Form 10-K/A: 0001837671-22-000029 compared to 0001837671-22-00002200018376712021FYFALSE——00018376712021-01-012021-12-3100018376712021-12-31xbrli:shares00018376712021-06-30iso4217:USD00018376712021-01-3000018376712021-01-302021-12-31iso4217:USDxbrli:shares0001837671cpt:TrustCertificatesMember2021-01-300001837671us-gaap:AdditionalPaidInCapitalMember2021-01-300001837671us-gaap:RetainedEarningsMember2021-01-300001837671us-gaap:RetainedEarningsMember2021-01-312021-12-3100018376712021-01-312021-12-310001837671cpt:TrustCertificatesMember2021-12-310001837671us-gaap:AdditionalPaidInCapitalMember2021-12-310001837671us-gaap:RetainedEarningsMember2021-12-310001837671srt:RetailSiteMember2021-01-30cpt:property0001837671srt:WarehouseMember2021-01-30cpt:lease0001837671srt:RetailSiteMember2021-12-31cpt:stateutr:sqft0001837671us-gaap:SeniorNotesMembercpt:FirstLienNotesMembercpt:OldCopperMember2020-10-28xbrli:pure00018376712021-01-302021-01-300001837671us-gaap:RevolvingCreditFacilityMembercpt:DIPFacilityMember2021-01-300001837671us-gaap:RevolvingCreditFacilityMembercpt:FirstLienNotesMember2021-01-300001837671srt:AffiliatedEntityMember2021-01-312021-12-310001837671us-gaap:BuildingAndBuildingImprovementsMembersrt:MinimumMember2021-01-012021-12-310001837671srt:MaximumMemberus-gaap:BuildingAndBuildingImprovementsMember2021-01-012021-12-310001837671us-gaap:LandImprovementsMembersrt:MinimumMember2021-01-012021-12-310001837671srt:MaximumMemberus-gaap:LandImprovementsMember2021-01-012021-12-31cpt:segment0001837671srt:RetailSiteMembercpt:FeeSimpleMember2021-01-300001837671srt:RetailSiteMembercpt:GroundLeaseholdMember2021-01-300001837671srt:WarehouseMembercpt:FeeSimpleMember2021-01-300001837671us-gaap:AboveMarketLeasesMember2021-12-310001837671us-gaap:LeasesAcquiredInPlaceMember2021-12-3100018376712021-12-312021-12-310001837671us-gaap:LeasesAcquiredInPlaceMember2021-01-312021-12-310001837671us-gaap:AboveMarketLeasesMember2021-01-312021-12-310001837671srt:RetailSiteMember2021-01-312021-12-310001837671srt:WarehouseMember2021-01-312021-12-310001837671cpt:SanDiegoCAMember2021-07-090001837671cpt:SanDiegoCAMember2021-07-092021-07-090001837671cpt:LoneTreeCOMember2021-07-290001837671cpt:LoneTreeCOMember2021-07-292021-07-290001837671cpt:FriscoTXMember2021-07-290001837671cpt:FriscoTXMember2021-07-292021-07-290001837671cpt:SanBrunoCAMember2021-09-140001837671cpt:SanBrunoCAMember2021-09-142021-09-140001837671cpt:CarsonCAMember2021-09-300001837671cpt:CarsonCAMember2021-09-302021-09-300001837671cpt:HoustonTXMember2021-11-030001837671cpt:HoustonTXMember2021-11-032021-11-030001837671cpt:SanAntonioTXMember2021-11-050001837671cpt:SanAntonioTXMember2021-11-052021-11-050001837671cpt:PhoenixAZMember2021-11-170001837671cpt:PhoenixAZMember2021-11-172021-11-170001837671cpt:TexasPortfolioMember2021-11-190001837671cpt:TexasPortfolioMember2021-11-192021-11-190001837671cpt:DistributionCenterPortfolioMember2021-12-170001837671cpt:DistributionCenterPortfolioMember2021-12-172021-12-170001837671cpt:QueensNYMember2021-12-230001837671cpt:QueensNYMember2021-12-232021-12-230001837671cpt:WoodburyMNMember2021-12-290001837671cpt:WoodburyMNMember2021-12-292021-12-290001837671cpt:TexasPortfolioMembersrt:RetailSiteMember2021-01-312021-12-310001837671srt:WarehouseMembercpt:DistributionCenterPortfolioMember2021-01-312021-12-310001837671cpt:SanDiegoCAMember2021-07-082021-07-080001837671us-gaap:SubsequentEventMembercpt:CulverCityCAMember2022-01-062022-01-060001837671us-gaap:SubsequentEventMembercpt:CulverCityCAMember2022-01-060001837671us-gaap:DisposalGroupHeldforsaleNotDiscontinuedOperationsMember2021-12-310001837671us-gaap:AboveMarketLeasesMembercpt:GroundLeaseholdMember2021-01-312021-12-310001837671cpt:GroundLeaseholdMember2021-01-312021-12-310001837671cpt:SanDiegoCAMember2021-07-090001837671cpt:SanDiegoCAMember2021-01-302021-12-310001837671cpt:QueensNYMember2021-12-230001837671cpt:QueensNYMember2021-01-302021-12-310001837671srt:RetailSiteMember2021-01-012021-12-310001837671srt:WarehouseMember2021-12-310001837671srt:WarehouseMember2021-01-012021-12-310001837671us-gaap:SubsequentEventMember2022-01-012022-01-310001837671us-gaap:SubsequentEventMember2022-02-012022-02-280001837671us-gaap:SubsequentEventMember2022-03-012022-03-140001837671cpt:CulverCityCAMember2021-12-310001837671cpt:AlderwoodMallMember2021-12-310001837671cpt:AllianceTownCenterMember2021-12-310001837671cpt:AntelopeValleyMallMember2021-12-310001837671cpt:ArdenFairMallMember2021-12-310001837671cpt:ArrowheadTowneCenterMember2021-12-310001837671cpt:AshlandTownCenterMember2021-12-310001837671cpt:BartonCreekSquareMember2021-12-310001837671cpt:BaybrookMallMember2021-12-310001837671cpt:BellisFairMember2021-12-310001837671cpt:BoiseTowneSquareMember2021-12-310001837671cpt:BreaMallMember2021-12-310001837671cpt:CenterAtOwassoMember2021-12-310001837671cpt:CherryHillMallMember2021-12-310001837671cpt:ChristianaMallMember2021-12-310001837671cpt:ClackamasTownCenterMember2021-12-310001837671cpt:ColumbiaCenterMember2021-12-310001837671cpt:CoolSpringsGalleriaMember2021-12-310001837671cpt:CoralRidgeMallMember2021-12-310001837671cpt:CorbinParkMember2021-12-310001837671cpt:CoronadaCenterMember2021-12-310001837671cpt:CottonwoodMallMember2021-12-310001837671cpt:DadelandMallMember2021-12-310001837671cpt:DanburyFairMember2021-12-310001837671cpt:DeerbrookMallMember2021-12-310001837671cpt:DullesTownCentreMember2021-12-310001837671cpt:ElMercadoPlazaMember2021-12-310001837671cpt:FairOaksMallMember2021-12-310001837671cpt:FairmontCenterMember2021-12-310001837671cpt:FirstMainTownCenterMember2021-12-310001837671cpt:FirstColonyMallMember2021-12-310001837671cpt:FlorenceMallMember2021-12-310001837671cpt:FoxRiverMallMember2021-12-310001837671cpt:FreeholdRacewayMallMember2021-12-310001837671cpt:GalleriaAtSunsetMember2021-12-310001837671cpt:GalleriaAtTylerMember2021-12-310001837671cpt:GatewayShoppingCenterIIIMember2021-12-310001837671cpt:GlendaleGalleriaMember2021-12-310001837671cpt:GoldenTriangleMallMember2021-12-310001837671cpt:GrandTraverseMallMember2021-12-310001837671cpt:HamiltonTownCenterMember2021-12-310001837671cpt:HawthornSCMember2021-12-310001837671cpt:HighPointeCommonsMember2021-12-310001837671cpt:HuntingtonParkCBDMember2021-12-310001837671cpt:ImperialValleyMallMember2021-12-310001837671cpt:KilleenMallMember2021-12-310001837671cpt:LakelineMallMember2021-12-310001837671cpt:LakesideMallMember2021-12-310001837671cpt:MallDelNorteMember2021-12-310001837671cpt:MallOfLouisianaMember2021-12-310001837671cpt:MayaguezMallMember2021-12-310001837671cpt:MeadowoodMallMember2021-12-310001837671cpt:MeadowsMallMember2021-12-310001837671cpt:MiamiInternationalMallMember2021-12-310001837671cpt:MidRiversMallMember2021-12-310001837671cpt:MidlandParkMallMember2021-12-310001837671cpt:MokenaMarketplaceMember2021-12-310001837671cpt:NewBraunfelsTCAtCreeksideMember2021-12-310001837671cpt:NewnanCrossingMember2021-12-310001837671cpt:NewportCentreMember2021-12-310001837671cpt:NorthRiversideParkMallMember2021-12-310001837671cpt:NorthridgeFashionCenterMember2021-12-310001837671cpt:NorthshoreMallMember2021-12-310001837671cpt:OakParkMallMember2021-12-310001837671cpt:OaklandMallMember2021-12-310001837671cpt:OakridgeCourtMember2021-12-310001837671cpt:OrlandSquareMember2021-12-310001837671cpt:PacificViewMallMember2021-12-310001837671cpt:PalmValleyCornerstoneMember2021-12-310001837671cpt:PembrokeLakesMallMember2021-12-310001837671cpt:PeninsulaTownCenterMember2021-12-310001837671cpt:PennSquareMallMember2021-12-310001837671cpt:PheasantLaneMallMember2021-12-310001837671cpt:PierParkMember2021-12-310001837671cpt:PlazaAtWestCovinaMember2021-12-310001837671cpt:PlazaCentroMember2021-12-310001837671cpt:PolarisFashionPlaceMember2021-12-310001837671cpt:PostOakMallMember2021-12-310001837671cpt:PromenadeAtTemeculaMember2021-12-310001837671cpt:RivertownCrossingsMember2021-12-310001837671cpt:RockawayTownsquareMember2021-12-310001837671cpt:RosedaleSCMember2021-12-310001837671cpt:RossParkMallMember2021-12-310001837671cpt:ShacklefordCrossingMember2021-12-310001837671cpt:ShermanTownCenterMember2021-12-310001837671cpt:ShopsAtMooreMember2021-12-310001837671cpt:SolanoTownCenterMember2021-12-310001837671cpt:SouthPointSCMember2021-12-310001837671cpt:SouthavenTowneCenterMember2021-12-310001837671cpt:SouthlandsSCMember2021-12-310001837671cpt:SouthParkCenterMember2021-12-310001837671cpt:SouthparkMallMember2021-12-310001837671cpt:SouthparkMeadowsSCMember2021-12-310001837671cpt:SpringfieldTownCenterMember2021-12-310001837671cpt:StCharlesTowneCenterMember2021-12-310001837671cpt:StatenIslandMallMember2021-12-310001837671cpt:StirlingLafayetteSCMember2021-12-310001837671cpt:StoneCreekTowneCenterMember2021-12-310001837671cpt:StoneridgeSCMember2021-12-310001837671cpt:StonesRiverMallMember2021-12-310001837671cpt:SunriseMallMember2021-12-310001837671cpt:SuperstitionSpringsMallMember2021-12-310001837671cpt:TeasCrossingMember2021-12-310001837671cpt:TheDistrictMember2021-12-310001837671cpt:TheLoopWestMember2021-12-310001837671cpt:TheMallAtBayPlazaMember2021-12-310001837671cpt:TheMallAtRobinsonTCMember2021-12-310001837671cpt:TheMallAtRockinghamParkMember2021-12-310001837671cpt:TheMallAtTurtleCreekMember2021-12-310001837671cpt:TheMallAtTuttleCrossingMember2021-12-310001837671cpt:TheMallAtWellingtonGreenMember2021-12-310001837671cpt:TheMallInColumbiaMember2021-12-310001837671cpt:TheOaksMember2021-12-310001837671cpt:TheOrchardAtSlattenRanchMember2021-12-310001837671cpt:TheParksAtArlingtonMember2021-12-310001837671cpt:ThePlazaAtShoalCreekMember2021-12-310001837671cpt:TheShoppesAtBucklandHillsMember2021-12-310001837671cpt:TheShopsAtFallenTimbersMember2021-12-310001837671cpt:TheShopsAtMontebelloMember2021-12-310001837671cpt:TheShopsAtStoneParkMember2021-12-310001837671cpt:TheStreetsAtSouthpointMember2021-12-310001837671cpt:TheWoodlandsMallMember2021-12-310001837671cpt:TownCenterAtAuroraMember2021-12-310001837671cpt:TwelveOaksMallMember2021-12-310001837671cpt:ValleVistaMallMember2021-12-310001837671cpt:ValleyPlazaMember2021-12-310001837671cpt:VictoriaGardensMember2021-12-310001837671cpt:WatersideMarketplaceMember2021-12-310001837671cpt:WaxahachieTowneCenterCrossingMember2021-12-310001837671cpt:WestGrandPromenadeMember2021-12-310001837671cpt:WestfarmsMallMember2021-12-310001837671cpt:WestfieldAnnapolisMember2021-12-310001837671cpt:WestfieldBrandonMember2021-12-310001837671cpt:WestfieldBrowardMember2021-12-310001837671cpt:WestfieldCountrysideMember2021-12-310001837671cpt:WestfieldGalleriaAtRosevilleMember2021-12-310001837671cpt:WestfieldNorthCountyMember2021-12-310001837671cpt:WestfieldPalmDesertMember2021-12-310001837671cpt:WestfieldPlazaBonitaMember2021-12-310001837671cpt:WestfieldSantaAnitaMember2021-12-310001837671cpt:WestfieldSouthcenterMember2021-12-310001837671cpt:WestminsterMallMember2021-12-310001837671cpt:WestmorelandMallMember2021-12-310001837671cpt:WhiteMarshMallMember2021-12-310001837671cpt:WolfchaseGalleriaMember2021-12-310001837671cpt:WoodbridgeCenterMember2021-12-310001837671cpt:YumaPalmsRegionalCenterMember2021-12-3100018376712020-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

