SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of August, 2025

Commission File Number 1-34129

CENTRAIS ELÉTRICAS BRASILEIRAS S.A. - ELETROBRÁS

(Exact name of registrant as specified in its charter)

BRAZILIAN ELECTRIC POWER COMPANY

(Translation of Registrant's name into English)

Rua da Quitanda, 196 – 24th floor,

Centro, CEP 20091-005,

Rio de Janeiro, RJ, Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No___X____

|

| TABLE OF CONTENTS | |

| 1. CONSOLIDATED RESULT | IFRS AND REGULATORY | 8 |

| 2. ADJUSTED REGULATORY INCOME STATEMENT | 11 |

| 3. ADJUSTED EBITDA | 13 |

| 4. ENERGY TRADING | 16 |

| 5. INVESTMENTS AND EXPANSION PROJECTS | 17 |

| 6. INDEBTEDNESS | 22 |

| 7. COMPULSORY LOAN | 24 |

| 8. CASH FLOW | 25 |

| 9. FINANCIAL PERFORMANCE | 26 |

| 9.1. Operating Revenue | 26 |

| 9.2. Operating Costs and Expenses | 31 |

| 9.3. Generation Contribution Margin | 38 |

| 9.4. Equity Holdings | 40 |

| 9.5. Financial Results | 41 |

| 9.6. Current and Deferred Taxes | 43 |

| 10. OPERATING PERFORMANCE | 44 |

| 10.1. Generation Segment | 44 |

| 10.2. Transmission Segment | 47 |

| 10.3. ESG | 48 |

| 11. APPENDIX | 49 |

| 11.1. Appendix 1 - Accounting Statements | 49 |

| 11.2. Appendix 2 - Statement on Thermal Power Plants Sale | 57 |

| 11.3. Appendix 3 - Statement on Furnas Merger | 57 |

| 11.4. Appendix 4 - Regulatory vs. IFRS Income Statement | 58 |

| 11.5. Appendix 5 - IFRS EBITDA | 61 |

| 11.6. Appendix 6 - IFRS Generation Revenue | 62 |

| 11.7. Appendix 7 - IFRS Transmission Revenue | 62 |

| 11.8. Appendix 8 - Regulatory Transmission Revenue - Adjustment Portion (PA) | 63 |

| 11.9. Appendix 9 - RBSE Financial Component (PRT 120/2016) | 65 |

| 11.10. Appendix 10 - RAP's Periodic Tariff Review of Tendered Contracts | 66 |

| 11.11. Appendix 11 - RAP Annual Readjustment - 2025/2026 cycle | 67 |

| 11.12. Appendix 12 - Financing and Loans Granted (Receivables) | 68 |

| 11.13. Appendix 13 - Reconciliation Regulatory vs. IFRS Results | 69 |

Earnings Release 2Q25 | 3 |

|

ELETROBRAS RELEASES 2ND QUARTER 2025 RESULTS

Eletrobras’ 2Q25 financial results reflected the positive impacts of energy sales and lower Personnel, Material, Services, and Other (PMSO) expenses, in line with the strategy of optimizing energy trading and the ongoing pursuit of operational efficiency.

2Q25 Main events:

Shareholder's remuneration: R$ 4,000 million in dividends, in line with Eletrobras’ capital allocation methodology. Since the release of the 4Q24 results, Management has delivered consistent performance and accelerated the Company’s risk mitigation efforts. These actions, combined with a more constructive outlook on energy prices, enabled the proposed dividend distribution, reinforcing the Company’s commitment to financial discipline and value creation for its shareholders.

Generation Contribution Margin: the contribution of generation to the results increased from R$ 2,892 million in 2Q24 to R$ 3,345 million in 2Q25. This variation is explained by the increase in gross revenue, driven by the Company's energy trading strategy, which more than offset higher expenses with energy purchased for resale. Lower network usage charges also contributed positively to the generation segment’s results in the period.

Compulsory Loan: the inventory of provisions was reduced by R$ 1.2 billion compared to 1Q25 and by R$ 3.3 billion compared to 2Q24, totaling R$ 12 billion in 2Q25. A net reversal of R$ 279 million was recorded in the quarter, related to favorable decisions and agreements signed.

Investments: R$ 1,966 million in 2Q25, in line with 2Q24 and up 116% when compared to 1Q25. Worth noting the investments in reinforcements and improvements in the transmission segment, which totaled R$ 1,108 million in 2Q25.

The Company is also currently executing 249 large-scale projects in the transmission segment with additional RAP of R$ 1.8 billion between 2025 and 2030 and total estimated CAPEX of R$13.3 billion.

In July, the company delivered the Caladinho project—its first post-privatization auction win—14 months ahead of ANEEL’s original deadline of September 2026.

Eletrobras also made capital contributions to Transnorte Energia S.A. (TNE), of R$ 225 million in April/2025 and R$ 282 million in July/2025, increasing its stake to 64.61%. The project, whose construction was resumed by Eletrobras in 2022, entails the development of a transmission line to connect the state of Roraima to the National Interconnected System (SIN).

Portfolio management: In April, Eletrobras completed the acquisition of a 51% stake in Eletronet, resulting in its control and consolidation. In May, the sale of the Amazonas thermal plants was finalized, generating R$2.9 billion in proceeds, and the asset uncrossing with Copel was also completed, adding 300 MW of hydro capacity to the Company's portfolio through full consolidation of Colíder HPP.

Financial management: Net debt totaled R$ 40.13 billion in 2Q25, up R$ 0.85 billion from 1Q25 and down R$ 2.84 billion from 2Q24. The Company's average debt maturity was extended by 2.6 months YoY, while the total average cost increased to CDI + 0.57% p.a. in 2Q25 from CDI + 0.48% p.a. in 2Q24.

In July 2025, Eletronorte raised R$ 2 billion through a debenture issuance, with final cost equivalent to CDI minus 0.56% p.a. after a swap operation.

Progress in energy trading: 781 clients in 2Q25, up 24% from 2Q24. Of this total, 688 are in the free trading environment (ACL), compared to 551 in the same period last year.

Earnings Release 2Q25 | 4 |

|

2Q25 Financial Highlights

| ▪ | Regulatory Net Operating Revenue: remained stable from 2Q24, reaching R$ 9,593 million: |

(+) growth in generation revenue, reflecting a 9.9% increase in average price and a 1.0% increase in volume. Growth in sales was registered in both the free contracting environment (ACL) and the regulated contracting environment (ACR).

(-) R$ 483 million YoY reduction in the Annual Permitted Revenue (RAP) related to the 2024 Periodic Tariff Review (2024 RTP), of which R$ 328 million related to Postponement Adjustment Portion (PA Postergação).

| ▪ | Adjusted PMSO: R$ 1,403 million (down -3.8% YoY), reflecting savings linked to efficiency gains. In 2Q25, adjusted PMSO was impacted by the following effects: |

(a) R$ 213 million related to Voluntary Dismissal Plans (VDPs) and severance costs;

(b) R$ 15 million in legal consulting expenses related to the contingency reduction strategy.

| ▪ | Energy Purchased for Resale (IFRS): R$ 1,356 million (up 70.1% vs. 2Q24), mainly driven by energy purchases to cover regulatory ballast requirements at Eletrobras. It is worth noting that these transactions have no impact on the P&L. |

| ▪ | Adjusted Regulatory Provisions: net provision of R$ 98 million, as a result of the lower default on energy sold to Amazonas Energia, from R$482 million in 2Q24 to a reversal of R$15 million in 2Q25. |

| ▪ | Adjusted Regulatory EBITDA: R$ 5,501 million (down 8.6% YoY). |

Excluding equity income, EBITDA reached R$ 5,706 million in 2Q25, up R$318 million YoY, reflecting:

(a) higher generation revenue;

(b) lower costs and expenses with personnel, materials, services and others;

(c) lower provisions recognized in the quarter;

These effects were partially offset by lower transmission revenue and higher costs with energy purchased for resale.

| ▪ | Adjusted IFRS Net Income: R$ 1,469 million, positively impacted by |

(a) an increase in generation revenue that outpaced the growth in energy production and purchase costs,

(b) higher recognition of transmission revenue, and

(c) reductions in PMSO and financial expenses. This combination more than offset the lower contribution from equity income.

Earnings Release 2Q25 | 5 |

|

Table 1 - Adjustments on Regulatory EBITDA (R$ mm)

| 2Q25 | 2Q24 | % | 1Q25 | % | 6M25 | 6M24 | |

| Regulatory EBITDA (a) | 5,820 | 6,125 | -5.0 | 5,485 | 6.1 | 11,305 | 11,821 |

| Total Adjustments on Regulatory EBITDA (b) | -319 | -108 | 196.3 | -108 | 194.7 | -427 | -198 |

| Gross Revenue: M&A Price Adjustment 2Q25 | 109 | 0 | 0.0 | 0 | 0.0 | 109 | 0 |

| PMSO | 228 | 171 | 33.6 | 191 | 19.1 | 419 | 203 |

| Voluntary Dismissal Plan (PDV) - Provision | 98 | 11 | 795.5 | 96 | 1.1 | 194 | 44 |

| Severance costs from 2025 | 109 | 0 | 0.0 | 31 | 249.7 | 140 | 0 |

| Severance costs from 2024 | 7 | 0 | 0.0 | 22 | -69.6 | 29 | 0 |

| Legal consulting related to the contingency reduction strategy | 15 | 42 | -64.0 | 42 | -63.5 | 57 | 42 |

| Judicial sentences | 0 | 118 | n.m. | 0 | 0.0 | 0 | 118 |

| Provisions | -95 | -396 | -76.0 | -166 | -42.9 | -261 | -514 |

| Provision for litigation | -74 | -89 | -17.3 | -99 | -25.7 | -173 | -228 |

| ECL - Loans and financing | 10 | 0 | 0.0 | 0 | 0.0 | 10 | 4 |

| Onerous contracts | -30 | -45 | -34.1 | -29 | 1.5 | -59 | -83 |

| Estimated losses on investments | -21 | 14 | -250.5 | -12 | 71.3 | -34 | 29 |

| Impairment | 0 | 0 | -56.0 | 0 | -1.3 | 0 | 6 |

| Provision for the Implementation of Lawsuits - Compulsory Loan | 20 | 17 | 19.9 | -26 | -178.0 | -6 | 50 |

| Fair value assessment of assets for sale | 0 | -293 | n.m. | 0 | 0.0 | 0 | -293 |

| Results from asset sale | -504 | 115 | -537.7 | 0 | 0.0 | -504 | 115 |

| Other income and expenses | -57 | 2 | n.m. | -133 | -57.4 | -190 | -3 |

| Regulatory Adjusted EBITDA (c) = (a) + (b) | 5,501 | 6,017 | -8.6 | 5,377 | 2.3 | 10,878 | 11,623 |

Earnings Release 2Q25 | 6 |

|

MAIN FINANCIAL AND OPERATING INDICATORS

Table 2 - Operating Highlights

| 2Q25 | 2Q24 | ∆% | 1Q25 | ∆% | |

| Generation and Trading | |||||

| Installed Generation Capacity (MW) | 44,368 | 44,279 | 0.2 | 44,359 | 0.0 |

| Assured Capacity (aMW) (1) | 21,655 | 22,012 | -1.6 | 21,915 | -1.2 |

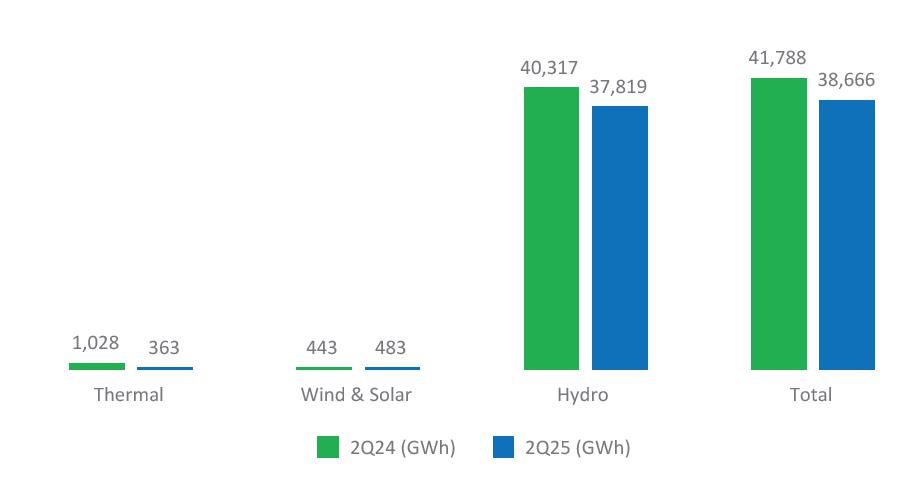

| Net Generation (TWh) | 38.7 | 41.7 | -7.2 | 45.5 | -15.1 |

| Energy Sold ACR (TWh) (2) | 8.7 | 8.8 | -0.4 | 10.0 | -12.8 |

| Energy Sold ACL (TWh) (3) | 17.9 | 15.8 | 13.2 | 23.2 | -22.8 |

| Energy Sold Quotas (TWh) (4) | 4.9 | 8.6 | -43.0 | 5.4 | -9.8 |

| Average ACR Price (R$/MWh) (5) | 220.97 | 213.30 | 3.6 | 212.54 | 4.0 |

| Average ACL Price (R$/MWh) | 152.45 | 147.30 | 3.5 | 143.36 | 6.3 |

| Transmission | |||||

| Transmission lines (km) | 73,774 | 73,803 | 0.0 | 74,097 | -0.4 |

| RAP (R$ mm) (6) | 17,209 | 17,856 | -3.6 | 17,164 | 0.3 |

(1) Assured Capacity (AC) reflects: (a) Ordinance GM/MME 544/21, which established the revision of AC values for plants that had their concessions renewed due to the capitalization (Quota regime plants: Tucuruí, Itumbiara, Sobradinho, Mascarenhas de Moraes, and Curuá-Una), leading to a significant AC reduction, effective from 2023; (b) Ordinance GM/MME 709/22, which introduced an Ordinary Review of the AC for hydroelectric power plants effective from 2023, impacting several Eletrobras plants; (c) the AC increase at Santa Cruz TPP due to the completion of the Combined Cycle, following ANEEL Order 481 of Feb 23, 2023 that authorized the start of commercial operations for a new generating unit at the plant.

(2) Does not include quotas.

(3) Includes contracts under Law 13.182/2015.

(4) The figures presented refer to the Assured Capacity of quotas in GWh.

(5) Excludes thermoelectric power plants.

(6) Approved RAP for the current regulatory cycle, considering the modules in operation at the end of each period—including those in operation at the start of the cycle, as well as new modules that entered commercial operation. Includes transmission contracts from Eletrobras Holding, Chesf, CGT Eletrosul, Eletronorte, TMT, and VSB.

Table 3 - Financial Highlights

| 2Q25 | 2Q24 | ∆% | 1Q25 | ∆% | |

| Financial Indicators | |||||

| Gross Revenue | 12,082 | 10,280 | 17.5 | 12,222 | -1.1 |

| Adjusted Gross Revenue | 12,191 | 10,280 | 18.6 | 12,222 | -0.3 |

| Net Operating Revenue | 10,199 | 8,395 | 21.5 | 10,414 | -2.1 |

| Adjusted Net Operating Revenue | 10,308 | 8,395 | 22.8 | 10,414 | -1.0 |

| Regulatory Net Operating Revenue | 9,593 | 9,620 | -0.3 | 9,708 | -1.2 |

| EBITDA | 1,259 | 4,430 | -71.6 | 4,318 | -70.8 |

| Adjusted EBITDA | 5,151 | 4,322 | 19.2 | 4,416 | 16.6 |

| Regulatory EBITDA | 5,820 | 6,125 | -5.0 | 5,485 | 6.1 |

| Adjusted Regulatory EBITDA | 5,501 | 6,017 | -8.6 | 5,377 | 2.3 |

| EBITDA Margin (%) | 12.3 | 52.8 | -40.4pp | 41.5 | -29.1pp |

| Adjusted EBITDA Margin (%) | 50.0 | 51.5 | -1.5pp | 42.4 | 7.6pp |

| Return on Equity (ROE %) | 5.6 | 3.9 | 1.7pp | 8.0 | -2.4pp |

| Adjusted Gross Debt | 71,042 | 70,375 | 0.9 | 71,192 | -0.2 |

| Adjusted Net Debt (Adj Net Debt) | 40,125 | 42,961 | -6.6 | 39,272 | 2.2 |

| Adj Net Debt/Adjusted LTM EBITDA | 1.5 | 2.5 | -38.7 | 1.5 | -1.1 |

| Net Income | -1,325 | 1,743 | -176.0 | -354 | 274.7 |

| Adjusted Net Income | 1,469 | 1,025 | 43.3 | -80 | n.m. |

| Investments | 1,966 | 2,000 | -1.7 | 912 | 115.5 |

Earnings Release 2Q25 | 7 |

|

HIGHLIGHTS OF CONSOLIDATED RESULTS

1. CONSOLIDATED RESULT | IFRS AND REGULATORY

Table 4 - Income Statement IFRS (R$ mm)

| 2Q25 | 2Q24 | 1Q25 | 6M25 | 6M24 | ||||||

| IFRS | Adjustment | Adjusted | Adjusted | % Y/Y | Adjusted | % Q/Q | Adjusted | Adjusted | % Y/Y | |

| Generation | 6,851 | 108.93 | 6,960 | 5,828 | 19.4 | 6,967 | -0.1 | 13,928 | 11,761 | 18.4 |

| Transmission | 5,079 | 0 | 5,079 | 4,395 | 15.6 | 5,186 | -2.1 | 10,264 | 8,954 | 14.6 |

| Others | 152 | 0 | 152 | 57 | 168.5 | 69 | 121.1 | 221 | 136 | 62.3 |

| Gross Revenue | 12,082 | 109 | 12,191 | 10,280 | 18.6 | 12,222 | -0.3 | 24,413 | 20,851 | 17.1 |

| (-) Deductions from Revenue | -1,883 | 0 | -1,883 | -1,884 | -0.1 | -1,807 | 4.2 | -3,691 | -3,737 | -1.3 |

| Net Revenue | 10,199 | 109 | 10,308 | 8,395 | 22.8 | 10,414 | -1.0 | 20,722 | 17,114 | 21.1 |

| Energy resale, grid, fuel and construction | -3,568 | 0 | -3,568 | -3,046 | 17.1 | -3,862 | -7.6 | -7,430 | -5,903 | 25.9 |

| Personnel, Material, Services and Others | -1,631 | 228 | -1,403 | -1,458 | -3.8 | -1,467 | -4.3 | -2,870 | -3,052 | -6.0 |

| Operating provisions | -133 | -43 | -177 | -269 | -34.3 | -86 | 106.3 | -262 | -583 | -55.0 |

| Results from asset sale | -105 | 105 | 0 | 0 | 0.0 | 0 | 0.0 | 0 | 0 | 0 |

| Regulatory remeasurements - Transmission contracts | -3,433 | 3,433 | 0 | 0 | 0.0 | -952 | n.m. | -952 | 0 | 0 |

| Other income and expenses | 57 | -57 | 0 | 0 | 0.0 | 0 | 0.0 | 0 | 0 | 0.0 |

| EBITDA, before Equity holdings | 1,385 | 3,775 | 5,160 | 3,622 | 42.5 | 4,049 | 27.5 | 9,209 | 7,575 | 21.6 |

| Equity holdings | -126 | 116 | -10 | 700 | -101.4 | 368 | -102.7 | 358 | 1,276 | -71.9 |

| EBITDA | 1,259 | 3892 | 5,151 | 4,322 | 19.2 | 4,416 | 16.6 | 9,567 | 8,852 | 8.1 |

| D&A | -1,131 | 0 | -1,131 | -968 | 16.9 | -1,112 | 1.7 | -2,244 | -1,965 | 14.2 |

| EBIT | 127 | 3,892 | 4,019 | 3,354 | 19.8 | 3,304 | 21.6 | 7,323 | 6,887 | 6.3 |

| Financial Result | -2,555 | 178 | -2,377 | -2,750 | -13.6 | -3,319 | -28.4 | -5,696 | -5,531 | 3.0 |

| EBT | -2,427 | 4,069 | 1,642 | 604 | 171.9 | -15 | n.m. | 1,627 | 1,356 | 20.0 |

| Income Tax and Social Contribution | 1,102 | -1,275 | -173 | 421 | -141.1 | -65 | 166.5 | -238 | 116 | -304.9 |

| Net Income | -1,325 | 2,794 | 1,469 | 1,025 | 43.3 | -80 | n.m. | 1,389 | 1,472 | -5.6 |

Earnings Release 2Q25 | 8 |

|

Table 5 - Regulatory IS (R$ mm)

| 2Q25 | 2Q24 | 1Q25 | 6M25 | 6M24 | ||||||

| Regulatory | Adjustment | Adjusted | Adjusted | % Y/Y | Adjusted | % Q/Q | Adjusted | Adjusted | % Y/Y | |

| Generation | 6,836 | 109 | 6,945 | 6,310 | 10.1 | 7,023 | -1.1 | 13,968 | 12,675 | 10.2 |

| Transmission | 4,488 | 0 | 4,488 | 5,138 | -12.7 | 4,423 | 1.5 | 8,911 | 10,129 | -12.0 |

| Others | 152 | 0 | 152 | 56 | 172.8 | 69 | 121.1 | 221 | 134 | 64.5 |

| Gross Revenue | 11,476 | 109 | 11,585 | 11,504 | 0.7 | 11,515 | 0.6 | 23,100 | 22,939 | 0.7 |

| (-) Deductions from Revenue | -1,883 | 0 | -1,883 | -1,884 | -0.1 | -1,807 | 4.2 | -3,691 | -3,737 | -1.3 |

| Net Revenue | 9,593 | 109 | 9,701 | 9,620 | 0.8 | 9,708 | -0.1 | 19,409 | 19,201 | 1.1 |

| Energy resale, grid, fuel and construction | -2,478 | 0 | -2,478 | -2,320 | 6.8 | -3,152 | -21.4 | -5,630 | -4,591 | 22.6 |

| Personnel, Material, Services and Others | -1,647 | 228 | -1,419 | -1,476 | -3.8 | -1,473 | -3.6 | -2,892 | -3,082 | -6.2 |

| Operating provisions | -3 | -95 | -98 | -437 | -77.5 | -77 | 27.1 | -175 | -981 | -82.1 |

| Results from asset sale | 504 | -504 | 0 | 0 | 0.0 | 0 | 0.0 | 0 | 0 | 0.0 |

| Regulatory remeasurements - Transmission contracts | 0 | 0 | 0 | 0 | 0.0 | 0 | 0.0 | 0 | 0 | 0.0 |

| Other income and expenses | 57 | -57 | 0 | 0 | 0.0 | 0 | 0.0 | 0 | 0 | 0.0 |

| EBITDA, before Equity holdings | 6,025 | -319 | 5,706 | 5,388 | 5.9 | 5,006 | 14.0 | 10,711 | 10,547 | 1.6 |

| Equity holdings | -205 | 0 | -205 | 629 | -132.5 | 371 | -155.1 | 166 | 1,076 | -84.5 |

| EBITDA | 5,820 | -319 | 5,501 | 6,017 | -8.6 | 5,377 | 2.3 | 10,878 | 11,623 | -6.4 |

| D&A | -1,615 | 0 | -1,615 | -1,450 | 11.3 | -1,592 | 1.4 | -3,206 | -2,929 | 9.5 |

| EBIT | 4,206 | -319 | 3,886 | 4,567 | -14.9 | 3,785 | 2.7 | 7,672 | 8,694 | -11.8 |

| Financial Result | -2,627 | 229 | -2,398 | -2,945 | -18.6 | -3,275 | -26.8 | -5,673 | -5,815 | -2.4 |

| EBT | 1,578 | -90 | 1,488 | 1,622 | -8.2 | 511 | 191.5 | 1,999 | 2,879 | -30.6 |

| Income Tax and Social Contribution | -330 | 86 | -244 | 84 | -389.2 | -101 | 140.6 | -345 | -286 | 20.7 |

| Net Income | 1,248 | -4 | 1,244 | 1,706 | -27.0 | 409 | 204.1 | 1,654 | 2,593 | -36.2 |

Earnings Release 2Q25 | 9 |

|

2Q24 Results: reclassifications

It is worth noting that the results presented in this report for 2Q24 differ from those originally disclosed on August 7, 2024. In both the IFRS and regulatory results, two expenses were reclassified as recurring under Other PMSO and Deferred Tax—an adjustment that had already been applied retroactively in the 4Q24 disclosure.

In the regulatory results, additional differences arise from the reclassification between income statement lines: (a) transmission revenue and charges for use of the electricity grid; and (b) other operating expenses (PMSO), operating provisions, and financial result.

The table below presents the originally disclosed amounts, the reclassified figures, and the resulting differences for both IFRS and regulatory results.

Table 6 - Adjusted Income Statement Reclassifications, 2Q24 (R$ mm)

| IFRS, Adjusted | Regulatory, Adjusted | |||||

|

Published in 2Q24 |

Reclassified | Difference |

Published in 2Q24 |

Reclassified | Difference | |

| Generation | 5,828 | 5,828 | 0 | 6,310 | 6,310 | 0 |

| Transmission | 4,395 | 4,395 | 0 | 5,254 | 5,138 | -115 |

| Others | 57 | 57 | 0 | 56 | 56 | 0 |

| Gross Revenue | 10,280 | 10,280 | 0 | 11,620 | 11,504 | -115 |

| (-) Deductions from Revenue | -1,884 | -1,884 | 0 | -1,884 | -1,884 | 0 |

| Net Revenue | 8,395 | 8,395 | 0 | 9,735 | 9,620 | -115 |

| Energy resale, grid, fuel and construction | -3,046 | -3,046 | 0 | -2,435 | -2,320 | 115 |

| Personnel, Material, Services and Others | -1,576 | -1,458 | 118 | -1,500 | -1,476 | 25 |

| Operating provisions | -269 | -269 | 0 | -419 | -437 | -17 |

| Results from asset sale | 0 | 0 | 0 | 0 | 0 | 0 |

| Regulatory remeasurements - Transmission contracts | 0 | 0 | 0 | 0 | 0 | 0 |

| Other income and expenses | 0 | 0 | 0 | 0 | 0 | 0 |

| EBITDA, before Equity Income | 3,504 | 3,622 | 118 | 5,380 | 5,388 | 7 |

| Equity Income | 700 | 700 | 0 | 629 | 629 | 0 |

| EBITDA | 4,204 | 4,322 | 118 | 6,010 | 6,017 | 7 |

| D&A | -968 | -968 | 0 | -1,450 | -1,450 | 0 |

| EBIT | 3,236 | 3,354 | 118 | 4,559 | 4,567 | 7 |

| Financial Result | -2,750 | -2,750 | 0 | -3,055 | -2,945 | 110 |

| EBT | 487 | 604 | 117 | 1,504 | 1,622 | 117 |

| Income Tax and Social Contribution | 129 | 421 | 292 | -208 | 84 | 292 |

| Net Income | 615 | 1,025 | 410 | 1,296 | 1,706 | 410 |

Earnings Release 2Q25 | 10 |

|

2. ADJUSTED REGULATORY INCOME STATEMENT

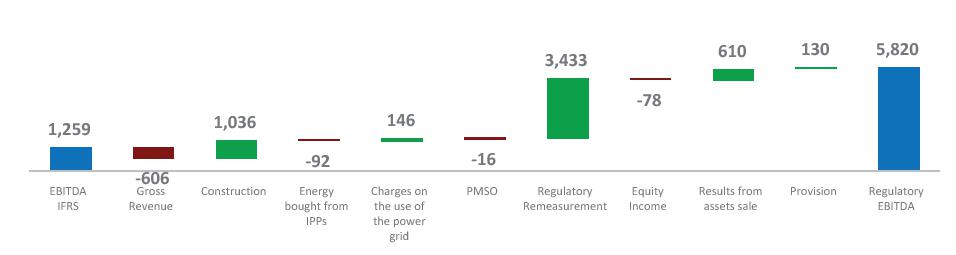

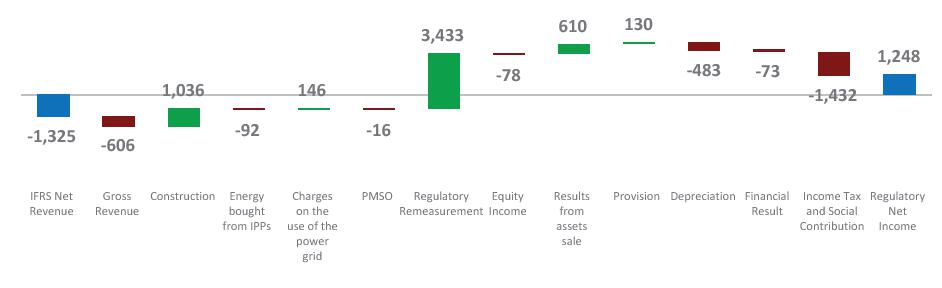

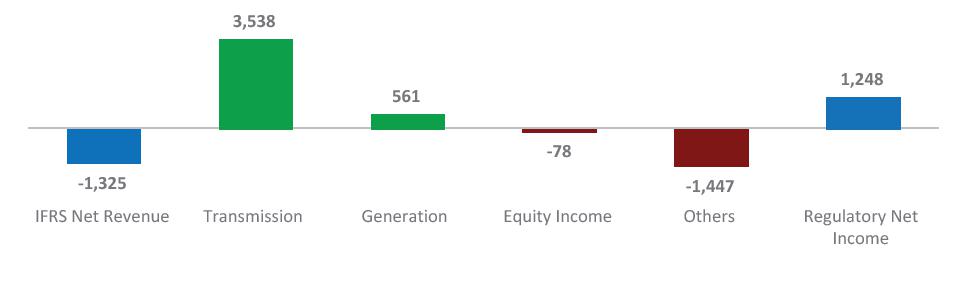

This section presents the reconciliation between Regulatory and IFRS Income Statements, along with the adjustments related to non-recurring events in the Regulatory Income Statement.

Additional explanations are provided in Appendix 4 of this report to support a better understanding of the topics.

A detailed reconciliation is also available in the “Regulatory and IFRS Income Statement Reconciliation” spreadsheet, accessible on the Company’s Investor Relations website, under Market Information > Historical Financial Information.

Table 7 - Regulatory IS x IFRS IS(R$ mm)

| 2Q25 IFRS | Difference | 2Q25 Regulatory | Non-recurring Adjustment | 2Q25 Regulatory Adjusted | |

| Generation | 6,851 | -15 | 6,836 | 109 | 6,945 |

| Transmission | 5,079 | -591 | 4,488 | 0 | 4,488 |

| Others | 152 | 0 | 152 | 0 | 152 |

| Gross Revenue | 12,082 | -606 | 11,476 | 109 | 11,585 |

| (-) Deductions from Revenue | -1,883 | 0 | -1,883 | 0 | -1,883 |

| Net Revenue | 10,199 | -606 | 9,593 | 109 | 9,701 |

| Construction | -1,036 | 1,036 | 0 | 0 | 0 |

| Energy resale | -1,356 | -92 | -1,447 | 0 | -1,447 |

| Grid | -955 | 146 | -809 | 0 | -809 |

| Fuel | -222 | 0 | -222 | 0 | -222 |

| Energy resale, grid, fuel and construction | -3,568 | 1,090 | -2,478 | 0 | -2,478 |

| Personnel | -997 | -3 | -1,000 | 213 | -787 |

| Material | -42 | 0 | -42 | 0 | -42 |

| Services | -456 | 0 | -456 | 15 | -441 |

| Others | -136 | -13 | -149 | 0 | -149 |

| Personnel, Material, Services and Others | -1,631 | -16 | -1,647 | 228 | -1,419 |

| Operating provisions | -133 | 130 | -3 | -95 | -98 |

| Results from asset sale | -105 | 610 | 504 | -504 | 0 |

| Regulatory remeasurements - Transmission contracts | -3,433 | 3,433 | 0 | 0 | 0 |

| Other income and expenses | 57 | 0 | 57 | -57 | 0 |

| EBITDA, before Equity holdings | 1,385 | 4,640 | 6,025 | -319 | 5,706 |

| Equity holdings | -126 | -78 | -205 | 0 | -205 |

| EBITDA | 1,259 | 4,561 | 5,820 | -319 | 5,501 |

| D&A | -1,131 | -483 | -1,615 | 0 | -1,615 |

| EBIT | 127 | 4,078 | 4,206 | -319 | 3,886 |

| Financial Result | -2,555 | -73 | -2,627 | 229 | -2,398 |

| EBT | -2,427 | 4,006 | 1,578 | -90 | 1,488 |

| Income Tax and Social Contribution | 1,102 | -1,432 | -330 | 86 | -244 |

| Net Income, continued | -1,325 | 2,573 | 1,248 | -4 | 1,244 |

Earnings Release 2Q25 | 11 |

|

Adjustments from non-recurring events

The following adjustments are based on events deemed non-recurring:

| ▪ | Generation Revenue: R$ 109 million, referring to adjustments in the valuation of sales transactions involving the Amazonas thermal plants at Eletronorte, as well as the asset uncrossing agreement with Copel at CGT Eletrosul. |

| ▪ | PMSO, Personnel: R$ 213 million, of which R$ 98 million was VDPs and R$ 115 million was severance. |

| ▪ | PMSO, Services: R$ 15 million, for legal consulting related to the contingency reduction strategy. |

| ▪ | Operating Provisions: -R$ 95 million, including provisions for litigation, adjustments related to the implementation of lawsuits linked to compulsory loans, estimated losses on investments and asset impairment, monetary update of onerous contracts, and estimated losses on loans and financing. |

| ▪ | Asset Disposal: -R$ 504 million, referring to non-cash impacts recognized in the income statement resulting from the completion of asset purchase and sale transactions during the quarter, including the sale of thermal plants in Amazonas, the asset uncrossing with Copel, and the acquisition of Eletronet's control. |

| ▪ | Other Income and Expenses: -R$ 57 million, with the entire line excluded. |

| ▪ | Financial Result: R$ 229 million, linked to the monetary update of compulsory loan and litigation. |

| ▪ | Income Tax and Social Contribution: R$ 86 million, due to the change in Eletronorte’s effective tax rate. |

Earnings Release 2Q25 | 12 |

|

3. ADJUSTED EBITDA

Adjusted Regulatory EBITDA

In 2Q25, adjusted regulatory EBITDA totaled R$ 5,501 million, down R$ 516 million YoY, reflecting lower transmission revenue and a negative contribution from equity income. These results were partially offset by higher generation revenue, lower PMSO costs and expenses, and a reduced volume of provisions recognized in the quarter, positive events that were also observed in 1Q25.

Excluding equity income, EBITDA reached R$ 5,706 million in 2Q25, up R$318 million YoY. Notably, equity income in the quarter reflected (i) the maintenance shutdown of Eletronuclear's Angra 1 Plant which included equipment modernization aimed at extending its useful life, and (ii) the negative impact on ISA Energia's net income due to a reduction in the receivables flow related to the RBSE financial component.

Table 8 - Adjusted Regulatory EBITDA (R$ mm)

| 2Q25 | 2Q24 | % | 1Q25 | % | 6M25 | 6M24 | % | |

| Net Revenue (1) | 9,701 | 9,620 | 0.8 | 9,708 | -0.1 | 19,409 | 19,201 | 1.1 |

| Energy resale, grid charges, fuel | -2,478 | -2,320 | 6.8 | -3,152 | -21.4 | -5,630 | -4,591 | 22.6 |

| - Personnel, Material, Services and Others | -1,419 | -1,476 | -3.8 | -1,473 | -3.6 | -2,892 | -3,082 | -6.2 |

| - Operating provisions (1) | -98 | -437 | -77.5 | -77 | 27.1 | -175 | -981 | -82.1 |

| - Results from asset sale | 0 | 0 | 0.0 | 0 | 0.0 | 0 | 0 | 0.0 |

| - Other income and expenses | 0 | 0 | 0.0 | 0 | 0.0 | 0 | 0 | 0.0 |

| + Equity Holdings | -205 | 629 | -132.5 | 371 | -155.1 | 166 | 1,076 | -84.5 |

| Adjusted Regulatory EBITDA | 5,501 | 6,017 | -8.6 | 5,377 | 2.3 | 10,878 | 11,623 | -6.4 |

(1) Recognizes the amount of R$ 432 million in 1Q24 related to revenue from Amazonas Energia. Due to default, these balances are also fully recognized in operating provisions. In 4Q24 and 1Q25, the revenue from thermal plants was recognized without any corresponding provision. As part of HPP Balbina's revenue remained—and continues to remain—in default, the amounts of R$ 32 million in 4Q24 and R$ 56 million in 1Q25 were provisioned.

Generation revenue was R$ 6,836 million in 2Q25, up R$ 526 million compared to 2Q24. The highlight was the R$ 1,000 million increase in revenue from energy settled in the short-term market, driven by higher volumes and prices. This was partially offset by a R$ 486 million decline in revenue from thermal plants, following the sale of the Amazonas thermal assets to Âmbar in May 2025.

The increase in revenue was accompanied by slightly higher costs associated with generation, of R$ 159 million, reaching R$ 2,478 million in 2Q25. Of note were expenses with energy purchased for resale, which went up by R$ 475 million, partially offset by: (i) lower spending on fuel for electricity production of R$ 242 million, reflecting the sale of Amazonas thermal plants, and (ii) a R$ 74 million reduction in spending on network usage charges.

It is also worth noting the progress in receivables related to energy sold by Eletrobras thermal plants and by Balbina HPP to Amazonas Energia (AmE) following the resumption of its recognition in 3Q24. In 2Q25 the regulatory gross revenue from energy sold by thermal plants and Balbina HPP totaled R$ 769 million, a lower amount compared to previous quarters, reflecting the completion of the sale of the Amazonas thermal plants. Approximately 52% of this revenue was billed under the Reserve Energy Contract (CER) and received through the Reserve Energy Charge, 27% under Availability Contract, and 21% billed to AmE. This latter portion was distributed across two categories:

(a) Sales contracts from thermal plants classified as Independent Power Producers, which were paid by AmE (5% of the total); and

(b) Energy sold by Balbina HPP (16% of the total).

Earnings Release 2Q25 | 13 |

|

The difference between revenues under the Regulatory and IFRS accounting environments is primarily due to the energy sold to, but not paid for by, Amazonas Energia. This amount is not recognized as revenue in the IFRS result, but is included in the Regulatory result, where it is fully provisioned.

Table 9 - Amazonas Energia (R$ mm)

| Regulatory | IFRS | |

| Gross Revenue | 119 | 134 |

| Paid | 134 | 134 |

| Outstanding | -15 | 0 |

| Provision/Reversal | 15 | 0 |

Transmission revenue was R$ 4,488 million in 2Q25, down R$ 651 million from 2Q24, mainly driven by reductions in Annual Permitted Revenue (RAP) and the Adjustment Portion (PA), revised as part of the Periodic Tariff Adjustment and Annual Adjustment processes for the 2024-2025 regulatory cycle, which started in July 2024.

Personnel, Material, Services and Others (PMSO) went down by R$ 56 million YoY, totaling R$ 1,419 million in 2Q25. As in the previous quarter, this decrease is primarily driven by the gains from various initiatives implemented by the Company to improve staff efficiency, as well as adjustments to processes and the organizational structure.

Provisions in the regulatory view decreased by R$ 338 million, reaching R$ 98 million in 2Q25 from R$ 437 million in 2Q24. This reduction essentially reflects the sharp decline in defaults on energy sales to Amazonas Energia, from R$ 482 million in 2Q24 to a reversal of R$ 15 million in 2Q25.

The second quarter of 2025 was characterized by favorable effects from energy sales, reduced PMSO expenses, and lower provisioning levels, driven by the ongoing strategy to optimize the energy trading portfolio, enhance operational efficiency, and mitigate contingencies.

Earnings Release 2Q25 | 14 |

|

Adjusted IFRS EBITDA

Adjusted IFRS EBITDA reached R$ 5,151 million in 2Q25, up 19.2% from 2Q24.

The increase in transmission and generation revenues, along with reductions in PMSO expenses, more than offset the increase in costs related to energy purchased for resale, higher provisions, and the lower contribution from equity income.

Table 10 - Adjusted IFRS EBITDA (R$ mm)

| 2Q25 | 2Q24 | % | 1Q25 | % | 6M25 | 6M24 | % | |

| Net Revenue | 10,308 | 8,395 | 22.8 | 10,414 | -1.0 | 20,722 | 17,114 | 21.1 |

| Energy resale, grid charges, fuel | -3,568 | -3,046 | 17.1 | -3,862 | -7.6 | -7,430 | -5,903 | 25.9 |

| Regulatory remeasurement – Transmission Contracts | 0 | 0 | 0.0 | -952 | n.m. | -952 | 0 | 0 |

| - Personnel, Material, Services and Others | -1,403 | -1,458 | -3.8 | -1,467 | -4.3 | -2,870 | -3,052 | -6.0 |

| - Operating provisions | -177 | -269 | -34.3 | -86 | 106.3 | -262 | -583 | -55.0 |

| - Results from asset sale | 0 | 0 | 0.0 | 0 | 0.0 | 0 | 0 | 0.0 |

| - Other income and expenses | 0 | 0 | 0.0 | 0 | 0.0 | 0 | 0 | 0.0 |

| + Equity Holdings | -10 | 700 | -101.4 | 368 | -102.7 | 358 | 1276 | -71.9 |

| Adjusted IFRS EBITDA | 5,151 | 4,322 | 19.2 | 4,416 | 16.6 | 9,567 | 8,852 | 8.1 |

The table detailing the EBITDA calculation, in accordance with CVM Resolution 156/2022, is presented in Appendix 5 of this document.

Earnings Release 2Q25 | 15 |

|

4. ENERGY TRADING

Eletrobras companies sold 31.5 TWh of energy in 2Q25, down 5.0% compared to the 33.2 TWh traded in 2Q24.

The volumes sold include energy from plants under the quota regime, renewed under Law 12,783/2013, as well as from plants operating under the ACL and ACR exploration regimes and Special Purpose Entities - SPEs, consolidated: HPPs Teles Pires (starting Oct/23), Baguari (starting Oct/23), Retiro Baixo (starting Nov/23), and Santo Antônio (starting Nov/23).

Table 11 - Energy Balance 2Q25 (aMW)

| 2025 | 2026 | 2027 | ||||

| Resources (A) | 16,635 | 17,017 | 17,872 | |||

| Own resources (1) (2) (3) (4) (5) | 14,247 | 15,600 | 16,759 | |||

| Hydraulic | 13,949 | 15,280 | 16,439 | |||

| Wind | 298 | 320 | 320 | |||

| Energy Purchase | 2,388 | 1,417 | 1,113 | |||

| Limit => | Lower | Higher | Lower | Higher | Lower | Higher |

| Sales (B) (6) | 11,998 | 14,096 | 9,347 | 11,847 | 7,148 | 9,148 |

| ACR - Except quotas | 3,498 | 3,597 | 3,148 | |||

| ACL - Bilateral Contracts + STM implemented (range) (6) | 8,500 | 10,598 | 5,750 | 8,250 | 4,000 | 6,000 |

| Average prices Contracts signed | ||||||

| Limit => | Lower | Higher | Lower | Higher | Lower | Higher |

| Average Price of Sales Contracts (ACR and ACL - R$/MWh) | 170 | 180 | 185 | 205 | 195 | 225 |

| Balance (A - B) | 4,637 | 2,539 | 7,670 | 5,170 | 10,724 | 8,724 |

| Balance considering estimated hedge (9) | 2,098 | 0 | 4,889 | 2,389 | 7,732 | 5,732 |

| Uncontracted energy considering estimated hedge (9) | 13% | 0% | 29% | 14% | 43% | 32% |

Contracts signed until 6/30/2025.

The energy balance reflects the SPEs consolidated into Eletrobras, including Santo Antônio HPP (since 3Q22) and HPPs Baguari and Retiro Baixo (since 4Q23) in terms of resources, sales, and average prices. Similarly, Teles Pires HPP, the SPE consolidated into Eletronorte (since 4Q23), is also included.

| 1. | The energy balance does not include Independent Power Producers (IPPs) contracts resulting from the Amazonas Distribuidora de-verticalization process, thermal plant availability contracts, or Assured Capacity Quotas, whether in terms of resources, requirements (sales), or average prices. |

| 2. | Own Resources include the decotization plants (new IPPs) and the New Grants—Sobradinho, Itumbiara, Tucuruí, Curuá-Una, and Mascarenhas de Moraes. For hydroelectric projects, the estimate of GFIS2 was used, representing Assured Capacity adjusted for Internal Losses, Losses in the Basic Grid, Availability, and portfolio-specific factors. |

| 3. | The revised Assured Capacity values, as outlined in Ordinance No. 709/GM/MME, of November 30, 2022, have been taken into account. |

| 4. | With the gradual phasing out of legacy contracts (decotization), plants currently operating under the quota regime are gradually granted new concessions under the IPP regime over a five-year period beginning in 2023. The Assured Capacity values were established in Ordinance GM/MME No. 544/21. |

| 5. | Considering the new concession grants from 2023 onward for the Sobradinho, Itumbiara, Tucuruí, Curuá-Una, and Mascarenhas de Moraes plants, whose Assured Capacity values were established in Ordinance GM/MME No. 544/21. |

| 6. | The balances include intercompany transactions, impacting both energy purchase and sales lines in the ACL, in the following amounts: approximately 800 aMW in 2025 and 200 aMW in 2026 and 2027. |

Table 12 - Assured Capacity Quotas of Hydroelectric Power Plants (aMW)

| 2025 | 2026 | 2027 | |

| Assured Capacity Quotas | 2,626 | 1,313 | 0 |

| 7. | This excludes the Assured Capacity of Jaguari HPP (12.7 aMW), whose concession remains under Eletrobras’ provisional management. |

| 8. | Decotization occurs gradually over a five-year period beginning in 2023. The Assured Capacity values applied from 2023 onward are those established in Ordinance GM/MME No. 544/21. |

| 9. | The figures represent an estimate of uncontracted energy. The projected values for 2025, 2026 and 2027 is 81.8%. Worth noting that the average historical GSF from 2019 to 2024 is 82.7%. Source: CCEE, obtained from the CCEE website at the following link: CCEE Data and Analysis (in Portuguese only, select the MRE option in the panel). It is important to note that this is only an estimate, based on past events. |

Earnings Release 2Q25 | 16 |

|

5. INVESTMENTS AND EXPANSION PROJECTS

Investments in 2Q25 totaled R$ 1,966 million, with R$ 1,199 million allocated to transmission, R$ 357 million to generation, R$ 117 million to infrastructure, R$ 68 million to the environmental area and R$ 225 million to SPEs.

The amount invested in infrastructure was allocated as follows: 37% to socio-environmental initiatives, 28% to IT, 25% to real estate, and 10% to equipment and vehicles.

In the socio-environmental area, key highlights included investments related to the maintenance of operating licenses for power plants and substations, as well as land compensation.

In 2Q25, Eletrobras contributed R$ 225 million to Transnorte Energia SA (TNE), increasing its stake in the venture to 59.11%. Including the additional contribution made in July 2025, the total stake now stands at 64.61%.

Table 13 - Investments (R$ mm)

| 2Q25 | 2Q24 | % | 1Q25 | % | 6M25 | 6M24 | % | |

| Generation Corporate | 357 | 732 | -51.2 | 167 | 114.7 | 524 | 1,234 | -57.5 |

| Implementation / Expansion | 45 | 412 | -89.0 | 37 | 23.7 | 82 | 710 | -88.4 |

| Maintenance | 312 | 320 | -2.4 | 130 | 140.4 | 442 | 524 | -15.6 |

| Transmission Corporate | 1,199 | 673 | 78.3 | 655 | 82.9 | 1,854 | 1,299 | 42.7 |

| Expansion | 85 | 22 | 288.2 | 54 | 57.4 | 139 | 25 | 446.2 |

| Reinforcements and improvements | 1,108 | 610 | 81.8 | 596 | 85.9 | 1,705 | 1,208 | 41.1 |

| Maintenance | 5 | 41 | -87.0 | 5 | 3.8 | 10 | 65 | -84.0 |

| Infrastructure | 117 | 49 | 136.7 | 43 | 169.9 | 161 | 69 | 134.2 |

| Environmental | 68 | 64 | 5.4 | 47 | 44.1 | 115 | 133 | -13.7 |

| SPEs | 225 | 481 | -53.2 | 0 | 0.0 | 225 | 486 | -53.7 |

| Generation - Contributions | 0 | 478 | n.m. | 0 | 0.0 | 0 | 478 | n.m. |

| Generation - Acquisition | 0 | 0 | 0.0 | 0 | 0.0 | 0 | 0 | 0.0 |

| Transmission - Contributions | 225 | 3 | n.m. | 0 | 0.0 | 225 | 8 | n.m. |

| Transmission - Acquisition | 0 | 0 | 0.0 | 0 | 0.0 | 0 | 0 | 0.0 |

| Total | 1,966 | 2,000 | -1.7 | 912 | 115.5 | 2,879 | 3,221 | -10.6 |

Earnings Release 2Q25 | 17 |

|

Generation

Investments in generation totaled R$ 357 million in 2Q25, compared to R$ 732 million in 2Q24.

The reduction is mainly explained by decreased expenses associated with the expansion of CGT Eletrosul, as the Coxilha Negra Wind Farm project nears completion.

In 2Q25, main expenditures were allocated to:

Table 14 - Investments in Generation[1]

| Generation (R$ mm) | 2Q25 | 2Q24 | % |

| Maintenance | 312 | 320 | -2.4 |

| Eletrobras Holding | 63 | 77 | -18.5 |

| Eletronorte | 45 | 80 | -43.5 |

| Chesf | 199 | 160 | 24.4 |

| CGT Eletrosul | 5 | 3 | 63.5 |

| Expansion | 45 | 412 | -89.0 |

| Eletrobras Holding | 2 | 5 | -54.0 |

| Eletronorte | 1 | 0 | 886.9 |

| Chesf | 1 | 4 | -65.5 |

| CGT Eletrosul | 40 | 403 | -90.0 |

| Total | 357 | 732 | -51.2 |

| ▪ | Maintenance: |

| ▪ | R$ 199 million by Chesf to replace equipment at the Paulo Afonso IV, Sobradinho and Luiz Gonzaga plants; |

| ▪ | R$ 45 million by Eletronorte, primarily involving Tucuruí, Curuá-Una and Samuel HPPs, and |

| ▪ | R$ 63 million by Eletrobras, with emphasis on Porto Colômbia, Simplício, Marimbondo, Corumbá, Manso, Mascarenhas de Moraes and Itumbiara HPPs. |

| ▪ | Expansion: |

| ▪ | R$ 40 million by CGT Eletrosul for the expansion of the Coxilha Negra Wind Farm, with the start of commercial operation of wind turbines in 3Q24; and |

| ▪ | R$ 1 million by Chesf for the Casa Nova B wind farm. |

[1] For more information on Eletrobras Holding's Corporate Structure, refer to Appendix 3 of this report.

Earnings Release 2Q25 | 18 |

|

Transmission

Investments in transmission totaled R$ 1,199 million in 2Q25, mainly in reinforcements and improvements (R&I) that reached R$ 1,108 million, up 82% YoY.

Investments in expansions reached R$ 85 million, reflecting the progress of activities in transmission lines and substations related to lots won in auctions in recent years.

In 2Q25, expenditures were distributed as follows:

Table 15 - Investments in Transmission[2]

| Transmission (R$ mm) | 2Q25 | 2Q24 | % |

| Reinforcements and Improvements | 1,108 | 610 | 81.8 |

| Eletrobras Holding | 573 | 145 | 295.7 |

| Eletronorte | 145 | 170 | -15.1 |

| Chesf | 283 | 220 | 28.8 |

| CGT Eletrosul | 107 | 74 | 44.1 |

| Maintenance | 5 | 41 | -87.0 |

| Eletrobras Holding | 0 | 21 | -98.1 |

| Eletronorte | 0 | 13 | -96.4 |

| Chesf | 0 | 0 | 0.0 |

| CGT Eletrosul | 4 | 7 | -33.8 |

| Expansion | 85 | 22 | 288.2 |

| Eletrobras Holding | 29 | 15 | 97.4 |

| Eletronorte | 56 | 6 | 912.5 |

| Chesf | 0 | 2 | -96.8 |

| CGT Eletrosul | 0 | 0 | 0.0 |

| Total | 1,199 | 673 | 78.3 |

| ▪ | Eletrobras Holding: R$ 573 million, of which R$ 422 million is large-scale and R$ 51 million is small-scale, primarily involving Substations Ivaiporã, Itaberá, Grajaú, Cachoeira Paulista, Campinas, Ibiuna, Brasília, Adrianópolis, Itumbiara and Vitória. |

| ▪ | Eletronorte: R$ 145 million, of which R$ 87 million was large-scale and R$ 58 million was small-scale, primarily involving Imperatriz, Marabá, São Luis, Pres. Dutra, Porto Velho, Colinas, Vila do Conde and Guamá substations. |

| ▪ | Chesf: R$ 283 million, of which R$ 183 million were large-scale and R$ 100 million were small-scale, primarily involving Delmiro Gouveia, Messias, Jardim e Teresina, Bongi, Poções and Piauí substations. |

| ▪ | CGT Eletrosul: R$ 107 million, of which R$ 70 million was large-scale and R$ 37 million was small-scale, primarily involving Gravataí, Itajai, Areia, Campos Novos, Blumenau and Curitiba substations. |

[2] For more information on Eletrobras Holding's Corporate Structure, refer to Appendix 3 of this report.

Earnings Release 2Q25 | 19 |

|

Expansion Projects - Transmission

Large Scale Projects

| ▪ | Sampling: 249 projects[3], including the Itaipu HVDC System Revitalization project. Throughout 2Q25, the sample was increased to 249 from 240, due to 9 projects that were energized and the inclusion of 18 new authorizations issued by the regulator. |

| ▪ | Estimated investment: R$ 6.95 billion, excluding the Itaipu HVDC System Revitalization project, as Eletrobras is responsible solely for the execution, and therefore does not benefit from associated revenue while being fully reimbursed for the amount disbursed. |

| ▪ | Additional associated RAP: R$ 1.8 billion between 2025-2030. |

| ▪ | Auctions: Investments of R$ 6.35 billion, in which the following SPEs stand out: Nova Era Janapu, which was part of the sample since 2Q24, while Nova Era Catarina, Nova Era Ceará, Nova Era Integração and Nova Era Teresina were added in 3Q24[4]. In addition, the sample also includes a lot awarded at Auction 01/2022, won by Eletronorte. |

Small Scale Projects

| ▪ | Sampling: database of the Improvement and Reinforcement Plan Management System (SGPMR). |

| ▪ | Projects: 9,194 small-scale events under implementation or to be implemented, of which 8,668 were improvements and 526 were reinforcements. |

[3] Referring to reinforcements, improvements and auction projects. Considers projects registered in ANEEL's Transmission Management System (SIGET). Projects are included when added to the system and excluded when they are either canceled or enter commercial operation. The 249 projects will add 2,313 km of transmission lines and 13,350 MVA in substations.

[4] Each of the 5 SPEs created holds the contracts signed in last years' transmission auctions. SPE Nova Era Janapu holds contract no. 09/2023-ANEEL for the 4th lot of Auction 01-2023; SPE Nova Era Teresina holds contract no. 04/2024-ANEEL for the 1st lot of Auction 01-2024; SPE Nova Era Ceará holds contract no. 06/2024-ANEEL for the 3rd lot of Auction 01-2024; SPE Nova Era Integração holds contract no. 08/2024-ANEEL for the 5th lot of Auction 01-2024; and SPE Nova Era Catarina holds contract no. 12/2024-ANEEL for the 9th lot of Auction 01-2024.

Earnings Release 2Q25 | 20 |

|

Expansion Projects - Generation

Two projects are currently under implementation and, once completed, will add approximately 330 MW to Eletrobras’ installed capacity.

Coxilha Negra Wind Farm (302.4 MW capacity, located in Rio Grande do Sul state)

| ▪ | The complex has a total of 72 wind turbines, distributed across 3 wind farms: Coxilha Negra 2, Coxilha Negra 3 and Coxilha Negra 4. |

| ▪ | Investment: R$2.4 billion |

| ▪ | Completion of assembly for 72 wind turbines. |

| ▪ | On April 4, 2025, the commissioning of the last wind turbine was completed and test operations began. |

| ▪ | On June 5, 2025, of the 72 wind turbines, 64 were in commercial operation and 8 had current rulings for test operation. |

| ▪ | Implementation concluded in April 2025 |

| ▪ | Testing began in February 2024, with commercial operations starting gradually in July 2024. At the end of 2Q25, the 72 wind turbines were operating. |

| ▪ | The project is currently in its final stages, which include resolving outstanding documentation, completing operations of the wind farm and the exclusive-use transmission system, demobilizing the construction site, and restoring degraded areas. These activities do not impact the project’s operation and are accounted for in the contract. |

Casa Nova B Wind Farm (27 MW capacity, located in Bahia state)

| ▪ | Estimated Investment: R$ 151 million |

| ▪ | Physical implementation progress: 86% |

| ▪ | Considering both phases of the project: Casa Nova A, which accounts for 60% of the project, is 100% complete, while Casa Nova B, representing the remaining 40%, is 66% complete. |

| ▪ | Physical Works: 2Q25 was a key period for reaching an efficient technical definition for certain equipment. A decision was made to recondition the blades, and the contracting process is already underway—marking an important step toward the project’s continuity. |

| ▪ | Expected start of full operations: 3Q27, with the possibility of an earlier start depending on transmission system access. This access is exclusively subject to technical conditions beyond the Company’s control, as these are projects managed by other agents. |

Earnings Release 2Q25 | 21 |

|

6. INDEBTEDNESS

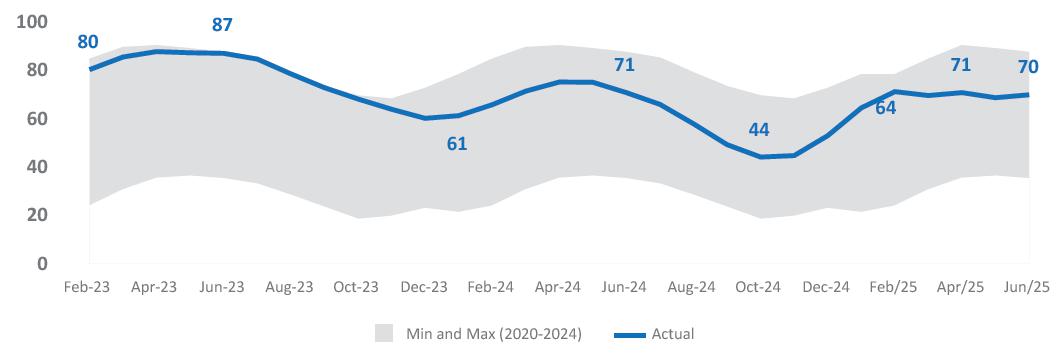

Net debt totaled R$ 40.13 billion in 2Q25, up R$ 0.85 billion from 1Q25 and down R$ 2.84 billion from 2Q24.

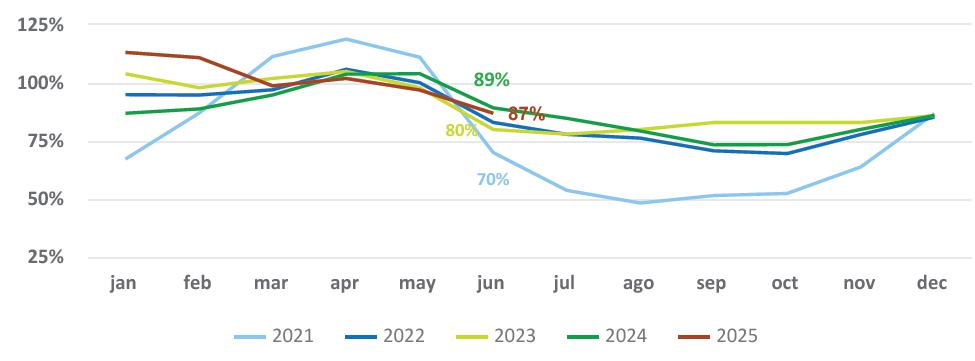

The Net Debt/Adjusted Regulatory EBITDA LTM ratio reached 1.8x in 2Q25, 1.7x in 1Q25 and 1.8x in 2Q24.

As a result of liability management and a 450 bps increase in the Brazilian basic interest rate (Selic), the Company's average debt maturity was extended by 2.6 months in 2Q25 when compared to 2Q24, while the total average cost increased to CDI + 0.57% p.a. in 2Q25 from CDI + 0.48% p.a. in 2Q24.

Table 16 - Net Debt (R$ mm)

| 06/30/2025 | 03/31/2025 | 06/30/2024 | |

| (+) Gross Debt | 70,290 | 70,890 | 70,814 |

| (+) Derivatives (currency hedge) Net | 752 | 302 | -439 |

| (-) Cash and Cash Equivalents + Current Securities | 29,387 | 30,281 | 26,167 |

| (-) Restricted Cash for Loans and Financing | 899 | 994 | 623 |

| (-) Loans receivable | 632 | 644 | 624 |

| Net Debt | 40,125 | 39,272 | 42,961 |

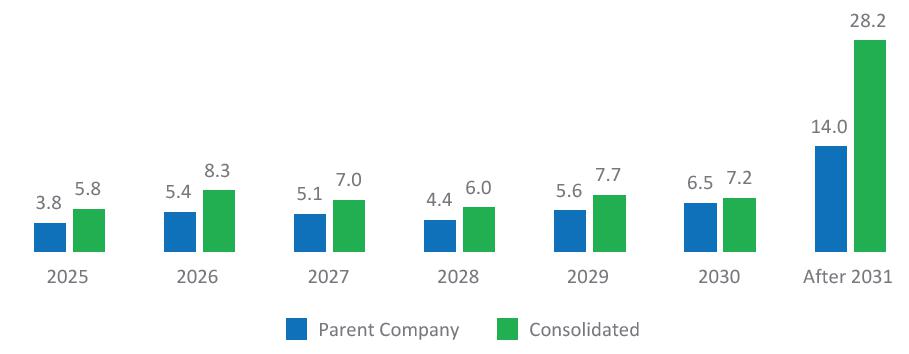

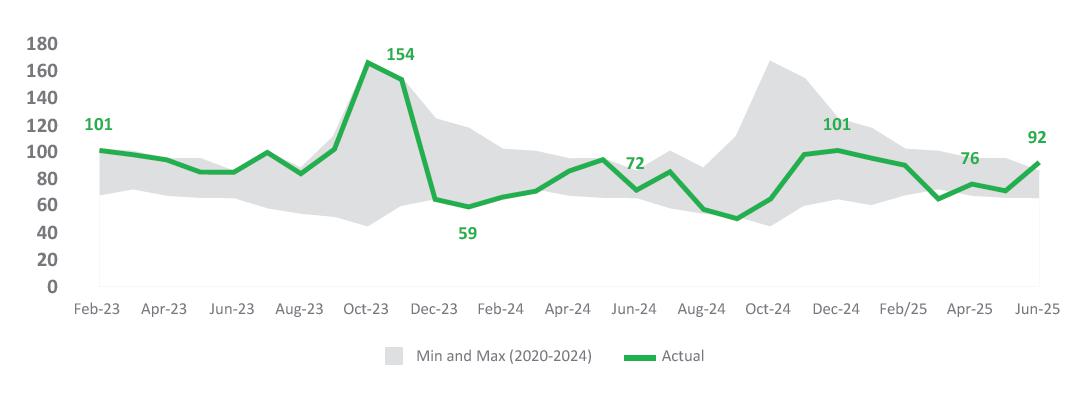

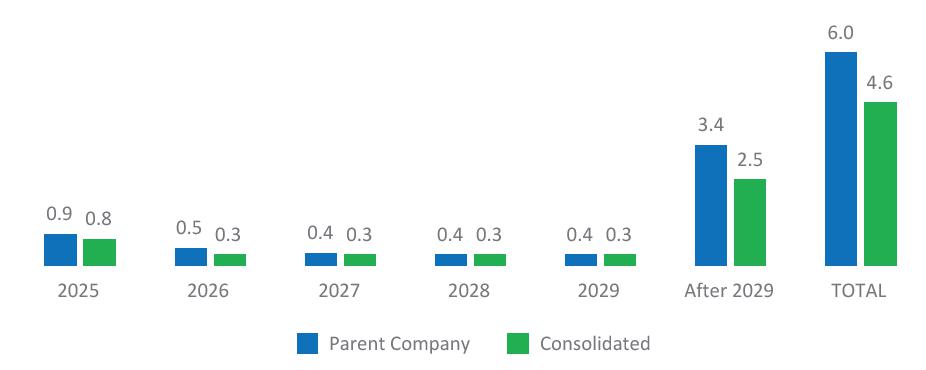

Chart 1 - Loans and Financing Payable (R$ billion)

Earnings Release 2Q25 | 22 |

|

Table 17 - Gross Debt Breakdown

| Creditor | Index |

Average cost (per year) |

Total Balance (R$ million) |

Share of Total (%) |

| Debentures & Commercial papers | CDI | CDI + 0.09% to 2.20% | 24,353 | 34.6 |

| Debentures & Commercial papers | IPCA | IPCA + 3.75% to 7.029% | 15,631 | 22.2 |

| BNDES | TJLP, IPCA; Fixed Rate |

IPCA + 5.38% to 6.41%; TJLP to TJLP + 3.28% |

6,046 | 8.6 |

| Banco do Brasil | CDI, IPCA, TJLP |

TJLP + 1.89% to 2.13%; CDI + 2% to 2.25%; IPCA + 6.56% |

2,028 | 2.9 |

| Caixa Econômica Federal | IPCA | IPCA + 6.56% | 1,514 | 2.2 |

| Bradesco | IPCA, CDI |

IPCA + 6.56%; CDI + 2.09% to 2.17% |

1,333 | 1.9 |

| Banco do Nordeste do Brasil | IPCA, TFC |

IPCA + 2.33% to 6.56%; 2.94% to 9.5% |

1,468 | 2.1 |

| Itaú | IPCA, CDI |

IPCA + 6.56%; CDI + 0.30% to 2.28% |

508 | 0.7 |

| Other Creditors | CDI, IPCA, TJLP, Fixed Rate |

CDI + 0.19% to 2.20%; IPCA + 6.56%; 2.94% to 10%; TJLP + 5% |

5,540 | 7.9 |

| Foreign Currency - Bonds and other debts | USD | 1.40% to 4.63% | 11,153 | 15.9 |

| Foreign currency - other debts | EUR | 2.00% to 4.4212% | 716 | 1.0 |

| TOTAL | 70,290 | 100.0 |

*It is important to note that the Company has carried out exchange rate hedge operations for certain foreign currency debts. The data below presents these debts along with their respective equivalent rates (post-hedge) linked to the CDI:

Bonds 2025 - 97.41% of CDI

Bonds 2030 - CDI + 1.70% p.a.

Bonds 2035 - 122.59% of CDI

Citibank - CDI + 0.19% to 1.70% p.a.

Itaú - CDI + 0.30% p.a.

** Exposure to BNDES only considers contracts under the BNDES direct line.

Earnings Release 2Q25 | 23 |

|

7. COMPULSORY LOAN

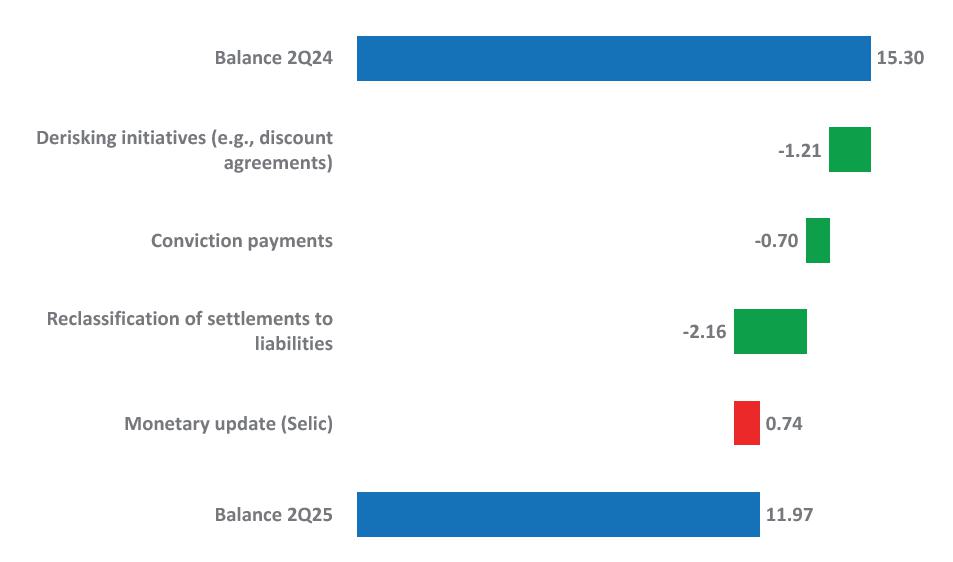

Eletrobras has implemented measures to mitigate risks associated with legal proceedings related to compulsory loans on electricity, which involve the monetary update of book-entry credits.To address this, the Company has strengthened its legal defense strategy and pursued settlements with discounts and full resolution of lawsuits. As a result of the negotiations:

| ▪ | The inventory of provisions was reduced by R$ 1.2 billion compared to 1Q25 and R$ 3.3 billion compared to 2Q24, totaling R$ 11.97 billion in 2Q25, mainly due to the agreements signed; |

| ▪ | Net reversal of R$ 279 million[5] due to agreements signed and favorable decisions in 2Q25; |

| ▪ | The amount recorded in 2Q25 under financial expenses related to monetary updates was R$ 176 million; |

| ▪ | In 2Q25, with the signing of new agreements, R$ 116 million in guarantees previously deposited in court were released. These amounts will be received by the Company following the corresponding judicial approvals, bringing the total guarantees released in favor of Eletrobras since 3Q22 to R$ 2.4 billion. |

Thus, as from 3Q22, when negotiations began, the provision inventory related to this set of lawsuits fell by R$ 13.8 billion, from R$25.8 billion to the current R$ 12.0 billion, even considering the accumulated monetary update of R$ 2.7 billion in the period. It is worth noting that this reduction included R$ 4 billion that had a direct impact on the P&L, as it was recorded as a provision reversal resulting from discounts obtained through executed agreements and favorable rulings.

In addition, the agreements signed also allowed for the elimination of R$ 9.6 billion in legal risks considered "off balance", of which R$ 913 million classified as possible and R$ 8.7 billion as remote. These reductions are in line with the Company's strategy of reducing its legacy legal liabilities.

Chart 2 - Total inventory of compulsory loan provisions (R$ bn)

[5] The amount presented considers only book-entry credits. The total result, which includes other lawsuits related to the compulsory loan, showed a net reversal of R$ 246 million, detailed in the provisions for litigation section.

Earnings Release 2Q25 | 24 |

|

8. CASH FLOW

It is worth highlighting for 2Q25 the net inflow of R$ 2.0 billion related to the completion of asset purchase and sale transactions, as well as capital contributions—including the sale of thermal plants in Amazonas, the acquisition of control of Eletronet, and the contribution to TNE.

Table 18 - Cash Flow (R$ bn)

| 2Q25 | 2Q24 | ∆% | |

| Ajusted Regulatory EBITDA, before Equity Holdings | 5.71 | 5.39 | 5.9 |

| EBITDA Adjustment | 0.32 | 0.11 | 196.3 |

| Income Tax and Social Contribution | -0.04 | -0.59 | -93.5 |

| Working Capital | -0.31 | -0.71 | -56.2 |

| Privatization Charges | -1.80 | -1.13 | 59.9 |

| Dividends Received | 0.25 | 0.80 | -68.8 |

| Operating Cash Flow | 4.12 | 3.87 | 6.6 |

| Investments * | -1.57 | -1.65 | -4.9 |

| Free Cash Flow | 2.55 | 2.21 | 15.2 |

| Debt Service | -1.22 | -2.16 | -43.2 |

| Litigation | -1.35 | -1.16 | 15.9 |

| Guarantees, Restricted Deposits and Others | 0.55 | -0.20 | -374.3 |

| Supplementary social security | -0.15 | -0.10 | 44.9 |

| Net Funding ** | -1.38 | 10.81 | -112.7 |

| Receipt of Loans and Financial Charges | 0.00 | 0.03 | -96.2 |

| Disposal of equity holdings | 2.02 | -0.01 | n.m. |

| Dividends | -1.80 | -1.29 | 39.8 |

| Free Net Cash | -0.78 | 8.13 | -109.6 |

| Change in Restricted Cash (short and long term) | 0.36 | 0.42 | -14.1 |

| Change in Financial Investments (long-term) | 0.00 | 0.02 | -102.3 |

| Net Cash | -0.42 | 8.57 | -104.9 |

*Excludes generation contributions.

**Net funding: debt raised, net of issuance costs.

Earnings Release 2Q25 | 25 |

|

FINANCIAL AND OPERATING RESULTS ANALYSIS

9. FINANCIAL PERFORMANCE

9.1. Operating Revenue

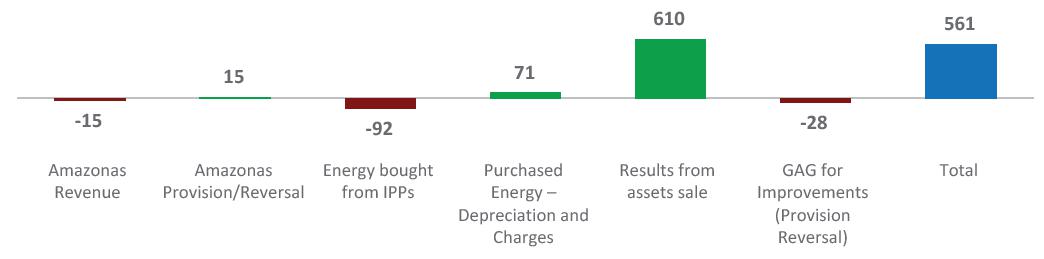

Regulatory Generation Revenue

Recurring regulatory revenue was R$ 6,945 million in 2Q25, R$ 15 million lower than adjusted IFRS generation revenue, reflecting the different treatment of the billing portion with Amazonas Energia, involving paid and unpaid amounts for the sale of energy to this customer.

Generation Revenue by Contracting Environment

In 2Q25, a negative amount of R$ 109 million was recognized, related to adjustments to the valuation of the sale of Amazonas thermal power plants and the asset uncrossing with Copel in CGT Eletrosul. These effects involve obligations and rights with terms longer than the completion of the transactions and are treated as non-recurring amounts adjusted in gross revenue for the period.

Thus, adjusted regulatory revenue from energy sales in all contracting environments totaled R$ 6,946 million in 2Q25, representing an increase of R$ 636 million compared to 2Q24.

The positive highlights were:

| ▪ | R$ 1,000 million increase in revenue in the short-term market, resulting from a 12.7% higher volume of energy settled in this environment combined with a higher average settlement price; |

| ▪ | R$ 229 million increase in revenue at the free market; |

| ▪ | R$198 million increase in revenue at the regulated market, excluding thermal plants and M&As. |

Such effects more than offset the reductions of:

| ▪ | R$ 486 million in revenue from thermal plants, reflecting the sale of the Amazonas thermal plants to Âmbar in May 2025, resulting in a lower contribution in 2Q25; |

| ▪ | R$ 288 million in revenue from the sale of O&M energy from the quota system plants, in line with the phasing out of legacy contracts (decotization). |

Considering all contracting environments, revenue went up 10.1% in 2Q25 compared to 2Q24, due to the 15.5% increase in the average price, more than offsetting the 4.7% drop in volume.

The 879 aMW reduction in total volume was mainly explained by the drop in GSF, to 95.3% in 2Q25 from 99.2% in 2Q24. Considering the energy sold and settled in different contracting environments, there was a reduction of 1,694 aMW in energy traded under the quota regime, partially offset by increases of 381 aMW in the free market and 450 aMW in the short-term market.

Earnings Release 2Q25 | 26 |

|

Table 19 - Generation Revenue by Contracting Environment (R$ mm)

| Revenue Generation |

Volume (aMW) (a) |

Price (R$/MWh) (b) |

Regulatory Revenue (c) = (a) x (b) | ||||||

| 2Q25 | % Y/Y | % Q/Q | 2Q25 | % Y/Y | % Q/Q | 2Q25 | % Y/Y | % Q/Q | |

| (+) Regulated Market | 3,999 | -0.4 | -13.8 | 271 | -11.1 | -8.8 | 2,365 | -11.4 | -20.5 |

| Existing | 3,308 | 9.9 | -7.3 | 219 | 4.0 | 4.4 | 1,584 | 14.3 | -2.1 |

| M&As (4) | 61 | -33.7 | -39.5 | 312 | 6.1 | 3.1 | 41 | -29.7 | -36.9 |

| Thermal | 631 | -30.9 | -35.0 | 537 | -12.6 | -12.8 | 740 | -39.6 | -42.7 |

| (+) Free Market | 7,619 | 5.3 | -15.6 | 154 | 4.3 | 2.0 | 2,557 | 9.8 | -12.9 |

| Existing | 7,619 | 5.3 | -15.6 | 154 | 4.3 | 2.0 | 2,557 | 9.8 | -12.9 |

| M&As (4) | 0 | 0.0 | 0.0 | 0 | 0.0 | 0.0 | 0 | 0.0 | 0.0 |

| (+) O&M (Quotas) | 2,248 | -43.0 | -10.8 | 104 | 12.0 | 8.8 | 510 | -36.1 | -1.9 |

| (+) ST Market (CCEE)(1) | 4,001 | 12.7 | -7.2 | 173 | 161.4 | 173.9 | 1,514 | 194.5 | 156.9 |

| (=) Revenue with energy sold | 17,867 | -4.7 | -12.8 | 178 | 15.5 | 12.2 | 6,946 | 10.1 | -1.1 |

| (+) Other (2) | — | — | — | — | — | — | -111 | n.m. | n.m. |

| (=) Total Revenue | — | — | — | — | — | — | 6,836 | 8.3 | -2.7 |

| Recurring | — | — | — | — | — | — | 6,945 | 10.1 | -1.1 |

| Non-recurring | — | — | — | — | — | — | -109 | 0.0 | 0.0 |

| Revenue Generation |

Regulatory Revenue (c) |

Accounting Adjustment (d) (3) |

Accounting Revenue (e) = (c) + (d) | ||||||||

| 2Q25 | 2Q24 | 1Q25 | 2Q25 | 2Q24 | 1Q25 | 2Q25 | 2Q24 | 2Q25x2Q24 | 1Q25 | 2Q25x1Q25 | |

| Regulated Market | 2,365 | 2,670 | 2,975 | 15 | -482 | -56 | 2,381 | 2,188 | 8.8 | 2,919 | -18.4 |

| Free Market | 2,557 | 2,328 | 2,937 | 0 | 0 | 0 | 2,557 | 2,328 | 9.8 | 2,937 | -12.9 |

| O&M (Quotas) | 510 | 798 | 520 | 0 | 0 | 0 | 510 | 798 | -36.1 | 520 | -1.9 |

| Short-term market (1) | 1,514 | 514 | 590 | 0 | 0 | 0 | 1,514 | 514 | 194.5 | 590 | 156.9 |

| Energy Sales | 6,946 | 6,311 | 7,021 | 15 | -482 | -56 | 6,962 | 5,829 | 19.4 | 6,965 | 0.0 |

| Others (2) | -111 | -1 | 2 | 0 | 0 | 0 | -111 | -1 | n.m. | 2 | n.m. |

| Total Revenue | 6,836 | 6,310 | 7,023 | 15 | -482 | -56 | 6,851 | 5,828 | 17.6 | 6,967 | -1.7 |

| Recurring | 6,945 | 6,310 | 7,023 | 15 | -482 | -56 | 6,960 | 5,828 | 19.4 | 6,967 | -0.1 |

| Non-recurring | -109 | 0 | 0 | 0 | 0 | 0 | -109 | 0 | 0.0 | 0 | 0.0 |

(1) Short-term market: Electricity Trading Chamber (CCEE)

(2) Main effect: recognition of a negative impact of R$ XX million related to adjustments in the valuation of the sale of the Amazonas thermal plants and the asset uncrossing with Copel at CGT Eletrosul, due to obligations and rights with maturities extending beyond the transaction closing dates.

(3) The differences between IFRS and regulatory revenues in 2Q24, 1Q25, and 2Q25 are related to energy sold but not paid for by Amazonas Energia. This amount is not recognized as revenue under IFRS, but is included in the regulatory result, where it is fully provisioned.

(4) M&A: includes revenue from assets in which Eletrobras' stake has changed over the last 12 months.

| ▪ | Regulated Contracting Environment (ACR): regulatory generation revenue in ACR totaled R$ 2,365 million in 2Q25, down R$ 305 million from R$ 2,670 million in 2Q24, mainly reflecting an 11.1% drop in average prices due to the thermal energy sales performance. Excluding thermal plants and M&A, revenue in 2Q25 totaled R$ 1,584 million, mainly impacted by the A-1 auction in December 2024 (+351 aMW; R$159/MWh), in addition to the inflation adjustment of existing contracts. Thermal plants, in turn, contributed R$ 740 million to revenues, while Mauá HPP contributed R$ 41 million referring to the portion of the quarter in which it remained in the portfolio, prior to its transfer to Copel following the completion of the asset uncrossing. |

Earnings Release 2Q25 | 27 |

|

| ▪ | Free Contracting Environment (ACL): regulatory generation revenue in ACL totaled R$ 2,557 million in 2Q25, up by R$ 229 million from 2Q24, mainly due to the 5.3% increase in volume sold, reflecting the strategy of expanding share in the free market, combined with a 4.3% increase in the average price. |

| ▪ | O&M: Operation and maintenance revenues totaled R$ 510 million in 2Q25, down R$ 288 million from 2Q24, mainly reflecting the gradual phasing out of legacy contracts (decotization), mitigated by the effects of the annual readjustment of the Annual Generation Revenue (RAG[6]). |

| ▪ | Short-Term Market (CCEE): revenue of R$ 1,514 million in 2Q25, up R$ 1,000 million from 2Q24, explained by the increases of 161% in price and of 13% in volume. |

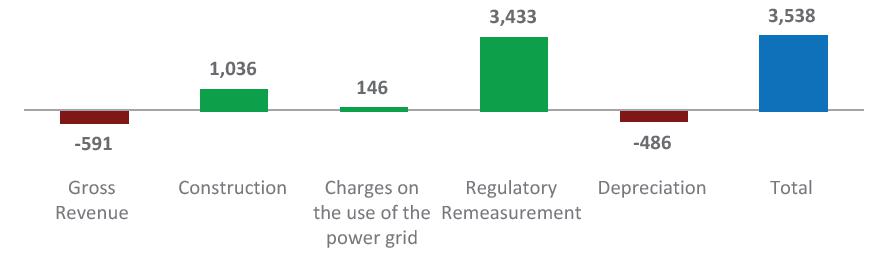

Regulatory Transmission Revenue

Regulatory transmission revenue was R$ 4,488 million, down 12.7% from 2Q24. The decrease reflected the approval, in July 2024, of the 2023 periodic tariff review (RTP), which were postponed to 2024, with a particular focus on the revenue review for concession contracts extended under Law No. 12,783/2013.

It is worth noting that the eliminations, both in regulatory and IFRS revenue, refer to the portion of transmission system usage charges paid by Eletrobras’ generation companies to the Group’s own transmission companies, which receive them as RAP. For consolidation purposes, these amounts are eliminated from transmission revenue and from the cost of transmission system charges in generation. The IFRS accounting considers the portion of revenue related to operation and maintenance (O&M), whereas under regulatory accounting, the elimination considers the RAP.

Table 20 - Quarterly IFRS vs. Regulatory Revenue (R$ mm)[7]

| 2Q25 | 2Q24 | Regulatory | |||||

| IFRS | Adjustments | Regulatory | IFRS | Adjustments | Regulatory | ∆% | |

| Eletrobras Holding | 1,994 | -131 | 1,863 | 1,727 | 469 | 2,196 | -15 |

| Chesf | 1,550 | -57 | 1,493 | 1,255 | 330 | 1,585 | -6 |

| CGT Eletrosul | 589 | -95 | 494 | 531 | 8 | 539 | -8 |

| Eletronorte | 1,064 | -177 | 886 | 966 | 51 | 1,017 | -13 |

| Eliminations | -118 | -131 | -249 | -83 | -115 | -199 | 25 |

| TOTAL | 5,079 | -591 | 4,488 | 4,395 | 744 | 5,138 | -13 |

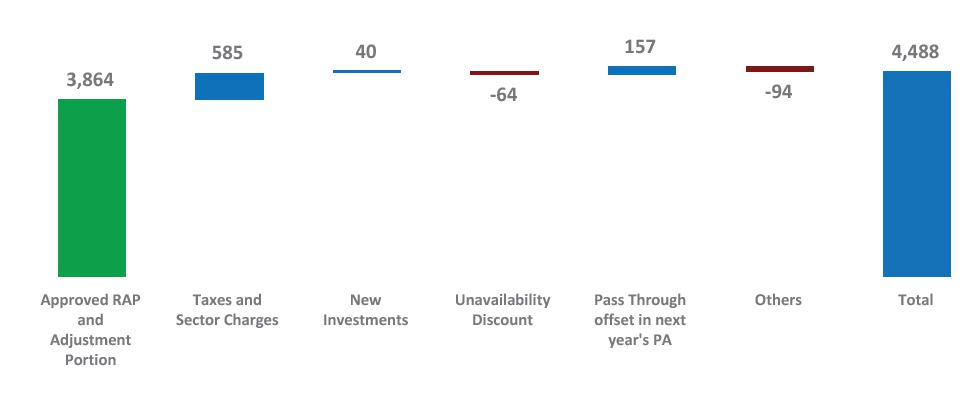

Chart 3 - Reconciliation RAP and Transmission Revenue 2Q25 (R$ mm)

[6] According to ANEEL Resolutions No. 3,225/2023 (2023-2024 cycle) and No. 3,353/2024 (2024-2025 cycle), impacting Eletronorte, Chesf and Furnas.

[7] For more information on Eletrobras Holding's Corporate Structure, refer to Appendix 3 of this report.

Earnings Release 2Q25 | 28 |

|

Definitions Approved RAP x Gross Revenue

Below is a simplified analysis of the regulatory gross revenue for the transmission segment. Additional details and explanations can be found in the “Modeling Support - Transmission” spreadsheet, available in the Results Center on the Company’s Investor Relations website.

| ▪ | Annual Permitted Revenue

(RAP) and Approved Adjustment Portion (PA) – 2Q25: Corresponds

to one-fourth of the RAP and PA amounts—R$ 16,983 million and R$ 1,529 million, respectively—approved for the 2024/2025 cycle

under ANEEL Resolution No. 3,348/2024, applicable to the transmission concession contracts of Eletrobras (post-Furnas incorporation),

Chesf, CGT Eletrosul, Eletronorte, TMT, and VSB. More details about PA in Appendix 8. |

| ▪ | Sector Taxes and Charges (pass-through): Includes PIS/COFINS taxes related to revenue from the Basic Network, Basic Border Network, and Shared DIT, as indicated in Credit Notices (AVCs) issued by ONS. It also includes the collection of contributions from consumers directly connected to Eletrobras transmission facilities, destined for the Energy Development Account (CDE) and the Incentive Program for Alternative Sources of Electric Energy (PROINFA). |

| ▪ | New Investments: Refers to additional RAP from new installations—primarily large-scale reinforcements and improvements—in the basic network, authorized with predefined revenues and placed into commercial operation during the quarter. |

| ▪ | Discount for Unavailability: Refers to the discounts applied under the Variable Portion (PV) and Suspension of Base Payment (PB) mechanisms, due to asset unavailability and pending Release Terms (Termos de Liberação – TL). In 2Q25, the total revenue reduction from unavailability amounted to approximately -R$63.5 million, of which -R$49.1 million was related to the Variable Portion. |

| ▪ | Items for which transmission companies only act as collectors and which will be deducted through the Adjustment Portion (PA) in the subsequent tariff cycle (pass-through): These are pass-through items recognized as revenue in the current cycle but offset in the next. They include differences in the Annual Permitted Revenue (RAP) calculation approved for billing by ONS, related to advance apportionment, as well as reimbursements from the CDE Fund—via CCEE—for amounts not collected due to tariff discounts. |

| ▪ | Others: Includes two groups of effects. (i) “Eliminations”, which represent transactions between companies within the same corporate group (i.e. Eletrobras companies). In 2Q25, total eliminations amounted to approximately R$ -249 million, and (ii) mismatches related to the RAP approved for the current tariff cycle, such as differences between the Annual Transmission and Distribution Adjustments, additional Credit Notices (AVCs) linked to the termination of Transmission System Use Agreements (CUST) by generators, among others. |

Earnings Release 2Q25 | 29 |

|

Main Events in the Transmission Segment in 2Q25

| ▪ | Change in RAP Receivables Flow Linked to the RBSE Financial Component |

More details on the changes, including breakdown by contract, are available in Appendix 9.

The effect on the regulatory result will only be reflected as from 3Q25, which marks the first quarter of the next tariff cycle (2025-26).

The effect on IFRS result is already reflected in 2Q25, through the recognition of a R$ 3,433 million expense accounted for as regulatory remeasurement. This expense, as well as the positive amount of R$ 882 million recognized as deferred tax associated with it, were considered as non-recurring items in 2Q25 and, therefore, adjusted in both EBITDA and Net Income.

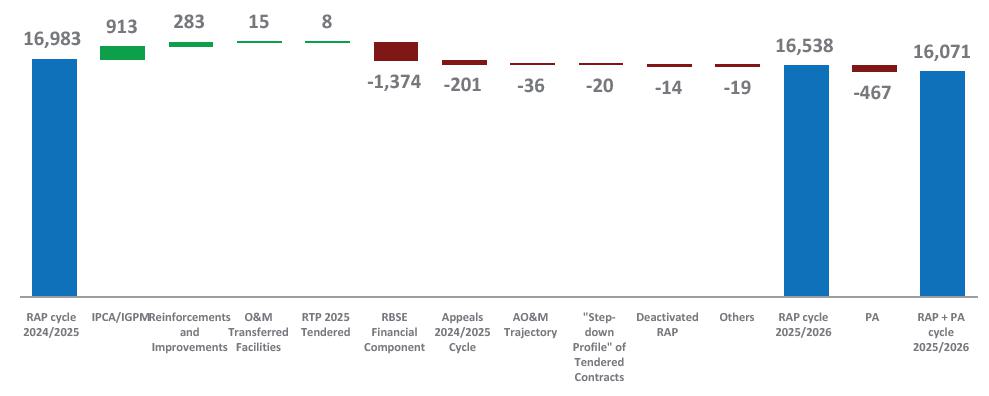

| ▪ | Periodic Tariff Review (RTP) for tendered contracts with review in 2025-26 |

More details on the changes, including breakdown by contract, are in Appendix 10.

| ▪ | Annual Adjustment (RA) for the 2025-26 Tariff Cycle: RAP and PA approval |

More details on the changes, including breakdown by contract, are in Appendix 11.

Earnings Release 2Q25 | 30 |

|

9.2. Operating Costs and Expenses

Table 21 - Operating Costs and Expenses (R$ mm)

| 2Q25 | 2Q24 | % | 1Q25 | % | 6M25 | 6M24 | % | |

| Energy purchased for resale | 1,356 | 797 | 70.1 | 1,560 | -13.1 | 2,916 | 1,534 | 90.0 |

| Charges on use of the electricity grid | 955 | 999 | -4.4 | 996 | -4.2 | 1,951 | 1,970 | -1.0 |

| Fuel for electricity production | 222 | 464 | -52.1 | 560 | -60.3 | 782 | 970 | -19.4 |

| Construction | 1,036 | 787 | 31.7 | 745 | 38.9 | 1,781 | 1,428 | 24.7 |

| Personnel, Material, Services and Others | 1,631 | 1,629 | 0.1 | 1,658 | -1.6 | 3,289 | 3,256 | 1.0 |

| Depreciation and Amortization | 1,131 | 968 | 16.9 | 1,112 | 1.7 | 2,244 | 1,965 | 14.2 |

| Operating provisions | 133 | -127 | -205.1 | 126 | 5.4 | 260 | 69 | 276.5 |

| Result from asset sale | 105 | 115 | -8.5 | 0 | 0.0 | 105 | 115 | -8.5 |

| Regulatory remeasurements | 3,433 | 0 | 0.0 | 952 | 260.7 | 4,385 | 0 | 0.0 |

| Costs and expenses | 10,002 | 5,632 | 77.6 | 7,710 | 29.7 | 17,712 | 11,307 | 56.6 |

| Non-recurring events | ||||||||

| (-) Non-recurring PMSO events | -228 | -171 | 33.6 | -191 | 19.1 | -419 | -203 | 106.2 |

| (-) Non-recurring provisions | 43 | 396 | -89.0 | -41 | -206.6 | 3 | 514 | -99.5 |

| (-) Result from asset sale | -105 | -115 | -8.5 | 0 | 0.0 | -105 | -115 | -8.5 |

| (-) Regulatory remeasurements | -3,433 | 0 | 0.0 | 0 | 0.0 | -3,433 | 0 | 0.0 |

| Adjusted Costs and Expenses | 6,279 | 5,742 | 9.4 | 7,478 | -16.0 | 13,757 | 11,503 | 19.6 |

| ▪ | Energy purchased for resale: Totaled R$ 1,356 million in 2Q25, up R$ 559 million from 2Q24. This increase was driven by energy purchases made to meet Eletrobras’ ballast requirements, aiming to rebalance available resources with the Company’s contracted sales commitments. It is worth noting that these transactions do not impact the P&L. |

| ▪ | Charges on use of the electricity grid: Totaled R$ 955 million in 2Q25, down R$ 44 million from 2Q24, mainly reflecting the lower value of the transmission system usage charges (EUST) in force after the definition of Resolution ANEEL No. 3,349/2024, replacing the values previously established by ANEEL Resolution No. 3,216/2023. |

| ▪ | Fuel for electricity production: Costs associated with the use of fuel for electricity production reached R$ 222 million in 2Q25, down R$ 242 million from 2Q24 due to the sale of the Amazonas thermal plants in May 2025. |

| ▪ | Construction-related costs: Totaled R$ 1,036 million in 2Q25, up by R$ 249 million compared to 2Q24. Highlights include increases of R$ 199 million from reinforcement and improvement works and R$ 72 million in civil construction tied to concession contracts secured through transmission auctions in recent years, partially offset by R$ 22 million in write-offs of Fixed Assets in Service. |

| ▪ | Regulatory Remeasurement - transmission contracts: R$ 3,433 million expense in 2Q25, reflecting changes in the payment flow of the RBSE financial component for contracts extended by Law No. 12,783/2013, applicable to the 2025-26, 2026-27 and 2027-28 tariff cycles, in view of the decision of ANEEL's board of directors at the 20th Ordinary Public Meeting held on June 10, 2025. |

| ▪ | Result from asset sale: R$ 105 million expense in 2Q25, reflecting non-cash adjustments due to negotiations concluded during the period, notably: |

| ▪ | - R$ 286 million: completion of the sale of the Amazonas thermal plants to Âmbar Energia; |

| ▪ | + R$ 257 million: Eletronet remeasurement; |

| ▪ | - R$ 76 million: asset uncrossing with Copel, with the acquisition of the Colíder HPP in exchange for a stake in the Jayme Canet Junior HPP (Mauá) and the Mata de Santa Genebra transmission plant. |

Earnings Release 2Q25 | 31 |

|

PMSO - Personnel, Material, Services and Others

Personnel: adjusted balance of R$ 784 million in 2Q25, down 15% from R$ 923 million in 2Q24, with the main effects being:

| ▪ | R$ 142 million in savings, of which R$ 95 million in compensation expenses and R$ 47 million in labor charges, reflecting the reduction in the number of employees resulting from the Voluntary Dismissal Plans (VDPs), partially offset by new hires, which increased expenses by R$ 30 million. |

| ▪ | R$ 38 million in savings resulting from efficiency gains achieved through team restructuring, driven by VDPs, new hiring models, and increased resource sharing among the group’s companies. |

Non-recurring effects: R$ 213 million, of which: (a) R$ 98 million with VDPs, (b) R$ 72 million with severance costs, and (c) R$ 44 million with severance indemnity fund (FGTS) fines linked to terminations.

Material: adjusted balance of R$ 42 million in 2Q25, up R$ 5 million when compared to R$ 37 million recorded in 2Q24. The variation reflects higher operational maintenance expenses.

There were no non-recurring effects in the quarter.

Services: adjusted balance of R$ 441 million in 2Q25, representing a 6% increase compared to R$ 415 million in 2Q24. The main highlights for the R$ 26 million increase were:

| ▪ | R$ 34 million increase related to the centralization and adjustment of cleaning and maintenance service contracts; |

| ▪ | R$ 8 million reduction due to the rescheduling of machine maintenance to the second half of 2025. |

Non-recurring effects: R$ 15 million related to success fee paid to legal consulting firms as part of the contingency reduction strategy.

Others: adjusted balance of R$ 136 million in 2Q25, up R$ 53 million compared to 2Q24, mainly reflecting the R$ 28 million increase in expenses related to the generation segment, including payments for hydrological risk renegotiation insurance and association contributions.

There were no non-recurring effects in the quarter.

Earnings Release 2Q25 | 32 |

|

Table 22 - PMSO 2Q25 (R$ mm)[8]

| PMSO | 2Q25 | ||||||

| (R$ million) | Eletrobras Holding | Chesf | Eletronorte | CGT Eletrosul | Total | Elimination | Consolidated IFRS |

| Personnel | 403 | 220 | 192 | 85 | 899 | 0 | 899 |

| Voluntary Dismissal Plan (PDV) - Provision | 76 | 4 | 15 | 3 | 98 | 0 | 98 |

| Material | 17 | 8 | 16 | 2 | 42 | 0 | 42 |

| Services | 225 | 95 | 101 | 35 | 456 | 0 | 456 |

| Other | 47 | 27 | 63 | 6 | 143 | -7 | 136 |

| PMSO | 768 | 353 | 386 | 131 | 1,638 | -7 | 1,631 |

| Non-recurring events | |||||||

| Personnel: PDV, PDC | -76 | -4 | -15 | -3 | -98 | 0 | -98 |

| Personnel: Termination Costs | -63 | -21 | -23 | -9 | -115 | 0 | -115 |

| Services: Success fee related to legal consulting | -11 | -2 | -2 | 0 | -15 | 0 | -15 |

| Other: Judicial convictions | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Other: Write-off of court deposits | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Adjusted PMSO | 618 | 326 | 346 | 119 | 1,410 | -7 | 1,403 |

Table 23 - PMSO 2Q24 (R$ mm)

| PMSO | 2Q24 | ||||||

| (R$ million) | Eletrobras + Furnas and Others | Chesf | Eletronorte | CGT Eletrosul | Total | Elimination | Consolidated IFRS |

| Personnel | 378 | 244 | 218 | 83 | 923 | 0 | 923 |

| Voluntary Dismissal Plan (PDV) - Provision | 15 | 6 | -10 | 0 | 11 | 0 | 11 |

| Material | 10 | 6 | 22 | -1 | 37 | 0 | 37 |

| Services | 251 | 87 | 84 | 36 | 457 | 0 | 457 |

| Other | 98 | 76 | 37 | 12 | 223 | -22 | 200 |

| PMSO | 752 | 419 | 350 | 130 | 1,651 | -22 | 1,629 |

| Non-recurring events | |||||||

| Personnel: PDV, PDC | -15 | -6 | 10 | 0 | -11 | 0 | -11 |

| Personnel: Retroactive profit Sharing (PLR) | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Personnel: allocation to investment activities | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| Services: Consultancies related to the transformation Plan | -42 | 0 | 0 | 0 | -42 | 0 | -42 |

| Other: Business Combination (1) | -118 | 0 | 0 | 0 | -118 | -118 | |

| Adjusted PMSO | 577 | 413 | 360 | 130 | 1,480 | -22 | 1,458 |

[8] For more information on Eletrobras Holding's Corporate Structure, refer to Appendix 3 of this report.

Earnings Release 2Q25 | 33 |

|

Table 24 - PMSO IFRS (R$ mm)

| 2Q25 | 2Q24 | 1Q25 | |||||

|

Total (a) |

Nonrecurring (b) |

Adjusted (c) = (a) + (b) |

Adjusted | ∆% | Adjusted | ∆% | |

| Personnel | 899 | -115 | 784 | 923 | -15.1 | 802 | -2.3 |

| VDP | 98 | -98 | 0 | 0 | 0.0 | 0 | 0.0 |

| Material | 42 | 0 | 42 | 37 | 13.0 | 52 | -19.1 |

| Services | 456 | -15 | 441 | 415 | 6.2 | 396 | 11.3 |

| Others | 136 | 0 | 136 | 83 | 64.6 | 217 | -37.1 |

| Total | 1,631 | -228 | 1,403 | 1,458 | -3.8 | 1,467 | -4.3 |

Table 25 - Detailed PMSO IFRS (R$ mm)

| 2Q25 | 2Q24 | % | 1Q25 | % | 6M25 | 6M24 | % | |

| Personnel | 899 | 923 | -2.6 | 855 | 5.1 | 1,755 | 1,868 | -6.1 |

| VDP | 98 | 11 | 795.5 | 96 | 1.1 | 194 | 44 | 344.5 |

| Material | 42 | 37 | 13.0 | 52 | -19.1 | 94 | 83 | 12.9 |

| Services | 456 | 457 | -0.3 | 438 | 4.2 | 894 | 896 | -0.2 |

| Others | 136 | 200 | -32.0 | 217 | -37.1 | 353 | 365 | -3.3 |

| PMSO (a) | 1,631 | 1,629 | 0.1 | 1,658 | -1.6 | 3,289 | 3,256 | 1.0 |

| Personnel | -115 | 0 | 0.0 | -53 | 116.5 | -169 | 0 | 0.0 |

| VDP | -98 | -11 | 795.5 | -96 | 1.1 | -194 | -44 | 344.5 |

| Material | 0 | 0 | 0.0 | 0 | 0.0 | 0 | 0 | 0.0 |

| Services | -15 | -42 | -64.0 | -42 | -63.5 | -57 | -42 | 34.8 |

| Others | 0 | -118 | n.m. | 0 | 0.0 | 0 | -118 | n.m. |

| Non recurring (b) | -228 | -171 | 33.6 | -191 | 19.1 | -419 | -203 | 106.2 |

| Personnel | 784 | 923 | -15.1 | 802 | -2.3 | 1,586 | 1,868 | -15.1 |

| VDP | 0 | 0 | 0.0 | 0 | 0.0 | 0 | 0 | 0.0 |

| Material | 42 | 37 | 13.0 | 52 | -19.1 | 94 | 83 | 12.9 |

| Services | 441 | 415 | 6.2 | 396 | 11.3 | 837 | 854 | -2.0 |

| Others | 136 | 83 | 64.6 | 217 | -37.1 | 353 | 247 | 42.7 |

| PMSO adjusted (c) = (a) + (b) | 1,403 | 1,458 | -3.8 | 1,467 | -4.3 | 2,870 | 3,052 | -6.0 |

| PMSO excluding TPP * (c.1) | 1,374 | 1,422 | -3.4 | 1,430 | -4.0 | 2,804 | 2,984 | -6.0 |

| expenses | 1,336 | 1,412 | -5.4 | 1,394 | -4.2 | 2,729 | 2,951 | -7.5 |

| costs: generation segment ** | 38 | 10 | 287.2 | 37 | 3.3 | 75 | 33 | 123.7 |

| Thermal Power Plants (c.2) | 29 | 36 | -18.7 | 36 | -19.4 | 66 | 68 | -3.6 |

* TPP: Thermal Power Plants. PMSO of thermal plants sold to Âmbar.

For 2Q25, considers amounts for the Santa Cruz Hydropower Plant for the full quarter.

For the other plants, whose sale was completed on May 15, 2025, amounts are considered up to that date.

** Other operating costs, related to generation operations: GSF insurance, association contributions, and other items.

Earnings Release 2Q25 | 34 |

|

Table 26 - Other Costs and Expenses (R$ mm)

| 2Q25 | 2Q24 | % | 1Q25 | % | 6M25 | 6M24 | % | |

| Convictions, losses and legal costs | 5 | 128 | -95.9 | 71 | -92.6 | 76 | 161 | -52.9 |

| GSF | 17 | 5 | 244.0 | 17 | 1.4 | 33 | 24 | 38.9 |

| Insurance | 24 | 27 | -12.0 | 23 | 5.7 | 47 | 47 | -0.1 |

| Equity Holding | 18 | 16 | 10.3 | 10 | 77.2 | 28 | 33 | -15.1 |

| Donations and contributions | 29 | 10 | 179.3 | 21 | 36.1 | 50 | 64 | -22.1 |

| Rent | 19 | 8 | 134.9 | 23 | -19.2 | 41 | 22 | 91.0 |