Securities Act of 1933 Registration No. 033-43758

Investment Company Act of 1940 Registration No. 811-06453

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-1A

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 [X]

[ ] Pre-Effective Amendment No. ______

[X] Post-Effective Amendment No. 64

and

REGISTRATION STATEMENT UNDER THE INVESTMENT COMPANY ACT OF 1940 [X]

[X] Amendment No. 64

Fidelity Court Street Trust II

(Exact Name of Registrant as Specified in Charter)

245 Summer Street, Boston, Massachusetts 02210

(Address of Principal Executive Offices)(Zip Code)

Registrant’s Telephone Number: 617-563-7000

Cynthia Lo Bessette, Secretary and Chief Legal Officer

245 Summer Street

Boston, Massachusetts 02210

(Name and Address of Agent for Service)

It is proposed that this filing will become effective on September 20, 2022 pursuant to paragraph (b) of Rule 485 at 5:30 p.m. Eastern Time.

| Fidelity® New Jersey Municipal Money Market Fund (formerly known as Fidelity® New Jersey AMT Tax-Free Money Market Fund) |

| Class/Ticker |

| Fidelity® New Jersey Municipal Money Market Fund/FAYXX |

In this prospectus, the term "shares" (as it relates to the fund) means the class of shares offered through this prospectus.

Prospectus

September 20, 2022

|

Like securities of all mutual funds, these securities have not been approved or disapproved by the Securities and Exchange Commission, and the Securities and Exchange Commission has not determined if this prospectus is accurate or complete. Any representation to the contrary is a criminal offense. |

245 Summer Street, Boston, MA 02210 |

Contents

| Fund Summary | ||

| Fund Basics | ||

| Shareholder Information |

Additional Information about the Purchase and Sale of Shares |

|

| Fund Services | ||

| Appendix |

Fund Summary

Fund/Class:

Fidelity® New Jersey Municipal Money Market Fund/Fidelity® New Jersey Municipal Money Market Fund

Investment Objective

The fund seeks as high a level of current income, exempt from federal and New Jersey personal income taxes, as is consistent with preservation of capital.

Fee Table

The following table describes the fees and expenses that may be incurred when you buy and hold shares of the fund. In addition to the fees and expenses described below, your broker may also require you to pay brokerage commissions on purchases and sales of certain share classes of the fund.

Shareholder fees

| (fees paid directly from your investment) |

Annual Operating Expenses

(expenses that you pay each year as a % of the value of your investment)

| Management fee | ||

| Distribution and/or Service (12b-1) fees | ||

| Other expenses(a) | ||

| Total annual operating expenses |

(a)

This example helps compare the cost of investing in the fund with the cost of investing in other funds.

Let's say, hypothetically, that the annual return for shares of the fund is 5% and that your shareholder fees and the annual operating expenses for shares of the fund are exactly as described in the fee table. This example illustrates the effect of fees and expenses, but is not meant to suggest actual or expected fees and expenses or returns, all of which may vary. For every $10,000 you invested, here's how much you would pay in total expenses if you sell all of your shares at the end of each time period indicated:

| 1 year | $ |

| 3 years | $ |

| 5 years | $ |

| 10 years | $ |

Principal Investment Strategies

- Normally investing in municipal money market securities.

- Normally investing at least 80% of assets in municipal securities whose interest is exempt from federal and New Jersey personal income taxes.

- Potentially investing up to 20% of assets in municipal securities whose interest is subject to New Jersey personal income tax.

- Potentially investing more than 25% of total assets in municipal securities that finance similar types of projects.

- Investing in compliance with industry-standard regulatory requirements for money market funds for the quality, maturity, liquidity, and diversification of investments.

Principal Investment Risks

- Municipal Market Volatility. The municipal market is volatile and can be significantly affected by adverse tax, legislative, or political changes and the financial condition of the issuers of municipal securities.

- Interest Rate Changes. Interest rate increases can cause the price of a money market security to decrease.

- Income Risk. A low or negative interest rate environment can adversely affect the fund’s yield.

- Foreign Exposure. Entities providing credit support or a maturity-shortening structure that are located in foreign countries can be affected by adverse political, regulatory, market, or economic developments in those countries.

- Geographic Concentration. Unfavorable political or economic conditions within New Jersey can affect the credit quality of issuers located in that state.

- Issuer-Specific Changes. A decline in the credit quality of an issuer or a provider of credit support or a maturity-shortening structure for a security can cause the price of a money market security to decrease.

Performance

The following information is intended to help you understand the risks of investing in the fund.

Visit

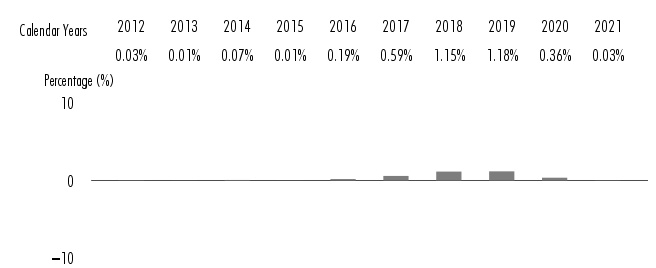

Year-by-Year Returns*

| During the periods shown in the chart: | Returns | Quarter ended |

Average Annual Returns*

| For the periods ended December 31, 2021 | Past 1 year | Past 5 years | Past 10 years |

* The returns shown above are for Premium Class, a class of shares of the fund that is not offered through this prospectus. Fidelity® New Jersey Municipal Money Market Fund would have substantially similar annual returns to Premium Class because the classes are invested in the same portfolio of securities. Fidelity® New Jersey Municipal Money Market Fund's returns will be lower than Premium Class's returns to the extent that Fidelity® New Jersey Municipal Money Market Fund has higher expenses.

Investment Adviser

Fidelity Management & Research Company LLC (FMR) (the Adviser) is the fund's manager. Other investment advisers serve as sub-advisers for the fund.

Purchase and Sale of Shares

The fund is a retail money market fund. Shares of the fund are available only to accounts beneficially owned by natural persons.

The fund will involuntarily redeem accounts that are not beneficially owned by natural persons, as determined by the fund, in order to implement the fund’s eligibility requirements as a retail money market fund. Shares held by these accounts will be sold at their net asset value per share calculated on the day that the fund closes the account position.

The fund may impose a fee upon the sale of fund shares or may temporarily suspend the ability to sell shares if the fund's liquidity falls below required minimums because of market conditions or other factors.

You may buy or sell shares through a Fidelity® brokerage or mutual fund account, or through an investment professional. You may buy or sell shares in various ways:

Internet

www.fidelity.com

Phone

Fidelity Automated Service Telephone (FAST®) 1-800-544-5555

To reach a Fidelity representative 1-800-544-6666

|

Additional purchases: Fidelity Investments |

Redemptions: Fidelity Investments |

TDD- Service for the Deaf and Hearing Impaired

1-800-544-0118

The price to buy one share is its net asset value per share (NAV). Shares will be bought at the NAV next calculated after an order is received in proper form.

The price to sell one share is its NAV. Shares will be sold at the NAV next calculated after an order is received in proper form.

The fund is open for business each day the New York Stock Exchange (NYSE) is open. Even if the NYSE is closed, the fund will be open for business on those days on which the Federal Reserve Bank of New York (New York Fed) is open, the primary trading markets for the fund's portfolio instruments are open, and the fund's management believes there is an adequate market to meet purchase and redemption requests.

There is no purchase minimum for fund shares.

