0000719739false00007197392023-01-192023-01-190000719739us-gaap:CommonStockMember2023-01-192023-01-190000719739us-gaap:SeriesAPreferredStockMember2023-01-192023-01-19

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 19, 2023

SVB Financial Group

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| | | | |

| Delaware | | 001-39154 | | 91-1962278 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (I.R.S. Employer

Identification No.) |

3003 Tasman Drive, Santa Clara, CA 95054-1191

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (408) 654-7400

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.142-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of Each Class | | Trading Symbol | | Name of Exchange on Which Registered |

| Common Stock, par value $0.001 per share | | SIVB | | The Nasdaq Stock Market LLC |

| | | | |

| Depositary shares, each representing a 1/40th interest in a share of 5.250% Fixed-Rate Non-Cumulative Perpetual Preferred Stock, Series A | | SIVBP | | The Nasdaq Stock Market LLC |

| | | | | |

| Item 2.02. | Results of Operations and Financial Condition. |

On January 19, 2023, SVB Financial Group (the “Company”) announced its financial results for the fourth quarter ended December 31, 2022. A copy of the release and a fourth quarter CEO letter and earnings slides are attached hereto as Exhibit 99.1 and Exhibit 99.2, respectively, and are incorporated herein by reference. The information in this report shall not be treated as “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, nor shall it be deemed incorporated by reference into any registration statement or other document pursuant to the Securities Act of 1933 or the Securities Act of 1934, except as expressly stated by specific reference in such filing.

On January 19, 2023, the Company's Board of Directors declared a quarterly cash dividend of $13.125 per share (representing $0.328125 per depositary share) on the Series A Preferred Stock. The dividend is payable on February 15, 2023 to holders of record at the close of business on February 1, 2023.

On January 19, 2023, the Company's Board of Directors declared a quarterly cash dividend of $1,025 per share (representing $10.25 per depositary share) on the Series B Preferred Stock. The dividend is payable on February 15, 2023 to holders of record at the close of business on February 1, 2023.

On January 19, 2023, the Company's Board of Directors declared a quarterly cash dividend of $1,000 per share (representing $10.00 per depositary share) on the Series C Preferred Stock. The dividend is payable on February 15, 2023 to holders of record at the close of business on February 1, 2023.

On January 19, 2023, the Company's Board of Directors declared a quarterly cash dividend of $1,062.50 per share (representing $10.625 per depositary share) on the Series D Preferred Stock. The dividend is payable on February 15, 2023 to holders of record at the close of business on February 1, 2023.

On January 19, 2023, the Company's Board of Directors declared a quarterly cash dividend of $1,175 per share (representing $11.75 per depositary share) on the Series E Preferred Stock. The dividend is payable on February 15, 2023 to holders of record at the close of business on February 1, 2023.

| | | | | |

| Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits.

| | | | | |

| Exhibit No. | Description |

| |

| 99.1 | |

| 99.2 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | | | | |

| Date: January 19, 2023 | | | | SVB FINANCIAL GROUP |

| | | |

| | | | By: | | /s/ KAREN HON |

| | | | Name: | | Karen Hon |

| | | | Title: | | Chief Accounting Officer and Principal Accounting Officer |

Exhibit 99.1

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| 3003 Tasman Drive, Santa Clara, CA 95054 | | | | | | | | Contact: |

| www.svb.com | | | | | | | | Meghan O'Leary |

| | | | | | | | Investor Relations |

| For release at 1:00 P.M. (Pacific Time) | | | | | | IR@SVB.com |

| January 19, 2023 | | | | | | | | (408) 654-6364 |

| | | | | | | | |

| NASDAQ: SIVB | | | | | | | | |

SVB FINANCIAL GROUP ANNOUNCES 2022 FOURTH QUARTER FINANCIAL RESULTS

Board of Directors declared a quarterly dividend on Series A, B, C, D and E Preferred Stock

SANTA CLARA, Calif. — January 19, 2023 — SVB Financial Group (NASDAQ: SIVB) today announced financial results for the fourth quarter ended December 31, 2022.

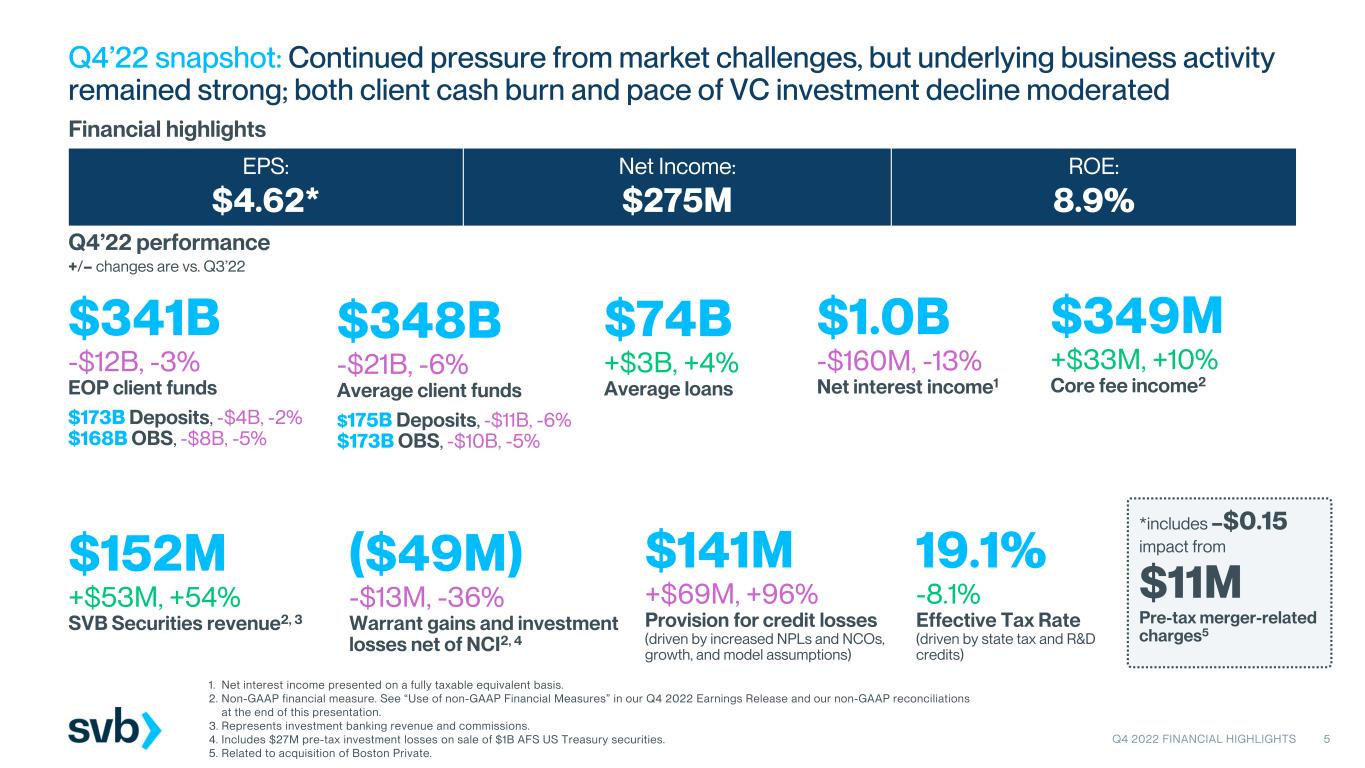

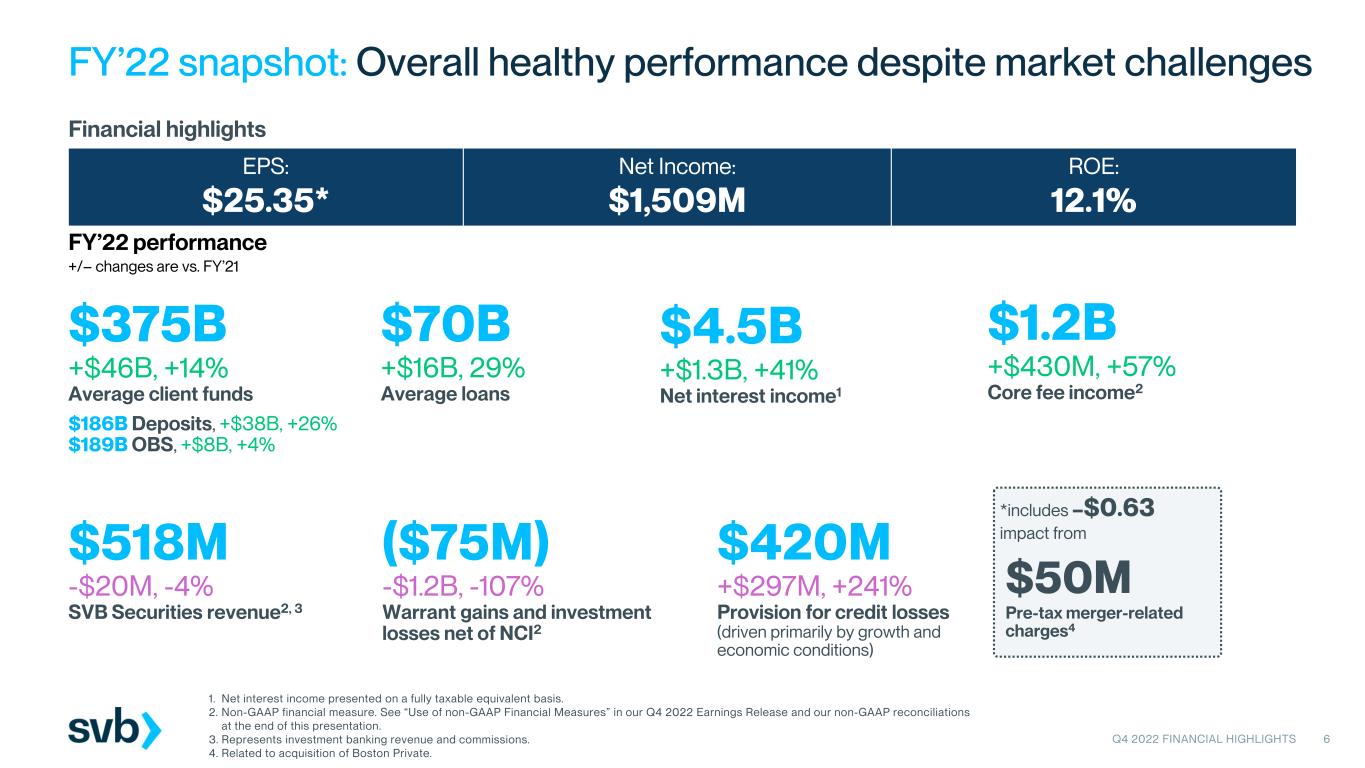

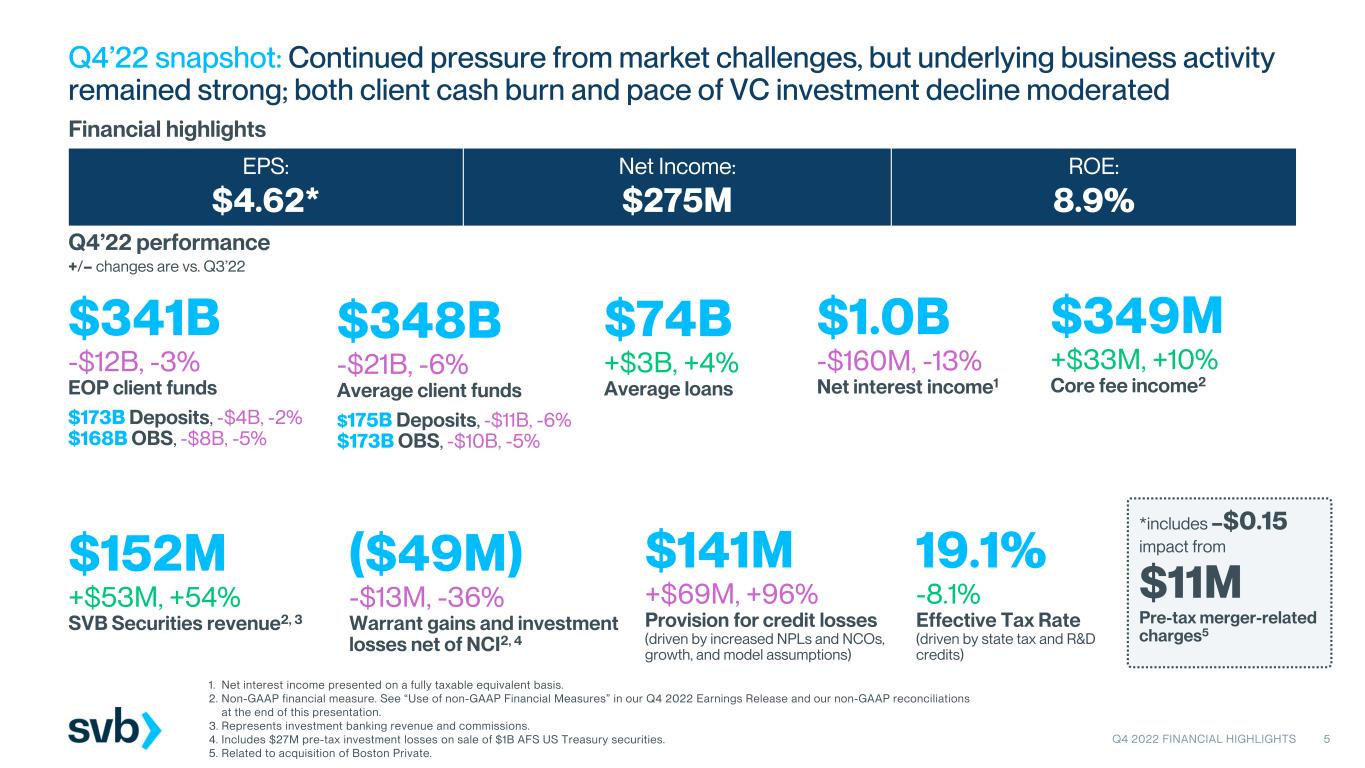

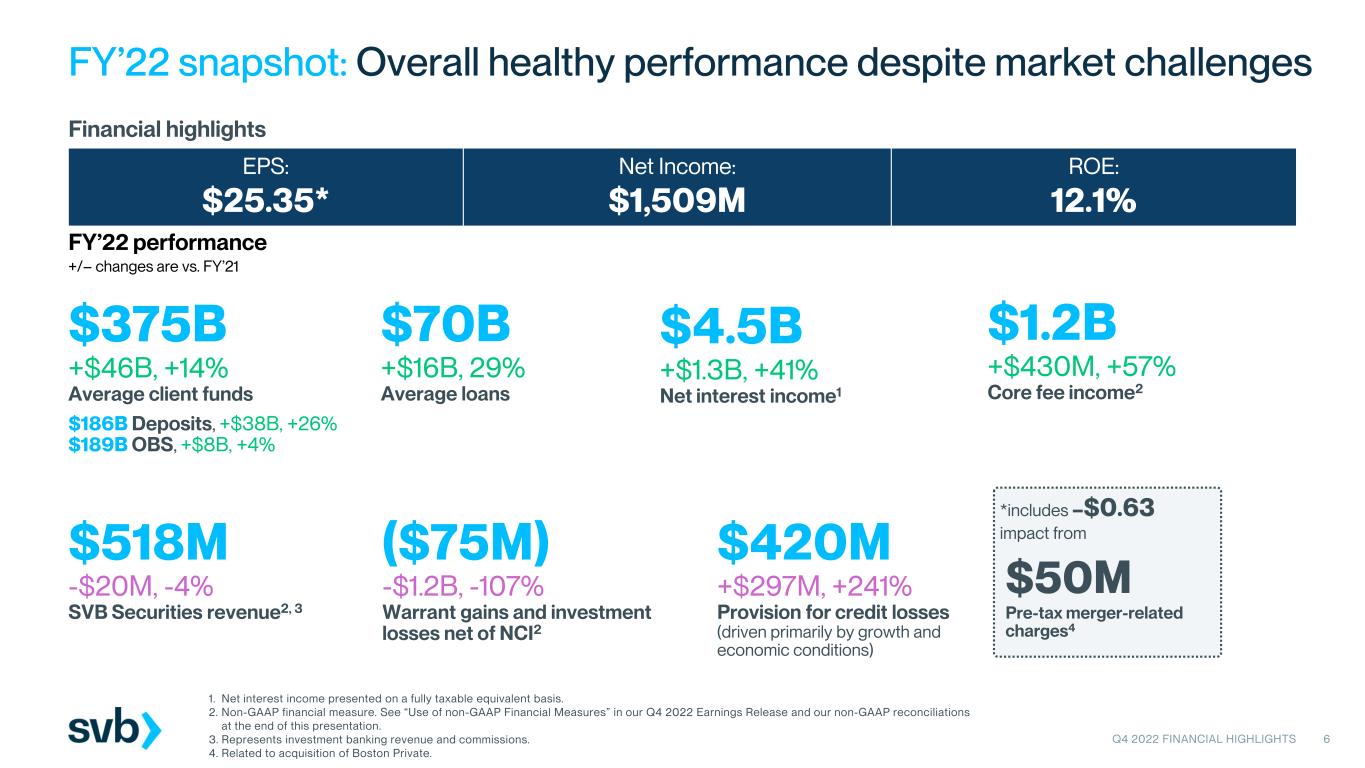

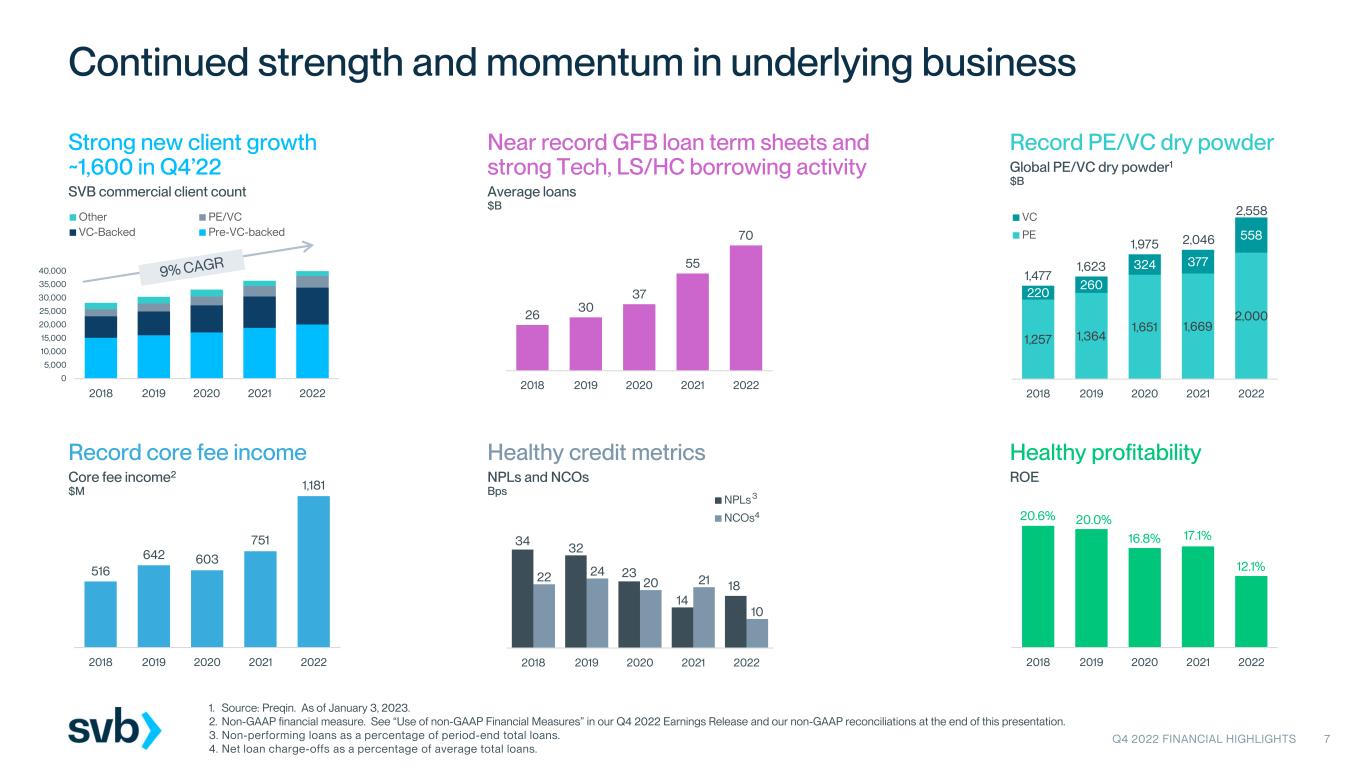

Consolidated net income available to common stockholders for the fourth quarter of 2022 was $275 million, or $4.62 per diluted common share, compared to $429 million, or $7.21 per diluted common share, for the third quarter of 2022 and $371 million, or $6.22 per diluted common share, for the fourth quarter of 2021. Consolidated net income available to common stockholders for the year ended December 31, 2022 was $1.5 billion, or $25.35 per diluted common share, compared to $1.8 billion, or $31.25 per diluted common share, for the comparable 2021 period.

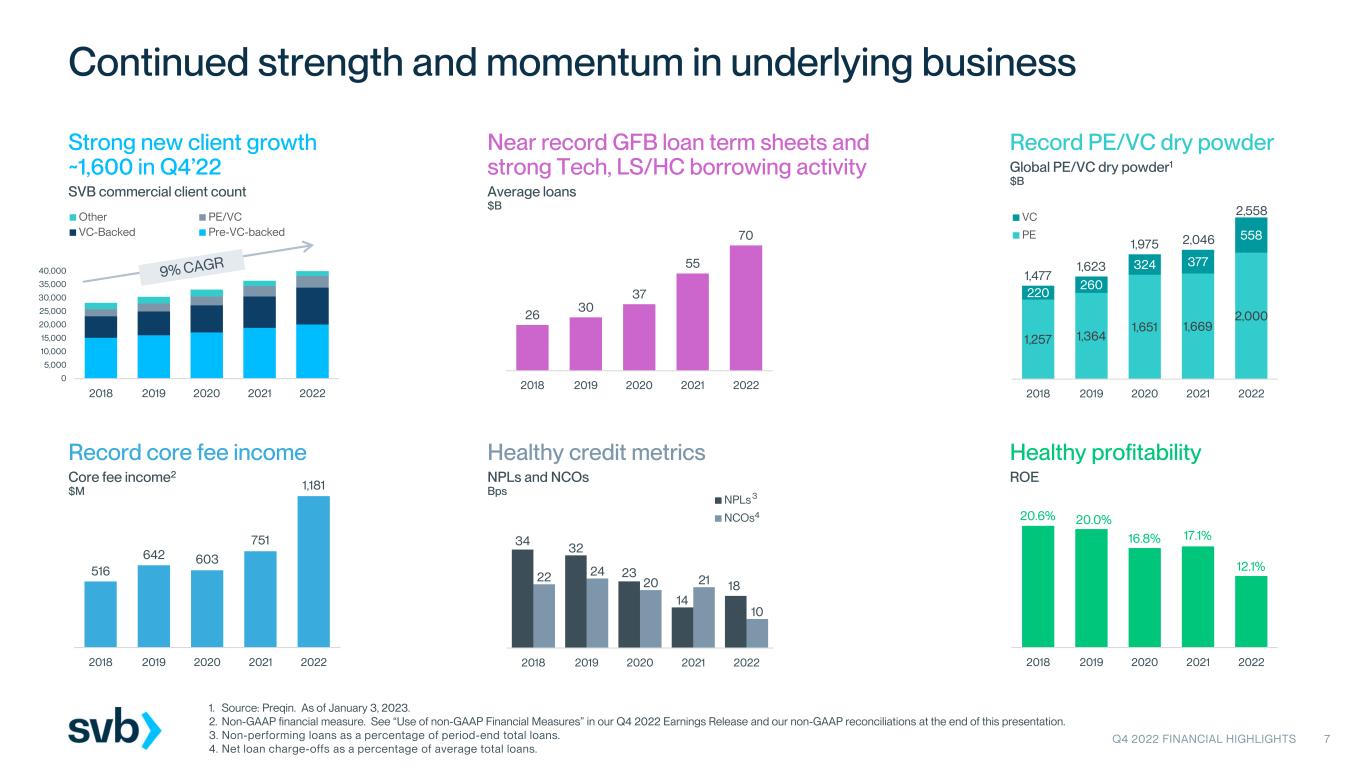

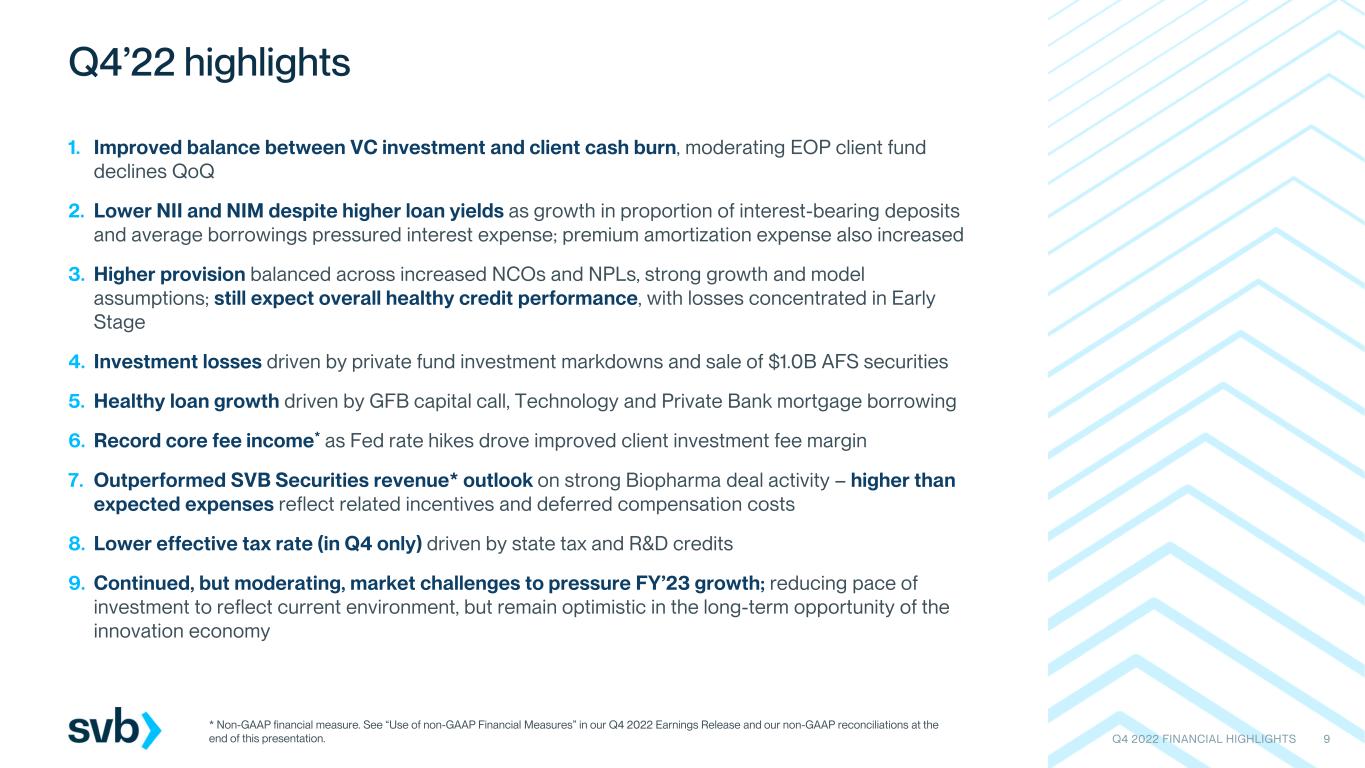

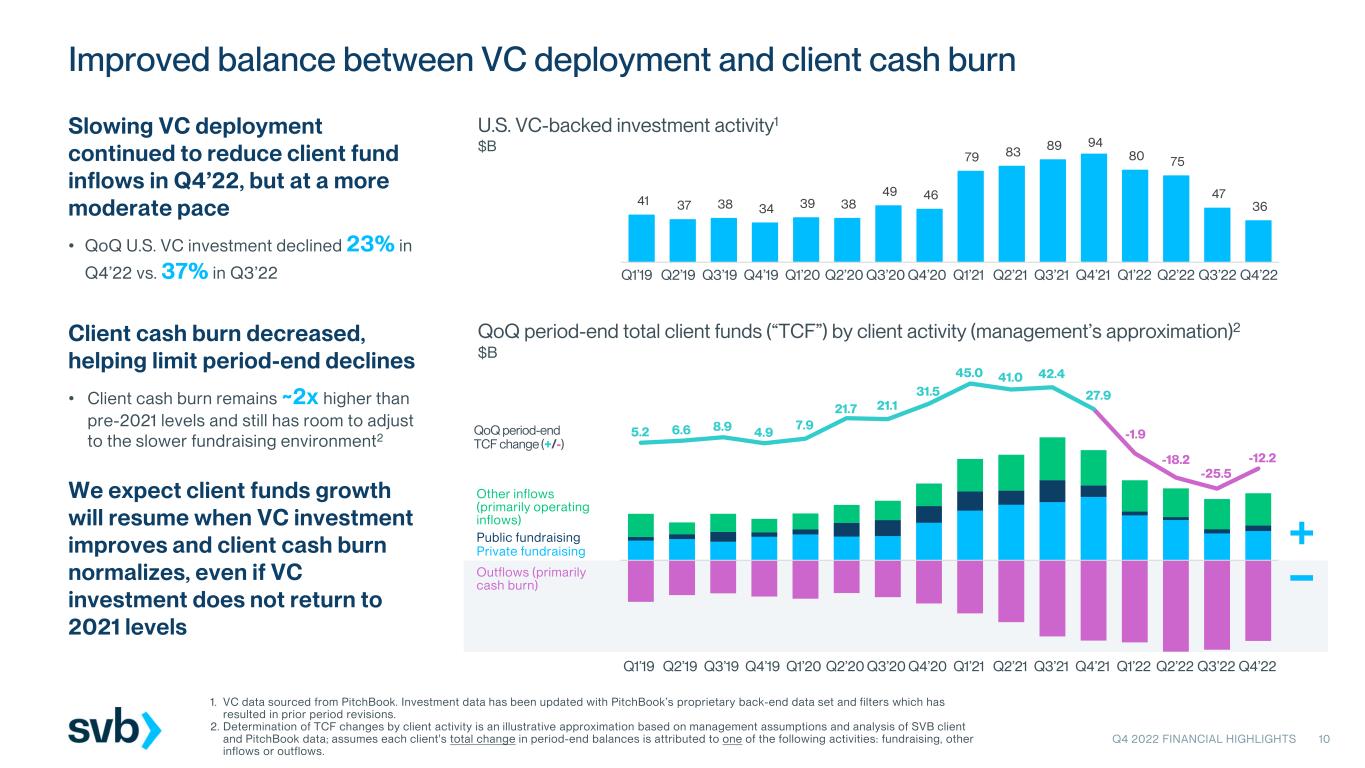

“In the fourth quarter, client cash burn and the pace of VC investment decline both moderated. We saw solid growth in loans and core fees, better-than-expected net interest income, and healthy investment banking activity driven by Biopharma deals,” said Greg Becker, President and CEO of SVB Financial Group. "While broader market conditions are limiting growth and driving somewhat higher credit costs, we continue to see strength in our underlying business, and a balance by our clients between near-term expense discipline and preparation for a return to investment and deployment. Until that shift occurs, we believe we remain well positioned with a strong balance sheet and the resources and expertise to manage successfully through the current environment.”

Highlights of our fourth quarter of 2022 results (compared to third quarter 2022, unless otherwise noted) included:

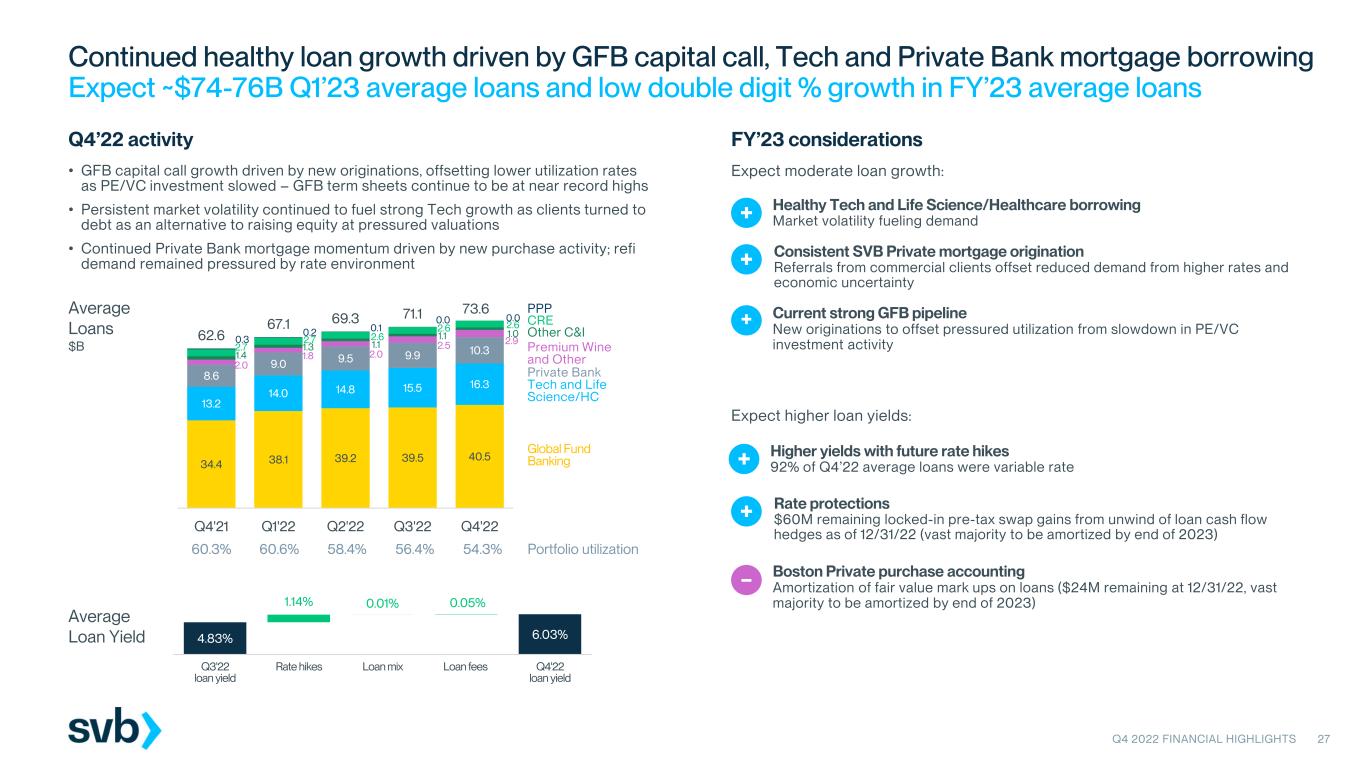

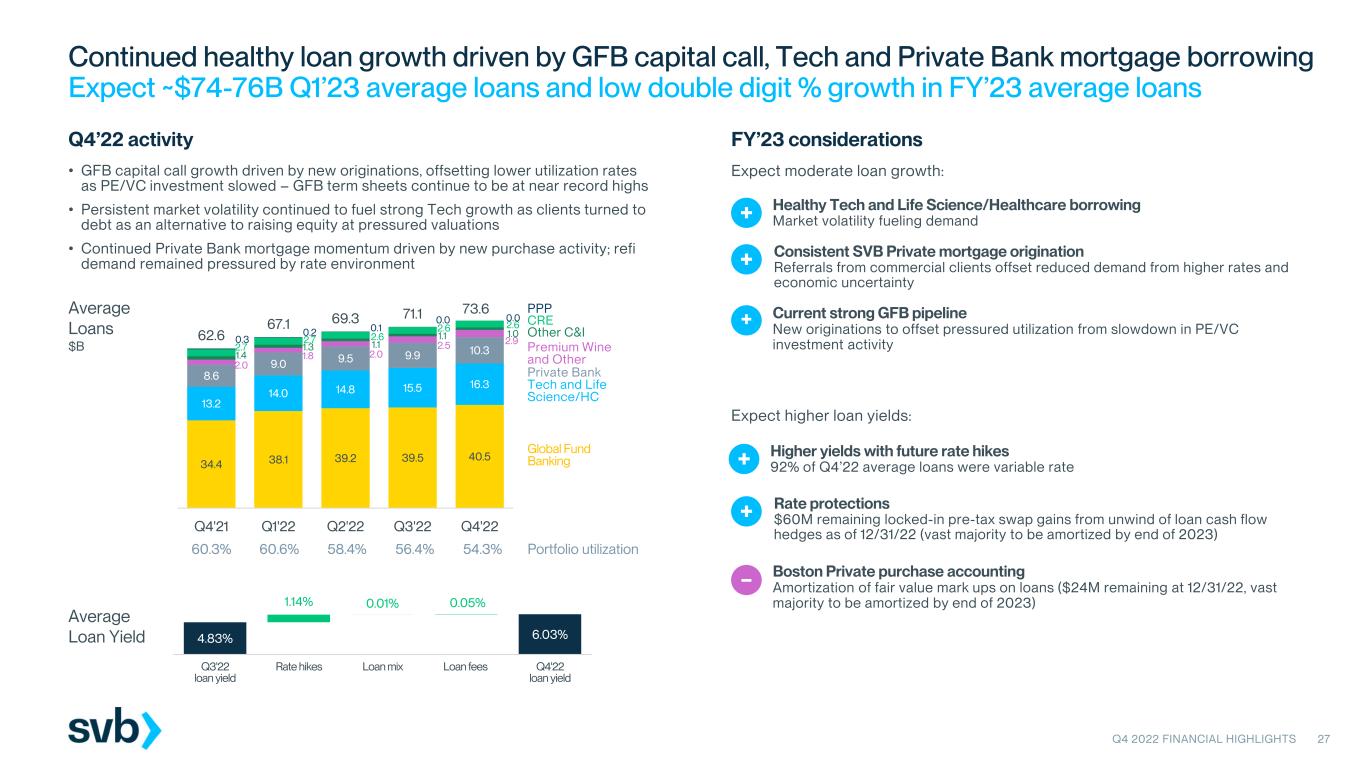

•Average loans of $73.6 billion, an increase of $2.5 billion (or 3.6 percent).

