false false00007887840000081033 0000788784 2023-02-21 2023-02-21 0000788784 pseg:PublicServiceElectricAndGasCompanyMember 2023-02-21 2023-02-21 0000788784 us-gaap:CommonStockMember 2023-02-21 2023-02-21 0000788784 pseg:FirstAndRefundingMortgageBondsEightPercentDueTwoThousandThirtySevenMember 2023-02-21 2023-02-21 0000788784 pseg:FirstAndRefundingMortgageBondsFivePercentDueTwoThousandThirtySevenMember 2023-02-21 2023-02-21

SECURITIES AND EXCHANGE COMMISSION

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) February 21, 2023

Public Service Enterprise Group Incorporated

(Exact name of registrant as specified in its charter)

| |

|

|

|

|

|

|

|

|

|

(State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification Number) |

(Address of principal executive offices) (Zip Code)

(Registrant’s telephone number, including area code)

Public Service Electric and Gas Company

(Exact name of registrant as specified in its charter)

| |

|

|

|

|

|

|

|

|

|

(State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification Number) |

(Address of principal executive offices) (Zip Code)

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form

8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule

14a-12

under the Exchange Act (17 CFR

240.14a-12)

☐ Pre-commencement

communications pursuant to Rule

14d-2(b)

under the Exchange Act (17 CFR

240.14d-2(b))

☐ Pre-commencement

communications pursuant to Rule

13e-4(c)

under the Exchange Act (17 CFR

240.13e-4(c))

| |

|

|

|

|

Securities registered pursuant to Section 12(b) of the Act: |

| |

|

|

|

|

|

|

|

Public Service Enterprise Group Incorporated |

|

|

|

|

| |

|

|

| Common Stock without par value |

|

PEG |

|

New York Stock Exchange |

| |

|

|

Public Service Electric and Gas Company |

|

|

|

|

| 8.00% First and Refunding Mortgage Bonds, due 2037 |

|

PEG37D |

|

New York Stock Exchange |

| 5.00% First and Refunding Mortgage Bonds, due 2037 |

|

PEG37J |

|

New York Stock Exchange |

Indicate by check mark whether any of the registrants is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule

12b-2

of the Securities Exchange Act of 1934

(§240.12b-2

of this chapter).

| |

|

|

| Emerging growth company ☐ |

| |

| If an emerging growth company, indicate by check mark if such registrant has elected not to use the extended transition period for complying with any |

| new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. |

|

☐ |

The information contained in Item 2.02. Results of Operations and Financial Condition in this Form

8-K

is furnished solely for Public Service Enterprise Group Incorporated (PSEG). The information contained in Item 7.01 Regulation FD Disclosure in this combined Form

8-K

is separately furnished, as noted, by PSEG and Public Service Electric and Gas Company (PSE&G). Information contained herein relating to any individual company is provided by such company on its own behalf and in connection with its respective Form

8-K.

PSE&G makes representations only as to itself and makes no other representations whatsoever as to any other company. The materials furnished as Exhibits 99 and 99.1 are available on the corporate.pseg.com website under the investor tab, or at http://investor.pseg.com.

Item 2.02 Results of Operations and Financial Condition

On February 21, 2023, PSEG announced financial results for the three and twelve months ended December 31, 2022. A copy of the earnings release dated February 21, 2023 is furnished as Exhibit 99 to this Form

8-K.

Item 7.01 Regulation FD Disclosure

On February 21, 2023, PSEG conducted an earnings call regarding its results for the three and twelve months ended December 31, 2022. A copy of the slideshow presentation used during the earnings call is furnished as Exhibit 99.1 to this Form

8-K.

Item 9.01 Financial Statements and Exhibits

Exhibit 104 Cover Page Interactive Data File (embedded within the Inline XBRL document).

2

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized. The signature of the undersigned company shall be deemed to relate only to matters having reference to such company and any subsidiaries thereof.

|

|

|

PUBLIC SERVICE ENTERPRISE GROUP INCORPORATED |

| (Registrant) |

|

|

| By: |

|

/s/ Rose M. Chernick |

|

|

ROSE M. CHERNICK |

|

|

Vice President and Controller |

|

|

(Principal Accounting Officer) |

Date: February 21, 2023

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized. The signature of the undersigned company shall be deemed to relate only to matters having reference to such company and any subsidiaries thereof.

|

|

|

PUBLIC SERVICE ELECTRIC AND GAS COMPANY |

| (Registrant) |

|

|

| By: |

|

/s/ Rose M. Chernick |

|

|

ROSE M. CHERNICK |

|

|

Vice President and Controller |

|

|

(Principal Accounting Officer) |

Date: February 21, 2023

3

EXHIBIT 99

|

|

|

|

|

| Investor Relations |

|

Public Service Enterprise Group

80 Park Plaza, T4 Newark, NJ

07102 |

|

|

CONTACT:

|

|

|

|

|

| Media Relations |

|

|

|

Investor Relations |

| Marijke.Shugrue@pseg.com |

|

|

|

Carlotta.Chan@pseg.com |

| 908-531-4253 |

|

|

|

973-430-6565 |

PSEG ANNOUNCES 2022 RESULTS

$2.06 PER SHARE NET INCOME

$3.47 PER SHARE

NON-GAAP OPERATING EARNINGS

Narrows Full-Year 2023 non-GAAP

Operating Earnings Guidance Range to $3.40 - $3.50 Per Share

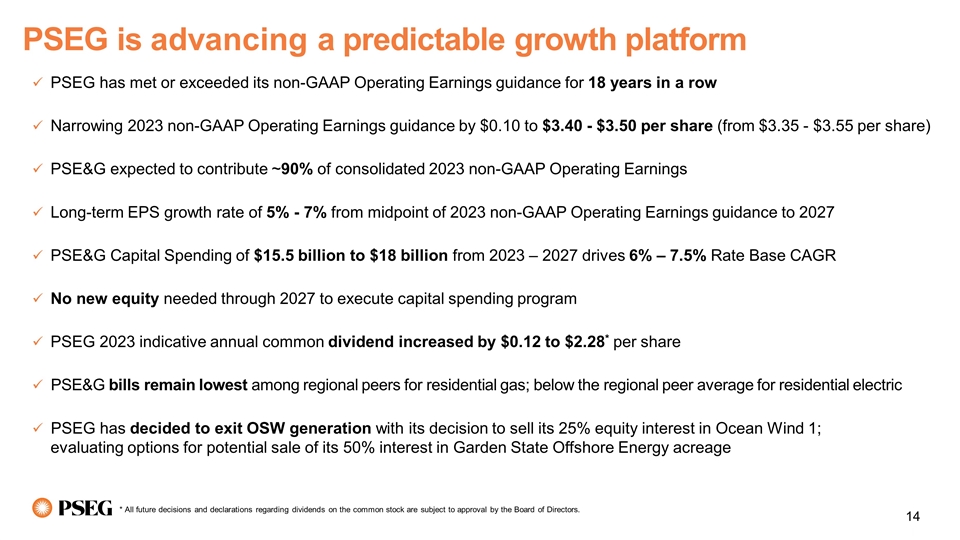

Affirms outlook for 5%-7% long-term

earnings growth through 2027

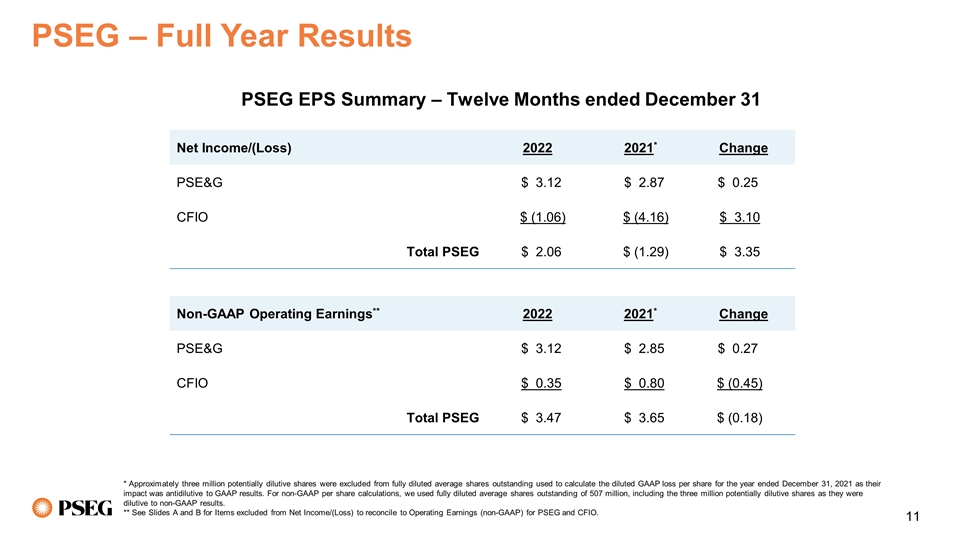

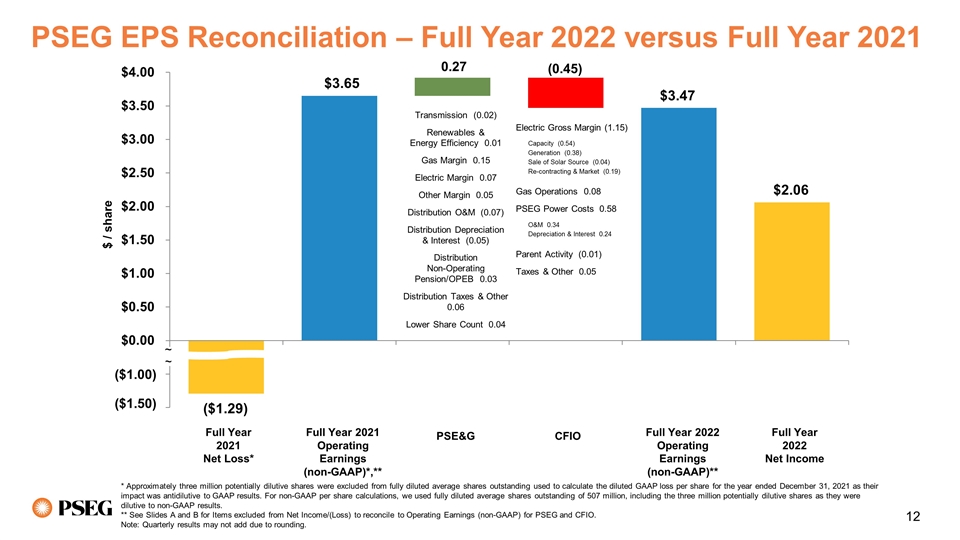

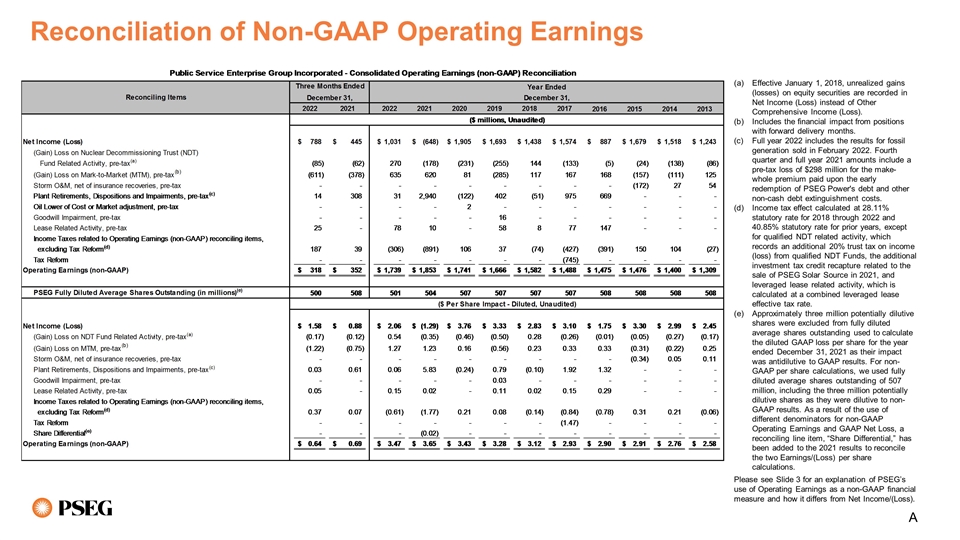

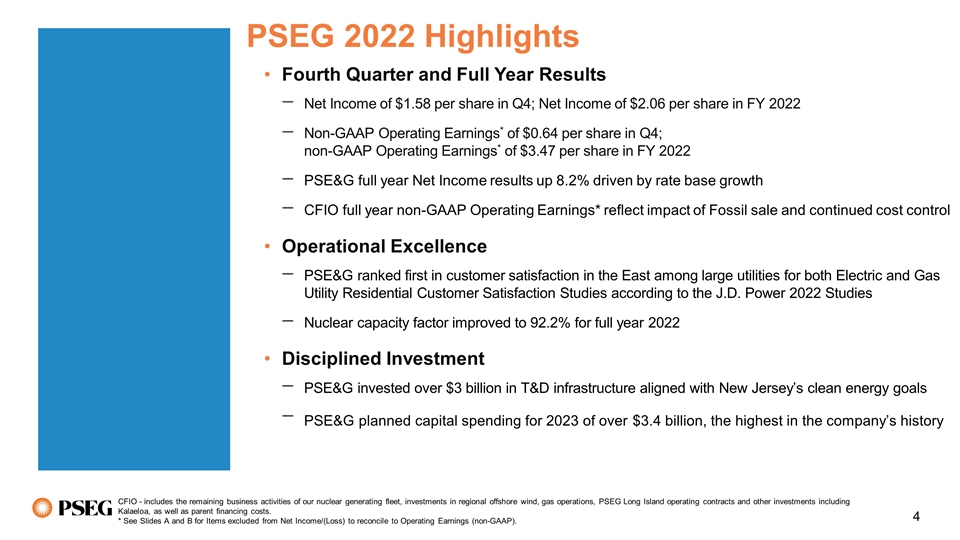

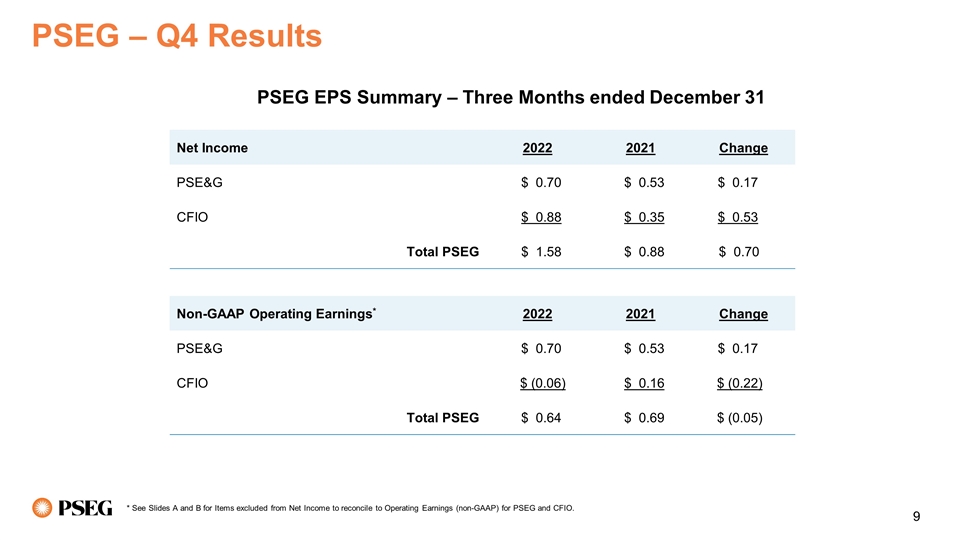

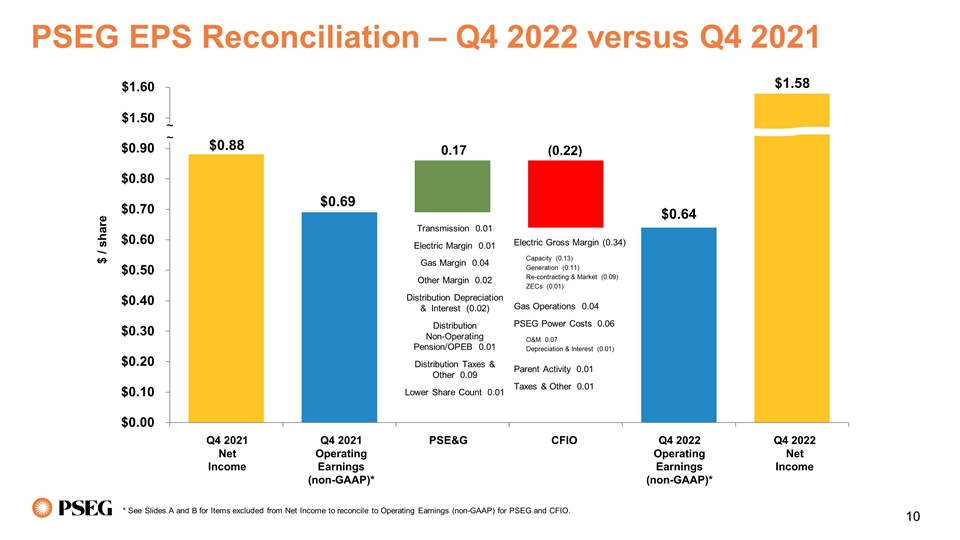

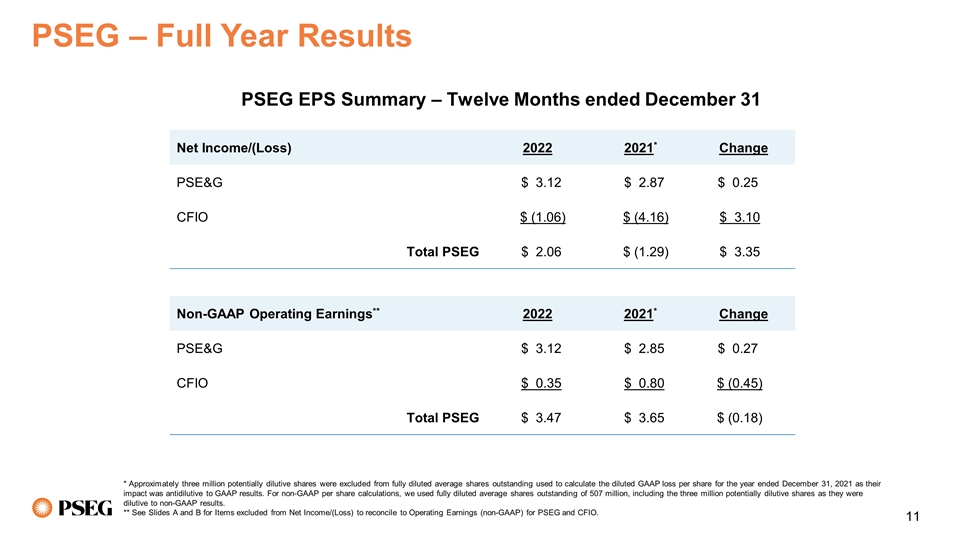

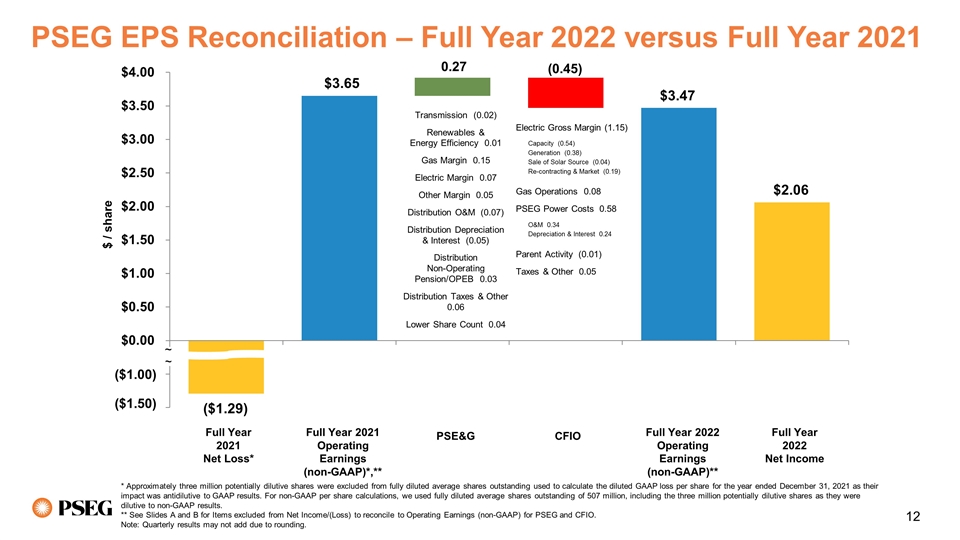

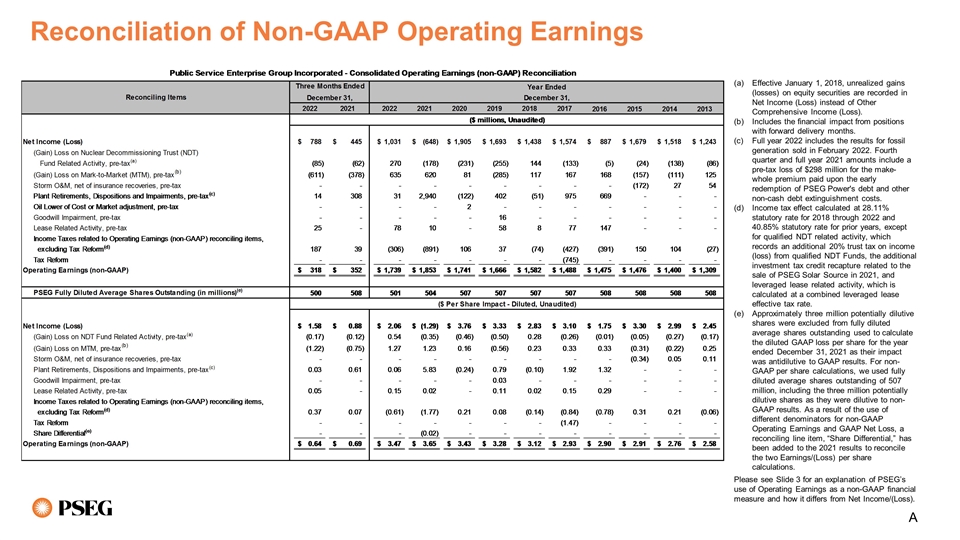

(February 21, 2023 – Newark, NJ) Public Service Enterprise Group (PSEG) reported full-year 2022 Net Income of

$1,031 million, or $2.06 per share, compared to a Net Loss of $648 million, or $1.29 per share for full-year 2021. Non-GAAP Operating Earnings for 2022 were $1,739 million, or $3.47 per share,

compared to $1,853 million, or $3.65 per share for 2021.

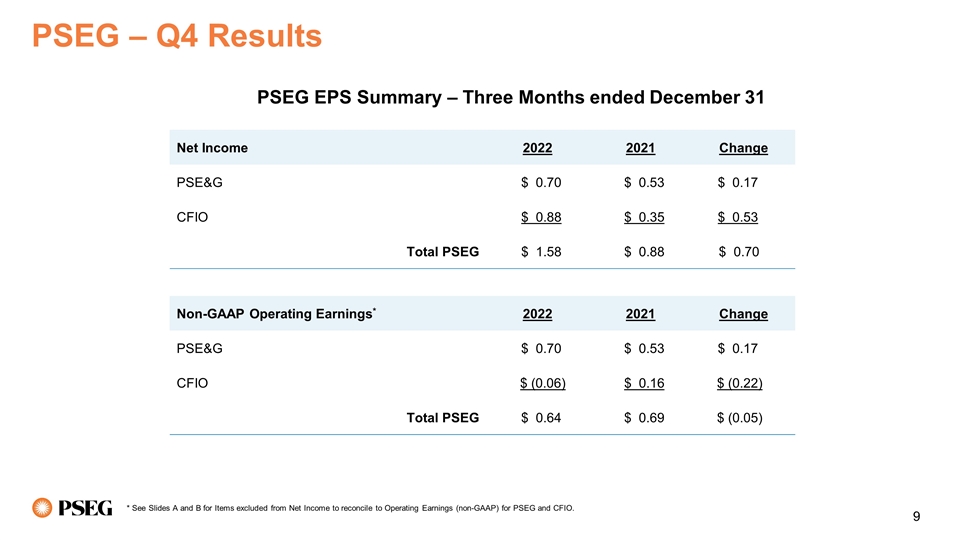

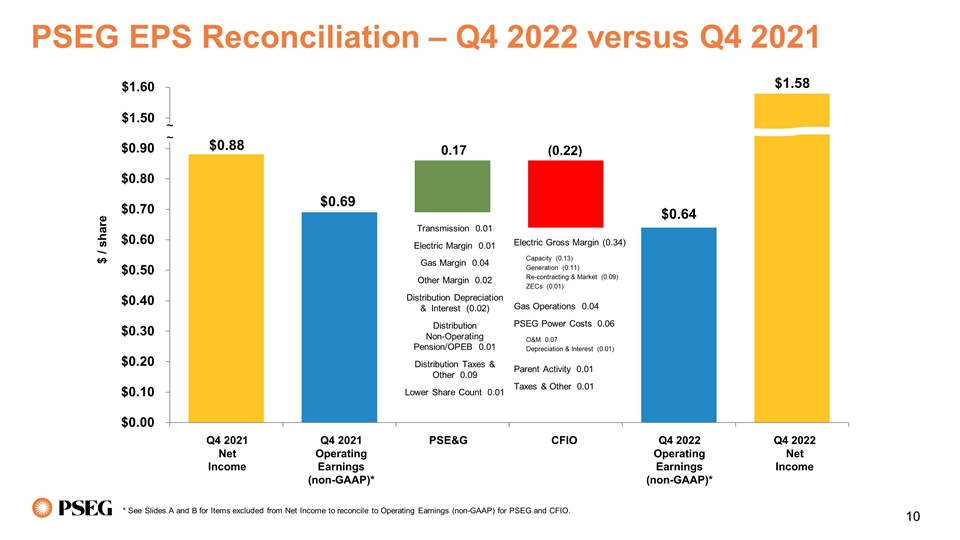

PSEG also reported Net Income for the fourth quarter of 2022 of $788 million, or

$1.58 per share. This compares to Net Income of $445 million, or $0.88 per share in 2021’s fourth quarter. Non-GAAP Operating Earnings for the fourth quarter of 2022 were $318 million, or $0.64

per share, compared to fourth quarter 2021 non-GAAP Operating Earnings of $352 million, or $0.69 per share. Non-GAAP results for the fourth quarter and full year of

2022 and 2021, respectively, exclude items shown in Attachments 8 and 9.

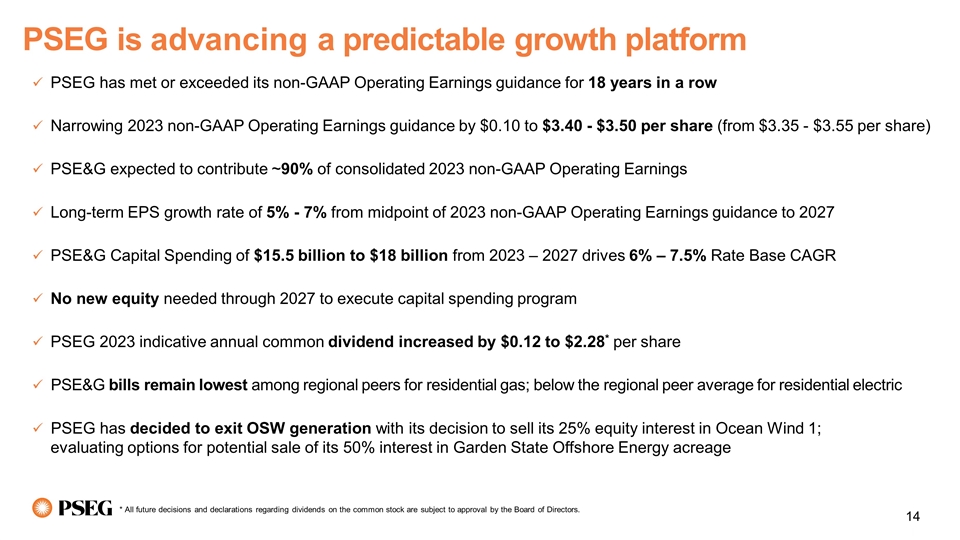

“We are pleased to report strong operating and financial results for

2022, marking the 18th year in a row that PSEG has delivered results within management’s non-GAAP Operating Earnings guidance. The main contributor to

our results, PSE&G, posted an 8.2% annual increase in Net Income, representing approximately 90% of PSEG’s consolidated non-GAAP Operating Earnings,” said Ralph LaRossa – chair, president

and chief executive officer of PSEG.

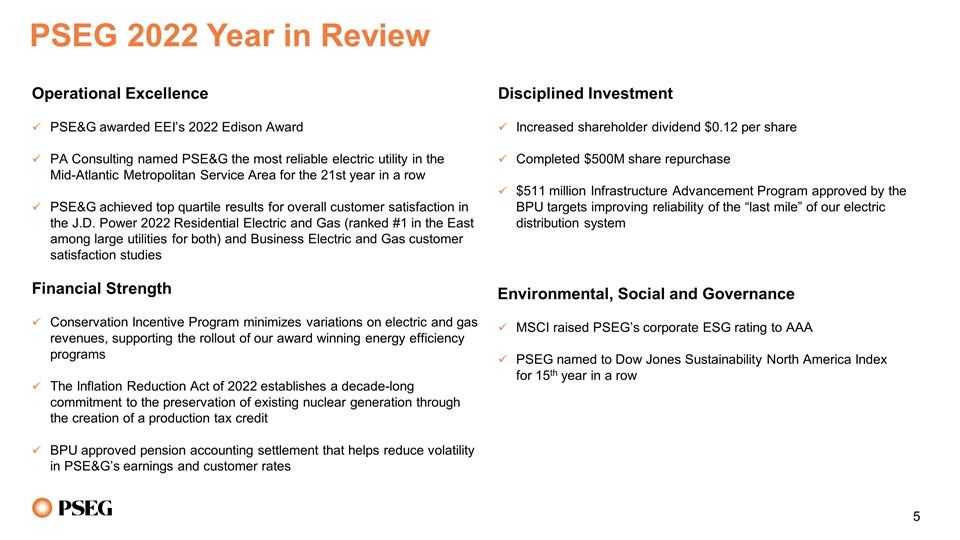

“PSEG successfully navigated last year’s challenges including inflation, supply chain disruptions,

energy price spikes, and the steep rise in interest rates to deliver financial results above the midpoint of our 2022 non-GAAP Operating Earnings guidance. The Edison Electric Institute recognized PSE&G

with its 2022 Edison Award, the electric power industry’s highest honor for leadership and innovation. We completed the sale of our fossil generating plants in February 2022, which simplified our business mix to approximately 90% regulated, and

completed a $500 million share repurchase in May 2022. The passage of the Inflation Reduction Act last August will help to preserve the financial viability of our carbon-free nuclear fleet into the next decade, and creates valuable incentives

in the near-term for our customers to transition to electric vehicles and advance New Jersey’s decarbonization goals.”

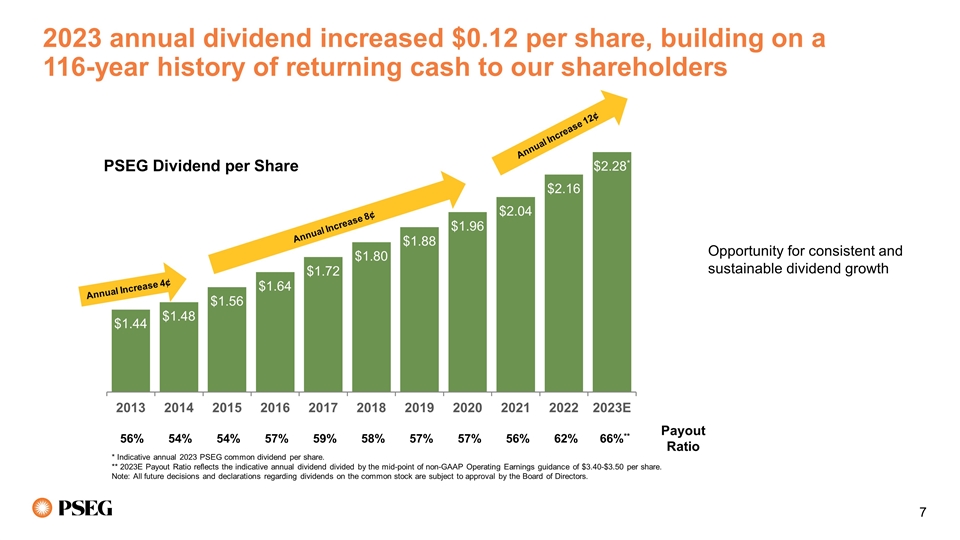

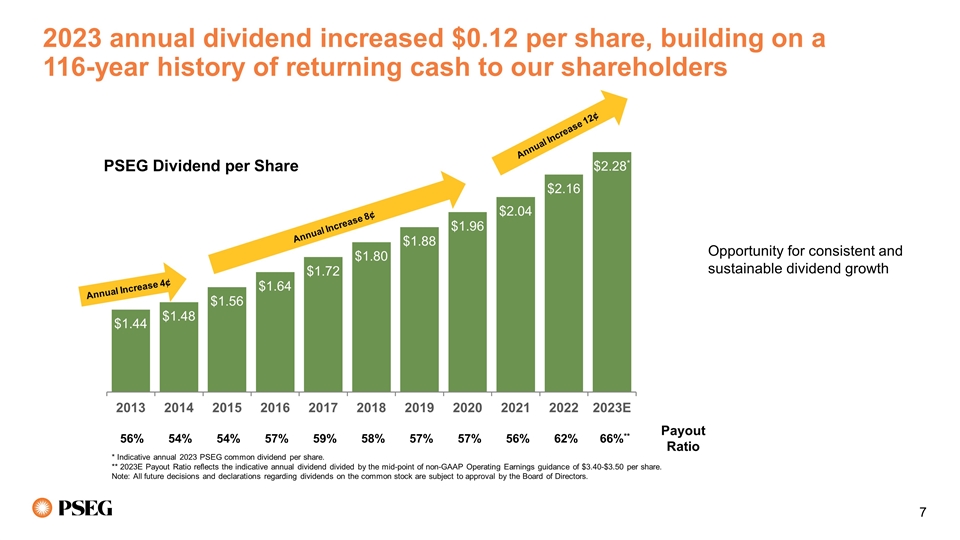

“The

simplified business platform created by the strategic actions PSEG has taken over the past two years now drives our long-term, compound annual earnings growth rate of 5% to 7% through 2027. Moving into

1

this year, we extended our 2022 dividend increase of $0.12 per share to set the 2023 indicative rate at $2.28 per share – a testament to the financial discipline that has enabled us to pay a

common dividend to our shareholders for 116 years.”

“Recognizing the critical importance shareholders place on the predictability and

visibility of our financial results and goals, I have made increasing both factors a key focus of PSEG’s strategic plan. We intend to share the details of this plan at our upcoming investor conference on March 10. I am honored to lead this

company and its 12,500 dedicated employees. Together, we will be guided by PSEG’s longstanding commitment to operational excellence, disciplined investment and financial strength as we continue building a practical path towards decarbonizing

the New Jersey economy,” said LaRossa.

The following tables provide a reconciliation of PSEG’s Net Income/(Loss) to non-GAAP Operating Earnings for the full year and the fourth quarter. See Attachments 8 and 9 for a complete list of items excluded from Net Income/(Loss) in the determination of

non-GAAP Operating Earnings.

PSEG CONSOLIDATED (unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

Full-Year

Comparative Results |

|

Income ($ millions) |

|

|

Diluted Earnings

(Per Share) |

|

| |

|

|

|

|

| |

|

|

2022 |

|

|

|

2021 |

|

|

|

2022 |

|

|

|

2021 |

|

| |

|

|

|

|

|

Net Income/(Loss) |

|

|

$1,031 |

|

|

|

$(648) |

|

|

|

$2.06 |

|

|

|

$(1.29) |

|

| |

|

|

|

|

|

Reconciling Items |

|

|

708 |

|

|

|

2,501 |

|

|

|

1.41 |

|

|

|

4.96 |

|

| |

|

|

|

|

|

Share Differential* |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(0.02) |

|

| |

|

|

|

|

|

Non-GAAP Operating Earnings |

|

|

$1,739 |

|

|

|

$1,853 |

|

|

|

$3.47 |

|

|

|

$3.65 |

|

| |

|

|

|

|

|

Average Shares |

|

|

|

|

|

|

|

|

|

|

501 |

|

|

|

504 |

|

|

| * Approximately three million

potentially dilutive shares were excluded from fully diluted average shares outstanding used to calculate the diluted GAAP loss per share for year ended December 31, 2021 as their impact was antidilutive to GAAP results. For non-GAAP per share calculations, we used fully diluted average shares outstanding of 507 million, including the three million potentially dilutive shares, as they were dilutive to

non-GAAP results. |

|

PSEG CONSOLIDATED (unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

Fourth Quarter

Comparative Results |

|

Income ($ millions) |

|

|

Diluted Earnings

(Per Share) |

|

| |

|

|

|

|

| |

|

|

2022 |

|

|

|

2021 |

|

|

|

2022 |

|

|

|

2021 |

|

| |

|

|

|

|

|

Net Income |

|

|

$788 |

|

|

|

$445 |

|

|

|

$1.58 |

|

|

|

$0.88 |

|

| |

|

|

|

|

|

Reconciling Items |

|

|

(470) |

|

|

|

(93) |

|

|

|

(0.94) |

|

|

|

(0.19) |

|

| |

|

|

|

|

|

Non-GAAP Operating Earnings |

|

|

$318 |

|

|

|

$352 |

|

|

|

$0.64 |

|

|

|

$0.69 |

|

| |

|

|

|

|

|

Average Shares |

|

|

|

|

|

|

|

|

|

|

500 |

|

|

|

508 |

|

During 2022, PSE&G invested over $3 billion upgrading its transmission and distribution infrastructure and in

clean energy future programs, and plans to invest over $3.4 billion in these capital programs in 2023. The utility’s 2023-2027 planned capital investment program is $15.5 billion to $18 billion, which is expected to produce 6% to

7.5% compound annual growth in PSE&G’s rate base over the five-year period. We also expect that PSEG’s strong cash flow and solid investment grade ratings will enable us to fund this five-year capital plan through 2027 without the need

to issue new equity.

