As filed with the U.S. Securities and Exchange Commission on April 15, 2025

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER THE

SECURITIES ACT OF 1933

Netcapital Inc.

(Exact name of registrant as specified in its charter)

| Utah | 6199 | 87-0409951 | ||

| (State

or other jurisdiction of incorporation or organization) |

(Primary

Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

1 Lincoln Street

Boston, MA 02111

Phone: (781) 925-1700

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Coreen Kraysler

Chief Financial Officer

1 Lincoln Street

Boston, MA 02111

Phone: (781) 925-1700

(Name, address including zip code, and telephone number, including area code, of agent for service)

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box: ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule l2b-2 of the Exchange Act.

Large accelerated filer ☐ Accelerated filer ☐ Non-accelerated filer ☒ Smaller reporting company ☒ Emerging Growth Company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offeror sale is not permitted.

| PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION | DATED APRIL 15, 2025 |

Netcapital Inc.

Up to 721,153 Shares of Upon Exercise of Certain Common Stock Purchase Warrants

This prospectus relates to the offer and resale by certain selling shareholders named herein (each, a “Selling Shareholder” and collectively, the “Selling Shareholders” of up to an aggregate of 721,153 shares (the “Shares”) of common stock, par value $0.001 per share (“Common Stock”), of Netcapital Inc. (the “Company”, “we”, “us” or “our”), consisting of shares of Common Stock issuable upon the exercise of various common stock purchase warrants, defined below as the “Warrants.” Specifically:

(i) common stock purchase warrants (the “A-5 Inducement Warrants”), to purchase up to 361,148 shares of Common Stock (the “A-5 Inducement Warrant Shares”), at an exercise price of $2.07 per share; issued by us to certain accredited investors on January 13, 2025 pursuant to an inducement offer letter agreement, dated as of January 9, 2025 (the “January 2025 Inducement Letter”);

(ii) common stock purchase warrants (the “A-6 Inducement Warrants”), to purchase up to 180,574 shares of Common Stock (the “A-6 Inducement Warrant Shares”), at an exercise price of $2.07 per share; issued by us to certain accredited investors on January 13, 2025 pursuant to the January 2025 Inducement Letter;

(iii) common stock purchase warrants (the “Placement Agent Warrants”) to purchase up to 20,315 shares of Common Stock (the “Placement Agent Warrant Shares”) issued by us on January 13, 2025 to designees of H.C. Wainwright & Co., LLC, as exclusive placement agent (“Wainwright”), at an exercise price of $2.25 per share pursuant to an engagement letter dated November 7, 2024 between the Company and Wainwright;

(iv) common stock purchase warrants (the “A-7 Inducement Warrants”), to purchase up to 79,558 shares of Common Stock (the “A-7 Inducement Warrant Shares”), at an exercise price of $2.03 per share; issued by us to certain accredited investors on March 5, 2025 pursuant to an inducement offer letter agreement, dated as of March 5, 2025 (the “March 2025 Inducement Letter”); and

(v) common stock purchase warrants (the “A-8 Inducement Warrants”), to purchase up to 79,558 shares of Common Stock (the “A-8 Inducement Warrant Shares”), at an exercise price of $2.03 per share; issued by us to certain accredited investors on March 5, 2025 pursuant to the March 2025 Inducement Letter.

For the purposes of this prospectus, the term “Warrants” collectively refers to the A-5 Inducement Warrants, A-6 Inducement Warrants, A-7 Inducement Warrants, A-8 Inducement Warrants, and the Placement Agent Warrants.

The shares issuable upon the exercise of these Warrants are collectively referred to as the “Warrant Shares,” with each type of Warrant having its corresponding Warrant Shares as defined in the paragraphs above.

The A-5 Inducement Warrants are exercisable on July 15, 2025 and expire on July 15, 2030. The A-6 Inducement Warrants are exercisable on July 13, 2025 and expire on January 13, 2027. The Placement Agent Warrants are exercisable on July 15, 2025 and expire on July 15, 2030. The A-7 Inducement Warrants are exercisable on September 5, 2025 and expire on September 5, 2030. The A-8 Inducement Warrants are exercisable on September 5, 2025 and expire on March 5, 2027

This prospectus describes the general manner in which the Shares may be offered and sold. If necessary, the specific manner in which the Warrant Shares may be offered and sold will be described in a supplement to this prospectus. The Warrants were each issued to the applicable Selling Shareholders in connection with private placement offerings pursuant to Section 4(a)(2) of the Securities Act of 1933, as amended (the “Securities Act”), and/or Regulation D promulgated thereunder. For additional information regarding the issuance of the Warrants and Warrant Shares, see “Issuance of Warrants” beginning on page 14.

The Shares will be resold from time to time by the Selling Shareholders listed in the section titled “Selling Shareholders” beginning on page 15.

The Selling Shareholders, or their respective transferees, pledgees, donees, or other successors-in-interest, will sell the Shares through public or private transactions at prevailing market prices, at prices related to prevailing market prices or at privately negotiated prices. The Selling Shareholders may sell any, all or none of the securities offered by this prospectus, and we do not know when or in what amount the Selling Shareholders may sell their Shares hereunder following the effective date of this registration statement. We provide more information about how a Selling Shareholder may sell its Shares in the section titled “Plan of Distribution” on page 21.

We are registering the Shares on behalf of the Selling Shareholders, to be offered and sold by them from time to time. While we will not receive any proceeds from the sale of our Common Stock by the Selling Shareholders in the offering described in this prospectus, we may receive up to (i) $2.07 per share upon the cash exercise of the A-5 and A-6 Inducement Warrants, (ii) 2.03 per share upon the cash exercise of the A-7 and A-8 Inducement Warrants and; (iii) $2.25 per share upon the cash exercise of the Placement Agent Warrants. Upon the exercise of the Warrants for all 721,153 Shares by payment of cash, we would receive aggregate gross proceeds of approximately $1,454,000. However, we cannot predict when and in what amounts or if the Warrants will be exercised, and it is possible that the Warrants may expire and never be exercised, in which case we would not receive any cash proceeds. We have agreed to bear all of the expenses incurred in connection with the registration of the Shares. The Selling Shareholders will pay or assume discounts, commissions, fees of underwriters, selling brokers or dealer managers and similar expenses, if any, incurred for the sale of the Shares.

The Common Stock is currently listed on the Nasdaq Capital Market under the symbol “NCPL” On April 11, 2025, the last reported sale price of our Common Stock was $1.7907

This offering will terminate on the earlier of (i) the date when all of the Securities registered hereunder have been sold pursuant to this prospectus or Rule 144 under the Securities Act, and (ii) the date on which all of such securities may be sold pursuant to Rule 144 without volume or manner-of-sale restrictions, unless we terminate it earlier.

Investing in our Common Stock involves risks. You should carefully review the risks described under the heading “Risk Factors” beginning on page 12 and in the documents which are incorporated by reference herein before you invest in our Common Stock.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is April 15, 2025.

TABLE OF CONTENTS

| i |

This prospectus relates to the offer and resale by certain selling shareholders named herein (each, a “Selling Shareholder: and collectively, the “Selling Shareholders” of up to an aggregate of 721,153 shares (the “Shares”) of common stock, par value $0.001 per share (“Common Stock”), of Netcapital Inc. (the “Company”, “we”, “us” or “our”), consisting of shares of Common Stock issuable upon the exercise of:

(i) the A-5 Inducement Warrants, to purchase up to 361,148 shares of Common Stock, at an exercise price of $2.07 per share; issued by us to certain accredited investors on January 13, 2025 pursuant to the January 2025 Inducement Letter;

(ii) the A-6 Inducement Warrants, to purchase up to 180,574 shares of Common Stock, at an exercise price of $2.07 per share; issued by us to certain accredited investors on January 13, 2025 pursuant to the January 2025 Inducement Letter; and

(iii) the Placement Agent Warrants to purchase up to 20,315 shares of Common Stock issued by us on January 13, 2025 to designees of Wainwright, at an exercise price of $2.25 per share pursuant to an engagement letter dated November 7, 2024 between the Company and Wainwright.

