PROSPECTUS

As filed with the Securities and Exchange Commission on November 27, 2023 | |

File Nos. | |

002-30761 | |

811-01700 | |

SECURITIES AND EXCHANGE COMMISSION | |

WASHINGTON, D.C. 20549 | |

FORM | |

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 | [X] |

Pre-Effective Amendment No. | |

Post-Effective Amendment No. 86 | [X] |

and/or | |

REGISTRATION STATEMENT UNDER THE INVESTMENT COMPANY ACT OF 1940 | [X] |

Amendment No. 61 | [X] |

(Exact Name of Registrant as Specified in Charter) | |

ONE FRANKLIN PARKWAY, SAN MATEO, CA 94403-1906 | |

(Address of Principal Executive Offices) (Zip Code) | |

Registrant’s Telephone Number, Including Area Code (650) 312-2000 | |

ALISON E. BAUR, ONE FRANKLIN PARKWAY, SAN MATEO, CA 94403-1906 | |

(Name and Address of Agent for Service of Process) | |

Approximate Date of Proposed Public Offering: | |

It is proposed that this filing will become effective (check appropriate box): | |

[ ] immediately upon filing pursuant to paragraph (b) | |

[X] on December 1, 2023 pursuant to paragraph (b) | |

[ ] 60 days after filing pursuant to paragraph (a)(1) | |

[ ] on (date) pursuant to paragraph (a)(1) | |

[ ] 75 days after filing pursuant to paragraph (a)(2) | |

[ ] on (date) pursuant to paragraph (a)(2) of Rule 485 | |

If appropriate, check the following box: | |

[ ] This post-effective amendment designates a new effective date for a previously filed post-effective amendment. | |

PROSPECTUS | |||||||

| |||||||

Class A | Class C | Class R6 | Advisor Class |

FKRCX | FRGOX | FGPMX | FGADX |

The U.S. Securities and Exchange Commission (SEC) has not approved or disapproved these securities or passed upon the adequacy of this prospectus. Any representation to the contrary is a criminal offense.

132 P 12/23 |

Contents

Fund Summary

Payments to Broker-Dealers and Other Financial Intermediaries |

Fund Details

Your Account

For More Information

Back Cover

FRANKLIN

GOLD AND PRECIOUS METALS FUND

FUND SUMMARY

Capital appreciation. The Fund's secondary goal is to provide shareholders with current income through dividends or interest received from its investments.

These tables describe the fees and expenses

that you may pay if you buy and hold shares of the Fund. You may pay other fees (including on Class R6

and Advisor Class shares), such as brokerage commissions and other fees to financial intermediaries,

which are not reflected in the tables and examples below.

(fees paid directly from your investment)

| Class A |

| Class C |

| Class R6 |

| Advisor

| |

Maximum Sales Charge

(Load) |

|

|

| |||||

Maximum

Deferred Sales Charge | 1 |

|

| |||||

|

|

|

|

|

|

|

|

|

1. | There is a 1% contingent deferred sales charge that applies to investments of $1 Million or more (see "Investment of $1 Million or More" under "Choosing a Share Class") and purchases by certain retirement plans without an initial sales charge on shares sold within 18 months of purchase. | |||||||

(expenses that you pay each year as a percentage of the value of your investment)

| Class A |

| Class C |

| Class R6 |

| Advisor

|

Management fees |

|

|

| ||||

Distribution and service (12b-1) fees |

|

|

| ||||

Other expenses |

|

|

| ||||

Total annual Fund operating expenses |

|

|

| ||||

Fee waiver and/or expense reimbursement1 |

|

| - |

| |||

Total annual Fund operating expenses after fee waiver and/or expense reimbursement |

|

|

|

4 | Prospectus | franklintempleton.com |

FRANKLIN

GOLD AND PRECIOUS METALS FUND

FUND SUMMARY

1.

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of the period. The Example also assumes that your investment has a 5% return each year and that the Fund's operating expenses remain the same. The Example reflects adjustments made to the Fund's operating expenses due to the fee waivers and/or expense reimbursements by management for the 1 Year numbers only. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

|

|

| 1 Year |

| 3 Years |

| 5 Years |

| 10 Years |

Class A |

| $ |

| $ |

| $ |

| $ | |

Class C |

| $ |

| $ |

| $ |

| $ | |

Class R6 |

| $ |

| $ |

| $ |

| $ | |

Advisor Class |

| $ |

| $ |

| $ |

| $ | |

|

|

|

|

|

|

| |||

Class C |

| $ |

| $ |

| $ |

| $ | |

|

|

|

|

|

|

|

|

| |

The Fund pays transaction costs, such as

commissions, when it buys and sells securities (or "turns over" its portfolio). A higher portfolio turnover

rate may indicate higher transaction costs and may result in higher taxes when Fund shares are held in

a taxable account. These costs, which are not reflected in annual Fund operating expenses or in the Example,

affect the Fund's performance. During the most recent fiscal year, the Fund's portfolio turnover rate

was

franklintempleton.com | Prospectus | 5 |

FRANKLIN

GOLD AND PRECIOUS METALS FUND

FUND SUMMARY

metals operation companies as long as the investment manager determines, in its sole discretion, that the company provides attractive exposure to precious metals.

The Fund is a "non-diversified" fund, which means it generally invests a greater portion of its assets in the securities of one or more issuers and may invest overall in a smaller number of issuers than a diversified fund.

The Fund may buy securities of gold and precious metals operation companies located anywhere in the world and in general invests predominantly in non-U.S. companies. Currently a substantial portion of the companies in which the Fund invests are domiciled in Canada, although the mining operations of such companies often take place in other countries, including emerging and frontier markets. The Fund may invest in companies without regard to market capitalization, and may heavily invest in small- and mid-capitalization companies. The Fund primarily invests in equity securities, primarily common stock. The Fund also invests in American, Global and European Depositary Receipts.

The Fund’s investment manager looks for companies with low cost reserves and experienced management teams with established track records, particularly focusing on companies with long life production profiles, expandable resource bases, and active exploration programs that can potentially drive future reserve and production growth.

Gold and Precious Metals: The prices of gold and precious metals operation companies are affected by the price of gold or other precious metals such as platinum, palladium and silver, as well as other prevailing market conditions. These prices may be volatile, fluctuating substantially over short periods of time. Depending on market conditions, gold and precious metals operation companies may dramatically outperform or underperform more traditional equity investments. In times of stable economic growth, traditional equity and debt investments could offer greater appreciation potential and the prices of gold and other precious metals may be adversely affected.

The prices of gold and other precious metals are affected by such factors as: (1) how much of the worldwide supply is held by large holders, such as governmental bodies and central banks; (2) unpredictable monetary policies and economic and political conditions in countries throughout the world; (3) supply and demand for gold bullion as an investment, including bars, coins or gold-backed financial

6 | Prospectus | franklintempleton.com |

FRANKLIN

GOLD AND PRECIOUS METALS FUND

FUND SUMMARY

instruments such as exchange-traded funds; (4) demand for gold jewelry; and (5) government policies meant to influence demand for gold and other precious metals.

The prices of gold and precious metals operation companies are directly affected by: (1) declines in the prices of gold and precious metals; (2) rising capital costs as well as labor and other costs in mining and production; (3) adverse currency fluctuations, economic events or natural disasters or other events with a significant economic effect in the countries where these companies operate; (4) labor disruptions; (5) operational issues and failures; (6) access to reliable energy and equipment supplies; and (7) changes in laws relating to mining, production, or sales. These factors may result in deviations between the prices of the underlying metals and the securities of the operation companies in which the Fund invests. In addition, some gold and precious metals mining companies have hedged, to varying degrees, their exposure to falls in the prices of gold or precious metals by selling forward future production, which could limit the company’s benefit from future rises in the prices of gold or precious metals or increase the risk that the company could fail to meet its contractual obligations. With respect to mining companies, mining operations have varying expected life spans and companies that have mines with a short expected life span may experience more stock price volatility.

