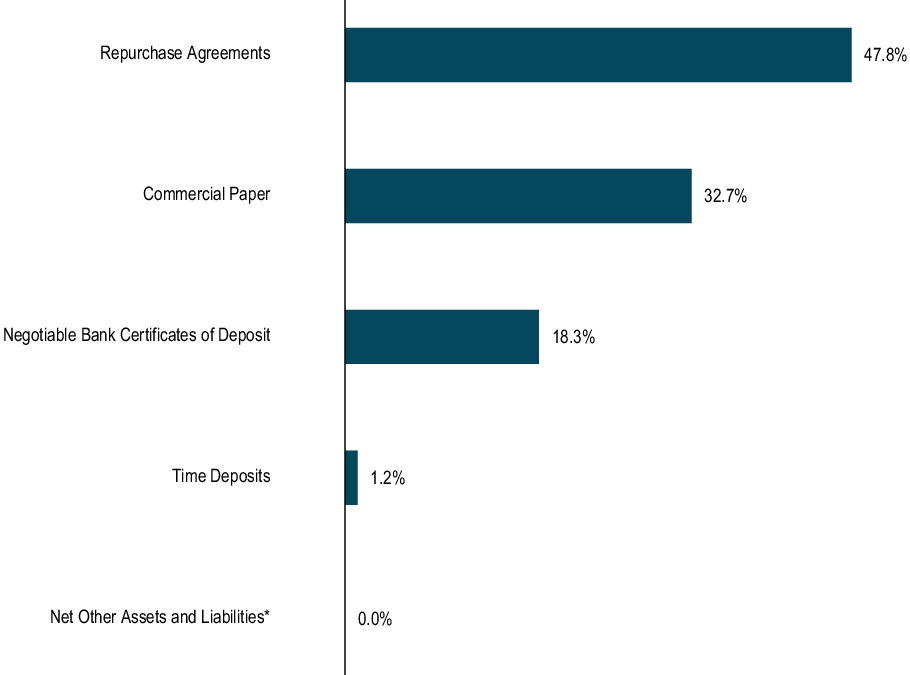

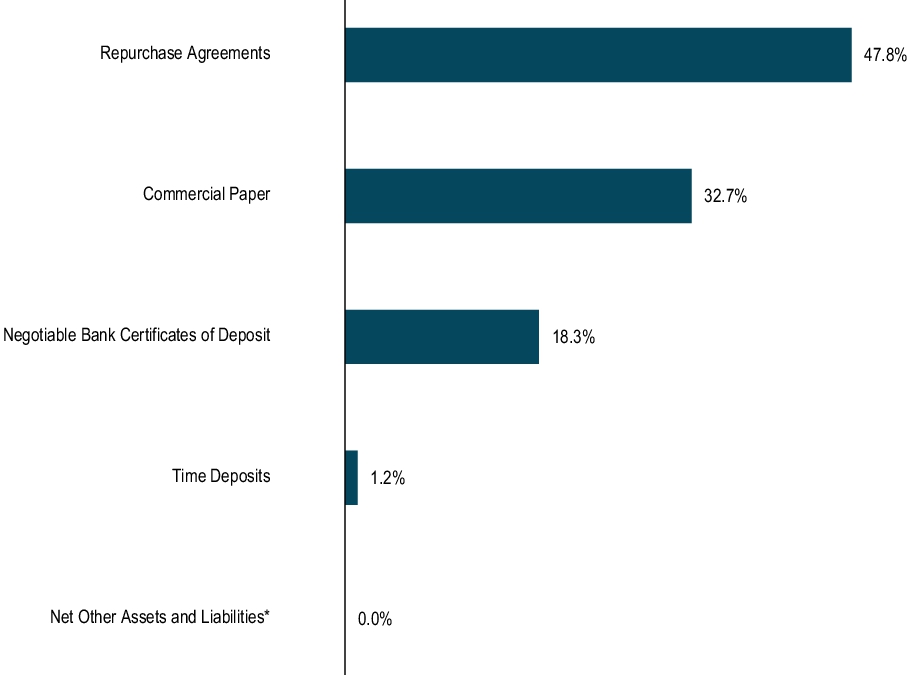

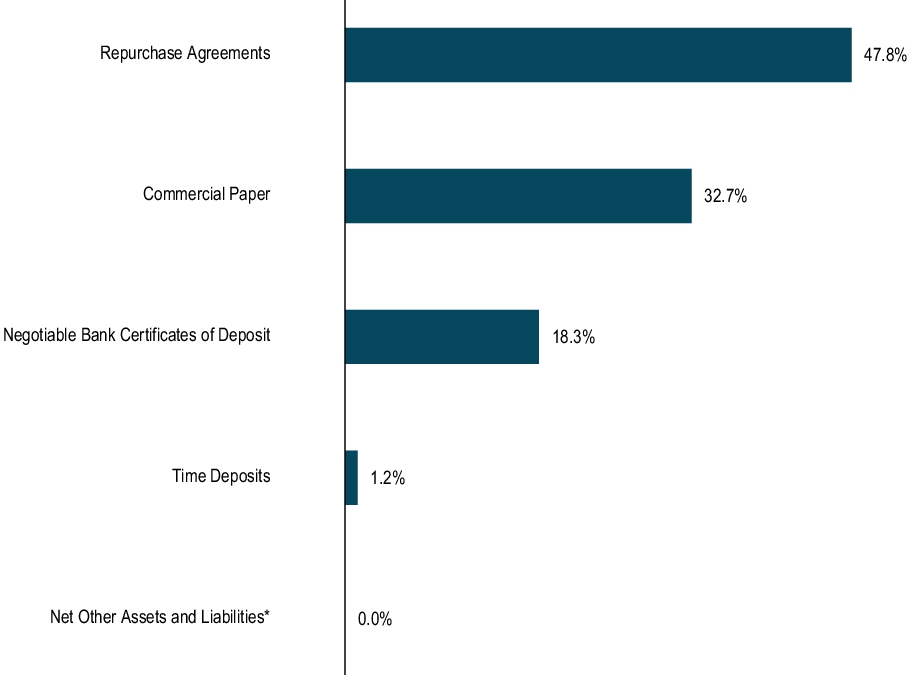

18.3

1.2

47.8

47.8

32.7

0.0

0.0

0.0

32.7

1.2

1.2

18.3

18.3

32.7

47.8

0000353560

false

N-1A

N-CSRS

0000353560

gmmfi:C000000265Member

2024-12-01

2025-05-31

0000353560

gmmfi:C000000266Member

2024-12-01

2025-05-31

0000353560

gmmfi:C000157127Member

2024-12-01

2025-05-31

0000353560

2024-12-01

2025-05-31

0000353560

gmmfi:C000000265Member

2025-05-31

0000353560

gmmfi:C000000265Member

us-gaap:CommercialPaperMember

2025-05-31

0000353560

gmmfi:C000000265Member

gmmfi:NegotiableBankCertificatesOfDepositMember

2025-05-31

0000353560

gmmfi:C000000265Member

gmmfi:NetOtherAssetsAndLiabilitiesMember

2025-05-31

0000353560

gmmfi:C000000265Member

us-gaap:RepurchaseAgreementsMember

2025-05-31

0000353560

gmmfi:C000000265Member

gmmfi:TimeDepositsMember

2025-05-31

0000353560

gmmfi:C000000266Member

2025-05-31

0000353560

gmmfi:C000000266Member

us-gaap:CommercialPaperMember

2025-05-31

0000353560

gmmfi:C000000266Member

gmmfi:NegotiableBankCertificatesOfDepositMember

2025-05-31

0000353560

gmmfi:C000000266Member

gmmfi:NetOtherAssetsAndLiabilitiesMember

2025-05-31

0000353560

gmmfi:C000000266Member

us-gaap:RepurchaseAgreementsMember

2025-05-31

0000353560

gmmfi:C000000266Member

gmmfi:TimeDepositsMember

2025-05-31

0000353560

gmmfi:C000157127Member

2025-05-31

0000353560

gmmfi:C000157127Member

us-gaap:CommercialPaperMember

2025-05-31

0000353560

gmmfi:C000157127Member

gmmfi:NegotiableBankCertificatesOfDepositMember

2025-05-31

0000353560

gmmfi:C000157127Member

gmmfi:NetOtherAssetsAndLiabilitiesMember

2025-05-31

0000353560

gmmfi:C000157127Member

us-gaap:RepurchaseAgreementsMember

2025-05-31

0000353560

gmmfi:C000157127Member

gmmfi:TimeDepositsMember

2025-05-31

iso4217:USDiso4217:USDxbrli:sharesxbrli:purexbrli:sharesutr:Dgmmfi:Holding

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number

General Money Market Fund, Inc.

