| FREE WRITING PROSPECTUS | ||

| FILED PURSUANT TO RULE 433 | ||

| REGISTRATION FILE NO.: 333-206677-25 | ||

|

|

Free Writing Prospectus

Structural and Collateral Term Sheet

$658,765,419

(Approximate Initial Pool Balance)

$571,479,000

(Approximate Aggregate Certificate Balance of Offered Certificates)

Wells Fargo Commercial Mortgage Trust 2018-C45

as Issuing Entity

Wells Fargo Commercial Mortgage Securities, Inc.

as Depositor

Wells Fargo Bank, National Association

Barclays Bank PLC

Rialto Mortgage Finance, LLC

C-III Commercial Mortgage LLC

as Sponsors and Mortgage Loan Sellers

Commercial

Mortgage Pass-Through Certificates

Series 2018-C45

June 19, 2018

WELLS FARGO SECURITIES

Co-Lead Manager and Joint Bookrunner |

BARCLAYS

Co-Lead Manager and Joint Bookrunner | |

Academy Securities Co-Manager |

STATEMENT REGARDING THIS FREE WRITING PROSPECTUS

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (’’SEC’’) (SEC File No. 333-206677) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the depositor, any underwriter, or any dealer participating in the offering will arrange to send you the prospectus after filing if you request it by calling toll free 1-800-745-2063 (8 a.m. – 5 p.m. EST) or by emailing wfs.cmbs@wellsfargo.com.

Nothing in this document constitutes an offer of securities for sale in any jurisdiction where the offer or sale is not permitted. The information contained herein is preliminary as of the date hereof, supersedes any such information previously delivered to you and will be superseded by any such information subsequently delivered and ultimately by the final prospectus relating to the securities. These materials are subject to change, completion, supplement or amendment from time to time.

This free writing prospectus has been prepared by the underwriters for information purposes only and does not constitute, in whole or in part, a prospectus for the purposes of Directive 2003/71/EC (as amended) and/or Part VI of the Financial Services and Markets Act 2000, as amended, or other offering document.

STATEMENT REGARDING ASSUMPTIONS AS TO SECURITIES, PRICING ESTIMATES AND OTHER INFORMATION

The attached information contains certain tables and other statistical analyses (the “Computational Materials”) which have been prepared in reliance upon information furnished by the Mortgage Loan Sellers. Numerous assumptions were used in preparing the Computational Materials, which may or may not be reflected herein. As such, no assurance can be given as to the Computational Materials’ accuracy, appropriateness or completeness in any particular context; or as to whether the Computational Materials and/or the assumptions upon which they are based reflect present market conditions or future market performance. The Computational Materials should not be construed as either projections or predictions or as legal, tax, financial or accounting advice. You should consult your own counsel, accountant and other advisors as to the legal, tax, business, financial and related aspects of a purchase of these securities. Any weighted average lives, yields and principal payment periods shown in the Computational Materials are based on prepayment and/or loss assumptions, and changes in such prepayment and/or loss assumptions may dramatically affect such weighted average lives, yields and principal payment periods. In addition, it is possible that prepayments or losses on the underlying assets will occur at rates higher or lower than the rates shown in the attached Computational Materials. The specific characteristics of the securities may differ from those shown in the Computational Materials due to differences between the final underlying assets and the preliminary underlying assets used in preparing the Computational Materials. The principal amount and designation of any security described in the Computational Materials are subject to change prior to issuance. None of Wells Fargo Securities, LLC, Barclays Capital Inc., Academy Securities, Inc., or any of their respective affiliates, make any representation or warranty as to the actual rate or timing of payments or losses on any of the underlying assets or the payments or yield on the securities. The information in this presentation is based upon management forecasts and reflects prevailing conditions and management’s views as of this date, all of which are subject to change. In preparing this presentation, we have relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources or which was provided to us by or on behalf of the Mortgage Loan Sellers or which was otherwise reviewed by us.

This free writing prospectus contains certain forward-looking statements. If and when included in this free writing prospectus, the words “expects”, “intends”, “anticipates”, “estimates” and analogous expressions and all statements that are not historical facts, including statements about our beliefs or expectations, are intended to identify forward-looking statements. Any forward-looking statements are made subject to risks and uncertainties which could cause actual results to differ materially from those stated. Those risks and uncertainties include, among other things, declines in general economic and business conditions, increased competition, changes in demographics, changes in political and social conditions, regulatory initiatives and changes in customer preferences, many of which are beyond our control and the control of any other person or entity related to this offering. The forward-looking statements made in this free writing prospectus are made as of the date stated on the cover. We have no obligation to update or revise any forward-looking statement.

Wells Fargo Securities is the trade name for the capital markets and investment banking services of Wells Fargo & Company and its subsidiaries, including but not limited to Wells Fargo Securities, LLC, a member of NYSE, FINRA, NFA and SIPC, Wells Fargo Prime Services, LLC, a member of FINRA, NFA and SIPC, and Wells Fargo Bank, N.A. Wells Fargo Securities, LLC and Wells Fargo Prime Services, LLC are distinct entities from affiliated banks and thrifts.

IMPORTANT NOTICE REGARDING THE OFFERED CERTIFICATES

The information herein is preliminary and may be supplemented or amended prior to the time of sale. In addition, the Offered Certificates referred to in these materials and the asset pool backing them are subject to modification or revision (including the possibility that one or more classes of certificates may be split, combined or eliminated at any time prior to issuance or availability of a final prospectus) and are offered on a “when, as and if issued” basis.

The underwriters described in these materials may from time to time perform investment banking services for, or solicit investment banking business from, any company named in these materials. The underwriters and/or their affiliates or respective employees may from time to time have a long or short position in any security or contract discussed in these materials.

The information contained herein supersedes any previous such information delivered to any prospective investor and will be superseded by information delivered to such prospective investor prior to the time of sale.

IMPORTANT NOTICE RELATING TO AUTOMATICALLY-GENERATED EMAIL DISCLAIMERS

Any legends, disclaimers or other notices that may appear at the bottom of any email communication to which this free writing prospectus is attached relating to (1) these materials not constituting an offer (or a solicitation of an offer), (2) any representation that these materials are accurate or complete and may not be updated or (3) these materials possibly being confidential, are not applicable to these materials and should be disregarded. Such legends, disclaimers or other notices have been automatically generated as a result of these materials having been sent via Bloomberg or another system.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

2

| Wells Fargo Commercial Mortgage Trust 2018-C45 | Certificate Structure |

I. Certificate Structure

| Class | Expected

Ratings (DBRS/Fitch/Moody’s)(1) |

Approximate

Initial Certificate Balance or Notional Amount(2) |

Approx.

|

Pass-Through Rate Description |

Weighted

Average Life (Years)(4) |

Expected

Principal Window(4) |

Certificate

Principal to Value Ratio(5) |

Certificate

Principal U/W NOI Debt Yield(6) | ||

| Offered Certificates | ||||||||||

| A-1 | AAA(sf)/AAAsf/Aaa(sf) | $14,405,000 | 30.000% | (7) | 2.87 | 08/18 – 03/23 | 42.8% | 14.8% | ||

| A-2 | AAA(sf)/AAAsf/Aaa(sf) | $5,559,000 | 30.000% | (7) | 4.66 | 03/23 – 03/23 | 42.8% | 14.8% | ||

| A-SB | AAA(sf)/AAAsf/Aaa(sf) | $37,388,000 | 30.000% | (7) | 7.20 | 03/23 – 12/27 | 42.8% | 14.8% | ||

| A-3 | AAA(sf)/AAAsf/Aaa(sf) | (8) | 30.000% | (7) | (8) | (8) | 42.8% | 14.8% | ||

| A-4 | AAA(sf)/AAAsf/Aaa(sf) | (8) | 30.000% | (7) | (8) | (8) | 42.8% | 14.8% | ||

| X-A | AAA(sf)/AAAsf/Aaa(sf) | $461,135,000(9) | N/A | Variable(10) | N/A | N/A | N/A | N/A | ||

| X-B | A(high)(sf)/A-sf/NR | $110,344,000(11) | N/A | Variable(12) | N/A | N/A | N/A | N/A | ||

| A-S | AAA(sf)/AAAsf/Aa2(sf) | $46,114,000 | 23.000% | (7) | 9.91 | 06/28 – 06/28 | 47.1% | 13.4% | ||

| B | AA(high)(sf)/AA-sf/NR | $32,115,000 | 18.125% | (7) | 9.91 | 06/28 – 06/28 | 50.1% | 12.6% | ||

| C | A(sf)/A-sf/NR | $32,115,000 | 13.250% | (7) | 9.91 | 06/28 – 06/28 | 53.1% | 11.9% | ||

| Non-Offered Certificates | ||||||||||

| X-D(13) | A(low)(sf)/BBB-sf/NR | $21,174,000(14) | N/A | Variable(15) | N/A | N/A | N/A | N/A | ||

| D(13) | BBB(high)(sf)/BBB-sf/NR | $21,174,000 | 10.036% | (7) | 9.91 | 06/28 – 06/28 | 55.0% | 11.5% | ||

| Risk Retention Certificates | ||||||||||

| E-RR(13) | BBB(low)(sf)/BBB-sf/NR | $14,234,000 | 7.875% | (7) | 9.92 | 06/28 – 07/28 | 56.3% | 11.2% | ||

| F-RR | BBB(low)(sf)/BB+sf/NR | $8,235,000 | 6.625% | (7) | 9.99 | 07/28 – 07/28 | 57.1% | 11.1% | ||

| G-RR | BB(sf)/BB-sf/NR | $9,881,000 | 5.125% | (7) | 9.99 | 07/28 – 07/28 | 58.0% | 10.9% | ||

| H-RR | B(high)(sf)/B-sf/NR | $7,411,000 | 4.000% | (7) | 9.99 | 07/28 – 07/28 | 58.7% | 10.8% | ||

| J-RR | NR/NR/NR | $26,351,419 | 0.000% | (7) | 9.99 | 07/28 – 07/28 | 61.2% | 10.3% | ||

| Notes: | |

| (1) | The expected ratings presented are those of DBRS, Inc. (“DBRS”), Fitch Ratings, Inc. (“Fitch”) and Moody’s Investors Service, Inc. (“Moody’s”), which the depositor hired to rate the Offered Certificates. One or more other nationally recognized statistical rating organizations that were not hired by the depositor may use information they receive pursuant to Rule 17g-5 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise, to rate or provide market reports and/or published commentary related to the Offered Certificates. We cannot assure you as to what ratings a non-hired nationally recognized statistical rating organization would assign or that its reports will not express differing, possibly negative, views of the mortgage loans and/or the Offered Certificates. The ratings of each class of Offered Certificates address the likelihood of the timely distribution of interest and, except in the case of the Class X-A, X-B and X-D Certificates, the ultimate distribution of principal due on those classes on or before the Rated Final Distribution Date. See “Risk Factors—Other Risks Relating to the Certificates—Nationally Recognized Statistical Rating Organizations May Assign Different Ratings to the Certificates; Ratings of the Certificates Reflect Only the Views of the Applicable Rating Agencies as of the Dates Such Ratings Were Issued; Ratings May Affect ERISA Eligibility; Ratings May Be Downgraded” and “Ratings” in the Preliminary Prospectus, expected to be dated June 19, 2018 (the “Preliminary Prospectus”). DBRS, Fitch and Moody’s have informed us that the “sf” designation in their ratings represents an identifier for structured finance product ratings. |

| (2) | The certificate balances and notional amounts set forth in the table are approximate. The actual initial certificate balances and notional amounts may be larger or smaller depending on the initial pool balance of the mortgage loans definitively included in the pool of mortgage loans, which aggregate cut-off date balance may be as much as 5% larger or smaller than the amount presented in the Preliminary Prospectus. In addition, the notional amounts of the Class X-A, X-B and X-D certificates may vary depending upon the final pricing of the classes of principal balance certificates whose certificate balances comprise such notional amounts, and, if, as a result of such pricing, the pass-through rate of the Class X-A, X-B or X-D certificates, as applicable, would be equal to zero at all times, such class of certificates may not be issued on the closing date of this securitization. |