Changes in U.S. or foreign tax, currency or mining laws may make it more expensive and/or more difficult to pursue the Fund's investment strategies.

Concentration: To the extent the Fund concentrates in a specific industry, a group of industries, sector or type of investment, the Fund will carry much greater risks of adverse developments and price movements in such industries, sectors or investments than a fund that invests in a wider variety of industries, sectors or investments. There is also the risk that the Fund will perform poorly during a slump in demand for securities of companies in such industries or sectors.

Market: The market values of securities or other investments owned by the Fund will go up or down, sometimes rapidly or unpredictably. The market value of a security or other investment may be reduced by market activity or other results of supply and demand unrelated to the issuer. This is a basic risk associated with all investments. When there are more sellers than buyers, prices tend to fall. Likewise, when there are more buyers than sellers, prices tend to rise.

The global outbreak of the novel strain of coronavirus, COVID-19 and its subsequent variants, has resulted in market closures and dislocations, extreme volatility, liquidity constraints and increased trading costs. The long-term impact on economies, markets, industries and individual issuers is not known. Some sectors of the economy and individual issuers have experienced or may experience particularly large losses. Periods of extreme volatility in the financial markets;

franklintempleton.com | Prospectus | 7 |

FRANKLIN

GOLD AND PRECIOUS METALS FUND

FUND SUMMARY

reduced liquidity of many instruments; and disruptions to supply chains, consumer demand and employee availability, may continue for some time.

Stock prices tend to go up and down more dramatically than those of debt securities. A slower-growth or recessionary economic environment could have an adverse effect on the prices of the various stocks held by the Fund.

Foreign Securities (non-U.S.): Investing in foreign securities typically involves more risks than investing in U.S. securities, and includes risks associated with: (i) internal and external political and economic developments – e.g., the political, economic and social policies and structures of some foreign countries may be less stable and more volatile than those in the U.S. or some foreign countries may be subject to trading restrictions or economic sanctions; (ii) trading practices – e.g., government supervision and regulation of foreign securities and currency markets, trading systems and brokers may be less than in the U.S.; (iii) availability of information – e.g., foreign issuers may not be subject to the same disclosure, accounting and financial reporting standards and practices as U.S. issuers; (iv) limited markets – e.g., the securities of certain foreign issuers may be less liquid (harder to sell) and more volatile; and (v) currency exchange rate fluctuations and policies – e.g., fluctuations may negatively affect investments denominated in foreign currencies and any income received or expenses paid by the Fund in that foreign currency. The risks of foreign investments may be greater in developing or emerging market countries.

Regional: Adverse conditions in a certain region or country can adversely affect securities of issuers in other countries whose economies appear to be unrelated. To the extent that the Fund invests a significant portion of its assets in a specific geographic region or a particular country, the Fund will generally have more exposure to the specific regional or country economic risks. In the event of economic or political turmoil or a deterioration of diplomatic relations in a region or country where a substantial portion of the Fund’s assets are invested, the Fund may experience substantial illiquidity or reduction in the value of the Fund’s investments.

Emerging Market Countries: The Fund’s investments in emerging market countries are subject to all of the risks of foreign investing generally, and have additional heightened risks due to a lack of established legal, political, business and social frameworks to support securities markets, including: delays in settling portfolio securities transactions; currency and capital controls; greater sensitivity to interest rate changes; pervasiveness of corruption and crime; currency exchange rate volatility; and inflation, deflation or currency devaluation.

Frontier Market Countries: Frontier market countries generally have smaller economies and even less developed capital markets than traditional developing markets, and, as a result, the risks of investing in developing market countries are

8 | Prospectus | franklintempleton.com |

FRANKLIN

GOLD AND PRECIOUS METALS FUND

FUND SUMMARY

magnified in frontier market countries. The magnification of risks are the result of: potential for extreme price volatility and illiquidity in frontier markets; government ownership or control of parts of private sector and of certain companies; trade barriers, exchange controls, managed adjustments in relative currency values and other protectionist measures imposed or negotiated by frontier market countries or their trading partners; and the relatively new and unsettled securities laws in many frontier market countries.

Small and Mid Capitalization Companies: Securities issued by small and mid capitalization companies may be more volatile in price than those of larger companies and may involve substantial risks. Such risks may include greater sensitivity to economic conditions, less certain growth prospects, lack of depth of management and funds for growth and development, and limited or less developed product lines and markets. In addition, small and mid capitalization companies may be particularly affected by interest rate increases, as they may find it more difficult to borrow money to continue or expand operations, or may have difficulty in repaying any loans.

Liquidity: The trading market for a particular security or type of security or other investments in which the Fund invests may become less liquid or even illiquid. Reduced liquidity will have an adverse impact on the Fund’s ability to sell such securities or other investments when necessary to meet the Fund’s liquidity needs, which may arise or increase in response to a specific economic event or because the investment manager wishes to purchase particular investments or believes that a higher level of liquidity would be advantageous. Reduced liquidity will also generally lower the value of such securities or other investments. Market prices for such securities or other investments may be relatively volatile.

Illiquid Securities: Certain securities are illiquid due to a limited trading market, financial weakness of the issuer, legal or contractual restrictions on resale or transfer, or are otherwise illiquid in the sense that they cannot be sold within seven days at approximately the price at which the Fund values them. Securities that are illiquid involve greater risk than securities with more liquid markets. Market quotations for such securities may be volatile and/or subject to large spreads between bid and ask prices. Illiquidity may have an adverse impact on market price and the Fund's ability to sell particular securities when necessary to meet the Fund's liquidity needs or in response to a specific economic event.

Income: Because the Fund can only distribute what it earns, the Fund's distributions to shareholders may decline when dividend income from investments in stocks declines or when the Fund does not have PFIC gains to be distributed. The Fund's income generally declines during periods of falling gold and precious metals prices.

franklintempleton.com | Prospectus | 9 |

FRANKLIN

GOLD AND PRECIOUS METALS FUND

FUND SUMMARY

Non-Diversification:

Depositary Receipts: Depositary receipts are subject to many of the risks of the underlying security. For some depositary receipts, the custodian or similar financial institution that holds the issuer's shares in a trust account is located in the issuer's home country. The Fund could be exposed to the credit risk of the custodian or financial institution, and in cases where the issuer’s home country does not have developed financial markets, greater market risk. In addition, the depository institution may not have physical custody of the underlying securities at all times and may charge fees for various services, including forwarding dividends and interest and corporate actions. The Fund would be expected to pay a share of the additional fees, which it would not pay if investing directly in the foreign securities. The Fund may experience delays in receiving its dividend and interest payments or exercising rights as a shareholder. There may be an increased possibility of untimely responses to certain corporate actions of the issuer in an unsponsored depositary receipt program. Accordingly, there may be less information available regarding issuers of securities underlying unsponsored programs and there may not be a correlation between this information and the market value of the depositary receipts.

Management: The Fund is subject to management risk because it is an actively managed investment portfolio. The Fund's investment manager applies investment techniques and risk analyses in making investment decisions for the Fund, but there can be no guarantee that these decisions will produce the desired results.

