®

®Annual report pursuant to section 13 or 15(d) of the Securities Exchange Act of 1934. For the fiscal year ended | |||||

| Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. For the transition period from __________ to __________ | |||||

®

®| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |||||||

| Title of each class | Trading Symbol | Name of each exchange on which registered | ||||||

| Item | Description | Page | ||||||||||||

Report of Independent Registered Public Accounting Firm (PCAOB ID | ||||||||||||||

| Location Country or State | Square Feet (in thousands) | |||||||

| Connecticut | 1,138 | |||||||

| Puerto Rico | 811 | |||||||

| Mexico | 762 | |||||||

| China | 735 | |||||||

| Minnesota | 623 | |||||||

| Italy | 485 | |||||||

| Ireland | 446 | |||||||

| Dominican Republic | 304 | |||||||

| Arizona | 294 | |||||||

| Switzerland | 283 | |||||||

| France | 268 | |||||||

| Colorado | 259 | |||||||

| Florida | 255 | |||||||

| California | 210 | |||||||

| Fiscal Period | Total Number of Shares Purchased | Average Price Paid per Share | Total Number of Shares Purchased as a Part of Publicly Announced Program | Maximum Approximate Dollar Value of Shares that may yet be Purchased Under the Program | ||||||||||||||||||||||

| 1/29/2022-2/25/2022 | 1,130,750 | $ | 103.16 | 1,130,750 | $ | 4,234,214,099 | ||||||||||||||||||||

| 2/26/2022-4/1/2022 | 6,141,716 | 107.85 | 6,141,716 | 3,571,839,180 | ||||||||||||||||||||||

| 4/2/2022-4/29/2022 | 5,627,112 | 110.47 | 5,627,112 | 2,950,215,113 | ||||||||||||||||||||||

| Total | 12,899,578 | $ | 108.58 | 12,899,578 | $ | 2,950,215,113 | ||||||||||||||||||||

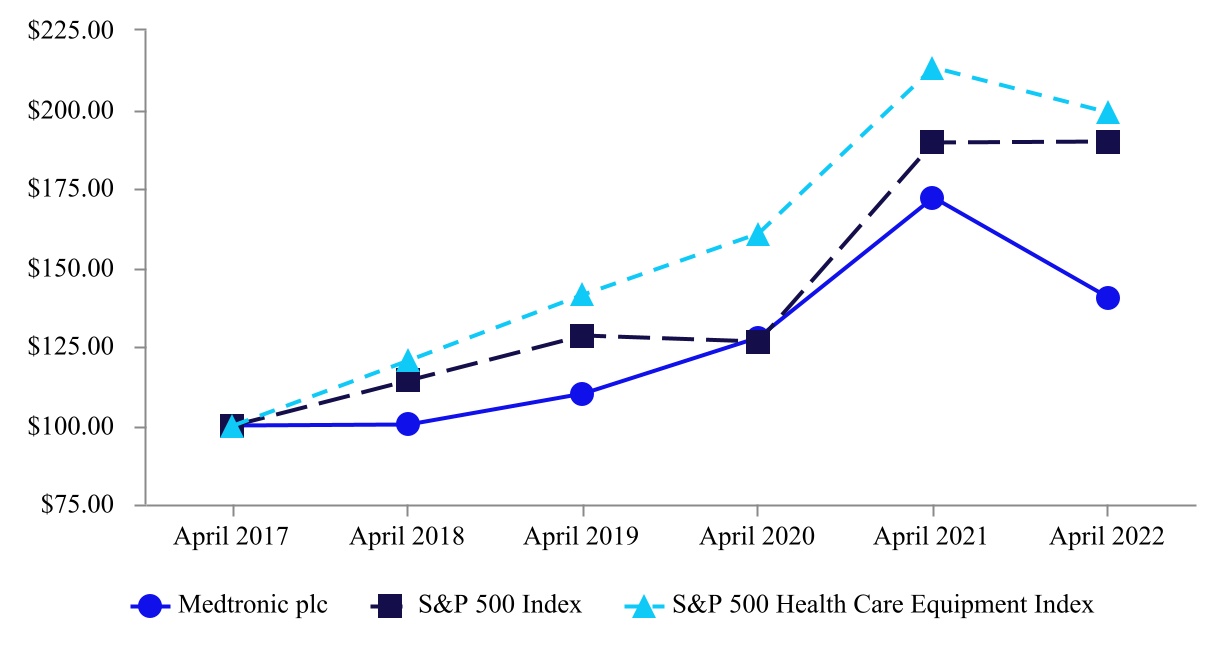

| Company/Index | April 2017 | April 2018 | April 2019 | April 2020 | April 2021 | April 2022 | ||||||||||||||||||||||||||||||||

| Medtronic plc | $ | 100.00 | $ | 100.06 | $ | 109.91 | $ | 127.67 | $ | 172.10 | $ | 140.27 | ||||||||||||||||||||||||||

| S&P 500 Index | 100.00 | 114.20 | 128.28 | 126.28 | 189.28 | 189.68 | ||||||||||||||||||||||||||||||||

| S&P 500 Health Care Equipment Index | 100.00 | 120.35 | 141.25 | 160.75 | 213.16 | 198.87 | ||||||||||||||||||||||||||||||||

| Fiscal year ended April 29, 2022 | |||||||||||||||||||||||||||||

| (in millions, except per share data) | Income Before Income Taxes | Income Tax Provision (Benefit) | Net Income Attributable to Medtronic | Diluted EPS | Effective Tax Rate | ||||||||||||||||||||||||

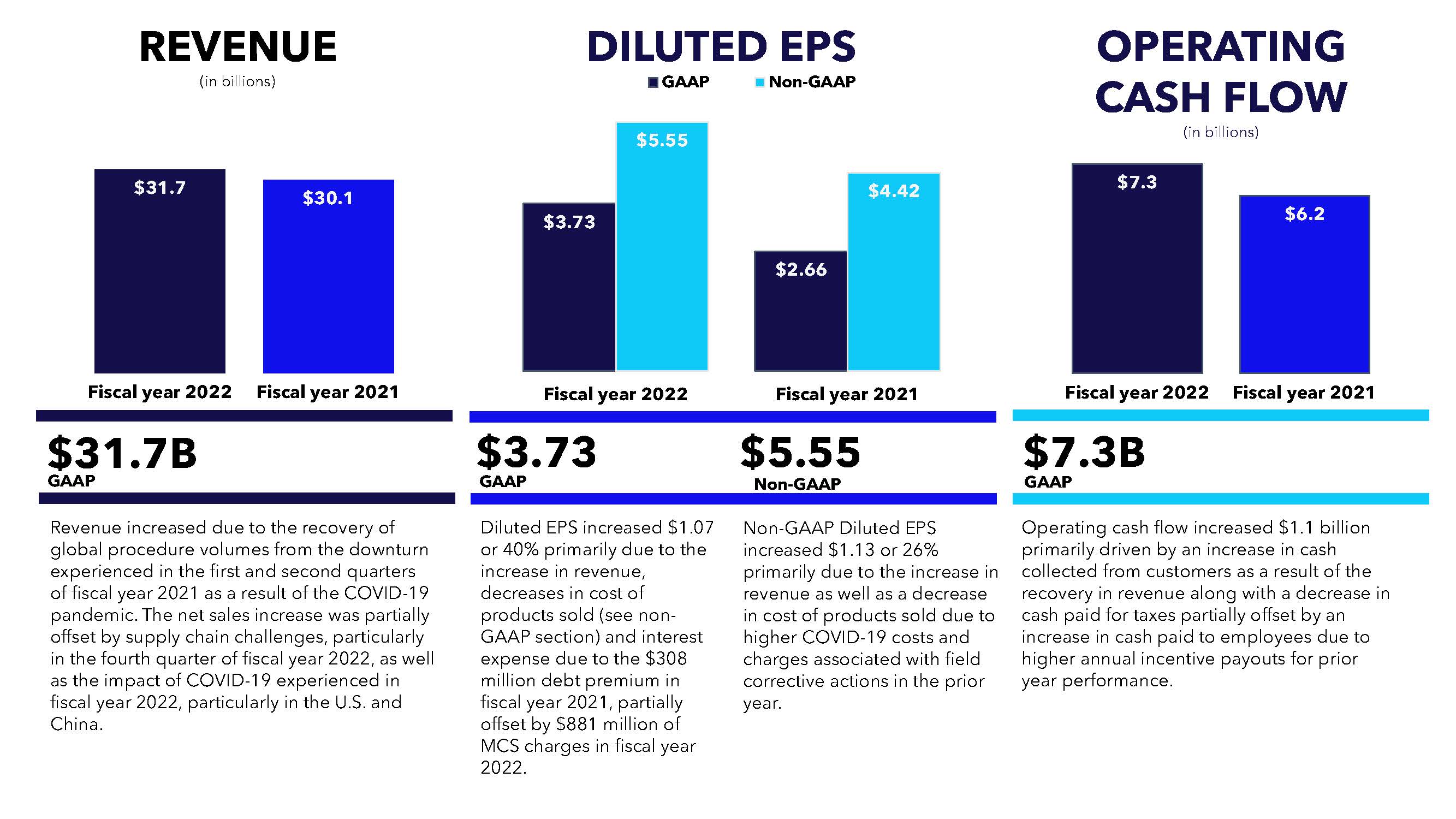

| GAAP | $ | 5,517 | $ | 456 | $ | 5,039 | $ | 3.73 | 8.3 | % | |||||||||||||||||||

| Non-GAAP Adjustments: | |||||||||||||||||||||||||||||

Restructuring and associated costs (1) | 335 | 54 | 281 | 0.21 | 16.1 | ||||||||||||||||||||||||

Acquisition-related items (2) | (43) | 5 | (48) | (0.04) | (11.6) | ||||||||||||||||||||||||

| Certain litigation charges | 95 | 17 | 78 | 0.06 | 17.9 | ||||||||||||||||||||||||

(Gain)/loss on minority investments (3) | (12) | — | (9) | (0.01) | — | ||||||||||||||||||||||||

Medical device regulations (4) | 102 | 16 | 86 | 0.06 | 15.7 | ||||||||||||||||||||||||

| Amortization of intangible assets | 1,733 | 266 | 1,467 | 1.09 | 15.3 | ||||||||||||||||||||||||

MCS impairment / costs (5) | 881 | 220 | 661 | 0.49 | 25.0 | ||||||||||||||||||||||||

Certain tax adjustments, net (6) | — | 50 | (50) | (0.04) | — | ||||||||||||||||||||||||

| Non-GAAP | $ | 8,609 | $ | 1,084 | $ | 7,505 | $ | 5.55 | 12.6 | % | |||||||||||||||||||

| Fiscal year ended April 30, 2021 | |||||||||||||||||||||||||||||

| (in millions, except per share data) | Income Before Income Taxes | Income Tax (Benefit) Provision | Net Income Attributable to Medtronic | Diluted EPS | Effective Tax Rate | ||||||||||||||||||||||||

| GAAP | $ | 3,895 | $ | 265 | $ | 3,606 | $ | 2.66 | 6.8 | % | |||||||||||||||||||

| Non-GAAP Adjustments: | |||||||||||||||||||||||||||||

Restructuring and associated costs (1) | 617 | 128 | 489 | 0.36 | 20.7 | ||||||||||||||||||||||||

Acquisition-related items (2) | (15) | (20) | 4 | — | 126.7 | ||||||||||||||||||||||||

| Certain litigation charges | 118 | 23 | 95 | 0.07 | 19.5 | ||||||||||||||||||||||||

(Gain)/loss on minority investments (3) | (61) | — | (57) | (0.04) | — | ||||||||||||||||||||||||

Impairment charges (7) | 76 | 7 | 68 | 0.05 | 10.5 | ||||||||||||||||||||||||

Medical device regulations (4) | 83 | 15 | 68 | 0.05 | 18.1 | ||||||||||||||||||||||||

Debt tender premium and other charges (8) | 308 | 60 | 248 | 0.18 | 19.5 | ||||||||||||||||||||||||

| Amortization of intangible assets | 1,783 | 283 | 1,500 | 1.11 | 15.9 | ||||||||||||||||||||||||

Certain tax adjustments, net (9) | — | 41 | (41) | (0.03) | — | ||||||||||||||||||||||||

| Non-GAAP | $ | 6,804 | $ | 802 | $ | 5,980 | $ | 4.42 | 11.8 | % | |||||||||||||||||||

| Fiscal Year | |||||||||||

| (in millions) | 2022 | 2021 | |||||||||

| Net cash provided by operating activities | $ | 7,346 | $ | 6,240 | |||||||

| Additions to property, plant, and equipment | (1,368) | (1,355) | |||||||||

| Free cash flow | $ | 5,978 | $ | 4,885 | |||||||

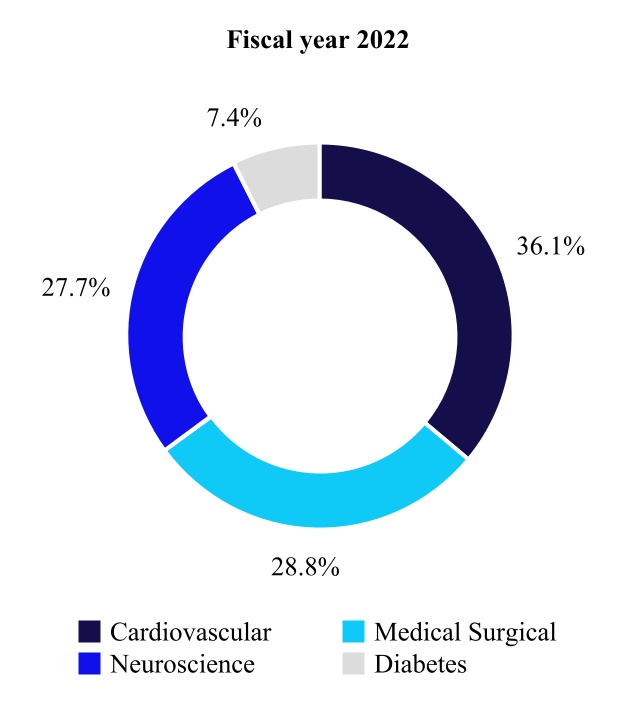

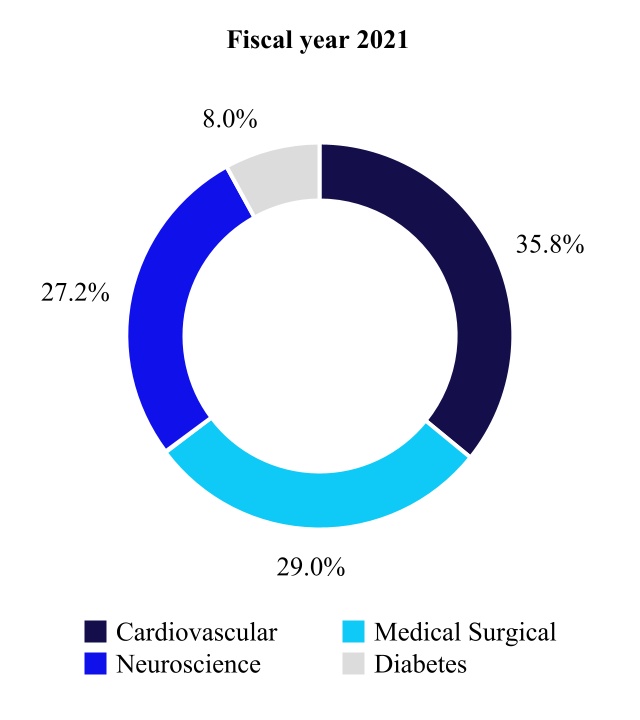

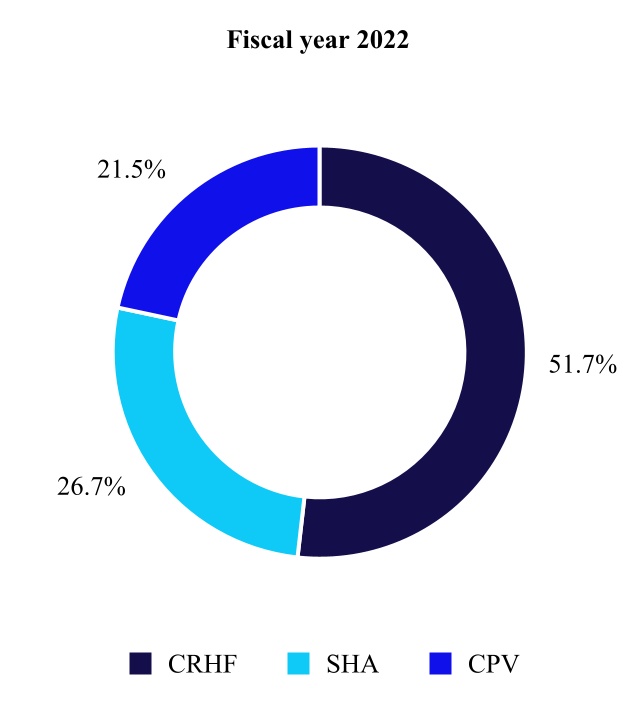

| Net Sales by Fiscal Year | Percent Change | ||||||||||||||||

| (in millions) | 2022 | 2021 | |||||||||||||||

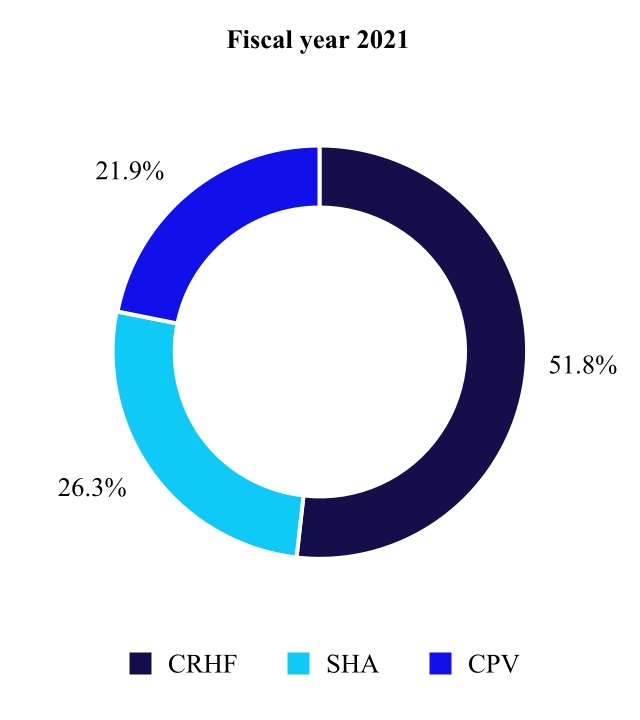

| Cardiac Rhythm & Heart Failure | $ | 5,908 | $ | 5,584 | 6 | % | |||||||||||

| Structural Heart & Aortic | 3,055 | 2,834 | 8 | ||||||||||||||

| Coronary & Peripheral Vascular | 2,460 | 2,354 | 5 | ||||||||||||||

| Cardiovascular | 11,423 | 10,772 | 6 | ||||||||||||||

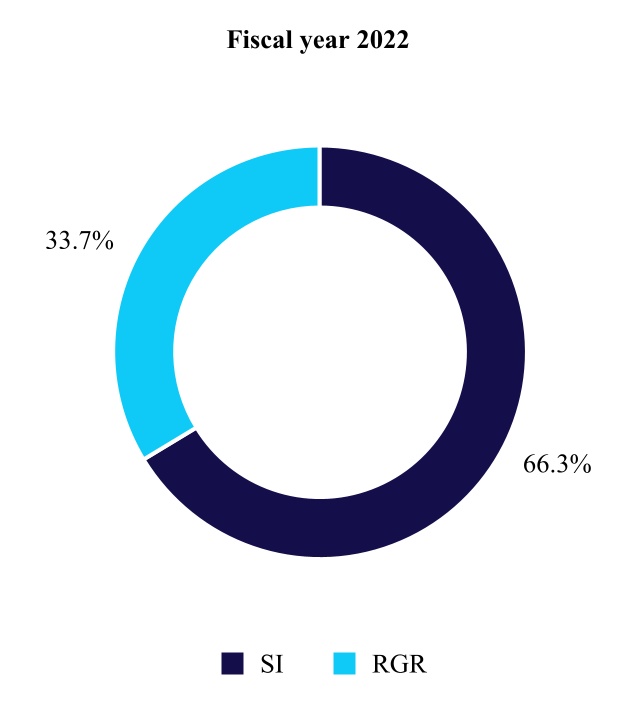

| Surgical Innovations | 6,060 | 5,438 | 11 | ||||||||||||||

| Respiratory, Gastrointestinal, & Renal | 3,081 | 3,298 | (7) | ||||||||||||||

| Medical Surgical | 9,141 | 8,737 | 5 | ||||||||||||||

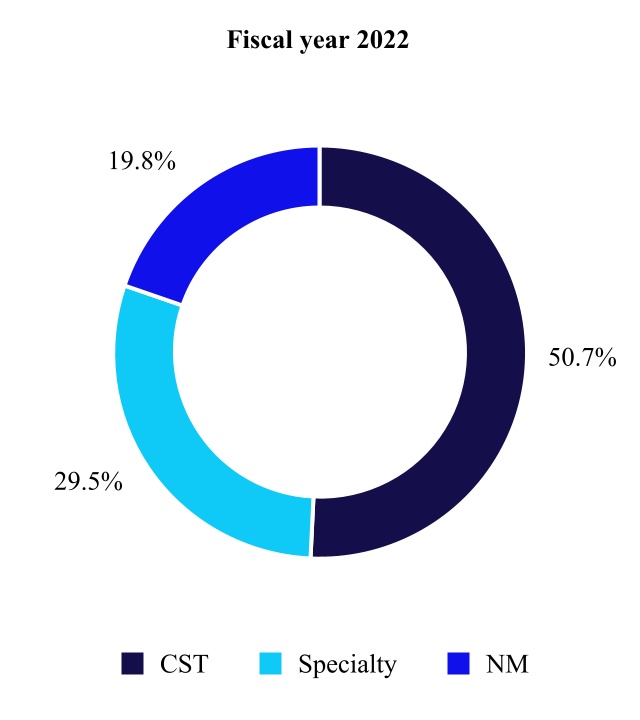

| Cranial & Spinal Technologies | 4,456 | 4,288 | 4 | ||||||||||||||

| Specialty Therapies | 2,592 | 2,307 | 12 | ||||||||||||||

| Neuromodulation | 1,735 | 1,601 | 8 | ||||||||||||||

| Neuroscience | 8,784 | 8,195 | 7 | ||||||||||||||

| Diabetes | 2,338 | 2,413 | (3) | ||||||||||||||

| Total | $ | 31,686 | $ | 30,117 | 5 | % | |||||||||||

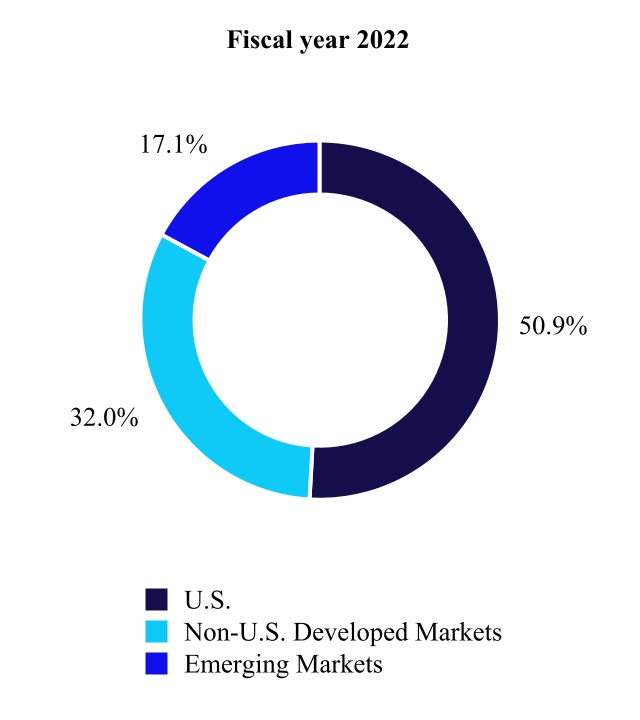

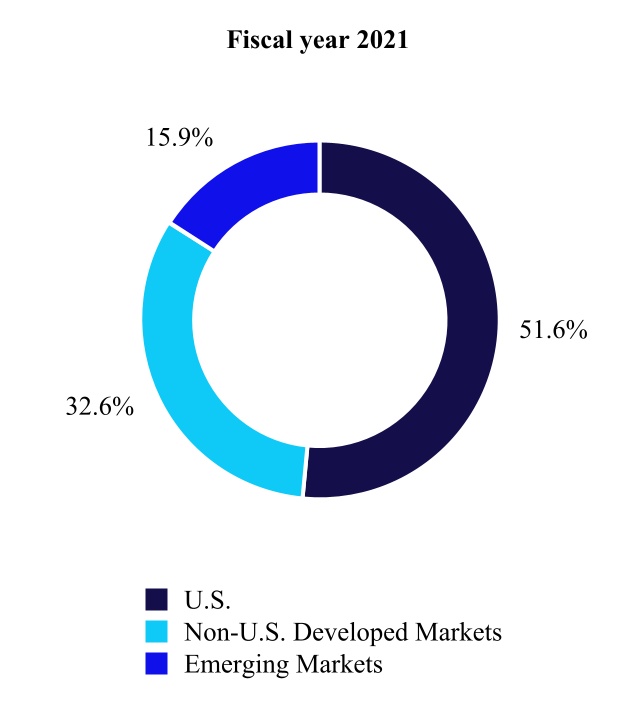

U.S.(1) | Non-U.S. Developed Markets(2) | Emerging Markets(3) | |||||||||||||||||||||||||||||||||||||||||||||||||||

| (in millions) | Fiscal Year 2022 | Fiscal Year 2021 | % Change | Fiscal Year 2022 | Fiscal Year 2021 | % Change | Fiscal Year 2022 | Fiscal Year 2021 | % Change | ||||||||||||||||||||||||||||||||||||||||||||

| Cardiovascular | $ | 5,545 | $ | 5,248 | 6 | % | $ | 3,866 | $ | 3,752 | 3 | % | $ | 2,012 | $ | 1,773 | 13 | % | |||||||||||||||||||||||||||||||||||

| Medical Surgical | 3,862 | 3,650 | 6 | 3,373 | 3,320 | 2 | 1,905 | 1,766 | 8 | ||||||||||||||||||||||||||||||||||||||||||||

| Neuroscience | 5,753 | 5,456 | 5 | 1,801 | 1,724 | 4 | 1,229 | 1,015 | 21 | ||||||||||||||||||||||||||||||||||||||||||||

| Diabetes | 974 | 1,171 | (17) | 1,085 | 1,019 | 6 | 279 | 222 | 26 | ||||||||||||||||||||||||||||||||||||||||||||

| Total | $ | 16,135 | $ | 15,526 | 4 | % | $ | 10,126 | $ | 9,815 | 3 | % | $ | 5,426 | $ | 4,777 | 14 | % | |||||||||||||||||||||||||||||||||||

| Fiscal Year | |||||||||||

| (in millions) | 2022 | 2021 | |||||||||

| Amortization of intangible assets | $ | 1,733 | $ | 1,783 | |||||||

| Restructuring charges, net | 60 | 293 | |||||||||

| Certain litigation charges | 95 | 118 | |||||||||

| Other operating expense, net | 862 | 315 | |||||||||

| Other non-operating income, net | (318) | (336) | |||||||||

| Interest expense | 553 | 925 | |||||||||

| Fiscal Year | |||||||||||

| (in millions) | 2022 | 2021 | |||||||||

| Income tax provision (benefit) | $ | 456 | $ | 265 | |||||||

| Income before income taxes | 5,517 | 3,895 | |||||||||

| Effective tax rate | 8.3 | % | 6.8 | % | |||||||

| Non-GAAP income tax provision | $ | 1,084 | $ | 802 | |||||||

| Non-GAAP income before income taxes | 8,609 | 6,804 | |||||||||

| Non-GAAP Nominal Tax Rate | 12.6 | % | 11.8 | % | |||||||

| Difference between the effective tax rate and Non-GAAP Nominal Tax Rate | 4.3 | % | 5.0 | % | |||||||

| Fiscal Year | |||||||||||

| (in millions) | 2022 | 2021 | |||||||||

| Cash provided by (used in): | |||||||||||

| Operating activities | $ | 7,346 | $ | 6,240 | |||||||

| Investing activities | (1,659) | (2,866) | |||||||||

| Financing activities | (5,336) | (4,136) | |||||||||

| Effect of exchange rate changes on cash and cash equivalents | (231) | 215 | |||||||||

| Net change in cash and cash equivalents | $ | 121 | $ | (547) | |||||||

Agency Rating (1) | ||||||||||||||

| April 29, 2022 | April 30, 2021 | |||||||||||||

| Standard & Poor's Ratings Services | ||||||||||||||

| Long-term debt | A | A | ||||||||||||

| Short-term debt | A-1 | A-1 | ||||||||||||

| Moody's Investors Service | ||||||||||||||

| Long-term debt | A3 | A3 | ||||||||||||

| Short-term debt | P-2 | P-2 | ||||||||||||

| Maturity by Fiscal Year | ||||||||||||||||||||||||||||||||||||||||||||

| (in millions) | Total | 2023 | 2024 | 2025 | 2026 | 2027 | Thereafter | |||||||||||||||||||||||||||||||||||||

| Contractual obligations related to off-balance sheet arrangements: | ||||||||||||||||||||||||||||||||||||||||||||

Commitments to fund minority investments, milestone payments, and royalty obligations(1) | $ | 233 | $ | 95 | $ | 54 | $ | 30 | $ | 18 | $ | 18 | $ | 19 | ||||||||||||||||||||||||||||||

Interest payments(2) | 6,902 | 466 | 460 | 460 | 394 | 391 | 4,732 | |||||||||||||||||||||||||||||||||||||

Other(3) | 995 | 445 | 235 | 121 | 66 | 34 | 94 | |||||||||||||||||||||||||||||||||||||

Contractual obligations reflected in the balance sheet(4): | ||||||||||||||||||||||||||||||||||||||||||||

Debt obligations(5) | $ | 24,275 | $ | 3,744 | $ | 6 | $ | 1,895 | $ | 2,133 | $ | 1,969 | $ | 14,528 | ||||||||||||||||||||||||||||||

| Operating leases | 976 | 213 | 164 | 130 | 103 | 82 | 284 | |||||||||||||||||||||||||||||||||||||

Contingent consideration(6) | 119 | 35 | 49 | 33 | 1 | — | — | |||||||||||||||||||||||||||||||||||||

Tax obligations(7) | 1,496 | 176 | 330 | 440 | 550 | — | — | |||||||||||||||||||||||||||||||||||||

| (in millions) | Medtronic & Medtronic Luxco Senior Notes (1) | CIFSA Senior Notes (2) | |||||||||

| Net sales | $ | 2,063 | $ | — | |||||||

| Operating profit | 469 | (5) | |||||||||

| Loss before income taxes | (518) | (974) | |||||||||

| Net loss attributable to Medtronic | (529) | (1,005) | |||||||||

| (in millions) | Medtronic & Medtronic Luxco Senior Notes (1) | CIFSA Senior Notes (2) | |||||||||

Total current assets(3) | $ | 20,767 | $ | 6,881 | |||||||

Total noncurrent assets(4) | 12,099 | 8,293 | |||||||||

Total current liabilities(5) | 32,647 | 24,302 | |||||||||

Total noncurrent liabilities(6) | 50,542 | 60,292 | |||||||||

| Noncontrolling interests | 171 | 171 | |||||||||

| Increase (decrease) | ||||||||||||||

| (in millions) | April 29, 2022 | April 30, 2021 | ||||||||||||

| 10% appreciation in the U.S. dollar | $ | 903 | $ | 995 | ||||||||||

| 10% depreciation in the U.S. dollar | (903) | (995) | ||||||||||||

| Increase (decrease) | ||||||||||||||

| (in millions) | April 29, 2022 | April 30, 2021 | ||||||||||||

| 10 basis point increase in interest rates | $ | 53 | $ | 21 | ||||||||||

| 10 basis point decrease in interest rates | (53) | (21) | ||||||||||||

/s/ | ||

| June 23, 2022 | ||

| Fiscal Year | |||||||||||||||||

| (in millions, except per share data) | 2022 | 2021 | 2020 | ||||||||||||||

| Net sales | $ | $ | $ | ||||||||||||||

| Costs and expenses: | |||||||||||||||||

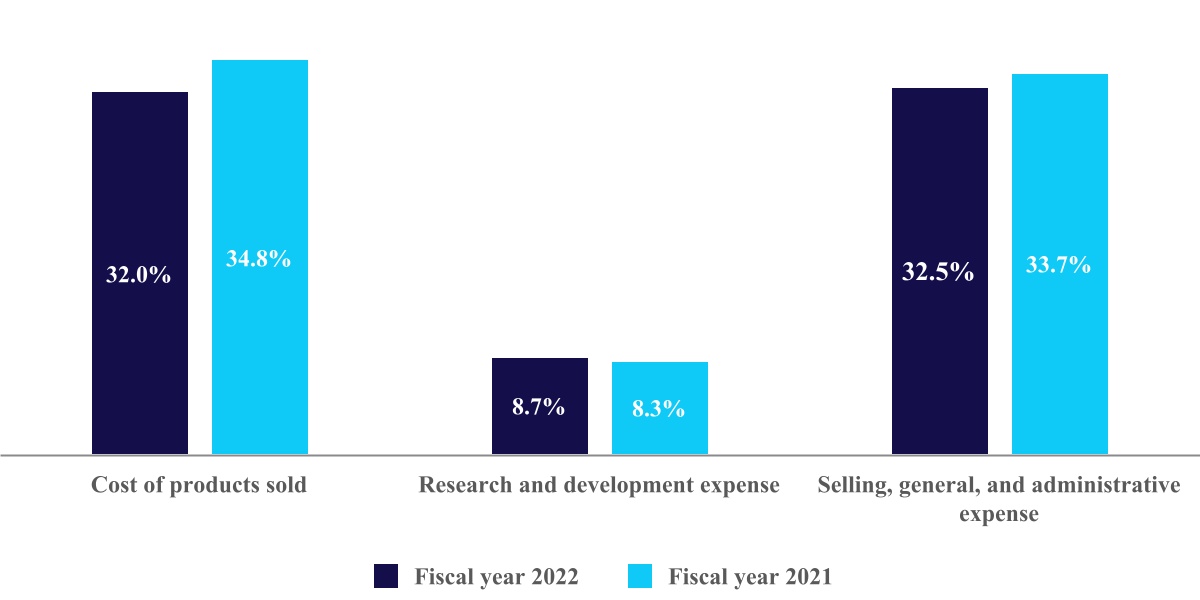

| Cost of products sold, excluding amortization of intangible assets | |||||||||||||||||

| Research and development expense | |||||||||||||||||

| Selling, general, and administrative expense | |||||||||||||||||

| Amortization of intangible assets | |||||||||||||||||

| Restructuring charges, net | |||||||||||||||||

| Certain litigation charges | |||||||||||||||||

| Other operating expense, net | |||||||||||||||||

| Operating profit | |||||||||||||||||

| Other non-operating income, net | ( | ( | ( | ||||||||||||||

| Interest expense | |||||||||||||||||

| Income before income taxes | |||||||||||||||||

| Income tax provision (benefit) | ( | ||||||||||||||||

| Net income | |||||||||||||||||

| Net income attributable to noncontrolling interests | ( | ( | ( | ||||||||||||||

| Net income attributable to Medtronic | $ | $ | $ | ||||||||||||||

| Basic earnings per share | $ | $ | $ | ||||||||||||||

| Diluted earnings per share | $ | $ | $ | ||||||||||||||

| Basic weighted average shares outstanding | |||||||||||||||||

| Diluted weighted average shares outstanding | |||||||||||||||||

| Fiscal Year | |||||||||||||||||

| (in millions) | 2022 | 2021 | 2020 | ||||||||||||||

| Net income | $ | $ | $ | ||||||||||||||

| Other comprehensive income (loss), net of tax: | |||||||||||||||||

| Unrealized (loss) gain on investment securities | ( | ||||||||||||||||

| Translation adjustment | ( | ( | |||||||||||||||

| Net investment hedge | ( | ||||||||||||||||

| Net change in retirement obligations | ( | ||||||||||||||||

| Unrealized (loss) gain on cash flow hedges | ( | ||||||||||||||||

| Other comprehensive income (loss) | ( | ||||||||||||||||

| Comprehensive income including noncontrolling interests | |||||||||||||||||

| Comprehensive income attributable to noncontrolling interests | ( | ( | ( | ||||||||||||||

| Comprehensive income attributable to Medtronic | $ | $ | $ | ||||||||||||||

| (in millions) | April 29, 2022 | April 30, 2021 | ||||||||||||

| ASSETS | ||||||||||||||

| Current assets: | ||||||||||||||

| Cash and cash equivalents | $ | $ | ||||||||||||

| Investments | ||||||||||||||

Accounts receivable, less allowances and credit losses of $ | ||||||||||||||

| Inventories, net | ||||||||||||||

| Other current assets | ||||||||||||||

| Total current assets | ||||||||||||||

| Property, plant, and equipment, net | ||||||||||||||

| Goodwill | ||||||||||||||

| Other intangible assets, net | ||||||||||||||

| Tax assets | ||||||||||||||

| Other assets | ||||||||||||||

| Total assets | $ | $ | ||||||||||||

| LIABILITIES AND EQUITY | ||||||||||||||

| Current liabilities: | ||||||||||||||

| Current debt obligations | $ | $ | ||||||||||||

| Accounts payable | ||||||||||||||

| Accrued compensation | ||||||||||||||

| Accrued income taxes | ||||||||||||||

| Other accrued expenses | ||||||||||||||

| Total current liabilities | ||||||||||||||

| Long-term debt | ||||||||||||||

| Accrued compensation and retirement benefits | ||||||||||||||

| Accrued income taxes | ||||||||||||||

| Deferred tax liabilities | ||||||||||||||

| Other liabilities | ||||||||||||||

| Total liabilities | ||||||||||||||

| Commitments and contingencies (Notes 3, 16, and 18) | ||||||||||||||

| Shareholders’ equity: | ||||||||||||||

Ordinary shares— par value $ | ||||||||||||||

| Additional paid-in capital | ||||||||||||||

| Retained earnings | ||||||||||||||

| Accumulated other comprehensive loss | ( | ( | ||||||||||||

| Total shareholders’ equity | ||||||||||||||

| Noncontrolling interests | ||||||||||||||

| Total equity | ||||||||||||||

| Total liabilities and equity | $ | $ | ||||||||||||

| Ordinary Shares | Additional Paid-in Capital | Retained Earnings | Accumulated Other Comprehensive Loss | Total Shareholders’ Equity | Noncontrolling Interests | Total Equity | ||||||||||||||||||||||||||||||||||||||||||||

| (in millions, except per share data) | Number | Par Value | ||||||||||||||||||||||||||||||||||||||||||||||||

| April 26, 2019 | $ | $ | $ | $ | ( | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||

| Net income | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||

| Other comprehensive loss | — | — | — | — | ( | ( | ( | ( | ||||||||||||||||||||||||||||||||||||||||||