•Period-end loans of $74.3 billion, an increase of $2.1 billion (or 2.9 percent).

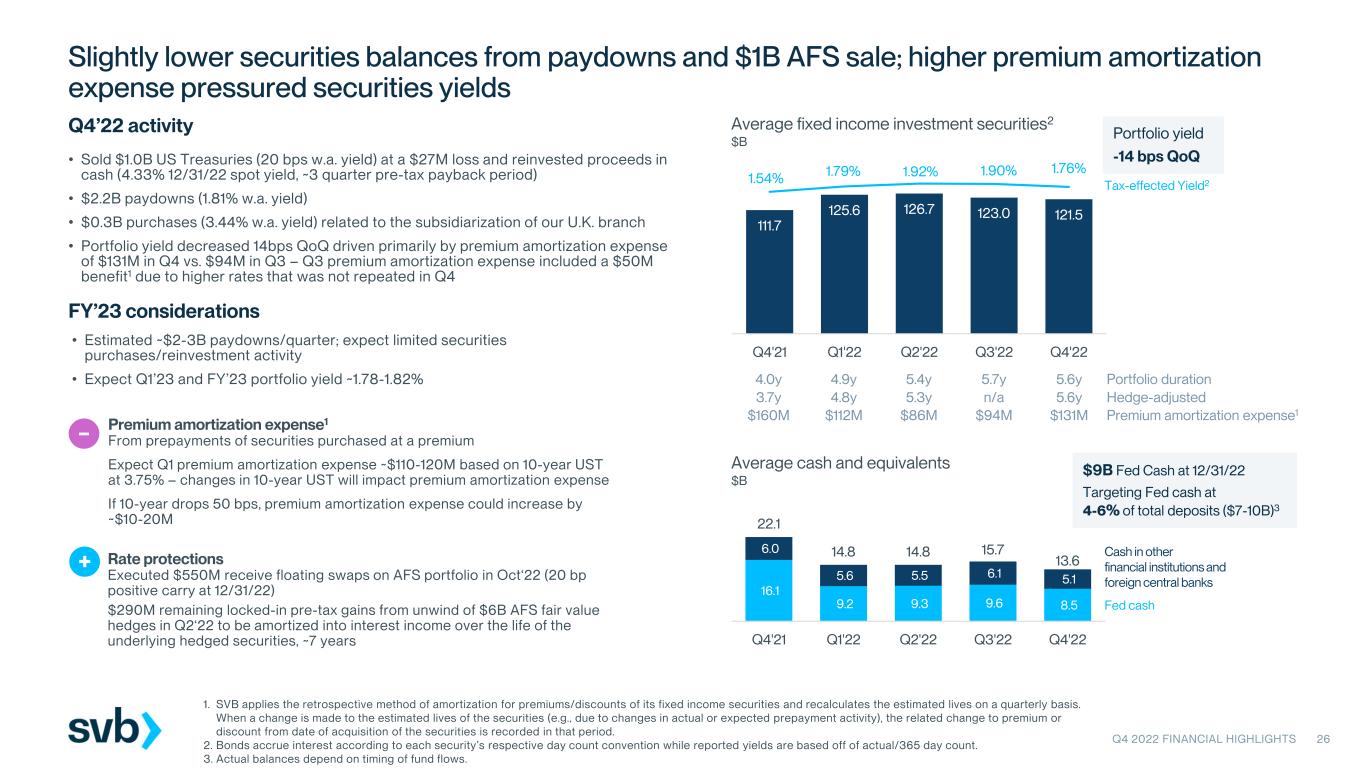

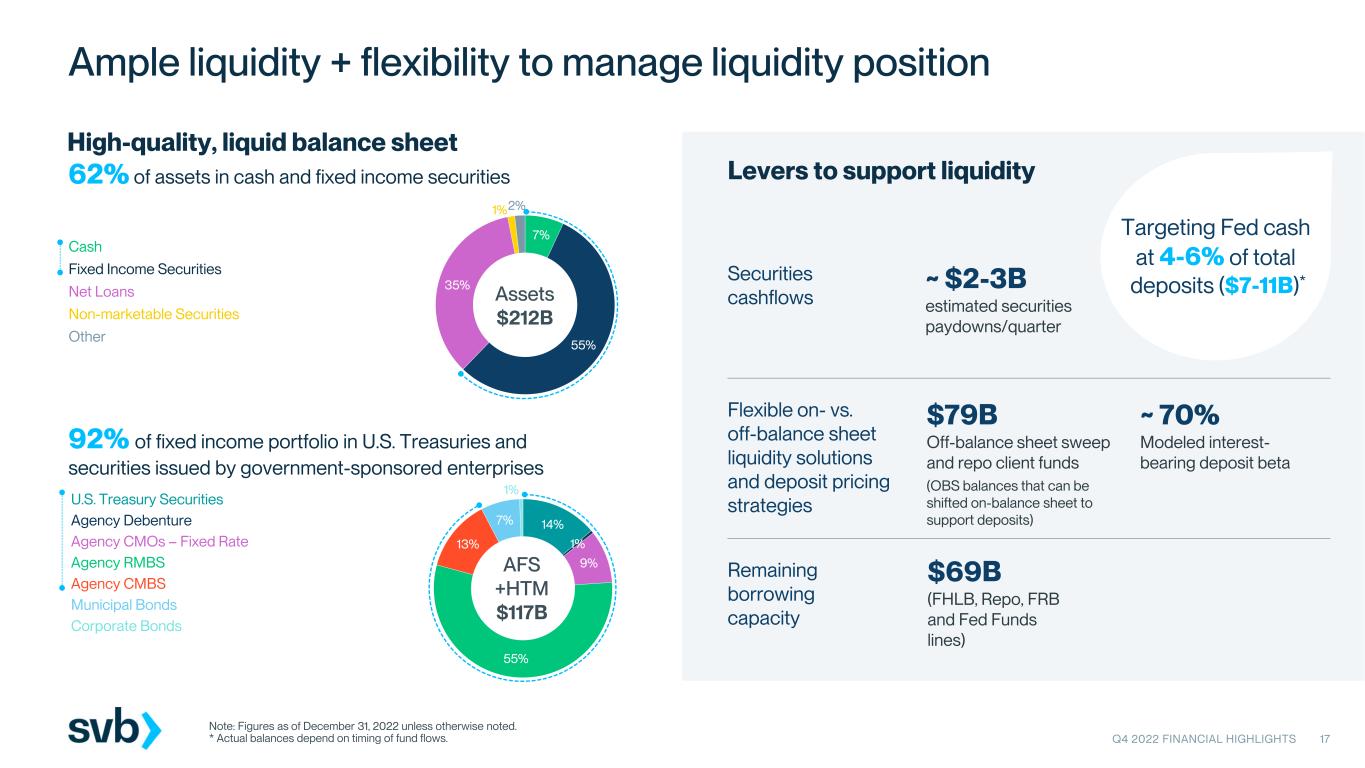

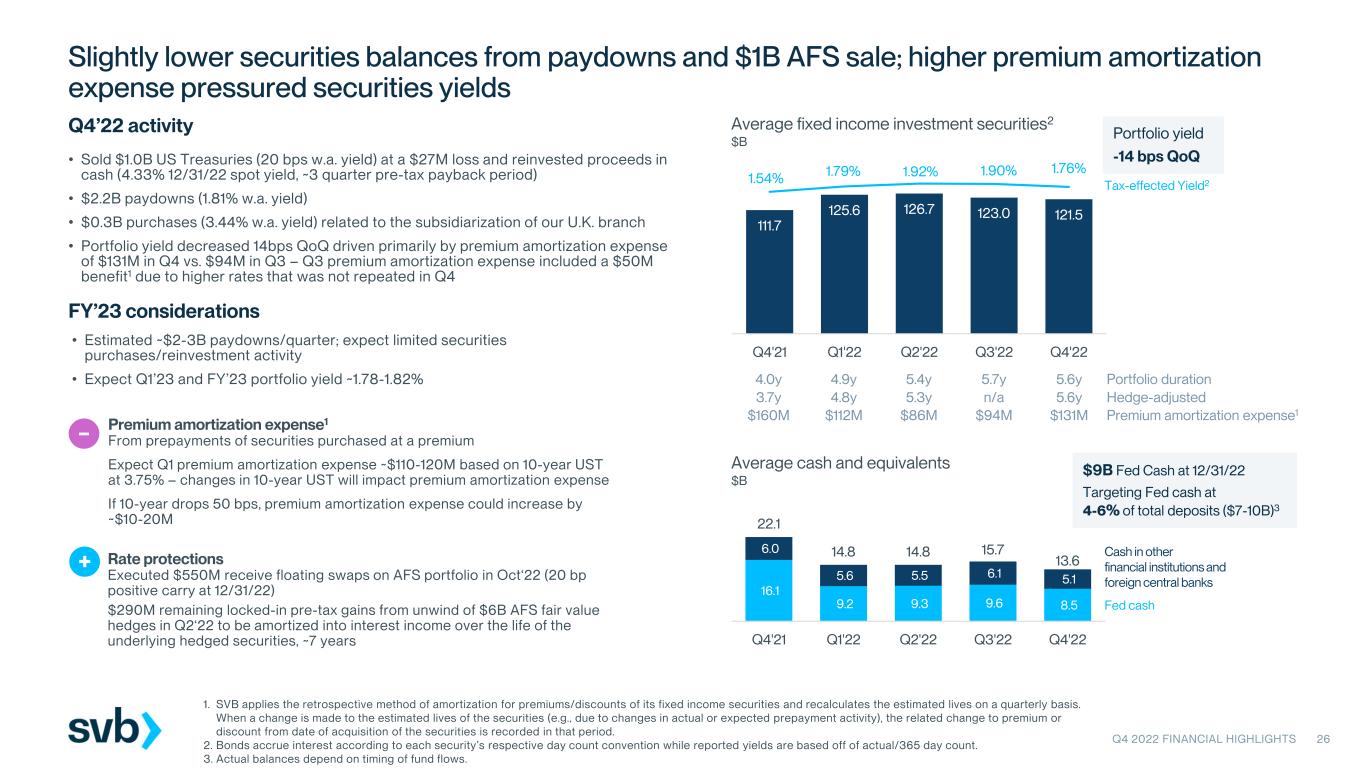

•Average fixed income investment securities of $121.5 billion, a decrease of $1.5 billion (or 1.2 percent).

•Period-end fixed income investment securities of $117.4 billion, a decrease of $2.6 billion (or 2.2 percent).

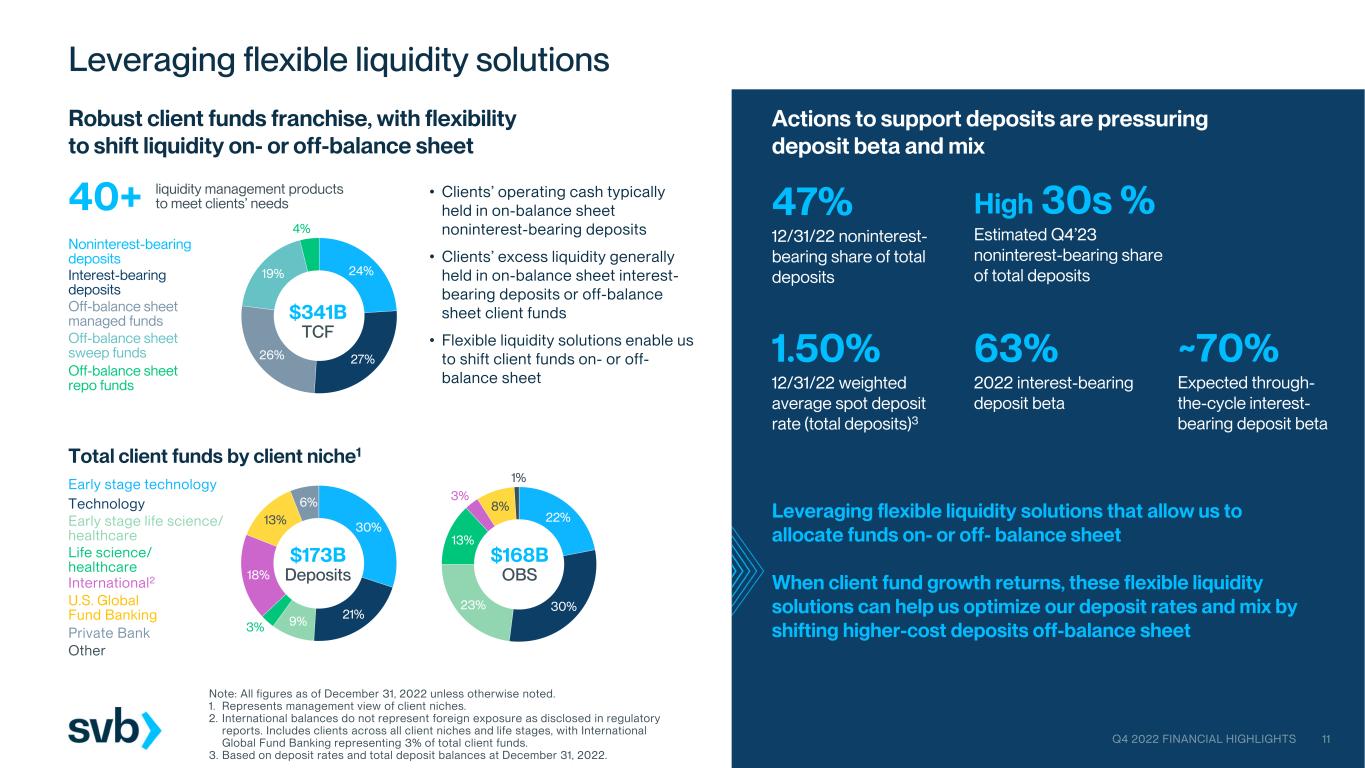

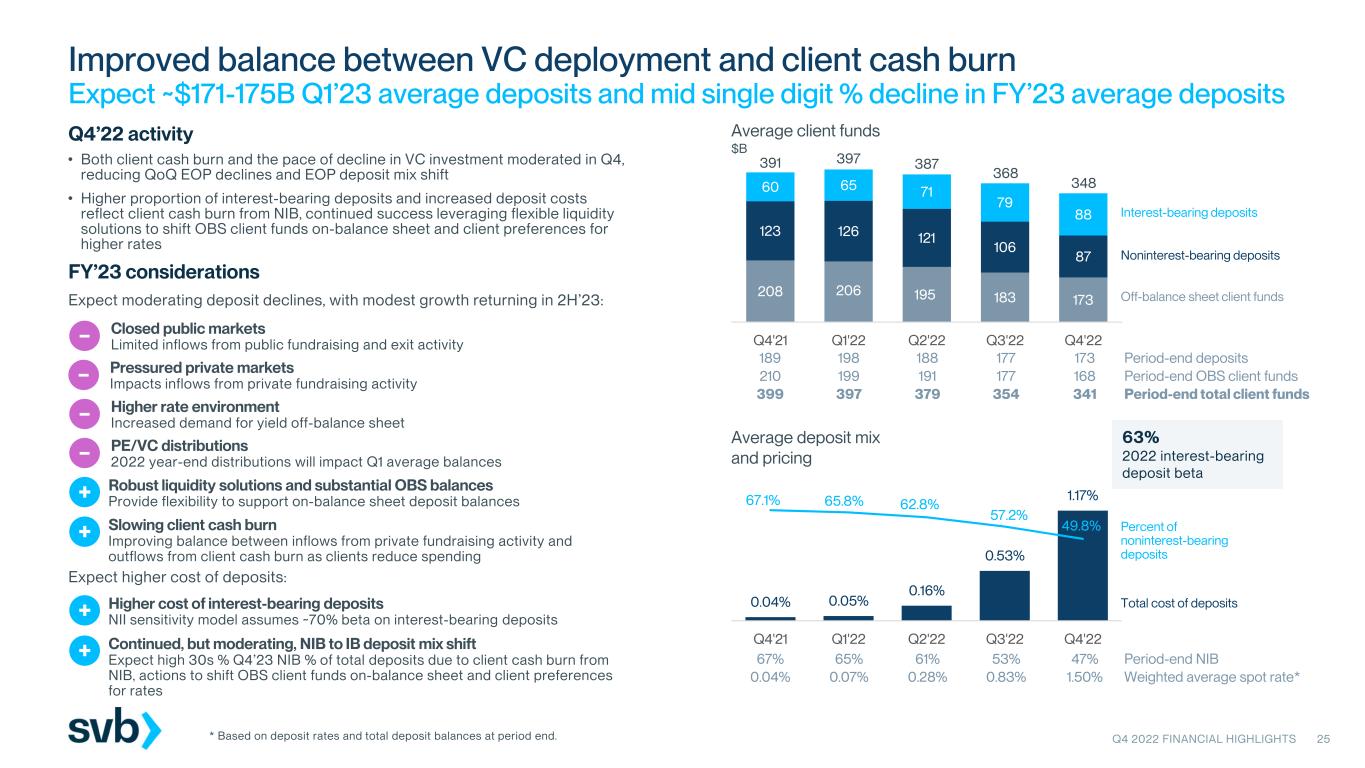

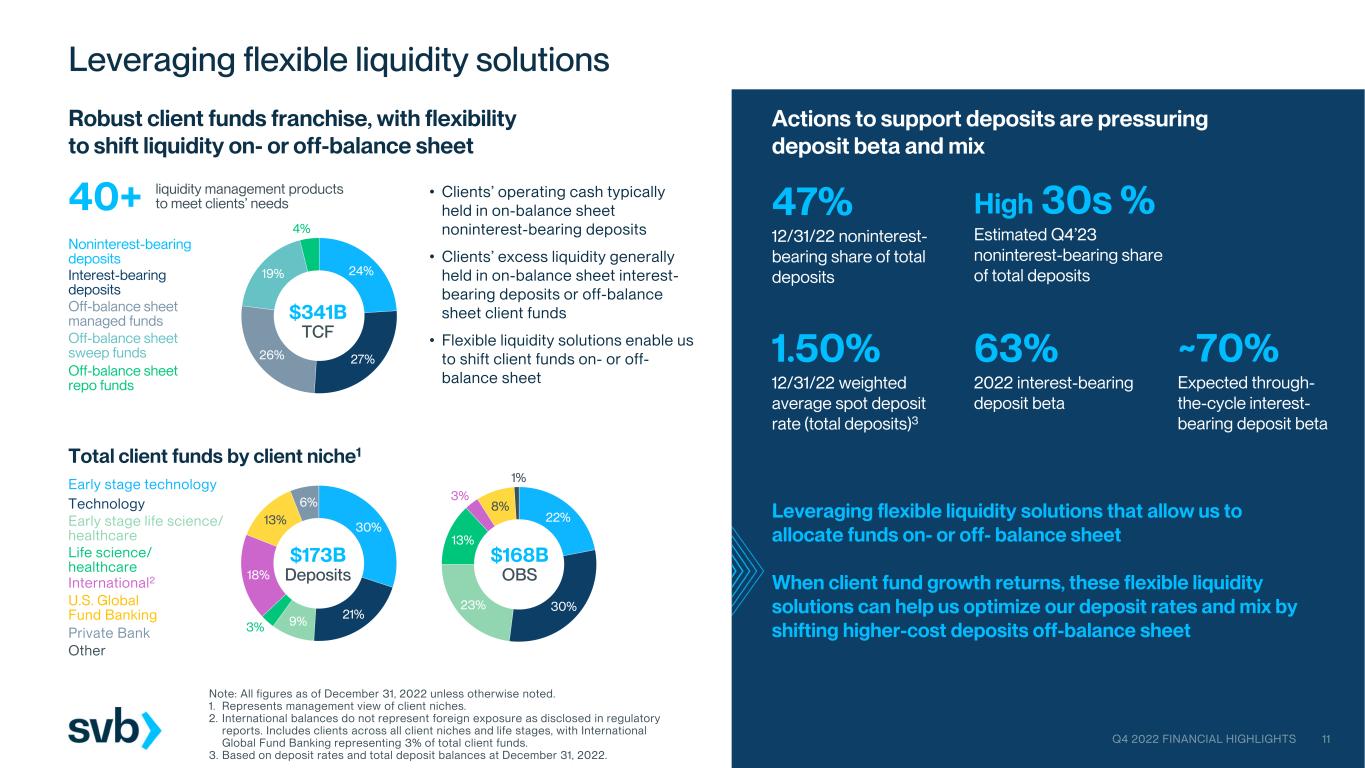

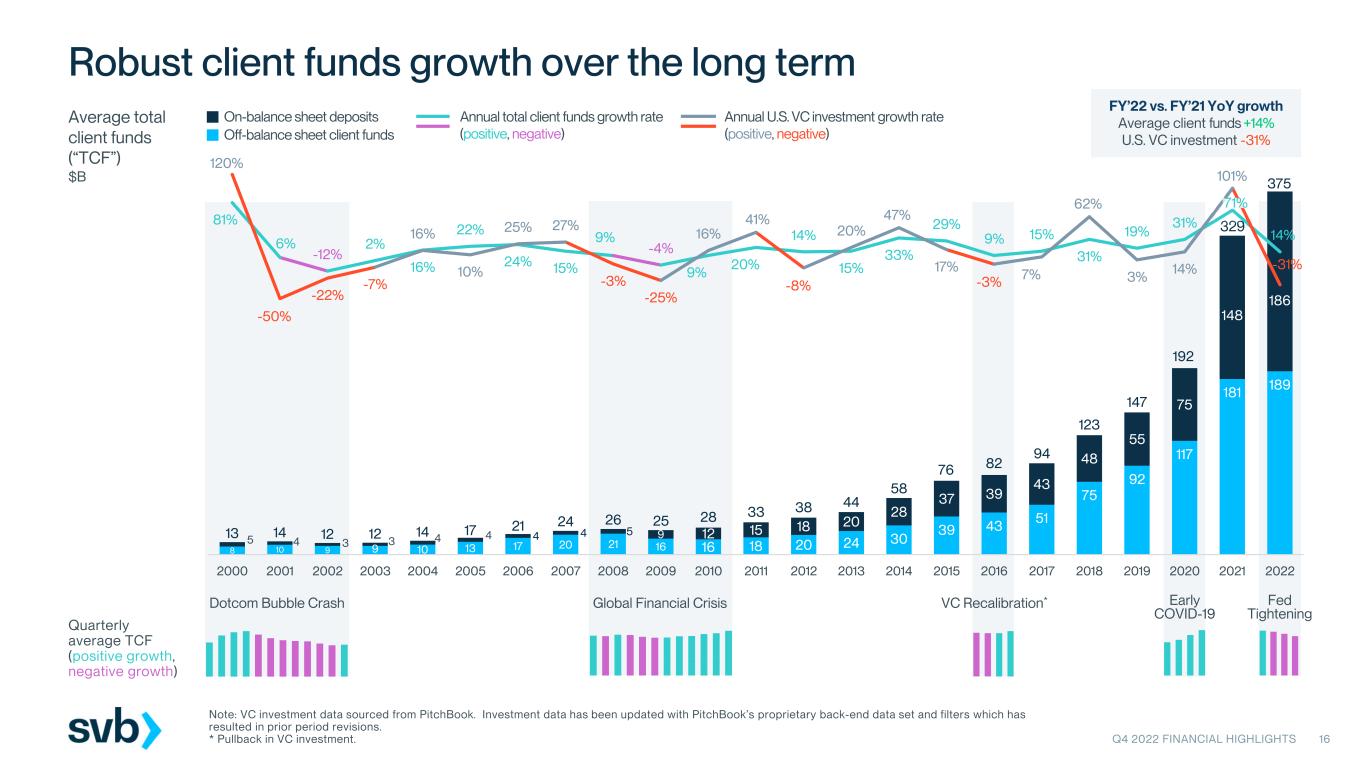

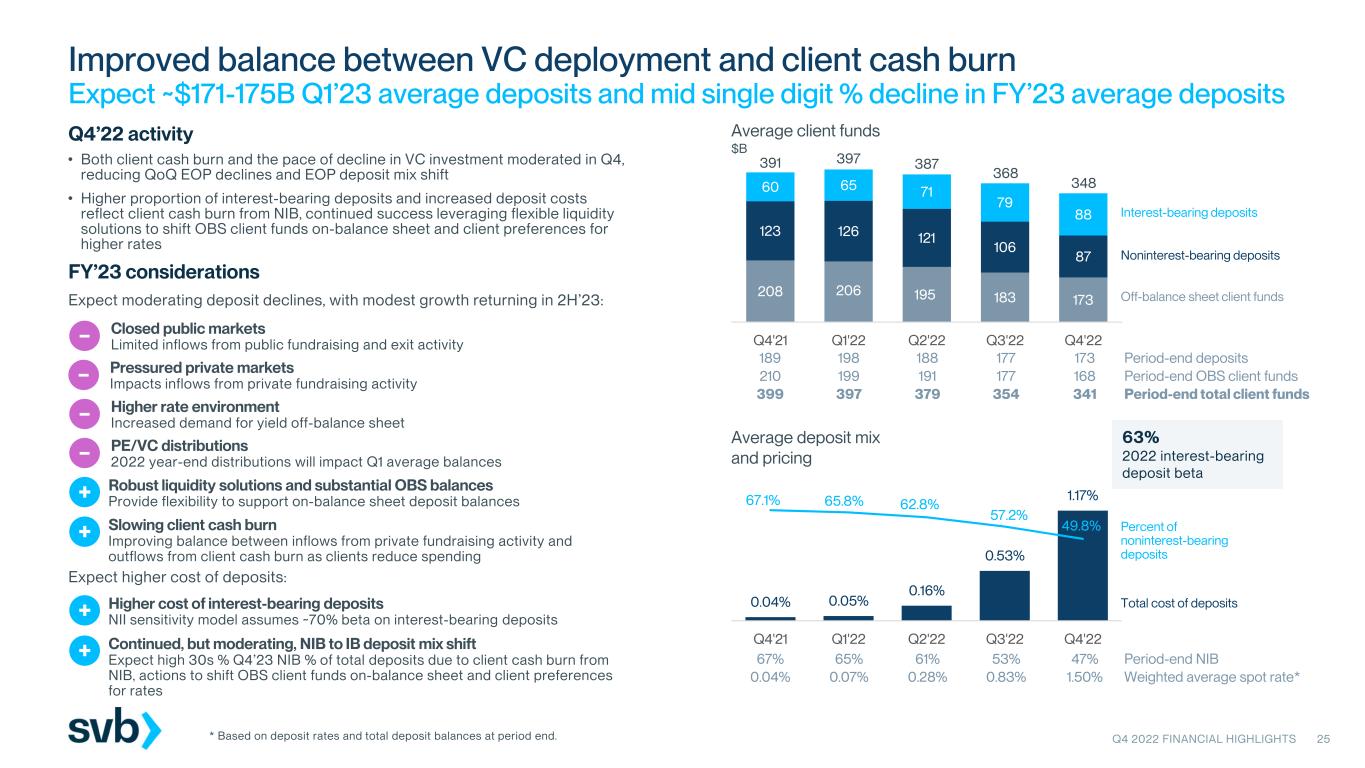

•Average total client funds (on-balance sheet deposits and off-balance sheet client investment funds) decreased $20.8 billion (or 5.7 percent) to $347.6 billion, which includes a decrease in average on-balance sheet deposits of $10.8 billion (or 5.8 percent).

•Period-end total client funds decreased $12.2 billion (or 3.4 percent) to $341.5 billion, which includes a decrease in period-end on-balance sheet deposits of $3.7 billion (or 2.1 percent).

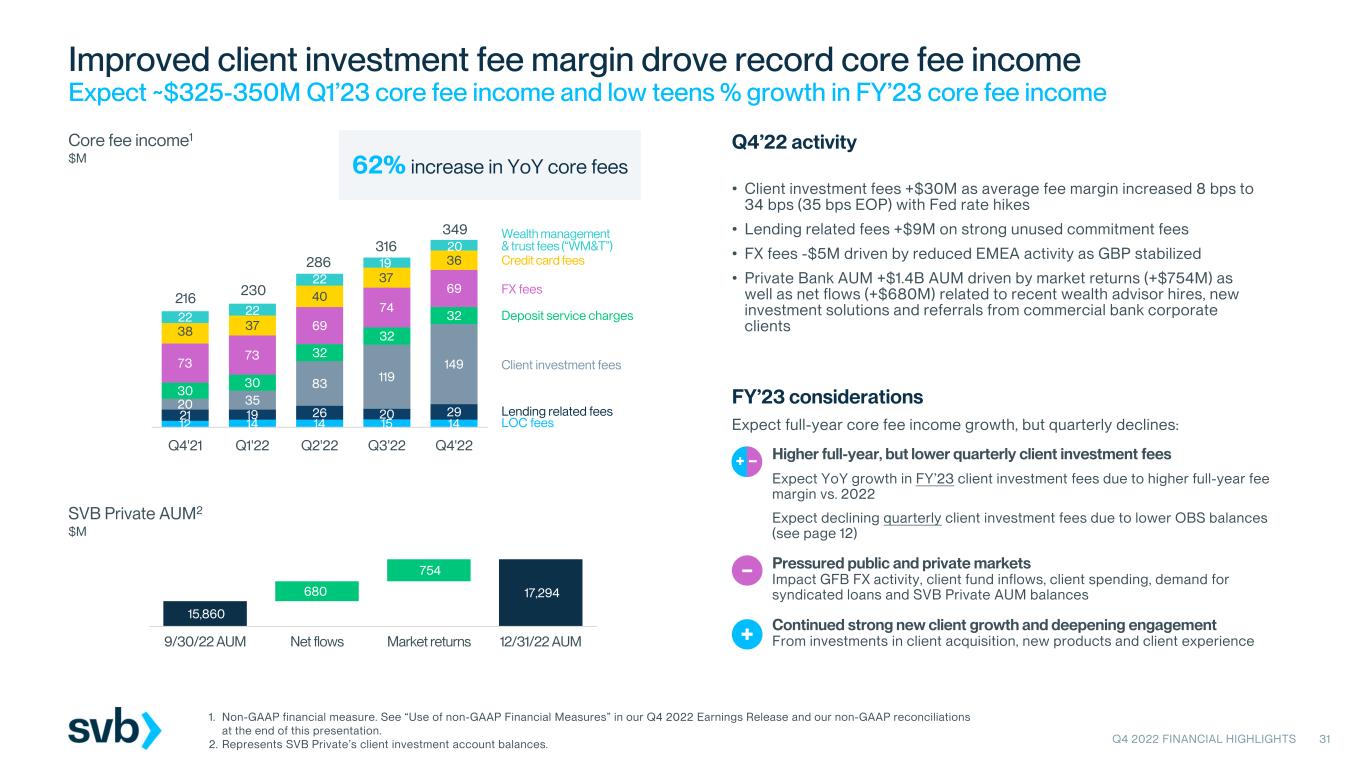

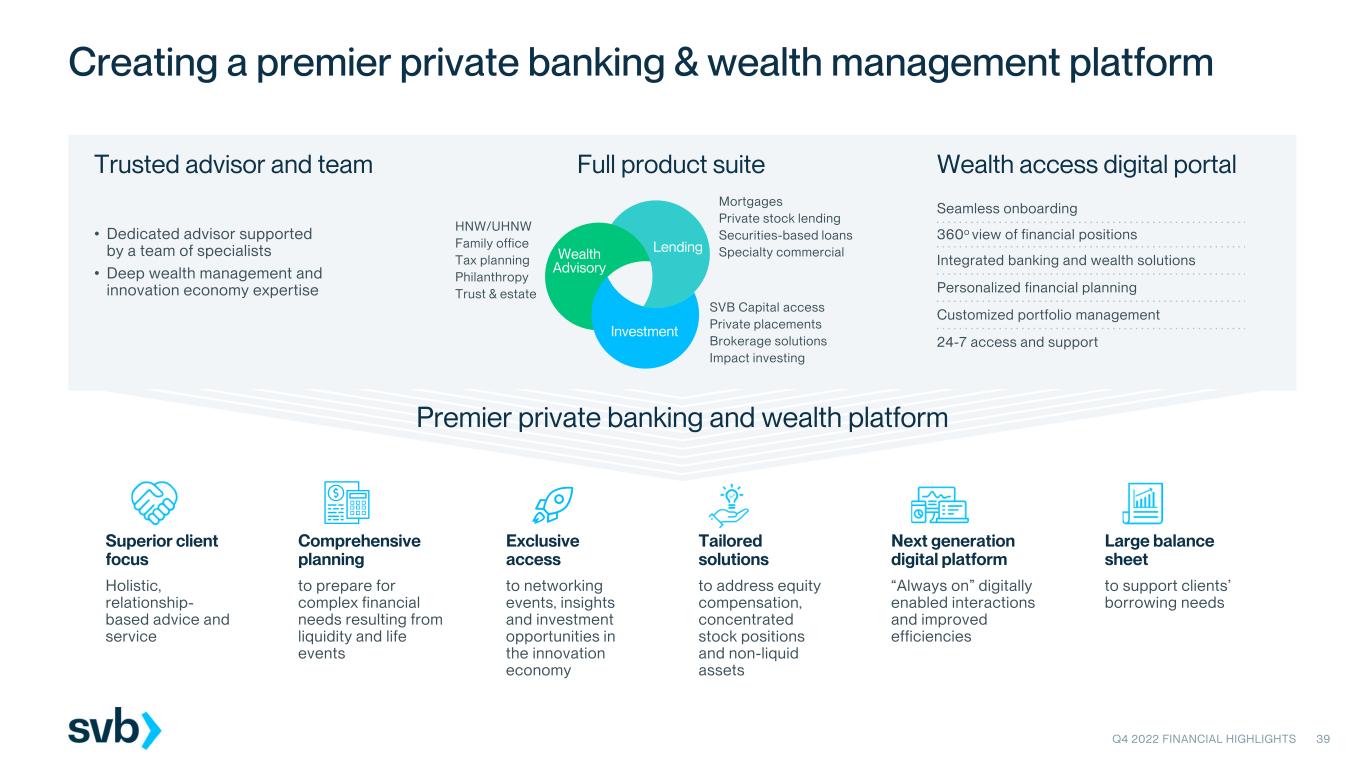

•Period-end SVB Private Assets Under Management (“AUM”) of $17.3 billion, an increase of $1.4 billion.