Tax Information

The fund seeks to earn income and pay dividends exempt from federal income tax and New Jersey personal income tax. A portion of the dividends you receive may be subject to federal, state, or local income tax, and, if applicable, may also be subject to the federal alternative minimum tax. You may also receive taxable distributions attributable to the fund's sale of municipal bonds.

Payments to Broker-Dealers and Other Financial Intermediaries

The fund, the Adviser, Fidelity Distributors Company LLC (FDC), and/or their affiliates may pay intermediaries, which may include banks, broker-dealers, retirement plan sponsors, administrators, or service-providers (who may be affiliated with the Adviser or FDC), for the sale of fund shares and related services. These payments may create a conflict of interest by influencing your intermediary and your investment professional to recommend the fund over another investment. Ask your investment professional or visit your intermediary's web site for more information.

Fund Basics

Investment Details

Investment Objective

Fidelity® New Jersey Municipal Money Market Fund seeks as high a level of current income, exempt from federal and New Jersey personal income taxes, as is consistent with preservation of capital.

Principal Investment Strategies

The Adviser normally invests the fund's assets in municipal money market securities.

The Adviser normally invests at least 80% of the fund's assets in municipal securities whose interest is exempt from federal and New Jersey personal income taxes. Municipal securities whose interest is exempt from federal and New Jersey personal income taxes include securities issued by U.S. territories and possessions, such as Guam, the Virgin Islands, and Puerto Rico, and their political subdivisions and public corporations.

The Adviser may invest up to 20% of the fund's assets in municipal securities whose interest is subject to New Jersey personal income tax under normal circumstances. The Adviser may invest all of the fund's assets in municipal securities whose interest is subject to the federal alternative minimum tax.

The supply of and demand for municipal money market securities can vary from time to time. When the Adviser believes that suitable municipal money market securities are not available, or during other unusual market conditions, the Adviser may leave a significant portion of the fund's assets uninvested, or may invest up to 20% of the fund's assets in securities subject to state and/or federal income tax.

The Adviser may invest more than 25% of the fund's total assets in municipal securities that finance similar projects, such as those relating to education, health care, transportation, and utilities.

In buying and selling securities for the fund, the Adviser complies with industry-standard regulatory requirements for money market funds regarding the quality, maturity, liquidity, and diversification of the fund's investments. The Adviser may invest the fund's assets in municipal money market securities by investing in other funds. The Adviser stresses maintaining a stable $1.00 share price, liquidity, and income.

Description of Principal Security Types

Money market securities are high-quality, short-term securities that pay a fixed, variable, or floating interest rate. Securities are often specifically structured so that they are eligible investments for a money market fund. For example, in order to satisfy the maturity restrictions for a money market fund, some money market securities have demand or put features, which have the effect of shortening the security's maturity. Municipal money market securities include variable rate demand notes, commercial paper, and municipal notes.

Municipal securities are issued to raise money for a variety of public and private purposes, including general financing for state and local governments, or financing for a specific project or public facility. Municipal securities may be fully or partially backed by the local government, by the credit of a private issuer, by the current or anticipated revenues from a specific project or specific assets, or by domestic or foreign entities providing credit support such as letters of credit, guarantees, or insurance.

Principal Investment Risks

Many factors affect the fund's performance. Developments that disrupt global economies and financial markets, such as pandemics and epidemics, may magnify factors that affect a fund’s performance. Because the fund concentrates its investments in New Jersey, the fund's performance is expected to be closely tied to economic and political conditions within that state and to be more volatile than the performance of a more geographically diversified fund.

A money market fund's yield will change daily based on changes in interest rates and other market conditions. Although a money market fund is managed to maintain a stable $1.00 share price, there is no guarantee that the fund will be able to do so. For example, a major increase in interest rates or a decrease in the credit quality of the issuer of one of the fund's investments could cause the fund's share price to decrease.

The following factors can significantly affect the fund's performance:

Municipal Market Volatility. Municipal securities can be significantly affected by political changes as well as uncertainties in the municipal market related to taxation, legislative changes, or the rights of municipal security holders. Because many municipal securities are issued to finance similar projects, especially those relating to education, health care, transportation, and utilities, conditions in those sectors can affect the overall municipal market. Budgetary constraints of local, state, and federal governments upon which the issuers may be relying for funding may also impact municipal securities. In addition, changes in the financial condition of an individual municipal insurer can affect the overall municipal market, and market conditions may directly impact the liquidity and valuation of municipal securities.

Interest Rate Changes. Money market securities have varying levels of sensitivity to changes in interest rates. In general, the price of a money market security can fall when interest rates rise and can rise when interest rates fall. Certain types of securities, such as securities with longer maturities, can be more sensitive to interest rate changes. Short-term securities tend to react to changes in short-term interest rates. The discontinuation and replacement of London Interbank Offered Rate (LIBOR) (an indicative measure of the average interest rate at which major global banks could borrow from one another) and other benchmark rates may have a significant impact on the financial markets and may adversely impact a fund’s performance.

Income Risk. The fund’s income, or yield, is based on short-term interest rates, which can fluctuate significantly over short periods. A low or negative interest rate environment can adversely affect the fund’s yield and, depending on its duration and severity, could prevent the fund from providing a positive yield and/or maintaining a stable $1.00 share price. In addition, the fund’s yield will vary as the short-term securities in its portfolio mature and the proceeds are reinvested in securities with different interest rates. From time to time, the Adviser may reimburse expenses or waive fees for a class of a fund in order to avoid a negative yield, but there is no guarantee that the class or fund will be able to avoid a negative yield.

Foreign Exposure. Entities providing credit support or a maturity-shortening structure that are located in foreign countries can involve increased risks. Extensive public information about the provider may not be available and unfavorable political, economic, or governmental developments could affect the value of the security.

Global economies and financial markets are becoming increasingly interconnected, which increases the possibilities that conditions in one country or region might adversely impact providers in a different country or region.

Geographic Concentration. While New Jersey's economy is broad, it is dependent on several sectors, including the manufacturing, logistics, construction, services and commercial agriculture sectors. Economic problems or factors affecting these sectors, as well as unfavorable political or economic conditions within New Jersey, can have a disproportionate impact on New Jersey municipal securities and entities issuing these securities. New Jersey and its municipalities are also facing rising levels of unfunded pension and similar liabilities as well as financial challenges stemming from the impact on the state's finances of the ongoing COVID-19 crisis, which are increasing pressure on their budgets and could adversely affect their ability to meet their outstanding debt obligations. In addition, prolonged inflationary pressures could adversely affect New Jersey's economy. The economic outlook for New Jersey is unpredictable.

Issuer-Specific Changes. Changes in the financial condition of an issuer or counterparty, changes in specific economic or political conditions that affect a particular type of issuer, and changes in general economic or political conditions can increase the risk of default by an issuer or counterparty, which can affect a security's or instrument's credit quality or value. Entities providing credit support or a maturity-shortening structure also can be affected by these types of changes, and if the structure of a security fails to function as intended, the security could decline in value. Municipal securities backed by current or anticipated revenues from a specific project or specific assets can be negatively affected by the discontinuance of the taxation supporting the project or assets or the inability to collect revenues for the project or from the assets. If the Internal Revenue Service (IRS) determines an issuer of a municipal security has not complied with applicable tax requirements, interest from the security could become taxable and the security could decline significantly in value.

