UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22491

BrandywineGLOBAL - Global Income Opportunities Fund Inc.

(Exact name of registrant as specified in charter)

620 Eighth Avenue, 47th Floor, New York, NY 10018

(Address of principal executive offices) (Zip code)

Marc A. De Oliveira

Franklin Templeton

100 First Stamford Place

Stamford, CT 06902

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-888-777-0102

Date of fiscal year end: October 31

Date of reporting period: October 31, 2024

| ITEM 1. | REPORT TO STOCKHOLDERS. |

The Annual Report to Stockholders is filed herewith.

|

III

|

|

|

1

|

|

|

10

|

|

|

11

|

|

|

13

|

|

|

24

|

|

|

25

|

|

|

26

|

|

|

27

|

|

|

28

|

|

|

30

|

|

|

47

|

|

|

48

|

|

|

54

|

|

|

61

|

|

|

62

|

|

|

63

|

|

|

81

|

|

|

83

|

|

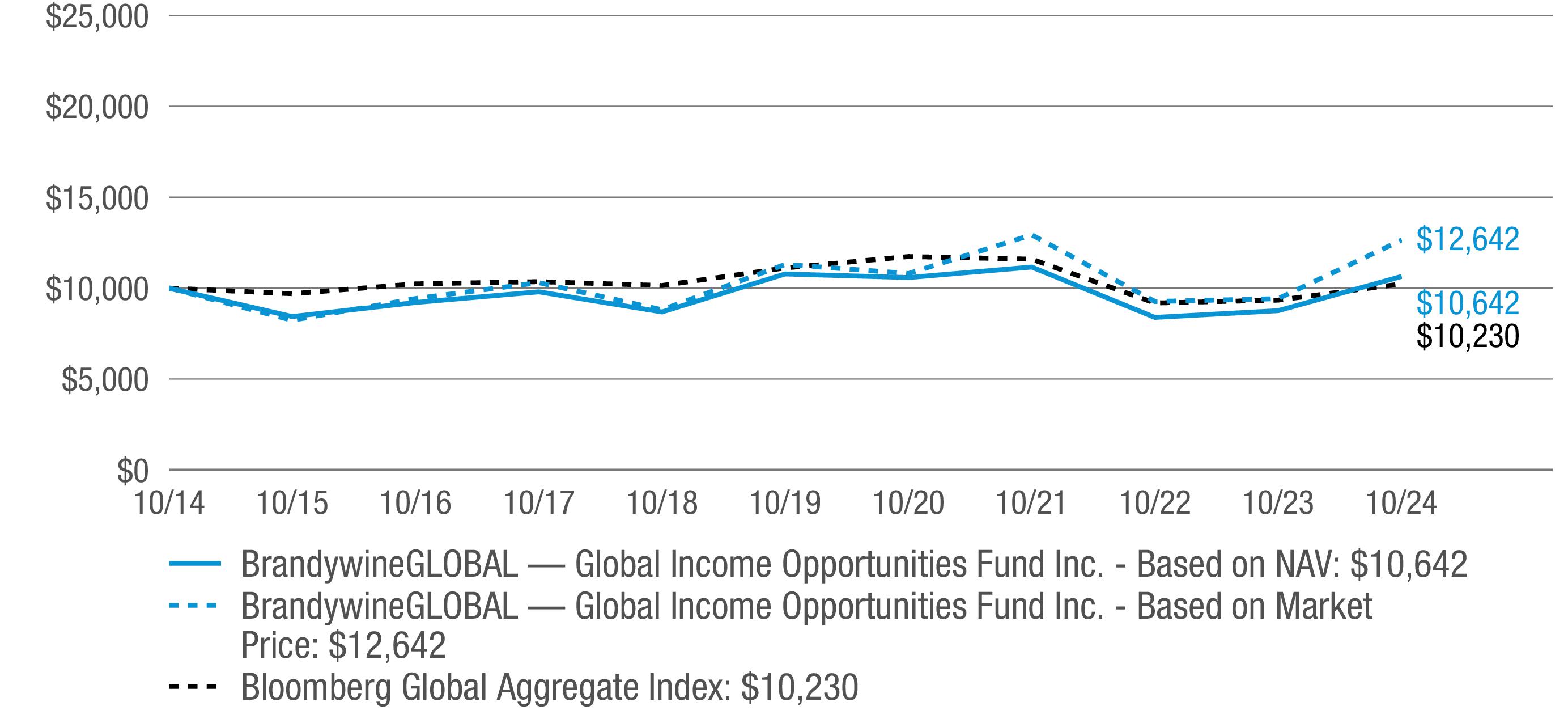

Performance Snapshot as of October 31, 2024

|

|

|

Price Per Share

|

12-Month

Total Return**

|

|

$9.19 (NAV)

|

21.50

%†

|

|

$8.42 (Market Price)

|

34.18

%‡

|

|

Net Asset Value

|

|

|

Average annual total returns1

|

|

|

Twelve Months Ended 10/31/24

|

21.50

%

|

|

Five Years Ended 10/31/24

|

-0.26

|

|

Ten Years Ended 10/31/24

|

0.62

|

|

Cumulative total returns1

|

|

|

10/31/14 through 10/31/24

|

6.41

%

|

|

Market Price

|

|

|

Average annual total returns2

|

|

|

Twelve Months Ended 10/31/24

|

34.18

%

|

|

Five Years Ended 10/31/24

|

2.26

|

|

Ten Years Ended 10/31/24

|

2.37

|

|

Cumulative total returns2

|

|

|

10/31/14 through 10/31/24

|

26.43

%

|

|

1

|

Assumes the reinvestment of all distributions, including returns of capital, if any,

at net asset value.

|

|

2

|

Assumes the reinvestment of all distributions, including returns of capital, if any,

in additional shares in

accordance with the Fund’s Dividend Reinvestment Plan.

|

|

Security

|

|

Rate

|

Maturity

Date

|

Face

Amount†

|

Value

|

|

Corporate Bonds & Notes — 100.1%

|

|||||

|

Communication Services — 10.1%

|

|||||

|

Diversified Telecommunication Services — 1.4%

|

|||||

|

Consolidated Communications Inc., Senior

Secured Notes

|

5.000%

|

10/1/28

|

890,000

|

$824,095

(a)(b)

|

|

|

Level 3 Financing Inc., Senior Secured Notes

|

10.500%

|

5/15/30

|

1,180,000

|

1,296,525

(a)(b)

|

|

|

Total Diversified Telecommunication Services

|

2,120,620

|

||||

|

Interactive Media & Services — 3.7%

|

|||||

|

ANGI Group LLC, Senior Notes

|

3.875%

|

8/15/28

|

2,200,000

|

1,992,808

(a)(b)

|

|

|

GrubHub Holdings Inc., Senior Notes

|

5.500%

|

7/1/27

|

4,000,000

|

3,736,587

(a)(b)

|

|

|

Total Interactive Media & Services

|

5,729,395

|

||||

|

Media — 5.0%

|

|||||

|

CCO Holdings LLC/CCO Holdings Capital

Corp., Senior Notes

|

4.500%

|

5/1/32

|

3,000,000

|

2,554,942

(b)

|

|

|

Colombia Telecomunicaciones SA ESP,

Senior Notes

|

4.950%

|

7/17/30

|

775,000

|

670,822

(a)(b)

|

|

|

DISH Network Corp., Senior Secured Notes

|

11.750%

|

11/15/27

|

1,000,000

|

1,053,390

(a)

|

|

|

Liberty Interactive LLC, Senior Notes

|

8.250%

|

2/1/30

|

725,000

|

372,131

(b)

|

|

|

Univision Communications Inc., Senior

Secured Notes

|

6.625%

|

6/1/27

|

3,000,000

|

2,979,448

(a)(b)

|

|

|

Total Media

|

7,630,733

|

||||

|

|

|||||

|

Total Communication Services

|

15,480,748

|

||||

|

Consumer Discretionary — 13.9%

|

|||||

|

Hotels, Restaurants & Leisure — 13.3%

|

|||||

|

Affinity Interactive, Senior Secured Notes

|

6.875%

|

12/15/27

|

3,000,000

|

2,465,117

(a)(b)

