105634ecd:PeoMembereme:AmountsReportedUnderStockAwardsInSummaryCompensationTableMember2020-01-012020-12-310000105634ecd:PeoMembereme:AmountsReportedUnderStockAwardsInSummaryCompensationTableMember2021-01-012021-12-310000105634eme:AmountsReportedUnderStockAwardsInSummaryCompensationTableMemberecd:PeoMember2022-01-012022-12-310000105634ecd:NonPeoNeoMembereme:ChangeInFairValueOfAwardsGrantedInPriorYearsThatVestedInTheCurrentYearMember2021-01-012021-12-310000105634ecd:PeoMembereme:FairValueOfAwardsGrantedDuringTheYearThatRemainOutstandingAndUnvestedAsOfYearEndMember2021-01-012021-12-310000105634ecd:PeoMembereme:FairValueOfAwardsGrantedDuringTheYearThatRemainOutstandingAndUnvestedAsOfYearEndMember2020-01-012020-12-310000105634ecd:NonPeoNeoMembereme:ChangeInFairValueOfAwardsGrantedInPriorYearsThatVestedInTheCurrentYearMember2020-01-012020-12-310000105634eme:FairValueOfAwardsGrantedDuringTheYearThatRemainOutstandingAndUnvestedAsOfYearEndMemberecd:PeoMember2022-01-012022-12-310000105634eme:ChangeInFairValueOfAwardsGrantedInPriorYearsThatRemainOutstandingAndUnvestedAsOfYearEndMemberecd:PeoMember2020-01-012020-12-310000105634eme:ChangeInFairValueOfAwardsGrantedInPriorYearsThatRemainOutstandingAndUnvestedAsOfYearEndMemberecd:PeoMember2022-01-012022-12-310000105634eme:ChangeInFairValueOfAwardsGrantedInPriorYearsThatRemainOutstandingAndUnvestedAsOfYearEndMemberecd:PeoMember2021-01-012021-12-310000105634ecd:NonPeoNeoMembereme:ChangeInFairValueOfAwardsGrantedInPriorYearsThatVestedInTheCurrentYearMember2022-01-012022-12-310000105634eme:AmountsReportedUnderStockAwardsInSummaryCompensationTableMemberecd:NonPeoNeoMember2020-01-012020-12-310000105634eme:AmountsReportedUnderStockAwardsInSummaryCompensationTableMemberecd:NonPeoNeoMember2021-01-012021-12-310000105634eme:AmountsReportedUnderStockAwardsInSummaryCompensationTableMemberecd:NonPeoNeoMember2022-01-012022-12-310000105634eme:ChangeInFairValueOfAwardsGrantedInPriorYearsThatRemainOutstandingAndUnvestedAsOfYearEndMemberecd:NonPeoNeoMember2021-01-012021-12-310000105634eme:FairValueOfAwardsGrantedDuringTheYearThatRemainOutstandingAndUnvestedAsOfYearEndMemberecd:NonPeoNeoMember2021-01-012021-12-310000105634eme:FairValueOfAwardsGrantedDuringTheYearThatRemainOutstandingAndUnvestedAsOfYearEndMemberecd:NonPeoNeoMember2022-01-012022-12-310000105634eme:FairValueOfAwardsGrantedDuringTheYearThatRemainOutstandingAndUnvestedAsOfYearEndMemberecd:NonPeoNeoMember2020-01-012020-12-310000105634eme:ChangeInFairValueOfAwardsGrantedInPriorYearsThatRemainOutstandingAndUnvestedAsOfYearEndMemberecd:NonPeoNeoMember2022-01-012022-12-310000105634eme:ChangeInFairValueOfAwardsGrantedInPriorYearsThatRemainOutstandingAndUnvestedAsOfYearEndMemberecd:NonPeoNeoMember2020-01-012020-12-31000010563412022-01-012022-12-31000010563422022-01-012022-12-31000010563432022-01-012022-12-31iso4217:USDiso4217:USDxbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

☐

|

Preliminary Proxy Statement

|

|

☐

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

☒

|

Definitive Proxy Statement

|

|

☐

|

Definitive Additional Materials

|

|

☐

|

Soliciting Material Pursuant to §240.14a-12

|

|

EMCOR GROUP, INC.

|

|

(Name of Registrant as Specified In Its Charter)

|

|

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

Payment of filing fee (Check the appropriate box):

|

☒

|

|

|

No fee required.

|

|

☐

|

|

|

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules

14a-6(i)(1) and 0-11.

|

|

☐

|

|

|

Fee paid previously with preliminary materials.

|

EMCOR GROUP, INC.

301 Merritt Seven

Norwalk, Connecticut 06851

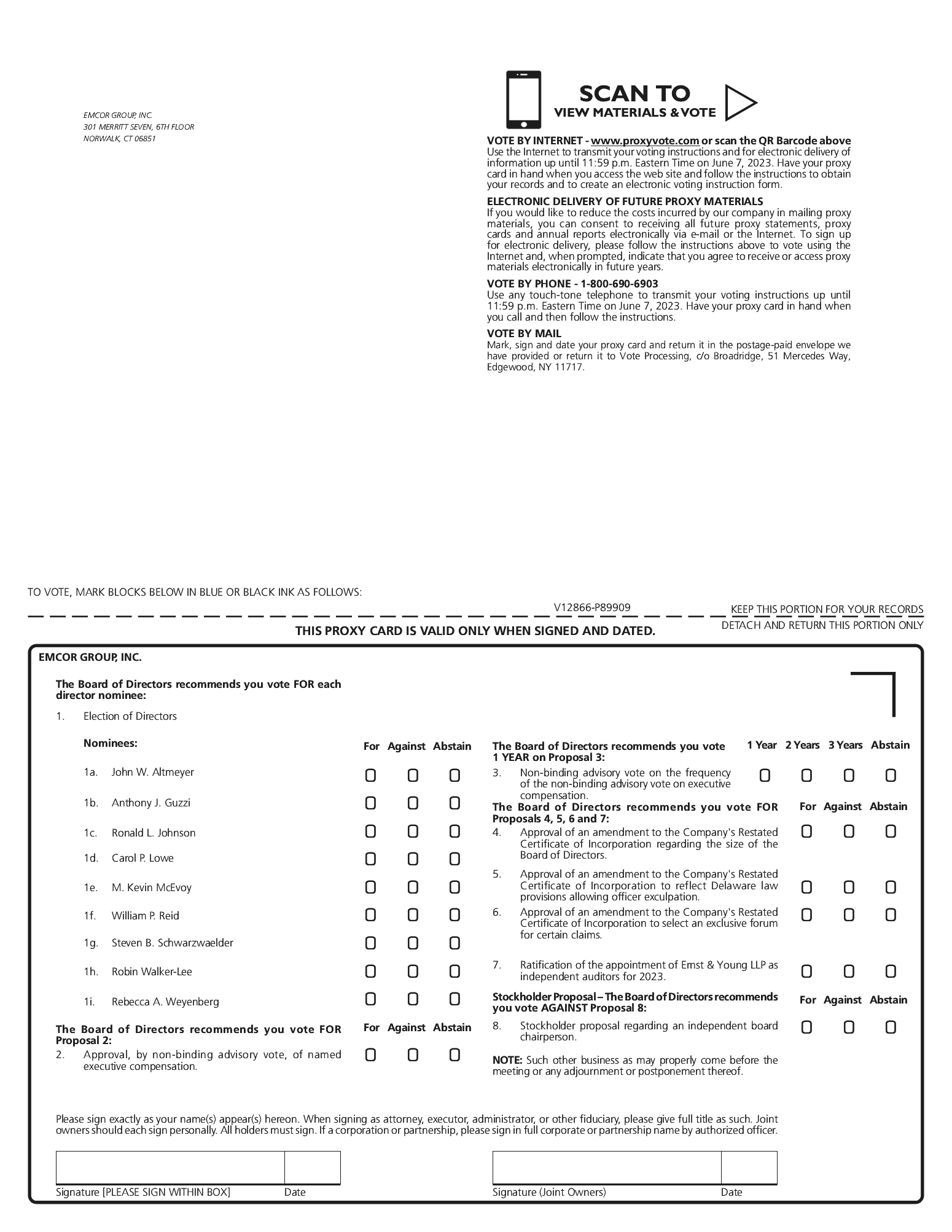

NOTICE OF ANNUAL MEETING

To the Stockholders of EMCOR Group, Inc.:

