UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| |

[X]

|

Annual Report Pursuant to Section 13 or 15(d)

|

|

| |

|

of the Securities Exchange Act of 1934

|

|

|

(Mark one)

|

|

for the fiscal year ended December 29, 2012

|

|

| |

|

Or

|

|

| |

[ ]

|

Transition Report Pursuant to Section 13 or 15(d)

|

|

| |

|

of the Securities Exchange Act of 1934

|

|

| |

|

for the transition period from to

|

|

Commission file number 0-20388

LITTELFUSE, INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

36-3795742

|

|

(State or other jurisdiction of

|

(I.R.S. Employer Identification No.)

|

|

incorporation or organization)

|

|

| |

|

|

8755 West Higgins Road, Suite 500,

|

|

|

Chicago, Illinois

|

60631

|

|

(Address of principal executive offices)

|

(ZIP Code)

|

773/628-1000

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| |

Name of Each Exchange

|

| Title of Each Class |

On Which Registered |

| Common Stock, $0.01 par value |

NASDAQ Global Select MarketSM |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [X] No [ ]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

(Cover continued from previous page)

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (Section 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [ X ] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ X]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “small reporting company” in Rule 12b-2 of the Exchange Act (Check one): Large accelerated filer [X] Accelerated filer [ ] Non-accelerated filer [ ] Smaller reporting company [ ]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ] No [X]

The aggregate market value of 21,676,302 shares of voting stock held by non-affiliates of the registrant was approximately $1,233,164,821 based on the last reported sale price of the registrant’s Common Stock as reported on the NASDAQ Global Select MarketSM on June 30, 2012.

As of February 15, 2013, the registrant had outstanding 23,608,450 shares of Common Stock.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Littelfuse, Inc. Proxy Statement for the 2013 Annual Meeting of Stockholders (the “Proxy Statement”) are incorporated by reference into Part III of this Form 10-K.

TABLE OF CONTENTS

| |

Page

|

| |

|

|

FORWARD-LOOKING STATEMENTS

|

4

|

| |

|

|

|

PART I

|

|

|

|

Item 1.

|

Business.

|

4

|

|

Item 1A.

|

Risk Factors.

|

12

|

|

Item 1B.

|

Unresolved Staff Comments.

|

16

|

|

Item 2.

|

Properties.

|

16

|

|

Item 3.

|

Legal Proceedings.

|

18

|

|

Item 4.

|

Mine Safety Disclosures.

|

18

|

| |

|

|

|

PART II

|

|

|

|

Item 5.

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

|

19

|

|

Item 6.

|

Selected Financial Data.

|

21

|

|

Item 7.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations.

|

21

|

|

Item 7A.

|

Quantitative and Qualitative Disclosures About Market Risk.

|

35

|

|

Item 8.

|

Financial Statements and Supplementary Data.

|

37

|

|

Item 9.

|

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure.

|

76

|

|

Item 9A.

|

Controls and Procedures.

|

76

|

|

Item 9B.

|

Other Information.

|

77

|

| |

|

|

|

PART III

|

|

|

|

Item 10.

|

Directors, Executive Officers and Corporate Governance.

|

78

|

|

Item 11.

|

Executive Compensation.

|

80

|

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters.

|

80

|

|

Item 13.

|

Certain Relationships and Related Transactions, and Director Independence.

|

80

|

|

Item 14.

|

Principal Accounting Fees and Services.

|

80

|

| |

|

|

|

PART IV

|

|

|

|

Item 15.

|

Exhibits, Financial Statement Schedules.

|

81

|

| |

Schedule II – Valuation and Qualifying Accounts and Reserves.

|

82

|

| |

Signatures.

|

83

|

| |

Exhibit Index.

|

84

|

FORWARD-LOOKING STATEMENTS

Certain statements contained in this Annual Report on Form 10-K that are not historical facts are intended to constitute “forward-looking statements” entitled to the safe-harbor provisions of the Private Securities Litigation Reform Act of 1995 (“PSRLA”). These statements may involve risks and uncertainties, including, but not limited to, risks relating to product demand and market acceptance, economic conditions, the impact of competitive products and pricing, product quality problems or product recalls, capacity and supply difficulties or constraints, coal mining exposures, failure of an indemnification for environmental liability, exchange rate fluctuations, commodity price fluctuations, the effect of the company’s accounting policies, labor disputes, restructuring costs in excess of expectations, pension plan asset returns being less than assumed, integration of acquisitions and other risks that may be detailed in “Item 1A. Risk Factors” below and in the company’s other Securities and Exchange Commission filings.

PART I

ITEM 1. BUSINESS.

GENERAL

Littelfuse, Inc. and its subsidiaries (the “company” or “Littelfuse” or “we” or “our”) is the world’s leading supplier of circuit protection products for the electronics, automotive and electrical industries. In addition to the broadest and deepest portfolio of circuit protection products and solutions, the company offers a comprehensive line of highly reliable electromechanical and electronic switch and control devices for commercial and specialty vehicles and sensors for automobile safety systems, as well as protection relays and power distribution centers for the safe control and distribution of electricity. The company has a network of global labs that develop new products and product enhancements, provide customer application support and test products for safety, reliability and regulatory compliance.

In the electronics market, the company supplies leading manufacturers such as Alcatel-Lucent, Cisco, Celestica, Delta, Flextronics, Foxconn, Hewlett-Packard, HTC, Huawei, IBM, Intel, Jabil, LG, Motorola, Nokia, Panasonic, Quanta, Samsung, Sanmina-SCI, Seagate, Siemens and Sony. The company is also the leading provider of circuit protection for the automotive industry and the third largest producer of electrical fuses in North America. In the automotive market, the company’s end customers include major automotive manufacturers in North America, Europe and Asia such as BMW, Caterpillar, Chrysler, Daimler Trucks NA, Ford Motor Company, General Motors, Hyundai Group and Volkswagen. The company also supplies wiring harness manufacturers and auto parts suppliers worldwide, including Advance Auto Parts, Continental, Delphi, Lear, Leoni, O’Reilly Auto Parts, Pep Boys, Sumitomo, Valeo and Yazaki. In the electrical market, the company supplies representative customers such as Abbott, Acuity Brands, Dow Chemical, DuPont, GE, General Motors, Heinz, International Paper, John Deere, SMA, First Solar, Samsung, Merck, Poland Springs, Procter & Gamble, Rockwell, United Technologies and 3M. Through the company’s Electrical business, the company supplies industrial ground fault protection in mining and other large industrial operations to customers such as Potash Corporation, Mosaic, Agrium and Cameco. See “Business Environment: Circuit Protection Market.”

The company reports its operations by three business unit segments: Electronics, Automotive, and Electrical. For segment and geographical information and consolidated net sales and operating earnings see “Item 7. Management’s Discussion And Analysis Of Financial Condition And Results Of Operations” and Note 16 of the Notes to Consolidated Financial Statements included in this report.

On May 31, 2012, the company acquired 100% of ACCEL AB (“Accel”), a manufacturer of advanced electromechanical products, including sensors and switches primarily for the automotive industry, for approximately $23.9 million. The acquisition allows the company to expand its automotive product offering and establish a presence in the growing automotive sensor market within its Automotive business unit segment. Accel is based in Vänersborg, Sweden with a manufacturing facility located in Kaunas, Lithuania. The company funded the acquisition with available cash.