| (3) | The approximate initial credit support with respect to the Class A-1, A-2, A-SB, A-3 and A-4 Certificates represents the approximate credit enhancement for the Class A-1, A-2, A-SB, A-3 and A-4 Certificates in the aggregate. |

| (4) | Weighted Average Lives and Expected Principal Windows are calculated based on an assumed prepayment rate of 0% CPR and the “Structuring Assumptions” described under “Yield and Maturity Considerations—Weighted Average Life” in the Preliminary Prospectus. |

| (5) | The Certificate Principal to Value Ratio for each Class of Certificates (other than the Class A-1, A-2, A-SB, A-3 and A-4 Certificates) is calculated as the product of (a) the weighted average Cut-off Date LTV Ratio for the mortgage loans and (b) a fraction, the numerator of which is the total initial Certificate Balance of such Class of Certificates and all Classes of Principal Balance Certificates (as defined in the Preliminary Prospectus) senior to such Class of Certificates and the denominator of which is the total initial Certificate Balance of all of the Principal Balance Certificates. The Certificate Principal to Value Ratio for each of the Class A-1, A-2, A-SB, A-3 and A-4 Certificates is calculated in the aggregate for those Classes as if they were a single Class and is calculated as the product of (a) the weighted average Cut-off Date LTV Ratio for the mortgage loans and (b) a fraction, the numerator of which is the total initial aggregate Certificate Balances of such Classes of Certificates and the denominator of which is the total initial Certificate Balance of all of the Principal Balance Certificates. In any event, however, excess mortgaged property value associated with a mortgage loan will not be available to offset losses on any other mortgage loan. |

| (6) | The Certificate Principal U/W NOI Debt Yield for each Class of Certificates (other than the Class A-1, A-2, A-SB, A-3 and A-4 Certificates) is calculated as the product of (a) the weighted average U/W NOI Debt Yield for the mortgage loans and (b) a fraction, the numerator of which is the total initial Certificate Balance of all of the Classes of Principal Balance Certificates and the denominator of which is the total initial Certificate Balance for such Class of Certificates and all Classes of Principal Balance Certificates senior to such Class of Certificates. The Certificate Principal U/W NOI Debt Yield for each of the Class A-1, A-2, A-SB, A-3 and A-4 Certificates is calculated in the aggregate for those Classes as if they were a single Class and is calculated as the product of (a) the weighted average U/W NOI Debt Yield for the mortgage loans and (b) a fraction, the numerator of which is the total initial Certificate Balance of all of the Classes of Principal Balance Certificates and the denominator of which is the total aggregate initial Certificate Balances for the Class A-1, A-2, A-SB, A-3 and A-4 Certificates. In any event, however, cash flow from each mortgaged property supports only the related mortgage loan and will not be available to support any other mortgage loan. |

| (7) | The pass-through rates for the Class A-1, A-2, A-SB, A-3, A-4, A-S, B, C, D, E-RR, F-RR, G-RR, H-RR and J-RR Certificates in each case will be one of the following: (i) a fixed rate per annum, (ii) a variable rate per annum equal to the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date, (iii) a variable rate per annum equal to the lesser of (a) a fixed rate and (b) the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date or (iv) a variable rate per annum equal to the weighted average of the net mortgage interest rates on the mortgage loans for the related |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

3

| Wells Fargo Commercial Mortgage Trust 2018-C45 | Certificate Structure |

| distribution date minus a specified percentage. For purposes of the calculation of the weighted average of the net mortgage interest rates on the mortgage loans for each distribution date, the mortgage interest rates will be adjusted as necessary to a 30/360 basis. | |

| (8) | The exact initial certificate balances of the Class A-3 and A-4 Certificates are unknown and will be determined based on the final pricing of those classes of certificates. However, the respective initial certificate balances, weighted average lives and principal windows of the Class A-3 and A-4 Certificates are expected to be within the applicable ranges reflected in the following chart. The aggregate initial certificate balance of the Class A-3 and A-4 Certificates is expected to be approximately $403,783,000, subject to a variance of plus or minus 5%. |

Class

of |

Expected

Range of |

Expected

Range of |

Expected Range of Principal Window |

| Class A-3 | $150,000,000 - $200,000,000 | 9.74 – 9.76 | 12/27 – 05/28 / 12/27 – 05/28 |

| Class A-4 | $203,783,000 - $253,783,000 | 9.87 – 9.88 | 05/28 – 06/28 / 05/28 – 06/28 |

| (9) | The Class X-A Certificates are notional amount certificates. The Notional Amount of the Class X-A Certificates will be equal to the aggregate Certificate Balance of the Class A-1, A-2, A-SB, A-3 and A-4 Certificates outstanding from time to time. The Class X-A Certificates will not be entitled to distributions of principal. |

| (10) | The pass-through rate for the Class X-A Certificates for any distribution date will be a per annum rate equal to the excess, if any, of (a) the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date, over (b) the weighted average of the pass-through rates on the Class A-1, A-2, A-SB, A-3 and A-4 Certificates for the related distribution date, weighted on the basis of their respective Certificate Balances outstanding immediately prior to that distribution date. For purposes of the calculation of the weighted average of the net mortgage interest rates on the mortgage loans for each distribution date, the mortgage interest rates will be adjusted as necessary to a 30/360 basis. |

| (11) | The Class X-B Certificates are notional amount certificates. The Notional Amount of the Class X-B Certificates will be equal to the aggregate Certificate Balance of the Class A-S, B and C Certificates outstanding from time to time. The Class X-B Certificates will not be entitled to distributions of principal. |

| (12) | The pass-through rate for the Class X-B Certificates for any distribution date will be a per annum rate equal to the excess, if any, of (a) the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date, over (b) the weighted average of the pass-through rates on the Class A-S, B and C Certificates for the related distribution date, weighted on the basis of their respective Certificate Balances outstanding immediately prior to that distribution date. For purposes of the calculation of the weighted average of the net mortgage interest rates on the mortgage loans for each distribution date, the mortgage interest rates will be adjusted as necessary to a 30/360 basis. |

| (13) | The initial notional amount of the X-D certificates and the initial certificate balance of each of the Class D and E-RR certificates are subject to change based on final pricing of all certificates and the final determination of the Class E-RR, F-RR, G-RR, H-RR and J-RR Certificates (collectively, the “horizontal risk retention certificates”) that will be retained by the retaining sponsor through a third party purchaser as part of the U.S. risk retention requirements. For more information regarding the methodology and key inputs and assumptions used to determine the sizing of the horizontal risk retention certificates, see “Credit Risk Retention” in the Preliminary Prospectus. |

| (14) | The Class X-D Certificates are notional amount certificates. The Notional Amount of the Class X-D Certificates will be equal to the Certificate Balance of the Class D Certificates outstanding from time to time. The Class X-D Certificates will not be entitled to distributions of principal. |

| (15) | The pass-through rate for the Class X-D Certificates for any distribution date will be a per annum rate equal to the excess, if any, of (a) the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date, over (b) the pass-through rate on the Class D Certificates for the related distribution date. For purposes of the calculation of the weighted average of the net mortgage interest rates on the mortgage loans for each distribution date, the mortgage interest rates will be adjusted as necessary to a 30/360 basis. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

4

| Wells Fargo Commercial Mortgage Trust 2018-C45 | Transaction Highlights |

II. Transaction Highlights

Mortgage Loan Sellers:

|

Mortgage Loan Seller |

Number |

Number

of |

Aggregate

Cut-off |

%

of Initial |

| Wells Fargo Bank, National Association | 14 | 27 | $271,350,036 | 41.2% |

| Barclays Bank PLC | 11 | 31 | 172,882,585 | 26.2 |

| Rialto Mortgage Finance, LLC | 7 | 13 | 113,800,000 | 17.3 |

| C-III Commercial Mortgage LLC | 17 | 18 | 100,732,798 | 15.3 |

Total |

49 |

89 |

$658,765,419 |

100.0% |

Loan Pool:

| Initial Pool Balance: | $658,765,419 |

| Number of Mortgage Loans: | 49 |

| Average Cut-off Date Balance per Mortgage Loan: | $13,444,192 |

| Number of Mortgaged Properties: | 89 |

| Average Cut-off Date Balance per Mortgaged Property(1): | $7,401,859 |

| Weighted Average Mortgage Interest Rate: | 4.899% |

| Ten Largest Mortgage Loans as % of Initial Pool Balance: | 54.6% |

| Weighted Average Original Term to Maturity or ARD (months): | 120 |

| Weighted Average Remaining Term to Maturity or ARD (months): | 118 |

| Weighted Average Original Amortization Term (months)(2): | 358 |

| Weighted Average Remaining Amortization Term (months)(2): | 358 |

| Weighted Average Seasoning (months): | 2 |

| (1) | Information regarding mortgage loans secured by multiple properties is based on an allocation according to relative appraised values or the allocated loan amounts or property-specific release prices set forth in the related loan documents or such other allocation as the related mortgage loan seller deemed appropriate. |

| (2) | Excludes any mortgage loan that does not amortize. |

Credit Statistics:

| Weighted Average U/W Net Cash Flow DSCR(1): | 1.66x |

| Weighted Average U/W Net Operating Income Debt Yield(1): | 10.3% |

| Weighted Average Cut-off Date Loan-to-Value Ratio(1): | 61.2% |

| Weighted Average Balloon or ARD Loan-to-Value Ratio(1): | 55.8% |

| % of Mortgage Loans with Additional Subordinate Debt(2): | 17.2% |

| % of Mortgage Loans with Single Tenants(3): | 9.9% |

| (1) | With respect to any mortgage loan that is part of a whole loan, loan-to-value ratio, debt service coverage ratio and debt yield calculations include the related pari passu companion loan(s) but exclude any related subordinate debt (unless otherwise stated). The debt service coverage ratio, debt yield and loan-to-value ratio information do not take into account any subordinate debt (whether or not secured by the related mortgaged property), that currently exists or is allowed under the terms of any mortgage loan. See “Description of the Mortgage Pool—Mortgage Pool Characteristics” in the Preliminary Prospectus and Annex A-1 to the Preliminary Prospectus. |

| (2) | The percentage figure expressed as “% of Mortgage Loans with Additional Subordinate Debt” is determined as a percentage of the initial pool balance and does not take into account any future subordinate debt (whether or not secured by the mortgaged property), if any, that may be permitted under the terms of any mortgage loan or the pooling and servicing agreement. See “Description of the Mortgage Pool—Additional Indebtedness—Other Unsecured Indebtedness” in the Preliminary Prospectus. |

| (3) | Excludes mortgage loans that are secured by multiple single tenant properties. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

5

| Wells Fargo Commercial Mortgage Trust 2018-C45 | Transaction Highlights |

Loan Structural Features:

Amortization: Based on the Initial Pool Balance, 74.5% of the mortgage pool (39 mortgage loans) has scheduled amortization, as follows:

54.7% (20 mortgage loans) provides for an interest-only period followed by an amortization period;

17.7% (18 mortgage loans) requires amortization during the entire loan term; and

2.1% (1 mortgage loan) provides for an interest-only period followed by an amortizing ARD period.

Interest-Only: Based on the Initial Pool Balance, 25.5% of the mortgage pool (10 mortgage loans) provides for interest-only payments during the entire loan term through maturity or ARD. The Weighted Average Cut-off Date Loan-to-Value Ratio and Weighted Average U/W Net Cash Flow DSCR for those mortgage loans are 59.0% and 2.02x, respectively.

Hard Lockboxes: Based on the Initial Pool Balance, 46.4% of the mortgage pool (15 mortgage loans) have hard lockboxes in place.

