| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||||||||

| OR | ||||||||

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||||||||

For the transition period from to | ||||||||

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |||||||||||||

| Title of Each Class | Trading Symbols | Name of Each Exchange on Which Registered | ||||||||||||||||||

| ☒ | Accelerated filer | ☐ | Non-accelerated filer | ☐ | Smaller reporting company | Emerging growth company | |||||||||||||||||||||||||||||||||||

| Page | ||||||||||||||

| PART I | ||||||||||||||

| Item 1. | ||||||||||||||

| Item 1A. | I-15 | |||||||||||||

| Item 1B. | I-25 | |||||||||||||

| Item 2. | I-25 | |||||||||||||

| Item 3. | I-26 | |||||||||||||

| Item 4. | I-26 | |||||||||||||

| PART II | ||||||||||||||

| Item 5. | II-1 | |||||||||||||

| Item 7. | II-3 | |||||||||||||

| Item 8. | II-46 | |||||||||||||

| Item 9. | II-107 | |||||||||||||

| Item 9A. | II-107 | |||||||||||||

| Item 9B. | II-107 | |||||||||||||

| Item 9C. | II-107 | |||||||||||||

| PART III | ||||||||||||||

| Item 10. | III-1 | |||||||||||||

| Item 11. | III-1 | |||||||||||||

| Item 12. | III-1 | |||||||||||||

| Item 13. | III-1 | |||||||||||||

| Item 14. | III-1 | |||||||||||||

| PART IV | ||||||||||||||

| Item 15. | IV-1 | |||||||||||||

| Item 16. | IV-1 | |||||||||||||

Item 1. | Business. | ||||

| Name | Age | Position | ||||||

| Robert M. Bakish | 59 | President and Chief Executive Officer, Director | ||||||

| Naveen Chopra | 49 | Executive Vice President, Chief Financial Officer | ||||||

| Christa A. D’Alimonte | 54 | Executive Vice President, General Counsel and Secretary | ||||||

| Doretha (DeDe) Lea | 58 | Executive Vice President, Global Public Policy and Government Relations | ||||||

| Julia Phelps | 45 | Executive Vice President, Chief Communications and Corporate Marketing Officer | ||||||

| Nancy Phillips | 55 | Executive Vice President, Chief People Officer | ||||||

Item 1A. | Risk Factors. | ||||

Item 1B. | Unresolved Staff Comments. | ||||

Item 2. | Properties. | ||||

Item 3. | Legal Proceedings. | ||||

Item 4. | Mine Safety Disclosures. | ||||

Item 5. | Market for Paramount Global’s Common Equity, Related Stockholder Matters and Purchases of Equity Securities. | ||||

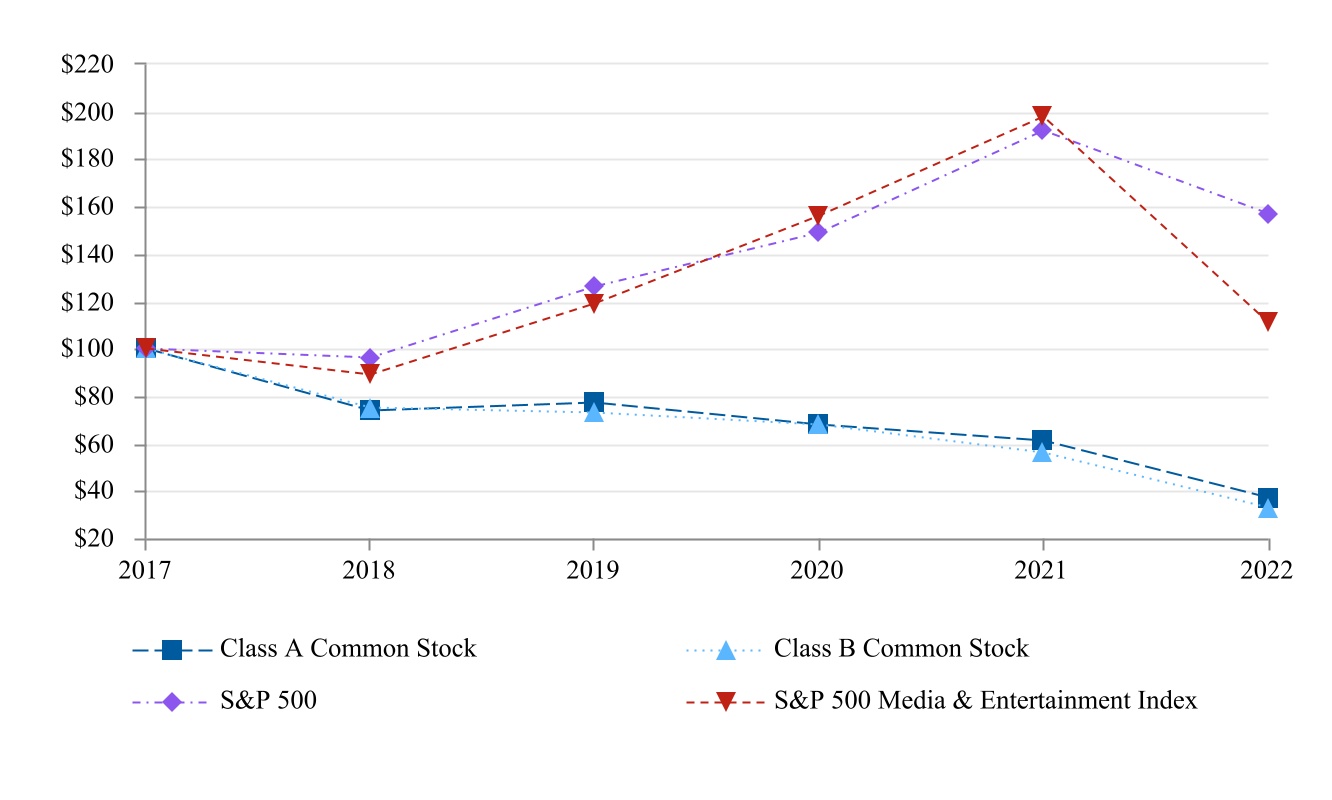

| December 31, | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | ||||||||||||||

| Class A Common Stock | $100 | $74 | $77 | $68 | $61 | $37 | ||||||||||||||

| Class B Common Stock | $100 | $75 | $73 | $68 | $56 | $33 | ||||||||||||||

| S&P 500 | $100 | $96 | $126 | $149 | $192 | $157 | ||||||||||||||

| S&P 500 Media & Entertainment Index | $100 | $89 | $119 | $156 | $198 | $111 | ||||||||||||||

| Item 7. | Management’s Discussion and Analysis of Results of Operations and Financial Condition. (Tabular dollars in millions, except per share amounts) | ||||

| Consolidated results of operations | Increase/(Decrease) | |||||||||||||||||||||||||

| Year Ended December 31, | 2022 | 2021 | $ | % | ||||||||||||||||||||||

| GAAP: | ||||||||||||||||||||||||||

| Revenues | $ | 30,154 | $ | 28,586 | $ | 1,568 | 5 | % | ||||||||||||||||||

| Operating income | $ | 2,342 | $ | 6,297 | $ | (3,955) | (63) | % | ||||||||||||||||||

Net earnings from continuing operations attributable to Paramount | $ | 725 | $ | 4,381 | $ | (3,656) | (83) | % | ||||||||||||||||||

Diluted EPS from continuing operations attributable to Paramount | $ | 1.03 | $ | 6.69 | $ | (5.66) | (85) | % | ||||||||||||||||||

Non-GAAP: (a) | ||||||||||||||||||||||||||

| Adjusted OIBDA | $ | 3,276 | $ | 4,444 | $ | (1,168) | (26) | % | ||||||||||||||||||

Adjusted net earnings from continuing operations attributable to Paramount | $ | 1,171 | $ | 2,292 | $ | (1,121) | (49) | % | ||||||||||||||||||

