U.S. SECURITIES AND EXCHANGE COMMISSION

PART II – OFFERING CIRCULAR

An offering statement pursuant to Regulation A relating to these shares has been filed with the U.S. Securities and Exchange Commission (the “Commission”). Information contained in this preliminary Offering Circular is subject to completion or amendment. These shares may not be sold nor may offers to buy be accepted before the offering statement filed with the Commission is qualified. This preliminary Offering Circular shall not constitute an offer to sell or a solicitation of an offer to buy or sell any of these shares in any state in which such offer, solicitation or sale would be unlawful before registration or qualification under the laws of any such state. We may elect to satisfy our obligation to deliver a final Offering Circular by sending you a notice within two business days after the completion of our sale to you that contains the URL where the final Offering Circular or the offering statement in which such final Offering Circular was filed may be obtained.

PRELIMINARY OFFERING CIRCULAR DATED [•], 2023

SKY QUARRY INC.

707 W. 700 S. Suite 101

Woods Cross, UT 84087

424-394-1090

www.skyquarry.com

Best Efforts Offering of up to 3,333,333 Shares of Common Stock

This is a public offering of securities of Sky Quarry Inc., a Delaware corporation (“we,” “us,” “our” or “our company”). We are offering up to 3,333,333 shares of common stock at an offering price of $6.00 per share (the “Offering Shares”) for aggregate maximum gross proceeds of $19,999,998. None of our existing shareholders, nor any of our officers, directors or affiliates are selling any securities in this Offering.

Reverse Stock Split

The Company intends to seek shareholder approval, and all other necessary consents, to file a Certificate of Amendment to our Certificate of Incorporation with the State of Delaware to effect a reverse stock split of its shares of common stock (the “Reverse Stock Split”) at a ratio of one-for-three (the “Split Ratio”), without changing the par value, rights, terms, conditions, and limitations of such shares of common stock, to be made effective on qualification of this Offering Circular by the Commission (the “Effective Split Date”). No fractional shares will be issued in connection with the Reverse Stock Split, and any of our stockholders that would be entitled to receive a fractional share as a result of the Reverse Stock Split will instead receive one additional share of our common stock in lieu of the fractional share. The reverse stock split will not in itself affect any stockholder’s ownership percentage of our common stock, except to the extent that any fractional share is rounded

II-1

up to the nearest whole share. The number of shares of common stock subject to the exercise of outstanding options, warrants and convertible securities will also be reduced by the Split Ratio as of the Effective Split Date and their respective exercise prices will be increased by the Split Ratio. Neither the authorized shares of capital stock nor the par value per share of our common stock will be affected by the Reverse Stock Split.

All historical share and per share information cited in this Offering Circular has been retroactively adjusted to reflect the impact of this reverse stock split. Our historical financial statements remain unchanged and have not been adjusted to reflect the reverse stock split.

Our common stock is not currently listed or quoted on any exchange. We have applied to have our common stock listed on the Nasdaq Capital Market (which we sometimes refer to as Nasdaq) under the symbol “SKYQ”. If approved, we intend to list our common stock on the Nasdaq Capital Market following Nasdaq’s certification of our Form 8-A to be filed concurrently with qualification of this, or a post-qualification amendment to this, Offering Statement. However, the listing of our common stock on the Nasdaq Capital Market is not a condition of our proceeding with this Offering, and no assurance can be given that our application to list on Nasdaq will be approved or that an active trading market for our common stock will develop.

This is a Regulation A+ Tier 2 offering and there is no minimum number of Offering Shares that we must sell in order to conduct a closing in this Offering. The offering will commence within two calendar days after this Offering Circular has been qualified by the Commission. See “Plan of Distribution” on page 25.This offering will terminate at the earliest of: (1) the date on which the maximum offering amount has been sold, (2) the date which is one year after this Offering is qualified by the Commission, and (3) the date on which this Offering is earlier terminated by us in our sole discretion.

| Price to

Public

|

| Underwriting

Discount and

Commissions (1)

|

| Proceeds to

Company (2)

|

Per Share

| $

| 6.00

|

| $

| 0.45

|

| $

| 5.55

|

Total Maximum

| $

| 19,999,998

|

| $

| 1,500,000

|

| $

| 18,499,998

|

(1)We have engaged Digital Offering, LLC (“Digital Offering”), a Commission registered broker/dealer and member of the Financial Industry Regulatory Authority (“FINRA”) to act as lead selling agent (the “Lead Selling Agent”) to offer the shares of our common stock, par value $0.0001 to prospective investors in this Offering on a “best efforts” basis, which means that there is no guarantee that any minimum amount will be received by us in this Offering. In addition, the Selling Agent may engage one or more sub-agents or selected dealers to assist in its marketing efforts (we sometimes refer to Digital Offering and such sub-agents and/or dealers collectively as the “Selling Agents”). Digital Offering is not purchasing the shares of common stock offered by us and is not required to sell any specific number or dollar amount of shares in this Offering before a closing occurs. We will pay a cash commission of 7.5% to Digital Offering on sales of the shares of common stock in this Offering and issue warrants to Digital Offering (the “Agent Warrants”) to purchase that number of shares of common stock equal to 5.0% of the total number of shares sold in this Offering. The Agent Warrants will have an exercise price of $7.50 per share and will be exercisable commencing six months after the date of commencement of sales in this Offering (in compliance with FINRA Rule 5110(e)(1)) and will be exercisable until the fifth anniversary of the date of commencement of sales in the offering. The Agent Warrants will contain customary terms and conditions, including without limitation, provisions for cashless exercise. The Agent Warrants and the shares issuable upon the exercise of the Agent Warrants are being registered by means of this Offering Circular for the offering. See “Plan of Distribution” for details.

(2)Does not include other expenses of the offering. See “Plan of Distribution” for a description of these expenses.

II-2

INVESTING IN THE COMMON STOCK OF SKY QUARRY, INC. IS SPECULATIVE AND INVOLVES SUBSTANTIAL RISKS. YOU SHOULD PURCHASE THESE SECURITIES ONLY IF YOU CAN AFFORD A COMPLETE LOSS OF YOUR INVESTMENT. SEE “RISK FACTORS” BEGINNING ON PAGE 9 TO READ ABOUT THE MORE SIGNIFICANT RISKS YOU SHOULD CONSIDER BEFORE BUYING THE COMMON STOCK OF THE COMPANY.

THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION DOES NOT PASS UPON THE MERITS OR GIVE ITS APPROVAL OF ANY SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SOLICITATION MATERIALS. THESE SECURITIES ARE OFFERED PURSUANT TO AN EXEMPTION FROM REGISTRATION WITH THE COMMISSION; HOWEVER, THE COMMISSION HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THE SECURITIES OFFERED ARE EXEMPT FROM REGISTRATION.

GENERALLY, NO SALE MAY BE MADE TO YOU IN THIS OFFERING IF THE AGGREGATE PURCHASE PRICE YOU PAY IS MORE THAN 10% OF THE GREATER OF YOUR ANNUAL INCOME OR NET WORTH. DIFFERENT RULES APPLY TO ACCREDITED INVESTORS AND NON-NATURAL PERSONS. BEFORE MAKING ANY REPRESENTATION THAT YOUR INVESTMENT DOES NOT EXCEED APPLICABLE THRESHOLDS, WE ENCOURAGE YOU TO REVIEW RULE 251(d)(2)(i)(C) OF REGULATION A. FOR GENERAL INFORMATION ON INVESTING, WE ENCOURAGE YOU TO REFER TO WWW.INVESTOR.GOV.

