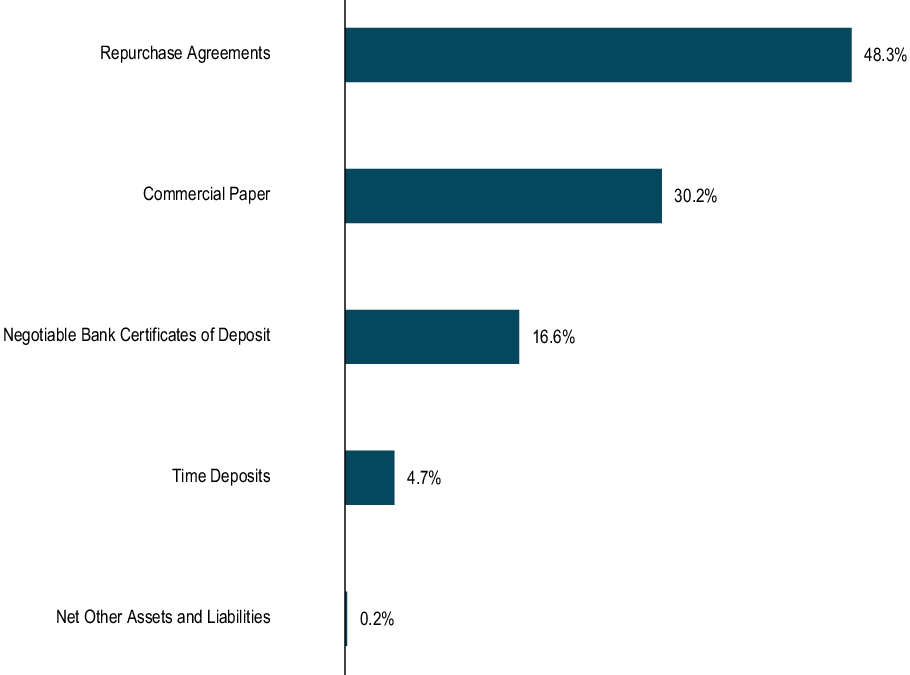

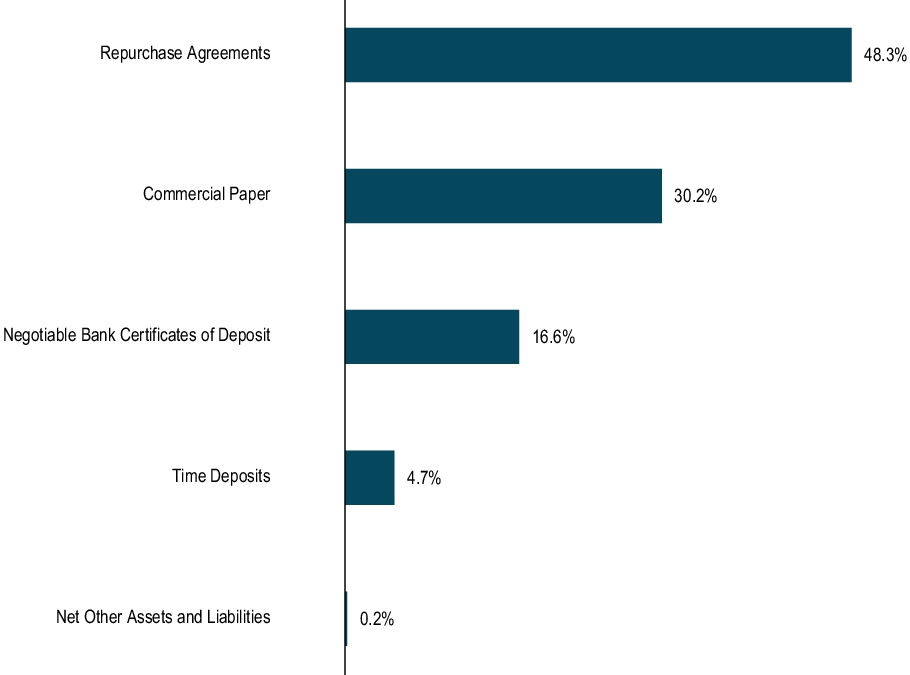

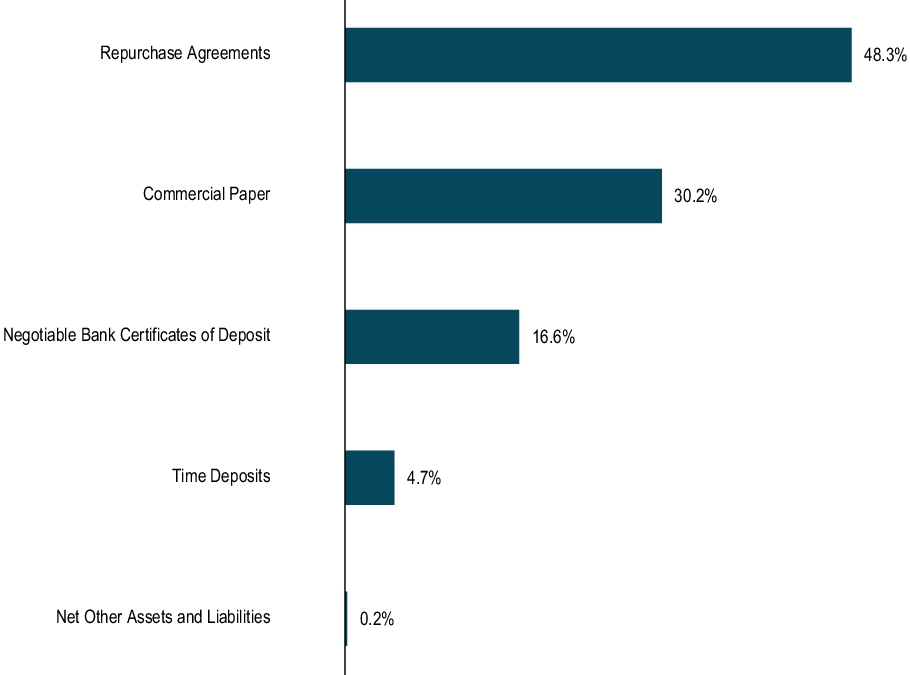

48.3

0.2

16.6

30.2

4.7

16.6

30.2

0.2

48.3

4.7

4.7

48.3

30.2

16.6

0.2

0000353560

false

N-1A

0000353560

2023-12-01

2024-11-30

0000353560

gmmfi:C000000265Member

2023-12-01

2024-11-30

0000353560

gmmfi:C000000266Member

2023-12-01

2024-11-30

0000353560

gmmfi:C000157127Member

2023-12-01

2024-11-30

0000353560

gmmfi:C000000265Member

2024-11-30

0000353560

gmmfi:C000000265Member

us-gaap:CommercialPaperMember

2024-11-30

0000353560

gmmfi:C000000265Member

gmmfi:NegotiableBankCertificatesOfDepositMember

2024-11-30

0000353560

gmmfi:C000000265Member

gmmfi:NetOtherAssetsAndLiabilitiesMember

2024-11-30

0000353560

gmmfi:C000000265Member

us-gaap:RepurchaseAgreementsMember

2024-11-30

0000353560

gmmfi:C000000265Member

gmmfi:TimeDepositsMember

2024-11-30

0000353560

gmmfi:C000000266Member

2024-11-30

0000353560

gmmfi:C000000266Member

us-gaap:CommercialPaperMember

2024-11-30

0000353560

gmmfi:C000000266Member

gmmfi:NegotiableBankCertificatesOfDepositMember

2024-11-30

0000353560

gmmfi:C000000266Member

gmmfi:NetOtherAssetsAndLiabilitiesMember

2024-11-30

0000353560

gmmfi:C000000266Member

us-gaap:RepurchaseAgreementsMember

2024-11-30

0000353560

gmmfi:C000000266Member

gmmfi:TimeDepositsMember

2024-11-30

0000353560

gmmfi:C000157127Member

2024-11-30

0000353560

gmmfi:C000157127Member

us-gaap:CommercialPaperMember

2024-11-30

0000353560

gmmfi:C000157127Member

gmmfi:NegotiableBankCertificatesOfDepositMember

2024-11-30

0000353560

gmmfi:C000157127Member

gmmfi:NetOtherAssetsAndLiabilitiesMember

2024-11-30

0000353560

gmmfi:C000157127Member

us-gaap:RepurchaseAgreementsMember

2024-11-30

0000353560

gmmfi:C000157127Member

gmmfi:TimeDepositsMember

2024-11-30

iso4217:USDiso4217:USDxbrli:sharesxbrli:purexbrli:sharesutr:Dgmmfi:Holding

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number

General Money Market Fund, Inc.