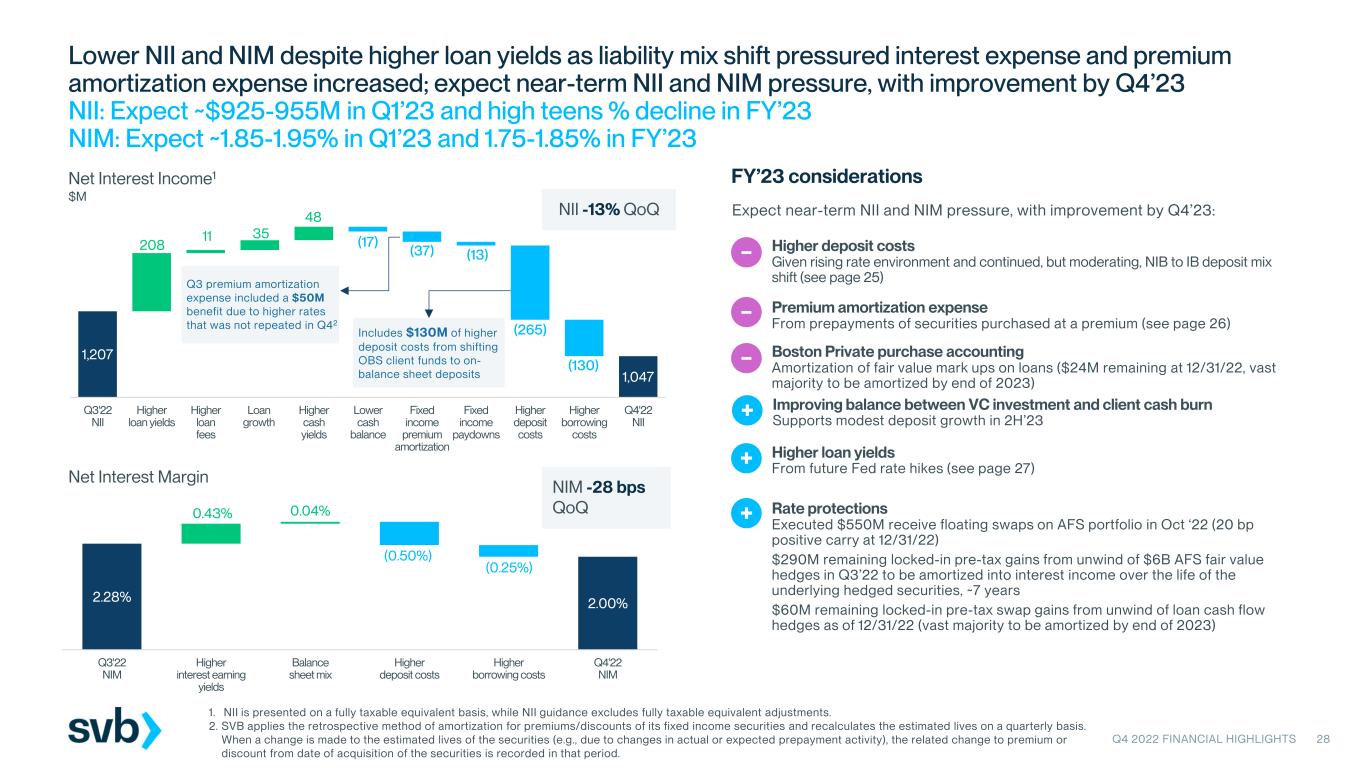

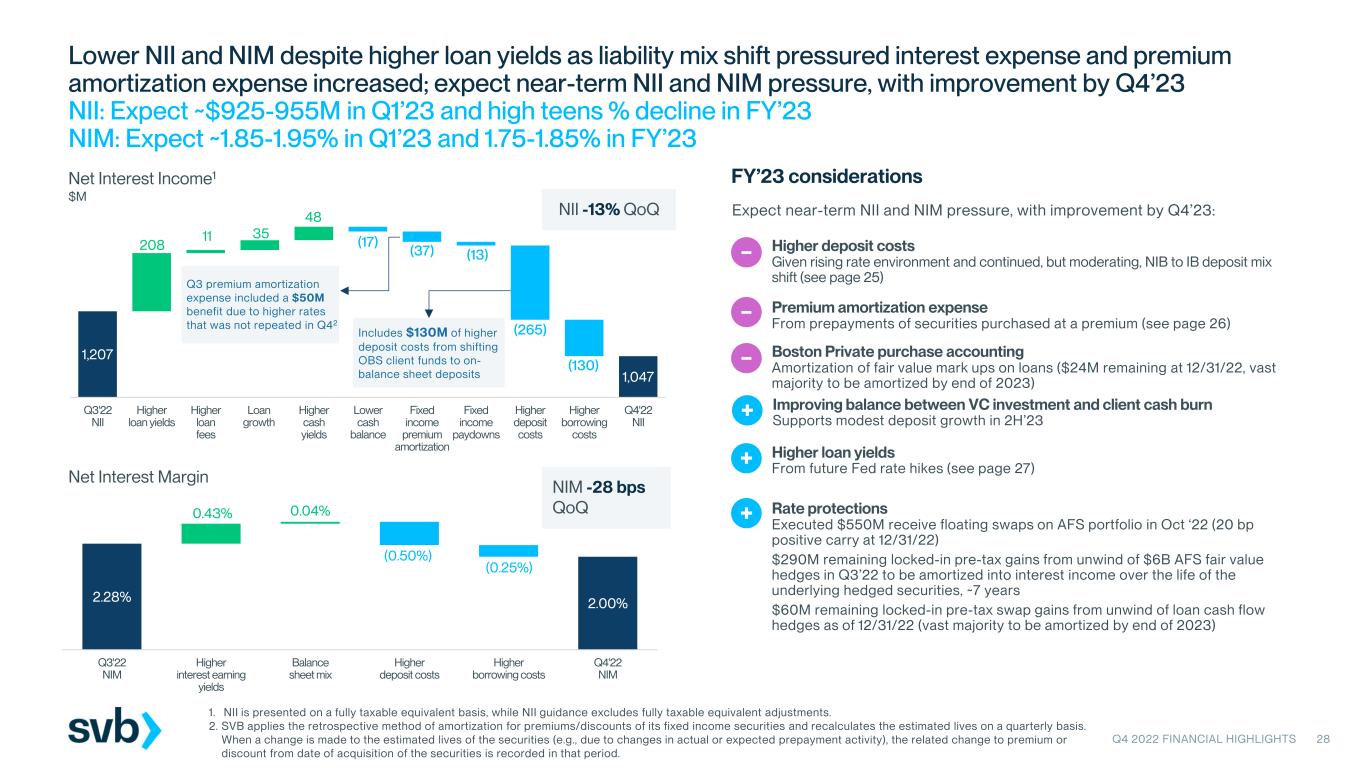

•Net interest income (fully taxable equivalent basis) of $1.0 billion, a decrease of $160 million (or 13.3 percent).

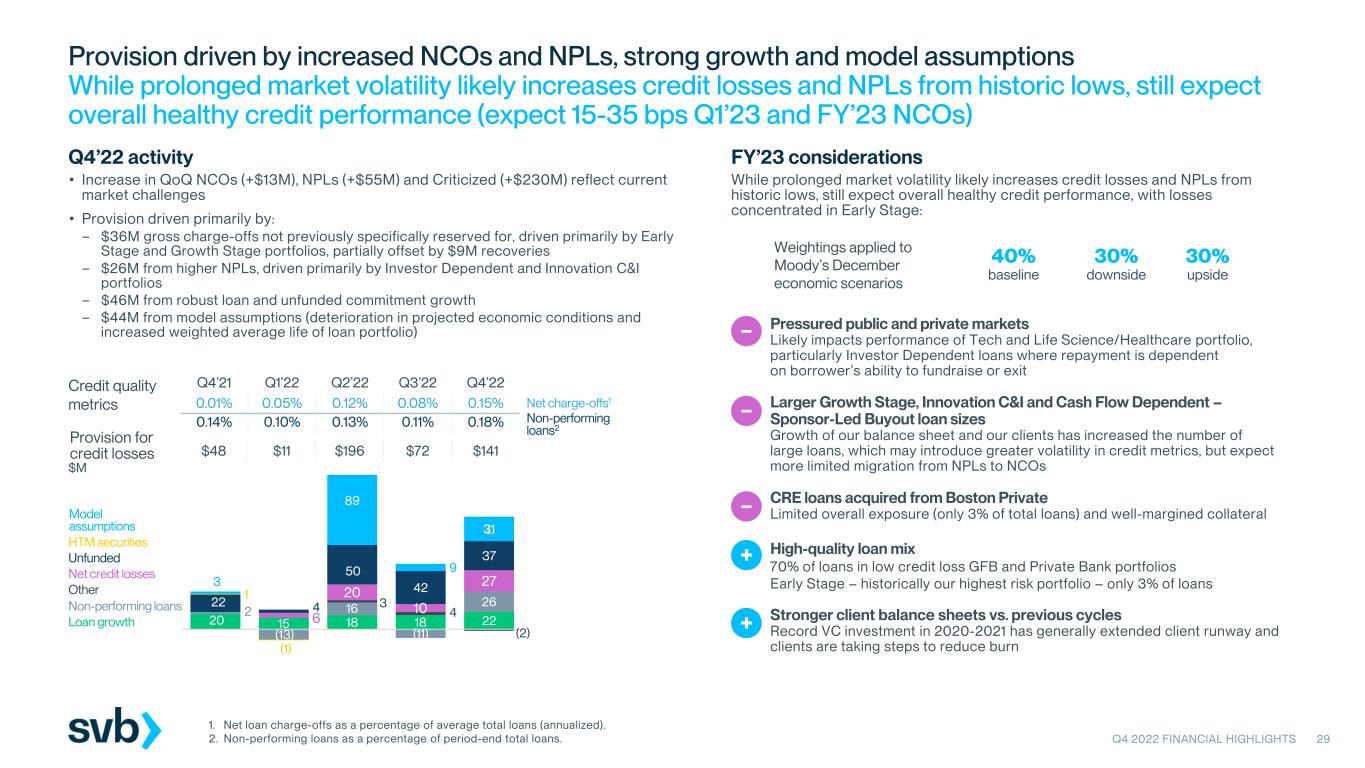

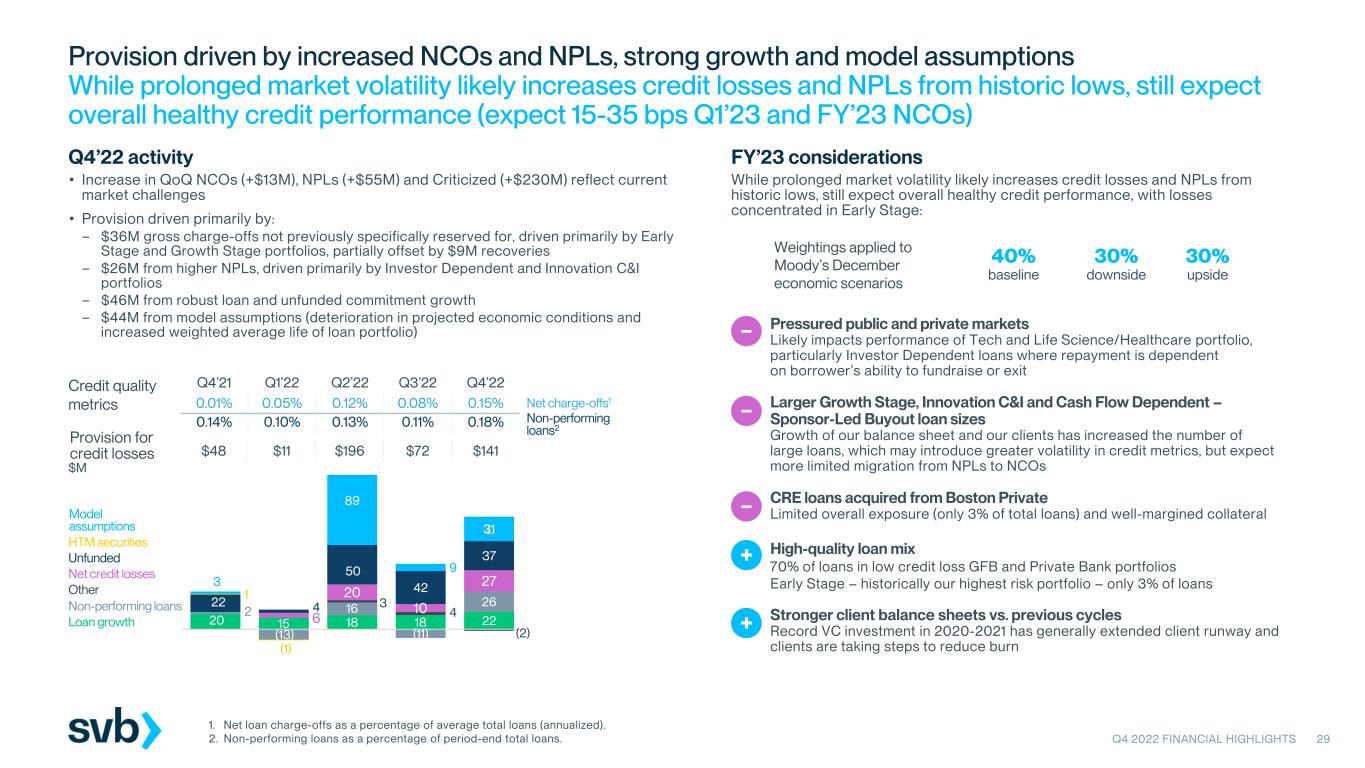

•Provision for credit losses was $141 million, compared to $72 million.

•Net loan charge-offs of $28 million, or 15 basis points of average total loans (annualized) compared to $15 million, or 8 basis points.

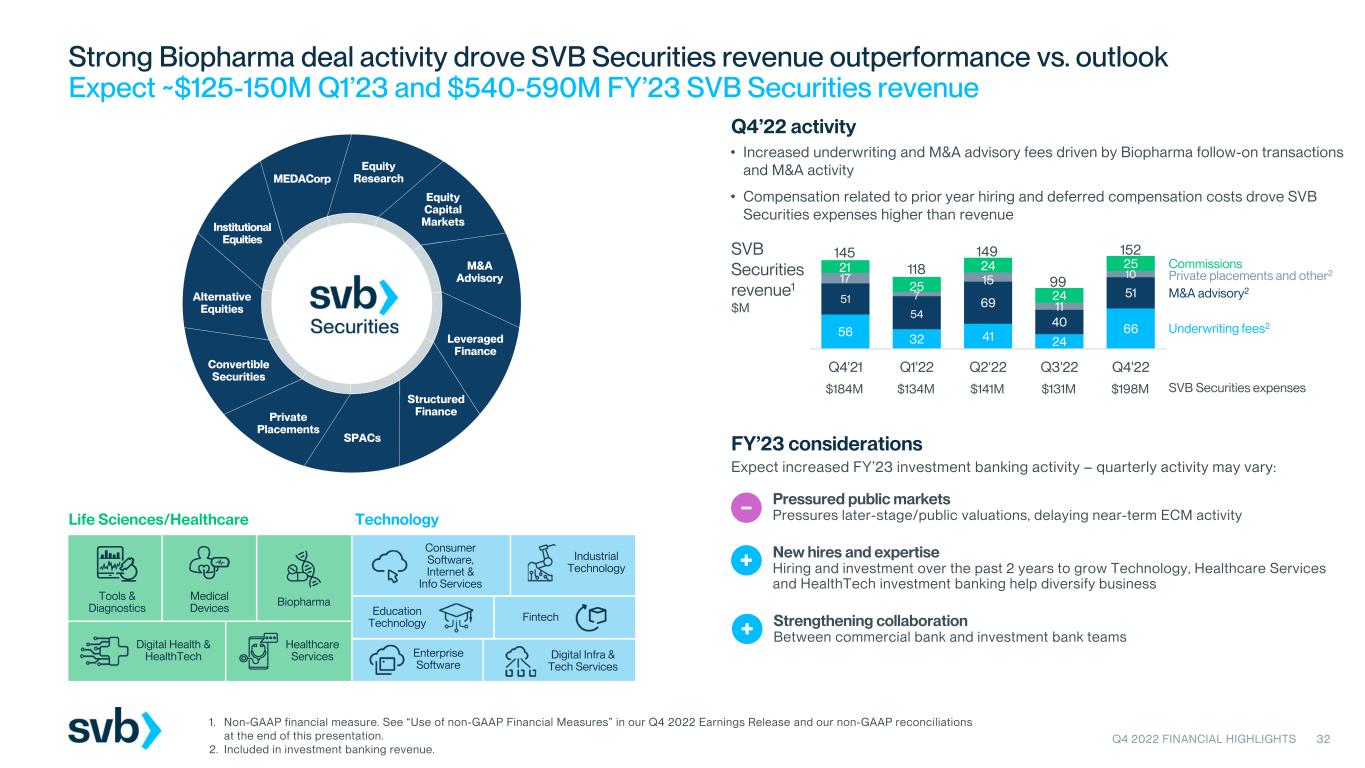

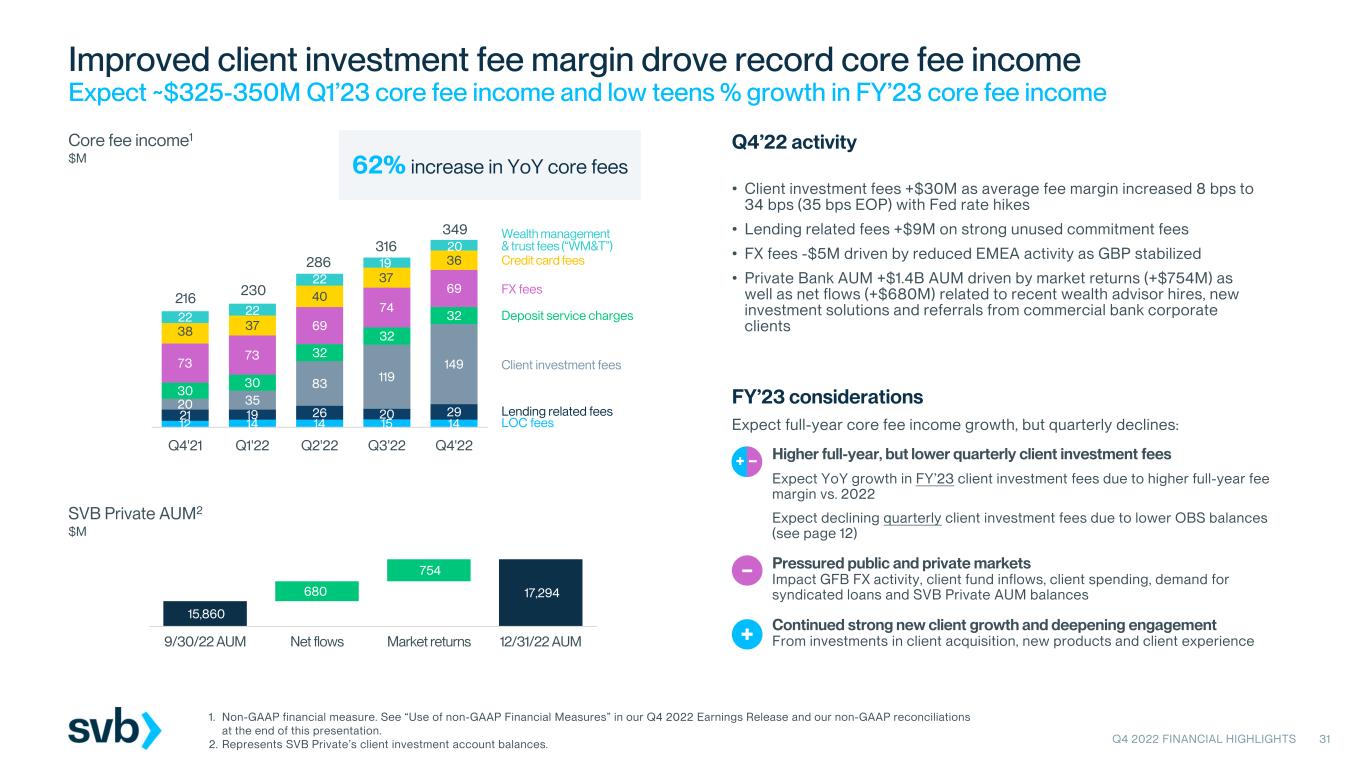

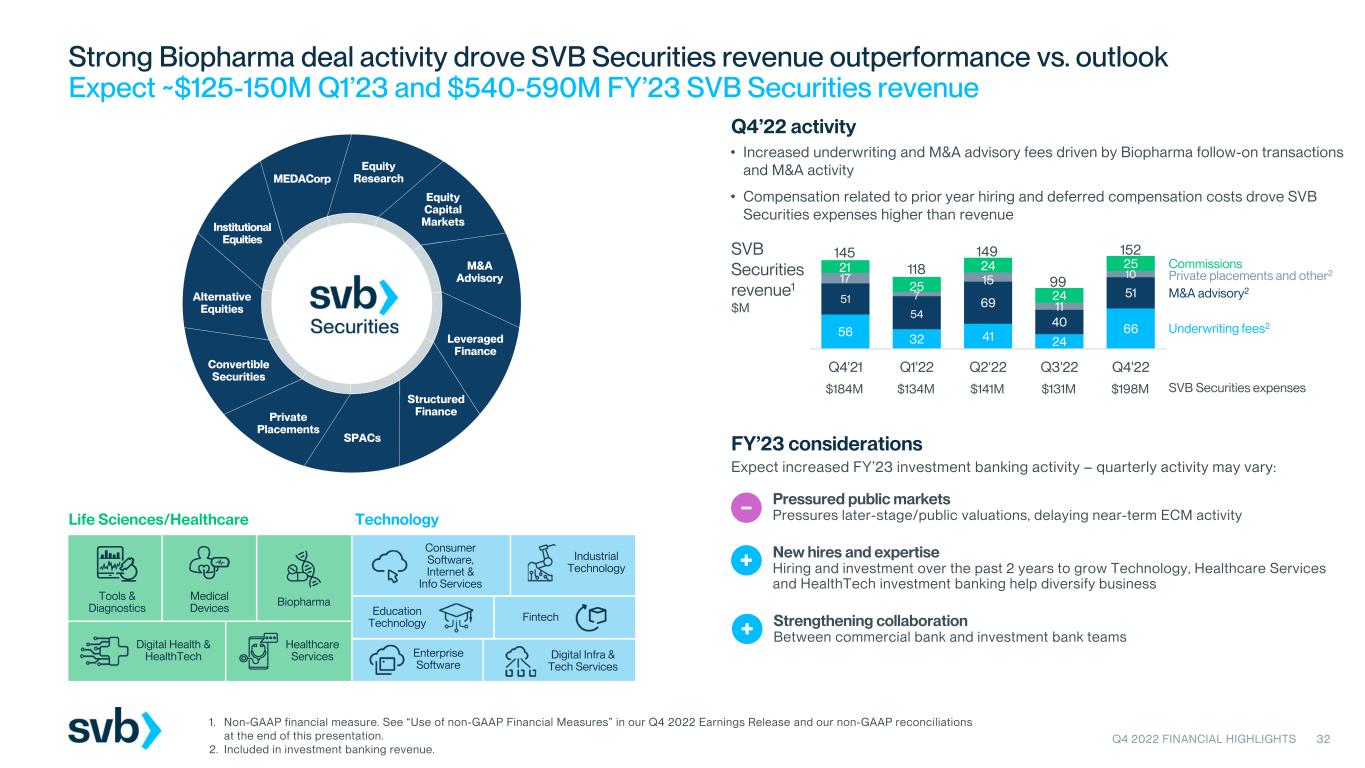

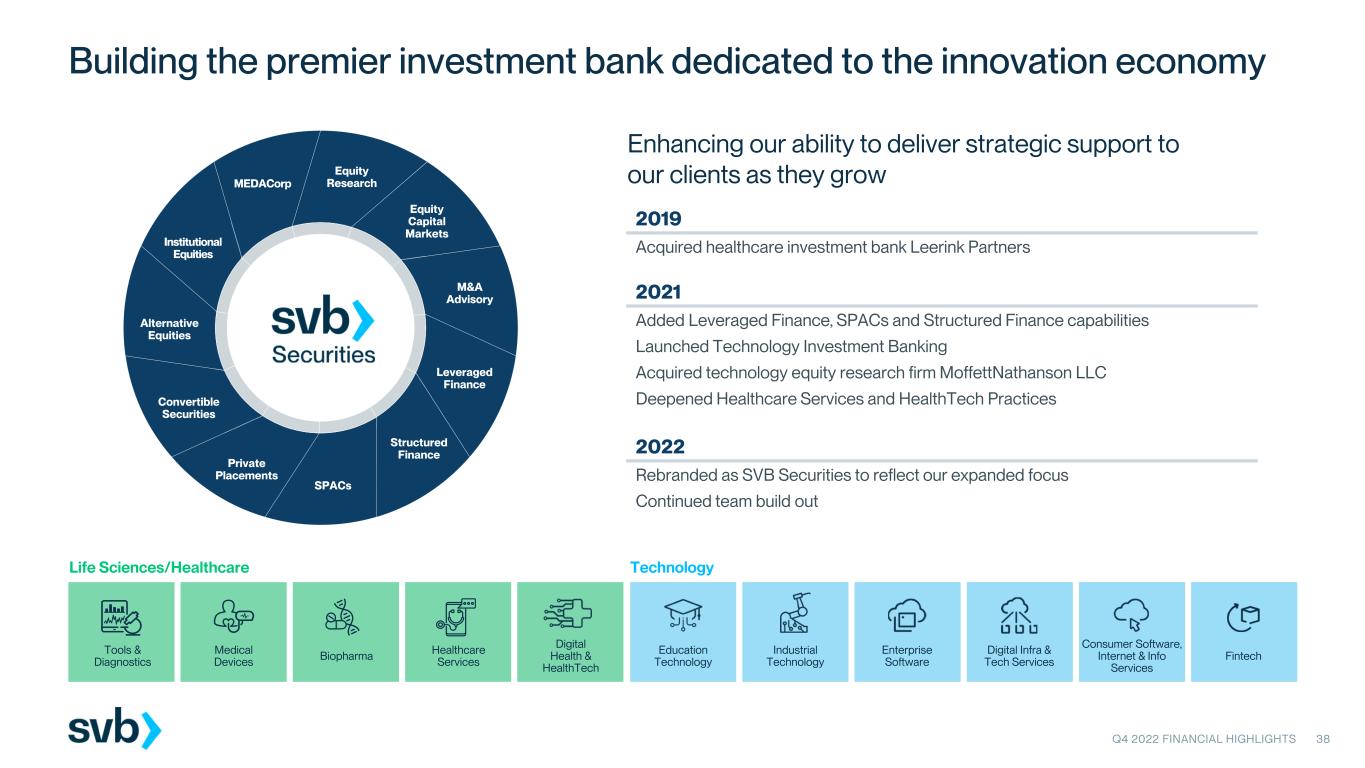

•Noninterest income of $490 million, an increase of $131 million (or 36.5 percent). Non-GAAP core fee income increased $33 million (or 10.4 percent) to $349 million. Non-GAAP SVB Securities revenue increased $53 million (or 53.5 percent) to $152 million. (See non-GAAP reconciliation under the section “Use of Non-GAAP Financial Measures.”)

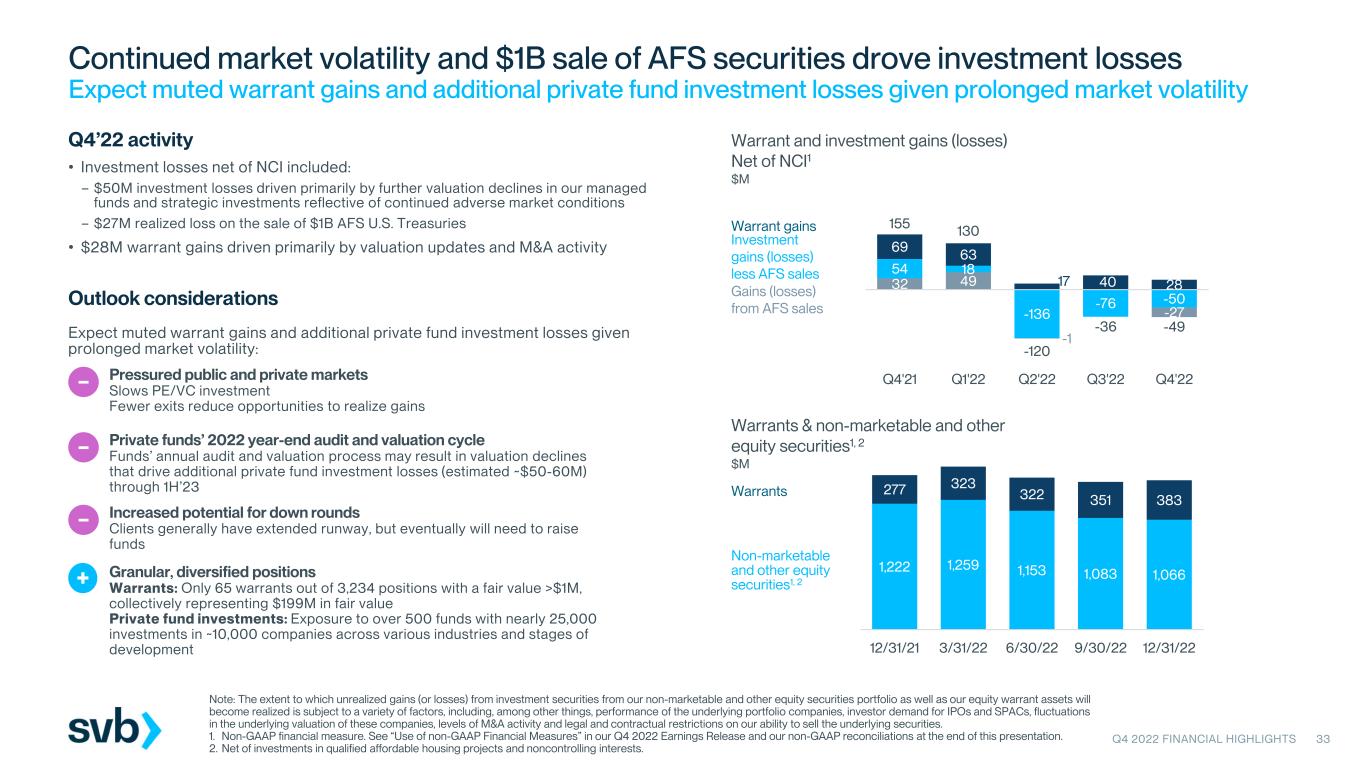

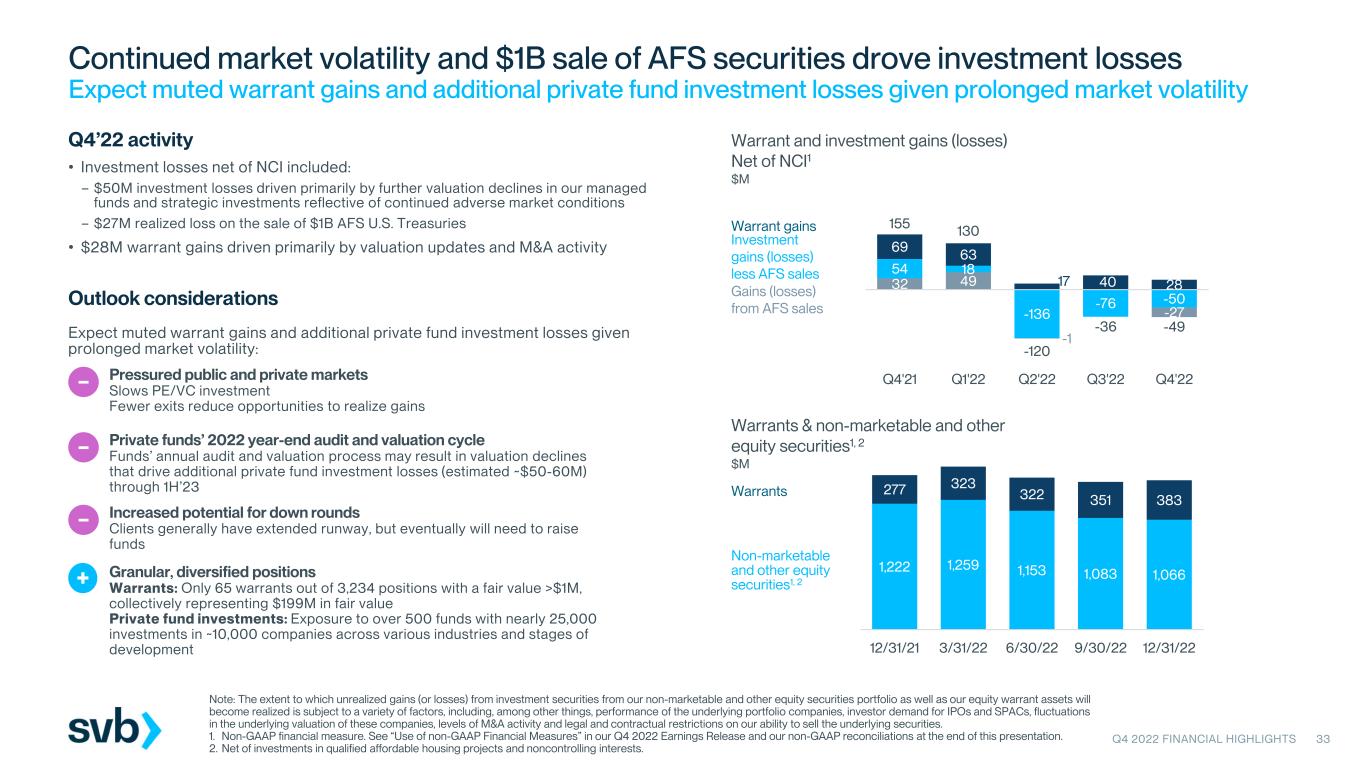

•Net losses on investment securities of $86 million compared to net losses of $127 million. Non-GAAP net losses on investment securities, net of noncontrolling interests, were $77 million, compared to net losses of $76 million. (See non-GAAP reconciliation under the section “Use of Non-GAAP Financial Measures.”)

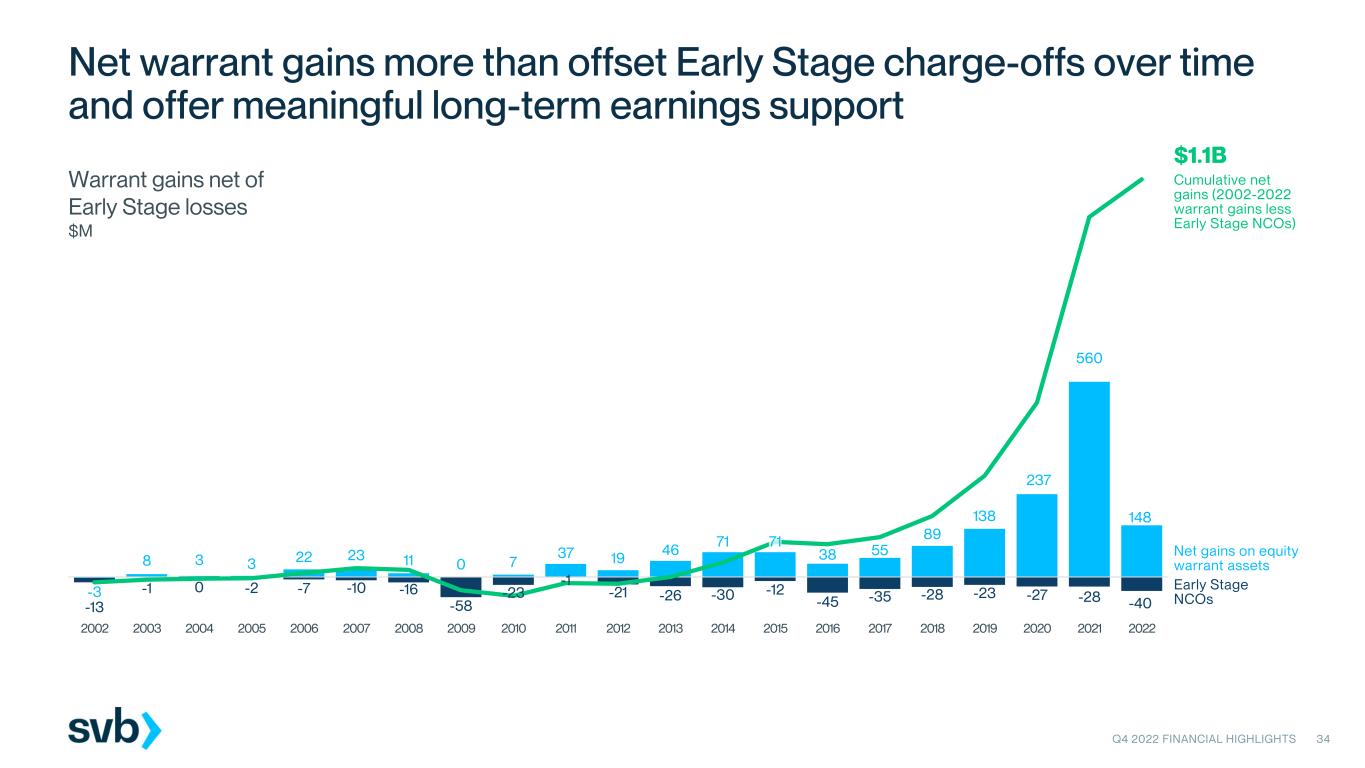

•Net gains on equity warrant assets of $28 million, compared to $40 million.

