UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ANNUAL REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

(Mark One)

| | | | | |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2024

OR

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

333-239650-01

(Commission File Number of issuing entity)

Carvana Auto Receivables Trust 2020-P1

(Exact name of issuing entity as specified in its charter)

Commission File Number of issuing entity: 333-239650-01

Central Index Key Number of issuing entity: 0001801738

Carvana Receivables Depositor LLC

(Exact name of depositor as specified in its charter)

Commission File Number of depositor: 333-239650

Central Index Key Number of depositor: 0001770373

Carvana, LLC

(Exact name of sponsor as specified in its charter)

Central Index Key Number of sponsor: 0001576462

| | | | | | | | |

| | |

| Delaware | | 84-6968156 |

(State or other jurisdiction of

organization of the issuing entity)

| | (I.R.S. Employer

Identification No.) |

| | | | | | | | |

| | |

c/o Carvana, LLC 300 East Rio Salado Parkway, Tempe, AZ 85281 | | 85281 |

| (Address of principal executive offices of the issuing entity) | | (Zip Code) |

(602) 922-9866

(Telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| Large Accelerated Filer | | ☐ | | Accelerated Filer | | ☐ |

| | | |

| Non-Accelerated Filer | | ☒ | | Smaller Reporting Company | | ☐ |

| | | |

| | | | Emerging Growth Company | | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter.

Registrant has no voting or non-voting class of common equity outstanding and held by nonaffiliates as of the date of this report, or as of the last business day of the registrant’s most recently completed second fiscal quarter.

EXPLANATORY NOTES

Wells Fargo Bank, N.A. (“Wells Fargo Bank”) was the original indenture trustee, paying agent and collateral custodian for Carvana Auto Receivables Trust 2020-P1. Effective as of November 1, 2021 (the “Computershare Closing Date”), Wells Fargo Bank and Wells Fargo Delaware Trust Company, N.A. (collectively with Wells Fargo Bank, “Wells Fargo”) sold substantially all of Wells Fargo’s Corporate Trust Services (“CTS”) business to Computershare Trust Company, National Association (“CTCNA”), Computershare Delaware Trust Company (collectively with CTCNA, “Computershare”) and Computershare Limited. Virtually all CTS employees, along with most CTS systems, technology, and offices, were transferred to Computershare. After the Computershare Closing Date but prior to December 31, 2023, Wells Fargo continued to perform and take responsibility for certain Item 1122(d) servicing criteria and CTCNA performed and took responsibility for other Item 1122(d) servicing criteria in the capacity as agent for Wells Fargo. As of December 31, 2023, Wells Fargo has transferred to CTCNA all of its trustee, paying agent, collateral custodian and/or related roles, and the duties, rights, and liabilities for such roles, under the relevant agreements. For all asset-backed securities offerings by issuing entities established by Carvana Receivables Depositor LLC that closed prior to the Computershare Closing Date, CTCNA performed all of Wells Fargo’s contractual activities for the twelve months ended December 31, 2024. Because of this, CTCNA is taking responsibility for assessing its compliance with the applicable servicing criteria as indenture trustee and collateral custodian, as detailed in its Item 1122(d) assessment of compliance reports attached as exhibits to this Form 10-K as of and for the twelve months ended December 31, 2024.

PART I

The following Items have been omitted in accordance with General Instruction J to Form 10-K:

| | | | | | | | |

| | (d) | Item 3, Legal Proceedings |

| | | | | |

| Item 1B. | Unresolved Staff Comments. |

None.

| | | | | |

| Item 4. | Mine Safety Disclosures. |

Not applicable.

Substitute information provided in accordance with General Instruction J to Form 10-K:

Item 1112(b) of Regulation AB. Significant Obligors of Pool Assets (Financial Information).

No single obligor represents 10% or more of the pool assets held by Carvana Auto Receivables Trust 2020-P1 (the “Issuing Entity”).

Item 1114(b)(2) of Regulation AB. Credit Enhancement and Other Support, Except for Certain Derivatives Instruments (Financial Information Regarding Significant Enhancement Providers).

No entity or group of affiliated entities provides any external credit enhancement or other support with respect to either payment of the pool assets held by the Issuing Entity or payments on the notes (the “Notes”) or certificates (the “Certificates”) issued by the Issuing Entity.

Item 1115(b) of Regulation AB. Certain Derivatives Instruments (Financial Information).

No entity or group of affiliated entities provides any derivative instruments that are used to alter the payment characteristics of the cashflows from the Issuing Entity.

Item 1117 of Regulation AB. Legal Proceedings.

Except as previously disclosed in the final prospectus relating to the Notes publicly offered by the Issuing Entity, no legal proceedings are pending, and no proceedings are known to be contemplated by governmental authorities, against any of the following companies, or of which any property of the following companies is the subject, that are or would be material to holders of the Notes or the Certificates: Carvana, LLC (the “Sponsor”), Carvana Receivables Depositor LLC (the “Depositor”), CTCNA as transferee of Wells Fargo Bank, as collateral custodian (in such capacity, the “Collateral Custodian”) and as indenture trustee (in such capacity, the “Indenture Trustee”), Bridgecrest Credit Company, LLC (the “Servicer”), or the Issuing Entity.

PART II

The following items have been omitted in accordance with General Instruction J to Form 10-K:

| | | | | | | | |

| | (a) | Item 5, Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

| | | | | | | | |

| | (b) | Item 6, Selected Financial Data |

| | | | | | | | |

| | (c) | Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations |

| | | | | | | | |

| | (d) | Item 7A, Quantitative and Qualitative Disclosures About Market Risk |

| | | | | | | | |

| | (e) | Item 8, Financial Statements and Supplementary Data |

| | | | | | | | |

| | (f) | Item 9, Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

| | | | | | | | |

| | (g) | Item 9A, Controls and Procedures |

| | | | | |

| Item 9B. | Other Information. |

None.

| | | | | |

Item 9C. |

Disclosure Regarding Foreign Jurisdictions that Prevent Inspections. |

Not Applicable.

PART III

The following items have been omitted in accordance with General Instruction J to Form 10-K:

| | | | | | | | |

| | (a) | Item 10, Directors, Executive Officers and Corporate Governance |

| | | | | | | | |

| | (b) | Item 11, Executive Compensation |

| | | | | | | | |

| | (c) | Item 12, Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

| | | | | | | | |

| | (d) | Item 13, Certain Relationships and Related Transactions, and Director Independence |

| | | | | | | | |

| | (e) | Item 14, Principal Accountant Fees and Services |

Substitute information provided in accordance with General Instruction J to Form 10-K:

Item 1119 of Regulation AB. Affiliations and Certain Relationships and Related Transactions.

Information required by Item 1119 of Regulation AB has been omitted from this report on Form 10-K in reliance on the Instruction to Item 1119 of Regulation AB.

Item 1122 of Regulation AB. Compliance with Applicable Servicing Criteria.

The Sponsor (in its role as administrator), the Servicer, the Collateral Custodian, the Indenture Trustee, the Collateral Custodian Agent and the Indenture Trustee Agent (collectively, the “Servicing Participants”) have each been identified by the registrant as a party participating in the servicing function with respect to the pool assets. Each of the Servicing Participants has provided a report on an assessment of compliance with the servicing criteria applicable to it (each, a “Servicing Report”), which Servicing Reports are attached as exhibits to this Form 10-K. In addition, each of the Servicing Participants has provided an attestation report (each, a “Report on Assessment”) by one or more registered public accounting firms, which Reports on Assessment are also attached as exhibits to this Form 10-K.

Management's Assessment of Compliance for the Sponsor has identified a material instance of noncompliance related to the servicing criterion set forth in Item 1122(d)(3)(i)(C)—reports to investors, including those to be filed with the Commission, were not maintained in accordance with the transaction agreements and applicable Commission requirements. Specifically, such reports are filed with the Commission as required by its rules and regulations. This material instance of noncompliance relates to the asset-backed securities covered in this Form 10-K and issued by the Issuer. The instance involves the matter set forth below:

The Sponsor became aware on February 19, 2025 that certain Form 10-D filings made in the month of December 2024 for the November 1, 2024 through November 30, 2024 collection period disclosed as Exhibit 99.1 the servicer's certificate for the October 1, 2024 through October 31, 2024 collection period. The impacted transactions were Carvana Auto Receivables Trust 2020-P1, Carvana Auto Receivables Trust 2021-P1, Carvana Auto Receivables Trust 2021-P2, Carvana Auto Receivables Trust 2021-P3, Carvana Auto Receivables Trust 2021-P4, Carvana Auto Receivables Trust 2022-P1, Carvana Auto Receivables Trust 2022-P2, Carvana Auto Receivables Trust 2022-P3, Carvana Auto Receivables Trust 2024-P2, and Carvana Auto Receivables Trust 2024-P3. The Depositor filed amended Forms 10-D for each of the impacted transactions on February 21, 2025. For each impacted transaction, the servicer's certificates for the correct collection period associated with such Forms 10-D were delivered to investors in a timely manner and all distributions to investors were correct and timely. This matter did involve the servicing of the assets backing the asset-backed securities covered in this Form 10-K.

To address these matters and the related instances of noncompliance, the Sponsor has instituted new policies and procedures, including additional layers of attorney oversight and compliance checks, to assure that everyone involved in the EDGAR filing process has clear and documented guidance on the applicable filing timelines. The Sponsor has also begun maintaining a comprehensive log of all outstanding transactions and filings made during each reporting period. This log will include hyperlinks to each submission on EDGAR, providing a centralized record for verification. In-house attorneys will use this log to confirm that each required filing has been made timely is properly reflected on EDGAR, and includes all necessary and correct exhibits. Further, the Sponsor has implemented measures including enhanced reviews of the servicer's certificates provided by the Servicer and clearer lines of communication associated with the distribution of the finalized monthly servicer's certificates. These new lines of communication require that there will only be one access point for the finalized servicer's certificates to ensure that each deal party is using the same finalized version of such servicer's certificate. Each of these procedural enhancements will be completed within five business days of the monthly distribution date for the Sponsor's transactions. These added layers of oversight will serve as a final quality control measure, ensuring that the registrant will make all required filings (Form 10-D, Form 10-K and Form 8-K) with the SEC under the applicable CIK number for each issuing entity of the registrant in a timely manner.

None of the other Servicing Reports or the Reports on Assessment have identified any material instance of noncompliance with the servicing criteria applicable to the respective Servicing Participants.

Item 1123 of Regulation AB. Servicer Compliance Statement.

The Servicer has been identified by the registrant as a servicer with respect to the asset pool held by the Issuing Entity. The Servicer has provided a statement of compliance with applicable servicing criteria (a “Compliance Statement”), signed by an authorized officer of the Sponsor. The Compliance Statement is attached as an exhibit to this Form 10-K.

PART IV

| | | | | |

| Item 15. | Exhibits and Financial Statement Schedules. |

| | | | | |

(a) (1) | List of documents filed as part of this report Not applicable. |

| | | | | |

| (3) | The exhibits filed in response to Item 601 of Regulation S-K are listed in Item 15(b) below. |

| | | | | |

| (b) | Exhibits required by Item 601 of Regulation S-K. |

The exhibits listed below are either included or incorporated by reference as indicated:

| | | | | |

| Item 16. | Form 10-K Summary. |

None.

SIGNATURES

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| By: | | Carvana Receivables Depositor LLC, as Depositor |

| |

| By: | | /s/ Mike McKeever |

| | Mike McKeever |

| | President |

Date: March 27, 2025

SUPPLEMENTAL INFORMATION TO BE FURNISHED WITH REPORTS FILED PURSUANT TO SECTION 15(d) OF THE ACT BY REGISTRANTS WHICH HAVE NOT REGISTERED SECURITIES PURSUANT TO SECTION 12 OF THE ACT.

No annual report to security holders, proxy statement, form of proxy or other proxy soliciting material has been sent to security holders or is anticipated to be furnished to security holders subsequent to the filing of this annual report on Form 10-K.

SUPPLEMENT NO. 1 TO

INDENTURE

This Supplement No. 1 to Indenture, dated as of February 12, 2024 (this “Supplement”), is by and among Carvana Auto Receivables Trust 2020-P1, a Delaware statutory trust (the “Issuing Entity”), Carvana Auto Receivables Grantor Trust 2020-P1, a Delaware statutory trust (the “Grantor Trust”), and Computershare Trust Company, National Association, successor to Wells Fargo Bank, National Association, a national banking association, as indenture trustee and not in its individual capacity (the “Indenture Trustee”).

WHEREAS, the Issuing Entity, the Grantor Trust and Indenture Trustee are parties to that certain Indenture, dated as of December 10, 2020 (as amended, supplemented and modified from time to time, the “Indenture”);

WHEREAS, the parties hereto desire to supplement the Indenture as set forth herein;

NOW, THEREFORE, for good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereby agree as follows:

SECTION 1. Definitions. Capitalized terms used in this Supplement and not otherwise defined herein shall have the meanings assigned thereto in Part I of Appendix A of the Indenture, as amended hereby.

SECTION 2. Amendments. The Indenture is hereby amended as follows:

New Section 8.2(b)(vii) will be added immediately following Section 8.2(b)(vi) and will read as follows:

“(vii) On any Distribution Date that the amount on deposit in the Reserve Account together with Available Funds is sufficient to pay all amounts due pursuant to Sections 2.7(b)(i) through (xiii) and the aggregate outstanding principal amount of the Class A Notes, the Class B Notes, the Class C Notes and the Class D Notes, then such amount will be used to repay all such outstanding classes of Notes in full on such Distribution Date.”

SECTION 3. Indenture in Full Force and Effect as Amended. Except as specifically amended hereby, all provisions of the Indenture shall remain in full force and effect. After this Supplement becomes effective, all references to the “Indenture,” “hereof,” “herein,” or words of similar effect referring to the Indenture shall be deemed to mean the Indenture as amended hereby. This Supplement shall not constitute a novation of the Indenture, but shall constitute a supplement thereto. This Supplement shall not be deemed to expressly or impliedly waive, amend or supplement any provision of the Indenture other than as expressly set forth herein.

