UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________________________________________________________

FORM 10-K

ý ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

For the fiscal year ended December 31, 2013 |

or

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

For the transition period from _____ to _____ |

Commission file number 1-13953

W. R. GRACE & CO.

|

| | |

Delaware | | 65-0773649 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification Number) |

7500 Grace Drive, Columbia, Maryland 21044-4098

(Address of principal executive offices) (Zip code)

(410) 531-4000

(Registrant's telephone number, including area code)

|

| | |

Securities registered pursuant to Section 12(b) of the Exchange Act: |

Title of each class | | Name of each exchange on which registered |

Common Stock, $.01 par value | | New York Stock Exchange, Inc. |

Preferred Stock Purchase Rights | | |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulations S-K is not contained herein and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer," and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

|

| | |

Large accelerated filer ý | | Accelerated filer o |

Non-accelerated filer o (Do not check if a smaller reporting company) | | Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No ý

The aggregate market value of W. R. Grace & Co. voting and non-voting common equity held by non-affiliates as of June 30, 2013 (the last business day of the registrant's most recently completed second fiscal quarter) based on the closing sale price of $84.04 as reported on the New York Stock Exchange was $6,435,601,758.

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes ý No o

At January 31, 2014, 77,063,385 shares of W. R. Grace & Co. Common Stock, $.01 par value, were outstanding.

DOCUMENTS INCORPORATED BYREFERENCE

TABLE OF CONTENTS

|

| | |

PART I | | |

| | |

| | |

| | |

| | |

| | |

| | |

PART II | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

PART III | | |

| | |

| | |

| | |

| | |

| | |

PART IV | | |

| | |

| |

Grace®, Grace® logo and, except as otherwise indicated, the other trademarks, service marks or trade names used in the text of this report are trademarks, service marks or trade names of operating units of W. R. Grace & Co. or its affiliates and/or subsidiaries. RESPONSIBLE CARE® is a trademark, registered in the United States and/or other countries, of the American Chemistry Council. UNIPOL® is a trademark, registered in the United States and/or other countries, of The Dow Chemical Company or an affiliated company of Dow. W. R. Grace & Co.-Conn. and/or its affiliates are licensed to use the UNIPOL® and UNIPOL UNIPPAC® trademarks in the area of polypropylene.

Unless the context otherwise indicates, in this document the terms "Grace," "we," "us," "our" or "the Company" mean W. R. Grace & Co. and/or its consolidated subsidiaries and affiliates. Unless otherwise indicated, the contents of websites mentioned in this report are not incorporated by reference or otherwise made a part of this Report.

PART I

Item 1. BUSINESS

BUSINESS OVERVIEW

W. R. Grace & Co. is engaged in the production and sale of specialty chemicals and specialty materials on a global basis through three operating segments: Grace Catalysts Technologies, which includes catalysts and related products and technologies used in refining, petrochemical and other chemical manufacturing applications; Grace Materials Technologies, which includes packaging technologies and engineered materials used in consumer, industrial, and pharmaceutical applications; and Grace Construction Products, which includes specialty construction chemicals and specialty building materials used in commercial, infrastructure and residential construction. We entered the specialty chemicals industry in 1954, when we acquired both the Dewey and Almy Chemical Company and the Davison Chemical Company. Grace is the successor to a company that began in 1854 and originally became a public company in 1953.

In 2001, Grace and 61 of its United States subsidiaries and affiliates filed voluntary petitions for reorganization under Chapter 11 of the United States Bankruptcy Code in the United States Bankruptcy Court for the District of Delaware. On February 3, 2014, the joint plan of reorganization filed by Grace and certain other parties became effective, concluding Grace’s status as a debtor under Chapter 11.

On December 2, 2013, we completed the acquisition of the assets of the polypropylene licensing and catalysts business of The Dow Chemical Company for a cash purchase price of $500 million, subject to customary working capital and post-closing adjustments.

Our principal executive offices are located at 7500 Grace Drive, Columbia, Maryland 21044, telephone (410) 531-4000. As of December 31, 2013, we had approximately 6,700 global employees.

Grace Catalysts Technologies produces and sells catalysts and related products and technologies used in refining, petrochemical and other chemical manufacturing applications including:

| |

• | Fluid catalytic cracking catalysts, also called FCC catalysts, that help to "crack" the hydrocarbon chain in distilled crude oil to produce transportation fuels, such as gasoline and diesel fuels, and other petroleum-based products; and FCC additives used to reduce sulfur in gasoline, maximize propylene production from refinery FCC units, and reduce emissions of sulfur oxides, nitrogen oxides and carbon monoxide from refinery FCC units; |

| |

• | Hydroprocessing catalysts, most of which are marketed through our Advanced Refining Technologies LLC, or ART, joint venture with Chevron Products Company in which we hold a 50% economic interest, that are used in process reactors to upgrade heavy oils into lighter, more useful products by removing impurities such as nitrogen, sulfur and heavy metals, allowing less expensive feedstocks to be used in the petroleum refining process (ART is not consolidated in our financial statements, so ART's sales are excluded from our sales); |

| |

• | Polyolefin catalysts and catalyst supports, for the production of polypropylene and polyethylene thermoplastic resins, which can be customized to enhance the performance of a wide range of industrial and consumer end-use applications including high pressure pipe, geomembranes, food packaging, automotive parts, medical devices, and textiles; and chemical catalysts used in a variety of industrial, environmental and consumer applications; and |

| |

• | Gas-phase polypropylene process technology which provides our licensees with a reliable capability to manufacture polypropylene products for a broad array of end-use applications. |

Grace Materials Technologies produces and sells specialty materials, coatings and sealants and related products used in coatings, consumer, industrial, pharmaceutical, and packaging applications including:

| |

• | Silica-based engineered materials, including silica-based and silica-alumina-based materials, used in: |

| |

• | Coatings and print media applications, including functional additives that provide matting effects and corrosion protection for industrial and consumer coatings and media and paper products to enhance quality in ink jet coatings; |

| |

• | Consumer applications, as a free-flow agent, carrier or processing aid in food and personal care products; as a toothpaste abrasive and thickener; and for the processing and stabilization of edible oils and beverages; |

| |

• | Industrial applications, such as tires and rubber, precision investment casting, refractory, insulating glass windows, biofuels, and drying applications, fulfilling various functions such as reinforcement, high temperature binding and moisture scavenging; |

| |

• | Pharmaceutical, life science and related applications including silica-based separation media, excipients and pharmaceutical intermediates; complementary purification products, chromatography consumables, and instruments; and CO2 adsorbents used in anesthesiology and mine safety applications; and |

| |

• | Packaging materials, including can and closure sealants used to seal and enhance the shelf life of can and bottle contents; coatings for cans and closures that prevent metal corrosion, protect package contents from the influence of metal and ensure proper adhesion of sealing compounds; and scavenging technologies designed to reduce off-taste and extend the shelf-life of packaged products. |

Grace Construction Products produces and sells specialty construction chemicals and specialty building materials, including:

| |

• | Construction chemicals including concrete admixtures and fibers used to modify the rheology, improve the durability and enhance various other properties of concrete, mortar, masonry and other cementitious construction materials; and additives used in cement processing to improve energy efficiency in manufacturing, enhance the characteristics of finished cement and improve ease of use; and |

| |

• | Building materials used in both new construction and renovation/repair projects. The products protect buildings and civil engineering structures from water, vapor and air penetration. The portfolio includes waterproofing membranes for commercial and residential buildings, specialty grouts for use in waterproofing and soil stabilization applications, air and vapor barriers, and other products to solve the specialized needs of preventative and repair applications. |

Global Scope

We operate our business on a global scale with approximately 71% of our 2013 sales outside the United States. We conduct business in over 40 countries and in more than 50 currencies. We manage our operating segments on a global basis, to serve global markets. Currency fluctuations affect our reported results of operations, cash flows, and financial position.