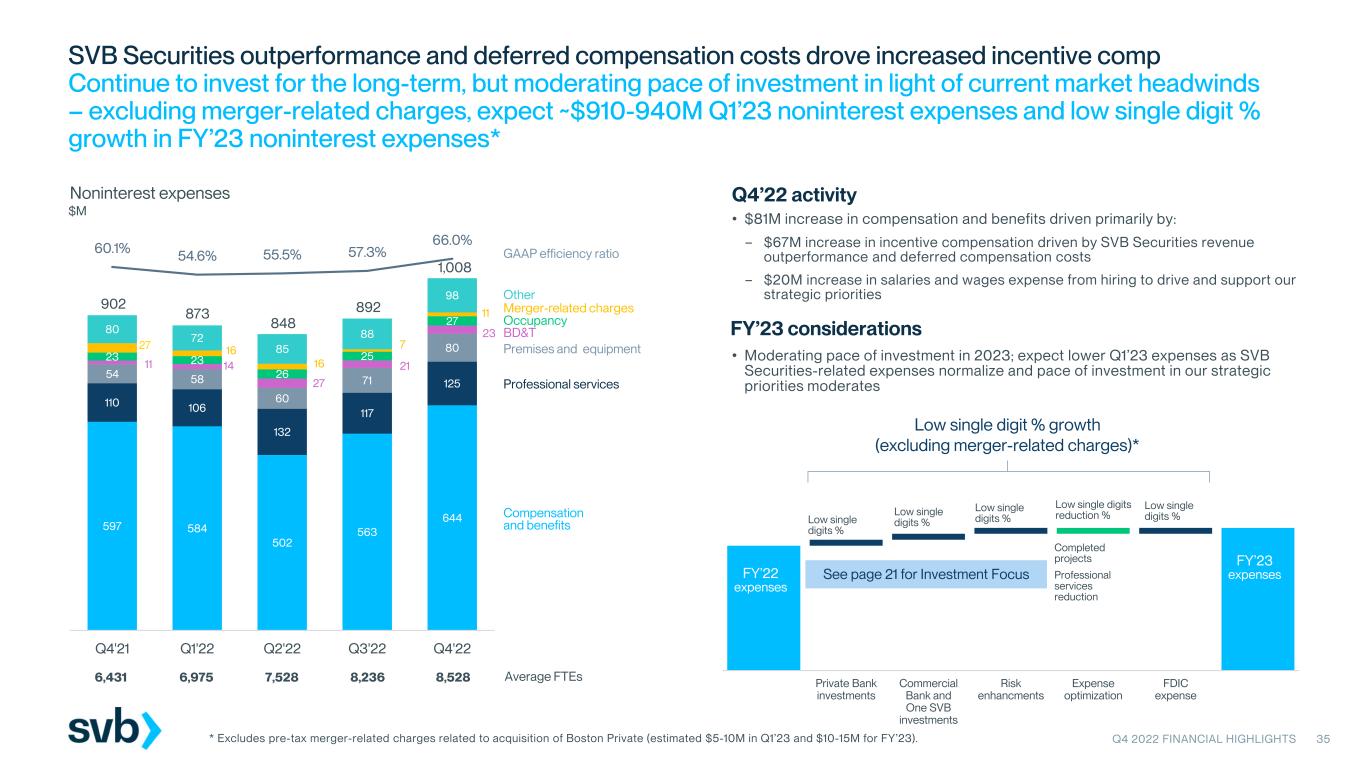

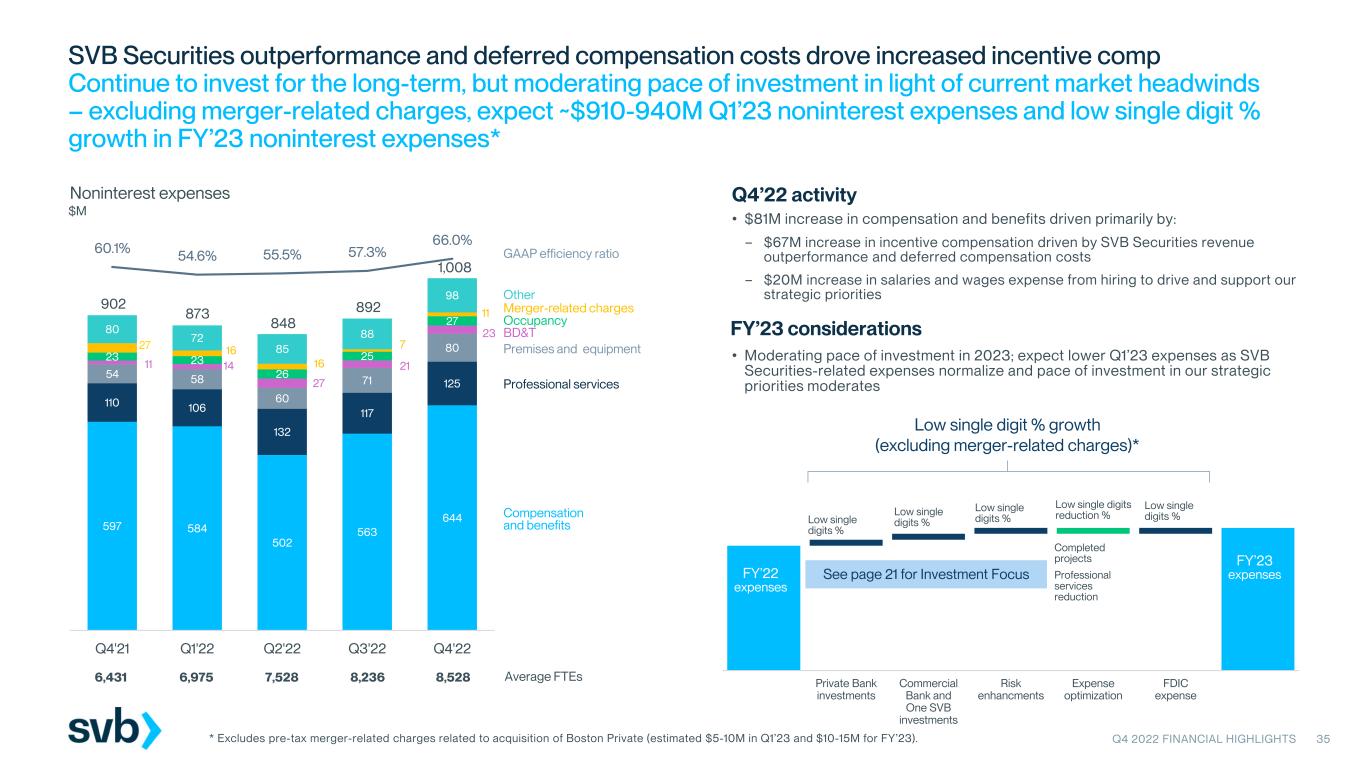

•Noninterest expense of $1.0 billion, an increase of $116 million (or 13.0 percent).

•Effective tax rate of 19.1 percent, compared to 27.2 percent.

•Operating efficiency ratio of 66.0 percent, compared to 57.3 percent, due to the increase in noninterest expense, driven primarily by higher incentive compensation expense due to SVB Securities revenue outperformance and deferred compensation costs, and lower net interest income, partially offset by an increase in noninterest income.

Fourth Quarter 2022 Summary

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

(Dollars in millions, except share data, employees and ratios) | | Three months ended | | Year ended |

| December 31, 2022 | | September 30, 2022 | | June 30, 2022 | | March 31, 2022 | | December 31, 2021 | | December 31, 2022 | | December 31, 2021 |

| Income statement: | | | | | | | | | | | | | | |

| Diluted earnings per common share | | $ | 4.62 | | | $ | 7.21 | | | $ | 5.60 | | | $ | 7.92 | | | $ | 6.22 | | | $ | 25.35 | | | $ | 31.25 | |

| Net income available to common stockholders | | 275 | | | 429 | | | 333 | | | 472 | | | 371 | | | 1,509 | | | 1,770 | |

| Net interest income | | 1,038 | | | 1,198 | | | 1,167 | | | 1,082 | | | 939 | | | 4,485 | | | 3,179 | |

| Provision for credit losses (1) (2) | | 141 | | | 72 | | | 196 | | | 11 | | | 48 | | | 420 | | | 123 | |

| Noninterest income | | 490 | | | 359 | | | 362 | | | 517 | | | 561 | | | 1,728 | | | 2,738 | |

| Noninterest expense | | 1,008 | | | 892 | | | 848 | | | 873 | | | 902 | | | 3,621 | | | 3,070 | |

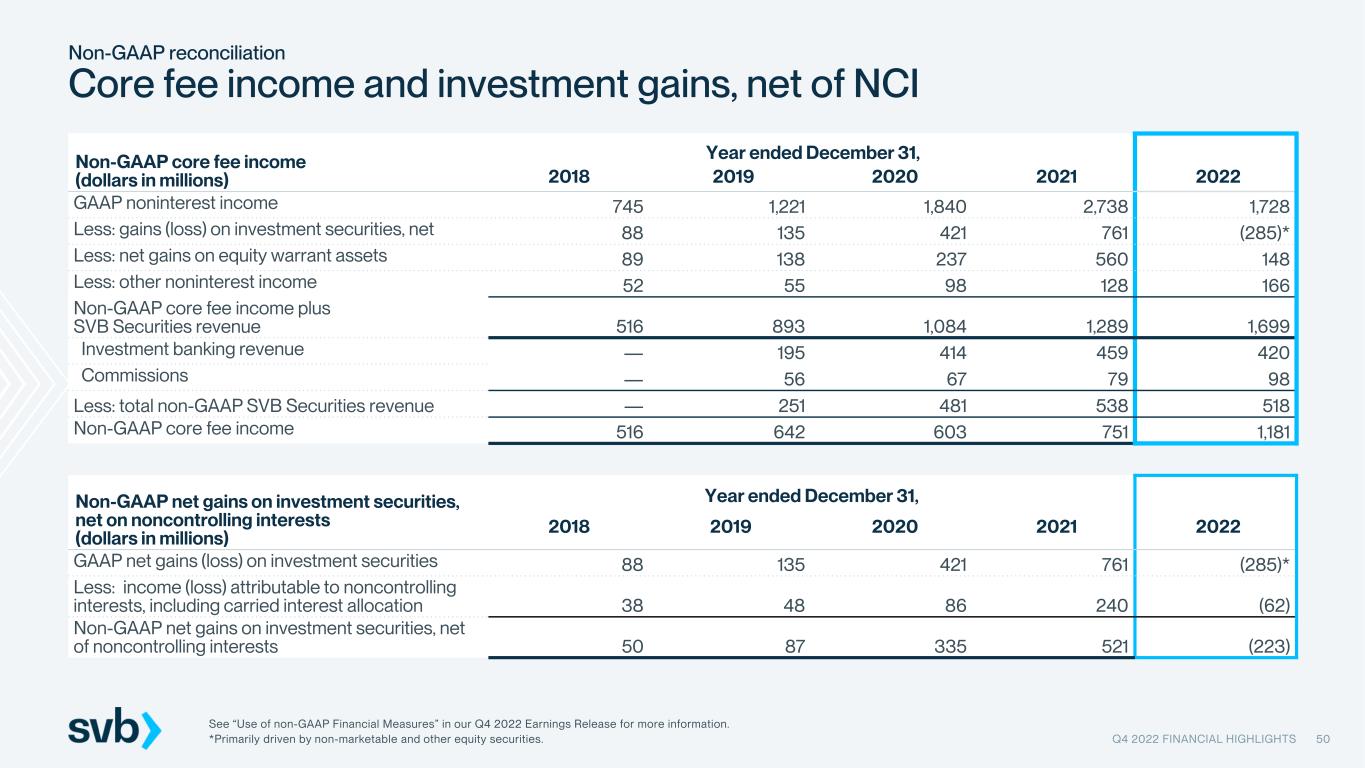

| Non-GAAP core fee income (3) | | 349 | | | 316 | | | 286 | | | 230 | | | 216 | | | 1,181 | | | 751 | |

| Non-GAAP core fee income plus SVB Securities revenue (3) | | 501 | | | 415 | | | 435 | | | 348 | | | 361 | | | 1,699 | | | 1,289 | |

| Non-GAAP SVB Securities revenue (3) | | 152 | | | 99 | | | 149 | | | 118 | | | 145 | | | 518 | | | 538 | |

| Effective tax rate (4) | | 19.1 | % | | 27.2 | % | | 26.1 | % | | 26.1 | % | | 26.4 | % | | 25.2 | % | | 26.2 | % |

| Fully taxable equivalent: | | | | | | | | | | | | | | |

| Net interest income (5) | | $ | 1,047 | | | $ | 1,207 | | | $ | 1,177 | | | $ | 1,091 | | | $ | 947 | | | $ | 4,522 | | | $ | 3,207 | |

| Net interest margin | | 2.00 | % | | 2.28 | % | | 2.24 | % | | 2.13 | % | | 1.91 | % | | 2.16 | % | | 2.02 | % |

| Balance sheet: | | | | | | | | | | | | | | |

| Average total assets | | $ | 214,716 | | | $ | 215,740 | | | $ | 217,998 | | | $ | 216,068 | | | $ | 204,760 | | | $ | 216,274 | | | $ | 166,011 | |

| Average loans, amortized cost | | 73,645 | | | 71,098 | | | 69,263 | | | 67,070 | | | 62,573 | | | 70,289 | | | 54,547 | |

| Average available-for-sale securities | | 29,429 | | | 28,855 | | | 29,922 | | | 26,946 | | | 24,154 | | | 28,795 | | | 24,996 | |

| Average held-to-maturity securities | | 92,111 | | | 94,141 | | | 96,732 | | | 98,677 | | | 87,579 | | | 95,394 | | | 58,030 | |

| Average noninterest-bearing demand deposits | | 86,969 | | | 106,112 | | | 120,679 | | | 125,568 | | | 122,789 | | | 109,676 | | | 99,461 | |

| Average interest-bearing deposits | | 87,784 | | | 79,444 | | | 71,388 | | | 65,150 | | | 60,273 | | | 76,013 | | | 48,486 | |

| Average total deposits | | 174,753 | | | 185,556 | | | 192,067 | | | 190,718 | | | 183,062 | | | 185,689 | | | 147,947 | |

| Average short-term borrowings | | 15,061 | | | 7,655 | | | 3,607 | | | 3,136 | | | 145 | | | 7,398 | | | 74 | |

| Average long-term debt | | 4,999 | | | 3,367 | | | 3,122 | | | 2,570 | | | 2,380 | | | 3,521 | | | 1,775 | |

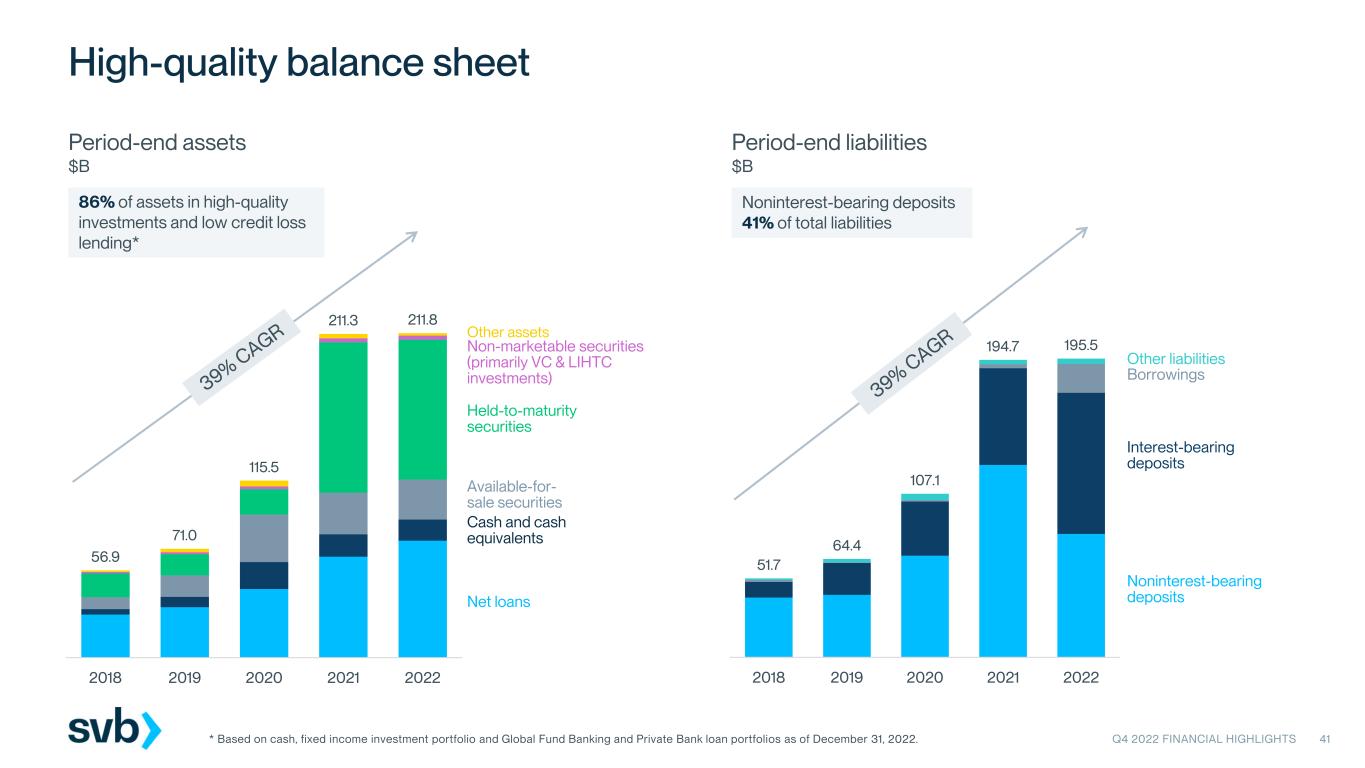

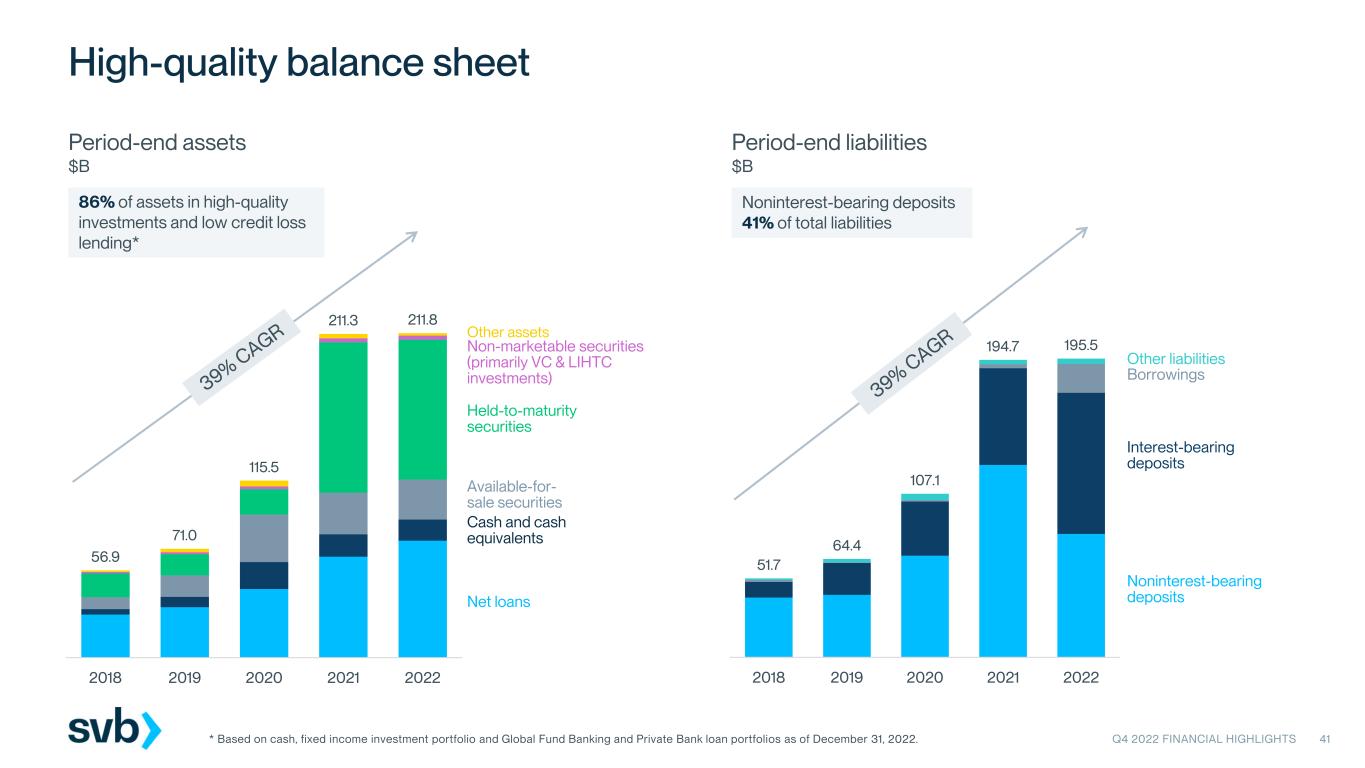

| Period-end total assets | | 211,793 | | | 212,867 | | | 214,389 | | | 220,355 | | | 211,308 | | | 211,793 | | | 211,308 | |

| Period-end loans, amortized cost | | 74,250 | | | 72,129 | | | 70,955 | | | 68,665 | | | 66,276 | | | 74,250 | | | 66,276 | |

| Period-end available-for-sale securities | | 26,069 | | | 26,711 | | | 26,223 | | | 25,991 | | | 27,221 | | | 26,069 | | | 27,221 | |

| Period-end held-to-maturity securities | | 91,321 | | | 93,286 | | | 95,814 | | | 98,707 | | | 98,195 | | | 91,321 | | | 98,195 | |

| Period-end non-marketable and other equity securities | | 2,664 | | | 2,595 | | | 2,645 | | | 2,605 | | | 2,543 | | | 2,664 | | | 2,543 | |

| Period-end noninterest-bearing demand deposits | | 80,753 | | | 93,988 | | | 113,969 | | | 127,997 | | | 125,851 | | | 80,753 | | | 125,851 | |

| Period-end interest-bearing deposits | | 92,356 | | | 82,831 | | | 73,976 | | | 70,137 | | | 63,352 | | | 92,356 | | | 63,352 | |

| Period-end total deposits | | 173,109 | | | 176,819 | | | 187,945 | | | 198,134 | | | 189,203 | | | 173,109 | | | 189,203 | |

| Period-end short-term borrowings | | 13,565 | | | 13,552 | | | 3,703 | | | 99 | | | 71 | | | 13,565 | | | 71 | |

| Period-end long-term debt | | 5,370 | | | 3,368 | | | 3,367 | | | 2,571 | | | 2,570 | | | 5,370 | | | 2,570 | |

| Off-balance sheet: | | | | | | | | | | | | | | |

| Average client investment funds | | $ | 172,825 | | | $ | 182,859 | | | $ | 194,637 | | | $ | 206,140 | | | $ | 207,578 | | | $ | 189,115 | | | $ | 181,193 | |

| Period-end client investment funds | | 168,377 | | | 176,861 | | | 191,244 | | | 199,216 | | | 210,086 | | | 168,377 | | | 210,086 | |

| Period-end assets under management | | 17,294 | | | 15,860 | | | 16,512 | | | 19,008 | | | 19,646 | | | 17,294 | | | 19,646 | |

| Total unfunded credit commitments | | 62,525 | | | 55,698 | | | 50,577 | | | 44,685 | | | 44,016 | | | 62,525 | | | 44,016 | |

| Earnings ratios: | | | | | | | | | | | | | | |

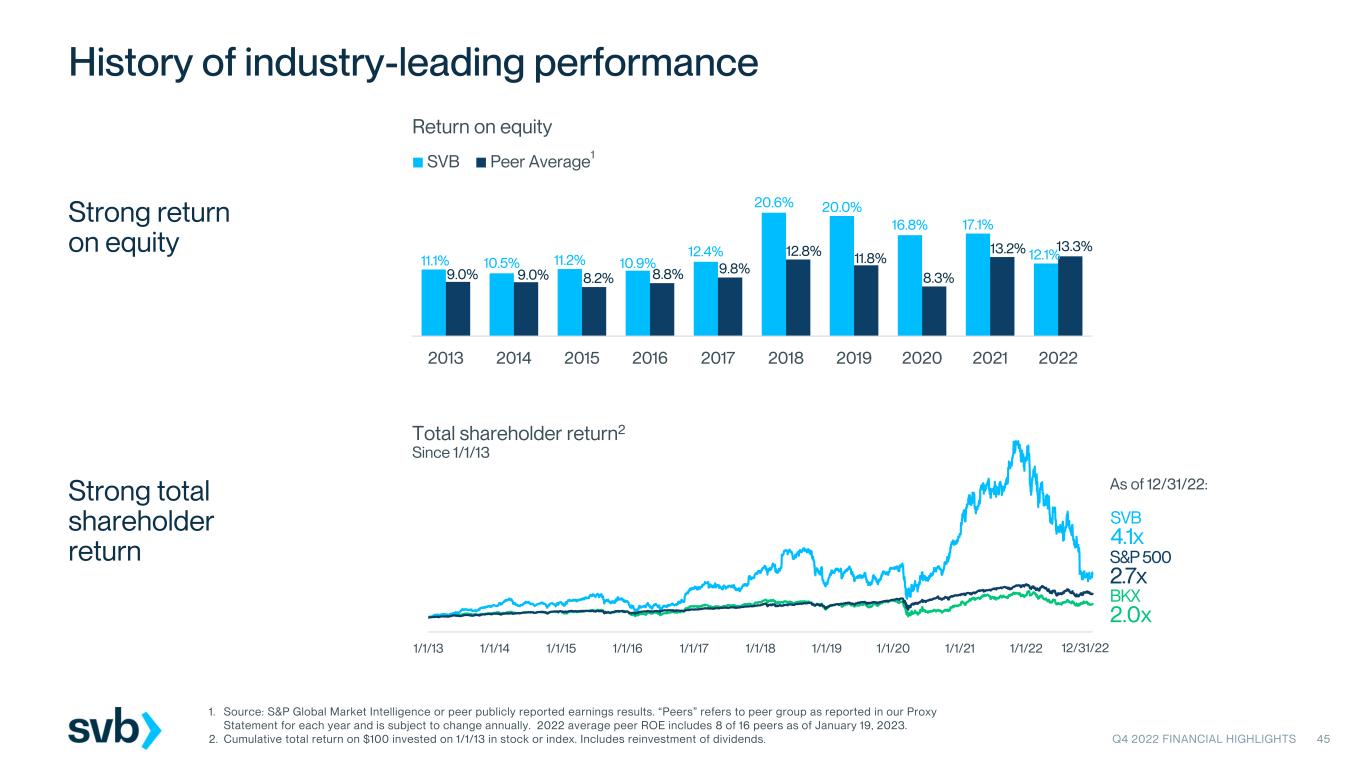

| Return on average assets (annualized) (6) | | 0.51 | % | | 0.79 | % | | 0.61 | % | | 0.89 | % | | 0.72 | % | | 0.70 | % | | 0.84 | % |

| Return on average SVBFG common stockholders’ equity (annualized) (7) | | 8.93 | | | 13.62 | | | 10.87 | | | 15.28 | | | 11.80 | | | 12.14 | | | 17.10 | |

| Asset quality ratios: | | | | | | | | | | | | | | |

| Allowance for credit losses for loans as a % of total loans | | 0.86 | % | | 0.77 | % | | 0.77 | % | | 0.61 | % | | 0.64 | % | | 0.86 | % | | 0.64 | |

| Allowance for credit losses for performing loans as a % of total performing loans | | 0.79 | | | 0.74 | | | 0.72 | | | 0.58 | | | 0.58 | | | 0.79 | | | 0.58 | |

| Gross loan charge-offs as a % of average total loans (annualized) (2) | | 0.20 | | | 0.15 | | | 0.13 | | | 0.11 | | | 0.06 | | | 0.15 | | | 0.25 | |

| Net loan charge-offs as a % of average total loans (annualized) (2) | | 0.15 | | | 0.08 | | | 0.12 | | | 0.05 | | | 0.01 | | | 0.10 | | | 0.21 | |

| Other ratios: | | | | | | | | | | | | | | |

| Operating efficiency ratio (8) | | 65.97 | % | | 57.29 | % | | 55.46 | % | | 54.60 | % | | 60.13 | % | | 58.28 | % | | 51.88 | % |

| Total cost of deposits (annualized) (9) | | 1.17 | | | 0.53 | | | 0.16 | | | 0.05 | | | 0.04 | | | 0.46 | | | 0.04 | |

| SVBFG CET 1 risk-based capital ratio | | 12.09 | | | 12.13 | | | 11.98 | | | 12.10 | | | 12.09 | | | 12.09 | | | 12.09 | |

| Bank CET 1 risk-based capital ratio | | 15.29 | | | 15.54 | | | 15.39 | | | 14.89 | | | 14.89 | | | 15.29 | | | 14.89 | |

| SVBFG tier 1 risk-based capital ratio | | 15.44 | | | 15.58 | | | 15.57 | | | 15.88 | | | 16.08 | | | 15.44 | | | 16.08 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Bank tier 1 risk-based capital ratio | | 15.29 | | | 15.54 | | | 15.39 | | | 14.89 | | | 14.89 | | | 15.29 | | | 14.89 | |

| SVBFG total risk-based capital ratio | | 16.22 | | | 16.26 | | | 16.22 | | | 16.39 | | | 16.58 | | | 16.22 | | | 16.58 | |

| Bank total risk-based capital ratio | | 16.08 | | | 16.23 | | | 16.05 | | | 15.41 | | | 15.40 | | | 16.08 | | | 15.40 | |

| SVBFG tier 1 leverage ratio | | 8.11 | | | 8.00 | | | 7.73 | | | 7.70 | | | 7.93 | | | 8.11 | | | 7.93 | |

| Bank tier 1 leverage ratio | | 7.96 | | | 7.91 | | | 7.55 | | | 7.09 | | | 7.24 | | | 7.96 | | | 7.24 | |

| Period-end loans, amortized cost, to deposits ratio | | 42.89 | | | 40.79 | | | 37.75 | | | 34.66 | | | 35.03 | | | 42.89 | | | 35.03 | |

| Average loans, amortized cost, to average deposits ratio | | 42.14 | | | 38.32 | | | 36.06 | | | 35.17 | | | 34.18 | | | 37.85 | | | 36.87 | |

| Book value per common share (10) | | $ | 208.85 | | | $ | 200.71 | | | $ | 207.71 | | | $ | 209.62 | | | $ | 214.30 | | | $ | 208.85 | | | $ | 214.30 | |

| Tangible book value per common share (3) (11) | | 200.77 | | | 192.54 | | | 199.27 | | | 201.07 | | | 205.64 | | | 200.77 | | | 205.64 | |

| Other statistics: | | | | | | | | | | | | | | |

| Average full-time equivalent ("FTE") employees | | 8,528 | | | 8,236 | | | 7,528 | | | 6,975 | | | 6,431 | | | 7,817 | | | 5,466 | |

| Period-end full-time equivalent ("FTE") employees | | 8,553 | | | 8,429 | | | 7,743 | | | 7,149 | | | 6,567 | | | 8,553 | | | 6,567 | |

(1)This metric for the year ended December 31, 2021 includes a post-combination provision of $46 million to record the allowance for credit losses for non-PCD loans and unfunded credit commitments acquired from Boston Private.

(2)This metric for the year ended December 31, 2021 includes the impact of an $80 million charge-off related to fraudulent activity discussed in previous filings.

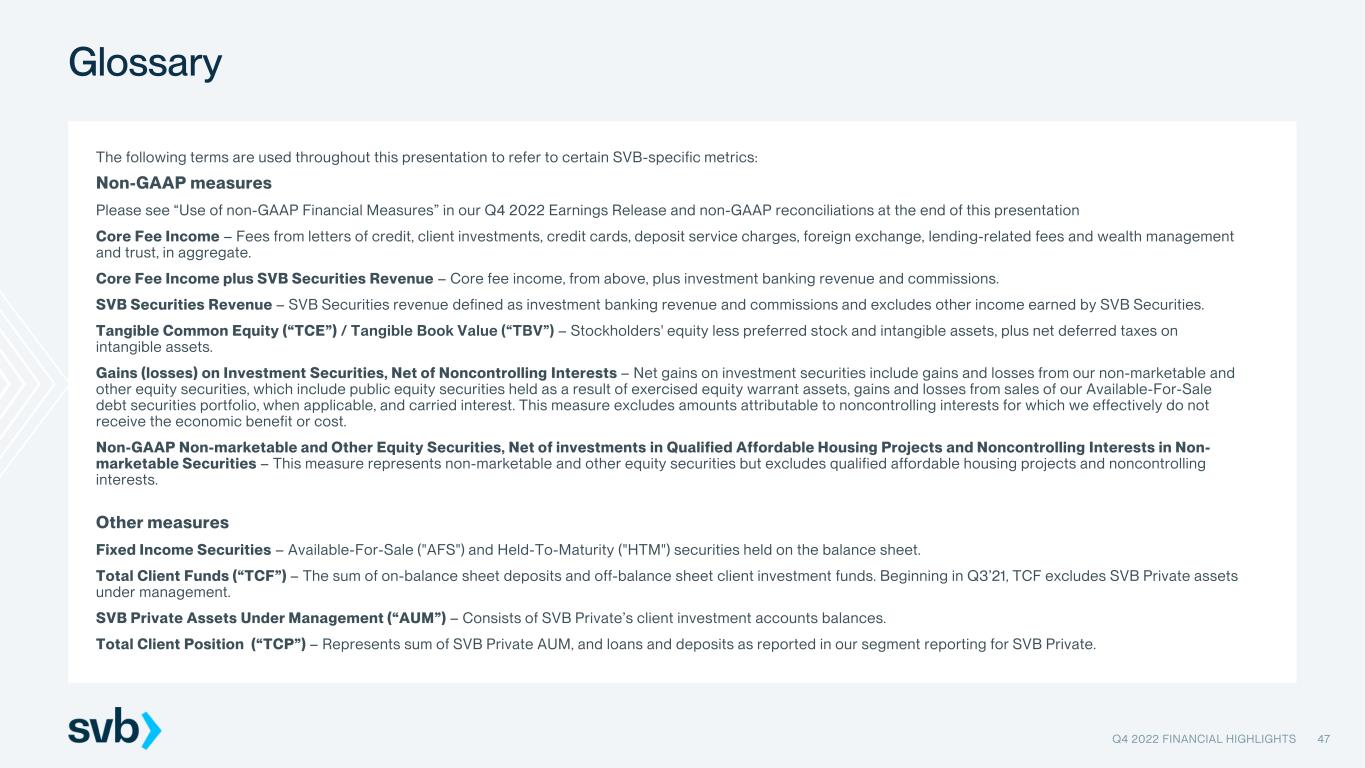

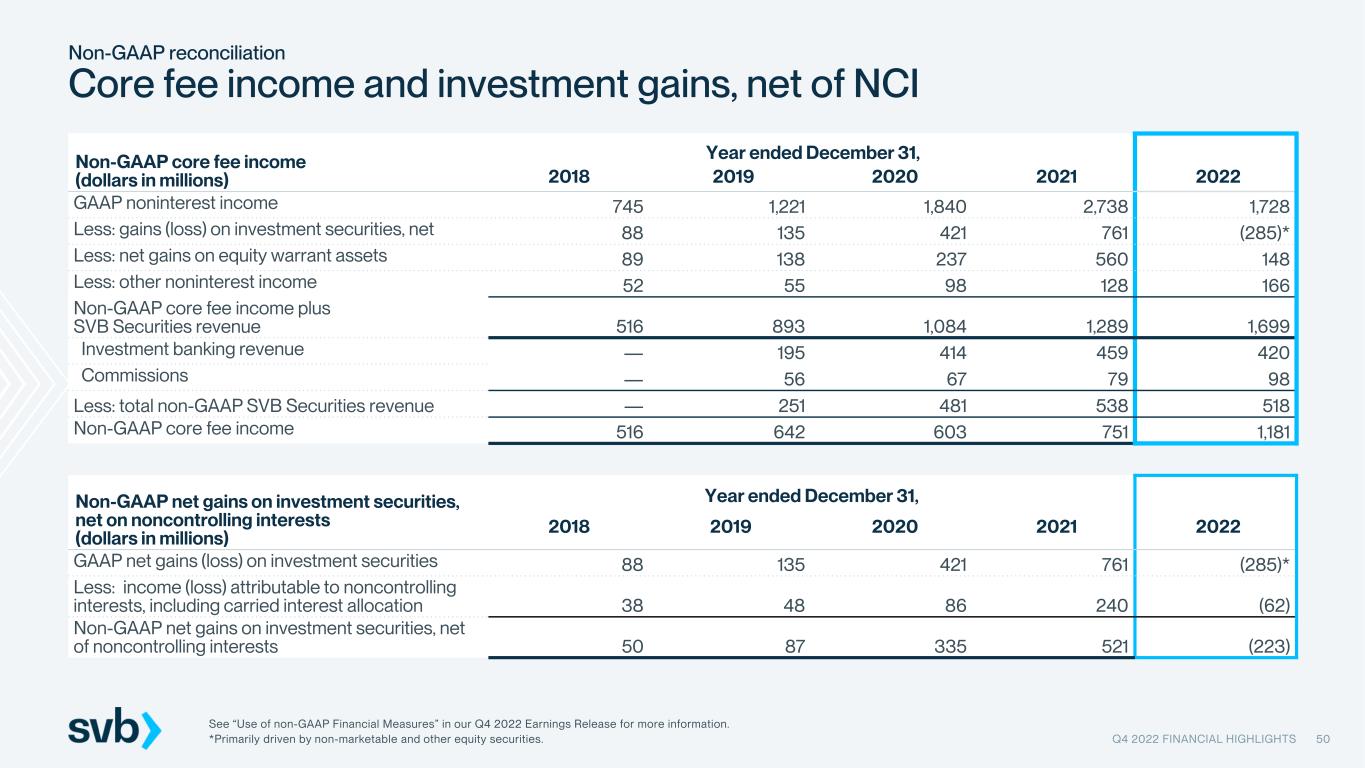

(3)To supplement our unaudited condensed consolidated financial statements presented in accordance with generally accepted accounting principles in the United States (“GAAP”), we use certain non-GAAP measures. A reconciliation of these non-GAAP measures to the most closely related GAAP measures is provided at the end of this release under the section “Use of Non-GAAP Financial Measures.”

