| REGISTRATION STATEMENT PURSUANT TO SECTION 12 OF THE SECURITIES EXCHANGE ACT OF 1934 |

| ANNUAL REPORT PURSUANT TO SECTION 13(a) OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Not applicable | ||||

| (Province or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number (if applicable)) |

(I.R.S. Employer Identification Number (if applicable)) |

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered | ||

| |

Annual Information Form |

Audited Annual Financial Statements |

† |

The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012. |

| Auditor Firm Id: |

Auditor Name: | |

Auditor Location: | |

FORWARD LOOKING STATEMENTS

This Form 40-F and the exhibits hereto contain forward-looking statements under the provisions of Section 27A of the United States Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Exchange Act, and forward-looking information within the meaning of applicable Canadian securities legislation, and such statements are subject to the safe harbor created by those sections and the United States Private Securities Litigation Reform Act of 1995, as amended.

Readers are cautioned not to place undue reliance on any forward-looking statements which reference issues only as of the date made. The following important factors could cause the Company’s actual financial performance to differ materially from that expressed in any forward-looking statement:

| • | Competition |

| • | Regulation |

| • | United States Operations |

| • | Operating Environment and Seasonality |

| • | General Economic, Credit and Business Conditions |

| • | Interest Rate Fluctuations |

| • | Currency Fluctuations |

| • | Price and Availability of Fuel |

| • | Insurance |

| • | Employee Relations |

| • | Drivers |

| • | Independent Contractors |

| • | Acquisition and Integration Risks |

| • | Growth |

| • | Environmental Matters |

| • | Environmental Contamination |

| • | Key Personnel |

| • | Dependence on Third Parties |

| • | Loan Default |

| • | Credit Facilities |

| • | Customers and Credit Risks |

| • | Availability of Capital |

| • | Information Systems |

| • | Litigation |

| • | Internal Control Over Financial Reporting |

| • | Dividends and Share Repurchases |

| • | Material Transactions |

| • | Public Health Crises, including the current COVID-19 pandemic |

The foregoing list should not be construed as exhaustive, and the Company disclaims any subsequent obligation to revise or update any previously made forward-looking statements unless required to do so by applicable securities laws. Unanticipated events are likely to occur. The Company’s future financial and operating results may fluctuate as a result of these and other risk factors.

Readers should also refer to the sections entitled “Forward-Looking Statements” in the Company’s Annual Information Form for the year ended December 31, 2022, attached hereto as Exhibit 99.1, and the Company’s Management’s Discussion and Analysis for the year ended December 31, 2022, attached hereto as Exhibit 99.3 (the “2022 MD&A”) for a discussion of forward-looking statements, as well as the section entitled “Risks and Uncertainties” in the 2022 MD&A for additional information on risk factors and other events that are not within the Company’s control.

Unless otherwise indicated or the context otherwise requires, all references in this Form 40-F to “TFI International”, the “Company”, “we”, “us”, and “our” mean TFI International Inc. and its consolidated subsidiaries.

CONTROLS AND PROCEDURES

Certifications

The required certifications are attached hereto as Exhibits 99.4, 99.5, 99.6, and 99.7.

Disclosure Controls and Procedures

The information provided in the section entitled “Controls and Procedures” under the sub-heading “Disclosure Controls and Procedures” contained in the 2022 MD&A filed as Exhibit 99.3 to this Annual Report on Form 40-F is incorporated by reference herein.

Management’s Annual Report on Internal Control over Financial Reporting

The information provided in the section entitled “Controls and Procedures” under the sub-headings “Management’s Annual Report on Internal Controls over Financial Reporting” contained in the 2022 MD&A filed as Exhibit 99.3 to this Annual Report on Form 40-F is incorporated by reference herein.

Attestation Report of the Independent Registered Public Accounting Firm

The effectiveness of the Company’s internal control over financial reporting as at December 31, 2022 has been audited by KPMG LLP, an independent registered public accounting firm, as stated in their report, which accompanies the Company’s Audited Consolidated Annual Financial Statements, filed as Exhibit 99.2 to this Annual Report on Form 40-F and is incorporated herein by reference.

Changes in Internal Control over Financial Reporting

The information provided in the section entitled “Controls and Procedures” under the sub-heading “Changes in Internal Controls over Financial Reporting” contained in the 2022 MD&A filed as Exhibit 99.3 to this Annual Report on Form 40-F is incorporated by reference herein.

NOTICES PURSUANT TO REGULATION BTR

There were no notices required by Rule 104 of Regulation BTR that the Company sent during the year ended December 31, 2022 concerning any equity security subject to a blackout period under Rule 101 of Regulation BTR.

AUDIT COMMITTEE AND AUDIT COMMITTEE FINANCIAL EXPERT

Audit Committee

The board of directors of the Company (the “Board”) has a separately designated standing audit committee (the “Audit Committee”) established in accordance with section 3(a)(58)(A) of the Exchange Act. The Board has appointed four independent directors, Diane Giard, William T. England (chair), André Bérard (interim member) and Debra Kelly-Ennis, to the Audit Committee.

The Board has determined that all members of the Audit Committee are “independent” within the meaning of applicable Commission regulations and the listing standards of the New York Stock Exchange (the “NYSE”).

Audit Committee Financial Expert

Management has determined that William T. England qualifies as an “audit committee financial expert” within the meaning of Item 407 of Regulation S-K.

The Commission has indicated that the designation of a person as an audit committee financial expert does not make such person an “expert” for any purpose (including, without limitation, Section 11 of the Securities Act) or impose any duties, obligations or liabilities on such person that are greater than those imposed on members of the Audit Committee and the Board who do not carry this designation, or affect the duties, obligations or liabilities of any other member of the Audit Committee or Board.

CODE OF ETHICS

The Company’s Code of Ethics is applicable to all of its employees, including the CEO, CFO, and persons performing similar functions. The Code of Ethics is available on the Company’s website at www.tfiintl.com. Except for the Code of Ethics, and notwithstanding any reference to the Company’s website or other websites in this Form 40-F or in the documents incorporated by reference herein or attached as Exhibits hereto, no information contained on the Company’s website or any other site shall be incorporated by reference in this Form 40-F or in the documents incorporated by reference herein or attached as Exhibits hereto.

PRINCIPAL ACCOUNTING FEES AND SERVICES

The aggregate amounts paid or accrued by the Company with respect to fees payable to KPMG LLP, the auditors of the Company, for audit, audit-related, tax and other services in the years ended December 31, 2022 and 2021 were as follows:

| Year ended December 31, | ||||||||||||

| 2022 | 2021 | |||||||||||

| In USD (4) | ||||||||||||

| Audit Fees(1) |

$ | 2,683,499 | $ | 2,997,049 | ||||||||

| Audit-Related Fees(2) |

$ | 382,553 | $ | 2,817 | ||||||||

| Tax Fees(3) |

$ | — | $ | 39,774 | ||||||||

| All Other Fees |

$ | — | $ | — | ||||||||

| TOTAL |

$ | 3,066,052 | $ | 3,039,640 | ||||||||

| (1) | Audit fees for 2022 and 2021 include fees related to the audit of the annual financial statements, the reviews of the interim financial statements and the audit of internal controls over financial reporting. Audit fees also include fees for any prospectus related work. |

| (2) | 2022 and 2021 Audit-Related Fees are for an audit of a special report for the Québec Commission des normes, de l’équité, de la santé et de la sécurité du travail (CNESST) and 2022 fees also include carve-out work related to the disposition of CFI and due diligence services. |

| (3) | No tax fees for 2022. Tax Fees for 2021 consist of tax compliance, including assistance with the preparation and review of tax returns, and other tax advisory services related to domestic and international taxation. |

| (4) | The amounts in the table above are shown in USD based on the average exchange rate of the Bank of Canada for the years 2022 and 2021 respectively, namely: |

| Currency |

2022 |

2021 |

||||||

| Euros |

— | 1.4828 |

||||||

| Mexican |

— | 0.06181 |

||||||

| CAD |

0.7685 |

0.7978 |

||||||

Audit Committee Pre-Approval Policies and Procedures

Generally, the Audit Committee reviews and approves in advance all non-audit services performed by the Company’s duly appointed external auditing firm. The Audit Committee may delegate to the chairman of the committee the authority to pre-approve non-audit services to be performed by the Company’s duly appointed external auditing firm. The pre-approval of such non-audit services by chairman to whom authority has been delegated must thereafter be presented to the Audit Committee at its first scheduled meeting following such pre-approval.