This offering circular is following the disclosure format of Part I of SEC Form S-1 pursuant to the general instructions of Part II(a)(1)(ii) of Form 1-A.

In the event that we become a reporting company under the Securities Exchange Act of 1934 (the “Exchange Act”), we intend to take advantage of the provisions that relate to “Emerging Growth Companies” under the JOBS Act of 2012 (the “JOBS Act”). See “Implications of Being an Emerging Growth Company.”

Digital Offering, LLC

Sales of these securities will commence on approximately [•], 2023.

II-3

You should rely only on the information contained in this Offering Circular. We have not authorized anyone to provide you with different information.

The information in this Offering Circular assumes that all of the Shares offered are sold.

Unless otherwise stated in this Offering Circular, “we,” “us,” “our,” “our company” or “Sky Quarry” refers to Sky Quarry Inc. and our predecessor operations.

II-4

IMPORTANT INFORMATION ABOUT THIS OFFERING CIRCULAR

We are offering to sell, and seeking offers to buy, our securities only in jurisdictions where such offers and sales are permitted. Please carefully read the information in this Offering Circular and any accompanying Offering Circular supplements, which we refer to collectively as the “Offering Circular.” You should rely only on the information contained in this Offering Circular. We have not authorized anyone to provide you with any information other than the information contained in this Offering Circular. The information contained in this Offering Circular is accurate only as of its date or as of the respective dates of any documents or other information incorporated herein by reference, regardless of the time of its delivery or of any sale or delivery of our securities. Neither the delivery of this Offering Circular nor any sale or delivery of our securities shall, under any circumstances, imply that there has been no change in our affairs since the date of this Offering Circular. This Offering Circular will be updated to the extent required by the federal securities laws.

This Offering Circular is part of an Offering Statement that we filed with the Commission using a continuous offering process pursuant to Rule 251(d)(3)(i)(F) under the Securities Act of 1933 (the “Securities Act”). Periodically, we may provide an Offering Circular supplement that would add, update or change information contained in this Offering Circular. Any statement that we make in this Offering Circular will be modified or superseded by any inconsistent statement made by us in a subsequent Offering Circular supplement. The Offering Statement we filed with the Commission includes exhibits that provide more detailed descriptions of the matters discussed in this Offering Circular. You should read this Offering Circular and the related exhibits filed with the Commission and any Offering Circular supplement, together with additional information contained in our annual reports, semi-annual reports and other reports that we will file periodically with the Commission. The Offering Statement and all supplements and reports that we have filed or will file in the future can be read at the Commission website, www.sec.gov.

Unless otherwise indicated, data contained in this Offering Circular concerning our business are based on information from various public sources. Although we believe that these data are generally reliable, such information is inherently imprecise, and our estimates and expectations based on these data involve a number of assumptions and limitations. As a result, you are cautioned not to give undue weight to such data, estimates or expectations.

Forward-Looking Statements

This document contains forward-looking statements. All statements pertaining to our future financial and/or operating results, future events, or future developments may constitute forward-looking statements. The statements may be identified by words such as “expect,” “look forward to,” “anticipate,” “intend,” “plan,” “believe,” “seek,” “estimate,” “will,” “project,” or words of similar meaning. Such statements are based on the current expectations and certain assumptions of our management, of which many are beyond control. These are subject to a number of risks, uncertainties, and factors, including but not limited to those described in disclosures. Should one or more of these risks or uncertainties materialize, or should underlying expectations not occur or assumptions prove incorrect, actual results, performance, or our achievements may (negatively or positively) vary materially from those described explicitly or implicitly in the relevant forward-looking statement. We neither intend, nor assume any obligation, to update or revise these forward-looking statements in light of developments which differ from those anticipated.

II-5

SUMMARY

This summary highlights certain information appearing elsewhere in this Offering Circular. For a more complete understanding of this Offering, you should read the entire Offering Circular carefully, including the risk factors and the financial statements.

Overview

We are an oil production, refining, and development-stage environmental remediation company formed to deploy technologies to facilitate the recycling of waste asphalt shingles and remediation of oil-saturated sands and soils. The recycling and production of oil from asphalt shingles is expected to reduce the dependence on landfills for the disposal of waste and to also reduce dependence on foreign and domestic virgin crude oil extraction for industrial uses.

We have developed a process for separating oil from oily sands and other oil-bearing solids utilizing a proprietary solvent which we refer to as our ECOSolv technology or the ECOSolv process. The solvent is used in a closed-loop distillation and evaporation circuit which results in over 99% of the solvent being recoverable for continuous reuse and requires no water. The solvent has demonstrated oil separation rates of over 95% in bench testing using samples of both mined crushed ore and ground asphalt shingles.

We intend to retrofit the PR Spring Facility, located in southeast Utah (as defined below) to recycle waste asphalt shingles using our ECOSolv technology, to produce and sell oil as well as asphalt paving aggregate mined from our bitumen deposit.

We also plan to develop a modular asphalt shingle recycling facility (“ASR Facility”), which can be deployed in areas with high concentrations of waste asphalt shingles and near asphalt shingle manufacturing centers.

Corporate History

We were incorporated in Delaware on June 4, 2019 as “Recoteq, Inc.” On April 22, 2020, we changed our name to “Sky Quarry Inc.”

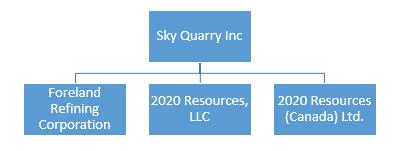

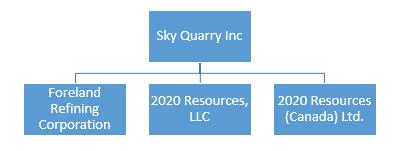

We have three (3) wholly-owned subsidiaries: 2020 Resources, LLC, a Delaware limited liability company; 2020 Resources (Canada) Ltd., an Alberta, Canadian corporation; and Foreland Refining Corporation, a Texas corporation.

On September 16, 2020, we acquired 2020 Resources LLC. The assets of 2020 Resources include an oil sands remediation facility (referred to in this Offering Circular as the “PR Spring Facility”) and a 100% interest in asphalt bitumen leases covering approximately 5,930 acres in the PR Spring region in Utah. On September 16, 2020, we also acquired 2020 Resources (Canada) Ltd, an entity which is currently inactive.

On September 30, 2022, we acquired Foreland Refining Corporation, which is engaged in the refining of heavy crude oil into diesel and other petroleum products (naphtha, vacuum gas oil, and paving asphalt liquids) at its Eagle Springs Refinery located near Ely, Nevada. The acquisition of Foreland is immediately accretive to our revenues and cash flow and provides a strong base for growth. We believe the acquisition is a strategic fit and will form an important role in the future enabling us to vertically integrate the production and refining of oil from waste materials to energy in a sustainable and efficient manner.

II-6

Corporate Information

Our principal executive offices are located at 707 W. 700 S. Suite 101, Woods Cross, UT 84087, telephone (424) 394-1090. Our principal website is www.skyquarry.com. Information provided on or accessible through our website, is not part of this Offering Circular and is included solely as an inactive textual reference.

Following this Offering, we intend to file a Form 8-A to become a fully reporting issuer under the Securities Exchange Act of 1934 (the “Exchange Act”).