SECTION 4. Issuing Entity Order. Pursuant to Section 9.1(a) of the Indenture, the Issuing Entity hereby directs the Indenture Trustee to execute this Supplement and such direction shall constitute an Issuing Entity Order.

| | | | | | | | |

| 1 | CRVNA 2020-P1: Supplement No. 1 to Indenture |

SECTION 5. Owner Trustee and Grantor Trust Trustee Order. The Administrator hereby directs (i) the Owner Trustee pursuant to Section 6.2 of the Trust Agreement and (ii) the Grantor Trust Trustee pursuant to Section 6.2 of the Grantor Trust Agreement to execute this Supplement. The Administrator hereby certifies that it has the power and authority under the Trust Agreement and Grantor Trust Agreement to direct the Owner Trustee and Grantor Trust Trustee with respect to the foregoing actions and that the above referenced actions are duly authorized pursuant to the and in accordance with the Trust Agreement and Grantor Trust Agreement and are not inconsistent with or in violation of the terms of the documents to which the Issuing Entity or Grantor Trust is a party. The Administrator further certifies that all conditions precedent to the above referenced actions have been satisfied or waived, including any actions required under Section 4.1 of the Trust Agreement or Grantor Trust Agreement. In addition, the Administrator agrees that all action taken by the Owner Trustee in connection with this direction is covered by the fee and indemnification provisions set forth in the Trust Agreement and Grantor Trust Agreement.

SECTION 6. Conditions to Effectiveness. This Supplement shall become effective on the date hereof, subject to:

(a) the mutual receipt by each of the Issuing Entity, the Grantor Trust and the Indenture Trustee of the executed counterparts to this Supplement;

(b) the receipt by the Depositor, the Grantor Trust Trustee and the Owner Trustee of an Opinion of Counsel to the effect that this Supplement would not cause the Grantor Trust or the Issuing Entity to fail to qualify as a grantor trust for United States federal income tax purposes; and

(c) the receipt by the Indenture Trustee of an Opinion of Counsel stating that the execution of this Supplement is authorized or permitted by the Indenture and an Officer’s Certificate stating that all conditions precedent to the execution and delivery of this Supplement have been satisfied.

SECTION 7. Miscellaneous.

(a) Governing Law; Consent to Jurisdiction; Waiver of Objection to Venue. THIS SUPPLEMENT SHALL BE GOVERNED BY, AND CONSTRUED IN ACCORDANCE WITH, THE LAWS OF THE STATE OF NEW YORK (WITHOUT REFERENCE TO ITS CONFLICT OF LAWS PROVISIONS (OTHER THAN §§ 5-1401 AND 5-1402 OF THE NEW YORK GENERAL OBLIGATIONS LAW)). EACH OF THE PARTIES HERETO HEREBY AGREES TO THE JURISDICTION OF THE COURTS OF THE STATE OF NEW YORK, LOCATED IN THE BOROUGH OF MANHATTAN AND THE FEDERAL COURTS LOCATED WITHIN THE STATE OF NEW YORK IN THE BOROUGH OF MANHATTAN. EACH OF THE PARTIES HERETO HEREBY WAIVES ANY OBJECTION BASED ON FORUM NON CONVENIENS, AND ANY OBJECTION TO VENUE OF ANY ACTION INSTITUTED HEREUNDER IN ANY OF THE AFOREMENTIONED COURTS AND CONSENTS TO THE GRANTING OF SUCH LEGAL OR EQUITABLE RELIEF AS IS DEEMED APPROPRIATE BY SUCH COURT.

| | | | | | | | |

| 2 | CRVNA 2020-P1: Supplement No. 1 to Indenture |

(b) Waiver of Jury Trial. TO THE EXTENT PERMITTED BY APPLICABLE LAW, EACH OF THE PARTIES HERETO WAIVES ANY RIGHT TO HAVE A JURY PARTICIPATE IN RESOLVING ANY DISPUTE, WHETHER SOUNDING IN CONTRACT, TORT OR OTHERWISE BETWEEN THE PARTIES HERETO ARISING OUT OF, CONNECTED WITH, RELATED TO, OR INCIDENTAL TO THE RELATIONSHIP BETWEEN ANY OF THEM IN CONNECTION WITH THIS SUPPLEMENT OR THE TRANSACTIONS CONTEMPLATED HEREBY. INSTEAD, ANY SUCH DISPUTE RESOLVED IN COURT WILL BE RESOLVED IN A BENCH TRIAL WITHOUT A JURY.

(c) Severability of Provisions. If any one or more of the covenants, agreements, provisions or terms of this Supplement shall for any reason whatsoever be held invalid, then such covenants, agreements, provisions or terms shall be deemed severable from the remaining covenants, agreements, provisions and terms of this Supplement and shall in no way affect the validity or enforceability of the other covenants, agreements, provisions or terms of this Supplement.

(d) No Waiver; Cumulative Remedies. No failure to exercise and no delay in exercising, on the part of the Purchaser or the Seller, any right, remedy, power or privilege hereunder shall operate as a waiver thereof; nor shall any single or partial exercise of any right, remedy, power or privilege hereunder preclude any other or further exercise thereof or the exercise of any other right, remedy, power or privilege. The rights, remedies, powers and privileges herein provided are cumulative and not exhaustive of any rights, remedies, powers and privileges provided by law.

(e) Counterparts. This Supplement may be executed in two (2) or more counterparts (and by different parties on separate counterparts), each of which shall be an original, but all of which together shall constitute one and the same instrument. Delivery of an executed counterpart of this Supplement by email or facsimile shall be effective as delivery of a manually executed counterpart of this Supplement. This Supplement shall be valid, binding, and enforceable against a party when executed and delivered by an authorized individual on behalf of the party by means of (i) an original manual signature; (ii) a faxed, scanned, or photocopied manual signature, or (iii) any other electronic signature permitted by the federal Electronic Signatures in Global and National Commerce Act, state enactments of the Uniform Electronic Transactions Act, and/or any other relevant electronic signatures law, including any relevant provisions of the Uniform Commercial Code (collectively, “Signature Law”), in each case to the extent applicable. Each faxed, scanned, or photocopied manual signature, or other electronic signature, shall for all purposes have the same validity, legal effect, and admissibility in evidence as an original manual signature. Each party hereto shall be entitled to conclusively rely upon, and shall have no liability with respect to, any faxed, scanned, or photocopied manual signature, or other electronic signature, of any other party and shall have no duty to investigate, confirm or otherwise verify the validity or authenticity thereof. For the avoidance of doubt, original manual signatures shall be used for execution or indorsement of writings when required under the UCC or other Signature Law due to the character or intended character of the writings.

(f) It is expressly understood and agreed by the parties hereto that (i) this Supplement is executed and delivered by Wilmington Trust, National Association (“WTNA”), not individually or personally but solely as Owner Trustee of the Issuing Entity and Grantor Trust Trustee of the

| | | | | | | | |

| 3 | CRVNA 2020-P1: Supplement No. 1 to Indenture |

Grantor Trust, in the exercise of the powers and authority conferred and vested in it, (ii) each of the representations, undertakings and agreements herein made on the part of the Issuing Entity or Grantor Trust, as applicable, is made and intended not as personal representations, undertakings and agreements by WTNA but is made and intended for the purpose of binding only the Issuing Entity or Grantor Trust, as applicable, (iii) nothing herein contained shall be construed as creating any liability on WTNA, individually or personally, to perform any covenant either expressed or implied contained herein of the Issuing Entity or the Grantor Trust, as applicable, all such liability, if any, being expressly waived by the parties hereto and by any Person claiming by, through or under the parties hereto, (iv) WTNA has made no investigation as to the accuracy or completeness of any representations and warranties made by the Issuing Entity or Grantor Trust, as applicable, in this Amendment and (v) under no circumstances shall WTNA be personally liable for the payment of any indebtedness or expenses of the Issuing Entity or Grantor Trust, as applicable, or be liable for the breach or failure of any obligation, representation, warranty or covenant made or undertaken by the Issuing Entity or Grantor Trust, as applicable under this Amendment.

[Signatures follow]

| | | | | | | | |

| 4 | CRVNA 2020-P1: Supplement No. 1 to Indenture |

IN WITNESS WHEREOF, the parties hereto have caused this Supplement to be executed by their respective officers thereunto duly authorized, as of the date first above written.

| | | | | | | | | | | |

| | | |

| CARVANA AUTO RECEIVABLES TRUST 2020-P1 |

| By: | WILMINGTON TRUST, NATIONAL ASSOCIATION, not in its individual capacity but solely as Owner Trustee |

| By: | /s/ Nancy E. Hagner | |

| Name: Nancy E. Hagner | |

| Vice President | |

| | | | | | | | | | | |

| | | |

| CARVANA AUTO RECEIVABLES GRANTOR TRUST 2020-P1 |

| By: | WILMINGTON TRUST, NATIONAL ASSOCIATION, not in its individual capacity but solely as Owner Trustee |

| By: | /s/ Nancy E. Hagner | |

| Name: Nancy E. Hagner | |

| Vice President | |

| | | | | | | | | | | |

| | | |

| COMPUTERSHARE TRUST COMPANY, NATIONAL ASSOCIATION, not in its individual capacity but solely as Indenture Trustee |

| By: | |

| /s/ Chris Wall | |

| Name: Chris Wall | |

| Vice President | |

| | | | | | | | | | | |

| | | |

| CARVANA, LLC, as Administrator |

| | |

| By: | /s/ Paul Breaux | |

| Name: Paul Breaux | |

| Vice President | |

| | | | | | | | |

| S-1 | CRVNA 2020-P1: Supplement No. 1 to Indenture |

Exhibit 31.1

Certifications

I, Mike McKeever, certify that:

1. I have reviewed this report on Form 10-K and all reports on Form 10-D required to be filed in respect of the period covered by this report on Form 10-K of Carvana Auto Receivables Trust 2020-P1 (the “Exchange Act periodic reports”);

2. Based on my knowledge, the Exchange Act periodic reports, taken as a whole, do not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this report;

3. Based on my knowledge, all of the distribution, servicing and other information required to be provided under Form 10-D for the period covered by this report is included in the Exchange Act periodic reports;

4. Based on my knowledge and the servicer compliance statement required in this report under Item 1123 of Regulation AB, and except as disclosed in the Exchange Act periodic reports, the servicer has fulfilled its obligations under the servicing agreement in all material respects; and

5. All of the reports on assessment of compliance with servicing criteria for asset-backed securities and their related attestation reports on assessment of compliance with servicing criteria for asset-backed securities required to be included in this report in accordance with Item 1122 of Regulation AB and Exchange Act Rules 13a-18 and 15d-18 have been included as an exhibit to this report, except as otherwise disclosed in this report. Any material instances of noncompliance described in such reports have been disclosed in this report on Form 10-K.

In giving the certifications above, I have reasonably relied on information provided to me by the following unaffiliated parties: Computershare Trust Company, National Association.

Date: March 27, 2025

| | |

|

| /s/ Mike McKeever |

| Mike Mckeever |

|

| President |

|

| Carvana Receivables Depositor LLC |

|

| (senior officer in charge of securitization) |

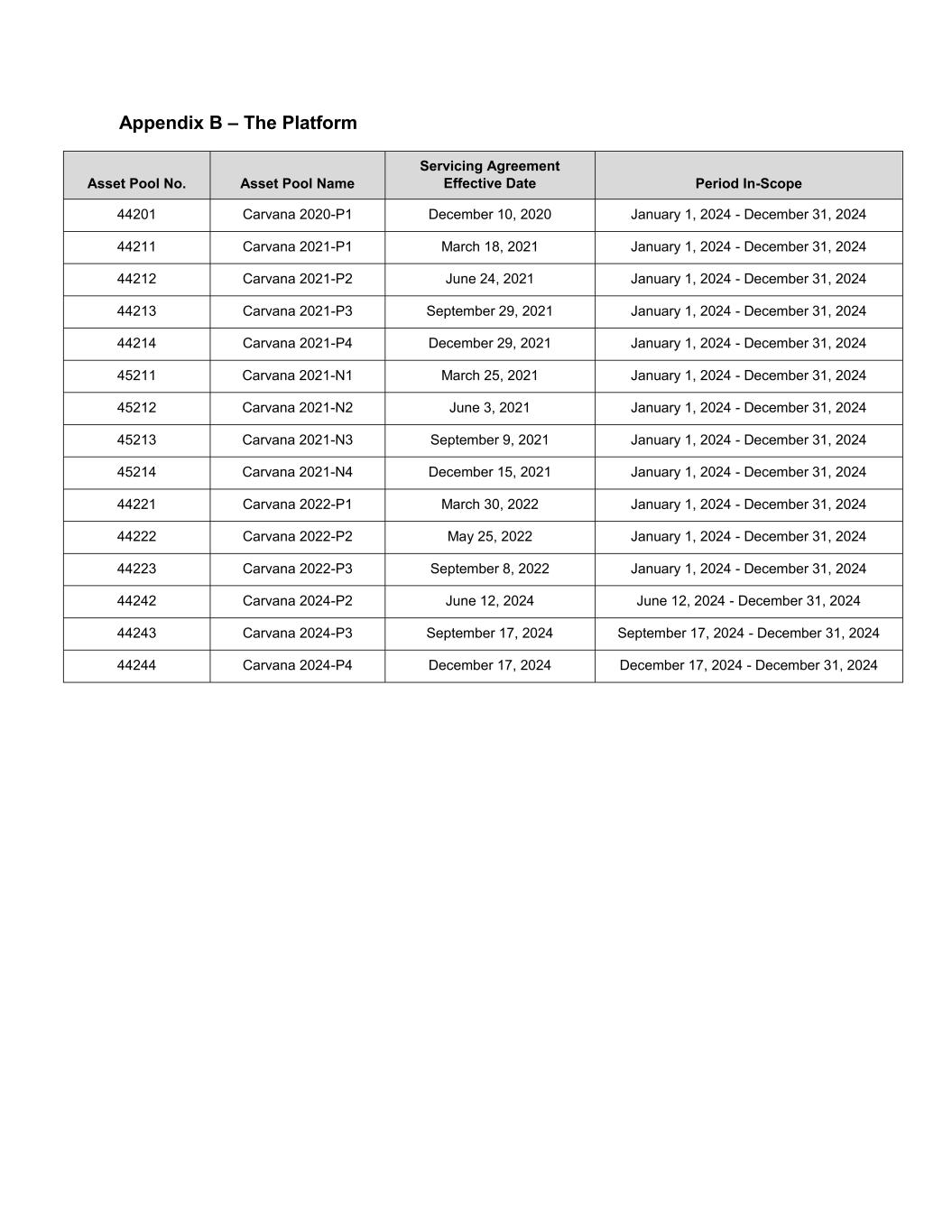

MANAGEMENT’S REPORT ON ASSESSMENT OF COMPLIANCE WITH SEC REGULATION AB SERVICING CRITERIA 1. Bridgecrest Credit Company, LLC (the “Company” or “Bridgecrest”), a wholly-owned subsidiary of Bridgecrest Acceptance Corporation, is responsible for assessing compliance with the servicing criteria applicable to it under paragraph (d) of Item 1122 of the U.S. Securities and Exchange Commission’s (“SEC”) Regulation AB as of and for the year ended December 31, 2024, (the “Reporting Period”), as set forth in Appendix A hereto. The transactions covered by this report (collectively referred to as the “CARVANA-Originated Public Auto Loan Receivables Platform” or the “Platform”) include asset-backed transactions and securities for which the Company acted as servicer as defined in Appendix B. 2. Except as set forth in paragraph 3 below, the Company used the criteria set forth in paragraph (d) of Item 1122 of Regulation AB to provide an assertion on the Company’s assessment of compliance with the applicable servicing criteria. 3. The criteria listed as “Inapplicable Servicing Criteria” in Appendix A hereto are inapplicable to the Company based on the activities it performed, directly or through its Vendors, with respect to the Platform for the Reporting Period. 4. With respect to servicing criteria 1122(d)(2)(i),1122(d)(3)(ii), 1122(d)(4)(iv), and 1122(d)(4)(viii), the Company has engaged various Vendors to perform some or all of the activities required by these servicing criteria. Management has determined that these Vendors are not considered a “servicer” as defined in Item 1101(j) of Regulation AB and has elected to take responsibility for assessing compliance with the servicing criteria applicable to each Vendor as permitted by the SEC’s Compliance & Disclosure Interpretation 200.06, Vendors Engaged by Servicers (“C&DI 200.06”), formerly Interpretation 17.06 of the SEC Division of Corporation Finance Manual of Publicly Available Telephone Interpretations. As permitted by C&DI 200.06, management asserts that it has policies and procedures in place designed to provide reasonable assurance that the Vendor’s activities comply in all material respects with the servicing criteria applicable to each Vendor. Management is not aware of any material deficiencies in such policies and procedures or any material instances of non-compliance of the servicing criteria as relates to the Company by such Vendors. Management is solely responsible for determining that it meets the SEC requirements to apply C&DI 200.06 for the Vendors and related servicing criteria. 5. Bridgecrest Credit Company, LLC has complied, in all material respects, with the applicable servicing criteria set forth in Item 1122(d) of Regulation AB for the Reporting Period with respect to the Platform taken as a whole. 6. Grant Thornton LLP, an independent registered public accounting firm, has issued an attestation report on the Company’s assertion on compliance with the applicable servicing criteria for the Reporting Period. Bridgecrest Credit Company, LLC March 12, 2025 __________________________________________ Monica Alvarez, Head of Treasury, Capital Markets, and Income Tax /s/ Monica Alvarez Exhibit 33.1

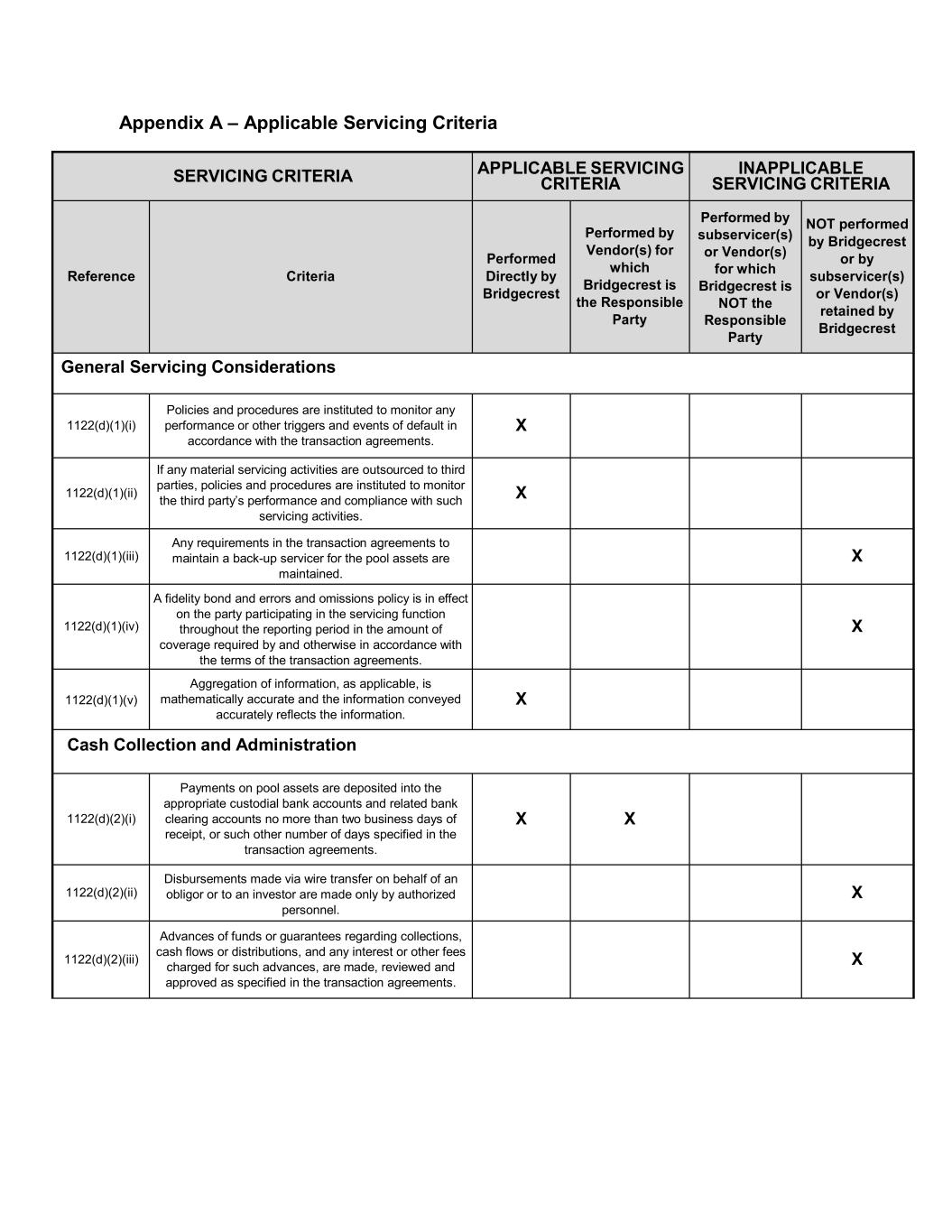

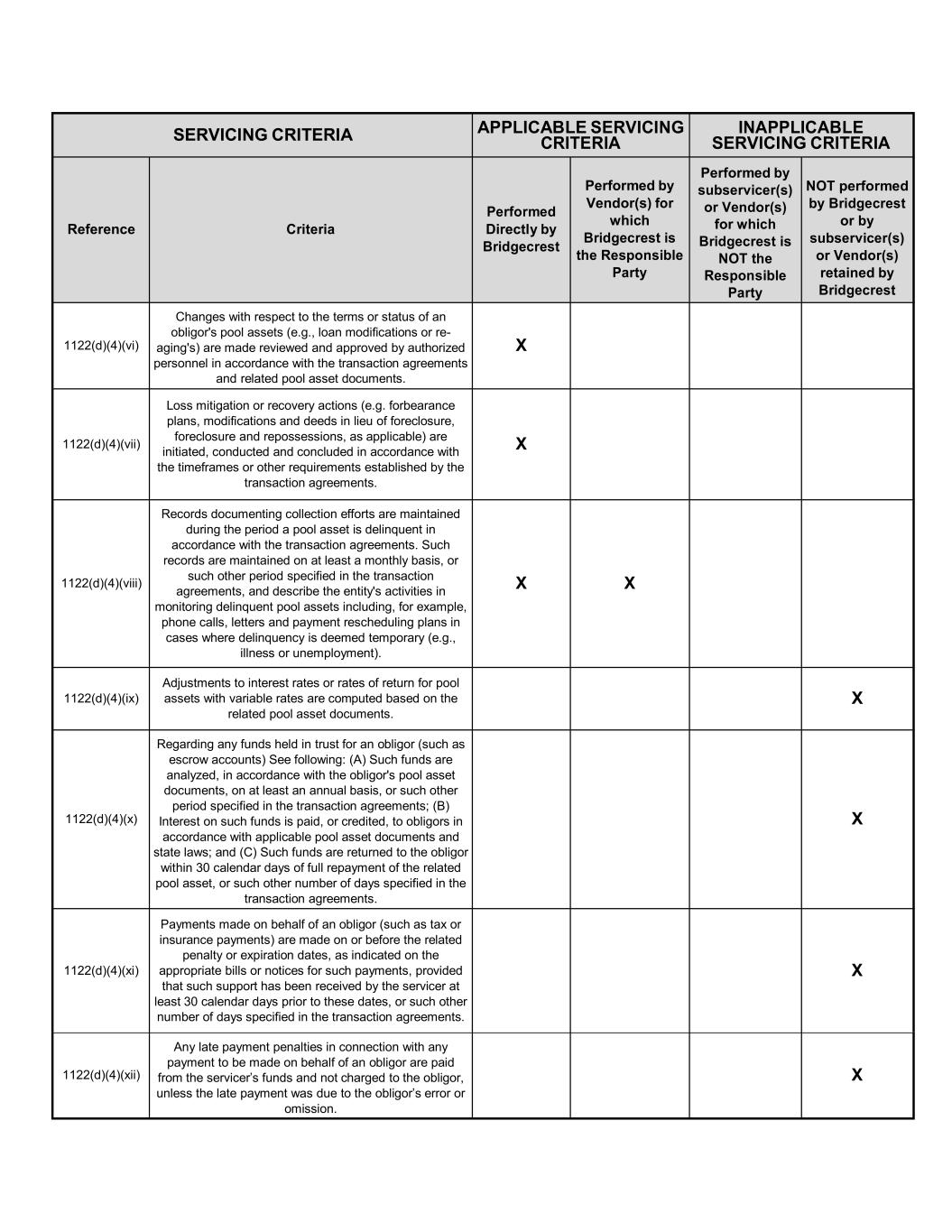

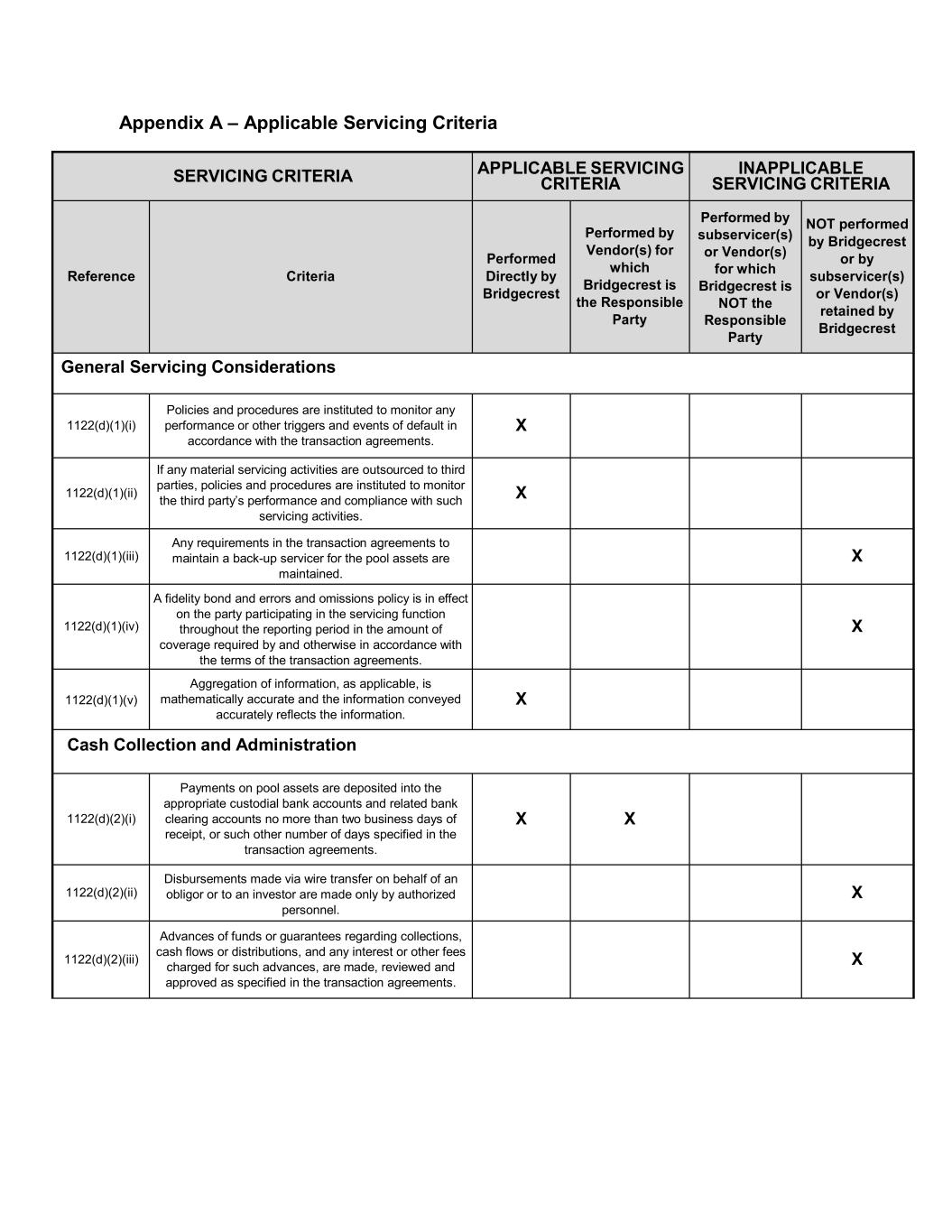

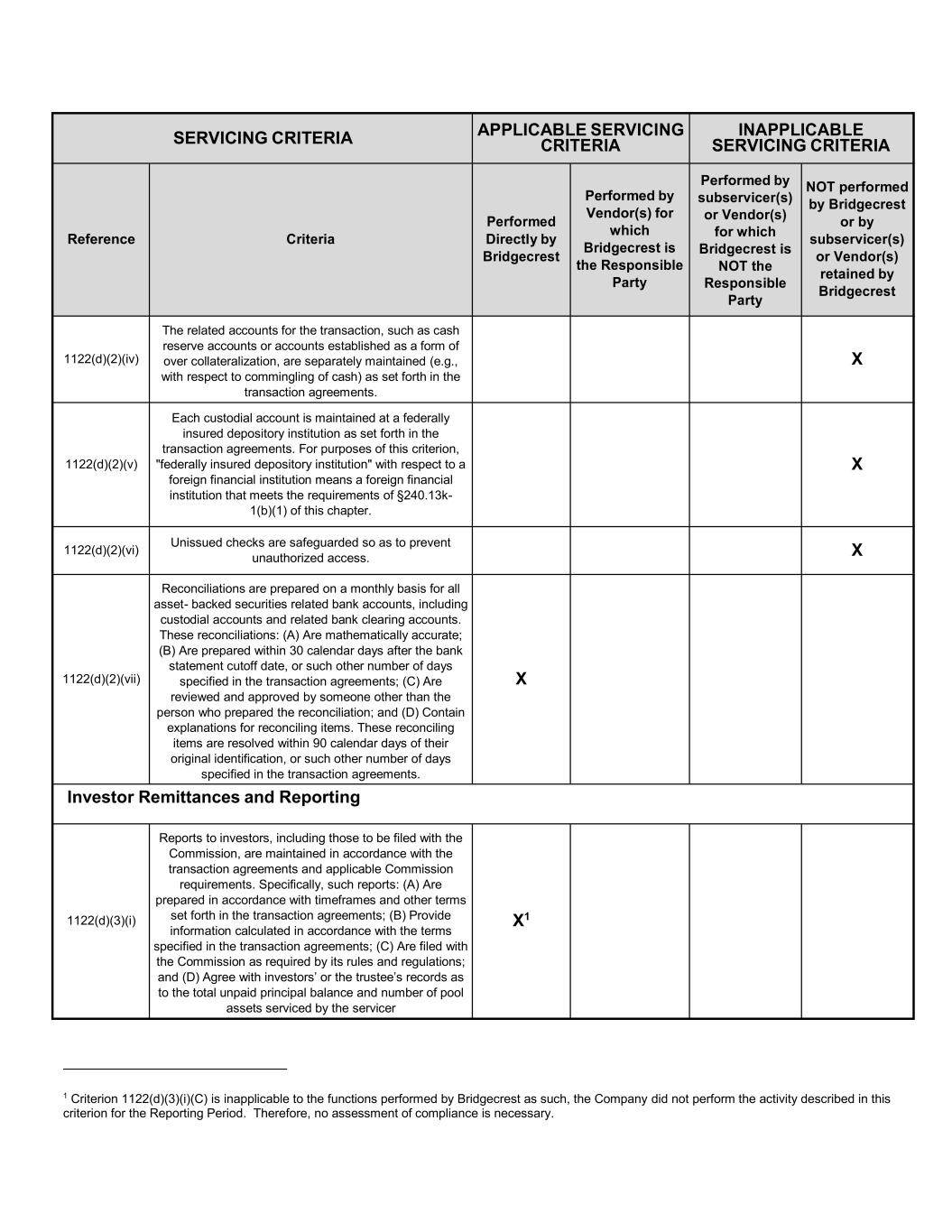

Appendix A – Applicable Servicing Criteria SERVICING CRITERIA APPLICABLE SERVICING CRITERIA INAPPLICABLE SERVICING CRITERIA Reference Criteria Performed Directly by Bridgecrest Performed by Vendor(s) for which Bridgecrest is the Responsible Party Performed by subservicer(s) or Vendor(s) for which Bridgecrest is NOT the Responsible Party NOT performed by Bridgecrest or by subservicer(s) or Vendor(s) retained by Bridgecrest General Servicing Considerations 1122(d)(1)(i) Policies and procedures are instituted to monitor any performance or other triggers and events of default in accordance with the transaction agreements. X 1122(d)(1)(ii) If any material servicing activities are outsourced to third parties, policies and procedures are instituted to monitor the third party’s performance and compliance with such servicing activities. X 1122(d)(1)(iii) Any requirements in the transaction agreements to maintain a back-up servicer for the pool assets are maintained. X 1122(d)(1)(iv) A fidelity bond and errors and omissions policy is in effect on the party participating in the servicing function throughout the reporting period in the amount of coverage required by and otherwise in accordance with the terms of the transaction agreements. X 1122(d)(1)(v) Aggregation of information, as applicable, is mathematically accurate and the information conveyed accurately reflects the information. X Cash Collection and Administration 1122(d)(2)(i) Payments on pool assets are deposited into the appropriate custodial bank accounts and related bank clearing accounts no more than two business days of receipt, or such other number of days specified in the transaction agreements. X X 1122(d)(2)(ii) Disbursements made via wire transfer on behalf of an obligor or to an investor are made only by authorized personnel. X 1122(d)(2)(iii) Advances of funds or guarantees regarding collections, cash flows or distributions, and any interest or other fees charged for such advances, are made, reviewed and approved as specified in the transaction agreements. X

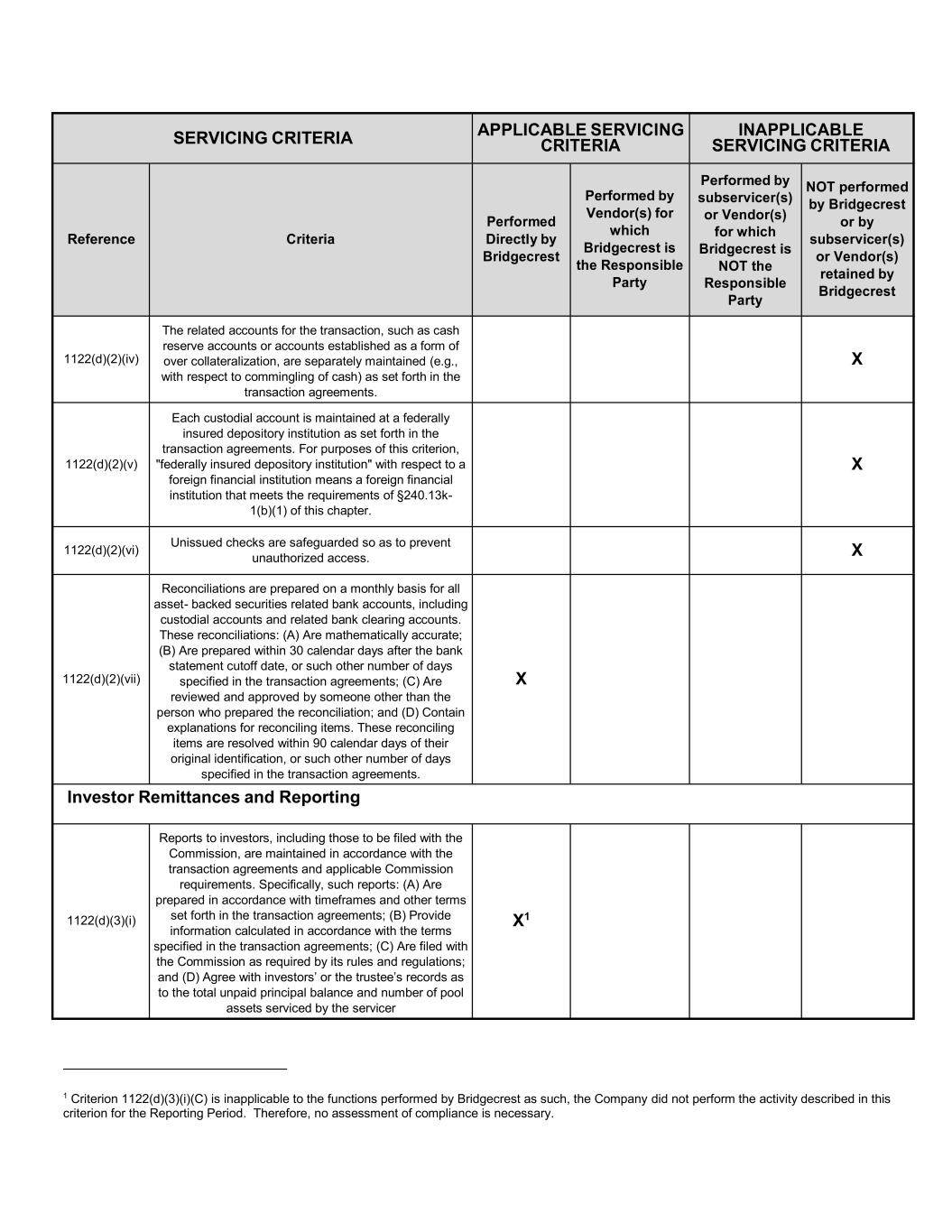

SERVICING CRITERIA APPLICABLE SERVICING CRITERIA INAPPLICABLE SERVICING CRITERIA Reference Criteria Performed Directly by Bridgecrest Performed by Vendor(s) for which Bridgecrest is the Responsible Party Performed by subservicer(s) or Vendor(s) for which Bridgecrest is NOT the Responsible Party NOT performed by Bridgecrest or by subservicer(s) or Vendor(s) retained by Bridgecrest 1122(d)(2)(iv) The related accounts for the transaction, such as cash reserve accounts or accounts established as a form of over collateralization, are separately maintained (e.g., with respect to commingling of cash) as set forth in the transaction agreements. X 1122(d)(2)(v) Each custodial account is maintained at a federally insured depository institution as set forth in the transaction agreements. For purposes of this criterion, "federally insured depository institution" with respect to a foreign financial institution means a foreign financial institution that meets the requirements of §240.13k- 1(b)(1) of this chapter. X 1122(d)(2)(vi) Unissued checks are safeguarded so as to prevent unauthorized access. X 1122(d)(2)(vii) Reconciliations are prepared on a monthly basis for all asset- backed securities related bank accounts, including custodial accounts and related bank clearing accounts. These reconciliations: (A) Are mathematically accurate; (B) Are prepared within 30 calendar days after the bank statement cutoff date, or such other number of days specified in the transaction agreements; (C) Are reviewed and approved by someone other than the person who prepared the reconciliation; and (D) Contain explanations for reconciling items. These reconciling items are resolved within 90 calendar days of their original identification, or such other number of days specified in the transaction agreements. X Investor Remittances and Reporting 1122(d)(3)(i) Reports to investors, including those to be filed with the Commission, are maintained in accordance with the transaction agreements and applicable Commission requirements. Specifically, such reports: (A) Are prepared in accordance with timeframes and other terms set forth in the transaction agreements; (B) Provide information calculated in accordance with the terms specified in the transaction agreements; (C) Are filed with the Commission as required by its rules and regulations; and (D) Agree with investors’ or the trustee’s records as to the total unpaid principal balance and number of pool assets serviced by the servicer X1 1 Criterion 1122(d)(3)(i)(C) is inapplicable to the functions performed by Bridgecrest as such, the Company did not perform the activity described in this criterion for the Reporting Period. Therefore, no assessment of compliance is necessary.

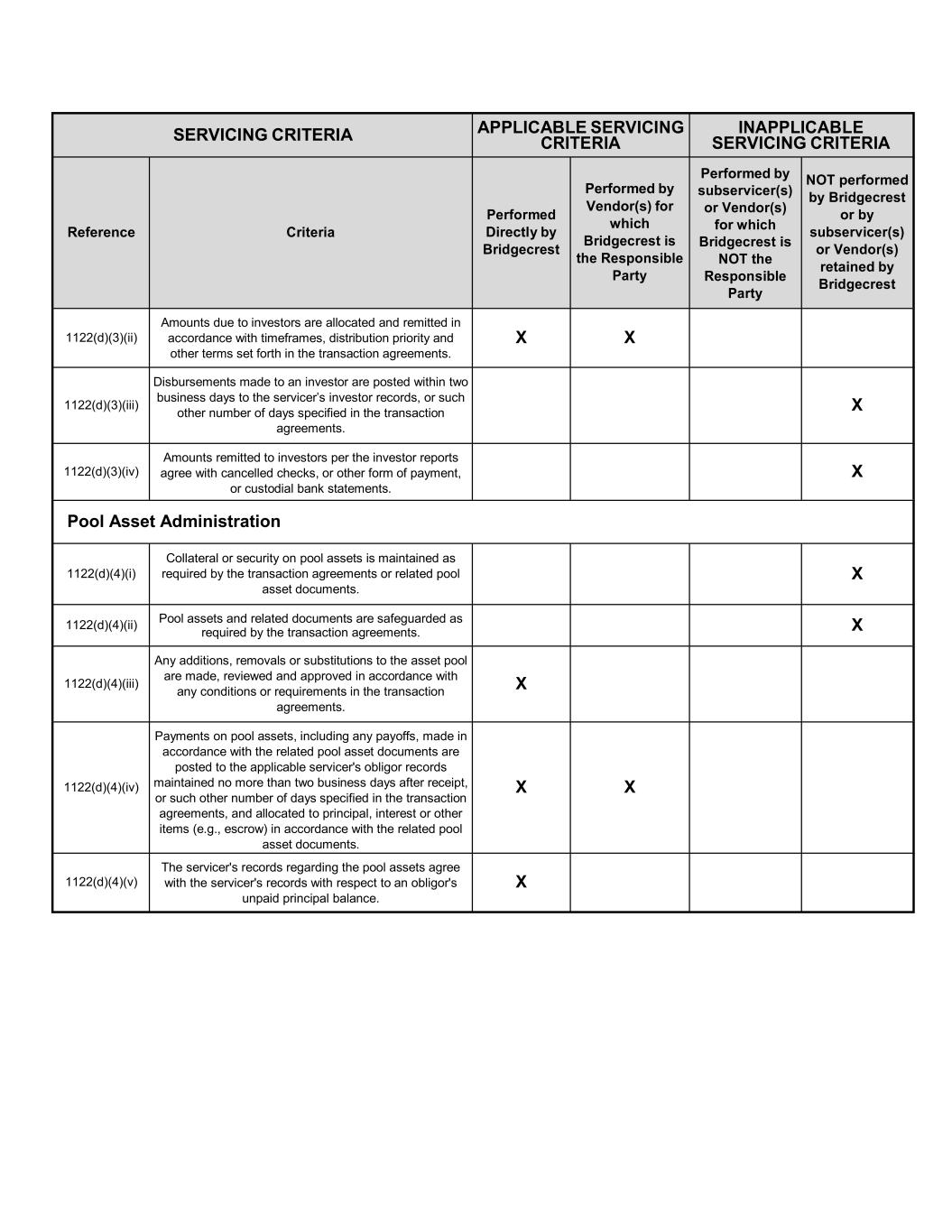

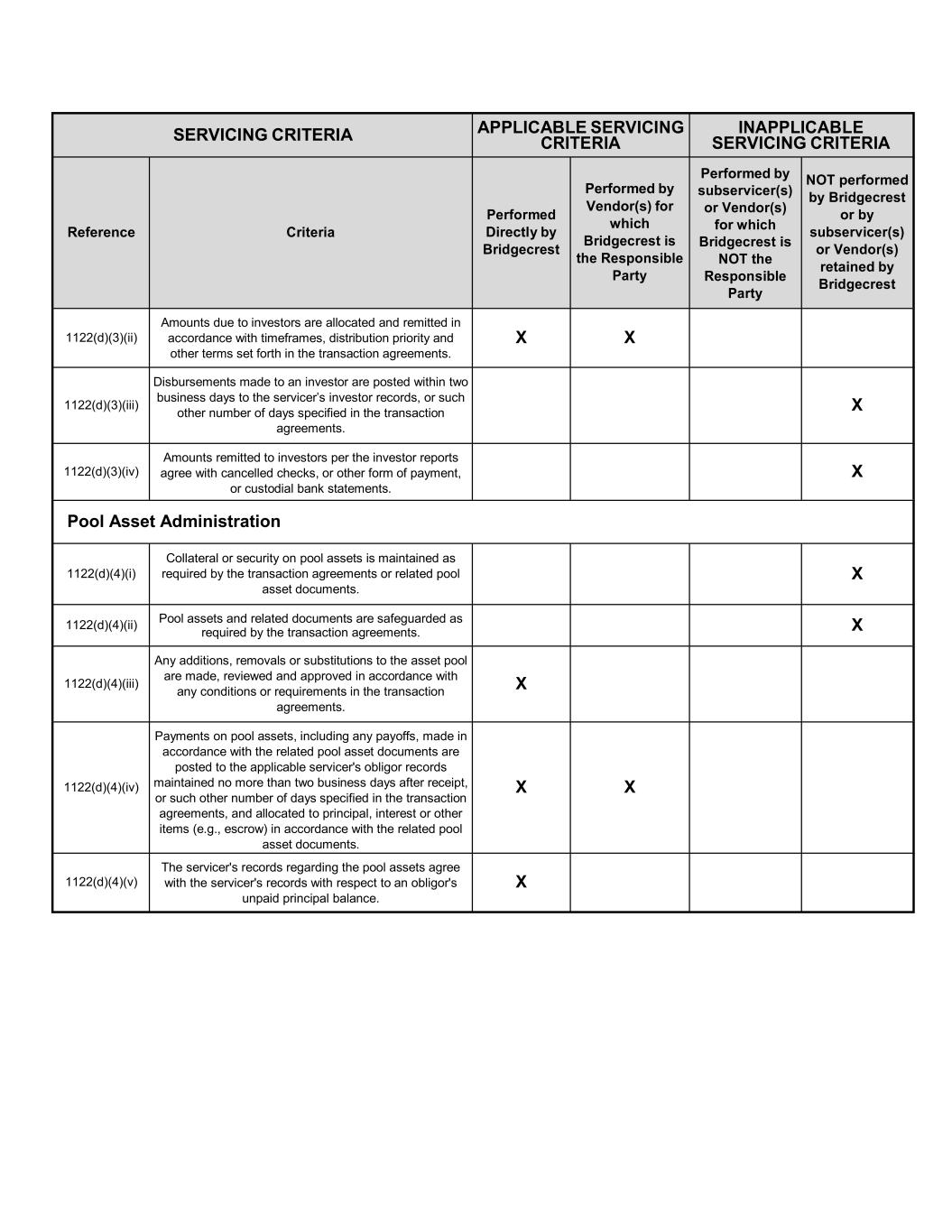

SERVICING CRITERIA APPLICABLE SERVICING CRITERIA INAPPLICABLE SERVICING CRITERIA Reference Criteria Performed Directly by Bridgecrest Performed by Vendor(s) for which Bridgecrest is the Responsible Party Performed by subservicer(s) or Vendor(s) for which Bridgecrest is NOT the Responsible Party NOT performed by Bridgecrest or by subservicer(s) or Vendor(s) retained by Bridgecrest 1122(d)(3)(ii) Amounts due to investors are allocated and remitted in accordance with timeframes, distribution priority and other terms set forth in the transaction agreements. X X 1122(d)(3)(iii) Disbursements made to an investor are posted within two business days to the servicer’s investor records, or such other number of days specified in the transaction agreements. X 1122(d)(3)(iv) Amounts remitted to investors per the investor reports agree with cancelled checks, or other form of payment, or custodial bank statements. X Pool Asset Administration 1122(d)(4)(i) Collateral or security on pool assets is maintained as required by the transaction agreements or related pool asset documents. X 1122(d)(4)(ii) Pool assets and related documents are safeguarded as required by the transaction agreements. X 1122(d)(4)(iii) Any additions, removals or substitutions to the asset pool are made, reviewed and approved in accordance with any conditions or requirements in the transaction agreements. X 1122(d)(4)(iv) Payments on pool assets, including any payoffs, made in accordance with the related pool asset documents are posted to the applicable servicer's obligor records maintained no more than two business days after receipt, or such other number of days specified in the transaction agreements, and allocated to principal, interest or other items (e.g., escrow) in accordance with the related pool asset documents. X X 1122(d)(4)(v) The servicer's records regarding the pool assets agree with the servicer's records with respect to an obligor's unpaid principal balance. X

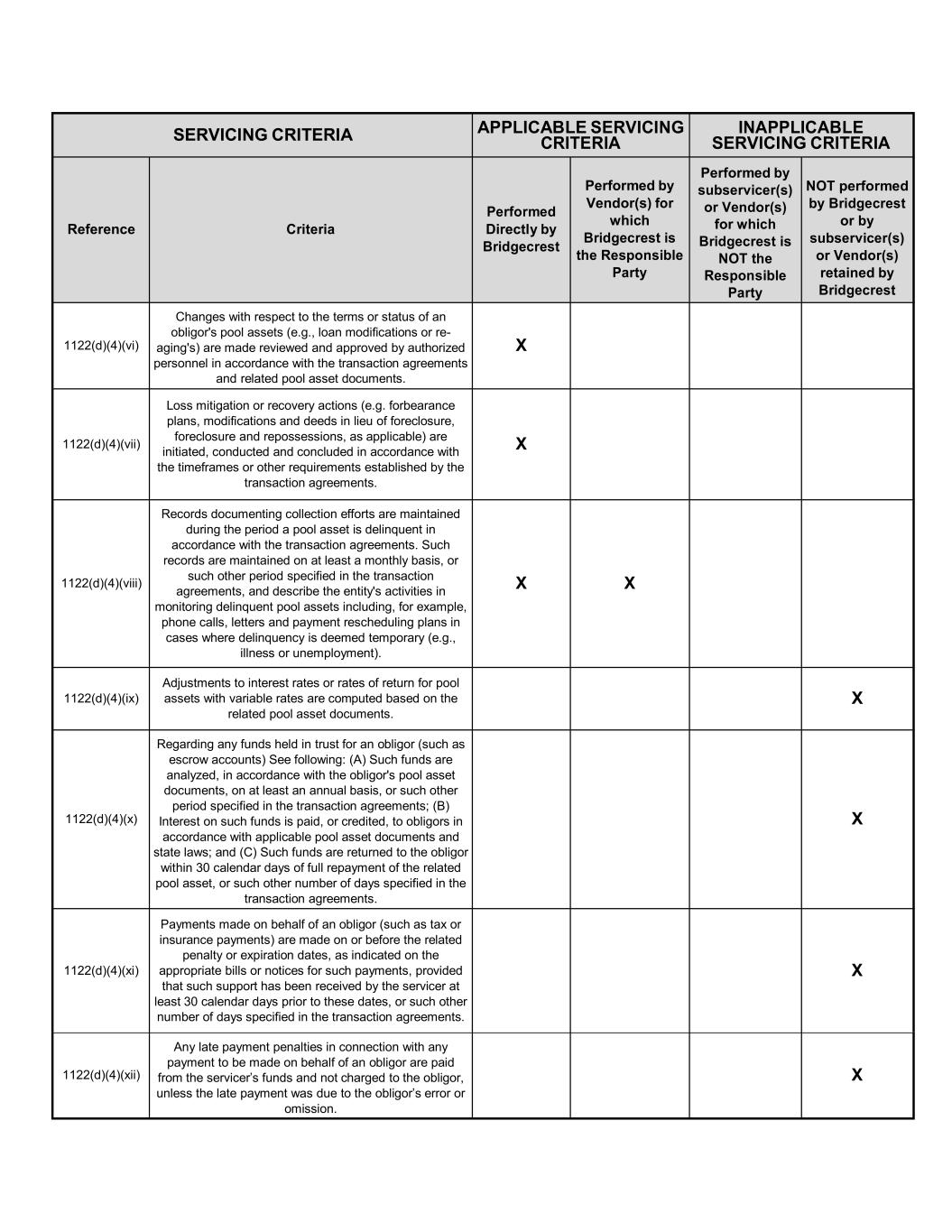

SERVICING CRITERIA APPLICABLE SERVICING CRITERIA INAPPLICABLE SERVICING CRITERIA Reference Criteria Performed Directly by Bridgecrest Performed by Vendor(s) for which Bridgecrest is the Responsible Party Performed by subservicer(s) or Vendor(s) for which Bridgecrest is NOT the Responsible Party NOT performed by Bridgecrest or by subservicer(s) or Vendor(s) retained by Bridgecrest 1122(d)(4)(vi) Changes with respect to the terms or status of an obligor's pool assets (e.g., loan modifications or re- aging's) are made reviewed and approved by authorized personnel in accordance with the transaction agreements and related pool asset documents. X 1122(d)(4)(vii) Loss mitigation or recovery actions (e.g. forbearance plans, modifications and deeds in lieu of foreclosure, foreclosure and repossessions, as applicable) are initiated, conducted and concluded in accordance with the timeframes or other requirements established by the transaction agreements. X 1122(d)(4)(viii) Records documenting collection efforts are maintained during the period a pool asset is delinquent in accordance with the transaction agreements. Such records are maintained on at least a monthly basis, or such other period specified in the transaction agreements, and describe the entity's activities in monitoring delinquent pool assets including, for example, phone calls, letters and payment rescheduling plans in cases where delinquency is deemed temporary (e.g., illness or unemployment). X X 1122(d)(4)(ix) Adjustments to interest rates or rates of return for pool assets with variable rates are computed based on the related pool asset documents. X 1122(d)(4)(x) Regarding any funds held in trust for an obligor (such as escrow accounts) See following: (A) Such funds are analyzed, in accordance with the obligor's pool asset documents, on at least an annual basis, or such other period specified in the transaction agreements; (B) Interest on such funds is paid, or credited, to obligors in accordance with applicable pool asset documents and state laws; and (C) Such funds are returned to the obligor within 30 calendar days of full repayment of the related pool asset, or such other number of days specified in the transaction agreements. X 1122(d)(4)(xi) Payments made on behalf of an obligor (such as tax or insurance payments) are made on or before the related penalty or expiration dates, as indicated on the appropriate bills or notices for such payments, provided that such support has been received by the servicer at least 30 calendar days prior to these dates, or such other number of days specified in the transaction agreements. X 1122(d)(4)(xii) Any late payment penalties in connection with any payment to be made on behalf of an obligor are paid from the servicer’s funds and not charged to the obligor, unless the late payment was due to the obligor’s error or omission. X

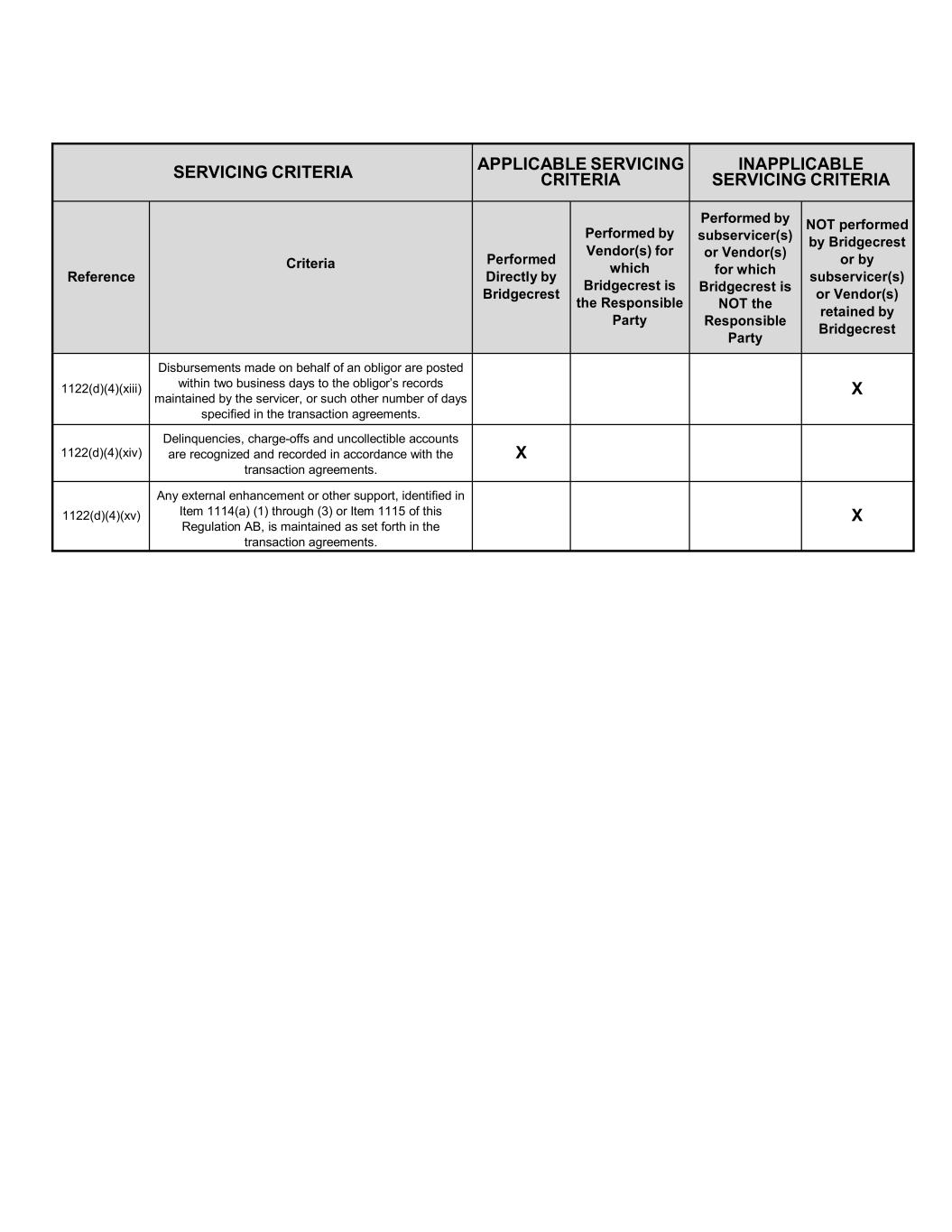

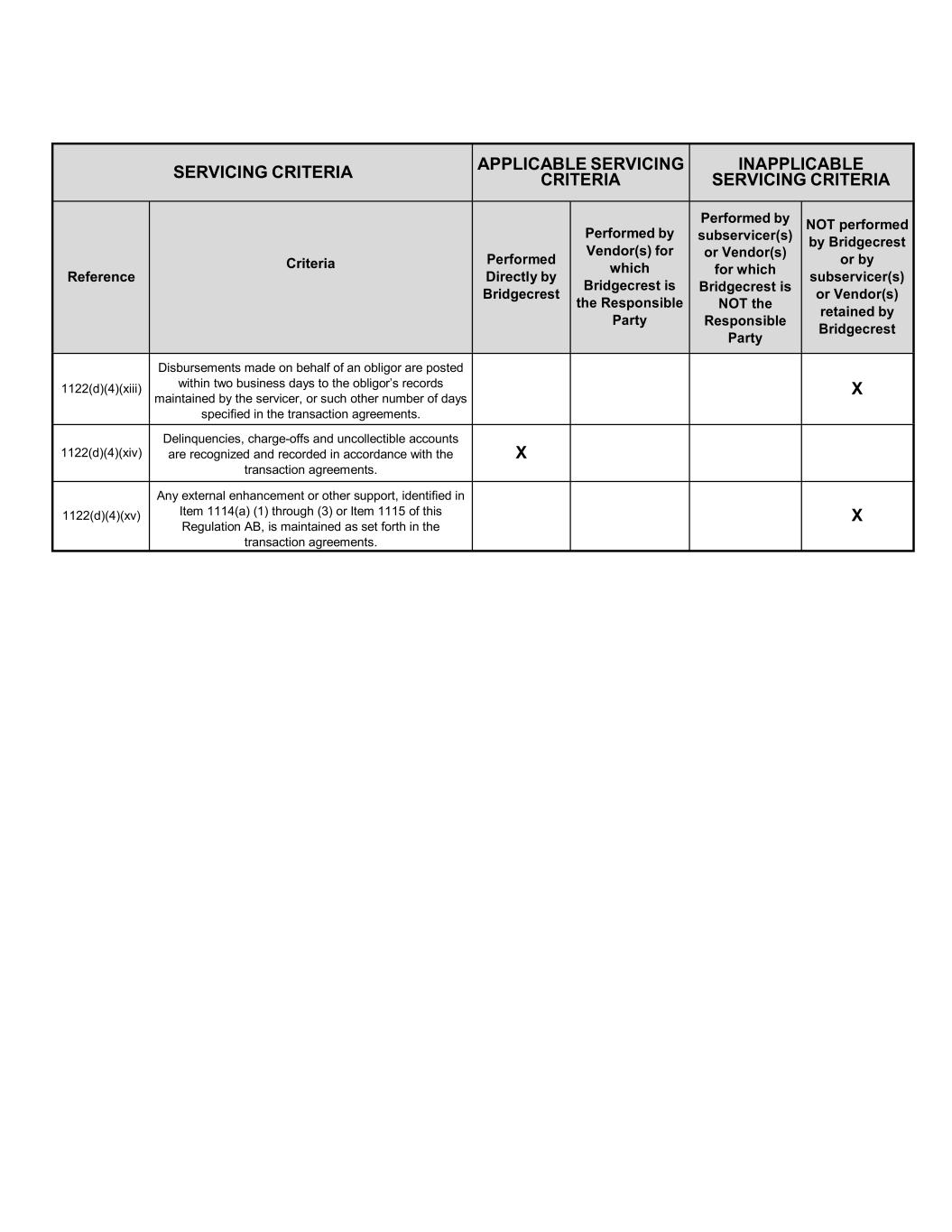

SERVICING CRITERIA APPLICABLE SERVICING CRITERIA INAPPLICABLE SERVICING CRITERIA Reference Criteria Performed Directly by Bridgecrest Performed by Vendor(s) for which Bridgecrest is the Responsible Party Performed by subservicer(s) or Vendor(s) for which Bridgecrest is NOT the Responsible Party NOT performed by Bridgecrest or by subservicer(s) or Vendor(s) retained by Bridgecrest 1122(d)(4)(xiii) Disbursements made on behalf of an obligor are posted within two business days to the obligor’s records maintained by the servicer, or such other number of days specified in the transaction agreements. X 1122(d)(4)(xiv) Delinquencies, charge-offs and uncollectible accounts are recognized and recorded in accordance with the transaction agreements. X 1122(d)(4)(xv) Any external enhancement or other support, identified in Item 1114(a) (1) through (3) or Item 1115 of this Regulation AB, is maintained as set forth in the transaction agreements. X

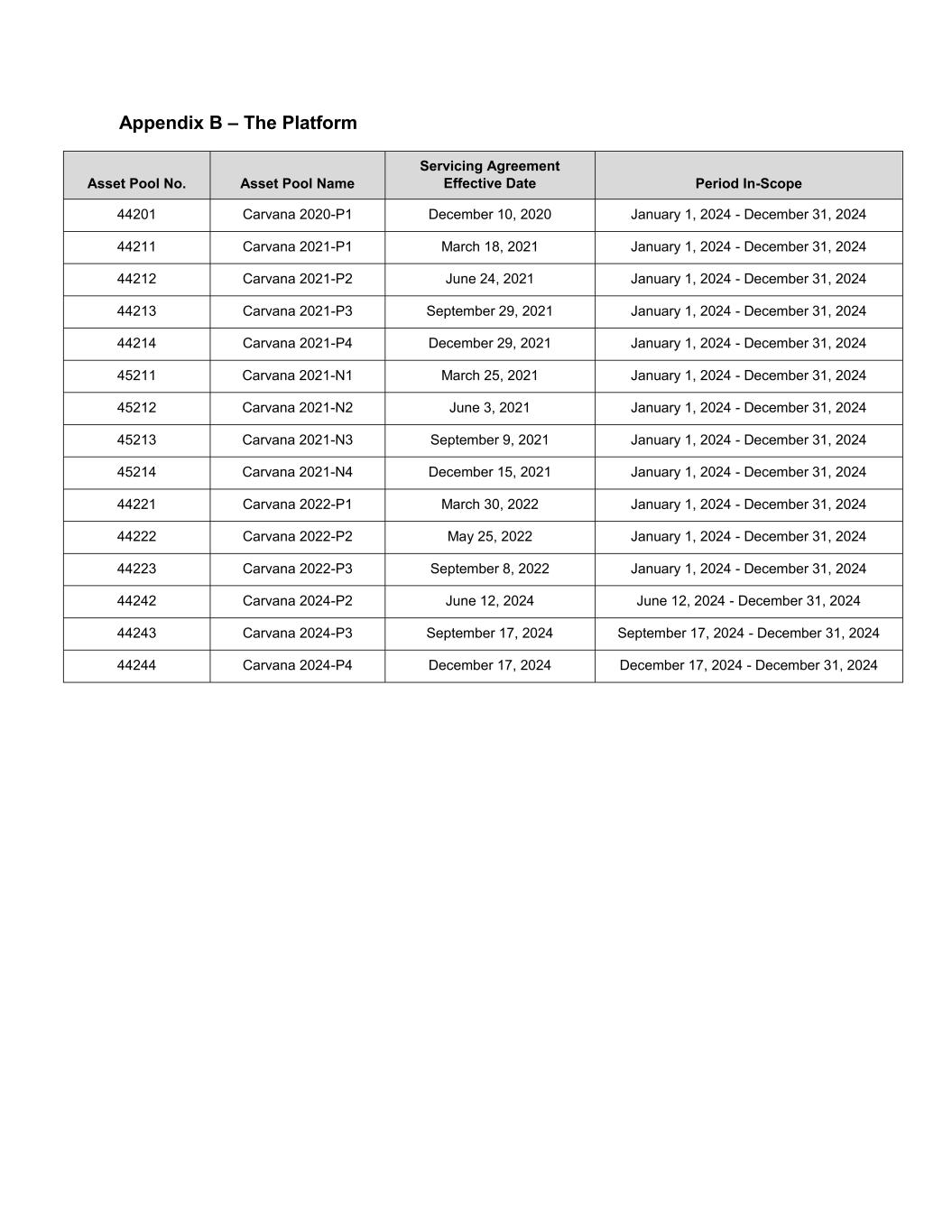

Appendix B – The Platform Asset Pool No. Asset Pool Name Servicing Agreement Effective Date Period In-Scope 44201 Carvana 2020-P1 December 10, 2020 January 1, 2024 - December 31, 2024 44211 Carvana 2021-P1 March 18, 2021 January 1, 2024 - December 31, 2024 44212 Carvana 2021-P2 June 24, 2021 January 1, 2024 - December 31, 2024 44213 Carvana 2021-P3 September 29, 2021 January 1, 2024 - December 31, 2024 44214 Carvana 2021-P4 December 29, 2021 January 1, 2024 - December 31, 2024 45211 Carvana 2021-N1 March 25, 2021 January 1, 2024 - December 31, 2024 45212 Carvana 2021-N2 June 3, 2021 January 1, 2024 - December 31, 2024 45213 Carvana 2021-N3 September 9, 2021 January 1, 2024 - December 31, 2024 45214 Carvana 2021-N4 December 15, 2021 January 1, 2024 - December 31, 2024 44221 Carvana 2022-P1 March 30, 2022 January 1, 2024 - December 31, 2024 44222 Carvana 2022-P2 May 25, 2022 January 1, 2024 - December 31, 2024 44223 Carvana 2022-P3 September 8, 2022 January 1, 2024 - December 31, 2024 44242 Carvana 2024-P2 June 12, 2024 June 12, 2024 - December 31, 2024 44243 Carvana 2024-P3 September 17, 2024 September 17, 2024 - December 31, 2024 44244 Carvana 2024-P4 December 17, 2024 December 17, 2024 - December 31, 2024

Exhibit 33.2

Computershare

9062 Old Annapolis Road

Columbia, Maryland 21045

www.computershare.com

ASSESSMENT OF COMPLIANCE WITH THE APPLICABLE SERVICING CRITERIA

Computershare Corporate Trust- ABS Platform

The management (“Management”) of the Computershare Corporate Trust division of Computershare Trust Company, National Association (the “Company”) is responsible for assessing the Company’s compliance with the applicable servicing criteria set forth in Item 1122(d) of Regulation AB of the Securities and Exchange Commission. Management has determined that the servicing criteria are applicable to the servicing platform for the period as follows:

Purchase of corporate trust business. On November 1, 2021, Wells Fargo Bank, N.A. (“Wells Fargo”) and certain of its affiliates sold substantially all of its Corporate Trust Services (“CTS”) division to the Company, Computershare Delaware Trust Company (“CDTC”), and Computershare Limited (“Computershare Limited,” and collectively with the Company and CDTC, “Computershare”). Virtually all CTS employees of Wells Fargo, along with most existing CTS systems, technology, and offices transferred to Computershare as part of the sale.

For the ABS Platform (defined below) transactions and during the Period (defined below), the Company either (i) served directly in the related trustee (except Delaware trustee or owner trustee), paying agent services, and/or related services, (collectively, the “ABS Platform Roles”), or (ii) served as agent for Wells Fargo who remained in the related ABS Platform Roles. More specifically, since its acquisition of the Wells Fargo CTS business on November 1, 2021, including during the Period, the Company has (i) closed new ABS transactions and (ii) completed the transfer of certain ABS transaction roles from Wells Fargo CTS to Computershare, for which, in each case, during all or a portion of the Period, the Company performed the related ABS Platform Roles directly (the “Company’s Direct Role Transactions”). As of the end of the Period, the Company’s Direct Role Transactions comprise a majority of the overall ABS Platform transactions. For a minority of ABS Platform transactions, the Company served, during all or a portion of the Period, as agent for Wells Fargo who remained in the related ABS Platform Roles (the “Company’s Agent Role Transactions”). For the Company’s Agent Role Transactions, Wells Fargo had not, as of the beginning of the Period, transferred to Computershare the ABS Platform Roles for the Company’s Agent Role Transactions, and therefore the Company performed, during all or a portion of the Period, virtually all of Wells Fargo’s contractual duties for such transactions as its agent. As a result, for the Company’s Agent Role Transactions, the Company and Wells Fargo have determined that the Company is a party participating in the servicing function with respect to the ABS Platform, and accordingly, the Company is taking responsibility for assessing its compliance with the Applicable Servicing Criteria (defined below) relevant to the servicing activities performed by the Company for the ABS Platform, as of and for the twelve months ended December 31, 2024.

Period: As of January 1, 2024 through and including December 31, 2024 (the “Period”).

Platform: The platform consists of asset-backed securities (“ABS”) transactions for which the Company provides trustee (except Delaware trustee or owner trustee), paying agent services, and/or related services, either directly in the related role for such services or as the agent of the party performing such services, and for which either (i) some or all of the issued securities for such ABS transactions were publicly offered pursuant to a registration statement delivered under the Securities Act of 1933, as amended, or (ii) the issued securities for such ABS transactions were privately offered pursuant to an exemption from registration and the Company (and/or the party for whom it acts as agent) has an obligation under the transaction agreements to deliver an assessment of compliance with the applicable servicing criteria under Item 1122(d) of Regulation AB; provided however that, the platform excludes (a) any transactions for which the securities issued are mortgage-backed securities or mortgage-related asset-backed securities and (b) any ABS transactions for which the issuing entity

has a fiscal year that ends on a date other than the end of the calendar year (the “ABS Platform”). Appendix A identifies the individual transactions defined by Management as constituting the ABS Platform for the Period.

Applicable Servicing Criteria: All servicing criteria set forth in Item 1122(d) are applicable to either the Company’s obligations, or the obligations of the party for whom the Company ultimately acts as agent, in either case under the related transaction agreements with respect to the ABS Platform for the Period (as applicable, the “Company’s Obligations”), except for the following servicing criteria: 1122(d)(1)(v), 1122(d)(2)(iii), 1122(d)(3)(i)(B), 1122(d)(3)(i)(C), 1122(d)(3)(i)(D), 1122(d)(4)(ii), 1122(d)(4)(iv), 1122(d)(4)(v), 1122(d)(4)(vi), 1122(d)(4)(vii), 1122(d)(4)(viii), 1122(d)(4)(ix), 1122(d)(4)(x), 1122(d)(4)(xi), 1122(d)(4)(xii), 1122(d)(4)(xiii), and 1122(d)(4)(xiv), which Management has determined are not applicable to the Company’s Obligations in the related transaction agreements with respect to the ABS Platform for the Period; provided however that, with respect to the ABS Platform (a) servicing criterion 1122(d)(3)(i)(A) is applicable only as it relates to the Company’s Obligation to distribute or make available to investors, in accordance with the timeframes set forth in the transaction agreements, the relevant investor reports received by the Company from the entity preparing such reports; (b) servicing criterion 1122(d)(3)(ii) is applicable only as it relates to the Company’s Obligation to make remittances to investors in accordance with the transaction agreements; and (c) servicing criterion 1122(d)(4)(iii) is applicable only as it relates to the Company’s Obligation to obtain an Officer’s Certificate from the servicer and report any additions, removals and substitutions to investors on the relevant investor report, in each case, in accordance with the transaction agreements (the “Applicable Servicing Criteria”).

Third parties classified as vendors: With respect to servicing criterion 1122(d)(2)(vi) for certain transactions in the ABS Platform, the Company engaged a vendor to make certain payments by check to investors and/or third parties, and such vendor also safeguards certain unissued checks. Management has determined that the vendor is not considered a “servicer” as defined in Item 1101(j) of Regulation AB, and Management elects to take responsibility for assessing compliance with the portion of the servicing criterion applicable to the vendor as permitted by the SEC’s Compliance and Disclosure Interpretation (“C&DI”) 200.06, Vendors Engaged by Servicers (“C&DI 200.06”). The Company has policies and procedures in place designed to provide reasonable assurance that the vendor’s activities comply in all material respects with the servicing criterion applicable to the vendor. Management is solely responsible for determining that the Company meets the SEC requirements to apply C&DI 200.06 for the vendor and the related servicing criterion.

With respect to the ABS Platform and the Period, Management provides the following assessment of the Company’s compliance with respect to the Applicable Servicing Criteria:

1. Management is responsible for assessing the Company’s compliance with the Applicable Servicing Criteria.

2. Management has assessed the Company’s compliance with the Applicable Servicing Criteria including the servicing criterion for which compliance is determined based on C&DI 200.06 as described above. In performing this assessment, Management used the criteria set forth by the Securities and Exchange Commission in paragraph (d) of Item 1122 of Regulation AB.

3. With respect to Applicable Servicing Criteria 1122(d)(4)(i) and 1122(d)(4)(xv), Management has determined that there were no activities performed during the Period with respect to the ABS Platform, because there were no occurrences of events that would require the Company to perform such activities.

4. Based on such assessment for the Period, the Company has complied in all material respects with the Applicable Servicing Criteria for the Period.

PricewaterhouseCoopers LLP, an independent registered public accounting firm, has issued an attestation report with respect to Management’s assessment of the Company’s compliance with the Applicable Servicing Criteria for the Period.

Computershare Trust Company, National Association

By: /s/ Eileen O’Connor

Eileen R. O’Connor

Title: Senior Vice President

Dated: February 18, 2025

Appendix A to the Company’s Assessment of Compliance with the Applicable Servicing Criteria

| | | | | |

ABS Platform Transactions |

CTCNA Deal Identifier | Long Name |

| BANKONESER1 | Chase Issuance Trust |

| CARVANA2020P1 | Carvana Auto Receivables Trust 2020-P1 |

| CARVANA2021N1 | Carvana Auto Receivables Trust 2021-N1 |

| CARVANA2021N2 | Carvana Auto Receivables Trust 2021-N2 |

| CARVANA2021N3 | Carvana Auto Receivables Trust 2021-N3 |

| CARVANA2021N4 | Carvana Auto Receivables Trust 2021-N4 |

| CARVANA2021P1 | Carvana Auto Receivables Trust 2021-P1 |

| CARVANA2021P2 | Carvana Auto Receivables Trust 2021-P2 |

| CARVANA2021P3 | Carvana Auto Receivables Trust 2021-P3 |

| CARVANA2021P4 | Carvana Auto Receivables Trust 2021-P4 |

| CARVANA2022N1 | Carvana Auto Receivables Trust 2022-N1 |

| CARVANA2022P1 | Carvana Auto Receivables Trust 2022-P1 |

| CARVANA2022P2 | Carvana Auto Receivables Trust 2022-P2 |

| CARVANA2022P3 | Carvana Auto Receivables Trust 2022-P3 |

| CARVANA2023N1 | Carvana Auto Receivables Trust 2023-N1 |

| CARVANA2023N2 | Carvana Auto Receivables Trust 2023-N2 |

| CARVANA2023N3 | Carvana Auto Receivables Trust 2023-N3 |

| CARVANA2023N4 | Carvana Auto Receivables Trust 2023-N4 |

| CARVANA2023P1 | Carvana Auto Receivables Trust 2023-P1 |

| CARVANA2023P2 | Carvana Auto Receivables Trust 2023-P2 |

| CARVANA2023P3 | Carvana Auto Receivables Trust 2023-P3 |

| CARVANA2023P4 | Carvana Auto Receivables Trust 2023-P4 |

| CARVANA2023P5 | Carvana Auto Receivables Trust 2023-P5 |

| CARVANA2024N1 | Carvana Auto Receivables Trust 2024-N1 |

| CARVANA2024N2 | Carvana Auto Receivables Trust 2024-N2 |

| CARVANA2024N3 | Carvana Auto Receivables Trust 2024-N3 |

| CARVANA2024P1 | Carvana Auto Receivables Trust 2024-P1 |

| CARVANA2024P2 | Carvana Auto Receivables Trust 2024-P2 |

| CARVANA2024P3 | Carvana Auto Receivables Trust 2024-P3 |

| CARVANA2024P4 | Carvana Auto Receivables Trust 2024-P4 |

| CITEL051 | CIT Education Loan Trust 2005-1 |

| DTBLAST231 | Bridgecrest Lending Auto Securitization Trust 2023-1 |

| DTBLAST241 | Bridgecrest Lending Auto Securitization Trust 2024-1 |

| DTBLAST242 | Bridgecrest Lending Auto Securitization Trust 2024-2 |

| DTBLAST243 | Bridgecrest Lending Auto Securitization Trust 2024-3 |

| DTBLAST244 | Bridgecrest Lending Auto Securitization Trust 2024-4 |

| EART203 | Exeter Automobile Receivables Trust 2020-3 |

| EART212 | Exeter Automobile Receivables Trust 2021-2 |

| GMALT213 | GM Financial Automobile Leasing Trust 2021-3 |

| GMALT221 | GM Financial Automobile Leasing Trust 2022-1 |

| GMALT222 | GM Financial Automobile Leasing Trust 2022-2 |

| GMALT223 | GM Financial Automobile Leasing Trust 2022-3 |

| GMALT231 | GM Financial Automobile Leasing Trust 2023-1 |

| GMALT232 | GM Financial Automobile Leasing Trust 2023-2 |

| GMALT233 | GM Financial Automobile Leasing Trust 2023-3 |

| GMALT241 | GM Financial Automobile Leasing Trust 2024-1 |

| GMALT242 | GM Financial Automobile Leasing Trust 2024-2 |

| GMALT243 | GM Financial Automobile Leasing Trust 2024-3 |

| GMAMCAR241 | AmeriCredit Automobile Receivables Trust 2024-1 |

| GMCAR203 | GM Financial Consumer Automobile Receivables Trust 2020-3 |

| GMCAR204 | GM Financial Consumer Automobile Receivables Trust 2020-4 |

| GREENTREE961 | Green Tree Manufactured Housing Contract Senior/Subordinate Pass-Through Certificates, Series 1996-1 |

| GREENTREE962 | Green Tree Manufactured Housing Contract Senior/Subordinate Pass-Through Certificates, Series 1996-2 |

| NAVIENT151 | Navient Student Loan Trust 2015-1 |

| | | | | |

| NAVIENT152 | Navient Student Loan Trust 2015-2 |

| NAVIENT153 | Navient Student Loan Trust 2015-3 |

| NSLT043 | Nelnet Student Loan Trust Student Loan Asset Backed Notes Series 2004-3 |

| NSLT044 | Nelnet Student Loan Trust Student Loan Asset Backed Notes Series 2004-4 |

| NSLT051 | Nelnet Student Loan Trust Student Loan Asset Backed Notes Series 2005-1 |

| NSLT052 | Nelnet Student Loan Trust Student Loan Asset Backed Notes Series 2005-2 |

| NSLT053 | Nelnet Student Loan Trust Student Loan Asset Backed Notes Series 2005-3 |

| NSLT054 | Nelnet Student Loan Trust Student Loan Asset Backed Notes Series 2005-4 |

| NSLT061 | Nelnet Student Loan Trust Student Loan Asset Backed Notes Series 2006-1 |

| NSLT062 | Nelnet Student Loan Trust Student Loan Asset Backed Notes Series 2006-2 |

| NSLT063 | Nelnet Student Loan Trust Student Loan Asset Backed Notes Series 2006-3 |

| NSLT071 | Nelnet Student Loan Trust Student Loan Asset Backed Notes Series 2007-1 |

| OAKWOOD2000C | Oakwood Mortgage Investors 2000-C Senior/Subordinate Pass-Through Certificates |

| OAKWOOD2000D | Oakwood Mortgage Investors Series 2000-D Senior/Subordinate Pass-Through Certificates |

| SDART201 | Santander Drive Auto Receivables Trust 2020-1 |

| SDART202 | Santander Drive Auto Receivables Trust 2020-2 |

| SDART203 | Santander Drive Auto Receivables Trust 2020-3 |

| SDART204 | Santander Drive Auto Receivables Trust 2020-4 |

| SDART211 | Santander Drive Auto Receivables Trust 2021-1 |

Exhibit 33.3

Computershare

9062 Old Annapolis Road

Columbia, Maryland 21045

www.computershare.com

ASSESSMENT OF COMPLIANCE WITH THE APPLICABLE SERVICING CRITERIA

Computershare Corporate Trust - Document Custody Platform

The management (“Management”) of the Computershare Corporate Trust division of Computershare Trust Company, National Association (the “Company”) is responsible for assessing the Company’s compliance with the applicable servicing criteria set forth in Item 1122(d) of Regulation AB of the Securities and Exchange Commission. Management has determined that the servicing criteria are applicable to the servicing platform for the period as follows:

Purchase of corporate trust business. On November 1, 2021, Wells Fargo Bank, N.A. (“Wells Fargo”) and certain of its affiliates sold substantially all of its Corporate Trust Services (“CTS”) division to the Company, Computershare Delaware Trust Company (“CDTC”), and Computershare Limited (“Computershare Limited,” and collectively with the Company and CDTC, “Computershare”). Virtually all CTS employees of Wells Fargo, along with most existing CTS systems, technology, and offices transferred to Computershare as part of the sale.

For the Document Custody Platform (defined below) transactions and during the Period (defined below), the Company either (i) served directly in the related document custody services role (collectively, the “Document Custody Platform Role”), or (ii) served as agent for Wells Fargo who remained in the related Document Custody Platform Role. More specifically, since its acquisition of the Wells Fargo CTS business on November 1, 2021, including during the Period, the Company has (i) closed new document custody transactions and (ii) completed the transfer of certain document custody transaction roles from Wells Fargo CTS to Computershare, for which, in each case, during all or a portion of the Period, the Company performed the related Document Custody Platform Role directly (the “Company’s Direct Role Transactions”). The Company’s Direct Role Transactions comprise a minority of the overall Document Custody Platform transactions for the Period. For a significant majority of the Document Custody Platform transactions, the Company served, during all or a portion of the Period, as agent for Wells Fargo who remained in the related Document Custody Platform Role (the “Company’s Agent Role Transactions”). For the Company’s Agent Role Transactions, Wells Fargo had not, as of the beginning of the Period, transferred to Computershare the Document Custody Platform Role, and therefore the Company performed, during all or a portion of the Period, virtually all of Wells Fargo’s contractual duties for such transactions as its agent. As a result, for the Company’s Agent Role Transactions, the Company and Wells Fargo have determined that the Company is a party participating in the servicing function with respect to the Document Custody Platform, and accordingly, the Company is taking responsibility for assessing its compliance with the Applicable Servicing Criteria (defined below) relevant to the servicing activities performed by the Company for the Document Custody Platform, as of and for the twelve months ended December 31, 2024.

Period: As of January 1, 2024 through and including December 31, 2024 (the “Period”).

Platform: The platform consists of residential mortgage-backed securities (“RMBS”) transactions, commercial mortgage-backed securities (“CMBS”) transactions, and other asset-backed securities (“ABS”) transactions, in each case for which the Company provides document custody services, either directly in the related role for such services or as the agent of the party performing such services, and for which either (a) some or all of the issued securities for such RMBS, CMBS, and ABS transactions were publicly offered on or after January 1, 2006 pursuant to a registration statement delivered under the Securities Act of 1933, as amended, or (b) the issued securities for such RMBS, CMBS, and ABS transactions were privately offered on or after January 1, 2006 pursuant to an exemption from registration and the Company (and/or the party for whom it acts as agent) has

an obligation under the transaction agreements to deliver an assessment of compliance with the applicable servicing criteria under Item 1122(d) of Regulation AB; provided however that, the platform excludes any transactions for which the offered securities were issued, sponsored and/or guaranteed by any agency or instrumentality of the U.S. government or any government-sponsored entity, other than certain RMBS transactions for which the offered securities were issued, sponsored and/or guaranteed by the Federal Deposit Insurance Corporation (the “Document Custody Platform”). Appendix A identifies the individual transactions defined by Management as constituting the Document Custody Platform for the Period.

Applicable Servicing Criteria: Management has determined that the servicing criteria set forth in Item 1122(d)(1)(ii), 1122(d)(1)(iv), 1122(d)(4)(i), 1122(d)(4)(ii) and 1122(d)(4)(iii) are applicable to the Company’s obligations, or the obligations of the party for whom the Company ultimately acts as agent, in either case under the related transaction agreements with respect to the Document Custody Platform for the Period (as applicable, the “Company’s Obligations”); provided however that, with respect to the Document Custody Platform, servicing criterion 1122(d)(4)(iii) is applicable only as it relates to the Company’s Obligation to review and maintain the required loan documents related to any additions, removals or substitutions in accordance with the transaction agreements (the “Applicable Servicing Criteria”). Management has determined that all other servicing criteria set forth in Item 1122(d) are not applicable to the Company’s Obligations with respect to the Document Custody Platform for the Period.

Third parties classified as vendors: With respect to servicing criteria 1122(d)(4)(i) and 1122(d)(4)(ii), for certain ABS transactions included in the Document Custody Platform, the Company has engaged a vendor to handle certain aspects of maintaining and safeguarding pool assets, the security thereon, and related documents as required by such servicing criteria. Management has determined that the vendor is not considered a “servicer” as defined in Item 1101(j) of Regulation AB, and Management elects to take responsibility for assessing compliance with the portion of servicing criteria 1122(d)(4)(i) and 1122(d)(4)(ii) applicable to this vendor as permitted by the SEC’s Compliance and Disclosure Interpretation (“C&DI”) 200.06, Vendors Engaged by Servicers (“C&DI 200.06”). The Company has policies and procedures in place designed to provide reasonable assurance that the vendor’s activities comply in all material respects with the servicing criteria applicable to the vendor. Management is solely responsible for determining that the Company meets the SEC requirements to apply C&DI 200.06 for the vendor and the related servicing criteria.

With respect to the Document Custody Platform and the Period, Management provides the following assessment of the Company’s compliance with respect to the Applicable Servicing Criteria:

1. Management is responsible for assessing the Company’s compliance with the Applicable Servicing Criteria.

2. Management has assessed the Company’s compliance with the Applicable Servicing Criteria, including the servicing criteria for which compliance is determined based on C&DI 200.06 as described above. In performing this assessment, Management used the criteria set forth by the Securities and Exchange Commission in paragraph (d) of Item 1122 of Regulation AB.

3. With respect to Applicable Servicing Criterion 1122(d)(4)(iii), Management has determined that there were no activities performed during the Period with respect to the Document Custody Platform, because there were no occurrences of events that would require the Company to perform such activities.

4. Based on such assessment for the Period, the Company has complied in all material respects with the Applicable Servicing Criteria for the Period.

PricewaterhouseCoopers LLP, an independent registered public accounting firm, has issued an attestation report with respect to Management’s assessment of the Company’s compliance with the Applicable Servicing Criteria for the Period.

Computershare Trust Company, National Association

By: /s/ Laddy Keomaniphone-Tran

Laddy Keomaniphone-Tran

Title: Senior Vice President

Dated: February 18, 2025

Appendix A to the Company’s Assessment of Compliance with the Applicable Servicing Criteria

| | | | | |

Document Custody Platform Transactions |

CTCNA Deal Identifier | Long Name |

| 36502021-PF1 | 3650R 2021-PF1 Commercial Mortgage Trust Commercial Mortgage Pass-Through Certificates Series 2021-PF1 |

| 3650R2022-PF2 | 3650R 2022-PF2 Commercial Mortgage Trust Commercial Mortgage Pass-Through Certificates Series 2022-PF2 |

| ABFC 2006-HE1 | ABFC 2006-HE1 Trust Asset-Backed Funding Corporation Asset-Backed Certificates, Series 2006-HE1 |

| ABFC 2006-OPT1 | ABFC 2006-OPT1 Trust Asset-Backed Funding Corporation Asset-Backed Certificates, Series 2006-OPT1 |

| ABFC 2006-OPT2 | ABFC 2006-OPT2 Trust Asset-Backed Funding Corporation Asset-Backed Certificates, Series 2006-OPT2 |

| ABFC 2006-OPT3 | ABFC 2006-OPT3 Trust Asset-Backed Funding Corporation Asset-Backed Certificates, Series 2006-OPT3 |

| ABFC 2007-WMC1 | ABFC 2007-WMC1 Trust Asset Backed Funding Corporation Asset Backed Certificates, Series 2007-WMC1 |

| ABSC2006-HE3 | Asset Backed Securities Corporation Home Equity Loan Trust, Series OOMC 2006-HE3 Asset Backed Pass-Through Certificates, Series OOMC 2006-HE3 |

| ABSC2006-HE5 | Asset Backed Securities Corporation Home Equity Loan Trust, Series OOMC 2006-HE5 Asset Backed Pass-Through Certificates, Series OOMC 2006-HE5 |

| ACE 2006-ASAP1 | ACE Securities Corp. Home Equity Loan Trust, Series 2006-ASAP1 Asset-Backed Pass-Through Certificates |

| ACE 2006-ASAP3 | ACE Securities Corp. Home Equity Loan Trust, Series 2006-ASAP3 Asset-Backed Pass-Through Certificates |

| ACE 2006-ASAP4 | ACE Securities Corp. Home Equity Loan Trust, Series 2006-ASAP4 Asset-Backed Pass-Through Certificates |

| ACE 2006-ASAP5 | ACE Securities Corp. Home Equity Loan Trust, Series 2006-ASAP5 Asset-Backed Pass-Through Certificates |

| ACE 2006-ASAP6 | ACE Securities Corp. Home Equity Loan Trust, Series 2006-ASAP6 Asset-Backed Pass-Through Certificates |

| ACE 2006-ASL1 | ACE Securities Corp. Home Equity Loan Trust, Series 2006-ASL1 Asset-Backed Pass-Through Certificates |

| ACE 2006-CW1 | ACE Securities Corp. Home Equity Loan Trust, Series 2006-CW1 Asset-Backed Pass-Through Certificates |

| ACE 2006-FM1 | ACE Securities Corp. Home Equity Loan Trust, Series 2006-FM1 Asset-Backed Pass-Through Certificates |

| ACE 2006-FM2 | ACE Securities Corp. Home Equity Loan Trust, Series 2006-FM2 Asset-Backed Pass-Through Certificates |

| ACE 2006-HE1 | ACE Securities Corp. Home Equity Loan Trust, Series 2006-HE1 Asset-Backed Pass-Through Certificates |

| ACE 2006-HE3 | ACE Securities Corp. Home Equity Loan Trust, Series 2006-HE3 Asset-Backed Pass-Through Certificates |

| ACE 2006-HE4 | ACE Securities Corp. Home Equity Loan Trust, Series 2006-HE4 Asset-Backed Pass-Through Certificates |

| ACE 2006-OP1 | ACE Securities Corp. Home Equity Loan Trust, Series 2006-OP1 Asset-Backed Pass-Through Certificates |

| ACE 2006-OP2 | ACE Securities Corp. Home Equity Loan Trust, Series 2006-OP2 Asset-Backed Pass-Through Certificates |

| ACE 2006-SD1 | ACE Securities Corp. Home Equity Loan Trust, Series 2006-SD1 Asset-Backed Pass-Through Certificates |

| ACE 2006-SD2 | ACE Securities Corp. Home Equity Loan Trust, Series 2006-SD2 Asset-Backed Pass-Through Certificates |

| ACE 2006-SL1 | ACE Securities Corp. Home Equity Loan Trust, Series 2006-SL1 Asset-Backed Pass-Through Certificates |

| ACE 2006-SL2 | ACE Securities Corp. Home Equity Loan Trust, Series 2006-SL2 Asset-Backed Pass-Through Certificates |

| ACE 2006-SL3 | ACE Securities Corp. Home Equity Loan Trust, Series 2006-SL3 Asset-Backed Pass-Through Certificates |

| ACE 2006-SL4 | ACE Securities Corp. Home Equity Loan Trust, Series 2006-SL4 Asset-Backed Pass-Through Certificates |

| ACE 2007-ASAP1 | ACE Securities Corp. Home Equity Loan Trust, Series 2007-ASAP1 Asset-Backed Pass-Through Certificates |

| ACE 2007 ASAP2 | ACE Securities Corp. Home Equity Loan Trust, Series 2007-ASAP2 Asset-Backed Pass-Through Certificates |

| ACE 2007-ASL1 | ACE Securities Corp. Home Equity Loan Trust, Series 2007-ASL1 Asset-Backed Pass-Through Certificates |

| ACE 2007-D1 | ACE Securities Corp. Mortgage Loan Trust, Series 2007-D1 |

| ACE 2007-HE1 | ACE Securities Corp. Home Equity Loan Trust, Series 2007-HE1 Asset-Backed Pass-Through Certificates |

| | | | | |

| ACE 2007-HE2 | ACE Securities Corp. Home Equity Loan Trust, Series 2007-HE2 Asset-Backed Pass-Through Certificates |

| ACE 2007-HE3 | ACE Securities Corp. Home Equity Loan Trust, Series 2007-HE3 Asset-Backed Pass-Through Certificates |

| ACE 2007-HE4 | ACE Securities Corp. Home Equity Loan Trust, Series 2007-HE4 Asset-Backed Pass-Through Certificates |

| ACE 2007-HE5 | ACE Securities Corp. Home Equity Loan Trust, Series 2007-HE5 Asset-Backed Pass-Through Certificates |

| ACE 2007-SL1 | ACE Securities Corp. Home Equity Loan Trust, Series 2007-SL1 Asset-Backed Pass-Through Certificates |

| ACE 2007-SL2 | ACE Securities Corp. Home Equity Loan Trust, Series 2007-SL2 Asset-Backed Pass-Through Certificates |

| ACE 2007-WM1 | ACE Securities Corp. Home Equity Loan Trust, Series 2007-WM1 Asset-Backed Pass-Through Certificates |

| ACE 2007-WM2 | ACE Securities Corp. Home Equity Loan Trust, Series 2007-WM2 Asset-Backed Pass-Through Certificates |

| AHPT2024-ATRM | Atrium Hotel Portfolio Trust 2024-ATRM Commercial Mortgage Pass-Through Certificates, Series 2024-ATRM |

| AMMST2021-MF2 | Arbor Multifamily Mortgage Securities Trust 2021-MF2 Multifamily Mortgage Pass-Through Certificates Series 2021-MF2 |

| AMMST2021-MF3 | Arbor Multifamily Mortgage Securities Trust 2021-MF3 Multifamily Mortgage Pass-Through Certificates Series 2021-MF3 |

| AMMST2022-MF4 | Arbor Multifamily Mortgage Securities Trust 2022-MF4 Multifamily Mortgage Pass-Through Certificates Series 2022-MF4 |

| ARMT 2006-2 | Adjustable Rate Mortgage Trust 2006-2 Adjustable Rate Mortgage-Backed Pass-Through Certificates, Series 2006-2 |

| ARMT 2006-3 | Adjustable Rate Mortgage Trust 2006-3 Adjustable Rate Mortgage-Backed Pass-Through Certificates, Series 2006-3 |

| BAC 2006-4 | Banc of America Commercial Mortgage Inc., Commercial Mortgage Pass-Through Certificates, Series 2006-4 |

| BACM 2008-LS1 | Banc of America Commercial Mortgage Inc., Commercial Mortgage Pass-Through Certificates, Series 2008-LS1 |

| BACM2016-UBS10 | Bank of America Merrill Lynch Commercial Mortgage Trust 2016-UBS10, Commercial Mortgage Pass-Through Certificates, Series 2016-UBS10 |

| BACM-2017-BNK3 | Bank of America Merrill Lynch Commercial Mortgage Trust 2017-BNK3, Commercial Mortgage Pass-Through Certificates, Series 2017-BNK3 |

| BACM2017-BNK6 | BANK 2017-BNK6 Commercial Mortgage Pass-Through Certificates, Series 2017-BNK6 |

| BACM2017-BNK9 | BANK 2017-BNK9 Commercial Mortgage Pass-Through Certificates, Series 2017-BNK9 |

| BACM2018-BNK12 | BANK 2018-BNK12 Commercial Mortgage Pass-Through Certificates, Series 2018-BNK12 |

| BACM2018-BNK15 | BANK 2018-BNK15 Commercial Mortgage Pass-Through Certificates, Series 2018-BNK15 |

| BACM2019-BNK18 | BANK 2019-BNK18 Commercial Mortgage Pass-Through Certificates, Series 2019-BNK18 |

| BACM2019-BNK21 | BANK 2019-BNK21 Commercial Mortgage Pass-Through Certificates, Series 2019-BNK21 |

| BACM2019-BNK24 | BANK 2019-BNK24 Commercial Mortgage Pass-Through Certificates, Series 2019-BNK24 |

| BACM2020-BNK27 | BANK 2020-BNK27 Commercial Mortgage Pass-Through Certificates, Series 2020-BNK27 |

| BACM2020-BNK30 | BANK 2020-BNK30 Commercial Mortgage Pass-Through Certificates, Series 2020-BNK30 |

| BACM2021-BNK33 | BANK 2021-BNK33 Commercial Mortgage Pass-Through Certificates, Series 2021-BNK33 |

| BACM2021-BNK36 | BANK 2021-BNK36 Commercial Mortgage Pass-Through Certificates, Series 2021-BNK36 |

| BAFC 2006-B | Banc of America Funding Corporation, Mortgage Pass-Through Certificates Series 2006-B |

| BAFC 2006-C | Banc of America Funding Corporation, Mortgage Pass-Through Certificates Series 2006-C |

| BAFC 2006-E | Banc of America Funding Corporation, Mortgage Pass-Through Certificates Series 2006-E |

| BAMLL2016-ISQR | BAMLL Commercial Mortgage Securities Trust 2016-ISQR, Commercial Mortgage Pass-Through Certificates, Series 2016-ISQR |

| BAMLL2017-AMO | Del Amo Fashion Center Trust 2017-AMO Commercial Mortgage Pass-Through Certificates, Series 2017-AMO |

| BAMLL2019-LIC | Jackson Park Trust 2019-LIC, Commercial Mortgage Pass-Through Certificates, Series 2019-LIC |

| BAMLL2020-BHP3 | BAMLL Commercial Mortgage Securities Trust 2020-BHP3, Commercial Mortgage Pass-Through Certificates, Series 2020-BHP3 |

| BAMLL2020-BOC | BAMLL Commercial Mortgage Securities Trust 2020-BOC, Commercial Mortgage Pass-Through Certificates, Series 2020-BOC |

| BAMLL2020-GRCE | Grace Trust 2020-GRCE Commercial Mortgage Pass-Through Certificates, Series 2020-GRCE |

| BANK2018-BNK11 | BANK 2018-BNK11 Commercial Mortgage Pass-Through Certificates, Series 2018-BNK11 |

| BANK2019-BNK23 | BANK 2019-BNK23 Commercial Mortgage Pass-Through Certificates, Series 2019-BNK23 |

| BANK2020-BNK26 | BANK 2020-BNK26 Commercial Mortgage Pass Through Certificates, Series 2020-BNK26 |

| BANK2020-BNK28 | BANK 2020-BNK28 Commercial Mortgage Pass-Through Certificates, Series 2020-BNK28 |