(Exact name of registrant as specified in charter)

c/o BNY Mellon Investment Adviser, Inc.

240 Greenwich Street

New York, New York 10286

(Address of Principal Executive Officer) (Zip Code)

Deirdre Cunnane, Esq.

240 Greenwich Street

New York, New York 10286

(Name and Address of Agent for Service)

Registrant's telephone number, including area code:

Date of reporting period:

ITEM 1 - Reports to Stockholders

Dreyfus Money Market Fund

SEMI-ANNUAL

SHAREHOLDER

REPORT

May 31, 2025

Wealth Shares – GMMXX

This semi-annual shareholder report contains important information about Dreyfus Money Market Fund (the “Fund”) for the period of December 1, 2024 to May 31, 2025. You can find additional information about the Fund at www.dreyfus.com/products/mm.html#overview. You can also request this information by calling 1-800-373-9387 (inside the U.S. only) or by sending an e-mail request to info@bny.com.

What were the Fund’s costs for the last six months ?

(based on a hypothetical $10,000 investment)

| Share Class |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

| Wealth Shares |

$27 |

0.53%* |

KEY FUND STATISTICS (AS OF 5/31/25 )

Fund Size (Millions) |

Number of Holdings |

| $2,111 |

90 |

| Not FDIC Insured. Not Bank-Guaranteed. May Lose Value |

Portfolio Holdings (as of 5/31/25 )

Allocation of Holdings (Based on Net Assets)

* Amount represents less than .01%.

For additional information about the Fund, including its prospectus, financial information and portfolio holdings, please visit www.dreyfus.com/products/mm.html#overview .

© 2025 BNY Mellon Securities Corporation, Distributor,

240 Greenwich Street, 9th Floor, New York, NY 10286

Code-0196SA0525

Not FDIC Insured. Not Bank-Guaranteed. May Lose Value

Dreyfus Money Market Fund

SEMI-ANNUAL

SHAREHOLDER

REPORT

May 31, 2025

Service Shares – GMBXX

This semi-annual shareholder report contains important information about Dreyfus Money Market Fund (the “Fund”) for the period of December 1, 2024 to May 31, 2025. You can find additional information about the Fund at www.dreyfus.com/products/mm.html#overview. You can also request this information by calling 1-800-373-9387 (inside the U.S. only) or by sending an e-mail request to info@bny.com.

What were the Fund’s costs for the last six months ?

(based on a hypothetical $10,000 investment)

| Share Class |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

| Service Shares* |

$50 |

1.00%** |

| * |

During the period, fees were waived and/or expenses reimbursed pursuant to an agreement with the Fund’s investment adviser, BNY Mellon Investment Adviser, Inc. If this agreement is not extended in the future, expenses could be higher.

|

| ** |

Annualized.

|

KEY FUND STATISTICS (AS OF 5/31/25 )

Fund Size (Millions) |

Number of Holdings |

| $2,111 |

90 |

| Not FDIC Insured. Not Bank-Guaranteed. May Lose Value |

Portfolio Holdings (as of 5/31/25 )

Allocation of Holdings (Based on Net Assets)

* Amount represents less than .01%.

For additional information about the Fund, including its prospectus, financial information and portfolio holdings, please visit www.dreyfus.com/products/mm.html#overview .

© 2025 BNY Mellon Securities Corporation, Distributor,

240 Greenwich Street, 9th Floor, New York, NY 10286

Code-0696SA0525

Not FDIC Insured. Not Bank-Guaranteed. May Lose Value

Dreyfus Money Market Fund

SEMI-ANNUAL

SHAREHOLDER

REPORT

May 31, 2025

Premier Shares – GMGXX

This semi-annual shareholder report contains important information about Dreyfus Money Market Fund (the “Fund”) for the period of December 1, 2024 to May 31, 2025. You can find additional information about the Fund at www.dreyfus.com/products/mm.html#overview. You can also request this information by calling 1-800-373-9387 (inside the U.S. only) or by sending an e-mail request to info@bny.com.

What were the Fund’s costs for the last six months ?

(based on a hypothetical $10,000 investment)

| Share Class |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

| Premier Shares |

$13 |

0.26%* |

KEY FUND STATISTICS (AS OF 5/31/25 )

Fund Size (Millions) |

Number of Holdings |

| $2,111 |

90 |

| Not FDIC Insured. Not Bank-Guaranteed. May Lose Value |

Portfolio Holdings (as of 5/31/25 )

Allocation of Holdings (Based on Net Assets)

* Amount represents less than .01%.

For additional information about the Fund, including its prospectus, financial information and portfolio holdings, please visit www.dreyfus.com/products/mm.html#overview .

© 2025 BNY Mellon Securities Corporation, Distributor,

240 Greenwich Street, 9th Floor, New York, NY 10286

Code-6168SA0525

Not FDIC Insured. Not Bank-Guaranteed. May Lose Value

Not applicable.

|

Item 3. |

Audit Committee Financial Expert. |

Not applicable.

|

Item 4. |

Principal Accountant Fees and Services. |

Not applicable.

|

Item 5. |

Audit Committee of Listed Registrants. |

Not applicable.

Not applicable.

Dreyfus Money Market Fund

SEMI-ANNUAL FINANCIALS

AND OTHER INFORMATION

Save

time. Save paper. View your next shareholder report online as soon as it’s available. Log into www.bny.com/investments

and sign up for eCommunications. It’s simple and only takes a few minutes.

The

views expressed in this report reflect those of the portfolio manager(s) only through the end of the period

covered and do not necessarily represent the views of BNY Mellon Investment Adviser, Inc. or any other

person in the BNY Mellon Investment Adviser, Inc. organization. Any such views are subject to change

at any time based upon market or other conditions and BNY Mellon Investment Adviser, Inc. disclaims

any responsibility to update such views. These views may not be relied on as investment advice and,

because investment decisions for a fund in the BNY Mellon Family of Funds are based on numerous factors,

may not be relied on as an indication of trading intent on behalf of any fund in the BNY Mellon

Family of

Funds.

Not FDIC-Insured

• Not Bank-Guaranteed • May Lose Value

Contents

Please note

the Semi-Annual Financials and Other Information only contains Items 7-11

required in Form N-CSR. All other required items will be filed with the Securities and Exchange

Commission (the “SEC”).

Item

7. Financial Statements and Financial Highlights for Open-End Management Investment Companies.

Dreyfus Money Market Fund

STATEMENT OF INVESTMENTS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Australia

& New Zealand Banking Group Ltd., (1 Month SOFR +

|

|

|

|

|

|

Bank

of Montreal, (3 Month SOFR +

0.25%)(b)

|

|

|

|

|

|

Bedford

Row Funding Corp.(a),(c)

|

|

|

|

|

|

Bedford

Row Funding Corp., (1 Month SOFR +

0.27%)(a),(b)

|

|

|

|

|

|

CDP

Financial, Inc.(a),(c)

|

|

|

|

|

|

Collateralized

Commercial Paper FLEX Co. LLC(a)

|

|

|

|

|

|

Collateralized

Commercial Paper V Co. LLC, (1 Month SOFR +

0.32%)(b)

|

|

|

|

|

|

Collateralized

Commercial Paper V Co. LLC, (1 Month SOFR +

0.38%)(b)

|

|

|

|

|

|

Collateralized

Commercial Paper V Co. LLC, (1 Month SOFR +

0.40%)(b)

|

|

|

|

|

|

Commonwealth

Bank of Australia, (1 Month SOFR +

0.25%)(a),(b)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DZ

Bank AG (New York)(a),(c)

|

|

|

|

|

|

ING

US Funding LLC(a),(c)

|

|

|

|

|

|

ING

US Funding LLC, (1 Month SOFR +

0.22%)(a),(b)