Dividends to shareholders ($ | — | — | — | ( | — | ( | — | ( | ||||||||||||||||||||||||||||||||||||||||||

| Issuance of shares under stock purchase and award plans | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||

| Repurchase of ordinary shares | ( | — | ( | — | — | ( | — | ( | ||||||||||||||||||||||||||||||||||||||||||

| Stock-based compensation | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||

| Changes to noncontrolling ownership interests | — | — | — | — | — | — | ( | ( | ||||||||||||||||||||||||||||||||||||||||||

| — | — | — | ( | — | ( | — | ( | |||||||||||||||||||||||||||||||||||||||||||

| April 24, 2020 | $ | $ | $ | $ | ( | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||

| Net income | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||

| Other comprehensive income | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||

Dividends to shareholders ($ | — | — | — | ( | — | ( | — | ( | ||||||||||||||||||||||||||||||||||||||||||

| Issuance of shares under stock purchase and award plans | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||

| Repurchase of ordinary shares | ( | — | ( | — | — | ( | — | ( | ||||||||||||||||||||||||||||||||||||||||||

| Stock-based compensation | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||

| Changes to noncontrolling ownership interests | — | — | ( | — | — | ( | ( | |||||||||||||||||||||||||||||||||||||||||||

| — | — | — | ( | — | ( | — | ( | |||||||||||||||||||||||||||||||||||||||||||

| April 30, 2021 | $ | $ | $ | $ | ( | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||

| Net income | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||

| Other comprehensive income | — | — | — | — | ( | |||||||||||||||||||||||||||||||||||||||||||||

Dividends to shareholders ($ | — | — | — | ( | — | ( | — | ( | ||||||||||||||||||||||||||||||||||||||||||

| Issuance of shares under stock purchase and award plans | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||

| Repurchase of ordinary shares | ( | — | ( | — | — | ( | — | ( | ||||||||||||||||||||||||||||||||||||||||||

| Stock-based compensation | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||

| Changes to noncontrolling ownership interests | — | — | — | — | ( | ( | ||||||||||||||||||||||||||||||||||||||||||||

| April 29, 2022 | $ | $ | $ | $ | ( | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||

| Fiscal Year | |||||||||||||||||

| (in millions) | 2022 | 2021 | 2020 | ||||||||||||||

| Operating Activities: | |||||||||||||||||

| Net income | $ | $ | $ | ||||||||||||||

| Adjustments to reconcile net income to net cash provided by operating activities: | |||||||||||||||||

| Depreciation and amortization | |||||||||||||||||

| Provision for credit losses | |||||||||||||||||

| Deferred income taxes | ( | ( | ( | ||||||||||||||

| Stock-based compensation | |||||||||||||||||

| Loss on debt extinguishment | |||||||||||||||||

| Asset impairment charges | |||||||||||||||||

| Other, net | |||||||||||||||||

| Change in operating assets and liabilities, net of acquisitions and divestitures: | |||||||||||||||||

| Accounts receivable, net | ( | ( | |||||||||||||||

| Inventories, net | ( | ( | |||||||||||||||

| Accounts payable and accrued liabilities | ( | ||||||||||||||||

| Other operating assets and liabilities | ( | ( | ( | ||||||||||||||

| Net cash provided by operating activities | |||||||||||||||||

| Investing Activities: | |||||||||||||||||

| Acquisitions, net of cash acquired | ( | ( | ( | ||||||||||||||

| Additions to property, plant, and equipment | ( | ( | ( | ||||||||||||||

| Purchases of investments | ( | ( | ( | ||||||||||||||

| Sales and maturities of investments | |||||||||||||||||

| Other investing activities, net | ( | ( | ( | ||||||||||||||

| Net cash used in investing activities | ( | ( | ( | ||||||||||||||

| Financing Activities: | |||||||||||||||||

| Change in current debt obligations, net | ( | ( | |||||||||||||||

| Proceeds from short-term borrowings (maturities greater than 90 days) | |||||||||||||||||

| Repayments from short-term borrowings (maturities greater than 90 days) | ( | ||||||||||||||||

| Issuance of long-term debt | |||||||||||||||||

| Payments on long-term debt | ( | ( | ( | ||||||||||||||

| Dividends to shareholders | ( | ( | ( | ||||||||||||||

| Issuance of ordinary shares | |||||||||||||||||

| Repurchase of ordinary shares | ( | ( | ( | ||||||||||||||

| Other financing activities | ( | ( | |||||||||||||||

| Net cash used in financing activities | ( | ( | ( | ||||||||||||||

| Effect of exchange rate changes on cash and cash equivalents | ( | ( | |||||||||||||||

| Net change in cash and cash equivalents | ( | ( | |||||||||||||||

| Cash and cash equivalents at beginning of period | |||||||||||||||||

| Cash and cash equivalents at end of period | $ | $ | $ | ||||||||||||||

| Supplemental Cash Flow Information | |||||||||||||||||

| Cash paid for: | |||||||||||||||||

| Income taxes | $ | $ | $ | ||||||||||||||

| Interest | |||||||||||||||||

| Net Sales by Fiscal Year | |||||||||||||||||

| (in millions) | 2022 | 2021 | 2020 | ||||||||||||||

| Cardiac Rhythm & Heart Failure | $ | $ | $ | ||||||||||||||

| Structural Heart & Aortic | |||||||||||||||||

| Coronary & Peripheral Vascular | |||||||||||||||||

| Cardiovascular | |||||||||||||||||

| Surgical Innovations | |||||||||||||||||

| Respiratory, Gastrointestinal, & Renal | |||||||||||||||||

| Medical Surgical | |||||||||||||||||

| Cranial & Spinal Technologies | |||||||||||||||||

| Specialty Therapies | |||||||||||||||||

| Neuromodulation | |||||||||||||||||

| Neuroscience | |||||||||||||||||

| Diabetes | |||||||||||||||||

| Total | $ | $ | $ | ||||||||||||||

U.S.(1) | Non-U.S. Developed Markets(2) | Emerging Markets(3) | |||||||||||||||||||||||||||||||||||||||||||||||||||

| (in millions) | Fiscal Year 2022 | Fiscal Year 2021 | Fiscal Year 2020 | Fiscal Year 2022 | Fiscal Year 2021 | Fiscal Year 2020 | Fiscal Year 2022 | Fiscal Year 2021 | Fiscal Year 2020 | ||||||||||||||||||||||||||||||||||||||||||||

| Cardiovascular | $ | $ | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||||

| Medical Surgical | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Neuroscience | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Diabetes | |||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total | $ | $ | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||||

| Fiscal Year | |||||||||||

| (in millions) | 2022 | 2021 | |||||||||

| Beginning Balance | $ | $ | |||||||||

| Purchase price contingent consideration | |||||||||||

| Purchase price allocation adjustments | |||||||||||

| Payments | ( | ( | |||||||||

| Change in fair value | ( | ||||||||||

| Ending Balance | $ | $ | |||||||||

| (in millions) | Fair Value at April 29, 2022 | Unobservable Input | Range | Weighted Average (1) | ||||||||||||||||||||||

| Discount rate | ||||||||||||||||||||||||||

| Revenue and other performance-based payments | $ | Probability of payment | ||||||||||||||||||||||||

| Projected fiscal year of payment | 2023 - 2027 | 2025 | ||||||||||||||||||||||||

| Discount rate | ||||||||||||||||||||||||||

| Product development and other milestone-based payments | $ | Probability of payment | ||||||||||||||||||||||||

| Projected fiscal year of payment | 2023 - 2024 | 2024 | ||||||||||||||||||||||||

| (in millions) | Employee Termination Benefits | Associated Costs(1) | Asset Write-downs | Other Costs | Total | ||||||||||||||||||||||||

| April 26, 2019 | $ | $ | $ | $ | $ | ||||||||||||||||||||||||

| Charges | |||||||||||||||||||||||||||||

| Cash payments | ( | ( | ( | ( | |||||||||||||||||||||||||

| Settled non-cash | ( | ( | |||||||||||||||||||||||||||

Accrual adjustments(2) | ( | ( | ( | ||||||||||||||||||||||||||

| April 24, 2020 | |||||||||||||||||||||||||||||

| Charges | |||||||||||||||||||||||||||||

| Cash payments | ( | ( | ( | ( | |||||||||||||||||||||||||

Accrual adjustments(2) | ( | ( | ( | ||||||||||||||||||||||||||

| April 30, 2021 | |||||||||||||||||||||||||||||

| Charges | |||||||||||||||||||||||||||||

| Cash payments | ( | ( | ( | ||||||||||||||||||||||||||

Accrual adjustments(2) | ( | ( | |||||||||||||||||||||||||||

| April 29, 2022 | $ | $ | $ | $ | $ | ||||||||||||||||||||||||

| April 29, 2022 | |||||||||||||||||||||||||||||||||||

| Valuation | Balance Sheet Classification | ||||||||||||||||||||||||||||||||||

| (in millions) | Cost | Unrealized Gains | Unrealized Losses | Fair Value | Investments | Other Assets | |||||||||||||||||||||||||||||

| Level 1: | |||||||||||||||||||||||||||||||||||

| U.S. government and agency securities | $ | $ | $ | ( | $ | $ | $ | ||||||||||||||||||||||||||||

| Level 2: | |||||||||||||||||||||||||||||||||||

| Corporate debt securities | ( | ||||||||||||||||||||||||||||||||||

| U.S. government and agency securities | ( | ||||||||||||||||||||||||||||||||||

| Mortgage-backed securities | ( | ||||||||||||||||||||||||||||||||||

| Non-U.S. government and agency securities | |||||||||||||||||||||||||||||||||||

| Certificates of deposit | |||||||||||||||||||||||||||||||||||

| Other asset-backed securities | ( | ||||||||||||||||||||||||||||||||||

| Total Level 2 | ( | ||||||||||||||||||||||||||||||||||

| Level 3: | |||||||||||||||||||||||||||||||||||

| Auction rate securities | ( | ||||||||||||||||||||||||||||||||||

| Total available-for-sale debt securities | $ | $ | $ | ( | $ | $ | $ | ||||||||||||||||||||||||||||

| April 30, 2021 | |||||||||||||||||||||||||||||||||||

| Valuation | Balance Sheet Classification | ||||||||||||||||||||||||||||||||||

| (in millions) | Cost | Unrealized Gains | Unrealized Losses | Fair Value | Investments | Other Assets | |||||||||||||||||||||||||||||

| Level 1: | |||||||||||||||||||||||||||||||||||

| U.S. government and agency securities | $ | $ | $ | ( | $ | $ | $ | ||||||||||||||||||||||||||||

| Level 2: | |||||||||||||||||||||||||||||||||||

| Corporate debt securities | ( | ||||||||||||||||||||||||||||||||||

| U.S. government and agency securities | ( | ||||||||||||||||||||||||||||||||||

| Mortgage-backed securities | ( | ||||||||||||||||||||||||||||||||||

| Non-U.S. government and agency securities | |||||||||||||||||||||||||||||||||||

| Certificates of deposit | |||||||||||||||||||||||||||||||||||

| Other asset-backed securities | ( | ||||||||||||||||||||||||||||||||||

| Debt funds | |||||||||||||||||||||||||||||||||||

| Total Level 2 | ( | ||||||||||||||||||||||||||||||||||

| Level 3: | |||||||||||||||||||||||||||||||||||

| Auction rate securities | ( | ||||||||||||||||||||||||||||||||||

| Total available-for-sale debt securities | $ | $ | $ | ( | $ | $ | $ | ||||||||||||||||||||||||||||

| April 29, 2022 | |||||||||||||||||||||||

| Less than 12 months | More than 12 months | ||||||||||||||||||||||

| (in millions) | Fair Value | Unrealized Losses | Fair Value | Unrealized Losses | |||||||||||||||||||

| U.S. government and agency securities | $ | $ | $ | $ | ( | ||||||||||||||||||

| Corporate debt securities | ( | ( | |||||||||||||||||||||

| Mortgage-backed securities | ( | ||||||||||||||||||||||

| Other asset-backed securities | ( | ||||||||||||||||||||||

| Auction rate securities | ( | ||||||||||||||||||||||

| Total | $ | $ | ( | $ | $ | ( | |||||||||||||||||

| April 30, 2021 | |||||||||||||||||||||||

| Less than 12 months | More than 12 months | ||||||||||||||||||||||

| (in millions) | Fair Value | Unrealized Losses | Fair Value | Unrealized Losses | |||||||||||||||||||

| U.S. government and agency securities | $ | $ | ( | $ | $ | ||||||||||||||||||

| Corporate debt securities | ( | ||||||||||||||||||||||

| Mortgage-backed securities | ( | ||||||||||||||||||||||

| Other asset-backed securities | ( | ||||||||||||||||||||||

| Auction rate securities | ( | ||||||||||||||||||||||

| Total | $ | $ | ( | $ | $ | ( | |||||||||||||||||

| (in millions) | April 29, 2022 | April 30, 2021 | April 24, 2020 | ||||||||||||||

| Proceeds from sales and maturities | $ | $ | $ | ||||||||||||||

| Gross realized gains | |||||||||||||||||

| Gross realized losses | ( | ( | ( | ||||||||||||||

| (in millions) | April 29, 2022 | ||||

| Due in one year or less | $ | ||||

| Due after one year through five years | |||||

| Due after five years through ten years | |||||

| Due after ten years | |||||

| Total debt securities | $ | ||||

| (in millions) | April 29, 2022 | April 30, 2021 | ||||||||||||

| Investments with readily determinable fair value (marketable equity securities) | $ | $ | ||||||||||||

| Investments without readily determinable fair values | ||||||||||||||

| Equity method and other investments | ||||||||||||||

| Total equity and other investments | $ | $ | ||||||||||||

| (in millions) | April 29, 2022 | April 30, 2021 | April 24, 2020 | |||||||||||||||||

| Proceeds from sales | $ | $ | $ | |||||||||||||||||

| Gross gains | ||||||||||||||||||||

| Gross losses | ( | ( | ( | |||||||||||||||||

| Impairment losses recognized | ( | ( | ( | |||||||||||||||||

| (in millions) | April 29, 2022 | April 30, 2021 | |||||||||

| Bank borrowings | $ | $ | |||||||||

| Finance lease obligations | |||||||||||

| $ | $ | ||||||||||

| April 29, 2022 | April 30, 2021 | ||||||||||||||||||||||||||||

| (in millions, except interest rates) | Maturity by Fiscal Year | Amount | Effective Interest Rate | Amount | Effective Interest Rate | ||||||||||||||||||||||||

| 2023 | $ | % | $ | % | |||||||||||||||||||||||||

| 2023 | |||||||||||||||||||||||||||||

| 2023 | |||||||||||||||||||||||||||||

| 2025 | |||||||||||||||||||||||||||||

| 2026 | |||||||||||||||||||||||||||||

| 2026 | |||||||||||||||||||||||||||||

| 2027 | |||||||||||||||||||||||||||||

| 2027 | |||||||||||||||||||||||||||||

| 2029 | |||||||||||||||||||||||||||||

| 2031 | |||||||||||||||||||||||||||||

| 2032 | |||||||||||||||||||||||||||||

| 2033 | |||||||||||||||||||||||||||||

| 2035 | |||||||||||||||||||||||||||||

| 2038 | |||||||||||||||||||||||||||||

| 2039 | |||||||||||||||||||||||||||||

| 2039 | |||||||||||||||||||||||||||||

| 2040 | |||||||||||||||||||||||||||||

| 2040 | |||||||||||||||||||||||||||||

| 2041 | |||||||||||||||||||||||||||||

| 2042 | |||||||||||||||||||||||||||||

| 2043 | |||||||||||||||||||||||||||||

| 2044 | |||||||||||||||||||||||||||||

| 2045 | |||||||||||||||||||||||||||||

| 2050 | |||||||||||||||||||||||||||||

| 2051 | |||||||||||||||||||||||||||||

| 2023-2035 | |||||||||||||||||||||||||||||

| Debt discount, net | 2023-2051 | ( | — | ( | — | ||||||||||||||||||||||||

| Deferred financing costs | 2023-2051 | ( | — | ( | — | ||||||||||||||||||||||||

| Long-term debt | $ | $ | |||||||||||||||||||||||||||

| (in millions) | |||||

| 2023 | $ | ||||

| 2024 | |||||

| 2025 | |||||

| 2026 | |||||

| 2027 | |||||

| Thereafter | |||||

| Total | $ | ||||

| (Gain) Loss Recognized in Accumulated Other Comprehensive Income | (Gain) Loss Reclassified into Income | ||||||||||||||||||||||||||||||||||||||||

| Fiscal Year | Fiscal Year | Location of (Gain) Loss in Income Statement | |||||||||||||||||||||||||||||||||||||||

| (in millions) | 2022 | 2021 | 2020 | 2022 | 2021 | 2020 | |||||||||||||||||||||||||||||||||||

| Cash flow hedges | |||||||||||||||||||||||||||||||||||||||||

| Currency exchange rate contracts | $ | ( | $ | $ | ( | $ | ( | $ | ( | $ | ( | Other operating expense, net | |||||||||||||||||||||||||||||

| Currency exchange rate contracts | Cost of products sold | ||||||||||||||||||||||||||||||||||||||||

| Net investment hedges | ( | ( | ( | Other operating expense, net | |||||||||||||||||||||||||||||||||||||

| Total | $ | ( | $ | $ | ( | $ | ( | $ | ( | $ | ( | ||||||||||||||||||||||||||||||

| (Gain) Loss Recognized in Income | |||||||||||||||||||||||

| Fiscal Year | Location of (Gain) Loss in Income Statement | ||||||||||||||||||||||

| (in millions) | 2022 | 2021 | 2020 | ||||||||||||||||||||

| Derivatives not designated as hedging instruments | |||||||||||||||||||||||

| Currency exchange rate contracts | $ | ( | $ | $ | ( | Other operating expense, net | |||||||||||||||||

| Total return swaps | ( | Other operating expense, net | |||||||||||||||||||||

| Total | $ | ( | $ | $ | ( | ||||||||||||||||||

| Fair Value - Assets | Fair Value - Liabilities | ||||||||||||||||||||||||||||||||||

| (in millions) | April 29, 2022 | April 30, 2021 | Balance Sheet Classification | April 29, 2022 | April 30, 2021 | Balance Sheet Classification | |||||||||||||||||||||||||||||

| Derivatives designated as hedging instruments | |||||||||||||||||||||||||||||||||||

| Currency exchange rate contracts | $ | $ | Other current assets | $ | $ | Other accrued expenses | |||||||||||||||||||||||||||||

| Currency exchange rate contracts | Other assets | Other liabilities | |||||||||||||||||||||||||||||||||

| Total derivatives designated as hedging instruments | |||||||||||||||||||||||||||||||||||

| Derivatives not designated as hedging instruments | |||||||||||||||||||||||||||||||||||

| Currency exchange rate contracts | Other current assets | Other accrued expenses | |||||||||||||||||||||||||||||||||

| Total return swaps | Other current assets | Other accrued expenses | |||||||||||||||||||||||||||||||||

| Total derivatives not designated as hedging instruments | |||||||||||||||||||||||||||||||||||

| Total derivatives | $ | $ | $ | $ | |||||||||||||||||||||||||||||||

| April 29, 2022 | April 30, 2021 | ||||||||||||||||||||||

| (in millions) | Level 1 | Level 2 | Level 1 | Level 2 | |||||||||||||||||||

| Derivative assets | $ | $ | $ | $ | |||||||||||||||||||

| Derivative liabilities | |||||||||||||||||||||||

| April 29, 2022 | ||||||||||||||||||||||||||

| Gross Amount Not Offset on the Balance Sheet | ||||||||||||||||||||||||||

| (in millions) | Gross Amount of Recognized Assets (Liabilities) | Financial Instruments | Cash Collateral (Received) Posted | Net Amount | ||||||||||||||||||||||

| Derivative assets: | ||||||||||||||||||||||||||

| Currency exchange rate contracts | $ | $ | ( | $ | ( | $ | ||||||||||||||||||||

| Derivative liabilities: | ||||||||||||||||||||||||||

| Currency exchange rate contracts | ( | |||||||||||||||||||||||||

| Total return swaps | ( | ( | ||||||||||||||||||||||||

| ( | ( | |||||||||||||||||||||||||

| Total | $ | $ | $ | ( | $ | |||||||||||||||||||||

| April 30, 2021 | ||||||||||||||||||||||||||

| Gross Amount Not Offset on the Balance Sheet | ||||||||||||||||||||||||||

| (in millions) | Gross Amount of Recognized Assets (Liabilities) | Financial Instruments | Cash Collateral (Received) Posted | Net Amount | ||||||||||||||||||||||

| Derivative assets: | ||||||||||||||||||||||||||

| Currency exchange rate contracts | $ | $ | ( | $ | $ | |||||||||||||||||||||

| Total return swaps | ||||||||||||||||||||||||||

| ( | ||||||||||||||||||||||||||

| Derivative liabilities: | ||||||||||||||||||||||||||

| Currency exchange rate contracts | ( | ( | ||||||||||||||||||||||||

| Total | $ | ( | $ | $ | $ | ( | ||||||||||||||||||||

| (in millions) | April 29, 2022 | April 30, 2021 | |||||||||

| Finished goods | $ | $ | |||||||||

| Work-in-process | |||||||||||

| Raw materials | |||||||||||

| Total | $ | $ | |||||||||

| (in millions) | Cardiovascular | Medical Surgical | Neuroscience | Diabetes | Total | ||||||||||||||||||||||||

| April 24, 2020 | $ | $ | $ | $ | $ | ||||||||||||||||||||||||

| Goodwill as a result of acquisitions | |||||||||||||||||||||||||||||

| Purchase accounting adjustments | ( | ( | ( | ( | |||||||||||||||||||||||||

| Currency translation and other | |||||||||||||||||||||||||||||

| April 30, 2021 | |||||||||||||||||||||||||||||

| Goodwill as a result of acquisitions | |||||||||||||||||||||||||||||

| Purchase accounting adjustments | ( | ||||||||||||||||||||||||||||

| Currency translation and other | ( | ( | ( | ( | ( | ||||||||||||||||||||||||

| April 29, 2022 | $ | $ | $ | $ | $ | ||||||||||||||||||||||||

| April 29, 2022 | April 30, 2021 | ||||||||||||||||||||||

| (in millions) | Gross Carrying Amount | Accumulated Amortization | Gross Carrying Amount | Accumulated Amortization | |||||||||||||||||||

| Definite-lived: | |||||||||||||||||||||||

| Customer-related | $ | $ | ( | $ | $ | ( | |||||||||||||||||

| Purchased technology and patents | ( | ( | |||||||||||||||||||||

| Trademarks and tradenames | ( | ( | |||||||||||||||||||||

| Other | ( | ( | |||||||||||||||||||||

| Total | $ | $ | ( | $ | $ | ( | |||||||||||||||||

| Indefinite-lived: | |||||||||||||||||||||||

| IPR&D | $ | $ | — | $ | $ | — | |||||||||||||||||

| (in millions) | Amortization Expense | ||||

| 2023 | $ | ||||

| 2024 | |||||

| 2025 | |||||

| 2026 | |||||

| 2027 | |||||

| (in millions) | April 29, 2022 | April 30, 2021 | Estimated Useful Lives (in years) | ||||||||||||||

| Equipment | $ | $ | Generally | ||||||||||||||

| Computer software | Up to | ||||||||||||||||

| Land and land improvements | Up to | ||||||||||||||||

| Buildings and leasehold improvements | Up to | ||||||||||||||||

| Construction in progress | — | ||||||||||||||||

| Property, plant, and equipment | |||||||||||||||||

| Less: Accumulated depreciation | ( | ( | |||||||||||||||

| Property, plant, and equipment, net | $ | $ | |||||||||||||||

| Fiscal Year | |||||||||||||||||

| (in millions) | 2022 | 2021 | 2020 | ||||||||||||||

| Stock options | $ | $ | $ | ||||||||||||||

| Restricted stock | |||||||||||||||||

| Performance share units | |||||||||||||||||

| Employee stock purchase plan | |||||||||||||||||

| Total stock-based compensation expense | $ | $ | $ | ||||||||||||||

| Cost of products sold | $ | $ | $ | ||||||||||||||

| Research and development expense | |||||||||||||||||

| Selling, general, and administrative expense | |||||||||||||||||

| Total stock-based compensation expense | |||||||||||||||||

| Income tax benefits | ( | ( | ( | ||||||||||||||

| Total stock-based compensation expense, net of tax | $ | $ | $ | ||||||||||||||

| Fiscal Year | |||||||||||||||||

| 2022 | 2021 | 2020 | |||||||||||||||

| Weighted average fair value of options granted | $ | $ | $ | ||||||||||||||

| Assumptions used: | |||||||||||||||||

| Expected life (years) | |||||||||||||||||

| Risk-free interest rate | % | % | % | ||||||||||||||

| Volatility | % | % | % | ||||||||||||||

| Dividend yield | % | % | % | ||||||||||||||

| Options (in thousands) | Wtd. Avg. Exercise Price | Wtd. Avg. Remaining Contractual Term (in years) | Aggregate Intrinsic Value (in millions) | ||||||||||||||||||||

Outstanding at April 30, 2021 | $ | ||||||||||||||||||||||

| Granted | |||||||||||||||||||||||

| Exercised | ( | ||||||||||||||||||||||

| Expired/Forfeited | ( | ||||||||||||||||||||||

Outstanding at April 29, 2022 | $ | ||||||||||||||||||||||

Expected to vest at April 29, 2022 | |||||||||||||||||||||||

Exercisable at April 29, 2022 | |||||||||||||||||||||||

| Fiscal Year | |||||||||||||||||

| (in millions) | 2022 | 2021 | 2020 | ||||||||||||||

| Cash proceeds from options exercised | $ | $ | $ | ||||||||||||||

| Intrinsic value of options exercised | |||||||||||||||||

| Tax benefit related to options exercised | |||||||||||||||||

| Units (in thousands) | Wtd. Avg. Grant Price | ||||||||||

Nonvested at April 30, 2021 | $ | ||||||||||

| Granted | |||||||||||

| Vested | ( | ||||||||||

| Forfeited | ( | ||||||||||

Nonvested at April 29, 2022 | |||||||||||

| Fiscal Year | |||||||||||||||||

| (in millions, except per share data) | 2022 | 2021 | 2020 | ||||||||||||||

| Weighted-average grant-date fair value per restricted stock | $ | $ | $ | ||||||||||||||

| Fair value of restricted stock vested | |||||||||||||||||

| Tax benefit related to restricted stock vested | |||||||||||||||||

| Units (in thousands) | Wtd. Avg. Grant Price | ||||||||||

Nonvested at April 30, 2021 | $ | ||||||||||

| Granted | |||||||||||

| Forfeited | ( | ||||||||||

Nonvested at April 29, 2022 | |||||||||||

| Fiscal Year | |||||||||||

| (in millions, except per share data) | 2022 | 2021 | |||||||||

| Weighted-average grant-date fair value per performance share units | $ | $ | |||||||||

| Fair value of performance share units vested | |||||||||||

| Tax benefit related to performance share units vested | |||||||||||

| Fiscal Year | |||||||||||||||||

| (in millions) | 2022 | 2021 | 2020 | ||||||||||||||

| U.S. | $ | $ | ( | $ | |||||||||||||

| International | |||||||||||||||||

| Income before income taxes | $ | $ | $ | ||||||||||||||

| Fiscal Year | |||||||||||||||||

| (in millions) | 2022 | 2021 | 2020 | ||||||||||||||

| Current tax expense: | |||||||||||||||||

| U.S. | $ | $ | $ | ||||||||||||||

| International | |||||||||||||||||

| Total current tax expense | |||||||||||||||||

| Deferred tax (benefit) expense: | |||||||||||||||||

| U.S. | ( | ( | ( | ||||||||||||||

| International | ( | ( | |||||||||||||||

| Net deferred tax benefit | ( | ( | ( | ||||||||||||||

Income tax provision (benefit) | $ | $ | $ | ( | |||||||||||||

| (in millions) | April 29, 2022 | April 30, 2021(1) | |||||||||

| Deferred tax assets: | |||||||||||

| Intangible assets | $ | $ | |||||||||

| Net operating loss, capital loss, and credit carryforwards | |||||||||||

| Capitalization of research and development | |||||||||||

| Other accrued liabilities | |||||||||||

| Accrued compensation | |||||||||||

| Pension and post-retirement benefits | |||||||||||

| Stock-based compensation | |||||||||||

| Inventory | |||||||||||

| Lease obligations | |||||||||||

| Federal and state benefit on uncertain tax positions | |||||||||||

| Interest limitation | |||||||||||

| Other | |||||||||||

| Gross deferred tax assets | |||||||||||

| Valuation allowance | ( | ( | |||||||||

| Total deferred tax assets | |||||||||||

| Deferred tax liabilities: | |||||||||||

| Intangible assets | ( | ( | |||||||||

| Realized loss on derivative financial instruments | ( | ( | |||||||||

| Right of use leases | ( | ( | |||||||||

| Unrealized gain on available-for-sale securities and derivative financial instruments | ( | ||||||||||

| Accumulated depreciation | ( | ( | |||||||||

| Outside basis difference of subsidiaries | ( | ( | |||||||||

| Other | ( | ( | |||||||||

| Total deferred tax liabilities | ( | ( | |||||||||

| Prepaid income taxes | |||||||||||

| Income tax receivables | |||||||||||

| Tax assets, net | $ | $ | |||||||||

| Reported as (after valuation allowance and jurisdictional netting): | |||||||||||

| Other current assets | $ | $ | |||||||||

| Tax assets | |||||||||||

| Deferred tax liabilities | ( | ( | |||||||||

| Tax assets, net | $ | $ | |||||||||

| Fiscal Year | |||||||||||||||||

| 2022 | 2021 | 2020 | |||||||||||||||

| U.S. federal statutory tax rate | % | % | % | ||||||||||||||

| Increase (decrease) in tax rate resulting from: | |||||||||||||||||

| U.S. state taxes, net of federal tax benefit | ( | ||||||||||||||||

| Research and development credit | ( | ( | ( | ||||||||||||||

| Puerto Rico excise tax | ( | ( | ( | ||||||||||||||

| International | ( | ( | ( | ||||||||||||||

| Stock based compensation | ( | ( | ( | ||||||||||||||

| Interest on uncertain tax positions | |||||||||||||||||

| Base erosion anti-abuse tax | |||||||||||||||||

| Foreign derived intangible income benefit | ( | ( | ( | ||||||||||||||

| Certain tax adjustments | ( | ( | ( | ||||||||||||||

| Legal entity restructuring | |||||||||||||||||

| U.S. tax on foreign earnings | |||||||||||||||||

| Other, net | ( | ||||||||||||||||

| Effective tax rate | % | % | ( | % | |||||||||||||

| Fiscal Year | |||||||||||||||||

| (in millions) | 2022 | 2021 | 2020 | ||||||||||||||

| Gross unrecognized tax benefits at beginning of fiscal year | $ | $ | $ | ||||||||||||||

| Gross increases: | |||||||||||||||||

| Prior year tax positions | |||||||||||||||||

| Current year tax positions | |||||||||||||||||

| Gross decreases: | |||||||||||||||||

| Prior year tax positions | ( | ( | ( | ||||||||||||||

| Settlements | ( | ( | ( | ||||||||||||||

| Statute of limitation lapses | ( | ( | ( | ||||||||||||||

| Gross unrecognized tax benefits at end of fiscal year | |||||||||||||||||

| Cash advance paid to taxing authorities | ( | ( | ( | ||||||||||||||

| Gross unrecognized tax benefits at end of fiscal year, net of cash advance | $ | $ | $ | ||||||||||||||

| Jurisdiction | Earliest Year Open | |||||||

| United States - federal and state | 2005 | |||||||

| Australia | 2018 | |||||||

| Brazil | 2017 | |||||||

| Canada | 2013 | |||||||

| China | 2015 | |||||||

| Costa Rica | 2018 | |||||||

| Dominican Republic | 2019 | |||||||

| France | 2019 | |||||||

| Germany | 2014 | |||||||

| India | 2002 | |||||||

| Ireland | 2012 | |||||||

| Israel | 2010 | |||||||

| Italy | 2005 | |||||||

| Japan | 2018 | |||||||

| Korea | 2017 | |||||||

| Luxembourg | 2017 | |||||||

| Mexico | 2017 | |||||||

| Puerto Rico | 2011 | |||||||

| Singapore | 2016 | |||||||

| Switzerland | 2010 | |||||||

| United Kingdom | 2017 | |||||||

| Fiscal Year | |||||||||||||||||

| (in millions, except per share data) | 2022 | 2021 | 2020 | ||||||||||||||

| Numerator: | |||||||||||||||||

| Net income attributable to ordinary shareholders | $ | $ | $ | ||||||||||||||

| Denominator: | |||||||||||||||||

| Basic – weighted average shares outstanding | |||||||||||||||||

| Effect of dilutive securities: | |||||||||||||||||

| Employee stock options | |||||||||||||||||

| Employee restricted stock units | |||||||||||||||||

| Other | |||||||||||||||||

| Diluted – weighted average shares outstanding | |||||||||||||||||

| Basic earnings per share | $ | $ | $ | ||||||||||||||

| Diluted earnings per share | $ | $ | $ | ||||||||||||||

| U.S. Pension Benefits | Non-U.S. Pension Benefits | ||||||||||||||||||||||

| Fiscal Year | Fiscal Year | ||||||||||||||||||||||

| (in millions) | 2022 | 2021 | 2022 | 2021 | |||||||||||||||||||

| Accumulated benefit obligation at end of year: | $ | $ | $ | $ | |||||||||||||||||||

| Change in projected benefit obligation: | |||||||||||||||||||||||

| Projected benefit obligation at beginning of year | $ | $ | $ | $ | |||||||||||||||||||

| Service cost | |||||||||||||||||||||||

| Interest cost | |||||||||||||||||||||||

| Employee contributions | |||||||||||||||||||||||

| Plan curtailments and settlements | ( | ( | |||||||||||||||||||||

Actuarial (gain) loss(1) | ( | ( | |||||||||||||||||||||

| Benefits paid | ( | ( | ( | ( | |||||||||||||||||||

| Special termination benefits | |||||||||||||||||||||||

| Currency exchange rate changes and other | ( | ||||||||||||||||||||||

| Projected benefit obligation at end of year | $ | $ | $ | $ | |||||||||||||||||||

| Change in plan assets: | |||||||||||||||||||||||

| Fair value of plan assets at beginning of year | $ | $ | $ | $ | |||||||||||||||||||

| Actual return on plan assets | ( | ||||||||||||||||||||||

| Employer contributions | |||||||||||||||||||||||

| Employee contributions | |||||||||||||||||||||||

| Plan settlements | ( | ( | |||||||||||||||||||||

| Benefits paid | ( | ( | ( | ( | |||||||||||||||||||

| Currency exchange rate changes and other | ( | ||||||||||||||||||||||

| Fair value of plan assets at end of year | $ | $ | $ | $ | |||||||||||||||||||

| Funded status at end of year: | |||||||||||||||||||||||

| Fair value of plan assets | $ | $ | $ | $ | |||||||||||||||||||

| Benefit obligations | |||||||||||||||||||||||

| Over (under) funded status of the plans | ( | ( | ( | ||||||||||||||||||||

| Recognized asset (liability) | $ | $ | ( | $ | ( | $ | ( | ||||||||||||||||

| Amounts recognized on the consolidated balance sheets consist of: | |||||||||||||||||||||||

| Non-current assets | $ | $ | $ | $ | |||||||||||||||||||

| Current liabilities | ( | ( | ( | ( | |||||||||||||||||||

| Non-current liabilities | ( | ( | ( | ( | |||||||||||||||||||

| Recognized asset (liability) | $ | $ | ( | $ | ( | $ | ( | ||||||||||||||||

| Amounts recognized in accumulated other comprehensive loss: | |||||||||||||||||||||||

| Prior service cost (credit) | $ | $ | $ | ( | $ | ( | |||||||||||||||||

| Net actuarial loss | |||||||||||||||||||||||

| Ending balance | $ | $ | $ | $ | |||||||||||||||||||

| Fiscal Year | |||||||||||

| (in millions) | 2022 | 2021 | |||||||||

| Accumulated benefit obligation | $ | $ | |||||||||

| Projected benefit obligation | |||||||||||

| Plan assets at fair value | |||||||||||

| Fiscal Year | |||||||||||

| (in millions) | 2022 | 2021 | |||||||||

| Projected benefit obligation | $ | $ | |||||||||

| Plan assets at fair value | |||||||||||

| U.S. Pension Benefits | Non-U.S. Pension Benefits | ||||||||||||||||||||||||||||||||||

| Fiscal Year | Fiscal Year | ||||||||||||||||||||||||||||||||||

| (in millions) | 2022 | 2021 | 2020 | 2022 | 2021 | 2020 | |||||||||||||||||||||||||||||

| Service cost | $ | $ | $ | $ | $ | $ | |||||||||||||||||||||||||||||

| Interest cost | |||||||||||||||||||||||||||||||||||

| Expected return on plan assets | ( | ( | ( | ( | ( | ( | |||||||||||||||||||||||||||||

| Amortization of prior service cost | ( | ( | ( | ||||||||||||||||||||||||||||||||

| Amortization of net actuarial loss | |||||||||||||||||||||||||||||||||||

| Settlement and curtailment (gain) loss | ( | ||||||||||||||||||||||||||||||||||

| Special termination benefits | |||||||||||||||||||||||||||||||||||

| Net periodic benefit cost | $ | $ | $ | $ | $ | $ | |||||||||||||||||||||||||||||

| (in millions) | U.S. Pension Benefits | Non-U.S. Pension Benefits | |||||||||

| Net actuarial gain | $ | ( | $ | ( | |||||||

| Amortization of prior service credit | |||||||||||

| Amortization and settlement recognition of actuarial loss | ( | ( | |||||||||

| Effect of exchange rates | ( | ||||||||||

| Total recognized in other comprehensive income | ( | ( | |||||||||

| Total recognized in net periodic benefit cost and other comprehensive income | $ | ( | $ | ( | |||||||

| U.S. Pension Benefits | Non-U.S. Pension Benefits | ||||||||||||||||||||||||||||||||||

| Fiscal Year | Fiscal Year | ||||||||||||||||||||||||||||||||||

| 2022 | 2021 | 2020 | 2022 | 2021 | 2020 | ||||||||||||||||||||||||||||||

| Critical assumptions – projected benefit obligation: | |||||||||||||||||||||||||||||||||||

| Discount rate | |||||||||||||||||||||||||||||||||||

| Rate of compensation increase | % | % | % | % | % | % | |||||||||||||||||||||||||||||

| Critical assumptions – net periodic benefit cost: | |||||||||||||||||||||||||||||||||||

Discount rate – benefit obligation | |||||||||||||||||||||||||||||||||||

Discount rate – service cost | |||||||||||||||||||||||||||||||||||

Discount rate – interest cost | |||||||||||||||||||||||||||||||||||

| Expected return on plan assets | % | % | % | % | % | ||||||||||||||||||||||||||||||

| Rate of compensation increase | % | % | % | % | % | ||||||||||||||||||||||||||||||

| U.S. Plans | Target Allocation | Actual Allocation | |||||||||||||||

April 29, 2022 | April 29, 2022 | April 30, 2021 | |||||||||||||||

| Asset Category: | |||||||||||||||||

| Equity securities | % | % | % | ||||||||||||||

| Debt securities | |||||||||||||||||

| Other | |||||||||||||||||

| Total | % | % | % | ||||||||||||||

| Fair Value at | |||||||||||||||||||||||||||||

| Fair Value Measurements Using Inputs Considered as | Investments Measured at Net Asset Value | ||||||||||||||||||||||||||||

| (in millions) | April 29, 2022 | Level 1 | Level 2 | Level 3 | |||||||||||||||||||||||||

| Short-term investments | $ | $ | $ | $ | $ | ||||||||||||||||||||||||

| Mutual funds | |||||||||||||||||||||||||||||

| Equity commingled trusts | |||||||||||||||||||||||||||||

| Fixed income commingled trusts | |||||||||||||||||||||||||||||

| Partnership units | |||||||||||||||||||||||||||||

| $ | $ | $ | $ | $ | |||||||||||||||||||||||||

| Fair Value at | Fair Value Measurements Using Inputs Considered as | Investments Measured at Net Asset Value | |||||||||||||||||||||||||||

| (in millions) | April 30, 2021 | Level 1 | Level 2 | Level 3 | |||||||||||||||||||||||||

| Short-term investments | $ | $ | $ | $ | $ | ||||||||||||||||||||||||

| Mutual funds | |||||||||||||||||||||||||||||

| Equity commingled trusts | |||||||||||||||||||||||||||||

| Fixed income commingled trusts | |||||||||||||||||||||||||||||

| Partnership units | |||||||||||||||||||||||||||||

| $ | $ | $ | $ | $ | |||||||||||||||||||||||||

| (in millions) | Partnership Units | ||||

April 24, 2020 | $ | ||||

| Total realized gains, net | |||||

| Total unrealized gains, net | |||||

| Purchases and sales, net | |||||

April 30, 2021 | |||||

| Total realized gains, net | |||||

| Total unrealized gains, net | |||||

| Purchases and sales, net | |||||

April 29, 2022 | $ | ||||

| Fair Value at | Fair Value Measurements Using Inputs Considered as | Investments Measured at Net Asset Value | |||||||||||||||||||||||||||

| (in millions) | April 29, 2022 | Level 1 | Level 2 | Level 3 | |||||||||||||||||||||||||

| Registered investment companies | $ | $ | $ | $ | $ | ||||||||||||||||||||||||

| Insurance contracts | — | ||||||||||||||||||||||||||||

| $ | $ | $ | $ | $ | |||||||||||||||||||||||||

| Fair Value at | Fair Value Measurements Using Inputs Considered as | Investments Measured at Net Asset Value | |||||||||||||||||||||||||||

| (in millions) | April 30, 2021 | Level 1 | Level 2 | Level 3 | |||||||||||||||||||||||||

| Registered investment companies | $ | $ | $ | $ | $ | ||||||||||||||||||||||||

| Insurance contracts | — | ||||||||||||||||||||||||||||

| $ | $ | $ | $ | $ | |||||||||||||||||||||||||

| (in millions) | Gross Payments | ||||||||||

| Fiscal Year | U.S. Pension Benefits | Non-U.S. Pension Benefits | |||||||||

| 2023 | $ | $ | |||||||||

| 2024 | |||||||||||

| 2025 | |||||||||||

| 2026 | |||||||||||

| 2027 | |||||||||||

| 2028 – 2032 | |||||||||||

| Total | $ | $ | |||||||||

| (in millions) | Balance Sheet Classification | April 29, 2022 | April 30, 2021 | ||||||||||||||

| Right-of-use assets | $ | $ | |||||||||||||||

| Current liability | |||||||||||||||||

| Non-current liability | |||||||||||||||||

| April 29, 2022 | April 30, 2021 | April 24, 2020 | ||||||||||||||||||

| Weighted-average remaining lease term | | |||||||||||||||||||

| Weighted-average discount rate | ||||||||||||||||||||

| Fiscal Year | ||||||||||||||||||||

| (in millions) | 2022 | 2021 | 2020 | |||||||||||||||||

| Operating lease cost | $ | $ | $ | |||||||||||||||||

| Short-term lease cost | ||||||||||||||||||||

| Total operating lease cost | $ | $ | $ | |||||||||||||||||

| Fiscal Year | ||||||||||||||||||||

| (in millions) | 2022 | 2021 | 2020 | |||||||||||||||||

| Cash paid for amounts included in the measurement of operating lease liabilities | $ | $ | $ | |||||||||||||||||

| Right-of-use assets obtained in exchange for operating lease liabilities | ||||||||||||||||||||

| (in millions) Fiscal Year | Operating Leases | |||||||

| 2023 | $ | |||||||

| 2024 | ||||||||

| 2025 | ||||||||

| 2026 | ||||||||

| 2027 | ||||||||

| Thereafter | ||||||||

| Total expected lease payments | ||||||||

| Less: Imputed interest | ( | |||||||

| Total lease liability | $ | |||||||

| (in millions) | Unrealized (Loss) Gain on Investment Securities | Cumulative Translation Adjustments | Net Investment Hedges | Net Change in Retirement Obligations | Unrealized (Loss) Gain on Cash Flow Hedges | Total Accumulated Other Comprehensive (Loss) Income | |||||||||||||||||||||||||||||

| April 26, 2019 | $ | ( | $ | ( | $ | ( | $ | ( | $ | $ | ( | ||||||||||||||||||||||||

| Other comprehensive income (loss) before reclassifications | ( | ( | ( | ||||||||||||||||||||||||||||||||

| Reclassifications | ( | ( | |||||||||||||||||||||||||||||||||

| Other comprehensive income (loss) | ( | ( | ( | ||||||||||||||||||||||||||||||||

| April 24, 2020 | ( | ( | ( | ||||||||||||||||||||||||||||||||

| Other comprehensive income (loss) before reclassifications | ( | ( | ( | ||||||||||||||||||||||||||||||||

| Reclassifications | |||||||||||||||||||||||||||||||||||

| Other comprehensive income (loss) | ( | ( | |||||||||||||||||||||||||||||||||

| April 30, 2021 | ( | ( | ( | ( | ( | ||||||||||||||||||||||||||||||

| Other comprehensive income (loss) before reclassifications | ( | ( | |||||||||||||||||||||||||||||||||

| Reclassifications | ( | ||||||||||||||||||||||||||||||||||

| Other comprehensive income (loss) | ( | ( | |||||||||||||||||||||||||||||||||

| April 29, 2022 | $ | ( | $ | ( | $ | $ | ( | $ | $ | ( | |||||||||||||||||||||||||

| Fiscal Year | |||||||||||||||||

| (in millions) | 2022 | 2021 | 2020 | ||||||||||||||

| Cardiovascular | $ | $ | $ | ||||||||||||||

| Medical Surgical | |||||||||||||||||

| Neuroscience | |||||||||||||||||

| Diabetes | |||||||||||||||||

| Segment operating profit | |||||||||||||||||

| Interest expense | ( | ( | ( | ||||||||||||||

| Other non-operating income, net | |||||||||||||||||

| Amortization of intangible assets | ( | ( | ( | ||||||||||||||

| Corporate | ( | ( | ( | ||||||||||||||

| Centralized distribution costs | ( | ( | ( | ||||||||||||||

| Restructuring and associated costs | ( | ( | ( | ||||||||||||||

| Acquisition-related items | ( | ||||||||||||||||

| Certain litigation charges | ( | ( | ( | ||||||||||||||

| Impairment charges | ( | ||||||||||||||||

| MCS impairment / costs | ( | ||||||||||||||||

| IPR&D charges | ( | ( | ( | ||||||||||||||

| Exit of businesses | ( | ||||||||||||||||

| Debt tender premium and other charges | |||||||||||||||||

| Medical device regulations | ( | ( | ( | ||||||||||||||

| Contribution to Medtronic Foundation | ( | ||||||||||||||||

| Income before income taxes | $ | $ | $ | ||||||||||||||

| Total Assets | Depreciation Expense | ||||||||||||||||||||||||||||

| (in millions) | April 29, 2022 | April 30, 2021 | 2022 | 2021 | 2020 | ||||||||||||||||||||||||

| Cardiovascular | $ | $ | $ | $ | $ | ||||||||||||||||||||||||

| Medical Surgical | |||||||||||||||||||||||||||||

| Neuroscience | |||||||||||||||||||||||||||||

| Diabetes | |||||||||||||||||||||||||||||

| Segments | |||||||||||||||||||||||||||||

| Corporate | |||||||||||||||||||||||||||||

| Total | $ | $ | $ | $ | $ | ||||||||||||||||||||||||

| Net sales | Property, plant, and equipment, net | ||||||||||||||||||||||||||||

| (in millions) | 2022 | 2021 | 2020 | April 29, 2022 | April 30, 2021 | ||||||||||||||||||||||||

| Ireland | $ | $ | $ | $ | $ | ||||||||||||||||||||||||

| United States | |||||||||||||||||||||||||||||

| Rest of world | |||||||||||||||||||||||||||||

| Total other countries, excluding Ireland | |||||||||||||||||||||||||||||

| Total | $ | $ | $ | $ | $ | ||||||||||||||||||||||||

| Name | Age | Position with the Company | ||||||||||||

| Geoffrey S. Martha | 52 | Chairman and Chief Executive Officer | ||||||||||||

| Ivan K. Fong | 60 | Executive Vice President, General Counsel and Corporate Secretary of the Company | ||||||||||||

| Karen L. Parkhill | 56 | Executive Vice President and Chief Financial Officer | ||||||||||||

| Carol A. Surface | 56 | Executive Vice President and Chief Human Resources Officer | ||||||||||||

| Robert ten Hoedt | 61 | Executive Vice President and President, EMEA Region, President, APAC Region | ||||||||||||

| Robert J. White | 59 | Executive Vice President and President, Medical Surgical Portfolio | ||||||||||||

| John Liddicoat, M.D. | 58 | Executive Vice President and President, Americas Region | ||||||||||||

| Sean Salmon | 57 | Executive Vice President and President, Diabetes Operating Unit, President, Cardiovascular Portfolio | ||||||||||||

| Brett Wall | 57 | Executive Vice President and President, Neuroscience Portfolio | ||||||||||||

| (a) | 1. Financial Statement Schedules | ||||

Schedule II. Valuation and Qualifying Accounts — years ended April 29, 2022, April 30, 2021, and April 24, 2020. | |||||

| Additions | Deductions | ||||||||||||||||||||||||||||

| Balance at Beginning of Fiscal Year | Charges to Income | Charges to Other Accounts | Other Changes (Debit) Credit | Balance at End of Fiscal Year | |||||||||||||||||||||||||

| Allowance for doubtful accounts: | |||||||||||||||||||||||||||||

| Fiscal year ended April 29, 2022 | $ | $ | $ | $ | ( | (a) | $ | ||||||||||||||||||||||

| Fiscal year ended April 30, 2021 | ( | (a) | |||||||||||||||||||||||||||

| Fiscal year ended April 24, 2020 | ( | (a) | |||||||||||||||||||||||||||

| Inventory reserve: | |||||||||||||||||||||||||||||

| Fiscal year ended April 29, 2022 | $ | $ | $ | $ | ( | (b) | $ | ||||||||||||||||||||||

| Fiscal year ended April 30, 2021 | ( | (b) | |||||||||||||||||||||||||||

| Fiscal year ended April 24, 2020 | ( | (b) | |||||||||||||||||||||||||||

| Deferred tax valuation allowance: | |||||||||||||||||||||||||||||

| Fiscal year ended April 29, 2022 | $ | $ | $ | ( | (e) | $ | ( | (d) | $ | ||||||||||||||||||||

| Fiscal year ended April 30, 2021 | (e) | ( | (d) | ||||||||||||||||||||||||||

| Fiscal year ended April 24, 2020 | ( | (c) | ( | (d) | |||||||||||||||||||||||||

| ( | (e) | ||||||||||||||||||||||||||||

| (a) Primarily consists of uncollectible accounts written off, less recoveries. | |||||

| (b) Primarily reflects utilization of the inventory reserve. | |||||

| (c) Reflects the impact from acquisitions and amounts recognized in accumulated other comprehensive income/loss. | |||||

| (d) Primarily reflects carryover attribute utilization and expiration. | |||||

| (e) Primarily reflects the effects of currency fluctuations. | |||||

| All other schedules are omitted because they are not applicable or the required information is shown in the financial statements or notes thereto. | |||||||||||||||||

| 2. Exhibits | |||||||||||||||||

| Exhibit No. | Description | ||||||||||

| 3.1 | |||||||||||

| 3.2 | |||||||||||

| 4.1 | |||||||||||

| 4.2 | |||||||||||

| 4.3 | |||||||||||

| 4.4 | |||||||||||

| 4.5 | |||||||||||

| 4.6 | |||||||||||

| 4.7 | |||||||||||

| 4.8 | |||||||||||

| 4.9 | |||||||||||

| 4.10 | |||||||||||

| 4.11 | |||||||||||

| 4.12 | |||||||||||

| 4.13 | |||||||||||

| 4.14 | |||||||||||

| 4.15 | |||||||||||

| 4.16 | |||||||||||

| 4.17 | |||||||||||

| 4.18 | |||||||||||

| 4.19 | |||||||||||

| 4.20 | |||||||||||

| 4.21 | |||||||||||

| 4.22 | |||||||||||

| 4.23 | |||||||||||

| 4.24 | |||||||||||

| #4.25 | |||||||||||

| 10.1 | |||||||||||

| 10.2 | |||||||||||

| 10.3 | |||||||||||

| 10.4 | |||||||||||

| 10.5 | |||||||||||

| *10.6 | |||||||||||

| *10.7 | |||||||||||

| *10.8 | |||||||||||

| *10.9 | |||||||||||

| *10.10 | |||||||||||

| *10.11 | |||||||||||

| *10.12 | |||||||||||

| *10.13 | |||||||||||

| *10.14 | |||||||||||

| *10.15 | |||||||||||

| *10.16 | |||||||||||

| *10.17 | |||||||||||

| *10.18 | |||||||||||

| *10.19 | |||||||||||

| *10.20 | |||||||||||

| *10.21 | |||||||||||

| *10.22 | |||||||||||

| *10.23 | |||||||||||

| *10.24 | |||||||||||

| *10.25 | |||||||||||

| *10.26 | |||||||||||

| *10.27 | |||||||||||

| *10.28 | |||||||||||

| *10.29 | |||||||||||

| *10.30 | |||||||||||

| *10.31 | |||||||||||

| *10.32 | |||||||||||

| *10.33 | |||||||||||

| *10.34 | |||||||||||

| *10.35 | |||||||||||

| *10.36 | |||||||||||

| *10.37 | |||||||||||

| *10.38 | |||||||||||

| *10.39 | |||||||||||

| *10.40 | |||||||||||

| *10.41 | |||||||||||

| *10.42 | |||||||||||

| *10.43 | |||||||||||

| *10.44 | |||||||||||

| *10.45 | |||||||||||

| *10.46 | |||||||||||

| *10.47 | |||||||||||

| *10.48 | |||||||||||

| *10.49 | |||||||||||

| *10.50 | |||||||||||

| *10.51 | |||||||||||

| *10.52 | |||||||||||

| *10.53 | |||||||||||

| *10.54 | |||||||||||

| *10.55 | |||||||||||

| *10.56 | |||||||||||

| *10.57 | |||||||||||

| *10.58 | |||||||||||

| *10.59 | |||||||||||

| *10.60 | |||||||||||

| *10.61 | |||||||||||

| *10.62 | |||||||||||

| *10.63 | |||||||||||

| *10.64 | |||||||||||

| *10.65 | |||||||||||

| *10.66 | |||||||||||

| *10.67 | |||||||||||

| *10.68 | |||||||||||

| *10.69 | |||||||||||

| *10.70 | |||||||||||

| *10.71 | |||||||||||

| *10.72 | |||||||||||

| *10.73 | |||||||||||

| *10.74 | |||||||||||

| *10.75 | |||||||||||

| 10.76 | |||||||||||

| *10.77 | |||||||||||

| *10.78 | |||||||||||

| *10.79 | |||||||||||

| *10.80 | |||||||||||

| *10.81 | |||||||||||

| *10.82 | |||||||||||

| #21 | |||||||||||

| #22 | |||||||||||

| #23 | |||||||||||

| #24 | |||||||||||

| #31.1 | |||||||||||

| #31.2 | |||||||||||

| #32.1 | |||||||||||

| #32.2 | |||||||||||

| #101.SCH | XBRL Taxonomy Extension Schema Document | ||||||||||

| #101.CAL | XBRL Taxonomy Extension Calculation Linkbase Document | ||||||||||

| #101.DEF | XBRL Taxonomy Extension Definition Linkbase Document | ||||||||||

| #101.LAB | XBRL Taxonomy Extension Label Linkbase Document | ||||||||||

| #101.PRE | XBRL Taxonomy Extension Presentation Linkbase Document | ||||||||||

| #104 | Cover Page Interactive Data File (formatted as Inline XBRL and contained in Exhibit 101) | ||||||||||

| *Exhibits that are management contracts or compensatory plans or arrangements. | ||||||||

| #Filed herewith | ||||||||

| Medtronic plc | ||||||||

| Dated: June 23, 2022 | By: | /s/ Geoffrey S. Martha | ||||||

| Geoffrey S. Martha | ||||||||

| Chairman and Chief Executive Officer | ||||||||

| Medtronic plc | ||||||||

| Dated: June 23, 2022 | By: | /s/ Geoffrey S. Martha | ||||||

| Geoffrey S. Martha | ||||||||

| Chairman and Chief Executive Officer | ||||||||

| (Principal Executive Officer) | ||||||||

| Dated: June 23, 2022 | By: | /s/ Karen L. Parkhill | ||||||

| Karen L. Parkhill | ||||||||

| Executive Vice President and Chief Financial Officer | ||||||||

| (Principal Financial Officer) | ||||||||

| Dated: June 23, 2022 | By: | /s/ Jennifer M. Kirk | ||||||

| Jennifer M. Kirk | ||||||||

| Global Controller and Chief Accounting Officer | ||||||||

| (Principal Accounting Officer) | ||||||||

| Directors | ||||||||

| Richard H. Anderson* | ||||||||

| Craig Arnold* | ||||||||

| Scott C. Donnelly* | ||||||||

| Andrea J. Goldsmith, PH.D.* | ||||||||

| Randall J. Hogan,* | ||||||||

| Kevin E. Lofton* | ||||||||

| Geoffrey S. Martha | ||||||||

| Elizabeth G. Nabel, M.D.* | ||||||||

| Denise M. O’Leary* | ||||||||

| Kendall J. Powell* | ||||||||

| Dated: June 23, 2022 | By: | /s/ Ivan K. Fong | ||||||

| Ivan K. Fong | ||||||||

| (a) | amending the objects or memorandum of association of Medtronic; | |||||||

| (b) | amending the Articles of Association; | |||||||

| (c) | approving a change of name of Medtronic; | |||||||

| (a) | a court-approved scheme of arrangement under the Irish Companies Act. A scheme of arrangement with shareholders requires a court order from the Irish High Court and the approval of a majority in number representing 75% in value of each class of shareholder present and voting in person or by proxy at a meeting called to approve the scheme; | |||||||

| (b) | through a tender or takeover offer by a third party for all of the shares of Medtronic. Where the holders of 80% or more of Medtronic’s shares have accepted an offer for their shares in Medtronic, the remaining shareholders may also be statutorily required to transfer their shares. If the bidder does not exercise its “squeeze out” right, then the non-accepting shareholders also have a statutory right to require the bidder to acquire their shares on the same terms. If shares of Medtronic were to be listed on the Irish Stock Exchange or another regulated stock exchange in the European Union, the “squeeze out” threshold would be increased to 90%; and | |||||||

| (c) | by way of a merger with a company incorporated in the European Economic Area (“EEA”) under the EU Cross-Border Mergers Directive (EU) 2017/1132 or with another Irish company under the Irish Companies Act. Such a merger must be approved by a special resolution. Shareholders also may be entitled to have their shares acquired for cash. See the section entitled “Description of Share Capital—Appraisal Rights” | |||||||

| (a) | in the event of an offer, all holders of securities of the target company should be afforded equivalent treatment and, if a person acquires control of a company, the other holders of securities must be protected; | |||||||

| (b) | the holders of the securities of the target company must have sufficient time and information to enable them to reach a properly informed decision on the offer; where it advises the holders of securities, the board of the target company must give its views on the effects of implementation of the offer on employment, conditions of employment and the locations of the target company’s places of business; | |||||||

| (c) | the board of the target company must act in the interests of the company as a whole and must not deny the holders of securities the opportunity to decide on the merits of the offer; | |||||||

| (d) | false markets must not be created in the securities of the target company, the bidder or of any other company concerned by the offer in such a way that the rise or fall of the prices of the securities becomes artificial and the normal functioning of the markets is distorted; | |||||||

| (e) | a bidder must announce an offer only after ensuring that he or she can fulfill in full, any cash consideration, if such is offered, and after taking all reasonable measures to secure the implementation of any other type of consideration; | |||||||

| (f) | a target company must not be hindered in the conduct of its affairs for longer than is reasonable by an offer for its securities; and | |||||||

| (g) | a substantial acquisition of securities (whether such acquisition is to be effected by one transaction or a series of transactions) shall take place only at an acceptable speed and shall be subject to adequate and timely disclosure. | |||||||

| (a) | the action is approved by Medtronic’s shareholders at a general meeting; or | ||||||||||

| (b) | the Irish Takeover Panel has given its consent, where: | ||||||||||

| (i) | it is satisfied the action would not constitute frustrating action; | ||||||||||

| (ii) | Medtronic shareholders that hold 50% of the voting rights state in writing that they approve the proposed action and would vote in favor of it at a general meeting; | ||||||||||

| (iii) | the action is taken in accordance with a contract entered into prior to the announcement of the offer; or | ||||||||||

| (iv) | the decision to take such action was made before the announcement of the offer and either has been at least partially implemented or is in the ordinary course of business. | ||||||||||

| Series | Maturity | Interest Rate | Interest Payment Dates | Record Dates | ||||||||||

| 2022 notes | December 2, 2022 | 0.00% | December 2 | Close of business on the business day immediately preceding the interest payment date. | ||||||||||

| 0.375% 2023 notes | March 7, 2023 | 0.375% | March 7 | Close of business on the business day immediately preceding the interest payment date. | ||||||||||

| 0.000% 2023 notes | March 15, 2023 | 0.00% | March 15 | Close of business on the business day immediately preceding the interest payment date. | ||||||||||

| 0.25% 2025 notes | July 2, 2025 | 0.250% | July 2 | Close of business on the business day immediately preceding the interest payment date. | ||||||||||

| 0.000% 2025 notes | October 15, 2025 | 0.00% | October 15 | Close of business on the business day immediately preceding the interest payment date. | ||||||||||

| 2027 notes | March 7, 2027 | 1.125% | March 7 | Close of business on the business day immediately preceding the interest payment date. | ||||||||||

| 2028 notes | October 15, 2025 | 0.375% | October 15 | Close of business on the business day immediately preceding the interest payment date. | ||||||||||

| 1.625% 2031 notes | March 7, 2031 | 1.625% | March 7 | Close of business on the business day immediately preceding the interest payment date. | ||||||||||

| 1.000% 2031 notes | July 2, 2031 | 1.000% | July 2 | Close of business on the business day immediately preceding the interest payment date. | ||||||||||

| 2032 notes | October 15, 2032 | 0.750% | October 15 | Close of business on the business day immediately preceding the interest payment date. | ||||||||||

| 2.250% 2039 notes | March 7, 2039 | 2.250% | March 7 | Close of business on the business day immediately preceding the interest payment date. | ||||||||||

| 1.500% 2039 notes | July 2, 2039 | 1.500% | July 2 | Close of business on the business day immediately preceding the interest payment date. | ||||||||||

| 2040 notes | October 15, 2040 | 1.375% | October 15 | Close of business on the business day immediately preceding the interest payment date. | ||||||||||

| 2049 notes | July 2, 2049 | 1.750% | July 2 | Close of business on the business day immediately preceding the interest payment date. | ||||||||||

| 2050 notes | October 15, 2050 | 1.625% | October 15 | Close of business on the business day immediately preceding the interest payment date. | ||||||||||

| • | 100% of the principal amount of the fixed rate notes of the applicable series being redeemed; and | |||||||