On March 16, 2008, Scailex Corporation Ltd. (the “Company”) filed a report with the Israel Securities Authority (the “ISA”) and The Tel Aviv Stock Exchange (the “TASE”), translations from Hebrew of which are attached hereto as Exhibit 99.1-99.4 and incorporated herein by reference.

| Exhibit 99.1 | Periodic reports, December 31, 2007. |

| Exhibit 99.2 | Directors’ Report, December 31, 2007. |

| Exhibit 99.3 | Financial Statements, December 31, 2007. |

| Exhibit 99.4 | Part D – additional information, December 31, 2007. |

2

SIGNATURE

Pursuant to the requirement of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

March 18, 2008 |

SCAILEX CORPORATION LTD. By: /s/ Shachar Rachim —————————————— Shachar Rachim Chief Financial Officer |

3

Exhibit 99.1

Scailex Corporation Ltd.

Periodic Report

Part A

Business Description

As of 31 December 2007

Contents

| Chapter 1: General | 4 |

| 1.1. Description of Business | 4 |

| 1.2. Legend | 5 |

| Chapter 2: General Development of the Corporation's Business | 6 |

| 2.1. Corporation Operations and Business Development Description | 6 |

| 2.2. Segments of Operation | 8 |

| 2.3. Investments in the Corporation's Capital | 8 |

| 2.4. Distribution of Dividends | 9 |

| Chapter 3: Other Information | 10 |

| 3.1. Financial information on the corporation's segments of activity | 10 |

| 3.2. Developments in the financial data of the Company | 10 |

| 3.3. General environment and the effect of external concerns on the Company | 11 |

| Chapter 4: Description of the Corporation's Business by segments of Activity | 12 |

| 4.1. Description of discontinued segments of activity | 12 |

| 4.2. Fast digital printing segment | 12 |

| 4.3. Wide-format digital printing segment | 13 |

| 4.4. Continuous digital ink jet printing for industrial applications | 15 |

| 4.5. Additional Transactions of sales of Scailex holdings | 16 |

| 4.6. The Company's assets management sector and the spotting of investments and business | |

| opportunities | 17 |

| 4.7. Acquisition of Holding in ORL | 17 |

| 4.8. Regulatories approvals for Holding in ORL | 29 |

| 4.9. Fixed assets and facilities | 32 |

| 4.10. Human capital | 33 |

| 4.11. Investments | 40 |

2

| 4.12. Financing | 40 |

| 4.13. Taxation | 42 |

| 4.14. Restrictions on and supervision of corporate business | 43 |

| 4.15. Material contracts | 43 |

| 4.16. Legal proceedings | 43 |

| 4.17. Business objectives and strategy | 43 |

| 4.18. Anticipated development over the next year | 44 |

| 4.19. Discussion of risk factors | 44 |

3

Chapter 1: General

| 1.1. | Description of Business |

| The Board of Directors of Scailex Corporation Ltd., is pleased to submit the business description of the Corporation as at December 31st, 2007, which reviews the Corporation and the development of its business in 2007 (hereinafter the "Report Period"). The Report has been prepared in compliance with the Securities Regulations (Periodic and Immediate Statements), -1970. Financial data included in the Report are stated in NIS at the exchange rate of the US Dollar as at December 31st, 2007 since the functional currency of the Company is the US dollar and the presentation currency is the NIS according to the guidelines of the Israeli Securities Authority. Unless otherwise indicated, claims in NIS are described in the financial statements at their nominal amount as at the date of submission of the claim. |

| The holding percentages in companies fully owned by the holding company are attributed to the holding company. Unless otherwise indicated, the holding percentages are rounded up to the next full percent value. |

| Unless otherwise indicated, the details that appear in this Report as updated to the date of the Report are updated to the date of its publication. |

| The significance of the information included in this periodic Report, including the description of substantial transactions, has been evaluated from the perspective of the Company. In some cases, the description has been expanded to provide a more comprehensive overview of the subject described. |

4

| 1.2. | Legend: |

| For convenience purposes, the acronyms and abbreviations included in this Report shall have the meaning indicated next to them: |

| HP | Hewlett Packard Company |

| PCH | Petroleum Capital Holdings Ltd. |

| SDP | Scailex Digital Printing Inc |

| Xerox | Xerox Corporation |

| Object | Object Geometrics Ltd. |

| ORA | Oil Refineries Ashdod Ltd. |

| Bazan or ORL | Oil Refineries Ltd. |

| Jemtex | Jemtex Ink Jet Printing Ltd. |

| Financial Statements | Audited financial statements of the Company as at December 31st, 2007 |

| Dollar | United States dollars |

| Discount | Discounts Investment Ltd. |

| Stock Exchange | The Tel Aviv Stock Exchange Ltd. |

| Israel Corp. | Israeli Company Ltd. |

| The Commissioner | The Commissioner of the antitrust authority. |

| The Authority | Israeli securities Authority. |

| The Corporation or the Company | Scailex Corporation Ltd. |

| The Antitrust Law | Restrictive Trade Practice - 1988 |

| Companies Law | Companies Law -1999 |

| Securities Law | Securities Law -1968 |

| Caol | Carmel Olefines Ltd. |

| Clal | Clal Industries and Investments Ltd. |

| Linura | Linura Holding AG |

| Nasdaq | The Nasdaq Global Market Burse in the US. |

| Scailex | Scailex Corporation Ltd. |

| Scailex Vision | Scailex Vision (Tel Aviv) Ltd |

| Paz | Paz Oil Company Ltd. |

| Petrochemical | Israel Petrochemical Enterprises Ltd. |

| Income Tax Ordinance | Income Tax Ordinance (New Version) -1961 |

| Vital Interests Order | The Vital Interests Order (Declaration of Essential Interests in Oil Refineries Ltd.) -2007 |

| ORL Group | ORL and its subsidiaries |

| ICL group | Israel Chemicals Ltd. and its subsidiaries. |

| Kodak | Eastman Kodak Company |

| Real Time | Real Time Image Ltd |

| NIS | New Israeli Shekel |

5

Chapter 2: General Development of the Corporation’s Business

| 2.1. | Corporation Operations and Business Development Description |

| 2.1.1. | Description of the corporation’s business |

| The Company incorporated in 1971 as a private Company which was engaged in development, manufacturing and marketing of colorful electronic printing systems. In the years 2004-2006 the Company sold all its operations in that field. Since the year 2006 the Company operates as a holding Company and most of its activities are the management of the Company’s assets, spotting of business opportunities and holding shares of ORL. |

| In March 1980, the Company became a public company, and its shares began to be traded on the NASDAQ. In 2006, the Company was delisted from the NASDAQ, and its shares are now quoted on the OTC Bulletin Board. Since 2001, the Company’s shares have also been traded on the Tel-Aviv Stock Exchange. |

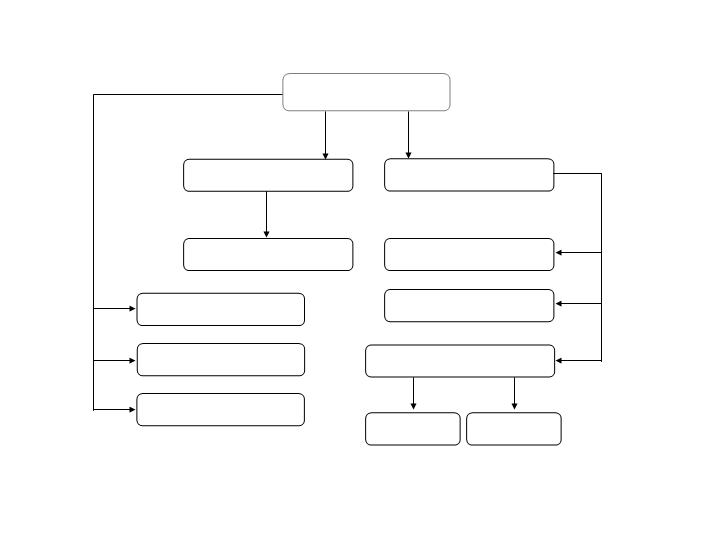

| 2.1.2. | Holdings Diagram |

| The following diagram describes the Company’s significant holdings as at the date of the report. |

Dor Ventures Israel Ltd.

Jemtex Ink Jet Printing Ltd.

Real Time Image Ltd.

Petroleum Capital Holdings Ltd.

Scailex Vision (Tel Aviv) Ltd.

Oil Refineries Ltd.