|

|

|

|

|

|

ING

US Funding LLC, (1 Month SOFR +

0.25%)(a),(b)

|

|

|

|

|

|

ING

US Funding LLC, (1 Month SOFR +

0.25%)(b)

|

|

|

|

|

|

ING

US Funding LLC, (1 Month SOFR +

0.26%)(a),(b)

|

|

|

|

|

|

Liberty

Street Funding LLC(a),(c)

|

|

|

|

|

|

Liberty

Street Funding LLC(a),(c)

|

|

|

|

|

|

Liberty

Street Funding LLC(a),(c)

|

|

|

|

|

|

|

|

|

|

|

|

|

Macquarie

Bank Ltd., (1 Month SOFR +

0.24%)(a),(b)

|

|

|

|

|

|

National

Australia Bank Ltd., (1 Month SOFR +

0.20%)(a),(b)

|

|

|

|

|

|

National

Australia Bank Ltd., (1 Month SOFR +

0.30%)(a),(b)

|

|

|

|

|

|

|

|

|

|

|

|

|

Nordea

Bank Abp, (1 Month SOFR +

0.19%)(a),(b)

|

|

|

|

|

|

Nordea

Bank Abp, (1 Month SOFR +

0.20%)(a),(b)

|

|

|

|

|

|

Nordea

Bank Abp, (1 Month SOFR +

0.20%)(a),(b)

|

|

|

|

|

|

|

|

|

|

|

|

|

Old

Line Funding, LLC(a),(c)

|

|

|

|

|

|

Old

Line Funding, LLC(a),(c)

|

|

|

|

|

|

Paradelle

Funding LLC, (1 Month SOFR +

0.32%)(b)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Podium

Funding Trust, (1 Month SOFR +

0.29%)(b)

|

|

|

|

|

|

Royal

Bank of Canada(a),(c)

|

|

|

|

|

|

Skandinaviska

Enskilda Banken AB(a),(c)

|

|

|

|

|

|

Skandinaviska

Enskilda Banken AB, (3 Month SOFR +

0.30%)(a),(b)

|

|

|

|

|

|

Sumitomo

Mitsui Banking Corp.(a),(c)

|

|

|

|

|

|

Svenska

Handelsbanken AB(a),(c)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Swedbank

AB, (1 Month SOFR +

0.22%)(a),(b)

|

|

|

|

|

|

STATEMENT OF INVESTMENTS (Unaudited)

(continued)

|

|

|

|

|

|

|

Commercial

Paper — 32.7% (continued) |

|

|

|

|

|

The

Toronto-Dominion Bank(a),(c)

|

|

|

|

|

|

Toyota

Motor Credit Corp.(c)

|

|

|

|

|

|

Toyota

Motor Credit Corp.(c)

|

|

|

|

|

|

Victory

Receivables Corp.(a),(c)

|

|

|

|

|

|

Westpac

Banking Corp.(a),(c)

|

|

|

|

|

|

Westpac

Securities NZ Ltd.(a),(c)

|

|

|

|

|

|

Total

Commercial Paper

(cost

$689,538,717) |

|

|

|

|

|

Negotiable

Bank Certificates of Deposit — 18.3% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Bank

of America NA, (1 Month SOFR +

0.27%)(b)

|

|

|

|

|

|

|

|

|

|

|

|

|

Bank

of Nova Scotia, (3 Month SOFR +

0.31%)(b)

|

|

|

|

|

|

Canadian

Imperial Bank of Commerce (New York), (1 Month SOFR +

|

|

|

|

|

|

Canadian

Imperial Bank of Commerce (New York), (1 Month SOFR +

|

|

|

|

|

|

Canadian

Imperial Bank of Commerce (New York), (1 Month SOFR +

|

|

|

|

|

|

|

|

|

|

|

|

|

Citibank

NA, (1 Month SOFR +

0.27%)(b)

|

|

|

|

|

|

Citibank

NA, (1 Month SOFR +

0.32%)(b)

|

|

|

|

|

|

Cooperatieve

Rabobank U.A. (New York) |

|

|

|

|

|

|

|

|

|

|

|

|

HSBC

Bank USA NA, (3 Month SOFR +

0.27%)(b)

|

|

|

|

|

|

Landesbank

Baden-Wurttemberg |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MUFG

Bank Ltd., (3 Month SOFR +

0.22%)(b)

|

|

|

|

|

|

Oversea-Chinese

Banking Corp. Ltd. (New York), (3 Month SOFR +

|

|

|

|

|

|

Svenska

Handelsbanken (New York) |

|

|

|

|

|

The

Toronto-Dominion Bank |

|

|

|

|

|

The

Toronto-Dominion Bank, (3 Month SOFR +

0.45%)(b)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Westpac

Banking Corp., (1 Month SOFR +

0.25%)(b)

|

|

|

|

|

|

Westpac

Banking Corp., (1 Month SOFR +

0.34%)(b)

|

|

|

|

|

|

Total

Negotiable Bank Certificates of Deposit

(cost

$386,500,275) |

|

|

|

|

|

|

|

|

|

|

|

|

Australia

& New Zealand Banking Group Ltd.

(cost

$ 25,000,000) |

|

|

|

|

|

Repurchase

Agreements — 47.8% |

|

|

|

|

|

Bank

of America Securities, Inc., Tri-Party Agreement thru BNY, dated

5/30/2025,

due at maturity date in the amount of $25,009,063, (fully

collateralized

by: Money Market, 0.00%-4.72%, due 6/10/2025-

2/28/2028,

valued at $25,500,001) |

|

|

|

|

|

|

|

|

|

|

|

|

Repurchase

Agreements — 47.8% (continued) |

|

|

|

|

|

BMO

Capital Markets Corp., Tri-Party Agreement thru BNY, dated

5/30/2025,

due at maturity date in the amount of $25,009,229 (fully

collateralized

by: Asset-Backed Securities, 9.08%, due 1/21/2037,

Corporate

Debt Securities, 3.50%-9.00%, due 8/25/2025-

12/21/2065,

Federal Home Loan Mortgage Corp-Agency

Collateralized

Mortgage Obligation, 7.50%, due 7/15/2027, Federal

Home

Loan Mortgage Corp-Agency Debentures and Agency Strips,

0.00%-4.00%,

due 12/25/2051-6/25/2055, Government National

Mortgage

Association-Agency Collateralized Mortgage Obligation,

0.00%-5.25%,

due 3/20/2042-11/20/2070, valued at $27,883,526) |

|

|

|

|

|

BNP

Paribas SA, Tri-Party Agreement thru BNY, dated 5/30/2025, due

at

maturity date in the amount of $50,018,458, (fully collateralized

by:

Asset-Backed Securities, 3.75%-6.64%, due 3/3/2028-5/25/2070,

Corporate

Debt Securities, 1.93%-7.70%, due 8/11/2025-

10/15/2097,

Private Label Collateralized Mortgage Obligations,

4.22%-5.77%,

due 2/18/2042-7/17/2056, valued at $51,500,001) |

|

|

|

|

|

Crédit

Agricole CIB, Tri-Party Agreement thru BNY, dated 5/30/2025,

due

at maturity date in the amount of $99,035,805, (fully

collateralized

by: U.S. Treasuries (including strips), 0.25%-5.00%, due

7/31/2025-8/15/2054,

valued at $100,980,001) |

|

|

|

|

|

Crédit

Agricole CIB, Tri-Party Agreement thru BNY, dated 5/30/2025,

due

at maturity date in the amount of $10,003,617, (fully

collateralized

by: U.S. Treasuries (including strips), 3.25%-4.88%, due

2/28/2027-5/15/2034,

valued at $10,200,000) |

|

|

|

|

|

Daiwa

Capital Markets America, Inc., Tri-Party Agreement thru BNY,

dated

5/30/2025, due at maturity date in the amount of

$75,027,188

(fully collateralized by: Federal Home Loan Mortgage

Corp-Agency

Debentures and Agency Strips, 1.33%-5.22%, due

4/25/2054-12/25/2054,

Federal Home Loan Mortgage Corp-Agency

Mortgage-Backed

Securities, 2.00%-7.83%, due 1/1/2032-5/1/2055,

Federal

National Mortgage Association-Agency Collateralized

Mortgage

Obligation, 3.00%-6.00%, due 1/25/2050-5/25/2055,

Federal

National Mortgage Association-Agency Mortgage-Backed

Securities,

2.00%-6.50%, due 9/1/2027-6/1/2055, Government

National

Mortgage Association-Agency Collateralized Mortgage

Obligation,

0.87%-5.33%, due 4/20/2051-3/20/2055, Government

National

Mortgage Association-Agency Mortgage-Backed Securities,

2.00%-7.50%,

due 8/20/2035-1/20/2055, U.S. Treasuries (including

strips),

0.63%-4.25%, due 2/15/2028-2/15/2054, valued at

$77,122,818)

|

|

|

|

|

|

Fixed

Income Clearing Corp., Tri-Party Agreement thru State Street

Corp.,

dated 5/30/2025, due at maturity date in the amount of

$300,108,500,

(fully collateralized by: U.S. Treasuries (including

strips),

3.25%, due 5/15/2042, valued at $306,000,023) |

|

|

|

|

|

STATEMENT OF INVESTMENTS (Unaudited)

(continued)

|

|

|

|

|

|

|

Repurchase

Agreements — 47.8% (continued) |

|

|

|

|

|

MUFG

Bank, Ltd., Tri-Party Agreement thru BNY, dated 5/30/2025, due

at

maturity date in the amount of $350,127,167, (fully collateralized

by:

Federal Home Loan Mortgage Corp-Agency Debentures and

Agency

Strips, 5.57%-6.32%, due 9/25/2053-2/25/2054, Federal

Home

Loan Mortgage Corp-Agency Mortgage-Backed Securities,

2.00%-5.50%,

due 8/1/2042-1/1/2054, Federal National Mortgage

Association-Agency

Collateralized Mortgage Obligation, 5.72%-6.42%,

due

10/25/2053-12/25/2054, Federal National Mortgage

Association-Agency

Mortgage-Backed Securities, 2.50%-6.50%, due

12/1/2027-1/1/2055,

Government National Mortgage Association-

Agency

Mortgage-Backed Securities, 3.00%-5.50%, due 4/20/2044-

9/20/2054,

U.S. Treasuries (including strips), 0.00%-4.75%, due

7/31/2025-8/15/2054,

valued at $375,812,623) |

|

|

|

|

|

Societe

Generale, Tri-Party Agreement thru BNY, dated 5/30/2025, due

at

maturity date in the amount of $75,027,813 (fully collateralized

by:

Asset-Backed Securities, 4.01%-5.51%, due 11/25/2034-

2/17/2039,

Corporate Debt Securities, 3.52%-12.25%, due 6/9/2025-

4/22/2051,

Private Label Collateralized Mortgage Obligations, 3.24%-

9.59%,

due 4/17/2034-5/12/2050, valued at $84,716,843) |

|

|

|

|

|

Total

Repurchase Agreements

(cost

$1,009,000,000) |

|

|

|

|

|

Total

Investments (cost $2,110,038,992)

|

|

|

|

|

|

Cash

and Receivables (Net) |

|

|

|

|

|

|

|

|

|

|

|

|

SOFR—Secured

Overnight Financing Rate |

|

|

Security

exempt from registration pursuant to Rule 144A under the Securities Act of 1933. These securities may be resold in transactions exempt

from

registration,

normally to qualified institutional buyers. At May 31, 2025, these securities amounted to $518,193,385 or 24.6% of net assets.

|

|

|

Variable

rate security—interest rate resets periodically and rate shown is the interest rate in effect at period end. Date shown represents

the earlier of the next

interest

reset date or ultimate maturity date. Security description also includes the reference rate and spread if published and available.

|

|

|

Security

is a discount security. Income is recognized through the accretion of discount. |

See notes to financial

statements.

STATEMENT

OF ASSETS AND LIABILITIES

May 31, 2025 (Unaudited)

|

|

|

|

|

|

|

|

Investments

in securities—See Statement of Investments |

|

|

Repurchase

agreements, at value and amortized cost—Note

1(b)

|

|

|

|

|

|

|

|

|

|

|

Receivable

for shares of Common Stock subscribed |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Due

to BNY Mellon Investment Adviser, Inc. and affiliates—Note

2(c)

|

|

|

Payable

for shares of Common Stock redeemed |

|

|

Directors’

fees and expenses payable |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Composition

of Net Assets ($): |

|

|

|

|

|

|

Total

distributable earnings (loss) |

|

|

|

|

|

|

Net

Asset Value Per Share |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net

Asset Value Per Share ($) |

|

|

|

See notes to financial statements.

Six Months Ended May

31, 2025 (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Administrative

services fees—Note 2(c)

|

|

Shareholder

servicing costs—Note 2(b)

|

|

Directors’

fees and expenses—Note 2(d)

|

|

|

|

|

|

|

|

|

|

|

Chief

Compliance Officer fees—Note 2(c)

|

|

Prospectus

and shareholders’ reports |

|

|

|

|

|

|

|

Less—reduction

in expenses due to undertaking—Note 2(a)

|

|

Less—reduction

in fees due to earnings credits—Note 2(c)

|

|

|

|

|

Net

Investment Income, representing net increase in net assets resulting from operations |

|

See notes to financial statements.

STATEMENT

OF CHANGES IN NET ASSETS

|

|

Six

Months Ended

May

31, 2025

(Unaudited)(a)

|

|

|

|

|

|

|

|

|

|

|

|

Net

realized gain (loss) on investments |

|

|

Net

Increase (Decrease) in Net Assets Resulting from Operations |

|

|

|

|

|

|

Distributions

to shareholders: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Capital

Stock Transactions ($1.00 per share): |

|

|

Net

proceeds from shares sold: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Distributions

reinvested: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Increase

(Decrease) in Net Assets from Capital Stock Transactions |

|

|

Total

Increase (Decrease) in Net Assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

During

the period ended May 31, 2025, 315,002 Wealth shares representing $315,265 were exchanged for 313,271 Premier shares.

|

|

|

During

the period ended November 30, 2024, 509,590 Wealth shares representing $510,160 were exchanged for 510,160 Premier shares, 5,766 Service

shares

representing

$5,783 were exchanged for 5,783 Wealth shares and 63,192 Service shares representing $63,393 were exchanged for 63,393 Premier shares.

|

See notes to financial statements.

The

following tables describe the performance for each share class for the fiscal periods indicated. All information reflects financial results

for a single fund share. Net asset

value total return is calculated assuming an initial investment made at the net asset value at the beginning of the period,

reinvestment of all dividends and distributions at net asset value during the period, and redemption at net asset value on the last day

of the period. Net asset value total

return includes adjustments in accordance with accounting principles generally accepted in the United States of

America and as such, the net asset value for financial reporting purposes and the returns based upon those net asset values may differ

from the net asset value and returns for shareholder

transactions.

|

|

Six

Months Ended

May

31, 2025

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net

asset value, beginning of period |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dividends

from net investment income |

|

|

|

|

|

|

Net

asset value, end of period |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ratios/Supplemental

Data (%): |

|

|

|

|

|

Ratio

of total expenses to average net assets |

|

|

|

|

|

|

Ratio

of net expenses to average net assets |

|

|

|

|

|

|

Ratio

of net investment income to average

net

assets |

|

|

|

|

|

|

Net

Assets, end of period ($ x 1,000) |

|

|

|

|

|

|

|

|

Effective

February 1, 2021, the fund Class A shares were renamed Wealth shares. |

|

|

Amount

represents less than $.001 per share. |

|

|

|

|

|

|

|

|

Amount

inclusive of reduction in fees due to earnings credits. |

|

|

Amount

inclusive of reduction in expenses due to undertaking. |

See notes to financial statements.

|

|

Six

Months Ended

May

31, 2025

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net

asset value, beginning of period |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dividends

from net investment income |

|

|

|

|

|

|

Net

asset value, end of period |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ratios/Supplemental

Data (%): |

|

|

|

|

|

Ratio

of total expenses to average net assets |

|

|

|

|

|

|

Ratio

of net expenses to average net assets(e)

|

|

|

|

|

|

|

Ratio

of net investment income to average

|

|

|

|

|

|

|

Net

Assets, end of period ($ x 1,000) |

|

|

|

|

|

|

|

|

Effective

February 1, 2021, the fund Class B shares were renamed Service shares. |

|

|

Amount

represents less than $.001 per share. |

|

|

|

|

|

|

|

|

Amount

inclusive of reduction in expenses due to undertaking. |

|

|

Amount

inclusive of reduction in fees due to earnings credits. |

See notes to financial statements.

