UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-02368

| Name of Registrant: |

Vanguard Fixed Income Securities Funds |

| Address of Registrant: |

P.O. Box 2600 |

| |

Valley Forge, PA 19482 |

| Name and address of agent for service: |

Tonya T. Robinson, Esquire |

| |

P.O. Box 876 |

| |

Valley Forge, PA 19482 |

Registrant’s telephone number, including area code: (610)

669-1000

Date of fiscal year end: January 31

Date of reporting period: February 1, 2024—January 31, 2025

Item 1: Reports to Shareholders.

TABLE OF CONTENTS

10183

50964

145202613

10897

55027

10210

100000000

97144679

10239

106637183

10327

124572985

10634

11219

117542026

11556

151683298

134763813

11270

10516

129880851

10679

145923277

10000

10232

51263

100000000

100000000

10895

10000

9984

113147952

110518068

10129

10347

133035562

160368676

10580

190031179

11600

12148

174033798

11787

207351751

261837930

10802

11028

51752

97110506

10319

11256

53280

10614

106513279

50000

124382109

11193

56246

11548

58088

117295167

11294

56863

151269355

10493

134285669

52885

10663

129343262

53798

10000

0000106444

falseN-1A

0000106444

vfisf:C000193720Member

2017-09-26

2025-01-31

0000106444

vfisf:DowJonesUSTotalStockMarketFloatAdjustedIndexMember

2017-09-26

2025-01-31

0000106444

vfisf:RealEstateSplicedIndexMember

2017-09-26

2025-01-31

0000106444

2024-02-01

2025-01-31

0000106444

vfisf:BloombergUSAggregateBondIndexMember

2020-02-01

2025-01-31

0000106444

vfisf:BloombergUSGNMABondIndexMember

2020-02-01

2025-01-31

0000106444

vfisf:C000007087Member

2020-02-01

2025-01-31

0000106444

vfisf:C000007088Member

2020-02-01

2025-01-31

0000106444

vfisf:C000193720Member

2020-02-01

2025-01-31

0000106444

vfisf:DowJonesUSTotalStockMarketFloatAdjustedIndexMember

2020-02-01

2025-01-31

0000106444

vfisf:RealEstateSplicedIndexMember

2020-02-01

2025-01-31

0000106444

vfisf:BloombergUSAggregateBondIndexMember

2024-02-01

2025-01-31

0000106444

vfisf:BloombergUSGNMABondIndexMember

2024-02-01

2025-01-31

0000106444

vfisf:C000007087Member

2024-02-01

2025-01-31

0000106444

vfisf:C000007088Member

2024-02-01

2025-01-31

0000106444

vfisf:C000193720Member

2024-02-01

2025-01-31

0000106444

vfisf:DowJonesUSTotalStockMarketFloatAdjustedIndexMember

2024-02-01

2025-01-31

0000106444

vfisf:RealEstateSplicedIndexMember

2024-02-01

2025-01-31

0000106444

vfisf:BloombergUSAggregateBondIndexMember

2015-02-01

2025-01-31

0000106444

vfisf:BloombergUSGNMABondIndexMember

2015-02-01

2025-01-31

0000106444

vfisf:C000007087Member

2015-02-01

2025-01-31

0000106444

vfisf:C000007088Member

2015-02-01

2025-01-31

0000106444

vfisf:BloombergUSAggregateBondIndexMember

2015-01-31

0000106444

vfisf:BloombergUSGNMABondIndexMember

2015-01-31

0000106444

vfisf:C000007087Member

2015-01-31

0000106444

vfisf:C000007088Member

2015-01-31

0000106444

vfisf:BloombergUSAggregateBondIndexMember

2016-01-31

0000106444

vfisf:BloombergUSGNMABondIndexMember

2016-01-31

0000106444

vfisf:C000007087Member

2016-01-31

0000106444

vfisf:C000007088Member

2016-01-31

0000106444

vfisf:BloombergUSAggregateBondIndexMember

2017-01-31

0000106444

vfisf:BloombergUSGNMABondIndexMember

2017-01-31

0000106444

vfisf:C000007087Member

2017-01-31

0000106444

vfisf:C000007088Member

2017-01-31

0000106444

vfisf:C000193720Member

2017-09-26

0000106444

vfisf:DowJonesUSTotalStockMarketFloatAdjustedIndexMember

2017-09-26

0000106444

vfisf:RealEstateSplicedIndexMember

2017-09-26

0000106444

vfisf:BloombergUSAggregateBondIndexMember

2018-01-31

0000106444

vfisf:BloombergUSGNMABondIndexMember

2018-01-31

0000106444

vfisf:C000007087Member

2018-01-31

0000106444

vfisf:C000007088Member

2018-01-31

0000106444

vfisf:C000193720Member

2018-01-31

0000106444

vfisf:DowJonesUSTotalStockMarketFloatAdjustedIndexMember

2018-01-31

0000106444

vfisf:RealEstateSplicedIndexMember

2018-01-31

0000106444

vfisf:BloombergUSAggregateBondIndexMember

2019-01-31

0000106444

vfisf:BloombergUSGNMABondIndexMember

2019-01-31

0000106444

vfisf:C000007087Member

2019-01-31

0000106444

vfisf:C000007088Member

2019-01-31

0000106444

vfisf:C000193720Member

2019-01-31

0000106444

vfisf:DowJonesUSTotalStockMarketFloatAdjustedIndexMember

2019-01-31

0000106444

vfisf:RealEstateSplicedIndexMember

2019-01-31

0000106444

vfisf:BloombergUSAggregateBondIndexMember

2020-01-31

0000106444

vfisf:BloombergUSGNMABondIndexMember

2020-01-31

0000106444

vfisf:C000007087Member

2020-01-31

0000106444

vfisf:C000007088Member

2020-01-31

0000106444

vfisf:C000193720Member

2020-01-31

0000106444

vfisf:DowJonesUSTotalStockMarketFloatAdjustedIndexMember

2020-01-31

0000106444

vfisf:RealEstateSplicedIndexMember

2020-01-31

0000106444

vfisf:BloombergUSAggregateBondIndexMember

2021-01-31

0000106444

vfisf:BloombergUSGNMABondIndexMember

2021-01-31

0000106444

vfisf:C000007087Member

2021-01-31

0000106444

vfisf:C000007088Member

2021-01-31

0000106444

vfisf:C000193720Member

2021-01-31

0000106444

vfisf:DowJonesUSTotalStockMarketFloatAdjustedIndexMember

2021-01-31

0000106444

vfisf:RealEstateSplicedIndexMember

2021-01-31

0000106444

vfisf:BloombergUSAggregateBondIndexMember

2022-01-31

0000106444

vfisf:BloombergUSGNMABondIndexMember

2022-01-31

0000106444

vfisf:C000007087Member

2022-01-31

0000106444

vfisf:C000007088Member

2022-01-31

0000106444

vfisf:C000193720Member

2022-01-31

0000106444

vfisf:DowJonesUSTotalStockMarketFloatAdjustedIndexMember

2022-01-31

0000106444

vfisf:RealEstateSplicedIndexMember

2022-01-31

0000106444

vfisf:BloombergUSAggregateBondIndexMember

2023-01-31

0000106444

vfisf:BloombergUSGNMABondIndexMember

2023-01-31

0000106444

vfisf:C000007087Member

2023-01-31

0000106444

vfisf:C000007088Member

2023-01-31

0000106444

vfisf:C000193720Member

2023-01-31

0000106444

vfisf:DowJonesUSTotalStockMarketFloatAdjustedIndexMember

2023-01-31

0000106444

vfisf:RealEstateSplicedIndexMember

2023-01-31

0000106444

vfisf:BloombergUSAggregateBondIndexMember

2024-01-31

0000106444

vfisf:BloombergUSGNMABondIndexMember

2024-01-31

0000106444

vfisf:C000007087Member

2024-01-31

0000106444

vfisf:C000007088Member

2024-01-31

0000106444

vfisf:C000193720Member

2024-01-31

0000106444

vfisf:DowJonesUSTotalStockMarketFloatAdjustedIndexMember

2024-01-31

0000106444

vfisf:RealEstateSplicedIndexMember

2024-01-31

0000106444

vfisf:BloombergUSAggregateBondIndexMember

2025-01-31

0000106444

vfisf:BloombergUSGNMABondIndexMember

2025-01-31

0000106444

vfisf:C000007087Member

2025-01-31

0000106444

vfisf:C000007087Member

vfisf:FifteenTo20YearsMember

2025-01-31

0000106444

vfisf:C000007087Member

vfisf:FiveTo10YearsMember

2025-01-31

0000106444

vfisf:C000007087Member

vfisf:OtherAssetsAndLiabilitiesNetMember

2025-01-31

0000106444

vfisf:C000007087Member

vfisf:Over25YearsMember

2025-01-31

0000106444

vfisf:C000007087Member

vfisf:TenTo15YearsMember

2025-01-31

0000106444

vfisf:C000007087Member

vfisf:TwentyTo25YearsMember

2025-01-31

0000106444

vfisf:C000007087Member

vfisf:ZeroTo5YearsMember

2025-01-31

0000106444

vfisf:C000007088Member

2025-01-31

0000106444