Strategy Overview

Our strategy is to increase enterprise value by profitably growing our specialty chemicals and specialty materials businesses in the global marketplace and achieving high levels of efficiency and cash flow. To meet these objectives, we plan to:

| |

• | invest in research and development activities, with the goal of introducing new high-performance, technically differentiated products and services and enhancing manufacturing processes and operations; |

| |

• | expand sales and manufacturing into emerging regions, including China, India, other economies in Asia, Eastern Europe, the Middle East and Latin America; |

| |

• | pursue selected acquisitions and alliances that complement our current product offerings or provide opportunities for faster penetration of desirable market or geographic segments; and |

| |

• | continue our commitment to process and productivity improvements and cost-management, such as rigorous controls on working capital and capital spending, integration of functional support services worldwide, and programs for improving operations and supply chain management. |

CHAPTER 11 CASES

On April 2, 2001, Grace, along with 61 of our United States subsidiaries and affiliates, filed voluntary petitions for reorganization under Chapter 11 of the United States Bankruptcy Code (the "Bankruptcy Code") in the United States Bankruptcy Court for the District of Delaware (the “Bankruptcy Court”). The cases were jointly administered

under case number 01-01139. Our non-U.S. subsidiaries and certain of our U.S. subsidiaries were not included in the bankruptcy filing.

On February 3, 2014 (the “Effective Date”), the joint plan of reorganization (the “Joint Plan”) filed by Grace and certain other parties became effective, concluding Grace’s status as a debtor under Chapter 11.

Under the Joint Plan, two asbestos trusts have been established and funded under Section 524(g) of the Bankruptcy Code. The order of the Bankruptcy Court confirming the Joint Plan contains a channeling injunction which provides that all pending and future asbestos-related personal injury claims and demands are to be channeled for resolution to an asbestos personal injury trust, the PI Trust, and all pending and future asbestos-related property damage claims and demands (PD Claims), including property damage claims related to Grace’s former attic insulation product, ZAI, are to be channeled to a separate asbestos property damage trust, the PD Trust. The PD Trust has two accounts (the two accounts have separate trustees and their assets may not be commingled), the PD Account, in respect of non-ZAI PD Claims, and the ZAI PD Account, in respect of ZAI PD Claims.

The trusts are the sole recourse for holders of asbestos-related claims; the channeling injunctions prohibit them from asserting such claims directly against Grace.

Under the Joint Plan, Grace is obligated to make future payments to the PI Trust, the PD Trust in respect of PD Claims, and the PD Trust in respect of ZAI PD Claims.

The amounts that Grace is obligated to pay to the PI Trust are fixed, and include only deferred payments of $110 million per year for 5 years beginning in 2019, and $100 million per year for 10 years beginning in 2024. Grace has recorded a liability for these deferred payments.

The amounts that Grace is obligated to pay to the PD Trust in respect of non-ZAI PD Claims are not fixed. Grace is obligated to make payments to the PD Trust every six months in the amount of any non-ZAI PD Claims allowed by the Bankruptcy Court during the preceding six months plus interest (if applicable) and the amount of PD Trust expenses. Grace has accrued for those unresolved non-ZAI PD Claims that it believes are probable and estimable. Grace has not accrued for other unresolved or unasserted non-ZAI PD Claims as it does not believe that payment on any such claims is probable.

The amounts that Grace is obligated to pay to the PD Trust in respect of ZAI PD Claims include a fixed amount and a capped contingent amount. Grace is obligated to make a fixed payment of $30 million to the ZAI PD Account on the third anniversary of the Effective Date, i.e., February 3, 2017. Grace is also obligated to make up to 10 contingent payments of $8 million per year to the ZAI PD Account during the 20-year period beginning on the fifth anniversary of the Effective Date, with each such payment due only if the assets of the ZAI PD Account fall below $10 million during the preceding year. Grace has recorded a liability for the fixed deferred payment but has not recorded a liability for the contingent payments as it does not currently believe these payments are probable.

These obligations to the asbestos trusts are secured by Grace's obligation to issue 77,372,257 shares of Grace common stock to the asbestos trusts in the event of default.

See disclosure in this Report in Item 8 (Financial Statements and Supplementary Data) in the Financial Supplement under Note 2 (Chapter 11 and Joint Plan of Reorganization) to the Consolidated Financial Statements for a detailed description of the Chapter 11 cases and the Joint Plan.

PRODUCTS AND MARKETS

Specialty Chemicals and Materials Industry Overview

Specialty chemicals and specialty materials are high value-added products used as catalysts, intermediates, components, protectants or additives in a wide variety of products and applications. They are generally produced in relatively small volumes (compared with commodity chemicals) and must satisfy well-defined performance requirements and specifications. Specialty chemicals and specialty materials are often critical components of end products, catalysts for the production of end products and components used in end products. Consequently, they are tailored to meet customer needs, which generally results in a close relationship between the producer and the customer.

We focus our business on the following, which we believe are important competitive factors in the specialty chemicals and specialty materials industry:

| |

• | value-added products, technologies and services, sold at competitive prices; |

| |

• | customer service, including rapid response to changing customer needs; |

| |

• | technological leadership (resulting from investment in research and development and technical customer service); and |

| |

• | reliability of product and supply. |

We believe that our focus on these competitive factors enables us to deliver increased value to customers and competitive operating margins notwithstanding the increased customer service and research and development costs that this focus entails.

Grace Catalysts Technologies Operating Segment

Catalysts Technologies principally applies alumina, zeolite and inorganic support technologies in the design and manufacture of products to create significant value for our diverse customer base. Our customers include major oil refiners and plastics and chemicals manufacturers. We believe that our technological expertise provides a competitive advantage, allowing us to quickly design products that help our customers create value in their markets.

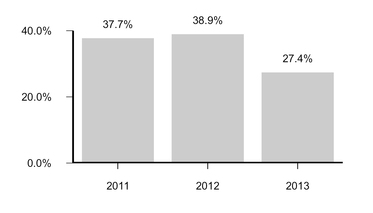

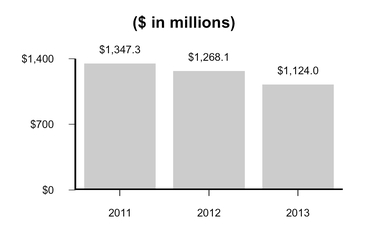

The following table sets forth Catalysts Technologies sales of similar products as a percentage of Grace total revenue.

|

| | | | | | | | | | | | | | | | | | | | |

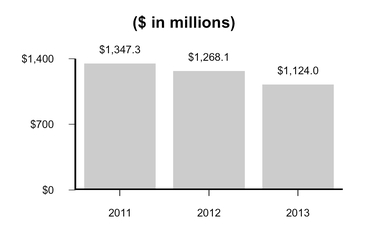

| 2013 | | 2012 | | 2011 |

(In millions) | Sales | | % of Grace Revenue | | Sales | | % of Grace Revenue | | Sales | | % of Grace Revenue |

Refining Catalysts | $ | 832.4 |

| | 27.2 | % | | $ | 986.8 |

| | 31.3 | % | | $ | 1,077.5 |

| | 33.5 | % |

Polyolefin and Chemical Catalysts | 291.6 |

| | 9.5 | % | | 281.3 |

| | 8.9 | % | | 269.8 |

| | 8.4 | % |

Total Catalysts Technologies Revenue | $ | 1,124.0 |

| | 36.7 | % | | $ | 1,268.1 |

| | 40.2 | % | | $ | 1,347.3 |

| | 41.9 | % |

The following table sets forth Catalysts Technologies sales by region as a percentage of Catalysts Technologies total revenue.