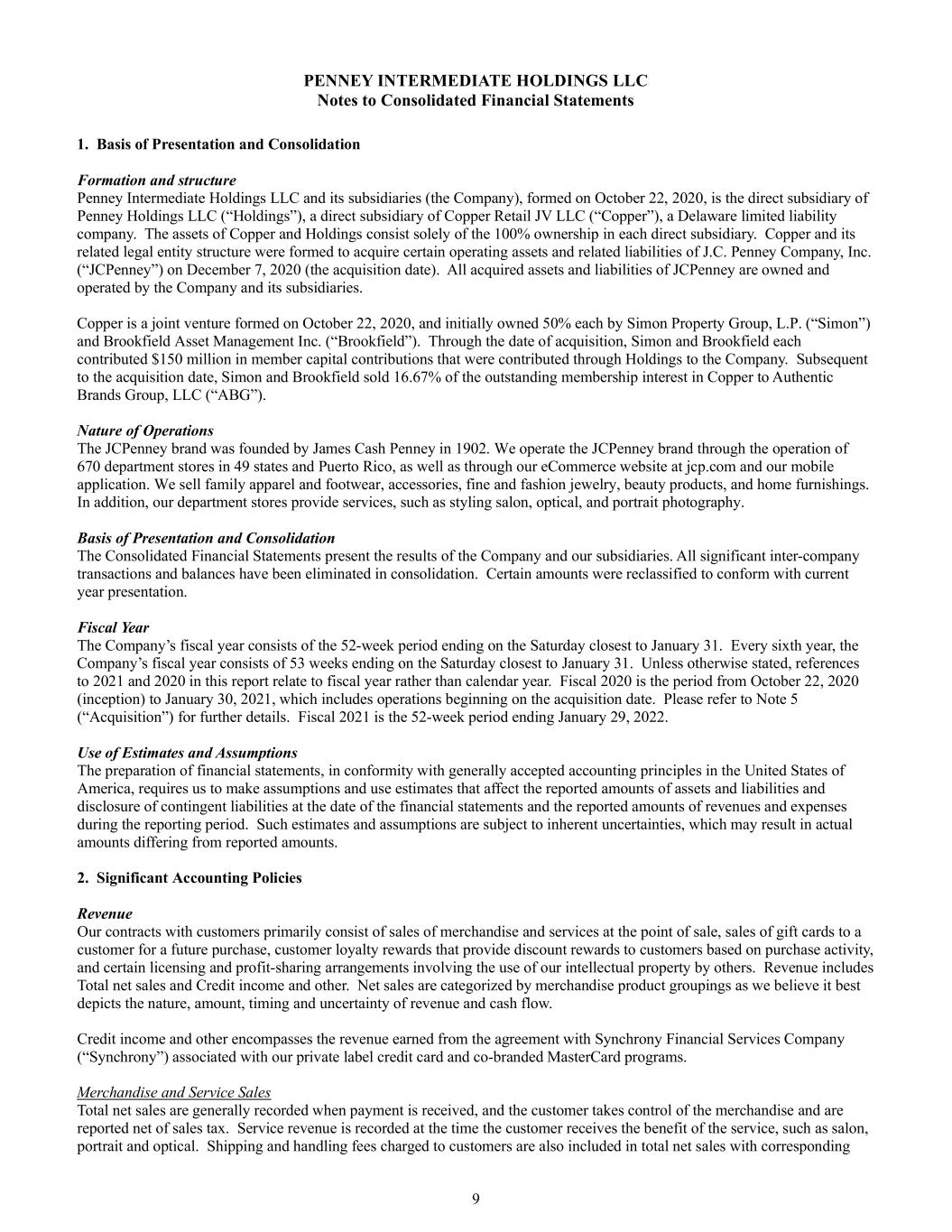

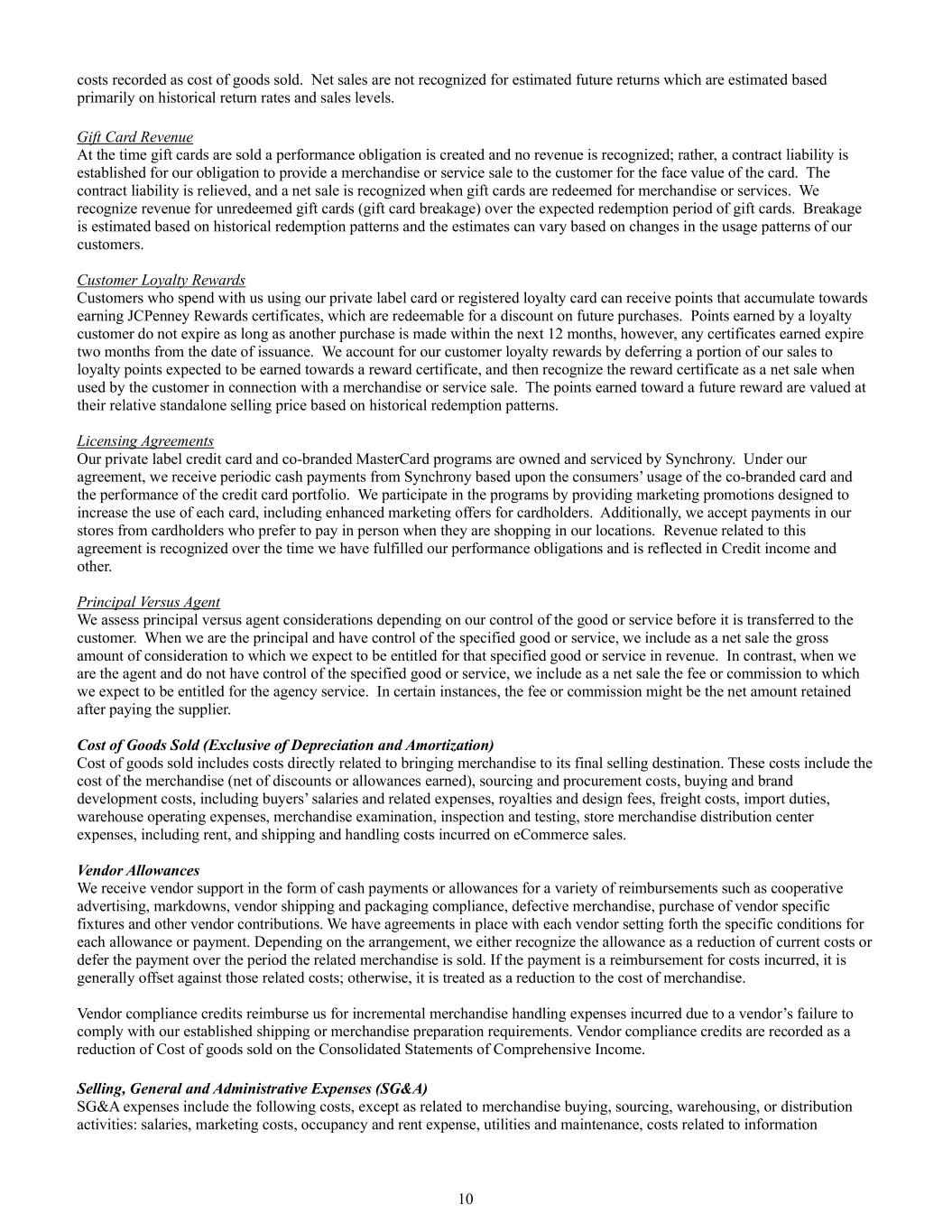

UNITED STATES

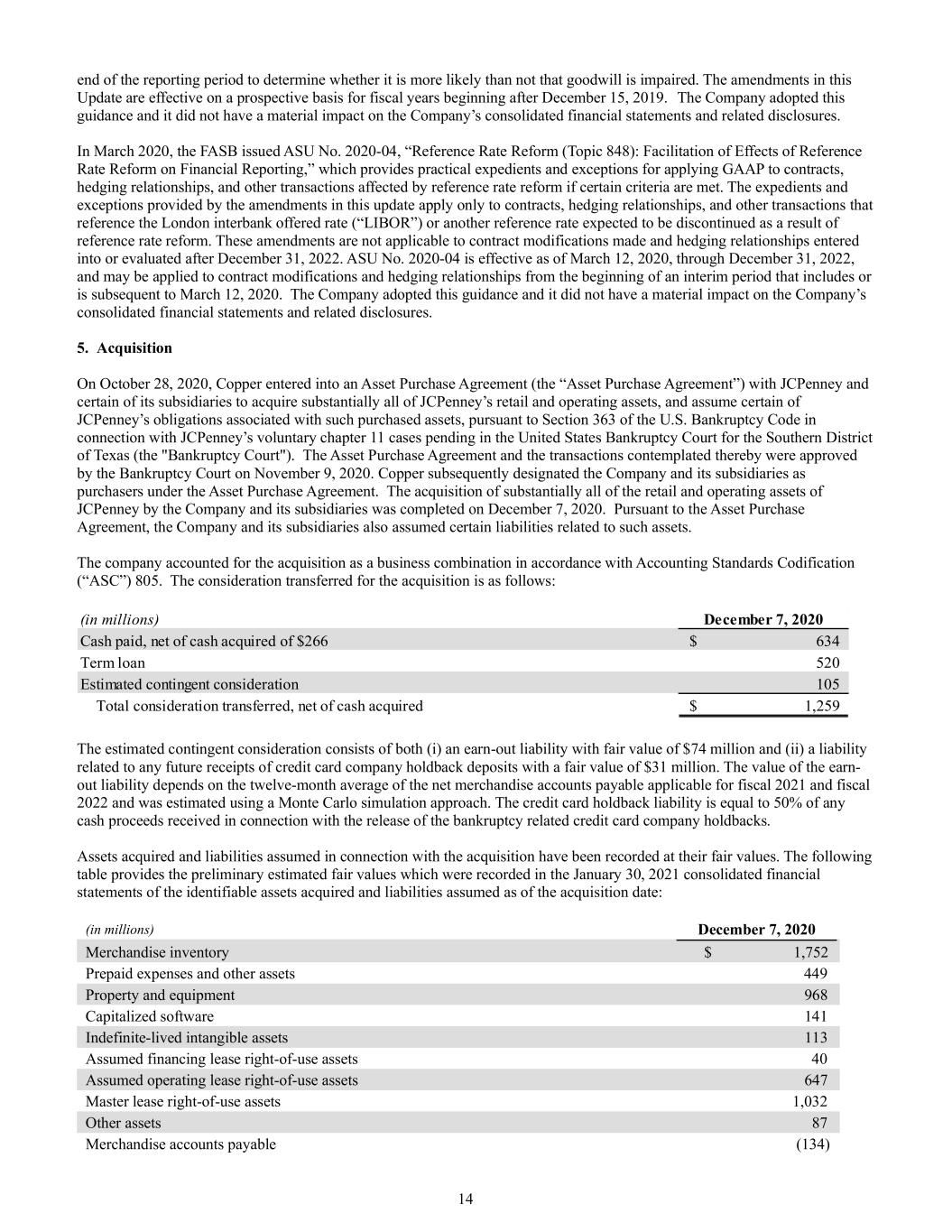

SECURITIES AND EXCHANGE COMMISSION

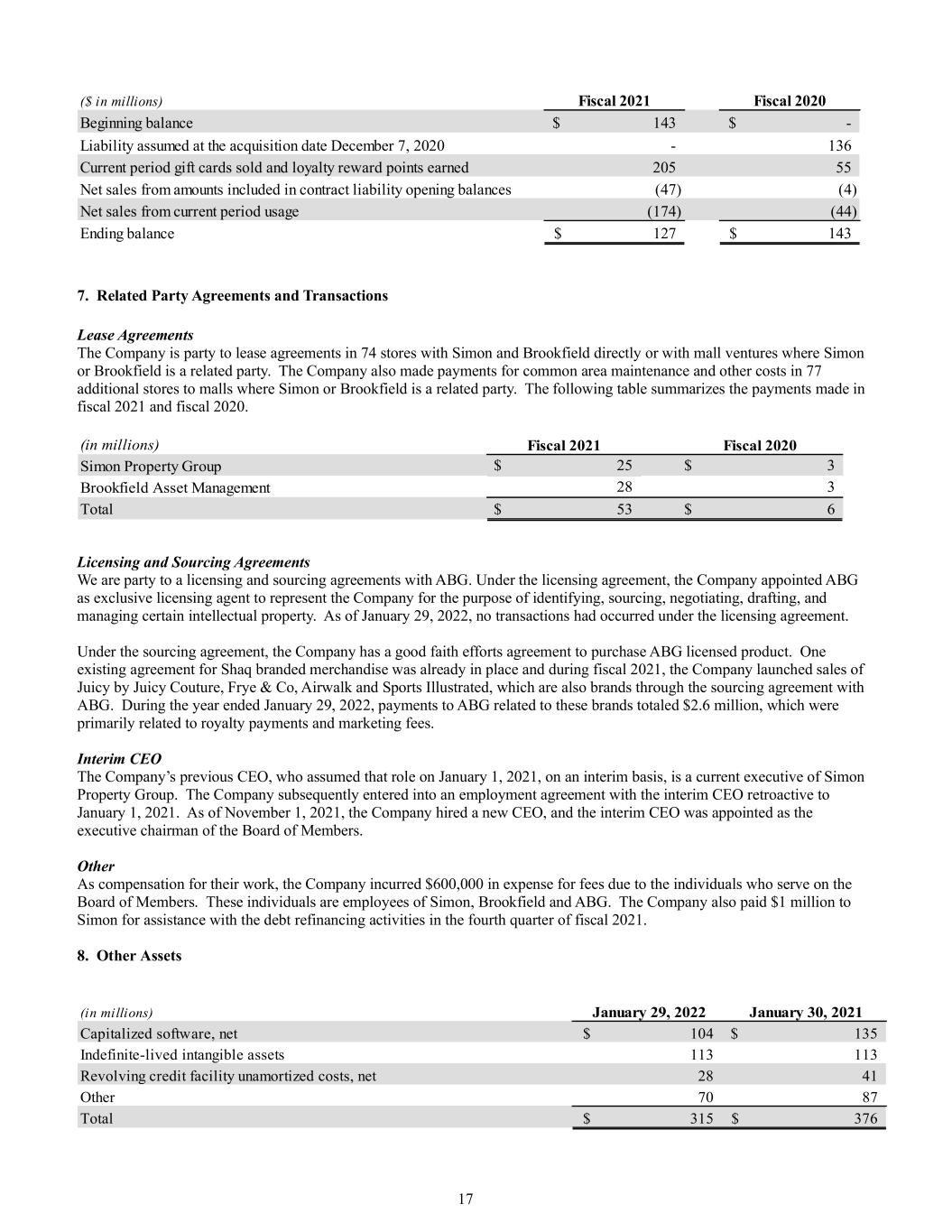

Washington, D.C. 20549

FORM 10-K/A

(Amendment No.1)

| | | | | | | | |

| ☒ | | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the period ended December 31, 2021

or

| | | | | | | | |

| ☐ | | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 000-56236

Copper Property CTL Pass Through Trust

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| New York | | 85-6822811 |

| | |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | |

3 Second Street, Suite 206 Jersey City, NJ 07311-4056 |

|

| (Address of principal executive offices and zip code) |

|

(201) 839-2200 |

|

| (Registrant’s telephone number, including area code) |

Securities registered pursuant to Section 12(g) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| N/A | | N/A | | N/A |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☐ No ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | |

| Large accelerated filer | ☐ | | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | | Smaller reporting company | ☐ |

| | | | Emerging growth company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

DOCUMENTS INCORPORATED BY REFERENCE

None.

