The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion. Dated , 2023.

Shares

Kodiak Gas Services, Inc.

Common Stock

This is an initial public offering of shares of common stock of Kodiak Gas Services, Inc. All of the shares of common stock are being sold by us.

Prior to this offering, there has been no public market for our common stock. It is currently expected that the initial public offering price per share will be between $ and $ . We intend to list our common stock on the New York Stock Exchange (“NYSE”) under the symbol “KGS.”

We are an “emerging growth company” as that term is used in the Jumpstart Our Business Startups Act of 2012 and, as such, we have elected to take advantage of certain reduced public company reporting requirements for this prospectus and future filings. See “Risk Factors” and “Prospectus Summary—Emerging Growth Company.”

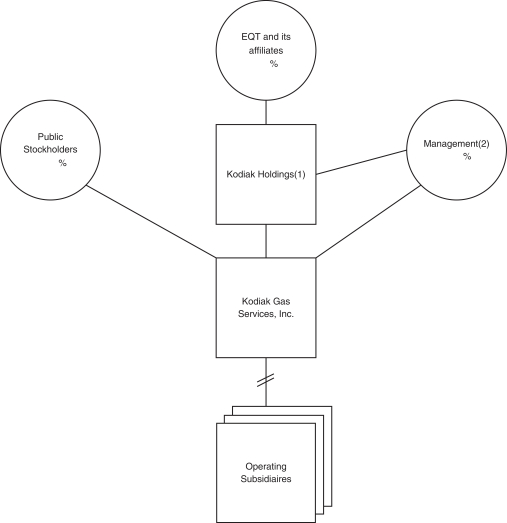

After the completion of this offering, an investment fund advised by an affiliate of EQT AB will beneficially own approximately % of our outstanding common stock (or % if the underwriters exercise in full their option to purchase additional shares of common stock). As a result, we will be a “controlled company” within the meaning of the rules of the NYSE; however, we do not currently intend to rely on any exemptions from the corporate governance requirements of the NYSE available to “controlled companies.” See “Management—Controlled Company Status.”

See “Risk Factors” beginning on page 27 to read about factors you should consider before buying shares of our common stock.

Neither the Securities and Exchange Commission (“SEC”) nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

| Per share | Total | |||||||

| Initial public offering price |

$ | $ | ||||||

| Underwriting discount and commissions(1) |

$ | $ | ||||||

| Proceeds, before expenses, to us |

$ | $ | ||||||

| (1) | See “Underwriting” for additional information regarding underwriting compensation. |

To the extent that the underwriters sell more than shares of common stock, the underwriters have the option, for a period of 30 days, to purchase up to an additional shares from us at the initial price to the public less the underwriting discount and commissions.

The underwriters expect to deliver the shares of common stock against payment on or about .

| Goldman Sachs & Co. LLC | J.P. Morgan |

| Barclays |

| BofA Securities | ||||||||||||||||

| Raymond James | RBC Capital Markets |

Stifel | Truist Securities | TPH&Co. | ||||||||||||

| Comerica Securities | Fifth Third Securities | Regions Securities LLC | Texas Capital Securities | |||||||

| AmeriVet Securities | Guzman & Company | R. Seelaus & Co., LLC | Siebert Williams Shank | |||||||||

Prospectus dated , 2023