| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |||||||

| , | |||||||||||||||||

| (Address of principal executive offices) | (Zip code) | ||||||||||||||||

| Registrant’s telephone number, including area code: | |||||||||||||||||

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered | ||||||

| x | Accelerated filer | ☐ | |||||||||

| Non-accelerated filer | ☐ | Smaller reporting company | |||||||||

| Emerging growth company | |||||||||||

| Page | ||||||||

| Item 1 | ||||||||

| Item 1A. | ||||||||

| Item 1B. | ||||||||

| Item 2. | ||||||||

| Item 3. | ||||||||

| Item 4. | ||||||||

| Item 5. | ||||||||

| Item 6. | ||||||||

| Item 7. | ||||||||

| Item 7A. | ||||||||

| Item 8. | ||||||||

| Item 9. | ||||||||

| Item 9A. | ||||||||

| Item 9B. | ||||||||

| Item 10. | ||||||||

| Item 11. | ||||||||

| Item 12. | ||||||||

| Item 13. | ||||||||

| Item 14. | ||||||||

| Item 15. | ||||||||

| Item 16. | ||||||||

| Offshore crude oil pipelines | Operator | System Miles | Design Capacity (Bbls/day)(1) | Interest Owned | Throughput (Bbls/day) 100% basis(1) | Throughput (Bbls/day) net to ownership interest | ||||||||||||||||||||||||||||||||

| Main Lines | ||||||||||||||||||||||||||||||||||||||

| CHOPS Pipeline | Genesis | 380 | 500,000 | 64 | % | 207,008 | 132,485 | |||||||||||||||||||||||||||||||

| Poseidon Pipeline | Genesis | 332 | 490,000 | 64 | % | 257,444 | 164,764 | |||||||||||||||||||||||||||||||

| Odyssey Pipeline | Shell Pipeline | 120 | 200,000 | 29 | % | 84,682 | 24,558 | |||||||||||||||||||||||||||||||

| Eugene Island Pipeline and Other | Genesis/Shell Pipeline | 184 | 39,000 | 29 | % | 6,964 | 6,964 | |||||||||||||||||||||||||||||||

| Total | 1,016 | 1,229,000 | 556,098 | 328,771 | ||||||||||||||||||||||||||||||||||

Lateral Lines(2) | ||||||||||||||||||||||||||||||||||||||

| SEKCO Pipeline | Genesis | 149 | 115,000 | 100 | % | |||||||||||||||||||||||||||||||||

| Shenzi Crude Oil Pipeline | Genesis | 83 | 230,000 | 100 | % | |||||||||||||||||||||||||||||||||

| Allegheny Crude Oil Pipeline | Genesis | 40 | 140,000 | 100 | % | |||||||||||||||||||||||||||||||||

| Marco Polo Crude Oil Pipeline | Genesis | 37 | 120,000 | 100 | % | |||||||||||||||||||||||||||||||||

| Constitution Crude Oil Pipeline | Genesis | 67 | 80,000 | 100 | % | |||||||||||||||||||||||||||||||||

| Tarantula | Genesis | 4 | 30,000 | 100 | % | |||||||||||||||||||||||||||||||||

| Offshore natural gas pipelines | Operator | System Miles | Design Capacity (MMcf/day)(1) | Interest Owned | ||||||||||||||||||||||

| High Island Offshore System | Genesis | 238 | 500 | 100 | % | |||||||||||||||||||||

| Anaconda Gathering System | Genesis | 183 | 300 | 100 | % | |||||||||||||||||||||

| Green Canyon Laterals | Genesis | 5 | 108 | 100% | ||||||||||||||||||||||

| Manta Ray Offshore Gathering System | Enbridge | 237 | 800 | 25.7 | % | |||||||||||||||||||||

| Nautilus System | Enbridge | 101 | 600 | 25.7 | % | |||||||||||||||||||||

| Total | 764 | 2,308 | ||||||||||||||||||||||||

| Offshore hub platform | Operator | Water Depth (Feet) | Natural Gas Capacity (MMcf/day)(1) | Crude Oil Capacity (Bbls/day)(1) | Interest Owned | |||||||||||||||||||||||||||

Marco Polo | Occidental | 4,300 | 300 | 120,000 | 100 | % | ||||||||||||||||||||||||||

| East Cameron 373 | Genesis | 441 | 195 | 3,000 | 100 | % | ||||||||||||||||||||||||||

| Total | 495 | 123,000 | ||||||||||||||||||||||||||||||

| Texas System | Jay System | Mississippi System | Louisiana System | ||||||||||||||||||||

| Product | Crude Oil | Crude Oil | Crude Oil | Crude Oil, Intermediates, and Refined Products | |||||||||||||||||||

| Interest Owned | 100% | 100% | 100% | 100% | |||||||||||||||||||

| Design Capacity (Bbls/day) | Existing 8" - 60,000 Looped 18" - 275,000 | 150,000 | 45,000 | 350,000 | |||||||||||||||||||

| 2022 Throughput (Bbls/day) | 90,562 | 6,601 | 5,725 | 94,389 | |||||||||||||||||||

| System Miles | 47 | 143 | 207 | 51 | |||||||||||||||||||

Approximate owned tankage storage capacity (Bbls) | 1,100,000 | 230,000 | 247,500 | 330,000 | |||||||||||||||||||

| Location | Hastings Junction, TX to Webster, TX Texas City, TX to Webster, TX | Southern AL/FL to Mobile, AL | Soso, MS to Liberty, MS | Port Hudson, LA to Baton Rouge, LA Baton Rouge, LA to Port Allen, LA | |||||||||||||||||||

| Rate Regulated | FERC/TXRRC | FERC | FERC | FERC | |||||||||||||||||||

| Inland | Offshore | American Phoenix | |||||||||||||||

| Aggregate Fleet Design Capacity (MBbls) | 2,285 | 884 | 330 | ||||||||||||||

Individual Vessel Capacity Range (MBbls)(1) | 23-39 | 65-135 | 330 | ||||||||||||||

| Number of: | |||||||||||||||||

| Push/Tug Boats | 33 | 9 | — | ||||||||||||||

| Barges | 82 | 9 | — | ||||||||||||||

| Product Tankers | — | — | 1 | ||||||||||||||

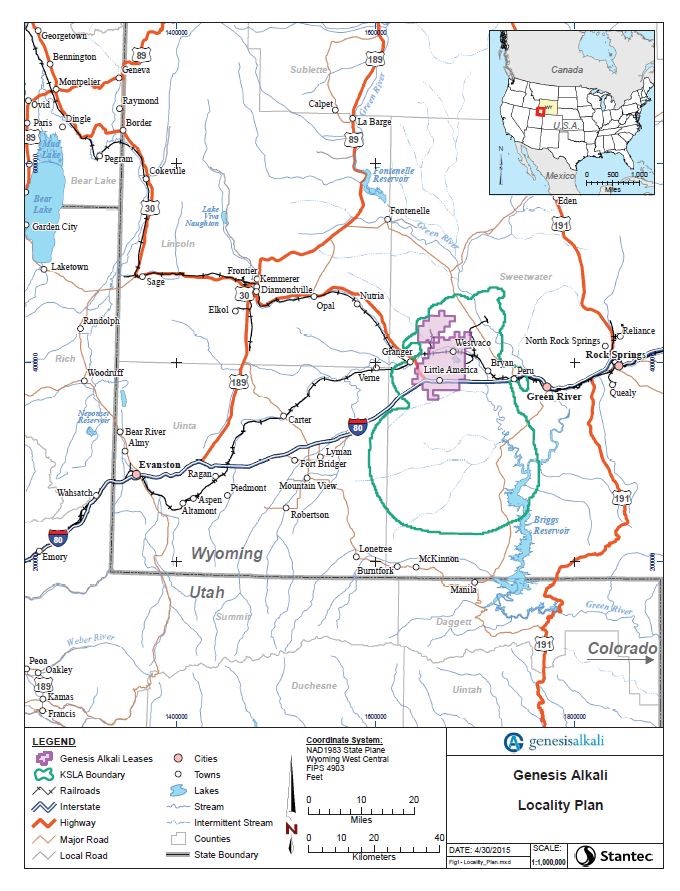

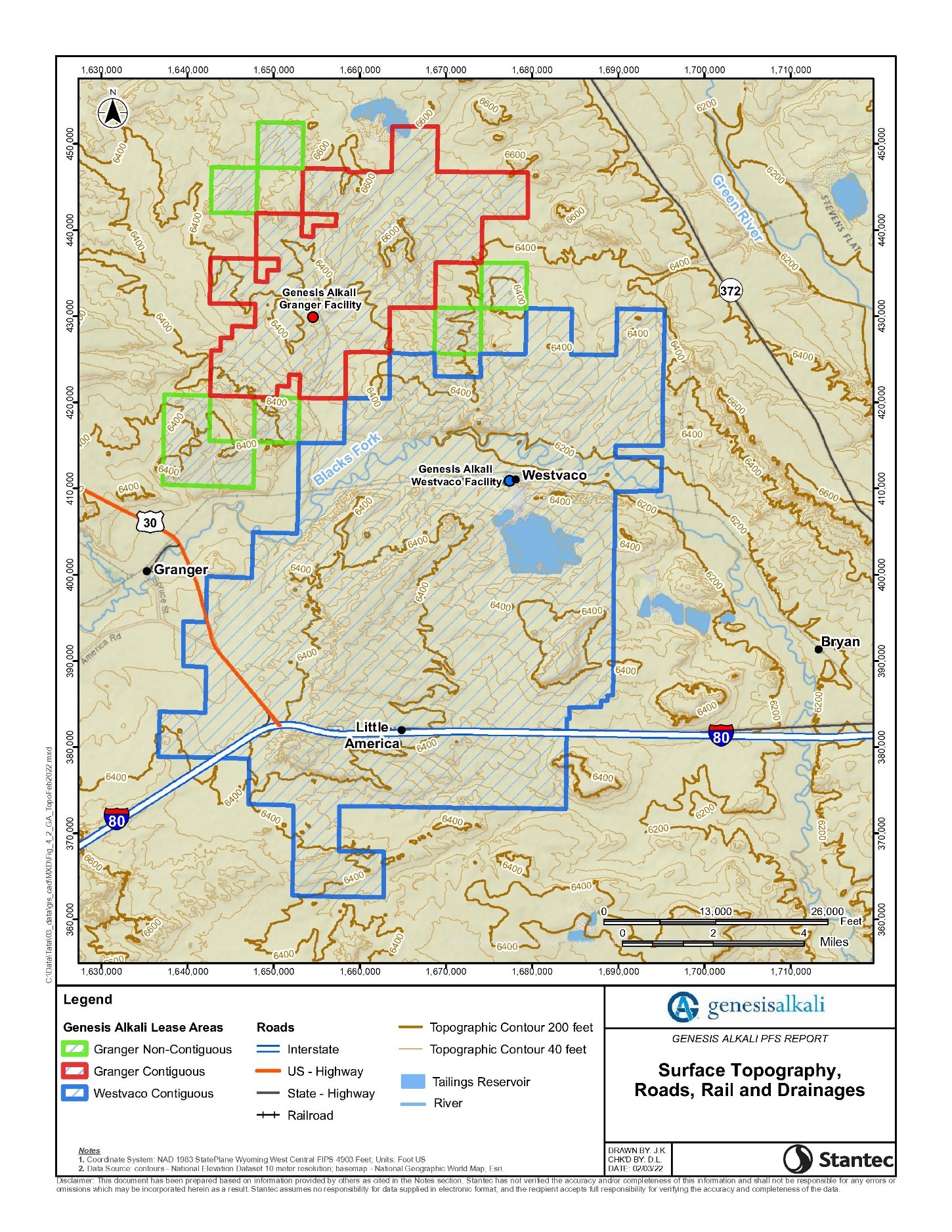

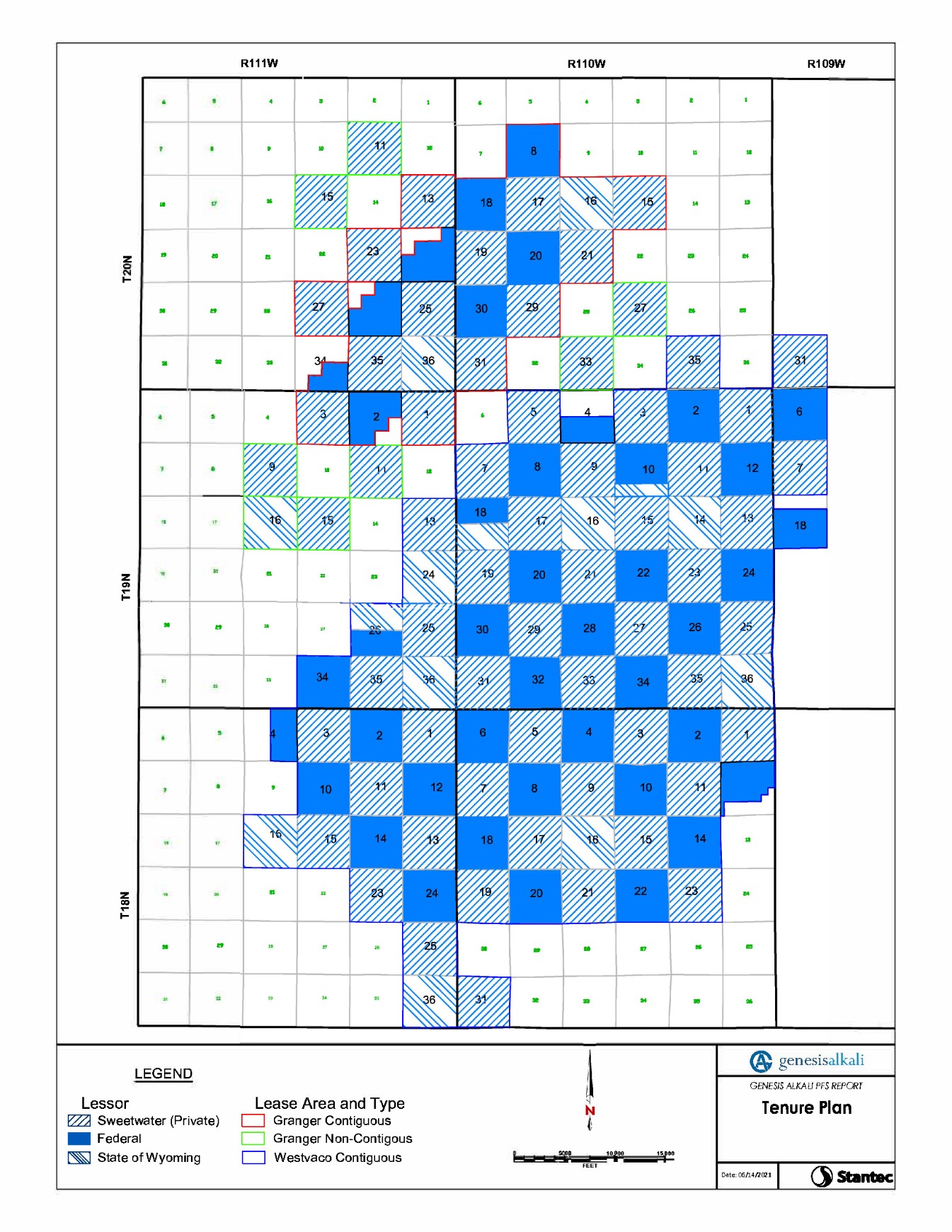

Area by lessor (acres) | ||||||||||||||||||||||||||

| Contiguous leases | Non-contiguous leases | |||||||||||||||||||||||||

| Location | Granger | Westvaco | Granger | Remaining | ||||||||||||||||||||||

| Federal | 4,236 | 19,699 | — | 320 | ||||||||||||||||||||||

| State | 1,280 | 6,403 | 640 | 13,280 | ||||||||||||||||||||||

| Sweetwater | 8,320 | 27,379 | 4,480 | — | ||||||||||||||||||||||

| Total Area | 13,836 | 53,481 | 5,120 | 13,600 | ||||||||||||||||||||||

| Year ended December 31, | ||||||||||||||||||||

| 2022 | 2021 | 2020 | ||||||||||||||||||

| Total (in thousands of tons) | 3,635 | 3,483 | 3,206 | |||||||||||||||||

| Area | Resource Category(1) | Million short tons (dry weight) | Grade (% Trona)(2) | |||||||||||||||||

| Granger Contiguous Leases | Measured | 617 | 84 | |||||||||||||||||

| Indicated | 145 | 89 | ||||||||||||||||||

| Measured + Indicated | 762 | 85 | ||||||||||||||||||

| Westvaco Contiguous Lease Area | Measured | 1,067 | 88 | |||||||||||||||||

| Indicated | 158 | 84 | ||||||||||||||||||

| Measured + Indicated | 1,225 | 87 | ||||||||||||||||||

| Inferred | 4 | 80 | ||||||||||||||||||

| Granger Non-Contiguous Leases | Measured | 87 | 85 | |||||||||||||||||

| Indicated | 60 | 84 | ||||||||||||||||||

| Measured + Indicated | 147 | 85 | ||||||||||||||||||

| Inferred | 3 | 84 | ||||||||||||||||||

| Total | Measured + Indicated | 2,134 | 86 | |||||||||||||||||

| Total | Measured + Indicated + Inferred | 2,141 | 86 | |||||||||||||||||

| December 31, 2022 | December 31, 2021 | |||||||||||||||||||||||||||||||

| Reserve Area/Type | Resource Category | Million short tons (dry weight)(1) | Grade (% Trona)(5) | Million short tons (dry weight)(1) | Grade (% Trona)(5) | |||||||||||||||||||||||||||

| Westvaco dry extraction | Proven(2) | 252 | 88 | 257 | 88 | |||||||||||||||||||||||||||

Probable(2) | 179 | 88 | 179 | 88 | ||||||||||||||||||||||||||||

Total Reserves(3) | 431 | 88 | 436 | 88 | ||||||||||||||||||||||||||||

| Westvaco solution mining | Proven(2) | — | — | |||||||||||||||||||||||||||||

Probable(2) | 369 | 88 | 371 | 88 | ||||||||||||||||||||||||||||

Total Reserves(4) | 369 | 88 | 371 | 88 | ||||||||||||||||||||||||||||

| Granger solution mining | Proven(2) | — | — | |||||||||||||||||||||||||||||

Probable(2) | 72 | 85 | 72 | 85 | ||||||||||||||||||||||||||||

Total Reserves(4) | 72 | 85 | 72 | 85 | ||||||||||||||||||||||||||||

| Total solution mining | Total Reserves(4) | 441 | 88 | 443 | 88 | |||||||||||||||||||||||||||

| Total dry extraction and solution mining | Total Reserves | 872 | 87 | 879 | 87 | |||||||||||||||||||||||||||

| Year Ended December 31, | ||||||||||||||||||||

| 2022 | 2021 | 2020 | ||||||||||||||||||

| (in thousands) | ||||||||||||||||||||

| Offshore pipeline transportation | $ | 363,373 | $ | 317,560 | $ | 270,078 | ||||||||||||||

| Sodium minerals and sulfur services | 306,718 | 166,773 | 130,083 | |||||||||||||||||

| Onshore facilities and transportation | 33,755 | 98,824 | 147,254 | |||||||||||||||||

| Marine transportation | 66,209 | 34,572 | 60,058 | |||||||||||||||||

| Total Segment Margin | $ | 770,055 | $ | 617,729 | $ | 607,473 | ||||||||||||||

| Year Ended December 31, | ||||||||||||||

| 2022 | 2021 | |||||||||||||

| (in thousands) | ||||||||||||||

| Offshore crude oil pipeline revenue, net to our ownership interest and excluding non-cash revenues | $ | 287,318 | $ | 264,690 | ||||||||||

| Offshore natural gas pipeline revenue, excluding non-cash revenues | 46,660 | 41,776 | ||||||||||||

| Offshore pipeline operating costs, net to our ownership interest and excluding non-cash expenses | (75,811) | (71,812) | ||||||||||||

Distributions from equity investments(1) | 73,206 | 82,906 | ||||||||||||

Distributions from unrestricted subsidiaries(2) | 32,000 | — | ||||||||||||

| Offshore pipeline transportation Segment Margin | $ | 363,373 | $ | 317,560 | ||||||||||

| Volumetric Data 100% basis: | ||||||||||||||

| Crude oil pipelines (average Bbls/day unless otherwise noted): | ||||||||||||||

| CHOPS | 207,008 | 189,904 | ||||||||||||

| Poseidon | 257,444 | 263,169 | ||||||||||||

| Odyssey | 84,682 | 114,128 | ||||||||||||

GOPL(3) | 6,964 | 7,826 | ||||||||||||

| Total crude oil offshore pipelines | 556,098 | 575,027 | ||||||||||||

| Natural gas transportation volumes (MMBtus/day) | 343,347 | 345,870 | ||||||||||||

Volumetric Data net to our ownership interest(4): | ||||||||||||||

| Crude oil pipelines (average Bbls/day unless otherwise noted): | ||||||||||||||

CHOPS(5) | 132,485 | 180,173 | ||||||||||||

| Poseidon | 164,764 | 168,428 | ||||||||||||

| Odyssey | 24,558 | 33,097 | ||||||||||||

GOPL(3) | 6,964 | 7,826 | ||||||||||||

| Total crude oil offshore pipelines | 328,771 | 389,524 | ||||||||||||

| Natural gas transportation volumes (MMBtus/day) | 108,908 | 107,417 | ||||||||||||

| Year Ended December 31, | |||||||||||

| 2022 | 2021 | ||||||||||

| Volumes sold : | |||||||||||

| NaHS volumes (Dry short tons “DST”) | 128,851 | 114,292 | |||||||||

| Soda Ash volumes (short tons sold) | 3,096,494 | 2,994,507 | |||||||||

| NaOH (caustic soda) volumes (DST sold) | 90,876 | 84,278 | |||||||||

| Revenues (in thousands): | |||||||||||

| NaHS revenues, excluding non-cash revenues | $ | 183,966 | $ | 128,959 | |||||||

| NaOH (caustic soda) revenues | 74,284 | 42,182 | |||||||||

| Revenues associated with our Alkali Business | 896,125 | 696,117 | |||||||||

| Other revenues | 8,226 | 4,728 | |||||||||

Total segment revenues, excluding non-cash revenues(1) | $ | 1,162,601 | $ | 871,986 | |||||||

Sodium minerals and sulfur services operating costs, excluding non-cash items(1) | (855,883) | (705,213) | |||||||||

| Segment Margin (in thousands) | $ | 306,718 | $ | 166,773 | |||||||

Average index price for NaOH per DST(2) | $ | 1,118 | $ | 787 | |||||||

| Year Ended December 31, | ||||||||||||||

| 2022 | 2021 | |||||||||||||

| (in thousands) | ||||||||||||||

| Gathering, marketing, and logistics revenue | $ | 890,719 | $ | 651,097 | ||||||||||

Crude oil and CO2 pipeline tariffs and revenues | 31,822 | 35,303 | ||||||||||||

Distributions from unrestricted subsidiaries not included in income(1) | — | 70,000 | ||||||||||||

Crude oil and products costs, excluding unrealized gains and losses from derivative transactions | (828,933) | (584,880) | ||||||||||||

Operating costs, excluding non-cash charges for long-term incentive compensation and other non-cash expenses | (66,400) | (60,992) | ||||||||||||

| Other | 6,547 | (11,704) | ||||||||||||

| Segment Margin | $ | 33,755 | $ | 98,824 | ||||||||||

| Volumetric Data (average Bbls/day unless otherwise noted): | ||||||||||||||

| Onshore crude oil pipelines: | ||||||||||||||

| Texas | 90,562 | 65,918 | ||||||||||||

| Jay | 6,601 | 7,941 | ||||||||||||

| Mississippi | 5,725 | 5,206 | ||||||||||||

Louisiana(2) | 94,389 | 99,927 | ||||||||||||

| Onshore crude oil pipelines total | 197,277 | 178,992 | ||||||||||||

| Total crude oil and petroleum products sales | 24,643 | 24,239 | ||||||||||||

Rail unload volumes(3) | 10,834 | 11,782 | ||||||||||||

| Year Ended December 31, | |||||||||||

| 2022 | 2021 | ||||||||||

| Revenues (in thousands): | |||||||||||

| Inland freight revenues | $ | 105,583 | $ | 73,465 | |||||||

| Offshore freight revenues | 87,587 | 68,703 | |||||||||

Other rebill revenues(1) | 100,125 | 48,659 | |||||||||

| Total segment revenues | $ | 293,295 | $ | 190,827 | |||||||

Operating costs, excluding non-cash charges for long-term incentive compensation and other non-cash expenses(1) | $ | 227,086 | $ | 156,255 | |||||||

| Segment Margin (in thousands) | $ | 66,209 | $ | 34,572 | |||||||

Fleet Utilization:(2) | |||||||||||

| Inland Barge Utilization | 98.6 | % | 81.9 | % | |||||||

| Offshore Barge Utilization | 96.9 | % | 95.9 | % | |||||||

| Year Ended December 31, | ||||||||||||||

| 2022 | 2021 | |||||||||||||

| (in thousands) | ||||||||||||||

| General and administrative expenses not separately identified below: | ||||||||||||||

| Corporate | $ | 47,306 | $ | 43,329 | ||||||||||

| Segment | 3,674 | 4,162 | ||||||||||||

| Long-term incentive based compensation plan expense | 8,279 | 4,748 | ||||||||||||

| Third-party costs related to business development activities and growth projects | 7,339 | 8,946 | ||||||||||||

| Total general and administrative expenses | $ | 66,598 | $ | 61,185 | ||||||||||

| Year Ended December 31, | ||||||||||||||

| 2022 | 2021 | |||||||||||||

| (in thousands) | ||||||||||||||

| Depreciation and depletion expense | $ | 285,302 | $ | 298,953 | ||||||||||

| Amortization expense | 10,903 | 10,793 | ||||||||||||

| Total depreciation, depletion and amortization expense | $ | 296,205 | $ | 309,746 | ||||||||||

| Year Ended December 31, | ||||||||||||||

| 2022 | 2021 | |||||||||||||

| (in thousands) | ||||||||||||||

| Interest expense, senior secured credit facility (including commitment fees) | $ | 10,980 | $ | 22,287 | ||||||||||

| Interest expense, Alkali senior secured notes | 15,811 | — | ||||||||||||

| Interest expense, senior unsecured notes | 209,001 | 206,352 | ||||||||||||

| Amortization of debt issuance costs, premium and discount | 8,479 | 9,452 | ||||||||||||

| Capitalized interest | (18,115) | (4,367) | ||||||||||||

| Interest expense, net | $ | 226,156 | $ | 233,724 | ||||||||||

| Year Ended December 31, | |||||||||||||||||

| 2022 | 2021 | ||||||||||||||||

| I. | Applicable to all Non-GAAP Measures | (in thousands) | |||||||||||||||

Differences in timing of cash receipts for certain contractual arrangements(1) | $ | 51,102 | $ | 15,482 | |||||||||||||

Distributions from unrestricted subsidiaries not included in income(2) | 32,000 | 70,000 | |||||||||||||||

| Certain non-cash items: | |||||||||||||||||

Unrealized losses (gains) on derivative transactions excluding fair value hedges, net of changes in inventory value(3) | (5,717) | 30,700 | |||||||||||||||

Loss on debt extinguishment(4) | 794 | 1,627 | |||||||||||||||

Adjustment regarding equity investees(5) | 21,199 | 26,207 | |||||||||||||||

| Other | (2,598) | 207 | |||||||||||||||

| Sub-total Select Items, net | 96,780 | 144,223 | |||||||||||||||

| II. | Applicable only to Available Cash before Reserves | ||||||||||||||||

Certain transaction costs(6) | 7,339 | 8,946 | |||||||||||||||

| Other | 2,208 | 1,398 | |||||||||||||||

| Total Select Items, net | $ | 106,327 | $ | 154,567 | |||||||||||||

| Year Ended December 31, | ||||||||||||||

| 2022 | 2021 | |||||||||||||

| (in thousands) | ||||||||||||||

| Net income (loss) attributable to Genesis Energy, L.P. | $ | 75,457 | $ | (165,067) | ||||||||||

| Income tax expense | 3,169 | 1,670 | ||||||||||||

| Depreciation, depletion, amortization, and accretion | 307,519 | 315,896 | ||||||||||||

| Gain on sale of assets | (32,000) | — | ||||||||||||

Plus (minus) Select Items, net | 106,327 | 154,567 | ||||||||||||

| Maintenance capital utilized | (57,400) | (53,150) | ||||||||||||

| Cash tax expense | (815) | (690) | ||||||||||||

| Distributions to preferred unitholders | (80,052) | (74,736) | ||||||||||||

Redeemable noncontrolling interest redemption value adjustments(1) | 30,443 | 25,398 | ||||||||||||

| Available Cash before Reserves | $ | 352,648 | $ | 203,888 | ||||||||||

| Interest Rate | Maturity Date | Principal | Estimated Annual Interest Payable | |||||||||||||||||||||||

| (in thousands) | ||||||||||||||||||||||||||

Senior secured credit facility(1) | Varies | March 15, 2024 | $ | 205,400 | $ | 12,324 | ||||||||||||||||||||

2024 Notes(2)(3) | 5.625% | June 15, 2024 | 341,135 | 19,189 | ||||||||||||||||||||||

2025 Notes(2) | 6.500% | October 1, 2025 | 534,834 | 34,764 | ||||||||||||||||||||||

2026 Notes(2) | 6.250% | May 15, 2026 | 339,310 | 21,207 | ||||||||||||||||||||||

2027 Notes(2) | 8.000% | January 15, 2027 | 981,245 | 78,500 | ||||||||||||||||||||||

2028 Notes(2) | 7.750% | February 1, 2028 | 679,360 | 52,650 | ||||||||||||||||||||||

| Total estimated payments | $ | 3,081,284 | $ | 218,634 | ||||||||||||||||||||||

| Payment Obligations | Estimated Interest Payments | Estimated Principal Payments | ||||||||||||

| 2023 | $ | 24,969 | $ | — | ||||||||||

| 2024 | 24,712 | 11,618 | ||||||||||||

| 2025 | 23,997 | 13,097 | ||||||||||||

| 2026 through 2042 | 227,794 | 400,285 | ||||||||||||

| 2024 Notes | 2025 Notes | 2026 Notes | 2027 Notes | 2028 Notes | ||||||||||||||||||||||||||||

| Redemption right beginning on | June 15, 2019 | October 1, 2020 | February 15, 2021 | January 15, 2024 | February 1, 2023 | |||||||||||||||||||||||||||

| Redemption of up to 35% of the principal amount of notes with the proceeds of an equity offering permitted prior to | June 15, 2019 | October 1, 2020 | February 15, 2021 | January 15, 2024 | February 1, 2023 | |||||||||||||||||||||||||||

| Years Ended December 31, | ||||||||||||||||||||

| 2022 | 2021 | 2020 | ||||||||||||||||||

| (in thousands) | ||||||||||||||||||||

| Capital expenditures for fixed and intangible assets: | ||||||||||||||||||||

| Maintenance capital expenditures: | ||||||||||||||||||||

| Offshore pipeline transportation assets | $ | 6,292 | $ | 8,749 | $ | 8,715 | ||||||||||||||

| Sodium mineral and sulfur services assets | 77,918 | 51,241 | 43,744 | |||||||||||||||||

| Marine transportation assets | 39,084 | 34,456 | 31,357 | |||||||||||||||||

| Onshore facilities and transportation assets | 2,928 | 4,476 | 3,644 | |||||||||||||||||

| Information technology systems | 6,317 | 946 | 383 | |||||||||||||||||

| Total maintenance capital expenditures | 132,539 | 99,868 | 87,843 | |||||||||||||||||

Growth capital expenditures: | ||||||||||||||||||||

Offshore pipeline transportation assets(1) | $ | 227,803 | $ | 41,445 | $ | 4,608 | ||||||||||||||

| Sodium minerals and sulfur services assets | 96,600 | 175,877 | 51,767 | |||||||||||||||||

Marine transportation assets | — | — | — | |||||||||||||||||

Onshore facilities and transportation assets | — | 133 | 489 | |||||||||||||||||

| Information technology systems | 9,379 | 8,259 | 6,331 | |||||||||||||||||

| Total growth capital expenditures | 333,782 | 225,714 | 63,195 | |||||||||||||||||

| Total capital expenditures for fixed and intangible assets | 466,321 | 325,582 | 151,038 | |||||||||||||||||

| Capital expenditures related to equity investees | 10,301 | 352 | — | |||||||||||||||||

| Total capital expenditures | $ | 476,622 | $ | 325,934 | $ | 151,038 | ||||||||||||||

| Distribution For | Date Paid | Per Common Unit Amount | Total Amount | Per Preferred Unit Amount | Total Amount | |||||||||||||||||||||||||||

| 2020 | ||||||||||||||||||||||||||||||||

1st Quarter | May 15, 2020 | $ | 0.1500 | $ | 18,387 | $ | 0.7374 | $ | 18,684 | |||||||||||||||||||||||

2nd Quarter | August 14, 2020 | $ | 0.1500 | $ | 18,387 | $ | 0.7374 | $ | 18,684 | |||||||||||||||||||||||

3rd Quarter | November 13, 2020 | $ | 0.1500 | $ | 18,387 | $ | 0.7374 | $ | 18,684 | |||||||||||||||||||||||

4th Quarter | February 12, 2021 | $ | 0.1500 | $ | 18,387 | $ | 0.7374 | $ | 18,684 | |||||||||||||||||||||||

| 2021 | ||||||||||||||||||||||||||||||||

1st Quarter | May 14, 2021 | $ | 0.1500 | $ | 18,387 | $ | 0.7374 | $ | 18,684 | |||||||||||||||||||||||

2nd Quarter | August 13, 2021 | $ | 0.1500 | $ | 18,387 | $ | 0.7374 | $ | 18,684 | |||||||||||||||||||||||

3rd Quarter | November 12, 2021 | $ | 0.1500 | $ | 18,387 | $ | 0.7374 | $ | 18,684 | |||||||||||||||||||||||

4th Quarter | February 14, 2022 | $ | 0.1500 | $ | 18,387 | $ | 0.7374 | $ | 18,684 | |||||||||||||||||||||||

| 2022 | ||||||||||||||||||||||||||||||||

1st Quarter | May 13, 2022 | $ | 0.1500 | $ | 18,387 | $ | 0.7374 | $ | 18,684 | |||||||||||||||||||||||

2nd Quarter | August 12, 2022 | $ | 0.1500 | $ | 18,387 | $ | 0.7374 | $ | 18,684 | |||||||||||||||||||||||

3rd Quarter | November 14, 2022 | $ | 0.1500 | $ | 18,387 | $ | 0.7374 | $ | 18,684 | |||||||||||||||||||||||

4th Quarter | February 14, 2023 | (1) | $ | 0.1500 | $ | 18,387 | $ | 0.9473 | $ | 24,000 | ||||||||||||||||||||||

| Balance Sheets | Genesis Energy, L.P. and Guarantor Subsidiaries | ||||

| December 31, 2022 | |||||

| (in thousands) | |||||

| ASSETS: | |||||

| Current assets | $ | 795,381 | |||

| Fixed assets, net | 3,680,119 | ||||

Non-current assets(1) | 869,793 | ||||

LIABILITIES AND CAPITAL:(2) | |||||

| Current liabilities | 498,358 | ||||

| Non-current liabilities | $ | 3,635,959 | |||

| Class A Convertible Preferred Units | 891,909 | ||||

| Statements of Operations | Genesis Energy, L.P. and Guarantor Subsidiaries | ||||

Year Ended December 31, 2022 | |||||

| (in thousands) | |||||

Revenues(3) | $ | 2,638,473 | |||

| Operating costs | 2,443,529 | ||||

| Operating income | 194,944 | ||||

| Net income before income taxes | 29,031 | ||||

Net income(2) | 25,862 | ||||

| Less: Accumulated distributions to Class A Convertible Preferred Units | (80,052) | ||||

| Net loss available to common unitholders | $ | (54,190) | |||

| Unit of Measure for Volume | Contract Volumes (in 000’s) | Unit of Measure for Price | Weighted Average Market Price | Contract Value (in 000’s) | Mark-to Market Change (in 000’s) | Settlement Value (in 000’s) | |||||||||||||||||||||||||||||||||||

| Futures and Swap Contracts | |||||||||||||||||||||||||||||||||||||||||

| Sell (Short) Contracts: | |||||||||||||||||||||||||||||||||||||||||

| Crude Oil | Bbl | 93 | Bbl | $ | 78.31 | $ | 7,282 | $ | 197 | $ | 7,479 | ||||||||||||||||||||||||||||||

| #6 Fuel Oil | Bbl | 25 | Bbl | $ | 56.15 | $ | 1,404 | $ | 95 | $ | 1,499 | ||||||||||||||||||||||||||||||

| Natural Gas | MMBtu | 1,480 | MMBtu | $ | 5.27 | $ | 7,794 | $ | (829) | $ | 6,965 | ||||||||||||||||||||||||||||||

| Buy (Long) Contracts: | |||||||||||||||||||||||||||||||||||||||||

| Crude Oil | Bbl | 90 | Bbl | $ | 76.43 | $ | 6,878 | $ | 348 | $ | 7,226 | ||||||||||||||||||||||||||||||

| Natural Gas Swaps | MMBtu | 9,765 | MMBtu | $ | 0.64 | $ | 6,231 | $ | 32,151 | $ | 38,382 | ||||||||||||||||||||||||||||||

| Natural Gas | MMBtu | 8,060 | MMBtu | $ | 5.36 | $ | 43,185 | $ | (8,809) | $ | 34,376 | ||||||||||||||||||||||||||||||

| Option Contracts | |||||||||||||||||||||||||||||||||||||||||

| Written Contracts: | |||||||||||||||||||||||||||||||||||||||||

| Natural Gas | MMBtu | 1,910 | MMBtu | $ | 0.70 | $ | 1,340 | $ | 559 | $ | 1,899 | ||||||||||||||||||||||||||||||

| Purchased Contracts: | |||||||||||||||||||||||||||||||||||||||||

| Natural Gas | MMBtu | 340 | MMBtu | $ | 0.03 | $ | 9 | $ | (9) | $ | — | ||||||||||||||||||||||||||||||

| Name | Age | Position | ||||||||||||

| Grant E. Sims | 67 | Director, Chairman of the Board, and Chief Executive Officer | ||||||||||||

| Conrad P. Albert | 76 | Director | ||||||||||||

| James E. Davison | 85 | Director | ||||||||||||

| James E. Davison, Jr. | 56 | Director | ||||||||||||

| Sharilyn S. Gasaway | 54 | Director | ||||||||||||

| Kenneth M. Jastrow II | 75 | Director | ||||||||||||

| Jack T. Taylor | 71 | Director | ||||||||||||

| Robert V. Deere | 68 | Chief Financial Officer | ||||||||||||

| Edward T. Flynn | 64 | Executive Vice President | ||||||||||||

| Kristen O. Jesulaitis | 53 | Chief Legal Officer and Senior Vice President | ||||||||||||

| Ryan S. Sims | 39 | Senior Vice President | ||||||||||||

| Garland G. Gaspard | 68 | Senior Vice President | ||||||||||||

| Karen N. Pape | 64 | Senior Vice President and Controller | ||||||||||||

| Richard R. Alexander | 47 | Vice President | ||||||||||||

| William S. Goloway | 62 | Vice President | ||||||||||||

| Chad A. Landry | 59 | Vice President | ||||||||||||

| Long-Term Incentive Cash Grant Value | ||||||||||||||||||||

| Name | 2022 (1) | 2021 (1) | 2020 (2) | |||||||||||||||||

| Grant E. Sims | $ | 4,000,000 | $ | 3,600,000 | $ | — | ||||||||||||||

| Robert V. Deere | 800,000 | 800,000 | — | |||||||||||||||||

| Edward T. Flynn | 1,500,000 | 1,500,000 | — | |||||||||||||||||

| Kristen O. Jesulaitis | 1,000,000 | 650,000 | — | |||||||||||||||||

| Garland G. Gaspard | 750,000 | 600,000 | — | |||||||||||||||||

| Name & Principal Position | Year | Salary ($) | Bonus ($)(2) | Non-equity Incentive Plan Compensation ($)(3) | All Other Compensation ($)(4) | Total ($) | ||||||||||||||||||||||||||||||||

| Grant E. Sims | 2022 | $ | 758,461 | $ | 665,000 | $ | 792,000 | $ | 716,488 | $ | 2,931,949 | |||||||||||||||||||||||||||

| Chief Executive Officer | 2021 | 650,000 | 480,000 | 495,360 | 8,154 | 1,633,514 | ||||||||||||||||||||||||||||||||

| (Principal Executive Officer) | 2020 | 650,000 | 480,000 | — | 37,034 | 1,167,034 | ||||||||||||||||||||||||||||||||

| Robert V. Deere | 2022 | 450,000 | 270,000 | 288,000 | 41,704 | 1,049,704 | ||||||||||||||||||||||||||||||||

| Chief Financial Officer | 2021 | 450,000 | 240,000 | 165,120 | 25,554 | 880,674 | ||||||||||||||||||||||||||||||||

| (Principal Financial Officer) | 2020 | 450,000 | 240,000 | — | 46,814 | 736,814 | ||||||||||||||||||||||||||||||||

Edward T. Flynn(1) | 2022 | 500,000 | 850,000 | 240,000 | 37,890 | 1,627,890 | ||||||||||||||||||||||||||||||||

| Executive Vice President | 2021 | 500,000 | 60,000 | 180,000 | 22,637 | 762,637 | ||||||||||||||||||||||||||||||||

| 2020 | 500,000 | 850,000 | — | 27,868 | 1,377,868 | |||||||||||||||||||||||||||||||||

| Kristen O. Jesulaitis | 2022 | 436,154 | 410,000 | 198,000 | 35,896 | 1,080,050 | ||||||||||||||||||||||||||||||||

| Chief Legal Officer and Senior Vice President | 2021 | 400,000 | 300,000 | 109,740 | 15,384 | 825,124 | ||||||||||||||||||||||||||||||||

| 2020 | 400,000 | 318,750 | — | 28,773 | 747,523 | |||||||||||||||||||||||||||||||||

| Garland G. Gaspard | 2022 | 365,307 | 295,000 | 180,000 | 44,754 | 885,061 | ||||||||||||||||||||||||||||||||

| Senior Vice President | 2021 | 340,000 | 240,000 | 123,840 | 25,554 | 729,394 | ||||||||||||||||||||||||||||||||

| 2020 | 340,000 | 390,000 | — | 36,721 | 766,721 | |||||||||||||||||||||||||||||||||

| Name | 401(k) Matching and Profit Sharing Contributions(1) | Insurance Premiums(2) | Totals | |||||||||||||||||

| Grant E. Sims | $ | 15,250 | $ | 701,238 | $ | 716,488 | ||||||||||||||

| Robert V. Deere | 33,550 | 8,154 | 41,704 | |||||||||||||||||

| Edward T. Flynn | 30,500 | 7,390 | 37,890 | |||||||||||||||||

| Kristen O. Jesulaitis | 33,550 | 2,346 | 35,896 | |||||||||||||||||

| Garland G. Gaspard | 36,600 | 8,154 | 44,754 | |||||||||||||||||

| Estimated Future Payouts Under | ||||||||||||||||||||||||||||||||

| Non-Equity Incentive Plan Awards | ||||||||||||||||||||||||||||||||

| Name | Grant Date(1) | Vest Date | Threshold | Target | Maximum | |||||||||||||||||||||||||||

| Grant E. Sims | 4/7/2022 | 4/7/2025 | 2,400,000 | 4,000,000 | 7,200,000 | |||||||||||||||||||||||||||

| Robert V. Deere | 4/7/2022 | 4/7/2025 | 480,000 | 800,000 | 1,440,000 | |||||||||||||||||||||||||||

| Edward T. Flynn | 4/7/2022 | 4/7/2025 | 900,000 | 1,500,000 | 2,700,000 | |||||||||||||||||||||||||||

| Kristen O. Jesulaitis | 4/7/2022 | 4/7/2025 | 600,000 | 1,000,000 | 1,800,000 | |||||||||||||||||||||||||||

| Garland G. Gaspard | 4/7/2022 | 4/7/2025 | 450,000 | 750,000 | 1,350,000 | |||||||||||||||||||||||||||

| Grant E. Sims | $ | 8,320,000 | |||

| Robert V. Deere | 1,760,000 | ||||

| Edward T. Flynn | 3,300,000 | ||||

| Kristen O. Jesulaitis | 1,780,000 | ||||

| Garland G. Gaspard | 1,470,000 | ||||

| Grant E. Sims | Robert V. Deere | Edward T. Flynn | Kristen O. Jesulaitis | Garland G. Gaspard | |||||||||||||||||||||||||

| Cash payment for vested awards under 2018 LTIP granted in 2022 | $ | 7,200,000 | $ | 1,440,000 | $ | 2,700,000 | $ | 1,800,000 | $ | 1,350,000 | |||||||||||||||||||

| Cash payment for vested awards under 2018 LTIP granted in 2021 | 7,200,000 | 1,600,000 | 3,000,000 | 1,300,000 | 1,200,000 | ||||||||||||||||||||||||

| Total | $ | 14,400,000 | $ | 3,040,000 | $ | 5,700,000 | $ | 3,100,000 | $ | 2,550,000 | |||||||||||||||||||

| Name | Fees Earned or Paid in Cash ($)(1) | Stock Awards ($)(2) (3) | All Other Compensation ($)(4) | Total | ||||||||||||||||||||||

| Conrad P. Albert | 109,000 | 115,000 | 21,475 | 245,475 | ||||||||||||||||||||||

| James E. Davison | $ | 100,000 | $ | 110,000 | $ | 20,890 | $ | 230,890 | ||||||||||||||||||

| James E. Davison, Jr. | 100,000 | 110,000 | 20,890 | 230,890 | ||||||||||||||||||||||

| Sharilyn S. Gasaway | 116,500 | 122,500 | 23,469 | 262,469 | ||||||||||||||||||||||

| Kenneth M. Jastrow II | 112,500 | 122,500 | 23,469 | 258,469 | ||||||||||||||||||||||

| Jack T. Taylor | 107,000 | 115,000 | 21,475 | 243,475 | ||||||||||||||||||||||

| Class A Common Units | Class B Common Units | |||||||||||||||||||||||||

| Name and Address of Beneficial Owner | Amount and Nature of Beneficial Ownership | (1) | Percent of Class | Amount and Nature of Beneficial Ownership | Percent of Class | |||||||||||||||||||||

| Conrad P. Albert | 15,000 | * | — | — | ||||||||||||||||||||||

| James E. Davison | 3,738,178 | (2) | 3.1 | % | 9,453 | 23.6 | % | |||||||||||||||||||

| James E. Davison, Jr. | 5,423,932 | (3) | 4.4 | % | 13,648 | 34.1 | % | |||||||||||||||||||

| Sharilyn S. Gasaway | 289,445 | * | 1,081 | 2.7 | % | |||||||||||||||||||||

| Kenneth M. Jastrow II | 150,000 | * | — | — | ||||||||||||||||||||||

| Jack T. Taylor | 32,865 | * | — | — | ||||||||||||||||||||||

| Grant E. Sims | 3,010,000 | (4) | 2.5 | % | 7,087 | 17.7 | % | |||||||||||||||||||

| Robert V. Deere | 829,987 | * | 1,052 | 2.6 | % | |||||||||||||||||||||

| Edward T. Flynn | 120,000 | * | — | — | ||||||||||||||||||||||

| Kristen O. Jesulaitis | 55,000 | * | — | — | ||||||||||||||||||||||

| Ryan S. Sims | 16,300 | * | — | — | ||||||||||||||||||||||

| Garland G. Gaspard | 12,000 | * | — | — | ||||||||||||||||||||||

| Karen N. Pape | 152,131 | * | — | — | ||||||||||||||||||||||

| Richard R. Alexander | 20,245 | (5) | * | — | — | |||||||||||||||||||||

| William S. Goloway | 10,000 | * | — | — | ||||||||||||||||||||||

| Chad A. Landry | 30,000 | (6) | * | — | — | |||||||||||||||||||||

All directors and executive officers as a group (16 in total) | 13,905,083 | 11.3 | % | 32,321 | 80.8 | % | ||||||||||||||||||||

| Steven K. Davison | 2,205,617 | (7) | 1.8 | % | 7,676 | 19.2 | % | |||||||||||||||||||

| Global X Management Company LLC | 6,307,420 | 5.1 | % | — | ||||||||||||||||||||||

| Invesco LTD | 16,209,740 | 13.2 | % | — | ||||||||||||||||||||||

| FMR LLC | 7,400,097 | 6.0 | % | |||||||||||||||||||||||

| ALPS Advisors, Inc. | 16,265,444 | 13.3 | % | — | ||||||||||||||||||||||

| Name and Address of Beneficial Owner | Class A Convertible Preferred Units | |||||||||||||

| Amount and Nature of Beneficial Ownership | Percent of Class (1) | |||||||||||||

GSO Rodeo Holdings LP (2) | 12,668,389 | 50.0 | % | |||||||||||

KKR Rodeo Aggregator L.P.(3) | 12,668,389 | 50.0 | % | |||||||||||

| 2022 | 2021 | |||||||||||||

| (in thousands) | ||||||||||||||

Audit Fees(1) | $ | 3,374 | $ | 3,087 | ||||||||||

All Other Fees(2) | 423 | 3 | ||||||||||||

| Total | $ | 3,797 | $ | 3,090 | ||||||||||

| 3.1 | Certificate of Limited Partnership of Genesis Energy, L.P. (incorporated by reference to Exhibit 3.1 to Amendment No. 2 of the Registration Statement on Form S-1 filed on November 15, 1996, File No. 333-11545). | ||||||||||

| 3.2 | |||||||||||

| 3.3 | |||||||||||

| 3.4 | |||||||||||

| 3.5 | |||||||||||

| 3.6 | |||||||||||

| 3.7 | |||||||||||

| 3.8 | |||||||||||

| 3.9 | |||||||||||

| 3.10 | |||||||||||

| 4.1 | |||||||||||

| 4.2 | |||||||||||

| 4.3 | |||||||||||

| 4.4 | |||||||||||

| 4.5 | |||||||||||

| 4.6 | |||||||||||

| 4.7 | |||||||||||

| * | 95 | ||||||||||

| 96.1 | |||||||||||

| * | 101.INS | XBRL Instance Document- the instance document does not appear in the Interactive Data File because its XBRL tags are embedded within the Inline XBRL document. | |||||||||

| * | 101.SCH | XBRL Schema Document. | |||||||||

| * | 101.CAL | XBRL Calculation Linkbase Document. | |||||||||

| * | 101.LAB | XBRL Label Linkbase Document. | |||||||||

| * | 101.PRE | XBRL Presentation Linkbase Document. | |||||||||

| * | 101.DEF | XBRL Definition Linkbase Document. | |||||||||

| * | 104 | Cover Page Interactive Data File (formatted as Inline XBRL) | |||||||||

| * | Filed herewith | ||||

| + | A management contract or compensation plan or arrangement. | ||||

| GENESIS ENERGY, L.P. | |||||||||||||||||

| (A Delaware Limited Partnership) | |||||||||||||||||

| By: | GENESIS ENERGY, LLC, | ||||||||||||||||

| as General Partner | |||||||||||||||||

| Date: | February 24, 2023 | By: | /s/ GRANT E. SIMS | ||||||||||||||

| Grant E. Sims | |||||||||||||||||

| Chief Executive Officer | |||||||||||||||||

| NAME | TITLE | DATE | ||||||

| (OF GENESIS ENERGY, LLC)* | ||||||||

| /s/ GRANT E. SIMS Grant E. Sims | Chairman of the Board, Director and Chief Executive Officer (Principal Executive Officer) | February 24, 2023 | ||||||

| /s/ ROBERT V. DEERE Robert V. Deere | Chief Financial Officer, (Principal Financial Officer) | February 24, 2023 | ||||||

| /s/ KAREN N. PAPE Karen N. Pape | Senior Vice President and Controller (Principal Accounting Officer) | February 24, 2023 | ||||||

| /s/ CONRAD P. ALBERT Conrad P. Albert | Director | February 24, 2023 | ||||||

| /s/ JAMES E. DAVISON James E. Davison | Director | February 24, 2023 | ||||||

| /s/ JAMES E. DAVISON, JR. James E. Davison, Jr. | Director | February 24, 2023 | ||||||

| /s/ SHARILYN S. GASAWAY Sharilyn S. Gasaway | Director | February 24, 2023 | ||||||

| /s/ KENNETH M. JASTROW, II Kenneth M. Jastrow, II | Director | February 24, 2023 | ||||||

| /s/ JACK T. TAYLOR Jack T. Taylor | Director | February 24, 2023 | ||||||

| * | Genesis Energy, LLC is our general partner. | ||||

| Page | |||||

Report of Independent Registered Public Accounting Firm (PCAOB ID: | |||||

| Revenue recognition - Estimation of variable consideration | ||||||||

| Description of the Matter | As described in Note 3 to the consolidated financial statements, the Partnership’s Offshore pipeline transportation segment has certain long-term contracts with customers that include variable consideration that must be estimated at contract inception and re-assessed at each reporting period. Total consideration for these arrangements is recognized as revenue over the performance obligation period, and the difference in timing of revenue recognition and billings results in contract assets and liabilities. As of December 31, 2022, the Partnership has recognized $2.1 million and $64.5 million in current and non-current contract liabilities, respectively, in the consolidated financial statements. Auditing the Partnership’s revenue recognition for these contracts is particularly challenging because the estimate of variable consideration for these contracts involves management’s judgments of volumes that customers are expected to produce and transport over the contract term. Changes in this assumption or a contract modification could have a material effect on the amount of variable consideration recognized as revenue. | |||||||

| How We Addressed the Matter in Our Audit | We tested controls that address the risk of material misstatement relating to the estimation of variable consideration and associated contract assets and liabilities. For example, we tested controls over the completeness and accuracy of volumes transported and billings during the year and management’s review of estimated production over the performance obligation period. To test the Partnership’s estimates of variable consideration, we performed audit procedures that included, among others, evaluating management’s determination of the performance obligations in each arrangement and information used to establish or reassess the estimates including contractual pipeline capacity reserved, historical actual throughput volumes, and third party production forecasts. We tested these assumptions by inspecting contracts, testing completeness and accuracy of production volumes and contract billings, and evaluating information obtained by management from customers and whether the information is consistent with publicly available information. We also performed a retrospective analysis of forecasted production volumes by comparing them to the actual volumes transported, and we performed sensitivity analyses to evaluate the changes in variable consideration that would result from changes in the Partnership’s significant assumptions discussed herein. We also recalculated the Partnership’s revenue recognized for these arrangements and the recorded contract assets and liabilities as of and for the year ended December 31, 2022. | |||||||

| December 31, 2022 | December 31, 2021 | ||||||||||

| ASSETS | |||||||||||

| CURRENT ASSETS: | |||||||||||

| Cash and cash equivalents | $ | $ | |||||||||

| Restricted cash | |||||||||||

| Accounts receivable—trade, net | |||||||||||

| Inventories | |||||||||||

| Other | |||||||||||

| Total current assets | |||||||||||

| FIXED ASSETS, at cost | |||||||||||

| Less: Accumulated depreciation | ( | ( | |||||||||

| Net fixed assets | |||||||||||

| MINERALS LEASEHOLDS, net of accumulated depletion | |||||||||||

| EQUITY INVESTEES | |||||||||||

| INTANGIBLE ASSETS, net of amortization | |||||||||||

| GOODWILL | |||||||||||

| RIGHT OF USE ASSETS, net | |||||||||||

| OTHER ASSETS, net of amortization | |||||||||||

| TOTAL ASSETS | $ | $ | |||||||||

| LIABILITIES AND PARTNERS’ CAPITAL | |||||||||||

| CURRENT LIABILITIES: | |||||||||||

| Accounts payable—trade | $ | $ | |||||||||

| Accrued liabilities | |||||||||||

| Total current liabilities | |||||||||||

| SENIOR SECURED CREDIT FACILITY | |||||||||||

| SENIOR UNSECURED NOTES, net of debt issuance costs and premium | |||||||||||

| ALKALI SENIOR SECURED NOTES, net of debt issuance costs and discount | |||||||||||

| DEFERRED TAX LIABILITIES | |||||||||||

| OTHER LONG-TERM LIABILITIES | |||||||||||

| Total liabilities | |||||||||||

| MEZZANINE CAPITAL | |||||||||||

Class A Convertible Preferred Units, | |||||||||||

Redeemable noncontrolling interests, no preferred units issued and outstanding at December 31, 2022 and | |||||||||||

| PARTNERS’ CAPITAL: | |||||||||||

Common unitholders, | |||||||||||

| Accumulated other comprehensive income (loss) | ( | ||||||||||

Noncontrolling interests | |||||||||||

| Total partners' capital | |||||||||||

| TOTAL LIABILITIES, MEZZANINE CAPITAL AND PARTNERS’ CAPITAL | $ | $ | |||||||||

| Year Ended December 31, | |||||||||||||||||

| 2022 | 2021 | 2020 | |||||||||||||||

| REVENUES: | |||||||||||||||||

| Offshore pipeline transportation | $ | $ | $ | ||||||||||||||

| Sodium minerals and sulfur services | |||||||||||||||||

| Onshore facilities and transportation | |||||||||||||||||

| Total revenues | |||||||||||||||||

| COSTS AND EXPENSES: | |||||||||||||||||

| Onshore facilities and transportation product costs | |||||||||||||||||

| Onshore facilities and transportation operating costs | |||||||||||||||||

| Marine transportation operating costs | |||||||||||||||||

| Sodium minerals and sulfur services operating costs | |||||||||||||||||

| Offshore pipeline transportation operating costs | |||||||||||||||||

| General and administrative | |||||||||||||||||

| Depreciation, depletion and amortization | |||||||||||||||||

| Impairment expense | |||||||||||||||||

| Loss (gain) on sale of assets | ( | ||||||||||||||||

| Total costs and expenses | |||||||||||||||||

| OPERATING INCOME (LOSS) | ( | ||||||||||||||||

| Equity in earnings of equity investees | |||||||||||||||||

| Interest expense | ( | ( | ( | ||||||||||||||

| Other expense, net | ( | ( | ( | ||||||||||||||

| Income (loss) from operations before income taxes | ( | ( | |||||||||||||||

| Income tax expense | ( | ( | ( | ||||||||||||||

| NET INCOME (LOSS) | ( | ( | |||||||||||||||

| Net income attributable to noncontrolling interests | ( | ( | ( | ||||||||||||||

| Net income attributable to redeemable noncontrolling interests | ( | ( | ( | ||||||||||||||

| NET INCOME (LOSS) ATTRIBUTABLE TO GENESIS ENERGY, L.P. | $ | $ | ( | $ | ( | ||||||||||||

| Less: Accumulated distributions attributable to Class A Convertible Preferred Units | ( | ( | ( | ||||||||||||||

| NET LOSS AVAILABLE TO COMMON UNITHOLDERS | $ | ( | $ | ( | $ | ( | |||||||||||

| BASIC AND DILUTED NET INCOME (LOSS) PER COMMON UNIT: | |||||||||||||||||

| Basic and Diluted | $ | ( | $ | ( | $ | ( | |||||||||||

| WEIGHTED AVERAGE OUTSTANDING COMMON UNITS: | |||||||||||||||||

| Basic and Diluted | |||||||||||||||||

| Year Ended December 31, | |||||||||||||||||

| 2022 | 2021 | 2020 | |||||||||||||||

| Net income (loss) | $ | $ | ( | $ | ( | ||||||||||||

| Other comprehensive income (loss): | |||||||||||||||||

| Decrease (increase) in benefit plan liability | ( | ||||||||||||||||

| Total Comprehensive income (loss) | ( | ( | |||||||||||||||

| Comprehensive income attributable to noncontrolling interests | ( | ( | ( | ||||||||||||||

| Comprehensive income attributable to redeemable noncontrolling interests | ( | ( | ( | ||||||||||||||

| Comprehensive income (loss) attributable to Genesis Energy, L.P. | $ | $ | ( | $ | ( | ||||||||||||

| Number of Common Units | Partners’ Capital | Noncontrolling Interest | Accumulated Other Comprehensive Income (Loss) | Total | |||||||||||||||||||||||||

| December 31, 2019 | $ | $ | ( | $ | ( | $ | |||||||||||||||||||||||

| Net income | — | ( | — | ( | |||||||||||||||||||||||||

| Cash distributions to partners | — | ( | — | — | ( | ||||||||||||||||||||||||

| Cash contributions from noncontrolling interests | — | — | — | ||||||||||||||||||||||||||

| Other comprehensive loss | — | — | — | ( | ( | ||||||||||||||||||||||||

Distributions to preferred unitholders | — | ( | — | — | ( | ||||||||||||||||||||||||

| December 31, 2020 | ( | ( | |||||||||||||||||||||||||||

| Net income (loss) | — | ( | — | ( | |||||||||||||||||||||||||

| Cash distributions to partners | — | ( | — | — | ( | ||||||||||||||||||||||||

| Sale of noncontrolling interest in subsidiary | — | — | |||||||||||||||||||||||||||

| Cash distributions to noncontrolling interests | — | — | ( | — | ( | ||||||||||||||||||||||||

Cash contributions from noncontrolling interests | — | — | — | ||||||||||||||||||||||||||

| Other comprehensive income | — | — | — | ||||||||||||||||||||||||||

Distributions to preferred unitholders | — | ( | — | — | ( | ||||||||||||||||||||||||

| December 31, 2021 | ( | ||||||||||||||||||||||||||||

| Net income | — | — | |||||||||||||||||||||||||||

| Cash distributions to partners | — | ( | — | — | ( | ||||||||||||||||||||||||

| Adjustment to valuation of noncontrolling interest in subsidiary | — | ( | — | — | |||||||||||||||||||||||||

| Cash distributions to noncontrolling interests | — | — | ( | — | ( | ||||||||||||||||||||||||

Cash contributions from noncontrolling interests | — | — | — | ||||||||||||||||||||||||||

| Other comprehensive income | — | — | — | ||||||||||||||||||||||||||

Distributions to preferred unitholders | — | ( | — | — | ( | ||||||||||||||||||||||||

| December 31, 2022 | $ | $ | $ | $ | |||||||||||||||||||||||||

| Year Ended December 31, | |||||||||||||||||

| 2022 | 2021 | 2020 | |||||||||||||||

| CASH FLOWS FROM OPERATING ACTIVITIES: | |||||||||||||||||

| Net income (loss) | $ | $ | ( | $ | ( | ||||||||||||

Adjustments to reconcile net income (loss) to net cash provided by operating activities - | |||||||||||||||||

| Depreciation, depletion and amortization | |||||||||||||||||

| Loss (gain) on sale of assets | ( | ||||||||||||||||

| Impairment expense | |||||||||||||||||

| Amortization and write-off of debt issuance costs and premium or discount | |||||||||||||||||

| Amortization of unearned income and initial direct costs on direct financing leases | ( | ||||||||||||||||

| Payments received under previously owned direct financing leases | |||||||||||||||||

| Equity in earnings of investments in equity investees | ( | ( | ( | ||||||||||||||

| Cash distributions of earnings of equity investees | |||||||||||||||||

| Non-cash effect of long-term incentive compensation plans | ( | ||||||||||||||||

| Deferred and other tax liabilities | |||||||||||||||||

| Cancellation of debt income | ( | ( | |||||||||||||||

| Unrealized losses (gains) on derivative transactions | ( | ||||||||||||||||

| Other, net | |||||||||||||||||

| ( | |||||||||||||||||

| Net cash provided by operating activities | |||||||||||||||||

| CASH FLOWS FROM INVESTING ACTIVITIES: | |||||||||||||||||

| Payments to acquire fixed and intangible assets | ( | ( | ( | ||||||||||||||

Cash distributions received from equity investees—return of investment | |||||||||||||||||

| Investments in equity investees | ( | ( | |||||||||||||||

| Proceeds from asset sales | |||||||||||||||||

| Net cash used in investing activities | ( | ( | ( | ||||||||||||||

| CASH FLOWS FROM FINANCING ACTIVITIES: | |||||||||||||||||

| Borrowings on senior secured credit facility | |||||||||||||||||

| Repayments on senior secured credit facility | ( | ( | ( | ||||||||||||||

Net proceeds from issuance of Alkali senior secured notes (Note 10) | |||||||||||||||||

| ( | |||||||||||||||||

Proceeds from issuance of senior unsecured notes (Note 10) | |||||||||||||||||

Net proceeds from issuance of preferred units (Note 11) | |||||||||||||||||

Repayment of senior unsecured notes (Note 10) | ( | ( | ( | ||||||||||||||

| Debt issuance costs | ( | ( | ( | ||||||||||||||

| Contributions from noncontrolling interests | |||||||||||||||||

| Distributions to noncontrolling interests | ( | ( | |||||||||||||||

Distributions to Class A Convertible Preferred unitholders (Note 11) | ( | ( | ( | ||||||||||||||

Distributions to common unitholders (Note 11) | ( | ( | ( | ||||||||||||||

| Cash proceeds from the sale of a noncontrolling interest in a subsidiary | |||||||||||||||||

| Other, net | ( | ( | |||||||||||||||

| Net cash provided by (used in) financing activities | ( | ( | |||||||||||||||

| Net increase (decrease) in cash and cash equivalents and restricted cash | ( | ( | |||||||||||||||

| Cash and cash equivalents and restricted cash at beginning of period | |||||||||||||||||

| Cash and cash equivalents and restricted cash at end of period | $ | $ | $ | ||||||||||||||

| Year Ended December 31, 2022 | |||||||||||||||||||||||||||||

| Offshore Pipeline Transportation | Sodium Minerals & Sulfur Services | Marine Transportation | Onshore Facilities & Transportation | Consolidated | |||||||||||||||||||||||||

| Fee-based revenues | $ | $ | $ | $ | $ | ||||||||||||||||||||||||

| Product Sales | |||||||||||||||||||||||||||||

| Refinery Services | |||||||||||||||||||||||||||||

| $ | $ | $ | $ | $ | |||||||||||||||||||||||||

| Year Ended December 31, 2021 | |||||||||||||||||||||||||||||

| Offshore Pipeline Transportation | Sodium Minerals & Sulfur Services | Marine Transportation | Onshore Facilities & Transportation | Consolidated | |||||||||||||||||||||||||

| Fee-based revenues | $ | $ | $ | $ | $ | ||||||||||||||||||||||||

| Product Sales | |||||||||||||||||||||||||||||

| Refinery Services | |||||||||||||||||||||||||||||

| $ | $ | $ | $ | $ | |||||||||||||||||||||||||

| Year Ended December 31, 2020 | |||||||||||||||||||||||||||||

| Offshore Pipeline Transportation | Sodium Minerals & Sulfur Services | Marine Transportation | Onshore Facilities & Transportation | Consolidated | |||||||||||||||||||||||||

| Fee-based revenues | $ | $ | $ | $ | $ | ||||||||||||||||||||||||

| Product Sales | |||||||||||||||||||||||||||||

| Refinery Services | |||||||||||||||||||||||||||||

| $ | $ | $ | $ | $ | |||||||||||||||||||||||||

| Contract Assets | Contract Liabilities | ||||||||||||||||

| Current Assets- Other | Accrued Liabilities | Other Long-Term Liabilities | |||||||||||||||

Balance at December 31, 2021 | $ | $ | $ | ||||||||||||||

Balance at December 31, 2022 | |||||||||||||||||

| Offshore Pipeline Transportation | Onshore Facilities and Transportation | ||||||||||

| 2023 | $ | $ | |||||||||

| 2024 | |||||||||||

| 2025 | |||||||||||

| 2026 | |||||||||||

| 2027 | |||||||||||

| Thereafter | |||||||||||

| Total | $ | $ | |||||||||

| Leases | Classification | Financial Statement Caption | December 31, 2022 | December 31, 2021 | ||||||||||||||||||||||

| Assets | ||||||||||||||||||||||||||

| Transportation Equipment | Right of Use Assets, net | $ | $ | |||||||||||||||||||||||

| Office Space & Equipment | Right of Use Assets, net | |||||||||||||||||||||||||

| Facilities and Equipment | Right of Use Assets, net | |||||||||||||||||||||||||

| Total Right of Use Assets, net | $ | $ | ||||||||||||||||||||||||

| Liabilities | ||||||||||||||||||||||||||

| Current | ||||||||||||||||||||||||||

| Non-Current | ||||||||||||||||||||||||||

| Total Lease Liability | $ | $ | ||||||||||||||||||||||||

| Maturity of Lease Liabilities | Transportation Equipment | Office Space and Equipment | Facilities and Equipment | Operating Leases | ||||||||||||||||||||||

| 2023 | $ | $ | $ | $ | ||||||||||||||||||||||

| 2024 | ||||||||||||||||||||||||||

| 2025 | ||||||||||||||||||||||||||

| 2026 | ||||||||||||||||||||||||||

| 2027 | ||||||||||||||||||||||||||

| Thereafter | ||||||||||||||||||||||||||

| Total Lease Payments | ||||||||||||||||||||||||||

| Less: Interest | ( | ( | ( | ( | ||||||||||||||||||||||

| Present value of operating lease liabilities | $ | $ | $ | $ | ||||||||||||||||||||||

| Lease Term and Discount Rate | December 31, 2022 | December 31, 2021 | ||||||||||||

| Weighted-average remaining lease term | ||||||||||||||

| Weighted-average discount rate | ||||||||||||||

| Year Ended December 31, | |||||||||||||||||

| Cash Flows Information | 2022 | 2021 | |||||||||||||||

| Cash paid for amounts included in the measurement of lease liabilities | $ | $ | |||||||||||||||

| Leased assets obtained in exchange for new operating lease liabilities | |||||||||||||||||

| Year Ended December 31, | ||||||||||||||||||||

| 2022 | 2021 | 2020 | ||||||||||||||||||

| M/T American Phoenix | $ | $ | $ | |||||||||||||||||

Free State Pipeline(1) | ||||||||||||||||||||

| December 31, | |||||||||||

| 2022 | 2021 | ||||||||||

| Accounts receivable - trade | $ | $ | |||||||||

| Allowance for credit losses | ( | ( | |||||||||

| Accounts receivable - trade, net | $ | $ | |||||||||

| December 31, | |||||||||||||||||

| 2022 | 2021 | 2020 | |||||||||||||||

| Balance at beginning of period | $ | $ | $ | ||||||||||||||

| Charges to (recoveries of) costs and expenses, net | ( | ||||||||||||||||

| Amounts written off | ( | ( | ( | ||||||||||||||

| Balance at end of period | $ | $ | $ | ||||||||||||||

| December 31, | |||||||||||

| 2022 | 2021 | ||||||||||

| Petroleum products | $ | $ | |||||||||

| Crude oil | |||||||||||

| Caustic soda | |||||||||||

| NaHS | |||||||||||

| Raw materials - Alkali Operations | |||||||||||

| Work-in-process - Alkali Operations | |||||||||||

| Finished goods, net - Alkali Operations | |||||||||||

| Materials and supplies, net - Alkali Operations | |||||||||||

| Total | $ | $ | |||||||||

| December 31, | |||||||||||

| 2022 | 2021 | ||||||||||

| Crude oil and natural gas pipelines and related assets | $ | $ | |||||||||

| Alkali facilities, machinery, and equipment | |||||||||||

| Onshore facilities, machinery, and equipment | |||||||||||

| Transportation equipment | |||||||||||

| Marine vessels | |||||||||||

| Land, buildings and improvements | |||||||||||

| Office equipment, furniture and fixtures | |||||||||||

Construction in progress (1) | |||||||||||

| Other | |||||||||||

| Fixed assets, at cost | |||||||||||

| Less: Accumulated depreciation | ( | ( | |||||||||

| Net fixed assets | $ | $ | |||||||||

| December 31, 2022 | December 31, 2021 | ||||||||||

| Mineral leaseholds | $ | $ | |||||||||

| Less: Accumulated depletion | ( | ( | |||||||||

| Mineral leaseholds, net | $ | $ | |||||||||

| December 31, 2020 | $ | ||||

| Accretion expense | |||||

| Revisions in timing and estimated costs of AROs | |||||

| Settlements | ( | ||||

| Acquisitions | |||||

| December 31, 2021 | $ | ||||

| Accretion expense | |||||

| Revisions in timing and estimated costs of AROs | |||||

| Settlements | ( | ||||

| December 31, 2022 | $ | ||||

| 2023 | $ | ||||

| 2024 | $ | ||||

| 2025 | $ | ||||

| 2026 | $ | ||||

| 2027 | $ | ||||

| Year Ended December 31, | |||||||||||||||||

| 2022 | 2021 | 2020 | |||||||||||||||

| Genesis’ share of operating earnings | $ | $ | $ | ||||||||||||||

| Amortization of differences attributable to Genesis’ carrying value of equity investments | ( | ( | ( | ||||||||||||||

| Net equity in earnings | $ | $ | $ | ||||||||||||||

Distributions received(1) | $ | $ | $ | ||||||||||||||

| December 31, | |||||||||||

| 2022 | 2021 | ||||||||||

| BALANCE SHEET DATA: | |||||||||||

| Assets | |||||||||||

| Current assets | $ | $ | |||||||||

| Fixed assets, net | |||||||||||

| Other assets | |||||||||||

| Total assets | $ | $ | |||||||||

| Liabilities and equity | |||||||||||

| Current liabilities | $ | $ | |||||||||

| Other liabilities | |||||||||||

| Equity | |||||||||||

| Total liabilities and equity | $ | $ | |||||||||

| Year Ended December 31, | |||||||||||||||||

| 2022 | 2021 | 2020 | |||||||||||||||

| STATEMENTS OF OPERATIONS DATA: | |||||||||||||||||

| Revenues | $ | $ | $ | ||||||||||||||

| Operating Income | $ | $ | $ | ||||||||||||||

| Net Income | $ | $ | $ | ||||||||||||||

| December 31, 2022 | December 31, 2021 | ||||||||||||||||||||||||||||||||||||||||

| Weighted Amortization Period in Years | Gross Carrying Amount | Accumulated Amortization | Carrying Value | Gross Carrying Amount | Accumulated Amortization | Carrying Value | |||||||||||||||||||||||||||||||||||

| Marine contract intangibles | $ | $ | $ | $ | $ | $ | |||||||||||||||||||||||||||||||||||

| Offshore pipeline contract intangibles | |||||||||||||||||||||||||||||||||||||||||

| Other | |||||||||||||||||||||||||||||||||||||||||

| Total | $ | $ | $ | $ | $ | $ | |||||||||||||||||||||||||||||||||||

| 2023 | 2024 | 2025 | 2026 | 2027 | |||||||||||||||||||||||||

| Marine contract intangibles | $ | $ | $ | $ | $ | ||||||||||||||||||||||||

| Offshore pipeline contract intangibles | |||||||||||||||||||||||||||||

| Other | |||||||||||||||||||||||||||||

| Total | $ | $ | $ | $ | $ | ||||||||||||||||||||||||

| December 31, | |||||||||||

| 2022 | 2021 | ||||||||||

Deferred marine charges, net (1) | $ | $ | |||||||||

| Unamortized debt issuance costs on senior secured credit facility | |||||||||||

| Other deferred costs | |||||||||||

| Other assets, net of amortization | $ | $ | |||||||||

| December 31, 2022 | December 31, 2021 | ||||||||||||||||||||||||||||||||||

| Principal | Unamortized Premium, Discount and Debt Issuance Costs | Net Value | Principal | Unamortized Premium and Debt Issuance Costs | Net Value | ||||||||||||||||||||||||||||||

Senior secured credit facility-Revolving Loan(1) | $ | $ | $ | $ | $ | $ | |||||||||||||||||||||||||||||

| Total long-term debt | $ | $ | $ | $ | $ | $ | |||||||||||||||||||||||||||||

| 2024 Notes | 2025 Notes | 2026 Notes | 2027 Notes | 2028 Notes | |||||||||||||||||||||||||

| Redemption right beginning on | June 15, 2019 | October 1, 2020 | February 15, 2021 | January 15, 2024 | February 1, 2023 | ||||||||||||||||||||||||

Redemption of up to | June 15, 2019 | October 1, 2020 | February 15, 2021 | January 15, 2024 | February 1, 2023 | ||||||||||||||||||||||||

| Distribution For | Date Paid | Per Unit Amount | Total Amount | |||||||||||||||||

| 2020 | ||||||||||||||||||||

1st Quarter | $ | $ | ||||||||||||||||||

2nd Quarter | $ | $ | ||||||||||||||||||

3rd Quarter | $ | $ | ||||||||||||||||||

4th Quarter | $ | $ | ||||||||||||||||||

| 2021 | ||||||||||||||||||||

1st Quarter | $ | $ | ||||||||||||||||||

2nd Quarter | $ | $ | ||||||||||||||||||

3rd Quarter | $ | $ | ||||||||||||||||||

4th Quarter | $ | $ | ||||||||||||||||||

| 2022 | ||||||||||||||||||||

1st Quarter | $ | $ | ||||||||||||||||||

2nd Quarter | $ | $ | ||||||||||||||||||

3rd Quarter | $ | $ | ||||||||||||||||||

4th Quarter | $ | $ | ||||||||||||||||||

| Distribution For | Date Paid | Per Unit Amount | Total Amount | |||||||||||||||||

| 2020 | ||||||||||||||||||||

1st Quarter | $ | $ | ||||||||||||||||||

2nd Quarter | $ | $ | ||||||||||||||||||

3rd Quarter | $ | $ | ||||||||||||||||||

4th Quarter | $ | $ | ||||||||||||||||||

| 2021 | ||||||||||||||||||||

1st Quarter | $ | $ | ||||||||||||||||||

2nd Quarter | $ | $ | ||||||||||||||||||

3rd Quarter | $ | $ | ||||||||||||||||||

4th Quarter | $ | $ | ||||||||||||||||||

| 2022 | ||||||||||||||||||||

1st Quarter | $ | $ | ||||||||||||||||||

2nd Quarter | $ | $ | ||||||||||||||||||

3rd Quarter | $ | $ | ||||||||||||||||||

4th Quarter | $ | $ | ||||||||||||||||||

Balance as of December 31, 2020 | $ | |||||||

Issuance of preferred units, net of issuance costs(1) | ||||||||

| PIK distribution | ||||||||

| Redemption accretion | ||||||||

Tax distributions(1) | ( | |||||||

Balance as of December 31, 2021 | ||||||||

Issuance of preferred units, net of issuance costs(1) | ||||||||

| PIK distribution | ||||||||

| Redemption accretion | ||||||||

Tax distributions(1) | ( | |||||||

| Adjustment to Base Preferred Return Amount | ||||||||

| Redemption of preferred units on May 17, 2022 | ( | |||||||

Balance as of December 31, 2022 | $ | |||||||

| Year Ended December 31, | |||||||||||||||||

| 2022 | 2021 | 2020 | |||||||||||||||

| Net income (loss) attributable to Genesis Energy L.P. | $ | $ | ( | $ | ( | ||||||||||||

| Less: Accumulated distributions attributable to Class A Convertible Preferred Units | ( | ( | ( | ||||||||||||||

| Net loss available to common unitholders | $ | ( | $ | ( | $ | ( | |||||||||||

| Weighted average outstanding units | |||||||||||||||||

| Basic and diluted net loss per common unit | $ | ( | $ | ( | $ | ( | |||||||||||

| Offshore Pipeline Transportation | Sodium Minerals & Sulfur Services | Onshore Facilities & Transportation | Marine Transportation | Total | |||||||||||||||||||||||||

Year Ended December 31, 2022 | |||||||||||||||||||||||||||||

Segment Margin(1) | $ | $ | $ | $ | $ | ||||||||||||||||||||||||

Capital expenditures(2) | $ | $ | $ | $ | $ | ||||||||||||||||||||||||

| Revenues: | |||||||||||||||||||||||||||||

| External customers | $ | $ | $ | $ | $ | ||||||||||||||||||||||||

Intersegment(3) | ( | $ | |||||||||||||||||||||||||||

| Total revenues of reportable segments | $ | $ | $ | $ | $ | ||||||||||||||||||||||||

Year Ended December 31, 2021 | |||||||||||||||||||||||||||||

Segment Margin(1) | $ | $ | $ | $ | $ | ||||||||||||||||||||||||

Capital expenditures(2) | $ | $ | $ | $ | $ | ||||||||||||||||||||||||

| Revenues: | |||||||||||||||||||||||||||||

| External customers | $ | $ | $ | $ | $ | ||||||||||||||||||||||||

Intersegment(3) | ( | $ | |||||||||||||||||||||||||||

| Total revenues of reportable segments | $ | $ | $ | $ | $ | ||||||||||||||||||||||||

Year Ended December 31, 2020 | |||||||||||||||||||||||||||||

Segment Margin(1) | $ | $ | $ | $ | $ | ||||||||||||||||||||||||

Capital expenditures(2) | $ | $ | $ | $ | $ | ||||||||||||||||||||||||

| Revenues: | |||||||||||||||||||||||||||||

| External customers | $ | $ | $ | $ | $ | ||||||||||||||||||||||||

Intersegment(3) | ( | ( | $ | ||||||||||||||||||||||||||

| Total revenues of reportable segments | $ | $ | $ | $ | $ | ||||||||||||||||||||||||

| December 31, 2022 | December 31, 2021 | ||||||||||

| Offshore pipeline transportation | $ | $ | |||||||||

| Sodium minerals and sulfur services | |||||||||||

| Onshore facilities and transportation | |||||||||||

| Marine transportation | |||||||||||

| Other assets | |||||||||||

| Total consolidated assets | $ | $ | |||||||||

| Year Ended December 31, | |||||||||||||||||

| 2022 | 2021 | 2020 | |||||||||||||||

| Net income (loss) attributable to Genesis Energy, L.P. | $ | $ | ( | $ | ( | ||||||||||||

| Corporate general and administrative expenses | |||||||||||||||||

| Depreciation, depletion, amortization and accretion | |||||||||||||||||

| Interest expense | |||||||||||||||||

Adjustment to exclude distributable cash generated by equity investees not included in income and include equity in investees net income(1) | |||||||||||||||||

Other non-cash items(2) | ( | ||||||||||||||||

Distributions from unrestricted subsidiaries not included in income(3) | |||||||||||||||||

| ( | ( | ||||||||||||||||

Loss on extinguishment of debt (Note 10) | |||||||||||||||||

Differences in timing of cash receipts for certain contractual arrangements(4) | |||||||||||||||||

Loss (gain) on sale of asset, net to our ownership interest (Note 7) | ( | ||||||||||||||||

| Change in provision for leased items no longer in use | ( | ||||||||||||||||

| Income tax expense | |||||||||||||||||

Redeemable noncontrolling interest redemption value adjustments(5) | |||||||||||||||||

| Total Segment Margin | $ | $ | $ | ||||||||||||||

| Year Ended December 31, | |||||||||||||||||

| 2022 | 2021 | 2020 | |||||||||||||||

| Revenues: | |||||||||||||||||

Revenues from services and fees to Poseidon Oil Pipeline Company, LLC(1) | |||||||||||||||||

| Revenues from product sales to ANSAC | |||||||||||||||||

| Expenses: | |||||||||||||||||

| Amounts paid to our CEO in connection with the use of his aircraft | $ | $ | $ | ||||||||||||||

Charges for products purchased from Poseidon Oil Pipeline Company, LLC(1) | |||||||||||||||||

| Charges for services from ANSAC | |||||||||||||||||

| December 31, | |||||||||||

| 2022 | 2021 | ||||||||||

| Receivables: | |||||||||||

| ANSAC | $ | $ | |||||||||

| Payables: | |||||||||||

| ANSAC | $ | $ | |||||||||

| Year Ended December 31, | |||||||||||||||||

| 2022 | 2021 | 2020 | |||||||||||||||

| (Increase) decrease in: | |||||||||||||||||

| Accounts receivable | $ | ( | $ | ( | $ | ||||||||||||

| Inventories | ( | ||||||||||||||||

| Deferred charges | |||||||||||||||||

| Other current assets | ( | ( | |||||||||||||||

| Increase (decrease) in: | |||||||||||||||||

| Accounts payable | ( | ||||||||||||||||

| Accrued liabilities | ( | ( | |||||||||||||||

| Net changes in components of operating assets and liabilities | $ | ( | $ | $ | |||||||||||||

| Service-Based Awards | |||||||||||||||||

| Number of Phantom Units | Average Grant Date Fair Value | Total Value (in thousands) | |||||||||||||||

Unvested at December 31, 2021 | $ | $ | |||||||||||||||

| Granted | |||||||||||||||||

| Settled | ( | ( | |||||||||||||||

Unvested at December 31, 2022 | $ | $ | |||||||||||||||

| Expense (Credit) Related to Equity-Based Compensation Plans | ||||||||||||||||||||

| Consolidated Statements of Operations | 2022 | 2021 | 2020 | |||||||||||||||||

| Onshore facilities and transportation operating costs | $ | $ | $ | ( | ||||||||||||||||

| Marine transportation operating costs | ( | |||||||||||||||||||

| Sodium minerals and sulfur services operating costs | ( | |||||||||||||||||||

| Offshore pipeline operating costs | ( | |||||||||||||||||||

| General and administrative expenses | ( | |||||||||||||||||||

| Total | $ | $ | $ | ( | ||||||||||||||||

| Sell (Short) Contracts | Buy (Long) Contracts | |||||||||||||

| Not qualifying or not designated as hedges under accounting rules: | ||||||||||||||

| Crude oil futures: | ||||||||||||||

| Contract volumes (1,000 Bbls) | ||||||||||||||

| Weighted average contract price per Bbl | $ | $ | ||||||||||||

| Natural gas swaps: | ||||||||||||||

| Contract volumes (10,000 MMBtu) | ||||||||||||||

| Weighted average price differential per MMBtu | $ | $ | ||||||||||||

| Natural gas futures: | ||||||||||||||

| Contract volumes (10,000 MMBtu) | ||||||||||||||

| Weighted average contract price per MMBtu | $ | $ | ||||||||||||

| Petroleum products (#6 fuel oil) futures: | ||||||||||||||

| Contract volumes (1,000 Bbls) | ||||||||||||||

| Weighted average contract price per Bbl | $ | $ | ||||||||||||

| Natural gas options: | ||||||||||||||

| Contract volumes (10,000 MMBtu) | ||||||||||||||

| Weighted average premium received/paid | $ | $ | ||||||||||||

| Derivative Instrument | Hedged Risk | Impact of Unrealized Gains and Losses | ||||||||||||||||||

| Consolidated Balance Sheets | Consolidated Statements of Operations | |||||||||||||||||||

| Designated as hedges under accounting guidance: | ||||||||||||||||||||

| Crude oil futures contracts (fair value hedge) | Volatility in crude oil prices - effect on market value of inventory | Derivative is recorded in “Current Assets - Other” (offset against margin deposits) and offsetting change in fair value of inventory is recorded in Inventories | Excess, if any, over effective portion of hedge is recorded in “Onshore facilities and transportation costs - product costs” Effective portion is offset in cost of sales against change in value of inventory being hedged | |||||||||||||||||

| Not qualifying or not designated as hedges under accounting guidance: | ||||||||||||||||||||

| Commodity hedges consisting of crude oil, heating oil, fuel oil, petroleum products and natural gas futures, forward contracts, swaps and put and call options | Volatility in crude oil, natural gas and petroleum products prices - effect on market value of inventory, fixed price purchase commitments or forecasted purchases | Derivative is recorded in “Current Assets - Other” (offset against margin deposits) or Accrued liabilities | Entire amount of change in fair value of derivative is recorded in “Onshore facilities and transportation costs - product costs” and “Sodium minerals and sulfur services operating costs” | |||||||||||||||||

| Preferred Distribution Rate Reset Election | This instrument is not related to a risk, but is rather part of a host contract with the issuance of our Class A Convertible Preferred Units | Derivative is recorded in “Other long-term liabilities” | Entire amount of change in fair value of derivative is recorded in “Other expense, net” | |||||||||||||||||

| Fair Value | ||||||||||||||||||||

| Consolidated Balance Sheets Location | December 31, 2022 | December 31, 2021 | ||||||||||||||||||

| Asset Derivatives: | ||||||||||||||||||||

| Natural Gas Swap (undesignated hedge) | Current Assets - Other | |||||||||||||||||||

| Commodity derivatives—futures and put and call options (undesignated hedges): | ||||||||||||||||||||

| Gross amount of recognized assets | Current Assets - Other | $ | $ | |||||||||||||||||

| Gross amount offset in the Consolidated Balance Sheets | Current Assets - Other | ( | ( | |||||||||||||||||

Net amount of assets presented in the Consolidated Balance Sheets | $ | $ | ||||||||||||||||||

| Commodity derivatives—futures (designated hedges): | ||||||||||||||||||||

| Gross amount of recognized assets | Current Assets - Other | $ | $ | |||||||||||||||||

| Gross amount offset in the Consolidated Balance Sheets | Current Assets - Other | ( | ||||||||||||||||||

Net amount of assets presented in the Consolidated Balance Sheets | $ | $ | ||||||||||||||||||

| Liability Derivatives: | ||||||||||||||||||||

Preferred Distribution Rate Reset Election(2) | Other Long-Term Liabilities(2) | $ | — | $ | ( | |||||||||||||||

| Natural Gas Swap (undesignated hedge) | Current Liabilities - Accrued Liabilities | ( | ( | |||||||||||||||||

| Commodity derivatives—futures and put and call options (undesignated hedges): | ||||||||||||||||||||

| Gross amount of recognized liabilities | Current Assets - Other(1) | $ | ( | $ | ( | |||||||||||||||

| Gross amount offset in the Consolidated Balance Sheets | Current Assets - Other(1) | |||||||||||||||||||

Net amount of liabilities presented in the Consolidated Balance Sheets | $ | ( | $ | |||||||||||||||||

| Commodity derivatives—futures (designated hedges): | ||||||||||||||||||||

| Gross amount of recognized liabilities | Current Assets - Other(1) | $ | $ | ( | ||||||||||||||||

| Gross amount offset in the Consolidated Balance Sheets | Current Assets - Other(1) | |||||||||||||||||||

Net amount of liabilities presented in the Consolidated Balance Sheets | $ | $ | ||||||||||||||||||

| Amount of Gain (Loss) Recognized in Income | |||||||||||||||||||||||

| Year Ended December 31, | |||||||||||||||||||||||

| Consolidated Statements of Operations Location | 2022 | 2021 | 2020 | ||||||||||||||||||||

Commodity derivatives—futures and options: | |||||||||||||||||||||||

Contracts designated as hedges under accounting guidance | Onshore facilities and transportation product costs | $ | $ | ( | $ | ( | |||||||||||||||||

Contracts not considered hedges under accounting guidance | Onshore facilities and transportation product costs, sodium minerals and sulfur services operating costs | ( | ( | ||||||||||||||||||||

| Total commodity derivatives | $ | $ | ( | $ | ( | ||||||||||||||||||

| Natural gas swaps | Sodium minerals and sulfur services operating costs | $ | $ | ||||||||||||||||||||

| Preferred Distribution Rate Reset Election | Other expense, net | $ | ( | $ | ( | $ | ( | ||||||||||||||||

| December 31, 2022 | December 31, 2021 | ||||||||||||||||||||||||||||||||||

| Recurring Fair Value Measures | Level 1 | Level 2 | Level 3 | Level 1 | Level 2 | Level 3 | |||||||||||||||||||||||||||||

| Commodity derivatives: | |||||||||||||||||||||||||||||||||||

| Assets | $ | $ | $ | $ | $ | $ | |||||||||||||||||||||||||||||

| Liabilities | $ | ( | $ | ( | $ | $ | ( | $ | ( | $ | |||||||||||||||||||||||||

| Preferred Distribution Rate Reset Election | $ | $ | $ | $ | $ | $ | ( | ||||||||||||||||||||||||||||

| Balance as of December 31, 2019 | $ | ( | ||||||

| Net loss for the period including earnings | ( | |||||||

Balance as of December 31, 2020 | ( | |||||||

| Net loss for the period including earnings | ( | |||||||

Balance as of December 31, 2021 | ( | |||||||

| Net loss for the period included in earnings | ( | |||||||

| Reclassification to Mezzanine Equity | ||||||||

Balance as of December 31, 2022 | $ | |||||||

| December 31, | |||||||||||

| 2022 | 2021 | ||||||||||

| Change in benefit obligation: | |||||||||||

| Benefit Obligation, beginning of year | $ | $ | |||||||||

| Service Cost | |||||||||||

| Interest Cost | |||||||||||

| Actuarial Gain | ( | ( | |||||||||

| Benefits Paid | ( | ( | |||||||||

| Benefit Obligation, end of year | |||||||||||

| Change in plan assets: | |||||||||||

| Fair Value of Plan Assets, beginning of year | |||||||||||

| Actual Return on Plan Assets | ( | ||||||||||

| Employer Contributions | |||||||||||

| Benefits Paid | ( | ( | |||||||||

| Fair Value of Plan assets, end of year | |||||||||||

| Funded Status at end of period | $ | ( | $ | ( | |||||||

| Amounts recognized in the Consolidated Balance Sheets: | |||||||||||

| Non-current assets | $ | $ | |||||||||

| Current liabilities | |||||||||||

| Non-current Liabilities | ( | ( | |||||||||

| Net Liability at end of year | $ | ( | $ | ( | |||||||

| Amounts recognized in accumulated other comprehensive income (loss): | |||||||||||

| Prior Service Cost | |||||||||||

| Net actuarial loss (gain) | ( | ||||||||||

| Amounts recognized in accumulated other comprehensive loss: | $ | ( | $ | ||||||||

| Employer Contributions | |||||

| Expected 2023 Contributions by Employer | $ | ||||

| Future Expected Benefit Payments | |||||

| 2023 | $ | ||||

| 2024 | |||||

| 2025 | |||||

| 2026 | |||||

| 2027 | |||||

| 2028-2032 | |||||

| December 31, | |||||||||||||||||

| 2022 | 2021 | 2020 | |||||||||||||||

| Service Cost | $ | $ | $ | ||||||||||||||

| Interest Cost | |||||||||||||||||

| Expected Return on Assets | ( | ( | ( | ||||||||||||||

| Amortization of Prior Service Cost | |||||||||||||||||

| Total Net Periodic Benefit Costs | $ | $ | $ | ||||||||||||||

| Weighted average assumptions used to determine benefit obligation: | December 31, 2022 | December 31, 2021 | |||||||||

| Discount Rate | % | % | |||||||||

| Expected Long-term Rate of Return | % | % | |||||||||

| Rate of Compensation Increase | N/A | N/A | |||||||||

| December 31, 2022 | |||||||||||||||||

| Target % | Minimum | Maximum | |||||||||||||||

| Equity securities | % | % | % | ||||||||||||||

| Fixed Income | % | % | % | ||||||||||||||

| Alternative Investments | % | % | % | ||||||||||||||

| Cash and Equivalents | % | % | % | ||||||||||||||

| 2022 | 2021 | ||||||||||||||||||||||||||||||||||||||||||||||

| Level 1 | Level 2 | Level 3 | Total | Level 1 | Level 2 | Level 3 | Total | ||||||||||||||||||||||||||||||||||||||||

| Cash and cash equivalents | $ | $ | $ | $ | $ | $ | $ | $ | |||||||||||||||||||||||||||||||||||||||

| Equity securities | |||||||||||||||||||||||||||||||||||||||||||||||

| Fixed income and other securities | |||||||||||||||||||||||||||||||||||||||||||||||

| $ | $ | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||

| Year Ended December 31, | |||||||||||||||||

| 2022 | 2021 | 2020 | |||||||||||||||

| Current: | |||||||||||||||||

| Federal | $ | $ | $ | ||||||||||||||

| State | |||||||||||||||||

| Total current income tax expense | $ | $ | $ | ||||||||||||||

| Deferred: | |||||||||||||||||

| Federal | $ | $ | $ | ||||||||||||||

| State | ( | ||||||||||||||||

| Total deferred income tax expense | $ | $ | $ | ||||||||||||||