vfisf:C000007088Member

vfisf:FifteenTo20YearsMember

2025-01-31

0000106444

vfisf:C000007088Member

vfisf:FiveTo10YearsMember

2025-01-31

0000106444

vfisf:C000007088Member

vfisf:OtherAssetsAndLiabilitiesNetMember

2025-01-31

0000106444

vfisf:C000007088Member

vfisf:Over25YearsMember

2025-01-31

0000106444

vfisf:C000007088Member

vfisf:TenTo15YearsMember

2025-01-31

0000106444

vfisf:C000007088Member

vfisf:TwentyTo25YearsMember

2025-01-31

0000106444

vfisf:C000007088Member

vfisf:ZeroTo5YearsMember

2025-01-31

0000106444

vfisf:C000193720Member

2025-01-31

0000106444

vfisf:C000193720Member

vfisf:DataCenterREITsMember

2025-01-31

0000106444

vfisf:C000193720Member

vfisf:HealthCareREITsMember

2025-01-31

0000106444

vfisf:C000193720Member

vfisf:IndustrialREITsMember

2025-01-31

0000106444

vfisf:C000193720Member

vfisf:MultiFamilyResidentialREITsMember

2025-01-31

0000106444

vfisf:C000193720Member

vfisf:OfficeREITsMember

2025-01-31

0000106444

vfisf:C000193720Member

vfisf:OtherAssetsAndLiabilitiesNetMember

2025-01-31

0000106444

vfisf:C000193720Member

vfisf:OtherSpecializedREITsMember

2025-01-31

0000106444

vfisf:C000193720Member

vfisf:RealEstateServicesMember

2025-01-31

0000106444

vfisf:C000193720Member

vfisf:RetailREITsMember

2025-01-31

0000106444

vfisf:C000193720Member

vfisf:SelfStorageREITsMember

2025-01-31

0000106444

vfisf:C000193720Member

vfisf:SingleFamilyResidentialREITsMember

2025-01-31

0000106444

vfisf:C000193720Member

vfisf:TelecomTowerREITsMember

2025-01-31

0000106444

vfisf:DowJonesUSTotalStockMarketFloatAdjustedIndexMember

2025-01-31

0000106444

vfisf:RealEstateSplicedIndexMember

2025-01-31

iso4217:USDiso4217:USDxbrli:sharesxbrli:purexbrli:sharesutr:Dvfisf:Holding

Vanguard Real Estate II Index Fund

Institutional Plus Shares (VRTPX)

Annual Shareholder Report | January 31, 2025

This annual shareholder report contains important information about Vanguard Real Estate II Index Fund (the "Fund") for the period of February 1, 2024, to January 31, 2025. You can find additional information about the Fund at https://personal1.vanguard.com/ngf-next-gen-form-webapp/fund-literature. You can also request this information by contacting us at 800-662-7447.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Share Class Name |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

| Institutional Plus Shares |

$8 |

0.08% |

How did the Fund perform during the reporting period?

-

For the 12 months ended January 31, 2025, the Fund performed in line with its benchmark.

-

In the United States, the economy saw steady growth during the fiscal period, supported by a solid labor market and inflation staying below 3% in the second half of 2024. The Federal Reserve began cutting short-term interest rates in September. This boosted stock returns, as did the prospects of tax cuts and less regulation under the incoming presidential administration.

-

Many benchmark sectors recorded positive returns for the 12 months. Health care REITs—which returned more than 40%—contributed most to performance. Retail REITs, multifamily residential REITs, and real estate services were also top performers, posting double-digit gains. Industrial REITs and telecom tower REITs detracted the most.

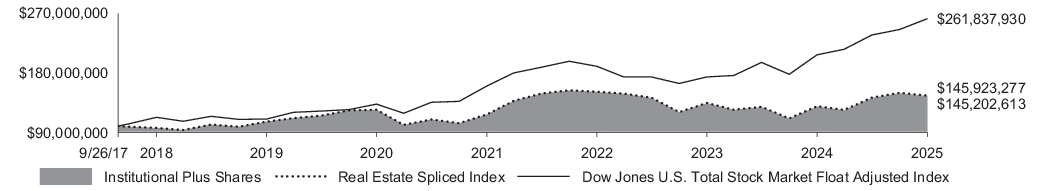

How did the Fund perform since inception?

Keep in mind that the Fund's past performance does not indicate how the Fund will perform in the future. Updated performance information is available on our website at vanguard.com/performance or by calling Vanguard toll-free at 800-662-7447. The graph and returns shown do not reflect taxes that a shareholder would pay on fund distributions or on the sale of fund shares.

Cumulative Performance: September 26, 2017, Through January 31, 2025

Initial Investment of $100,000,000

| Average Annual Total Returns |

|

|

|

|

1 Year |

5 Years |

Since Inception

(9/26/2017) |

| Institutional Plus Shares |

12.26% |

3.14% |

5.21% |

| Real Estate Spliced Index |

12.35% |

3.21% |

5.28% |

| Dow Jones U.S. Total Stock Market Float Adjusted Index |

26.28% |

14.50% |

14.00% |

This table reflects the Fund’s investments, including short-term investments, derivatives and other assets and liabilities.

Fund Statistics

(as of January 31, 2025) |

|

Fund Net Assets

(in millions) |

$9,445 |

| Number of Portfolio Holdings |

160 |

| Portfolio Turnover Rate |

4% |

Total Investment Advisory Fees

(in thousands) |

$150 |

Portfolio Composition % of Net Assets

(as of January 31, 2025) |

|

| Data Center REITs |

9.6% |

| Health Care REITs |

12.1% |

| Industrial REITs |

11.1% |

| Multi-Family Residential REITs |

8.7% |

| Office REITs |

3.3% |

| Other Specialized REITs |

6.6% |

| Real Estate Services |

8.1% |

| Retail REITs |

13.3% |

| Self-Storage REITs |

6.3% |

| Single-Family Residential REITs |

4.0% |

| Telecom Tower REITs |

10.0% |

| Other Assets and Liabilities—Net |

6.9% |

Where can I find additional information about the Fund?

Additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information is available at https://personal1.vanguard.com/ngf-next-gen-form-webapp/fund-literature.

Connect with Vanguard ® • vanguard.com

Fund Information • 800-662-7447

Institutional Investor Services • 800-523-1036

Text Telephone for People Who Are Deaf or Hard of Hearing • 800-749-7273

© 2025 The Vanguard Group, Inc.

All rights reserved.

Vanguard Marketing Corporation, Distributor.

AR2023

Vanguard GNMA Fund

Investor Shares (VFIIX)

Annual Shareholder Report | January 31, 2025

This annual shareholder report contains important information about Vanguard GNMA Fund (the "Fund") for the period of February 1, 2024, to January 31, 2025. You can find additional information about the Fund at https://personal1.vanguard.com/ngf-next-gen-form-webapp/fund-literature. You can also request this information by contacting us at 800-662-7447.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Share Class Name |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

| Investor Shares |

$21 |

0.21% |

How did the Fund perform during the reporting period?

-

For the 12 months ended January 31, 2025, the Fund outperformed its benchmark, the Bloomberg U.S. GNMA Bond Index.

-

In the United States, the economy saw steady growth during the fiscal period, supported by a solid labor market and inflation staying below 3% in the second half of 2024. While the Federal Reserve began cutting short-term interest rates in September, sticky inflation, solid growth, and potential tariffs clouded prospects for further rate cuts, weighing on bond prices.

-

While Fed rate cuts drove down yields of very short-term U.S. Treasuries, yields of longer-term Treasuries finished the period higher amid expectations for inflation down the road. The bellwether 10-year note added 0.63 percentage points to end the period at 4.54%.

-

The Fund’s outperformance was aided by security selection in 30-year GNMA securities. Out-of-benchmark allocations to agency collateralized mortgage obligations and 30-year conventional mortgages also contributed.

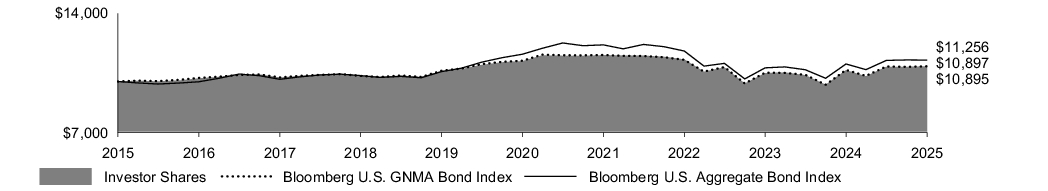

How did the Fund perform over the past 10 years?

