UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

N-CSR

CERTIFIED

SHAREHOLDER REPORT

OF

REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment

Company Act file number: 811-02968-99

| Name of Registrant: |

Vanguard Trustees’

Equity Fund |

| Address of Registrant: |

P.O. Box 2600 |

| |

Valley Forge, PA 19482 |

| Name

and address of agent for service: |

Anne E. Robinson,

Esquire |

| |

P.O. Box 876 |

| |

Valley Forge, PA 19482 |

Registrant’s

telephone number, including area code: (610) 669-1000

Date

of fiscal year end: October 31

Date

of reporting period: November 1, 2021—October 31, 2022

Item

1: Reports to Shareholders

Annual Report | October 31, 2022

Vanguard

International Value Fund

Contents

Please note: The

opinions expressed in this report are just that—informed opinions. They should not be considered promises or advice. Also, please keep in mind that the information and opinions cover the period through the date

on the front of this report. Of course, the risks of investing in your fund are spelled out in the prospectus.

Your Fund’s Performance at a Glance

| •

| The 12 months ended October 31, 2022, were a volatile, challenging period for financial markets. Vanguard International Value Fund returned –21.28%, which, was ahead of the –24.73% return of its

benchmark.

|

| •

| The global economic backdrop deteriorated as inflation reached multidecade highs, notably in energy and food prices after Russia invaded Ukraine. Price increases then broadened to other goods and services, adding to

concerns that inflation would remain stubbornly high. Many central banks tightened aggressively to try to rein in inflation, which increased fears of a recession.

|

| •

| All sectors except energy declined for both the fund and its benchmark. The advisors’ selections in energy and financial stocks helped performance relative to the benchmark, as did an underweight to

information technology. The health care, utilities, and consumer staples sectors all detracted slightly.

|

| •

| Declines prevailed in most regions, but emerging markets aided relative performance primarily through an underweight to China, an overweight to Brazil, and security selection in Indonesia. European stocks were

strong contributors, notably through stock selection in France and the Netherlands. Pacific markets, particularly Japan, Australia, and Hong Kong, hurt relative performance the most.

|

| •

| For the decade ended October 31, 2022, the fund’s average annualized return was 3.93%, outpacing the 3.27% return of its benchmark.

|

Market Barometer

|

| Average Annual Total Returns

Periods Ended October 31, 2022

|

|

| One Year

| Three Years

| Five Years

|

| Stocks

|

|

|

|

| Russell 1000 Index (Large-caps)

| -16.38%

| 9.99%

| 10.19%

|

| Russell 2000 Index (Small-caps)

| -18.54

| 7.05

| 5.56

|

| Russell 3000 Index (Broad U.S. market)

| -16.52

| 9.79

| 9.87

|

| FTSE All-World ex US Index (International)

| -24.20

| -1.16

| -0.18

|

| Bonds

|

|

|

|

Bloomberg U.S. Aggregate Float Adjusted Index

(Broad taxable market)

| -15.69%

| -3.73%

| -0.50%

|

Bloomberg Municipal Bond Index

(Broad tax-exempt market)

| -11.98

| -2.18

| 0.37

|

| FTSE Three-Month U.S. Treasury Bill Index

| 0.88

| 0.59

| 1.15

|

| CPI

|

|

|

|

| Consumer Price Index

| 7.75%

| 5.01%

| 3.85%

|

For the 12 months ended October 31, 2022,

Vanguard International Value Fund returned –21.28%. It outpaced its benchmark, the MSCI ACWI ex USA Index, which returned –24.73%.

Your fund is managed by three

independent advisors, a strategy that enhances its diversification by providing exposure to distinct yet complementary investment approaches. It’s not uncommon for different advisors to have different views

about individual securities or the broader investment environment.

The accompanying table lists

the advisors, the amount and percentage of fund assets each manages, and brief descriptions of their investment strategies.

The advisors have provided the

following assessment of the investment environment during the past 12 months and the notable successes and shortfalls in their portfolios. These comments were prepared on November 15, 2022.

Lazard Asset Management LLC

Portfolio Managers:

Michael G. Fry, Managing

Director

Michael A. Bennett, CPA,

Managing Director

International markets fell

sharply as the level and sustainability of inflation continued to surprise investors. The resulting higher interest rate environment, along with some rolling COVID

lockdowns, drove very weak equity markets for

international investors. The U.S. dollar appreciated on interest rate differentials and its perceived safe-haven status. The deeply discounted valuations of international benchmarks relative to the U.S. have supported

outperformance versus the U.S. in local terms. Weaker currencies contributed to a nearly 12-percentage-point headwind for international equities, a level that now represents the largest headwind to local performance

over the past 20 years.

Stock selection in the

financial sector was a large driver of strong relative performance during the period, where our preference for high-quality, strong deposit franchise banks was rewarded amid rising rates. Key outperformers were

Mexico’s Grupo Banorte, Indonesia’s Bank Mandiri, and India’s ICICI Bank. Stock selection in the energy sector was also beneficial, as shares of U.K.-based integrated oil and gas company BP rose

after the company announced a 10% dividend increase and a $3.5 billion share buyback. These results support our investment thesis of strong cash-flow production and should enable shareholder returns in the low-to-mid

teens (through buyback and dividends) as well as debt paydown.

In contrast, stock selection

in the utilities sector hurt relative returns. China Longyuan, the Chinese wind farm company, underperformed as investors gauged the impact of COVID restrictions in China, which prompted a general sell-off in Hong

Kong stocks. Additionally, slightly weaker wind speeds in China

during the first half led to some concerns

over results, which proved to be fine.

In this environment, where the

market, in our opinion, is expecting a contraction in earnings, we are finding an increasing number of relative value opportunities. Many are high-quality compounders whose valuations have fallen enough in our

estimation because of higher interest rates. Others are very inexpensive but higher-quality cyclicals whose valuations, in our view, are already discounting pressure to earnings. We believe the portfolio is well

balanced within relative value, between more defensive compounders and higher-quality cyclicals, and we continue to avoid the extremes of still-expensive growth and low quality.

Higher inflation and interest

rates have changed the investment landscape, and we anticipate a much broader set of relative value ideas to materialize. This leadership, driven by the combination of higher financial productivity and less expensive

valuations, should enable stock selection to drive performance once again.

Sprucegrove Investment

Management Ltd.

Portfolio Managers:

Arjun Kumar, CFA,

Chief Executive Officer and Managing

Director

Co-Lead of International

Equities

Shirley Woo, CFA, Managing

Director

Co-Lead of International Equities

The global economy was still

facing several post-COVID challenges during the period, including inflation concerns, and the start of the conflict in Ukraine added another layer of uncertainty. International equities steadily declined to reach

two-year lows.

The sharp rise in commodity

prices, particularly in energy, further fueled inflationary pressures that forced central banks to raise rates quicker and by wider margins than anticipated. This, combined with the magnitude of the energy shock in

Europe, makes a recession in the region highly likely in the coming months.

This environment was also

marked by large currency extremes. The U.S. dollar has risen to its highest level in decades, supported by the Federal Reserve’s aggressive rate hikes and its safe-haven appeal during times of market volatility.

This has weighed on currency-adjusted returns for U.S.-based investors.

Outperformance over the past

year was led by stock selection in the information technology, communication services, and consumer discretionary sectors, which contain some of the most highly valued stocks in the index. Our discipline on valuations

was an advantage this year, as higher interest rates hurt growth stocks the most.

From a regional perspective,

emerging markets was a significant contributor due to an underweight position to China, no

exposure to Russia, and strong performance

from several of our Brazilian and Indonesian holdings, which provided rare positive returns.

Critical to understanding is

how the portfolio is positioned today. Our bottom-up, fundamental approach has been consistently applied over the decades, as we continue to focus on constructing portfolios of quality companies at attractive

valuations. Over the course of the past year, we have added new names to the portfolio and augmented several existing positions as opportunities presented themselves.