On September 26, 2012, the company acquired 100% of Terra Power Systems, LLC ("Terra Power") , a U.S. manufacturer of electromechanical components including power distribution modules and fuse holders for commercial vehicle products in the automotive industry for $10.6 million. The acquisition allows the company to strengthen its position in the commercial vehicle products market by adding new products and new customers within its Automotive business unit segment. Terra Power is based in Bellingham, Washington. The company funded the acquisition with available cash.

Net sales by business unit segment for the periods indicated are as follows (in thousands):

| |

|

Fiscal Year

|

|

| |

|

2012

|

|

|

2011

|

|

|

2010

|

|

|

Electronics

|

|

$ |

329,466 |

|

|

$ |

354,487 |

|

|

$ |

373,370 |

|

|

Automotive

|

|

|

206,222 |

|

|

|

197,586 |

|

|

|

139,096 |

|

|

Electrical

|

|

|

132,225 |

|

|

|

112,882 |

|

|

|

95,555 |

|

|

Total

|

|

$ |

667,913 |

|

|

$ |

664,955 |

|

|

$ |

608,021 |

|

The company operates in three geographic regions: the Americas, Europe and Asia-Pacific. The company manufactures products and sells to customers in all three regions.

Net sales in the company’s three geographic regions, based upon the shipped to destination, are as follows (in thousands):

| |

|

Fiscal Year

|

|

| |

|

2012

|

|

|

2011

|

|

|

2010

|

|

|

Americas

|

|

$ |

303,598 |

|

|

$ |

288,592 |

|

|

$ |

227,747 |

|

|

Europe

|

|

|

107,512 |

|

|

|

114,895 |

|

|

|

115,113 |

|

|

Asia-Pacific

|

|

|

256,803 |

|

|

|

261,468 |

|

|

|

265,161 |

|

|

Total

|

|

$ |

667,913 |

|

|

$ |

664,955 |

|

|

$ |

608,021 |

|

The company’s products are sold worldwide through distributors, a direct sales force and manufacturers’ representatives. For the fiscal year ended December 29, 2012, approximately 67% of the company’s net sales were to customers outside the United States, including approximately 21% to China.

The company manufactures many of its products on fully integrated manufacturing and assembly equipment. The company maintains product quality through a Global Quality Management System with most manufacturing sites certified under ISO 9001:2000. In addition, several of the Littelfuse manufacturing sites are also certified under TS 16949 and ISO 14001.

References herein to “2012” or “fiscal 2012” refer to the fiscal year ended December 29, 2012. References herein to “2011” or “fiscal 2011” refer to the fiscal year ended December 31, 2011. References herein to “2010” or “fiscal 2010” refer to the fiscal year ended January 1, 2011.

The company’s annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and all amendments to those reports are available free of charge through the “Investor Relations” section of the company’s Internet website (http://www.littelfuse.com), as soon as practicable after such material is electronically filed with, or furnished to, the Securities and Exchange Commission (the “SEC”), accessible via a link to the website maintained by the SEC. Except as otherwise provided herein, such information is not incorporated by reference into this Annual Report on Form 10-K.

BUSINESS ENVIRONMENT: CIRCUIT PROTECTION MARKET

Electronic Products

Electronic circuit protection products are used to protect circuits in a multitude of electronic systems. The company’s product offering includes a complete line of overcurrent and overvoltage solutions, including (i) fuses and protectors, (ii) positive temperature coefficient (“PTC”) resettable fuses, (iii) varistors, (iv) polymer electrostatic discharge (“ESD”) suppressors, (v) discrete transient voltage suppression (“TVS”) diodes, TVS diode arrays and protection thyristors, (vi) gas discharge tubes, (vii) power switching components and (viii) fuseholders, blocks and related accessories.

Electronic fuses and protectors are devices that contain an element that melts in an overcurrent condition. Electronic miniature and subminiature fuses are designed to provide circuit protection in the limited space requirements of electronic equipment. The company’s fuses are used in a wide variety of electronic products, including mobile phones, flat-screen TVs, computers and telecommunications equipment. The company markets these products under trademarked brand names including PICO® II and NANO2® SMF.

Resettable fuses are PTC polymer devices that limit the current when an overcurrent condition exists and then reset themselves once the overcurrent condition has cleared. The company’s product line offers both radial leaded and surface mount products. Varistors are ceramic-based, high-energy absorption devices that provide transient overvoltage and surge suppression for automotive, telecommunication, consumer electronics and industrial applications. The company’s product line offers both radial leaded and multilayer surface mount products.

Polymer ESD suppressors are polymer-based devices that protect an electronic system from failure due to rapid transfer of electrostatic charge to the circuit. The company’s PulseGuard® line of ESD suppressors is used in PC and PC peripherals, digital consumer electronics and wireless applications.

Discrete diodes, diode arrays and protection thyristors are fast switching silicon semiconductor structures. Discrete diodes protect a wide variety of applications from overvoltage transients such as ESD, inductive load switching or lightning, while diode arrays are used primarily as ESD suppressors. Protection thyristors are commonly used to protect telecommunications circuits from overvoltage transients such as those resulting from lightning. Applications include telephones, modems, data transmission lines and alarm systems. The company markets these products under trademarked brand names including TECCOR®, SIDACtor®, Battrax® and SPA™.

Gas discharge tubes are very low capacitance devices designed to suppress any transient voltage event that is greater than the breakover voltage of the device. These devices are primarily used in telecommunication interface and conversion equipment applications as protection from overvoltage transients such as lightning.

Power switching components are used to regulate energy to various types of loads most commonly found in industrial and home applications. These components are easily activated from simple control circuits or interfaced to computers for more complex load control. Typical applications include heating, cooling, battery chargers and lighting.

In addition to the above products, the company is also a supplier of fuse holders (including OMNI-BLOK®), fuse blocks and fuse clips primarily to customers that purchase circuit protection devices from the company.

Automotive Products

Fuses are extensively used in automobiles, trucks, buses and off-road equipment to protect electrical circuits and the wires that supply electrical power to operate lights, heating, air conditioning, radios, windows and other controls. Currently, a typical automobile contains 30 to 100 fuses, depending upon the options installed. The fuse content per vehicle is expected to continue to grow as more electronic features are included in automobiles. The company also supplies fuses for the protection of electric and hybrid vehicles.

The company is a primary supplier of automotive fuses to United States, Asian and European automotive original equipment manufacturers (“OEM”), automotive component parts manufacturers and automotive parts distributors. The company also sells its fuses in the replacement parts market, with its products being sold through merchandisers, discount stores and service stations, as well as under private label by national firms. The company invented and owns U.S. and foreign patents related to blade-type fuses, which is the standard and most commonly used fuse in the automotive industry. The company’s automotive fuse products are marketed under trademarked brand names, including ATO®, MINI®, MAXI, MIDI®, MEGA®, MasterFuse, JCASE® and CablePro™.

A majority of the company’s automotive fuse sales are made to main-fuse box and wire harness manufacturers that incorporate the fuses into their products. The remaining automotive fuse sales are made directly to automotive manufacturers, retailers who sell automotive parts and accessories, and distributors who in turn sell most of their products to wholesalers, service stations and non-automotive OEMs.