(iv) the A-7 Inducement Warrants, to purchase up to 79,558 shares of Common Stock at an exercise price of $2.03 per share; issued by us to certain accredited investors on March 5, 2025 pursuant to the March 2025 Inducement Letter; and

(v) the A-8 Inducement Warrants, to purchase up to 79,558 shares of Common Stock at an exercise price of $2.03 per share; issued by us to certain accredited investors on March 5, 2025 pursuant to the March 2025 Inducement Letter.

You should rely only on the information contained in this prospectus and the related exhibits, any prospectus supplement or amendment thereto and the documents incorporated by reference, or to which we have referred you, before making your investment decision. Neither we nor the Selling Shareholders have authorized anyone to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. This prospectus, any prospectus supplement or amendments thereto do not constitute an offer to sell, or a solicitation of an offer to purchase, the shares of Common Stock offered by this prospectus, any prospectus supplement or amendments thereto in any jurisdiction to or from any person to whom or from whom it is unlawful to make such offer or solicitation of an offer in such jurisdiction. You should not assume that the information contained in this prospectus, any prospectus supplement or amendments thereto, as well as information we have previously filed with the U.S. Securities and Exchange Commission (the “SEC”), is accurate as of any date other than the date on the front cover of the applicable document.

If necessary, the specific manner in which the shares of our common stock may be offered and sold will be described in a supplement to this prospectus, which supplement may also add, update or change any of the information contained in this prospectus. To the extent there is a conflict between the information contained in this prospectus and any prospectus supplement, you should rely on the information in such prospectus supplement, provided that if any statement in one of these documents is inconsistent with a statement in another document having a later date - for example, a document incorporated by reference in this prospectus or any prospectus supplement - the statement in the document having the later date modifies or supersedes the earlier statement.

Neither the delivery of this prospectus nor any distribution of shares of our common stock pursuant to this prospectus shall, under any circumstances, create any implication that there has been no change in the information set forth or incorporated by reference into this prospectus or in our affairs since the date of this prospectus. Our business, financial condition, results of operations and prospects may have changed since such date.

When used herein, unless the context requires otherwise, references to “NCPL”, the “Company”, “we”, “our” or “us” refer to Netcapital Inc., a Utah corporation, and its subsidiaries on a consolidated basis.

| ii |

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus, any amendment and the information incorporated by reference into this prospectus contain various forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Securities and Exchange Act of 1934, as amended (the “Exchange Act”), which represent our expectations or beliefs concerning future events. Forward-looking statements include statements that are predictive in nature, which depend upon or refer to future events or conditions, and/or which include words such as “believes,” “plans,” “intends,” “anticipates,” “estimates,” “expects,” “may,” “will” or similar expressions. In addition, any statements concerning future financial performance, ongoing strategies or prospects, and possible future actions including any potential strategic transaction involving us, which may be provided by our management, are also forward-looking statements. Forward-looking statements are based on current expectations and projections about future events and are subject to risks, uncertainties, and assumptions about our company, economic and market factors, and the industry in which we do business, among other things. These statements are not guarantees of future performance, and we undertake no obligation to publicly update any forward-looking statements, whether as a result of new information, future events, or otherwise, except as required by law. Actual events and results may differ materially from those expressed or forecasted in forward-looking statements due to a number of factors. Factors that could cause our actual performance, future results and actions to differ materially from any forward-looking statements include, but are not limited to, those discussed under the heading “Risk Factors” in this prospectus and in any of our filings with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act incorporated by reference into this prospectus. The forward-looking statements in this prospectus, and the information incorporated by reference herein represent our views as of the date such statements are made. These forward-looking statements should not be relied upon as representing our views as of any date subsequent to the date such statements are made.

Unless otherwise indicated, information contained in this prospectus concerning our industry and the market in which we operate, including our market position, market opportunity and market size, is based on information from various sources, on assumptions that we have made based on such data and other similar sources and on our knowledge of the markets for our products. These data sources involve a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates.

We have not independently verified any third-party information. While we believe the market position, market opportunity and market size information included in this prospectus is generally reliable, such information is inherently imprecise. In addition, projections, assumptions and estimates of our future performance and the future performance of the industry in which we operate is necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in the section titled “Risk Factors” and elsewhere in this prospectus and in any documents that we incorporate by reference into this prospectus and the registration statement of which this prospectus forms a part. These and other factors could cause results to differ materially from those expressed in the estimates made by the independent parties and by us.

| iii |

This summary highlights selected information contained elsewhere in this prospectus or incorporated by reference into this prospectus. This summary does not contain all of the information that you should consider before investing in our Common Stock. You should carefully read this entire prospectus, and our other filings with the SEC, including the following sections, which are either included herein and/or incorporated by reference herein, “Risk Factors”, “Special Note Regarding Forward-Looking Statements”, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the consolidated financial statements and notes to consolidated financial statements incorporated by reference herein, before making a decision about whether to invest in our securities.

On August 1, 2024, we effectuated a 1-for-70 reverse split of our outstanding shares of common stock. No fractional shares were issued in connection with the reverse stock split and all such fractional interests were rounded up to the nearest whole number of shares of common stock. The exercise prices of our issued and outstanding convertible securities, including shares issuable upon exercise of outstanding stock options and warrants, have been adjusted accordingly. All information presented in this prospectus has been retroactively restated to give effect to our 1-for70 reverse split of our outstanding shares of common stock and unless otherwise indicated, all such amounts and corresponding exercise price data set forth in this prospectus have been adjusted to give effect to the reverse stock split.

Company Overview

Netcapital Inc. is a fintech company with a scalable technology platform that allows private companies to raise capital online from accredited and non-accredited investors. We give all investors the opportunity to access investments in private companies. Our model is disruptive to traditional private equity investing and is based on Title III, Regulation Crowdfunding (“Reg CF”) of the Jumpstart Our Business Startups Act (“JOBS Act”). In addition, we have recently expanded our model to include Regulation A (“Reg A”) offerings. We generate fees from listing private companies on our funding portal located at www.netcapital.com. We also generate fees from advising companies with respect to their Reg A offerings posted on www.netcapital.com. Our consulting group, Netcapital Advisors Inc. (“Netcapital Advisors”), which is a wholly-owned subsidiary, provides marketing and strategic advice to companies in exchange for cash fees and/or equity positions. The Netcapital funding portal is registered with the SEC, is a member of the Financial Industry Regulatory Authority (“FINRA”), a registered national securities association, and provides investors with opportunities to invest in private companies. Beginning on November 22, 2024, Netcapital Securities Inc., a Netcapital subsidiary, is a broker- dealer, and can represent Reg A offerings on the www.netcapital.com website.

Our Business

We provide private companies with access to investments from accredited and non-accredited investors through our online portal located at www.netcapital.com, which is operated by our wholly owned subsidiary, Netcapital Funding Portal, Inc. The Netcapital funding portal charges a $5,000 listing fee and a 4.9% success fee for capital raised at closing. In addition, the portal generates fees for other ancillary services, such as rolling closes. Netcapital Advisors generates fees and equity stakes from consulting in select portfolio companies (“Portfolio Companies”) and non-portfolio clients. With respect to its services for Reg A offerings, Netcapital Advisors charges a monthly flat fee for each month the offering is listed on the netcapital.com website as well as a nominal administrative flat fee for each investor that is processed to cover out-of-pocket costs.

