NUCOR CORP false 0000073309 0000073309 2023-01-26 2023-01-26

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 26, 2023

NUCOR CORPORATION

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

| Delaware |

|

1-4119 |

|

13-1860817 |

| (State or Other Jurisdiction of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

|

|

| 1915 Rexford Road, Charlotte, NC |

|

28211 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s Telephone Number, Including Area Code: (704) 366-7000

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.40 per share |

|

NUE |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 2.02. |

Results of Operations and Financial Condition. |

On January 26, 2023, Nucor Corporation issued a news release reporting its financial results for the quarter ended December 31, 2022. A copy of the news release is furnished as Exhibit 99.1 and incorporated herein by reference.

| Item 7.01. |

Regulation FD Disclosure. |

On January 26, 2023, Nucor Corporation, in conjunction with the issuance of the aforementioned news release, posted an investor presentation to its Investor Relations website. A copy of the investor presentation is furnished as Exhibit 99.2 and incorporated herein by reference.

| Item 9.01. |

Financial Statements and Exhibits. |

The information contained in this Current Report on Form 8-K, including the exhibits attached hereto, is being furnished and shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section. Furthermore, the information contained in this Current Report on Form 8-K shall not be deemed to be incorporated by reference into any registration statement or other document filed pursuant to the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in any such registration statement or other document.

1

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

NUCOR CORPORATION |

|

|

|

| Date: January 26, 2023 |

|

By: |

|

/s/ Stephen D. Laxton |

|

|

|

|

Stephen D. Laxton |

|

|

|

|

Chief Financial Officer, Treasurer and Executive Vice President |

2

Exhibit 99.1

|

|

|

|

|

| News Release |

|

|

|

|

Nucor Reports Record Annual Earnings for 2022

| |

• |

|

Nucor reports safest and most profitable year in Company history, eclipsing prior records set in 2021

|

| |

• |

|

Fourth quarter and full year 2022 earnings per diluted share of $4.89 and $28.79, respectively

|

| |

• |

|

Returned $3.3 billion of capital to stockholders through dividends and share repurchases

|

| |

• |

|

Announced increased dividend for 50th consecutive year since

initial NYSE listing in 1972 |

CHARLOTTE, N.C. – January 26, 2023 - Nucor Corporation (NYSE: NUE) today announced consolidated

net earnings of $1.26 billion, or $4.89 per diluted share, for the fourth quarter of 2022. By comparison, Nucor reported consolidated net earnings of $1.69 billion, or $6.50 per diluted share, for the third quarter of 2022 and

$2.25 billion, or $7.97 per diluted share, for the fourth quarter of 2021.

For the full year 2022, Nucor reported record consolidated net earnings

of $7.61 billion, or $28.79 per diluted share, surpassing the previous record of consolidated net earnings of $6.83 billion, or $23.16 per diluted share, in 2021.

Included in the fourth quarter of 2022 results was an after-tax net benefit of $60.4 million, or $0.24 per

diluted share, related to state tax credits and an after-tax net benefit of $88.0 million, or $0.34 per diluted share, related to a change in the valuation allowance of a state deferred tax asset. Also

included in the fourth quarter of 2022 results was a pre-tax $96.0 million, or $0.29 per diluted share, write-off of the remaining carrying value of the

Company’s leasehold interest in unproved oil and gas properties that is included in the raw materials segment. Of these three items, only the state tax credits were known at the time and considered as part of our quantitative guidance in mid-December 2022.

“I am proud to report that 2022 was both the safest and most profitable year in Nucor history.

This is the fourth consecutive year the Nucor team has exhibited record-breaking safety performance, as we strive to become the world’s safest steel company,” said Leon Topalian, Nucor’s Chair, President, and Chief Executive Officer.

“In terms of profitability for the year, Nucor generated consolidated net earnings of $7.61 billion, or $28.79 per diluted share, which exceeds

our previous record of $23.16 per diluted share, set in 2021, by 24%. These records are a testament of the world class performance of the 31,000 Nucor teammates that live our culture every single day. Looking ahead to 2023, while we recognize there

is uncertainty about the near-term U.S. economic outlook, we’re starting to see a number of demand drivers gathering momentum, including the reshoring of manufacturing, large infrastructure investments and grid modernization. We believe

Nucor’s steel and steel products with lower greenhouse gas intensity will be essential building blocks to our nation’s clean energy future, security, and productivity for years to come.”

Page 1 of 10

Nucor Executive Offices: 1915 Rexford Road, Charlotte, North Carolina 28211

Phone 704-366-7000 Fax 704-362-4208 www.nucor.com

|

|

|

|

|

| News Release |

|

|

|

|

Nucor Reports Record Annual Earnings for 2022 (Continued)

Selected Segment Data

Earnings (loss) before income taxes and noncontrolling interests by segment for the fourth quarter and full year 2022 and 2021 were as follows (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months (13 Weeks) Ended |

|

|

Twelve Months (52 Weeks) Ended |

|

| |

|

Dec. 31, 2022 |

|

|

Dec. 31, 2021 |

|

|

Dec. 31, 2022 |

|

|

Dec. 31, 2021 |

|

| Steel mills |

|

$ |

516,655 |

|

|

$ |

3,128,700 |

|

|

$ |

7,199,087 |

|

|

$ |

9,735,020 |

|

| Steel products |

|

|

1,081,461 |

|

|

|

451,713 |

|

|

|

4,093,105 |

|

|

|

1,291,450 |

|

| Raw materials |

|

|

(141,817 |

) |

|

|

44,708 |

|

|

|

496,823 |

|

|

|

549,956 |

|

| Corporate/eliminations |

|

|

77,106 |

|

|

|

(617,364 |

) |

|

|

(1,544,171 |

) |

|

|

(2,375,568 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

1,533,405 |

|

|

$ |

3,007,757 |

|

|

$ |

10,244,844 |

|

|

$ |

9,200,858 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Financial Review

Nucor’s consolidated net sales decreased 17% to $8.72 billion in the fourth quarter of 2022 compared with $10.50 billion in the third quarter of

2022 and decreased 16% compared with $10.36 billion in the fourth quarter of 2021. Average sales price per ton in the fourth quarter of 2022 decreased 7% compared with the third quarter of 2022 and decreased 6% compared with the fourth quarter

of 2021. Approximately 5,738,000 tons were shipped to outside customers in the fourth quarter of 2022, an 11% decrease from both the third quarter of 2022 and the fourth quarter of 2021. Total steel mill shipments in the fourth quarter of 2022

decreased 13% as compared to both the third quarter of 2022 and the fourth quarter of 2021. Steel mill shipments to internal customers represented 20% of total steel mill shipments in the fourth quarter of 2022, a decrease compared to 22% in both

the third quarter of 2022 and the fourth quarter of 2021. Downstream steel product shipments to outside customers in the fourth quarter of 2022 decreased 9% from the third quarter of 2022 and increased 2% compared to the fourth quarter of 2021.

For the full year 2022, Nucor’s consolidated net sales of $41.51 billion increased 14% compared with consolidated net sales of $36.48 billion

reported in the full year 2021. Total tons shipped to outside customers in 2022 were approximately 25,524,000 tons, a decrease of 10% from 2021, while the average sales price per ton in 2022 increased 26% from 2021.

The average scrap and scrap substitute cost per gross ton used in the fourth quarter of 2022 was $427, a 15% decrease compared to $502 in the third quarter of

2022 and a 16% decrease compared to $508 in the fourth quarter of 2021. The average scrap and scrap substitute cost per gross ton used in the full year 2022 was $492, a 5% increase compared to $469 in the full year 2021.

Pre-tax pre-operating and start-up

costs related to the Company’s growth projects were approximately $73 million, or $0.22 per diluted share, in the fourth quarter of 2022, compared with approximately $52 million, or $0.15 per diluted share, in the third quarter of

2022 and approximately $54 million, or $0.15 per diluted share, in the fourth quarter of 2021.

Page 2 of 10

Nucor Executive Offices: 1915 Rexford Road, Charlotte, North Carolina 28211

Phone 704-366-7000 Fax 704-362-4208 www.nucor.com

|

|

|

|

|

| News Release |

|

|

|

|

Nucor Reports Record Annual Earnings for 2022 (Continued)

In the full year 2022, pre-tax pre-operating and start-up costs

related to the Company’s growth projects were approximately $247 million, or $0.71 per diluted share, compared with approximately $130 million, or $0.34 per diluted share, in the full year 2021.

Overall operating rates at the Company’s steel mills decreased to 70% in the fourth quarter of 2022 as compared to 77% in the third quarter of 2022 and

89% in the fourth quarter of 2021. Operating rates for the full year 2022 decreased to 77% as compared to 94% for the full year 2021.

Financial

Strength

At the end of the fourth quarter of 2022, Nucor had $4.94 billion in cash and cash equivalents, short-term investments

and restricted cash and cash equivalents on hand. The Company’s $1.75 billion revolving credit facility remains undrawn and does not expire until November 2026. Nucor continues to have the strongest credit rating in the North American

steel sector with unchanged long-term senior unsecured ratings from Moody’s (Baa1) and Standard & Poor’s (A-). On January 24, 2023, Fitch Ratings initiated coverage of Nucor and

established new long-term and short-term credit ratings of A- and F1, respectively. Nucor’s credit rating outlook from all three rating agencies is stable.

Commitment to Returning Capital to Stockholders

On December 14, 2022, Nucor’s Board of Directors declared a cash dividend of $0.51 per share. This cash dividend is payable on February 10, 2023

to stockholders of record as of December 30, 2022 and is Nucor’s 199th consecutive quarterly cash dividend. Nucor has increased its regular, or base, dividend for 50 consecutive years

– every year since it first began paying dividends in 1973.

During the fourth quarter of 2022, Nucor repurchased approximately 3.1 million

shares of its common stock at an average price of $130.30 per share (approximately 20.6 million shares in the full year 2022 at an average price of $134.29 per share). As of December 31, 2022, Nucor had approximately 253.0 million

shares outstanding and approximately $1.10 billion remaining available for repurchases under its share repurchase program. This share repurchase authorization is discretionary and has no scheduled expiration date.

For the full year 2022, Nucor returned approximately $3.3 billion to stockholders in the form of share repurchases and dividend payments, consistent with

the Company’s capital allocation strategy of returning at least 40% of earnings to stockholders.

Page 3 of 10

Nucor Executive Offices: 1915 Rexford Road, Charlotte, North Carolina 28211

Phone 704-366-7000 Fax 704-362-4208 www.nucor.com

|

|

|

|

|

| News Release |

|

|

|

|

Nucor Reports Record Annual Earnings for 2022 (Continued)

Fourth Quarter of 2022 Analysis

Steel mills segment earnings in the fourth quarter of 2022 decreased compared to the third quarter of 2022 due to lower average selling prices, margin

compression, and lower volumes, with the largest decrease in profitability at our sheet mills. The modest decrease in the steel products segment earnings in the fourth quarter of 2022 as compared to the third quarter of 2022 was due to lower volumes

and selling prices. Raw materials segment earnings decreased significantly in the fourth quarter of 2022 as compared to the third quarter of 2022 primarily due to decreased profitability at our direct reduced iron, or DRI, facilities, both of which

experienced planned outages during the fourth quarter, decreased selling prices for raw materials, and the previously mentioned write-off of the leasehold interest in unproved oil and gas properties.

First Quarter of 2023 Outlook

The profitability

of the steel mills segment is expected to increase in the first quarter of 2023 as compared to the fourth quarter of 2022 due to higher margins and volumes, with the largest improvement expected to occur at our sheet mills.

Within the steel products segment, we expect continued strong profitability in the first quarter of 2023, with some decrease expected from the fourth quarter

of 2022 due to seasonally slower construction activity and some reductions in realized pricing. Overall, we expect first quarter 2023 steel products segment earnings to be higher than the first quarter of 2022.

In the raw materials segment, excluding the impact of the impairment charge recorded in the fourth quarter of 2022, we expect increased profitability compared

to the fourth quarter of 2022 due to higher volumes at our DRI facilities and scrap recycling and brokerage operations.

On a combined basis, the

operating income during the first quarter of 2023 from our three business segments is expected to exceed that of the fourth quarter of 2022. However, we expect consolidated net earnings to decrease compared to the fourth quarter of 2022 due to

intercompany eliminations in the first quarter of 2023 and the absence of state tax benefits that were recorded in the fourth quarter of 2022.

Earnings Conference Call

An earnings call is

scheduled for January 26, 2023 at 2 pm Eastern Time to review Nucor’s fourth-quarter and full year 2022 financial results and business update. The call can be accessed via webcast from the Investor Relations section of Nucor’s website

(nucor.com/investors). A presentation with supplemental information to accompany the call has been posted to Nucor’s Investor Relations website A recording and transcript of the call will be posted to the same site within one day of the live

event.

Page 4 of 10

Nucor Executive Offices: 1915 Rexford Road, Charlotte, North Carolina 28211

Phone 704-366-7000 Fax 704-362-4208 www.nucor.com

|

|

|

|

|

| News Release |

|

|

|

|

Nucor Reports Record Annual Earnings for 2022 (Continued)

About Nucor

Nucor and its affiliates are manufacturers of steel and steel products, with operating facilities in the United States, Canada and Mexico. Products produced

include: carbon and alloy steel — in bars, beams, sheet and plate; hollow structural section tubing; electrical conduit; steel racking; steel piling; steel joists and joist girders; steel deck; fabricated concrete reinforcing steel; cold

finished steel; precision castings; steel fasteners; metal building systems; insulated metal panels; overhead doors; steel grating; and wire and wire mesh. Nucor, through The David J. Joseph Company and its affiliates, also brokers ferrous and

nonferrous metals, pig iron and hot briquetted iron / direct reduced iron; supplies ferro-alloys; and processes ferrous and nonferrous scrap. Nucor is North America’s largest recycler.

Forward-Looking Statements

Certain statements

contained in this news release are “forward-looking statements” that involve risks and uncertainties which we expect will or may occur in the future and may impact our business, financial condition and results of operations. The words

“anticipate,” “believe,” “expect,” “intend,” “project,” “may,” “will,” “should,” “could” and similar expressions are intended to identify those forward-looking

statements. These forward-looking statements reflect the Company’s best judgment based on current information, and, although we base these statements on circumstances that we believe to be reasonable when made, there can be no assurance that

future events will not affect the accuracy of such forward-looking information. As such, the forward-looking statements are not guarantees of future performance, and actual results may vary materially from the projected results and expectations

discussed in this news release. Factors that might cause the Company’s actual results to differ materially from those anticipated in forward-looking statements include, but are not limited to: (1) competitive pressure on sales and pricing,

including pressure from imports and substitute materials; (2) U.S. and foreign trade policies affecting steel imports or exports; (3) the sensitivity of the results of our operations to general market conditions, and in particular,

prevailing market steel prices and changes in the supply and cost of raw materials, including pig iron, iron ore and scrap steel; (4) the availability and cost of electricity and natural gas, which could negatively affect our cost of steel

production or result in a delay or cancellation of existing or future drilling within our natural gas drilling programs; (5) critical equipment failures and business interruptions; (6) market demand for steel products, which, in the case

of many of our products, is driven by the level of nonresidential construction activity in the United States; (7) impairment in the recorded value of inventory, equity investments, fixed assets, goodwill or other long-lived assets;

(8) uncertainties and volatility surrounding the global economy, including excess world capacity for steel production, inflation and interest rate changes; (9) fluctuations in currency conversion rates; (10) significant changes in

laws or government regulations affecting environmental compliance, including legislation and regulations that result in greater regulation of greenhouse gas emissions that could increase our energy costs, capital expenditures and operating costs or

cause one or more of our permits to be revoked or make it more difficult to obtain permit modifications; (11) the cyclical nature of the steel industry; (12) capital investments and their impact on our performance; (13) our safety

performance; (14) our ability to integrate businesses we acquire; and (15) the impact of the COVID-19 pandemic, any variants of the virus, and

Page 5 of 10

Nucor Executive Offices: 1915 Rexford Road, Charlotte, North Carolina 28211

Phone 704-366-7000 Fax 704-362-4208 www.nucor.com

|

|

|

|

|

| News Release |

|

|

|

|

Nucor Reports Record Annual Earnings for 2022 (Continued)

any other similar pandemic or public health situation. These and other factors are discussed in Nucor’s regulatory filings with the United States Securities and Exchange Commission,

including those in “Item 1A. Risk Factors” of Nucor’s Annual Report on Form 10-K for the year ended December 31, 2021. The forward-looking statements contained in this news release speak

only as of this date, and Nucor does not assume any obligation to update them, except as may be required by applicable law.

Contact Information

For Investor/Analyst Inquiries - Jack Sullivan, 704-264-8942, or

Paul Donnelly, 704-264-8807

For Media Inquiries - Katherine Miller, 704-353-9015

Page 6 of 10

Nucor Executive Offices: 1915 Rexford Road, Charlotte, North Carolina 28211

Phone 704-366-7000 Fax 704-362-4208 www.nucor.com

|

|

|

|

|

| News Release |

|

|

|

|

Nucor Reports Record Annual Earnings for 2022 (Continued)

Tonnage Data

(In thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months (13 Weeks) Ended |

|

|

Twelve Months (52 Weeks) Ended |

|

| |

|

Dec. 31, 2022 |

|

|

Dec. 31, 2021 |

|

|

Percent

Change |

|

|

Dec. 31, 2022 |

|

|

Dec. 31, 2021 |

|

|

Percent

Change |

|

| Steel mills total shipments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Sheet |

|

|

2,314 |

|

|

|

2,502 |

|

|

|

-8 |

% |

|

|

10,310 |

|

|

|

11,131 |

|

|

|

-7 |

% |

| Bars |

|

|

1,907 |

|

|

|

2,177 |

|

|

|

-12 |

% |

|

|

8,635 |

|

|

|

9,269 |

|

|

|

-7 |

% |

| Structural |

|

|

445 |

|

|

|

607 |

|

|

|

-27 |

% |

|

|

2,292 |

|

|

|

2,649 |

|

|

|

-13 |

% |

| Plate |

|

|

375 |

|

|

|

489 |

|

|

|

-23 |

% |

|

|

1,626 |

|

|

|

2,289 |

|

|

|

-29 |

% |

| Other |

|

|

69 |

|

|

|

94 |

|

|

|

-27 |

% |

|

|

378 |

|

|

|

352 |

|

|

|

7 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5,110 |

|

|

|

5,869 |

|

|

|

-13 |

% |

|

|

23,241 |

|

|

|

25,690 |

|

|

|

-10 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Sales tons to outside customers: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Steel mills |

|

|

4,067 |

|

|

|

4,606 |

|

|

|

-12 |

% |

|

|

18,200 |

|

|

|

20,296 |

|

|

|

-10 |

% |

| Joist |

|

|

174 |

|

|

|

173 |

|

|

|

1 |

% |

|

|

671 |

|

|

|

702 |

|

|

|

-4 |

% |

| Deck |

|

|

127 |

|

|

|

132 |

|

|

|

-4 |

% |

|

|

515 |

|

|

|

536 |

|

|

|

-4 |

% |

| Cold finished |

|

|

99 |

|

|

|

112 |

|

|

|

-12 |

% |

|

|

467 |

|

|

|

495 |

|

|

|

-6 |

% |

| Rebar fabrication products |

|

|

302 |

|

|

|

289 |

|

|

|

4 |

% |

|

|

1,282 |

|

|

|

1,232 |

|

|

|

4 |

% |

| Piling |

|

|

94 |

|

|

|

103 |

|

|

|

-9 |

% |

|

|

443 |

|

|

|

554 |

|

|

|

-20 |

% |

| Tubular products |

|

|

215 |

|

|

|

222 |

|

|

|

-3 |

% |

|

|

950 |

|

|

|

1,013 |

|

|

|

-6 |

% |

| Other steel products |

|

|

167 |

|

|

|

122 |

|

|

|

37 |

% |

|

|

687 |

|

|

|

447 |

|

|

|

54 |

% |

| Raw materials |

|

|

493 |

|

|

|

658 |

|

|

|

-25 |

% |

|

|

2,309 |

|

|

|

2,972 |

|

|

|

-22 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5,738 |

|

|

|

6,417 |

|

|

|

-11 |

% |

|

|

25,524 |

|

|

|

28,247 |

|

|

|

-10 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Page 7 of 10

Nucor Executive Offices: 1915 Rexford Road, Charlotte, North Carolina 28211

Phone 704-366-7000 Fax 704-362-4208 www.nucor.com

|

|

|

|

|

| News Release |

|

|

|

|

Nucor Reports Record Annual Earnings for 2022 (Continued)