Cybersecurity: Cybersecurity incidents, both intentional and unintentional, may allow an unauthorized party to gain access to Fund assets, Fund or customer data (including private shareholder information), or proprietary information, cause the Fund, the investment manager, and/or their service providers (including, but not limited to, Fund accountants, custodians, sub-custodians, transfer agents and financial intermediaries) to suffer data breaches, data corruption or loss of operational functionality or prevent Fund investors from purchasing, redeeming or exchanging shares or receiving distributions. The investment manager has limited ability to prevent or mitigate cybersecurity incidents affecting third party service providers, and such third party service providers may have limited indemnification obligations to the Fund or the investment manager. Cybersecurity incidents may result in financial losses to the Fund and its shareholders, and substantial costs may be incurred in an effort to prevent or mitigate future cybersecurity incidents. Issuers of securities in which the Fund invests are also subject to cybersecurity

10 | Prospectus | franklintempleton.com |

FRANKLIN

GOLD AND PRECIOUS METALS FUND

FUND SUMMARY

risks, and the value of these securities could decline if the issuers experience cybersecurity incidents.

Because technology is frequently changing, new ways to carry out cyber attacks are always developing. Therefore, there is a chance that some risks have not been identified or prepared for, or that an attack may not be detected, which puts limitations on the Fund's ability to plan for or respond to a cyber attack. Like other funds and business enterprises, the Fund, the investment manager, and their service providers are subject to the risk of cyber incidents occurring from time to time.

franklintempleton.com | Prospectus | 11 |

FRANKLIN

GOLD AND PRECIOUS METALS FUND

FUND SUMMARY

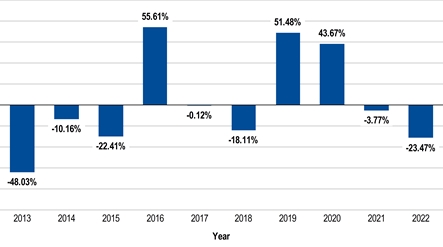

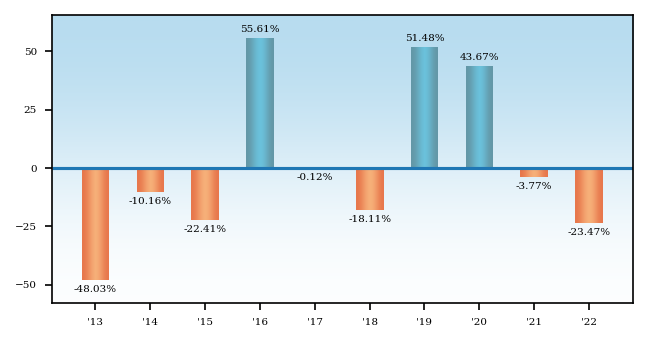

The secondary index in the table below shows how the Fund's performance compares to a group of securities that reflects the broader equity markets universe.

- |

12 | Prospectus | franklintempleton.com |

FRANKLIN

GOLD AND PRECIOUS METALS FUND

FUND SUMMARY

(figures reflect sales charges)

For periods ended December 31, 2022

|

| 1 Year |

| 5 Years |

| 10 Years |

| Since Inception |

| |

Franklin Gold and Precious Metals Fund - Class A |

|

|

|

|

|

|

|

|

| |

|

| - |

| |

| - |

| — |

| |

|

|

- |

| |

| - |

| — |

| |

|

|

- |

| |

| - |

| — |

| |

Franklin Gold and Precious Metals Fund - Class C |

| - |

| |

| - |

| — |

| |

Franklin Gold and Precious Metals Fund - Class R6 |

| - |

| |

| — |

|

| 1 | |

Franklin Gold and Precious Metals Fund - Advisor Class |

| - |

| |

| - |

| — |

| |

|

- |

| |

| - |

| — |

| ||

| - |

| |

| |

| — |

| ||

|

|

|

|

|

|

|

|

|

|

|

1. | Since inception May 1, 2013. | |||||||||

No one index is representative of the Fund's portfolio.

The figures in the average annual total returns table above reflect the Class A shares maximum front-end sales charge of 5.50%. Prior to September 10, 2018, Class A shares were subject to a maximum front-end sales charge of 5.75%. If the prior maximum front-end sales charge of 5.75% was reflected, performance for Class A shares in the average annual total returns table would be lower.

The after-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor's tax situation and may differ from those shown. After-tax returns are not relevant to investors who hold their Fund shares through tax-advantaged arrangements, such as 401(k) plans or individual retirement accounts. After-tax returns are shown only for Class A and after-tax returns for other classes will vary.

Franklin Advisers, Inc. (Advisers or investment manager)

Stephen M. Land, CFA

Portfolio Manager of

Advisers and portfolio manager of the Fund since 1999.

Frederick G. Fromm, CFA

Vice

President of Advisers and portfolio manager of the Fund since 2005.

franklintempleton.com | Prospectus | 13 |

FRANKLIN

GOLD AND PRECIOUS METALS FUND

FUND SUMMARY

Purchase and Sale of Fund Shares

You may purchase or redeem shares of the Fund on any business day online through our website at franklintempleton.com, by mail (Franklin Templeton Investor Services, P.O. Box 997151, Sacramento, CA 95899-7151), or by telephone at (800) 632-2301. For Class A and C, the minimum initial purchase for most accounts is $1,000 (or $25 under an automatic investment plan). Class R6 and Advisor Class are only available to certain qualified investors and the minimum initial investment will vary depending on the type of qualified investor, as described under "Your Account — Choosing a Share Class — Qualified Investors — Class R6" and "— Advisor Class" in the Fund's prospectus. There is no minimum investment for subsequent purchases.

The Fund’s distributions are generally taxable to you as ordinary income, capital gains, or some combination of both, unless you are investing through a tax-advantaged arrangement, such as a 401(k) plan or an individual retirement account, in which case your distributions would generally be taxed when withdrawn from the tax-advantaged account.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase shares of the Fund through a broker-dealer or other financial intermediary (such as a bank), the Fund and its related companies may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment. Ask your financial advisor or visit your financial intermediary's website for more information.

14 | Prospectus | franklintempleton.com |

FRANKLIN

GOLD AND PRECIOUS METALS FUND

FUND DETAILS

Investment Goal

The Fund's principal investment goal is capital appreciation. Its secondary goal is to provide shareholders with current income through dividends or interest received from its investments.

Principal Investment Policies and Practices

Under normal market conditions, the Fund invests at least 80% of its net assets in securities of gold and precious metals operation companies. Shareholders will be given at least 60 days' advance written notice of any change to the 80% policy. Gold and precious metals operation companies include companies that mine, process, or deal in gold or other precious metals, such as silver, platinum, and palladium, including mining finance and exploration companies as well as operating companies with long- or medium-life mines.

Several metals, including non-precious metals such as copper, zinc or nickel, often can be found in the earth together and as a result, precious metals may not be the primary business of the company. For purposes of the Fund’s 80% policy, such companies may be considered to be gold and precious metals operation companies as long as the investment manager determines, in its sole discretion, that the company provides attractive exposure to precious metals.

The Fund may buy securities of gold and precious metals operation companies located anywhere in the world and in general invests predominantly in non-U.S. companies. Currently a substantial portion of the companies in which the Fund invests are domiciled in Canada, although the mining operations of such companies often take place in other countries, including emerging and frontier markets. The Fund may invest in companies without regard to market capitalization and may heavily invest in companies falling within the small-capitalization (market capitalization less than $1.5 billion) and mid-capitalization (market capitalization of $1.5 billion to $10 billion) ranges.

The Fund primarily invests in equity securities, primarily common stock. An equity security, or stock, represents a proportionate share of the ownership of a company; its value is based on the success of the company's business, any income paid to stockholders, the value of its assets, and general market conditions. Common stocks and preferred stocks are examples of equity securities. The Fund also invests in American, Global and European Depositary Receipts, which are certificates typically issued by a bank or trust company that give their holders the right to receive securities issued by a foreign or domestic corporation.

franklintempleton.com | Prospectus | 15 |

FRANKLIN

GOLD AND PRECIOUS METALS FUND

FUND DETAILS

The Fund may make private investments in public companies in the form of private placements which are exempt from registration under the federal or applicable country's securities laws and are only sold to certain investors meeting predefined criteria.