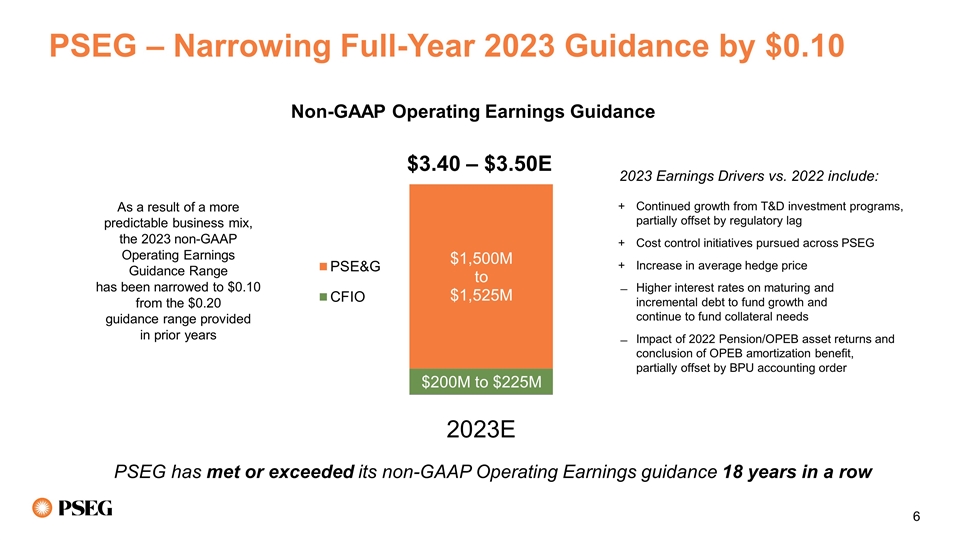

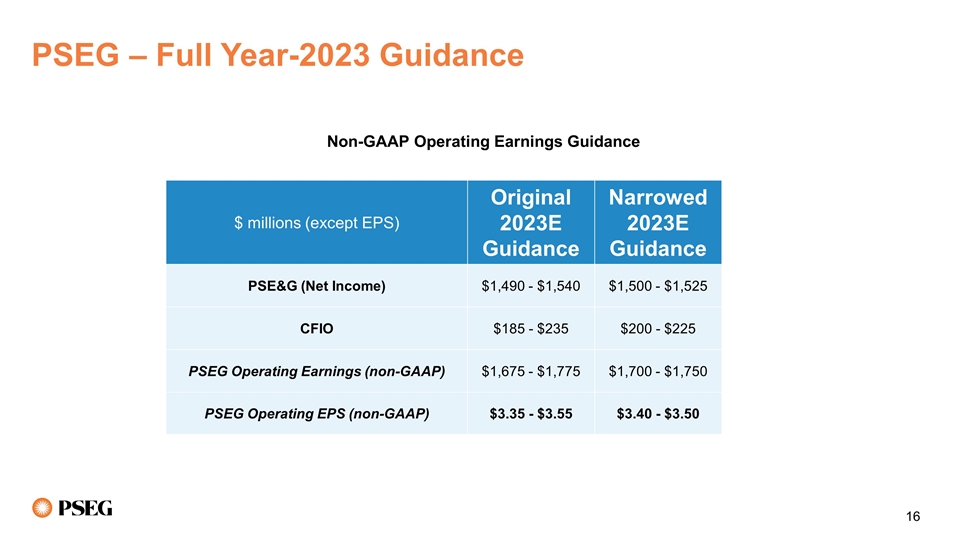

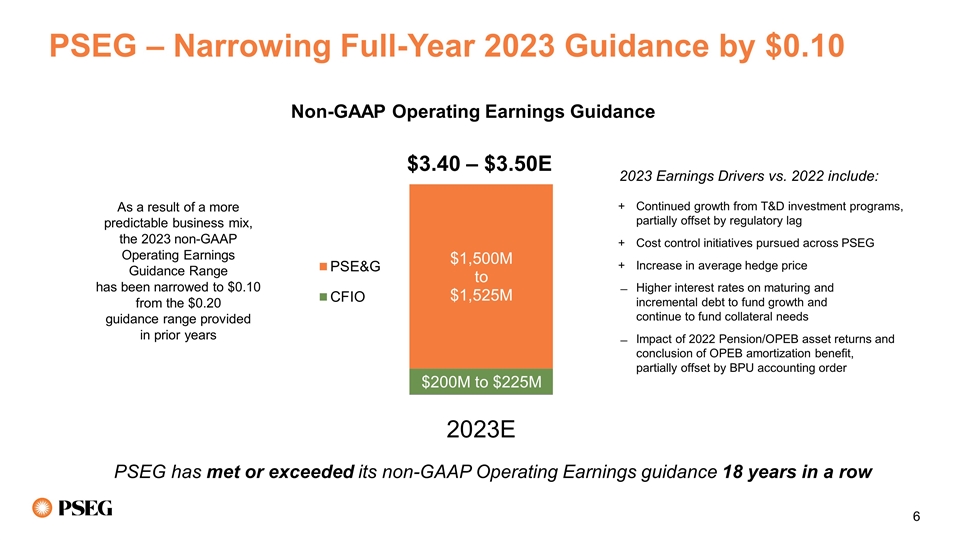

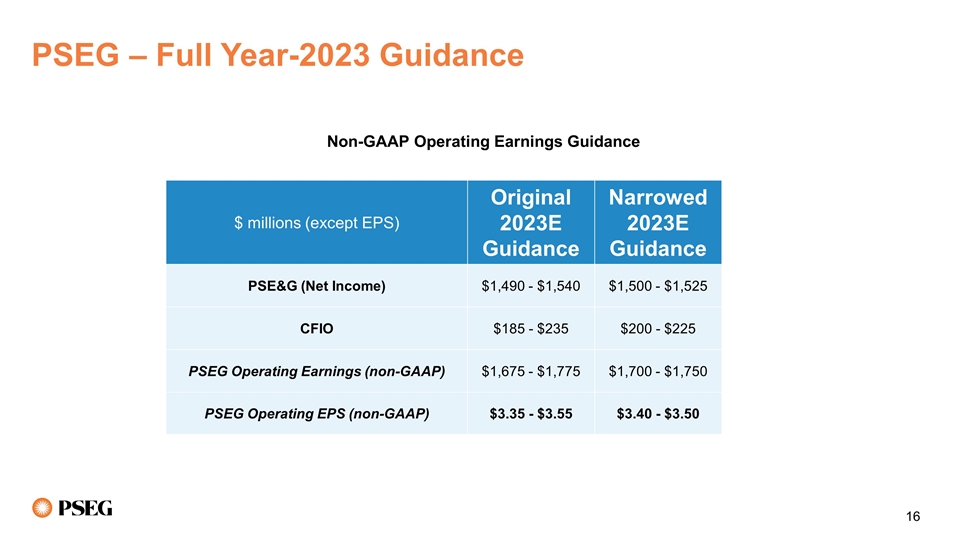

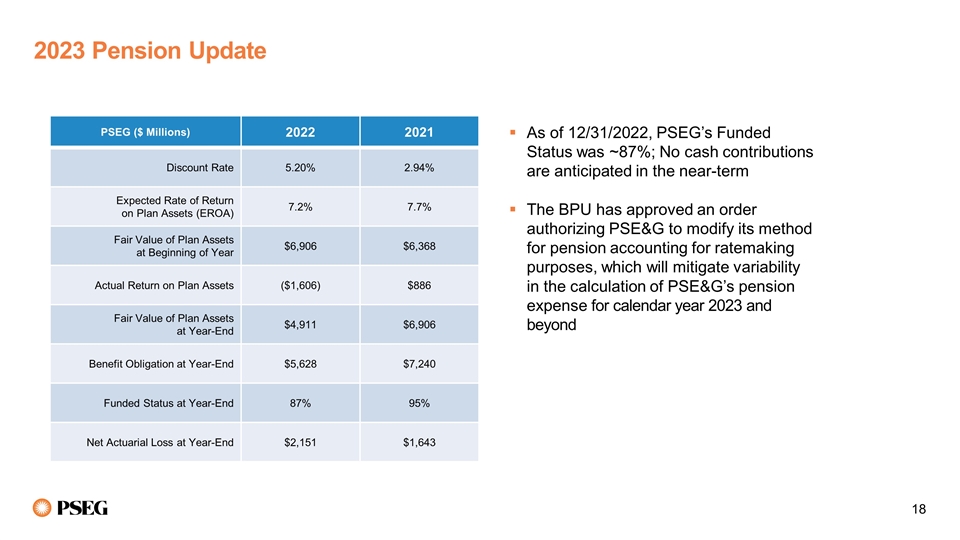

The following table outlines PSEG’s full-year 2023 non-GAAP Operating Earnings

expectations at the narrowed range of $3.40 to $3.50 per share, from the original range of $3.35 to $3.55 per share initiated in November 2022. The subsidiary ranges for 2023 reflect the impact of actual 2022 investment returns on 2023 pension

calculations and higher expected interest expense, partly offset by operation and maintenance

2

(O&M) expense savings and the recent Board of Public Utilities (BPU) approval of an accounting order that defers PSE&G’s recognition of gains and losses on the pension trust

assets.

PSEG 2023

Non-GAAP Operating Earnings Guidance

and 2022 Non-GAAP

Operating Earnings Results

|

|

|

|

|

|

|

| |

|

|

|

| ($ millions, except EPS) |

|

2023E Narrowed |

|

2023E Original |

|

2022A |

| |

|

|

|

|

PSE&G |

|

$1,500 - $1,525 |

|

$1,490 - $1,540 |

|

$1,565 |

| |

|

|

|

|

Carbon-Free, Infrastructure & Other |

|

200 - 225 |

|

185 - 235 |

|

174 |

| |

|

|

|

|

PSEG non-GAAP Operating Earnings |

|

$1,700 - $1,750 |

|

$1,675 - $1,775 |

|

$1,739 |

| |

|

|

|

|

PSEG Non-GAAP Operating EPS |

|

$3.40 - $3.50 |

|

$3.35 - $3.55 |

|

$3.47 |

Results and Outlook by Operating Subsidiary

PSE&G

Public Service Electric and Gas

Fourth Quarter & Full Year Comparative Results

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

($ millions, except per share amounts) |

|

|

4Q 2022 |

|

|

|

4Q 2021 |

|

|

|

FY 2022 |

|

|

|

FY 2021 |

|

| |

|

|

|

|

|

Net Income |

|

|

$352 |

|

|

|

$271 |

|

|

|

$1,565 |

|

|

|

$1,446 |

|

| |

|

|

|

|

|

Earnings Per Share |

|

|

$0.70 |

|

|

|

$0.53 |

|

|

|

$3.12 |

|

|

|

$2.87 |

|

| |

|

|

|

|

|

Share Differential* |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(0.02) |

|

| |

|

|

|

|

|

Non-GAAP Operating EPS |

|

|

$0.70 |

|

|

|

$0.53 |

|

|

|

$3.12 |

|

|

|

$2.85 |

|

|

| *Approximately three million

potentially dilutive shares were excluded from fully diluted average shares outstanding used to calculate PSEG’s diluted GAAP loss per share for year ended December 31, 2021, as their impact was antidilutive to PSEG’s consolidated

GAAP results. For non-GAAP per share calculations, we used fully diluted average shares outstanding of 507 million, including the three million potentially dilutive shares, as they were dilutive to non-GAAP results. |

|

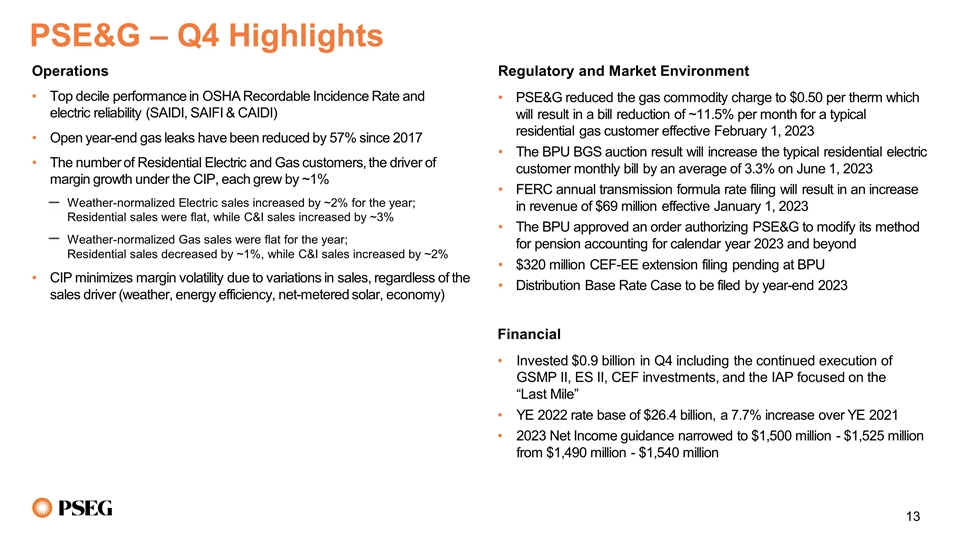

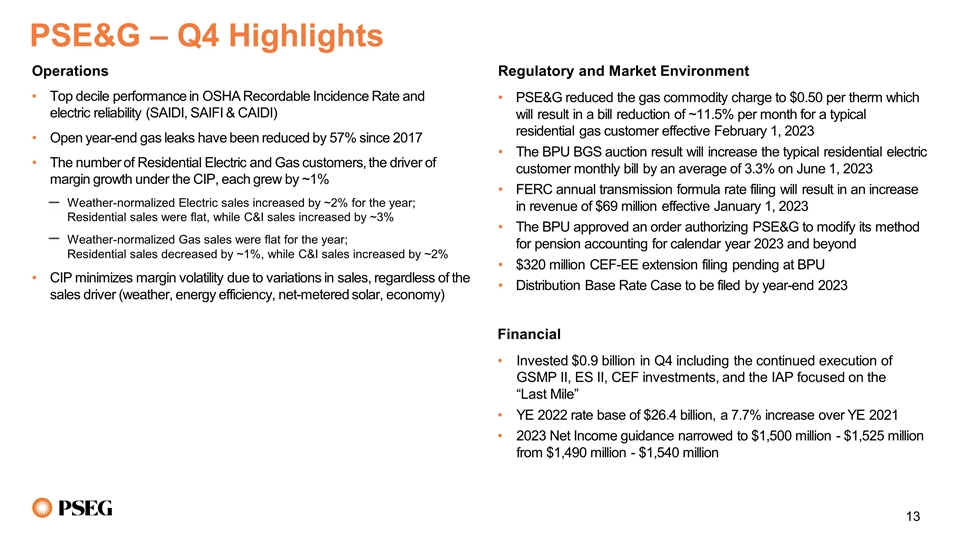

For the full-year of 2022, PSE&G Net Income rose by $119 million, over 8% compared with 2021 results.

For the fourth quarter of 2022, net Transmission margin added $0.01 per share compared with the year-earlier quarter, reflecting growth in rate base

partly offset by the timing of O&M recovery. Gas, electric and other margin combined to add $0.07 per share compared with last year’s fourth quarter, reflecting Gas System Modernization Program (GSMP) II

roll-ins, the Conservation Incentive Program (CIP) decoupling for both electric and gas, appliance service and other margin. O&M was flat versus the prior-year quarter. Higher distribution depreciation and

interest expense each reduced results by $0.01 per share, reflecting higher plant in service and investment. Lower pension expense added $0.01 per share versus the year-ago quarter. Flow through taxes, the

impact of lower shares, and other items added $0.10 per share compared to the fourth quarter of 2021, with $0.07 of that amount reversing the timing impact of taxes from prior quarters in 2022.

During 2022, the BPU authorized our $511 million Infrastructure Advancement Program (IAP) to improve the reliability of the “last mile”

of our electric distribution system and address aging substations and gas metering and regulation stations. PSE&G invested over $3 billion in planned capital spending to upgrade transmission and distribution facilities, enhance reliability

and increase resiliency, implement clean energy future programs, and launch the IAP. At year-end 2022, PSE&G’s rate base was approximately $26.4 billion, a 7.7% increase over year-end 2021.

3

The number of Electric and Gas customers, the driver of margin growth under the CIP, rose by

approximately 1% each in 2022. Weather-normalized Electric sales increased by ~2% for the year; with Residential sales flat, while C&I sales increased by ~3%. Weather-normalized Gas sales were flat for the year, with Residential sales down by

~1%, while C&I sales increased by ~2%.

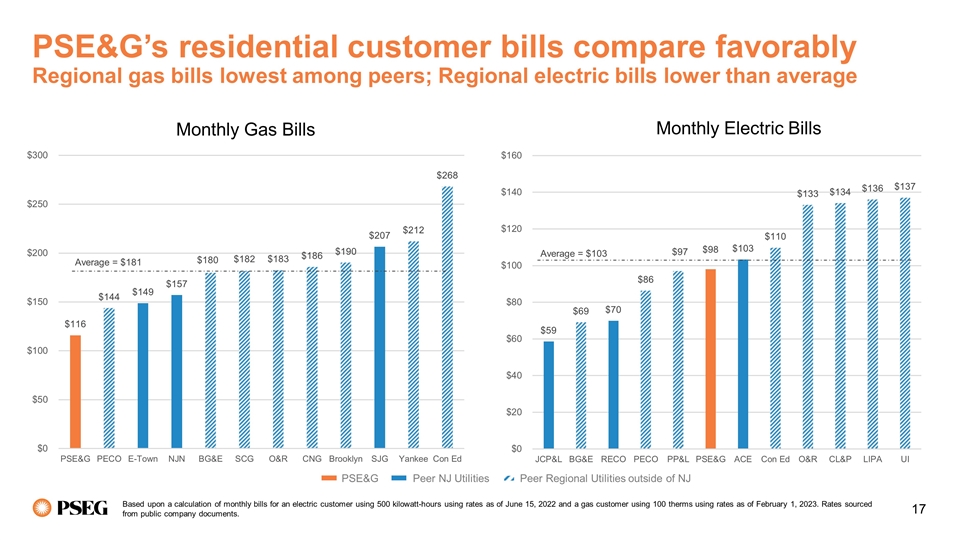

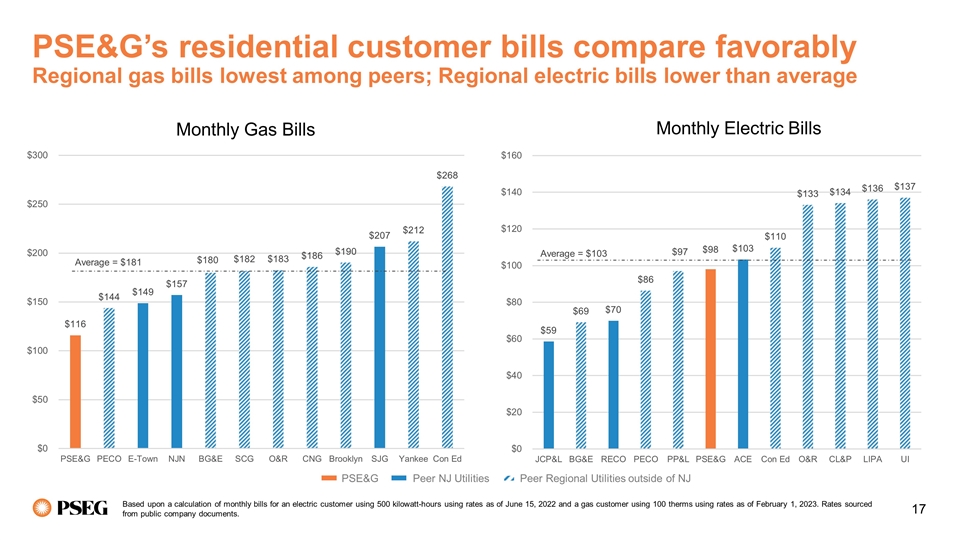

Earlier in February 2023, PSE&G reduced its Basic Gas Supply Service residential rate by $0.15 to

$0.50 cents per therm for the balance of the winter 2022/2023 heating season. This decrease in the pass-through commodity charge will reduce the typical residential winter gas bill by $13 per month, or 11.5%. On the electric side, the BPU recently

completed its annual Basic Generation Service auction for default electric supply rates beginning June 1, 2023. A typical PSE&G residential customer will see this latest BGS auction reflected in an average estimated monthly bill increase of

3.3%.

During 2022, PSE&G was named the most reliable electric utility in the Mid-Atlantic region for

the 21st year in a row by PA Consulting. In addition, PSE&G ranked first in Residential customer satisfaction in the East among large utilities in both the Electric and Gas J.D. Power 2022

Studies.

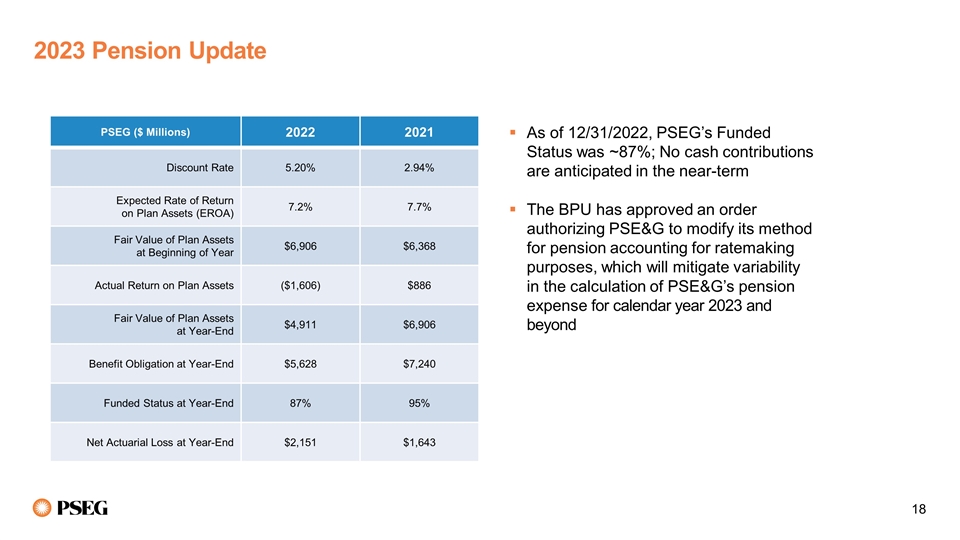

We have narrowed PSE&G’s forecast of Net Income for 2023 to $1,500 million - $1,525 million, which reflects lower pension

and OPEB income compared to 2022, offset by the benefit of near contemporaneously recovered investments, the predictability of utility margin from the Conservation Incentive Program, as well as the implementation of the pension accounting filing

effective January 1, 2023.

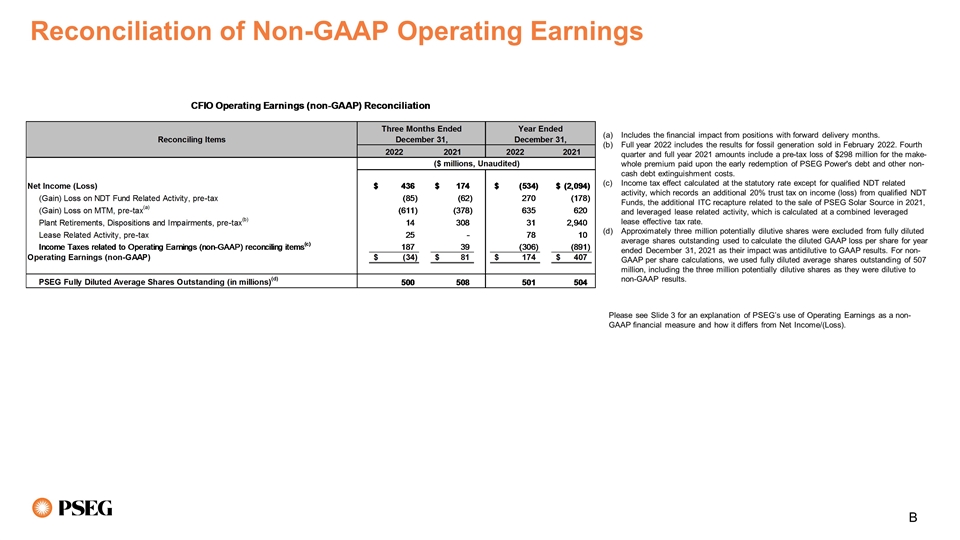

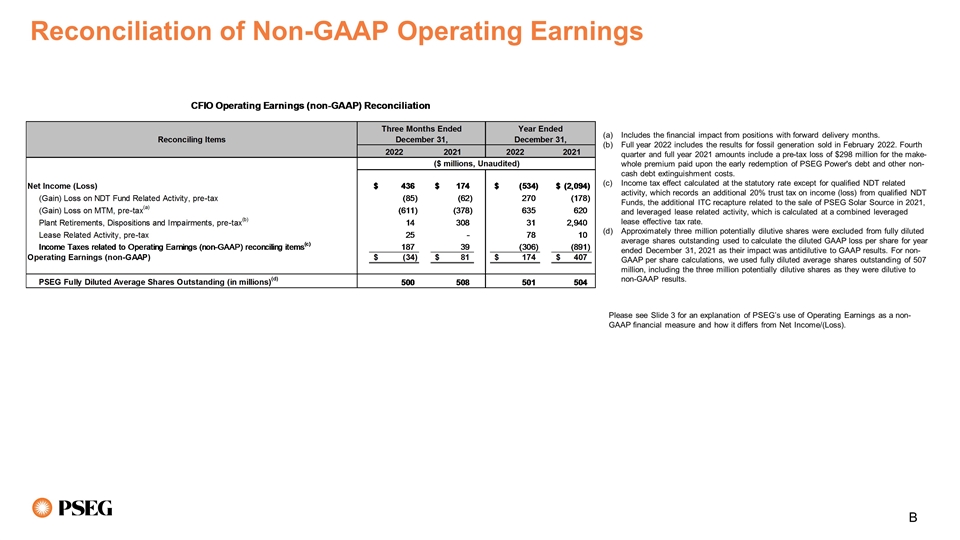

PSEG Carbon-Free, Infrastructure & Other (CFIO)

Carbon-Free, Infrastructure & Other

Fourth Quarter & Full Year Comparative Results

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

($ millions, except per share amounts) |

|

|

4Q 2022 |

|

|

|

4Q 2021 |

|

|

|

FY 2022 |

|

|

|

FY 2021 |

|

| |

|

|

|

|

|

Net Income/(Loss) |

|

|

$436 |

|

|

|

$174 |

|

|

|

$(534) |

|

|

|

$(2,094) |

|

| |

|

|

|

|

|

Earnings/(Loss) Per Share (EPS) |

|

|

$0.88 |

|

|

|

$0.35 |

|

|

|

$(1.06) |

|

|

|

$(4.16) |

|

| |

|

|

|

|

|

Non-GAAP Operating Earnings |

|

|

$(34) |

|

|

|

$81 |

|

|

|

$174 |

|

|

|

$407 |

|

| |

|

|

|

|

|

Non-GAAP EPS (Loss) |

|

|

$(0.06) |

|

|

|

$0.16 |

|

|

|

$0.35 |

|

|

|

$0.80 |

|

For full-year 2022, CFIO’s Net Loss of $534 million reflected higher losses on both mark-to-market transactions and nuclear decommissioning trust (NDT) fund related activity. The Net Loss for full-year 2021 included impairments and debt extinguishment costs

related to the Fossil sale. Non-GAAP Operating Earnings declined to $174 million from $407 million for the full-year 2021, reflecting the absence of Fossil.

For the fourth quarter of 2022, CFIO’s Net Income improved to $436 million, from $174 million in the prior year period, reflecting higher

gains on mark-to market transactions and NDT fund related activity. Net Income for the fourth quarter of 2021 included debt extinguishment costs and other charges related to the Fossil sale. The non-GAAP Operating Earnings of ($34) million compares to non-GAAP Operating Earnings of $81 million for the fourth quarter of 2021, which included the cessation of

depreciation and lower interest costs related to the Fossil sale.