77.04%

80.1%

SVA disbursement

C Shell 201 * (formerly Tech Ink, SA)

Kovacs 183* SA

Kovacs 319* SA

Scailex Vision International Ltd.

15.76%

100%

100%

100%

100%

100%

Scailex Corporation Ltd.

15%

14.9%

13.2%

6

| 2.1.3. | Year and Method of Incorporation |

| The Company is a public company incorporated on November 2nd, 1971 pursuant to the laws of the State of Israel as a company limited by shares under the name Sci-Tex Corporation Ltd.. In January 1981, the Company changed its name to Scitex Corporation Ltd. In December 2005, the Company changed its name to its current name, Scailex Corporation Ltd. |

| 2.1.4. | Structural Changes, Acquisition, Sale and Transfer of Significant Assets |

| 2.1.4.1. | From 1980 until October 23rd, 2006, the Company’s shares were traded at the NASDAQ Global Market (NASDAQ). On September 18th, 2006, the trade of the Company’s shares at NASDAQ was suspended and on October 23rd, 2006, the Company’s shares were delisted following the NASDAQ determination that the Company was a “Public Shell” (a non-operating business) due to the sale of its operations and assets. As at the date of the Report, the Company’s shares are traded on the Over the Counter (OTC) Bulletin Board in the United States. |

| The Company’s shares are registered at the Tel Aviv Stock Exchange as of the year 2001. |

| 2.1.4.2. | In July 2006, the main shareholders of the Company, Discounts Investment Ltd. (Discount) and Clal Industries and Investments Ltd. (Clal) sold their entire holdings in the Company to Israel Petrochemical Enterprises Ltd. (Petrochemical) which turn to be the controlled company of the Company. For details, see clause 2.3.1.1. |

| 2.1.4.3. | In recent years, the Company sold the core of its operations and assets in the field of digital printing (for details on the discontinued operations – see clauses 4.1-4.4 below) |

| 2.1.4.4. | During 2007, the Company acquired, through PCH – a subsidiary under the Company’s control, 15.76% of the share capital of ORL. For additional details, see clauses 4.7.2, 4.7.3 below. |

| 2.1.5. | Liquidation, Receivership, Settlements |

| The Company is engaged in the liquidation of subsidiaries whose operations have ceased and/or which have been sold and hove no creditors. For additional details, see Note 1c to the Financial Statements. |

7

| As of the date of the publication of this report, the Company operates in one business sector – the management of the Company’s assets, spotting of business opportunities and holding shares of ORL as – see clauses 4.6, 4.7 below.. |

| 2.2. | Spheres of Activity |

| As of the date of the publication of this report, the Company operates in one business sector – the management of the Company’s assets, spotting of business opportunities and holding shares of ORL, see clauses 4.6, 4.7 below. |

| 2.3. | Investments in the Corporation’s Capital and other Transactions in its shares |

| The following is a list of the investment and other substantial transactions executed by the interested parties in the Corporation: |

| 2.3.1.1. | In May 2006, the main shareholders of the Company, Discount and Clal, entered into an agreement for the sale of the entire stake of Clal (24.85%) and Discount (24.54%) in the Company to Petrochemical, in exchange for a total amount of approximately NIS 741.3 million (approximately NIS 39.4 per share), subject, among others, to the payment adjustment mechanism for distribution of dividends by Scailex Vision and for the return of taxes received by certain Company subsidiaries. Pursuant to the provisions of the agreement, Petrochemical undertook to cause Scailex Vision to make a distribution to its shareholders at a reasonable early date until distribution of all the cash in the possession of Scailex Vision, and to cause the voluntary liquidation of Scailex Vision upon completion of said distribution. |

| The sale transaction was completed in July 2006 and, in accordance with the payment adjustment mechanism, the total payment paid by Petrochemical to Discount and Clal for the aforementioned shares amounted to approximately NIS 752.7 million (approximately NIS 40.0 per share). |

| 2.3.1.2. | In February 2007, two Company officials exercised, cumulatively, 112,000 share options (for additional details, see clause 4.10.8.4 to the Report) and sold them to Petrochemical. As a result, the Company’s issued share capital increased by 112,000 shares. Furthermore, in February 2007, Petrochemical purchased, through Petrochemical Holdings Ltd. (a fully owned subsidiary of Petrochemical), 200,000 additional ordinary shares of the Company on the stock exchange, at an average price of NIS 36.4 per share. |

8

| Consequently, the stake of Petrochemical in the Company increased to 50.06% of the issued share capital (49.95% fully diluted). |

| 2.3.1.3. | Undertakings in Respect of Additional Investments in the Corporation |

| As at the date of the Report, the Company is not aware of any undertakings to make additional investments in the Company. |

| 2.4. | Distribution of Dividends |

| Dividends Announced and Distributed Within the Last Two Years |

| During 2006 and 2007, the Company did not distribute dividends. |

| For additional details about dividends distributed by Scailex Vision, see clauses 4.3.3 and 4.3.4 to the Report. |

| 2.4.1. | External Restrictions in Respect of the Corporation’s Ability to Distribute Dividends |

| As at the date of the Report, there are no external restrictions in respect of the Corporation’s ability to distribute dividends. |

| 2.4.2. | Policy for Distribution of Dividends |

| As at the date of the Report, the Company has not made a decision in respect of a policy for the distribution of dividends. |

9

Chapter 3: Other Information

| 3.1 | Financial information on the corporation’s segments of activity |

The following table contains information about the corporations segments of activities:

| NIS in millions | Year ended December 31 | |||

| 2007 | 2006 | 2005 | ||

| Income | From externals (financing and other) | 82.9 | 79.0 | 38.1 |

| From other segments of activity | -.- | -.- | -.- | |

| Total | 82.9 | 79.0 | 38.1 | |

| Total attributed costs | Costs not constituting income in another segments of activity (administrative and general, financing and other) | 42.8 | 16.5 | 15.2 |

| Costs constituting income of other fields of activity | -.- | -.- | -.- | |

| Total | 42.8 | 16.5 | 15.2 | |

| Profit from ordinary activity | 40.1 | 62.5 | 22.9 | |

| Total assets | 1,717.9 | 1,352.6 | 1,624.2 | |

| Minority share in income from externals | (16.3) | 1.9 | -.- | |

The above data are identical with the income statement figures appearing in the consolidated financial statements as of December 31st, 2007.

| 3.2 | Developments in the financial data of the Company |

| For developments in the financial data of the Company see explanation in the directors report in clauses 2, 3 and 4. |

10

| 3.3 | General environment and the effect of external concerns on the Company |

| Correct to the publication date of this report, the Company, through its subsidiary PCH (80.1%), holds approximately 15.76% of ORL’s issued share capital, which were purchased within the framework of a public offer for sale proceeding during February 2007 (9.2%), as well as in subsequent purchases on the stock market. The Company’s business results are likely to be materially affected by its ability to obtain the requisite regulatory approvals for the control and holding of ORL as specified below, which, correct to the publication date of this report, have not yet been obtained. These approvals are conditions to the signing of the control agreement with Israel Corp. which lead to a joint control with Israel Corp. in ORL. |

| For details about the regulatory approvals that are needed in order to hold and control ORL, as well as the current status of same, see clause 4.8 below. For details about the possible ramifications of a failure to receive the regulatory approvals as stated on the Company’s business results, see clause 4.19.1.4 below. |

| Besides the holding of ORL shares, the majority of the Company’s assets are cash or similar liquid investments. Therefore, the financial data and the business results of the Company as on December 31, 2007 are mainly affected by changing trends in the capital markets in Israel and internationally (including in the U.S. bond market), as well as by changes in interest rates (mainly in the United States), inflation and exchange rates. |