(Exact name of registrant as specified in charter)

c/o BNY Mellon Investment Adviser, Inc.

240 Greenwich Street

New York, New York 10286

(Address of Principal Executive Officer) (Zip Code)

Deirdre Cunnane, Esq.

240 Greenwich Street

New York, New York 10286

(Name and Address of Agent for Service)

Registrant's telephone number, including area code:

Date of reporting period:

ITEM 1 - Reports to Stockholders

Dreyfus Money Market Fund

ANNUAL

SHAREHOLDER

REPORT

November 30, 2024

Wealth Shares – GMMXX

This annual shareholder report contains important information about Dreyfus Money Market Fund (the “Fund”) for the period of December 1, 2023 to November 30, 2024. You can find additional information about the Fund at www.dreyfus.com/products/mm.html#overview. You can also request this information by calling 1-800-373-9387 (inside the U.S. only) or by sending an e-mail request to info@bny.com.

What were the Fund’s costs for the last year ?

(based on a hypothetical $10,000 investment)

| Share Class |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

| Wealth Shares |

$55 |

0.54% |

KEY FUND STATISTICS (AS OF 11/30/24 )

Fund Size (Millions) |

Number of Holdings |

Total Advisory Fee Paid During

Period |

| $2,154 |

93 |

$4,183,576 |

| Not FDIC Insured. Not Bank-Guaranteed. May Lose Value |

Portfolio Holdings (as of 11/30/24 )

Allocation of Holdings (Based on Net Assets)

For additional information about the Fund, including its prospectus, financial information and portfolio holdings, please visit www.dreyfus.com/products/mm.html#overview .

© 2025 BNY Mellon Securities Corporation, Distributor,

240 Greenwich Street, 9th Floor, New York, NY 10286

Code-0196AR1124

Dreyfus Money Market Fund

ANNUAL

SHAREHOLDER

REPORT

November 30, 2024

Service Shares – GMBXX

This annual shareholder report contains important information about Dreyfus Money Market Fund (the “Fund”) for the period of December 1, 2023 to November 30, 2024. You can find additional information about the Fund at www.dreyfus.com/products/mm.html#overview. You can also request this information by calling 1-800-373-9387 (inside the U.S. only) or by sending an e-mail request to info@bny.com.

What were the Fund’s costs for the last year ?

(based on a hypothetical $10,000 investment)

| Share Class |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

| Service Shares* |

$102 |

1.00% |

| * |

During the period, fees were waived and/or expenses reimbursed pursuant to an agreement with the Fund’s investment adviser, BNY Mellon Investment Adviser, Inc. If this agreement is not extended in the future, expenses could be higher.

|

KEY FUND STATISTICS (AS OF 11/30/24 )

Fund Size (Millions) |

Number of Holdings |

Total Advisory Fee Paid During

Period |

| $2,154 |

93 |

$4,183,576 |

| Not FDIC Insured. Not Bank-Guaranteed. May Lose Value |

Portfolio Holdings (as of 11/30/24 )

Allocation of Holdings (Based on Net Assets)

For additional information about the Fund, including its prospectus, financial information and portfolio holdings, please visit www.dreyfus.com/products/mm.html#overview .

© 2025 BNY Mellon Securities Corporation, Distributor,

240 Greenwich Street, 9th Floor, New York, NY 10286

Code-0696AR1124

Dreyfus Money Market Fund

ANNUAL

SHAREHOLDER

REPORT

November 30, 2024

Premier Shares – GMGXX

This annual shareholder report contains important information about Dreyfus Money Market Fund (the “Fund”) for the period of December 1, 2023 to November 30, 2024. You can find additional information about the Fund at www.dreyfus.com/products/mm.html#overview. You can also request this information by calling 1-800-373-9387 (inside the U.S. only) or by sending an e-mail request to info@bny.com.

What were the Fund’s costs for the last year ?

(based on a hypothetical $10,000 investment)

| Share Class |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

| Premier Shares |

$29 |

0.28% |

KEY FUND STATISTICS (AS OF 11/30/24 )

Fund Size (Millions) |

Number of Holdings |

Total Advisory Fee Paid During

Period |

| $2,154 |

93 |

$4,183,576 |

| Not FDIC Insured. Not Bank-Guaranteed. May Lose Value |

Portfolio Holdings (as of 11/30/24 )

Allocation of Holdings (Based on Net Assets)

For additional information about the Fund, including its prospectus, financial information and portfolio holdings, please visit www.dreyfus.com/products/mm.html#overview .

© 2025 BNY Mellon Securities Corporation, Distributor,

240 Greenwich Street, 9th Floor, New York, NY 10286

Code-6168AR1124

The Registrant has adopted a code of ethics

that applies to the Registrant's principal executive officer, principal financial officer, principal accounting officer or controller,

or persons performing similar functions. There have been no amendments to, or waivers in connection with, the Code of Ethics during the

period covered by this Report.

|

Item 3. |

Audit Committee Financial Expert. |

The Registrant's Board has determined that Joseph

S. DiMartino, a member of the Audit Committee of the Board, is an audit committee financial expert as defined by the Securities and Exchange

Commission (the "SEC"). Mr. DiMartino is "independent" as defined by the SEC for purposes of audit committee financial

expert determinations.

|

Item 4. |

Principal Accountant Fees and Services. |

(a) Audit

Fees. The aggregate fees billed for each of the last two fiscal years (the "Reporting Periods") for professional services

rendered by the Registrant's principal accountant (the "Auditor") for the audit of the Registrant's annual financial statements

or services that are normally provided by the Auditor in connection with the statutory and regulatory filings or engagements for the Reporting

Periods, were $36,261 in 2023 and $36,986 in 2024.

(b) Audit-Related

Fees. The aggregate fees billed in the Reporting Periods for assurance and related services by the Auditor that are reasonably

related to the performance of the audit of the Registrant's financial statements and are not reported under paragraph (a) of this Item

4 were $8,025 in 2023 and $7,332 in 2024. These services consisted of one or more of the following: (i) agreed upon procedures related

to compliance with Internal Revenue Code section 817(h), (ii) security counts required by Rule 17f-2 under the Investment Company Act

of 1940, as amended, (iii) advisory services as to the accounting or disclosure treatment of Registrant transactions or events and (iv)

advisory services to the accounting or disclosure treatment of the actual or potential impact to the Registrant of final or proposed rules,

standards or interpretations by the Securities and Exchange Commission, the Financial Accounting Standards Boards or other regulatory

or standard-setting bodies.

The aggregate fees billed in the Reporting Periods

for non-audit assurance and related services by the Auditor to the Registrant's investment adviser (not including any sub-investment adviser

whose role is primarily portfolio management and is subcontracted with or overseen by another investment adviser), and any entity controlling,

controlled by or under common control with the investment adviser that provides ongoing services to the Registrant ("Service Affiliates"),

that were reasonably related to the performance of the annual audit of the Service Affiliate, which required pre-approval by the Audit

Committee were $0 in 2023 and $0 in 2024.

(c) Tax

Fees. The aggregate fees billed in the Reporting Periods for professional services rendered by the Auditor for tax compliance,

tax advice, and tax planning ("Tax Services") were $3,342 in 2023 and $3,342 in 2024. These services consisted of: (i) review

or preparation of U.S. federal, state, local and excise tax returns; (ii) U.S. federal, state and local tax planning, advice and assistance

regarding statutory, regulatory or administrative developments; (iii) tax advice regarding tax qualification matters and/or treatment

of various financial instruments held or proposed to be acquired or held, and (iv) determination of Passive Foreign Investment Companies.