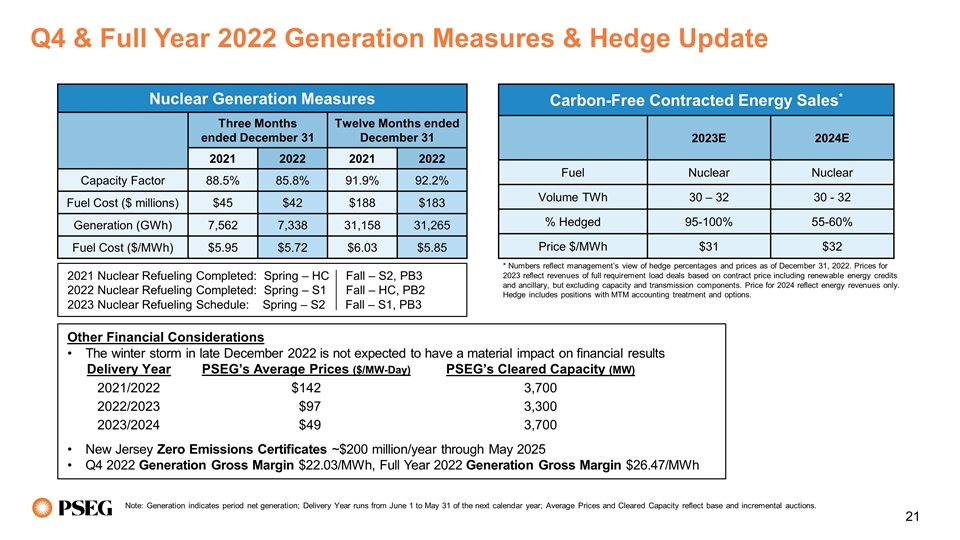

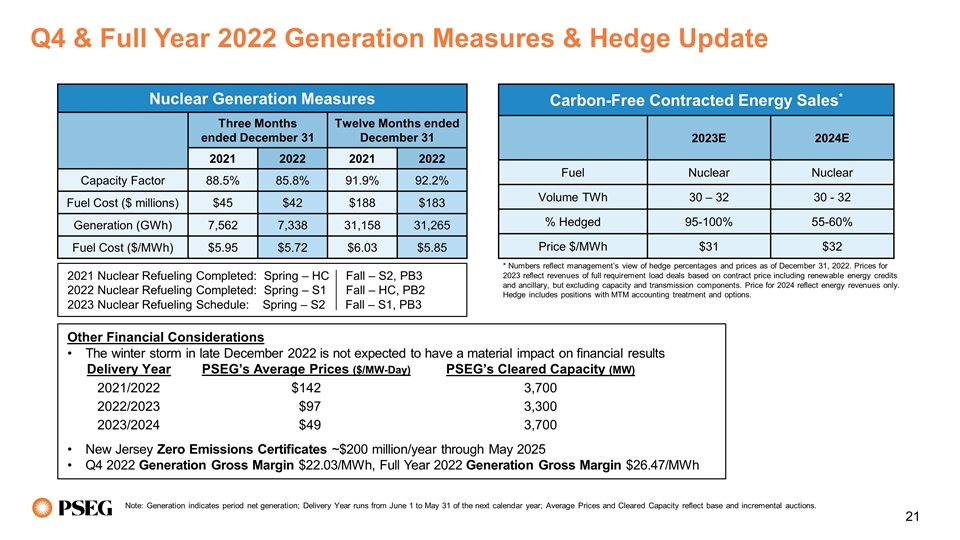

The nuclear fleet operated at an average capacity factor of 85.8% during the

fourth quarter, which included a scheduled refueling at our 100%-owned Hope Creek station, and produced 7.3 TWh of

4

generation. An unplanned outage at Salem unit 2 in late December 2022 occurred during a PJM region-wide generation emergency action and resulted in capacity performance penalties. The net

financial impact of the outage, including replacement power, capacity penalties, as well as bonuses earned by the other operating PSEG units, is not expected to be material.

For the full-year, the nuclear fleet operated at an average capacity factor of 92.2% and produced 31.3 TWh of carbon-free, base load power. PSEG is

forecasting total baseload nuclear generation of approximately 31 TWh for the full year of 2023, hedged 95%-100% at an average price of $31 per MWh – an increase of approximately $4 per MWh compared to

2022. For 2024, total nuclear generation is forecast to be approximately 31 TWh and is 55%-60% hedged at an average price of $32 per MWh.

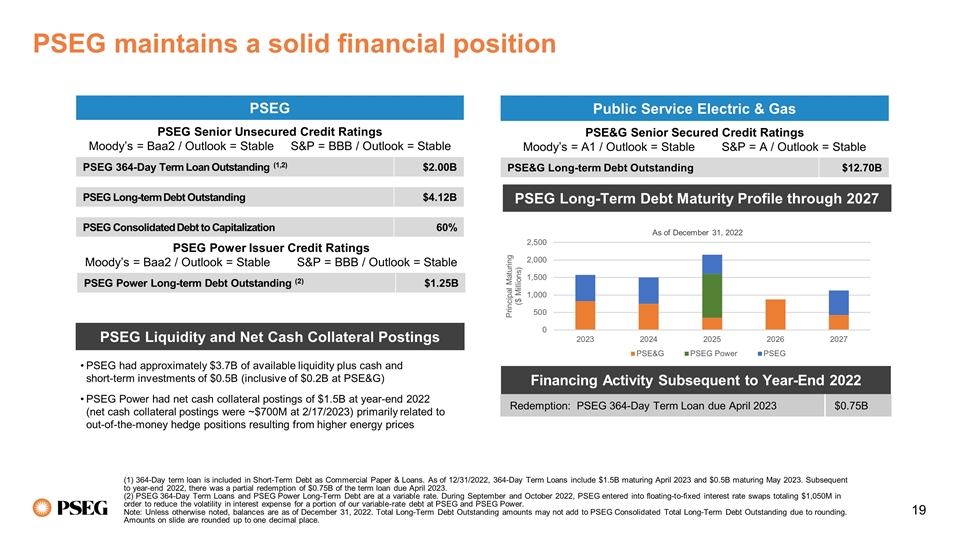

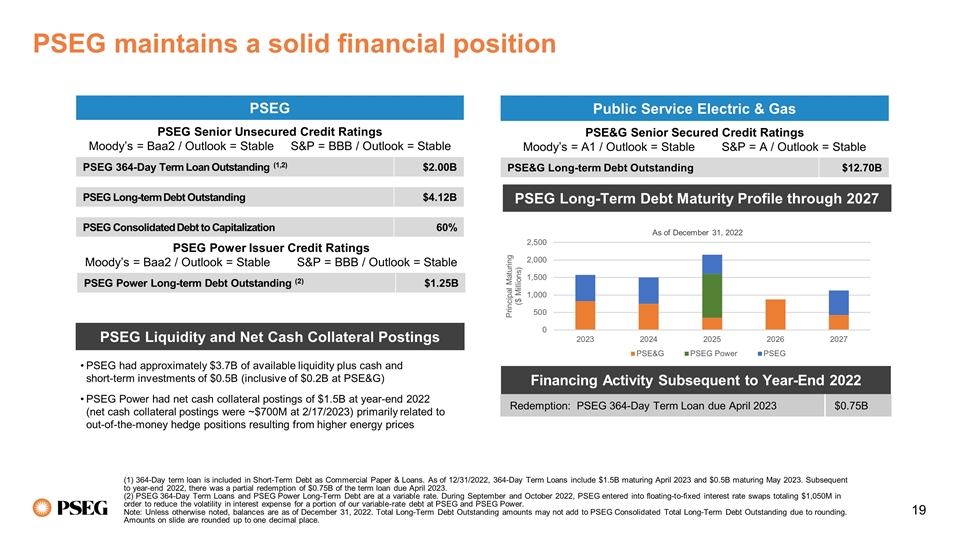

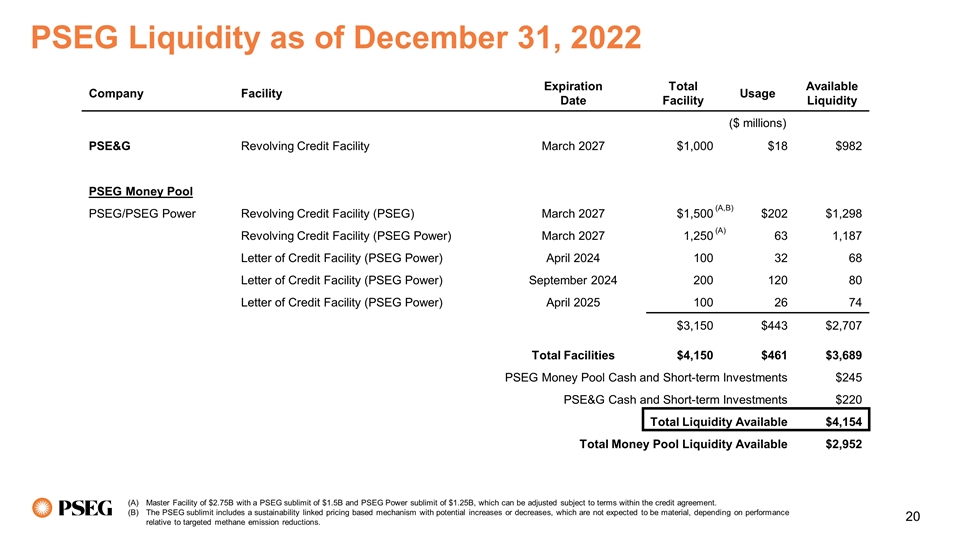

PSEG Power had net cash collateral postings of $1.5 billion at December 31, primarily related to out-of-the-money hedge positions because of higher energy prices throughout 2022. As of February 17, 2023, net cash collateral postings were approximately

$700 million, reflecting recent declines in power prices.

In January 2023, PSEG announced it would sell its 25% equity interest in the Ocean

Wind 1 offshore wind generation project to Ørsted. The sale is expected to close in the first half of 2023. PSEG has also decided not to exercise its option to purchase 50% of Ørsted’s two Skipjack generating projects in Maryland

or pursue an ownership interest in Ørsted’s Ocean Wind 2 project or other offshore wind generation projects. PSEG is evaluating its options for the potential sale of its 50% interest in Garden State Offshore Energy, which holds rights to

an offshore wind lease area south of New Jersey.

We have narrowed our forecast of non-GAAP Operating

Earnings for Carbon-Free, Infrastructure and Other to $200 million - $225 million from our prior guidance of $185 million - $235 million.

###

PSEG will host a conference call to review its Fourth

Quarter and Full-Year 2022 results with the financial community at 11AM EDT today. You can register to access this event by visiting https://investor.pseg.com/investor-news-and-events.

Public Service Enterprise

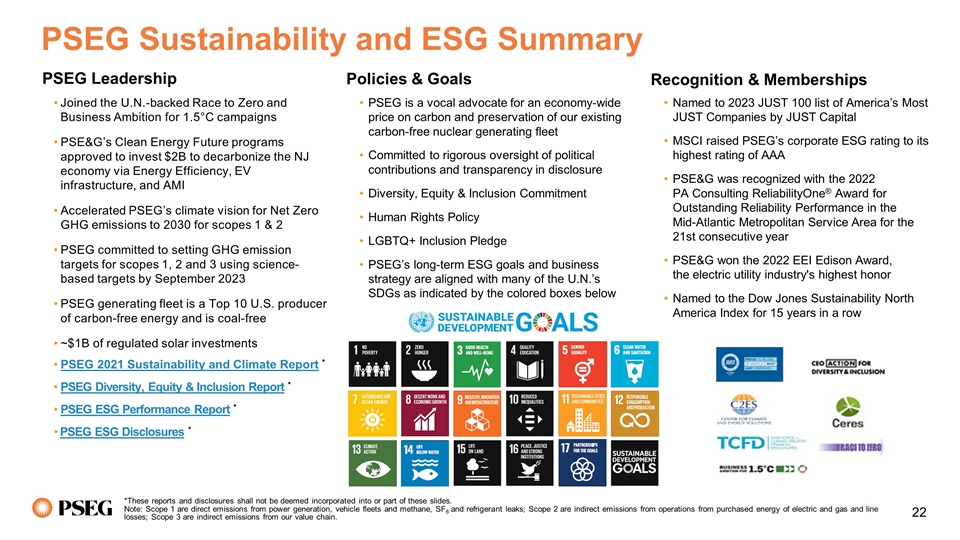

Group (PSEG) (NYSE: PEG) is a predominantly regulated infrastructure company focused on a clean energy future. Guided by its Powering Progress vision, PSEG aims to power a future where people use less energy, and it’s cleaner, safer and

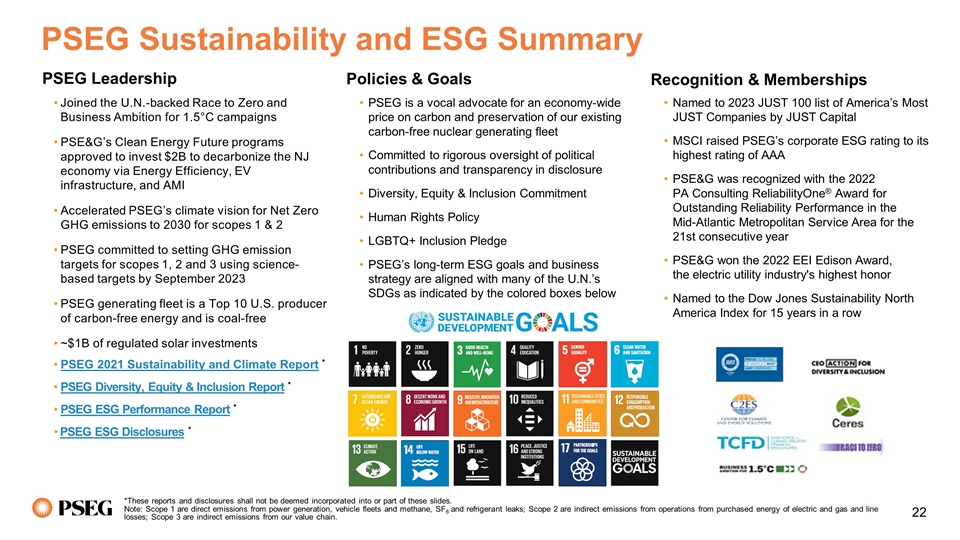

delivered more reliably than ever. PSEG’s commitment to ESG and sustainability is demonstrated in our net-zero 2030 climate vision and participation in the U.N. Race to Zero, as well as our inclusion on

the Dow Jones Sustainability North America Index and the list of America’s most JUST Companies. PSEG’s businesses include Public Service Electric and Gas Co. (PSE&G), PSEG Power and PSEG Long Island (https://corporate.pseg.com).

Non-GAAP Financial

Measures

Management uses non-GAAP Operating Earnings in its internal analysis, and in communications

with investors and analysts, as a consistent measure for comparing PSEG’s financial performance to previous financial results. Non-GAAP Operating Earnings exclude the impact of returns (losses) associated

with the Nuclear Decommissioning Trust (NDT), Mark-to-Market (MTM) accounting and material one-time items.

See Attachments 8 and 9 for a complete list of items excluded from Net Income/(Loss) in the determination of

non-GAAP Operating Earnings. The presentation of non-GAAP Operating Earnings is intended to complement, and should not be considered an alternative to the presentation

of Net Income/(Loss), which is an indicator of financial performance determined in accordance with GAAP. In addition, non-GAAP Operating Earnings as presented in this release may not be comparable to similarly

titled measures used by other companies.

Due to the forward-looking nature of non-GAAP Operating Earnings,

PSEG is unable to reconcile this non-GAAP financial measure to the most directly comparable GAAP financial measure because comparable GAAP measures are not reasonably accessible or reliable due to the inherent

difficulty in forecasting and quantifying measures that would be required for such reconciliation. Namely, we are not able to reliably project without unreasonable effort MTM and NDT gains (losses), for

5

future periods due to market volatility. These items are uncertain, depend on various factors, and may have a material impact on our future GAAP results.

Forward-Looking Statements

Certain of

the matters discussed in this report about our and our subsidiaries’ future performance, including, without limitation, future revenues, earnings, strategies, prospects, consequences and all other statements that are not purely historical

constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements are subject to risks and uncertainties, which could cause actual results to differ

materially from those anticipated. Such statements are based on management’s beliefs as well as assumptions made by and information currently available to management. When used herein, the words “anticipate,” “intend,”

“estimate,” “believe,” “expect,” “plan,” “should,” “hypothetical,” “potential,” “forecast,” “project,” variations of such words and similar expressions are

intended to identify forward-looking statements. Factors that may cause actual results to differ are often presented with the forward-looking statements themselves. Other factors that could cause actual results to differ materially from those

contemplated in any forward-looking statements made by us herein are discussed in Item 1A. Risk Factors, Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations (MD&A), Item 8. Financial Statements and

Supplementary Data—Note 15. Commitments and Contingent Liabilities, and other filings we make with the United States Securities and Exchange Commission (SEC), including our subsequent reports on Form 10-Q

and Form 8-K. These factors include, but are not limited to:

| |

• |

|

any inability to successfully develop, obtain regulatory approval for, or construct transmission and distribution, and other

generation projects; |

| |

• |

|

the physical, financial and transition risks related to climate change, including risks relating to potentially increased

legislative and regulatory burdens changing customer preferences and lawsuits; |

| |

• |

|

any equipment failures, accidents, critical operating technology or business system failures, severe weather events, acts of

war, terrorism or other acts of violence, sabotage, physical attacks or security breaches, cyberattacks or other incidents that may impact our ability to provide safe and reliable service to our customers; |

| |

• |

|

any inability to recover the carrying amount of our long-lived assets; |

| |

• |

|

disruptions or cost increases in our supply chain, including labor shortages; |

| |

• |

|

any inability to maintain sufficient liquidity or access sufficient capital on commercially reasonable terms;

|

| |

• |

|

the impact of cybersecurity attacks or intrusions or other disruptions to our information technology, operational or other

systems; |

| |

• |

|

a material shift away from natural gas toward increased electrification and a reduction in the use of natural gas;

|

| |

• |

|

the impact of the coronavirus pandemic; |

| |

• |

|

failure to attract and retain a qualified workforce; |

| |

• |

|

inflation, including increases in the costs of equipment, materials, fuel and labor; |

| |

• |

|

the impact of our covenants in our debt instruments and credit agreements on our business; |

| |

• |

|

adverse performance of our defined benefit plan trust funds and Nuclear Decommissioning Trust Fund and increases in funding

requirements and pension costs; |

| |

• |

|

fluctuations in wholesale power and natural gas markets, including the potential impacts on the economic viability of our

generation units; |

| |

• |

|

our ability to obtain adequate nuclear fuel supply; |

| |

• |

|

changes in technology related to energy generation, distribution and consumption and changes in customer usage patterns;

|

| |

• |

|

third-party credit risk relating to and purchase of nuclear fuel; |

| |

• |

|

any inability to meet our commitments under forward sale obligations and Regional Transmission Organization rules;

|

| |

• |

|

reliance on transmission facilities to maintain adequate transmission capacity for our nuclear generation fleet;

|

| |

• |

|

the impact of changes in state and federal legislation and regulations on our business, including PSE&G’s ability

to recover costs and earn returns on authorized investments; |

| |

• |

|

PSE&G’s proposed investment programs may not be fully approved by regulators and its capital investment may be

lower than planned; |

| |

• |

|

our ability to advocate for and our receipt of appropriate regulatory guidance to ensure long-term support for our nuclear

fleet; |

| |

• |

|

adverse changes in and non-compliance with energy industry laws, policies,

regulations and standards, including market structures and transmission planning and transmission returns; |

| |

• |

|

risks associated with our ownership and operation of nuclear facilities, including increased nuclear fuel storage costs,

regulatory risks, such as compliance with the Atomic Energy Act and trade control, environmental and other regulations, as well as financial, environmental and health and safety risks; |

| |

• |

|

changes in federal and state environmental laws and regulations and enforcement; |

| |

• |

|

delays in receipt of, or an inability to receive, necessary licenses and permits and siting approvals; and

|

| |

• |

|

changes in tax laws and regulations. |

All of the forward-looking statements made in this report are qualified by these cautionary statements and we cannot assure you that the results or

developments anticipated by management will be realized or even if realized, will have the expected consequences to, or effects on, us or our business, prospects, financial condition, results of operations or cash flows. Readers are cautioned not to

place undue reliance on these forward-looking statements in making any investment decision. Forward-looking statements made in this report apply only as of the date of this report. While we may elect to update forward-looking statements from time to

time, we specifically disclaim any obligation to do so, even in light of new information or future events, unless otherwise required by applicable securities laws.

The forward-looking statements contained in this report are intended to qualify for the safe harbor provisions of Section 27A of the Securities Act

of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended.

|

| |

|

From time to time, PSEG and PSE&G release important information via postings on their corporate Investor Relations website at https://investor.pseg.com. Investors and other interested parties are encouraged to visit the Investor Relations website to review new postings. You can sign up for automatic email alerts regarding new postings at the

bottom of the webpage at https://investor.pseg.com or by navigating to the Email Alerts webpage at https://investor.pseg.com/resources/email-alerts/default.aspx. |

6

Attachment 1

PUBLIC SERVICE ENTERPRISE GROUP INCORPORATED

Consolidating Statements of Operations

(Unaudited, $ millions, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended December 31, 2022 |

|

|

|

| |

|

|

|

|

|

|

|

|

| |

|

PSEG |

|

|

Eliminations |

|

|

PSE&G |

|

|

Carbon-Free,

Infrastructure &

Other (CFIO)(a) |

|

|

|

|

|

|

|

|

|

| OPERATING REVENUES |

|

$ |

3,139 |

|

|

$ |

(466 |

) |

|

$ |

2,030 |

|

|

$ |

1,575 |

|

|

|

|

|

|

|

|

|

| OPERATING EXPENSES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Energy Costs |

|

|

996 |

|

|

|

(466 |

) |

|

|

881 |

|

|

|

581 |

|

|

|

| Operation and Maintenance |

|

|

868 |

|

|

|

- |

|

|

|

489 |

|

|

|

379 |

|

|

|

| Depreciation and Amortization |

|

|

278 |

|

|

|

- |

|

|

|

238 |

|

|

|

40 |

|

|

|

| Losses on Asset Dispositions and Impairments |

|

|

33 |

|

|

|

- |

|

|

|

1 |

|

|

|

32 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Operating Expenses |

|

|

2,175 |

|

|

|

(466 |

) |

|

|

1,609 |

|

|

|

1,032 |

|

|

|

|

|

|

|

|

|

| OPERATING INCOME |

|

|

964 |

|

|

|

- |

|

|

|

421 |

|

|

|

543 |

|

|

|

|

|

|

|

|

|

| Loss from Equity Method Investments |

|

|

(2 |

) |

|

|

- |

|

|

|

- |

|

|

|

(2 |

) |

|

|

| Net Gains (Losses) on Trust Investments |

|

|

87 |

|

|

|

- |

|

|

|

- |

|

|

|

87 |

|

|

|

| Other Income (Deductions) |

|

|

38 |

|

|

|

- |

|

|

|

22 |

|

|

|

16 |

|

|

|

| Net Non-Operating Pension and OPEB Credits (Costs) |

|

|

94 |

|

|

|

- |

|

|

|

70 |

|

|

|

24 |

|

|

|

| Interest Expense |

|

|

(178 |

) |

|

|

- |

|

|

|

(108 |

) |

|

|

(70 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| INCOME BEFORE INCOME TAXES |

|

|

1,003 |

|

|

|

- |

|

|

|

405 |

|

|

|

598 |

|

|

|

|

|

|

|

|

|

| Income Tax Expense |

|

|

(215 |

) |

|

|

- |

|

|

|

(53 |

) |

|

|

(162 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| NET INCOME |

|

$ |

788 |

|

|

$ |

- |

|

|

$ |

352 |

|

|

$ |

436 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Reconciling Items Excluded from Net Income(b) |

|

|

(470 |

) |

|

|

- |

|

|

|

- |

|

|

|

(470 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OPERATING EARNINGS (non-GAAP) |

|

$ |

318 |

|

|

$ |

- |

|

|

$ |

352 |

|

|

$ |

(34 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings Per Share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| NET INCOME |

|

$ |

1.58 |

|

|

$ |

- |

|

|

$ |

0.70 |

|

|

$ |

0.88 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Reconciling Items Excluded from Net Income(b) |

|

|

(0.94 |

) |

|

|

- |

|

|

|

- |

|

|

|

(0.94 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OPERATING EARNINGS (non-GAAP) |

|

$ |

0.64 |

|

|

$ |

- |

|

|

$ |

0.70 |

|

|

$ |

(0.06 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended December 31, 2021 |

|

|

|

| |

|

|

|

|

|

|

|

|

| |

|

PSEG |

|

|

Eliminations |

|

|

PSE&G |

|

|

CFIO(a) |

|

|

|

|

|

|

|

|

|

| OPERATING REVENUES |

|

$ |

3,056 |

|

|

$ |

(363 |

) |

|

$ |

1,715 |

|

|

$ |

1,704 |

|

|

|

|

|

|

|

|

|

| OPERATING EXPENSES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Energy Costs |

|

|

1,004 |

|

|

|

(363 |

) |

|

|

632 |

|

|

|

735 |

|

|

|

| Operation and Maintenance |

|

|

858 |

|

|

|

- |

|

|

|

453 |

|

|

|

405 |

|

|

|

| Depreciation and Amortization |

|

|

270 |

|

|

|

- |

|

|

|

230 |

|

|

|

40 |

|

|

|

| Losses on Asset Dispositions and Impairments |

|

|

22 |

|

|

|

- |

|

|

|

- |

|

|

|

22 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Operating Expenses |

|

|

2,154 |

|

|

|

(363 |

) |

|

|

1,315 |

|

|

|

1,202 |

|

|

|

|

|

|

|

|

|

| OPERATING INCOME |

|

|

902 |

|

|

|

- |

|

|

|

400 |

|

|

|

502 |

|

|

|

|

|

|

|

|

|

| Income from Equity Method Investments |

|

|

4 |

|

|

|

- |

|

|

|

- |

|

|

|

4 |

|

|

|

| Net Gains (Losses) on Trust Investments |

|

|

70 |

|

|

|

- |

|

|

|

1 |

|

|

|

69 |

|

|

|

| Other Income (Deductions) |

|

|

5 |

|

|

|

- |

|

|

|

16 |

|

|

|

(11 |

) |

|

|

| Net Non-Operating Pension and OPEB Credits (Costs) |

|

|

82 |

|

|

|

- |

|

|

|

65 |

|

|

|

17 |

|

|

|

| Loss on Extinguishment of Debt |

|

|

(298 |

) |

|

|

- |

|

|

|

- |

|

|

|

(298 |

) |

|

|

| Interest Expense |

|

|

(134 |

) |

|

|

- |

|

|

|

(101 |

) |

|

|

(33 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| INCOME BEFORE INCOME TAXES |

|

|

631 |

|

|

|

- |

|

|

|

381 |

|

|

|

250 |

|

|

|

|

|

|

|

|

|

| Income Tax Expense |

|

|

(186 |

) |

|

|

- |

|

|

|

(110 |

) |

|

|

(76 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| NET INCOME |

|

$ |

445 |

|

|

$ |

- |

|

|

$ |

271 |

|

|

$ |

174 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Reconciling Items Excluded from Net Income(b) |

|

|

(93 |

) |

|

|

- |

|

|

|

- |

|

|

|

(93 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OPERATING EARNINGS (non-GAAP) |

|

$ |

352 |

|

|

$ |

- |

|

|

$ |

271 |

|

|

$ |

81 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings Per Share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| NET INCOME |

|

$ |

0.88 |

|

|

$ |

- |

|

|

$ |

0.53 |

|

|

$ |

0.35 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Reconciling Items Excluded from Net Income(b) |

|

|

(0.19 |

) |

|

|

- |

|

|

|

- |

|

|

|

(0.19 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OPERATING EARNINGS (non-GAAP) |

|

$ |

0.69 |

|

|

$ |

- |

|

|

$ |

0.53 |

|

|

$ |

0.16 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

(a) |

Includes activities at PSEG Power, PSEG Long Island, Energy Holdings, PSEG Services Corporation and the Parent.

|

| |

(b) |

See Attachments 8 and 9 for details of items excluded from Net Income (Loss) to compute Operating Earnings (non-GAAP). |

Attachment 2

PUBLIC SERVICE ENTERPRISE GROUP INCORPORATED

Consolidating Statements of Operations

(Unaudited, $ millions, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended December 31, 2022 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

PSEG |

|

|

Eliminations |

|

|

PSE&G |

|

|

CFIO(a) |

|

|

|

|

|

|

|

|

|

| OPERATING REVENUES |

|

$ |

9,800 |

|

|

$ |

(1,401 |

) |

|

$ |

7,935 |

|

|

$ |

3,266 |

|

|

|

|

|

|

|

|

|

| OPERATING EXPENSES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Energy Costs |

|

|

4,018 |

|

|

|

(1,401 |

) |

|

|

3,270 |

|

|

|

2,149 |

|

|

|

| Operation and Maintenance |

|

|

3,178 |

|

|

|

- |

|

|

|

1,838 |

|

|

|

1,340 |

|

|

|

| Depreciation and Amortization |

|

|

1,100 |

|

|

|

- |

|

|

|

935 |

|

|

|

165 |

|

|

|

| Losses on Asset Dispositions and Impairments |

|

|

123 |

|

|

|

- |

|

|

|

- |

|

|

|

123 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Operating Expenses |

|

|

8,419 |

|

|

|

(1,401 |

) |

|

|

6,043 |

|

|

|

3,777 |

|

|

|

|

|

|

|

|

|

| OPERATING INCOME |

|

|

1,381 |

|

|

|

- |

|

|

|

1,892 |

|

|

|

(511 |

) |

|

|

|

|

|

|

|

|

| Income from Equity Method Investments |

|

|

14 |

|

|

|

- |

|

|

|

- |

|

|

|

14 |

|

|

|

| Net Gains (Losses) on Trust Investments |

|

|

(265 |

) |

|

|

- |

|

|

|

(2 |

) |

|

|

(263 |

) |

|

|

| Other Income (Deductions) |

|

|

124 |

|

|

|

(1 |

) |

|

|

88 |

|

|

|

37 |

|

|

|

| Net Non-Operating Pension and OPEB Credits (Costs) |

|

|

376 |

|

|

|

- |

|

|

|

281 |

|

|

|

95 |

|

|

|

| Interest Expense |

|

|

(628 |

) |

|

|

1 |

|

|

|

(427 |

) |

|

|

(202 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| INCOME (LOSS) BEFORE INCOME TAXES |

|

|

1,002 |

|

|

|

- |

|

|

|

1,832 |

|

|

|

(830 |

) |

|

|

|

|

|

|

|

|

| Income Tax Benefit (Expense) |

|

|

29 |

|

|

|

- |

|

|

|

(267 |

) |

|

|

296 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| NET INCOME (LOSS) |

|

$ |

1,031 |

|

|

$ |

- |

|

|

$ |

1,565 |

|

|

$ |

(534 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Reconciling Items Excluded from Net Income

(Loss)(b) |

|

|

708 |

|

|

|

- |

|

|

|

- |

|

|

|

708 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OPERATING EARNINGS (non-GAAP) |

|

$ |

1,739 |

|

|

$ |

- |

|

|

$ |

1,565 |

|

|

$ |

174 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings Per Share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| NET INCOME (LOSS) |

|

$ |

2.06 |

|

|

$ |

- |

|

|

$ |

3.12 |

|

|

$ |

(1.06 |

) |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Reconciling Items Excluded from Net Income (Loss)

(b) |

|

|

1.41 |

|

|

|

- |

|

|

|

- |

|

|

|

1.41 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OPERATING EARNINGS (non-GAAP) |

|

$ |

3.47 |

|

|

$ |

- |

|

|

$ |

3.12 |

|

|

$ |

0.35 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended December 31,

2021 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

PSEG |

|

|

Eliminations |

|

|

PSE&G |

|

|

CFIO (a) |

|

|

|

| OPERATING REVENUES |

|

$ |

9,722 |

|

|

$ |

(1,167 |

) |

|

$ |

7,122 |

|

|

$ |

3,767 |

|

|

|

| OPERATING EXPENSES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Energy Costs |

|

|

3,499 |

|

|

|

(1,167 |

) |

|

|

2,688 |

|

|

|

1,978 |

|

|

|

| Operation and Maintenance |

|

|

3,226 |

|

|

|

- |

|

|

|

1,692 |

|

|

|

1,534 |

|

|

|

| Depreciation and Amortization |

|

|

1,216 |

|

|

|

- |

|

|

|

928 |

|

|

|

288 |

|

|

|

| (Gains) Losses on Asset Dispositions and Impairments |

|

|

2,637 |

|

|

|

- |

|

|

|

(4 |

) |

|

|

2,641 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Operating Expenses |

|

|

10,578 |

|

|

|

(1,167 |

) |

|

|

5,304 |

|

|

|

6,441 |

|

|

|

|

|

|

|

|

|

| OPERATING INCOME |

|

|

(856 |

) |

|

|

- |

|

|

|

1,818 |

|

|

|

(2,674 |

) |

|

|

|

|

|

|

|

|

| Income from Equity Method Investments |

|

|

16 |

|

|

|

- |

|

|

|

- |

|

|

|

16 |

|

|

|

| Net Gains (Losses) on Trust Investments |

|

|

194 |

|

|

|

- |

|

|

|

2 |

|

|

|

192 |

|

|

|

| Other Income (Deductions) |

|

|

98 |

|

|

|

- |

|

|

|

88 |

|

|

|

10 |

|

|

|

| Net Non-Operating Pension and OPEB Credits (Costs) |

|

|

328 |

|

|

|

- |

|

|

|

264 |

|

|

|

64 |

|

|

|

| Loss on Extinguishment of Debt |

|

|

(298 |

) |

|

|

- |

|

|

|

- |

|

|

|

(298 |

) |

|

|

| Interest Expense |

|

|

(571 |

) |

|

|

- |

|

|

|

(402 |

) |

|

|

(169 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| INCOME (LOSS) BEFORE INCOME TAXES |

|

|

(1,089 |

) |

|

|

- |

|

|

|

1,770 |

|

|

|

(2,859 |

) |

|

|

| Income Tax Benefit (Expense) |

|

|

441 |

|

|

|

- |

|

|

|

(324 |

) |

|

|

765 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| NET INCOME (LOSS) |

|

$ |

(648 |

) |

|

$ |

- |

|

|

$ |

1,446 |

|

|

$ |

(2,094 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Reconciling Items Excluded from Net Income

(Loss)(b) |

|

|

2,501 |

|

|

|

- |

|

|

|

- |

|

|

|

2,501 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OPERATING EARNINGS (non-GAAP) |

|

$ |

1,853 |

|

|

$ |

- |

|

|

$ |

1,446 |

|

|

$ |

407 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings Per Share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| NET INCOME (LOSS) |

|

$ |

(1.29 |

) |

|

$ |

- |

|

|

$ |

2.87 |

|

|

$ |

(4.16 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Reconciling Items Excluded from Net Income

(Loss)(b) |

|

|

4.96 |

|

|

|

- |

|

|

|

- |

|

|

|

4.96 |

|

|

|

| Share Differential(b) |

|

|

(0.02 |

) |

|

|

- |

|

|

|

(0.02 |

) |

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| OPERATING EARNINGS (non-GAAP) |

|

$ |

3.65 |

|

|

$ |

- |

|

|

$ |

2.85 |

|

|

$ |

0.80 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

(a) |

Includes activities at PSEG Power, PSEG Long Island, Energy Holdings, PSEG Services Corporation and the Parent.

|

| |

(b) |

See Attachments 8 and 9 for details of items excluded from Net Income (Loss) to compute Operating Earnings (non-GAAP) and the impact of using different share amounts (Share Differential) for calculating earnings per share for PSEG’s consolidated GAAP Net Loss versus consolidated Operating Earnings (non-GAAP). |

Attachment 3

PUBLIC SERVICE ENTERPRISE GROUP INCORPORATED

Capitalization Schedule

(Unaudited, $

millions)

|

|

|

|

|

|

|

|

|

| |

|

December 31, |

|

|

December 31, |

|

| |

|

2022 |

|

|

2021 |

|

| DEBT |

|

|

|

|

|

|

|

|

| Commercial Paper and Loans |

|

$ |

2,200 |

|

|

$ |

3,519 |

|

| Long-Term Debt* |

|

|

18,070 |

|

|

|

15,919 |

|

|

|

|

|

|

|

|

|

|

| Total Debt |

|

|

20,270 |

|

|

|

19,438 |

|

|

|

|

| STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

| Common Stock |

|

|

5,065 |

|

|

|

5,045 |

|

| Treasury Stock |

|

|

(1,377 |

) |

|

|

(896 |

) |

| Retained Earnings |

|

|

10,591 |

|

|

|

10,639 |

|

| Accumulated Other Comprehensive Loss |

|

|

(550 |

) |

|

|

(350 |

) |

|

|

|

|

|

|

|

|

|

| Total Stockholders’ Equity |

|

|

13,729 |

|

|

|

14,438 |

|

|

|

|

|

|

|

|

|

|

| Total Capitalization |

|

$ |

33,999 |

|

|

$ |

33,876 |

|

|

|

|

|

|

|

|

|

|

*Includes current portion of Long-Term Debt

Attachment 4

PUBLIC SERVICE ENTERPRISE GROUP INCORPORATED

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited, $ millions)

|

|

|

|

|

|

|

|

|

| |

|

Year Ended December 31, |

|

| |

|

2022 |

|

|

2021 |

|

| CASH FLOWS FROM OPERATING ACTIVITIES |

|

|

|

|

|

|

|

|

| Net Income (Loss) |

|

$ |

1,031 |

|

|

$ |

(648 |

) |

| Adjustments to Reconcile Net Income(Loss) to Net Cash Flows From Operating Activities |

|

|

472 |

|

|

|

2,384 |

|

|

|

|

|

|

|

|

|

|

| NET CASH PROVIDED BY (USED IN) OPERATING ACTIVITIES |

|

|

1,503 |

|

|

|

1,736 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| NET CASH PROVIDED BY (USED IN) INVESTING ACTIVITIES |

|

|

(1,101 |

) |

|

|

(2,244 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

| NET CASH PROVIDED BY (USED IN) FINANCING ACTIVITIES |

|

|

(754 |

) |

|

|

799 |

|

|

|

|

|

|

|

|

|

|

| Net Change in Cash, Cash Equivalents and Restricted Cash |

|

|

(352 |

) |

|

|

291 |

|

| Cash, Cash Equivalents and Restricted Cash at Beginning of Period |

|

|

863 |

|

|

|

572 |

|

|

|

|

|

|

|

|

|

|

| Cash, Cash Equivalents and Restricted Cash at End of Period |

|

$ |

511 |

|

|

$ |

863 |

|

|

|

|

|

|

|

|

|

|

Attachment 5

PUBLIC SERVICE ELECTRIC & GAS COMPANY

Retail Sales

(Unaudited)

December 31, 2022

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Electric Sales

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Sales (millions

kWh) |

|

Three Months

Ended |

|

|

Change vs.

2021 |

|

|

Year

Ended |

|

|

Change vs.

2021 |

|

| Residential |

|

|

2,659 |

|

|

|

(5%) |

|

|

|

13,975 |

|

|

|

0% |

|

| Commercial & Industrial |

|

|

6,498 |

|

|

|

4% |

|

|

|

26,508 |

|

|

|

2% |

|

| Other |

|

|

97 |

|

|

|

(2%) |

|

|

|

341 |

|

|

|

(1%) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total |

|

|

9,254 |

|

|

|

1% |

|

|

|

40,824 |

|

|

|

2% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

| Gas Sold and Transported

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Sales (millions

therms) |

|

Three Months

Ended |

|

|

Change vs.

2021 |

|

|

Year

Ended |

|

|

Change vs.

2021 |

|

| Firm Sales |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Residential Sales |

|

|

467 |

|

|

|

17% |

|

|

|

1,497 |

|

|

|

5% |

|

| Commercial & Industrial |

|

|

314 |

|

|

|

19% |

|

|

|

1,070 |

|

|

|

8% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Firm Sales |

|

|