Share class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class A | $ | % * |

| Fund net assets (in millions) | $ |

| Total number of portfolio holdings | |

| Portfolio turnover rate | % |

Share class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class A | $ | % * |

| Fund net assets (in millions) | $ |

| Total number of portfolio holdings | |

| Portfolio turnover rate | % |

Share class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class C | $ | % * |

| Fund net assets (in millions) | $ |

| Total number of portfolio holdings | |

| Portfolio turnover rate | % |

Share class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class T | $ | % * |

| Fund net assets (in millions) | $ |

| Total number of portfolio holdings | |

| Portfolio turnover rate | % |

Share class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class F-1 | $ | % * |

| Fund net assets (in millions) | $ |

| Total number of portfolio holdings | |

| Portfolio turnover rate | % |

Share class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class F-2 | $ | % * |

| Fund net assets (in millions) | $ |

| Total number of portfolio holdings | |

| Portfolio turnover rate | % |

Share class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class F-3 | $ | % * |

| Fund net assets (in millions) | $ |

| Total number of portfolio holdings | |

| Portfolio turnover rate | % |

Share class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class 529-A | $ | % * |

| Fund net assets (in millions) | $ |

| Total number of portfolio holdings | |

| Portfolio turnover rate | % |

Share class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class 529-C | $ | % * |

| Fund net assets (in millions) | $ |

| Total number of portfolio holdings | |

| Portfolio turnover rate | % |

Share class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class 529-E | $ | % * |

| Fund net assets (in millions) | $ |

| Total number of portfolio holdings | |

| Portfolio turnover rate | % |

Share class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class 529-T | $ | % * |

| Fund net assets (in millions) | $ |

| Total number of portfolio holdings | |

| Portfolio turnover rate | % |

Share class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class 529-F-1 | $ | % * |

| Fund net assets (in millions) | $ |

| Total number of portfolio holdings | |

| Portfolio turnover rate | % |

Share class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class 529-F-2 | $ | % * |

| Fund net assets (in millions) | $ |

| Total number of portfolio holdings | |

| Portfolio turnover rate | % |

Share class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class 529-F-3 | $ | % * |

| Fund net assets (in millions) | $ |

| Total number of portfolio holdings | |

| Portfolio turnover rate | % |

Share class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class R-1 | $ | % * |

| Fund net assets (in millions) | $ |

| Total number of portfolio holdings | |

| Portfolio turnover rate | % |

Share class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class R-2 | $ | % * |

| Fund net assets (in millions) | $ |

| Total number of portfolio holdings | |

| Portfolio turnover rate | % |

Share class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class R-2E | $ | % * |

| Fund net assets (in millions) | $ |

| Total number of portfolio holdings | |

| Portfolio turnover rate | % |

Share class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class R-3 | $ | % * |

| Fund net assets (in millions) | $ |

| Total number of portfolio holdings | |

| Portfolio turnover rate | % |

Share class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class R-4 | $ | % * |

| Fund net assets (in millions) | $ |

| Total number of portfolio holdings | |

| Portfolio turnover rate | % |

Share class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class R-5E | $ | % * |

| Fund net assets (in millions) | $ |

| Total number of portfolio holdings | |

| Portfolio turnover rate | % |

Share class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class R-5 | $ | % * |

| Fund net assets (in millions) | $ |

| Total number of portfolio holdings | |

| Portfolio turnover rate | % |

Share class | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Class R-6 | $ | % * |

| Fund net assets (in millions) | $ |

| Total number of portfolio holdings | |

| Portfolio turnover rate | % |

ITEM 2 - Code of Ethics

Not applicable for filing of semi-annual reports to shareholders.

ITEM 3 - Audit Committee Financial Expert

Not applicable for filing of semi-annual reports to shareholders.

ITEM 4 - Principal Accountant Fees and Services

Not applicable for filing of semi-annual reports to shareholders.

ITEM 5 - Audit Committee of Listed Registrants

Not applicable to this Registrant, insofar as the Registrant is not a listed issuer as defined in Rule 10A-3 under the Securities Exchange Act of 1934.

ITEM 6 - Investments

The schedule of investments is included as part of the material filed under Item 7 of this Form.

ITEM 7 - Financial Statements and Financial Highlights for Open-End Management Investment Companies