The Fund is a "non-diversified" fund, which means it generally invests a greater portion of its assets in the securities of one or more issuers and may invest overall in a smaller number of issuers than a diversified fund.

Portfolio Selection

The Fund’s investment manager looks for companies with low cost reserves and experienced management teams with established track records, particularly focusing on companies with long life production profiles, expandable resource bases, and active exploration programs that can potentially drive future reserve and production growth. Alongside traditional financial and economic analyses, the investment manager assesses the potential impacts of material environmental, social and governance (ESG) factors on a company, which the investment manager believes provide a measure of the company’s sustainability. In analyzing ESG factors, the investment manager assesses whether a company’s practices pose a material financial risk or opportunity. Consideration of ESG factors and risks is only one component of the investment manager’s assessment of eligible investments and may not be a determinative factor in the investment manager’s final decision on whether to invest in a company. In addition, the weight given to ESG factors may vary across types of investments, industries, regions and issuers and ESG factors and weights considered may change over time. The investment manager does not assess every investment for ESG factors and, when it does, not every ESG factor may be identified or evaluated.

Temporary Investments

When the investment manager believes market or economic conditions are unfavorable for investors, the investment manager may invest up to 100% of the Fund's assets in a temporary defensive manner by holding all or a substantial portion of its assets in cash, cash equivalents or other high quality short-term investments. Temporary defensive investments generally may include preferred stocks, rated or unrated debt securities, securities of the U.S. government and its agencies, various bank debt instruments, money market fund shares, and money market instruments including repurchase agreements collateralized by U.S. government securities. The investment manager may also invest in these types of securities or hold cash while looking for suitable investment opportunities or to maintain liquidity. In these circumstances, the Fund may be unable to achieve its investment goals.

16 | Prospectus | franklintempleton.com |

FRANKLIN

GOLD AND PRECIOUS METALS FUND

FUND DETAILS

Gold and Precious Metals: The Fund’s investments are concentrated in gold and other precious metals (particularly platinum, palladium and silver) operation companies. By concentrating in the industries in a single sector, the Fund carries a much greater risk of adverse developments than a fund that invests in companies from a wide variety of industries. Also, there currently are a limited number of platinum and palladium operation companies, which restricts the Fund's ability to diversify its investments in those companies.

The prices of gold and precious metals operation companies are affected by the prices of gold and other precious metals such as platinum, palladium and silver, as well as other prevailing market conditions. These prices may fluctuate substantially over short periods of time, so the Fund's share price may be more volatile than other types of investments. Depending on market conditions, gold and precious metals operation companies may dramatically outperform or underperform more traditional equity investments. In times of stable economic growth, traditional equity and debt investments could offer greater appreciation potential and the prices of gold and other precious metals may be adversely affected, which could in turn affect the Fund's returns. The prices of gold and other precious metals are affected by such factors as: (1) how much of the worldwide supply is held by large holders, such as governmental bodies and central banks; for example, if the U.S. or another large holder decided to sell some of its gold or other precious metals reserves, the supply would go up, and the price would generally go down; (2) unpredictable monetary policies and economic and political conditions in countries throughout the world; (3) supply and demand for gold bullion as an investment, including bars, coins or gold-backed financial instruments such as exchange-traded funds; (4) demand for gold jewelry; and (5) government policies meant to influence demand for gold and other precious metals, as exemplified by the Government of India’s ongoing attempts to curb demand for gold through tax policy.

Some gold and precious metals mining companies have hedged, to varying degrees, their exposure to decreases in the prices of gold or precious metals by selling forward future production. Such hedging also limits a company’s ability to benefit from future increases in the prices of gold or precious metals. In addition, hedging techniques introduce their own risks, including the possible inability of a mining company or another party to meet its contractual obligations and potential margin requirements.

The prices of gold and precious metals operation companies are directly affected by: (1) declines in the prices of gold and precious metals; (2) rising capital, labor, and other costs in mining and production; (3) adverse currency fluctuations, economic events or natural disasters or other events with a significant economic effect within the countries where these companies operate; (4) changes in laws

franklintempleton.com | Prospectus | 17 |

FRANKLIN

GOLD AND PRECIOUS METALS FUND

FUND DETAILS

relating to environmental permits, mining, production, or sales; (5) labor disruptions; (6) operational issues and failures; and (7) access to reliable energy and equipment supplies. These factors may result in deviations between the prices of the underlying metals and the securities of the companies in which the Fund invests. The Fund generally invests a substantial portion of its assets in the securities of mining companies. Mining operations have varying expected life spans. Securities of mining companies that have mines with a short expected life span may experience greater price volatility than those that have mines with a long expected life span. In addition, exploration and development of metal deposits involve significant expenses and may not always be successful.

Certain mines are supported by base metal co-products and by-products such as copper, zinc and nickel. These mines are subject to the same or similar risks as described above with respect to their mining of such co-products and by-products such as copper, zinc and nickel.

Changes in U.S. or foreign tax, currency or mining laws may make it more expensive and/or more difficult to pursue the Fund's investment strategies.

Concentration: To the extent the Fund concentrates in a specific industry, a group of industries, sector or type of investment, the Fund will carry much greater risks of adverse developments and price movements in such industries, sectors or investments than a fund that invests in a wider variety of industries, sectors or investments. There is also the risk that the Fund will perform poorly during a slump in demand for securities of companies in such industries or sectors.

Market: The market values of securities or other investments owned by the Fund will go up or down, sometimes rapidly or unpredictably. The Fund’s investments may decline in value due to factors affecting individual issuers (such as the results of supply and demand), or sectors within the securities markets. The value of a security or other investment also may go up or down due to general market conditions that are not specifically related to a particular issuer, such as real or perceived adverse economic conditions, changes in interest rates or exchange rates, or adverse investor sentiment generally. Furthermore, events involving limited liquidity, defaults, non-performance or other adverse developments that affect one industry, such as the financial services industry, or concerns or rumors about any events of these kinds, have in the past and may in the future lead to market-wide liquidity problems, may spread to other industries, and could negatively affect the value and liquidity of the Fund’s investments. In addition, unexpected events and their aftermaths, such as the spread of diseases; natural, environmental or man-made disasters; financial, political or social disruptions; terrorism and war; and other tragedies or catastrophes, can cause investor fear and panic, which can adversely affect the economies of many companies, sectors, nations, regions and the market in general, in ways that cannot necessarily be foreseen. During a general downturn in the securities markets, multiple asset

18 | Prospectus | franklintempleton.com |

FRANKLIN

GOLD AND PRECIOUS METALS FUND

FUND DETAILS

classes may decline in value. When markets perform well, there can be no assurance that securities or other investments held by the Fund will participate in or otherwise benefit from the advance.

The global outbreak of the novel strain of coronavirus, COVID-19 and its subsequent variants, has resulted in market closures and dislocations, extreme volatility, liquidity constraints and increased trading costs. The long-term impact on economies, markets, industries and individual issuers is not known. Some sectors of the economy and individual issuers have experienced or may experience particularly large losses. Periods of extreme volatility in the financial markets; reduced liquidity of many instruments; and disruptions to supply chains, consumer demand and employee availability, may continue for some time. The U.S. government and the Federal Reserve, as well as certain foreign governments and central banks, have taken extraordinary action to support local and global economies and the financial markets in response to the COVID-19 pandemic. This and other government interventions into the economy and financial markets may not work as intended, and have resulted in a large expansion of government deficits and debt, the long term consequences of which are not known. In addition, the COVID-19 pandemic, and measures taken to mitigate its effects, could result in disruptions to the services provided to the Fund by its service providers.