We generated revenues of $465,437, with costs of service of $37,156, in the nine months ended January 31, 2025 for a gross profit of $428,281 in the nine months ended January 31, 2025 as compared to revenues of $4,604,260, with costs of service of $97,062, in the nine months ended January 31, 2024 for a gross profit of $4,507,198 (consisting of $3,489,013 in equity securities from Portfolio Companies for payment of services and $1,115,247 in cash-based revenues, offset by $97,062 for costs of services) in the nine months ended January 31, 2024.

We generated revenues of $4,951,435, with costs of service of $108,060, in the year ended April 30, 2024 for a gross profit of $4,843,375 (consisting of $3,537,700 in equity securities for payment of services and $1,413,736 in cash-based revenues, offset by $108,060 for costs of services) as compared to revenues of $8,493,985 with costs of service of $85,038 in the year ended April 30, 2023 for a gross profit of $8,408,947 (consisting of $7,105,000 in equity securities for the payment of services and $1,388,985 in cash-based revenues, offset by $85,038 for costs of services). We provided additional services for two (2) and four (4) of our Portfolio Companies during the years ended April 30, 2024 and 2023, respectively, and our cash-based gross profits as a percentage of gross profits were approximately 1% in both fiscal years.

| 1 |

In fiscal 2024 and 2023, the average amount raised in an offering on the Netcapital funding portal was $280,978 and $128,170, respectively. The total number of offerings on the Netcapital funding portal in fiscal 2024 and 2023 that closed was 70 and 63, respectively, of which 17 and 13 offerings hosted on the Netcapital funding platform in fiscal 2024 and 2023, respectively, terminated their listings without raising the required minimum dollar amount of capital. For the three- and nine-month periods ended January 31, 2025, 6 and 32 issuers have launched an offering on the portal, respectively, as compared to 27 and 64 issuers that launched an offering in the three- and nine-month periods ended January 31, 2024, respectively. As of the date of this report, we own minority equity positions in 20 Portfolio Companies that have utilized the funding portal to facilitate their offerings, for which equity was received as payment for services.

Funding Portal

Netcapital Funding Portal, Inc. is an SEC-registered funding portal that enables private companies to raise capital online, while investors are able to invest from almost anywhere in the world, at any time, with just a few clicks. Securities offerings on the Netcapital funding portal are accessible through individual offering pages, where companies include product or service details, market size, competitive advantages, and financial documents. Companies can accept an investment from virtually anyone, including friends, family, customers, and employees. Customer accounts on our platform will not be permitted to hold digital securities.

In addition to access to the funding portal, the Netcapital funding portal provides the following services:

● a fully automated onboarding process;

● automated filing of required regulatory documents;

● compliance review;

● custom-built offering page on our portal website;

● third party transfer agent and custodial services;

● email marketing to our proprietary list of investors;

● rolling closes, which provide potential access to liquidity before final close date of offering;

● assistance with annual filings; and

● direct access to our team for ongoing support.

Consulting Business

Our consulting group, Netcapital Advisors, helps companies at all stages to raise capital. Netcapital Advisors provides strategic advice, technology consulting and online marketing services to assist with fundraising campaigns on the Netcapital platform. We also act as an incubator and accelerator, taking equity stakes in select disruptive start-ups. In the instances where we take equity stakes in a company, such interests are of the same class of securities that are offered on the Netcapital platform.

Netcapital Advisors’ services include:

| ● | incubation of technology start-ups; | |

| ● | investor introductions; | |

| ● | online marketing; | |

| ● | website design, software and software development; | |

| ● | message crafting, including pitch decks, offering pages, and ad creation; | |

| ● | strategic advice; and | |

| ● | technology consulting. |

Broker-Dealer Business

In November 2024, our recently formed wholly owned subsidiary, Netcapital Securities Inc. was accepted as a broker-dealer by the Financial Industry Regulatory Authority (“FINRA”). We believe that by having a registered broker-dealer, it will create opportunities to expand revenue base by hosting and generating additional fees from Reg A+ and Reg D offerings on the Netcapital platform, earning additional fees in connection with offerings that may result from the introduction of clients to other FINRA broker-dealers and expanding our distribution capabilities by leveraging strategic partnerships with other broker-dealers to distribute offerings of issuers that utilize the Netcapital platform to a wider range of investors in order to maximize market penetration and optimize capital raising efforts. As of the date of this prospectus, Netcapital Securities Inc. has been engaged by one issuer seeking to raise capital via a Regulation A offering.

| 2 |

Regulatory Overview

In an effort to enhance economic growth and to democratize access to private investment opportunities, Congress finalized the JOBS Act in 2016. Title III of the JOBS Act enabled early-stage companies to offer and sell securities to the general public for the first time. The SEC then adopted Reg CF, in order to implement the JOBS Act’s crowdfunding provisions.

Reg CF has several important features that changed the landscape for private capital raising and investment. For the first time, this regulation:

| ● | Allowed the general public to invest in private companies, no longer limiting early-stage investment opportunities to less than 10% of the population; | |

| ● | Enabled private companies to advertise their securities offerings to the public (general solicitation); and | |

| ● | Conditionally exempted securities sold under Section 4(a)(6) from the registration requirements of the Securities and Exchange Act of 1934, as amended (the “Exchange Act”). |

The SEC had also adopted rules to implement Section 401 of the Jumpstart Our Business Startups (JOBS) Act by expanding Reg A into two tiers

| ● | Tier 1, for securities offerings of up to $20 million in a 12-month period; and | |

| ● | Tier 2, for securities offerings of up to $75 million in a 12-month period. |

In addition, Reg A allows companies that are subject to the ongoing reporting requirements of Section 13 or 15(d) of the Exchange Act to use Reg A. Further, Reg A also enables issuers to raise funds from non-accredited investors and accredited investors.

We are subject, both directly and indirectly, to various laws and regulations relating to our business. If any of the laws are amended, compliance could become more expensive and directly affect our income. We intend to comply with such laws, but new restrictions may arise that could materially adversely affect our Company. Specifically, the SEC regulates our funding portal business, and our funding portal is also a member of FINRA and is regulated by FINRA. We are also subject to the USA Patriot Act of 2001, which contains anti-money laundering and financial transparency laws and mandates various regulations applicable to financial services companies, including standards for verifying client identification at account opening, and obligations to monitor client transactions and report suspicious activities. Anti-money laundering laws outside of the United States contain some similar provisions. Now that our wholly owned subsidiary, Netcapital Securities Inc., has received a broker-dealer license, we are subject to additional regulation and supervision of the SEC and FINRA, including without limitation Rule 15c3-1 under the Securities Exchange Act of 1934 (the Uniform Net Capital Rule). The Uniform Net Capital Rule specifies minimum capital requirements intended to ensure the general financial soundness and liquidity of broker-dealers. The Uniform Net Capital Rule prohibits broker-dealers from paying cash dividends, making unsecured advances or loans or repaying subordinated loans if such payment would result in a net capital amount of less than 5% of aggregate debit balances or less than 120% of its minimum dollar requirement. Our failure to comply with these requirements as applicable to us could have a material adverse effect on us.

Our Market

The traditional funding model restricts access to capital, investments and liquidity. According to Harvard Business Review, venture capital firms (“VCs”) invest in fewer than 1% of the companies they consider and only 10% of VC meetings are obtained through cold outreach. In addition, only 2% of VC funding went to women-owned firms in 2024, according to PitchBook, while Crunchbase revealed that only 0.4% of startup funding went to black-owned firms.

| 3 |

Furthermore, under the traditional model, the average investor lacked access to early-stage investments. Prior to the JOBS Act, almost 90% of U.S. households were precluded from investing in private deals, per dqydj.com. Liquidity has also been an issue, as private investments are generally locked up until IPO or takeout.