The Annual Meeting of Stockholders of EMCOR Group, Inc. will be held

at 301 Merritt Seven, Norwalk, Connecticut on June 8, 2023 at 10:00 A.M. (local time) for the following purposes:

|

1.

|

To elect the nine directors identified in this Proxy Statement to serve until the next Annual Meeting and until their

successors are duly elected and qualified.

|

|

2.

|

To consider a non-binding advisory resolution approving named executive officer compensation.

|

|

3.

|

To consider a non-binding advisory resolution on the frequency of the non-binding advisory vote on executive compensation.

|

|

4.

|

To approve an amendment to the Company’s Restated Certificate of Incorporation regarding the size of the Board of Directors.

|

|

5.

|

To approve an amendment to the Company’s Restated Certificate of Incorporation to reflect Delaware law provisions allowing

officer exculpation.

|

|

6.

|

To approve an amendment to the Company’s Restated Certificate of Incorporation to select an exclusive forum for certain claims.

|

|

7.

|

To ratify the appointment of Ernst & Young LLP as our independent auditors for 2023.

|

|

8.

|

To consider a stockholder proposal regarding an independent board chairperson, if properly presented.

|

|

9.

|

To transact such other business as may properly come before the meeting or any adjournment thereof.

|

The Board of Directors has fixed the close of business on April 11,

2023 as the record date for determination of stockholders entitled to receive notice of, and to vote at (in person, by remote communication or by legally-appointed proxy), our Annual Meeting and any adjournment thereof.

Your attention is respectfully directed to the

accompanying Proxy Statement.

|

|

|

|

By Order of the Board of Directors

|

|

|

|

|

|

|

|

Maxine L. Mauricio

|

|

|

|

|

Corporate Secretary

|

|

Norwalk, Connecticut

|

|

|

|

|

|

April 25, 2023

|

|

|

|

EMCOR GROUP, INC.

PROXY STATEMENT

QUESTIONS AND ANSWERS ABOUT THE 2023 ANNUAL MEETING OF STOCKHOLDERS

What is the purpose of this Proxy Statement?

The EMCOR Board of Directors is soliciting proxies from holders of

our Common Stock to vote on the matters to be considered at the 2023 Annual Meeting of Stockholders (the “Annual Meeting”) to be held at 301 Merritt Seven, Norwalk, Connecticut on Thursday, June 8, 2023 at 10:00 A.M. (local time).

What is the Notice of Internet Availability of Proxy Materials?

We have elected to provide access to our proxy materials on the

Internet, consistent with the rules of the Securities and Exchange Commission. Accordingly, we are mailing a Notice of Internet Availability of Proxy Materials to our stockholders of record as of April 11, 2023. You can access our proxy materials

on the website referred to in the Notice of Internet Availability of Proxy Materials or you may request printed versions of our proxy materials for the Annual Meeting. Instructions on how to access our proxy materials on the Internet or to

request printed versions are provided in the Notice of Internet Availability of Proxy Materials. In addition, you may request to receive proxy materials in printed form by mail or electronically by e-mail on an ongoing basis.

The Notice of Internet Availability of Proxy Materials is a document

that:

|

•

|

Indicates that our Notice of 2023 Annual Meeting of Stockholders and Proxy Statement and our 2022 Annual Report are available

at www.proxyvote.com;

|

|

•

|

Provides instructions on how holders of our Common Stock may vote their shares; and

|

|

•

|

Indicates how holders of our Common Stock may request printed copies of these materials, including the proxy card or a voting

instruction form.

|

We will begin distributing the Notice of Internet Availability of

Proxy Materials on or about April 25, 2023.

For those stockholders who have requested printed copies, we will

first send or deliver copies of the proxy materials for our Annual Meeting and our 2022 Annual Report on or about April 25, 2023.

Important Notice Regarding the Availability of Proxy Materials for the

Annual Meeting to be Held on June 8, 2023

We have sent or are sending the Notice of

Internet Availability of Proxy Materials, which indicates that this Notice of 2023 Annual Meeting of Stockholders and Proxy Statement and our 2022 Annual Report will be made available at www.proxyvote.com. If you wish to receive paper or e-mail

copies of any of these materials, please follow the instructions on your Notice of Internet Availability of Proxy Materials and/or www.proxyvote.com. These materials are also available on our website at www.emcorgroup.com/proxyannualreport.

What items of business will be voted

on at the Annual Meeting?

At the Annual Meeting, we will:

|

1.

|

Vote for the election of the 9 director nominees identified in this Proxy Statement;

|

|

2.

|

Consider a non-binding advisory resolution approving named executive officer compensation, as described in the “Compensation

Discussion and Analysis,” executive compensation tables, and accompanying narrative disclosures of this Proxy Statement;

|

|

3.

|

Consider a non-binding advisory resolution on the frequency of the non-binding advisory stockholder resolution on executive

compensation;

|

|

4.

|

Consider an amendment to the Company’s Restated Certificate of Incorporation regarding the size of the Board of Directors;

|

|

5.

|

Consider an amendment to the Company’s Restated Certificate of Incorporation to reflect Delaware law provisions allowing

officer exculpation;

|

|

6.

|

Consider an amendment to the Company’s Restated Certificate of Incorporation to select an exclusive forum for certain claims;

|

|

7.

|

Consider the ratification of the appointment of Ernst & Young LLP to serve as our independent auditors for 2023; and

|

|

8.

|

Consider a stockholder proposal regarding an independent board chairperson, if properly presented.

|

Who is entitled to vote at the Annual Meeting?

Holders of our Common Stock as of the record date of April 11, 2023

are entitled to notice of, and to vote at (in person, by remote communication or by legally-appointed proxy), the Annual Meeting and any postponement or adjournment of the Annual Meeting. For ten days before the Annual Meeting, a list of

stockholders entitled to vote will be available for inspection at our offices located at 301 Merritt Seven, 6th Floor, Norwalk, Connecticut during ordinary business hours.

How does the Board of Directors

recommend holders of Common Stock vote on the business of the Annual Meeting?

The Board of Directors recommends stockholders vote their shares:

|

1.

|

“FOR” the election of each of the 9 director nominees identified in this Proxy Statement;

|

|

2.

|

“FOR” the adoption of the advisory resolution approving named executive officer compensation;

|

|

3.

|

In favor of holding a non-binding advisory vote on executive compensation every “1 YEAR”;

|

|

4.

|

“FOR” the amendment to the Company’s Restated Certificate of Incorporation regarding the size of the Board of Directors;

|

|

5.

|

“FOR” the amendment to the Company’s Restated Certificate of Incorporation to reflect Delaware law provisions allowing officer

exculpation;

|

|

6.

|

“FOR” the amendment to the Company’s Restated Certificate of Incorporation to select an exclusive forum for certain claims;

|

|

7.

|

“FOR” the ratification of the appointment of Ernst & Young LLP to serve as our independent auditors for 2023; and

|

|

8.

|

“AGAINST” the stockholder proposal regarding an independent board chairperson.

|

How many shares can vote at the Annual Meeting?

At the close of business on April 11, 2023, we had 47,584,362

shares of Common Stock outstanding, and each of those shares is entitled to one vote.

How many shares must be present or represented at the Annual Meeting

to conduct business?

