UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

(Mark One)

or

For the fiscal year ended

or

For the transition period from to

or

Date of event requiring this shell company report

Commission file number

MakeMyTrip Limited

(Exact Name of Registrant as specified in its charter)

Not Applicable |

|

|

(Translation of Registrant’s Name Into English) |

|

(Jurisdiction of Incorporation or Organization) |

(Address of principal executive offices)

Group Chief Financial Officer

(

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

(Title of Class) |

(Trading Symbol) |

(Name of Exchange On Which Registered) |

Securities registered or to be registered pursuant to Section 12(g) of the Act.

None

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

None

(Title of Class)

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the Annual Report.

Class |

Number of Shares Outstanding as of March 31, 2023 |

Ordinary shares, $0.0005 par value per share (“ordinary shares”) |

|

Class B convertible ordinary shares, par value $0.0005 per share (“Class B Shares”) |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes ☐

Note — Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Accelerated filer ☐ |

Non-accelerated filer ☐ |

|

|

|

Emerging growth company |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ☐

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

Yes

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

US GAAP ☐ |

Other ☐ |

|

|

by the International Accounting Standards Board ☒ |

|

If “Other” has been checked in the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

Item 17 ☐ Item 18 ☐

If this is an Annual Report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Securities Exchange Act of 1934).

Yes

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court:

Yes ☐ No ☐

TABLE OF CONTENTS

|

PAGE |

PART I |

|

|

|

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS |

8 |

|

|

8 |

|

|

|

8 |

|

|

|

39 |

|

|

|

66 |

|

|

|

67 |

|

|

|

101 |

|

|

|

114 |

|

|

|

117 |

|

|

|

129 |

|

|

|

129 |

|

|

|

ITEM 11. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK |

154 |

|

|

ITEM 12. DESCRIPTION OF SECURITIES OTHER THAN EQUITY SECURITIES |

155 |

|

|

PART II |

|

|

|

156 |

|

|

|

ITEM 14. MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE OF PROCEEDS |

156 |

|

|

156 |

|

|

159 |

|

|

159 |

|

|

|

159 |

|

|

|

159 |

|

|

|

ITEM 16D. EXEMPTIONS FROM THE LISTING STANDARDS FOR AUDIT COMMITTEES |

160 |

|

|

ITEM 16E. PURCHASES OF EQUITY SECURITIES BY THE ISSUER AND AFFILIATED PURCHASERS |

160 |

|

|

161 |

|

|

|

161 |

|

|

|

161 |

|

|

|

ITEM 16I. DISCLOSURE REGARDING FOREIGN JURISDICTIONS THAT PREVENT INSPECTIONS. |

161 |

|

|

161 |

|

PART III |

|

|

|

162 |

|

|

|

162 |

|

|

|

163 |

|

|

|

166 |

|

|

|

F-1 |

|

|

|

CONVENTIONS USED IN THIS ANNUAL REPORT

In this Annual Report, we refer to information regarding the travel service industry and our competitors from market research reports, analyst reports and other publicly available sources, including the Directorate General of Civil Aviation, the Indian governmental regulatory body for civil aviation, or the DGCA; the World Economic Forum, or WEF; and the International Air Transport Association, or IATA.

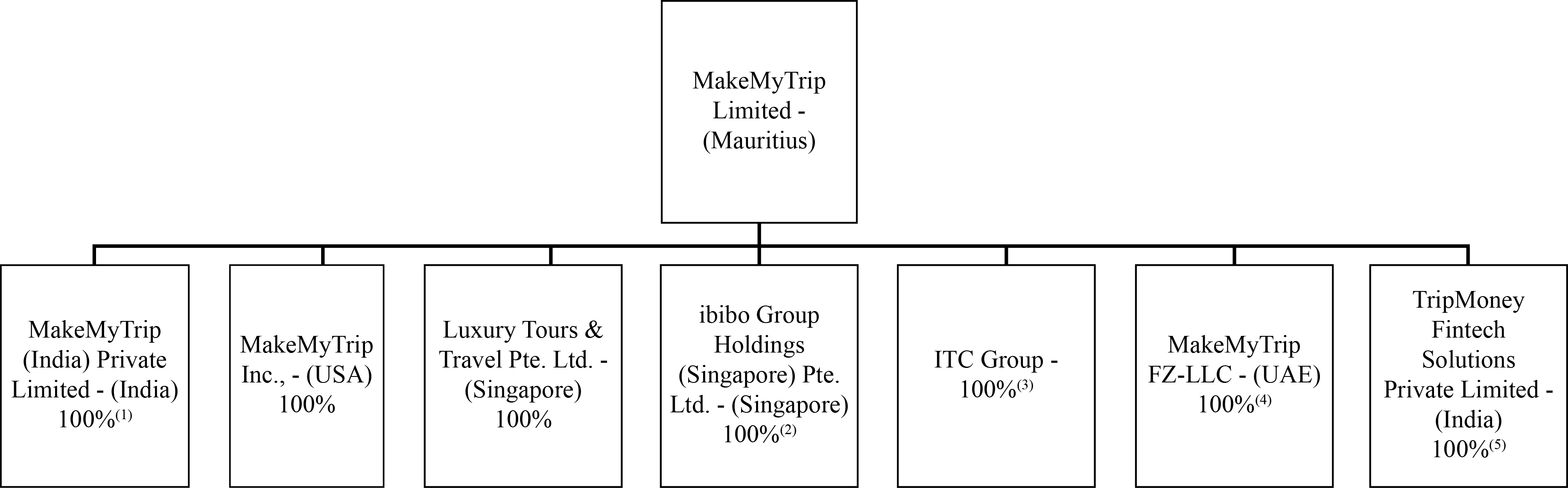

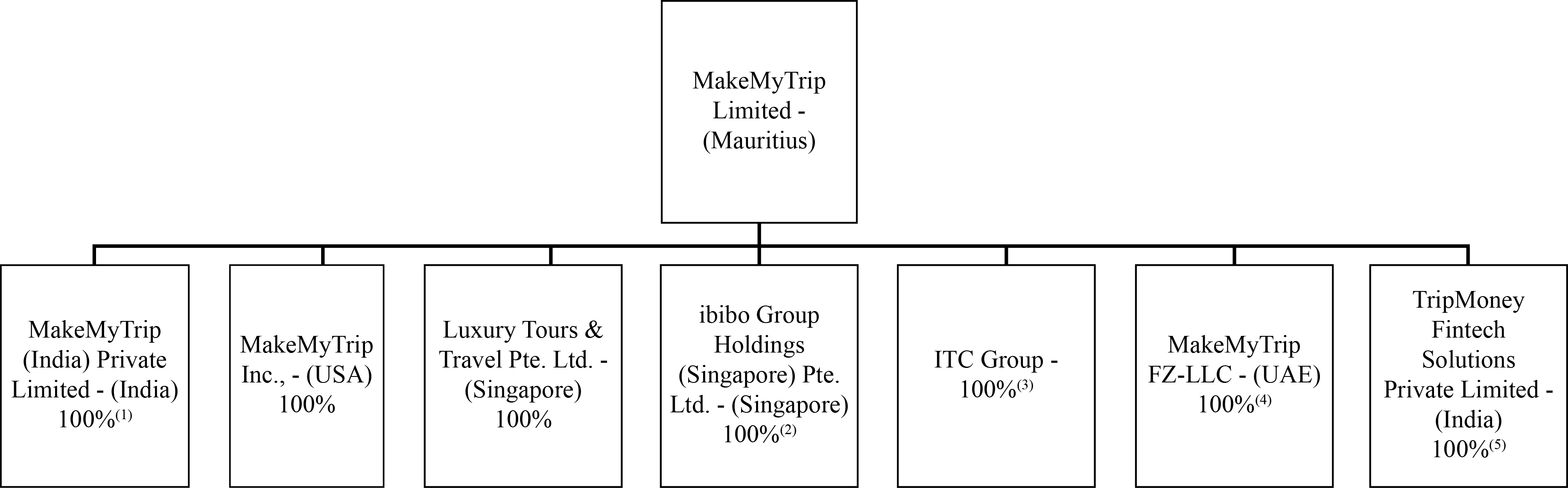

We conduct our business principally through our wholly-owned Indian subsidiaries, MakeMyTrip (India) Private Limited, or MMT India, and redBus India Private Limited, or redBus India. On February 1, 2023, we completed the transfer of our Goibibo business from ibibo Group Private Limited, or ibibo India, to MMT India pursuant to a scheme of arrangement between our wholly-owned Indian subsidiaries, MMT India and ibibo India. Our redBus business was retained by ibibo India and ibibo India was subsequently renamed redBus India. References to “MakeMyTrip”, “Goibibo” and “redBus” in this Annual Report refer to our MakeMyTrip, Goibibo and redBus brands and platforms, respectively. Our other key operating subsidiaries include ITC Bangkok Co., Ltd., Thailand, the main operating entity of the group of companies known as the ITC Group; Luxury Tours & Travel Pte. Ltd., Singapore, or Luxury Tours; MakeMyTrip Inc., or MMT USA; MakeMyTrip Travel & Tourism L.L.C, or MMT UAE; Bitla Software Private Limited, or Bitla; Quest 2 Travel.com India Private Limited, or Quest 2 Travel; Book My Forex Private Limited, or Book My Forex; Simplotel Technologies Private Limited, or Simplotel; and TripMoney Fintech Solutions Private Limited, or TripMoney. In this Annual Report, unless otherwise stated or unless the context otherwise requires, references to “we”, “us”, “our”, “our company” or “our group” are to MakeMyTrip Limited and its subsidiaries collectively, and references to “our holding company” are to MakeMyTrip Limited on a standalone basis.

In this Annual Report, references to “US”, “U.S.”, “the United States” or “USA” are to the United States of America, its territories and its possessions, references to “India” are to the Republic of India, references to “Colombia” are to the Republic of Colombia, references to “GCC” are to the Gulf Cooperation Council, references to “Indonesia” are to the Republic of Indonesia, references to “Malaysia” are to the Federation of Malaysia, references to “Mauritius” are to the Republic of Mauritius, references to “Peru” are to the Republic of Peru, references to “Singapore” are to the Republic of Singapore, references to “Thailand” are to the Kingdom of Thailand and references to “UAE” are to the United Arab Emirates. References to “$”, “dollars” or “US dollars” are to the legal currency of the United States and references to “Rs.,” “Rupees”, “INR” or “Indian Rupees” are to the legal currency of India and references to “Emirati Dirhams” are to the legal currency of the UAE.

Solely for the convenience of the reader, this Annual Report contains translations of certain Indian Rupee amounts into US dollars at specified rates. Except as otherwise stated in this Annual Report, all translations from Indian Rupees to US dollars are based on the middle rate of Rs.82.16 per $1.00 on March 31, 2023 as per rates available on www.oanda.com. No representation is made that the Indian Rupee amounts referred to in this Annual Report could have been or could be converted into US dollars at such rates or any other rates. Any discrepancies in any table between totals and sums of the amounts listed are due to rounding.

Unless otherwise indicated, the consolidated financial statements as of March 31, 2022 and 2023 and for the fiscal years ended March 31, 2021, 2022 and 2023 included elsewhere in this Annual Report have been prepared in accordance with International Financial Reporting Standards, or IFRS, as issued by the International Accounting Standards Board, or IASB. References to a particular “fiscal year” are to our fiscal year ended March 31 of that year. Our fiscal quarters end on June 30, September 30, December 31 and March 31. References to a year other than a “fiscal” year are to the calendar year ended December 31.

4

CERTAIN KEY PERFORMANCE INDICATORS AND NON-IFRS MEASURES

We refer to certain non-IFRS measures in various places within this Annual Report, including “Adjusted Operating Profit (Loss)”, “Adjusted Net Profit (Loss)”, “Adjusted Diluted Earnings (Loss) per Share” and constant currency results. Our key performance indicators are “Adjusted Margin” and “Adjusted Margin %” which are also non-IFRS measures referred to in various places within this Annual Report.

We evaluate our financial performance in each of our reportable segments based on our key performance indicators, Adjusted Margin and Adjusted Margin %, which are non-IFRS measures and segment profitability measures. Adjusted Margin represents IFRS revenue after adding back customer inducement costs in the nature of customer incentives, customer acquisition costs and loyalty program costs which are reported as a reduction of revenue, and deducting the cost of acquisition of services primarily relating to sales to customers where we act as the principal. Adjusted Margin % represents Adjusted Margin as a percentage of gross bookings.

Our Consolidated Statement of Profit or Loss and Other Comprehensive Income reports customer inducement costs as a reduction of revenue in the respective revenue lines. As certain parts of our revenues are recognized on a “net” basis when we are acting as an agent, and other parts of our revenue are recognized on a “gross” basis when we are acting as the principal, we evaluate our financial performance in each of our reportable segments based on Adjusted Margin, which is a non-IFRS measure and a segment profitability measure, as we believe that Adjusted Margin reflects the value addition of the travel services that we provide to our customers. Income from packages, including income on airline tickets sold to customers as a part of tours and packages is accounted for on a “gross” basis as the Company controls the services before such services are transferred to travelers. Revenue from the packages business which is accounted for on a “gross” basis represents the total amount paid by customers for these travel services and products, while our cost of procuring the relevant services and products for sale to our customers in this business is classified as service cost. See “Item 5. Operating and Financial Review and Prospects — Our Revenue, Service Cost and Expenses — Revenue.”

We also refer to Adjusted Operating Profit (Loss), Adjusted Net Profit (Loss) and Adjusted Diluted Earnings (Loss) per Share which are non-IFRS measures and most directly comparable to results from operating activities, profit (loss) for the year and diluted earnings (loss) per share for the year, respectively, each of which is an IFRS measure. We use financial measures that exclude share-based compensation expense, merger and acquisitions related expenses, amortization of acquired intangibles, provision for litigations, gain on discontinuation of equity-accounted investment, net change in financial liability relating to acquisitions, change in fair value of financial asset measured at fair value through profit or loss (FVTPL), share of loss (profit) of equity-accounted investees, interest expense on financial liabilities measured at amortized cost and income tax benefit for our internal management reporting, budgeting and decision making purposes, including comparing our operating results to that of our competitors.

A limitation of using Adjusted Operating Profit (Loss), Adjusted Net Profit (Loss) and Adjusted Diluted Earnings (Loss) per Share instead of results from operating activities, profit (loss) for the year and diluted earnings (loss) per share calculated in accordance with IFRS as issued by the IASB is that these non-IFRS measures exclude a recurring cost, for example, share-based compensation. Management compensates for this limitation by providing specific information on the IFRS amounts excluded from Adjusted Operating Profit (Loss), Adjusted Net Profit (Loss) and Adjusted Diluted Earnings (Loss) per Share. Because of varying available valuation methodologies and subjective assumptions that companies can use when adopting IFRS 2 “Share based payment,” management believes that providing non-IFRS measures that exclude such expenses allows investors to make additional comparisons between our operating results and those of other companies. For a description of the components and calculation of “Adjusted Operating Profit (Loss)”, “Adjusted Net Profit (Loss)”, and “Adjusted Diluted Earnings (Loss) per Share” and a reconciliation of these non-IFRS measures to the most directly comparable IFRS measures, see “Item 5. Operating and Financial Review and Prospects — Certain Key Performance Indicators and Non-IFRS Measures” elsewhere in this Annual Report.

Constant currency results are financial measures that are not prepared in accordance with IFRS, and assume constant currency exchange rates used for translation based on the rates in effect during the comparable period in the prior fiscal year. Because the impact of changing foreign currency exchange rates may not provide an accurate baseline for analyzing trends in our business, management believes percentage growth in constant currency is an important metric for evaluating our operations. Constant currency is a non-IFRS measure and it should not be considered as a substitute for measures prepared in accordance with IFRS.

5

We believe that our current calculations of Adjusted Operating Profit (Loss), Adjusted Net Profit (Loss), Adjusted Diluted Earnings (Loss) per Share, Adjusted Margin, Adjusted Margin % and change in constant currency represent a balanced approach to adjusting for the impact of certain discrete, unusual or non-cash items and other items such as customer inducement costs in the nature of customer incentives, customer acquisition costs and loyalty program costs, which we believe are representative of our operating results and provide useful information to investors and analysts. We believe that investors and analysts in our industry use these non-IFRS measures and key performance indicators to compare our company and our performance to that of our global peers.

However, the presentation of these non-IFRS measures and key performance indicators are not meant to be considered in isolation or as a substitute for our consolidated financial results prepared in accordance with IFRS as issued by the IASB. These non-IFRS measures and key performance indicators may not be comparable to similarly titled measures reported by other companies due to potential differences in the method of calculation.

For further information and a reconciliation of these non-IFRS measures to the most directly comparable IFRS measures, see “Item 5. Operating and Financial Review and Prospects — Certain Key Performance Indicators and Non-IFRS Measures” elsewhere in this Annual Report.

6

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report contains forward-looking statements that relate to our current expectations and views of future events. These forward-looking statements are contained principally in the sections entitled “Item 3. Key Information,” “Item 4. Information on the Company” and “Item 5. Operating and Financial Review and Prospects.” These statements relate to events that involve known and unknown risks, uncertainties and other factors, including those listed under “Item 3. Key Information — D. Risk Factors,” which may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements.

In some cases, these forward-looking statements can be identified by words or phrases such as “may”, “will”, “expect”, “anticipate”, “aim”, “estimate”, “intend”, “plan”, “believe”, “potential”, “continue”, “is/are likely to”, “project”, “seek”, “should” or other similar expressions.

These forward-looking statements are subject to risks, uncertainties and assumptions, some of which are beyond our control. In addition, these forward-looking statements reflect our current views with respect to future events and are not a guarantee of future performance. Actual outcomes may differ materially from the information contained in the forward-looking statements as a result of a number of factors, including, without limitation, the risk factors set forth in “Item 3. Key Information — D. Risk Factors,” and the following:

The forward-looking statements made in this Annual Report relate only to events or information as of the date on which the statements are made in this Annual Report. Our actual results, performance, or achievement may differ materially from those expressed in, or implied by, these forward-looking statements. Accordingly, we can give no assurances that any of the events anticipated by these forward-looking statements will transpire or occur or, if any of the foregoing factors or other risks and uncertainties described elsewhere in this Annual Report were to occur, what impact they would have on these forward-looking statements, including our results of operations or financial condition. In view of these uncertainties, you are cautioned not to place undue reliance on these forward-looking statements.

Except as required by law, we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events.

7

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

ITEM 3. KEY INFORMATION

A. [Reserved]

B. Capitalization and Indebtedness

Not applicable.

C. Reasons for the Offer and Use of Proceeds

Not applicable.

D. Risk Factors

This Annual Report contains forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those anticipated in these forward-looking statements as a result of a number of factors, including those described in the following risk factors and elsewhere in this Annual Report. If any of the following risks actually occur, our business, financial condition and results of operations could suffer.

Risks Related to Us and Our Industry

The COVID-19 Pandemic Has Materially Adversely Affected, And May Further Adversely Impact, the Travel Industry and Our Business, Financial Condition, Results of Operations and Cash Flows.

Since the fourth quarter of fiscal year 2020, the world has been and continues to be impacted by the COVID-19 pandemic. In response to the COVID-19 pandemic, the government in India and governments in many countries and regions implemented containment measures, such as imposing lockdowns and restrictions on travel and business operations and advising or requiring individuals to drastically limit the time spent outside of their homes. The ability to travel was diminished by city, state and national border closures, mandated travel restrictions and limited operations of airlines and hotels. Many of our customers and suppliers, including hotels and airlines, drastically reduced their service offerings or ceased operations entirely.

The measures implemented to contain and mitigate the COVID-19 pandemic had a significant negative effect on our business, financial condition, results of operations and cash flows throughout much of fiscal years 2021 and 2022. For example, in the fourth quarter of fiscal year 2020, we experienced a significant decline in travel demand resulting in significant customer cancellations and refund requests and reduced new orders relating to international and domestic travel and lodging. We observed a significant decrease in supply of domestic transportation tickets and international air tickets in response to comprehensive containment measures in India and international regions.

The COVID-19 pandemic had severely impacted travel demand globally in terms of affecting consumers’ sentiment and their willingness to travel, which had caused airlines and hotels in India and around the world to operate at significantly reduced service levels throughout much of fiscal years 2021 and 2022. The COVID-19 pandemic also contributed to significant weakness in the macroeconomic environment and heightened volatility in financial markets, including rising inflation and interest rates. In India, we witnessed a rapid resurgence of daily recorded case counts towards the end of the fourth quarter of fiscal year 2021 which peaked in the first quarter of fiscal year 2022, resulting in a second wave of the COVID-19 pandemic in India.

During the fiscal year 2023, we experienced significant growth in travel demand due to high pent-up demand and sustained consumer sentiment for travel as a result of increased COVID-19 vaccination rates and comparatively lower COVID-19 infection rates. This, along with our continued focus on optimizing costs by

8

leveraging our highly variable and more efficient fixed cost structure during the fiscal year 2023, led to improved results across our operating segments in the fiscal year 2023 as compared to the fiscal years 2022 and 2021.

However, the extent and duration of the effects of the COVID-19 pandemic over the longer term on our business, results of operations, cash flows and growth prospects remain uncertain and would be dependent on future developments that cannot be accurately predicted at this time. These include, but are not limited to, the severity, extent and duration of the COVID-19 pandemic, its impact on the travel industry and consumer spending, rates of vaccination, the occurrence of new mutations or variants and the effectiveness of vaccinations against various mutations or variants of the COVID-19 virus.

Our business and the travel industry in general is particularly sensitive to reductions in personal and business-related discretionary travel and spending levels. The COVID-19 pandemic could continue to impede global economic activity, even as restrictions are lifted, leading to decreased per capita income and disposable income, increased and prolonged unemployment or a decline in consumer confidence, change in consumer behavior and preferences, all of which could significantly reduce discretionary travel and spending by individuals and businesses. In turn, that could have a negative impact on demand for our services and could result in us, our suppliers or our competitors having to reduce prices or offer incentives to attract travelers, despite already operating in a highly competitive industry. Such circumstances or developments could have a material adverse impact on our business, financial condition, results of operations and cash flows. We cannot reasonably estimate the impact of the COVID-19 pandemic on our future revenues, results of operations, cash flows, liquidity or financial condition.

Declines or Disruptions in the Travel Industry Could Adversely Affect Our Business and Financial Performance.

Our business and financial performance is affected by the health of the travel industry in India and worldwide, including changes in supply and pricing. Events specific to the travel industry that could negatively affect our business include changes in the commercial aviation landscape, fare increases, travel-related strikes, aviation accidents or labor unrest, general civil unrest, fuel price volatility and bankruptcies or liquidations of our suppliers. For example, the COVID-19 pandemic has had a significant negative impact on the travel industry in India, including our business, and around the world. The global travel industry was severely disrupted by the COVID-19 pandemic throughout much of fiscal years 2021 and 2022, which resulted in significant travel cancellations and a steep reduction of domestic and international travel. In India, virtually all travel was halted due to the nationwide stay at home orders implemented by the Indian government in March 2020 to slow down the spread of the virus. Although our business started to recover gradually in the second and third quarters of fiscal year 2021 following the lifting of India’s nationwide lockdown in end May 2020, India witnessed a rapid resurgence of daily record case count towards the end of the fourth quarter of fiscal year 2021 which peaked in the first quarter of fiscal year 2022, resulting in a second wave of COVID-19 pandemic in India. The resulting economic conditions caused by the lockdowns and travel restrictions orders imposed by several state governments in India from April 2021, which continued for part of fiscal year 2022, and the emergence and spread of new variants of the COVID-19 virus, including for example, the Omicron variant, which emerged in December 2021, resulted in a third wave of COVID-19 pandemic in India and also had a negative impact on revenue for all our reportable segments in the fiscal year 2022. For more information, see “Risk Factors — Risks Related to Us and Our Industry — The COVID-19 Pandemic Has Materially Adversely Affected, And May Further Adversely Impact, the Travel Industry and Our Business, Financial Condition, Results of Operations and Cash Flows.”

Political and social unrest, including in Asia and Europe has also adversely impacted travel to and within India at times in the past. Such events, particularly in the Middle East, also impact crude oil prices, which may have an adverse impact on the travel industry globally, including our business. For example, the escalation of tensions between Ukraine and Russia which culminated in war in February 2022, continues to have a significant impact on oil prices globally and to affect travel sentiments for that particular region. Similarly, the social and economic unrest in Sri Lanka in 2022 affected demand for travel to Sri Lanka. Sudden disruptions in travel have also followed terrorist attacks carried out both domestically in India and internationally in countries such as the United States, Sri Lanka, France, Belgium and the United Kingdom, adverse weather conditions or other natural disasters, such as the earthquake in Turkey and Syria in February 2023. In addition, the drop in the average value of the Indian Rupee as compared to the US dollar in the last few fiscal years has adversely impacted the Indian travel industry as it made overseas travel for Indian consumers more expensive.

The majority of the domestic Indian air travel industry is concentrated among a small base of domestic airlines. Therefore, adverse market developments, particularly among the most dominant domestic airlines, are more likely to impact our business. For example, in May 2023, Go Airlines (India) Limited, or Go First, being

9

one of our top five domestic airline suppliers, filed an application for voluntary insolvency resolution proceedings and suspended all of its flight operations from May 3, 2023. Go First's flight operations remain suspended as of the date of this Annual Report. This has reduced the supply of air travel tickets available on our platform and resulted in disruptions to our customers’ travel plans.

Additionally, our business is sensitive to safety concerns, and thus our business has in the past declined and may in the future decline after incidents of actual or threatened terrorism, during periods of political instability or conflict or during other periods in which travelers become concerned about safety issues, including as a result of natural disasters such as tsunamis or earthquakes or when travel might involve health-related risks, such as the COVID-19 pandemic, monkeypox virus, Ebola virus, Middle East respiratory syndrome, the influenza A virus (H1N1), avian flu (H5N1 and H7N9), Severe Acute Respiratory Syndrome, the Zika virus or other epidemics or pandemics. In addition, there may be work stoppages or labor unrest at airlines or airports. Acts of terrorism and adverse weather conditions or other natural disasters may also in the future have a negative impact on our travel business.

Our businesses may also be negatively impacted by direct and indirect impacts of climate change. Direct effects may include disruptions to travel due to more frequent or severe storms, hurricanes, flooding, rising sea levels, shortages of water, droughts and wildfires, and indirect effects may include new travel-related regulations, policies or conditions related to sustainability and climate change concerns. In addition, increased focus on the environmental impact of travel may disrupt travel, or limit the ability or willingness of travelers to visit certain locations.

Such events are outside our control and could result in a significant decrease in demand for our travel services. Any such decrease in demand, depending on its scope and duration, together with any other issues affecting travel safety, could significantly and adversely affect our business and financial performance over the short and long term. The occurrence of such events could result in disruptions to our customers’ travel plans and we may incur additional costs and face liquidity constraints if we provide relief to affected customers by not charging cancellation fees or by refunding the cost of airline tickets, hotel reservations and other travel services and products. If there is a prolonged substantial decrease in travel volumes, for these or any other reasons, our business, financial condition and results of operations would be adversely affected.

Our Business and Results of Operations Could Be Adversely Affected by Global Economic Conditions.

Perceived or actual adverse economic conditions, including slow, slowing or negative economic growth, unemployment rates, inflation and weakening currencies, and concerns over government responses such as higher taxes and reduced government spending, could impair consumer spending and adversely affect travel demand. Consumer purchases of discretionary items generally decline during periods of recession and other periods in which disposable income is adversely affected. As a substantial portion of travel expenditure, for both business and leisure, is discretionary, the travel industry tends to experience weak or reduced demand during economic downturns.

Unfavorable changes in the above factors or in other business and economic conditions affecting our customers could result in fewer reservations made through our websites, and have a material adverse effect on our business, financial condition and results of operations.

The global economy may be adversely impacted by unforeseen events beyond our control including incidents of actual or threatened terrorism, regional hostilities or instability, unusual weather patterns, natural disasters, political instability, war between countries and health concerns (including epidemics or pandemics), defaults on government debt, tax increases and other matters that could reduce discretionary spending, tightening of credit markets and further decline in consumer confidence. For example, the COVID-19 pandemic has had a significant negative impact on the travel industry in India, including our business, and around the world. See also “Risk Factors — Risks Related to Us and Our Industry — The COVID-19 Pandemic Has Materially Adversely Affected, And May Further Adversely Impact, the Travel Industry and Our Business, Financial Condition, Results of Operations and Cash Flows.” In addition, the uncertainty of macro-economic factors and their impact on consumer behavior, which may differ across regions, makes it more difficult to forecast industry and consumer trends and the timing and degree of their impact on our markets and business, which in turn could adversely affect our ability to effectively manage our business and adversely affect our results of operations. The weakness and uncertainty in the global economy has negatively impacted both corporate and consumer spending patterns and demand for travel services, globally and in India, and may continue to do so in the future. For example, the recent economic crisis in Sri Lanka has reduced the demand for travel to that country.

As an intermediary in the travel industry, a significant portion of our revenue is affected by fares and tariffs charged by our suppliers as well as volumes of sales made by us. During periods of poor economic conditions,

10

airlines and hotels tend to reduce rates or offer discounted sales or run promotions to stimulate demand, thereby reducing our commission-based income. A slowdown in economic conditions may also result in a decrease in transaction volumes and adversely affect our revenue. It is difficult to predict the effects of the uncertainty in global economic conditions. If economic conditions worsen globally or in India, our growth plans, business, financial condition and results of operations could be adversely impacted.