Generally, the fund purchases municipal securities whose interest, in the opinion of bond counsel, is free from federal income tax. Neither the Adviser nor the fund guarantees that this opinion is correct, and there is no assurance that the IRS will agree with bond counsel's opinion. Issuers or other parties generally enter into covenants requiring continuing compliance with federal tax requirements to preserve the tax-free status of interest payments over the life of the security. If at any time the covenants are not complied with, or if the IRS otherwise determines that the issuer did not comply with relevant tax requirements, interest payments from a security could become federally taxable, possibly retroactively to the date the security was issued. For certain types of structured securities, the tax status of the pass-through of tax-free income may also be based on the federal and state tax treatment of the structure.

In response to market, economic, political, or other conditions, a fund may temporarily use a different investment strategy (including leaving a significant portion of the fund's assets uninvested) for defensive purposes. Uninvested assets do not earn income for a fund, which may have a significant negative impact on the fund's yield and may prevent the fund from achieving its investment objective. In addition, different factors could affect a fund's performance, and the fund could distribute income subject to federal or New Jersey personal income tax.

Fundamental Investment Policies

The following is fundamental, that is, subject to change only by shareholder approval:

Fidelity® New Jersey Municipal Money Market Fund seeks as high a level of current income, exempt from federal and New Jersey personal income taxes, as is consistent with preservation of capital. The fund normally invests at least 80% of its assets in municipal securities whose interest is exempt from federal and New Jersey personal income taxes.

Valuing Shares

The fund is open for business each day the NYSE is open. Even if the NYSE is closed, a fund will be open for business on those days on which the New York Fed is open, the primary trading markets for the fund's portfolio instruments are open, and the fund's management believes there is an adequate market to meet purchase and redemption requests.

The NAV is the value of a single share. Fidelity normally calculates NAV as of the close of business of the NYSE, normally 4:00 p.m. Eastern time. The fund's assets normally are valued as of this time for the purpose of computing NAV. Fidelity calculates NAV separately for each class of shares of a multiple class fund.

NAV is not calculated and the fund will not process purchase and redemption requests submitted on days when the fund is not open for business. The time at which shares are priced and until which purchase and redemption orders are accepted may be changed as permitted by the Securities and Exchange Commission (SEC).

To the extent that the fund's assets are traded in other markets on days when the fund is not open for business, the value of the fund's assets may be affected on those days. In addition, trading in some of the fund's assets may not occur on days when the fund is open for business.

A fund's assets are valued on the basis of amortized cost.

Shareholder Information

Additional Information about the Purchase and Sale of Shares

The fund is a retail money market fund. Shares of the fund are available only to accounts beneficially owned by natural persons.

The fund will involuntarily redeem accounts that are not beneficially owned by natural persons, as determined by the fund, in order to implement the fund's eligibility requirements as a retail money market fund. Shares held by these accounts will be sold at their net asset value per share calculated on the day that the fund closes the account position.

The fund may impose a fee upon the sale of fund shares or may temporarily suspend the ability to sell shares if the fund's liquidity falls below required minimums because of market conditions or other factors.

As used in this prospectus, the term "shares" generally refers to the shares offered through this prospectus.

General Information

Information on Fidelity

Fidelity Investments was established in 1946 to manage one of America's first mutual funds. Today, Fidelity is one of the world's largest providers of financial services.

In addition to its mutual fund business, the company operates one of America's leading brokerage firms, Fidelity Brokerage Services LLC. Fidelity is also a leader in providing tax-advantaged retirement plans for individuals investing on their own or through their employer.

Ways to Invest

Subject to the purchase and sale requirements stated in this prospectus, you may buy or sell shares through a Fidelity® brokerage account or a Fidelity® mutual fund account. If you buy or sell shares (other than by exchange) through a Fidelity® brokerage account, your transactions generally involve your Fidelity® brokerage core (a settlement vehicle included as part of your Fidelity® brokerage account).

If you do not currently have a Fidelity® brokerage account or a Fidelity® mutual fund account and would like to invest in a fund, you may need to complete an application. For more information about a Fidelity® brokerage account or a Fidelity® mutual fund account, please visit Fidelity's web site at www.fidelity.com, call 1-800-FIDELITY, or visit a Fidelity Investor Center (call 1-800-544-9797 for the center nearest you).

You may also buy or sell shares through an investment professional. If you buy or sell shares through an investment professional, the procedures for buying, selling, and exchanging shares and the account features and policies may differ from those discussed in this prospectus. Fees in addition to those discussed in this prospectus may also apply. For example, you may be charged a transaction fee if you buy or sell shares through a non-Fidelity broker or other investment professional.

Information on Placing Orders

You should include the following information with any order:

- Your name

- Your account number

- Type of transaction requested

- Name(s) of fund(s) and class(es)

- Dollar amount or number of shares

Certain methods of contacting Fidelity may be unavailable or delayed (for example, during periods of unusual market activity). In addition, the level and type of service available may be restricted.

Frequent Purchases and Redemptions

The fund may reject for any reason, or cancel as permitted or required by law, any purchase or exchange, including transactions deemed to represent excessive trading, at any time.

Excessive trading of fund shares can harm shareholders in various ways, including reducing the returns to long-term shareholders by increasing costs to the fund (such as spreads paid to dealers who sell money market instruments to a fund) and disrupting portfolio management strategies.

The Adviser anticipates that shares of the fund will be purchased and sold frequently because a money market fund is designed to offer a liquid cash option. Accordingly, the Board of Trustees has not adopted policies and procedures designed to discourage excessive trading of fund shares and the fund accommodates frequent trading.

The fund has no limit on purchase or exchange transactions but may in its discretion restrict, reject, or cancel any purchases that, in the Adviser's opinion, may be disruptive to the management of the fund or otherwise not be in the fund's interests.

The fund reserves the right at any time to restrict purchases or exchanges or impose conditions that are more restrictive on excessive trading than those stated in this prospectus.

Buying Shares

Eligibility

Shares are generally available only to investors residing in the United States.

Shares of the fund, which is a retail money market fund, are available only to accounts beneficially owned by natural persons.

Investors may be required to demonstrate eligibility to buy shares of the fund before an investment is accepted.

There is no minimum balance or purchase minimum for fund shares.

Price to Buy

The price to buy one share is its NAV. Shares are sold without a sales charge.

Shares will be bought at the NAV next calculated after an order is received in proper form.

The fund has authorized certain intermediaries to accept orders to buy shares on its behalf. When authorized intermediaries receive an order in proper form, the order is considered as being placed with the fund, and shares will be bought at the NAV next calculated after the order is received by the authorized intermediary. If applicable, orders by funds of funds for which Fidelity serves as investment manager will be treated as received by the fund at the same time that the corresponding orders are received in proper form by the funds of funds.

The fund may stop offering shares completely or may offer shares only on a limited basis, for a period of time or permanently, including, if applicable, periods when redemptions are suspended.

If your payment is not received and collected, your purchase may be canceled and you could be liable for any losses or fees the fund or Fidelity has incurred.

Under applicable anti-money laundering rules and other regulations, purchase orders may be suspended, restricted, or canceled and the monies may be withheld.

Selling Shares

The price to sell one share is its NAV.

Shares will be sold at the NAV next calculated after an order is received in proper form. Normally, redemptions will be processed by the next business day, but it may take up to seven days to pay the redemption proceeds if making immediate payment would adversely affect the fund.

The fund has authorized certain intermediaries to accept orders to sell shares on its behalf. When authorized intermediaries receive an order in proper form, the order is considered as being placed with the fund, and shares will be sold at the NAV next calculated after the order is received by the authorized intermediary. If applicable, orders by funds of funds for which Fidelity serves as investment manager will be treated as received by the fund at the same time that the corresponding orders are received in proper form by the funds of funds.

See "Policies Concerning the Redemption of Fund Shares" below for additional redemption information.