Stock prices tend to go up and down more dramatically than those of debt securities. A slower-growth or recessionary economic environment could have an adverse effect on the prices of the various stocks held by the Fund.

Foreign Securities (non-U.S.): Investing in foreign securities typically involves more risks than investing in U.S. securities, including risks related to currency exchange rates and policies, country or government specific issues, less favorable trading practices or regulation and greater price volatility. Certain of these risks also may apply to securities of U.S. companies with significant foreign operations.

Currency exchange rates: Foreign securities may be issued and traded in foreign currencies. As a result, their market values in U.S. dollars may be affected by changes in exchange rates between such foreign currencies and the U.S. dollar, as well as between currencies of countries other than the U.S. For example, if the value of the U.S. dollar goes up compared to a foreign currency, an investment traded in that foreign currency will go down in value because it will be worth fewer U.S. dollars. The Fund accrues additional expenses when engaging in currency exchange transactions, and valuation of the Fund's foreign securities may be subject to greater risk because both the currency (relative to the U.S. dollar) and the security must be considered.

Political and economic developments: The political, economic and social policies or structures of some foreign countries may be less stable and more volatile than those in the United States. Investments in these countries may be subject to

franklintempleton.com | Prospectus | 19 |

FRANKLIN

GOLD AND PRECIOUS METALS FUND

FUND DETAILS

greater risks of internal and external conflicts, expropriation, nationalization of assets, foreign exchange controls (such as suspension of the ability to transfer currency from a given country), restrictions on removal of assets, political or social instability, military action or unrest, diplomatic developments, currency devaluations, foreign ownership limitations, and substantial, punitive or confiscatory tax increases. It is possible that a government may take over the assets or operations of a company or impose restrictions on the exchange or export of currency or other assets. Some countries also may have different legal systems that may make it difficult or expensive for the Fund to vote proxies, exercise shareholder rights, and pursue legal remedies with respect to its foreign investments. Diplomatic and political developments could affect the economies, industries, and securities and currency markets of the countries in which the Fund is invested. These developments include rapid and adverse political changes; social instability; regional conflicts; sanctions imposed by the United States, other nations or other governmental entities, including supranational entities; terrorism; and war. In addition, such developments could contribute to the devaluation of a country’s currency, a downgrade in the credit ratings of issuers in such country, or a decline in the value and liquidity of securities of issuers in that country. An imposition of sanctions upon, or other government actions impacting, certain issuers in a country could result in (i) an immediate freeze of that issuer’s securities, impairing the ability of the Fund to buy, sell, receive or deliver those securities or (ii) other limitations on the Fund’s ability to invest or hold such securities. These factors would affect the value of the Fund’s investments and are extremely difficult, if not impossible, to predict and take into account with respect to the Fund's investments.

Trading practices: Brokerage commissions, withholding taxes, custodial fees, and other fees generally are higher in foreign markets. The policies and procedures followed by foreign stock exchanges, currency markets, trading systems and brokers may differ from those applicable in the United States, with possibly negative consequences to the Fund. The procedures and rules governing foreign trading, settlement and custody (holding of the Fund's assets) also may result in losses or delays in payment, delivery or recovery of money or other property. Foreign government supervision and regulation of foreign securities and currency markets and trading systems may be less than or different from government supervision in the United States, and may increase the Fund's regulatory and compliance burden and/or decrease the Fund's investor rights and protections.

Availability of information: Foreign issuers may not be subject to the same disclosure, accounting, auditing and financial reporting standards and practices as U.S. issuers. Thus, there may be less information publicly available about foreign issuers than about most U.S. issuers. In addition, information provided by foreign

20 | Prospectus | franklintempleton.com |

FRANKLIN

GOLD AND PRECIOUS METALS FUND

FUND DETAILS

issuers may be less timely or less reliable than information provided by U.S. issuers.

Limited markets: Certain foreign securities may be less liquid (harder to sell) and their prices may be more volatile than many U.S. securities. Illiquidity tends to be greater, and valuation of the Fund's foreign securities may be more difficult, due to the infrequent trading and/or delayed reporting of quotes and sales.

Regional: Adverse conditions in a certain region or country can adversely affect securities of issuers in other countries whose economies appear to be unrelated. To the extent that the Fund invests a significant portion of its assets in a specific geographic region or a particular country, the Fund will generally have more exposure to the economic risks affecting that specific geographic region or country. In the event of economic or political turmoil or a deterioration of diplomatic relations in a region or country where a substantial portion of the Fund’s assets are invested, the Fund may experience substantial illiquidity or reduction in the value of the Fund’s investments.

Emerging market countries: The Fund's investments in emerging market issuers are subject to all of the risks of foreign investing generally, and have additional heightened risks due to a lack of established legal, political, business and social frameworks to support securities markets. Some of the additional significant risks include:

· less social, political and economic stability;

· a higher possibility of the devaluation of a country’s currency, a downgrade in the credit ratings of issuers in such country, or a decline in the value and liquidity of securities of issuers in that country if the United States, other nations or other governmental entities (including supranational entities) impose sanctions on issuers that limit or restrict foreign investment, the movement of assets or other economic activity in the country due to political, military or regional conflicts or due to terrorism or war;

· smaller securities markets with low or non-existent trading volume and greater illiquidity and price volatility;

· more restrictive national policies on foreign investment, including restrictions on investment in issuers or industries deemed sensitive to national interests;

· less transparent and established taxation policies;

· less developed regulatory or legal structures governing private and foreign investment or allowing for judicial redress for injury to private property, such as bankruptcy;

· less familiarity with a capital market structure or market-oriented economy and more widespread corruption and fraud;

franklintempleton.com | Prospectus | 21 |

FRANKLIN

GOLD AND PRECIOUS METALS FUND

FUND DETAILS

· less financial sophistication, creditworthiness and/or resources possessed by, and less government regulation of, the financial institutions and issuers with which the Fund transacts;

· less government supervision and regulation of business and industry practices, stock exchanges, brokers and listed companies than in the U.S.;

· greater concentration in a few industries resulting in greater vulnerability to regional and global trade conditions;

· higher rates of inflation and more rapid and extreme fluctuations in inflation rates;

· greater sensitivity to interest rate changes;

· increased volatility in currency exchange rates and potential for currency devaluations and/or currency controls;

· greater debt burdens relative to the size of the economy;

· more delays in settling portfolio transactions and heightened risk of loss from share registration and custody practices; and

· less assurance that when favorable economic developments occur, they will not be slowed or reversed by unanticipated economic, political or social events in such countries.

Because of the above factors, the Fund's investments in emerging market issuers may be subject to greater price volatility and illiquidity than investments in developed markets.

Frontier market countries: Frontier market countries, which are a subset of emerging market countries, generally have smaller economies and even less developed capital markets than traditional emerging markets, and, as a result, the risks of investing in emerging market countries are magnified in frontier market countries. The magnification of risks are the result of: potential for extreme price volatility and illiquidity in frontier markets; government ownership or control of parts of private sector and of certain companies; trade barriers, exchange controls, managed adjustments in relative currency values and other protectionist measures imposed or negotiated by the countries with which frontier market countries trade; and the relatively new and unsettled securities laws in many frontier market countries.

Small and Mid Capitalization Companies: While small and mid capitalization companies may offer substantial opportunities for capital growth, they also may involve more risks than larger companies. Historically, securities issued by small and mid capitalization companies have been more volatile in price than securities that are issued by larger companies, especially over the short term. Among the reasons for the greater price volatility are the less certain growth prospects of small and mid capitalization companies, the lower degree of liquidity in the markets for

22 | Prospectus | franklintempleton.com |

FRANKLIN

GOLD AND PRECIOUS METALS FUND

FUND DETAILS

such securities, and the greater sensitivity of small and mid capitalization companies to changing economic conditions.