Reserves: The mortgage loans require amounts to be escrowed monthly as follows (excluding any mortgage loans with springing provisions):

| Real Estate Taxes: | 87.9% of the pool |

| Insurance: | 51.8% of the pool |

| Capital Replacements: | 82.6% of the pool |

| TI/LC: | 81.4% of the pool(1) |

| (1) | The percentage of Initial Pool Balance for mortgage loans with TI/LC reserves is based on the aggregate principal balance allocable to loans that include retail, office, mixed use and industrial properties. |

Call Protection/Defeasance: Based on the Initial Pool Balance, the mortgage pool has the following call protection and defeasance features:

88.0% of the mortgage pool (42 mortgage loans) features a lockout period, then defeasance only until an open period;

6.0% of the mortgage pool (5 mortgage loans) features a lockout period, then the greater of a prepayment premium or yield maintenance until an open period;

3.0% of the mortgage pool (1 mortgage loan) features a lockout period, then the greater of a prepayment premium or yield maintenance, then the greater of a prepayment premium or yield maintenance or defeasance until an open period; and

3.0% of the mortgage pool (1 mortgage loan) features a lockout period, then the greater of a prepayment premium or yield maintenance or defeasance until an open period.

Prepayment restrictions for each mortgage loan reflect the entire life of the mortgage loan. Please refer to Annex A-1 to the Preliminary Prospectus and the footnotes related thereto for further information regarding individual loan call protection.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

6

| Wells Fargo Commercial Mortgage Trust 2018-C45 | Issue Characteristics |

| III. | Issue Characteristics |

| Securities Offered: | $571,479,000 approximate monthly pay, multi-class, commercial mortgage REMIC pass-through certificates consisting of eleven classes (Classes A-1, A-2, A-SB, A-3, A-4, A-S, B, C, X-A and X-B), which are offered pursuant to a registration statement filed with the SEC (such classes of certificates, the “Offered Certificates”). |

| Mortgage Loan Sellers: | Wells Fargo Bank, National Association (“WFB”), Barclays Bank PLC (“Barclays”), Rialto Mortgage Finance, LLC (“RMF”) and C-III Commercial Mortgage LLC (“CIIICM”). |

| Joint Bookrunners and Co-Lead Managers: | Wells Fargo Securities, LLC and Barclays Capital Inc. |

| Co-Manager: | Academy Securities, Inc. |

| Rating Agencies: | DBRS, Inc., Fitch Ratings, Inc. and Moody’s Investors Service, Inc. |

| Master Servicer: | Wells Fargo Bank, National Association |

| Special Servicer: | LNR Partners, LLC |

| Certificate Administrator: | Wells Fargo Bank, National Association |

| Trustee: | Wilmington Trust, National Association |

| Operating Advisor: | Park Bridge Lender Services LLC |

| Asset Representations Reviewer: | Park Bridge Lender Services LLC |

| Initial Majority Controlling Class Certificateholder: | Prime Finance Long Duration (B-Piece) II Holdco I, L.P. or an affiliate |

| U.S. Credit Risk Retention: | For a discussion on the manner in which the U.S. credit risk retention requirements will be satisfied by Wells Fargo Bank, National Association, as the retaining sponsor, see “Credit Risk Retention” in the Preliminary Prospectus.

This transaction is being structured with a “third party purchaser” that will acquire an “eligible horizontal residual interest”, which will be comprised of the Class E-RR, F-RR, G-RR, H-RR and J-RR certificates (the “horizontal risk retention certificates”). Prime Finance Long Duration (B-Piece) II Holdco I, L.P. (in satisfaction of the retention obligations of Wells Fargo Bank, National Association, as the retaining sponsor) will be contractually obligated to retain the horizontal risk retention certificates for a minimum of five years after the closing date, subject to certain permitted exceptions provided for under the risk retention rules. During this time, Prime Finance Long Duration (B-Piece) II Holdco I, L.P. will agree to comply with hedging, transfer and financing restrictions that are applicable to third party purchasers under the credit risk retention rules. For additional information, see “Credit Risk Retention” in the Preliminary Prospectus.

|

| EU Credit Risk Retention | None of the sponsors, the depositor or the issuing entity intends to retain a material net economic interest in the securitization constituted by the issue of the Offered Certificates in accordance with the EU risk retention and due diligence requirements or to take any other action which may be required by EEA-regulated investors for the purposes of their compliance with the EU risk retention and due diligence requirements or similar requirements. |

| Cut-off Date: | The Cut-off Date with respect to each mortgage loan is the due date for the monthly debt service payment that is due in July 2018 (or, in the case of any mortgage loan that has its first due date in August 2018, the date that would have been its due date in July 2018 under the terms of that mortgage loan if a monthly debt service payment were scheduled to be due in that month). |

| Expected Closing Date: | On or about July 17, 2018. |

| Determination Dates: | The 11th day of each month (or if that day is not a business day, the next succeeding business day), commencing in August 2018. |

| Distribution Dates: | The fourth business day following the Determination Date in each month, commencing in August 2018. |

| Rated Final Distribution Date: | The Distribution Date in June 2051. |

| Interest Accrual Period: | With respect to any Distribution Date, the calendar month immediately preceding the month in which such Distribution Date occurs. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

7

| Wells Fargo Commercial Mortgage Trust 2018-C45 | Issue Characteristics |

| Day Count: | The Offered Certificates will accrue interest on a 30/360 basis. |

| Minimum Denominations: | $10,000 for each Class of Offered Certificates (other than the Class X-A and X-B Certificates) and $1,000,000 for the Class X-A and X-B Certificates. Investments may also be made in any whole dollar denomination in excess of the applicable minimum denomination. |

| Clean-up Call: | 1.0% |

| Delivery: | DTC, Euroclear and Clearstream Banking |

| ERISA/SMMEA Status: | Each Class of Offered Certificates is expected to be eligible for exemptive relief under ERISA. No Class of Offered Certificates will be SMMEA eligible. |

| Risk Factors: | THE CERTIFICATES INVOLVE CERTAIN RISKS AND MAY NOT BE SUITABLE FOR ALL INVESTORS. SEE THE “RISK FACTORS” SECTION OF THE PRELIMINARY PROSPECTUS. |

| Bond Analytics Information: | The Certificate Administrator will be authorized to make distribution date statements, CREFC® reports and certain supplemental reports (other than confidential information) available to certain financial modeling and data provision services, including Bloomberg, L.P., Trepp, LLC, Intex Solutions, Inc., Interactive Data Corp., Markit Group Limited, BlackRock Financial Management, Inc., CMBS.com, Inc., Moody’s Analytics, MBS Data, LLC and Thomson Reuters Corporation. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

8

| Wells Fargo Commercial Mortgage Trust 2018-C45 | Characteristics of the Mortgage Pool |

IV. Characteristics of the Mortgage Pool(1)

A. Ten Largest Mortgage Loans

| Mortgage Loan Seller |

Mortgage Loan Name | City | State | Number of Mortgage Loans / Mortgaged Properties | Mortgage Loan Cut-off Date Balance ($) | %

of Initial Pool Balance (%) |

Property Type |

Number of SF/Units |

Cut-off Date Balance Per SF/Unit |

Cut-off

Date LTV Ratio (%) |

Balloon

or ARD LTV Ratio (%) |

U/W

NCF DSCR (x) |

U/W

NOI Debt Yield (%) |

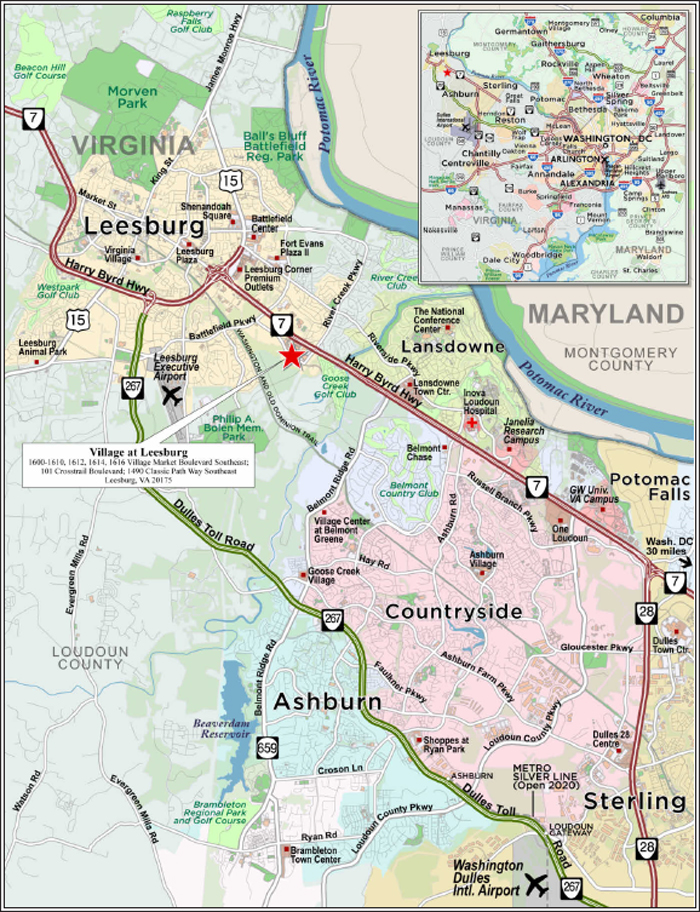

| WFB | Village at Leesburg | Leesburg | VA | 1/1 | $65,250,000 | 9.9% | Retail | 546,107 | $240 | 58.1% | 53.4% | 1.28x | 8.4% |

| WFB | Westport Self Storage Portfolio | Various | Various | 1/12 | 48,300,000 | 7.3 | Self Storage | 851,164 | 57 | 58.7 | 56.0 | 1.51 | 9.7 |

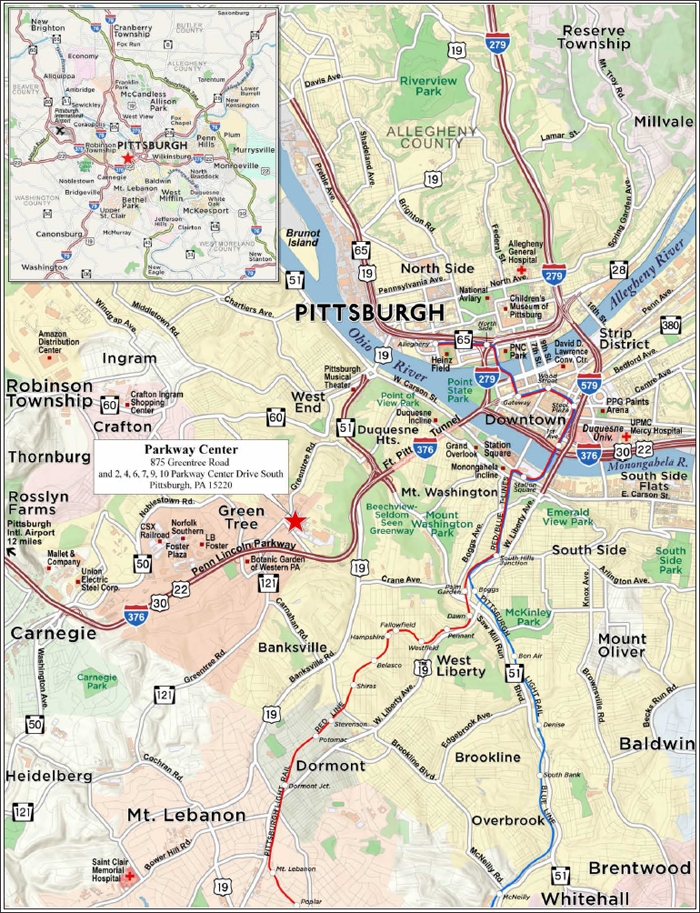

| CIIICM | Parkway Center | Pittsburgh | PA | 1/1 | 42,560,000 | 6.5 | Office | 588,913 | 72 | 63.9 | 56.7 | 1.38 | 10.7 |