A signature guarantee is designed to protect you and Fidelity from fraud. If you hold your shares in a Fidelity® mutual fund account and submit your request to Fidelity by mail, Fidelity may require that your request be made in writing and include a signature guarantee in certain circumstances, such as:

- When you wish to sell more than $100,000 worth of shares.

- When the address on your account (record address) has changed within the last 15 days or you are requesting that a check be mailed to an address different than the record address.

- When you are requesting that redemption proceeds be paid to someone other than the account owner.

- In certain situations when the redemption proceeds are being transferred to a Fidelity® mutual fund account with a different registration.

You should be able to obtain a signature guarantee from a bank, broker (including Fidelity® Investor Centers), dealer, credit union (if authorized under state law), securities exchange or association, clearing agency, or savings association. A notary public cannot provide a signature guarantee.

When you place an order to sell shares, note the following:

- Redemption proceeds (other than exchanges) may be delayed until money from prior purchases sufficient to cover your redemption has been received and collected.

- Redemptions may be suspended or payment dates postponed when the NYSE is closed (other than weekends or holidays), when trading on the NYSE is restricted, or as permitted by the SEC.

- Redemption proceeds may be paid in securities or other property rather than in cash if the Adviser determines it is in the best interests of the fund.

- If you hold your shares in a Fidelity® mutual fund account and you sell shares by writing a check, if available, and the amount of the check is greater than the value of your fund position, your check will be returned to you and you may be subject to additional charges.

- You will not receive interest on amounts represented by uncashed redemption checks.

- If you hold your shares in a Fidelity® mutual fund account and your redemption check remains uncashed for six months, the check may be invested in additional shares at the NAV next calculated on the day of the investment.

- Under applicable anti-money laundering rules and other regulations, redemption requests may be suspended, restricted, canceled, or processed and the proceeds may be withheld.

Special Limitations Affecting Redemptions:

The fund may impose liquidity fees and temporarily suspend redemptions based on the amount of fund assets that are “weekly liquid assets.” Weekly liquid assets generally include cash, direct obligations of the U.S. government, certain other U.S. government or agency securities, and securities that will mature or are subject to a demand feature that is exercisable and payable within five business days.

If, at any time, the weekly liquid assets of the fund fall below 30% of total assets and the fund’s Board of Trustees determines it is in the fund’s best interests, the fund may, as early as the same day, impose a liquidity fee of no more than 2% and/or temporarily suspend redemptions for up to 10 business days in any 90 day period.

If, at the end of any business day, the weekly liquid assets of the fund fall below 10% of total assets, the fund will impose a liquidity fee of 1% on all redemptions beginning on the next business day, unless the fund’s Board of Trustees determines that imposing such a fee would not be in the fund’s best interests or determines that a lower or higher fee (not to exceed 2%) would be in the fund’s best interests. Any such fee would remain in effect until weekly liquid assets return to 30% or the fund’s Board of Trustees determines that the fee is no longer in the fund’s best interests. The Board of Trustees of the fund may determine that it would not be in the fund’s best interests to continue operating if the fund’s weekly liquid assets fall below 10% or under other circumstances, at which point, the fund may permanently suspend redemptions and liquidate.

Liquidity fees are designed to transfer the costs of liquidating fund securities from shareholders who remain in the fund to those who leave the fund during periods when liquidity is scarce. The fees are payable to the fund and any fees charged to a shareholder will fully or partially offset the gain or increase the loss realized by that shareholder upon redemption.

If liquidity fees are imposed or redemptions are suspended, the fund will notify shareholders on the fund’s website or by press release.

Policies Concerning the Redemption of Fund Shares

Regardless of whether your account is held directly with a fund or through an intermediary, a fund typically expects to pay redemption proceeds on the next business day (or earlier to the extent a fund offers a same day settlement feature) following receipt of a redemption order in proper form. Proceeds from the periodic and automatic sale of shares of a Fidelity® money market fund that are used to buy shares of another Fidelity® fund are settled simultaneously. To the extent your account is held through an intermediary, it is the responsibility of your investment professional to transmit your order to sell shares to Fidelity before the close of business on the day you place your order.

As noted elsewhere, payment of redemption proceeds may take longer than the time a fund typically expects and may take up to seven days from the date of receipt of the redemption order as permitted by applicable law.

Redemption Methods Available. Generally a fund expects to pay redemption proceeds in cash. To do so, a fund typically expects to satisfy redemption requests either by using available cash (or cash equivalents) or by selling portfolio securities. On a less regular basis, a fund may also satisfy redemption requests by utilizing one or more of the following sources, if permitted: borrowing from another Fidelity® fund; drawing on an available line or lines of credit from a bank or banks; or using reverse repurchase agreements (if authorized). These methods may be used during both normal and stressed market conditions.

In addition to paying redemption proceeds in cash, a fund reserves the right to pay part or all of your redemption proceeds in readily marketable securities instead of cash (redemption in-kind). Redemption in-kind proceeds will typically be made by delivering the selected securities to the redeeming shareholder within seven days after the receipt of the redemption order in proper form by a fund.

Exchanging Shares

An exchange involves the redemption of all or a portion of the shares of one fund and the purchase of shares of another fund.

As a shareholder, you have the privilege of exchanging shares for shares of other Fidelity® funds.

However, you should note the following policies and restrictions governing exchanges:

- The fund may refuse any exchange purchase for any reason. For example, the fund may refuse exchange purchases by any person or group if, in the Adviser's judgment, the fund would be unable to invest the money effectively in accordance with its investment objective and policies, or would otherwise potentially be adversely affected.

- Before any exchange, read the prospectus for the shares you are purchasing, including any purchase and sale requirements.

- The shares you are acquiring by exchange must be available for sale in your state.

- Exchanges may have tax consequences for you.

- If you are exchanging between accounts that are not registered in the same name, address, and taxpayer identification number (TIN), there may be additional requirements.

- Under applicable anti-money laundering rules and other regulations, exchange requests may be suspended, restricted, canceled, or processed and the proceeds may be withheld.

The fund may terminate or modify exchange privileges in the future.

Other funds may have different exchange restrictions and minimums. Check each fund's prospectus for details.

Features and Policies

Features

The following features may be available to buy and sell shares of the fund or to move money to and from your account, depending on whether you are investing through a Fidelity® brokerage account or a Fidelity® mutual fund account. Please visit Fidelity's web site at www.fidelity.com or call 1-800-544-6666 for more information.

Electronic Funds Transfer: electronic money movement through the Automated Clearing House

- To transfer money between a bank account and a Fidelity® brokerage account or Fidelity® mutual fund account.

- You can use electronic funds transfer to:

- Make periodic (automatic) purchases of Fidelity® fund shares or payments to your Fidelity® brokerage account.

- Make periodic (automatic) redemptions of Fidelity® fund shares or withdrawals from your Fidelity® brokerage account.

Wire: electronic money movement through the Federal Reserve wire system

- To transfer money between a bank account and a Fidelity® brokerage account or Fidelity® mutual fund account.

Automatic Transactions: periodic (automatic) transactions

- To directly deposit all or a portion of your compensation from your employer (or the U.S. Government, in the case of Social Security) into a Fidelity® brokerage account or Fidelity® mutual fund account.

- To make contributions from a Fidelity® mutual fund account to a Fidelity® mutual fund IRA.

- To sell shares of a Fidelity® money market fund and simultaneously to buy shares of another Fidelity® fund in a Fidelity® mutual fund account.

Checkwriting

- To sell Fidelity® fund shares from your Fidelity® mutual fund account or withdraw money from your Fidelity® brokerage account.

Policies

The following apply to you as a shareholder.