The aggregate fees billed in the Reporting Periods for Tax Services by the Auditor to Service Affiliates, which required pre-approval

by the Audit Committee were $8,158 in 2023 and $7,799 in 2024.

(d) All

Other Fees. The aggregate fees billed in the Reporting Periods for products and services provided by the Auditor, other than the

services reported in paragraphs (a) through (c) of this Item,

were

$11,024

in

2023

and

$12,577

in

2024.

These

services

consisted

of

a

review

of

the

Registrant's

anti-money

laundering

program.

The

aggregate

fees

billed

in

the

Reporting

Periods

for

Non-Audit

Services

by

the

Auditor

to

Service

Affiliates,

other

than

the

services

reported

in

paragraphs

(b)

through

(c)

of

this

Item,

which

required

pre-approval

by

the

Audit

Committee,

were

$0

in

2023

and

$0

in

2024.

(e)(1)

Audit

Committee

Pre-Approval

Policies

and

Procedures.

The

Registrant's

Audit

Committee

has

established

policies

and

procedures

(the

"Policy")

for

pre-approval

(within

specified

fee

limits)

of

the

Auditor's

engagements

for

non-audit

services

to

the

Registrant

and

Service

Affiliates

without

specific

case-by-case

consideration.

The

pre-approved

services

in

the

Policy

can

include

pre-approved

audit

services,

pre-approved

audit-related

services,

pre-approved

tax

services

and

pre-approved

all

other

services.

Pre-approval

considerations

include

whether

the

proposed

services

are

compatible

with

maintaining

the

Auditor's

independence.

Pre-approvals

pursuant

to

the

Policy

are

considered

annually.

(e)(2)

Note.

None

of

the

services

described

in

paragraphs

(b)

through

(d)

of

this

Item

4

were

approved

by

the

Audit

Committee

pursuant

to

paragraph

(c)(7)(i)(C)

of

Rule

2-01

of

Regulation

S-X.

(f)

None

of

the

hours

expended

on

the

principal

accountant's

engagement

to

audit

the

registrant's

financial

statements

for

the

most

recent

fiscal

year

were

attributed

to

work

performed

by

persons

other

than

the

principal

accountant's

full-time,

permanent

employees.

Non-Audit

Fees.

The

aggregate

non-audit

fees

billed

by

the

Auditor

for

services

rendered

to

the

Registrant,

and

rendered

to

Service

Affiliates,

for

the

Reporting

Periods

were

$1,886,566

in

2023

and

$1,486,377

in

2024.

Auditor

Independence.

The

Registrant's

Audit

Committee

has

considered

whether

the

provision

of

non-audit

services

that

were

rendered

to

Service

Affiliates,

which

were

not

pre-approved

(not

requiring

pre-approval),

is

compatible

with

maintaining

the

Auditor's

independence.

|

Item 5. |

Audit Committee of Listed Registrants. |

Not applicable.

Not applicable.

Dreyfus Money Market Fund

ANNUAL FINANCIALS

AND OTHER INFORMATION

IMPORTANT NOTICE – CHANGES

TO ANNUAL AND SEMI-ANNUAL REPORTS

The Securities

and Exchange Commission (the “SEC”) has adopted rule and form amendments which have resulted

in changes to the design and delivery of annual and semi-annual fund reports (“Reports”). Reports are

now streamlined to highlight key information. Certain information previously included in Reports, including

financial statements, no longer appear in the Reports but will be available online within the Semi-Annual

and Annual Financials and Other Information, delivered free of charge to shareholders upon request,

and filed with the SEC.

Save

time. Save paper. View your next shareholder report online as soon as it’s available. Log into www.bny.com/investments

and sign up for eCommunications. It’s simple and only takes a few minutes.

The

views expressed in this report reflect those of the portfolio manager(s) only through the end of the period

covered and do not necessarily represent the views of BNY Mellon Investment Adviser, Inc. or any other

person in the BNY Mellon Investment Adviser, Inc. organization. Any such views are subject to change

at any time based upon market or other conditions and BNY Mellon Investment Adviser, Inc. disclaims

any responsibility to update such views. These views may not be relied on as investment advice and,

because investment decisions for a fund in the BNY Mellon Family of Funds are based on numerous factors,

may not be relied on as an indication of trading intent on behalf of any fund in the BNY Mellon

Family of

Funds.

Not FDIC-Insured

• Not Bank-Guaranteed • May Lose Value

Contents

Please note

the Annual Financials and Other Information only contains Items 7-11 required in Form

N-CSR. All other required items will be filed with the SEC.

Item

7. Financial Statements and Financial Highlights for Open-End Management Investment Companies.

Dreyfus Money Market Fund

Statement of Investments

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ANZ

Group Holdings Ltd.(a)

|

|

|

|

|

|

Australia

& New Zealand Banking Group Ltd.(a)

|

|

|

|

|

|

Australia

& New Zealand Banking Group Ltd.(a)

|

|

|

|

|

|

Australia

& New Zealand Banking Group Ltd., (3 Month SOFR +

|

|

|

|

|

|

|

|

|

|

|

|

|

Bedford

Row Funding Corp.(a)

|

|

|

|

|

|

Bedford

Row Funding Corp., (1 Month SOFR +

0.21%)(b),(c)

|

|

|

|

|

|

Bedford

Row Funding Corp., (1 Month SOFR +

0.23%)(b),(c)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CDP

Financial, Inc., (1 Month SOFR +

0.20%)(b),(c)

|

|

|

|

|

|

|

|

|

|

|

|

|

Collateralized

Commercial Paper FLEX Co. LLC(b)

|

|

|

|

|

|

Collateralized

Commercial Paper V Co. LLC, (1 Month SOFR +

|

|

|

|

|

|

Collateralized

Commercial Paper V Co. LLC, (1 Month SOFR +

|

|

|

|

|

|

Collateralized

Commercial Paper V Co. LLC, (1 Month SOFR +

|

|

|

|

|

|

Commonwealth

Bank of Australia, (1 Month SOFR +

0.20%)(b),(c)

|

|

|

|

|

|

Commonwealth

Bank of Australia, (1 Month SOFR +

0.25%)(b),(c)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Federation

des Caisses Desjardins du Quebec(a)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ING

US Funding LLC, (1 Month SOFR +

0.26%)(b),(c)

|

|

|

|

|

|

ING

US Funding LLC, (1 Month SOFR +

0.28%)(c)

|

|

|

|

|

|

|

|

|

|

|

|

|

Macquarie

Bank Ltd., (1 Month SOFR +

0.21%)(b),(c)

|

|

|

|

|

|

Macquarie

Bank Ltd., (1 Month SOFR +

0.24%)(b),(c)

|

|

|

|

|

|

Mizuho

Bank Ltd. (Singapore)(a)

|

|

|

|

|

|

National

Australia Bank Ltd.(a)

|

|

|

|

|

|

National

Bank of Canada, (1 Month SOFR +

0.20%)(b),(c)

|

|

|

|

|

|

Natixis

SA/New York NY(a)

|

|

|

|

|

|

Natixis

SA/New York NY(a)

|

|

|

|

|

|

Nordea

Bank Abp, (1 Month SOFR +

0.20%)(b),(c)

|

|

|

|

|

|

Nordea

Bank Abp, (1 Month SOFR +

0.21%)(b),(c)

|

|

|

|

|

|

Podium

Funding Trust, (1 Month SOFR +

0.24%)(c)

|

|

|

|

|

|

Podium

Funding Trust, (1 Month SOFR +

0.29%)(c)

|

|

|

|

|

|

|

|

|

|

|

|

|

Skandinaviska

Enskilda Banken AB(a)

|

|

|

|

|

|

Statement of Investments (continued)

|

|

|

|

|

|

|

Commercial

Paper — 30.2% (continued) |

|

|

|

|

|

Skandinaviska

Enskilda Banken AB(a)

|

|

|

|

|

|

Skandinaviska

Enskilda Banken AB, (3 Month SOFR +

0.25%)(b),(c)

|

|

|

|

|

|

Starbird

Funding Corp., (1 Month SOFR +

0.24%)(b),(c)

|

|

|

|

|

|

Sumitomo

Mitsui Banking Corp., (1 Month SOFR +

0.23%)(b),(c)

|

|

|

|

|

|

Sumitomo

Mitsui Trust Bank Ltd. (Singapore)(a)

|

|

|

|

|

|

Swedbank

AB, (1 Month SOFR +

0.24%)(b),(c)

|

|

|

|

|

|

Toyota

Motor Credit Corp.(a)

|

|

|

|

|

|

United

Overseas Bank Ltd.(a)

|

|

|

|

|

|

United

Overseas Bank Ltd., (1 Month SOFR +

0.20%)(b),(c)

|

|

|

|

|

|

Victory

Receivables Corp.(a)

|

|

|

|

|

|

Total

Commercial Paper

(cost

$650,957,921) |

|

|

|

|

|

Negotiable

Bank Certificates of Deposit — 16.6% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Canadian

Imperial Bank of Commerce (New York) |

|

|

|

|

|

Canadian

Imperial Bank of Commerce (New York) |

|

|

|

|

|

Canadian

Imperial Bank of Commerce (New York), (1 Month SOFR +

|

|

|

|

|

|

Canadian

Imperial Bank of Commerce (New York), (1 Month SOFR +

|

|

|

|

|

|

Canadian

Imperial Bank of Commerce (New York), (1 Month SOFR +

|

|

|

|

|

|

Citibank

NA, (1 Month SOFR +

0.27%)(c)

|

|

|

|

|

|

Cooperatieve

Rabobank U.A. (New York) |

|

|

|

|

|

Cooperatieve

Rabobank U.A. (New York) |

|

|

|

|

|

Cooperatieve

Rabobank U.A. (New York) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

HSBC

Bank USA NA, (3 Month SOFR +

0.23%)(c)

|

|

|

|

|

|

HSBC

Bank USA NA, (3 Month SOFR +

0.27%)(c)

|

|

|

|

|

|

Landesbank

Baden-Wurttemberg |

|

|

|

|

|

Mizuho

Bank Ltd., (1 Month SOFR +

0.23%)(c)

|

|

|

|

|

|

Oversea-Chinese

Banking Corp. Ltd. (New York) |

|

|

|

|

|

Oversea-Chinese

Banking Corp. Ltd. (New York), (3 Month SOFR +

|

|

|

|

|

|

Oversea-Chinese

Banking Corp. Ltd. (New York), (3 Month SOFR +

|

|

|

|

|

|

Skandinaviska

Enskilda Banken AB (New York) |

|

|

|

|

|

Sumitomo

Mitsui Banking Corp., (1 Month SOFR +

0.24%)(c)

|

|

|

|

|

|

Sumitomo

Mitsui Trust Bank Ltd. (New York), (1 Month SOFR +

|

|

|

|

|

|

Svenska

Handelsbanken (New York), (1 Month SOFR +

0.23%)(c)

|

|

|

|

|

|

Svenska

Handelsbanken (New York), (1 Month SOFR +

0.35%)(c)

|

|

|

|

|

|

Westpac

Banking Corp., (1 Month SOFR +

0.25%)(c)

|

|

|

|

|

|

Total

Negotiable Bank Certificates of Deposit

(cost

$356,800,000) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Australia

& New Zealand Banking Group Ltd. |

|

|

|

|

|

|

|

|

|

|

|

|

Time

Deposits

(cost

$101,000,000) |

|

|

|

|

|

Repurchase

Agreements — 48.3% |

|

|

|

|

|

Bank

of America Securities, Inc., Tri-Party Agreement thru BNY,

dated

11/29/2024, due at maturity date in the amount of

$25,009,625,

(fully collateralized by: Asset-Backed Securities,

3.40%-7.88%,

due 8/27/2036-8/26/2069, valued at $26,250,001) |

|

|

|

|

|

BMO

Capital Markets Corp., Tri-Party Agreement thru BNY, dated

11/29/2024,

due at maturity date in the amount of $50,019,500,

(fully

collateralized by: Asset-Backed Securities, 0.00%-13.06%,

due

10/20/2031-7/26/2066, Corporate Debt Securities, 2.90%-

8.25%,

due 2/1/2025-3/1/2052, Government National Mortgage

Association-Agency

Collateralized Mortgage Obligation, 0.36%-

6.00%,

due 4/20/2054-7/20/2072, Other Instrument

(collateralized

debt obligation), 7.24%, due 9/21/2037, Private

Label

Collateralized Mortgage Obligations, 1.20%-7.50%, due

3/25/2036-7/25/2069,

U.S. Treasuries (including strips), 4.63%,

due

9/30/2028, valued at $53,549,279) |

|

|

|

|

|

BNP

Paribas SA, Tri-Party Agreement thru BNY, dated 11/29/2024,

due

at maturity date in the amount of $50,019,458, (fully

collateralized

by: Asset-Backed Securities, 1.37%-6.66%, due

2/22/2027-1/15/2046,

Corporate Debt Securities, 1.78%-8.75%,

due

6/23/2025-12/15/2086, Private Label Collateralized

Mortgage

Obligations, 0.22%-9.10%, due 6/15/2033-4/25/2069,

valued

at $51,500,000) |

|

|

|

|

|

Crédit

Agricole CIB, Tri-Party Agreement thru BNY, dated

11/29/2024,

due at maturity date in the amount of $10,003,817,

(fully

collateralized by: U.S. Treasuries (including strips), 0.00%-

1.75%,

due 7/15/2025-5/15/2049, valued at $10,200,000) |

|

|

|

|

|

Crédit

Agricole CIB, Tri-Party Agreement thru BNY, dated

11/29/2024,

due at maturity date in the amount of $150,057,250,

(fully

collateralized by: U.S. Treasuries (including strips), 1.38%-

4.63%,

due 2/15/2042-11/15/2054, valued at $153,000,012) |

|

|

|

|

|

Statement of Investments (continued)

|

|

|

|

|

|

|

Repurchase

Agreements — 48.3% (continued) |

|

|

|

|

|

Daiwa

Capital Markets America, Tri-Party Agreement thru BNY,

dated

11/29/2024, due at maturity date in the amount of

$75,028,688,

(fully collateralized by: Federal Farm Credit Bank-

Agency

Debentures and Agency Strips, 4.55%-4.90%, due

11/12/2027-10/28/2031,

Federal Home Loan Banks-Agency

Debentures

and Agency Strips, 3.50%, due 9/24/2029, Federal

Home

Loan Mortgage Corp-Agency Collateralized Mortgage

Obligation,

3.50%, due 3/15/2046, Federal Home Loan Mortgage

Corp-Agency

Debentures and Agency Strips, 0.92%-6.00%, due

1/25/2054-12/25/2054,

Federal Home Loan Mortgage Corp-

Agency

Mortgage-Backed Securities, 2.00%-7.83%, due 1/1/2032-

11/1/2054,

Federal National Mortgage Association-Agency

Collateralized

Mortgage Obligation, 3.00%-6.21%, due 6/25/2050-

12/25/2054,

Federal National Mortgage Association-Agency

Mortgage-Backed

Securities, 2.00%-7.50%, due 9/1/2027-

11/1/2054,

Government National Mortgage Association-Agency

Collateralized

Mortgage Obligation, 0.44%-5.72%, due

12/16/2050-11/20/2054,

Government National Mortgage

Association-Agency

Mortgage-Backed Securities, 2.00%-7.50%,

due

8/20/2035-11/20/2054, U.S. Treasuries (including strips),

0.00%-6.13%,

due 1/15/2025-2/15/2054, valued at $77,357,212) |

|

|

|

|

|

Fixed

Income Clearing Corp., Tri-Party Agreement thru State Street

Corp.,

dated 11/29/2024, due at maturity date in the amount of

$300,114,750,

(fully collateralized by: U.S. Treasuries (including

strips),

3.88%-4.00%, due 2/15/2043-11/15/2052, valued at

$306,000,125)

|

|

|

|

|

|

|

|

|

|

|

|

|

Repurchase

Agreements — 48.3% (continued) |

|

|

|

|

|

MUFG

Securities (Canada) Ltd., Tri-Party Agreement thru BNY, dated

11/29/2024,

due at maturity date in the amount of $305,116,663,

(fully

collateralized by: Federal Home Loan Mortgage Corp-Agency

Debentures

and Agency Strips, 5.98%-6.13%, due 9/25/2053-

10/25/2053,

Federal Home Loan Mortgage Corp-Agency

Mortgage-Backed

Securities, 3.50%-7.50%, due 7/1/2037-

11/1/2054,

Federal National Mortgage Association-Agency

Collateralized

Mortgage Obligation, 6.83%, due 12/25/2053,

Federal

National Mortgage Association-Agency Mortgage-Backed

Securities,

2.50%-7.48%, due 4/1/2029-9/1/2054, Government

National

Mortgage Association-Agency Mortgage-Backed

Securities,

3.36%-5.50%, due 6/20/2052-7/15/2059,

U.S.

