As filed with the Securities and Exchange Commission on July 29, 2021

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-8

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Robinhood Markets, Inc.

(Exact name of registrant as specified in its charter)

| | | | | |

| Delaware | 46-4364776 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

85 Willow Road, Menlo Park, California 94025

(Address of principal executive offices, including zip code)

2020 Equity Incentive Plan

Amended and Restated 2013 Stock Plan

Restricted Stock Award Agreement

(Full title of the plans)

Vladimir Tenev

Co-Founder, Chief Executive Officer and President

Robinhood Markets, Inc.

85 Willow Road, Menlo Park, California 94025

(844) 428-5411

(Name, address and telephone number, including area code, of agent for service)

Copies to:

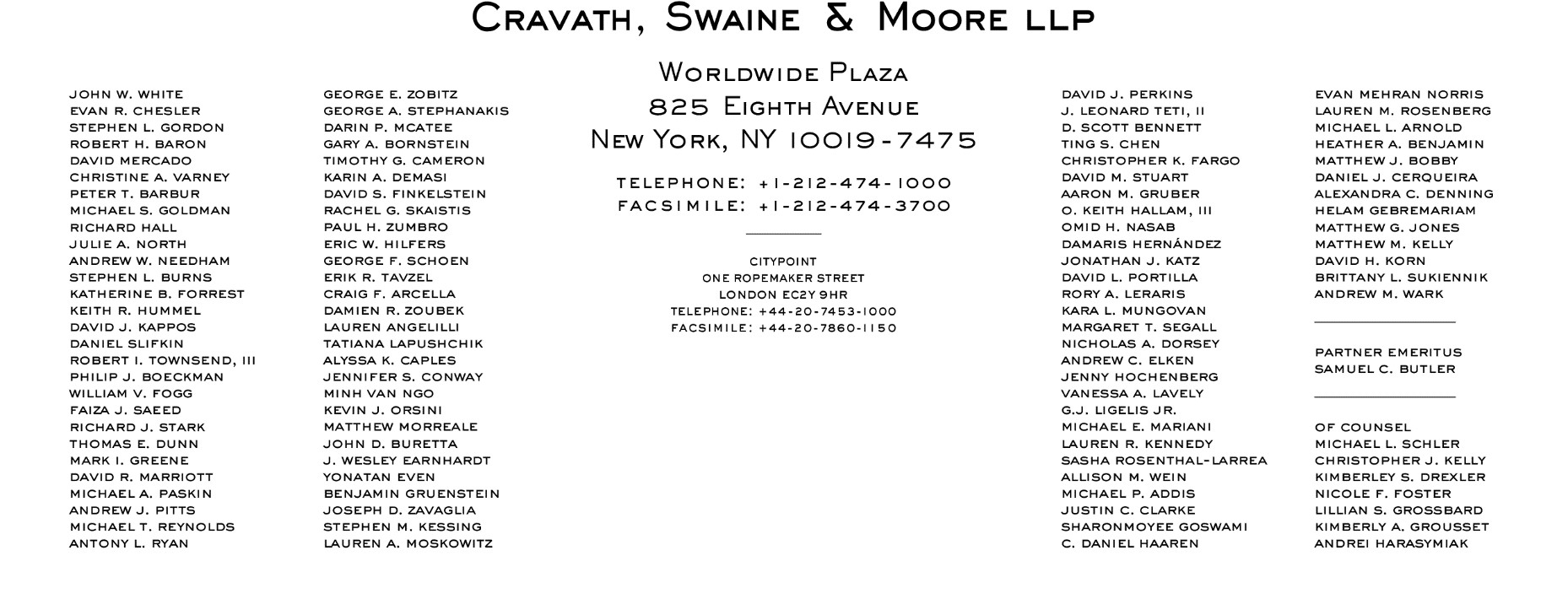

| | | | | |

Andrew J. Pitts D. Scott Bennett Jonathan J. Katz Claudia J. Ricciardi Cravath, Swaine & Moore LLP 825 Eighth Avenue New York, New York 10019 (212) 474-1000 | Daniel Gallagher Christina Y. Lai Weilyn Wood Steve Pickering Robinhood Markets, Inc. 85 Willow Road Menlo Park, California 94025 (844) 428-5411 |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large accelerated filer | o | Accelerated filer | o |

| Non-accelerated filer | x | Smaller reporting company | o |

| | Emerging growth company | x |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. x

CALCULATION OF REGISTRATION FEE

| | | | | | | | | | | | | | |

Title of Securities to be Registered | Amount to be Registered(1) | Proposed Maximum Offering Price Per Share(5) | Proposed Maximum Aggregate Offering Price | Amount of Registration Fee |

Class A common stock, par value $0.0001 per share: | | | | |

—Shares issued pursuant to stock options and restricted stock units granted under the 2020 Equity Incentive Plan | 5,591,024(2) | $38.00 | $ | 212,458,912 | | $ | 23,179.27 | |

—Shares issued pursuant to stock options and restricted stock units granted under the Amended and Restated 2013 Stock Plan | 36,863,780(3) | $38.00 | $ | 1,400,823,640 | | $ | 152,829.86 | |

—Shares issued pursuant to the Restricted Stock Award Agreement | 6,000(4) | $38.00 | $ | 228,000 | | $ | 24.87 | |

TOTAL: | 42,460,804 | | $ | 1,613,510,552 | | $ | 176,034.00 | |

(1)Pursuant to Rule 416(a) of the Securities Act of 1933, as amended (the “Securities Act”), this registration statement on Form S-8 (this “Registration Statement”) covers any additional shares of Class A common stock, par value $0.0001 per share (the “Class A common stock”) of Robinhood Markets, Inc. (the “Registrant”) that become issuable under the Registrant’s 2020 Equity Incentive Plan (the “2020 Plan”) and the Registrant’s Amended and Restated 2013 Stock Plan (the “2013 Plan”), by reason of any stock dividend, stock split, recapitalization or other similar transaction effected without the Registrant’s receipt of consideration which results in an increase in the number of the outstanding shares of Class A common stock.

(2)Represents (i) shares of Class A common stock issued in connection with the exercise of stock options under the 2020 Plan and (ii) shares of Class A common stock issued pursuant to the settlement of restricted stock units (“RSUs”) granted under the 2020 Plan.

(3)Represents (i) shares of Class A common stock issued in connection with the exercise of stock options under the 2013 Plan and (ii) shares of Class A common stock issued pursuant to the settlement of RSUs granted under the 2013 Plan.

(4)Represents shares of Class A common stock issued pursuant to a certain restricted stock award agreement, dated as of July 29, 2020 (the “Restricted Stock Award Agreement”).

(5)Estimated in accordance with Rule 457(h) of the Securities Act solely for the purpose of calculating the registration fee on the basis of $38.00 per share, which is the initial public offering price per share of Class A common stock as set forth in the Registrant’s Registration Statement on Form S-1 (File No. 333-257602), as amended, declared effective on July 28, 2021.

EXPLANATORY NOTE

This Registration Statement contains a “reoffer prospectus” prepared in accordance with Part I of Form S-3 (in accordance with Instruction C of the General Instructions to Form S-8). This reoffer prospectus may be used for reoffers and resales on a continuous or delayed basis of certain of those shares of Class A common stock of the Registrant referred to above that constitute “control securities” or “restricted securities,” within the meaning of the Securities Act, by certain stockholders that are current and former employees, consultants, and advisors of the registrant (the “Selling Stockholders”) for their own accounts. As specified in General Instruction C of Form S-8, the amount of securities to be reoffered or resold under the reoffer prospectus by each Selling Stockholder and any other person with whom he or she is acting in concert for the purpose of selling the Registrant’s securities, may not exceed, during any three-month period, the amount specified in Rule 144(e) under the Securities Act.

REOFFER PROSPECTUS

ROBINHOOD MARKETS, INC.

42,460,804 Shares of Class A Common Stock

___________________________

This prospectus relates to 42,460,804 shares (the “Shares”) of Class A common stock, par value $0.0001 per share (the “Class A common stock”), of Robinhood Markets, Inc. ( “Robinhood,” the “Company” or the “Registrant”), which may be offered from time to time by certain stockholders that are current or former employees, consultants, and advisors of the Registrant (the “Selling Stockholders”) for their own accounts. We will not receive any of the proceeds from the sale of Shares by the Selling Stockholders made hereunder. The Shares were acquired by the Selling Stockholders pursuant to our 2020 Equity Incentive Plan (the “2020 Plan”), the Amended and Restated 2013 Stock Plan (the “2013 Plan”) and that certain restricted stock award agreement, dated as of July 29, 2020 (the “Restricted Stock Unit Award Agreement”) .

The Selling Stockholders may sell the securities described in this prospectus in a number of different ways and at varying prices, including sales in the open market, sales in negotiated transactions and sales by a combination of these methods. The Selling Stockholders may sell any, all or none of the Shares and we do not know when or in what amount the Selling Stockholders may sell their Shares hereunder following the effective date of this Registration Statement. The price at which any of the Shares may be sold, and the commissions, if any, paid in connection with any such sale, are unknown and may vary from transaction to transaction. The Shares may be sold at the market price of the Class A common stock at the time of a sale, at prices relating to the market price over a period of time, or at prices negotiated with the buyers of Shares. The Shares may be sold through underwriters or dealers which the Selling Stockholders may select. If underwriters or dealers are used to sell the Shares, we will name them and describe their compensation in a prospectus supplement. We provide more information about how the Selling Stockholders may sell their Shares in the section titled “Plan of Distribution.” The Selling Stockholders will bear all sales commissions and similar expenses. Any other expenses incurred by us in connection with the registration and offering that are not borne by the Selling Stockholders will be borne by us.

Our Class A common stock has been approved for listing on the Nasdaq Global Select Market under the symbol “HOOD.” The initial public offering price of our Class A common stock pursuant to our Registration Statement on Form S-1, as amended (File No. 333-257602), declared effective on July 28, 2021, was $38.00 per share.

The amount of securities to be offered or resold under this reoffer prospectus by each Selling Stockholder or other person with whom he or she is acting in concert for the purpose of selling our securities, may not exceed, during any three month period, the amount specified in Rule 144(e) under the Securities Act of 1933, as amended (the “Securities Act”).

___________________________

Investing in our securities involves a high degree of risk. Before buying any securities, you should carefully read the discussion of the risks of investing in our securities in “Risk Factors” beginning on page 2 of this prospectus.

The Securities and Exchange Commission (the “SEC”) may take the view that, under certain circumstances, the Selling Stockholders and any broker-dealers or agents that participate with the Selling Stockholders in the distribution of the Shares may be deemed to be “underwriters” within the meaning of the Securities Act. Commissions, discounts or concessions received by any such broker-dealer or agent may be deemed to be underwriting commissions under the Securities Act. See the section titled “Plan of Distribution.”

Neither the SEC nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

___________________________

The date of this prospectus is July 29, 2021

TABLE OF CONTENTS

___________________________

You should rely only on the information contained in this prospectus or in any accompanying prospectus supplement by us or on our behalf. We have not authorized any other person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We are not making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume the information appearing in this prospectus is accurate only as of the date on the front cover of this prospectus, regardless of the time of delivery of this prospectus or of any sale of the Shares. Our business, financial condition, results of operations and prospects may have changed since that date.