|

| | | | | | | | | | | | | | | | | | | | |

| 2013 | | 2012 | | 2011 |

(In millions) | Sales | | % of Catalysts Technologies Revenue | | Sales | | % of Catalysts Technologies Revenue | | Sales | | % of Catalysts Technologies Revenue |

North America | $ | 359.8 |

| | 32.0 | % | | $ | 382.1 |

| | 30.1 | % | | $ | 462.4 |

| | 34.3 | % |

Europe Middle East Africa | 459.2 |

| | 40.9 | % | | 543.5 |

| | 42.8 | % | | 600.2 |

| | 44.5 | % |

Asia Pacific | 223.0 |

| | 19.8 | % | | 256.9 |

| | 20.3 | % | | 216.4 |

| | 16.1 | % |

Latin America | 82.0 |

| | 7.3 | % | | 85.6 |

| | 6.8 | % | | 68.3 |

| | 5.1 | % |

Total Catalysts Technologies Revenue | $ | 1,124.0 |

| | 100.0 | % | | $ | 1,268.1 |

| | 100.0 | % | | $ | 1,347.3 |

| | 100.0 | % |

Grace Catalysts Technologies—Refining Catalysts

FCC Catalysts

We are a global leader in developing and manufacturing fluid catalytic cracking, or FCC, catalysts and additives that enable petroleum refiners to increase profits by improving product yields, value and quality. Our FCC products also enable refiners to reduce emissions from their FCC units and reduce sulfur content in the gasoline that they produce.

Oil refining is a highly specialized discipline, and FCC catalysts must be tailored to meet local variations in crude oil and a refinery's product mix. We work regularly with our customers to identify the most appropriate catalyst formulations for their changing needs. We are dependent on the economics of the petroleum industry, specifically, the impacts of demand for transportation fuels and petrochemical products and crude oil supply, which affect the extent to which our customers utilize the available capacity of their refinery FCC units. In general, as a refinery utilizes more of its capacity, it needs a greater amount of FCC catalyst. In recent years global economic growth,

especially in emerging regions, has increased the demand for transportation fuels, and our FCC catalysts and additives. Other factors may reduce the demand for petroleum-based transportation fuels such as weak economic conditions and high retail gasoline and diesel fuel prices. In addition, government policy that encourages the use of non-petroleum-based fuels, discourages the use of diesel fuel or encourages greater vehicular fuel economy may negatively affect demand for our FCC catalysts and additives.

Refinery feedstocks vary in quality from light to heavy, sweet to sour crude oil. Sweet crude feedstocks are typically more expensive than heavy crude and yield a greater proportion of high-value petroleum products. They also yield a lower proportion of residual oil, or "resid," which is generally the lowest-value feedstock contained in crude oil. Although heavy crude feedstocks with high resid content are typically less expensive than higher quality feedstocks, the processing of high-resid feedstocks is more difficult because of their relatively high metals, nitrogen and sulfur contamination and higher boiling points. We have designed our MIDAS® catalyst, IMPACT® catalyst, NEKTOR™ catalyst, and GENESIS® catalyst product portfolios to enable our customers to increase the efficiency and yield of high-resid feedstock refining.

During 2010, the People's Republic of China reduced its quotas on exports of the rare earths that we use in the manufacture of FCC catalysts, causing significant increases in global prices of rare earths in 2010 and early 2011. In response to these price increases, we developed our RESIDULTRA™ low-rare earth FCC catalyst and our REPLACER® product line of no-rare earth FCC catalysts to mitigate the higher cost of rare earths without sacrificing performance. Starting in the third quarter of 2011, global prices of rare earths declined rapidly and significantly. Since then, we have added rare earth to some of our FCC catalyst formulations because it improves the performance and value of the catalyst.

Many U.S. petroleum refiners have entered into consent decrees with the U.S. Environmental Protection Agency (EPA) under which the refiners have agreed to reduce emissions of nitrogen oxides and sulfur oxides. The European Union has also imposed requirements on refineries with respect to nitrogen oxides and sulfur oxides emissions. FCC units are generally the largest emitters of these pollutants in a refinery. Our additives are designed to assist refineries in meeting their obligations to reduce these pollutants. Our Super DESOX® additive reduces sulfur oxides emissions from commercial FCC units. During 2011, we also launched our two low rare earth versions of Super DESOX® additive. Our DENOX® additives are designed to achieve reductions in nitrogen oxides emissions comparable to those obtained from capital intensive alternatives available to a refinery, while our non-platinum-based combustion promoters XNOX® and CP®P enable refiners to control carbon monoxide emissions without increasing NOx.

Global economic growth, especially in emerging regions, has increased the demand for plastics. As a result, our refinery customers have sought increased profits from petrochemicals by increasing the yield of propylene from their FCC units. Our ZSM-5-based technology, including our OLEFINSMAX® and OLEFINSULTRA® additive products, is designed to maximize the propylene output of FCC units.

In recent years, many countries and regions, including the U.S., European Union, Russia, India and China have imposed or increased the regulatory limitations on the sulfur content of gasoline and diesel fuel. We have developed a portfolio of products designed to assist refiners in meeting their gasoline sulfur reduction targets including our D-PRISM® and GSR® additives and our SURCA® catalyst family.

Competition in FCC catalysts and additives is based on technology, product performance, customer service and price. Our principal global FCC catalyst competitors are Albemarle Corp. and BASF which, with Johnson Matthey, are also principal global competitors in FCC additives. We also have multiple regional competitors for FCC catalysts and additives.

Hydroprocessing Catalysts

We market hydroprocessing catalysts, primarily through ART, our joint venture with Chevron. We established ART to combine our technology with that of Chevron and to develop, market and sell hydroprocessing catalysts to customers in the petroleum refining industry worldwide.

As discussed above, our business is dependent on the economics of the petroleum industry. Refineries increasingly use feedstocks that have high resid content. We are a leading supplier of hydroprocessing catalysts designed for processing these feedstocks. We offer products for fixed-bed resid hydrotreating, on-stream catalyst replacement and ebullating-bed resid hydrocracking processes.

We also offer a full line of catalysts, customized for individual refiners, used in distillate hydrotreating to produce ultra-low sulfur content gasoline and diesel fuel, including our SMART CATALYST SYSTEM® and APART® catalyst system. As discussed above, regulatory limitations on the sulfur content of gasoline and diesel fuel are becoming more common. These products are designed to help refiners to reduce the sulfur content of their products.

In early 2013, ART announced that it had obtained rights to sell hydrocracking and lubes hydroprocessing catalysts to licensees of Chevron Lummus Global and other petroleum refiners for unit refills. This arrangement is intended to streamline hydroprocessing catalyst supply and improve technical service for refining customers by establishing ART as the single point of contact for all their hydroprocessing catalyst needs.

Competition in the hydroprocessing catalyst industry is based on technology, product performance, customer service and price. Criterion, Albemarle, Haldor Topsoe, UOP and Axens are our leading global competitors in hydroprocessing catalysts. We also have multiple regional competitors.

Grace Catalysts Technologies—Polyolefin Catalysts, Catalyst Supports and Polypropylene Process Technology

We are a leading provider of catalyst systems and catalyst supports to the polyolefins industry for a variety of polyethylene and polypropylene process technologies. These types of catalysts are used for the manufacture of polyethylene and polypropylene thermoplastic resins used in products such as plastic film, high-performance plastic pipe, automobile parts, household appliances and household containers. We use a combination of proprietary catalyst and support technology, as well as technology licensed from third parties, to provide unique catalyst-based solutions to industry, and to provide a broad technology portfolio for enhancing collaboration opportunities with technology leaders.

Our MAGNAPORE® polymerization catalyst is used to produce high performance polyethylene in the slurry loop process for pipe and film applications. Our POLYTRAK® polymerization catalyst is designed to achieve improved polypropylene performance, particularly for impact resistant applications such as automobile bumpers and household appliances.

