TABLE OF CONTENTS

As filed with the Securities and Exchange Commission on January 13, 2023

File No. 000-56494

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10

(Amendment No. 1)

GENERAL FORM FOR REGISTRATION OF SECURITIES PURSUANT TO SECTION 12(b) OR

12(g) OF THE SECURITIES EXCHANGE ACT OF 1934

Kennedy Lewis Capital Company

(Exact name of registrant as specified in its charter)

Delaware | | | 88-6117755 |

(State or other jurisdiction of

incorporation or organization) | | | (I.R.S. Employer

Identification No.) |

225 Liberty St. Suite 4210, New York, NY | | | 10281 |

(Address of principal executive offices) | | | (Zip Code) |

Registrant’s telephone number, including area code: (212) 782-3842

with copies to:

Richard Horowitz

Dechert LLP

1095 Avenue of the Americas

New York, NY 10036

(212) 698-3500

Securities to be registered pursuant to Section 12(b) of the Act:

None

Securities to be registered pursuant to Section 12(g) of the Act:

Common Shares of Beneficial Interest, par value $0.01 per share

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | | | ☐ | | | Accelerated filer | | | ☐ |

Non-accelerated filer | | | ☒ | | | Smaller reporting company | | | ☐ |

| | | | | | Emerging growth company | | | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

TABLE OF CONTENTS

TABLE OF CONTENTS

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

TABLE OF CONTENTS

Kennedy Lewis Capital Company is filing this registration statement on Form 10 (the “Registration Statement”) with the Securities and Exchange Commission (the “SEC”) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), on a voluntary basis to permit it to file an election to be regulated as a business development company (a “BDC”), under the Investment Company Act of 1940, as amended (the “1940 Act”), to provide current public information to the investment community and to comply with applicable requirements for possible future quotations or listing of its securities on a national securities exchange or other public trading market.

Unless indicated otherwise in this Registration Statement or the context requires otherwise, the terms:

• | “We,” “us,” “our” and the “Company” refer to Kennedy Lewis Capital Company; |

• | “Kennedy Lewis Capital Holdings” refers to Kennedy Lewis Capital Holdings LLC; |

• | “Advisor” refers to Kennedy Lewis Capital Holdings; and |

• | “Kennedy Lewis” refers to Kennedy Lewis Management, together with Kennedy Lewis Capital Holdings and its affiliates. |

The Company is an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). As a result, the Company is eligible to take advantage of certain reduced disclosure and other requirements that are otherwise applicable to public companies including, but not limited to, not being subject to the auditor attestation requirements of Section 404(b) of the Sarbanes-Oxley Act of 2002. See “Item 1. Business – JOBS Act.”

Upon the effective date of this Registration Statement, we will be subject to the requirements of Section 13(a) of the Exchange Act, including the rules and regulations promulgated under the Exchange Act, which will require us to file annual reports on Form 10-K, quarterly reports on Form 10-Q, and current reports on Form 8-K. We will also be required to comply with the proxy rules in Section 14 of the Exchange Act and all other obligations of the Exchange Act applicable to issuers filing registration statements pursuant to Section 12(g) of the Exchange Act. The SEC maintains a website (http://www.sec.gov) that contains the reports mentioned in this section.

Investing in our common shares of beneficial interest (the “Common Shares”) may be considered speculative and involves a high degree of risk, including the following:

• | An investment in our Common Shares is not suitable for you if you might need access to the money you invest in the foreseeable future. |

• | If you are unable to sell your Common Shares, you will be unable to reduce your exposure on any market downturn. |

• | Our Common Shares are not currently listed on an exchange and given that we have no current intention of pursuing any such listing, it is unlikely that a secondary trading market will develop for our Common Shares. The purchase of our Common Shares is intended to be a long-term investment. We do not intend to list our Common Shares on a national securities exchange. |

• | Our distributions may be funded from unlimited amounts of offering proceeds or borrowings, which may constitute a return of capital (i.e., a distribution funded solely by investors’ subscription amounts) and reduce the amount of capital available to us for investment. Any capital returned to you through distributions will be distributed after payment of fees and expenses. |

• | Repurchases of Common Shares by the Company, if any, are expected to be very limited. |

• | Investment in the Company is suitable only for sophisticated investors and requires the financial ability and willingness to accept the high risks and lack of liquidity inherent in an investment in the Company. |

• | The Company intends to invest primarily in privately-held companies for which very little public information exists. Such companies are also generally more vulnerable to economic downturns and may experience substantial variations in operating results. |

• | The privately-held companies and below-investment-grade securities in which the Company will invest will be difficult to value and are illiquid. |

TABLE OF CONTENTS

• | The Company has elected to be regulated as a BDC under the 1940 Act, which imposes numerous restrictions on the activities of the Company, including restrictions on leverage and on the nature of its investments. |

TABLE OF CONTENTS

FORWARD-LOOKING STATEMENTS

This Registration Statement contains forward-looking statements regarding the plans and objectives of management for future operations. Any such forward-looking statements may involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from future results, performance or achievements expressed or implied by any forward-looking statements. Forward-looking statements, which involve assumptions and describe our future plans, strategies and expectations, are generally identifiable by use of the words “may,” “will,” “should,” “expect,” “anticipate,” “estimate,” “believe,” “intend,” “target,” “goals,” “plan,” “forecast,” “project,” other variations on these words or comparable terminology, or the negative of these words. These forward-looking statements are based on assumptions that may be incorrect, and we cannot assure you that the projections included in these forward-looking statements will come to pass. Our actual results could differ materially from those expressed or implied by the forward-looking statements as a result of various factors, including the factors discussed in Item 1A entitled “Risk Factors” in Part I of this Registration Statement and elsewhere in this Registration Statement. Other factors that could cause our actual results and financial condition to differ materially include, but are not limited to, changes in political, economic or industry conditions, the interest rate environment or conditions affecting the financial and capital markets, including with respect to changes from the impact of the COVID-19 pandemic and Russia’s large-scale invasion of Ukraine; risks associated with possible disruption due to terrorism in our operations or the economy generally; and future changes in laws or regulations and conditions in our operating areas.

We have based the forward-looking statements included in this Registration Statement on information available to us on the date of this Registration Statement, and we assume no obligation to update any such forward-looking statements, unless we are required to do so by applicable law. However, you are advised to consult any additional disclosures that we may make directly to you or through reports that we in the future may file with the SEC, including subsequent amendments to this Registration Statement, annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K.

Summary of Risk Factors

An investment in the Common Shares involves significant risks. The risk factors described below are a summary of the principal risk factors associated with an investment in the Common Shares. These are not the only risks the Company faces. This summary should be read closely together with the risk factors set forth below in “Item 1A. Risk Factors” of this Registration Statement and other reports and documents the Company files with the SEC.

• | The Company is a new company with no operating history. |

• | The Company has elected to be regulated as a BDC under the 1940 Act, which imposes numerous restrictions on the activities of the Company, including restrictions on leverage and on the nature of its investments. |

• | The Company intends to invest primarily in privately-held companies for which very little public information exists. Such companies are also generally more vulnerable to economic downturns and may experience substantial variations in operating results. |

• | The privately-held companies and below-investment-grade securities in which the Company will invest will be difficult to value and are illiquid. |

• | Defaults by portfolio companies will harm the Company’s operating results. |

• | Investment in the Company is suitable only for sophisticated investors and requires the financial ability and willingness to accept the high risks and lack of liquidity inherent in an investment in the Company. |

• | An investment in our Common Shares is not suitable for you if you might need access to the money you invest in the foreseeable future. |

• | If you are unable to sell your Common Shares, you will be unable to reduce your exposure on any market downturn. |

• | Our Common Shares are not currently listed on an exchange and given that we have no current intention of pursuing any such listing, it is unlikely that a secondary trading market will develop for our Common Shares. The purchase of our Common Shares is intended to be a long-term investment. We do not intend to list our Common Shares on a national securities exchange. |

TABLE OF CONTENTS

• | Our distributions may be funded from unlimited amounts of offering proceeds or borrowings, which may constitute a return of capital (i.e., a distribution funded solely by investors’ subscription amounts) and reduce the amount of capital available to us for investment. Any capital returned to you through distributions will be distributed after payment of fees and expenses. |

• | The Company is subject to risks associated with the current interest rate environment and to the extent the Company uses debt to finance its investments, changes in interest rates will affect the cost of capital and net investment income. |

• | The discontinuation of LIBOR may adversely affect the Company’s business and results of operations. |

• | The Company depends upon Kennedy Lewis, the Advisor and the Administrator for its success and upon their access to investment professionals. |

• | The Company operates in a highly competitive market for investment opportunities. |

• | The Company’s debt investments may be risky and could result in the loss of all or part of its investments. |

• | There is no public market for the Common Shares. |

• | There are restrictions on holders of the Common Shares. |

• | There is a risk that investors may not receive distributions. |

• | The Company is operating in a period of capital markets disruption and economic uncertainty. |

• | The Company’s regulatory structure and tax status as a BDC and a regulated investment company (a “RIC”) could limit certain of the Company’s investments or negatively affect the Company’s investment returns. |

• | Future changes in laws or regulations and conditions in the Company’s operating areas could have an adverse impact on the Company. |

TABLE OF CONTENTS

The Company

Kennedy Lewis Capital Company, a Delaware statutory trust (the “Company”), has been established to invest primarily in debt or other debt-like securities across the capital structure of middle market companies located in the United States and, selectively, in other North American countries and in Europe, with the ability to consider investments focused on other geographic markets. We generally define middle market companies as those having enterprise values between $300 million and $3 billion. The Company’s investment objectives are to maximize the total return to its holders of Common Shares (each a “shareholder”) in the form of current income and, to a lesser extent, capital appreciation. The Company will employ a strategy to provide capital to middle market companies, with a focus on direct originations in private, first lien, senior secured, performing credits. The Company expects to generate returns primarily from interest income and fees from senior secured loans, with some capital appreciation through nominal equity co-investments.

The Company is externally managed by Kennedy Lewis Capital Holdings LLC (“Kennedy Lewis Capital Holdings,” in such capacity, the “Advisor”), a Delaware limited liability company that is registered with the U.S. Securities and Exchange Commission (the “SEC”) as an investment adviser under the Investment Advisers Act of 1940, as amended (the “Advisers Act”) pursuant to an investment advisory agreement between the Company and the Advisor (as amended, the “Advisory Agreement”). Kennedy Lewis Management LP (“Kennedy Lewis Management,” and together with Kennedy Lewis Capital Holdings and its affiliates, “Kennedy Lewis”) is registered with the SEC as an investment adviser under the Advisers Act. Kennedy Lewis Capital Holdings has entered into a resource sharing agreement (“Resource Sharing Agreement”) with Kennedy Lewis Management, pursuant to which Kennedy Lewis Management makes certain personnel and resources available to Kennedy Lewis Capital Holdings to provide certain investment advisory services to the Company. Kennedy Lewis Management serves as the Company’s administrator (in such capacity, the “Administrator”) pursuant to an administration agreement (the “Administration Agreement”). The Administrator may retain a sub-administrator to perform any or all of its obligations under the Administration Agreement.

The Company is a Delaware statutory trust structured as an externally managed, diversified closed-end management investment company. The Company has elected to be treated as a business development company (a “BDC”) under the U.S. Investment Company Act of 1940, as amended (the “1940 Act”). In addition, the Company intends to elect to be treated as a regulated investment company (a “RIC”) for U.S. federal income tax purposes under Subchapter M of the Internal Revenue Code of 1986, as amended (the “Code”).

Subject to the supervision of the Company’s Board of Trustees (the “Board”), a majority of which constitutes trustees who are not “interested persons” as defined in Section 2(a)(19) of the 1940 Act (“Independent Trustees”), the Advisor manages the Company’s day-to-day operations and provides the Company with investment advisory and management services. Trustees who are “interested persons” as defined in Section 2(a)(19) of the 1940 Act are referred to herein as “Interested Trustees.”

The Investment Team and Kennedy Lewis

Kennedy Lewis is an established credit manager with offices in New York and Miami. Kennedy Lewis was founded in 2017 by David Kennedy Chene and Darren Lewis Richman. Prior to founding Kennedy Lewis, Mr. Chene was a Managing Director with CarVal Investors and Mr. Richman was a Senior Managing Director with Blackstone. Together, Messrs. Chene and Richman have nearly 50 years of combined investment management experience across various economic cycles, asset classes, industries and geographies. Messrs. Chene and Richman’s complementary skillsets and prior experience working together at DiMaio Ahmad Capital help to ensure their harmonious relationship and provide the foundation for Kennedy Lewis’s collegial culture.

Doug Logigian, the President of Kennedy Lewis, is a Co-Managing Partner alongside Messrs. Chene and Richman (collectively the “Co-Managing Partners”). Mr. Logigian is responsible for overseeing the Advisor’s investment and origination processes. Prior to joining Kennedy Lewis, Mr. Logigian was a Senior Managing Director with Blackstone where he worked directly with Mr. Richman for a decade.

TABLE OF CONTENTS

James Didden, as President of the Company, is responsible for overseeing its distribution and operations. Mr. Didden was an original Partner of GSO Capital Partners and was involved in the formation of GSO’s private lending business. He subsequently became a Senior Managing Director at Blackstone upon its acquisition of GSO in 2008. At Blackstone, Mr. Didden worked directly with Messrs. Richman and Logigian as well as other members of the Investment Team (defined below).

The Co-Managing Partners and Mr. Didden are joined by a dynamic and seasoned senior investment team comprised of four Partners and five Managing Directors who have institutional pedigrees, substantial sector and credit investing expertise, and experience working together both at Kennedy Lewis and prior to Kennedy Lewis’ formation. This senior investment team is supported by twenty-two additional investment professionals (collectively with the Co-Managing Partners and the senior investment team, the “Investment Team”) as well as twenty-four business management and business development professionals. The Investment Team shares a disciplined approach to originating, executing upon, and monetizing investments.

Kennedy Lewis believes the Company will benefit from the firm’s Collateralized Loan Obligation (“CLO”) business, which targets par loans with attractive risk-return profiles. Access to the capabilities, industry insights, and credit coverage of Kennedy Lewis’ thirteen CLO professionals, including ten investment and three operational professionals, is expected to enhance the Company’s investment strategy as well as further strengthen and differentiate the Investment Team’s sourcing through additional access to the bank loan market. Access to Kennedy Lewis’ CLO professionals and platform:

• | Expands the Advisor’s credit and industry research coverage; |

• | Increases the Advisor’s relevance to The Street; |

• | Provides the Advisor with additional access to a range of credits and industry insights that can serve as early warning signs of distress; and |

• | Strengthens and differentiates the Advisor’s sourcing capabilities through additional access to the bank loan market which the Company is expected to invest in. |

Biographies of the Investment Team

David Kennedy Chene – Co-Managing Partner and Co-Founder of Kennedy Lewis Investment Management LLC, Co-Portfolio Manager of Kennedy Lewis Management LP, and Co-Chair of the Advisor’s and Kennedy Lewis Management LP’s Investment Committees

David Chene co-founded Kennedy Lewis with Darren Richman in 2017. Mr. Chene is a Co-Portfolio Manager and a Co-Managing Partner of Kennedy Lewis Management LP, and he Co-Chairs the Advisor’s and Kennedy Lewis Management LP’s Investment Committees and Kennedy Lewis’ Executive Committee. Mr. Chene was formerly a Managing Director with CarVal Investors, responsible for managing the US Corporate Securities business based in Minneapolis, from 2012 to 2016. Prior to his role in the US, he was Co-Head of CarVal’s European Corporate Securities business based in London. In both roles, he focused on special situations and distressed investments, including the firm’s global liquidations exposures and European financial investments. Before joining CarVal, Mr. Chene worked at Credit Suisse in London, running the firm’s European Distressed business, and was responsible for risk management across the firm’s European Leveraged Finance trading activities, from 2010 to 2012. Prior to Credit Suisse, Mr. Chene was a Senior Distressed Trader for Morgan Stanley in London, from 2009 to 2010. Prior to Morgan Stanley, Mr. Chene was a Research Analyst at DiMaio Ahmad Capital from 2003 to 2009, first in New York and then later as Head of the Firm’s Asian Platform, based in Singapore. Mr. Chene began his career at CIBC World Markets as a Research Analyst in its Leveraged Finance Investment Banking Division in New York, from 2001 to 2003.

Mr. Chene is on the Board of Sanctuary Wealth. Mr. Chene actively supports charitable causes such as Ironman Foundation, Seeds of Peace, TreeHouse, Urban Ventures, WATCH, and Women for Women International. He is an Eagle Scout and an 8-time full distance Ironman finisher, including 2-times at the Ironman World Championships in Kona, Hawaii.

He received a BA in Business Economics and Accounting from the University of California at Los Angeles in 2001.

TABLE OF CONTENTS

Darren Lewis Richman – Co-Managing Partner and Co-Founder of Kennedy Lewis Investment Management LLC, Co-Portfolio Manager of Kennedy Lewis Management LP, and Co-Chair of the Advisor’s and Kennedy Lewis Management LP’s Investment Committees

Darren Richman co-founded Kennedy Lewis with David Chene in 2017. Mr. Richman is a Co-Portfolio Manager and a Co-Managing Partner of Kennedy Lewis Management LP, and he Co-Chairs the Advisor’s and Kennedy Lewis Management LP’s Investment Committees and Kennedy Lewis’ Executive Committee. Mr. Richman was formerly a Senior Managing Director with Blackstone from 2006 to 2016. He focused on special situations and distressed investments, and he sat on the Investment Committee for many of GSO’s special situation-oriented funds. Before joining GSO Capital Partners, Mr. Richman worked at DiMaio Ahmad Capital, where he was a Founding Member and the Co-Head of its Investment Research Team, from 2003 to 2006. Prior to joining DiMaio Ahmad, Mr. Richman was a Vice President and Senior Special Situations Analyst at Goldman Sachs, from 1999 to 2003. Mr. Richman began his career with Deloitte & Touche, ultimately serving as a Manager in the Firm’s Mergers & Acquisitions Services Group, from 1994 to 1999.

Mr. Richman is on the Boards of Eastman Kodak and Outward Bound USA, and the Executive Board of New York University’s Stern School of Business. He previously sat on the Board of Sorenson Communications, F45, Seneca Mortgage and Warrior Coal. He is a member of the Economic Club of New York and formerly served on its strategic planning committee.

Mr. Richman received a BS/BA degrees in Accounting from the University of Hartford in 1993, and an MBA from NYU’s Stern School of Business in 2000. He was formerly a Certified Public Accountant and a Member of the American Institute of Certified Public Accountants.

Doug Logigian – Co-Managing Partner and President of Kennedy Lewis Investment Management LLC and Member of the Advisor’s and Kennedy Lewis Management LP’s Investment Committees

See “Item 5 – Directors and Executive Officers – Trustees Biography – Interested Trustees” for Mr. Logigian’s biography.

J. Richard “Dik” Blewitt – Partner, Head of Tactical Opportunities

J. Richard “Dik” Blewitt joined Kennedy Lewis in 2020 and is a Partner and Head of Tactical Opportunities for the Firm. Mr. Blewitt serves on the Investment Committee of Kennedy Lewis Management LP. Mr. Blewitt previously spent 6 years at GSO Capital Partners, a division of Blackstone, as a Managing Director focused on structured finance/credit investments. He was the Senior Portfolio Manager for Carador Income Fund PLC, a member of the Global Structured Credit Investment committee for the firm’s Liquid Credit business, as well as a member of Blackstone Insurance Solutions Investment Committee. Prior to that, he was a Managing Director and Co-Head of the Securitized Asset Team within Blackrock’s Fixed Income Portfolio Management Group, a senior PM for Blackrock BMI, PPIF, and TALF funds, as well as the Partner in charge of Securitization and Insurance Products for the R3 Capital Hedge Fund. Prior to Blackrock acquiring R3, Mr. Blewitt was with Lehman Brothers as a Managing Director and Head of Securitization and Insurance Product Investments for the Global Principal Strategies business. Mr. Blewitt was formerly a Managing Director and Global Head of Distribution for the Global Structured Products Group at Bank of America Securities, and previously spent 7 years with JP Morgan in Structured Finance.

Mr. Blewitt was on the Board of Viva Life Settlement Co, Altus Power America, JG Wentworth, Vendor Assistance Program, and LoanX.

Mr. Blewitt earned a BS in Finance from Lehigh University, and an MBA in Finance/International Business from the Stern School of Business at New York University.

Mark Crawford – Partner, Head of Power

Mark Crawford joined Kennedy Lewis in 2017 and is a Partner and Head of Power. Mr. Crawford serves on the Investment Committee of Kennedy Lewis Management LP. Mr. Crawford was formerly a Director with CarVal Investors, responsible for managing North American special situations and distressed investments, specifically focusing on power and energy investments, from 2008 to 2016. Before joining CarVal, he was a Senior Credit Analyst with GSC Group, focusing on liquid investment strategies within the firm’s distressed for control private equity unit, from 2006 to 2008. Prior to GSC Group, Mr. Crawford was a Research Analyst in the Carlyle Group’s High Yield Business, focusing on power, automotive and consumer product investments, from 2005 to 2006. Prior to Carlyle,

TABLE OF CONTENTS

he was an Investment Banking Associate at Credit Suisse First Boston, primarily working in the Distressed Finance and Global Energy groups, from 2003 to 2005. Prior to starting a career in finance, Mr. Crawford began as a Surface Warfare Officer in the U.S. Navy, during which he deployed to the North Atlantic, Mediterranean, Middle East and Latin America, from 1993 to 1998.

Mr. Crawford is on the Boards of T1 Holdings and TexGen. He was formerly a member of the Boards of Granite Ridge Holdings, Bosque Power Company, and Tapstone Energy.

Mr. Crawford received a BS in Economics from the United States Naval Academy in 1993, a MS in Information and Telecommunications Systems from Johns Hopkins University in 2000, and an MBA from the Wharton School at the University of Pennsylvania in 2003.

Brian Dubin – Partner

Brian Dubin joined Kennedy Lewis in 2018 and is a Partner focused on investments in the Technology, Media, and Telecom (TMT), Industrials and Fitness sectors. Mr. Dubin serves on the Investment Committee of Kennedy Lewis Management LP. Mr. Dubin was formerly a Senior Analyst at Mariner Investment Group, a leading alternative investment advisory firm, specifically focusing on stressed loans, from 2015 to 2018. Before joining Mariner Investment Group, Mr. Dubin was a Partner and Research Analyst at MeehanCombs, a global credit opportunities fund, where he was responsible for specialty finance investments, from 2012 to 2015. Prior to MeehanCombs, Mr. Dubin was a Senior Analyst at Eos Partners, a distressed credit fund, where he focused on investments in the financial services industry, from 2008 to 2012. Prior to Eos Partners, Mr. Dubin was a Specialty Finance and Industrials Analyst at GSO Capital Partners from 2005 to 2008. Mr. Dubin began his career as an Investment Banking Analyst in the Global Industrial Group of UBS investment bank from 2003 to 2005.

Mr. Dubin received a BS from the Wharton School at the University of Pennsylvania in 2002.

Biographies of Key Personnel of the Advisor

James Didden – Head of Private Wealth Solutions & President of Kennedy Lewis Capital Company

See “Item 5 – Directors and Executive Officers – Trustees Biography – Interested Trustees” for Mr. Didden’s biography.

Anthony Pasqua – Partner, Chief Financial Officer/Chief Operating Officer

See “Item 5 – Directors and Executive Officers – Executive Officers Who are not Trustees” for Mr. Pasqua’s biography.

Ben Schryber – Partner, Head of Business Development

Ben Schryber joined Kennedy Lewis in 2018 and is a Partner and the Head of Business Development with responsibility for the Firm’s investor relations activities. Mr. Schryber was formerly a Managing Director at the Carlyle Group where he led its credit sales activities globally. Prior to Carlyle, Mr. Schryber was the Global Head of Credit at First Avenue Partners, a leading credit placement agent, where he oversaw for the origination, distribution, and ongoing management of credit funds. Prior to First Avenue, Mr. Schryber worked for Albourne Partners where he led the Advisor’s due diligence on private credit funds. Prior to that, he worked for Blue Ridge Partners as a management consultant focused on company-level due diligence on behalf of private equity funds.

Mr. Schryber earned a B.A. with Highest Honors from the University of Florida and was a Visiting Scholar at the University of Cambridge.

Josh Smith – Managing Director, Chief Risk Officer

Josh Smith joined Kennedy Lewis in 2019 and is a Managing Director and the Firm’s Chief Risk Officer. Mr. Smith is responsible for monitoring and analyzing portfolio and macroeconomic risk. Mr. Smith was formerly Chief Risk Officer with GSO Capital Partners, a division of Blackstone, where he worked from 2008 to 2019. At GSO he managed a team of 20 across Dublin and New York and was responsible for leading the firm’s Quantitative Portfolio Analytics, Portfolio Compliance and Risk Management efforts. Prior to GSO, he spent 10 years in technology designing, developing, and implementing financial systems for the corporate and public sectors. From 1994 to 1997 he was a calculus teacher at Delbarton School in New Jersey.

TABLE OF CONTENTS

Mr. Smith received a BS in Mathematics and Economics from Williams College and a Masters in Financial Engineering from Columbia University in 2008. He is a CFA charterholder.

All of the investment professional listed above have their principal business address at c/o Kennedy Lewis Capital Company, 225 Liberty St. Suite 4210, New York, NY 10281.

The Private Offering

We are offering on a continuous basis our Common Shares (the “Private Offering”), pursuant to the terms set forth in subscription agreements that we will enter into with investors in connection with the Private Offering (each, a “Subscription Agreement”). Although the Common Shares in the Private Offering are being sold under the exemption provided by Section 4(a)(2) of the Securities Act of 1933 (the “Securities Act”) only to investors that are “accredited investors” in accordance with Rule 506 of Regulation D promulgated under the Securities Act, and other exemptions of similar import in the laws of the states and jurisdictions where the offering will be made, there can be no assurance that we will not need to suspend our continuous offering for various reasons, including but not limited to regulatory review from the SEC and various state regulators, to the extent applicable.

The Company seeks to raise equity capital through private placements on a continuous basis through one or more closings (“Closings”) at which the Company will accept funds from investors in connection with such investors’ purchases of Common Shares (each such agreement, a “Subscription Agreement,” the first such Closing the “Initial Closing” and each subsequent closing a “Subsequent Closing”). The Initial Closing is expected to occur during the first quarter of 2023 (the “Initial Closing Date”). Each Subsequent Closing will generally occur on a monthly basis on the last calendar day of the month or on a date as determined by the Company or the Advisor in its sole discretion.

Each investor is required to fully fund its subscription amount by wire to the Company’s bank account on or before the last business day of the month of its respective Closing. Any shareholder that seeks to purchase additional Common Shares will be required to enter into an additional, short form Subscription Agreement with the Company (a “Short Form Subscription Agreement”). For the avoidance of doubt, each shareholder that enters into a Short Form Subscription Agreement will be required to fully fund its additional subscription amount by wire to the Company’s bank account on or before the last business day of the month of its respective Closing. The minimum investment for any Subscription Agreement and any Short Form Subscription Agreement is $10,000.

The purchase of our Common Shares is intended to be a long-term investment. We do not intend to list our shares on a national securities exchange, except as noted in “Item 9. Market Price of and Dividends on the Registrant’s Common Equity and Related Stockholder Matters – Market Information.”

Beginning no later than the first full calendar quarter after the one-year anniversary of the Initial Closing Date, and at the discretion of the Company, the Company intends to commence a share repurchase program in which it would repurchase, in each quarter, an amount not to exceed 5.0% of its outstanding Common Shares as of the close of the previous calendar quarter; provided, however, that the Advisor, subject to the Board's discretion and approval, shall cause the Company to repurchase Common Shares from the shareholders in an amount at least equal to 10% of the Company's net asset value in respect of the fourth calendar quarter of each of the eighth and tenth calendar years following the Initial Closing Date. The Company may amend, suspend, or terminate the share repurchase program if it deems such action to be in its best interest and the best interest of its shareholders, subject to the Board’s discretion and approval. As a result, share repurchases may not be available each quarter. The Company intends to conduct such repurchase offers in accordance with the requirements of Rule 13e-4 promulgated under the Exchange Act and the 1940 Act. See “Item 9. Market Price of and Dividends on the Registrant’s Common Equity and Related Stockholder Matters – Discretionary Repurchase of Shares.”

TABLE OF CONTENTS

Our Business Strategy

Investment Objectives

The Company’s investment objectives are to maximize the total return to its shareholders in the form of current income and, to a lesser extent, capital appreciation. The Company seeks to meet its investment objectives by:

• | utilizing the experience and expertise of Kennedy Lewis, along with its broader resources, network of relationships (including founders, management teams, minority equity owners, portfolio companies, banks, prior financing relationships, etc.), and human capital, including its capabilities as it relates to sourcing, evaluating, and structuring transactions; |

• | employing a defensive investment approach focused on long-term credit performance and principal protection; |

• | focusing on investing primarily in debt or other debt-like securities across the capital structure of middle market companies located in the United States and, selectively, in other North American countries and in Europe, with the ability to consider investments focused on other geographic markets; |

• | investing primarily in established, stable, enterprises with positive cash flow, strong competitive positioning in their industries, experienced management teams, and diverse customer and supplier bases; and |

• | maintaining rigorous portfolio monitoring in an attempt to anticipate and pre-empt negative credit events within the Company’s portfolio. |

To realize its investment objectives, the Company will leverage the team’s experience investing across cycles, geographies, and a range of industries where it has expertise to generally self-originate senior secured loans sourced through its network of relationships, including founders, management teams, minority equity owners, portfolio companies, banks and prior financing relationships. As part of the opportunistic credit strategy that Kennedy Lewis manages through its family of opportunistic private credit funds, Kennedy Lewis regularly sources loans that are appropriate for the Company’s investment strategy. These loans are generally first lien instruments in performing companies with return characteristics that the Advisor believes are appropriate for the Company to meet its investment objectives. These are loans that flow from Kennedy Lewis’ existing deal origination efforts across a range of industries and corners of the market that exhibit uncorrelated or counter-cyclical characteristics. The Advisor’s experienced team has originated and structured private investments in a variety of macro-economic environments to create diverse portfolios of loans that span multiple industries.

In addition to investing in self-originated instruments, the Company will also invest in broadly syndicated senior secured loans. The Company expects to generate returns primarily from interest income, fees and, to a lesser extent, capital appreciation, which collectively contribute to the Company’s expected total investment return.

Most of the debt instruments the Company will invest in are unrated or rated below investment grade, which is often an indication of size, credit worthiness and speculative nature relative to the capacity of the borrower to pay interest and principal. Generally, if the Company’s unrated investments were rated, they would be rated below investment grade. These securities, which are often referred to as “junk” or “high yield”, have predominantly speculative characteristics with respect to the issuer’s capacity to pay interest and repay principal. They may also be difficult to value and are illiquid.

The Advisor also considers environmental, social and governance (“ESG”) factors in the investment decision making process, in accordance with the Advisor’s ESG policy, including a negative screen for certain industries as well as an analysis of the likelihood of material ESG-related risk based on the industry and industry subsector of the potential portfolio company, with further diligence and analysis based on this categorization as well as other factors identified during diligence.

Investment Allocation

Kennedy Lewis provides investment management services to other investment funds and client accounts and will share any investment and sale opportunities with its other clients and the Company in accordance with applicable law, including the Advisers Act, firm-wide allocation policies, and any exemptive order from the SEC permitting co-investment activities (as further described below), which generally provide for sharing eligible investments pro rata among the eligible participating funds and accounts, subject to certain allocation factors.

TABLE OF CONTENTS

As a BDC regulated under the 1940 Act, the Company will be subject to certain limitations relating to co-investments and joint transactions with affiliates, which, in certain circumstances, may limit the Company’s ability to make investments or enter into other transactions alongside other clients. The Advisor has applied for an exemptive order from the SEC that will permit the Company, among other things, to co-invest with certain other persons, including certain affiliates of the Advisor and certain funds managed and controlled by the Advisor, Kennedy Lewis and its affiliates, subject to certain terms and conditions. There is no assurance that the co-investment exemptive order will be granted by the SEC. Pursuant to such order, the Board may establish Board Criteria clearly defining co-investment opportunities in which the Company will have the opportunity to participate with other public or private Kennedy Lewis funds that target similar assets. If an investment falls within the Board Criteria, Kennedy Lewis must offer an opportunity for the Company to participate. The Company may determine to participate or not to participate, depending on whether the Advisor determines that the investment is appropriate for the Company (e.g., based on investment strategy). The co-investment would generally be allocated to the Company and the other Kennedy Lewis funds that target similar assets pro rata based on available capital in the asset class being allocated. If the Advisor determines that such investment is not appropriate for the Company, the investment will not be allocated to us, but the Advisor will be required to report such investment and the rationale for its determination for us to not participate in the investment to the Board at the next quarterly board meeting.

Payment of the Company’s Expenses

All investment professionals of the Advisor, when and to the extent engaged in providing investment advisory and management services to the Company, and the compensation and routine compensation-related overhead expenses of personnel allocable to these services to the Company, are provided and paid for by the Advisor and not by the Company. The Company will bear all other out-of-pocket costs and expenses of its operations and transactions, including, without limitation, those relating to:

• | All direct and indirect costs and expenses incurred by the Advisor for office space rental, office equipment, utilities and other non-compensation related overhead allocable to performance of investment advisory services under the Advisory Agreement by the Advisor, including the costs and expenses of due diligence of potential investments, monitoring performance of the Company’s investments, serving as trustees and officers of portfolio companies, providing managerial assistance to portfolio companies, enforcing the Company’s rights in respect of its investments and disposing of investments; |

• | organizational and offering expenses; |

• | expenses incurred in valuing the Company’s assets and computing its net asset value per share (including the cost and expenses of any independent valuation firm); |

• | expenses incurred by the Company’s administrator or payable to third parties, including agents, consultants or other advisors, in monitoring financial and legal affairs for the Company and in monitoring the Company’s investments and performing due diligence on the Company’s prospective portfolio companies or otherwise related to, or associated with, evaluating and making investments; |

• | interest payable on debt, if any, incurred to finance the Company’s investments and other fees and expenses related to the Company’s borrowings; |

• | expenses related to unsuccessful portfolio acquisition efforts; |

• | offerings of the Common Shares and other securities (including underwriting, placement agent and similar fees and commissions); |

• | Base Management Fees (as defined below) and Incentive Fees (as defined below); |

• | third-party investor hosting and similar platforms and service providers; |

• | transfer agent and custody fees and expenses; |

• | federal and state registration fees; |

• | all costs of registration and listing the Company’s Common Shares on any securities exchange; |

• | federal, state and local taxes; |

• | Independent Trustees’ fees and expenses; |

• | costs of preparing and filing reports or other documents required by the SEC or other regulators; |

• | costs of any reports, proxy statements or other notices to shareholders, including printing costs; |

TABLE OF CONTENTS

• | the costs associated with individual or group shareholders; |

• | the Company’s allocable portion of the fidelity bond, trustees and officers/errors and omissions liability insurance, and any other insurance premiums; |

• | direct costs and expenses of administration and operation, including printing, mailing, long distance telephone, copying, secretarial and other staff, independent auditors, third-party investor hosting and similar platforms and service providers, and outside legal costs; and |

• | all other expenses incurred by the Company or the Advisor in connection with administering the Company’s business, such as the allocable portion of overhead under the Administration Agreement, including rent, and the allocable portion of the cost of the Company’s Chief Financial Officer and Chief Compliance Officer and their respective staffs. |

Distributions; Dividend Reinvestment Program

The Company intends to make quarterly distributions to shareholders. Distributions will be made to shareholders at such times and in such amounts as determined by the Board.

In addition, the Company has adopted a dividend reinvestment plan (“DRP”), pursuant to which each shareholder will receive dividends in the form of additional Common Shares unless they notify the Company that they instead desire to receive cash or a combination of cash and Common Shares. If a shareholder receives dividends in the form of Common Shares, dividend proceeds that otherwise would have been distributed in cash will be retained by the Company for reinvestment. Shareholders who receive dividends and other distributions in the form of Common Shares generally are subject to the same U.S. federal tax consequences as investors who elect to receive their distributions in cash; however, since their cash dividends will be reinvested, those investors will not receive cash with which to pay any applicable taxes on re-invested dividends. A shareholder may elect to receive dividends and other distributions in cash or a combination of cash and Common Shares by notifying the Company in writing at least 20 business days prior to the distribution date fixed by the Board for such dividend. If such notice is received by the Company less than 20 business days prior to the relevant distribution date, then that dividend will be paid in the form of Common Shares and any subsequent dividends will be paid in cash.

Management Agreements

The Advisor serves as the Company’s investment adviser and is registered as an investment adviser under the Advisers Act. In addition, Kennedy Lewis Management serves as the Company’s administrator.

Advisory Agreement

Subject to the overall supervision of the Board and in accordance with the 1940 Act, the Advisor manages the Company’s day-to-day operations and provides investment advisory services to the Company. Under the terms of the Advisory Agreement, the Advisor:

• | determines the composition of the Company’s portfolio, the nature and timing of the changes to its portfolio and the manner of implementing such changes; |

• | identifies, evaluates and negotiates the structure of the investments the Company makes; |

• | executes, closes, services and monitors the investments the Company makes; |

• | determines the securities and other assets that the Company purchases, retains or sells; |

• | performs due diligence on prospective portfolio companies; and |

• | provides the Company with such other investment advisory, research and related services as the Company may, from time to time, reasonably require for the investment of its funds. |

Under the Advisory Agreement, the Company will pay the Advisor fees for investment management services consisting of a base management fee (the “Base Management Fee”) and an incentive fee (the “Incentive Fee”).

Base Management Fee

The Company will pay the Advisor a Base Management Fee equal to an annual rate of 1.25% of the average of the Company’s net assets, at the end of the two most recently completed quarters. Subsequent to any IPO (as defined below) or Exchange Listing (as defined below), the Company will pay the Advisor a base management fee calculated at an annual rate of 1.25% of the Company’s average gross assets at the end of the two most recently completed quarters. The Base Management Fee will be payable quarterly in arrears.

TABLE OF CONTENTS

Incentive Fee

The Incentive Fee consists of two components that are independent of each other, with the result that one component may be payable even if the other is not. A portion of the Incentive Fee is based on a percentage of income and a portion is based on a percentage of capital gains, each as described below.

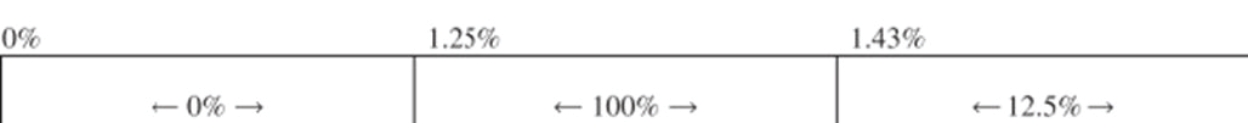

Income-Based Incentive Fee. The portion based on the Company’s income is based on Pre-Incentive Fee Net Investment Income Returns. “Pre-Incentive Fee Net Investment Income Returns” means, as the context requires, either the dollar value of, or percentage rate of return on the value of net assets at the end of the immediate preceding quarter from, interest income, dividend income and any other income (including any other fees (other than fees for providing managerial assistance), such as commitment, origination, structuring, diligence and consulting fees or other fees that are received from portfolio companies) accrued during the calendar quarter, minus operating expenses accrued for the quarter (including the management fee, expenses payable under the Administration Agreement entered into between the Company and the Administrator, and any interest expense or fees on any credit facilities or outstanding debt and dividends paid on any issued and outstanding preferred shares, but excluding the Incentive Fee and any shareholder servicing and/or distribution fees). Pre-Incentive Fee Net Investment Income Returns include, in the case of investments with a deferred interest feature (such as original issue discount, debt instruments with payment-in-kind (“PIK”) interest and zero coupon securities), accrued income that has not yet been received in cash. Pre-Incentive Fee Net Investment Income Returns do not include any realized capital gains, realized capital losses or unrealized capital appreciation or depreciation. The impact of expense support payments and recoupments are also excluded from Pre-Incentive Fee Net Investment Income Returns. Pre-Incentive Fee Net Investment Income Returns, expressed as a rate of return on the value of the Company’s net assets at the end of the immediate preceding quarter, is compared to a “hurdle rate” of return of 1.25% per quarter (5.0% annualized).

The Company pays the Advisor an Income Based Incentive Fee quarterly in arrears with respect to the Company’s Pre-Incentive Fee Net Investment Income Returns in each calendar quarter as follows:

• | No incentive fee based on Pre-Incentive Fee Net Investment Income Returns in any calendar quarter in which Pre-Incentive Fee Net Investment Income Returns do not exceed the hurdle rate of 1.25% per quarter (5.0% annualized); |

• | 100.0% of the dollar amount of Pre-Incentive Fee Net Investment Income Returns with respect to that portion of such Pre-Incentive Fee Net Investment Income Returns, if any, that exceeds the hurdle rate until the Advisor has received 12.5% of the total Pre-Incentive Fee Net Investment Income Returns for that calendar quarter. The Company refers to this portion of the Pre-Incentive Fee Net Investment Income Returns (which exceeds the hurdle rate) as the “catch-up.” This “catch-up” is meant to provide the Advisor an Incentive Fee of 12.5% on all Pre-Incentive Fee Net Investment Income Returns when that amount equals 1.43% in a calendar quarter (5.72% annualized), which is the rate at which the catch-up is achieved. |

• | 12.5% of the dollar amount of all Pre-Incentive Fee Net Investment Income Returns, if any, that exceed a rate of return of 1.43%. |

Pre-Incentive Fee Net Investment Income Returns

(expressed as a percentage of the value of net assets per quarter)

TABLE OF CONTENTS

These calculations are prorated for any period of less than three months, including the first quarter the Company commenced operations, and are adjusted for any share issuances or repurchases during the relevant quarter.

Capital Gains Incentive Fee. The second part of the Incentive Fee is determined and payable in arrears as of the end of each calendar year in an amount equal to 12.5% of cumulative realized capital gains from inception through the end of such calendar, computed net of all realized capital losses and unrealized capital depreciation on a cumulative basis, less the aggregate amount of any previously paid Incentive Fee on capital gains as calculated in accordance with U.S. GAAP (the “Capital Gains Incentive Fee”).

Examples of Quarterly Incentive Fee Calculation

Example 1 – Incentive Fee on Pre-Incentive Fee Net Investment Income Returns for each quarter

Pre-Incentive Fee Net Investment Income Returns for the quarter | | | 1.00% | | | 1.35% | | | 2.00% |

Catch up incentive fee (maximum of 0.18%) | | | 0.00% | | | -0.10% | | | -0.18% |

Split incentive fee (12.50% above 1.43%) | | | 0.00% | | | 0.00% | | | -0.07% |

Net Investment income | | | 1.00% | | | 1.25% | | | 1.75% |

Scenario 1 – Incentive Fee on Income

Pre-Incentive Fee Net Investment Income Returns does not exceed the 1.25% quarterly hurdle rate, therefore there is no catch up or split incentive fee on Pre-Incentive Fee Net Investment Income Returns.

Scenario 2 – Incentive Fee on Income

Pre-Incentive Fee Net Investment Income Returns falls between the 1.25% quarterly hurdle rate and the upper level breakpoint of 1.43%, therefore the incentive fee on Pre-Incentive Fee Net Investment Income Returns is 100% of the Pre-Incentive Fee above the 1.25% quarterly hurdle rate.

Scenario 3 – Incentive Fee on Income

Pre-Incentive Fee Net Investment Income Returns exceeds the 1.25% hurdle rate and the 1.43% upper-level breakpoint provision. Therefore, the upper-level breakpoint provision is fully satisfied by the 0.18% of Pre- Incentive Fee Net Investment Income Returns above the 1.25% hurdle rate and there is a 12.50% incentive fee on Pre-Incentive Fee Net Investment Income Returns above the 1.43% upper-level breakpoint. This ultimately provides an incentive fee which represents 12.50% of Pre-Incentive Fee Net Investment Income Returns.

Example 2 – Capital Gains Incentive Fee

Assumptions

Year 1:

| No net realized capital gains or losses |

Year 2:

| 6.00% realized capital gains and 1.00% realized capital losses and unrealized capital depreciation; Capital Gain Incentive Fee = 12.50% × (realized capital gains for year computed net of all realized capital losses and unrealized capital depreciation at year end) |

Year 1 Capital Gains Incentive Fee

| = 12.50% × (0)

|

=0

= No Capital Gains Incentive Fee

Year 2 Capital Gains Incentive Fee

| = 12.50% × (6.00% −1.00)%

|

= 12.50% × 5.00%

= 0.63%

TABLE OF CONTENTS

Subsequent to any IPO or Exchange Listing (each as defined below), the Company will pay the Advisor (i) a base management fee calculated at an annual rate of 1.25% of the Company’s average gross assets, at the end of the two most recently completed calendar quarters and (ii) the Income Incentive Fee and Capital Gains Incentive Fee described above except that all of the 12.5% figures referenced therein will be increased to 15.0%. In addition, the expense support aspect (but not the conditional reimbursement aspect) of the Expense Support Agreement (as defined below) will no longer be of any force or effect subsequent thereto with respect to the Company.

Indemnification

The Advisory Agreement provides that the Advisor and its officers, managers, partners, agents, employees, controlling persons and members, and any other person or entity affiliated with it, are entitled to indemnification from the Company for any damages, liabilities, costs and expenses (including reasonable attorneys’ fees and amounts reasonably paid in settlement) arising from the rendering of the Advisor’s services under the Advisory Agreement or otherwise as the Company’s investment adviser.

Duration and Termination

Unless terminated earlier as described below, the Advisory Agreement will continue in effect for a period of two years from its effective date. It will remain in effect from year to year thereafter if approved annually by the Board or by the affirmative vote of the holders of a majority of the Company’s outstanding voting securities, and, in either case, if also approved by a majority of the Independent Trustees. The Advisory Agreement automatically terminates in the event of its assignment, as defined in the 1940 Act, by the Advisor and may be terminated by the Board or the Advisor without penalty upon 60 days’ written notice to the other. The holders of a majority of the Company’s outstanding voting securities may also terminate the Advisory Agreement without penalty upon 60 days’ written notice.

Administration Agreement

Under the Administration Agreement, the Administrator furnishes the Company with office facilities and equipment and will provide the Company with clerical, bookkeeping, recordkeeping and other administrative services at such facilities. The Administrator also performs, or oversees the performance of, the Company’s required administrative services, which include being responsible for the financial and other records that the Company is required to maintain and preparing reports to its shareholders and reports and other materials filed with the SEC. In addition, the Administrator assists the Company in determining and publishing its net asset value, oversees the preparation and filing of its tax returns and the printing and dissemination of reports and other materials to its shareholders, and generally oversees the payment of its expenses and the performance of administrative and professional services rendered to the Company by others. Under the Administration Agreement, the Administrator also provides managerial assistance on the Company’s behalf to those portfolio companies that have accepted the Company’s offer to provide such assistance.

Payments under the Administration Agreement are equal to an amount based upon the Company’s allocable portion (subject to the review of the Board) of the Administrator’s overhead in performing its obligations under the Administration Agreement, including rent, the fees and expenses associated with performing compliance functions and the Company’s allocable portion of the cost of the Company’s Chief Financial Officer and Chief Compliance Officer and their respective staffs.

Indemnification

The Administration Agreement provides that the Administrator, its affiliates and their respective, officers, managers, partners, agents, employees, controlling persons and members, and any other person or entity affiliated with it, are entitled to indemnification from the Company for any damages, liabilities, costs and expenses (including reasonable attorneys’ fees and amounts reasonably paid in settlement) arising from the rendering of the Administrator’s services under the Administration Agreement or otherwise as the Administrator.

Resource Sharing Agreement

The Advisor has entered into a resource sharing agreement (the “Resource Sharing Agreement”) with Kennedy Lewis Management, pursuant to which Kennedy Lewis Management makes its investment and portfolio management and monitoring teams available to the Advisor. The Resource Sharing Agreement (i) provides the Company with

TABLE OF CONTENTS

access to deal flow generated by Kennedy Lewis in the ordinary course of its business; and (ii) provides the Company with access to Kennedy Lewis Management’s investment professionals and non-investment employees. Subject at all times to any co-investment exemptive relief order and applicable laws and regulations, the Advisor is responsible for determining if the Company will participate in deal flow generated by Kennedy Lewis.

License Agreement

The Company has entered into a license agreement with Kennedy Lewis under which Kennedy Lewis has agreed to grant the Company a non-exclusive, royalty-free license to use the name “Kennedy Lewis.” Under this agreement, the Company has a right to use the “Kennedy Lewis” name for so long as the Advisor or one of its affiliates remains the Company’s investment adviser. Other than with respect to this limited license, the Company has no legal right to the “Kennedy Lewis” name. This license agreement will remain in effect for so long as the Advisory Agreement with the Advisor is in effect.

Transfer Agency Agreement

The Company has entered into a transfer agency agreement with DST Systems, Inc. under which DST Systems, Inc. has agreed to provide transfer agency, shareholder record keeping and related services to the Company. This agreement will remain in effect until the expiration or termination of the transfer agency agreement.

Expense Support and Conditional Reimbursement Agreement

The Company has entered into an expense support and conditional reimbursement agreement (as amended, the “Expense Support Agreement”) with the Advisor, pursuant to which the Advisor has contractually agreed to pay Other Operating Expenses (as defined below) of the Company on the Company’s behalf (each such payment, a “Required Expense Payment” such that Other Operating Expenses of the Company do not exceed 1.00% (on an annualized basis) of the Company’s applicable quarter-end net asset value. “Other Operating Expenses” include the Company’s organizational and offering expenses (including the Company’s allocable portion of compensation and overhead (including rent, office equipment and utilities) and other expenses incurred by the Administrator in performing its administrative obligations under the Administration Agreement, excluding Base Management Fees and Incentive Fees owed to the Advisor and any interest expenses owed by the Company.

At such times as the Advisor determines, the Advisor may elect to pay certain additional expenses of the Company on the Company’s behalf (each such payment, a “Voluntary Expense Payment” and together with a Required Expense Payment, the “Expense Payments”). In making a Voluntary Expense Payment, the Advisor will designate, as it deems necessary or advisable, what type of expense it is paying (including, whether it is paying organizational or offering expenses).

Following any calendar quarter in which Available Operating Funds (as defined below) exceed the cumulative distributions accrued to the Company’s shareholders based on distributions declared with respect to record dates occurring in such calendar quarter (the amount of such excess referred to in this Registration Statement as “Excess Operating Funds”), the Company will pay such Excess Operating Funds, or a portion thereof, to the Advisor until such time as all Expense Payments made by the Advisor to the Company within three years prior to the last business day of such calendar quarter have been reimbursed. Any payments required to be made by the Company under the Expense Support Agreement are referred to in this Registration Statement as a “Reimbursement Payment.” “Available Operating Funds” means the sum of (i) the Company’s net investment company taxable income (including net short-term capital gains reduced by net long-term capital losses), (ii) the Company’s net capital gains (including the excess of net long-term capital gains over net short-term capital losses) and (iii) dividends and other distributions paid to the Company on account of investments in portfolio companies (to the extent such amounts listed in clause (iii) are not included under clauses (i) and (ii) above).

The amount of the Reimbursement Payment for any calendar quarter will equal the lesser of (i) the Excess Operating Funds in such quarter and (ii) the aggregate amount of all Expense Payments made by the Advisor to the Company within three years prior to the last business day of such calendar quarter that have not been previously reimbursed by the Company to the Advisor; provided that the Advisor may waive its right to receive all or a portion of any Reimbursement Payment in any particular calendar quarter, in which case such waived amount will remain unreimbursed Expense Payments reimbursable in future quarters pursuant to the terms of the Expense Support Agreement.

TABLE OF CONTENTS

No Reimbursement Payment for any quarter shall be made if: (1) the Effective Rate of Distributions Per Share (as defined below) declared by the Company at the time of such Reimbursement Payment is less than the Effective Rate of Distributions Per Share at the time the Expense Payment was made to which such Reimbursement Payment relates, (2) the Company’s Operating Expense Ratio at the time of such Reimbursement Payment is greater than the Operating Expense Ratio at the time the Expense Payment was made to which such Reimbursement Payment relate, or (3) the Company’s Other Operating Expenses at the time of such Reimbursement Payment exceeds 1.00% of the Company’s applicable quarter-end net asset value. The Effective Rate of Distributions Per Share means the annualized rate, based on a 365-day year, of regular cash distributions per share exclusive of returns of capital and declared special dividends or special distributions, if any. The Company’s Operating Expense Ratio is calculated by dividing Operating Expenses (i.e. the Company’s operating costs and expenses incurred, as determined in accordance with generally accepted accounting principles), less organizational and offering expenses, Base Management Fees and Incentive Fees owed to the Advisor, shareholder servicing and/or distribution fees, and interest expense, by the Company’s net assets.

The Company’s obligation to make a Reimbursement Payment will automatically become a liability of the Company on the last business day of the applicable calendar quarter, except to the extent the Advisor has waived its right to receive such payment for the applicable quarter. The Reimbursement Payment for any calendar quarter will be paid by the Company to the Advisor in any combination of cash or other immediately available funds as promptly as possible following such calendar quarter and in no event later than 45 days after the end of such calendar quarter. All Reimbursement Payments shall be deemed to relate to the earliest unreimbursed Expense Payments made by the Advisor to the Company within three years prior to the last business day of the calendar quarter in which such Reimbursement Payments obligation is accrued.

Either the Company or the Advisor may terminate the Expense Support Agreement at any time, with or without notice, without the payment of any penalty, provided that any Expense Payments that have not been reimbursed by us to the Advisor will remain the obligation of the Company following any such termination, subject to the terms of the Expense Support Agreement.

Determination of Net Asset Value

The net asset value per share of the Company’s outstanding Common Shares is determined monthly by dividing the value of total assets minus liabilities by the total number of shares outstanding.

The Company shall value its investments in accordance with valuation procedures approved by the Board (the “Valuation Policy”). In accordance with Rule 2a-5 under the 1940 Act, the Board has designated the Advisor as the Company’s “Valuation Designee”. The Advisor has established a Valuation Committee that is responsible for determining in good faith the fair value of the Company’s investments in instances where there is no readily available market value. A readily available market value is not expected to exist for most of the investments in the Company’s portfolio, and the Company values these portfolio investments at fair value as determined in good faith by the Valuation Designee. The types of factors that the Valuation Designee may take into account in determining the fair value of the Company’s investments generally include, as appropriate, comparisons of financial ratios portfolio company to peer companies that are public, the nature and realizable value of any collateral, the portfolio company’s ability to make payments and its earnings and discounted cash flow, the markets in which the portfolio company does business, and other relevant factors. Investments for which market quotations are readily available may be priced by independent pricing services. The Company has retained an external, independent valuation firm to provide data and valuation analyses on the Company’s portfolio companies.

The Company has adopted Accounting Standards Board Accounting Standards Codification 820, Fair Value Measurements and Disclosures (“ASC 820”). This accounting statement requires the Company to assume that the portfolio investment is assumed to be sold in the principal market to market participants, or in the absence of a principal market, the most advantageous market, which may be a hypothetical market. Market participants are defined as buyers and sellers in the principal or most advantageous market that are independent, knowledgeable, and willing and able to transact. In accordance with ASC 820, the market in which the Company can exit portfolio investments with the greatest volume and level activity is considered its principal market.

When an external event such as a purchase transaction, public offering or subsequent equity sale occurs, the Company considers the pricing indicated by the external event to corroborate its valuation. Due to the inherent uncertainty of determining the fair value of investments that do not have a readily available market value, the fair value of the investments determined in good faith by the Advisor and approved by the Board may differ materially

TABLE OF CONTENTS

from the values that would have been used had a readily available market value existed for such investments. In addition, changes in the market environment and other events that may occur over the life of the investments may cause the gains or losses ultimately realized on these investments to be different from the valuations currently assigned.

With respect to investments for which market quotations are not readily available, the Advisor undertakes a multi-step valuation process, as described below:

• | The valuation process begins with each portfolio company or investment being initially valued by the investment professionals of the Advisor responsible for the portfolio investment; |

• | Preliminary valuation conclusions are then documented and discussed with the Advisor’s Valuation Committee and presented to the Advisor; |

• | The Advisor then reviews the preliminary valuations recommended by the Valuation Committee and determines the fair value of each investment in the Company’s portfolio in good faith; and |

• | The Audit Committee of the Board provides oversight of the valuation process in accordance with Rule 2a-5, which includes a review of the quarterly reports prepared by the Advisor and the fair valuation determinations made by the Advisor. |

As part of the overall process noted above, the Company has retained and may engage another independent valuation firm (each, a “Pricing Service”) to provide management with assistance in determining the fair value of selected portfolio investments each quarter. In selecting which portfolio investments to engage a Pricing Service, the Advisor considers a number of factors, including, but not limited to, the qualifications, experience, and history of the Pricing Service; the valuation methods or techniques, inputs, and assumptions used by the Pricing Service for different classes of holdings, and how they are affected (if at all) as market conditions change (including whether the Pricing Service is relying on inputs or assumptions provided by the Advisor); the quality of the pricing information provided by the Pricing Service and the extent to which the Pricing Service determines its pricing information as close as possible to the time as of which the Company calculates its NAV; the Pricing Service’s process for considering pricing challenges, including how the Pricing Service incorporates information received from price challenges into its pricing information; the Pricing Service’s actual and potential conflicts of interest and the steps the Pricing Service takes to mitigate such conflicts; the Pricing Services SOC reports, IT development, cybersecurity and business continuity policies; and the testing processes used by the Pricing Service. The scope of services rendered by the Pricing Service is at the discretion of the Advisor and subject to approval of the Board, and the Company may engage a Pricing Service to value all or some of our portfolio investments.

In determining the fair value of a portfolio investment in good faith, the Company recognizes these determinations are made using the best available information that is knowable or reasonably knowable. In addition, changes in the market environment, portfolio company performance and other events that may occur over the duration of the investments may cause the gains or losses ultimately realized on these investments to be materially different than the valuations currently assigned. The change in fair value of each individual investment is recorded as an adjustment to the investment's fair value and the change is reflected in unrealized appreciation or depreciation.

In following these approaches, the types of factors that are taken into account in determining the fair value of the Company’s investments include, as relevant, but are not limited to:

• | available current market data, including relevant and applicable market trading and transaction comparables; |

• | applicable market yields and multiples; |

• | call protection provisions; |

• | the nature and realizable value of any collateral; |

• | the portfolio company’s ability to make payments, its earnings and discounted cash flows and the markets in which it does business; |

• | comparisons of financial ratios of peer companies that are public; |

• | comparable merger and acquisition transactions; and |

• | the principal market and enterprise values. |

TABLE OF CONTENTS

Certain BDC Regulation Considerations

A BDC must be organized in the United States for the purpose of investing in or lending to primarily private companies and making significant managerial assistance available to them. As with other companies regulated by the 1940 Act, a BDC must adhere to certain substantive regulatory requirements.

SEC Reporting

The Company is subject to the reporting requirements of the Exchange Act, which includes annual and quarterly reporting requirements.

Governance

The Company is a statutory trust and, as such, is governed by a board of trustees. The 1940 Act requires that a majority of the Company’s trustees be persons other than “interested persons,” as that term is defined in the 1940 Act. In addition, the 1940 Act provides that the Company may not change the nature of its business so as to cease to be, or to withdraw its election as, a BDC unless approved by the holders of a majority of the outstanding voting securities.

Ownership Restrictions

The Company does not intend to acquire securities issued by any investment company that exceed the limits imposed by the 1940 Act. Under these limits, except for registered money market funds, a BDC generally cannot acquire more than 3% of the voting stock of any investment company, invest more than 5% of the value of its total assets in the securities of one investment company or invest more than 10% of the value of its total assets in the securities of investment companies in the aggregate.

Qualifying Assets

Under the 1940 Act, a BDC may not acquire any asset other than assets of the type listed in section 55(a) of the 1940 Act, which are referred to as qualifying assets, unless, at the time the acquisition is made and after giving effect to such acquisition, qualifying assets represent at least 70% of the BDC’s total assets. The principal categories of qualifying assets relevant to the Company’s business are the following:

• | Securities purchased in transactions not involving any public offering from the issuer of such securities, which issuer (subject to certain limited exceptions) is an “eligible portfolio company” (as defined in the 1940 Act), or from any person who is, or has been during the preceding 13 months, an affiliated person of an eligible portfolio company, or from any other person, subject to such rules as may be prescribed by the SEC. An eligible portfolio company is defined in the 1940 Act as any issuer which: |

• | is organized under the laws of, and has its principal place of business in, the United States; |

• | is not an investment company (other than a small business investment company wholly owned by the Company) or a company that would be an investment company but for certain exclusions under the 1940 Act; and |

• | satisfies any of the following: |

-

| has an equity capitalization of less than $250 million or does not have any class of securities listed on a national securities exchange; |

-

| is controlled by a BDC or a group of companies including a BDC, the BDC actually exercises a controlling influence over the management or policies of the eligible portfolio company, and, as a result thereof, the BDC has an affiliated person who is a director of the eligible portfolio company; or |

-

| is a small and solvent company having total assets of not more than $4 million and capital and surplus of not less than $2 million. |

• | Securities of any eligible portfolio company that the Company controls. |