Adjusted diluted EPS from continuing operations attributable to Paramount | $ | 1.71 | $ | 3.48 | $ | (1.77) | (51) | % | ||||||||||||||||||

| Year Ended December 31, | 2022 | 2021 | 2020 | ||||||||||||||

| Operating income (GAAP) | $ | 2,342 | $ | 6,297 | $ | 4,139 | |||||||||||

Depreciation and amortization (a) | 405 | 390 | 430 | ||||||||||||||

Restructuring and other corporate matters (b) | 585 | 100 | 618 | ||||||||||||||

Programming charges (b) | — | — | 159 | ||||||||||||||

Net gain on dispositions (b) | (56) | (2,343) | (214) | ||||||||||||||

| Adjusted OIBDA (Non-GAAP) | $ | 3,276 | $ | 4,444 | $ | 5,132 | |||||||||||

| Year Ended December 31, 2022 | |||||||||||||||||||||||||||||||||||||||||||||||

| Earnings from Continuing Operations Before Income Taxes | Provision for Income Taxes | Net Earnings from Continuing Operations Attributable to Paramount | Diluted EPS from Continuing Operations | ||||||||||||||||||||||||||||||||||||||||||||

| Reported (GAAP) | $ | 1,266 | $ | (227) | $ | 725 | $ | 1.03 | |||||||||||||||||||||||||||||||||||||||

| Items affecting comparability: | |||||||||||||||||||||||||||||||||||||||||||||||

Restructuring and other corporate matters (a) | 585 | (137) | 448 | .69 | |||||||||||||||||||||||||||||||||||||||||||

Impairment charge (b) | 27 | (7) | 20 | .03 | |||||||||||||||||||||||||||||||||||||||||||

Gain on dispositions (c) | (56) | 14 | (42) | (.06) | |||||||||||||||||||||||||||||||||||||||||||

Loss from investments (d) | 9 | (1) | 8 | .01 | |||||||||||||||||||||||||||||||||||||||||||

| Loss on extinguishment of debt | 120 | (28) | 92 | .14 | |||||||||||||||||||||||||||||||||||||||||||

Discrete tax items (e) | — | (80) | (80) | (.13) | |||||||||||||||||||||||||||||||||||||||||||

| Adjusted (Non-GAAP) | $ | 1,951 | $ | (466) | $ | 1,171 | $ | 1.71 | |||||||||||||||||||||||||||||||||||||||

| Year Ended December 31, 2021 | |||||||||||||||||||||||||||||||||||||||||||||||

| Earnings from Continuing Operations Before Income Taxes | Provision for Income Taxes | Net Earnings from Continuing Operations Attributable to Paramount | Diluted EPS from Continuing Operations | ||||||||||||||||||||||||||||||||||||||||||||

| Reported (GAAP) | $ | 5,206 | $ | (646) | $ | 4,381 | $ | 6.69 | |||||||||||||||||||||||||||||||||||||||

| Items affecting comparability: | |||||||||||||||||||||||||||||||||||||||||||||||

Restructuring (a) | 100 | (25) | 75 | .11 | |||||||||||||||||||||||||||||||||||||||||||

Net gain on dispositions (b) | (2,343) | 592 | (1,751) | (2.67) | |||||||||||||||||||||||||||||||||||||||||||

Gains from investments (c) | (47) | 11 | (36) | (.05) | |||||||||||||||||||||||||||||||||||||||||||

| Loss on extinguishment of debt | 128 | (30) | 98 | .15 | |||||||||||||||||||||||||||||||||||||||||||

Pension settlement charge (d) | 10 | (2) | 8 | .01 | |||||||||||||||||||||||||||||||||||||||||||

Discrete tax items (e) | — | (517) | (517) | (.79) | |||||||||||||||||||||||||||||||||||||||||||

| Impairment of equity-method investment, net of tax | — | — | 34 | .05 | |||||||||||||||||||||||||||||||||||||||||||

Impact of antidilution of Mandatory Convertible Preferred Stock (f) | — | — | — | (.02) | |||||||||||||||||||||||||||||||||||||||||||

| Adjusted (Non-GAAP) | $ | 3,054 | $ | (617) | $ | 2,292 | $ | 3.48 | |||||||||||||||||||||||||||||||||||||||

| Year Ended December 31, 2020 | |||||||||||||||||||||||||||||||||||||||||||||||

| Earnings from Continuing Operations Before Income Taxes | Provision for Income Taxes | Net Earnings from Continuing Operations Attributable to Paramount | Diluted EPS from Continuing Operations | ||||||||||||||||||||||||||||||||||||||||||||

| Reported (GAAP) | $ | 3,147 | $ | (535) | $ | 2,305 | $ | 3.73 | |||||||||||||||||||||||||||||||||||||||

| Items affecting comparability: | |||||||||||||||||||||||||||||||||||||||||||||||

Restructuring and other corporate matters (a) | 618 | (133) | 485 | .79 | |||||||||||||||||||||||||||||||||||||||||||

Impairment charge (b) | 25 | (6) | 19 | .03 | |||||||||||||||||||||||||||||||||||||||||||

Depreciation of abandoned technology (c) | 12 | (3) | 9 | .01 | |||||||||||||||||||||||||||||||||||||||||||

Programming charges (d) | 159 | (39) | 120 | .20 | |||||||||||||||||||||||||||||||||||||||||||

Gain on dispositions (e) | (214) | 31 | (183) | (.30) | |||||||||||||||||||||||||||||||||||||||||||

Net gains from investments (f) | (206) | 50 | (156) | (.25) | |||||||||||||||||||||||||||||||||||||||||||

| Loss on extinguishment of debt | 126 | (29) | 97 | .16 | |||||||||||||||||||||||||||||||||||||||||||

Discrete tax items (g) | — | (110) | (110) | (.18) | |||||||||||||||||||||||||||||||||||||||||||

| Impairment of equity-method investment, net of tax | — | — | 9 | .01 | |||||||||||||||||||||||||||||||||||||||||||

| Adjusted (Non-GAAP) | $ | 3,667 | $ | (774) | $ | 2,595 | $ | 4.20 | |||||||||||||||||||||||||||||||||||||||

| Revenues by Type | % of Total | % of Total | Increase/(Decrease) | |||||||||||||||||||||||||||||||||||||||||||||||

| Year Ended December 31, | 2022 | Revenues | 2021 | Revenues | $ | % | ||||||||||||||||||||||||||||||||||||||||||||

| Advertising | $ | 10,890 | 36 | % | $ | 11,412 | 40 | % | $ | (522) | (5) | % | ||||||||||||||||||||||||||||||||||||||

| Affiliate and subscription | 11,551 | 38 | 10,442 | 36 | 1,109 | 11 | ||||||||||||||||||||||||||||||||||||||||||||

| Theatrical | 1,223 | 4 | 241 | 1 | 982 | 407 | ||||||||||||||||||||||||||||||||||||||||||||

| Licensing and other | 6,490 | 22 | 6,491 | 23 | (1) | — | ||||||||||||||||||||||||||||||||||||||||||||

| Total Revenues | $ | 30,154 | 100 | % | $ | 28,586 | 100 | % | $ | 1,568 | 5 | % | ||||||||||||||||||||||||||||||||||||||

| % of | % of | |||||||||||||||||||||||||||||||||||||||||||||||||

| Operating Expenses by Type | Operating | Operating | Increase/(Decrease) | |||||||||||||||||||||||||||||||||||||||||||||||

| Year Ended December 31, | 2022 | Expenses | 2021 | Expenses | $ | % | ||||||||||||||||||||||||||||||||||||||||||||

| Content costs | $ | 15,980 | 81 | % | $ | 14,703 | 83 | % | $ | 1,277 | 9 | % | ||||||||||||||||||||||||||||||||||||||

| Distribution and other | 3,865 | 19 | 3,041 | 17 | 824 | 27 | ||||||||||||||||||||||||||||||||||||||||||||

| Total Operating Expenses | $ | 19,845 | 100 | % | $ | 17,744 | 100 | % | $ | 2,101 | 12 | % | ||||||||||||||||||||||||||||||||||||||

| Increase/(Decrease) | ||||||||||||||||||||||||||

| Year Ended December 31, | 2022 | 2021 | $ | % | ||||||||||||||||||||||

| Selling, general and administrative expenses | $ | 7,033 | $ | 6,398 | $ | 635 | 10 | % | ||||||||||||||||||

| Increase/(Decrease) | ||||||||||||||||||||||||||

| Year Ended December 31, | 2022 | 2021 | $ | % | ||||||||||||||||||||||

| Depreciation and amortization | $ | 405 | $ | 390 | $ | 15 | 4 | % | ||||||||||||||||||

| Year Ended December 31, | 2022 | 2021 | |||||||||

Severance (a) | $ | 260 | $ | 65 | |||||||

| Lease impairments and other exit costs | 68 | 35 | |||||||||

| Restructuring charges | 328 | 100 | |||||||||

| Other corporate matters | 257 | — | |||||||||

| Restructuring and other corporate matters | $ | 585 | $ | 100 | |||||||

| Increase/(Decrease) | ||||||||||||||||||||||||||

| Year Ended December 31, | 2022 | 2021 | $ | % | ||||||||||||||||||||||

| Interest expense | $ | 931 | $ | 986 | $ | (55) | (6) | % | ||||||||||||||||||

| Interest income | $ | 108 | $ | 53 | $ | 55 | 104 | % | ||||||||||||||||||

| Weighted Average | Weighted Average | |||||||||||||||||||||||||||||||||||||

| At December 31, | 2022 | Interest Rate | 2021 | Interest Rate | ||||||||||||||||||||||||||||||||||

| Total long-term debt | $ | 15,781 | 5.13 | % | $ | 17,658 | 4.93 | % | ||||||||||||||||||||||||||||||

| Other bank borrowings | $ | 55 | 7.09 | % | $ | 35 | 3.50 | % | ||||||||||||||||||||||||||||||

| Increase/(Decrease) | ||||||||||||||||||||||||||

| Year Ended December 31, | 2022 | 2021 | $ | % | ||||||||||||||||||||||

| Net gains (losses) from investments | $ | (9) | $ | 47 | $ | (56) | (119) | % | ||||||||||||||||||

| Year Ended December 31, | 2022 | 2021 | |||||||||

| Pension and postretirement benefit costs | $ | (65) | $ | (43) | |||||||

| Foreign exchange losses | (58) | (26) | |||||||||

Pension settlement charge (a) | — | (10) | |||||||||

| Other | (1) | 2 | |||||||||

| Other items, net | $ | (124) | $ | (77) | |||||||

| Increase/(Decrease) | ||||||||||||||||||||||||||

| Year Ended December 31, | 2022 | 2021 | $ | % | ||||||||||||||||||||||

| Equity in loss of investee companies | $ | (237) | $ | (140) | $ | (97) | (69) | % | ||||||||||||||||||

| Tax benefit | 33 | 49 | (16) | (33) | ||||||||||||||||||||||

| Equity in loss of investee companies, net of tax | $ | (204) | $ | (91) | $ | (113) | (124) | % | ||||||||||||||||||

| Increase/(Decrease) | ||||||||||||||||||||||||||

| Year Ended December 31, | 2022 | 2021 | $ | % | ||||||||||||||||||||||

| Net earnings from continuing operations attributable to Paramount | $ | 725 | $ | 4,381 | $ | (3,656) | (83) | % | ||||||||||||||||||

| Diluted EPS from continuing operations attributable to Paramount | $ | 1.03 | $ | 6.69 | $ | (5.66) | (85) | % | ||||||||||||||||||

| Year Ended December 31, 2022 | Simon & Schuster | Other (a) | Total | |||||||||||||||||||||||

| Revenues | $ | 1,177 | $ | — | $ | 1,177 | ||||||||||||||||||||

| Costs and expenses: | ||||||||||||||||||||||||||

| Operating | 746 | (30) | 716 | |||||||||||||||||||||||

| Selling, general and administrative | 180 | — | 180 | |||||||||||||||||||||||

| Restructuring charges | 3 | — | 3 | |||||||||||||||||||||||

| Total costs and expenses | 929 | (30) | 899 | |||||||||||||||||||||||

| Operating income | 248 | 30 | 278 | |||||||||||||||||||||||

| Termination fee, net of advisory fees | 190 | — | 190 | |||||||||||||||||||||||

| Other items, net | (12) | — | (12) | |||||||||||||||||||||||

| Earnings from discontinued operations | 426 | 30 | 456 | |||||||||||||||||||||||

| Income tax provision | (70) | (7) | (77) | |||||||||||||||||||||||

| Net earnings from discontinued operations, net of tax | $ | 356 | $ | 23 | $ | 379 | ||||||||||||||||||||

| Year Ended December 31, 2021 | Simon & Schuster | Other (a) | Total | |||||||||||||||||||||||

| Revenues | $ | 993 | $ | — | $ | 993 | ||||||||||||||||||||

| Costs and expenses: | ||||||||||||||||||||||||||

| Operating | 618 | (16) | 602 | |||||||||||||||||||||||

| Selling, general and administrative | 158 | — | 158 | |||||||||||||||||||||||

| Depreciation and amortization | 3 | — | 3 | |||||||||||||||||||||||

| Restructuring charges | 1 | — | 1 | |||||||||||||||||||||||

| Total costs and expenses | 780 | (16) | 764 | |||||||||||||||||||||||

| Operating income | 213 | 16 | 229 | |||||||||||||||||||||||

| Other items, net | (10) | — | (10) | |||||||||||||||||||||||

| Earnings from discontinued operations | 203 | 16 | 219 | |||||||||||||||||||||||

| Income tax provision | (46) | (11) | (57) | |||||||||||||||||||||||

| Net earnings from discontinued operations, net of tax | $ | 157 | $ | 5 | $ | 162 | ||||||||||||||||||||

| Revenues by Type | % of Total | % of Total | Increase/(Decrease) | |||||||||||||||||||||||||||||||||||||||||||||||

| Year Ended December 31, | 2021 | Revenues | 2020 | Revenues | $ | % | ||||||||||||||||||||||||||||||||||||||||||||

| Advertising | $ | 11,412 | 40 | % | $ | 9,751 | 39 | % | $ | 1,661 | 17 | % | ||||||||||||||||||||||||||||||||||||||

| Affiliate and subscription | 10,442 | 36 | 9,166 | 36 | 1,276 | 14 | ||||||||||||||||||||||||||||||||||||||||||||

| Theatrical | 241 | 1 | 180 | 1 | 61 | 34 | ||||||||||||||||||||||||||||||||||||||||||||

| Licensing and other | 6,491 | 23 | 6,188 | 24 | 303 | 5 | ||||||||||||||||||||||||||||||||||||||||||||

| Total Revenues | $ | 28,586 | 100 | % | $ | 25,285 | 100 | % | $ | 3,301 | 13 | % | ||||||||||||||||||||||||||||||||||||||

| % of | % of | |||||||||||||||||||||||||||||||||||||||||||||||||

| Operating Expenses by Type | Operating | Operating | Increase/(Decrease) | |||||||||||||||||||||||||||||||||||||||||||||||

| Year Ended December 31, | 2021 | Expense | 2020 | Expense | $ | % | ||||||||||||||||||||||||||||||||||||||||||||

| Content costs | $ | 14,703 | 83 | % | $ | 11,933 | 80 | % | $ | 2,770 | 23 | % | ||||||||||||||||||||||||||||||||||||||

| Programming charges | — | — | 159 | 1 | (159) | n/m | ||||||||||||||||||||||||||||||||||||||||||||

| Distribution and other | 3,041 | 17 | 2,900 | 19 | 141 | 5 | ||||||||||||||||||||||||||||||||||||||||||||

| Total Operating Expenses | $ | 17,744 | 100 | % | $ | 14,992 | 100 | % | $ | 2,752 | 18 | % | ||||||||||||||||||||||||||||||||||||||

| Increase/(Decrease) | ||||||||||||||||||||||||||

| Year Ended December 31, | 2021 | 2020 | $ | % | ||||||||||||||||||||||

| Selling, general and administrative expenses | $ | 6,398 | $ | 5,320 | $ | 1,078 | 20 | % | ||||||||||||||||||

| Increase/(Decrease) | ||||||||||||||||||||||||||

| Year Ended December 31, | 2021 | 2020 | $ | % | ||||||||||||||||||||||

| Depreciation and amortization | $ | 390 | $ | 430 | $ | (40) | (9) | % | ||||||||||||||||||

| Year Ended December 31, | 2021 | 2020 | |||||||||

Severance (a) | $ | 65 | $ | 472 | |||||||

| Lease impairments and other exit costs | 35 | 70 | |||||||||

| Restructuring charges | 100 | 542 | |||||||||

| Merger-related costs | — | 56 | |||||||||

| Other corporate matters | — | 20 | |||||||||

| Restructuring and other corporate matters | $ | 100 | $ | 618 | |||||||

| Increase/(Decrease) | ||||||||||||||||||||||||||

| Year Ended December 31, | 2021 | 2020 | $ | % | ||||||||||||||||||||||

| Interest expense | $ | 986 | $ | 1,031 | $ | (45) | (4) | % | ||||||||||||||||||

| Interest income | $ | 53 | $ | 60 | $ | (7) | (12) | % | ||||||||||||||||||

| Weighted Average | Weighted Average | |||||||||||||||||||||||||||||||||||||

| At December 31, | 2021 | Interest Rate | 2020 | Interest Rate | ||||||||||||||||||||||||||||||||||

| Total long-term debt | $ | 17,658 | 4.93 | % | $ | 19,612 | 4.80 | % | ||||||||||||||||||||||||||||||

| Other bank borrowings | $ | 35 | 3.50 | % | $ | 95 | 3.50 | % | ||||||||||||||||||||||||||||||

| Increase/(Decrease) | ||||||||||||||||||||||||||

| Year Ended December 31, | 2021 | 2020 | $ | % | ||||||||||||||||||||||

| Net gains from investments | $ | 47 | $ | 206 | $ | (159) | (77) | % | ||||||||||||||||||

| Year Ended December 31, | 2021 | 2020 | |||||||||

| Pension and postretirement benefit costs | $ | (43) | $ | (69) | |||||||

| Foreign exchange losses | (26) | (35) | |||||||||

Pension settlement charge (a) | (10) | — | |||||||||

| Other | 2 | 3 | |||||||||

| Other items, net | $ | (77) | $ | (101) | |||||||

| Increase/(Decrease) | ||||||||||||||||||||||||||

| Year Ended December 31, | 2021 | 2020 | $ | % | ||||||||||||||||||||||

| Equity in loss of investee companies | $ | (140) | $ | (47) | $ | (93) | (198) | % | ||||||||||||||||||

| Tax benefit | 49 | 19 | 30 | 158 | ||||||||||||||||||||||

| Equity in loss of investee companies, net of tax | $ | (91) | $ | (28) | $ | (63) | (225) | % | ||||||||||||||||||

| Year Ended December 31, | 2021 | 2020 | |||||||||

| Net earnings attributable to noncontrolling interests | $ | (88) | $ | (279) | |||||||

| Increase/(Decrease) | ||||||||||||||||||||||||||

| Year Ended December 31, | 2021 | 2020 | $ | % | ||||||||||||||||||||||

| Net earnings from continuing operations attributable to Paramount | $ | 4,381 | $ | 2,305 | $ | 2,076 | 90 | % | ||||||||||||||||||

| Diluted EPS from continuing operations attributable to Paramount | $ | 6.69 | $ | 3.73 | $ | 2.96 | 79 | % | ||||||||||||||||||

| Year Ended December 31, 2021 | Simon & Schuster | Other (a) | Total | |||||||||||||||||||||||

| Revenues | $ | 993 | $ | — | $ | 993 | ||||||||||||||||||||

| Costs and expenses: | ||||||||||||||||||||||||||

| Operating | 618 | (16) | 602 | |||||||||||||||||||||||

| Selling, general and administrative | 158 | — | 158 | |||||||||||||||||||||||

| Depreciation and amortization | 3 | — | 3 | |||||||||||||||||||||||

| Restructuring charges | 1 | — | 1 | |||||||||||||||||||||||

| Total costs and expenses | 780 | (16) | 764 | |||||||||||||||||||||||

| Operating income | 213 | 16 | 229 | |||||||||||||||||||||||

| Other items, net | (10) | — | (10) | |||||||||||||||||||||||

| Earnings from discontinued operations | 203 | 16 | 219 | |||||||||||||||||||||||

| Income tax provision | (46) | (11) | (57) | |||||||||||||||||||||||

| Net earnings from discontinued operations, net of tax | $ | 157 | $ | 5 | $ | 162 | ||||||||||||||||||||

| Year Ended December 31, 2020 | Simon & Schuster | Other (a) | Total | |||||||||||||||||||||||

| Revenues | $ | 901 | $ | — | $ | 901 | ||||||||||||||||||||

| Costs and expenses: | ||||||||||||||||||||||||||

| Operating | 573 | (19) | 554 | |||||||||||||||||||||||

| Selling, general and administrative | 172 | — | 172 | |||||||||||||||||||||||

| Depreciation and amortization | 5 | — | 5 | |||||||||||||||||||||||

| Restructuring charges | 10 | — | 10 | |||||||||||||||||||||||

| Total costs and expenses | 760 | (19) | 741 | |||||||||||||||||||||||

| Operating income | 141 | 19 | 160 | |||||||||||||||||||||||

| Other items, net | (5) | — | (5) | |||||||||||||||||||||||

| Earnings from discontinued operations | 136 | 19 | 155 | |||||||||||||||||||||||

| Income tax provision | (34) | (4) | (38) | |||||||||||||||||||||||

| Net earnings from discontinued operations, net of tax | $ | 102 | $ | 15 | $ | 117 | ||||||||||||||||||||

| % of Total | % of Total | Increase/(Decrease) | ||||||||||||||||||||||||||||||||||||||||||||||||

| Year Ended December 31, | 2022 | Revenues | 2021 | Revenues | $ | % | ||||||||||||||||||||||||||||||||||||||||||||

| Revenues: | ||||||||||||||||||||||||||||||||||||||||||||||||||

| TV Media | $ | 21,732 | 72 | % | $ | 22,734 | 80 | % | $ | (1,002) | (4) | % | ||||||||||||||||||||||||||||||||||||||

| Direct-to-Consumer | 4,904 | 16 | 3,327 | 12 | 1,577 | 47 | ||||||||||||||||||||||||||||||||||||||||||||

| Filmed Entertainment | 3,706 | 13 | 2,687 | 9 | 1,019 | 38 | ||||||||||||||||||||||||||||||||||||||||||||

| Eliminations | (188) | (1) | (162) | (1) | (26) | (16) | ||||||||||||||||||||||||||||||||||||||||||||

| Total Revenues | $ | 30,154 | 100 | % | $ | 28,586 | 100 | % | $ | 1,568 | 5 | % | ||||||||||||||||||||||||||||||||||||||