Definitions

In this document, we refer to the following terms:

“Asphalt” is a dark brown to black, highly viscous, hydrocarbon produced from petroleum distillation residue. This distillation can occur naturally, resulting in asphalt lakes, or occur in a petroleum refinery using crude oil.

“Asphalt Cement” means a bitumen-based liquid binder used in asphalt pavement.

“ASR Facility” refers to our asphalt shingle recycling facility currently under development. Our design contemplates a modular, scalable, purpose-built facility capable of remediating waste asphalt shingles and separation into their base components of bitumen / asphalt cement, shingle granules, sand aggregate, limestone and fiberglass.

“bbl” refers to barrels of oil.

“DOT” means the U.S. Federal Department of Transportation.

“Eagle Springs Refinery” refers to our heavy oil refinery located near Ely in eastern Nevada.

“ECOSolv” refers to our proprietary “environmentally clean oil” waterless solvent and process we intend to use in the separation of oil from oily sands and also during the asphalt shingle remediation process.

“HMA” refers to hot mix asphalt paving aggregate, a combination of crushed or screened gravel, asphalt cement, and binding additives.

“JP Morgan” refers to JPMorgan Chase Funding Inc, a wholly owned subsidiary of JPMorgan Chase & Co.

“PR Spring Facility” refers to our oil sands remediation facility located in PR Spring in eastern Utah.

“WAS” means waste asphalt shingles recovered from construction and demolition waste (roof replacement), also known as “tear-offs” and from rejected manufactured shingles, also known as “manufacturer’s scrap”.

“WTI” refers to the New York Mercantile Exchange (NYMEX) West Texas Intermediate Crude Oil spot contract, an oil price benchmark that is central to global commodities trading, and is used to forecast energy input and commodity sale prices.

Implications of Being an Emerging Growth Company

As an issuer with less than $1 billion in total annual gross revenues during our last fiscal year, we will qualify as an “emerging growth company” under the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”) and this status will be significant if and when we become subject to the ongoing reporting

II-7

requirements of the Exchange Act upon filing a Form 8-A. An emerging growth company may take advantage of certain reduced reporting requirements and is relieved of certain other significant requirements that are otherwise generally applicable to public companies. In particular, as an emerging growth company we:

·will not be required to obtain an auditor attestation on our internal controls over financial reporting pursuant to the Sarbanes-Oxley Act of 2002;

·will not be required to provide a detailed narrative disclosure discussing our compensation principles, objectives and elements and analyzing how those elements fit with our principles and objectives (commonly referred to as “compensation discussion and analysis”);

·will not be required to obtain a non-binding advisory vote from our shareholders on executive compensation or golden parachute arrangements (commonly referred to as the “say-on-pay,” “say-on-frequency” and “say-on-golden-parachute” votes);

·will be exempt from certain executive compensation disclosure provisions requiring a pay-for-performance graph and CEO pay ratio disclosure;

·may present only two years of audited financial statements and only two years of related Management’s Discussion and Analysis of Financial Condition and Results of Operations, or MD&A; and

·will be eligible to claim longer phase-in periods for the adoption of new or revised financial accounting standards.

We intend to take advantage of all of these reduced reporting requirements and exemptions, including the longer phase-in periods for the adoption of new or revised financial accounting standards, and hereby elect to do so. Our election to use the phase-in periods may make it difficult to compare our financial statements to those of non-emerging growth companies and other emerging growth companies that have opted out of the phase-in periods under Section 107 of the JOBS Act.

Under the JOBS Act, we may take advantage of the above-described reduced reporting requirements and exemptions for up to five years after our initial sale of common equity pursuant to a registration statement declared effective under the Securities Act, as amended, or such earlier time that we no longer meet the definition of an emerging growth company. Note that this Offering, while a public offering, is not a sale of common equity pursuant to a registration statement since the offering is conducted pursuant to an exemption from the registration requirements. In this regard, the JOBS Act provides that we would cease to be an “emerging growth company” if we have more than $1 billion in annual revenues, have more than $700 million in market value of our common stock held by non-affiliates, or issue more than $1 billion in principal amount of non-convertible debt over a three-year period.

Certain of these reduced reporting requirements and exemptions are also available to us due to the fact that we may also qualify, once listed, as a “smaller reporting company” under the rules of the Commission. For instance, smaller reporting companies are not required to obtain an auditor attestation on their assessment of internal control over financial reporting; are not required to provide a compensation discussion and analysis; are not required to provide a pay-for-performance graph or Chief Executive Officer pay ratio disclosure; and may present only two years of audited financial statements.

If we do not become a public reporting company under the Exchange Act for any reason, we will be required to publicly report on an ongoing basis under the reporting rules set forth in Regulation A for Tier 2 issuers. The ongoing reporting requirements under Regulation A are more relaxed than for “emerging growth companies” under the Exchange Act. The differences include, but are not limited to, being required to file only annual and semiannual reports, rather than annual and quarterly reports. Annual reports are due within 120 calendar days after the end of the issuer’s fiscal year, and semiannual reports are due within 90 calendar days after the end of the first six months of the issuer’s fiscal year.

II-8

THE OFFERING

Securities offered and price per share:

|

| Up to 3,333,333 shares of common stock, at $6.00 per share (the “Offering Shares”).

|

|

|

|

Best efforts offering:

|

| There is no minimum number of Offering Shares that we must sell in order to conduct a closing in this Offering. Our directors and officers shall be entitled to purchase Shares in the Offering.

|

|

|

|

Securities outstanding prior to this Offering:

|

| ·16,323,089 shares of common stock (1);

·1 share of Series A Preferred Stock;

·200,000 shares of Series B Preferred Stock

|

|

|

|

Securities outstanding after this Offering:

|

| ·19,656,422 shares of common stock (1) (2) (3);

|

|

|

|

Selling Agent

|

| We have engaged Digital Offering to serve as our lead selling agent to assist in the placement of the Offering Shares in this Offering on a “best efforts” basis. In addition, Digital Offering may engage one or more sub-agents or selected dealers to assist in its marketing efforts. See “Plan of Distribution” for further details.

|

|

|

|

Use of proceeds:

|

| See “Use of Proceeds” beginning on page 24.

|

|

|

|

Termination of the Offering:

|

| This offering will terminate at the earliest of: (1) the date on which the maximum offering amount has been sold, (2) the date which is one year after this Offering is qualified by the Commission, and (3) the date on which this Offering is earlier terminated by us in our sole discretion.

|

|

|

|

Proposed listing of common stock:

|

| Our common stock is not currently listed or quoted on any exchange. We have applied to have our common stock listed on the Nasdaq Capital Market under the symbol “SKYQ”. If approved, we intend to list our common stock on the Nasdaq Capital Market following Nasdaq’s certification of our Form 8-A to be filed concurrently with qualification of this, or a post-qualification amendment to this, Offering Statement. However, the listing of our common stock on the Nasdaq Capital Market is not a condition of our proceeding with this Offering, and no assurance can be given that our application to list on Nasdaq will be approved or that an active trading market for our common stock will develop.

|

|

|

|

Risk factors:

|

| Investing in our common stock involves a high degree of risk. See “Risk Factors” beginning at page 9.

|

(1)As of December 19, 2023 we have 48,969,268 shares of common stock issued and outstanding. We estimate that upon qualification and following a reverse stock split of 1:3 we will have approximately 16,323,089 shares issued and outstanding. This does not reflect shares of common stock issuable upon exercise of warrants to purchase 5,599,079 shares, options to purchase 566,667 shares, 119,048 shares of common stock issuable upon the conversion of 200,000 shares of Series B Convertible Preferred Stock and 416,667 shares of common stock issuable upon the conversion of a secured promissory note. Assuming the full exercise and

II-9

conversion of the above, the shares of common stock outstanding before and after the Offering would be 16,323,089 and 27,338,836 shares, respectively.

(2)Assumes we raise sufficient capital to repurchase the one (1) share of Series A Preferred Stock and 2,249,880 shares of common stock from JP Morgan. See “Use of Proceeds”.

(3)All of the outstanding shares of Series B Preferred Stock will automatically convert into shares of our common stock simultaneously with the completion of the Offering.

II-10

RISK FACTORS

Any investment in our common stock involves a high degree of risk. You should consider carefully the following information, together with the other information contained in this Offering Circular, before you decide to buy our common stock. If one or more of the following events actually occurs, our business will suffer, and as a result our financial condition or results of operations will be adversely affected. In this case, the market price, if any, of our common stock could decline, and you could lose all or part of your investment in our common stock.

We are providing services to an industry that is heavily regulated under federal law and the laws of most states. We face risks in developing our product candidates and services and eventually bringing them to market. We also face risks that our business model may become obsolete. The following risks are material risks that we face. If any of these risks occur, our business, our ability to achieve revenues, our operating results and our financial condition could be seriously harmed.

SUMMARY

·There is no guarantee that we will ever successfully develop the technology that is essential to our business.

·We are a comparatively early-stage technology company that has incurred operating losses in the past and may never achieve or maintain profitability.

·We operate in a highly competitive industry that is dominated by several very large, well-capitalized market leaders, and the size and resources of some of our competitors may allow them to compete more effectively than we can.

·We rely on third parties to provide services essential to the success of our business. If the third parties we rely on to provide services necessary to our business become insolvent, it would be materially disruptive to our business, and we may incur high costs and time to secure alternative supply.

·Substantially all of our assets are pledged as collateral to certain lenders.

·We are controlled by our officers and directors and a small number of large shareholders.

·In certain circumstances, investors will not have dissenters’ rights.

·As of the date of this Offering Circular there was no market for our common stock.

·Management determined that as of the issuance of the Company’s financial statements as of and for the year ended December 31, 2022, that there was substantial doubt about the Company’s ability to continue as a going concern. The independent registered public accounting firm’s opinion related to those financials statements is also modified to reflect a “going concern”.

·Investors in this Offering may not be entitled to a jury trial with respect to claims arising under the Subscription Agreement, which could result in less favorable outcomes to the plaintiff(s) in any action under these agreements.

RISKS RELATED TO OUR COMPANY

Our recurring losses from operations could continue to raise substantial doubt regarding our ability to continue as a going concern. Our ability to continue as a going concern requires that we obtain sufficient funding to finance our operations.

We have sustained losses from operations of $1,481,445 and $1,436,491 for the years ended December 31, 2022 and 2021, respectively. Accordingly, we have concluded that substantial doubt exists regarding our ability to continue as a going concern. Our audited consolidated financial statements for the year ended December 31, 2022 have been prepared on a going concern basis, which contemplates the realization of assets and satisfaction of liabilities in the ordinary course of business. These consolidated

II-11

financial statements do not include any adjustments relating to the recoverability and classification of recorded asset amounts or the amounts and classification of liabilities that might result from the outcome of these uncertainties related to our ability to operate on a going concern basis. In its report on our consolidated financial statements for the years ended December 31, 2022 and 2021, our independent registered public accounting firm included an explanatory paragraph stating that our recurring losses from operations and net capital deficiency raise substantial doubt about our ability to continue as a going concern. The perception that we may not be able to continue as a going concern may cause others to choose not to deal with us due to concerns about our ability to meet our contractual obligations, which would have a material adverse effect on our operations.

Our ability to continue as a going concern requires that we obtain sufficient funding to finance our operations. If we are unable to obtain sufficient funding, our business, prospects, financial condition and results of operations will be materially and adversely affected, and we may be unable to continue as a going concern. If we are unable to continue as a going concern, we may have to liquidate our assets and may receive less than the value at which those assets are carried on our audited financial statements, and it is likely that investors will lose all or a part of their investment. If we seek additional financing to fund our business activities in the future and there remains substantial doubt about our ability to continue as a going concern, investors or other financing sources may be unwilling to provide additional funding to us on commercially reasonable terms or at all.

We may not raise enough capital in this Offering to begin generating revenue at our PR Spring Facility.

During the first and second quarters of 2024, we expect to begin generating revenues from the operations of our PR Spring Facility. However, we will need approximately $4,500,000 to complete the retrofit of the facility, and as a result may need to raise additional funds after this Offering for such purposes. Assuming we are able to raise additional capital sufficient to retrofit the PR Spring Facility within or after this Offering, we expect that a significant portion of our gross revenues for the year ended December 31, 2024 will be derived from sales of oil and recycled WAS byproducts from our PR Spring Facility. If we are unsuccessful in raising sufficient funds to complete the retrofit, our PR Spring operations and business plan may be curtailed or fail.

We have a limited operating history upon which you can evaluate our performance, have a history of losses and have only been operating the Eagle Springs Refinery since September 30, 2022. Accordingly, our prospects must be considered in light of the risks that any new company encounters.

We were incorporated under the laws of Delaware on June 4, 2019. We have generated limited revenues and have a history of losses. On September 30, 2022, we acquired the Eagle Springs Refinery, and have only had operational control of that facility for less than one year. The likelihood of our creation of a viable business must be considered in light of the problems, expenses, difficulties, complications, and delays frequently encountered in connection with the integration of a newly acquired operating business, the growth of our business from the PR Spring Facility, operation in a competitive industry, and the continued development of our technology and products. We anticipate that our operating expenses will increase for the near future, and there is no assurance that we will be profitable in the near future, if at all. You should consider our business, operations, and prospects in light of the risks, expenses, and challenges facing our company in its early stages.

Our future operating results will depend on many factors, including but not limited to:

·our ability to raise adequate working capital;

·the success of the development of our facilities;

·the level of our competition;

·the WTI market;

II-12

·our ability to successfully integrate the acquisition of the Eagle Springs Refinery and operations;

·our ability to attract and maintain key management and employees; and

·our ability to efficiently develop and produce sufficient quantities of saleable products from waste asphalt shingles in a highly competitive and speculative environment while maintaining quality and controlling costs.

We depend on several significant customers, and a loss of one or more significant customers could adversely affect our results of operations.

As of June 30, 2023, three customers accounted for 43%, 16% and 10%, respectively, of our accounts receivable balance. During the six-month period ended June 30, 2023, three of our customers represented 36%, 25% and 20% of our revenues.

These customers do not have any ongoing commitment to purchase our products. While additional customers continue to be sourced, customer concentration risk still exists. The loss of or a sustained decrease in demand by these customers could result in a substantial loss of revenues and could have a material adverse effect on our results of operations. In addition, should these large customers default in their obligations to pay, our results of operations and cash flows could be adversely affected.

We depend on several principal suppliers for the majority of our crude oil. A disruption in supply or a change in our relationship with any one of them could adversely affect our business, financial condition and results of operations.

As of June 30, 2023, three vendors accounted for 23%, 20% and 19%, respectively, of our supply of crude oil and other petroleum fuel operational inputs. A change of vendors, a disruption in supply or a significant change in pricing with any of these suppliers could have a material adverse effect on our business, financial condition and results of operations.

Our future success is dependent on the continued service of our management team.

Our future success is dependent, in a large part, on retaining the services of our current management team. Our executive officers possess a unique and comprehensive knowledge of our industry, our technology and related matters that are vital to our success within the industry. The knowledge, leadership and technical expertise of these individuals would be difficult to replace and the loss of one or more of our officers could have a material adverse effect on our operating and financial performance, including our ability to develop and execute our long-term business strategy. We do not maintain a key person life insurance policy on any of the members of our senior management team. As a result, we would have no way to cover the financial loss if we were to lose the services of our directors or officers. Notwithstanding the above, none of our officers have any experience in recycling waste asphalt shingles.

Certain corporate actions need the consent of one of our principal shareholders.

JP Morgan owns approximately 13% of our outstanding shares of common stock. We have an agreement with JP Morgan which prohibits certain corporate actions without the consent of JP Morgan. If we do not raise sufficient funds in this Offering to redeem JP Morgan’s shares of common stock and Series A Preferred Stock, JP Morgan will continue to have control over certain corporate actions, which could adversely affect our ability to manage and operate our business.

II-13

Part of our asset base is currently pledged as collateral to one or more lenders.

We have entered into financing arrangements with lenders that contain covenants that could limit our ability to engage in specified types of transactions. These covenants may limit our ability to, among other things, consolidate, merge, sell, or otherwise dispose of all or substantially all of our assets.

A breach of any of the covenants with our lenders could result in a default under the terms of certain financings in which the lender could elect to declare all amounts outstanding thereunder to be immediately due and payable. If the current secured financial obligations are repaid, we may need to pledge all of our assets as collateral to secure additional financing in the future.

Acquisition opportunities may present themselves that in hindsight did not achieve the positive results anticipated by our management.

From time to time, acquisition opportunities may become available to us. Those opportunities may involve the acquisition of specific assets, such as intellectual property or inventory, or may involve the assumption of the business operations of another entity. Our goal with any future acquisition is that any acquisition should be able to contribute neutral to positive EBITDA to us after integration. To effect these acquisitions, we will likely be required to obtain lender financing or issue additional shares of stock in exchange for the shares of the target entity. If the performance of the acquired assets or entity does not produce positive results for us, the terms of the acquisition, whether it is interest rate on debt, or additional dilution of stockholders, may prove detrimental to our financial results or the performance of your particular shares.

Environmental and regulatory compliance may impose substantial costs on us.

Our operations are or will be subject to stringent federal, state and local laws and regulations relating to improving or maintaining environmental quality. Environmental laws often require parties to pay for remedial action or to pay damages regardless of fault. Environmental laws also often impose liability with respect to divested or terminated operations, even if the operations were terminated or divested many years ago.

Our activities are or will be subject to extensive laws and regulations governing our remediation, and recycling activities, as well as those governing exports, taxes, labor standards, occupational health, waste disposal, land use, protection and remediation of the environment, protection of endangered and protected species, operational safety, toxic substances and other matters. Generally, our activities and operations may be subject to risks and liabilities associated with pollution of the environment and disposal of any waste products. Compliance with these laws and regulations may impose substantial costs on us and may subject us to potential liabilities. In addition, should there be changes to existing laws or regulations, our competitive position within the industry may be adversely affected, as many industry players may have greater resources than we do.

We may be exposed to third party liability and environmental liability in the operation of our business.

Our operations could result in liability for personal injuries, property damage, discharge of hazardous materials, remediation and clean-up costs and other environmental damage. We could be liable for environmental damages caused by previous owners. As a result, substantial liabilities to third parties or governmental entities may be incurred, and the payment of such liabilities could have a material adverse effect on our financial condition and results of operations. The release of harmful substances in the environment or other environmental damages caused by our activities could result in us losing our operating and environmental permits or inhibit us from obtaining new permits or renewing existing permits. We currently have a limited amount of insurance and at such time as we commence operations we expect to be able to obtain and maintain additional insurance coverage for our operations, including limited coverage

II-14

for sudden environmental damages. Accordingly, we could incur substantial costs to comply with environmental laws and regulations which could affect our ability to operate as planned.

We rely on technology to conduct our business, and our technology could become ineffective or obsolete.

We rely on technology, including proprietary techniques, processes, and intellectual property, as well as closely-held economic models, to develop our plans and estimates and to guide our development, processing, and production activities. We will be required to continually enhance and update our technologies in order to maintain their efficacy and to avoid obsolescence. As such, our business may carry with it a greater degree of technological risk than other projects that employ commercially proven technologies. If major process design changes are required, the costs of doing so may be substantial and may be higher than the costs that we anticipate for technology maintenance and development. If we are unable to maintain the efficacy of our technology, our ability to manage our business and to compete may be impaired. Further, even if we are able to maintain technical effectiveness, our technology may not be the most efficient means of reaching our objectives, in which case we may incur higher operating costs than if we were technology more efficient.

RISKS RELATED TO ASPHALT SHINGLE RECYCLING

The nature of our WAS recycling operations may involve various risks.

Our anticipated operations in asphalt shingle recycling and reclamation involves many risks that even a combination of experience, knowledge and careful evaluation may not be able to overcome. Furthermore, the marketability of any products produced from waste asphalt shingles will be affected by numerous factors beyond our control. These factors include, but are not limited to, price fluctuations, proximity and capacity of processing equipment, equipment and labor availability and government regulations (including, without limitation, regulations relating to prices, taxes, royalties, allowable production, importing and exporting of base components of asphalt cement, shingle granules, sand aggregate, limestone and fiberglass, land use and environmental protection). The extent of these factors cannot be accurately predicted, but the combination of these factors may result in us not receiving an adequate return on invested capital.

Our ECOSolv Technology May Not Work as Expected.

The recovery of oil from our bitumen deposit and the process of recycling WAS is dependent on the viability of our proprietary technology, which we refer to as the ECOSolv process. However, the ECOSolv technology has never been used on a commercial scale. If the ECOSolv technology does not perform as expected, our WAS business plan is likely to fail.

The viability of our asphalt shingle recycling and reclamation business plan, business operations, and future operating results and financial condition are and will be exposed to fluctuating prices for our end-products.

Prices for asphalt cement, shingle granules, sand aggregate, limestone and fiberglass, and their related products are affected by supply and demand, which can fluctuate significantly. Factors that influence supply and demand include operational issues, natural disasters, weather, political instability or conflicts, and economic conditions. Price fluctuations can have a material effect on our ability to raise capital and fund our activities, our potential future earnings, and our financial condition.

Because of the speculative nature of asphalt shingle recycling, there is a risk that our business may not succeed.

We cannot provide investors with any assurance that we will be able to obtain a requisite amount of feed stock or asphalt shingles necessary for the success of our asphalt shingle recycling and reclamation

II-15

operations, which may force us to abandon or curtail our business plan related to asphalt shingle recycling and reclamation and, as a result, any investment in us may become materially adversely effected.

The price for asphalt cement, shingle granules, sand aggregate, limestone and/or fiberglass is subject to a variety of factors that are beyond our control.

These factors include:

·consumer and/or industrial demand;

·supply of asphalt shingles;

·domestic governmental regulations and taxes;

·the price and availability of solvent materials and feedstocks;

·adverse weather conditions;

·worldwide economic conditions.

The market for asphalt cement, shingle granules, sand aggregate, limestone and/or fiberglass may be highly competitive, and intensely competitive pressures could force us to abandon or curtail our business plan related to asphalt shingle recycling and reclamation.

The market for asphalt cement, shingle granules, sand aggregate, limestone and/or fiberglass products may be highly competitive, and we can only expect competition to intensify in the future. Numerous well-established companies are focusing significant resources on similar recycling and remediation activities and may be competing with us for opportunities. Competitors include larger companies which, in particular, may have access to greater resources, may be more successful in the recruitment and retention of qualified employees and may conduct their own marketing operations, which may give them a competitive advantage. Actual or potential competitors may be strengthened through the acquisition of additional assets and interests. As a result, there can be no assurance that we will be able to compete successfully or that competitive pressures will not adversely affect our business, results of operations and financial condition. If we are not able to successfully compete in the marketplace, we could be forced to curtail or even abandon our current business plan, which could cause any investment in us to become worthless.

Decommissioning costs are unknown and may be substantial. Unplanned costs could divert resources from other projects.

In the future, we may become responsible for costs associated with abandoning and reclaiming facilities which we use for recycling of asphalt shingles. Abandonment and reclamation of these facilities and the costs associated therewith is often referred to as “decommissioning.” The use of funds to satisfy such decommissioning costs could impair our ability to focus capital investment in other areas of our business.

We may have difficulty marketing or distributing the asphalt cement, shingle granules, sand aggregate, limestone and/or fiberglass we may produce, which could harm our financial condition.

In order to sell the finished asphalt cement, shingle granules, sand aggregate, limestone and fiberglass that we are able to produce from the asphalt shingle recycling process, if any, we must be able to make economically viable arrangements for the storage, transportation and distribution of these products to the market. We will rely on local infrastructure and the availability of transportation for storage and shipment of our products, but infrastructure development and storage and transportation facilities may be insufficient for our needs at commercially acceptable terms in the localities in which we operate.

II-16

Furthermore, weather conditions or natural disasters, actions by companies doing business in one or more of the areas in which we will operate, or labor disputes may impair the distribution of our products and in turn diminish our financial condition or ability to maintain our operations.

We do not yet have a market for the anticipated recycled products that we expect to generate from our PR Spring Facility.

There can be no assurance that a market will develop for the recycled products that we intend to produce. We do not have any sales or supply agreements with any company for the byproducts of waste asphalt shingles.

Our shingle remediation activities will be dependent upon having an available supply of waste asphalt shingles from waste haulers, shingle manufacturers or other third parties.

As of the date of this Offering Circular we do not have any supply agreements with landfills and/or private waste haulers to supply us with waste asphalt shingles, which if we are unable to acquire, will adversely affect our business operations and financial results.

RISKS RELATED TO OIL SANDS EXPLORATION

We do not have any proven oil reserves.

As of the date of this Offering Circular our bitumen deposit did not have any proven oil reserves. If our oil sands do not contain economically recoverable heavy oil and bitumen, and/or we are unable to commercially extract such quantities, we may be forced to abandon or curtail our planned operations at PR Spring and, as a result, any investment in us may severely impaired or could become worthless.

The price of oil has historically been volatile.

Our future financial condition and results of operations will depend, in part, upon the price for oil. Oil prices historically have been volatile and likely will continue to be volatile in the future, especially given current world geopolitical conditions. Our cash flows from operations will be highly dependent on the prices that we receive for oil. This price volatility also affects the amount of our cash flows available for capital expenditures and our ability to borrow money or raise additional capital. The price for oil is subject to a variety of additional factors that are beyond our control. These factors include:

·the level of consumer and industrial demand for oil;

·the domestic and foreign supply of oil;

·the ability of the members of the Organization of Petroleum Exporting Countries (“OPEC”) to agree to and maintain oil price and production controls;

·domestic governmental regulations and taxes;

·adverse weather conditions;

·market uncertainty due to political conditions in oil and gas producing regions; and

·worldwide economic conditions.

These factors as well as the volatility of the energy markets generally make it extremely difficult to predict future oil price movements with any certainty. In a low oil price environment oil sands exploration and development may not be economically or financially viable or profitable. Prolonged periods of low oil prices, or rising costs, could result in our mining and processing operations being delayed or cancelled.

Furthermore, our ability to sell oil will be affected by numerous factors beyond our control. These factors include, but are not limited to, proximity and capacity of refineries and pipelines and processing equipment, equipment and labor availability and government regulations (including, without limitation,

II-17

regulations relating to taxes, royalties, importing and exporting of oil, and land use and environmental protection). Weather conditions or natural disasters or labor disputes may impair the distribution of oil and in turn diminish our financial condition and our ability to maintain our operations.

Oil sands development involves many risks.

The oil sands development business involves a variety of operating hazards and risks such as explosions, fires, spills, pollution, release of toxic gas and other environmental hazards and risks. These hazards and risks could result in substantial losses to us from, among other things, injury or loss of life, severe damage to or destruction of property, natural resources and equipment, pollution or other environmental damage, cleanup responsibilities, regulatory investigation and penalties and suspension of operations. As a result, substantial liabilities to third parties or governmental entities may be incurred, the payment of which could reduce or eliminate the funds available to us and/or force us to expend substantial monies in connection with litigation or settlements.

Decommissioning costs are unknown and may be substantial. Unplanned costs could divert resources from other projects.

In the future, we may become responsible for costs associated with abandoning and reclaiming wells and facilities which we use for processing of oil sands. Abandonment and reclamation of these facilities and the costs associated therewith is often referred to as “decommissioning”. If decommissioning is required before economic depletion of our properties or if our estimates of the costs of decommissioning exceed the value of the reserves remaining at any particular time to cover such decommissioning costs, we may have to draw on funds from other sources to satisfy such costs. The use of other funds to satisfy such decommissioning costs could impair our ability to focus capital investment in other areas of our business.

RISKS RELATED TO OIL REFINING AND FUELS PRODUCTION

Volatility in crude oil and wholesale diesel prices affect our business, financial condition and results of operations.

Wholesale diesel prices are directly related to, and fluctuate with, the price of crude oil. Volatility in the price of crude oil, and subsequently wholesale fuel prices, is caused by many factors, including general political, regulatory and economic conditions, acts of war, terrorism or armed conflict, instability in oil producing regions, particularly in the Middle East and South America, refinery capacity and the value of U.S. dollars relative to other foreign currencies, particularly those of oil producing nations. In addition, the supply of fuel and our wholesale purchase costs could be adversely affected in the event of a shortage or oversupply of product, which could result from, among other things, the Russian invasion of Ukraine and the sanctions imposed on Russia and other countries, interruptions of fuel production at oil refineries, new supply sources, and sustained increases or decreases in global demand for diesel fuels. Significant increases and volatility in wholesale fuel prices could result in lower gross profit, as an increase in the retail price of motor fuel could impact consumer demand for diesel and could result in lower wholesale fuel gross profit dollars. As the market prices of crude oil, and, correspondingly, the market prices of wholesale fuels, experience significant and rapid fluctuations, we attempt to pass along wholesale price changes to our customers; however, we are not always able to do so immediately. The timing of any related increase or decrease in sales prices is affected by competitive conditions in our market areas. As such, our revenues and gross profit can increase or decrease significantly and rapidly over short periods of time and potentially adversely impact our business, financial condition, and results of operations. The volatility in crude oil and wholesale fuel costs and sales prices makes it extremely difficult to forecast future gross profits or predict the effect that future wholesale costs and sales price fluctuations will have on our operating results and financial condition.

II-18

A significant decrease in demand for diesel and gasoline, including increased consumer preference for alternative fuels or improvements in fuel efficiency, in the areas we serve would materially affect our revenues and profitability.

The Energy Information Administration of the U.S. Department of Energy projects that U.S. motor gasoline consumption will decline at an average rate of 1.1% per year between 2012 and 2040 as improvements in fuel efficiency are expected to outpace increases in miles driven. A significant decrease in demand for these products in the areas we serve could significantly reduce our revenues. Our revenues are dependent on various trends, such as trends in consumer disposable income, the trucking industry, and travel in our market areas, and these trends can change. Regulatory action, including government-imposed fuel efficiency standards, may also affect demand for these fuels. Because certain of our operating costs and expenses are fixed and do not vary with the volumes of products we distribute, our costs and expenses might not decrease notably or at all should we experience such a reduction. As a result, we may experience declines in our profit margin if our fuel distribution volumes decrease.

Any technological advancements, regulatory changes or changes in consumer preferences causing a significant shift toward alternative products could reduce demand for the conventional petroleum-based fuels we currently produce. Additionally, a shift toward electric, hydrogen, natural gas or other alternative-power vehicles could fundamentally change our customers’ shopping habits or lead to new forms of fueling destinations or new competitive pressures.

New technologies have been developed and governmental mandates have been implemented to improve fuel efficiency, which may result in decreased demand for petroleum-based fuel. For example, in December 2021, the Biden Administration announced revised GHG emissions standards for light-duty vehicle fleets for Model Years 2023-2026, which some manufacturers may meet by increasing fuel efficiency or increasing the prevalence of zero-emissions vehicles in their fleets. The Biden Administration has also set a goal for federal vehicle acquisitions to be 100% zero-emissions vehicles by 2035, which may further influence the composition of vehicle fleets. Any of these outcomes could result in a reduction in demand from our wholesale customers, which could have a material adverse effect on our business, financial condition, results of operations and future prospects.

The industries in which we operate are subject to seasonal trends, which may cause our operating costs to fluctuate, affecting our cash flow.

We typically experience more demand for diesel in the late spring and summer months than during the fall and winter. Travel, farming, recreation and construction are typically higher in these months in the market areas in which we operate, increasing the demand for fuel that we sell and distribute. Therefore, our revenues and cash flows are typically higher in the second and third quarters of our fiscal year. As a result, our results from operations may vary widely from period to period, affecting our cash flow.

Our operations are subject to stringent environmental laws and regulations that may expose us to significant costs and liabilities that could exceed current expectations.

Our operations are subject to stringent and complex federal, state and local laws and regulations governing the release, disposal or discharge of materials into the environment, health and safety aspects of our operations, or otherwise relating to environmental protection.

There is inherent risk of incurring significant environmental costs and liabilities in the performance of our operations due to our handling of petroleum hydrocarbons and other hazardous substances and wastes, as a result of air emissions related to our operations. Spills or other releases of regulated substances, including such spills and releases that occur in the future, could expose us to material losses, expenditures and liabilities under applicable environmental laws and regulations. Under certain of such laws and regulations, we could be held strictly liable for the removal or remediation of previously released hazardous materials or property contamination, regardless of whether we were responsible for the release or

II-19

contamination and even if our operations met previous standards in the industry at the time they were conducted. In connection with certain acquisitions, we could acquire, or be required to provide indemnification against, environmental liabilities that could expose us to material losses. In addition, claims for damages to persons or property, including natural resources, may result from the environmental, health and safety impacts of our operations. Our insurance may not cover all environmental risks and costs or may not provide sufficient coverage if an environmental claim is made against us. Moreover, public interest in the protection of the environment has increased dramatically in recent years. The trend of more expansive and stringent environmental legislation and regulations applied to the trucking industry could continue, resulting in increased costs of doing business and consequently affecting profitability. Changes in environmental laws and regulations occur frequently, and any changes that result in more stringent or costly storage, transport, disposal or cleanup requirements could require us to make significant expenditures to attain and maintain compliance and may otherwise have a material adverse effect on our industry in general in addition to our own results of operations, competitive position or financial condition. To the extent laws are enacted or other governmental action is taken that restricts development or imposes more stringent and costly operating, disposal and cleanup requirements, our business, prospects, financial condition or results of operations could be materially adversely affected.

A climate-related decrease in demand for crude oil could negatively affect our business.

Supply and demand for crude oil is dependent upon a variety of factors, many of which are beyond our control. These factors include, among others, the potential adoption of new government regulations, including those related to fuel conservation measures and climate change regulations, technological advances in fuel economy and energy generation devices. For example, legislative, regulatory or executive actions intended to reduce emissions of GHGs could increase the cost of consuming crude oil, thereby potentially causing a reduction in the demand for this product. A broader transition to alternative fuels or energy sources, whether resulting from potential new government regulation, carbon taxes or consumer preferences could result in decreased demand for products like crude oil. Any decrease in demand could consequently reduce demand for our services and could have a negative effect on our business.

Our business operations may be materially adversely affected by negative impacts to the global economy, capital markets, or other geopolitical conditions resulting from economic uncertainty, armed conflicts, acts of terrorism, political unrest or health epidemics.

During the last several years, the global supply and demand for crude oil has experienced periodic downturns and sustained volatility, impacted by such factors as the COVID-19 pandemic and recovery, Russia’s invasion of Ukraine and the related sanctions imposed on Russia, the ongoing conflict in Israel and the Gaza Strip and the ensuing conflict in the Middle East, the global response to such conflicts, supply chain constraints and rising interest rates and costs of capital. Furthermore, the United States experienced a significant inflationary environment in 2022 that, along with international geopolitical risks, has contributed to concerns of a potential recession in 2023 that has caused oil and gas prices to retreat from their earlier highs in 2022 and has created further volatility. In 2023, OPEC announced production cuts to reduce the global oil supply. The actions of OPEC with respect to oil production levels and announcements of potential changes in such levels, including agreement on and compliance with production cuts, may result in further volatility in commodity prices and the oil industry in general.

Our business, financial condition and results of operations could be materially and adversely affected by further negative impact on the global economy and capital markets resulting from these global economic conditions, particularly if such conditions are prolonged or worsen. Any such disruptions may also magnify the impact of other risks described in this Offering Circular.

II-20

RISKS RELATED TO OUR COMMON STOCK

Investors in this Offering may not be entitled to a jury trial with respect to certain claims which could result in less favorable outcomes to the plaintiff(s) in any action against us.

Investors in this Offering will be bound by the Subscription Agreement, which includes a provision under which investors waive the right to a jury trial of any claim they may have against us arising out of or relating to these agreements. By signing this agreement, the investor warrants that the investor has reviewed this waiver with his or her legal counsel, and knowingly and voluntarily waives the investor’s jury trial rights following consultation with the investor’s legal counsel.

If we oppose a jury trial demand based on any waiver, a court will determine whether the waiver would be enforceable based on the facts and circumstances of that case in accordance with the applicable state and federal laws. To our knowledge, the enforceability of a contractual pre-dispute jury trial waiver in connection with claims arising under the Federal securities laws has not been finally adjudicated by a Federal court. However, we believe that a contractual pre-dispute jury trial waiver provision is generally enforceable, including under the laws of the State of Delaware and in the Court of Chancery in the State of Delaware, which governs the Subscription Agreement. In determining whether to enforce a contractual pre-dispute jury trial waiver provision, courts will generally consider whether the visibility of the jury trial waiver provision within the agreement is sufficiently prominent such that a party knowingly, intelligently, and voluntarily waived the right to a jury trial. We believe that this is the case with respect to the Subscription Agreement. You should consult legal counsel regarding the jury waiver provision before signing the Subscription Agreement.

If you bring a claim against us in connection with matters arising under the Subscription Agreement, including claims under Federal securities laws, you may not be entitled to a jury trial with respect to those claims, which may have the effect of limiting and discouraging lawsuits against us. If a lawsuit is brought against us it may be heard only by a judge or justice of the applicable trial court, which would be conducted according to different civil procedures and may result in different outcomes than a trial by jury would have had, including results that could be less favorable to the plaintiff(s) in such an action.

Nevertheless, if this jury trial waiver provision is not permitted by applicable law, an action could proceed under the terms of the Subscription Agreement with a jury trial. No condition, stipulation, or provision of the Subscription Agreement serves as a waiver by an investor, of compliance with any provision of the federal securities laws and the rules and regulations promulgated under those laws.

In addition, when the shares are transferred, the transferee is required to agree to all the same conditions, obligations and restrictions applicable to the shares or to the transferor with regard to ownership of the shares that were in effect immediately prior to the transfer of the Shares, including but not limited to the Subscription Agreement.

Claims of U.S. civil liabilities may not be enforceable against our management.

Certain members of our Board of Directors and senior management are residents of Canada, and many of the assets of such persons are located outside of the United States. As a result, it may not be possible to serve process on such persons in the United States or to enforce judgments obtained in U.S. courts against them based on civil liability provisions of the securities laws of the United States.

The United States and Canada do not currently have a treaty providing for recognition and enforcement of judgments (other than arbitration awards) in civil and commercial matters. Consequently, a final judgment for payment given by a court in the United States, whether or not predicated solely upon U.S. securities laws, would not automatically be recognized or enforceable in Canada. In addition, uncertainty exists as to whether Canadian courts would entertain original actions brought in the United States against our Canadian directors or senior management predicated upon the securities laws of the

II-21

United States or any state in the United States. Any final and conclusive monetary judgment for a definite sum obtained against us in U.S. courts would be treated by the courts of Canada as a cause of action in itself and sued upon as a debt at common law so that no retrial of the issues would be necessary, provided that certain requirements are met. Whether these requirements are met in respect of a judgment based upon the civil liability provisions of the U.S. securities laws, including whether the award of monetary damages under such laws would constitute a penalty, is an issue for the court making such decision. If a Canadian court gives judgment for the sum payable under a U.S. judgment, the Canadian judgment will be enforceable by methods generally available for this purpose. These methods generally permit the Canadian court discretion to prescribe the manner of enforcement.

As a result, U.S. investors may not be able to enforce any judgments obtained in U.S. courts in civil and commercial matters, including judgments under the U.S. federal securities laws, against our officers or directors who are residents of Canada.

We may issue shares of preferred stock that would have a liquidation preference to our common stock.

Our articles of incorporation currently authorize the issuance of 25,000,000 shares of our preferred stock, of which there is one share of Series A Preferred Stock authorized, issued and outstanding and 4,800,000 shares of Series B Convertible Preferred Stock have been authorized, of which 200,000 shares are issued and outstanding as of December 19, 2023. Only the shares of Series B Preferred Stock have liquidation rights, which have preference over our shares of common stock in connection with the liquidation of our company. Upon our liquidation or winding up, the holders of the Series B Convertible Preferred Stock shall be entitled to receive $2.50 per share, plus all accrued and unpaid dividends, prior to the distribution to common stockholders, if any. In addition to the shares of Series A and Series B Preferred Stock that have previously been authorized for issuance by our board of directors, the board has the power to issue shares without shareholder approval, and such shares can be issued with such rights, preferences, and limitations as may be determined by our board of directors. The rights of the holders of common stock will be subject to, and may be adversely affected by, the rights of any holders of preferred stock that may be issued in the future. Other than the Series B Convertible Preferred Stock, we presently have no commitments or contracts to issue any shares of preferred stock. Authorized and unissued preferred stock could delay, discourage, hinder or preclude an unsolicited acquisition of our company, could make it less likely that shareholders receive a premium for their shares as a result of any such attempt, and could adversely affect the market prices of, and the voting and other rights, of the holders of outstanding shares of our common stock.

As of the date of this Offering Circular there was no market for our common stock.

If you want to sell your shares of common stock in the future, you may not be able to find a buyer. Although we have applied for listing of our common stock on a national stock exchange there are several requirements that we may or may not be able to satisfy in a timely manner. Even if we obtain that listing, we do not know the extent to which investor interest will lead to the development and maintenance of a liquid trading market. In addition, should a market develop for our common stock in the future, some brokerage firms will not accept the deposit of microcap securities or the fees charged to deposit your securities with a broker may be high. You should assume that you may not be able to liquidate your investment for some time should a public market develop for our common stock.

Disclosure requirements pertaining to penny stocks may reduce the level of trading activity for our common stock if and when it is publicly traded.

Trades of our common stock, should a market ever develop, may be subject to Rule 15g-9 of the Commission, which rule imposes certain requirements on broker/dealers who sell securities subject to the rule to persons other than established customers and accredited investors. For transactions covered by the rule, brokers/dealers must make a special suitability determination for purchasers of the securities and receive the purchaser’s written agreement to the transaction prior to sale. The Commission also has rules

II-22

that regulate broker/dealer practices in connection with transactions in “penny stocks”. Penny stocks generally are equity securities with a price of less than $5.00 (other than securities registered on certain national securities exchanges or quoted on the NASDAQ system, provided that current price and volume information with respect to transactions in that security is provided by the exchange or system). The penny stock rules require a broker/ dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document prepared by the Commission that provides information about penny stocks and the nature and level of risks in the penny stock market. The broker/dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker/dealer and its salesperson in the transaction, and monthly account statements showing the market value of each penny stock held in the customer’s account. The bid and offer quotations, and the broker/dealer and salesperson compensation information, must be given to the customer orally or in writing prior to effecting the transaction and must be given to the customer in writing before or with the customer’s confirmation.

There is no minimum amount required to be raised in this Offering.

We may not have enough funds to sustain our business until it becomes profitable, as we may not accurately anticipate how quickly we may use the funds that are raised in the Offering and whether such funds are sufficient to bring our business to profitability. If we fail to raise sufficient capital from this Offering, we intend to seek additional financing either through the sale of equity or loans from third parties. However, there can be no assurance that we will be able to obtain any additional capital.

We expect to raise additional capital through equity and/or debt offerings to support our working capital requirements and operating losses.

To fund future growth and development, we will likely need to raise additional funds in the future by offering shares of our common stock and/or other classes of equity, or debt that convert into shares of common stock, any of which offerings would dilute the ownership percentage of investors in this Offering. See “Dilution.” In order to issue sufficient shares in this regard, we may be required to amend our certificate of incorporation to increase our authorized capital stock, which would require us to obtain the consent of a majority of our shareholders. Furthermore, if we raise capital through debt, the holders of our debt would have priority over holders of common stock, and we may be required to accept terms that restrict its ability to incur more debt. We cannot assure you that the necessary funds will be available on a timely basis, on favorable terms, or at all, or that such funds, if raised, would be sufficient. The level and timing of future expenditures will depend on a number of factors, many of which are outside our control. If we are not able to obtain additional capital on acceptable terms, or at all, we may be forced to curtail or abandon our growth plans, which could adversely impact us, our business, development, financial condition, operating results or prospects.

Any valuation at this stage is difficult to assess.