Form 10-K: 0001683168-23-002461 compared to 0001683168-22-002406

0001552979

false

20212022

FY

0001552979

20212022-01-01

20212022-12-31

0001552979

20212023-06-30

0001552979

2022-032023-04-17

0001552979

2022-12-2831

0001552979

2021-12-31

0001552979

2020-12-31

0001552979

2020-12-312021-01-01

2020-12-31

0001552979

us-gaap:PreferredStockMember

2019-12-31

0001552979

us-gaap:CommonStockMember

2019-12-31

0001552979

us-gaap:AdditionalPaidInCapitalMember

2019-12-31

0001552979

us-gaap:RetainedEarningsMember

2019-12-31

0001552979

2019-12-312021-12-31

0001552979

us-gaap:PreferredStockMember

2020-12-31

0001552979

us-gaap:CommonStockMember

2020-12-31

0001552979

us-gaap:AdditionalPaidInCapitalMember

2020-12-31

0001552979

us-gaap:RetainedEarningsMember

2020-12-31

0001552979

2020-12-31

0001552979

us-gaap:PreferredStockMember

2020-01-01

2020-12-312021-12-31

0001552979

us-gaap:CommonStockMember

2020-01-01

2020-12-312021-12-31

0001552979

us-gaap:AdditionalPaidInCapitalMember

2020-01-01

2020-12-312021-12-31

0001552979

us-gaap:RetainedEarningsMember

2020-01-01

2020-12-31

0001552979

2020-01-01

2020-12-312021-12-31

0001552979

us-gaap:PreferredStockMember

2021-01-01

2021-12-31

0001552979

us-gaap:CommonStockMember

2021-01-01

2021-12-31

0001552979

us-gaap:AdditionalPaidInCapitalMember

2021-01-01

2021-12-31

0001552979

us-gaap:RetainedEarningsMember

2021-01-01

2021-12-31

0001552979

us-gaap:PreferredStockMember

20212022-01-01

2022-12-31

0001552979

us-gaap:CommonStockMember

2022-01-01

2022-12-31

0001552979

us-gaap:AdditionalPaidInCapitalMember

2022-01-01

2022-12-31

0001552979

us-gaap:RetainedEarningsMember

2022-01-01

2022-12-31

0001552979

us-gaap:PreferredStockMember

2022-12-31

0001552979

us-gaap:CommonStockMember

20212022-12-31

0001552979

us-gaap:AdditionalPaidInCapitalMember

20212022-12-31

0001552979

us-gaap:RetainedEarningsMember

2021-12-31

0001552979

us-gaap:CommonStockMember

2021-12-31

0001552979

us-gaap:SeriesAPreferredStockMember

2021-12-31

0001552979

us-gaap:PreferredStockMember

20212022-12-31

0001552979

CDXQ:ConvertiblePreferredSeriesAStockMember

2021-02-02

2021-02-03

0001552979

srt:MaximumMember

2017-12-01

2017-12-22

0001552979

srt:MinimumMember

2017-12-01

2017-12-22

0001552979

CDXQ:NotesPayableMember

2022-01-01

2022-12-31

0001552979

CDXQ:NotesPayableMember

2022-12-31

0001552979

CDXQ:NotesPayableMember

2021-12-31

0001552979

CDXQ:NotesPayable1Member

2022-01-01

2022-12-31

0001552979

CDXQ:NotesPayable1Member

2022-12-31

0001552979

CDXQ:NotesPayable1Member

2021-12-31

0001552979

CDXQ:NotesPayable2Member

2022-01-01

2022-12-31

0001552979

CDXQ:NotesPayable2Member

2022-12-31

0001552979

CDXQ:NotesPayable2Member

2021-12-31

0001552979

CDXQ:NotesPayable3Member

2022-01-01

2022-12-31

0001552979

CDXQ:NotesPayable3Member

2022-12-31

0001552979

CDXQ:NotesPayable3Member

2021-12-31

0001552979

CDXQ:NotesPayable4Member

2022-01-01

2022-12-31

0001552979

CDXQ:NotesPayable4Member

2022-12-31

0001552979

CDXQ:NotesPayable4Member

2021-12-31

0001552979

CDXQ:NotesPayable5Member

2022-01-01

2022-12-31

0001552979

CDXQ:NotesPayable5Member

2022-12-31

0001552979

CDXQ:NotesPayable5Member

2021-12-31

0001552979

CDXQ:NotesPayable6Member

2022-01-01

2022-12-31

0001552979

CDXQ:NotesPayable6Member

2022-12-31

0001552979

CDXQ:NotesPayable6Member

2021-12-31

0001552979

CDXQ:NotesPayable7Member

2022-01-01

2022-12-31

0001552979

CDXQ:NotesPayable7Member

2022-12-31

0001552979

CDXQ:NotesPayable7Member

2021-12-31

0001552979

CDXQ:NotesPayable8Member

2022-01-01

2022-12-31

0001552979

CDXQ:NotesPayable8Member

2022-12-31

0001552979

CDXQ:NotesPayable8Member

2021-12-31

0001552979

CDXQ:NotesPayable9Member

2022-01-01

2022-12-31

0001552979

CDXQ:NotesPayable9Member

2022-12-31

0001552979

CDXQ:NotesPayable9Member

2021-12-31

0001552979

CDXQ:TotalNotesPayableMember

2022-12-31

0001552979

CDXQ:TotalNotesPayableMember

2021-12-31

0001552979

us-gaap:SeriesAPreferredStockMember

2022-12-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________

FORM 10-K

_________________

| (Mark One) |

|

|

| ☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 20212022. |

|

or

or

| ☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from

to |

|

Commission File Number: 333-182761

_____________________

NHALE INC.CHINA DE XIAO QUAN CARE GROUP CO., LTD

(Exact name of registrant as specified in its charter)

_____________________

| Nevada |

|

38-3870905 |

|

(State or other jurisdiction of

incorporation or organization) |

|

(I.R.S. Employer

Identification No.) |

| |

|

|

| 42 Mott Street |

, 4th 4th Floor, New York, NY

|

10013 |

| (Address of principal executive offices) |

|

(Zip Code) |

86-1370164788

(Registrant’s telephone

number, including area code)

Securities registered pursuant to Section 12(g)

of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| N/ACommon Stock |

N/ACDXQ |

N/AOTC |

_________________

Indicate by check mark if the registrant is

a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not

required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐☐ No ☒

Indicate by check mark whether the registrant

(1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months

(or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements

for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant

has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405

of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company.

See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company”,

and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ |

|

Accelerated filer ☐ |

| |

|

|

| Non-accelerated filer ☒☐ |

Smaller reporting company ☒ |

| |

|

| |

Emerging Growth Company ☐ |

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant

has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial

reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or

issued its audit report.

Yes Yes ☐ No ☒

No ☒

If securities are registered pursuant to Section

12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction

of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections

are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive

officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as

defined in Rule 12b-2 of the Act). Yes ☐ YesNo ☒ No ☐

State theThe aggregate market value of the voting

and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the

average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second

fiscal quarter. was $0200,000.

As of MarchApril 2817, 20222023, there were 30,000,000 shares

outstanding of the registrant’s common stock.

TABLE OF CONTENTS

PART

I

(a) Business Development

The Company was organized

under the laws of the State of Nevada on March 8,2021 2012, under Gankit Corporation. The Company was development

stage company as an e-commerce business focused on selling a diverse set of products

through its website Gankit.com.

On

May 12, 2014, the control block of stock, 20,000,000 shares of restricted common stock were purchased resulting in a change of control.

The Company then ceased to operate its e-commerce website and abandoned that business model, and re-focused on the development, branding,

and distribution of non-flame smoking devices. The Company changed its name at this time to Nhale, Inc.