Under our Second Amended and Restated By-Laws, which we refer to as

our “By-Laws,” the holders of a majority of our shares of Common Stock outstanding on the record date, present in person, by remote communication or by proxy at the Annual Meeting, constitute a quorum to conduct business at the Annual Meeting.

Abstentions and broker non-votes will be treated as present for purposes of determining a quorum.

What vote is required to approve each of the items of business?

With respect to item 1, a majority of the votes cast is required for

the election of directors in an uncontested election (which is the case for the election of directors at the Annual Meeting). A majority of the votes cast means that the number of votes cast “for” a nominee must exceed the number of votes cast

“against” or “abstain” with respect to that nominee for such nominee to be elected. Our Corporate Governance Guidelines contain details and procedures to be followed in the event one or more director nominees do not receive a majority of the

votes cast at the Annual Meeting. An abstention on item 1 will have the effect of a vote against that item.

Because we are asking in item 2 above for a non-binding, advisory

vote approving our named executive officer compensation, there is no “required vote” that would constitute approval. We value the opinions expressed by our stockholders on this advisory vote and our Board of Directors’ Compensation and Personnel

Committee, which is responsible for overseeing and administering our executive compensation programs, will consider the outcome of the non-binding advisory vote when designing our compensation programs and making future compensation decisions for

our named executive officers. Abstentions and broker non-votes, if any, will not have any effect on the results of those deliberations.

Item 3 also calls for a non-binding, advisory vote. Our Board of

Directors has recommended an annual vote. However, if another frequency receives more votes, our Board of Directors will take that fact into account when making its decision on how often to hold executive compensation advisory votes. Abstentions

and broker non-votes, if any, will not have any effect on the results of those deliberations.

The affirmative vote of a majority of the votes cast at the Annual

Meeting or represented by proxy at the Annual Meeting is required to approve item 4, item 5, item 6, item 7 and item 8 above, and any other matter that may properly come before the meeting. An abstention on item 4, item 5, item 6, item 7 or item

8 will have no effect on the voting results for those items.

The Board recommends a vote “FOR” election of each of the director

nominees listed in this Proxy Statement, “FOR” approval of the compensation of our named executive officers, in favor of a non-binding advisory vote on executive compensation every “1 YEAR,” “FOR” the amendment to the Company’s Restated

Certificate of Incorporation regarding the size of the Board of Directors, “FOR” the amendment to the Company’s Restated Certificate of Incorporation to reflect Delaware law provisions allowing officer exculpation, “FOR” the amendment to the

Company’s Restated Certificate of Incorporation to select an exclusive forum for certain claims, “FOR” ratification of Ernst & Young LLP as our independent auditors for 2023, and “AGAINST” the stockholder proposal regarding an independent

board chairperson.

What effect do broker non-votes have on the items of business?

Broker non-votes may occur because certain beneficial holders of our

Common Stock hold their shares in “street name” through a broker or other nominee that is a member of the New York Stock Exchange. Under the rules of the New York Stock Exchange, we believe the only item of business to be acted upon at our Annual

Meeting with respect to which such broker or nominee will be permitted to exercise voting discretion is item 7, the ratification of the appointment of Ernst & Young LLP to serve as our independent auditors for 2023. Therefore, if a beneficial

holder of our Common Stock does not give the broker or nominee specific voting instructions on items 1, 2, 3, 4, 5, 6 or 8, such holder’s shares will not be voted on that item and a broker non-vote will occur. Broker non-votes will have no effect

on the voting results for such items of business.

How can I vote my shares at the Annual Meeting?

Voting by Proxy

Holders of our Common Stock may submit a proxy by:

|

•

|

following the instructions on the Notice of Internet Availability of Proxy Materials to vote by telephone or the Internet; or

|

|

•

|

completing, signing, dating and returning the proxy card or voting instruction form by mail or verifiable electronic

transmission.

|

Anthony J. Guzzi, Maxine L. Mauricio and Mark A. Pompa (the “proxy

holders”) have been designated by our Board of Directors to vote the shares represented by proxy at the Annual Meeting. Mr. Guzzi, Ms. Mauricio and Mr. Pompa are executive officers of the Company, and Mr. Guzzi is also a director nominee.

|

•

|

The proxy holders will vote the shares represented by your valid and timely received proxy in accordance with your

instructions.

|

|

•

|

If you do not specify instructions on your signed proxy when you submit it, the proxy holders will vote the shares represented

by the proxy in accordance with the recommendations of our Board of Directors on each item of business identified on page 2. |

|

•

|

If any other matter properly comes before the Annual Meeting, the proxy holders will vote the shares represented by proxy on

that matter in their discretion.

|

If your shares are held in a brokerage account in

your broker’s name or in the name of a bank or other nominee (this is called “street name”), please follow the voting instructions provided by your bank, broker or other nominee. In most cases, you may submit

voting instructions by telephone or by Internet to your bank, broker or other nominee, or you can sign, date and return a voting instruction form to your bank, broker or other nominee. If you provide specific voting instructions by telephone,

by Internet or by mail, your bank, broker or other nominee must vote your shares as you have directed. If you wish to vote in person at the Annual Meeting, you must request a legal proxy from your bank, broker or other nominee and be prepared

to present photo identification to be admitted to the Annual Meeting.

Voting other than by Proxy

While we encourage voting in advance by proxy, record holders of our

Common Stock also have the option of voting their shares in person or by remote communication at the Annual Meeting.

How do I attend the Annual Meeting in person? What do I need to bring?

You are entitled to attend the Annual Meeting or any adjournment or

postponement of the meeting only if you were a holder of our Common Stock as of the record date of April 11, 2023 or are the legal proxy holder or qualified representative of a stockholder who held our Common Stock as of the record date. Please

be prepared to present photo identification to be admitted to the Annual Meeting. If you are attending the Annual Meeting in person as a proxy or qualified representative of a stockholder, you will need to bring your legal proxy or authorization

letter, in addition to photo identification.

We ask that any stockholder who attends the Annual Meeting follow

recommended guidance, mandates and applicable executive orders from federal and state authorities regarding COVID-19. We will require all attendees to comply with our policies in place at the time of the meeting, which may include, but are not

limited to, requiring proof of vaccination and a booster, a temperature check, and completing a health check questionnaire. Anyone with a fever or other symptoms of COVID-19 will be turned away at the door and will not be allowed to attend the

Annual Meeting in person. If you are not feeling well, have had close contact with someone who has tested positive for COVID-19 or otherwise think you may have been exposed to COVID-19, you should not attend the Annual Meeting in person. Note

that, for health and safety reasons, no food or drinks will be served at the Annual Meeting.

Can I change my vote or revoke my proxy after I return my proxy card?

You may change your vote or revoke your proxy before the proxy is

voted in person at the Annual Meeting by:

|

•

|

sending written notice to Corporate Secretary, EMCOR Group, Inc., 301 Merritt Seven, 6th Floor, Norwalk, CT 06851;

|

|

•

|

timely delivery of a valid later-dated proxy or a later-dated vote by telephone or on the Internet; or

|

|

•

|

if you are a record holder, attending the Annual Meeting and voting in person and voting again.

|

If you hold your shares in street name, you may submit new voting

instructions by contacting your broker or other holder of record.

Do I have any dissenters’ or appraisal rights with respect to any of

the matters to be voted upon at the Annual Meeting?

No. Delaware law does not provide shareholders any dissenters’ or

appraisal rights with respect to the matters to be voted on at the Annual Meeting.

Who will count the votes?

We have retained Broadridge Financial Solutions, Inc. for the

receipt, validation and tabulation of the votes at the Annual Meeting.

Where can I find the voting results of the Annual Meeting?

We will publish the results of the voting in a Current Report on

Form 8-K within four business days of the Annual Meeting.

What is Householding?