“Robinhood Markets, Inc.,” our logo, and other trademarks or trade names of Robinhood appearing in this prospectus are our property. This prospectus also contains trademarks and trade names of other companies, which are the property of their respective owners. Solely for convenience, trademarks and trade names referred to in this prospectus may appear without the ® or ™ symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the right of the applicable licensor to these trademarks and trade names.

Unless the context otherwise requires, we use the terms “we,” “us” and “our” in this prospectus to refer to Robinhood Markets, Inc. and its consolidated subsidiaries.

THE COMPANY

Robinhood Markets, Inc.

Our mission is to democratize finance for all.

Robinhood was founded on the belief that everyone should be welcome to participate in our financial system. We are creating a modern financial services platform for everyone, regardless of their wealth, income or background.

The stock market is widely recognized as one of the greatest wealth creators of the last century. But systemic barriers to investing, like expensive commissions, minimum balance requirements and complicated, jargon-filled paperwork, have dissuaded millions of people from feeling welcome or able to participate.

Robinhood has set out to change this. We use technology to deliver a new way for people to interact with the financial system. We believe investing should be familiar and welcoming, with simple design and intuitive interface, so that customers are empowered to achieve their goals. We started with a revolutionary, bold brand and design, and the Robinhood app now makes investing approachable for millions.

Our platform, which began as a U.S. stock-focused retail brokerage, currently offers:

•trading in U.S. listed stocks and Exchange Traded Funds, as well as related options and American Depositary Receipts;

•cryptocurrency trading through our subsidiary, Robinhood Crypto, LLC;

•fractional trading, which enables all of our customers—regardless of budget—to build a diversified portfolio and access stocks previously out of reach;

•recurring investments, which help customers make investing routine and employ dollar-cost averaging;

•Cash Management, which includes Robinhood-branded debit cards and enables customers to save and spend by paying bills, writing checks, earning interest, withdrawing funds via ATMs and receiving Federal Deposit Insurance Corporation pass-through insurance on cash swept from their brokerage account; and

•Robinhood Gold, our monthly paid subscription service that provides customers with premium features, such as enhanced instant access to deposits, professional research, Nasdaq Level II market data and, upon approval, access to margin investing.

Corporate Information

We were incorporated in the State of Delaware on November 22, 2013. Our principal executive offices are located at 85 Willow Road in Menlo Park, California 94025, and our telephone number at that address is (844) 428-5411. Our website address is www.robinhood.com. Information contained on our website is not incorporated by reference into this prospectus, and you should not consider it to be part of this prospectus.

RISK FACTORS

Investing in our Class A common stock involves risks. You should carefully consider the risks and uncertainties set forth under the caption “Risk Factors” in our Registration Statement on Form S-1, as amended (File No. 333-257602), filed with the SEC on July 27, 2021, which are incorporated by reference herein, and subsequent reports filed with the SEC, together with all of the other information contained or incorporated by reference in this prospectus, before deciding to invest in our Class A common stock. Our business, financial condition, results of operations and prospects could be materially and adversely affected by any of these risks or uncertainties. In that case, the trading price of our Class A common stock could decline, and you could lose all or part of your investment. Additional risks and uncertainties that we are unaware of or that we currently see as immaterial may also adversely affect our business.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and the documents incorporated by reference herein contain forward-looking statements within the meaning of the federal securities laws, which statements involve substantial risks and uncertainties. Forward-looking statements generally relate to future events or our future financial or operating performance. In some cases, you can identify forward-looking statements because they contain words such as “may,” “will,” “should,” “expect,” “plan,” “anticipate,” “could,” “intend,” “target,” “project,” “contemplate,” “believe,” “estimate,” “predict,” “potential” or “continue” or the negative of these words or other similar terms or expressions that concern our expectations, strategy, plans or intentions. Forward-looking statements contained in this prospectus include statements about:

•our estimates of the size of our market opportunities;

•our ability to effectively manage our growth;

•our ability to successfully enter new markets, including any expansion into international markets, and comply with any applicable laws and regulations;

•our ability to invest in and develop our products and services to operate with changing technology;

•the expected benefits of our products to our customers and the impact of our products on our business;

•the effects of increased competition from our market competitors;

•the success of our marketing efforts and the ability to grow brand awareness and maintain, protect and enhance our brand;

•the impact of negative publicity on our brand and reputation;

•our ability to attract and retain our customers;

•our ability to maintain the security and availability of our platform;

•our ability to attract and retain key personnel and highly qualified personnel;

•our expectations regarding the impacts of accounting guidance;

•our expectations regarding litigation and regulatory proceedings;

•our expectations regarding share-based compensation;

•our ability to collect, store, share, disclose, transfer, receive, use and otherwise process customer information and other data, and compliance with laws, rules and regulations related to data privacy, protection and security;

•our ability to comply with modified or new laws and regulations applying to our business, and potential harm to our business as a result of those laws and regulations;

•the impact of adverse economic conditions;

•our expectations regarding the continuing impact of COVID-19 on our business;

•our expectations regarding the loss of our status as an emerging growth company; and

•the increased expenses associated with being a public company.

The forward-looking statements in this prospectus and the documents incorporated by reference herein are only predictions and are based largely on our current expectations and projections about future events and trends that we believe may affect our financial condition, results of operations, business strategy, short-term and long-term business operations and objectives, and financial needs. These forward-looking statements are subject to a number

of known and unknown risks, uncertainties and assumptions, including those described in the section titled “Risk Factors” and elsewhere in this prospectus and the documents incorporated by reference herein. Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. In light of these risks, uncertainties and assumptions, the future events and trends discussed in this prospectus may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements.

Because forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified, you should not rely upon these forward-looking statements as predictions of future events. The events and circumstances reflected in the forward-looking statements may not be achieved or occur. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, performance or achievements. Moreover, the forward-looking statements made or incorporated by reference in this prospectus relate only to the events as of the date on which the statements are made. We undertake no obligation to update any of these forward-looking statements for any reason after the date of this prospectus or the documents incorporated by reference herein or to conform these statements to actual results or revised expectations, except as required by law.

You should read this prospectus, the documents incorporated herein and the documents that we reference in this prospectus and have filed with the SEC as exhibits to the Registration Statement of which this prospectus is a part with the understanding that our actual future results, performance, and events and circumstances may be materially different from what we expect.

USE OF PROCEEDS

We will not receive any of the proceeds from the sale of the Shares. All proceeds from the sale of the Shares will be for the account of the Selling Stockholders, as described below. See the sections titled “Selling Stockholders” and “Plan of Distribution” described below.

SELLING STOCKHOLDERS

The following table sets forth information with respect to beneficial ownership of our Class A common stock as of July 28, 2021, as adjusted to reflect the Shares that may be sold from time to time pursuant to this prospectus, for all Selling Stockholders, consisting of the individuals shown as having Shares listed in the column entitled “Class A Common Stock Being Offered.”

The number of shares beneficially owned by each stockholder is determined under rules of the SEC and includes voting or investment power with respect to securities. Under these rules, beneficial ownership includes any shares as to which the individual or entity has sole or shared voting power or investment power. Unless otherwise indicated below, to our knowledge, the persons and entities named in the table have sole voting and sole investment power with respect to all shares they beneficially owned as of July 28, 2021, subject to community property laws where applicable. In computing the number of shares beneficially owned by an individual or entity and the percentage ownership of that person, shares of our Class A common stock subject to options, warrants or other rights held by such person that are currently exercisable or will become exercisable within 60 days of July 28, 2021 are considered outstanding, although these shares are not considered outstanding for purposes of computing the percentage ownership of any other person.

We have based our calculation of the applicable percentage of beneficial ownership prior to this offering on 655,874,456 shares of our Class A common stock, 132,573,754 shares of our Class B common stock and no shares of our Class C common stock outstanding as of July 28, 2021, assuming:

•the automatic conversion, on a one-to-one basis, of all of our outstanding redeemable convertible preferred stock into shares of our Class A common stock, which will occur immediately prior to the completion of our initial public offering, as if such conversion had occurred on July 28, 2021;

•the automatic conversion of all of our outstanding Tranche I convertible notes, of which we had $2,601.4 million in aggregate amount as of July 28, 2021, including accrued interest, into 97,796,792 shares of our Class A common stock upon the completion of our initial public offering, based on a conversion price of $26.60 (which is the lower of (i) 70% of the initial public offering price of our Class A common stock of $38.00 per share and (ii) $38.29), as if such conversion had occurred on July 28, 2021;

•the automatic conversion of all of our outstanding Tranche II convertible notes, of which we had $$1,048.0 million million in aggregate amount as of July 28, 2021, including accrued interest, into 39,397,201 shares of our Class A common stock upon the completion of our initial public offering, based on a conversion price of $26.60 (which is the lower of (i) 70% of the initial public offering price of our Class A common stock of $38.00 per share and (ii) $42.12), as if such conversion had occurred on July 28, 2021;

•the issuance of 2,829,445 shares of our Class A common stock and 199,652 shares of our Class B common stock upon the vesting and settlement of outstanding time-based restricted stock units (“RSUs”) for which both the time-based and the liquidity-based vesting condition was met in connection with our initial public offering (“IPO-Vesting Time-Based RSUs”), based on the number of IPO-Vesting Time-Based RSUs for which the time-based vesting condition was satisfied as of July 28, 2021, after withholding an aggregate of approximately 2,478,262 shares to satisfy the associated estimated income tax obligations (based on the initial public offering price of our Class A common stock of $38.00 per share and an assumed 45% tax withholding rate);

•the issuance of 2,218,856 shares of our Class B common stock upon the vesting and settlement of certain market-based RSUs that were granted to our co-founders under the 2013 Plan for which the market-based vesting conditions were satisfied in connection with our initial public offering (“IPO-Vesting Market-Based RSUs”), assuming the effectiveness of our initial public offering on July 28, 2021 for purposes of any applicable time-based vesting conditions and, for purposes of determining the satisfaction of the market-based vesting condition, the initial public offering price of our Class A common stock of

$38.00 per share, after withholding an aggregate of approximately 1,815,428 shares to satisfy the associated estimated income tax obligations (based on an assumed 45% tax withholding rate);

•the filing and effectiveness of our Charter in Delaware, which will occur immediately prior to the completion of our initial public offering and which will effect the reclassification of our common stock into Class A common stock;

•no exercise of outstanding warrants, of which $379.8 million aggregate maximum purchase amount was outstanding as of July 28, 2021 based on an exercise price of $26.60 (which is the lower of (i) 70% of the initial public offering price of our Class A common stock of $38.00 per share and (ii) $38.29);

•no exercise of other outstanding Company options, settlement of outstanding RSUs or conversion of our convertible notes except as described above; and

•that our founders elect to exchange all shares of Class A common stock initially received by them upon such vesting and settlement for an equivalent number of shares of Class B common stock pursuant to certain equity exchange rights.

We have based our calculation of the applicable percentage of beneficial ownership after this offering on 52,375,000 shares of our Class A common stock issued by us in our initial public offering, 2,625,000 shares of our Class A common stock sold by selling stockholders in our initial public offering, and 710,749,456 shares of our Class A common stock, 130,073,754 shares of our Class B common stock and no shares of our Class C common stock outstanding immediately after the completion of our initial public offering, giving effect to the foregoing assumptions and assuming that the underwriters will not exercise their option to purchase additional shares of' our Class A common stock from us in our initial public offering.

