UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-D

ASSET-BACKED ISSUER

DISTRIBUTION REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934.

For the monthly distribution period from April 1, 2025 to April 30, 2025

Commission File Number of issuing entity: 333-239650-01

Central Index Key Number of issuing entity: 0001801738

Carvana Auto Receivables Trust 2020-P1

(Exact name of issuing entity as specified in its charter)

Commission File Number of depositor: 333-239650

Central Index Key Number of depositor: 0001770373

Carvana Receivables Depositor LLC

(Exact name of depositor as specified in its charter)

Central Index Key Number of sponsor: 0001576462

Carvana, LLC

(Exact name of sponsor as specified in its charter)

Mike McKeever, President and Chief Executive Officer, (480) 719-8809

(Name and telephone number, including area code, of the person to contact in connection with this filing)

Delaware

(State or other jurisdiction of incorporation or organization of the issuing entity)

84-6968156

(I.R.S. Employer Identification No.)

300 East Rio Salado Parkway, Tempe, AZ 85281

(Address, including zip code, of principal executive offices of the issuing entity)

(602) 922-9866

(Telephone number, including area code, of the issuing entity)

Former name or former address, if changed since last report: Not applicable.

| | | | | | | | | | | | | | |

| Registered/reporting pursuant to (check one): |

Title of class | Section 12(b) | Section 12(g) | Section 15(d) | Name of exchange (If Section 12(b)) |

Asset Backed Notes, Class A-1 | ☐ | ☐ | ☒ | ☐ |

Asset Backed Notes, Class A-2 | ☐ | ☐ | ☒ | ☐ |

Asset Backed Notes, Class A-3 | ☐ | ☐ | ☒ | ☐ |

Asset Backed Notes, Class A-4 | ☐ | ☐ | ☒ | ☐ |

Asset Backed Notes, Class B | ☐ | ☐ | ☒ | ☐ |

Asset Backed Notes, Class C | ☐ | ☐ | ☒ | ☐ |

Asset Backed Notes, Class D | ☐ | ☐ | ☒ | ☐ |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and

(2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

PART I – DISTRIBUTION INFORMATION

Item 1. Distribution and Pool Performance Information.

Distribution and pool performance information with respect to the asset pool of Carvana Auto Receivables Trust 2020-P1 (the “Issuing Entity”) for the reporting period covered by this Form 10-D (the “Reporting Period”) is set forth in the Servicer’s Certificate, attached hereto as Exhibit 99.1 and incorporated by reference into this Item 1.

No assets held by Issuing Entity were the subject of a demand to repurchase or replace for breach of the representations and warranties during the Reporting Period.

Carvana Receivables Depositor LLC (Central Index Key Number: 0001770373), as securitizer, most recently filed a Form ABS-15G on January 16, 2025, with the Securities and Exchange Commission (the “Commission”) with respect to all asset-backed securities sponsored by it.

Item 1A. Asset-Level Information.

Asset level data for the Reporting Period is included in Exhibit 102 to the Form ABS-EE filed by the Issuing Entity with the Commission on the date hereof (the “Form ABS-EE”) and is incorporated by reference into this Item 1A.

Additional asset level information or explanatory language is included in Exhibit 103 to the Form ABS-EE and is also incorporated by reference into this Item 1A.

Item 1B. Asset Representations Reviewer and Investor Communication.

None.

PART II – OTHER INFORMATION

Item 2. Legal Proceedings.

None.

Item 3. Sales of Securities and Use of Proceeds.

None.

Item 4. Defaults Upon Senior Securities.

None.

Item 5. [Reserved.]

Item 6. Significant Obligors of Pool Assets.

None.

Item 7. Change in Sponsor Interest in the Securities.

None.

Item 8. Significant Enhancement Provider Information.

None.

Item 9. Other Information.

None.

Item 10. Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the reporting entity has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | |

| CARVANA RECEIVABLES DEPOSITOR LLC |

| | |

| By: | /s/ Mike McKeever | |

| Name: Mike McKeever | |

| President and Chief Executive Officer | |

Date: May 15, 2025

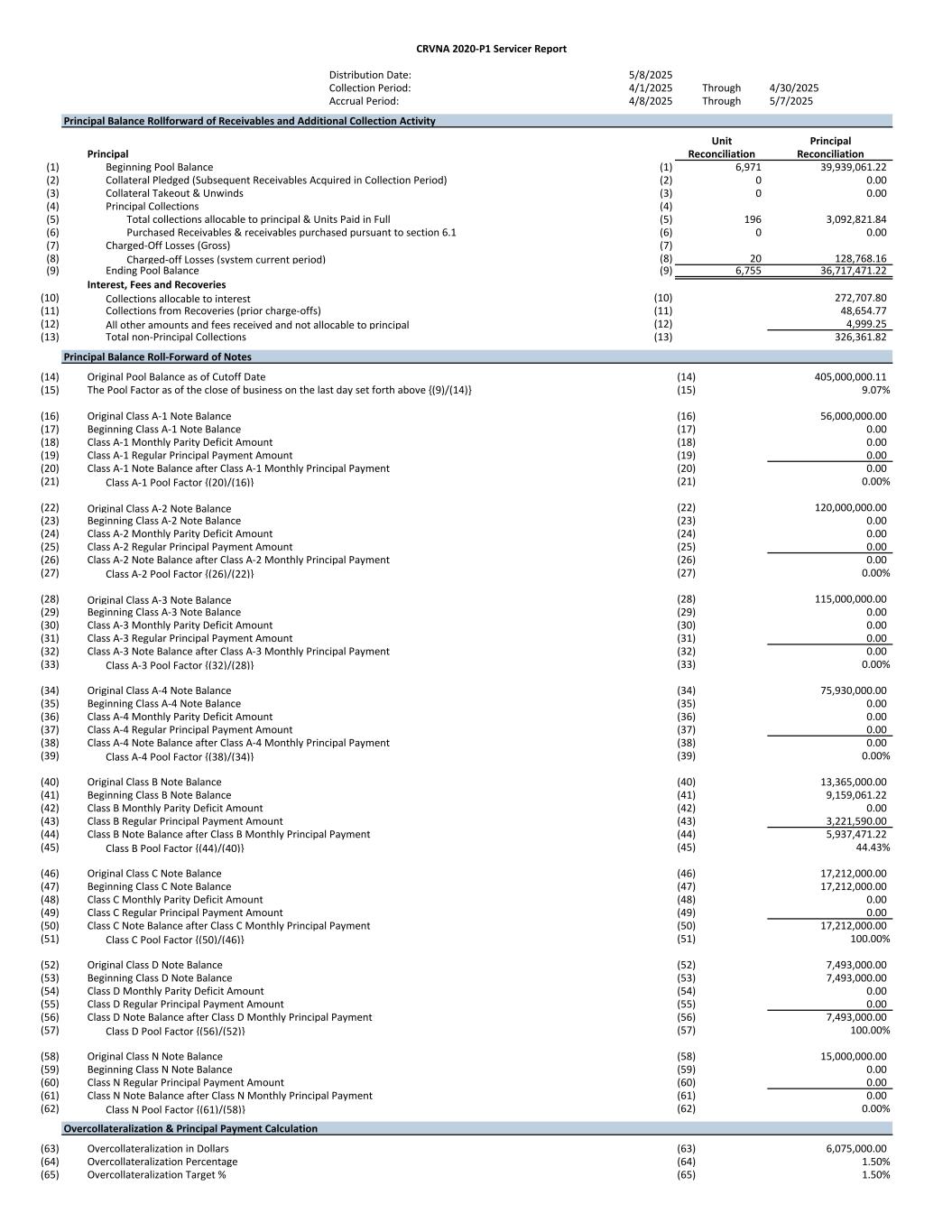

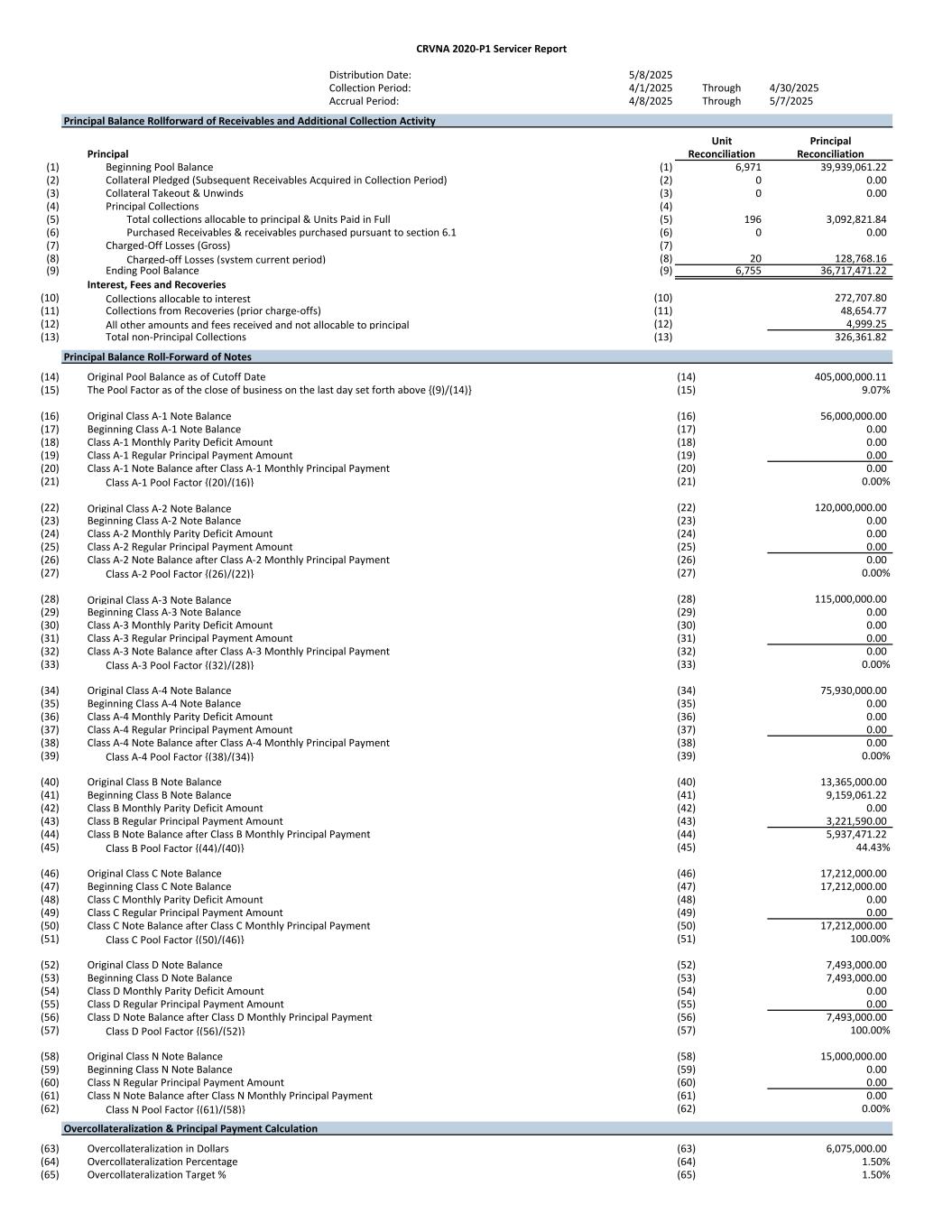

CRVNA 2020-P1 Servicer Report Distribution Date: 5/8/2025 Collection Period: 4/1/2025 Through 4/30/2025 Accrual Period: 4/8/2025 Through 5/7/2025 Principal Balance Rollforward of Receivables and Additional Collection Activity Unit Principal Principal Reconciliation Reconciliation (1) Beginning Pool Balance (1) 6,971 39,939,061.22 (2) Collateral Pledged (Subsequent Receivables Acquired in Collection Period) (2) 0 0.00 (3) Collateral Takeout & Unwinds (3) 0 0.00 (4) Principal Collections (4) (5) Total collections allocable to principal & Units Paid in Full (5) 196 3,092,821.84 (6) Purchased Receivables & receivables purchased pursuant to section 6.1 (6) 0 0.00 (7) Charged-Off Losses (Gross) (7) (8) Charged-off Losses (system current period) (8) 20 128,768.16 (9) Ending Pool Balance (9) 6,755 36,717,471.22 Interest, Fees and Recoveries (10) Collections allocable to interest (10) 272,707.80 (11) Collections from Recoveries (prior charge-offs) (11) 48,654.77 (12) All other amounts and fees received and not allocable to principal (12) 4,999.25 (13) Total non-Principal Collections (13) 326,361.82 Principal Balance Roll-Forward of Notes (14) Original Pool Balance as of Cutoff Date (14) 405,000,000.11 (15) The Pool Factor as of the close of business on the last day set forth above {(9)/(14)} (15) 9.07% (16) Original Class A-1 Note Balance (16) 56,000,000.00 (17) Beginning Class A-1 Note Balance (17) 0.00 (18) Class A-1 Monthly Parity Deficit Amount (18) 0.00 (19) Class A-1 Regular Principal Payment Amount (19) 0.00 (20) Class A-1 Note Balance after Class A-1 Monthly Principal Payment (20) 0.00 (21) Class A-1 Pool Factor {(20)/(16)} (21) 0.00% (22) Original Class A-2 Note Balance (22) 120,000,000.00 (23) Beginning Class A-2 Note Balance (23) 0.00 (24) Class A-2 Monthly Parity Deficit Amount (24) 0.00 (25) Class A-2 Regular Principal Payment Amount (25) 0.00 (26) Class A-2 Note Balance after Class A-2 Monthly Principal Payment (26) 0.00 (27) Class A-2 Pool Factor {(26)/(22)} (27) 