FINANCIAL

HIGHLIGHTS (continued)

|

|

Six

Months Ended

May

31, 2025

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net

asset value, beginning of period |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dividends

from net investment income |

|

|

|

|

|

|

Net

asset value, end of period |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ratios/Supplemental

Data (%): |

|

|

|

|

|

Ratio

of total expenses to average net assets |

|

|

|

|

|

|

Ratio

of net expenses to average net assets |

|

|

|

|

|

|

Ratio

of net investment income to average

net

assets |

|

|

|

|

|

|

Net

Assets, end of period ($ x 1,000) |

|

|

|

|

|

|

|

|

Effective

February 1, 2021, the fund Dreyfus Class shares were renamed Premier shares. |

|

|

Amount

represents less than $.001 per share. |

|

|

|

|

|

|

|

|

Amount

inclusive of reduction in fees due to earnings credits. |

|

|

Amount

inclusive of reduction in expenses due to undertaking. |

See notes to financial statements.

NOTES

TO FINANCIAL STATEMENTS (Unaudited)

NOTE

1—

Significant

Accounting Policies:

Dreyfus Money

Market Fund (the “fund”) is the sole series of General Money Market Fund, Inc. (the “Company”), which is registered

under the Investment Company Act

of 1940, as amended (the “Act”), as a diversified open-end management investment company. The fund’s

investment objective is to seek as high a level of current income as is consistent with the preservation of capital. BNY Mellon Investment

Adviser, Inc. (the “Adviser”), a wholly-owned subsidiary of The Bank of New York Mellon Corporation (“BNY”), serves

as the fund’s investment adviser.

Dreyfus, a division of Mellon Investment Corporation (the “Sub-Adviser”),

an indirect wholly-owned subsidiary of BNY and an

affiliate of the Adviser, serves as the fund’s sub-adviser.

BNY Mellon

Securities Corporation (the “Distributor”), a wholly-owned subsidiary of the Adviser, is the distributor of the fund’s

shares, which are sold without a

sales charge. The fund is authorized to issue 42.5 billion shares of $.001 par value Common Stock. The fund currently

has authorized three classes of shares: Wealth shares (7 billion shares authorized), Service shares (28.5 billion shares authorized) and

Premier shares (7 billion shares authorized). Wealth, Service and Premier shares are identical except for the services offered to and

the expenses borne by each class,

the allocation of certain transfer agency costs and certain voting rights. Wealth, Service and Premier shares

are subject to Shareholder Services Plans. Service shares is subject to Administrative Services Plan. Income, expenses (other than expenses

attributable to a specific class), and realized and unrealized gains or losses on investments are allocated to each class of shares based

on its relative net assets.

The fund operates

as a “retail

money market fund” as that term is defined in Rule 2a-7 under the Act (a “Retail Fund”). It is the fund’s policy

to maintain a constant net asset value (“NAV”) per share of $1.00, and the fund has adopted certain investment, portfolio

valuation and dividend and distribution

policies to enable it to do so. There is no assurance, however, that the fund will be able to maintain

a constant NAV per share of $1.00.

The Financial

Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) is the exclusive reference of authoritative

U.S. generally accepted accounting principles (“GAAP”) recognized by the FASB to be applied by nongovernmental entities. Rules

and interpretive releases of the SEC under authority of federal laws are also sources of authoritative GAAP for SEC registrants. The

fund is an investment company and applies the accounting and reporting guidance of the FASB ASC Topic 946 Financial Services-Investment

Companies. The fund’s financial statements are prepared in accordance with GAAP, which may require the use of management

estimates and assumptions. Actual results could differ from those estimates.

The Company

enters into contracts that contain a variety of indemnifications. The fund’s maximum exposure under these arrangements is

unknown. The fund does not anticipate recognizing any loss related to these arrangements.

(a) Portfolio

valuation: Investments in securities are valued at

amortized cost in accordance with Rule 2a-7 under the Act. If amortized

cost is determined not to approximate fair market value, the fair value of the portfolio securities will be determined by procedures

established by and under the general oversight of the Company’s Board of Directors

(the “Board”) pursuant to Rule 2a-5 under

the Act.

The fair value

of a financial instrument is the amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction

between market participants at the measurement date (i.e., the exit price). GAAP establishes a fair value hierarchy that prioritizes

the inputs of valuation techniques used to measure fair value. This hierarchy gives the highest priority to unadjusted quoted prices

in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements).

Additionally,

GAAP provides guidance on determining whether the volume and activity in a market has decreased significantly and whether

such a decrease in activity results in transactions that are not orderly. GAAP requires enhanced disclosures around valuation inputs

and techniques used during annual and interim periods.

Various inputs

are used in determining the value of the fund’s investments relating to fair value measurements. These inputs are summarized

in the three broad levels listed below:

Level 1—unadjusted

quoted prices in active markets for identical investments.

Level 2—other

significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit

risk, etc.).

Level 3—significant

unobservable inputs (including the fund’s own assumptions in determining the fair value of investments).

The inputs

or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

For example, money market securities are valued using amortized cost, in accordance with rules under the Act. Generally,

NOTES

TO FINANCIAL STATEMENTS (Unaudited) (continued)

amortized

cost approximates the current fair value of a security, but since the value is not obtained from a quoted price in an active market,

such securities are reflected within Level 2 of the fair value hierarchy.

The following is a summary

of the inputs used as of May 31, 2025 in valuing the fund’s investments:

|

|

Level

1 -

Unadjusted

Quoted

Prices |

Level

2- Other

Significant

Observable

Inputs |

Level

3-

Significant

Unobservable

Inputs

|

|

|

|

|

|

|

|

Investments

in Securities:†

|

|

|

|

|

|

|

|

|

|

|

Negotiable

Bank Certificates of Deposit |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See

Statement of Investments for additional detailed categorizations, if any. |

(b) Securities

transactions and investment income: Securities

transactions are recorded on a trade date basis. Interest income, adjusted

for accretion of discount and amortization of premium on investments, is earned from settlement date and is recognized on the accrual

basis. Realized gains and losses from securities transactions are recorded on the identified cost basis.

The fund may

enter into repurchase agreements with financial institutions, deemed to be creditworthy by the Adviser, subject to the seller’s

agreement to repurchase and the fund’s agreement to resell such securities at a mutually agreed upon price. Pursuant to the terms

of the repurchase agreement, such

securities must have an aggregate market value greater than or equal to the terms of the repurchase price

plus accrued interest at all times. If the value of the underlying securities falls below the value of the repurchase price plus accrued

interest, the fund will require

the seller to deposit additional collateral by the next business day. If the request for additional collateral is not

met, or the seller defaults on its repurchase obligation, the fund maintains its right to sell the underlying securities at market value

and may claim any resulting loss

against the seller. The collateral is held on behalf of the fund by the tri-party administrator with respect to

any tri-party agreement. The fund may also jointly enter into one or more repurchase agreements with other funds managed by the Adviser

in accordance with an exemptive order granted by the SEC pursuant to section 17(d) and Rule 17d-1 under the Act. Any joint repurchase

agreements must be collateralized fully by U.S. Government securities.

For financial

reporting purposes, the fund elects not to offset assets and liabilities subject to a Repurchase Agreement, if any, in the Statement

of Assets and Liabilities. Therefore, all qualifying transactions are presented on a gross basis in the Statement of Assets and Liabilities.

As of May 31, 2025, the impact of netting of assets and liabilities and the offsetting of collateral pledged or received, if any, based

on contractual netting/set-off provisions in the Repurchase Agreement are detailed in the following table:

|

|

|

|

Gross

amount of Repurchase

Agreements,

at value, as disclosed in

the

Statement of Assets and Liabilities |

|

|

Collateral

(received)/posted not offset

in

the Statement of Assets and

Liabilities

|

|

|

|

|

|

|

|

|

The

value of the related collateral received by the fund exceeded the value of the repurchase agreement by the fund. See Statement of Investments

for detailed

information

regarding collateral received for open repurchase agreements. |

(c) Market

Risk: The value of the securities in which the fund

invests may be affected by political, regulatory, economic and social developments.

Events such as war, acts of terrorism, the spread of infectious illness or other public health issue, recessions, or other events

could have a significant impact on the fund and its investments. Recent examples include pandemic risks related to COVID-19

and aggressive measures taken world-wide in response by governments, including closing borders, restricting international and

NOTES

TO FINANCIAL STATEMENTS (Unaudited) (continued)

domestic

travel, and the imposition of prolonged quarantines of large populations, and by businesses, including changes to operations and

reducing staff.

Interest Rate Risk: This

risk refers to the decline in the prices of fixed-income securities that may accompany a rise in the overall level of

interest rates. A sharp and unexpected rise in interest rates could impair the fund’s ability to maintain a stable net asset value.

A wide variety of market factors

can cause interest rates to rise, including central bank monetary policy, rising inflation and changes in general economic

conditions. It is difficult to predict the pace at which central banks or monetary authorities may increase (or decrease) interest rates

or the timing, frequency, or magnitude of such changes. Changing interest rates may have unpredictable effects on markets, may result

in heightened market volatility and may detract from fund performance. For floating and variable rate obligations, there may be a

lag between an actual change in the underlying interest rate benchmark and the reset time for an interest payment of such an obligation,

which could harm or benefit the fund, depending on the interest rate environment or other circumstances.

Banking Industry Risk:The

risks generally associated with concentrating investments (i.e., hold 25% or more of its total assets) in the banking

industry include interest rate risk, credit risk, and regulatory developments relating to the banking industry. Banks may be particularly

susceptible to certain economic factors such as interest rate changes, adverse developments in the real estate market, fiscal and

monetary policy and general economic cycles. An adverse development in the banking industry (domestic or foreign) may affect the

value of the fund’s investments more than if

such investments were not concentrated in the banking industry.

Repurchase Agreement Counterparty

Risk: The fund is subject to the risk that a counterparty

in a repurchase agreement and/or, for a

tri-party repurchase agreement, the third party bank providing payment administration, collateral custody and management services for

the transaction, could fail to honor the terms of the agreement.

(d) Dividends

and distributions to shareholders: It is the policy

of the fund to declare dividends daily from net investment income. Such

dividends are paid monthly. Dividends from net realized capital gains, if any, are normally declared and paid annually, but the fund may

make distributions on a more frequent basis to comply with the distribution requirements of the Internal Revenue Code of 1986, as

amended (the “Code”). To the extent that net realized capital gains can be offset by capital loss carryovers, it is the policy

of the fund not to distribute such gains.

(e) Federal

income taxes: It is the policy of the fund to continue

to qualify as a regulated investment company, if such qualification is in

the best interests of its shareholders, by complying with the applicable provisions of the Code, and to make distributions of taxable

income and net realized capital gain sufficient to

relieve it from substantially all federal income and excise taxes.

As of and

during the period ended May 31, 2025, the fund did not have any liabilities for any uncertain tax positions. The fund recognizes

interest and penalties, if any, related to uncertain tax positions as income tax expense in the Statement of Operations. During the

period ended May 31, 2025, the fund did not incur any interest or penalties.

Each tax year

in the three-year period ended November 30, 2024 remains subject to examination by the Internal Revenue Service and state

taxing authorities.

The fund is

permitted to carry forward capital losses for an unlimited period. Furthermore, capital loss carryovers retain their character as

either short-term or long-term capital losses.

The fund has

an unused capital loss carryover of $33,824 available for federal income tax purposes to be applied against future net realized

capital gains, if any, realized subsequent to November 30, 2024. These short-term capital losses can be carried forward for an unlimited

period.

The tax character

of distributions paid to shareholders during the fiscal year ended November 30, 2024 was as follows: ordinary income $97,564,841.

The tax character of current year distributions will be determined at the end of the current fiscal year.

At May

31, 2025, the cost of investments for federal income tax purposes was substantially the same as the cost for financial reporting purposes

(see the Statement of Investments).

(f) Operating

segment reporting: In this reporting period, the

fund adopted FASB Accounting Standards Update 2023-07, Segment Reporting

(Topic 280) - Improvements to Reportable Segment Disclosures (“ASU 2023-07”). Adoption of the new standard impacted financial

statement disclosures only and did not affect the fund’s financial position or the results of its operations. The ASU 2023-07 is

effective for public entities for

fiscal years beginning after December 15, 2023, and requires retrospective application for all prior periods presented

within the financial statements.

Since its

commencement, the fund operates and is managed as a single reportable segment deriving returns in the form of dividends, interest

and/or gains from the investments made in pursuit of its single stated investment objective as outlined in the fund’s prospectus.

NOTES

TO FINANCIAL STATEMENTS (Unaudited) (continued)

The

accounting policies of the fund are consistent with those described in these Notes to Financial Statements. The chief operating decision

maker (“CODM”) is represented by BNY Investments, the management of the Adviser, comprising Senior Management and Directors.

The CODM considers net increase in net assets resulting from operations in deciding whether to purchase additional investments

or to make distributions to fund shareholders. Detailed financial information for the fund is disclosed within these financial statements

with total assets and liabilities disclosed on the Statement of Assets and Liabilities, investments held on the Statement of Investments,

results of operations and significant segment expenses on the Statement of Operations and other information about the fund’s

performance, including total return and ratios within the Financial Highlights.

NOTE

2—

Management

Fee, Sub-Advisory Fee

and Other Transactions with Affiliates:

(a) Pursuant

to a management agreement (the “Agreement”) with the Adviser, the management fee is computed at the annual rate of .20%

of the value of the fund’s average daily net assets and is payable monthly. The Agreement provides that if in any fiscal year the

aggregate expenses of the fund (excluding

taxes, brokerage commissions and extraordinary expenses) exceed 1½% of the value of the fund’s

average daily net assets, the fund may deduct from the fees paid to the Adviser, or the Adviser will bear such excess expense. During

the period ended May 31, 2025, there was no reduction in expenses pursuant to the Agreement.

The Adviser

has also contractually agreed, from December 1, 2024 through March 31, 2026, to waive receipt of its fees and/or assume the

direct expenses of the fund’s Service shares so that the direct expenses of the fund’s Service shares (excluding taxes, brokerage

commissions and extraordinary expenses)

do not exceed an annual rate of 1.00% of the value of the average daily net assets of Service shares.

To the extent that it is necessary for the Adviser to waive receipt of its management fee or reimburse the fund’s common expenses,

the amount of the waiver or reimbursement

will be applied equally to each share class of the fund. On or after March 31, 2026, the Adviser

may terminate the expense limitation agreement at any time. The reduction in expenses for Service shares, pursuant to the undertaking,

amounted to $198,552 during the period ended May 31, 2025.

The Adviser

and the Distributor have undertaken, that if, in any fiscal year of the fund, the “total charges against net assets to provide for

sales related expenses and/or service

fees” (calculated as provided for in FINRA Rule 2341 Section (d)) exceed .25% of the value of the Wealth

and Premier shares’ average net assets for such fiscal year, the fund may deduct from the payments to be made to the Distributor,

or the Adviser will bear, such excess

expense. If said rule is amended in any material respect (e.g. to provide for a limit that exceeds .25%),

this undertaking shall terminate automatically. During the period ended May 31, 2025, there was no reduction in expenses pursuant

to the undertaking.

Pursuant to

a sub-investment advisory agreement between the Adviser and the Sub-Adviser, the Adviser pays to the Sub-Adviser a monthly

fee of 50% of the monthly management fee the Adviser receives from the fund with respect to the value of the sub-advised net assets

of the fund, net of any fee waivers and/or expense reimbursements made by the Adviser.