11

Chapter 4: Description

of the Corporation’s Business by

Segments of Activity

| 4.1 | Description of discontinued segments of activity |

| Until January 2004, November 2005 and August 2006, the Company engaged through SDP, Scailex Vision and Jemtex, in a number of activities that have meanwhile been discontinued. Subsequent to those dates, and as of the reporting date, the Company no longer engages in the discontinued activities. In its financial statements, the Company presented the results of activity of the three abovementioned segments as discontinued activities, and also reclassified its operating results of the precedent reporting periods. For details on the operating results of the discontinued activities, see Note 1c of the financial statements. |

| Correct to the publication date of this report, the undertakings of the parties to the agreements for the sale of the operations and/or holdings of the Company in subsidiaries (the agreements are specified below in clauses 4.1 – 4.4) have been completed and fulfilled. Regarding agreements stipulating an escrow period, the said escrow period has expired in all such agreements, and no further claims may be filed to the trustee (with the exception of the agreement specified below in clause 4.5.3, which prescribes that the escrow period shall expire in 2008). |

| Notwithstanding that stated above, as is customary in agreements of this type, the prescription period in respect of certain representations that the Company gave is longer than the escrow period and has not yet expired. Nonetheless, in light of the time that has elapsed since the engagement in the above-mentioned agreements, and in light of the expiry of the escrow period in respect thereof, the Company assesses that the chances that it will be sued in the future in respect of these causes are slim. Therefore, the Company assesses that the sums that it allocated are adequate in respect of future claims and in respect of claims already filed in relation to the agreements (for additional details, see clause 4.3.1 below). |

| The information contained in this clause, about the chances of future claims in respect of agreements for the sale of operations, is “forward-looking information,” as this term is defined in the Securities Act; these chances depend upon factors external to the Company. There is no certainty that additional claims will not be filed against the Company in respect of the above agreements for the sale of the operations, and that the provisions allocated will actually cover all liabilities. |

Details on discontinued segments of activity as follows:

| 4.2 | Fast digital printing segment |

| 4.2.1 | In January 2004, the Company completed a transaction of the sale of most of the assets, liabilities and activities of SDP, relating to SDP’s fast digital printing activities, including most of the distribution channels that had served SDP for Eastman Kodak Company (“Kodak”) in consideration of a sum of approximately NIS 1,102 million (250 million dollars) in cash. |

12

| 4.2.2 | In addition, a sum of approximately NIS 52.9 million (12 million dollars) remained in possession of SDP following the execution of the transaction. Under the terms of the agreement, approximately NIS 110.1 million (25 million dollars) of the consideration was deposited in the hands of a trustee; of that amount, the following amounts were transferred to the subsidiary: (1) a sum of approximately NIS 66.6 million (15 million dollars) in February, 2004 (2) a sum of approximately NIS 21.9 million (5 million dollars) in January 2005; and (3) a sum of approximately NIS 22.9 million (5 million dollars) in January 2006. Following the aforesaid transaction, the Company recorded a profit of approximately NIS 264.6 million. Prior to the sale of the activity of SDP in January 2004, the Company engaged, through the subsidiary company SDP, in the development, design and marketing of fast digital printers. |

| 4.2.3 | In December 2004, following completion of the audit performed by the US Internal Revenue Service on the American subsidiaries SDP and SDC for the years 1992 – 1996, the Company filed an application for Federal tax refunds in respect of amended tax reports for the years 1994, 1995 and 1997. In July 2006, the Company received such tax refunds amounting to approximately NIS 56.6 million (approximately 12.6 million dollars). |

| 4.2.4 | For details on the current liabilities of SDP and the profit from the discontinued activity of SDP, see Note 1c of the financial statements. |

| 4.3 | Wide-format digital printing segment |

| 4.3.1 | In November 2005, Scailex Vision completed a transaction for the sale of the majority of its assets and business activity to Hewlett Packard Company (“HP”) in consideration of a sum of approximately NIS 1,067.2 million (230 million dollar) in cash (subject to certain adjustments in accordance with the agreement). Out of this sum, the sum of approximately NIS 95.6 million (USD 23 million) was held in escrow by a trustee until December 2007 to secure representations and undertakings in the sale agreement. |

| Up until the said date, claims totaling approximately USD 15.8 million were filed with the trustee, as specified below, and therefore, upon the expiry of the escrow period, the balance, which exceeds the total claims by the inclusive sum of USD 8.8 million (principal and interest, net of withholding tax) was released to Scailex Vision. The causes of claim, which relate to various localities around the world, are varied, and include breach of representations and undertakings of the Company, which pertain to the tax liability of a subsidiary of Scailex Vision in Mexico, causes relating to environmental quality, safety, health and other associated matters. The claims are being clarified opposite HP according to the mechanism prescribed in the said sale agreement. |

13

| The Company has allocated provisions totaling approximately USD 11 million (NIS 42.3 million) in respect of claims relating to the escrow sum. For details, see note 6.b.2 of the financial statements. |

| The Company has examined the gamut of causes of HP’s claims specified above and, at this stage, particularly taking into account their multiplicity and geographical dispersion, the Company Management assesses that the provisions are adequate to cover these claims, and that all that stated above is not expected to adversely affect Scailex Vision’s equity, its operating results, or the Company. |

| It is emphasized that that stated above includes, inter alia, “forward-looking information,” as this term is defined in the Securities Act. At this stage, there is no certainty that the Company’s provisions will be sufficient, and that the claims will not have additional consequences on the Company’s equity and financial results. |

| 4.3.2 | Subsequent to the said transaction, Scailex Vision recorded profit at the sum of approximately NIS 426.9 million. In April 2006, a transaction price adjustment was made, pursuant whereto, Scailex Vision received an additional sum of approximately NIS 30 million (USD 6.6 million). Up until the sale of the operations of Scailex Vision to HP as stated, the Company engaged, through the subsidiary Scailex Vision, in the development, design and marketing of wide-format digital printers using inkjet technology via drop on demand to the industrial segment. |

| 4.3.3 | On February 9th, 2006, Scailex Vision distributed cash dividend of approximating the amount available for distribution, following completion of a transaction for the sale of the assets to HP. The net aggregate dividend amounted to approximately NIS 624 million (of which the Company received NIS 467 million), by way of payment of approximately NIS 3.7 per share to each of the shareholders and NIS 1.8 to whoever held an option prior to the payment and waived the option. |

| 4.3.4 | In December 2006, Scailex vision filed an application with the Tel-Aviv District Court for the approval of a distribution not meeting the profit criterion in accordance with clause 303 of the Companies Law -1999 (“The Companies Law”) in a sum of up to 20 million dollars, to its shareholders. The application of Scailex Vision for a reduction of capital by 20 million dollars was approved by the court on January 29th, 2007, and the said amount was distributed to the shareholders on February 5th, 2007 (of which, the Company received NIS 60 million). |

| 4.3.5 | For details on the assets and liabilities of Scailex Vision and the operating results in respect of the discontinued activity of Scailex Vision, see Note 1c to the financial statements. |

14

| 4.4 | Continuous digital ink jet printing for industrial applications |

| 4.4.1 | In August 2006, the Company contracted under a reorganization agreement with the senior management of Jemtex whereby the Company transferred most of its holdings in Jemtex to the Company’s two senior managers – Messrs Avraham Raby and Dr. Yehoshua Sheinman. |

| As a result of this transaction, the Company’s holdings in Jemtex declined from approximately 75% to approximately 15% (on a fully diluted basis). Under the terms of the reorganization agreement, the Company converted a sum of approximately NIS 29.7 million out of an aggregate amount of approximately NIS 42.7 million, provided by the Company to Jemtex by way of loans, into shares of Jemtex. As to the remaining amount of approximately NIS 12.9 million, it was determined that the amount would be paid to the Company over a period of 5 to 7 years, unless Jemtex pays the Company the sum of 1 million dollars by January 4, 2007, whereupon the debt will be deemed to have been fully repaid. It was moreover determined that the Company would be protected against dilution (for the preservation of the Company’s holdings at a rate of 15% of the Company’s fully diluted capital) which shall remain in effect until repayment of the outstanding loan amount,. In addition, it was determined that as long as the outstanding loan amount stands at 3 million dollars, and has not been fully repaid, the Company shall be enabled to invest in Jemtex a sum of up to 5 million dollars at a company value of 20 million dollars. |

| Among the additional matters agreed and included in the reorganization agreement were a covenant on the part of the senior managers to continue their employment with the Company for a certain period of time, and also an agreement whereby the managers’ shares would be transferred 50% to Jemtex and 50% to the Company in case of termination of their employment under certain circumstances. |

| 4.4.2 | On January 4th, 2007, Jemtex contracted under an investment agreement with a third party, whereby there was paid to the Company the sum of 1 million dollars (plus interest), and accordingly, the Company viewed the loan that stood to its credit, in the sum of 3 million dollars, as having been fully repaid in accordance with the reorganization agreement. Also amended in order to facilitate the advent of the investors were, inter alia, a number of conditions in the reorganization agreement as follows: the Company waived most of the veto rights vesting in it in accordance with the Articles of Association of Jemtex; a condition was added whereby there would be partly preserved, after the month of August 2009, the Company’s right to receive at least 3 million dollars from the assets available for distribution in case of liquidation or events deemed to be the liquidation of Jemtex, (such as the sale of all or the great majority of the shares or assets of Jemtex, etc.) by means of an agreement whereby the senior managers of Jemtex would share with the Company in part of the assets available for distribution; the Company continues to be entitled to receive 50% of the shares of the senior managers in case of the transaction being concluded in circumstances agreed under the reorganization agreement, and the new investor will receive 50% of such shares (and in a certain instance, part will be transferred also to Mr Raby); the Company was also granted an option to invest in the shares of Jemtex a sum of three million dollars at a company value (before money) of 20 million dollars through August 3rd, 2009. |