If the amount to be paid by the Company to the Company’s duly appointed external auditing firm is less than seventy-five thousand dollars (CAD$75,000) for each specific mandate, up to an aggregate annual amount of all the non-audit services not more than One Hundred Fifty Thousand Dollars (CAD$150,000), such non-audit services are deemed to be pre-approved by the Audit Committee if they are approved by the Chairman of the Audit Committee and provided that the services are promptly brought to the attention of the Audit Committee at its first scheduled meeting following such non-audit services are given.

No audit-related, tax, or other non-audit services were approved by the Audit Committee pursuant to the de minimis exception to the pre-approval requirement under Rule 2-01(c)(7)(i)(C), of SEC Regulation S-X during the year ended December 31, 2022.

OFF-BALANCE SHEET ARRANGEMENTS

The Company does not currently have any “off-balance sheet arrangements” that have or are reasonably likely to have a current or future effect on the Company’s financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that is material to investors.

DISCLOSURE OF CONTRACTUAL OBLIGATIONS

The information provided under the heading “Contractual obligations, commitments, contingencies and off-balance sheet arrangements” in the 2022 MD&A is incorporated by reference herein.

COMPARISON WITH NEW YORK STOCK EXCHANGE GOVERNANCE RULES

The Company is subject to the listing standards of the Toronto Stock Exchange (the “TSX”) and the corporate governance rules of Canadian Securities Administrators. These listing standards and corporate governance rules are substantially similar to the NYSE listing standards. The Company complies with these TSX listing standards and Canadian corporate governance rules.

The following are the significant ways in which the Company’s governance practices differ from those followed by U.S. domestic companies listed on the NYSE:

| • | Section 303A.08 of the NYSE’s Listed Company Manual requires shareholder approval of all equity compensation plans and material revisions to such plans. The definition of “equity compensation plans” covers plans that provide for the delivery of both newly issued and treasury securities, as well as plans that rely on securities re-acquired in the open market by the issuing company for the purpose of redistribution to employees and directors. The TSX rules require that shareholders approve the adoption of only those security-based compensation arrangements that provide for new issuances or potential issuances of securities from treasury. Further, the TSX rules require that: (i) every three years after institution, all unallocated options, rights or other entitlements under a security based compensation arrangement which does not have a fixed maximum aggregate of securities issuable, must be approved by the listed issuer’s shareholders; (ii) any amendment to a security based compensation arrangement must be approved by the listed issuer’s shareholders unless the security based compensation arrangement contains detailed provisions which specify those amendments requiring shareholder approval under the TSX rules and those amendments which can be made by the listed issuer’s board of directors without shareholder approval; and (iii) shareholder approval is required for the introduction of, and subsequent amendments to, such amending provisions. The Company follows the TSX rules with respect to the requirements for shareholder approval of security-based compensation arrangements and amendments thereto. |

| • | Section 310.00 of the NYSE Listed Company Manual generally requires that a listed company provide for a quorum for any meeting of the holders of the company’s common shares that is sufficiently high to insure a representative vote. Pursuant to the NYSE corporate governance rules we, as a foreign private issuer, have elected to comply with practices that are permitted under Canadian law in lieu of the provisions of Section 310.00. Our by-laws provide that two or more shareholders present in person and personally holding or representing by proxy not less than twenty percent (20%) of the issued and outstanding shares of the Company entitled to vote at the meeting, constitutes a quorum. |

| • | In lieu of Section 312 of the NYSE’s Listed Company Manual, the Company intends to follow the TSX rules for shareholder approval of new issuances of its common shares. The TSX will generally require shareholder approval for an issuance of shares if, in the opinion of the TSX, the transaction (i) materially affects control of the listed issuer or (ii) provides consideration to insiders in aggregate of 10% or greater of the market capitalization of the listed issuer, during any six-month period. Shareholder approval is also required, pursuant to the TSX rules: (i) in the case of private placements (x) for an aggregate number of listed securities issuable greater than 25% of the number of securities of the listed issuer which are outstanding, on a non-diluted basis, prior to the date of closing of the transaction if the price per security is less than the “market price”, as that term is defined in the TSX rules, or (y) that during any six-month period are to insiders for listed securities or options, rights or other entitlements to listed securities greater than 10% of the number of securities of the listed issuer which are outstanding, on a non-diluted basis, prior to the date of the closing of the first private placement to an insider during the six-month period; (ii) for a private placement of convertible securities in which the conversion price is determined on a basis that could result in a conversion price lower than that determined in accordance with the TSX rules; (iii) in those instances where the number of securities issued or issuable in payment of the purchase price for an acquisition exceeds 25% of the number of securities of the listed issuer which are outstanding, on a non-diluted basis; and (iv) in those instances where the number of securities issued or issuable to insiders as a group, together with any securities issued or made issuable to insiders as a group for acquisitions during the preceding six months, in payment of the purchase price for an acquisition exceeds 10% of the number of securities of the listed issuer which are outstanding on a non-diluted basis, prior to the date of closing of the transaction; |

Except as stated above, the Company is in compliance with the rules generally applicable to U.S. domestic companies listed on the NYSE.

UNDERTAKINGS

The Company undertakes to make available, in person or by telephone, representatives to respond to inquiries made by the Commission staff, and to furnish promptly, when requested to do so by the Commission staff, information relating to: the securities registered pursuant to Form 40-F; the securities in relation to which the obligation to file an annual report on Form 40-F arises; or transactions in said securities.

EXHIBITS

The following documents are being filed with the Commission as exhibits to this Form 40-F.

| Exhibit Number |

Description | |

| 99.1 | Annual Information Form for the Registrant for the year ended December 31, 2022 | |

| 99.2 | Audited Consolidated Annual Financial Statements of the Registrant as at and for the years ended December 31, 2022 and December 31, 2021, together with the notes thereto and the auditors’ reports thereon | |

| 99.3 | Management’s Discussion and Analysis of the Registrant for the year ended December 31, 2022 | |

| 99.4 | Certification of Chief Executive Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 | |

| 99.5 | Certification of Chief Financial Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 | |

| 99.6 | Certification of the Chief Executive Officer pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the United States Sarbanes Oxley Act of 2002 | |

| 99.7 | Certification of the Chief Financial Officer pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the United States Sarbanes Oxley Act of 2002 | |

| 99.8 | Consent of KPMG LLP | |

| 101 | Interactive Data File (formatted in Inline XBRL) | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRLs) | |

SIGNATURES

Pursuant to the requirements of the Exchange Act, the Registrant certificates that it meets all of the requirements for filing on Form 40-F and has duly caused this Annual Report to be signed on its behalf by the undersigned, thereunto duly authorized.

| TFI International Inc. | ||

| By: | /s/ Alain Bédard | |

| Name: Alain Bédard | ||

| Title: Chairman of the Board, President and Chief Executive Officer | ||

Date: February 23, 2023

Exhibit 99.1

ANNUAL INFORMATION FORM

FOR THE FISCAL YEAR ENDED

DECEMBER 31, 2022

February 23, 2023

TABLE OF CONTENTS

FORWARD-LOOKING STATEMENTS……………………………………………………….... |

3 |

ORGANIZATIONAL STRUCTURE…………………...……………………………………….... |

4 |

GENERAL DEVELOPMENT OF THE BUSINESS……………………………………………. |

6 |

Strategic Acquisitions & Dispositions…………...…………………………........ |

9 |

DESCRIPTION OF THE BUSINESS……………………………………………………………. |

9 |

Trends………………………………………………………………………………………………….. |

9 |

Equipment……………………………………………………………………………………. |

10 |

Licenses………………………………………………………………………………………. |

10 |

Markets And Distribution……………………………………………………………... |

10 |

Seasonality Of Operations…………………………………………………………... |

11 |

Revenues ………………………..…………………………………………………………… |

11 |

Competition…………………………………………………………………………………. |

11 |

Human Resources………………………………………………………………………… |

11 |

Environmental Matters……………………………………………………………….. |

12 |

Trademarks…………………………………………………………………………………. |

13 |

RISK FACTORS…………………………………………………………………………………... |

13 |

DIVIDENDS………………………………………………………………………………………... |

13 |

DESCRIPTION OF CAPITAL STRUCTURE…………………………………………………… |

14 |

Common Shares……………………………………………………………………………. |

14 |

Preferred Shares………………………………………………………………………… |

14 |

MARKET FOR SECURITIES…………………………………………………………………….. |

14 |

DIRECTORS AND OFFICERS………………………………………………………………….. |

15 |

Conflicts Of Interest…………………………………………………………………... |

19 |

AUDIT COMMITTEE……………………………………………………………………………… |

20 |

LEGAL PROCEEDINGS AND REGULATORY ACTIONS…………………………………… |

21 |

INTEREST OF MANAGEMENT AND OTHERS IN MATERIAL TRANSACTIONS………... |

21 |

TRANSFER AGENTS AND REGISTRARS...………………………………………………….. |

22 |

MATERIAL CONTRACTS………………………………………………………………………... |

22 |

NAME AND INTERESTS OF EXPERTS……………………………………………………….. |

22 |

ADDITIONAL INFORMATION…………………………………………………………………… |

22 |

SCHEDULE A: Audit Committee Charter ……………………………………………………… |

23 |

2

Renewal Annual Information Form 2008

TransForce Inc.

Forward-looking statements

TFI International Inc. (the “Corporation”) may make statements in this annual information form that reflect its current expectations regarding future results of operations, performance, and achievements. They are based on information currently available to management. Words such as “may”, “could”, “should”, “would”, “believe”, “expect”, “anticipate”, “intend” and words and expressions of similar import are intended to identify these forward-looking statements. Such forward-looking statements are subject to certain risks, and uncertainties that could cause actual results, performance or achievements to differ materially from historical results, and those presently anticipated or projected.

The Corporation cautions readers not to place undue reliance on any forward-looking statements, which reference only the date as of which they are made. The following important factors could cause the Corporation’s actual financial performance to differ materially from that expressed in any forward-looking statement:

The foregoing list should not be construed as exhaustive, and readers should also refer to the section entitled “Risk Factors” in this annual information form and in the Corporation’s annual Management Discussion & Analysis (“MD&A”) for the fiscal year ended December 31, 2022, under the heading “Risk and Uncertainties”, for additional information on risk factors and other events that are not within the Corporation’s control. The Corporation’s future financial and operating results may fluctuate as a result of these and other risk factors.

Annual Information Form 2022

TFI International Inc.

3

Although forward-looking statements are generally based upon what the Corporation believes to be reasonable assumptions, they may prove to be inaccurate and many of them involve factors which are beyond the Corporation’s control. The Corporation cannot assure readers that actual results will be consistent with these forward-looking statements. These forward-looking statements are made as of the date of this annual information form, and the Corporation does not assume any obligation to update or revise them to reflect new events or circumstances, except as required under applicable securities laws.

ORGANIZATIONAL STRUCTURE

The Corporation was formerly known as TransForce Inc. On December 23, 2016, the Corporation amended its Articles so as to change its corporate name to TFI International Inc.

In this annual information form, the terms “Corporation” and “TFI International” mean TFI International Inc., a corporation incorporated pursuant to the Canada Business Corporations Act, its subsidiaries and, as the case may be, its predecessors.

The Corporation was incorporated on March 28, 2008 for the purpose of acquiring all of the issued and outstanding units of TransForce Income Fund (the “Fund”) and “tracking share units” of TFI Holdings Inc. (now known as TForce Holdings Inc.), an indirect subsidiary of the Fund, pursuant to a plan of arrangement under which the Fund was converted into the Corporation. The Corporation, through its subsidiaries, now operates the transportation business formerly operated under the Fund, and the former unitholders of the Fund continue to own, to the extent they remained shareholders of the Corporation, an economic interest in the business formerly operated by the Fund.

The Fund resulted from the conversion on September 30, 2002 of TransForce Inc. (“TransForce”), a corporation incorporated on April 30, 1985 pursuant to the Companies Act (Québec), into an income trust. Immediately following the conversion, the Fund, through its subsidiaries, continued to operate the transportation business of TransForce, and the former shareholders of TransForce continued to own, to the extent they remained unitholders of the Fund, an economic interest in the business of TransForce.

TransForce was formerly known as 2320-2351 Québec Inc. Its articles were amended on October 9, 1985, October 1, 1986, July 22, 1987, October 19, 1987, March 4, 1988, July 5, 1989 and May 30, 1995, in each case changing its share capital. The articles were also amended on October 1, 1986 to change the corporate name to Groupe Cabano d’Anjou Inc. and on August 7, 1987 to change the corporate name to Cabano Expeditex Inc. On October 19, 1987, Cabano Expeditex Inc. amalgamated with Location Speribel Inc. The articles were subsequently amended on December 4, 1990 to change the corporate name to Groupe Transport Cabano Inc./Cabano Transportation Group Inc., on May 30, 1995 to change the corporate name to Cabano-Kingsway Inc. and on April 23, 1999 to change the corporate name to TransForce Inc.

The Corporation’s head office is at 8801 Trans-Canada Highway, Suite 500, Saint-Laurent, Québec, Canada, H4S 1Z6 and its executive office is at 96 Disco Road, Etobicoke, Ontario, Canada, M9W 0A3.

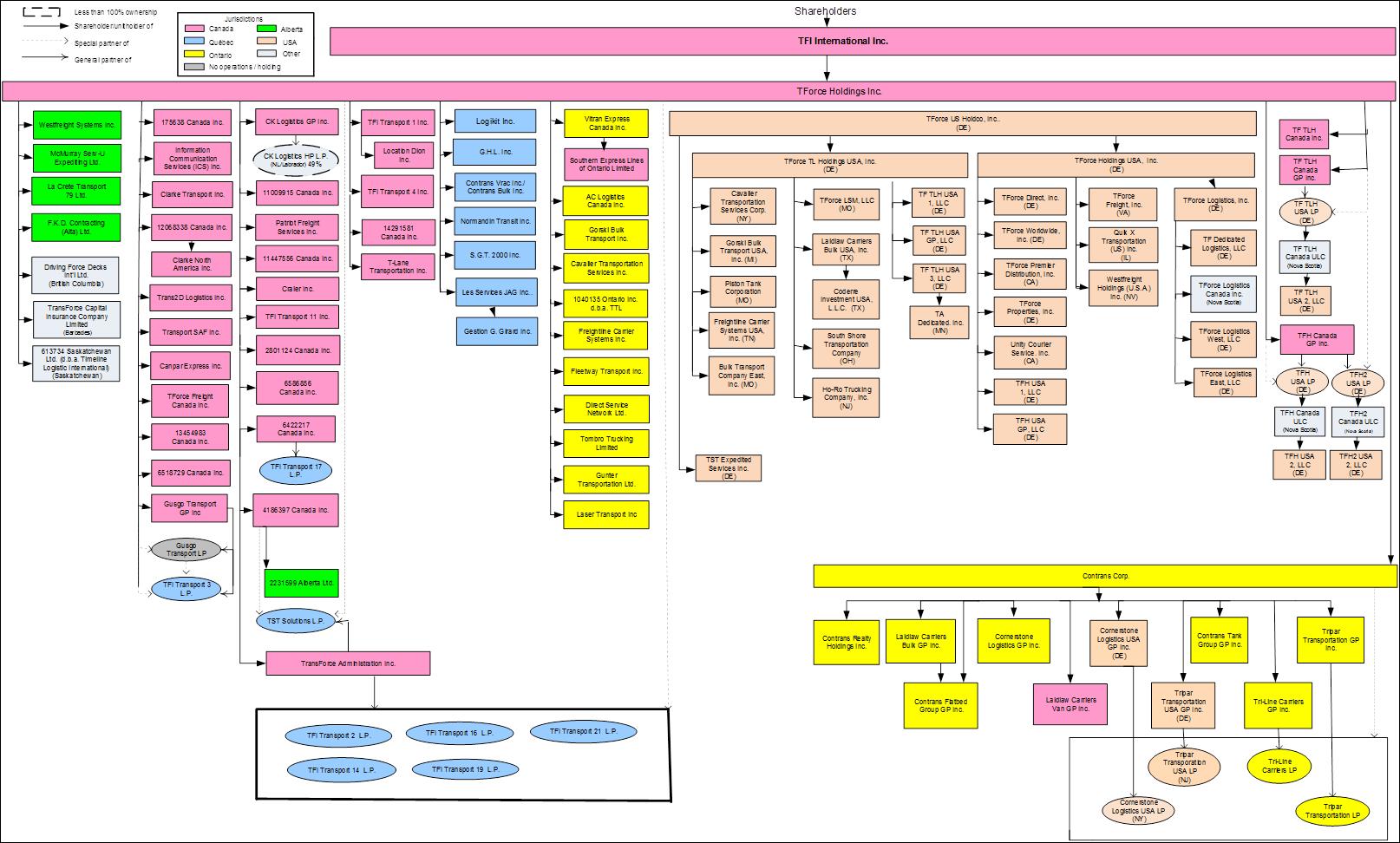

The diagram on the following page sets out the organizational structure of the Corporation as of December 31, 2022 and the jurisdiction of incorporation of each of the entities therein. Unless otherwise indicated, each of the entities is wholly-owned, directly or indirectly, by the Corporation.