Statements that Fidelity sends to you, if applicable, include the following:

- Confirmation statements (after transactions affecting your fund balance except, to the extent applicable, reinvestment of distributions in the fund or another fund, certain transactions through automatic investment or withdrawal programs, and certain transactions in the fund that are followed by a monthly account statement).

- Monthly or quarterly account statements (detailing fund balances and all transactions completed during the prior month or quarter).

Current regulations allow Fidelity to send a single copy of shareholder documents for Fidelity® funds, such as prospectuses, annual and semi-annual reports, and proxy materials, to certain mutual fund customers whom we believe are members of the same family who share the same address. For certain types of accounts, we will not send multiple copies of these documents to you and members of your family who share the same address. Instead, we will send only a single copy of these documents. This will continue for as long as you are a shareholder, unless you notify us otherwise. If at any time you choose to receive individual copies of any documents, please call 1-800-544-8544. We will begin sending individual copies to you within 30 days of receiving your call.

Electronic copies of most financial reports and prospectuses are available at Fidelity's web site. To participate in Fidelity's electronic delivery program, call Fidelity or visit Fidelity's web site for more information.

You may initiate many transactions by telephone or electronically. Fidelity will not be responsible for any loss, cost, expense, or other liability resulting from unauthorized transactions if it follows reasonable security procedures designed to verify the identity of the investor. Fidelity will request personalized security codes or other information, and may also record calls. For transactions conducted through the Internet, Fidelity recommends the use of an Internet browser with 128-bit encryption. You should verify the accuracy of your confirmation statements upon receipt and notify Fidelity immediately of any discrepancies in your account activity. If you do not want the ability to sell and exchange by telephone, call Fidelity for instructions.

You may also be asked to provide additional information in order for Fidelity to verify your identity in accordance with requirements under anti-money laundering regulations. Accounts may be restricted and/or closed, and the monies withheld, pending verification of this information or as otherwise required under these and other federal regulations. In addition, the fund reserves the right to involuntarily redeem an account in the case of: (i) actual or suspected threatening conduct or actual or suspected fraudulent, illegal or suspicious activity by the account owner or any other individual associated with the account; or (ii) the failure of the account owner to provide information to the fund related to opening the accounts. Your shares will be sold at the NAV, minus any applicable shareholder fees, calculated on the day Fidelity closes your fund position.

Fidelity may charge a fee for certain services, such as providing historical account documents.

Dividends and Capital Gain Distributions

The fund earns interest, dividends, and other income from its investments, and distributes this income (less expenses) to shareholders as dividends. The fund may also realize capital gains from its investments, and distributes these gains (less losses), if any, to shareholders as capital gain distributions.

Distributions from a money market fund consist primarily of dividends. A money market fund normally declares dividends daily and pays them monthly.

Earning Dividends

The fund processes purchase and redemption requests only on days it is open for business.

Shares generally begin to earn dividends on the first business day following the day of purchase.

Shares generally earn dividends until, but not including, the next business day following the day of redemption.

Exchange requests will be processed only when both funds are open for business.

Distribution Options

When you open an account, specify on your application how you want to receive your distributions. The following distribution options are available:

1. Reinvestment Option. Any dividends and capital gain distributions will be automatically reinvested in additional shares. If you do not indicate a choice on your application, you will be assigned this option.

2. Cash Option. Any dividends and capital gain distributions will be paid in cash.

3. Directed Dividends® Option. Any dividends will be automatically invested in shares of another identically registered Fidelity® fund. Any capital gain distributions will be automatically invested in shares of another identically registered Fidelity® fund, automatically reinvested in additional shares of the fund, or paid in cash.

Not all distribution options may be available for every account and certain restrictions may apply. If the distribution option you prefer is not listed on your account application, or if you want to change your current distribution option, visit Fidelity's web site at www.fidelity.com or call 1-800-544-6666 for more information.

If you elect to receive distributions paid in cash by check and the U.S. Postal Service does not deliver your checks, your distribution option may be converted to the Reinvestment Option. You will not receive interest on amounts represented by uncashed distribution checks.

If your dividend check(s) remains uncashed for six months, your check(s) may be invested in additional shares at the NAV next calculated on the day of the investment.

Tax Consequences

As with any investment, your investment in the fund could have tax consequences for you.

The fund seeks to earn income and pay dividends exempt from federal income tax and New Jersey personal income tax.

A portion of the dividends you receive may be subject to federal, state, or local income tax and, if applicable, may also be subject to the federal alternative minimum tax. You may also receive taxable distributions attributable to the fund's sale of municipal bonds.

For federal tax purposes, certain of the fund's distributions, including distributions of short-term capital gains and gains on the sale of bonds characterized as market discount, are taxable to you as ordinary income, while the fund's distributions of long-term capital gains, if any, are taxable to you generally as capital gains.

For New Jersey personal income tax purposes, distributions derived from interest on municipal securities of New Jersey issuers and from interest on qualifying securities issued by U.S. territories and possessions are generally exempt from tax. Distributions that are federally taxable as capital gains are generally exempt from New Jersey personal income tax to the extent derived from municipal securities of New Jersey issuers. All other distributions may be taxable for New Jersey personal income tax purposes.

Any taxable distributions you receive from the fund will normally be taxable to you when you receive them, regardless of your distribution option. If you elect to receive distributions in cash or to invest distributions automatically in shares of another Fidelity® fund, you will receive certain December distributions in January, but those distributions will be taxable as if you received them on December 31.

Fund Services

Fund Management

The fund is a mutual fund, an investment that pools shareholders' money and invests it toward a specified goal.

Adviser

FMR. The Adviser is the fund's manager. The address of the Adviser is 245 Summer Street, Boston, Massachusetts 02210.

As of December 31, 2021, the Adviser had approximately $3.6 trillion in discretionary assets under management, and approximately $4.5 trillion when combined with all of its affiliates' assets under management.

As the manager, the Adviser has overall responsibility for directing the fund's investments and handling its business affairs.

Sub-Adviser(s)

FMR Investment Management (UK) Limited (FMR UK), at 1 St. Martin's Le Grand, London, EC1A 4AS, United Kingdom, serves as a sub-adviser for the fund. As of December 31, 2021, FMR UK had approximately $30.9 billion in discretionary assets under management. FMR UK may provide investment research and advice on issuers based outside the United States and may also provide investment advisory services for the fund. FMR UK is an affiliate of the Adviser.

Fidelity Management & Research (Hong Kong) Limited (FMR H.K.), at Floor 19, 41 Connaught Road Central, Hong Kong, serves as a sub-adviser for the fund. As of December 31, 2021, FMR H.K. had approximately $19.0 billion in discretionary assets under management. FMR H.K. may provide investment research and advice on issuers based outside the United States and may also provide investment advisory services for the fund. FMR H.K. is an affiliate of the Adviser.

Fidelity Management & Research (Japan) Limited (FMR Japan), at Kamiyacho Prime Place, 1-17, Toranomon-4-Chome, Minato-ku, Tokyo, Japan, serves as a sub-adviser for the fund. As of March 31, 2022, FMR Japan had approximately $6.9 billion in discretionary assets under management. FMR Japan may provide investment research and advice on issuers based outside the United States and may also provide investment advisory services for the fund. FMR Japan is an affiliate of the Adviser.

From time to time a manager, analyst, or other Fidelity employee may express views regarding a particular company, security, industry, or market sector. The views expressed by any such person are the views of only that individual as of the time expressed and do not necessarily represent the views of Fidelity or any other person in the Fidelity organization. Any such views are subject to change at any time based upon market or other conditions and Fidelity disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a Fidelity® fund are based on numerous factors, may not be relied on as an indication of trading intent on behalf of any Fidelity® fund.

