UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR

15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

ANNUAL REPORT PURSUANT TO SECTION 13 OR

15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE FISCAL YEAR ENDED DECEMBER 31, 2013

TRANSITION REPORT PURSUANT TO SECTION

13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

TRANSITION REPORT PURSUANT TO SECTION

13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission File Number 1-2958

HUBBELL

INCORPORATED

(Exact name of registrant as specified in its charter)

| STATE OF CONNECTICUT |

06-0397030 |

| (State

or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

| 40 Waterview Drive, Shelton, CT |

06484 |

| (Address

of principal executive offices) |

(Zip Code) |

| (475) 882-4000 |

| (Registrant’s

telephone number, including area code) |

| |

| SECURITIES

REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT: |

| Title of each Class |

Name of Exchange on which Registered |

| Class A Common — $.01 par value (20 votes per share) |

New York Stock Exchange |

| Class B Common — $.01 par value (1 vote per share) |

New York Stock Exchange |

| Series A Junior Participating Preferred Stock Purchase Rights |

New York Stock Exchange |

| Series B Junior Participating Preferred Stock Purchase Rights |

New York Stock Exchange |

| SECURITIES

REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT: |

| NONE |

| Indicate by check mark |

|

|

Yes |

No |

| • |

if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. |

|

|

| • |

if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. |

|

|

| • |

if the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such report), and (2) has been subject to such filing requirements for the past 90 days. |

|

|

| • |

whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). |

|

|

| • |

if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. |

|

| • |

whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one): |

| |

|

Non-accelerated

filer  |

|

Large

accelerated filer  |

Accelerated filer  |

(Do not check if a smaller

reporting company) |

Smaller reporting company

|

| • |

whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). |

|

|

The approximate aggregate market value of the voting stock held

by non-affiliates of the registrant as of June 30, 2013 was $5,348,026,071*. The number of shares outstanding of the Class A Common

Stock and Class B Common Stock as of February 11, 2014 was 7,167,506 and 52,060,200 respectively.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the definitive proxy statement for the annual meeting

of shareholders scheduled to be held on May 6, 2014, to be filed with the Securities and Exchange Commission (the “SEC”),

are incorporated by reference in answer to Part III of this Form 10-K.

*Calculated by excluding all shares held by Executive Officers

and Directors of registrant and the Louie E. Roche Trust, the Harvey Hubbell Trust, the Harvey Hubbell Foundation and the registrant’s

pension plans, without conceding that all such persons or entities are “affiliates” of registrant for purpose of the

Federal Securities Laws.

| HUBBELL

INCORPORATED - Form 10-K |

2 |

Hubbell Incorporated (herein referred to as “Hubbell”,

the “Company”, the “registrant”, “we”, “our” or “us”, which references

shall include its divisions and subsidiaries as the context may require) was founded as a proprietorship in 1888, and was incorporated

in Connecticut in 1905. Hubbell is primarily engaged in the design, manufacture and sale of quality electrical and electronic products

for a broad range of non-residential and residential construction, industrial and utility applications. Products are either sourced

complete, manufactured or assembled by subsidiaries in the United States, Canada, Switzerland, Puerto Rico, Mexico, the People’s

Republic of China (“China”), Italy, the United Kingdom (“UK”), Brazil and Australia. Hubbell also participates

in joint ventures in Taiwan and Hong Kong, and maintains offices in Singapore, China, India, Mexico, South Korea and countries

in the Middle East.

The Company’s reporting segments consist of the

Electrical segment (comprised of electrical systems products and lighting products) and the Power segment, as described

below. See also Item 7. Management’s Discussion and Analysis – “Executive Overview of the Business”,

and “Results of Operations” as well as Note 20 – Industry Segments and Geographic Area Information in the

Notes to Consolidated Financial Statements.

The Company’s annual report on Form 10-K,

quarterly reports on Form 10-Q, current reports on Form 8-K, and all amendments to those reports are made available

free of charge through the Investor Relations section of the Company’s website at http://www.hubbell.com as

soon as practicable after such material is electronically filed with, or furnished to, the SEC. These filings are also available

for reading and copying at the SEC’s Public Reference Room at 100 F Street N.E., Washington, D.C. 20549.

Information on the operation of the Public Reference Room may be obtained by calling the SEC at 1-800-SEC-0330. In addition,

the Company’s SEC filings can be accessed from the SEC’s homepage on the Internet at http://www.sec.gov.

The information contained on the Company’s website or connected to our website is not incorporated by reference into

this Annual Report on Form 10-K and should not be considered part of this report.

Electrical Segment

The Electrical segment (71%, 69% and 70%

of consolidated revenues in 2013, 2012 and 2011, respectively) is comprised of businesses that sell stock and custom products

including standard and special application wiring device products, rough-in electrical products, connector and grounding

products, lighting fixtures and controls, as well as other electrical equipment. The products are typically used in and

around industrial, commercial and institutional facilities by electrical contractors, maintenance personnel, electricians and

telecommunications companies. In addition, certain businesses design and manufacture a variety of high voltage test and

measurement equipment, industrial controls and communication systems used in the non-residential and industrial markets. Many

of these products are designed such that they can also be used in harsh and hazardous locations where a potential for fire

and explosion exists due to the presence of flammable gasses and vapors. Harsh and hazardous products are primarily used in

the oil and gas (onshore and offshore) and mining industries. There are also a variety of lighting fixtures, wiring devices

and electrical products that have residential and utility applications.

These products are primarily sold through electrical and industrial

distributors, home centers, retail and hardware outlets, lighting showrooms and residential product oriented internet sites. Special

application products are sold primarily through wholesale distributors to contractors, industrial customers and original equipment

manufacturers (“OEMs”). High voltage products are sold primarily by direct sales to customers through our sales engineers.

Hubbell maintains a sales and marketing organization to assist potential users with the application of certain products to their

specific requirements, and with architects, engineers, industrial designers, OEMs and electrical contractors for the design of

electrical systems to meet the specific requirements of industrial, non-residential and residential users. Hubbell is also represented

by independent manufacturers’ sales agents for many of its product offerings.

Hubbell Electrical Systems

Hubbell designs, manufactures and sells thousands of wiring and electrical

products which are supplied principally to industrial, non-residential and residential customers. These products include items

such as:

| • |

Cable reels |

• |

Wiring devices & accessories |

• |

Junction boxes, plugs & receptacles |

| • |

Cable glands & fittings |

• |

Switches & dimmers |

• |

Datacom connectivity & enclosures |

| • |

Connectors & tooling |

• |

Pin & sleeve devices |

• |

Speciality communications equipment |

| • |

Floor boxes |

• |

Electrical motor controls |

• |

High voltage test systems |

| • |

Ground fault devices |

• |

Steel & plastic enclosures |

• |

Mining communication & controls |

These wiring and electrical products are sold under various brands

and/or trademarks, including:

| • |

Hubbell® |

• |

Bell® |

• |

Victor™ |

| • |

Kellems® |

• |

TayMac® |

• |

GAI-Tronics® |

| • |

Bryant® |

• |

Wiegmann® |

• |

Gleason Reel® |

| • |

Burndy® |

• |

Killark® |

• |

Haefely® |

| • |

CMC® |

• |

Hawke™ |

• |

Hipotronics® |

| • |

Raco® |

• |

Chalmit™ |

• |

Austdac™ |

| HUBBELL

INCORPORATED - Form 10-K |

3 |

Lighting Products

Hubbell manufactures and sells lighting

fixtures and controls for indoor and outdoor applications. The markets served include non-residential and residential. For

the non-residential market the Company typically targets products that would be considered specification grade. A fast

growing trend within the lighting industry is the adoption of light emitting diode (“LED”) technology as the

light source. LED technology is both energy efficient and long–lived and as a result offers customers the economic

benefits of lower energy and maintenance costs. The Company has a broad array of LED-luminaire products within its portfolio

and the majority of new product development efforts are oriented towards expanding those offerings. Examples of these

lighting products or applications include:

| • |

Canopy lights |

• |

Parking lot/parking garage fixtures |

• |

Decorative landscape fixtures |

| • |

Emergency lighting/exit signs |

• |

Bollards |

• |

Fluorescent fixtures |

| • |

Floodlights & poles |

• |

Bath/vanity fixtures & fans |

• |

Ceiling fans |

| • |

Recessed, surface mounted & track fixtures |

• |

Chandeliers & sconces |

• |

Site & area lighting |

| • |

LED components |

• |

Athletic & recreational field fixtures |

• |

Occupancy, dimming & daylight harvesting sensors |

These lighting products are sold under various brands and/or trademarks,

including:

| • |

Kim Lighting® |

• |

Security Lighting Systems™ |

• |

Spaulding Lighting™ |

| • |

Sportsliter Solutions™ |

• |

Columbia Lighting® |

• |

Alera Lighting® |

| • |

Kurt Versen |

• |

Prescolite® |

• |

Dual-Lite® |

| • |

Beacon Products |

• |

Precision-Paragon [P2] |

• |

Progress Lighting® |

| • |

Architectural Area Lighting |

• |

Hubbell Building Automation |

• |

Hubbell Outdoor Lighting |

Power Segment

The Power segment (29%, 31% and 30% of

consolidated revenues in 2013, 2012 and 2011, respectively) consists of operations that design and manufacture various

distribution, transmission, substation and telecommunications products primarily used by the electrical utility industry. In

addition, certain of these products are used in the civil construction and transportation industries. Products are sold to

distributors and directly to users such as electric utilities, telecommunication companies, pipeline and mining operations,

industrial firms, construction and engineering firms. While Hubbell believes its sales in this area are not materially

dependent upon any customer or group of customers, a substantial decrease in purchases by electrical utilities would affect

this segment.

Distribution, Transmission and Substation Utility

Products

Hubbell manufactures and sells a wide variety of electrical distribution,

transmission, substation and telecommunications products. These products include items such as:

| • |

Arresters |

• |

High voltage bushings |

• |

Grounding equipment |

| • |

Cutouts & fuse links |

• |

Insulators |

• |

Programmable reclosers |

| • |

Lineman tools, hoses & gloves |

• |

Cable terminations & accessories |

• |

Sectionalizers |

| • |

Helical anchors & foundations |

• |

Formed wire products |

• |

Pole line hardware |

| • |

Overhead, pad mounted & capacitor switches |

• |

Splices, taps & connectors |

• |

Polymer concrete & fiberglass enclosures and equipment pads |

These products are sold under the following brands and/or trademarks:

| • |

Ohio Brass® |

• |

Chance® |

• |

Anderson® |

| • |

Fargo® |

• |

Hubbell® |

• |

Polycast® |

| • |

Quazite® |

• |

Quadri*sil® |

• |

Trinetics® |

| • |

Electro Composites™ |

• |

USCO™ |

• |

CDR™ |

| • |

Hot Box® |

• |

PCORE® |

• |

Delmar |

Information Applicable to All General Categories

International Operations

The Company has several operations located outside of the United States.

These operations manufacture, assemble and/or market Hubbell products and service both the Electrical and Power segments.

As a percentage of total net sales, shipments from foreign operations

directly to third parties were 16% in 2013 and 17% in both 2012 and 2011, with the Canada, UK and Brazil operations representing approximately 30%,

24% and 12%, respectively, of 2013 international net sales. See also Note 20-Industry Segments and Geographic Area Information

in the Notes to Consolidated Financial Statements and Item 1A. Risk Factors relating to manufacturing in and sourcing from foreign

countries.

| HUBBELL

INCORPORATED - Form 10-K |

4 |

Raw Materials

Raw materials used in the manufacture of Hubbell products primarily

include steel, aluminum, brass, copper, bronze, plastics, phenolics, zinc, nickel, elastomers and petrochemicals. Hubbell also

purchases certain electrical and electronic components, including solenoids, lighting ballasts, printed circuit boards, integrated

circuit chips and cord sets, from a number of suppliers. Hubbell is not materially dependent upon any one supplier for raw materials

used in the manufacture of its products and equipment, and at the present time, raw materials and components essential to its operation

are in adequate supply. However, some of these principal raw materials are sourced from a limited number of suppliers. See also

Item 7A. Quantitative and Qualitative Disclosures about Market Risk.

Patents

Hubbell has approximately 1,580 active United States and foreign patents

covering many of its products, which expire at various times. While Hubbell deems these patents to be of value, it does not consider

its business to be dependent upon patent protection. Hubbell also licenses products under patents owned by others, as necessary,

and grants licenses under certain of its patents.

Working Capital

Inventory, accounts receivable and accounts payable levels, payment

terms and, where applicable, return policies are in accordance with the general practices of the electrical products industry and

standard business procedures. See also Item 7. Management’s Discussion and Analysis of Financial Condition and Results

of Operations.

Backlog

Substantially all of the backlog existing at December 31, 2013 is

expected to be shipped to customers in 2014. Backlog of orders believed to be firm at December 31, 2013 was approximately $295.4 million

compared to $290.5 million at December 31, 2012. Although this backlog is important, the majority of Hubbell’s

revenues result from sales of inventoried products or products that have short periods of manufacture.

Competition

Hubbell experiences substantial

competition in all categories of its business, but does not compete with the same companies in all of its product categories.

The number and size of competitors vary considerably depending on the product line. Hubbell cannot specify with precision the

number of competitors in each product category or their relative market position. However, some of its competitors are larger

companies with substantial financial and other resources. Hubbell considers product performance, reliability, quality and

technological innovation as important factors relevant to all areas of its business, and considers its reputation as a

manufacturer of quality products to be an important factor in its business. In addition, product price, service levels and

other factors can affect Hubbell’s ability to compete.

Research and Development

Research and development expenditures represent costs to discover

and/or apply new knowledge in developing a new product or process, or in bringing about significant improvement in an existing

product or process. Research and development expenses are recorded as a component of Cost of goods sold. Expenses for research

and development were approximately 2% of Cost of goods sold for each of the years 2013, 2012 and 2011.

Environment

The Company is subject to various federal, state and local government

requirements relating to the protection of employee health and safety and the environment. The Company believes that, as a general

matter, its policies, practices and procedures are properly designed to prevent unreasonable risk of environmental damage and personal

injury to its employees and its customers’ employees and that the handling, manufacture, use and disposal of hazardous or

toxic substances are in accordance with environmental laws and regulations.

Like other companies engaged in similar businesses, the Company has

incurred or acquired through business combinations, remedial response and voluntary cleanup costs for site contamination and is

a party to product liability and other lawsuits and claims associated with environmental matters, including past production of

product containing toxic substances. Additional lawsuits, claims and costs involving environmental matters are likely to continue

to arise in the future. However, considering past experience and reserves, the Company does not anticipate that these matters will

have a material impact on earnings, capital expenditures, financial condition or competitive position. See also Item 1A. Risk Factors

and Note 15 — Commitments and Contingencies in the Notes to Consolidated Financial Statements.

Employees

As of December 31, 2013, Hubbell had approximately 14,300 salaried

and hourly employees of which approximately 7,800 of these employees, or 55%, are located in the United States. Approximately 2,200

of these U.S. employees are represented by 17 labor unions. Hubbell

considers its labor relations to be satisfactory.

| HUBBELL

INCORPORATED - Form 10-K |

5 |

Executive Officers of the Registrant

| Name |

|

Age(1) |

|

Present Position |

|

Business Experience |

| David G. Nord |

|

56 |

|

President and Chief

Executive Officer |

|

Chief Executive Officer since January 1, 2013; President since June 6, 2012; Chief Operating Officer June 6, 2012 to December

31, 2012; Senior Vice President and Chief Financial Officer September 19, 2005 to June 6, 2012; previously Chief Financial

Officer of Hamilton Sundstrand Corporation, a United Technologies company, April 2003 to September 2005, and Vice President,

Controller of United Technologies Corporation October 2000 to March 2003. |

| William R. Sperry |

|

51 |

|

Senior Vice President and

Chief Financial Officer |

|

Present position since June 6, 2012; Vice President, Corporate Strategy and Development August 15, 2008 to June 6, 2012;

previously, Managing Director, Lehman Brothers August 2006 to April 2008, various positions, including Managing Director,

of J.P. Morgan and its predecessor institutions, 1994-2006. |

| Gary N. Amato |

|

62 |

|

Group Vice President

(Electrical Systems) |

|

Present position since December 23, 2008; Group Vice President (Electrical Products) October 2006-December 23, 2008; Vice

President October 1997-September 2006; Vice President and General Manager of the Company’s Industrial Controls Divisions

(ICD) 1989-1997; Marketing Manager, ICD, April 1988-March 1989. |

| Gerben W. Bakker |

|

49 |

|

Group Vice President

(Power Systems) |

|

Present position since February 1, 2014; previously, Division Vice President, Hubbell Power Systems, Inc. (“HPS”)

August 2009 - February 1, 2014; President, HPS Brazil June 2005 – July 2009; Vice President, Sourcing, HPS March 2004

– May 2005. |

| Scott H. Muse |

|

56 |

|

Group Vice President

(Lighting Products) |

|

Present position since April 27, 2002 (elected as an officer of the Company on December 3, 2002); previously President

and Chief Executive Officer of Lighting Corporation of America, Inc. 2000-2002, and President of Progress Lighting, Inc. 1993-2000. |

| James H. Biggart, Jr. |

|

61 |

|

Vice President and Treasurer |

|

Present position since January 1, 1996; Treasurer since 1987; Assistant Treasurer 1986-1987; Director of Taxes 1984-1986. |

| Joseph A. Capozzoli |

|

39 |

|

Vice President and

Controller |

|

Present position since April 22, 2013; previously, Assistant Corporate Controller of Stanley Black & Decker, Inc.

(“Stanley”) April 2011 to April 2013; Global Operations Controller at Stanley 2010-2011; Director of Cost Accounting

at Stanley, 2006-2010. |

| An-Ping Hsieh |

|

53 |

|

Vice President, General

Counsel |

|

Present position since September 4, 2012; previously, Vice President, Secretary and Associate General Counsel of United

Technologies Corporation (“UTC”) February 2008 to September 2012; Vice President and General Counsel, UTC Fire

and Security 2003-2008; Deputy General Counsel, Otis Elevator Company, a United Technologies company 2001-2003. |

| Stephen M. Mais |

|

49 |

|

Vice President,

Human Resources |

|

Present position since August 22, 2005; previously Director, Staffing and Capability, Pepsi Bottling Group (“Pepsi”)

2001-2005; Director, Human Resources Southeastern U.S., Pepsi 1997-2001. |

| W. Robert Murphy |

|

64 |

|

Executive Vice President,

Marketing and Sales |

|

Present position since October 1, 2007; Senior Group Vice President 2001-2007; Group Vice President 2000-2001; Senior

Vice President Marketing and Sales (Wiring Systems) 1985-1999; and various sales positions (Wiring Systems) 1975-1985. |

| William T. Tolley |

|

56 |

|

Senior Vice President,

Growth and Innovation |

|

Present position since February 1, 2014, previously, Group Vice President (Power Systems) December 23, 2008-February 1,

2014; Group Vice President (Wiring Systems) October 1, 2007-December 23, 2008; Senior Vice President of Operations and Administration

(Wiring Systems) October 2005-October 2007; Director of Special Projects April 2005-October 2005; administrative leave November

2004-April 2005; Senior Vice President and Chief Financial Officer February 2002-November 2004. |

| (1) |

As of February 18, 2014. |

There are no family relationships between

any of the above-named executive officers. For information related to our Board of Directors, refer to Item 10. Directors,

Executive Officers and Corporate Governance.

| HUBBELL

INCORPORATED - Form 10-K |

6 |

Our business, operating results, financial condition, and cash flows

may be impacted by a number of factors including, but not limited to those set forth below. Any one of these factors could cause

our actual results to vary materially from recent results or future anticipated results. See also Item 7. Management’s

Discussion and Analysis — “Executive Overview of the Business”, “Outlook”, and “Results

of Operations”.

We operate in markets that are subject to competitive

pressures that could affect selling prices or demand for our products.

We compete on the basis of product performance, quality, service and/or

price. Our competitive strategy is to design and manufacture high quality products at the lowest possible cost. Our strategy is

to also increase selling prices to offset rising costs of raw materials and components. Competitive pricing pressures may not allow

us to offset some or all of our increased costs through pricing actions. Alternatively, if raw material and component costs decline,

the Company may not be able to maintain current pricing levels. Competition could also affect future selling prices or demand for

our products which could have an adverse impact on our results of operations, financial condition and cash flows.

Global economic uncertainty could adversely affect

us.

During periods of prolonged slow growth, or a downturn in conditions

in the worldwide or domestic economies, we could experience reduced orders, payment delays, supply chain disruptions or other factors

caused by economic challenges faced by our customers, prospective customers and suppliers. Depending upon their severity and duration,

these conditions could have an adverse impact on our results of operations, financial condition and cash flows.

We may not be able to successfully implement initiatives

that improve productivity and streamline operations to control or reduce costs.

Achieving our long-term profitability goals depends significantly

on our ability to control or reduce our operating costs. Because many of our costs are affected by factors outside, or substantially

outside, our control, we generally must seek to control or reduce costs through productivity initiatives. If we are not able to

identify and implement initiatives that control or reduce costs and increase operating efficiency, or if the cost savings initiatives

we have implemented to date do not generate expected cost savings, our financial results could be adversely impacted.

We manufacture and source products and materials

from various countries throughout the world. A disruption in the availability, price or quality of these products or materials

could impact our operating results.

Our business is subject to risks associated with global manufacturing

and sourcing. We use a variety of raw materials in the production of our products including steel, aluminum, brass, copper, bronze,

zinc, nickel and plastics. We also purchase certain electrical and electronic components, including lighting ballasts, printed

circuit boards and integrated circuit chips from third party providers. Significant shortages in the availability of these materials

or significant price increases could increase our operating costs and adversely impact the competitive positions of our products,

which could adversely impact our results of operations.

We continue to increase the amount of materials, components and finished

goods that are sourced from or manufactured in foreign countries including Mexico, China, and other international countries. Political

instability in any country where we do business could have an adverse impact on our results of operations.

We rely on our suppliers to produce high quality materials, components

and finished goods according to our specifications. Although we have quality control procedures in place, there is a risk that

products may not meet our specifications which could impact our ability to ship quality products to our customers on a timely basis,

which could adversely impact our results of operations.

Future tax law changes could increase our prospective

tax expense. In addition, tax payments may ultimately differ from amounts currently recorded by the Company.

We are subject to income taxes as well as non-income based taxes,

in both the United States and various foreign jurisdictions. We are subject to ongoing tax audits in various jurisdictions. Tax

authorities may disagree with certain positions we have taken and assess additional taxes. We regularly assess the likely outcomes

of these audits in order to determine the appropriateness of our tax provisions. However, there can be no assurance that we will

accurately predict the outcomes of these audits, and the future outcomes of these audits could adversely affect our results of

operations, financial condition and cash flows.

We engage in acquisitions and strategic investments

and may encounter difficulty in obtaining appropriate acquisitions and in integrating these businesses.

Part of the Company’s future growth strategy involves acquisitions.

We have pursued and will continue to seek acquisitions and other strategic investments to complement and expand our existing businesses

within our core markets. The rate and extent to which acquisitions become available may impact our growth rate. The success of

these transactions will depend on our ability to integrate these businesses into our operations and realize the planned synergies.

We may encounter difficulties in integrating acquisitions into our operations and in managing strategic investments. Failure to

effectively complete or manage acquisitions may adversely affect our existing businesses as well

as our results of operations, financial condition and cash flows.

We are subject to risks surrounding our information

systems.

The proper functioning of Hubbell’s information systems is critical

to the successful operation of our business. Although our information systems are protected with robust backup and security systems,

these systems are still susceptible to outages due to fire, floods, power loss, telecommunications failures, viruses, break-ins

and similar events, or breaches of security. A failure of our information technology systems could impact our ability to process

orders, maintain proper levels of inventory, collect accounts receivable and pay expenses; all of which could have an adverse effect

on our results of operations, financial condition and cash flows.

| HUBBELL

INCORPORATED - Form 10-K |

7 |

We have continued to work on improving our utilization of our enterprise

resource planning system, expanding standardization of business processes and performing implementations at our remaining businesses.

We expect to incur additional costs related to future implementations, process reengineering efforts as well as enhancements and

upgrades to the system. These system modifications and implementations could result in operating inefficiencies which could adversely

impact our operating results and/or our ability to perform necessary business transactions.

Deterioration in the credit quality of our

customers could have a material adverse effect on our operating results and financial condition.

We have an extensive customer base of distributors, wholesalers, electric

utilities, OEMs, electrical contractors, telecommunications companies and retail and hardware outlets. We are not dependent on

a single customer, however, our top ten customers account for approximately one-third of our net sales. Deterioration in the credit

quality of several major customers could adversely affect our results of operations, financial condition and cash flows.

Inability to access capital markets or failure

to maintain our credit ratings may adversely affect our business.

Our ability to invest in our business and make strategic acquisitions

may require access to the capital markets. If general economic and capital market conditions deteriorate significantly, it could

impact our ability to access the capital markets. Failure to maintain our credit ratings could also impact our ability to access

credit markets and could adversely impact our cost of borrowing. While we have not encountered significant financing difficulties

recently, the capital and credit markets have experienced significant volatility in recent years. Market conditions could make

it more difficult for us to access capital to finance our investments and acquisitions. This could adversely affect our results

of operations, financial condition and cash flows.

If the underlying investments of our defined

benefit plans do not perform as expected, we may have to make additional contributions to these plans.

We sponsor certain pension and other postretirement defined benefit

plans. The performance of the financial markets and interest rates impact these plan expenses and funding obligations. Significant

changes in market interest rates, investment losses on plan assets and changes in discount rates may increase our funding obligations

and could adversely impact our results of operations and cash flows. Furthermore, there can be no assurance that the value of the

defined benefit plan assets will be sufficient to meet future requirements.

Volatility in currency exchange rates may

adversely affect our financial condition, results of operations and cash flows.

Our international operations accounted for approximately 16% of our

net sales in 2013. We are exposed to the effects (both positive and negative) that fluctuating exchange rates have on translating

the financial statements of our international operations, most of which are denominated in local currencies, into the U.S. dollar.

Fluctuating exchange rates may adversely impact our results of operations and cash flows. Our primary foreign currency exposures

are in British pounds, Canadian dollars, Australian dollars and Brazilian Real. In 2013, foreign currency fluctuations negatively

impacted net sales by approximately $13.2 million and operating income by $2.2 million.

Our success depends on attracting and retaining

qualified personnel.

Our ability to sustain and grow our business requires us to hire,

retain and develop a highly skilled and diverse management team and workforce. Failure to ensure that we have the depth and breadth

of personnel with the necessary skill set and experience could impede our ability to deliver our growth objectives and execute

our strategy.

Our reputation and our ability to conduct

business may be impaired by improper conduct by any of our employees, agents or business partners.

We cannot provide absolute assurance that our internal controls and

compliance systems will always protect us from acts committed by our employees, agents or business partners that would violate

U.S. and/or non-U.S. laws, including the laws governing payments to government officials, bribery, fraud, anti-kickback and false

claims rules, competition, export and import compliance, money laundering and data privacy. In particular, the U.S. Foreign Corrupt

Practices Act, the U.K. Bribery Act, and similar anti-bribery laws in other jurisdictions generally prohibit companies and their

intermediaries from making improper payments to government officials for the purpose of obtaining or retaining business, and we

operate in parts of the world that have experienced governmental corruption to some degree. Despite meaningful measures that we

undertake to facilitate lawful conduct, which include training and internal control policies, these measures may not always prevent

reckless or criminal acts by our employees or agents. Any such improper actions could damage our reputation and subject us to civil

or criminal investigation in the United States and in other jurisdictions, could lead to substantial civil and criminal, monetary

and non-monetary penalties and could cause us to incur significant legal and investigative fees.

Our inability to effectively develop and introduce

new products could adversely affect our ability to compete.

New product introductions and enhancement of existing products and

services are key to the Company’s competitive strategy. The success of new product introductions is dependent on a number

of factors, including, but not limited to, timely and successful development of

new products, market acceptance of these products and the Company’s ability to manage the risks associated with these introductions.

These risks include production capabilities, management of inventory levels to support anticipated demand, and the risk that new

products may have quality defects in the early stages of introduction. The Company cannot predict with certainty the ultimate impact

new product introductions could have on our results of operations, financial condition or cash flows.

We could incur significant and/or unexpected

costs in our efforts to successfully avoid, manage, defend and litigate intellectual property matters.

The Company relies on certain patents, trademarks, copyrights, trade

secrets and other intellectual property of which the Company cannot be certain that others have not and will not infringe upon.

Although management believes that the loss or expiration of any single intellectual property right would not have a material impact

on its operating results, intellectual property litigation could be costly and time consuming and the Company could incur significant

legal expenses pursuing these claims against others.

From time to time, we receive notices from third parties alleging

intellectual property infringement, including the lawsuit against us by Powerweb Energy, Inc. Any dispute or litigation involving

intellectual property could be costly and time-consuming due to the complexity and the uncertainty of intellectual property litigation.

Our intellectual property portfolio may not be useful in asserting a counterclaim, or negotiating a license, in response to a claim

of infringement or misappropriation. In addition, as a result of such claims, the Company may lose its rights to utilize critical

technology or may be required to pay substantial damages or license fees with respect to the infringed rights or be required to

redesign our products at a substantial cost, any of which could negatively impact our operating results. Even if we successfully

defend against claims of infringement, we may incur significant costs that could adversely affect our results of operations, financial

condition and cash flow. See Item 3 “Legal Proceedings” for a discussion of our legal proceedings.

| HUBBELL

INCORPORATED - Form 10-K |

8 |

We may be required to recognize impairment

charges for our goodwill and other intangible assets.

As of December 31, 2013, the net carrying value of our goodwill and

other intangible assets totaled approximately $1.1 billion. As required by generally accepted accounting principles, we periodically

assess these assets to determine if they are impaired. Impairment of intangibles assets may be triggered by developments both within

and outside the Company’s control. Deteriorating economic conditions, technological changes, disruptions to our business,

inability to effectively integrate acquired businesses, unexpected significant changes or planned changes in use of the assets,

intensified competition, divestitures, market capitalization declines and other factors may impair our goodwill and other intangible

assets. Any charges relating to such impairments could adversely affect our results of operations in the periods an impairment

is recognized.

We have two classes of common stock with different

voting rights, which results in a concentration of voting power of our common stock.

As of December 31, 2013, the holders of our Class A common stock (with

20 votes per share) held approximately 73% of the voting power represented by all outstanding shares of our common stock and approximately

11% of the Company’s total equity value, and the Hubbell Trust and Roche Trust collectively held approximately 49% of our

Class A common stock. The holders of the Class A common stock thus are in a position to influence matters that are brought to a

vote of the holders of our common stock, including, among others, the election of the board of directors, any amendments to our

charter documents, and the approval of material transactions. In order to further the interests of our shareholders, the Company

routinely reviews various alternatives to meet its capital structure objectives, including equity, reclassification and debt transactions.

We are subject to litigation and environmental

regulations that may adversely impact our operating results.

We are a party to a number of legal proceedings and claims, including

those involving product liability, intellectual property and environmental matters, which could be significant. It is not possible

to predict with certainty the outcome of every claim and lawsuit. In the future, we could incur judgments or enter into settlements

of lawsuits and claims that could have a materially adverse effect on our results of operations and financial condition. In addition,

while we maintain insurance coverage with respect to certain claims, such insurance may not provide adequate coverage against such

claims. We establish reserves based on our assessment of contingencies, including contingencies related to legal claims asserted

against us. Subsequent developments in legal proceedings may affect our assessment and estimates of the loss contingency recorded

as a reserve and require us to make additional payments, which could have a materially adverse effect on our results of operations,

financial condition and cash flow.

We are also subject to various laws and regulations relating to environmental

protection and the discharge of materials into the environment, and we could incur substantial costs as a result of the noncompliance

with or liability for clean up or other costs or damages under environmental laws. In addition, we could be affected by future

laws or regulations, including those imposed in response to climate change concerns. Compliance with any future laws and regulations

could result in a materially adverse affect on our business and financial results.

New regulations related to conflict-free minerals

may cause us to incur additional expenses and may create challenges with our customers.

The Dodd-Frank Wall Street Reform and Consumer Protection Act contains

provisions to improve transparency and accountability regarding the use of “conflict” minerals mined from the Democratic

Republic of Congo and adjoining countries (“DRC”). In August 2012 the SEC established annual disclosure and reporting

requirements for those companies who use “conflict” minerals sourced from the DRC in their products. These new requirements

could limit the pool of suppliers who can provide conflict-free minerals and as a result, we cannot ensure that we will be able

to obtain these conflict-free minerals at competitive prices. Compliance with these new requirements may also increase our costs.

In addition, we may face challenges with our customers if we are unable to sufficiently verify the origins of the minerals used

in our products.

Health care reform could adversely affect

our operating results.

In 2010, the United States federal government enacted comprehensive

health care reform legislation. Due to the breadth and complexity of this legislation, as well as its phased-in nature of implementation

and lack of interpretive guidance, it is difficult for the Company to predict the overall effects it will have on our business.

To date, the Company has not experienced material costs related to the health care reform legislation, however, it is possible

that our operating results could be adversely affected in the future by increased costs, expanded liability exposure and requirements

that change the ways we provide healthcare and other benefits to our employees.

We face the potential harms of natural disasters,

terrorism, acts of war, international conflicts or other disruptions to our operations.

Natural disasters, acts or threats of war or terrorism, international

conflicts, and the actions taken by the United States and other governments in response to such events could cause damage to or

disrupt our business operations, our suppliers or our customers, and could create political or economic instability, any of which

could have an adverse effect on our business. Although it is not possible to predict such events or their consequences, these events could decrease demand for our products,

make it difficult or impossible for us to deliver products, or disrupt our supply chain.

| ITEM 1B |

Unresolved Staff Comments |

None

| HUBBELL

INCORPORATED - Form 10-K |

9 |

Hubbell’s manufacturing and warehousing

facilities, classified by reporting segment, are located in the following countries. The Company believes its manufacturing and

warehousing facilities are adequate to carry on its business activities.

| | |

| |

Number of Facilities | | |

Total Approximate Floor

Area in Square Feet | |

| Segment | |

Location | |

Warehouses | | |

Manufacturing | | |

Owned | | |

Leased | |

| Electrical segment | |

United States | |

| 13 | | |

| 34 | | |

| 3,341,900 | | |

| 1,648,400 | |

| | |

Australia | |

| 1 | | |

| 2 | | |

| - | | |

| 39,600 | |

| | |

Brazil | |

| - | | |

| 1 | | |

| 105,900 | | |

| - | |

| | |

Canada | |

| 2 | | |

| 3 | | |

| 178,700 | | |

| 33,100 | |

| | |

Italy | |

| - | | |

| 1 | | |

| - | | |

| 8,100 | |

| | |

Mexico | |

| 2 | | |

| 3 | | |

| 659,400 | | |

| 103,500 | |

| | |

China | |

| - | | |

| 1 | | |

| - | | |

| 185,900 | |

| | |

Puerto Rico | |

| - | | |

| 1 | | |

| 162,400 | | |

| - | |

| | |

Singapore | |

| 1 | | |

| - | | |

| - | | |

| 8,700 | |

| | |

Switzerland | |

| - | | |

| 1 | | |

| 95,000 | | |

| - | |

| | |

United Kingdom | |

| 1 | | |

| 4 | | |

| 133,600 | | |

| 53,600 | |

| Power segment | |

United States | |

| 1 | | |

| 9 | | |

| 2,140,900 | | |

| 137,300 | |

| | |

Brazil | |

| - | | |

| 1 | | |

| 138,300 | | |

| - | |

| | |

Canada | |

| - | | |

| 1 | | |

| 30,000 | | |

| - | |

| | |

Mexico | |

| - | | |

| 2 | | |

| 173,600 | | |

| 120,900 | |

| | |

China | |

| 1 | | |

| 1 | | |

| - | | |

| 64,900 | |

| TOTAL | |

| |

| 22 | | |

| 65 | | |

| 7,159,700 | | |

| 2,404,000 | |

The Company is subject to various legal proceedings

arising in the normal course of its business. These proceedings include claims for damages arising out of use of the Company’s

products, intellectual property, workers’ compensation and environmental matters. The Company is self-insured up to specified

limits for certain types of claims, including product liability and workers’ compensation, and is fully self-insured for

certain other types of claims, including environmental and intellectual property matters. The Company recognizes a liability for

any contingency that in management’s judgment is probable of occurrence and can be reasonably estimated. We continually reassess

the likelihood of adverse judgments and outcomes in these matters, as well as estimated ranges of possible losses based upon an

analysis of each matter which includes consideration of outside legal counsel and, if applicable, other experts.

On February 10, 2012, Powerweb Energy, Inc.

filed a lawsuit against Hubbell Lighting, Inc. and Hubbell Building Automation, Inc., two wholly owned subsidiaries of the Company,

in the U.S. District Court for the District of Connecticut (the “District Court”). The case is captioned Powerweb

Energy, Inc. v. Hubbell Lighting, Inc. and Hubbell Building Automation, Inc. (U.S. D.C., D. Conn, No. 3:12-CV-00220). The

lawsuit alleges breach of contract, breach of the duty of good faith and fair dealing, unjust enrichment, misappropriation of

trade secrets, misappropriation of idea, conversion, breach of fiduciary duty, and unfair trade practices as a result of actions

including the Company’s development and sale of wiHUBB wireless lighting technology. The lawsuit seeks damages, court costs,

interest, attorney’s fees, a constructive trust, and an injunction prohibiting the Company and its two subsidiaries from

using Powerweb’s claimed technology or disclosing the claimed Powerweb technology to any third parties. The Company’s

motion to dismiss the case was denied by the District Court in November 2012. Discovery is now complete, the Company has moved

for summary judgment on all of Powerweb’s claims as well as its principal damages theory, and no trial date has been set.

The Company believes it has meritorious defenses against all claims and will continue to vigorously defend this matter. Given

the inherent uncertainty of litigation, however, the ultimate resolution of this matter remains unclear and could have a material

adverse effect on the Company’s financial position, liquidity and results of operations.

| ITEM 4 |

Mine Safety Disclosures |

Not applicable.

| HUBBELL

INCORPORATED - Form 10-K |

10 |

| ITEM 5 |

Market for the Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

The Company’s Class A and Class B Common Stock is principally

traded on the New York Stock Exchange under the symbols “HUBA” and “HUBB”. The following tables provide

information on market prices, dividends declared, number of common shareholders, and repurchases by the Company of shares of its

Class A and Class B Common Stock.

| Market Prices (Dollars Per Share) | |

| | |

Class A Common | | |

Class B Common | |

| Years Ended December 31, | |

| | |

High | | |

Low | | |

High | | |

Low | |

| 2013

— Fourth quarter | |

| | | |

| 97.98 | | |

| 91.02 | | |

| 109.29 | | |

| 101.51 | |

| 2013 —

Third quarter | |

| | | |

| 99.91 | | |

| 89.40 | | |

| 110.90 | | |

| 99.63 | |

| 2013 —

Second quarter | |

| | | |

| 93.51 | | |

| 83.08 | | |

| 102.68 | | |

| 91.94 | |

| 2013 —

First quarter | |

| | | |

| 88.00 | | |

| 78.62 | | |

| 97.73 | | |

| 84.80 | |

| 2012 — Fourth quarter | |

| | | |

| 80.73 | | |

| 72.98 | | |

| 86.48 | | |

| 78.95 | |

| 2012 — Third quarter | |

| | | |

| 78.91 | | |

| 72.91 | | |

| 83.34 | | |

| 78.85 | |

| 2012 — Second quarter | |

| | | |

| 76.66 | | |

| 68.67 | | |

| 81.31 | | |

| 72.82 | |

| 2012 — First quarter | |

| | | |

| 76.95 | | |

| 60.97 | | |

| 79.39 | | |

| 67.80 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Dividends Declared (Dollars

Per Share) | |

| | | |

Class A Common | | |

Class B Common | |

| Years Ended December 31, | |

| | | |

| 2013 | | |

| 2012 | | |

| 2013 | | |

| 2012 | |

| First quarter | |

| | | |

| 0.45 | | |

| 0.41 | | |

| 0.45 | | |

| 0.41 | |

| Second quarter | |

| | | |

| 0.45 | | |

| 0.41 | | |

| 0.45 | | |

| 0.41 | |

| Third quarter | |

| | | |

| 0.45 | | |

| 0.41 | | |

| 0.45 | | |

| 0.41 | |

| Fourth quarter | |

| | | |

| 0.50 | | |

| 0.45 | | |

| 0.50 | | |

| 0.45 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Number of Common Shareholders of Record | |

| | | |

| | | |

| | | |

| | | |

| | |

| At December 31, | |

| 2013 | | |

| 2012 | | |

| 2011 | | |

| 2010 | | |

| 2009 | |

| Class A | |

| 394 | | |

| 426 | | |

| 458 | | |

| 483 | | |

| 526 | |

| Class B | |

| 2,225 | | |

| 2,389 | | |

| 2,549 | | |

| 2,731 | | |

| 2,860 | |

Our dividends are declared at the discretion of our Board of Directors.

In October 2013, the Company’s Board of Directors approved an increase in the common stock dividend rate from $0.45 to $0.50

per share per quarter. The increased quarterly dividend payment commenced with the December 13, 2013 dividend payment made to the

shareholders of record on November 29, 2013.

Purchases of Equity Securities

In September 2011, the Board of Directors approved a stock repurchase

program and authorized the repurchase of up to $200 million of Class A and Class B Common Stock. During 2013, the Company

spent $31.0 million on the repurchase of common shares. There were no shares repurchased during the fourth quarter of 2013.

As of December 31, 2013, approximately $93.4 million remains authorized for future repurchases under this program. Depending upon

numerous factors, including market conditions and alternative uses of cash, we may conduct discretionary repurchases through open

market and privately negotiated transactions during our normal trading windows.

| HUBBELL

INCORPORATED - Form 10-K |

11 |

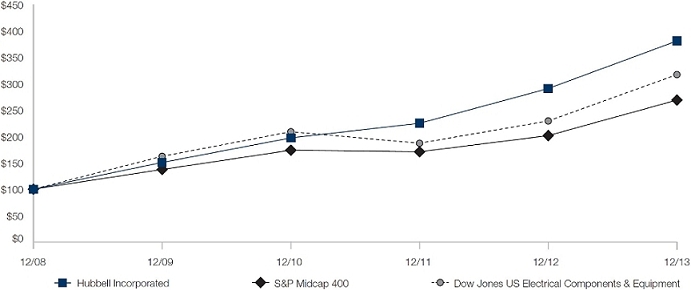

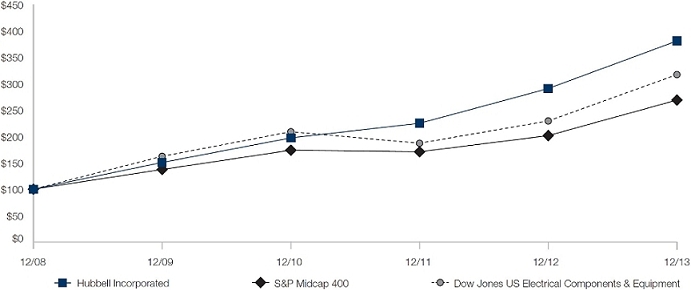

Corporate Performance Graph

The following graph compares the total return to shareholders

on the Company’s Class B Common Stock during the five years ended December 31, 2013, with a cumulative total return

on the (i) Standard & Poor’s MidCap 400 (“S&P MidCap 400”) and (ii) the Dow Jones U.S. Electrical Components

& Equipment Index (“DJUSEC”). The Company is a member of the S&P MidCap 400. As of December 31, 2013, the DJUSEC

reflects a group of sixteen company stocks in the electrical components and equipment market segment, and serves as the Company’s

peer group for purposes of this graph. The comparison assumes $100 was invested on December 31, 2008 in the Company’s Class

B Common Stock and in each of the foregoing indices and assumes reinvestment of dividends.

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN*

Among Hubbell Incorporated, the S&P Midcap 400 Index,

and the Dow Jones US Electrical Components & Equipment Index

| |

*$100 invested on 12/31/08 in

stock or index, including reinvestment of dividends. Fiscal year ending December 31.

Copyright© 2014

S&P, a division of The McGraw-Hill Companies Inc. All rights reserved.

Copyright©

2014 Dow Jones & Co. All rights reserved. |

| |

|

| HUBBELL

INCORPORATED - Form 10-K |

12 |

| ITEM 6 |

Selected Financial Data |

The following summary should be read in conjunction with the consolidated

financial statements and notes contained herein (dollars and shares in millions, except per share amounts).

| OPERATIONS, years ended December 31, | |

2013 | | |

2012 | | |

2011 | | |

2010 | | |

2009 | |

| Net sales | |

$ | 3,183.9 | | |

$ | 3,044.4 | | |

$ | 2,871.6 | | |

$ | 2,541.2 | | |

$ | 2,355.6 | |

| Gross profit | |

$ | 1,070.5 | | |

$ | 1,012.2 | | |

$ | 923.7 | | |

$ | 828.7 | | |

$ | 725.9 | |

| Operating income | |

$ | 507.6 | | |

$ | 471.8 | | |

$ | 423.8 | | |

$ | 367.8 | | |

$ | 294.7 | |

| Operating income as a % of sales | |

| 15.9 | % | |

| 15.5 | % | |

| 14.8 | % | |

| 14.5 | % | |

| 12.5 | % |

| Loss on extinguishment of debt | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | (14.7 | )(1) | |

$ | - | |

| Net income attributable to Hubbell | |

$ | 326.5 | | |

$ | 299.7 | | |

$ | 267.9 | | |

$ | 217.2

| (1) | |

$ | 180.1 | |

| Net income attributable to Hubbell as a %

of net sales | |

| 10.3 | % | |

| 9.8 | % | |

| 9.3 | % | |

| 8.5 | % | |

| 7.6 | % |

| Net income attributable to Hubbell as a %

of Hubbell shareholders’ average equity | |

| 18.3 | % | |

| 19.2 | % | |

| 18.3 | % | |

| 15.8 | % | |

| 15.6 | % |

| Earnings per share — diluted | |

$ | 5.47 | | |

$ | 5.00 | | |

$ | 4.42 | | |

$ | 3.59 | (1) | |

$ | 3.15 | |

| Cash dividends declared per common share | |

$ | 1.85 | | |

$ | 1.68 | | |

$ | 1.52 | | |

$ | 1.44 | | |

$ | 1.40 | |

| Average number of common shares outstanding — diluted | |

| 59.6 | | |

| 59.8 | | |

| 60.4 | | |

| 60.3 | | |

| 57.0 | |

| Cost of acquisitions, net of cash acquired | |

$ | 96.5 | | |

$ | 90.7 | | |

$ | 29.6 | | |

$ | - | | |

$ | 355.8 | |

| FINANCIAL POSITION, AT

YEAR-END | |

| | | |

| | | |

| | | |

| | | |

| | |

| Working capital | |

$ | 1,165.4 | | |

$ | 1,008.8 | | |

$ | 861.4 | | |

$ | 781.1 | | |

$ | 492.8 | |

| Total assets | |

$ | 3,187.2 | | |

$ | 2,947.0 | | |

$ | 2,846.5 | | |

$ | 2,705.8 | | |

$ | 2,402.8 | |

| Total debt | |

$ | 597.5 | | |

$ | 596.7 | | |

$ | 599.2 | | |

$ | 597.7 | | |

$ | 497.2 | |

| Total Hubbell shareholders’ equity | |

$ | 1,906.4 | | |

$ | 1,661.2 | | |

$ | 1,467.8 | | |

$ | 1,459.2 | | |

$ | 1,298.2 | |

| NUMBER OF EMPLOYEES, AT

YEAR-END | |

| 14,300 | | |

| 13,600 | | |

| 13,500 | | |

| 13,000 | | |

| 12,700 | |

| (1) |

In 2010, the Company recorded a $14.7 million pre-tax charge ($9.1 million after-tax) related to its early extinguishment of debt. The earnings per diluted share impact of this charge was $0.15. |

| |

|

| ITEM 7 |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

Executive Overview of the Business

The Company is primarily engaged in the design, manufacture and

sale of quality electrical and electronic products for a broad range of non-residential and residential construction, industrial

and utility applications. Products are either sourced complete, manufactured or assembled by subsidiaries in the United States,

Canada, Switzerland, Puerto Rico, China, Mexico, Italy, the United Kingdom, Brazil and Australia. The Company also participates

in joint ventures in Taiwan and Hong Kong, and maintains offices in Singapore, China, India, Mexico, South Korea and countries

in the Middle East. The Company employs approximately 14,300 individuals worldwide.

The Company continues to make management changes as part of its

succession planning program. Effective January 1, 2013, Mr. David G. Nord was appointed President and Chief Executive Officer succeeding

Mr. Timothy H. Powers who remained the Company’s Chairman of the Board of Directors. In April of 2013, Mr. Joseph A.

Capozzoli was appointed Vice President, Controller succeeding Mr. Darrin S. Wegman who moved into a senior role within one of the

Company’s operating divisions. Most recently, in February 2014, the Company promoted Mr. Gerben W. Bakker to Group Vice President,

Power Systems. Mr. William T. Tolley, the previous Group Vice President, Power Systems, has been named to the newly created position

of Senior Vice President, Growth and Innovation.

The Company’s reporting segments consist of the Electrical

segment and the Power segment. Results for 2013, 2012 and 2011 by segment are included under “Segment Results” within

this Management’s Discussion and Analysis.

The Company is focused on growing profits and delivering attractive

returns to our shareholders by executing a business plan focused on the following key initiatives: revenue growth, price realization,

productivity improvements and capital deployment.

As part of our revenue growth initiative, we remain focused on

expanding market share through new product introductions and more effective utilization of sales and marketing efforts across the

organization. In addition, we continue to assess opportunities to expand sales through acquisitions of businesses that fill product

line gaps or allow for expansion into new markets.

Price realization and productivity improvements are key

areas of focus for our company. Productivity programs impact virtually all functional areas within the Company by reducing or

eliminating waste and improving processes. We continue to expand our efforts surrounding global product and component

sourcing and supplier cost reduction programs. Value engineering efforts, product transfers and the use of lean process

improvement techniques are expected to continue to increase manufacturing efficiency. In addition, we continue to build upon

the benefits of our enterprise resource planning system across all functions and have also implemented a sustainability

program across the organization. Material costs are approximately two-thirds of our cost of goods sold therefore volatility

in this area can significantly impact profitability. Our goal is to have pricing and productivity programs that offset

material and other inflationary cost increases as well as pay for investments in key growth areas.

| HUBBELL INCORPORATED - Form 10-K |

13 |

Outlook

For 2014, we expect our overall net sales to increase by five

to six percent compared to 2013, with balanced growth from completed acquisitions and organic volume. We expect our end markets

to grow approximately two to three percent in 2014 led by double digit growth in the residential market. The industrial and non-residential

markets are expected to grow in the low single digit range while the utility market is anticipated to remain flat.

We plan to continue to work on productivity initiatives, including

improved sourcing, product redesign and lean projects focused on both factory and back office efficiencies. We anticipate cost

increases from materials, including both commodities and purchased products, healthcare and other inflationary costs. We plan to

continue to invest in people and resources to support our growth initiatives. Overall we expect to expand operating margin by approximately

20 to 30 basis points in 2014 compared to 2013. We expect our 2014 tax rate to increase to approximately 32.5% primarily due to

the expiration of the research and development tax credit. In addition, the 2013 tax rate included a benefit from the retroactive

reinstatement of the 2012 research and development tax credit. As a result, we expect to increase our earnings in 2014 through

higher sales, acquisitions, careful management of pricing relative to material costs and by continuing our productivity programs.

In 2014, we anticipate free cash flow (defined as cash flows from

operations less capital expenditures) to approximate net income. Finally, with our strong financial position, we expect to enhance

shareholder value through capital deployments with an emphasis on acquisitions.

Results of Operations

Our operations are classified into two reportable segments: Electrical

and Power. For a complete description of the Company’s segments, see Part I, Item 1 of this Annual Report on Form 10-K. Within

these segments, Hubbell primarily serves customers in the non-residential and residential construction, industrial and utility

markets. The Company’s served markets, in order of magnitude of net sales for the Company, are primarily non-residential

construction, industrial, utility and to a lesser extent, residential construction.

In 2013, our overall end markets improved slightly. The non-residential

new construction market declined slightly as declines in public investment were only partially offset by increases in private spending.

Renovation and relight projects continued to be a source of growth in 2013. The industrial market grew modestly as stronger demand

for high voltage test equipment and increased sales in the extractive industries sector was offset by weakness in the mining and

communications sectors. The utility market was weak with transmission projects being delayed while distribution related spending

was mixed due to budget constraints resulting from lower consumption of electricity. The residential market increased substantially

in 2013 primarily due to improvements in both single and multi-family housing starts.

SUMMARY OF CONSOLIDATED RESULTS (IN MILLIONS, EXCEPT PER SHARE

DATA)

| | |

For the Year Ending December 31, | |

| | |

2013 | | |

% of Net sales | | |

2012 | | |

% of Net sales | | |

2011 | | |

% of Net sales | |

| Net sales | |

$ | 3,183.9 | | |

| | | |

$ | 3,044.4 | | |

| | | |

$ | 2,871.6 | | |

| | |

| Cost of goods sold | |

| 2,113.4 | | |

| 66.4 | % | |

| 2,032.2 | | |

| 66.8 | % | |

| 1,947.9 | | |

| 67.8 | % |

| Gross profit | |

| 1,070.5 | | |

| 33.6 | % | |

| 1,012.2 | | |

| 33.2 | % | |

| 923.7 | | |

| 32.2 | % |

| Selling & administrative expenses | |

| 562.9 | | |

| 17.7 | % | |

| 540.4 | | |

| 17.7 | % | |

| 499.9 | | |

| 17.4 | % |

| Operating income | |

| 507.6 | | |

| 15.9 | % | |

| 471.8 | | |

| 15.5 | % | |

| 423.8 | | |

| 14.8 | % |

| Net income attributable to Hubbell | |

| 326.5 | | |

| 10.3 | % | |

| 299.7 | | |

| 9.8 | % | |

| 267.9 | | |

| 9.3 | % |

| EARNINGS PER SHARE - DILUTED | |

$ | 5.47 | | |

| | | |

$ | 5.00 | | |

| | | |

$ | 4.42 | | |

| | |

2013 Compared to 2012

Net Sales

Net sales for the year ended 2013 were $3.2 billion, an increase

of 5% over the year ended 2012. Acquisitions added three percentage points to net sales in 2013 compared to 2012 while volume increased

net sales by two percentage points. Price realization was offset by unfavorable foreign currency translation, each less than one

percentage point.

Cost of Goods Sold

As a percentage of net sales, cost of goods sold decreased to

66.4% for 2013 compared to 66.8% in 2012. The decrease was primarily due to productivity in excess of other cost increases, favorable

price realization and slightly lower material costs. Lower material costs for commodities such as copper, steel and aluminum more

than offset higher costs for resins, chemicals, purchased finished goods and value added components.

Gross Profit

The gross profit margin for 2013 expanded to 33.6% compared to

33.2% in 2012. The increase was primarily due to productivity in excess of other cost increases, favorable price realization and

slightly lower material costs. Lower material costs for commodities such as copper, steel and aluminum more than offset higher

costs for resins, chemicals, purchased finished goods and value added components, as described above.

Selling & Administrative Expenses (“S&A”)

S&A expenses increased 4% compared to 2012 primarily due to

the impact of the businesses acquired. Higher costs for wages, benefits, legal and advertising were almost entirely offset by lower

pension costs and other spending reductions. As a percentage of net sales, S&A expenses remained constant at 17.7% in 2013

compared to 2012.

| HUBBELL

INCORPORATED - Form 10-K |

14 |

Operating Income

Operating income increased 8% to $507.6 million primarily due

to higher net sales and gross profit partially offset by higher selling and administrative costs, as described above. Operating

margin of 15.9% in 2013 increased 40 basis points compared to 15.5% in 2012 as a result of productivity, lower material costs and

price realization, partially offset by other inflationary increases.

Total Other Expense

In 2013, total other expense was $33.8 million compared to $30.0

million in 2012. The $3.8 million increase was primarily due to higher net foreign currency transaction losses in 2013 compared

to 2012.

Income Taxes

The effective tax rate in 2013 was 30.4% compared to 31.6% in

2012. The lower tax rate for 2013 was due primarily to both the current year and retroactive application of certain tax provisions,

including the research and development tax credit that were part of the American Taxpayer Relief Act of 2012, which became law

during the first quarter of 2013. Additional information related to the Company’s effective tax rate is included in Note

12 — Income Taxes in the Notes to Consolidated Financial Statements.

Net Income Attributable to Hubbell and Earnings Per Diluted

Share

For the reasons described above, net income attributable to Hubbell

and earnings per diluted share in 2013 each increased 9% compared to 2012. The average number of diluted shares outstanding for

the year were lower by approximately 0.2 million as compared to 2012.

Segment Results

Electrical Segment

| (In millions) | |

2013 | | |

2012 | |

| Net sales | |

$ | 2,262.6 | | |

$ | 2,114.6 | |

| Operating income | |

$ | 341.1 | | |

$ | 303.7 | |

| Operating margin | |

| 15.1 | % | |

| 14.4 | % |

Net sales in the Electrical segment increased 7% in 2013 compared

with 2012 due to acquisitions and higher organic volume. Acquisitions and organic volume added four and three percentage points,

respectively, to net sales. In addition, price realization was offset by the negative impacts of foreign currency translation,

each less than one percentage point.

Within the segment, electrical systems products net sales increased

7% in 2013 compared to 2012 due to acquisitions and slightly higher organic demand. Favorable price realization was offset by unfavorable

foreign currency translation. Higher net sales of electrical systems products included growth in high voltage projects and improvements

in the construction sector. The extractive industries sector was essentially flat while industrial demand was lower. Sales of lighting

products increased 8% in 2013 compared to 2012 due to strong organic volume growth in the non-residential market, which continued

to benefit from increased relight and retrofit renovation project demand, strong growth in the residential market and the impact

of the Norlux acquisition.

Operating income in 2013 increased 12% to $341.1 million compared

to 2012 while operating margin expanded by 70 basis points to 15.1%. Operating income increased primarily due to acquisitions,

higher volume and favorable price realization partially offset by unfavorable product mix driven by lower industrial demand. In

addition, productivity exceeded all other cost increases. Operating margin improved primarily due to productivity in excess of

cost increases, lower material costs and favorable price realization.

Power Segment

| (In millions) | |

2013 | | |

2012 | |

| Net sales | |

$ | 921.3 | | |

$ | 929.8 | |

| Operating income | |

$ | 166.5 | | |

$ | 168.1 | |

| Operating margin | |

| 18.1 | % | |

| 18.1 | % |

Net sales in the Power segment declined 1% in 2013 compared to

2012. The decrease was due to lower organic volume and the unfavorable impact of foreign currency translation largely offset by

the impact of an acquisition. The acquisition contributed two percentage points to net sales, while the decline in organic volume

and impact of foreign currency translation decreased net sales by two and one percentage points, respectively. The organic volume

decline was almost entirely due to the impact of higher sales in the fourth quarter of 2012 related to Superstorm Sandy.

Operating income decreased 1% to $166.5 million and operating

margin remained at 18.1% in 2013 compared to 2012. The drop in operating income was primarily due to lower volume, unfavorable

price realization, higher material costs and other cost increases, including $5.0 million of facility consolidation costs, partially

offset by productivity improvements and favorable product mix.

2012 Compared to 2011

Net Sales

Net sales for the year ended 2012 were $3.0 billion, an increase

of 6% over the year ended 2011 primarily due to higher organic volume. Volume added four percentage points to net sales in 2012

compared to 2011 while acquisitions and price realization increased net sales by two and one percentage points, respectively. Foreign

currency translation decreased net sales by one percentage point.

Cost of Goods Sold

As a percentage of net sales, cost of goods sold decreased to

66.8% for 2012 compared to 67.8% in 2011. The decrease was primarily due to price realization, productivity improvements and slightly

lower material costs. Lower costs for commodities such as copper, steel and aluminum were partially offset by higher costs for

resins, chemicals, purchased finished goods and value added components.

Gross Profit

The gross profit margin for 2012 increased to 33.2% compared to

32.2% in 2011. The increase was primarily due to price realization, productivity improvements and slightly lower material costs.

Lower costs for commodities such as copper, steel and aluminum were partially offset by higher costs for resins, chemicals, purchased

finished goods and value added components.

| HUBBELL

INCORPORATED - Form 10-K |

15 |

Selling & Administrative Expenses (“S&A”)

S&A expenses increased 8% compared to 2011 due to the impact