0.00% (28) Original Class A-3 Note Balance (28) 115,000,000.00 (29) Beginning Class A-3 Note Balance (29) 0.00 (30) Class A-3 Monthly Parity Deficit Amount (30) 0.00 (31) Class A-3 Regular Principal Payment Amount (31) 0.00 (32) Class A-3 Note Balance after Class A-3 Monthly Principal Payment (32) 0.00 (33) Class A-3 Pool Factor {(32)/(28)} (33) 0.00% (34) Original Class A-4 Note Balance (34) 75,930,000.00 (35) Beginning Class A-4 Note Balance (35) 0.00 (36) Class A-4 Monthly Parity Deficit Amount (36) 0.00 (37) Class A-4 Regular Principal Payment Amount (37) 0.00 (38) Class A-4 Note Balance after Class A-4 Monthly Principal Payment (38) 0.00 (39) Class A-4 Pool Factor {(38)/(34)} (39) 0.00% (40) Original Class B Note Balance (40) 13,365,000.00 (41) Beginning Class B Note Balance (41) 9,159,061.22 (42) Class B Monthly Parity Deficit Amount (42) 0.00 (43) Class B Regular Principal Payment Amount (43) 3,221,590.00 (44) Class B Note Balance after Class B Monthly Principal Payment (44) 5,937,471.22 (45) Class B Pool Factor {(44)/(40)} (45) 44.43% (46) Original Class C Note Balance (46) 17,212,000.00 (47) Beginning Class C Note Balance (47) 17,212,000.00 (48) Class C Monthly Parity Deficit Amount (48) 0.00 (49) Class C Regular Principal Payment Amount (49) 0.00 (50) Class C Note Balance after Class C Monthly Principal Payment (50) 17,212,000.00 (51) Class C Pool Factor {(50)/(46)} (51) 100.00% (52) Original Class D Note Balance (52) 7,493,000.00 (53) Beginning Class D Note Balance (53) 7,493,000.00 (54) Class D Monthly Parity Deficit Amount (54) 0.00 (55) Class D Regular Principal Payment Amount (55) 0.00 (56) Class D Note Balance after Class D Monthly Principal Payment (56) 7,493,000.00 (57) Class D Pool Factor {(56)/(52)} (57) 100.00% (58) Original Class N Note Balance (58) 15,000,000.00 (59) Beginning Class N Note Balance (59) 0.00 (60) Class N Regular Principal Payment Amount (60) 0.00 (61) Class N Note Balance after Class N Monthly Principal Payment (61) 0.00 (62) Class N Pool Factor {(61)/(58)} (62) 0.00% Overcollateralization & Principal Payment Calculation (63) Overcollateralization in Dollars (63) 6,075,000.00 (64) Overcollateralization Percentage (64) 1.50% (65) Overcollateralization Target % (65) 1.50%

