UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________

FORM

_________________

| (Mark One) | ||

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended |

or

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to |

Commission File Number:

_____________________

(Exact name of registrant as specified in its charter)

_____________________

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| (Address of principal executive offices) | (Zip Code) |

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(g) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| OTC |

_________________

Indicate by check mark if the registrant is

a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate by check mark if the registrant is not

required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐

Indicate by check mark whether the registrant

(1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months

(or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements

for the past 90 days.

Indicate by check mark whether the registrant

has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405

of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company”, and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ | |

| Smaller reporting company | ||

| Emerging Growth Company | ||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. Yes ☐ No ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as

defined in Rule 12b-2 of the Act). Yes ☐

The aggregate market value of the voting

and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the

average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second

fiscal quarter was $

As of April 17, 2023, there were shares outstanding of the registrant’s common stock.

TABLE OF CONTENTS

| i |

PART I

| Item 1. | Business |

(a) Business Development

The Company was organized under the laws of the State of Nevada on March 8, 2012, under Gankit Corporation. The Company was development stage company as an e-commerce business focused on selling a diverse set of products through its website Gankit.com.

On May 12, 2014, the control block of stock, 20,000,000 shares of restricted common stock were purchased resulting in a change of control. The Company then ceased to operate its e-commerce website and abandoned that business model, and re-focused on the development, branding, and distribution of non-flame smoking devices. The Company changed its name at this time to Nhale, Inc.

Business operations for Nhale Inc. was abandoned by former management and a custodianship action, as described in the subsequent paragraph, was commenced in 2020. The Company filed its last 10-Q in 2016, this financial report included liabilities and debts. As of the date of this filing, these liabilities and debts have not been addressed.

On November 24. 2020, the Eighth District Court of Clark County, Nevada granted the Application for Appointment of Custodian as a result of the absence of a functioning board of directors and the revocation of the Company’s charter. The order appointed Small Cap Compliance, LLC (“SCC”, the “Custodian”) custodian with the right to appoint officers and directors, negotiate and compromise debt, execute contracts, issue stock, and authorize new classes of stock. Rhonda Keaveney is the sole member and control person for Small Cap Compliance, LLC.

The court awarded custodianship to SCC based on the absence of a functioning board of directors, revocation of the company’s charter, and abandonment of the business. At this time, Rhonda Keaveney was appointed sole officer and director.

Upon appointment as the Custodian of CDXQ and under its duties stipulated by the Nevada court, SCC took initiative to organize the business of the issuer. As Custodian, the duties were to conduct daily business, hold shareholder meetings, appoint officers and directors, reinstate the company with the Nevada Secretary of State. SCC also had authority to enter into contracts and find a suitable merger candidate. SCC was compensated for its role as custodian in the amount of 500,000 shares of Convertible Series A Preferred Stock. SCC did not receive any additional compensation, in the form of cash or stock, for custodian services. The custodianship was discharged on April 7 2021.

On January 20, 2021, SCC entered into a Stock Purchase Agreement with Bridgeview Capital Partners, LLC, whereby Bridgeview Capital Partners, LLC purchased 500,000 shares of Convertible Series A Preferred Stock for $37,000. These shares represent the controlling block of stock. Ms. Keaveney resigned her position of sole officer and director and appointed Michael Dobbs as as CEO, Treasurer, Secretary, and Director of the Company.

Bridgeview Capital Partners, LLC is controlled by Michael Dobbs and Sean Lanci.

Bridgeview Capital Partners, LLC entered into a Stock Purchas Agreement with Yang Chong Yi whereby Yang Chong Yi purchased 500,000 shares of Convertible Series A Preferred Stock. Michael Dobbs resigned as sole officer and director and appointed Yang Chong Yi as its CEO, Treasurer, Secretary, and Director of the Company.

Nhale, Inc. filed an amendment to its Articles of Incorporation and changed its name to China De Xiao Quan Care Group Co., LTD on Sept. 22, 2022, trading symbol CDXQ.

| 2 |

Since October of 2022, the Company’s operations consist of a research and development, branding and distribution of non-flame smoking devices, along with computer software development, sales and service for the brand, and elder care services, development, and management.

The Company implemented a new business model in 2022, statements made relating to our business plan are forward looking statements and we have limited history of performance.

The analysis will be undertaken by or under the supervision of our management. In our continued efforts to implement our business plan, we intend to consider the following factors:

| · | Potential for growth, indicated by anticipated market expansion or new technology; | |

| · | Competitive position as compared to other businesses of similar size and experience within our contemplated segment as well as within the industry as a whole; | |

| · | Strength and diversity of management, and the accessibility of required management expertise, personnel, services, professional assistance and other required items; | |

| · | Capital requirements and anticipated availability of required funds, to be provided by the Company or from operations, through the sale of additional securities or convertible debt, through joint ventures or similar arrangements or from other sources; | |

| · | The extent to which the business opportunity can be advanced in our contemplated marketplace; and | |

| · | Other relevant factors |

In applying the foregoing criteria, management will attempt to analyze all factors and circumstances and make a determination based upon reasonable investigative measures and available data. Due to our limited capital available for investigation, we may not discover or adequately evaluate adverse facts about the opportunity to be acquired. Additionally, we will be competing against other entities that may have greater financial, technical, and managerial capabilities for identifying and completing our business plan.

We are unable to predict when we will, if ever, be profitable. We anticipate that business opportunities would be made available to us through personal contacts of our directors, officers and principal stockholders, professional advisors, broker-dealers, venture capitalists, members of the financial community and others who may present unsolicited proposals. In certain cases, we may agree to pay a finder’s fee or to otherwise compensate the persons who introduce the Company to business opportunities in which we participate.

We expect that our due diligence will encompass, among other things, meetings with incumbent management of the target business and inspection of its facilities, as necessary, as well as a review of financial and other information, which is made available to the Company. This due diligence review will be conducted either by our management or by third parties we may engage. We anticipate that we may rely on the issuance of our common stock in lieu of cash payments for services or expenses related to any analysis.

We may incur time and costs required to select and evaluate our business structure and complete our business plan, which cannot presently be determined with any degree of certainty. Any costs incurred with respect to the indemnification and evaluation of a prospective business that is not ultimately completed may result in a loss to the Company. These fees may include legal costs, accounting costs, finder’s fees, consultant’s fees and other related expenses. We have no present arrangements for any of these types of fees.

| 3 |

As of the time of this filing, the Company is in the business of research and development, branding and distribution of non-flame smoking devices, along with computer software development, sales and service for the brand, and elder care services, development, and management.

Our elderly care system incorporates integrated control of community elderly care; standardization of home elderly care services; traceable tracking of financial income and expenditure; big data monitoring of health management; big data support of user portrait; convenient and barrier-free operation mode.