Index to Exhibits begins on page 60. 3.

Auditor Firm Id: PCAOB ID 238 Auditor Name: PricewaterhouseCoopers LLP Auditor Location: Chicago, Illinois

COPPER PROPERTY CTL PASS THROUGH TRUST

TABLE OF CONTENTS

PART I

All dollar amounts in this Form 10-K in Items 1. through 7A. are stated in thousands with the exception of per share, per square foot and per unit amounts

ITEM 1. BUSINESSExplanatory Note

General and Operating History

Copper Property CTL Pass Through Trust, a New York common law trust (the “Trust,” “we,” “our” or “us”) was formed on December 12, 2020, in connection with the reorganization of Old Copper Company, Inc. (f/k/a J. C. Penney Company, Inc.) (“Old Copper”), and became effective on January 30, 2021 (the “Effective Date”) pursuant to the terms of the Amended Joint Chapter 11 Plan of Reorganization of Old Copper and certain of its subsidiaries (collectively, the “Debtors”) (the “Plan of Reorganization”).

On the Effective Date, through separate wholly-owned property holding companies (the “PropCos”), we owned 160 retail properties (the “Retail Properties”) and six distribution centers (the “Warehouses” and, together with the Retail Properties, the “Properties”), all of which were leased under two Master Leases to one or more subsidiaries of Copper Retail JV LLC (“OpCo Purchaser”) (collectively with its subsidiaries, “New JCP”), an entity formed by and under the control of a joint venture formed by Simon Property Group, L.P. and Brookfield Asset Management Inc.

During the period from the Effective Date to December 31, 2021, we sold thirteen Retail Properties and the six Warehouses for proceeds of $245,295 and $548,352, respectively. As a result of these sales, we recorded a gain on sales of investment properties of $109,696.

During the period from the Effective Date to December 31, 2021, we paid distributions to Certificateholders of $261,466 with the balance of the net proceeds of sales being distributed in January 2022.

As of December 31, 2021, we owned 147 Retail Properties in the United States across 37 states and Puerto Rico, comprising 19.7 million square feet of leasable space.

Business Objectives and Strategies

Our operations consist primarily of (i) owning the Properties, (ii) operating and leasing the Properties under the terms of the Master Leases to New JCP as the sole tenant and (iii) subject to market conditions and the conditions set forth in the Trust Agreement, selling the Properties to third-party purchasers.

The Amended and Restated Trust Agreement (the “Trust Agreement”) dated as of the Effective Date, created a series of equity trust certificates designated as “Copper Property CTL Pass Through Certificates” (the “Trust Certificates”), 75 million of which were issued on the Effective Date. Each Trust Certificate represents a fractional undivided beneficial interest in the Trust and represents the interests of the holders of the Trust Certificates (“Certificateholders”) in the Trust.

GLAS Trust Company, LLC serves as our independent third-party trustee (the "Trustee") pursuant to the terms of the Trust Agreement. The Trustee performs trust administration duties, including treasury management and certificate administration.

Hilco JCP LLC, an affiliate of Hilco Real Estate LLC, serves as our independent third-party manager (the "Manager") pursuant to the terms of the Management Agreement (the "Management Agreement") dated as of the Effective Date. The Manager performs asset management duties with respect to the Properties, primarily including collection of rents and other charges from New JCP, enforcement of the terms of the Master Leases, arranging for

the sale of the Properties, coordinating with the Trustee in connection with the administration of the Trust, reporting to the Certificateholders, distribution of funds to vendors and Certificateholders, and performing duties necessary to support our day-to-day operations.

Tax Status

We intend to qualify as a liquidating trust within the meaning of United States Treasury Regulation (hereinafter “Treasury Regulation”) Section 301.7701-4(d) or, in the event we are not so treated, a partnership other than a partnership taxable as a corporation under Section 7704 of the Internal Revenue Code of 1986, as amended (the “Code”).

Competition

From a real estate sales perspective, we compete with other retail properties, which could impact our ability to sell the Properties and the sale price that can be achieved for such sales. We compete for buyers based on a number of factors that include location, rental rates and suitability of the property’s design to prospective users’ needs.

We may compete for tenants with other entities advised or sponsored by affiliates of New JCP. Our ability to compete is also impacted by national and local economic trends, availability and cost of capital, maintenance and renovation costs, existing laws and regulations, new legislation and population trends.

Government Regulation

General

Compliance with various governmental regulations has an impact on our business, including on our capital expenditures, earnings and competitive position, which could be material. We monitor and take actions to comply with governmental regulations that are applicable to our business, which include, among others, federal securities laws and regulations, tax laws and regulations, environmental and health and safety laws and regulations, local zoning, usage and other regulations relating to real property, and the Americans with Disabilities Act of 1990 ("ADA"). In addition to the discussion above regarding our tax status and below regarding the ADA and certain environmental matters, see Item 1A. “Risk Factors” for a discussion of material risks to us, including, risks relating to governmental regulations, and see Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations” together with our consolidated financial statements, including the related notes included therein, for a discussion of material information relevant to an assessment of our financial condition and results of operations, including, to the extent material, the effects that compliance with governmental regulations may have on our capital expenditures and earnings.

Americans with Disabilities Act (ADA)

Our properties must comply with Title III of the ADA to the extent that such properties are “public accommodations” as defined by the ADA. The ADA may require removal of structural barriers to allow access by persons with disabilities in certain public areas of our properties where such removal is readily achievable. We believe our existing properties are substantially in compliance with the ADA and that we will not be required to incur significant capital expenditures to address the requirements of the ADA. Refer to Item 1A. “Risk Factors” for more information regarding compliance with the ADA.

Environmental Matters

The Properties are subject to various environmental laws regulating, among other things, air emissions, wastewater discharges and the release of, or exposure to, hazardous materials (including asbestos). Failure to comply could result in material fines and penalties. Certain environmental laws can impose joint and several liability without

regard to fault of responsible parties, including current and former owners and operators of real property, related to contamination. We could be liable with respect to contamination at currently owned properties for contamination that occurred prior to our ownership, at a formerly owned or operated property for contamination caused during our ownership or operation or with respect to a site which our tenant previously sent wastes for disposal. Based on Phase I environmental site assessments prepared in connection with the acquisition of the Properties, we do not believe that environmental liabilities presently known will have a material adverse effect on our financial condition or results of operations. In addition, we carry customary environmental liability insurance coverage. However, we cannot predict the impact of unforeseen environmental liabilities or new or changed laws or regulations on properties in which we hold an interest. The Tenant and the Lease Guarantors have entered into an Environmental Indemnity Agreement, dated as of December 7, 2020, pursuant to which they are required to comply with applicable environmental laws with respect to the Properties from and after the effective date of the Master Leases and to indemnify us if their noncompliance results in losses or claims against us. Refer to Item 1A. “Risk Factors” for more information regarding environmental matters.

Human Capital Resources

We do not have any employees. We are externally managed by the Manager pursuant to the Management Agreement. Our principal executive officers are employed by an affiliate of the Manager.

Insurance

The Master Leases require the Tenant to maintain insurance, including (i) “replacement cost” casualty insurance coverage insuring against customary hazards, including earthquake and flood coverage, (ii) commercial liability coverage and (iii) environmental liability coverage.

In addition, the Manager maintains (a) business interruption / contingent loss of rents and property insurance to protect the Trust for real property and loss of rents if primary insurance maintained by the Tenant fails, is inadequate or is not obtained by New JCP, (b) contingent lessors’ risk insurance to protect the Trust against exposure for third party bodily injury and property damage claims if primary insurance maintained by the Tenant fails, is inadequate or is not obtained by New JCP, (c) customary professional liability insurance with respect to services provided by the Manager to the Trust pursuant to the Management Agreement, (d) customary directors’ and officers’ liability insurance coverage and (e) customary environmental liability insurance coverage.

Access to Company Information

The Trust’s annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and all amendments to those reports are available free of charge on the Company’s website at www.ctltrust.net as soon as reasonably practicable after such material is electronically filed with, or furnished to, the Securities and Exchange Commission. The information contained on our website, or other websites linked to our website, is not part of this document. Our reports may also be obtained by accessing the EDGAR database at the SEC’s website at www.sec.gov.

ITEM 1A. RISK FACTORS

Set forth below are the risks that we believe are material to our Certificateholders and careful consideration should be given to these risk factors, in addition to the other information included in this annual report. Each of these risk factors could adversely affect our business operating results and/or financial condition, as well as adversely affect the value of our Certificates. In addition to the following disclosures, please refer to the explanation of qualification and limitations on forward-looking statements beginning on page 18 and you should also refer to the other information contained in this report, including the accompanying consolidated financial statements and the related notes.