The JOBS Act helped provide a solution to these issues by establishing the funding portal industry, which is currently in its infancy. Title III of the JOBS Act outlines Reg CF, which traditionally allowed private companies to raise up to $1.07 million. In March 2021, regulatory enhancements by the SEC went into effect and increased the limit to $5 million. These amendments increased the offering limits for Reg CF, Reg A and Regulation D, Rule 504 offerings as follows: Reg CF increased to $5 million; Regulation D, Rule 504 increased to $10 million from $5 million; and Reg A Tier 2 increased to $75 million from $50 million.

According to KingsCrowd, the 2021 increase in offering limits has served to boost the attractiveness of Reg CF to later stage issuers. While the previous $1 million cap on annual funding was perceived as too restrictive for capital-intensive companies, $5 million every twelve months can be a viable alternative for companies post seed stage.

Reg CF funding grew from $74.8 million in 2018 to $343.6 million in 2024, an increase of 360%, according to KingsCrowd. Although funding was down from its 2021 peak of $496.1 million, the number of Reg CF raises reached a new high in the final month of 2024 to 569 offerings, above the previous high in March 2022 of 561. The average investment size also increased by 26% in 2024 to $1,500 from $1,190 in the previous year. We believe a significant opportunity exists to disrupt private capital markets via the Netcapital funding portal.

Reg A+ offerings raised $244 million in 2024, an increase of 7.5% from the previous year, according to KingsCrowd. While 61 offerings closed during the year, 34 new offerings were launched. $2 million was the 2024 median Reg A+ raise, while the average raise was $7.7 million. We plan to support Reg A+ raises through our broker-dealer subsidiary, Netcapital Securities.

Our Technology

The Netcapital platform is a scalable, real-time, transaction-processing engine that runs 24 hours a day, seven days a week.

For companies raising capital, the technology provides fully automated onboarding with integrated regulatory filings. Funds are collected from investors and held in escrow until the offering closes. For entrepreneurs, the technology facilitates access to capital at low cost. For investors, the platform provides access to investments in private, early-stage companies that were previously unavailable to the general public. Both entrepreneurs and investors can track and view their investments through their dashboard on netcapital.com. As of the date of this prospectus, the platform currently has approximately 125,000 users.

Scalability was demonstrated in November 2021, when the platform processed more than 2,000 investments in less than two hours, totaling more than $2 million.

Our infrastructure is designed in a way that can horizontally scale to meet our capacity needs. Using Docker containers and Amazon Elastic Container Service (“Amazon ECS”), we are able to automate the creation and launch of our production web and application programming interface (“API”), endpoints in order to replicate them as needed behind Elastic Load Balancers (ELBs).

Additionally, all of our public facing endpoints live behind CloudFlare to ensure protection from large scale traffic fluctuations (including distributed denial of service (“DdoS”) attacks).

Our main database layer is built on Amazon RDS and features a Multi-AZ deployment that can also be easily scaled up or down as needed. General queries are cached in our API layer, and we monitor to optimize very complex database queries that are generated by the API. Additionally, we cache the most complex queries (such as analytics data) in our NoSQL (Mongo) data store for improved performance.

Most of our central processing unit (“CPU”), intensive data processing happens asynchronously through a worker/jobs system managed by AWS ElastiCache’s Redis endpoint. This component can be easily fine-tuned for any scale necessary.

| 4 |

The technology necessary to operate our funding portal is licensed from Netcapital Systems LLC, a Delaware limited liability company (“Netcapital DE LLC”), of which Jason Frishman, Founder and former CEO of Netcapital Funding Portal Inc., owns a 29% interest, under a license agreement with Netcapital Funding Portal, Inc., for an annual license fee of $380,000, payable in quarterly installments.

Proposed Alternative Trading (“ATS”) Relationship

We believe that lack of liquidity is a key issue for investors in private companies in our targeted market. We also recognize that secondary trading of securities in private companies is subject to extensive regulation and oversight. Such regulation and oversight includes, but is not limited to, the need to be a registered broker-dealer that is licensed to operate an ATS, or to partner with an entity that is licensed to do so. In order to try to address what we believe is a large, unmet need, our wholly-owned subsidiary, Netcapital Systems LLC, a Utah limited liability company (“Netcapital UT LLC”), entered into a software license and services agreement on January 2, 2023 (the “Templum License Agreement”) with Templum Markets LLC (“Templum”), to provide issuers and investors on the Netcapital platform with the potential for greater distribution and liquidity. Templum is a company that provides capital markets infrastructure for trading private equity securities and operates an ATS with approval in 53 U.S. states and territories for the trading of unregistered or private securities. We are currently working with Templum to design the software required to allow issuers and investors on the Netcapital platform to access the Templum ATS in order to engage in secondary trading of securities in a regulatorily compliant manner. The operation of the Templum ATS, however, remains subject to extensive regulation and oversight. Accordingly, any regulatory delays or objections will result in delays in our ability to launch the proposed platform. While we are currently working with Templum on the design of the required software to enable the access to secondary trading on the Templum ATS, no assurance can be given as to when, or if, we will be able to successfully complete this project in order to enable access to a secondary trading feature beta (testing) version to a closed group of users for testing before any final launch is made to the public, and Templum’s approval. Milestones required to launch the platform include, but are not limited to, plug-in of Templum’s KYC and AML requirements to enable interested users to directly send to the Templum ATS any KYC/AML information required by Templum for review and approval, as well as the launch of a beta version to a closed group of users. In July 2024, we announced the launch of our beta version for this secondary trading platform and our goal was to offer such secondary trading platform through the Templum ATS to all issuers and investors on the Netcapital funding portal before the end of 2024 subject to compliance with all regulatory requirements, however, we do not know when, or if, this feature will be fully completed and launched, as there are many details that remain to be completed.

The operation of the Templum ATS is subject to extensive regulation and oversight. Accordingly, any regulatory delays or objections will result in delays in our ability to launch the proposed platform. In addition, because we cannot easily switch between operators of secondary trading platforms of this nature, any disruption of or interference, whether due to regulatory issues or natural disasters, cyber-attacks, terrorist attacks, power losses, telecommunications failures, or other similar events, would impact our operations and may adversely affect the ability of issuers and investors to utilize this platform. There is no obligation for Templum to renew its agreements with us on commercially reasonable terms or at all.

Institutions and individual investors may face significant risk when buying securities on our proposed secondary trading platform. These risks include the following:

| ● | private companies are not required to make periodic public filings, and therefore certain capitalization, operational and financial information may not be available for evaluation; | |

| ● | an investment may only be appropriate for investors with a long-term investment horizon and a capacity to absorb a loss of some or all of their investment; | |

| ● | the securities, when purchased, are generally highly illiquid, are often subject to further transfer restrictions, and no public market exists for such securities; and | |

| ● | transactions may fail to settle, which could harm our reputation. |

| 5 |

Further, we may become involved in disputes and litigation matters between customers with respect to transactions on our proposed secondary trading platform. There is a risk that clients may increasingly look to us to make them whole for delayed and/or broken trades. Customers may litigate over a failure of sellers to deliver securities or over the untimely deliveries of securities. Any litigation to which we are a party could be expensive and time consuming, regardless of the ultimate outcome, and the potential costs and risks of such litigation may incentivize us to settle, which could harm our reputation or have a material adverse effect on our business or results or operations.

We estimate that the cost for developing this platform will not exceed $1.0 million, most of which has already been incurred and consists of salaries or fees paid to engineers and consultants. We have and continue to pay these expenses from our working capital. We do not currently have a revenue model associated with the sales of securities on the proposed ATS. However, we may seek to incorporate this revenue model in the future, provided that we determine any such revenue model is in strict compliance with all regulatory guidelines.

We currently anticipate that we will also be able to sell our interests in any portfolio company using the Templum ATS provided such sales are made in a regulatorily compliant matter. We expect to place a restriction on any sales during any period in which an issuer is offering its securities for sale on the Netcapital funding platform. In addition, securities issued in a Reg CF transaction generally cannot be resold for a period of one year, unless the securities are transferred: (1) to the issuer of the securities; (2) to an “accredited investor”; (3) as part of an offering registered with the SEC; or (4) to a member of the family of the purchaser or the equivalent, to a trust controlled by the purchaser, to a trust created for the benefit of a member of the family of the purchaser or the equivalent, or in connection with the death or divorce of the purchaser or other similar circumstance.. Accordingly, any shares owned by us would also be subject to these restrictions. Additional restrictions may be implemented, and there can be no assurance that we will ever sell any of our interests in any portfolio company using the Templum ATS. Further, our insider trading policy prohibits all of our employees, officers, consultants and directors from buying or selling securities while in possession of material non-public information and all such parties are also required to maintain strict confidentiality of all such information. In addition, in order to maintain compliance with our insider trading policies, any affiliate or employee seeking to trade securities in any issuer listed on the funding portal must receive prior approval and clearance from our Chief Financial Officer and all such requests for clearance will be documented and maintained with our compliance department.

Our Netcapital funding portal is currently registered with the SEC and is a member of FINRA. For so long as we continue to operate our Netcapital platform solely for primary offerings by issuers under Reg CF, we believe that we are not required to register under Regulation ATS.

Competitive Advantages

Based upon publicly available information either published on the websites of our peer group (StartEngine Crowdfunding, Inc., Wefunder Inc. and Republic Core LLC) or included in offering statements of issuers hosted on such offering platforms, we believe that we provide a low-cost solution for online capital raising. We also believe, based upon our facilitated technology platforms, our strong emphasis on customer support, and feedback received from clients that have onboarded to our platform, that our access and onboarding of new clients are superior due to our facilitated technology platforms. Our network continues to rapidly expand as a result of our enhanced marketing and broad distribution to reach new investors.

Our competitors include StartEngine Crowdfunding, Inc., Wefunder Inc. and Republic Core LLC. Given the rapid growth in the industry and its potential to disrupt the multi-billion dollar private capital market, we believe there is sufficient room for multiple players.

| 6 |

Our Strategy

Two major tailwinds are driving accelerated growth in the shift to the use of online funding portals: (i) the COVID-19 pandemic and (ii) the increase in funding limits under Reg CF. The pandemic drove a rapid need to bring as many processes as possible online. With travel restrictions in place and most people in lockdown, entrepreneurs were no longer able to fundraise in person and have increasingly turned to online capital raising through funding portals.

There are numerous industry drivers and tailwinds that complement investor demand for access to investments in private companies. To capitalize on these, our strategy is to:

| ● | Generate New Investor Accounts. Growing the number of investor accounts on our platform is a top priority. Investment dollars that continue to flow through our platform are the key revenue driver. When issuers advertise their offerings, they are generating new investor accounts for the Netcapital funding platform at no cost to us. We plan to supplement our issuers’ spend on advertising by increasing our online marketing spend as well, which may include virtual conferences going forward. | |

| ● | Hire Additional Business Development Staff. We seek to hire additional business development staff that are technology advanced and financially passionate about capital markets to handle our growing backlog of potential customers. | |

| ● | Increase the Number of Companies on Our Platform via Marketing. When a new company lists on our platform, they bring their customers, supporters, and brand ambassadors as new investors to Netcapital. We plan to increase our marketing budget to help grow our portal and advisory clients. | |

| ● | Invest in Technology. Technology is critical to everything that we do. We plan to invest in developing innovative technologies that enhance our platform and allow us to pursue additional service offerings. | |

| ● | Incubate and accelerate our advisory clients. The advisory clients and our equity interests in select advisory clients represent potential upside for our shareholders. We seek to grow this model of advisory clients. | |

| ● | Expand Internationally. We believe there is a significant opportunity to expand the marketing of Netcapital funding platform and the services we offer into Europe and Asia as an appetite abroad grows for U.S. stocks. | |

| ● | Provide a secondary trading feature. We believe that lack of liquidity is a key issue for investors in private companies in our targeted market. Accordingly, we are exploring ways in which we can provide our clients with the ability to access a secondary trading feature. In January 2023, we entered into the Templum License Agreement to provide issuers and investors on the Netcapital platform with the potential for greater distribution and liquidity. Templum is an operator of an ATS with approval in 53 U.S. states and territories for the trading of unregistered or private securities to provide issuers and investors on the Netcapital platform with the potential for greater distribution and liquidity. We are currently working with Templum on the design of the required software to enable issuers and investors on the Netcapital platform to access the Templum ATS in order to engage in secondary trading of securities. In July 2024, we announced the launch of our beta version for this secondary trading platform and our goal is to offer such secondary trading platform through the Templum ATS to all issuers and investors on the Netcapital funding portal before the end of 2025 subject to compliance with all regulatory requirements, however, we do not know when, or if, this feature will be fully completed and launched, as there are many details that remain to be completed. | |

| ● | New Verticals Represent a Significant Opportunity. We operate in a regulated market supported by the JOBS Act. We are pursuing expanding our model to include Reg A and Regulation D offerings. | |

| ● | Secure Broker-Dealer License. In November 2024, we announced that our wholly-owned subsidiary, Netcapital Securities Inc. received its broker-dealer registration with the Financial Industry Regulatory Authority (“FINRA”). We believe that by having a registered broker-dealer, it could create opportunities to expand revenue base by hosting and generating additional fees from Reg A+ and Reg D offerings on the Netcapital platform; earning additional fees in connection with offerings that may result from the introduction of clients to other FINRA broker-dealers and expanding our distribution capabilities by leveraging strategic partnerships with other broker-dealers to distribute offerings of issuers that utilize the Netcapital platform to a wider range of investors in order to maximize market penetration and optimize capital raising efforts. |

| 7 |

Our Management

Our management team is experienced in finance, technology, entrepreneurship, and marketing.

Martin Kay is our Chief Executive Officer (“CEO”) and a director. He previously served as Managing Director at Accenture Strategy, from October 2015 to December 2022 and holds a BA in physics from Oxford University and an MBA from Stanford University Graduate School of Business. Mr. Kay is an experienced C-suite advisor and digital media entrepreneur, working at the intersection of business and technology. His experience includes oversight of our funding portal when he served on the board of managers of Netcapital DE LLC from 2017 to 2021.

Coreen Kraysler, CFA, is our Chief Financial Officer (“CFO”). With over 30 years of investment experience, she was formerly a Senior Vice President and Principal at Independence Investments, where she managed several 5-star rated mutual funds and served on the Investment Committee. She also worked at Eaton Vance as a Vice President, Equity Analyst on the Large and Midcap Value teams. She received a B.A. in Economics and French, cum laude from Wellesley College and a Master of Science in Management from MIT Sloan.

Jason Frishman is our Founder and former chief executive officer of our funding portal subsidiary, Netcapital Funding Portal Inc. Mr. Frishman founded Netcapital Funding Portal Inc. to help reduce the systemic inefficiencies that early-stage companies face in securing capital. He currently holds advisory positions at leading organizations in the financial technology ecosystem and has spoken as an external expert at Morgan Stanley, University of Michigan, Young Presidents’ Organization (YPO), and others. Mr. Frishman has a background in the life sciences and previously conducted research in medical oncology at the Dana Farber Cancer Institute and cognitive neuroscience at the University of Miami, where he graduated summa cum laude with a B.S. in Neuroscience.

Corporate Information

The Company was incorporated in Utah in 1984 as DBS Investments, Inc. (“DBS”). DBS merged with Valuesetters L.L.C. in December 2003 and changed its name to Valuesetters, Inc. In November 2020, the Company purchased Netcapital Funding Portal Inc. from Netcapital DE LLC and changed the name of the Company from Valuesetters, Inc. to Netcapital Inc. In November 2021, the Company purchased MSG Development Corp.

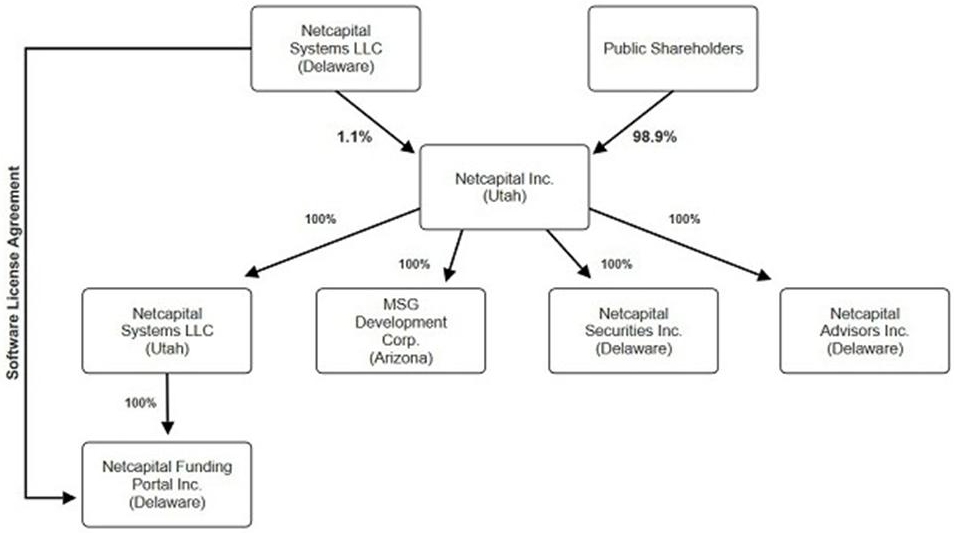

Attached below is an organization chart for the Company as of the date of this prospectus:

| 8 |

Implications of Being a Smaller Reporting Company

We have elected to take advantage of certain of the reduced disclosure obligations in this prospectus and may elect to take advantage of other reduced reporting requirements in future filings. As a result, the information that we provide to our stockholders may be different than what you might receive from other public reporting companies in which you hold equity interests.

We are a “smaller reporting company,” meaning that the market value of our stock held by non-affiliates plus the proposed aggregate amount of gross proceeds to us as a result of this offering is less than $700 million and our annual revenue was less than $100 million during the most recently completed fiscal year. We may continue to be a smaller reporting company after this offering if either (i) the market value of our common stock held by non-affiliates is less than $250 million or (ii) our annual revenue was less than $100 million during the most recently completed fiscal year and the market value of our stock held by non-affiliates is less than $700 million. As a smaller reporting company, we may continue to rely on exemptions from certain disclosure requirements that are available to smaller reporting companies. Specifically, as a smaller reporting company we may choose to present only the two most recent fiscal years of audited financial statements in our Annual Report on Form 10-K and, similar to emerging growth companies, smaller reporting companies have reduced disclosure obligations regarding executive compensation.

Recent Developments

March 2025 Note Financing

On March 26, 2025, we entered into a Securities Purchase Agreement with 1800 Diagonal Lending LLC (the “Lender”), and issued a promissory note to Lender in the principal amount of $181,540 (the “March 2025 Note”). The March 2025 Note was issued with an original issue discount of $25,040, and we received net proceeds of $150,000, after legal and due diligence fees.

The March 2025 Note bears a one-time interest charge of 12% and matures on January 30, 2026. The Note is repayable in five scheduled monthly payments beginning on September 30, 2025, with a total repayment amount of $203,324. We may prepay the Note under certain conditions and at a discount of (i) 4% if the March 2025 Note is prepaid within 90 days of the issuance date; (ii) 3% if the March 2025 Note is repaid during the period beginning ninety-one (91) days following the issuance date and ending on the date which is one hundred fifty (150) days following the issuance date and (iii) 2% during the period beginning one hundred fifty one (151) days following the issuance date and ending on the date which is one hundred eighty (180) days following the issuance date .

Upon the occurrence and during the continuation of any Event of Default (as defined in the March 2025 Note), the March 2025 Note shall become immediately due and payable and we are required to pay Lender, in full satisfaction of its obligations hereunder, an amount equal to 150% (“Default Percentage”) times the sum of (w) the then outstanding principal amount of this Note plus (x) accrued and unpaid interest on the unpaid principal amount of this March 2025 Note to the date of payment (the “Mandatory Prepayment Date”) plus (y) Default Interest, if any, on the amounts referred to in clauses (w) and/or (x) plus (z) any amounts owed to the Lender pursuant to Article IV of the March 2025 Note (the then outstanding principal amount of this Note to the date of payment plus the amounts referred to in clauses (x), (y) and (z) shall collectively be known as the “Default Amount”) and all other amounts payable hereunder shall immediately become due and payable, all without demand, presentment or notice, all of which hereby are expressly waived, together with all costs, including, without limitation, legal fees and expenses, of collection, and the Lender shall be entitled to exercise all other rights and remedies available at law or in equity. Notwithstanding anything to the contrary contained herein, in the event that following an Event of Default (other than Section 3.2), a default pursuant to Section 3.2 of the March 2025 Note related to Conversion and the Shares occurs, the Default Percentage shall be immediately adjusted to 200%.

Following an event of default, the March 2025 Note becomes convertible into shares of our common stock at the then existing conversion price (the “March 2025 Note Conversion Price”), a discount to the trading price, subject to limitations. During the period beginning on the issuance date of the March 2025 Note and ending on the date which is one hundred eighty (180) days following the issuance date of this Note (the “Initial Period”), the March 2025 Note Conversion Price will be $1.00; and; following the Initial Period, the March 2025 Note Conversion Price shall mean 75% multiplied by the Market Price (as defined herein) (representing a discount rate of 25%). “Market Price” means the lowest trading price for our common stock during the ten (10) trading day period ending on the latest complete trading day prior to the a conversion date. The Mach 2025 Note includes customary default provisions, including for non-payment, failure to deliver shares upon conversion, and cessation of operations.

| 9 |

Articles of Amendment to Articles of Incorporation

On March 25, 2025, we filed articles of amendment (the “Articles of Amendment”) to our Articles of Incorporation, as amended, with the Utah Department of Commerce, Division of Corporations and Commercial Code to authorize 10,000,000 shares of “blank check” preferred stock. Following the filing of the Articles of Amendment, we have the authority to issue 910,000,000 shares of capital stock, such total shares consisting of (i) 900,000,000 shares of common stock and (ii) 10,000,000 shares of preferred stock.

March 2025 Warrant Inducement

On March 5, 2025, the Company entered into inducement offer letter agreements with certain warrant holders to exercise 79,558 outstanding warrants for cash at a reduced exercise price of $1.80 per share (previously $8.74 per share). In consideration, the Company issued Series A-7 and Series A-8 Common Stock Purchase Warrants to purchase an aggregate of 159,116 shares of common stock at an exercise price of $2.03. The Series A-7 Warrants expire five years from their initial exercise date of September 5, 2025, and the Series A-8 Warrants expire eighteen months from the same date. The transaction closed on March 6, 2025, generating gross proceeds of approximately $143,000, before deducting fees and expenses.

January 2025 Warrant Inducement

On January 9, 2025, the Company entered into inducement offer letter agreements with certain investors that held certain outstanding warrants to purchase up to an aggregate of 270,861 shares of the Company’s common stock, that were originally issued to the warrant holders in December 2023 and May 2024 (the “Existing Warrants”). The Existing Warrants had an exercise price of $10.85 per share. Pursuant to the inducement letter agreements, the warrant holders agreed to exercise for cash the Existing Warrants at a reduced exercise price of $1.80 per share in partial consideration for the Company’s agreement to issue in a private placement (x) new Series A-5 Common Stock purchase warrants (the “Series A-5 Warrants”) to purchase up to 361,148 shares of our common stock and (y) new Series A-6 Common Stock Purchase Warrants (the “Series A-6 Warrants” and, together with the Series A-5 Warrants, the “New Warrants”) to purchase up to 180,574 shares of common stock. The New Warrants are exercisable beginning on July 13, 2025 (the “Initial Exercise Date”), with such warrants expiring on (i) the five year anniversary of the Initial Exercise Date for the Series A-5 Warrants and (ii) the eighteen month anniversary of the Initial Exercise Date for the Series A-6 Warrants.

The closing of the transactions contemplated by the inducement letters agreements occurred on January 13, 2025. The Company received aggregate gross proceeds of approximately $487,000 from the exercise of the Existing Warrants by the warrant holders, before deducting placement agent fees and other expenses payable by the Company. The Company also issued warrants, that expire on July 15, 2030, to designees of Wainwright to purchase up to 20,315 shares of our common stock at an exercise price of $2.25 per share.

| 10 |

This prospectus relates to the offer and resale by the Selling Shareholders of up to 721,153 shares of Common Stock issuable upon the exercise of the Warrants. All of the Shares, if and when sold, will be sold by the Selling Shareholders. The Selling Shareholders may sell the Shares from time to time at prevailing market prices or at privately negotiated prices.

| Shares offered by the Selling Shareholders: | Up to 721,153 shares of Common Stock consisting of: (i) 361,148 shares of Common Stock upon exercise of the A-5 Inducement Warrants; (ii) 180,574 shares of Common Stock issuable upon exercise of the A-6 Inducement Warrants; (iii) 79,558 shares of Common Stock upon exercise of the A-7 Inducement Warrants; (iv) 79,558 shares of Common Stock issuable upon exercise of the A-8 Inducement Warrants; and (iii) 20,315 shares of Common Stock issuable upon exercise of the Placement Agent Warrants. | |

| Shares of Common Stock outstanding after completion of this offering (assuming full exercise of the Warrants that are exercisable for the Warrant Shares offered hereby): | 2,913,169 shares(1) | |

| Use of proceeds: | We will not receive any proceeds from any sale of the Shares by the Selling Shareholders. We will receive proceeds in the event that any of the Warrants are exercised at the exercise prices per share for cash which would result in gross proceeds of approximately $1,454,000 if all such Warrants are exercised for cash. Any proceeds that we receive from the exercise of the Warrants will be used for working capital, capital expenditures, product development, and other general corporate purposes, including investments in sales and marketing in the United States and internationally. See “Use of Proceeds.” | |

| Risk factors: | An investment in the shares of Common Stock offered under this prospectus is highly speculative and involves substantial risk. Please carefully consider the “Risk Factors” section on page 12, other information in this prospectus and in the documents incorporated by reference herein for a discussion of risks. Additional risks and uncertainties not presently known to us or that we currently deem to be immaterial may also impair our business and operations | |

| NASDAQ symbol: | NCPL |

(1) The number of shares of Common Stock to be outstanding after this offering is based on 2,192,046 shares of our Common Stock outstanding as of April 15, 2025, and excludes:

| ● | 49,322 shares of common stock reserved for future issuance under our 2021 Equity Incentive Plan and our 2023 Omnibus Equity Incentive Plan; |

| ● | 28,594 shares of common stock issuable upon exercise of outstanding options with a weighted average exercise price of $154.48 per share; |

| ● | 1,257,880, of common stock issuable upon the exercise of stock warrants outstanding at a weighted average exercise price of $11.85 per share; and |

| ● | 180 shares of common stock to be issued in connection with our acquisition of MSG Development Corp., which will be issued by October 31, 2025. |

Unless otherwise indicated, all information in this prospectus assumes no exercise of the outstanding options or warrants, described above.

| 11 |

An investment in our securities involves a high degree of risk. Before deciding whether to invest in our securities, you should consider carefully the risks described below, together with other information in this prospectus, the accompanying prospectus and the information and documents incorporated by reference. You should also consider the risks, uncertainties and assumptions discussed under the heading “Risk Factors” included in our most recent Annual Report on Form 10-K and the subsequent reports that we file with the SEC which are on file with the SEC and are incorporated herein by reference, and which may be amended, supplemented or superseded from time to time by other reports we file with the SEC in the future. If any of these risks actually occur, our business, financial condition, results of operations or cash flow could be adversely effected. This could cause the trading price of our common stock to decline, resulting in a loss of all or part of your investment. The risks and uncertainties described below are not the only ones facing us. Additional risks and uncertainties not presently known to us, or that we currently see as immaterial, may also harm our business. Please also read carefully the section above entitled “Special Note Regarding Forward-Looking Statements.”

Risks Related to the Resale of the Shares

The Selling Shareholders may choose to sell the Shares at prices below the current market price.

The Selling Shareholders are not restricted as to the prices at which they may sell or otherwise dispose of the Shares covered by this prospectus. Sales or other dispositions of the Shares below the then-current market prices could adversely affect the market price of our Common Stock.

A large number of shares of Common Stock may be sold in the market following this offering, which may significantly depress the market price of our Common Stock.

The Shares sold in the offering will be freely tradable without restriction or further registration under the Securities Act. As a result, a substantial number of shares of Common Stock may be sold in the public market following this offering. If there are significantly more shares of Common Stock offered for sale than buyers are willing to purchase, then the market price of our Common Stock may decline to a market price at which buyers are willing to purchase the offered Common Stock and sellers remain willing to sell Common Stock.

Neither we nor the Selling Shareholders have authorized any other party to provide you with information concerning us or this offering.

You should carefully evaluate all of the information in this prospectus, including the documents incorporated by reference herein and therein. We may receive media coverage regarding our Company, including coverage that is not directly attributable to statements made by our officers, that incorrectly reports on statements made by our officers or employees, or that is misleading as a result of omitting information provided by us, our officers or employees. Neither we nor the Selling Shareholders have authorized any other party to provide you with information concerning us or this offering, and recipients should not rely on this information.

You may experience future dilution as a result of issuance of the Shares, future equity offerings by us and other issuances of our Common Stock or other securities. In addition, the issuance of the Shares and future equity offerings and other issuances of our Common Stock or other securities may adversely affect our Common Stock price.

In order to raise additional capital, we may in the future offer additional shares of our Common Stock or other securities convertible into or exchangeable for our Common Stock at prices that may not be the same as the price per share as prior issuances of Common Stock. We may not be able to sell shares or other securities in any other offering at a price per share that is equal to or greater than the price per share previously paid by investors, and investors purchasing shares or other securities in the future could have rights superior to existing stockholders. The price per share at which we sell additional shares of our Common Stock or securities convertible into Common Stock in future transactions may be higher or lower than the prices per share. ln addition, the exercise price of the Warrants for the Warrant Shares may be greater than the price per share previously paid by certain investors. You will incur dilution upon exercise of any outstanding stock options, warrants or upon the issuance of shares of Common Stock under our stock incentive programs. In addition, the issuance of the Shares and any future sales of a substantial number of shares of our Common Stock in the public market, or the perception that such sales may occur, could adversely affect the price of our Common Stock. We cannot predict the effect, if any, that market sales of those shares of Common Stock or the availability of those shares for sale will have on the market price of our Common Stock.

| 12 |

Our obligations to the U.S. Small Business Administration is secured by security interests in our assets, so if we default on those obligations, they could foreclose on some or all of our assets.

Our obligations to the U.S. Small Business Administration (“SBA”) is secured by security interests in our assets. As of the March 31, 2025. approximately $0.5 million was owed to the SBA. If we default on our obligations under these agreements, the SBA could foreclose on their security interests and liquidate some or all of these assets, which would harm our financial condition and results of operations and would require us to reduce or cease operations and possibly seek bankruptcy protection.

The loan and security documents encompassing our secured obligations to the SBA contain restrictive covenants which limit management’s discretion to operate our business

In order to obtain the SBA loan, we agreed to certain covenants that place significant restrictions on, among other things, our ability to incur additional indebtedness with any superior liens on the collateral, to create liens or other encumbrances, , and to sell or otherwise dispose of assets and merge or consolidate with other entities. Any failure to comply with these covenants i could result in an event of default, which could trigger an acceleration of the related debt. If we were unable to repay the debt upon any such acceleration, the SBA could seek to foreclose on our assets in an effort to seek repayment under the loans. If the SBA was successful, we would be unable to conduct our business as it is presently conducted and our ability to generate revenues and fund our ongoing operations would be materially adversely affected.

In the event we pursue bankruptcy protection, we will be subject to the risks and uncertainties associated with such proceedings.

In the event we file for relief under the United States Bankruptcy Code, our operations, our ability to develop and execute our business plan and our continuation as a going concern will be subject to the risks and uncertainties associated with bankruptcy proceedings, including, among others: our ability to execute, confirm and consummate a plan of reorganization; the additional, significant costs of bankruptcy proceedings and related fees; our ability to obtain sufficient financing to allow us to emerge from bankruptcy and execute our business plan post-emergence, and our ability to comply with terms and conditions of that financing; our ability to continue our operations in the ordinary course; our ability to maintain our relationships with our consumers, business partners, counterparties, employees and other third parties; our ability to obtain, maintain or renew contracts that are critical to our operations on reasonably acceptable terms and conditions; our ability to attract, motivate and retain key employees; the ability of third parties to use certain limited safe harbor provisions of the United States Bankruptcy Code to terminate contracts without first seeking Bankruptcy Court approval; the ability of third parties to force us to into Chapter 7 proceedings rather than Chapter 11 proceedings and the actions and decisions of our stakeholders and other third parties who have interests in our bankruptcy proceedings that may be inconsistent with our operational and strategic plans. Any delays in our bankruptcy proceedings would increase the risks of our being unable to reorganize our business and emerge from bankruptcy proceedings and may increase our costs associated with the bankruptcy process or result in prolonged operational disruption for us. Also, we would need the prior approval of the bankruptcy court for transactions outside the ordinary course of business during the course of any bankruptcy proceedings, which may limit our ability to respond timely to certain events or take advantage of certain opportunities. Because of the risks and uncertainties associated with any bankruptcy proceedings, we cannot accurately predict or quantify the ultimate impact of events that could occur during any such proceedings. There can be no guarantees that if we seek bankruptcy protection we will emerge from Bankruptcy Protection as a going concern or that holders of our common stock will receive any recovery from any bankruptcy proceedings.

In the event we are unable to pursue bankruptcy protection under Chapter 11 of the United States Bankruptcy Code, or, if pursued, successfully emerge from such proceedings, it may be necessary to pursue Bankruptcy Protection under Chapter 7 of the United States Bankruptcy Code for all or a part of our businesses.

In the event we are unable to pursue bankruptcy protection under Chapter 11 of the United States Bankruptcy Code, or, if pursued, successfully emerge from such proceedings, it may be necessary for us to pursue bankruptcy protection under Chapter 7 of the United States Bankruptcy Code for all or a part of our businesses. In such event, a Chapter 7 trustee would be appointed or elected to liquidate our assets for distribution in accordance with the priorities established by the United States Bankruptcy Code. We believe that liquidation under Chapter 7 would result in significantly smaller distributions being made to our stakeholders than those we might obtain under Chapter 11 primarily because of the likelihood that the assets would have to be sold or otherwise disposed of in a distressed fashion over a short period of time rather than in a controlled manner and as a going concern.

| 13 |

The shares of Common Stock being registered for resale in this prospectus include shares issuable upon the exercise of the following warrants:

| (i) | The January Inducement Warrants: On January 9, 2025, we entered into inducement offer letter agreements with certain investors that held certain outstanding Series A-1, A-3, and A-4 warrants to purchase up to an aggregate of 270,861 shares of our common stock with an exercise price of $8.74 per share, originally issued in December 2023 and May 2024 at a reduced exercise price of $1.80 per share in partial consideration for the Company’s agreement to issue in a private placement (i) new Series A-5 common stock purchase warrants to purchase up to 361,148 shares of our common stock at an exercise price of $2.07 per share and (ii) new Series A-6 common stock purchase warrants to purchase up to 180,574 shares of our common stock at an exercise price of $2.07 per share. Issued on January 13, 2025, these warrants were provided to certain accredited investors as part of an inducement arrangement. The Company received aggregate gross proceeds of approximately $487,000 from the exercise of the existing warrants, before deducting placement agent fees and other expenses payable by the Company |

| (ii) | Placement Agent Warrants: Also issued on January 13, 2025, these warrants were granted to designees of Wainwright, which acted as the exclusive placement agent for the January 2025 inducement transaction. The Placement Agent Warrants permit the purchase of up to 20,315 shares of Common Stock at an exercise price of $2.25 per share, expiring on July 15, 2030.

| |

| (iii) | The March Inducement Warrants: On March 5, 2025, the Company entered into inducement offer letter agreements with certain warrant holders to exercise 79,558 outstanding warrants for cash at a reduced exercise price of $1.80 per share (previously $8.74 per share). In consideration, the Company issued Series A-7 and Series A-8 Common Stock Purchase Warrants to purchase an aggregate of 159,116 shares of common stock at an exercise price of $2.03. The Series A-7 Warrants expire five years from their initial exercise date of September 5, 2025, and the Series A-8 Warrants expire eighteen months from the same date. Issued on March 5, 2025, these warrants were provided to certain accredited investors as part of an inducement arrangement. The Company received aggregate gross proceeds of approximately $143,000, before deducting fees and expenses. |

The A-5 Inducement Warrants, A-6 Inducement Warrants and Placement Agent Warrants are exercisable on July 13, 2025. The expiration date for the A-6 Inducement Warrants is January 13, 2027. The expiration date for the A-5 Inducement warrants and the Placement Agent Warrants is July 15, 2030. The A-7 Inducement Warrants and A-8 Inducement Warrants are exercisable on September 5, 2025. The expiration date for the A-7 Inducement Warrants is September 5, 2030. The expiration date for the A-8 Inducement warrants is March 5, 2027.

| 14 |

The Shares being offered by the Selling Shareholders are those issuable upon the exercise of the Warrants. For additional information regarding the issuance of these securities, see “Issuance of Warrants” beginning on page 14 of this prospectus. We are registering the Warrant Shares issuable upon exercise of the Warrants in order to permit the Selling Shareholders to offer such shares for resale from time to time. Except for the ownership of the Warrants, none of the Selling Shareholders have had any material relationship with us within the past three (3) years except as set forth below.