Stockholders of record who have the same last name and address and

who request paper copies of the proxy materials will receive only one copy unless one or more of them notifies us that they wish to receive individual copies. We agree to deliver promptly, upon written or oral request, a set of proxy materials,

as requested, to any stockholder at the shared address to which a single copy of those documents was delivered. Stockholders will continue to receive separate proxy cards. If you prefer to receive separate copies of the proxy materials, or if you

are receiving multiple copies and would like to receive only one copy for your household, contact Broadridge Financial Solutions, Inc. at 866-540-7095 or in writing to Broadridge Financial Solutions, Inc., Householding Department, 51 Mercedes

Way, Edgewood, New York 11717.

COMPANY INFORMATION AND MAILING ADDRESS

We are a Delaware corporation. Our mailing address is EMCOR Group,

Inc., 301 Merritt Seven, 6th Floor, Norwalk, CT, 06851, and our telephone number is (203) 849-7800. Our website address is www.emcorgroup.com. References in this Proxy Statement to “EMCOR,” “Company,” “we,” “us” and “our” refer to EMCOR Group,

Inc. and our consolidated subsidiaries, unless the context requires otherwise. Information on our website is not intended to be incorporated into this Proxy Statement.

We have a long history of good corporate governance practices that

has greatly aided our long-term success. Our Board of Directors, which we sometimes refer to as our “Board,” and our management have recognized for many years the need for sound corporate governance practices in fulfilling their respective duties

and responsibilities to our stockholders. Our Board and management have taken numerous steps to enhance our policies and procedures to comply with the corporate governance listing standards of the New York Stock Exchange and the rules and

regulations of the Securities and Exchange Commission.

Proxy Access. On December 14, 2016, following extensive deliberation, our Board adopted a proxy access by-law amendment. The Board adopted the amendment in response to the support at the Company’s 2016 Annual

Meeting of Stockholders of a non-binding stockholder proposal advocating in favor of proxy access.

The amendment added to our By-Laws a “proxy access” provision that,

consistent with the stockholder proposal, provides for inclusion in the Company’s proxy materials of director candidates if such candidates are nominated by stockholders owning at least 3% of our outstanding Common Stock continuously for at least

three years. As provided in the stockholder proposal, the number of such director candidates may not exceed 25% of the number of directors then serving on the Board but shall not be less than two. While the stockholder proposal was silent as to

an aggregation limit, the Board capped at 25 the number of stockholders who may aggregate holdings to reach the 3% threshold. In drafting the amendment, we conducted a comprehensive review of market practice among companies that had adopted proxy

access provisions in their by-laws. We found that aggregation limits are extremely common and permitting 25 stockholders to aggregate exceeds the more typical 20 stockholder limit. After considering this and discussing the limit with our

stockholders as described below, the Board determined that a limit is a sensible provision and viewed 25 as the right limit for the Company as it balances the administrative burden on the Company to review and verify the stockholders’ eligibility

for proxy access while assuring that our stockholders have a fair and reasonable opportunity to nominate candidates by forming groups. In addition, our Board noted that, at such time, each of our top 6 stockholders held in excess of 3% of our

outstanding Common Stock and each of our top 25 stockholders held in excess of 1% of our outstanding Common Stock. Similarly concentrated ownership of our Common Stock by our top stockholders remains true today. Nominations are subject to certain

eligibility, procedural, and disclosure requirements, including the requirement that the Company receive notice no earlier than 150 calendar days, and no later than 120 calendar days, prior to the anniversary of the issuance of the prior year’s

proxy materials.

Following our 2016 Annual Meeting of Stockholders, we communicated

with 30 stockholders representing approximately seventy percent (70%) of our outstanding Common Stock to discuss proxy access, including provisions not contemplated by the stockholder proposal. Such stockholders were generally supportive of our

proxy access provision. After extensive Board deliberation over several meetings, and considering the factors described above, including feedback from stockholders, the Board adopted the proxy access provision as described above.

On October 25, 2022, our Board adopted further amendments to our

proxy access by-law (i) to clarify that the Company will not be required to include in its proxy materials any successor, substitute or replacement director nominee by a stockholder if the notice requirements set out in the proxy access by-law

are not met and (ii) to clarify the extent to which Rule 14a-19 under the Exchange Act applies to shareholder nominations to our Board.

We continue to engage with our stockholders regarding proxy access

and other corporate governance matters.

Corporate Governance

Guidelines. Our Corporate Governance Guidelines provide the framework for our governance. The Nominating and Corporate Governance Committee of our Board, which we refer to as the “Corporate

Governance Committee,” regularly reviews corporate governance developments and makes recommendations to our Board with respect to modifications to our Corporate Governance Guidelines.

Our Corporate Governance Guidelines and By-Laws address majority

voting in uncontested director elections, Board leadership (including the respective roles and responsibilities of the Board Chairman and Lead Director), a mandatory retirement age and term limits for directors, stock ownership guidelines and

hedging and pledging prohibitions for our directors and named executive officers, and, with respect to our named executive officers, an incentive compensation recoupment policy, in each case as further described below:

|

•

|

Majority Voting. Under our By-Laws, a majority of the votes cast is

required for the election of directors in an uncontested election (which is the case for the election of directors at the Annual Meeting). A majority of the votes cast means that the number of votes cast “for” a nominee must exceed the

number of votes

|

cast “against” or “withheld” from that nominee for such nominee to be elected. Each

director nominee is required to deliver to the Company an irrevocable contingent resignation in advance of the distribution of the proxy materials for an annual meeting at which the director is expected to be nominated for election. If a director

nominee does not receive a majority of the votes cast in an uncontested election, our Corporate Governance Committee is to recommend whether to accept or reject that director’s resignation and/or whether to take other action. The Board is, within

90 days of the certification of the election results and after consideration of the Corporate Governance Committee’s recommendation, to make a determination whether to accept the resignation and/or take such other action as the Board determines

appropriate. The Corporate Governance Committee, in making its recommendation, and the Board, in making its determination, are to evaluate the best interests of the Company and its stockholders and may consider any factors or other information

they deem relevant.

|

•

|

Independent Lead Director. Our Corporate Governance Guidelines

require that, if the Board determines that the best interests of stockholders are best served by electing a Chairperson that is not independent under the criteria of the listing standards of the New York Stock Exchange, an independent

Lead Director be elected by majority vote of the independent directors. The Board evaluates the leadership structure of the Board, including whether to elect an independent Chairperson and/or appoint an independent Lead Director, on an

annual basis. A Lead Director may also be appointed in other instances if the Board so determines, even if the Chairperson is also independent. Our current Chairman of the Board, Mr. Anthony J. Guzzi, is not an independent director and,

accordingly, on June 1, 2018, the Board elected Mr. M. Kevin McEvoy, one of our independent directors, as Lead Director. The Lead Director presides at meetings at which the Chairperson is not present, including executive sessions;

participates in the formation of, and approves, the agenda for each Board meeting, whether or not the Chairperson is present; calls meetings of the independent directors; serves as a liaison between the Chairperson and the independent

directors; ensures that he or she is available for consultation and direct communication with stockholders and other key constituents; guides the annual performance review and succession planning for the Chief Executive Officer; partners

with the Governance Committee to conduct the Board’s annual self-evaluation; and performs such other duties as the Board may from time to time delegate.

|

|

•

|

Director Retirement Policy. A

director may not be nominated for re-election if the director has or will have reached age 76 when he or she would otherwise stand for election. This policy may be waived by the Board.

|

|

•

|

Director Term Limit Policy. A non-management director may not be

nominated for re-election if the director has or will have served for 20 years or more when he or she would otherwise stand for election. This policy may be waived by the Board.

|

|

•

|

Stock Ownership Guidelines. In an effort to further align the

interests of our non-employee directors and named executive officers with our stockholders, our stock ownership guidelines require directors and our named executive officers to own and retain a significant financial stake in our Common