Risks Relating to Limited Purpose and Recent Formation

The Trust has a limited purpose and does not expect to generate or receive cash other than from limited sources. Pursuant to the Trust Agreement, the Trust was established and exists for the purpose of collecting, holding, administering, distributing and liquidating the Properties for the benefit of the Certificateholders. The Trust Agreement further provides that the Trust shall have no objective or authority to continue or to engage in the conduct of a trade or business, except to the extent reasonably necessary to carry out the purpose of the Trust as set forth therein. The Trust does not expect to receive cash other than through lease payments from the Tenant and from sales of the Properties.

The Trust has a limited operating history. The Trust was established in December 2020 and capitalized in January 2021 when it acquired the Properties. The Trust's limited operating history makes it difficult to forecast, among other things, its future cash proceeds from sales of the Properties. In assessing its business prospects, you should consider various risks and difficulties encountered by newly organized companies. These risks include the Trust’s ability to implement and execute its business plan and respond effectively to operational and competitive challenges.

The Trust will incur significant costs as a result of the registration of the Trust Certificates under the Exchange Act and the Trust becoming a reporting issuer under the Exchange Act. As a reporting entity under the Exchange Act, the Trust will incur significant legal, accounting and other expenses that a non-reporting entity would not incur. In addition, the Exchange Act imposes various requirements on reporting entities that will require the Executive Officer, the Financial Officer and the Manager’s employees, management and other personnel to devote a substantial amount of time to compliance initiatives.

Risks Relating to Real Estate Assets

There is limited liquidity in real estate investments. Real estate is a relatively illiquid asset. The Trust may not be able to sell the Properties at the optimal time or for an optimal price in order to maximize its recovery. The number of potential buyers for the Retail Properties may be limited by the presence of such properties in retail or mall complexes. In addition, the Trust’s ability to sell or dispose of the Properties may be hindered by the fact that such Properties are subject to the terms of the Master Lease, or the fact that the Properties are subject to the leasehold rights of the Tenant may make such Properties less attractive to a potential buyer than alternative properties that may be for sale.

The Trust’s real estate asset portfolio’s tenant base is not diversified. The Properties consist entirely of retail stores leased to New JCP under the Master Lease. Pursuant to the Trust Agreement, the Trust will not acquire new real estate assets to diversify the tenants in its portfolio. This lack of diversification means that the Trust is particularly sensitive to the risks and fluctuations in the price of retail-related real estate, and any worsening of this particular market would result in a significant and outsized negative impact on the Trust. In addition, periods of economic slowdown or recession or declining demand for real estate in the United States, or the public perception that any of these events may occur, could result in a general decline in property values, which could materially adversely affect the Trust’s business, financial position, results of operations or cash flow. This could, in turn, adversely affect the Trust’s ability to make distributions to the Certificateholders.

If the Trust is unable to sell the Properties within a reasonable period of time, it may need to consider bulk marketing and disposition. The pool of potential buyers for the Properties is limited and, depending on market conditions, price reductions or bulk sales may be necessary. One or more bulk sales of the Properties may not yield as high an aggregate value as individual property sales, and a bulk sale may possibly depress prices in the market for the Properties, negatively affecting the Trust’s ability to recover the highest value for its remaining properties.

If the Trust is unable to sell the Properties within the approved sale period, the Properties may be transferred into a REIT. The Trust may not be able to sell all of the Properties by December 10, 2025, or any extended sale period

approved by the Certificateholders (the "approved sale period"). Should the Trust be unable to sell all of the Properties within the approved sale period, the Manager may develop a plan for the conversion of one or more subsidiaries of the Trust to a REIT, the contribution of one or more of the Properties to an existing REIT, or the transfer of the Properties to an alternative investment vehicle. If the remaining Properties are held by a newly-formed REIT, the requirements applicable to such a REIT may delay further sales of Properties. Upon transfer of properties into a REIT, the amount or timing of distributions may be negatively affected.

Competition from other sellers of commercial real properties in the markets in which the Properties are located may adversely affect the Trust’s financial condition and net assets in liquidation. The addition of new retail properties in the markets where the Properties are located may increase the available supply of similar properties, creating downward pressure on sales prices and protracted sales periods for the Properties. In addition, any sales that do not satisfy the guidelines set out in the Trust Agreement may require the consent of up to two-thirds of the Certificateholders. Other sellers of retail properties will generally not be subject to similar selling restrictions, which may put the Trust at a competitive disadvantage relative to other sellers.

The land underlying some of the Properties is subject to ground leases, which could limit our use of such Properties, and a breach or termination of the ground leases could materially and adversely affect us. We lease the land underlying some of the Properties from third parties through ground leases covering such land. As a lessee under a ground lease, we are exposed to the possibility of losing the right to use the portion of the Properties covered by the ground lease upon termination, or upon an earlier breach by us, of the ground lease. The ground lease may also restrict our use of such Properties, which may limit our flexibility in renting such Properties and may adversely impact our ability to sell such Properties. In addition, certain ground leases contain options in favor of the ground lessor to purchase the ground lessee’s leasehold interest under certain circumstances, including cessation of the operation of retail business at the applicable Property.

Environmental compliance costs and liabilities associated with the Properties may materially impair the value of those assets. As an owner of real property, the Trust is subject to various federal, state and local environmental and health and safety laws and regulations. Although the Trust does not operate or manage the Properties, the Trust may be held primarily or jointly and severally liable for costs relating to the investigation and clean-up of any property from which there has been a release or threatened release of a regulated material as well as other affected properties, regardless of whether the Trust knew of or caused the release. The failure to properly clean a Property may adversely affect our ability to lease, sell or rent the Property or to borrow funds using the Property as collateral. Further, some environmental laws create a lien on a contaminated site in favor of the government for damages and the costs the government incurs in connection with such contamination. In addition, the presence of contamination or the failure to remediate contamination may adversely affect the Trust’s ability to sell the Properties.

Adverse weather conditions and natural disasters could adversely affect the Trust’s operations and results. The Trust may not be able to obtain insurance at reasonable rates for natural disasters and other events that are beyond its control. Although the Tenant is required to maintain property insurance coverage, such coverage is subject to deductibles and limits on maximum benefits. We cannot assure you that the Tenant or the Trust will be able to fully insure such losses or that, in the case of business interruption coverage, such insurance will be maintained at all, or that the Tenant or the Trust will be able to fully collect, if at all, on claims resulting from such natural disasters. Inflation, changes in building codes and ordinances, environmental considerations and other factors also may make it infeasible to use insurance proceeds to replace the damaged property. Furthermore, the Tenant or the Trust may not be able to obtain insurance for these types of events for all of the Properties at reasonable rates.

Risks Relating to Leasing to the Tenant

The Trust is dependent on New JCP as a tenant until the Properties are sold. Therefore, an event that has a material adverse effect on New JCP’s businesses, financial positions or results of operations could have a material adverse effect on the Trust’s business, financial position or results of operations. New JCP is the sole lessee of the Properties pursuant to the Master Lease. Together with the proceeds from sales of the Properties, the

rent and other payment obligations under the Master Lease will account for all of the Trust’s revenues. Additionally, because the Master Lease is a triple-net lease, the Trust will depend on New JCP to pay insurance, taxes, utilities and maintenance and repair expenses in connection with the Properties and to indemnify, defend and hold the Landlord harmless from and against various claims, litigation and liabilities arising in connection therewith. Although the Lease Guarantors guarantee the Tenant's obligations under the Master Lease, there can be no assurance that the Lease Guarantors and the Tenant will have sufficient assets, income and access to financing to enable them to satisfy their payment obligations on account of the Master Lease. The inability or unwillingness of the Tenant and the Lease Guarantors to meet their rent and other obligations under the Master Lease and the related Lease Guaranty could materially adversely affect the Trust’s business, financial position or results of operations, including the Trust’s ability to make distributions to the Certificateholders. Such an event could also affect both the ability of the Trust to sell the Properties as well as the sales prices obtainable. In addition, due to the Trust’s dependence on rental payments from the Tenant as a primary source of revenues (in addition to sales proceeds from the sale of Properties), the Trust may be limited in its ability to enforce its rights under the Master Lease or to terminate the Master Lease. Failure by a Tenant and the Lease Guarantors to comply with their obligations under the Master Lease and the Lease Guaranties, as applicable, could require the Trust to find another tenant for such Property, and there could be a decrease or cessation of rental payments. In such event, the Trust may be unable to locate a suitable tenant at similar rental rates or at all, which would have the effect of reducing the Trust’s rental revenues.

The bankruptcy or insolvency of the Tenant and the Lease Guarantors could result in the termination of the Master Lease and material losses to the Trust. A bankruptcy or insolvency of the Tenant (which is the Trust’s sole tenant) and the Lease Guarantors (which are the Trust’s sole source of credit support for the Tenant’s obligations under the Master Leases) could result in a loss of a substantial portion of the Trust’s revenue and materially and adversely affect the Trust. Such an event could also affect both the ability of the Trust to sell the Properties as well as the sales prices obtainable. Each Master Lease is a single, unitary lease of all of the applicable Properties, such that in the event of a bankruptcy proceeding, the Tenant shall only be entitled to assume, reject or assign the entire Master Lease and not merely a portion thereof. Any claims against a bankrupt Tenant for unpaid future rent are subject to statutory limitations that would likely result in the Landlord’s receipt, if at all, of rental revenues that are substantially less than the contractually specified rent owed. In addition, any claim such Landlord has for unpaid past rent would likely not be paid in full. If a Tenant becomes bankrupt or insolvent, federal law may prohibit the Landlord from evicting such Tenant based solely upon such bankruptcy or insolvency. The Trust may also be unable to re-lease a terminated or rejected space or re-lease it on comparable or more favorable terms. If the Trust does re-lease rejected space, it will likely incur significant costs for brokerage, marketing and tenant inducement expenses. In addition, although the Trust believes that the Master Leases are “true leases” for purposes of bankruptcy law, it is possible that a bankruptcy court could re-characterize the lease transactions set forth in the Master Leases as a secured lending transaction, in which case the Trust would not be treated as the owner of the property and could lose certain rights as the owner in the bankruptcy proceeding.