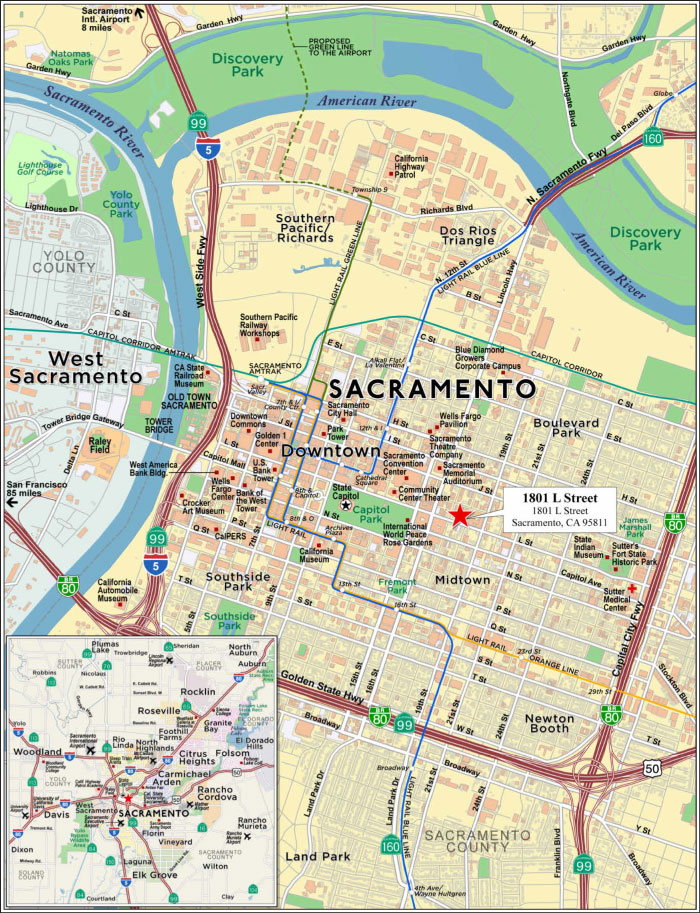

| WFB | 1801 L Street | Sacramento | CA | 1/1 | 38,000,000 | 5.8 | Multifamily | 176 | 215,909 | 63.1 | 63.1 | 1.61 | 8.1 |

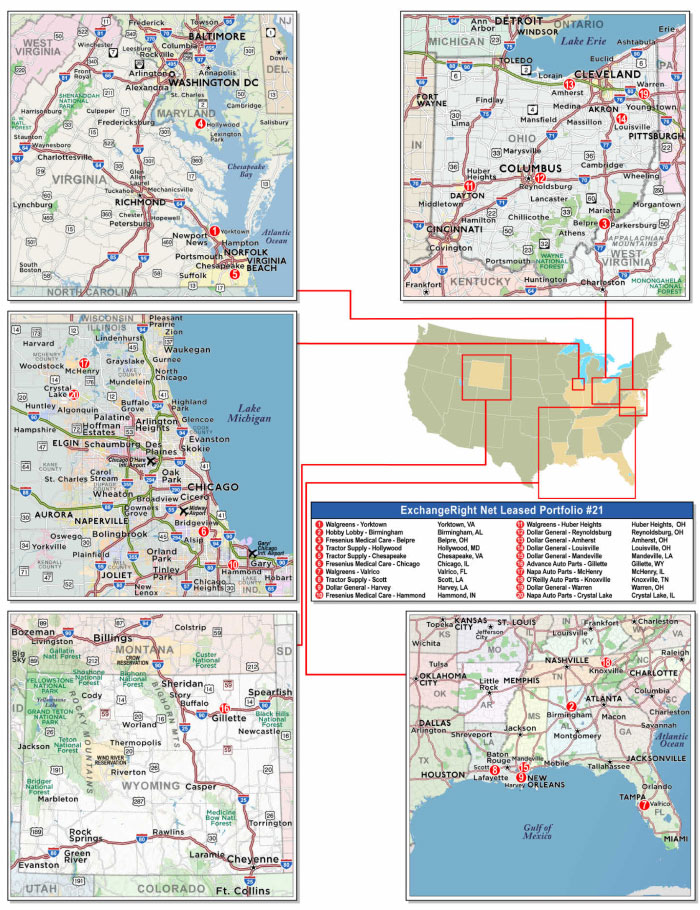

| Barclays | ExchangeRight Net Leased Portfolio #21 | Various | Various | 1/20 | 37,795,000 | 5.7 | Various | 263,629 | 143 | 61.7 | 61.7 | 2.19 | 9.6 |

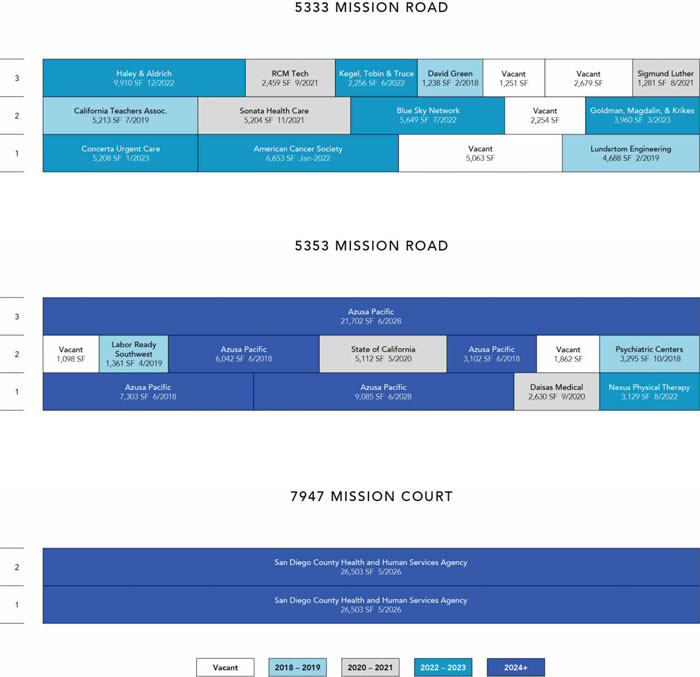

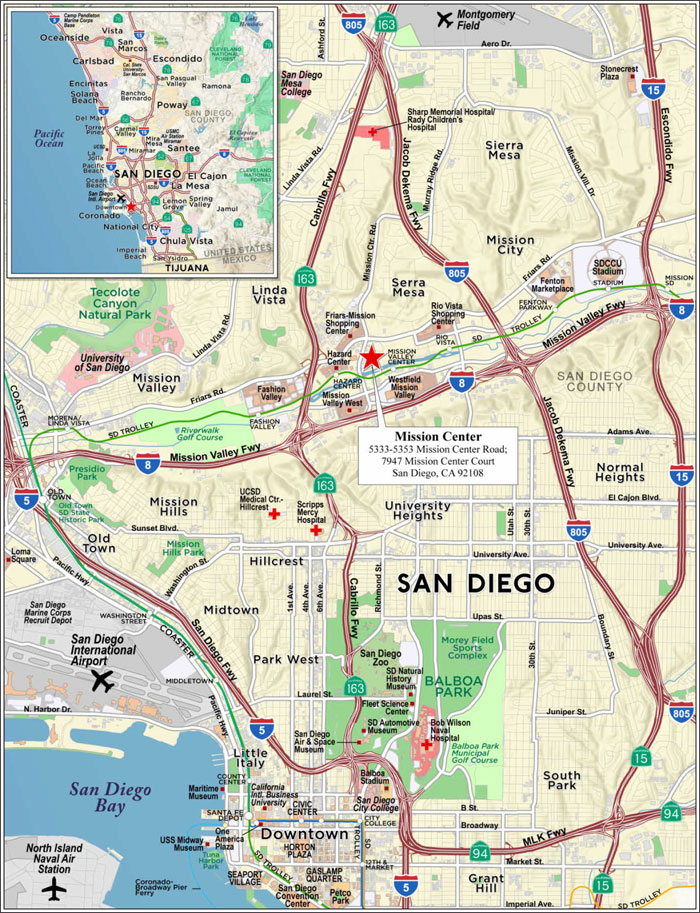

| WFB | Mission Center | San Diego | CA | 1/1 | 29,750,000 | 4.5 | Office | 183,410 | 162 | 68.4 | 62.4 | 1.68 | 11.0 |

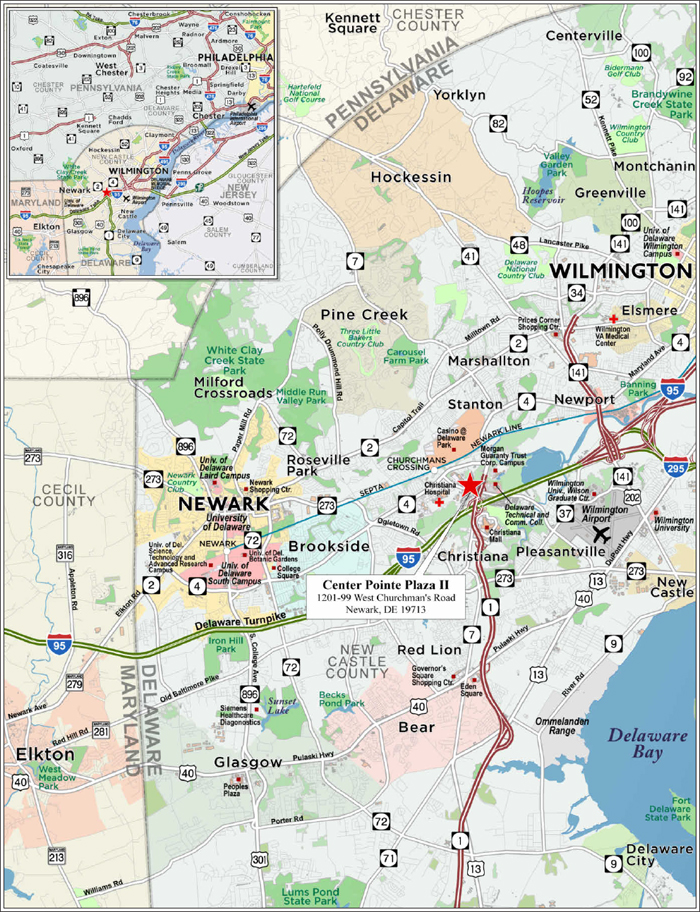

| Barclays | Center Pointe Plaza II | Newark | DE | 1/1 | 28,270,000 | 4.3 | Retail | 187,900 | 150 | 57.9 | 49.7 | 2.00 | 13.1 |

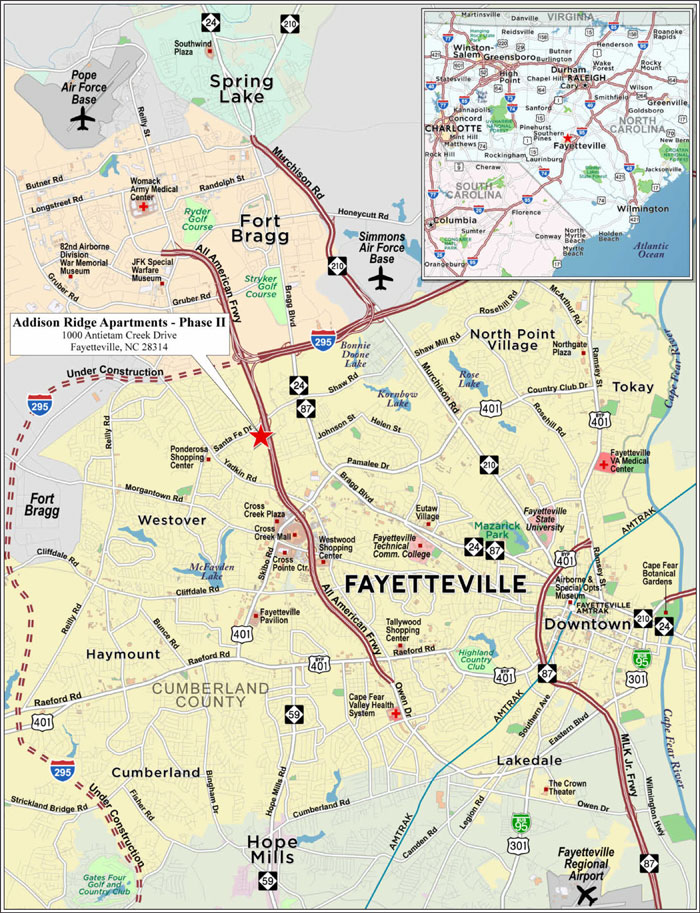

| RMF | Addison Ridge Apartments - Phase II | Fayetteville | NC | 1/1 | 25,000,000 | 3.8 | Multifamily | 214 | 116,822 | 69.8 | 63.6 | 1.36 | 9.3 |