15

| 4.4.3 | Consequent on the above-mentioned selling agreement and the decrease in the rate of holding in Jemtex, the Company ceased to consolidate the financial results of Jemtex in its financial statements and classified the activity of Jemtex as discontinued activity. For additional details see Note 1c to the financial statements. |

| 4.5 | Additional Transactions of sales of Scailex holdings |

| 4.5.1 | On June 28th, 2005, the Company sold its entire holdings in Objet Geometries Ltd. (22.9% of its issued and paid-up share capital), a private company incorporated in Israel that engaged in the manufacture of three-dimensional models, photo polymers and consumable products, for the consideration of a total of approximately USD 3 million. The Company recorded a capital gain at the sum of approximately NIS 13.2 million in respect of this transaction. |

| 4.5.2 | In July 2005, IDX Information Corporation Systems acquired the activity of Real Time Image Ltd (“Real Time”). Real Time was incorporated in Israel in 1997, and engaged at the date of the sale in the development of products enabling transfer of medical documents to the Internet without compression. The Company, which at that time held approximately 14.9% of the issued and paid up share capital of Real Time, has received, as of the reporting date, a sum of approximately NIS 14.2 million out of the sale. |

| 4.5.3 | On November 9th, 2006, Xerox Corporation acquired XMPie Inc., a private company incorporated in the state of Delaware, United States, which the Company had held as a small minority holding (2.3%), at a sum of approximately NIS 230.7 million. as of the reporting date, the Company has received in respect of the transaction, a sum of approximately NIS 5.6 million out of approximately NIS 6.4 million while the balance is held in trust in accordance with the sale agreement1. The Company recorded in the fourth quarter of 2006 a capital gain of approx. NIS 5.6 million in respect of that transaction. |

1 Out of the sum held in escrow as stated: (1) the sum of approximately USD 111,600 is to be transferred to the Company by no later than April 2008 – this sum serves to secure all of the Company’s representations and undertakings pertaining to the transaction and (2) the sum of approximately USD 79,700, which serves to secure the Company’s obligation pertaining to tax implications of the transaction; this sum is to be transferred to the Company after the last date on which the relevant tax authorities can charge the Company taxes in relation to the transaction.

16

| 4.6 | The Company’s assets management sector and the spotting of investments and business opportunities |

| As of the reporting date, the Company’s sole sector of operations is that of the management of its assets described above, and the spotting of investments and business opportunities. |

| As of the reporting date, the Company’s assets consist primarily of the investment in ORL, cash, and similar liquid investments such as daily dollar deposits, US Government bonds and debentures of companies carrying a low risk rating. |

| As of December 31, 2007, a sum of approximately NIS 1,229.2 million was invested in financial assets being available for sale (1,182.3 in ORL shares) and held to maturity for short and long term redemption, and a sum of approximately NIS 453.9 million in daily dollar deposits that during 2007 bore average dollar interest at a rate of 5.1% and in NIS deposits that during 2007 bore average NIS interest at a rate of some 3.8%. |

| 4.7 | Acquisition of Holdings in ORL |

| 4.7.1 | ORL – General |

| ORL was incorporated and registered in Israel in August 1959 under the name of Oil Refineries Haifa Ltd. On June 6, 1972, its name was changed to Oil Refineries Ltd. The founding of ORL was the outcome of the Government decision to acquire and obtain the rights of an English oil company pursuant to a concession granted to it, as well as the ownership of the Haifa oil refinery which previously had been under the control of foreign shareholders. |

| In 1971, the Israel Corporation purchased shares in ORL, which vested it with 26% of the equity and voting rights in ORL. The sums of the Israel Corporation’s investment were earmarked and used, inter alia, to construct an oil refinery in Ashdod, which began operating in 1973. On February 12, 2002, the Israel Corporation sold all of its shares in ORL to the State of Israel for the consideration of the sum of approximately NIS 677.5 million, and ceased to be a shareholder, so that, subsequent to that date, the State of Israel held all of ORL’s issued and paid-up share capital. |

| Until September 28, 2006 (hereinafter: “the Determinant Date”), ORL operated a refinery in Haifa and a refinery in Ashdod. Within the scope of the privatization of ORL, ORL’s operations were split on the Determinant Date, whereby the oil refinery in Ashdod was sold to an ORL subsidiary, ORA, which was sold on the Determinant Date to Paz. Correct to the publication date of this report, ORL operates solely the refinery in Haifa. |

| Within the scope of a private sale offer of ORL shares that the State of Israel issued on February 12, 2007, and a public sale offer of ORL shares pursuant to the prospectus of February 13, 2007, and as part of the privatization of ORL, the State of Israel sold all of ORL’s issued and paid-up share capital, in such manner that, subsequent to the sale as stated, ORL ceased to be a government company. |

17

| 4.7.2 | Cooperation for the purchase of ORL shares with the Israel Corporation |

| 4.7.2.1 | On February 18, 2007, the Company and its subsidiary, PCH (hereinafter jointly: “Scailex Group”), engaged with the Israel Corporation in a binding memorandum of agreements (hereinafter: “the Memorandum of Agreements”), pursuant whereto, the Israel Corporation and Scailex Group would submit a joint offer to purchase ORL shares within the scope of the public offer of ORL shares. |

| 4.7.2.2 | The Memorandum of Agreements specified that the Israel Corporation and Scailex Group would submit joint offers for the purchase of ORL shares on the dates stipulated in the prospectus, in such manner that the Israel Corporation would hold 80% of the ORL shares to be purchased, while Scailex Group would hold the remaining 20% of these shares (hereinafter: “the Initial Holding Ratio”). |

| 4.7.2.3 | The parties further agreed that the quantity of shares and the price to be offered would be determined by the mutual consent of both parties and that, in the event of a disagreement, each of the parties would be allowed to act according to its own discretion and the Memorandum of Agreements would be terminated. |

| 4.7.2.4 | Within the scope of the public sale offer as stated, the Israel Corporation purchased (36.8%) and PCH (9.2%) and together, approximately 46% of ORL’s issued share capital, for the inclusive consideration of approximately NIS 2.43 billion. |

| 4.7.2.5 | Following are additional provisions of the Memorandum of Agreements: |

| (a) | Additional shares or securities of ORL that shall be purchased by one of the parties after the offering, jointly or severally, shall be part of the holding of ORL shares to which the provisions of the Memorandum of Agreements shall apply. Decisions to purchase ORL shares in the secondary market subsequent to the conclusion of the offering, whether on or off the stock exchange, including a public offering, shall be reached by mutual consent. |

| (b) | Each of the parties shall be allowed to exploit opportunities and purchase ORL shares, provided that it shall offer the other party, within three business days of the purchase date, an opportunity to purchase a proportionate share of the shares that it purchased as if the call option was exercised on that date; i.e., 55% to the Israel Corporation and 45% to PCH, this at cost price plus market interest until the actual payment date. |