The Trust is dependent on the retail industry and may be susceptible to the risks associated with it, which could materially adversely affect its business, financial position or results of operations. As the landlord of retail stores, the Trust is impacted by the risks associated with the retail industry, which may be adversely affected by economic conditions in general, changes in consumer trends and preferences and other factors over which the Trust has no control. As the Trust is subject to risks inherent in having substantial investments in a single industry, a decrease in the retail industry would likely have a greater adverse effect on its revenues than if the Trust owned a more diversified real estate portfolio, particularly because the ability of the Tenant and the Lease Guarantors to pay the rent under the Master Leases is based, over time, on the performance of the retail stores operated by New JCP at the Properties and New JCP’s other properties. The retail industry is characterized by a high degree of competition among a large number of participants, and competition is intense in most of the markets where the Properties are located. Additionally, decreases in discretionary consumer spending brought about by weakened general economic conditions such as lackluster recoveries from recessions, high unemployment levels, higher income taxes, a rise in inflation in the U.S., low levels of consumer confidence, cultural and demographic changes, increased stock market volatility, shipping delays and global supply chain issues may negatively impact the Trust’s revenues and operating

cash flows. In particular, the global COVID-19 pandemic has had, and may continue to have an unprecedented impact on both the global and the U.S. economy in general, and the retail industry in particular.

Risks Relating to the Trust Certificates

The Trust cannot predict with certainty the timing or amount of distributions to the Certificateholders. It is not possible to predict with certainty the timing and amount of future distributions to the Certificateholders. The cash receipts that distributions are based on cannot be predicted with certainty because they are subject to conditions that are beyond the Trust’s control or that are inherently uncertain, such as the amount and timing of the Trust’s sale of the Properties. As the Trust continues to sell Properties, the cash available from lease payments will decrease and therefore, so will distributions to the Certificateholders. In addition, as such payments decrease, it is possible that the amount to be distributed will not be sufficient to cover expenses, which must be paid prior to distributions to the Certificateholders. It is therefore possible that for any distribution date there may be a limited distribution or no distribution to Certificateholders. Further, the Trust’s objective is to sell all Properties to third-party investors as promptly as practicable after the Effective Date, and the Trust is not permitted to acquire new or additional properties, which may increase certain of the risks discussed herein. In addition, certain Properties cannot be sold immediately and therefore Certificateholders may need to hold the Trust Certificates for an extended period of time in order to receive distributions that include the proceeds of the sales of such Properties. See “Item 1. Business—Description of the Trust Documents—Master Leases—Lockout Periods.”

The Trust Certificates are not suitable as a long-term investment. The Trust intends to complete the sale of the Properties in as short a time as is consistent with the maximization of the value of its assets, without regard to the potential long-term capital appreciation of the Properties.

The value of the Trust Certificates is expected to decrease over time. The value of the Trust Certificates will depend primarily on the anticipated net liquidation value of the assets of the Trust, which is expected to decrease with each distribution of the proceeds of Property sales.

The market for our Trust Certificates is thinly traded and you may find it difficult to dispose of your Trust Certificates, which could cause you to lose all or a portion of your investment in our company. Although our Trust Certificates trade over the counter, only limited trading in our Trust Certificates has developed and we expect to have only a limited trading market for the foreseeable future. As a result, you may find it difficult to dispose of our Trust Certificates and you may suffer a loss of all or a substantial portion of your investment in our Trust Certificates. The Trust is pursuing a listing of the Trust Certificates on a national securities exchange, but there can be no assurance that the Trust will successfully obtain listing of the Trust Certificates.

If a trading market for Trust Certificates develops, the market price may be volatile. Many factors could cause the market price of the Trust Certificates to rise and fall, including the following:

•sales of Properties held by the Trust;

•changes in real estate market conditions;

•actual or anticipated fluctuations in the Trust’s quarterly or annual financial results;

•the financial guidance and projections the Trust may provide to the public, any changes in such guidance and projections, or the failure to meet such guidance and projections;

•changes in the market valuations of other companies in the same industry as the Trust;

•various market factors or perceived market factors, including rumors, whether or not correct, involving the Trust, the Properties, potential buyers of the Properties, the Tenant, the impact of the preferential offer rights held by the Tenant and the Trust’s or Tenant's competitors;

•sales, or anticipated sales, of large blocks of Trust Certificates, including short selling by investors;

•regulatory developments;

•litigation and governmental or regulatory investigations; and

•general economic, political and financial market conditions or events.

To the extent that there is volatility in the price of Trust Certificates, the Trust may also become the target of securities litigation. Securities litigation could result in substantial costs and divert the Trustee’s attention and the Trust’s resources as well as depress the value of the Trust Certificates.

Certain Certificateholders may be deemed under the Bankruptcy Code to be “underwriters” and may not be able to sell or transfer their Trust Certificates in reliance upon the Bankruptcy Code’s exemption from the registration requirements of federal and state securities laws provided by Section 1145 of the Bankruptcy Code. The issuance of the Trust Certificates is expected to be exempt pursuant to Section 1145 of the Bankruptcy Code. However, any initial recipient thereof that (i) is an “affiliate” of the Debtors or the Trust, as defined in Rule 144(a)(1) under the Securities Act, (ii) has been such an “affiliate” within 90 days of such transfer, or (iii) is an entity that is an “underwriter,” as defined in subsection (b) of Section 1145 of the Bankruptcy Code will not be permitted to freely sell their Trust Certificates. Such persons may include holders of 10% or more of the Trust Certificates, and such persons may not be able to offer or sell their Trust Certificates without registration under the Securities Act or applicable state securities (i.e., “blue sky”) laws unless such offer and sale is exempted from the registration requirements of such laws. The offer and sale of Trust Certificates by statutory underwriters in reliance upon an exemption from registration under the Securities Act may require compliance with the requirements and conditions of Rule 144 of such law, including those regarding the holding period, the adequacy of current public information regarding the Trust, sale volume restrictions, broker transactions and the filing of a notice. The Trust has entered into a cooperation agreement and agreed to register the Trust Certificates for resale in certain circumstances, but delays in connection with such registration statement becoming effective could delay sales of Trust Certificates beyond the time when a statutory underwriter wishes to sell its Trust Certificates.

The Trust Agreement includes provisions that limit the Certificateholders’ approval rights. Under the Trust Agreement, the Certificateholders have limited approval rights and the Trust will not have Certificateholder meetings. The Certificateholders take no part in the management or control of the Trust. Accordingly, the Certificateholders do not have the right to authorize actions, appoint service providers or take other actions as may be taken by shareholders of other trusts or companies where shares carry such rights. The Certificateholders’ limited voting rights give significant control under the Trust Agreement to the Manager and the Trustee. The Manager and the Trustee may take actions in the operation of the Trust that may be adverse to the interests of the Certificateholders and may adversely affect the value of the Trust Certificates.

Certificateholders have limited rights to institute any suit, action or proceeding at law or in equity or otherwise with respect to this Trust Agreement or the Certificates. A Certificateholder shall not have the right to institute any suit, action or proceeding at law or in equity or otherwise with respect to this Trust Agreement or the Certificates or otherwise, or for the appointment of a receiver or for the enforcement of any other remedy under the Trust Agreement or the Certificates or otherwise, unless, among other items, Certificateholders holding Certificates evidencing Fractional Undivided Interests aggregating not less than 25% of the Trust Interests shall have requested the Trustee in writing to institute such suit, action or proceeding and shall have offered to the Trustee indemnity as provided in the Trust Agreement. The Trust believes that this provision is applicable to both initial certificate holders and purchasers in secondary transactions.

Certificateholders may not be entitled to a jury trial with respect to claims arising under the Trust Agreement, which could result in less favorable outcomes to the plaintiff(s) in any action under the Trust Agreement. The Trust Agreement provides that, to the fullest extent permitted by law, the parties to the agreement waive the right to a trial by jury in any legal proceeding directly or indirectly arising out of or relating to the Trust Agreement, any Certificate or any of the transactions contemplated thereby. The Trust believes that this waiver is applicable to both initial Certificateholders and purchasers in secondary transactions.

If the Trust opposed a jury trial demand based on the waiver, the court would determine whether the waiver was enforceable based on the facts and circumstances of that case in accordance with the applicable state and federal law. To our knowledge, the enforceability of a contractual pre-dispute jury trial waiver in connection with claims arising under the federal securities laws has not been finally adjudicated. However, we believe that a contractual pre-dispute

jury trial waiver provision is generally enforceable, including under the laws of the State of New York, which govern the Trust Agreement, by a federal or state court in the City of New York, which has non-exclusive jurisdiction over matters arising under the Trust Agreement. In determining whether to enforce a contractual pre-dispute jury trial waiver provision, courts will generally consider whether a party knowingly, intelligently and voluntarily waived the right to a jury trial. The Trust believes that this is the case with respect to the Trust Agreement and the Certificates.

If any Certificateholder brings a claim against us the Trust in connection with matters arising under the Trust Agreement or the Certificates, including claims under federal securities laws, such Certificateholder may not be entitled to a jury trial with respect to such claims, which may have the effect of limiting and discouraging lawsuits against the Trust. If a lawsuit is brought against the Trust under the Trust Agreement, it may be heard only by a judge or justice of the applicable trial court, which would be conducted according to different civil procedures and may result in different outcomes than a trial by jury would have had, including results that could be less favorable to the plaintiff(s) in any such action.