Annual Information Form 2022

TFI International Inc.

4

Annual Information Form 2022

TFI International Inc.

5

GENERAL DEVELOPMENT OF THE BUSINESS

The Corporation, through its wholly-owned subsidiaries, operates a transportation business whose origins can be traced back to 1957. In the mid-1990s, after nearly 40 years of operations, the Corporation updated its corporate strategy for the evolving North American transportation market. To this end, in 1996 a new management team led by Mr. Alain Bédard, the Chairman of the Board, President and Chief Executive Officer of the Corporation, was appointed upon the recommendation of the Corporation’s then-principal shareholder.

The new management team identified three key objectives for the Corporation: (i) increase revenues from profitable business segments and customers; (ii) strengthen the Corporation’s position in the North American transportation market; and (iii) achieve a more balanced revenue mix. To achieve these three objectives, the management team implemented a strategic plan aimed at expanding the Corporation’s operations beyond its traditional Less-Than-Truckload (“LTL”) base as well as increasing the Corporation’s geographic footprint, primarily by entering the trans-border market. The Corporation has carried out its strategic plan, in large part by acquiring profitable and well-managed companies offering services throughout North America in segments of the transportation industry not traditionally served by the Corporation, such as Package and Courier, Truckload (“TL”), Waste Management and Logistics. The Corporation’s independent subsidiaries are recognized for their professional expertise. The Corporation continues to carry out this strategy.

As part of the strategic plan, in March 1998, the Corporation entered the trans-border TL business with the acquisition of Entreprises de Transport J.C.G. Inc., which was complemented by the acquisition of Papineau International Transport Inc. in October 1998. The major acquisition of TST Solutions Inc. and its subsidiaries in March 2000 allowed the Corporation to significantly increase its share of the trans-border LTL market and also provided an entry into the specialized transport. A second major acquisition, that of Canpar Transport Ltd. in July 2002, enabled the Corporation to achieve its goal of becoming a full-service transportation provider, by adding Parcel Delivery to its LTL service offering. In 2004, the Corporation made two other major acquisitions: in January 2004, the Corporation completed the acquisition of substantially all of the assets of Canadian Freightways Limited and its associated companies, which increased route density and extended the Corporation’s LTL and TL operations across Canada, particularly in the western provinces and in the United States. Canadian Freightways also offers specialized services in the areas of logistics and fleet management, customs brokerage and bonded warehousing and international freight forwarding; and in October 2004, the Corporation completed the acquisition of 3846113 Canada Inc. (Highland Transport), which strengthened the Corporation’s presence in the TL transportation sector across Canada.

In February 2005, the Corporation acquired Services Matrec Inc. and its subsidiaries. Services Matrec Inc. specialized in the integrated management of industrial, commercial and residential solid-waste collection and treatment, including waste, recyclable materials, yard waste, construction and demolition materials, and hazardous waste. Services Matrec Inc. was a catalyst for the expansion of the Corporation into a new area, that is, waste management services.

In 2006, the Corporation acquired Kos Corp Oilfield Transportation, Hemphill Trucking Inc. and Streeper Contracting Ltd. These acquisitions provided the Corporation with a solid platform in rig-moving activities. Kos, through its well-established position, served as the foundation for this platform and as a catalyst for future growth within the sector. With the acquisition of Hemphill Trucking Inc. in 2006 and the assets of Speedy Heavy Hauling Inc. in 2010, the Corporation’s presence in the United States in this sector grew. The Corporation’s expansion into rig-moving services was consistent with its diversification strategy.

In 2007, the Corporation acquired Location Beaudry, Les Consultants en Personnel Logipro 1997 Inc. and MTC Agence de Personnel Inc., introducing a new niche in the Logistics and Other Services sector, namely the leasing of equipment as well as personnel placement services.

Annual Information Form 2022

TFI International Inc.

6

In 2009, the acquisition of ATS Andlauer Retail Solutions Division (now known as TForce Integrated Solutions) introduced new services to complement the Corporation’s package and courier sector, by offering customized freight transportation solutions adapted specifically for regional and national retail and supply chain customers.

In 2011, the Corporation acquired Dynamex Inc. (now known as TForce Logistics), adding same-day delivery service to existing customers. Furthermore, the combination of the Corporation’s existing operations and TForce Logistics constituted a powerful offering to potential new clients. More importantly, incorporating TForce Logistics’ services opened doors for the Corporation in the U.S. market.

Also in 2011, the Corporation acquired selected assets of DHL Express (Canada) Ltd (“DHL”), now known as Loomis Express, and concluded a strategic alliance with DHL to offer fully integrated international and domestic shipping services, which enables the Corporation, through DHL, to offer international coverage to its customers.

The acquisition of QuikX Transportation in January 2012, followed by the acquisition of Clarke Transport Inc. and Clarke Road Transport in January 2014 and Vitran Corporation Inc. in March 2014, further enhanced the Corporation’s LTL intermodal (over-the-rail) transportation services in Canada.

In 2013 and early 2014, the Corporation ceased its rig-moving activities in Western Canada and disposed of its personnel placement services.

In 2014, the Corporation acquired Transport America, Inc., an important provider of TL transportation and logistics services. This acquisition provided the Corporation with a new presence in the United States TL market.

At the end of 2014, the Corporation also acquired all the shares of Contrans Group Inc., an important player in Specialized TL in Canada.

During 2015, the Corporation ceased its rig-moving activities in the United States.

In February 2016, after 11 years of operations, the Corporation disposed of its Waste Management segment, acquired in 2005.

In October 2016, through the acquisition of Transportation Resources Inc. and its subsidiaries, the Corporation acquired the North American TL operations of XPO Logistics Inc. (now known as CFI), one of the largest service providers of cross-border trucking into Mexico. This acquisition significantly strengthened the Corporation’s presence in the North American TL landscape with prominent market positions in domestic U.S. and cross-border Mexico freight.

On February 13, 2020, the Corporation’s common shares (the “Common Shares”) commenced trading on the New York Stock Exchange in conjunction with the Corporation’s marketed offering of Common Shares in the United States and Canada, representing the Corporation’s initial public offering in the United States. The Corporation issued a total of 6,900,000 Common Shares, including 900,000 Common Shares following the exercise in full by the underwriters of their over-allotment option, at a price of US$33.35 per share, the equivalent of CA$44.20 per share based on the Bank of Canada exchange rate at the time of pricing, for gross proceeds to the Corporation of US$230,115,000 (approximately CA$305 million). The public offering was conducted through a syndicate of underwriters led by Morgan Stanley, BofA Securities, J.P. Morgan and Credit Suisse as joint lead book-running managers, with RBC Capital Markets and UBS Investment Bank as joint-bookrunners and Cowen, National Bank of Canada Financial, Stephens Inc., Stifel and Wolfe Capital Markets and Advisory as co-managers.

On August 17, 2020, the Corporation completed a second marketed offering of Common Shares in the United States and Canada in which it issued a total of 5,060,000 Common Shares, including 660,000 Common Shares following the

Annual Information Form 2022

TFI International Inc.

7

exercise in full by the underwriters of their over-allotment option, at a price of US$43.25 per share, the equivalent of CA$57.32 per share based on the Bank of Canada exchange rate at the time of pricing, for gross proceeds to the Corporation of US$218,845,000 (approximately CA$290 million). The public offering was conducted through a syndicate of underwriters led by Morgan Stanley, BofA Securities, Credit Suisse, Goldman Sachs & Co. LLC and J.P. Morgan, as joint lead book-running managers, with RBC Capital Markets and UBS Investment Bank as joint-bookrunners and Cowen, National Bank of Canada Financial Inc., Stephens Inc., Stifel and Wolfe Capital Markets and Advisory as co-managers.

In November 2020, the Corporation purchased DLS Worldwide, a division of RR Donnelley & Son Company and now operating in the Corporation’s logistics segment in the United States under the name TForce Worldwide. This acquisition opened the doors to the US LTL market through the logistics services offered by the division.

On April 30, 2021, the Corporation purchased UPS Ground Freight, Inc. (now TForce Freight, Inc.), the LTL and dedicated TL divisions of United Parcel Service, Inc. (NYSE: UPS) with US$3 billion in revenues in the United States. As a result of this transaction, the LTL networks in the United States and Canada were combined to provide extensive North American coverage, accelerating industrial and e-commerce growth opportunities. This acquisition contributed to a major change in the Corporation’s geographic revenue allocation derived from the United States and Canada.

In August 2022, the Corporation disposed of Transportation Resources, Inc., the parent company of CFI’s Truckload, Temp Control and Mexican Logistics Businesses (the “CFI Business”). The CFI Business operated primarily in the US-based Conventional TL operating segment of TFI’s Truckload segment and provided comprehensive truckload service offerings, including time definite dry-van truckload, long-haul and short-haul freight transportation, reefer transportation and Mexico-based non-asset logistics services. The disposition of the CFI Business resulted in the exiting of TFI from the Mexican market.

Since 1996, the Corporation has acquired more than 200 companies as part of its strategic plan. Among the criteria applied by the Corporation to the acquisition of companies is that such companies be profitable and led by experienced and competent management teams. Once acquired by the Corporation, many of the newly-acquired companies continue to operate as wholly-owned subsidiaries under their original names and management teams. The Corporation continues to carry out this strategy.

As a result of the implementation of its strategic plan, the Corporation is today a leading player in the North American transportation and logistics industry, with total revenue of US$8,8 billion for the fiscal year ended December 31, 2022. The Corporation has a solid financial position with customers covering a broad cross-section of industries. It has 25,836 employees who work in TFI International’s different business segments across Canada and the United States. The Corporation offers its clients transportation solutions that are firmly supported by the specialization of its subsidiaries and the competence of its management and employees in their areas of expertise. More than 25 years after the strategic plan was implemented, the Corporation now operates the following reportable segments: (i) Package and Courier; (ii) LTL; (iii) TL; and (iv) Logistics.

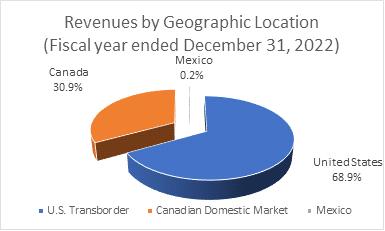

As a result of the strategic plan, the Corporation has been able to benefit from and expand its geographic market, as illustrated in the following chart which sets out the geographic breakdown, based on the origin of the service’s location, of the Corporation’s consolidated revenues for the fiscal year ended December 31, 2022:

Annual Information Form 2022

TFI International Inc.

8

Strategic Acquisitions & Dispositions

Acquisitions

During the fiscal year ended December 31, 2022, the Corporation did not make any significant acquisitions nor dispositions.

During the fiscal year ended December 31, 2022, the Corporation made the following non-significant acquisitions:

Name |

Date |

Operating Segment |

Unity Courier Service, Inc. |

March 19 |

Logistics |

South Shore Transportation |

May 27 |

TL |

Premium Ventures Inc |

June 10 |

TL |

Cedar Creek Express LLC & DDW Transportation, LLC |

June 17 |

TL |

Transport St-Amour |

July 3 |

TL |

Ho-Ro Trucking Company |

July 10 |

TL |

Transport St-Michel Inc. |

August 28 |

TL |

Transport Boutin Inc. |

September 13 |

TL |

LLL Holdings Inc. (Girton) |

September 30 |

TL |

Quévrac Ltée |

October 2 |

TL |

T-Lane Transportation Inc. |

November 20 |

TL |

Dispositions

During the fiscal year ended December 31, 2022, the Corporation made the following non-significant disposition:

Name |

Date |

Operating Segment |

Transportation Resources, Inc. (including CFI’s Truckload, Temp Control and Mexican Logistics Businesses). |

August 31 |

TL |

Annual Information Form 2022

TFI International Inc.

9

DESCRIPTION OF THE BUSINESS

The Corporation is a leading player in the transportation and logistics industry. The Corporation believes that, through its operating subsidiaries, it directly services more urban centres than any other carrier in Canada. The Corporation offers its clients transportation solutions that are firmly supported by the specialization of its wholly-owned subsidiaries and the competence of its management and employees in their areas of expertise. The Corporation’s scope extends to all of the United States and Canada. The Corporation offers efficient, global solutions to its clientele in the following reportable segments: (i) Package and Courier; (ii) LTL; (iii) TL; and (iv) Logistics. Through internal growth and acquisitions, the Corporation has significantly increased its geographic scope.

The Package and Courier segment offers pickup, transport and delivery of items across Canada and the United States. The LTL segment provides pickup, consolidation, transport and delivery of smaller loads. The TL segment provides full loads carried directly from the customer to the destination using a closed van or specialized equipment to meet customers’ specific needs. The TL segment includes expedited transportation, flatbed, tank container and dedicated services as well as TL brokerage. The Logistics segment provides a wide range of asset-light logistics services, including brokerage, freight forwarding and transportation management, as well as small parcel delivery.

Trends

Demand for freight transport is closely linked to the state of the overall economy. Consequently, a change in general economic conditions could impact the Corporation’s performance. However, the Corporation’s extensive customer base, broad geographic dispersion and participation in four distinct segments are intended to help mitigate the effects of any economic downturn.

Equipment

The Corporation believes it has the largest trucking fleet in Canada and a significant presence in the United States. As at December 31, 2022, the Corporation had 11,442. tractors, 38,091 trailers and 6,905 independent contractors. This compares to 13,384 tractors, 50,091 trailers and 7,524 independent contractors as at December 31, 2021.

Licenses

In Canada, passenger and merchandise road transport licenses are issued by provincial authorities. With respect to interprovincial transport, provincial authorities are delegated the right to issue licenses according to the Canada Transportation Act. Provincial authorities exercise control over the issuance, modification and transfer of licenses and govern in a general manner various aspects of license-holders’ activities. In the United States, the Department of Transportation exercises similar authority. The operating subsidiaries of the Corporation have all the necessary licenses to operate in Canada and the United States, as applicable.

Markets and Distribution

The Corporation has a diverse base of clients operating across a broad cross-section of industries. Due to the breadth of its client base, a downturn in the activities of individual customers or in a particular industry is not expected to have a material adverse effect on the Corporation’s operations. In the last several years, the Corporation concluded strategic alliances with other transport companies in North America, in order to offer its customers a network extending across Canada and the United States.

Annual Information Form 2022

TFI International Inc.

10

Seasonality of Operations

The activities conducted by the Corporation are subject to general demand for freight transportation. Historically, demand has been relatively stable with the first quarter being generally the weakest in terms of demand. Furthermore, during the harsh winter months, fuel consumption and maintenance costs tend to rise.

Revenues

(in percentages)

During the fiscal years ended December 31, 2022 and 2021, the Corporation’s revenues by reportable segment were as follows:

Fiscal year ended December 31, | ||

|

2022(1) |

2021(1) |

Package and Courier |

7% |

9% |

Less-Than-Truckload (LTL) |

45% |

39% |

Truckload (TL) |

28% |

30% |

Logistics |

20% |

23%

|

Competition

The transportation and logistics industry is fragmented and consists of relatively few large companies and many small companies serving target markets. The target markets are defined by geographical location, point-to-point service location, target customer industries and the type of service provided, such as Package and Courier, LTL, TL and Logistics. The smaller operators typically operate in a highly-specialized yet competitive environment in which the customer may have several alternative carriers available. Many of the large carriers are independent subsidiaries of larger transportation companies and offer a wide variety of freight services on a national basis.

Carriers compete primarily on price and on their ability to provide reliable, efficient and safe transportation services. The Corporation’s main competitors are: in the Package and Courier sector, Purolator, UPS and Fedex; in the LTL sector, Old Dominion, SAIA, Arcbest, Yellow and XPO (in the United States), Mullen and Manitoulin Transport Inc. (in Canada); in the TL sector, Trimac Transportation, Challenger Motor Freight, and Bison Transport (in Canada) and Knight-Swift Transportation Holdings Inc., Werner Enterprise, Inc. Schneider National, Inc. and Heniff Transportation Systems (in the United States); and in the Logistics sector C.H. Robinson Worldwide, Inc., Lasership, OnTrac Shipping and Echo Global Logistics.

In addition, the Corporation and other trucking operations must compete with other modes of transportation such as rail, airfreight and maritime transportation. These modes of transportation play an important role in the areas served by the Corporation.

Human Resources

As at December 31, 2022, the Corporation has 25,836 employees who work in TFI International’s different business segments across Canada and the United States. This compares to 29,539 employees as at December 31, 2021. The Corporation considers that it has a relatively low turnover rate (except in U.S. TL) among its employees and that employee relations are very good for its industry. A number of these employees are subject to collective agreements. The Corporation ensures that a number of programs for driver training and client service are maintained. In conjunction with the continuous investments in new technologies, such as the use of on-board computers, the Corporation has extended its employee training programs to maximize the use of such technological tools. These initiatives are

Annual Information Form 2022

TFI International Inc.

11

designed to ensure the quality of services provided to the Corporation’s clientele while enabling it to better control its labour costs. The Corporation also works to ensure the successful integration and training of the employees of any newly-acquired businesses, as applicable.

Environmental Matters

The operations and properties of the Corporation are subject to environmental laws and requirements in both Canada and the United States relating to, among other things, air emissions and the management of contaminants.

The Corporation has adopted sustainable measures to reduce energy waste in its day-to-day operations, such as investing in new technology to reduce the consumption of fuel by its trucks and converting a portion of its fleet to propane. Also, some of the Corporation’s most recent buildings were built with the LEED certification for their high energy efficiency and their design, which together reduce the consumption of energy and therefore, operating costs.

A risk of environmental liabilities is inherent in transportation operations, the historic activities associated with such operations, as well as the ownership, management and control of real estate.

The cargo carried by the Corporation in its freight-transportation operations can be classified as either non-regulated freight or regulated freight such as hazardous materials and environmentally-regulated waste. Strict parameters must be met before the Corporation and the individual drivers are permitted to transport regulated freight. This involves specific insurance requirements, training programs and registration permits with the various provinces and states in which the Corporation operates.

A number of the Corporation’s terminals provide full maintenance service and fuel facilities. Each terminal has a series of operational systems that have been implemented to control environmental impact relating to its specific operation.

In 2021, the Corporation appointed a Vice-President, Environment, whose duties include the following:

In 2022, the environmental department of TFI International did the following, among other things:

For 2022, the environmental management by the Corporation did not require significant expenditures to ensure compliance of its ongoing operations or for material remediation of any environmental matter. The Corporation does

Annual Information Form 2022

TFI International Inc.

12

not expect that environmental protection requirements will have a material effect on its capital expenditures, profit or loss or competitive position during the 2023 fiscal year.

Trademarks

The Corporation had a total of 113 applied-for or registered trademarks in Canada and the United States as at December 31, 2022, of which 83 are for use in Canada and 30 are for use in the United States. Of the foregoing trademarks, the most important are: (i) “TFI International”, “TransForce” and “a TransForce Company” in Canada and “a TFI International Company” in Canada and the United States; (ii) “Kingsway” in Canada; (iii) “TST” family of trademarks in Canada; (iv) “Quik X” family of trademarks in Canada and the United States; (v) “ICS Courier” in Canada; (vi) “Canpar” family of trademarks, including “Canpar Courier”, in Canada; (vii) “TForce” family of trademarks in Canada and the United States, including “TForce Freight”; (viii) “Loomis Express” in Canada; (ix) “TF Dedicated” in the United States; (x) “Vitran” family of trademarks in Canada and the United States, including “Vitran Express”; (xi) “Contrans” in Canada; and (xii) “Canadian Freightways” family of trademarks in Canada. In addition, the Corporation uses a number of unregistered trademarks. The Corporation re-evaluates its intellectual property portfolio on a regular basis and, in this regard, may deem it advisable to register additional trademarks in the future.

risk factors

The Corporation’s future results may be affected by a number of uncertainties and risk factors, over many of which the Corporation has little or no control. These uncertainties and risk factors, among others, are discussed in the Corporation’s annual MD&A for the fiscal year ended December 31, 2022, specifically under the heading “Risks and Uncertainties”, which section is incorporated by reference herein. These uncertainties and risk factors should be considered in evaluating the Corporation’s business and growth outlook. The Corporation’s annual MD&A for the fiscal year ended December 31, 2022 is available under the Corporation’s profile on SEDAR at www.sedar.com and on EDGAR at www.sec.gov.

dividends

The Corporation cannot declare or pay a dividend if it is in default, or if the payment of a dividend would cause the Corporation to be in default, under its current credit facilities.

The Corporation’s dividend policy consists of distributing 15% to 30% of its annualized free cash flow from continuing operations every year as dividends to shareholders on a quarterly basis. The Board of Directors has determined that this level of distribution will allow the Corporation to maintain sufficient financial resources and flexibility to execute its operating and disciplined acquisition strategies, while providing an adequate return on shareholders’ capital. The Board of Directors may also, at its discretion and at any time, change the amount of dividends distributed and/or elect not to distribute a dividend, whether as a result of a one-time decision or a change in the dividend policy.

The dividend is payable quarterly on the 15th day following the end of each quarter to shareholders of record as of the last trading day of such quarter. The following dividends (per common share) were declared for the 2022, 2021 and 2020 fiscal years:

Annual Information Form 2022

TFI International Inc.

13

|

|

Fiscal year ended December 31, | ||

|

|

2022 |

2021 |

2020 |

|

|

In USD(1) |

In USD(1) |

In USD(1) |

First Quarter |

|

$0.27 |

$0.23 |

$0.19 |

Second Quarter |

|

$0.27 |

$0.23 |

$0.19 |

Third Quarter |

|

$0.27 |

$0.23 |

$0.20 |

Fourth Quarter |

|

$0.35 |

$0.27 |

$0.23 |

(1)

Beginning with the first quarter of

2021, dividends are declared and paid in USD. All amounts shown in the table above are in USD. The amounts of the dividends declared and paid in 2020 were converted from CAD to USD as at the dates on which the respective dividends were announced

based on the applicable Bank of Canada exchange rate.

| ||||

Description of capital structure

The Corporation is authorized to issue an unlimited number of Common Shares and preferred shares, issuable in series. As at December 31, 2022, there were 86,539,559 Common Shares and no preferred shares issued and outstanding.

Common Shares

The Common Shares entitle the holders thereof to one vote per share. The holders of the Common Shares are entitled to receive any dividend declared by the Corporation on the Common Shares. Subject to the rights, privileges, restrictions and conditions attaching to any other class of shares of the Corporation, the holders of the Common Shares are entitled to receive the remaining property of the Corporation upon its dissolution, liquidation or winding-up.

Preferred Shares

The preferred shares may be issued in one or more series, with such rights and conditions as may be determined by resolution of the directors, which shall determine the designation, rights, privileges, conditions and restrictions to be attached to the preferred shares of such series. There are no voting rights attached to the preferred shares except as prescribed by law. In the event of the liquidation, dissolution or winding-up of the Corporation, or any other distribution of assets of the Corporation among its shareholders, the holders of the preferred shares of each series are entitled to receive, in priority over the Common Shares and any other shares ranking junior to the preferred shares of the Corporation, an amount equal to the redemption price for such shares plus an amount equal to any dividends declared thereon but unpaid and no more. The preferred shares of each series are also entitled to such other preferences over the Common Shares and any other shares ranking junior to the preferred shares as may be determined as to their respective series authorized to be issued. The preferred shares of each series shall be on a parity basis with the preferred shares of every other series with respect to payment of dividends and return of capital. There are no preferred shares currently issued and outstanding.

MARKET FOR SECURITIES

The Common Shares are listed on the Toronto Stock Exchange and on the New York Stock Exchange under the symbol “TFII”. The Common Shares are included in the S&P/TSX Equity, Capped Equity, Equity Completion and Equity SmallCap Indices.

Annual Information Form 2022

TFI International Inc.

14

The table below sets out the price ranges and total volume of Common Shares traded on the Toronto Stock Exchange on a monthly basis during the fiscal year ended December 31, 2022.

Month |

|

High |

|

Low |

|

Volume |

January |

CAD |

142.00 |

CAD |

114.62 |

# |

11,075,482 |

February |

|

140.36 |

|

121.86 |

|

8,750,765 |

March |

|

140.82 |

|

115.26 |

|

10,744,748 |

April |

|

134.75 |

|

99.47 |

|

14,404,304 |

May |

|

110.49 |

|

96.72 |

|

9,646,925 |

June |

|

108.04 |

|

93.63 |

|

8,505,517 |

July |

|

128.24 |

|

101.43 |

|

8,312,100 |

August |

|

140.39 |

|

126.36 |

|

9,437,154 |

September |

|

138.66 |

|

122.04 |

|

7,598,988 |

October |

|

137.21 |

|

117.42 |

|

7,517,498 |

November |

|

146.31 |

|

122.30 |

|

7,396,609 |

December |

|

148.94 |

|

133.66 |

|

4,750,038 |

The table below sets out the price ranges and total volume of Common Shares traded on the New York Stock Exchange on a monthly basis during the fiscal year ended December 31, 2022.

Month |

|

High |

|

Low |

|

Volume |

January |

USD |

112.49 |

USD |

90.57 |

# |

4,543,434 |

February |

|

110.58 |

|

96.12 |

|

5,674,051 |

March |

|

112.25 |

|

89.74 |

|

4,968,591 |

April |

|

107.51 |

|

78.37 |

|

8,013,814 |

May |

|

86.43 |

|

75.37 |

|

5,697,440 |

June |

|

86.23 |

|

71.63 |

|

4,225,540 |

July |

|

100.12 |

|

78.87 |

|

5,028,133 |

August |

|

109.03 |

|

98.04 |

|

6,147,806 |

September |

|

106.71 |

|

89.85 |

|

4,594,709 |

October |

|

100.99 |

|

85.86 |

|

5,642,177 |

November |

|

108.83 |

|

88.82 |

|

6,763,238 |

December |

|

109.81 |

|

98.32 |

|

3,931,949 |

|

|

|

|

|

|

|

DIRECTORS AND OFFICERS

The following table sets out the name, city, province or state and country of residence, position held with the Corporation and principal occupation of each person who is a director of the Corporation as of the date hereof and the year in which the person became a director. Except as otherwise indicated, each person has held his or her principal occupation for the last five years. Each of the directors has been elected to serve until the next annual meeting of shareholders of the Corporation.

Annual Information Form 2022

TFI International Inc.

15

Name, City, Province/State and Country of Residence |

Position with the Corporation |

Principal Occupation |

Principal Occupation within the Preceding Five Years |

First Year |

Leslie Abi-Karam(3) Palm Beach Gardens, Florida, USA

|

Director |

Corporate Director |

— |

2018 |

Alain Bédard, FCPA Lac Brome, Québec, Canada |

Director, |

President and Chief Executive Officer of the Corporation |

— |

1993 |

André Bérard(2)(3)(4) Canada |

Lead Director |

Corporate Director |

— |

2003 |

William T. England(1) Burr Ridge, Illinois, USA |

Director Chairman of the Audit Committee

|

Corporate Director |

— |

2020 |

Diane Giard(1) Shefford, Québec, Canada |

Director |

Corporate Director |

Prior to July 2018, Executive Vice-President, National Bank of Canada |

2018 |

Debra Kelly-Ennis(1) Palm Beach Gardens, Florida, USA |

Director |

Corporate Director |

— |

2017 |

Neil D. Manning(2)(3) Edmonton, Alberta, Canada |

Director |

Corporate Director |

— |

2013 |

John Pratt Kenilworth, Illinois USA |

Director

|

Corporate Director |

— |

2022 |

Annual Information Form 2022

TFI International Inc.

16

Name, City, Province/State and Country of Residence |

Position with the Corporation |

Principal Occupation |

Principal Occupation within the Preceding Five Years |

First Year |

Joey Saputo(2) Canada |

Director Interim Chairman of the Human Resources and Compensation Committee |

President of Arbec Forest Products Inc. and Groupe Hôtelier Grand Chateau Inc.; Chairman of Groupe Remabec (forestry), Bologna FC 1909 and CF Montréal; and board member of Major League Soccer

|

Prior to January 2019, President of CF Montréal and Stade Saputo

|

1996 |

Rosemary Turner(2) Las Vegas, Nevada, USA

|

Director |

Corporate Director |

— |

2020

|

The following table sets out, for each person who is an officer of the Corporation as of the date hereof (with the exception of the Chairman of the Board of Directors, President and Chief Executive Officer included in the table above), his or her name, city, province or state and country of residence and position held with the Corporation. In each case, the principal occupation of the officer is as set out under “Position with the Corporation”. Except as otherwise indicated, each officer has held his or her principal occupation for the last five years.

Name, City, Province/State and Country of Residence |

Position with the Corporation |

Principal Occupation within the preceding five years |

David Saperstein, MBA, BA Palm Beach Gardens, Florida, USA |

Chief Financial Officer |

Prior to January 2019, Vice-President, Mergers and Acquisitions of the Corporation |

Kal Atwal, CPA, CMA Caledon, Ontario, Canada |

Executive Vice-President |

Prior to July 2019, President of TForce Logistics Canada and AC Logistics Canada

|

Steven Brookshaw, CPA, CMA Mount Pleasant, Ontario, Canada |

Senior Executive Vice-President |

Prior to 2023, Executive Vice-President of the Corpoporation and prior to 2018, Vice-President of Flatbed Operations of Contrans Group

|

Kristen Fess Vittoria, Ontario, Canada |

Executive Vice-President |

Prior to 2023, Senior Vice President of Contrans Flatbed Group |

Annual Information Form 2022

TFI International Inc.

17

Name, City, Province/State and Country of Residence |

Position with the Corporation |

Principal Occupation within the preceding five years |

Rick Hashie Streetsville, Ontario, Canada |

Executive Vice-President |

— |

Robert McGonigal Aurora, Ontario, Canada |

Executive Vice-President |

— |

Junior Roy St-Augustin de Desmaures, Québec, Canada

|

Executive Vice-President |

Prior to 2021, President of JCG Group, and prior to 2020, President of Kingsway Bulk |

Christopher Traikos |

Executive Vice-President |

Prior to 2021, President of Vitran Express |

Daniel Auger, ENG, MBA Laval, Québec, Canada |

Chief Information Officer |

Prior to 2022, Vice-President, Information Technology of the Corporation |

Norman Brazeau Ste-Thérèse, Québec, Canada |

Vice-President, Real Estate |

Prior to 2021, Director, Property Management and Vice-President and General Manager of TLS |

Daniel Chevalier, CPA Laval, Québec, Canada |

Vice President, Finance, Operational Reporting |

Prior to January 2019, Director, Finance – Operational Support of the Corporation |

Patrick Croteau, CPA Kirkland, Québec, Canada |

Vice-President, Finance & Control |

Prior to January 2019, Corporate Controller of the Corporation |

Johanne Dean Lac Brome, Québec, Canada |

Vice-President, Marketing & Communications |

— |

Sylvain Desaulniers, CIRC |

Vice-President, Human Resources |

— |

Paul Freund, Austin, Texas, USA |

Vice-President, Information Technology Security |

From April to October 2022, Cybersecurity Consultant for Brinks, Inc., prior to April 2022, Director of Cybersecurity and GRC and acting Global CISO for Wesco Aircraft Hardware Corp. and prior to 2019, Director of Information and acting CISO for North America and Europe for NCInteractive, LLC.

|

Josiane M. Langlois, LL.M. |

Vice-President, Legal Affairs & Corporate Secretary |

— |

Annual Information Form 2022

TFI International Inc.

18

Name, City, Province/State and Country of Residence |

Position with the Corporation |

Principal Occupation within the preceding five years |

Sylvain Lemay, CPA Montreal, Québec, Canada |

Vice-President, Information Technology |

Prior to 2023, Director IT ERP and Architecture |

Chantal Martel, LL.B. |

Vice-President, Insurance & Compliance |

— |

Suri Musiri, MBA, CIA Naperville, Illinois, USA |

Vice-President, Internal Audit |

Prior to 2022, Vice President, Internal Audit at Echo Global Logistics |

Bill Preece Kitchener, Ontario, Canada

|

Vice-President, Environment |

Prior to 2021, Director of Business Development, Regulated Materials of Contrans Group |

Martin Quesnel, CPA |

Vice-President, Finance |

— |

Ken Tourangeau, CPA |

Vice-President, Tax |

Prior to January 2020, Executive Vice President and prior to January 2019, Vice-President, Finance and Control of the Corporation |

As at December 31, 2022, the directors and executive officers of the Corporation, as a group, beneficially owned or otherwise exercised control or direction over, directly or indirectly, an aggregate of 5,103,761 Common Shares, representing approximately 5.9% of the issued and outstanding Common Shares.

To the knowledge of the Corporation, none of the foregoing directors or executive officers of the Corporation (and with respect to (b) and (c) below, none of the shareholders of the Corporation holding a sufficient number of Common Shares to affect materially the control of the Corporation):

Annual Information Form 2022

TFI International Inc.

19

To the knowledge of the Corporation, none of the foregoing directors or executive officers of the Corporation and none of the shareholders of the Corporation holding a sufficient number of Common Shares to affect materially the control of the Corporation, has been subject to:

Conflicts of Interest

To the knowledge of the Corporation, no director or officer of the Corporation or any of its subsidiaries has an existing or potential material conflict of interest with the Corporation or any of its subsidiaries.

Audit committee

Audit Committee Charter

The Audit Committee charter is annexed as Schedule A to this annual information form.

Audit Committee Composition

The Audit Committee is composed of four members, namely William T. England, Chairman, André Bérard (interim member), Debra Kelly-Ennis and Diane Giard. In the opinion of the Board of Directors of the Corporation, each member of the Audit Committee is independent and financially literate within the meaning of National Instrument 52-110 Audit Committees.

Relevant Education and Experience

In the opinion of the Board of Directors of the Corporation, each member of the Audit Committee has a good command of generally accepted accounting principles and has the ability to understand a set of financial statements that present a breadth and level of complexity of accounting issues that are generally comparable to the breadth and complexity of the issues that can reasonably be expected to be raised by the Corporation’s financial statements. This section describes at greater length how these members acquired their financial literacy.

William T. England is a retired partner of PricewaterhouseCoopers (PwC), where he held various executive positions.

André Bérard is a Corporate Director and Lead Director.

Debra Kelly-Ennis is the former President and CEO of Diageo Canada. She held executive leadership positions with General Motors Corporation, Gerber Foods Company, RJR/Nabisco, Inc. and The Coca-Cola Company Foods Division.

Annual Information Form 2022

TFI International Inc.

20

Diane Giard retired as Executive Vice President of the National Bank of Canada in 2018. Before joining the National Bank of Canada, she held different management positions at Scotia Bank.

Pre-approval Policies and Procedures for Non-Audit Services

The Audit Committee has adopted in its charter, a specific policy and procedure for the engagement of non-audit services.

External Auditor Service Fees (by Category)

The aggregate amounts paid or accrued by the Company with respect to fees payable to KPMG LLP, the auditors of

the Company, for audit, audit-related, tax and other services in the years ended December 31, 2022 and 2021 were as follows:

Year ended December 31, | ||||

|

2022 |

2021 | ||

|

In US$(4) | |||

Audit Fees(1) |

$ |

2,683,499 |

$ |

2,997,049 |

Audit-Related Fees(2) |

$ |

382,553 |

$ |

2,817 |

Tax Fees(3) |

$ |

0 |

$ |

39,774 |

All Other Fees |

$ |

0 |

$ |

0 |

TOTAL |

$ |

3,066,052 |

$ |

3,039,640 |

____________________

Currency |

2022 |

2021 |

Euro |

- |

1.4828 |

Mexican peso |

- |

0.06181 |

CAD |

0.7685 |

0.7978 |

LEGAL PROCEEDINGS and Regulatory actions

Management of the Corporation is not aware of any material litigation outstanding, threatened or pending as of the date hereof by or against the Corporation other than in the normal course of business.

During the fiscal year ended December 31, 2022, the Corporation was not subject to:

Annual Information Form 2022

TFI International Inc.

21

INTEREST OF MANAGEMENT AND OTHERS IN MATERIAL TRANSACTIONS

No directors or executive officers of the Corporation, and no person or corporation that is the beneficial owner of, or who exercises control or direction over, directly or indirectly, more than 10% of the Corporation’s shares or any of their respective associates or affiliates, has or has had a material interest, direct or indirect, in any transaction, whether proposed or concluded, which had, or may have, a material effect on the Corporation or its subsidiaries within the three most recently-completed financial years or during the current financial year.

Transfer AgentS and RegistrarS

The transfer agents and registrars for the Common Shares are Computershare Trust Company of Canada at its principal offices in Montreal, Québec and Toronto, Ontario and Computershare Trust Company, N.A. at its principal offices in Canton, Massachusetts.

Material Contracts

No contract, other than contracts entered into in the ordinary course of business, considered material to the Corporation has been entered into during its last fiscal year.

Name and Interests of Experts

KPMG LLP prepared the Independent Auditors' Report with respect to the Corporation's consolidated financial statements for the years ended December 31, 2022 and 2021.

KPMG LLP are the auditors of the Corporation and have confirmed with respect to the Corporation that they are independent within the meaning of the relevant rules and related interpretations prescribed by the relevant professional bodies in Canada and any applicable Canadian legislation or regulations and are independent accountants with respect to the Corporation under all relevant U.S. professional and regulatory standards.

ADDITIONAL INFORMATION

Additional information, including directors’ and officers’ remuneration and indebtedness (if any), principal holders of the Corporation’s securities, options to purchase securities and interests of insiders in material transactions, if applicable, is contained in the Corporation’s Management Proxy Circular in respect of the annual meeting of shareholders held on April 25, 2022.

Additional financial information is provided in the Corporation’s audited consolidated financial statements and management’s discussion and analysis relating thereto for the fiscal year ended December 31, 2022. These documents, as well as additional information relating to the Corporation, including any of the Corporation’s news releases, are also available on SEDAR at www.sedar.com and EDGAR at www.sec.gov.

Annual Information Form 2022

TFI International Inc.

22

Schedule A

Audit Committee Charter

Revised July 2021

PURPOSE

The primary function of the Audit Committee (the “Committee”) of TFI International Inc. (the “Corporation”) is to assist the Board of Directors (the “Board”) in fulfilling its oversight responsibilities by reviewing with its

auditors: (a) the financial reports and other financial information provided by the Corporation to any governmental body or the public, being understood that the financial statements are the responsibility of management and that the

Committee’s role is solely to assist the Board in fulfilling its oversight responsibilities; (b) the Corporation’s systems of internal controls regarding finance and accounting that management and the Board have established; and (c)

the Corporation’s auditing, accounting and financial reporting processes generally.

All of the requirements in this Charter are qualified by the understanding that the role of the Committee is to act in an oversight capacity and is not intended to require a detailed review of the work performed by the external auditors unless specific circumstances are brought to its attention warranting such a review.

The Committee has the authority to conduct any investigation appropriate to fulfilling its responsibilities and it has direct access to the external and internal auditors as well as anyone in the organization. The Committee has the ability to retain, at the Corporation’s expense, specific advisors, consultants or experts it deems necessary in the performance of its duties.

COMPOSITION

The Committee shall be composed of three or more Directors as determined by the Board. All members of the Committee must be independent (must be free of any relationship to the Corporation that may interfere with the exercise of their independence from management and the Corporation) in accordance with subsection 3.1 (3) of Regulation 52-110 concerning audit committees (the “Independence Standards”).

All members of the Committee must be financially literate and shall possess an understanding of financial statements, including balance sheet, income statement and cash flow statement or be able to do so within a reasonable period of time after his or her appointment to the Committee. At least one member of the Committee shall have accounting or related financial management expertise, as the Board, in its business judgment, interprets such qualification.

The members of the Committee shall be appointed by the Board at the annual or any regular meeting of the Board. The members of the Committee shall serve until their successors shall be duly elected and qualified or their earlier resignation or removal. The Chair of the Committee shall be appointed by the Chairman of the Board. If a Chair is not elected by the full Board or is not present at a particular meeting, the members of the Committee may designate a Chair by majority vote of the Committee membership in attendance.

MEETINGS

The Committee shall meet at least four times annually, or more frequently as circumstances dictate. The Committee should meet at least annually with management, the internal and external auditors and as a Committee, in separate executive sessions, to discuss any matters that the Committee or each of these groups believe should be discussed privately. In addition, the Committee, or at least the Chair, should meet with the external auditors and management quarterly, either in person or telephonically, to review the Corporation’s interim financial statements. The Committee Chair shall prepare and/or approve the agenda in advance of each meeting.

Annual Information Form 2022

TFI International Inc.

23

RESPONSIBILITIES AND DUTIES

To fulfill its responsibilities and duties, the Committee shall perform the following:

Documents/Reports Review

The Chair of the Committee may represent the entire Committee for purposes of this review, in case of emergency in the event the Committee is unable to meet.

External Auditors

Annual Information Form 2022

TFI International Inc.

24

Bookkeeping or other services related to the Corporation’s accounting records or financial statements;

Financial information systems design and implementation;

Appraisal or valuation services for financial reporting purposes;

Actuarial services for items recorded in the financial statements;

Internal audit outsourcing services;

Management functions;

Human resources;

Certain corporate finance and other services;

Legal services;

Certain expert services unrelated to the audit.

Internal Audit

Financial Reporting Processes

Annual Information Form 2022

TFI International Inc.

25

Other