18

| (c) | Scailex Group was granted a call option to increase the rate of its holdings from the Initial Holding Ratio to 45% of the shares to be purchased by the parties within the scope of the offering, this within 120 days of the date that the ministers’ approval pursuant to the Government Companies Order is obtained, or nine months after the signing date of the Memorandum of Agreements, whichever is earlier. Scailex Group will not be allowed to exercise the call option in relation to that portion of the shares that is the subject of the call option, but rather, only in relation to all of them. For details regarding the approval required pursuant to the Government Companies Order, see clause 4.8.1 below. |

| (d) | The parties determined their policy in the Memorandum of Agreements in relation to various issues, including the manner of appointing directors, voting during general assemblies, the dividend distribution policy, right of first refusal, tag-along right, the rights of the parties in the event that the call option is exercised, minority interests, as well as a BMBY mechanism. |

| 4.7.3 | Termination of the Memorandum of Agreements, which was entered into by Scailex Group and the Israel Corporation, and Scailex Group’s receipt of a letter of undertaking from the Israel Corporation |

| Pursuant to the Vital Interests Order, the control and operation of a means of control in ORL are subject to the approval of the Prime Minister and the Minister of Finance (hereinafter: “Ministers’ Approval” or “Control Permit”), and the consent of the Commissioner. Accordingly, Scailex Group and the Israel Corporation submitted an application to receive the Control Permit, during which Scailex Group was required to provide additional details in relation thereto by the relevant authorities, inter alia, in relation to Linura, which held 19.9% of PCH’s share capital (for additional details about the PCH shareholder agreement, see clause 4.7.4 below). |

| Whereas the Scailex Group and the Israel Corporation were of the opinion that the best interests of ORL require control thereof as soon as possible, and that the Israel Corporation, which had been a material shareholder in ORL until February 2006, could obtain the Control Permit pursuant to the Government Companies Order faster than PCH could obtain it, and in light of the demands for additional particulars, on May 10, 2007, the Israel Corporation and the Scailex Group agreed to terminate the Memorandum of Agreements, and in lieu thereof, the Israel Corporation issued a letter of undertaking (hereinafter –“the Letter of Undertaking”) to the Scailex Group, that the Scailex Group agreed to act according therewith, and whose main points are as specified below: |

19

| 4.7.3.1 | Receipt of the Requisite Approvals by the Scailex Group by and no later than May 15, 2009 (hereinafter in this clause: “the Determinant Date”), shall lead to the engagement in and signing of a joint ORL control agreement by the Israel Corporation and Scailex Group (hereinafter: “the Control Agreement”), according to the version agreed upon between the parties, whose main points are specified below. |

| 4.7.3.2 | Exercise of the call option (hereinafter: “the Call Option”), which shall be granted to PCH pursuant to the Control Agreement, shall be exercisable until the Determinant Date (i.e., May 15, 2009) or until 120 days after receipt of the Requisite Approvals, whichever is earlier. Exercise of the Call Option would enable PCH to purchase and receive by way of transfer from the Israel Corporation 230 million shares of ORL (hereinafter: “the Exercised Shares”) in such manner that, subsequent to the exercise of the Call Option, the internal holding ratio in the control core in ORL (which includes 50.25% of ORL’s share capital) shall be: the Israel Corporation – 55%; PCH – 45%. The price of the Exercised Shares is cost price of the purchase of the control core shares that were purchased in the sale offer; i.e., the sum of NIS 3.3 per share, and a total of NIS 759 million, plus index linkage differentials and linked interest at the rate of 5% per annum, calculated and charged six months after the purchase date, after deducting dividends distributed (if any), plus index linkage differentials and interest as stated. It should be noted that, according to the Memorandum of Agreements, the Call Option will be valid for a shorter period – up to nine months after the signing of the Memorandum of Agreements or 120 days after receiving the Requisite Approvals, whichever is earlier. |

| 4.7.3.3 | The sale and transfer of ORL shares owned by PCH to a third party or a sale of the control in PCH (subject to certain conditions), in Scailex or in the corporation controlling Scailex (directly or indirectly), with the exception of IPE and the corporations controlling it, to a third party, shall confer upon the Israel Corporation (subject to certain conditions) a right of first refusal to purchase or a right to purchase (as the case may be) all control core shares in ORL, the relevant securities according to provisions prescribed in the Control Agreement, as specified in clause 4.7.3.8 below. |

| 4.7.3.4 | Scailex’s rights to engage in the Control Agreement are transferable to a third party, in such manner that if PCH shall sell all of its ORL shares to a third party (and the Israel Corporation shall not exercise the right of first refusal conferred upon it), or if Scailex shall sell the control in PCH to a third party, and if the third party shall receive by and no later than by the Determinant Date, all of the Requisite Approvals, then, in such instance, the Israel Corporation shall engage with the third party in the Control Agreement, and the third party shall subrogate Scailex Group for all intents and purposes. |

20

| 4.7.3.5 | Until engagement in the Control Agreement, the Israel Corporation shall be entitled to operate its control power in ORL (subject to its receiving the Control Permit pursuant to the Government Companies Act) at its discretion, without any restriction. |

| 4.7.3.6 | On the signing date of the Letter of Undertaking, PCH signed an irrevocable letter of authorization, pursuant whereto it empowers the Israel Corporation to vote under its name and on its behalf during general assemblies of ORL shareholders in respect of one hundred million shares of ORL that it owns, which constitute 5% of ORL’s issued share capital (hereinafter: “Letter of Authorization”). The Letter of Authorization expired six months after the date of the Letter of Undertaking, on November 10, 2007. |

| 4.7.3.7 | Main points in the Control Agreement |

| Following are the main points of the Control Agreement, which shall be signed by the Israel Corporation on the one hand, and Scailex Group on the other hand, upon receipt of the Requisite Approvals by the parties, and it shall take effect on the date it is signed. |

| (a) | Definition of the controlling shares in ORL – the control core shares shall constitute 50.25% of ORL’s issued and paid-up share capital (hereinafter: “the Control Core Shares”). |

| (b) | The granting of a Call Option to PCH, as specified above in clause 4.7.3.2. |

| (c) | Restrictions on a transfer of Control Core Shares – |

| 1. | Freeze period – the agreement prescribes a freeze period of six months, to be counted from the signing date of the Control Agreement, whereby none of the parties shall be permitted to transfer the Control Core Shares. |

| 2. | Right of first refusal – Scailex Group shall grant a right of first refusal to the Israel Corporation to purchase and to receive by way of transfer all Control Core Shares that shall be offered for sale by it to a third party as of the signing date of the Control Agreement, while the Israel Corporation shall grant a right as stated to Scailex Group as of the exercise date of the Call Option. The right of first refusal shall also apply, mutatis mutandis, in the event that a lien that shall apply (if any shall apply) on the Control Core Shares shall be exercised by the holder of the lien on these shares. |

21

| A direct transfer of control in PCH or an authorized transferee (holding the Control Core Shares) to a third party (hereinafter: “Transfer of the Control”) shall constitute an event entitling the Israel Corporation to a right to purchase all of the securities (but not a portion thereof) constituting a subject of the transaction for Transfer of the Control, according to the conditions prescribed with the third party, and all according to the provisions prescribed in the Control Agreement. |

| A transfer of control in Scailex or in the corporation controlling Scailex (directly or indirectly), with the exception of IPE and the corporations controlling it, to a third party, whereby the Control Core Shares to be held at that time by PCH and/or by one of its authorized transferees constitute the majority of the assets of the relevant corporation wherein a Transfer of Control shall be effected, shall confer to the Israel Corporation (subject to certain conditions) a right to purchase all (but not a portion) of the Control Core Shares in ORL or the relevant securities, according to the provisions specified in the Control Agreement. |

| In this clause, “majority of the assets” means: that the relevant corporation has no other assets (save the Control Core Shares), the value of which, pursuant to its last audited consolidated annual financial statements or pursuant to its last reviewed consolidated quarterly financial statements, exceeds the sum of USD two hundred (200) million. In the context of the provisions of this clause, “assets” – do not include cash and cash equivalents. |

| 3. | In the instance whereby a right shall arise to the Israel Corporation to purchase from PCH the Control Core Shares in ORL as stated above, the consideration shall be determined on the basis of the average closing prices of ORL shares during the 60 trading days that preceded the date of the notice of a transfer of control, multiplied by the number of Control Core Shares being sold, plus a premium of 15%. |

| 4. | It is clarified that a party to the Control Agreement shall be allowed to sell and/or to transfer all of the Control Core Shares held by it at that time – but not a portion thereof. |

| 5. | Tag-along right – each of the parties shall have a right to join in on the sale of the Control Core Shares of the other party, provided that the right of first refusal has not been exercised. The Israel Corporation’s tag-along right shall come into effect only as of the date on which PCH duly exercises its Call Option. |