Business operations for Nhale

Inc. was abandoned by former management and a custodianship action, as described in the subsequent paragraph, was commenced in 2020. The

Company filed its last 10-Q in 2016, this financial report included liabilities and debts. As of the date of this filing, these liabilities

and debts have not been addressed.

On

November 24. 2020, the Eighth District Court of Clark County, Nevada granted the Application for Appointment of Custodian as a result

of the absence of a functioning board of directors and the revocation of the Company’s charter. The order appointed Small Cap Compliance,

LLC (“SCC”, the “Custodian”) custodian with the right to appoint officers and directors, negotiate and compromise

debt, execute contracts, issue stock, and authorize new classes of stock. Rhonda Keaveney is the sole member and control person for Small

Cap Compliance, LLC.

The court awarded custodianship

to SCC based on the absence of a functioning board of directors, revocation of the company’s charter, and abandonment of the business.

At this time, Rhonda Keaveney was appointed sole officer and director.

The Company was severely delinquent in filing annual reports for the

Company’s charter. The last annual report was filed on May 31, 2016, on Form 10-K. In addition, the company was subject to Exchange

Act reporting requirements including filing 10-Q’s and 10-Ks. The Company filed its last 10-Q for quarter ending November 30, 2016

and was out of compliance with Exchange Act reporting. SCC attempted to contact the Company’s officers and directors through letters,

emails, and phone calls, with no success.

The Custodian was a shareholder in the Company and applied to the Court

for an Order appointing SCC as the Custodian. This application was for the purpose of reinstating NHLE’s corporate charter to do

business and restoring value to the Company for the benefit of the stockholders.

The Custodian performed the following actions in its capacity as custodian:

The Custodian paid the following expenses

on behalf of the company:

Nevada Secretary of State for reinstatement of the Company, $4,850

Transfer agent, Island Stock Transfer, $13,230

Upon appointment as the Custodian of NHLEUpon appointment as the Custodian

of CDXQ and under its duties stipulated by the Nevada court, SCC took initiative to organize the business of the issuer. As Custodian,

the duties were to conduct daily business, hold shareholder meetings, appoint officers and directors, reinstate the company with the Nevada

Secretary of State. SCC also had authority to enter into contracts and find a suitable merger candidate. SCC was compensated for its role

as custodian in the amount of 500,000 shares of Convertible Series A Preferred Stock. SCC did not receive any additional compensation,

in the form of cash or stock, for custodian services. The custodianship was discharged on April 7 2021.

On January 20, 2021, SCC

entered into a Stock Purchase Agreement with Bridgeview Capital Partners, LLC, whereby Bridgeview Capital Partners, LLC purchased 500,000

shares of Convertible Series A Preferred Stock for $37,000. These shares represent the controlling block of stock. Ms. Keaveney resigned

her position of sole officer and director and appointed Michael Dobbs as as CEO, Treasurer, Secretary, and Director of the Company.

Bridgeview

Capital Partners, LLC is controlled by Michael Dobbs and Sean Lanci.

Bridgeview Capital Partners,

LLC entered into a Stock Purchas Agreement with Yang Chong Yi whereby Yang Chong Yi purchased 500,000 shares of Convertible Series A Preferred

Stock. Michael Dobbs resigned as sole officer and director and appointed Yang Chong Yi as its CEO, Treasurer, Secretary, and Director

of the Company.

We are currently a shell company, as defined

in Rule 405 under the Securities Act of 1933, as amended (the “Securities Act”), and Rule 12b-2.

(b) Business of Issuer

Nhale Inc. isNhale, Inc. filed a developmental stage company,

incorporated under the lawsan amendment to its Articles

of the State of Nevada on JuneIncorporation and changed its name to China De Xiao Quan Care Group Co., LTD on Sept. 18, 2012. Our plan of business has not been implemented but will incorporate

the implementation of carbon footprint neutrality and purification through artificial intelligence and emission reduction. Our target

market will be both business and residential and include government agencies, schools, hospitals, health clubs, and family residences.

At present financial revenue has not yet been realized. The Company

hopes to raise capital to fund its business plan.

All statements involving our business plan are forward looking statements

and have not been implemented as of this filing.

The

Company is moving in a new direction, statements made relating to our business plan are forward looking statements and we have no history

of performance. Current management have limited experience in carbon footprint neutrality and purification but is actively looking

for a suitable person to incorporate into the management team.

We feel that our business plan addresses the

need for additional development in carbon reduction and neutrality.

We are in the business of carbon neutrality and air purification and

will incorporate artificial intelligence (“AI”) to achieve our goals.

Ambient air pollution is harmful to the environment and human health,

and is a local, regional, and hemispheric issue. Climate change is a global challenge driven by the observed increase in atmospheric greenhouse

gas concentrations, as a result of emissions from human activities. Most air pollutants (APs) and greenhouse gases (GHGs) are closely

interlinked, once they have common sources, which mainly arise from fuel combustion and industrial processes. Reductions in GHG emissions

can bring ancillary benefits of improved air quality and reduced premature mortality, in addition to slowing climate change. Moreover,

air quality co-benefits on morbidity, mortality, and agriculture could globally offset the costs of climate policy22, 2022, trading symbol CDXQ.

Our AI technology will perform air purificationSince October of 2022, the Company’s

operations consist of a research and optimization to

reach carbon neutrality. Through our AI we will be able to access substances indevelopment, branding and distribution of non-flame smoking devices, along with computer software

development, sales and service for the air, thus greatly improving efficiencybrand, and reducing

energy consumption/emissions. The company currently plans to select 20 cities in the developed coastal areas and corresponding provincial

capitals as the first phase cities that key services will be launched. The plan is expected to cover 600,000 spaces and benefit more than

2 million people. On this basis, services will be delivered in more cities gradually and the country's first community that focus on people’s

health via respiratory health services. The projects that the company puts emphasis on fully conform to the Chinese government’s

health strategy of establishing a national public health system and doing the work well in disease prevention and treatment. It is also

in line with the international commitment of energy saving, emission reduction and carbon neutrality. It is a project with comprehensive

benefits that meets international social and corporate needs. Our vision incorporates the spirit of social responsibility, not only on

a local community basis but also on a global scale and is generally taken to includeelder care services, development, and management.

The Company

intends to implement itsimplemented a new business model in 2022, statements made relating to our business plan upon raising capital. Subject to available capital, the Company intends to invest in:

Development

Implementation

are forward looking statements and we have limited

history of performance.

The analysis will be undertaken by or under the

supervision of our management. As of the date of this filing, we have not entered into definitive agreements. In our continued efforts to analyze potentialimplement our business plan, we intend to consider the following factors:

| |

· |

Potential for growth, indicated by anticipated market expansion or new technology; |

| |

|

|

| |

· |

Competitive position as compared to other businesses of similar size and experience within our contemplated segment as well as within the industry as a whole; |

| |

|

|

| |

· |

Strength and diversity of management, and the accessibility of required management expertise, personnel, services, professional assistance and other required items; |

| |

|

|

| |

· |

Capital requirements and anticipated availability of required funds, to be provided by the Company or from operations, through the sale of additional securities or convertible debt, through joint ventures or similar arrangements or from other sources; |

| |

|

|

| |

· |

The extent to which the business opportunity can be advanced in our contemplated marketplace; and |

| |

|

|

| |

· |

Other relevant factors |

In applying the foregoing criteria, management

will attempt to analyze all factors and circumstances and make a determination based upon reasonable investigative measures and available

data. Due to our limited capital available for investigation, we may not discover or adequately evaluate adverse facts about the opportunity

to be acquired. Additionally, we will be competing against other entities that may have greater financial, technical, and managerial capabilities

for identifying and completing our business plan.