(4)Our effective tax rate is calculated by dividing income tax expense by the sum of income before income tax expense and net income attributable to noncontrolling interests.

(5)Interest income on non-taxable investments is presented on a fully taxable equivalent basis using the federal statutory income tax rate of 21.0 percent. The taxable equivalent adjustments were $9 million, $9 million, $10 million, $9 million and $8 million for the quarters ended December 31, 2022, September 30, 2022, June 30, 2022, March 31, 2022 and December 31, 2021, respectively. The taxable equivalent adjustments were $37 million and $28 million for the year ended December 31, 2022 and December 31, 2021, respectively.

(6)Ratio represents annualized consolidated net income available to common stockholders divided by average assets.

(7)Ratio represents annualized consolidated net income available to common stockholders divided by average SVB Financial Group ("SVBFG") common stockholders’ equity.

(8)Ratio is calculated by dividing noninterest expense by total net interest income plus noninterest income.

(9)Ratio represents annualized total cost of deposits and is calculated by dividing interest expense from deposits by average total deposits.

(10)Book value per common share is calculated by dividing total SVBFG common stockholders’ equity by total outstanding common shares.

(11)Tangible book value per common share is calculated by dividing tangible common equity by total outstanding common shares. Tangible common equity is a non-GAAP measure defined under the section “Use of Non-GAAP Financial Measures.”

Investment Securities

Our investment securities portfolio is comprised of: (i) our available-for-sale ("AFS") and held-to-maturity ("HTM") securities portfolios, each consisting of fixed income investments which are managed to earn an appropriate portfolio yield over the long-term while maintaining sufficient liquidity and addressing our asset/liability management objectives; and (ii) our non-marketable and other equity securities portfolio, which primarily represents investments managed as part of our funds management business as well as public equity securities held as a result of equity warrant assets exercised.

The following table provides further details on our AFS and HTM securities portfolios:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Available-for-sale securities | | Held-to-maturity securities |

| | Three Months ended | | Three Months ended |

| (Dollars in millions) | | December 31, 2022 | | September 30, 2022 | | December 31, 2021 | | December 31, 2022 | | September 30, 2022 | | December 31, 2021 |

| Average balance (1) | | $ | 29,429 | | | $ | 28,855 | | | $ | 24,154 | | | $ | 92,111 | | | $ | 94,141 | | | $ | 87,579 | |

| Period-end balance | | 26,069 | | | 26,711 | | | 27,221 | | | 91,321 | | | 93,286 | | | 98,195 | |

| Weighted-average duration (in years) | | 3.6 | | 3.7 | | 3.5 | | 6.2 | | 6.3 | | 4.1 |

| Weighted-average duration including fair value swaps (in years) (2) | | 3.6 | | N/A | | 2.4 | | N/A | | N/A | | N/A |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

(1)Represents AFS securities at an average amortized cost basis.

(2)The total notional value of our pay-fixed, receive-floating interest rate swap fair value hedge contracts for AFS securities was $550 million as of December 31, 2022, zero as of September 30, 2022, and $10.7 billion as of December 31, 2021.

The period-end decrease in AFS securities was driven by the sale of $1.0 billion of US Treasury securities, $279 million of paydowns and maturities, partially offset by purchases of $318 million and an increase of $317 million in the fair value of our AFS securities portfolio. In October 2022, we entered into interest rate swap contracts with a notional balance of $550 million to hedge against our exposure to decreases in the fair value of our AFS securities resulting from increases in interest rates.

The period-end decrease in HTM securities was driven primarily by approximately $2.0 billion in paydowns.

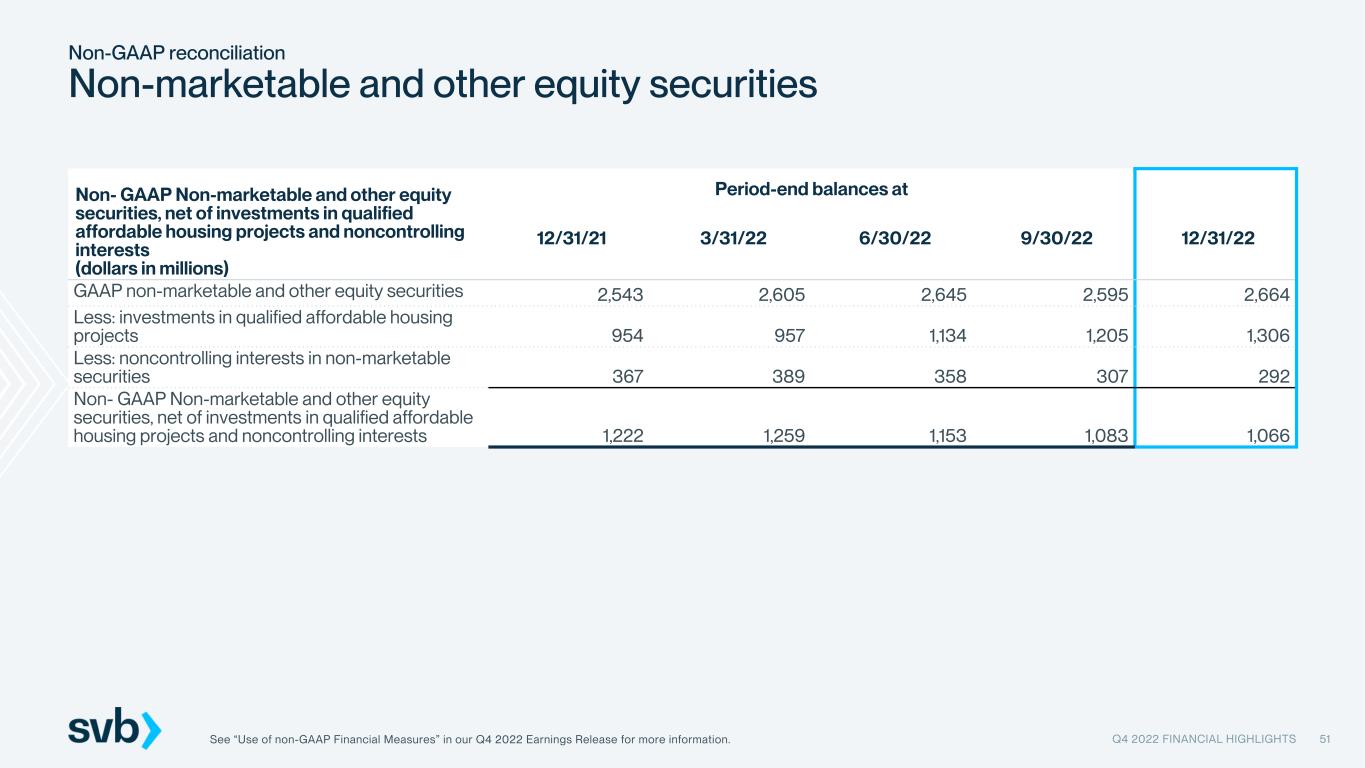

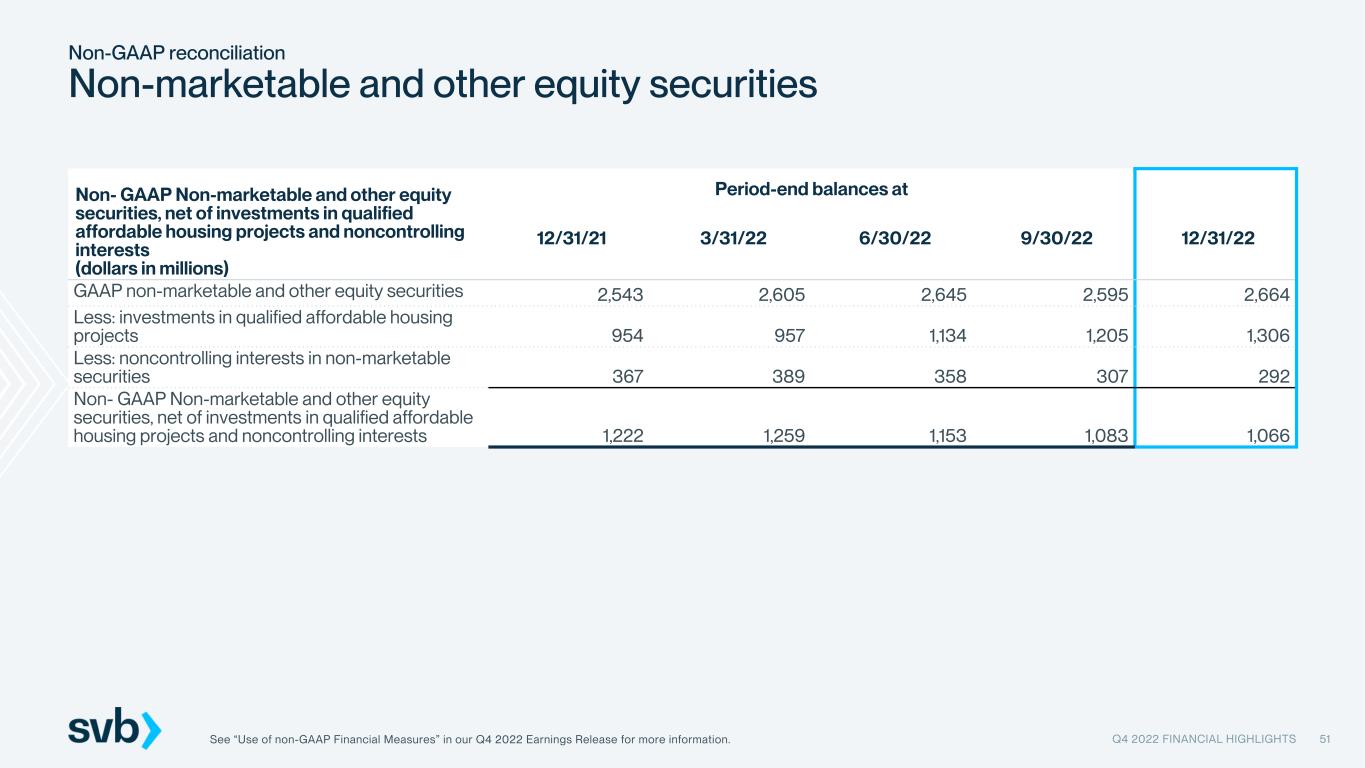

The following table provides further details on our non-marketable securities portfolio:

| | | | | | | | | | | | | | | | | | | | |

| (Dollars in millions) | | December 31, 2022 | | September 30, 2022 | | December 31, 2021 |

| GAAP non-marketable and other equity securities | | $ | 2,664 | | | $ | 2,595 | | | $ | 2,543 | |

| Less: investments in qualified affordable housing projects | | 1,306 | | | 1,205 | | 954 |

| Less: noncontrolling interests in non-marketable securities | | 292 | | | 307 | | 367 |

| Non-GAAP non-marketable and other equity securities, net of investments in qualified affordable housing projects and noncontrolling interests (1) | | $ | 1,066 | | | $ | 1,083 | | | $ | 1,222 | |

(1)Non-marketable and other equity securities, net of investments in qualified affordable housing projects and noncontrolling interests is a non-GAAP measure defined under the section “Use of Non-GAAP Financial Measures.”

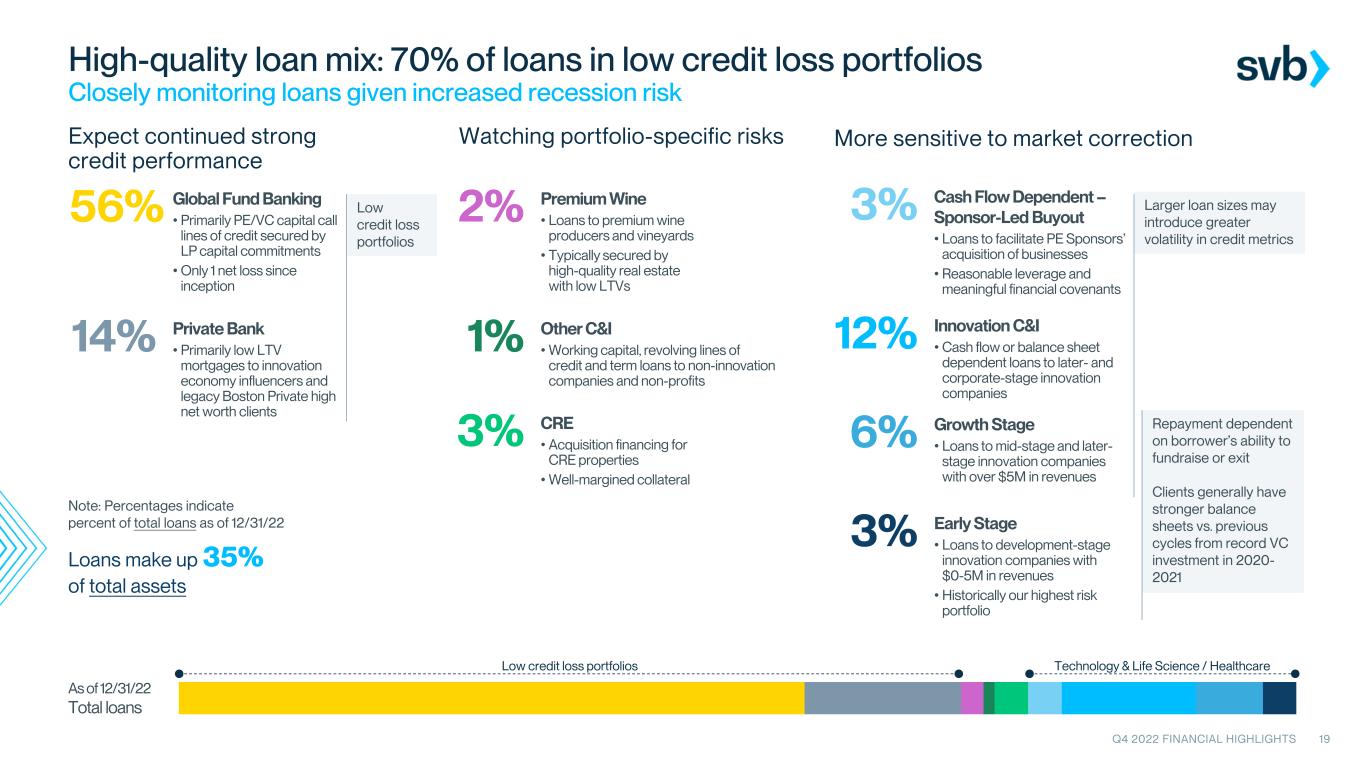

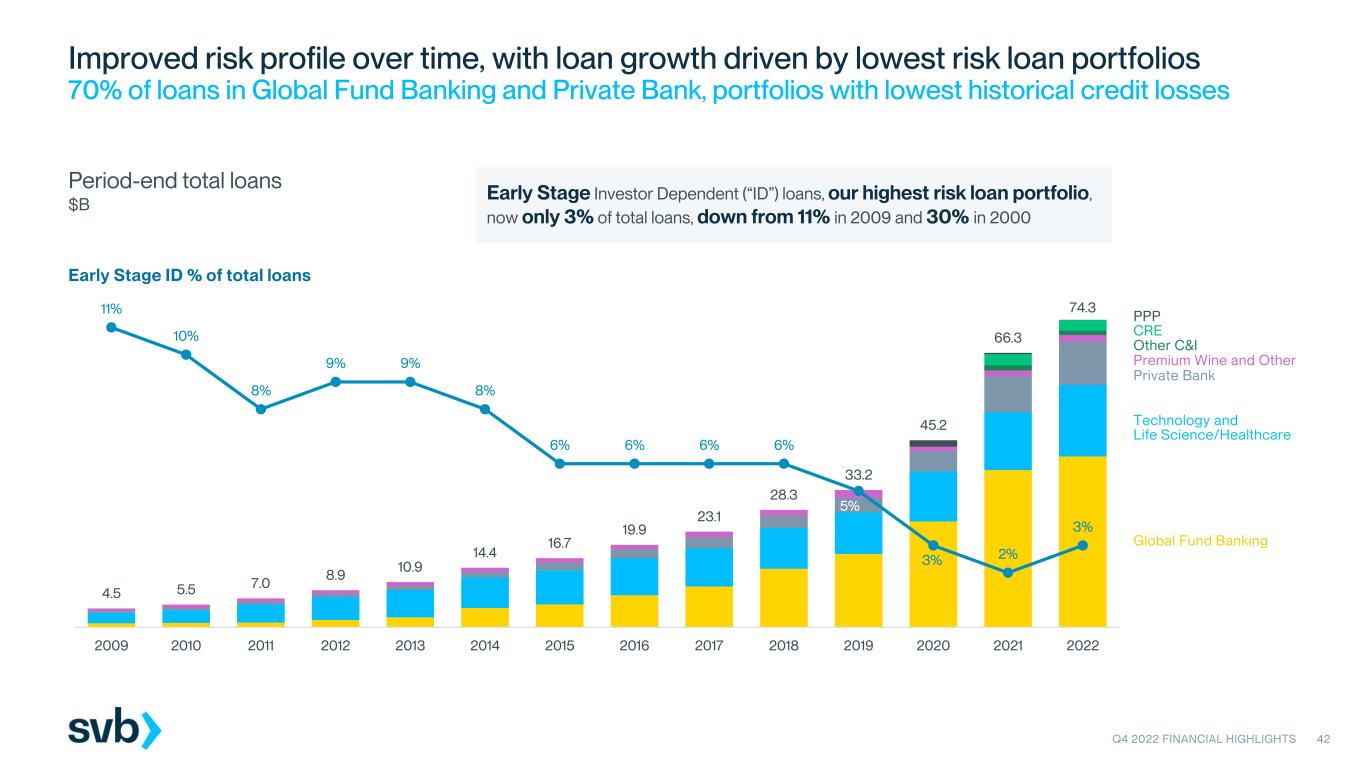

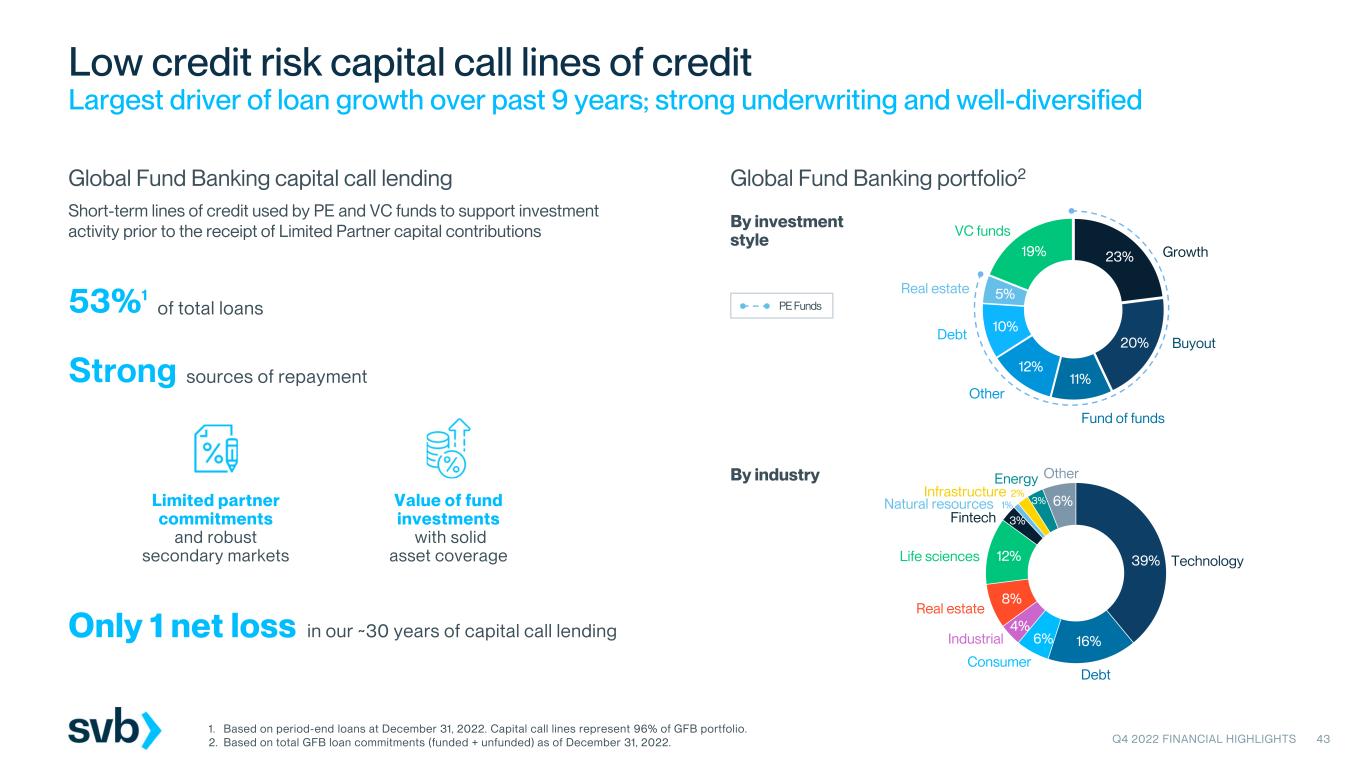

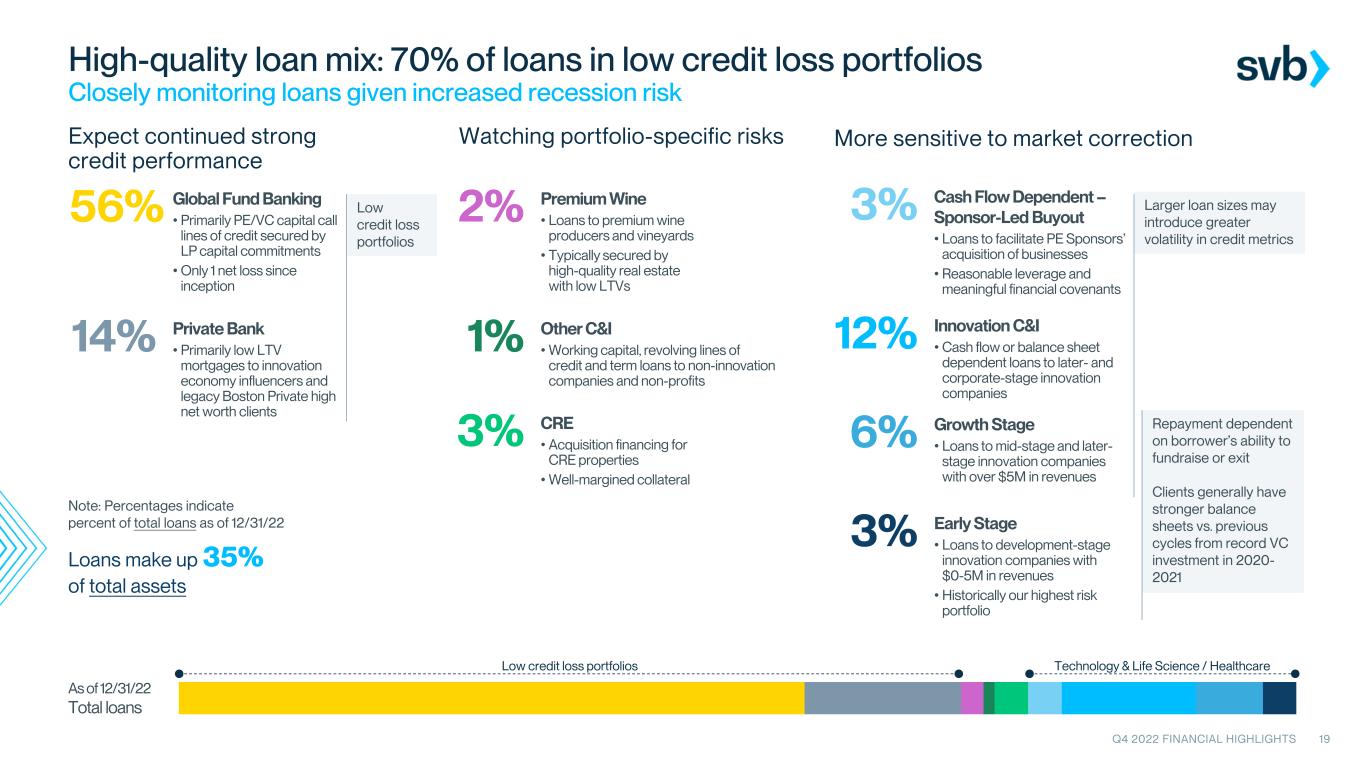

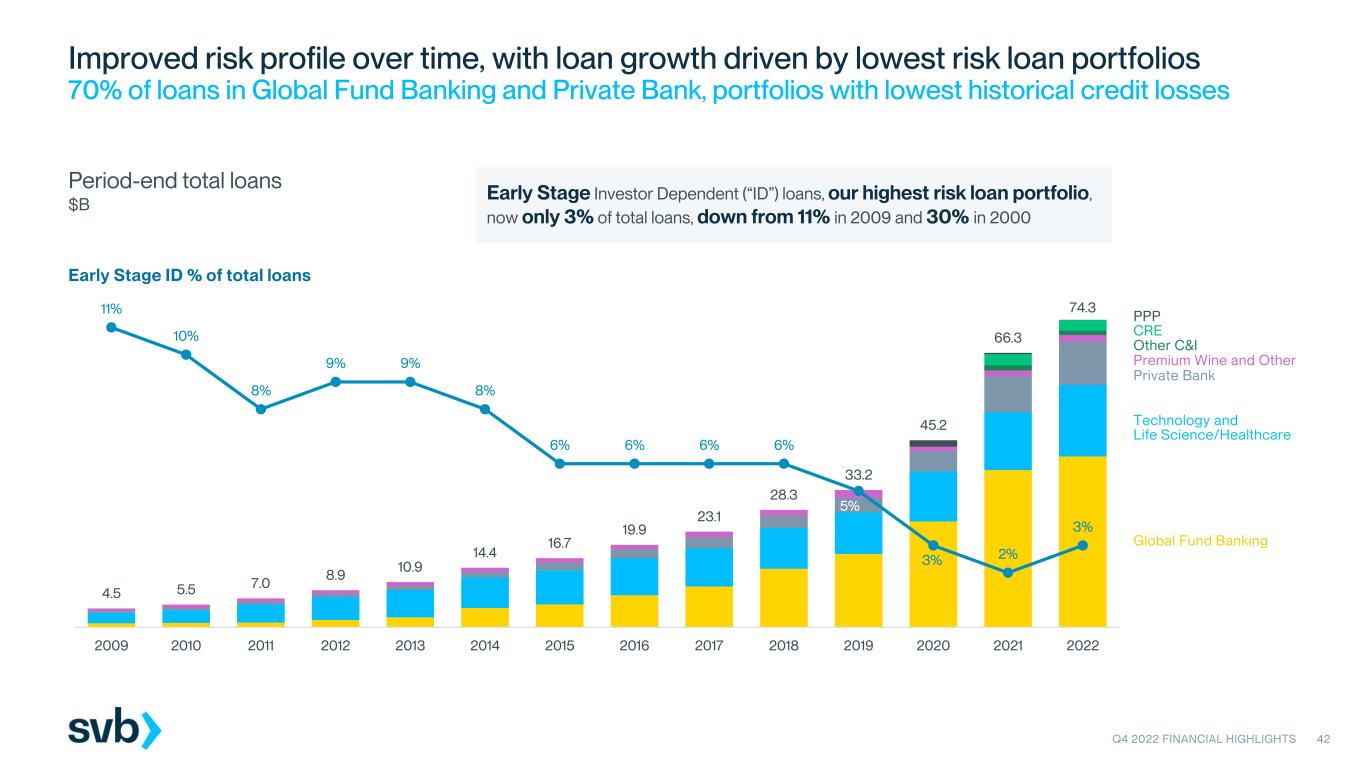

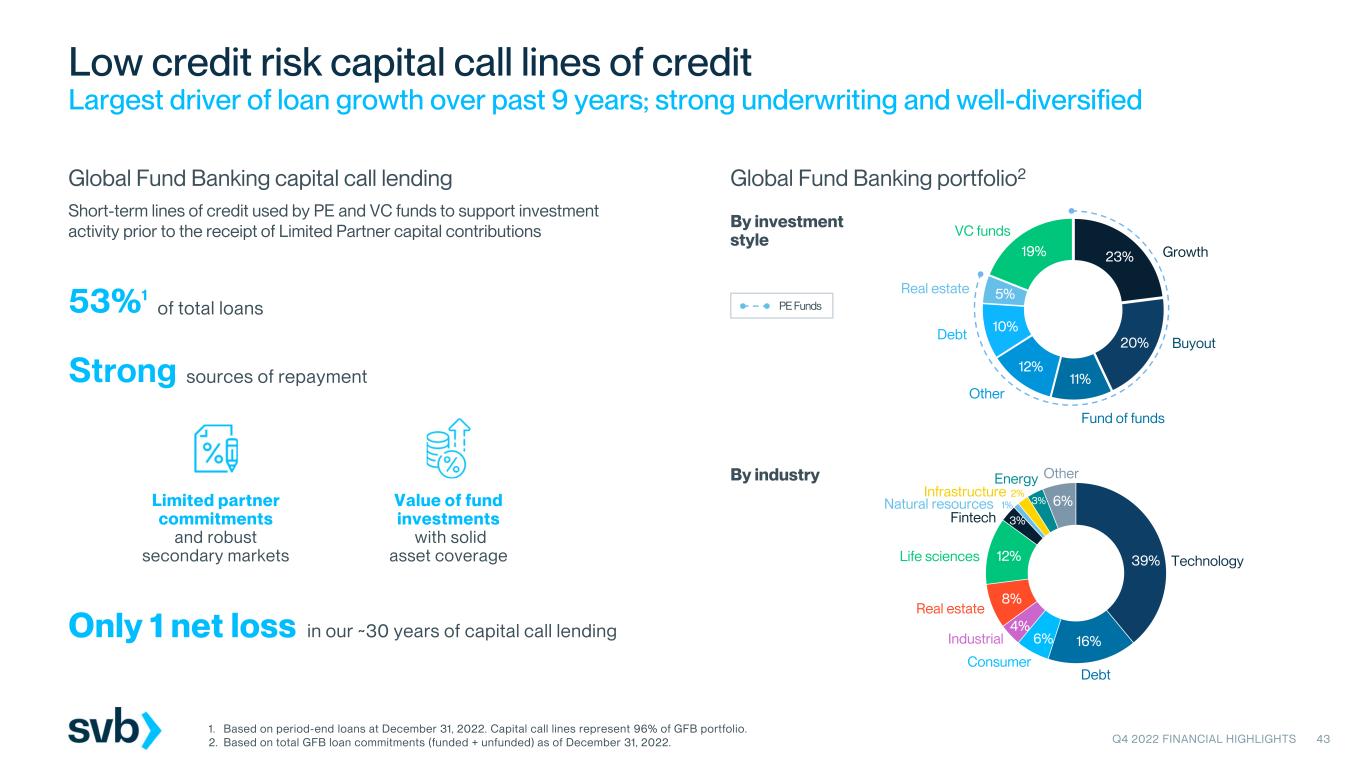

Loans

Average loans increased by $2.5 billion to $73.6 billion for the fourth quarter of 2022, compared to $71.1 billion for the third quarter of 2022. Period-end loans increased by $2.1 billion to $74.3 billion at December 31, 2022, compared to $72.1 billion at September 30, 2022. Average and period-end loan growth was driven primarily by our Global Fund Banking portfolios, with additional growth in our Technology and Private Bank loan portfolios.

The following table provides a summary of our loans at amortized cost basis broken out by class of financing receivable.

| | | | | | | | | | | | | | | | | | | | |

| (Dollars in millions) | | December 31, 2022 | | September 30, 2022 | | December 31, 2021 |

| Global fund banking | | $ | 41,269 | | | $ | 40,337 | | | $ | 37,958 | |

| Investor dependent | | | | | | |

| Early stage | | 1,950 | | | 1,911 | | | 1,593 | |

| Growth stage | | 4,763 | | | 4,398 | | | 3,951 | |

| Total investor dependent | | 6,713 | | | 6,309 | | | 5,544 | |

| Cash flow dependent - SLBO | | 1,966 | | | 1,845 | | | 1,798 | |

| Innovation C&I | | 8,609 | | | 8,321 | | | 6,673 | |

| Private bank | | 10,477 | | | 10,102 | | | 8,743 | |

| CRE | | 2,583 | | | 2,609 | | | 2,670 | |

| Premium wine | | 1,158 | | | 1,117 | | | 985 | |

| Other C&I | | 1,038 | | | 1,087 | | | 1,257 | |

| Other | | 414 | | | 374 | | | 317 | |

| PPP | | 23 | | | 28 | | | 331 | |

| Total loans | | $ | 74,250 | | | $ | 72,129 | | | $ | 66,276 | |

Net Interest Income and Margin

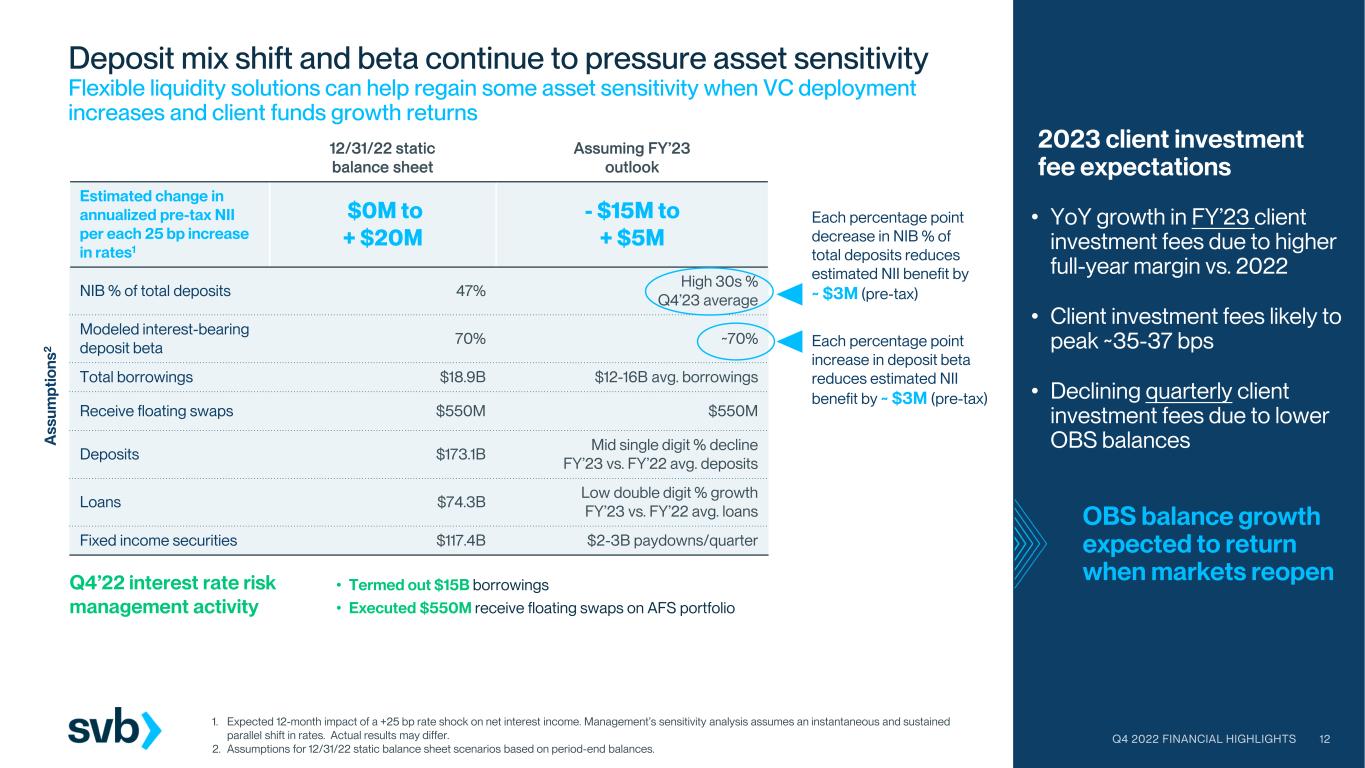

Net interest income, on a fully taxable equivalent basis, was $1.0 billion for the fourth quarter of 2022, compared to $1.2 billion for the third quarter of 2022. The $160 million decrease was attributable primarily to the following:

•An increase of $395 million in interest expense due primarily to an increase in interest paid on our interest-bearing deposits driven by higher market rates and a shift in our deposit mix. Additionally, we saw higher interest expense due to an increase in short-term borrowings expense driven by an increase in average short-term borrowings and higher borrowing costs due to market rate increases.