| Increase/(Decrease) | ||||||||||||||||||||||||||

| Year Ended December 31, | 2022 | 2021 | $ | % | ||||||||||||||||||||||

| Adjusted OIBDA: | ||||||||||||||||||||||||||

| TV Media | $ | 5,451 | $ | 5,892 | $ | (441) | (7) | % | ||||||||||||||||||

| Direct-to-Consumer | (1,819) | (992) | (827) | (83) | ||||||||||||||||||||||

| Filmed Entertainment | 272 | 207 | 65 | 31 | ||||||||||||||||||||||

| Corporate/Eliminations | (470) | (491) | 21 | 4 | ||||||||||||||||||||||

| Stock-based compensation | (158) | (172) | 14 | 8 | ||||||||||||||||||||||

| Total Adjusted OIBDA | 3,276 | 4,444 | (1,168) | (26) | ||||||||||||||||||||||

| Depreciation and amortization | (405) | (390) | (15) | (4) | ||||||||||||||||||||||

| Restructuring and other corporate matters | (585) | (100) | (485) | (485) | ||||||||||||||||||||||

| Net gain on dispositions | 56 | 2,343 | (2,287) | (98) | ||||||||||||||||||||||

| Total Operating Income | $ | 2,342 | $ | 6,297 | $ | (3,955) | (63) | % | ||||||||||||||||||

| Increase/(Decrease) | ||||||||||||||||||||||||||

| Year Ended December 31, | 2022 | 2021 | $ | % | ||||||||||||||||||||||

| Advertising | $ | 9,350 | $ | 10,105 | $ | (755) | (7) | % | ||||||||||||||||||

| Affiliate and subscription | 8,180 | 8,413 | (233) | (3) | ||||||||||||||||||||||

| Licensing and other | 4,202 | 4,216 | (14) | — | ||||||||||||||||||||||

| Revenues | $ | 21,732 | $ | 22,734 | $ | (1,002) | (4) | % | ||||||||||||||||||

| Adjusted OIBDA | $ | 5,451 | $ | 5,892 | $ | (441) | (7) | % | ||||||||||||||||||

| (in millions) | ||||||||||||||||||||||||||

| Year Ended December 31, | 2022 | 2021 | Increase/(Decrease) | |||||||||||||||||||||||

Advertising | $ | 1,533 | $ | 1,298 | $ | 235 | 18 | % | ||||||||||||||||||

| Subscription | 3,371 | 2,029 | 1,342 | 66 | ||||||||||||||||||||||

| Revenues | $ | 4,904 | $ | 3,327 | $ | 1,577 | 47 | % | ||||||||||||||||||

| Adjusted OIBDA | $ | (1,819) | $ | (992) | $ | (827) | (83) | % | ||||||||||||||||||

Global Streaming Subscribers (a) | 77.3 | 56.1 | 21.2 | 38 | % | |||||||||||||||||||||

| (in millions) | ||||||||||||||||||||||||||

| Year Ended December 31, | 2022 | 2021 | Increase/(Decrease) | |||||||||||||||||||||||

| Paramount+ (Global) | ||||||||||||||||||||||||||

Subscribers (a) | 55.9 | 32.8 | 23.1 | 70 | % | |||||||||||||||||||||

| Revenues | $ | 2,767 | $ | 1,347 | $ | 1,420 | 105 | % | ||||||||||||||||||

| Pluto TV (Global) | ||||||||||||||||||||||||||

MAUs (b) | 78.5 | 64.4 | 14.1 | 22 | % | |||||||||||||||||||||

| Revenues | $ | 1,112 | $ | 1,059 | $ | 53 | 5 | % | ||||||||||||||||||

| Increase/(Decrease) | ||||||||||||||||||||||||||

| Year Ended December 31, | 2022 | 2021 | $ | % | ||||||||||||||||||||||

| Advertising | $ | 23 | $ | 18 | $ | 5 | 28 | % | ||||||||||||||||||

| Theatrical | 1,223 | 241 | 982 | 407 | ||||||||||||||||||||||

| Licensing and other | 2,460 | 2,428 | 32 | 1 | ||||||||||||||||||||||

| Revenues | $ | 3,706 | $ | 2,687 | $ | 1,019 | 38 | % | ||||||||||||||||||

| Adjusted OIBDA | $ | 272 | $ | 207 | $ | 65 | 31 | % | ||||||||||||||||||

| % of Total | % of Total | Increase/(Decrease) | ||||||||||||||||||||||||||||||||||||||||||||||||

| Year Ended December 31, | 2021 | Revenues | 2020 | Revenues | $ | % | ||||||||||||||||||||||||||||||||||||||||||||

| Revenues: | ||||||||||||||||||||||||||||||||||||||||||||||||||

| TV Media | $ | 22,734 | 80 | % | $ | 21,120 | 83 | % | $ | 1,614 | 8 | % | ||||||||||||||||||||||||||||||||||||||

| Direct-to-Consumer | 3,327 | 12 | 1,815 | 7 | 1,512 | 83 | ||||||||||||||||||||||||||||||||||||||||||||

| Filmed Entertainment | 2,687 | 9 | 2,470 | 10 | 217 | 9 | ||||||||||||||||||||||||||||||||||||||||||||

| Corporate/Eliminations | (162) | (1) | (120) | — | (42) | (35) | ||||||||||||||||||||||||||||||||||||||||||||

| Total Revenues | $ | 28,586 | 100 | % | $ | 25,285 | 100 | % | $ | 3,301 | 13 | % | ||||||||||||||||||||||||||||||||||||||

| Increase/(Decrease) | ||||||||||||||||||||||||||

| Year Ended December 31, | 2021 | 2020 | $ | % | ||||||||||||||||||||||

| Adjusted OIBDA: | ||||||||||||||||||||||||||

| TV Media | $ | 5,892 | $ | 5,816 | $ | 76 | 1 | % | ||||||||||||||||||

| Direct-to-Consumer | (992) | (171) | (821) | (480) | ||||||||||||||||||||||

| Filmed Entertainment | 207 | 158 | 49 | 31 | ||||||||||||||||||||||

| Corporate/Eliminations | (491) | (485) | (6) | (1) | ||||||||||||||||||||||

| Stock-based compensation | (172) | (186) | 14 | 8 | ||||||||||||||||||||||

| Total Adjusted OIBDA | 4,444 | 5,132 | (688) | (13) | ||||||||||||||||||||||

| Depreciation and amortization | (390) | (430) | 40 | 9 | ||||||||||||||||||||||

| Restructuring and other corporate matters | (100) | (618) | 518 | 84 | ||||||||||||||||||||||

| Programming charges | — | (159) | 159 | n/m | ||||||||||||||||||||||

| Net gain on dispositions | 2,343 | 214 | 2,129 | n/m | ||||||||||||||||||||||

| Total Operating Income | $ | 6,297 | $ | 4,139 | $ | 2,158 | 52 | % | ||||||||||||||||||

| Increase/(Decrease) | ||||||||||||||||||||||||||

| Year Ended December 31, | 2021 | 2020 | $ | % | ||||||||||||||||||||||

| Advertising | $ | 10,105 | $ | 9,062 | $ | 1,043 | 12 | % | ||||||||||||||||||

| Affiliate and subscription | 8,413 | 8,037 | 376 | 5 | ||||||||||||||||||||||

| Licensing and other | 4,216 | 4,021 | 195 | 5 | ||||||||||||||||||||||

| Revenues | $ | 22,734 | $ | 21,120 | $ | 1,614 | 8 | % | ||||||||||||||||||

| Adjusted OIBDA | $ | 5,892 | $ | 5,816 | $ | 76 | 1 | % | ||||||||||||||||||

| (in millions) | ||||||||||||||||||||||||||

| Year Ended December 31, | 2021 | 2020 | Increase/(Decrease) | |||||||||||||||||||||||

| Advertising | $ | 1,298 | $ | 686 | $ | 612 | 89 | % | ||||||||||||||||||

| Subscription | 2,029 | 1,129 | 900 | 80 | ||||||||||||||||||||||

| Revenues | $ | 3,327 | $ | 1,815 | $ | 1,512 | 83 | % | ||||||||||||||||||

| Adjusted OIBDA | $ | (992) | $ | (171) | $ | (821) | (480) | % | ||||||||||||||||||