We are unable to predict when we will, if ever,

identify and implement our business planbe profitable. We anticipate that proposed business planopportunities would be made available to us through personal contacts of our directors, officers

and principal stockholders, professional advisors, broker-dealers, venture capitalists, members of the financial community and others

who may present unsolicited proposals. In certain cases, we may agree to pay a finder’s fee or to otherwise compensate the persons

who introduce the Company to business opportunities in which we participate.

As of the time of this filing, the Company

has not implemented its business plan.

We expect that our due diligence will encompass,

among other things, meetings with incumbent management of the target business and inspection of its facilities, as necessary, as well

as a review of financial and other information, which is made available to the Company. This due diligence review will be conducted either

by our management or by third parties we may engage. We anticipate that we may rely on the issuance of our common stock in lieu of cash

payments for services or expenses related to any analysis.

We may incur time and costs required to select

and evaluate our business structure and complete our business plan, which cannot presently be determined with any degree of certainty.

Any costs incurred with respect to the indemnification and evaluation of a prospective international education programbusiness that is not ultimately completed may result

in a loss to the Company. These fees may include legal costs, accounting costs, finder’s fees, consultant’s fees and other

related expenses. We have no present arrangements for any of these types of fees.

We anticipate that the investigation of specific

business opportunities and the negotiation, drafting and execution of relevant agreements, disclosure documents and other instruments

will require substantial management time and attention and substantial cost for accountants, attorneys, consultants, and others. Costs

may be incurred in the investigation process, which may not be recoverable. Furthermore, even if an agreement is reached for the participation

in a specific business opportunity, the failure to consummate that transaction may result in a loss to the Company of the related costs

incurred.

Competition

Our

company expects to compete with many countries in the carbon neutrality and air purification industry. In addition, there are several

competitors that are larger and more profitable than NHLE. We expect that the quantity and composition of our competitive environment

will continue to evolve as the industry matures. Additionally, increased competition is possible to the extent that new geographies enter

the marketplace as a result of continued enactment of regulatory and legislative changes. We believe that diligently establishing and

expanding our funding sources will establish us in this emerging industry. Additionally, we expect that establishing our product offerings

on new platforms are factors that mitigate the risk associated with operating in a developing competitive environment. Additionally, the

contemporaneous growth of the industry as a whole will result in new technology within the marketplace, thereby further mitigating the

impact of competition on our future operations and results.

Compliance with government standards

and guidelines will increase development costs and the cost of operating our business. In turn, we may not be able to meet the competitive

price point for our air purification products as dictated by the market and our competitors.

Again,

these are forward looking statements and not an indication of past performance. There is no guarantee that we will be able to implement

our business plan and have no merger candidates as of the time of this filing.As of the time of this filing, the Company

is in the business of research and development, branding and distribution of non-flame smoking devices, along with computer software development,

sales and service for the brand, and elder care services, development, and management.

Our

elderly care system incorporates integrated control of community elderly care; standardization of home elderly care services; traceable

tracking of financial income and expenditure; big data monitoring of health management; big data support of user portrait; convenient

and barrier-free operation mode.

On

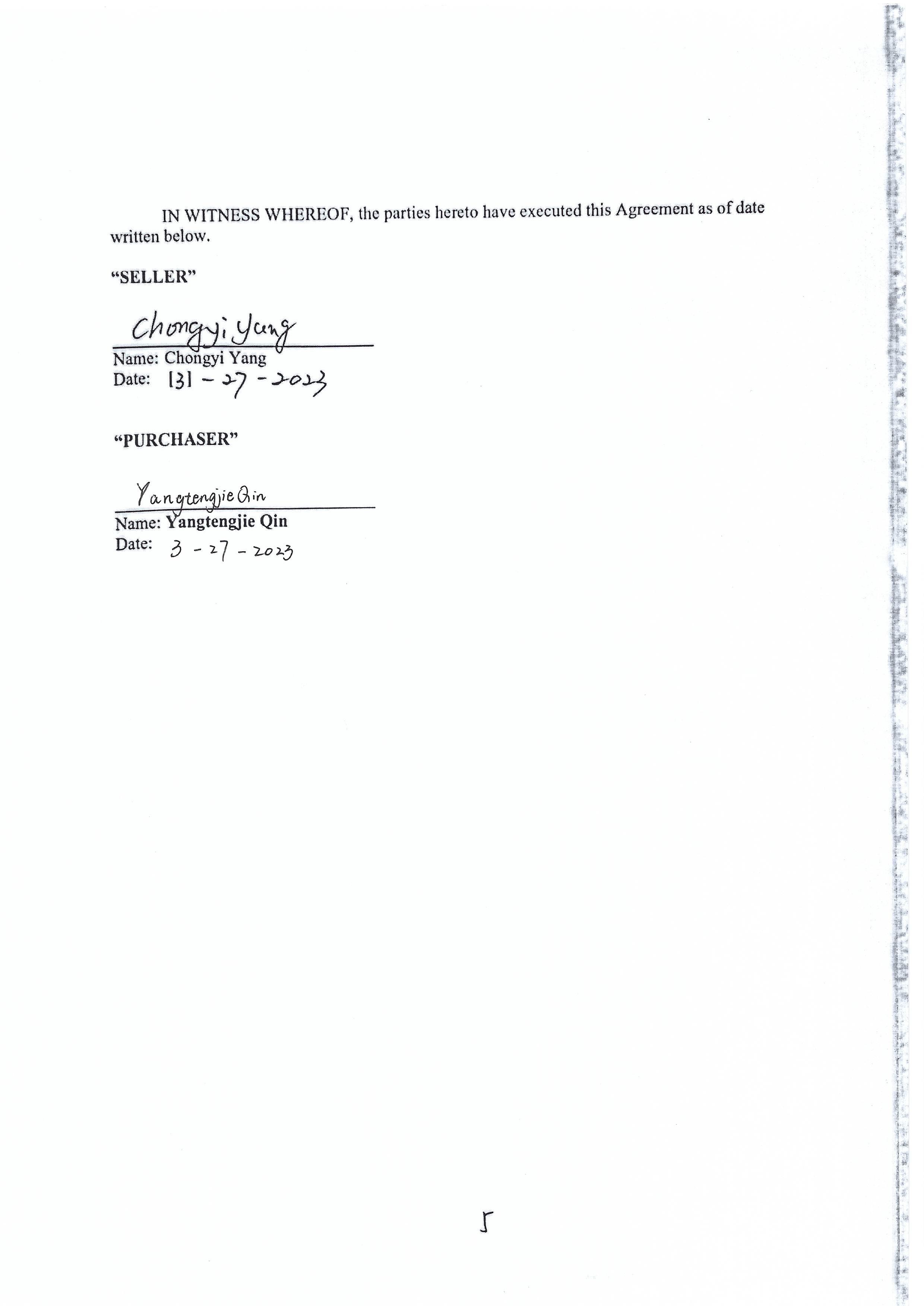

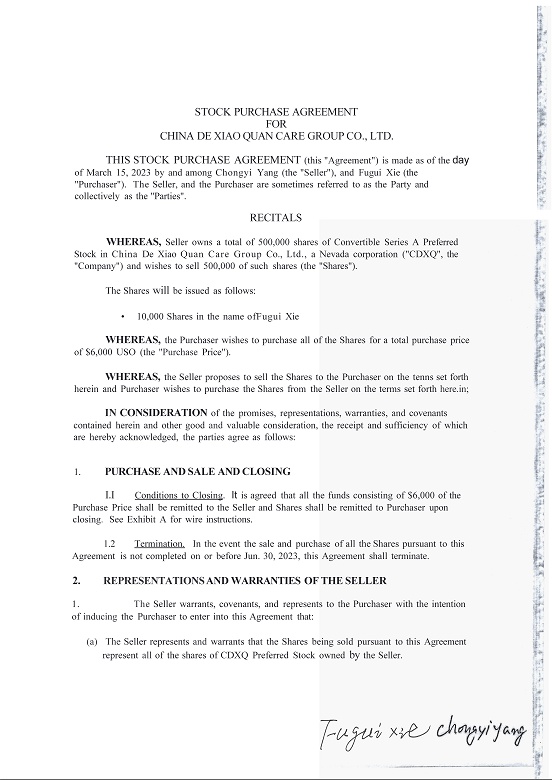

March 15, 2023, there was a change in control. Chongyi Yang sold the control block of Preferred A Stock to the persons as follows:

Chunsheng

Qin purchased 475,000 shares

Yangtenglie

Quin purchased 15,000 shares

Fugui

Xie purchased 10,000 shares

The

purchase price was $285,000 and Chunsheng Qin became the majority shareholder of CDXQ.

On March 27, 2023, China

De Xiao Quan Care Group Co., Ltd. (“CDXQ”) entered into a Non-Binding Letter of Intent (the “LOI”) in which the

Company would acquire all of the issued and outstanding securities of China Care Holding Group Inc., a Cayman corporation (“China

Care”). Mr. Chunsheng Qin is the sole owner of China De Ziao Quan Care Group Co., Ltd.

The LOI contemplates the

acquisition of China Care, by CDXQ. China Care, which owns and operates Jiangsu De Xiao Quan Technology Group, a pioneer in elderly caring

industry, combining new generation of cloud intelligence with human-focused management. The company has self-developed an intelligent

caring system based on big data analysis and artificial intelligence, strengthening better care and tracking management for the elderly.

The LOI was entered into following arm’s length negotiations.

The LOI proposes that CDXQ

would acquire 51% of the issued and outstanding stock of China Care in exchange for the newly issued CDXQ stock issuance to the shareholders

of 70 million shares of newly issued unregistered shares of common stock, par value $0.0001 per share, with no expiration date on the

conversion.

Completion of the transaction

is subject to, among other matters, the completion of due diligence, the negotiation of a definitive agreement providing for the transaction

and employment agreements, satisfaction of the conditions negotiated therein and approval of the transaction by CDXQ’s board of

directors, and all applicable state and federal law. No assurance can be given that the parties will be able to negotiate and execute

a definitive agreement or that the transactions herein contemplated will close. CDXQ will file notice of such agreement with the Securities

and Exchange Commission on form 8-K when and if any such agreement is reached.

On March 31, 2023, Chongyi

Yang resigned his position of officer and director and appointed Chunsheng Qin as President, CEO, Treasurer, Secretary and Director.

Our Industry

In 2021,

18.9% of China's population was over the age of 60, around 267.36 million people. And there are 20.56 million of the population over the

age of 65, accounting for 14.2 per cent. This means that there were 2.37 working-aged persons for every one retired person. In 2050, the

ratio is expected to drastically drop to 1.82 working persons for every one retired person. Furthermore, currently, 180 million Chinese

seniors suffer from chronic diseases, and over 15 million are facing dementia such as Alzheimer's disease. The current care system is

unable to sustain these drastic demographic and economic shifts.

To address

this issue, the government is looking to increase private capital and investments in the industry, hoping to provide seniors with better

quality and more accessible services and options.

Under China's

14th Five Year Plan (2021-2025), the development of an efficient long-term care (LTC) system is a government priority. The plan specifies

major goals and tasks for the five years, including expanding the supply of elderly care services, improving the health support mechanism

for the elderly, and advancing the innovative and integrated development of service models.

It lists

nine major indicators, such as the number of elderly care beds of the ratio of nursing care beds in elderly care institutions, to mobilize

society to actively respond to population ageing. China will step up institutional innovation and boost policy support and financial investment

to enable the elderly to share in China's development achievements. Moreover, it is stated that China would also plan to establish about

10 industrial parks dedicated to the silver economy and build a string of cities into models.

Competition

China De Xiao Quan Care Group Co., Ltd is in direct competition within

our industry with entities that possess significantly greater experience and resources. Moreover, the Company also competes with numerous

other companies similar to it for such opportunities. We believe that acquiring China Care Holding Group Inc., will greatly increase our

competitive edge in the elder care services industry.

Effect of Existing or Probable Governmental

Regulations on the Business

Upon effectiveness of this Form 10, we will

beWe are subject to the Exchange Act and the Sarbanes-Oxley

Act of 2002. Under the Exchange Act, we will beand are required to file with the SEC annual reports on Form 10-K, quarterly reports on Form 10-Q

and current reports on Form 8-K. The Sarbanes-Oxley Act creates a strong and independent accounting oversight board to oversee the conduct

of auditors of public companies and to strengthen auditor independence. It also (1) requires steps be taken to enhance the direct responsibility

of senior members of management for financial reporting and for the quality of financial disclosures made by public companies; (2) establishes

clear statutory rules to limit, and to expose to public view, possible conflicts of interest affecting securities analysts; (3) creates

guidelines for audit committee members’ appointment, and compensation and oversight of the work of public companies’ auditors;

(4) prohibits certain insider trading during pension fund blackout periods; and (5) establishes a federal crime of securities fraud, among

other provisions.

We willare also be subject to Section 14(a) of the Exchange

Act, which requires all companies with securities registered pursuant to Section 12(g) of the Exchange Act to comply with the rules and

regulations of the SEC regarding proxy solicitations, as outlined in Regulation 14A. Matters submitted to our stockholders at a special

or annual meeting thereof or pursuant to a written consent will require us to provide our stockholders with the information outlined in

Schedules 14A or 14C of Regulation 14A. Preliminary copies of this information must be submitted to the SEC at least 10 days prior to

the date that definitive copies of this information are provided to our stockholders.

Employees

As of June 30, 2021, we had one officer and

director. We anticipate that we will begin to fill out our management team as and when we raise capital to begin implementing our business

plan. In the interim, we will utilize independent consultants to assist with accounting and administrative matters. We currently have

no employment agreements and believe our consulting relationships are satisfactory. We plan to continue to hire independent consultants

from time to time on an as-needed basisThe Company had 1 officer during this reporting

period. Dr. Chongyi Yang serves as Chief Executive Officer, Treasurer, and Secretary. Mr. Yang resigned

on March 31, 2023 and appointed Chunsheng Qin as sole officer and director.

Risks RelatingManagement of the Company expects to Our Business

Our

business plan involves a number of very significant risks. Our future business, operating resultsuse consultants,

attorneys and financial condition could be seriously

harmed as aaccountants as necessary, and it is not expected that the Company will have any full-time or other employees, except as

may be the result of the occurrence of any of the following risks. You could lose all or part of your investment due to any of these

risks. You should invest in our common stock only if you can afford to lose your entire investment.

Our officers and directors

reside outside the United States, investors may have limited legal recourse against them including difficulties in enforcing judgments

made against them by U.S. courts. There is neither treaty nor any reciprocal arrangement between China and the United States regarding

recognition or enforcement of civil judgmentscompleting a transaction.

Our Auditor is U.S. based and registered with the PCAOB so Our

Company is Subject to PCAOB InspectionsIntellectual Property

The Holding Foreign Companies Accountable Act (“HFCAA”)

became lawAs of the date of this report, we do in December 2020 and prohibits foreign companies from listing their securities on U.S.

exchanges if the company has been unavailable for PCAOB inspection or investigation for three consecutive years.

The HFCAA requires the SEC to identify registrants that have

retained a registered public accounting firm to issue an audit report where that registered public

accounting firm has a branch or office that:

not own any patents,

trademarks, licenses, franchises, concessions, and royalty agreements, or other intellectual property contracts.