Condensed Consolidated Statements of Earnings (Unaudited)

(In thousands, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months (13 Weeks) Ended |

|

|

Twelve Months (52 Weeks) Ended |

|

| |

|

Dec. 31, 2022 |

|

|

Dec. 31, 2021 |

|

|

Dec. 31, 2022 |

|

|

Dec. 31, 2021 |

|

| Net sales |

|

$ |

8,723,956 |

|

|

$ |

10,364,412 |

|

|

$ |

41,512,467 |

|

|

$ |

36,483,939 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Costs, expenses and other: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of products sold |

|

|

6,626,469 |

|

|

|

6,841,211 |

|

|

|

29,009,187 |

|

|

|

25,458,525 |

|

| Marketing, administrative and other expenses |

|

|

422,823 |

|

|

|

502,070 |

|

|

|

1,997,178 |

|

|

|

1,706,609 |

|

| Equity in (earnings) losses of unconsolidated affiliates |

|

|

12,532 |

|

|

|

(37,962 |

) |

|

|

(10,714 |

) |

|

|

(103,068 |

) |

| Losses and impairments of assets |

|

|

101,756 |

|

|

|

11,191 |

|

|

|

101,756 |

|

|

|

62,161 |

|

| Interest expense, net |

|

|

26,971 |

|

|

|

40,145 |

|

|

|

170,216 |

|

|

|

158,854 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

7,190,551 |

|

|

7,356,655 |

|

|

31,267,623 |

|

|

27,283,081 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings before income taxes and noncontrolling interests |

|

|

1,533,405 |

|

|

|

3,007,757 |

|

|

|

10,244,844 |

|

|

|

9,200,858 |

|

| Provision for income taxes |

|

|

207,160 |

|

|

|

667,625 |

|

|

|

2,165,204 |

|

|

|

2,078,488 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net earnings |

|

|

1,326,245 |

|

|

|

2,340,132 |

|

|

|

8,079,640 |

|

|

|

7,122,370 |

|

| Earnings attributable to noncontrolling interests |

|

|

70,512 |

|

|

|

89,714 |

|

|

|

472,303 |

|

|

|

294,909 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net earnings attributable to Nucor stockholders |

|

$ |

1,255,733 |

|

|

$ |

2,250,418 |

|

|

$ |

7,607,337 |

|

|

$ |

6,827,461 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net earnings per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

$ |

4.90 |

|

|

$ |

7.99 |

|

|

$ |

28.88 |

|

|

$ |

23.23 |

|

| Diluted |

|

$ |

4.89 |

|

|

$ |

7.97 |

|

|

$ |

28.79 |

|

|

$ |

23.16 |

|

| Average shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

|

255,402 |

|

|

|

280,451 |

|

|

|

262,348 |

|

|

|

292,491 |

|

| Diluted |

|

|

255,838 |

|

|

|

281,046 |

|

|

|

263,176 |

|

|

|

293,390 |

|

Page 8 of 10

Nucor Executive Offices: 1915 Rexford Road, Charlotte, North Carolina 28211

Phone 704-366-7000 Fax 704-362-4208 www.nucor.com

|

|

|

|

|

| News Release |

|

|

|

|

Nucor Reports Record Annual Earnings for 2022 (Continued)

Condensed Consolidated Balance Sheets (Unaudited)

(In thousands)

|

|

|

|

|

|

|

|

|

| |

|

Dec. 31, 2022 |

|

|

Dec. 31, 2021 |

|

| ASSETS |

|

|

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

4,280,852 |

|

|

$ |

2,364,858 |

|

| Short-term investments |

|

|

576,946 |

|

|

|

253,005 |

|

| Accounts receivable, net |

|

|

3,591,030 |

|

|

|

3,853,972 |

|

| Inventories, net |

|

|

5,453,531 |

|

|

|

6,011,182 |

|

| Other current assets |

|

|

789,325 |

|

|

|

316,540 |

|

|

|

|

|

|

|

|

|

|

| Total current assets |

|

|

14,691,684 |

|

|

|

12,799,557 |

|

| Property, plant and equipment, net |

|

|

9,616,920 |

|

|

|

8,114,818 |

|

| Restricted cash and cash equivalents |

|

|

80,368 |

|

|

|

143,800 |

|

| Goodwill |

|

|

3,920,060 |

|

|

|

2,827,344 |

|

| Other intangible assets, net |

|

|

3,322,265 |

|

|

|

1,103,759 |

|

| Other assets |

|

|

847,913 |

|

|

|

833,794 |

|

|

|

|

|

|

|

|

|

|

| Total assets |

|

$ |

32,479,210 |

|

|

$ |

25,823,072 |

|

|

|

|

|

|

|

|

|

|

| LIABILITIES |

|

|

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

|

| Short-term debt |

|

$ |

49,081 |

|

|

$ |

107,723 |

|

| Current portion of long-term debt and finance lease obligations |

|

|

28,582 |

|

|

|

615,678 |

|

| Accounts payable |

|

|

1,649,523 |

|

|

|

1,974,041 |

|

| Salaries, wages and related accruals |

|

|

1,654,210 |

|

|

|

1,495,166 |

|

| Accrued expenses and other current liabilities |

|

|

948,348 |

|

|

|

964,805 |

|

|

|

|

|

|

|

|

|

|

| Total current liabilities |

|

|

4,329,744 |

|

|

|

5,157,413 |

|

| Long-term debt and finance lease obligations due after one year |

|

|

6,613,687 |

|

|

|

4,961,410 |

|

| Deferred credits and other liabilities |

|

|

1,965,873 |

|

|

|

1,100,455 |

|

|

|

|

|

|

|

|

|

|

| Total liabilities |

|

|

12,909,304 |

|

|

|

11,219,278 |

|

|

|

|

|

|

|

|

|

|

| EQUITY |

|

|

|

|

|

|

|

|

| Nucor stockholders’ equity: |

|

|

|

|

|

|

|

|

| Common stock |

|

|

152,061 |

|

|

|

152,061 |

|

| Additional paid-in capital |

|

|

2,143,520 |

|

|

|

2,140,608 |

|

| Retained earnings |

|

|

24,754,873 |

|

|

|

17,674,100 |

|

| Accumulated other comprehensive loss, net of income taxes |

|

|

(137,517 |

) |

|

|

(115,282 |

) |

| Treasury stock |

|

|

(8,498,243 |

) |

|

|

(5,835,098 |

) |

|

|

|

|

|

|

|

|

|

| Total Nucor stockholders’ equity |

|

|

18,414,694 |

|

|

|

14,016,389 |

|

| Noncontrolling interests |

|

|

1,155,212 |

|

|

|

587,405 |

|

|

|

|

|

|

|

|

|

|

| Total equity |

|

|

19,569,906 |

|

|

|

14,603,794 |

|

|

|

|

|

|

|

|

|

|

| Total liabilities and equity |

|

$ |

32,479,210 |

|

|

$ |

25,823,072 |

|

|

|

|

|

|

|

|

|

|

Page 9 of 10

Nucor Executive Offices: 1915 Rexford Road, Charlotte, North Carolina 28211

Phone 704-366-7000 Fax 704-362-4208 www.nucor.com

|

|

|

|

|

| News Release |

|

|

|

|

Nucor Reports Record Annual Earnings for 2022 (Continued)

Condensed Consolidated Statements of Cash Flows (Unaudited)

(In thousands)

|

|

|

|

|

|

|

|

|

| |

|

Twelve Months (52 Weeks) Ended |

|

| |

|

Dec. 31, 2022 |

|

|

Dec. 31, 2021 |

|

| Operating activities: |

|

|

|

|

|

|

|

|

| Net earnings |

|

$ |

8,079,640 |

|

|

$ |

7,122,370 |

|

| Adjustments: |

|

|

|

|

|

|

|

|

| Depreciation |

|

|

826,692 |

|

|

|

735,406 |

|

| Amortization |

|

|

234,942 |

|

|

|

129,157 |

|

| Stock-based compensation |

|

|

136,834 |

|

|

|

135,775 |

|

| Deferred income taxes |

|

|

(46,849 |

) |

|

|

11,665 |

|

| Distributions from affiliates |

|

|

57,071 |

|

|

|

200 |

|

| Equity in earnings of unconsolidated affiliates |

|

|

(10,714 |

) |

|

|

(103,068 |

) |

| Losses and impairments of assets |

|

|

101,756 |

|

|

|

62,161 |

|

| Changes in assets and liabilities (exclusive of acquisitions and dispositions): |

|

|

|

|

|

|

|

|

| Accounts receivable |

|

|

501,225 |

|

|

|

(1,392,084 |

) |

| Inventories |

|

|

962,424 |

|

|

|

(2,307,336 |

) |

| Accounts payable |

|

|

(496,234 |

) |

|

|

383,428 |

|

| Federal income taxes |

|

|

(337,359 |

) |

|

|

313,679 |

|

| Salaries, wages and related accruals |

|

|

155,005 |

|

|

|

997,034 |

|

| Other operating activities |

|

|

(92,379 |

) |

|

|

142,389 |

|

|

|

|

|

|

|

|

|

|

| Cash provided by operating activities |

|

|

10,072,054 |

|

|

|

6,230,776 |

|

|

|

|

|

|

|

|

|

|

| Investing activities: |

|

|

|

|

|

|

|

|

| Capital expenditures |

|

|

(1,947,897 |

) |

|

|

(1,621,989 |

) |

| Investment in and advances to affiliates |

|

|

(258 |

) |

|

|

(237 |

) |

| Sale of business |

|

|

99,681 |

|

|

|

— |

|

| Disposition of plant and equipment |

|

|

32,277 |

|

|

|

19,401 |

|

| Acquisitions (net of cash acquired) |

|

|

(3,553,191 |

) |

|

|

(1,426,424 |

) |

| Purchase of investments |

|

|

(913,898 |

) |

|

|

(493,889 |

) |

| Proceeds from the sale of investments |

|

|

590,173 |

|

|

|

648,887 |

|

| Other investing activities |

|

|

(9,596 |

) |

|

|

399 |

|

|

|

|

|

|

|

|

|

|

| Cash used in investing activities |

|

|

(5,702,709 |

) |

|

|

(2,873,852 |

) |

|

|

|

|

|

|

|

|

|

| Financing activities: |

|

|

|

|

|

|

|

|

| Net change in short-term debt |

|

|

(58,642 |

) |

|

|

49,817 |

|

| Proceeds from issuance of long-term debt, net of discount |

|

|

2,091,934 |

|

|

|

196,990 |

|

| Repayment of long-term debt |

|

|

(1,111,000 |

) |

|

|

— |

|

| Bond issuance related costs |

|

|

(13,138 |

) |

|

|

— |

|

| Proceeds from exercise of stock options |

|

|

22,852 |

|

|

|

145,255 |

|

| Payment of tax withholdings on certain stock-based compensation |

|

|

(64,079 |

) |

|

|

(73,260 |

) |

| Distributions to noncontrolling interests |

|

|

(332,293 |

) |

|

|

(150,700 |

) |

| Cash dividends |

|

|

(533,589 |

) |

|

|

(483,469 |

) |

| Acquisition of treasury stock |

|

|

(2,762,568 |

) |

|

|

(3,276,088 |

) |

| Proceeds from government incentives |

|

|

275,000 |

|

|

|

— |

|

| Other financing activities |

|

|

(25,340 |

) |

|

|

(11,424 |

) |

|

|

|

|

|

|

|

|

|

| Cash used in financing activities |

|

|

(2,510,863 |

) |

|

|

(3,602,879 |

) |

|

|

|

|

|

|

|

|

|

| Effect of exchange rate changes on cash |

|

|

(5,920 |

) |

|

|

(316 |

) |

|

|

|

|

|

|

|

|

|

| Increase (decrease) in cash and cash equivalents and restricted cash and cash

equivalents |

|

|

1,852,562 |

|

|

|

(246,271 |

) |

| Cash and cash equivalents and restricted cash and cash equivalents - beginning of

year |

|

|

2,508,658 |

|

|

|

2,754,929 |

|

|

|

|

|

|

|

|

|

|

| Cash and cash equivalents and restricted cash and cash equivalents - end of

year |

|

$ |

4,361,220 |

|

|

$ |

2,508,658 |

|

|

|

|

|

|

|

|

|

|

| Non-cash investing activity: |

|

|

|

|

|

|

|

|

| Change in accrued plant and equipment purchases |

|

$ |

4,568 |

|

|

$ |

78,375 |

|

|

|

|

|

|

|

|

|

|

Page 10 of 10

Nucor Executive Offices: 1915 Rexford Road, Charlotte, North Carolina 28211

Phone 704-366-7000 Fax 704-362-4208 www.nucor.com

Fourth quarter AND full year 2022

EARNINGS CALL Leon TopAlian Chair, President and CEO Steve Laxton Executive Vice President and CFO January 26, 2023 Exhibit 99.2

Forward-Looking Statements Certain

statements made in this presentation may constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements involve risks and uncertainties. The words “anticipate,”

“believe,” “expect,” “intend,” “may,” “project,” “will,” “should,” “could” and similar expressions are intended to identify forward-looking statements.

These forward-looking statements reflect the Company’s best judgment based on current information, and although we base these statements on circumstances that we believe to be reasonable when made, there can be no assurance that future events

will not affect the accuracy of such forward-looking information. The Company does not undertake any obligation to update these statements. The forward-looking statements are not guarantees of future performance, and actual results may vary

materially from the projected results and expectations discussed in this presentation. Factors that might cause the Company’s actual results to differ materially from those anticipated in forward-looking statements include, but are not limited

to: (1) competitive pressure on sales and pricing, including pressure from imports and substitute materials; (2) U.S. and foreign trade policies affecting steel imports or exports; (3) the sensitivity of the results of our operations to general

market conditions, and in particular, prevailing market steel prices and changes in the supply and cost of raw materials, including pig iron, iron ore and scrap steel; (4) the availability and cost of electricity and natural gas, which could

negatively affect our cost of steel production or result in a delay or cancellation of existing or future drilling within our natural gas drilling programs; (5) critical equipment failures and business interruptions; (6) market demand for steel

products, which, in the case of many of our products, is driven by the level of nonresidential construction activity in the United States; (7) impairment in the recorded value of inventory, equity investments, fixed assets, goodwill or other

long-lived assets; (8) uncertainties and volatility surrounding the global economy, including excess world capacity for steel production, inflation and interest rate changes; (9) fluctuations in currency conversion rates; (10) significant changes in

laws or government regulations affecting environmental compliance, including legislation and regulations that result in greater regulation of greenhouse gas emissions that could increase our energy costs, capital expenditures and operating costs or

cause one or more of our permits to be revoked or make it more difficult to obtain permit modifications; (11) the cyclical nature of the steel industry; (12) capital investments and their impact on our performance; (13) our safety performance; (14)

our ability to integrate businesses we acquire; (15) the impact of the COVID-19 pandemic, any variants of the virus, and any other similar public health situation; and (16) the risks discussed in “Item 1A. Risk Factors” of the

Company’s Annual Report on Form 10-K for the year ended December 31, 2021 and elsewhere therein and in the other reports we file with the U.S. Securities and Exchange Commission.