The company has expanded the Automotive Business Segment into the commercial vehicle market with the acquisition of Cole Hersee and Terra Power. Additional products in this market include: power distribution modules, low current switches, high current switches, solenoids and relays, electronic switches, battery management products and ignition key switches.

The company has expanded into the automotive sensor market with the acquisition of Accel AB. Additional products in this market include advanced electromechanical sensors and switches.

Electrical Products

The company entered the electrical market in 1983 and manufactures and sells a broad range of low-voltage and medium-voltage circuit protection products to electrical distributors and their customers in the construction, OEM and industrial maintenance, repair and operating supplies (“MRO”) markets. The company also designs and manufactures portable custom electrical equipment for the mining industry in Canada as well as protection relays for the global mining, oil and gas, industrial and marine markets.

Power fuses are used to protect circuits in various types of industrial equipment and in industrial and commercial buildings. They are rated and listed under one of many Underwriters Laboratories’ fuse classifications. Major applications for power fuses include protection from over-load and short-circuit currents in motor branch circuits, heating and cooling systems, control systems, lighting circuits, solar and electrical distribution networks.

The company’s POWR-GARD® product line features the Indicator™ series power fuse used in both the OEM and MRO markets. The Indicator™ technology provides visual blown-fuse indication at a glance, reducing maintenance and downtime on production equipment. The Indicator™ product offering is widely used in motor protection and industrial control panel applications.

Protection relays are used to protect personnel and equipment in mining, oil & gas and industrial environments from excessive currents, over voltages and electrical shock hazards called ground-faults. Major applications for protection relays include protection of motor, transformer and power-line distribution circuits. Ground-fault relays are used to protect personnel and equipment in wet environments such as underground mining or water treatment applications where there is a greater risk for electricity to come in contact with water and create a shock hazard.

Custom electrical equipment is used in harsh environments such as underground mining where standard electrical gear will not meet customer needs for reliability and durability. Portable power substations are used to transform and distribute electrical power to mobile equipment such as mining cutting machines and other electrical machinery. Miner control units provide power management for critical electrically operated underground production equipment.

PRODUCT DESIGN AND DEVELOPMENT

The company employs scientific, engineering and other personnel to continually improve its existing product lines and to develop new products at its research and engineering facilities in Champaign and Chicago, Illinois, Boston, Massachusetts, Canada, China, Germany, the Philippines, Taiwan, and Mexico. The Product & Development Technology departments maintain a staff of engineers, chemists, material scientists and technicians whose primary responsibility is to design and develop new products.

Proposals for the development of new products are initiated primarily by sales and marketing personnel with input from customers. The entire product development process usually ranges from a few months to 18 months based on the complexity of development, with continuous efforts to reduce the development cycle. During fiscal years 2012, 2011 and 2010, the company expended $21.2 million, $19.4 million and $17.6 million, respectively, on research, product design and development (“R&D”). During 2010, the company completed moving R&D operations to lower cost locations closer to its customers. R&D operations are now in Canada, China, Germany, the Philippines, Taiwan, and Mexico, as well as the United States.

PATENTS, TRADEMARKS AND OTHER INTELLECTUAL PROPERTY

The company generally relies on patent and trademark laws and license and nondisclosure agreements to protect intellectual property and proprietary products. In cases where it is deemed necessary by management, key employees are required to sign an agreement that they will maintain the confidentiality of the company’s proprietary information and trade secrets.

As of December 29, 2012, the company owned 219 patents in North America, 100 patents in the European Union and 149 patents in other foreign countries. The company also has registered trademark protection for certain of its brand names and logos. The 219 North American patents are in the following product categories: 135 electronics, 49 automotive and 35 electrical. Patents and licenses are amortized over a period of 7-12 years, with a weighted average life of 11.8 years. Distribution networks are amortized over a period of 3-20 years, with a weighted average life of 13.6 years. Trademarks and tradenames are amortized over a period of 5-20 years, with a weighted average life of 13.5 years. The company recorded amortization expense of $6.1 million, $6.6 million and $5.0 million in 2012, 2011 and 2010, respectively, related to amortizable intangible assets.

New products are continually being developed to replace older products. The company regularly applies for patent protection on such new products. Although, in the aggregate, the company’s patents are important in the operation of its businesses, the company believes that the loss by expiration or otherwise of any one patent or group of patents would not materially affect its business.

License royalties amounted to $0.7 million, $1.0 million and $0.2 million for fiscal 2012, 2011 and 2010, respectively, and are included in other expense (income), net on the Consolidated Statements of Net Income.

MANUFACTURING

The company performs the majority of its own fabrication, stamps some of the metal components used in its fuses, holders and switches from raw metal stock and makes its own contacts and springs. In addition, the company fabricates silicon wafers for certain applications and performs its own plating (silver, nickel, zinc, tin and oxides). All thermoplastic molded component requirements used for such products as the ATO®, MINI® and MAXI fuse product lines are met through the company’s in-house molding capabilities. After components are stamped, molded, plated and readied for assembly, final assembly is accomplished on fully automatic and semi-automatic assembly machines. Quality assurance and operations personnel, using techniques such as statistical process control, perform tests, checks and measurements during the production process to maintain the highest levels of product quality and customer satisfaction.

The principal raw materials for the company’s products include copper and copper alloys, heat-resistant plastics, zinc, melamine, glass, silver, gold, raw silicon, solder and various gases. The company uses a sole source for several heat-resistant plastics and for zinc, but believes that suitable alternative heat-resistant plastics and zinc are available from other sources at comparable prices. All other raw materials are purchased from a number of readily available outside sources.

A computer-aided design and manufacturing system (CAD/CAM) expedites product development and machine design and the company’s laboratories test new products, prototype concepts and production run samples. The company participates in “just-in-time” delivery programs with many of its major suppliers and actively promotes the building of strong cooperative relationships with its suppliers by utilizing early supplier involvement techniques and engaging them in pre-engineering product and process development.

MARKETING

The company’s domestic sales and marketing staff of over 35 people maintains relationships with major OEMs and distributors. The company’s sales, marketing and engineering personnel interact directly with OEM engineers to ensure appropriate circuit protection and reliability within the parameters of the OEM’s circuit design. Internationally, the company maintains a sales and marketing staff of over 100 people with sales offices in the U.K., Germany, Spain, Italy, Singapore, Taiwan, Japan, Brazil, Hong Kong, Korea, China and India. The company also markets its products indirectly through a worldwide organization of over 60 manufacturers’ representatives and distributes through an extensive network of electronics, automotive and electrical distributors.

Electronics

The company uses manufacturers’ representatives to sell its electronics products domestically and to call on major domestic and international OEMs and distributors. The company sells approximately 15% of its domestic products directly to OEMs, with the remainder sold through distributors nationwide.

In the Asia-Pacific region, the company maintains a direct sales staff and utilizes distributors in Japan, Singapore, Korea, Taiwan, China, Malaysia, Hong Kong, India and the Philippines. In the Americas, the company maintains a direct sales staff in the U.S. and Brazil and utilizes manufacturers’ representatives and distributors in Canada. In Europe, the company maintains a direct sales force and utilizes manufacturers’ representatives and distributors to support a wide array of customers.