Treasuries (including strips), 2.25%, due 8/15/2046, valued at

$327,930,111)

|

|

|

|

|

|

Societe

Generale, Tri-Party Agreement thru BNY, dated 11/29/2024,

due

at maturity date in the amount of $75,029,375, (fully

collateralized

by: Asset-Backed Securities, 4.19%-5.86%, due

7/15/2030-1/25/2037,

Corporate Debt Securities, 2.50%-11.00%,

due

2/26/2025-6/1/2051, Private Label Collateralized Mortgage

Obligations,

7.65%, due 1/18/2039, valued at $78,956,652) |

|

|

|

|

|

Total

Repurchase Agreements

(cost

$1,040,000,000) |

|

|

|

|

|

Total

Investments (cost $2,148,757,921)

|

|

|

|

|

|

Cash

and Receivables (Net) |

|

|

|

|

|

|

|

|

|

|

|

|

SOFR—Secured

Overnight Financing Rate |

|

|

Security

is a discount security. Income is recognized through the accretion of discount. |

|

|

Security

exempt from registration pursuant to Rule 144A under the Securities Act of 1933. These securities may be resold in transactions exempt

from

registration,

normally to qualified institutional buyers. At November 30, 2024, these securities amounted to $225,998,795 or 10.5% of net assets.

|

|

|

Variable

rate security—interest rate resets periodically and rate shown is the interest rate in effect at period end. Date shown represents

the earlier of the next

interest

reset date or ultimate maturity date. Security description also includes the reference rate and spread if published and available.

|

See notes to financial

statements.

STATEMENT

OF ASSETS AND LIABILITIES

November 30, 2024

|

|

|

|

|

|

|

|

Investments

in securities—See Statement of Investments

(including

repurchase agreements of $1,040,000,000)—Note

1(b)

|

|

|

|

|

|

|

|

|

|

|

Receivable

for shares of Common Stock subscribed |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Due

to BNY Mellon Investment Adviser, Inc. and affiliates—Note

2(c)

|

|

|

Payable

for shares of Common Stock redeemed |

|

|

Directors’

fees and expenses payable |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Composition

of Net Assets ($): |

|

|

|

|

|

|

Total

distributable earnings (loss) |

|

|

|

|

|

|

Net

Asset Value Per Share |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net

Asset Value Per Share ($) |

|

|

|

See notes to financial

statements.

Year Ended November

30, 2024

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Administrative

service fees—Note 2(c)

|

|

Shareholder

servicing costs—Note 2(b)

|

|

Directors’

fees and expenses—Note 2(d)

|

|

|

|

|

|

|

|

Prospectus

and shareholders’ reports |

|

|

|

|

Chief

Compliance Officer fees—Note 2(c)

|

|

|

|

|

|

|

|

Less—reduction

in expenses due to undertaking—Note 2(a)

|

|

Less—reduction

in fees due to earnings credits—Note 2(c)

|

|

|

|

|

|

|

|

Net

Realized Gain (Loss) on Investments—Note 1(b) ($) |

|

Net

Increase in Net Assets Resulting from Operations |

|

See notes to financial

statements.

STATEMENT

OF CHANGES IN NET ASSETS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net

realized gain (loss) on investments |

|

|

Net

Increase (Decrease) in Net Assets Resulting from Operations |

|

|

|

|

|

|

Distributions

to shareholders: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Capital

Stock Transactions ($1.00 per share): |

|

|

Net

proceeds from shares sold: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Distributions

reinvested: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Increase

(Decrease) in Net Assets from Capital Stock Transactions |

|

|

Total

Increase (Decrease) in Net Assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

During

the period ended November 30, 2024, 509,590 Wealth shares representing $510,160 were exchanged for 510,160 Premier shares, 5,766 Service

shares

representing

$5,783 were exchanged for 5,783 Wealth shares, and 63,192 Service shares representing $63,393 were exchanged for 63,393 Premier shares.

|

|

|

During

the period ended November 30, 2023, 1,727,250 Wealth shares representing $1,731,910 were exchanged for 1,731,910 Premier shares.

|

See notes to financial

statements.

The

following tables describe the performance for each share class for the fiscal periods indicated. All information reflects financial results

for a single fund share. Net asset

value total return is calculated assuming an initial investment made at the net asset value at the beginning of the period,

reinvestment of all dividends and distributions at net asset value during the period, and redemption at net asset value on the last day

of the period. Net asset value total

return includes adjustments in accordance with accounting principles generally accepted in the United States of

America and as such, the net asset value for financial reporting purposes and the returns based upon those net asset values may differ

from the net asset value and returns for shareholder

transactions.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net

asset value, beginning of period |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dividends

from net investment income |

|

|

|

|

|

Net

asset value, end of period |

|

|

|

|

|

|

|

|

|

|

|

|

Ratios/Supplemental

Data (%): |

|

|

|

|

Ratio

of total expenses to average net assets |

|

|

|

|

|

Ratio

of net expenses to average net assets |

|

|

|

|

|

Ratio

of net investment income to average net assets |

|

|

|

|

|

Net

Assets, end of period ($ x 1,000) |

|

|

|

|

|

|

|

Effective

February 1, 2021, the fund Class A shares were renamed Wealth shares. |

|

|

Amount

represents less than $.001 per share. |

See notes to financial statements.

FINANCIAL

HIGHLIGHTS (continued)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net

asset value, beginning of period |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dividends

from net investment income |

|

|

|

|

|

Net

asset value, end of period |

|

|

|

|

|

|

|

|

|

|

|

|

Ratios/Supplemental

Data (%): |

|

|

|

|

Ratio

of total expenses to average net assets |

|

|

|

|

|

Ratio

of net expenses to average net assets |

|

|

|

|

|

Ratio

of net investment income to average net assets |

|

|

|

|

|

Net

Assets, end of period ($ x 1,000) |

|

|

|

|

|

|

|

Effective

February 1, 2021, the fund Class B shares were renamed Service shares. |

|

|

Amount

represents less than $.001 per share. |

See notes to financial statements.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net

asset value, beginning of period |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dividends

from net investment income |

|

|

|

|

|

Net

asset value, end of period |

|

|

|

|

|

|

|

|

|

|

|

|

Ratios/Supplemental

Data (%): |

|

|

|

|

Ratio

of total expenses to average net assets |

|

|

|

|

|

Ratio

of net expenses to average net assets |

|

|

|

|

|

Ratio

of net investment income to average net assets |

|

|

|

|

|

Net

Assets, end of period ($ x 1,000) |

|

|

|

|

|

|

|

Effective

February 1, 2021, the fund Dreyfus Class shares were renamed Premier shares. |

|

|

Amount

represents less than $.001 per share. |

See notes to financial

statements.

NOTES

TO FINANCIAL STATEMENTS

NOTE

1—

Significant

Accounting Policies:

Dreyfus Money

Market Fund (the “fund”) is the sole series of General Money Market Fund, Inc. (the “Company”), which is registered

under the Investment Company Act

of 1940, as amended (the “Act”), as a diversified open-end management investment company. The fund’s

investment objective is to seek as high a level of current income as is consistent with the preservation of capital. BNY Mellon Investment

Adviser, Inc. (the “Adviser”), a wholly-owned subsidiary of The Bank of New York Mellon Corporation (“BNY”), serves

as the fund’s investment adviser.