(b) Under

the Reimbursement Shareholder Services Plan with respect to Premier shares (the “Reimbursement Shareholder Services Plan”),

Premier shares reimburse the Distributor at an amount not to exceed an annual rate of .25% of the value of the average daily net assets

of its shares for certain allocated expenses of providing certain services to the holders of Premier shares. The services provided may

include personal services relating

to shareholder accounts, such as answering shareholder inquiries regarding the fund, and services related

to the maintenance of shareholder accounts. During the period ended May 31, 2025, Premier shares were charged $37,459

pursuant to the Reimbursement Shareholder Services Plan.

Under the

Compensation Shareholder Services Plan with respect to Wealth and Service shares (the “Compensation Shareholder Services Plan”),

Wealth and Service shares pay the Distributor at an annual rate of .25% of the value of the average daily net assets of its shares for

the provision of certain services.

The services provided may include personal services relating to shareholder accounts, such as answering shareholder

inquiries regarding the fund, and services related to the maintenance of shareholder accounts. The Distributor may make payments

to Service Agents with respect to these services. The Distributor determines the amounts to be paid to Service Agents. During the

period ended May 31, 2025, Wealth and Service shares were charged $916,024 and $1,425,476, respectively, pursuant to each of their

respective Compensation Shareholder Services Plan.

(c) Under

the Administrative Services Plan with respect to Service shares, pursuant to which the fund may pay the Distributor for the provision

of certain type of recordkeeping and other related services (which are not services for which a “service fee” as defined under

the Conduct Rules of FINRA is intended

to compensate). Pursuant to the Administrative Services Plan, the fund will pay the Distributor at

an annual rate of .55% of the value of the fund’s Service shares average daily net assets attributable to the fund’s

Service shares for the provision

of such services, which include, at a minimum: mailing periodic reports, prospectuses and other fund communications to beneficial

owners; client onboarding; anti-money laundering and related regulatory oversight; manual transaction processing;

NOTES

TO FINANCIAL STATEMENTS (Unaudited) (continued)

transmitting

wires; withholding on dividends and distributions as may be required by state or Federal authorities from time to time; receiving,

tabulating, and transmitting proxies executed by beneficial owners; fund statistical reporting; technical support; business continuity

support; and blue sky support. During the period ended May 31, 2025, Service shares were charged $3,136,047 pursuant to the

Administrative Services Plan.

The fund has

an arrangement with BNY Mellon Transfer, Inc., (the “Transfer Agent”), a subsidiary of BNY and an affiliate of the Adviser,

whereby the fund may receive earnings credits when positive cash balances are maintained, which are used to offset Transfer Agent

fees. For financial reporting purposes, the fund includes transfer agent net earnings credits, if any, as an expense offset in the Statement

of Operations.

The fund has

an arrangement with The Bank of New York Mellon (the “Custodian”), a subsidiary of BNY and an affiliate of the Adviser, whereby

the fund will receive interest income or be charged overdraft fees when cash balances are maintained. For financial reporting purposes,

the fund includes this interest income and overdraft fees, if any, as interest income in the Statement of Operations.

The fund compensates

the Transfer Agent, under a transfer agency agreement, for providing transfer agency and cash management services

for the fund. The majority of Transfer Agent fees are comprised of amounts paid on a per account basis, while cash management fees

are related to fund subscriptions and redemptions. During the period ended May 31, 2025, the fund was charged $183,314 for transfer

agency services. These fees are included in Shareholder servicing costs in the Statement of Operations. These fees were partially offset

by earnings credits of $43,253.

The fund compensates

the Custodian, under a custody agreement, for providing custodial services for the fund. These fees are determined

based on net assets, geographic region and transaction activity. During the period ended May 31, 2025, the fund was charged $19,007

pursuant to the custody agreement.

The fund compensates

the Custodian, under a shareholder redemption draft processing agreement, for providing certain services related to

the fund’s check writing privilege. During the period ended May 31, 2025, the fund was charged $18,243 pursuant to the agreement,

which is included in Shareholder servicing costs

in the Statement of Operations.

During the

period ended May 31, 2025, the fund was charged $15,490 for services performed by the fund’s Chief Compliance Officer and

his staff. These fees are included in Chief Compliance Officer fees in the Statement of Operations.

The components

of “Due to BNY Mellon Investment Adviser, Inc. and affiliates” in the Statement of Assets and Liabilities consist of:

Management fee of $363,799, Administrative Services Plan fees of $509,190, Shareholder Services Plans fees of $383,137, Custodian

fees of $13,927, Chief Compliance Officer fees of $2,880, Transfer Agent fees of $60,001 and Checkwriting fees of $5,200, which are

offset against an expense reimbursement currently in effect in the amount of $43,948.

(d) Each

board member of the fund also serves as a board member of other funds in the BNY Mellon Family of Funds complex. Annual retainer

fees and attendance fees are allocated to each fund based on net assets.

Item

8. Changes in and Disagreements with Accountants for Open-End Management Investment Companies

(Unaudited)

Item

9. Proxy Disclosures for Open-End Management Investment Companies (Unaudited)

Item

10. Remuneration Paid to Directors, Officers, and Others of Open-End Management Investment Companies

(Unaudited)

Each

board member also serves as a board member of other funds in the BNY Mellon Family of Funds complex, and annual retainer fees and

meeting attendance fees are allocated to each fund based on net assets. The fund is charged for services performed by the fund’s

Chief Compliance Officer. Compensation

paid by the fund during the period to the board members and the Chief Compliance Officer are

within Item 7. Statement of Operations as Directors’ fees and expenses and Chief Compliance Officer fees, respectively. The aggregate

amount of Directors’ fees and expenses and Chief Compliance Officer fees paid by the fund during the period was $101,649.

Item

11. Statement Regarding Basis for Approval of Investment Advisory Contracts (Unaudited)

At

a meeting of the fund’s Board of Directors (the “Board”)

held on March 4-5, 2025, the Board considered the renewal of the fund’s Management

Agreement, pursuant to which the Adviser provides the fund with investment advisory and administrative services, and the

Sub-Investment Advisory Agreement (together with the Management Agreement, the “Agreements”),

pursuant to which Dreyfus, a division

of Mellon Investments Corporation (the “Sub-Adviser”),

provides day-to-day management of the fund’s investments. The Board

members, none of whom are “interested

persons”

(as defined in the Investment Company Act of 1940, as amended) of the fund, were

assisted in their review by independent legal counsel and met with counsel in executive session separate from representatives of the Adviser

and the Sub-Adviser. In considering the renewal of the Agreements, the Board considered several factors that it believed to be relevant,

including those discussed below. The Board did not identify any one factor as dispositive, and each Board member may have attributed

different weights to the factors considered.

Analysis

of Nature, Extent, and Quality of Services Provided to the Fund.

The Board considered information provided to it at the meeting

and in previous presentations from representatives of the Adviser regarding the nature, extent, and quality of the services provided

to funds in the BNY fund complex, including the fund. The Adviser provided the number of open accounts in the fund, the fund’s

asset size and the allocation of fund assets among distribution channels. The Adviser also had previously provided information regarding

the diverse intermediary relationships and distribution channels of funds in the BNY fund complex (such as retail direct or intermediary,

in which intermediaries typically are paid by the fund and/or the Adviser) and the Adviser’s corresponding need for broad, deep,

and diverse resources to be able to provide ongoing shareholder services to each intermediary or distribution channel, as applicable to

the fund.

The Board

also considered research support available to, and portfolio management capabilities of, the fund’s portfolio management personnel

and that the Adviser also provides oversight of day-to-day fund operations, including fund accounting and administration and

assistance in meeting legal and regulatory requirements. The Board also considered the Adviser’s extensive administrative, accounting

and compliance infrastructures, as well as the Adviser’s supervisory activities over the Sub-Adviser.

Comparative

Analysis of the Fund’s Performance and Management Fee and Expense Ratio.

The Board reviewed reports prepared by Broadridge

Financial Solutions, Inc. (“Broadridge”),

an independent provider of investment company data based on classifications provided

by Thomson Reuters Lipper (“Lipper”),

which included information comparing (1) the performance of the fund’s Wealth shares

with the performance of a group of retail no-load money market instrument funds selected by Broadridge as comparable to the fund

(the “Performance

Group”)

and with a broader group of funds consisting of all retail money market instrument funds (the “Performance

Universe”),

all for various periods ended December 31, 2024, and (2) the fund’s actual and contractual management fees and

total expenses with those of the same group of funds in the Performance Group (the “Expense

Group”)

and with a broader group of funds

consisting of all retail no-load money market instrument funds, excluding outliers (the “Expense

Universe”),

the information for which was derived

in part from fund financial statements available to Broadridge as of the date of its analysis. The Performance Group and

Performance Universe comparisons were provided based on both “gross”

(i.e., without including fees and expenses) and “net”

(i.e., including fees and expenses)

total returns. The Adviser previously had furnished the Board with a description of the methodology Broadridge

used to select the Performance Group and Performance Universe and the Expense Group and Expense Universe.