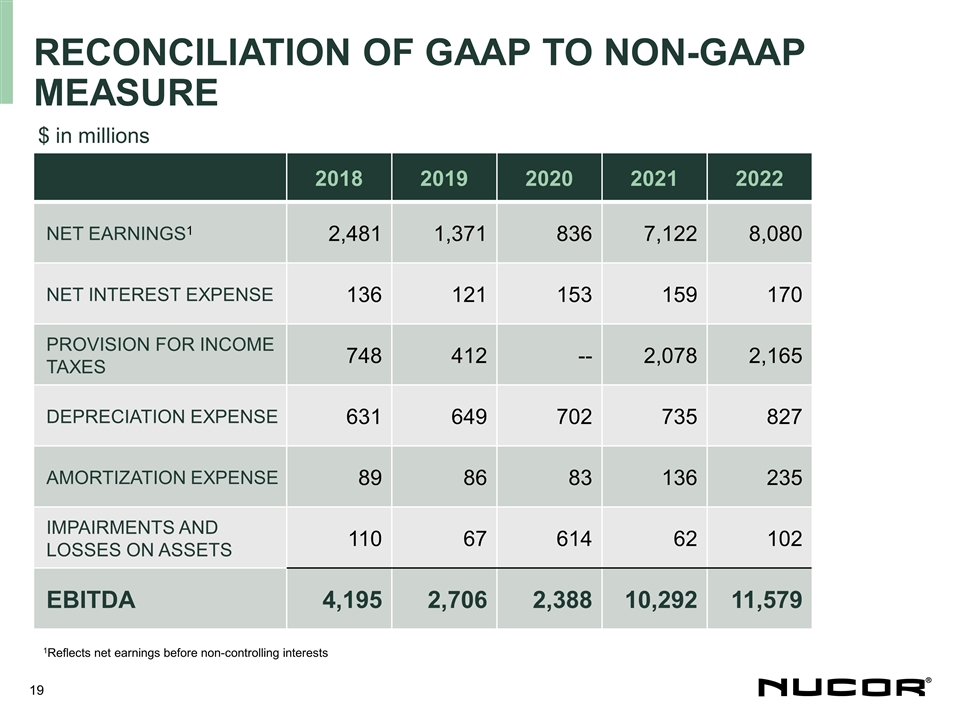

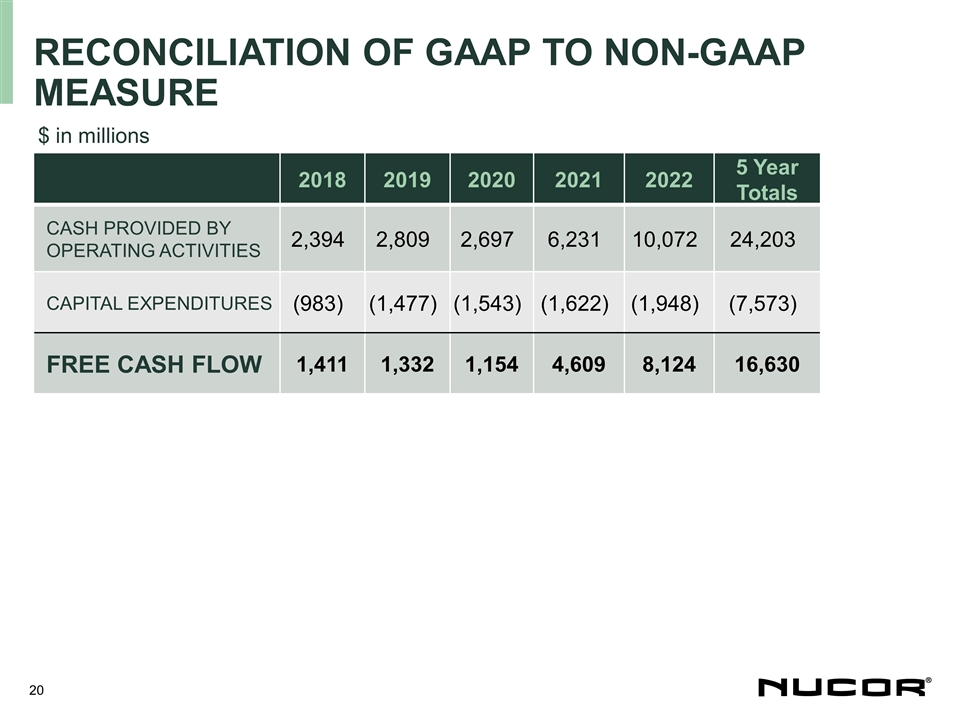

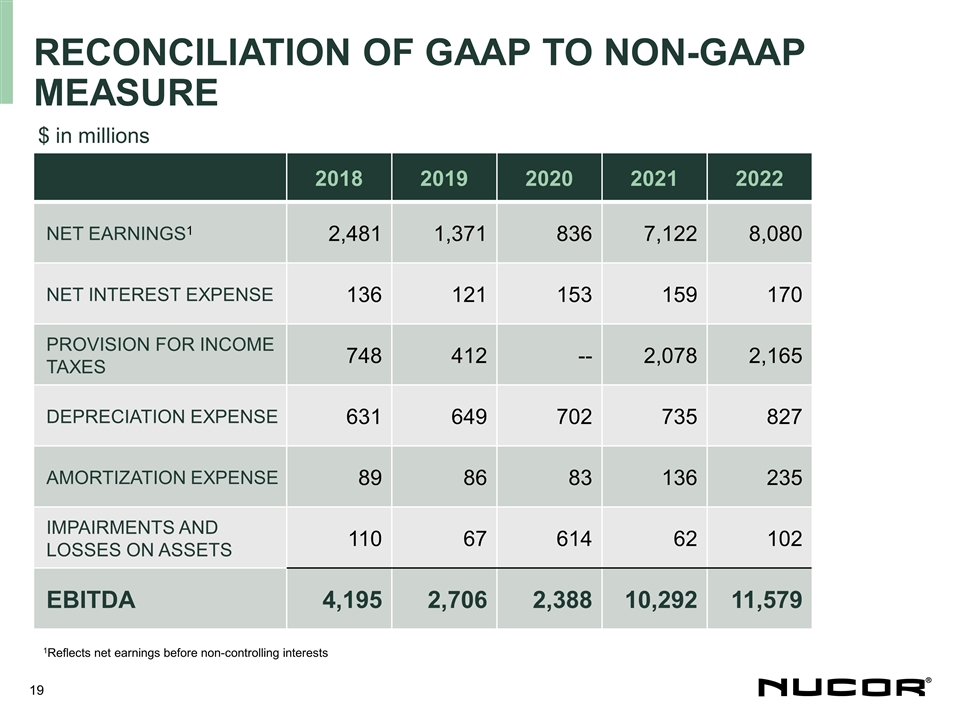

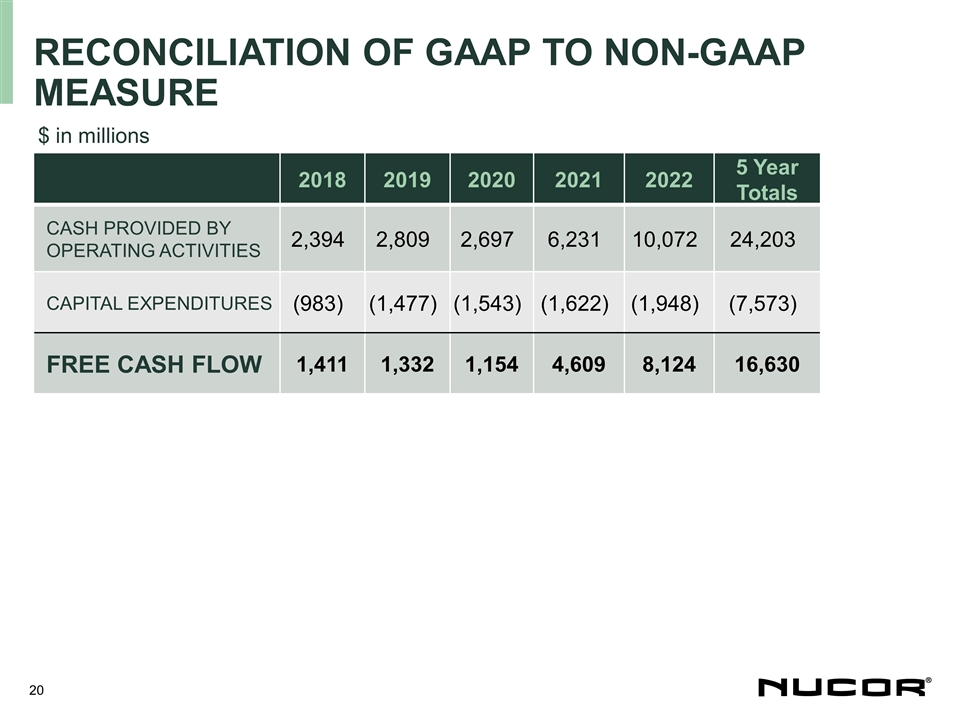

Non-GAAP Financial Measures The Company

uses certain non-GAAP (Generally Accepted Accounting Principles) financial measures in this presentation, including EBITDA and free cash flow. Generally, a non-GAAP financial measure is a numerical measure of a company’s performance or

financial position that either excludes or includes amounts that are not normally excluded or included in the most directly comparable measure calculated and presented in accordance with GAAP. We define EBITDA as net earnings before interest, taxes,

and depreciation and amortization expense, and impairments and losses on assets and free cash flow as cash provided by operating activities less capital expenditures. Please note that other companies might define their non-GAAP financial measures

differently than we do. Management presents these non-GAAP financial measures in this presentation because it considers them to be important supplemental measures of performance. Management uses these non-GAAP financial measures for planning

purposes, including analysis of the Company’s performance against prior periods, the preparation of operating budgets, and to determine appropriate levels of operating and capital investments. Management believes that these non-GAAP financial

measures provide additional insight for analysts and investors evaluating the Company’s financial and operational performance. Management also intends to provide these non-GAAP financial measures as part of the Company’s future earnings

discussions and, therefore, their inclusion should provide consistency in the Company’s financial reporting. Non-GAAP financial measures have limitations as an analytical tool. Where possible we have included reconciliations of the non-GAAP

financial measures provided to GAAP financial measures. Investors are encouraged to review the reconciliation of the non-GAAP measures in the appendix to this presentation.

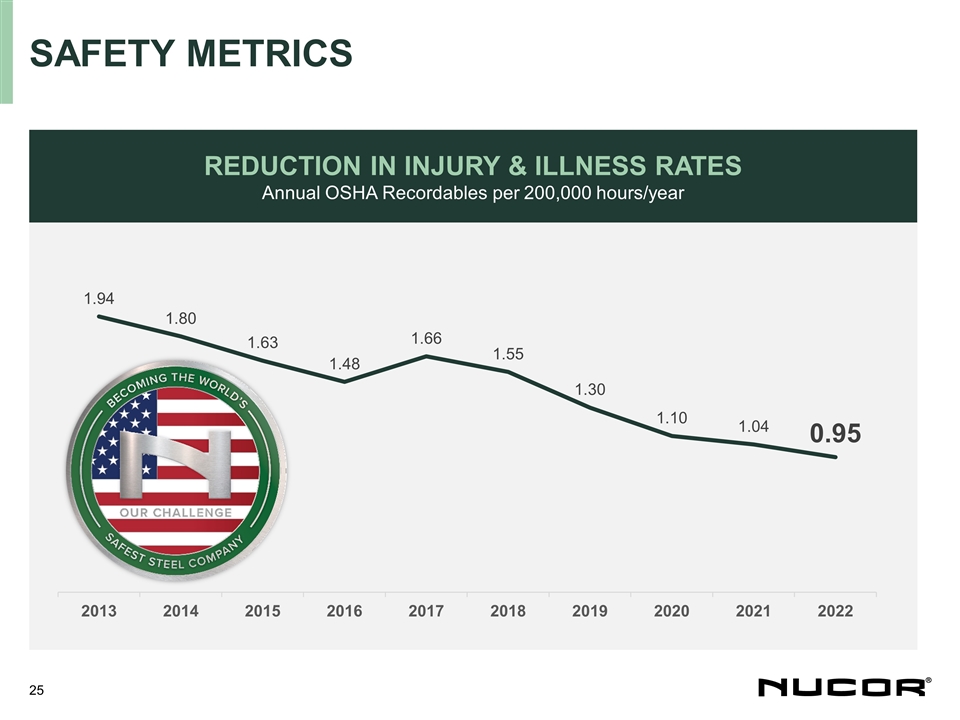

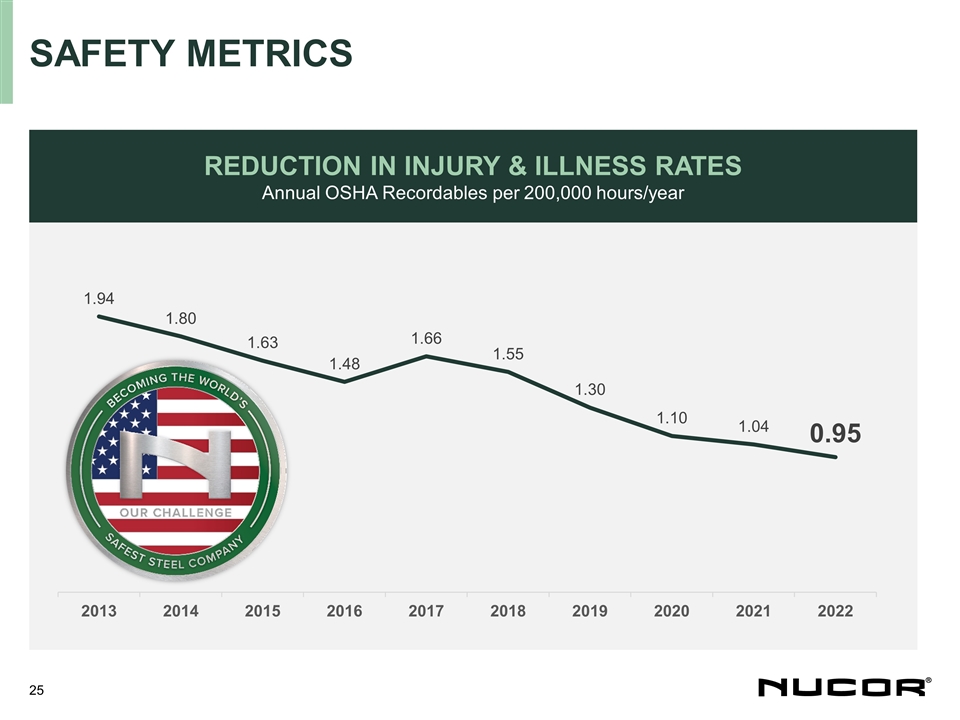

2022 Key accomplishments &

Highlights Industry-leading safety record Fourth consecutive year setting new record low injury/illness rate Record safety results across all four primary metrics we track 20 Nucor divisions with zero recordable injuries in 2022 Most profitable year

in Nucor history Record EPS of $28.79 on $7.6B of Net Income $10.1B Cash from Operations, $11.6B EBITDA(1), $8.1B FCF(1) Returned $3.3B to shareholders via dividends and buybacks ROIC of ~35% and increased dividend for 50th consecutive year Strong

execution of strategic initiatives Deployed ~$2.0B capex, primarily to grow our core operations Closed 5 acquisitions (~$3.6B) to expand into new markets Advanced our sustainability goals through key partnerships 1EBITDA and Free Cash Flow (FCF) are

non-GAAP financial measures. For a reconciliation of non-GAAP measures, please refer to the Appendix.

Advancing our mission MISSION Strategic

rationale & Action Plans GROW THE CORE Shifting mix to higher margin, value-added end products Building on cost leadership position and growing market share Capitalizing on deep relationships in strong regional markets EXPAND BEYOND Leveraging

our core competencies to grow in complementary businesses with high synergy potential Capitalizing on macro trends that intersect with the steel industry Diversifying product mix to generate more consistent earnings profile LIVE OUR CULTURE How we

succeed matters; safety, health & well-being above all else Inclusive, performance-based culture driving growth and innovation Empowered teammates delivering world-class results Industry leader in sustainability, with plans for further

improvement Continuing to execute the Company’s three-part mission, and becoming a more diversified, efficient, industrial manufacturer of value-added steel products

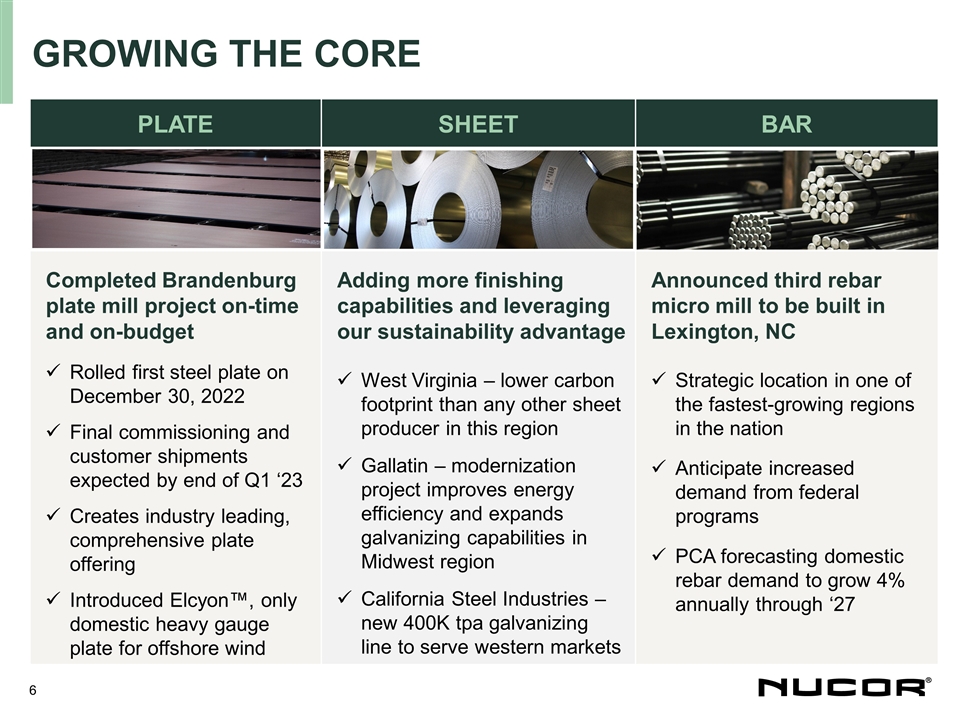

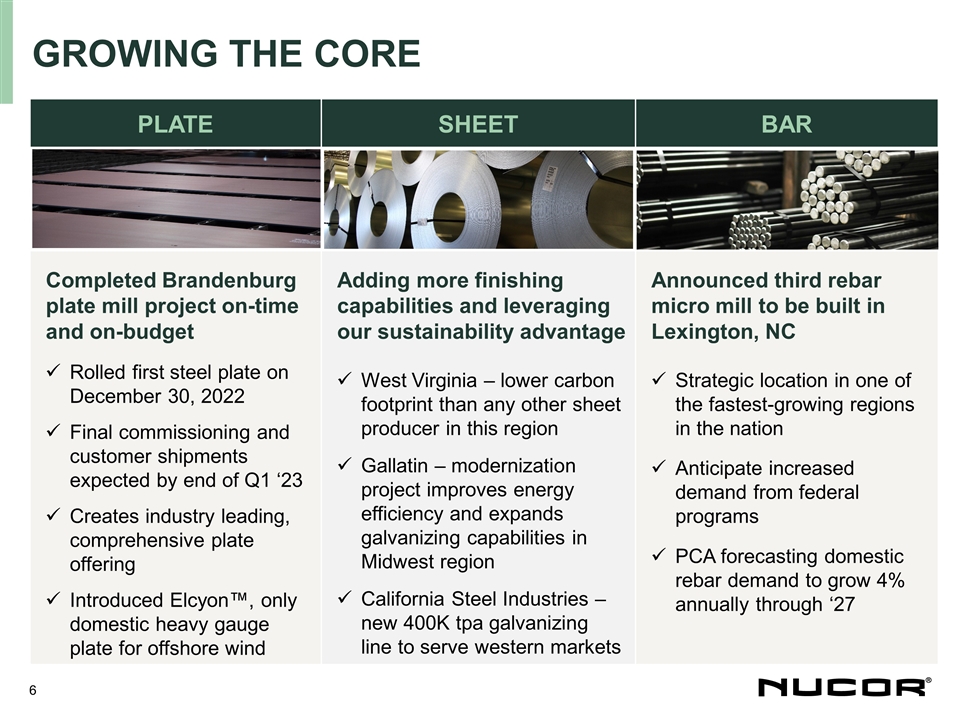

Growing the core PLATE SHEET BAR

Completed Brandenburg plate mill project on-time and on-budget Rolled first steel plate on December 30, 2022 Final commissioning and customer shipments expected by end of Q1 ‘23 Creates industry leading, comprehensive plate offering Introduced

Elcyon™, only domestic heavy gauge plate for offshore wind Adding more finishing capabilities and leveraging our sustainability advantage West Virginia – lower carbon footprint than any other sheet producer in this region Gallatin

– modernization project improves energy efficiency and expands galvanizing capabilities in Midwest region California Steel Industries –new 400K tpa galvanizing line to serve western markets Announced third rebar micro mill to be built in

Lexington, NC Strategic location in one of the fastest-growing regions in the nation Anticipate increased demand from federal programs PCA forecasting domestic rebar demand to grow 4% annually through ‘27