Dreyfus, a division of Mellon Investment Corporation (the “Sub-Adviser”),

an indirect wholly-owned subsidiary of BNY and an

affiliate of the Adviser, serves as the fund’s sub-adviser.

BNY Mellon

Securities Corporation (the “Distributor”), a wholly-owned subsidiary of the Adviser, is the distributor of the fund’s

shares, which are sold without a

sales charge. The fund is authorized to issue 42.5 billion shares of $.001 par value Common Stock. The fund currently

has authorized three classes of shares: Wealth shares (7 billion shares authorized), Service shares (28.5 billion shares authorized) and

Premier shares (7 billion shares authorized). Wealth, Service and Premier shares are identical except for the services offered to and

the expenses borne by each class,

the allocation of certain transfer agency costs and certain voting rights. Wealth, Service and Premier shares

are subject to Shareholder Services Plans. Service shares is subject to Administrative Services Plan. Income, expenses (other than expenses

attributable to a specific class), and realized and unrealized gains or losses on investments are allocated to each class of shares based

on its relative net assets.

The fund operates

as a “retail

money market fund” as that term is defined in Rule 2a-7 under the Act (a “Retail Fund”). It is the fund’s policy

to maintain a constant net asset value (“NAV”) per share of $1.00, and the fund has adopted certain investment, portfolio

valuation and dividend and distribution

policies to enable it to do so. There is no assurance, however, that the fund will be able to maintain

a constant NAV per share of $1.00.

The Financial

Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) is the exclusive reference of authoritative

U.S. generally accepted accounting principles (“GAAP”) recognized by the FASB to be applied by nongovernmental entities. Rules

and interpretive releases of the SEC under authority of federal laws are also sources of authoritative GAAP for SEC registrants.

The fund is an investment company

and applies the accounting and reporting guidance of the FASB ASC Topic 946 Financial Services-Investment

Companies. The fund’s financial statements are prepared in accordance with GAAP, which may require the use of management

estimates and assumptions. Actual results could differ from those estimates.

The Company

enters into contracts that contain a variety of indemnifications. The fund’s maximum exposure under these arrangements is

unknown. The fund does not anticipate recognizing any loss related to these arrangements.

(a) Portfolio

valuation: Investments in securities are valued at

amortized cost in accordance with Rule 2a-7 under the Act. If amortized

cost is determined not to approximate fair market value, the fair value of the portfolio securities will be determined by procedures

established by and under the general oversight of the Company’s Board of Directors (the “Board”) pursuant to Rule 2a-5

under the Act.

The fair value

of a financial instrument is the amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction

between market participants at the measurement date (i.e., the exit price). GAAP establishes a fair value hierarchy that prioritizes

the inputs of valuation techniques used to measure fair value. This hierarchy gives the highest priority to unadjusted quoted prices

in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements).

Additionally,

GAAP provides guidance on determining whether the volume and activity in a market has decreased significantly and whether

such a decrease in activity results in transactions that are not orderly. GAAP requires enhanced disclosures around valuation inputs

and techniques used during annual and interim periods.

Various inputs

are used in determining the value of the fund’s investments relating to fair value measurements. These inputs are summarized

in the three broad levels listed below:

Level 1—unadjusted

quoted prices in active markets for identical investments.

Level 2—other

significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit

risk, etc.).

Level 3—significant

unobservable inputs (including the fund’s own assumptions in determining the fair value of investments).

The inputs

or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

For example, money market securities are valued using amortized cost, in accordance with rules under the Act. Generally,

NOTES

TO FINANCIAL STATEMENTS (continued)

amortized

cost approximates the current fair value of a security, but since the value is not obtained from a quoted price in an active market,

such securities are reflected within Level 2 of the fair value hierarchy.

The following is a summary

of the inputs used as of November 30, 2024 in valuing the fund’s investments:

|

|

Level

1 -

Unadjusted

Quoted

Prices |

Level

2- Other

Significant

Observable

Inputs |

Level

3-

Significant

Unobservable

Inputs

|

|

|

|

|

|

|

|

Investments

in Securities:†

|

|

|

|

|

|

|

|

|

|

|

Negotiable

Bank Certificates of Deposit |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See

Statement of Investments for additional detailed categorizations, if any. |

(b) Securities

transactions and investment income: Securities

transactions are recorded on a trade date basis. Interest income, adjusted

for accretion of discount and amortization of premium on investments, is earned from settlement date and is recognized on the accrual

basis. Realized gains and losses from securities transactions are recorded on the identified cost basis.

The fund may

enter into repurchase agreements with financial institutions, deemed to be creditworthy by the Adviser, subject to the seller’s

agreement to repurchase and the fund’s agreement to resell such securities at a mutually agreed upon price. Pursuant to the terms

of the repurchase agreement, such

securities must have an aggregate market value greater than or equal to the terms of the repurchase price

plus accrued interest at all times. If the value of the underlying securities falls below the value of the repurchase price plus accrued

interest, the fund will require

the seller to deposit additional collateral by the next business day. If the request for additional collateral is not

met, or the seller defaults on its repurchase obligation, the fund maintains its right to sell the underlying securities at market value

and may claim any resulting loss

against the seller. The collateral is held on behalf of the fund by the tri-party administrator with respect to

any tri-party agreement. The fund may also jointly enter into one or more repurchase agreements with other funds managed by the Adviser

in accordance with an exemptive order granted by the SEC pursuant to section 17(d) and Rule 17d-1 under the Act. Any joint repurchase

agreements must be collateralized fully by U.S. Government securities.

For financial

reporting purposes, the fund elects not to offset assets and liabilities subject to a Repurchase Agreement, if any, in the Statement

of Assets and Liabilities. Therefore, all qualifying transactions are presented on a gross basis in the Statement of Assets and Liabilities.

As of November 30, 2024, the impact of netting of assets and liabilities and the offsetting of collateral pledged or received, if any,

based on contractual netting/set-off provisions in the Repurchase Agreement are detailed in the following table:

|

|

|

|

Gross

amount of Repurchase

Agreements,

at value, as disclosed in

the

Statement of Assets and Liabilities |

|

|

Collateral

(received)/posted not offset

in

the Statement of Assets and

Liabilities

|

|

|

|

|

|

|

|

|

The

value of the related collateral received by the fund exceeded the value of the repurchase agreement by the fund. See Statement of Investments

for detailed

information

regarding collateral received for open repurchase agreements. |

(c) Market

Risk: The value of the securities in which the fund

invests may be affected by political, regulatory, economic and social developments.

Events such as war, acts of terrorism, the spread of infectious illness or other public health issue, recessions, or other events

could have a significant impact on the fund and its investments. Recent examples include pandemic risks related to COVID-19

and aggressive measures taken world-wide in response by governments, including closing borders, restricting international and domestic

travel, and the imposition of prolonged quarantines of large populations, and by businesses, including changes to operations and

reducing staff.

NOTES

TO FINANCIAL STATEMENTS (continued)

Repurchase

Agreement Counterparty Risk: The fund is subject

to the risk that a counterparty in a repurchase agreement and/or, for a

tri-party repurchase agreement, the third party bank providing payment administration, collateral custody and management services for

the transaction, could fail to honor the terms of the agreement.

(d) Dividends

and distributions to shareholders: It is the policy

of the fund to declare dividends daily from net investment income. Such

dividends are paid monthly. Dividends from net realized capital gains, if any, are normally declared and paid annually, but the fund may

make distributions on a more frequent basis to comply with the distribution requirements of the Internal Revenue Code of 1986, as

amended (the “Code”). To the extent that net realized capital gains can be offset by capital loss carryovers, it is the policy

of the fund not to distribute such gains.

(e) Federal

income taxes: It is the policy of the fund to continue

to qualify as a regulated investment company, if such qualification is in

the best interests of its shareholders, by complying with the applicable provisions of the Code, and to make distributions of taxable

income and net realized capital gain sufficient to

relieve it from substantially all federal income and excise taxes.