As compared to the benchmark

at the end of the period, the fund represents higher quality and lower risk (as gauged by financial leverage) and was more attractively valued. These characteristics are critical to our quest to achieve superior

investment returns through a full market cycle.

ARGA Investment Management,

LP

Portfolio Managers:

A. Rama Krishna, CFA, Founder

and

Chief Investment Officer

Steven Morrow, CFA, Director

of Research

International equities plunged

as world markets reacted to rate hikes, ongoing inflation, recessionary fears, supply chain disruptions, adverse regulation, and geopolitical tensions. Investor attention generally fixated on risks rather than

opportunities.

In ARGA’s experience as

a value manager, fear and uncertainty create opportunity. Accordingly, ARGA’s response to the year’s chaos was to identify new investment opportunities and control risk. The portfolio’s long-term

orientation took advantage of significant near-term stress affecting many global businesses. Fundamental research showed many stressed businesses appear capable of surviving prolonged economic weakness and emerging

competitively stronger when conditions normalize. Companies deemed most underpriced relative to their earning power were added to the portfolio.

This valuation discipline,

coupled with rigorous risk management, led to a smaller decline in the ARGA portfolio than the broader market. ARGA believes that mandatory stress tests for every portfolio company helped mitigate the downside.

The current portfolio reflects

a combination of older opportunities where full potential has yet to be realized and newer opportunities resulting from recent stress. While portfolio composition arises from company valuations rather than targeted

industries or geographies, broad areas of opportunity include: (1) aerospace, airline, lodging, and other travel holdings positioned to benefit from travel recovery; (2) Chinese internet companies facing regulatory

risk and slowing Chinese growth but with solid franchises generating strong cash flows; and (3) select opportunities in auto, steel, chemical, and other industries.

Market risks and challenges of

the past year may well persist. ARGA believes this creates meaningful opportunity for patient investors in general and value investors in particular.

Vanguard International Value

Fund Investment Advisors

|

| Fund Assets Managed

|

|

| Investment Advisor

| %

| $ Million

| Investment Strategy

|

| Lazard Asset Management LLC

| 39

| 4,594

| The advisor uses a research-driven, bottom-up, relative-value approach in selecting stocks. The goal is to

identify individual stocks that offer an appropriate trade-off between low relative valuation and high financial productivity.

|

| Sprucegrove Investment Management Ltd.

| 35

| 4,090

| The advisor employs a concentrated, low-turnover, value-oriented investment approach that results in a

portfolio of companies with good long-term prospects and below-market price/earnings ratios. In-depth fundamental research on industries and companies is central to this investment process.

|

| ARGA Investment Management, LP

| 24

| 2,767

| The advisor invests in deeply undervalued securities with long-term upside. Its valuation discipline is

based on fundamental research and present value, with full integration of ESG risks and opportunities.

|

| Cash Investments

| 2

| 281

| These short-term reserves are invested by Vanguard in equity index products to simulate investments in

stocks. Each advisor may also maintain a modest cash position.

|

About Your Fund’s Expenses

As a shareholder of the fund,

you incur ongoing costs, which include costs for portfolio management, administrative services, and shareholder reports (like this one), among others. Operating expenses, which are deducted from a fund’s gross

income, directly reduce the investment return of the fund.

A fund‘s expenses are

expressed as a percentage of its average net assets. This figure is known as the expense ratio. The following examples are intended to help you understand the ongoing costs (in dollars) of investing in your fund and

to compare these costs with those of other mutual funds. The examples are based on an investment of $1,000 made at the beginning of the period shown and held for the entire period.

The accompanying table

illustrates your fund’s costs in two ways:

| •

| Based on actual fund return. This section helps you to estimate the actual expenses that you paid over the period. The ”Ending Account Value“ shown is derived from the fund’s actual return, and the

third column shows the dollar amount that would have been paid by an investor who started with $1,000 in the fund. You may use the information here, together with the amount you invested, to estimate the expenses that

you paid over the period.

|

To do so, simply divide your

account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number given for your fund under the heading ”Expenses Paid During Period.“

| •

| Based on hypothetical 5% yearly return. This section is intended to help you compare your fund‘s costs with those of other mutual funds. It assumes that the fund had a yearly return of 5% before expenses, but that the

expense ratio is unchanged. In this case—because the return used is not the fund’s actual return—the results do not apply to your investment. The example is useful in making comparisons because the

Securities and Exchange Commission requires all mutual funds to calculate expenses based on a 5% return. You can assess your fund’s costs by comparing this hypothetical example with the hypothetical examples

that appear in shareholder reports of other funds.

|

Note that the expenses shown

in the table are meant to highlight and help you compare ongoing costs only and do not reflect transaction costs incurred by the fund for buying and selling securities. Further, the expenses do not include any purchase, redemption, or

account service fees described in the fund prospectus. If such fees were applied to your account, your costs would be higher. Your fund does not carry a “sales load.”

The calculations assume no

shares were bought or sold during the period. Your actual costs may have been higher or lower, depending on the amount of your investment and the timing of any purchases or redemptions.

You can find more information

about the fund’s expenses, including annual expense ratios, in the Financial Statements section of this report. For additional information on operating expenses and other shareholder costs, please refer to your

fund’s current prospectus.

| Six Months Ended October 31, 2022

|

|

|

|

| International Value Fund

| Beginning

Account Value

4/30/2022

| Ending

Account Value

10/31/2022

| Expenses

Paid During

Period

|

| Based on Actual Fund Return

| $1,000.00

| $884.60

| $1.85

|

| Based on Hypothetical 5% Yearly Return

| 1,000.00

| 1,023.24

| 1.99

|

The calculations are

based on expenses incurred in the most recent six-month period. The fund's annualized six-month expense ratio for that period is 0.39%. The dollar amounts shown as ”Expenses Paid” are equal to the

annualized expense ratio multiplied by the average account value over the period, multiplied by the number of days in the most recent six-month period, then divided by the number of days in the most recent 12-month

period (184/365).

All of the returns in this

report represent past performance, which is not a guarantee of future results that may be achieved by the fund. (Current performance may be lower or higher than the performance data cited. For performance data current

to the most recent month-end, visit our website at vanguard.com/performance.) Note, too, that both investment returns and principal value can fluctuate widely, so an investor’s shares, when sold, could be worth

more or less than their original cost. The returns shown do not reflect taxes that a shareholder would pay on fund distributions or on the sale of fund shares.

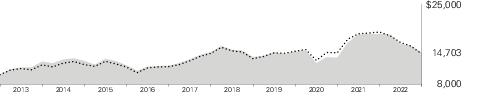

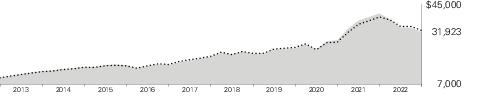

Cumulative Performance: October

31, 2012, Through October 31, 2022

Initial Investment of

$10,000

|

|

| Average Annual Total Returns

Periods Ended October 31, 2022

|

|

|

|

| One

Year

| Five

Years

| Ten

Years

| Final Value

of a $10,000

Investment

|

| International Value Fund

| -21.28%

| -0.13%

| 3.93%

| $14,703

|

| MSCI All Country World Index ex USA

| -24.73

| -0.60

| 3.27

| 13,796

|

See Financial

Highlights for dividend and capital gains information.

|

|

| United Kingdom

| 13.9%

|

| Japan

| 11.3

|

| Germany

| 9.3

|

| France

| 8.9

|

| Switzerland

| 6.9

|

| China

| 6.3

|

| India

| 5.4

|

| Hong Kong

| 4.7

|

| Netherlands

| 4.4

|

| Brazil

| 3.9

|

| South Korea

| 3.4

|

| United States

| 3.4

|

| Singapore

| 2.6

|

| Canada

| 2.5

|

| Indonesia

| 2.4

|

| Ireland

| 2.2

|

| Finland

| 1.2

|

| Other

| 7.3

|

The table reflects the fund’s

investments, except for short-term investments and derivatives.