Our DAVICAT® standard and customized catalysts offer a wide range of chemical and physical properties based on our material science technology for supported catalysts, polystyrene, herbicide, neutriceuticals and on purpose olefins. Our RANEY® nickel, cobalt and copper hydrogenation and dehydrogenation catalysts are used for the synthesis of organic compounds for the fibers, polyurethanes, engineered plastics, pharmaceuticals, sweeteners and petroleum industries.

Our non-phthalate CONSISTA® and traditional SHAC® catalysts along with CONSISTA® and ADT donors have been designed for the UNIPOL® gas-phase polypropylene process technology but are also adaptable to a variety of other polypropylene gas-phase and slurry-phase polymerization processes.

The polyolefin catalyst and supports industry is technology-intensive and suppliers must provide products formulated to meet customer specifications. There are many manufacturers of polyolefin catalysts and supports including PQ/INEOS, Albemarle, LyondellBasell, Univation and BASF, and most sell their products worldwide.

We are also a leading licensor of gas-phase polypropylene process technology to polypropylene manufacturers. Our UNIPOL® technology, acquired in 2013, is designed to have fewer moving parts and require less equipment than other competing technologies in order to reduce operating costs. This technology provides our licensees with a reliable capability to manufacture products for a broad array of end-use applications. The polypropylene process licensing industry is technology-intensive and licensors must adapt the technology and the related licenses to meet individual customer needs. The major competing polypropylene process licensor is LyondellBasell.

Grace Catalysts Technologies—Manufacturing, Marketing and Raw Materials

Our Catalysts Technologies products are manufactured by a network of globally coordinated plants. Our integrated planning organization is responsible for the effective utilization of our manufacturing capabilities.

We use a global organization of technical professionals with extensive experience in refining processes, catalyst development, and catalyst applications to market our refining catalysts and additives. These professionals work to tailor our technology to the needs of each specific customer. We generally negotiate prices for our refining catalysts because our formulations are specific to the needs of each customer and each customer receives individual attention and technical service. We sell a significant portion of our hydroprocessing catalysts through multiple-year supply agreements with our geographically diverse customer base.

We use a global direct sales force for our polyolefin catalysts, supports and technologies and chemical catalysts that seeks to maintain close working relationships with our customers. These relationships enable us to cooperate with major polymer and chemical producers to develop catalyst technologies that complement their process or application developments. We have geographically distributed our sales and technical service professionals to make them responsive to the needs of our geographically diverse customers. We typically operate under long-term contracts with our customers.

Seasonality does not have a significant overall effect on our Catalysts Technologies operating segment. However, sales of FCC catalysts tend to be lower in the first calendar quarter prior to the shift in production by refineries from home heating oil for the winter season to gasoline production for the summer season. FCC catalysts and ebullating-bed hydroprocessing catalysts are consumed at a relatively steady rate and are replaced regularly. Fixed-bed hydroprocessing catalysts are consumed over a period of years and are replaced in bulk in an irregular pattern. Since our customers periodically shut down their refining processes to replace fixed-bed hydroprocessing catalysts in bulk, our hydroprocessing catalyst sales to any customer can vary substantially over the course of a year and between years based on that customer's catalyst replacement schedule.

The principal raw materials for Catalysts Technologies products include rare earths, molybdenum, caustic soda, aluminum, sodium aluminate, nickel, alumina, kaolin and cobalt. Multiple suppliers are generally available for each of these materials; however, some of our raw materials may be provided by single sources of supply. We seek to mitigate the risk of using single source suppliers by identifying and qualifying alternative suppliers or, for unique materials, by using alternative formulations from other suppliers or by passing price increases on to customers. In some instances, we produce our own raw materials and intermediates.

Prices for many of our raw materials, including metals and petroleum-based specialty and commodity materials such as resins and solvents, have been volatile in recent years. In response to increases in raw material costs, we generally take actions to mitigate the effect of higher costs including increasing prices, developing alternative formulations for our products and increasing productivity. In particular, during 2010, the People's Republic of China reduced its quotas on exports of the rare earths that we use in the manufacture of FCC catalysts, which significantly increased global prices. In response, in late 2010, we implemented rare earth surcharges on certain FCC catalysts that subsequently were removed in mid-2013 when the prices of these materials returned to stable levels. Rare earth surcharges increased sales by approximately $15 million, $110 million and $280 million in years 2013, 2012 and 2011, respectively. We also have taken other actions to reduce the impact of higher raw material costs on us and our customers.

As in many chemical businesses, we consume significant quantities of natural gas in the production of Catalysts Technologies products. World events and other economic factors have caused volatility in the price of natural gas. Increases or decreases in the cost of natural gas and raw materials can have a significant impact on our operating margins.

Grace Materials Technologies Operating Segment

Materials Technologies principally applies specialty silica, zeolite and resin technologies in the design and manufacture of products to create significant value for our diverse customer base. Our customers include coatings manufacturers, consumer product manufacturers, plastics manufacturers, producers of rigid food and beverage packaging, and pharmaceutical companies. We believe that our technological expertise provides a competitive advantage, allowing us to quickly design products that help our customers create value in their markets.

The following table sets forth Materials Technologies sales of similar products as a percentage of Grace total revenue.

|

| | | | | | | | | | | | | | | | | | | | |

| 2013 | | 2012 | | 2011 |

(In millions) | Sales | | % of Grace Revenue | | Sales | | % of Grace Revenue | | Sales | | % of Grace Revenue |

Engineered Materials | $ | 494.4 |

| | 16.2 | % | | $ | 478.3 |

| | 15.1 | % | | $ | 500.5 |

| | 15.6 | % |

Packaging Products | 384.1 |

| | 12.5 | % | | 384.3 |

| | 12.2 | % | | 372.1 |

| | 11.6 | % |

Total Materials Technologies Revenue | $ | 878.5 |

| | 28.7 | % | | $ | 862.6 |

| | 27.3 | % | | $ | 872.6 |

| | 27.2 | % |

The following table sets forth Materials Technologies sales by region as a percentage of Materials Technologies total revenue.

|

| | | | | | | | | | | | | | | | | | | | |

| 2013 | | 2012 | | 2011 |

(In millions) | Sales | | % of Materials Technologies Revenue | | Sales | | % of Materials Technologies Revenue | | Sales | | % of Materials Technologies Revenue |

North America | $ | 176.7 |

| | 20.1 | % | | $ | 174.0 |

| | 20.2 | % | | $ | 173.1 |

| | 19.8 | % |

Europe Middle East Africa | 367.8 |

| | 41.9 | % | | 362.4 |

| | 41.9 | % | | 378.6 |

| | 43.4 | % |

Asia Pacific | 197.4 |

| | 22.5 | % | | 185.9 |

| | 21.6 | % | | 184.1 |

| | 21.1 | % |

Latin America | 136.6 |

| | 15.5 | % | | 140.3 |

| | 16.3 | % | | 136.8 |

| | 15.7 | % |

Total Materials Technologies Revenue | $ | 878.5 |

| | 100.0 | % |

| $ | 862.6 |

| | 100.0 | % | | $ | 872.6 |

| | 100.0 | % |

Grace Materials Technologies—Silica-based Materials

We provide enabling technologies that are silica- and silica-alumina-based functional additives and process aids, such as silica gel, colloidal silica, zeolitic adsorbents, precipitated silica and silica-aluminas, for a wide variety of applications. Our product portfolio includes:

|

| | | | |

Application | | Use | | Key Brands |

Coatings and Print Media | | Matting agents, anticorrosion pigments, TiO2 extenders and moisture scavengers for paints and lacquers | | SYLOID®, SHIELDEX®, SYLOSIV®, SYLOWHITE™ |

| | Additives and formulations for matte, semi-glossy and glossy ink receptive coatings on high performance ink jet papers, photo paper, and commercial wide-format print media | | SYLOJET®, DURAFILL®, LUDOX® |

| | Paper retention aids, functional fillers, paper frictionizers | | DURAFILL®, LUDOX® |