|

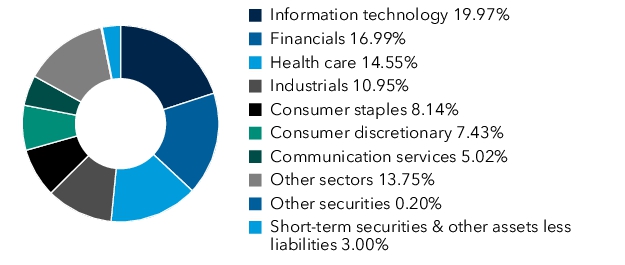

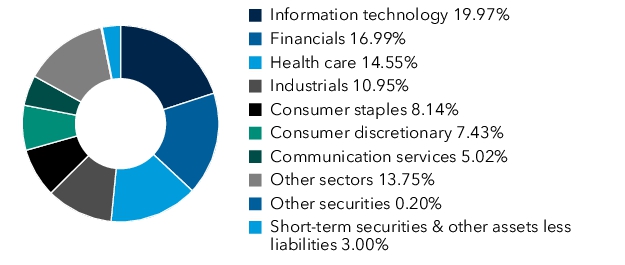

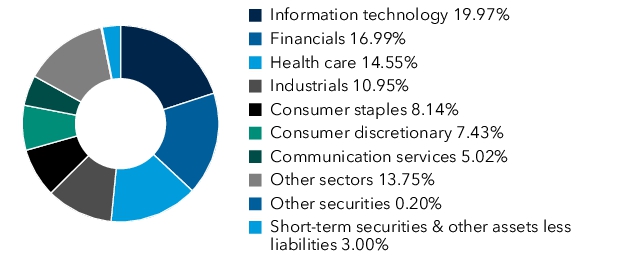

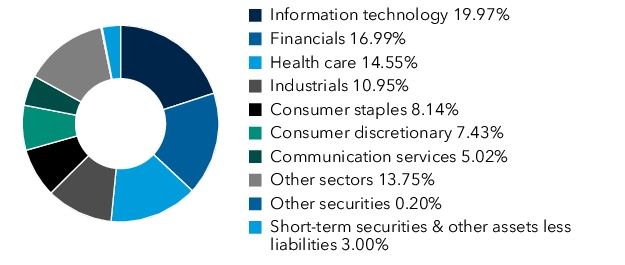

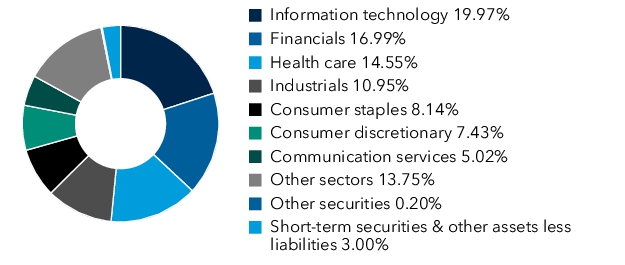

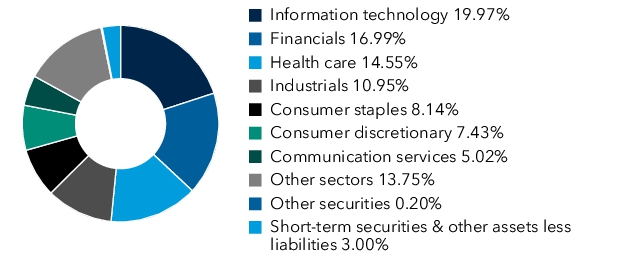

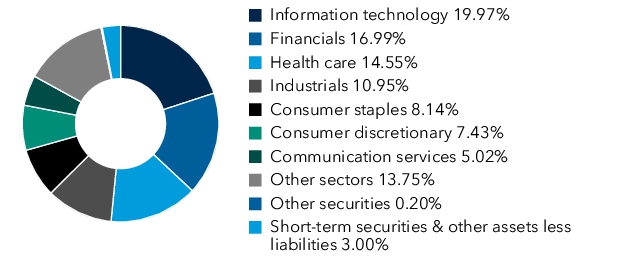

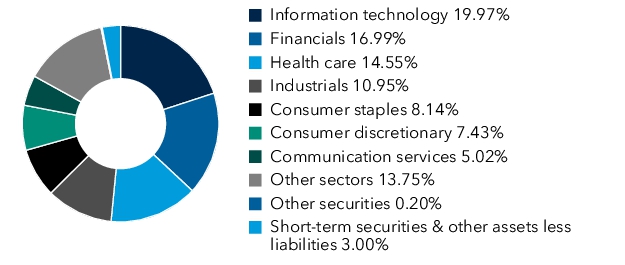

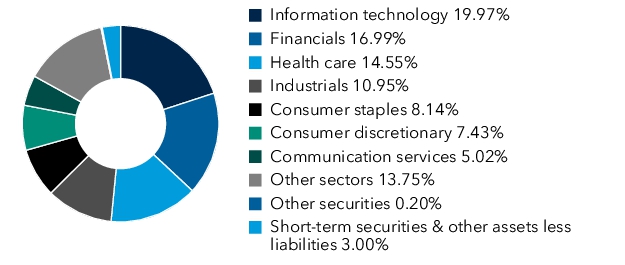

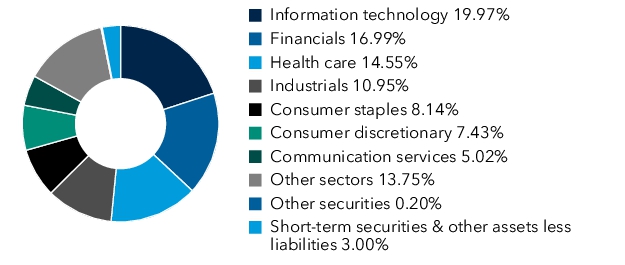

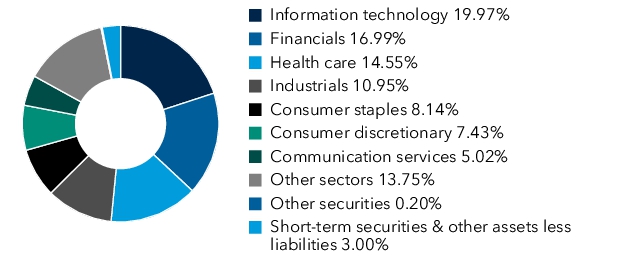

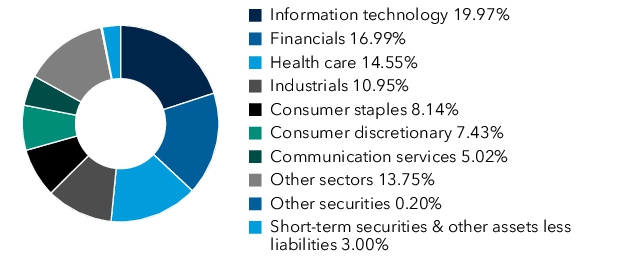

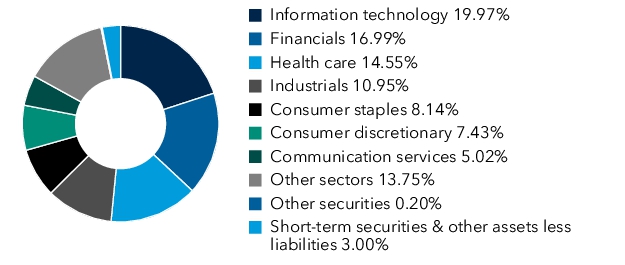

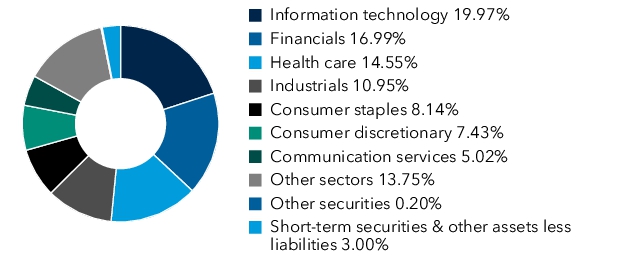

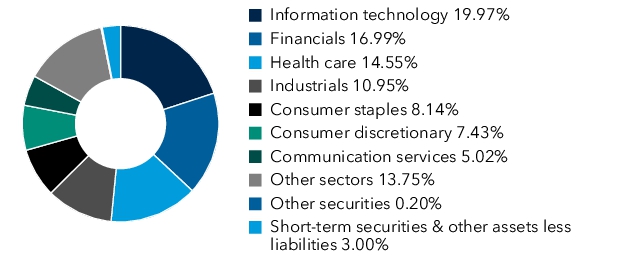

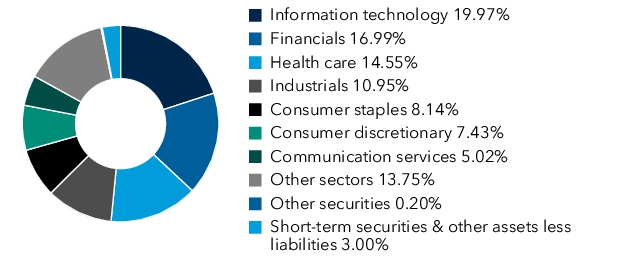

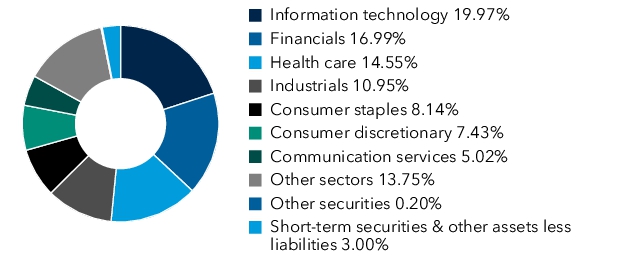

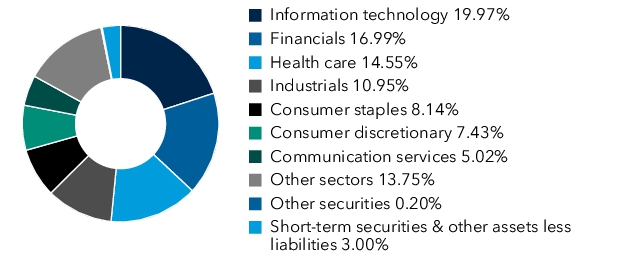

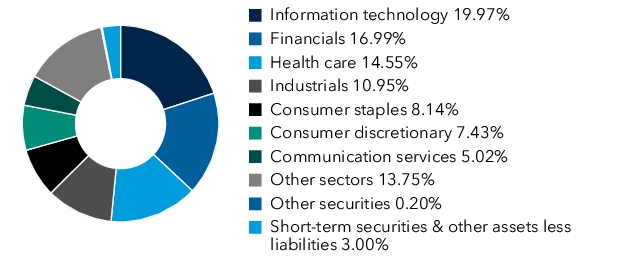

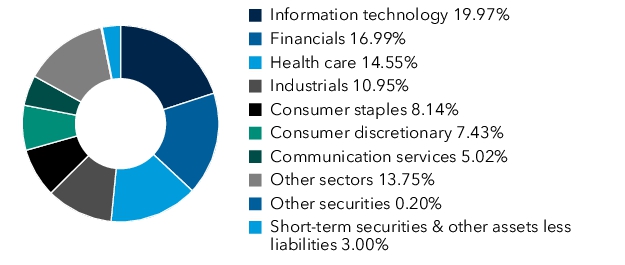

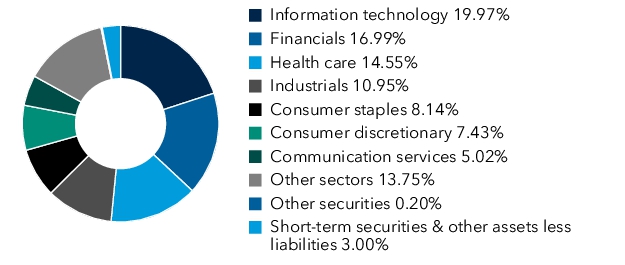

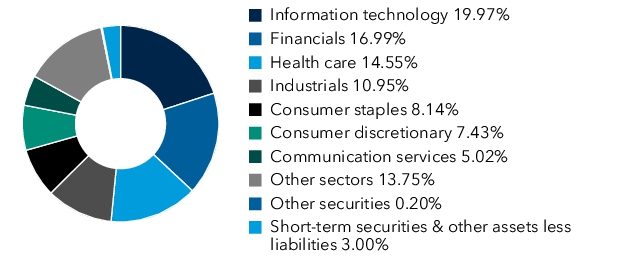

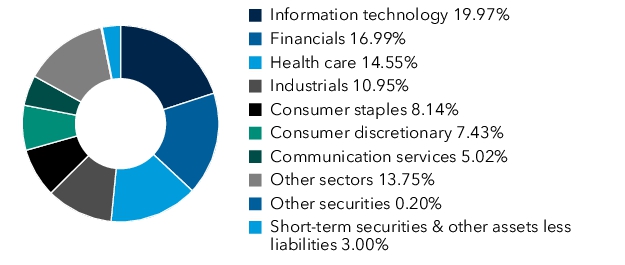

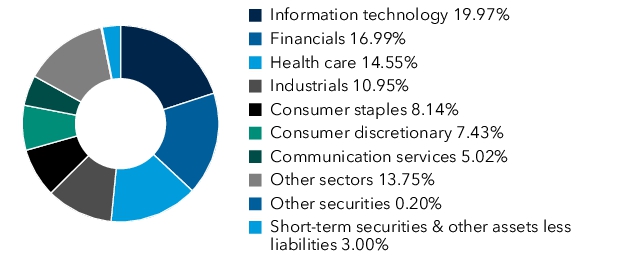

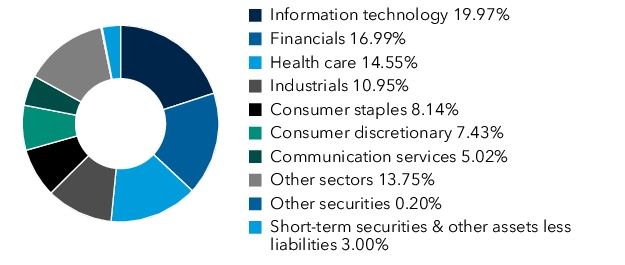

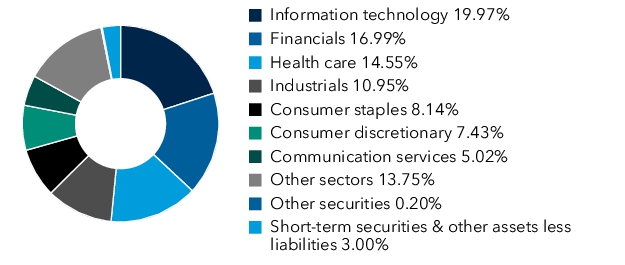

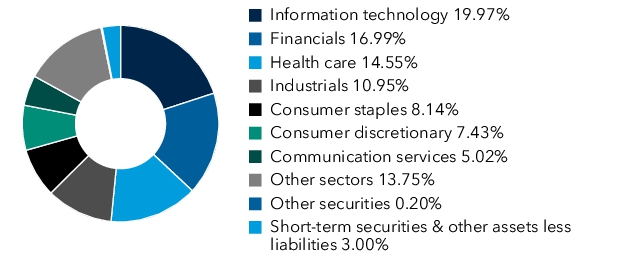

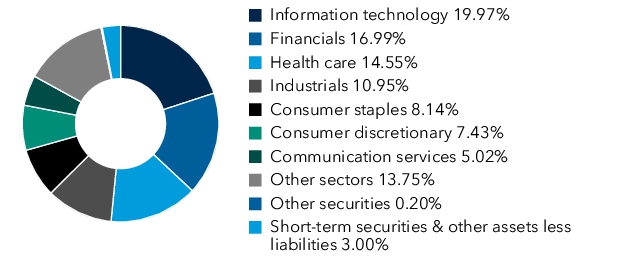

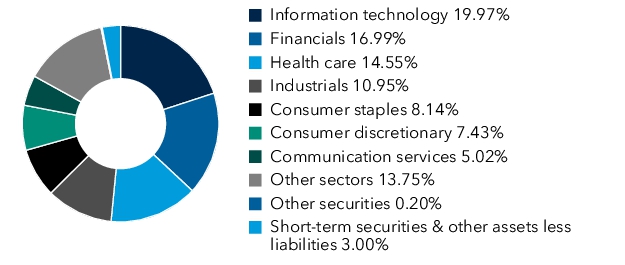

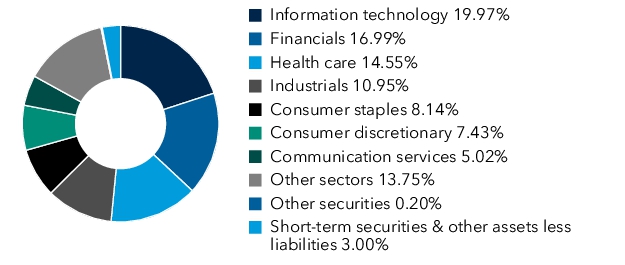

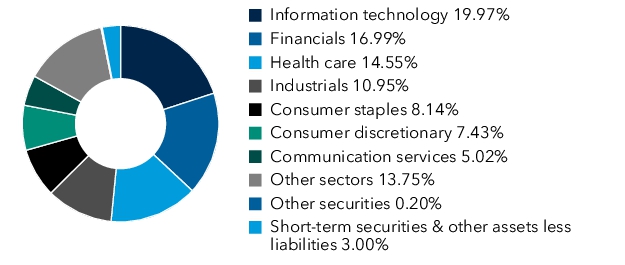

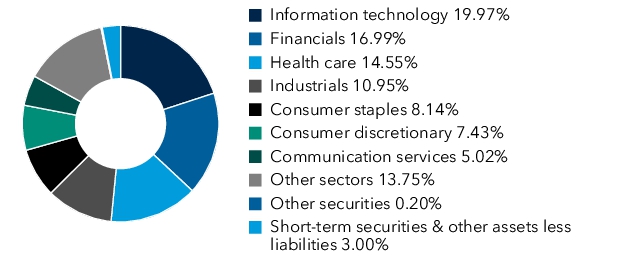

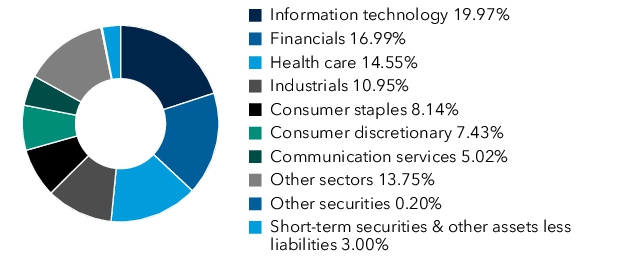