Advisory Fee(s)

The fund pays a management fee to the Adviser. The management fee is calculated and paid to the Adviser every month. The Adviser pays all of the other expenses of the fund with certain exceptions.

The fund's annual management fee rate is 0.20% of its average net assets.

The Adviser pays FMR UK, FMR H.K., and FMR Japan for providing sub-advisory services.

The basis for the Board of Trustees approving the management contract and sub-advisory agreements for the fund is available in the fund's annual report for the fiscal period ended November 30, 2021.

From time to time, the Adviser or its affiliates may agree to reimburse or waive certain fund expenses while retaining the ability to be repaid if expenses fall below the specified limit prior to the end of the fiscal year.

Reimbursement or waiver arrangements can decrease expenses and boost performance.

Fund Distribution

The fund is composed of multiple classes of shares. All classes of the fund have a common investment objective and investment portfolio.

FDC distributes the fund's shares.

Intermediaries may receive from the Adviser, FDC, and/or their affiliates compensation for providing recordkeeping and administrative services, as well as other retirement plan expenses, and compensation for services intended to result in the sale of fund shares. This compensation may take the form of payments for additional distribution-related activities and/or shareholder services and payments for educational seminars and training, including seminars sponsored by Fidelity, or by an intermediary. These payments are described in more detail in this section and in the statement of additional information (SAI).

Distribution and Service Plan(s)

The fund has adopted a Distribution and Service Plan pursuant to Rule 12b-1 under the Investment Company Act of 1940 (1940 Act) that recognizes that the Adviser may use its management fee revenues, as well as its past profits or its resources from any other source, to pay FDC for expenses incurred in connection with providing services intended to result in the sale of fund shares and/or shareholder support services. The Adviser, directly or through FDC, may pay significant amounts to intermediaries that provide those services. Currently, the Board of Trustees of the fund has authorized such payments for shares of the fund. Please speak with your investment professional to learn more about any payments his or her firm may receive from the Adviser, FDC, and/or their affiliates, as well as fees and/or commissions the investment professional charges. You should also consult disclosures made by your investment professional at the time of purchase.

If payments made by the Adviser to FDC or to intermediaries under the Distribution and Service Plan were considered to be paid out of a class's assets on an ongoing basis, they might increase the cost of your investment and might cost you more than paying other types of sales charges.

From time to time, FDC may offer special promotional programs to investors who purchase shares of Fidelity® funds. For example, FDC may offer merchandise, discounts, vouchers, or similar items to investors who purchase shares of certain Fidelity® funds during certain periods. To determine if you qualify for any such programs, contact Fidelity or visit our web site at www.fidelity.com.

No dealer, sales representative, or any other person has been authorized to give any information or to make any representations, other than those contained in this prospectus and in the related SAI, in connection with the offer contained in this prospectus. If given or made, such other information or representations must not be relied upon as having been authorized by the fund or FDC. This prospectus and the related SAI do not constitute an offer by the fund or by FDC to sell shares of the fund to or to buy shares of the fund from any person to whom it is unlawful to make such offer.

Appendix

Financial Highlights

Financial Highlights are intended to help you understand the financial history of fund shares for the past 5 years (or, if shorter, the period of operations). Certain information reflects financial results for a single share. The total returns in the table represent the rate that an investor would have earned (or lost) on an investment in shares (assuming reinvestment of all dividends and distributions). Because Fidelity® New Jersey Municipal Money Market Fund, a class of shares of the fund, has not commenced operations as of the end of the fund's fiscal year, financial highlights are not available. The annual information has been audited by PricewaterhouseCoopers LLP, independent registered public accounting firm, whose report, along with fund financial statements, is included in the annual report. Annual reports are available for free upon request.

Fidelity New Jersey Municipal Money Market Fund Premium Class

| Years ended November 30, | 2021 | 2020 | 2019 | 2018 | 2017 |

| Selected Per–Share Data | |||||

| Net asset value, beginning of period | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 |

| Income from Investment Operations | |||||

| Net investment income (loss) | –A | .004 | .012 | .011 | .005 |

| Net realized and unrealized gain (loss)A | – | – | – | – | – |

| Total from investment operations | –A | .004 | .012 | .011 | .005 |

| Distributions from net investment income | –A | (.004) | (.012) | (.011) | (.005) |

| Distributions from net realized gain | – | – | – | –A | – |

| Total distributions | –A | (.004) | (.012) | (.011) | (.005) |

| Net asset value, end of period | $1.00 | $1.00 | $1.00 | $1.00 | $1.00 |

| Total ReturnB | .01% | .44% | 1.21% | 1.11% | .55% |

| Ratios to Average Net AssetsC,D | |||||

| Expenses before reductions | .30% | .30% | .30% | .30% | .30% |

| Expenses net of fee waivers, if any | .10% | .27% | .30% | .30% | .30% |

| Expenses net of all reductions | .10% | .27% | .30% | .30% | .30% |

| Net investment income (loss) | .01% | .47% | 1.20% | 1.11% | .55% |

| Supplemental Data | |||||

| Net assets, end of period (000 omitted) | $127,495 | $139,392 | $172,947 | $185,546 | $151,989 |

AAmount represents less than $.0005 per share.

BTotal returns would have been lower if certain expenses had not been reduced during the applicable periods shown.

CFees and expenses of any underlying mutual funds or exchange-traded funds (ETFs) are not included in the Fund's expense ratio. The Fund indirectly bears its proportionate share of these expenses. For additional expense information related to investments in Fidelity Central Funds, please refer to the "Investments in Fidelity Central Funds" note found in the Notes to Financial Statements section of the most recent Annual or Semi-Annual report.

DExpense ratios reflect operating expenses of the class. Expenses before reductions do not reflect amounts reimbursed, waived, or reduced through arrangements with the investment adviser, brokerage services, or other offset arrangements, if applicable, and do not represent the amount paid by the class during periods when reimbursements, waivers or reductions occur.

IMPORTANT INFORMATION ABOUT OPENING A NEW ACCOUNT

To help the government fight the funding of terrorism and money laundering activities, the Uniting and Strengthening America by Providing Appropriate Tools Required to Intercept and Obstruct Terrorism Act of 2001 (USA PATRIOT ACT), requires all financial institutions to obtain, verify, and record information that identifies each person or entity that opens an account.

For individual investors opening an account: When you open an account, you will be asked for your name, address, date of birth, and other information that will allow Fidelity to identify you. You may also be asked to provide documents that may help to establish your identity, such as your driver's license.

For investors other than individuals: When you open an account, you will be asked for the name of the entity, its principal place of business and taxpayer identification number (TIN). You will be asked to provide information about the entity's control person and beneficial owners, and person(s) with authority over the account, including name, address, date of birth and social security number. You may also be asked to provide documents, such as drivers' licenses, articles of incorporation, trust instruments or partnership agreements and other information that will help Fidelity identify the entity.

You can obtain additional information about the fund. A description of the fund's policies and procedures for disclosing its holdings is available in its SAI and on Fidelity's web sites. The SAI also includes more detailed information about the fund and its investments. The SAI is incorporated herein by reference (legally forms a part of the prospectus). The fund's annual and semi-annual reports also include additional information.

For a free copy of any of these documents or to request other information or ask questions about the fund, call Fidelity at 1-800-544-8544. In addition, you may visit Fidelity's web site at www.fidelity.com for a free copy of a prospectus, SAI, or annual or semi-annual report or to request other information.

The SAI, the fund's annual and semi-annual reports and other related materials are available from the Electronic Data Gathering, Analysis, and Retrieval (EDGAR) Database on the SEC's web site (http://www.sec.gov). You can obtain copies of this information, after paying a duplicating fee, by sending a request by e-mail to publicinfo@sec.gov or by writing the Public Reference Section of the SEC, Washington, D.C. 20549-1520. You can also review and copy information about the fund, including the fund's SAI, at the SEC's Public Reference Room in Washington, D.C. Call 1-202-551-8090 for information on the operation of the SEC's Public Reference Room.

Investment Company Act of 1940, File Number(s), 811-06453

FDC is a member of the Securities Investor Protection Corporation (SIPC). You may obtain information about SIPC, including the SIPC brochure, by visiting www.sipc.org or calling SIPC at 202-371-8300.

Fidelity, Fidelity Investments & Pyramid Design, FAST, and Directed Dividends are registered service marks of FMR LLC. © 2022 FMR LLC. All rights reserved.

Any third-party marks that may appear above are the marks of their respective owners.

| 1.9906054.101 | NJN-R-PRO-0922 |

| Fund/Class | Ticker |

| Fidelity® New Jersey Municipal Money Market Fund (formerly known as Fidelity® New Jersey AMT Tax-Free Money Market Fund)/Fidelity® New Jersey Municipal Money Market Fund | FAYXX |

Fund of Fidelity Court Street Trust II

STATEMENT OF ADDITIONAL INFORMATION

September 20, 2022

This statement of additional information (SAI) is not a prospectus. Portions of the fund's annual report are incorporated herein. The annual report is supplied with this SAI.

To obtain a free additional copy of the prospectus or SAI, dated September 20, 2022, or an annual or semi-annual report, please call Fidelity at 1-800-544-8544 or visit Fidelity’s web site at www.fidelity.com.

NJN-R-PTB-0922

1.9906055.101

245 Summer Street, Boston, MA 02210

TABLE OF CONTENTS

INVESTMENT POLICIES AND LIMITATIONS

The following policies and limitations supplement those set forth in the prospectus. Unless otherwise noted, whenever an investment policy or limitation states a maximum percentage of the fund's assets that may be invested in any security or other asset, or sets forth a policy regarding quality standards, such standard or percentage limitation will be determined immediately after and as a result of the fund's acquisition of such security or other asset. Accordingly, any subsequent change in values, net assets, or other circumstances will not be considered when determining whether the investment complies with the fund's investment policies and limitations.

The fund's fundamental investment policies and limitations cannot be changed without approval by a "majority of the outstanding voting securities" (as defined in the Investment Company Act of 1940 (1940 Act)) of the fund. However, except for the fundamental investment limitations listed below, the investment policies and limitations described in this SAI are not fundamental and may be changed without shareholder approval.

The following are the fund's fundamental investment limitations set forth in their entirety.

Diversification

The fund may not purchase the securities of any issuer, if, as a result, the fund would not comply with any applicable diversification requirements for a money market fund under the Investment Company Act of 1940 and the rules thereunder, as such may be amended from time to time.

Senior Securities

The fund may not issue senior securities, except in connection with the insurance program established by the fund pursuant to an exemptive order issued by the Securities and Exchange Commission or as otherwise permitted under the Investment Company Act of 1940.

Short Sales

The fund may not sell securities short, unless it owns, or by virtue of ownership of other securities, has the right to obtain at no added costs, securities equivalent in kind and amount to the securities sold short.

Margin Purchases

The fund may not purchase securities on margin, except that the fund may obtain such short-term credits as are necessary for the clearance of transactions.

Borrowing

The fund may not borrow money, except that the fund may borrow money for temporary or emergency purposes (not for leveraging or investment) in an amount not exceeding 33 1/3% of its total assets (including the amount borrowed) less liabilities (other than borrowings). Any borrowings that come to exceed this amount will be reduced within three days (not including Sundays and holidays) to the extent necessary to comply with the 33 1/3% limitation.

Underwriting

The fund may not underwrite securities issued by others, except to the extent that the fund may be considered an underwriter within the meaning of the Securities Act of 1933 in the disposition of restricted securities or in connection with investments in other investment companies.

Concentration

The fund may not purchase the securities of any issuer (other than securities issued or guaranteed by the U.S. Government or any of its agencies or instrumentalities, or tax-exempt obligations issued or guaranteed by a U.S. territory or possession or a state or local government, or a political subdivision of any of the foregoing) if, as a result, more than 25% of the fund's total assets would be invested in securities of companies whose principal business activities are in the same industry.

For purposes of the fund's concentration limitation discussed above, Fidelity Management & Research Company LLC (FMR) identifies the issuer of a security depending on its terms and conditions. In identifying the issuer, FMR will consider the entity or entities responsible for payment of interest and repayment of principal and the source of such payments; the way in which assets and revenues of an issuing political subdivision are separated from those of other political entities; and whether a governmental body is guaranteeing the security.

For purposes of the fund's concentration limitation discussed above, FMR may analyze the characteristics of a particular issuer and security and assign an industry or sector classification consistent with those characteristics in the event that the third-party classification provider used by FMR does not assign a classification.

Real Estate

The fund may not purchase or sell real estate unless acquired as a result of ownership of securities or other instruments (but this shall not prevent the fund from investing in securities or other instruments backed by real estate or securities of companies engaged in the real estate business).

Commodities

The fund may not purchase or sell physical commodities unless acquired as a result of ownership of securities.

Loans

The fund may not lend any security or make any other loan if, as a result, more than 33 1/3% of its total assets would be lent to other parties, but this limitation does not apply to purchases of debt securities or to repurchase agreements, or to acquisitions of loans, loan participations or other forms of debt instruments.

Pooled Funds

The fund may, notwithstanding any other fundamental investment policy or limitation, invest all of its assets in the securities of a single open-end management investment company managed by FMR or an affiliate or successor with substantially the same fundamental investment objective, policies, and limitations as the fund.

The following investment limitations are not fundamental and may be changed without shareholder approval.

Diversification

With respect to 75% of its total assets, the fund does not currently intend to purchase the securities of any issuer (other than securities issued or guaranteed by the U.S. Government or any of its agencies or instrumentalities, or securities of other money market funds) if, as a result, more than 5% of the fund's total assets would be invested in the securities of that issuer.

For purposes of the fund's diversification limitation discussed above, FMR identifies the issuer of a security depending on its terms and conditions. In identifying the issuer, FMR will consider the entity or entities responsible for payment of interest and repayment of principal and the source of such payments; the way in which assets and revenues of an issuing political subdivision are separated from those of other political entities; and whether a governmental body is guaranteeing the security.

For purposes of the fund's diversification limitation discussed above, certain securities subject to guarantees (including insurance, letters of credit and demand features) are not considered securities of their issuer, but are subject to separate diversification requirements, in accordance with industry standard requirements for money market funds.

Borrowing

The fund may borrow money only (a) from a bank or from a registered investment company or portfolio for which FMR or an affiliate serves as investment adviser or (b) by engaging in reverse repurchase agreements with any party (reverse repurchase agreements are treated as borrowings for purposes of the fundamental borrowing investment limitation).

Illiquid Securities

The fund does not currently intend to purchase any security if, as a result, more than 5% of its total assets would be invested in securities that are deemed to be illiquid because they are subject to legal or contractual restrictions on resale or because they cannot be sold or disposed of in the ordinary course of business within seven days at approximately the value ascribed to it by the fund.

For purposes of the fund's illiquid securities limitation discussed above, if through a change in values, net assets, or other circumstances, the fund were in a position where more than 5% of its total assets were invested in illiquid securities, it would consider appropriate steps to protect liquidity.

Loans

The fund does not currently intend to engage in repurchase agreements or make loans, but this limitation does not apply to purchases of debt securities.

Pooled Funds

The fund does not currently intend to invest all of its assets in the securities of a single open-end management investment company managed by FMR or an affiliate or successor with substantially the same fundamental investment objective, policies, and limitations as the fund.

In addition to the fund's fundamental and non-fundamental investment limitations discussed above:

In order to qualify as a "regulated investment company" under Subchapter M of the Internal Revenue Code of 1986, as amended, the fund currently intends to comply with certain diversification limits imposed by Subchapter M.

The following pages contain more detailed information about types of instruments in which the fund may invest, techniques the fund's adviser (or a sub-adviser) may employ in pursuit of the fund's investment objective, and a summary of related risks. The fund's adviser (or a sub-adviser) may not buy all of these instruments or use all of these techniques unless it believes that doing so will help the fund achieve its goal. However, the fund's adviser (or a sub-adviser) is not required to buy any particular instrument or use any particular technique even if to do so might benefit the fund.

On the following pages in this section titled "Investment Policies and Limitations," and except as otherwise indicated, references to "an adviser" or "the adviser" may relate to the fund's adviser or a sub-adviser, as applicable.

Affiliated Bank Transactions. A Fidelity® fund may engage in transactions with financial institutions that are, or may be considered to be, "affiliated persons" of the fund under the 1940 Act. These transactions may involve repurchase agreements with custodian banks; short-term obligations of, and repurchase agreements with, the 50 largest U.S. banks (measured by deposits); municipal securities; U.S. Government securities with affiliated financial institutions that are primary dealers in these securities; short-term currency transactions; and short-term borrowings. In accordance with exemptive orders issued by the Securities and Exchange Commission (SEC), the Board of Trustees has established and periodically reviews procedures applicable to transactions involving affiliated financial institutions.

Borrowing. The fund may make additional investments while borrowings are outstanding.

Cash Management. A fund may hold uninvested cash. A municipal fund's uninvested cash may earn credits that reduce fund expenses.

Central Funds are special types of investment vehicles created by Fidelity for use by the Fidelity® funds and other advisory clients. Central funds are used to invest in particular security types or investment disciplines, or for cash management. Central funds incur certain costs related to their investment activity (such as custodial fees and expenses), but do not pay additional management fees. The investment results of the portions of a Fidelity® fund's assets invested in the central funds will be based upon the investment results of those funds.

Commodity Futures Trading Commission (CFTC) Notice of Exclusion. The Adviser, on behalf of the Fidelity® fund to which this SAI relates, has filed with the National Futures Association a notice claiming an exclusion from the definition of the term "commodity pool operator" (CPO) under the Commodity Exchange Act, as amended, and the rules of the CFTC promulgated thereunder, with respect to the fund's operation. Accordingly, neither a fund nor its adviser is subject to registration or regulation as a commodity pool or a CPO. As of the date of this SAI, the adviser does not expect to register as a CPO of the fund. However, there is no certainty that a fund or its adviser will be able to rely on an exclusion in the future as the fund's investments change over time. A fund may determine not to use investment strategies that trigger additional CFTC regulation or may determine to operate subject to CFTC regulation, if applicable. If a fund or its adviser operates subject to CFTC regulation, it may incur additional expenses.

Disruption to Financial Markets and Related Government Intervention. Economic downturns can trigger various economic, legal, budgetary, tax, and regulatory reforms across the globe. Instability in the financial markets in the wake of events such as the 2008 economic downturn led the U.S. Government and other governments to take a number of then-unprecedented actions designed to support certain financial institutions and segments of the financial markets that experienced extreme volatility, and in some cases, a lack of liquidity. Federal, state, local, foreign, and other governments, their regulatory agencies, or self-regulatory organizations may take actions that affect the regulation of the instruments in which a fund invests, or the issuers of such instruments, in ways that are unforeseeable. Reforms may also change the way in which a fund is regulated and could limit or preclude a fund's ability to achieve its investment objective or engage in certain strategies. Also, while reforms generally are intended to strengthen markets, systems, and public finances, they could affect fund expenses and the value of fund investments in unpredictable ways.

Similarly, widespread disease including pandemics and epidemics, and natural or environmental disasters, such as earthquakes, droughts, fires, floods, hurricanes, tsunamis and climate-related phenomena generally, have been and can be highly disruptive to economies and markets, adversely impacting individual companies, sectors, industries, markets, currencies, interest and inflation rates, credit ratings, investor sentiment, and other factors affecting the value of a fund's investments. Economies and financial markets throughout the world have become increasingly interconnected, which increases the likelihood that events or conditions in one region or country will adversely affect markets or issuers in other regions or countries, including the United States. Additionally, market disruptions may result in increased market volatility; regulatory trading halts; closure of domestic or foreign exchanges, markets, or governments; or market participants operating pursuant to business continuity plans for indeterminate periods of time. Further, market disruptions can (i) prevent a fund from executing advantageous investment decisions in a timely manner, (ii) negatively impact a fund's ability to achieve its investment objective, and (iii) may exacerbate the risks discussed elsewhere in a fund’s registration statement, including political, social, and economic risks.

The value of a fund's portfolio is also generally subject to the risk of future local, national, or global economic or natural disturbances based on unknown weaknesses in the markets in which a fund invests. In the event of such a disturbance, the issuers of securities held by a fund may experience significant declines in the value of their assets and even cease operations, or may receive government assistance accompanied by increased restrictions on their business operations or other government intervention. In addition, it remains uncertain that the U.S. Government or foreign governments will intervene in response to current or future market disturbances and the effect of any such future intervention cannot be predicted.

Funds of Funds and Other Large Shareholders. Certain Fidelity® funds and accounts (including funds of funds) invest in other funds ("underlying funds") and, as a result, may at times have substantial investments in one or more underlying funds.

An underlying fund may experience large redemptions or investments due to transactions in its shares by funds of funds, other large shareholders, or similarly managed accounts. While it is impossible to predict the overall effect of these transactions over time, there could be an adverse impact on an underlying fund's performance. In the event of such redemptions or investments, an underlying fund could be required to sell securities or to invest cash at a time when it may not otherwise desire to do so. Such transactions may increase an underlying fund's brokerage and/or other transaction costs and affect the liquidity of a fund's portfolio. In addition, when funds of funds or other investors own a substantial portion of an underlying fund's shares, a large redemption by such an investor could cause actual expenses to increase, or could result in the underlying fund's current expenses being allocated over a smaller asset base, leading to an increase in the underlying fund's expense ratio. Redemptions of underlying fund shares could also accelerate the realization of taxable capital gains in the fund if sales of securities result in capital gains. The impact of these transactions is likely to be greater when a fund of funds or other significant investor purchases, redeems, or owns a substantial portion of the underlying fund's shares.

When possible, Fidelity will consider how to minimize these potential adverse effects, and may take such actions as it deems appropriate to address potential adverse effects, including redemption of shares in-kind rather than in cash or carrying out the transactions over a period of time, although there can be no assurance that such actions will be successful. A high volume of redemption requests can impact an underlying fund the same way as the transactions of a single shareholder with substantial investments. As an additional safeguard, Fidelity® fund of funds may manage the placement of their redemption requests in a manner designed to minimize the impact of such requests on the day-to-day operations of the underlying funds in which they invest. This may involve, for example, redeeming its shares of an underlying fund gradually over time.