Global Streaming Subscribers | 56.1 | 29.9 | 26.2 | 88 | % | |||||||||||||||||||||

| (in millions) | ||||||||||||||||||||||||||

| Year Ended December 31, | 2021 | 2020 | Increase/(Decrease) | |||||||||||||||||||||||

Paramount+ (Global) (a) | ||||||||||||||||||||||||||

Subscribers | 32.8 | 11.7 | 21.1 | 180 | % | |||||||||||||||||||||

| Revenues | $ | 1,347 | $ | 627 | $ | 720 | 115 | % | ||||||||||||||||||

| Pluto TV (Global) | ||||||||||||||||||||||||||

MAUs | 64.4 | 43.1 | 21.3 | 49 | % | |||||||||||||||||||||

| Revenues | $ | 1,059 | $ | 562 | $ | 497 | 88 | % | ||||||||||||||||||

| Increase/(Decrease) | ||||||||||||||||||||||||||

| Year Ended December 31, | 2021 | 2020 | $ | % | ||||||||||||||||||||||

| Advertising | $ | 18 | $ | 18 | $ | — | — | % | ||||||||||||||||||

| Theatrical | 241 | 180 | 61 | 34 | ||||||||||||||||||||||

| Licensing and other | 2,428 | 2,272 | 156 | 7 | ||||||||||||||||||||||

| Revenues | $ | 2,687 | $ | 2,470 | $ | 217 | 9 | % | ||||||||||||||||||

| Adjusted OIBDA | $ | 207 | $ | 158 | $ | 49 | 31 | % | ||||||||||||||||||

| Increase/ (Decrease) | Increase/ (Decrease) | ||||||||||||||||||||||||||||||||||||||||

| Year Ended December 31, | 2022 | 2021 | 2022 vs. 2021 | 2020 | 2021 vs. 2020 | ||||||||||||||||||||||||||||||||||||

| Net cash flow (used for) provided by operating activities: | |||||||||||||||||||||||||||||||||||||||||

| Continuing operations | $ | (142) | $ | 835 | $ | (977) | $ | 2,215 | $ | (1,380) | |||||||||||||||||||||||||||||||

| Discontinued operations | 361 | 118 | 243 | 79 | 39 | ||||||||||||||||||||||||||||||||||||

| Net cash flow provided by operating activities | 219 | 953 | (734) | 2,294 | (1,341) | ||||||||||||||||||||||||||||||||||||

| Net cash flow (used for) provided by investing activities: | |||||||||||||||||||||||||||||||||||||||||

| Continuing operations | (518) | 2,402 | (2,920) | 63 | 2,339 | ||||||||||||||||||||||||||||||||||||

| Discontinued operations | (8) | (7) | (1) | (7) | — | ||||||||||||||||||||||||||||||||||||

| Net cash flow (used for) provided by investing activities | (526) | 2,395 | (2,921) | 56 | 2,339 | ||||||||||||||||||||||||||||||||||||

| Net cash flow used for financing activities | (2,981) | (152) | (2,829) | (90) | (62) | ||||||||||||||||||||||||||||||||||||

| Effect of exchange rate changes on cash and cash equivalents | (94) | (48) | (46) | 25 | (73) | ||||||||||||||||||||||||||||||||||||

| Net (decrease) increase in cash, cash equivalents and restricted cash | $ | (3,382) | $ | 3,148 | $ | (6,530) | $ | 2,285 | $ | 863 | |||||||||||||||||||||||||||||||

| Year Ended December 31, | 2022 | 2021 | 2020 | ||||||||||||||

Investments (a) | $ | (254) | $ | (193) | $ | (59) | |||||||||||

Capital expenditures (b) | (358) | (354) | (324) | ||||||||||||||

Acquisitions, net of cash acquired (c) | — | (54) | (147) | ||||||||||||||

Proceeds from dispositions (d) | 95 | 3,028 | 593 | ||||||||||||||

| Other investing activities | (1) | (25) | — | ||||||||||||||

| Net cash flow (used for) provided by investing activities from continuing operations | (518) | 2,402 | 63 | ||||||||||||||

| Net cash flow used for investing activities from discontinued operations | (8) | (7) | (7) | ||||||||||||||

| Net cash flow (used for) provided by investing activities | $ | (526) | $ | 2,395 | $ | 56 | |||||||||||

| Year Ended December 31, | 2022 | 2021 | 2020 | ||||||||||||||

| Repayments of commercial paper borrowings, net | $ | — | $ | — | $ | (698) | |||||||||||

| Proceeds from issuance of debt | 1,138 | 58 | 4,375 | ||||||||||||||

| Repayment of debt | (3,140) | (2,230) | (2,909) | ||||||||||||||

| Dividends paid on preferred stock | (58) | (30) | — | ||||||||||||||

| Dividends paid on common stock | (631) | (617) | (600) | ||||||||||||||

| Proceeds from issuance of preferred stock | — | 983 | — | ||||||||||||||

| Proceeds from issuance of common stock | — | 1,672 | — | ||||||||||||||

| Purchase of Company common stock | — | — | (58) | ||||||||||||||

| Payment of payroll taxes in lieu of issuing shares for stock-based compensation | (31) | (110) | (93) | ||||||||||||||

| Proceeds from exercise of stock options | — | 408 | 5 | ||||||||||||||

| Payments to noncontrolling interests | (218) | (235) | (59) | ||||||||||||||

| Other financing activities | (41) | (51) | (53) | ||||||||||||||

| Net cash flow used for financing activities | $ | (2,981) | $ | (152) | $ | (90) | |||||||||||

| At December 31, | 2022 | 2021 | |||||||||

| Senior debt (2.90%-7.875% due 2023-2050) | $ | 14,149 | $ | 16,501 | |||||||

| Junior debt (5.875%-6.375% due 2057 and 2062) | 1,632 | 1,157 | |||||||||

| Other bank borrowings | 55 | 35 | |||||||||

| Obligations under finance leases | 10 | 16 | |||||||||

Total debt (a) | 15,846 | 17,709 | |||||||||

| Less current portion of long-term debt | 239 | 11 | |||||||||

| Total long-term debt, net of current portion | $ | 15,607 | $ | 17,698 | |||||||

| Item 7A. | Quantitative and Qualitative Disclosures About Market Risk. | ||||

Item 8. | Financial Statements and Supplementary Data. | ||||

| Page | ||||||||||||||

| Item 15(a)(1) Financial Statements: | ||||||||||||||

| 1. | II-47 | |||||||||||||

| 2. | Report of Independent Registered Public Accounting Firm (PCAOB ID: | II-48 | ||||||||||||

| 3. | II-51 | |||||||||||||

| 4. | II-52 | |||||||||||||

| 5. | II-53 | |||||||||||||

| 6. | II-54 | |||||||||||||

| 7. | II-55 | |||||||||||||

| 8. | II-56 | |||||||||||||

| Item 15(a)(2) Financial Statement Schedule: | ||||||||||||||

F-1 | ||||||||||||||

| PARAMOUNT GLOBAL | |||||||||||

| By: | /s/ Robert M. Bakish | ||||||||||

Robert M. Bakish President and Chief Executive Officer | |||||||||||

| By: | /s/ Naveen Chopra | ||||||||||

Naveen Chopra Executive Vice President, Chief Financial Officer | |||||||||||

| By: | /s/ Katherine Gill-Charest | ||||||||||

Katherine Gill-Charest Executive Vice President, Controller and Chief Accounting Officer | |||||||||||