If a PCAOB auditor is unable to inspect the issuer's public accounting

firm for three consecutive years, the issuer's securities are banned from trade on a national exchange or through other methods. The United

States Senate passed the Accelerating Holding Foreign Companies Accountable Act, which, if enacted, would decrease the number of non-inspection

years from three years to two years. As a result, our securities could be delisted rendering our stock worthless as a result of "non-inspection"

by the PCAOB.Available Information

On December 16, 2021, the PCAOB issued a reportOur Periodic Reports including Quarterly Reports on

its determinations

that if theForm 10-Q, Current Reports on Board is unable to inspect or investigate completely PCAOB-registered public accounting firms headquartered in mainland China

and in Hong Kong, a Special Administrative Region of the People’s Republic of China (PRC), because of positions taken by PRC authorities

in those jurisdictions, it will suspend trading of the issuer. The Board made these determinations pursuant to PCAOB Rule 6100 which

provides a framework for how the PCAOB fulfills its responsibilities under the Holding Foreign Companies Accountable Act (HFCAA).

On December 16, 2021, the following amendments to the HCFAA were adopted

byForm 8-K and other reports, and amendments to those reports, and other forms that we file with or furnish

to the Securities and Exchange Commission:

Consistent with the HFCAA, the final amendments require Commission-Identified

Issuers to submit documentation to the SEC through the EDGAR system on or before its annual report due date that establishes that it is

not owned or controlled by a governmental entity in its public accounting firm’s foreign jurisdiction. The final amendments also

require a Commission-Identified Issuer that is also a “foreign issuer,” as defined in Exchange Act Rule 3b-4, to provide certain

additional specified disclosures in their annual report for itself and its consolidated foreign operating entity or entities, including

any variable-interest entity or similar structure that results in additional foreign entities being consolidated in the registrant’s

financial statements.

The required disclosures include:

The SEC will identify a registrant as a Commission-Identified Issuer

as early as possible after the registrant files its annual report and on a rolling basis. The SEC will “provisionally identify”

a registrant as a Commission-Identified Issuer on the SEC’s website at www.sec.gov/HFCAA. For 15 business days after this provisional

identification, a registrant may email the SEC if it believes it has been incorrectly identified, providing evidence supporting its claim.

After reviewing the information, the registrant will be notified whether the SEC will “conclusively identify” the registrant

as a Commission-Identified Issuer.

A Commission-Identified Issuer is a registrant identified by the SEC

as having filed an annual report with an audit report issued by a registered public accounting firm that is located in a foreign jurisdiction

and that the Public Company Accounting Oversight Board (PCAOB) is unable to inspect or investigate completely because of a position taken

by an authority in that jurisdiction (PCAOB-Identified Firm). The SEC will identify such issuers promptly after the filing of their annual

reports by evaluating whether the annual report contains an audit report signed by a PCAOB-Identified Firm. We may be subject to the HFCAA

if we are identified as a "Commission-Identified Issuer" in accordance with such HFCAA amendments

If the registrant does not contact the SEC to dispute the provisional

identification within 15 business days, the SEC will conclusively identify the registrant as a Commission-Identified Issuer. The SEC will

publish a list on its website identifying Commission-Identified Issuers, indicating the number of years a Commission-Identified Issuer

has been published on the list, and noting whether the Commission-Identified Issuer has been subject to any prior trading prohibitions.

The HFCAA requires the SEC to prohibit the trading of the securities

of certain Commission Identified Issuers on a national securities exchange or through any other method that is within the jurisdiction

of the SEC to regulate, including through over-the-counter trading. As a result, the SEC will impose an initial trading prohibition on

a registrant as soon as practicable after it is conclusively identified as a Commission-Identified Issuer for three consecutive years.

If the SEC ends the initial trading prohibition and, thereafter, the

registrant is again determined to be a Commission-Identified Issuer, the SEC will impose a subsequent trading prohibition on the registrant

for a minimum of five years. To end an initial or subsequent trading prohibition, a Commission-Identified Issuer must certify that it

has retained or will retain a registered public accounting firm that the PCAOB has determined it is able to inspect or investigate. To

make that certification, the Commission-Identified Issuer must file financial statements that include an audit report signed by such a

registered public accounting firm.

Our auditor, BFBorgers CPA PC,

is required to undergo regular inspections by the PCAOB as an auditor of companies that are publicly traded in the United States and a

firm registered with the PCAOB. NHLE will be subject to the HFCAA adopted amendments if it is located within the PRC jurisdiction where

the PCAOB is unable to conduct inspections without the approval of the Chinese government authorities. If our auditor is not inspected

by the PCAOB as specified in the HFCAA, our securities may be prohibited from trading, and this ultimately could result in being delisted.

Our Business is Subject to Numerous

Legal and Regulatory Risks that Could Have an Adverse Impact on Our Contemplated Business.

We are subject to differing and sometimes

conflicting laws and regulations in the various China jurisdictions where we provide our services. As the carbon neutrality and air purification

is still at a relatively early stage of development, new laws and regulations may be adopted from time to time to address new issues that

come to the authorities' attention. In addition, considerable uncertainties still exist with respect to the interpretation and implementation

of existing laws and regulations governing our contemplated business activities. A large number of proposals are before various national,

regional, and local legislative bodies and regulatory entities regarding issues related to our industry or our business model. As we implement

our business plan and expand into new cities or countries or as we add new products and services to our platform, we may become subject

to additional laws and regulations that we are not subject to now. Existing or new laws and regulations could expose us to substantial

liability, including significant expenses necessary to comply with such laws and regulations, and could dampen our growth, which could

adversely affect our business and results of operations.

NHLE may implement the VIE structure as discussed

in the Introductory Comment page. If the PRC rules that the VIE structure is illegal, NHLE would greatly be limited in our ability to

offer or continue to offer securities, which in turn impacts liquidity for investors. Our stock could significantly decline in value or

become worthless.

Risks Related to Access to Information

and Regulatory Oversight

PRC Securities Law state that no overseas securities regulator can

directly conduct investigations or evidence collection activities within the PRC and no entity or individual in China may provide documents

and information relating to securities business activities to overseas regulators without Chinese government approval. The SEC, U.S. Department

of Justice, and other U.S. authorities face substantial challenges in bringing and enforcing actions against China-based Issuers and their

officers and directors. As a result, investors in China-based Issuers may not benefit from a regulatory environment that fosters effective

enforcement of U.S. federal securities laws.

China’s legal system and regulation enforcement could greatly

limit our ability to offer or continue to offer securities, which in turn impacts liquidity for investors. Our stock could significantly

decline in value or become worthless.

Risks Related to the Regulatory Environment

China’s legal system is substantially different from the legal

system in the United States and may raise risks and uncertainties concerning the intent, effect, and enforcement of its laws, rules, and

regulations, including those that restrict the inflow and outflow of foreign capital or provide the Chinese government with significant

authority to exert influence on a China-based Issuer’s ability to conduct business or raise capital. This lack of certainty may

result in the inconsistent and unpredictable interpretation and enforcement of laws, rules, and regulations, which may change quickly.

China-based Issuers face risks related to evolving laws and regulations, which could impede their ability to obtain or maintain permits

or licenses required to conduct business in China. In the absence of required permits or licenses, governmental authorities may impose

material sanctions or penalties on the company. Such actions could significantly limit or completely hinder our ability to offer or continue

to offer securities to investors and cause the value of our securities to significantly decline or be worthless.