•A decrease of $50 million in interest income from HTM agency mortgage-backed fixed income securities primarily driven by higher premium amortization in the fourth quarter of 2022 compared to the third quarter of 2022. The increase in interest rates through the third quarter of 2022 impacted the cash flows received, as well as future estimated cash flows, resulting in a $50 million benefit in the third quarter of 2022 from the remeasurement of agency mortgage-backed securities in the third quarter of 2022.

The overall decrease in interest income was partially offset by,

•An increase of $254 million in interest income from loans due primarily to higher yields driven by the increase in market rates as well as growth in average loans of $2.5 billion and

•An increase of $31 million in interest income from increased market rates on interest-earning cash, partially offset by lower average balances.

Net interest margin, on a fully taxable equivalent basis, was 2.00 percent for the fourth quarter of 2022, compared to 2.28 percent for the third quarter of 2022. The 28 basis point decrease in our net interest margin was due primarily to the increase in interest-bearing deposit and short-term borrowings expense as well as the increase in premium amortization expense mentioned above, partially offset by improved loan and cash yields reflective of the higher rate environment.

For the fourth quarter of 2022, approximately 92 percent, or $67.8 billion, of our average loans were variable-rate loans that adjust at prescribed measurement dates. Of our variable-rate loans, approximately 60 percent are tied to prime-lending rates, 14 percent are tied to LIBOR and 26 percent are tied to alternate reference rates.

SVB has launched alternative reference rates in line with industry standards across USD (SOFR), GBP (SONIA), and EUR (€STR). For USD, SVB supports Term SOFR (1-,3-, and 6-month tenors) and Daily Simple SOFR conventions. We have made significant progress on legacy contract migration away from LIBOR to alternate reference rates. SVB does not expect any material changes in net interest income or net interest expense from product spread adjustments as a result of offering alternative reference rates.

Credit Quality

The following table provides a summary of our allowance for credit losses for loans, unfunded credit commitments and HTM securities:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended | | Year ended |

| (Dollars in millions, except ratios) | | December 31, 2022 | | September 30, 2022 | | December 31, 2021 | | December 31, 2022 | | December 31, 2021 |

| Allowance for credit losses for loans, beginning balance | | $ | 557 | | | $ | 545 | | | $ | 398 | | | $ | 422 | | | $ | 448 | |

| | | | | | | | | | |

| Initial allowance on PCD loans | | — | | | — | | | — | | | — | | | 22 | |

| Provision for loans (1) (2) | | 104 | | | 30 | | | 25 | | | 288 | | | 66 | |

| Gross loan charge-offs (2) | | (37) | | | (26) | | | (9) | | | (103) | | | (138) | |

| Loan recoveries | | 9 | | | 11 | | | 8 | | | 32 | | | 24 | |

| Foreign currency translation adjustments | | 3 | | | (3) | | | — | | | (3) | | | — | |

| Allowance for credit losses for loans, ending balance | | $ | 636 | | | $ | 557 | | | $ | 422 | | | $ | 636 | | | $ | 422 | |

| Allowance for credit losses for unfunded credit commitments, beginning balance | | $ | 265 | | | $ | 224 | | | $ | 149 | | | 171 | | | 121 | |

| | | | | | | | | | |

| Provision for unfunded credit commitments (1) | | 37 | | | 42 | | | 22 | | | 133 | | | 50 | |

| Foreign currency translation adjustments | | 1 | | | (1) | | | — | | | (1) | | | — | |

| Allowance for credit losses for unfunded credit commitments, ending balance (3) | | $ | 303 | | | $ | 265 | | | $ | 171 | | | $ | 303 | | | $ | 171 | |

| Allowance for credit losses for HTM securities, beginning balance | | $ | 6 | | | $ | 6 | | | $ | 6 | | | 7 | | | — | |

| | | | | | | | | | |

| Provision (reduction) for HTM securities | | — | | | — | | | 1 | | | (1) | | | 7 | |

| Allowance for credit losses for HTM securities, ending balance (4) | | $ | 6 | | | $ | 6 | | | $ | 7 | | | $ | 6 | | | $ | 7 | |

| Ratios and other information: | | | | | | | | | | |

| Provision for loans as a percentage of period-end total loans (annualized) | | 0.56 | % | | 0.17 | % | | 0.15 | % | | 0.39 | % | | 0.10 | % |

| Gross loan charge-offs as a percentage of average total loans (annualized) | | 0.20 | | | 0.15 | | | 0.06 | | | 0.15 | | | 0.25 | |

| Net loan charge-offs as a percentage of average total loans (annualized) | | 0.15 | | | 0.08 | | | 0.01 | | | 0.10 | | | 0.21 | |

| Allowance for credit losses for loans as a percentage of period-end total loans | | 0.86 | | | 0.77 | | | 0.64 | | | 0.86 | | | 0.64 | |

| Provision for credit losses (1) | | $ | 141 | | | $ | 72 | | | $ | 48 | | | $ | 420 | | | $ | 123 | |

| Period-end total loans | | 74,250 | | | 72,129 | | | 66,276 | | | 74,250 | | | 66,276 | |

| Average total loans | | 73,645 | | | 71,098 | | | 62,573 | | | 70,289 | | | 54,547 | |

| Allowance for credit losses for nonaccrual loans | | 51 | | | 25 | | | 35 | | | 51 | | | 35 | |

| Nonaccrual loans | | 132 | | | 76 | | | 84 | | | 132 | | | 84 | |

(1)The provision for credit losses for the year ended December 31, 2021 includes $46 million recognized as a result of the Boston Private acquisition, which consists of a $44 million provision for loan losses related to non-PCD loans and a $2 million provision for unfunded commitments.

(2)Metrics for the year ended December 31, 2021 include the impact of an $80 million charge-off related to potentially fraudulent activity discussed in previous filings.

(3)The “allowance for credit losses for unfunded credit commitments” is included as a component of “other liabilities.”

(4)The "allowance for credit losses for HTM securities" is included as a component of HTM securities and presented net in our consolidated financial statements.

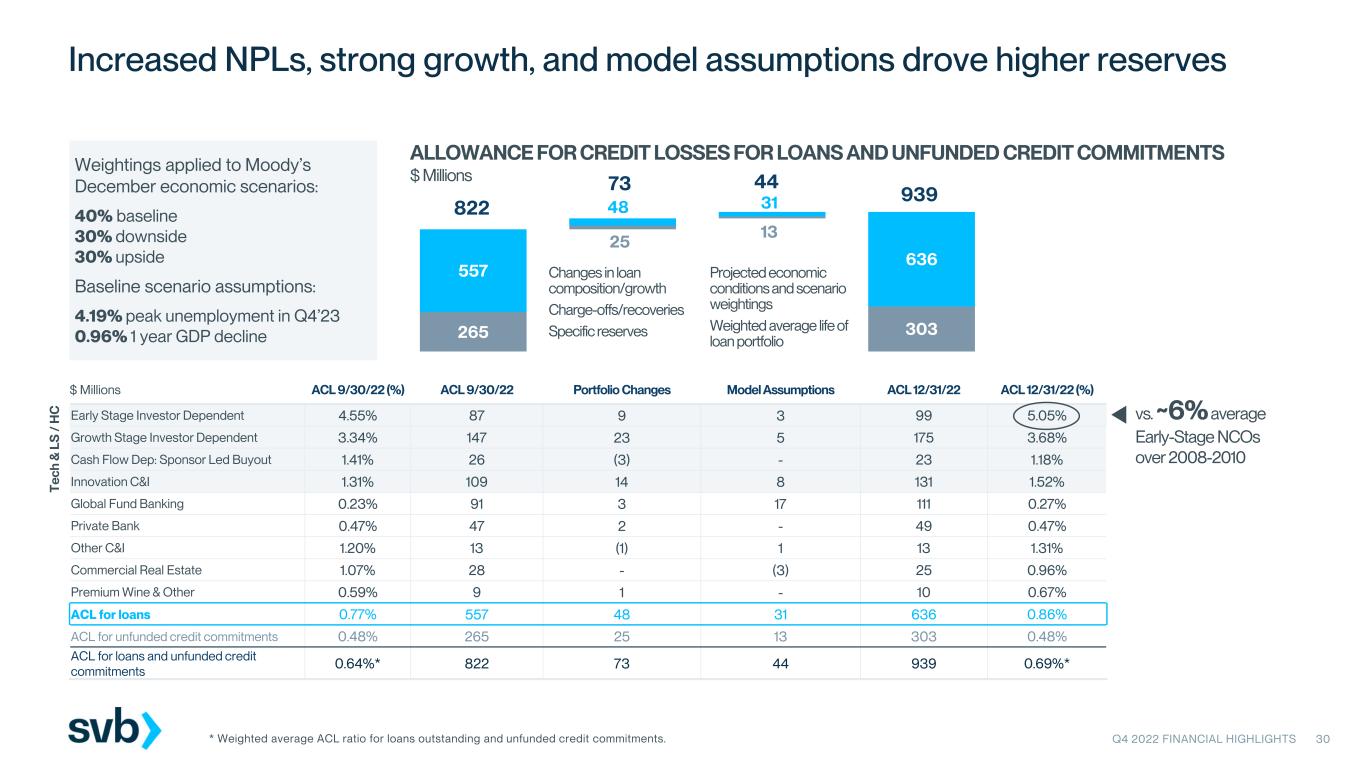

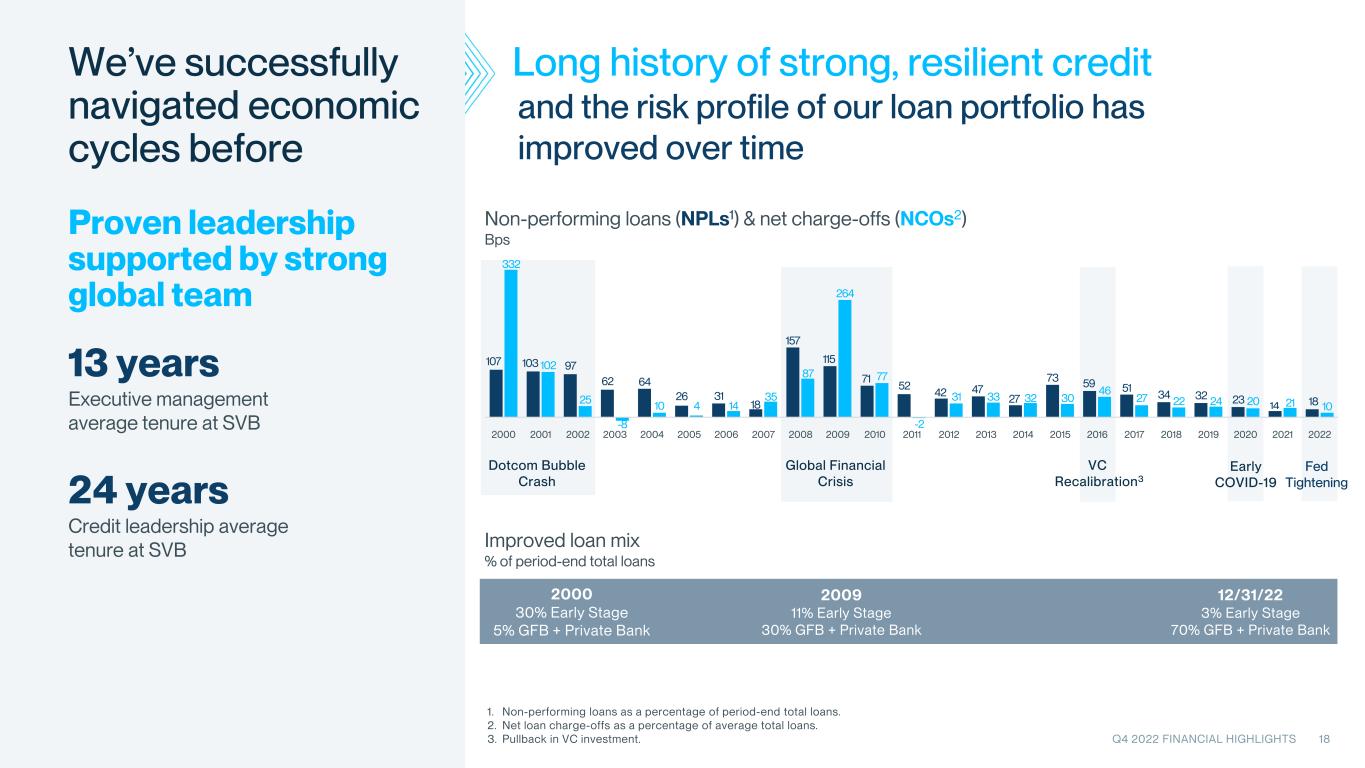

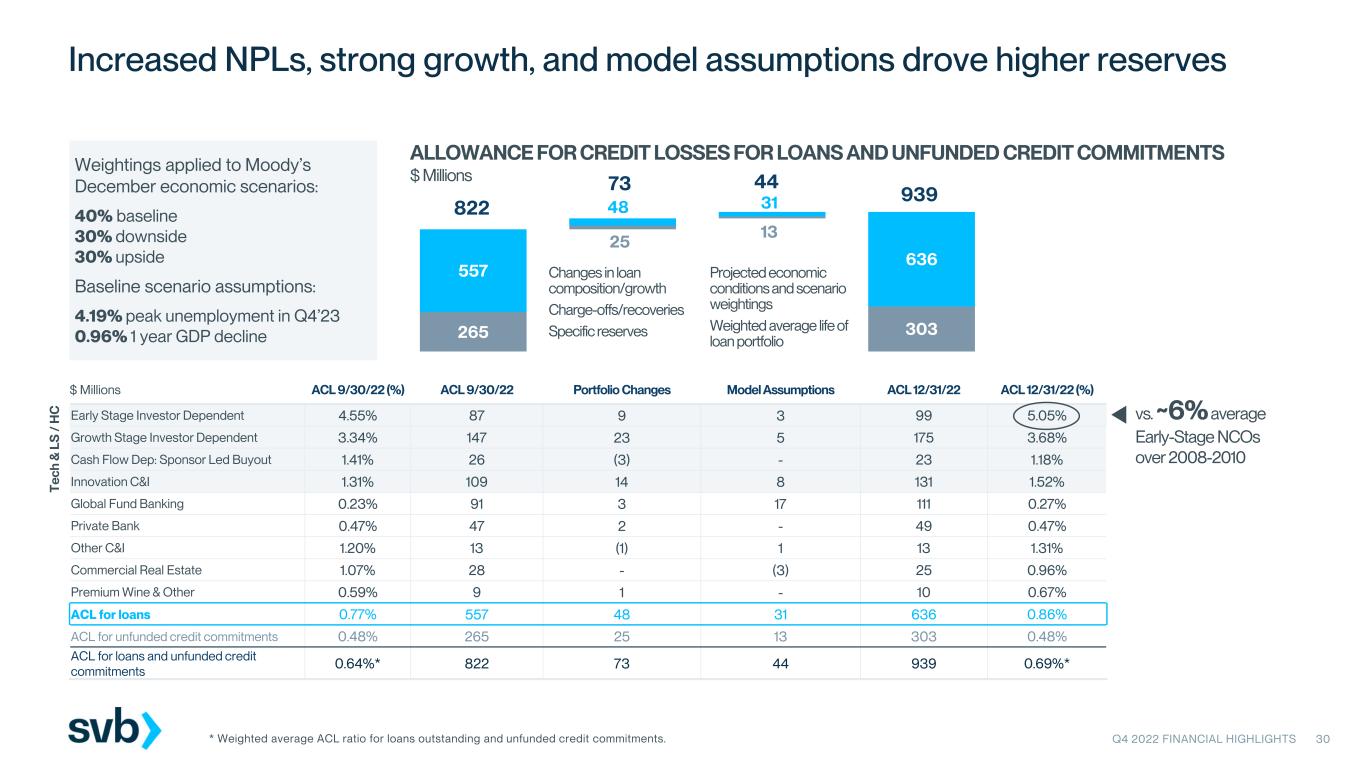

Our allowance for credit losses for loans increased $79 million to $636 million at December 31, 2022, compared to $557 million at September 30, 2022. As a percentage of total loans, our allowance for credit losses for loans was 0.86 percent at December 31, 2022 compared to 0.77 percent at September 30, 2022.

The provision for credit losses was $141 million for the fourth quarter of 2022, consisting of the following:

•A provision for credit loss for loans of $104 million, driven primarily by the impact of nonaccrual loans reflective of $36 million of gross charge-offs not previously specifically reserved for and a $26 million increase in nonaccrual reserves from an increase in nonaccrual loans. Other drivers of the provision were an increase of $31 million due to changes in model assumptions, including a deterioration in economic assumptions and an increase in the weighted average life of the portfolio, as well as loan growth, which accounted for $22 million of the provision. These were offset by $9 million in recoveries.

•A provision for credit loss for unfunded credit commitments of $37 million, driven primarily by growth in our unfunded commitments, which accounted for $24 million of the provision, and $13 million from the changes in model assumptions discussed above.

•A reduction in the allowance for credit losses for HTM securities of less than $1 million, based on ongoing stability within the HTM bond portfolio.

Gross loan charge-offs were $37 million for the fourth quarter of 2022, of which $36 million was not specifically reserved for at September 30, 2022. Gross loan charge-offs were primarily driven by clients in our Technology and Life Sciences/Healthcare portfolios, including $13 million of charge-offs from Investor Dependent - Early Stage clients and $13 million from the Investor Dependent - Growth Stage portfolio.

Nonaccrual loans increased seven basis points as a percentage of total loans to $132 million at December 31, 2022, compared to $76 million at September 30, 2022. The increase in nonaccrual loans is due to $72 million of additions. New nonaccrual loans were primarily driven by Investor Dependent and Innovation C&I clients. The allowance for credit losses for nonaccrual loans increased $26 million to $51 million in the fourth quarter of 2022. The increase is due to the higher nonaccrual balances, which are reflective of the current economic conditions.

Client Funds

Our Total Client Funds consist of the sum of both our on-balance sheet deposits and off-balance sheet client investment funds. The following tables provide a summary of our average and period-end on-balance sheet deposits and off-balance sheet client investment funds:

Average On-Balance Sheet Deposits and Off-Balance Sheet Client Investment Funds (1)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Average balances for the |

| | | Three months ended | | Year ended |

| (Dollars in millions) | | December 31, 2022 | | September 30, 2022 | | December 31, 2021 | | December 31, 2022 | | December 31, 2021 |

| Interest-bearing deposits | | $ | 87,784 | | | $ | 79,444 | | | $ | 60,273 | | | $ | 76,013 | | | $ | 48,486 | |

| Noninterest bearing demand deposits | | 86,969 | | | 106,112 | | | 122,789 | | | 109,676 | | | 99,461 | |

| Total average on-balance sheet deposits | | $ | 174,753 | | | $ | 185,556 | | | $ | 183,062 | | | $ | 185,689 | | | $ | 147,947 | |

| | | | | | | | | | |

| Sweep money market funds | | $ | 71,201 | | | $ | 81,726 | | | $ | 108,350 | | | $ | 89,305 | | | $ | 88,913 | |

| Managed client investment funds (2) | | 87,829 | | | 86,100 | | | 84,188 | | | 85,922 | | | 78,450 | |

| Repurchase agreements | | 13,795 | | | 15,033 | | | 15,040 | | | 13,888 | | | 13,830 | |

| Total average off-balance sheet client investment funds | | $ | 172,825 | | | $ | 182,859 | | | $ | 207,578 | | | $ | 189,115 | | | $ | 181,193 | |

Period-end On-Balance Sheet Deposits and Off-Balance Sheet Client Investment Funds (1)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Period-end balances at |

| (Dollars in millions) | | December 31, 2022 | | September 30, 2022 | | June 30, 2022 | | March 31, 2022 | | December 31, 2021 |

| Interest-bearing deposits | | $ | 92,356 | | | $ | 82,831 | | | $ | 73,976 | | | $ | 70,137 | | | $ | 63,352 | |

| Noninterest-bearing demand deposits | | 80,753 | | | 93,988 | | | 113,969 | | | 127,997 | | | 125,851 | |

| Total period-end on-balance sheet deposits | | $ | 173,109 | | | $ | 176,819 | | | $ | 187,945 | | | $ | 198,134 | | | $ | 189,203 | |

| | | | | | | | | | |

| Sweep money market funds | | $ | 64,262 | | | $ | 76,111 | | | $ | 89,544 | | | $ | 102,550 | | | $ | 109,241 | |

| Managed client investment funds (2) | | 89,392 | | | 85,926 | | | 86,849 | | | 83,988 | | | 85,475 | |

| Repurchase agreements | | 14,723 | | | 14,824 | | | 14,851 | | | 12,678 | | | 15,370 | |

| Total period-end off-balance sheet client investment funds | | $ | 168,377 | | | $ | 176,861 | | | $ | 191,244 | | | $ | 199,216 | | | $ | 210,086 | |

(1)Off-Balance sheet client investment funds are maintained at third-party financial institutions.

(2)These funds represent investments in third-party money market mutual funds and fixed income securities managed by SVB Asset Management.

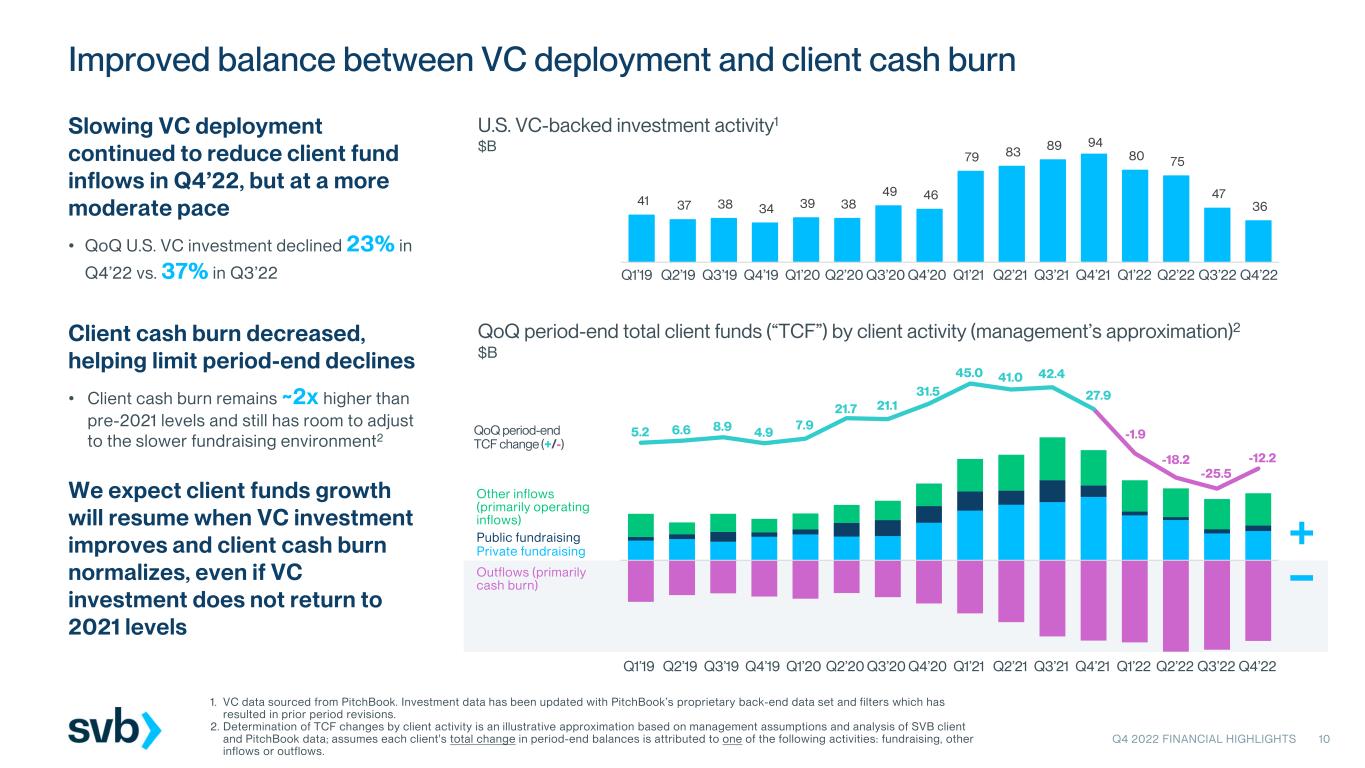

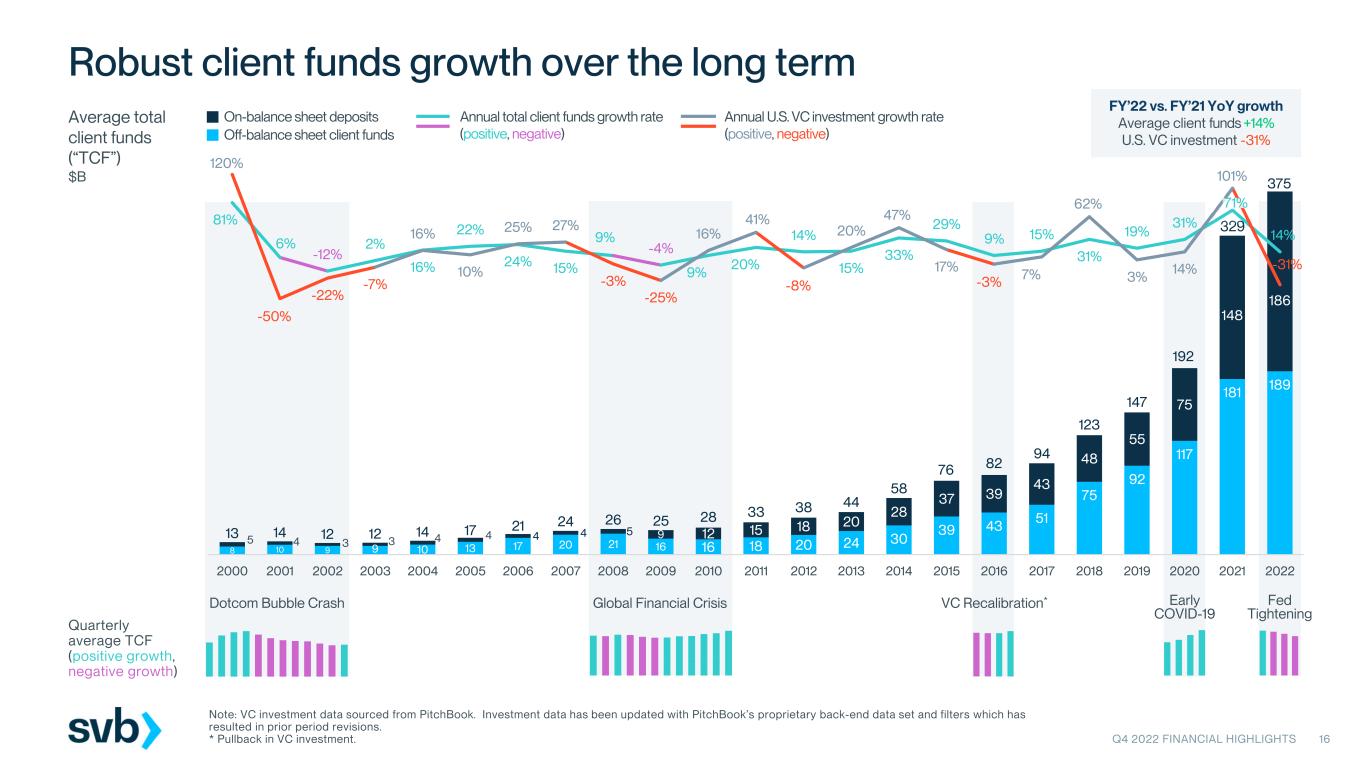

Average Total Client Funds decreased by $20.8 billion to $347.6 billion for the fourth quarter of 2022, compared to $368.4 billion for the third quarter of 2022. Period-end Total Client Funds decreased $12.2 billion to $341.5 billion at December 31, 2022, compared to $353.7 billion at September 30, 2022. Both client cash burn and the pace of decline in VC investment moderated during the fourth quarter of 2022 which reduced quarter over quarter period-end declines.

SVB Private Assets Under Management ("AUM")

AUM consists of SVB Private's (formerly known as SVB Private Bank) client investment account balances and generated fee income included in financial statement line item wealth management and trust fees included in our consolidated statements of income. The increase in SVB Private AUM was driven by favorable market returns and net inflows. The following table summarizes the activity relating to AUM for the three months ended December 31, 2022, September 30, 2022 and December 31, 2021 respectively:

| | | | | | | | | | | | | | | | | | | | |

| | | Three months ended |

| (Dollars in millions) | | December 31, 2022 | | September 30, 2022 | | December 31, 2021 |

| Beginning balance | | $ | 15,860 | | | $ | 16,512 | | | $ | 19,565 | |

| Net flows | | 680 | | | (76) | | | (891) | |

| Market returns | | 754 | | | (576) | | | 972 | |

| Ending balance | | $ | 17,294 | | | $ | 15,860 | | | $ | 19,646 | |

| | | | | | |

| | | | | | |

Noninterest Income

Noninterest income was $490 million for the fourth quarter of 2022, compared to $359 million for the third quarter of 2022. The increase was driven by higher investment banking revenue and client investment fees as well as a decrease in investment losses.

Items impacting noninterest income for the fourth quarter of 2022 were as follows:

Net (losses) gains on investment securities

The following tables provide a summary of non-GAAP net losses on investment securities, net of noncontrolling interests, for the three months ended December 31, 2022 and September 30, 2022, respectively:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three months ended December 31, 2022 |

| (Dollars in millions) | | Managed

Funds of Funds | | Managed Direct Venture Funds | | Managed Credit Funds | | Public Equity Securities | | Sales of AFS Securities | | | | Strategic

and Other

Investments | | SVB Securities | | Total |

| GAAP (losses) gains on investment securities, net | | $ | (10) | | | $ | (11) | | | $ | (6) | | | $ | (2) | | | $ | (27) | | | | | $ | (28) | | | $ | (2) | | | $ | (86) | |

| Less: income attributable to noncontrolling interests, including carried interest allocation | | (3) | | | (5) | | | 1 | | | — | | | — | | | | | — | | | (2) | | | (9) | |

| Non-GAAP (losses) gains on investment securities, net of noncontrolling interests | | $ | (7) | | | $ | (6) | | | $ | (7) | | | $ | (2) | | | $ | (27) | | | | | $ | (28) | | | $ | — | | | $ | (77) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three months ended September 30, 2022 |

| (Dollars in millions) | | Managed

Funds of Funds | | Managed Direct Venture Funds | | Managed Credit Funds | | Public Equity Securities | | | | | | Sales of AFS Securities | | Strategic

and Other

Investments | | SVB Securities | | Total |

| GAAP (losses) gains on investment securities, net | | $ | (78) | | | $ | 3 | | | $ | 5 | | | $ | (6) | | | | | | | $ | — | | | $ | (47) | | | $ | (4) | | | $ | (127) | |

| Less: income attributable to noncontrolling interests, including carried interest allocation | | (52) | | | 2 | | | 1 | | | — | | | | | | | — | | | — | | | (2) | | | (51) | |

| Non-GAAP (losses) gains on investment securities, net of noncontrolling interests | | $ | (26) | | | $ | 1 | | | $ | 4 | | | $ | (6) | | | | | | | $ | — | | | $ | (47) | | | $ | (2) | | | $ | (76) | |

Non-GAAP net losses on investment securities, net of noncontrolling interests of $77 million for the fourth quarter of 2022 were driven primarily by further valuation declines in our managed funds and strategic and other investments reflective of continued adverse market conditions and realized losses of $27 million on the sale of $1.0 billion of AFS US Treasury securities.

Net gains on equity warrant assets

The following table provides a summary of our net gains on equity warrant assets:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three months ended | | Year ended |

| (Dollars in millions) | | December 31, 2022 | | September 30, 2022 | | December 31, 2021 | | December 31, 2022 | | December 31, 2021 |

| Equity warrant assets: | | | | | | | | | | |

| Gains on exercises, net | | $ | 4 | | | $ | 9 | | | $ | 44 | | | $ | 45 | | | $ | 446 | |

| Terminations | | (1) | | | (1) | | | — | | | (4) | | | (2) | |

| Changes in fair value, net | | 25 | | | 32 | | | 25 | | | 107 | | | 116 | |

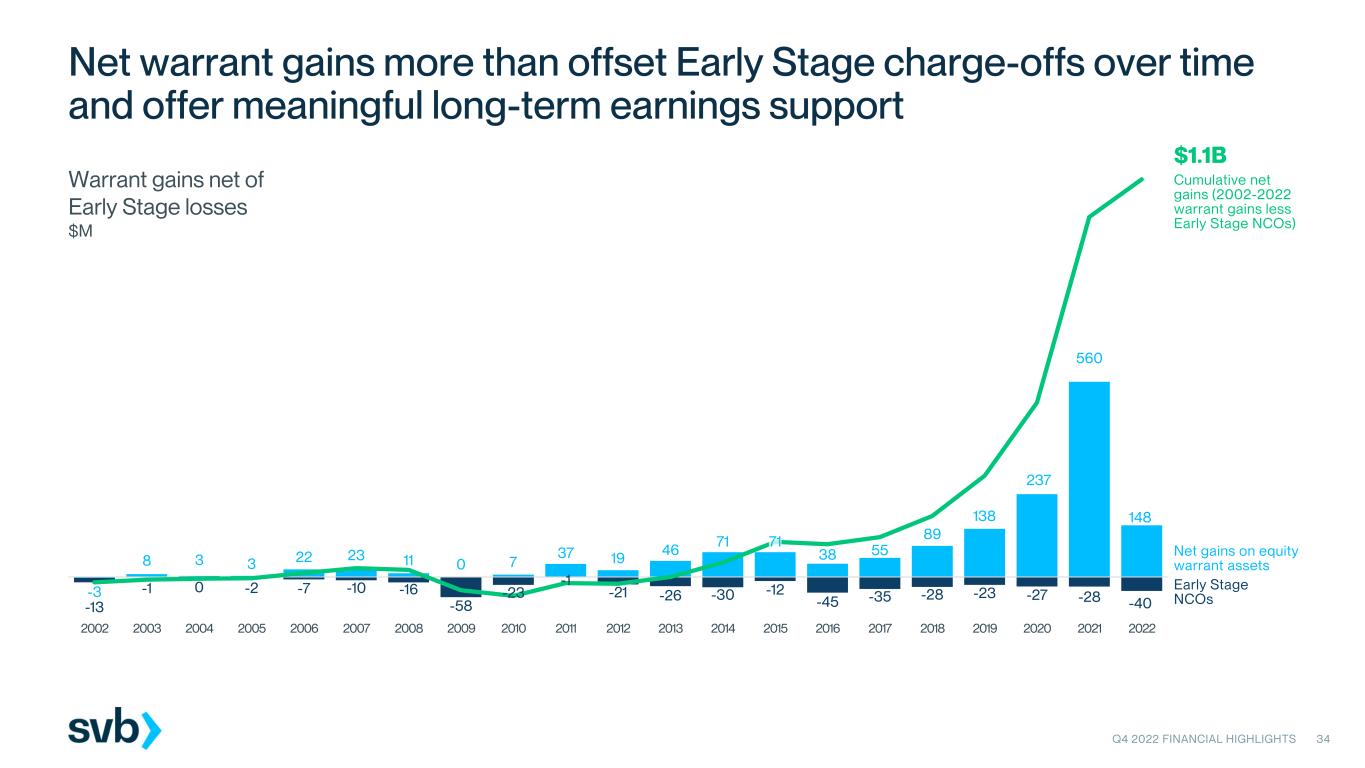

| Total net gains on equity warrant assets | | $ | 28 | | | $ | 40 | | | $ | 69 | | | $ | 148 | | | $ | 560 | |

Net gains on equity warrant assets for the fourth quarter of 2022 were driven by $25 million in net valuation increases due to valuation updates and $4 million in gains on exercises of warrants driven mainly by M&A activity.

At December 31, 2022, we held warrants in 3,234 companies with a total fair value of $383 million. Warrants in 65 companies each had fair values greater than $1 million and collectively represented $199 million, or 51.9%, of the fair value of the total warrant portfolio at December 31, 2022.

The gains (or losses) from investment securities from our non-marketable and other equity securities portfolio as well as our equity warrant assets resulting from changes in valuations (fair values) are currently unrealized, and the extent to which such gains (or losses) will become realized is subject to a variety of factors, including, among other things, performance of the underlying portfolio companies, investor demand for IPOs and SPACs, fluctuations in the underlying valuation of these companies, levels of M&A activity and legal and contractual restrictions on our ability to sell the underlying securities.