Stock. Currently, all directors and executive officers are in compliance with such ownership requirements. Such guidelines set stock ownership targets expressed as the value of the shares of the Common Stock held by a director or named

executive officer that is equivalent to three times the director annual cash retainer in effect as of October 22, 2012 (the “Effective Date”) for non-employee directors, five times the annual base salary rate as of the Effective Date for

our Chief Executive Officer, and three times the annual base salary rate as of the Effective Date for each other named executive officer. A non-employee director who is first elected to the Board after the Effective Date is expected to

own within five years of his/her election shares equivalent in market value to three times the director’s annual cash retainer in effect on the date of such director’s initial election to the Board. An individual who is first elected

Chief Executive Officer of the Company or a named executive officer of the Company is expected to own, within five years of such officer’s initial election as such, shares equivalent in market value to five times or three times,

respectively, of such officer’s annual base salary, in each case, as in effect on the date of such officer’s initial election to such position. Shares of Common Stock held by a director or named executive officer, as applicable, are

valued based upon the greater of the value of a share of Common Stock on (a) the applicable measurement date, or (b) the date of the grant of such shares of Common Stock. Shares owned separately by the individual,

|

owned jointly with or separately with an immediate family member residing in the same

household, held in trust for such officer or director, or members of such officer’s or director’s immediate family, and restricted stock and restricted stock units, are counted for purposes of determining compliance with the stock ownership

guidelines.

|

•

|

No Hedging and No Pledging Policy. We prohibit our directors and

named executive officers from participating in any hedging or monetization transactions involving Company securities. The policy also prohibits directors and named executive officers from holding any Company securities in a margin account

and from pledging their Company securities as collateral for a loan.

|

|

•

|

Executive Compensation Recoupment Policy. Our Executive

Compensation Recoupment Policy provides that if the Company is required to prepare an accounting restatement to correct an error that is material to its previously issued financial statements, then the Board can generally seek

reimbursement from our named executive officers of incentive based compensation that was granted, earned or became vested based wholly or in part upon the attainment of a financial reporting measure during the three completed fiscal years

immediately preceding the date of such accounting restatement to the extent that such incentive based compensation would have been lower had the financial reporting measure been based upon the restated financial results. We intend to

adopt a new Executive Compensation Recoupment Policy to address the recovery of erroneously-awarded incentive compensation in compliance with the requirements of final SEC rules and applicable New York Stock Exchange listing standards,

which will become effective in 2023.

|

|

•

|

Stockholder Right to Call Special Meetings. Our By-Laws require

that the Board convene a special meeting at the request of stockholders owning at least 25% of our outstanding Common Stock. This stockholder right does not contain any material restrictions. This threshold carefully balances stockholder

empowerment and protection. The Board believes that, given the stock ownership concentration of our outstanding Common Stock (two of our stockholders currently hold in excess of 10% of our outstanding Common Stock), 25% is the appropriate

threshold.

|

Independence of Directors. To assist our Board in determining the independence of each director, our Board has adopted categorical Standards for Determining Director Independence, a copy of which is attached to this Proxy

Statement as Exhibit A and available on our website at www.emcorgroup.com. To be considered independent, our Board must affirmatively determine that the director has no material relationship with us. Our Board has determined that nine of our

ten current directors are independent, including all members of the Audit Committee of our Board, which we refer to as the “Audit Committee,” the Compensation and Personnel Committee of our Board, which we refer to as the “Compensation

Committee,” and the Corporate Governance Committee, as the term “independent” is defined by the listing standards of the New York Stock Exchange and all applicable rules and regulations of the Securities and Exchange Commission, and in the case

of the Compensation Committee, for purposes of Rule 162(m) of the Internal Revenue Code of 1986, as amended. Our nine independent directors are: John W. Altmeyer, Ronald L. Johnson, David H. Laidley, Carol P. Lowe, M. Kevin McEvoy, William P.

Reid, Steven B. Schwarzwaelder, Robin Walker-Lee and Rebecca A. Weyenberg. Anthony J. Guzzi, our Chairman, President and Chief Executive Officer, is not independent.

Executive Sessions of the

Board. At regularly scheduled meetings of the Board, our independent directors meet without any management representatives present and with Mr. McEvoy, our independent Lead Director,

presiding as Chairman.

Board Leadership Structure. Our Chairman of the Board is Mr. Anthony J. Guzzi. Mr. Guzzi was first elected to the Board on December 15, 2009 and was elected as the Chairman of the Board on June 1, 2018. He presides at

meetings of the Board and at annual meetings of stockholders and sets the agenda for our Board meetings in collaboration with, and subject to the approval of, our independent Lead Director.

Board Committee Charters. Our Board has adopted written charters for its Audit Committee, Compensation Committee, and Corporate Governance Committee. At least annually, each committee reviews its charter and recommends

any proposed changes to the Board for approval. A copy of each committee charter is available on our website at www.emcorgroup.com.

Annual Board Assessments and

Succession Planning. The Board conducts a self-assessment of its performance and effectiveness as well as that of its committees on an annual basis. For 2022, each director completed

a written questionnaire which solicited open-ended and candid feedback on an

anonymous basis. The collective ratings and comments were compiled, summarized and presented to the Board and its committees. During this evaluation process, the Board also conducts succession planning with respect to its own composition and that

of its committees.

Management Succession

Planning. Management conducts regular succession planning reviews with the Board of Directors. During these reviews, our Chief Executive Officer and the Board discuss succession plans for key

positions and identify top talent for development in future leadership roles. The Board is actively engaged in this process and regularly evaluates our succession strategy and leadership pipeline for key roles. High potential leaders are given

exposure and visibility to the Board when they are invited to lead Board presentations and attend informal Board events.

Standards of Conduct. Our Code of Business Conduct and Ethics applies to all of our directors, officers and employees and those of our subsidiaries. In addition, our Board has adopted a separate Code of Ethics for

our Chief Executive Officer and Senior Financial Officers which imposes additional ethical obligations upon them.

Political Activities and

Contributions. We do not use corporate funds for lobbying activities. Our Code of Business Conduct and Ethics prohibits direct or indirect contributions, loans, gifts or services to any

political candidate, campaign, committee, political party or political action committee without the prior written approval of our General Counsel. The Code of Business Conduct and Ethics also prohibits political contributions by employees that

are made on our behalf, reimbursed by the Company or charged to customers. Our General Counsel oversees compliance with these policies, in coordination with our Corporate Governance Committee.

Stockholder Communications. Stockholders and other interested persons may communicate with our Board as a whole, or with one or more members of our Board (including all independent directors) individually or as a group, by

writing to them c/o EMCOR Group, Inc., 301 Merritt Seven, 6th Floor, Norwalk, Connecticut 06851, Attention: Corporate Secretary. Such communications will be forwarded to the individuals addressed. However, the Corporate Secretary will not

forward communications to the Board that advocate illegal activity, are offensive or lewd, have no relevance to the business or operations of the Company, or constitute mass mailings, solicitations or advertisements. The Corporate Secretary

will determine when a communication is not to be forwarded.

Policies and Procedures for

Related Party Transactions. Under our written policy regarding transactions with related parties, which policy is contained in our Corporate Governance Guidelines, we generally require that

any transaction involving $120,000 or more (a “Related Party Transaction”) be approved in advance by the Corporate Governance Committee if we are, or one of our subsidiaries is, a participant in the transaction and if any of the following

persons has a direct or indirect material interest in the transaction:

|

•

|

a director or director nominee;

|

|

•

|

a beneficial holder of 5% or more of our Common Stock, which we refer to as a “Significant Holder;”

|

|

•

|

an immediate family member of an executive officer, director, director nominee or Significant Holder; or

|

|

•

|

an entity which is directly or indirectly owned or controlled by one of the above persons or in which one of the above persons

has a direct or indirect substantial ownership interest.

|

We refer to each of the foregoing as a “Related Party.”

A member of the Board who or whose immediate family member has an

interest in a Related Party Transaction may not participate in the Corporate Governance Committee’s approval process. The Related Party must disclose any such proposed transaction, and all material facts relating to the transaction, to

Ms. Walker-Lee, the Chairperson of our Corporate Governance Committee, and our General Counsel, who is to communicate such information to our Board for its consideration. No such transaction is to be approved if the Corporate Governance Committee

determines that the transaction is inconsistent with our interests and the interests of our stockholders.

In order to ensure that material relationships and Related Party

transactions have been identified, reviewed and disclosed in accordance with applicable policies and procedures, each director and executive officer also completes a questionnaire at the end of each fiscal year that requests confirmation that

there are no material relationships or Related Party Transactions between such individual (or members of such individual’s immediate family) and the Company other than those previously disclosed to the Company.

Environmental

Responsibility and Sustainability. We have adopted governance and oversight policies, and undertaken specific initiatives, to seek to ensure that our business is conducted in compliance with

applicable environmental laws and regulatory requirements and in a manner that reflects our commitment to sustainability and environmental responsibility. We are also focused on structuring our governance and risk-management strategies to

evaluate and address climate-related risks and opportunities.

Our Corporate Governance Committee directly oversees the development

and implementation of these policies and initiatives and engages with management to evaluate our environmental and sustainability goals and metrics. In 2021, we established the EMCOR Group, Inc. Sustainability Task Force, a cross-functional

leadership peer group established to explore, develop, and refine strategies and best practices to meet and track EMCOR’s sustainability goals, including targeted reduction of greenhouse gas (“GhG”) emissions both within our operations and for

our customers. The mission of the Sustainability Task Force is to assist our Board in establishing these goals, including science-based GhG emissions reduction targets, to develop, share and report on the most effective ways to meet those goals,

and collect data to track our progress towards meeting them. The Sustainability Task Force is comprised of a diverse team of leaders in our operations, procurement, safety, and compliance functions, including employees who assist our customers in

reducing their own carbon emissions. Through a steering committee (the “Sustainability Steering Committee”), the Sustainability Task Force provides the Corporate Governance Committee and the Board with periodic reports on its work and progress.

The Sustainability Steering Committee includes senior executives, including our Executive Vice President and Chief Financial Officer, Executive Vice President – Shared Services, Executive Vice President and General Counsel, Senior Vice President

and Chief Accounting Officer, and Vice President for Safety, Quality, and Productivity.

The Company shares the broad concerns about the risks and impacts of

global climate change. While the impact of warming average temperatures on our business is difficult to predict or measure, we believe that our business will be able to serve our customers as they seek to reduce energy consumption and create a

safer and more comfortable environment at their facilities through the construction, installation, retrofit and maintenance of heating, air conditioning and fire protection systems. In addition, our work in the areas of alternative energy sources

and energy infrastructure, as well as the work we do to construct electric vehicle (“EV”) charging stations, EV manufacturing plants and EV battery production facilities, will further provide opportunities for us in market sectors that can help

transition towards a low-carbon economy.

The Corporate Governance Committee and Audit Committee, with support

from our Sustainability Steering Committee and third-party advisors, has prioritized identifying and evaluating risks and opportunities facing our business due to climate change across the short (within one year), medium (one to five years) and

long (beyond five years) term time horizons. This analysis includes physical risks, such as business interruption and impacts to our workforce and job sites, and transition risks, including shifts in market demand, changes to electric and clean

energy equipment and infrastructure, and the impacts of emerging regulations. Certain of the risks the Company may face due to climate change are described within “Item 1A - Risk Factors – Climate Change Related Risk Factors” beginning on page 17

of our Form 10-K for the period ended December 31, 2022.

For 2022, our named executive officers had personal objectives

related to sustainability, including setting and achieving carbon emission reduction goals, as well as a focus on human capital, corporate culture and achieving our safety metrics. A description of those personal objectives, and their impact on

named executive officer compensation, can be found under “Annual Incentive Program” beginning on page

26.

Our policies and initiatives in support of sustainability and

environmental responsibility, and some of the ways in which we contribute to the efforts of our clients and local communities to further those goals, include the following:

|

•

|

Environmental Handbook. We provide our employees with clear

guidelines to identify and comply with broadly-applicable environmental regulatory requirements, in the form of the Environmental Overview Handbook (the “Handbook”). The Handbook is a company-wide resource provided to all employees,

offering practical guidance on key topics of environmental responsibility. We provide our employees with regular training sessions with respect to the Handbook.

|

|

•

|

Environmental and EHS Policies. The EMCOR Group, Inc. Environmental

Policy and EMCOR Group, Inc. Environmental, Health and Safety Policy establish standards relating to the management of environmental impacts and environmental, health and safety for all our operations, applying to all EMCOR employees and

business partners, including vendors and subcontractors.

|

|

•

|

Third-Party Advisors and Accountability. We work closely with a

leading global consulting firm to review compliance company-wide, conduct investigations and, when necessary, advise us on any testing or remediation appropriate to comply with applicable laws, our own internal policies and the

requirements of our customers. In 2018, we also partnered with EcoVadis, an international sustainability platform, to evaluate our sustainability efforts on an annual basis. Our most recent evaluation earned us a “Bronze Recognition

Level” score, in the top 50% of all evaluated companies.

|

|

•

|

Assisting Customers Enhance Efficiency. We provide clients with

expertise, technology and smart solutions to improve energy efficiency and provide greater control over energy use, sourcing and costs. This includes analyzing, designing and reviewing energy projects for customer facilities; lowering

energy costs and reducing our customers’ carbon footprint through facility retrofitting and re-commissioning; Leadership in Energy and Environmental Design (LEED) certification and support; installation, maintenance and support for

photovoltaic, fuel cell, solar, wind, biomass, landfill gas, tidal and biofuel energy generation and transport; waste-heat recovery energy generation and other waste-to-energy systems; energy efficiency program management and consulting,

including operation of customer energy systems and energy producing equipment; energy audits; water system conservation and retrofits; and lighting, mechanical and electrical system retrofits. A recent example of the results of these

efforts is the planned mechanical replacements and lighting retrofits performed by our subsidiary EMCOR Facilities Services, Inc. for a national bank at over 900 retail banking locations across the U.S. The customer is projected to reduce

its GhG emissions by the equivalent of more than 20,000 metric tons of carbon dioxide. To put this in perspective, this amounts to emissions from burning 22,128,184 pounds of coal, emissions from the annual average electricity use of

3,891 homes, or the carbon sequestered by 23,669 acres of forest.

|

|

•

|

Evolving with the Energy Sector. Our industrial services segment

provides specialized service, construction and manufacturing expertise tailored for the complex needs of a range of energy industry clients, from oil and gas operations to cutting edge solar energy projects. Our services help to improve

the energy efficiency of oil and gas refineries and petrochemical plants. As we anticipate that the need for these services may decline in the future, we have started to expand our expertise in this area to include the ability to

construct and maintain carbon capture technologies and alternative energy resources. For example, our subsidiaries Ardent Services, LLC and Rabalais Constructors, LLC recently provided power distribution and DC “power gathering” services

for the Corazon Ranch Solar Farm, a 200-megawatt solar farm in southern Texas. EMCOR’s range of energy infrastructure expertise played a key role in this 16,000 acre, 660,000 photovoltaic solar panel project, capable of powering up to

38,000 homes.

|

|

•

|

Measuring and Reducing our Carbon Footprint. We have implemented a

broad array of internal programs to measure and analyze our GhG emissions, in line with the Greenhouse Gas Protocol, and continue to look for ways to reduce our carbon footprint. In 2015, we launched a company-wide carbon footprint

analysis to measure energy usage and emissions, which includes detailed breakdowns of energy usage by subsidiary operating company, comprehensive fuel consumption tracking, and energy vendor source type and carbon dioxide equivalency. To

improve energy efficiency and reduce emissions, we are installing and maintaining more energy efficient electrical and environmental control systems at our facilities, as well as alternative energy solutions at certain facilities. Since

our largest source of direct carbon emissions is our fleet of approximately 13,200 service vehicles, we are undertaking improvements to equipment and practices across the board to reduce fuel usage and increase efficiency through better

use of our GPS routing and tracking systems, a change in the mix of our fleet by vehicle size and capacity, and the use of hybrid and electric vehicles. Current projects include working with most of the major vehicle manufacturers to

pilot and test more fuel-efficient vehicles. Through this process, we have set a target of reducing our use of carbon-based fuels across our service fleet on a per capita basis by 30 to 40 percent by 2035, based on a 2021 baseline

(following a determination that 2020 would not be a representative baseline due to the adverse impacts of the COVID-19 pandemic in that year).

|

|

•

|

Setting and Achieving Emissions Targets. In recognition of the

importance of reducing global net carbon emissions in the coming decades to prevent the worst consequences of climate change, we have planned to achieve a 20 percent reduction in our per capita Scope 1 and Scope 2 GhG emissions by 2035

(based on a 2021 baseline, and not on 2020, for the reasons discussed above). After engagement with our stockholders, we have retained a leading third-party consulting firm to assist us in evaluating the establishment of independently

verified short, medium, and long-term science-based GhG emissions

|

reduction targets, in line with the Science Based Targets initiative (the “SBTi”). In

December of 2022, we submitted a formal commitment notice regarding setting such targets to the SBTi and are currently undertaking a comprehensive effort to establish those targets.

|

•

|

Air Filtration and Sanitation. The COVID-19 pandemic has

underscored the importance of indoor air quality (IAQ) systems to help protect the health and safety of occupants. Our IAQ services are helping clients address these concerns across a broad range of facilities and industries. Indoor air

pollutants can negatively impact tenant satisfaction and cause serious health problems for occupants who have respiratory conditions, autoimmune disorders or environmental allergies. Airborne pathogens also build up in HVAC systems,

leading to decreases in cooling capacity and reductions in energy efficiency. Our IAQ experts and professional technicians offer a full suite of services aimed at improving health and safety, ranging from routine maintenance and duct

cleaning to the latest in ultra-violet (UV-C) technology and patented ionization products to kill and remove most pathogens. During the COVID-19 pandemic, our customers engaged us to help them increase air filtration and sanitization in

their facilities as part of efforts to keep their employees, customers and tenants safe. We are proud that a number of our services and areas of expertise are important elements of various efforts to address and mitigate the risks and

impacts of health emergencies such as the COVID-19 pandemic.

|

Additional information on our corporate responsibility initiatives

and our services to improve energy efficiency and sustainability as well as health and safety can be found in our Sustainability Report, which is available on our website at www.emcorgroup.com.

Corporate Culture. Our Board oversees our general corporate culture and “tone at the top” established by management. By requiring regular compliance updates from management and supporting training programs at all

levels, our Board works to ensure that the EMCOR Values of Mission First: Integrity, Discipline, and Transparency; People Always: Mutual Respect and Trust, Commitment to Safety, and Teamwork, are reflected in our actions every day.

Board Oversight of Human

Capital Management. Our Board is committed to our EMCOR Values, especially those comprising People Always. Recognizing that our

people are central to this vision, the Board engages in direct oversight of the Company’s human capital management across a broad range of areas, including employee safety, training and development, and succession planning. The Board requires

regular updates on the Company’s safety and training programs and initiatives at all levels and regularly evaluates our success metrics. The Compensation Committee, in close consultation with the full Board and with management, also oversees

the Company’s recruiting, retention, compensation and benefits, regularly evaluating our policies and practices to advance responsible and effective management of the Company’s key resource, its human capital.

We believe that our focus on employee safety and wellbeing is

reflected in our results. During a year in which our people worked a total of approximately 77.5 million hours, the Company’s Total Recordable Incident Rate in 2022 was approximately 1.2, which was approximately 55% lower than the U.S. Bureau of

Labor Statistics’ most recently available industry average of 2.70 for NAICS Code 2382, Building Equipment Contractors. This represents our fourteenth consecutive year with a Total Recordable Incident Rate which was less than half the industry

average. Our position as an industry leader in safety begins with a strong culture of care and vigilance embodied in our EMCOR Values and is supported by a comprehensive suite of training, resources, and analytics. These include our signature Be

There for Life! Zero Injuries Program and Be Vigilant! Campaign, incident and injury prevention planning, including in-person and online training tools and best practice guides available through our company intranet, enterprise level reporting

and analysis of leading and lagging indicators, a 24-hour incident reporting hotline, and a company-wide program to share and champion best safety practices across our range of businesses. These tools are evolving with the way our people work,

including employees in the field. For example, in 2021 we deployed an online safety training program available to any employee on a mobile device.

People Always also includes helping all our employees realize their full potential. This starts by always striving to provide a diverse and inclusive workplace and to provide all employees with an equal

opportunity to succeed in a safe and respectful environment. We believe that a diverse workforce is important to the long-term success of our business. We actively seek to increase the diversity of our workforce and to practice our commitment

to diversity and inclusion in hiring, development and training. This extends to our senior leadership and Board of Directors, where we require any search for new non-management director candidates or for recruited corporate officer positions to

include candidates from underrepresented demographics. We have also designed and

implemented policies and practices to promote a workplace free from discrimination, including our Affirmative Action and Equal Opportunity Policy. The implementation, effectiveness and reporting requirements of such policies are overseen by our

designated Affirmative Action Officer.

All EMCOR employees are required to complete Diversity &

Inclusion Training, and our current and future leaders undergo Implicit Association and Unconscious Bias training. To develop and reinforce our values company-wide and empower our leaders to perform at the highest levels, all senior leaders are

invited to our Leadership for Results course at Babson College and our Leading with Character program at the Thayer Leadership Development Group at West Point. We also work to unlock the full potential of all employees at every level through the

EMCOR Manager Certificate Program to promote supervisor management skills, tuition reimbursement for continuing education through our Degree Assistance Program, and the powerful resources of our online learning platform, the EMCOR Learning

Center, providing thousands of on-demand training courses on a wide range of topics.

Through these programs and the Board’s engagement and oversight, we

strive to remain an employer of choice for the most talented employees in each of the industries and markets in which we operate.

At December 31, 2022, we employed approximately 35,500 people,

approximately 32,000 of whom were located within the United States and approximately 3,500 of whom were located in the United Kingdom.

Based on the most recent information available from our latest

filing with the U.S. Equal Employment Opportunity Commission (the “EEOC”), our U.S. employees had the following gender demographics:

|

Male

|

|

|

90%

|

|

Female

|

|

|

10%

|

Additionally, based on the most recent information available from

our latest EEOC filing, which is available on our website at www.emcorgroup.com/EMCOR_Group_Inc._2021_EEO-1_Report.pdf, our U.S. employees had the following race and ethnicity demographics:

|

Black / African American

|

|

|

8%

|

|

Asian

|

|

|

2%

|

|

Hispanic / Latinx

|

|

|

18%

|

|

White

|

|

|

69%

|

|

Multiracial, Native American, Native Hawaiian and Pacific Islander

|

|

|

3%

|

Approximately 60% of our employees are represented by various unions

pursuant to nearly 450 collective bargaining agreements between our individual subsidiaries or trade associations and local unions, as well as two collective bargaining agreements that are national in scope. We believe that our employee relations

are generally good.

DIVERSITY TABLE

The following table sets forth the gender, ethnicity and other

diverse characteristics for our directors and named executive officers. For further information on the experience and skills of each director standing for re-election, please see the Skills, Qualifications and Experience table on page

21 and “Proposal No. 1 — Election of Directors” on page

57.

|

John W. Altmeyer

|

|

|

Director

|

|

|

Compensation Chairperson

|

|

|

Male

|

|

|

White

|

|

|

|

|

Anthony J. Guzzi

|

|

|

Chairman, President and CEO

|

|

|

|

|

|

Male

|

|

|

White

|

|

|

Veteran

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ronald L. Johnson

|

|

|

Director

|

|

|

Governance

|

|

|

Male

|

|

|

Black and African American

|

|

|

Veteran

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

David H. Laidley

|

|

|

Director

|

|

|

Audit Chairperson

|

|

|

Male

|

|

|

White

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Carol P. Lowe

|

|

|

Director

|

|

|

Audit

|

|

|

Female

|

|

|

White

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

M. Kevin McEvoy

|

|

|

Lead Director

|

|

|

Audit, Compensation and Governance

|

|

|

Male

|

|

|

White

|

|

|

Veteran

|

|

William P. Reid

|

|

|

Director

|

|

|

|

|

|

Male

|

|

|

White

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Steven B. Schwarzwaelder

|

|

|

Director

|

|

|

Compensation

|

|

|

Male

|

|

|

White

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Robin Walker-Lee

|

|

|

Director

|

|

|

Governance Chairperson

|

|

|

Female

|

|

|

White

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rebecca A. Weyenberg

|

|

|

Director

|

|

|

|

|

|

Female

|

|

|

White

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

R. Kevin Matz

|

|

|

EVP – Shared Services

|

|

|

N/A

|

|

|

Male

|

|

|

White

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Maxine L. Mauricio

|

|

|

EVP, General Counsel and Corporate Secretary

|

|

|

N/A

|

|

|

Female

|

|

|

Native Hawaiian and Asian American

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mark A. Pompa

|

|

|

EVP and CFO

|

|

|

N/A

|

|

|

Male

|

|

|

White

|

|

|

|

|

Board of Directors

|

|

|

30%

|

|

|

10%

|

|

|

30%

|

|

Named Executive Officers

|

|

|

25%

|

|

|

25%

|

|

|

25%

|

Engaging with our Community

People Always also includes the responsibility to participate in the communities in which our people live and work, and we partner with local and national causes to support public health and social awareness,

as well as our military service members and their families. These causes include:

|

•

|

The EMCOR Pink Hard Hat Program, supporting breast cancer awareness and highlighting our “Protect Yourself. Get Screened Today”

initiative.

|

|

•

|

EMCOR’s Troop Support Program, supporting veteran employment, sending care packages to active duty servicemembers and providing

education assistance to veterans and their families through the Johnny Mac Soldiers Fund.

|

|

•

|

Combating Human Trafficking by sponsoring Womankind’s Annual Anti-Trafficking Conference and supporting Womankind’s efforts to

help survivors of domestic violence, human trafficking and sexual violence.

|

|

•

|

Our Communities For A Cause program, which supports local charitable causes and community outreach programs of our

subsidiaries. The Company donates to these local organizations, which include food banks, homeless housing projects, community clean-ups, and scholarships.

|

Availability of Corporate

Governance Materials. Our categorical Standards for Determining Director Independence, Corporate Governance Guidelines, including the policies and procedures for Related Party Transactions,

Code of Business Conduct and Ethics, Code of Ethics for our Chief Executive Officer and Senior Financial Officers, and other corporate governance materials may be obtained on our website at www.emcorgroup.com or by writing to us at 301 Merritt

Seven, 6th Floor, Norwalk, Connecticut 06851, Attention: Corporate Secretary.

MEETINGS AND COMMITTEES OF THE BOARD OF DIRECTORS

During 2022, our Board met 11 times, and committees of our Board

held an aggregate of 15 meetings. Each director attended at least 75% of the meetings of our Board and the meetings of the committees on which he or she served during 2022. As provided in our Corporate Governance Guidelines, all directors are

expected to attend annual meetings of our stockholders, and all of our directors standing for re-election who were directors at the time attended the Company’s 2022 Annual Meeting of Stockholders either in person or virtually via the Internet.

Our Board has standing Audit, Compensation, and Corporate Governance

Committees comprised solely of independent directors as defined in the listing standards of the New York Stock Exchange. The members and the principal responsibilities of these committees are as follows:

Audit Committee.

The Audit Committee is comprised of Mr. Laidley, Ms. Lowe, and Mr. McEvoy. Mr. Laidley serves as Chairperson of the Audit Committee. Mr. Laidley is not standing for re-election due to the

Director Retirement Policy described on page 7 under “Director Retirement Policy.” Among other things, it is responsible for:

|

•

|

engaging (subject to ratification by stockholders), overseeing, and discharging our independent auditors;

|

|

•

|

setting our independent auditors’ fees;

|

|

•

|

reviewing the scope and audit procedures of our independent auditors;

|

|

•

|

approving audit and permitted non-audit services;

|

|

•

|

reviewing the senior audit engagement team members;

|

|

•

|

reviewing our annual and quarterly financial statements;

|

|

•

|

receiving periodic reports from our independent auditors and management regarding the auditors’ independence;

|

|

•

|

meeting with our management and independent auditors on matters relating to, among other things, major issues regarding

accounting principles and practices and financial statement presentation, and the adequacy of our internal controls over financial reporting;

|

|

•

|

reviewing our internal auditing and accounting personnel;

|

|

•

|

advising our Board with respect to our policies and procedures regarding compliance with applicable laws and regulations;

|

|

•

|

discussing with our management and independent auditors the Company’s guidelines, policies, programs and practices with respect

to risk assessment and risk management, including, without limitation, cybersecurity and climate related risks, the Company’s major risk exposures, and steps management takes to monitor and control such exposures;

|

|

•

|

confirming, together with the Compensation Committee, that our compensation practices and programs do not encourage excessive

or unnecessary risk; and

|

|

•

|

overseeing of our share repurchase program.

|

The Audit Committee met five times during 2022. Our Board has

determined that each of the members of the Audit Committee, Messrs. McEvoy and Laidley and Ms. Lowe, is an “audit committee financial expert” within the meaning of the rules of the Securities and Exchange Commission.

Board Risk Oversight. Our Board of Directors performs risk oversight primarily through the Audit Committee, whose principal responsibilities are set forth above. In addition, the Board has delegated to the Audit

Committee responsibility for reviewing with management and our independent auditors guidelines and policies with respect to (i) risk assessment and risk management, (ii) our major risk exposures, and (iii) the steps management has taken to

monitor and control such exposures. The Audit Committee receives periodic reports relating to risk assessment and risk management, including cybersecurity risks, from our senior management, including our Chief Executive Officer, Chief Financial

Officer, General Counsel, Chief Information Security Officer, the head of our Internal Audit Department, our Vice President for Risk Management and our independent auditors. A cybersecurity update is provided to the Audit Committee at least

quarterly. The Audit Committee also oversees climate-related risk management and reporting of financial and other data relating to climate impacts. The Company, through its Risk Department with oversight by the Audit Committee, also works with

our insurance carriers to evaluate physical risks

to our facilities and operations that may result from or be exacerbated by climate

change, to ensure that we maintain appropriate levels of insurance coverage to minimize the potential financial impact or business disruption that may occur as a result of such risks. A more detailed discussion of the material risks to our

business, financial position and results of operations, including additional detail about cyber risk and climate change risk, can be found in “Item 1A - Risk Factors” beginning on page 8 of our Form 10-K for the period ended December 31, 2022.

Audit Committee members meet in executive session with

representatives of our independent auditors and separately with the head of our Internal Audit Department. In addition, the Chairperson of the Audit Committee provides a report of each meeting of the Audit Committee to our Board to the extent

that such Audit Committee meeting was not attended by the other directors. However, all Board members are expected to attend the financial results discussion portion of all Audit Committee meetings. Our Board of Directors also provides risk

oversight through its periodic reviews of the financial and operational performance of the Company.

Compensation Committee. The Compensation Committee is comprised of Messrs. Altmeyer, McEvoy and Schwarzwaelder. Mr. Altmeyer serves as the Chairperson of the Compensation Committee. Among other things, it is