Limitations on Shareholder Rights and

Recourse

Legal claims, including federal securities

law claims, against China-based Issuers, or their officers, directors, and gatekeepers, may be difficult or impossible for investors to

pursue in U.S. courts. Even if an investor obtains a judgment in a U.S. court, the investor may be unable to enforce such judgment, particularly

in the case of a China-based Issuer, where the related assets or persons are typically located outside of the United States and in jurisdictions

that may not recognize or enforce U.S. judgments. If an investor is unable to bring a U.S. claim or collect on a U.S. judgment, the investor

may have to rely on legal claims and remedies available in China or other overseas jurisdictions where the China-based Issuer may maintain

assets. The claims and remedies available in these jurisdictions are often significantly different from those available in the United

States and difficult to pursue. An investor could lose their entire investment and incur legal costs if unable to enforce their judgment.

Greater Chinese regulatory oversight

may impact our contemplated business

We are not currently required to comply with regulations and policies

of the Cyberspace Administration of China (CAC) because we have not commenced our business in China.

CAC regulates the collection of personal information, which is recorded

electronically, or in any other form, to recognize the identity of a natural person. In light of greater oversight regarding the collection

of personal information we will be subject to cybersecurity upon execution of our contemplated business plan.

If CAC determines that we have violated any portion of PRC laws and

regulation, our ability to obtain or maintain permits or licenses required to conduct business in China may be affected. In the absence

of required permits or licenses, governmental authorities may impose material sanctions or penalties on the company. Such actions could

significantly limit or completely hinder our ability to offer or continue to offer securities to investors and cause the value of our

securities to significantly decline or be worthless.

Merger & Acquisition Approval

is Required

Under the PRC Anti-monopoly Law, merger & acquisitions that meet

certain turnover thresholds must notify the State Administration for Market Regulation (SAMR) for merger control clearance and may not

be implemented without SAMR’s approval.

NHLE may merge with, or acquire, a target company to commence its contemplated

business operations. If our target business meets the threshold for review by SAMR, we will be required to submit an application for approval.

The SAMR utilizes a substantive test for merger review. The substantive

test takes into consideration the:

As of this time, NHLE is not required to submit an application to SAMR

as we have not identified a merger or acquisition candidate. However, if we locate a suitable merger or acquisition candidate, we may

be required to submit an approval request to SAMR. We don’t anticipate merging with a company that is large enough to trigger anti-monopoly

threshold for review. However, if SAMR denies our application, such actions could significantly limit or completely hinder our ability

to offer, or continue to offer, securities to investors and cause the value of such securities to significantly decline or be worthless.

Risks Related to the Company’s Organizational Structure

Although NHLE has not implemented a VIE structure at this time, the

Company may use this structure once its contemplated business operations have been implemented. The China-based Issuer VIE structures

pose risks to U.S. investors that are not present in other organizational structures. The Chinese government could determine that the

agreements establishing the VIE structure do not comply with Chinese law and regulations, including those related to restrictions on foreign

ownership, which could subject a China-based Issuer to penalties, revocation of business and operating licenses, or forfeiture of ownership

interests. A China-based Issuer’s control over a VIE may also be jeopardized if a natural person who holds the equity interest in

the VIE breaches the terms of the agreements, is subject to legal proceedings, or if any physical instruments, such as chops and seals,

are used without the China-based Issuer’s authorization to enter into contractual arrangements in China.

If we decide to move forward with a VIE structure, our shares may decline

in value or become worthless if we are unable to assert our contractual control rights over the assets of our PRC subsidiaries that conduct

all or substantially all of our operations. These risks or events are only applicable if we decide to implement a VIE structure.

Resale limitations of Rule 144(i) on your shares

According to the Rule 144(i), Rule 144 is not available for the resale

of securities initially issued by either a reporting or non-reporting shell company. Moreover, Rule 144(i)(1)(ii) states that Rule 144

is not available to securities initially issued by an issuer that has been “at any time previously” a reporting or non-reporting

shell company. Rule 144(i)(1)(ii) prohibits shareholders from utilizing Rule 144 to sell their shares in a company that at any time in

its existence was a shell company. However, according to Rule 144(i)(2), an issuer can “cure” its shell status.

To “cure” a company’s current or former shell company

status, the conditions of Rule 144(i)(2) must be satisfied regardless of the time that has elapsed since the public company ceased to

be a shell company and regardless of when the shares were issued. The availability of Rule 144 for resales of shares issued while the

company is a shell company or thereafter may be restricted even after the expiration of the one-year period since it filed its Form 10

information if the company is not current on all of its periodic reports required to be filed within the SEC during the 12 months before

the date of the shareholder’s sale. Thus, the company must file all 10-Qs and 10-K for the preceding 12 months and since the filing

of the Form 10, or Rule 144 is not available for the resale of securities

We have limited assets, have incurred

operating losses, and have no current source of revenue

We have had minimal assets. We do not expect

to generate revenues until we begin to implement our business plan. However, we can provide no assurance that we will produce any material

revenues for our stockholders, or that our business will operate on a profitable basis.

We will, likely, sustain operating expenses

without corresponding revenues, at least until the consummation of our business plan. This may result in our incurring a net operating

loss that will increase unless we consummate a business plan with a profitable business or internally develop our business. We cannot

assure you that we can identify a suitable business combination or successfully internally develop our business, or that any such business

will be profitable at the time of its acquisition by the Company or ever.

Our capital resources may not be sufficient

to meet our capital requirements, and in the absence of additional resources we may have to curtail or cease business operations

We have historically generated negative cash

flow and losses from operations and could experience negative cash flow and losses from operations in the future. Our independent auditors

have included an explanatory paragraph in their report on our financial statements for the fiscal years ended December 31, 2020, and 2019

expressing doubt regarding our ability to continue as a going concern. We currently only have a minimal amount of cash available, which

will not be sufficient to fund our anticipated future operating needs. The Company will need to raise substantial sums to implement its

business plan. There can be no assurance that the Company will be successful in raising funds. To the extent that the Company is unable

to raise funds, we will be required to reduce our planned operations or cease any operations.

We may encounter substantial competition

in our business and our failure to compete effectively may adversely affect our ability to generate revenue

Carbon neutrality through air purification

is an emerging industry. We believe that existing and new competitors will continue to improve in cost control and performance of their

curriculum. We have global competitors, and we will be required to continue to invest in product development and productivity improvements

to compete effectively in our markets. Our competitors could develop a more efficient product or undertake more aggressive and costly

marketing campaigns than ours, which may adversely affect our marketing strategies and could have a material adverse effect on our business,

results of operations and financial condition.

Our major competitors may be better able than

we to successfully endure downturns in our industrial sector. In periods of reduced demand for our product, we can either choose to maintain

market share by reducing our selling prices to meet competition or maintain selling prices, which would likely sacrifice market share.

Sales and overall profitability would be reduced in either case. In addition, we cannot assure you that additional competitors will not

enter our existing markets, or that we will be able to compete successfully against existing or new competition.

Effect of Environmental Laws

We believe that we are in compliance with

all applicable environmental laws, in all material respects. We do not expect future compliance with environmental laws to have a material

adverse effect on our business.

We may not be able to obtain regulatory

approvals for our product

Our business is subject to laws and regulations governing development

of AI for air purification. The Company believes acquisition of already compliant merger candidate will mitigate this risk.

All operating plans have been made in consideration of existing environmental

regulations. Regulations that most affect operations are related to emission reduction technologies of the private corporations we acquire.

We face a number of risks associated

with our business plan, including the possibility that we may incur substantial debt or convertible debt, which could adversely affect

our financial condition

We intend to use reasonable efforts to complete

our business plan. The risks commonly encountered in implementing our business plan is insufficient revenues to offset increased expenses

associated with finding a merger candidate. Failure to raise sufficient capital to carry out our business plan. Additionally, we have

no operations at this time so our expenses are likely to increase, and it is possible that we may incur substantial debt or convertible

debt in order to complete our business plan, which can adversely affect our financial condition. Incurring a substantial amount of debt

or convertible debt may require us to use a significant portion of our cash flow to pay principal and interest on the debt, which will

reduce the amount available to fund working capital, capital expenditures, and other general purposes. Our indebtedness may negatively

impact our ability to operate our business and limit our ability to borrow additional funds by increasing our borrowing costs, and impact

the terms, conditions, and restrictions contained in possible future debt agreements, including the addition of more restrictive covenants;

impact our flexibility in planning for and reacting to changes in our business as covenants and restrictions contained in possible future

debt arrangements may require that we meet certain financial tests and place restrictions on the incurrence of additional indebtedness

and place us at a disadvantage compared to similar companies in our industry that have less debt.

Our future success is highly dependent

on the ability of management to locate and attract suitable business opportunities and our stockholders will not know what business we

will enter into until we consummate a transaction with the approval of our then existing directors and officers

At this time, we have no operations and future

implementation of our business plan is highly speculative, there is a consequent risk of loss of an investment in the Company. The success

of our plan of operations will depend to a great extent on the operations, financial condition and management of future business and internal

development. While management intends to seek businesses opportunities with entities having established operating histories, we cannot

provide any assurance that we will be successful in locating opportunities meeting that criterion. In the event we complete a business

plan, the success of our operations will be dependent upon management, its financial position and numerous other factors beyond our control.

There can be no assurance that we will

successfully consummate a business plan or internally develop a successful business

We are a blank check company and can give

no assurance that we will successfully identify and evaluate suitable business opportunities or that we will successfully implement our

business plan. We cannot guarantee that we will be able to negotiate contracts on favorable terms. No assurances can be given that we

will successfully identify and evaluate suitable business opportunities, that we will conclude a business plan or that we will be able

to develop a successful business. Our management and affiliates will play an integral role in establishing the terms for any future business.

We will incur increased costs as a result

of becoming a reporting company, and given our limited capital resources, such additional costs may have an adverse impact on our profitability.

Following the effectiveness of this Form 10,

we will be an SEC reporting company. The Company currently has no business and no revenue. However, the rules and regulations under the

Exchange Act require a public company to provide periodic reports with interactive data files which will require the Company to engage

legal, accounting and auditing services, and XBRL and EDGAR service providers. The engagement of such services can be costly, and the

Company is likely to incur losses, which may adversely affect the Company’s ability to continue as a going concern. In addition,

the Sarbanes-Oxley Act of 2002, as well as a variety of related rules implemented by the SEC, have required changes in corporate governance

practices and generally increased the disclosure requirements of public companies. For example, as a result of becoming a reporting company,

we will be required to file periodic and current reports and other information with the SEC and we must adopt policies regarding disclosure

controls and procedures and regularly evaluate those controls and process.

The additional costs we will incur in connection

with becoming a reporting company will serve to further stretch our limited capital resources. The expenses incurred for filing periodic

reports and implementing disclosure controls and procedures may be as high as $70,000 USD annually. In other words, due to our limited

resources, we may have to allocate resources away from other productive uses in order to pay any expenses we incur in order to comply

with our obligations as an SEC reporting company. Further, there is no guarantee that we will have sufficient resources to meet our reporting

and filing obligations with the SEC as they come due.

The time and cost of preparing a private

company to become a public reporting company may preclude us from entering into an acquisition or merger with the most attractive private

companies and others

From time to time the Company may come across

target merger companies. These companies may fail to comply with SEC reporting requirements may delay or preclude acquisitions. Sections

13 and 15(d) of the Exchange Act require reporting companies to provide certain information about significant acquisitions, including

certified financial statements for the company acquired, covering one or two years, depending on the relative size of the acquisition.

The time and additional costs that may be incurred by some target entities to prepare these statements may significantly delay or essentially

preclude consummation of an acquisition. Otherwise, suitable acquisition prospects that do not have or are unable to obtain the required

audited statements may be inappropriate for acquisition so long as the reporting requirements of the Exchange Act are applicable.

A Business may result in a change of

control and a change of management.

In conjunction with completion of a business

acquisition, it is anticipated that (SEC) are available to review on the SEC’s EDGAR website.

Corporate Governance

In accordance with and pursuant to relevant related

rules and regulations of the SEC, the Board of Directors of the Company has established and periodically update our corporate governance

guide, which is applicable to we may issue an amount of our authorized but unissued common or preferred stock which represents the

majority of the voting power and equity of our capital stock, which would result in stockholders of a target company obtaining a controlling

interest in us. As a condition of the business combination agreement, our current stockholders may agree to sell or transfer all or a

portion of our common stock as to provide the target company with all or majority control. The resulting change in control may result

in removal of our present officers and directors and a corresponding reduction in or elimination of their participation in any future

affairsall directors, officers and employees of the Company. We have not yet established an audit committee of

our board of directors.

We depend on our officers and the loss of their services would

have an adverse effect on our business

We have officers and directors of the Company that are critical to

our chances for business success. We are dependent on their services to operate our business and the loss of these persons, or any of

them would have an adverse impact on our future operations until such time as he or she could be replaced, if he could be replaced. We

do not have employment contracts or employment agreements with our officers, and we do not carry key man life insurance on their lives.

Because we are significantly smaller than some of our competitors,

we may lack the resources needed to capture market share

The carbon neutrality and air purification industry is highly competitive,

and our business plan has not been implemented and we are smaller in size than some of our competitors. We are at a disadvantage as a

blank check company, we do not have an established business. Many of our competitors have an already established their business, more

established market presence, and substantially greater financial, marketing, and other resources than do we. New competitors may emerge

and may develop new or innovative products that compete with our anticipated future production. No assurance can be given that we will

be able to compete successfully within the international education industry.

Our ability to use our net operating loss carry-forwards and

certain other tax attributes may be limited

We have incurred losses during our history. To the extent that we continue

to generate taxable losses, unused losses will carry forward to offset future taxable income, if any, until such unused losses expire.

Under Sections 382 and 383 of the Internal Revenue Code of 1986, as amended, if a corporation undergoes an “ownership change,”

generally defined as a greater than 50% change (by value) in its equity ownership over a three-year period, the corporation’s ability

to use its pre-change net operating loss carry-forwards, or NOLs, and other pre-change tax attributes (such as research tax credits) to

offset its post-change income may be limited. We may experience ownership changes in the future because of subsequent shifts in our stock

ownership. As a result, if we earn net taxable income, our ability to use our pre-change net operating loss carryforwards to offset U.S.

federal taxable income may be subject to limitations, which could potentially result in increased future tax liability to us. In addition,

at the state level, there may be periods during which the use of NOLs is suspended or otherwise limited, which could accelerate or permanently

increase state taxes owed.

Our ability to hire and retain key personnel

will be an important factor in the success of our business and a failure to hire and retain key personnel may result in our inability

to manage and implement our business plan

Our management has limited experience in the

carbon neutrality and air purification industry and we may not be able to attract and retain the necessary qualified personnel. If we

are unable to retain or to hire qualified personnel as required, we may not be able to adequately manage and implement our business plan.

Legal disputes could have an impact on our Company

We plan to engage in business matters that are common to the business

world that can result in disputations of a legal nature. In the event the Company is ever sued or finds it necessary to bring suit

against others, there is the potential that the results of any such litigation could have an adverse impact on the Company.

Our common stock is quoted on the OTC MARKETS. An investment

in our common stock is risky and there can be no assurance that the price for our stock will not decrease substantially in the future

Our common stock is quoted on the OTC Markets. The market for our stock

has been volatile and has been characterized by large swings in the trading price that do not appear to be directly related to our business

or financial condition. As a result, an investment in our common stock is risky and there can be no assurance that the price for our stock

will not decrease substantially in the future.