Non-GAAP core fee income plus non-GAAP SVB Securities revenue

The following table provides a summary of our non-GAAP core fee income, non-GAAP SVB Securities revenue and non-GAAP core fee income plus SVB Securities revenue:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three months ended | | Year ended |

| (Dollars in millions) | | December 31, 2022 | | September 30, 2022 | | December 31, 2021 | | December 31, 2022 | | December 31, 2021 |

| Non-GAAP core fee income: | | | | | | | | | | |

| Client investment fees | | $ | 149 | | | $ | 119 | | | $ | 20 | | | $ | 386 | | | $ | 75 | |

| Wealth management and trust fees | | 20 | | | 19 | | | 22 | | | 83 | | | 44 | |

| Foreign exchange fees | | 69 | | | 74 | | | 73 | | | 285 | | | 262 | |

| Credit card fees | | 36 | | | 37 | | | 38 | | | 150 | | | 131 | |

| Deposit service charges | | 32 | | | 32 | | | 30 | | | 126 | | | 112 | |

| Lending related fees | | 29 | | | 20 | | | 21 | | | 94 | | | 76 | |

| Letters of credit and standby letters of credit fees | | 14 | | | 15 | | | 12 | | | 57 | | | 51 | |

| Total non-GAAP core fee income | | $ | 349 | | | $ | 316 | | | $ | 216 | | | $ | 1,181 | | | $ | 751 | |

| Investment banking revenue | | 127 | | | 75 | | | 124 | | | 420 | | | 459 | |

| Commissions | | 25 | | | 24 | | | 21 | | | 98 | | | 79 | |

| Total non-GAAP SVB Securities revenue | | $ | 152 | | | $ | 99 | | | $ | 145 | | | $ | 518 | | | $ | 538 | |

| Total non-GAAP core fee income plus SVB Securities revenue | | $ | 501 | | | $ | 415 | | | $ | 361 | | | $ | 1,699 | | | $ | 1,289 | |

Non-GAAP core fee income increased from the third quarter of 2022 to the fourth quarter of 2022 primarily due to an increase of $30 million in client investment fees, which is reflective of improved fee margins resulting from higher short-term interest rates driven by Federal Funds Rate increases.

Non-GAAP SVB Securities revenue increased $53 million from the third quarter of 2022 to the fourth quarter of 2022 driven by an increase in advisory and equity capital markets transactions most notably within the Biopharma sector.

Reconciliations of our non-GAAP net gains on investment securities, non-GAAP core fee income, non-GAAP SVB Securities revenue and non-GAAP core fee income plus SVB Securities revenue are provided under the section “Use of Non-GAAP Financial Measures.”

Noninterest Expense

Noninterest expense was $1.0 billion for the fourth quarter of 2022, compared to $892 million for the third quarter of 2022. The increase of $116 million from the prior quarter was attributable primarily to increases in our compensation and benefits expense.

The following table provides a summary of our compensation and benefits expense:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three months ended | | Year ended |

| (Dollars in millions, except employees) | | December 31, 2022 | | September 30, 2022 | | December 31, 2021 | | December 31, 2022 | | December 31, 2021 |

| Compensation and benefits: | | | | | | | | | | |

| Salaries and wages | | $ | 300 | | | $ | 280 | | | $ | 217 | | | $ | 1,080 | | | $ | 721 | |

| Incentive compensation plans | | 212 | | | 145 | | | 243 | | | 668 | | | 784 | |

| Other employee incentives and benefits (1) | | 132 | | | 138 | | | 137 | | | 545 | | | 510 | |

| Total compensation and benefits | | $ | 644 | | | $ | 563 | | | $ | 597 | | | $ | 2,293 | | | $ | 2,015 | |

| Period-end full-time equivalent employees | | 8,553 | | 8,429 | | 6,567 | | 8,553 | | 6,567 |

| Average full-time equivalent employees | | 8,528 | | 8,236 | | 6,431 | | 7,817 | | 5,466 |

(1)Other employee incentives and benefits expense includes employer payroll taxes, group health and life insurance, share-based compensation, 401(k), ESOP, warrant incentive and retention plans, agency fees and other employee-related expenses.

The $81 million increase in total compensation and benefits expense consists primarily of the following:

•An increase of $67 million in incentive compensation plans expense driven by SVB Securities revenue outperformance and deferred compensation costs, and

•An increase of $20 million in salaries and wages expense primarily due to an increase in FTEs as we continue to invest in our revenue-generating lines of business and support functions.

Income Tax Expense

Our effective tax rate was 19.1 percent for the fourth quarter of 2022, compared to 27.2 percent for the third quarter of 2022. Our effective tax rate was 25.2 percent for the year ended 2022, compared to 26.2 percent for the year ended 2021. The decrease reflects our 2021 provision to return adjustment and a lower 2022 estimated state tax expense, as well as higher R&D tax credit benefits. Our effective tax rate is calculated by dividing income tax expense by the sum of income before income tax expense and net income attributable to noncontrolling interests.

SVBFG Stockholders’ Equity

Total SVBFG stockholders’ equity increased by $495 million to $16.0 billion at December 31, 2022, compared to $15.5 billion at September 30, 2022. The increase was driven primarily by net income available to common stockholders and an increase in other comprehensive income (“OCI”). The increase in OCI was driven primarily by short-dated fixed income securities valuation increases, price appreciation on mortgage-backed securities from spread compression and sales and paydowns of fixed income securities in our AFS securities portfolio.

The following table provides a summary of the changes in SVBFG stockholders' equity during the quarter:

| | | | | | | | |

| (Dollars in millions) | | |

| Beginning balance at September 30, 2022 | | $ | 15,509 | |

| Net income available to common stockholders (1) | | 275 | |

| Other comprehensive income | | 174 | |

| Other | | 46 | |

| Ending balance at December 31, 2022 | | $ | 16,004 | |

(1)Excludes $40 million of preferred dividends paid during the fourth quarter of 2022.

Preferred Stock

On January 19, 2023, the Company's Board of Directors declared the following quarterly preferred stock dividends payable on February 15, 2023 to holders of record at the close of business on February 1, 2023:

| | | | | | | | | | | | | | |

| | Cash dividend | | Cash dividend per depositary share |

| Series A Preferred Stock | | $ | 13.125 | | | $ | 0.328125 | |

| Series B Preferred Stock | | 1,025.00 | | | 10.25 | |

| Series C Preferred Stock | | 1,000.00 | | | 10.00 | |

| Series D Preferred Stock | | 1,062.50 | | | 10.625 | |

| Series E Preferred Stock | | 1,175.00 | | | 11.75 | |

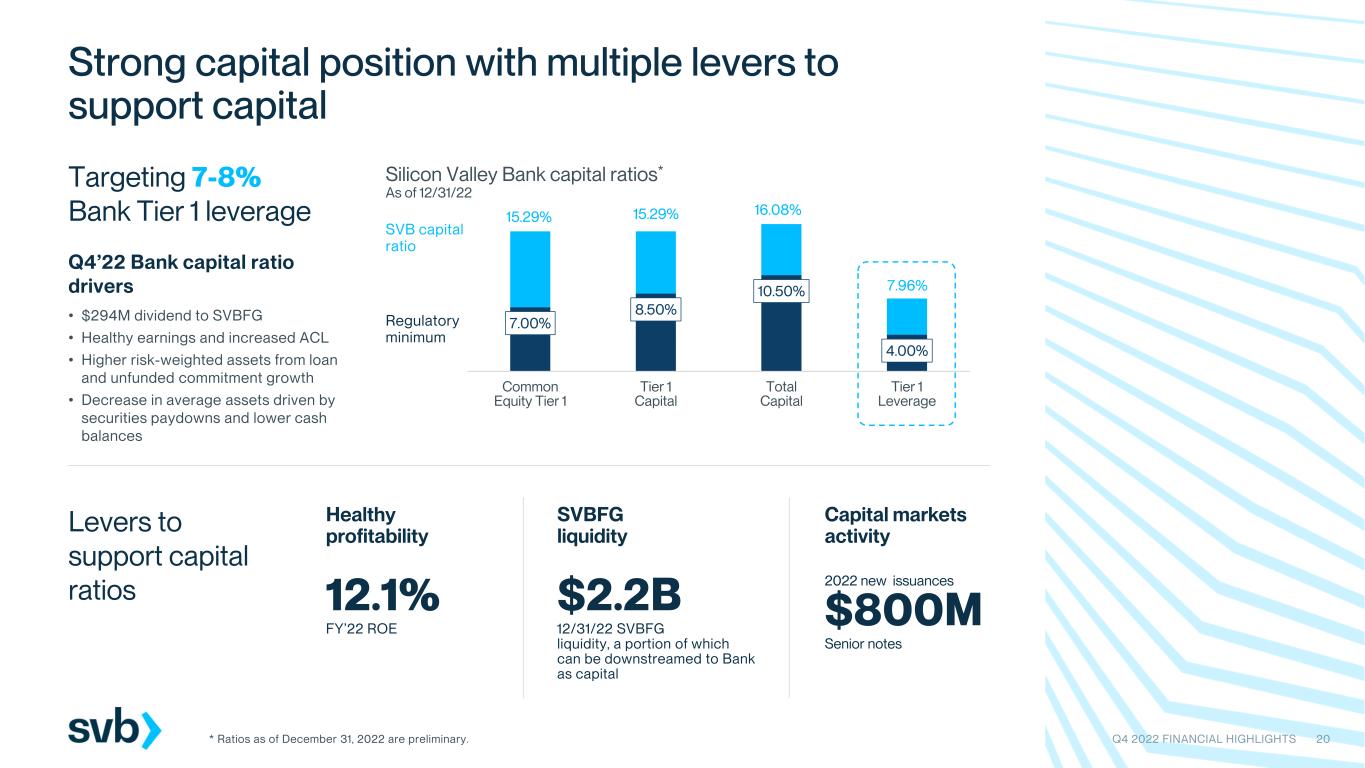

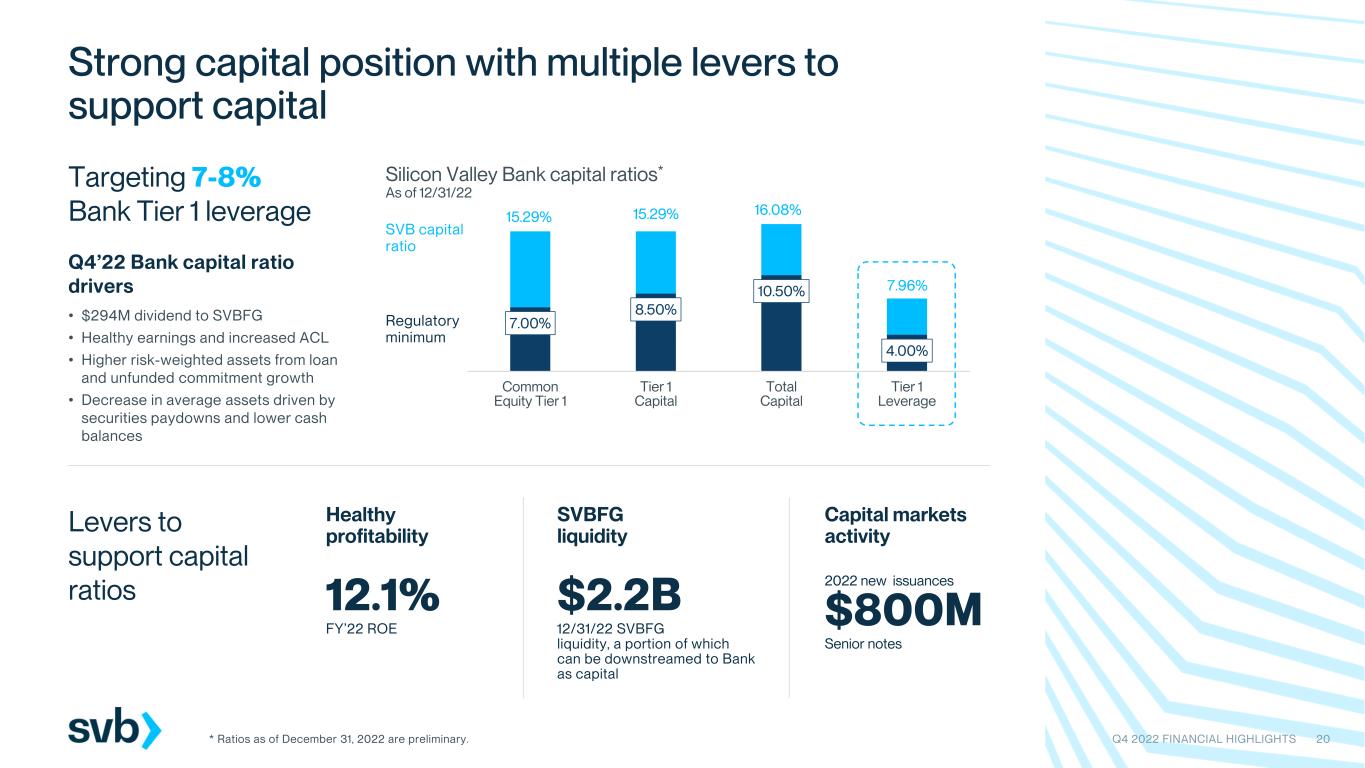

SVB Financial and Bank Capital Ratios(1)

| | | | | | | | | | | | | | | | | | | | |

| | December 31, 2022 | | September 30, 2022 | | December 31, 2021 |

| SVB Financial: | | | | | | |

| CET 1 risk-based capital ratio | | 12.09 | % | | 12.13 | % | | 12.09 | % |

| Tier 1 risk-based capital ratio | | 15.44 | | | 15.58 | | | 16.08 | |

| Total risk-based capital ratio | | 16.22 | | | 16.26 | | | 16.58 | |

| Tier 1 leverage ratio | | 8.11 | | | 8.00 | | | 7.93 | |

| Tangible common equity to tangible assets ratio (2) | | 5.62 | | | 5.36 | | | 5.73 | |

| Tangible common equity to risk-weighted assets ratio (2) | | 10.48 | | | 10.24 | | | 11.98 | |

| Silicon Valley Bank: | | | | | | |

| CET 1 risk-based capital ratio | | 15.29 | % | | 15.54 | % | | 14.89 | % |

| Tier 1 risk-based capital ratio | | 15.29 | | | 15.54 | | | 14.89 | |

| Total risk-based capital ratio | | 16.08 | | | 16.23 | | | 15.40 | |

| Tier 1 leverage ratio | | 7.96 | | | 7.91 | | | 7.24 | |

| Tangible common equity to tangible assets ratio (2) | | 7.28 | | | 7.08 | | | 7.09 | |

| Tangible common equity to risk-weighted assets ratio (2) | | 13.67 | | | 13.62 | | | 15.06 | |

(1)Regulatory capital ratios as of December 31, 2022 are preliminary.

(2)These are non-GAAP measures. A reconciliation of non-GAAP measures to GAAP is provided at the end of this release under the section “Use of Non-GAAP Financial Measures.”

December 31, 2022 Preliminary Results

Our risk-based capital ratios decreased for both SVB Financial and Silicon Valley Bank as of December 31, 2022, compared to September 30, 2022. The decreases were due to growth in our risk-weighted assets outpacing the growth in our regulatory capital. The increase in risk-weighted assets for both SVB Financial and Silicon Valley Bank was driven by an increase in our loan portfolio and unfunded commitments. Regulatory capital for SVB Financial and Silicon Valley Bank increased due to net income and an increase in the allowance for credit losses. Increases in regulatory capital for Silicon Valley Bank from net income and increase in allowance for credit losses was offset by dividends paid to SVB Financial.

The increase in the leverage ratio for both SVB Financial and Silicon Valley Bank were reflective of the growth in regulatory capital and a decrease in average assets. The decrease in average assets for both SVB Financial and Silicon Valley Bank was driven primarily by a decrease in investment securities and cash balances held at depository institutions partially offset by an increase in our loan portfolio.

All of our reported capital ratios remain above the levels considered to be “well capitalized” under applicable banking regulations.

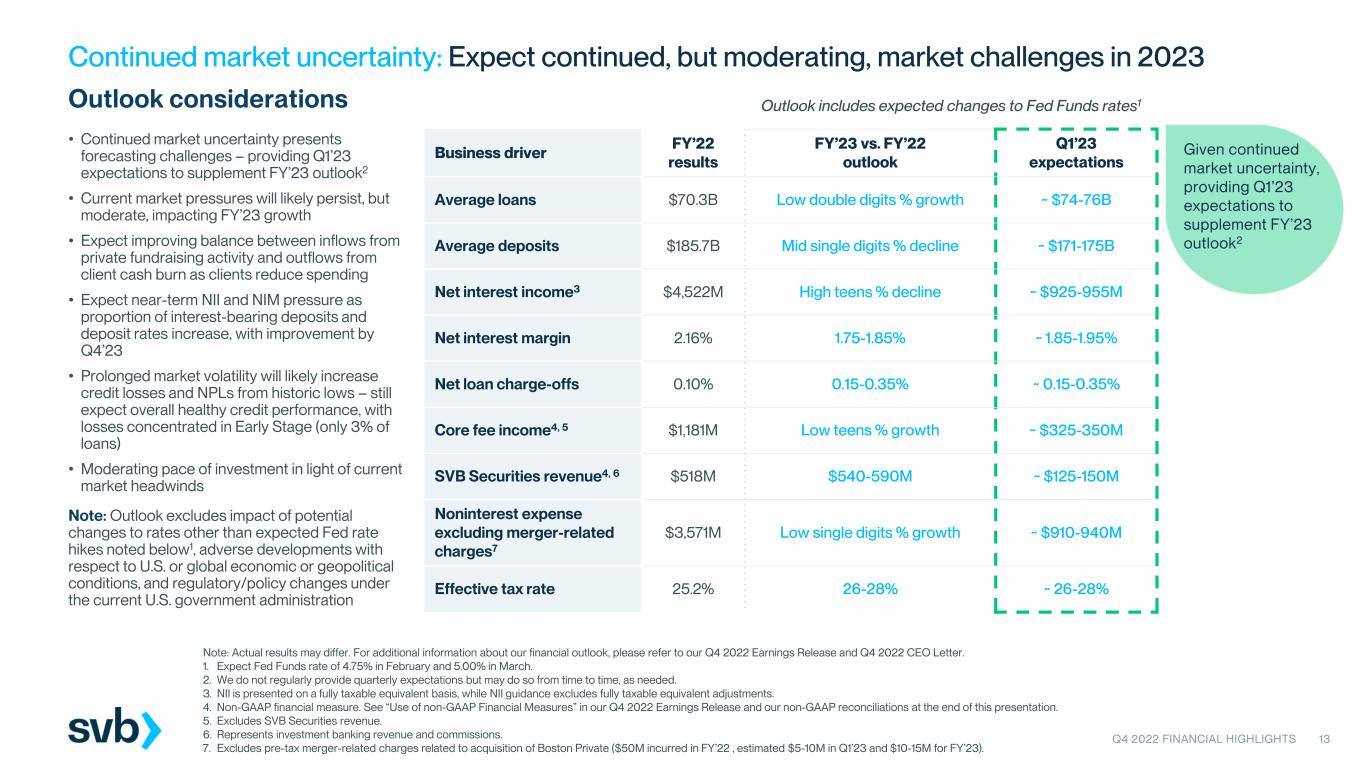

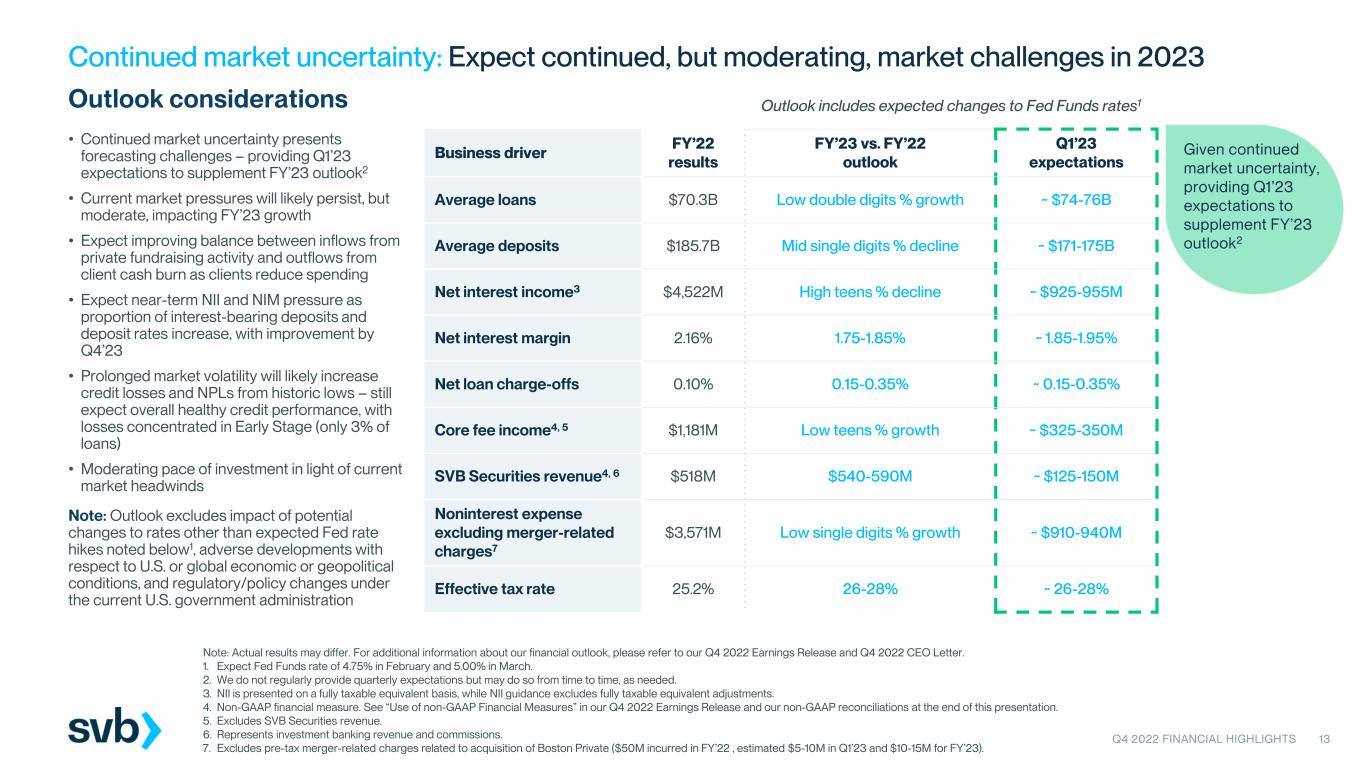

Financial Outlook for the Year Ending December 31, 2023 and the First Quarter of 2023

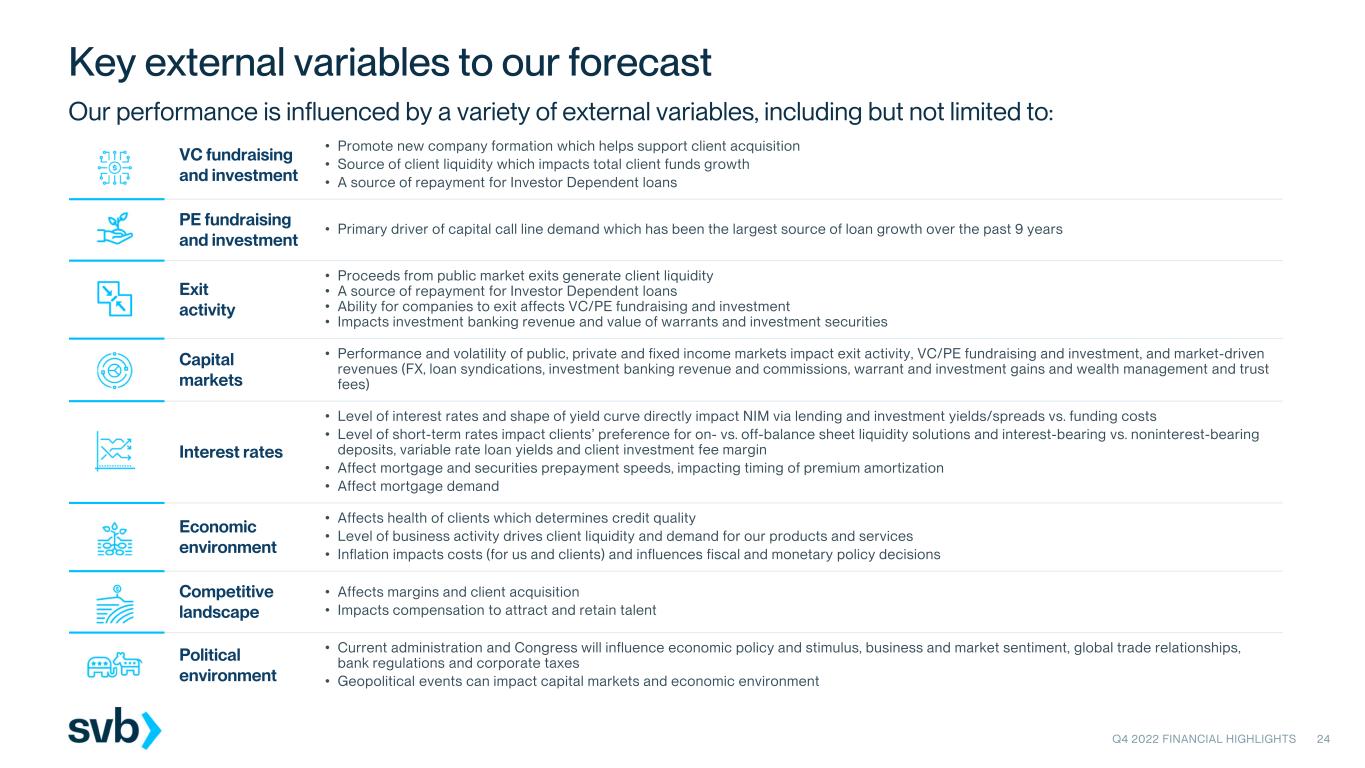

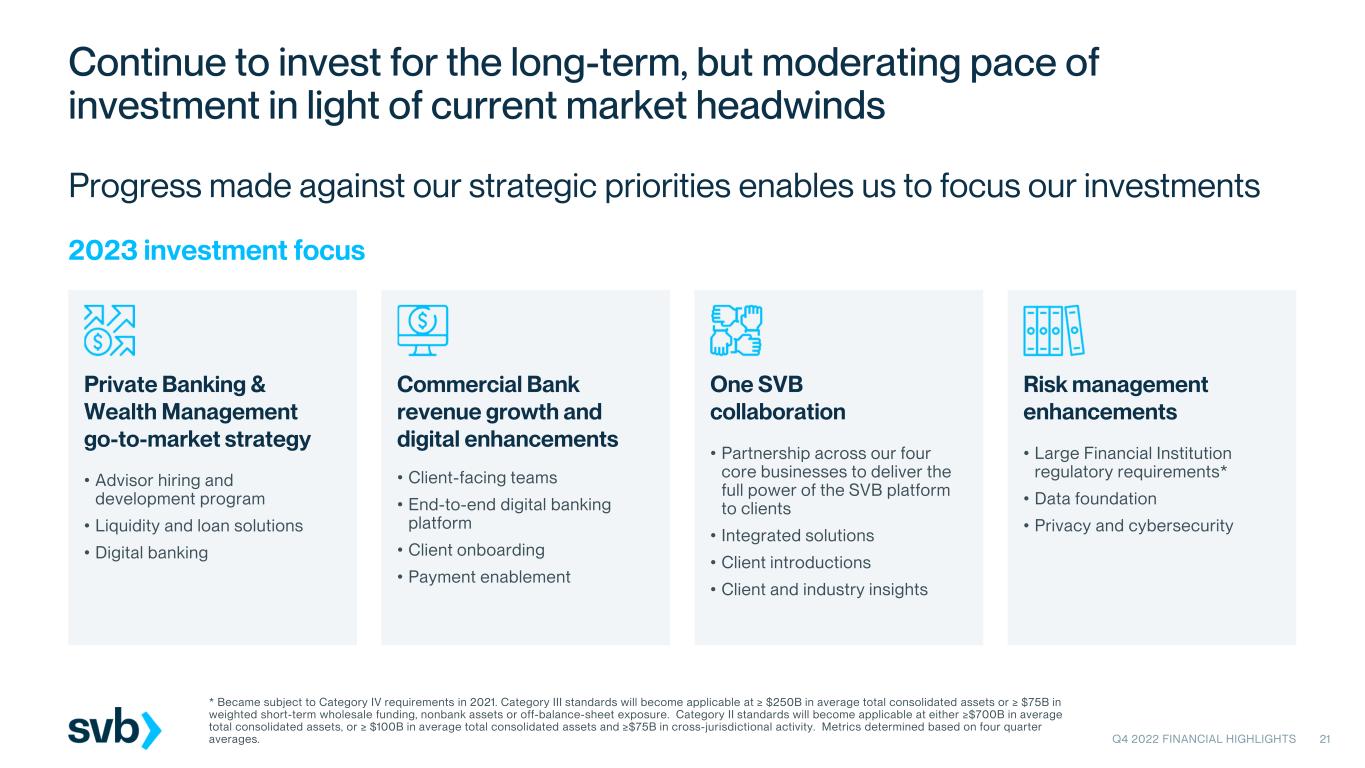

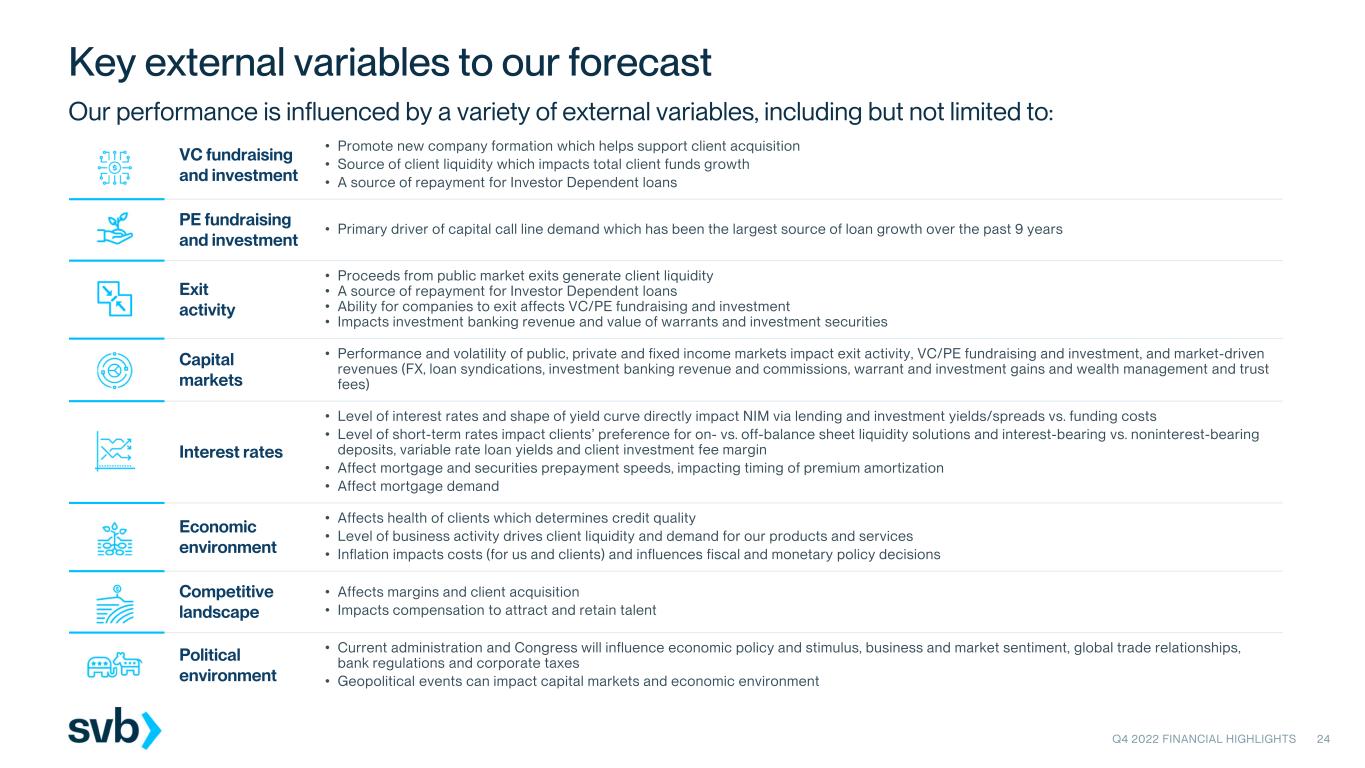

Our outlook for the year ending December 31, 2023 and the first quarter of 2023 is provided below on a GAAP basis, unless otherwise noted. We have provided our current outlook for the expected full year 2023 and first quarter of 2023 results of our significant forecasted activities based on management's assumptions and current expectations. Except for the items noted below, we do not provide an outlook for certain items (such as gains or losses from warrants and investment securities) where the timing or financial impact are particularly uncertain and/or subject to market or other conditions beyond our control (such as the level of IPO, SPAC, M&A or general financing activity), or for potential unusual or non-recurring items. The outlook and the underlying assumptions presented are, by their nature, forward-looking statements and are subject to substantial risks and uncertainties, including risks and uncertainties related to a material deterioration in the overall economy, the COVID-19 pandemic and related government actions, geopolitical instability, and other factors which are discussed below under the section “Forward-Looking Statements.” Actual results may differ. (For additional information about our financial outlook, please refer to Q4 2022 Earnings Slides. See "Additional Information" below.)

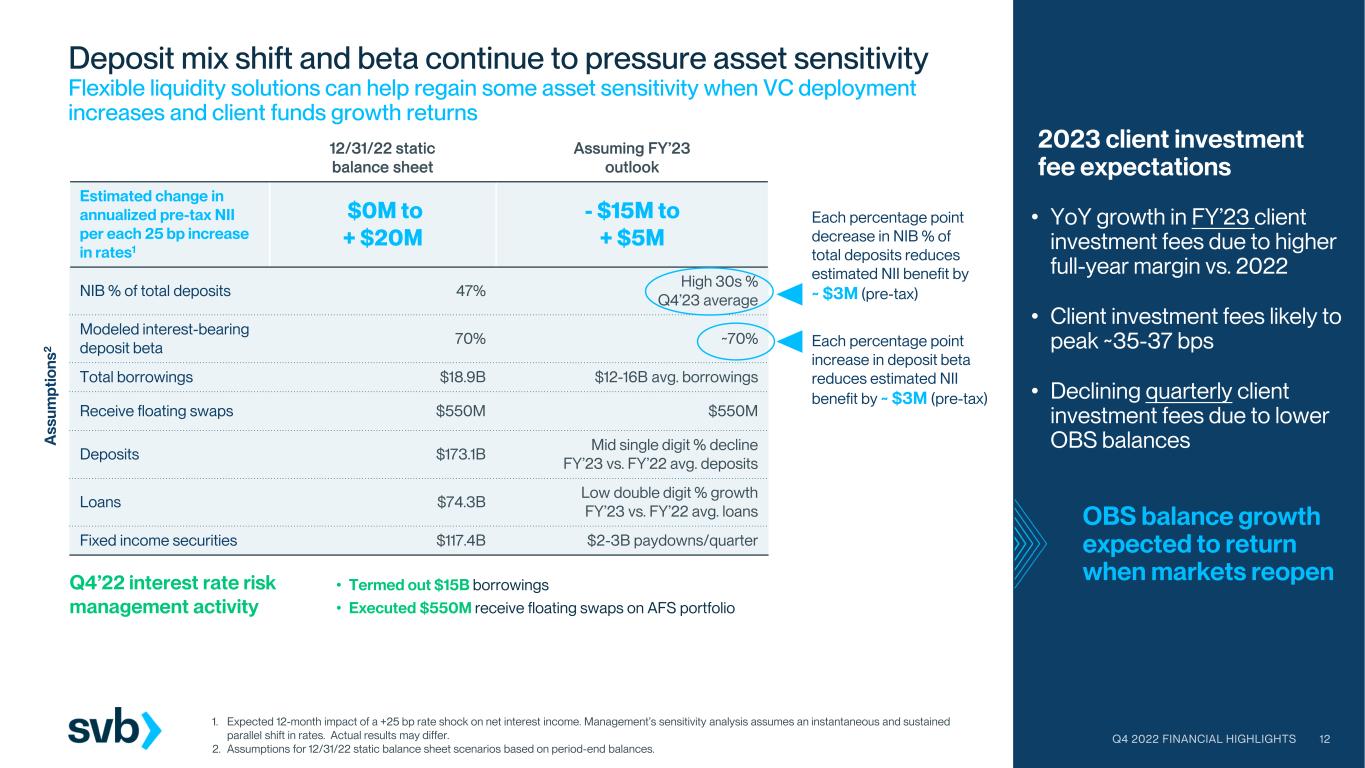

For the full year ending December 31, 2023 compared to our full year 2022 and first quarter of 2023 results, we currently expect the following outlook (please note that the outlook below does not include and/or take into account: (i) changes to to interest rates other than expected Federal Reserve rate increases in February and March, (ii) regulatory/policy changes under the current U.S. government administration, or (iii) adverse developments with respect to U.S. or global economic or geopolitical conditions):

| | | | | | | | |

| Current full year 2023 outlook compared to 2022 results (1) | First quarter 2023 expectations (1) (2) |

| Average loan balances | Low double digits growth | $74.0 billion — $76.0 billion |

| Average deposit balances | Mid-single digits decline | $171.0 billion — $175.0 billion |

| Net interest income (3) | High teens decline | $925 million — $955 million |

| Net interest margin (3) | 1.75% — 1.85% | 1.85% — 1.95% |

| Net loan charge-offs | 0.15% — 0.35% of average loans | 0.15% — 0.35% of average loans |

| Core fee income (client investment fees, wealth management and trust fees, foreign exchange fees, credit card fees, deposit service charges, lending related fees and letters of credit fees) (4) | Low teens growth | $325 million — $350 million |

| SVB Securities revenue (4) | $540 million — $590 million | $125 million — $150 million |

| Noninterest expense excluding merger-related charges (5) (6) | Low single digits growth | $910 million — $940 million |

| Effective tax rate (7) | 26% — 28% | 26% — 28% |

(1)Our outlook incorporates changes in interest rates implied by the January 9, 2023 forward curve (implies Fed Funds rate of 4.75% in February and 5.00% in March).