Unless otherwise indicated, the address of each beneficial owner listed below is c/o Robinhood Markets, Inc., 85 Willow Road, Menlo Park, California 94025.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Class A Common

Stock Beneficially Owned

Prior to the Offering | | Class A

Common Stock Being

Offered | | Class A Common Stock Beneficially Owned After the Offering(1) |

| Selling Stockholder | Shares | | Percentage of Class | | Shares | | Shares | | Percentage of Class |

| Aparna Chennapgragada | 60,991(2) | | * | | 60,991 | | — | | * |

| Daniel Gallagher | 350,442(3) | | * | | 267,830 | | 82,612 | | * |

| Gretchen Howard | 682,155(4) | | * | | 625,090 | | 57,065 | | * |

| Christina Smedley | 99,884(5) | | * | | 99,884 | | — | | * |

Named Selling Stockholders(6) | 56,409,826(7) | | 8.6% | | 41,407,009 | | 15,002,817 | | 2.1% |

_______________

*Represents beneficial ownership of less than 1% of the outstanding shares of our common stock.

(1)Assumes that all of the Shares held by each Selling Stockholder and being offered under this prospectus are sold, and that no Selling Stockholder will acquire additional shares of Class A common stock before the completion of this offering.

(2)Consists of 60,991 shares of our Class A common stock issued upon net settlement of IPO-Vesting Time-Based RSUs.

(3)Consists of (i) 82,612 shares of our Class A common stock subject to stock options exercisable within 60 days of July 28, 2021 and (ii) 267,830 shares of our Class A common stock issued upon net settlement of IPO-Vesting Time-Based RSUs.

(4)Includes (i) 172,064 shares of our Class A common stock held by the Howard 2021 Family Trust, (ii) 57,065 shares of our Class A common stock subject to stock options exercisable within 60 days of July 28, 2021 and (iii) 419,300 shares of our Class A common stock issued upon net settlement of IPO-Vesting Time-Based RSUs.

(5)Consists of 99,884 shares of our Class A common stock issued upon net settlement of IPO-Vesting Time-Based RSUs.

(6)Includes the following 2,679 named non-affiliate selling stockholders: Alejandra Mendoza, Umnouy Ponsukcharoen, Uday Kumar Raju Ruddarraju, Perk Lun Lim, Pavan Piratla, Alexandra Bond, Hongjian Qi, Sahil Upadhyay, Zero Cho, Soh Yoon Ahn, Jerry Li, Shanthi Shanmugam, Daniel Hill, Youngjae Park, Lorraine Hammer, Jingyi Xue, Sam Lau, Christopher O'Neil, Abhishek Ray, Lee Byron, Deqing Chen, Lavinia Chirico, Amber Nuño, Shibo Zhang, Brandon Singh, Adele Faure, James Nguyen, Alison Wu, Jaren Glover, Marco Calderon, Qianyi Zhu, Chike Amajoyi, Yanlin Duan, Heng Wang, Evelyn Montiel, Nitin Narasimhan, Jonathan Chu, Henry Tay, Miles Wellesley, Samuel Kim, Abhishek Fatehpuria, Jayendra Jog, Sanyam Satia, Manuela Rios, Wander Rutgers, Curran Kaushik, Deen Adzemovic, Joseph Gillespie, Rundong Lyu, Nathan Ziebart, Ameya Khare, Weston Mizumoto, Jason Clavelli, Hongyi Li, Sahill Poddar, Jamshed Vesuna, Karen Shih, Arpan Shah, Hongxia Zhong, Brianna Bain, Mayank Agarwal and Sonal Dubey COMMUNITY PROPERTY WROS, Patrick Grossmann-Kavanagh, Nathan Yan, Oluwajare Fagbemi, David Cao, Joshua Hernandez, Stephen Chang, Xiaote Zhu, Kyle Matson, Kamran Malik, Daniel Chen, Thomas Linford, Onkur Sen, Eun Kyung Jeong, Mayank Agarwal, Nadezda Asoyan, Robert Thompson, Davina Boedijono, Amanda Drennan, Christine Brown, Jinyan Cao, John Reinstra, Peter Csiba, Ruby Wang, Xuewen Zhu, Yana Boubnova, Tristan Hayter, Robert Picard, David Nickels Jr, Felicia Kuznetsov, Jack Randall, Daniel Strizhevsky, Daniel Hsu, Smeeta Ramarathnam, Samuel Brin, Joseph Binney, Daesun Yim, Xuan Zhao, Bobo Li, Michael Machuca, Amy Shen, Joseph Zemek, Zoe Shewer, Gang Wu, Matthew Pearson, Zhuoying Wang, Jason Joyner, Divakar Vijayakumar, Shuo Xiang, Nathan Rodland, James Bator, Hao-Hsien Ko, Mengfei He, Brian Reisbeck, Josh Elman, Chun-Ho Hung, Charles Tennant, Neeraj Baid, Nicholas Benavides, Chuan Shi, Jing Wen, Cheung Kit So, Edmond Wong, Griselda Carlos Arzate, Lijia Hong, Calvin Luu, Yuxin Jin, Karthik Rangarajan, Chelsea Spinos, Marco Morales, Cosmin Gheorghe, Andrew Lee and Elizabeth Carter Su JT, Vineet Goel, Victoria Lai, Norases Vesdapunt, Zhemin Li, Noah Smith, Cody Goodermote, Caroline Brin, Brian Rowen, Max Bergen, Zane Bevan, Nathaniel Tucker, Sharon Huang, Nafeesa Remtilla, Sharadin Graham, Scott Kaczmarek, Yue Lu, Anne Ciccarelli, Shrey Kumar Shahi, Ralph Furmaniak, Alan Livshin, Tyrus Wilkins and Martha Christine Wilkins JT, Nigel Sussman, Ilie Ciorba, Stedman Wilson, Robert Cordes, Kathi Parsons, Monica Van Vleck, Meng Wu, Sunita Patradoon, Cynthia Owyoung, Marcia Cooper-Burrows, Sarah Sachs, Sherri Kacludis, Kayla Miller, Jonathan Azara, Rusudan Komakhidze, Melissa Wojcik, Richard Nuss, Joshua Steele, Anca Dulca, Margi Tucker, Xiaoxiao Fan, James Bahati, Laura Bones, Kirtan Mehta, Vikrant Goel, Ryan Tseng, Joshuah Touyz, Boney Sekh, Yao Li, Lisa Lam, Mitchell Bolin, Chi Zhang, TaNeika Francisco, Jenna Garden, Samuel Armstrong, Ryan Roubal, Sydney Young, Dennis Zhao, Vanessa Loya, William Patterson, Andy Smith, Patrick Keating, Viral Parekh, Tarimotimi Awipi, Hang Qian, Shane Hansen II, Kevin Stultz, Jeremy Moye, Chanel Summerset, Sheng Li, Yuan Lyu, Ryan Burns, Brian Zindell, Michael Conroy, Daniel Ortiz Rivas, David Straub, Xinlei Pan, Ryan Lewis, William Hu, Weston Gotuzzo, Genevieve Cruz, Monica Bobadilla, Fontaine Yuk, Cyrus Sarrafpour, Sofia Alvarado, Shivam Sarodia, Kenysha Felix, Hilary Kunz, Adrien Truong, Jason Lucibello, Angela Tucker, Lionel D'adesky, Marisa Thein, Matthew Etheridge, Pepe Nava, Felipe Estrada, Dylan Waters, Alexander Mastando, Tammy Halawi, David Flagg, Jerome Atkinson, Matthew Philabaun, Aaron Weiss, Douglas Miller, Richard Reitzfeld, Francisco Cano, Jonathan Brennan, Carly Dalbey, Douglas Hindman, Bulat Bazarbayev, Casey Becker, Francis Choi, Cody Koelzer, Daniel Simmons, Jason Graham, Ashley Csencsits, Brandon Tanguay, Jaspal Basra, Anthony Medina, Joseph Mortenson, William Irwin, Nili Moghaddam, Katelin Dilger, Yong Woo Rhee, Denzel Singletary, Robert MacGilvray, Kathryn Clabby, Andrew Yeung, Bernardo Leal, Paul Duan, Alex Beech, Kathryn Holmes, Gilbert Saunders, Kesav Mulakaluri, Jose Ulloa, Jared Edwards, Scott Batley, Madhukiran Muthukumar, Caleb Sima, Elizabeth Kran, Allum Ross, Sebastian Morales, David Wilson, Yukun Gao, Brooke Wendell, Natasha Fredrickson, Daniel Chung, Thomas Yu, Monika Hutchinson, Brian Blick, Connie Schan, Jesper Johansson, Grant Sander, Carly Moore, Robert Velez, Oliver Lead, John Bourdeau, Anthony Cao, Yara Akiki, Elijah Verdoorn, Lynn Chyi, Lillian Yamada, Brendan Byrne, Khalena Muslem, Mervyn Bradley Haw, Donovan Espree, Chad Hicks, Parasto Shamlou, Derrick Ho, Vidit Drolia, Samuel Chapman, Scott Young, Daniel Turner, Erica McCormick, Daniel Manata, Yuhao Zheng, Andrea D'Eramo, Kathryn Wallace, Andrew Reed, Guangchen Chen, Emanuel Mazzilli, Josue Pasarell, Brianna Watterson, William Galvin III, Wendy Qian, Xuan Zhang, Alexander Shaffer, Pooja Anand, Ashley Lancaster, Austin Garcia, Amy Liu, Minh Le, Denver Louis, Song Wang, Akhila Bhoopalam, Jingbo Jiang, Daimon Greaves, Katharin Powers, Christopher Hill, John Drake, Chen Cheng, Mario Cediel, Surabhi Gupta, Jeremiah Leeper, John Olson, Nivetha Purusothaman, Keyan Zhang, Colin Seale, Mack Colen, Brett Bingham, Eric Wolfman, Frank Sanford, Kimberly Hranicky, Olaolu Adedoyin, Juan Saa Gutierrez, Benjamin Leder, Matt McDermott, Bryanna Vanenburg, Joynesha Battle,

Jacob Austin, John Pantin, Azeem Khalid-Segraves, Chuyue Ming, Kennedy Stumpf, Patrick Moody, Mack McCain, John Hoard, Scot Galvin, Ryan Quevedo, John Newkirk, Steve Pickering, Ashley Tang, Nicholas Dellamaggiore, Xinyu Zhang, Britnee Marshall, Bradley King, Stephanie Jefferis, Nahyua Mu?iz, John Turner, Brian Taylor, Jill Perks, Ryan Ragona, Lisa Newkirk, Mercedes Escandon, Steven Alvarez, Tremaine Tasher, Cade Flory, Anthony Diveglia, Bobbek Hakimzadeh, Zibo Gong, Taeshima White, Andrew Goodman, Jonathan Howell, Amrita Shah, Cecilia Ng, Vishal Parikh, Brianna Anderson, Amy Jennison, Dustin Meade, Reyna Valdez Serrano, Karin Ostrander, Quentin Lafontaine, Remy Virin, Piotr Filipiuk, Renjie Zhu, Alex Chang, Edward Lian, William Kenny, Christopher Knox, Fengchen Guo, Christopher Clarke, Jarred Tompkins, Sunny Yu Yeung Chan, Bo Teng, Alyssa Junk, Christopher Hart, Jin Yang, Micheal Harpe, Daniel Bringle, LaSalle Vaughn, Meng Dong, Pablo Rodriguez Pacheco, Adam Vanek, Shawn Vanschoonhoven, Nicholas Lin, Jie Cai, Tessa Bryant, Angela Hung, Jennifer Hsu, David Jones, Kristin Ardourel, Andrew Lee, Weisi Duan, Guangyu Zhang, Matthew Carroll, Matthew Brownlee, Aarati Soman, Stuart Olivera, Kiefer Hurst, Wesley Strickland, Kevin Khaw, Tiffany Soebijantoro, Wei Sun, Travis Bowie, Marina Berhosky, Mananki Parulekar, Dana Mitri, Ugur Yildirim, Joaquin Coria, Elexis Palmer, Wes Vallentine, Kevin Jimenez, Richard Brightman, Yun Chi, Harrison Pollock, Charlie Pisuraj, Cris Partidas, Jaime Beaman, Flora Somogyi, Kevin Spinosa, Marcus Rulloda, Janet Ng, Alan Spivey, Sadie Braxton, Alvin Dacenay, Brandon Glass, Anna Gasparyan, Brandon Beach, Michael Pompeo, Chandra Kuchi, Paula Desmond, Joseph Carbone, Blake Transano, Lefei Zhang, Andrew Tower, Kunal Bisla, Philip Morris, Buckinson Levasseur, Matthew Ferro, Luis Ceja, Christian Young, Brandon Stout, Brandon Ramirez, Elizabeth Reasch, Inna VanMatre, Priyesh Patel, Austin Randall, Alina Cheng, Sean Yoo, David Bruder, Donald Onejeme, Emmanuel Masona, Jacqueline Baker, Devin Skolnick, Gabriel Gurau, Jared Eskenazi, Daniel Zayas, Ruhan Wang, Ijeoma Emeagwali, Simone Garreau, John Cukierski, Lonnie Lester, Judith Garb, Davi Augusto Caetano de Jesus, Aashna Aashna, Kelly Zigaitis, LeRahn Murray, Robert Knox, Kristy Briggs, Yue Li, Samantha Kattalia, Luis Zapata, Martin Fiemawhle, Soumya Kalra, Laurent Linville, Erica Crosland, Ngan My Tran, Ashley Baker, Balaji Varadarajan, Christopher Gruendel, Pui Lam Lee, Spencer Janyk, Ryan Muise, Charles Beck, Polina Morozov, Hui Lu, Shen Jin, Brian Francis, Joe Zhao, Nicholas Miller, Muthiah M Muthaia Chettiar, Andrew Brenner, Keith Kelley, Michael Bailey, Grace Qi, Michael Bailey, Valerie Kocsis, Dylan Norton, Serena Rizzo, David Ezeibeamadi, Erica Almonte-Wiggins, Kylie O'Connor, Brian Myers, Cesar Colon Rivera, Richard Frank, Abdul Syed, Sean Wallace, Joshua Powell, Teri Agricola, Sodbileg Bolor, Brandon Webb, Victor Bravo, Jessica Price, Cameron Rogowski, Xin Xia, Scott Porteous, Ishita Shah, Amogh Vasekar, Shaan Appel, Ashley Santiago, Miriam Hertz, Calvin Liang, Karen Pan, Alan Aisbitt, Gina Baker, Kurt Meyers, Marcel Perry, Christian Rubio, Ryan Joslin, Stephan Zharkov, Stephanie Macias, Esther Layode, Alison Malamud, Breana Fish, Thomas Nelson, Sylvia Chaudoir, Aaron Luu, Sami Mansur, Taylor Scanlon, Caroline Wong, Changyuan Liu-Navarro, JoAnna Martin, Matthew Schumann, Eric Prusinski, Antonique Foster, Amir Homayounfar, Kelly Panagon, Kimberly Hsiao, Carley Olivas, Zachary Diaz, Andy Le, Henry Liu, David Junker, Daniel Liu, Troy Delaney, Aihua Peng, Mercedes Hauck, Joann Chang, Aaron Walker, Michael Aldrich, Boyang Dun, Honghao Zhang, Charles Davidson, Jacob Roth, Stephanie Pogoda, Shannon Maharajh, Imelda Romero, Shawn Olsen, Yue Cao, Christian Legnitto, Shan Lu, Brenna Monahan, Daniel Belay, Yasmine Briedj, Clemens Buehling, Alexander Keefe, Tiffany Siu, Audrey McNay, Jaimeson Smith, Kyle Marston, Justin Hauck, Chao Chen, Tobian Wong, Midelene Pierre Fils, Jessica Denton, Ian MacGilvray, Eric Castro, Avneet Behniwal, Laverne Kuo, Bernard Boulos, David Stephens, Chase Smith, Jack Qian, Allyssa Peterson, Shelly DeVries, Sheira Sarfaty, Tianhao Wang, Jainin Shah, James Harnar, Rodly Cazy, Bryce Dupree, Haley Fisher, Yijie Feng, Prashant Nadagoud, Prashant Kumar, Ryan Tite, Scott Shultz, Christopher Martinez, Ashley Rich, Gary Shen, Renata Paulino Policicio, Junchen Zhang, Charles Peterson, Aminaaz Jaffer, Leigha Jackson, Evan Brooke, Afnan Arif Abdullah Binshikhan Al Yafaey, Ellen Luo, Joshua Rosenfeld, Joshua Hall, Leiann Nuzum, Alexandra Betrone-Harpst, Ian Levesque, Christopher Grant, Joshua Rountree, Scott Trotter, Heather Breslow, William Reich, David Verdin, Joseph Hoard, Simon Beyene, Joana Nguyen, Janette Herrera, Siyu Chen, Leon Nansaram, Kristen Lange, Nicholas Dotson, Rachel McClintock, Melissa Branch, Chandrabh Akireddy, Ken Langlinais, Francis Miles, Binyomin Einstein, Puneet Kumar, Chase McQueen, Kevin Wyatt, Jonathan Toung, Daniel Johnson, Andrew Arifin, Zachary Greene, Alexandra Kiner, Nazanin Arandi, Andrew Jordan, Alexander Thomas, John Karas, Emily Foster, Katelyn Drakos, Sylvie Brillaud, Zeyuan Jin, Yvette Ferrari, Matthew Utley, Shawn Mooring, Sharmaine Eugenio, Julian Williams, Anthony Armada, Jeremiah Torbit, Amitabh Sural, Rumana Patel, Tiffany Chen, Yebin Tao, James McCorriston, Ariel Horowitz, Ayan Siddiqui, Eugene Shapiro, Savitri Acharya, Jasmine Hanley, Gabriela Gonzalez, Brendan Goodwin, William Gray, James McElhannon, Paul Wilson, Adam Fine, Yibin Lin, Mingzhu Liu, Scott Chou, Jenny Lam, Oluwabukunmi Ayanbule, Allie Kind, Noel Lamb, Heather Peterson, Justin Kelly, Robert Salvador, Matthew Mersman, Zachary Bartlett, Alissa Dominguez, Amber Rymer, Zhicheng Wen, Jay Pandya, Jenny Prior,

Sheree Lee, Philip Balikowski, Robert Coleman, Natalia Kanevsky, Nathan Fox, Catherynn Vuong, Michael Fretwell, Michael Sternberg, Andrew Busker, Joshua Demeke, Vasantha Nandi, Pavel Tenenbaum, Jacqueline White, Paul Armstrong, Xianrui Meng, Maxwell Carpenter, Tanvi Motwani, Yi Ren, Corey Harris, Valerie Zavitsanos, Adam Wolf, David Michael McFarlane, Britten Michalik, Shawn Strong, Anton Bohomol, Jennifer Hammond, Samantha Davison, Sarah Prather, Chelsea Marie Fuerte, Peter Tamburo, Amelia Goldberg, Constance Lam, Adithya Shricharan Srinivasa Rao, Ben Rindels, Andrew Fry, Jizhou Fu, Daniel Kozlowski, Alyssa Knox, Warren Harvey, Robert Spickler, Matthew Gantz, Cody Dawkins, John Louie, Tianyi Wang, Christopher Werker, Robert Tressler, Jamie Leatham, Junlin Liu, Andre Hafner, Matthew Cleto, Timothy Brenden, Tatiana Pena, John Parker, Jackson Reid, Nikolai Hristov, Jimmy Fang, Jasmine Rhodes, Dong Chen, Michael Dennis, Otto Santos, Jorge Londono, Martin Umpierrez Icaza, Sophie Allen, Conria D'Souza, Paul Stanley, Xavier Rashotsky, Emily Hinger, Chester Mcgowan, Jura Bogomolov, Daniel Peterson, Mathangi Sankaran, Archit Shah, Yen-Ting Liu, Molly McDaniel, Daniel Claytor, Perry Elizabeth Wong Costa, Alexander Lee, Alexis Munger, David Moss, Ifigenia Pedretti, Isaiah Haynes, Ryan Beach, Benjamin Jiang, Kayla Yuen, Xinsui Zhang, Brady Shi, Aaron Lancaster, Karima Osman, Sabrina Hand, Noah Tseng, Zhaohua Zeng, Yunjia Xu, Anjana Guliani, Tyler Goltl, Olivia Barreras, Chase Patterson, Christine Jue, Martin Garcia, Andres Riverway, John Ramsey, Kaylee Marohl, Zachary Porter, Joshua Carpenter, Sandeep Koppala, Chenyu Yan, Melissa McCann, Sidney Muse, Steve Lusietto III, Oluwayaymisi Noni Marks, Santiago Buenahora, Daniel Ha, Gabriella Castillo, Minh Vo, Abhishek Shivanna, Erika Balbuena, Steven Ross, Noah Zahnd, Abbey Abate, Akash Ramani, Jacob Wondolowski, Quinton Ranzau, Paolo Cruz, Giovanni Campanale, Tyler Wall, Tevita Tapavalu, Eric Igberaese, Peng Yuan, Nathan Teale, Sandy Zanaty, Regina DeNatale, Xier Zheng, Charles Young, Cyrus-Charles Weaver, Denise Burgos, Lindsay Morrison, Rigoberto Marquez, Andre An, Savannah Schultz, Ryan Gordanier, Marc Hernried, Edson Vargas, Moisey Khaimov, Carl Oehmig, Takeem Mitchell, Phillip Vasquez, Jiabei Xu, Michael Hauser, Gabriel Benmergui, James Wang, Adrian Cruz, Dawit Aboye, Avery Waldera, Abraham Sandoval, Xiao Wen, Qihui Xu, Moises Urrutia, Krishna Santosh Reddy Suravaram, Saraj Munjal, Vincent Forand, Michael Eisendrath, Cody Taylor, Kelsey Emmert, Frederick Dannen III, Pratikbhai Patel, Xiandong Ren, Joalma Holland, Bradley Groth, Amir El-Baghdady, Vanessa Castrillo, Nicholas Sharp, Riddhi Shah, Andrew Burks, Ciera Logan, Ryland Thomas Carter, Keegan Connor, Katherine Sotiroff, Sharise Harrison, James Herriotts, Mitch Atkinson, Jacquetta Woods, Jace Hartley, Radu Marin, Muhammad Ahmad, Joseph Hahm, Yan Yan, Jasmine Baliwag, Alkin Sen, Bryan Hang, Taylor Brown, Chinyere Atufunwa, Priscilla Bence, Kelechi Dike, Cornelle Hehmann, Vartika Jain, Tao Huang, Christopher Hahne, Juan Gutierrez, Junhui Zhang, Alfonso Pozo-Gutierrez, Lauren Hinkle, Tori Brackens, Mark Rietveld, Jae Hyeon Bae, Benjamin Fogler, Curtis Carnahan, Pearce Wray, Duy Nguyen, Eric Appel, Samantha Lee, Beth Bailen, Sivaramakrishnan Subramanian, Christine Hung, Jemal Osejo Santana, Crystal Sims, Tahlese Wright, Scott Hershorin, Vincent Widjaya, Hannah Primm, Oscar Rodrigo Roldan, Haitong Li, Francoise Finance, Emmerly Khounlo, Lauren Ottinger, Cynthia Mao, Songlin Li, William Bogle, Yue Shi, Aaron Khan, Teddy Dulca, Jesse Faggioli, Mark Murphy, Dino Piazza, Juan Rodriguez, David Long, Grace Boatwright, Grecia Liliana Chavez Alvarez, Cynthia Oam, Nicholas Tulenko, Donald Gatewood, Nathan Leung, Preston Bordelon, Raul Lucero Luevano, Terra Prince, Chad Johnson, Hannarae Annie Nam, William Yoshimura, Kristian Tran, Kenneth Jacobs Jr, Seok Lee, Chloe Kurzon, Hector Hurtado, Hanna Neisz, Hayley Bierbaum, Yajaira Roldan, Mark Berger, Yuchen Jiang, Brennan Reinert Jr, Bart Tissue, Lianghui Li, Ashley Hulting, Marc Helou, Vandita Bakore, Anupriya Ghate, Kathleen Chaykowski, Mireille Delbecq, Gabriel Del Rio, Raechel Kimbriel, Jeffrey Dillard, Bianca Dahlen, Ryan Kelley, James Coulter, Kevin Dagostino, Gianni Bessette, Jakob Hochberg, Nicholas Reina, Johann Kerbrat, Ben Ellenbogen, James Armstrong, Sammar Edstrom, Brandon Burtner, Rachel Momperousse, Henry Roach, Callum Powers, Megan Propst, Mahdi Raza, Yomna Hawas, Paul Marshall, Devon Ashbridge, Preston Walchli, Philip Yates, Thejaswi Kadur, David Vennefron, Vasavi Bollaram, Sebastian Novelo, Harry Sanabria, Jacob Osterman, Lorianne Woldehanna, Austin McKinley, Michael Luksich, Michael Lepore, Krystal Tillman, Diana Tunon, Ernesto Ortega, Joshua Snyder, Rohit Ranjan, Kamal Ramchandani, Brian Tate, Jun Yoon, Daniel Fuchs, Charles Gavlak, Brandon Campbell, Gemma Horn, Eric Ragland, Meredith Lyons, Dongliang XU, David Dusseault, Lucas McLean, Jena Bennett, Samuel Begley, Jessica Carter, Nabeha Brown, Andrew Nemetz, Tushar Bansal, Sriram Bhargav Karnati, Jennifer Aguilar, Zitong Li, Stephanie Stevenson, Yaning Yu, Munish Bhatnagar, Trang Huynh, Anna Radyvonyuk, Matthew Monius, Qian Mu, Sara Ali, Moyuan Huang, Dorian Leyva, Mitchell Thunell, Anne Novikov, Tony Fu, Tiffany Chung, James Tan, Abigail Robinson, Ali Janmohammad, Rhys Williams, David Favreau, Marisabel Fernandez, Esther Fialho, Rhonda Sims, Allen Bevans, Kyle Kinsey, Raymond Zheng, Fuad Elfar, Kizel Lewis, Shawn Jordan, Huy Vo, Parker Godkin, Tyler Hines, Jai Srivastav, John Roman, Matthew Carter, Michele Soanes, Laci Davis, Lauren Zaroukian, John McMahan, Ayan Bandyopadhyay, Matthew Denney, Christopher Garcia, Margaux Lee, Claire Chiu, Dawei Zhao, Aza Dargalaye, Aravind Rao,