Consumer | | Toothpaste abrasives and thickening agents, free-flow agents, anticaking agents, tabletting aids, cosmetic additives and flavor carriers | | SYLOID® FP, SYLODENT®, SYLOID®, SYLOBLANC®, ELFADENT®, SYLOSIV® |

| | Edible oil refining agents, beer stabilizers and clarification aids for beer, juices and other beverages | | DARACLAR®, TRISYL® |

Industrial | | Reinforcing agents for rubber and tires | | PERKASIL® |

| | Inorganic binders and surface smoothening aids for precision investment casting and refractory applications | | LUDOX® |

| | Adsorbents for dual pane windows and industrial applications, desiccant granules, beads, powders and bags and polyurethane moisture scavengers | | PHONOSORB®, SYLOBEAD®, SYLOSIV®, CRYOSIV®, SAFETYSORB® |

| | Chemical metal polishing aids and formulations for chemical mechanical planarization/electronics applications | | LUDOX®, POLIEDGE® |

| | Polymer additives for producers and processors of plastic products that prevent layers of polymer film from sticking together, improve dispersal of pigments and ease removal from molds | | SYLOBLOC® |

| | Process adsorbents used in petrochemical and natural gas processes for such applications as ethylene-cracked-gas-drying, natural gas drying and sulfur removal | | SYLOBEAD® |

Discovery Sciences | | Flash chromatography systems and consumables | | REVELERIS®, REVEALX™, GRACERESOLV™ |

| | Preparative scale purification products including media, column hardware, and equipment | | DAVISIL®, VYDAC®, MODCOL®, SPRING®, MULTIPACKER® |

| | Pharmaceutical excipients and intermediates | | SYLOID® FP |

| | Analytical scale high performance liquid chromatography (HPLC) columns and detectors | | VISIONHT®, VYDAC®, ALLTECH®, ALLTIMA® |

| | CO2 adsorbents for anesthesiology and re-breathing applications | | SODASORB® |

| | Fine chemical intermediates | | SYNTHETECH® |

Our silica-based engineered materials are integrated into our customers' manufacturing processes and, when combined with our technical support, increase the efficiency and performance of their products. By working closely with our customers, we help them to respond quickly to the changing needs of brand owners and consumers. We focus on high-growth segments and seek to develop and introduce new products that add additional value to the current and future needs of our customers. For example, our customers have incorporated our products into higher resolution print media, less abrasive high cleaning toothpastes and technologies that are friendly to the environment such as water-based and VOC-compliant coatings, green tires with lower roll resistance and non-toxic anticorrosion protection. Our discovery sciences products are used in a wide range of applications, including drug discovery and purification for the healthcare, pharmaceutical and biotechnology industries, environmental analysis, forensics, petrochemical analysis and the manufacture of food, cosmetics, vitamins and biofuels. We also market chromatography consumables and analytical and preparative columns packed with our specialty media. We can modify the base silica and surface chemistry for analytical, preparative and process-scale customers in order to enhance our product performance for their unique applications.

Our silica-based engineered materials sales are global. There are many manufacturers of engineered materials that market their products on a global basis including Evonik, PQ/INEOS, and UOP. Competition is generally based on product performance, technical service and reliability, price, and additional value-added features to address the needs of our customers, end-users and brand owners. Our discovery sciences products compete on the basis of product quality, distinct technology and customer support. Competition for these products is highly fragmented with a large number of companies that sell their products on a global and regional basis, although a number of companies, such as Waters Corporation, Agilent Technologies and Thermo-Fisher, have a substantial global position and a relatively large installed customer base.

Grace Materials Technologies—Packaging Products

We are a global leader in can and closure sealants that, along with our specialized can and closure coatings, we supply to the packaging industry. Our product portfolio includes:

|

| | |

Products | | Key Brands |

Can sealants for rigid containers that ensure a hermetic seal between the lid and the body of beverage, food, aerosol and other cans | | DAREX® |

Sealants for metal and plastic bottle closures that are used on pry-off and twist-off metal crowns, as well as roll-on pilfer-proof and plastic closures to seal and enhance the shelf life of food and beverages in glass and plastic bottles and jars | | DAREX®, DARAFORM®, DARASEAL®, DARABLEND®, SINCERA®, CELOX® |

Coatings for metal packaging that are used in the manufacture of cans and closures to protect the metal against corrosion, protect the contents against the influences of metal, ensure proper adhesion of sealing compounds to metal surfaces, and provide base coats for inks and for decorative purposes | | DAREX®, APPERTA®, SISTIAGA® |

Our packaging products are designed to address major industry trends such as lighter weight packaging, lower energy consumption, personal convenience, and highly individualized packaging. Our growth is driven by innovation of higher performing products, continuous development of new applications, increasing demand for sustainability and rising disposable income in emerging regions. We seek to capitalize upon our technical customer service, global infrastructure and expertise in global regulatory compliance (including food law compliance) to enhance our growth, especially in emerging regions. We also seek to develop and introduce new products that add additional value to the current and future needs of our customers, such as our introduction of products with oxygen scavenging functionality.

Our packaging products sales are global. There are many manufacturers of packaging products that market their products on a global basis including Altana, Akzo Nobel, PPG and Valspar. Competition is generally based on product performance, technical service and reliability, price and additional value-added features to address the needs of our customers, end-users and brand owners.

Grace Materials Technologies—Manufacturing, Marketing and Raw Materials

Our Materials Technologies products are manufactured by a network of globally integrated plants that are positioned to service our customers regionally. Our packaging products are manufactured in both large facilities to permit economies of scale and a network of smaller operations that enable customization to local market conditions. Our integrated planning organization is responsible for the effective utilization of our manufacturing capabilities.

We use country-based direct sales forces that are dedicated to each product line and backed by application-specific technical customer service teams to market our Materials Technologies products. Our sales force seeks to develop long-term relationships with our customers and focuses on consultative sales, technical support and key account growth programs. To ensure full geographic coverage, our direct sales organization is further supplemented by a network of agents and distributors.

Seasonality does not have a significant overall effect on our Materials Technologies operating segment; however, our packaging products and some of our construction-related products such as insulated glass desiccants are affected by seasonal and weather-related factors including the consumption of beverages, the size and quality of food crops and the level of construction activity. These impacts are mitigated by the global scope of our business.

The principal raw materials for Materials Technologies products include sodium silicate, solvents, resins, latexes (including certain food-grade raw materials) and rubber. Multiple suppliers are generally available for each of these materials; however, some of our raw materials may be provided by single sources of supply. We seek to mitigate the risk of using single source suppliers by identifying and qualifying alternative suppliers or, for unique materials, by using alternative formulations from other suppliers or by passing price increases on to customers. In some instances, we produce our own raw materials and intermediates.

Prices for many of our raw materials, including specialty and commodity materials such as latex, rubbers, pigments, resins and solvents, have been volatile in recent years. In response to increases in raw material costs, we generally take actions to mitigate the effect of higher costs including increasing prices, developing alternative formulations for our products and increasing productivity.

As in many chemical businesses, we consume significant quantities of natural gas in the production of Materials Technologies products. World events and other economic factors have caused volatility in the price of natural gas. Increases or decreases in the cost of natural gas and raw materials can have a significant impact on our operating margins.

Since we manufacture a substantial portion of our packaging products in emerging regions using raw materials from suppliers in the U.S., Europe and other advanced economies, changes in the values of the currencies of these emerging regions versus the U.S. dollar and the euro may adversely affect our raw material costs and the prices we may charge for our products.

Grace Construction Products Operating Segment

Construction Products produces and sells specialty construction chemicals and specialty building materials. We are a supplier to the nonresidential (commercial and infrastructure) construction industry, and to a lesser extent, the residential construction and repair and restoration industries.