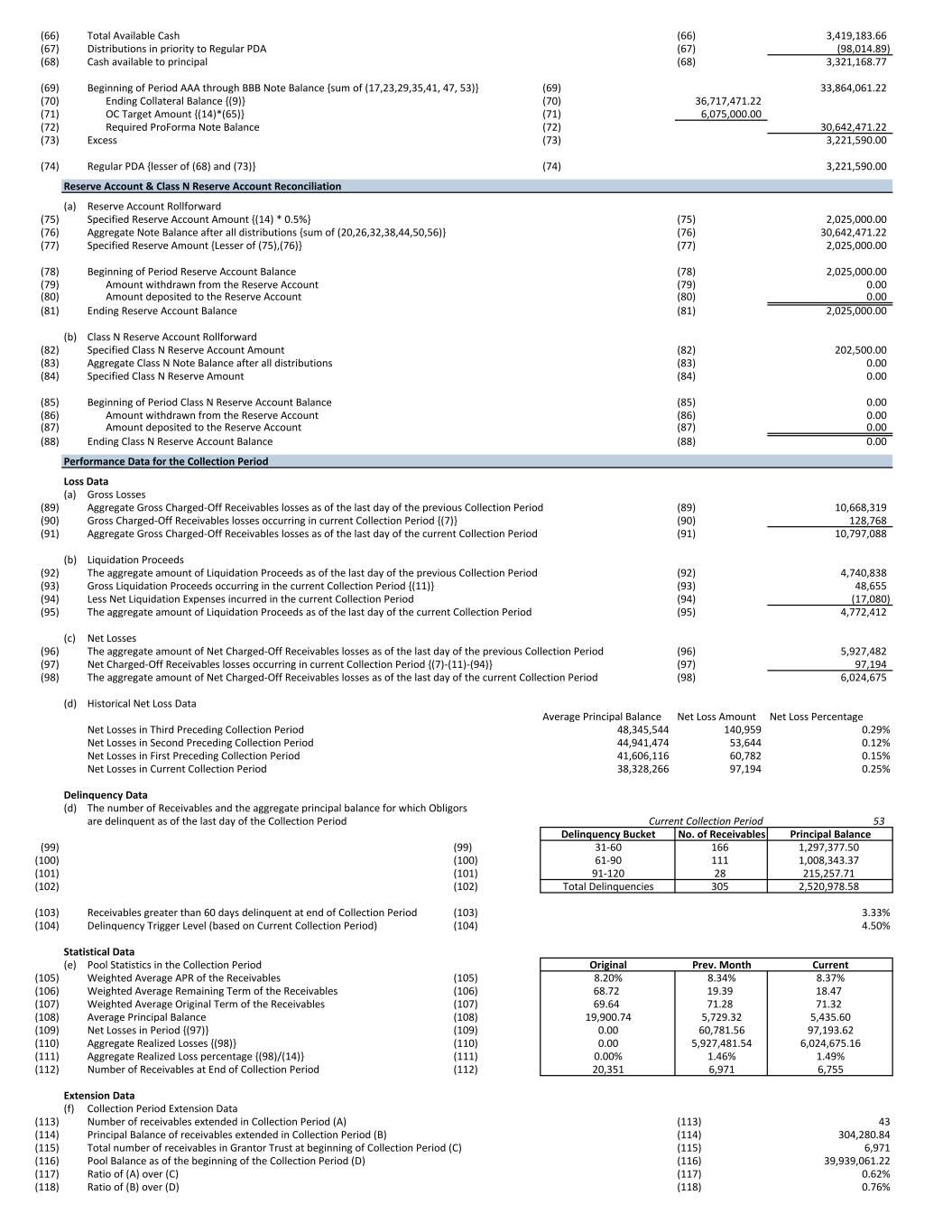

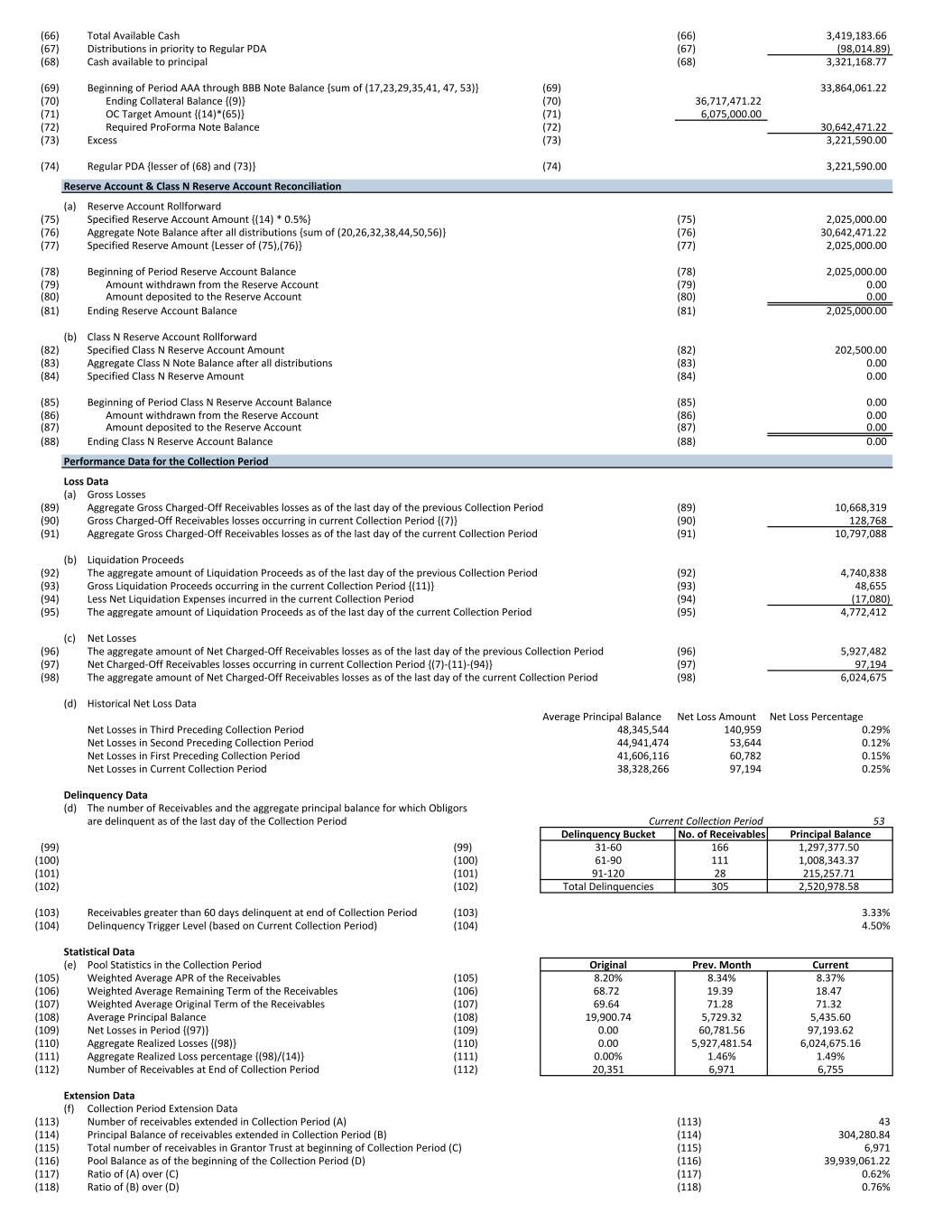

(66) Total Available Cash (66) 3,419,183.66 (67) Distributions in priority to Regular PDA (67) (98,014.89) (68) Cash available to principal (68) 3,321,168.77 (69) Beginning of Period AAA through BBB Note Balance {sum of (17,23,29,35,41, 47, 53)} (69) 33,864,061.22 (70) Ending Collateral Balance {(9)} (70) 36,717,471.22 (71) OC Target Amount {(14)*(65)} (71) 6,075,000.00 (72) Required ProForma Note Balance (72) 30,642,471.22 (73) Excess (73) 3,221,590.00 (74) Regular PDA {lesser of (68) and (73)} (74) 3,221,590.00 Reserve Account & Class N Reserve Account Reconciliation (a) Reserve Account Rollforward (75) Specified Reserve Account Amount {(14) * 0.5%} (75) 2,025,000.00 (76) Aggregate Note Balance after all distributions {sum of (20,26,32,38,44,50,56)} (76) 30,642,471.22 (77) Specified Reserve Amount {Lesser of (75),(76)} (77) 2,025,000.00 (78) Beginning of Period Reserve Account Balance (78) 2,025,000.00 (79) Amount withdrawn from the Reserve Account (79) 0.00 (80) Amount deposited to the Reserve Account (80) 0.00 (81) Ending Reserve Account Balance (81) 2,025,000.00 (b) Class N Reserve Account Rollforward (82) Specified Class N Reserve Account Amount (82) 202,500.00 (83) Aggregate Class N Note Balance after all distributions (83) 0.00 (84) Specified Class N Reserve Amount (84) 0.00 (85) Beginning of Period Class N Reserve Account Balance (85) 0.00 (86) Amount withdrawn from the Reserve Account (86) 0.00 (87) Amount deposited to the Reserve Account (87) 0.00 (88) Ending Class N Reserve Account Balance (88) 0.00 Performance Data for the Collection Period Loss Data (a) Gross Losses (89) Aggregate Gross Charged-Off Receivables losses as of the last day of the previous Collection Period (89) 10,668,319 (90) Gross Charged-Off Receivables losses occurring in current Collection Period {(7)} (90) 128,768 (91) Aggregate Gross Charged-Off Receivables losses as of the last day of the current Collection Period (91) 10,797,088 (b) Liquidation Proceeds (92) The aggregate amount of Liquidation Proceeds as of the last day of the previous Collection Period (92) 4,740,838 (93) Gross Liquidation Proceeds occurring in the current Collection Period {(11)} (93) 48,655 (94) Less Net Liquidation Expenses incurred in the current Collection Period (94) (17,080) (95) The aggregate amount of Liquidation Proceeds as of the last day of the current Collection Period (95) 4,772,412 (c) Net