Amy Enamorado, Gurpreet Suri, Bhavishyavani Ravi, Kelly Hoppensteadt, Cristopher Crisologo, Xiaoyong Zhou, Ian Johnson, Amanda McBride, Ada Ruzer, Cameron Kopplinger, Melody Zanaty, Andreea Goncearenco, Baogang Song, Rushikesh Deshpande, Bryan Jung, Geoffrey George, Will Danuser, Chelsea Oertel, Chinsin Sim, John Brereton, Fernando Morales, Christina Kapadia, Virginia Brake, Dao Han Lim, Lisa Robinson, Colin Umbarger, John Greer, Dina Finkilshteyn, John Hill, Geoffrey Gaudoin, Dexter Smiley, Mohammed Jaffer, Laurel Hilbert, Alvin Lee, Rachel Depew, Patricio Pereyra, Nizam'Alam Fatani, Henry Wong, Kelley Davidson, Xin Hu, Andrew Walsh, Richard Jackson, Ashley Smith, Tiera Jackson, Alexa Nordic, Cameron McLenaghan, Zachary Shelden, Pratiksha Rakesh Singh, Esther Lin, Matthew Goss, Nick Castellano, Gabriel Silk, Joseph Wong, Lindsey Holt, Dijohn Mckinney, Arthur James Shello, Scott Friedman, Elizabeth Yeh, Alyssa Clang, Uday Patil, Heather Wellman, Joanna Denison, Marnie Flynn, Cathy Liu, James Marecle, Annie Herlitz, Sophia Huard, Swaroon Sridhar, Carlo Callwood, Kevin Le, Togan Gencoglu, Elizabeth Osborn, James Baxendale, Bhupendra Ubeja, James Ginn, Brendan Davis, Rebecca Moretti, Ibrahim Nabhan, Kisalaya Prasad, Peyton Collins, Michelle Piwowarski, Sofia Young, Jeffrey Seto, Brian Jackson, Matthew Tatham, Nan Yin, Paul Davis, Jisung Kim, Shiv Verma, Wenting Xi, Nicholas Wilson, Jason Hall, Chabula Mulumbu, Tanya Smith, Kelly Cruz, Michelle Chen, Xuandong Lei, Chenheng Liu, Garrett Crissman, Benjamin Grauel, Barbara Flathers, Mantas Matelis, Eric Hains, Paula Loop, Thomas Floyd, Cassandra Kjorness, Jingru Ren, Rich Bessel, Matthew Yorkavich, Auster Chen, Albi Mema, Lauren Cahill, Kate Mapstone, Jeffrey Giuffrida, Garrett Minton, Samuel Yau, Tealee Hinger, Michael Obucina, Nathan Hernandez, Hunter Cowper, Austin Geraghty, Nicole Wright, Zachery Crane, Noah Madover, Andrew Hsu, Uday Anand, Alex Mesa, Samantha Haertl, Jose Sanchez, Chelsy Alexander, Natalia Wojtowicz, Matthew Hunter, Krishna Behara, Idaraobong Ikafia, Brielle Filtch, Venkata Krishna Pavan Kalubandi, Jennifer Henion, Raymond Poloncic, Duy Vo, John Priest, Navya Mayyadi Pedemane, Edward Rossman, Michael Dalton, Alexander Vladimirov, Audra McKay, Christopher Kienle, Kayla Jackson, Keenan Fultz, Sandeep Kaur, Vishal Kuo, Matthew Kellie, Tianze Hu, Catherine Most, Mi Hua, Lauren Hollett-Mott, Justin Kelly, Jonty Fox, Julia Borello, Kyla Samad, Jalyn Isley, Alexander Batoon, Kelly Harvell, Cherlyn Medina, Arth Acharya, Bryan Cathey, Hugo Larrazabal, Maria Cobb, Brandon Ellerby, Yvana Pham, Briana Richardson, Arpitha Nandakumar Kashyap, Alexandra Methot, Ian Samms, Caleb DeLaet, Katherine Creamer, Braedon Martinez, Alexander Masbruch, Tarique Rubab, Zhanat Abylkassym, John Sims Jr., John Lyons, Sierra Molina, Jessica Chang, Ann Rajan, Samantha Klonaris, Stephanie Vazquez, Amanda Amat, Gerlishia Bracy, Britney Hamlin, Riley O'Neil, Taylor Davis, Collin Irwin, Suraj Jagadeesh, Jennifer Losier, Aaron Smith, Tanner Freeman, Megan Ferris, Philip Chang, Herman Guillen, Renee Motley, Wren Wegner, Amy Yang, Martha Sandra Cabatic, Blake Williams, Christopher Olenik, Frank Valles III, Jun Helzer, Lauren Van Cavage, Benjamin Rosamond, Eunhye Suh, Ilan Goodman, Bethany Hamilton, Jisu Yoo, Xu Tjhin, Bradley Wong, Jenna Morris, Michelle Hurst, Sujith Katakam, Beau Burton, Eric Heden, Bailey Landrum, Eduardo Gaitan, Amelia Moreno, Ryhan Otmane-Tani, Maria Katrina Munez, Nicholas Gottfred, Benjamin Holt, Elyce Ladany, Kyra Sopinka, Weilyn Wood, Valeriana Wisniewski Budilov, Sophia Dutra, Leah Evans, Patrick Diomede, Jason Lu, Ryan Maddux, Nosa Alonge, Jingyi Huang, Jake Weintraub, Everett Barney, Tawny Labrum, Hali Reedy, Zachary Woolford, Itzael Vargas, Alexa DeGroat, John Hawkins, Xi Zheng, Jonathan Johannemann, Andrew Wagner, Derrick Haggard, Chase Crighton, Scott Dishnow, Rocir Marcos Leite Santiago, Brenton Bade, Doran Rivera, Alexis Bernstein, Mitchell Kager, Matthew Thompson, Quiana Davis, Kevin Sorensen, Jack Forrest, Eileen Dai, Amanda Enters, Mark Wolff, Raj Solanki, Kevin J Schillo, Alesa Roti, Yunfan Feng, Rebecca Sheridan, John McCay, Brandon White, Sarah Harley, Sakhi Gandhi, David Neisz, Zachary Johnson, Ian Kitts, Hailey Williams, LaRosa Osborne, Marcos Juarez Lopez, Yufei Wang, Thoufique Haq, Varun Mohan, Kristin Dixon, Tyler Yep, Alexander Eagle, Nicholas Ciuffo, Jonathan Meador, Melissa Rush, Jayden Rolstone-Kobal, John Cahill, Vikram Sharma, Pooja Arondekar, Jessica Salvesen, Nanxi Liu, Nicholas Miller, Kamini Ortiz, Ryan Hickey, Jennifer Walker, Andrew Truong, Grant Bradford, Bradley Hall, Hao Chang, Gabrielle Eliason, Avani Sharma, Anthony Cavallaro, Sangita Bajpai, Matthew Starr, Adam Wagner, Matthew Jordan, Tiffany Citra, Yuchen Jiang, Christopher Yturralde, Rinkal Agrawal, Annie Longley, Sophie Manoukian, Jeffrey Weiss, Katelyn Harrison, Sabrina Espinoza, Robert Luna, Nancy Sarokhan, Destry Garcia, Kyle Winters, George Garcia-Serra, Inha Joo, Eric Black, Matthew Sousa, Sean McGowan, Rongrong Yang, Bethany Zorc, Angela Perkinson, Kwesi Nketia, Nan Wang, Janice Kwong, Benjamin Fox, Nurym Kudaibergen, Joshua Dutill, Hannah Ginsburg, Joseph Barreras, Garret Frank, Jocelyn Yap, Neeharika Komma, Alisa Young, Lucas Moskowitz, Connor Howell, Isidro Perez, Kunal Desai, Lindsey Graetz, Andrew Cheek, Nathan Odeh, Garret Kelly, Yevgeniy Pushin, Elaine Lin, Thery Prok, Timothy Dolquist, Gavin Hagestad, Elliott Forde, Dominique Cotto, Caesar Gamulja, Abon Chaudhuri, Marc O'Such, Matthew Scott, Tyrone Croutch, Scott Racusin, James Swartwout, Shruti Batra, Mary Westberg, Lindsey Henry, Bradford Strickland, Trevor Beckwith, Shannon Bridgeman, Sarah Hill, Burton Wheatlake, Eric Noel, Wenlong Xiong, John Allen, Georgios Takos, Kaitlyn Vinson, Laurence Gross,

Matthew Argomaniz, Ariel Chait, Guillermo Injoque, Samantha Pritchard, Jamie Emerson, Mohamed El-Ghoroury, Hongtai Li, Jasmine Yi, Nicholas Williams, Morgan Chow, Anushree Rajendra Jain, Kevin Jacobs, Maria Pimenova, Ilya Izrailevsky, Margaret Ketchum, Abraham Zamudio, Brian Zimmerman, Alvin Vicioso, Stacie Schwartz, Ryan Fitzgerald, Rana Bahri, Rob Balian, Marcelo Modica, Jianda Zhou, Rafael Resende Jr, James Hunt, LaRae Sanchez, Oliver O'Neal, Morgan Fields, Aaliyah Phillips, John-Carlos Rivera, Yuchen Li, Kevin Yeung, Mandar Samant, Lucia Pradas-Bergnes, Luke Scriffiny, Taylor Jacob, Terrence Ho, Anthony Barbato, Alan Van Dorn, Chloe Bierman, Hemal Doshi, Dat Tran, Di Chen, Chandler Mercer, Ivan Zhou, Erik Leff, Colin Dickens, Aman Singh, Dheerja Kaur, Nicholas Reid, Connor Coleman, Won-Woo Chung, Marc Barnett, Dennis Lafferty, Anne DeSantis, Mabruk Bessiouni, Olliver Joseph, Joseph Iraci, Zainab Akande, Fangqi Zhao, Gongzhan Xie, Anthony Liggins, Joshua Love, Johanna Phu, Zachary Petersen, Althea Dunn, MingPeng Chen, Tyler Davlin, Juan Roa Echeverria, Paul Berger, Ximena Keirouz, Dolly Ye, Nora Chan, Tiffany Booth, Yvette Zayas, Shiyi Zhao, Dunyuan Chen, Savanna Foster, Heaba Shishani, Tyler Pruitt, Nicole Evans, Zhimin Zong, Mehdi Taifi, Eric Carlson, Husain Talawala, Katie Van Loo, Evelyn Yonaki, Devin Malone, Brian Etheridge, Mac Liu, Cory Howard, Ekaterina Presnetsova, Ema Milojkovic, Yeounoh Chung, Irvin Sha, Daniel Zou, Jiaxi Kang, Holly Livolsi, Linda Som, Daniel Cronin, Artemis Brown, Dominic Bunch, Oluwatobi Oluwo, Brian Tao, John Markle, Anthony Aviles, Paul Lewenberg, Adam McCarthy, Alec Richter, Hyewon Lee, Rama Alebouyeh, Pinal Shah, Katherine White, Patrick Devlin, Eric Lovett, Taylor Osborn, Christopher Dangerfield, Cody Hooten, Ya Yu, Chad Butler, Gina Rollings, Alexandra Toribio-Cruzado, Rachel Mastro, Yi Chen Cao, Brooks Taylor, Chloe Kennedy, Amanda Do, Michael Holmes, Dylan Jones, Aaron Moreton, Julia Setnicker, Andrew Davis, Michael Smith, Christopher Boggs, Christopher Merrill, Dennis McDaid, Monica Jin, Joyce Park, Srivatsan Sridharan, Nathaniel Moore, Joshua Drobnyk, Mitchell Colen, Jared Gray, Loni Bogenschutz, Shahmeer Navid, Emily Carlson, Megh Mehta, Evan Kenebrew, Emilee Peavler, Courtney May, Matthew Depew, Joanne Chai, Jean Bredeche, Crystal Gilbertson, Ulises Rojas-Sandoval, Jade Van Horn, Aayush Tyagi, Seyed Hossein Kaffash Bokharaei, Paul Radulovic, Louis Finley, Taylor Wingard, Yunong Jiang, David Aghassi, Daniel Shepherd, Aries Vazquez, Renjini Ramesh, Richard Dana, Jorge Tirado Tolosa, Benjamin Miller, Evans Smalley, Kan Ta, Aaron Barstad, Daniel Ziegler, Christopher Gates, Henry Foster, Tiffany Arrington, Reno Mathews, Kevin Acala, William Haltmar, Boyang An, Kathryn Kitchell, Ricardo Bravo, Melina Iacovou, Christopher Owen, Amanda Fitz, Christopher Chalek, Lee Rodriguez Mercado, Laura Rushing, Alvin Hui, Corinne Cuddeback, Kaegan Crayton, Michael Lambard, Lawrence Johnson, James Loat, Noah Adams, Mun Yong Jang, Jeremy Lieber, Junrui Hu, Bjoern Eivind Rostad, Casey Baker, Randall Purdy, Yemin Shou, Bohan Ren, Harneet Kaur, Taylor Mann, Patrick Dunn, Christian Theilemann, John Parker Kelliher, Bret Wade, Robert Ballance, Kyle McCann, Victoria Nguyen, Adam Lessen, Michael Headrick, Monika Qualls, Queenie Ma, Thomas Elliott, Amanda Cendejas, Shaherzad Azim, Michael Snowden, Kahlela Mungin, Ronald Ding, Phillip Langston, John Hellweg, Yuzhang Wu, Michael Morell, Yuyang Xie, Phyo Kyaw, Thomas Krohn, Connor Brockmeier, Milena Milojicic, Amy Shan, Nolan Ray, Bhavesh Viswanath, Michael Bush, Carston Cook, Aparna Verma, Richard Mulvihill, Jessica Koehler, John Jones II, Jay Sridharan, Galinda Marquez, Kenneth Ton, Jade Buchmyer, Viyat Bhalodia, Keyra Galvan, Tennessee Lee, Desiree Brewer, Tatum Thornton, Alexandra Nagy, Javonte Duncan, Natee Tesfa, Vanesa Huang, Christopher Grajales, Louie Rosales, Yang Xiao, Eric Deacon, Mitchell Burke, Daniel Odom, Khin Phong, Weimin Ma, Jose Ortiz, Abigail Brown, John Steigerwald, Miles Mobley, Hanna Lee, Mukaddes Dreischhoff, Louis Vetter, Imogen Morris, Kyle Considder, Lucy Ijatomi, Zezhou Liu, Stephanie Selvius, Abraham Chong, Claudia Del Rio, Jenna Shorten, Anthony Gentry, Mazin Bokhari, Zhenting Huang, Christian Mladenov, Riley Wood, Erik Bush, Guillermo Gallegos, Sarah Mort, Olivia Cheung, Devin Sullivan, Erin Ward, Turner Albertson, Kaustubh Rudrawar, Atit Doctor, Cody Liversedge, Thorvald Bean, Erin Weno, Fiona Naughton, Stephen Colgan, Vigneshwer Vaidyanathan, Alix Davie, Zun Wang, John Black, Vina Uriarte, Kelly Miller, Jeremy Croston, Kristina Delgado, Austin Bach, Varun Gurnaney, Xiaoyu Fang, John Gebhardt, Philip Wettersten, Jinshan Jia, Christopher Duroseau, Chirantan Mahipal, Piret Loone, Travis Nichols, William Diskin, Symone Chavez, Britt Clark, Milton Patrick, James Amurao, Evan Nolan, Christopher Artnak, Brittany Frescoln, Nathan Navasca, Dawn Pagliaro, Maxwell Sidebotham, Michael Landau, Bhavya Bharat Agarwal, Haley Lit, Xiaoyu Chen, Robert Gonzalez, Saibra Rubadue, Joe Letchford, Simoul Alva, Yan Sun, Li-Fan Yu, Mehdi Aourir, Jung Yeon Ryu, Christina Lai, Adrian Bilotti, Devin Smith, Brady Cooper, ChenGuang Dong, Brian Lin, Drake Sichak, Marina Canova, Brooke Ichinose, Wen Bin Wu, Andrew Coleman, Thomas Kushnerick, Wenbiao Xing, Michael Quilatan, Luke Willets, Joel Hull, Rahul Sihag, Arvind Raghavan, Jordan Frasse, Dai Jun Tang, Jessica Clouse, Aaron Ko, Aubrey DeBose, Vamsee Yarlagadda, Tamara Bain, Adam Gorelick, Noreen Juliano, Whitney Anderson, Allen Ma, Peisen Zhao, Cara Bain, Muhammad Hussein, Cheyenne Knueppel, Corey Perrigo, Ramon Salvador, Dallas Brignone, Boris Epstein, William Hendricks, Elliott Wells, Jennifer Howard, Radha Krishna Kollipara, Dana Hawkins, Arthur Murdock, Joseph Wells, Dean Mincer,

Nicolas Martell, Yang Liu, Stephanie Truong, Dylan Walters, Nicholas Pita, Christopher Lawson, Sherwin Li, Peter Stephenson, Vibhav Kotriwala, Sierra Stein, Ahmed Zahran, Joshua Cockrell, Rachel Pharazyn, Shanshan Zhu, Peng Liu, David Ellis, Nicole Bartel, Jordan Meaux, Joscaly Hodge, Diana Laguna, Christopher Wong, Aloke Fernandes, Adam Sassatelli, Yuliya Foerster, Rachel Maples, Matthew Rosario, Michael Hunter, Paul Tarjan, Johnny Nguyen, Qihao Xie, Alexander Brown, Murat Ogul, Devon Reese, Victor Bivol, Tianyue Xiao, Fay Vlahu Scott, Wilson Turner, Kasen Quiring, Robert Chappell, Ben Beatty, Jacqueline Ortiz Ramsay, Simon Herran, Reneze Trim, Shuai Sun, Tyler Mathis, Alexandre Farran, Jonathan Stockton, Joseph Nichols, Jairo Henao, Charlotte Keeler, Qiyao Qin, William Richardson, Betty Zhao, Jorge Cepeda, Shuotian Cheng, Daniel Bolin, Benjamin Dunn, Kyle Polley, Sheila Masley, Siddharth Patel, William McEachern IV, Emily Anding, Zhengguang Chen, Giselle Rivera-Davila, Edwin Rodriguez, Alexandra Vorrasi, Amy Liang, Michelle Brewster, Christian Horn, Nathan Palmer, Keun Park, Karthik Kenchaiah, Chen-Hung Wu, Nicholas Olson, Jacob Martin, Seong Seog Lee, Joshua Martin, Zhuosheng Jiang, Can Wang, Vincent Maccariello, Annie Yu, Justin Lu, Megan Lowecki, Tiffany Clark, Kyle Melkert, Tess Singha, Kristin Brown, Samuel Lopez Cuevas, Jiahe Xiao, Cody Scott, Carrie Brown-Coats, Nicole Ostertag, Krystyna Tuchkova, Divya Mathew, Xin Yu Yuan, Patrick Southern, Jonah Torrison, John Cosbey-Lewis, Byron Wilson, Michael Tom, Cody Ipock, Holly Shirmenzagas, Silvestras Visockas, James Layton, Ishaan Parikh, Tanaya Joshi, Michael O'Toole, Mitchell Salers, Ziyou Zheng, Jessica Woods, Jhoselyne Canales, Robert Malone, Guillermo Ramirez, Alix Claude, Brooke Norton, Mark Buckingham, Julia Cadena, Wicky Dharani, Joseph Song, Francois Benjamin, Justin Bell, Diana Ramirez, Brandon Tucker, Mihaela Ciocanu, Jacob Schwartz, Timothy Kallander, Brian Denny, Robert Eller, Owen Mellick, Connor Carion, Quanlai Li, Jeffrey Lee, Anna Chernov, Nicole Nelson, Brian Hines, Jonathan Rubinstein, Noman Goheer, Yue Ding, Suvrat Rao, Kyle Black, Jennifer Daemon, David Jolly, Patrick Howell, Lori Meacham, Neil LaVigne, Jose Albiter, Radha Modi, Jensen Meaux, Victorino Chavarria, Jared Nowak, Ruirong Yang, Amanda Magyar, Xuying Zhu, Travis Shimizu, Rebecca Kruse, Jeffrey Hood, Sabrina Ali, Dennis Leverette Jr., McKenna Granger, Nguyet Tran, Andres Ruiz, Ashley Berger, Alexander Cheney, Sachin Gupta, Tejaswi Venugopal, Nigel Mills, Kelsey Parker, Wai Chip Ngai, Nicholas McElroy, Samuel Thompson, Yinyi Wang, George Shell III, Richard Cho, Philip Rykyto, Jarrett Butler, Tyson Lersch, Ask Hoel, Cayce Martin, Andrew Godwin, Jamie DeCrescenzo, Rena Park, Renata Menezes, Mohamed Ewumi, Debbie Croasdaile, Bethany Kwitek, Anthony Lawrence, Stephanie Zau, Qing Li, Christina Diaz, Christopher Fahy, Erik Drygas, Charris Wells, Leslie Simonson, Ashley Velasquez, Krista Fryauff, Yoojung Jung, Marcellus Pelcher, Devon Lloyd, Omar Rayward, Ziqiang Yu, Shiho Sakai, Vy Mai, Thomas McGinn, Caroline Harris, Clayton Halim, Jamaly Farquharson, Brandon Laiche, Cristian Vega Valadez, John Ricklefs, Rachel Haigh, Russell Lifson, Thayrine Rodrigues Downing, Andrew Chen, Molly Sundeen, Camilo Aldana, Carleen Liu, Elijah Pandolfo, Chelsea Krogwold, Ivy Murphy, Stanley Kwong, Roukyatou Diallo, Kelsey Dunn, Averill Snyder, Eleanor Newcomb, Giselle Martinez Flores, Mengyi Li, Shana Terry, Albert Choi, Kelsey Yee, Michael De Gaglia, Steijn Pelle, Mingkang Zhang, Victoria Thompson, Kristina Petersen, Stephon Angry, Adarsh Pandiri, Pio DiBenedetto, Deborah Beene, Robert Lipps, Lucy Yip, Carina Pappu, Caitlyn Crawley, David Vigano, Michael Heath, Christine Williams, Julia Dranov, Joseph Barrett, Sang Su Lee, Michael Vernon, Yu Xie, Huanjun Bao, Ella Corey, Yen-Ming Lee, Matthew Edwards, Mike Yoffa, Mohit Bhura, Kyle Walsleben, Indira Pal, Kevin Chin, William Keeth, Amry Kimmerly, Amandeep Sheena, Stephanie Dempster, Nourhan Nasser, Rashad Drakeford, Mai Nguyen, David Keyser, Apoorva Iyer, Derrick Routier, Morgan Levine, Solace Shen, Maxim Rabiciuc, Anne Milliken, Charlene Delapena, Sonali Upadhye, Chantal De Soto, Swathi Chandrasekar, Paridhi Khaitan, Gregory Crane, Youngeun Hyun, Cody Meyers, Celeste Ewing, Jaylon Briggs, Rob Carman, Tatiana Denisova, Annamarie Gamez, Andrew Peng, Zixu Zhu, Geoffrey Boss, Adam Harris, Cody Drummond, Timothy Trautman, Ronnie Higgs, Shelley Carella, Jennifer Hollenkamp, Tanner Owens, Avery Peterson, Trevor Healy, Cuisheng Yao, Andrew Wright, Collin Emmert, Erik Buckman, Kerry Underwood, Pieter Weyns, Craig Barrere, Eugene Shen, Jiawei An, Amanda Higgins, Ahmad Fulwood, Jiawei Zhang, Callie Reber, Thomas Beattie, Abby Fournier, Jacob Letzring, Lindsay Koprivica, Jordan Garside, Susan Terenzio, Katrina Gamutan, Brandon Velasquez, George Wright, Richard Myers, Sagar Agarwal, Margot Valenzuela, Syrina Rice, Ikai Lan, Conrad Verkler, Zhi Zhang, Craig Reyes, Andrew Mulhall, John Beaty, Tian Zhang, Jeane Ferdinand Carlos, Aniket Mandalik, Carolyn Kao, Tara Meilinger, Alexander Chiou, Diana Hernandez, Daniel Mahoney, Rachel Marie Reyes, Jonathan Barrett, Hector Arellano, John Castelly, Bahrom Akramov, Ryan Kofron, Pierce Edwards, Cody Marshall, Patrick Fahey, Brandon Sterling, Anthony Centeno Torres, George Tong, Victor Regalado, Omid Scheybani, Lisa Murray, Ilana Black, Xiaohang Liu, Joshua Weaver, Sean Kennedy, Eli Arzhevskiy, Colin Reisterer, Bhupesh Bansal, Matthew Reilley, Matthew De Silva, Simeon Schopf, Shannon Rowell, Jediah Powers, Jose Garcia, David Dalton, Jean Carlo Sanclemente, Qingjun Zhang, Nathan Chou, Steven Lysenko, Megan Finch, Samuel Yanez, Carina Cater, Maria Wood, Tyler Todd, Prenston Perry, Daniel Haire, Ethan Behnke, Ryan Williams, Angelica Davis,

Jeffrey Meyers, John Kramer, James Cruz-Youll, Bradley Olson, Leon Love, Shray Pungaliya, Justin Farmer, Katherine Burke, Jessica Shu, Danielle Lavigne, Depei Zhang, Bryanna Mundy, Kevin King, Shriram Gharpure, Evan Dawson, Wouter Massa, Rachel Fletcher, Mary Elizabeth Taylor, Mihika Poddar, Jacob Shattuck, Joseph Bianco, Caroline Langner, Jeremy Leu, Mark Dye, Zihan Ban, Matthew Miller, Camilo Ossa, Norman Ashkenas, Kwan-I Lee, Krystelle Buenafe, Adam Wolff, Rashim Khadka, Shulin Yang, Randal Howell, Myles Baker, Syed Kumail Naqvi, Chengyin Liu, Stacy Johnson, Giti Baghban, Sang Won Suh, Desiree Caballero, Sam Nordstrom, Michelle Dawson, Andrea Wright-Macedo, Lorenzo Pavia, Shubhi Badjatiya, Mayur Saxena, Jordan Lanthier, Rasarag Sarsam, Kendra Doty, Robert Zoellick, Alicia Phan, Jonathan Chiou, Christopher Munn, Desiree Choy, Gunner Pinkerton, Melody Tackitt, Bianca Walters, Ping Chan Lin, Maxwell Taylor, Michael Longstreet, Samantha Chieng, Emily Marie Mares, Itzel Carreon Tapia, Teddy Ni, Kevin Yin, Charlie Martell, Teddy Doodnauth, Annie Mandell, Malik Manogin, Akshay Jain, Berott Mathnov, Ian Young, Kyle Podgurski, Tyler Whitten, Chia-Huei Lo, Courtney Dunbar, Robert Guzman, Lauren Gibson, Ali Algarmi, Christopher Saloman, Chen Chen, Oliwia Szczerbowska, Danielle Owusu, Siddharth Vartak, Devonte Snowden, Lauren Resende, Candice O'Hara, Jerry Tsui, Anthony Taranto, Rosalie Kim, Dan Feldstein, David Nicponski, Alexis Jean, Joshua Indykiewicz, Eric Ngo, George Escandon, Carlos Acosta Moncada, Allan Liu, Michael Sherron, Nimit Agrawal, Jeffrey Lee, Christian Zwicky, Bradley Schlagel, Bruce Martin, Sy-yang Na, Caleb Luckett, Dylan Lindimore, Matthew Strope, Archana Matela, Dana Kaplan, Melissa Kincaid, Marcella Cindy Prasetio, Matthew Cunningham, Danielle DiCoscia, Daniel Ramirez, Matthew Hingst, Calum McWhir, Agung Atmaja, Joseph Grundfest, Michael Bueno, Brandon Land, Micah Rouse, Turmunkh Zorigt, Dhruv Rajan, Katherine Abbott, Simon Shulman, Kari Mertz, Garrett Holden, Andrew Rimmer, Ashleah Yzaguirre, Chu Ngo, Crystal Haka, Walter Carroll, Rebekah Bourque, James Kong, Aaron Shequen, Helen Zhang, Melissa Lester, Loren Sexton, Kiley Rourke, Alexander Katz, Eleanor Trinh, Woradorn Kamolpornwijit, Ankit Katiyar, Ricardo Duenas, Asad Rana, Michael Kornegay, Chris Mahan, Michael Bouchier, Connor Nagelvoort, John Reese, Lisa Boss, Nalina Bergman, Daniel Mitchell, Chelsea Goodfellow, Abdullah Hashmi, Lei Gao, William Lipplett, Eric Pond, Tyler Livermont, Ian Tejeda, Jennifer Scheck, Brian Haberly, Christopher Flannery, Abdiel Rivas, Rida Safdar, Aaron Pimienta, Daniel Himmelstein, Thomas Grey III, Vladimir Tikhonov, Harshini Kalpesh Shah, Damian Wieczorek, Allan Reyes, Ying Wang, Arami Reyes, Dustin Beaver, Carrie Rivers, Joyce Ehrlinger, Erin Merchant, Kelly Zhang, Jeffery Abbott, Cindy Aguilera, Mark Kohl, David Applegate, Raza Rasheed, Maria Rosca, Luis Brahm-Smart, Krishna Sunil Yekasi, Nicholas Winant, Tracy Firmin, Staci Smith, Erin Todus, Diana Mazo, Adia Brown, Muema Lombe, Graham Roth, William Butler, Wanqian Zhou, Golbanoo Naghshineh, Yuan Liu, Edward Morris, Lily Wang, Ryan Jensen, Thushara Mudireddy, Jeffrey Hobble, Jessica Robson, Heidy Hernandez Breton, Sunny Sang, Kerry Schmidt, Josiah Bales, Rajeev Krithivasan, Ryan Cook, Ashley Wong, Brian Dzou, Michael Jensen, Beatriz Santiesteban Horta, Jill Stoever, Kamal Boparai, Cal Singleton, Erika Dean, Stephanie Wallin, Stephanie Garcia, Shannon Amin, Cole Mitchell, Justin Maher, Dominique Doan, Tuan Anh Dau, Stephanie Rabinowitz, Qichen Gao, Dante Bouldin, Thant Htoo Zaw, Haley House, Christopher Weaver, Aaron Henry, Isaiah Wright-Wiggins, Di Liu, Garrett Phillips, Bryan Velasco, Creston Stickels Jr, Matthew Greenhalgh, Louis Fernandez, Blake Martin, Hannah O'Toole, Destinee Gutierrez, Hye Won Lee, Zona Pan, Scott Shields, Gilles Mischler, James Molina, Lauren Pettinato, Justin Bynum, Rob Wang, Clint Edwards, Anthony Link, Savannah Smart, Christopher Harrison, Jacob Conway, David Glynn, Tongbo Luo, Monica Philip, Holly Miller, Joseph Burgess, Taelor Fair, Kevin Jin, Daniel Kelati, DeAnna Caggiano, Jialiang Wang, Brad Hesla, Siyu Liu, Caitlin Boyle, Nolan Bland, Taylor Evans, Ryan McCaffrey, Lindsay Perez, Haotian Xu, Shan He, Jason Dewn, Yifan Li, Jonathan Quinteros, Valeria Hurtado-Lopez, Noah Lazaro, Melisa Fich, Mahim Patel, Jerrell Taylor, Srikanth Devidi, Bryant Obeng, Joel Knight, Jake DeBellis, Kevin Serwatka, Christopher Tassone, Addie Ford, Javier Oviedo, Jin Gong, Svetoslava Slavova, Binxiang Ni, David Paley, Gabriella Garcia, Yuyang Zhang, Trisha Patel, Nicholas Zurick, Jing Wang, Mark Gillean, Greg Pstrucha, Cecilia Chen, Brian Pipkin, Shana Green, Benjamin Parks, Tsz Choi Lau, Madeline Schnipper, Mohamed El Fellah, Mohammad Fathi, Rex Dendinger, Edward Myles, Akshay Udiavar, Ye Liu, Brian Correro, Dawei Deng, Nicholas Luisi, Rachel Shern Mae Leong, Jennifer Chen, Jonathan Fersh, Josue Calvillo, Jose Michel, Gustavo Marquez, Ann Bergquist, Robert Choe, Hal Anderson, Wenxu Mao, Qingqing Zhang, Christopher Rapp, Christa Tallman, Jason Lyons, Jeffrey Tribble, Craig Pinkston, Chase Turnage, Matt Dusseault, Kathleen Robinson, Ranier Lopez, Desiree Desai, Anthony Onochie, Tara Vishnesky, Jeffrey Wang, Robin Soto, Siddharth Bidasaria, Chloe Barz, Monica Murray, Vikram Atre, Li Zhang, Tami Davis, Selam Kidane, Deanna Shears, Lauren Faltys, Jordan Campbell, Camila Hernandez Bojorquez, Hamna Nazir, Weiqi Cai, Boyang Tian, Iwona Wakuluk, Richard Wood, Chadwick Albert, John Fawcett, Joyce Lee, Debleena Roy, Kendall Messmer, Leslie Rojas, Puneeth Gadangi, Calli Singleton, Sreeram Ramji, Ayse Erkan, Gabriela Trio, Yizhou Ye, Priscilla Hernandez, Ozan Demirlioglu, Gavin Duke, Saige Xie, Tyler Duignan, Santiago Murillo, Robert Ewing, Eric Charway, Ninya Beyer, Diana Fu, Osasumwen

Obaizamomwan, Lauren Remson, Congnan Zheng, Steven Hanson, Sul Ah Seo, Cory Pruce, Jordan Schroeder, Sara Rush, Heather Greening, Jose Maceda, Michelle Gard, Yichuan Huang, Christine Reyes, Patrick LeFevre, Dustin Wilhelm, Strongpoint Holdings LLC, Kamran Malik and Shafaq Latif JT, The Friedman Family Revocable Trust, The Nicole K Friedman Family Trust, SIF IRREVOCABLE TRUST, NKF IRREVOCABLE TRUST, Michael Patrick Milliken and Anne Hoge Milliken, Co-Trustees of the Milliken Family Trust u/a/d 11/11/2005, KJCY Resources, LLC, FMB Resources, LLC, FAD Resources, LLC, KCJ Resources, LLC, Nadezda Asoyan and Paul Asoyan TENCOM, Max T Bergen and Sarah Azizi COMMUNITY PROPERTY WROS, Gottipati Aravind, Barcenas Christian, Scott Kaczmarek and Abigail Perri Barnes TENCOM, David Nickels and Jeff Lutman COMMUNITY PROPERTY WROS, Sara D. Friedman Irrevocable Trust, Niko G. Friedman Irrevocable Trust, Howard 2021 Family Trust, The Ray Investment Trust, Anne Ciccarelli and Sabrina Ciccarelli TENCOM, Heather Elizabeth Breslow and Andrew Breslow TENCOM, Stephen Chang and Lisa Guo TENCOM, Eun Kyung Jeong and Jihoon Kim TENCOM, Davina Boedijono and Edmund Loo TENCOM, Peter Csiba and Katarina Csiba Sabova TENCOM, Nicholas James Dellamaggiore and Catherine Marie Dellamaggiore TENCOM, Zane Bevan and Lisa Preville COMMUNITY PROPERTY WROS, Mitchell Burbick, Dave Babulak, Jeffrey Currier, AnYuan Guo, Michael Liou, Andrew Myers, Andrew Ondrak, Jeffrey Feinglas, and Michael Rauchman. Each of these persons or entities beneficially owns less than 1% of our Class A common stock.

(7)Includes (i) 15,002,817 shares of our Class A common stock subject to stock options exercisable within 60 days of July 28, 2021 and (ii) 11,472,654 shares of our Class A common stock issued upon net settlement of IPO-Vesting Time-Based RSUs (based on an assumed 22% tax withholding rate).

PLAN OF DISTRIBUTION

We are registering the Shares covered by this prospectus to permit the Selling Stockholders to conduct public secondary trading of these Shares from time to time after the date of this prospectus. We will not receive any of the proceeds of the sale of the Shares offered by this prospectus. The aggregate proceeds to the Selling Stockholders from the sale of the Shares will be the purchase price of the Shares less any discounts and commissions. We will not pay any brokers’ or underwriters’ discounts and commissions in connection with the registration and sale of the Shares covered by this prospectus. The Selling Stockholders reserve the right to accept and, together with their respective agents, to reject, any proposed purchases of Shares to be made directly or through agents.

The Shares offered by this prospectus may be sold from time to time to purchasers:

•directly by the Selling Stockholders, or

•through underwriters, broker-dealers or agents, who may receive compensation in the form of discounts, commissions or agent’s commissions from the Selling Stockholders or the purchasers of the Shares.

Any underwriters, broker-dealers or agents who participate in the sale or distribution of the Shares may be deemed to be “underwriters” within the meaning of the Securities Act. As a result, any discounts, commissions or concessions received by any such broker-dealer or agents who are deemed to be underwriters will be deemed to be underwriting discounts and commissions under the Securities Act. Underwriters are subject to the prospectus delivery requirements of the Securities Act and may be subject to certain statutory liabilities under the Securities Act and the Exchange Act. We will make copies of this prospectus available to the Selling Stockholders for the purpose of satisfying the prospectus delivery requirements of the Securities Act. To our knowledge, there are currently no plans, arrangements or understandings between the Selling Stockholders and any underwriter, broker-dealer or agent regarding the sale of the Shares by the Selling Stockholders.

The Shares may be sold in one or more transactions at:

•fixed prices;

•prevailing market prices at the time of sale;

•prices related to such prevailing market prices;

•varying prices determined at the time of sale; or

•negotiated prices.

These sales may be effected in one or more transactions:

•on any national securities exchange or quotation service on which the Shares may be listed or quoted at the time of sale, including the Nasdaq Global Select Market;

•in the over-the-counter market;

•in transactions otherwise than on such exchanges or services or in the over-the-counter market;

•any other method permitted by applicable law; or

•through any combination of the foregoing.

These transactions may include block transactions or crosses. Crosses are transactions in which the same broker acts as an agent on both sides of the trade.

At the time a particular offering of the Shares is made, a prospectus supplement, if required, will be distributed, which will set forth the name of the Selling Stockholders, the aggregate amount of Shares being offered and the terms of the offering, including, to the extent required, (1) the name or names of any underwriters, broker-dealers or

agents, (2) any discounts, commissions and other terms constituting compensation from the Selling Stockholders and (3) any discounts, commissions or concessions allowed or reallowed to be paid to broker-dealers.

The Selling Stockholders will act independently of us in making decisions with respect to the timing, manner, and size of each resale or other transfer. There can be no assurance that the Selling Stockholders will sell any or all of the Shares under this prospectus. Further, we cannot assure you that the Selling Stockholders will not transfer, distribute, devise or gift the Shares by other means not described in this prospectus. In addition, any Shares covered by this prospectus that qualify for sale under Rule 144 of the Securities Act may be sold under Rule 144 rather than under this prospectus. The Shares may be sold in some states only through registered or licensed brokers or dealers. In addition, in some states the Shares may not be sold unless they have been registered or qualified for sale or an exemption from registration or qualification is available and complied with.

The Selling Stockholders and any other person participating in the sale of the Shares will be subject to the Exchange Act. The Exchange Act rules include, without limitation, Regulation M, which may limit the timing of purchases and sales of any of the Shares by the Selling Stockholders and any other person. In addition, Regulation M may restrict the ability of any person engaged in the distribution of the Shares to engage in market-making activities with respect to the particular Shares being distributed. This may affect the marketability of the Shares and the ability of any person or entity to engage in market-making activities with respect to the Shares.

The Selling Stockholders may indemnify any broker or underwriter that participates in transactions involving the sale of the Shares against certain liabilities, including liabilities arising under the Securities Act.

LEGAL MATTERS

The validity of the shares of Class A common stock offered hereby has been passed upon by Cravath, Swaine & Moore LLP.

EXPERTS

The consolidated financial statements of Robinhood Markets, Inc. appearing in Robinhood Markets, Inc.’s Registration Statement (Form S-1) for the years ended December 31, 2020 and 2019 have been audited by Ernst & Young LLP, independent registered public accounting firm, as set forth in their report thereon, included therein, and incorporated herein by reference. Such consolidated financial statements are incorporated herein by reference in reliance upon such report given on the authority of such firm as experts in accounting and auditing.

INFORMATION INCORPORATED BY REFERENCE

The following documents filed with the SEC are hereby incorporated by reference in this prospectus:

•Amendment No. 2 to the Registrant’s Registration Statement on Form S-1 filed with the SEC on July 27, 2021 (File No. 333-257602), which contains the Registrant’s audited financial statements for the latest fiscal year for which such statements have been filed. •The Registrant’s Prospectus to be filed on or about July 30, 2021 pursuant to Rule 424(b) under the Securities Act, relating to the Registration Statement on Form S-1, as amended (File No. 333-257602).

•The description of the Registrant’s Class A common stock which is contained in a Registration Statement on Form 8-A filed on July 29, 2021 (File No. 001-40691) under the Exchange Act, including any amendment or report filed for the purpose of updating such description. All documents filed by the Registrant pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act on or after the date of this Registration Statement and prior to the filing of a post-effective amendment to this Registration Statement that indicates that all securities offered have been sold or that deregisters all securities then remaining unsold shall be deemed to be incorporated by reference in this Registration Statement and to be part hereof from the date of filing of such documents; provided, however, that documents or information deemed to have been furnished and not filed in accordance with the rules of the SEC shall not be deemed incorporated by reference into this Registration Statement.