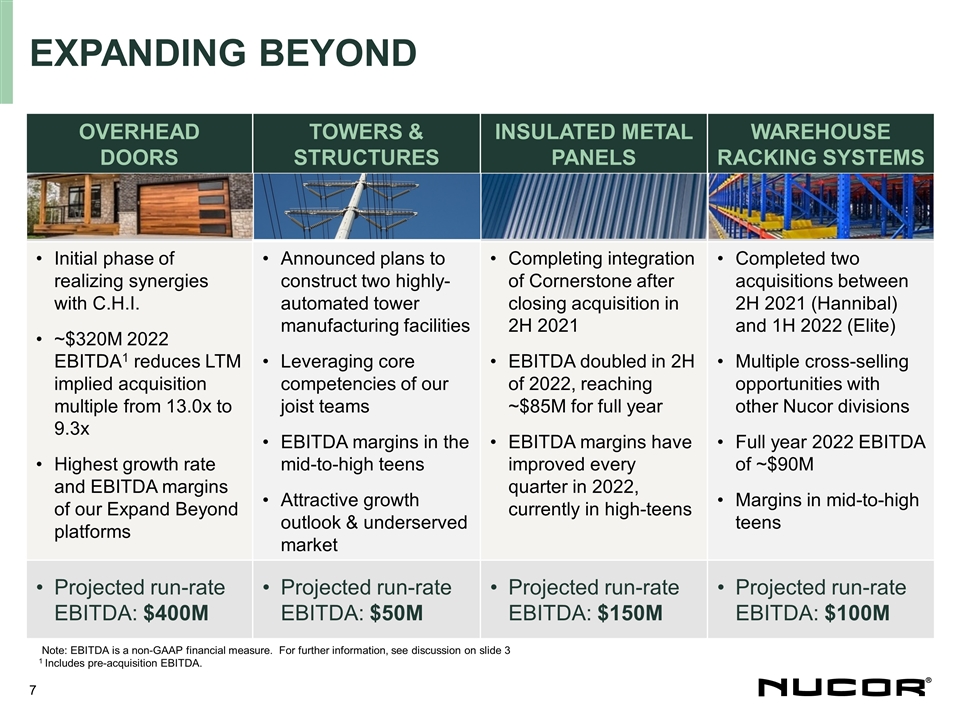

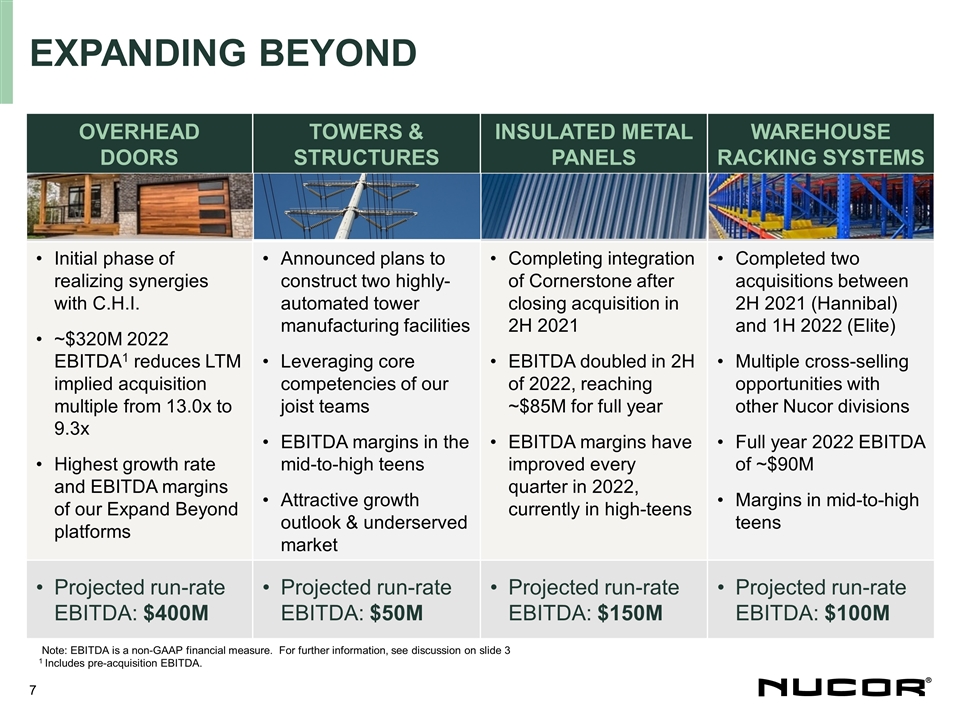

Overhead Doors Towers & Structures

Insulated Metal Panels Warehouse Racking Systems Initial phase of realizing synergies with C.H.I. ~$320M 2022 EBITDA1 reduces LTM implied acquisition multiple from 13.0x to 9.3x Highest growth rate and EBITDA margins of our Expand Beyond platforms

Announced plans to construct two highly-automated tower manufacturing facilities Leveraging core competencies of our joist teams EBITDA margins in the mid-to-high teens Attractive growth outlook & underserved market Completing integration of

Cornerstone after closing acquisition in 2H 2021 EBITDA doubled in 2H of 2022, reaching ~$85M for full year EBITDA margins have improved every quarter in 2022, currently in high-teens Completed two acquisitions between 2H 2021 (Hannibal) and 1H 2022

(Elite) Multiple cross-selling opportunities with other Nucor divisions Full year 2022 EBITDA of ~$90M Margins in mid-to-high teens Projected run-rate EBITDA: $400M Projected run-rate EBITDA: $50M Projected run-rate EBITDA: $150M Projected run-rate

EBITDA: $100M Expanding beyond Note: EBITDA is a non-GAAP financial measure. For further information, see discussion on slide 3 1 Includes pre-acquisition EBITDA.

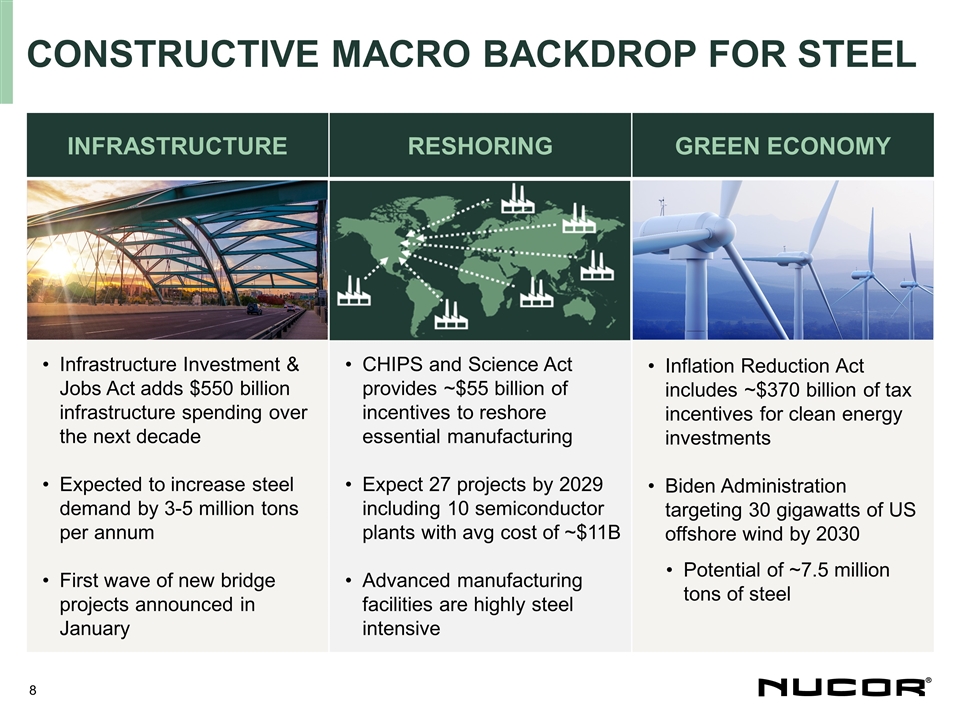

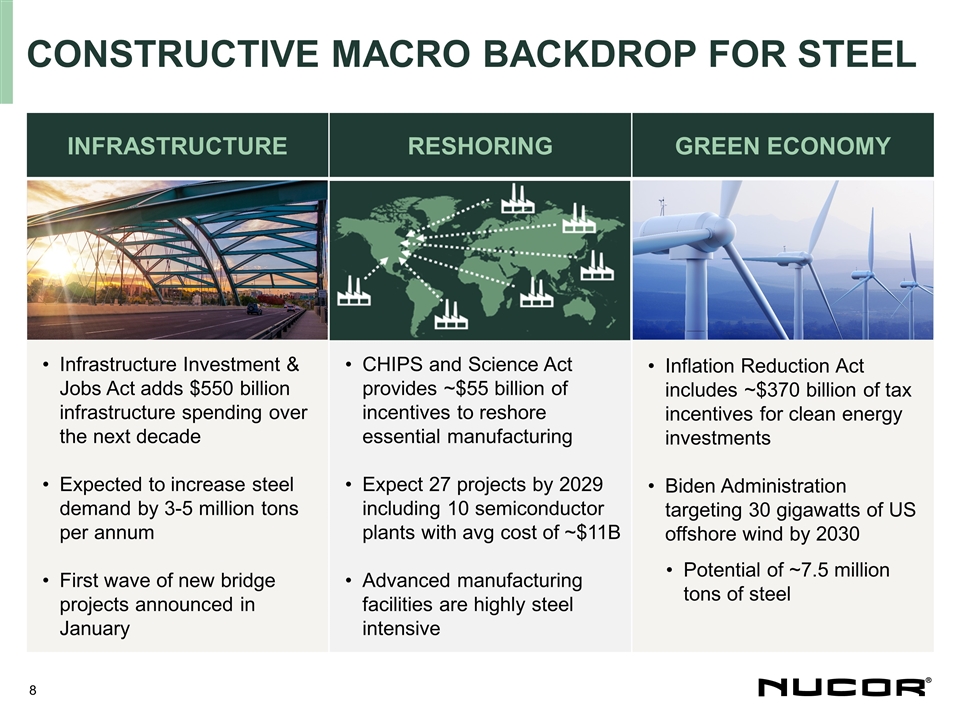

INFRASTRUCTURE RESHORING GREEN ECONOMY

Infrastructure Investment & Jobs Act adds $550 billion infrastructure spending over the next decade Expected to increase steel demand by 3-5 million tons per annum First wave of new bridge projects announced in January CHIPS and Science Act

provides ~$55 billion of incentives to reshore essential manufacturing Expect 27 projects by 2029 including 10 semiconductor plants with avg cost of ~$11B Advanced manufacturing facilities are highly steel intensive Inflation Reduction Act includes

~$370 billion of tax incentives for clean energy investments Biden Administration targeting 30 gigawatts of US offshore wind by 2030 Potential of ~7.5 million tons of steel Constructive macro backdrop for steel

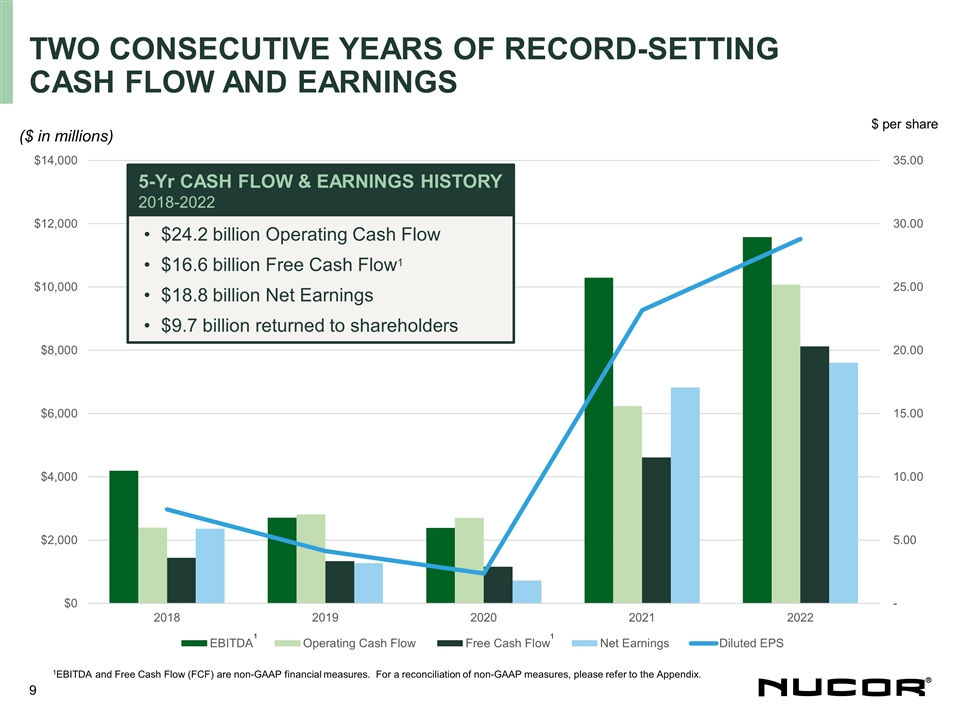

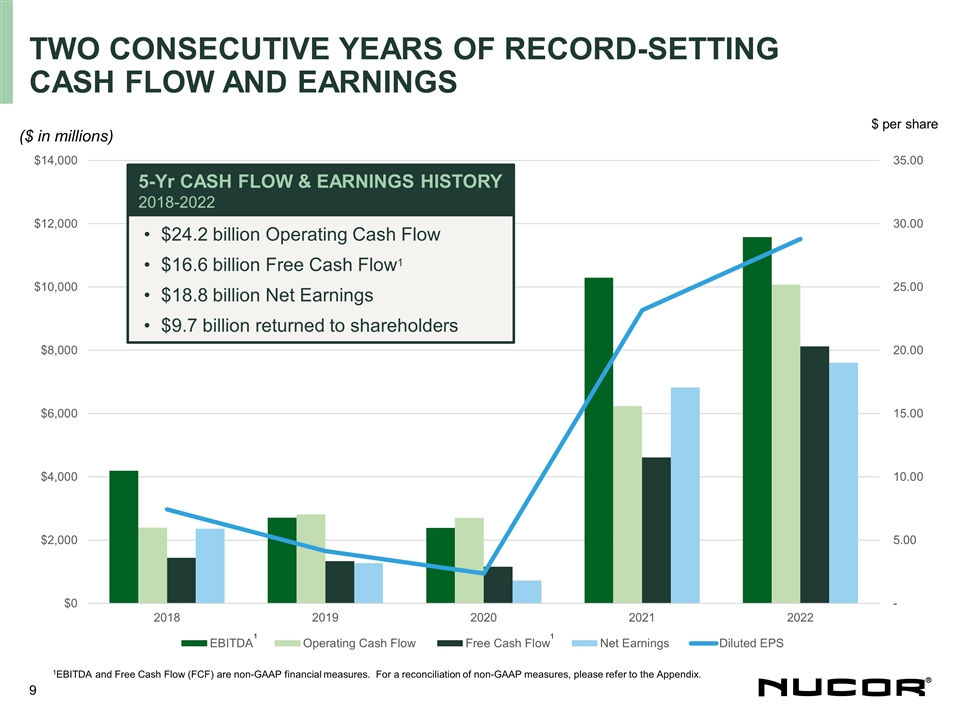

Two consecutive years of record-setting

Cash flow and earnings ($ in millions) $ per share $24.2 billion Operating Cash Flow $16.6 billion Free Cash Flow1 $18.8 billion Net Earnings $9.7 billion returned to shareholders 5-Yr CASH FLOW & EARNINGS HISTORY 2018-2022 1 1 1EBITDA and Free

Cash Flow (FCF) are non-GAAP financial measures. For a reconciliation of non-GAAP measures, please refer to the Appendix.

