INFORMATION CONTAINED IN THIS PRELIMINARY OFFERING CIRCULAR IS SUBJECT TO COMPLETION OR AMENDMENT. THESE SECURITIES MAY NOT BE SOLD NOR MAY OFFERS TO BUY BE ACCEPTED BEFORE THE OFFERING STATEMENT TO BE FILED WITH THE SECURITIES AND EXCHANGE COMMISSION IS QUALIFIED. THIS PRELIMINARY OFFERING CIRCULAR SHALL NOT CONSTITUTE AN OFFER TO SELL OR THE SOLICITATION OF AN OFFER TO BUY NOR MAY THERE BE ANY SALES OF THESE SECURITIES IN ANY STATE IN WHICH SUCH OFFER, SOLICITATION OR SALE WOULD BE UNLAWFUL BEFORE REGISTRATION OR QUALIFICATION UNDER THE LAWS OF ANY SUCH STATE. WE MAY ELECT TO SATISFY OUR OBLIGATION TO DELIVER A FINAL OFFERING CIRCULAR BY SENDING YOU A NOTICE WITHIN TWO BUSINESS DAYS AFTER THE COMPLETION OF OUR SALE TO YOU THAT CONTAINS THE URL WHERE THE FINAL OFFERING CIRCULAR OR THE OFFERING STATEMENT IN WHICH SUCH FINAL OFFERING CIRCULAR WAS FILED MAY BE OBTAINED.

PRELIMINARY OFFERING CIRCULAR, DATED SEPTEMBER 15, 2021

OFFERING CIRCULAR

ANDREW ARROYO REAL ESTATE INC. d/b/a AARE

12636 High Bluff Drive, Suite 400

San Diego, CA 92130

888-32-AGENT

www.aare.org

| Minimum Offering (USD)1 | $1,000,000 |

| Minimum Offering (Shares2)1 | 200,000 Shares |

| Maximum Offering (USD)1 | $5,000,000 |

| Maximum Offering (Shares2)1 | 1,000,000 Shares |

|

|

|

| Offering Price per Share2,1 | $5.00 per Share |

| Minimum Investment (USD)1 | $10,000 |

| Minimum Investment (Shares2)1 | 2,000 Shares |

_________________

1 Our primary shareholder, Andrew Michael Arroyo, is participating as a selling shareholder in this Offering at a rate of 30%, meaning 30% of any invested funds will go to Mr. Arroyo to acquire shares owned by him and we will not receive that portion of the funds or issue that portion of the Shares.

2 “Shares” or “Share” refers to the Company’s Common Stock, Par Value $0.001 per Share. See Item 14, “Securities Being Offered” for a complete description of the Common Stock.

Andrew Arroyo Real Estate Inc., a Delaware corporation d/b/a AARE (the “Company”,

“AARE”, we or our) is offering a maximum of 1,000,000 shares and a minimum of 200,000 shares of Common Stock, Par Value $0.001 per Share, at an offering price of $5.00 per Share (the “Offered Shares” or “Securities”) on a “best efforts” basis. The Offering will terminate at the earlier of: (1) the date at which the maximum offering amount has been sold, (2) the date which is one year from this offering being qualified by the Securities and Exchange Commission, or (3) the date at which the offering is earlier terminated by us in our sole discretion.

Escrow Until Minimum Offering Met

Until we achieve the minimum offering amount of $1,000,000, the proceeds for the offering will be kept in an escrow account with no funds available to us. Upon achievement of the minimum offering amount and the closing on such amount, the proceeds from the minimum offering amount will be distributed to the Company and the associated Offered Shares will be issued to the investors in the Initial Closing. If the offering does not close for any reason, the proceeds for the offering will be promptly returned to investors, without deduction and generally without interest. Union Bank N.A. will serve as the escrow agent (in such capacity, the “Escrow Agent”). The minimum purchase requirement per investor is 2,000 of the Offered Shares or a minimum of $10,000; however, we can waive the minimum purchase requirement on a case-by-case basis in our sole discretion.

| 1 |

| Table of Contents |

Subscriptions are irrevocable and the purchase price is non-refundable as expressly stated in this Offering Circular. All proceeds received by us from subscribers for this Offering will be available for use by us upon acceptance of subscriptions for the Securities by us.

Sale of these shares will commence within two calendar days of the qualification date (the “Qualification Date”) and it will be a continuous Offering pursuant to Rule 251(d)(3)(i)(F).

GENERALLY, NO SALE MAY BE MADE TO YOU IN THIS OFFERING IF THE AGGREGATE PURCHASE PRICE YOU PAY IS MORE THAN 10% OF THE GREATER OF YOUR ANNUAL INCOME OR NET WORTH. DIFFERENT RULES APPLY TO ACCREDITED INVESTORS AND NON-NATURAL PERSONS. BEFORE MAKING ANY REPRESENTATION THAT YOUR INVESTMENT DOES NOT EXCEED APPLICABLE THRESHOLDS, WE ENCOURAGE YOU TO REVIEW RULE 251(d)(2)(i)(C) OF REGULATION A. FOR GENERAL INFORMATION ON INVESTING, WE ENCOURAGE YOU TO REFER TO www.investor.gov.

Investing in our Common Stock involves a high degree of risk. See “Risk Factors” beginning on page 9 for a discussion of certain risks that you should carefully consider in connection with an investment in our Common Stock.

THE SEC DOES NOT PASS UPON THE MERITS OF OR GIVE ITS APPROVAL TO ANY SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SOLICITATION MATERIALS. THESE SECURITIES ARE OFFERED PURSUANT TO AN EXEMPTION FROM REGISTRATION WITH THE COMMISSION; HOWEVER, THE COMMISSION HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THE SECURITIES OFFERED ARE EXEMPT FROM REGISTRATION.

|

|

| Price to Public(1) |

|

| Maximum Number of Shares to be Offered |

|

| Underwriting Discount and Commissions(2) |

|

| Proceeds to Issuer(2)(3)(4) |

|

| Proceeds to Other Persons(5) |

| |||||

| Per Share |

| $ | 5.00 |

|

|

| N/A |

|

| $ | 0 |

|

| $ | 3.50 |

|

| $ | 1.50 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total (Offering Minimum) |

| $ | 5.00 |

|

|

| 200,000 |

|

| $ | 0 |

|

| $ | 700,000 |

|

| $ | 300,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total (Offering Maximum) |

| $ | 5.00 |

|

|

| 1,000,000 |

|

| $ | 0 |

|

| $ | 3,500,000 |

|

| $ | 1,500,000 |

|

____________

1 We are offering on a continuous basis starting on the Qualification Date.

2 We do not intend to use underwriters or commissioned sales agents.

3 This is a “best efforts” offering. The proceeds of this offering will be placed into an escrow account until the Minimum Offering has been met. We will offer the Shares primarily through our management. See “Plan of Distribution” on page 23, hereof.

4 Does not include expenses of the offering including, but not limited to, costs of blue-sky compliance or costs of posting offering information on other media, which offering expenses are estimated to be $50,000 if this offering is fully subscribed. See “Plan of Distribution” on page 23, hereof.

5 Our primary shareholder, Andrew Michael Arroyo, is participating as a selling shareholder in this Offering at a rate of 30%, meaning 30% of any invested funds will go to Mr. Arroyo to acquire shares owned by him and we will not receive that portion of the funds or issue that portion of the Shares.

THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION DOES NOT PASS UPON THE MERITS OR GIVE ITS APPROVAL OF ANY SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SOLICITATION MATERIALS. THESE SECURITIES ARE OFFERED PURSUANT TO AN EXEMPTION FROM REGISTRATION WITH THE COMMISSION; HOWEVER, THE COMMISSION HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THE SECURITIES OFFERED ARE EXEMPT FROM REGISTRATION.

| 2 |

| Table of Contents |

We are using the Form 1-A Offering Circular format for the disclosure in this Offering Circular.

There is currently no trading market for our Common Stock.

These are speculative securities. Investing in our Common Stock involves significant risks. You should purchase these securities only if you can afford a complete loss of your investment. See “Risk Factors” beginning on page 9.

We are offering to sell, and seeking offers to buy, our securities only in jurisdictions where such offers and sales are permitted. You should rely only on the information contained in this Offering Circular. We have not authorized anyone to provide you with any information other than the information contained in this Offering Circular. The information contained in this Offering Circular is accurate only as of its date, regardless of the time of its delivery or of any sale or delivery of our securities. Neither the delivery of this Offering Circular nor any sale or delivery of our securities shall, under any circumstances, imply that there has been no change in our affairs since the date of this Offering Circular. This Offering Circular will be updated and made available for delivery to the extent required by federal securities laws.

Unless otherwise indicated, data contained in this Offering Circular concerning the business of the Company, including estimates and other statistical data, are based on information from various public sources. Although we believe that this data is generally reliable, such information is inherently imprecise, and our estimates and expectations based on these data involves a number of assumptions and limitations. As a result, you are cautioned not to give undue weight to such data, estimates or expectations.