In addition, small and mid capitalization companies may lack depth of management, be unable to generate funds necessary for growth or development, have limited product lines or be developing or marketing new products or services for which markets are not yet established and may never become established. Small and mid capitalization companies may be particularly affected by interest rate increases, as they may find it more difficult to borrow money to continue or expand operations, or may have difficulty in repaying loans, particularly those with floating interest rates.

Liquidity: Liquidity risk exists when the markets for particular securities or types of securities or other investments are or become relatively illiquid so that the Fund is unable, or it becomes more difficult for the Fund, to sell the security or other investment at the price at which the Fund has valued the security. Illiquidity may result from political, economic or issuer specific events; supply/demand imbalances; changes in a specific market’s size or structure, including the number of participants; or overall market disruptions. Securities or other investments with reduced liquidity or that become illiquid may involve greater risk than securities with more liquid markets. Market prices or quotations for illiquid securities may be volatile, and there may be large spreads between bid and ask prices. Reduced liquidity may have an adverse impact on market price and the Fund's ability to sell particular securities when necessary to meet the Fund's liquidity needs, which may arise or increase in response to a specific economic event or because the investment manager wishes to purchase particular investments or believes that a higher level of liquidity would be advantageous. An investment may become illiquid if the Fund and its affiliates receive material non-public information about the issuer or the investment. To the extent that the Fund and its affiliates hold a significant portion of an issuer's outstanding securities, the Fund may be subject to greater liquidity risk than if the issuer's securities were more widely held.

Illiquid Securities: Certain securities are illiquid due to a limited trading market, financial weakness of the issuer, legal or contractual restrictions on resale or transfer, or are otherwise illiquid in the sense that they cannot be sold within seven days at approximately the price at which the Fund values them. Securities that are illiquid involve greater risk than securities with more liquid markets. Market quotations for such securities may be volatile and/or subject to large spreads between bid and ask prices. Illiquidity may have an adverse impact on market price and the Fund's ability to sell particular securities when necessary to meet the Fund's liquidity needs or in response to a specific economic event.

Private Investments in Public Companies: Private investments in public companies in the form of private placements involve certain risks. Such private placements are purchased directly from a publicly traded company often at a

franklintempleton.com | Prospectus | 23 |

FRANKLIN

GOLD AND PRECIOUS METALS FUND

FUND DETAILS

discount to the market price of the company’s common stock and are subject to resale restrictions under applicable securities laws. While the public issuers of such private placement securities typically agree that they will register the securities for public resale by a fund after the transaction closes and in certain jurisdiction such registration generally occurs automatically after a set time period (thereby removing resale restrictions), there is no guarantee that the securities will be registered (particularly with respect to U.S. issuers). In addition, a public issuer may require a fund to agree to other resale restrictions as a condition to the sale of such securities. Private placement securities may also be subject to substantial holding periods and/or are not traded in public markets, thereby affecting the liquidity of such investments. As a result, such private placement securities of public companies will be fair valued, may be deemed illiquid and may be difficult to sell at a desirable time or at the prices at which the Fund has valued the investments. There is no assurance that such private placement securities will ever be registered with the applicable regulatory authority (particularly with respect to U.S. issuers) and there may be a significant delay before private placement securities may be sold. Further, since private placement securities are not registered with applicable regulatory authorities, investors in a private placement have less protection under the federal or applicable country’s securities laws against improper practices than investors in registered securities.

Income: Because the Fund can only distribute what it earns, the Fund's distributions to shareholders may decline when dividend income from investments in stocks declines or when the Fund does not have PFIC gains to be distributed. The Fund's income generally declines during periods of falling gold and precious metals prices.

Non-Diversification: The Fund is a "non-diversified" fund. It generally invests a greater portion of its assets in the securities of one or more issuers and invests overall in a smaller number of issuers than a diversified fund. The Fund may be more sensitive to a single economic, business, political, regulatory or other occurrence than a more diversified fund might be, which may negatively impact the Fund’s performance and result in greater fluctuation in the value of the Fund's shares.

Depositary Receipts: Depositary receipts are subject to many of the risks of the underlying security. For some depositary receipts, the custodian or similar financial institution that holds the issuer's shares in a trust account is located in the issuer's home country. The Fund could be exposed to the credit risk of the custodian or financial institution, and in cases where the issuer’s home country does not have developed financial markets, greater market risk. In addition, the depository institution may not have physical custody of the underlying securities at all times and may charge fees for various services, including forwarding dividends and interest and corporate actions. The Fund would be expected to pay a share of the

24 | Prospectus | franklintempleton.com |

FRANKLIN

GOLD AND PRECIOUS METALS FUND

FUND DETAILS

additional fees, which it would not pay if investing directly in the foreign securities. The Fund may experience delays in receiving its dividend and interest payments or exercising rights as a shareholder. There may be an increased possibility of untimely responses to certain corporate actions of the issuer in an unsponsored depositary receipt program. Accordingly, there may be less information available regarding issuers of securities underlying unsponsored programs and there may not be a correlation between this information and the market value of the depositary receipts.

Management: The Fund is actively managed and could experience losses if the investment manager’s judgment about markets, interest rates or the attractiveness, relative values, liquidity, or potential appreciation of particular investments made for the Fund's portfolio prove to be incorrect. The Fund could also experience losses if there are imperfections, errors or limitations in the models, tools, and data used by the investment manager or if the investment manager’s techniques or investment decisions do not produce the desired results. Additionally, legislative, regulatory, or tax developments may affect the investment techniques available to the investment manager in connection with managing the Fund and may also adversely affect the ability of the Fund to achieve its investment goal.

ESG Considerations: ESG considerations are one of a number of factors that the investment manager examines when considering investments for the Fund’s portfolio. In light of this, the issuers in which the Fund invests may not be considered ESG-focused issuers and may have lower or adverse ESG assessments. Consideration of ESG factors may affect the Fund’s exposure to certain issuers or industries and may not work as intended. In addition, ESG considerations assessed as part of the Fund’s investment process may vary across types of eligible investments and issuers. The investment manager does not assess every investment for ESG factors and, when it does, not every ESG factor may be identified or evaluated. The investment manager’s assessment of an issuer’s ESG factors is subjective and will likely differ from that of investors, third party service providers (e.g., ratings providers) and other funds. As a result, securities selected by the investment manager may not reflect the beliefs and values of any particular investor. The investment manager also may be dependent on the availability of timely, complete and accurate ESG data reported by issuers and/or third-party research providers, the timeliness, completeness and accuracy of which is out of the investment manager’s control. ESG factors are often not uniformly measured or defined, which could impact the investment manager’s ability to assess an issuer. While the investment manager views ESG considerations as having the potential to contribute to the Fund’s long-term performance, there is no guarantee that such results will be achieved.

Cybersecurity: Cybersecurity incidents, both intentional and unintentional, may allow an unauthorized party to gain access to Fund assets, Fund or customer data

franklintempleton.com | Prospectus | 25 |

FRANKLIN

GOLD AND PRECIOUS METALS FUND

FUND DETAILS

(including private shareholder information), or proprietary information, cause the Fund, the investment manager, and/or their service providers (including, but not limited to, Fund accountants, custodians, sub-custodians, transfer agents and financial intermediaries) to suffer data breaches, data corruption or loss of operational functionality or prevent Fund investors from purchasing, redeeming or exchanging shares or receiving distributions. The investment manager has limited ability to prevent or mitigate cybersecurity incidents affecting third party service providers, and such third party service providers may have limited indemnification obligations to the Fund or the investment manager. Cybersecurity incidents may result in financial losses to the Fund and its shareholders, and substantial costs may be incurred in an effort to prevent or mitigate future cybersecurity incidents. Issuers of securities in which the Fund invests are also subject to cybersecurity risks, and the value of these securities could decline if the issuers experience cybersecurity incidents.