|

|

|

GPS Hospitality Holding Co. LLC/GPS

Finco Inc., Senior Secured Notes

|

7.000%

|

8/15/28

|

1,225,000

|

760,861

(a)(b)

|

|

|

Grupo Posadas SAB de CV, Senior Secured

Notes, Step bond (7.000% PIK to 12/30/25

then 8.000% Cash)

|

7.000%

|

12/30/27

|

3,000,000

|

2,742,166

(c)(d)

|

|

|

Lindblad Expeditions LLC, Senior Secured

Notes

|

6.750%

|

2/15/27

|

1,000,000

|

1,005,528

(a)(b)

|

|

|

Marriott Ownership Resorts Inc., Senior

Notes

|

4.500%

|

6/15/29

|

580,000

|

538,553

(a)(b)

|

|

|

Melco Resorts Finance Ltd., Senior Notes

|

5.250%

|

4/26/26

|

3,000,000

|

2,944,397

(a)(b)

|

|

|

Mohegan Tribal Gaming Authority, Secured

Notes

|

8.000%

|

2/1/26

|

2,780,000

|

2,763,036

(a)(b)

|

|

|

Studio City Co. Ltd., Senior Secured Notes

|

7.000%

|

2/15/27

|

3,000,000

|

3,020,730

(a)

|

|

|

Viking Cruises Ltd., Senior Notes

|

6.250%

|

5/15/25

|

645,000

|

645,646

(a)(b)

|

|

|

Viking Cruises Ltd., Senior Notes

|

5.875%

|

9/15/27

|

3,600,000

|

3,579,523

(a)(b)

|

|

|

Total Hotels, Restaurants & Leisure

|

20,465,557

|

||||

|

Security

|

|

Rate

|

Maturity

Date

|

Face

Amount†

|

Value

|

|

|

|||||

|

Specialty Retail — 0.6%

|

|||||

|

Michaels Cos. Inc., Senior Secured Notes

|

5.250%

|

5/1/28

|

1,400,000

|

$1,009,173

(a)(b)

|

|

|

|

|||||

|

Total Consumer Discretionary

|

21,474,730

|

||||

|

Consumer Staples — 5.4%

|

|||||

|

Consumer Staples Distribution & Retail — 1.7%

|

|||||

|

Walgreens Boots Alliance Inc., Senior Notes

|

8.125%

|

8/15/29

|

2,700,000

|

2,685,883

(b)

|

|

|

Food Products — 2.7%

|

|||||

|

Minerva Luxembourg SA, Senior Notes

|

4.375%

|

3/18/31

|

2,630,000

|

2,227,573

(a)(b)

|

|

|

Simmons Foods Inc./Simmons Prepared

Foods Inc./Simmons Pet Food Inc./Simmons

Feed Ingredients Inc., Secured Notes

|

4.625%

|

3/1/29

|

2,115,000

|

1,961,375

(a)(b)

|

|

|

Total Food Products

|

4,188,948

|

||||

|

Tobacco — 1.0%

|

|||||

|

Turning Point Brands Inc., Senior Secured

Notes

|

5.625%

|

2/15/26

|

1,480,000

|

1,475,739

(a)(b)

|

|

|

|

|||||

|

Total Consumer Staples

|

8,350,570

|

||||

|

Energy — 23.7%

|

|||||

|

Oil, Gas & Consumable Fuels — 23.7%

|

|||||

|

CITGO Petroleum Corp., Senior Secured

Notes

|

6.375%

|

6/15/26

|

1,425,000

|

1,427,562

(a)

|

|

|

CNX Resources Corp., Senior Notes

|

6.000%

|

1/15/29

|

1,310,000

|

1,299,848

(a)(b)

|

|

|

Diamondback Energy Inc., Senior Notes

|

6.250%

|

3/15/53

|

1,000,000

|

1,034,121

(b)

|

|

|

Energean Israel Finance Ltd., Senior Secured

Notes

|

5.375%

|

3/30/28

|

2,500,000

|

2,258,736

(d)

|

|

|

Geopark Ltd., Senior Notes

|

5.500%

|

1/17/27

|

1,620,000

|

1,529,512

(a)(b)

|

|

|

Greenfire Resources Ltd., Senior Secured

Notes

|

12.000%

|

10/1/28

|

1,594,000

|

1,719,328

(a)(b)

|

|

|

Leviathan Bond Ltd., Senior Secured Notes

|

6.125%

|

6/30/25

|

2,000,000

|

1,978,337

(d)

|

|

|

Leviathan Bond Ltd., Senior Secured Notes

|

6.500%

|

6/30/27

|

4,000,000

|

3,801,971

(d)

|

|

|

Magnolia Oil & Gas Operating LLC/Magnolia

Oil & Gas Finance Corp., Senior Notes

|

6.000%

|

8/1/26

|

2,315,000

|

2,312,469

(a)(b)

|

|

|

New Fortress Energy Inc., Senior Secured

Notes

|

6.750%

|

9/15/25

|

445,000

|

444,427

(a)(b)

|

|

|

New Fortress Energy Inc., Senior Secured

Notes

|

6.500%

|

9/30/26

|

2,500,000

|

2,317,769

(a)(b)

|

|

|

Petroleos Mexicanos, Senior Notes

|

5.350%

|

2/12/28

|

5,290,000

|

4,930,973

(b)

|

|

|

SierraCol Energy Andina LLC, Senior Notes

|

6.000%

|

6/15/28

|

1,420,000

|

1,292,112

(a)(b)

|

|

|

SM Energy Co., Senior Notes

|

6.625%

|

1/15/27

|

3,000,000

|

3,001,741

(b)

|

|

|

Teine Energy Ltd., Senior Notes

|

6.875%

|

4/15/29

|

4,000,000

|

3,953,402

(a)(b)

|

|

|

YPF SA, Senior Notes

|

8.500%

|

7/28/25

|

2,600,000

|

2,612,698

(d)

|

|

|

Security

|

|

Rate

|

Maturity

Date

|

Face

Amount†

|

Value

|

|

|

|||||

|

Oil, Gas & Consumable Fuels — continued

|

|||||

|

YPF SA, Senior Secured Notes

|

9.000%

|

2/12/26

|

673,846

|

$680,999

(d)

|

|

|

|

|||||

|

Total Energy

|

36,596,005

|

||||

|

Financials — 33.3%

|

|||||

|

Banks — 10.7%

|

|||||

|

Bank of America Corp., Subordinated Notes

|

7.750%

|

5/14/38

|

6,345,000

|

7,644,488

(b)

|

|

|

Societe Generale SA, Subordinated Notes

|

7.367%

|

1/10/53

|

5,000,000

|

5,108,665

(a)(b)

|

|

|

Societe Generale SA, Subordinated Notes

(7.132% to 1/19/54 then 1 year Treasury

Constant Maturity Rate + 2.950%)

|

7.132%

|

1/19/55

|

2,740,000

|

2,718,415

(a)(b)(e)

|

|

|

Texas Capital Bancshares Inc., Subordinated

Notes (4.000% to 5/6/26 then 5 year

Treasury Constant Maturity Rate + 3.150%)

|

4.000%

|

5/6/31

|

1,000,000

|

950,076

(b)(e)

|

|

|

Total Banks

|

16,421,644

|

||||

|

Capital Markets — 8.9%

|

|||||

|

Blue Owl Technology Finance Corp., Senior

Notes

|

4.750%

|

12/15/25

|

3,385,000

|

3,326,783

(a)(b)

|

|

|

Goldman Sachs Group Inc., Subordinated

Notes

|

6.750%

|

10/1/37

|

7,000,000

|

7,684,868

(b)

|

|

|

Golub Capital BDC Inc., Senior Notes

|

2.050%

|

2/15/27

|

3,000,000

|

2,764,955

(b)

|

|

|

Total Capital Markets

|

13,776,606

|

||||

|

Consumer Finance — 10.5%

|

|||||

|

Ally Financial Inc., Junior Subordinated

Notes (4.700% to 5/15/26 then 5 year

Treasury Constant Maturity Rate + 3.868%)

|

4.700%

|

5/15/26

|

3,150,000

|

2,843,634

(b)(e)(f)