Nevertheless, if this jury trial waiver provision is not permitted by applicable law, an action could proceed under the terms of the Trust Agreement with a jury trial. No condition, stipulation or provision of the Trust Agreement or the Certificates serves as a waiver by any Certificateholder or the Trust of compliance with any substantive provision of the U.S. federal securities laws and the rules and regulations promulgated thereunder.

The value of the Trust Certificates may be adversely affected if the Trust is required to indemnify the Trustee or the Manager under the Trust Documents. Under the Trust Documents, the Trustee and the Manager each has a right to be indemnified by the Trust for certain liabilities or expenses that it incurs without gross negligence, bad faith or willful misconduct on its part. If the Trust is required to indemnify the Trustee or the Manager under the Trust Documents, it could reduce the value of the Trust Certificates.

Risk Relating to the Trustee, the Manager and Brokers

Certificateholders will have only limited rights against the Trustee, and the Trustee has limited liability to the Trust. The Trust Agreement provides that the Trustee (and its affiliates, directors, officers, employees and representatives) and any officer, employee or agent of the Trust or its affiliates shall not incur any liability to the Trust or the Certificateholders for any act or omission thereunder unless the Trustee has acted with gross negligence, bad faith or willful misconduct. The Certificateholders will therefore have no recourse to such parties for actions taken or not taken for which they disagree, absent such gross negligence, bad faith or willful misconduct.

The Trust’s success depends on the efforts of third-party managers and real estate brokers. The Trust has retained the Manager, who is an independent third party, to perform asset management duties with respect to the Properties, and the Manager will retain third-party real estate brokers to sell the Properties. Any of these third-party service providers may terminate their relationship with the Trust at any time upon relatively short notice or no notice. In addition, the Certificateholders may disagree with the third parties chosen by the Manager but will not have the ability to change or remove such third parties other than pursuant to limited approval rights.

The Manager has a limited history of managing investment vehicles like the Trust and its experience may be inadequate or unsuitable to manage the Trust. Although the Manager has a significant history of asset and property management, the past performances of the Manager in other investment vehicles is not an indication of its ability to manage an investment vehicle such as the Trust. If the experience of the Manager and its employees is inadequate or unsuitable to manage the Trust, the operations of the Trust may be adversely affected.

The Trust may need to find and appoint a replacement Manager quickly, which could pose a challenge to the operations of the Trust. The Majority Certificateholders could decide to replace the current Manager. Transferring responsibilities to another party will likely be complex and could subject the Trust to the risk of loss during the transfer, which could have a negative impact on the value of the Trust Certificates or result in loss of the Trust’s

assets and the Manager may also resign. The Trustee and the Certificateholders may not be able to find a party willing to serve as the Manager under the same terms as the current Management Agreement. To the extent that the Trustee and the Certificateholders are not able to find a suitable party willing to serve as the Manager, or to the extent that doing so requires entering into a modified Management Agreement that is less favorable for the Trust, the value of the Trust Certificates could be adversely affected.

Risks Relating to Taxes

If the Trust is not treated as a liquidating trust for federal tax purposes, there may be adverse tax consequences to the Trust and the Certificateholders. Pursuant to the Trust Agreement, the Trust was organized with the intention that it qualify as a liquidating trust under applicable federal income tax rules. A liquidating trust is treated as a grantor trust, which is a pass-through entity for federal income tax purposes. However, no legal opinions have been requested from counsel, and no rulings have been or will be requested from the Internal Revenue Service (the “IRS”), as to the tax treatment of the Trust. Accordingly, there can be no assurance that the IRS will not assert, and that a court would not conclude, that the Trust does not qualify as a liquidating trust. If the Trust does not qualify as a liquidating trust, it is intended that the Trust be treated as a partnership for U.S. federal income tax purposes (which would also be a pass-through entity for federal income tax purposes although the tax consequences of owning a partnership may differ from those of owning a grantor trust in some respects, possibly adversely); however, that treatment as a partnership is also not certain. Because a significant proportion of the Trust’s income is expected to be real property rents received from New JCP or an assignee or sub-lessee thereof, the Trust Agreement includes restrictions on the transferability of Trust Certificates to Certificateholders that directly or indirectly own 4.9% or more of the Trust Certificates, which restrictions are intended to ensure that the Trust’s rental income is not treated as received from a lessee or sub-lessee that is treated as related to the Trust for purposes of the publicly traded partnership “qualifying income” rules. These restrictions are intended to preserve the status of the Trust’s rental income as “qualifying income” and thus, preserve the Trust’s status as a partnership for U.S. federal income tax purposes in the event that the Trust is not treated as a grantor trust. However, New JCP is permitted to transfer its rights and obligations under the Master Leases in a variety of situations and the Trust may be unable to control who becomes a lessee or sublessee thereunder. Accordingly, even if the Trust Agreement’s transfer restrictions are complied with, they may not prevent some or all of the Trust’s rental income from being treated as related party rent for purposes of the publicly traded partnership rules, which could cause the Trust to fail to qualify as a partnership. If the Trust does not qualify as a liquidating trust and is not treated as a partnership for federal income tax purposes, there may be adverse federal income tax consequences, including taxation of the income of the Trust at the entity level, which could reduce the amount of cash available for distributions to the Certificateholders, and additional tax payable by the Certificateholders upon their receipt of distributions.

A Certificateholder’s tax liability could exceed distributions. Given the intended treatment of the Trust as a liquidating trust treated as a grantor trust for federal income tax purposes, the Certificateholders will be subject to tax on their share of the Trust’s income, regardless of whether any distributions are made by the Trust. Therefore, for any particular year, taxable income recognized by a Certificateholder with respect to its Trust Certificates may exceed the amount of distributions, if any, that are made, in which case such Certificateholder would need to satisfy any tax liabilities arising from the ownership of Trust Certificates from such Certificateholder’s own funds.

Before purchasing Trust Certificates, investors are urged to engage in careful tax planning with a tax professional. The federal income tax treatment of the Trust Certificates is complex and may not be clear in all cases. Additionally, the federal income tax treatment of the Trust Certificates may vary depending on the investor’s particular facts and circumstances. Investors other than individual citizens or residents of the United States or United States corporations should consider the impact of their status on the tax treatment of such an investment.

Purchasers of Trust Certificates may be required to make special calculations to determine tax gain or loss on the sale of Trust Certificates. The owner of beneficial interests in a grantor trust (like a Trust Certificate) for most federal income tax purposes is treated as owning its proportionate share of the trust’s assets, incurring its proportionate share of the trust’s liabilities and earning its proportionate share of the income of the trust. The Trust

does not expect to maintain a separate basis account for any subsequent purchaser of a Trust Certificate in an open market transaction. However, to the extent the Trust is treated as a grantor trust, such a subsequent purchaser may be treated as though such purchaser purchased the assets of the Trust deemed to have been owned by the selling Certificateholder by reason of owning Trust Certificates. The subsequent purchaser should have a fair market value tax basis in the acquired Trust Certificates equal to such purchaser’s purchase price of the Trust Certificates. However, the books and records of the Trust may not reflect this new basis. Upon the sale of assets by the Trust, such a subsequent purchaser may need to make special calculations to report correctly its share of gain or loss for federal income tax purposes. Investors are urged to consult with their tax advisors regarding the acquisition, ownership and disposition of Trust Certificates.

The ownership and disposition of Trust Certificates may give rise to adverse tax consequences for non-U.S. and certain tax-exempt Certificateholders. The Trust is expected to sell or otherwise dispose of its assets as quickly as commercially possible. Until individual assets are sold, such assets will generate rental income pursuant to the Master Leases. Such income will be allocated to the Certificateholders, and each Certificateholder should assume this income may be treated as income from the active conduct of a trade or business in the United States for federal income tax purposes. As a result, a non-U.S. Certificateholder that is not otherwise required to file federal income tax returns or pay federal income tax may be deemed engaged in such a U.S. trade or business and required to file a federal income tax return and pay federal income tax with respect to income (including income allocated to it by the Trust) that is connected to such trade or business. If the rental income is not treated as income from the active conduct of a U.S. trade or business, a non-US. Certificateholder generally would be subject to 30% gross basis withholding tax (or such lower rate specified by an applicable tax treaty) on distributions that are attributable to such rental income unless a special election is made to treat such rental income as income from a U.S. trade or business. In addition, gain arising in connection with the disposition of Properties is expected to be treated as gain from the disposition of a U.S. real property interest, subject to federal income tax for a non-U.S. Certificateholder. A withholding agent may withhold at the highest applicable rate on distributions to non-U.S. Certificateholders that are attributable to any such dispositions, and non-U.S. Certificateholders will be required to file federal income tax returns and pay federal income tax, to the extent not previously withheld, on their allocable share of any gain. A Certificateholder that is a non-U.S. corporation may be subject to a 30% branch profits tax (or such lower rate specified by an applicable tax treaty) of its effectively connected earnings and profits for each taxable year, as adjusted for certain taxes.

If a Certificateholder disposes of Trust Certificates, such disposition generally will be treated for federal income tax purposes as a disposition of an undivided interest in each of the underlying assets of the Trust. As such, unless the Trust Certificates are considered to be regularly traded on an established securities market for purposes of the Foreign Investment in Real Property Tax Act (“FIRPTA”), any amounts received on the disposition of the Trust Certificates that are attributable to a non-U.S. Certificateholder’s deemed disposition of a U.S. real property interest held by the Trust generally will be taxed on a net income basis in the manner described above. In addition, a buyer of Trust Certificates generally would be required to withhold 15% of the purchase price for such Trust Certificates to the extent the disposition of such Trust Certificates by the seller is attributable to the deemed disposition of underlying assets that constitute U.S. real property interests. If the Trust Certificates are considered to be regularly traded on an established securities market for purposes of FIRPTA, the disposition of the Trust Certificates generally would be subject to the rules under FIRPTA that govern publicly traded interests in publicly traded corporations. In such case, a non-U.S. Certificateholder that is not otherwise required to file federal income tax returns or pay federal income tax generally would only be subject to federal income tax under FIRPTA if such non-U.S. Certificateholder owned more than 5% of the Trust Certificates at any time during an applicable measuring period. It is not clear whether the Trust Certificates will be considered to be regularly traded on an established securities market for purposes of FIRPTA. These restrictions and the restrictions described below may make ownership and disposition of the Trust Certificates less attractive.