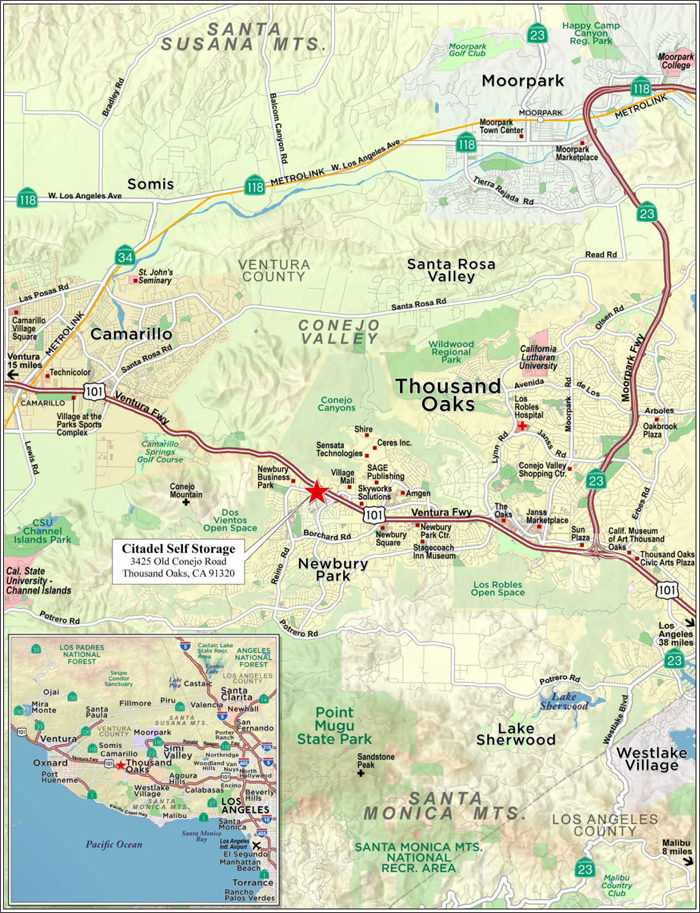

| RMF | Citadel Self Storage | Thousand Oaks | CA | 1/1 | 25,000,000 | 3.8 | Self Storage | 143,754 | 174 | 59.9 | 53.7 | 1.25 | 8.7 |

| Barclays | 181 Fremont Street | San Francisco | CA | 1/1 | 20,000,000 | 3.0 | Office | 436,332 | 573 | 39.6 | 39.6 | 3.14 | 11.8 |

| Top Three Total/Weighted Average | 3 / 14 | $156,110,000 | 23.7% | 59.9% | 55.1% | 1.38x | 9.4% | ||||||

| Top Five Total/Weighted Average | 5 / 35 | $231,905,000 | 35.2% | 60.7% | 57.5% | 1.55x | 9.2% | ||||||

| Top Ten Total/Weighted Average | 10 / 40 | $359,925,000 | 54.6% | 60.5% | 56.5% | 1.65x | 9.8% | ||||||

| Non-Top Ten Total/Weighted Average | 39 / 49 | $298,840,419 | 45.4% | 61.9% | 55.0% | 1.67x | 11.0% | ||||||

| (1) | With respect to any mortgage loan that is part of a whole loan, Cut-off Date Balance Per SF/Unit, loan-to-value ratio, debt service coverage ratio and debt yield calculations include the related pari passu companion loan(s) but exclude any related subordinate debt (unless otherwise stated). With respect to each mortgage loan, debt service coverage ratio, debt yield and loan-to-value ratio information do not take into account subordinate debt (whether or not secured by the related mortgaged property), if any, that currently exists or is allowed under the terms of such mortgage loan. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

9

Wells Fargo Commercial Mortgage Trust 2018-C45 |

Characteristics of the Mortgage Pool |

| B. | Summary of the Whole Loans |

| Property Name | Mortgage Loan

Seller in |

Note(s)(1) | Original Balance | Holder of Note(1) | Lead Servicer for Whole Loan |

Master

Servicer Under |

Special Servicer Under Lead Securitization Servicing Agreement |

| Village at Leesburg | WFB | A-1 | $66,000,000 | WFCM 2018-C44 | Yes | Wells Fargo Bank, National Association | Rialto Capital Advisors, LLC |

| A-2 | $65,250,000 | WFCM 2018-C45 | No | ||||

| CoolSprings Galleria | WFB | A-1 | $75,000,000 | BANK 2018-BNK12 | Yes | Wells Fargo Bank, National Association | Midland Loan Services, a Division of PNC Bank, National Association |

| A-2 | $15,000,000 | BANK 2018-BNK12 | No | ||||

| A-3 | $20,000,000 | WFCM 2018-C45 | No | ||||

| A-4 | $45,000,000 | WFB | No | ||||

| 181 Fremont Street(2) | Barclays | A-1 | $50,000,000 | Deutsche Bank AG, New York Branch | Yes | Wells Fargo Bank, National Association(2) | Rialto Capital Advisors, LLC(2) |

| A-2 | $58,000,000 | BANK 2018-BNK12 | No | ||||

| A-3 | $22,000,000 | WFB | No | ||||

| A-4 | $30,000,000 | Deutsche Bank AG, New York Branch | No | ||||

| A-5 | $40,000,000 | Deutsche Bank AG, New York Branch | No | ||||

| A-6-1 | $30,000,000 | WFCM 2018-C44 | No | ||||

| A-6-2 | $20,000,000 | WFCM 2018-C45 | No | ||||

| A-1 | $59,000,000 | CGCMT 2018-C5(3) | Yes | Midland Loan Services, a Division of PNC Bank, National Association | |||

| Flats at East Bank | RMF | A-2 | $13,000,000 | WFCM 2018-C45 | No | KeyBank National Association | |

| B | $21,000,000 | ACREFI Mortgage Lending, LLC | No |

| (1) | Unless otherwise indicated, each note not currently held by a securitization trust is expected to be contributed to a future securitization. No assurance can be provided that any such note will not be split further. |

| (2) | The 181 Fremont Street whole loan is currently being serviced under the pooling and servicing agreement governing the WFCM 2018-C44 securitization. On and after the securitization of the related “lead” pari passu note (namely, the related pari passu note marked “Yes” in the column entitled “Lead Servicer for Whole Loan”), such whole loan will be serviced under the pooling and servicing agreement governing such securitization. The master servicer and special servicer for such securitization will be identified in a notice, report or statement to holders of the WFCM 2018-C45 certificates after the closing of such securitization. |

| (3) | The CGCMT 2018-C5 securitization is expected to close on or about June 21, 2018. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

10

Wells Fargo Commercial Mortgage Trust 2018-C45 |

Characteristics of the Mortgage Pool |

| C. | Mortgage Loans with Additional Secured and Mezzanine Financing |

| Loan No. | Mortgage

Loan Seller |

Mortgage Loan Name | Mortgage Loan Cut-off Date Balance ($) |

%

of Initial Pool Balance (%) |

Sub Debt Cut-off Date Balance ($) | Mezzanine

Debt Cut-off Date Balance ($) |

Total

Debt Interest Rate (%)(1) |

Mortgage Loan U/W NCF DSCR (x)(2) |

Total

Debt U/W NCF DSCR (x) |

Mortgage Loan Cut-off Date U/W NOI Debt Yield (%)(2) |

Total

Debt Cut-off Date U/W NOI Debt Yield (%) |

Mortgage Loan Cut-off Date LTV Ratio (%)(2) |

Total

Debt Cut-off Date LTV Ratio (%) |

| 3 | CIIICM | Parkway Center | $42,560,000 | 6.5% | NAP | $4,700,000 | 5.5873% | 1.38x | 1.18x | 10.7% | 9.6% | 63.9% | 71.0% |

| 4 | WFB | 1801 L Street | 38,000,000 | 5.8 | 6,244,117 | NAP | NAP(3) | 1.61 | NAP(3) | 8.1 | NAP(3) | 63.1 | 73.4 |

| 10 | Barclays | 181 Fremont Street | 20,000,000 | 3.0 | NAP | 225,000,000 | 4.4340 | 3.14 | 1.38 | 11.8 | 6.2 | 39.6 | 75.2 |

| 18 | RMF | Flats at East Bank | 13,000,000 | 2.0 | 20,829,951 | NAP | 6.0167 | 1.90 | 1.05 | 9.9 | 7.7 | 52.0 | 67.1 |

| Total/Weighted Average | $113,560,000 | 17.2% | $27,074,068 | $229,700,000 | 5.3559% | 1.83x | 1.21x | 9.9% | 8.4% | 58.0% | 72.1% | ||

| (1) | Total Debt Interest Rate for any specified mortgage loan reflects the weighted average of the interest rates on the respective components of the total debt. |

| (2) | With respect to any mortgage loan that is part of a whole loan, the loan-to-value ratio, debt service coverage ratio and debt yield calculations include the related pari passu companion loan(s). |

| (3) | Please see the “Subordinate and Mezzanine Indebtedness” section of the 1801 L Street mortgage loan large loan summary herein. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

11

Wells Fargo Commercial Mortgage Trust 2018-C45 |

Characteristics of the Mortgage Pool |

| D. | Previous Securitization History(1) |

| Loan No. |

Mortgage

Loan Seller |

Mortgage Loan or Mortgaged Property Name |

City | State | Property Type |

Mortgage

Loan or Mortgaged Property Cut-off Date Balance ($) |

%

of Initial Pool Balance (%) |

Previous

Securitization |

| 9 | RMF | Citadel Self Storage | Thousand Oaks | CA | Self Storage | 25,000,000 | 3.8 | CFCRE 2011-C1 |

| 12.01 | RMF | Sunset Country MHC | Pueblo | CO | Manufactured Housing Community | 6,700,000 | 1.0 | GSMS 2011-GC3 |

| 12.03 | RMF | Oasis MHC | Pueblo | CO | Manufactured Housing Community | 5,700,000 | 0.9 | GSMS 2011-GC3 |

| 13 | WFB | Roseville Corporate Center | Roseville | CA | Office | 16,000,000 | 2.4 | BACM 2007-4 |

| 36 | WFB | The Shops at Vacaville Crossings | Vacaville | CA | Retail | 4,127,500 | 0.6 | BSCMS 2006-PW13 |

| Total | $57,527,500 | 8.7% |

| (1) | The table above represents the most recent securitization with respect to the mortgaged property securing the related mortgage loan, based on information provided by the related borrower or obtained through searches of a third-party database. While loans secured by the above mortgaged properties may have been securitized multiple times in prior transactions, mortgage loans in this securitization are only listed in the above chart if the mortgage loan paid off a loan in another securitization. The information has not otherwise been confirmed by the mortgage loan sellers. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

12

Wells Fargo Commercial Mortgage Trust 2018-C45 |

Characteristics of the Mortgage Pool |

| E. | Mortgage Loans with Scheduled Balloon Payments and Related Classes |

| Class A-2(1) | ||||||||||||||||

| Loan No. | Mortgage

Loan Seller |

Mortgage Loan Name | State | Property

Type |

Mortgage

Loan Cut-off Date Balance ($) |

%

of Initial Pool Balance (%) |

Mortgage Loan Balance at Maturity or ARD ($) |

% of Class A-2 Certificate Principal Balance (%)(2) |

SF | Loan per SF ($) |

U/W

NCF DSCR (x) |

U/W NOI Debt Yield (%) | Cut-off Date LTV Ratio (%) | Balloon Or ARD LTV Ratio (%) |

Rem. IO Period (mos.) | Rem.