Keep in mind that the Fund's past performance does not indicate how the Fund will perform in the future. Updated performance information is available on our website at vanguard.com/performance or by calling Vanguard toll-free at 800-662-7447. The graph and returns shown do not reflect taxes that a shareholder would pay on fund distributions or on the sale of fund shares.

Cumulative Performance: January 31, 2015, Through January 31, 2025

Initial Investment of $10,000

| Average Annual Total Returns |

|

|

|

|

1 Year |

5 Years |

10 Years |

| Investor Shares |

2.19% |

-0.54% |

0.86% |

| Bloomberg U.S. GNMA Bond Index |

2.02% |

-0.59% |

0.86% |

| Bloomberg U.S. Aggregate Bond Index |

2.07% |

-0.60% |

1.19% |

This table reflects the Fund’s investments, including short-term investments, derivatives and other assets and liabilities.

Fund Statistics

(as of January 31, 2025) |

|

Fund Net Assets

(in millions) |

$14,022 |

| Number of Portfolio Holdings |

127 |

| Portfolio Turnover Rate |

388% |

Total Investment Advisory Fees

(in thousands) |

$1,626 |

Distribution by Stated Maturity % of Net Asset

(as of January 31, 2025) |

|

| 0 - 5 Years |

1.0% |

| 5 - 10 Years |

2.6% |

| 10 - 15 Years |

1.8% |

| 15 - 20 Years |

13.5% |

| 20 - 25 Years |

21.9% |

| Over 25 Years |

57.7% |

| Other Assets and Liabilities—Net |

1.5% |

Where can I find additional information about the Fund?

Additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information is available at https://personal1.vanguard.com/ngf-next-gen-form-webapp/fund-literature.

Connect with Vanguard ® • vanguard.com

Fund Information • 800-662-7447

Direct Investor Account Services • 800-662-2739

Text Telephone for People Who Are Deaf or Hard of Hearing • 800-749-7273

© 2025 The Vanguard Group, Inc.

All rights reserved.

Vanguard Marketing Corporation, Distributor.

AR36

Vanguard GNMA Fund

Admiral™ Shares (VFIJX)

Annual Shareholder Report | January 31, 2025

This annual shareholder report contains important information about Vanguard GNMA Fund (the "Fund") for the period of February 1, 2024, to January 31, 2025. You can find additional information about the Fund at https://personal1.vanguard.com/ngf-next-gen-form-webapp/fund-literature. You can also request this information by contacting us at 800-662-7447.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Share Class Name |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

| Admiral Shares |

$11 |

0.11% |

How did the Fund perform during the reporting period?

-

For the 12 months ended January 31, 2025, the Fund outperformed its benchmark, the Bloomberg U.S. GNMA Bond Index.

-

In the United States, the economy saw steady growth during the fiscal period, supported by a solid labor market and inflation staying below 3% in the second half of 2024. While the Federal Reserve began cutting short-term interest rates in September, sticky inflation, solid growth, and potential tariffs clouded prospects for further rate cuts, weighing on bond prices.

-

While Fed rate cuts drove down yields of very short-term U.S. Treasuries, yields of longer-term Treasuries finished the period higher amid expectations for inflation down the road. The bellwether 10-year note added 0.63 percentage points to end the period at 4.54%.

-

The Fund’s outperformance was aided by security selection in 30-year GNMA securities. Out-of-benchmark allocations to agency collateralized mortgage obligations and 30-year conventional mortgages also contributed.

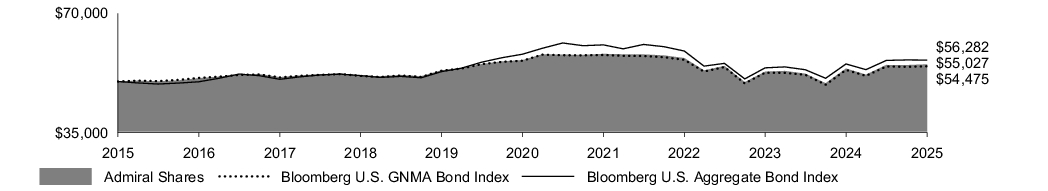

How did the Fund perform over the past 10 years?

Keep in mind that the Fund's past performance does not indicate how the Fund will perform in the future. Updated performance information is available on our website at vanguard.com/performance or by calling Vanguard toll-free at 800-662-7447. The graph and returns shown do not reflect taxes that a shareholder would pay on fund distributions or on the sale of fund shares.

Cumulative Performance: January 31, 2015, Through January 31, 2025

Initial Investment of $50,000

| Average Annual Total Returns |

|

|

|

|

1 Year |

5 Years |

10 Years |

| Admiral Shares |

2.28% |

-0.44% |

0.96% |

| Bloomberg U.S. GNMA Bond Index |

2.02% |

-0.59% |

0.86% |

| Bloomberg U.S. Aggregate Bond Index |

2.07% |

-0.60% |

1.19% |

This table reflects the Fund’s investments, including short-term investments, derivatives and other assets and liabilities.

Fund Statistics

(as of January 31, 2025) |

|

Fund Net Assets

(in millions) |

$14,022 |

| Number of Portfolio Holdings |

127 |

| Portfolio Turnover Rate |

388% |

Total Investment Advisory Fees

(in thousands) |

$1,626 |

Distribution by Stated Maturity % of Net Asset

(as of January 31, 2025) |

|

| 0 - 5 Years |

1.0% |

| 5 - 10 Years |

2.6% |

| 10 - 15 Years |

1.8% |

| 15 - 20 Years |

13.5% |

| 20 - 25 Years |

21.9% |

| Over 25 Years |

57.7% |

| Other Assets and Liabilities—Net |

1.5% |

Where can I find additional information about the Fund?

Additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information is available at https://personal1.vanguard.com/ngf-next-gen-form-webapp/fund-literature.

Connect with Vanguard ® • vanguard.com

Fund Information • 800-662-7447

Direct Investor Account Services • 800-662-2739

Text Telephone for People Who Are Deaf or Hard of Hearing • 800-749-7273

© 2025 The Vanguard Group, Inc.

All rights reserved.

Vanguard Marketing Corporation, Distributor.

AR536

Item 2: Code of Ethics.

The Registrant has adopted a code of ethics that applies to the Registrant’s

principal executive officer, principal financial officer, principal accounting officer or controller or persons performing similar functions.

The Code of Ethics was amended during the reporting period covered by this report to make certain technical, non-material changes.

Item 3: Audit Committee Financial Expert.

All members of the Audit and Risk Committee have been determined by

the Registrant’s Board of Trustees to be Audit Committee Financial Experts and to be independent: Mark Loughridge, Sarah Bloom Raskin,

Peter F. Volanakis, and Tara Bunch.

Item 4: Principal Accountant Fees and Services.

Includes fees billed in connection with services to the Registrant

only.

| | |

Fiscal Year Ended

January 31, 2025 | | |

Fiscal Year Ended

January 31, 2024 | |

| (a) Audit Fees. | |

$ | 452,000 | | |

$ | 460,000 | |

| (b) Audit-Related Fees. | |

| 0 | | |

| 0 | |

| (c) Tax Fees. | |

| 0 | | |

| 0 | |

| (d) All Other Fees. | |

| 0 | | |

| 0 | |

| Total. | |

$ | 452,000 | | |

$ | 460,000 | |

| (e) | (1) Pre-Approval Policies. The audit committee is responsible for pre-approving all audit and non-audit services provided by

PwC to: (i) the Vanguard funds; and (ii) Vanguard, or any entity controlled by Vanguard that provides ongoing services to the Vanguard

funds. All services provided to Vanguard entities by the independent auditor, whether or not they are subject to preapproval, must be

disclosed to the audit committee. The audit committee chair may preapprove any permissible audit and non-audit services as long as any

preapproval is brought to the attention of the full audit committee at the next scheduled meeting. |

| | (2) No percentage of the principal accountant’s fees

or services were approved pursuant to the waiver provision of paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X. |

| (f) | For the most recent fiscal year, over 50% of the hours worked

under the principal accountant’s engagement were not performed by persons other than full-time, permanent employees

of the principal accountant. |

| (g) | Aggregate Non-Audit Fees. |

Includes fees billed for non-audit services provided to the Registrant,

other registered investment companies in the Vanguard complex, The Vanguard Group, Inc., and Vanguard Marketing Corporation.

| | |

Fiscal Year Ended

January 31, 2025 | | |

Fiscal Year Ended

January 31, 2024 | |

| Non-audit fees to the Registrant only, listed as (b) through (d) above. | |

$ | 0 | | |

$ | 0 | |

| | |

| | | |

| | |

| Non-audit Fees to other registered investment companies in the Vanguard complex, The Vanguard Group, Inc., and Vanguard Marketing Corporation. | |

| | | |

| | |

| Audit-Related Fees. | |

$ | 3,664,500 | | |

$ | 3,295,934 | |

| Tax Fees. | |

$ | 1,898,992 | | |

$ | 1,678,928 | |

| All Other Fees. | |

$ | 25,000 | | |

$ | 25,000 | |

| Total. | |

$ | 5,588,492 | | |

$ | 4,999,862 | |

| (h) | For the most recent fiscal year, the Audit and Risk Committee

has determined that the provision of all non-audit services was consistent with maintaining the principal accountant’s independence. |

Item 5: Audit Committee of Listed Registrants.

The Registrant is a listed issuer as defined in rule 10A-3 under the

Securities Exchange Act of 1934 (“Exchange Act”). The Registrant has a separately-designated standing audit committee established

in accordance with Section 3(a)(58)(A) of the Exchange Act. The Registrant’s audit committee members are: Mark Loughridge, Sarah

Bloom Raskin, Peter F. Volanakis, and Tara Bunch.

Item 6: Investments.

Not applicable. The complete schedule of investments is included in

the financial statements filed under Item 7 of this Form.

Item 7: Financial Statements and Financial Highlights for

Open-End Management Investment Companies.

Financial Statements

For the year ended January

31, 2025

Vanguard Real Estate Index Funds

| Vanguard Real Estate Index Fund

|

| Vanguard Real Estate II Index Fund

|

Contents

Real Estate Index Fund

| 1

|

Real Estate II Index Fund

| 17

|

Report of Independent Registered

Public Accounting Firm

| 29

|

Tax information

| 30

|

|

|

|

Schedule of Investments

As of January 31, 2025

The fund files its complete

schedule of portfolio holdings with the Securities and Exchange Commission (SEC) for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The fund’s Form N-PORT reports

are available on the SEC’s website at www.sec.gov.

|

|

|

|

|

| Shares

| Market

Value•

($000)

|

| Equity Real Estate Investment Trusts (REITs) (92.2%)

|

| Data Center REITs (8.1%)

|

|

| Equinix Inc.

| 3,573,343

| 3,264,821

|

|

| Digital Realty Trust Inc.

| 12,667,413

| 2,075,682

|

|

|

|

|

|

|

| 5,340,503

|

| Diversified REITs (1.7%)

|

|

| WP Carey Inc.

| 8,470,264

| 473,572

|

|

| Essential Properties Realty Trust Inc.

| 6,782,366

| 217,714

|

|

| Broadstone Net Lease Inc.

| 7,291,063

| 114,761

|

|

| Global Net Lease Inc.

| 7,575,473

| 54,468

|

|

| Empire State Realty Trust Inc. Class A

| 5,439,752

| 52,004

|

|

| Alexander & Baldwin Inc.

| 2,811,380

| 50,183

|

|

| American Assets Trust Inc.

| 1,886,411

| 45,802

|

|

| Armada Hoffler Properties Inc.

| 3,087,179

| 30,193

|

|

| Gladstone Commercial Corp.

| 1,642,668

| 26,628

|

|

| One Liberty Properties Inc.

| 662,130

| 16,997

|

|

| CTO Realty Growth Inc.

| 804,807

| 15,798

|

|

| NexPoint Diversified Real Estate Trust

| 1,277,645

| 7,065

|

|

|

|

|

|

|

| 1,105,185

|

| Health Care REITs (10.4%)

|

|

| Welltower Inc.

| 23,428,765

| 3,197,558

|

|

| Ventas Inc.

| 16,047,636

| 969,598

|

|

| Alexandria Real Estate Equities Inc.

| 6,092,646

| 593,119

|

|

| Healthpeak Properties Inc.

| 27,063,814

| 559,138

|

|

| Omega Healthcare Investors Inc.

| 9,973,650

| 369,624

|

|

| Healthcare Realty Trust Inc. Class A

| 14,042,412

| 235,211

|

|

| American Healthcare REIT Inc.

| 5,871,613

| 166,108

|

|

| CareTrust REIT Inc.

| 5,965,260

| 158,079

|

|

| Sabra Health Care REIT Inc.

| 9,061,784

| 151,423

|

|

| National Health Investors Inc.

| 1,787,652

| 121,757

|

| 1

| Medical Properties Trust Inc.

| 22,047,621

| 103,403

|

|

| LTC Properties Inc.

| 1,681,452

| 57,842

|

|

| Sila Realty Trust Inc.

| 2,127,153

| 52,881

|

|

| Community Healthcare Trust Inc.

| 1,085,919

| 21,534

|

|

| Universal Health Realty Income Trust

| 509,125

| 19,876

|

|

| Global Medical REIT Inc.

| 2,415,663

| 18,939

|

|

| Diversified Healthcare Trust

| 6,497,729

| 16,114

|

|

|

|

|

|

|

| 6,812,204

|

| Hotel & Resort REITs (2.0%)

|

|

| Host Hotels & Resorts Inc.

| 27,171,652

| 454,038

|

|

| Ryman Hospitality Properties Inc.

| 2,201,207

| 230,775

|

|

| Apple Hospitality REIT Inc.

| 8,846,356

| 136,588

|

|

| Park Hotels & Resorts Inc.

| 8,080,986

| 109,013

|

|

| Sunstone Hotel Investors Inc.

| 7,476,654

| 84,711

|

|

| DiamondRock Hospitality Co.

| 8,019,165

| 70,408

|

|

| Pebblebrook Hotel Trust

| 4,659,788

| 61,183

|

|

| Xenia Hotels & Resorts Inc.

| 3,942,878

| 58,985

|

|

| RLJ Lodging Trust

| 5,992,887

| 58,431

|

|

| Summit Hotel Properties Inc.

| 4,190,723

| 28,120

|

| 1

| Service Properties Trust

| 6,112,770

| 17,421

|

|

| Chatham Lodging Trust

| 1,894,671

| 16,559

|

|

|

|

|

|

|

| 1,326,232

|

| Industrial REITs (9.5%)

|

|

| Prologis Inc.

| 35,823,133

| 4,271,909

|

|

| Rexford Industrial Realty Inc.

| 8,491,406

| 345,261

|

|

| EastGroup Properties Inc.

| 1,884,954

| 319,726

|

|

| First Industrial Realty Trust Inc.

| 5,119,295

| 273,319

|

|

| Terreno Realty Corp.

| 3,748,272

| 245,212

|

|

| STAG Industrial Inc.

| 7,044,059

| 240,766

|

|

| Americold Realty Trust Inc.

| 10,441,808

| 228,153

|

|

|

|

|

|

| Shares

| Market

Value•

($000)

|

|

| Lineage Inc.

| 2,642,235

| 158,534

|

|

| LXP Industrial Trust

| 11,383,222

| 94,708

|

|

| Innovative Industrial Properties Inc.

| 1,095,849

| 78,550

|

|

| Plymouth Industrial REIT Inc.

| 1,582,948

| 26,594

|

|

|

|

|

|

|

| 6,282,732

|

| Multi-Family Residential REITs (7.5%)

|

|

| AvalonBay Communities Inc.

| 5,502,515

| 1,218,862

|

|

| Equity Residential

| 13,203,134

| 932,537

|

|

| Essex Property Trust Inc.

| 2,485,081

| 707,179

|

|

| Mid-America Apartment Communities Inc.

| 4,522,885

| 690,102

|

|

| UDR Inc.

| 12,127,281

| 506,193

|

|

| Camden Property Trust

| 4,124,868

| 469,039

|

|

| Independence Realty Trust Inc.

| 8,937,261

| 171,685

|

|

| Elme Communities

| 3,401,112

| 51,901

|

|

| Veris Residential Inc.

| 3,231,909

| 51,517

|

|

| Apartment Investment & Management Co. Class A

| 4,935,886

| 44,620

|

|

| Centerspace

| 591,696

| 35,946

|

|

| NexPoint Residential Trust Inc.

| 885,177

| 34,947

|

|

| BRT Apartments Corp.

| 435,322

| 7,461

|

|

|

|

|

|

|

| 4,921,989

|

| Office REITs (2.8%)

|

|

| BXP Inc.

| 5,803,662

| 424,480

|

|

| Vornado Realty Trust

| 6,263,840

| 270,974

|

|

| Cousins Properties Inc.

| 5,884,942

| 179,667

|

| 1

| SL Green Realty Corp.

| 2,507,153

| 168,957

|

|

| Kilroy Realty Corp.

| 4,313,535

| 168,314

|

|

| COPT Defense Properties

| 4,357,421

| 128,283

|

|

| Highwoods Properties Inc.

| 4,100,496

| 122,154

|

|

| Douglas Emmett Inc.

| 6,475,513

| 118,890

|

|

| JBG SMITH Properties

| 3,181,338

| 49,343

|

|

| Easterly Government Properties Inc. Class A

| 3,788,987

| 43,043

|

|

| Piedmont Office Realty Trust Inc. Class A

| 4,799,247

| 41,945

|

|

| Brandywine Realty Trust

| 6,682,326

| 36,686

|

|

| Paramount Group Inc.

| 6,732,603

| 32,922

|

| *

| NET Lease Office Properties

| 571,923

| 18,256

|

|

| Hudson Pacific Properties Inc.

| 4,915,632

| 15,386

|

|

| Peakstone Realty Trust

| 1,404,768

| 15,101

|

|

| Orion Office REIT Inc.

| 1,934,021

| 7,833

|

|

| Office Properties Income Trust

| 2,101,443

| 1,909

|

| *,2

| New York REIT Liquidating LLC

| 1,208

| 8

|

|

|

|

|

|

|

| 1,844,151

|

| Other (13.9%)3

|

| 4,5

| Vanguard Real Estate II Index Fund

| 420,563,078

| 9,159,864

|

| Other Specialized REITs (5.5%)

|

|

| Iron Mountain Inc.

| 11,349,581

| 1,152,777

|

|

| VICI Properties Inc. Class A

| 37,115,743

| 1,104,936

|

|

| Gaming & Leisure Properties Inc.

| 10,619,590

| 513,882

|

|

| Lamar Advertising Co. Class A

| 3,399,393

| 429,751

|

|

| EPR Properties

| 2,928,819

| 135,018

|

|

| Four Corners Property Trust Inc.

| 3,583,957

| 98,308

|

|

| Outfront Media Inc.

| 5,139,075

| 94,559

|

|

| Uniti Group Inc.

| 9,442,595

| 51,462

|

|

| Safehold Inc.

| 1,798,679

| 29,156

|

| 1

| Farmland Partners Inc.

| 1,770,234

| 20,659

|

| 1

| Gladstone Land Corp.

| 1,316,078

| 14,293

|

|

|

|

|

|

|

| 3,644,801

|

| Retail REITs (11.6%)

|

|

| Simon Property Group Inc.

| 12,614,000

| 2,193,070

|

|

| Realty Income Corp.

| 33,692,327

| 1,840,949

|

|

| Kimco Realty Corp.

| 26,088,186

| 585,680

|

|

| Regency Centers Corp.

| 6,673,594

| 479,431

|

|

| Federal Realty Investment Trust

| 2,912,849

| 316,423

|

|

| Brixmor Property Group Inc.

| 11,656,613

| 303,771

|

| 1

| Agree Realty Corp.

| 3,892,414

| 282,472

|

|

| NNN REIT Inc.

| 7,104,033

| 279,828

|

|

| Macerich Co.

| 9,613,569

| 199,770

|

|

| Kite Realty Group Trust

| 8,497,106

| 196,708

|

|

|

|

|

|

| Shares

| Market

Value•

($000)

|

|

| Phillips Edison & Co. Inc.

| 4,738,406

| 172,146

|

|

| Tanger Inc.

| 4,230,033

| 138,830

|

|

| Urban Edge Properties

| 4,693,198

| 95,460

|

|

| Acadia Realty Trust

| 4,074,635

| 93,880

|

|

| Curbline Properties Corp.

| 3,650,596

| 89,330

|

| 1

| InvenTrust Properties Corp.

| 2,984,943

| 88,772

|

|

| Retail Opportunity Investments Corp.

| 4,927,448

| 86,083

|

|

| Getty Realty Corp.

| 1,990,252

| 61,718

|

| 1

| NETSTREIT Corp.

| 2,989,717

| 43,291

|

|

| SITE Centers Corp.

| 1,825,880

| 27,352

|

|

| Whitestone REIT

| 1,644,207

| 22,032

|

|

| Saul Centers Inc.

| 515,098

| 18,811

|

|

| Alexander's Inc.

| 88,794

| 16,866

|

|

| CBL & Associates Properties Inc.

| 469,866

| 14,383

|

| *,2

| Spirit MTA REIT

| 2,071,263

| 186

|

|

|

|

|

|

|

| 7,647,242

|

| Self-Storage REITs (5.4%)

|

|

| Public Storage

| 6,094,304

| 1,819,028

|

|

| Extra Space Storage Inc.

| 8,199,756

| 1,262,763

|

|

| CubeSmart

| 8,711,031

| 363,250

|

|

| National Storage Affiliates Trust

| 2,791,531

| 103,705

|

|

|

|

|

|

|

| 3,548,746

|

| Single-Family Residential REITs (3.4%)

|

|

| Invitation Homes Inc.

| 22,520,492

| 701,513

|

|

| Sun Communities Inc.

| 4,822,435

| 610,038

|

|

| Equity LifeStyle Properties Inc.

| 6,854,142

| 448,604

|

|

| American Homes 4 Rent Class A

| 12,737,054

| 441,084

|

|

| UMH Properties Inc.

| 2,884,138

| 51,886

|

|

|

|

|

|

|

| 2,253,125

|

| Telecom Tower REITs (8.6%)

|

|

| American Tower Corp.

| 18,070,773

| 3,342,189

|

|

| Crown Castle Inc.

| 16,813,050

| 1,501,069

|

|

| SBA Communications Corp. Class A

| 4,158,645

| 821,582

|

|

|

|

|

|

|

| 5,664,840

|

| Timber REITs (1.8%)

|

|

| Weyerhaeuser Co.

| 28,142,699

| 861,729

|

|

| Rayonier Inc.

| 5,689,962

| 148,736

|

|

| PotlatchDeltic Corp.

| 3,052,264

| 136,528

|

|

|

|

|

|

|

| 1,146,993

|

| Total Equity Real Estate Investment Trusts (REITs) (Cost $57,488,561)

| 60,698,607

|

| Real Estate Management & Development (7.4%)

|

| Diversified Real Estate Activities (0.2%)

|

|

| St. Joe Co.

| 1,581,014

| 76,047

|

| *

| Tejon Ranch Co.

| 776,852

| 12,600

|

|

| RMR Group Inc. Class A

| 610,486

| 11,398

|

|

|

|

|

|

|

| 100,045

|

| Real Estate Development (0.2%)

|

| *,1

| Howard Hughes Holdings Inc.

| 1,263,231

| 96,473

|

| *

| Forestar Group Inc.

| 784,036

| 18,707

|

|

|

|

|

|

|

| 115,180

|

| Real Estate Operating Companies (0.1%)

|

|

| Kennedy-Wilson Holdings Inc.

| 4,254,603

| 38,504

|

| 1

| Landbridge Co. LLC Class A

| 494,295

| 32,065

|

| *,1

| Seritage Growth Properties Class A

| 1,315,811

| 4,921

|

|

|

|

|

|

|

| 75,490

|

| Real Estate Services (6.9%)

|

| *

| CBRE Group Inc. Class A

| 11,856,097

| 1,716,052

|

| *

| CoStar Group Inc.

| 15,856,504

| 1,214,608

|

| *

| Jones Lang LaSalle Inc.

| 1,835,984

| 519,216

|

| *

| Zillow Group Inc. Class C

| 5,948,905

| 489,119

|

| *

| Zillow Group Inc. Class A

| 2,098,167

| 166,175

|

| *

| Cushman & Wakefield plc

| 8,867,428

| 122,282

|

| *

| Compass Inc. Class A

| 16,610,824

| 120,428

|

|

| Newmark Group Inc. Class A

| 5,461,627

| 77,173

|

|

| Marcus & Millichap Inc.

| 974,056

| 37,170

|

| *

| Redfin Corp.

| 4,356,431

| 34,851

|

|

|

|

|

|

| Shares

| Market

Value•

($000)

|

| 1

| eXp World Holdings Inc.

| 2,975,305

| 33,859

|

| *

| Opendoor Technologies Inc.

| 23,112,550

| 31,895

|

| *

| Anywhere Real Estate Inc.

| 3,872,212

| 13,979

|

|

|

|

|

|

|

| 4,576,807

|

| Total Real Estate Management & Development (Cost $4,408,090)

| 4,867,522

|

| Temporary Cash Investments (0.6%)

|

| Money Market Fund (0.6%)

|

| 6,7

| Vanguard Market Liquidity Fund, 4.371% (Cost $403,270)

| 4,033,379

| 403,298

|

| Total Investments (100.2%) (Cost $62,299,921)

|

| 65,969,427

|

| Other Assets and Liabilities—Net (-0.2%)

|

| (123,639)

|

| Net Assets (100%)

|

| 65,845,788

|

| •

| See Note A in Notes to Financial Statements.

|

| *

| Non-income-producing security.

|

| 1

| Includes partial security positions on loan to broker-dealers. The total value of securities on loan is $162,745,000.

|

| 2

| Security value determined using significant unobservable inputs.

|

| 3

| “Other” represents securities that are not classified by the fund’s benchmark index.

|

| 4

| Considered an affiliated company of the fund as the issuer is another member of The Vanguard Group.

|

| 5

| Represents a wholly owned subsidiary of the fund. See accompanying financial statements for Vanguard Real Estate II Index Fund's Schedule of Investments.

|

| 6

| Affiliated money market fund available only to Vanguard funds and certain trusts and accounts managed by Vanguard. Rate shown is the 7-day yield.

|

| 7

| Collateral of $171,027,000 was received for securities on loan.

|

|

| REIT—Real Estate Investment Trust.

|

Derivative Financial

Instruments Outstanding as of Period End

| Over-the-Counter Total Return Swaps

|

| Reference Entity

| Termination

Date

| Counterparty

| Notional

Amount

($000)

| Floating

Interest

Rate

Received

(Paid)1

(%)

| Value and

Unrealized

Appreciation

($000)

| Value and

Unrealized

(Depreciation)

($000)

|

| Equinix Inc.

| 8/29/25

| BANA

| 94,289

| (4.438)

| —

| (3,260)

|

| Redfin Corp.

| 1/30/26

| GSI

| 2,800

| (4.334)

| —

| —

|

| VICI Properties Inc. Class A

| 8/29/25

| BANA

| 99,314

| (5.088)

| 2,968

| —

|

| Welltower Inc.

| 8/29/25

| BANA

| 63,015

| (4.488)

| 4,997

| —

|

|

|

|

|

|

| 7,965

| (3,260)

|

| 1

| Based on Overnight Bank Funding Rate as of the most recent reset date. Floating interest payment received/paid monthly.

|

|

| BANA—Bank of America, N.A.

|

|

| GSI—Goldman Sachs International.

|

At January 31, 2025, the

counterparties had deposited in segregated accounts securities with a value of $6,396,000 in connection with open over-the-counter swap contracts.

See accompanying Notes,

which are an integral part of the Financial Statements.

Statement of Assets and Liabilities

|

|

| ($000s, except shares, footnotes, and per-share amounts)

| Amount

|

| Assets

|

|

| Investments in Securities, at Value1

|

|

| Unaffiliated Issuers (Cost $54,019,207)

| 56,406,265

|

| Affiliated Issuers (Cost $403,270)

| 403,298

|

| Vanguard Real Estate II Index Fund (Cost $7,877,444)

| 9,159,864

|

| Total Investments in Securities

| 65,969,427

|

| Investment in Vanguard

| 1,495

|

| Cash

| 30,633

|

| Receivables for Investment Securities Sold

| 2,173

|

| Receivables for Accrued Income

| 39,762

|

| Receivables for Capital Shares Issued

| 40,681

|

| Unrealized Appreciation—Over-the-Counter Swap Contracts

| 7,965

|

| Total Assets

| 66,092,136

|

| Liabilities

|

|

| Payables for Investment Securities Purchased

| 41,572

|

| Collateral for Securities on Loan

| 171,027

|

| Payables for Capital Shares Redeemed

| 27,282

|

| Payables to Vanguard

| 3,207

|

| Unrealized Depreciation—Over-the-Counter Swap Contracts

| 3,260

|

| Total Liabilities

| 246,348

|

| Net Assets

| 65,845,788

|

| 1 Includes $162,745,000 of securities on loan.

|

|

At January 31, 2025, net assets consisted of:

|

|

|

|

|

| Paid-in Capital

| 67,141,665

|

| Total Distributable Earnings (Loss)

| (1,295,877)

|

| Net Assets

| 65,845,788

|

|

|

| Investor Shares—Net Assets

|

|

Applicable to 2,638,094 outstanding $.001 par value shares of

beneficial interest (unlimited authorization)

| 79,440

|

| Net Asset Value Per Share—Investor Shares

| $30.11

|

|

|

| ETF Shares—Net Assets

|

|

Applicable to 387,682,990 outstanding $.001 par value shares of

beneficial interest (unlimited authorization)

| 35,126,904

|

| Net Asset Value Per Share—ETF Shares

| $90.61

|

|

|

| Admiral™ Shares—Net Assets

|

|

Applicable to 159,725,763 outstanding $.001 par value shares of

beneficial interest (unlimited authorization)

| 20,511,103

|

| Net Asset Value Per Share—Admiral Shares

| $128.41

|

|

|

| Institutional Shares—Net Assets

|

|

Applicable to 509,595,485 outstanding $.001 par value shares of

beneficial interest (unlimited authorization)

| 10,128,341

|

| Net Asset Value Per Share—Institutional Shares

| $19.88

|

See accompanying Notes, which are an integral

part of the Financial Statements.

|

|

|

| Year Ended

January 31, 2025

|

|

| ($000)

|

| Investment Income

|

|

| Income

|

|

| Dividends—Unaffiliated Issuers

| 1,627,691

|

| Dividends—Vanguard Real Estate II Index Fund

| 253,552

|

| Interest—Unaffiliated Issuers

| 189

|

| Interest—Affiliated Issuers

| 8,101

|

| Securities Lending—Net

| 2,843

|

| Total Income

| 1,892,376

|

| Expenses

|

|

| The Vanguard Group—Note B

|

|

| Investment Advisory Services

| 1,151

|

| Management and Administrative—Investor Shares

| 200

|

| Management and Administrative—ETF Shares

| 34,699

|

| Management and Administrative—Admiral Shares

| 21,608

|

| Management and Administrative—Institutional Shares

| 8,952

|

| Marketing and Distribution—Investor Shares

| 4

|

| Marketing and Distribution—ETF Shares

| 1,355

|

| Marketing and Distribution—Admiral Shares

| 906

|

| Marketing and Distribution—Institutional Shares

| 338

|

| Custodian Fees

| 114

|

| Auditing Fees

| 39

|

| Shareholders’ Reports and Proxy Fees—Investor Shares

| 2

|

| Shareholders’ Reports and Proxy Fees—ETF Shares

| 2,797

|

| Shareholders’ Reports and Proxy Fees—Admiral Shares

| 737

|

| Shareholders’ Reports and Proxy Fees—Institutional Shares

| 333

|

| Trustees’ Fees and Expenses

| 37

|

| Other Expenses

| 40

|

| Total Expenses

| 73,312

|

| Net Investment Income

| 1,819,064

|

| Realized Net Gain (Loss)

|

|

| Capital Gain Distributions Received—Unaffiliated Issuers

| 229,434

|

| Capital Gain Distributions Received—Vanguard Real Estate II Index Fund

| —

|

| Investment Securities Sold—Unaffiliated Issuers1

| 675,476

|

| Investment Securities Sold—Affiliated Issuers

| 6

|

| Investment Securities Sold—Vanguard Real Estate II Index Fund

| —

|

| Swap Contracts

| 26,695

|

| Realized Net Gain (Loss)

| 931,611

|

| Change in Unrealized Appreciation (Depreciation)

|

|

| Investment Securities—Unaffiliated Issuers

| 4,014,043

|

| Investment Securities—Affiliated Issuers

| (41)

|

| Investment Securities—Vanguard Real Estate II Index Fund

| 746,909

|

| Swap Contracts

| 10,403

|

| Change in Unrealized Appreciation (Depreciation)

| 4,771,314

|

| Net Increase (Decrease) in Net Assets Resulting from Operations

| 7,521,989

|

| 1

| Includes $1,717,582,000 of net gain (loss) resulting from in-kind redemptions.

|

See accompanying Notes, which

are an integral part of the Financial Statements.

Statement of Changes in Net Assets

|

|

|

| Year Ended January 31,

|

|

| 2025

($000)

| 2024

($000)

|

| Increase (Decrease) in Net Assets

|

|

|

| Operations

|

|

|

| Net Investment Income

| 1,819,064

| 1,899,119

|

| Realized Net Gain (Loss)

| 931,611

| 277,070

|

| Change in Unrealized Appreciation (Depreciation)

| 4,771,314

| (5,161,675)

|

| Net Increase (Decrease) in Net Assets Resulting from Operations

| 7,521,989

| (2,985,486)

|

| Distributions

|

|

|

| Net Investment Income and/or Realized Capital Gains

|

|

|

| Investor Shares

| (2,305)

| (2,871)

|

| ETF Shares

| (1,010,254)

| (1,004,365)

|

| Admiral Shares

| (601,430)

| (620,267)

|

| Institutional Shares

| (303,772)

| (301,203)

|

| Return of Capital

|

|

|

| Investor Shares

| (723)

| (994)

|

| ETF Shares

| (317,245)

| (347,576)

|

| Admiral Shares

| (188,864)

| (214,652)

|

| Institutional Shares

| (95,392)

| (104,235)

|

| Total Distributions

| (2,519,985)

| (2,596,163)

|

| Capital Share Transactions

|

|

|

| Investor Shares

| (13,347)

| (30,815)

|

| ETF Shares

| 217,195

| (1,415,940)

|

| Admiral Shares

| (947,161)

| (516,200)

|

| Institutional Shares

| (621,858)

| 80,493

|

| Net Increase (Decrease) from Capital Share Transactions

| (1,365,171)

| (1,882,462)

|

| Total Increase (Decrease)

| 3,636,833

| (7,464,111)

|

| Net Assets

|

|

|

| Beginning of Period

| 62,208,955

| 69,673,066

|

| End of Period

| 65,845,788

| 62,208,955

|

See accompanying Notes, which are an integral

part of the Financial Statements.

| Investor Shares

|

|

|

|

|

|

For a Share Outstanding

Throughout Each Period

| Year Ended January 31,

|

| 2025

| 2024

| 2023

| 2022

| 2021

|

| Net Asset Value, Beginning of Period

| $27.89

| $30.26

| $35.37

| $28.23

| $31.21

|

| Investment Operations

|

|

|

|

|

|

| Net Investment Income1

| .774

| .787

| .684

| .602

| .586

|

| Net Realized and Unrealized Gain (Loss) on Investments

| 2.544

| (2.036)

| (4.766)

| 7.475

| (2.498)

|

| Total from Investment Operations

| 3.318

| (1.249)

| (4.082)

| 8.077

| (1.912)

|

| Distributions

|

|

|

|

|

|

| Dividends from Net Investment Income

| (.836)

| (.833)

| (.686)

| (.620)

| (.624)

|

| Distributions from Realized Capital Gains

| —

| —

| —

| —

| —

|

| Return of Capital

| (.262)

| (.288)

| (.342)

| (.317)

| (.444)

|

| Total Distributions

| (1.098)

| (1.121)

| (1.028)

| (.937)

| (1.068)

|

| Net Asset Value, End of Period

| $30.11

| $27.89

| $30.26

| $35.37

| $28.23

|

| Total Return2

| 12.07%

| -3.91%

| -11.39%

| 28.73%

| -5.88%

|

| Ratios/Supplemental Data

|

|

|

|

|

|

| Net Assets, End of Period (Millions)

| $79

| $86

| $127

| $196

| $188

|

| Ratio of Total Expenses to Average Net Assets

| 0.26%

| 0.26%

| 0.26%3

| 0.26%

| 0.26%

|

| Acquired Fund Fees and Expenses4

| 0.01%

| 0.01%

| —

| —

| —

|

| Ratio of Net Investment Income to Average Net Assets

| 2.62%

| 2.87%

| 2.18%

| 1.77%

| 2.18%

|

| Portfolio Turnover Rate5

| 7%

| 9%

| 7%

| 7%

| 8%

|

| 1

| Calculated based on average shares outstanding.

|

| 2

| Total returns do not include account service fees that may have applied in the periods shown. Fund prospectuses provide information about any applicable account service fees.

|

| 3

| The ratio of expenses to average net assets for the period net of reduction from custody fee offset arrangements was 0.25%.

|

| 4

| For the fiscal year ended January 31, 2023, and for each prior period, the acquired fund fees and expenses were less than 0.01%.

|

| 5

| Excludes the value of portfolio securities received or delivered as a result of in-kind purchases or redemptions of the fund’s capital shares, including ETF

Creation Units.

|

See accompanying Notes,

which are an integral part of the Financial Statements.

| ETF Shares

|

|

|

|

|

|

For a Share Outstanding

Throughout Each Period

| Year Ended January 31,

|

| 2025

| 2024

| 2023

| 2022

| 2021

|

| Net Asset Value, Beginning of Period

| $83.94

| $91.06

| $106.44

| $84.96

| $93.93

|

| Investment Operations

|

|

|

|

|

|

| Net Investment Income1

| 2.473

| 2.527

| 2.240

| 1.960

| 1.889

|

| Net Realized and Unrealized Gain (Loss) on Investments

| 7.631

| (6.154)

| (14.394)

| 22.486

| (7.525)

|

| Total from Investment Operations

| 10.104

| (3.627)

| (12.154)

| 24.446

| (5.636)

|

| Distributions

|

|

|

|

|

|

| Dividends from Net Investment Income

| (2.613)

| (2.595)

| (2.152)

| (1.943)

| (1.947)

|

| Distributions from Realized Capital Gains

| —

| —

| —

| —

| —

|

| Return of Capital

| (.821)

| (.898)

| (1.074)

| (1.023)

| (1.387)

|

| Total Distributions

| (3.434)

| (3.493)

| (3.226)

| (2.966)

| (3.334)

|

| Net Asset Value, End of Period

| $90.61

| $83.94

| $91.06

| $106.44

| $84.96

|

| Total Return

| 12.22%

| -3.81%

| -11.25%

| 28.88%

| -5.80%

|

| Ratios/Supplemental Data

|

|

|

|

|

|

| Net Assets, End of Period (Millions)

| $35,127

| $32,359

| $36,825

| $46,673

| $32,064

|

| Ratio of Total Expenses to Average Net Assets

| 0.12%

| 0.12%

| 0.12%2

| 0.12%

| 0.12%

|

| Acquired Fund Fees and Expenses3

| 0.01%

| 0.01%

| —

| —

| —

|

| Ratio of Net Investment Income to Average Net Assets

| 2.78%

| 3.07%

| 2.38%

| 1.90%

| 2.33%

|

| Portfolio Turnover Rate4

| 7%

| 9%

| 7%

| 7%

| 8%

|

| 1

| Calculated based on average shares outstanding.

|

| 2

| The ratio of expenses to average net assets for the period net of reduction from custody fee offset arrangements was 0.12%.

|

| 3

| For the fiscal year ended January 31, 2023, and for each prior period, the acquired fund fees and expenses were less than 0.01%.

|

| 4

| Excludes the value of portfolio securities received or delivered as a result of in-kind purchases or redemptions of the fund’s capital shares, including ETF

Creation Units.

|

See accompanying Notes,

which are an integral part of the Financial Statements.

| Admiral Shares

|

|

|

|

|

|

For a Share Outstanding

Throughout Each Period

| Year Ended January 31,

|

| 2025

| 2024

| 2023

| 2022

| 2021

|

| Net Asset Value, Beginning of Period

| $118.96

| $129.05

| $150.85

| $120.40

| $133.12

|

| Investment Operations

|

|

|

|

|

|

| Net Investment Income1

| 3.495

| 3.613

| 3.201

| 2.761

| 2.677

|

| Net Realized and Unrealized Gain (Loss) on Investments

| 10.820

| (8.752)

| (20.428)

| 31.890

| (10.672)

|

| Total from Investment Operations

| 14.315

| (5.139)

| (17.227)

| 34.651

| (7.995)

|

| Distributions

|

|

|

|

|

|

| Dividends from Net Investment Income

| (3.702)

| (3.678)

| (3.050)

| (2.770)

| (2.759)

|

| Distributions from Realized Capital Gains

| —

| —

| —

| —

| —

|

| Return of Capital

| (1.163)

| (1.273)

| (1.523)

| (1.431)

| (1.966)

|

| Total Distributions

| (4.865)

| (4.951)

| (4.573)

| (4.201)

| (4.725)

|

| Net Asset Value, End of Period

| $128.41

| $118.96

| $129.05

| $150.85

| $120.40

|

| Total Return2

| 12.22%

| -3.75%

| -11.26%

| 28.91%

| -5.74%

|

| Ratios/Supplemental Data

|

|

|

|

|

|

| Net Assets, End of Period (Millions)

| $20,511

| $19,879

| $22,110

| $25,764

| $19,702

|

| Ratio of Total Expenses to Average Net Assets

| 0.12%

| 0.12%

| 0.12%3

| 0.12%

| 0.12%

|

| Acquired Fund Fees and Expenses4

| 0.01%

| 0.01%

| —

| —

| —

|

| Ratio of Net Investment Income to Average Net Assets

| 2.77%

| 3.10%

| 2.41%

| 1.90%

| 2.33%

|

| Portfolio Turnover Rate5

| 7%

| 9%

| 7%

| 7%

| 8%

|

| 1

| Calculated based on average shares outstanding.

|

| 2

| Total returns do not include account service fees that may have applied in the periods shown. Fund prospectuses provide information about any applicable account service fees.

|

| 3

| The ratio of expenses to average net assets for the period net of reduction from custody fee offset arrangements was 0.12%.

|

| 4

| For the fiscal year ended January 31, 2023, and for each prior period, the acquired fund fees and expenses were less than 0.01%.

|

| 5

| Excludes the value of portfolio securities received or delivered as a result of in-kind purchases or redemptions of the fund’s capital shares, including ETF

Creation Units.

|

See accompanying Notes,

which are an integral part of the Financial Statements.

| Institutional Shares

|

|

|

|

|

|

For a Share Outstanding

Throughout Each Period

| Year Ended January 31,

|

| 2025

| 2024

| 2023

| 2022

| 2021

|

| Net Asset Value, Beginning of Period

| $18.41

| $19.97

| $23.35

| $18.64

| $20.60

|

| Investment Operations

|

|

|

|

|

|

| Net Investment Income1

| .542

| .565

| .500

| .432

| .421

|

| Net Realized and Unrealized Gain (Loss) on Investments

| 1.685

| (1.355)

| (3.168)

| 4.933

| (1.646)

|

| Total from Investment Operations

| 2.227

| (.790)

| (2.668)

| 5.365

| (1.225)

|

| Distributions

|

|

|

|

|

|

| Dividends from Net Investment Income

| (.576)

| (.572)

| (.475)

| (.432)

| (.429)

|

| Distributions from Realized Capital Gains

| —

| —

| —

| —

| —

|

| Return of Capital

| (.181)

| (.198)

| (.237)

| (.223)

| (.306)

|

| Total Distributions

| (.757)

| (.770)

| (.712)

| (.655)

| (.735)

|

| Net Asset Value, End of Period

| $19.88

| $18.41

| $19.97

| $23.35

| $18.64

|

| Total Return

| 12.28%

| -3.73%

| -11.27%

| 28.91%

| -5.68%

|

| Ratios/Supplemental Data

|

|

|

|

|

|

| Net Assets, End of Period (Millions)

| $10,128

| $9,885

| $10,610

| $12,089

| $9,478

|

| Ratio of Total Expenses to Average Net Assets

| 0.10%

| 0.10%

| 0.10%2

| 0.10%

| 0.10%

|

| Acquired Fund Fees and Expenses3

| 0.01%

| 0.01%

| —

| —

| —

|

| Ratio of Net Investment Income to Average Net Assets

| 2.78%

| 3.13%

| 2.43%

| 1.92%

| 2.37%

|

| Portfolio Turnover Rate4

| 7%

| 9%

| 7%

| 7%

| 8%

|

| 1

| Calculated based on average shares outstanding.

|

| 2

| The ratio of expenses to average net assets for the period net of reduction from custody fee offset arrangements was 0.10%.

|

| 3

| For the fiscal year ended January 31, 2023, and for each prior period, the acquired fund fees and expenses were less than 0.01%.

|

| 4

| Excludes the value of portfolio securities received or delivered as a result of in-kind purchases or redemptions of the fund’s capital shares, including ETF

Creation Units.

|

See accompanying Notes,

which are an integral part of the Financial Statements.

Notes to Financial Statements

Vanguard Real Estate Index

Fund is registered under the Investment Company Act of 1940 as an open-end investment company, or mutual fund. The fund offers four classes of shares: Investor Shares, ETF Shares, Admiral Shares, and Institutional

Shares. Each of the share classes has different eligibility and minimum purchase requirements, and is designed for different types of investors. ETF Shares are listed for trading on NYSE Arca; they can be purchased

and sold through a broker.

As a part of its principal

investment strategy, the fund attempts to replicate its benchmark index by investing all, or substantially all, of its assets—either directly or indirectly through a wholly owned subsidiary—in the stocks

that make up the index. Vanguard Real Estate II Index Fund (“the Subsidiary”) is the wholly owned subsidiary in which the fund has invested a portion of its assets. Expenses of the Subsidiary are reflected

in the Acquired Fund Fees and Expenses in the Financial Highlights. For additional financial information about the Subsidiary, refer to the accompanying financial statements.

A. The following significant accounting policies conform to generally accepted accounting principles for U.S. investment companies. The fund consistently follows such policies in preparing its

financial statements.

1. Security Valuation:

Securities are valued as of the close of trading on the New York Stock Exchange (generally 4 p.m., Eastern time) on the valuation date. Equity securities are valued at the latest quoted sales prices or official

closing prices taken from the primary market in which each security trades; such securities not traded on the valuation date are valued at the mean of the latest quoted bid and asked prices. Securities for which

market quotations are not readily available, or whose values have been affected by events occurring before the fund's pricing time but after the close of the securities’ primary markets, are valued by methods

deemed by the valuation designee to represent fair value and subject to oversight by the board of trustees.

Investments in affiliated Vanguard funds are

valued at that fund's net asset value.

2. Swap Contracts: The

fund has entered into equity swap contracts to earn the total return on selected reference stocks or indexes in the fund’s target index. Under the terms of the swaps, the fund receives the total return on the

referenced stock (i.e., receiving the increase or paying the decrease in value of the selected reference stock and receiving the equivalent of any dividends in respect of the selected referenced stock) over a

specified period of time, applied to a notional amount that represents the value of a designated number of shares of the selected reference stock at the beginning of the equity swap contract. The fund also pays a

floating rate that is based on short-term interest rates, applied to the notional amount. At the same time, the fund generally invests an amount approximating the notional amount of the swap in high-quality temporary

cash investments.

A risk associated with all

types of swaps is the possibility that a counterparty may default on its obligation to pay net amounts due to the fund. The fund’s maximum amount subject to counterparty risk is the unrealized appreciation on

the swap contract. The fund mitigates its counterparty risk by entering into swaps only with a diverse group of prequalified counterparties, monitoring their financial strength, entering into master netting

arrangements with its counterparties, and requiring its counterparties to transfer collateral as security for their performance. In the absence of a default, the collateral pledged or received by the fund cannot be

repledged, resold, or rehypothecated. In the event of a counterparty’s default (including bankruptcy), the fund may terminate any swap contracts with that counterparty, determine the net amount owed by either

party in accordance with its master netting arrangements, and sell or retain any collateral held up to the net amount owed to the fund under the master netting arrangements. The swap contracts contain provisions

whereby a counterparty may terminate open contracts if the fund's net assets decline below a certain level, triggering a payment by the fund if the fund is in a net liability position at the time of the termination.

The payment amount would be reduced by any collateral the fund has pledged. Any securities pledged as collateral for open contracts are noted in the Schedule of Investments. The value of collateral received or pledged

is compared daily to the value of the swap contracts exposure with each counterparty, and any difference, if in excess of a specified minimum transfer amount, is adjusted and settled within two business days.

The notional amounts of swap

contracts are not recorded in the Statement of Assets and Liabilities. Swaps are valued daily based on market quotations received from independent pricing services or recognized dealers and the change in value is

recorded in the Statement of Assets and Liabilities as an asset (liability) and in the Statement of Operations as unrealized appreciation (depreciation) until periodic payments are made or the termination of the swap,

at which time realized gain (loss) is recorded.

During the year ended January

31, 2025, the fund’s average amounts of investments in total return swaps represented less than 1% of net assets, based on the average of notional amounts at each quarter-end during the period.

3. Federal Income Taxes:

The fund intends to continue to qualify as a regulated investment company and distribute virtually all of its taxable income. The fund’s tax returns are open to examination by the relevant tax authorities until

expiration of the applicable statute of limitations, which is generally three years after the filing of the tax return. Management has analyzed the fund’s tax positions taken for all open federal and state

income tax years, and has concluded that no provision for income tax is required in the fund’s financial statements.

4. Distributions:

Distributions to shareholders are recorded on the ex-dividend date. The portion of distributions that exceed a fund's current and accumulated earnings and profits, as measured on a tax basis, constitute a non-taxable

return of capital. Distributions are determined on a tax basis at the fiscal year-end and may differ from net investment income and realized capital gains for financial reporting purposes.

5. Securities Lending:

To earn additional income, the fund lends its securities to qualified institutional borrowers. Security loans are subject to termination by the fund at any time, and are required to be secured at all times by

collateral in an amount at least equal to the market value of securities loaned. Daily market fluctuations could cause the value of loaned securities to be more or less than the value of the collateral received. When

this occurs, the collateral is adjusted and settled before the opening of the market on the next business day. The fund further mitigates its counterparty risk by entering into securities lending transactions only

with a diverse group of prequalified counterparties, monitoring their financial strength, and entering into master securities lending agreements with its counterparties. The master securities lending agreements

provide that, in the event of a counterparty’s default (including bankruptcy), the fund may terminate any loans with that borrower, determine the net amount owed, and sell or retain the collateral up to the net

amount owed to the fund; however, such actions may be subject to legal proceedings. While collateral mitigates counterparty risk, in the event of a default, the fund may experience delays and costs in recovering the

securities loaned. The fund invests cash collateral received in Vanguard Market Liquidity Fund, and records a liability in the Statement of Assets and Liabilities for the return of the collateral, during the period

the

securities are on loan. Collateral

investments in Vanguard Market Liquidity Fund are subject to market appreciation or depreciation. Securities lending income represents fees charged to borrowers plus income earned on invested cash collateral, less

expenses associated with the loan. During the term of the loan, the fund is entitled to all distributions made on or in respect of the loaned securities.

6. Credit Facilities and