Certain tax-exempt Certificateholders may be subject to tax with respect to their share of the Trust’s income if such income is unrelated business taxable income (“UBTI”), including income treated as “debt financed” income. Tax-exempt Certificateholders are strongly encouraged to consult their own tax advisors regarding all aspects of UBTI.

The Certificateholders may be subject to state and local income taxes and may have to file tax returns in each jurisdiction where a Property is located. The Trust owns real property located in a significant number of U.S. states. Many U.S. states impose income taxes on income earned with respect to real property located in such jurisdiction, including on gains resulting from the disposition of such property. States or localities that respect the pass-through nature of the Trust for tax purposes may require a Certificateholder to file a tax return and pay income tax in their jurisdiction. Because the Trust owns properties in 37 U.S. states, this could result in the Certificateholders being required to file tax returns and paying taxes in a large number of jurisdictions.

Expenses incurred by the Trust may not be deductible by the Certificateholders. Expenses incurred by the Trust generally will be deemed to have been proportionately paid by each Certificateholder. As such, these expenses may not be deductible or may be subject to limitations on deductibility. Investors are urged to consult with their tax advisors regarding the acquisition, ownership and disposition of Trust Certificates.

Risks Relating to Accounting, Financial Reporting and Information Management

The Properties may be subject to impairment charges that may materially affect our financial results. Economic and other conditions may adversely impact the valuation of our assets, resulting in impairment charges that could have a material adverse effect on our results of operations and earnings. On a regular basis, we evaluate our assets for impairments based on various triggers, including changes in the projected cash flows of such assets and market conditions. If we determine that an impairment has occurred, then we would be required to make an adjustment to the net carrying value of the asset, which could have a material adverse effect on our results of operations in the accounting period in which the adjustment is made. Furthermore, changes in estimated future cash flows due to a change in our plans, policies or views of market and economic conditions could result in the recognition of additional impairment losses for already impaired assets, which, under the applicable accounting guidance, could be material.

If the Trust is unable to maintain effective internal control over financial reporting in the future, the accuracy and timeliness of its financial reporting may be adversely affected. If the Trust identifies one or more material weaknesses in the Trust’s internal control over financial reporting, the Trust may be required to disclose that its internal control over financial reporting is ineffective. Were this to occur, the Trust could lose investor confidence in the accuracy and completeness of its financial reports, which could have a material adverse effect on the Trust’s reputation and the value of the Trust Certificates.

Any decision on the part of the Trust, as an emerging growth company, to choose reduced disclosures applicable to emerging growth companies could make the Trust Certificates less attractive to investors. The Trust is an “emerging growth company,” as defined in the Securities Act, and for so long as it continues to be an emerging growth company, it may choose to take advantage of certain exemptions from various reporting requirements applicable to other public companies, including the extended transition period for complying with new or revised financial accounting standards. As a result of our reduced reporting, investors may be unable to compare our business with other companies in our industry if they believe that our financial accounting is not as transparent or complete as other companies in our industry. No assurance can be given that this reduced reporting will not have an impact on the price of the Trust Certificates. We are not required to comply with certain reporting requirements, including those relating to auditor's attestation reports on the effectiveness of our system of internal control over financial reporting, accounting standards and disclosure about our executive compensation, that apply to other public companies.

The JOBS Act contains provisions that, among other things, relax certain reporting requirements for emerging growth companies, including certain requirements relating to accounting standards and compensation disclosure. We are classified as an emerging growth company. For as long as we are an emerging growth company, which may be up to five full fiscal years, unlike other public companies, we are not required to (1) provide an auditor's attestation report on the effectiveness of our system of internal control over financial reporting pursuant to Section 404 of the

Sarbanes-Oxley Act, (2) comply with any new or revised financial accounting standards applicable to public companies until such standards are also applicable to private companies until such standards are also applicable to private companies under Section 102(b)(1) of the JOBS Act, (3) comply with any new requirements adopted by the Public Company Accounting Oversight Board ("PCAOB") requiring mandatory audit firm rotation or a supplement to the auditor's report in which the auditor would be required to provide additional information about the audit and the financial statements of the issuer, (4) comply with any new audit rules adopted by the PCAOB after April 5, 2012 unless the SEC determines otherwise, (5) provide certain disclosures regarding executive compensation required of larger public companies or (6) hold stockholder advisory votes on executive compensation.

Once we are no longer an emerging growth company, so long as shares of common stock are not traded on a securities exchange, we will be deemed to be a "non-accelerated filer" under the Exchange Act, and as a non-accelerated filer, we will be exempt from compliance with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act. In addition, so long as we are externally managed by the Manager and we do not directly compensate our executive officers, or reimburse the Manager or its affiliates for salaries, bonuses, benefits and severance payments for any persons who also serve as one of our executive officers or as an executive officer of the Manager, we do not have any executive compensation, making the exemptions listed in (5) and (6) above generally inapplicable.

We cannot predict if investors will find the Trust Certificates less attractive because we choose to rely on any of the exemptions discussed above.

Information technology, data security breaches and other similar events could harm the Trust. The Trust and its service providers, including the Manager, rely on information technology and other computer resources to perform operational activities as well as to maintain the Trust’s business records and financial data. These computer systems are subject to damage or interruption from power outages, computer attacks by hackers, viruses, catastrophes, hardware and software failures and breach of data security protocols by its personnel or third-party service providers. Cyber incidents have been increasing in sophistication and frequency and can include third parties gaining access to employee or customer data using stolen or inferred credentials, computer malware, viruses, spamming, phishing attacks, ransomware, card skimming code, and other deliberate attacks and attempts to gain unauthorized access. Although the Trust has implemented administrative and technical controls and taken other actions to minimize the risk of cyber incidents and otherwise protect its information technology, computer intrusion efforts are becoming increasingly sophisticated, thereby increasing the difficult of detecting and defending against them, and even the controls that the Trust has installed might be breached. Additionally, security breaches of the Trust’s information technology systems could result in the misappropriation or unauthorized disclosure of proprietary, personal and confidential information, which could result in significant financial or reputational damages to the Trust. Further, most of these computer resources are provided to the Trust or are maintained on behalf of the Trust by third-party service providers pursuant to agreements that specify certain security and service level standards, but which ultimately are outside of the Trust’s control. The Trust's third-party service providers or business partners’ information technology systems, or hardware/software provided by such third parties for use in our information technology systems, may be vulnerable to similar threats and our business could be affected by those or similar third-party relationships.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

ITEM 2. PROPERTIES

For summary information regarding our owned and ground-leased Retail Properties as of December 31, 2021, which includes the Retail Property classified as held for sale, see Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations." Square feet and annual base rent are presented in thousands. For additional details on our Retail Properties, see “Real Estate and Accumulated Depreciation (Schedule III)” herein.

ITEM 3. LEGAL PROCEEDINGS

We are subject, from time to time, to various legal proceedings and claims that arise in the ordinary course of business. Neither the Trust nor any of its subsidiaries are currently a party as plaintiff or defendant to and none of our properties are the subject of any pending legal proceedings that we believe to be material or that individually or in the aggregate would be expected to have a material effect on our business, financial condition or results of operations if determined adversely to us. We are not aware of any similar proceedings that are contemplated by governmental authorities.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

PART II

ITEM 5. MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Market Information

There is currently a limited trading market for the Trust Certificates.

Holders

At March 11, 2022, we had one certificateholder of record because all our Certificates are in book entry form through the Depository Trust Company. The number of beneficial owners is substantially greater than the number of record holders, because all of our Certificates are held in “street name” by banks and brokers.

Dividend Policy

The Trust paid distributions to the Certificateholders of $261,466 or $3.49 per certificate from the Effective Date to December 31, 2021.

The Trust is required to distribute on a monthly basis the proceeds from lease payments under the Master Leases (until such time as all of the Properties have been sold) and all sales proceeds from the disposition of Properties, in each case pro rata, to the Certificateholders as of the record date immediately preceding the applicable distribution date. Such distributions shall be net of tax payments to be made by the Trust, fees and expenses of the Trustee, the Manager and any other professional advisors, and funds to be set aside for the Trustee’s and Manager’s reserve accounts.

Sales of Unregistered Equity Securities

There were no unregistered sales of equity securities during the quarter ended December 31, 2021.

Trust Purchases of Equity Securities

There were no purchases of equity securities by the Trust during the quarter ended December 31, 2021.

ITEM 6. RESERVED

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Certain statements in this “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and elsewhere in this Annual Report on Form 10-K may constitute “forward-looking statements” within the meaning of the safe harbor from civil liability provided for such statements by the Private Securities Litigation Reform Act of 1995 (set forth in Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act). Forward-looking statements involve numerous risks and uncertainties and you should not rely on them as predictions of future events. Forward-looking statements depend on assumptions, data or methods which may be incorrect or imprecise and we may not be able to realize them. We do not guarantee that the transactions and events described will happen as described or that they will happen at all. You can identify forward-looking statements by the use of forward-looking terminology such as “believes,” “expects,” “may,” “should,” “intends,” “plans,” “estimates” or “anticipates” and variations of such words or similar expressions or the negative of such words. You can also identify forward-looking statements by discussions of strategies, plans or intentions. Risks, uncertainties and changes in the following factors, among others, could cause actual results and future events to differ materially from those set forth or contemplated in the forward-looking statements: