false2022FY000156341100015634112022-01-012022-12-310001563411dei:OtherAddressMember2022-01-012022-12-310001563411dei:BusinessContactMember2022-01-012022-12-3100015634112022-12-31xbrli:sharesiso4217:EUR00015634112021-01-012021-12-3100015634112020-01-012020-12-31iso4217:EURxbrli:shares00015634112021-12-310001563411ifrs-full:IssuedCapitalMember2021-12-310001563411ifrs-full:SharePremiumMember2021-12-310001563411ifrs-full:ReserveOfRemeasurementsOfDefinedBenefitPlansMember2021-12-310001563411cstm:ReserveOfCashFlowHedgesAndNetInvestmentHedgesMember2021-12-310001563411ifrs-full:ReserveOfExchangeDifferencesOnTranslationMember2021-12-310001563411ifrs-full:OtherReservesMember2021-12-310001563411ifrs-full:RetainedEarningsMember2021-12-310001563411ifrs-full:EquityAttributableToOwnersOfParentMember2021-12-310001563411ifrs-full:NoncontrollingInterestsMember2021-12-310001563411ifrs-full:RetainedEarningsMember2022-01-012022-12-310001563411ifrs-full:EquityAttributableToOwnersOfParentMember2022-01-012022-12-310001563411ifrs-full:NoncontrollingInterestsMember2022-01-012022-12-310001563411ifrs-full:ReserveOfRemeasurementsOfDefinedBenefitPlansMember2022-01-012022-12-310001563411cstm:ReserveOfCashFlowHedgesAndNetInvestmentHedgesMember2022-01-012022-12-310001563411ifrs-full:ReserveOfExchangeDifferencesOnTranslationMember2022-01-012022-12-310001563411ifrs-full:OtherReservesMember2022-01-012022-12-310001563411ifrs-full:IssuedCapitalMember2022-12-310001563411ifrs-full:SharePremiumMember2022-12-310001563411ifrs-full:ReserveOfRemeasurementsOfDefinedBenefitPlansMember2022-12-310001563411cstm:ReserveOfCashFlowHedgesAndNetInvestmentHedgesMember2022-12-310001563411ifrs-full:ReserveOfExchangeDifferencesOnTranslationMember2022-12-310001563411ifrs-full:OtherReservesMember2022-12-310001563411ifrs-full:RetainedEarningsMember2022-12-310001563411ifrs-full:EquityAttributableToOwnersOfParentMember2022-12-310001563411ifrs-full:NoncontrollingInterestsMember2022-12-310001563411ifrs-full:IssuedCapitalMember2020-12-310001563411ifrs-full:SharePremiumMember2020-12-310001563411ifrs-full:ReserveOfRemeasurementsOfDefinedBenefitPlansMember2020-12-310001563411cstm:ReserveOfCashFlowHedgesAndNetInvestmentHedgesMember2020-12-310001563411ifrs-full:ReserveOfExchangeDifferencesOnTranslationMember2020-12-310001563411ifrs-full:OtherReservesMember2020-12-310001563411ifrs-full:RetainedEarningsMember2020-12-310001563411ifrs-full:EquityAttributableToOwnersOfParentMember2020-12-310001563411ifrs-full:NoncontrollingInterestsMember2020-12-3100015634112020-12-310001563411ifrs-full:RetainedEarningsMember2021-01-012021-12-310001563411ifrs-full:EquityAttributableToOwnersOfParentMember2021-01-012021-12-310001563411ifrs-full:NoncontrollingInterestsMember2021-01-012021-12-310001563411ifrs-full:ReserveOfRemeasurementsOfDefinedBenefitPlansMember2021-01-012021-12-310001563411cstm:ReserveOfCashFlowHedgesAndNetInvestmentHedgesMember2021-01-012021-12-310001563411ifrs-full:ReserveOfExchangeDifferencesOnTranslationMember2021-01-012021-12-310001563411ifrs-full:OtherReservesMember2021-01-012021-12-310001563411ifrs-full:IssuedCapitalMember2019-12-310001563411ifrs-full:SharePremiumMember2019-12-310001563411ifrs-full:ReserveOfRemeasurementsOfDefinedBenefitPlansMember2019-12-310001563411cstm:ReserveOfCashFlowHedgesAndNetInvestmentHedgesMember2019-12-310001563411ifrs-full:ReserveOfExchangeDifferencesOnTranslationMember2019-12-310001563411ifrs-full:OtherReservesMember2019-12-310001563411ifrs-full:RetainedEarningsMember2019-12-310001563411ifrs-full:EquityAttributableToOwnersOfParentMember2019-12-310001563411ifrs-full:NoncontrollingInterestsMember2019-12-3100015634112019-12-310001563411ifrs-full:RetainedEarningsMember2020-01-012020-12-310001563411ifrs-full:EquityAttributableToOwnersOfParentMember2020-01-012020-12-310001563411ifrs-full:NoncontrollingInterestsMember2020-01-012020-12-310001563411ifrs-full:ReserveOfRemeasurementsOfDefinedBenefitPlansMember2020-01-012020-12-310001563411cstm:ReserveOfCashFlowHedgesAndNetInvestmentHedgesMember2020-01-012020-12-310001563411ifrs-full:ReserveOfExchangeDifferencesOnTranslationMember2020-01-012020-12-310001563411ifrs-full:OtherReservesMember2020-01-012020-12-31cstm:facilitycstm:centercstm:sitecstm:employee0001563411currency:USD2022-01-012022-12-31xbrli:pure0001563411currency:USD2021-01-012021-12-310001563411currency:USD2020-01-012020-12-310001563411currency:USD2022-12-310001563411currency:USD2021-12-310001563411currency:USD2020-12-310001563411currency:CHF2022-01-012022-12-310001563411currency:CHF2021-01-012021-12-310001563411currency:CHF2020-01-012020-12-310001563411currency:CHF2022-12-310001563411currency:CHF2021-12-310001563411currency:CHF2020-12-310001563411currency:CZK2022-01-012022-12-310001563411currency:CZK2021-01-012021-12-310001563411currency:CZK2020-01-012020-12-310001563411currency:CZK2022-12-310001563411currency:CZK2021-12-310001563411currency:CZK2020-12-310001563411ifrs-full:BuildingsMemberifrs-full:BottomOfRangeMember2022-01-012022-12-310001563411ifrs-full:BuildingsMemberifrs-full:TopOfRangeMember2022-01-012022-12-310001563411ifrs-full:BottomOfRangeMembercstm:MachineryAndEquipment1Member2022-01-012022-12-310001563411ifrs-full:TopOfRangeMembercstm:MachineryAndEquipment1Member2022-01-012022-12-310001563411ifrs-full:BottomOfRangeMemberifrs-full:VehiclesMember2022-01-012022-12-310001563411ifrs-full:TopOfRangeMemberifrs-full:VehiclesMember2022-01-012022-12-310001563411ifrs-full:TechnologybasedIntangibleAssetsMember2022-01-012022-12-310001563411cstm:CustomerRelationships1Member2022-01-012022-12-310001563411ifrs-full:ComputerSoftwareMemberifrs-full:BottomOfRangeMember2022-01-012022-12-310001563411ifrs-full:TopOfRangeMemberifrs-full:ComputerSoftwareMember2022-01-012022-12-310001563411cstm:PackagingRolledProductsMember2022-01-012022-12-310001563411cstm:PackagingRolledProductsMember2021-01-012021-12-310001563411cstm:PackagingRolledProductsMember2020-01-012020-12-310001563411cstm:AutomotiveRolledProductsMember2022-01-012022-12-310001563411cstm:AutomotiveRolledProductsMember2021-01-012021-12-310001563411cstm:AutomotiveRolledProductsMember2020-01-012020-12-310001563411cstm:SpecialtyAndOtherThinrolledProductsMember2022-01-012022-12-310001563411cstm:SpecialtyAndOtherThinrolledProductsMember2021-01-012021-12-310001563411cstm:SpecialtyAndOtherThinrolledProductsMember2020-01-012020-12-310001563411cstm:AerospaceRolledProductsMember2022-01-012022-12-310001563411cstm:AerospaceRolledProductsMember2021-01-012021-12-310001563411cstm:AerospaceRolledProductsMember2020-01-012020-12-310001563411cstm:TransportationIndustryAndOtherRolledProductsMember2022-01-012022-12-310001563411cstm:TransportationIndustryAndOtherRolledProductsMember2021-01-012021-12-310001563411cstm:TransportationIndustryAndOtherRolledProductsMember2020-01-012020-12-310001563411cstm:AutomotiveExtrudedProductsMember2022-01-012022-12-310001563411cstm:AutomotiveExtrudedProductsMember2021-01-012021-12-310001563411cstm:AutomotiveExtrudedProductsMember2020-01-012020-12-310001563411cstm:OtherExtrudedProductsMember2022-01-012022-12-310001563411cstm:OtherExtrudedProductsMember2021-01-012021-12-310001563411cstm:OtherExtrudedProductsMember2020-01-012020-12-310001563411country:DE2022-01-012022-12-310001563411country:DE2021-01-012021-12-310001563411country:DE2020-01-012020-12-310001563411country:FR2022-01-012022-12-310001563411country:FR2021-01-012021-12-310001563411country:FR2020-01-012020-12-310001563411country:GB2022-01-012022-12-310001563411country:GB2021-01-012021-12-310001563411country:GB2020-01-012020-12-310001563411country:CH2022-01-012022-12-310001563411country:CH2021-01-012021-12-310001563411country:CH2020-01-012020-12-310001563411country:ES2022-01-012022-12-310001563411country:ES2021-01-012021-12-310001563411country:ES2020-01-012020-12-310001563411country:CZ2022-01-012022-12-310001563411country:CZ2021-01-012021-12-310001563411country:CZ2020-01-012020-12-310001563411cstm:OtherEuropeMember2022-01-012022-12-310001563411cstm:OtherEuropeMember2021-01-012021-12-310001563411cstm:OtherEuropeMember2020-01-012020-12-310001563411srt:EuropeMember2022-01-012022-12-310001563411srt:EuropeMember2021-01-012021-12-310001563411srt:EuropeMember2020-01-012020-12-310001563411country:US2022-01-012022-12-310001563411country:US2021-01-012021-12-310001563411country:US2020-01-012020-12-310001563411cstm:AsiaAndOtherPacificMember2022-01-012022-12-310001563411cstm:AsiaAndOtherPacificMember2021-01-012021-12-310001563411cstm:AsiaAndOtherPacificMember2020-01-012020-12-310001563411cstm:OtherCountriesMember2022-01-012022-12-310001563411cstm:OtherCountriesMember2021-01-012021-12-310001563411cstm:OtherCountriesMember2020-01-012020-12-310001563411ifrs-full:GoodsOrServicesTransferredOverTimeMember2022-01-012022-12-310001563411cstm:PackagingAndAutomotiveRolledProductsMember2022-12-31cstm:country0001563411cstm:AerospaceAndTransportationMember2022-12-310001563411cstm:AutomotiveStructuresAndIndustryMember2022-12-310001563411ifrs-full:OperatingSegmentsMembercstm:PackagingAndAutomotiveRolledProductsMember2022-01-012022-12-310001563411cstm:PackagingAndAutomotiveRolledProductsMemberifrs-full:EliminationOfIntersegmentAmountsMember2022-01-012022-12-310001563411cstm:PackagingAndAutomotiveRolledProductsMember2022-01-012022-12-310001563411ifrs-full:OperatingSegmentsMembercstm:PackagingAndAutomotiveRolledProductsMember2021-01-012021-12-310001563411cstm:PackagingAndAutomotiveRolledProductsMemberifrs-full:EliminationOfIntersegmentAmountsMember2021-01-012021-12-310001563411cstm:PackagingAndAutomotiveRolledProductsMember2021-01-012021-12-310001563411ifrs-full:OperatingSegmentsMembercstm:PackagingAndAutomotiveRolledProductsMember2020-01-012020-12-310001563411cstm:PackagingAndAutomotiveRolledProductsMemberifrs-full:EliminationOfIntersegmentAmountsMember2020-01-012020-12-310001563411cstm:PackagingAndAutomotiveRolledProductsMember2020-01-012020-12-310001563411ifrs-full:OperatingSegmentsMembercstm:AerospaceAndTransportationMember2022-01-012022-12-310001563411cstm:AerospaceAndTransportationMemberifrs-full:EliminationOfIntersegmentAmountsMember2022-01-012022-12-310001563411cstm:AerospaceAndTransportationMember2022-01-012022-12-310001563411ifrs-full:OperatingSegmentsMembercstm:AerospaceAndTransportationMember2021-01-012021-12-310001563411cstm:AerospaceAndTransportationMemberifrs-full:EliminationOfIntersegmentAmountsMember2021-01-012021-12-310001563411cstm:AerospaceAndTransportationMember2021-01-012021-12-310001563411ifrs-full:OperatingSegmentsMembercstm:AerospaceAndTransportationMember2020-01-012020-12-310001563411cstm:AerospaceAndTransportationMemberifrs-full:EliminationOfIntersegmentAmountsMember2020-01-012020-12-310001563411cstm:AerospaceAndTransportationMember2020-01-012020-12-310001563411ifrs-full:OperatingSegmentsMembercstm:AutomotiveStructuresAndIndustryMember2022-01-012022-12-310001563411cstm:AutomotiveStructuresAndIndustryMemberifrs-full:EliminationOfIntersegmentAmountsMember2022-01-012022-12-310001563411cstm:AutomotiveStructuresAndIndustryMember2022-01-012022-12-310001563411ifrs-full:OperatingSegmentsMembercstm:AutomotiveStructuresAndIndustryMember2021-01-012021-12-310001563411cstm:AutomotiveStructuresAndIndustryMemberifrs-full:EliminationOfIntersegmentAmountsMember2021-01-012021-12-310001563411cstm:AutomotiveStructuresAndIndustryMember2021-01-012021-12-310001563411ifrs-full:OperatingSegmentsMembercstm:AutomotiveStructuresAndIndustryMember2020-01-012020-12-310001563411cstm:AutomotiveStructuresAndIndustryMemberifrs-full:EliminationOfIntersegmentAmountsMember2020-01-012020-12-310001563411cstm:AutomotiveStructuresAndIndustryMember2020-01-012020-12-310001563411ifrs-full:OperatingSegmentsMember2022-01-012022-12-310001563411ifrs-full:EliminationOfIntersegmentAmountsMember2022-01-012022-12-310001563411ifrs-full:OperatingSegmentsMember2021-01-012021-12-310001563411ifrs-full:EliminationOfIntersegmentAmountsMember2021-01-012021-12-310001563411ifrs-full:OperatingSegmentsMember2020-01-012020-12-310001563411ifrs-full:EliminationOfIntersegmentAmountsMember2020-01-012020-12-310001563411cstm:HoldingsAndCorporateMember2022-01-012022-12-310001563411cstm:HoldingsAndCorporateMember2021-01-012021-12-310001563411cstm:HoldingsAndCorporateMember2020-01-012020-12-3100015634112022-10-012022-10-310001563411cstm:OtherPostEmploymentBenefitMember2021-01-012021-12-310001563411cstm:COVID19PandemicMember2020-01-012020-12-310001563411ifrs-full:OperatingSegmentsMembercstm:PackagingAndAutomotiveRolledProductsMember2022-12-310001563411ifrs-full:OperatingSegmentsMembercstm:PackagingAndAutomotiveRolledProductsMember2021-12-310001563411ifrs-full:OperatingSegmentsMembercstm:AerospaceAndTransportationMember2022-12-310001563411ifrs-full:OperatingSegmentsMembercstm:AerospaceAndTransportationMember2021-12-310001563411ifrs-full:OperatingSegmentsMembercstm:AutomotiveStructuresAndIndustryMember2022-12-310001563411ifrs-full:OperatingSegmentsMembercstm:AutomotiveStructuresAndIndustryMember2021-12-310001563411ifrs-full:OperatingSegmentsMembercstm:HoldingsAndCorporateMember2022-12-310001563411ifrs-full:OperatingSegmentsMembercstm:HoldingsAndCorporateMember2021-12-310001563411ifrs-full:OperatingSegmentsMember2022-12-310001563411ifrs-full:OperatingSegmentsMember2021-12-310001563411ifrs-full:UnallocatedAmountsMember2022-12-310001563411ifrs-full:UnallocatedAmountsMember2021-12-310001563411cstm:OneLargestCustomerMembercstm:PackagingAndAutomotiveRolledProductsMember2022-01-012022-12-310001563411cstm:OneLargestCustomerMembercstm:PackagingAndAutomotiveRolledProductsMember2021-01-012021-12-310001563411cstm:OneLargestCustomerMembercstm:PackagingAndAutomotiveRolledProductsMember2020-01-012020-12-310001563411country:US2022-12-310001563411country:US2021-12-310001563411country:FR2022-12-310001563411country:FR2021-12-310001563411country:DE2022-12-310001563411country:DE2021-12-310001563411country:CZ2022-12-310001563411country:CZ2021-12-310001563411cstm:OtherCountriesMember2022-12-310001563411cstm:OtherCountriesMember2021-12-310001563411cstm:TotalOperatingExpensesMember2022-01-012022-12-310001563411cstm:TotalOperatingExpensesMember2021-01-012021-12-310001563411cstm:TotalOperatingExpensesMember2020-01-012020-12-310001563411cstm:AerospaceAndTransportationAndAutomotiveStructuresAndIndustryMembercstm:COVID19PandemicMember2020-01-012020-12-310001563411cstm:RevenueFromContractWithCustomersMember2022-01-012022-12-310001563411cstm:RevenueFromContractWithCustomersMember2021-01-012021-12-310001563411cstm:RevenueFromContractWithCustomersMember2020-01-012020-12-310001563411cstm:CostOfSales1Member2022-01-012022-12-310001563411cstm:CostOfSales1Member2021-01-012021-12-310001563411cstm:CostOfSales1Member2020-01-012020-12-310001563411cstm:OtherGainsAndLossesNetMember2022-01-012022-12-310001563411cstm:OtherGainsAndLossesNetMember2021-01-012021-12-310001563411cstm:OtherGainsAndLossesNetMember2020-01-012020-12-31iso4217:USD0001563411cstm:ConstelliumSESeniorNotesMember2022-01-012022-12-310001563411cstm:ConstelliumSESeniorNotesMember2021-01-012021-12-310001563411cstm:ConstelliumSESeniorUnsecuredNotesIssuedFebruaryTwoThousandSeventeenDueTwoThousandTwentyFiveMember2021-02-012021-02-280001563411cstm:ConstelliumSESeniorUnsecuredNotesIssuedMayTwoThousandFourteenDueTwoThousandTwentyFourMember2021-06-012021-06-300001563411cstm:ConstelliumSESeniorUnsecuredNotesIssuedNovemberTwoThousandSeventeenDueTwoThousandTwentySixMember2021-11-012021-11-300001563411cstm:ConstelliumSESeniorUnsecuredNotesIssuedNovemberTwoThousandSeventeenDueTwoThousandTwentySixMember2021-11-300001563411cstm:SubsidiariesInCapitalControlRestrictionsCountriesMember2022-12-310001563411ifrs-full:GrossCarryingAmountMember2022-12-310001563411ifrs-full:GrossCarryingAmountMember2021-12-310001563411ifrs-full:AccumulatedImpairmentMember2022-12-310001563411ifrs-full:AccumulatedImpairmentMember2021-12-310001563411cstm:UnbilledToolingCostsMember2022-12-310001563411cstm:UnbilledToolingCostsMember2021-12-310001563411ifrs-full:CurrentMember2022-12-310001563411ifrs-full:CurrentMember2021-12-310001563411cstm:PastDueOneToThirtyDaysMember2022-12-310001563411cstm:PastDueOneToThirtyDaysMember2021-12-310001563411ifrs-full:LaterThanOneMonthAndNotLaterThanTwoMonthsMember2022-12-310001563411ifrs-full:LaterThanOneMonthAndNotLaterThanTwoMonthsMember2021-12-310001563411currency:EUR2022-12-310001563411currency:EUR2021-12-310001563411cstm:OtherCurrenciesMember2022-12-310001563411cstm:OtherCurrenciesMember2021-12-310001563411ifrs-full:FactoringOfReceivablesMembercountry:UScstm:MuscleShoalsFactoringFacilityMember2022-01-012022-12-310001563411ifrs-full:FactoringOfReceivablesMembercstm:ConstelliumAutomotiveMembercountry:US2022-01-012022-12-310001563411country:FRifrs-full:FactoringOfReceivablesMember2022-01-012022-12-310001563411cstm:FactoringReceivableRecourseLineMembercountry:FR2022-01-012022-12-310001563411ifrs-full:FactoringOfReceivablesMembercstm:GermanySwitzerlandAndCzechRepublicMember2022-01-012022-12-310001563411cstm:LandAndPropertyRightsMember2021-12-310001563411ifrs-full:BuildingsMember2021-12-310001563411cstm:MachineryAndEquipment1Member2021-12-310001563411ifrs-full:ConstructionInProgressMember2021-12-310001563411ifrs-full:OtherPropertyPlantAndEquipmentMember2021-12-310001563411cstm:LandAndPropertyRightsMember2022-01-012022-12-310001563411ifrs-full:BuildingsMember2022-01-012022-12-310001563411cstm:MachineryAndEquipment1Member2022-01-012022-12-310001563411ifrs-full:ConstructionInProgressMember2022-01-012022-12-310001563411ifrs-full:OtherPropertyPlantAndEquipmentMember2022-01-012022-12-310001563411cstm:LandAndPropertyRightsMember2022-12-310001563411ifrs-full:BuildingsMember2022-12-310001563411cstm:MachineryAndEquipment1Member2022-12-310001563411ifrs-full:ConstructionInProgressMember2022-12-310001563411ifrs-full:OtherPropertyPlantAndEquipmentMember2022-12-310001563411ifrs-full:GrossCarryingAmountMembercstm:LandAndPropertyRightsMember2022-12-310001563411ifrs-full:GrossCarryingAmountMemberifrs-full:BuildingsMember2022-12-310001563411ifrs-full:GrossCarryingAmountMembercstm:MachineryAndEquipment1Member2022-12-310001563411ifrs-full:GrossCarryingAmountMemberifrs-full:ConstructionInProgressMember2022-12-310001563411ifrs-full:GrossCarryingAmountMemberifrs-full:OtherPropertyPlantAndEquipmentMember2022-12-310001563411cstm:LandAndPropertyRightsMemberifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMember2022-12-310001563411ifrs-full:BuildingsMemberifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMember2022-12-310001563411ifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMembercstm:MachineryAndEquipment1Member2022-12-310001563411ifrs-full:ConstructionInProgressMemberifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMember2022-12-310001563411ifrs-full:OtherPropertyPlantAndEquipmentMemberifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMember2022-12-310001563411ifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMember2022-12-310001563411cstm:LandAndPropertyRightsMember2020-12-310001563411ifrs-full:BuildingsMember2020-12-310001563411cstm:MachineryAndEquipment1Member2020-12-310001563411ifrs-full:ConstructionInProgressMember2020-12-310001563411ifrs-full:OtherPropertyPlantAndEquipmentMember2020-12-310001563411cstm:LandAndPropertyRightsMember2021-01-012021-12-310001563411ifrs-full:BuildingsMember2021-01-012021-12-310001563411cstm:MachineryAndEquipment1Member2021-01-012021-12-310001563411ifrs-full:ConstructionInProgressMember2021-01-012021-12-310001563411ifrs-full:OtherPropertyPlantAndEquipmentMember2021-01-012021-12-310001563411ifrs-full:GrossCarryingAmountMembercstm:LandAndPropertyRightsMember2021-12-310001563411ifrs-full:GrossCarryingAmountMemberifrs-full:BuildingsMember2021-12-310001563411ifrs-full:GrossCarryingAmountMembercstm:MachineryAndEquipment1Member2021-12-310001563411ifrs-full:GrossCarryingAmountMemberifrs-full:ConstructionInProgressMember2021-12-310001563411ifrs-full:GrossCarryingAmountMemberifrs-full:OtherPropertyPlantAndEquipmentMember2021-12-310001563411cstm:LandAndPropertyRightsMemberifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMember2021-12-310001563411ifrs-full:BuildingsMemberifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMember2021-12-310001563411ifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMembercstm:MachineryAndEquipment1Member2021-12-310001563411ifrs-full:ConstructionInProgressMemberifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMember2021-12-310001563411ifrs-full:OtherPropertyPlantAndEquipmentMemberifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMember2021-12-310001563411ifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMember2021-12-310001563411ifrs-full:BuildingsMemberifrs-full:RightofuseAssetsMember2021-12-310001563411ifrs-full:RightofuseAssetsMembercstm:MachineryAndEquipment1Member2021-12-310001563411ifrs-full:RightofuseAssetsMemberifrs-full:OtherPropertyPlantAndEquipmentMember2021-12-310001563411ifrs-full:RightofuseAssetsMember2021-12-310001563411ifrs-full:BuildingsMemberifrs-full:RightofuseAssetsMember2022-01-012022-12-310001563411ifrs-full:RightofuseAssetsMembercstm:MachineryAndEquipment1Member2022-01-012022-12-310001563411ifrs-full:RightofuseAssetsMemberifrs-full:OtherPropertyPlantAndEquipmentMember2022-01-012022-12-310001563411ifrs-full:RightofuseAssetsMember2022-01-012022-12-310001563411ifrs-full:BuildingsMemberifrs-full:RightofuseAssetsMember2022-12-310001563411ifrs-full:RightofuseAssetsMembercstm:MachineryAndEquipment1Member2022-12-310001563411ifrs-full:RightofuseAssetsMemberifrs-full:OtherPropertyPlantAndEquipmentMember2022-12-310001563411ifrs-full:RightofuseAssetsMember2022-12-310001563411ifrs-full:GrossCarryingAmountMemberifrs-full:BuildingsMemberifrs-full:RightofuseAssetsMember2022-12-310001563411ifrs-full:GrossCarryingAmountMemberifrs-full:RightofuseAssetsMembercstm:MachineryAndEquipment1Member2022-12-310001563411ifrs-full:GrossCarryingAmountMemberifrs-full:RightofuseAssetsMemberifrs-full:OtherPropertyPlantAndEquipmentMember2022-12-310001563411ifrs-full:GrossCarryingAmountMemberifrs-full:RightofuseAssetsMember2022-12-310001563411ifrs-full:BuildingsMemberifrs-full:RightofuseAssetsMemberifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMember2022-12-310001563411ifrs-full:RightofuseAssetsMemberifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMembercstm:MachineryAndEquipment1Member2022-12-310001563411ifrs-full:RightofuseAssetsMemberifrs-full:OtherPropertyPlantAndEquipmentMemberifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMember2022-12-310001563411ifrs-full:RightofuseAssetsMemberifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMember2022-12-310001563411ifrs-full:BuildingsMemberifrs-full:RightofuseAssetsMember2020-12-310001563411ifrs-full:RightofuseAssetsMembercstm:MachineryAndEquipment1Member2020-12-310001563411ifrs-full:RightofuseAssetsMemberifrs-full:OtherPropertyPlantAndEquipmentMember2020-12-310001563411ifrs-full:RightofuseAssetsMember2020-12-310001563411ifrs-full:BuildingsMemberifrs-full:RightofuseAssetsMember2021-01-012021-12-310001563411ifrs-full:RightofuseAssetsMembercstm:MachineryAndEquipment1Member2021-01-012021-12-310001563411ifrs-full:RightofuseAssetsMemberifrs-full:OtherPropertyPlantAndEquipmentMember2021-01-012021-12-310001563411ifrs-full:RightofuseAssetsMember2021-01-012021-12-310001563411ifrs-full:GrossCarryingAmountMemberifrs-full:BuildingsMemberifrs-full:RightofuseAssetsMember2021-12-310001563411ifrs-full:GrossCarryingAmountMemberifrs-full:RightofuseAssetsMembercstm:MachineryAndEquipment1Member2021-12-310001563411ifrs-full:GrossCarryingAmountMemberifrs-full:RightofuseAssetsMemberifrs-full:OtherPropertyPlantAndEquipmentMember2021-12-310001563411ifrs-full:GrossCarryingAmountMemberifrs-full:RightofuseAssetsMember2021-12-310001563411ifrs-full:BuildingsMemberifrs-full:RightofuseAssetsMemberifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMember2021-12-310001563411ifrs-full:RightofuseAssetsMemberifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMembercstm:MachineryAndEquipment1Member2021-12-310001563411ifrs-full:RightofuseAssetsMemberifrs-full:OtherPropertyPlantAndEquipmentMemberifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMember2021-12-310001563411ifrs-full:RightofuseAssetsMemberifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMember2021-12-310001563411cstm:SellingAndAdministrativeExpenses1Member2022-01-012022-12-310001563411cstm:SellingAndAdministrativeExpenses1Member2021-01-012021-12-310001563411cstm:SellingAndAdministrativeExpenses1Member2020-01-012020-12-310001563411cstm:ResearchAndDevelopmentExpensesMember2022-01-012022-12-310001563411cstm:ResearchAndDevelopmentExpensesMember2021-01-012021-12-310001563411cstm:ResearchAndDevelopmentExpensesMember2020-01-012020-12-310001563411cstm:AerospaceAndTransportationMember2020-12-31cstm:cash_generating_unit0001563411cstm:AerospaceAndTransportationMembercstm:MontreuilJuignMember2020-01-012020-12-310001563411cstm:UsselMembercstm:AerospaceAndTransportationMember2020-01-012020-12-310001563411cstm:AutomotiveStructuresAndIndustryMember2020-12-310001563411cstm:NanjingPlantMembercstm:AutomotiveStructuresAndIndustryMember2020-01-012020-12-310001563411cstm:AutomotiveStructuresAndIndustryMembercstm:WhiteGeorgiaMember2020-01-012020-12-310001563411cstm:AutomotiveStructuresAndIndustryMembercstm:WhiteGeorgiaMember2020-12-310001563411ifrs-full:TechnologybasedIntangibleAssetsMember2021-12-310001563411ifrs-full:ComputerSoftwareMember2021-12-310001563411cstm:CustomerRelationships1Member2021-12-310001563411cstm:WorkInProgressMember2021-12-310001563411ifrs-full:OtherIntangibleAssetsMember2021-12-310001563411ifrs-full:TechnologybasedIntangibleAssetsMember2022-01-012022-12-310001563411ifrs-full:ComputerSoftwareMember2022-01-012022-12-310001563411cstm:CustomerRelationships1Member2022-01-012022-12-310001563411cstm:WorkInProgressMember2022-01-012022-12-310001563411ifrs-full:OtherIntangibleAssetsMember2022-01-012022-12-310001563411ifrs-full:TechnologybasedIntangibleAssetsMember2022-12-310001563411ifrs-full:ComputerSoftwareMember2022-12-310001563411cstm:CustomerRelationships1Member2022-12-310001563411cstm:WorkInProgressMember2022-12-310001563411ifrs-full:OtherIntangibleAssetsMember2022-12-310001563411ifrs-full:GrossCarryingAmountMemberifrs-full:TechnologybasedIntangibleAssetsMember2022-12-310001563411ifrs-full:GrossCarryingAmountMemberifrs-full:ComputerSoftwareMember2022-12-310001563411ifrs-full:GrossCarryingAmountMembercstm:CustomerRelationships1Member2022-12-310001563411ifrs-full:GrossCarryingAmountMembercstm:WorkInProgressMember2022-12-310001563411ifrs-full:GrossCarryingAmountMemberifrs-full:OtherIntangibleAssetsMember2022-12-310001563411ifrs-full:TechnologybasedIntangibleAssetsMemberifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMember2022-12-310001563411ifrs-full:ComputerSoftwareMemberifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMember2022-12-310001563411cstm:CustomerRelationships1Memberifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMember2022-12-310001563411ifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMembercstm:WorkInProgressMember2022-12-310001563411ifrs-full:OtherIntangibleAssetsMemberifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMember2022-12-310001563411ifrs-full:TechnologybasedIntangibleAssetsMember2020-12-310001563411ifrs-full:ComputerSoftwareMember2020-12-310001563411cstm:CustomerRelationships1Member2020-12-310001563411cstm:WorkInProgressMember2020-12-310001563411ifrs-full:OtherIntangibleAssetsMember2020-12-310001563411ifrs-full:TechnologybasedIntangibleAssetsMember2021-01-012021-12-310001563411ifrs-full:ComputerSoftwareMember2021-01-012021-12-310001563411cstm:CustomerRelationships1Member2021-01-012021-12-310001563411cstm:WorkInProgressMember2021-01-012021-12-310001563411ifrs-full:OtherIntangibleAssetsMember2021-01-012021-12-310001563411ifrs-full:GrossCarryingAmountMemberifrs-full:TechnologybasedIntangibleAssetsMember2021-12-310001563411ifrs-full:GrossCarryingAmountMemberifrs-full:ComputerSoftwareMember2021-12-310001563411ifrs-full:GrossCarryingAmountMembercstm:CustomerRelationships1Member2021-12-310001563411ifrs-full:GrossCarryingAmountMembercstm:WorkInProgressMember2021-12-310001563411ifrs-full:GrossCarryingAmountMemberifrs-full:OtherIntangibleAssetsMember2021-12-310001563411ifrs-full:TechnologybasedIntangibleAssetsMemberifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMember2021-12-310001563411ifrs-full:ComputerSoftwareMemberifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMember2021-12-310001563411cstm:CustomerRelationships1Memberifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMember2021-12-310001563411ifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMembercstm:WorkInProgressMember2021-12-310001563411ifrs-full:OtherIntangibleAssetsMemberifrs-full:AccumulatedDepreciationAmortisationAndImpairmentMember2021-12-310001563411ifrs-full:TopOfRangeMembercstm:PackagingAndAutomotiveRolledProductsMember2022-12-310001563411ifrs-full:BottomOfRangeMembercstm:PackagingAndAutomotiveRolledProductsMember2022-12-310001563411cstm:LongTermAssetsMember2021-12-310001563411cstm:LongTermAssetsMember2022-01-012022-12-310001563411cstm:LongTermAssetsMember2022-12-310001563411cstm:InventoryMember2021-12-310001563411cstm:InventoryMember2022-01-012022-12-310001563411cstm:InventoryMember2022-12-310001563411cstm:PensionsMember2021-12-310001563411cstm:PensionsMember2022-01-012022-12-310001563411cstm:PensionsMember2022-12-310001563411cstm:DerivativeValuationMember2021-12-310001563411cstm:DerivativeValuationMember2022-01-012022-12-310001563411cstm:DerivativeValuationMember2022-12-310001563411cstm:TaxLossesCarriedForwardMember2021-12-310001563411cstm:TaxLossesCarriedForwardMember2022-01-012022-12-310001563411cstm:TaxLossesCarriedForwardMember2022-12-310001563411cstm:OtherDeferredTaxAssetsAndLiabilitiesMember2021-12-310001563411cstm:OtherDeferredTaxAssetsAndLiabilitiesMember2022-01-012022-12-310001563411cstm:OtherDeferredTaxAssetsAndLiabilitiesMember2022-12-310001563411cstm:LongTermAssetsMember2020-12-310001563411cstm:LongTermAssetsMember2021-01-012021-12-310001563411cstm:InventoryMember2020-12-310001563411cstm:InventoryMember2021-01-012021-12-310001563411cstm:PensionsMember2020-12-310001563411cstm:PensionsMember2021-01-012021-12-310001563411cstm:DerivativeValuationMember2020-12-310001563411cstm:DerivativeValuationMember2021-01-012021-12-310001563411cstm:TaxLossesCarriedForwardMember2020-12-310001563411cstm:TaxLossesCarriedForwardMember2021-01-012021-12-310001563411cstm:OtherDeferredTaxAssetsAndLiabilitiesMember2020-12-310001563411cstm:OtherDeferredTaxAssetsAndLiabilitiesMember2021-01-012021-12-310001563411ifrs-full:UnusedTaxLossesMemberifrs-full:LaterThanOneYearAndNotLaterThanFiveYearsMember2022-12-310001563411ifrs-full:UnusedTaxLossesMemberifrs-full:LaterThanOneYearAndNotLaterThanFiveYearsMember2021-12-310001563411ifrs-full:UnusedTaxLossesMembercstm:LaterThanFiveYearsAndLimitedMember2022-12-310001563411ifrs-full:UnusedTaxLossesMembercstm:LaterThanFiveYearsAndLimitedMember2021-12-310001563411ifrs-full:UnusedTaxLossesMembercstm:UnlimitedMember2022-12-310001563411ifrs-full:UnusedTaxLossesMembercstm:UnlimitedMember2021-12-310001563411ifrs-full:UnusedTaxLossesMember2022-12-310001563411ifrs-full:UnusedTaxLossesMember2021-12-310001563411cstm:LongTermAssetsMember2022-12-310001563411cstm:LongTermAssetsMember2021-12-310001563411cstm:PensionsMember2022-12-310001563411cstm:PensionsMember2021-12-310001563411ifrs-full:OtherTemporaryDifferencesMember2022-12-310001563411ifrs-full:OtherTemporaryDifferencesMember2021-12-310001563411ifrs-full:TemporaryDifferenceMember2022-12-310001563411ifrs-full:TemporaryDifferenceMember2021-12-310001563411ifrs-full:DisposalGroupsClassifiedAsHeldForSaleMember2022-12-310001563411cstm:DeferredToolingRevenueMember2022-12-310001563411cstm:DeferredToolingRevenueMember2021-12-310001563411cstm:AdvancePaymentFromCustomersMember2022-12-310001563411cstm:AdvancePaymentFromCustomersMember2021-12-310001563411cstm:UnrecognizedVariableConsiderationMember2022-12-310001563411cstm:UnrecognizedVariableConsiderationMember2021-12-310001563411cstm:OtherContractLiabilitiesMember2022-12-310001563411cstm:OtherContractLiabilitiesMember2021-12-310001563411cstm:SecuredPanUSABLMember2022-12-310001563411cstm:SecuredPanUSABLMember2021-12-310001563411cstm:FrenchPGEMember2022-12-310001563411cstm:FrenchPGEMember2021-12-310001563411cstm:ConstelliumSESeniorUnsecuredNotesIssuedNovemberTwoThousandSeventeenDueTwoThousandTwentySixMember2022-12-310001563411cstm:ConstelliumSESeniorUnsecuredNotesIssuedNovemberTwoThousandSeventeenDueTwoThousandTwentySixMember2022-01-012022-12-310001563411cstm:ConstelliumSESeniorUnsecuredNotesIssuedNovemberTwoThousandSeventeenDueTwoThousandTwentySixMember2021-12-310001563411cstm:ConstelliumSESeniorUnsecuredNotesIssuedNovemberTwoThousandSeventeenDueTwoThousandTwentySixOneMember2022-12-310001563411cstm:ConstelliumSESeniorUnsecuredNotesIssuedNovemberTwoThousandSeventeenDueTwoThousandTwentySixOneMember2022-01-012022-12-310001563411cstm:ConstelliumSESeniorUnsecuredNotesIssuedNovemberTwoThousandSeventeenDueTwoThousandTwentySixOneMember2021-12-310001563411cstm:ConstelliumSESeniorUnsecuredNotesIssuedJuneTwoThousandTwentyDueTwoThousandTwentyEightMember2022-12-310001563411cstm:ConstelliumSESeniorUnsecuredNotesIssuedJuneTwoThousandTwentyDueTwoThousandTwentyEightMember2022-01-012022-12-310001563411cstm:ConstelliumSESeniorUnsecuredNotesIssuedJuneTwoThousandTwentyDueTwoThousandTwentyEightMember2021-12-310001563411cstm:ConstelliumSESeniorSustainabilityLinkedNotesIssuedFebruary2021DueFebruary2029Member2022-12-310001563411cstm:ConstelliumSESeniorSustainabilityLinkedNotesIssuedFebruary2021DueFebruary2029Member2022-01-012022-12-310001563411cstm:ConstelliumSESeniorSustainabilityLinkedNotesIssuedFebruary2021DueFebruary2029Member2021-12-310001563411cstm:ConstelliumSESeniorSustainabilityLinkedNotesIssuedJune2021DueJune2029Member2022-12-310001563411cstm:ConstelliumSESeniorSustainabilityLinkedNotesIssuedJune2021DueJune2029Member2022-01-012022-12-310001563411cstm:ConstelliumSESeniorSustainabilityLinkedNotesIssuedJune2021DueJune2029Member2021-12-310001563411cstm:UnsecuredCreditFacilitySwitzerlandMember2022-12-31iso4217:CHF0001563411cstm:UnsecuredCreditFacilitySwitzerlandMember2022-01-012022-12-310001563411cstm:UnsecuredCreditFacilitySwitzerlandMember2021-12-310001563411cstm:OtherLoansMember2022-12-310001563411cstm:OtherLoansMember2021-12-310001563411cstm:SecuredPanUSABLMember2022-06-300001563411cstm:FrenchPGEMember2021-05-012021-05-310001563411cstm:ConstelliumSESeniorSustainabilityLinkedNotesIssuedFebruary2021DueFebruary2029Member2021-02-280001563411cstm:ConstelliumSESeniorSustainabilityLinkedNotesIssuedJune2021DueJune2029Member2021-06-30cstm:target0001563411cstm:ConstelliumSESeniorSustainabilityLinkedNotesIssuedFebruary2021DueFebruary2029Membercstm:BorrowingCovenantPeriodOneMember2021-02-012021-02-280001563411cstm:ConstelliumSESeniorSustainabilityLinkedNotesIssuedFebruary2021DueFebruary2029Membercstm:BorrowingCovenantPeriodTwoMember2021-02-012021-02-280001563411cstm:FinancingArrangementsMember2022-12-310001563411cstm:SecuredInventoryFacilityMember2022-12-310001563411cstm:MoneyMarketFacilityMember2022-12-310001563411cstm:SecuredPanUSABLMember2022-01-012022-12-3100015634112021-01-012021-06-300001563411cstm:ConstelliumSESeniorSustainabilityLinkedNotesIssuedFebruary2021DueFebruary2029Member2021-02-012021-02-280001563411cstm:ConstelliumSESeniorSustainabilityLinkedNotesIssuedJune2021DueJune2029Member2021-06-012021-06-300001563411ifrs-full:FinancialAssetsAtAmortisedCostMembercstm:CashandCashEquivalentsMember2022-12-310001563411ifrs-full:FinancialAssetsAtFairValueThroughProfitOrLossCategoryMembercstm:CashandCashEquivalentsMember2022-12-310001563411cstm:CashandCashEquivalentsMemberifrs-full:FinancialAssetsAtFairValueThroughOtherComprehensiveIncomeCategoryMember2022-12-310001563411cstm:CashandCashEquivalentsMember2022-12-310001563411ifrs-full:FinancialAssetsAtAmortisedCostMembercstm:CashandCashEquivalentsMember2021-12-310001563411ifrs-full:FinancialAssetsAtFairValueThroughProfitOrLossCategoryMembercstm:CashandCashEquivalentsMember2021-12-310001563411cstm:CashandCashEquivalentsMemberifrs-full:FinancialAssetsAtFairValueThroughOtherComprehensiveIncomeCategoryMember2021-12-310001563411cstm:CashandCashEquivalentsMember2021-12-310001563411ifrs-full:TradeReceivablesMemberifrs-full:FinancialAssetsAtAmortisedCostMember2022-12-310001563411ifrs-full:TradeReceivablesMemberifrs-full:FinancialAssetsAtFairValueThroughProfitOrLossCategoryMember2022-12-310001563411ifrs-full:TradeReceivablesMemberifrs-full:FinancialAssetsAtFairValueThroughOtherComprehensiveIncomeCategoryMember2022-12-310001563411ifrs-full:TradeReceivablesMember2022-12-310001563411ifrs-full:TradeReceivablesMemberifrs-full:FinancialAssetsAtAmortisedCostMember2021-12-310001563411ifrs-full:TradeReceivablesMemberifrs-full:FinancialAssetsAtFairValueThroughProfitOrLossCategoryMember2021-12-310001563411ifrs-full:TradeReceivablesMemberifrs-full:FinancialAssetsAtFairValueThroughOtherComprehensiveIncomeCategoryMember2021-12-310001563411ifrs-full:TradeReceivablesMember2021-12-310001563411cstm:OtherFinancialAssetsMemberifrs-full:FinancialAssetsAtAmortisedCostMember2022-12-310001563411cstm:OtherFinancialAssetsMemberifrs-full:FinancialAssetsAtFairValueThroughProfitOrLossCategoryMember2022-12-310001563411cstm:OtherFinancialAssetsMemberifrs-full:FinancialAssetsAtFairValueThroughOtherComprehensiveIncomeCategoryMember2022-12-310001563411cstm:OtherFinancialAssetsMember2022-12-310001563411cstm:OtherFinancialAssetsMemberifrs-full:FinancialAssetsAtAmortisedCostMember2021-12-310001563411cstm:OtherFinancialAssetsMemberifrs-full:FinancialAssetsAtFairValueThroughProfitOrLossCategoryMember2021-12-310001563411cstm:OtherFinancialAssetsMemberifrs-full:FinancialAssetsAtFairValueThroughOtherComprehensiveIncomeCategoryMember2021-12-310001563411cstm:OtherFinancialAssetsMember2021-12-310001563411ifrs-full:FinancialAssetsAtAmortisedCostMember2022-12-310001563411ifrs-full:FinancialAssetsAtFairValueThroughProfitOrLossCategoryMember2022-12-310001563411ifrs-full:FinancialAssetsAtFairValueThroughOtherComprehensiveIncomeCategoryMember2022-12-310001563411ifrs-full:FinancialAssetsAtAmortisedCostMember2021-12-310001563411ifrs-full:FinancialAssetsAtFairValueThroughProfitOrLossCategoryMember2021-12-310001563411ifrs-full:FinancialAssetsAtFairValueThroughOtherComprehensiveIncomeCategoryMember2021-12-310001563411ifrs-full:FinancialLiabilitiesAtAmortisedCostMembercstm:TradePayablesMember2022-12-310001563411ifrs-full:FinancialLiabilitiesAtFairValueThroughProfitOrLossCategoryMembercstm:TradePayablesMember2022-12-310001563411cstm:FinancialLiabilitiesAtFairValueThroughOtherComprehensiveIncomeCategoryMembercstm:TradePayablesMember2022-12-310001563411cstm:TradePayablesMember2022-12-310001563411ifrs-full:FinancialLiabilitiesAtAmortisedCostMembercstm:TradePayablesMember2021-12-310001563411ifrs-full:FinancialLiabilitiesAtFairValueThroughProfitOrLossCategoryMembercstm:TradePayablesMember2021-12-310001563411cstm:FinancialLiabilitiesAtFairValueThroughOtherComprehensiveIncomeCategoryMembercstm:TradePayablesMember2021-12-310001563411cstm:TradePayablesMember2021-12-310001563411ifrs-full:FinancialLiabilitiesAtAmortisedCostMembercstm:Borrowings1Member2022-12-310001563411ifrs-full:FinancialLiabilitiesAtFairValueThroughProfitOrLossCategoryMembercstm:Borrowings1Member2022-12-310001563411cstm:FinancialLiabilitiesAtFairValueThroughOtherComprehensiveIncomeCategoryMembercstm:Borrowings1Member2022-12-310001563411cstm:Borrowings1Member2022-12-310001563411ifrs-full:FinancialLiabilitiesAtAmortisedCostMembercstm:Borrowings1Member2021-12-310001563411ifrs-full:FinancialLiabilitiesAtFairValueThroughProfitOrLossCategoryMembercstm:Borrowings1Member2021-12-310001563411cstm:FinancialLiabilitiesAtFairValueThroughOtherComprehensiveIncomeCategoryMembercstm:Borrowings1Member2021-12-310001563411cstm:Borrowings1Member2021-12-310001563411ifrs-full:FinancialLiabilitiesAtAmortisedCostMembercstm:OtherFinancialLiabilitiesMember2022-12-310001563411ifrs-full:FinancialLiabilitiesAtFairValueThroughProfitOrLossCategoryMembercstm:OtherFinancialLiabilitiesMember2022-12-310001563411cstm:FinancialLiabilitiesAtFairValueThroughOtherComprehensiveIncomeCategoryMembercstm:OtherFinancialLiabilitiesMember2022-12-310001563411cstm:OtherFinancialLiabilitiesMember2022-12-310001563411ifrs-full:FinancialLiabilitiesAtAmortisedCostMembercstm:OtherFinancialLiabilitiesMember2021-12-310001563411ifrs-full:FinancialLiabilitiesAtFairValueThroughProfitOrLossCategoryMembercstm:OtherFinancialLiabilitiesMember2021-12-310001563411cstm:FinancialLiabilitiesAtFairValueThroughOtherComprehensiveIncomeCategoryMembercstm:OtherFinancialLiabilitiesMember2021-12-310001563411cstm:OtherFinancialLiabilitiesMember2021-12-310001563411ifrs-full:FinancialLiabilitiesAtAmortisedCostMember2022-12-310001563411ifrs-full:FinancialLiabilitiesAtFairValueThroughProfitOrLossCategoryMember2022-12-310001563411cstm:FinancialLiabilitiesAtFairValueThroughOtherComprehensiveIncomeCategoryMember2022-12-310001563411ifrs-full:FinancialLiabilitiesAtAmortisedCostMember2021-12-310001563411ifrs-full:FinancialLiabilitiesAtFairValueThroughProfitOrLossCategoryMember2021-12-310001563411cstm:FinancialLiabilitiesAtFairValueThroughOtherComprehensiveIncomeCategoryMember2021-12-310001563411ifrs-full:AtFairValueMembercstm:ConstelliumSESeniorUnsecuredNotesIssuedMayTwoThousandFourteenDueTwoThousandTwentyFourMemberifrs-full:Level1OfFairValueHierarchyMember2022-12-310001563411ifrs-full:AtFairValueMembercstm:ConstelliumSESeniorUnsecuredNotesIssuedFebruaryTwoThousandSeventeenDueTwoThousandTwentyFiveMemberifrs-full:Level1OfFairValueHierarchyMember2022-12-310001563411ifrs-full:AtFairValueMembercstm:ConstelliumSEEURandUSDseniorunsecurednotesissuedNovembertwothousandseventeenDueTwoThousandTwentySixMemberifrs-full:Level1OfFairValueHierarchyMember2022-12-310001563411ifrs-full:AtFairValueMemberifrs-full:Level1OfFairValueHierarchyMembercstm:ConstelliumSESeniorUnsecuredNotesIssuedJuneTwoThousandTwentyDueTwoThousandTwentyEightMember2022-12-310001563411cstm:AluminiumAndPremiumFutureContractMember2022-12-310001563411cstm:AluminiumAndPremiumFutureContractMember2021-12-310001563411cstm:EnergyFutureContractMember2022-12-310001563411cstm:EnergyFutureContractMember2021-12-310001563411cstm:OtherCommodityDerivativesMember2022-12-310001563411cstm:OtherCommodityDerivativesMember2021-12-310001563411cstm:CurrencyCommercialContractsMember2022-12-310001563411cstm:CurrencyCommercialContractsMember2021-12-310001563411cstm:CurrencyNetDebtDerivativesMember2022-12-310001563411cstm:CurrencyNetDebtDerivativesMember2021-12-310001563411cstm:AluminiumAndPremiumFutureContractMember2022-12-310001563411cstm:AluminiumAndPremiumFutureContractMember2021-12-310001563411cstm:EnergyFutureContractMember2022-12-310001563411cstm:EnergyFutureContractMember2021-12-310001563411cstm:OtherCommodityDerivativesMember2022-12-310001563411cstm:OtherCommodityDerivativesMember2021-12-310001563411cstm:CurrencyCommercialContractsMember2022-12-310001563411cstm:CurrencyCommercialContractsMember2021-12-310001563411cstm:CurrencyNetDebtDerivativesMembercstm:ForwardPurchaseContractsVersusEuroMember2021-12-310001563411cstm:CurrencyNetDebtDerivativesMembercstm:ForwardPurchaseContractsVersusEuroMember2021-01-012021-12-310001563411ifrs-full:Level1OfFairValueHierarchyMember2022-12-310001563411ifrs-full:Level2OfFairValueHierarchyMember2022-12-310001563411ifrs-full:Level3OfFairValueHierarchyMember2022-12-310001563411ifrs-full:Level1OfFairValueHierarchyMember2021-12-310001563411ifrs-full:Level2OfFairValueHierarchyMember2021-12-310001563411ifrs-full:Level3OfFairValueHierarchyMember2021-12-310001563411ifrs-full:CurrencyRiskMember2022-01-012022-12-310001563411cstm:UsdEurForwardDerivativesSalesMemberifrs-full:NotLaterThanOneYearMemberifrs-full:CurrencyRiskMember2022-12-31cstm:EUR_0001563411cstm:UsdEurForwardDerivativesSalesMemberifrs-full:CurrencyRiskMemberifrs-full:LaterThanOneYearMember2022-12-310001563411cstm:EurChfForwardDerivativesSalesMemberifrs-full:NotLaterThanOneYearMemberifrs-full:CurrencyRiskMember2022-12-310001563411cstm:EurChfForwardDerivativesSalesMemberifrs-full:CurrencyRiskMemberifrs-full:LaterThanOneYearMember2022-12-310001563411ifrs-full:NotLaterThanOneYearMembercstm:EURCZKForwardDerivativesSalesMemberifrs-full:CurrencyRiskMember2022-12-310001563411cstm:EURCZKForwardDerivativesSalesMemberifrs-full:CurrencyRiskMemberifrs-full:LaterThanOneYearMember2022-12-310001563411cstm:OtherCurrenciesForwardDerivativesSalesMemberifrs-full:NotLaterThanOneYearMemberifrs-full:CurrencyRiskMember2022-12-310001563411cstm:OtherCurrenciesForwardDerivativesSalesMemberifrs-full:CurrencyRiskMemberifrs-full:LaterThanOneYearMember2022-12-310001563411ifrs-full:NotLaterThanOneYearMemberifrs-full:CurrencyRiskMembercstm:UsdEurForwardDerivativesPurchasesMember2022-12-310001563411ifrs-full:CurrencyRiskMemberifrs-full:LaterThanOneYearMembercstm:UsdEurForwardDerivativesPurchasesMember2022-12-310001563411ifrs-full:NotLaterThanOneYearMembercstm:EurChfForwardDerivativesPurchasesMemberifrs-full:CurrencyRiskMember2022-12-310001563411cstm:EurChfForwardDerivativesPurchasesMemberifrs-full:CurrencyRiskMemberifrs-full:LaterThanOneYearMember2022-12-310001563411cstm:ForwardDerivativesPurchasesEurCzkMemberifrs-full:NotLaterThanOneYearMemberifrs-full:CurrencyRiskMember2022-12-310001563411cstm:ForwardDerivativesPurchasesEurCzkMemberifrs-full:CurrencyRiskMemberifrs-full:LaterThanOneYearMember2022-12-310001563411ifrs-full:NotLaterThanOneYearMemberifrs-full:CurrencyRiskMembercstm:OtherCurrenciesForwardDerivativesPurchasesMember2022-12-310001563411ifrs-full:CurrencyRiskMemberifrs-full:LaterThanOneYearMembercstm:OtherCurrenciesForwardDerivativesPurchasesMember2022-12-310001563411cstm:DerivativeClassifiedAsCashFlowHedgeMember2022-12-310001563411cstm:DerivativeClassifiedAsCashFlowHedgeMember2021-12-310001563411cstm:NonqualifyingHedgesMemberifrs-full:FinancialAssetsAtFairValueThroughProfitOrLossCategoryMember2022-01-012022-12-310001563411cstm:NonqualifyingHedgesMemberifrs-full:FinancialAssetsAtFairValueThroughProfitOrLossCategoryMember2021-01-012021-12-310001563411cstm:NonqualifyingHedgesMemberifrs-full:FinancialAssetsAtFairValueThroughProfitOrLossCategoryMember2020-01-012020-12-310001563411cstm:QualifyingHedgesMemberifrs-full:FinancialAssetsAtFairValueThroughOtherComprehensiveIncomeCategoryMember2022-01-012022-12-310001563411cstm:QualifyingHedgesMemberifrs-full:FinancialAssetsAtFairValueThroughOtherComprehensiveIncomeCategoryMember2021-01-012021-12-310001563411cstm:QualifyingHedgesMemberifrs-full:FinancialAssetsAtFairValueThroughOtherComprehensiveIncomeCategoryMember2020-01-012020-12-310001563411ifrs-full:FinancialAssetsAtFairValueThroughProfitOrLossCategoryMembercstm:QualifyingHedgesMember2022-01-012022-12-310001563411ifrs-full:FinancialAssetsAtFairValueThroughProfitOrLossCategoryMembercstm:QualifyingHedgesMember2021-01-012021-12-310001563411ifrs-full:FinancialAssetsAtFairValueThroughProfitOrLossCategoryMembercstm:QualifyingHedgesMember2020-01-012020-12-310001563411cstm:ForeignExchangeForwardContractsMembercstm:ForwardPurchaseContractsVersusEuroMember2022-01-012022-12-310001563411ifrs-full:FinancialAssetsAtFairValueThroughProfitOrLossCategoryMemberifrs-full:CurrencyRiskMember2022-01-012022-12-310001563411ifrs-full:FinancialAssetsAtFairValueThroughProfitOrLossCategoryMemberifrs-full:CurrencyRiskMember2021-01-012021-12-310001563411ifrs-full:FinancialAssetsAtFairValueThroughProfitOrLossCategoryMemberifrs-full:CurrencyRiskMember2020-01-012020-12-310001563411cstm:OtherCurrenciesMember2022-01-012022-12-310001563411ifrs-full:TradeReceivablesMembercstm:TenPercentageStrengtheningUsDollarEuroMember2022-01-012022-12-310001563411cstm:TradePayablesMembercstm:TenPercentageStrengtheningUsDollarEuroMember2022-01-012022-12-310001563411cstm:TenPercentageStrengtheningUsDollarEuroMembercstm:DerivativesOnCommercialTransactionMember2022-01-012022-12-310001563411cstm:TenPercentageStrengtheningUsDollarEuroMembercstm:CommercialTransactionExposureMember2022-01-012022-12-310001563411cstm:CashInBankAndIntercompanyLoansMembercstm:TenPercentageStrengtheningUsDollarEuroMember2022-01-012022-12-310001563411cstm:Borrowings1Membercstm:TenPercentageStrengtheningUsDollarEuroMember2022-01-012022-12-310001563411cstm:DerivativesOnFinancingTransactionMembercstm:TenPercentageStrengtheningUsDollarEuroMember2022-01-012022-12-310001563411cstm:TenPercentageStrengtheningUsDollarEuroMembercstm:FinancingTransactionExposureMember2022-01-012022-12-310001563411cstm:TenPercentageStrengtheningUsDollarEuroMember2022-01-012022-12-310001563411ifrs-full:CommodityPriceRiskMember2022-01-012022-12-310001563411ifrs-full:NotLaterThanOneYearMembercstm:AluminiumMemberifrs-full:CommodityPriceRiskMember2022-12-310001563411ifrs-full:LaterThanOneYearMembercstm:AluminiumMemberifrs-full:CommodityPriceRiskMember2022-12-310001563411ifrs-full:NotLaterThanOneYearMembercstm:PremiumsMemberifrs-full:CommodityPriceRiskMember2022-12-310001563411ifrs-full:LaterThanOneYearMembercstm:PremiumsMemberifrs-full:CommodityPriceRiskMember2022-12-310001563411ifrs-full:NotLaterThanOneYearMembercstm:CopperMemberifrs-full:CommodityPriceRiskMember2022-12-310001563411cstm:CopperMemberifrs-full:LaterThanOneYearMemberifrs-full:CommodityPriceRiskMember2022-12-310001563411ifrs-full:NotLaterThanOneYearMembercstm:SilverMemberifrs-full:CommodityPriceRiskMember2022-12-310001563411ifrs-full:LaterThanOneYearMembercstm:SilverMemberifrs-full:CommodityPriceRiskMember2022-12-310001563411ifrs-full:NotLaterThanOneYearMembercstm:NaturalGasMemberifrs-full:CommodityPriceRiskMember2022-12-310001563411ifrs-full:LaterThanOneYearMembercstm:NaturalGasMemberifrs-full:CommodityPriceRiskMember2022-12-310001563411ifrs-full:NotLaterThanOneYearMembercstm:ZincMemberifrs-full:CommodityPriceRiskMember2022-12-310001563411ifrs-full:LaterThanOneYearMembercstm:ZincMemberifrs-full:CommodityPriceRiskMember2022-12-310001563411ifrs-full:CommodityPriceRiskMember2021-01-012021-12-310001563411ifrs-full:CommodityPriceRiskMember2020-01-012020-12-310001563411cstm:TenPercentageIncreaseOrDecreaseInTheMarketPriceMembercstm:AluminiumMember2022-01-012022-12-310001563411ifrs-full:TopOfRangeMembercstm:FiftyBasisPointIncreaseOrDecreaseInTheLiborOrEuriborInterestRatesMember2022-01-012022-12-310001563411ifrs-full:TopOfRangeMembercstm:FiftyBasisPointIncreaseOrDecreaseInTheLiborOrEuriborInterestRatesMember2021-01-012021-12-310001563411cstm:RatedAaOrBetterMember2022-12-31cstm:counterparty0001563411cstm:RatedAaOrBetterMember2021-12-310001563411cstm:RatedAMember2022-12-310001563411cstm:RatedAMember2021-12-310001563411cstm:RatedBaaMember2022-12-310001563411cstm:RatedBaaMember2021-12-310001563411ifrs-full:CurrencyRiskMember2021-01-012021-12-310001563411ifrs-full:NotLaterThanOneYearMembercstm:NetCashFlowsFromDerivativeAssetsRelatedToCurrenciesAndCommoditiesMember2022-12-310001563411cstm:NetCashFlowsFromDerivativeAssetsRelatedToCurrenciesAndCommoditiesMemberifrs-full:LaterThanOneYearAndNotLaterThanFiveYearsMember2022-12-310001563411ifrs-full:LaterThanFiveYearsMembercstm:NetCashFlowsFromDerivativeAssetsRelatedToCurrenciesAndCommoditiesMember2022-12-310001563411ifrs-full:NotLaterThanOneYearMembercstm:NetCashFlowsFromDerivativeAssetsRelatedToCurrenciesAndCommoditiesMember2021-12-310001563411cstm:NetCashFlowsFromDerivativeAssetsRelatedToCurrenciesAndCommoditiesMemberifrs-full:LaterThanOneYearAndNotLaterThanFiveYearsMember2021-12-310001563411ifrs-full:LaterThanFiveYearsMembercstm:NetCashFlowsFromDerivativeAssetsRelatedToCurrenciesAndCommoditiesMember2021-12-310001563411ifrs-full:TradeReceivablesMemberifrs-full:NotLaterThanOneYearMember2022-12-310001563411ifrs-full:TradeReceivablesMemberifrs-full:LaterThanOneYearAndNotLaterThanFiveYearsMember2022-12-310001563411ifrs-full:TradeReceivablesMemberifrs-full:LaterThanFiveYearsMember2022-12-310001563411ifrs-full:TradeReceivablesMemberifrs-full:NotLaterThanOneYearMember2021-12-310001563411ifrs-full:TradeReceivablesMemberifrs-full:LaterThanOneYearAndNotLaterThanFiveYearsMember2021-12-310001563411ifrs-full:TradeReceivablesMemberifrs-full:LaterThanFiveYearsMember2021-12-310001563411ifrs-full:NotLaterThanOneYearMember2022-12-310001563411ifrs-full:LaterThanOneYearAndNotLaterThanFiveYearsMember2022-12-310001563411ifrs-full:LaterThanFiveYearsMember2022-12-310001563411ifrs-full:NotLaterThanOneYearMember2021-12-310001563411ifrs-full:LaterThanOneYearAndNotLaterThanFiveYearsMember2021-12-310001563411ifrs-full:LaterThanFiveYearsMember2021-12-310001563411ifrs-full:NotLaterThanOneYearMembercstm:Borrowings1Member2022-12-310001563411cstm:Borrowings1Memberifrs-full:LaterThanOneYearAndNotLaterThanFiveYearsMember2022-12-310001563411ifrs-full:LaterThanFiveYearsMembercstm:Borrowings1Member2022-12-310001563411ifrs-full:NotLaterThanOneYearMembercstm:Borrowings1Member2021-12-310001563411cstm:Borrowings1Memberifrs-full:LaterThanOneYearAndNotLaterThanFiveYearsMember2021-12-310001563411ifrs-full:LaterThanFiveYearsMembercstm:Borrowings1Member2021-12-310001563411ifrs-full:NotLaterThanOneYearMembercstm:InterestsMember2022-12-310001563411cstm:InterestsMemberifrs-full:LaterThanOneYearAndNotLaterThanFiveYearsMember2022-12-310001563411ifrs-full:LaterThanFiveYearsMembercstm:InterestsMember2022-12-310001563411ifrs-full:NotLaterThanOneYearMembercstm:InterestsMember2021-12-310001563411cstm:InterestsMemberifrs-full:LaterThanOneYearAndNotLaterThanFiveYearsMember2021-12-310001563411ifrs-full:LaterThanFiveYearsMembercstm:InterestsMember2021-12-310001563411cstm:NetCashFlowsFromDerivativesLiabilitiesRelatedToCurrenciesAndCommoditiesMemberifrs-full:NotLaterThanOneYearMember2022-12-310001563411cstm:NetCashFlowsFromDerivativesLiabilitiesRelatedToCurrenciesAndCommoditiesMemberifrs-full:LaterThanOneYearAndNotLaterThanFiveYearsMember2022-12-310001563411cstm:NetCashFlowsFromDerivativesLiabilitiesRelatedToCurrenciesAndCommoditiesMemberifrs-full:LaterThanFiveYearsMember2022-12-310001563411cstm:NetCashFlowsFromDerivativesLiabilitiesRelatedToCurrenciesAndCommoditiesMemberifrs-full:NotLaterThanOneYearMember2021-12-310001563411cstm:NetCashFlowsFromDerivativesLiabilitiesRelatedToCurrenciesAndCommoditiesMemberifrs-full:LaterThanOneYearAndNotLaterThanFiveYearsMember2021-12-310001563411cstm:NetCashFlowsFromDerivativesLiabilitiesRelatedToCurrenciesAndCommoditiesMemberifrs-full:LaterThanFiveYearsMember2021-12-310001563411ifrs-full:NotLaterThanOneYearMembercstm:TradePayablesAndOtherFixedAssetPayabalesMember2022-12-310001563411ifrs-full:LaterThanOneYearAndNotLaterThanFiveYearsMembercstm:TradePayablesAndOtherFixedAssetPayabalesMember2022-12-310001563411ifrs-full:LaterThanFiveYearsMembercstm:TradePayablesAndOtherFixedAssetPayabalesMember2022-12-310001563411ifrs-full:NotLaterThanOneYearMembercstm:TradePayablesAndOtherFixedAssetPayabalesMember2021-12-310001563411ifrs-full:LaterThanOneYearAndNotLaterThanFiveYearsMembercstm:TradePayablesAndOtherFixedAssetPayabalesMember2021-12-310001563411ifrs-full:LaterThanFiveYearsMembercstm:TradePayablesAndOtherFixedAssetPayabalesMember2021-12-310001563411ifrs-full:ActuarialAssumptionOfDiscountRatesMember2022-01-012022-12-310001563411ifrs-full:ActuarialAssumptionOfDiscountRatesMember2022-12-310001563411country:FRifrs-full:ActuarialAssumptionOfDiscountRatesMember2022-12-310001563411country:DEifrs-full:ActuarialAssumptionOfDiscountRatesMember2022-12-310001563411ifrs-full:ActuarialAssumptionOfDiscountRatesMembercountry:CH2022-12-310001563411ifrs-full:ActuarialAssumptionOfDiscountRatesMembercountry:US2022-12-310001563411country:CH2022-12-310001563411country:CH2021-12-310001563411cstm:HourlyPensionMembercountry:US2022-12-310001563411cstm:HourlyPensionMembercountry:USifrs-full:BottomOfRangeMember2022-12-310001563411ifrs-full:TopOfRangeMembercstm:HourlyPensionMembercountry:US2022-12-310001563411cstm:HourlyPensionMembercountry:US2021-12-310001563411cstm:HourlyPensionMembercountry:USifrs-full:BottomOfRangeMember2021-12-310001563411ifrs-full:TopOfRangeMembercstm:HourlyPensionMembercountry:US2021-12-310001563411cstm:SalariedPensionMembercountry:US2022-12-310001563411cstm:SalariedPensionMembercountry:US2021-12-310001563411cstm:OtherPostEmploymentBenefitMembercountry:US2022-12-310001563411cstm:OtherPostEmploymentBenefitMembercountry:USifrs-full:BottomOfRangeMember2022-12-310001563411ifrs-full:TopOfRangeMembercstm:OtherPostEmploymentBenefitMembercountry:US2022-12-310001563411cstm:OtherPostEmploymentBenefitMembercountry:US2021-12-310001563411cstm:OtherPostEmploymentBenefitMembercountry:USifrs-full:BottomOfRangeMember2021-12-310001563411ifrs-full:TopOfRangeMembercstm:OtherPostEmploymentBenefitMembercountry:US2021-12-310001563411country:UScstm:OtherEmployeeBenefitsMember2022-12-310001563411country:USifrs-full:BottomOfRangeMembercstm:OtherEmployeeBenefitsMember2022-12-310001563411ifrs-full:TopOfRangeMembercountry:UScstm:OtherEmployeeBenefitsMember2022-12-310001563411country:UScstm:OtherEmployeeBenefitsMember2021-12-310001563411country:USifrs-full:BottomOfRangeMembercstm:OtherEmployeeBenefitsMember2021-12-310001563411ifrs-full:TopOfRangeMembercountry:UScstm:OtherEmployeeBenefitsMember2021-12-310001563411country:FRifrs-full:BottomOfRangeMember2022-12-310001563411country:FRifrs-full:BottomOfRangeMember2021-12-310001563411country:FRifrs-full:TopOfRangeMember2021-12-310001563411country:FRcstm:RetirementBenefitsMember2022-12-310001563411country:FRcstm:RetirementBenefitsMember2021-12-310001563411country:FRcstm:OtherPostRetirementBenefitsMember2022-12-310001563411country:FRcstm:OtherPostRetirementBenefitsMember2021-12-310001563411cstm:OtherPostEmploymentBenefitMembercstm:TwoThousandTwentyMembercstm:PreSixtyFiveMember2022-12-310001563411cstm:TwoThousandTwentyNineMembercstm:OtherPostEmploymentBenefitMembercstm:PreSixtyFiveMember2022-12-310001563411cstm:OtherPostEmploymentBenefitMembercstm:TwoThousandTwentyMembercstm:PostSixtyFiveMember2022-12-310001563411cstm:TwoThousandTwentyNineMembercstm:OtherPostEmploymentBenefitMembercstm:PostSixtyFiveMember2022-12-310001563411ifrs-full:PensionDefinedBenefitPlansMember2022-12-310001563411cstm:OtherBenefitPlansMember2022-12-310001563411ifrs-full:PensionDefinedBenefitPlansMember2021-12-310001563411cstm:OtherBenefitPlansMember2021-12-310001563411ifrs-full:PresentValueOfDefinedBenefitObligationMemberifrs-full:PensionDefinedBenefitPlansMember2021-12-310001563411cstm:OtherBenefitPlansMemberifrs-full:PresentValueOfDefinedBenefitObligationMember2021-12-310001563411ifrs-full:PresentValueOfDefinedBenefitObligationMember2021-12-310001563411ifrs-full:PlanAssetsMember2021-12-310001563411ifrs-full:PresentValueOfDefinedBenefitObligationMemberifrs-full:PensionDefinedBenefitPlansMember2022-01-012022-12-310001563411cstm:OtherBenefitPlansMemberifrs-full:PresentValueOfDefinedBenefitObligationMember2022-01-012022-12-310001563411ifrs-full:PresentValueOfDefinedBenefitObligationMember2022-01-012022-12-310001563411ifrs-full:PlanAssetsMember2022-01-012022-12-310001563411ifrs-full:PresentValueOfDefinedBenefitObligationMemberifrs-full:PensionDefinedBenefitPlansMember2022-12-310001563411cstm:OtherBenefitPlansMemberifrs-full:PresentValueOfDefinedBenefitObligationMember2022-12-310001563411ifrs-full:PresentValueOfDefinedBenefitObligationMember2022-12-310001563411ifrs-full:PlanAssetsMember2022-12-310001563411ifrs-full:PresentValueOfDefinedBenefitObligationMemberifrs-full:PensionDefinedBenefitPlansMember2020-12-310001563411cstm:OtherBenefitPlansMemberifrs-full:PresentValueOfDefinedBenefitObligationMember2020-12-310001563411ifrs-full:PresentValueOfDefinedBenefitObligationMember2020-12-310001563411ifrs-full:PlanAssetsMember2020-12-310001563411ifrs-full:PresentValueOfDefinedBenefitObligationMemberifrs-full:PensionDefinedBenefitPlansMember2021-01-012021-12-310001563411cstm:OtherBenefitPlansMemberifrs-full:PresentValueOfDefinedBenefitObligationMember2021-01-012021-12-310001563411ifrs-full:PresentValueOfDefinedBenefitObligationMember2021-01-012021-12-310001563411ifrs-full:PlanAssetsMember2021-01-012021-12-310001563411cstm:OtherPostEmploymentBenefitMember2022-01-012022-12-310001563411cstm:OtherBenefitPlansMember2018-01-012018-12-310001563411country:FR2022-12-310001563411country:FR2021-12-310001563411country:DE2022-12-310001563411country:DE2021-12-310001563411country:CH2022-12-310001563411country