|

|

|

Credit Acceptance Corp., Senior Notes

|

6.625%

|

3/15/26

|

1,920,000

|

1,919,924

(b)

|

|

|

goeasy Ltd., Senior Notes

|

9.250%

|

12/1/28

|

4,000,000

|

4,269,008

(a)(b)

|

|

|

PRA Group Inc., Senior Notes

|

5.000%

|

10/1/29

|

3,700,000

|

3,351,413

(a)(b)

|

|

|

World Acceptance Corp., Senior Notes

|

7.000%

|

11/1/26

|

3,800,000

|

3,773,741

(a)(b)

|

|

|

Total Consumer Finance

|

16,157,720

|

||||

|

Financial Services — 3.2%

|

|||||

|

Freedom Mortgage Corp., Senior Notes

|

7.625%

|

5/1/26

|

2,470,000

|

2,481,179

(a)(b)

|

|

|

Freedom Mortgage Corp., Senior Notes

|

6.625%

|

1/15/27

|

2,500,000

|

2,472,824

(a)(b)

|

|

|

Total Financial Services

|

4,954,003

|

||||

|

|

|||||

|

Total Financials

|

51,309,973

|

||||

|

Industrials — 4.7%

|

|||||

|

Aerospace & Defense — 1.2%

|

|||||

|

Boeing Co., Senior Notes

|

5.805%

|

5/1/50

|

2,000,000

|

1,887,780

(b)

|

|

|

Commercial Services & Supplies — 0.3%

|

|||||

|

Deluxe Corp., Senior Notes

|

8.000%

|

6/1/29

|

565,000

|

533,346

(a)(b)

|

|

|

Security

|

|

Rate

|

Maturity

Date

|

Face

Amount†

|

Value

|

|

|

|||||

|

Construction & Engineering — 0.2%

|

|||||

|

ATP Tower Holdings LLC/Andean Tower

Partners Colombia SAS/Andean Telecom

Partners Peru S.R.L., Senior Secured Notes

|

4.050%

|

4/27/26

|

300,000

|

$289,676

(a)

|

|

|

Passenger Airlines — 1.2%

|

|||||

|

US Airways Pass-Through Trust

|

4.625%

|

6/3/25

|

1,823,989

|

1,816,091

(b)

|

|

|

Professional Services — 1.8%

|

|||||

|

Concentrix Corp., Senior Notes

|

6.850%

|

8/2/33

|

2,700,000

|

2,720,975

(b)

|

|

|

|

|||||

|

Total Industrials

|

7,247,868

|

||||

|

Information Technology — 3.3%

|

|||||

|

Communications Equipment — 1.6%

|

|||||

|

CommScope LLC, Senior Secured Notes

|

6.000%

|

3/1/26

|

1,370,000

|

1,339,117

(a)(b)

|

|

|

Viasat Inc., Senior Secured Notes

|

5.625%

|

4/15/27

|

1,300,000

|

1,215,073

(a)(b)

|

|

|

Total Communications Equipment

|

2,554,190

|

||||

|

IT Services — 1.7%

|

|||||

|

Sabre GLBL Inc., Senior Secured Notes

|

9.250%

|

4/15/25

|

628,000

|

631,969

(a)(b)

|

|

|

Sabre GLBL Inc., Senior Secured Notes

|

8.625%

|

6/1/27

|

2,000,000

|

1,931,960

(a)(b)

|

|

|

Total IT Services

|

2,563,929

|

||||

|

|

|||||

|

Total Information Technology

|

5,118,119

|

||||

|

Materials — 3.9%

|

|||||

|

Chemicals — 2.0%

|

|||||

|

Braskem Idesa SAPI, Senior Secured Notes

|

7.450%

|

11/15/29

|

1,340,000

|

1,063,950

(a)(b)

|

|

|

Braskem Netherlands Finance BV, Senior

Notes

|

8.500%

|

1/12/31

|

2,000,000

|

2,072,536

(a)(b)

|

|

|

Total Chemicals

|

3,136,486

|

||||

|

Metals & Mining — 1.9%

|

|||||

|

First Quantum Minerals Ltd., Senior Notes

|

6.875%

|

10/15/27

|

2,920,000

|

2,902,629

(a)

|

|

|

|

|||||

|

Total Materials

|

6,039,115

|

||||

|

Real Estate — 0.5%

|

|||||

|

Hotel & Resort REITs — 0.5%

|

|||||

|

XHR LP, Senior Secured Notes

|

4.875%

|

6/1/29

|

850,000

|

798,645

(a)(b)

|

|

|

|

|||||

|

Utilities — 1.3%

|

|||||

|

Water Utilities — 1.3%

|

|||||

|

Solaris Midstream Holdings LLC, Senior

Notes

|

7.625%

|

4/1/26

|

2,000,000

|

2,012,234

(a)(b)

|

|

|

|

|||||

|

Total Corporate Bonds & Notes (Cost — $151,506,798)

|

154,428,007

|

||||

|

Security

|

|

Rate

|

Maturity

Date

|

Face

Amount†

|

Value

|

|

|

|||||

|

Sovereign Bonds — 23.2%

|

|||||

|

Argentina — 1.3%

|

|||||

|

Argentine Republic Government International

Bond, Senior Notes, Step bond (0.750% to

7/9/27 then 1.750%)

|

0.750%

|

7/9/30

|

3,043,200

|

$2,055,170

|

|

|

Brazil — 7.0%

|

|||||

|

Brazil Notas do Tesouro Nacional Serie F,

Notes

|

10.000%

|

1/1/31

|

70,715,000

BRL

|

10,821,197

|

|

|

El Salvador — 0.8%

|

|||||

|

El Salvador Government International Bond,

Senior Notes

|

7.125%

|

1/20/50

|

1,640,000

|

1,254,760

(a)

|

|

|

Mexico — 10.6%

|

|||||

|

Mexican Bonos, Bonds

|

8.000%

|

11/7/47

|

170,400,000

MXN

|

6,808,975

|

|

|

Mexican Bonos, Bonds

|

8.000%

|

7/31/53

|

146,000,000

MXN

|

5,764,577

|

|

|

Mexican Bonos, Senior Notes

|

7.750%

|

11/13/42

|

94,100,000

MXN

|

3,724,804

|

|

|

Total Mexico

|

16,298,356

|

||||

|

Panama — 3.5%

|

|||||

|

Panama Government International Bond,

Senior Notes

|

3.870%

|

7/23/60

|

4,855,000

|

2,746,938

(b)

|

|

|

Panama Government International Bond,

Senior Notes

|

4.500%

|

1/19/63

|

4,120,000

|

2,612,609

(b)

|

|

|

Total Panama

|

5,359,547

|

||||

|

|

|||||

|

Total Sovereign Bonds (Cost — $42,455,227)

|

35,789,030

|

||||

|

Collateralized Mortgage Obligations(g) — 19.7%

|

|||||

|

1211 Avenue of the Americas Trust, 2015-

1211 A1A2

|

3.901%

|

8/10/35

|

2,500,000

|

2,456,735

(a)

|

|

|

Banc of America Merrill Lynch Commercial

Mortgage Trust, 2017-BNK3 XA, IO

|

1.004%

|

2/15/50

|

37,965,061

|

654,028

(e)

|

|

|

BANK, 2017-BNK4 XA, IO

|

1.331%

|

5/15/50

|

3,751,870

|

98,400

(e)

|

|

|

BX Trust, 2019-OC11 C

|

3.856%

|

12/9/41

|

3,500,000

|

3,198,015

(a)

|

|

|

CFCRE Commercial Mortgage Trust, 2016-C3

A3

|

3.865%

|

1/10/48

|

1,800,000

|

1,776,423

|

|

|

Citigroup Commercial Mortgage Trust, 2014-

GC25 AS

|

4.017%

|

10/10/47

|

154,177

|

153,920

|

|

|

Eagle RE Ltd., 2021-2 M1B (30 Day Average

SOFR + 2.050%)

|

6.907%

|

4/25/34

|

252,647

|

252,997

(a)(e)

|

|

|

Federal Home Loan Mortgage Corp. (FHLMC)

REMIC, 5326 SA, IO (-1.000 x 30 Day

Average SOFR + 5.900%)

|

1.043%

|

8/25/53

|

52,526,843

|

2,851,162

(e)

|

|

|

Security

|

|

Rate

|

Maturity

Date

|

Face

Amount†

|

Value

|

|

Collateralized Mortgage Obligations(g) — continued

|

|||||

|

Federal Home Loan Mortgage Corp. (FHLMC)

REMIC, 5411 SC, IO (-1.000 x 30 Day

Average SOFR + 7.092%)

|

2.235%

|

5/25/54

|

59,843,452

|

$5,717,018

(e)

|

|

|

Federal Home Loan Mortgage Corp. (FHLMC)

REMIC, Structured Agency Credit Risk Trust,

2022-DNA1 M1A (30 Day Average SOFR +

1.000%)

|

5.857%

|

1/25/42

|

1,131,697

|

1,132,106

(a)(e)

|

|

|

Federal Home Loan Mortgage Corp. (FHLMC)

REMIC, Structured Agency Credit Risk Trust,

2022-DNA2 M1B (30 Day Average SOFR +

2.400%)

|

7.257%

|

2/25/42

|

1,800,000

|

1,842,357

(a)(b)(e)

|

|

|

Federal Home Loan Mortgage Corp. (FHLMC)

REMIC, Structured Agency Credit Risk Trust,

2022-HQA1 M1B (30 Day Average SOFR +

3.500%)

|

8.357%

|

3/25/42

|

1,500,000

|

1,564,206

(a)(b)(e)

|

|

|

Federal Home Loan Mortgage Corp. (FHLMC)

REMIC, Structured Agency Credit Risk Trust,

2023-HQA1 M1A (30 Day Average SOFR +

2.000%)

|

6.857%

|

5/25/43

|

1,089,347

|

1,099,457

(a)(e)

|

|

|

Federal Home Loan Mortgage Corp. (FHLMC)

Structured Agency Credit Risk Trust, 2019-

DNA2 M2 (30 Day Average SOFR + 2.564%)

|

7.421%

|

3/25/49

|

686,342

|

702,164

(a)(e)

|

|

|

Federal National Mortgage Association

(FNMA) — CAS, 2018-C06 2B1 (30 Day

Average SOFR + 4.214%)

|

9.071%

|

3/25/31

|

1,300,000

|

1,433,878

(b)(e)

|

|

|

Federal National Mortgage Association

(FNMA) — CAS, 2024-R02 1M1 (30 Day

Average SOFR + 1.100%)

|

5.957%

|

2/25/44

|

802,989

|

803,343

(a)(b)(e)

|

|

|

Morgan Stanley Bank of America Merrill

Lynch Trust, 2015-C23 B

|

4.137%

|

7/15/50

|

1,450,000

|

1,404,257

(e)

|

|

|

Oaktown RE Ltd., 2021-1A M1B (30 Day

Average SOFR + 2.050%)

|

6.907%

|

10/25/33

|

21,968

|

21,981

(a)(e)

|

|

|

Wells Fargo Commercial Mortgage Trust,

2015-C31 B

|

4.482%

|

11/15/48

|

2,080,000

|

2,037,352

(e)

|

|

|

Western Alliance Bank, 2022-CL4 M1 (30

Day Average SOFR + 2.250%)

|

7.107%

|

10/25/52

|

1,188,461

|

1,233,065

(a)(e)

|

|

|

WFRBS Commercial Mortgage Trust, 2013-

C15 XA, IO

|

0.000%

|

8/15/46

|

2,995,100

|

30

(e)

|

|

|

|

|||||

|

Total Collateralized Mortgage Obligations (Cost — $31,013,819)

|

30,432,894

|

||||

|

Security

|

|

Rate

|

Maturity

Date

|

Face

Amount†

|

Value

|

|

|

|||||

|

Mortgage-Backed Securities — 15.7%

|

|||||

|

FHLMC — 3.3%

|

|||||

|

Federal Home Loan Mortgage Corp. (FHLMC)

|

6.000%

|

11/1/53-

7/1/54 |

5,105,826

|

$5,140,686

(b)

|

|

|

FNMA — 1.6%

|

|||||

|

Federal National Mortgage Association

(FNMA)

|

6.000%

|

11/1/53

|

2,524,753

|

2,543,220

(b)

|

|

|

GNMA — 10.8%

|

|||||

|

Government National Mortgage Association

(GNMA) II

|

5.500%

|

6/20/53-

12/20/53 |

16,676,151

|

16,616,321

(b)

|

|

|

|

|||||

|

Total Mortgage-Backed Securities (Cost — $24,135,840)

|

24,300,227

|

||||

|

Senior Loans — 3.9%

|

|||||

|

Communication Services — 3.9%

|

|||||

|

Diversified Telecommunication Services — 2.1%

|

|||||

|

Numericable U.S. LLC, USD Term Loan B14 (3

mo. Term SOFR + 5.500%)

|

10.156%

|

8/15/28

|

3,989,874

|

3,206,143

(e)(h)(i)

|

|

|

Wireless Telecommunication Services — 1.8%

|

|||||

|

Gogo Intermediate Holdings LLC, Initial Term

Loan (1 mo. Term SOFR + 3.864%)

|

8.550%

|

4/30/28

|

3,000,000

|

2,818,935

(e)(h)(i)

|

|

|

|

|||||

|

Total Senior Loans (Cost — $5,869,572)

|

6,025,078

|

||||

|

Convertible Bonds & Notes — 3.2%

|

|||||

|

Communication Services — 3.2%

|

|||||

|

Media — 3.2%

|

|||||

|

Cable One Inc., Senior Notes

|

1.125%

|

3/15/28

|

3,000,000

|

2,372,926

|

|

|

DISH Network Corp., Senior Notes

|

3.375%

|

8/15/26

|

3,070,000

|

2,600,636

|

|

|

|

|||||

|

Total Convertible Bonds & Notes (Cost — $5,345,659)

|

4,973,562

|

||||

|

Total Investments before Short-Term Investments (Cost — $260,326,915)

|

255,948,798

|

||||

|

|

|||||

|

Short-Term Investments — 1.8%

|

|||||

|

Egypt Treasury Bills (Cost — $2,827,985)

|

30.587%

|

1/28/25

|

145,000,000

EGP

|

2,776,079

(j)

|

|

|

Total Investments — 167.6% (Cost — $263,154,900)

|

258,724,877

|

||||

|

Mandatory Redeemable Preferred Stock, at Liquidation Value — (32.4)%

|

(50,000,000

)

|

||||

|

Other Liabilities in Excess of Other Assets — (35.2)%

|

(54,365,675

)

|

||||

|

Total Net Assets Applicable to Common Shareholders — 100.0%

|

$154,359,202

|

||||

|

†

|

Face amount denominated in U.S. dollars, unless otherwise noted.

|

|

(a)

|

Security is exempt from registration under Rule 144A of the Securities Act of 1933.

This security may be resold in

transactions that are exempt from registration, normally to qualified institutional

buyers. This security has been

deemed liquid pursuant to guidelines approved by the Board of Directors.

|

|

(b)

|

All or a portion of this security is pledged as collateral pursuant to the loan agreement (Note 5).

|

|

(c)

|

Payment-in-kind security for which the issuer has the option at each interest payment

date of making interest

payments in cash or additional securities.

|

|

(d)

|

Security is exempt from registration under Regulation S of the Securities Act of 1933.

Regulation S applies to

securities offerings that are made outside of the United States and do not involve

direct selling efforts in the

United States. This security has been deemed liquid pursuant to guidelines approved

by the Board of Directors.

|

|

(e)

|

Variable rate security. Interest rate disclosed is as of the most recent information

available. Certain variable rate

securities are not based on a published reference rate and spread but are determined

by the issuer or agent and

are based on current market conditions. These securities do not indicate a reference

rate and spread in their

description above.

|

|

(f)

|

Security has no maturity date. The date shown represents the next call date.

|

|

(g)

|

Collateralized mortgage obligations are secured by an underlying pool of mortgages

or mortgage pass-through

certificates that are structured to direct payments on underlying collateral to different

series or classes of the

obligations. The interest rate may change positively or inversely in relation to one

or more interest rates, financial

indices or other financial indicators and may be subject to an upper and/or lower

limit.

|

|

(h)

|

Interest rates disclosed represent the effective rates on senior loans. Ranges in

interest rates are attributable to

multiple contracts under the same loan.

|

|

(i)

|

Senior loans may be considered restricted in that the Fund ordinarily is contractually

obligated to receive approval

from the agent bank and/or borrower prior to the disposition of a senior loan.

|

|

(j)

|

Rate shown represents yield-to-maturity.

|

|

Abbreviation(s) used in this schedule:

|

||

|

BRL

|

—

|

Brazilian Real

|

|

CAS

|

—

|

Connecticut Avenue Securities

|

|

EGP

|

—

|

Egyptian Pound

|

|

IO

|

—

|

Interest Only

|

|

MXN

|

—

|

Mexican Peso

|

|

PIK

|

—

|

Payment-In-Kind

|

|

REMIC

|

—

|

Real Estate Mortgage Investment Conduit

|

|

SOFR

|

—

|

Secured Overnight Financing Rate

|

|

USD

|

—

|

United States Dollar

|

|

|

Number of

Contracts

|

Expiration

Date

|

Notional

Amount

|

Market

Value

|

Unrealized

Depreciation

|

|

Contracts to Buy:

|

|

|

|

|

|

|

U.S. Treasury 5-Year Notes

|

264

|

12/24

|

$28,930,168

|

$28,309,876

|

$(620,292

)

|

|

U.S. Treasury 10-Year Notes

|

242

|

12/24

|

27,563,580

|

26,733,438

|

(830,142

)

|

|

Net unrealized depreciation on open futures contracts

|

$(1,450,434

)

|

||||

|

Currency

Purchased

|

Currency

Sold

|

Counterparty

|

Settlement

Date

|

Unrealized

Appreciation

(Depreciation)

|

||

|

USD

|

13,639,281

|

EUR

|

12,230,000

|

HSBC Securities Inc.

|

11/7/24

|

$331,549

|

|

EUR

|

12,230,000

|

USD

|

13,382,262

|

JPMorgan Chase & Co.

|

11/7/24

|

(74,530

)

|

|

USD

|

499,981

|

EUR

|

460,000

|

JPMorgan Chase & Co.

|

11/7/24

|

(555

)

|

|

EUR

|

460,000

|

USD

|

506,827

|

Standard Chartered PLC

|

11/7/24

|

(6,291

)

|

|

ZAR

|

144,900,000

|

USD

|

8,125,199

|

Barclays Bank PLC

|

11/15/24

|

82,881

|

|

USD

|

7,828,658

|

ZAR

|

144,900,000

|

HSBC Securities Inc.

|

11/15/24

|

(379,422

)

|

|

ZAR

|

28,400,000

|

USD

|

1,604,656

|

HSBC Securities Inc.

|

11/15/24

|

4,105

|

|

ZAR

|

40,000,000

|

USD

|

2,272,030

|

HSBC Securities Inc.

|

11/15/24

|

(6,170

)

|

|

ZAR

|

41,200,000

|

USD

|

2,330,185

|

HSBC Securities Inc.

|

11/15/24

|

3,652

|

|

ZAR

|

56,400,000

|

USD

|

3,181,049

|

HSBC Securities Inc.

|

11/15/24

|

13,814

|

|

USD

|

9,393,544

|

ZAR

|

166,000,000

|

Morgan Stanley & Co. Inc.

|

11/15/24

|

(9,777

)

|

|

USD

|

11,313,986

|

GBP

|

8,490,000

|

Goldman Sachs Group Inc.

|

12/12/24

|

367,429

|

|

GBP

|

8,490,000

|

USD

|

11,160,767

|

HSBC Securities Inc.

|

12/12/24

|

(214,210

)

|

|

USD

|

1,293,353

|

BRL

|

7,380,000

|

HSBC Securities Inc.

|

1/22/25

|

29,630

|

|

CAD

|

11,000,000

|

USD

|

7,997,644

|

Citibank N.A.

|

1/27/25

|

(72,621

)

|

|

USD

|

9,309,024

|

MXN

|

188,100,000

|

Citibank N.A.

|

1/29/25

|

51,633

|

|

Net unrealized appreciation on open forward foreign currency contracts

|

$121,117

|

|||||

|

Abbreviation(s) used in this table:

|

||

|

BRL

|

—

|

Brazilian Real

|

|

CAD

|

—

|

Canadian Dollar

|

|

EUR

|

—

|

Euro

|

|

GBP

|

—

|

British Pound

|

|

MXN

|

—

|

Mexican Peso

|

|

USD

|

—

|

United States Dollar

|

|

ZAR

|

—

|

South African Rand

|

|

OTC CREDIT DEFAULT SWAPS ON CORPORATE ISSUES — SELL PROTECTION1

|

|||||||

|

Swap

Counterparty

(Reference Entity)

|

Notional

Amount2

|

Termination

Date

|

Implied

Credit

Spread at

October 31,

20243

|

Periodic

Payments

Received by

the Fund†

|

Market

Value

|

Upfront

Premiums

Paid

(Received)

|

Unrealized

Appreciation

|

|

Morgan Stanley &

Co. Inc. (Lumen

Technologies Inc.,

5.625%, due

4/1/25)

|

$1,625,000

|

6/20/25

|

1.792%

|

1.000% quarterly

|

$(8,092)

|

$(21,577)

|

$13,485

|

|

1

|

If the Fund is a seller of protection and a credit event occurs, as defined under

the terms of that particular swap

agreement, the Fund will either (i) pay to the buyer of protection an amount equal

to the notional amount of the

swap and take delivery of the referenced obligation or underlying securities comprising

the referenced index or (ii)

pay a net settlement amount in the form of cash or securities equal to the notional

amount of the swap less the

recovery value of the referenced obligation or underlying securities comprising the

referenced index.

|

|

2

|

The maximum potential amount the Fund could be required to pay as a seller of credit

protection or receive as a

buyer of credit protection if a credit event occurs as defined under the terms of

that particular swap agreement.

|

|

3

|

Implied credit spreads, utilized in determining the market value of credit default

swap agreements on corporate or

sovereign issues as of period end, serve as an indicator of the current status of

the payment/performance risk and

represent the likelihood or risk of default for the credit derivative. The implied

credit spread of a particular

referenced entity reflects the cost of buying/selling protection and may include upfront

payments required to be

made to enter into the agreement. Wider credit spreads represent a deterioration of the referenced entity’s credit

soundness and a greater likelihood or risk of default or other credit event occurring

as defined under the terms of

the agreement. A credit spread identified as “Defaulted” indicates a credit event has occurred for the referenced

entity or obligation.

|

|

†

|

Percentage shown is an annual percentage rate.

|

|

Summary of Investments by Country# (unaudited)

|

|

|

United States

|

62.6

%

|

|

Mexico

|

9.7

|

|

Brazil

|

5.8

|

|

France

|

4.3

|

|

Canada

|

3.8

|

|

Israel

|

3.1

|

|

Panama

|

2.1

|

|

Argentina

|

2.1

|

|

Colombia

|

1.3

|

|

Macau

|

1.2

|

|

Hong Kong

|

1.1

|

|

Zambia

|

1.1

|

|

El Salvador

|

0.5

|

|

Chile

|

0.1

|

|

Bermuda

|

0.1

|

|

Short-Term Investments

|

1.1

|

|

|

100.0

%

|

|

#

|

As a percentage of total investments. Please note that the Fund holdings are as of

October 31, 2024, and are

subject to change.

|

|

Assets:

|

|

|

Investments, at value (Cost — $263,154,900)

|

$258,724,877

|

|

Foreign currency, at value (Cost — $477)

|

471

|

|

Cash

|

7,121,159

|

|

Interest receivable

|

4,132,035

|

|

Deposits with brokers for open futures contracts

|

888,875

|

|

Unrealized appreciation on forward foreign currency contracts

|

884,693

|

|

Deposits with brokers for OTC derivatives

|

20,000

|

|

Dividends receivable from affiliated investments

|

18,308

|

|

Receivable for open OTC swap contracts

|

1,896

|

|

Deposits with brokers

|

12

|

|

Prepaid expenses

|

5,597

|

|

Total Assets

|

271,797,923

|

|

Liabilities:

|

|

|

Loan payable (Note 5)

|

61,000,000

|

|

Mandatory Redeemable Preferred Stock ($10 liquidation value per share; 5,000,000 shares

issued and outstanding) (net of deferred offering costs of $133,135) (Note 6)

|

49,866,865

|

|

Payable for securities purchased

|

3,344,826

|

|

Distributions payable to Common Shareholders

|

1,343,347

|

|

Unrealized depreciation on forward foreign currency contracts

|

763,576

|

|

Distributions payable to Mandatory Redeemable Preferred Stockholders

|

377,898

|

|

Interest and commitment fees payable

|

298,872

|

|

Investment management fee payable

|

147,732

|

|

Payable to brokers — net variation margin on open futures contracts

|

93,844

|

|

OTC swaps, at value (premiums received — $21,577)

|

8,092

|

|

Directors’ fees payable

|

3,266

|

|

Accrued expenses

|

190,403

|

|

Total Liabilities

|

117,438,721

|

|

Total Net Assets Applicable to Common Shareholders

|

$154,359,202

|

|

Net Assets Applicable to Common Shareholders:

|

|

|

Common stock par value ($0.001 par value; 16,791,836 shares issued and outstanding;

95,000,000 common shares authorized)

|

$16,792

|

|

Paid-in capital in excess of par value

|

240,490,553

|

|

Total distributable earnings (loss)

|

(86,148,143

)

|

|

Total Net Assets Applicable to Common Shareholders

|

$154,359,202

|

|

Common Shares Outstanding

|

16,791,836

|

|

Net Asset Value Per Common Share

|

$9.19

|

|

Investment Income:

|

|

|

Interest

|

$21,655,013

|

|

Dividends from affiliated investments

|

365,496

|

|

Less: Foreign taxes withheld

|

(14,836

)

|

|

Total Investment Income

|

22,005,673

|

|

Expenses:

|

|

|

Interest expense (Note 5)

|

3,697,600

|

|

Investment management fee (Note 2)

|

2,280,066

|

|

Distributions to Mandatory Redeemable Preferred Stockholders (Notes 1 and 6)

|

1,819,975

|

|

Amortization of preferred stock offering costs (Note 6)

|

139,639

|

|

Commitment fees (Note 5)

|

99,124

|

|

Fund accounting fees

|

83,007

|

|

Transfer agent fees

|

64,943

|

|

Audit and tax fees

|

63,099

|

|

Shareholder reports

|

61,794

|

|

Directors’ fees

|

53,446

|

|

Legal fees

|

50,675

|

|

Custody fees

|

29,115

|

|

Rating agency fees

|

23,934

|

|

Stock exchange listing fees

|

12,506

|

|

Insurance

|

2,116

|

|

Miscellaneous expenses

|

42,303

|

|

Total Expenses

|

8,523,342

|

|

Less: Fee waivers and/or expense reimbursements (Note 2)

|

(543,052

)

|

|

Net Expenses

|

7,980,290

|

|

Net Investment Income

|

14,025,383

|

|

Realized and Unrealized Gain (Loss) on Investments, Futures Contracts, Swap Contracts,

Forward

Foreign Currency Contracts and Foreign Currency Transactions (Notes 1, 3 and 4):

|

|

|

Net Realized Gain (Loss) From:

|

|

|

Investment transactions in unaffiliated securities

|

(7,162,537

)†

|

|

Futures contracts

|

415,430

|

|

Swap contracts

|

49,331

|

|

Forward foreign currency contracts

|

1,241,999

|

|

Foreign currency transactions

|

(336,409

)

|

|

Net Realized Loss

|

(5,792,186

)

|

|

Change in Net Unrealized Appreciation (Depreciation) From:

|

|

|

Investments in unaffiliated securities

|

19,740,077

‡

|

|

Futures contracts

|

(281,713

)

|

|

Swap contracts

|

377,821

|

|

Forward foreign currency contracts

|

1,650,622

|

|

Foreign currencies

|

(15,078

)

|

|

Change in Net Unrealized Appreciation (Depreciation)

|

21,471,729

|

|

Net Gain on Investments, Futures Contracts, Swap Contracts, Forward Foreign

Currency Contracts and Foreign Currency Transactions

|

15,679,543

|

|

Increase in Net Assets Applicable to Common Shareholders From Operations

|

$29,704,926

|

|

†

|

Net of foreign capital gains tax of $26,839.

|

|

‡

|

Net of change in accrued foreign capital gains tax of $(33,831).

|

|

For the Years Ended October 31,

|

2024

|

2023

|

|

Operations:

|

|

|

|

Net investment income

|

$14,025,383

|

$13,645,995

|

|

Net realized loss

|

(5,792,186

)

|

(22,854,816

)

|

|

Change in net unrealized appreciation (depreciation)

|

21,471,729

|

16,567,357

|

|

Increase in Net Assets Applicable to Common Shareholders

From Operations

|

29,704,926

|

7,358,536

|

|

Distributions to Common Shareholders From (Note 1):

|

|

|

|

Total distributable earnings

|

(9,653,905

)

|

(1,900,010

)

|

|

Return of capital

|

(6,466,258

)

|

(14,891,826

)

|

|

Decrease in Net Assets From Distributions to Common

Shareholders

|

(16,120,163

)

|

(16,791,836

)

|

|

Increase (Decrease) in Net Assets Applicable to Common

Shareholders

|

13,584,763

|

(9,433,300

)

|

|

Net Assets Applicable to Common Shareholders:

|

|

|

|

Beginning of year

|

140,774,439

|

150,207,739

|

|

End of year

|

$154,359,202

|

$140,774,439

|

|

Increase (Decrease) in Cash:

|

|

|

Cash Flows from Operating Activities:

|

|

|

Net increase in net assets applicable to common shareholders resulting from operations

|

$29,704,926

|

|

Adjustments to reconcile net increase in net assets resulting from operations to net

cash

provided (used) by operating activities:

|

|

|

Purchases of portfolio securities

|

(159,113,269

)

|

|

Sales of portfolio securities

|

148,934,405

|

|

Net purchases, sales and maturities of short-term investments

|

12,162,196

|

|

Net amortization of premium (accretion of discount)

|

(1,746,968

)

|

|

Decrease in receivable for securities sold

|

2,823,817

|

|

Decrease in interest receivable

|

192,513

|

|

Decrease in prepaid expenses

|

11,176

|

|

Decrease in dividends receivable from affiliated investments

|

14,035

|

|

Decrease in net premiums received for OTC swap contracts

|

(34,187

)

|

|

Increase in payable for securities purchased

|

3,344,826

|

|

Amortization of preferred stock offering costs

|

139,639

|

|

Increase in investment management fee payable

|

7,953

|

|

Decrease in Directors’ fees payable

|

(1,482

)

|

|

Decrease in interest and commitment fees payable

|

(26,552

)

|

|

Increase in accrued expenses

|

9,543

|

|

Increase in distributions payable to Mandatory Redeemable Preferred Stockholders

|

4,975

|

|

Increase in payable to brokers — net variation margin on futures contracts

|

61,843

|

|

Net realized loss on investments

|

7,162,537

|

|

Change in net unrealized appreciation (depreciation) of investments, OTC swap contracts

and forward foreign currency contracts

|

(21,768,520

)

|

|

Net Cash Provided in Operating Activities*

|

21,883,406

|

|

Cash Flows from Financing Activities:

|

|

|

Distributions paid on common stock (net of distributions payable)

|

(16,120,163

)

|

|

Net Cash Used by Financing Activities

|

(16,120,163

)

|

|

Net Increase in Cash and Restricted Cash

|

5,763,243

|

|

Cash and restricted cash at beginning of year

|

2,267,274

|

|

Cash and restricted cash at end of year

|

$8,030,517

|

|

*

|

Included in operating expenses is $3,823,276 paid for interest and commitment fees

on borrowings and $1,815,000

paid for distributions to Mandatory Redeemable Preferred Stockholders.

|

|

|

October 31, 2024

|

|

Cash

|

$7,121,630

|

|

Restricted cash

|

908,887

|

|

Total cash and restricted cash shown in the Statement of Cash Flows

|

$8,030,517

|

|

For a common share of capital stock outstanding throughout each year ended October

31:

|

|||||

|

|

20241

|

20231

|

20221

|

20211

|

20201

|

|

Net asset value, beginning of year

|

$8.38

|

$8.95

|

$13.16

|

$13.35

|

$14.46

|

|

Income (loss) from operations:

|

|||||

|

Net investment income

|

0.84

|

0.81

|

0.79

|

0.75

|

0.65

|

|

Net realized and unrealized gain (loss)

|

0.93

|

(0.38

)

|

(3.93

)

|

(0.00

)2

|

(0.93

)

|

|

Total income (loss) from operations

|

1.77

|

0.43

|

(3.14)

|

0.75

|

(0.28)

|

|

Less distributions to common shareholders

from:

|

|

|

|

|

|

|

Net investment income

|

(0.57

)

|

(0.11

)

|

(0.99

)

|

(0.67

)

|

(0.84

)

|

|

Return of capital

|

(0.39

)

|

(0.89

)

|

(0.08

)

|

(0.27

)

|

—

|

|

Total distributions to common

shareholders

|

(0.96

)

|

(1.00

)

|

(1.07

)

|

(0.94

)

|

(0.84

)

|

|

Anti-dilutive impact of tender offer

|

—

|

—

|

—

|

—

|

0.01

3

|

|

Net asset value, end of year

|

$9.19

|

$8.38

|

$8.95

|

$13.16

|

$13.35

|

|

Market price, end of year

|

$8.42

|

$7.03

|

$7.83

|

$12.23

|

$11.01

|

|

Total return, based on NAV4,5

|

21.50

%

|

4.40

%

|

(24.82

)%

|

5.46

%

|

(1.83

)%

|

|

Total return, based on Market Price6

|

34.18

%

|

1.71

%

|

(28.37

)%

|

19.70

%

|

(4.41

)%

|

|

Net assets applicable to common

shareholders, end of year (millions)

|

$154

|

$141

|

$150

|

$221

|

$224

|

|

Ratios to average net assets:

|

|||||

|

Gross expenses

|

5.42

%

|

5.29

%

|

3.47

%

|

2.81

%

|

3.05

%7

|

|

Net expenses8,9

|

5.08

|

5.00

|

3.27

|

2.66

|

2.89

7

|

|

Net investment income

|

8.92

|

8.83

|

7.19

|

5.40

|

4.75

7

|

|

Portfolio turnover rate

|

59

%

|

51

%

|

32

%

|

49

%

|

61

%

|

|

Supplemental data:

|

|

|

|

|

|

|

Loan Outstanding, End of Year (000s)

|

$61,000

|

$61,000

|

$61,000

|

$60,000

|

$60,000

|

|

Asset Coverage Ratio for Loan Outstanding10

|

435

%

|

413

%

|

428

%

|

568

%

|

573

%

|

|

Asset Coverage, per $1,000 Principal Amount of

Loan Outstanding10

|

$4,350

|

$4,127

|

$4,282

|

$5,682

|

$5,735

|

|

Weighted Average Loan (000s)

|

$61,000

|

$61,000

|

$66,255

|

$60,000

|

$88,962

|

|

Weighted Average Interest Rate on Loan

|

5.96

%

|

5.48

%

|

1.78

%

|

0.79

%

|

1.50

%

|

|

Mandatory Redeemable Preferred Stock at

Liquidation Value, End of Year (000s)

|

$50,000

|

$50,000

|

$50,000

|

$60,000

|

$60,000

|

|

Asset Coverage Ratio for Mandatory

Redeemable Preferred Stock11

|

239

%

|

227

%

|

235

%

|

284

%

|

287

%

|

|

Asset Coverage, per $10 and/or $100,000

Liquidation Value per Share of Mandatory

Redeemable Preferred Stock11

|

$24

|

$23

|

$24

|

$284,115

|

$286,740

|

|

1

|

Per share amounts have been calculated using the average shares method.

|

|

2

|

Amount represents less than $0.005 or greater than $(0.005) per share.

|

|

3

|

The tender offer was completed at a price of $13.53 for 4,197,959 shares and $56,798,385

for the year ended

October 31, 2020.

|

|

4

|

The total return calculation assumes that distributions are reinvested at NAV. Past

performance is no guarantee of

future results.

|

|

5

|

Performance figures may reflect compensating balance arrangements, fee waivers and/or

expense

reimbursements. In the absence of compensating balance arrangements, fee waivers and/or

expense

reimbursements, the total return would have been lower. Past performance is no guarantee

of future results.

|

|

6

|

The total return calculation assumes that distributions are reinvested in accordance with the Fund’s dividend

reinvestment plan. Past performance is no guarantee of future results.

|

|

7

|

Included in the expense ratios are certain non-recurring legal and transfer agent

fees that were incurred by the

Fund during the period. Without these fees, the gross and net expense ratios would

have been 2.85% and 2.69%,

respectively.

|

|

8

|

Reflects fee waivers and/or expense reimbursements.

|

|

9

|

The manager has agreed to waive the Fund’s management fee to an extent sufficient to offset the net management

fee payable in connection with any investment in an affiliated money market fund.

|

|

10

|

Represents value of net assets plus the loan outstanding and mandatory redeemable

preferred stock at the end of

the period divided by the loan outstanding at the end of the period.

|

|

11

|

Represents value of net assets plus the loan outstanding and mandatory redeemable

preferred stock at the end of

the period divided by the loan and mandatory redeemable preferred stock outstanding

at the end of the period.

|

|

ASSETS

|

||||

|

Description

|

Quoted Prices

(Level 1)

|

Other Significant

Observable Inputs

(Level 2)

|

Significant

Unobservable

Inputs

(Level 3)

|

Total

|

|

Long-Term Investments†:

|

|

|

|

|

|

Corporate Bonds & Notes

|

—

|

$154,428,007

|

—

|

$154,428,007

|

|

Sovereign Bonds

|

—

|

35,789,030

|

—

|

35,789,030

|

|

Collateralized Mortgage

Obligations

|

—

|

30,432,894

|

—

|

30,432,894

|

|

Mortgage-Backed Securities

|

—

|

24,300,227

|

—

|

24,300,227

|

|

Senior Loans

|

—

|

6,025,078

|

—

|

6,025,078

|

|

Convertible Bonds & Notes

|

—

|

4,973,562

|

—

|

4,973,562

|

|

Total Long-Term Investments

|

—

|

255,948,798

|

—

|

255,948,798

|

|

Short-Term Investments†

|

—

|

2,776,079

|

—

|

2,776,079

|

|

Total Investments

|

—

|

$258,724,877

|

—

|

$258,724,877

|

|

Other Financial Instruments:

|

|

|

|

|

|

Forward Foreign Currency

Contracts††

|

—

|

$884,693

|

—

|

$884,693

|

|

Total

|

—

|

$259,609,570

|

—

|

$259,609,570

|

|

LIABILITIES

|

||||

|

Description

|

Quoted Prices

(Level 1)

|

Other Significant

Observable Inputs

(Level 2)

|

Significant

Unobservable

Inputs

(Level 3)

|

Total

|

|

Other Financial Instruments:

|

|

|

|

|

|

Futures Contracts††

|

$1,450,434

|

—

|

—

|

$1,450,434

|

|

Forward Foreign Currency

Contracts††

|

—

|

$763,576

|

—

|

763,576

|

|

OTC Credit Default Swaps on

Corporate Issues — Sell

Protection‡

|

—

|

8,092

|

—

|

8,092

|

|

Total

|

$1,450,434

|

$771,668

|

—

|

$2,222,102

|

|

†

|

See Schedule of Investments for additional detailed categorizations.

|

|

††

|

Reflects the unrealized appreciation (depreciation) of the instruments.

|

|

‡

|

Value includes any premium paid or received with respect to swap contracts.

|

|

|

Total Distributable

Earnings (Loss)

|

Paid-in

Capital

|

|

(a)

|

$127,317

|

$(127,317)

|

|

|

Investments

|

U.S. Government &

Agency Obligations

|

|

Purchases

|

$107,237,142

|

$51,876,127

|

|

Sales

|

117,129,323

|

31,805,082

|

|

|

Cost/Premiums

Paid (Received)

|

Gross

Unrealized

Appreciation

|

Gross

Unrealized

Depreciation

|

Net

Unrealized

Appreciation

(Depreciation)

|

|

Securities

|

$263,247,694

|

$6,721,331

|

$(11,244,148)

|

$(4,522,817)

|

|

Futures contracts

|

—

|

—

|

(1,450,434)

|

(1,450,434)

|

|

Forward foreign currency contracts

|

—

|

884,693

|

(763,576)

|

121,117

|

|

Swap contracts

|

(21,577)

|

13,485

|

—

|

13,485

|

|

ASSET DERIVATIVES1

|

|

|

|

Foreign

Exchange Risk

|

|

Forward foreign currency contracts

|

$884,693

|

|

LIABILITY DERIVATIVES1

|

||||

|

|

Interest

Rate Risk

|

Foreign

Exchange Risk

|

Credit

Risk

|

Total

|

|

Futures contracts2

|

$1,450,434

|

—

|

—

|

$1,450,434

|

|

Forward foreign currency contracts

|

—

|

$763,576

|

—

|

763,576

|

|

OTC swap contracts3

|

—

|

—

|

$8,092

|

8,092

|

|

Total

|

$1,450,434

|

$763,576

|

$8,092

|

$2,222,102

|

|

1

|

Generally, the balance sheet location for asset derivatives is receivables/net unrealized

appreciation and for

liability derivatives is payables/net unrealized depreciation.

|

|

2

|

Includes cumulative unrealized appreciation (depreciation) of futures contracts as

reported in the Schedule of

Investments. Only net variation margin is reported within the receivables and/or payables

on the Statement of

Assets and Liabilities.

|

|

3

|

Values include premiums paid (received) on swap contracts which are shown separately

in the Statement of

Assets and Liabilities.

|

|

AMOUNT OF NET REALIZED GAIN (LOSS) ON DERIVATIVES RECOGNIZED

|

|||||

|

|

Interest

Rate Risk

|

Foreign

Exchange Risk

|

Credit

Risk

|

Equity

Risk

|

Total

|

|

Futures contracts

|

$900,906

|

—

|

—

|

$(485,476

)

|

$415,430

|

|

Swap contracts

|

—

|

—

|

$49,331

|

—

|

49,331

|

|

Forward foreign currency contracts

|

—

|

$1,241,999

|

—

|

—

|

1,241,999

|

|

Total

|

$900,906

|

$1,241,999

|

$49,331

|

$(485,476

)

|

$1,706,760

|

|

CHANGE IN NET UNREALIZED APPRECIATION (DEPRECIATION) ON DERIVATIVES RECOGNIZED

|

||||

|

|

Interest

Rate Risk

|

Foreign

Exchange Risk

|

Credit

Risk

|

Total

|

|

Futures contracts

|

$(281,713

)

|

—

|

—

|

$(281,713

)

|

|

Swap contracts

|

—

|

—

|

$377,821

|

377,821

|

|

Forward foreign currency contracts

|

—

|

$1,650,622

|

—

|

1,650,622

|

|

Total

|

$(281,713

)

|

$1,650,622

|

$377,821

|

$1,746,730

|

|

|

Average Market

Value

|

|

Futures contracts (to buy)

|

$51,312,844

|

|

Futures contracts (to sell)†

|

392,261

|

|

Forward foreign currency contracts (to buy)

|

61,106,811

|

|

Forward foreign currency contracts (to sell)

|

73,482,924

|

|

|

Average Notional

Balance

|

|

Credit default swap contracts (sell protection)

|

$1,625,000

|

|

†

|

At October 31, 2024, there were no open positions held in this derivative.

|

|

Counterparty

|

Gross Assets

Subject to

Master

Agreements1

|

Gross

Liabilities

Subject to

Master

Agreements1

|

Net Assets

(Liabilities)

Subject to

Master

Agreements

|

Collateral

Pledged

(Received)2,3

|

Net

Amount4,5

|

|

Barclays Bank PLC

|

$82,881

|

—

|

$82,881

|

—

|

$82,881

|

|

Citibank N.A.

|

51,633

|

$(72,621)

|

(20,988)

|

—

|

(20,988)

|

|

Goldman Sachs Group Inc.

|

367,429

|

—

|

367,429

|

—

|

367,429

|

|

Counterparty (cont’d)

|

Gross Assets

Subject to

Master

Agreements1

|

Gross

Liabilities

Subject to

Master

Agreements1

|

Net Assets

(Liabilities)

Subject to

Master

Agreements

|

Collateral

Pledged

(Received)2,3

|

Net

Amount4,5

|

|

HSBC Securities Inc.

|

$382,750

|

$(599,802)

|

$(217,052)

|

—

|

$(217,052)

|

|

JPMorgan Chase & Co.

|

—

|

(75,085)

|

(75,085)

|

—

|

(75,085)

|

|

Morgan Stanley & Co. Inc.

|

—

|

(17,869)

|

(17,869)

|

$17,869

|

—

|

|

Standard Chartered PLC

|

—

|

(6,291)

|

(6,291)

|

—

|

(6,291)

|

|

Total

|

$884,693

|

$(771,668)

|

$113,025

|

$17,869

|

$130,894

|

|

1

|

Absent an event of default or early termination, derivative assets and liabilities

are presented gross and not

offset in the Statement of Assets and Liabilities.

|

|

2

|

Gross amounts are not offset in the Statement of Assets and Liabilities.

|

|

3

|

In some instances, the actual collateral received and/or pledged may be more than

the amount shown here due

to overcollateralization.

|

|

4

|

Net amount may also include forward foreign currency exchange contracts that are not

required to be

collateralized.

|

|

5

|

Represents the net amount receivable (payable) from (to) the counterparty in the event

of default.

|

|

Series

|

Term

Redemption

Date

|

Rate

|

Shares

|

Liquidation

Preference

Per Share

|

Aggregate

Liquidation

Value

|

Estimated

Fair Value

|

|

Series D

|

12/30/2024

|

3.55%

|

2,500,000

|

$10

|

$25,000,000

|

$24,258,289

|

|

Series E

|

12/30/2026

|

3.71%

|

2,500,000

|

10

|

25,000,000

|

23,830,965

|

|

|

|

|

|

|

$50,000,000

|

$48,089,254

|

|

Record Date

|

Payable Date

|

Amount

|

|

10/24/2024

|

11/1/2024

|

$0.0800

|

|

11/21/2024

|

12/2/2024

|

$0.0800

|

|

12/23/2024

|

12/31/2024

|

$0.0800

|

|

1/24/2025

|

2/3/2025

|

$0.0800

|

|

2/21/2025

|

3/3/2025

|

$0.0800

|

|

|

Affiliate

Value at

October 31, 2023

|

Purchased

|

Sold

|

||

|

Cost

|

Shares

|

Proceeds

|

Shares

|

||

|

Western Asset

Premier

Institutional U.S.

Treasury Reserves,

Premium Shares

|

$12,286,239

|

$121,874,795

|

121,874,795

|

$134,161,034

|

134,161,034

|

|

(cont’d)

|

Realized

Gain (Loss)

|

Dividend

Income

|

Net Increase

(Decrease) in

Unrealized

Appreciation

(Depreciation)

|

Affiliate

Value at

October 31,

2024

|

|

Western Asset Premier

Institutional U.S.

Treasury Reserves,

Premium Shares

|

—

|

$365,496

|

—

|

—

|

|

|

2024

|

2023

|

|

Distributions paid from:

|

|

|

|

Ordinary income:

|

|

|

|

Common shareholders

|

$9,653,905

|

$1,900,010

|

|

Mandatory redeemable preferred shares

|

1,819,975

|

1,815,003

|

|

Total taxable distributions

|

$11,473,880

|

$3,715,013

|

|

Return of capital:

|

|

|

|

Common shareholders

|

$6,466,258

|

$14,891,826

|

|

Total tax return of capital

|

$6,466,258

|

$14,891,826

|

|

Total distributions paid

|