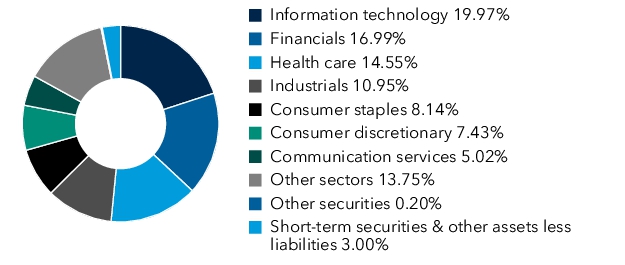

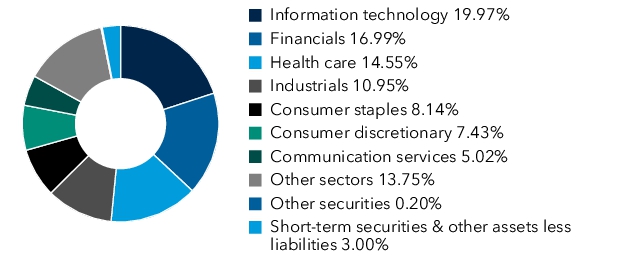

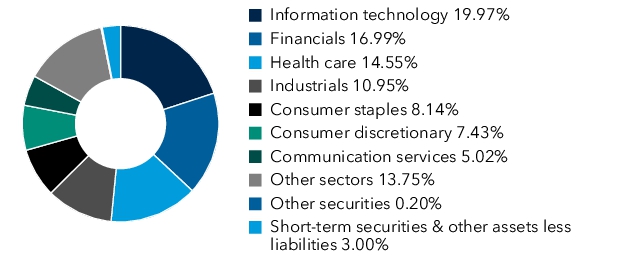

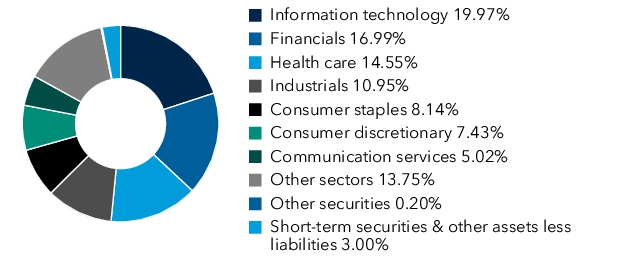

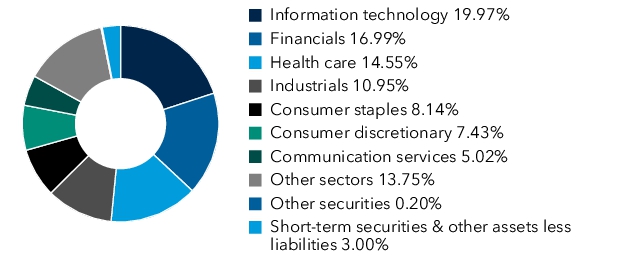

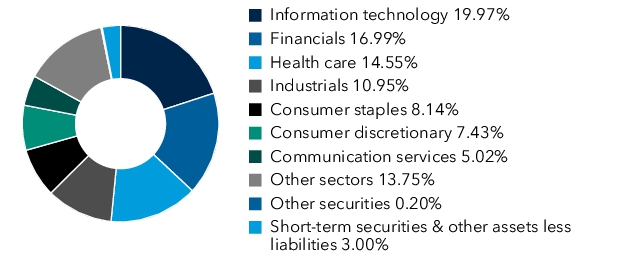

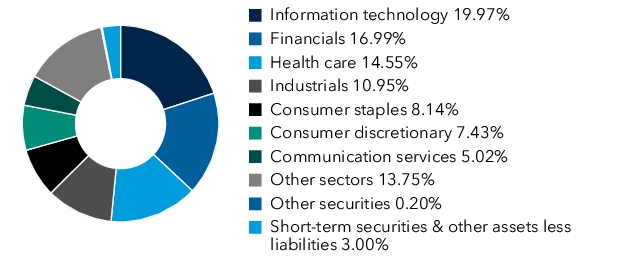

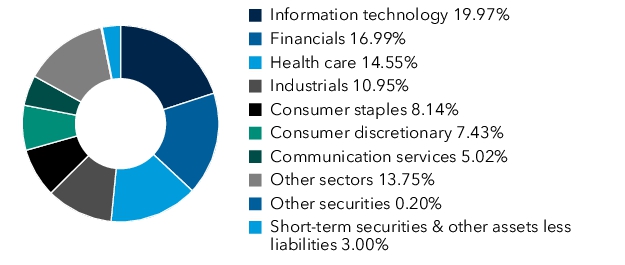

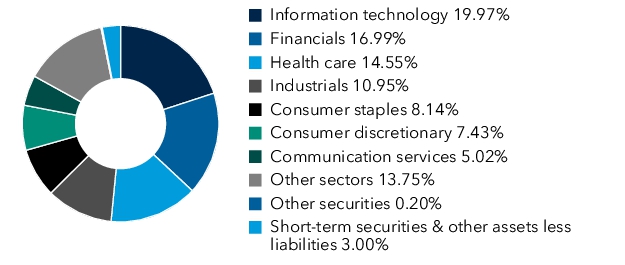

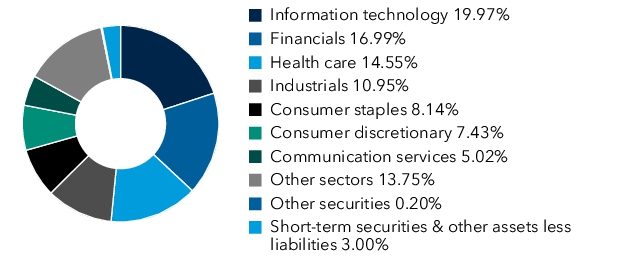

Common stocks 96.80%

|

|

Shares

|

Value

(000)

|

|

|

Energy

4.41%

|

||||

|

Canadian Natural Resources, Ltd.

|

34,959,725

|

$1,189,330

|

||

|

Cenovus Energy, Inc.

|

16,143,893

|

259,432

|

||

|

|

Chevron Corp.

|

4,624,354

|

688,196

|

|

|

|

ConocoPhillips

|

7,389,612

|

809,458

|

|

|

|

EOG Resources, Inc.

|

16,311,754

|

1,989,382

|

|

|

|

Exxon Mobil Corp.

|

17,687,141

|

2,065,504

|

|

|

|

Halliburton Co.

|

21,475,170

|

595,721

|

|

|

|

Schlumberger NV

|

7,239,368

|

290,082

|

|

|

|

South Bow Corp.1

|

1,787,678

|

44,620

|

|

|

|

TC Energy Corp.

|

8,938,391

|

415,725

|

|

|

|

|

|

|

8,347,450

|

|

|

||||

|

Materials

2.80%

|

||||

|

Air Products and Chemicals, Inc.

|

374,095

|

116,168

|

||

|

Celanese Corp.

|

5,101,614

|

642,650

|

||

|

|

Corteva, Inc.

|

13,834,019

|

842,769

|

|

|

|

Freeport-McMoRan, Inc.