:CH2021-12-310001563411country:US2022-12-310001563411country:US2021-12-310001563411cstm:PlanAssetCategoriesQuotedInAnActiveMarketMember2022-12-310001563411cstm:PlanAssetCategoriesNotQuotedInAnActiveMarketMember2022-12-310001563411cstm:PlanAssetCategoriesQuotedInAnActiveMarketMember2021-12-310001563411cstm:PlanAssetCategoriesNotQuotedInAnActiveMarketMember2021-12-310001563411ifrs-full:PensionDefinedBenefitPlansMember2022-01-012022-12-310001563411cstm:OtherBenefitPlansMember2022-01-012022-12-310001563411ifrs-full:ProvisionForDecommissioningRestorationAndRehabilitationCostsMember2021-12-310001563411ifrs-full:RestructuringProvisionMember2021-12-310001563411ifrs-full:LegalProceedingsProvisionMember2021-12-310001563411ifrs-full:ProvisionForDecommissioningRestorationAndRehabilitationCostsMember2022-01-012022-12-310001563411ifrs-full:RestructuringProvisionMember2022-01-012022-12-310001563411ifrs-full:LegalProceedingsProvisionMember2022-01-012022-12-310001563411ifrs-full:ProvisionForDecommissioningRestorationAndRehabilitationCostsMember2022-12-310001563411ifrs-full:RestructuringProvisionMember2022-12-310001563411ifrs-full:LegalProceedingsProvisionMember2022-12-310001563411ifrs-full:ProvisionForDecommissioningRestorationAndRehabilitationCostsMember2020-12-310001563411ifrs-full:RestructuringProvisionMember2020-12-310001563411ifrs-full:LegalProceedingsProvisionMember2020-12-310001563411ifrs-full:ProvisionForDecommissioningRestorationAndRehabilitationCostsMember2021-01-012021-12-310001563411ifrs-full:RestructuringProvisionMember2021-01-012021-12-310001563411ifrs-full:LegalProceedingsProvisionMember2021-01-012021-12-310001563411ifrs-full:BottomOfRangeMemberifrs-full:LegalProceedingsProvisionMembercstm:DiseaseClaimsMember2022-01-012022-12-310001563411ifrs-full:TopOfRangeMemberifrs-full:LegalProceedingsProvisionMembercstm:DiseaseClaimsMember2022-01-012022-12-310001563411ifrs-full:LegalProceedingsProvisionMembercstm:DiseaseClaimsMember2022-01-012022-12-31cstm:claim0001563411ifrs-full:LegalProceedingsProvisionMembercstm:DiseaseClaimsMember2021-01-012021-12-310001563411ifrs-full:TopOfRangeMemberifrs-full:LegalProceedingsProvisionMembercstm:DiseaseClaimsMember2021-01-012021-12-310001563411ifrs-full:OrdinarySharesMember2022-12-31cstm:vote0001563411ifrs-full:OrdinarySharesMember2021-12-310001563411ifrs-full:OrdinarySharesMembercstm:EmployeesMember2022-01-012022-12-310001563411ifrs-full:IssuedCapitalMember2022-01-012022-12-310001563411ifrs-full:SharePremiumMember2022-01-012022-12-310001563411ifrs-full:PropertyPlantAndEquipmentMember2022-12-310001563411ifrs-full:PropertyPlantAndEquipmentMember2021-12-310001563411cstm:FrenchGovernmentMembercstm:FrenchPGEMember2020-05-130001563411ifrs-full:SubsidiariesMembercstm:FrenchGovernmentMembercstm:FrenchPGEMember2020-05-130001563411cstm:PerformanceShareUnitsMember2022-01-012022-12-310001563411cstm:PerformanceShareUnitsMemberifrs-full:BottomOfRangeMember2022-01-012022-12-310001563411ifrs-full:TopOfRangeMembercstm:PerformanceShareUnitsMember2022-01-012022-12-310001563411cstm:PerformanceShareUnitsMember2017-07-012017-07-310001563411cstm:PerformanceShareUnitsMember2020-07-012020-07-310001563411cstm:PerformanceShareUnitsMember2018-05-012018-05-310001563411cstm:PerformanceShareUnitsMember2020-05-012020-05-310001563411cstm:PerformanceShareUnitsMember2019-04-012019-04-300001563411cstm:PerformanceShareUnitsMember2022-04-012022-04-300001563411cstm:PerformanceShareUnitsMember2021-01-012021-12-310001563411cstm:RestrictedStockUnitsMembercstm:CertainEmployeesAndChiefFinancialOfficerMember2022-01-012022-12-310001563411ifrs-full:KeyManagementPersonnelOfEntityOrParentMembercstm:RestrictedStockUnitsMember2019-01-012019-12-310001563411ifrs-full:KeyManagementPersonnelOfEntityOrParentMembercstm:RestrictedStockUnitsMember2020-01-012020-12-310001563411ifrs-full:KeyManagementPersonnelOfEntityOrParentMembercstm:RestrictedStockUnitsMember2022-01-012022-12-310001563411ifrs-full:KeyManagementPersonnelOfEntityOrParentMembercstm:RestrictedStockUnitsMember2021-01-012021-12-310001563411cstm:PerformanceBasedRestrictedStockUnitsMember2020-12-310001563411cstm:RestrictedStockUnitsMember2020-12-310001563411cstm:EquityAwardsPlanMember2020-12-310001563411cstm:PerformanceBasedRestrictedStockUnitsMember2021-01-012021-12-310001563411cstm:RestrictedStockUnitsMember2021-01-012021-12-310001563411cstm:EquityAwardsPlanMember2021-01-012021-12-310001563411cstm:PerformanceBasedRestrictedStockUnitsMember2021-12-310001563411cstm:RestrictedStockUnitsMember2021-12-310001563411cstm:EquityAwardsPlanMember2021-12-310001563411cstm:PerformanceBasedRestrictedStockUnitsMember2022-01-012022-12-310001563411cstm:RestrictedStockUnitsMember2022-01-012022-12-310001563411cstm:EquityAwardsPlanMember2022-01-012022-12-310001563411cstm:PerformanceBasedRestrictedStockUnitsMember2022-12-310001563411cstm:RestrictedStockUnitsMember2022-12-310001563411cstm:EquityAwardsPlanMember2022-12-310001563411cstm:CrossOperatingSegmentMembercstm:ConstelliumSingenGmbHMember2022-01-012022-12-310001563411cstm:ConstelliumValaisSAMembercstm:CrossOperatingSegmentMember2022-01-012022-12-310001563411cstm:ConstelliumAutomotiveUSALLCMembercstm:AutomotiveStructuresAndIndustryMember2022-01-012022-12-310001563411cstm:ConstelliumEngleyChangchunAutomotiveStructuresCoLtdMembercstm:AutomotiveStructuresAndIndustryMember2022-01-012022-12-310001563411cstm:ConstelliumExtrusionsDecinSroMembercstm:AutomotiveStructuresAndIndustryMember2022-01-012022-12-310001563411cstm:ConstelliumExtrusionsDeutschlandGmbHMembercstm:AutomotiveStructuresAndIndustryMember2022-01-012022-12-310001563411cstm:AutomotiveStructuresAndIndustryMembercstm:ConstelliumExtrusionsLandauGmbHMember2022-01-012022-12-310001563411cstm:ConstelliumExtrusionsBurgGmbHMembercstm:AutomotiveStructuresAndIndustryMember2022-01-012022-12-310001563411cstm:ConstelliumExtrusionsFranceSASMembercstm:AutomotiveStructuresAndIndustryMember2022-01-012022-12-310001563411cstm:AutomotiveStructuresAndIndustryMembercstm:ConstelliumExtrusionsLeviceSroMember2022-01-012022-12-310001563411cstm:AutomotiveStructuresAndIndustryMembercstm:ConstelliumAutomotiveMexicoSDERLDECVMember2022-01-012022-12-310001563411cstm:ConstelliumAutomotiveMexicoTradingSDERLDECVMembercstm:AutomotiveStructuresAndIndustryMember2022-01-012022-12-310001563411cstm:AutomotiveStructuresAndIndustryMembercstm:AstrexIncMember2022-01-012022-12-310001563411cstm:AutomotiveStructuresAndIndustryMembercstm:ConstelliumAutomotiveZilinaSroMember2022-01-012022-12-310001563411cstm:AutomotiveStructuresAndIndustryMembercstm:ConstelliumAutomotiveNanjingCoLtdMember2022-01-012022-12-310001563411cstm:ConstelliumAutomotiveSpainSLMembercstm:AutomotiveStructuresAndIndustryMember2022-01-012022-12-310001563411cstm:ConstelliumUKLimitedMembercstm:AutomotiveStructuresAndIndustryMember2022-01-012022-12-310001563411cstm:ConstelliumIssoireSASMembercstm:AerospaceAndTransportationMember2022-01-012022-12-310001563411cstm:AerospaceAndTransportationMembercstm:ConstelliumMontreuilJuigneMember2022-01-012022-12-310001563411cstm:ConstelliumChinaCoLtdMembercstm:AerospaceAndTransportationMember2022-01-012022-12-310001563411cstm:AerospaceAndTransportationMembercstm:ConstelliumJapanKKMember2022-01-012022-12-310001563411cstm:AerospaceAndTransportationMembercstm:ConstelliumRolledProductsRavenswoodLLCMember2022-01-012022-12-310001563411cstm:AerospaceAndTransportationMembercstm:ConstelliumUsselSASMember2022-01-012022-12-310001563411cstm:AerospaceAndTransportationMembercstm:AluinfraServicesSAMember2022-01-012022-12-310001563411cstm:PackagingAndAutomotiveRolledProductsMembercstm:ConstelliumDeutschlandGmbHMember2022-01-012022-12-310001563411cstm:ConstelliumRolledProductsSingenGmbHKGMembercstm:PackagingAndAutomotiveRolledProductsMember2022-01-012022-12-310001563411cstm:PackagingAndAutomotiveRolledProductsMembercstm:ConstelliumNeufBrisachMember2022-01-012022-12-310001563411cstm:PackagingAndAutomotiveRolledProductsMembercstm:ConstelliumMuscleShoalsLLCMember2022-01-012022-12-310001563411cstm:ConstelliumHoldingMuscleShoalsLLCMembercstm:PackagingAndAutomotiveRolledProductsMember2022-01-012022-12-310001563411cstm:ConstelliumMuscleShoalsFundingTwoLLCMembercstm:PackagingAndAutomotiveRolledProductsMember2022-01-012022-12-310001563411cstm:ConstelliumMuscleShoalsFundingIIILLCMembercstm:PackagingAndAutomotiveRolledProductsMember2022-01-012022-12-310001563411cstm:ConstelliumMetalProcurementLLCMembercstm:PackagingAndAutomotiveRolledProductsMember2022-01-012022-12-310001563411cstm:ConstelliumUACJABSLLCMembercstm:PackagingAndAutomotiveRolledProductsMember2022-01-012022-12-310001563411cstm:RhenarollSaMembercstm:PackagingAndAutomotiveRolledProductsMember2022-01-012022-12-310001563411cstm:HoldingsAndCorporateMembercstm:CtecConstelliumTechnologyCenterSASMember2022-01-012022-12-310001563411cstm:HoldingsAndCorporateMembercstm:ConstelliumFinanceSASMember2022-01-012022-12-310001563411cstm:HoldingsAndCorporateMembercstm:ConstelliumFranceIIISASMember2022-01-012022-12-310001563411cstm:HoldingsAndCorporateMembercstm:ConstelliumFranceHoldcoSASMember2022-01-012022-12-310001563411cstm:HoldingsAndCorporateMembercstm:ConstelliumInternationalSASMember2022-01-012022-12-310001563411cstm:HoldingsAndCorporateMembercstm:ConstelliumParisSASMember2022-01-012022-12-310001563411cstm:ConstelliumGermanyHoldcoGmbHAndCoKGMembercstm:HoldingsAndCorporateMember2022-01-012022-12-310001563411cstm:HoldingsAndCorporateMembercstm:ConstelliumGermanyVerwaltungsGmbhMember2022-01-012022-12-310001563411cstm:HoldingsAndCorporateMembercstm:ConstelliumUSHoldingsILLCMember2022-01-012022-12-310001563411cstm:ConstelliumUSIntermediateHoldingsLLCMembercstm:HoldingsAndCorporateMember2022-01-012022-12-310001563411cstm:HoldingsAndCorporateMembercstm:ConstelliumSwitzerlandAGMember2022-01-012022-12-310001563411cstm:HoldingsAndCorporateMembercstm:ConstelliumTreuhandUGMember2022-01-012022-12-310001563411cstm:EngineeredProductsInternationalSASMembercstm:HoldingsAndCorporateMember2022-01-012022-12-310001563411ifrs-full:DisposalOfMajorSubsidiaryMember2023-02-022023-02-02

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________________________________________________________________

FORM 20-F

__________________________________________________________________________

| | | | | |

| ☐ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| | | | | |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2022

OR

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| | | | | |

| ☐ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number 001-35931

__________________________________________________________________________

Constellium SE

(Exact Name of Registrant as Specified in its Charter)

__________________________________________________________________________

Constellium SE

(Translation of Registrant’s name into English)

__________________________________________________________________________

France

(Jurisdiction of incorporation or organization)

__________________________________________________________________________

| | | | | |

| Washington Plaza, | 300 East Lombard Street |

| 40-44 rue Washington | Suite 1710 |

75008 Paris | Baltimore, MD, 21202 |

| France | United States |

| (Head Office) | |

| (Address of principal executive offices) |

| | |

| Rina E. Teran |

Chief Securities Counsel |

300 East Lombard Street, Suite 1710, Baltimore, MD, 21202 |

| United States |

Tel: (443) 420-7861 |

E-mail: rina.teran@constellium.com |

(Name, telephone, e-mail and/or facsimile number and address of company contact person)

__________________________________________________________________________

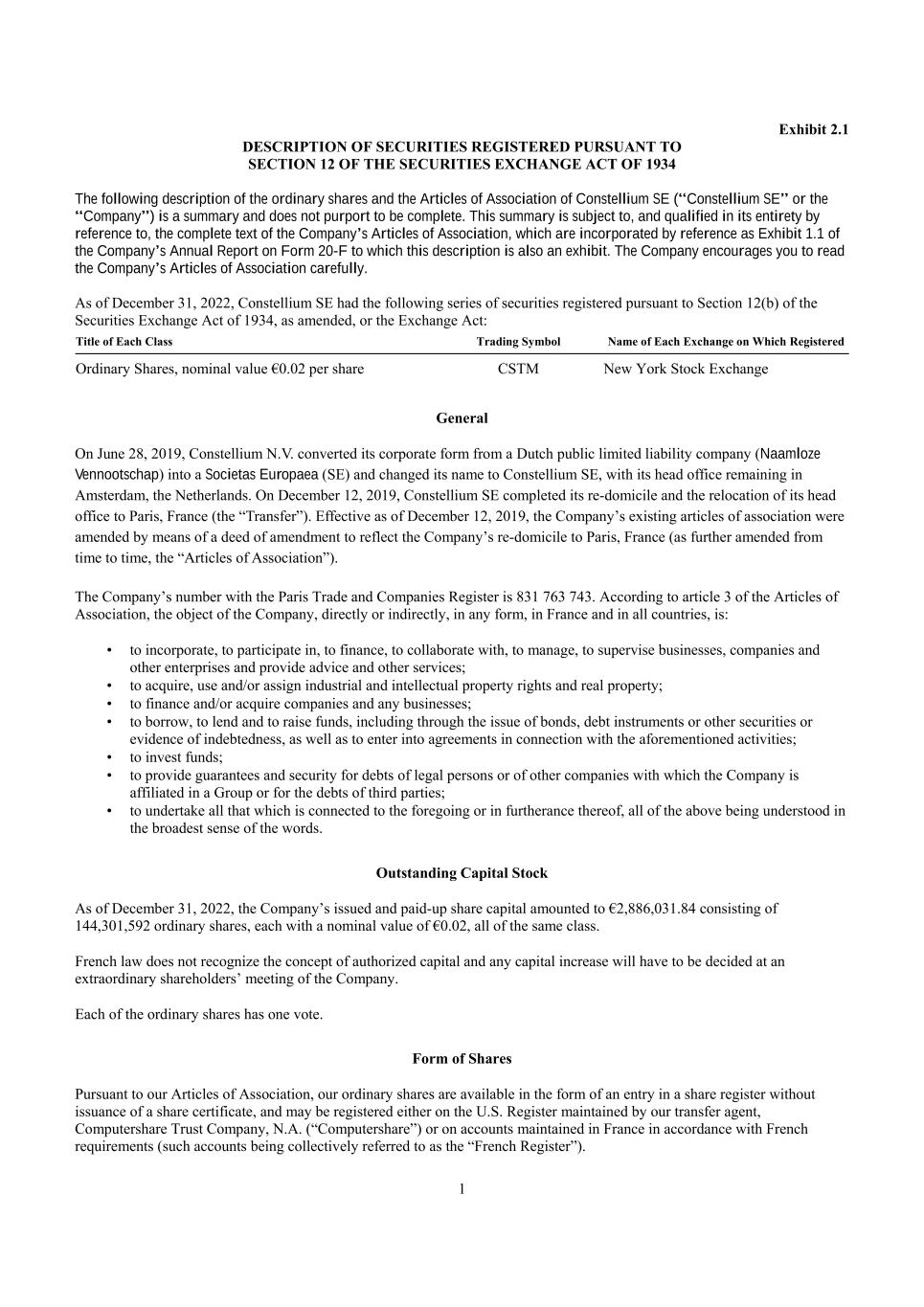

Securities registered or to be registered pursuant to Section 12(b) of the Act.

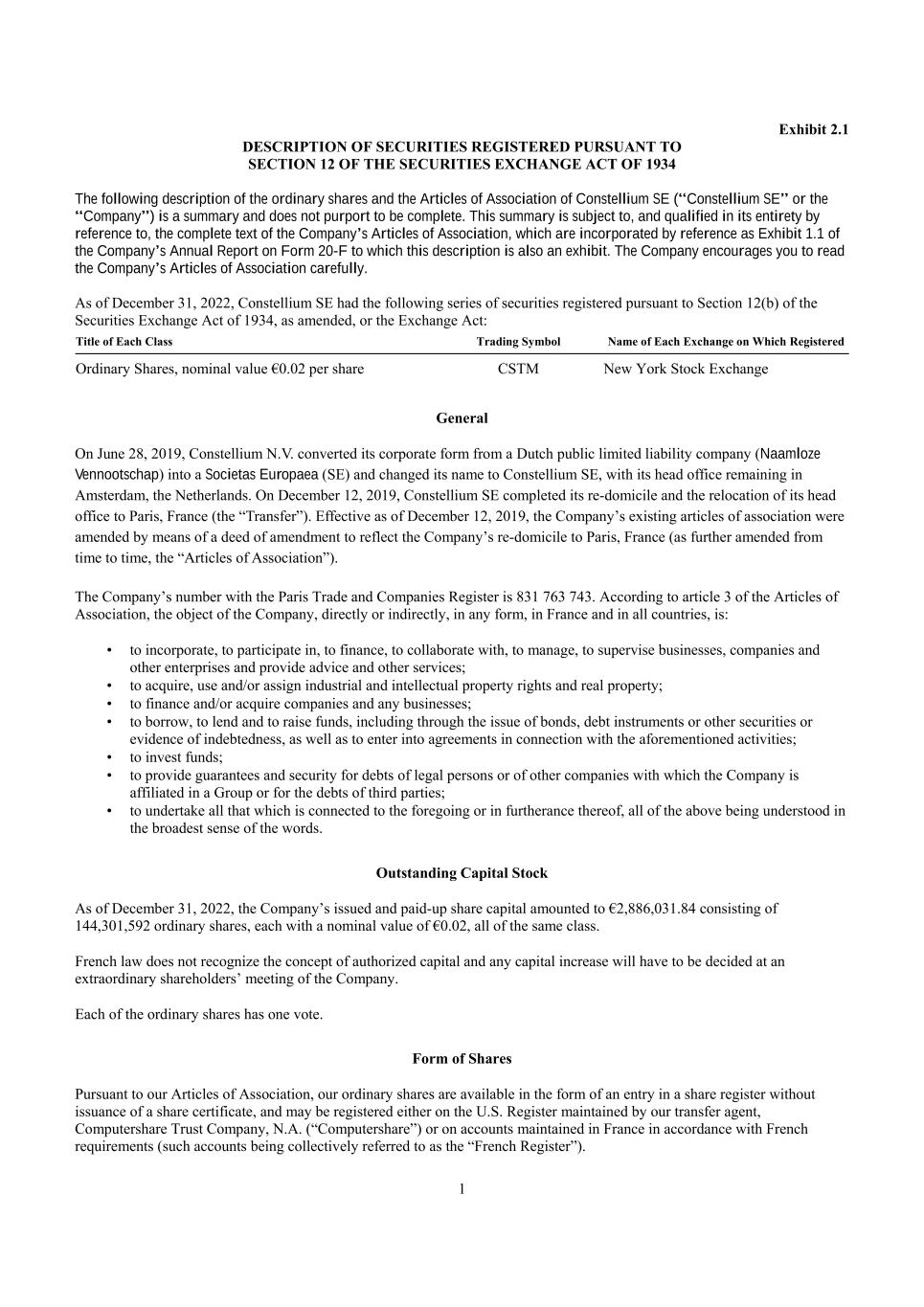

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| Ordinary Shares | | CSTM | | New York Stock Exchange |

Securities registered or to be registered pursuant to Section 12(g) of the Act:

None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

_____________________________

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report:

144,301,592 Ordinary Shares, Nominal Value €0.02 per share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. x Yes ☐ No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. ☐ Yes x No

Note—Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

x Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer”, "accelerated filer", and "emerging growth company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer x Accelerated filer ☐ Non-accelerated filer ☐ Emerging growth company ☐

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| | | | | | | | | | | | | | |

| U.S. GAAP ☐ | | International Financial Reporting Standards | | Other ☐ |

| | as issued by the International Accounting Standards Board x | | |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow: Item 17 ☐ Item 18 ☐

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes x No

| | | | | | | | | | | | | | |

| PCAOB ID: | | Auditor Name: | | Auditor Location: |

| 1347 | | PricewaterhouseCoopers Audit | | Neuilly-sur-Seine, France |

TABLE OF CONTENTS

| | | | | |

| Page |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Item 12. Description of Securities Other than Equity Securities | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| F-1 |

SPECIAL NOTE ABOUT FORWARD-LOOKING STATEMENTS

This annual report on Form 20-F (this “Annual Report”) of Constellium SE (“Constellium SE” or “the Company”, and when referred to together with its subsidiaries, "the Group" or "Constellium") contains “forward-looking statements” with respect to our business, results of operations and financial condition, and our expectations or beliefs concerning future events and conditions. You can identify certain forward-looking statements because they contain words such as, but not limited to, “believes,” “expects,” “may,” “should,” “approximately,” “anticipates,” “estimates,” “intends,” “plans,” “targets,” “likely,” “will,” “would,” “could” and similar expressions (or the negative of these terminologies or expressions). All forward-looking statements involve risks and uncertainties. Many risks and uncertainties are inherent in our industry and markets. Others are more specific to our business and operations. The occurrence of the events described and the achievement of the expected results depend on many events, some or all of which are not predictable or within our control. Actual results may differ materially from the forward-looking statements contained in this Annual Report.

Important factors that could cause actual results to differ materially from those expressed or implied by the forward-looking statements are disclosed under “Item 3. Key Information—D. Risk Factors” and elsewhere in this Annual Report, including, without limitation, in conjunction with the forward-looking statements included in this Annual Report. All forward-looking statements in this Annual Report and subsequent written and oral forward-looking statements attributable to us, or persons acting on our behalf, are expressly qualified in their entirety by the cautionary statements. Some of the factors that we believe could materially affect our results include:

•We may not be able to compete successfully in the highly competitive markets in which we operate, and new competitors could emerge, which could negatively impact our share of industry sales, sales volumes and selling prices.