Securities Act File No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-14

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

|

☐ Pre-Effective Amendment No. __

|

☐ Post-Effective Amendment No. __

|

(Check appropriate box or boxes)

__________________________________________________________________

BNY MELLON ABSOLUTE INSIGHT FUNDS, INC.

(Exact Name of Registrant as Specified in its Charter)

Registrant's Telephone Number, including Area Code: (212) 922-6000

c/o BNY Mellon Investment Adviser, Inc.

240 Greenwich Street

New York, New York 10286

(Address of Principal Executive Offices)

Jeff Prusnofsky, Esq.

c/o BNY Mellon Investment Adviser, Inc.

240 Greenwich Street

New York, New York 10286

(Name and Address of Agent for Service)

COPY TO:

David Stephens, Esq.

Stradley Ronon Stevens & Young, LLP

100 Park Avenue

New York, New York 10017

Approximate Date of Proposed Public Offering: As soon as practicable after the effective date of this Registration Statement.

It is proposed that this filing will become effective on December 12, 2024 pursuant to Rule 488 under the Securities Act of 1933.

No filing fee is due because Registrant is relying on Section 24(f) of the Investment Company Act of 1940, as amended.

SUBJECT TO COMPLETION DATED NOVEMBER 12, 2024

BNY Mellon U.S. Mortgage Fund, Inc.

c/o BNY Mellon Investment Adviser, Inc.

240 Greenwich Street

New York, New York 10286

1-800-373-9387

www.bnyfunds.com

Dear Shareholder:

As a shareholder of BNY Mellon U.S. Mortgage Fund, Inc. (the "Fund"), a Maryland corporation, you are being asked to vote on an Agreement and Plan of

Reorganization to allow the Fund to transfer all of its assets in a tax-free reorganization to BNY Mellon Core Plus Fund (the "Acquiring Fund"), in exchange solely for Class A shares, Class C shares, Class I

shares and Class Y shares of the Acquiring Fund and the assumption by the Acquiring Fund of the Fund's stated liabilities. BNY Mellon Investment Adviser, Inc. ("BNYM Investment Adviser") is the investment adviser to the Acquiring Fund and the Fund.

Insight North America LLC ("INA"), an affiliate of BNYM Investment Adviser, is the sub-adviser to the Acquiring Fund and the Fund. BNYM Investment Adviser and INA are wholly-owned subsidiaries of The Bank of New York Mellon Corporation. The

Acquiring Fund is a series of BNY Mellon Absolute Insight Funds, Inc. (the "Acquiring Company"), a Maryland corporation.

Management of BNYM Investment Adviser recommended to the Fund's Board of Directors and the Acquiring Company's Board of Directors that the Fund be consolidated

with the Acquiring Fund. After review, the Fund's Board of Directors and the Acquiring Company's Board of Directors have each unanimously determined that the reorganization of the Fund is advisable and in the best interests of the Fund and the

Acquiring Fund, respectively, and approved the reorganization of the Fund. The reorganization of the Fund is expected to occur on or about March 28, 2025 if approved by Fund shareholders.

If the Agreement and Plan of Reorganization is approved and consummated for the Fund, you would no longer be a shareholder of the Fund, but would become a

shareholder of the Acquiring Fund. Holders of Class A shares, Class C shares, Class I shares or Class Y shares of the Fund will receive shares of the corresponding class of the Acquiring Fund, and holders of Class Z shares of the Fund will receive

Class A shares of the Acquiring Fund, with an aggregate net asset value equal to the aggregate net asset value of the shareholder's investment in the Fund. Management of BNYM Investment Adviser believes that the reorganization will permit Fund

shareholders to pursue similar investment goals in a substantially larger combined fund that has a lower management fee than the Fund. In addition, the Acquiring Fund's shares had a lower gross annual expense ratio (before current fee waivers and

expense reimbursements) than the Fund and the same or a lower net annual expense ratio (after current fee waivers and expense reimbursements) as the Fund, based on the expenses of each fund as of August 31, 2024. The Fund normally invests in U.S.

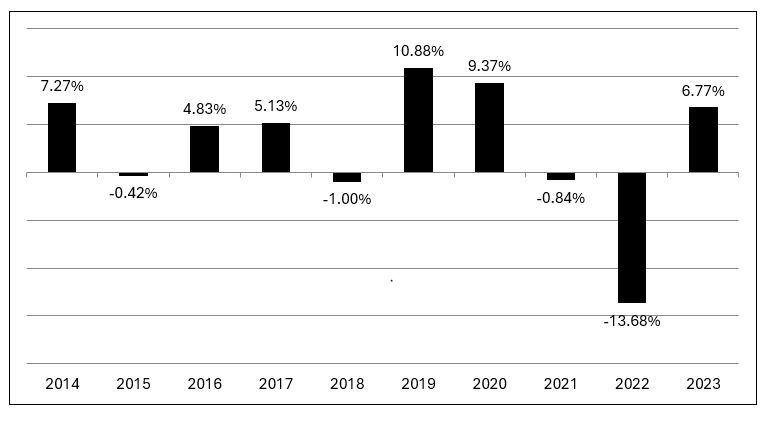

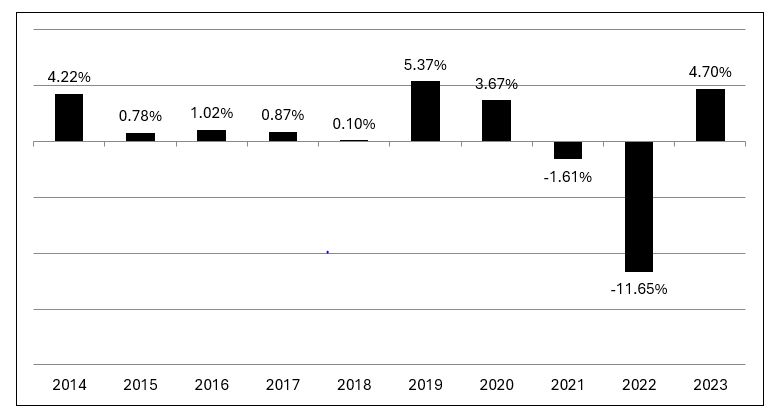

mortgage-related securities and the Acquiring Fund normally invests in a diversified portfolio of fixed-income securities of U.S. and foreign issuers. The Acquiring Fund's Class A shares outperformed the Fund's Class A shares for the one-year,

five-year and ten-year periods ended December 31, 2023. Management of BNYM Investment Adviser believes that, as a result of becoming shareholders in a substantially larger combined fund, the reorganization should enable Fund shareholders to benefit

from more efficient portfolio management and will eliminate the duplication of resources and costs associated with servicing the funds as separate entities. As a result, management of BNYM Investment Adviser recommended to the Fund's Board of

Directors that the Fund be consolidated with the Acquiring Fund.

After review, the Fund's Board of Directors has unanimously approved the proposed reorganization of the Fund. The Fund's Board

of Directors believes that the reorganization will permit Fund shareholders to pursue similar investment goals in a substantially larger combined fund that has a lower management fee and a lower gross annual expense ratio (before current fee

waivers and expense reimbursements) than the Fund and the same or a lower net annual expense ratio (after current fee waivers and expense reimbursements) as the Fund. In approving the reorganization, the Fund's Board of Directors determined that

the reorganization is advisable and in the best interests of the Fund and that the interests of the Fund's shareholders will not be diluted as a result of the reorganization. The Fund's Board of Directors

recommends that you read the enclosed materials carefully and then vote FOR the proposal.

Your vote is extremely important, no matter how large or small your Fund holdings. By voting promptly, you can help avoid additional costs that are incurred

with follow-up letters and calls.

To vote, you may use any of the following methods:

|

• |

By Mail. Please complete, date and sign the enclosed proxy card and mail it in the enclosed, postage-paid envelope.

|

|

• |

Over the Internet. Have your proxy card available. Go to the website listed on the proxy card. Enter your control number from your proxy card. Follow the instructions on the website.

|

|

• |

By Telephone. Have your proxy card available. Call the toll-free number listed on the proxy card. Enter your control number from your proxy card. Follow the recorded instructions.

|

|

• |

At the Meeting. You will not be able to attend the meeting in person, but you may attend the meeting virtually and vote over the Internet during the meeting.

|

The meeting will be conducted over the Internet in a virtual meeting format only. However, if it is determined that the meeting will be held in person, we will

make an announcement in the manner discussed in the Notice of Special Meeting of Shareholders.

We encourage you to vote over the Internet or by telephone using the number that appears on your proxy card. If you later decide to attend the meeting

virtually, you may revoke your proxy and vote your shares over the Internet during the meeting. Whichever voting method you choose, please take the time to read the full text of the Prospectus/Proxy Statement before you vote.

Further information about the proposed reorganization is contained in the enclosed materials, which you should carefully review before you vote. If you have any

questions after considering the enclosed materials, please call the Fund's proxy solicitor, Sodali & Co. Fund Solutions, at 1-888-864-6108. Thank you.

| |

Sincerely,

|

| |

/s/ David DiPetrillo

|

| |

David DiPetrillo

President

BNY Mellon U.S. Mortgage Fund, Inc.

|

December [_], 2024

PROPOSED REORGANIZATION OF

BNY MELLON U.S. MORTGAGE FUND, INC.

With and Into

BNY MELLON CORE PLUS FUND

QUESTIONS AND ANSWERS

The enclosed materials include a Prospectus/Proxy Statement containing information you need to make an informed decision about the proposed reorganization. However, we thought

it also would be helpful to begin by answering some of the important questions you might have about the proposed reorganization.

WHAT WILL HAPPEN TO MY BNY MELLON U.S. MORTGAGE FUND, INC. INVESTMENT IF THE PROPOSED REORGANIZATION IS APPROVED?

You will become a shareholder of BNY Mellon Core Plus Fund (the "Acquiring Fund"), an open-end investment company managed by BNY Mellon Investment Adviser, Inc. ("BNYM Investment

Adviser"), on or about March 28, 2025 (the "Closing Date"), and will no longer be a shareholder of BNY Mellon U.S. Mortgage Fund, Inc., a Maryland corporation (the "Fund"). You will receive the class of shares of the Acquiring Fund corresponding to

your class of shares of the Fund, except holders of Class Z shares of the Fund will receive Class A shares of the Acquiring Fund, with an aggregate net asset value equal to the aggregate net asset value of your investment in the Fund as of the

Closing Date. The Fund will then cease operations and be dissolved, in connection with which it will terminate its registration with the Securities and Exchange Commission as a registered investment company under the Investment Company Act of 1940,

as amended (the "1940 Act"). The Acquiring Fund is a series of BNY Mellon Absolute Insight Funds, Inc. (the "Acquiring Company"), a Maryland corporation.

WHAT ARE THE EXPECTED BENEFITS OF THE PROPOSED REORGANIZATION OF THE FUND FOR ME?

The Fund's Board of Directors (the "Board") believes that the reorganization will permit Fund shareholders to pursue similar investment goals in a substantially larger combined

fund that is also managed by BNYM Investment Adviser and sub-advised by Insight North America LLC ("INA"), an affiliate of BNYM Investment Adviser. As of September 30, 2024, the Acquiring Fund had approximately $2.2 billion and the Fund had

approximately $179.0 million in net assets. The Acquiring Fund has a lower management fee than the Fund and had a lower gross annual expense ratio (before current fee waivers and expense reimbursements) than the Fund and the same or a lower net

annual expense ratio (after current fee waivers and expense reimbursements) as the Fund, based on the expenses of each fund as of August 31, 2024. See "Will the Proposed Reorganization of the Fund Result in a Higher Management Fee or Higher Total

Fund Expenses?" below and "Summary—Comparison of the Acquiring Fund and the Fund—Fees and Expenses" in the Prospectus/Proxy Statement. Although past performance is no guarantee of future results, the Acquiring Fund's Class A shares outperformed the

Fund's Class A shares for the one-year, five-year and ten-year periods ended December 31, 2023. See "Summary—Past Performance" in the Prospectus/Proxy Statement. The reorganization also may enable Fund shareholders to benefit from the more diverse

portfolio of fixed-income investments of the Acquiring Fund. Management of BNYM Investment Adviser also believes that, by combining the Fund with the Acquiring Fund, shareholders of the Fund should benefit from more efficient portfolio management

and certain operational efficiencies. The reorganization should enable INA, as the Acquiring Fund's and the Fund's sub-adviser, to more efficiently manage the larger combined fund's portfolio through various measures, including trade orders and

executions, and permit the funds' service providers—including BNYM Investment Adviser—to operate and service a single fund (and its shareholders), instead of having to operate and service both funds with similar shareholder bases.

DO THE FUNDS HAVE SIMILAR INVESTMENT GOALS, STRATEGIES AND RISKS?

The Acquiring Fund and the Fund have similar investment objectives. The Acquiring Fund seeks high total return consistent with preservation of capital. The Fund seeks to

maximize total return, consisting of capital appreciation and current income. However, the investment practices and limitations of each fund are not identical.

To pursue its goal, the Fund normally invests at least 80% of its net assets, plus any borrowings for investment purposes, in U.S. mortgage-related securities. These

mortgage-related securities may include certificates (debt securities) issued, and guaranteed as to timely payment of principal and interest, by the Government National Mortgage Association (GNMA) (popularly called "Ginnie Maes"); securities issued

by government-related organizations such as Fannie Mae and Freddie Mac; residential and commercial mortgage-backed securities issued by governmental agencies or private entities; and collateralized mortgage obligations. The Fund invests at least 65%

of its net assets in Ginnie Maes. The Fund's policy with respect to the investment of at least 80% of its net assets may be changed by the Fund's Board upon 60 days' prior notice to shareholders. However, the Fund's policy to invest at least 65% of

its net assets in GNMAs may not be changed without the approval of the holders of a majority of the Fund's outstanding voting securities.

INA, as the Fund's sub-adviser, begins the investment process for the Fund with a macroeconomic view, and considers the overall risk environment in light of broad portfolio themes

and overall portfolio quality in relation to the Fund's current positions. Potential purchases and sales of securities are viewed on absolute and relative value bases in relation to other potential opportunities available to the Fund.

To pursue its goal, the Acquiring Fund normally invests in a diversified portfolio of fixed-income securities of U.S. and foreign issuers. The Acquiring Fund is not limited to

investing in mortgage-related securities. As of August 31, 2024, approximately 29.23% of the Acquiring Fund's portfolio consisted of U.S. mortgage-related securities, of which 1.74% were Ginnie Maes. The fixed-income securities in which the

Acquiring Fund may invest include: (i) U.S. government securities; (ii) corporate debt securities; (iii) mortgage-related securities; (iv) asset-backed securities; (v) inflation indexed bonds issued by governments or corporations; (vi) structured

notes; (vii) loan participations and assignments; (viii) delayed funding loans and revolving credit facilities; (ix) bank certificates of deposit, fixed time deposits and bankers' acceptances; (x) repurchase agreements and reverse repurchase

agreements; (xi) municipal securities; (xii) obligations of foreign governments; and (xiii) obligations of international agencies or supranational entities.

In constructing the Acquiring Fund's portfolio, INA, as the Acquiring Fund's sub-adviser, relies primarily on proprietary, internally-generated credit research. This credit

research focuses on both industry/sector analysis and detailed individual security selection. INA seeks to identify investment opportunities for the Acquiring Fund based on the relative value of securities. INA analyzes individual issuer credit

risk based on factors such as management depth and experience, competitive advantage, market and product position and overall financial strength. INA may supplement its internal research with external, third-party credit research and related credit

tools. The Acquiring Fund may sell securities when INA anticipates market declines or credit downgrades. In addition, the Acquiring Fund may sell securities when INA identifies new investment opportunities.

The Acquiring Fund normally invests primarily in fixed-income securities rated, at the time of purchase, investment grade (i.e., Baa3/BBB- or higher) or, if unrated, determined to

be of comparable quality by INA. The Acquiring Fund may invest up to 25% of its net assets in fixed-income securities rated, at the time of purchase, below investment grade ("high yield" or "junk" bonds) or the unrated equivalent as determined by

INA. As of August 31, 2024, the average credit quality rating of the Acquiring Fund's portfolio was A1/A2. As of August 31, 2024, 2.19% of the Acquiring Fund's portfolio consisted of securities that were

rated below investment grade. The Fund is permitted to invest in privately issued mortgage-backed securities with a BBB or higher credit quality, but currently invests in only

those securities with an A or higher credit quality. As of August 31, 2024, the average credit quality rating of the Fund's portfolio was AAA. As of August 31, 2024, the Fund did not own any securities that were rated below investment grade.

Under normal conditions, the dollar-weighted average maturity of the Fund's portfolio generally is not expected to exceed 30 years, and the Fund's average duration generally is

not expected to exceed eight years. Typically, the Acquiring Fund's portfolio can be expected to have an average effective duration ranging between three and eight years. INA may lengthen or shorten the Acquiring Fund's portfolio duration outside

this range depending on its evaluation of market conditions. As of August 31, 2024, the dollar-weighted average maturity and the average duration of the Fund's portfolio were 6.36 years and 5.02 years, respectively. As of August 31, 2024, the

dollar-weighted average maturity and the average duration of the Acquiring Fund's portfolio were 9.13 years and 5.89 years, respectively.

The risks associated with an investment in the Acquiring Fund and the Fund are similar but not identical. Because the Fund invests a higher percentage of its assets in

mortgage-related securities than the Acquiring Fund, the Fund is subject to a greater extent than the Acquiring Fund to the credit risk associated with these securities, including the market's perception of the creditworthiness of the issuing federal

agency, as well as the credit quality of the underlying assets. Although certain mortgage-related securities are guaranteed as to the timely payment of interest and principal by a third party (such as a U.S. government agency or instrumentality with

respect to government-related mortgage securities) the market prices for such securities are not guaranteed and will fluctuate. Ginnie Maes carry additional risks and may be more volatile than other types of fixed-income securities due to unexpected

changes in interest rates. The Acquiring Fund normally invests in a diversified portfolio of fixed-income securities of U.S. and foreign issuers and, thus, may be subject to changes in the outlook for corporate earnings, changes in interest or

currency rates or adverse investor sentiment generally that affect these securities to a greater extent than the Fund. Because the Acquiring Fund may invest a higher percentage of its assets in fixed-income securities rated below investment grade

and foreign issuers than the Fund, the Acquiring Fund may be subject to certain of the risks associated with investments in high yield securities and foreign securities to a greater extent than the Fund. High yield ("junk") securities involve

greater credit risk, including the risk of default, than investment grade securities, and are considered predominantly speculative with respect to the issuer's ability to make principal and interest payments. To the extent the Acquiring Fund invests

in foreign securities, the Acquiring Fund's performance will be influenced by political, social and economic factors affecting investments in foreign issuers. See "Summary—Comparison of the Acquiring Fund and the Fund—Principal Investment Risks" in

the Prospectus/Proxy Statement.

BNYM Investment Adviser is the investment adviser to the Acquiring Fund and the Fund. BNYM Investment Adviser has engaged its affiliate, INA, to serve as the sub-adviser to the

Acquiring Fund and the Fund and provide day-to-day management of the Acquiring Fund's and the Fund's investments, in the case of the Fund, pursuant to an interim sub-investment advisory agreement. Robert Bayston, an employee of INA, is the Fund's

primary portfolio manager. James DiChiaro, Scott Zaleski, CFA and Brendan Murphy, CFA, each an employee of INA, are the Acquiring Fund's primary portfolio managers. BNY Mellon Securities Corporation, a wholly-owned subsidiary of BNYM Investment

Adviser, distributes the shares of the Acquiring Fund and the Fund. For additional information regarding the Acquiring Fund and the Fund, please refer to the enclosed Prospectus/Proxy Statement. See "Fund Details—Investment Adviser and Sub-Adviser"

and "—Primary Portfolio Managers" in the Prospectus/Proxy Statement.

WHAT ARE THE TAX CONSEQUENCES OF THE PROPOSED REORGANIZATION?

The reorganization will not be a taxable event for federal income tax purposes. Shareholders will not recognize any capital gain or loss as a direct result of the

reorganization. A shareholder's tax basis in Fund

shares will carry over to the shareholder's Acquiring Fund shares, and the holding period for such Acquiring Fund shares will include the holding period for the shareholder's Fund

shares. As a condition to the closing of the reorganization, the Fund and the Acquiring Fund will receive an opinion of counsel to the effect that, for federal income tax purposes, the reorganization will qualify as a tax-free reorganization and,

thus, no gain or loss will be recognized by the Fund, the Fund's shareholders, or the Acquiring Fund as a result of the reorganization. The Fund will distribute any undistributed net investment income and net realized capital gains (after reduction

for any capital loss carryforwards) prior to the reorganization, which distribution will be taxable to shareholders. If the reorganization is approved by Fund shareholders, management currently estimates that portfolio securities representing

approximately 50% of the Fund's net assets (approximately $89.1 million of the Fund's net assets) may be sold by the Fund before consummation of the reorganization, subject to any restrictions imposed by the Internal Revenue Code. Based on that

assumption, management estimates that brokerage commissions and other transaction costs associated with such portfolio sales will be approximately $167,000. The tax impact of the sale of such portfolio securities will depend on the difference

between the price at which such securities are sold and the Fund's tax basis in such securities. Any capital gains recognized as a result of these sales on a net basis, after the application of any available capital loss carryforward, will be

distributed to the Fund's shareholders as capital gain dividends and/or ordinary dividends, and such distributions will be taxable to Fund shareholders who hold shares in taxable accounts. Based on the above assumptions, management currently

estimates that the Fund would recognize approximately $5.3 million in capital losses (approximately $0.384 or 2.95% per share) as a result of the sale of such portfolio securities before consummation of the reorganization. As of April 30, 2024, the

Fund's most recent fiscal year end, and more currently, as of August 31, 2024, the Fund had unused capital loss carryforwards of approximately $22.5 million and $26.8 million, respectively, none of which is expected to be lost as a result of the

reorganization. See "Summary— Federal Income Tax Consequences" and "Information about the Reorganization—Federal Income Tax Consequences" and "—Capital Loss Carryforwards." in the Prospectus/Proxy Statement.

WILL I ENJOY THE SAME PRIVILEGES AS A SHAREHOLDER OF THE ACQUIRING FUND THAT I CURRENTLY HAVE AS A SHAREHOLDER OF THE FUND?

Yes. The Acquiring Fund will offer you the same shareholder privileges, such as the Fund Exchanges service, Auto-Exchange Privilege, Wire Redemption, TeleTransfer Privilege, Checkwriting Privilege,

Automatic Asset Builder, Payroll Savings Plan, Government Direct Deposit Privilege, Dividend Options, Automatic Withdrawal Plan and Express voice-activated account access, that you currently have as a shareholder of the Fund. In addition, holders of

Class A shares will have the ability to write redemption checks against their Acquiring Fund account through the Checkwriting Privilege. If you had the Checkwriting Privilege on your Fund account and wrote a check within the past year, you will

receive under separate cover a checkbook with respect to your shares of the Acquiring Fund. When you receive this checkbook, please begin using the new checks immediately. While any outstanding checks written during the 60-day grace period after

the Closing Date will be honored, it is important that you destroy any unused checks assigned to the Fund. Except as provided below, the privileges you currently have on your Fund account will transfer automatically to your account with the

Acquiring Fund.

While you will continue to have the same privileges as a holder of Class A shares, Class C shares, Class I shares or Class Y shares of the Acquiring Fund as you previously did as

a holder of Class A shares, Class C shares, Class I shares, Class Y shares or Class Z shares of the Fund, please note that if you had the Checkwriting Privilege on your Fund account but have not written a check within the past year, you will need to

update your account as described below. In addition, if you participated in Government Direct Deposit or made incoming wire transactions or other incoming Automated Clearing House ("ACH") transactions to your Fund account, you will need to update

your incoming ACH and/or wiring instructions with new information with respect to your shares of the Acquiring Fund in order to continue these services and avoid having these transactions rejected by the Acquiring Fund. To continue participating in

the

Checkwriting Privilege or Government Direct Deposit or to provide ACH and/or wiring instructions as a shareholder of the Acquiring Fund, please call your financial adviser, or

call 1-800-645-6561, visit www.bnyfunds.com or write to the Acquiring Fund at BNY Shareholder Services, P.O. Box 534434, Pittsburgh, Pennsylvania 15253-4434.

WILL THE PROPOSED REORGANIZATION RESULT IN A HIGHER MANAGEMENT FEE OR HIGHER TOTAL FUND EXPENSES?

The Fund has agreed to pay BNYM Investment Adviser a management fee at the annual rate of 0.50% of the value of the Fund's average daily net assets. BNYM Investment Adviser, in turn, pays INA for

the provision of sub-investment advisory services to the Fund. The Acquiring Fund has agreed to pay BNYM Investment Adviser a management fee at the annual rate of 0.35% of the value of the Acquiring Fund's average daily net assets. BNYM Investment

Adviser, in turn, pays INA for the provision of sub-investment advisory services to the Acquiring Fund. In addition, the Acquiring Fund's shares had a lower gross annual expense ratio (before current fee waivers and expense reimbursements) than the

Fund and the same or a lower net annual expense ratio (after current fee waivers and expense reimbursements) as the Fund, based on the expenses of each fund as of August 31, 2024. See "Summary—Fees and Expenses" in the Prospectus/Proxy Statement.

BNYM Investment Adviser has contractually agreed, until August 30, 2025, to waive receipt of its fees and/or assume the direct expenses of the Acquiring Fund so that the direct expenses of none of

the Acquiring Fund's share classes (excluding Rule 12b-1 fees, shareholder services fees, taxes, interest expense, brokerage commissions, commitment fees on borrowings and extraordinary expenses) exceed 0.45%. On or after August 30, 2025, BNYM

Investment Adviser may terminate this expense limitation agreement at any time. Total expenses of the Acquiring Fund may increase after the termination of this expense limitation agreement.

BNYM Investment Adviser has contractually agreed, until August 30, 2025, to waive receipt of its fees and/or assume the direct expenses of the Fund so that the direct expenses of the Fund's Class A shares, Class C

shares, Class I shares, Class Y shares and Class Z shares (excluding taxes, interest expense, brokerage commissions, commitment fees on borrowings and extraordinary expenses) do not exceed an annual rate of 0.80%, 1.55%, 0.55%, 0.55% and 0.70%,

respectively. On or after August 30, 2025, BNYM Investment Adviser may terminate this expense limitation agreement at any time. Total expenses of the Fund may increase after the termination of this expense limitation agreement.

WILL I BE CHARGED A SALES CHARGE, REDEMPTION FEE OR CONTINGENT DEFERRED SALES CHARGE ("CDSC") AT THE TIME OF THE REORGANIZATION?

No. No sales charge, redemption fee or CDSC will be imposed at the time of the reorganization. Any redemption of Class C shares (or Class A shares subject to a CDSC) received in

the reorganization will be subject to the same CDSC as the redemption of Class C shares (or Class A shares subject to a CDSC) of the Fund (calculated from the date of original purchase of Fund shares). Any shares of the Acquiring Fund acquired after

the reorganization will be subject to any applicable sales charges and CDSCs.

WHO WILL PAY THE EXPENSES OF THE PROPOSED REORGANIZATION?

BNYM Investment Adviser or an affiliate of BNYM Investment Adviser will pay the expenses relating to the reorganization, whether or not the reorganization is consummated. The

Fund and the Acquiring Fund

will not bear any expenses relating to the proposed reorganization. The funds, however, will bear their respective portfolio transaction costs whether or not associated with the

reorganization.

HOW DOES THE FUND'S BOARD RECOMMEND I VOTE?

Management of BNYM Investment Adviser recommended to the Fund's Board that the Fund be consolidated with the Acquiring Fund. After considering the terms and conditions of the

reorganization, the investment objectives, management policies and strategies of, as well as shareholder services offered by, the Fund and the Acquiring Fund, the fees and expenses, including the gross and net annual expense ratios, of the Fund and

the Acquiring Fund, and the relative performance of the Fund and the Acquiring Fund, the Fund's Board has unanimously concluded that reorganizing the Fund into the Acquiring Fund is advisable and in the best interests of the Fund and that the

interests of the Fund's shareholders will not be diluted as a result of the reorganization. In reaching this conclusion, the Fund's Board determined that reorganizing the Fund into the Acquiring Fund, which also is managed by BNYM Investment Adviser

and sub-advised by INA, and has a similar investment objective as the Fund, offers potential benefits to Fund shareholders. These potential benefits include permitting Fund shareholders to pursue similar investment goals in a substantially larger

combined fund that has a lower management fee and had a lower gross annual expense ratio (before current fee waivers and expense reimbursements) than the Fund and the same or a lower net annual expense ratio (after current fee waivers and expense

reimbursements) as the Fund, based on the expenses of each fund as of August 31, 2024. In addition, although past performance is no guarantee of future results, the Acquiring Fund's Class A shares outperformed the Fund's Class A shares for the

one-year, five-year and ten-year periods ended December 31, 2023. The reorganization also may enable Fund shareholders to benefit from the more diverse portfolio of fixed-income investments of the Acquiring Fund. By combining the Fund with the

Acquiring Fund, shareholders of the Fund also should benefit from more efficient portfolio management and certain operational efficiencies. Therefore, the Fund's Board, all of whose members are not "interested persons" (as defined in the 1940 Act)

of the Fund or the Acquiring Fund, unanimously recommends that you vote FOR the Agreement and Plan of Reorganization. See "Reasons for the Reorganization" in the Prospectus/Proxy Statement.

WHO IS SODALI & CO. FUND SOLUTIONS?

Sodali & Co. Fund Solutions (the "Proxy Solicitor") is a company that has been engaged by BNYM Investment Adviser, on behalf of the Fund, to assist in the solicitation of

proxies, which is expected to cost approximately $25,000, plus any out-of-pocket expenses. BNYM Investment Adviser or an affiliate of BNYM Investment Adviser will pay the solicitation expenses. The Proxy Solicitor is not affiliated with the Fund or

BNYM Investment Adviser. In order to hold a shareholder meeting, a certain percentage of the Fund's shares (often referred to as "quorum") must be represented at the meeting. If a quorum is not attained for the Fund, the meeting must adjourn to a

future date. The Fund may attempt to reach shareholders through multiple mailings to remind the shareholders to cast their votes. The Proxy Solicitor also may contact by telephone shareholders who have not yet voted their shares so that the meeting

does not have to be adjourned or postponed.

HOW CAN I VOTE MY SHARES?

You can vote in any one of the following ways:

|

• |

By mail, with the enclosed proxy card and postage-paid envelope;

|

|

• |

By telephone, with a toll-free call to the number listed on your proxy card;

|

|

• |

Over the Internet, at the website address listed on your proxy card; or

|

|

• |

At the meeting, by attending virtually and voting over the Internet during the meeting.

|

In addition, if you would like to quickly vote your shares, call the Proxy Solicitor, toll free at 1-888-864-6108. Agents are available 10:00 a.m. – 11:00

p.m., Eastern time, Monday through Friday.

We encourage you to vote over the Internet or by telephone. Whichever voting method you choose, please take the time to read the Prospectus/Proxy Statement before you vote.

Please note: if you sign and date your proxy card, but do not provide voting instructions, your shares will be voted FOR the proposal. Thank you in advance for your vote.

MAY I ATTEND THE MEETING PHYSICALLY?

No. The meeting will be conducted exclusively online via live webcast. Shareholders will not be able to attend the meeting physically but may participate over the Internet.

Shareholders may request the meeting credentials by emailing msfs-meetinginfo@morrowsodali.com. Please include your full name, address and the control number found on your enclosed proxy card. The meeting will begin promptly at 10:00 a.m., Eastern

time, on Thursday, February 13, 2025. The Fund encourages you to request the meeting credentials before the date of the meeting and to access the meeting a few minutes prior to the start time leaving ample time for the check in. Only shareholders

of the Fund will be able to participate in the meeting. You may vote during the meeting by following the instructions available on the meeting website.

PRELIMINARY COPY

BNY MELLON U.S. MORTGAGE FUND, INC.

__________________________

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

___________________________

To the Shareholders:

A Special Meeting of Shareholders (the "Meeting") of BNY Mellon U.S. Mortgage Fund, Inc. (the "Fund"), a Maryland corporation, will be held over the Internet in

a virtual meeting format only on Thursday, February 13, 2025 at 10:00 a.m., Eastern Time, for the following purpose:

To approve an Agreement and Plan of Reorganization providing for the transfer of all of the assets of the Fund to BNY Mellon Core Plus Fund (the "Acquiring Fund"), in exchange

solely for shares of the Acquiring Fund having an aggregate net asset value equal to the value of the Fund's net assets and the assumption by the Acquiring Fund of the Fund's stated liabilities (the "Reorganization"). Class A shares, Class C shares,

Class I shares and Class Y shares of the Acquiring Fund received by the Fund in the Reorganization will be distributed by the Fund to holders of its Class A shares, Class C shares, Class I shares and Class Y shares, respectively, with holders of

Class Z shares of the Fund receiving Class A shares of the Acquiring Fund, in liquidation of the Fund, after which the Fund will cease operations and will be dissolved.

The Meeting will be held in a virtual meeting format only. You will not be able to attend the Meeting physically, but you may participate over the Internet as described below.

However, if it is determined that the Meeting will be held in person, we will make an announcement in the manner noted below.

Shareholders of record as of the close of business on December 9, 2024 will be entitled to receive notice of and to vote at the Meeting. Pursuant to Maryland law and the

Fund's Bylaws, only the matters set forth in this Notice may be considered and voted on at the Meeting.

To participate in the Meeting, you must request the Meeting credentials by emailing msfs-meetinginfo@morrowsodali.com. Please include your full name and address, your control

number found on your enclosed proxy card and your intent to attend the virtual Meeting, and write "BNY Mellon U.S. Mortgage Fund, Inc." in the subject line. The Meeting will begin promptly at 10:00 a.m., Eastern time, on Thursday, February 13,

2025. If you hold your shares through an intermediary, such as a bank or broker, you must register in advance of the Meeting. To register, you must submit proof of your proxy power (legal proxy provided by your intermediary) reflecting your Fund

holdings along with your name and email address to msfs-meetinginfo@morrowsodali.com. You may also forward proof of ownership from your intermediary to msfs-meetinginfo@morrowsodali.com. Requests for registration should be received no later than

12:00 p.m., Eastern time, on Tuesday, February 11, 2025. You will receive a confirmation email from msfs-meetinginfo@morrowsodali.com of your registration and control number that will allow you to vote over the Internet during the Meeting.

If you have any questions after considering the enclosed materials, please call the Fund's proxy solicitor, Sodali & Co. Fund Solutions, at 1-888-864-6108.

PLEASE NOTE: If it is determined that the Meeting will be held in person, instead of virtually, an announcement of the change will be

provided by means of a press release, which will be posted on our website www.bny.com/investments/us/en/individual/resources/proxy-materials.html. We encourage you

to check the website prior to the Meeting. An announcement of any change will also be filed with the Securities and Exchange Commission via its EDGAR system.

| |

By Order of the Board of Directors

|

| |

Sarah S. Kelleher

Secretary

|

New York, New York

December __, 2024

|

WE NEED YOUR PROXY VOTE

A SHAREHOLDER MAY THINK HIS OR HER VOTE IS NOT IMPORTANT, BUT IT IS VITAL. BY LAW, THE MEETING OF SHAREHOLDERS OF THE FUND WILL HAVE TO BE ADJOURNED OR POSTPONED

WITHOUT CONDUCTING ANY BUSINESS IF SHAREHOLDERS REPRESENTING LESS THAN A QUORUM OF FUND SHARES ELIGIBLE TO VOTE ARE PRESENT. IN THAT EVENT, THE FUND WOULD CONTINUE TO SOLICIT VOTES IN AN ATTEMPT TO ACHIEVE A QUORUM. CLEARLY, YOUR VOTE COULD

BE CRITICAL TO ENABLE THE FUND TO HOLD THE MEETING AS SCHEDULED, SO PLEASE RETURN YOUR PROXY CARD OR OTHERWISE VOTE PROMPTLY. YOU AND ALL OTHER FUND SHAREHOLDERS WILL BENEFIT FROM YOUR COOPERATION.

|

Proposed Reorganization of

BNY MELLON U.S. MORTGAGE FUND, INC.

With and Into

BNY MELLON CORE PLUS FUND

A Series of BNY Mellon Absolute Insight Funds, Inc.

_______________________________________

PROSPECTUS/PROXY STATEMENT

[_______], 2024

_______________________________________

Special Meeting of Shareholders

To Be Held on Thursday, February 13, 2025

This Prospectus/Proxy Statement is furnished in connection with a solicitation of proxies by the Board of Directors (the "Board") of BNY Mellon U.S. Mortgage

Fund, Inc., a Maryland corporation (the "Fund"), to be exercised at the Special Meeting of Shareholders (the "Meeting") of the Fund to be held over the Internet in a virtual meeting format only on Thursday, February 13, 2025 at 10:00 a.m., Eastern

Time, and at any and all adjournments or postponements thereof, for the purpose set forth in the accompanying Notice of Special Meeting of Shareholders. Pursuant to Maryland law and the Fund's Bylaws, only the matters set forth in the Notice of

Special Meeting of Shareholders may be considered and voted on at the Meeting.

Shareholders of record as of the close of business on December 9, 2024 are entitled to receive notice of and to vote over the Internet during the Meeting.

Shareholders are entitled to one vote for each Fund share held and fractional votes for each fractional Fund share held. Shareholders will not be able to attend the Meeting physically but may participate over the Internet as described in the Notice

of Special Meeting of Shareholders.

It is proposed that the Fund transfer all of its assets to BNY Mellon Core Plus Fund (the "Acquiring Fund"), in exchange solely for Class A shares, Class C

shares, Class I shares and Class Y shares of the Acquiring Fund, par value $0.001 per share, and the assumption by the Acquiring Fund of the Fund's stated liabilities, as described in this Prospectus/Proxy Statement (the "Reorganization"). Upon

consummation of the Reorganization, the Acquiring Fund's shares received by the Fund will be distributed to Fund shareholders, with each shareholder receiving a pro rata distribution of the Acquiring Fund's shares (or fractions thereof) received by

the Fund, for Fund shares held prior to the Reorganization. It is contemplated that each shareholder will receive for his or her Fund shares a number of Class A shares, Class C shares, Class I shares and Class Y shares (or fractions thereof) of the

Acquiring Fund, with holders of Class Z shares of the Fund, par value $0.001 per share, receiving Class A shares (or fractions thereof) of the Acquiring Fund, with an aggregate net asset value equal to the aggregate net asset value of the

shareholder's Fund shares as of the date of the Reorganization.

This Prospectus/Proxy Statement, which should be retained for future reference, concisely sets forth information about the Acquiring Fund that Fund shareholders

should know before voting on the proposal or investing in the Acquiring Fund. The Acquiring Fund and the Fund have their principal executive offices at 240 Greenwich Street, New York, New York 10286. The phone number for the Acquiring Fund and the

Fund is 1-800-373-9387.

A Statement of Additional Information ("

SAI") dated December [__], 2024, relating to this Prospectus/Proxy Statement,

has been filed with the Securities and Exchange Commission (the "Commission") and is incorporated by reference in its entirety. The Commission maintains a website (http://www.sec.gov) that contains the SAI, material incorporated in this

Prospectus/Proxy Statement by reference, and other information regarding the Acquiring Fund and the Fund. A copy of the SAI is available without charge by writing to the Acquiring Fund at its offices at 144 Glenn Curtiss Boulevard, Uniondale, New

York 11556-0144, or by calling 1-800-373-9387 (inside the U.S. only).

____________________________________________________________________________________

Shares of the Acquiring Fund and the Fund are not bank deposits and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency.

Investing in the Acquiring Fund, as in the Fund, involves certain risks, including the possible loss of principal.

____________________________________________________________________________________

The Securities and Exchange Commission has not approved or disapproved the Acquiring Fund's shares or passed upon the accuracy or adequacy of this Prospectus/Proxy Statement. Any

representation to the contrary is a criminal offense.

______________________________________________________________________________

The Acquiring Fund and the Fund are open-end management investment companies advised by BNY Mellon Investment Adviser, Inc. ("BNYM Investment Adviser").

Insight North America LLC ("INA"), an affiliate of BNYM Investment Adviser, serves as the sub-adviser to the Acquiring Fund and the Fund. The Acquiring Fund and the Fund have similar investment objectives. However, the investment practices and

limitations of each fund are not identical. The Fund normally invests in U.S. mortgage-related securities and the Acquiring Fund normally invests in a diversified portfolio of fixed-income securities of U.S. and foreign issuers. Typically, the

Acquiring Fund can be expected to have an average effective portfolio duration ranging between three and eight years. Under normal conditions, the dollar-weighted average maturity of the Fund's portfolio generally is not expected to exceed 30 years,

and the Fund's average duration generally is not expected to exceed eight years. The Acquiring Fund normally invests primarily in fixed-income securities rated, at the time of purchase, investment grade (i.e., Baa3/BBB- or higher) or the unrated

equivalent as determined by INA. The Fund is permitted to invest in privately issued mortgage-backed securities with a BBB or higher credit quality, but currently invests in only those securities with an A or higher credit quality. The Acquiring

Fund is a series of BNY Mellon Absolute Insight Funds, Inc. (the "Acquiring Company"), a Maryland corporation. A comparison of the Acquiring Fund and the Fund is set forth in this Prospectus/Proxy Statement.

For more information regarding the Acquiring Fund, see the current

Acquiring Fund's Prospectus, dated August 30, 2024, and

Statement of Additional Information, dated December 29, 2023, as revised or amended, filed with the Securities and Exchange Commission (File No.

333-202460), which are incorporated into this Prospectus/Proxy Statement by reference. The

Acquiring Fund's Annual Report (including its audited financial

statements for the fiscal year) for its fiscal year ended April 30, 2024 (File No. 811-23036) also is incorporated into this Prospectus/Proxy Statement by reference.

For more information regarding the Fund, see the current

Fund Prospectus, dated August 30, 2024, and

Statement of Additional Information, dated December 29, 2023, as revised or amended, filed with the Securities and Exchange Commission (File No.

2-95553), which are incorporated into this Prospectus/Proxy Statement by reference. The

Fund's Annual Report (including its audited financial statements for

the fiscal year) for its fiscal year ended April 30, 2024 (File No. 811-04215) also is incorporated into this Prospectus/Proxy Statement by reference.

The

Acquiring Fund's Prospectus, dated

August 30, 2024, accompanies this Prospectus/Proxy Statement. For a free copy of the

Fund's Prospectus, dated August 30, 2024, or the

Fund's Annual Report, please call your financial adviser, or call 1-800-645-6561, visit

www.bnyfunds.com or write to the Fund at BNY Shareholder

Services, P.O. Box 534434, Pittsburgh, Pennsylvania 15253-4434.

Shareholders are entitled to one vote for each Fund share held and fractional votes for each fractional Fund share held. Holders of Class A shares, Class C shares, Class I shares, Class Y shares and Class Z shares of the Fund will vote together on the proposal. Fund shares represented by executed and unrevoked proxies will be voted in accordance with

the specifications made thereon. Unmarked but properly signed and dated proxy cards will be voted "FOR" the Reorganization. If the enclosed proxy card is executed and returned, or if you have voted by telephone or over the Internet, your vote

nevertheless may be revoked after it is received by sending a written notice of revocation to the proxy tabulator at the address listed on the proxy card or by mailing a duly executed proxy card bearing a later date; you may also change your vote by

calling the toll-free telephone number listed under "To vote by Telephone" on the proxy card or over the Internet by going to the website listed on the proxy card and following the instructions on the website. To be effective, such revocation or

vote change must be received before your prior proxy is exercised at the Meeting. If you hold shares through a bank or other intermediary, please consult your bank or intermediary regarding your ability to revoke voting instructions after such

instructions have been provided. In addition, any shareholder who attends the Meeting virtually may vote over the Internet during the Meeting, thereby canceling any proxy previously given.

As of October 15, 2024, the following numbers of Fund shares were issued and outstanding:

|

|

|

|

|

|

|

915,987.602

|

15,183.875

|

158,518.015

|

65.746

|

12,511,154.649

|

It is estimated that proxy materials will be mailed to shareholders of record on or about December 23, 2024. To reduce expenses, only one copy of the proxy

materials will be mailed to certain addresses shared by two or more accounts. If you wish to revoke this arrangement and receive individual copies, you may do so at any time by writing to the address or calling the phone number set forth above. The

Fund will begin sending you individual copies promptly after receiving your request.

IMPORTANT NOTICE REGARDING INTERNET

AVAILABILITY OF PROSPECTUS/PROXY MATERIALS

The Letter to Shareholders, Notice of Special Meeting of Shareholders, and Prospectus/Proxy Statement and

Form of Proxy Card are available at www.bny.com/investments/us/en/individual/resources/proxy-materials.html

TABLE OF CONTENTS

|

SUMMARY

|

5

|

|

FUND DETAILS

|

20

|

|

REASONS FOR THE REORGANIZATION

|

34

|

|

INFORMATION ABOUT THE REORGANIZATION

|

35

|

|

ADDITIONAL INFORMATION ABOUT THE ACQUIRING FUND AND THE FUND

|

39

|

|

VOTING INFORMATION

|

39

|

|

FINANCIAL STATEMENTS AND EXPERTS

|

44

|

|

OTHER MATTERS

|

44

|

|

NOTICE TO BANKS, BROKER/DEALERS AND VOTING TRUSTEES AND THEIR NOMINEES

|

44

|

|

AGREEMENT AND PLAN OF REORGANIZATION

|

A-1

|

APPROVAL OF AN AGREEMENT AND PLAN

OF REORGANIZATION PROVIDING FOR THE TRANSFER OF

ALL OF THE FUND'S ASSETS TO THE ACQUIRING FUND

SUMMARY

Additional information is contained elsewhere in this Prospectus/Proxy Statement, the Acquiring Fund's Prospectus and Statement of Additional Information, the

Fund's Prospectus and Statement of Additional Information, and the Agreement and Plan of Reorganization (the "Plan") attached to this Prospectus/Proxy Statement as Exhibit A.

Proposed Transaction. The Fund's Board, all of whose members are not "interested persons" (as defined in the

Investment Company Act of 1940, as amended (the "1940 Act")) of the Fund or the Acquiring Fund ("Independent Board Members"), has unanimously approved the Plan for the Fund. The Plan provides that, subject to the requisite approval of the Fund's

shareholders, on the date of the Reorganization the Fund will assign, transfer and convey to the Acquiring Fund all of the assets of the Fund, including all securities and cash, in exchange solely for Class A shares, Class C shares, Class I shares

and Class Y shares of the Acquiring Fund having an aggregate net asset value equal to the value of the Fund's net assets, and the Acquiring Fund will assume the Fund's stated liabilities. The Fund will distribute all Acquiring Fund shares received

by it among its shareholders so that each shareholder of the Fund will receive a pro rata distribution of the Acquiring Fund's shares (or fractions thereof) having an aggregate net asset value equal to the aggregate net asset value of the

shareholder's Fund shares as of the date of the Reorganization. Shareholders will receive the class of shares of the Acquiring Fund corresponding to their class of shares of the Fund, except holders of Class Z shares of the Fund will receive Class A

shares of the Acquiring Fund. The number of the Acquiring Fund's shares (or fractions thereof) a Fund shareholder receives may be different from the number of Fund shares (or fractions thereof) held by the shareholder as of the date of the

Reorganization, but the aggregate net asset value will be equal. Thereafter, the Fund will cease operations and be dissolved and its registration with the Commission as a registered investment company under the 1940 Act will be terminated.

As a result of the Reorganization, each Fund shareholder will cease to be a shareholder of the Fund and will become a shareholder of the Acquiring Fund as of

the close of business on the date of the Reorganization. No sales charge, redemption fee or contingent deferred sales charge ("CDSC") will be imposed at the time of the Reorganization. Any redemption of the Acquiring Fund's Class C shares (or Class

A shares subject to a CDSC) received in the Reorganization will be subject to the same CDSC as the redemption of the Fund's Class C shares (or Class A shares subject to a CDSC) and would be calculated from the date of original purchase of your Fund

shares. Any shares of the Acquiring Fund acquired after the Reorganization will be subject to any applicable sales charges and CDSCs.

The Fund's Board has unanimously concluded that the Reorganization is advisable and in the best interests of the Fund, and that the interests of the Fund's

existing shareholders will not be diluted as a result of the Reorganization. Similarly, the Acquiring Company's Board of Directors has unanimously concluded that the Reorganization is advisable and in the best

interests of the Acquiring Fund, and that the interests of the Acquiring Fund's existing shareholders will not be diluted as a result of the Reorganization. See "Reasons for the Reorganization."

Federal Income Tax Consequences. The Reorganization will not be a taxable event for federal income tax purposes. As a

condition to the closing of the Reorganization, the Fund and the Acquiring Fund will receive an opinion of counsel to the effect that, for federal income tax purposes, the Reorganization will qualify as a tax-free reorganization and, thus, no gain or

loss will be recognized by the Fund, the Fund's shareholders, or the Acquiring Fund as a direct result of the Reorganization. The Fund will distribute any

undistributed net investment income and net realized capital gains (after reduction for any capital loss carryforwards) prior to the Reorganization, which distribution will be

taxable to shareholders who hold shares in taxable accounts. Certain tax attributes of the Fund will carry over to the Acquiring Fund, including the ability of the Acquiring Fund to utilize the Fund's capital loss carryforwards, if any. As of April

30, 2024, the Fund's most recent fiscal year end, and more currently, as of August 31, 2024, the Fund had unused capital loss carryforwards of approximately $22.5 million and $26.8 million, respectively, none of which is expected to be lost as a

result of the reorganization. See "Information about the Reorganization—Federal Income Tax Consequences," "—Capital Loss Carryforwards."

Comparison of the Acquiring Fund and the Fund. The following discussion is primarily a summary of certain parts of the

Acquiring Fund's Prospectus and the

Fund's Prospectus. Additional information is set forth in such Prospectuses, which are incorporated herein by reference.

Investment Objective and Principal Investment Strategies. The Acquiring Fund and the Fund have similar investment objectives. The Acquiring Fund seeks

high total return consistent with preservation of capital. The Fund seeks to maximize total return, consisting of capital appreciation and current income. Each fund's investment objective is a fundamental policy which cannot be changed without the

approval of the holders of a majority (as defined in the 1940 Act) of the relevant fund's outstanding voting securities.

To pursue its goal, the Acquiring Fund normally invests in a diversified portfolio of fixed-income securities of U.S. and foreign issuers. The fixed-income

securities in which the Acquiring Fund may invest include: (i) securities issued or guaranteed by the U.S. government, its agencies or government sponsored enterprises (U.S. government securities); (ii) corporate debt securities of U.S. and non-U.S.

issuers, including convertible securities, preferred stock and corporate commercial paper; (iii) mortgage-related securities; (iv) asset-backed securities; (v) inflation indexed bonds issued by governments or corporations; (vi) structured notes

(i.e., specially designed debt instruments whose return is determined by reference to an index or security); (vii) loan participations and assignments; (viii) delayed funding loans and revolving credit facilities; (ix) bank certificates of deposit,

fixed time deposits and bankers' acceptances; (x) repurchase agreements and reverse repurchase agreements; (xi) debt securities issued by states or local governments or their agencies, authorities or other government sponsored enterprises (municipal

securities); (xii) obligations of foreign governments or their subdivisions, agencies or government sponsored enterprises; and (xiii) obligations of international agencies or supranational entities. The Acquiring Fund normally invests primarily in

fixed-income securities rated, at the time of purchase, investment grade (i.e., Baa3/BBB- or higher) or the unrated equivalent as determined by INA. The Acquiring Fund, however, may invest up to 25% of its net assets in fixed-income securities

rated, at the time of purchase, below investment grade ("high yield" or "junk" bonds) or the unrated equivalent as determined by INA.

Typically, the Acquiring Fund's portfolio can be expected to have an average effective duration ranging between three and eight years. The Acquiring Fund's

sub-adviser may lengthen or shorten the Acquiring Fund's portfolio duration outside this range depending on its evaluation of market conditions. Duration is an indication of an investment's "interest rate risk," or how sensitive a bond or the fund's

portfolio may be to changes in interest rates. Generally, the longer a bond's duration, the more likely it is to react to interest rate fluctuations and the greater its long-term risk/return potential.

In constructing the Acquiring Fund's portfolio, INA, as the Acquiring Fund's sub-adviser, relies primarily on proprietary, internally-generated credit research. This credit

research focuses on both industry/sector analysis and detailed individual security selection. INA seeks to identify investment opportunities for the Acquiring Fund based on the relative value of securities. INA analyzes individual issuer credit

risk based on factors such as management depth and experience, competitive advantage, market and product position and overall financial strength. INA may supplement its internal research with

external, third-party credit research and related credit tools. The Acquiring Fund may sell securities when INA anticipates market declines or credit downgrades. In addition, the Acquiring Fund

may sell securities when INA identifies new investment opportunities.

The Acquiring Fund may use derivative instruments as a substitute for investing directly in an underlying asset, to increase returns, to manage interest rate risk, to manage the

effective duration or maturity of the Acquiring Fund's portfolio, or as part of a hedging strategy. The derivative instruments in which the Acquiring Fund may invest typically include options, futures and options on futures (including those relating

to securities, foreign currencies, indices and interest rates), forward contracts (including foreign currency forward contracts), swaps (including total return, currency, interest rate and credit default swaps), and other derivative instruments

(including structured notes).

To pursue its goal, the Fund normally invests at least 80% of its net assets, plus any borrowings for investment purposes, in U.S. mortgage-related securities.

These mortgage-related securities may include certificates (debt securities) issued, and guaranteed as to timely payment of principal and interest, by the Government National Mortgage Association (GNMA) (popularly called "Ginnie Maes"); securities

issued by government-related organizations such as Fannie Mae and Freddie Mac; residential and commercial mortgage-backed securities issued by governmental agencies or private entities; and collateralized mortgage obligations (CMOs). The Fund will

invest at least 65% of its net assets in Ginnie Maes. The Fund can invest in privately issued mortgage-backed securities with a "BBB" or higher credit quality, but currently intends to invest in only those securities with an "A" or higher credit

quality. The Fund is not subject to any maturity or duration restrictions, however, under normal conditions, the dollar-weighted average maturity of the Fund's portfolio generally is not expected to exceed 30 years, and the Fund's average duration

generally is not expected to exceed eight years.

The Fund may purchase or sell securities on a forward commitment (including "TBA" (to be announced)) basis. These transactions involve a commitment by the Fund

to purchase or sell particular securities, such as mortgage-related securities, with payment and delivery taking place at a future date, and permit the Fund to lock in a price or yield on a security it owns or intends to purchase. To enhance current

income, the Fund also may engage in a series of purchase and sale contracts or forward roll transactions in which the Fund sells a mortgage-related security, for example, to a financial institution and simultaneously agrees to purchase a similar

security from the institution at a later date at an agreed-upon price. Forward roll transactions will significantly increase the Fund's portfolio turnover rate.

The Fund may use derivative instruments as a substitute for investing directly in an underlying asset, to increase returns, to manage interest rate risk, as part

of a hedging strategy, or for other purposes related to the management of the Fund. The derivative instruments in which the Fund may invest typically include options, futures and options on futures (including those relating to securities and

interest rates), swap agreements (including credit default swap agreements on mortgage-related and asset-backed securities), options on swap agreements and other credit derivatives.

In deciding to buy and sell securities, the investment process of the Fund's sub-adviser, INA, begins with a macroeconomic view, and considers the overall risk

environment in light of broad portfolio themes and overall portfolio quality in relation to the Fund's current positions. Potential purchases and sales of securities are viewed on absolute and relative value bases in relation to other potential

opportunities available to the Fund.

The Fund does not have any limitations regarding portfolio turnover and, at times, the Fund may engage in active and frequent trading, which will increase portfolio turnover.

The Acquiring Fund is not limited to investing in mortgage-related securities. As of August 31, 2024, approximately 29.23% of the Acquiring Fund's portfolio consisted of U.S.

mortgage-related securities, of which 1.74% were Ginnie Maes.

The Acquiring Fund and the Fund have substantially similar fundamental and non-fundamental investment restrictions, except that, as a fundamental policy, the

Fund invests at least 65% of its net assets in Ginnie Maes.

Principal Investment Risks. An investment in the Acquiring Fund, as well as in the Fund, is not a bank deposit. It is not insured or guaranteed by the

Federal Deposit Insurance Corporation or any other government agency. It is not a complete investment program. The value of your investment in the Acquiring Fund, as in the Fund, will fluctuate, sometimes dramatically, which means you could lose

money.

The risks associated with an investment in the Acquiring Fund and the Fund are similar but not identical. Because the Fund invests a higher percentage of its

assets in mortgage-related securities than the Acquiring Fund, the Fund is subject to a greater extent than the Acquiring Fund to the credit risk associated with these securities, including the market's perception of the creditworthiness of the

issuing federal agency, as well as the credit quality of the underlying assets. Although certain mortgage-related securities are guaranteed as to the timely payment of interest and principal by a third party (such as a U.S. government agency or

instrumentality with respect to government-related mortgage securities) the market prices for such securities are not guaranteed and will fluctuate. Ginnie Maes carry additional risks and may be more volatile than other types of fixed-income

securities due to unexpected changes in interest rates. The Acquiring Fund normally invests in a diversified portfolio of fixed-income securities of U.S. and foreign issuers and, thus, may be subject to changes in the outlook for corporate earnings,

changes in interest or currency rates or adverse investor sentiment generally that affect these securities to a greater extent than the Fund. Because the Acquiring Fund may invest a higher percentage of its assets in fixed-income securities rated

below investment grade and foreign issuers than the Fund, the Acquiring Fund may be subject to certain of the risks associated with investments in high yield securities and foreign securities to a greater extent than the Fund. As of August 31, 2024,

2.19% of the Acquiring Fund's portfolio consisted of securities that were rated below investment grade. As of August 31, 2024, the Fund did not own any securities that were rated below investment grade.

The Acquiring Fund and the Fund are subject to the following principal risks:

|

• |

Fixed-income market risk: (Each fund) The market value of a fixed-income security may decline due to general market conditions that are not specifically related to a particular company, such as

real or perceived adverse economic conditions, changes in the outlook for corporate earnings, changes in interest or currency rates or adverse investor sentiment generally. The fixed-income securities market can be susceptible to increases

in volatility and decreases in liquidity. Liquidity can decline unpredictably in response to overall economic conditions or credit tightening. Increases in volatility and decreases in liquidity may be caused by a rise in interest rates (or

the expectation of a rise in interest rates). An unexpected increase in fund redemption requests, including requests from shareholders who may own a significant percentage of the fund's shares, which may be triggered by market turmoil or an

increase in interest rates, could cause the fund to sell its holdings at a loss or at undesirable prices and adversely affect the fund's share price and increase the fund's liquidity risk, fund expenses and/or taxable distributions. Federal

Reserve policy in response to market conditions, including with respect to interest rates, may adversely affect the value, volatility and liquidity of dividend and interest paying securities. Policy and legislative changes worldwide are

affecting many aspects of financial regulation. The impact of these changes on the markets and the practical implications for market participants may not be fully known for some time.

|

|

• |

Interest rate risk: (Each fund) Prices of certain mortgage-related and other fixed rate fixed-income securities tend to move inversely with changes in interest rates. Typically, a rise in rates

will adversely affect these securities and, accordingly, will cause the value of the fund's

|

investments in these securities to decline. A wide variety of market factors can cause interest rates to rise, including central bank monetary policy, rising inflation and

changes in general economic conditions. It is difficult to predict the pace at which central banks or monetary authorities may increase (or decrease) interest rates or the timing, frequency, or magnitude of such changes. During periods of very low

interest rates, which occur from time to time due to market forces or actions of governments and/or their central banks, including the Board of Governors of the Federal Reserve System in the U.S., the fund may be subject to a greater risk of

principal decline from rising interest rates. When interest rates fall, the fund's investments in new securities may be at lower yields and may reduce the fund's income. Changing interest rates may have unpredictable effects on markets, may result

in heightened market volatility and may detract from fund performance. The magnitude of these fluctuations in the market price of fixed-income securities is generally greater for securities with longer effective maturities and durations because such

instruments do not mature, reset interest rates or become callable for longer periods of time. Unlike investment grade bonds, however, the prices of high yield ("junk") bonds may fluctuate unpredictably and not necessarily inversely with changes in

interest rates. Mortgage-related securities can have a different interest rate sensitivity than other fixed-income securities, however, because of prepayment and extension risks.

Ginnie Maes carry additional risks and may be more volatile than other types of fixed-income securities due to unexpected changes in interest rates.

|

• |

Mortgage-related securities risk: (The Fund) Mortgage-related securities are subject to credit, prepayment and extension risk, and may be more volatile, less liquid and more difficult to price

accurately than more traditional debt securities. The Fund is subject to the credit risk associated with these securities, including the market's perception of the creditworthiness of the issuing federal agency, as well as the credit quality

of the underlying assets. Although certain mortgage-related securities are guaranteed as to the timely payment of interest and principal by a third party (such as a U.S. government agency or instrumentality with respect to government-related

mortgage securities) the market prices for such securities are not guaranteed and will fluctuate. As with other interest-bearing securities, the prices of certain mortgage-related securities are inversely affected by changes in interest

rates. However, although the value of a mortgage-related security may decline when interest rates rise, the converse is not necessarily true, since in periods of declining interest rates the mortgages underlying the security are more likely

to be prepaid causing the fund to purchase new securities at current market rates, which usually will be lower. The loss of higher yielding underlying mortgages and the reinvestment of proceeds at lower interest rates, known as prepayment

risk, can reduce the fund's potential price gain in response to falling interest rates, reduce the fund's yield and/or cause the fund's share price to fall. When interest rates rise, the effective duration of the fund's mortgage-related and

other asset-backed securities may lengthen due to a drop in prepayments of the underlying mortgages or other assets. This is known as extension risk and would increase the fund's sensitivity to rising interest rates and its potential for

price declines.

|

|

• |

Liquidity risk: (Each fund) When there is little or no active trading market for specific types of securities, it can become more difficult to sell the securities in a timely manner at or near

their perceived value. In such a market, the value of such securities and the fund's share price may fall dramatically. Investments that are illiquid or that trade in lower volumes may be more difficult to value.

|

The market for below investment grade securities may be less liquid and therefore these securities may be harder to value or sell at an acceptable price, especially during times

of market volatility or decline. Foreign securities in which the Acquiring Fund may invest tend to have greater exposure to liquidity risk than domestic securities.

|

• |

Market risk: (Each fund) The value of the securities in which the fund invests may be affected by political, regulatory, economic and social developments, and developments that impact specific

economic sectors, industries or segments of the market. In addition, turbulence in financial markets and reduced liquidity in equity, credit and/or fixed-income markets may negatively affect many issuers, which could adversely affect the

fund. Global economies and financial markets are becoming increasingly interconnected, and conditions and events in one country, region or financial market may adversely impact issuers in a different country, region or financial market.

These risks may be magnified if certain events or developments adversely interrupt the global supply chain; in these and other circumstances, such risks might affect companies world-wide.

|

|

• |

Portfolio turnover risk: (The Fund) The Fund may engage in short-term trading, which could produce higher transaction costs and taxable distributions, and lower the Fund's after-tax performance.

The Fund's forward roll transactions will increase its portfolio turnover rate.

|

|

• |

Derivatives risk: (Each fund) A small investment in derivatives could have a potentially large impact on the fund's performance. The use of derivatives involves risks different from, or possibly

greater than, the risks associated with investing directly in the underlying assets, and the fund's use of derivatives may result in losses to the fund. Derivatives in which the fund may invest can be highly volatile, illiquid and difficult

to value, and there is the risk that changes in the value of a derivative held by the fund will not correlate with the underlying assets or the fund's other investments in the manner intended. Certain derivatives have the potential for

unlimited loss, regardless of the size of the initial investment, and involve greater risks than the underlying assets because, in addition to general market risks, they are subject to liquidity risk, credit and counterparty risk (failure of

the counterparty to the derivatives transaction to honor its obligation) and pricing risk (risk that the derivative cannot or will not be accurately valued).

|

|

• |

Management risk: (Each fund) The investment process used by the fund's sub-adviser could fail to achieve the fund's investment goal and cause your fund investment to lose value.

|

|

• |

Issuer risk: (The Acquiring Fund) A security's market value may decline for a number of reasons which directly relate to the issuer, such as management performance, financial leverage and reduced

demand for the issuer's products or services, or factors that affect the issuer's industry, such as labor shortages or increased production costs and competitive conditions within an industry.

|

|

• |

Credit risk: (The Acquiring Fund) Failure of an issuer of a security to make timely interest or principal payments when due, or a decline or perception of a decline in the credit quality of the

security, can cause the security's price to fall. The lower a security's credit rating, the greater the chance that the issuer of the security will default or fail to meet its payment obligations.

|

|

• |

High yield securities risk: (The Acquiring Fund) High yield ("junk") securities involve greater credit risk, including the risk of default, than investment grade securities, and are considered

predominantly speculative with respect to the issuer's ability to make principal and interest payments. These securities are especially sensitive to adverse changes in general economic conditions, to changes in the financial condition of

their issuers and to price fluctuation in response to changes in interest rates. During periods of economic downturn or rising interest rates, issuers of below investment grade securities may experience financial stress that could adversely

affect their ability to make payments of principal and interest and increase the possibility of default.

|

|

• |

Foreign investment risk: (The Acquiring Fund) To the extent the Acquiring Fund invests in foreign securities, the Acquiring Fund's performance will be influenced by political, social and

|

economic factors affecting investments in foreign issuers. Special risks associated with investments in foreign issuers include exposure to currency fluctuations, less liquidity,

less developed or less efficient trading markets, lack of comprehensive company information, political and economic instability and differing auditing and legal standards.

|

• |

Foreign government obligations and securities of supranational entities risk: (The Acquiring Fund) Investing in foreign government obligations, debt obligations of supranational entities and the