UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

OR

For

the fiscal year ended

OR

OR

Date of event requiring this shell company report ____________________________

For the transition period from_________________to______________

Commission

File Number:

(Exact name of Registrant as specified in its charter)

(Jurisdiction of incorporation or organization)

(Address of principal executive offices)

(+

(Name, telephone, e-mail and/or facsimile number and address of company contact person)

Securities registered or to be registered pursuant to section 12(b) of the Act: None

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

(Title of Class)

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report. common shares.

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

If

this report is an annual or a transition report, indicate by check mark if the registrant is not required to file reports pursuant to

Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes ☐

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days.

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted and pursuant to

Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit and post such files). Yes ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ☐ | Accelerated filer ☐ | |||

| Emerging

growth company |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. Yes ☐ No ☒

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP ☐ | Other ☐ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow: Item 17 ☐ Item 18 ☐

If

this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange

Act). Yes ☐

GENERAL

In this Annual Report on Form 20-F (the “Annual Report”), references to “we”, “us”, “our”, the “Company”, and “Patagonia” means Patagonia Gold Corp., and its subsidiaries, unless the context requires otherwise. All currency amounts in this Annual Report are stated in United States Dollars unless otherwise indicated. The financial statements and summaries of financial information have been prepared in accordance with International Financial Reporting Standards (“IFRS”), as issued by the International Accounting Standards Board (the “IASB”).

NOTE REGARDING REVERSE TAKE-OVER TRANSACTION

On July 24, 2019, Patagonia Gold Corp. (formerly Hunt Mining Corp (“Hunt”)) and Patagonia Gold Limited (“PGL”) (formerly Patagonia Gold PLC (“PGP”)) completed a reverse acquisition (the “RTO”) resulting in the Company acquiring all of the issued common stock of PGL in exchange for common shares of the Company on the basis of 10.76 common shares for each PGL share then outstanding. The Company issued 254,355,192 common shares to the shareholders of PGL representing an ownership interest of approximately 80%. The operating name of Hunt Mining Corp. was changed to Patagonia Gold Corp after the RTO.

As a result of the RTO, former shareholders of PGL acquired control of the Company, and the transaction was accounted for as an RTO that constitutes a business combination for accounting purposes. PGL is deemed to be the acquiring company under IFRS and its assets and liabilities, equity and historical operating results are included at their historical carrying values, and the net assets of the Company are recorded at the fair value as at the date of the transaction.

All comparative financial information disclosed in this Annual Report prior to the date of the RTO is that of PGL.

NOTE REGARDING FOREIGN PRIVATE ISSUER STATUS

Patagonia Gold Corp. was incorporated under the Business Corporations Act (Alberta) and currently exists under and is governed by the Business Corporations Act (British Columbia). Our business is administered principally outside of the United States and the majority of our assets are located outside of the United States. Pursuant to the RTO, shareholders of PGL received 254,355,192 common shares of the Company (representing an ownership interest of approximately 80%). As a result, as of December 31, 2021, 77.89% of the Company’s common stock was held by non-United States citizens and residents.

| 1 |

NOTE REGARDING THE PREPARATION OF THE COMPANY’S FINANCIAL STATEMENTS

Prior to the RTO, the Company did not qualify as a foreign private issuer and was therefore required to file its financial statements with the U.S. Securities and Exchange Commission (the “SEC”) in accordance with United States generally accepted accounting principles (“U.S. GAAP”). As a result of the RTO and the Company qualifying as a foreign private issuer, the Company prepared its financial statements for the year ended December 31, 2021 and 2020 in accordance with IFRS, as issued by the IASB. The Company’s financial statements included in this Annual Report for the years ended December 31, 2019 were previously prepared in accordance with U.S. GAAP and converted for the purposes of this Annual Report in order to comply with IFRS, as issued by the IASB.

GLOSSARY OF MINING TERMS

The following explanations are not intended as technical definitions, but rather are intended to assist the reader in understanding some of the terms used in this annual report.

“Adularia” - A low temperature variety of potassium feldspar as an accessory mineral in low sulfidations mineral deposits.

“Andesite” – A dark-colored, fine-grained, mostly extrusive (volcanic) rock, that is the fine-grained equivalent of diorite, and composed of plagioclase feldspar and one or more mafic minerals (e.g., biotite, hornblende, pyroxene, usually <20%).

“Argillic” - Pertaining to clay or clay minerals (i.e., argillic alteration in which certain minerals of a rock are converted to minerals of the clay group).

“Breccia / brecciated” - A coarse-grained clastic rock, composed of angular broken rock fragments held together by a mineral cement or in a fine-grained matrix. Breccia may form from explosive igneous activity, collapse of rock material, faulting or other processes.

“Chalcedonic” - A general term for all varieties of quartz that are made of microscopic or submicroscopic crystals.

“Chargeability and resistivity” - The response of geologic body to the flow of an electrical current: i.e., conduct or retain (chargeable) or resist (resistivity), often used in geophysical mineral exploration.

“Cockade / cockade texture” - Fault or cavity fillings in which the fragments are surrounded by concentric layers of cementing minerals (e.g. quartz) common in low-temperature, hydrothermal mineral deposits.

“Colloform” - Said of the rounded, finely-banded mineral texture formed by ultra-fine-grained rhythmic precipitation of minerals like quartz.

“Cutoff grade / cut-off grade” - The minimum grade required for a mineral commodity to be economically mined (or processed).

“Depletion” - The decrease in quantity of ore in a deposit or property resulting from extraction or production.

| 2 |

“Development” - Activities involved in preparing a mine for ore extraction and a planned production level, including tunneling, shaft sinking, crosscutting, drifting and raising, and those costs incurred to enable the conversion of mineralization to reserves.

“Dilution” - The mixing of waste rock with ore, resulting in a decrease in the overall grade.

“Diamond drilling / core drilling” - A form of rotary drilling which uses a diamond-impregnated drill bit attached to the end of the drill pipe to extract a cylindrical section of rock from the subsurface.

“Dilational” - A widening of a structural feature (i.e. dilational fault).

“Dissolution” - the process whereby a metal is dissolved and becomes amenable to separation from the gangue material.

“Electrum” - A naturally occurring alloy of gold and silver.

“Epithermal” - Said of a mineral deposit that deposited from warm waters at shallow depth under conditions in the lower ranges of temperature and pressure (used to describe mineral veins and ore deposits.

“Exploration” - Activities associated with ascertaining the existence, location, extent or quality of mineralization, including economic and technical evaluations of mineralization.

“Flotation” - The process whereby certain chemicals are added to the material fed to the leach circuit in order to float the desired minerals to produce a concentrate of the mineral to be processed. This process can be carried out in flotation cells.

“Ginguro / ginguro banding” – Gray to black colloform bands of quartz colored by sulfides.

“Grade” - The quantity of metal per unit mass of ore expressed as a percentage or, for gold, as grams of gold per tonne of ore.

“Grinding” - Reducing rock to the consistency of fine sand by crushing and abrading in a rotating steel grinding mill.

“Hydrothermal / hydrothermal processes” - Said of the subsurface movement of hot mineral-laden fluids.

“Kaolinite” - A clay mineral, with the chemical composition Al₂Si₂O₄.

“Illite” - A light-colored clay mineral of the muscovite mica group.

“IP-Res/Pole-dipole/PDP-IP” (Induced polarization-Resistivity) - Electrical geophysical methods used in mineral exploration to measure the flow, or resistance to flow, of an artificial electrical current.

“Landsat Thematic Mapper” – One of the satellite-based, earth observing sensors introduced in the Landsat program, images which are commonly used in mineral exploration.

| 3 |

“Leaching” – Dissolution of gold from the crushed and milled material, including reclaimed slime followed by absorption and concentration onto the activated carbon.

“Low sulfidation processes / mineral deposits” - Low sulfidation epithermal deposits represent the uppermost, or most distal, parts of intrusion-related hydrothermal mineral systems. They generally form within 500 meters of surface but may extend to 1-2 kilometers.

“Massif” – A geologically distinct mass of rock or a series of connected masses.

“Milling” or “mill” - The comminution of the ore, although the term has come to cover the broad range of machinery inside the treatment plant where the gold is separated from the ore.

“Mineralization” - The presence of a target mineral in a mass of host rock.

“Mineralized shoot” - A concentration of mineralization deposited in a portion of a vein or fissure. The shoot consists of the most valuable part(s) of the mineral deposit.

“Net smelter return” or “NSR” - The volume of a refined metal sold during the relevant period multiplied by the average spot metal price and the average exchange rate for the period, less refining, transport and insurance costs.

“Open pit” - Mining in which the ore is extracted from a pit. The geometry of the pit may vary with the characteristics of the ore body.

“Ore” - A mixture of material containing minerals from which at least one of the minerals can be mined and processed at an economic profit.

“Ore body” - A well defined mass of material of sufficient mineral content to make extraction economically viable.

“Ore grade” - The average amount of gold contained in a tonne of gold-bearing ore expressed in grams per tonne.

“Ore reserves” or “reserves” - That part of a mineral deposit which could be economically and legally extracted or produced at the time of the reserve determination.

“Ounce” - One troy ounce, which equals 31.1035 grams.

“Porphyritic” - An adjective used to describe igneous rocks with a distinct difference in the size of mineral crystals, with the larger crystals known as phenocrysts. Both extrusive and intrusive rocks can be porphyritic.

“Prospect” - To investigate a site with insufficient data available on mineralization to determine if minerals are economically recoverable or a site deemed favorable for mineral exploration activities.

| 4 |

“RAB” (Rotary Air Blast) - A drilling technique to collect small fragments of rock by rotation and percussion (impact) using high-pressure air to move to fragments to surface between the drill pipe and the wall rock.

“RC or RVC” - Reverse circulation: A drilling technique in which rock fragments are moved up the center tube of a special type of rotary, percussion drilling machine.

“Refining” - The final stage of metal production in which final impurities are removed from the molten metal by introducing air and fluxes. The impurities are removed as gases or slag.

“Sampling” - Taking small pieces of rock at intervals along exposed mineralization for assay (to determine the mineral content).

“Silicified” - Said of a geologic formation that has been replaced by silica, as quartz, chalcedony, or opal.

“Sinter” - A near surface incrustation formed by precipitation of minerals from hot or cold mineral waters in springs, lakes, or streams; specif. siliceous sinter and calcareous sinter.

“Smectite” - A group of hydrous, aluminous phyllosilicate minerals (micas) with variable amounts of iron, magnesium, alkali metals, and other cations. Common accessory mineral in hydrothermal mineral deposits.

“Sulfosalts” - A group of sulfide minerals that contain one or more true metals, sulfur, and either of the semi-metals antimony, arsenic, or bismuth. They are generally soft, have a metallic luster.

“Tenement” - A piece of land held by an owner. Also referred to as concession or claim.

CAUTIONARY NOTE REGARDING ESTIMATES OF MINERAL RESOURCES

Except where noted, the reserve and resource estimates in this Annual Report have been prepared in accordance with the requirements of SEC Regulation S-K (Subpart 1300) (“S-K 1300”) which came into force on January 1, 2021 and replaces Industry Guide 7. S-K 1300 now aligns most mining disclosure for SEC registrants in accordance with the definitions provided by the Committee for Reserves International Reporting Standards (“CRIRSCO”). Investors are cautioned however, that all reserve and resource estimates previously furnished or filed by the Company with the SEC were initially prepared in accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”). NI 43-101 is a rule developed by the Canadian Securities Administrators which establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. NI 43-101 was also developed in accordance with CRIRSCO guidelines.

S-K 1300 includes the adoption of terms describing mineral reserves and mineral resources that are substantially similar to the corresponding terms under CRIRSCO. As a result of the adoption of S-K 1300, the SEC will now recognize estimates of “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources”. In addition, the SEC has amended its definitions of “proven mineral reserves” and “probable mineral reserves” to be substantially similar to CRIRSCO definitions.

| 5 |

Investors are cautioned that while the above terms are substantially similar to CRIRSCO terms, there are differences in the definitions under S-K 1300 and CRIRSCO. Accordingly, there is no assurance any mineral reserves or mineral resources that the Company may report as “proven reserves”, “probable reserves”, “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources” under NI 43-101 would be the same had the Company prepared the reserve or resource estimates under the standards adopted under S-K 1300.

Investors are also cautioned that while the SEC will now recognize “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources”, (i) a “measured mineral resource” has a higher level of confidence than that applying to either an “indicated mineral resource” or an “inferred mineral resource”, it may be converted to a “proven mineral reserve” or to a “probable mineral reserve”, (ii) an “indicated mineral resource” has a lower level of confidence than that applying to a “measured mineral resource” and may only be converted to a “probable mineral reserve”, and (iii) an “inferred mineral resource” has a lower level of confidence than that applying to an “indicated mineral resource” and must not be converted to a “mineral reserve”. Mineralization described using these terms has a greater amount of uncertainty as to their existence and feasibility than mineralization that has been characterized as reserves. Accordingly, investors are cautioned not to assume that any “measured mineral resources”, “indicated mineral resources”, or “inferred mineral resources” that the Company reports are or will be economically or legally mineable.

NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements contained in this report (including information incorporated by reference) are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the United States Private Securities Litigation Reform Act of 1995, and “forward-looking information” within the meaning of applicable Canadian securities legislation. The Company’s forward-looking statements include current expectations and projections about future production, results, performance, prospects and opportunities, including reserves and other mineralization. The Company has tried to identify these forward-looking statements by using words such as “may,” “might,” “will,” “expect,” “anticipate,” “believe,” “could,” “intend,” “plan,” “estimate” and similar expressions. While these forward-looking statements, and any assumptions upon which they are based, are made in good faith and reflect our current judgment regarding the direction of our business, actual results will almost always vary, sometimes materially, from any estimates, predictions, projections, assumptions or other future performance suggested herein. Such estimates, projections or other forward-looking statements involve various risks and uncertainties and other factors, including the risks in the section titled “Risk Factors” below, which may cause our actual results, levels of activities, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. We caution the reader that important factors in some cases have affected and, in the future, could materially affect actual results and cause actual results to differ materially from the results expressed in any such estimates, projections or other forward-looking statements. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform those statements to actual results.

| 6 |

Please see “Item 3. Key Information — D. Risk Factors” for a further discussion of certain factors that may cause actual results to differ materially from those indicated by our forward-looking statements. The statements contained in Item 4 – “Information on the Company”, Item 5 – “Operating and Financial Review and Prospects” and Item 11 – “Quantitative and Qualitative Disclosures about Market Risk” are inherently subject to a variety of risks and uncertainties that could cause actual results, performance or achievements to differ significantly.

PART I

Item 1. Identity of Directors, Senior Management and Advisers

Not applicable.

Item 2. Offer Statistics and Expected Timetable

Not applicable.

Item 3. Key Information

| A. | [Reserved] |

Not Applicable.

| B. | Capitalization and Indebtedness |

Not Applicable.

| C. | Reasons for the Offer and Use of Proceeds |

Not Applicable.

| D. | Risk Factors |

The Company’s securities are highly speculative and subject to a number of risks. Investors should not consider an investment in the Company’s securities unless they are capable of sustaining an economic loss of the entire investment. Furthermore, if other risks not presently known to the Company, or that the Company does not currently believe to be significant, occur or become significant, the Company’s financial condition and results of operations could suffer and the trading price of the common shares could decline. In addition to the other information presented in this Annual Report, the following risk factors should be given special consideration when evaluating an investment in the Company’s securities.

Investing in the Company’s common shares involves a high degree of risk. Prospective investors should carefully consider the risks described below, together with all of the other information included in or referred to in this report, before purchasing shares of our common shares. There are numerous and varied risks, known and unknown, that may prevent the Company from achieving our goals. The risks described below are not the only ones the Company will face. If any of these risks actually occurs, the Company’s business, financial condition or results of operation may be materially adversely affected. In such case, the trading price of the Company’s common shares could decline and investors in the Company’s common shares could lose all or part of their investment. The information in this Annual Report is complete and accurate as of the dates referenced herein, but the information may change after such date.

Should one or more of the foregoing risks or uncertainties materialize or should the underlying assumptions of the Company’s business prove incorrect, actual results may differ significantly from those anticipated, believed, estimated, expected, intended or planned.

| 7 |

Additional funding requirements

The continuing exploration and development of the Company’s projects will depend upon the ability to obtain funding through debt financing, equity financing, the joint venturing of projects, or other means. There is no assurance that the Company will be successful in obtaining the required financing for these or other purposes, including for general working capital or that any funds raised will be sufficient for the purposes contemplated. Failure to obtain additional funding on a timely basis could cause the Company to reduce or terminate its proposed operations. There can be no certainty that capital will be available to the Company on acceptable terms. If additional funds are raised through further issuances of equity or convertible debt securities, existing shareholders could suffer significant dilution, and any new equity securities issued could have rights, preferences and privileges superior to those they possess prior to such issuances. Any debt financing secured in the future could involve restrictive covenants relating to capital raising activities and other financial and operational matters, which may make it more difficult for the Company to obtain additional capital and to pursue business opportunities, including potential acquisitions.

COVID-19

On March 11, 2020, the World Health Organization (WHO) stated the “public health emergency of international concern” and declared the state of pandemic worldwide due to the COVID-19’s outbreak in Wuhan, China and its subsequent global spread.

Following this statement, on March 19, 2020, the Argentine Government ordered the “Social, Preventive and Compulsory Isolation” (“ASPO” for its acronym in Spanish), by Necessity and Urgency Decree No. 297/2020, imposing border closures and stringent restrictions on domestic circulation of individuals. Such measures comprised several exceptions, including activities that were considered “essential” and, therefore, were excluded from such restrictions. Successive Necessity and Urgency Decrees extended the term of the mentioned measures until November 8, 2020. As of November 9, 2020, by Necessity and Urgency Decree No. 875/2020 and its amendments, it was established the Preventive and Compulsory Social Distancing (“DISPO” for its acronym in Spanish) that is in full force and effect through February 28, 2021 and can be extended for as long as it may be considered necessary in view of the epidemiological situation.

Subsequently, on December 30, 2020, the Ministry of Health’s Resolution No. 2883/2020, approving the “Strategic COVID-19 Vaccination Plan” in the Republic of Argentina, was issued. It aimed to reduce morbidity, mortality, and socio-economic impacts of the pandemic, based on the stepped and progressive vaccination of certain population groups.

Because of the various measures adopted by the Argentine government, and within the scenario of the economic activity’s generalised recession, the Company has implemented a protocol establishing the working conditions to operate in strict compliance with the public health standards issued by national and provincial authorities, in order to minimize the risk of contagion of co-workers, clients and providers, and to enable the business continuity. It is worth emphasising that, as of the date of this Annual Report, the COVID-19 pandemic continues to be a prevalent situation, the duration of which is uncertain, and the measures taken by the different authorities (national, provincial, and pertaining to town) in response thereto are constantly evolving.

| 8 |

Although the continuity of the Company’s operation has not been significantly affected, the extent of COVID-19’s impact on the operational and financial performance will depend on the evolution of events (including the spread rate and duration, as well as the national and international governmental measures taken in such regard) and on the impact this situation may cause on our main clients, employees, and providers; all of which is uncertain and, at present, not possible to foresee. However, the Company’s Management does not anticipate that such impacts will affect the business continuity or the ability to meet financial commitments in the next twelve (12) months.

Limited operating history

The Company has a history of producing metals from its current mineral properties, which continued through 2021 albeit at a lower level than that of the prior year. The Company is subject to all of the risks associated with establishing new mining operations and business enterprises including:

| ● | the timing and cost, which can be considerable, of the construction of mining and processing facilities; | |

| ● | the availability and costs of skilled labour and mining equipment; | |

| ● | the availability and cost of appropriate smelting and/or refining arrangements; | |

| ● | the need to obtain necessary environmental and other governmental approvals and permits, and the timing of those approvals and permits; and | |

| ● | the availability of funds to finance construction and development activities. |

The costs, timing and complexities of mine construction and development are increased by the location of the Company’s mining properties. It is common in new mining operations to experience unexpected problems and delays during construction, development, and mine start-up. In addition, delays in the commencement of mineral production often occur. Accordingly, there are no assurances that the Company’s activities will result in profitable mining operations or that the Company will successfully establish mining operations or profitably produce metals at any of its properties. Actual capital costs, production and economic returns may differ significantly from those the Company has anticipated and there are no assurances that any future development activities will result in profitable mining operations.

Economics of Developing Mineral Properties

The exploration for and development of mineral deposits involves significant risks, which even a combination of careful evaluation, experience and knowledge may not eliminate. While the discovery of an ore body may result in substantial rewards, few properties that are explored are ultimately developed into producing mines. Major expenses may be required to locate and establish mineral reserves, to develop metallurgical processes and to construct mining and processing facilities at a particular site. It is impossible to ensure that the exploration or development programs planned by the Company will result in a profitable commercial mining operation. Whether a mineral deposit will be commercially viable depends on a number of factors, some of which are: the particular attributes of the deposit, such as size, grade and proximity to infrastructure; metal prices that are highly cyclical; and government regulations, including regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals and environmental protection. The exact effect of these factors cannot be accurately predicted, but the combination of these factors may result in Patagonia not receiving an adequate return on invested capital. There is no certainty that the expenditures made by Patagonia towards the search and evaluation of mineral deposits will result in discoveries or development of commercial quantities of ore.

| 9 |

Exploration risks

Resource exploration, development and operations are highly speculative, characterized by a number of significant risks, which even a combination of careful evaluation, experience and knowledge may not eliminate, including, among other things, unprofitable efforts resulting not only from the failure to discover mineral reserves but from finding mineral reserves which, though present, are insufficient in quantity and quality to return a profit from production. Few properties that are explored are ultimately developed into production. The majority of exploration companies fail to ever locate an economic deposit. Substantial expenditures are required to establish mineral reserves. No assurance can be given that minerals will be discovered in sufficient grade or quantities to justify commercial operations or that funds required for development can be obtained on a timely basis. Whether an exploration property will be commercially viable depends on a number of factors, some of which are: the particular attributes of the deposit, such as size, grade and proximity to infrastructure; metal prices, which are highly cyclical; and government regulations, including regulations relating to prices, taxes, royalties, land tenure, land use, and environmental protection. The exact effect of these factors cannot accurately be predicted, but the combination of these factors may result in the Company not receiving an adequate return on invested capital or not obtaining the required capital to develop any project. The Company will evaluate the political and economic environment in considering any properties for acquisition. There can be no assurance that significant restrictions will not be placed on the exploration areas and any other properties the Company may acquire or its operations. Such restrictions may have a material adverse effect on the Company’s business and results of operation.

Ability to exploit current and future discoveries

It may not always be possible for the Company to participate in the exploitation of successful discoveries. Such exploitation may involve the need to obtain licences or clearances from the relevant authorities, which may not be available on a timely basis or may require conditions to be satisfied and/or the exercise of discretion by such authorities. It may or may not be possible for such conditions to be satisfied, and such conditions may prove uneconomic or not practical. Furthermore, the decision to proceed to further exploration may require the participation of other companies whose interests and objectives may not be consistent with those of the Company. Such further exploitation may also require the Company to meet or commit to financial obligations which it may not have anticipated or may not be able to commit to due to a lack of funds or an inability to raise funds.

Higher than normal capital costs to take some of the Company’s projects into production

None of the Company’s mineral properties have a significant operating history upon which the Company can accurately base estimates of future operating costs. Decisions about the development of these and other mineral properties will ultimately be based upon studies which derive estimates of cash operating costs based upon, among other things:

| ● | anticipated tonnage, grades and metallurgical characteristics of the material to be mined and processed; | |

| ● | anticipated recovery rates of gold, copper and other metals from the processed material; | |

| ● | cash operating costs of comparable facilities and equipment; and | |

| ● | anticipated climatic conditions. |

Cash operating costs, production and economic returns, and other estimates contained in studies or estimates prepared by or for the Company, if prepared, may differ significantly from those anticipated by current studies and estimates, and there can be no assurance that the Company’s actual operating costs will not be higher than currently anticipated. Whether income will result from projects undergoing exploration and development programs depends on the successful establishment of mining operations. Successful project development is affected by factors such as:

| ● | costs; | |

| ● | actual mineralization; | |

| ● | consistency and reliability of ore grades; and | |

| ● | commodity prices. |

| 10 |

The design and construction of efficient processing facilities, the existence of competent operational management and prudent financial administration, as well as the availability and reliability of appropriately skilled and experienced consultants also can affect successful project development.

Increased demand for and cost of contract mining services and equipment

Recent increases in metal prices have encouraged increases in mining exploration, development and construction activities, which have resulted in increased demand for and cost of contract exploration, development and construction services and equipment. Increased demand for and cost of services and equipment could cause project costs to increase materially, resulting in delays if services or equipment cannot be obtained in a timely manner due to inadequate availability, and increase potential scheduling difficulties and costs due to the need to coordinate the availability of services or equipment, any of which could materially increase project exploration, development or construction costs, result in project delays or both.

Variance in mineral production yield than is currently estimated

The Company’s current reported mineral resources are only estimates. The Company cannot give any assurance that the estimated mineral resources will be recovered or that they will be recovered or the rates at which they will be recovered. The failure of the Company to achieve its production estimates could have a material and adverse effect on any or all of its future cash flows, profitability, results of operations and financial condition. Such production estimates are dependent on, among other things:

| ● | the accuracy of mineral resource estimates; | |

| ● | the accuracy of assumptions regarding in situ grades and recovery rates; | |

| ● | ground conditions; | |

| ● | physical characteristics of the material mined; | |

| ● | the presence or absence of particular metallurgical characteristics; and | |

| ● | the accuracy of estimated rates and costs of mining, ore haulage and processing. |

Mineral resource estimates may require revision (either up or down) based on actual experience. Market fluctuations in the price of metals, as well as changes in costs or recovery rates, may render certain mineral resources uneconomic and may ultimately result in a restatement of resources. Moreover, short-term operating factors relating to the mineral resources, such as the need for sequential development of mineral deposits and the processing of new or different grades, may adversely affect the Company’s profitability in any particular accounting period.

Dependence on limited mining properties

The Calcatreu and Cap-Oeste properties account for a significant majority of the Company’s mineral resources and the potential for the future generation of revenue. Any adverse development affecting the progress of the Calcatreu and Cap-Oeste properties such as, but not limited to, obtaining financing on commercially suitable terms, hiring suitable personnel and mining contractors, or securing supply agreements on commercially suitable terms, may have a material adverse effect of the Company’s financial performance and results of operations.

| 11 |

Most exploration projects do not result in the discovery of commercially mineable ore deposits and no assurance can be given that any particular level of mining or metallurgical recovery will be realized or that any identified mineral deposit will ever qualify as a mineral reserve which can be legally and economically exploited. Estimates of reserves, mineral deposits and production costs can also be affected by such factors as environmental permitting regulations and requirements, weather conditions, environmental factors, unforeseen technical difficulties, unusual or unexpected geological formations and work interruptions. Material changes in ore reserves, grades, stripping ratios or recovery rates may affect the economic viability of any project.

In addition, if the Company discovers a mineral deposit, it would typically take several years from the initial phases of exploration until production is achieved. During this time, the economic feasibility of production may change. As a result of these uncertainties, there can be no assurance that the Company will successfully acquire additional mineral rights.

Changes in laws

Changes to any of the laws, rules, regulations or policies to which the Company is subject could have a significant impact on the Company’s business. There can be no assurance that the Company will be able to comply with any future laws, rules, regulations and policies. Failure by the Company to comply with applicable laws, rules, regulations and policies may subject it to civil or regulatory proceedings, including fines or injunctions, which may have a material adverse effect on the Company’s business, financial condition, liquidity and results of operations. In addition, compliance with any future laws, rules, regulations and policies could negatively impact the Company’s profitability and have a material adverse effect on its business, financial condition, liquidity and results of operations.

Dependence on the directors and officers

The Company’s future success is dependent on its ability to attract and retain suitably qualified directors and officers in the future and the ability of such directors and officers to deal effectively with complex risks and relationships and to execute the Company’s exploration plan and future development plans. The success of the Company is, and will continue to be, to a significant extent dependent on the expertise and experience of its directors and officers and the loss of one or more of the directors or officers could have a material adverse effect on the Company. The success of the Company will depend on the ability of its directors and officers to interpret market, engineering, metallurgical and geological data correctly and to interpret and respond to economic, market and other conditions in order to locate and adopt appropriate investment opportunities, monitor such investments and ultimately, if required, successfully divest such investments. Furthermore, two of the Company’s directors (Messrs. Miguens and Hunt) collectively, hold directly or indirectly 62.84% of the Company’s issued and outstanding common shares on a non-diluted basis and the Company has agreed that they each have a right (the “Participation Rights”) to maintain their percentage interest in the Company upon certain equity issuances undertaken by the Company until December 31, 2022 so long as their ownership interest is not less than 20%. As a result of their shareholdings and the Participation Rights, they have the ability, among other things, to approve significant corporate transactions and delay or prevent a change of control of the Company that could otherwise be beneficial to minority shareholders. They will also have the ability to control the outcome of any matter submitted for the vote or consent of the Company’s shareholders. In some cases, their interests may not be the same as those of the Company’s other shareholders, and conflicts of interest may arise from time to time that may be resolved in a manner detrimental to the Company or its minority shareholders.

| 12 |

Dependence on key personnel

The Company has a small management team and the loss of a key individual, or its inability to attract suitably qualified persons in the future, could have a material adverse effect on the Company.

Dependence on third party contractors

The Company is heavily dependent on third party contractors for exploration work as well as for developing, operating and maintaining a workable system for mining and processing. A failure of a contractor or disputes with a contractor could have a material adverse effect on the Company, its business, the results of operations and its financial condition. The Company is also exposed to risks associated with the failure of counterparties to perform their operational or other obligations to the Company in compliance with the terms of contractual arrangements between the Company and such counterparties.

Labour and employment matters

Adverse changes in labor regulations may have a material adverse effect on the Company’s business, results of operations and financial condition.

Failure of third parties’ reviews, reports and projections to be accurate

The Company relies upon third parties to provide analysis, reviews, reports, advice and opinions regarding the Company’s projects. There is a risk that such analysis, reviews, reports, advice, opinions and projects are inaccurate, in particular with respect to resource estimation, process development and recommendations for products to be produced as well as with respect to economic assessment including estimating the capital and operating costs of the Company’s projects and forecasting potential future revenue streams. Uncertainties are also inherent in such estimations.

Litigation

Legal proceedings may arise from time to time in the course of the Company’s business. There have been a number of cases where the rights and privileges of mining companies have been subject to litigation. The directors cannot preclude that such litigation may be brought against the Company in the future from time to time or that it may be subject to any other form of litigation.

Political instability, sovereign and regulatory risk

The Company’s mineral exploration activities and future project development could be affected in varying degrees by political instability and changes in government regulation relating to foreign investment and the mining business, including expropriation. Operations may also be affected in varying degrees by possible terrorism, military conflict, crime, fluctuations in currency rates and high inflation. In addition, from time to time, governments may nationalize private businesses, including mining companies. There can be no assurance that the governments of countries where the Company or its affiliates operate or the governments with whom the Company works will not nationalize mining companies and their assets in the future or impose burdensome obligations or restrictions. There can also be no assurance that foreign governments will not impose burdensome obligations or restrictions on the Company, the Company’s affiliates or their projects, or will not put in place exploitation regulations in a timely manner or on commercial terms sufficiently attractive to the Company to enable development of its projects.

| 13 |

Environmental risk and hazards

There is no assurance that future changes in environmental regulation, if any, will not adversely affect the Company’s operations. Governmental approvals and permits are currently and may in future be required in connection with the Company’s operations. To the extent such approvals are required and not obtained, the Company may be curtailed or prohibited from proceeding with planned exploration or development of mineral properties. Failure to comply with applicable laws, regulations and permitting requirements may result in enforcement actions thereunder, including orders issued by regulatory or judicial authorities causing operations to cease or be curtailed and may include corrective measures requiring capital expenditures, installation of additional equipment, or remedial actions. Parties engaged in mining operations may be required to compensate those suffering loss or damage by reason of the mining activities and may have civil or criminal fines or penalties imposed for violations of applicable laws and regulations.

General project risks

Whether a mineral deposit will be commercially viable depends on a number of factors, which may include: the particular attributes of the deposit, such as size, grade and proximity to infrastructure, metal prices, which are highly cyclical, and government/regulatory body regulations, including regulations relating to prices, taxes, royalties, tenure, land use, importing and exporting of minerals and environmental protection. The exact effect of these factors cannot be accurately predicted, but the combination of these factors may result in the Company not receiving an adequate return on invested capital. Some of the Company’s projects are at an early stage of exploration. Any further development of such projects will only follow upon obtaining satisfactory exploration results, environmental impact assessments and the scrutiny of environmental, technical and feasibility reports. Substantial expenditures are required to discover and establish sufficient resources and ore reserves and to develop the mining and processing facilities and infrastructure at any sites selected for mining and processing. There can be no assurance that the Company will be able to realize sufficient financing to facilitate such development.

Management of growth

The ability of the Company to implement its strategy requires effective planning and management control systems. The Company’s plans may place a significant strain on its management, operational, financial and personnel resources. The Company’s future growth and prospects will depend on its ability to manage this growth and to continue to expand and improve operational, financial and management information and quality control systems on a timely basis, whilst at the same time maintaining effective cost controls. Any failure to expand and improve operational, financial and management information and quality control systems in line with the Company’s growth could have a material adverse effect on the Company’s business, financial condition and results of operations. There are also risks associated with establishing and maintaining systems of internal controls.

Commodities Price Risk

The profitability of mining operations is significantly affected by changes in the market price of metals and the cost of power, petroleum fuels and oil. The level of interest rates, the rate of inflation, world supply of metals and stability of exchange rates can all cause significant fluctuations in base metal, precious metal, chemical reagent and oil prices. Such external economic factors are in turn influenced by changes in international investment patterns, monetary systems and political developments. The price of gold, silver and other minerals, and oil has fluctuated widely in recent years. Depending on the price of gold, silver, and the cost of power, chemical reagents, petroleum fuels and oil, cash flow from mining operations may not be sufficient to cover the Company’s operating costs or costs of servicing debt. The Company is not currently a party to any commodity hedging contracts.

| 14 |

Permits and licences

Operations of the Company require or will require licences and permits from various governmental authorities. The Company anticipates that it will be able to obtain in the future all necessary licences and permits to carry on the activities which it intends to conduct, and that it intends to comply in all material respects with the terms of such licences and permits. However, there can be no guarantee that the Company will be able to obtain at all or on reasonable terms, and maintain, at all times, all necessary licences and permits required to undertake its proposed exploration and development or to place its properties into commercial production and to operate mining facilities thereon. In addition, the cost of compliance with changes in governmental regulations has the potential to reduce the profitability of any producing operations or preclude the economic development of any property.

Competition

The international natural resources industry is highly competitive. Competition in the mining exploration and development business is intense and could adversely affect the ability of the Company to suitably develop its properties. The Company will be competing with many other exploration and development companies possessing greater financial resources and technical facilities. There is a risk that competitors may find substitutes for the metals for which the Company is exploring or find lower cost sources of, or more efficient processes to extract, such metals. There can be no assurance that the necessary funds can be raised or that any projected work will be completed.

Environmental matters

All of the Company’s exploration and development operations will be subject to environmental permitting and regulations, which can make operations expensive or prohibit them altogether. The Company may be subject to potential risks and liabilities associated with pollution of the environment and the disposal of waste products that could occur as a result of its exploration, development and production activities.

To the extent the Company is subject to environmental liabilities, the payment of such liabilities or the costs that it may incur to remedy environmental pollution would reduce funds otherwise available to it and could have a material adverse effect on the Company. If the Company is unable to fully remedy an environmental problem, it might be required to suspend operations or enter into interim compliance measures pending completion of the required remedy. The potential exposure may be significant and could have a material adverse effect on the Company.

All of the Company’s exploration, development and production activities will be subject to regulation under one or more environmental laws and regulations. Many of the regulations require the Company to obtain permits for its activities. The Company must update and review its permits from to time, and is subject to environmental impact analyses and public review processes prior to approval of the additional activities.

It is possible that future changes in applicable laws, regulations and permits or changes in their enforcement or regulatory interpretation could have a significant impact on some portion of the Company’s business, causing those activities to be economically re-evaluated at that time.

| 15 |

Conflicts of interest

Certain of the officers and directors of Patagonia are also directors, officers or shareholders of other companies. Such associations may give rise to conflicts of interest from time to time. The Company’s board of directors (the “Board”) will be required by law to act honestly and in good faith with a view to the best interests of the Company and to disclose any interest which they may have in any project or opportunity of the Company. If a conflict arises at a meeting of the Board, any director in a conflict will disclose his interest and abstain from voting on such matter. In determining whether or not the Company will participate in any project or opportunity, the director will primarily consider the degree of risk to which the Company may be exposed and its financial position at that time.

Title to Mining Properties

Acquiring the title to the mining property is a detailed and prolonged process. Title may be challenged or be subject to legal disputes. Although the Company has researched in the most diligent and fullest possible manner the title to its mining properties, there is no certainty that its title will not be disputed or challenged in the future.

Currency Risk

As a result of the use of different currencies, the Company is subject to foreign currency fluctuations which may materially affect its business, results of operations and financial condition.

Liquidity risk

The Company might incur further debt in order to fund its exploration and operational programs, which would reduce its financial flexibility and could have a material adverse effect on the Company’s business, financial condition or results of operations. The Company’s ability to meet its debt obligations and reduce its level of indebtedness depends on future performance. General economic conditions, mineral prices and financial, business and other factors affect the Company’s operations and future performance. Many of these factors are beyond the Company’s control. The Company cannot assure investors that it will be able to generate sufficient cash flow to pay the interest on its debt or that future working capital, borrowings or equity financing will be available to pay or refinance such debt. Factors that will affect its ability to raise cash through an offering of securities or a refinancing of any debt include financial market conditions and the value of its assets and performance at the time the Company needs capital. The Company cannot assure investors that it will have sufficient funds to make such payments. If the Company does not have sufficient funds and is otherwise unable to negotiate renewals of its borrowings or arrange new financing, it might have to sell significant assets. Any such sale could have a material adverse effect on the Company’s business, operations and financial results.

Failure to obtain additional financing, if required, on a timely basis, could cause the Company to reduce or delay its proposed operations.

The majority of sources of funds expected to be available to the Company for potential acquisitions and its exploration and development projects are in large portion expected to be derived from the issuance of equity. While the Company has been able in the past to obtain equity financing and has secured shareholder loans to undertake planned exploration and development programs, there is no assurance that the Company will be able to obtain adequate financing in the future or that such financing will be on terms advantageous to the Company. Although the Company intends to generate operating income and cash flow from mining operations, there can be no assurances that the Company will have sustainable economic operations or be able to generate positive operating income or cash flow from such operations.

| 16 |

Disruption from non-governmental organizations

As is the case with any businesses which operate in the mining industry, the Company may become subject to pressure and lobbying from non-governmental organizations. There is a risk that the demands and actions of non-governmental organizations may cause significant disruption to the Company’s business which may have a material adverse effect on its operations and financial condition.

Infrastructure

Exploration, processing, development and exploitation activities depend on adequate infrastructure. Reliable roads, bridges, ports, rail, power sources and water supply are important requirements, which affect capital and operating costs. Unusual or infrequent weather phenomena, sabotage, government or other interference in the maintenance or provision of such infrastructure could adversely affect the future operations of the Company.

Uninsurable Risks

Exploration, development and production operations on mineral properties involve numerous risks, including unexpected or unusual geological operating conditions, rock bursts, cave-ins, fires, floods, earthquakes and other environmental occurrences, as well as political and social instability. It is not always possible to obtain insurance against all such risks and the Company may decide not to insure against certain risks because of high premiums or other reasons. Should such liabilities arise, they could reduce or eliminate any further profitability and result in increasing costs and a decline in the value of the securities of the Company.

Operating hazards and risks

Mineral resource exploration and development and the operation of mineral and chemical processing facilities involves many risks, which even a combination of experience, knowledge and careful evaluation may not be able to overcome. These hazards include failure of equipment or processing facilities to operate in accordance with specifications or expectations, cost escalation, unavailability of materials and equipment, government or regulatory action or delays, unanticipated events related to health, safety and environmental matters, formation pressures, fires, power outages, labor disruptions, flooding, explosions, and the inability to obtain suitable or adequate machinery, equipment or labor.

Operations in which the Company will have a direct or indirect interest will be subject to all the hazards and risks normally incidental to exploration, development and production of mineral products as well as the operation of a processing facility, any of which could result in damage to or destruction of producing facilities, damage to life and property, environmental damage and possible legal liability for any or all damage. Although the Company intends to maintain liability insurance in an amount which it considers adequate, the nature of these risks is such that liabilities could exceed policy limits, in which event the Company could incur significant costs that could have a materially adverse effect upon its financial condition.

| 17 |

Health and safety

Mining, like many other exploration or extractive natural resource industries, is subject to potential risks and liabilities due to accidents that could result in serious injury or death. The impact of such accidents could affect the profitability of the operations, cause an interruption to operations, lead to a loss of licenses, affect the reputation of the Company and its ability to obtain further licenses, damage community relations and reduce the perceived appeal of the Company as an employer.

There is no assurance that the Company has been or will at all times be in full compliance with all laws and regulations or hold, and be in full compliance with, all required health and safety permits. The potential costs and delays associated with compliance with such laws, regulations and permits could prevent the Company from proceeding with the development of a project or the operation or further development of a project, and any noncompliance therewith may adversely affect the Company’s business, financial condition and results of operations. Amendments to current laws, regulations and permits governing operations and activities of mining companies, or more stringent implementation thereof, could have a material adverse impact on the Company and cause increases in exploration expenses, capital expenditures or production costs, reduction in the levels of production at producing properties, or abandonment or delays in development of new mining properties.

Influence of joint-venture partners

Exploration, development and mining projects are often conducted through joint-venture agreements which may require the unanimous approval of the parties to the joint-venture or their representatives for certain fundamental decisions relating to the governance and operations of the joint-venture. As a result, a party may have a veto right, or similar power, with respect to such decisions which could lead to a deadlock and negatively impact or limit the future business operations or financial position of the Company.

Fluctuations in the price of consumed commodities

Prices and availability of commodities or inputs consumed or used in connection with exploration, development and mining, such as diesel, oil, electricity, chemicals and reagents, fluctuate and affect the costs of production at the Company’s operations. These fluctuations can be unpredictable, can occur over short periods of time and may have a materially adverse impact on operating costs or the timing and costs of various projects.

Risks relating to Argentina

The Company may be responsible for corruption and anti-bribery law violations

The Company’s business will be subject to the Corruption of Foreign Public Officials Act (Canada) (“CFPOA”), which generally prohibit companies and company employees from engaging in bribery or other prohibited payments to foreign officials for the purpose of obtaining or retaining business. Since all of the Company’s interests will be located in Argentina, there is a risk of potential CFPOA violations. In addition, the Company will be subject to the anti-bribery laws of Argentina and of any other countries in which it conducts business in the future. The Company’s employees or other agents may, without its knowledge and despite its best efforts, engage in prohibited conduct under the Company’s policies and procedures and the CFPOA or other anti-bribery laws for which the Company may be held responsible. If the Company’s employees or other agents are found to have engaged in such practices, the Company could suffer severe penalties and other consequences that may have a material adverse effect on its business, financial condition and results of operations.

| 18 |

Project production and profitability

The commercial viability of mineral deposits of the kind located and believed to be located on the Martha Mine and the its other Patagonia properties is dependent upon a number of factors, including the quality, size, grade, and other attributes of the deposits and the proximity to, and availability of, infrastructure necessary to develop and exploit minerals on a commercial scale.

Potential political, social and economic instability in Argentina

The principal mineral property interests of the Company will be located exclusively in Argentina. Although the Company believes that the current conditions in Argentina are relatively stable and conducive to conducting business, the Company’s current and future mineral exploration and mining activities could be impacted by adverse political or economic developments. Such adverse developments may include widespread civil unrest and rebellion, the imposition of unfavorable government regulations on foreign investment, production and extraction, prices, exports, income taxes, expropriation of property, environmental compliance and worker safety.

Argentinean taxes affecting cost estimates provided by the Company

The Company will be required to pay taxes in Argentina on earnings generated from its Argentinean operations and these taxes are subject to change in the future. The operating costs at the Company’s Argentinean operations have assumed a current Argentinean tax rate, which may be increased in the future. Accordingly, cost estimates may not represent an accurate statement of future tax costs.

Mining tax regime risk

Mining tax regimes in foreign jurisdictions are subject to differing interpretations and are subject to constant change and may include fiscal stability guarantees. The Company’s interpretation of taxation law as applied to its transactions and activities may not coincide with that of the tax authorities. As a result, transactions may be challenged by tax authorities and the Company’s operations may be assessed, which could result in significant additional taxes, penalties and interest.

Risks associated with the transportation of concentrate

The concentrates to be produced by the Company have significant value and will be loaded onto road vehicles for transport. The geographic location of the Martha Mine and it other Patagonia properties in Argentina and trucking routes taken through the country to the smelters and ports for delivery, give rise to risks including concentrate theft, road blocks and terrorist attacks, losses caused by adverse weather conditions, delays in delivery of shipments, and environmental liabilities in the event of an accident or spill.

Theft of concentrate

The Company may have significant concentrate inventories at its facilities or on consignment at other warehouses awaiting shipment. The Company will take steps to secure its concentrate, whether in storage or in transit. The Company will have insurance coverage for its inventory while in transit; however, recovery of the full market value may not always be possible. Despite these risk mitigation measures, there remains a continued risk that theft of concentrate may have a material impact on the Company’s financial results.

| 19 |

Risks Relating to Emerging Markets

The Company operates in Argentina, which is considered an emerging market. Emerging market investments generally pose a greater degree of risk than investment in more mature market economies because the economies in the developing world are more susceptible to destabilization resulting from domestic and international developments. The Company’s operations in Argentina expose it to heightened risks relating to prevailing political and socioeconomic conditions which have historically included, but are not limited to: high rates of inflation; military repression; social and labour unrest; violent crime; civil disturbance; extreme fluctuations in currency exchange rates; expropriation and nationalization; renegotiation or nullification of existing concessions, licenses, permits and contracts; changes in taxation policies; underdeveloped industrial and economic infrastructure; unenforceability of contractual rights; restrictions on foreign exchange and repatriation; and changing political norms, currency controls and governmental regulations that favour or require the Company to award contracts in, employ citizens of, or purchase supplies from, a particular jurisdiction.

As an example, in May 2012, the previous government of Argentina re-nationalized YPF, the country’s largest oil and gas company. There can be no assurance that the government of Argentina will not nationalize other businesses operating in the country, including the business of the Company. The Company has not purchased any “political risk” insurance coverage and currently has no plans to do so. Argentinean regulators have broad authority to shut down and/or levy fines against operations that do not comply with regulations or standards. In addition to factors such as those listed above, the Company’s mineral exploration and potential future mining activities in Argentina may also be affected in varying degrees by government regulations with respect to restrictions on production, price controls, foreign exchange controls, export controls, taxes, royalties, environmental legislation and mine safety. Such factors may prevent or restrict mining of some or all of any deposits which the Company may find on the Company’s properties. Government authorities in emerging market countries often have a high degree of discretion and at times appear to act selectively or arbitrarily, without hearing or prior notice, and sometimes in a manner that may not be in full accordance with the law or that may be influenced by political or commercial considerations. Unlawful, selective or arbitrary governmental actions could include denial or withdrawal of licences, sudden and unexpected tax audits, forced liquidation, criminal prosecutions and civil actions. Although unlawful, selective or arbitrary government action may be challenged in court, such action, if directed at the Company or its shareholders, could have a material adverse effect on the Company’s business, results of operations, financial condition and future prospects. Companies operating in emerging markets are subject from time to time to the illegal activities of others, corruption or claims of illegal activities. Often in these markets the bribery of officials remains common, relative to developed markets. Social instability caused by criminal activity and corruption could increase support for renewed central authority, nationalism or violence and thus materially adversely affect the Company’s ability to conduct its business effectively. Such activities have not had a significant effect on the Company’s operations; however, there can be no assurance that they will not in the future, in which case they could restrict the Company’s operations, business, financial condition, results of operations and future prospects, and the value of the Company could be adversely affected by illegal activities by others, corruption or by claims, even if groundless, implicating the Company in illegal activities. Investors in emerging markets should be aware that these markets are subject to greater risk than more developed markets, including in some cases significant legal, fiscal, economic and political risks. Accordingly, investors should exercise particular care in evaluating the risks involved in an investment in the Company and must decide for themselves whether, in the light of those risks, their investment is appropriate. Generally, investment in emerging and developing markets is suitable only for sophisticated investors who fully appreciate the significance of the risks involved.

| 20 |

Risks Relating to the Company’s Common Shares

If the Company’s business is unsuccessful, its shareholders may lose their entire investment

Although shareholders will not be bound by or be personally liable for the Company’s expenses, liabilities or obligations beyond their total original capital contributions, should the Company suffer a deficiency in funds with which to meet its obligations, the shareholders as a whole may lose their entire investment in the Company.

The price of the Company’s common shares has been and may continue to be volatile

The common shares of the Company are currently listed and posted for trading on the TSX Venture Exchange (the “TSXV”) under the symbol “PGDC”. The trading price for the Company’s common shares has been and is likely to continue to be highly volatile. Factors that could adversely affect the price of its common shares include:

| ● | fluctuations in operating results; | |

| ● | changes in governmental regulation; | |

| ● | litigation; | |

| ● | general stock market and economic conditions; | |

| ● | number of shares available for trading (float); and | |

| ● | inclusion in or dropping from stock indexes. |

As a “foreign private issuer”, the Company is exempt from certain sections of the Exchange Act, which results in shareholders having less complete and timely data than if the Company were a domestic U.S. issuer

As a “foreign private issuer,” as defined under U.S. securities laws, the Company is exempt from certain sections of the U.S. Securities Exchange Act of 1934, as amended (the “Exchange Act”). In particular, it is exempt from Section 14 proxy rules which are applicable to domestic U.S. issuers. The submission of proxy and annual meeting of shareholder information (prepared to Canadian standards) on Form 6-K has typically been more limited than the submissions required of U.S. issuers and results in shareholders having less complete and timely data, including, among others, with respect to disclosure of: (i) personal and corporate relationships and age of directors and officers; (ii) material legal proceedings involving the Company, affiliates of the Company, and directors, officers promoters and control persons; (iii) the identity of principal shareholders and certain significant employees; (iv) related party transactions; (v) audit fees and change of auditors; (vi) voting policies and procedures; (vii) executive compensation; and (viii) composition of the compensation committee. In addition, due to the company’s status as a foreign private issuer, the officers, directors and principal shareholders of the Company are exempt from the short-swing insider disclosure and profit recovery provisions of Section 16 of the Exchange Act. Therefore, these officers, directors and principal shareholders are exempt from short-swing profits which apply to insiders of U.S. issuers. The foregoing exemption results in shareholders having less data in this regard than is available with respect to U.S. issuers.

| 21 |

The Company could lose its “foreign private issuer” status in the future, which could result in significant additional costs and expenses.

In order to maintain the Company’s current status as a “foreign private issuer” (as defined in Rule 405 under the United States Securities Act of 1933), where more than 50% of its outstanding voting securities are directly or indirectly owned by residents of the United States, the Company must not have any of the following: (i) a majority of its executive officers or directors being U.S. citizens or residents, (ii) more than 50% of its assets being located in the United States, or (iii) its business being principally administered in the United States. If the Company were to lose its foreign private issuer status:

| ● | it would no longer be exempt from certain of the provisions of U.S. securities laws, such as Regulation FD and the Section 16 short swing profit rules; | |

| ● | it would be required to commence reporting on forms required of U.S. companies, such as Forms l0-K, 10-Q and 8-K, rather than the forms currently available to it, such as Forms 20-F and 6-K; | |

| ● | it would be subject to additional restrictions on offers and sales of securities outside the United States, including in Canada; and | |

| ● | if it engages in capital raising activities after losing its foreign private issuer status, there is a higher likelihood that investors may require the Company to file resale registration statements with the SEC as a condition to any such financing. |

Investors’ interests in the Company will be diluted and investors may suffer dilution in their net book value per share if the Company issues additional shares or raise funds through the sale of equity securities

The Company’s constating documents currently authorize the issuance of an unlimited number of its common shares without par value. If it is required to issue any additional shares or enter into private placements to raise financing through the sale of equity securities, investors’ interests in the Company will be diluted and investors may suffer dilution in their net book value per share depending on the price at which such securities are sold. If the Company issues any such additional shares, such issuances also will cause a reduction in the proportionate ownership and voting power of all other shareholders. Further, any such issuance may result in a change in control of the Company.

The Company does not intend to pay dividends on any investment in its common shares

The Company has never paid any cash dividends and currently does not intend to pay any dividends for the foreseeable future. To the extent that the Company requires additional funding currently not provided for in its financing plan, its funding sources may prohibit the payment of a dividend. Because the Company does not intend to declare dividends, any gain on an investment in the Company will need to come through an increase in the market price of its common shares. This may never happen and investors may lose all of their investment in the Company.

Item 4 . Information on the Company

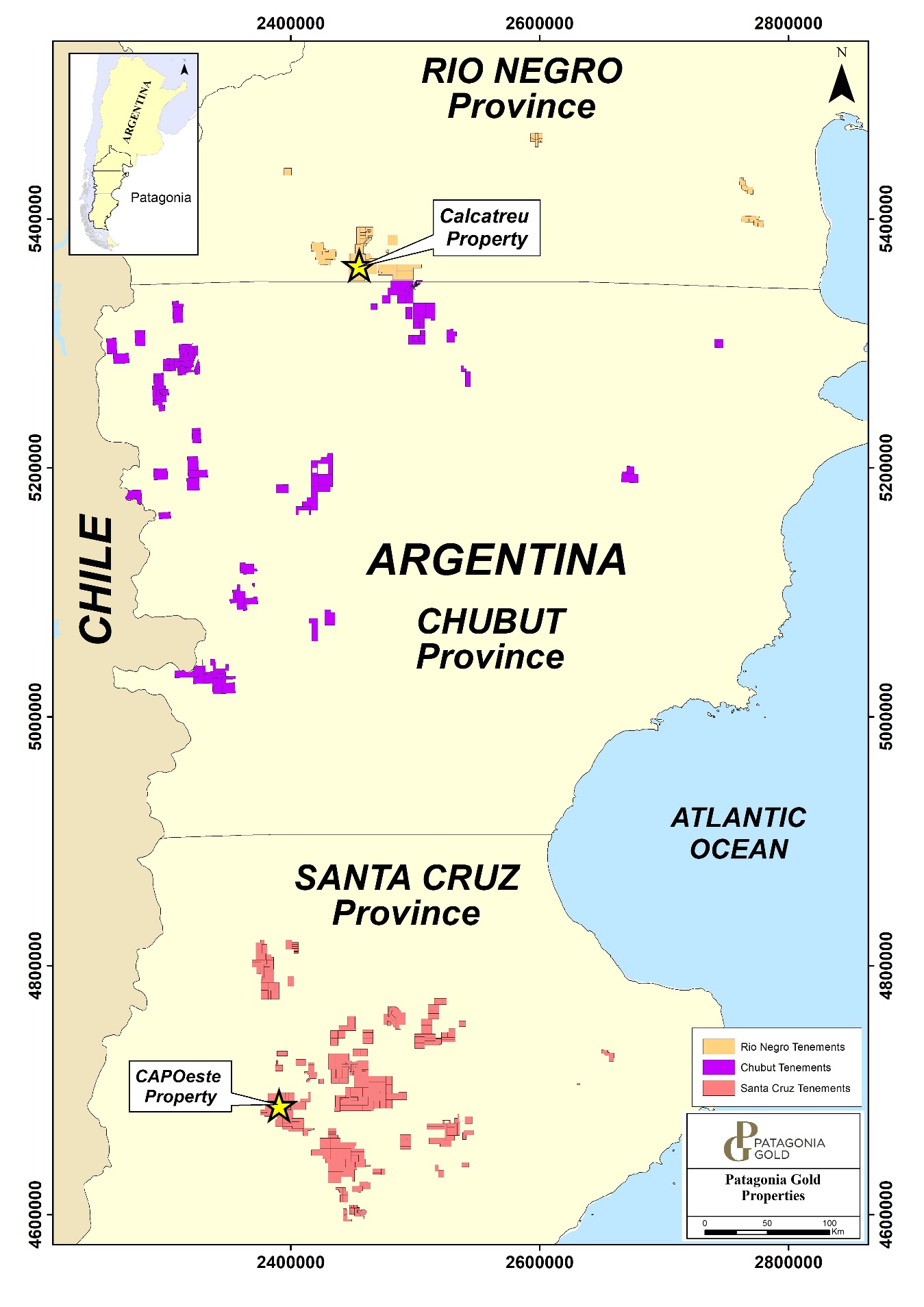

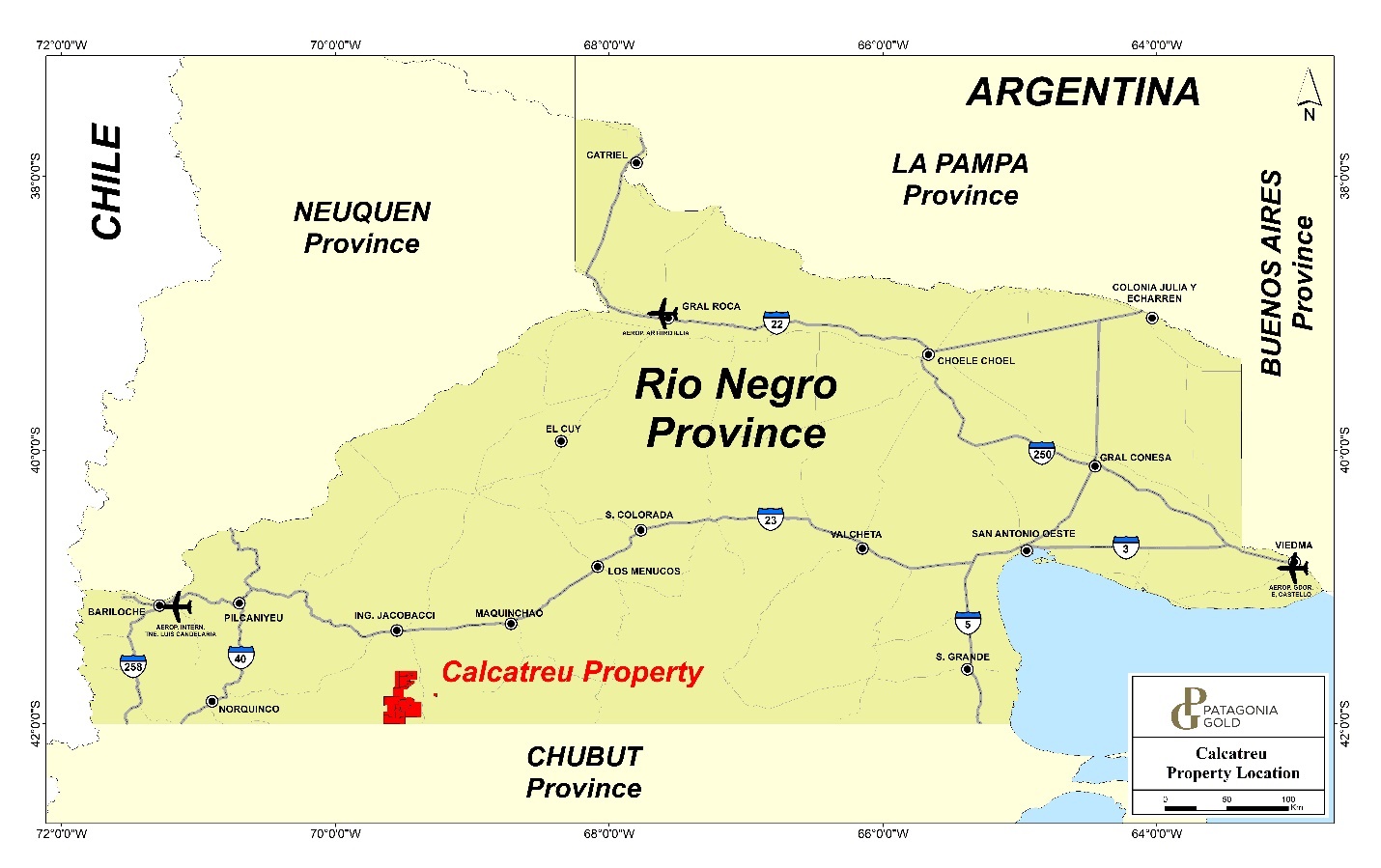

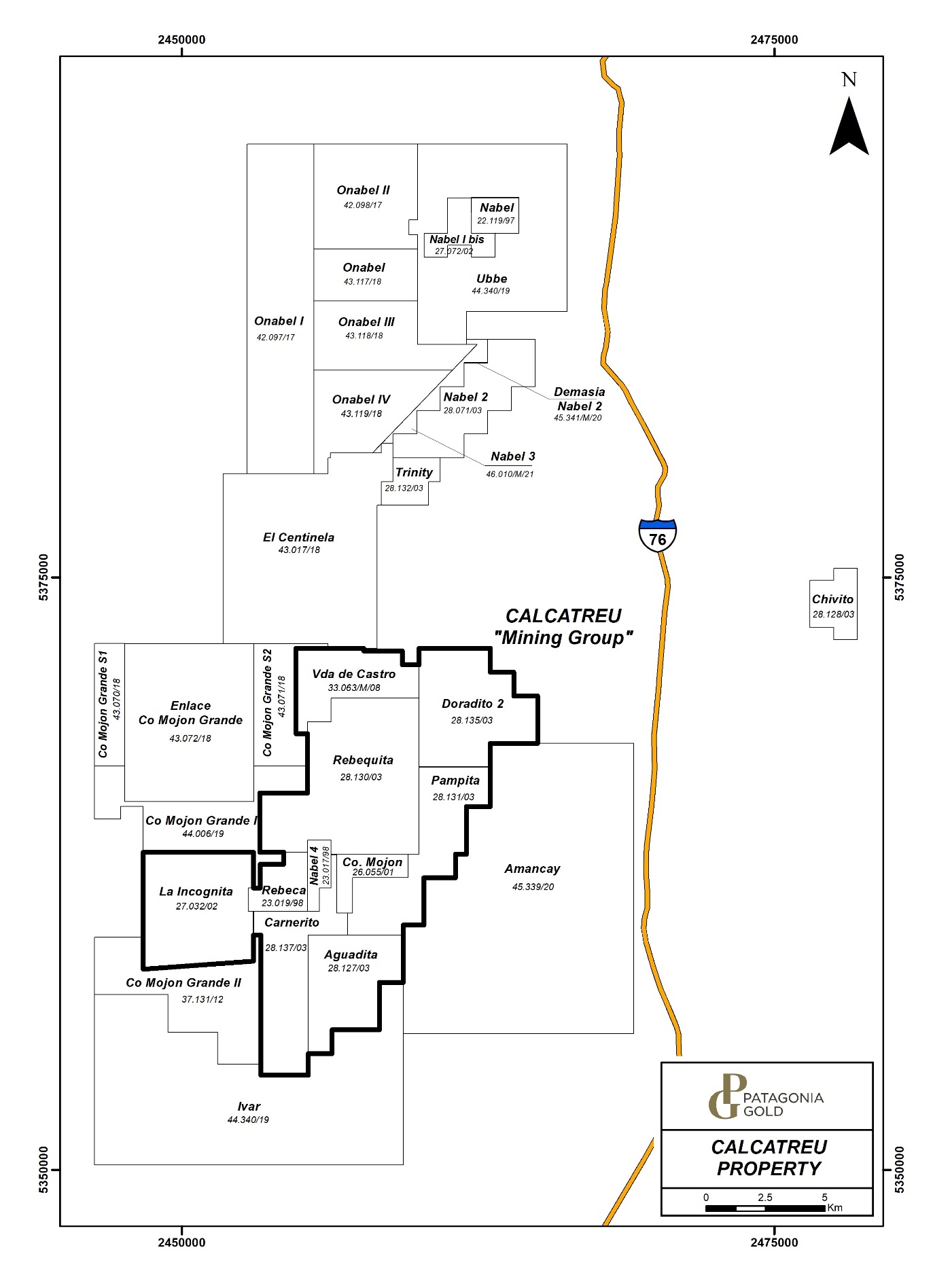

| A. | History and Development of the Company |