(2)Due to continued market uncertainty, we are including first quarter 2023 expectations to supplement our full year 2023 outlook. We do not regularly provide quarterly expectations but may do so from time to time, as needed.

(3)Our outlook for net interest income and net interest margin is based primarily on management's current forecast of average deposit and loan balances. Such forecasts are subject to change, and actual results may differ, based on market conditions, a material deterioration in the overall economy, COVID-19 pandemic and its effects on the economic and business environments in which we operate, actual prepayment rates, geopolitical instability and other factors described under the section "Forward-Looking Statements" below.

(4)Core fee income and SVB Securities revenue are each non-GAAP measures, which collectively represent noninterest income, but exclude certain line items where performance is typically subject to market or other conditions beyond our control. As we are unable to quantify such line items that would be required to be included in the comparable GAAP financial measure for the future period presented without unreasonable efforts, no reconciliation for the outlook of non-GAAP core fee income and non-GAAP SVB Securities revenue to GAAP noninterest income for fiscal year ending 2022 is included in this release, as we believe such reconciliation would imply a degree of precision that would be confusing or misleading to investors. See "Use of Non-GAAP Financial Measures" at the end of this release for further information regarding the calculation and limitations of this measure. Core fee income does not include SVB Securities revenue. SVB Securities revenue represents investment banking revenue and commissions.

(5)Our outlook for noninterest expense is partly based on management's current forecast of performance-based incentive compensation expenses. Such forecasts are subject to change, and actual results may differ, based on our performance relative to our internal performance targets.

(6)Excludes pre-tax merger-related charges related to the acquisition of Boston Private ($50 million incurred during 2022 with an estimated $5 million to $10 million in the first quarter of 2023 and $10 million to $15 million for 2023).

(7)Our outlook for our effective tax rate is based on management's current assumptions with respect to, among other things, SVB Financial Group's earnings, state income tax levels, tax deductions and estimated performance-based compensation activity and does not include assumptions for potential future tax rate changes.

Forward-Looking Statements

This release contains forward-looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are subject to known and unknown risks and uncertainties, many of which may be beyond our control. Forward-looking statements are statements that are not historical facts, such as forecasts of our future financial results and condition, expectations for our operations and business, and our underlying assumptions of such forecasts and expectations. In addition, forward-looking statements generally can be identified by the use of such words as “becoming,” “may,” “will,” “should,” “could,” “would,” “predict,” “potential,” “continue,” “anticipate,” “believe,” “estimate,” “assume,” “seek,” “expect,” “plan,” “intend,” the negative of such words or comparable terminology. In this release, including our CEO's statement and in the section “Financial Outlook for the Year Ending December 31, 2023 and the First Quarter of 2023,” we make forward-looking statements discussing management’s expectations for 2023 and the first quarter of 2023 about, among other things, economic conditions; the continuing and potential effects of the COVID-19 pandemic; opportunities in the market; the outlook on our clients' performance; our financial, credit, and business performance, including loan and deposit growth, mix and yields/rates; expense levels; our expected effective tax rate; accounting impacts; and financial results (and the components of such results).

Although we believe that the expectations reflected in our forward-looking statements are reasonable, we have based these expectations on our current beliefs as well as our assumptions, and such expectations may not prove to be correct. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which are outside our control. Our actual results of operations and financial performance could differ significantly from those expressed in or implied by our management’s forward-looking statements. Important factors that could cause our actual results and financial condition to differ from the expectations stated in the forward-looking statements include, among others:

•market and economic conditions (including elevated inflation levels, sustained interest rate increases, the general condition of the capital and equity markets, private equity and venture capital investment, IPO, secondary offering, SPAC fundraising, M&A and other financing activity levels) and the associated impact on us (including effects on total client funds and client demand for our commercial and investment banking and other financial services, as well as on the valuations of our investments);

•disruptions to the financial markets as a result of the current or anticipated impact of military conflict, including the ongoing military conflict between Russia and Ukraine, terrorism and other geopolitical events;

•the COVID-19 pandemic, including COVID-19 variants and their effects on the economic and business environments in which we operate, and its effects on our business and operations;

•the impact of changes from the Biden-Harris administration and the U.S. Congress on the economic environment, capital markets and regulatory landscape, including monetary, tax and other trade policies, as well as regulatory changes from bank regulatory agencies;

•changes in the volume and credit quality of our loans as well as volatility of our levels of nonperforming assets and charge-offs;

•the impact of changes in interest rates or market levels or factors affecting or affected by them, including on our loan and investment portfolios and deposit costs;

•the adequacy of our allowance for credit losses and the need to make provisions for credit losses for any period;

•the sufficiency of our capital and liquidity positions, and our ability to generate capital or raise capital on favorable terms;

•changes in the levels or composition of our loans, deposits and client investment fund balances;

•changes in the performance or equity valuations of funds or companies in which we have invested or hold derivative instruments or equity warrant assets;

•variations from our expectations as to factors impacting our cost structure;

•changes in our assessment of the creditworthiness or liquidity of our clients or unanticipated effects of credit concentration risks which create or exacerbate deterioration of such creditworthiness or liquidity;

•variations from our expectations as to factors impacting the timing and level of employee share-based transactions;

•the occurrence of fraudulent activity, including breaches of our information security or cyber security-related incidents;

•business disruptions and interruptions due to natural disasters and other external events;

•the impact on our reputation and business from our interactions with business partners, counterparties, service providers and other third parties;

•the expansion of our business internationally, and the impact of geopolitical events and international market and economic events on us;

•the effectiveness of our risk management framework and quantitative models;

•our ability to maintain or increase our market share, including through successfully implementing our business strategy and undertaking new business initiatives, including through the continuing integration of Boston Private, the expansion of SVB Private and the growth and expansion of SVB Securities;

•greater than expected costs or other difficulties related to the continuing integration of our business and that of Boston Private;

•variations from our expectations as to the amount and timing of business opportunities, growth prospects and cost savings associated with the acquisition of Boston Private;

•the inability to retain existing Boston Private clients and employees following the Boston Private acquisition;

•unfavorable resolution of legal proceedings or claims, as well as legal or regulatory proceedings or governmental actions;

•variations from our expectations as to factors impacting our estimate of our full-year effective tax rate;

•changes in applicable accounting standards and tax laws; and

•regulatory or legal changes (including changes to the laws and regulations that apply to us as a result of the growth of our business), and their impact on us.

For additional information about these and other factors, please refer to our public reports filed with the U.S. Securities and Exchange Commission, including under the caption "Risk Factors" in our most recent Annual Report filed on Form 10-K. The forward-looking statements included in this release are made only as of the date of this release. We do not intend, and undertake no obligation, to update these forward-looking statements.

Earnings Conference Call

On Thursday, January 19, 2023, we will host a conference call at 3:00 p.m. (Pacific Time) to discuss the financial results for the quarter ended December 31, 2022. The conference call can be accessed by dialing (888) 330-3016 or (646) 960-0828 and entering the confirmation number "5682116". A live webcast of the audio portion of the call can be accessed on the Investor Relations section of our website at www.svb.com. A replay of the audio webcast will also be available on www.svb.com for 12 months beginning on January 19, 2023.

Additional Information

For additional information about our business, financial results for the fourth quarter 2022 and financial outlook, please refer to our Q4 2022 Earnings Slides and Q4 2022 CEO Letter, which are available on the Investor Relations section of our website at www.svb.com. These materials should be read together with this release, and include important supplemental information including key considerations that may impact our financial outlook.

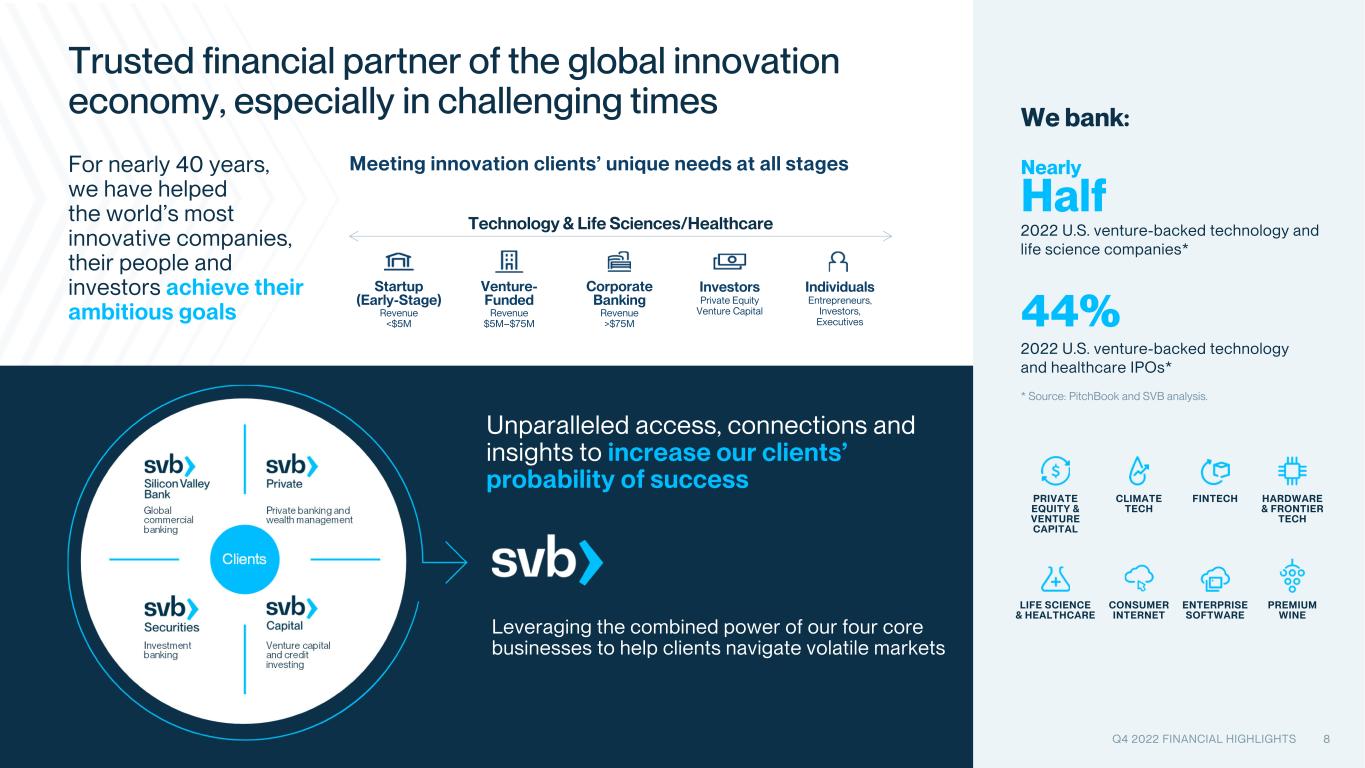

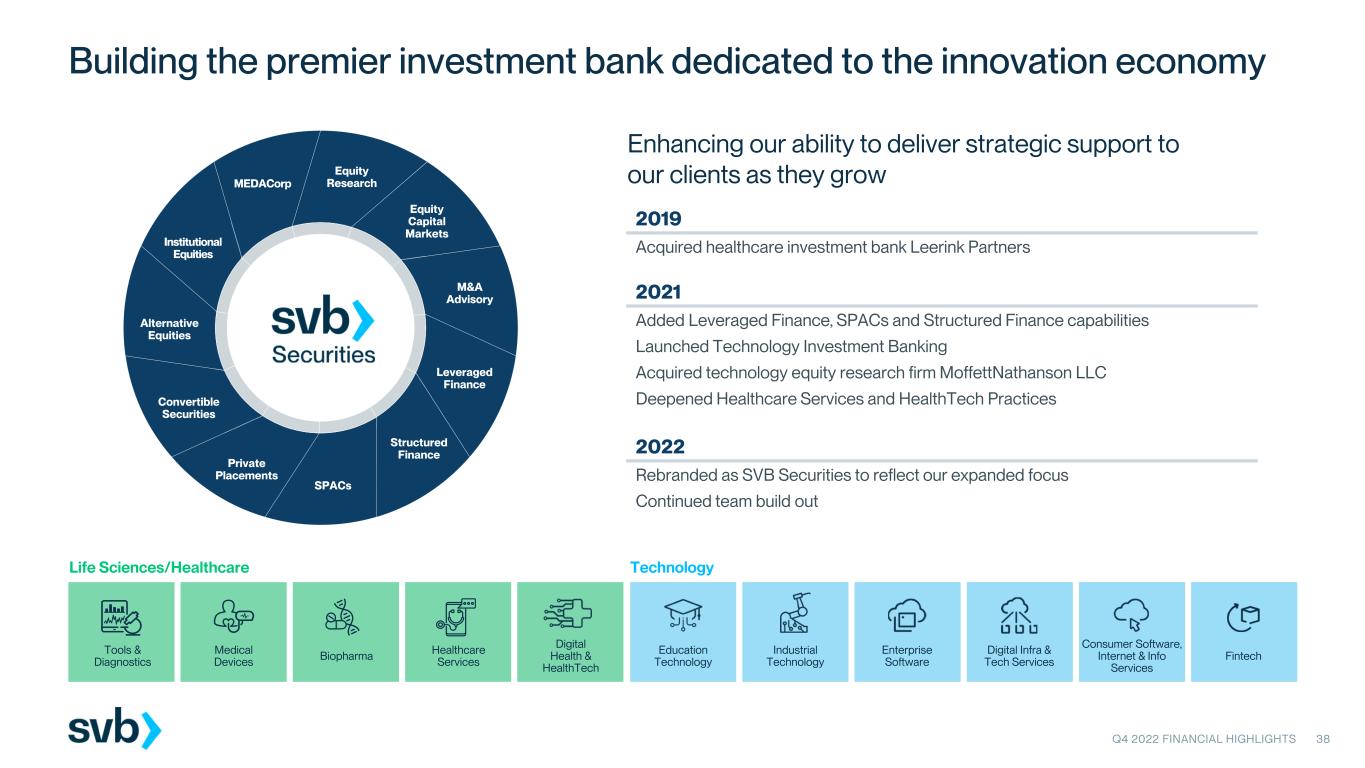

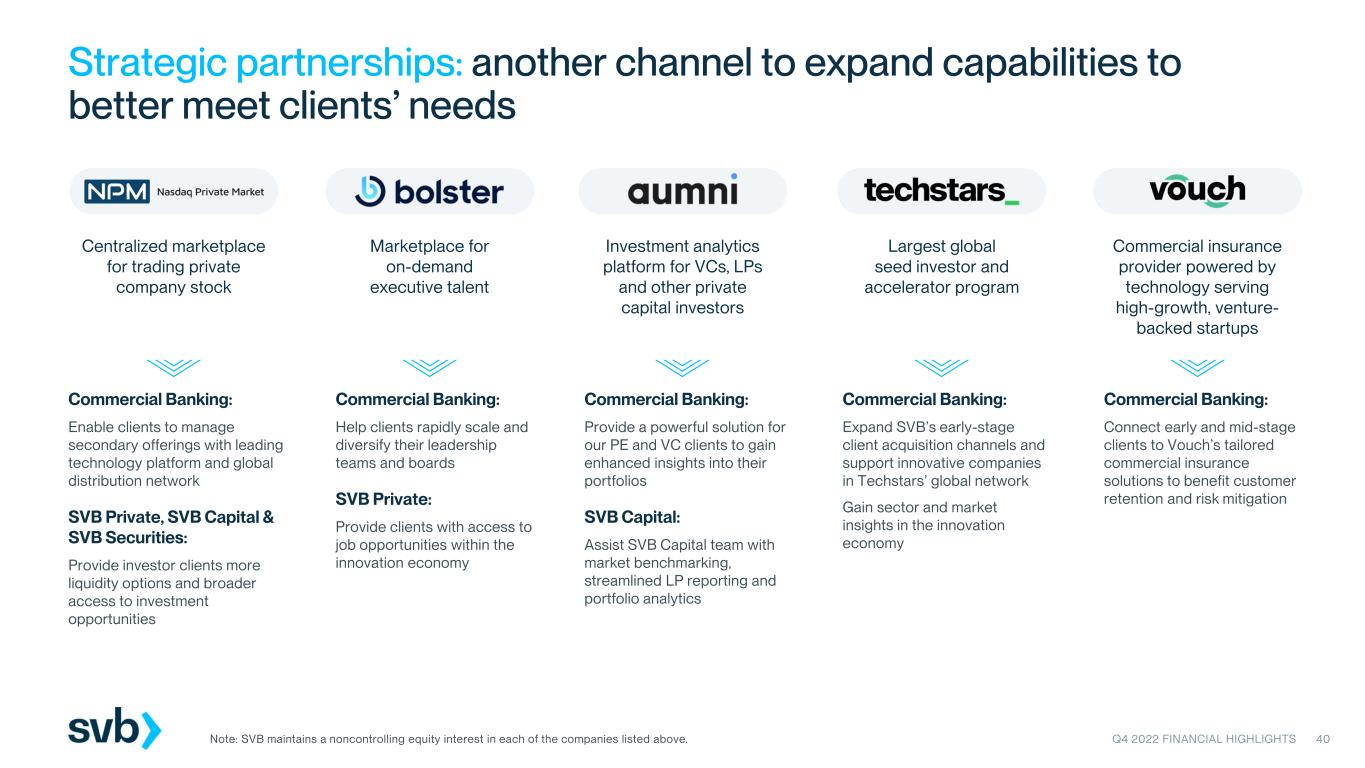

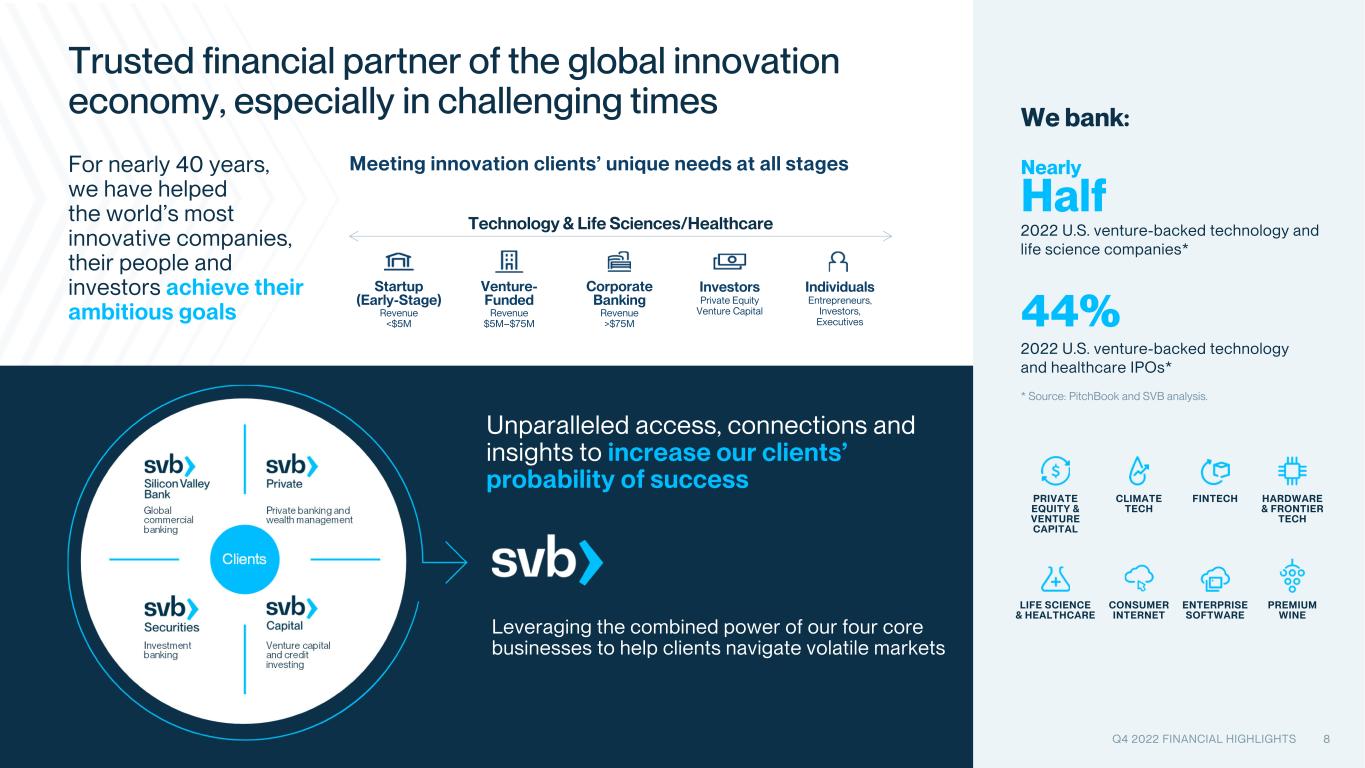

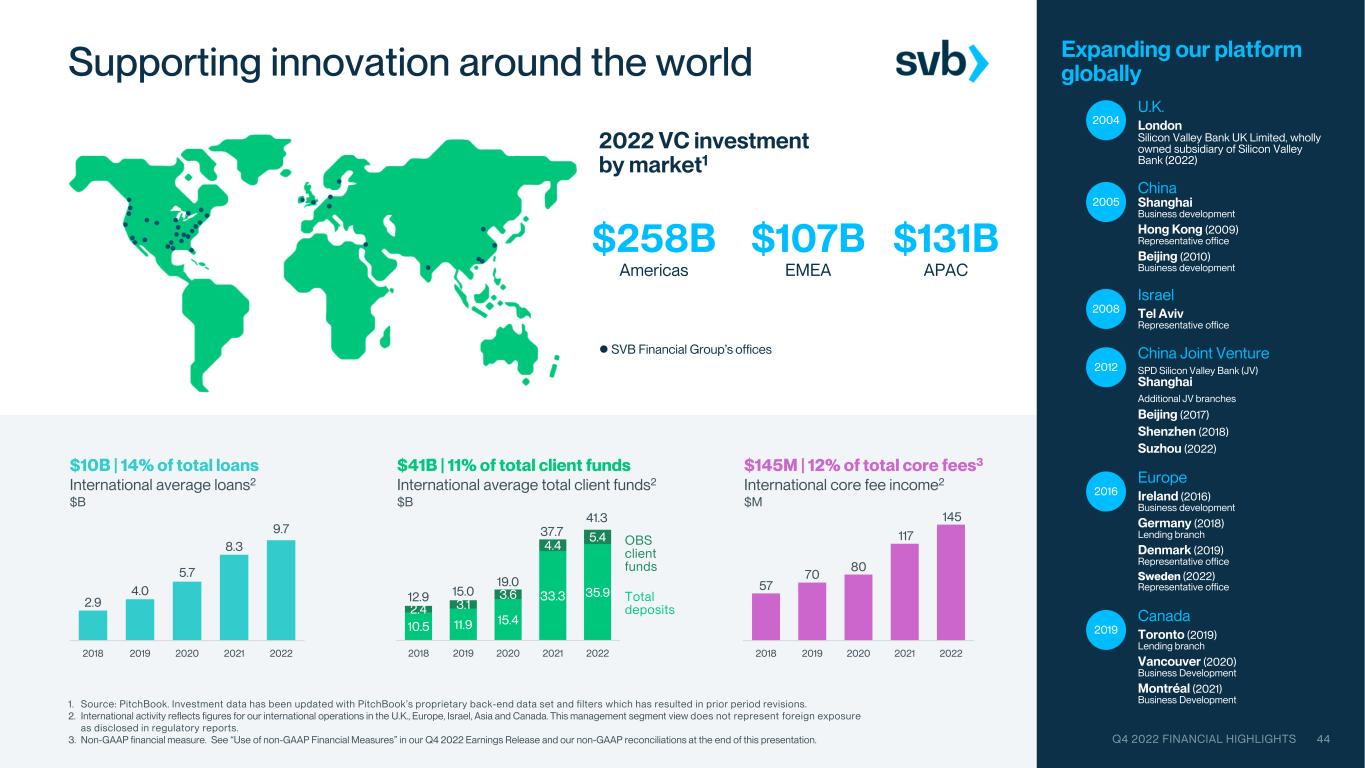

About SVB Financial Group

SVB is the financial partner of the innovation economy, helping individuals, investors and the world’s most innovative companies achieve their ambitious goals. SVB’s businesses - Silicon Valley Bank, SVB Capital, SVB Private and SVB Securities - together offer the services that dynamic and fast-growing clients require as they grow, including commercial banking, venture investing, wealth planning and investment banking. Headquartered in Santa Clara, California, SVB operates in centers of innovation around the world. Learn more at svb.com/global.

SVB Financial Group (Nasdaq: SIVB) is the holding company for all business units and groups. © 2023 SVB Financial Group. All rights reserved. SVB, SVB FINANCIAL GROUP, SILICON VALLEY BANK, SVB SECURITIES, SVB PRIVATE, SVB CAPITAL and the chevron device are trademarks of SVB Financial Group, used under license. Silicon Valley Bank is a member of the FDIC and the Federal Reserve System. Silicon Valley Bank is the California bank subsidiary of SVB Financial Group.

SVB FINANCIAL GROUP AND SUBSIDIARIES

INTERIM CONSOLIDATED STATEMENTS OF INCOME

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three months ended | | Year ended |

| (Dollars in millions, except share data) | | December 31, 2022 | | September 30, 2022 | | December 31, 2021 | | December 31, 2022 | | December 31, 2021 |

| Interest income: | | | | | | | | | | |

| Loans | | $ | 1,119 | | | $ | 865 | | | $ | 544 | | | $ | 3,208 | | | $ | 1,966 | |

| Investment securities: | | | | | | | | | | |

| Taxable | | 495 | | | 545 | | | 392 | | | 2,113 | | | 1,199 | |

| Non-taxable | | 35 | | | 35 | | | 33 | | | 140 | | | 106 | |

| Federal funds sold, securities purchased under agreements to resell and other short-term investment securities | | 107 | | | 76 | | | 6 | | | 212 | | | 18 | |

| Total interest income | | 1,756 | | | 1,521 | | | 975 | | | 5,673 | | | 3,289 | |

| Interest expense: | | | | | | | | | | |

| Deposits | | 514 | | | 249 | | | 21 | | | 862 | | | 62 | |

| Borrowings | | 204 | | | 74 | | | 15 | | | 326 | | | 48 | |

| Total interest expense | | 718 | | | 323 | | | 36 | | | 1,188 | | | 110 | |

| Net interest income | | 1,038 | | | 1,198 | | | 939 | | | 4,485 | | | 3,179 | |

| Provision for credit losses | | 141 | | | 72 | | | 48 | | | 420 | | | 123 | |

| Net interest income after provision for credit losses | | 897 | | | 1,126 | | | 891 | | | 4,065 | | | 3,056 | |

| Noninterest income: | | | | | | | | | | |

| Gains/(loss) on investment securities, net | | (86) | | | (127) | | | 100 | | | (285) | | | 761 | |

| Gains on equity warrant assets, net | | 28 | | | 40 | | | 69 | | | 148 | | | 560 | |

| Client investment fees | | 149 | | | 119 | | | 20 | | | 386 | | | 75 | |

| Wealth management and trust fees | | 20 | | | 19 | | | 22 | | | 83 | | | 44 | |

| Foreign exchange fees | | 69 | | | 74 | | | 73 | | | 285 | | | 262 | |

| Credit card fees | | 36 | | | 37 | | | 38 | | | 150 | | | 131 | |

| Deposit service charges | | 32 | | | 32 | | | 30 | | | 126 | | | 112 | |

| Lending related fees | | 29 | | | 20 | | | 21 | | | 94 | | | 76 | |

| Letters of credit and standby letters of credit fees | | 14 | | | 15 | | | 12 | | | 57 | | | 51 | |

| Investment banking revenue | | 127 | | | 75 | | | 124 | | | 420 | | | 459 | |

| Commissions | | 25 | | | 24 | | | 21 | | | 98 | | | 79 | |

| Other | | 47 | | | 31 | | | 31 | | | 166 | | | 128 | |

| Total noninterest income | | 490 | | | 359 | | | 561 | | | 1,728 | | | 2,738 | |

| Noninterest expense: | | | | | | | | | | |

| Compensation and benefits | | 644 | | | 563 | | | 597 | | | 2,293 | | | 2,015 | |

| Professional services | | 125 | | | 117 | | | 110 | | | 480 | | | 392 | |

| Premises and equipment | | 80 | | | 71 | | | 54 | | | 269 | | | 178 | |

| Net occupancy | | 27 | | | 25 | | | 23 | | | 101 | | | 83 | |

| Business development and travel | | 23 | | | 21 | | | 11 | | | 85 | | | 24 | |

| FDIC and state assessments | | 18 | | | 25 | | | 15 | | | 75 | | | 48 | |

| Merger-related charges | | 11 | | | 7 | | | 27 | | | 50 | | | 129 | |

| Other | | 80 | | | 63 | | | 65 | | | 268 | | | 201 | |

| Total noninterest expense | | 1,008 | | | 892 | | | 902 | | | 3,621 | | | 3,070 | |

| Income before income tax expense | | 379 | | | 593 | | | 550 | | | 2,172 | | | 2,724 | |

| Income tax expense | | 74 | | | 175 | | | 142 | | | 563 | | | 651 | |

| Net income before noncontrolling interests and dividends | | 305 | | | 418 | | | 408 | | | 1,609 | | | 2,073 | |

| Net (income)/loss attributable to noncontrolling interests | | 10 | | | 51 | | | (14) | | | 63 | | | (240) | |

| Preferred stock dividends | | (40) | | | (40) | | | (23) | | | (163) | | | (63) | |

| Net income available to common stockholders | | $ | 275 | | | $ | 429 | | | $ | 371 | | | $ | 1,509 | | | $ | 1,770 | |

| Earnings per common share—basic | | $ | 4.65 | | | $ | 7.26 | | | $ | 6.32 | | | $ | 25.58 | | | $ | 31.74 | |

| Earnings per common share—diluted | | 4.62 | | | 7.21 | | | 6.22 | | | 25.35 | | | 31.25 | |

| Weighted average common shares outstanding—basic | | 59,112,507 | | | 59,096,090 | | | 58,702,618 | | | 58,987,169 | | | 55,762,874 | |

| Weighted average common shares outstanding—diluted | | 59,454,723 | | | 59,549,402 | | | 59,623,961 | | | 59,515,565 | | | 56,637,591 | |

SVB FINANCIAL GROUP AND SUBSIDIARIES

INTERIM CONSOLIDATED BALANCE SHEETS

(Unaudited)

| | | | | | | | | | | | | | | | | | | | |

| (Dollars in millions, except par value and share data) | | December 31, 2022 | | September 30, 2022 | | December 31, 2021 |

| Assets: | | | | | | |

| Cash and cash equivalents | | $ | 13,803 | | | $ | 13,968 | | | $ | 14,586 | |

Available-for-sale securities, at fair value (cost $28,602, $29,502 and $27,370, respectively) | | 26,069 | | | 26,711 | | | 27,221 | |

Held-to-maturity securities, at amortized cost and net of allowance for credit losses of $6, $6 and $7 (fair value of $76,169, $77,370 and $97,227), respectively | | 91,321 | | | 93,286 | | | 98,195 | |

| Non-marketable and other equity securities | | 2,664 | | | 2,595 | | | 2,543 | |

| Investment securities | | 120,054 | | | 122,592 | | | 127,959 | |

| Loans, amortized cost | | 74,250 | | | 72,129 | | | 66,276 | |

| Allowance for credit losses: loans | | (636) | | | (557) | | | (422) | |

| Net loans | | 73,614 | | | 71,572 | | | 65,854 | |

| Premises and equipment, net of accumulated depreciation and amortization | | 394 | | | 346 | | | 270 | |

| Goodwill | | 375 | | | 375 | | | 375 | |

| Other intangible assets, net | | 136 | | | 142 | | | 160 | |

| Lease right-of-use assets | | 335 | | | 349 | | | 313 | |

| Accrued interest receivable and other assets | | 3,082 | | | 3,523 | | | 1,791 | |

| Total assets | | $ | 211,793 | | | $ | 212,867 | | | $ | 211,308 | |

| Liabilities and total equity: | | | | | | |

| Liabilities: | | | | | | |

| Noninterest-bearing demand deposits | | $ | 80,753 | | | $ | 93,988 | | | $ | 125,851 | |

| Interest-bearing deposits | | 92,356 | | | 82,831 | | | 63,352 | |

| Total deposits | | 173,109 | | | 176,819 | | | 189,203 | |

| Short-term borrowings | | 13,565 | | | 13,552 | | | 71 | |

| Lease liabilities | | 413 | | | 429 | | | 388 | |

| Other liabilities | | 3,041 | | | 2,889 | | | 2,467 | |

| Long-term debt | | 5,370 | | | 3,368 | | | 2,570 | |

| Total liabilities | | 195,498 | | | 197,057 | | | 194,699 | |

| SVBFG stockholders’ equity: | | | | | | |

| Preferred stock, $0.001 par value, 20,000,000 shares authorized; 383,500 shares, 383,500 shares and 383,500 shares issued and outstanding, respectively | | 3,646 | | | 3,646 | | | 3,646 | |

| Common stock, $0.001 par value, 150,000,000 shares authorized; 59,171,883 shares, 59,104,124 shares and 58,748,469 shares issued and outstanding, respectively | | — | | | — | | | — | |

| Additional paid-in capital | | 5,318 | | | 5,272 | | | 5,157 | |

| Retained earnings | | 8,951 | | | 8,676 | | | 7,442 | |

| Accumulated other comprehensive (loss) income | | (1,911) | | | (2,085) | | | (9) | |

| Total SVBFG stockholders’ equity | | 16,004 | | | 15,509 | | | 16,236 | |

| Noncontrolling interests | | 291 | | | 301 | | | 373 | |

| Total equity | | 16,295 | | | 15,810 | | | 16,609 | |

| Total liabilities and total equity | | $ | 211,793 | | | $ | 212,867 | | | $ | 211,308 | |

SVB FINANCIAL GROUP AND SUBSIDIARIES

INTERIM AVERAGE BALANCES, RATES AND YIELDS

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three months ended |

| | | December 31, 2022 | | September 30, 2022 | | December 31, 2021 |

| (Dollars in millions, except yield/rate and ratios) | | Average

Balance | | Interest

Income/

Expense | | Yield/

Rate | | Average

Balance | | Interest

Income/

Expense | | Yield/

Rate | | Average

Balance | | Interest

Income/

Expense | | Yield/

Rate |

Interest-earning assets: | | | | | | | | | | | | | | | | | | |

Federal reserve deposits, federal funds sold, securities purchased under agreements to resell and other short-term investment securities (1) | | $ | 13,605 | | | $ | 107 | | | 3.11 | % | | $ | 15,739 | | | $ | 76 | | | 1.91 | % | | $ | 22,112 | | | $ | 6 | | | 0.10 | % |

Investment securities: (2) | | | | | | | | | | | | | | | | | | |

| Available-for-sale securities: | | | | | | | | | | | | | | | | | | |

| Taxable (3) | | 29,429 | | | 126 | | | 1.70 | | | 28,855 | | | 124 | | | 1.71 | | | 24,154 | | | 68 | | | 1.13 | |

| Held-to-maturity securities: | | | | | | | | | | | | | | | | | | |

| Taxable | | 85,113 | | | 369 | | | 1.72 | | | 87,130 | | | 421 | | | 1.92 | | | 81,121 | | | 324 | | | 1.58 | |

| Non-taxable (4) | | 6,998 | | | 44 | | | 2.52 | | | 7,011 | | | 44 | | | 2.51 | | | 6,458 | | | 41 | | | 2.50 | |