The fund files its complete

schedule of portfolio holdings with the Securities and Exchange Commission (SEC) for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The fund’s Form N-PORT reports

are available on the SEC’s website at www.sec.gov.

|

|

|

|

|

| Shares

| Market

Value•

($000)

|

| Common Stocks (94.6%)

|

| Australia (0.8%)

|

|

| National Australia Bank Ltd.

| 2,155,160

| 44,767

|

|

| QBE Insurance Group Ltd.

| 4,298,322

| 33,677

|

|

| Adbri Ltd.

| 9,598,354

| 9,677

|

|

|

|

|

|

|

| 88,121

|

| Brazil (3.7%)

|

| 1

| Banco Bradesco SA ADR

| 42,762,052

| 162,068

|

|

| Ambev SA ADR

| 33,935,500

| 103,164

|

|

| Gerdau SA Preference Shares

| 12,126,300

| 60,450

|

|

| Petroleo Brasileiro SA Preference Shares

| 10,417,600

| 60,120

|

|

| Petroleo Brasileiro SA ADR

| 3,893,780

| 49,918

|

|

|

|

|

|

|

| 435,720

|

| Canada (2.3%)

|

|

| Suncor Energy Inc.

| 3,256,143

| 112,000

|

|

| Saputo Inc.

| 2,201,749

| 53,591

|

|

| Bank of Nova Scotia

| 761,351

| 36,801

|

|

| Alimentation Couche-Tard Inc.

| 693,700

| 31,061

|

|

| Stella-Jones Inc.

| 915,400

| 27,569

|

|

| North West Co. Inc.

| 435,500

| 11,332

|

|

|

|

|

|

|

| 272,354

|

| China (5.9%)

|

| *

| Alibaba Group Holding Ltd.

| 21,140,600

| 164,366

|

| *

| Baidu Inc. ADR

| 1,152,791

| 88,269

|

|

| Tencent Holdings Ltd.

| 3,113,800

| 81,821

|

|

| ENN Energy Holdings Ltd.

| 4,943,400

| 49,148

|

|

| China Longyuan Power Group Corp. Ltd. Class H

| 39,737,000

| 45,406

|

|

| Shandong Weigao Group Medical Polymer Co. Ltd. Class H

| 32,448,000

| 44,706

|

|

| Sungrow Power Supply Co. Ltd. Class A

| 2,380,460

| 42,769

|

|

|

|

|

|

| Shares

| Market

Value•

($000)

|

| *

| Alibaba Group Holding Ltd. ADR

| 620,407

| 39,445

|

|

| Wuxi Lead Intelligent Equipment Co. Ltd. Class A

| 4,502,616

| 30,957

|

|

| Autohome Inc. ADR

| 1,112,003

| 29,046

|

|

| Hengan International Group Co. Ltd.

| 7,215,500

| 27,976

|

|

| Ping An Insurance Group Co. of China Ltd. Class H

| 5,304,000

| 21,234

|

| *

| Weibo Corp. ADR

| 1,429,981

| 16,187

|

| *

| Trip.com Group Ltd. ADR

| 641,343

| 14,514

|

|

|

|

|

|

|

| 695,844

|

| Denmark (0.8%)

|

|

| Carlsberg A/S Class B

| 498,698

| 58,720

|

|

| Vestas Wind Systems A/S

| 1,969,298

| 38,822

|

|

|

|

|

|

|

| 97,542

|

| Egypt (0.3%)

|

|

| Commercial International Bank Egypt SAE (Registered) GDR

| 25,685,548

| 32,597

|

| Finland (1.2%)

|

|

| Sampo OYJ Class A

| 1,571,237

| 71,849

|

|

| Nokian Renkaat OYJ

| 2,855,350

| 32,199

|

|

| Nokia OYJ

| 6,980,867

| 31,023

|

|

|

|

|

|

|

| 135,071

|

| France (8.4%)

|

|

| Airbus SE

| 1,637,523

| 177,186

|

|

| TotalEnergies SE

| 3,033,640

| 165,495

|

|

| Air Liquide SA

| 902,385

| 118,044

|

|

| Engie SA

| 8,409,958

| 109,274

|

|

| Bureau Veritas SA

| 2,962,936

| 73,304

|

|

| Pernod Ricard SA

| 416,762

| 73,147

|

|

| Thales SA

| 567,781

| 72,210

|

|

| Legrand SA

| 842,306

| 64,188

|

|

| Societe Generale SA

| 1,854,645

| 42,540

|

|

| Teleperformance

| 158,348

| 42,426

|

| *

| Accor SA

| 1,309,358

| 31,374

|

|

|

|

|

|

| Shares

| Market

Value•

($000)

|

|

| Publicis Groupe SA

| 247,452

| 13,859

|

|

| Safran SA

| 41,270

| 4,596

|

|

|

|

|

|

|

| 987,643

|

| Germany (8.8%)

|

|

| MTU Aero Engines AG

| 628,158

| 112,414

|

|

| Henkel AG & Co. KGaA Preference Shares

| 1,561,313

| 98,361

|

|

| Merck KGaA

| 531,717

| 86,651

|

|

| Fresenius SE & Co. KGaA

| 3,519,031

| 80,984

|

|

| Bayerische Motoren Werke AG

| 919,000

| 72,134

|

|

| Porsche Automobil Holding SE Preference Shares

| 1,209,821

| 67,596

|

|

| BASF SE

| 1,476,590

| 66,256

|

|

| Infineon Technologies AG

| 2,451,511

| 59,487

|

|

| Henkel AG & Co. KGaA

| 975,920

| 57,292

|

| 2

| Covestro AG

| 1,681,860

| 57,093

|

|

| SAP SE

| 478,150

| 46,023

|

|

| Fresenius Medical Care AG & Co. KGaA

| 1,585,910

| 43,867

|

|

| Continental AG

| 830,599

| 43,021

|

|

| Jungheinrich AG Preference Shares

| 1,566,012

| 38,917

|

| 2

| Siemens Healthineers AG

| 790,012

| 36,193

|

|

| FUCHS PETROLUB SE Preference Shares

| 1,257,070

| 36,001

|

|

| Vonovia SE

| 1,612,640

| 35,656

|

|

|

|

|

|

|

| 1,037,946

|

| Hong Kong (4.4%)

|

|

| AIA Group Ltd.

| 18,921,000

| 143,323

|

| *

| Sands China Ltd.

| 47,010,000

| 82,184

|

| *

| Melco Resorts & Entertainment Ltd. ADR

| 10,563,690

| 57,783

|

|

| Jardine Matheson Holdings Ltd.

| 1,173,100

| 54,042

|

|

| Galaxy Entertainment Group Ltd.

| 9,079,000

| 41,479

|

| 2

| ESR Group Ltd.

| 19,250,600

| 32,829

|

|

| Xinyi Glass Holdings Ltd.

| 20,644,000

| 26,531

|

|

| Hongkong Land Holdings Ltd.

| 5,380,000

| 20,712

|

| 2

| WH Group Ltd.

| 40,747,243

| 20,578

|

|

| CK Asset Holdings Ltd.

| 3,466,500

| 19,165

|

|

| Yue Yuen Industrial Holdings Ltd.

| 18,050,500

| 18,351

|

|

|

|

|

|

|

| 516,977

|

| India (5.1%)

|

|

| ICICI Bank Ltd. ADR

| 6,094,587

| 134,325

|

|

| Zee Entertainment Enterprises Ltd. Class B

| 31,279,583

| 99,370

|

|

| Housing Development Finance Corp. Ltd.

| 3,133,250

| 93,680

|

|

| Reliance Industries Ltd.

| 2,790,471

| 86,105

|

|

| Adani Ports & Special Economic Zone Ltd.

| 7,612,517

| 75,799

|

|

|

|

|

|

| Shares

| Market

Value•

($000)

|

|

| UPL Ltd.

| 5,608,124

| 49,509

|

|

| GAIL India Ltd.