In this Offering Circular, unless the context indicates otherwise, references to “we”, the “Company”, “our” and “us” refer to Andrew Arroyo Real Estate Inc., a Delawre corporation d/b/a AARE, the combined entity after the merger described herein that closed on July 31, 2021. References to the “board”, the “board of directors”, the “Board” or the “Board of Directors” means the Board of Directors of Andrew Arroyo Real Estate Inc., a Delaware corporation d/b/a AARE.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

Some of the statements under “Summary”, “Risk Factors”, “Management’s Discussion and Analysis of Financial Condition and Results of Operations”, “Our Business” and elsewhere in this Offering Circular constitute forward-looking statements. Forward-looking statements relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar matters that are not historical facts. In some, but not all, cases, you can identify forward-looking statements by terms such as “anticipate”, “assume”, “believe”, “could”, “estimate”, “expect”, “intend”, “goal”, “may”, “might”, “objective”, “plan”, “possible”, “potential”, “project”, “should”, “strategy”, “will” and “would” or the negatives of these terms or other comparable terminology.

| 3 |

| Table of Contents |

Our forward-looking statements may include, without limitation, statements with respect to:

|

| 1. | Future services; |

|

| 2. | Future products; |

|

| 3. | The availability of, and terms and costs related to, future borrowing and financing; |

|

| 4. | Estimates of future sale; |

|

| 5. | Future transactions; |

|

| 6. | Estimates regarding the amount of funds we will need to fund our operations for specific periods; |

|

| 7. | Estimates regarding potential cost savings and productivity; and |

|

| 8. | Our listing, and the commencement of trading of our Common Stock, on the NASDAQ, OTC Markets or other exchanges and the timing thereof. |

The cautionary statements set forth in this Offering Circular, including those set forth in the “Risk Factors” section and elsewhere, identify important factors that you should consider in evaluating our forward-looking statements.

Although the forward-looking statements in this Offering Circular are based on our beliefs, assumptions and expectations, taking into account all information currently available to us, we cannot guarantee future transactions, results, performance, achievements or outcomes. No assurance can be made to any investor by anyone that the expectations reflected in our forward-looking statements will be attained or that deviations from them will not be material and adverse. We undertake no obligation, except as required by law, to re-issue this Offering Circular or otherwise make public statements updating our forward-looking statements. For the reasons set forth above, you should not place undue reliance on forward-looking statements in this Offering Circular.

The Offering Circular Summary highlights information contained elsewhere and does not contain all the information that you should consider in making your investment decision. Before investing in our Common Stock, you should carefully read this entire Offering Circular, including our financial statements and related notes. You should consider among other information, the matters described under “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

| 4 |

| Table of Contents |

| ITEM 2 | TABLE OF CONTENTS | 5 |

| 6 | ||

| 8 | ||

| 21 | ||

| 22 | ||

| 24 | ||

| 25 | ||

| 27 | ||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 27 | |

| 37 | ||

| 39 | ||

| SECURITY OWNERSHIP OF MANAGEMENT AND CERTAIN SECURITY HOLDERS | 41 | |

| 43 | ||

| 44 | ||

| F-1 | ||

| 46 |

| 5 |

| Table of Contents |

ITEM 3 SUMMARY AND RISK FACTORS

This summary highlights selected information contained elsewhere in this Offering Circular. This summary is not complete and does not contain all the information that you should consider before deciding whether to invest in our Common Stock. You should carefully read the entire Offering Circular, including the risks associated with an investment in our Company discussed in the “Risk Factors” section of this Offering Circular, before making an investment decision.

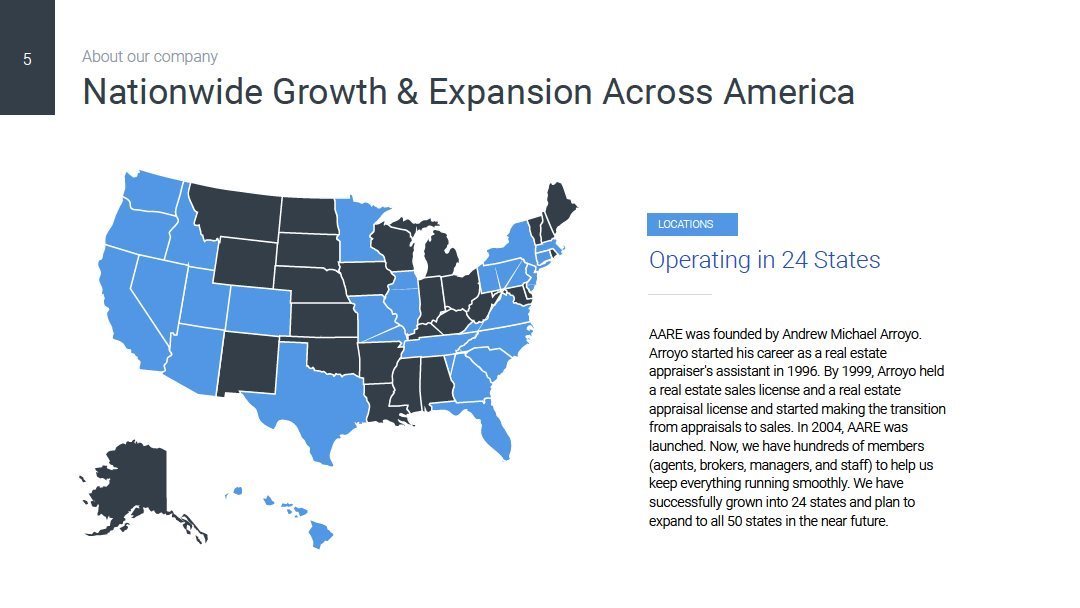

Summary Company Information

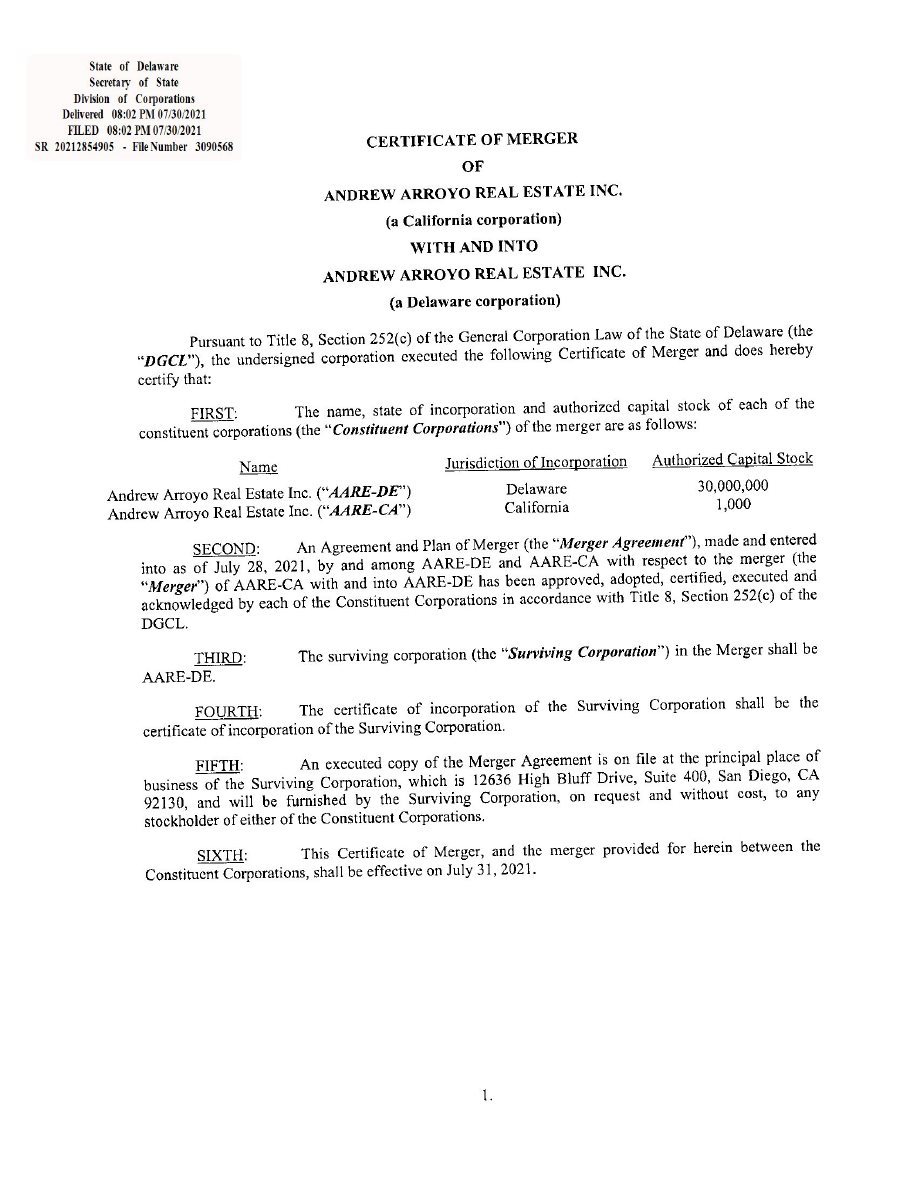

We were originally incorporated under the laws of the State of Delaware on June 18, 2020. On July 31, 2021, we completed a merger transaction with Andrew Arroyo Real Estate, Inc., a California corporation (“AARE-CA”), in a transaction in which we were the surviving entity and we assumed the assets, operations and liabilities of AARE-CA. AARE-DE had no operations prior to the close of the merger. As a result of the merger, we now have AARE-CA’s operations and the current and historical references to our business and operations herein relates to the business of AARE-CA. We have a trademark for, use a d/b/a, and are known as “AARE.” AARE-CA was in business for over 17 years and had grown to become a well-respected real estate agency. The primary purpose of the merger was to re-incorporate the company from California to Delaware as part of a plan to prepare for our nationwide expansion, capital fundraising and this offering. We (AARE-DE) are licensed and registered in 24 states to conduct real estate services. AARE-CA was merged out of existence as a result of the merger. Our principal executive office is located at 12636 High Bluff Drive Suite 400, San Diego, CA 92130; our telephone number is 888-322-4368, our fax number is 858-720-1166 and our website address is www.aare.org.

We do not incorporate the information on or accessible through our website into this Offering Circular, and you should not consider any information on, or that can be accessed through, our website as a part of this Offering Circular.

Summary Business Information

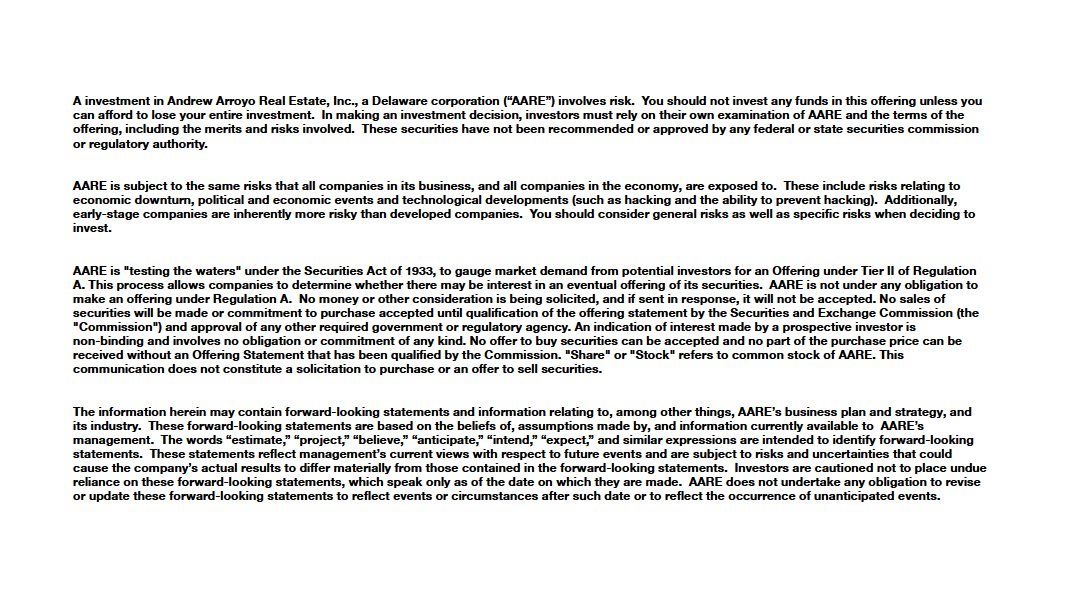

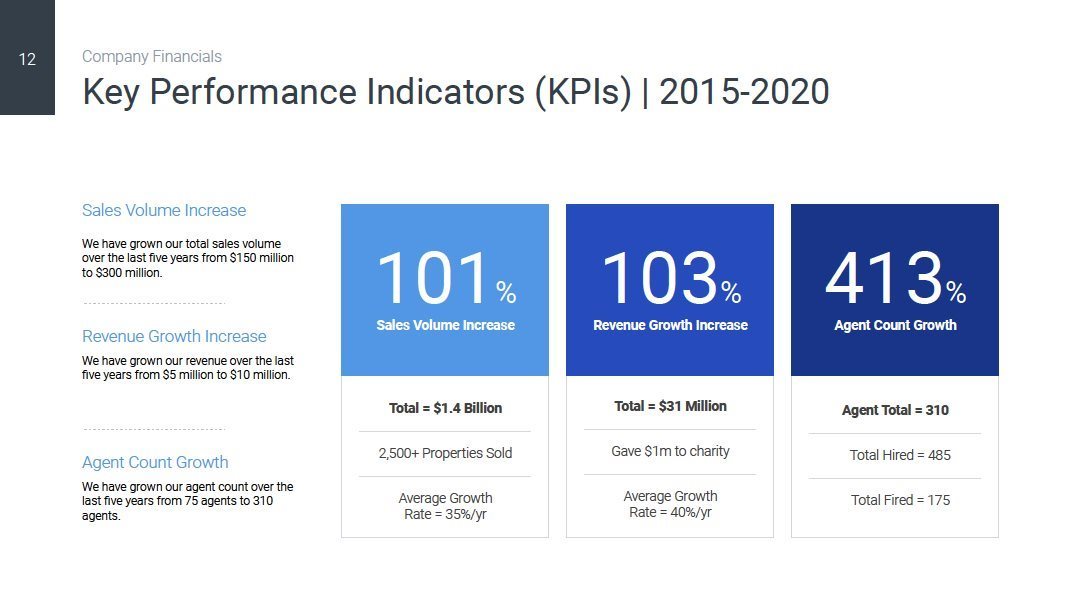

We provide real estate brokerage and property management services. These services include assisting clients to buy, sell, manage, and invest in residential and commercial properties as well as business opportunities. We were founded by Andrew Michael Arroyo. Mr. Arroyo started his career as a real estate appraiser's assistant. By 1999, Mr. Arroyo held a California real estate sales license and a California real estate appraisal license and started making the transition from appraisals to sales. Mr. Arroyo upgraded his license to become a managing broker in 2001. Since AARE-CA opened its doors as a one-agent company back in 2004, we’ve been through the boom times and the "bust times," and just kept right on growing. Now, we have more than three hundred members (agents, brokers, managers, and staff) to help us keep everything running smoothly. With a successful track record of thousands of real estate sales (totaling more than $1 billion in the last five years alone), we are passionate about our mission of giving back to others in need and fulfilling God's will through the business of real estate while increasing value for our shareholders.

We believe the three key benefits that separate our real estate company from competitors include:

|

| · | Residential, commercial, and property management services all under one umbrella; |

|

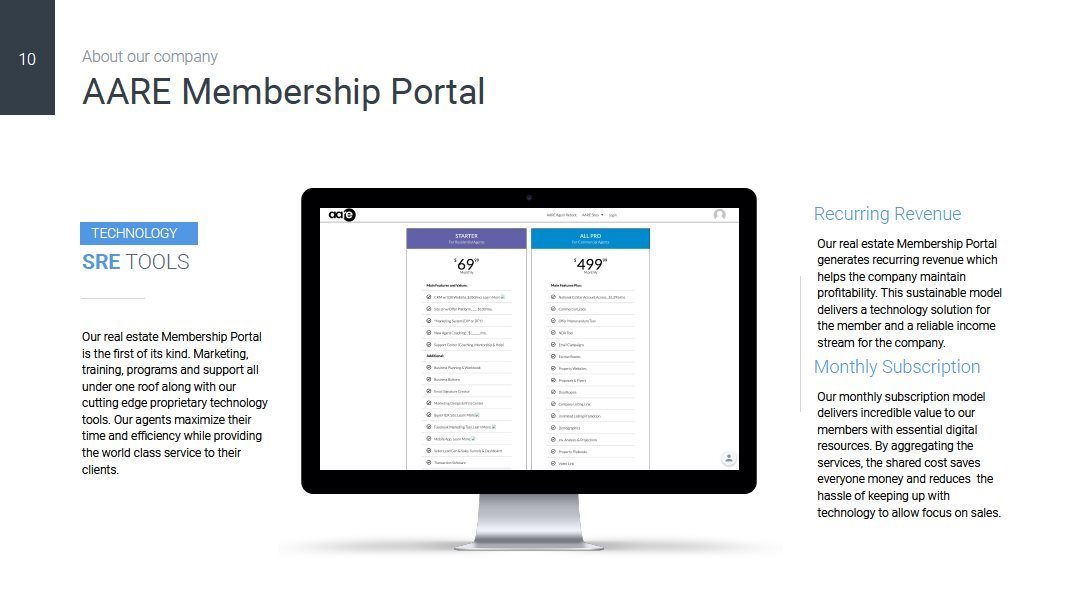

| · | Advanced technology for smoother operations as the industry transitions to the digital age; |

|

| · | Culture based on generosity and social responsibility during a generational change in workforce. |

We believe our business is currently characterized by the following:

|

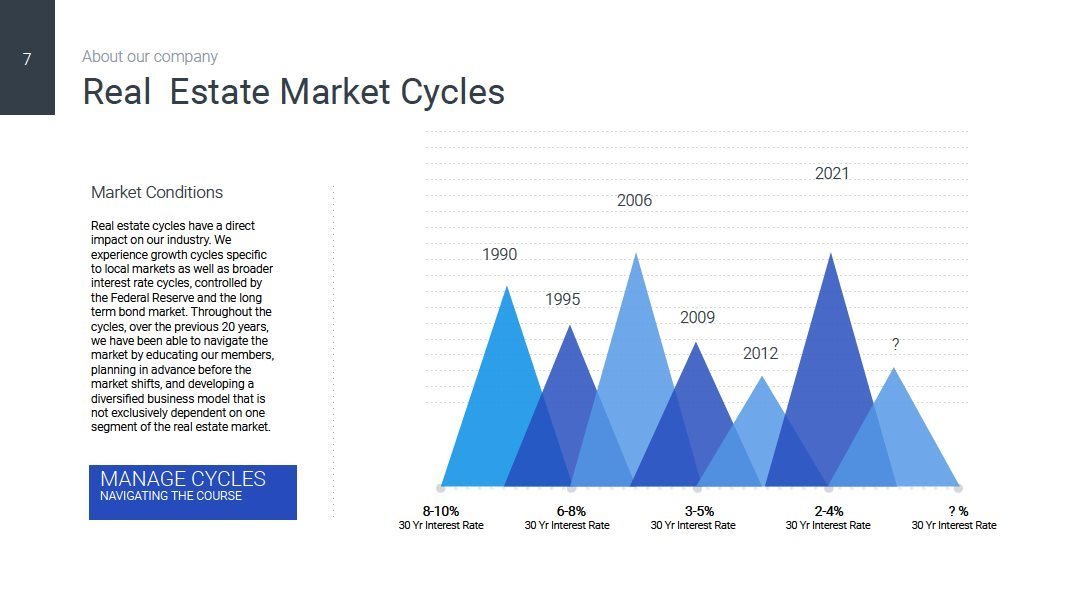

| · | Market: We participate in a market that we expect to experience significant growth throughout North America facilitated by ultra-low interest rates, a steady increase in new U.S. demand for housing/investments, and the fact we are able to provide real estate services in multiple segments of our market including residential, commercial, property management, business opportunities, and syndication. |

|

| · | Up-to-date services designed specifically for the real estate market: Our services have been hand tailored to be the most up-to-date services in the market. We also hold copyrights and trademarks that protect our intellectual property. |

|

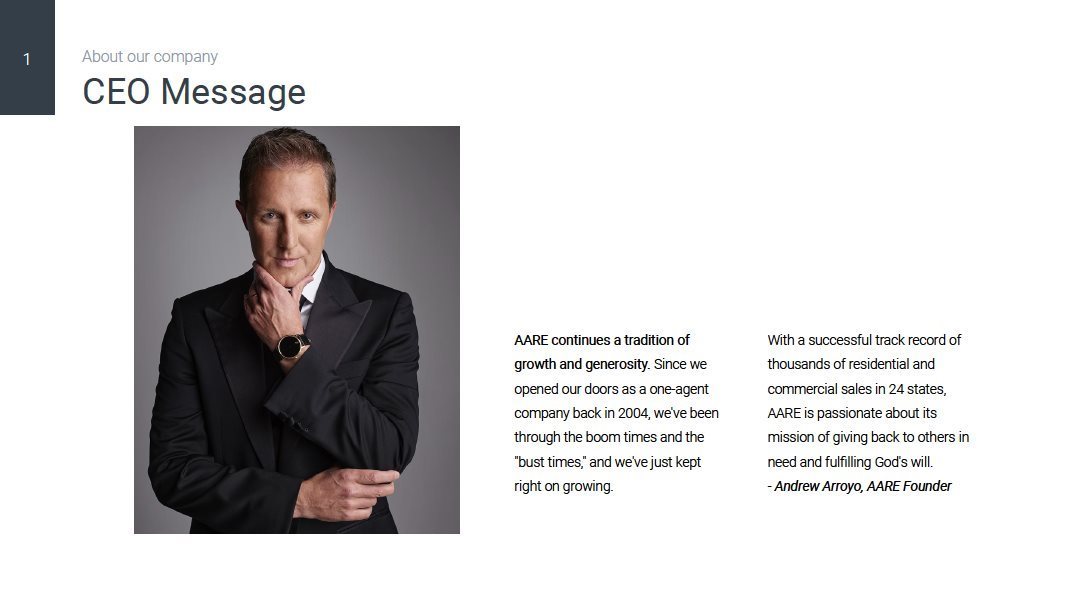

| · | Focused management team: Our experienced management team is dedicated solely to our operation and to implementing our business strategies. Each member of the executive team has been involved with the Company for several years and has been instrumental in developing our strategy. |

|

| · | Strong name recognition and loyalty: We believe the AARE name has a strong legacy dating from the launch of the California corporation in 2004, and we believe it has to this day retained a strong brand loyalty amongst clients and agents in California and is now being introduced in 23 more states in the U.S. |

|

| · | Growing sales network: In the last year, we have been licensed in 23 more states in the U.S. and established our sales network throughout North America that is overseen by our team of regional sales managers. |

|

| · | Recurring revenue stream from our property management services and joint venture with Smart Real Estate Tools, LLC: Because of the cyclical nature of the real estate sales cycle, we have developed a recurring revenue stream through a membership platform and through our property management services, which now account for approximately 2% of the Company revenue. Our goal will be to grow this revenue to constitute approximately 5% to 10% of our annual total revenue as it is characterized by higher margins than sales. |

| 6 |

| Table of Contents |

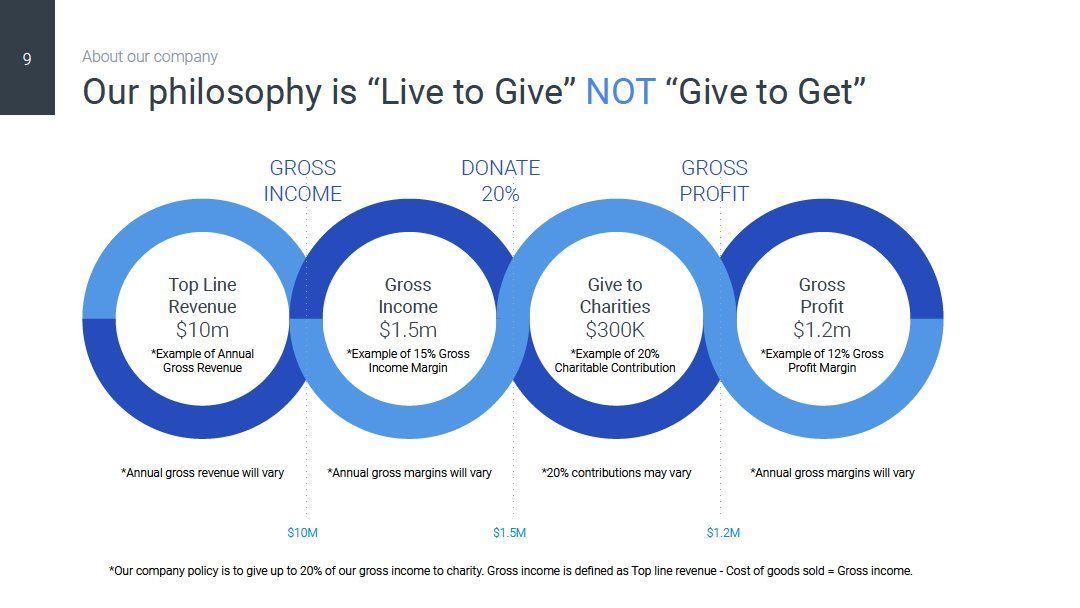

We believe it is our core beliefs that make our real estate brokerage and property management services extraordinary. In addition, our management steadfastly believes that charitable giving and sharing are a vital component of a successful business. To that end, up to twenty percent (20%) of our gross profit on every transaction goes to charity (our gross income minus our cost of sales). We believe that with success comes the responsibility to do what we can for those less fortunate. As a result, we give charitable contributions to faith-based and secular non-profit organizations that support a variety of social improvement projects. This includes missions and ministries with significant human impact that improve our local communities, the environment, and our social well-being while demonstrating a positive form of governance. We have no intention of deviating from this policy. The charitable giving policy has been written into our Bylaws. The amount of charitable giving could have a significant impact on our bottom line and affect shareholders’ earnings per share. Investors should not invest if they are not comfortable with our charitable contribution plans.

Summary Offering Information

| Shares offered by Company | Up to 1,000,000 Shares. |

|

|

|

| Common Shares outstanding before the offering | 3,000,000 Common Shares as of the date hereof. |

|

|

|

| Common Shares outstanding after the offering | 4,000,000 Common Shares. |

|

|

|

| Price per Share | $5.00 per Share. |

|

|

|

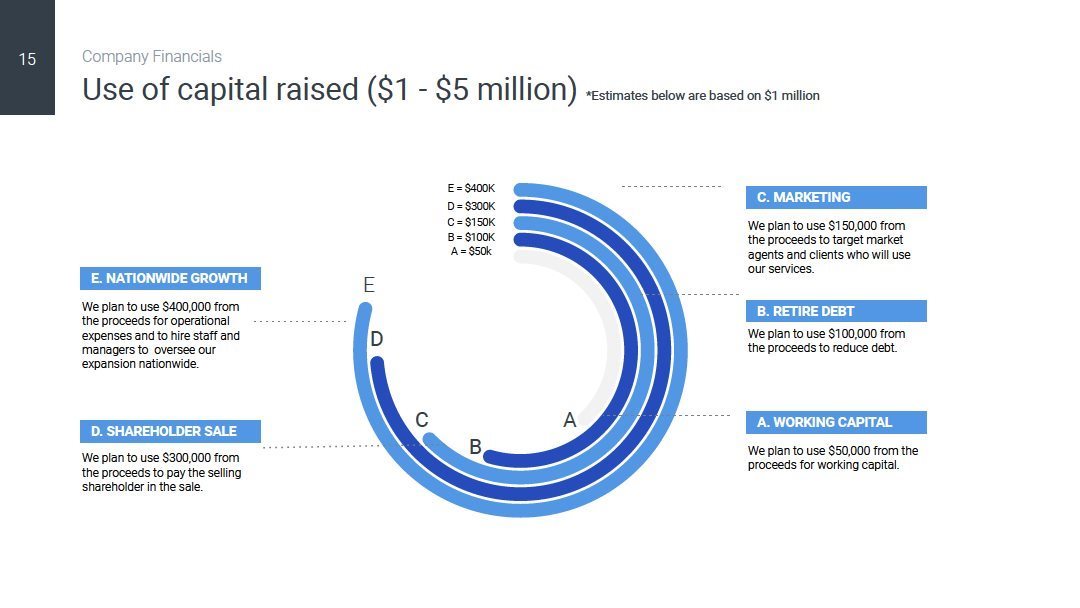

| Use of Proceeds | If we sell all the Shares and complete the Maximum Offering, our proceeds will be $5,000,000. We intend to use these proceeds primarily for:

- Nationwide Growth (planning to hire Managing Brokers (24 States) - Marketing & Advertising - Retire SBA Debt & Credit Lines - 30% Proceeds to Selling Shareholders - Working Capital

See “Use of Proceeds” on page 25 of this Offering Circular. |

|

|

|

| Offering Amount | $1,000,000 - $5,000,000 |

|

|

|

| Risk Factors | The Common Shares offered hereby involves a high degree of risk and should not be purchased by investors who cannot afford the loss of their entire investment. See “Risk Factors”. |

We are offering, through this Offering Circular, a limited number of shares of our Common Stock to investors as described herein. We are offering a minimum of 300,000 shares and a maximum of 1,000,000 shares of our Common Stock, par value $0.001 per share. We are authorized to issue 25,000,000 shares of common stock, par value $0.001, and 5,000,000 shares of preferred stock, par value $0.001. We currently have 3,000,000 shares of common stock and 2,000,000 shares of preferred stock outstanding. See “Securities Being Offered”.. Our Preferred Stock will not be offered in this Offering.

We are authorized to issue additional classes of Common Stock from time to time pursuant to other offering materials containing financial terms and conditions that may differ from those set forth herein. As of the date set forth hereof, we are offering Common Stock in one (1) class. Our investment objective and strategy with regard to the Common Stock are set forth below, and investors are directed to such materials. We may, from time to time, refine or change our strategy without prior notice to, or approval by, the shareholders.

| 7 |

| Table of Contents |

Risk Factors

An investment in our Securities involves a high degree of risk and many uncertainties. You should carefully consider the specific factors listed below, together with the cautionary statement that follows this section and the other information included in this Offering Circular before purchasing our Securities in this Offering. If one or more of the possibilities described as risks below actually occur, our operating results and financial condition would likely suffer and the trading price, if any, of our Securities could fall, causing you to lose some or all of your investment. The following is a description of what we consider the key challenges and material risks to our business and an investment in our Securities.

Although some of the risk factors summarized below may apply to many start-up companies, we have included them because an emerging growth company such as our Company is inherently subject to these risks, and other risks, which could cause actual results to differ materially from those projected in this Offering. Additionally, early-stage companies are inherently riskier than more developed companies. You should consider general risks as well as specific risks when deciding whether to invest. Investors should carefully consider the risks and uncertainties described below, together with all the other information in this Offering Circular, before deciding whether to invest in the Securities of our company.

INVESTMENT IN OUR COMMON STOCK IS HIGHLY SPECULATIVE AND INVOLVES A HIGH DEGREE OF RISK. OUR COMMON STOCK SHOULD NOT BE PURCHASED BY ANY PERSON WHO CANNOT AFFORD THE LOSS OF THEIR ENTIRE INVESTMENT. YOU SHOULD CAREFULLY CONSIDER THE RISKS DESCRIBED BELOW, AS WELL AS SPECIFIC RISKS IN THE OFFERING MATERIALS, WHEN EVALUATING WHETHER TO MAKE AN INVESTMENT. THE RISKS DESCRIBED BELOW ARE NOT THE ONLY RISKS ASSOCIATED WITH AN INVESTMENT. YOU SHOULD ALSO CONSULT WITH YOUR OWN LEGAL, TAX AND FINANCIAL ADVISORS ABOUT AN INVESTMENT IN THE SECURITIES. IF ANY OF THE FOLLOWING RISKS ACTUALLY OCCUR, THE FINANCIAL CONDITION AND RESULTS OF OPERATION COULD BE MATERIALLY AND ADVERSELY AFFECTED AND YOU COULD LOSE ALL OR PART OF YOUR INVESTMENT.

General risk relating to COVID-19 pandemic

The novel coronavirus (COVID-19) pandemic may have an expected effect on our business, financial condition and results of operations.

In March 2020, the World Health Organization declared COVID-19 a global pandemic, and governmental authorities around the world have implemented measures to reduce the spread of COVID-19. These measures adversely affected workforces, customers, supply chains, consumer sentiment, economies, and financial markets, and, along with decreased consumer spending, have led to an economic downturn across many global economies.

The COVID-19 pandemic rapidly escalated in the United States, creating significant uncertainty and economic disruption and leading to record levels of unemployment nationally. Numerous state and local jurisdictions imposed, and subsequently lifted, shelter-in-place orders, quarantines, shut-downs of non-essential businesses, and similar government orders and restrictions on their residents to control the spread of COVID-19. These orders may be imposed again in the future if the COVID-19 pandemic continues to spike in certain locales, partially as a result of COVID variants. Such orders or restrictions have resulted, and will result, in temporary facility closures, work stoppages, slowdowns and travel restrictions, among other effects, thereby adversely impacting our operations. In addition, we expect to be impacted by a downturn in the United States economy in the long run, which could have an adverse impact on discretionary consumer spending and may have a significant impact on our business operations and/or our ability to generate revenues and profits.

In response to the COVID-19 disruptions, we have implemented a number of measures designed to protect the health and safety of our staff and contractors. These measures include restrictions on non-essential business travel, the institution of work-from-home policies wherever feasible and the implementation of strategies for workplace safety at our facilities that remain open. We are following the guidance from public health officials and government agencies, including implementation of enhanced cleaning measures, social distancing guidelines and wearing of masks.

| 8 |

| Table of Contents |

The extent to which COVID-19 ultimately impacts our business, financial condition and results of operations will depend on future developments, which are highly uncertain and unpredictable, including new information which may emerge concerning the severity and duration of the COVID-19 outbreak and the effectiveness of actions taken to contain the COVID-19 outbreak or treat its impact, among others. Additionally, the extent to which COVID-19 ultimately impacts our operations will depend on a number of factors, many of which will be outside of our control. The COVID-19 outbreak is evolving and new information emerges daily; accordingly, the ultimate consequences of the COVID-19 outbreak cannot be predicted with certainty. In addition to the COVID-19 disruptions possibly adversely impacting our business and financial results, they may also have the effect of heightening many of the other risks described in “Risk Factors,” including risks relating to changes due to our limited operating history; our ability to generate sufficient revenue, to generate positive cash flow; our relationships with third parties, and many other factors. We will endeavor to minimize these impacts, but there can be no assurance relative to the potential impacts that may be incurred.

The COVID-19 pandemic poses specific risks related to our business due to the nature of our business.

The COVID-19 pandemic poses specific risks related to our Company. Specifically, it makes it difficult for us to evaluate specific properties, visit certain areas easily, meet with potential clients or investors and joint venture partners. Some companies may also determine that because we are a growth company, that we will be delayed unreasonably in our ability to provide brokerage services to property owners in a timely manner. This may influence them in a negative manner, and they may make decisions not to work with us based on our limited performance.

Where we manage or sell properties that are tenanted, there may be unforeseen delays and late payments due to COVID-19. This may reduce our ability to sell or manage those properties. This would require the Company to work for an extended period of time without payment, be asked to agree to unreasonable compensation or abandon those property listings altogether. This will increase our cost and create delays in earning commissions, and these listings may turn into short sales or REO (bank-owned) properties. As of July 2021, there are approximately 1.75 million property owners in forbearance. This means they have stopped paying their mortgage.

In either case, the COVID-19 pandemic will cause continued disruption in the property market for an unknown time period. This may delay our future growth plans for its nationwide services.

We have a limited operating history and historical financial information upon which you may evaluate our performance.

We were recently incorporated in Delaware in June 2020. In July 2021, we entered into a merger transaction with AARE-CA under which AARE-CA merged into our company and we assumed AARE-CA’s operations.

Accordingly, the Delaware Corporation has only a limited history upon which an evaluation of its prospects and future performance can be made. Past performance of any Director, Officer or Key Employee or the success of the President in any similar venture is no assurance of future success.

Our proposed operations are subject to all business risks associated with growing enterprises. The likelihood of our success must be considered in light of the problems, expenses, difficulties, complications, and delays frequently encountered in connection with the expansion of a business, operation in a competitive industry, and the continued development of advertising, promotions and a corresponding customer base. There is a possibility that we could sustain losses in the future or fail to even operate profitably.

We have a limited operating history nationwide and limited capital.

We have a limited operating history nationwide upon which investors may base an evaluation of its performance; therefore, we are still subject to all of the risks incident to the creation and development of a new business on a nationwide scale. We plan to conduct closings of sales of our Common Stock as Subscriptions are received after the $1,000,000 Minimum Offering is met.

| 9 |

| Table of Contents |

We have limited assets, limited operating history, and limited operating revenue (outside of California) to date. We are still working on recruiting agents, brokers and staff members, and it will be some time before we are in a position to begin producing significant revenue. Thus, our proposed business is subject to all the risks inherent in new business ventures. The likelihood of success must be considered in light of the expenses, complications, and delays frequently encountered with the start-up of new businesses and the competitive environment in which start-up companies operate.

Our business is subject to general economic conditions.

Our financial success is sensitive to adverse changes in general economic conditions in the United States, such as recession, inflation, unemployment, and interest rates, and overseas, such as currency fluctuations. Such changing conditions could reduce demand in the marketplace for our services. Management believes that the impending growth of the markets we service will insulate us from excessive reduced demand. Nevertheless, we have no control over these changes.

Adverse changes in global and domestic economic conditions or a worsening of the United States economy could materially adversely affect us. Our sales and performance depend significantly on consumer confidence and discretionary spending, which are still under pressure from United States and global economic conditions. A worsening of the economy and decrease in consumer spending may adversely impact our sales, ability to market our services, build customer loyalty, or otherwise implement our business strategy and further diversify the geographical concentration of our operations.

Although we have generated significant revenues in the past several years, the current nationwide expansion plan will require financial resources. Without significant revenues to match the significant ongoing capital costs of the expansion, we will not realize its plans on the projected timetable in order to reach sustainable or profitable operations. Any material deviation from our timetable could require that we seek additional capital. Additional funding may not be available at reasonable cost and it may materially dilute the investment of investors in this Offering.

Our growth and profitability are dependent on a number of factors.

Our growth and profitability are dependent on a number of factors, and our historical growth may not be indicative of our future growth.

Our historic results since the implementation of our new expansion strategy in 2021 should not be considered as indicative of our future performance. We may not be successful in executing our growth strategy, and even if we achieve our strategic plan, we may not be able to sustain profitability. In future periods, our revenue could continue to decline or grow more slowly than we expect. We also may incur significant losses in the future for a number of reasons, including the following risks and the other risks described in this Offering Circular, and we may encounter unforeseen expenses, difficulties, complications, delays and other unknown factors.

We may fail to manage our growth effectively.

We plan to expand our operations by hiring brokers and real estate agents throughout the United States. The anticipated growth could place a significant strain on our management and operational and financial resources. Effective management of the anticipated growth shall require expanding our management and financial controls, hiring additional qualified personnel as required and developing additional expertise by existing management personnel. However, we may not be able to effectively implement these or other measures designed to increase our capability to manage such anticipated growth or to do so in a timely and cost-effective manner. Moreover, management of growth is especially challenging for a company with a short operating history (outside of California) and limited financial resources, and the failure to effectively manage growth could have a material adverse effect on our operations.

| 10 |

| Table of Contents |

We are highly dependent on key personnel and management.

In its current stage of growth, our business will be significantly dependent on our current management team, particularly our CEO, and the Vice Presidents of Administration, Communications and Humanitarian department. The loss of any one of these individuals could have a material adverse effect on us and our operations. We currently maintain a key-executive life insurance policy insuring the life of two of our key executives, and we intend to apply for greater coverage on the existing life insurance policies as well as additional key-executive life insurance policies upon completion of funding.

Our business depends on attracting and retaining qualified management personnel and agents.

The unanticipated departure of any key member of our management team or high producing real estate agents could have an adverse effect on our business. Given our relative size and the breadth of our operations, there are a limited number of qualified management personnel to assume the responsibilities of management-level employees should there be management turnover. Our success depends to a significant extent upon a number of key employees, including members of senior management. The loss of the services of one or more of these key employees could have a material adverse effect on our results of operations and prospects. In addition, because of the required licensing and specialized nature of our business, our future performance depends on the continued service of, and our ability to attract and retain, qualified management, producing real estate agents, and commercial and technical personnel. Competition for such personnel is intense, and we may be unable to continue to attract or retain such personnel to support our growth and operational initiatives and replace executives or real estate agents who quit, retire or resign. Failure to retain our leadership team and attract and retain other important management and technical personnel could place a constraint on our growth and operational initiatives, which could have a material adverse effect on our revenues, results of operations and product development efforts, and eventually result in a decrease in profitability.

Our charitable giving policy is not ordinary.

Giving and sharing are more than buzzwords at AARE. To that end, up to twenty percent (20%) of our gross profit on every transaction goes to charity (our gross income minus our cost of sales). We believe that with success comes the responsibility to do what we can for those less fortunate. As a result, we give charitable contributions to faith-based and secular non-profit organizations that support a variety of social improvement projects. This includes missions and ministries with significant human impact that improve our local communities, the environment, and our social well-being while demonstrating a positive form of governance. We have no intention of deviating from this policy or reducing the amount we give to charity. The charitable giving policy has been written into our Bylaws. The amount of charitable giving could have a significant impact on our bottom line and affect shareholders’ earnings per share. Investors should not invest if they are not comfortable with our charitable contribution plans.

We may face scrutiny or disaffiliation/abandonment by our members or clients if there is a change in our faith-based values and culture.

Our core values include relationships, faith, accountability, integrity, natural and spiritual gifts, truth, honesty, trust, standards of excellence, generous giving, education, understanding, clear communication, work-life balance, morals, ethics, loyalty, gratefulness, success, and rewards. Our mission as an organization is to fulfill God's will through the business of real estate. Our vision is to bear much fruit which means to yield positive results. We honor God within our real estate agency by nurturing a culture where giving and serving others’ needs before our own is a priority. We obey Him by growing our business based on His moral, ethical and biblical principles. While operating within the legal requirements of the law, and including people of all faiths and walks of life, our business model and culture has been developed based on biblical principles. A shift or adherence to a different set of core values within the organization could impact the retention of our current members and could have a material adverse effect on the Company's operations.

We may face limitations on our ability to integrate acquired businesses.

From time to time, we may engage in acquisitions involving risks, including the possible failure to successfully integrate and realize the expected benefits of these acquisitions. We anticipate making acquisitions in the future, and our ability to realize the anticipated benefits of these transactions, including the expected combination benefits, will depend largely on our ability to integrate acquired businesses.

| 11 |

| Table of Contents |

The risks associated with future acquisitions may include:

|

| 1. | The business culture of the acquired business may not match well with our culture; |

|

| 2. | Technological and product synergies, economies of scale and cost reductions may not occur as expected; |

|

| 3. | We may acquire or assume unexpected liabilities; |

|

| 4. | Faulty assumptions may be made regarding the integration process; |

|

| 5. | Unforeseen difficulties may arise in integrating operations and systems; |

|

| 6. | We may fail to retain, motivate and integrate key management and other employees of the acquired business; |

|

| 7. | Higher than expected finance costs may arise due to unforeseen changes in tax, trade, environmental, labor, safety, payroll or pension policies in any jurisdiction in which the acquired business conducts its operations; and |

|

| 8. | We may experience problems in retaining customers of the acquired business. |

The successful integration of any newly acquired business would also require us to implement effective internal control processes in the acquired business. We cannot ensure newly acquired companies will operate profitably, that the intended beneficial effect from these acquisitions will be realized or that we will not encounter difficulties in implementing effective internal control processes in these acquired businesses, particularly when the acquired business operates in foreign jurisdictions and/or was privately owned.

If we cannot raise sufficient funds, we will not succeed or will require significant additional capital infusions.

We are offering Common Stock in the amount of up to $5,000,000 in this offering but may sell much less. Even if the maximum amount is raised, we may need additional funds in the future in order to grow, and if we cannot raise those funds for whatever reason, including reasons outside our control, such as another significant downturn in the economy, we may not survive. If we do not sell all of the Common Stock we are offering, we will have to find other sources of funding in order to develop our business.

Even if we are successful in selling all of the Common Stock being offered, our proposed business may require significant additional capital infusions before we can achieve sustainable profitability. Furthermore, in order to expand, we are likely to raise funds again in the future, either by offerings of securities or through borrowing from banks or other sources. The terms of future capital infusions may include covenants that give creditors rights over our financial resources or sales of equity securities that will dilute the holders of our Common Stock.

Terms of subsequent financings may adversely impact your investment.

We may need to engage in common equity, debt, or preferred stock financing in the future. We are engaging in this offering under Regulation A to sell a minimum of 200,000 and a maximum of 1,000,000 shares of Common Stock at $5.00 per share. Your rights and the value of your investment in the Common Stock could be reduced. Interest on debt securities could increase costs and negatively impact operating results. Preferred Stock could be issued in series from time to time with such designations, rights, preferences, and limitations as needed to raise capital. The terms of Preferred Stock could be more advantageous to those investors than to the holders of Common Stock. In addition, if we need to raise more equity capital from the sale of Common Stock, institutional or other investors may negotiate terms at least as, and possibly more, favorable than the terms of your investment. Shares of Common Stock that we sell could be sold into any market that develops, which could adversely affect the market price.

Risks of borrowing may negatively impact our business.

We may have to seek loans from financial institutions. Typical loan agreements might contain restrictive covenants, which may impair our operating flexibility. A default under any loan agreement could result in a charging order that would have a material adverse effect on our business, results of operations or financial condition.

| 12 |

| Table of Contents |

Some of our key personnel allocate their time to other interest, which may reduce the time spent on our business and operations.

Our future success depends on the efforts of key personnel and consultants, especially our CEO. The loss of services of any key personnel or consultants may have an adverse effect on us. There can be no assurance that we will be successful in attracting and retaining other personnel or consultants we require to develop and conduct our proposed operations. In addition, our CEO, Andrew Michael Arroyo, does not work exclusively for us and divides his time among us and his other interests. If circumstances arise in which Mr. Arroyo is required to spend substantially more time attending to matters unrelated to our operations, it could adversely affect our business.

We are subject to substantial regulation, which is evolving, and unfavorable changes or failure by us to comply with these regulations could substantially harm our business and operating results.

Licensed real estate companies and their associate licensees are subject to substantial regulation under international, federal, state, local and foreign laws. We, and our associate licensees, need to comply with many governmental standards and regulations relating to licensing laws and state administrative codes, among others. In addition, we need to comply with state laws that regulate the buying, selling, investing and managing of real property. Staying compliant with all of these requirements may adversely affect our business and financial condition. Also, we are subject to laws and regulations applicable to real estate services internationally. For example, we will be required to meet country-specific licensing standards that are often materially different from U.S. requirements, thus resulting in the need for additional investment and systems to ensure regulatory compliance. These processes necessitate that foreign regulatory officials review and certify us prior to providing services and market entry. In addition, we must comply with regulations applicable to real estate services after we enter the market, including foreign reporting requirements and foreign management systems. We may incur significant costs in complying with these regulations and may be required to incur additional costs to comply with any changes to such regulations.

We may need to defend ourselves against patent or trademark infringement claims, which may be time-consuming and would cause us to incur substantial costs.

Companies, organizations or individuals, including our competitors, may hold or obtain patents, trademarks or other proprietary rights that would prevent, limit or interfere with our ability to buy, sell, manage or market real estate properties, which could make it more difficult for us to operate our business. From time to time, we may receive communications from holders of patents or trademarks regarding their proprietary rights. Companies holding patents or other intellectual property rights may bring suits alleging infringement of such rights or otherwise assert their rights and urge us to take licenses. In addition, if we are determined to have infringed upon a third party's intellectual property rights, we may be required to do one or more of the following:

|

| · | Cease selling, incorporating certain components into, or offering goods or services that incorporate or use the challenged intellectual property; |

|

| · | Pay substantial damages; |

|

| · | Seek a license from the holder of the infringed intellectual property right, which license may not be available on reasonable terms or at all; |

|

| · | Redesign our service offerings or certain components; |

|

| · | Establish and maintain alternative branding for our products and services. |

We may also need to file lawsuits to protect our intellectual property rights from infringement from third parties, which lawsuits could be expensive and time consuming and distract management’s attention from our core operations.

If we are unable to adequately control the costs associated with operating our business, including our costs of sales, our business, financial condition, operating results and prospects will suffer.

If we are unable to maintain a sufficiently low level of costs for supporting our real estate agents and maintain a sufficiently low level of costs for marketing, selling and managing properties relative to the fees and commissions earned, our operating results, gross margins, business and prospects could be materially and adversely impacted. We have made, and will be required to continue to make, significant investments into the technological systems that allow us to efficiently service our real estate clients and manage properties. There can be no assurances that our costs of producing and delivering efficient real estate services will be less than the revenue we generate from real estate commissions or that we will ever achieve a positive gross margin on sales.

| 13 |

| Table of Contents |

If we are unable to address the service requirements of our future customers, our business will be materially and adversely affected.

In order to sustain our business we be able to adequately address the service requirements of our customers. If we are unable to do this, our business and prospects will be materially and adversely affected. In addition, we anticipate the level and quality of the service we provide our customers will have a direct impact on the success of our future business and referrals. If we are unable to satisfactorily service our customers, our ability to generate customer loyalty, grow our business, and sell and manage additional properties could be impaired.

We may become subject to liability claims, which could harm our financial condition and liquidity if we are not able to successfully defend or insure against such claims.

The risk of professional liability claims, product recalls, and associated adverse publicity is inherent in the real estate brokerage business. We may become subject to liability claims, which could harm our business, prospects, operating results and financial condition. The real estate industry experiences significant liability claims, and we face inherent risk of exposure to claims in the event our employees, officers or real estate agents do not perform as expected per our policy manual. A successful liability claim against us could require us to pay a substantial monetary award. In addition, a liability claim could generate substantial negative publicity about our service and business, which would have material adverse effect on our brand, business, prospects and operating results. Any lawsuit, regardless of its merit, may have a material adverse effect on our reputation, business and financial condition. To help mitigate the financial risks, we carry professional Errors & Omissions liability insurance, which offers financial protection up to $1,000,000 per claim.

We may not be able to properly manage our planned expansion.

We plan on expanding our business through the introduction of a sophisticated marketing campaign to recruit agents nationwide. Any expansion of operations we may undertake will entail risks. Such actions may involve specific operational activities, which may negatively impact our profitability. Consequently, shareholders must assume the risk that (i) such expansion may ultimately involve expenditures of funds beyond the resources available to us at that time, and (ii) management of such expanded operations may divert management’s attention and resources away from its existing operations, and all of those factors may have a material adverse effect on our present and prospective business activities.

Developing new products, services and technologies entails significant risks and uncertainties.

We regularly research and develop new technology and communication systems. Delays or cost overruns in the development of these systems and/or failure of the product or service to meet our performance estimates may be caused by, among other things, unanticipated technological hurdles, difficulties in programming, changes to design and regulatory hurdles. Any of these events could materially and adversely affect our operating performance and results of operations.

We may not be successful in developing a larger customer base.

While we believe we can further develop our existing customer base and develop a new customer base through the marketing and promotion of our services, our inability to further develop such a customer base could have a material adversely affect us. Although we believe that our real estate services offer advantages over competitive companies, our services may not attain a degree of market acceptance on a sustained basis or generate revenues sufficient for sustained profitable operations.

| 14 |

| Table of Contents |

Changes in consumer behavior could reduce profitability.

Our customers could change their behavior and purchase patterns in unpredictable ways. Our success therefore depends on its ability to successfully predict and adapt to changing consumer behavior outside, as well as inside, the United States. Moreover, we must often invest substantial amounts in research and development before we learn the extent to which products and services will earn consumer acceptance. If our products and services do not achieve sufficient consumer acceptance, our revenue may decline and adversely affect the profitability of the business.

Because we face intense competition, we may not be able to operate profitably in our markets.

Competition in the real estate industry is significant. There are more than 1 million real estate agents nationwide and more than 100,000 real estate brokerage firms. While significant competition does exist, our management believes that our products and services are demographically well positioned, top quality and unique in nature, while offering greater value. The expertise of management combined with training, culture and the innovative nature of its marketing approach set us apart from its competitors. However, there is the possibility that new competitors could seize upon our business model and produce competing products or services with similar focus. Likewise, these new competitors could be better capitalized than we are, which could give them a significant advantage over us. There is the possibility that the competitors could capture significant market share of our intended market.

Trends in consumer preferences and spending can change quickly and be sporadic.

Our operating results may fluctuate significantly from period to period as a result of a variety of factors, including purchasing patterns of customers, competitive pricing, debt service and principal reduction payments, and general economic conditions. We may not be successful in marketing any of its services nationwide or the revenues from such services may not be significant. Consequently, our revenues may vary by quarter, and our operating results may experience fluctuations that will impede appreciation and slow our growth.

We may suffer potential fluctuations in quarterly revenue.

Significant annual and quarterly fluctuations in our revenue may be caused by, among other factors, the volume of revenues generated by us, the timing of new product or service announcements and releases by us and our competitors in the marketplace, and general economic conditions. Our level of revenues and profits, in any particular fiscal period, may be significantly higher or lower than in other fiscal periods, including comparable fiscal periods. Our expense levels are based, in part, on its expectations as to future revenues.

As a result, if future revenues are below expectations, net income or loss may be disproportionately affected by a reduction in revenues, as any corresponding reduction in expenses may not be proportionate to the reduction in revenues. As a result, we believe that period-to-period comparisons of its results of operations may not necessarily be meaningful and should not be relied upon as indications of future performance.

We may face unanticipated obstacles to execution of our business plan.

Our business plans may change significantly. Many of our potential business endeavors are capital intensive and may be subject to statutory or regulatory requirements. Management believes that our chosen activities and strategies are achievable in light of current economic and legal conditions with the skills, background, and knowledge of our principals and advisors. Management reserves the right to make significant modifications to our stated strategies depending on future events. We may not be successful in our the execution of our business plan.

Management maintains wide discretion as to the use of proceeds from this Offering.

We plan to use the net proceeds from this Offering for the purposes described under Item 4 “Use of Proceeds.” However, we reserve the right to use the funds obtained from this Offering for other similar purposes not presently contemplated, which our management deems to be in the best interests of our company and its shareholders in order to address changed circumstances or opportunities. As a result of the foregoing, our success will be substantially dependent upon the discretion and judgment of Management with respect to application and allocation of the net proceeds of this Offering. Investors for the Securities offered hereby will be entrusting their funds to our Management, upon whose judgment and discretion the investors must depend.

| 15 |

| Table of Contents |

We will be subject to the significant influence of one of our current stockholders after this Offering, and their interests may not always coincide with those of our other stockholders.

Andrew Michael Arroyo, currently beneficially owns 100% of our outstanding common stock and 100% of our outstanding preferred stock. If the Maximum Offering is sold to investors, Mr. Arroyo will beneficially own 75% of our outstanding Common Stock and control 90% of the outstanding voting rights. As a result, Mr. Arroyo will be able to significantly influence all matters requiring approval by our stockholders, including the election of directors and the approval of mergers or other business combination transactions. Because the interests of Mr. Arroyo may not always coincide with those of our other stockholders, such stockholder may influence or cause us to take actions with which our other stockholders disagree.

We plan to reinvest any profits into the business for the foreseeable future.

We intend to retain any initial future earnings to fund operations and expand our business. A Shareholder will not be entitled to receive profits proportionate to the amount of shares of Common Stock held by that Shareholder. Our Board of Directors is vested with the power to declare a dividend to distribute profits based upon our results of operations, financial condition, capital requirements and other circumstances. However, at this time and for the foreseeable future, our Board of Directors has no intention to distribute profits or declare a dividend.

We may be unable to adequately protect our proprietary rights.

In certain cases, we may rely on trade secrets to protect intellectual property, proprietary technology and processes, which we have acquired, developed or may develop in the future. There is a risk that secrecy obligations may not be honored or that others will not independently develop similar or superior products or technology. The protection of intellectual property and/or proprietary technology through claims of trade secret status has been the subject of increasing claims and litigation by various companies both in order to protect proprietary rights as well as for competitive reasons even where proprietary claims are unsubstantiated. The prosecution of proprietary claims or the defense of such claims is costly and uncertain given the uncertainty and rapid development of the principles of law pertaining to this area. We, in common with other firms, may also be subject to claims by other parties with regard to the use of intellectual property, technology information and data, which may be deemed proprietary to others.

We have certain legal and regulatory compliance related to the sale of securities and related to this Offering that we must follow.

Failure to comply with applicable laws and regulations could harm our business and financial results. We intend to develop and implement policies and procedures designed to comply with all applicable federal and state laws, accounting and reporting requirements, tax rules and other regulations and requirements, including but not limited to those imposed by the SEC.

In addition to potential damage to our reputation and brand, failure to comply with the various laws and regulations, as well as changes in laws and regulations or the manner in which they are interpreted or applied, may result in civil and criminal liability, damages, fines and penalties, increased cost of regulatory compliance, and restatements of our financial statements. Future laws or regulations, or the cost of complying with such laws, regulations or requirements, could also adversely affect our business and results of operations.

This Offering Circular contains forward-looking statements that are based on our current expectations, estimates and projections but are not guarantees of future performance and are subject to risks and uncertainties..

Management has prepared projections regarding our anticipated financial performance. These projections are hypothetical and based upon our presumed financial performance, the addition of a sophisticated and well-funded marketing plan and other factors influencing our business. The projections are based on Management’s best estimate of our probable results of operations, based on present circumstances, and have not been reviewed by our independent accountants or auditors. These projections are based on several assumptions, set forth therein, which Management believes are reasonable. Some assumptions, upon which the projections are based, however, invariably will not materialize because of the inevitable occurrence of unanticipated events and circumstances beyond Management’s control. Therefore, actual results of operations will vary from the projections, and such variances may be material. Assumptions regarding future changes in sales and revenues are necessarily speculative in nature. In addition, projections do not and cannot take into account such factors as general economic conditions, unforeseen regulatory changes, the entry into our market of additional competitors, the terms and conditions of future capitalization, and other risks inherent to our business. While Management believes that the projections accurately reflect possible future results of our operations, those results cannot be guaranteed.

| 16 |

| Table of Contents |

Technology risks

Rapid technological changes may adversely affect our business.

Our ability to remain competitive may depend in part upon its ability to develop new and enhanced new products, services or distribution, and to introduce these products or services in a timely and cost-effective manner. In addition, product and service introductions or enhancements by our competitors, or the use of other technologies could cause a decline in sales or loss of market acceptance of our existing products and services.

Our success in developing, introducing, selling and supporting new and enhanced products or services depends upon a variety of factors, including timely and efficient completion of service and product design and development, as well as timely and efficient implementation of product and service offerings. Because new product and service commitments may be made well in advance of sales, new product or service decisions must anticipate changes in the industries served. We may not be successful in selecting, developing, and marketing new products and services or in enhancing its existing products or services. Failure to do so successfully may adversely affect our business, financial condition and results of operations.

We are dependent on computer infrastructure.

We rely on Internet and computer technology to maintain its records and to market and sell our products and services. Therefore, an Internet or major computer server failure would adversely affect our performance. We presently have limited redundancy systems, rely on third party backup facilities, and only have a limited disaster recovery plan. Despite the implementation of network security measures by us, our servers may be vulnerable to computer viruses, physical or electronic break-ins and similar disruptive problems, which could lead to interruptions, delays or stoppages in service to users of our services and products, which could cause a material adverse effect on our business, operations and financial condition.

Our website faces inside and outside security risks.

If the security measures we use to protect the personal information of our website users, employees, real estate agents and clients, such as credit card numbers, are ineffective, it could result in a reduction in revenues from decreased customer confidence, an increase in operating expenses, as well as possible liability and compliance costs.

Any breach in our website security, whether intentional or unintentional, could cause our users to lose their confidence in our website and as a result stop using our service and websites. This would result in reduced revenues and increased operating expenses, which would impair us from achieving profitability. Additionally, breaches of our users' personal information could expose us to possible liability as any involved user or users may choose to sue us. Breaches resulting in disclosure of users' personal information may also result in regulatory fines for noncompliance with online privacy rules and regulations.

We believe that as a result of advances in computer capabilities, new discoveries in the field of cryptography and other developments, a compromise or breach of our security precautions may occur. A compromise in the proposed security for our computer systems could severely harm our business because a party who is able to circumvent our proposed security measures could misappropriate proprietary information, including customer credit card information, or other sensitive data that would cause interruptions in the operation of our services and websites. We may be required to spend significant funds and other resources to protect against the threat of security breaches or to alleviate problems caused by these breaches. However, protection may not be available at a reasonable price or at all. Concerns regarding the security of e-commerce and the privacy of users may also inhibit the growth of the Internet as a means of conducting commercial transactions in general. Our users may have these concerns as well, and this may result in a reduction in revenues and increase in our operating expenses, which would prevent us from achieving profitability. We rely on encryption and authentication technology licensed from third parties whose area of expertise is to provide secure transmission of confidential information.

| 17 |

| Table of Contents |

We are dependent on the functionality of our websites.

If the software for our various websites contains undetected errors, we could lose the confidence of users, resulting in loss of customers and a reduction of revenue. Our online systems, including but not limited to its websites, software applications and online sales for services and products, could contain undetected errors or "bugs" that could adversely affect their performance. We regularly update and enhance all sales, websites and other online systems, as well as introduce new versions of our software products and applications. The occurrence of errors in any of these may cause us to lose market share, damage our reputation and brand name, and reduce our revenues.

Risks related to the offering

There is no current market for our shares.

There is no established public trading market for the resale of our Common Stock; however, we have plans to apply for or otherwise seek trading or quotation of our Common Stock on an over-the-counter market. Investors should assume that they may not be able to liquidate their investment for some time or be able to pledge their shares of Common Stock as collateral.

Our securities have limited transferability and liquidity.

To satisfy the requirements of certain exemptions from registration under the Securities Act, and to conform with applicable state securities laws, each Investor must acquire his/her/its Securities for investment purposes only and not with a view toward distribution. Consequently, certain conditions of the Securities Act may need to be satisfied prior to any sale, transfer, or other disposition of the Securities. Some of these conditions may include a minimum holding period; availability of certain reports, including financial statements from us; limitations on the percentage of Securities sold; and the manner in which they are sold. We can prohibit any sale, transfer or disposition unless it receives an opinion of counsel provided at the holder’s expense, in a form satisfactory to us, stating that the proposed sale, transfer or other disposition will not result in a violation of applicable federal or state securities laws and regulations. No public market exists for the securities at the moment, and no market is expected to develop until we list the securities on an exchange. Consequently, owners of the Securities may have to hold their investment indefinitely and may not be able to liquidate their investments in our securities or pledge them as collateral for a loan in the event of an emergency.

As stated above, there is no formal marketplace for the resale of our Securities. Shares of our Securities may be traded to the extent any demand and/or trading platform(s) exists. However, there is no guarantee there will be demand for the Securities, or a trading platform that allows you to sell them. We have plans to apply for and seek trading/quotation of our Securities on an over-the-counter (OTC) market. It is hard to predict if we will ever be able to obtain a quotation over-the-counter, or “up list” to the NASDAQ or similar stock exchange, although that will be the goal. Investors should assume that they may not be able to liquidate their investment for some time, if at all.

Investors in our Securities should view the investment as a long term investment.

An investment in the Securities may be long term and illiquid. As discussed herein, the offer and sale of the Securities will not be registered under the Securities Act or any foreign or state securities laws by reason of exemptions from such registration, which depends in part on the investment intent of the investors. Accordingly, purchasers of our Securities must be willing and able to bear the economic risk of their investment for an indefinite period of time. It is likely that investors will not be able to liquidate their investment in the event of an emergency, unless we are listed on an exchange at that time where shares can be openly traded.

| 18 |

| Table of Contents |

Our management has arbitrarily determined the offering price for the Securities sold hereunder.

The offering price of the Securities has been arbitrarily established by our management, considering such matters as the state of our business development, the general condition of the industry in which we operate, the amount of funds sought from this Offering, and the number of shares the Board of Directors is willing to issue in order to raise such funds. Accordingly, there is no relationship between the price of the Offering and our assets, earnings or book value, the market value of our Securities, or any other recognized criteria of value. As such, the price does not necessarily indicate the current value of our Securities and should not be regarded as an indication of any future market price of our stock.

There is not a firm underwritten commitment for this Offering.

The Securities are offered on a “best efforts” basis by the Company without compensation. We may, in the future, engage the services of certain Financial Industry Regulatory Authority (FINRA) registered broker-dealers to market the Securities on a “best efforts” basis that enter into Participating Broker-Dealer Agreements with us; however, we have not entered into any agreement with any FINRA registered broker-dealer. Accordingly, there is no assurance that we, or any FINRA broker-dealer, will sell the maximum securities offered or any lesser amount.

Investing in our company is highly speculative; you could lose your entire investment.

Purchasing the offered Securities is highly speculative and involves significant risk. The offered Securities should not be purchased by any person who cannot afford to lose their entire investment. Our business objectives are also speculative, and it is possible that we would be unable to accomplish them. Our shareholders may be unable to realize a substantial or any return on their purchase of the offered Securities and may lose their entire investment. For this reason, each prospective purchaser of the offered Securities should read this Offering Circular and all of its exhibits carefully and consult with their attorney, business and/or investment advisor.

Investing in our company may result in an immediate loss because investors will pay more for our Securities than what the pro rata portion of the assets are worth.

The Offering price and other terms and conditions regarding our Securities have been arbitrarily determined and do not bear any relationship to assets, earnings, book value or any other objective criteria of value. No investment banker, appraiser or other independent third party has been consulted concerning the Offering price for the Securities or the fairness of the Offering price used for the Securities.

The arbitrary Offering price of $5.00 per Share as determined herein is substantially higher than the net tangible book value per share of our Common Stock. Our assets do not substantiate a share price of $5.00 per Share. This premium in share price applies to the terms of this Offering. The Offering price will not change for the duration of the Offering even if we obtain a listing on any exchange or become quoted on the OTC Markets.

Although we have an escrow account with the subscriptions for investors, if we file for or are forced into bankruptcy protection, investors will lose their entire investment.

Invested funds for this Offering, up to $5,000,000, will be placed in an escrow account, and if we file for bankruptcy protection or a petition for involuntary bankruptcy is filed by creditors against us, your funds will become part of the bankruptcy estate and administered according to the bankruptcy laws. As such, you will lose your investment and your funds will be used to pay creditors.

| 19 |

| Table of Contents |

In the event that our Securities are traded, they may trade for less than $5.00 per share and thus will be considered a penny stock. Trading penny stocks has many restrictions, and these restrictions could severely affect the price and liquidity of our shares.

In the event that our Securities are traded, and our stock trades below $5.00 per share, our stock would be known as a “penny stock”, which is subject to various regulations involving disclosures to be given to you prior to the purchase of any penny stock. The U.S. Securities and Exchange Commission has adopted regulations that generally define a “penny stock” to be any equity security that has a market price of less than $5.00 per share, subject to certain exceptions. Depending on market fluctuations, our Common Stock could be considered to be a “penny stock”. A penny stock is subject to rules that impose additional sales practice requirements on broker/dealers who sell these securities to persons other than established customers and Accredited Investors. For transactions covered by these rules, the broker/dealer must make a special suitability determination for the purchase of these securities. In addition, he must receive the purchaser’s written consent to the transaction prior to the purchase. He must also provide certain written disclosures to the purchaser. Consequently, the “penny stock” rules may restrict the ability of broker/dealers to sell our securities and may negatively affect the ability of holders of shares of our Common Stock to resell them. These disclosures require you to acknowledge that you understand the risks associated with buying penny stocks and that you can absorb the loss of your entire investment. Penny stocks are low priced securities that do not have a very high trading volume. Consequently, the price of the stock is often volatile and you may not be able to buy or sell the stock when you want to.

Financial Industry Regulatory Authority (“FINRA”) sales practice requirements may also limit your ability to buy and sell our Securities, which could depress the price of our shares.