Our stock trades below $5.00 per share and is subject to special

sales practice requirements that could have an adverse impact on any trading market that may develop for our stock

If our stock trades below $5.00 per share and is subject to special

sales practice requirements applicable to "penny stocks" which are imposed on broker-dealers who sell low-priced securities

of this type. These rules may be anticipated to affect the ability of broker-dealers to sell our stock, which may in turn be anticipated

to have an adverse impact on the market price for our stock if and when an active trading market should develop.

Our officers, directors and principal stockholders own a large

percentage of our issued and outstanding shares and other stockholders have little or no ability to elect directors or influence corporate

matters

As of August 9, 2021, our officers, directors, and principal stockholders

were deemed to be the beneficial owners of approximately of our 100% issued and outstanding shares of Preferred shares. These shares are

convertible into 500,000,000 shares of common stock and represents 94% of our issued and outstanding common shares. As a result, such

persons can determine the outcome of any actions taken by us that require stockholder approval. For example, they will be able to elect

all of our directors and control the policies and practices of the Company.

Risks Related to Our Shareholders and Shares

of Common Stock

There is presently no public market

for our securities

Our common stock is not currently trading

on any market, and a robust and active trading market may never develop. Because of our current status as a “shell company,”

Rule 144 is not currently available. Future sales of our common stock by existing stockholders pursuant to an effective registration statement

or upon the availability of Rule 144 could adversely affect the market price of our common stock. A shareholder who decides to sell some,

or all, of their shares in a private transaction may be unable to locate persons who are willing to purchase the shares, given the restrictions.

Also, because of the various risk factors described above, the price of the publicly traded common stock may be highly volatile and not

provide the true market price of our common stock.

Our stock is not traded, so you may

be unable to sell your shares at or near the quoted bid prices if you need to sell a significant number of your shares

Even if our stock becomes trading, it is likely

that our common stock will be thinly traded, meaning that the number of persons interested in purchasing our common shares at or near

bid prices at any given time may be relatively small or non-existent. This situation is attributable to a number of factors, including

the fact that we are a small company which is relatively unknown to stock analysts, stock brokers, institutional investors and others

in the investment community that generate or influence sales volume, and that even if we came to the attention of such persons, they tend

to be risk-averse and would be reluctant to follow an unproven company such as ours or purchase or recommend the purchase of our shares

until such time as we became more seasoned and viable. Consequently, there may be periods of several days or more when trading activity

in our shares is minimal or non-existent, as compared to a seasoned issuer which has a large and steady volume of trading activity that

will generally support continuous sales without an adverse effect on share price. We cannot give you any assurance that a broader or more

active public trading market for our common shares will develop or be sustained, or that current trading levels will be sustained. Due

to these conditions, we can give you no assurance that you will be able to sell your shares at or near bid prices or at all if you need

money or otherwise desire to liquidate your shares.

Our common stock is be considered a

“penny stock,” and thereby be subject to additional sale and trading regulations that may make it more difficult to sell

A common stock is a “penny stock”

if it meets one or more of the following conditions (i) the stock trades at a price less than $5.00 per share; (ii) it is not traded on

a “recognized” national exchange; (iii) it is not quoted on the Nasdaq Capital Market, or even if so, has a price less than

$5.00 per share; or (iv) is issued by a company that has been in business less than three years with net tangible assets less than $5

million.

The principal result or effect of being designated

a “penny stock” is that securities broker-dealers participating in sales of our common stock will be subject to the “penny

stock” regulations set forth in Rules 15g-2 through 15g-9 promulgated under the Exchange Act. For example, Rule 15g-2 requires broker-dealers

dealing in penny stocks to provide potential investors with a document disclosing the risks of penny stocks and to obtain a manually signed

and dated written receipt of the document at least two business days before effecting any transaction in a penny stock for the investor’s

account. Moreover, Rule 15g-9 requires broker-dealers in penny stocks to approve the account of any investor for transactions in such

stocks before selling any penny stock to that investor. This procedure requires the broker-dealer to (i) obtain from the investor information

concerning his or her financial situation, investment experience and investment objectives; (ii) reasonably determine, based on that information,

that transactions in penny stocks are suitable for the investor and that the investor has sufficient knowledge and experience as to be

reasonably capable of evaluating the risks of penny stock transactions; (iii) provide the investor with a written statement setting forth

the basis on which the broker-dealer made the determination in (ii) above; and (iv) receive a signed and dated copy of such statement

from the investor, confirming that it accurately reflects the investor’s financial situation, investment experience and investment

objectives. Compliance with these requirements may make it more difficult and time consuming for holders of our common stock to resell

their shares to third parties or to otherwise dispose of them in the market or otherwise.

We may issue more shares in an acquisition

or merger, which will result in substantial dilution

Our Articles of Incorporation, as amended, authorize the Company to

issue an aggregate of 100,000,000 shares of common stock of which 30,000,000 shares are currently outstanding and 1,000,000 shares of

Preferred A Stock are authorized, of which 500,000 shares are outstanding. Any acquisition or merger effected by the Company may result

in the issuance of additional securities without stockholder approval and may result in substantial dilution in the percentage of our

common stock held by our then existing stockholders. Moreover, shares of our common stock issued in any such merger or acquisition transaction

may be valued on an arbitrary or non-arm’s-length basis by our management, resulting in an additional reduction in the percentage

of common stock held by our then existing stockholders. In an acquisition type transaction, our Board of Directors has the power to issue

any, or all, of such authorized but unissued shares without stockholder approval. To the extent that additional shares of common stock

are issued in connection with a business combination or otherwise, dilution to the interests of our stockholders will occur and the rights

of the holders of common stock might be materially adversely affected.

Obtaining additional capital though

the sale of common stock will result in dilution of stockholder interests

We may raise additional funds in the future

by issuing additional shares of common stock or other securities, which may include securities such as convertible debentures, warrants

or preferred stock that are convertible into common stock. Any such sale of common stock or other securities will lead to further dilution

of the equity ownership of existing holders of our common stock. Additionally, the existing conversion rights may hinder future equity

offerings, and the exercise of those conversion rights may have an adverse effect on the value of our stock. If any such conversion rights

are exercised at a price below the then current market price of our shares, then the market price of our stock could decrease upon the

sale of such additional securities. Further, if any such conversion rights are exercised at a price below the price at which any stockholder

purchased shares, then that particular stockholder will experience dilution in his or her investment.

Our directors have the authority to

authorize the issuance of preferred stock

Our Articles of Incorporation, as amended,

authorize the Company to issue an aggregate of 1,000,000 shares of Preferred Stock. Our directors, without further action by our stockholders,

have the authority to issue shares to be determined by our board of directors of Preferred Stock with the relative rights, conversion

rights, voting rights, preferences, special rights, and qualifications as determined by the board without approval by the shareholders.

Any issuance of Preferred Stock could adversely affect the rights of holders of common stock. Additionally, any future issuance of preferred

stock may have the effect of delaying, deferring, or preventing a change in control of the Company without further action by the shareholders

and may adversely affect the voting and other rights of the holders of common stock. Our Board does not intend to seek shareholder approval

prior to any issuance of currently authorized stock, unless otherwise required by law or stock exchange rules.

We have never paid dividends on our

common stock, nor are we likely to pay dividends in the foreseeable future. Therefore, you may not derive any income solely from ownership

of our stock

We have never declared or paid dividends on

our common stock and do not presently intend to pay any dividends in the foreseeable future. We anticipate that any funds available for

payment of dividends will be re-invested into the Company to further our business strategy. This means that your potential for economic

gain from ownership of our stock depends on appreciation of our stock price and will only be realized by a sale of the stock at a price

higher than your purchase price.

|

Not applicable