|

4,498,454

|

202,520

|

|

|

|

H.B. Fuller Co.

|

1,612,937

|

118,035

|

|

|

|

Linde PLC

|

4,082,436

|

1,862,203

|

|

|

|

LyondellBasell Industries NV

|

2,593,633

|

225,257

|

|

|

|

Mosaic Co.

|

5,993,648

|

160,390

|

|

|

|

Nucor Corp.

|

1,992,519

|

282,619

|

|

|

|

Rio Tinto PLC (ADR)

|

4,614,043

|

299,405

|

|

|

|

Royal Gold, Inc.

|

469,839

|

68,625

|

|

|

|

Wheaton Precious Metals Corp.2

|

7,182,532

|

474,119

|

|

|

|

|

|

|

5,294,760

|

|

|

||||

|

Industrials

10.95%

|

||||

|

3M Co.

|

2,544,126

|

326,844

|

||

|

ABB, Ltd. (ADR)2

|

8,277,862

|

458,842

|

||

|

|

BAE Systems PLC (ADR)

|

3,112,789

|

200,619

|

|

|

|

Boeing Co. (The)1

|

5,197,558

|

776,047

|

|

|

|

Broadridge Financial Solutions, Inc.

|

783,768

|

165,265

|

|

|

|

Carrier Global Corp.

|

8,836,580

|

642,596

|

|

|

|

Caterpillar, Inc.

|

4,878,249

|

1,835,197

|

|

|

|

CSX Corp.

|

19,292,848

|

649,011

|

|

|

|

Deere & Co.

|

1,211,365

|

490,227

|

|

|

|

Delta Air Lines, Inc.

|

5,383,090

|

308,020

|

|

|

|

Equifax, Inc.

|

1,327,805

|

351,895

|

|

|

|

FedEx Corp.

|

1,218,710

|

333,744

|

|

|

|

General Electric Co.

|

12,943,155

|

2,223,375

|

|

|

|

HEICO Corp.

|

771,609

|

189,006

|

|

|

|

Honeywell International, Inc.

|

792,967

|

163,098

|

|

|

|

Ingersoll-Rand, Inc.

|

3,362,567

|

322,806

|

|

|

|

Johnson Controls International PLC

|

9,175,870

|

693,237

|

|

|

|

L3Harris Technologies, Inc.

|

4,070,129

|

1,007,235

|

|

|

|

Lennox International, Inc.

|

150,894

|

90,924

|

|

|

|

Lockheed Martin Corp.

|

310,835

|

169,731

|

|

|

|

Northrop Grumman Corp.

|

3,989,577

|

2,030,775

|

|

|

|

PACCAR, Inc.

|

5,073,423

|

529,057

|

|

|

|

Parker-Hannifin Corp.

|

183,522

|

116,366

|

|

|

|

Paychex, Inc.

|

8,718,321

|

1,214,724

|

|

|

|

Republic Services, Inc.

|

1,181,526

|

233,942

|

|

|

|

RTX Corp.

|

19,531,677

|

2,363,138

|

|

|

|

Southwest Airlines Co.

|

10,061,229

|

307,672

|

|

|

|

TransUnion

|

3,225,040

|

326,697

|

|

|

|

Union Pacific Corp.

|

5,582,057

|

1,295,428

|

|

|

|

United Parcel Service, Inc., Class B

|

1,121,791

|

150,387

|

|

|

|

Veralto Corp.

|

2,340,659

|

239,192

|

|

|

|

Waste Connections, Inc.

|

1,728,053

|

305,433

|

|

|

|

Waste Management, Inc.

|

960,906

|

207,412

|

|

|

|

|

|

|

20,717,942

|

|

1

|

Washington Mutual Investors Fund

|

|

Common stocks (continued)

|

|

Shares

|

Value

(000)

|

|

|

|

||||

|

Consumer

discretionary

7.43%

|

||||

|

Advance Auto Parts, Inc.2

|

521,357

|

$18,606

|

||

|

Amazon.com, Inc.1

|

2,401,029

|

447,552

|

||

|

Chipotle Mexican Grill, Inc.1

|

2,190,250

|

122,150

|

||

|

|

D.R. Horton, Inc.

|

1,997,925

|

337,649

|

|

|

|

Darden Restaurants, Inc.3

|

9,509,021

|

1,521,634

|

|

|

|

General Motors Co.

|

25,155,404

|

1,276,888

|

|

|

|

Home Depot, Inc.

|

6,277,709

|

2,471,848

|

|

|

|

Lennar Corp., Class A

|

1,066,048

|

181,548

|

|

|

|

Marriott International, Inc., Class A

|

1,731,856

|

450,317

|

|

|

|

McDonald’s Corp.

|

1,108,634

|

323,843

|

|

|

|

NIKE, Inc., Class B

|

10,818,582

|

834,437

|

|

|

|

Royal Caribbean Cruises, Ltd.

|

9,214,736

|

1,901,461

|

|

|

|

Sony Group Corp. (ADR)2

|

3,653,445

|

64,301

|

|

|

|

Starbucks Corp.

|

11,689,439

|

1,142,058

|

|

|

|

Tesla, Inc.1

|

420,111

|

104,965

|

|

|

|

TJX Companies, Inc. (The)

|

5,782,062

|

653,547

|

|

|

|

Tractor Supply Co.

|

1,172,850

|

311,403

|

|

|

|

Vail Resorts, Inc.

|

1,835,904

|

304,191

|

|

|

|

YUM! Brands, Inc.

|

12,060,964

|

1,581,916

|

|

|

|

|

|

|

14,050,314

|

|

|

||||

|

Consumer staples

8.14%

|

||||

|

Altria Group, Inc.

|

21,005,626

|

1,143,966

|

||

|

British American Tobacco PLC (ADR)

|

20,574,565

|

719,698

|

||

|

|

Bunge Global SA

|

1,339,540

|

112,548

|

|

|

|

Church & Dwight Co., Inc.

|

3,197,918

|

319,504

|

|

|

|

Coca-Cola Co.

|

8,240,022

|

538,156

|

|

|

|

Constellation Brands, Inc., Class A

|

6,061,459

|

1,408,319

|

|

|

|

Costco Wholesale Corp.

|

561,619

|

490,956

|

|

|

|

Danone (ADR)2

|

26,491,854

|

379,628

|

|

|

|

Dollar General Corp.

|

5,053,180

|

404,457

|

|

|

|

Hershey Co.

|

4,145,088

|

736,085

|

|

|

|

Keurig Dr Pepper, Inc.

|

37,722,927

|

1,242,971

|

|

|

|

Kimberly-Clark Corp.

|

1,645,577

|

220,804

|

|

|

|

Kraft Heinz Co. (The)

|

19,510,449

|

652,820

|

|

|

|

Mondelez International, Inc., Class A

|

7,191,766

|

492,492

|

|

|

|

Philip Morris International, Inc.

|

35,585,119

|

4,722,145

|

|

|

|

Procter & Gamble Co.

|

4,744,619

|

783,716

|

|

|

|

Reckitt Benckiser Group PLC (ADR)

|

4,249,507

|

51,377

|

|

|

|

Sysco Corp.

|

5,144,902

|

385,610

|

|

|

|

Target Corp.

|

3,987,065

|

598,219

|

|

|

|

|

|

|

15,403,471

|

|

|

||||

|

Health care

14.55%

|

||||

|

Abbott Laboratories

|

16,577,414

|

1,879,381

|

||

|

AbbVie, Inc.

|

15,456,359

|

3,151,088

|

||

|

|

Amgen, Inc.

|

2,347,354

|

751,529

|

|

|

|

AstraZeneca PLC (ADR)

|

23,690,375

|

1,685,570

|

|

|

|

Bristol-Myers Squibb Co.

|

6,450,211

|

359,728

|

|

|

|

CVS Health Corp.

|

24,073,519

|

1,359,191

|

|

|

|

Danaher Corp.

|

4,957,041

|

1,217,747

|

|

|

|

Elevance Health, Inc.

|

1,686,862

|

684,461

|

|

|

|

Eli Lilly and Co.

|

6,248,220

|

5,184,398

|

|

|

|

Gilead Sciences, Inc.

|

22,525,757

|

2,000,738

|

|

|

|

Humana, Inc.

|

1,310,778

|

337,958

|

|

|

|

Illumina, Inc.1

|

237,829

|

34,281

|

|

|

|

Johnson & Johnson

|

2,138,653

|

341,885

|

|

|

|

Merck & Co., Inc.

|

6,540,695

|

669,244

|

|

|

|

Novo Nordisk AS, Class B (ADR)

|

3,940,909

|

441,185

|

|

|

|

Pfizer, Inc.

|

11,222,599

|

317,599

|

|

|

|

Regeneron Pharmaceuticals, Inc.1

|

97,677

|

81,873

|

|

|

|

UnitedHealth Group, Inc.

|

9,739,254

|

5,497,809

|

|

|

|

Vertex Pharmaceuticals, Inc.1

|

2,936,678

|

1,397,800

|

|

|

|

Zoetis, Inc., Class A

|

808,214

|

144,492

|

|

|

|

|

|

|

27,537,957

|

|

Washington Mutual Investors Fund

|

2

|

|

Common stocks (continued)

|

|

Shares

|

Value

(000)

|

|

|

|

||||

|

Financials

16.99%

|

||||

|

American Express Co.

|

1,416,991

|

$382,701

|

||

|

Aon PLC, Class A

|

1,730,978

|

635,044

|

||

|

|

Apollo Asset Management, Inc.

|

7,092,861

|

1,016,123

|

|

|

|

Arthur J. Gallagher & Co.

|

3,762,337

|

1,057,969

|

|

|

|

Bank of America Corp.

|

12,167,268

|

508,835

|

|

|

|

BlackRock, Inc.

|

2,360,464

|

2,315,686

|

|

|

|

Blackstone, Inc.

|

10,542,489

|

1,768,503

|

|

|

|

Brookfield Asset Management, Ltd., Class A

|

8,341,072

|

442,410

|

|

|

|

Canadian Imperial Bank of Commerce2

|

4,935,470

|

308,763

|

|

|

|

Capital One Financial Corp.