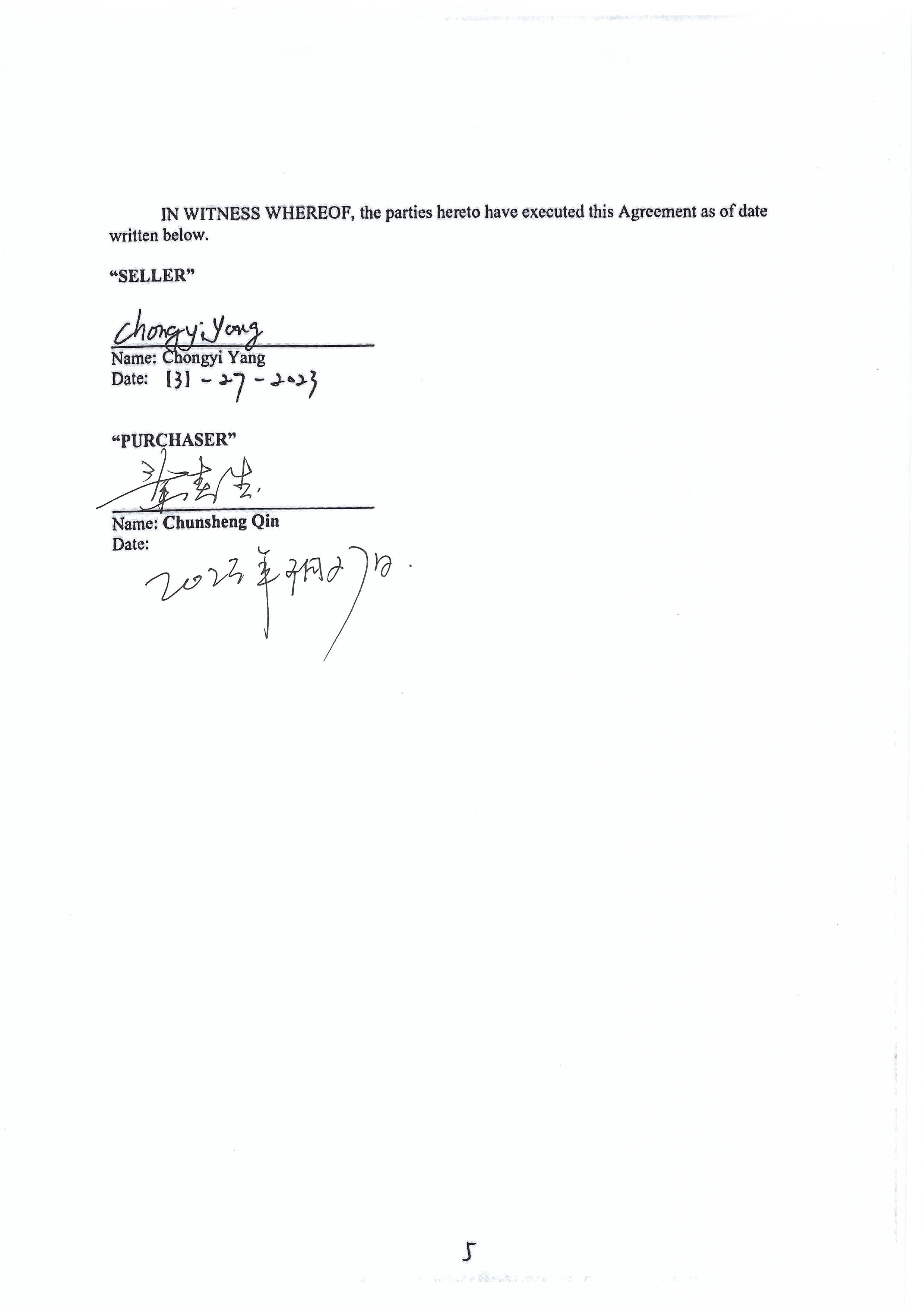

On March 15, 2023, there was a change in control. Chongyi Yang sold the control block of Preferred A Stock to the persons as follows:

Chunsheng Qin purchased 475,000 shares

Yangtenglie Quin purchased 15,000 shares

Fugui Xie purchased 10,000 shares

The purchase price was $285,000 and Chunsheng Qin became the majority shareholder of CDXQ.

On March 27, 2023, China De Xiao Quan Care Group Co., Ltd. (“CDXQ”) entered into a Non-Binding Letter of Intent (the “LOI”) in which the Company would acquire all of the issued and outstanding securities of China Care Holding Group Inc., a Cayman corporation (“China Care”). Mr. Chunsheng Qin is the sole owner of China De Ziao Quan Care Group Co., Ltd.

The LOI contemplates the acquisition of China Care, by CDXQ. China Care, which owns and operates Jiangsu De Xiao Quan Technology Group, a pioneer in elderly caring industry, combining new generation of cloud intelligence with human-focused management. The company has self-developed an intelligent caring system based on big data analysis and artificial intelligence, strengthening better care and tracking management for the elderly. The LOI was entered into following arm’s length negotiations.

The LOI proposes that CDXQ would acquire 51% of the issued and outstanding stock of China Care in exchange for the newly issued CDXQ stock issuance to the shareholders of 70 million shares of newly issued unregistered shares of common stock, par value $0.0001 per share, with no expiration date on the conversion.

Completion of the transaction is subject to, among other matters, the completion of due diligence, the negotiation of a definitive agreement providing for the transaction and employment agreements, satisfaction of the conditions negotiated therein and approval of the transaction by CDXQ’s board of directors, and all applicable state and federal law. No assurance can be given that the parties will be able to negotiate and execute a definitive agreement or that the transactions herein contemplated will close. CDXQ will file notice of such agreement with the Securities and Exchange Commission on form 8-K when and if any such agreement is reached.

On March 31, 2023, Chongyi Yang resigned his position of officer and director and appointed Chunsheng Qin as President, CEO, Treasurer, Secretary and Director.

Our Industry

In 2021, 18.9% of China's population was over the age of 60, around 267.36 million people. And there are 20.56 million of the population over the age of 65, accounting for 14.2 per cent. This means that there were 2.37 working-aged persons for every one retired person. In 2050, the ratio is expected to drastically drop to 1.82 working persons for every one retired person. Furthermore, currently, 180 million Chinese seniors suffer from chronic diseases, and over 15 million are facing dementia such as Alzheimer's disease. The current care system is unable to sustain these drastic demographic and economic shifts.

To address this issue, the government is looking to increase private capital and investments in the industry, hoping to provide seniors with better quality and more accessible services and options.

| 4 |

Under China's 14th Five Year Plan (2021-2025), the development of an efficient long-term care (LTC) system is a government priority. The plan specifies major goals and tasks for the five years, including expanding the supply of elderly care services, improving the health support mechanism for the elderly, and advancing the innovative and integrated development of service models.

It lists nine major indicators, such as the number of elderly care beds of the ratio of nursing care beds in elderly care institutions, to mobilize society to actively respond to population ageing. China will step up institutional innovation and boost policy support and financial investment to enable the elderly to share in China's development achievements. Moreover, it is stated that China would also plan to establish about 10 industrial parks dedicated to the silver economy and build a string of cities into models.

Competition

China De Xiao Quan Care Group Co., Ltd is in direct competition within our industry with entities that possess significantly greater experience and resources. Moreover, the Company also competes with numerous other companies similar to it for such opportunities. We believe that acquiring China Care Holding Group Inc., will greatly increase our competitive edge in the elder care services industry.

Effect of Existing or Probable Governmental Regulations on the Business

We are subject to the Exchange Act and the Sarbanes-Oxley Act of 2002. Under the Exchange Act, and are required to file with the SEC annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K. The Sarbanes-Oxley Act creates a strong and independent accounting oversight board to oversee the conduct of auditors of public companies and to strengthen auditor independence. It also (1) requires steps be taken to enhance the direct responsibility of senior members of management for financial reporting and for the quality of financial disclosures made by public companies; (2) establishes clear statutory rules to limit, and to expose to public view, possible conflicts of interest affecting securities analysts; (3) creates guidelines for audit committee members’ appointment, and compensation and oversight of the work of public companies’ auditors; (4) prohibits certain insider trading during pension fund blackout periods; and (5) establishes a federal crime of securities fraud, among other provisions.

We are also subject to Section 14(a) of the Exchange Act, which requires all companies with securities registered pursuant to Section 12(g) of the Exchange Act to comply with the rules and regulations of the SEC regarding proxy solicitations, as outlined in Regulation 14A. Matters submitted to our stockholders at a special or annual meeting thereof or pursuant to a written consent will require us to provide our stockholders with the information outlined in Schedules 14A or 14C of Regulation 14A. Preliminary copies of this information must be submitted to the SEC at least 10 days prior to the date that definitive copies of this information are provided to our stockholders.

Employees

The Company had 1 officer during this reporting period. Dr. Chongyi Yang serves as Chief Executive Officer, Treasurer, and Secretary. Mr. Yang resigned on March 31, 2023 and appointed Chunsheng Qin as sole officer and director.

Management of the Company expects to use consultants, attorneys and accountants as necessary, and it is not expected that the Company will have any full-time or other employees, except as may be the result of completing a transaction.

Intellectual Property

As of the date of this report, we do not own any patents, trademarks, licenses, franchises, concessions, and royalty agreements, or other intellectual property contracts.

| 5 |

Available Information

Our Periodic Reports including Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and other reports, and amendments to those reports, and other forms that we file with or furnish to the Securities and Exchange Commission (SEC) are available to review on the SEC’s EDGAR website.

Corporate Governance

In accordance with and pursuant to relevant related rules and regulations of the SEC, the Board of Directors of the Company has established and periodically update our corporate governance guide, which is applicable to all directors, officers and employees of the Company. We have not yet established an audit committee of our board of directors.

| Item 1A. | Risk Factors |

Not applicable to a smaller reporting company.

| Item 1B. | Unresolved Staff Comments |

None

| Item 2. | Properties |

We do not own any property but rent office space.

| Item 3. | Legal Proceedings |

There are not any material pending legal proceedings to which the Registrant is a party or as to which any of its property is subject, and no such proceedings are known to the Registrant to be threatened or contemplated against it.

| Item 4. | Mine Safety Disclosures |

N/A

| 6 |

PART II

| Item 5. | Market Price and Dividends on the Registrant’s Common Equity and Related Stockholder Matters |

(a) Market information.

Our Common Stock is not trading on any stock exchange. It is listed, but not quoted, OTC Markets under the symbol CDXQ and there is no established public trading market for the class of common equity.

| Fiscal Year 2022 | HIGH | LOW | ||||||

| First Quarter (Jan.1, 2022 – March 31, 2022) | $ | .07 | $ | .01 | ||||

| Second Quarter (April 1, 2022– June 30, 2022) | .06 | .006 | ||||||

| Third Quarter (July 1, 2022 – Sept. 30, 2022) | .03 | .01 | ||||||

| Fourth Quarter (Oct. 1, 2022 – Dec. 31, 2022) | .06 | .01 | ||||||

| Fiscal Year 2021 | ||||||||

| First Quarter (Jan.1, 2022 – March 31, 2022) | $ | .06 | $ | .01 | ||||

| Second Quarter (April 1, 2022– June 30, 2022) | .08 | .01 | ||||||

| Third Quarter (July 1, 2022 – Sept. 30, 2022) | .06 | .02 | ||||||

| Fourth Quarter (Oct. 1, 2022 – Dec. 31, 2022) | .03 | .001 | ||||||

Holders

(b) Holders.

As of March 31, 2022, there are approximately 4 holders of an aggregate of 30,000,000 shares of our Common Stock issued and outstanding.

(c) Dividends.

We have not declared any cash dividends on our Common Stock since our inception and do not anticipate paying such dividends in the foreseeable future. We plan to retain any future earnings for use in our business. Any decisions as to future payments of dividends will depend on our earnings and financial position and such other facts, as the Board of Directors deems relevant.

(d) Securities authorized for issuance under equity compensation plans.

We have not adopted an equity compensation plan and no securities have been authorized or reserved for issuance under any equity compensation plan.

Description of Securities

The following description is a summary of the material terms of the provisions of our Articles of Incorporation and Bylaws. The Articles of Incorporation and Bylaws have been filed with the SEC as exhibits to our registration statement on Form 10.

Common Stock

We are authorized to issue 100,000,000 shares of Common Stock with $0.0001 par value per share. As of our fiscal year ended December 31, 2022, there were 30,000,000 shares of Common Stock issued and outstanding.

| 7 |

Each share of Common Stock entitles the holder to one vote, either in person or by proxy, at meetings of stockholders. Accordingly, the holders of our Common Stock who hold, in the aggregate, more than fifty percent of the total voting rights can elect all of our directors and, in such event, the holders of the remaining minority shares will not be able to elect any of such directors. The vote of the holders of a majority of the issued and outstanding shares of Common Stock entitled to vote thereon is sufficient to authorize, affirm, ratify or consent to such act or action, except as otherwise provided by law.

Holders of Common Stock are entitled to receive ratably such dividends, if any, as may be declared by the Board of Directors out of funds legally available. We have not paid any dividends since our inception, and we presently anticipate that all earnings, if any, will be retained for development of our business. Any future disposition of dividends will be at the discretion of our Board of Directors and will depend upon, among other things, our future earnings, operating and financial condition, capital requirements, and other factors.

Holders of our Common Stock have no preemptive rights or other subscription rights, conversion rights, redemption or sinking fund provisions. Upon our liquidation, dissolution or windup, the holders of our Common Stock will be entitled to share ratably in the net assets legally available for distribution to stockholders after the payment of all of our debts and other liabilities. There are not any provisions in our Articles of Incorporation or our Bylaws that would prevent or delay change in our control.

Our stock transfer agent is Securities Transfer Corporation., located at 2901 N. Dallas Parkway, Suite 380, Plano, TX 75093.

Preferred Stock

Our Articles of Incorporation, as amended, authorizes the issuances of up to 1,000,000 shares of Preferred Stock with the following designations, rights and preferences:

One (1) share of the as Convertible Series A Preferred Stock shall be converted into one thousand (1,000) shares of common stock of the Corporation and entitled to one thousand (1,000) votes of common stock for every one (1) share of as Convertible Series A Preferred Stock owned. The holders of the Convertible Series A Preferred Stock shall not be entitled to receive dividends.

From time to time its Board of Directors may amend the Preferred class of stock. Accordingly, our Board of Directors is empowered, without stockholder approval, to issue Preferred Stock with dividend, liquidation, conversion, voting, or other rights, which could adversely affect the voting power or, other rights of the holders of the Common Stock. In the event of issuance, the Preferred Stock could be utilized, under certain circumstances, as a method of discouraging, delaying or preventing a change in control of the Company.

At this time there are 1,000,000 shares of Preferred Stock authorized as Convertible Series A Preferred Stock and 500,000 are issued and outstanding.

| 8 |

Promissory Notes

During 2013 - 2016 the Company borrowed an aggregate amount of $1,240,000 through 24 promissory notes maturing various within 2015 to 2018. As at December 31, 2022 and 2021, there were 23 promissory notes with an aggregated amount of $1,190,000 in default.

| December 31, | ||||||||||||||||||||||

| Notes Payable | 2022 | 2021 | ||||||||||||||||||||

| Issue Date | Maturity Date | Nominal Amount | Interest Rate | Interest rate in default | Interest Accrued | |||||||||||||||||

| June 2, 2016 | June 2, 2018 | $ | 10,000.00 | 15% | 24% | $ | 13,250 | 10,850 | ||||||||||||||

| June 17, 2015 | June 17, 2018 | 20,000.00 | 15% | 24% | 26,425 | 21,625 | ||||||||||||||||

| August 16, 2016 | August 16, 2018 | 50,000.00 | 15% | 24% | 65,313 | 53,313 | ||||||||||||||||

| November 30, 2016 | November 30, 2018 | 25,000.00 | 15% | 24% | 32,000 | 26,000 | ||||||||||||||||

| April 5, 2013 | December 31, 2015 | 50,000.00 | 15% | 15% | 45,625 | 38,125 | ||||||||||||||||

| June 21, 2013 | December 31, 2015 | 150,000.00 | 15% | 18% | 164,250 | 137,250 | ||||||||||||||||

| November 17, 2013 | May 31, 2016 | 400,000.00 | 15% | 25% | 608,333 | 508,333 | ||||||||||||||||

| November 17, 2013 | April 12, 2017 | 400,000.00 | 15% | 25% | 593,333 | 493,333 | ||||||||||||||||

| July 31, 2015 | July 31, 2017 | 50,000.00 | 15% | 25% | 72,708 | 60,208 | ||||||||||||||||

| April 27, 2016 | April 27, 2018 | 35,000.00 | 15% | 25% | 48,271 | 39,521 | ||||||||||||||||

| Total | $ | 1,190,000.00 | $ | 1,669,508 | 1,388,558 | |||||||||||||||||

| Notes & Interest accrued forgiven | (600,000.00 | ) | (818,208 | ) | ||||||||||||||||||

| Balances as of December 31, 2022 | $ | 590,000.00 | $ | 851,300 | ||||||||||||||||||

For debts in default taken out in Nevada, the statutes of limitations on debt collection for written contracts are 6 years. The Company engages an attorney, who issued an opinion of debt forgiveness on April 13, 2023 to clear out the debts in default more than six years in accordance with the law of State of Nevada above. Based on the attorney letter, for all the notes payable in default for more than 6 years as of December 31, 2022 and subsequent as of April 12, 2023, the Company recognized gain on debt forgiveness totaling $1,418,208 and 1,004,444, respectively. As of December 31, 2022 and 2021, the Company held $590,000 and $1,190,000 notes payable with $851,300 and $1,388,558 accrued interest outstanding, respectively.