Term to Maturity or ARD (mos.) |

| 35 | RMF | Citi Bank - Chicago | IL | Retail | $5,200,000 | 0.8% | $5,014,760 | 90.2% | 7,200 | $722 | 1.36x | 10.1% | 67.5% | 65.1% | 20 | 56 |

| Total/Weighted Average | $5,200,000 | 0.8% | $5,014,760 | 90.2% | 1.36x | 10.1% | 67.5% | 65.1% | 20 | 56 | ||||||

| (1) | The table above presents the mortgage loan(s) whose balloon payments would be applied to pay down the principal balance of the Class A-2 Certificates, assuming a 0% CPR and applying the “Structuring Assumptions” described in the Preliminary Prospectus, including the assumptions that (i) none of the mortgage loans in the pool experience prepayments prior to maturity (or, in the case of an ARD loan, its anticipated repayment date), defaults or losses; (ii) there are no extensions of maturity dates of any mortgage loans in the pool; and (iii) each mortgage loan in the pool is paid in full on its stated maturity date (or, in the case of an ARD loan, its anticipated repayment date). Each Class of Certificates evidences undivided ownership interests in the entire pool of mortgage loans. Debt service coverage ratio, debt yield and loan-to-value ratio information do not take into account subordinate debt (whether or not secured by the related mortgaged property), if any, that currently exists or is allowed under the terms of any mortgage loan. See Annex A-1 to the Preliminary Prospectus. |

| (2) | Reflects the percentage equal to the Balloon Balance divided by the initial Class A-2 Certificate Balance. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

13

Wells Fargo Commercial Mortgage Trust 2018-C45 |

Characteristics of the Mortgage Pool |

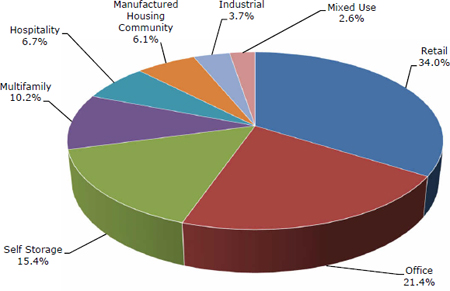

| F. | Property Type Distribution(1) |

| Property Type | Number of Mortgaged Properties | Aggregate

Cut-off Date Balance ($) |

%

of Initial Pool Balance (%) |

Weighted

Average Cut- off Date LTV Ratio (%) |

Weighted

Average Balloon or ARD LTV Ratio (%) |

Weighted

Average U/W NCF DSCR (x) |

Weighted

Average U/W NOI Debt Yield (%) |

Weighted

Average U/W NCF Debt Yield (%) |

Weighted

Average Mortgage Rate (%) | ||||||||

| Retail | 34 | $223,732,106 | 34.0 | % | 59.4 | % | 54.3 | % | 1.66 | x | 10.2 | % | 9.7 | % | 4.812 | % | |

| Anchored | 7 | 131,605,357 | 20.0 | 58.3 | 53.1 | 1.55 | 10.0 | 9.4 | 4.821 | ||||||||

| Single Tenant | 18 | 35,515,000 | 5.4 | 62.5 | 62.2 | 2.07 | 9.7 | 9.6 | 4.539 | ||||||||

| Shadow Anchored | 5 | 19,974,600 | 3.0 | 68.8 | 61.1 | 1.45 | 9.9 | 9.3 | 5.035 | ||||||||

| Super Regional Mall | 1 | 19,950,390 | 3.0 | 48.0 | 39.0 | 1.91 | 12.8 | 12.1 | 4.839 | ||||||||

| Unanchored | 3 | 16,686,759 | 2.5 | 63.2 | 57.4 | 1.59 | 9.8 | 9.3 | 5.020 | ||||||||

| Office | 10 | 140,937,221 | 21.4 | 61.4 | 56.0 | 1.85 | 11.2 | 10.1 | 4.678 | ||||||||

| Suburban | 5 | 104,187,221 | 15.8 | 64.6 | 58.0 | 1.62 | 11.3 | 9.9 | 4.872 | ||||||||

| CBD | 1 | 20,000,000 | 3.0 | 39.6 | 39.6 | 3.14 | 11.8 | 11.8 | 3.709 | ||||||||

| Medical | 4 | 16,750,000 | 2.5 | 68.0 | 63.2 | 1.73 | 9.4 | 9.1 | 4.629 | ||||||||

| Self Storage | 19 | 101,447,884 | 15.4 | 62.1 | 56.8 | 1.40 | 9.3 | 9.1 | 5.082 | ||||||||

| Self Storage | 19 | 101,447,884 | 15.4 | 62.1 | 56.8 | 1.40 | 9.3 | 9.1 | 5.082 | ||||||||

| Multifamily | 3 | 67,091,470 | 10.2 | 66.2 | 63.1 | 1.50 | 8.6 | 8.4 | 5.071 | ||||||||

| Low Rise | 1 | 38,000,000 | 5.8 | 63.1 | 63.1 | 1.61 | 8.1 | 7.9 | 4.845 | ||||||||

| Garden | 2 | 29,091,470 | 4.4 | 70.2 | 63.1 | 1.35 | 9.3 | 9.1 | 5.367 | ||||||||

| Hospitality | 5 | 44,430,416 | 6.7 | 62.3 | 51.4 | 1.95 | 14.3 | 12.7 | 5.071 | ||||||||

| Limited Service | 4 | 30,447,281 | 4.6 | 61.7 | 51.0 | 1.90 | 14.0 | 12.5 | 5.109 | ||||||||

| Select Service | 1 | 13,983,135 | 2.1 | 63.6 | 52.3 | 2.05 | 14.9 | 13.2 | 4.986 | ||||||||

| Manufactured Housing Community | 13 | 39,992,909 | 6.1 | 60.6 | 55.3 | 1.58 | 9.8 | 9.6 | 5.208 | ||||||||

| Manufactured Housing Community | 13 | 39,992,909 | 6.1 | 60.6 | 55.3 | 1.58 | 9.8 | 9.6 | 5.208 | ||||||||

| Industrial | 2 | 24,137,006 | 3.7 | 62.7 | 54.9 | 1.57 | 10.1 | 9.8 | 4.709 | ||||||||

| Warehouse | 2 | 24,137,006 | 3.7 | 62.7 | 54.9 | 1.57 | 10.1 | 9.8 | 4.709 | ||||||||

| Mixed Use | 3 | 16,996,408 | 2.6 | 53.5 | 52.4 | 1.81 | 9.8 | 9.7 | 5.183 | ||||||||

| Multifamily/Retail | 1 | 13,000,000 | 2.0 | 52.0 | 52.0 | 1.90 | 9.9 | 9.8 | 5.090 | ||||||||

| Retail/Multifamily | 1 | 2,100,000 | 0.3 | 52.5 | 52.5 | 1.68 | 8.9 | 8.8 | 5.160 | ||||||||

| Self Storage/Office | 1 | 1,896,408 | 0.3 | 64.7 | 54.8 | 1.37 | 10.5 | 9.7 | 5.850 | ||||||||

| Total/Weighted Average: | 89 | $658,765,419 | 100.0 | % | 61.2 | % | 55.8 | % | 1.66 | x | 10.3 | % | 9.7 | % | 4.899 | % | |

| (1) | Because this table presents information relating to the mortgaged properties and not the mortgage loans, the information for mortgage loans secured by more than one mortgaged property is based on allocated amounts (allocating the principal balance of the mortgage loan to each of those properties according to the relative appraised values of the mortgaged properties or the allocated loan amounts or property-specific release prices set forth in the related mortgage loan documents or such other allocation as the related mortgage loan seller deemed appropriate). With respect to any mortgage loan that is part of a whole loan, the loan-to-value ratio, debt service coverage ratio and debt yield calculations include the related pari passu companion loan(s) but exclude any related subordinate debt (unless otherwise stated). With respect to each mortgage loan, debt service coverage ratio, debt yield and loan-to-value ratio information do not take into account any subordinate debt (whether or not secured by the related mortgaged property) that currently exists or is allowed under the terms of such mortgage loan. See Annex A-1 to the Preliminary Prospectus. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

14

Wells Fargo Commercial Mortgage Trust 2018-C45 |

Characteristics of the Mortgage Pool |

| G. | Geographic Distribution(1) |

| Location | Number of Mortgaged Properties | Aggregate

Cut-off Date Balance ($) |

%

of Initial Pool Balance (%) |

Weighted

Average Cut-off Date LTV Ratio (%) |

Weighted

Average Balloon or ARD LTV Ratio (%) |

Weighted

Average U/W NCF DSCR (x) |

Weighted

Average U/W NOI Debt Yield (%) |

Weighted

Average U/W NCF Debt Yield (%) |

Weighted Average Mortgage Rate (%) | ||||||||

| California | 11 | $176,625,344 | 26.8 | % | 60.8 | % | 57.5 | % | 1.81 | x | 10.1 | % | 9.5 | % | 4.786 | % | |

| Northern California | 6 | 91,320,009 | 13.9 | 58.2 | 56.6 | 2.00 | 9.8 | 9.5 | 4.644 | ||||||||

| Southern California | 5 | 85,305,335 | 12.9 | 63.6 | 58.4 | 1.59 | 10.3 | 9.6 | 4.938 | ||||||||

| Texas | 14 | 73,028,847 | 11.1 | 62.6 | 57.1 | 1.50 | 10.2 | 9.7 | 4.881 | ||||||||

| Virginia | 3 | 72,275,000 | 11.0 | 58.4 | 54.2 | 1.37 | 8.5 | 8.1 | 4.711 | ||||||||

| Ohio | 9 | 43,528,746 | 6.6 | 58.8 | 54.9 | 1.74 | 9.8 | 9.6 | 4.854 | ||||||||

| Pennsylvania | 1 | 42,560,000 | 6.5 | 63.9 | 56.7 | 1.38 | 10.7 | 9.0 | 5.100 | ||||||||

| North Carolina | 8 | 39,497,884 | 6.0 | 68.4 | 63.8 | 1.51 | 9.4 | 9.2 | 5.256 | ||||||||

| Delaware | 1 | 28,270,000 | 4.3 | 57.9 | 49.7 | 2.00 | 13.1 | 12.4 | 4.655 | ||||||||

| Tennessee | 4 | 28,204,990 | 4.3 | 53.5 | 45.3 | 1.81 | 12.0 | 11.4 | 4.865 | ||||||||

| New York | 4 | 22,778,555 | 3.5 | 59.5 | 53.5 | 1.65 | 10.4 | 9.8 | 5.020 | ||||||||

| Washington | 2 | 20,175,865 | 3.1 | 55.5 | 46.8 | 1.92 | 13.8 | 12.5 | 5.020 | ||||||||

| Georgia | 4 | 19,382,545 | 2.9 | 71.6 | 61.9 | 1.39 | 9.7 | 9.2 | 5.238 | ||||||||

| Colorado | 3 | 18,400,000 | 2.8 | 57.6 | 50.2 | 1.43 | 9.7 | 9.5 | 5.320 | ||||||||

| Arizona | 1 | 13,983,135 | 2.1 | 63.6 | 52.3 | 2.05 | 14.9 | 13.2 | 4.986 | ||||||||

| Florida | 6 | 12,375,345 | 1.9 | 57.6 | 54.0 | 1.67 | 10.0 | 9.7 | 4.843 | ||||||||

| Illinois | 4 | 9,639,825 | 1.5 | 64.8 | 63.5 | 1.74 | 9.9 | 9.7 | 5.263 | ||||||||

| Alabama | 2 | 7,080,000 | 1.1 | 64.2 | 61.1 | 1.89 | 9.8 | 9.5 | 4.592 | ||||||||

| Nebraska | 1 | 6,991,281 | 1.1 | 62.7 | 51.3 | 1.73 | 12.6 | 10.9 | 4.805 | ||||||||

| Maryland | 2 | 6,966,470 | 1.1 | 67.9 | 60.9 | 1.67 | 9.4 | 9.1 | 4.940 | ||||||||

| Louisiana | 3 | 4,885,286 | 0.7 | 61.7 | 61.7 | 2.19 | 9.6 | 9.5 | 4.270 | ||||||||

| Connecticut | 1 | 3,492,811 | 0.5 | 65.9 | 55.1 | 1.33 | 10.3 | 9.1 | 5.470 | ||||||||

| New Mexico | 1 | 2,497,299 | 0.4 | 69.4 | 58.1 | 1.44 | 10.0 | 9.9 | 5.570 | ||||||||

| Michigan | 1 | 1,896,408 | 0.3 | 64.7 | 54.8 | 1.37 | 10.5 | 9.7 | 5.850 | ||||||||

| Oregon | 1 | 1,750,000 | 0.3 | 70.7 | 60.9 | 1.81 | 11.6 | 11.4 | 4.830 | ||||||||

| Indiana | 1 | 1,550,000 | 0.2 | 61.7 | 61.7 | 2.19 | 9.6 | 9.5 | 4.270 | ||||||||

| Wyoming | 1 | 929,781 | 0.1 | 61.7 | 61.7 | 2.19 | 9.6 | 9.5 | 4.270 | ||||||||

| Total/Weighted Average | 89 | $658,765,419 | 100.0 | % | 61.2 | % | 55.8 | % | 1.66 | x | 10.3 | % | 9.7 | % | 4.899 | % | |

| (1) | Because this table presents information relating to the mortgaged properties and not the mortgage loans, the information for mortgage loans secured by more than one mortgaged property is based on allocated amounts (allocating the principal balance of the mortgage loan to each of those properties according to the relative appraised values of the mortgaged properties or the allocated loan amounts or property-specific release prices set forth in the related mortgage loan documents or such other allocation as the related mortgage loan seller deemed appropriate). With respect to any mortgage loan that is part of a whole loan, the loan-to-value ratio, debt service coverage ratio and debt yield calculations include the related pari passu companion loan(s) but exclude any related subordinate debt (unless otherwise stated). With respect to each mortgage loan, debt service coverage ratio, debt yield and loan-to-value ratio information do not take into account any subordinate debt (whether or not secured by the related mortgaged property) that currently exists or is allowed under the terms of such mortgage loan. See Annex A-1 to the Preliminary Prospectus. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

15

| Wells Fargo Commercial Mortgage Trust 2018-C45 | Characteristics of the Mortgage Pool |

| H. | Characteristics of the Mortgage Pool(1) |

| CUT-OFF DATE BALANCE | |||

| Range

of Cut-off Date Balances ($) |

Number

of Mortgage Loans |

Aggregate

Cut-off Date Balance |

Percent

by Aggregate Cut-off Date Pool Balance (%) |

| 797,183 - 1,000,000 | 1 | $797,183 | 0.1% |

| 1,000,001 - 2,000,000 | 4 | 7,192,719 | 1.1 |

| 2,000,001 - 3,000,000 | 5 | 12,478,849 | 1.9 |

| 3,000,001 - 4,000,000 | 2 | 6,985,357 | 1.1 |

| 4,000,001 - 5,000,000 | 2 | 8,218,970 | 1.2 |

| 5,000,001 - 6,000,000 | 2 | 11,050,000 | 1.7 |

| 6,000,001 - 7,000,000 | 5 | 33,500,540 | 5.1 |

| 7,000,001 - 8,000,000 | 2 | 14,888,582 | 2.3 |

| 8,000,001 - 9,000,000 | 2 | 17,388,639 | 2.6 |

| 9,000,001 - 10,000,000 | 2 | 18,758,585 | 2.8 |

| 10,000,001 - 15,000,000 | 9 | 113,230,606 | 17.2 |

| 15,000,001 - 20,000,000 | 4 | 74,350,390 | 11.3 |

| 20,000,001 - 30,000,000 | 4 | 108,020,000 | 16.4 |

| 30,000,001 - 50,000,000 | 4 | 166,655,000 | 25.3 |

| 50,000,001 - 65,250,000 | 1 | 65,250,000 | 9.9 |

| Total: | 49 | $658,765,419 | 100.0% |

| Weighted Average | $13,444,192 | ||

| UNDERWRITTEN NOI DEBT SERVICE COVERAGE RATIO | |||

| Range

of U/W NOI DSCRs (x) |

Number

of Mortgage Loans |

Aggregate Cut-off Date Balance |

Percent

by Aggregate Cut-off Date Pool Balance (%) |

| 1.26 - 1.30 | 1 | $25,000,000 | 3.8% |

| 1.31 - 1.40 | 9 | 128,037,080 | 19.4 |

| 1.41 - 1.50 | 8 | 55,592,739 | 8.4 |

| 1.51 - 1.60 | 5 | 80,004,911 | 12.1 |

| 1.61 - 1.70 | 5 | 92,650,000 | 14.1 |

| 1.71 - 1.80 | 3 | 28,679,551 | 4.4 |

| 1.81 - 1.90 | 5 | 52,866,750 | 8.0 |

| 1.91 - 2.00 | 2 | 19,991,281 | 3.0 |

| 2.01 - 3.00 | 10 | 155,943,106 | 23.7 |

| 3.01 - 3.15 | 1 | 20,000,000 | 3.0 |

| Total: | 49 | $658,765,419 | 100.0% |

| Weighted Average | 1.76x | ||

| UNDERWRITTEN NCF DEBT SERVICE COVERAGE RATIO | |||

Range

of U/W NCF |

Number

of Mortgage Loans |

Aggregate Cut-off Date Balance |

Percent

by Aggregate Cut-off Date Pool Balance (%) |

| 1.25 - 1.30 | 5 | $96,687,080 | 14.7% |

| 1.31 - 1.40 | 11 | 128,907,858 | 19.6 |

| 1.41 - 1.50 | 5 | 39,522,292 | 6.0 |

| 1.51 - 1.60 | 7 | 90,047,051 | 13.7 |

| 1.61 - 1.70 | 4 | 84,550,000 | 12.8 |

| 1.71 - 1.80 | 3 | 15,858,031 | 2.4 |

| 1.81 - 1.90 | 3 | 27,250,000 | 4.1 |

| 1.91 - 2.00 | 6 | 85,373,422 | 13.0 |

| 2.01 - 3.00 | 4 | 70,569,684 | 10.7 |

| 3.01 - 3.14 | 1 | 20,000,000 | 3.0 |

| Total: | 49 | $658,765,419 | 100.0% |

| Weighted Average | 1.66x | ||

| LOAN PURPOSE | |||

| Loan Purpose | Number

of Mortgage Loans |

Aggregate Cut-off Date Balance |

Percent

by Aggregate Cut-off Date Pool Balance (%) |

| Refinance | 31 | $402,551,518 | 61.1% |

| Acquisition | 17 | 190,963,902 | 29.0 |

| Recapitalization | 1 | 65,250,000 | 9.9 |

| Total: | 49 | $658,765,419 | 100.0% |

| MORTGAGE RATE | |||

Range

of Mortgage |

Number

of Mortgage Loans |

Aggregate

Cut-off Date Balance |

Percent

by Aggregate Cut-off Date Pool Balance (%) |

| 3.709 | 1 | $20,000,000 | 3.0% |

| 4.251 - 4.500 | 2 | 67,545,000 | 10.3 |

| 4.501 - 4.750 | 5 | 115,220,000 | 17.5 |

| 4.751 - 5.000 | 13 | 203,762,906 | 30.9 |

| 5.001 - 5.250 | 11 | 119,854,715 | 18.2 |

| 5.251 - 5.500 | 7 | 76,165,466 | 11.6 |

| 5.501 - 5.750 | 6 | 46,775,314 | 7.1 |

| 5.751 - 6.000 | 3 | 4,242,018 | 0.6 |

| 6.001 - 6.110 | 1 | 5,200,000 | 0.8 |

| Total: | 49 | $658,765,419 | 100.0% |

| Weighted Average | 4.899% | ||

| UNDERWRITTEN NOI DEBT YIELD | |||

Range

of U/W NOI |

Number

of Mortgage Loans |

Aggregate

Cut-off Date Balance |

Percent

by Aggregate Cut-off Date Pool Balance (%) |

| 8.1 - 9.0 | 7 | $156,900,000 | 23.8% |

| 9.1 - 10.0 | 18 | 238,493,238 | 36.2 |

| 10.1 - 11.0 | 10 | 110,490,248 | 16.8 |

| 11.1 - 12.0 | 5 | 43,742,545 | 6.6 |

| 12.1 - 13.0 | 2 | 26,941,672 | 4.1 |

| 13.1 - 14.0 | 2 | 37,270,000 | 5.7 |

| 14.1 - 15.0 | 3 | 34,647,585 | 5.3 |

| 15.1 - 16.0 | 1 | 2,791,549 | 0.4 |

| 16.1 - 16.2 | 1 | 7,488,582 | 1.1 |

| Total: | 49 | $658,765,419 | 100.0% |

| Weighted Average | 10.3% | ||

| UNDERWRITTEN NCF DEBT YIELD | |||

| Range

of U/W NCF Debt Yields (%) |

Number

of Mortgage Loans |

Aggregate

Cut-off Date Balance |

Percent

by Aggregate Cut-off Date Pool Balance (%) |

| 7.9 - 8.0 | 3 | $110,650,000 | 16.8% |

| 8.1 - 9.0 | 9 | 123,821,470 | 18.8 |

| 9.1 - 10.0 | 21 | 258,927,126 | 39.3 |

| 10.1 - 11.0 | 6 | 41,468,717 | 6.3 |

| 11.1 - 12.0 | 2 | 21,750,000 | 3.3 |

| 12.1 - 13.0 | 5 | 77,884,840 | 11.8 |

| 13.1 - 14.0 | 1 | 13,983,135 | 2.1 |

| 14.1 - 14.5 | 2 | 10,280,131 | 1.6 |

| Total: | 49 | $658,765,419 | 100.0% |

| Weighted Average | 9.7% | ||

| ORIGINAL TERM TO MATURITY OR ARD | |||

| Original

Terms to Maturity or ARD (months) |

Number

of Mortgage Loans |

Aggregate

Cut-off Date Balance |

Percent

by Aggregate Cut-off Date Pool Balance (%) |

| 60 | 1 | $5,200,000 | 0.8% |

| 120 | 48 | 653,565,419 | 99.2 |

| Total: | 49 | $658,765,419 | 100.0% |

| Weighted Average | 120 | ||

| (1) | With respect to any mortgage loan that is part of a whole loan, the loan-to-value ratio, debt service coverage ratio and debt yield calculations include the related pari passu companion loan(s) but exclude any related subordinate debt (unless otherwise stated). With respect to each mortgage loan, debt service coverage ratio, debt yield and loan-to-value ratio information do not take into account any subordinate debt (whether or not secured by the related mortgaged property) that currently exists or is allowed under the terms of such mortgage loan. See Annex A-1 to the Preliminary Prospectus. Prepayment provisions for each mortgage loan reflects the entire life of the loan (from origination to maturity or ARD). |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

16

| Wells Fargo Commercial Mortgage Trust 2018-C45 | Characteristics of the Mortgage Pool |

| REMAINING TERM TO MATURITY OR ARD | ||||

| Range

of Remaining Terms to Maturity or ARD (months) |

Number of Mortgage Loans |

Aggregate

Cut-off Date Balance |

Percent

by Aggregate Cut-off Date Pool Balance (%) | |

| 56 | 1 | $5,200,000 | 0.8% | |

| 57 - 120 | 48 | 653,565,419 | 99.2 | |

| Total | 49 | $658,765,419 | 100.0% | |

| Weighted Average | 118 months | |||

| ORIGINAL AMORTIZATION TERM(2) | ||||

| Range

of Original Amortization Terms (months) |

Number

of Mortgage Loans |

Aggregate

Cut-off Date Balance |

Percent

by Aggregate Cut-off Date Pool Balance (%) | |

| Non-Amortizing | 10 | $167,861,750 | 25.5% | |

| 300 | 1 | 7,488,582 | 1.1 | |

| 301 - 360 | 38 | 483,415,088 | 73.4 | |

| Total: | 49 | $658,765,419 | 100.0% | |

| Weighted Average(3) | 358 months | |||

(2) The original amortization term shown for any mortgage loan that is interest-only for part of its term does not include the number of months in its interest-only period and reflects only the number of months as of the commencement of amortization remaining from the end of such interest-only period. (3) Excludes the non-amortizing mortgage loans. | ||||

| REMAINING AMORTIZATION TERM(4) | ||||

| Range

of Remaining Amortization Terms (months) |

Number

of Mortgage Loans |

Aggregate

Cut-off Date Balance |

Percent by Aggregate Cut-off Date Pool Balance (%) | |

| Non-Amortizing | 10 | $167,861,750 | 25.5% | |

| 299 | 1 | $7,488,582 | 1.1 | |

| 301 - 360 | 38 | 483,415,088 | 73.4 | |

| Total: | 49 | $658,765,419 | 100.0% | |

| Weighted Average(5) | 358 months | |||

(4) The remaining amortization term shown for any mortgage loan that is interest-only for part of its term does not include the number of months in its interest-only period and reflects only the number of months as of the commencement of amortization remaining from the end of such interest-only period. (5) Excludes the non-amortizing mortgage loans. | ||||

| LOCKBOXES | ||||

| Type of Lockbox | Number

of Mortgage Loans |

Aggregate

Cut-off Date Balance |

Percent

by Aggregate Cut-off Date Pool Balance (%) | |

| Springing | 32 | $321,362,581 | 48.8% | |

| Hard/Springing Cash Management | 11 | 199,814,257 | 30.3 | |

| Hard/Upfront Cash Management | 4 | 105,738,582 | 16.1 | |

| Soft/Springing Cash Management | 1 | 29,750,000 | 4.5 | |

| None | 1 | 2,100,000 | 0.3 | |

| Total: | 49 | $658,765,419 | 100.0% | |

| PREPAYMENT PROVISION SUMMARY(6) | ||||

| Prepayment Provision | Number

of Mortgage Loans |

Aggregate

Cut-off Date Balance |

Percent

by Aggregate Cut-off Date Pool Balance (%) | |

| Lockout / Defeasance / Open | 42 | $579,525,029 | 88.0% | |

| Lockout / GRTR 1% or YM / Open | 5 | 39,290,000 | 6.0 | |

| Lockout / GRTR 1% or YM / GRTR 1% or YM or Def / Open | 1 | 20,000,000 | 3.0 | |

| Lockout / GRTR 1% or YM or Defeasance / Open | 1 | 19,950,390 | 3.0 | |

| Total: | 49 | $658,765,419 | 100.0% | |

(6) As a result of property releases or the application of funds in a performance reserve, partial principal prepayments could occur during a period that voluntary principal prepayments are otherwise prohibited.

| ||||

| CUT-OFF DATE LOAN-TO-VALUE RATIO | |||

| Range

of Cut-off Date LTV Ratios (%) |

Number

of Mortgage Loans |

Aggregate

Cut-off Date Balance |

Percent

by Aggregate Cut-off Date Pool Balance (%) |

| 39.6 - 45.0 | 1 | $20,000,000 | 3.0% |

| 45.1 - 50.0 | 2 | 22,450,390 | 3.4 |

| 50.1 - 55.0 | 3 | 24,100,000 | 3.7 |

| 55.1 - 60.0 | 12 | 241,048,823 | 36.6 |

| 60.1 - 65.0 | 14 | 200,011,010 | 30.4 |

| 65.1 - 70.0 | 10 | 107,945,841 | 16.4 |

| 70.1 - 74.5 | 7 | 43,209,354 | 6.6 |

| Total: | 49 | $658,765,419 | 100.0% |

| Weighted Average | 61.2% | ||

BALLOON OR ARD LOAN-TO-VALUE RATIO | |||

| Range of Balloon or ARD LTV Ratios (%) | Number

of Mortgage Loans |

Aggregate

Cut-off Date Balance |

Percent

by Aggregate Cut-off Date Pool Balance (%) |

| 39.0 - 40.0 | 2 | $39,950,390 | 6.1% |

| 40.1 - 45.0 | 4 | 27,377,221 | 4.2 |

| 45.1 - 50.0 | 6 | 59,714,112 | 9.1 |

| 50.1 - 55.0 | 11 | 164,657,837 | 25.0 |

| 55.1 - 60.0 | 9 | 135,410,156 | 20.6 |

| 60.1 - 65.0 | 15 | 210,455,704 | 31.9 |

| 65.1 - 66.4 | 2 | 21,200,000 | 3.2 |

| Total: | 49 | $658,765,419 | 100.0% |

| Weighted Average | 55.8% | ||

AMORTIZATION TYPE | |||

| Amortization Type | Number

of Mortgage Loans |

Aggregate

Cut-off Date Balance |

Percent

by Aggregate Cut-off Date Pool Balance (%) |

| Interest-only, Amortizing Balloon | 20 | $360,502,100 | 54.7% |

| Interest-only, Balloon | 9 | 147,861,750 | 22.4 |

| Amortizing Balloon | 18 | 116,751,569 | 17.7 |

| Interest-only, ARD | 1 | 20,000,000 | 3.0 |

| Interest-only, Amortizing ARD | 1 | 13,650,000 | 2.1 |

| Total: | 49 | $658,765,419 | 100.0% |

ORIGINAL TERM OF INTEREST-ONLY PERIOD FOR PARTIAL IO LOANS | |||

| IO Terms (months) | Number

of Mortgage Loans |

Aggregate

Cut-off Date Balance |

Percent

by Aggregate Cut-off Date Pool Balance (%) |

| 24 | 8 | $85,510,000 | 13.0% |

| 36 | 6 | 93,757,500 | 14.2 |

| 42 | 1 | 10,434,600 | 1.6 |

| 48 | 1 | 25,000,000 | 3.8 |

| 60 | 4 | 111,150,000 | 16.9 |

| 84 | 1 | 48,300,000 | 7.3 |

| Total: | 21 | $374,152,100 | 56.8% |

| Weighted Average | 48 months | ||

SEASONING | |||

| Seasoning (months) | Number

of Mortgage Loans |

Aggregate

Cut-off Date Balance |

Percent

by Aggregate Cut-off Date Pool Balance (%) |

| 0 | 2 | $52,700,000 | 8.0% |

| 1 | 23 | 312,970,530 | 47.5 |

| 2 | 15 | 149,368,340 | 22.7 |

| 3 | 6 | 134,276,549 | 20.4 |

| 4 | 1 | 5,200,000 | 0.8 |

| 6 | 1 | 2,500,000 | 0.4 |

| 7 | 1 | 1,750,000 | 0.3 |

| Total: | 49 | $658,765,419 | 100.0% |

| Weighted Average | 2 months | ||

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

17

| Wells Fargo Commercial Mortgage Trust 2018-C45 | Certain Terms and Conditions |

| V. | Certain Terms and Conditions |

| Interest Entitlements: | The interest entitlement of each Class of Certificates on each Distribution Date generally will be the interest accrued during the related Interest Accrual Period on the related Certificate Balance or Notional Amount at the related pass-through rate, net of any prepayment interest shortfalls allocated to that Class for such Distribution Date as described below. If prepayment interest shortfalls arise from voluntary prepayments (without Master Servicer consent) on particular non-specially serviced loans during any collection period, the Master Servicer is required to make a compensating interest payment to offset those shortfalls, generally up to an amount equal to the portion of its master servicing fees that accrue at 0.25 basis points per annum. The remaining amount of prepayment interest shortfalls will be allocated to reduce the interest entitlement on all Classes of Certificates entitled to interest, on a pro rata basis, based on their respective amounts of accrued interest for the related Distribution Date. If a Class receives less than the entirety of its interest entitlement on any Distribution Date, then the shortfall (excluding any shortfall due to prepayment interest shortfalls), together with interest thereon, will be added to its interest entitlement for the next succeeding Distribution Date. |

| Principal Distribution Amount: | The Principal Distribution Amount for each Distribution Date generally will be the aggregate amount of principal received or advanced in respect of the mortgage loans, net of any non-recoverable advances and interest thereon and workout-delayed reimbursement amounts that are reimbursed to the Master Servicer, the Special Servicer or the Trustee during the related collection period. Non-recoverable advances and interest thereon are reimbursable from principal collections and advances before reimbursement from other amounts. Workout-delayed reimbursement amounts are reimbursable from principal collections. |

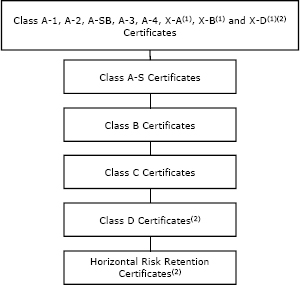

| Subordination, Allocation of Losses and Certain Expenses | The chart below describes the manner in which the payment rights of certain Classes of Certificates will be senior or subordinate, as the case may be, to the payment rights of other Classes of Certificates. The chart also shows the corresponding entitlement to receive principal and/or interest of certain Classes of Certificates (other than excess interest that accrues on each mortgage loan that has an anticipated repayment date) on any distribution date in descending order. It also shows the manner in which losses are allocated to certain Classes of Certificates in ascending order (beginning with the Non-Offered Certificates, and other than the Class V and R certificates) to reduce the balance of each such class to zero; provided that no principal payments or mortgage loan losses will be allocated to the Class X-A, X-B, X-D, V or R Certificates, although principal payments and losses may reduce the notional amounts of the Class X-A, X-B and X-D certificates and, therefore, the amount of interest they accrue. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

18

| Wells Fargo Commercial Mortgage Trust 2018-C45 | Certain Terms and Conditions |

| |

(1) The Class X-A, X-B and X-D Certificates are interest-only certificates. (2) Non-Offered Certificates.

| |

| Distributions: | On each Distribution Date, funds available for distribution from the mortgage loans, net of specified trust fees, expenses and reimbursements will generally be distributed in the following amounts and order of priority (in each case to the extent of remaining available funds): |

| 1. Class A-1, A-2, A-SB, A-3, A-4, X-A, X-B and X-D Certificates: To interest on the Class A-1, A-2, A-SB, A-3, A-4, X-A, X-B and X-D Certificates, pro rata, according to their respective interest entitlements. | |

| 2. Class A-1, A-2, A-SB, A-3 and A-4 Certificates: To principal on the Class A-1, A-2, A-SB, A-3 and A-4 Certificates in the following amounts and order of priority: (i) first, to principal on the Class A-SB Certificates, in an amount up to the Principal Distribution Amount for such Distribution Date until their Certificate Balance is reduced to the Class A-SB Planned Principal Balance for such Distribution Date; (ii) second, to principal on the Class A-1 Certificates until their Certificate Balance is reduced to zero, up to the remainder of the Principal Distribution Amount for such Distribution Date; (iii) third, to principal on the Class A-2 Certificates until their Certificate Balance is reduced to zero, up to the remainder of the Principal Distribution Amount for such Distribution Date; (iv) fourth, to principal on the Class A-3 Certificates until their Certificate Balance is reduced to zero, up to the remainder of the Principal Distribution Amount for such Distribution Date; (v) fifth, to principal on the Class A-4 Certificates until their Certificate Balance is reduced to zero, up to the remainder of the Principal Distribution Amount for such Distribution Date; and (vi) sixth, to principal on the Class A-SB Certificates until their Certificate Balance is reduced to zero, up to the remainder of the Principal Distribution Amount for such Distribution Date. However, if the Certificate Balance of each Class of Principal Balance Certificates, other than the Class A-1, A-2, A-SB, A-3 and A-4 Certificates, has been reduced to zero as a result of the allocation of Mortgage Loan losses and expenses and any of the Class A-1, A-2, A-SB, A-3 and A-4 Certificates remains outstanding, then the Principal Distribution Amount will be distributed to the Class A-1, A-2, A-SB, A-3 and A-4 Certificates, pro rata, based on their respective outstanding Certificate Balances, until their Certificate Balances have been reduced to zero. | |

| 3. Class A-1, A-2, A-SB, A-3 and A-4 Certificates: To reimburse the holders of the Class A-1, A-2, A-SB, A-3 and A-4 Certificates, pro rata, on the basis of previously allocated unreimbursed losses, for any previously unreimbursed losses (plus interest thereon) on the mortgage loans that were previously allocated in reduction of the Certificate Balances of such Classes. |