Losses (96) The aggregate amount of Net Charged-Off Receivables losses as of the last day of the previous Collection Period (96) 5,927,482 (97) Net Charged-Off Receivables losses occurring in current Collection Period {(7)-(11)-(94)} (97) 97,194 (98) The aggregate amount of Net Charged-Off Receivables losses as of the last day of the current Collection Period (98) 6,024,675 (d) Historical Net Loss Data Average Principal Balance Net Loss Amount Net Loss Percentage Net Losses in Third Preceding Collection Period 48,345,544 140,959 0.29% Net Losses in Second Preceding Collection Period 44,941,474 53,644 0.12% Net Losses in First Preceding Collection Period 41,606,116 60,782 0.15% Net Losses in Current Collection Period 38,328,266 97,194 0.25% Delinquency Data (d) The number of Receivables and the aggregate principal balance for which Obligors are delinquent as of the last day of the Collection Period Current Collection Period 53 Delinquency Bucket No. of Receivables Principal Balance (99) (99) 31-60 166 1,297,377.50 (100) (100) 61-90 111 1,008,343.37 (101) (101) 91-120 28 215,257.71 (102) (102) Total Delinquencies 305 2,520,978.58 (103) Receivables greater than 60 days delinquent at end of Collection Period (103) 3.33% (104) Delinquency Trigger Level (based on Current Collection Period) (104) 4.50% Statistical Data (e) Pool Statistics in the Collection Period Original Prev. Month Current (105) Weighted Average APR of the Receivables (105) 8.20% 8.34% 8.37% (106) Weighted Average Remaining Term of the Receivables (106) 68.72 19.39 18.47 (107) Weighted Average Original Term of the Receivables (107) 69.64 71.28 71.32 (108) Average Principal Balance (108) 19,900.74 5,729.32 5,435.60 (109) Net Losses in Period {(97)} (109) 0.00 60,781.56 97,193.62 (110) Aggregate Realized Losses {(98)} (110) 0.00 5,927,481.54 6,024,675.16 (111) Aggregate Realized Loss percentage {(98)/(14)} (111) 0.00% 1.46% 1.49% (112) Number of Receivables at End of Collection Period (112) 20,351 6,971 6,755 Extension Data (f) Collection Period Extension Data (113) Number of receivables extended in Collection Period (A) (113) 43 (114) Principal Balance of receivables extended in Collection Period (B) (114) 304,280.84 (115) Total number of receivables in Grantor Trust at beginning of Collection Period (C) (115) 6,971 (116) Pool Balance as of the beginning of the Collection Period (D) (116) 39,939,061.22 (117) Ratio of (A) over (C) (117) 0.62% (118) Ratio of (B) over (D) (118) 0.76%

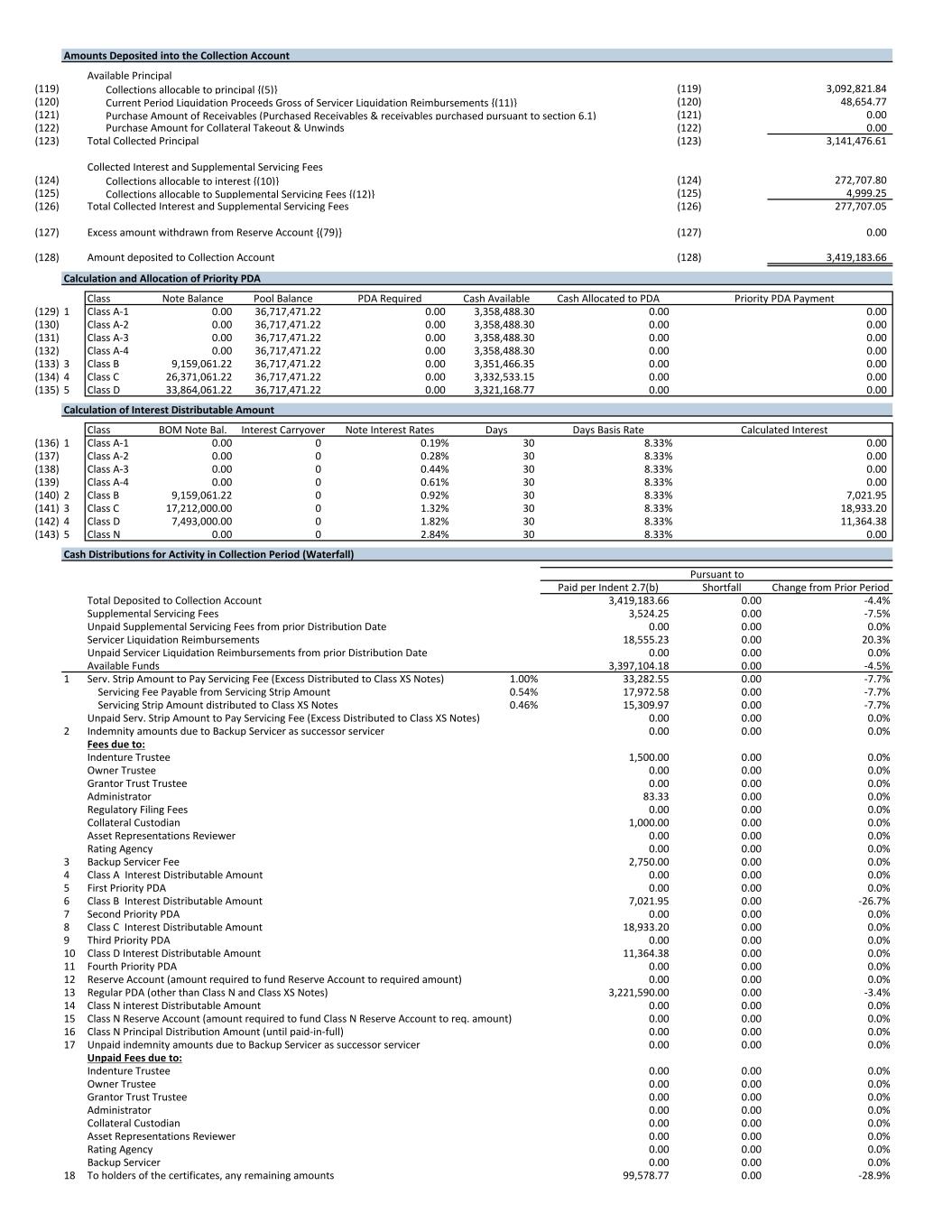

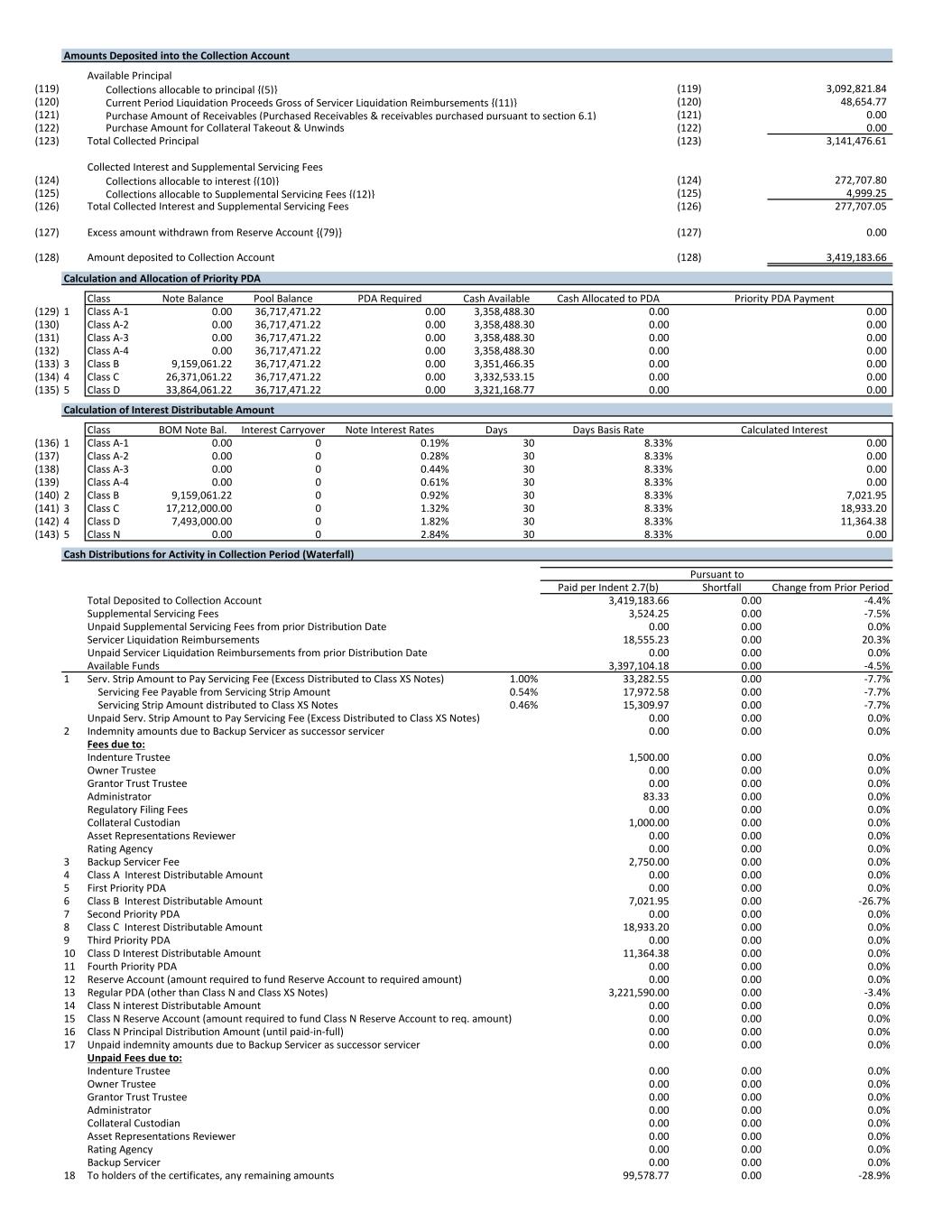

Amounts Deposited into the Collection Account Available Principal (119) Collections allocable to principal {(5)} (119) 3,092,821.84 (120) Current Period Liquidation Proceeds Gross of Servicer Liquidation Reimbursements {(11)} (120) 48,654.77 (121) Purchase Amount of Receivables (Purchased Receivables & receivables purchased pursuant to section 6.1) (121) 0.00 (122) Purchase Amount for Collateral Takeout & Unwinds (122) 0.00 (123) Total Collected Principal (123) 3,141,476.61 Collected Interest and Supplemental Servicing Fees (124) Collections allocable to interest {(10)} (124) 272,707.80 (125) Collections allocable to Supplemental Servicing Fees {(12)} (125) 4,999.25 (126) Total Collected Interest and Supplemental Servicing Fees (126) 277,707.05 (127) Excess amount withdrawn from Reserve Account {(79)} (127) 0.00 (128) Amount deposited to Collection Account (128) 3,419,183.66 Calculation and Allocation of Priority PDA Class Note Balance Pool Balance PDA Required Cash Available Cash Allocated to PDA Priority PDA Payment (129) 1 Class A-1 0.00 36,717,471.22 0.00 3,358,488.30 0.00 0.00 (130) Class A-2 0.00 36,717,471.22 0.00 3,358,488.30 0.00 0.00 (131) Class A-3 0.00 36,717,471.22 0.00 3,358,488.30 0.00 0.00 (132) Class A-4 0.00 36,717,471.22 0.00 3,358,488.30 0.00 0.00 (133) 3 Class B 9,159,061.22 36,717,471.22 0.00 3,351,466.35 0.00 0.00 (134) 4 Class C 26,371,061.22 36,717,471.22 0.00 3,332,533.15 0.00 0.00 (135) 5 Class D 33,864,061.22 36,717,471.22 0.00 3,321,168.77 0.00 0.00 Calculation of Interest Distributable Amount Class BOM Note Bal. Interest Carryover Note Interest Rates Days Days Basis Rate Calculated Interest (136) 1 Class A-1 0.00 0 0.19% 30 8.33% 0.00 (137) Class A-2 0.00 0 0.28% 30 8.33% 0.00 (138) Class A-3 0.00 0 0.44% 30 8.33% 0.00 (139) Class A-4 0.00 0 0.61% 30 8.33% 0.00 (140) 2 Class B 9,159,061.22 0 0.92% 30 8.33% 7,021.95 (141) 3 Class C 17,212,000.00 0 1.32% 30 8.33% 18,933.20 (142) 4 Class D 7,493,000.00 0 1.82% 30 8.33% 11,364.38 (143) 5 Class N 0.00 0 2.84% 30 8.33% 0.00 Cash Distributions for Activity in Collection Period (Waterfall) Pursuant to Paid per Indent 2.7(b) Shortfall Change from Prior Period Total Deposited to Collection Account 3,419,183.66 0.00 -4.4% Supplemental Servicing Fees 3,524.25 0.00 -7.5% Unpaid Supplemental Servicing Fees from prior Distribution Date 0.00 0.00 0.0% Servicer Liquidation Reimbursements 18,555.23 0.00 20.3% Unpaid Servicer Liquidation Reimbursements from prior Distribution Date 0.00 0.00 0.0% Available Funds 3,397,104.18 0.00 -4.5% 1 Serv. Strip Amount to Pay Servicing Fee (Excess Distributed to Class XS Notes) 1.00% 33,282.55 0.00 -7.7% Servicing Fee Payable from Servicing Strip Amount 0.54% 17,972.58 0.00 -7.7% Servicing Strip Amount distributed to Class XS Notes 0.46% 15,309.97 0.00 -7.7% Unpaid Serv. Strip Amount to Pay Servicing Fee (Excess Distributed to Class XS Notes) 0.00 0.00 0.0% 2 Indemnity amounts due to Backup Servicer as successor servicer 0.00 0.00 0.0% Fees due to: Indenture Trustee 1,500.00 0.00 0.0% Owner Trustee 0.00 0.00 0.0% Grantor Trust Trustee 0.00 0.00 0.0% Administrator 83.33 0.00 0.0% Regulatory Filing Fees 0.00 0.00 0.0% Collateral Custodian 1,000.00 0.00 0.0% Asset Representations Reviewer 0.00 0.00 0.0% Rating Agency 0.00 0.00 0.0% 3 Backup Servicer Fee 2,750.00 0.00 0.0% 4 Class A Interest Distributable Amount 0.00 0.00 0.0% 5 First Priority PDA 0.00 0.00 0.0% 6 Class B Interest Distributable Amount 7,021.95 0.00 -26.7% 7 Second Priority PDA 0.00 0.00 0.0% 8 Class C Interest Distributable Amount 18,933.20 0.00 0.0% 9 Third Priority PDA 0.00 0.00 0.0% 10 Class D Interest Distributable Amount 11,364.38 0.00 0.0% 11 Fourth Priority PDA 0.00 0.00 0.0% 12 Reserve Account (amount required to fund Reserve Account to required amount) 0.00 0.00 0.0% 13 Regular PDA (other than Class N and Class XS Notes) 3,221,590.00 0.00 -3.4% 14 Class N interest Distributable Amount 0.00 0.00 0.0% 15 Class N Reserve Account (amount required to fund Class N Reserve Account to req. amount) 0.00 0.00 0.0% 16 Class N Principal Distribution Amount (until paid-in-full) 0.00 0.00 0.0% 17 Unpaid indemnity amounts due to Backup Servicer as successor servicer 0.00 0.00 0.0% Unpaid Fees due to: Indenture Trustee 0.00 0.00 0.0% Owner Trustee 0.00 0.00 0.0% Grantor Trust Trustee 0.00 0.00 0.0% Administrator 0.00 0.00 0.0% Collateral Custodian 0.00 0.00 0.0% Asset Representations Reviewer 0.00 0.00 0.0% Rating Agency 0.00 0.00 0.0% Backup Servicer 0.00 0.00 0.0% 18 To holders of the certificates, any remaining amounts 99,578.77 0.00 -28.9%