Performance Comparisons.

Representatives of the Adviser stated that the usefulness of performance comparisons may be affected by a number

of factors, including different investment limitations and policies that may be applicable to the fund and comparison funds and the

end date selected. The Board also considered the fund’s performance in light of overall financial market conditions. The Board discussed

with representatives of the Adviser and Sub-Adviser the results of the comparisons and considered that the fund’s gross total return

performance was slightly above or equal to the Performance Group median for all periods, except for the four-, five- and ten-year periods

when the fund’s gross total return performance was slightly below the Performance Group median, and was slightly below the Performance

Universe median for all periods. The Board also considered that the fund’s net total return performance was slightly below the

Performance Group median for all periods, except for the three- and four-year periods when the fund’s net total return performance

was slightly above the Performance

Group median, and was below the Performance Universe medians for all periods. The Board considered

the relative proximity of the fund’s gross and net total return performance to the Performance Group and/or Performance Universe

medians in certain periods when the fund’s performance was below median.

Management Fee and Expense

Ratio Comparisons. The Board reviewed and considered

the contractual management fee rate payable by the

fund to the Adviser in light of the nature, extent and quality of the management services and the sub-advisory services provided by

Item

11. Statement Regarding Basis for Approval of Investment Advisory Contracts (Unaudited) (continued)

the

Adviser and the Sub-Adviser, respectively. In addition, the Board reviewed and considered the actual management fee rate paid by the

fund over the fund’s last fiscal year, which included reductions for an expense limitation arrangement in place that reduced the

management fee paid to the Adviser.

The Board also reviewed the range of actual and contractual management fees and total expenses as

a percentage of average net assets of the Expense Group and Expense Universe funds and discussed the results of the comparisons.

The Board

considered that the fund’s contractual management fee was lower than the Expense Group median contractual management fee,

the fund’s actual management fee was lower than the Expense Group median and approximately equivalent to than the Expense Universe

median actual management fee, and the fund’s total expenses were approximately equivalent to the Expense Group median and

higher than the Expense Universe median total expenses.

Representatives

of the Adviser noted that there were no other funds advised by the Adviser that are in the same Lipper category as the fund

or separate accounts and/or other types of client portfolios advised by the Adviser or the Sub-Adviser that are considered to have similar

investment strategies and policies as the fund.

The Board

considered the fee payable to the Sub-Adviser in relation to the fee payable to the Adviser by the fund and the respective services

provided by the Sub-Adviser and the Adviser. The Board also took into consideration that the Sub-Adviser’s fee is paid by the Adviser,

out of its fee from the fund, and not the fund.

Analysis

of Profitability and Economies of Scale. Representatives

of the Adviser reviewed the expenses allocated and profit received by the

Adviser and its affiliates and the resulting profitability percentage for managing the fund and the aggregate profitability percentage

to the Adviser and its affiliates

for managing the funds in the BNY fund complex, and the method used to determine the expenses and profit.

The Board concluded that the profitability results were not excessive, given the services rendered and service levels provided by the

Adviser and its affiliates. The Board also considered the expense limitation arrangement and its effect on the profitability of the Adviser

and its affiliates. The Board also had been provided with information prepared by an independent consulting firm regarding the Adviser’s

approach to allocating costs to, and determining the profitability of, individual funds and the entire BNY fund complex. The consulting

firm also had analyzed where any economies of scale might emerge in connection with the management of a fund.

The Board

considered, on the advice of its counsel, the profitability analysis (1) as part of its evaluation of whether the fees under the Agreements,

considered in relation to the mix of services provided by the Adviser and the Sub-Adviser, including the nature, extent and quality

of such services, supported the renewal of the Agreements and (2) in light of the relevant circumstances for the fund and the extent

to which economies of scale would be realized if the fund grows and whether fee levels reflect these economies of scale for the benefit

of fund shareholders. Representatives of the Adviser stated that, as a result of shared and allocated costs among funds in the BNY fund

complex, the extent of economies of scale could depend substantially on the level of assets in the complex as a whole, so that increases

and decreases in complex-wide assets can affect potential economies of scale in a manner that is disproportionate to, or even in the

opposite direction from, changes in the fund’s asset level. The Board also considered potential benefits to the Adviser and the

Sub-Adviser from acting as investment

adviser and sub-investment adviser, respectively, and took into consideration that there were no soft

dollar arrangements in effect for trading the fund’s investments.

At the conclusion

of these discussions, the Board agreed that it had been furnished with sufficient information to make an informed business

decision with respect to the renewal of the Agreements. Based on the discussions and considerations as described above, the Board

concluded and determined as follows.

●The

Board concluded that the nature, extent and quality of the services provided by the Adviser and the Sub-Adviser are satisfactory

and appropriate.

●The

Board was generally satisfied with the fund’s performance.

●The

Board concluded that the fees paid to the Adviser and the Sub-Adviser continued to be appropriate under the circumstances and

in light of the factors and the totality of the services provided as discussed above.

●The

Board determined that the economies of scale which may accrue to the Adviser and its affiliates in connection with the management

of the fund had been adequately considered by the Adviser in connection with the fee rate charged to the fund pursuant

to the Management Agreement and that, to the extent in the future it were determined that material economies of scale had

not been shared with the fund, the Board would seek to have those economies of scale shared with the fund.

In

evaluating the Agreements, the Board considered these conclusions and determinations and also relied on its previous knowledge, gained

through meetings and other interactions with the Adviser and its affiliates and the Sub-Adviser, of the Adviser and the Sub-Adviser

and the services provided to the fund by the Adviser and the Sub-Adviser. The Board also relied on information received on a routine

and regular basis throughout the year relating to the operations of the fund and the investment management and other services provided

under the Agreements, including information on the investment performance of the fund in comparison to similar mutual funds

and benchmark performance measures; general market outlook as applicable to the fund; and compliance reports. In addition, the Board’s

consideration of the contractual fee arrangements for the fund had the benefit of a number of years of reviews of the Agreements for

the fund, or substantially similar agreements for other BNY funds that the Board oversees, during which lengthy discussions took place

between the Board and representatives of the Adviser. Certain aspects of the arrangements may receive greater scrutiny in some years

than in others, and the Board’s conclusions may be based, in part, on its consideration of the fund’s arrangements, or substantially

similar arrangements for other BNY funds that the

Board oversees, in prior years. The Board determined to renew the Agreements.

©

2025 BNY Mellon Securities Corporation

Code-0196NCSRSA0525

|

Item 12. |

Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies. |

Not applicable.

|

Item 13. |

Portfolio Managers for Closed-End Management Investment Companies. |

Not applicable.

|

Item 14. |

Purchases of Equity Securities By Closed-End Management Investment Companies and Affiliated Purchasers.

|

Not applicable.

|

Item 15. |

Submission of Matters to a Vote of Security Holders. |

There have been no materials changes to the procedures

applicable to Item 15.

|

Item 16. |

Controls and Procedures. |

|

(a) |

The Registrant's principal executive and principal financial officers have concluded, based on their

evaluation of the Registrant's disclosure controls and procedures as of a date within 90 days of the filing date of this report, that

the Registrant's disclosure controls and procedures are reasonably designed to ensure that information required to be disclosed by the

Registrant on Form N-CSR is recorded, processed, summarized and reported within the required time periods and that information required

to be disclosed by the Registrant in the reports that it files or submits on Form N-CSR is accumulated and communicated to the Registrant's

management, including its principal executive and principal financial officers, as appropriate to allow timely decisions regarding required

disclosure. |

|

(b) |

There were no changes to the Registrant's internal control over financial reporting that occurred

during the period covered by this report that have materially affected, or are reasonably likely to materially affect, the Registrant's