As of and

during the period ended November 30, 2024, the fund did not have any liabilities for any uncertain tax positions. The fund recognizes

interest and penalties, if any, related to uncertain tax positions as income tax expense in the Statement of Operations. During the

period ended November 30, 2024, the fund did not incur any interest or penalties.

Each tax year

in the four-year period ended November 30, 2024 remains subject to examination by the Internal Revenue Service and state

taxing authorities.

At November

30, 2024, the components of accumulated earnings on a tax basis were as follows: undistributed ordinary income $162,978

and accumulated capital losses $33,824.

The fund is

permitted to carry forward capital losses for an unlimited period. Furthermore, capital loss carryovers retain their character as

either short-term or long-term capital losses.

The accumulated

capital loss carryover is available for federal income tax purposes to be applied against future net realized capital gains, if

any, realized subsequent to November 30, 2024. The fund has $33,824 of short-term capital losses which can be carried forward for an

unlimited period.

The tax character

of distributions paid to shareholders during the fiscal years ended November 30, 2024 and November 30, 2023 were as

follows: ordinary income $97,564,841 and $102,360,392, respectively.

At November

30, 2024, the cost of investments for federal income tax purposes was substantially the same as the cost for financial reporting

purposes (see the Statement of Investments).

NOTE

2—

Management

Fee, Sub-Advisory Fee

and Other Transactions with Affiliates:

(a) Pursuant

to a management agreement (the “Agreement”) with the Adviser, the management fee is computed at the annual rate of .20%

of the value of the fund’s average daily net assets and is payable monthly. The Agreement provides that if in any fiscal year the

aggregate expenses of the fund (excluding

taxes, brokerage commissions and extraordinary expenses) exceed 1½% of the value of the fund’s

average daily net assets, the fund may deduct from the fees paid to the Adviser, or the Adviser will bear such excess expense. During

the period ended November 30, 2024, there was no reduction in expenses pursuant to the Agreement.

The Adviser

has also contractually agreed, from December 1, 2023 through March 29, 2025, to waive receipt of its fees and/or assume the

direct expenses of the fund’s Service shares so that the direct expenses of the fund’s Service shares (excluding taxes, brokerage

commissions and extraordinary expenses)

do not exceed an annual rate of 1.00% of the value of the average daily net assets of Service shares.

To the extent that it is necessary for the Adviser to waive receipt of its management fee or reimburse the fund’s common expenses,

the amount of the waiver or reimbursement

will be applied equally to each share class of the fund. On or after March 29, 2025, the Adviser

may terminate the expense limitation agreement at any time. The reduction in expenses for Service shares, pursuant to the undertaking,

amounted to $455,486 during the period ended November 30, 2024.

The Adviser

and the Distributor have undertaken, that if, in any fiscal year of the fund, the “total charges against net assets to provide for

sales related expenses and/or service

fees” (calculated as provided for in FINRA Rule 2341 Section (d)) exceed .25% of the value of the Wealth

and Premier shares’ average net assets for such fiscal year, the fund may deduct from the payments to be made to the Distributor,

or the Adviser will bear, such excess

expense. If said rule is amended in any material respect (e.g. to provide for a limit that exceeds .25%),

this undertaking shall terminate automatically. During the period ended November 30, 2024, there was no reduction in expenses

pursuant to the undertaking.

NOTES

TO FINANCIAL STATEMENTS (continued)

Pursuant

to a sub-investment advisory agreement between the Adviser and the Sub-Adviser, the Adviser pays to the Sub-Adviser a monthly

fee of 50% of the monthly management fee the Adviser receives from the fund with respect to the value of the sub-advised net assets

of the fund, net of any fee waivers and/or expense reimbursements made by the Adviser.

(b) Under

the Reimbursement Shareholder Services Plan with respect to Premier shares (the “Reimbursement Shareholder Services Plan”),

Premier shares reimburse the Distributor at an amount not to exceed an annual rate of .25% of the value of the average daily net assets

of its shares for certain allocated expenses of providing certain services to the holders of Premier shares. The services provided may

include personal services relating

to shareholder accounts, such as answering shareholder inquiries regarding the fund, and services related

to the maintenance of shareholder accounts. During the period ended November 30, 2024, Premier shares were charged $93,775

pursuant to the Reimbursement Shareholder Services Plan.

Under the

Compensation Shareholder Services Plan with respect to Wealth and Service shares (the “Compensation Shareholder Services Plan”),

Wealth and Service shares pay the Distributor at an annual rate of .25% of the value of the average daily net assets of its shares for

the provision of certain services.

The services provided may include personal services relating to shareholder accounts, such as answering shareholder

inquiries regarding the fund, and services related to the maintenance of shareholder accounts. The Distributor may make payments

to Service Agents with respect to these services. The Distributor determines the amounts to be paid to Service Agents. During the

period ended November 30, 2024, Wealth and Service shares were charged $1,830,444 and $2,774,335, respectively, pursuant to each

of their respective Compensation Shareholder Services Plan.

(c) Under

the Administrative Services Plan with respect to Service shares, pursuant to which the fund may pay the Distributor for the provision

of certain recordkeeping and other related services (which are not services for which a “service fee” as defined under the

Conduct Rules of FINRA is intended

to compensate). Pursuant to the Administrative Services Plan, the fund will pay the Distributor at

an annual rate of .55% of the value of the fund’s Service shares average daily net assets attributable to the fund’s Service

shares for the provision of

such services, which include, at a minimum: mailing periodic reports, prospectuses and other fund communications to beneficial

owners; client onboarding; anti-money laundering and related regulatory oversight; manual transaction processing; transmitting

wires; withholding on dividends and distributions as may be required by state or Federal authorities from time to time; receiving,

tabulating, and transmitting proxies executed by beneficial owners; fund statistical reporting; technical support; business continuity

support; and blue sky support. During the period ended November 30, 2024, Service shares were charged $6,103,536, pursuant

to the Administrative Services Plan.

The fund has

an arrangement with BNY Mellon Transfer, Inc., (the “Transfer Agent”), a subsidiary of BNY and an affiliate of the Adviser,

whereby the fund may receive earnings credits when positive cash balances are maintained, which are used to offset Transfer Agent

fees. For financial reporting purposes, the fund includes transfer agent net earnings credits, if any, as an expense offset in the Statement

of Operations.

The fund has

an arrangement with The Bank of New York Mellon (the “Custodian”), a subsidiary of BNY and an affiliate of the Adviser, whereby

the fund will receive interest income or be charged overdraft fees when cash balances are maintained. For financial reporting purposes,

the fund includes this interest income and overdraft fees, if any, as interest income in the Statement of Operations.

The fund compensates

the Transfer Agent, under a transfer agency agreement, for providing transfer agency and cash management services

for the fund. The majority of Transfer Agent fees are comprised of amounts paid on a per account basis, while cash management fees

are related to fund subscriptions and redemptions. During the period ended November 30, 2024, the fund was charged $484,384

for transfer agency services. These fees are included in Shareholder servicing costs in the Statement of Operations. These fees were

partially offset by earnings credits of $102,694.

The fund compensates

the Custodian, under a custody agreement, for providing custodial services for the fund. These fees are determined

based on net assets, geographic region and transaction activity. During the period ended November 30, 2024, the fund was charged

$55,288 pursuant to the custody agreement.

The fund compensates

the Custodian, under a shareholder redemption draft processing agreement, for providing certain services related to

the fund’s check writing privilege. During the period ended November 30, 2024, the fund was charged $33,801 pursuant to the agreement,

which is included in Shareholder servicing costs in the Statement of Operations.

During the

period ended November 30, 2024, the fund was charged $19,942 for services performed by the fund’s Chief Compliance Officer

and his staff. These fees are included in Chief Compliance Officer fees in the Statements of Operations.

The components

of “Due to BNY Mellon Investment Adviser, Inc. and affiliates” in the Statement of Assets and Liabilities consist of:

Management fee of $348,837, Administrative Services Plan fees of $518,102, Shareholder Services Plans fees of $387,398, Custo

NOTES

TO FINANCIAL STATEMENTS (continued)

dian

fees of $15,938, Chief Compliance Officer fees of $2,705 and Transfer Agent fees of $122,855, which are offset against an expense reimbursement

currently in effect in the amount of $33,068.