|

3,606,761

|

587,145

|

|

|

|

Carlyle Group, Inc. (The)

|

5,260,283

|

263,172

|

|

|

|

Chubb, Ltd.

|

5,977,041

|

1,688,156

|

|

|

|

Citizens Financial Group, Inc.

|

18,424,930

|

776,058

|

|

|

|

CME Group, Inc., Class A

|

2,889,466

|

651,170

|

|

|

|

Discover Financial Services

|

7,558,634

|

1,121,928

|

|

|

|

Fifth Third Bancorp

|

3,004,436

|

131,234

|

|

|

|

Goldman Sachs Group, Inc.

|

646,068

|

334,528

|

|

|

|

Intercontinental Exchange, Inc.

|

3,242,799

|

505,455

|

|

|

|

JPMorgan Chase & Co.

|

13,684,503

|

3,036,865

|

|

|

|

KKR & Co., Inc.

|

12,533,272

|

1,732,600

|

|

|

|

Marsh & McLennan Companies, Inc.

|

19,757,546

|

4,311,887

|

|

|

|

Mastercard, Inc., Class A

|

3,780,562

|

1,888,731

|

|

|

|

Morgan Stanley

|

8,864,253

|

1,030,469

|

|

|

|

MSCI, Inc.

|

174,834

|

99,865

|

|

|

|

Nasdaq, Inc.

|

4,020,878

|

297,223

|

|

|

|

PNC Financial Services Group, Inc.

|

1,175,817

|

221,371

|

|

|

|

S&P Global, Inc.

|

1,927,676

|

925,978

|

|

|

|

Truist Financial Corp.

|

14,775,383

|

636,080

|

|

|

|

Visa, Inc., Class A

|

7,564,400

|

2,192,541

|

|

|

|

Wells Fargo & Co.

|

19,805,387

|

1,285,766

|

|

|

|

|

|

|

32,154,256

|

|

|

||||

|

Information

technology

19.97%

|

||||

|

Accenture PLC, Class A

|

1,386,273

|

478,015

|

||

|

Apple, Inc.

|

18,598,890

|

4,201,675

|

||

|

Applied Materials, Inc.

|

6,390,539

|

1,160,394

|

||

|

|

ASM International NV (ADR)

|

466,887

|

260,836

|

|

|

|

ASML Holding NV (ADR)

|

2,110,831

|

1,419,639

|

|

|

|

Broadcom, Inc.

|

69,937,340

|

11,873,262

|

|

|

|

Cadence Design Systems, Inc.1

|

691,589

|

190,962

|

|

|

|

Intel Corp.

|

11,590,730

|

249,432

|

|

|

|

KLA Corp.

|

869,621

|

579,368

|

|

|

|

Microsoft Corp.

|

24,826,990

|

10,088,447

|

|

|

|

Motorola Solutions, Inc.

|

2,658,926

|

1,194,788

|

|

|

|

NetApp, Inc.

|

1,594,318

|

183,841

|

|

|

|

NVIDIA Corp.

|

13,358,758

|

1,773,509

|

|

|

|

Oracle Corp.

|

5,897,355

|

989,812

|

|

|

|

Salesforce, Inc.

|

1,289,634

|

375,761

|

|

|

|

SAP SE (ADR)2

|

7,766,717

|

1,814,616

|

|

|

|

Synopsys, Inc.1

|

554,785

|

284,943

|

|

|

|

Texas Instruments, Inc.

|

3,312,266

|

672,920

|

|

|

|

|

|

|

37,792,220

|

|

|

||||

|

Communication

services

5.02%

|

||||

|

Alphabet, Inc., Class A

|

6,987,667

|

1,195,660

|

||

|

Alphabet, Inc., Class C

|

12,395,139

|

2,140,516

|

||

|

AT&T, Inc.

|

2,584,647

|

58,258

|

||

|

|

Comcast Corp., Class A

|

63,882,387

|

2,789,744

|

|

|

|

Deutsche Telekom AG (ADR)2

|

3,790,388

|

114,508

|

|

|

|

Electronic Arts, Inc.

|

2,052,672

|

309,645

|

|

|

|

Meta Platforms, Inc., Class A

|

3,390,970

|

1,924,647

|

|

|

|

Verizon Communications, Inc.

|

6,891,494

|

290,339

|

|

|

|

Walt Disney Co. (The)

|

7,055,934

|

678,781

|

|

|

|

|

|

|

9,502,098

|

|

3

|

Washington Mutual Investors Fund

|

|

Common stocks (continued)

|

|

Shares

|

Value

(000)

|

|

|

|

||||

|

Utilities

3.73%

|

||||

|

CenterPoint Energy, Inc.

|

9,534,757

|

$281,561

|

||

|

Constellation Energy Corp.

|

7,984,885

|

2,099,705

|

||

|

|

Entergy Corp.

|

2,031,552

|

314,444

|

|

|

|

FirstEnergy Corp.

|

23,653,431

|

989,423

|

|

|

|

NextEra Energy, Inc.

|

2,137,276

|

169,379

|

|

|

|

Public Service Enterprise Group, Inc.

|

4,250,000

|

379,993

|

|

|

|

Sempra

|

17,797,468

|

1,483,775

|

|

|

|

Southern Co. (The)

|

14,626,223

|

1,331,425

|

|

|

|

|

|

|

7,049,705

|

|

|

||||

|

Real estate

2.81%

|

||||

|

American Tower Corp. REIT

|

2,098,900

|

448,199

|

||

|

Equinix, Inc. REIT

|

482,685

|

438,317

|

||

|

|

Extra Space Storage, Inc. REIT

|

7,872,276

|

1,285,543

|

|

|

|

Mid-America Apartment Communities, Inc. REIT

|

3,237,142

|

489,909

|

|

|

|

Prologis, Inc. REIT

|

4,326,156

|

488,596

|

|

|

|

Public Storage REIT

|

791,547

|

260,466

|

|

|

|

Welltower, Inc. REIT

|

14,188,512

|

1,913,746

|

|

|

|

|

|

|

5,324,776

|

|

|

Total common stocks (cost: $103,017,203,000)

|

|

|

183,174,949

|

|

Convertible stocks 0.20%

|

|

|

|

|

|

Industrials

0.16%

|

||||

|

Boeing Co., Series A, convertible preferred depositary shares, 6.00% 10/15/2027

|

5,811,500

|

312,252

|

||

|

|

||||

|

Financials

0.04%

|

||||

|

Apollo Global Management, Inc., Class A, cumulative convertible preferred shares,

6.75% 7/31/2026

|

906,506

|

69,230

|

||

|

Total convertible stocks (cost: $335,900,000)

|

|

|

381,482

|

|

|

Short-term securities 3.14%

|

|

|

|

|

|

Money market investments 3.01%

|

||||

|

|

Capital Group Central Cash Fund 4.87%3,4

|

56,926,986

|

5,692,699

|

|

|

|

|

|

|

|

|

Money market investments purchased with collateral from securities on loan 0.13%

|

||||

|

|

Capital Group Central Cash Fund 4.87%3,4,5

|

934,650

|

93,465

|

|

|

|

Invesco Short-Term Investments Trust – Government & Agency Portfolio,

Institutional Class 4.77%4,5

|

38,864,220

|

38,865

|

|

|

|

BlackRock Liquidity Funds – FedFund, Institutional Shares 4.76%4,5

|

16,400,000

|

16,400

|

|

|

|

Dreyfus Treasury Obligations Cash Management, Institutional Shares 4.72%4,5

|

16,400,000

|

16,400

|

|

|

|

Fidelity Investments Money Market Government Portfolio, Class I 4.70%4,5

|

16,400,000

|

16,400

|

|

|

|

Goldman Sachs Financial Square Government Fund, Institutional Shares 4.70%4,5

|

16,400,000

|

16,400

|

|

|

|

Morgan Stanley Institutional Liquidity Funds – Government Portfolio,

Institutional Class 4.78%4,5

|

16,400,000

|

16,400

|

|

|

|

State Street Institutional U.S. Government Money Market Fund,

Premier Class 4.82%4,5

|

16,083,052

|

16,083

|

|

|

|

RBC Funds Trust – U.S. Government Money Market Fund,

RBC Institutional Class 1 4.77%4,5

|

12,000,000

|

12,000

|

|

|

|

|

|

|

242,413

|

|

|

Total short-term securities (cost: $5,935,138,000)

|

|

|

5,935,112

|

|

|

Total investment securities 100.14% (cost: $109,288,241,000)

|

|

|

189,491,543

|

|

|

Other assets less liabilities (0.14)%

|

|

|

(268,326

)

|

|

|

Net assets 100.00%

|

|

|

$189,223,217

|

|

Washington Mutual Investors Fund

|

4

|

|

|

Value at

5/1/2024

(000)

|

Additions

(000)

|

Reductions

(000)

|

Net

realized

gain (loss)

(000)

|

Net

unrealized

appreciation

(depreciation)

(000)

|

Value at

10/31/2024

(000)

|

Dividend

or interest

income

(000)

|

|

Common stocks 0.80%

|

|

|

|

|

|

|

|

|

Materials 0.00%

|

|

|

|

|

|

|

|

|

Celanese Corp.

6

|

$1,193,729

|

$—

|

$337,492

|

$(16,246

)

|

$(197,341

)

|

$—

|

$9,009

|

|

Consumer discretionary 0.80%

|

|

|

|

|

|

|

|

|

Darden Restaurants, Inc.

|

1,217,193

|

226,493

|

417

|

269

|

78,096

|

1,521,634

|

24,417

|

|

YUM! Brands, Inc.6

|

2,194,316

|

1,253

|

464,394

|

(12,181

)

|

(137,078

)

|

—

|

20,813

|

|

|

|

|

|

|

|

1,521,634

|

|

|

Total common stocks

|

|

|

|

|

|

1,521,634

|

|

|

Short-term securities 3.06%

|

|

|

|

|

|

|

|

|

Money market investments 3.01%

|

|

|

|

|

|

|

|

|

Capital Group Central Cash Fund 4.87%

4

|

6,398,719

|

8,649,566

|

9,355,563

|

235

|

(258

)

|

5,692,699

|

171,548

|

|

Money market investments purchased with collateral

from securities on loan 0.05%

|

|

|

|

|

|

|

|

|

Capital Group Central Cash Fund 4.87%

4,5

|

659

|

92,806

7

|

|

|

|

93,465

|

—

8

|

|

Total short-term securities

|

|

|

|

|

|

5,786,164

|

|

|

Total 3.86%

|

|

|

|

$(27,923

)

|

$(256,581

)

|

$7,307,798

|

$225,787

|

|

1

|

Security did not produce income during the last 12 months.

|

|

2

|

All or a portion of this security was on loan. The total value of all such securities

was $262,170,000, which represented .14% of the net assets of the fund. Refer to

Note 5 for more information on securities lending.

|

|

3

|

Affiliate of the fund or part of the same “group of investment companies“ as the fund, as defined under the Investment Company Act of 1940, as amended.

|

|

4

|

Rate represents the seven-day yield at 10/31/2024.

|

|

5

|

Security purchased with cash collateral from securities on loan. Refer to Note 5 for

more information on securities lending.

|

|

6

|

Affiliated issuer during the reporting period but no longer an affiliate at 10/31/2024.

Refer to the investment portfolio for the security value at 10/31/2024.

|

|

7

|

Represents net activity. Refer to Note 5 for more information on securities lending.

|

|

8

|

Dividend income is included with securities lending income in the fund’s statement of operations and is not shown in this table.

|

|

Key to abbreviation(s)

|

|

ADR = American Depositary Receipts

|

|

REIT = Real Estate Investment Trust

|

|

5

|

Washington Mutual Investors Fund

|

|

Assets:

|

|

|

|

Investment securities, at value (includes $262,170 of

investment securities on loan):

|

|

|

|

Unaffiliated issuers (cost: $102,426,883)

|

$182,183,745

|

|

|

Affiliated issuers (cost: $6,861,358)

|

7,307,798

|

$189,491,543

|

|

Cash

|

|

418

|

|

Cash denominated in currencies other than U.S. dollars (cost: $5,257)

|

|

5,257

|

|

Receivables for:

|

|

|

|

Sales of investments

|

204,352

|

|

|

Sales of fund’s shares

|

127,968

|

|

|

Dividends

|

210,511

|

|

|

Securities lending income

|

63

|

|

|

Other

|

3

|

542,897

|

|

|

|

190,040,115

|

|

Liabilities:

|

|

|

|

Collateral for securities on loan

|

|

242,413

|

|

Payables for:

|

|

|

|

Purchases of investments

|

368,722

|

|

|

Repurchases of fund’s shares

|

121,931

|

|

|

Investment advisory services

|

36,325

|

|

|

Services provided by related parties

|

28,207

|

|

|

Board members’ deferred compensation

|

18,429

|

|

|

Other

|

871

|

574,485

|

|

Net assets at October 31, 2024

|

|

$189,223,217

|

|

Net assets consist of:

|

|

|

|

Capital paid in on shares of beneficial interest

|

|

$100,981,306

|

|

Total distributable earnings (accumulated loss)

|

|

88,241,911

|

|

Net assets at October 31, 2024

|

|

$189,223,217

|

|

Washington Mutual Investors Fund

|

6

|

|

|

Net assets

|

Shares

outstanding

|

Net asset value

per share

|

|

Class A

|

$87,461,875

|

1,374,726

|

$63.62

|

|

Class C

|

1,390,282

|

22,279

|

62.40

|

|

Class T

|

15

|

—

*

|

63.61

|

|

Class F-1

|

2,286,409

|

36,135

|

63.27

|

|

Class F-2

|

35,014,803

|

551,127

|

63.53

|

|

Class F-3

|

11,230,991

|

176,636

|

63.58

|

|

Class 529-A

|

3,498,855

|

55,182

|

63.41

|

|

Class 529-C

|

75,965

|

1,207

|

62.94

|

|

Class 529-E

|

112,268

|

1,786

|

62.86

|

|

Class 529-T

|

25

|

—

*

|

63.61

|

|

Class 529-F-1

|

18

|

—

*

|

63.14

|

|

Class 529-F-2

|

438,398

|

6,892

|

63.61

|

|

Class 529-F-3

|

111

|

2

|

63.61

|

|

Class R-1

|

67,105

|

1,071

|

62.63

|

|

Class R-2

|

778,545

|

12,510

|

62.23

|

|

Class R-2E

|

118,578

|

1,877

|

63.18

|

|

Class R-3

|

1,729,690

|

27,536

|

62.82

|

|

Class R-4

|

2,652,049

|

42,015

|

63.12

|

|

Class R-5E

|

557,063

|

8,776

|

63.47

|

|

Class R-5

|

662,692

|

10,422

|

63.59

|

|

Class R-6

|

41,147,480

|

646,313

|

63.66

|

|

7

|

Washington Mutual Investors Fund

|

|

Investment income:

|

|

|

|

Income:

|

|

|

|

Dividends (net of non-U.S. taxes of $10,646;

also includes $225,787 from affiliates)

|

$1,871,119

|

|

|

Interest from unaffiliated issuers

|

1,360

|

|

|

Securities lending income (net of fees)

|

820

|

$1,873,299

|

|

Fees and expenses*:

|

|

|

|

Investment advisory services

|

207,585

|

|

|

Distribution services

|

130,449

|

|

|

Transfer agent services

|

50,499

|

|

|

Administrative services

|

28,011

|

|

|

529 plan services

|

1,123

|

|

|

Reports to shareholders

|

1,403

|

|

|

Registration statement and prospectus

|

1,265

|

|

|

Board members’ compensation

|

1,971

|

|

|

Auditing and legal

|

298

|

|

|

Custodian

|

3,010

|

|

|

Other

|

163

|

425,777

|

|

Net investment income

|

|

1,447,522

|

|

Net realized gain (loss) and unrealized appreciation (depreciation):

|

|

|

|

Net realized gain (loss) on:

|

|

|

|

Investments:

|

|

|

|

Unaffiliated issuers

|

7,585,927

|

|

|

Affiliated issuers

|

(27,923

)

|

|

|

In-kind redemptions

|

35,981

|

|

|

Currency transactions

|

(200

)

|

7,593,785

|

|

Net unrealized appreciation (depreciation) on:

|

|

|

|

Investments:

|

|

|

|

Unaffiliated issuers

|

11,964,091

|

|

|

Affiliated issuers

|

(256,581

)

|

|

|

Currency translations

|

10

|

11,707,520

|

|

Net realized gain (loss) and unrealized appreciation (depreciation)

|

|

19,301,305

|

|

Net increase (decrease) in net assets resulting from operations

|

|

$20,748,827

|

|

Washington Mutual Investors Fund

|

8

|

|

|

Six months ended

October 31,

|

Year ended

April 30,

|

|

|

2024*

|

2024

|

|

|

|

|

|

Operations:

|

|

|

|

Net investment income

|

$1,447,522

|

$2,934,207

|

|

Net realized gain (loss)

|

7,593,785

|

12,179,738

|

|

Net unrealized appreciation (depreciation)

|

11,707,520

|

13,891,146

|

|

Net increase (decrease) in net assets resulting from operations

|

20,748,827

|

29,005,091

|

|

Distributions paid to shareholders

|

(9,333,812

)

|

(10,257,462

)

|

|

Net capital share transactions

|

3,871,852

|

1,554,663

|

|

Total increase (decrease) in net assets

|

15,286,867

|

20,302,292

|

|

Net assets:

|

|

|

|

Beginning of period

|

173,936,350

|

153,634,058

|

|

End of period

|

$189,223,217

|

$173,936,350

|

|

9

|

Washington Mutual Investors Fund

|

|

Share class

|

Initial sales charge

|

Contingent deferred sales

charge upon redemption

|

Conversion feature

|

|

Classes A and 529-A

|

Up to 5.75% for

Class A; up to 3.50% for

Class 529-A

|

None (except 1.00% for certain

redemptions within 18 months of purchase

without an initial sales charge)

|

None

|

|

Classes C and 529-C

|

None

|

1.00% for redemptions within one year of

purchase

|

Class C converts to Class A

after eight years and Class 529-C

converts to Class 529-A after five years

|

|

Class 529-E

|

None

|

None

|

None

|

|

Classes T and 529-T*

|

Up to 2.50%

|

None

|

None

|

|

Classes F-1, F-2, F-3, 529-F-1,

529-F-2 and 529-F-3

|

None

|

None

|

None

|

|

Classes R-1, R-2, R-2E, R-3, R-4,

R-5E, R-5 and R-6

|

None

|

None

|

None

|

|

Washington Mutual Investors Fund

|

10

|

|

11

|

Washington Mutual Investors Fund

|

|

Washington Mutual Investors Fund

|

12

|

|

13

|

Washington Mutual Investors Fund

|

|

Undistributed ordinary income

|

$400,411

|

|

Undistributed long-term capital gains

|

8,034,054

|

|

Gross unrealized appreciation on investments

|

$81,922,630

|

|

Gross unrealized depreciation on investments

|

(1,806,902

)