| 30,736,329

| 33,881

|

|

| Ambuja Cements Ltd.

| 4,670,849

| 30,099

|

|

|

|

|

|

|

| 602,768

|

| Indonesia (2.2%)

|

|

| Astra International Tbk. PT

| 212,997,700

| 91,020

|

|

| Bank Mandiri Persero Tbk. PT

| 133,290,200

| 90,045

|

|

| Telkom Indonesia Persero Tbk. PT ADR

| 1,567,073

| 43,596

|

|

| Telkom Indonesia Persero Tbk. PT

| 77,847,500

| 21,863

|

|

| Selamat Sempurna Tbk. PT

| 164,317,700

| 15,797

|

|

|

|

|

|

|

| 262,321

|

| Ireland (2.1%)

|

| *

| Ryanair Holdings plc ADR

| 1,534,725

| 105,727

|

| *

| ICON plc

| 379,267

| 75,034

|

|

| CRH plc

| 1,732,400

| 62,398

|

|

|

|

|

|

|

| 243,159

|

| Israel (0.1%)

|

| *

| Check Point Software Technologies Ltd.

| 94,500

| 12,212

|

| Italy (0.8%)

|

|

| Brembo SpA

| 5,290,233

| 55,306

|

|

| UniCredit SpA

| 2,776,866

| 34,437

|

|

|

|

|

|

|

| 89,743

|

| Japan (10.7%)

|

|

| Olympus Corp.

| 4,512,800

| 95,150

|

|

| Mitsubishi Electric Corp.

| 9,260,100

| 81,476

|

|

| Toyota Motor Corp.

| 5,410,100

| 75,063

|

|

| Disco Corp.

| 285,100

| 68,190

|

|

| Bandai Namco Holdings Inc.

| 1,022,700

| 67,603

|

|

| Daikin Industries Ltd.

| 431,600

| 64,648

|

|

| Denso Corp.

| 1,268,100

| 62,918

|

|

| Nidec Corp.

| 1,066,800

| 58,657

|

|

| Hoya Corp.

| 561,100

| 52,161

|

|

| Nomura Research Institute Ltd.

| 2,304,800

| 51,006

|

|

| Nitto Denko Corp.

| 953,000

| 50,210

|

|

| Nihon Kohden Corp.

| 2,226,200

| 49,849

|

|

| ITOCHU Corp.

| 1,803,300

| 46,605

|

|

| Daiwa Securities Group Inc.

| 11,814,800

| 46,097

|

|

| Kubota Corp.

| 3,035,300

| 42,341

|

|

| Daito Trust Construction Co. Ltd.

| 400,000

| 39,610

|

|

| Ain Holdings Inc.

| 939,600

| 39,473

|

|

| Koito Manufacturing Co. Ltd.

| 2,623,200

| 37,241

|

|

| Suzuki Motor Corp.

| 1,063,800

| 35,967

|

|

| Shimano Inc.

| 227,500

| 35,204

|

|

| Subaru Corp.

| 1,996,600

| 31,209

|

|

|

|

|

|

| Shares

| Market

Value•

($000)

|

|

| Kansai Electric Power Co. Inc.

| 4,020,200

| 30,454

|

|

| Komatsu Ltd.

| 1,453,900

| 28,482

|

|

| Nomura Holdings Inc.

| 7,414,800

| 23,994

|

|

| Seria Co. Ltd.

| 1,123,400

| 18,352

|

|

| FANUC Corp.

| 82,900

| 10,848

|

|

| Omron Corp.

| 163,100

| 7,607

|

|

| Taiheiyo Cement Corp.

| 222,600

| 3,025

|

|

|

|

|

|

|

| 1,253,440

|

| Mexico (0.8%)

|

|

| Grupo Financiero Banorte SAB de CV

| 11,158,700

| 90,703

|

| Netherlands (4.1%)

|

|

| Wolters Kluwer NV

| 729,476

| 77,513

|

|

| Koninklijke DSM NV

| 561,313

| 66,028

|

|

| Aegon NV

| 13,585,908

| 62,891

|

|

| Universal Music Group NV

| 2,940,057

| 57,729

|

|

| Akzo Nobel NV

| 749,534

| 46,273

|

|

| SBM Offshore NV

| 3,001,810

| 40,625

|

| *

| AerCap Holdings NV

| 563,815

| 30,113

|

| 2

| ABN AMRO Bank NV

| 2,835,943

| 27,879

|

| *

| Prosus NV

| 621,904

| 26,892

|

|

| Koninklijke Vopak NV

| 1,229,500

| 25,121

|

|

| IMCD NV

| 176,025

| 22,830

|

|

|

|

|

|

|

| 483,894

|

| Norway (0.5%)

|

|

| Equinor ASA

| 1,014,614

| 36,966

|

|

| Bakkafrost P/F

| 481,190

| 24,068

|

|

|

|

|

|

|

| 61,034

|

| Panama (0.7%)

|

| *

| Copa Holdings SA Class A

| 1,114,653

| 83,855

|

| Philippines (0.2%)

|

|

| Puregold Price Club Inc.

| 43,303,300

| 22,468

|

| Singapore (2.5%)

|

|

| United Overseas Bank Ltd.

| 4,032,700

| 79,117

|

|

| DBS Group Holdings Ltd.

| 2,860,400

| 69,154

|

|

| Singapore Telecommunications Ltd.

| 28,890,600

| 50,869

|

|

| Venture Corp. Ltd.

| 3,731,000

| 41,986

|

|

| Sembcorp Industries Ltd.

| 20,083,100

| 41,284

|

| *,1

| SATS Ltd.

| 6,163,700

| 11,897

|

|

|

|

|

|

|

| 294,307

|

| South Africa (0.3%)

|

|

| Mr Price Group Ltd.

| 3,450,376

| 33,209

|

| South Korea (3.3%)

|

|

| Samsung Electronics Co. Ltd.

| 2,498,844

| 104,002

|

|

| POSCO Holdings Inc.

| 568,173

| 99,027

|

|

|

|

|

|

| Shares

| Market

Value•

($000)

|

| 2

| Samsung Electronics Co. Ltd. GDR

| 91,980

| 94,997

|

|

| SK Hynix Inc.

| 1,303,719

| 75,474

|

| *

| SK Square Co. Ltd.

| 309,162

| 7,994

|

|

|

|

|

|

|

| 381,494

|

| Spain (0.3%)

|

| 1

| Industria de Diseno Textil SA

| 1,577,858

| 35,815

|

| Sweden (0.3%)

|

|

| Assa Abloy AB Class B

| 1,845,802

| 37,271

|

| Switzerland (6.5%)

|

| *

| Holcim AG

| 3,855,713

| 175,174

|

|

| Novartis AG (Registered)

| 1,526,264

| 123,461

|

|

| Roche Holding AG

| 332,866

| 110,444

|

|

| Cie Financiere Richemont SA (Registered)

| 974,903

| 95,281

|

|

| ABB Ltd. (Registered)

| 3,243,410

| 90,070

|

|

| Adecco Group AG (Registered)

| 2,048,922

| 64,123

|

|

| Credit Suisse Group AG (Registered)

| 9,768,204

| 40,464

|

|

| Swatch Group AG

| 154,510

| 34,720

|

|

| UBS Group AG (Registered)

| 1,811,608

| 28,722

|

|

|

|

|

|

|

| 762,459

|

| Taiwan (0.6%)

|

|

| Taiwan Semiconductor Manufacturing Co. Ltd.

| 5,694,000

| 68,454

|

| United Kingdom (13.2%)

|

|

| BP plc

| 32,156,484

| 177,909

|

|

| RELX plc

| 5,282,048

| 141,878

|

|

| Shell plc

| 4,693,650

| 130,022

|

|

| Unilever plc

| 2,049,036

| 93,138

|

|

| Compass Group plc

| 4,213,789

| 88,750

|

|

| Anglo American plc

| 2,858,401

| 85,621

|

|

| Smiths Group plc

| 4,720,940

| 84,564

|

|

| HSBC Holdings plc (XHKG)

| 14,812,400

| 76,022

|

|

| HSBC Holdings plc

| 14,415,035

| 73,979

|

|

| Berkeley Group Holdings plc

| 1,592,176

| 63,349

|

|

| IMI plc

| 4,136,690

| 58,273

|

|

| Victrex plc

| 2,598,116

| 49,345

|

|

| Weir Group plc

| 2,721,260

| 47,415

|

|

| Travis Perkins plc

| 4,999,053

| 47,116

|

|

| Ferguson plc

| 428,260

| 46,706

|

|

| Spectris plc

| 1,176,470

| 40,775

|

|

| Smith & Nephew plc

| 3,445,023

| 40,710

|

|

| Barclays plc

| 22,953,206

| 39,003

|

|

| RS Group plc

| 2,786,400

| 30,660

|

|

| Prudential plc

| 2,736,608

| 25,422

|

| *,1

| easyJet plc

| 6,237,379

| 24,835

|

|

| Taylor Wimpey plc

| 20,793,159

| 22,355

|

|

| Renishaw plc

| 530,507

| 21,288

|

|

|

|

|

|

| Shares

| Market

Value•

($000)

|

|

| Whitbread plc

| 653,543

| 19,235

|

|

| Lloyds Banking Group plc

| 31,286,248

| 15,026

|

|

| Direct Line Insurance Group plc

| 220,462

| 509

|

|

|

|

|

|

|

| 1,543,905

|

| United States (3.2%)

|

|

| Aon plc Class A

| 416,187

| 117,152

|

|

| Accenture plc Class A

| 237,551

| 67,441

|

|

| RenaissanceRe Holdings Ltd.

| 407,363

| 63,011

|

| *

| TechnipFMC plc

| 4,627,975

| 49,010

|

| 1

| Linde plc

| 130,895

| 39,083

|

|

| NXP Semiconductors NV

| 201,591

| 29,448

|

| *

| Capri Holdings Ltd.

| 317,426

| 14,500

|

|

|

|

|

|

|

| 379,645

|

| Vietnam (0.5%)

|

|

| Vietnam Dairy Products JSC

| 16,775,900

| 52,952

|

|

| Phu Nhuan Jewelry JSC

| 2,229,200

| 9,251

|

|

|

|

|

|

|

| 62,203

|

Total Common Stocks

(Cost $12,065,534)

| 11,104,174

|

| Temporary Cash Investments (5.9%)

|

| Money Market Fund (5.9%)

|

| 3,4

| Vanguard Market Liquidity Fund, 3.117% (Cost $685,572)

| 6,858,440

| 685,707

|

Total Investments (100.5%)

(Cost $12,751,106)

|

| 11,789,881

|

| Other Assets and Liabilities—Net (-0.5%)

|

| (57,350)

|

| Net Assets (100%)

|

| 11,732,531

|

| •

| See Note A in Notes to Financial Statements.

|

| *

| Non-income-producing security.

|

| 1

| Includes partial security positions on loan to broker-dealers. The total value of securities on loan is $106,341,000.

|

| 2

| Security exempt from registration under Rule 144A of the Securities Act of 1933. Such securities may be sold in transactions exempt from registration, normally to qualified

institutional buyers. At October 31, 2022, the aggregate value was $269,569,000, representing 2.3% of net assets.

|

| 3

| Affiliated money market fund available only to Vanguard funds and certain trusts and accounts managed by Vanguard. Rate shown is the 7-day yield.

|

| 4

| Collateral of $113,548,000 was received for securities on loan.

|

|

| ADR—American Depositary Receipt.

|

|

| GDR—Global Depositary Receipt.

|

Derivative Financial

Instruments Outstanding as of Period End

| Futures Contracts

|

|

|

|

| ($000)

|

|

| Expiration

| Number of

Long (Short)

Contracts

| Notional

Amount

| Value and

Unrealized

Appreciation

(Depreciation)

|

| Long Futures Contracts

|

| MSCI EAFE Index

| December 2022

| 2,328

| 204,387

| (6,775)

|

| MSCI Emerging Market Index

| December 2022

| 1,997

| 85,232

| (9,844)

|

|

|

|

|

| (16,619)

|

See accompanying

Notes, which are an integral part of the Financial Statements.

Statement of Assets and Liabilities

|

|

| ($000s, except shares and per-share amounts)

| Amount

|

| Assets

|

|

| Investments in Securities, at Value1

|

|

| Unaffiliated Issuers (Cost $12,065,534)

| 11,104,174

|

| Affiliated Issuers (Cost $685,572)

| 685,707

|

| Total Investments in Securities

| 11,789,881

|

| Investment in Vanguard

| 452

|

| Foreign Currency, at Value (Cost $18,195)

| 18,096

|

| Cash Collateral Pledged—Futures Contracts

| 14,752

|

| Receivables for Investment Securities Sold

| 27,765

|

| Receivables for Accrued Income

| 42,841

|

| Receivables for Capital Shares Issued

| 7,815

|

| Total Assets

| 11,901,602

|

| Liabilities

|

|

| Due to Custodian

| 860

|

| Payables for Investment Securities Purchased

| 20,329

|

| Collateral for Securities on Loan

| 113,548

|

| Payables for Capital Shares Redeemed

| 11,894

|

| Payables to Investment Advisor

| 5,305

|

| Payables to Vanguard

| 1,496

|

| Variation Margin Payable—Futures Contracts

| 2,122

|

| Deferred Foreign Capital Gains Taxes

| 13,517

|

| Total Liabilities

| 169,071

|

| Net Assets

| 11,732,531

|

| 1 Includes $106,341 of securities on loan.

|

|

At October 31, 2022, net assets consisted of:

|

|

|

|

|

| Paid-in Capital

| 12,745,069

|

| Total Distributable Earnings (Loss)

| (1,012,538)

|

| Net Assets

| 11,732,531

|

|

|

|

| Net Assets

|

|

Applicable to 355,915,884 outstanding $.001 par value shares of

beneficial interest (unlimited authorization)

| 11,732,531

|

| Net Asset Value Per Share

| $32.96

|

See accompanying Notes, which are an

integral part of the Financial Statements.

|

|

|

| Year Ended

October 31, 2022

|

|

| ($000)

|

| Investment Income

|

|

| Income

|

|

| Dividends1

| 410,933

|

| Interest2

| 5,917

|

| Securities Lending—Net

| 822

|

| Total Income

| 417,672

|

| Expenses

|

|

| Investment Advisory Fees—Note B

|

|

| Basic Fee

| 22,279

|

| Performance Adjustment

| 492

|

| The Vanguard Group—Note C

|

|

| Management and Administrative

| 26,339

|

| Marketing and Distribution

| 1,181

|

| Custodian Fees

| 737

|

| Auditing Fees

| 42

|

| Shareholders’ Reports

| 223

|

| Trustees’ Fees and Expenses

| 5

|

| Other Expenses

| 545

|

| Total Expenses

| 51,843

|

| Net Investment Income

| 365,829

|

| Realized Net Gain (Loss)

|

|

| Investment Securities Sold2,3

| (230,362)

|

| Futures Contracts

| (74,220)

|

| Forward Currency Contracts

| 95

|

| Foreign Currencies

| (9,992)

|

| Realized Net Gain (Loss)

| (314,479)

|

| Change in Unrealized Appreciation (Depreciation)

|

|

| Investment Securities2,4

| (3,243,240)

|

| Futures Contracts

| (13,965)

|

| Foreign Currencies

| (2,315)

|

| Change in Unrealized Appreciation (Depreciation)

| (3,259,520)

|

| Net Increase (Decrease) in Net Assets Resulting from Operations

| (3,208,170)

|

| 1

| Dividends are net of foreign withholding taxes of $28,171,000.

|

| 2

| Interest income, realized net gain (loss), capital gain distributions received, and change in unrealized appreciation (depreciation) from an affiliated company of the fund were

$5,917,000, ($263,000), $19,000, and $82,000, respectively. Purchases and sales are for temporary cash investment purposes.

|

| 3

| Realized Gain (Loss) is net of foreign capital gains taxes of $4,497,000.

|

| 4

| The change in unrealized appreciation (depreciation) is net of the change in deferred foreign capital gains taxes of ($7,973,000).

|

See accompanying Notes, which are an

integral part of the Financial Statements.

Statement of Changes in Net Assets

|

|

|

| Year Ended October 31,

|

|

| 2022

($000)

| 2021

($000)

|

| Increase (Decrease) in Net Assets

|

|

|

| Operations

|

|

|

| Net Investment Income

| 365,829

| 351,127

|

| Realized Net Gain (Loss)

| (314,479)

| 897,431

|

| Change in Unrealized Appreciation (Depreciation)

| (3,259,520)

| 2,275,436

|

| Net Increase (Decrease) in Net Assets Resulting from Operations

| (3,208,170)

| 3,523,994

|

| Distributions

|

|

|

| Total Distributions

| (633,591)

| (189,189)

|

| Capital Share Transactions

|

|

|

| Issued

| 2,352,101

| 4,442,988

|

| Issued in Lieu of Cash Distributions

| 576,930

| 173,403

|

| Redeemed

| (2,573,910)

| (2,140,447)

|

| Net Increase (Decrease) from Capital Share Transactions

| 355,121

| 2,475,944

|

| Total Increase (Decrease)

| (3,486,640)

| 5,810,749

|

| Net Assets

|

|

|

| Beginning of Period

| 15,219,171

| 9,408,422

|

| End of Period

| 11,732,531

| 15,219,171

|

See accompanying Notes, which are an

integral part of the Financial Statements.

For a Share Outstanding

Throughout Each Period

| Year Ended October 31,

|

| 2022

| 2021

| 2020

| 2019

| 2018

|

| Net Asset Value, Beginning of Period

| $43.76

| $32.48

| $36.63

| $35.86

| $39.26

|

| Investment Operations

|

|

|

|

|

|

| Net Investment Income1

| 1.019

| 1.091

| .684

| 1.104

| .950

|

| Net Realized and Unrealized Gain (Loss) on Investments

| (10.011)

| 10.824

| (3.723)

| 1.669

| (3.607)

|

| Total from Investment Operations

| (8.992)

| 11.915

| (3.039)

| 2.773

| (2.657)

|

| Distributions

|

|

|

|

|

|

| Dividends from Net Investment Income

| (1.087)

| (.635)

| (1.111)

| (.943)

| (.743)

|

| Distributions from Realized Capital Gains

| (.721)

| —

| —

| (1.060)

| —

|

| Total Distributions

| (1.808)

| (.635)

| (1.111)

| (2.003)

| (.743)

|

| Net Asset Value, End of Period

| $32.96

| $43.76

| $32.48

| $36.63

| $35.86

|

| Total Return2

| -21.28%

| 36.91%

| -8.69%

| 8.48%

| -6.95%

|

| Ratios/Supplemental Data

|

|

|

|

|

|

| Net Assets, End of Period (Millions)

| $11,733

| $15,219

| $9,408

| $10,360

| $9,524

|

| Ratio of Total Expenses to Average Net Assets3

| 0.38%

| 0.36%

| 0.35%

| 0.37%

| 0.38%

|

| Ratio of Net Investment Income to Average Net Assets

| 2.68%

| 2.56%

| 2.05%

| 3.15%

| 2.41%

|

| Portfolio Turnover Rate

| 37%

| 33%

| 72%

| 38%

| 28%

|

| 1

| Calculated based on average shares outstanding.

|

| 2

| Total returns do not include account service fees that may have applied in the periods shown. Fund prospectuses provide information about any applicable account service fees.

|

| 3

| Includes performance-based investment advisory fee increases (decreases) of 0.00%, (0.01%), (0.02%), (0.01%), and (0.01%).

|

See accompanying Notes, which are an

integral part of the Financial Statements.

Notes to Financial Statements

Vanguard International Value

Fund is registered under the Investment Company Act of 1940 as an open-end investment company, or mutual fund. The fund invests in securities of foreign issuers, which may subject it to investment risks not normally

associated with investing in securities of U.S. corporations. Significant market disruptions, such as those caused by pandemics (e.g., COVID-19 pandemic), natural or environmental disasters, war (e.g., Russia's

invasion of Ukraine), acts of terrorism, or other events, can adversely affect local and global markets and normal market operations. Any such disruptions could have an adverse impact on the value of the fund's

investments and fund performance.

A. The following significant accounting policies conform to generally accepted accounting principles for U.S. investment companies. The fund consistently follows such policies in preparing its

financial statements.

1. Security Valuation:

Securities are valued as of the close of trading on the New York Stock Exchange (generally 4 p.m., Eastern time) on the valuation date. Equity securities are valued at the latest quoted sales prices or official

closing prices taken from the primary market in which each security trades; such securities not traded on the valuation date are valued at the mean of the latest quoted bid and asked prices. Securities for which

market quotations are not readily available, or whose values have been affected by events occurring before the fund’s pricing time but after the close of the securities’ primary markets, are valued by

methods deemed by the valuation designee to represent fair value and subject to oversight by the board of trustees. These procedures include obtaining quotations from an independent pricing service, monitoring news to

identify significant market- or security-specific events, and evaluating changes in the values of foreign market proxies (for example, ADRs, futures contracts, or exchange-traded funds), between the time the foreign

markets close and the fund’s pricing time. When fair-value pricing is employed, the prices of securities used by a fund to calculate its net asset value may differ from quoted or published prices for the same

securities. Investments in Vanguard Market Liquidity Fund are valued at that fund's net asset value.

2. Foreign Currency:

Securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollars using exchange rates obtained from an independent third party as of the fund’s pricing time on the

valuation date. Realized gains (losses) and unrealized appreciation (depreciation) on investment securities include the effects of changes in exchange rates since the securities were purchased, combined with the

effects of changes in security prices. Fluctuations in the value of other assets and liabilities resulting from changes in exchange rates are recorded as unrealized foreign currency gains (losses) until the assets or

liabilities are settled in cash, at which time they are recorded as realized foreign currency gains (losses).

3. Futures Contracts:

The fund uses index futures contracts to a limited extent, with the objective of maintaining full exposure to the stock market while maintaining liquidity. The fund may purchase or sell futures contracts to achieve a

desired level of investment, whether to accommodate portfolio turnover or cash flows from capital share transactions. The primary risks associated with the use of futures contracts are imperfect correlation between

changes in market values of stocks held by the fund and the prices of futures contracts, and the possibility of an illiquid market. Counterparty risk involving futures is mitigated because a regulated clearinghouse is

the counterparty instead of the clearing broker. To further mitigate counterparty risk, the fund trades futures contracts on an exchange, monitors the financial strength of its clearing brokers and clearinghouse, and

has entered into clearing agreements with its clearing brokers. The

clearinghouse imposes initial margin

requirements to secure the fund’s performance and requires daily settlement of variation margin representing changes in the market value of each contract. Any securities pledged as initial margin for open

contracts are noted in the Schedule of Investments.

Futures contracts are valued

at their quoted daily settlement prices. The notional amounts of the contracts are not recorded in the Statement of Assets and Liabilities. Fluctuations in the value of the contracts are recorded in the Statement of

Assets and Liabilities as an asset (liability) and in the Statement of Operations as unrealized appreciation (depreciation) until the contracts are closed, when they are recorded as realized gains (losses) on futures

contracts.

During the year ended October

31, 2022, the fund’s average investments in long and short futures contracts represented 2% and 0% of net assets, respectively, based on the average of the notional amounts at each quarter-end during the

period.

4. Forward Currency

Contracts: The fund enters into forward currency contracts to protect the value of securities and related receivables and payables against changes in future foreign exchange rates. The fund’s risks in using

these contracts include movement in the values of the foreign currencies relative to the U.S. dollar and the ability of the counterparties to fulfill their obligations under the contracts. The fund mitigates its

counterparty risk by entering into forward currency contracts only with a diverse group of prequalified counterparties, monitoring their financial strength, entering into master netting arrangements with its

counterparties, and requiring its counterparties to transfer collateral as security for their performance. In the absence of a default, the collateral pledged or received by the fund cannot be repledged, resold, or

rehypothecated. The master netting arrangements provide that, in the event of a counterparty’s default (including bankruptcy), the fund may terminate the forward currency contracts, determine the net amount owed

by either party in accordance with its master netting arrangements, and sell or retain any collateral held up to the net amount owed to the fund under the master netting arrangements. The forward currency contracts

contain provisions whereby a counterparty may terminate open contracts if the fund’s net assets decline below a certain level, triggering a payment by the fund if the fund is in a net liability position at the

time of the termination. The payment amount would be reduced by any collateral the fund has pledged. Any securities pledged as collateral for open contracts are noted in the Schedule of Investments. The value of

collateral received or pledged is compared daily to the value of the forward currency contracts exposure with each counterparty, and any difference, if in excess of a specified minimum transfer amount, is adjusted and

settled within two business days.

Forward currency contracts are

valued at their quoted daily prices obtained from an independent third party, adjusted for currency risk based on the expiration date of each contract. The notional amounts of the contracts are not recorded in the

Statement of Assets and Liabilities. Fluctuations in the value of the contracts are recorded in the Statement of Assets and Liabilities as an asset (liability) and in the Statement of Operations as unrealized

appreciation (depreciation) until the contracts are closed, when they are recorded as realized gains (losses) on forward currency contracts.

During the year ended October

31, 2022, the fund’s average investment in forward currency contracts represented less than 1% of net assets, based on the average of the notional amounts at each quarter-end during the period. The fund had no

open forward currency contracts at October 31, 2022.

5. Federal Income Taxes:

The fund intends to continue to qualify as a regulated investment company and distribute virtually all of its taxable income. The fund’s tax returns are open to examination by the relevant tax authorities until

expiration of the applicable statute of limitations, which is generally three years after the filing of the tax return. Management has analyzed the fund’s tax positions taken for all open federal and state

income tax years, and has concluded that no provision for income tax is required in the fund’s financial statements.

6. Distributions:

Distributions to shareholders are recorded on the ex-dividend date. Distributions are determined on a tax basis at the fiscal year-end and may differ from net investment income and realized capital gains for financial

reporting purposes.

7. Securities Lending:

To earn additional income, the fund lends its securities to qualified institutional borrowers. Security loans are subject to termination by the fund at any time, and are required to be secured at all times by

collateral in an amount at least equal to the market value of securities loaned. Daily market fluctuations could cause the value of loaned securities to be more or less than the value of the collateral received. When

this occurs, the collateral is adjusted and settled before the opening of the market on the next business day. The fund further mitigates its counterparty risk by entering into securities lending transactions only

with a diverse group of prequalified counterparties, monitoring their financial strength, and entering into master securities lending agreements with its counterparties. The master securities lending agreements

provide that, in the event of a counterparty’s default (including bankruptcy), the fund may terminate any loans with that borrower, determine the net amount owed, and sell or retain the collateral up to the net

amount owed to the fund; however, such actions may be subject to legal proceedings. While collateral mitigates counterparty risk, in the event of a default, the fund may experience delays and costs in recovering the

securities loaned. The fund invests cash collateral received in Vanguard Market Liquidity Fund, and records a liability in the Statement of Assets and Liabilities for the return of the collateral, during the period

the securities are on loan. Collateral investments in Vanguard Market Liquidity Fund are subject to market appreciation or depreciation. Securities lending income represents fees charged to borrowers plus income

earned on invested cash collateral, less expenses associated with the loan. During the term of the loan, the fund is entitled to all distributions made on or in respect of the loaned securities.

8. Credit Facilities and

Interfund Lending Program: The fund and certain other funds managed by The Vanguard Group ("Vanguard") participate in a $4.4 billion committed credit facility provided by a syndicate of lenders pursuant to a credit

agreement and an uncommitted credit facility provided by Vanguard. Both facilities may be renewed annually. Each fund is individually liable for its borrowings, if any, under the credit facilities. Borrowings may be

utilized for temporary or emergency purposes and are subject to the fund’s regulatory and contractual borrowing restrictions. With respect to the committed credit facility, the participating funds are charged

administrative fees and an annual commitment fee of 0.10% of the undrawn committed amount of the facility, which are allocated to the funds based on a method approved by the fund’s board of trustees and included

in Management and Administrative expenses on the fund’s Statement of Operations. Any borrowings under either facility bear interest at an agreed-upon spread plus the higher of the federal funds effective rate,

the overnight bank funding rate, or the Daily Simple Secured Overnight Financing Rate inclusive of an additional agreed-upon spread. However, borrowings under the uncommitted credit facility may bear interest based

upon an alternate rate agreed to by the fund and Vanguard.

In accordance with an

exemptive order (the “Order”) from the SEC, the fund may participate in a joint lending and borrowing program that allows registered open-end Vanguard funds to borrow

money from and lend money to each other for

temporary or emergency purposes (the “Interfund Lending Program”), subject to compliance with the terms and conditions of the Order, and to the extent permitted by the fund’s investment objective and

investment policies. Interfund loans and borrowings normally extend overnight but can have a maximum duration of seven days. Loans may be called on one business day’s notice. The interest rate to be charged is

governed by the conditions of the Order and internal procedures adopted by the board of trustees. The board of trustees is responsible for overseeing the Interfund Lending Program.

For the year ended October 31,

2022, the fund did not utilize the credit facilities or the Interfund Lending Program.

9. Other: Dividend

income is recorded on the ex-dividend date. Non-cash dividends included in income, if any, are recorded at the fair value of the securities received. Interest income includes income distributions received from

Vanguard Market Liquidity Fund and is accrued daily. Security transactions are accounted for on the date securities are bought or sold. Costs used to determine realized gains (losses) on the sale of investment

securities are those of the specific securities sold.

Taxes on foreign dividends and

capital gains have been provided for in accordance with the fund’s understanding of the applicable countries’ tax rules and rates. Deferred foreign capital gains tax, if any, is accrued daily based upon

net unrealized gains. The fund has filed tax reclaims for previously withheld taxes on dividends earned in certain European Union countries. These filings are subject to various administrative and judicial proceedings

within these countries. Amounts related to these reclaims are recorded when there are no significant uncertainties as to the ultimate resolution of proceedings, the likelihood of receipt of these reclaims, and

the potential timing of payment. Such tax reclaims and related professional fees, if any, are included in dividend income and other expenses, respectively.

B. The investment advisory firms Lazard Asset Management LLC, ARGA Investment Management, LP, and Sprucegrove Investment Management Ltd. each provide investment advisory services to a portion

of the fund for a fee calculated at an annual percentage rate of average net assets managed by the advisor. The basic fees of Lazard Asset Management LLC and ARGA Investment Management, LP, are subject to quarterly

adjustments based on performance relative to the MSCI All Country World Index ex US for the preceding five years. The basic fee of Sprucegrove Investment Management Ltd. is subject to quarterly adjustments based on

performance relative to the MSCI All Country World Index ex US since October 31, 2020.

Vanguard manages the cash

reserves of the fund as described below.

For the year ended October 31,

2022, the aggregate investment advisory fee represented an effective annual basic rate of 0.16% of the fund’s average net assets, before a increase of $492,000 (0.00%) based on performance.

C. In accordance with the terms of a Funds’ Service Agreement (the “FSA”) between Vanguard and the fund, Vanguard furnishes to the fund corporate management, administrative,

marketing, distribution, and cash management services at Vanguard’s cost of operations (as defined by the FSA). These costs of operations are allocated to the fund based on methods and guidelines approved by the

board of trustees and are generally settled twice a month.

Upon the request of Vanguard,

the fund may invest up to 0.40% of its net assets as capital in Vanguard. At October 31, 2022, the fund had contributed to Vanguard capital in the amount of $452,000, representing less than 0.01% of the fund’s

net assets and 0.18% of Vanguard’s capital

received pursuant to the FSA. The

fund’s trustees and officers are also directors and employees, respectively, of Vanguard.

D. Various inputs may be used to determine the value of the fund’s investments and derivatives. These inputs are summarized in three broad levels for financial statement purposes. The

inputs or methodologies used to value securities are not necessarily an indication of the risk associated with investing in those securities.

Level 1—Quoted prices in active markets for identical securities.

Level 2—Other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.).

Level 3—Significant unobservable inputs (including the fund’s own assumptions used to determine the fair value of investments). Any investments and derivatives valued with significant

unobservable inputs are noted on the Schedule of Investments.

The following table summarizes

the market value of the fund's investments and derivatives as of October 31, 2022, based on the inputs used to value them:

|

| Level 1

($000)

| Level 2

($000)

| Level 3

($000)

| Total

($000)

|

| Investments

|

|

|

|

|

| Assets

|

|

|

|

|

| Common Stocks—North and South America

| 1,223,194

| 39,083

| —

| 1,262,277

|

| Common Stocks—Other

| 741,248

| 9,100,649

| —

| 9,841,897

|

| Temporary Cash Investments

| 685,707

| —

| —

| 685,707

|

| Total

| 2,650,149

| 9,139,732

| —

| 11,789,881

|

|

|

|

|

|

|

| Derivative Financial Instruments

|

|

|

|

|

| Liabilities

|

|

|

|

|

| Futures Contracts1

| 16,619

| —

| —

| 16,619

|

| 1

| Includes cumulative appreciation (depreciation) on futures contracts and centrally cleared swaps, if any, as reported in the Schedule of Investments. Only current

day’s variation margin is reported within the Statement of Assets and Liabilities.

|

E. Realized net gain (loss) and the change in unrealized appreciation (depreciation) on derivatives for the year ended October 31, 2022, were:

| Realized Net Gain (Loss) on Derivatives

| Equity

Contracts

($000)

| Foreign

Exchange

Contracts

($000)

| Total

($000)

|

| Futures Contracts

| (74,220)

| —

| (74,220)

|

| Forward Currency Contracts

| —

| 95

| 95

|

| Realized Net Gain (Loss) on Derivatives

| (74,220)

| 95

| (74,125)

|

|

|

| Change in Unrealized Appreciation (Depreciation) on Derivatives

|

| Futures Contracts

| (13,965)

| —

| (13,965)

|

F. Permanent differences between book-basis and tax-basis components of net assets are reclassified among capital accounts in the financial statements to reflect their tax character. These

reclassifications have no effect on net assets or net asset value per share. As of period end, permanent differences primarily attributable to the accounting for applicable foreign currency transactions, passive

foreign investment companies, and tax expense on capital gains were reclassified between the individual components of total distributable earnings (loss).

Temporary differences between

book-basis and tax-basis components of total distributable earnings (loss) arise when certain items of income, gain, or loss are recognized in different periods for financial statement and tax purposes; these

differences will reverse at some time in the future. The differences are primarily related to the deferral of losses from wash sales; the recognition of unrealized gains or losses from certain derivative contracts;

and the recognition of unrealized gains from passive foreign investment companies. As of period end, the tax-basis components of total distributable earnings (loss) are detailed in the table as follows:

|

| Amount

($000)

|

| Undistributed Ordinary Income

| 303,807

|

| Undistributed Long-Term Gains

| —

|

| Capital Loss Carryforwards

| (290,452)

|

| Qualified Late-Year Losses

| —

|

| Net Unrealized Gains (Losses)

| (1,029,753)

|

The tax character of

distributions paid was as follows:

|

| Year Ended October 31,

|

|

| 2022

Amount

($000)

| 2021

Amount

($000)

|

| Ordinary Income*

| 633,591

| 189,189

|

| Long-Term Capital Gains

| —

| —

|

| Total

| 633,591

| 189,189

|

| *

| Includes short-term capital gains, if any.

|

As of October 31, 2022, gross

unrealized appreciation and depreciation for investments and derivatives based on cost for U.S. federal income tax purposes were as follows:

|

| Amount

($000)

|

| Tax Cost

| 12,804,237

|

| Gross Unrealized Appreciation

| 1,279,290

|

| Gross Unrealized Depreciation

| (2,293,646)

|

| Net Unrealized Appreciation (Depreciation)

| (1,014,356)

|

G. During the year ended October 31, 2022, the fund purchased $5,116,196,000 of investment securities and sold $4,812,568,000 of investment securities, other than temporary cash

investments.

H. Capital shares issued and redeemed were:

|

| Year Ended October 31,

|

|

|

| 2022

Shares

(000)

|

| 2021

Shares

(000)

|

|

|

|

|

|

| Issued

| 61,320

|

| 104,505

|

|

| Issued in Lieu of Cash Distributions

| 14,416

|

| 4,428

|

|

| Redeemed

| (67,638)

|

| (50,767)

|

|

| Net Increase (Decrease) in Shares Outstanding

| 8,098

|

| 58,166

|

|

I. Management has determined that no events or transactions occurred subsequent to October 31, 2022, that would require recognition or disclosure in these financial statements.

Report of Independent Registered

Public Accounting Firm

To the Board of Trustees of Vanguard

Trustees' Equity Fund and Shareholders of Vanguard International Value Fund

Opinion on the Financial

Statements

We have audited the accompanying statement of

assets and liabilities, including the schedule of investments, of Vanguard International Value Fund (one of the funds constituting Vanguard Trustees' Equity Fund, referred to hereafter as the "Fund") as of October 31,

2022, the related statement of operations for the year ended October 31, 2022, the statement of changes in net assets for each of the two years in the period ended October 31, 2022, including the related notes, and

the financial highlights for each of the five years in the period ended October 31, 2022 (collectively referred to as the "financial statements"). In our opinion, the financial statements present fairly, in all

material respects, the financial position of the Fund as of October 31, 2022, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period ended October

31, 2022 and the financial highlights for each of the five years in the period ended October 31, 2022 in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the

responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public

Company Accounting Oversight Board (United States) (PCAOB) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of

the Securities and Exchange Commission and the PCAOB.

We conducted our audits of

these financial statements in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of

material misstatement, whether due to error or fraud.

Our audits included performing

procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test

basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating

the overall presentation of the financial statements. Our procedures included confirmation of securities owned as of October 31, 2022 by correspondence with the custodian, transfer agent and brokers; when replies were

not received from brokers, we performed other auditing procedures. We believe that our audits provide a reasonable basis for our opinion.

/s/PricewaterhouseCoopers

LLP

Philadelphia, Pennsylvania

December 16, 2022

We have served as the auditor

of one or more investment companies in The Vanguard Group of Funds since 1975.

Tax information

(unaudited)

The fund hereby designates

$370,335,000, or if subsequently determined to be different, the maximum amount allowable by law, as qualified dividend income for individual shareholders for the fiscal year.

The fund hereby designates

$31,000, or if subsequently determined to be different, the maximum amount allowable by law, of interest earned from obligations of the U.S. government which is generally exempt from state income tax.

For nonresident alien

shareholders, 100% of short-term capital gain dividends distributed by the fund for the fiscal year are qualified short-term capital gains.

The fund designates to

shareholders foreign source income of $439,020,000 and foreign taxes paid of $29,451,000, or if subsequently determined to be different, the maximum amounts allowable by law. Shareholders will receive more detailed

information with their Form 1099-DIV to determine the calendar-year amounts to be included on their tax returns.

This page intentionally left blank.

The People Who Govern Your Fund

The trustees of your mutual