TIAA Retirement Annuity Accounts | Exhibit 99.1 | ||||||||||||||

TIAA Real Estate Account | |||||||||||||||

Real Estate | As of 6/30/19 | ||||||||||||||

Portfolio Net Assets $26.7 Billion | Inception Date 10/2/1995 | Symbol QREARX | Estimated Annual Expenses1 2 3 0.83% | ||||||||||||

Investment Description | Performance | ||||||||||||||

This Account seeks to generate favorable total returns primarily through the rental income and appreciation of real estate investments and offers investors guaranteed, daily liquidity. The Account intends to invest between 75% and 85% of its net assets directly in real estate or real estate-related investments, which TIAA believes have the potential to generate rental income and appreciation. The remainder of its investments will be invested in publicly traded, liquid investments. | Total Return | Average Annual Total Return | |||||||||||||

3 Months | YTD | 1 Year | 3 Years | 5 Years | 10 Years | Since Inception | |||||||||

TIAA Real Estate Account | 1.32% | 3.06% | 5.26% | 4.74% | 6.36% | 6.91% | 6.28% | ||||||||

Learn More | |||||||||||||||

For more information please contact: 800-842-2252 Weekdays, 8 a.m. to 10 p.m. (ET), Saturdays, 9 a.m. to 6 p.m. (ET), or visit TIAA.org | The returns quoted represent past performance, which is no guarantee of future results. Returns and the principal value of your investment will fluctuate. Current performance may be higher or lower than that shown, and you may have a gain or a loss when you redeem your accumulation units. For current performance information, including performance to the most recent month-end, please visit TIAA.org, or call 800-842-2252. Performance may reflect waivers or reimbursements of certain expenses. Absent these waivers or reimbursement arrangements, performance may be lower. | ||||||||||||||

1 The total annual expense deduction, which includes investment management, administration, and distribution expenses, mortality and expense risk charges, and the liquidity guarantee, is estimated each year based on projected expense and asset levels. Differences between actual expenses and the estimate are adjusted quarterly and are reflected in current investment results. Historically, adjustments have been small. | |||||||||||||||

2 The Account’s total annual expense deduction appears in the Account’s prospectus, and may be different than that shown herein due to rounding. Please refer to the prospectus for further details. | |||||||||||||||

3 The liquidity guarantee expense deduction of 0.24% will not be effective until August 1, 2019. Between May 1, 2019 and August 1, 2019, the liquidity guarantee expense charge will remain at 0.20% and the total expense deduction will remain at 0.79%. | |||||||||||||||

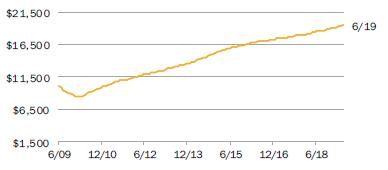

Hypothetical Growth of $10,000 | |||||||||||||||

The chart illustrates the performance of a hypothetical $10,000 investment on June 30, 2009 and redeemed on June 30, 2019. |  | ||||||||||||||

— TIAA Real Estate Account | $19,501 | ||||||||||||||

The total returns are not adjusted to reflect sales charges, the effects of taxation or redemption fees, but are adjusted to reflect actual ongoing expenses, and assume reinvestment of dividends and capital gains, net of all recurring costs. | |||||||||||||||

Properties by Type | (As of 6/30/19) | Properties by Region | (As of 6/30/19) | ||||||||||||

% of Real Estate Investments3 4 | % of Real Estate Investments3 | ||||||||||||||

Office | 38.2 | % | West | 40.0 | % | ||||||||||

Apartment | 24.7 | % | East | 32.5 | % | ||||||||||

Retail | 19.0 | % | South | 25.2 | % | ||||||||||

Industrial | 14.9 | % | Midwest | 2.3 | % | ||||||||||

Other | 3.2 | % | |||||||||||||

| 3 Wholly owned properties are represented at fair value and gross of any debt, while joint venture properties are represented at the net equity value. | ||||||||||||||

4 Other properties represents interest in Storage Portfolio investments, a fee interest encumbered by a ground lease real estate investment and land. | |||||||||||||||