(d) Each

board member of the fund also serves as a board member of other funds in the BNY Mellon Family of Funds complex. Annual retainer

fees and attendance fees are allocated to each fund based on net assets.

REPORT

OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the

Shareholders and the Board of Directors of Dreyfus Money Market Fund

Opinion on the Financial Statements

We have audited

the accompanying statement of assets and liabilities of Dreyfus Money Market Fund (the “Fund”)

(the sole fund constituting General Money

Market Fund, Inc. (the “Company”)),

including the statement of investments, as of November 30, 2024, and the related statement of operations

for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, the financial highlights

for each of the five years in the

period then ended and the related notes (collectively referred to as the “financial

statements”).

In our opinion, the financial statements

present fairly, in all material respects, the financial position of the Fund (the sole fund constituting General Money Market Fund,

Inc.) at November 30, 2024, the results

of its operations for the year then ended, the changes in its net assets for each of the two years in the period then

ended and its financial highlights for each of the five years in the period then ended, in conformity with U.S. generally accepted accounting

principles.

These financial

statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on the Fund’s financial

statements based on our audits. We

are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”)

and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable

rules and regulations of the Securities and Exchange

Commission and the PCAOB.

We conducted

our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable

assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Company is not

required to have, nor were we engaged

to perform, an audit of the Company’s internal control over financial reporting. As part of our audits, we are required

to obtain an understanding of internal control over financial reporting but not for the purposes of expressing an opinion on the effectiveness

of the Company’s internal control over financial

reporting. Accordingly, we express no such opinion.

Our audits

included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud,

and performing procedures that respond

to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures

in the financial statements. Our procedures included confirmation of securities owned as of November 30, 2024, by correspondence with

the custodian, brokers and others;

when replies were not received from brokers and others, we preformed other auditing procedures. Our audits also included

evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation

of the financial statements. We believe that our audits

provide a reasonable basis for our opinion.

We have served

as the auditor of one or more investment companies in the BNY Mellon Family of Funds since at least 1957, but we are unable to determine

the specific year.

New

York, New York

January 23, 2025

IMPORTANT

TAX INFORMATION (Unaudited)

For

federal tax purposes, the fund hereby reports 73.88% of ordinary income dividends paid during the fiscal period ended November

30, 2024 as qualifying interest related dividends.

Item

8. Changes in and Disagreements with Accountants for Open-End Management Investment Companies

(Unaudited)

Item

9. Proxy Disclosures for Open-End Management Investment Companies (Unaudited)

Item

10. Remuneration Paid to Directors, Officers, and Others of Open-End Management Investment Companies

(Unaudited)

Each

board member also serves as a board member of other funds in the BNY Mellon Family of Funds complex. Annual retainer fees and

attendance fees are allocated to each fund based on net assets. Directors fees paid by the fund are within Item 7. Statement of Operations

as Directors’ fees and expenses.

Item

11. Statement Regarding Basis for Approval of Investment Advisory Contracts (Unaudited)

©

2025 BNY Mellon Securities Corporation

Code-0196NCSRAR1124

|

Item 12. |

Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies. |

Not applicable.

|

Item 13. |

Portfolio Managers for Closed-End Management Investment Companies. |

Not applicable.

|

Item 14. |

Purchases of Equity Securities By Closed-End Management Investment Companies and Affiliated Purchasers.

|

Not applicable.

|

Item 15. |

Submission of Matters to a Vote of Security Holders. |

There have been no material changes to the procedures

applicable to Item 15.

|

Item 16. |

Controls and Procedures. |

|

(a) |

The Registrant's principal executive and principal financial officers have concluded, based on their

evaluation of the Registrant's disclosure controls and procedures as of a date within 90 days of the filing date of this report, that

the Registrant's disclosure controls and procedures are reasonably designed to ensure that information required to be disclosed by the

Registrant on Form N-CSR is recorded, processed, summarized and reported within the required time periods and that information required

to be disclosed by the Registrant in the reports that it files or submits on Form N-CSR is accumulated and communicated to the Registrant's

management, including its principal executive and principal financial officers, as appropriate to allow timely decisions regarding required

disclosure. |

|

(b) |

There were no changes to the Registrant's internal control over financial reporting that occurred

during the period covered by this report that have materially affected, or are reasonably likely to materially affect, the Registrant's

internal control over financial reporting. |

|

Item 17. |

Disclosure of Securities Lending Activities for Closed-End Management Investment Companies. |

Not applicable.

|

Item 18. |

Recovery of Erroneously Awarded Compensation. |

Not applicable.

(a)(1) Code of ethics referred to in Item 2.

(a)(3) Not applicable.

SIGNATURES

Pursuant

to

the

requirements

of

the

Securities

Exchange

Act

of

1934

and

the

Investment

Company

Act

of

1940,

the

Registrant

has

duly

caused

this

Report

to

be

signed

on

its

behalf

by

the

undersigned,

thereunto

duly

authorized.

General

Money

Market

Fund,

Inc.

By: /s/

David

J.

DiPetrillo

David

J.

DiPetrillo

President

(Principal

Executive

Officer)

Date: January

23,

2025

Pursuant

to

the

requirements

of

the

Securities

Exchange

Act

of

1934

and

the

Investment

Company

Act

of

1940,

this

Report

has

been

signed

below

by

the

following

persons

on

behalf

of

the

Registrant

and

in

the

capacities

and

on

the

dates

indicated.

By: /s/

David

J.

DiPetrillo

David

J.

DiPetrillo

President

(Principal

Executive

Officer)

Date: January

23,

2025

By: /s/

James

Windels

James

Windels

Treasurer

(Principal

Financial

Officer)

Date: January

23,

2025

EXHIBIT

INDEX

|

(a)(1) |

Code of ethics referred to in Item 2. |

|

(a)(2) |

Certifications of principal executive and principal financial officers as required by Rule 30a-2(a)

under the Investment Company Act of 1940. (EX-99.CERT) |

|

(b) |

Certification of principal executive and principal financial officers as required by Rule 30a-2(b)

under the Investment Company Act of 1940. (EX-99.906CERT) |

THE BNY MELLON FAMILY OF

FUNDS

BNY MELLON FUNDS TRUST

Principal Executive Officer and Senior Financial

Officer

Code of Ethics

I.

Covered Officers/Purpose of the

Code

This code of ethics (the "Code"), adopted by

the funds in the BNY Mellon Family of Funds and BNY Mellon Funds Trust (each, a

"Fund"), applies to each Fund's Principal Executive Officer,

Principal Financial Officer, Principal Accounting Officer or Controller, or

other persons performing similar functions, each of whom is listed on Exhibit A (the "Covered Officers"),

for the purpose of promoting:

·

honest and ethical conduct,

including the ethical handling of actual or apparent conflicts of interest

between personal and professional relationships;

·

full, fair, accurate, timely and

understandable disclosure in reports and documents that the Fund files with, or

submits to, the Securities and Exchange Commission (the "SEC") and in

other public communications made by the Fund;

·

compliance with applicable laws

and governmental rules and regulations;

·

the prompt internal reporting of

violations of the Code to an appropriate person or persons identified in the

Code; and

·

accountability for adherence to

the Code.

Each Covered Officer should adhere to a high standard

of business ethics and should be sensitive to situations that may give rise to

actual as well as apparent conflicts of interest.

II.

Covered Officers Should Handle

Ethically Actual and Apparent Conflicts of Interest

Overview. A

"conflict of interest" occurs when a Covered Officer's private

interest interferes with the interests of, or his service to, the Fund. For

example, a conflict of interest would arise if a Covered Officer, or a member

of his family, receives improper personal benefits as a result of his position

with the Fund.

Certain conflicts of interest arise out of the

relationships between Covered Officers and the Fund and already are subject to

conflict of interest provisions in the Investment Company Act of 1940, as

amended (the "Investment Company Act"), and the Investment Advisers Act

of 1940, as amended (the "Investment Advisers Act"). For example,

Covered Officers may not individually engage in certain transactions (such as

the purchase or sale of securities or other property) with the Fund because of