Because technology is frequently changing, new ways to carry out cyber attacks are always developing. Therefore, there is a chance that some risks have not been identified or prepared for, or that an attack may not be detected, which puts limitations on the Fund's ability to plan for or respond to a cyber attack. Like other funds and business enterprises, the Fund, the investment manager, and their service providers are subject to the risk of cyber incidents occurring from time to time.

More detailed information about the Fund and its policies and risks can be found in the Fund's Statement of Additional Information (SAI).

A description of the Fund's policies and procedures regarding the release of portfolio holdings information is also available in the Fund's SAI. Portfolio holdings information can be viewed online at franklintempleton.com.

Franklin Advisers, Inc. (Advisers or investment manager), One Franklin Parkway, San Mateo, CA 94403-1906, is the Fund’s investment manager. Advisers is a wholly-owned subsidiary of Franklin Resources, Inc. (Resources). Together, Advisers and its affiliates manage, as of May 31, 2023, $1.33 trillion in assets, and have been in the investment management business since 1947.

The Fund is managed by a team of dedicated professionals focused on investments in gold and precious metals operations companies. The portfolio managers of the Fund are as follows:

Stephen M. Land, CFA Portfolio Manager of Advisers

Mr.

Land has been lead portfolio manager of the Fund since 1999. He has primary responsibility for the investments

of the Fund. He has final authority over all aspects of the Fund's investment portfolio, including but

not limited to, purchases

26 | Prospectus | franklintempleton.com |

FRANKLIN

GOLD AND PRECIOUS METALS FUND

FUND DETAILS

and sales of individual securities, portfolio risk assessment, and the management of daily cash balances in accordance with anticipated investment management requirements. The degree to which he may perform these functions, and the nature of these functions, may change from time to time. He joined Franklin Templeton in 1997.

Frederick G. Fromm, CFA Vice President of Advisers

Mr.

Fromm has been a portfolio manager of the Fund since 2005, providing research and advice on the purchases

and sales of individual securities, and portfolio risk assessment. He joined Franklin Templeton in 1992.

CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute.

The Fund’s SAI provides additional information about portfolio manager compensation, other accounts that they manage and their ownership of Fund shares.

The Fund pays Advisers a fee for managing the Fund’s assets.

Advisers has agreed to reduce its fees to reflect reduced services resulting from the Fund’s investments in Franklin Templeton affiliated funds. In addition, transfer agency fees on Class R6 shares of the Fund have been capped so that transfer agency fees for that class do not exceed 0.03%. These arrangements are expected to continue until November 30, 2024. During the terms, the fee waiver and expense reimbursement agreements may not be terminated or amended without approval of the board of trustees except to add series or classes, to reflect the extension of termination dates or to lower the waiver and expense limitation.

For the fiscal year ended July 31, 2023, the Fund paid Advisers an effective management fee of 0.47% of the Fund’s average net assets for investment management services.

A discussion regarding the basis for the board of trustees’ approval of the Fund’s investment management agreement is available in the Fund’s annual report for the period ended July 31, 2023.

Income and Capital Gain Distributions

As a regulated investment company, the Fund generally pays no federal income tax on the income and gains it distributes to you. The Fund intends to pay income dividends at least annually from its net investment income. Capital gains, if any, may be paid at least annually. The Fund may distribute income dividends and capital gains more frequently, if necessary, in order to reduce or eliminate federal excise or income taxes on the Fund. The amount of any distribution will vary, and there is no guarantee the Fund will pay either income dividends or capital gain distributions. Your income dividends and capital gain distributions will be

franklintempleton.com | Prospectus | 27 |

FRANKLIN

GOLD AND PRECIOUS METALS FUND

FUND DETAILS

automatically reinvested in additional shares at net asset value(NAV) unless you elect to receive them in cash.

Annual statements. After the close of each calendar year, you will receive tax information from the Fund with respect to the federal income tax treatment of the Fund’s distributions and any taxable sales or exchanges of Fund shares occurring during the prior calendar year. If the Fund finds it necessary to reclassify its distributions or adjust the cost basis of any shares sold or exchanged after you receive your tax information, the Fund will send you revised tax information. Distributions declared in October, November or December to shareholders of record in such month and paid in January are taxable as if they were paid in December. Additional tax information about the Fund’s distributions is available at franklintempleton.com.

Avoid "buying a dividend." At the time you purchase your Fund shares, the Fund’s net asset value may reflect undistributed income, undistributed capital gains, or net unrealized appreciation in the value of the portfolio securities held by the Fund. For taxable investors, a subsequent distribution to you of such amounts, although constituting a return of your investment, would be taxable. Buying shares in the Fund just before it declares an income dividend or capital gain distribution is sometimes known as “buying a dividend.”

Tax Considerations

If you are a taxable investor, Fund distributions are generally taxable to you as ordinary income, capital gains or some combination of both. This is the case whether you reinvest your distributions in additional Fund shares or receive them in cash.

Dividend income. Income dividends are generally subject to tax at ordinary rates. Income dividends reported by the Fund to shareholders as qualified dividend income may be subject to tax by individuals at reduced long-term capital gains tax rates provided certain holding period requirements are met. A return-of-capital distribution is generally not taxable but will reduce the cost basis of your shares, and will result in a higher capital gain or a lower capital loss when you later sell your shares.

Capital gains. Fund distributions of short-term capital gains are also subject to tax at ordinary rates. Fund distributions of long-term capital gains are taxable at the reduced long-term capital gains rates no matter how long you have owned your Fund shares. For single individuals with taxable income not in excess of $44,625 in 2023 ($89,250 for married individuals filing jointly), the long-term capital gains tax rate is 0%. For single individuals and joint filers with taxable income in excess of these amounts but not more than $492,300 or $553,850, respectively, the long-term capital gains tax rate is 15%. The rate is 20% for single individuals with taxable income in excess of $492,300 and married individuals filing jointly with

28 | Prospectus | franklintempleton.com |

FRANKLIN

GOLD AND PRECIOUS METALS FUND

FUND DETAILS

taxable income in excess of $553,850. An additional 3.8% Medicare tax may also be imposed as discussed below.

Sales of Fund shares. When you sell your shares in the Fund, or exchange them for shares of a different Franklin Templeton or Legg Mason fund, you will generally recognize a taxable capital gain or loss. If you have owned your Fund shares for more than one year, any net long-term capital gains will qualify for the reduced rates of taxation on long-term capital gains. An exchange of your shares in one class of the Fund for shares of another class of the same Fund is not taxable and no gain or loss will be reported on the transaction.

Cost basis reporting. If you acquire shares in the Fund on or after January 1, 2012, generally referred to as “covered shares," and sell or exchange them after that date, the Fund is generally required to report cost basis information to you and the IRS annually. The Fund will compute the cost basis of your covered shares using the average cost method, the Fund’s “default method,” unless you contact the Fund to select a different method, or choose to specifically identify your shares at the time of each sale or exchange. If your account is held by your financial advisor or other broker-dealer, that firm may select a different default method. In these cases, please contact the firm to obtain information with respect to the available methods and elections for your account. Shareholders should carefully review the cost basis information provided by the Fund and make any additional basis, holding period or other adjustments that are required when reporting these amounts on their federal and state income tax returns. Additional information about cost basis reporting is available at franklintempleton.com/costbasis.

Medicare tax. An additional 3.8% Medicare tax is imposed on certain net investment income (including ordinary dividends and capital gain distributions received from the Fund and net gains from redemptions or other taxable dispositions of Fund shares) of U.S. individuals, estates and trusts to the extent that such person’s “modified adjusted gross income” (in the case of an individual) or “adjusted gross income” (in the case of an estate or trust) exceeds a threshold amount. Any liability for this additional Medicare tax is reported on, and paid with, your federal income tax return.