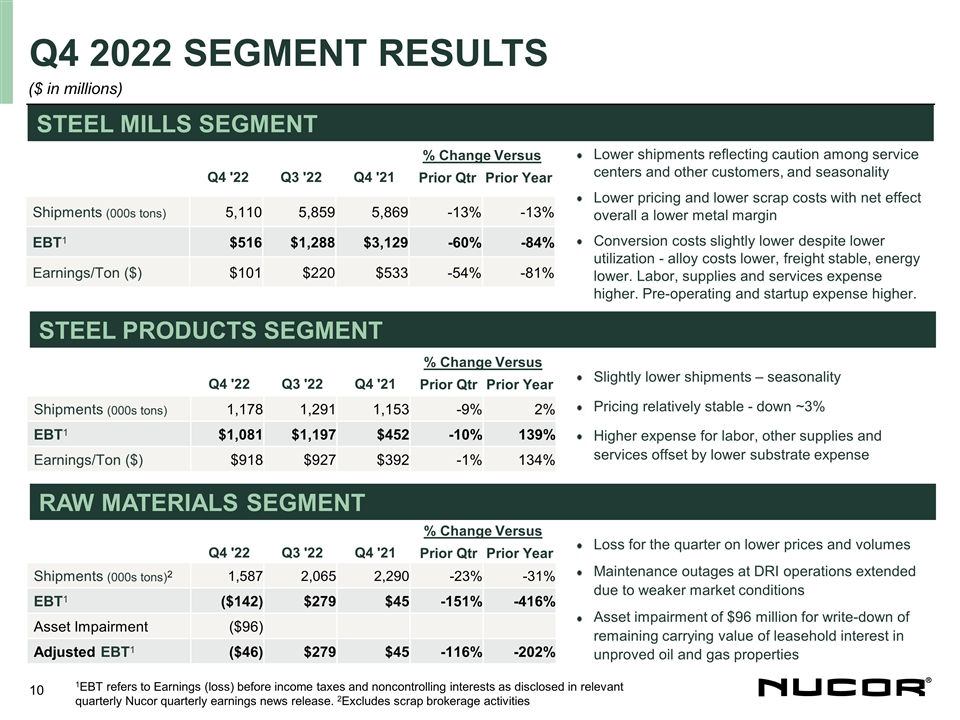

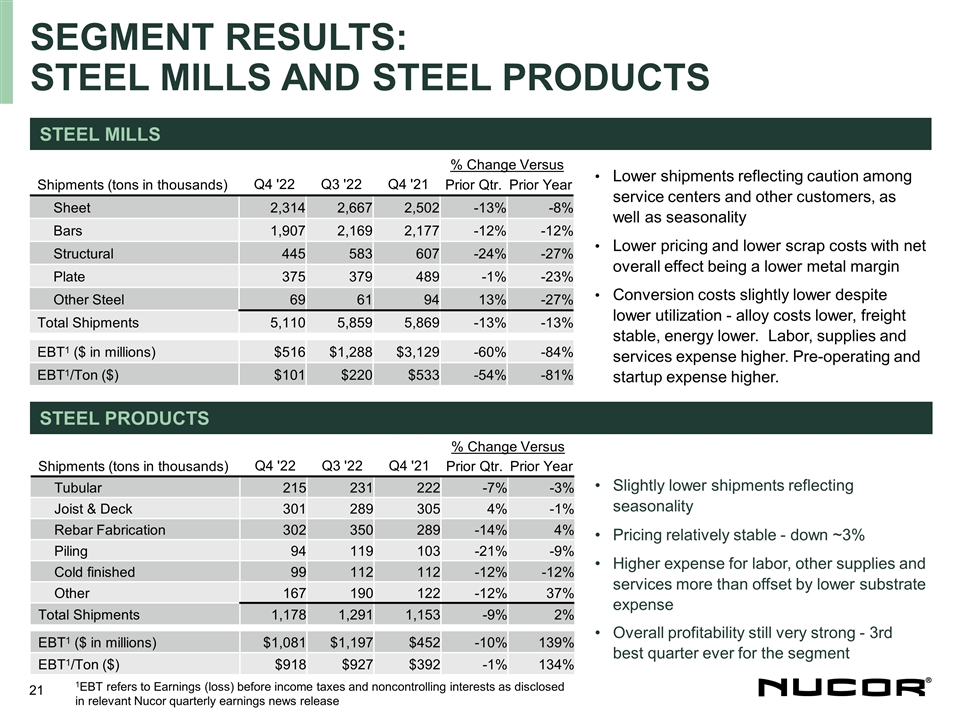

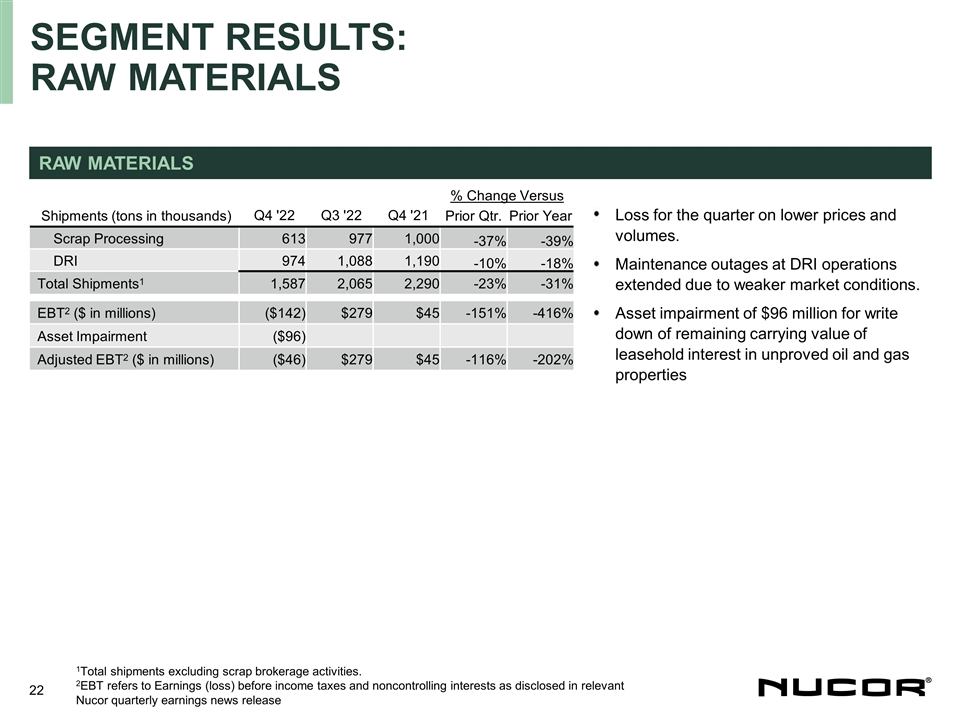

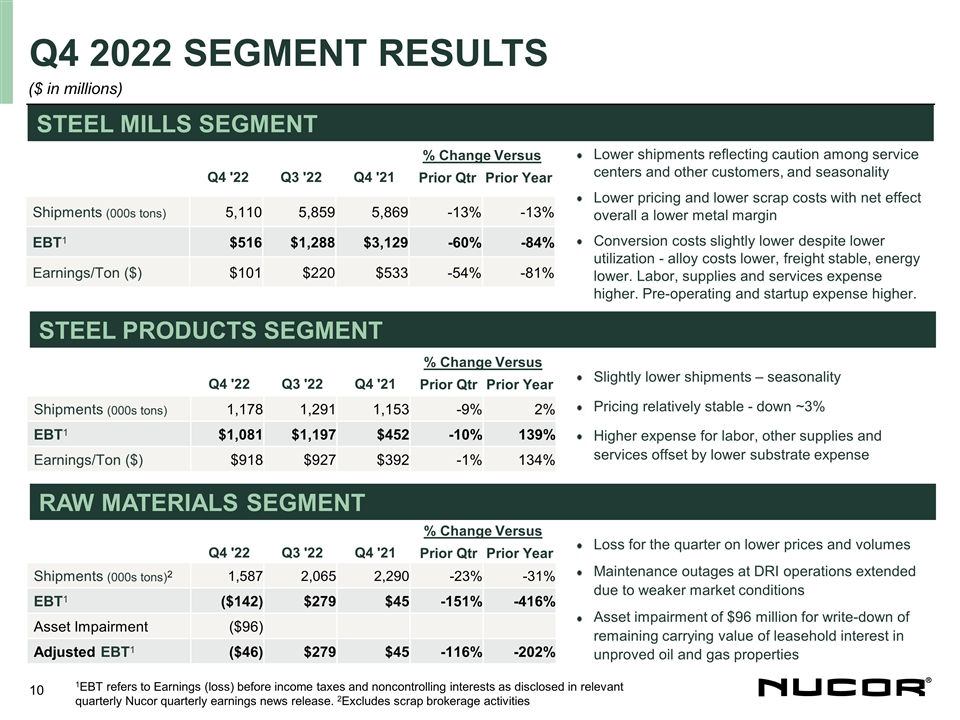

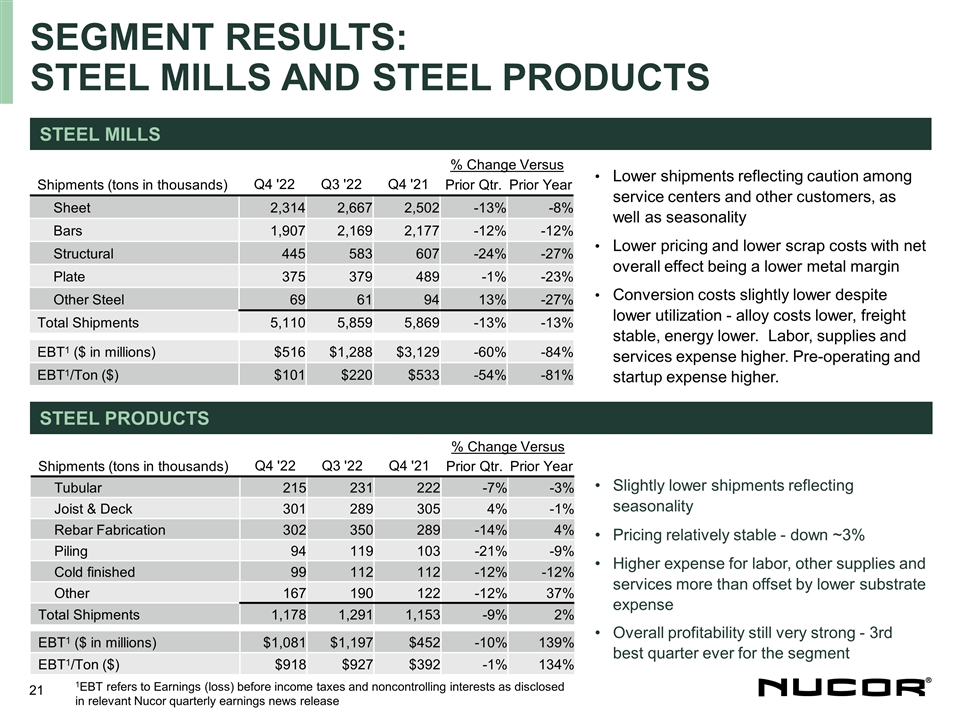

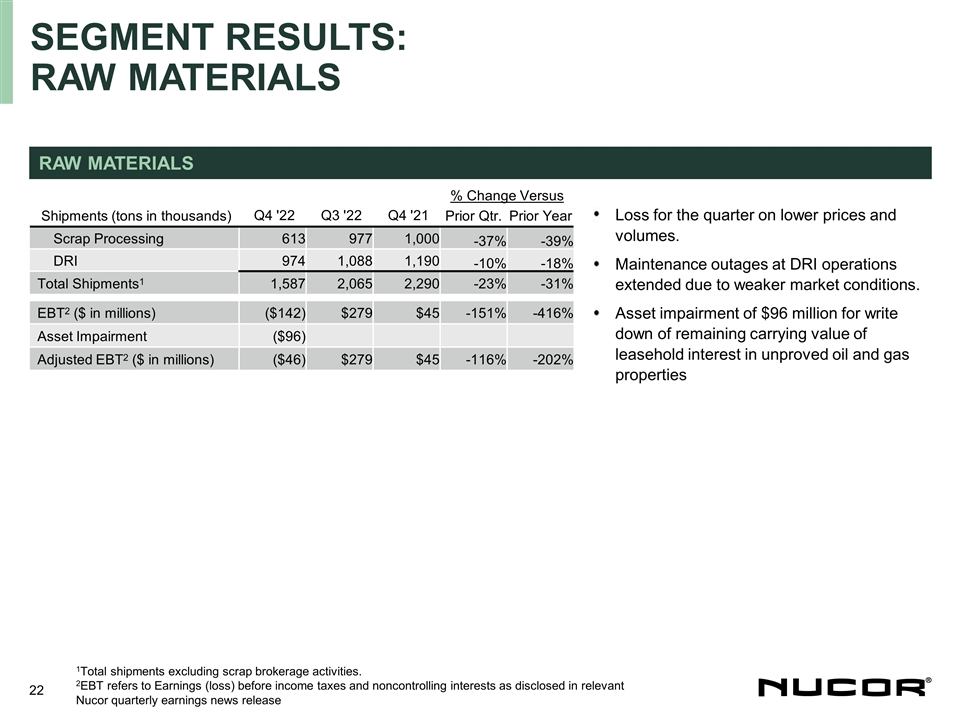

% Change Versus Q4 '22 Q3 '22 Q4 '21

Prior Qtr Prior Year Shipments (000s tons)2 1,587 2,065 2,290 -23% -31% EBT1 ($142) $279 $45 -151% -416% Asset Impairment ($96) Adjusted EBT1 ($46) $279 $45 -116% -202% % Change Versus Q4 '22 Q3 '22 Q4 '21 Prior Qtr Prior Year Shipments (000s tons)

1,178 1,291 1,153 -9% 2% EBT1 $1,081 $1,197 $452 -10% 139% Earnings/Ton ($) $918 $927 $392 -1% 134% % Change Versus Q4 '22 Q3 '22 Q4 '21 Prior Qtr Prior Year Shipments (000s tons) 5,110 5,859 5,869 -13% -13% EBT1 $516 $1,288 $3,129 -60% -84%

Earnings/Ton ($) $101 $220 $533 -54% -81% Q4 2022 Segment results STEEL MILLS SEGMENT STEEL PRODUCTS SEGMENT RAW MATERIALS SEGMENT Lower shipments reflecting caution among service centers and other customers, and seasonality Lower pricing and lower

scrap costs with net effect overall a lower metal margin Conversion costs slightly lower despite lower utilization - alloy costs lower, freight stable, energy lower. Labor, supplies and services expense higher. Pre-operating and startup expense

higher. Loss for the quarter on lower prices and volumes Maintenance outages at DRI operations extended due to weaker market conditions Asset impairment of $96 million for write-down of remaining carrying value of leasehold interest in unproved oil

and gas properties 1EBT refers to Earnings (loss) before income taxes and noncontrolling interests as disclosed in relevant quarterly Nucor quarterly earnings news release. 2Excludes scrap brokerage activities ($ in millions) Slightly lower

shipments – seasonality Pricing relatively stable - down ~3% Higher expense for labor, other supplies and services offset by lower substrate expense

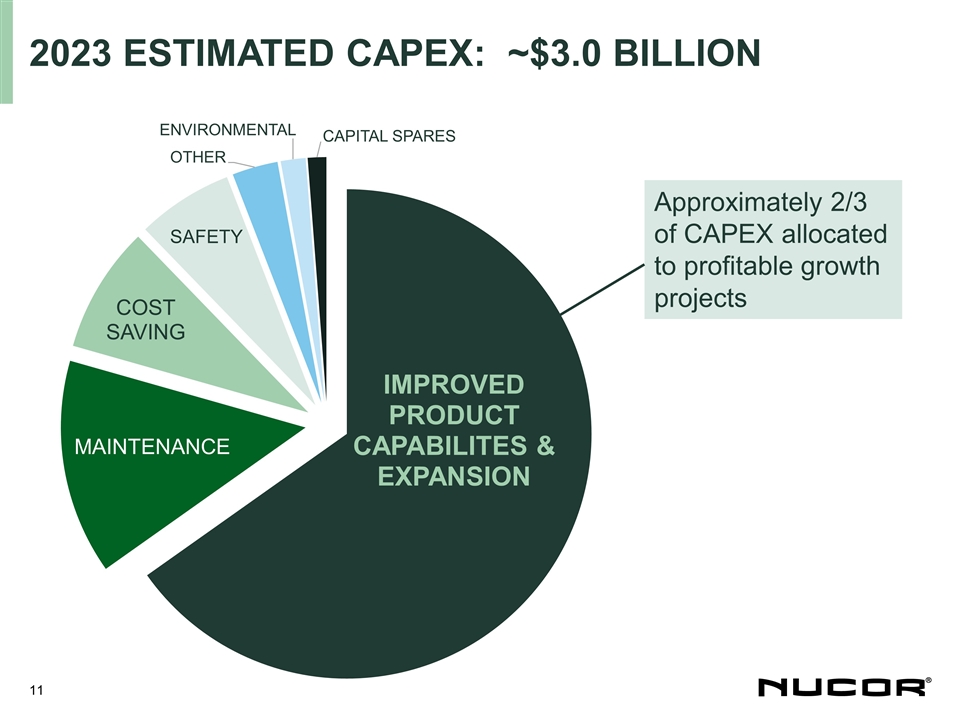

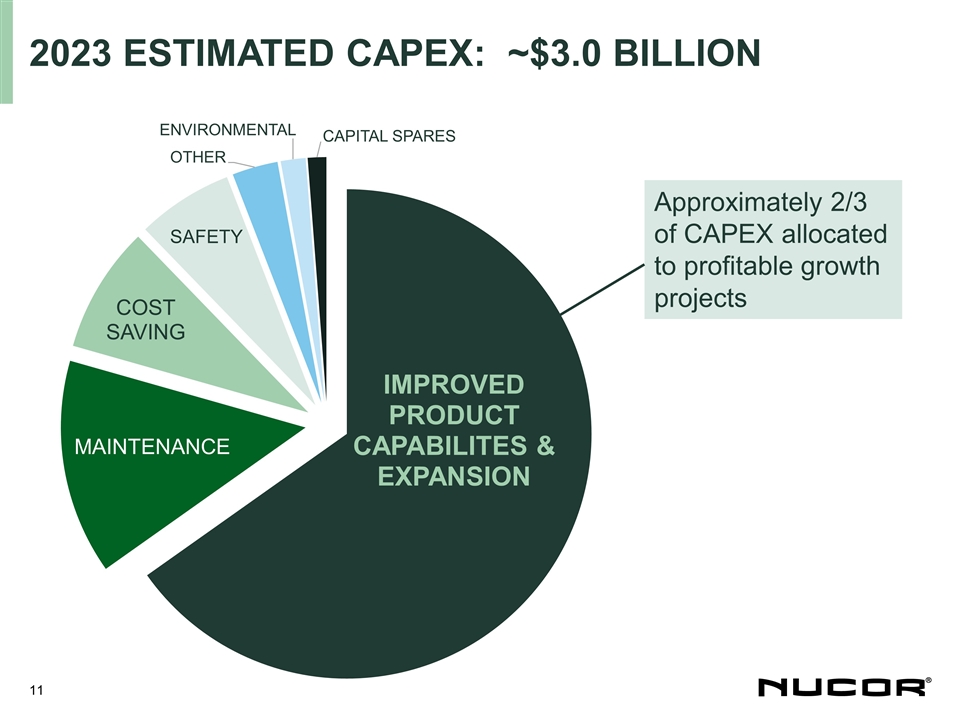

2023 Estimated Capex: ~$3.0 Billion

SAFETY Approximately 2/3 of CAPEX allocated to profitable growth projects

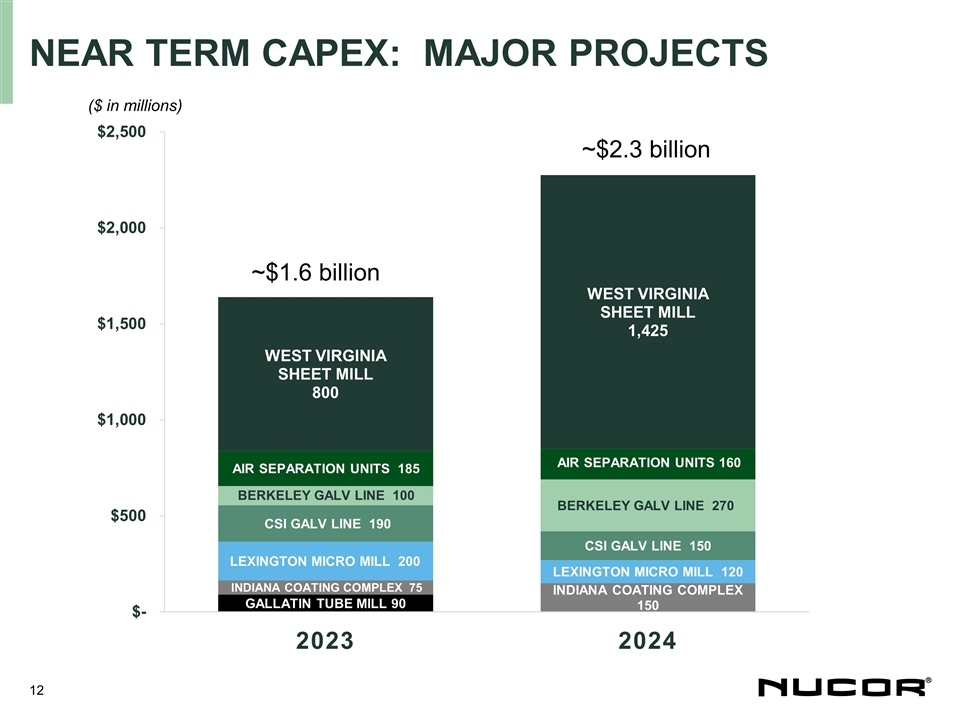

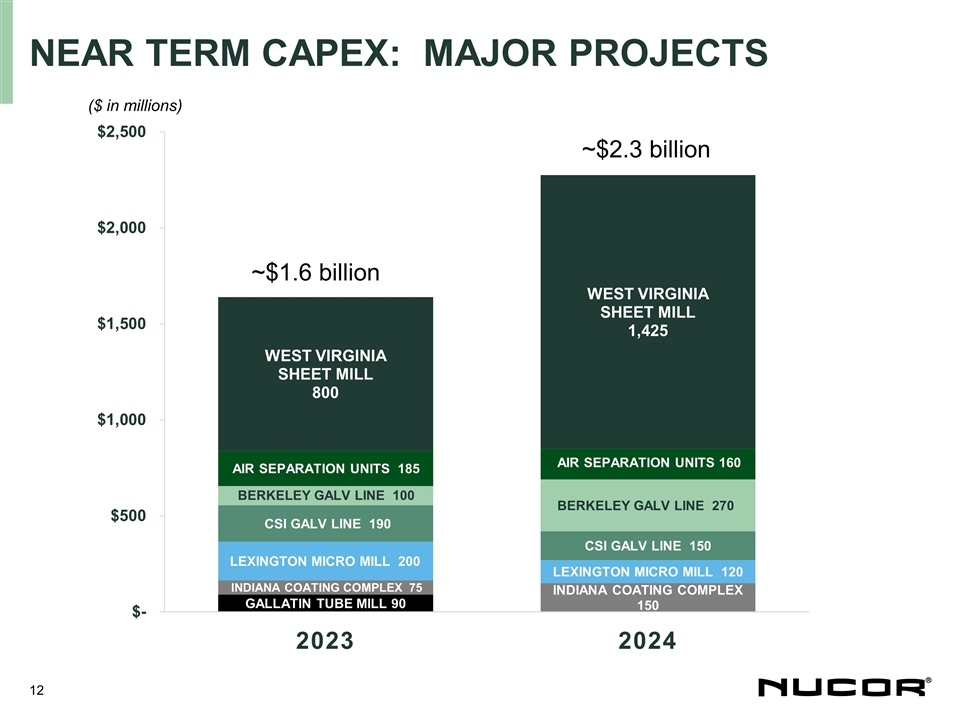

Near Term Capex: major projects ($

in millions)

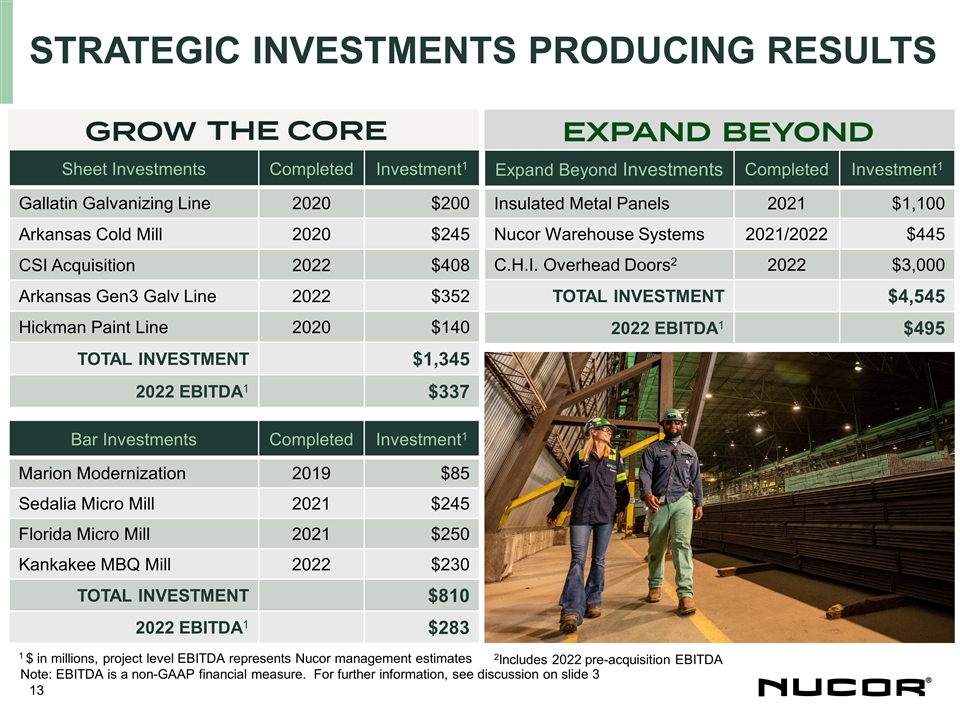

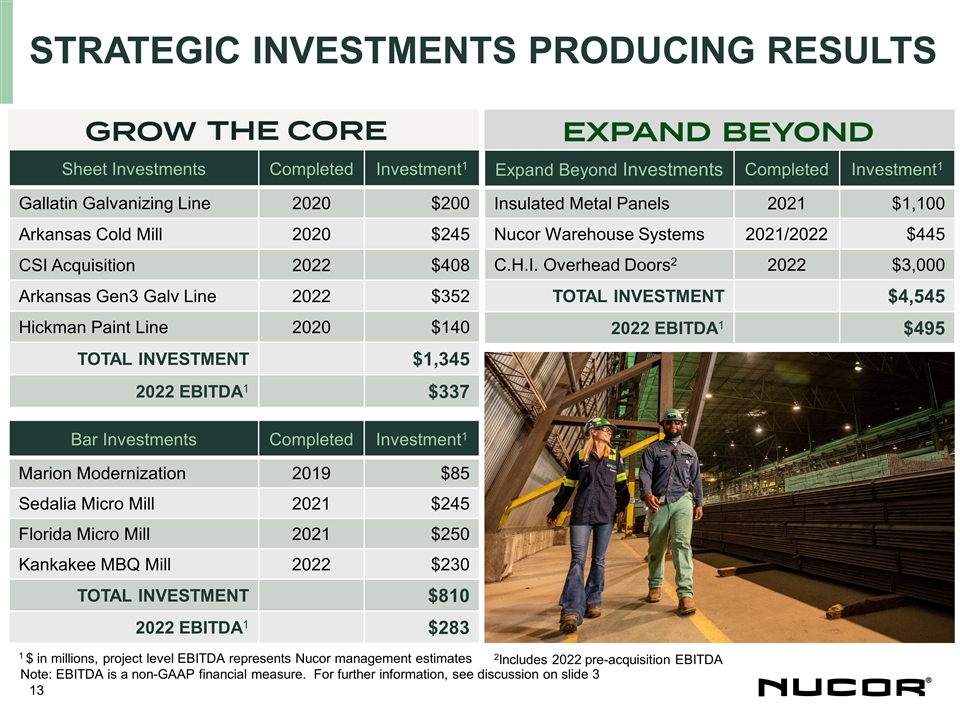

Strategic investments producing

results Sheet Investments Completed Investment1 Gallatin Galvanizing Line 2020 $200 Arkansas Cold Mill 2020 $245 CSI Acquisition 2022 $408 Arkansas Gen3 Galv Line 2022 $352 Hickman Paint Line 2020 $140 TOTAL INVESTMENT $1,345 2022 EBITDA1 $337 Bar

Investments Completed Investment1 Marion Modernization 2019 $85 Sedalia Micro Mill 2021 $245 Florida Micro Mill 2021 $250 Kankakee MBQ Mill 2022 $230 TOTAL INVESTMENT $810 2022 EBITDA1 $283 Expand Beyond Investments Completed Investment1 Insulated

Metal Panels 2021 $1,100 Nucor Warehouse Systems 2021/2022 $445 C.H.I. Overhead Doors2 2022 $3,000 TOTAL INVESTMENT $4,545 2022 EBITDA1 $495 1 $ in millions, project level EBITDA represents Nucor management estimates 2Includes 2022 pre-acquisition

EBITDA Note: EBITDA is a non-GAAP financial measure. For further information, see discussion on slide 3

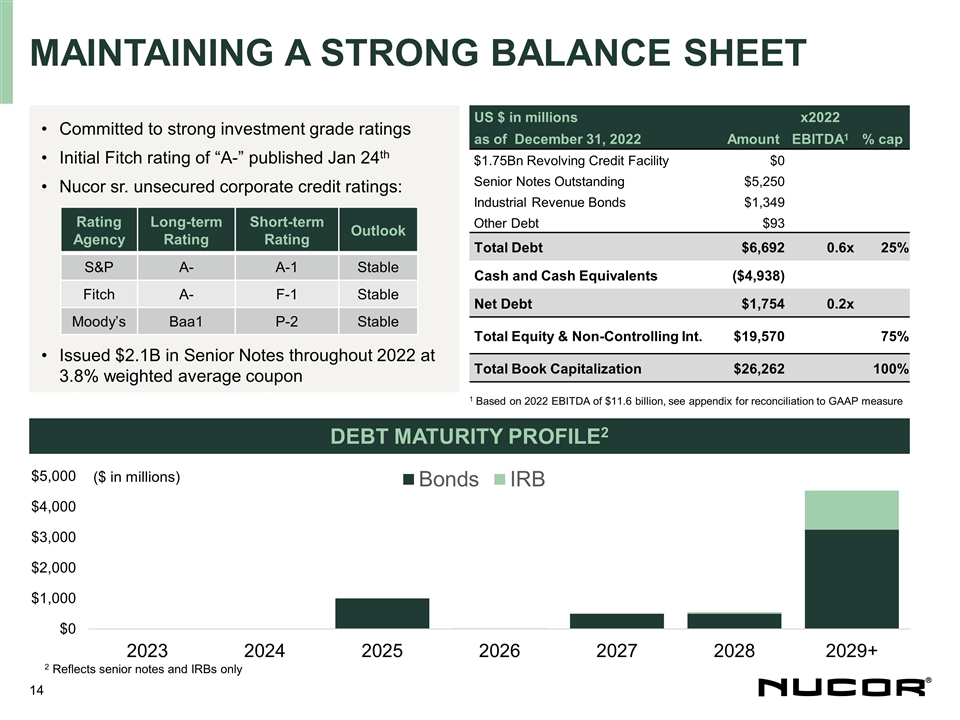

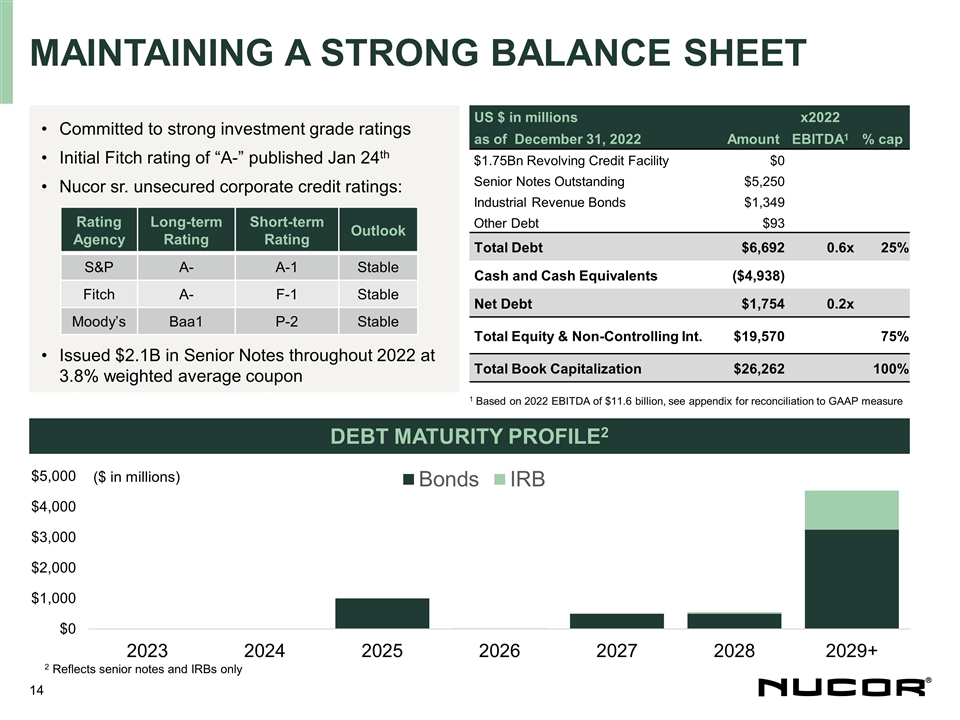

Maintaining a Strong Balance sheet

US $ in millions x2022 as of December 31, 2022 Amount EBITDA1 % cap $1.75Bn Revolving Credit Facility $0 Senior Notes Outstanding $5,250 Industrial Revenue Bonds $1,349 Other Debt $93 Total Debt $6,692 0.6x 25% Cash and

Cash Equivalents ($4,938) Net Debt $1,754 0.2x Total Equity & Non-Controlling Int. $19,570 75% Total Book Capitalization $26,262 100% 1 Based on 2022 EBITDA of $11.6 billion, see appendix for reconciliation to GAAP measure DEBT MATURITY

PROFILE2 Committed to strong investment grade ratings Initial Fitch rating of “A-” published Jan 24th Nucor sr. unsecured corporate credit ratings: Issued $2.1B in Senior Notes throughout 2022 at 3.8% weighted average coupon Rating

Agency Long-term Rating Short-term Rating Outlook S&P A- A-1 Stable Fitch A- F-1 Stable Moody’s Baa1 P-2 Stable ($ in millions) 2 Reflects senior notes and IRBs only

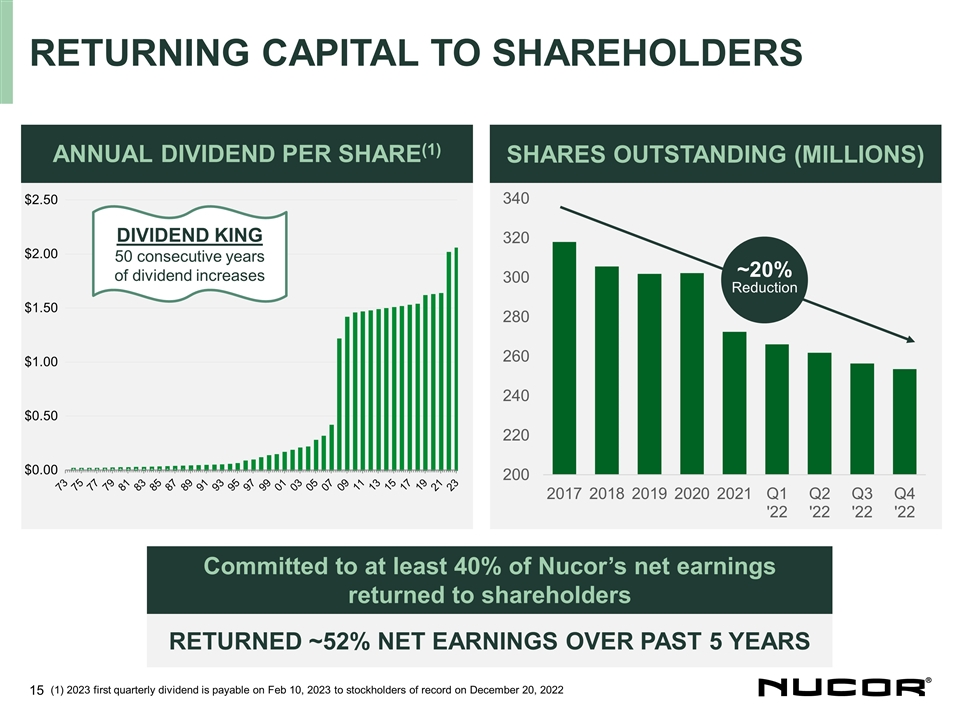

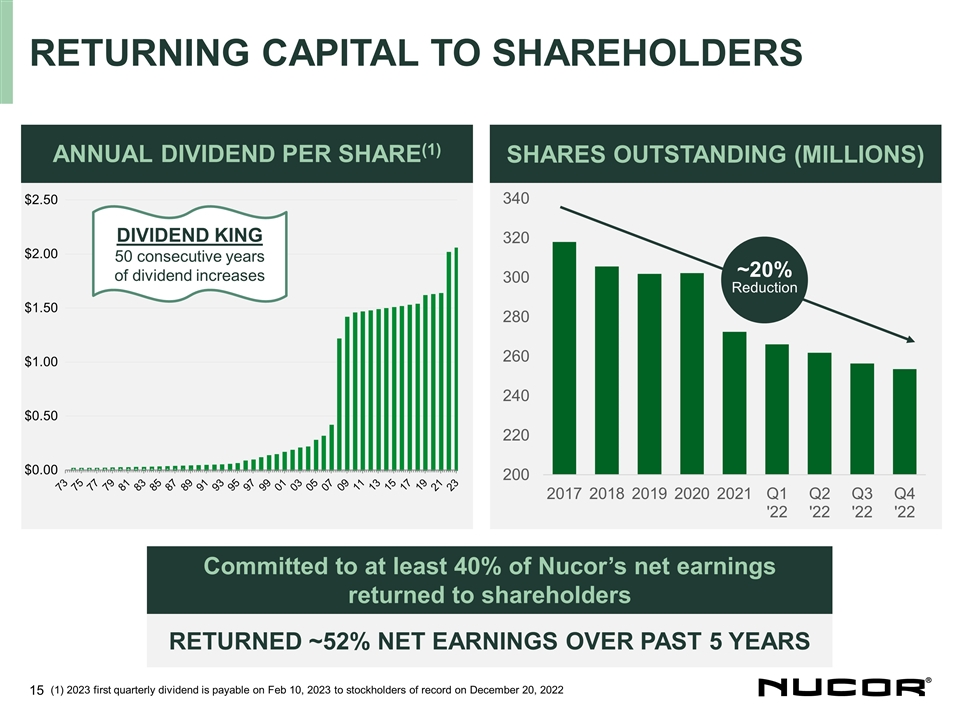

Returning capital to shareholders

ANNUAL DIVIDEND PER SHARE(1) SHARES OUTSTANDING (MILLIONS) Committed to at least 40% of Nucor’s net earnings returned to shareholders Returned ~52% net earnings over past 5 years ~20% Reduction DIVIDEND KING 50 consecutive years of dividend

increases (1) 2023 first quarterly dividend is payable on Feb 10, 2023 to stockholders of record on December 20, 2022

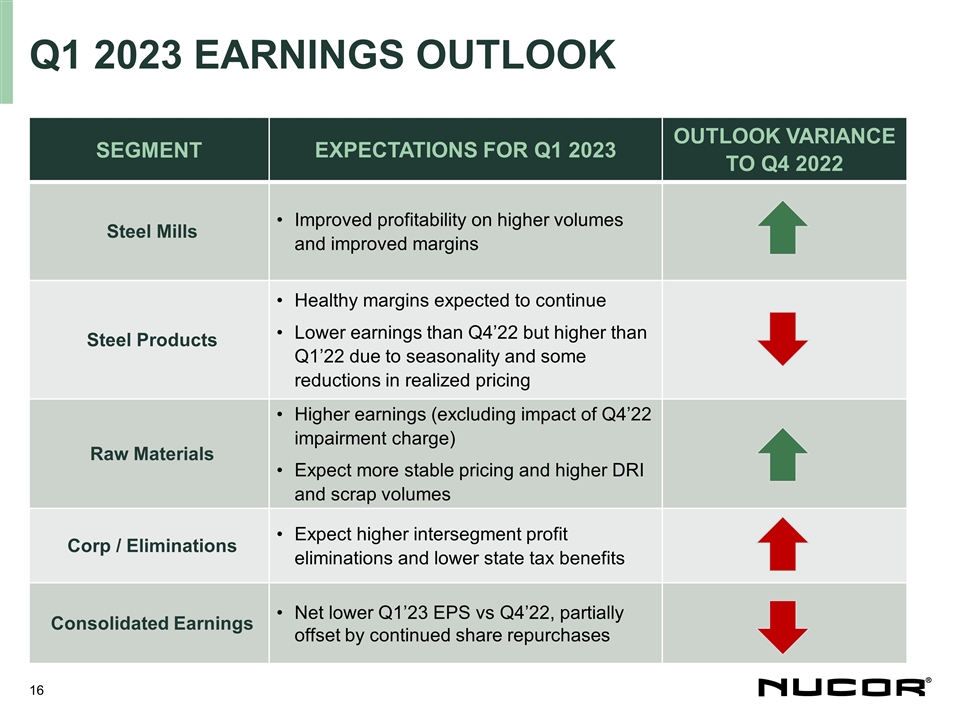

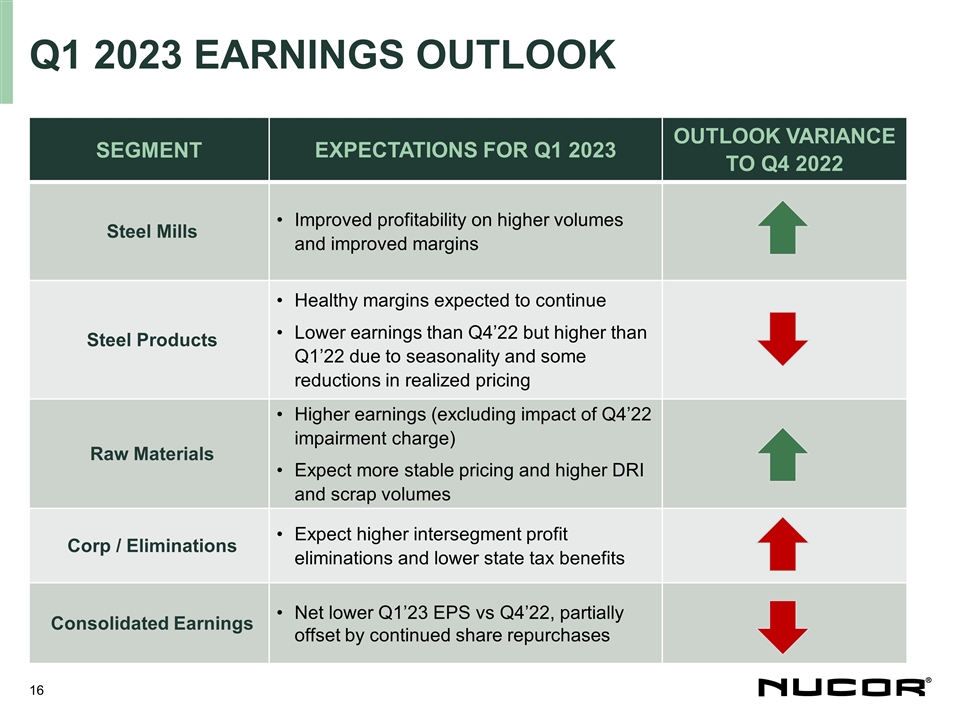

Q1 2023 Earnings Outlook SEGMENT

EXPECTATIONS FOR Q1 2023 OUTLOOK VARIANCE TO Q4 2022 Steel Mills Improved profitability on higher volumes and improved margins Steel Products Healthy margins expected to continue Lower earnings than Q4’22 but higher than Q1’22 due to

seasonality and some reductions in realized pricing Raw Materials Higher earnings (excluding impact of Q4’22 impairment charge) Expect more stable pricing and higher DRI and scrap volumes Corp / Eliminations Expect higher intersegment profit

eliminations and lower state tax benefits Consolidated Earnings Net lower Q1’23 EPS vs Q4’22, partially offset by continued share repurchases

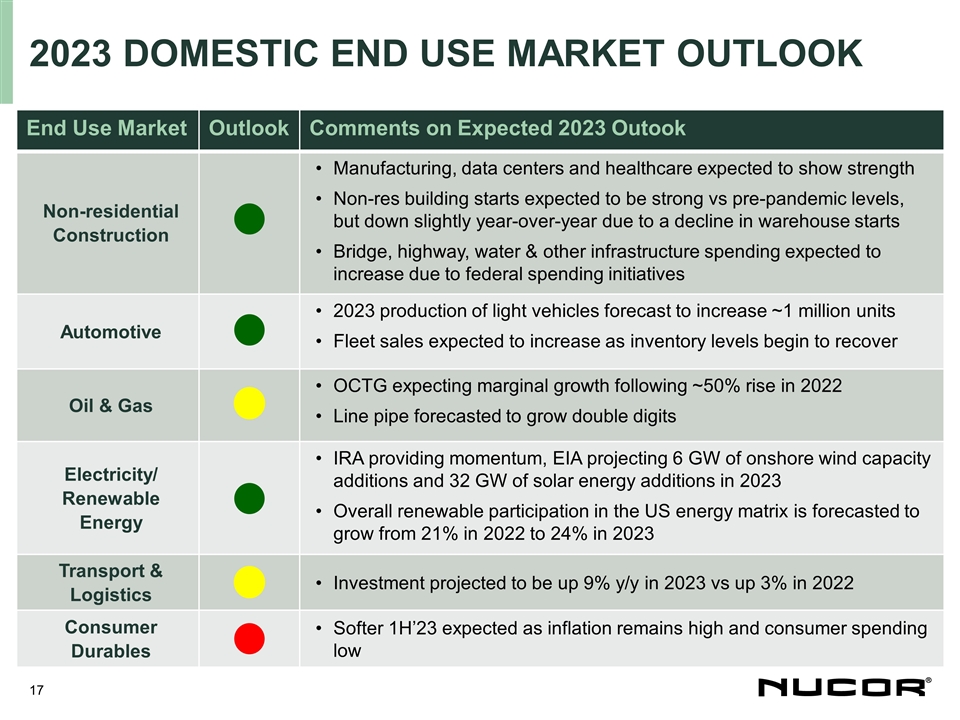

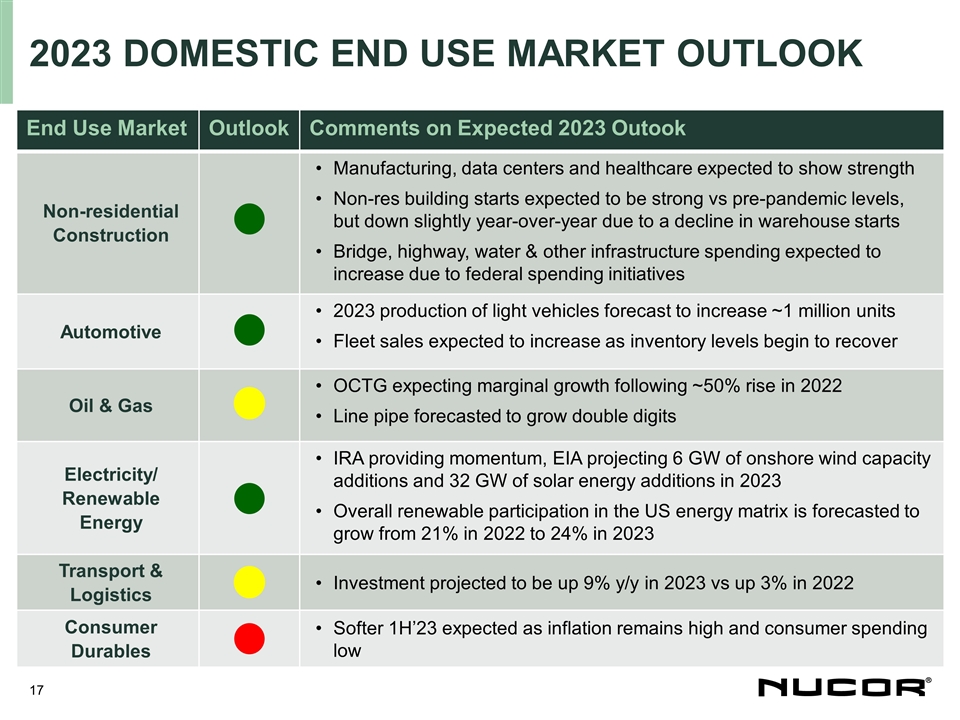

2023 Domestic End use MARKET outlook

End Use Market Outlook Comments on Expected 2023 Outook Non-residential Construction Manufacturing, data centers and healthcare expected to show strength Non-res building starts expected to be strong vs pre-pandemic levels, but down slightly

year-over-year due to a decline in warehouse starts Bridge, highway, water & other infrastructure spending expected to increase due to federal spending initiatives Automotive 2023 production of light vehicles forecast to increase ~1 million

units Fleet sales expected to increase as inventory levels begin to recover Oil & Gas OCTG expecting marginal growth following ~50% rise in 2022 Line pipe forecasted to grow double digits Electricity/ Renewable Energy IRA providing momentum, EIA

projecting 6 GW of onshore wind capacity additions and 32 GW of solar energy additions in 2023 Overall renewable participation in the US energy matrix is forecasted to grow from 21% in 2022 to 24% in 2023 Transport & Logistics Investment

projected to be up 9% y/y in 2023 vs up 3% in 2022 Consumer Durables Softer 1H’23 expected as inflation remains high and consumer spending low

APPENDIX

Reconciliation of gaap to non-gaap

measure 2018 2019 2020 2021 2022 Net earnings1 2,481 1,371 836 7,122 8,080 Net Interest expense 136 121 153 159 170 Provision for income taxes 748 412 -- 2,078 2,165 Depreciation expense 631 649 702 735 827 Amortization expense 89 86 83 136 235

Impairments and losses on assets 110 67 614 62 102 EBITDA 4,195 2,706 2,388 10,292 11,579 1Reflects net earnings before non-controlling interests $ in millions

Reconciliation of gaap to non-gaap

measure 2018 2019 2020 2021 2022 5 Year Totals Cash provided by operating Activities 2,394 2,809 2,697 6,231 10,072 24,203 Capital Expenditures (983) (1,477) (1,543) (1,622) (1,948) (7,573) Free Cash FLow 1,411 1,332 1,154 4,609 8,124 16,630 $

in millions

% Change Versus Shipments (tons in

thousands) Q4 '22 Q3 '22 Q4 '21 Prior Qtr. Prior Year Tubular Tubular 215 231 222 -7% -3% Joist & Deck Joist & Deck 301 289 305 4% -1% Rebar Fabrication Rebar Fabrication 302 350 289 -14% 4% Piling Piling 94 119 103 -21% -9% Cold finished

Cold finished 99 112 112 -12% -12% Other Other 167 190 122 -12% 37% Total Shipments 1,178 1,291 1,153 -9% 2% EBT1 ($ in millions) $1,081 $1,197 $452 -10% 139% EBT1/Ton ($) $918 $927 $392 -1% 134% % Change Versus Shipments (tons in thousands) Q4 '22

Q3 '22 Q4 '21 Prior Qtr. Prior Year Sheet Sheet 2,314 2,667 2,502 -13% -8% Bars Bars 1,907 2,169 2,177 -12% -12% Structural Structural 445 583 607 -24% -27% Plate Plate 375 379 489 -1% -23% Other Steel Other Steel 69 61 94 13% -27% Total Shipments

5,110 5,859 5,869 -13% -13% EBT1 ($ in millions) $516 $1,288 $3,129 -60% -84% EBT1/Ton ($) $101 $220 $533 -54% -81% SEGMENT RESULTS: Steel Mills and Steel Products STEEL PRODUCTS STEEL MILLS Lower shipments reflecting caution among service centers

and other customers, as well as seasonality Lower pricing and lower scrap costs with net overall effect being a lower metal margin Conversion costs slightly lower despite lower utilization - alloy costs lower, freight stable, energy lower. Labor,

supplies and services expense higher. Pre-operating and startup expense higher. Slightly lower shipments reflecting seasonality Pricing relatively stable - down ~3% Higher expense for labor, other supplies and services more than offset by lower

substrate expense Overall profitability still very strong - 3rd best quarter ever for the segment 1EBT refers to Earnings (loss) before income taxes and noncontrolling interests as disclosed in relevant Nucor quarterly earnings news

release

RAW MATERIALS SEGMENT RESULTS: raw

materials % Change Versus Shipments (tons in thousands) Q4 '22 Q3 '22 Q4 '21 Prior Qtr. Prior Year Scrap Processing Tubular 613 977 1,000 -37% -39% DRI Other 974 1,088 1,190 -10% -18% Total Shipments1 1,587 2,065 2,290 -23% -31% EBT2 ($ in millions)

($142) $279 $45 -151% -416% Asset Impairment ($96) Adjusted EBT2 ($ in millions) ($46) $279 $45 -116% -202% 1Total shipments excluding scrap brokerage activities. 2EBT refers to Earnings (loss) before income taxes and noncontrolling interests as

disclosed in relevant Nucor quarterly earnings news release Loss for the quarter on lower prices and volumes. Maintenance outages at DRI operations extended due to weaker market conditions. Asset impairment of $96 million for write down of remaining

carrying value of leasehold interest in unproved oil and gas properties

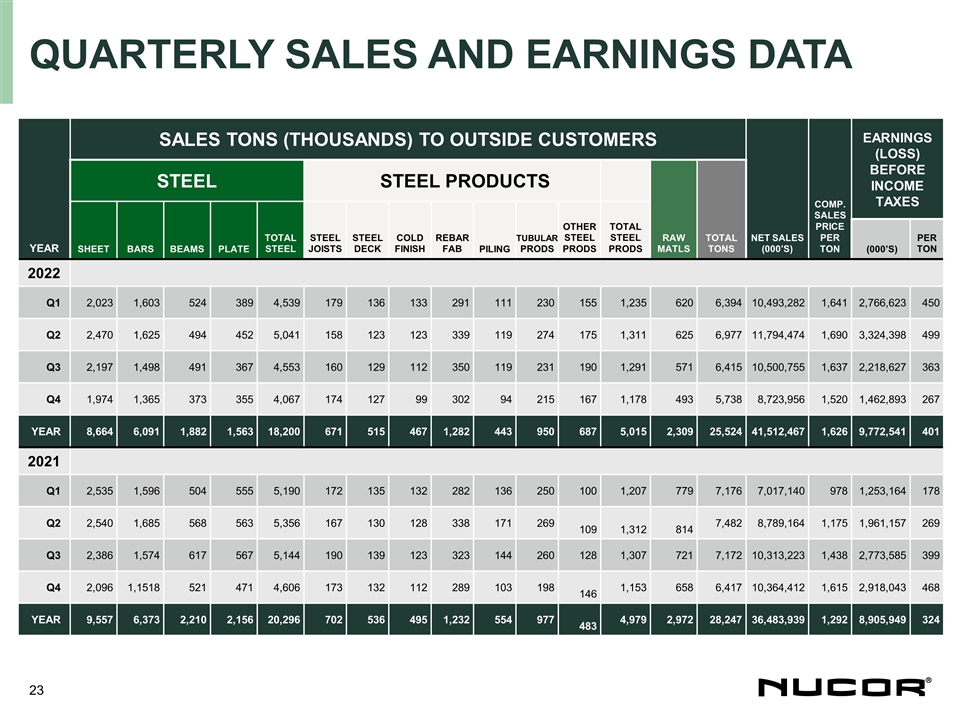

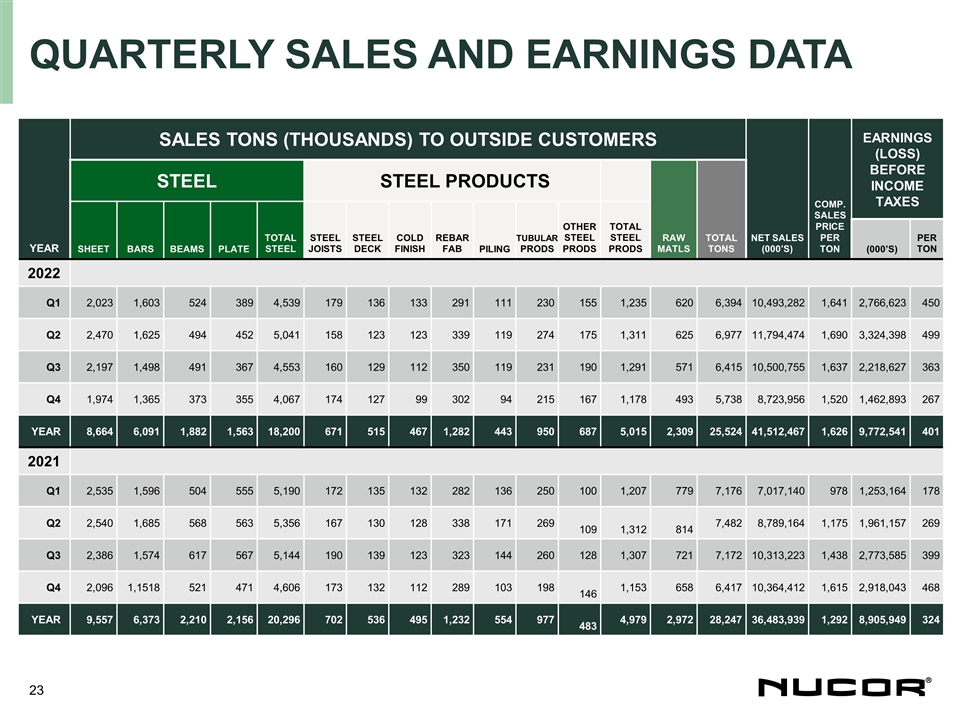

YEAR SALES TONS (THOUSANDS) TO

OUTSIDE CUSTOMERS NET SALES (000’s) Comp. SALES PRICE PER TON EARNINGS (LOSS) BEFORE INCOME TAXES STEEL STEEL PRODUCTS RAW MATlS TOTAL TONS SHEET BARS BEAMS PLATE TOTAL STEEL STEEL JOISTS STEEL DECK COLD FINISH REBAR FAB PILING Tubular prods

OTHER STEEL PRODS TOTAL STEEL PRODS SHEET BARS BEAMS PLATE TOTAL STEEL STEEL JOISTS STEEL DECK COLD FINISH REBAR FAB PILING Tubular prods OTHER STEEL PRODS TOTAL STEEL PRODS (000’s) Per ton 2022 Q1 2,023 1,603 524 389 4,539 179 136 133 291 111

230 155 1,235 620 6,394 10,493,282 1,641 2,766,623 450 Q2 2,470 1,625 494 452 5,041 158 123 123 339 119 274 175 1,311 625 6,977 11,794,474 1,690 3,324,398 499 Q3 2,197 1,498 491 367 4,553 160 129 112 350 119 231 190 1,291 571 6,415 10,500,755 1,637

2,218,627 363 Q4 1,974 1,365 373 355 4,067 174 127 99 302 94 215 167 1,178 493 5,738 8,723,956 1,520 1,462,893 267 year 8,664 6,091 1,882 1,563 18,200 671 515 467 1,282 443 950 687 5,015 2,309 25,524 41,512,467 1,626 9,772,541 401 2021 Q1 2,535

1,596 504 555 5,190 172 135 132 282 136 250 100 1,207 779 7,176 7,017,140 978 1,253,164 178 Q2 2,540 1,685 568 563 5,356 167 130 128 338 171 269 109 1,312 814 7,482 8,789,164 1,175 1,961,157 269 Q3 2,386 1,574 617 567 5,144 190 139 123 323 144 260

128 1,307 721 7,172 10,313,223 1,438 2,773,585 399 Q4 2,096 1,1518 521 471 4,606 173 132 112 289 103 198 146 1,153 658 6,417 10,364,412 1,615 2,918,043 468 YEAR 9,557 6,373 2,210 2,156 20,296 702 536 495 1,232 554 977 483 4,979 2,972 28,247

36,483,939 1,292 8,905,949 324 QUARTERLY SALES AND Earnings data

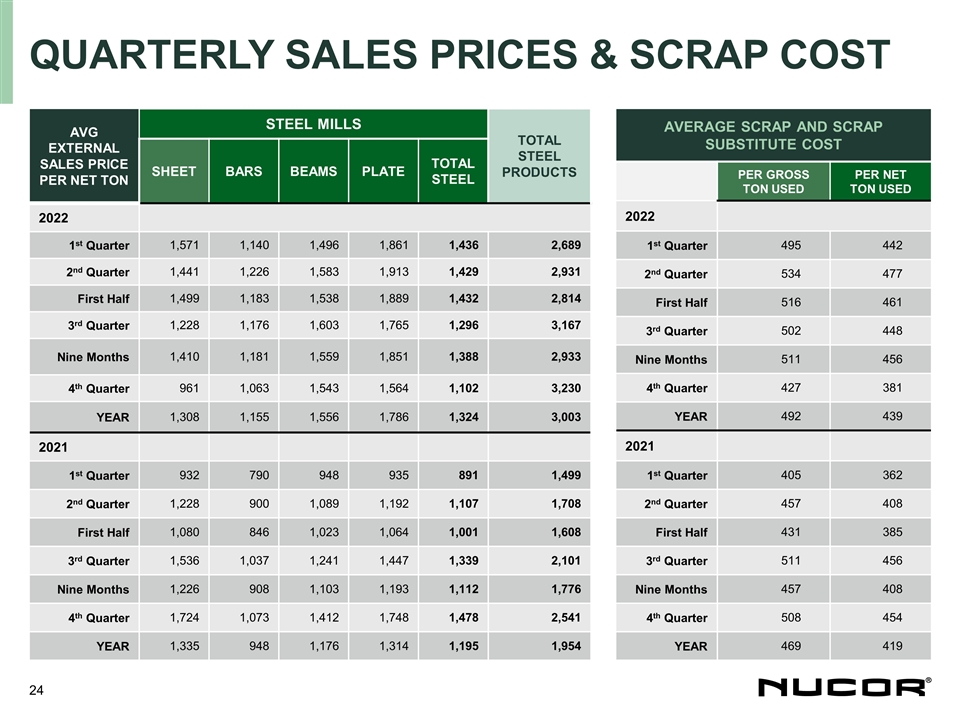

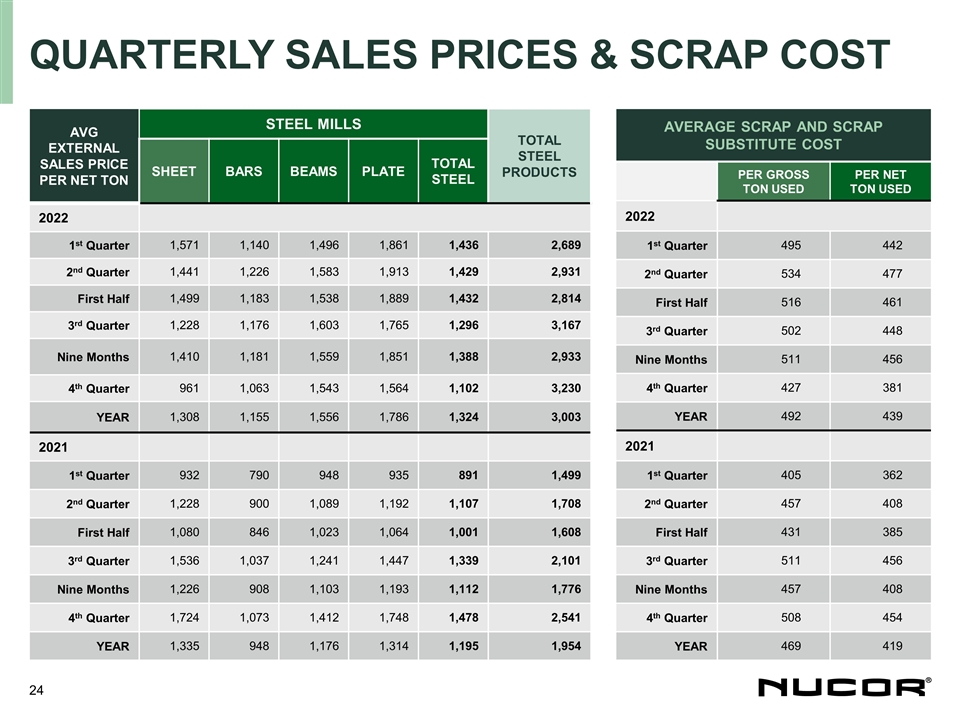

AVG EXTERNAL SALES PRICE PER NET TON

STEEL Mills Total STEEL PRODUCTS SHEET BARS BEAMS PLATE TOTAL STEEL 2022 1st Quarter 1,571 1,140 1,496 1,861 1,436 2,689 2nd Quarter 1,441 1,226 1,583 1,913 1,429 2,931 First Half 1,499 1,183 1,538 1,889 1,432 2,814 3rd Quarter 1,228 1,176 1,603

1,765 1,296 3,167 Nine Months 1,410 1,181 1,559 1,851 1,388 2,933 4th Quarter 961 1,063 1,543 1,564 1,102 3,230 YEAR 1,308 1,155 1,556 1,786 1,324 3,003 2021 1st Quarter 932 790 948 935 891 1,499 2nd Quarter 1,228 900 1,089 1,192 1,107 1,708 First

Half 1,080 846 1,023 1,064 1,001 1,608 3rd Quarter 1,536 1,037 1,241 1,447 1,339 2,101 Nine Months 1,226 908 1,103 1,193 1,112 1,776 4th Quarter 1,724 1,073 1,412 1,748 1,478 2,541 YEAR 1,335 948 1,176 1,314 1,195 1,954 AVERAGE SCRAP AND SCRAP

SUBSTITUTE COST PER GROSS TON USED PER NET TON USED 2022 1st Quarter 495 442 2nd Quarter 534 477 First Half 516 461 3rd Quarter 502 448 Nine Months 511 456 4th Quarter 427 381 YEAR 492 439 2021 1st Quarter 405 362 2nd Quarter 457 408 First

Half 431 385 3rd Quarter 511 456 Nine Months 457 408 4th Quarter 508 454 YEAR 469 419 QUARTERLY SALES prices & scrap cost

Safety metrics REDUCTION IN INJURY

& ILLNESS RATES Annual OSHA Recordables per 200,000 hours/year

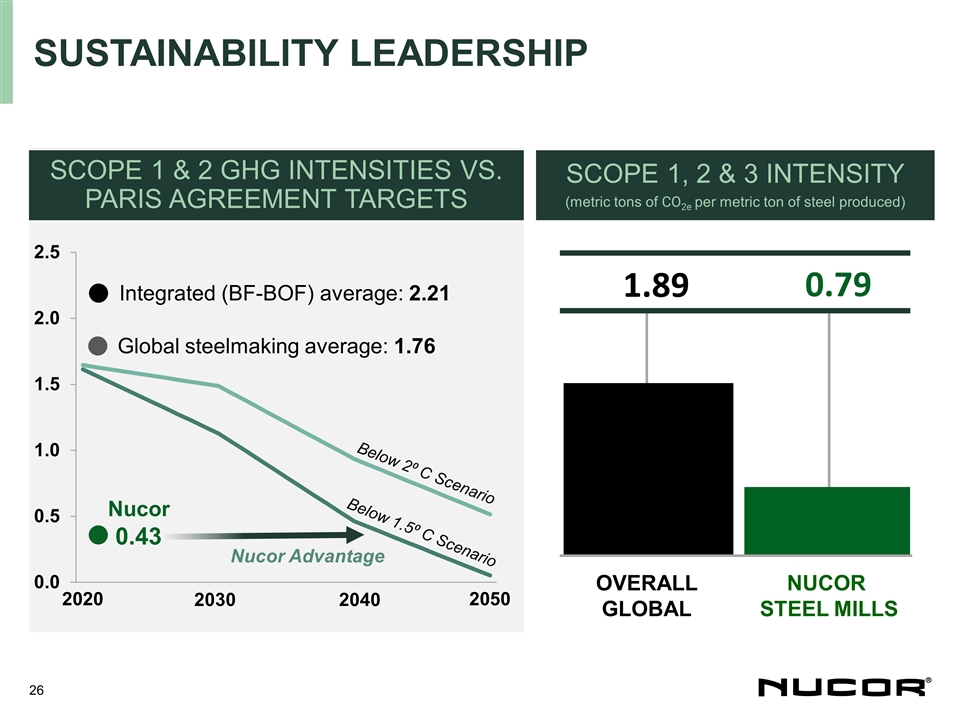

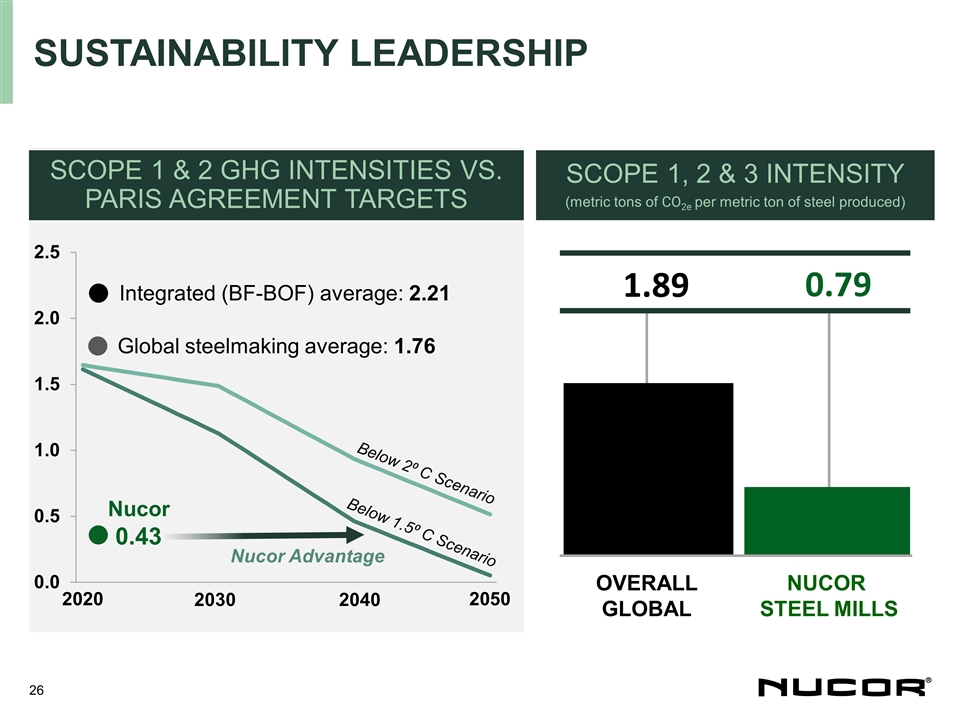

Below 2⁰ C Scenario Integrated

(BF-BOF) average: 2.21 Global steelmaking average: 1.76 Nucor 0.43 Nucor Advantage Sustainability leadership SCOPE 1 & 2 GHG INTENSITIES VS. PARIS AGREEMENT TARGETS Below 1.5⁰ C Scenario 2030 2040 SCOPE 1, 2 & 3 INTENSITY (metric tons

of CO2e per metric ton of steel produced) 1.89 0.79 NUCOR STEEL MILLS OVERALL GLOBAL

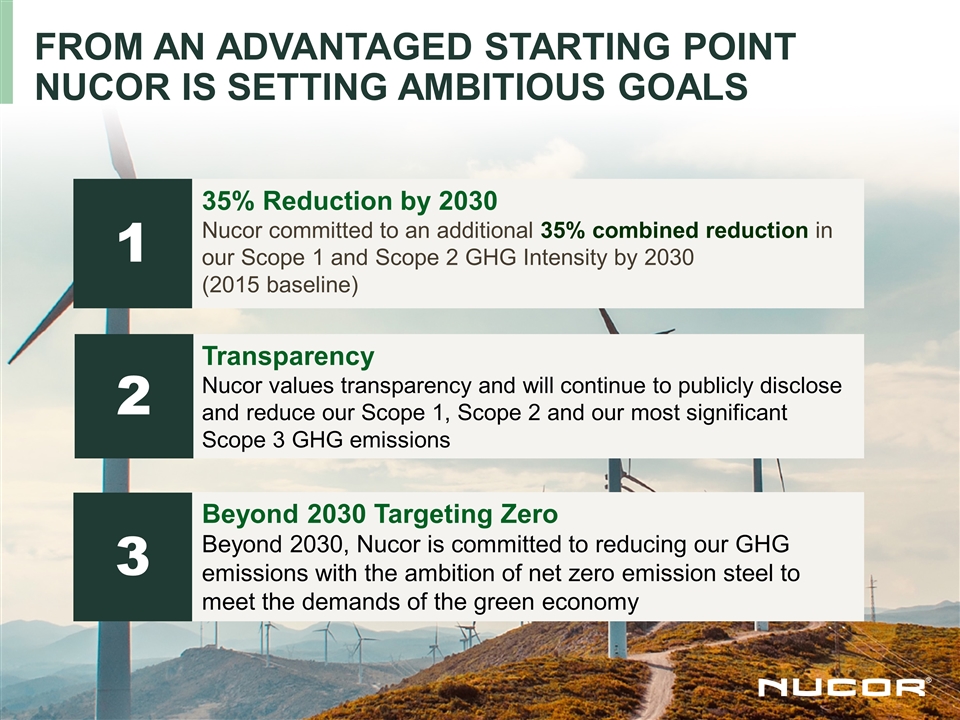

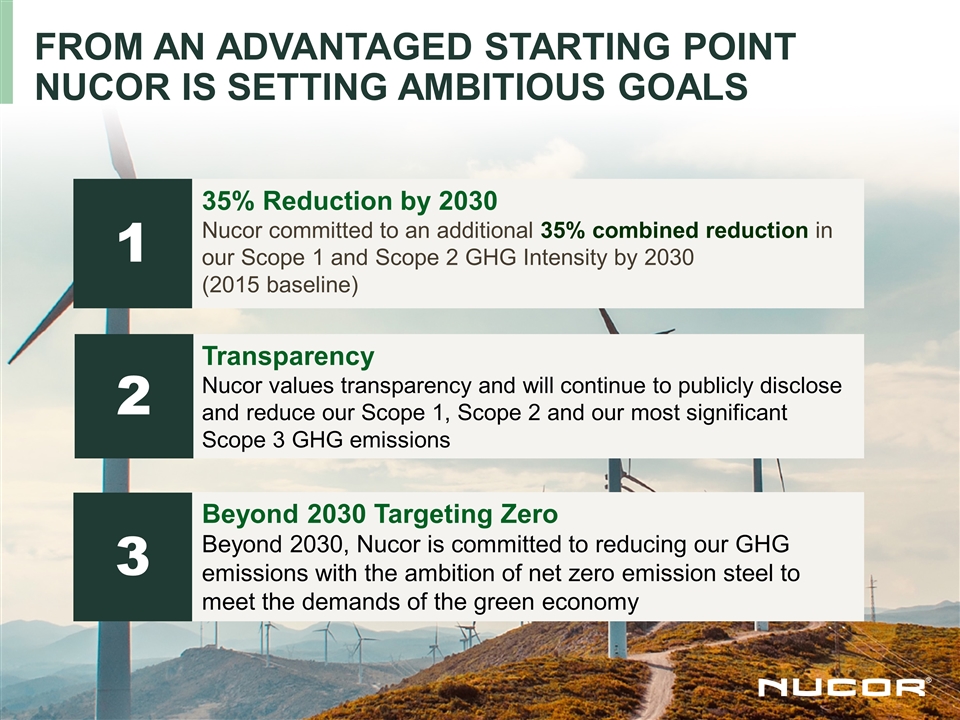

35% Reduction by 2030 Nucor

committed to an additional 35% combined reduction in our Scope 1 and Scope 2 GHG Intensity by 2030 (2015 baseline) Transparency Nucor values transparency and will continue to publicly disclose and reduce our Scope 1, Scope 2 and our most significant

Scope 3 GHG emissions Beyond 2030 Targeting Zero Beyond 2030, Nucor is committed to reducing our GHG emissions with the ambition of net zero emission steel to meet the demands of the green economy 1 2 3 FROM AN ADVANTAGED STARTING POINT NUCOR IS

SETTING AMBITIOUS GOALS

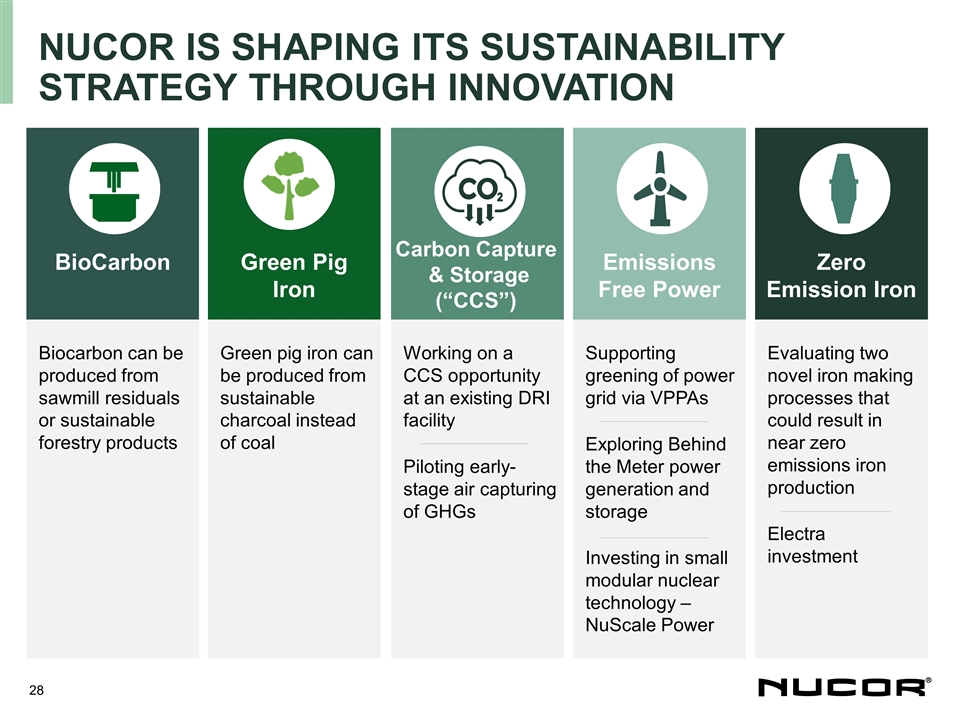

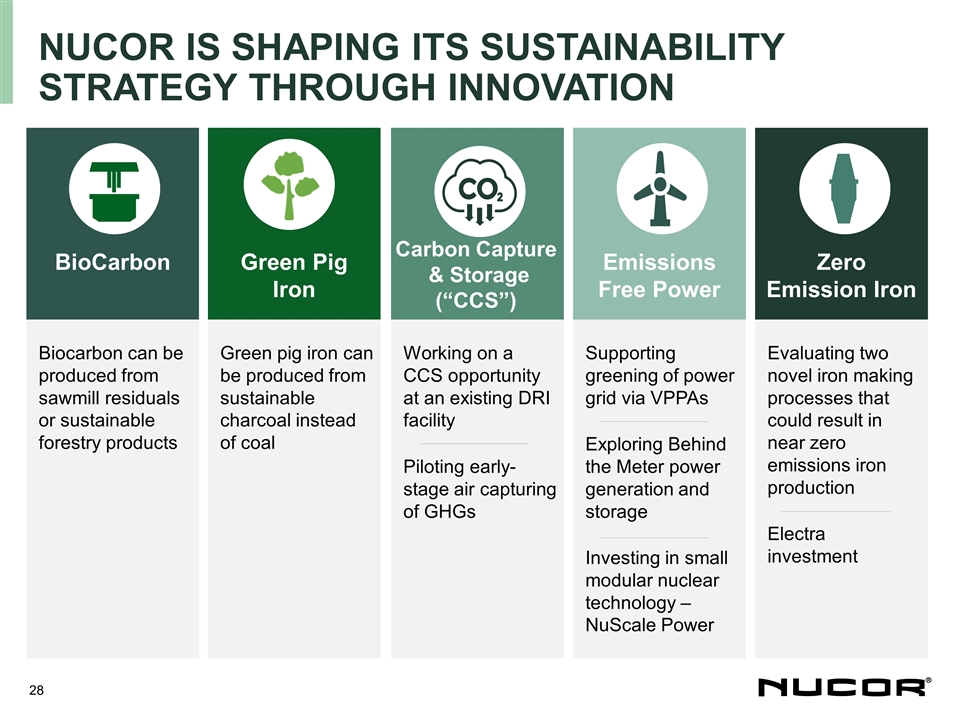

Nucor is shaping its sustainability

strategy through innovation Emissions Free Power Supporting greening of power grid via VPPAs Exploring Behind the Meter power generation and storage Investing in small modular nuclear technology – NuScale Power BioCarbon Biocarbon can be

produced from sawmill residuals or sustainable forestry products Carbon Capture & Storage (“CCS”) Working on a CCS opportunity at an existing DRI facility Piloting early-stage air capturing of GHGs Zero Emission Iron Evaluating two

novel iron making processes that could result in near zero emissions iron production Electra investment Green Pig Iron Green pig iron can be produced from sustainable charcoal instead of coal

v3.22.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |