Filed by Morgan Stanley

(Commission File No.: 1-11758)

Pursuant to Rule 425 of the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12

of the Securities Exchange Act of 1934

Subject Company: E*TRADE Financial Corporation

(Commission File No.: 001-11921)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of report (date of earliest event reported): February 20, 2020 (February 20, 2020)

MORGAN STANLEY

(Exact name of registrant as specified in its charter)

Commission File Number: 1-11758

|

Delaware |

36-3145972 | |||

| (State or other jurisdiction of incorporation or organization) | (IRS Employer Identification No.) |

1585 Broadway, New York, New York, 10036

(Address of principal executive offices, including zip code)

(212) 761-4000

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

| ☒ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 140.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.01 par value | MS | New York Stock Exchange |

| Depositary Shares, each representing 1/1,000th interest in a share of Floating Rate Non-Cumulative Preferred Stock, Series A, $0.01 par value | MS/PA |

New York Stock Exchange |

| Depositary Shares, each representing 1/1,000th interest in a share of Fixed-to-Floating Rate Non-Cumulative Preferred Stock, Series E, $0.01 par value | MS/PE |

New York Stock Exchange |

| Depositary Shares, each representing 1/1,000th interest in a share of Fixed-to-Floating Rate Non-Cumulative Preferred Stock, Series F, $0.01 par value | MS/PF |

New York Stock Exchange |

| Depositary Shares, each representing 1/1,000th interest in a share of Fixed-to-Floating Rate Non-Cumulative Preferred Stock, Series I, $0.01 par value | MS/PI |

New York Stock Exchange |

| Depositary Shares, each representing 1/1,000th interest in a share of Fixed-to-Floating Rate Non-Cumulative Preferred Stock, Series K, $0.01 par value | MS/PK |

New York Stock Exchange |

| Depositary Shares, each representing 1/1,000th interest in a share of 4.875% Non-Cumulative Preferred Stock, Series L, $0.01 par value | MS/PL |

New York Stock Exchange |

| Global Medium-Term Notes, Series A, Fixed Rate Step-Up Senior Notes Due 2026 of Morgan Stanley Finance LLC (and Registrant’s guarantee with respect thereto) | MS/26C |

New York Stock Exchange |

| Market Vectors ETNs due March 31, 2020 (two issuances) | URR/DDR | NYSE Arca, Inc. |

| Market Vectors ETNs due April 30, 2020 (two issuances) | CNY/INR | NYSE Arca, Inc. |

|

Morgan Stanley Cushing® MLP High Income Index ETNs due March 21, 2031 |

MLPY | NYSE Arca, Inc. |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR 230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR 240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01 Other Events

On February 20, 2020, Morgan Stanley, a Delaware corporation (the “Morgan Stanley”) and E*TRADE Financial Corporation, a Delaware Corporation (“E*TRADE”) entered into an Agreement and Plan of Merger, among Morgan Stanley, E*TRADE and Moon-Eagle Merger Sub, Inc., a Delaware corporation and wholly owned subsidiary of Morgan Stanley (the “Merger Agreement”), pursuant to which, subject to the satisfaction or waiver of certain conditions set forth therein, Morgan Stanley has agreed to acquire E*TRADE.

On February 20, 2020, Morgan Stanley issued a joint press release with E*TRADE announcing the execution of the Merger Agreement and that Morgan Stanley will hold an investor conference call. A copy of the joint press release is filed as Exhibit 99.1 hereto, and the full text of such joint press release is incorporated herein by reference. A copy of the investor presentation presented on the conference call is filed as Exhibit 99.2 hereto and posted on Morgan Stanley’s website, and the full text of such investor presentation is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits. The following exhibits are filed with this report:

Exhibit No. |

Description | |

| 99.1 | Joint Press Release dated February 20, 2020 | |

| 99.2 | Investor Presentation dated February 20, 2020 | |

| 101 | Interactive Data Files pursuant to Rule 406 of Regulation S-T formatted in Inline eXtensible Business Reporting Language (“Inline XBRL”). | |

| 104 | Cover Page Interactive Data File (formatted in Inline XBRL and contained in Exhibit 101). |

Important Information about the Transaction and Where to Find It

In connection with the proposed transaction between Morgan Stanley and E*TRADE (“E*TRADE”), Morgan Stanley and E*TRADE will file relevant materials with the Securities and Exchange Commission (the “SEC”), including a Morgan Stanley registration statement on Form S-4 that will include a proxy statement of E*TRADE that also constitutes a prospectus of Morgan Stanley and a definitive proxy statement/prospectus will be mailed to stockholders of E*TRADE. BEFORE MAKING ANY VOTING OR INVESTMENT DECISION, INVESTORS AND SECURITY HOLDERS OF Morgan Stanley AND E*TRADE ARE URGED TO READ THE REGISTRATION STATEMENT, THE PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS THAT ARE FILED OR WILL BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND RELATED MATTERS. Investors and security holders may obtain free copies of the registration statement and the proxy statement/prospectus (when they become available), as well as other filings containing information about Morgan Stanley or E*TRADE, without charge at the SEC’s Internet website (http://www.sec.gov) or by contacting the investor relations department of Morgan Stanley or E*TRADE at the following:

| Morgan Stanley | E*TRADE |

| 1585 Broadway | 671 North Glebe Road, Ballston Tower |

| New York, NY 10036 | Arlington, VA 22203 |

|

Media Relations: 212-761-2448 mediainquiries@morganstanley.com |

Media Relations: 646-521-4418 mediainq@etrade.com Investor Relations: 1-646-521-4406 |

| investorrelations@morganstanley.com | IR@etrade.com |

Participants in the Solicitation

Morgan Stanley, E*TRADE, their respective directors and certain of their respective executive officers may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. Information regarding the directors and

executive officers of Morgan Stanley and E*TRADE, and their direct or indirect interests in the transaction, by security holdings or otherwise will be set forth in the proxy statement/prospectus and other relevant matters when they are filed with the SEC. Information regarding the directors and executive officers of Morgan Stanley is contained in Morgan Stanley’s Form 10-K for the year ended December 31, 2018 and its proxy statement filed with the SEC on April 5, 2019. Information regarding the directors and executive officers of E*TRADE is contained in E*TRADE’s Form 10-K for the year ended December 31, 2019 and its proxy statement filed with the SEC on March 26, 2019. Additional information regarding the participants in the proxy solicitations and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement/prospectus and other relevant materials filed with the SEC when they become available.

No Offer or Solicitation

This communication is for informational purposes and is not intended to, and shall not, constitute an offer to sell or the

solicitation of an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote of approval,

nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior

to registration or qualification under the securities laws of any such jurisdiction.

Forward-Looking Statements

This communication contains “forward-looking statements” within the meaning of the federal securities laws, including Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. In this context, forward-looking statements often address expected future business and financial performance and financial condition, and often contain words such as “expect,” “anticipate,” “intend,” “plan,” “believe,” “seek,” “see,” “will,” “would,” “target,” similar expressions, and variations or negatives of these words. Forward-looking statements by their nature address matters that are, to different degrees, uncertain, such as statements about the consummation of the proposed transaction and the anticipated benefits thereof. All such forward-looking statements are subject to risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed in such forward-looking statements. Important risk factors that may cause such a difference include, but are not limited to, (i) the completion of the proposed transaction on anticipated terms and timing, including obtaining required stockholder and regulatory approvals, anticipated tax treatment, unforeseen liabilities, future capital expenditures, revenues, expenses, earnings, synergies, economic performance, indebtedness, financial condition, losses, future prospects, business and management strategies for the management, expansion and growth of the combined company’s operations and other conditions to the completion of the acquisition, including the possibility that any of the anticipated benefits of the proposed transaction will not be realized or will not be realized within the expected time period, (ii) the ability of Morgan Stanley and E*TRADE to integrate the business successfully and to achieve anticipated synergies, risks and costs, (iii) potential litigation relating to the proposed transaction that could be instituted against Morgan Stanley, E*TRADE or their respective directors, (iv) the risk that disruptions from the proposed transaction will harm Morgan Stanley’s and E*TRADE’s business, including current plans and operations, (v) the ability of Morgan Stanley or E*TRADE to retain and hire key personnel, (vi) potential adverse reactions or changes to business relationships resulting from the announcement or completion of the acquisition, (vii) continued availability of capital and financing and rating agency actions, (viii) legislative, regulatory and economic developments, (ix) potential business uncertainty, including changes to existing business relationships, during the pendency of the acquisition that could affect Morgan Stanley’s and/or E*TRADE’s financial performance, (x) certain restrictions during the pendency of the acquisition that may impact Morgan Stanley’s or E*TRADE’s ability to pursue certain business opportunities or strategic transactions, (xi) unpredictability and severity of catastrophic events, including, but not limited to, acts of terrorism or outbreak of war or hostilities, as well as management’s response to any of the aforementioned factors, (xii) dilution caused by Morgan Stanley’s issuance of additional shares of its common stock in connection with the proposed transaction, (xiii) the possibility that the transaction may be more expensive to complete than anticipated, including as a result of unexpected factors or events, (xiv) those risks described in Item 1A of Morgan Stanley’s most recently filed Annual Report on Form 10-K and subsequent reports on Forms 10-Q and 8-K, (xv) those risks described in Item 1A of E*TRADE’s most recently filed Annual Report on Form 10-K and subsequent reports on Forms 10-Q and 8-K and (xvi) those risks that will be described in the proxy statement/prospectus on Form S-4 available from the sources indicated above. These risks, as well as other risks associated with the proposed acquisition, will be more fully discussed in the proxy statement/prospectus that will be included in the registration statement on Form S-4 that will be filed with the SEC in connection with the proposed acquisition. While the list of factors presented here is, and the list of factors to be presented in the registration statement on Form S-4 will be, considered representative, no such list should be considered to be a complete statement of all potential risks and uncertainties. Unlisted factors may present significant additional obstacles to the realization of forward-looking statements. Consequences of material differences in results as compared with those anticipated in the forward-looking statements could include, among other things, business disruption, operational problems, financial loss, legal liability to third parties and similar risks, any of which could have a material adverse effect on Morgan Stanley’s or E*TRADE’s consolidated financial condition, results of

operations, credit rating or liquidity. Neither Morgan Stanley nor E*TRADE assumes any obligation to publicly provide revisions or updates to any forward-looking statements, whether as a result of new information, future developments or otherwise, should circumstances change, except as otherwise required by securities and other applicable laws.

Signature(s)

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| MORGAN STANLEY | ||

|

By: /s/ Martin M. Cohen | ||

| Date: February 20, 2020 | Name: Martin M. Cohen | |

| Title: Corporate Secretary |

Exhibit 99.1

|

|

February 20, 2020 – FOR IMMEDIATE RELEASE

Morgan Stanley to Acquire E*TRADE, Creating a Leader in all

Major Wealth Management Channels

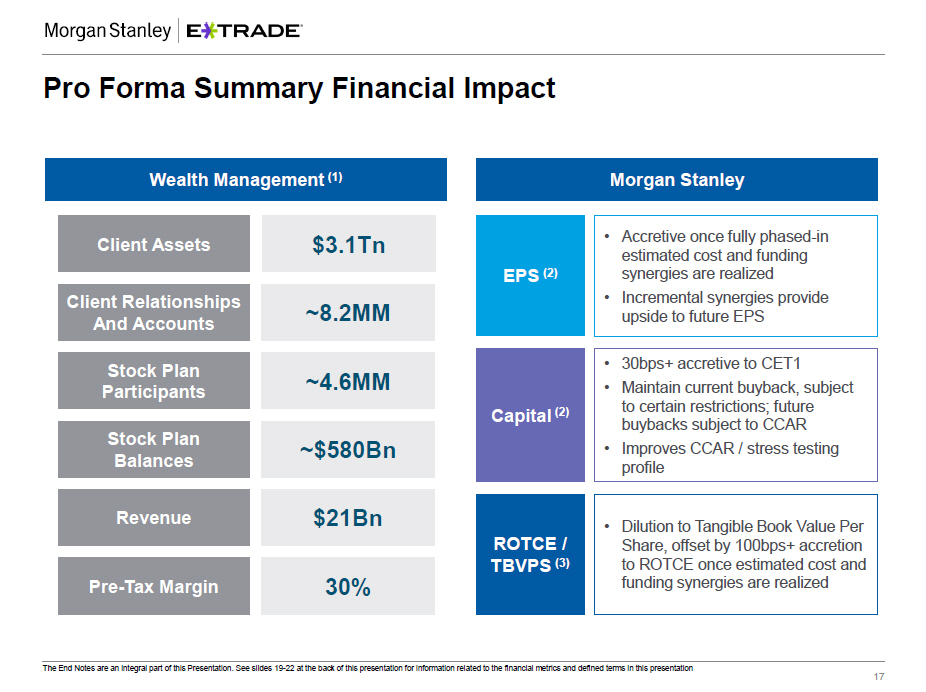

• Combined platforms will have $3.1Tn client assets, 8.2MM retail client relationships and accounts, and 4.6MM stock plan participants

• Combination increases Wealth Management scale, fills product and services gaps through complementary offerings, and enhances digital capabilities; positions Morgan Stanley as a top player across all three channels: Financial Advisory, Workplace, and Self-Directed

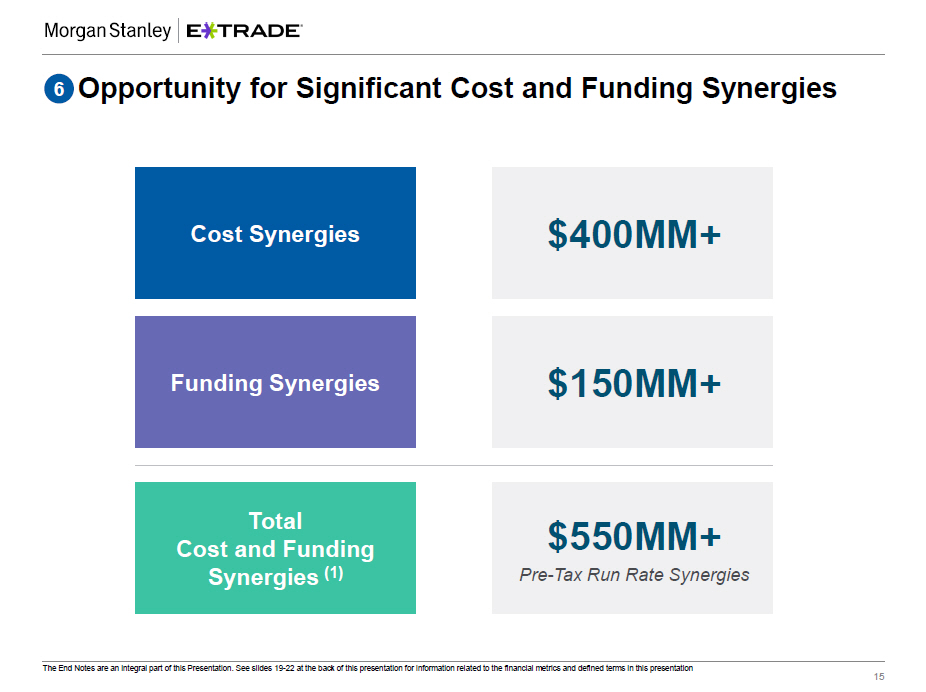

• Significant cost and funding synergies will result in stronger financial performance and shareholder value creation

• Combination accelerates Morgan Stanley’s transition to a more balance sheet light business mix and more durable sources of revenue

NEW YORK/ARLINGTON - Morgan Stanley (NYSE: MS) and E*TRADE Financial Corporation (NASDAQ: ETFC) have entered into a definitive agreement under which Morgan Stanley will acquire E*TRADE, a leading financial services company and pioneer in the online brokerage industry, in an all-stock transaction valued at approximately $13 billion. Under the terms of the agreement, E*TRADE stockholders will receive 1.0432 Morgan Stanley shares for each E*TRADE share, which represents per share consideration of $58.74 based on the closing price of Morgan Stanley common stock on February 19, 2020.

The combination will significantly increase the scale and breadth of Morgan Stanley’s Wealth Management franchise, and positions Morgan Stanley to be an industry leader in Wealth Management across all channels and wealth segments. E*TRADE has over 5.2 million client accounts with over $360 billion of retail client assets, adding to Morgan Stanley’s existing 3 million client relationships and $2.7 trillion of client assets. Morgan Stanley’s full-service, advisor-driven model coupled with E*TRADE’s direct-to-consumer and digital capabilities, will allow the combined business to have best-in-class product and service offerings to support the full spectrum of wealth.

“E*TRADE represents an extraordinary growth opportunity for our Wealth Management business and a leap forward in our Wealth Management strategy. The combination adds an iconic brand in the direct-to-consumer channel to our leading advisor-driven model, while

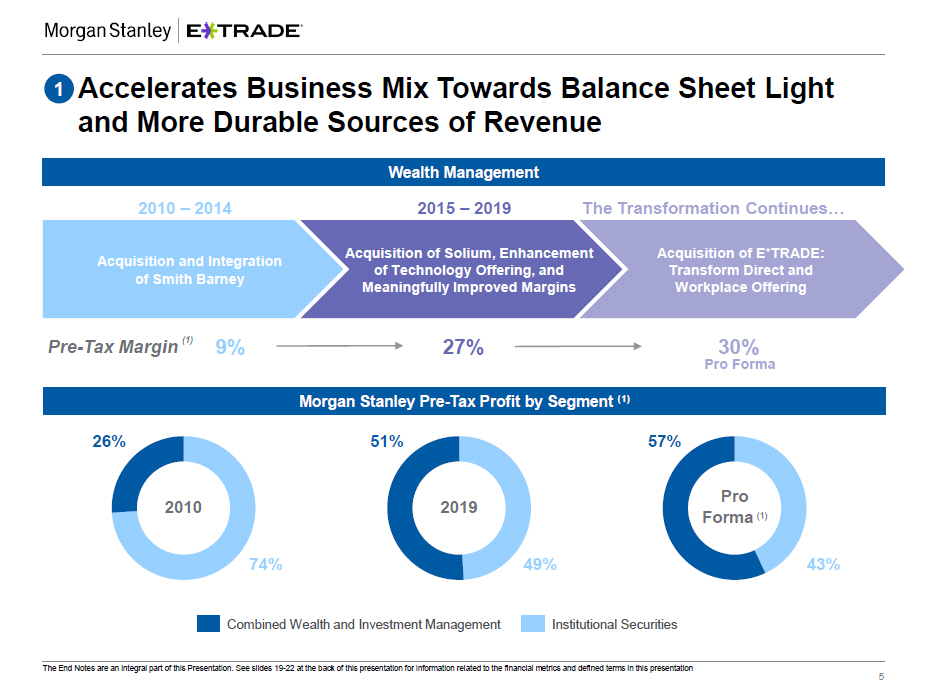

also creating a premier Workplace Wealth provider for corporations and their employees. E*TRADE’s products, innovation in technology, and established brand will help position Morgan Stanley as a top player across all three channels: Financial Advisory, Self-Directed, and Workplace,” said James Gorman, Chairman and CEO of Morgan Stanley. “In addition, this continues the decade-long transition of our Firm to a more balance sheet light business mix, emphasizing more durable sources of revenue.”

“Finally, I am delighted that Mike Pizzi, CEO of E*TRADE, will be joining Morgan Stanley. Mike will continue to run the E*TRADE business within the Morgan Stanley franchise and lead the ongoing integration effort. Mike will report to me and will join the Morgan Stanley Operating and Management Committees. In addition, we will invite one of E*TRADE’s independent directors to join our Board. We look forward to welcoming the infusion of management and technology talent that E*TRADE will bring to Morgan Stanley.”

“Since we created the digital brokerage category nearly 40 years ago, E*TRADE has consistently disrupted the status quo and delivered cutting-edge tools and services to investors, traders, and stock plan administrators,” said Mike Pizzi, Chief Executive Officer of E*TRADE. “By joining Morgan Stanley, we will be able to take our combined offering to the next level and deliver an even more comprehensive suite of wealth management capabilities. Bringing E*TRADE’s brand and offerings under the Morgan Stanley umbrella creates a truly exciting wealth management value proposition and enables our collective team to serve a far wider spectrum of clients.”

The transaction will create a leading player in Workplace Wealth, combining E*TRADE’s leading U.S. stock plan business with Shareworks by Morgan Stanley, a top provider of public stock plan administration and private cap table management solutions. This combination will enable Morgan Stanley to accelerate initiatives aimed at enhancing the workplace offering through online brokerage and digital banking capabilities, providing a significantly enhanced client experience.

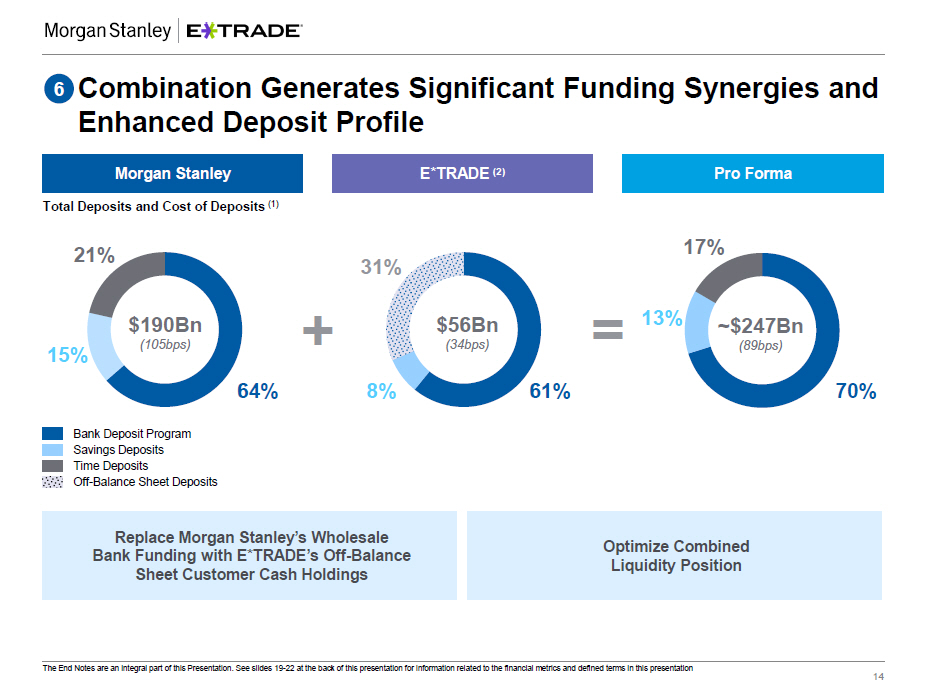

E*TRADE has been a pioneer in the digital brokerage and banking space for nearly 40 years and is an iconic brand. E*TRADE’s hallmarked, consumer-facing technology platforms will complement Morgan Stanley’s leading advisor-facing technology. E*TRADE also provides a full suite of digital banking services, including direct integration with brokerage accounts, checking and high-yield savings accounts, significantly accelerating Morgan Stanley’s digital banking efforts. The transaction adds approximately $56 billion of low-cost deposits, which will provide significant funding benefits to Morgan Stanley.

Importantly, the acquisition marks a continuation of Morgan Stanley’s decade-long effort to rebalance the Firm’s portfolio of businesses so that a greater percentage of Firm revenues

and income are derived from balance sheet light and more durable sources of revenues. Upon integration, the combined Wealth and Investment Management businesses will contribute approximately 57% of the Firm’s pre-tax profits, excluding potential synergies, compared to only approximately 26% in 2010.

The transaction provides significant upside potential for shareholders of both Morgan Stanley and E*TRADE. Shareholders from both companies will benefit from potential cost savings estimated at approximately $400 million from maximizing efficiencies of technology infrastructure, optimizing shared corporate services and combining the bank entities, as well as potential funding synergies of approximately $150 million from optimizing E*TRADE’s approximate $56 billion of deposits. In addition, Morgan Stanley will have enhanced technology and service capabilities to capture a larger portion of the estimated approximate $7.3 trillion of combined current customer assets held away, which will drive significant revenue opportunities.

Morgan Stanley will be better positioned to generate attractive financial returns through increased scale, improved efficiency, higher margins, stronger returns on tangible common equity, and long-term earnings accretion. Morgan Stanley expects the acquisition to be accretive once fully phased-in estimated cost and funding synergies are realized. Morgan Stanley will maintain its strong capital position, with the Firm’s common equity tier 1 ratio estimated to increase by over 30bps at closing. The transaction is expected to increase the Firm’s return on tangible common equity by more than 100bps with fully phased-in cost and funding synergies and improve Wealth Management’s pre-tax profit margin to over 30%.

The acquisition is subject to customary closing conditions, including regulatory approvals and approval by E*TRADE shareholders, and is expected to close in the fourth quarter of 2020.

A conference call to discuss the announced transaction will be held today at 8:30 a.m. ET, hosted by Morgan Stanley Chairman and CEO, James Gorman; Morgan Stanley CFO, Jonathan Pruzan; and E*TRADE CEO, Michael Pizzi. The call and presentation will be available at www.morganstanley.com or by dialing 1-877-895-9527 (domestic) and 1-706-679-2291 (international); the passcode is 5097722. To listen to the playback, please visit our website or dial: 1-855-859-2056 (domestic) or 1-404-537-3406 (international); the passcode is 8469949.

About E*TRADE

E*TRADE Financial and its subsidiaries provide financial services including brokerage and banking products and services to traders, investors, stock plan administrators and participants, and registered investment advisers (RIAs). Securities products and services

are offered by E*TRADE Securities LLC (Member FINRA/SIPC). Commodity futures and options on futures products and services are offered by E*TRADE Futures LLC (Member NFA). Managed Account Solutions are offered through E*TRADE Capital Management, LLC, a Registered Investment Adviser. Bank products and services are offered by E*TRADE Bank, and RIA custody solutions are offered by E*TRADE Savings Bank, both of which are federal savings banks (Members FDIC). Employee stock and student loan benefit plan solutions are offered by E*TRADE Financial Corporate Services, Inc. More information is available at https://us.etrade.com/.

About Morgan Stanley

Morgan Stanley is a leading global financial services firm providing a wide range of investment banking, securities, wealth management and investment management services. With offices in more than 41 countries, the Firm’s employees serve clients worldwide including corporations, governments, institutions and individuals. For further information about Morgan Stanley, please visit www.morganstanley.com.

# # #

Important Information about the Transaction and Where to Find It

In connection with the proposed transaction between Morgan Stanley and E*TRADE (“E*TRADE”), Morgan Stanley and E*TRADE will file relevant materials with the Securities and Exchange Commission (the “SEC”), including a Morgan Stanley registration statement on Form S-4 that will include a proxy statement of E*TRADE that also constitutes a prospectus of Morgan Stanley and a definitive proxy statement/prospectus will be mailed to stockholders of E*TRADE. BEFORE MAKING ANY VOTING OR INVESTMENT DECISION, INVESTORS AND SECURITY HOLDERS OF Morgan Stanley AND E*TRADE ARE URGED TO READ THE REGISTRATION STATEMENT, THE PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS THAT ARE FILED OR WILL BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND RELATED MATTERS. Investors and security holders may obtain free copies of the registration statement and the proxy statement/prospectus (when they become available), as well as other filings containing information about Morgan Stanley or E*TRADE, without charge at the SEC’s Internet website (http://www.sec.gov) or by contacting the investor relations department of Morgan Stanley or E*TRADE at the following:

| Morgan Stanley | E*TRADE |

| 1585 Broadway | 671 North Glebe Road, Ballston Tower |

| New York, NY 10036 | Arlington, VA 22203 |

Media Relations: 212-761-2448 mediainquiries@morganstanley.com |

Media Relations: 646-521-4418 mediainq@etrade.com Investor Relations: 1-646-521-4406 |

| investorrelations@morganstanley.com | IR@etrade.com |

Participants in the Solicitation

Morgan Stanley, E*TRADE, their respective directors and certain of their respective executive officers may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. Information regarding the directors and executive officers of Morgan Stanley and E*TRADE, and their direct or indirect interests in the transaction, by security holdings or otherwise will be set forth in the proxy statement/prospectus and other relevant matters when they are filed with the SEC. Information regarding the directors and executive officers of Morgan Stanley is contained in Morgan Stanley’s Form 10-K for the year ended December 31, 2018 and its proxy statement filed with the SEC on April 5, 2019. Information regarding the directors and executive officers of E*TRADE is contained in E*TRADE’s Form 10-K for the year ended December 31, 2019 and its proxy statement filed with the SEC on March 26, 2019. Additional information regarding the participants in the proxy solicitations and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement/prospectus and other relevant materials filed with the SEC when they become available.

No Offer or Solicitation

This communication is for informational purposes and is not intended to, and shall not, constitute an offer to sell or the

solicitation of an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote of approval,

nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior

to registration or qualification under the securities laws of any such jurisdiction.

Forward-Looking Statements

This communication contains “forward-looking statements” within the meaning of the federal securities laws, including Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. In this context, forward-looking statements often address expected future business and financial performance and financial condition, and often contain words such as “expect,” “anticipate,” “intend,” “plan,” “believe,” “seek,” “see,” “will,” “would,” “target,” similar expressions, and variations or negatives of these words. Forward-looking statements by their nature address matters that are, to different degrees, uncertain, such as statements about the consummation of the proposed transaction and the anticipated benefits thereof. All such forward-looking statements are subject to risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed in such forward-looking statements. Important risk factors that may cause such a difference include, but are not limited to, (i) the completion of the proposed transaction on anticipated terms and timing, including obtaining required stockholder and regulatory approvals, anticipated tax treatment, unforeseen liabilities, future capital expenditures, revenues, expenses, earnings, synergies, economic performance, indebtedness, financial condition, losses, future prospects, business and management strategies for the management, expansion and growth of the combined company’s operations and other conditions to the completion of the acquisition, including the possibility that any of the anticipated benefits of the proposed transaction will not be realized or will not be realized within the expected time period, (ii) the ability of Morgan Stanley and E*TRADE to integrate the business successfully and to achieve anticipated synergies, risks and costs, (iii) potential litigation relating to the proposed transaction that could be instituted against Morgan Stanley, E*TRADE or their respective directors, (iv) the risk that disruptions from the proposed transaction will harm Morgan Stanley’s and E*TRADE’s business, including current plans and operations, (v) the ability of Morgan Stanley or E*TRADE to retain and hire key personnel, (vi) potential adverse reactions or changes to business relationships resulting from the announcement or completion of the acquisition, (vii) continued availability of capital and financing and rating agency actions, (viii) legislative, regulatory and economic developments, (ix) potential business uncertainty, including changes to existing business relationships, during the pendency

of the acquisition that could affect Morgan Stanley’s and/or E*TRADE’s financial performance, (x) certain restrictions during the pendency of the acquisition that may impact Morgan Stanley’s or E*TRADE’s ability to pursue certain business opportunities or strategic transactions, (xi) unpredictability and severity of catastrophic events, including, but not limited to, acts of terrorism or outbreak of war or hostilities, as well as management’s response to any of the aforementioned factors, (xii) dilution caused by Morgan Stanley’s issuance of additional shares of its common stock in connection with the proposed transaction, (xiii) the possibility that the transaction may be more expensive to complete than anticipated, including as a result of unexpected factors or events, (xiv) those risks described in Item 1A of Morgan Stanley’s most recently filed Annual Report on Form 10-K and subsequent reports on Forms 10-Q and 8-K, (xv) those risks described in Item 1A of E*TRADE’s most recently filed Annual Report on Form 10-K and subsequent reports on Forms 10-Q and 8-K and (xvi) those risks that will be described in the proxy statement/prospectus on Form S-4 available from the sources indicated above. These risks, as well as other risks associated with the proposed acquisition, will be more fully discussed in the proxy statement/prospectus that will be included in the registration statement on Form S-4 that will be filed with the SEC in connection with the proposed acquisition. While the list of factors presented here is, and the list of factors to be presented in the registration statement on Form S-4 will be, considered representative, no such list should be considered to be a complete statement of all potential risks and uncertainties. Unlisted factors may present significant additional obstacles to the realization of forward-looking statements. Consequences of material differences in results as compared with those anticipated in the forward-looking statements could include, among other things, business disruption, operational problems, financial loss, legal liability to third parties and similar risks, any of which could have a material adverse effect on Morgan Stanley’s or E*TRADE’s consolidated financial condition, results of operations, credit rating or liquidity. Neither Morgan Stanley nor E*TRADE assumes any obligation to publicly provide revisions or updates to any forward-looking statements, whether as a result of new information, future developments or otherwise, should circumstances change, except as otherwise required by securities and other applicable laws.

Exhibit 99.2

The Next Strategic Step in Our Transformation February 20, 2020

No t ice Important Information about the Transaction and Where to Find It In connection with the proposed transaction between Morgan Stanley (“Morgan Stanley”) and E*TRADE (“E*TRADE”), Morgan Stanley and E*TRADE will file relevant materials with the Securities and Exchange Commission (the “SEC”), including a Morgan Stanley registration statement on Form S - 4 that will include a proxy statement of E*TRADE that also constitutes a prospectus of Morgan Stanley, and a definitive proxy statement/prospectus will be mailed to stockholders of E*TRADE. BEFORE MAKING ANY VOTING OR INVESTMENT DECISION, INVESTORS AND SECURITY HOLDERS OF MORGAN STANLEY AND E*TRADE ARE URGED TO READ THE REGISTRATION STATEMENT, THE PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS THAT ARE FILED OR WILL BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND RELATED MATTERS. Investors and security holders may obtain free copies of the registration statement and the proxy statement/prospectus (when they become available), as well as other filings containing information about Morgan Stanley or E*TRADE, without charge at the SEC’s Internet website ( www.sec.gov ) or by contacting the investor relations department of Morgan Stanley or E*TRADE at the following: Morgan Stanley 1585 Broadway New York, NY 10036 Attention: Investor Relations 1 - 212 - 762 - 8131 investorrelations@morganstanley.com E*TRADE 671 North Glebe Road, Ballston Tower Arlington, VA 22203 Attention: Investor Relations 1 - 646 - 521 - 4406 IR@etrade.com Participants in the Solicitation Morgan Stanley, E*TRADE, their respective directors and certain of their respective executive officers may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. Information regarding the directors and executive officers of Morgan Stanley and E*TRADE, and their direct or indirect interests in the transaction, by security holdings or otherwise will be set forth in the proxy statement/prospectus and other relevant matters when they are filed with the SEC. Information regarding the directors and executive officers of Morgan Stanley is contained in Morgan Stanley’s Form 10 - K for the year ended December 31, 2018 and its proxy statement filed with the SEC on April 5, 2019. Information regarding the directors and executive officers of E*TRADE is contained in E*TRADE’s Form 10 - K for the year ended December 31, 2019 and its proxy statement filed with the SEC on March 26, 2019. Additional information regarding the participants in the proxy solicitations and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement/prospectus and other relevant materials filed with the SEC when they become available. No Offer or Solicitation This communication is for informational purposes and is not intended to, and shall not, constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote of approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. Forward - Looking Statements This communication contains “forward - looking statements” within the meaning of the federal securities laws, including Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. In this context, forward - looking statements often address expected future business and financial performance and financial condition, and often contain words such as “expect,” “anticipate,” “intend,” “plan,” “believe,” “seek,” “see,” “will,” “would,” “target,” similar expressions, and variations or negatives of these words. Forward - looking statements by their nature address matters that are, to different degrees, uncertain, such as statements about the consummation of the proposed transaction and the anticipated benefits thereof. 2

No t ice 3 All such forward - looking statements are subject to risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed in such forward - looking statements. Important risk factors that may cause such a difference include, but are not limited to, (i) the completion of the proposed transaction on anticipated terms and timing, including obtaining required stockholder and regulatory approvals, anticipated tax treatment, unforeseen liabilities, future capital expenditures, revenues, expenses, earnings, synergies, economic performance, indebtedness, financial condition, losses, future prospects, business and management strategies for the management, expansion and growth of the combined company’s operations and other conditions to the completion of the acquisition, including the possibility that any of the anticipated benefits of the proposed transaction will not be realized or will not be realized within the expected time period, (ii) the ability of Morgan Stanley and E*TRADE to integrate the business successfully and to achieve anticipated synergies, risks and costs, (iii) potential litigation relating to the proposed transaction that could be instituted against Morgan Stanley, E*TRADE or their respective directors, (iv) the risk that disruptions from the proposed transaction will harm Morgan Stanley’s and E*TRADE’s business, including current plans and operations, (v) the ability of Morgan Stanley or E*TRADE to retain and hire key personnel, (vi) potential adverse reactions or changes to business relationships resulting from the announcement or completion of the acquisition, (vii) continued availability of capital and financing and rating agency actions, (viii) legislative, regulatory and economic developments, (ix) potential business uncertainty, including changes to existing business relationships, during the pendency of the acquisition that could affect Morgan Stanley’s and/or E*TRADE’s financial performance, (x) certain restrictions during the pendency of the acquisition that may impact Morgan Stanley’s or E*TRADE’s ability to pursue certain business opportunities or strategic transactions, (xi) unpredictability and severity of catastrophic events, including, but not limited to, acts of terrorism or outbreak of war or hostilities, as well as management’s response to any of the aforementioned factors, (xii) dilution caused by Morgan Stanley’s issuance of additional shares of its common stock in connection with the proposed transaction, (xiii) the possibility that the transaction may be more expensive to complete than anticipated, including as a result of unexpected factors or events, (xiv) those risks described in Item 1A of Morgan Stanley’s most recently filed Annual Report on Form 10 - K and subsequent reports on Forms 10 - Q and 8 - K, (xv) those risks described in Item 1A of E*TRADE’s most recently filed Annual Report on Form 10 - K and subsequent reports on Forms 10 - Q and 8 - K and (xvi) those risks that will be described in the proxy statement/prospectus on Form S - 4 available from the sources indicated above. These risks, as well as other risks associated with the proposed acquisition, will be more fully discussed in the proxy statement/prospectus that will be included in the registration statement on Form S - 4 that will be filed with the SEC in connection with the proposed acquisition. While the list of factors presented here is, and the list of factors to be presented in the registration statement on Form S - 4 will be, considered representative, no such list should be considered to be a complete statement of all potential risks and uncertainties. Unlisted factors may present significant additional obstacles to the realization of forward - looking statements. Consequences of material differences in results as compared with those anticipated in the forward - looking statements could include, among other things, business disruption, operational problems, financial loss, legal liability to third parties and similar risks, any of which could have a material adverse effect on Morgan Stanley’s or E*TRADE’s consolidated financial condition, results of operations, credit rating or liquidity. Neither Morgan Stanley nor E*TRADE assumes any obligation to publicly provide revisions or updates to any forward - looking statements, whether as a result of new information, future developments or otherwise, should circumstances change, except as otherwise required by securities and other applicable laws. Presentation The Morgan Stanley information provided herein includes certain non - GAAP financial measures. The definition of such measures and/or the reconciliation of such measures to the comparable U.S. GAAP figures are included in this presentation, or in the Morgan Stanley's (the "Company") Annual Report on Form 10 - K, Definitive Proxy Statement, Quarterly Reports on Form 10 - Q and the Company’s Current Reports on Form 8 - K, as applicable, including any amendments thereto, which are available on www.morganstanley.com The E*TRADE information contained herein has been extracted from E*TRADE's Annual Report on Form 10 - K for the year ended December 31, 2019, Current Report on Form 8 - K, dated January 23, 2020 or E*TRADE's Investor Presentation, dated January 2020, which is available on us.etrade.com . The End Notes are an integral part of this presentation. See slides 19 - 22 at the back of this presentation for information related to the financial metrics and defined terms in this presentation. Please note this presentation is available at www.morganstanley.com .

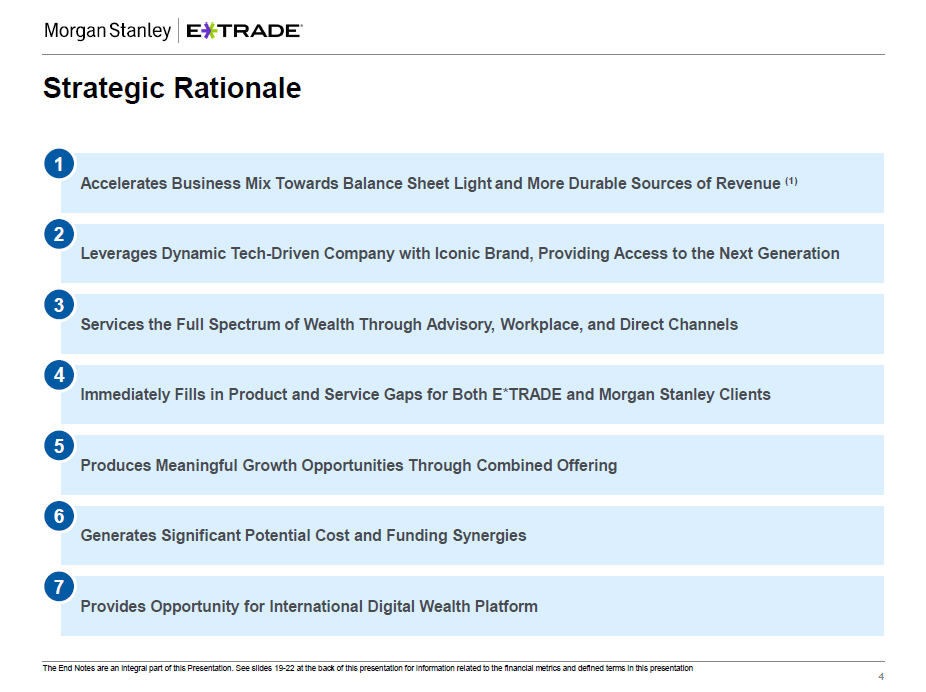

Strategic Rationale 1 Accelerates Business Mix Towards Balance Sheet Light and More Durable Sources of Revenue (1) 2 Leverages Dynamic Tech - Driven Company with Iconic Brand, Providing Access to the Next Generation 3 Services the Full Spectrum of Wealth Through Advisory, Workplace, and Direct Channels 4 Immediately Fills in Product and Service Gaps for Both E*TRADE and Morgan Stanley Clients 5 Produces Meaningful Growth Opportunities Through Combined Offering 6 Generates Significant Potential Cost and Funding Synergies 7 Provides Opportunity for International Digital Wealth Platform The End Notes are an integral part of this Presentation. See slides 19 - 22 at the back of this presentation for information related to the financial metrics and defined terms in this presentation 4

Accelerates Business Mix Towards Balance Sheet Light and More Durable Sources of Revenue 1 Wealth Management 2010 – 2014 2015 – 2019 The Transformation Continues… 9% 27% 43% 49% 26 % 51 % 57% 74% Institutional Securities Combined Wealth and Investment Management 2010 2019 Pro Forma (1) Wealth Management Morgan Stanley Pre - Tax Profit by Segment (1) 30% Pro Forma The End Notes are an integral part of this Presentation. See slides 19 - 22 at the back of this presentation for information related to the financial metrics and defined terms in this presentation 5 Pre - Tax Margin (1) Acquisition of Solium, Enhancement of Technology Offering, and Meaningfully Improved Margins Acquisition of E*TRADE: Transform Direct and Workplace Offering Acquisition and Integration of Smith Barney

Leverages Dynamic Tech - Driven Company with Iconic Brand, Providing Access to the Next Generation 2 Pioneering Brokerage Platform with an Iconic Brand Digital Banking Capabilities Including Checking and Savings Accounts ~$360Bn of Retail Client Assets across ~5.2MM Client Accounts (1) $39Bn of Deposits; additional $18Bn of Off - Balance Sheet Deposits (2) Leading Stock Plan Administrator ~$300Bn of Corporate Services Assets across ~1.9MM Accounts (3) Innovative Technology Platforms Backed by Professional Grade Support Mobile and Cloud - Based Platforms Power E*TRADE Equity Edge Online The End Notes are an integral part of this Presentation. See slides 19 - 22 at the back of this presentation for information related to the financial metrics and defined terms in this presentation 6

Combination With E*TRADE Adds Cutting Edge Technology Portfolio to All Wealth Management Channels 2 Financial Advisors W o rk p lace Self - Directed The End Notes are an integral part of this Presentation. See slides 19 - 22 at the back of this presentation for information related to the financial metrics and defined terms in this presentation 7 Goals Based Planning Next Best Action Risk Analytics Digital Financial Wellness, Planning, and Student Loan Benefits Private Company Management Public Equity Administration Platform Digital Checking and Savings Accounts Self - Directed Brokerage Accounts Trading Tools for Active Investors

Combination Services Full Spectrum of Wealth Across All Channels of Client Acquisition… 3 The End Notes are an integral part of this Presentation. See slides 19 - 22 at the back of this presentation for information related to the financial metrics and defined terms in this presentation 8 Financial Advisors (1) Self - Directed (3) Workplace (2) #1 47% Fee - Based Assets $2.7Tn Client Assets 3MM+ Client Relationships 291K Daily Average Revenue Trades ~$360Bn Retail Client Assets ~5.2MM Client Accounts ~$580Bn Combined Stock Plan Balances ~4.6MM Stock Plan Participants 15% E*TRADE Proceeds Retained Top 3 Top 3

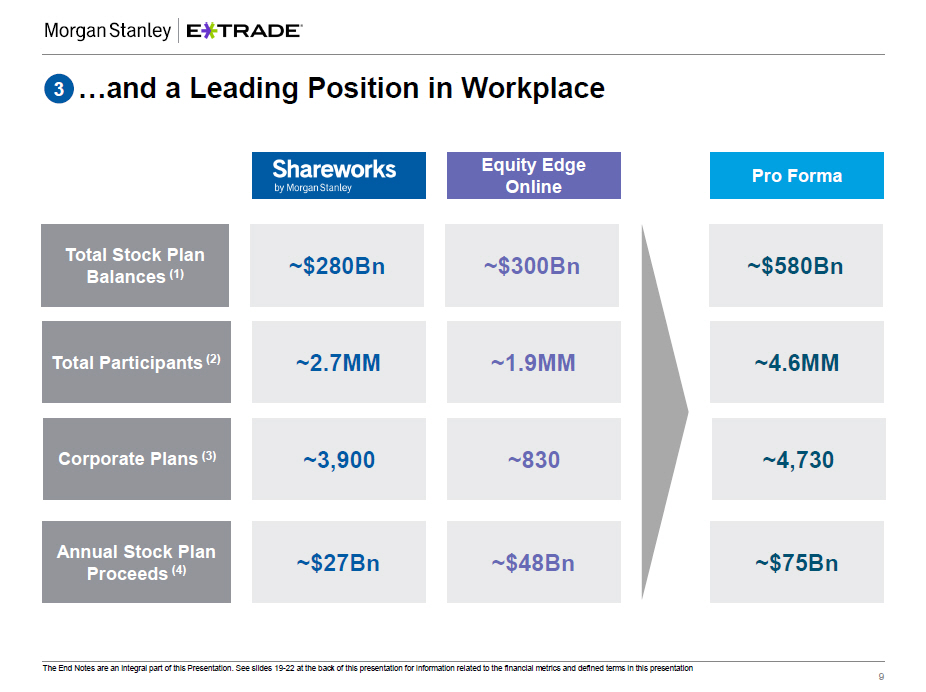

…and a Leading Position in Workplace 3 Equity Edge Online Pro Forma Total Participants (2) ~2.7MM ~1.9MM ~4.6MM Corporate Plans (3) ~3,900 ~830 ~4,730 Total Stock Plan Balances (1) ~$280Bn ~$300Bn ~$580Bn Annual Stock Plan Proceeds (4) ~$27Bn ~$48Bn ~$75Bn The End Notes are an integral part of this Presentation. See slides 19 - 22 at the back of this presentation for information related to the financial metrics and defined terms in this presentation 9

Immediately Fills in Product and Service Gaps for Both E*TRADE and Morgan Stanley Clients 4 Full Offering Partial Offering / Not at Scale Morgan Stanley E*TRADE Pro Forma Equities, ETFs, and Mutual Funds Fixed Income Derivatives Se l f - Di r ec t ed Brokerage Public Stock Plan Administration Private Company Financial Wellness and Planning Workplace High Yield Savings Accounts Checking Accounts Digital Banking (1) Wealth M a n a g e me n t Full Service Advisory Research Asset Management Products Virtual Advisor No Offering x x x x x x x x x x x x The End Notes are an integral part of this Presentation. See slides 19 - 22 at the back of this presentation for information related to the financial metrics and defined terms in this presentation 10

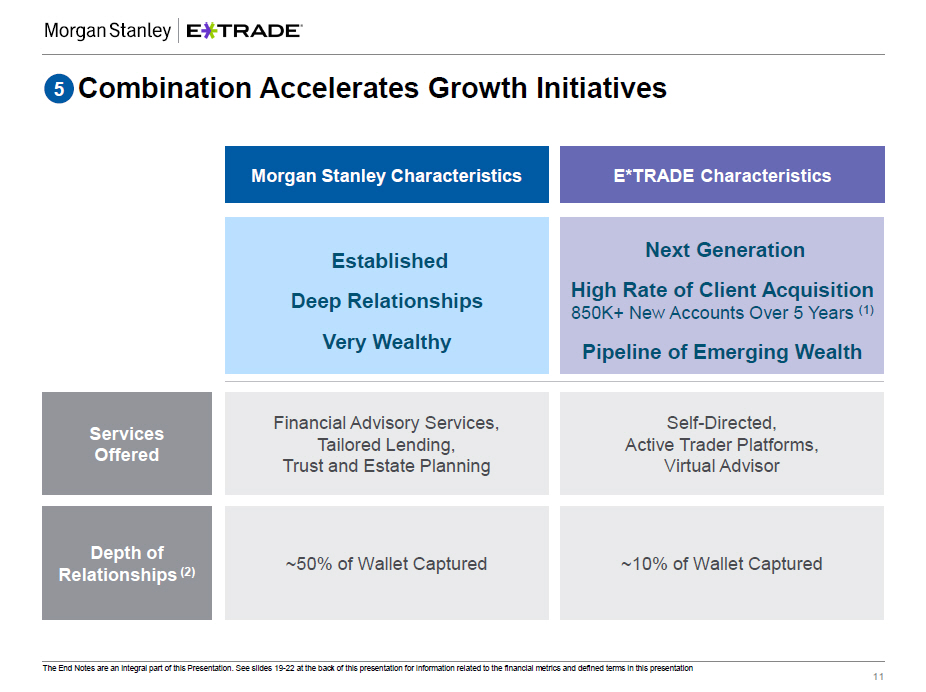

Combination Accelerates Growth Initiatives 5 Morgan Stanley Characteristics E*TRADE Characteristics Established Deep Relationships Very Wealthy Next Generation High Rate of Client Acquisition 850K+ New Accounts Over 5 Years (1) Pipeline of Emerging Wealth Ser v ices Offered Depth of Relationships (2) Financial Advisory Services, Tailored Lending, Trust and Estate Planning ~50% of Wallet Captured Self - Directed, Active Trader Platforms, Virtual Advisor ~10% of Wallet Captured The End Notes are an integral part of this Presentation. See slides 19 - 22 at the back of this presentation for information related to the financial metrics and defined terms in this presentation 11

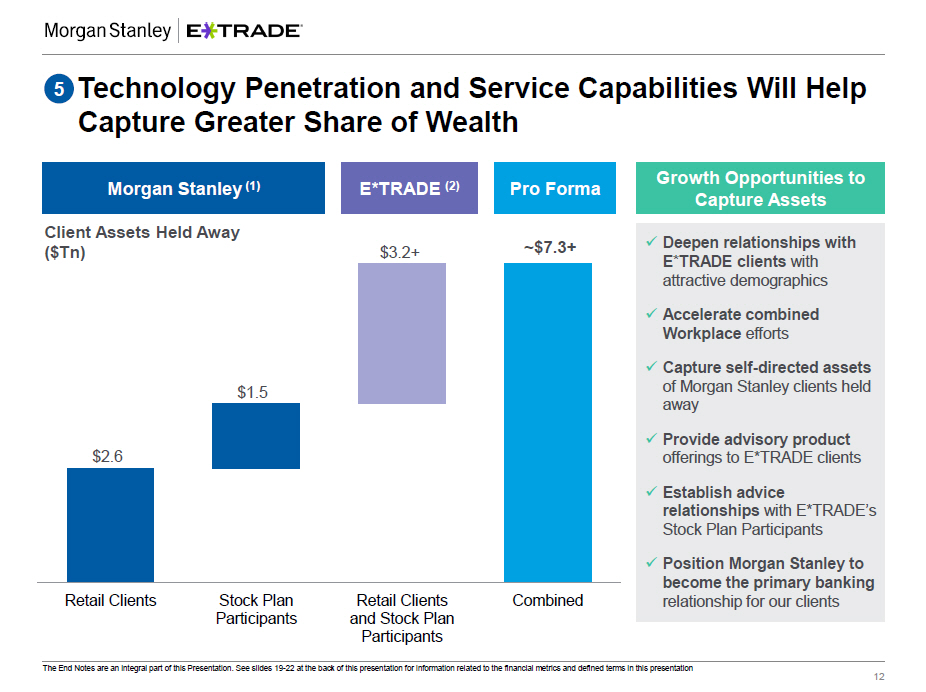

Technology Penetration and Service Capabilities Will Help Capture Greater Share of Wealth 5 Retail Clients The End Notes are an integral part of this Presentation. See slides 19 - 22 at the back of this presentation for information related to the financial metrics and defined terms in this presentation 12 Stock Plan P a r t i ci p an ts Retail Clients and Stock Plan Participants Combined $3 . 2 + ~$7.3+ $2 .6 $1 .5 E*TRADE (2) Morgan Stanley (1) Pro Forma x Deepen relationships with E*TRADE clients with attractive demographics x Accelerate combined Workplace efforts x Capture self - directed assets of Morgan Stanley clients held away x Provide advisory product offerings to E*TRADE clients x Establish advice relationships with E*TRADE’s Stock Plan Participants x Position Morgan Stanley to become the primary banking relationship for our clients Growth Opportunities to Capture Assets Client Assets Held Away ($Tn)

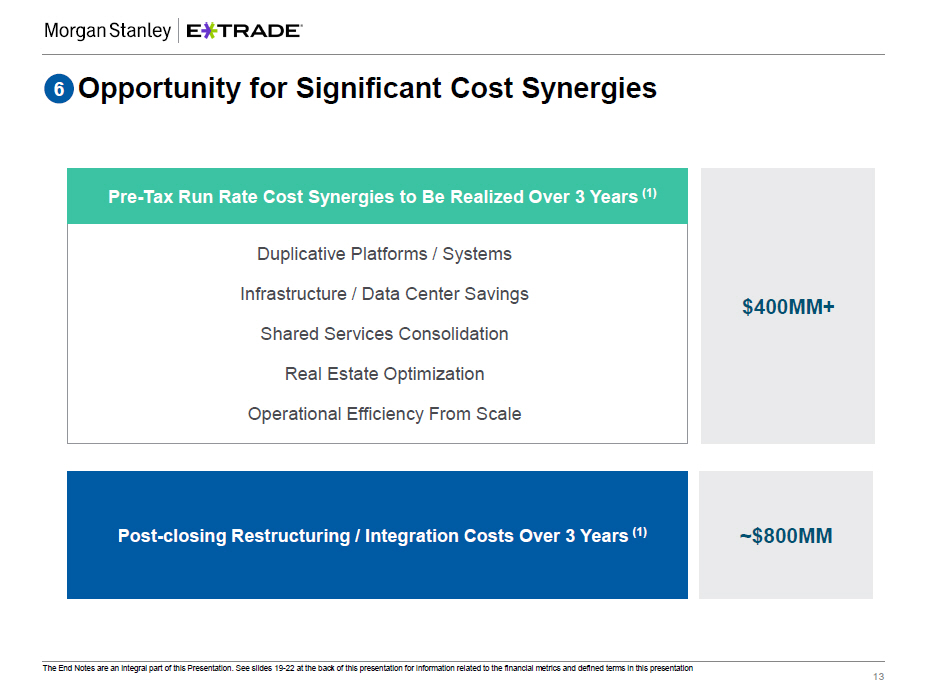

Opportunity for Significant Cost Synergies 6 $400MM+ ~$800MM Duplicative Platforms / Systems Infrastructure / Data Center Savings Shared Services Consolidation Real Estate Optimization Operational Efficiency From Scale Pre - Tax Run Rate Cost Synergies to Be Realized Over 3 Years (1) The End Notes are an integral part of this Presentation. See slides 19 - 22 at the back of this presentation for information related to the financial metrics and defined terms in this presentation 13 Post - closing Restructuring / Integration Costs Over 3 Years (1)

Combination Generates Significant Funding Synergies and Enhanced Deposit Profile 6 E*TRADE (2) Morgan Stanley Pro Forma 64% 15% 21% $190Bn (105bps) 61% 8% $56Bn (34bps) Total Deposits and Cost of Deposits (1) Replace Morgan Stanley’s Wholesale Bank Funding with E*TRADE’s Off - Balance Sheet Customer Cash Holdings Optimize Combined Liquidity Position + = 31% Bank Deposit Program Savings Deposits Time Deposits Off - Balance Sheet Deposits 70% The End Notes are an integral part of this Presentation. See slides 19 - 22 at the back of this presentation for information related to the financial metrics and defined terms in this presentation 14 13% 17% ~$247Bn (89bps)

$550MM+ Pre - Tax Run Rate Synergies Opportunity for Significant Cost and Funding Synergies 6 Total Cost and Funding Synergies (1) $150MM+ Funding Synergies Cost Synergies The End Notes are an integral part of this Presentation. See slides 19 - 22 at the back of this presentation for information related to the financial metrics and defined terms in this presentation 15 $400MM+

Transaction Summary The End Notes are an integral part of this Presentation. See slides 19 - 22 at the back of this presentation for information related to the financial metrics and defined terms in this presentation 16 Key Transaction Terms Summary Transaction Assumptions (1) Governance / Brand Timing / Approvals • $13 billion transaction value; 100% stock consideration • Fixed exchange ratio of 1.0432 per Morgan Stanley share; implies $58.74 per share value based on Morgan Stanley’s closing price of $56.31 on February 19, 2020 • Cost synergies of $400MM, phased - in over three years • Funding synergies of $150MM, phased - in over two years • Post - closing restructuring / integration costs of approximately $800MM pre - tax over a three year period • One member of E*TRADE Board to be added to the Morgan Stanley Board of Directors • Retention of iconic E*TRADE brand • Expected to close in 4Q 2020 • Subject to customary receipt of regulatory approvals and E*TRADE shareholder approval

Pro Forma Summary Financial Impact The End Notes are an integral part of this Presentation. See slides 19 - 22 at the back of this presentation for information related to the financial metrics and defined terms in this presentation 17 ROTCE / TBVPS (3) • Dilution to Tangible Book Value Per Share, offset by 100 bps+ accretion to ROTCE once estimated cost and funding synergies are realized EPS (2) • Accretive once fully phased - in estimated cost and funding synergies are realized • Incremental synergies provide upside to future EPS Capital (2) • 30bps+ accretive to CET1 • Maintain current buyback, subject to certain restrictions; future buybacks subject to CCAR • Improves CCAR / stress testing profile Wealth Management (1) Morgan Stanley Revenue $21Bn 30% ~8.2MM $3.1Tn ~4.6MM ~$580Bn Pre - Tax Margin Client Relationships And Accounts Client Assets Stock Plan Partici p a n ts Stock Plan Balances

Strategic Rationale 1 Accelerates Business Mix Towards Balance Sheet Light and More Durable Sources of Revenue (1) 2 Leverages Dynamic Tech - Driven Company with Iconic Brand, Providing Access to the Next Generation 3 Services the Full Spectrum of Wealth Through Advisory, Workplace, and Direct Channels 4 Immediately Fills in Product and Service Gaps for Both E*TRADE and Morgan Stanley Clients 5 Produces Meaningful Growth Opportunities Through Combined Offering 6 Generates Significant Potential Cost and Funding Synergies 7 Provides Opportunity for International Digital Wealth Platform The End Notes are an integral part of this Presentation. See slides 19 - 22 at the back of this presentation for information related to the financial metrics and defined terms in this presentation 18

End Notes 19 These notes refer to the financial metrics and/or defined term presented on Slide 4 1. Balance Sheet Light , as it relates to the Morgan Stanley Wealth Management segment, refers to a lower Risk Weighted Assets (‘RWAs’) intensity. Durable Sources of Revenues , as it relates to the Morgan Stanley, represent revenues associated with fee - based pricing arrangements, financing and lending that are generally less susceptible to significant fluctuation as a result of market volatility when compared to other Firm revenues, and are comprised of: Asset Management revenues in the Wealth and Investment Management segments; revenues from Financing and Secured Lending activities in the Institutional Securities and Wealth Management segments; and revenues from Investment Banking Advisory services. These notes refer to the financial metrics and/or defined term presented on Slide 5 1. Pre - Tax Margin represents Pre - Tax Profit divided by Net revenues. Pre - Tax Profit represents Income from continuing operations before income taxes. Pre - Tax Profit for 2010 excludes the negative impact of DVA of approximately $873 million. DVA represents the change in fair value resulting from fluctuations in our debt credit spreads and other credit factors related to borrowings and other liabilities carried under the fair value option. The full amount of the Net revenues DVA adjustment was recorded in the Institutional Securities segment. Pre - Tax Profit, excluding DVA is a non - GAAP financial measure that the Firm considers useful for analysts, investors and other stakeholders to assess operating performance. E*TRADE’s Pre - Tax Margin and Pre - Tax Profit based on E*TRADE’s Annual Report on Form 10 - K for the year ended December 31, 2019 (‘E*TRADE’s 2019 Form 10 - K’ ). Pro Forma Pre - Tax Margin and Pro Forma Pre - Tax Profit by Segment does not include estimated cost and funding synergies and post - closing restructuring / integration costs associated with the transaction and does not factor in any potential attrition of assets or revenues post closing due to limited anticipated disruption to the existing business models. These notes refer to the financial metrics and/or defined term presented on Slide 6 and unless otherwise indicated were extracted from E*TRADE’s 2019 Form 10 - K 1. Retail Client Assets of $362 billion at December 31, 2019 represent the market value of retail customer assets held by E*TRADE including security holdings and customer cash and deposits, exclusive of advisor services accounts based on E*TRADE’s Current Report on Form 8 - K, dated January 23, 2020 (‘E*TRADE’s January 2020 Form 8 - K’). Client Accounts represent retail services accounts, defined as those with a minimum balance of $25 or a trade within the prior six months. End of period (at December 31, 2019) retail accounts were 5.2 million. 2. $39 billion of On - Balance Sheet Deposits at December 31, 2019 consist of: brokerage sweep deposits of $27.9 billion; bank sweep deposits of $6.4 billion; and savings, checking, and other banking assets of $4.3 billion. Beginning November 2019, bank sweep deposits include E*TRADE’s Premium Savings Accounts participating in a sweep deposit account program. $18 billion of Off - Balance Sheet Deposits at December 31, 2019 represent brokerage sweep deposits of $16.9 billion and bank sweep deposits of $0.8 billion held at unaffiliated financial institutions. 3. Corporate Services Assets are inclusive of vested equity holdings, vested options holdings, and unvested holdings and totaled $296 billion as of December 31, 2019. End of period (at December 31, 2019) corporate services accounts of ~1.9 million represent those holding any type of vested or unvested securities from E*TRADE’s corporate services client company or with a trade in the prior six months.

End Notes 20 These notes refer to the financial metrics and/or defined term presented on Slide 8 1. Position in Financial Advisory represents estimated client assets based on internal analysis aggregated for Morgan Stanley and the following peers, per company filings: Bank of America, Wells Fargo and UBS. Peer data reflects client assets or client balances as of December 31, 2019. Client balances for Bank of America Global Wealth Management excludes balances within U.S. Trust. Financial Advisory Client Relationships are based on Morgan Stanley internal data as of December 31, 2019. Morgan Stanley client relationships may include more than one retail client account. Morgan Stanley’s Client Assets are as of December 31, 2019. Fee - Based Assets represent the amount of assets in client accounts where the basis of payment for services is a fee calculated on those assets. Fee based assets are as of December 31, 2019. 2. Pro forma Workplace Rank Position derived from Morgan Stanley internal analysis informed by latest available data for Bank of America, Carta, Certent, Charles Schwab, Computershare, Fidelity, and UBS. Pro forma Stock Plan Participants are defined as accounts of the corporate plans serviced with vested and unvested awards. Shareworks by Morgan Stanley stock plan participants of ~2.7 million are as of December 31, 2019. E*TRADE’s ~1.9 million accounts represent those holding any type of vested or unvested securities from E*TRADE’s corporate services client company or with a trade in the prior six months as of December 31, 2019 based on E*TRADE’s 2019 Form 10 - K. Pro forma Stock Plan Balances consist of vested and unvested awards. Shareworks by Morgan Stanley balances of ~$280 billion are as of December 31, 2019. E*TRADE’s corporate services assets are inclusive of vested equity holdings, vested options holdings, and unvested holdings totaling $296 billion are as of December 31, 2019 based on E*TRADE’s 2019 Form 10 - K. Proceeds Retained for E*TRADE refers to sales proceeds converted into E*TRADE brokerage accounts 12 months post exercise as reported in the January 2020 Investor presentation posted on the E*TRADE Investor Relations website (‘January 2020 Investor Presentation’) at us.etrade.com 3. Position in Self - Directed derived from Aite Group “New Realities in Wealth Management: U.S. Client Asset Growth Stalls in Down Market” report (May 2019). Peers include Fidelity, Charles Schwab / TD Ameritrade, Merrill Edge and others. Client Accounts represent retail services accounts, defined as those with a minimum balance of $25 or a trade within the prior six months. End of period (December 31, 2019) retail accounts of 5.2 million based on E*TRADE’s 2019 Form 10 - K. Retail Client Assets of $362 billion at December 31, 2019 represent the market value of retail customer assets held by E*TRADE including security holdings and customer cash and deposits, exclusive of advisor services accounts based on E*TRADE’s January 2020 Form 8 - K. Daily Average Revenue Trades (‘DARTs’) defined as total commissionable trades in a period divided by the number of trading days during that period. Beginning in November 2019, the definition of DARTs was updated to reflect all customer - directed trades. This includes trades associated with no - transaction - fee mutual funds, options trades through the Dime Buyback Program, and all exchange - traded funds transactions (including those formerly classified as commission - free). DARTs is calculated by dividing these customer - directed trades by the number of trading days during the period. DARTs metric included in E*TRADE’s 2019 Form 10 - K. These notes refer to the financial metrics and/or defined term presented on Slide 9 1. Total Stock Plan balances consist of vested and unvested securities held by the company. Shareworks by Morgan Stanley balances of ~$280 billion are as of December 31, 2019. E*TRADE’s corporate services assets are inclusive of vested equity holdings, vested options holdings, and unvested hold ing s totaling $296 billion are as of December 31, 2019 based on E*TRADE’s 2019 Form 10 - K. 2. Total Participants are defined as accounts of the corporate plans serviced with vested and unvested securities held by company. Shareworks by Morgan Stanley stock plan participants of ~2.7 million are as of December 31, 2019. E*TRADE’s ~1.9 million accounts represent those holding any type of vested or unvested securities from E*TRADE’s corporate services client company or with a trade in the prior six months are as of December 31, 2019 based on E*TRADE’s 2019 Form 10 - K. 3. Corporate Plans reflects aggregate public and private companies serviced by the respective parties as of December 31, 2019. E*TRADE provides plan administration services for public and private companies globally through corporate services channel. E*TRADE’s 831 total US publicly traded companies is as reported in the January 2020 Investor presentation at us.etrade.com 4. Stock Plan Proceeds: ~$27 billion distributions of Shareworks by Morgan Stanley refer to legacy Morgan Stanley (excluding Solium) stock plan annual domestic and international proceeds as of December 31, 2019. E*TRADE annual stock distributions of ~$48 billion refer to annual domestic and international participant proceeds as of December 31, 2019 and are based on reported amounts in the January 2020 Investor Presentation at us.etrade.com

End Notes 21 These notes refer to the financial metrics and/or defined term presented on Slide 10 1. Current Morgan Stanley Digital Banking offering is through the broker - dealer entity and not through Morgan Stanley bank entities. These notes refer to the financial metrics and/or defined term presented on Slide 11 1. Net New Retail Accounts are based on quarterly earnings reports included in E*TRADE’s Current Reports on Form 8 - K for the periods from the first quarter of 2015 through the fourth quarter of 2019, adjusted in 2018 for the acquisition of approximately one million retail brokerage accounts from Capital One completed on November 6, 2018 as described in E*TRADE ’s 2019 Form 10 - K . 2. Wallet Captured is representative of the estimated percentage of assets Morgan Stanley/E*TRADE hold of clients’ total wallet in aggregate. Morgan Stanley client wallet share per IXI as of April 2019. E*TRADE client wallet share is estimated by Morgan Stanley using brokerage assets only and leveraging IXI data as of June 2019 for existing customers, and for households that joined E*TRADE after June 2019, IXI data is as of their sign up date. For households where E*TRADE’s assets are greater than IXI assets, IXI assets were updated to equal to E*TRADE’s assets (making share of wallet 100%). These notes refer to the financial metrics and/or defined term presented on Slide 12 1. $2.6 trillion of Morgan Stanley’s Retail Clients’ Assets Held Away is estimated using data from IXI as of April 2019. $1.5 trillion of Morgan Stanley’s Stock Plan Participants’ Assets Held Away , which includes both legacy Solium and Morgan Stanley participants, is estimated using data from IXI as of November 2018. 2. $3.2+ trillion of E*TRADE’s Retail Clients and Stock Plan Participants Assets Held Away is estimated using data from IXI as of June 2019. These notes refer to the financial metrics and/or defined term presented on Slide 13 1. Expected Pre - Tax Run Rate Cost Synergies and Post - closing Restructuring/Integration Costs are Morgan Stanley estimates, expected to be realized three years from the closing date of the transaction. These notes refer to the financial metrics and/or defined term presented on Slide 14 1. Morgan Stanley and E*TRADE Deposits are as of December 31, 2019. Cost of Deposits is calculated as total interest expense divided by average balances for full - year 2019 for Morgan Stanley, E*TRADE and on a Pro Forma basis. E*TRADE amounts are based on their 2019 Form 10 - K. 2. $39 billion of On - Balance Sheet Deposits at December 31, 2019 consist of: brokerage sweep deposits of $27.9 billion; bank sweep deposits of $6.4 billion; and savings, checking, and other banking assets of $4.3 billion. Beginning November 2019, bank sweep deposits include E*TRADE’s Premium Savings Accounts participating in a sweep deposit account program. $18 billion of Off - Balance Sheet Deposits at December 31, 2019 represent brokerage sweep deposits of $16.9 billion and bank sweep deposits of $0.8 billion held at unaffiliated financial institutions. Amounts included in E*TRADE’s 2019 Form 10 - K.

End Notes 22 These notes refer to the financial metrics and/or defined term presented on Slide 15 1. Total Cost and Funding Synergies are Morgan Stanley estimates. Estimated cost synergies are phased in over three years, and estimated funding synergies are phased in over two years, from the closing date of the transaction. These notes refer to the financial metrics and/or defined term presented on Slide 16 1. Cost and Funding Synergies and Post - closing Restructuring / Integration Costs are Morgan Stanley estimates. Estimated cost synergies are phased in over three years, estimated funding synergies are phased in over two years, and post - closing restructuring / integration costs are phased in over three years, from the closing date of the transaction. These notes refer to the financial metrics and/or defined term presented on Slide 17 1. Financial Advisory Client Assets and Client Relationships and Client Accounts on a Pro Forma basis are as of December 31, 2019. Morgan Stanley client relationships may include more than one retail client account. E*TRADE Retail Client Accounts and Retail Client Assets are based on E*TRADE’s 2019 Form 10 - K and January 2020 8 - K, respectively. Pro Forma Stock Plan Participants are defined as accounts of the corporate plans serviced with vested and unvested awards. Shareworks by Morgan Stanley stock plan participants of ~2.7 million are as of December 31, 2019. E*TRADE’s ~1.9 million accounts represent those holding any type of vested or unvested securities from E*TRADE’s corporate services client company or with a trade in the prior six months are as of December 31, 2019 based on E*TRADE’s 2019 Form 10 - K. Pro forma Stock Plan Balances consist of vested and unvested awards. Shareworks by Morgan Stanley balances of ~$280 billion are as of December 31, 2019. E*TRADE’s corporate services assets are inclusive of vested equity holdings, vested options holdings, and unvested holdings totaling $296 billion are as of December 31, 2019 based on E*TRADE’s 2019 Form 10 - K. Pro Forma Revenues are equal to the combined full - year 2019 revenues of Morgan Stanley Wealth Management, of $17.7 billion, and E*TRADE, of $2.9 billion based on E*TRADE’s 2019 Form 10 - K. Pre - Tax Margin represents Pre - Tax Profit divided by Net revenues. Pre - Tax Profit represents Income from continuing operations before income taxes. E*TRADE’s Pre - Tax Margin and Pre - Tax Profit based on E*TRADE’s 2019 Form 10 - K. Pro Forma Pre - Tax Margin does not include estimated cost and funding synergies and post - closing restructuring / integration costs associated with the transaction and does not factor in any potential attrition of assets or revenues post closing due to limited anticipated disruption to the existing business models. 2. EPS and CET1 Accretion are Morgan Stanley estimates. Estimated funding synergies are phased in over two years, and estimated cost synergies are phased in over three years, from the closing date of the transaction 3. The calculation of ROTCE uses pro forma net income applicable to Morgan Stanley less preferred dividends as a percentage of pro forma average tangible common equity (‘TCE’). Tangible Book Value per Common Share (‘TBVPS’) equals pro forma TCE divided by period end common shares outstanding, as adjusted for the transaction. Pro forma ROTCE and Tangible Book Value per Share are non - GAAP financial measures that the Firm considers useful for analysts, investors and other stakeholders to assess operating performance. These notes refer to the financial metrics and/or defined term presented on Slide 18 1. Balance Sheet Light , as it relates to the Morgan Stanley Wealth Management segment, refers to a lower Risk Weighted Assets (‘RWAs’) intensity. Durable Sources of Revenues , as it relates to the Morgan Stanley, represent revenues associated with fee - based pricing arrangements, financing and lending that are generally less susceptible to significant fluctuation as a result of market volatility when compared to other Firm revenues, and are comprised of: Asset Management revenues in the Wealth and Investment Management segments; revenues from Financing and Secured Lending activities in the Institutional Securities and Wealth Management segments; and revenues from Investment Banking Advisory services.

The Next Strategic Step in Our Transformation February 20, 2020