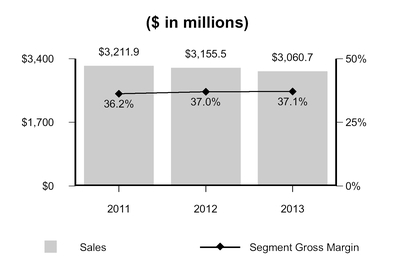

The following table sets forth Construction Products sales of similar products as a percentage of Grace total revenue.

|

| | | | | | | | | | | | | | | | | | | | |

| 2013 | | 2012 | | 2011 |

(In millions) | Sales | | % of Grace Revenue | | Sales | | % of Grace Revenue | | Sales | | % of Grace Revenue |

Specialty Construction Chemicals | $ | 688.0 |

| | 22.5 | % | | $ | 680.7 |

| | 21.6 | % | | $ | 656.6 |

| | 20.5 | % |

Specialty Building Materials | 370.2 |

| | 12.1 | % | | 344.1 |

| | 10.9 | % | | 335.4 |

| | 10.4 | % |

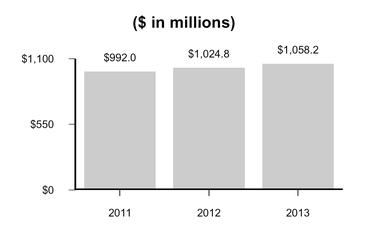

Total Construction Products Revenue | $ | 1,058.2 |

| | 34.6 | % | | $ | 1,024.8 |

| | 32.5 | % | | $ | 992.0 |

| | 30.9 | % |

The following table sets forth Construction Products sales by region as a percentage of Construction Products total revenue.

|

| | | | | | | | | | | | | | | | | | | | |

| 2013 | | 2012 | | 2011 |

(In millions) | Sales | | % of Construction Products Revenue | | Sales | | % of Construction Products Revenue | | Sales | | % of Construction Products Revenue |

North America | $ | 423.2 |

| | 39.9 | % | | $ | 411.5 |

| | 40.2 | % | | $ | 406.3 |

| | 41.0 | % |

Europe Middle East Africa | 260.9 |

| | 24.7 | % | | 269.7 |

| | 26.3 | % | | 281.6 |

| | 28.4 | % |

Asia Pacific | 233.7 |

| | 22.1 | % | | 217.5 |

| | 21.2 | % | | 198.8 |

| | 20.0 | % |

Latin America | 140.4 |

| | 13.3 | % | | 126.1 |

| | 12.3 | % | | 105.3 |

| | 10.6 | % |

Total Construction Products Revenue | $ | 1,058.2 |

| | 100.0 | % | | $ | 1,024.8 |

| | 100.0 | % | | $ | 992.0 |

| | 100.0 | % |

Grace Construction Products—Specialty Construction Chemicals

We supply concrete admixtures and fibers used to modify the rheology, improve the durability and enhance various other properties of concrete, mortar, masonry and other cementitious construction materials; and additives used in cement processing to improve energy efficiency in manufacturing, enhance the characteristics of finished cement and improve ease of use, including the following products:

|

| | | | | | |

Products | | Uses | | Customers | | Key Brands |

Concrete admixtures | | Concrete admixtures and polymeric fibers used to reduce the production and in-place costs of concrete, increase the performance of concrete and improve the life cycle cost of the structure | | Ready-mix and precast concrete producers, engineers and specifiers | | ADVA®, STRUX®, MIRA®, POLARSET®, ECLIPSE® |

Additives for cement processing | | Cement additives added to the grinding stage of the cement manufacturing process to improve the energy efficiency of the plant and enhance the performance of the finished cement. Chromium reducing additives help cement manufacturers in Europe meet environmental regulations | | Cement manufacturers | | CBA®, SYNCHRO®, HEA2®, TDA® |

Products for architectural concrete | | Products for architectural concrete include surface retarders, coatings, pigments and release agents used by concrete producers and contractors to enhance the surface appearance and aesthetics of concrete | | Precast concrete producers and architects | | PIERI® |

Admixtures for masonry concrete | | Products for masonry concrete used by block and paver producers for process efficiency and to improve the appearance, durability and water resistance of finished concrete masonry units | | Masonry block manufacturers | | DRY-BLOCK®, OPTEC®, QUANTEC® |

Process control solutions for ready mix concrete | | Electro-mechanical devices, sensors and other technologies that assist concrete producers in controlling product quality and production costs | | Ready mix concrete manufacturers | | VERIFI® |

Grace Construction Products—Specialty Building Materials

We supply building materials used in both new construction and renovation/repair projects. The products protect buildings and civil engineering structures from water, vapor and air penetration. The portfolio includes waterproofing membranes for commercial and residential buildings, specialty grouts for use in waterproofing and soil stabilization applications, air and vapor barriers, and other products to solve the specialized needs of preventative and repair applications including the following:

|

| | | | | | |

Products | | Uses | | Customers | | Key Brands |

Structural waterproofing, vapor and air barrier systems | | Structural waterproofing and air barrier systems to prevent water, vapor and/or air infiltration in commercial structures, including self-adhered sheet and liquid membranes, joint sealing materials, drainage composites and waterstops. | | Architects and structural engineers; specialty waterproofing and general contractors; specialty waterproofing distributors | | BITUTHENE®, PROCOR®, PREPRUFE®, ADPRUFE®, HYDRODUCT®, PERM-A-BARRIER®, ADCOR®ES, SILCOR® |

Residential building materials | | Specialty roofing membranes and flexible flashings for windows, doors, decks and detail areas, including fully adhered roofing underlayments, synthetic underlayments and self-adhered flashing. | | Roofing contractors, home builders and remodelers; specialty roofing distributors, lumberyards and home centers; homeowners; architects and specifiers | | ICE & WATER SHIELD®, TRI-FLEX®, VYCOR® |

Remedial waterproofing | | Products for repair and remediation in waterproofing applications and soil stabilization | | Contractors, municipalities and other owners of large infrastructure facilities | | DENEEF® HYDRO ACTIVE® Cut, DENEEF® AC-400, DENEEF® SWELLSEAL® WA, DENEEF® MC-500™ |

Fire protection | | Fire protection products spray-applied to the structural steel frame, encasing and insulating the steel and protecting the building in the event of fire. | | Local contractors and specialty subcontractors and applicators; building materials distributors; industrial manufacturers; architects and structural engineers | | MONOKOTE® |

Grace Construction Products—Manufacturing, Marketing and Raw Materials

In view of our diversity of customers and customer requirements, and because specialty construction chemicals and specialty building materials require intensive sales and customer service efforts, we maintain a direct sales and technical support team with sales personnel based in approximately 40 countries worldwide. This sales and support team sells products under global contracts, under U.S. or regional contracts, and on a job-by-job basis. We also use distributors in both U.S. and non-U.S. markets. We compete globally with several large construction materials suppliers, and regionally and locally with numerous smaller competitors. Competition for our construction products is based on product performance, technical support and service, brand name recognition in the construction industry and price. Our major global specialty construction chemicals competitors are BASF and Sika.

In recent years, the cement and concrete industry has experienced some consolidation, thereby increasing the importance of serving well our global customers. For some customer groups, such as producers and contractors, operational efficiency and total applied cost are key factors in making purchasing decisions, while for others, such as architects and engineers, product performance and design versatility are more important.

We seek to improve our products, adapt them for new applications and add new products through our growth and innovation processes that focus on understanding the needs of our customers, key performance indicators and research and development.

In addition to new product introductions and product enhancements, we look for growth opportunities in emerging regions where increasing construction activity, improvement in building codes, and sophistication of construction practices can accelerate demand for our construction products. We continue to expand our commercial and manufacturing capabilities in these geographic areas.

The key raw materials used in our specialty construction products are obtained from a variety of suppliers, including basic chemical and petrochemical producers. The majority of our raw materials are organic chemicals derived from olefins. We also make significant purchases of inorganic materials such as gypsum, as well as specialty materials including specialty films, papers and fibers. In most instances, these materials are available from multiple sources. Global supply and demand factors, changes in currency exchange rates, and petroleum prices have significantly impacted the price and availability of key raw materials in recent years.

Since we manufacture a substantial portion of our construction products in emerging regions using raw materials from suppliers in the U.S., Europe and other advanced economies, changes in the values of the currencies of these emerging regions versus the U.S. dollar and the euro may adversely affect our raw material costs and the prices we may charge for our products.

The construction business is cyclical in response to economic conditions and construction demand. The construction business is also seasonal and dependent on favorable weather conditions, with a decrease in construction activity during the winter months. Demand for our specialty construction products is primarily driven by global non-residential construction activity and U.S. residential construction activity. We seek to increase profitability and minimize the impact of cyclical downturns in regional economies by introducing technically advanced high-performance products and expanding geographically. Although these strategies have been successful in reducing the impact of cyclicality, the decline in U.S. and European construction activity since 2007 has had a negative impact on our sales.

FINANCIAL INFORMATION ABOUT INDUSTRY SEGMENTS AND GEOGRAPHIC AREAS

Disclosure of financial information about industry segments and geographic areas for 2013, 2012 and 2011 is provided in this Report in Item 8 (Financial Statements and Supplementary Data) in the Financial Supplement under Note 20 (Operating Segment Information) to the Consolidated Financial Statements, which disclosure is incorporated herein by reference. Disclosure of risks attendant to our foreign operations is provided in this Report in Item 1A (Risk Factors).

BACKLOG OF ORDERS

While at any given time there may be some backlog of orders, this backlog is not material in respect to our total annual sales, nor are the changes, from time to time, significant.

INTELLECTUAL PROPERTY; RESEARCH ACTIVITIES

Competition in the specialty chemicals and specialty materials industry is often based on technological superiority and innovation. Our ability to maintain our margins and effectively compete with other suppliers depends on our ability to introduce new products based on innovative technology, as well as our ability to obtain patent or other intellectual property protection. Our research and development programs emphasize development of new products and processes, improvement of existing products and processes and application of existing products and processes to new industries and uses. We conduct research in all regions, with North America and Europe accounting for the most activity.

We routinely file and obtain patents in a number of countries around the world that are significant to our businesses in order to protect our investments in innovation, research, and product development. Numerous patents and patent applications protect our products, formulations, manufacturing processes, equipment, and improvements. We also benefit from the use of trade secret information, including know-how and other proprietary information relating to many of our products and processing technologies. There can be no assurance, however, that our patents, patent applications and precautions to protect trade secrets and know-how will provide sufficient protection for our intellectual property. In addition, other companies may independently develop technology that could replicate, and thus diminish the advantage provided by, our trade secrets. Other companies may also develop alternative technology or design-arounds that could circumvent our patents or may acquire patent rights applicable to our business which might interpose some limitation on expansion of the business in the future.

Research and development expenses were approximately $65 million in 2013 and 2012 and $69 million in 2011. These amounts include depreciation and amortization expenses related to research and development and expenses incurred in funding external research projects. The amount of research and development expenses relating to government- and customer-sponsored projects (rather than projects that we sponsor) was not material during these periods. Grace also conducts research and development activities with our ART joint venture, which is not included in the amounts above.

ENVIRONMENT, HEALTH AND SAFETY MATTERS

We are subject, along with other manufacturers of specialty chemicals, to stringent regulations under numerous U.S. federal, state and local and foreign environment, health and safety laws and regulations relating to the generation, storage, handling, discharge, disposition and stewardship of hazardous wastes and other materials. Environmental laws require that certain responsible parties, as defined in the relevant statute, fund remediation actions regardless of legality of original disposal or ownership of a disposal site. We are involved in remediation actions to address hazardous wastes or other materials as required by U.S. federal, state and local and foreign laws.

We have expended substantial funds to comply with environmental laws and regulations and expect to continue to do so in the future. The following table sets forth our expenditures in the past three years, and our

estimated expenditures in 2014 and 2015, for (i) the operation and maintenance of manufacturing facilities and the disposal of wastes; (ii) capital expenditures for environmental control facilities; and (iii) site remediation:

|

| | | | | | | | | | | | | |

Year (In millions) | | Operation of Facilities and Waste Disposal | | Capital Expenditures | | Site Remediation | |

2011 | | $ | 58 |

| | $ | 6 |

| | $ | 12 |

| |

2012 | | 61 |

| | 9 |

| | 13 |

| |

2013 | | 59 |

| | 17 |

| | 14 |

| |

2014 | | 59 |

| | 19 |

| | 18 |

| * |

2015 | | 60 |

| | 10 |

| | 7 |

| * |

| |

* | Amounts are based on site remediation matters for which sufficient information is available to estimate remediation costs. We do not have sufficient information to estimate all of Grace's possible future remediation costs. As we receive new information, our estimate of remediation costs may change materially. |

Additional information about our environmental remediation activities is provided in this Report in Item 8 (Financial Statements and Supplementary Data) in the Financial Supplement under Note 13 (Commitments and Contingent Liabilities) to the Consolidated Financial Statements.

We continuously seek to improve our environmental, health and safety performance. To the extent applicable, we extend the basic elements of the American Chemistry Council's RESPONSIBLE CARE® program to all our locations worldwide, embracing specific performance objectives in the key areas of management systems, product stewardship, employee health and safety, community awareness and emergency response, distribution, process safety and pollution prevention. We have implemented key elements of the RESPONSIBLE CARE® Security Code for our operations and systems. We have completed a review of our existing security (including cyber-security) vulnerability and have taken actions to enhance our security systems and protect our assets. We have undertaken certain activities to comply with the Department of Homeland Security (DHS) Chemical Facility Anti-Terrorism Standards, including identifying facilities subject to the standards, conducting security vulnerability assessments and developing site security plans, as necessary.

EMPLOYEE RELATIONS

As of December 31, 2013, we employed approximately 6,700 persons, of whom approximately 2,700 were employed in the United States. Of our total employees, approximately 4,700 were salaried and 2,000 were hourly.

Approximately 750 of our manufacturing employees in the United States are represented for collective bargaining purposes by nine different local collective bargaining groups. We have operated without a labor work stoppage for more than 10 years.

We have works councils representing the majority of our European sites serving approximately 1,400 employees.

AVAILABILITY OF REPORTS AND OTHER DOCUMENTS

We maintain an Internet website at www.grace.com. Our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports, filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, are available, free of charge, on our website as soon as reasonably practicable after such reports are electronically filed with, or furnished to, the Securities and Exchange Commission, or SEC. These reports may be accessed through our website's investor information page.

In addition, the charters for the Audit, Compensation, Nominating and Governance, and Corporate Responsibility Committees of our Board of Directors, our corporate governance guidelines and code of ethics are available, free of charge, on our website at www.grace.com/About/Leadership/Governance/. Printed copies of the charters, governance guidelines and code of ethics may be obtained free of charge by contacting Grace Shareholder Services at 410-531-4167.

The information on our website is not, and shall not be deemed to be, a part of this report or incorporated into any other filings we make with the SEC.

Our Chief Executive Officer and Chief Financial Officer have submitted certifications to the SEC pursuant to the Sarbanes Oxley Act of 2002 as exhibits to this Report.

EXECUTIVE OFFICERS

See Part III, Item 10 of this Report for information about our Executive Officers.

Item 1A. RISK FACTORS

This Report, including the Financial Supplement, contains, and our other public communications may contain, forward-looking statements; that is, information related to future, not past, events. Such statements generally include the words "believes," "plans," "intends," "targets," "will," "expects," "suggests," "anticipates," "outlook," "continues" or similar expressions. Forward-looking statements include, without limitation, all statements regarding: our Chapter 11 case; expected financial positions; results of operations; cash flows; financing plans; business strategy; budgets; capital and other expenditures; competitive positions; growth opportunities for existing products; benefits from new technology and cost reduction initiatives; plans and objectives; and markets for securities. For these statements, we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. Like other businesses, we are subject to risks and uncertainties that could cause our actual results to differ materially from our projections or that could cause other forward-looking statements to prove incorrect. Factors that could cause actual events to materially differ from those contained in the forward-looking statements include those factors set forth below and elsewhere in this Annual Report on Form 10-K. Our reported results should not be considered as an indication of our future performance. Readers are cautioned not to place undue reliance on our projections and forward-looking statements, which speak only as of the date thereof. We undertake no obligation to publicly release any revisions to the projections and forward-looking statements contained in this document, or to update them to reflect events or circumstances occurring after the date of this document. In addition to general economic, business and market conditions, we are subject to other risks and uncertainties, including, without limitation, the following:

The length and depth of product and industry business cycles in our segments may result in periods of reduced sales, earnings and cash flows, and portions of our business are subject to seasonality and weather-related effects.

Our operating segments are sensitive to the cyclical nature of the industries they serve. Our construction business is cyclical in response to economic conditions and construction demand and is also seasonal and dependent on favorable weather conditions, with a decrease in construction activity during the winter months. Sales of our FCC catalysts tend to be lower in the first calendar quarter prior to the shift in production by refineries from home heating oil for the winter season to gasoline production for the summer season. Our packaging products are affected by seasonal and weather-related factors including the consumption of beverages and the size and quality of food crops.

The global scope of our operations subjects us to the risks of doing business in foreign countries, which could adversely affect our business, financial condition and results of operations.

We operate our business on a global scale with approximately 71% of our 2013 sales outside the United States. We conduct business in over 40 countries and in more than 50 currencies. We currently have many production facilities, research and development facilities and administrative and sales offices located outside North America, including facilities and offices located in Europe, the Middle East, Africa, Asia and Latin America. We expect non-U.S. sales to continue to represent a substantial majority of our revenue. Accordingly, our business is subject to risks related to the differing legal, political, social and regulatory requirements and economic conditions of many jurisdictions. Risks inherent in non-U.S. operations include the following:

| |

• | commercial agreements may be more difficult to enforce and receivables more difficult to collect; |

| |

• | intellectual property rights may be more difficult to enforce; |

| |

• | increased shipping costs, disruptions in shipping or reduced availability of freight transportation; |

| |

• | we may have difficulty transferring our profits or capital from foreign operations to other countries where such funds could be more profitably deployed; |

| |

• | we may experience unexpected adverse changes in export duties, quotas and tariffs and difficulties in obtaining export licenses; |

| |

• | some foreign countries have adopted, and others may impose, additional withholding taxes or adopt other restrictions on foreign trade or investment, including currency exchange and capital controls; |

| |

• | foreign governments may nationalize private enterprises; |

| |

• | our business and profitability in a particular country could be affected by political or economic repercussions on a domestic, country specific or global level from terrorist activities and the response to such activities; |

| |

• | we may be affected by unexpected adverse changes in foreign laws or regulatory requirements; and |

| |

• | unanticipated events, such as geopolitical changes, could adversely affect these operations. |

Our success as a global business will depend, in part, upon our ability to succeed in differing legal, regulatory, economic, social and political conditions by developing, implementing and maintaining policies and strategies that are effective in each location where we do business.

We are exposed to currency exchange rate changes that impact our profitability.

We are exposed to currency exchange rate risk through our U.S. and non-U.S. operations. Changes in currency exchange rates may materially affect our operating results. For example, changes in currency exchange rates may affect the relative prices at which we and our competitors sell products in the same region and the cost of materials used in our operations. A substantial portion of our net sales and assets are denominated in currencies other than the U.S. dollar. When the U.S. dollar strengthens against other currencies, at a constant level of business, our reported sales, earnings, assets and liabilities are reduced because the non-U.S. currencies translate into fewer U.S. dollars.

We incur a currency transaction risk whenever one of our operating subsidiaries enters into either a purchase or a sales transaction using a currency different from the operating subsidiary's functional currency. Given the volatility of exchange rates, we may not be able to manage our currency transaction risks effectively, or volatility in currency exchange rates may expose our financial condition or results of operations to a significant additional risk.

Prices for certain raw materials and energy are volatile; we may not be able to pass through increases in costs for raw materials and energy or maintain our current pricing levels, which may hurt our profitability.

We use petroleum-based materials, metals, natural gas and other materials in the manufacture of our products. Prices for these materials are volatile and can have a significant effect on our pricing, sales, manufacturing and supply chain strategies as we seek to maximize our profitability. In 2012 and 2011, our Grace Catalysts Technologies sales were affected by significant increases in the prices of the rare earths used in the manufacture of our FCC catalysts. In response, we implemented surcharges on our FCC catalysts. In the 2011 third quarter, rare earth prices reached a peak and have since declined significantly. As a result, the amount of our surcharges has decreased with a corresponding decrease in sales. In 2013 and 2012, respectively, the negative effect of lower rare earth surcharges on sales was approximately $97 million and $170 million compared with the respective prior year. Our ability to successfully adjust strategies in response to volatile raw material and energy prices is a significant factor in maintaining or improving our profitability. If we are unable to successfully adjust our strategies in response to volatile prices, such volatility could have a negative effect on our sales and earnings in future periods.

A substantial portion of our raw materials are commodities whose prices fluctuate as market supply and demand fundamentals change.

We attempt to manage exposure to price volatility of major commodities through:

| |

• | long-term supply contracts; |

| |

• | contracts with customers that permit adjustments for changes in prices of commodity-based materials and energy; |

| |

• | forward buying programs that layer in our expected requirements systematically over time; and |

| |

• | limited use of financial instruments. |

Although we regularly assess our exposure to raw material price volatility, we cannot always predict the prospects of volatility and we cannot always cover the risk in a cost effective manner.

We have a policy of maintaining, when available, multiple sources of supply for raw materials. However, certain of our raw materials may be provided by single sources of supply. We may not be able to obtain sufficient raw materials due to unforeseen developments that would cause an interruption in supply. Even if we have multiple sources of supply for raw materials, these sources may not make up for the loss of a major supplier.

If we are not able to continue our technological innovation and successful introduction of new products, our customers may turn to other suppliers to meet their requirements.

The specialty chemicals industry and the end-use markets into which we sell our products experience ongoing technological change and product improvements. A key element of our business strategy is to invest in research and development activities with the goal of introducing new high-performance, technically differentiated products. We may not be successful in developing new technology and products that successfully compete with products introduced by our competitors, and our customers may not accept, or may have lower demand for, our new products. If we fail to keep pace with evolving technological innovations or fail to improve our products in response to our customers’ needs, then our business, financial condition and results of operations could be adversely affected as a result of reduced sales of our products.

We spend large amounts of money for environmental compliance in connection with our current and former operations.

As a manufacturer of specialty chemicals and specialty materials, we are subject to stringent regulations under numerous U.S. federal, state, local and foreign environmental, health and safety laws and regulations relating to the generation, storage, handling, discharge, disposition and stewardship of hazardous wastes and other materials. We have expended substantial funds to comply with such laws and regulations and have established a policy to minimize our emissions to the environment. Nevertheless, legislative, regulatory and economic uncertainties (including existing and potential laws and regulations pertaining to climate change) make it difficult for us to project future spending for these purposes and if there is an acceleration in new regulatory requirements, we may be required to expend substantial additional funds to remain in compliance.

We are subject to environmental clean-up costs, fines, penalties and damage claims that have been and continue to be costly.