If We Are Unable to Maintain Existing, and Establish New, Arrangements with Travel Suppliers, Our Business May Be Adversely Affected.

Our business is dependent on our ability to maintain our relationships and arrangements with existing suppliers, such as airlines which supply air tickets to us directly, Amadeus IT Group SA, Travelport Worldwide Ltd and Trip.com (our largest shareholder) and its subsidiaries, our global distribution system or GDS service providers, Indian Railways, hotels, hotel suppliers and destination management companies, bus operators and car hire companies, as well as our ability to establish and maintain relationships with new travel suppliers. In addition, we rely on a limited number of travel suppliers and aggregators to provide the majority of our accommodation and other travel products in markets outside India. A substantial portion of our Revenue and Adjusted Margin is derived from fees and commissions negotiated with travel suppliers for bookings made through our websites, mobile platforms or via our other distribution channels. Adverse changes in existing arrangements, including an inability by any travel supplier to fulfill their payment obligation to us in a timely manner, increasing industry consolidation or our inability to enter into or renew arrangements with such parties on favorable terms, could reduce the amount, quality, pricing and breadth of the travel services and products that we are able to offer, which could adversely affect our business, financial condition and results of operations. For example, we have experienced short-term disruptions in the supply of tickets from domestic airlines in the past, such as the recent suspension of flights from May 3, 2023 by Go First, one of our top five domestic airline suppliers.

In addition, adverse economic developments affecting the travel industry could also adversely impact our ability to maintain our existing relationships and arrangements with one or more of our suppliers. In particular, adverse changes to the overall business and financial climate for the airline industry in India due to various factors including, but not limited to, rising fuel costs, high taxes, significant depreciation of the Indian Rupee as compared to the US dollar making travel for Indian consumers outside India more expensive, and increased liquidity constraints, could affect the ability of one or more of our airline suppliers to continue to operate or otherwise meet our demand for tickets, which, in turn, could materially and adversely affect our financial results.

The COVID-19 pandemic has had a significant negative impact on the travel industry in India, including our business, and around the world. For more information, see “Risk Factors — Risks Relating to Us and Our Industry — The COVID-19 Pandemic Has Materially Adversely Affected, And May Further Adversely Impact, the Travel Industry and Our Business, Financial Condition, Results of Operations and Cash Flows.” The COVID-19 or any similar pandemic may also result in interruptions to the operation of our suppliers, which could in turn adversely affect our ability to provide certain services to our customers.

Over the last few years, the domestic airlines in India have reduced the base commissions paid to travel agencies, which has had an adverse impact on our business. In addition, rising competition in the Indian travel market prompted us to significantly increase our spending on marketing and sales promotion expenses to promote transactions on our platforms in India. Any consolidation in the airline industry involving our suppliers may also adversely affect our existing relationships and arrangements with such suppliers.

No assurance can be given that our agreements or arrangements with our travel suppliers or GDS service providers will continue. In addition, our travel suppliers or GDS service providers may further reduce or eliminate fees or commissions or attempt to charge us for content, terminate our contracts, make their products or services unavailable to us as part of exclusive arrangements with our competitors or default on or dispute their payment or other obligations towards us, any of which could reduce our revenue and Adjusted Margin or may require us to initiate legal or arbitral proceedings to enforce their contractual payment obligations, which may adversely affect our business and financial performance. See also “Risk Factors — Risks Related to Us and Our Industry —Some of Our Airline Suppliers (Including Our GDS Service Providers) May Reduce or Eliminate the Commission and Other Fees They Pay to Us for the Sale of Air Tickets and This Could Adversely Affect Our Business and Results of Operations.”

We Do Not Have Formal Agreements with Many of Our Travel Suppliers.

We rely on various travel suppliers to facilitate the sale of our travel services. We do not have formal agreements with many of our travel suppliers whose booking systems or central reservations systems are relied upon by us for bookings and confirmation as well as certain payment gateway arrangements, and there can be no

11

assurance that these third parties will not terminate these arrangements with us at short notice or without notice. Further, where we have entered into formal agreements, many of these agreements are short-term contracts, requiring periodic renewal and providing our counterparties with a right to terminate at short notice or without notice. Some of these agreements are scheduled to expire in the near future and we are in the process of renewing those agreements. Many of our suppliers with whom we have formal agreements, including airlines, are also able to alter the terms of their contracts with us at will or at short notice. Our agreement with Indian Railways Catering and Tourism Corporation Limited, or IRCTC, which allows us to transact with Indian Railways’ passenger reservation system through the internet, can be terminated or temporarily suspended by IRCTC without prior notice and at its sole discretion. Termination, non-renewal or suspension or an adverse amendment of any of the abovementioned agreements and/or arrangements could have a material adverse effect on our business, financial condition and results of operations.

We Have Sustained Operating Losses in the Past and May Continue to Experience Operating Losses in the Future.

We sustained operating losses in fiscal years from 2013 to 2022 and in all our fiscal years prior to and including fiscal year 2010. While we generated operating profits in fiscal years 2011, 2012 and 2023, there can be no assurance that we will continue to be profitable or that we can avoid operating losses in the future. We expect to continue making investments in mobile technology, marketing and sales promotion (including brand building) and customer acquisition programs and expanding our hotels and packages offerings as part of our long-term strategy to increase the contribution of our hotels and packages business and to increase the share of outbound travel from India. The degree of increases in these expenses will be largely based on anticipated organizational growth and revenue trends, the competitive environment, pricing trends and trends in online penetration of the Indian travel market. As a result, any decrease or delay in generating additional sales volumes and revenue could result in substantial operating losses. In recent years, we made significant investments in our ongoing customer inducement and acquisition programs, such as cash incentives and select loyalty program incentive promotions, to accelerate growth in our business in response to increased competition in the domestic travel market in India. In fiscal year 2021, we implemented various cost saving measures in response to lower travel demand due to the COVID-19 pandemic and reduced our operating expenses (including marketing and sales promotions expenses) and reported an operating loss of $(67.7) million. In fiscal year 2022, in response to the gradual recovery in domestic travel demand as a result of the diminishing impact of the COVID-19 pandemic in India, our revenue and operating expenses (including marketing and sales promotions expenses) increased and we reported an operating loss of $(30.4) million. In fiscal year 2023, due to the strong recovery in travel demand as a result of the diminishing impact of the COVID-19 pandemic, our revenue was higher than our operating expenses (including marketing and sales promotions expenses) and we reported an operating profit of $23.6 million.

The Travel Industry in India and Worldwide is Highly Competitive, and We May Not Be Able to Effectively Compete in the Future.

The market for travel services and products is highly competitive. We compete with established and emerging providers of travel services and products, including other online travel agencies such as Yatra.com, Booking.com, Cleartrip.com, EaseMyTrip.com, Airbnb.co.in, Ixigo and Expedia.com, and offline traditional travel agencies, tour operators and travel suppliers. We also face potential competition from payment platforms, online marketplaces, search engines and intermediaries that also offer travel services. Many large, established internet search engines who offer travel services and meta-search companies that can aggregate travel search results also compete with us for customers. Consumers may favor travel services offered by meta-search platforms or search companies over online travel companies such as ours, which could reduce traffic to our online platforms and require us to further increase our expenditures on marketing and other customer acquisition. The Indian market is highly competitive, and current and new competitors may be able to launch new services at a lower cost. In the hotels and packages segment, we primarily compete with traditional travel players such as Thomas Cook, Travel Triangle and others in packages offerings, as well as online travel agencies in standalone hotel bookings and new entrants.

12

Factors affecting our competitive success include, among other things, price, availability and breadth of choice of travel services and products, brand recognition, customer service, fees charged to travelers, ease of use, accessibility and reliability. Certain of our competitors have launched brand marketing campaigns to increase their visibility with customers. In addition, many large hotel chains have launched initiatives, such as increased discounting and incentives, to encourage consumers to book accommodations through their websites. Discounting and couponing coupled with a high degree of consumer shopping behavior is particularly common in Asian markets we operate in, while brand loyalty in such markets is less important. In some cases, our competitors are willing to make little or no profit on a transaction, or offer travel services at a loss, in order to gain market share. Some of our competitors have significantly greater financial, marketing, personnel and other resources than us and certain of our competitors have a longer history of established businesses and reputations in the Indian travel market (particularly in the hotels and packages business) as compared to us. From time to time, we may be required to reduce service fees and commissions charged to our customers or suppliers in order to compete effectively and maintain or gain market share.

Over the years, there has been a proliferation of new channels through which accommodation providers can offer reservations as the market for travel services has evolved. For example, several leading online travel companies now allow alternative accommodation property owners, particularly individuals, to list alternative accommodations on their platforms, which has resulted in direct competition with our alternative accommodation services. Further, we may also face increased competition from new entrants in our industry, some of whom may offer discounted rates and other incentives from time to time. We cannot assure you that we will be able to successfully compete against existing or new competitors in our existing lines of business as well as new lines of business into which we may venture. If we are not able to compete effectively, our business, financial condition and results of operations may be adversely affected.

Some travel suppliers are seeking to decrease their reliance on distribution intermediaries like us, by promoting direct distribution channels. Many airlines, hotels, car rental companies and tour operators have call centers and have established their own travel distribution websites and mobile applications. From time to time, travel suppliers offer advantages, such as bonus loyalty awards and lower transaction fees or discounted prices, when their services and products are purchased from supplier-related channels.

We also compete with competitors who may offer less content, functionality and marketing reach but at a relatively lower cost to suppliers. If our access to supplier-provided content or features were to be diminished either relative to our competitors or in absolute terms or if we are unable to compete effectively with travel supplier-related channels or other competitors, our business could be materially and adversely affected.

We Have Incurred and May Continue to Incur Significant Expenses to Grow Our Businesses, Including Marketing and Sales Promotion Expenses.

In order to drive our growth strategy in the hotels business, in the past we have incurred increased marketing and sales promotion expenses. Over the last few years, we have also made significant investments in customer acquisition through our customer inducement programs such as cash incentives and select loyalty program incentive promotions, to accelerate growth in our business in response to increased competition in the domestic travel market in India. We may continue to incur such expenses in future, including expenses associated with our strategy of converting our traditional offline customers into online customers. We have incurred and expect to continue to incur expenses associated with customer inducement and acquisition programs in our hotels and packages business to offer cash incentives and select loyalty program incentive promotions from time to time on our booking platforms. We may also increase our marketing and sales promotion expenses as a result of our expansion into new markets and such expenses may not be offset by increased revenue particularly at the initial commencement of business in these new markets. We may also be required to lower our fees and commissions charged to hotel suppliers to retain and increase our market share in response to competitors that are able to negotiate better rates and higher performance linked and other incentives from such suppliers, including new entrants with greater financial resources than us. We may also incur increasing marketing and sales promotion expenses as we grow our redBus business in India as well as overseas, and which competes with, among others, Abhibus, Paytm and other regional competitors. Although we implemented various cost saving measures in response to lower travel demand due to the COVID-19 pandemic, including by reducing our marketing and sales promotions expenses in fiscal year 2021, we increased our marketing and sales promotion expenses in anticipation of increased domestic and international travel demand in fiscal year 2022. Further, in fiscal year 2023, due to the strong recovery in travel demand as a result of the diminishing impact of the COVID-19 pandemic in India, we increased our marketing and sales promotions expenses and expect to continue to do so in future. Such expenses and any loss of revenue from competitive pressures may adversely affect our business, financial condition and results of operations.

13

In The Past, We Identified a Material Weakness in Our Internal Control Over Financial Reporting. We Cannot Assure You That Additional Material Weaknesses Will Not be Identified in The Future. Our Failure to Implement And Maintain Effective Internal Control Over Financial Reporting Could Result in Material Misstatements in Our Financial Statements Which Could Require Us to Restate Financial Statements in The Future, Cause Investors to Lose Confidence in Our Reported Financial Information And Have a Negative Effect on Our Stock Price.

In connection with our management’s assessment of the effectiveness of our internal control over financial reporting for fiscal year 2020, our management identified a material weakness in our internal control over financial reporting and had concluded that as of March 31, 2020, our disclosure controls and procedures and internal control over financial reporting were not effective. In the fourth quarter of fiscal year 2020, as a result of the significant negative impact related to COVID-19 pandemic on the travel industry and our stock price and market capitalization, we performed a quantitative assessment of goodwill and, following that assessment, we recorded an impairment charge of our goodwill amounting to $272.2 million, primarily related to our Goibibo business, which we had acquired in fiscal year 2017. Forecast financial information produced to support Goibibo business’ annual planning process is a key data input into the impairment assessment. While the COVID-19 pandemic has made it challenging to forecast financial information in the travel industry, the controls associated with the business planning process were not effective to mitigate the risk of material misstatement. Specifically, controls over development and review of forecast financial information including related assumptions used in goodwill impairment testing did not operate as designed to address the related risks of material misstatement. Our management had determined that this deficiency constituted a material weakness in internal control over financial reporting as of March 31, 2020, based on our evaluation under the criteria in Internal Control — Integrated Framework (May 2013) issued by the Committee of Sponsoring Organizations of the Treadway Commission (“COSO”). Accordingly, management concluded that we did not maintain effective internal control over financial reporting as of March 31, 2020.

Despite our efforts to ensure the integrity of our financial reporting process and the steps that we have taken to remediate this material weakness, we cannot assure you that additional material weaknesses or significant deficiencies in our internal control over financial reporting will not be identified in the future. Any failure to maintain or improve existing controls or implement new controls could result in material misstatements in our financial statements and adversely affect the results of annual management evaluations regarding the effectiveness of our internal control over financial reporting. In addition, any such failure could result in additional material weaknesses or significant deficiencies and cause us to fail to meet our periodic reporting obligations which in turn could cause our shares to be de-listed or suspended from trading on the Nasdaq Global Market. Any of the foregoing could cause investors to lose confidence in our reported financial information, leading to a decline in our share price.

We Rely on Third-Party Systems and Service Providers, and Any Disruption or Adverse Change in Their Businesses Could Have a Material Adverse Effect on Our Business.

We currently rely on a variety of third-party systems, service providers and software companies. These include the GDSs and, other electronic central reservation systems used by airlines, various offline and online channel managing systems and reservation systems used by hotels and accommodation suppliers and aggregators. We also rely on systems used by Indian Railways, systems used by bus and car operators and aggregators, technologies used by payment gateway providers, as well as systems used by the local transit authorities, amusement parks, tourist attractions. In particular, we rely on third parties to:

14

Any interruption or deterioration in performance of these third-party systems and services could have a material adverse effect on our business. Further, the information provided to us by certain of these third-party systems, such as the central reservations systems of certain of our hotel suppliers, may not always be accurate due to either technical glitches or human error, and we may incur monetary and/or reputational loss as a result.

Our success is also dependent on our ability to maintain our relationships with these third-party systems and service providers, including our technology partners. In the event our arrangements with any of these third parties are impaired or terminated, we may not be able to find an alternative source of systems support on a timely basis or on commercially reasonable terms, which could result in significant additional costs or disruptions to our business.

Our Strategic Investments and Acquisitions May Not Bring Us Anticipated Benefits, and We May Not Be Successful in Pursuing Future Investments and Acquisitions.

Part of our growth strategy is the pursuit of strategic investments and acquisitions, and we have made a number of investments and acquisitions in the past. For example, in January 2017, we acquired ibibo Group Holdings (Singapore) Pte. Ltd. or, ibibo Group, which provides online travel services. In July 2018, we acquired Bitla, which provides technology support for bus operators. In April 2019, we acquired a majority shareholding from the existing shareholders of Quest 2 Travel, which provides travel solutions for various corporates across India. In November 2022, we acquired an additional equity interest in Quest 2 Travel. In April 2022, we acquired a majority interest in Book My Forex, which offers currency exchange, multi-currency prepaid forex cards, and cross border remittances, as well as other ancillary products, to Indians travelling abroad. In September 2022, we acquired an additional equity interest in Simplotel, which is engaged in building websites and booking technology for hotels, and now hold a majority equity interest in Simplotel. We believe that our investments and acquisitions serve to strengthen our presence in key geographic markets and expand the travel products and services that we offer to our customers.

There can be no assurance that our investments and acquisitions will achieve their anticipated benefits. We may not be able to integrate acquired operations, personnel and technologies successfully or effectively manage our combined business following the acquisition. Our investments and acquisitions may subject us to uncertainties and risks, including potential ongoing and unforeseen or hidden liabilities, diversion of management resources and cost of integrating acquired businesses. We may also experience difficulties and additional expenses associated with supporting legacy products and hosting infrastructure of the acquired business and retaining suppliers and customers of the acquired business. For example, we acquired a group of companies known as the Hotel Travel Group in 2012, which experienced a significant reduction in its operations and that resulted in the recognition of an impairment of goodwill and brands of $14.6 million in fiscal year 2017. In addition, in the fourth quarter of fiscal year 2020, we performed a quantitative assessment of goodwill and, following that assessment, we recorded an impairment charge of our goodwill amounting to $272.2 million primarily related to our Goibibo business, which we had acquired in fiscal year 2017, though this non-cash charge does not affect our long-term operating plans for the Goibibo brand. We plan to continue driving synergies across our portfolio of multiple brands on the path of disciplined and financially sustainable growth while making appropriate investments to drive online penetration in various travel segments to support the long-term growth of our company, including the Goibibo brand.

We may not succeed in implementing our strategy of growth through strategic investments and acquisitions in the future, as it is subject to many factors, which are beyond our control, including our ability to identify, attract and successfully execute suitable acquisition opportunities and partnerships. Any failure to achieve the anticipated benefits of our past investments and acquisitions or to consummate new investments and acquisitions in the future could negatively impact our ability to compete in the travel industry and have a material adverse effect on our business.

For details on our investments and acquisitions, see “Item 4. Information On the Company — History and Development of our Company — Investments and Acquisitions.”

Our Results of Operations Are Subject to Fluctuations in Currency Exchange Rates.

Our presentation currency is the US dollar. However, the functional currency of MMT India and redBus India, our key operating subsidiaries, is the Indian Rupee. We receive a substantial portion of our revenue in Indian Rupees and most of our costs are incurred in Indian Rupees. Any fluctuation in the value of the Indian Rupee against the US dollar, such as the approximately 6.7% depreciation in the average value of the Indian Rupee as compared to the US dollar in fiscal year 2023 as compared to the average value of the Indian Rupee against the US dollar in fiscal year 2022, will affect our results of operations. The drop in the average value of the Indian

15

Rupee as compared to the US dollar and other foreign currencies in fiscal years 2022 and 2023 adversely impacted the Indian travel industry as it made outbound travel for Indian consumers more expensive. In addition, our exposure to foreign currency risk also arises in respect of our non-Indian Rupee-denominated trade and other receivables, trade and other payables, loans and borrowings and cash and cash equivalents.

Based on our operations in fiscal year 2023, a 10.0% appreciation of the US dollar against the Indian Rupee as of March 31, 2023, assuming all other variables remained constant, would have increased our loss for fiscal year 2023 by $20.9 million. Similarly, a 10.0% depreciation of the US dollar against the Indian Rupee as of March 31, 2023, assuming all other variables remained constant, would have decreased our loss for fiscal year 2023 by $20.9 million.

We currently do not have any hedging agreements or similar arrangements with any counter-party to cover our exposure to any fluctuations in foreign exchange rates. Fluctuation in the Indian Rupee-US dollar exchange rate could have a material adverse effect on our business financial condition and results of operations, which we report in US dollars.

We Outsource a Significant Portion of Our Call Center Services and If Our Outsourcing Service Providers Fail to Meet Our Requirements or Face Operational or System Disruptions, Our Business May Be Adversely Affected.

We outsource our call center service for sales of all international flights and for post-sales customer service support for all flights (domestic and international), hotel reservations and packages, and rail and bus ticketing, as well as back office fulfillment and ticketing services, to various third parties in India. If our outsourcing service providers experience difficulty meeting our requirements for quality and customer service standards, our reputation could suffer and our business and prospects could be adversely affected. Our operations and business could also be materially and adversely affected if our outsourcing service providers face any operational or system interruptions.

Additionally, many of our contracts with the outsourcing service providers have short notice periods. In the event one or more of our contracts with our outsourcing service providers is terminated on short notice, we may be unable to find alternative outsourcing service providers on commercially reasonable terms, or at all. Further, the quality of the service provided by a new or replacement outsourcing service provider may not meet our requirements, including during the transition and training phase. Hence, termination of any of our contracts with our outsourcing service providers could cause a decline in the quality of our services, disrupt, and adversely affect our business, financial condition and results of operations.

16

We Rely on Information Technology to Operate Our Business and Maintain Our Competitiveness, and Any Failure to Adapt to Technological Developments or Industry Trends Could Harm Our Business.

The markets in which we compete are characterized by rapidly changing technology, evolving industry standards, competitor consolidation, frequent new service announcements and changing consumer demands. We may not be able to keep up with these rapid changes. In addition, these market characteristics are heightened by the progress of technology adoption in various markets, including the continuing adoption of the internet and online commerce in certain geographies and the emergence and growth of the use of smartphones and tablets for mobile e-commerce transactions, including through the increasing use of mobile applications. New developments in other areas, such as cloud computing, could make entering our markets easier for competitors due to lower upfront technology costs. As a result, our future success depends in part on our ability to adapt to rapidly changing technologies, to adapt our services and online platforms to evolving industry standards and to continually innovate and improve the performance, features and reliability of our services and online platforms in response to competitive service offerings and the evolving demands of the marketplace. In particular, it is increasingly important for us to effectively offer our services on mobile devices through mobile applications and mobile-optimized websites. Any failure by us to successfully develop and achieve customer adoption of our mobile applications and mobile-optimized websites would have a material and adverse effect on our growth, market share, business and results of operations. We believe that ease-of-use, comprehensive functionality and the look and feel of our mobile applications and mobile-optimized websites are increasingly critical as consumers obtain more of their travel and related services through mobile devices. As a result, we intend to continue to invest in the maintenance, development and enhancement of our websites and mobile platforms. Further, technical innovation often results in bugs and other system failures. Any such bug or failure, especially in connection with a significant technical implementation could result in loss of business, harm to our brands or reputation, customer complaints and other adverse consequences, any of which could adversely affect our business, financial condition and results of operations.

Our MakeMyTrip, Goibibo and redBus platforms are hosted on Amazon Web Services, or AWS, which provides a high degree of reliability, security and scalability and helps us to maintain adequate capacity, however, the ability to restore any disruption of these services is therefore outside of our control. In addition, we license from third-parties some of the technologies incorporated into our websites, and there can be no assurance that we will be able to renew such licenses on favorable terms or at all. As we continue to introduce new services that incorporate new technologies, we may be required to license additional technology. We cannot be sure that such technology licenses will be available on commercially reasonable terms, if at all.

17

Some of Our Airline Suppliers (Including Our GDS Service Providers) May Reduce or Eliminate the Commission and Other Fees They Pay to Us for the Sale of Air Tickets, and This Could Adversely Affect Our Business and Results of Operations.

In our air ticketing business, we generate revenue through commissions and incentive payments from airline suppliers, service fees charged to our customers and fees or incentives earned from our GDS service providers. Our airline suppliers may reduce or eliminate the commissions and incentive payments they pay to us. If airlines continue to move away from distribution through GDSs and use other distribution channels, it may result in a decrease in our fees or incentives earned from our GDS providers. For example, airlines in India have been reducing the base commissions paid to travel agencies since fiscal year 2015. To the extent any of our airline suppliers further reduce or eliminate the commissions or incentive payments they pay to us in the future, our revenue may be further reduced unless we are able to adequately mitigate such reduction by increasing the service fees we charge to our customers in a sustainable manner. Any increase in service fees, to mitigate reductions in or elimination of commissions or otherwise, may also result in a loss of potential customers. Our business would also be negatively impacted if competition or regulation in the travel industry causes us to reduce or eliminate our service fees.

We Rely on the Value of Our Brands, and Any Failure to Maintain or Enhance Consumer Awareness of Our Brands Could Have a Material Adverse Effect on Our Business, Financial Condition and Results of Operations.

We believe continued investment in our brands, “MakeMyTrip”, “Goibibo”, and “redBus”, is critical to retain and expand our business. We believe that our brands are well respected and recognized in the Indian travel market. We have invested in developing and promoting our brands and expect to continue to spend on maintaining our brands’ value to enable us to compete against increased spending by our competitors, as well as against emerging competitors, including search engines and meta-search engines, and to allow us to expand into new geographies and products where our brands are not well known. There is no assurance that we will be able to successfully maintain or enhance consumer awareness of our brands. Even if we are successful in our branding efforts, such efforts may not be cost-effective. If we are unable to maintain or enhance consumer awareness of our brands and generate demand in a cost-effective manner, it would negatively impact our ability to compete in the travel industry and would have a material adverse effect on our business.

Negative events or circumstances could also adversely affect consumer perception and the value of our brands. Unfavorable publicity regarding, among other things, our business model or offerings, user support, sales and marketing activities, platform quality, privacy or security practices, regulatory compliance and financial or operating performance could adversely affect our reputation. Such negative publicity could also harm the size of our network and the engagement and loyalty of our users that utilize our platform, which could adversely affect our business, financial condition, results of operations and prospects. In addition, the foregoing risks are increased by the widespread use of social media and the increasing incidence of fake or unsubstantiated news, particularly on social media and other online platforms.

See also “Risk Factors — Risks Related to Us and Our Industry — We Cannot Be Sure That Our Intellectual Property Is Protected from Copying or Use by Others, Including Current or Potential Competitors, and We May Be Subject to Third Party Claims for Intellectual Property Rights Infringement”.

We May Not Be Successful in Implementing Our Growth Strategies.

Our growth strategies involve expanding our hotels and packages business (including through our travel agents’ network and our outbound air ticketing and hotels business for overseas travel), expanding our service and product offerings, enhancing our service platforms by investing in technology, expanding into new geographic markets and pursuing strategic partnerships and acquisitions.

Our success in implementing our growth strategies is affected by:

18

Many of these factors are beyond our control and there can be no assurance that we will succeed in implementing our strategies.

Even if we are successful in executing our growth strategies, our different businesses may not grow at the same rate or with a uniform effect on our revenues and profitability. For example, the rate of growth in our hotels and packages and bus ticketing business, which has generally outpaced our air ticketing business and is a relatively higher margin business, may not grow at a pace to affect our overall growth in the short term.

We are also subject to additional risks involved in our strategies of expanding into new geographic markets and pursuing strategic partnerships and acquisitions. See “Risk Factors — Risks Related to Us and Our Industry” “— Our International Operations Involve Additional Risks” and “— Our Strategic Investments and Acquisitions May Not Bring Us Anticipated Benefits, and We May Not Be Successful in Pursuing Future Investments and Acquisitions.”

Our International Operations Involve Additional Risks.

We have been operating in the United States since 2000, servicing mainly the air ticketing needs of non-resident Indians in the United States traveling inbound to India. We launched our website in the UAE in December 2009. We need to continue to tailor our services and business model to the unique circumstances of such markets to succeed, including building new supplier relationships and customer preferences. We have also expanded, and intend to continue to expand, our business in other new markets, particularly those with a significant non-resident Indian population as well as those with proximity to India or favored by Indian travelers. We had previously entered into new geographies in Southeast Asia, in Europe and in Latin America through our acquisitions of Luxury Tours, the Hotel Travel Group, the EasyToBook Group, the ITC Group and the redBus entities in Peru and Colombia. These acquisitions have not always yielded the benefits that we anticipated. For example, after we acquired the Hotel Travel Group in 2012, which experienced a significant reduction in its operations and that resulted in the recognition of an impairment of goodwill and brands of $14.6 million in fiscal year 2017.

Adapting our practices and models effectively to the supplier and customer preferences in these, or other, new markets could be difficult and costly and could divert management and personnel resources. We could also face additional regulatory requirements in these, or other new markets, which could be onerous. We cannot assure you that we will be able to efficiently or effectively manage the growth of our operations in these, or other, new markets.

In addition, we are subject to risks in our international operations that may not exist in our Indian operations, including:

19

If we are not able to effectively mitigate or eliminate these risks, our results of operations could be adversely affected.

Our Business Could Be Negatively Affected by Changes in Search Engine Logic.

A portion of the traffic to our websites is driven by Google, and, to a lesser extent, we use other search and meta-search websites and social websites to generate traffic to our websites, principally through pay-per-click advertising campaigns. The pricing and operating dynamics on these search and metasearch websites can experience rapid change commercially, technically and competitively. For example, Google frequently updates and changes the logic, which determines the placement and display of its search results, such that the placement of links to our websites can be negatively affected and our costs to improve or maintain our placement in search results can increase. Changes by Google in how it presents travel search results, including its promotion of its travel metasearch services, or the manner in which it conducts the auction for placement among search results, may be competitively disadvantageous to us and may impact our ability to efficiently generate traffic to our websites, which in turn would have an adverse effect on our business, market share and results of operations. Similarly, changes by our other search and meta-search partners in how they present travel search results or the manner in which they conduct the auction for placement among search results may be competitively disadvantageous to us and may impact our ability to efficiently generate traffic to our websites.

In addition, we rely on various third-party distribution channels (i.e., marketing affiliates) to distribute hotel accommodation and airline ticket reservations. Should one or more of such third parties cease distribution of reservations made through us, or suffer deterioration in its search or meta-search ranking, due to changes in search or meta-search algorithms or otherwise, our business, market share and results of operations could be negatively affected.

Processing, Storage, Use and Disclosure of Personal Data by Us and Our Third-Party Providers Exposes Us to Risks of Internal or External Security Breaches and Could Give Rise to Liabilities.