|

|

Net unrealized appreciation (depreciation) on investments

|

80,115,728

|

|

Cost of investments

|

109,375,815

|

|

|

Six months ended October 31, 2024

|

Year ended April 30, 2024

|

||||

|

Share class

|

Ordinary

income

|

Long-term

capital gains

|

Total

distributions

paid

|

Ordinary

income

|

Long-term

capital gains

|

Total

distributions

paid

|

|

Class A

|

$558,608

|

$3,725,157

|

$4,283,765

|

$1,289,727

|

$3,415,650

|

$4,705,377

|

|

Class C

|

4,043

|

61,972

|

66,015

|

12,914

|

61,450

|

74,364

|

|

Class T

|

—

*

|

1

|

1

|

—

*

|

1

|

1

|

|

Class F-1

|

13,932

|

97,880

|

111,812

|

34,325

|

95,971

|

130,296

|

|

Class F-2

|

254,482

|

1,479,384

|

1,733,866

|

565,839

|

1,336,514

|

1,902,353

|

|

Class F-3

|

84,737

|

455,664

|

540,401

|

178,292

|

397,074

|

575,366

|

|

Class 529-A

|

21,722

|

150,154

|

171,876

|

50,866

|

138,493

|

189,359

|

|

Class 529-C

|

202

|

3,501

|

3,703

|

704

|

3,684

|

4,388

|

|

Class 529-E

|

575

|

4,861

|

5,436

|

1,444

|

4,619

|

6,063

|

|

Class 529-T

|

—

*

|

1

|

1

|

—

*

|

1

|

1

|

|

Class 529-F-1

|

—

*

|

1

|

1

|

—

*

|

1

|

1

|

|

Class 529-F-2

|

3,183

|

18,315

|

21,498

|

6,761

|

15,849

|

22,610

|

|

Class 529-F-3

|

1

|

7

|

8

|

—

*

|

1

|

1

|

|

Class R-1

|

186

|

2,947

|

3,133

|

574

|

2,830

|

3,404

|

|

Class R-2

|

2,174

|

34,588

|

36,762

|

6,823

|

32,541

|

39,364

|

|

Class R-2E

|

484

|

5,167

|

5,651

|

1,244

|

4,622

|

5,866

|

|

Class R-3

|

8,400

|

76,493

|

84,893

|

21,734

|

71,851

|

93,585

|

|

Class R-4

|

16,636

|

116,059

|

132,695

|

41,487

|

114,114

|

155,601

|

|

Class R-5E

|

3,817

|

22,338

|

26,155

|

10,148

|

24,368

|

34,516

|

|

Class R-5

|

5,159

|

29,298

|

34,457

|

12,813

|

30,264

|

43,077

|

|

Class R-6

|

320,464

|

1,751,219

|

2,071,683

|

701,854

|

1,570,015

|

2,271,869

|

|

Total

|

$1,298,805

|

$8,035,007

|

$9,333,812

|

$2,937,549

|

$7,319,913

|

$10,257,462

|

|

Washington Mutual Investors Fund

|

14

|

|

Share class

|

Currently approved limits

|

Plan limits

|

|

Class A

|

0.25

%

|

0.25

%

|

|

Class 529-A

|

0.25

|

0.50

|

|

Classes C, 529-C and R-1

|

1.00

|

1.00

|

|

Class R-2

|

0.75

|

1.00

|

|

Class R-2E

|

0.60

|

0.85

|

|

Classes 529-E and R-3

|

0.50

|

0.75

|

|

Classes T, F-1, 529-T, 529-F-1 and R-4

|

0.25

|

0.50

|

|

15

|

Washington Mutual Investors Fund

|

|

Share class

|

Distribution

services

|

Transfer agent

services

|

Administrative

services

|

529 plan

services

|

|

Class A

|

$104,771

|

$23,988

|

$12,984

|

Not applicable

|

|

Class C

|

6,953

|

387

|

211

|

Not applicable

|

|

Class T

|

—

|

—

*

|

—

*

|

Not applicable

|

|

Class F-1

|

2,796

|

1,333

|

340

|

Not applicable

|

|

Class F-2

|

Not applicable

|

18,928

|

5,167

|

Not applicable

|

|

Class F-3

|

Not applicable

|

61

|

1,611

|

Not applicable

|

|

Class 529-A

|

3,976

|

888

|

520

|

$953

|

|

Class 529-C

|

386

|

21

|

12

|

22

|

|

Class 529-E

|

275

|

15

|

17

|

30

|

|

Class 529-T

|

—

|

—

*

|

—

*

|

—

*

|

|

Class 529-F-1

|

—

|

—

*

|

—

*

|

—

*

|

|

Class 529-F-2

|

Not applicable

|

77

|

64

|

118

|

|

Class 529-F-3

|

Not applicable

|

—

*

|

—

*

|

—

*

|

|

Class R-1

|

332

|

29

|

10

|

Not applicable

|

|

Class R-2

|

2,930

|

1,310

|

117

|

Not applicable

|

|

Class R-2E

|

357

|

117

|

18

|

Not applicable

|

|

Class R-3

|

4,350

|

1,268

|

261

|

Not applicable

|

|

Class R-4

|

3,323

|

1,277

|

400

|

Not applicable

|

|

Class R-5E

|

Not applicable

|

404

|

81

|

Not applicable

|

|

Class R-5

|

Not applicable

|

167

|

101

|

Not applicable

|

|

Class R-6

|

Not applicable

|

229

|

6,097

|

Not applicable

|

|

|

|

|

|

|

|

Total class-specific expenses

|

$130,449

|

$50,499

|

$28,011

|

$1,123

|

|

Washington Mutual Investors Fund

|

16

|

|

|

Sales*

|

Reinvestments of

distributions

|

Repurchases*

|

Net increase

(decrease)

|

||||

|

Share class

|

Amount

|

Shares

|

Amount

|

Shares

|

Amount

|

Shares

|

Amount

|

Shares

|

|

Six months ended October 31, 2024

|

||||||||

|

Class A

|

$1,807,337

|

29,040

|

$4,205,506

|

70,062

|

$(4,642,513

)

|

(74,722

)

|

$1,370,330

|

24,380

|

|

Class C

|

81,313

|

1,331

|

65,625

|

1,115

|

(182,032

)

|

(2,984

)

|

(35,094

)

|

(538

)

|

|

Class T

|

—

|

—

|

—

|

—

|

—

|

—

|

—

|

—

|

|

Class F-1

|

71,977

|

1,169

|

110,696

|

1,854

|

(160,869

)

|

(2,607

)

|

21,804

|

416

|

|

Class F-2

|

2,910,134

|

46,967

|

1,699,247

|

28,344

|

(3,853,523

)

|

(62,054

)

|

755,858

|

13,257

|

|

Class F-3

|

1,261,513

|

20,226

|

533,504

|

8,890

|

(980,755

)

|

(15,804

)

|

814,262

|

13,312

|

|

Class 529-A

|

143,244

|

2,307

|

171,847

|

2,873

|

(267,047

)

|

(4,319

)

|

48,044

|

861

|

|

Class 529-C

|

7,470

|

121

|

3,702

|

63

|

(17,162

)

|

(279

)

|

(5,990

)

|

(95

)

|

|

Class 529-E

|

5,843

|

95

|

5,435

|

92

|

(10,339

)

|

(169

)

|

939

|

18

|

|

Class 529-T

|

—

|

—

|

1

|

—

†

|

—

|

—

|

1

|

—

†

|

|

Class 529-F-1

|

—

|

—

|

1

|

—

†

|

—

|

—

|

1

|

—

†

|

|

Class 529-F-2

|

35,970

|

578

|

21,495

|

358

|

(39,805

)

|

(640

)

|

17,660

|

296

|

|

Class 529-F-3

|

23

|

1

|

8

|

—

†

|

(69

)

|

(1

)

|

(38

)

|

—

†

|

|

Class R-1

|

3,429

|

56

|

3,132

|

53

|

(6,095

)

|

(99

)

|

466

|

10

|

|

Class R-2

|

50,539

|

829

|

36,758

|

626

|

(91,489

)

|

(1,500

)

|

(4,192

)

|

(45

)

|

|

Class R-2E

|

9,903

|

162

|

5,651

|

95

|

(14,710

)

|

(239

)

|

844

|

18

|

|

Class R-3

|

109,276

|

1,778

|

84,784

|

1,431

|

(212,060

)

|

(3,453

)

|

(18,000

)

|

(244

)

|

|

Class R-4

|

97,578

|

1,582

|

132,680

|

2,229

|

(266,953

)

|

(4,333

)

|

(36,695

)

|

(522

)

|

|

Class R-5E

|

60,766

|

986

|

26,151

|

436

|

(44,340

)

|

(715

)

|

42,577

|

707

|

|

Class R-5

|

25,119

|

404

|

34,163

|

569

|

(86,523

)

|

(1,394

)

|

(27,241

)

|

(421

)

|

|

Class R-6

|

1,367,697

|

22,051

|

2,071,329

|

34,479

|

(2,512,710

)

|

(40,472

)

|

926,316

|

16,058

|

|

Total net increase

(decrease)

|

$8,049,131

|

129,683

|

$9,211,715

|

153,569

|

$(13,388,994

)

|

(215,784

)

|

$3,871,852

|

67,468

|

|

17

|

Washington Mutual Investors Fund

|

|

|

Sales*

|

Reinvestments of

distributions

|

Repurchases*

|

Net increase

(decrease)

|

||||

|

Share class

|

Amount

|

Shares

|

Amount

|

Shares

|

Amount

|

Shares

|

Amount

|

Shares

|

|

Year ended April 30, 2024

|

||||||||

|

Class A

|

$3,665,274

|

65,121

|

$4,615,092

|

83,465

|

$(8,129,220

)

|

(144,910

)

|

$151,146

|

3,676

|

|

Class C

|

166,846

|

3,016

|

73,874

|

1,363

|

(370,783

)

|

(6,706

)

|

(130,063

)

|

(2,327

)

|

|

Class T

|

—

|

—

|

—

|

—

|

—

|

—

|

—

|

—

|

|

Class F-1

|

109,754

|

1,966

|

129,064

|

2,349

|

(441,124

)

|

(7,978

)

|

(202,306

)

|

(3,663

)

|

|

Class F-2

|

4,986,562

|

88,863

|

1,863,182

|

33,718

|

(5,937,917

)

|

(106,023

)

|

911,827

|

16,558

|

|

Class F-3

|

1,766,211

|

31,453

|

568,662

|

10,280

|

(1,772,662

)

|

(31,582

)

|

562,211

|

10,151

|

|

Class 529-A

|

273,594

|

4,879

|

189,283

|

3,435

|

(497,288

)

|

(8,905

)

|

(34,411

)

|

(591

)

|

|

Class 529-C

|

16,189

|

291

|

4,386

|

80

|

(35,263

)

|

(636

)

|

(14,688

)

|

(265

)

|

|

Class 529-E

|

7,418

|

134

|

6,062

|

111

|

(18,767

)

|

(340

)

