| | | | | | | | |

| | |

| | PRIMECAP Odyssey Aggressive Growth Fund

Summary Prospectus February 28, 2025

|

| | |

| | |

| Before you invest, you may want to review the Fund’s Prospectus, which contains more information about the Fund and its risks. You can find the Fund’s Prospectus, Reports to Shareholders, Statement of Additional Information and other information about the Fund online at http://www.primecap.com. You may also obtain this information at no cost by calling 1-800-729-2307 or by email at prospectus@odysseyfunds.com. The Fund’s Prospectus and Statement of Additional Information dated February 28, 2025 are incorporated by reference into this Summary Prospectus |

Investment Objective

The PRIMECAP Odyssey Aggressive Growth Fund seeks to provide long-term capital appreciation.

Fees and Expenses of the Fund

This table describes the fees and expenses that you may pay if you buy, hold, and sell shares of the Fund. You may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the tables and examples below.

| | | | | |

Shareholder Fees

(Fees paid directly from your investment) | |

Maximum sales charge on purchases or reinvested dividends | None |

| Redemption or exchange fees | None |

| | | | | |

Annual Fund Operating Expenses

(Expenses that you pay each year as a percentage of the value of your investment) | |

| Management fees | 0.55% |

| Other expenses | 0.11% |

Total annual fund operating expenses(1) | 0.66% |

(1) Total Annual Fund Operating Expenses do not correlate to the Ratio of Expenses to Average Net Assets in the Financial Highlights section of the statutory prospectus, which reflects the operating expenses of the Fund and does not include acquired fund fees and expenses.

Example

The example below is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The example assumes that you invest $10,000 in the Fund for the time periods indicated and then redeem all of your shares at the end of those periods. The example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain the same. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

| | | | | | | | | | | | | | | | | | | | |

| 1 Year | | 3 Years | | 5 Years | | 10 Years |

| $67 | | $211 | | $368 | | $822 |

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover may indicate higher transaction costs and may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the example, affect the Fund’s performance. During the most recent fiscal year, the Fund’s portfolio turnover rate was 9% of the average value of its portfolio.

Principal Investment Strategies

The Fund invests primarily in the common stocks of U.S. companies, emphasizing those companies with prospects for rapid earnings growth. The Fund may invest in stocks across all market sectors and market capitalizations and has historically invested significant portions of its assets in mid- and small-capitalization companies. Because of the bottom-up stock selection process of PRIMECAP Management Company (the “Advisor”), the Fund may maintain a significantly overweight or underweight position in a particular sector relative to the S&P 500® index, a market capitalization-weighted index of 500 large-capitalization stocks commonly used to represent the U.S. equity market, at any time. The Fund may also invest substantial assets in foreign securities through depository receipts or stocks traded on U.S. or foreign exchanges.

The Advisor, through its fundamental research, seeks to identify stocks that are poised for rapid earnings growth. Catalysts for the desired growth may include new products, new markets, new management, restructuring, a structural shift in demand or supply, or other changes in industry dynamics. These stocks typically provide little or no current income. The Advisor looks for companies that, in its judgment, will grow faster and/or will be more profitable than their current market valuations suggest and for companies with asset values that are not adequately reflected in their stock prices. The Advisor may sell a stock if its market price appears to have risen above its fundamental value, if other securities appear to be more favorably priced, if the reasons for which the stock was purchased no longer hold true, or for other reasons. The Advisor maintains a long-term focus and attempts to identify stocks that it believes will outperform the S&P 500® index over a three- to five-year time frame.

| | | | | | | | |

| WWW.PRIMECAP.COM | • | 800-729-2307 |

Principal Risks

You may lose money by investing in the Fund. You should expect the Fund’s share price and total return to fluctuate within a wide range, like the fluctuations of the overall stock market. The Fund’s performance could be hurt by:

•Stock market risk. The chance that stock prices overall will decline. Stock markets tend to move in cycles, with periods of rising prices and periods of falling prices.

•Manager risk. The chance that, as a result of poor security selection by the Advisor, the Fund may underperform relative to its benchmarks or other funds with similar investment objectives.

•Investment style risk. The chance that returns from the mix of small- and mid-cap stocks in the Fund’s portfolio will trail returns from the overall stock market. Historically, these stocks have been more volatile in price than the large-cap stocks that dominate the overall stock market, and they often perform quite differently. Additionally, from time to time, growth stocks may be more volatile than the overall stock market.

•Growth stocks risk. The chance that returns from growth stocks in the Fund’s portfolio will trail returns from the overall stock market. Growth stocks are likely to be more volatile in price than the stock market as a whole. Historically, growth funds have tended to outperform the market as a whole in rising markets and underperform the market as a whole in declining markets. Of course, there is no guarantee that this pattern will continue in the future.

•Small- and mid-cap stocks risk. The chance that small- and mid-cap stocks may trade less frequently or in more limited volume than those of larger, more established companies; may fluctuate in value more; and, as a group, may suffer more severe price declines during periods of generally declining stock prices.

•Sector-focus risk. Investing a significant portion of the Fund’s assets in one sector of the market exposes the Fund to greater market risk and potential monetary losses than if those assets were spread among various sectors. If the Fund’s portfolio is overweighted in a certain sector, any negative development affecting that sector will have a greater impact on the Fund than a fund that is not overweighted in that sector. As of October 31, 2024, investments in the health care and information technology sectors each represented more than 25% of the Fund's net assets.

•Asset concentration risk. The chance that, because the Fund tends to invest a high percentage of its assets in its largest holdings, the Fund's performance may be hurt disproportionately by the poor performance of relatively few stocks.

•Foreign securities risk. The chance that the value of foreign securities will be adversely affected by the political and economic environments and other overall economic conditions in the countries where the Fund invests. Investing in foreign securities involves: country risk, which is the chance that domestic events - such as political upheaval, financial troubles, corruption, or natural disasters - will weaken a country’s securities markets; and currency risk, which is the chance that the value of a foreign investment, measured in U.S. dollars, will decrease because of unfavorable changes in currency exchange rates. Foreign companies are generally subject to different legal and accounting standards than U.S. companies, and foreign financial intermediaries may be subject to less supervision and regulation than U.S. financial firms.

•U.S. Administration Foreign Policy and Government Restructuring Risk. On January 20, 2025, Donald Trump was inaugurated as the President of the United States. The Trump administration’s aggressive foreign policy agenda, as well as its attempts to restructure federal government agencies, may have unforeseen consequences on the United States’ relations with foreign countries, the economy, and markets generally. The potential risks are not fully known and the Funds may be negatively affected by such events.

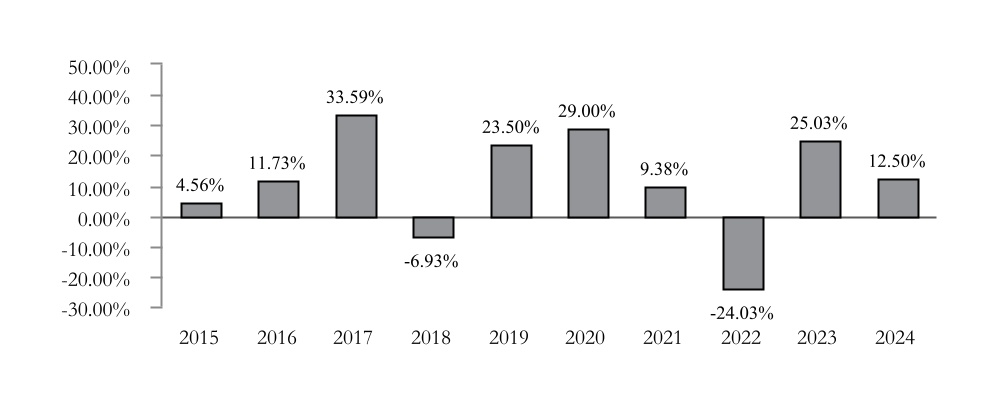

Fund Performance

The following performance information indicates some of the risks of investing in the Fund by showing changes in the Fund’s performance over time. The bar chart below illustrates the Fund’s total return for each of the last ten calendar years. The table below illustrates the Fund’s average annual return over time compared with a domestic broad-based securities market index. The Fund’s past performance, before and after taxes, is not necessarily an indication of how the Fund will perform in the future. Unlike the Fund’s returns, the index returns do not reflect any deductions for fees, expenses, or taxes. For additional information on the index, please see “Index Description” on page 41 of the statutory prospectus. Updated performance is available on the Fund’s website at www.primecap.com.

Calendar Year Total Return

During the period shown in the bar chart, the Fund’s highest quarterly return was +28.84% for the quarter ended June 30, 2020, and the lowest quarterly return was -22.47% for the quarter ended March 31, 2020.

| | | | | | | | |

| WWW.PRIMECAP.COM | • | 800-729-2307 |

Average Annual Total Returns as of December 31, 2024

| | | | | | | | | | | | | | |

| 1 Year | 5 Year | 10 Year | Annualized Since Inception (November 1, 2004) |

| PRIMECAP Odyssey Aggressive Growth Fund | | |

| Return Before Taxes | 12.50% | 8.56% | 10.46% | 12.22% |

| Return After Taxes on Distributions | 10.17% | 6.44% | 8.68% | 11.15% |

| Return After Taxes on Distributions and Sale of Fund Shares | 9.18% | 6.57% | 8.27% | 10.54% |

S&P 500® index (reflects no deduction for fees, expenses, or taxes) | 25.02% | 14.53% | 13.10% | 10.67% |

After-tax returns are calculated using the historical highest individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s tax situation and may differ from those shown, and after-tax returns shown may not be relevant to investors who hold their Fund shares through tax-advantaged arrangements, such as 401(k) plans or individual retirement accounts (“IRAs”).

The “Return After Taxes on Distributions and Sale of Fund Shares” is higher than other return figures when a capital loss occurs upon the redemption of Fund shares.

Investment Advisor

PRIMECAP Management Company is the investment advisor for the PRIMECAP Odyssey Aggressive Growth Fund.

Portfolio Managers

Theo A. Kolokotrones, Chairman Emeritus, Joel P. Fried, Chairman, Alfred W. Mordecai, President, M. Mohsin Ansari, Vice Chairman, and James Marchetti, Executive Vice President, each independently manages a portion of the PRIMECAP Odyssey Aggressive Growth Fund. Each of Messrs. Kolokotrones, Fried, and Mordecai has managed his respective portion of the Fund since its inception in 2004. Mr. Ansari has managed his portion of the Fund since April 2012. Mr. Marchetti has managed his portion of the Fund since January 2014.

Purchase and Sale of Fund Shares

Investors may purchase, exchange, or redeem Fund shares on any business day by written request or telephone. Shares may be purchased or redeemed by wire transfer. Certain transactions may be conducted online on the Fund’s website. You can conduct transactions by mail at PRIMECAP Odyssey Funds, c/o U.S. Bank Global Fund Services, P.O. Box 701, Milwaukee, Wisconsin 53201-0701 (for regular mail) or 615 East Michigan Street, 3rd Floor, Milwaukee, Wisconsin 53202-5207 (for overnight mail); by telephone at 1‑800‑729‑2307; or online at www.primecap.com. Redemptions by telephone are only permitted if the Fund has previously received appropriate authorization. Investors who wish to purchase, exchange, or redeem Fund shares through a broker-dealer should contact the broker-dealer directly. The minimum initial investment in the Fund is $2,000 for regular accounts and $1,000 for retirement accounts; subsequent investments must be at least $100.

Tax Information

The Fund’s distributions will normally be taxed as ordinary income, qualified dividend income, capital gains, or a combination of the three, unless you are investing through a tax-advantaged arrangement, such as a 401(k) plan or an IRA.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase the Fund through a broker-dealer or other financial intermediary, the Fund and its related companies may pay the intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by influencing the broker-dealer or other intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

| | | | | | | | |

| WWW.PRIMECAP.COM | • | 800-729-2307 |

This page intentionally left blank

| | | | | | | | |

| WWW.PRIMECAP.COM | • | 800-729-2307 |