22

| (d) | BMBY (Buy Me Buy You) – each of the parties to the agreement shall have the right to activate a BMBY mechanism in relation to the Control Core Shares (after the expiration of the six-month freeze period), whereby it can offer to the other party to purchase all of the Control Core Shares that shall be held by the other party at the price quoted in the offer, or to sell to the other party all of the Control Core Shares to be held by it at the said price. |

| (e) | Appointment of directors – the parties to the Control Agreement shall undertake within the scope thereof to operate all voting power available to them during ORL’s general assemblies for the election or appointment of members of ORL’s board of directors, in the following manner: |

| a. | As long as the Call Option has not been exercised, ORL’s board of directors shall appoint 9 members (including 2 external directors), whereby the Israel Corporation shall recommend the appointment of 5 directors, PCH shall recommend the appointment of 2 directors, and the recommendation regarding the identities of the 2 external directors shall be made by mutual consent. |

| b. | Once the Call Option is exercised, ORL’s board of directors shall appoint 11 members (including 2 external directors), whereby the Israel Corporation shall recommend the appointment of five directors and the appointment of one external director, and PCH shall recommend the appointment of 4 directors, and the appointment of one external director. |

| Inter alia, it was prescribed that the right of representation of the Israel Corporation and PCH on ORL’s board of directors, as stated above, shall also relate to all of ORL’s board committees, with the exception of the audit committee, and, to the extent possible, also to the boards of directors of ORL’s subsidiaries and affiliates, this on the basis of the principles specified in the above clauses a. and b. |

| (f) | The Control Agreement prescribes that, once the Call Option is exercised, and subject to all statutory provisions, the parties, in their capacities as ORL shareholders, shall act so that the appointment of the CEO of ORL, the auditors and attorneys of ORL, the subsidiaries of ORL, and, to the extent possible, of ORL’s affiliates – shall be done by mutual consent. Furthermore, subject to all statutory provisions, ORL’s chairman of the board shall be appointed according to the recommendation of the Israel Corporation. |

23

| (g) | Voting on certain issues – the Control Agreement prescribes a number of issues that, should they be placed on the agenda and for resolution by ORL’s general assemblies of shareholders, the parties will agree in advance about how they will vote in relation to these issues, and, in the absence of agreement between them, an agreed arbitrator shall decide how they shall vote. It was further prescribed that the parties would act to amend ORL’s Articles of Association in order that the resolution in relation to those same agreed issues, being submitted for resolution by ORL’s board of directors, would be transferred for decision-making to ORL’s general assembly of shareholders, or that the resolution in relation thereto shall require a supermajority of 75% of all directors present. That stated shall take effect only after the Call Option is exercised. Following is a list of the agreed issues: (a) entry by ORL or by any of its subsidiaries into new spheres of activity; (b) the offering of shares or of other securities by ORL and/or by any subsidiary and/or affiliate; (c) amendment of ORL’s Articles of Association and/or of any subsidiary and/or affiliate; merger or split or reorganization of ORL or of any subsidiary; (e) transactions other than during the ordinary course of business of ORL or of any subsidiary or affiliate with interested parties (f) appointment of ORL’s accountants; (g) liquidation or stay of proceedings of ORL and/or of any subsidiary and/or affiliate thereof; (h) a material purchase or sale transaction of ORL. “Material” means: that the transaction may have a material affect on its assets or liabilities or profits. |

| (h) | Dividend policy – the parties to the Control Agreement shall act, subject to any statute, so that ORL and its subsidiaries shall adopt a dividend policy whereby at least 75% of the annual profit suitable for distribution shall be distributed each year. |

| (i) | Period of the agreement – the Control Agreement shall take effect on the date of the signing thereof and shall terminate (a) pursuant to the provisions thereof, or (b) as of the date on which a party shall cease to hold at least 10% of ORL’s share capital. |

| (j) | Additional provisions – the agreement includes additional provisions, which are customary in agreements of this type, including clauses addressing confidentiality, remedy, nonwaiver of rights, arbitration, jurisdiction, and the like. |

24

| (k) | Scailex guarantee – Scailex is guaranteeing all of PCH’s liabilities pursuant to the Control Agreement. |

| 4.7.3.8. | On June 27, 2007, the Israel Corporation received a Control Permit for ORL. Correct to the publication date of this report, PCH has not yet received the Control Permit for ORL. For additional details about the Control Permit, see clause 4.8.1 below. |

| 4.7.4 | Shareholder agreement between Linura and the Company in relation to their holdings in PCH |

| On December 21st, 2006, the Company engaged with Linura in a shareholder agreement, which regulates the rights and obligations of the shareholders of PCH (hereinafter: “PCH Shareholder Agreement”), whose main points are specified below (the Company and Linura shall be called hereinafter in this clause: “the Parties”). It should be noted that, following the difficulties in receiving the Control Permit, as stated in clause 4.8.1 below, the Parties reached an agreement in principle, whereby, the Company would purchase Linura’s holdings in PCH, so that PCH shall become a company wholly owned by Scailex. |

| Further to the said consent, on March 13th, 2008, Scailex and Linura reached an agreement whereby the Company shall purchase Linura’s entire holdings in PCH for the consideration of a total of USD 57.2 million, and shall receive, by way of assignment, the capital note that PCH had issued to Linura. The consideration shall be paid in a single payment by March 28th, 2008. Upon completion of the acquisition of Linura’s shares in PCH, the PCH Shareholders’ Agreement shall expire, whose main points are as follows: |

| 4.7.4.1 | The Parties shall purchase shares of ORL through PCH. |

| 4.7.4.2 | The Shareholder Agreement prescribes that the Company shall hold 80.1% of PCH’s share capital and Linura shall hold 19.9% of PCH’s share capital. It was further prescribed that the Company shall provide management and administrative services to PCH for no charge, with the exception of the payment of expenses in kind that it shall incur in respect of these services. |

| 4.7.4.3 | PCH's board of directors and the passing of resolutions |

| The Shareholder Agreement prescribes that PCH’s board of directors shall appoint at least three and no more than seven members, and, as long as Linura holds 19.9% of PCH’s share capital, it shall be entitled to appoint one director. |

25

| Correct to the publication date of this report, three directors are serving on PCH’s board of directors on behalf of Scailex and one on behalf of Linura. The Company is entitled to appoint the chairman of the board. The chairman of the board does not have an additional vote. |

| 4.7.4.4 | PCH's general assembly of shareholders and the passing of resolutions |

| As long as Linura holds 15% of PCH’s share capital, the following resolutions shall require the approval of all shareholders of PCH: amendment to PCH’s incorporation documents; merger, split, reorganization; purchase, sale or a granting of a special license in relation to all or a material portion of the assets within the scope of a single transaction or a series of transactions; as well as winding up, liquidation; a settlement agreement or any other arrangement with creditors; an application for liquidation or a stay of proceedings; as well as an application to register shares or bonds for trading on the stock exchange. |

| 4.7.4.5 | Financing of PCH |

| (a) Scailex and Linura agreed that their share in the financing of the purchase of ORL shares would be through PCH and effected by way of a shareholder loan against capital notes (hereinafter: “the Capital Notes”), pari passu to the Parties’ holdings of PCH, up to the sum to be decided between them in accordance with agreed frameworks. |

| (b) The Parties also agreed that no dividend would be distributed until the Capital Notes are repaid to the shareholders. |

| On August 9, 2007, the board of directors and general assembly of shareholders of PCH approved an amendment to the Shareholders’ Agreement with Linura of December 21, 2006 (hereinafter: the Amendment to the Shareholders’Agreement”). The Amendment to the Shareholders’ Agreement prescribed the terms and conditions of the loans provided by PCH’s shareholders. |

| It was prescribed, inter alia, that the loan sums quoted in USD would bear dollar interest as of the investment date until August 9, 2007. On August 9, 2007, these loans were converted into shekel loans and Capital Notes were issued in respect thereof. The payment for the Capital Notes is to be rendered in NIS, will not bear interest, linkage differentials or revaluation and, in any case, shall not be paid before January 1, 2009. |

26

| 4.7.4.6 | Restrictions on transfers of PCH shares |

| Up until the expiration date of the first Put Option and the first Call Option (as defined below), the Parties shall not be allowed to effect any transfer of any right deriving from this agreement, with the exception of a transfer permitted pursuant to the Shareholders’ Agreement, such as a transfer to subsidiaries. Subsequent to the restriction period, the Parties shall be allowed to transfer only the ordinary shares, pursuant to the PCH Shareholders’ Agreement and the incorporation documents, subject to that stated below. |

| 4.7.4.7 | Rights of refusal and tag-along |

| The Company has a right of refusal in the event that Linura shall desire to sell its holdings to a third party, in accordance with an offer received from that third party (“First Refusal”). Linura has a right of First Offer, whereby, in the event that the Company shall desire to sell all of its holdings to a third party, it shall enable Linura to purchase them; should Linura refuse the offer, the Company shall be allowed to force Linura to sell its shares in PCH under the same conditions (“Bring-Along”). |

| Linura has a right to join in on sales of the Company to a third party, pari passuto its holdings in PCH (“Tag-along”). |

| The Parties have a right to a First Offer, in the event that PCH shall sell all of its holdings in ORL to third parties, pari passu to their holdings in PCH. |

| 4.7.4.8 | Expiration of the PCH Shareholders' Agreement after the Control Permit was not received |

| In the event that, after exhausting all efforts to obtain the Control Permit, PCH shall not receive the Control Permit for ORL, the Parties have determined the following mechanism: |

| In the event that the nonreceipt of the Permit derives from Linura’s holding of PCH shares, Scailex shall be able to terminate the agreement, and shall have the right to purchase Linura’s PCH shares, at the price equivalent to the price of the capital that Linura had invested in PCH, after deducting dividend payments and repayments of Linura’s investments in PCH. |

| In the event that the nonreceipt of the Permit derives from Scailex’s holding of PCH shares, Scailex shall be able to choose between selling ORL shares that shall be held by PCH to a third party and liquidating PCH, or, alternatively, to jointly sell the PCH shares held by Scailex and Linura to a third party. |

27

| 4.7.4.9 | First Put Option |

| If within twelve (12) months from the date of the Offer for Sale PCH shall not acquire control of ORL, Linura shall be entitled to force Scailex to sell its shares in PCH (hereinafter, the “First Put Option”). The price of the purchase shall be equal to the price of the capital investment made by Linura in PCH, plus interest, less all dividends or payment of investments in capital made by Linura pursuant to the mechanism stipulated in the Agreement. |

| 4.7.4.10 | First Call Option |

| If Linura fails to exercise the First Put Option within thirty days from the date it became entitled to exercise said option, Scailex shall be entitled to purchase all the shares of Linura in PCH (hereinafter, the “First Call Option”) at a price to be determined pursuant to the mechanism stipulated in the Agreement. |

| 4.7.4.11 | Second Put Option |

| At the end of one year from the date of acquisition of the control of ORL, Linura shall be entitled to force Scailex to purchase all its shares in PCH (hereinafter, the “Second Put Option”) in exchange for the investments in capital made by Linura in PCH less dividends and proportional payment of investments in capital paid to Linura, pursuant to the mechanism stipulated in the agreement. |

| 4.7.4.12 | Second Call Option |

| If Linura fails to exercise the Second Put Option within thirty (30) days from the date of the option can be exercised, Scailex shall be entitled to purchase all the shares of Linura in PCH at the price that shall be determined pursuant to the mechanism stipulated in the agreement. |

| 4.7.4.13 | General |

| (a) | The Parties agree that neither Party shall transfer its shares to a third party if said transfer violates the Control Permit or prevents PCH from receiving the Control Permit. |

| (b) | Linura shall appoint a company, an international supplier of raw oil and refined products, that shall make utmost efforts to offer ORL competitive conditions, for ORL’s good. For as long as Linura holds 19.9% of the share capital of PCH and subject to the legal and regulatory restrictions, the Company and Linura agree to make utmost efforts through PCH to substantially increase the share of the aforementioned company in the supply of raw oil and/or refined products sold to ORL. |

28

| 4.8 | Regulatory Approvals for Holdings in ORL Holdings |

| 4.8.1 | Control Permit and holding of controlling stakes in ORL |

| Pursuant to the provisions of the Government Companies Order, if an individual held control or control means in ORL in rates that are subject of approval by virtue of the Interests Order (24% and higher), said individual must submit a request to the Ministers (Minister of Finance and Prime Minister) for approval of said individual’s holdings within 48 hours (hereinafter the “Request”). |

| As long as no approval is granted for control or holding of control means at the rates subject to approval (24% and higher), as the case may be, the rights in ORL by virtue of the shares acquired, including dividends, appointment of directors and officials, and in respect of voting rights in the Annual General Meeting of ORL shareholders shall not enter into effective. This is for an individual who holds more than 24% in ORL. |

| Pursuant to the notification of the Prime Minister and the Minister of Finance, on October 26th, 2007, the 60-day period elapsed since the last date on which PCH submitted additional particulars in relation to the control permit. Pursuant to the Vital Interests Order, the answer of the Prime Minister and the Minister of Finance in relation to PCH’s application for a control permit was supposed to have been issued by that date. A temporary arrangement was proposed to the competent authority during the contacts between PCH and the State authorities, pursuant whereto, shares of two foreign entities, who are directly and indirectly holding PCH, Linura and the Alder Group (shareholders of the indirect controlling shareholder – see details about the holdings of interested parties below in regulation 24 of clause D. of the report), in relation to whom questions were raised by the competent authority, would be deposited in escrow until the final decision on the matter of the permit. |

| On November 22nd, 2007, the authority’s answer was received, pursuant whereto, the proposed arrangement, whether temporary or permanent, does not provide a solution to the State’s difficulty to agree to PCH’s application for a Control Permit. |

| Taking heed of the authority’s answer as stated, consent was achieved between the Company and Linura, whereby Linura would completely exit PCH, so that all share capital and controlling shares of PCH would be held solely by the Company. Also achieved was Alder Group’s consent to cancel the lien that it has on a portion of the shares of the control group. |

29

| On February 21st, 2008, the response of the Government Companies Authority was received, pursuant whereto, it would be possible to consider PCH’s application for control of ORL jointly with the Israel Corporation, only if the influence of the Alder Group, directly or indirectly, on the control in PCH, both as a material shareholder in Modgal Industries Ltd. (which is the controlling shareholder in PCH, through corporations under its control), and as a creditor, would be completely removed. |

| Following the response, it was advised that, in light of that stated, the apparent position, that of recommending to the Prime Minister and the Minister of Finance that PCH’s application for the control permit should be rejected, was presented to the State Attorney General. |

| The Company referred to its controlling shareholder and updated it about the said response. In its response to the Company, Modgal Industries Ltd. (“Modgal”), an indirect controlling shareholder in the Company, stated that, in its opinion, the position of the competent authority is extremely unreasonable. It was further stated that Modgal and its controlling shareholders are examining possible alternatives to resolve the problem, but that there is no certainty that they will succeed in formulating a solution that meets the excessive requirements of the competent authority. |

| In light of receiving the response as stated, PCH, together with its advisors, is examining the various channels available to it in relation to all matters pertaining to its holding of ORL shares and the control permit. |

| 4.8.2 | Approval of the Antitrust Authority |

| Within the framework of the resolution to privatize ORL, it was decided that, within the framework of the privatization of ORL, expression would be given to conditions stipulated in the Commissioner’s position in his notifications, as attached to the privatization resolution. |

| On February 6th, 2007, the Antitrust Authority published a notification pursuant to which, would it become apparent upon publication of the results of the Public Offering of ORL’s shares, that an entity, jointly with others or severally, acquired holdings in excess of one quarter of any of the rights in ORL, the Antitrust Authority would then refrain from enforcing any measures against said entity even though it failed to receive prior approval pursuant to the provisions of the Antitrust Law -1988, provided the following cumulative conditions were met: |

30

| 4.8.2.1. | The purchaser and ORL provide a merge notification not later than thirty business days from the date of publication of the results of the public tender. |

| 4.8.2.2. | Until receipt of the approval by the General Director, the purchaser refrains from exercising any of the rights attached to the shares (higher than one quarter), including the right to appoint directors, to vote in the Annual General Meeting, and to participate in the profits of the corporation. |

| 4.8.2.3. | Until receipt of the approval from the General Director, the purchaser refrains from exercising any influence on the business of ORL, including appointment of ORL officials and the taking of business decisions or making recommendations for decisions as aforementioned. |

| 4.8.2.4. | These limitations supplement the provisions of the Essential Interests Order and shall be valid even if approval is granted pursuant to the Essential Interests Order, for as long as there is no approval by the General Director of the Israel Antitrust Authority. |

| On March 27, 2007, PCH received the Antitrust Commissioner’s decision to approve the merger between ORL, the Israel Corporation and PCH, conditionally. The main points of the conditions stipulated by the Antitrust Commissioner are as follows: |

| (a) | Rotem Amfert Negev Ltd. (hereinafter: “Rotem”), a company of the Israel Chemical group, shall not unreasonably refuse to purchase sulfur originating from ORA, and shall not make a purchase thereof conditional upon conditions which, by nature or according to customary trade terms, do not concern the subject of the engagement; and that Rotem shall not discriminate against ORA vis-à-vis ORL, in the purchase of sulfur; and that Rotem shall document in writing and in detail every sulfur purchase from ORA or from ORL, and shall save such documentation in its offices for three years after effecting any transaction, which shall be furnished to the Commissioner upon request. |

| (b) | COL, a company of the ORL group, shall not unreasonably refuse to purchase a stream of C4 and a stream of propylene (hereinafter in this clause: “the Products”) being conveyed from ORA, and shall not make a purchase thereof conditional upon conditions which, by nature or according to customary trade terms, do not concern the subject of the engagement; and that COL shall not discriminate against ORA vis-à-vis ORL in the purchase of the Products; and that COL shall document in writing and in detail all purchases of the Products, and shall save such documentation for three years after effecting any transaction, which shall be furnished to the Commissioner for perusal upon request. |

31

| (c) | ORL shall not unreasonably refuse to sell a propylene stream to ORA that it received from COL within the scope of its obligations included in the agreement between ORL, IPE and COL, including partial assignment thereof to ORA, and shall not make the sale thereof conditional upon conditions which, by nature or according to customary trade terms, do not concern the subject of the engagement; and that ORL shall not discriminate against ORA in the conveyance of a propylene stream that was conveyed to it from COL as stated; and that ORL shall not discriminate against ORA in relation to the propylene flow conveyance terms from COL to ORL itself; and that COL shall document in writing and in detail every conveyance of propylene stream to ORL, and ORL shall document in writing and in detail every conveyance of propylene stream to ORA, and shall save such documentation for three years after effecting any transaction, which shall be furnished to the Commissioner for perusal upon request. |

| (d) | Pursuant to the conditions, ORL, COL and Rotem are required to furnish a confirmation to the Commissioner every year that, in the preceding year, each of them has fulfilled the conditions applicable to it according to the Commissioner’s decision, in their entirety. |

| According to ORL’s assessment, the implementation of the above conditions is not expected to have any material effect (if any whatsoever) on its operations or business results. |

| 4.8.2.5. | It should be noted that, in light of the termination of the Memorandum of Agreements, as stated above in clause 4.7.3, it is possible that, formally, a new approval from the Commissioner will be required in order to validate the agreement for the joint control of ORL by the Israel Corporation and Scailex Group. Nonetheless, correct to the publication date of this report, the Company is not aware of any change in circumstances, which might prevent PCH from receiving a renewed approval from the Antitrust Commissioner, if and to the extent that an approval of this type is required at all. |

| 4.9 | Fixed assets and facilities |

| In January 2007, the Company contracted under an agreement with a third party for the leasing of offices in an aggregate area of approximately 387 sq.m in an office building in Herzliya, in consideration of rent and monthly management fees aggregating approximately NIS 33,000. The agreement is in force for a period of five years and may be extended for a further up to ten year period (with an option of extension for five leasehold terms of two years each). |

32

| 4.10 | Human capital |

| 4.10.1 | Payrolled employees by fields of activity |

| As of the reporting date, the Company payrolls five employees in Israel (including the CEO and the CFO). |

| 4.10.2 | Material changes in the personnel establishment. |

| In July 2006, Mr. Yahel Shachar, who until that time had served as the Company’s CFO, was appointed CEO of the Company. Mr. Shachar Rachim, who until then had served as the Company’s controller, was appointed as the Company’s CFO. |

| 4.10.3 | Material dependency on a particular employee |

| As of the reporting date, the Company has no material dependency on any employee. |

| 4.10.4 | Corporate Investment in Training and Courses |

| Company employees participate in seminars, conferences and courses in business, legal, accounting and taxation areas relevant to the Company’s business in order to enrich their knowledge and to keep them current with developments and changes in such areas. The Company also obtains current updates from professional entities on these issues. |

| 4.10.5 | Benefits and nature of employment contracts |

| Employment terms of company employees are set forth in individual employment contracts on a monthly basis. These employment terms typically include payments to Managers’ Insurance policies or to a Pension Fund, annual vacation, sick pay and vacation pay. The employment contracts are for an undetermined term, and each party may terminate the contract by prior written notice, as set forth in the contract. |

| 4.10.6 | Group of officeholders and senior management staff in the corporation |

| The employment conditions of the Company’s CFO are regulated in a personal employment agreement that took effect on August 18, 2006 and is for indefinite period not predetermined, whereby each party may terminate the agreement by three months’ prior notice to the other party. |

33

| 4.10.6.1 | CEO employment agreement |

| The employment conditions of the Company’s CEO. are regulated in a personal employment agreement that took effect on August 18, 2006 and is for indefinite period not predetermined, whereby each party may terminate the agreement by three months’ prior notice to the other party. |

| 4.10.6.2 | Employment agreement of the Company’s CFO |

| The employment conditions of the Company’s CFO. are regulated in a personal employment agreement that took effect on August 18, 2006 and is for indefinite period not predetermined, whereby each party may terminate the agreement by three months’ prior notice to the other party. |

| 4.10.7 | Management services agreement - the Company's chairman of the board |

| On April 30, 2007, after the audit committee and board of directors of the Company had given its approval thereto, an extraordinary general assembly of the Company approved the Company’s engagement in a management services agreement (hereinafter: “the Management Agreement”) with Globecom Investments Ltd. (hereinafter: “Globecom”), a private company controlled by Mr. Eran Schwartz, pursuant whereto, the services of Mr. Eran Schwartz, as the active chairman of the board of the Company would be provided by it, in accordance with the conditions specified hereunder |

| 4.10.7.1 | The agreement will be valid for approximately 18 months, commencing July 18th, 2006, the date on which Mr. Eran Schwartz took office as the chairman of the board of Scailex, and until December 31st, 2007. Nonetheless, each of the parties would be able to terminate it by prior notice of six months. On December 31st, 2007, the annual general assembly of the Company approved the extension of the validity of the Management Agreement with Globecom, so that the Management Agreement shall be valid until six (6) months after a termination notice is given by either of the parties to the other, as the case may be. |

| 4.10.7.2 | Globecom is a private company controlled by Mr. Eran Schwartz, and shall retain this status for the duration of the agreement. |

34

| 4.10.7.3 | Globecom shall provide services to Scailex of an active chairman of the board solely through Mr. Eran Schwartz (hereinafter: “the Services”). The nature of Scailex’s operations, by virtue of it being a holding company, is dynamic, and the scope of the management Services required vary according to the various ventures and investments in which Scailex is involved. Consequently, no minimum scope was stipulated for the Services and the actual scope of the Services shall be according to Scailex’s needs. Accordingly, it is possible that during certain periods, during which the Management Services shall focus on new investments and ventures, or on material decisions relating to existing investments, the scope of the Services shall be extensive, while during other periods, when the Management Services shall focus on current issues, it is possible that the Services shall be of lesser scope. |

| 4.10.7.4 | The inclusive monthly cost that Scailex shall pay to Globecom in respect of the provision of the Services shall be the sum of NIS 100,900 (hereinafter: “the Monthly Consideration”). This sum is based on a monthly wage at the sum of NIS 75,000, plus sums, including an estimated cost of benefit components. |

| 4.10.7.5 | The Monthly Consideration shall be linked to the Consumer Price Index as shall be published from time to time, whereby the base index is the index that was known on the date that the Agreement took effect; i.e., the index of June 2006, and, in any case, the Monthly Consideration shall not diminish from the sum of NIS 100,900. In addition, Globecom shall be entitled to reasonable reimbursement of expenses from Scailex in respect of board and lodging expenses and other expenses, which Globecom incurred within the scope of providing the Services to Scailex. |

| 4.10.7.6 | Scailex shall insure Mr. Schwartz and Globecom (to the extent possible) under directors’ and officeholders’ liability insurance, and shall grant them indemnification and exemption to the extent customary in Scailex. |

| 4.10.7.7 | Employer-employee relations shall not exist between Scailex and Mr. Eran Schwartz. Scailex shall be entitled to indemnify Globecom in respect of any damage or expense that shall be caused to it in respect of any allegation that Mr. Eran Schwartz was an employee of Scailex. |

| 4.10.7.8 | The Monthly Consideration and all other sums to be paid pursuant to the Agreement as stated, shall be paid on the first day of each month for the following month, plus V.A.T. as required by law, and against a tax invoice. |

35