|

(5,287

)

|

(95

)

|

|

Class 529-T

|

—

|

—

|

1

|

—

†

|

—

|

—

|

1

|

—

†

|

|

Class 529-F-1

|

—

|

—

|

1

|

—

†

|

—

|

—

|

1

|

—

†

|

|

Class 529-F-2

|

66,907

|

1,190

|

22,603

|

408

|

(63,302

)

|

(1,130

)

|

26,208

|

468

|

|

Class 529-F-3

|

130

|

2

|

1

|

—

†

|

—

|

—

|

131

|

2

|

|

Class R-1

|

6,394

|

116

|

3,376

|

62

|

(15,302

)

|

(280

)

|

(5,532

)

|

(102

)

|

|

Class R-2

|

116,286

|

2,122

|

39,336

|

728

|

(175,588

)

|

(3,195

)

|

(19,966

)

|

(345

)

|

|

Class R-2E

|

19,210

|

343

|

5,866

|

107

|

(23,814

)

|

(428

)

|

1,262

|

22

|

|

Class R-3

|

213,728

|

3,855

|

93,480

|

1,712

|

(353,972

)

|

(6,392

)

|

(46,764

)

|

(825

)

|

|

Class R-4

|

204,112

|

3,638

|

155,574

|

2,837

|

(583,273

)

|

(10,490

)

|

(223,587

)

|

(4,015

)

|

|

Class R-5E

|

98,373

|

1,745

|

34,515

|

625

|

(225,601

)

|

(3,841

)

|

(92,713

)

|

(1,471

)

|

|

Class R-5

|

59,677

|

1,059

|

42,729

|

775

|

(203,281

)

|

(3,655

)

|

(100,875

)

|

(1,821

)

|

|

Class R-6

|

3,122,527

|

55,403

|

2,271,459

|

41,030

|

(4,615,918

)

|

(82,803

)

|

778,068

|

13,630

|

|

Total net increase

(decrease)

|

$14,899,192

|

265,196

|

$10,118,546

|

183,085

|

$(23,463,075

)

|

(419,294

)

|

$1,554,663

|

28,987

|

|

Washington Mutual Investors Fund

|

18

|

|

|

|

Income (loss) from investment operations1

|

Dividends and distributions

|

|

|

|

|

|

|

||||

|

Year ended

|

Net asset

value,

beginning

of year

|

Net

investment

income

(loss)

|

Net gains

(losses) on

securities

(both

realized and

unrealized)

|

Total from

investment

operations

|

Dividends

(from net

investment

income)

|

Distributions

(from capital

gains)

|

Total

dividends

and

distributions

|

Net asset

value,

end

of year

|

Total return2,3

|

Net assets,

end of

year

(in millions)

|

Ratio of

expenses to

average net

assets before

reimburse-

ments4

|

Ratio of

expenses to

average net

assets after

reimburse-

ments3,4

|

Ratio of

net income

(loss) to

average

net assets3

|

|

|

|||||||||||||

|

Class A:

|

|||||||||||||

|

10/31/20245,6

|

$59.84

|

$.45

|

$6.51

|

$6.96

|

$(.41

)

|

$(2.77

)

|

$(3.18

)

|

$63.62

|

11.97

%7

|

$87,462

|

.56

%8

|

.56

%8

|

1.45

%8

|

|

4/30/2024

|

53.38

|

.95

|

9.02

|

9.97

|

(.96

)

|

(2.55

)

|

(3.51

)

|

59.84

|

19.36

|

80,801

|

.57

|

.57

|

1.69

|

|

4/30/2023

|

55.52

|

1.00

|

.15

|

1.15

|

(1.02

)

|

(2.27

)

|

(3.29

)

|

53.38

|

2.45

|

71,892

|

.57

|

.57

|

1.91

|

|

4/30/2022

|

56.35

|

.92

|

1.91

|

2.83

|

(.85

)

|

(2.81

)

|

(3.66

)

|

55.52

|

4.98

|

72,922

|

.57

|

.57

|

1.59

|

|

4/30/2021

|

41.94

|

.83

|

15.12

|

15.95

|

(.87

)

|

(.67

)

|

(1.54

)

|

56.35

|

38.63

|

71,469

|

.58

|

.58

|

1.73

|

|

4/30/2020

|

46.68

|

.88

|

(2.36

)

|

(1.48

)

|

(.88

)

|

(2.38

)

|

(3.26

)

|

41.94

|

(3.63

)

|

54,235

|

.58

|

.58

|

1.93

|

|

Class C:

|

|||||||||||||

|

10/31/20245,6

|

58.75

|

.22

|

6.38

|

6.60

|

(.18

)

|

(2.77

)

|

(2.95

)

|

62.40

|

11.55

7

|

1,390

|

1.31

8

|

1.31

8

|

.70

8

|

|

4/30/2024

|

52.48

|

.52

|

8.84

|

9.36

|

(.54

)

|

(2.55

)

|

(3.09

)

|

58.75

|

18.43

|

1,340

|

1.32

|

1.32

|

.94

|

|

4/30/2023

|

54.62

|

.60

|

.15

|

.75

|

(.62

)

|

(2.27

)

|

(2.89

)

|

52.48

|

1.71

|

1,319

|

1.32

|

1.32

|

1.16

|

|

4/30/2022

|

55.48

|

.48

|

1.89

|

2.37

|

(.42

)

|

(2.81

)

|

(3.23

)

|

54.62

|

4.20

|

1,452

|

1.32

|

1.32

|

.84

|

|

4/30/2021

|

41.33

|

.47

|

14.87

|

15.34

|

(.52

)

|

(.67

)

|

(1.19

)

|

55.48

|

37.56

|

1,509

|

1.33

|

1.33

|

.99

|

|

4/30/2020

|

46.01

|

.54

|

(2.31

)

|

(1.77

)

|

(.53

)

|

(2.38

)

|

(2.91

)

|

41.33

|

(4.33

)

|

1,497

|

1.33

|

1.33

|

1.19

|

|

Class T:

|

|||||||||||||

|

10/31/20245,6

|

59.82

|

.53

|

6.52

|

7.05

|

(.49

)

|

(2.77

)

|

(3.26

)

|

63.61

|

12.14

7,9

|

—

10

|

.31

8,9

|

.31

8,9

|

1.69

8,9

|

|

4/30/2024

|

53.38

|

1.09

|

9.00

|

10.09

|

(1.10

)

|

(2.55

)

|

(3.65

)

|

59.82

|

19.62

9

|

—

10

|

.32

9

|

.32

9

|

1.94

9

|

|

4/30/2023

|

55.51

|

1.14

|

.15

|

1.29

|

(1.15

)

|

(2.27

)

|

(3.42

)

|

53.38

|

2.75

9

|

—

10

|

.30

9

|

.30

9

|

2.17

9

|

|

4/30/2022

|

56.34

|

1.06

|

1.92

|

2.98

|

(1.00

)

|

(2.81

)

|

(3.81

)

|

55.51

|

5.25

9

|

—

10

|

.32

9

|

.32

9

|

1.84

9

|

|

4/30/2021

|

41.93

|

.95

|

15.12

|

16.07

|

(.99

)

|

(.67

)

|

(1.66

)

|

56.34

|

38.96

9

|

—

10

|

.33

9

|

.33

9

|

1.98

9

|

|

4/30/2020

|

46.68

|

1.00

|

(2.38

)

|

(1.38

)

|

(.99

)

|

(2.38

)

|

(3.37

)

|

41.93

|

(3.39

)9

|

—

10

|

.34

9

|

.34

9

|

2.18

9

|

|

Class F-1:

|

|||||||||||||

|

10/31/20245,6

|

59.53

|

.43

|

6.47

|

6.90

|

(.39

)

|

(2.77

)

|

(3.16

)

|

63.27

|

11.92

7

|

2,286

|

.63

8

|

.63

8

|

1.38

8

|

|

4/30/2024

|

53.12

|

.91

|

8.97

|

9.88

|

(.92

)

|

(2.55

)

|

(3.47

)

|

59.53

|

19.28

|

2,126

|

.63

|

.63

|

1.64

|

|

4/30/2023

|

55.26

|

.97

|

.15

|

1.12

|

(.99

)

|

(2.27

)

|

(3.26

)

|

53.12

|

2.40

|

2,092

|

.63

|

.63

|

1.85

|

|

4/30/2022

|

56.10

|

.88

|

1.90

|

2.78

|

(.81

)

|

(2.81

)

|

(3.62

)

|

55.26

|

4.91

|

2,216

|

.63

|

.63

|

1.52

|

|

4/30/2021

|

41.76

|

.80

|

15.05

|

15.85

|

(.84

)

|

(.67

)

|

(1.51

)

|

56.10

|

38.53

|

2,422

|

.64

|

.64

|

1.68

|

|

4/30/2020

|

46.49

|

.85

|

(2.35

)

|

(1.50

)

|

(.85

)

|

(2.38

)

|

(3.23

)

|

41.76

|

(3.68

)

|

2,529

|

.64

|

.64

|

1.88

|

|

Class F-2:

|

|||||||||||||

|

10/31/20245,6

|

59.76

|

.51

|

6.50

|

7.01

|

(.47

)

|

(2.77

)

|

(3.24

)

|

63.53

|

12.08

7

|

35,015

|

.37

8

|

.37

8

|

1.64

8

|

|

4/30/2024

|

53.32

|

1.06

|

9.00

|

10.06

|

(1.07

)

|

(2.55

)

|

(3.62

)

|

59.76

|

19.57

|

32,142

|

.37

|

.37

|

1.89

|

|

4/30/2023

|

55.46

|

1.10

|

.15

|

1.25

|

(1.12

)

|

(2.27

)

|

(3.39

)

|

53.32

|

2.67

|

27,795

|

.37

|

.37

|

2.10

|

|

4/30/2022

|

56.29

|

1.03

|

1.92

|

2.95

|

(.97

)

|

(2.81

)

|

(3.78

)

|

55.46

|

5.18

|

28,561

|

.37

|

.37

|

1.78

|

|

4/30/2021

|

41.89

|

.93

|

15.11

|