Weighted average interest rate of default was 12.0%-25.0% for the years ended December 31, 2022 and 2021. The Company accrued interest expenses of $280,950 and $280,950 for the years of 2022 and 2021, respectively.

| Item 6. | [Reserved] |

N/A

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

INTRODUCTION

This section provides management’s discussion of the financial condition, changes in financial condition and results of operations of China De Xiao Quan Care Group Co., Ltd. with specific information on results of operations and liquidity and capital resources. It includes management’s interpretation of our financial results, the factors affecting these results, the major factors expected to affect future operating results and future investment and financing plans. This discussion should be read in conjunction with our consolidated financial statements and notes thereto.

| 9 |

Cautionary Statement for the Purposes of the Safe Harbor under the Private Securities Litigation Reform Act of 1995

The statements contained in this Annual Report on Form 10-K may contain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. All statements other than statements of historical fact included in this Report are forward-looking statements made in good faith by us and are intended to qualify for the safe harbor from liability established by the Private Securities Litigation Reform Act of 1995. When used in this Report, or any other of our documents or oral presentations, the words “anticipate”, “believe”, “estimate”, “expect”, “forecast”, “goal”, “intend”, “objective”, “plan”, “projection”, “seek”, “strategy” or similar words are intended to identify forward-looking statements. Such forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those expressed or implied in the statements relating to our strategy, operations, markets, services, and other factors all of which are difficult to predict and many of which are beyond our control. Accordingly, while we believe these forward-looking statements to be reasonable, there can be no assurance that they will approximate actual experience or that the expectations derived from them will be realized. Further, we undertake no obligation to update or revise any of our forward-looking statements whether as a result of new information, future events or otherwise.

Results of Operations for China De Xiao Quan Care Group Co., LTD — Comparison of the Years ended December 31, 2022 and 2021

Revenue

We had no revenues from operations during either 2022 or 2021.

Selling and General & Administrative Expense

Selling and General & Administrative Expenses were $0 for the year ended December 31, 2022, compared to $0 for the year ended December 31, 2021, an decrease of $0.

Other Income(expense)

Other Income was 1,137,258, a net of gain on debt forgiveness of 1,418,208 and interest expense of 280,950 for the year ended December 31, 2022, compared to an expense of 370,950 for the year ended December 31, 2021.

During the year ended December 31, 2022, we incurred $0 in non-cash stock compensation expense from the issuance of Common Stock for payment of debt on behalf of the company. During year ended December 31, 2021, there were $90,000 in non-cash compensation expense from the issuance of Preferred A Stock for payment of debt on behalf of the company.

Net Profit/Loss

We had a net profit of $1,137,258 for the year ended December 31, 2022, compared to a net loss of $370,950 for the year ended December 31, 2021.

Liquidity and Capital Resources

As of December 31, 2022, we had $0 of cash, $1,930,344 in liabilities, and an accumulated deficit of $2,133,594. We used zero of cash in operations for the year ended December 31,2022 and received net proceeds from financing of $0.

| 10 |

The financial statements accompanying this Report have been prepared on a going concern basis, which contemplates the realization of assets and settlement of liabilities and commitments in the normal course of our business. As reflected in the accompanying financial statements, we have not yet generated any revenue, had a net profit of $1,137,258 and have an accumulated stockholders’ deficit of $2,133,594 as of December 31, 2022. These factors raise substantial doubt about our ability to continue as a going concern. Our ability to continue as a going concern is dependent on our ability to raise additional funds and implement our business plan. The financial statements do not include any adjustments that might be necessary if we are unable to continue as a going concern.

| Item 7A. | Quantitative and Qualitative Disclosures About Market Risk. |

As of December 31, 2022, we were not subject to any market or interest rate risk.

| Item 8. | Financial Statements and Supplementary Data. |

This information appears following Item 15 of this Report and is included herein by reference.

| Item 9. | Changes in and Disagreements With Accountants on Accounting and Financial Disclosure. |

N/A

| Item 9A. |

Controls and Procedures. |

Management’s Evaluation of Disclosure Controls and Procedures

Our disclosure controls and procedures are designed to provide reasonable assurance that the information required to be disclosed by us in reports that we file or submit under the Exchange Act is accumulated and communicated to our management, including our principal executive officer and principal financial officer, as appropriate to allow timely decisions regarding required disclosure and is recorded, processed, summarized and reported within the time periods specified in the rules and forms of the SEC. Based upon that evaluation, our principal executive officer and principal financial officer concluded that, as of the end of the period covered by this report, our disclosure controls and procedures were effective at the reasonable assurance level.

Management’s Report on Internal Control over Financial Reporting

Our management, with the participation of our principal executive officer and principal financial officer, is responsible for establishing and maintaining adequate internal control over our financial reporting. Our internal control system was designed to provide reasonable assurance to management regarding the preparation and fair presentation of published financial statements.

Our management, consisting of our principal executive officer and principal financial officer, does not expect that our disclosure controls and procedures or our internal controls over financial reporting will prevent all error and all fraud. A control system, no matter how well conceived and operated, can provide only reasonable, not absolute, assurance that the objectives of the control system are met. Further, the design of a control system must reflect the fact that there are resource constraints, and the benefits of controls must be considered relative to their costs. Because of the inherent limitations in all control systems, no evaluation of controls can provide absolute assurance that all control issues, misstatements, errors, and instances of fraud, if any, within our company have been or will be prevented or detected. These inherent limitations include the realities that judgments in decision-making can be faulty and that breakdowns can occur because of simple error or mistake. The design of any system of controls is based in part on certain assumptions about the likelihood of future events, and there can be no assurance that any design will succeed in achieving its stated goals under all potential future conditions. Projections of any evaluation of controls effectiveness to future periods are subject to risks that internal controls may become inadequate as a result of changes in conditions, or through the deterioration of the degree of compliance with policies or procedures.

| 11 |

Changes in Internal Control over Financial Reporting

There was no change in the Company’s internal control over financial reporting that occurred during the year ended December 31, 2022 that has materially affected, or is reasonably likely to materially affect, our internal control over financial reporting.

Management's Assessment Regarding Internal Control Over Financial Reporting

At the end of the period covered by this Annual Report on Form 10-K, an evaluation was carried out under the supervision of and with the participation of our management, including the Principal Executive Officer and the Principal Financial Officer of the effectiveness of the design and operations of our disclosure controls and procedures (as defined in Rule 13a – 15(e) and Rule 15d – 15(e) under the Exchange Act) as of the end of the period covered by this report. Based on that evaluation, the Principal Executive Officer and the Principal Financial Officer have concluded that our disclosure controls and procedures were not effective in ensuring that: (i) information required to be disclosed by the Company in reports that it files or submits to the Securities and Exchange Commission under the Exchange Act is recorded, processed, summarized, and reported within the time periods specified in applicable rules and forms and (ii) material information required to be disclosed in our reports filed under the Exchange Act is accumulated and communicated to our management, including our CEO and CFO, as appropriate, to allow for accurate and timely decisions regarding required disclosure.

Disclosure controls and procedures were not effective due primarily to a material weakness in the segregation of duties in the Company’s internal control of financial reporting as discussed below.

Internal Control over Financial Reporting

Management is responsible for establishing and maintaining adequate internal control over financial reporting for the Company (including its consolidated subsidiaries) and all related information appearing in our Annual Report on Form 10-K. Our internal control over financial reporting is designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with accounting principles generally accepted in the United States of America

Management conducted an evaluation of the design and operation of our internal control over financial reporting as of the end of the period covered by this report, based on the criteria in a framework developed by the Company’s management pursuant to and in compliance with the criteria established. This evaluation included review of the documentation of controls, evaluation of the design effectiveness of controls, walkthroughs of the operating effectiveness of controls and a conclusion on this evaluation. Based on this evaluation, management has concluded that our internal control over financial reporting was not effective, because management identified a material weakness in the Company’s internal control over financial reporting related to the segregation of duties as described below.

While the Company does adhere to internal controls and processes that were designed, it is difficult with a very limited staff to maintain appropriate segregation of duties in the initiating and recording of transactions, thereby creating a segregation of duties weakness. Due to: (i) the significance of segregation of duties to the preparation of reliable financial statements; (ii) the significance of potential misstatement that could have resulted due to the deficient controls; and (iii) the absence of sufficient other mitigating controls, we determined that this control deficiency resulted in more than a remote likelihood that a material misstatement or lack of disclosure within the annual or interim financial statements may not be prevented or detected.

Management’s Remediation Initiatives

Management has evaluated, and continues to evaluate, avenues for mitigating our internal controls weaknesses, but mitigating controls to completely mitigate internal control weaknesses have been deemed to be impractical and prohibitively costly, due to the size of our organization at the current time. Management expects to continue to use reasonable care in following and seeking improvements to effective internal control processes that have been and continue to be in use at the Company.

| 12 |

Changes in internal controls over financial reporting

There were no changes in the Company’s internal control over financial reporting that occurred prior to the Company’s most recent financial quarter that materially affected, or are reasonably likely to materially affect, the Company’s internal control over financial reporting.

| Item 9B. | Other Information. |

| N/A | |

| Item 9C. | Disclosure Regarding Foreign Jurisdictions that Prevent Inspections. |

N/A

| 13 |

PART III

| Item 10. | Directors, Executive Officers and Corporate Governance |

Our Officers and directors and additional information concerning them are as follows:

| Name | Age | Position | ||

| Dr. Chongyi Yang until 3/31/2023 | 61 | President, CEO, Secretary, Treasurer, Director | ||

| Qin Chunsheng, present | 65 | President, CEO, Secretary, Treasurer, Director |

Officer Bios

Dr. Yang Chong Yi, Chief Executive Officer to 3/31/2023

Dr. Yang Chong Yi is experienced in both governmental and private sectors, specializing in investment banking, and merger and acquisitions. Dr. Yang has held the following positions:

| · | Deputy Chief in the Bureau of Commodity Price in Shanghai Development and Reform Center | |

| · | Associate Director in Hongkong First Eastern Investment Group | |

| · | General Manager in Shanghai First Food Investment Management Company | |

| · | Managing Director of a state-owned private equity fund |

Dr. Yang also has experience consulting businesses in preparation for IPOs on listings on NASDAQ in addition to consulting commercial complex projects in the cities of New York and Los Angeles.

Dr. Yang Chong Yi is the author of “Winning at Quitting” and “The Economics of Popularity” and Visiting Professor at Shanghai Lixin Institute of Finance and Accounting, a Distinguished Research Institution at the Economic Development Research Center of the Shanghai Municipal Government. Lastly, Dr. Yang is Executive Secretary of the Financial and Economic Committee (Shanghai) of the US-China International Chamber of Commerce.

Qin Chunsheng, Current Chief Executive Officer

Qin Chunsheng, was born on April 15, 1958 in Nanjing, Jiangsu Province, China. He has worked as a farmer and a soldier in many fields and has rich economic work experience. He is good at planning and organizing large-scale economic activities, and has many unique modes and techniques for the operation of large-scale projects. Qin Chunsheng is the chairman of the Health and Elderly Care Professional Committee of the China Population and Culture Promotion Association. He is also an EMBA from Lincoln University in the United States and a graduate student of leading figures in the elderly care industry at Peking University in China.

The "Dexiaoquan Intelligent Elderly Care Platform" created by Qin Chunsheng has been recognized by the national brand power, promoted by the Ministry of Commerce as a trustworthy enterprise, and won the top ten innovation leaders in the 2020 brand power (elderly care industry), the 2021 China Excellent Private Entrepreneurs, the 2021 China Business Model Innovation Award, the most influential leading brand for public satisfaction in elderly care services in China, model enterprise for intelligent health elderly care, 2022 Brand influence, and Top 10 innovative brands for smart health and elderly care; In 2023, he was awarded the top ten ingenious figures for intelligent elderly care.

| 14 |

Qin Chunsheng is the founder of China Dexiaoquan Health Care Group Co., Ltd., and the chairman and CEO of the board of directors. He has developed more than 200 software works and patent certificates for the management system of elderly care institutions. He is a pioneer in the elderly care industry, an organizer of market resources, a leader in model innovation, a defender of transaction rules, and a guardian of market order, promoting the elderly care industry in China to a new era.

| Item 11. | Executive Compensation |

For each of the fiscal years ended December 31, 2022, and 2021 there was no direct compensation awarded to, earned by, or paid by us to any of our executive officers.

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

(a) Security ownership of certain beneficial owners.

The following table sets forth, as of December 31, 2022, the number of shares of common stock owned of record and beneficially by our executive officer, director and persons who beneficially own more than 5% of the outstanding shares of our common stock.

| Name and Address of Beneficial Owner |

Amount and Nature of Beneficial Ownership |

Percentage of Class |

|||

| Riverside Heights LLC | 20,000,000 Restricted Common Shares | 66% | |||

| Adam Harden | |||||

| 302 Pinesap Drive | |||||

| Houston, TX 77079 | |||||

| Dr. Chongyi Yang | 500,000 Preferred A Shares | 100% | |||

| 19F, No.38 West Nanjing Road | |||||

| Jing’An District, Shanghai | |||||

| China 200041 |

| Item 13. | Certain Relationships and Related Transactions, and Director Independence |

N/A

| Item 14. | Principal Accounting Fees and Services |

Simon & Edward, LLP served as the Company’s independent auditor for the year ended December 31, 2022.

BFBorgers CPA PC (“BFB”) served as the Company’s independent auditor for the year ended December 31, 2021.

| 15 |

The following table presents fees billed for professional audit services rendered by Simon & Edward, LLP in connection with its audits of the Company’s annual financial statements for the year ended December 31, 2022. The fees billed to the CHJI by Simon & Edward, LLP and BFB during 2021 were the following:

| December 31, | December 31, | |||||||

| 2022 | 2021 | |||||||

| ASSETS | ||||||||

| Audit Fees | $ | 12,000 | $ | 12,000 | ||||

| Audit Related Fees (auditor admin. Fees) | – | – | ||||||

| Tax Fees | – | – | ||||||

| All Other Fees | – | – | ||||||

| Total Fees | $ | 12,000 | $ | 12,000 | ||||

As used in the table above, the following terms have the meanings set forth below.

Audit Fees

The fees for professional services rendered in connection with the audit of the Company’s annual financial statements, for the review of the financial statements included in our Quarterly Reports on Form 10 and for services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements.

Audit-Related Fees

The fees for assurance and related services that are reasonably related to the performance of the audit or review of our financial statements.

Tax Fees

The fees for professional services rendered for tax compliance, tax advice and tax planning.

All Other Fees

The fees for products and services provided, other than for the services reported under the headings “Audit Fees,” “Audit Related Fees” and “Tax Fees.” The Company has adopted a policy regarding the services of its independent auditors under which our independent accounting firm is not allowed to perform any service which may have the effect of jeopardizing the registered public accountant’s independence. Without limiting the foregoing, the independent accounting firm shall not be retained to perform the following:

| · | Bookkeeping or other services related to the accounting records or financial statements |

| · | Financial information systems design and implementation |

| · | Appraisal or valuation services, fairness opinions or contribution-in-kind reports |

| · | Actuarial services |

| · | Internal audit outsourcing services |

| · | Management functions |

| · | Broker-dealer, investment adviser or investment banking services |

| · | Legal services |

| · | Expert services unrelated to the audit |

| 16 |

PART IV

| Item 15. | Exhibits, Financial Statement Schedules. |

| Item 16. | Form 10-K Summary |

N/A

| 17 |

CHINA DE XIAO QUAN CARE GROUP CO., LTD

CONSOLIDATED FINANCIAL STATEMENTS

(Audited)

| 18 |

Report of Independent Registered Public Accounting Firm

Shareholders and Board of Directors

China De Xiao Quan Care Group Co., LTD

New York, NY

Opinion on the Financial Statements

We have audited the accompanying balance sheets of China De xiao Quan Care Group Co., LTD. (the “Company”) as of December 31, 2022 and 2021, the related statements of operations, stockholders’ deficit, and cash flows for each of the years then ended, and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Company at December 31, 2022 and 2021, and the results of its operations and its cash flows for the years then ended, in conformity with accounting principles generally accepted in the United States of America.

Substantial Doubt About the Company’s Ability to Continue as a Going Concern

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As described in Note 3 to the financial statements, the Company has suffered recurring losses from operations that raise substantial doubt about its ability to continue as a going concern. Management’s evaluation of the events and conditions and management’s plans regarding these matters are also described in Note 3. The financial statements do not include any adjustments that might result from the outcome of this uncertainty. Our opinion is not modified with respect to this matter.

Basis for Opinion

These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on the Company’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Company in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

Critical Audit Matter

Critical audit matters are matters arising from the current period audit of the financial statements that were communicated or required to be communicated to the audit committee and that: (1) relate to accounts or disclosures that are material to the financial statements and (2) involved our especially challenging, subjective, or complex judgments. We determined that there are no critical audit matters.

/s/

We have served as the Company's auditor since 2022.

April 17, 2023

| 19 |

CHINA DE XIAO QUAN CARE GROUP CO., LTD

BALANCE SHEETS

| As at | ||||||||

| Dec. 31, 2022 | Dec. 31, 2021 | |||||||

| Assets | ||||||||

| Cash and cash equivalents | $ | $ | ||||||

| Total current assets | ||||||||

| TOTAL ASSETS | $ | $ | ||||||

| LIABILITIES AND STOCKHOLDERS' DEFICIT | ||||||||

| Payables and accrued interests | $ | $ | ||||||

| Notes payable in default | ||||||||

| Total current liabilities | ||||||||

| TOTAL LIABILITIES | $ | $ | ||||||

| STOCKHOLDERS' DEFICIT | ||||||||

| Common stock, $ par value; million shares authorized, issued and outstanding at Dec. 31, 2022 and 2021 | $ | $ | ||||||

| Convertible Series A Preferred Stock, $ par value; shares designated, issued and outstanding at Dec. 31, 2022 and 2021 | ||||||||

| Additional paid in capital | ||||||||

| Accumulated deficit | ( | ) | ( | ) | ||||

| TOTAL STOCKHOLDERS' DEFICIT | $ | ( | ) | $ | ( | ) | ||

| TOTAL LIABILITIES AND STOCKHOLDERS' DEFICIT | $ | $ | ||||||

The accompanying notes are an integral part of these financial statements

| 20 |

CHINA DE XIAO QUAN CARE GROUP CO., LTD

STATEMENTS OF OPERATIONS

| For the years ended December 31, | ||||||||

| 2022 | 2021 | |||||||

| OTHER INCOME/(EXPENSE) | ||||||||

| Interest expense | $ | ( | ) | $ | ( | ) | ||

| Compensation expense | ( | ) | ||||||

| Gain on debt forgiveness | ||||||||

| Total other income (expense), net | ( | ) | ||||||

| Net Profit (loss) | $ | $ | ( | ) | ||||

| Earnings per share - basic | $ | $ | ( | ) | ||||

| Earnings per share - diluted | $ | $ | ( | ) | ||||

| Weighted average number of common shares – basic | ||||||||

| Weighted average number of common shares – dilutive | ||||||||

The accompanying notes are an integral part of these financial statements

| 21 |

CHINA DE XIAO QUAN CARE GROUP CO., LTD

STATEMENTS OF CHANGES IN STOCKHOLDERS’ DEFICIT

| Series A Preferred Stock | Common Stock | Additional Paid in Capital | Accumulated Deficit | Total | ||||||||||||||||||||||||

| Shares | Amount | Shares | Amount | |||||||||||||||||||||||||

| Balance, December 31, 2020 | $ | $ | $ | $ | ( | ) | $ | ( | ) | |||||||||||||||||||

| Issue of Preferred shares | – | |||||||||||||||||||||||||||

| Net loss | – | – | ( | ) | ( | ) | ||||||||||||||||||||||

| Balance, December 31, 2021 | ( | ) | ( | ) | ||||||||||||||||||||||||

| Net income | – | – | ||||||||||||||||||||||||||

| Balance, December 31, 2022 | $ | $ | $ | $ | ( | ) | $ | ( | ) | |||||||||||||||||||

The accompanying notes are an integral part of these financial statements

| 22 |

CHINA DE XIAO QUAN CARE GROUP CO., LTD

STATEMENTS OF CASH FLOWS

| For the years ended December 31, | ||||||||

| 2022 | 2021 | |||||||

| CASH FLOWS FROM OPERATING ACTIVITIES | ||||||||

| Net income (loss) | $ | $ | ( | ) | ||||

| Adjustments to reconcile net income (loss) to net cash used in operating activities: | ||||||||

| Compensation expenses for convertible Series A Preferred Stock | ||||||||

| Gain on debt forgiveness | ( | ) | ||||||

| Changes in operating assets and liabilities: | ||||||||

| Payables and accrued interests | ||||||||

| Cash used in operating activities | ||||||||

| Net change in cash | ||||||||

| Cash, beginning of period | ||||||||

| Cash, end of period | $ | $ | ||||||

| Supplemental Cash Flow Information: | ||||||||

| Cash paid for interest | $ | $ | ||||||

| Cash paid for income taxes | $ | $ | ||||||

The accompanying notes are an integral part of these financial statements

| 23 |

CHINA DE XIAO QUAN CARE GROUP CO., LTD

Notes to Financial Statements

NOTE 1 – ORGANIZATION AND DESCRIPTION OF BUSINESS

China Dexiaoquan Care Group Co., Ltd. (“CDXQ” or the “Company”) was incorporated as GankIt Corporation in the state of Nevada on March 8, 2012, with a fiscal year end of May 31, which was subsequently changed to December 31 by unanimous consent of Directors in 2019.

Until May 12, 2014, we were an e-commerce business focused on selling a diverse set of products through a website that could either be won through a bidding process or purchased at a discount to the suggested retail price.

On May 12, 2014, Riverview Heights, LLC purchased 20,000,000 shares of common stock of the 30,000,000 total issued and outstanding shares common stock of Company, thus becoming the Majority Shareholder (hereafter the “Majority Shareholder”).

On January 20, 2021, Bridgeview Capital Partners, LLC as the custodian received 500,000 shares of Convertible Preferred Series A Stock of the 500,000 total issued and outstanding Convertible Preferred Series A Stock of the Company as for services rendered and debts paid by the Custodian.

On February 3,2021, Bridgeview Capital Partners, LLC and Mr. Chongyi Yang reached agreement to sell shares of Convertible Preferred Series A Stock to Mr. Chongyi Yang. The deal has been done before March 31st, 2021.

On September, 2022, the Company changed the name as China Dexiaoquan Care Group Co., Ltd. and the code from NHLE to CDXQ correspondingly.

The Company is focused on from the development, branding and distribution of non-flame smoking devices to the development, sales and service of computer software, network software; elder care services, development, and management, and related commodity sales etc. The Company is not actively trading during the current reporting period.

NOTE 2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation

The accompanying financial statements of China Dexiaoquan Care Group Co., Ltd. (“CDXQ” or the “Company”) have been prepared in accordance with accounting principles generally accepted in the United States of America.

Use of estimates

The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. These estimates and assumptions are based on the Company’s historical results as well as management’s future expectations. Actual results could differ from those estimates.

| 24 |

Fair value of financial instruments

The Company follows paragraph 825-10-50-10 of the FASB Accounting Standards Codification for disclosures about fair value of its financial instruments and paragraph 820-10-35-37 of the FASB Accounting Standards Codification (“Paragraph 820-10-35-37”) to measure the fair value of its financial instruments. Paragraph 820-10-35-37 establishes a framework for measuring fair value in accounting principles generally accepted in the United States of America (U.S. GAAP), and expands disclosures about fair value measurements. To increase consistency and comparability in fair value measurements and related disclosures, Paragraph 820-10-35-37 establishes a fair value hierarchy which prioritizes the inputs to valuation techniques used to measure fair value into three (3) broad levels. The fair value hierarchy gives the highest priority to quoted prices (unadjusted) in active markets for identical assets or liabilities and the lowest priority to unobservable inputs. The three (3) levels of fair value hierarchy defined by Paragraph 820-10-35-37 are described below:

| Level 1: | Quoted market prices available in active markets for identical assets or liabilities as of the reporting date. | |

| Level 2: | Pricing inputs other than quoted prices in active markets included in Level 1, which are either directly or indirectly observable as of the reporting date. | |

| Level 3: | Pricing inputs that are generally unobservable inputs and not corroborated by market data. |

The carrying amount of the Company’s financial assets and liabilities, such as accounts payable and accrued expenses approximate their fair value because of the short maturity of those instruments.

Income taxes

The Company follow ASC 740-10-30, which requires recognition of deferred tax assets and liabilities for the expected future tax consequences of events that have been included in the financial statements or tax returns. Under this method, deferred tax assets and liabilities are based on the differences between the financial statement and tax bases of assets and liabilities using enacted tax rates in effect for the fiscal year in which the differences are expected to reverse. Deferred tax assets are reduced by a valuation allowance to the extent management concludes it is more likely than not that the assets will not be realized. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the fiscal years in which those temporary differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in the Statements of Income in the period that includes the enactment date.

On December 22, 2017, the President of the United

States signed into law the Tax Reform Act. The Tax Reform Act permanently reduces the U.S. corporate income tax rate from a maximum of

Net income (loss) per common share is computed pursuant to section 260-10-45 of the FASB Accounting Standards Codification. Basic net income (loss) per common share is computed by dividing net income (loss) by the weighted average number of shares of common stock outstanding during the period. Diluted net income (loss) per common share is computed by dividing net income (loss) by the weighted average number of shares of common stock and potentially outstanding shares of common stock during the period. The weighted average number of common shares outstanding and potentially outstanding common shares assumes that the Company incorporated as of the beginning of the first period presented.

| 25 |

For the years ended December 31, 2022 and 2021, there are outstanding common shares and potentially dilutive shares from convertible preferred stock. Each share of the Convertible Series A Preferred Stock shall be converted into shares of common stock of the Corporation and entitled to 1,000 votes of common stock for each share of Convertible Series A Preferred Stock owned. The holders of the Convertible Series A Preferred Stock shall not be entitled to receive dividends.

However, these shares have not been considered in the weighted average share calculation as their inclusion would be anti-dilutive due to the net loss position for the years then ended.

Related parties

A party is considered to be related to the Company if the party directly or indirectly or through one or more intermediaries, controls, is controlled by, or is under common control with the Company. Related parties also include principal owners of the Company, its management, members of the immediate families of principal owners of the Company and its management and other parties with which the Company may deal if one party controls or can significantly influence the management or operating policies of the other to an extent that one of the transacting parties might be prevented from fully pursuing its own separate interests. A party which can significantly influence the management or operating policies of the transacting parties or if it has an ownership interest in one of the transacting parties and can significantly influence the other to an extent that one or more of the transacting parties might be prevented from fully pursuing its own separate interests is also a related party.

Recently issued accounting pronouncements

The Company has implemented all new accounting pronouncements that are in effect. These pronouncements did not have any material impact on the financial statements unless otherwise disclosed, and the Company does not believe that there are any other new accounting pronouncements that have been issued that might have a material impact on its financial position or results of operations.

NOTE 3 – GOING CONCERN

The Company’s financial statements are prepared

using accounting principles generally accepted in the United States of America applicable to a going concern that contemplates the realization

of assets and liquidation of liabilities in the normal course of business. The Company has yet established any source of revenue to cover

its operating costs and has an accumulated deficit of $

In addition to operational expenses, as the Company executes its business plan, it is incurring expenses related to complying with its public reporting requirements. In order to finance these expenditures, the Company has raised capital in the form of debt, which will have to be repaid, as discussed in detail below. The Company has depended on loans from private investors and outside investors for most of its operating capital. The Company will need to raise capital in the next twelve months in order to remain in business.

Management anticipates that significant dilution will occur as a result of any future sales of the Company’s common stock and this will reduce the value of its outstanding shares. The Company cannot project the future level of dilution that will be experienced by investors as a result of its future financings, but it will significantly affect the value of its shares.

The accompanying financial statements do not include any adjustments to reflect the possible future effects on the recoverability and classification of assets or the amounts and classifications of liabilities that may result from the possible inability of the Company to continue as a going concern.

| 26 |

NOTE 4 – PAYABLES AND ACCRUED INTERESTS

| As of December 31, | 2022 | 2021 | ||||||

| Other payables | $ | $ | ||||||

| Accrued Interests | ||||||||

| Total | $ | $ | ||||||

NOTE 5 – NOTES PAYABLE

During 2013 - 2016 the Company borrowed an aggregate

amount of $1,240,000 through 24 promissory notes maturing various within 2015 to 2018. As at December 31, 2022 and 2021, there were 23

promissory notes with an aggregated amount of $

| December 31, | ||||||||||||||||||||||

| Notes Payable | 2022 | 2021 | ||||||||||||||||||||

| Issue Date | Maturity Date | Nominal Amount | Interest Rate | Interest rate in default | Interest Accrued | |||||||||||||||||

| $ | $ | |||||||||||||||||||||

| Total | $ | $ | ||||||||||||||||||||

| Notes & Interest accrued forgiven | ( | ) | ( | ) | ||||||||||||||||||

| Balances as of December 31, 2022 | $ | $ | ||||||||||||||||||||

For debts in default taken out in Nevada, the statutes

of limitations on debt collection for written contracts are 6 years. The Company engages an attorney, who issued an opinion of debt forgiveness

on April 13, 2023 to clear out the debts in default more than six years in accordance with the law of State of Nevada above. Based on

the attorney letter, for all the notes payable in default for more than 6 years as of December 31, 2022 and subsequent as of April 12,

2023, the Company recognized gain on debt forgiveness totaling $

| 27 |

Weighted average interest rate of default was 12.0%-25.0%

for the years ended December 31, 2022 and 2021. The Company accrued interest expenses of $

NOTE 6 – COMMON STOCK AND PREFERRED STOCK

The Company has shares of common stock

authorized at par value of $, and shares of common stock were issued and outstanding at total par value of $

The Company has designated shares of Series

A convertible preferred stock at par value of $, and issued as at December 31, 2022 with total par value of $

Each share of the Convertible Series A Preferred Stock shall be converted into shares of common stock of the Corporation and entitled to 1,000 votes of common stock for each share of Convertible Series A Preferred Stock owned. The holders of the Convertible Series A Preferred Stock shall not be entitled to receive dividends.

NOTE 7 – INCOME TAXES

Deferred taxes are provided on a liability method whereby deferred tax assets are recognized for deductible temporary differences and operating loss and tax credit carry forwards and deferred tax liabilities are recognized for taxable temporary differences. Temporary differences are the differences between the reported amounts of assets and liabilities and their tax bases. Deferred tax assets are reduced by a valuation allowance when, in the opinion of management, it is more likely than not that some portion or all of the deferred tax assets will not be realized. The Company has evaluated Staff Accounting

Bulletin No. 118 regarding the impact of the decreased tax rates of the Tax Cuts & Jobs Act. Deferred tax assets and liabilities are adjusted for the effects of changes in tax laws and rates on the date of enactment. The U.S. federal income tax rate of 21% is being used due to the new tax law recently enacted.

Deferred income taxes reflect the tax consequences on future years of differences between the tax bases. Net operating loss carry-forwards and tax benefits arising therefore are as follows:

| Deferred tax assets | 2022 | 2021 | ||||||

| Net operating loss ("NOL") brought forward | $ | $ | ||||||

| Net (profit) loss for the period / year | ( | ) | ||||||

| NOL carried forward | ||||||||

| Tax benefit from NOL carried forward | ||||||||

| Valuation allowance | ( | ) | ( | ) | ||||

| Deferred tax assets | $ | $ | ||||||

NOTE 8 – COMMITMENTS AND CONTINGENCIES

As at the end of the reporting period, the company has no commitments and contingencies to disclose.

| 28 |

NOTE 9 – SUBSEQUENT EVENTS

The Company has evaluated subsequent events through the date the financial statements were issued and filed with the Securities and Exchange Commission. Based on our evaluation, no other event has occurred requiring adjustment or disclosure, except the following:

On March 15, 2023, there was a change in control. Chongyi Yang sold the control block of Preferred A Stock to the persons as follows:

Chunsheng Qin purchased 475,000 shares

Yangtenglie Quin purchased 15,000 shares

Fugui Xie purchased 10,000 shares

The purchase price was $285,000 and Chunsheng Qin became the majority shareholder of CDXQ.

On March 27, 2023, China De Xiao Quan Care Group Co., Ltd (“CDXQ”) entered into a Non-Binding Letter of Intent (the “LOI”) in which the Company would acquire all of the issued and outstanding securities of China Care Holding Group Inc, a Cayman corporation (“China Care”).

The LOI contemplates the acquisition of China Care, by CDXQ. China Care, which owns and operates Jiangsu De Xiao Quan Technology Group, a pioneer in elderly caring industry, combining new generation of cloud intelligence with human-focused management. The company has self-developed an intelligent caring system based on big data analysis and artificial intelligence, strengthening better care and tracking management for the elderly. The LOI was entered into following arm’s length negotiations.

The LOI proposes that CDXQ would acquire 51% of the issued and outstanding stock of China Care in exchange for the newly issued CDXQ stock issuance to the shareholders of 70 million shares of newly issued unregistered shares of common stock, par value $0.0001 per share, with no expiration date on the conversion.

Completion of the transaction is subject to, among other matters, the completion of due diligence, the negotiation of a definitive agreement providing for the transaction and employment agreements, satisfaction of the conditions negotiated therein and approval of the transaction by CDXQ’s board of directors, and all applicable state and federal law. No assurance can be given that the parties will be able to negotiate and execute a definitive agreement or that the transactions herein contemplated will close. CDXQ will file notice of such agreement with the Securities and Exchange Commission on form 8-K when and if any such agreement is reached.

On March 31, 2023, Chongyi Yang resigned his position of officer and director and appointed Chunsheng Qin as President, CEO, Treasurer, Secretary and Director.

NOTE 10 – IMPACT OF THE COVID-19 PANDEMIC

As the Company is not actively trading in the current reporting period, there is no impact of the COVID-19 pandemic on financial statements as at and for the year ended December 31, 2022.

| 29 |

SIGNATURES

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| CHINA DE XIAO QUAN CARE GROUP CO., LTD | ||

| By: | /s/ Dr. Chongyi Yang | |

| Dr. Chongyi Yang CEO | ||

Date: April 17, 2023

| 30 |

Exhibit 5.1

| BARNETT & LINN | ||

| ATTORNEYS AT LAW | ||

| 60 Kavenish Drive • Rancho Mirage, CA 92270 | ||

| www.barnettandlinn.com | ||

| WILLIAM B. BARNETT | TELEPHONE: 422-599-1299 | |

| Attorney/Principal | wbarnett@wbarnettlaw.com |

April 13, 2023

China De Xiao Quan Care Group Co., Ltd

42 Mott Street, Floor

New York, NY10013

Atten: Dr. Yang, Cong Yi

Re: Cancellation of Indebtedness Due to Statute of Limitations

Dr. Yang, Chong Yi:

We are furnishing you this opinion at the request of China De Xiao Quan Care Group., Ltd. (the “Issuer” or, the “Company”) in connection with the fair presentation of the financial condition of the Issuer: specifically, whether certain indebtedness in the total amount of $2,422,652 (the “Debt”) should continue to be reflected as due and payable by the Issuer.

We have assumed and relied upon the following additional information in rendering our opinion:

| 1. | All securities filings made by the Issuer and filed with Securities and Exchange Commission (“SEC”) and OTCMarkets were true and correct, as of the date of filing. | |

| 2. | Since the date of the last SEC filing, a Form 10-Q for the quarter ended September 30, 2022 and filed with the SEC on November 16, 2022, (the “Most Recent Filing”), there has been no payment made on any of the Debt, and no agreements with any of the holders of the Debt. | |

| 3. | Furthermore, a review of the Company’s spread sheet discloses that the Debt (a) as of December 31, 2022 is comprised of promissory notes payable in the aggregate amount of $600,000 of principal and $818,208 derived from accrued interest on the promissory notes and (b) as of April 12, 2023, there was an additional note in the principal amount of $400,000 and $604,444 derived from accrued interest. The total amount owed and due in regard to the promissory notes in question as of April 12, 2023 is $2,422,652. The Company’s auditors and the Company’s management have also responded to our inquiries that as of April 12, 2023, there have been no payments made on any of the Debt, and no agreements with any of the holders of the Debt. | |

| 4. | The promissory notes were issued by the Company between April 5, 2013 and November 17, 2013. The promissory notes all had maturity dates of between December 31, 2015 and April 12, 2017. | |

| 5. | The demand notes and laws governing their liabilities are governed, by the laws of the State of Nevada. |

In connection with this opinion, we have reviewed applicable federal and state laws, rules and regulations and have made such investigations and examined such documents and material related to the Company as we have deemed necessary and appropriate under the circumstances.

| 1 |

Our review has been limited to reports filed with the SEC in compliance with the Securities Exchange Act of 1934, as amended, and with representations made by the management of the Company, without having independently verified such factual matters.

The documents that we have reviewed included, but are not limited to, the Most Recent Filing and all other documents and disclosures posted on the SEC and OTC Markets websites, as well as a review of the draft financials reviewed by the auditors of the Company, as of the date of this letter.

In our examination, we have assumed and have not verified, (i) the genuineness of all signatures, (ii) the authenticity of all documents submitted to us as originals, if any (iii) the conformity with the originals of all documents supplied to us as copies, and (iv) the accuracy and completeness of all corporate records and documents and of all certificates and statements of fact given or made available to us by the Company.

State of the Law

The statute of limitations for the collection of promissory notes in Nevada is found in Section 104.3118 of the Nevada Revised Statutes. This Section provides that a debt payable at a specific time must be commenced within six years after the due date. An action to collect a note payable on demand must be commenced within six years after the demand, or when there have been no payments of principal or interest for a continuous period of six years. With the limited exception noted below for demand notes, there is a 6-year statute of limitations for the collection of a corporate debt issued in the State of Nevada. As explained below, the determination of when the limitations period begins depends on whether the debt is evidenced by a promissory note or by another written contract. The debts reflected in the Most Recent Filing do not indicate the terms of the loan. Even if it is assumed that the loan constituted demand obligations, the demand obligation was entered into more than six years prior to the date of this letter.