Backup withholding. A shareholder may be subject to backup withholding on any distributions of income capital gains or proceeds from the sale or exchange of Fund shares if the shareholder has provided either an incorrect tax identification number or no number at all, is subject to backup withholding by the IRS for failure to properly report payments of interest or dividends, has failed to certify that the shareholder is not subject to backup withholding, or has not certified that the shareholder is a U.S. person (including a U.S. resident alien). The backup withholding rate is currently 24%. State backup withholding may also apply.

franklintempleton.com | Prospectus | 29 |

FRANKLIN

GOLD AND PRECIOUS METALS FUND

FUND DETAILS

State, local and foreign taxes. Distributions of ordinary income and capital gains, and gains from the sale of your Fund shares, are generally subject to state and local taxes. If the Fund qualifies, it may elect to pass through to you as a foreign tax credit or deduction any foreign taxes that it pays on its investments.

Non-U.S. investors. Non-U.S. investors may be subject to U.S. withholding tax at 30% or a lower treaty rate on Fund dividends of ordinary income. Non-U.S. investors may be subject to U.S. estate tax on the value of their shares. They are subject to special U.S. tax certification requirements to avoid backup withholding, claim any exemptions from withholding and claim any treaty benefits. Exemptions from U.S. withholding tax are generally provided for capital gains realized on the sale of Fund shares, capital gain dividends paid by the Fund from net long-term capital gains, short-term capital gain dividends paid by the Fund from net short-term capital gains and interest-related dividends paid by the Fund from its qualified net interest income from U.S. sources. However, notwithstanding such exemptions from U.S. withholding tax at source, any such dividends and distributions of income and capital gains will be subject to backup withholding at a rate of 24% if you fail to properly certify that you are not a U.S. person.

Other reporting and withholding requirements. Payments to a shareholder that is either a foreign financial institution or a non-financial foreign entity within the meaning of the Foreign Account Tax Compliance Act (FATCA) may be subject to a 30% withholding tax on income dividends paid by the Fund. The FATCA withholding tax generally can be avoided by such foreign entity if it provides the Fund, and in some cases, the IRS, information concerning the ownership of certain foreign financial accounts or other appropriate certifications or documentation concerning its status under FATCA. The Fund may be required to report certain shareholder account information to the IRS, non-U.S. taxing authorities or other parties to comply with FATCA.

Other tax information. This discussion of "Distributions and Taxes" is for general information only and is not tax advice. You should consult your own tax advisor regarding your particular circumstances, and about any federal, state, local and foreign tax consequences before making an investment in the Fund. Additional information about the tax consequences of investing in the Fund may be found in the SAI.

30 | Prospectus | franklintempleton.com |

FRANKLIN

GOLD AND PRECIOUS METALS FUND

FUND DETAILS

The Financial Highlights present the Fund's financial performance for the past five years or since its inception. Certain information reflects financial results for a single Fund share. The total returns represent the rate that an investor would have earned or lost on an investment in the Fund assuming reinvestment of dividends and capital gains. This information has been audited by PricewaterhouseCoopers LLP, an independent registered public accounting firm, whose report, along with the Fund's financial statements, are included in the annual report, which is available upon request.

Franklin Gold and Precious Metals Fund - Class A

Year Ended July 31, | |||||||||||

2023 | 2022 | 2021 | 2020 | 2019 | |||||||

Per

share operating performance | |||||||||||

Net asset value, beginning of year | $16.40 | $24.23 | $28.04 | $16.68 | $13.56 | ||||||

Income from investment operationsa: | |||||||||||

Net investment income (loss)b | 0.10 | 0.13 | 0.04 | (0.04 | ) | (0.02 | ) | ||||

Net realized and unrealized gains (losses) | 0.92 | (5.90 | ) | (1.20 | ) | 11.40 | 3.14 | ||||

Total from investment operations | 1.02 | (5.77 | ) | (1.16 | ) | 11.36 | 3.12 | ||||

Less distributions from: | |||||||||||

Net investment income | — | (2.06 | ) | (2.65 | ) | — | — | ||||

Net asset value, end of year | $17.42 | $16.40 | $24.23 | $28.04 | $16.68 | ||||||

Total returnc | 6.22% | (25.63)% | (3.80)% | 68.05% | 23.01% | ||||||

Ratios to average net assets | |||||||||||

Expensesd | 0.92% | e | 0.88% | 0.90% | e | 0.93% | e | 0.98% | e | ||

Net investment income (loss) | 0.58% | 0.58% | 0.17% | (0.20)% | (0.15)% | ||||||

Supplemental data | |||||||||||

Net assets, end of year (000’s) | $679,841 | $656,071 | $921,127 | $938,555 | $645,108 | ||||||

Portfolio turnover rate | 12.92% | 17.60% | 18.91% | 17.00% | 12.82% | ||||||

a. The amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

b. Based on average daily shares outstanding.

c. Total return does not reflect sales commissions or contingent deferred sales charges, if applicable.

d. Benefit of waiver and payments by affiliates rounds to less than 0.01%.

e. Benefit of expense reduction rounds to less than 0.01%.

franklintempleton.com | Prospectus | 31 |

FRANKLIN

GOLD AND PRECIOUS METALS FUND

FUND DETAILS

Franklin Gold and Precious Metals Fund - Class C

Year Ended July 31, | |||||||||||

2023 | 2022 | 2021 | 2020 | 2019 | |||||||

Per

share operating performance | |||||||||||

Net asset value, beginning of year | $14.50 | $21.71 | $25.42 | $15.24 | $12.49 | ||||||

Income from investment operationsa: | |||||||||||

Net investment (loss)b | (0.02 | ) | (0.03 | ) | (0.13 | ) | (0.16 | ) | (0.11 | ) | |

Net realized and unrealized gains (losses) | 0.81 | (5.23 | ) | (1.09 | ) | 10.34 | 2.86 | ||||

Total from investment operations | 0.79 | (5.26 | ) | (1.22 | ) | 10.18 | 2.75 | ||||

Less distributions from: | |||||||||||

Net investment income | — | (1.95 | ) | (2.49 | ) | — | — | ||||

Net asset value, end of year | $15.29 | $14.50 | $21.71 | $25.42 | $15.24 | ||||||

Total returnc | 5.45% | (26.18)% | (4.53)% | 66.80% | 22.02% | ||||||

Ratios to average net assets | |||||||||||

Expensesd | 1.67% | e | 1.63% | 1.65% | e | 1.68% | e | 1.73% | e | ||

Net investment (loss) | (0.15)% | (0.17)% | (0.59)% | (0.94)% | (0.90)% | ||||||

Supplemental data | |||||||||||

Net assets, end of year (000’s) | $51,872 | $58,538 | $93,615 | $106,271 | $75,129 | ||||||

Portfolio turnover rate | 12.92% | 17.60% | 18.91% | 17.00% | 12.82% | ||||||

a. The amount shown for a share outstanding throughout the period may not correlate with the Statement of Operations for the period due to the timing of sales and repurchases of the Fund’s shares in relation to income earned and/or fluctuating fair value of the investments of the Fund.

b. Based on average daily shares outstanding.

c. Total return does not reflect sales commissions or contingent deferred sales charges, if applicable.

d. Benefit of waiver and payments by affiliates rounds to less than 0.01%.

e. Benefit of expense reduction rounds to less than 0.01%.

32 | Prospectus | franklintempleton.com |

FRANKLIN

GOLD AND PRECIOUS METALS FUND

FUND DETAILS

Franklin Gold and Precious Metals Fund - Class R6

Year Ended July 31, | |||||||||||