Automotive

The company maintains a direct sales force to service all the major automotive and commercial vehicle OEMs and system suppliers domestically. Over 20 manufacturers’ representatives sell the company’s products to aftermarket fuse retailers such as O’Reilly Auto Parts and Pep Boys. The company also uses about 15 manufacturers’ representatives to sell to the commercial vehicle aftermarket. In Europe, the company uses both a direct sales force and manufacturers’ representatives to distribute its products to OEMs, major system suppliers and aftermarket distributors. In the Asia-Pacific region, the company uses both a direct sales force and distributors to supply to major OEMs and system suppliers.

Electrical

The company markets and sells its power fuses and protection relays through over 35 manufacturers’ representatives across North America. These representatives sell power fuse products through an electrical and industrial distribution network comprised of approximately 2,000 distributor buying locations. These distributors have customers that include electrical contractors, municipalities, utilities and factories (including both MRO and OEM).

The company’s field sales force (including regional sales managers and application engineers) and manufacturers’ representatives call on both distributors and end-users (consulting engineers, municipalities, utilities and OEMs) in an effort to educate these customers on the capabilities and characteristics of the company’s products.

CUSTOMERS

The company sells to over 5,000 customers and distributors worldwide. Sales to Arrow Electronics (an Electronics distributor) were less than 10% of net sales for 2012 and 2011, respectively, but were 10.4% for 2010. No other single customer accounted for more than 10% of net sales during any of the last three years. During fiscal 2012, 2011 and 2010, net sales to customers outside the United States accounted for approximately 67%, 66% and 69%, respectively, of the company’s total net sales.

COMPETITION

The company’s products compete with similar products of other manufacturers, some of which have substantially greater financial resources than the company. In the electronics market, the company’s competitors include Cooper Industries, Bel Fuse, Bourns, EPCOS, On Semiconductor, STMicroelectronics, Semtech, Vishay and TE Connectivity. In the automotive market, the company’s competitors include Cooper Industries, Pacific Engineering (a private company in Japan) and MTA (a private company in Italy). In the electrical market, the company’s major competitors include Cooper Industries and Mersen. The company believes that it competes on the basis of innovative products, the breadth of its product line, the quality and design of its products and the responsiveness of its customer service, in addition to price.

BACKLOG

The backlog of unfilled orders at December 29, 2012 was approximately $79.2 million, compared to $92.4 million at December 31, 2011. Substantially all of the orders currently in backlog are scheduled for delivery in 2013.

EMPLOYEES

As of December 29, 2012, the company employed approximately 6,000 employees worldwide. Approximately 730 employees in Mexico and three employees in Germany are covered by collective bargaining agreements. The Mexico collective bargaining agreement, covering employees in Piedras Negras, expires January 31, 2014.

The Germany collective bargaining agreement, covering three employees in Essen, expires March 31, 2013. During 2011, a collective bargaining agreement covering 28 employees at the company’s Dünsen, Germany facility was terminated as a result of plant closure.

Approximately 12% of the company's total workforce was employed under collective bargaining agreements at December 29, 2012. The employees covered by a collective bargaining agreement that will expire within one year of December 29, 2012 represent less than 1% of the company's total workforce.

Overall, the company has historically maintained satisfactory employee relations and considers employee relations to be good.

ENVIRONMENTAL REGULATION

The company is subject to numerous foreign, federal, state and local regulations relating to air and water quality, the disposal of hazardous waste materials, safety and health. Compliance with applicable environmental regulations has not significantly changed the company’s competitive position, capital spending or earnings in the past and the company does not presently anticipate that compliance with such regulations will change its competitive position, capital spending or earnings for the foreseeable future.

The company employs an environmental engineer to monitor regulatory matters and believes that it is currently in compliance in all material respects with applicable environmental laws and regulations.

Littelfuse GmbH, which was acquired by the company in May 2004, is responsible for maintaining closed coal mines from legacy acquisitions. The company is compliant with German regulations pertaining to the maintenance of the mines and has an accrual related to certain of these coal mine shafts based on an engineering study estimating the cost of remediating the dangers (such as a shaft collapse) of certain of these closed coal mine shafts in Germany. The reserve is reviewed annually and calculated based upon the cost of remediating the shafts that the study deems most risky. Further information regarding the coal mine liability reserve is provided in Note 11 of the Notes to Consolidated Financial Statements included in this report.

ITEM 1A. RISK FACTORS.

Our business, financial condition and results of operations are subject to various risks and uncertainties, including the risk factors we have identified below. These factors are not necessarily listed in order of importance. We may amend or supplement the risk factors from time to time by other reports that we file with the SEC in the future.

Our industry is subject to intense competitive pressures.

We operate in markets that are highly competitive. We compete on the basis of price, quality, service and/or brand name across the industries and markets we serve. Competitive pressures could affect the prices we are able to charge our customers or the demand for our products.

We may not always be able to compete on price, particularly when compared to manufacturers with lower cost structures. Some of our competitors have substantially greater sales, financial and manufacturing resources and may have greater access to capital than Littelfuse. As other companies enter our markets or develop new products, competition may further intensify. Our failure to compete effectively could materially adversely affect our business, financial condition and results of operations.

We may be unable to manufacture and deliver products in a manner that is responsive to our customers’ needs.

The end markets for our products are characterized by technological change, frequent new product introductions and enhancements, changes in customer requirements and emerging industry standards. The introduction of products embodying new technologies and the emergence of new industry standards could render our existing products obsolete and unmarketable before we can recover any or all of our research, development and commercialization expenses on capital investments. Furthermore, the life cycles of our products may change and are difficult to estimate.

Our future success will depend upon our ability to manufacture and deliver products in a manner that is responsive to our customers’ needs. We will need to develop and introduce new products and product enhancements on a timely basis that keep pace with technological developments and emerging industry standards and address increasingly sophisticated requirements of our customers. We invest heavily in research and development without knowing that we will recover these costs. Our competitors may develop products or technologies that will render our products non-competitive or obsolete. If we cannot develop and market new products or product enhancements in a timely and cost-effective manner, our business, financial condition and results of operations could be materially adversely affected.

Our business may be interrupted by labor disputes or other interruptions of supplies.

A work stoppage could occur at certain of our facilities, most likely as a result of disputes under collective bargaining agreements or in connection with negotiations of new collective bargaining agreements. In addition, we may experience a shortage of supplies for various reasons, such as financial distress, work stoppages, natural disasters or production difficulties that may affect one of our suppliers. A significant work stoppage, or an interruption or shortage of supplies for any reason, if protracted, could substantially adversely affect our business, financial condition and results of operations. The transfer of our manufacturing operations and changes in our distribution model could disrupt operations for a limited time.

Our revenues may vary significantly from period to period.

Our revenues may vary significantly from one accounting period to another due to a variety of factors including:

| |

·

|

changes in our customers’ buying decisions;

|

| |

·

|

changes in demand for our products;

|

| |

·

|

changes in our distributor inventory stocking;

|

| |

·

|

our effectiveness in managing manufacturing processes;

|

| |

·

|

costs and timing of our component purchases;

|

| |

·

|

the effectiveness of our inventory control;

|

| |

·

|

the degree to which we are able to utilize our available manufacturing capacity;

|

| |

·

|

our ability to meet delivery schedules;

|

| |

·

|

general economic and industry conditions;

|

| |

·

|

local conditions and events that may affect our production volumes, such as labor conditions and political instability; and

|

| |

·

|

seasonality of certain product lines.

|

The bankruptcy or insolvency of a major customer could adversely affect us.

The bankruptcy or insolvency of a major customer could result in lower sales revenue and cause a material adverse effect on our business, financial condition and results of operations. In addition, the bankruptcy or insolvency of a major U.S. auto manufacturer or significant supplier likely could lead to substantial disruptions in the automotive supply base, resulting in lower demand for our products, which likely would cause a decrease in sales revenue and have a substantial adverse impact on our business, financial condition and results of operations.

Our ability to manage currency or commodity price fluctuations or shortages is limited.

As a resource-intensive manufacturing operation, we are exposed to a variety of market and asset risks, including the effects of changes in foreign currency exchange rates, commodity prices and interest rates. We have multiple sources of supply for the majority of our commodity requirements. However, significant shortages that disrupt the supply of raw materials or result in price increases could affect prices we charge our customers, our product costs and the competitive position of our products and services. We monitor and manage these exposures as an integral part of our overall risk management program, which recognizes the unpredictability of markets and seeks to reduce the potentially adverse effects on our results. Nevertheless, changes in currency exchange rates, commodity prices and interest rates cannot always be predicted. In addition, because of intense price competition and our high level of fixed costs, we may not be able to address such changes even if they are foreseeable. Substantial changes in these rates and prices could have a material adverse effect on our results of operations and financial condition. For additional discussion of interest rate, currency or commodity price risk, see "Item 7A. Quantitative and Qualitative Disclosures about Market Risks.”

Operations and supply sources located outside the United States, particularly in emerging markets, are subject to greater risks.

Our operating activities outside the United States contribute significantly to our revenues and earnings. Serving a global customer base and remaining competitive in the global marketplace requires the company to place our production in countries outside the United States, including emerging markets, to capitalize on market opportunities and maintain a cost-efficient structure. In addition, we source a significant amount of raw materials and other components from third-party suppliers in low-cost countries. Our international operating activities are subject to a number of risks generally associated with international operations, including risks relating to the following:

| |

·

|

general economic conditions;

|

| |

·

|

currency fluctuations and exchange restrictions;

|

| |

·

|

import and export duties and restrictions;

|

| |

·

|

the imposition of tariffs and other import or export barriers;

|

| |

·

|

compliance with regulations governing import and export activities;

|

| |

·

|

current and changing regulatory requirements;

|

| |

·

|

political and economic instability;

|

| |

·

|

potentially adverse income tax consequences;

|

| |

·

|

transportation delays and interruptions;

|

| |

·

|

public health concerns;

|

| |

·

|

difficulties in staffing and managing multi-national operations; and

|

| |

·

|

limitations on our ability to enforce legal rights and remedies.

|

Any of these factors could have a material adverse effect on our business, financial condition and results of operations.

We engage in acquisitions and may encounter difficulties in integrating these businesses.

We are a company that, from time to time, seeks to grow through strategic acquisitions. We have in the past acquired a number of businesses or companies and additional product lines and assets. We intend to continue to expand and diversify our operations with additional acquisitions. The success of these transactions depends on our ability to integrate the assets and personnel acquired in these acquisitions. We may encounter difficulties in integrating acquisitions with our operations and may not realize the degree or timing of the benefits that we anticipated from an acquisition.

Environmental liabilities could adversely impact our financial position.

Federal, state and local laws and regulations impose various restrictions and controls on the discharge of materials, chemicals and gases used in our manufacturing processes or in our finished goods. These environmental regulations have required us to expend a portion of our resources and capital on relevant compliance programs. Under these laws and regulations, we could be held financially responsible for remedial measures if our current or former properties are contaminated or if we send waste to a landfill or recycling facility that becomes contaminated, even if we did not cause the contamination. We may be subject to additional common law claims if we release substances that damage or harm third parties. In addition, future changes in environmental laws or regulations may require additional investments in capital equipment or the implementation of additional compliance programs. Any failure to comply with new or existing environmental laws or regulations could subject us to significant liabilities and could have a material adverse effect on our business, financial condition or results of operations.

In the conduct of our manufacturing operations, we have handled and do handle materials that are considered hazardous, toxic or volatile under federal, state and local laws. The risk of accidental release of such materials cannot be completely eliminated. In addition, we operate or own facilities located on or near real property that was formerly owned and operated by others. Certain of these properties were used in ways that involved hazardous materials. Contaminants may migrate from, within or through these properties. These releases or migrations may give rise to claims. Where third parties are responsible for contamination, the third parties may not have funds, or not make funds available when needed, to pay remediation costs imposed upon us under environmental laws and regulations.

The company is responsible for the maintenance of discontinued coal mining operations in Germany. The risk of environmental remediation exists and the company is in the process of remediating the mines considered to be the most at risk.

We derive a substantial portion of our revenues from customers in the automotive, consumer electronics and communications industries, and we are susceptible to trends and factors affecting those industries as well as the success of our customers’ products.

Net sales to the automotive, consumer electronics and communications industries represent a substantial portion of our revenues. Factors negatively affecting these industries and the demand for products also negatively affect our business, financial condition or results of operations. Any adverse occurrence, including industry slowdown, recession, political instability, costly or constraining regulations, armed hostilities, terrorism, excessive inflation, prolonged disruptions in one or more of our customers’ production schedules or labor disturbances, that results in significant decline in the volume of sales in these industries, or in an overall downturn in the business and operations of our customers in these industries, could materially adversely affect our business, financial condition or results of operations. For example, the automotive industry as well as the consumer electronics market is highly cyclical in nature and sensitive to changes in general economic conditions, consumer preferences and interest rates. In addition, the global automotive and electronic industries have overall manufacturing capacity far exceeding demand. To the extent that demand for certain of our customers’ products declines, the demand for our products may decline. Reduced demand relating to general economic conditions, consumer preferences, interest rates or industry over-capacity may have a material adverse effect upon our business, financial condition or results of operations.

The inability to maintain access to capital markets may adversely affect our business and financial results.

Our ability to invest in our businesses, make strategic acquisitions and refinance maturing debt obligations may require access to the capital markets and sufficient bank credit lines to support short-term borrowings. If we are unable to access the capital markets or bank credit facilities, we could experience a material adverse affect on our business, financial condition and results of operations.

Fixed costs may reduce operating results if our sales fall below expectations.

Our expense levels are based, in part, on our expectations for future sales. Many of our expenses, particularly those relating to capital equipment and manufacturing overhead, are relatively fixed. We might be unable to reduce spending quickly enough to compensate for reductions in sales. Accordingly, shortfalls in sales could materially and adversely affect our operating results.

The volatility of our stock price could affect the value of an investment in our stock and our future financial position.

The market price of our stock has fluctuated widely. Between January 1, 2012 and December 29, 2012, the closing sale price of our common stock ranged between a low of $43.81 and a high of $64.86, experiencing greater volatility over that time than the broader markets. The volatility of our stock price may be related to any number of factors, such as general economic conditions, industry conditions, analysts’ expectations concerning our results of operations, or the volatility of our revenues as discussed above under “Our Revenues May Vary Significantly from Period to Period.” The historic market price of our common stock may not be indicative of future market prices. We may not be able to sustain or increase the value of our common stock. Declines in the market price of our stock could adversely affect our ability to retain personnel with stock incentives, to acquire businesses or assets in exchange for stock and/or to conduct future financing activities with or involving our common stock.

Customer demands and new regulations related to conflict-free minerals may force us to incur additional expenses.

The Dodd-Frank Wall Street Reform and Consumer Protection Act requires disclosure of use of “conflict” minerals mined from the Democratic Republic of Congo and adjoining countries and efforts to prevent the use of such minerals. In the semiconductor industry, these minerals are most commonly found in metals. As there may be only a limited number of suppliers offering “conflict free” metals, we cannot be sure that we will be able to obtain necessary metals in sufficient quantities or at competitive prices. Also, we may face challenges with our customers and suppliers if we are unable to sufficiently verify that the metals used in our products are “conflict free.”

Our Information Technology (“IT”) systems could be breached.

We face certain security threats relating to the confidentiality and integrity of our IT systems. Despite implementation of security measures, our IT systems may be vulnerable to damage from computer viruses, cyber attacks and other unauthorized access and these security breaches could result in a disruption to our operations. A material network breach of our IT systems could involve the theft of intellectual property or customer data which may be used by competitors. To the extent that any security breach results in a loss or damage to data, or inappropriate disclosure of confidential or proprietary information, it could cause damage to our reputation, affect our customer relations, lead to claims against us, increase our costs to protect against future damage and could result in a material adverse effect on our business and financial position.

ITEM 1B. UNRESOLVED STAFF COMMENTS.

None.

ITEM 2. PROPERTIES.

LITTELFUSE FACILITIES

The company’s operations are located in 44 owned or leased facilities worldwide, totaling approximately 1.6 million square feet. The company’s corporate headquarters is located in the U.S. in Chicago, Illinois. The company has North American manufacturing facilities in Saskatoon, Canada, Piedras Negras, Mexico, Melchor Muzquiz, Mexico and Bellingham, Washington. During 2010, the European headquarters and the primary European distribution center, previously located in Utrecht, the Netherlands, until the property was sold in 2010, were relocated to Dünsen, Germany. The Dünsen facility was closed during 2011 and sold in 2012. Manufacturing operations were transferred from Dünsen to Piedras Negras, Mexico. The office and European headquarters were subsequently transferred to Bremen, Germany. The company has added manufacturing facilities in Roskilde, Denmark and Kaunas, Lithuania through acquisitions completed in 2011 and 2012, respectively. The company has entered into a binding agreement for the future sale of its Des Plaines, Illinois, property which was closed in 2009. The Des Plaines building was demolished in 2010 to facilitate the sale of the underlying property. The Dundalk, Ireland facility, which was also closed in 2009, was sold in 2012.

Asia-Pacific operations include sales and distribution centers located in Singapore, Taiwan, Japan, China and Korea, with manufacturing plants in China and the Philippines. The manufacturing plant previously located in Taiwan was closed and sold during 2012. The company does not believe that it will encounter any difficulty in renewing its existing leases upon the expiration of their current terms. Management believes that the company’s facilities are adequate to meet its requirements for the foreseeable future.

The following table provides certain information concerning the company’s facilities at December 29, 2012, and the use of these facilities during fiscal 2012:

|

Location

|

Use

|

Size

(sq. ft.)

|

Lease/Own

|

Lease

Expiration

Date

|

Primary Product

|

|

Chicago, Illinois

|

Administrative, Engineering, Research and Testing

|

54,838

|

|

Leased

|

2024

|

Auto, Electronics and Electrical

|

|

Elk Grove Village, Illinois

|

Engineering and Research

|

5,000

|

|

Leased

|

2013

|

Auto and Electronics

|

|

Bensenville, Illinois

|

Research and Development

|

3,140

|

|

Leased

|

2013

|

Electronics

|

|

Champaign, Illinois

|

Research and Development

|

13,503

|

|

Leased

|

2025

|

Auto and Electronics

|

|

Campbell, California

|

Engineering

|

1,001

|

|

Leased

|

2014

|

Electronics

|

|

Troy, Michigan

|

Sales

|

2,224

|

|

Leased

|

2016

|

Auto

|

|

Boston, Massachusetts

|

Administrative, Engineering, Research and Development

|

26,000

|

|

Leased

|

2016

|

Auto

|

|

Schertz, Texas

|

Warehouse and Distribution

|

32,000

|

|

Leased

|

2014

|

Auto

|

|

Melchor Muzquiz, Mexico

|

Manufacturing

|

39,365

|

|

Leased

|

2016

|

Auto

|

|

Bellingham, Washington

|

Manufacturing

|

8,000

|

|

Leased

|

2013

|

Auto

|

|

Piedras Negras, Mexico

|

Administrative / Manufacturing

|

99,822

|

|

Leased

|

2015

|

Auto

|

|

Piedras Negras, Mexico

|

Manufacturing

|

68,088

|

|

Leased

|

2013

|

Electrical

|

|

Piedras Negras, Mexico

|

Manufacturing

|

22,381

|

|

Leased

|

2013

|

Electrical

|

|

Piedras Negras, Mexico

|

Manufacturing

|

164,785

|

|

Owned

|

—

|

Auto

|

|

Eagle Pass, Texas

|

Distribution

|

15,400

|

|

Leased

|

2016

|

Auto, Electronics and Electrical

|

|

Saskatoon, Canada

|

Manufacturing

|

67,500

|

|

Owned

|

—

|

Electrical

|

|

Calgary, Canada

|

Sales

|

1,000

|

|

Leased

|

2017

|

Electrical

|

|

Sao Paulo, Brazil

|

Sales

|

538

|

|

Leased

|

2013

|

Electronics and Auto

|

|

Manaus, Brazil

|

Warehouse

|

2,002

|

|

Leased

|

2014

|

Electronics and Auto

|

|

Roskilde, Denmark

|

Administrative, Manufacturing, Research and Development and Sales

|

18,740

|

|

Leased

|

2017

|

Electrical

|

|

Dubai, UAE

|

Sales

|

1,356

|

|

Leased

|

2014

|

Electrical

|

|

Swindon, U.K.

|

Administrative

|

304

|

|

Leased

|

2013

|

Electronics

|

| |

|

|

|

|

|

|

|

Bremen, Germany

|

Administrative

|

13,455

|

|

Leased

|

2015

|

Auto, Electronics and Electrical

|

|

Essen, Germany

|

Leased to third party

|

37,244

|

|

Owned

|

—

|

—

|

|

Essen, Germany

|

Administrative

|

3,703

|

|

Leased

|

2013

|

Auto and Electronic

|

| Location |

Use

|

Size

(sq. ft.)

|

Lease/Own

|

Lease

Expiration

Date

|

Primary Product

|

|

Amsterdam, Netherlands

|

Warehouse

|

21,851

|

|

Leased

|

2013

|

Auto and Electronic

|

|

Trollhättan, Sweden

|

Sales

|

3,281

|

|

Leased

|

2015

|

Auto

|

|

Stockholm, Sweden

|

Sales

|

150

|

|

Leased

|

2013

|

Auto

|

|

Kaunas, Lithuania

|

Administrative, Manufacturing, Testing, Research and Engineering

|

15,640

|

|

Owned

|

—

|

Auto

|

|

Kaunas, Lithuania

|

Manufacturing

|

35,984

|

|

Leased

|

2014

|

Auto

|

|

Singapore

|

Sales and Distribution

|

1,572

|

|

Leased

|

2015

|

Electronics

|

|

Taipei, Taiwan

|

Sales

|

7,876

|

|

Leased

|

2014

|

Electronics

|

|

Seoul, Korea

|

Sales

|

3,643

|

|

Leased

|

2013

|

Auto and Electronics

|

|

Lipa City, Philippines

|

Manufacturing

|

116,046

|

|

Owned

|

—

|

Electronics

|

|

Lipa City, Philippines

|

Manufacturing

|

22,733

|

|

Leased

|

2013

|

Electronics

|

|

Dongguan, China

|

Manufacturing

|

264,792

|

|

Leased

|

2014

|

Electronics

|

|

Suzhou, China

|

Manufacturing

|

143,458

|

|

Owned

|

—

|

Auto and Electronics

|

|

Beijing, China

|

Sales

|

452

|

|

Leased

|

2013

|

Electronics

|

|

Shenzen, China

|

Sales

|

3,100

|

|

Leased

|

2015

|

Electronics

|

|

Shanghai, China

|

Sales

|

4,774

|

|

Leased

|

2015

|

Auto and Electronics

|

|

Chu-Pei City, Taiwan

|

Research and Development

|

5,328

|

|

Leased

|

2013

|

Electronics

|

|

Wuxi, China

|

Manufacturing

|

221,429

|

|

Owned

|

—

|

Electronics

|

|

Hong Kong, China

|

Sales

|

743

|

|

Leased

|

2014

|

Auto, Electronics and Electrical

|

|

Yokohama, Japan

|

Sales

|

3,509

|

|

Leased

|

2015

|

Auto, Electronics and Electrical

|

Properties with lease expirations in 2013 renew at various times throughout the year. The company does not anticipate any material impact as a result of such expirations.

ITEM 3. LEGAL PROCEEDINGS.

The company is not a party to any material legal proceedings, other than routine litigation incidental to our business.

ITEM 4. MINE SAFETY DISCLOSURES.

Not applicable.

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES.

Shares of the company’s common stock are traded under the symbol “LFUS” on the NASDAQ Global Select MarketSM. As of February 15, 2013, there were 91 holders of record of the company’s common stock.

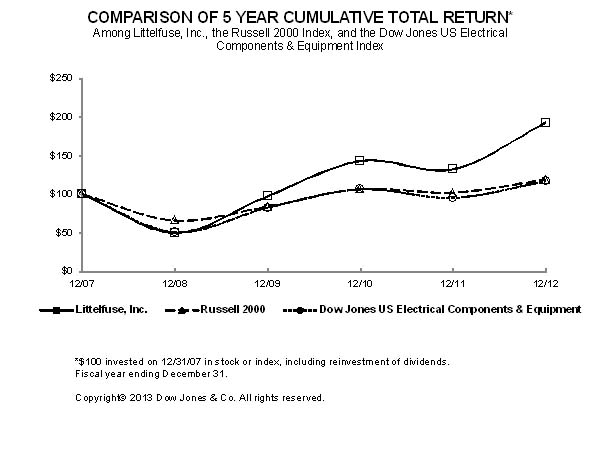

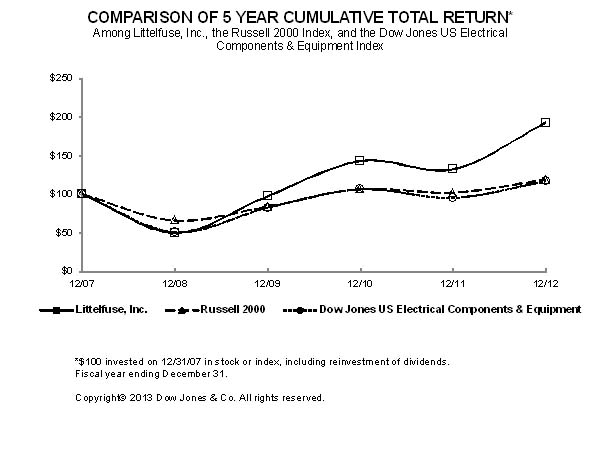

Stock Performance Graph

The following stock performance graph and related information shall not be deemed “soliciting material” or “filed” with the Securities and Exchange Commission, nor shall such information be incorporated by reference into any future filings under the Securities Act of 1933 or Securities Act of 1934, each as amended, except to the extent that the company specifically incorporates it by reference into such filing.

The following stock performance graph compares the five-year cumulative total return on Littelfuse common stock to the five-year cumulative total returns on the Russell 2000 Index and the Dow Jones Electrical Components and Equipment Industry Group Index. The company believes that the Russell 2000 Index and the Dow Jones Electrical Components and Equipment Industry Group Index represent a broad market index and peer industry group for total return performance comparison. The stock performance shown on the graph below represents historical stock performance and is not necessarily indicative of future stock price performance.

The Dow Jones Electrical Components and Equipment Industry Group Index includes the common stock of American Superconductor Corp.; Amphenol Corp.; Anaren Microwave, Inc.; Arrow Electronics, Inc.; Avnet, Inc.; AVX Corp.; Benchmark Electronics, Inc.; C&D Technologies, Inc.; Capstone Turbine Corp.; CTS Corp.; General Cable Corp.; Hubbell Inc. Class B; Jabil Circuit, Inc.; KEMET Corp.; Littelfuse, Inc.; Methode Electronics, Inc.; Molex, Inc. and Molex, Inc. Class A; Park Electrochemical Corp.; Plexus Corp.; Power-One, Inc.; Powerwave Technologies, Inc.; Pulse Electronics, Inc.; Regal-Beloit Corp.; Sanmina Corp.; Thomas & Betts Corp.; Valence Technology, Inc.; Vicor Corp.; and Vishay Intertechnology, Inc.

In the case of the Russell 2000 Index and the Dow Jones Electrical Components and Equipment Industry Group Index, a $100 investment made on December 31, 2007, and reinvestment of all dividends is assumed. In the case of the company, a $100 investment made on December 31, 2007, is assumed. (The company paid no dividends in 2007, 2008 or 2009 but did pay dividends in 2010, 2011 and 2012.) Returns for the company’s fiscal years presented above are as of the last day of the respective fiscal year which were December 27, 2008, January 2, 2010, January 1, 2011, December 31, 2011 and December 29, 2012 for the fiscal years 2008, 2009, 2010, 2011 and 2012 respectively.

The company initiated cash dividends in the fourth quarter of 2010. The company previously had not paid any cash dividends prior to fiscal 2010. Future dividend policy will be determined by the Board of Directors based upon its evaluation of earnings, cash availability and general business prospects. Currently, there are restrictions on the payment of dividends contained in the company’s credit agreements that relate to the maintenance of a minimum net worth and certain financial ratios. However, the company expects to continue paying cash dividends on a quarterly basis for the foreseeable future.

The Board of Directors authorized the repurchase of up to 1,000,000 shares of the company’s common stock under a program for the period May 1, 2012 to April 30, 2013. The company did not repurchase any shares during 2012 and 1,000,000 shares remain available for purchase under the initial program as of December 29, 2012.

The company withheld 27,417 shares of stock in lieu of withholding taxes on behalf of employees who became vested in restricted share units during fiscal 2012. Shares withheld were 23,081 during the period March 31, 2011 to April 28, 2012 and 4,336 during the period June 30, 2012 to July 28, 2012. Shares withheld are classified as Treasury stock on the Consolidated Balance Sheet.

The table below provides information with respect to the company’s quarterly stock prices and cash dividends declared and paid for each quarter during fiscal 2012 and 2011:

| |

|

2012

|

|

|

2011

|

|

| |

|

|

4Q |

|

|

|

3Q |

|

|

|

2Q |

|

|

|

1Q |

|

|

|

4Q |

|

|

|

3Q |

|

|

|

2Q |

|

|

|

1Q |

|

|

High

|

|

$ |

61.23 |

|

|

$ |

58.26 |

|

|

$ |

64.86 |

|

|

$ |

62.70 |

|

|

$ |

52.04 |

|

|

$ |

61.76 |

|

|

$ |

64.82 |

|

|

$ |

58.10 |

|

|

Low

|

|

|

51.93 |

|

|

|

50.50 |

|

|

|

55.05 |

|

|

|

43.81 |

|

|

|

38.65 |

|

|

|

38.56 |

|

|

|

54.40 |

|

|

|

48.44 |

|

|

Close

|

|

|

59.97 |

|

|

|

56.54 |

|

|

|

56.89 |

|

|

|

62.70 |

|

|

|

42.98 |

|

|

|

40.21 |

|

|

|

60.54 |

|

|

|

58.10 |

|

|

Dividends

|

|

|

0.20 |

|

|

|

0.20 |

|

|

|

0.18 |

|

|

|

0.18 |

|

|

|

0.18 |

|

|

|

0.15 |

|

|

|

0.15 |

|

|

|

0.15 |

|

ITEM 6. SELECTED FINANCIAL DATA.

The information presented below provides selected financial data of the company during the past five fiscal years and should be read in conjunction with Management’s Discussion and Analysis of Financial Condition and Results of Operations and the Consolidated Financial Statements and Notes to Consolidated Financial Statements set forth in Item 7 and Item 8, respectively, for the respective years presented (amounts in thousands, except per share data):

| |

|

2012

|

|

|

2011

|

|

|

2010

|

|

|

2009

|

|

|

2008

|

|

|

Net sales

|

|

$ |

667,913 |

|

|

$ |

664,955 |

|

|

$ |

608,021 |

|

|

$ |

430,147 |

|

|

$ |

530,869 |

|

|

Gross profit

|

|

|

258,467 |

|

|

|

256,694 |

|

|

|

233,872 |

|

|

|

125,361 |

|

|

|

143,669 |

|

|

Operating income

|

|

|

106,870 |

|

|

|

113,904 |

|

|

|

107,574 |

|

|

|

13,695 |

|

|

|

8,495 |

|

|

Net income

|

|

|

75,332 |

|

|

|

87,024 |

|

|

|

78,663 |

|

|

|

9,411 |

|

|

|

8,016 |

|

|

Per share of common stock:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income from continuing operations

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- Basic

|

|

|

3.45 |

|

|

|

3.96 |

|

|

|

3.58 |

|

|

|

0.43 |

|

|

|

0.37 |

|

|

- Diluted

|

|

|

3.40 |

|

|

|

3.90 |

|

|

|

3.52 |

|

|

|

0.43 |

|

|

|

0.37 |

|

|

Cash dividends paid

|

|

|

0.76 |

|

|

|

0.63 |

|

|

|

0.15 |

|

|

|

— |

|

|

|

— |

|

|

Cash and cash equivalents

|

|

|

235,404 |

|

|

|

164,016 |

|

|

|

109,720 |

|

|

|

70,354 |

|

|

|

70,937 |

|

|

Total assets

|

|

|

777,728 |

|

|

|

678,424 |

|

|

|

621,129 |

|

|

|

533,127 |

|

|

|

538,928 |

|

| Short-term debt |

|

|

84,000 |

|

|

|

85,000 |

|

|

|

33,000 |

|

|

|

14,183 |

|

|

|

8,000 |

|

|

Long-term debt, less current portion

|

|

|

— |

|

|

|

— |

|

|

|

41,000 |

|

|

|

49,000 |

|

|

|

72,000 |

|

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

Littelfuse, Inc. and its subsidiaries (the “company” or “Littelfuse”) design, manufacture and sell circuit protection devices for use in the electronics, automotive and electrical markets throughout the world. The following Management’s Discussion and Analysis of Financial Condition and Results of Operations (“MD&A”) is designed to provide the reader with information that will assist in understanding the company’s Consolidated Financial Statements, the changes in certain key items in those financial statements from year to year, and the primary factors that accounted for those changes, as well as how certain accounting principles affect the Consolidated Financial Statements. The discussion also provides information about the financial results of the various business unit segments to provide a better understanding of how those segments and their results affect the financial condition and results of operations of Littelfuse as a whole.

Business Segment Information

U.S. Generally Accepted Accounting Principles (“GAAP”) dictates annual and interim reporting standards for an enterprise's operating segments and related disclosures about its products, services, geographic areas and major customers. Within U.S. GAAP, an operating segment is defined as a component of an enterprise that engages in business activities from which it may earn revenues and incur expenses, and about which separate financial information is regularly evaluated by the Chief Operating Decision Maker (“CODM”) in deciding how to allocate resources. The CODM is the company’s President and Chief Executive Officer.

The company reports its operations by three business unit segments: Electronics, Automotive and Electrical. The following table is a summary of the company’s operating segments’ net sales by business unit and geography (in millions):

| |

|

Fiscal Year

|

|

| |

|

2012

|

|

|

2011(b)

|

|

|

2010

|

|

|

Business Unit

|

|

|

|

|

|

|

|

|

|

|

Electronics

|

|

$ |

329.5 |

|

|

$ |

354.5 |

|

|

$ |

373.4 |

|

|

Automotive(b) (d)

|

|

|

206.2 |

|

|

|

197.6 |

|

|

|

139.1 |

|

|

Electrical(c)

|

|

|

132.2 |

|

|

|

112.9 |

|

|

|

95.5 |

|

|

Total

|

|

$ |

667.9 |

|

|

$ |

665.0 |

|

|

$ |

608.0 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Geography(a)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Americas(c)

|

|

$ |

303.6 |

|

|

$ |

288.6 |

|

|

$ |

227.7 |

|

|

Europe(d)

|

|

|

107.5 |

|

|

|

114.9 |

|

|

|

115.1 |

|

|

Asia-Pacific

|

|

|

256.8 |

|

|

|

261.5 |

|

|

|

265.2 |

|

|

Total

|

|

$ |

667.9 |

|

|

$ |

665.0 |

|

|

$ |

608.0 |

|

| |

(a)

|

Sales by geography represent sales to customer or distributor locations.

|

| |

(b)

|

2012 and 2011 include Cole Hersee net sales of $47.2 million and $46.9 million for fiscal years 2012 and 2011, respectively.

|

| |

(c)

|

2012 and 2011 include Selco net sales of $6.0 million and $3.2 million for fiscal years 2012 and 2011, respectively.

|

| |

(d)

|

2012 includes Accel and Terra Power net sales of $11.2 million and $1.7 million, respectively.

|

Business unit segment information is described more fully in Note 16 of the Notes to Consolidated Financial Statements. The following discussion provides an analysis of the information contained in the Consolidated Financial Statements and accompanying Notes to Consolidated Financial Statements at December 29, 2012 and December 31, 2011, and for the three fiscal years ended December 29, 2012, December 31, 2011 and January 1, 2011.

Results of Operations — 2012 compared with 2011