| Year Ended December 31, | |||||||||||||||||

| 2022 | 2021 | 2020 | |||||||||||||||

| Revenues | $ | $ | $ | ||||||||||||||

| Costs and expenses: | |||||||||||||||||

| Operating | |||||||||||||||||

| Selling, general and administrative | |||||||||||||||||

| Depreciation and amortization | |||||||||||||||||

| Restructuring and other corporate matters | |||||||||||||||||

| Total costs and expenses | |||||||||||||||||

| Net gain on dispositions | |||||||||||||||||

| Operating income | |||||||||||||||||

| Interest expense | ( | ( | ( | ||||||||||||||

| Interest income | |||||||||||||||||

| Net gains (losses) from investments | ( | ||||||||||||||||

| Loss on extinguishment of debt | ( | ( | ( | ||||||||||||||

| Other items, net | ( | ( | ( | ||||||||||||||

Earnings from continuing operations before income taxes and equity in loss of investee companies | |||||||||||||||||

| Provision for income taxes | ( | ( | ( | ||||||||||||||

| Equity in loss of investee companies, net of tax | ( | ( | ( | ||||||||||||||

| Net earnings from continuing operations | |||||||||||||||||

| Net earnings from discontinued operations, net of tax | |||||||||||||||||

| Net earnings (Paramount and noncontrolling interests) | |||||||||||||||||

| Net earnings attributable to noncontrolling interests | ( | ( | ( | ||||||||||||||

| Net earnings attributable to Paramount | $ | $ | $ | ||||||||||||||

| Amounts attributable to Paramount: | |||||||||||||||||

| Net earnings from continuing operations | $ | $ | $ | ||||||||||||||

| Net earnings from discontinued operations, net of tax | |||||||||||||||||

| Net earnings attributable to Paramount | $ | $ | $ | ||||||||||||||

| Basic net earnings per common share attributable to Paramount: | |||||||||||||||||

| Net earnings from continuing operations | $ | $ | $ | ||||||||||||||

| Net earnings from discontinued operations | $ | $ | $ | ||||||||||||||

| Net earnings | $ | $ | $ | ||||||||||||||

| Diluted net earnings per common share attributable to Paramount: | |||||||||||||||||

| Net earnings from continuing operations | $ | $ | $ | ||||||||||||||

| Net earnings from discontinued operations | $ | $ | $ | ||||||||||||||

| Net earnings | $ | $ | $ | ||||||||||||||

| Weighted average number of common shares outstanding: | |||||||||||||||||

| Basic | |||||||||||||||||

| Diluted | |||||||||||||||||

| Year Ended December 31, | |||||||||||||||||

| 2022 | 2021 | 2020 | |||||||||||||||

| Net earnings (Paramount and noncontrolling interests) | $ | $ | $ | ||||||||||||||

| Other comprehensive income (loss), net of tax: | |||||||||||||||||

| Cumulative translation adjustments | ( | ( | |||||||||||||||

| Decrease (increase) to net actuarial loss and prior service costs | ( | ||||||||||||||||

Other comprehensive income (loss) from continuing operations, net of tax (Paramount and noncontrolling interests) | ( | ||||||||||||||||

| Other comprehensive income (loss) from discontinued operations | ( | ( | |||||||||||||||

| Comprehensive income | |||||||||||||||||

| Less: Comprehensive income attributable to noncontrolling interests | |||||||||||||||||

| Comprehensive income attributable to Paramount | $ | $ | $ | ||||||||||||||

| At December 31, | |||||||||||||||||

| 2022 | 2021 | ||||||||||||||||

| ASSETS | |||||||||||||||||

| Current Assets: | |||||||||||||||||

| Cash and cash equivalents | $ | $ | |||||||||||||||

| Receivables, net | |||||||||||||||||

| Programming and other inventory | |||||||||||||||||

| Prepaid expenses and other current assets | |||||||||||||||||

| Current assets of discontinued operations | |||||||||||||||||

| Total current assets | |||||||||||||||||

| Property and equipment, net | |||||||||||||||||

| Programming and other inventory | |||||||||||||||||

| Goodwill | |||||||||||||||||

| Intangible assets, net | |||||||||||||||||

| Operating lease assets | |||||||||||||||||

| Deferred income tax assets, net | |||||||||||||||||

| Other assets | |||||||||||||||||

| Assets held for sale | |||||||||||||||||

| Assets of discontinued operations | |||||||||||||||||

| Total Assets | $ | $ | |||||||||||||||

LIABILITIES AND STOCKHOLDERS’ EQUITY | |||||||||||||||||

| Current Liabilities: | |||||||||||||||||

| Accounts payable | $ | $ | |||||||||||||||

| Accrued expenses | |||||||||||||||||

| Participants’ share and royalties payable | |||||||||||||||||

| Accrued programming and production costs | |||||||||||||||||

| Deferred revenues | |||||||||||||||||

| Debt | |||||||||||||||||

| Other current liabilities | |||||||||||||||||

| Current liabilities of discontinued operations | |||||||||||||||||

| Total current liabilities | |||||||||||||||||

| Long-term debt | |||||||||||||||||

| Participants’ share and royalties payable | |||||||||||||||||

| Pension and postretirement benefit obligations | |||||||||||||||||

| Deferred income tax liabilities, net | |||||||||||||||||

| Operating lease liabilities | |||||||||||||||||

| Program rights obligations | |||||||||||||||||

| Other liabilities | |||||||||||||||||

| Liabilities of discontinued operations | |||||||||||||||||

| Redeemable noncontrolling interest | |||||||||||||||||

Commitments and contingencies (Note 20) | |||||||||||||||||

| Paramount stockholders’ equity: | |||||||||||||||||

Class A Common Stock, par value $ | |||||||||||||||||

Class B Common Stock, par value $ | |||||||||||||||||

| Additional paid-in capital | |||||||||||||||||

Treasury stock, at cost; | ( | ( | |||||||||||||||

| Retained earnings | |||||||||||||||||

| Accumulated other comprehensive loss | ( | ( | |||||||||||||||

| Total Paramount stockholders’ equity | |||||||||||||||||

| Noncontrolling interests | |||||||||||||||||

| Total Equity | |||||||||||||||||

| Total Liabilities and Equity | $ | $ | |||||||||||||||

| Year Ended December 31, | ||||||||||||||||||||

| 2022 | 2021 | 2020 | ||||||||||||||||||

| Operating Activities: | ||||||||||||||||||||

| Net earnings (Paramount and noncontrolling interests) | $ | $ | $ | |||||||||||||||||

| Less: Net earnings from discontinued operations, net of tax | ||||||||||||||||||||

| Net earnings from continuing operations | ||||||||||||||||||||

Adjustments to reconcile net earnings from continuing operations to net cash flow (used for) provided by operating activities from continuing operations: | ||||||||||||||||||||

| Depreciation and amortization | ||||||||||||||||||||

| Amortization of content costs and participation and residuals expense | ||||||||||||||||||||

| Deferred tax provision (benefit) | ( | |||||||||||||||||||

| Stock-based compensation | ||||||||||||||||||||

| Net gain on dispositions | ( | ( | ( | |||||||||||||||||

| Net (gains) losses from investments | ( | ( | ||||||||||||||||||

| Loss on extinguishment of debt | ||||||||||||||||||||

| Equity in loss of investee companies, net of tax and distributions | ||||||||||||||||||||

| Change in assets and liabilities | ||||||||||||||||||||

| (Increase) decrease in receivables | ( | ( | ||||||||||||||||||

| Increase in inventory and related program, participation, and residuals liabilities | ( | ( | ( | |||||||||||||||||

| Increase in accounts payable and other liabilities | ||||||||||||||||||||

| Decrease in pension and postretirement benefit obligations | ( | ( | ( | |||||||||||||||||

| Increase in income taxes | ||||||||||||||||||||

| Other, net | ( | ( | ||||||||||||||||||

| Net cash flow (used for) provided by operating activities from continuing operations | ( | |||||||||||||||||||

| Net cash flow provided by operating activities from discontinued operations | ||||||||||||||||||||

| Net cash flow provided by operating activities | ||||||||||||||||||||

| Investing Activities: | ||||||||||||||||||||

| Investments | ( | ( | ( | |||||||||||||||||

| Capital expenditures | ( | ( | ( | |||||||||||||||||

| Acquisitions, net of cash acquired | ( | ( | ||||||||||||||||||

| Proceeds from dispositions | ||||||||||||||||||||

| Other investing activities | ( | ( | ||||||||||||||||||

| Net cash flow (used for) provided by investing activities from continuing operations | ( | |||||||||||||||||||

| Net cash flow used for investing activities from discontinued operations | ( | ( | ( | |||||||||||||||||

| Net cash flow (used for) provided by investing activities | ( | |||||||||||||||||||

| Financing Activities: | ||||||||||||||||||||

| Repayments of commercial paper borrowings, net | ( | |||||||||||||||||||

| Proceeds from issuance of debt | ||||||||||||||||||||

| Repayment of debt | ( | ( | ( | |||||||||||||||||

| Dividends paid on preferred stock | ( | ( | ||||||||||||||||||

| Dividends paid on common stock | ( | ( | ( | |||||||||||||||||

| Proceeds from issuance of preferred stock | ||||||||||||||||||||

| Proceeds from issuance of common stock | ||||||||||||||||||||

| Purchase of Company common stock | ( | |||||||||||||||||||

| Payment of payroll taxes in lieu of issuing shares for stock-based compensation | ( | ( | ( | |||||||||||||||||

| Proceeds from exercise of stock options | ||||||||||||||||||||

| Payments to noncontrolling interests | ( | ( | ( | |||||||||||||||||

| Other financing activities | ( | ( | ( | |||||||||||||||||

| Net cash flow used for financing activities | ( | ( | ( | |||||||||||||||||

| Effect of exchange rate changes on cash and cash equivalents | ( | ( | ||||||||||||||||||

| Net (decrease) increase in cash, cash equivalents and restricted cash | ( | |||||||||||||||||||

Cash, cash equivalents and restricted cash at beginning of year (includes $ | ||||||||||||||||||||

Cash, cash equivalents and restricted cash at end of year (includes $ | $ | $ | $ | |||||||||||||||||

| Preferred Stock | Class A and B Common Stock | Treasury Stock | Additional Paid-In Capital | Retained Earnings | Accumulated Other Comprehensive Loss | Total Paramount Stockholders’ Equity | Non-Controlling Interests | Total Equity | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (Shares) | (Shares) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| December 31, 2019 | $ | $ | $ | ( | $ | $ | $ | ( | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Stock-based compensation activity | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Class B Common Stock purchased | — | — | ( | — | ( | — | — | — | ( | — | ( | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Common stock dividends | — | — | — | — | — | — | ( | — | ( | — | ( | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Noncontrolling interests | — | — | — | — | — | — | — | (a) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net earnings | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other comprehensive income (loss) | — | — | — | — | — | — | — | ( | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| December 31, 2020 | ( | ( | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Stock-based compensation activity | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Stock issuances | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Preferred stock dividends | — | — | — | — | — | — | ( | — | ( | — | ( | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Common stock dividends | — | — | — | — | — | — | ( | — | ( | — | ( | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Noncontrolling interests | — | — | — | — | — | ( | — | ( | ( | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net earnings | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other comprehensive loss | — | — | — | — | — | — | — | ( | ( | ( | ( | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| December 31, 2021 | ( | ( | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Stock-based compensation activity | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Preferred stock dividends | — | — | — | — | — | — | ( | — | ( | — | ( | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Common stock dividends | — | — | — | — | — | — | ( | — | ( | — | ( | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Noncontrolling interests | — | — | — | — | — | ( | — | ( | ( | ( | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net earnings | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Other comprehensive loss | — | — | — | — | — | — | — | ( | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| December 31, 2022 | $ | $ | $ | ( | $ | $ | $ | ( | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Buildings and building improvements | |||||

| Leasehold improvements | |||||

| Equipment and other (including finance leases) | |||||

| Year Ended December 31, | 2022 | 2021 | 2020 | ||||||||||||||

| (in millions) | |||||||||||||||||

| Weighted average shares for basic EPS | |||||||||||||||||

Dilutive effect of shares issuable under stock-based compensation plans | |||||||||||||||||

| Conversion of Mandatory Convertible Preferred Stock | |||||||||||||||||

| Weighted average shares for diluted EPS | |||||||||||||||||

| Year Ended December 31, | 2022 | 2021 | ||||||||||||

| Amounts attributable to Paramount: | ||||||||||||||

| Net earnings from continuing operations | $ | $ | ||||||||||||

| Preferred stock dividends | ( | ( | ||||||||||||

| Net earnings from continuing operations for basic EPS calculation | ||||||||||||||

| Preferred stock dividend adjustment | ||||||||||||||

| Net earnings from continuing operations for diluted EPS calculation | $ | $ | ||||||||||||

| Amounts attributable to Paramount: | ||||||||||||||

| Net earnings | $ | $ | ||||||||||||

| Preferred stock dividends | ( | ( | ||||||||||||

| Net earnings for basic EPS calculation | ||||||||||||||

| Preferred stock dividend adjustment | ||||||||||||||

| Net earnings for diluted EPS calculation | $ | $ | ||||||||||||

| Year Ended December 31, 2022 | Simon & Schuster | Other (a) | Total | |||||||||||||||||||||||

| Revenues | $ | $ | $ | |||||||||||||||||||||||

| Costs and expenses: | ||||||||||||||||||||||||||

| Operating | ( | |||||||||||||||||||||||||

| Selling, general and administrative | ||||||||||||||||||||||||||

| Restructuring charges | ||||||||||||||||||||||||||

| Total costs and expenses | ( | |||||||||||||||||||||||||

| Operating income | ||||||||||||||||||||||||||

| Termination fee, net of advisory fees | ||||||||||||||||||||||||||

| Other items, net | ( | ( | ||||||||||||||||||||||||

| Earnings from discontinued operations | ||||||||||||||||||||||||||

| Income tax provision | ( | ( | ( | |||||||||||||||||||||||

| Net earnings from discontinued operations, net of tax | $ | $ | $ | |||||||||||||||||||||||

| Year Ended December 31, 2021 | Simon & Schuster | Other (a) | Total | |||||||||||||||||||||||

| Revenues | $ | $ | $ | |||||||||||||||||||||||

| Costs and expenses: | ||||||||||||||||||||||||||

| Operating | ( | |||||||||||||||||||||||||

| Selling, general and administrative | ||||||||||||||||||||||||||

| Depreciation and amortization | ||||||||||||||||||||||||||

| Restructuring charges | ||||||||||||||||||||||||||

| Total costs and expenses | ( | |||||||||||||||||||||||||

| Operating income | ||||||||||||||||||||||||||

| Other items, net | ( | ( | ||||||||||||||||||||||||

| Earnings from discontinued operations | ||||||||||||||||||||||||||

| Income tax provision | ( | ( | ( | |||||||||||||||||||||||

| Net earnings from discontinued operations, net of tax | $ | $ | $ | |||||||||||||||||||||||

| Year Ended December 31, 2020 | Simon & Schuster | Other (a) | Total | |||||||||||||||||||||||

| Revenues | $ | $ | $ | |||||||||||||||||||||||

| Costs and expenses: | ||||||||||||||||||||||||||

| Operating | ( | |||||||||||||||||||||||||

| Selling, general and administrative | ||||||||||||||||||||||||||

| Depreciation and amortization | ||||||||||||||||||||||||||

| Restructuring charges | ||||||||||||||||||||||||||

| Total costs and expenses | ( | |||||||||||||||||||||||||

| Operating income | ||||||||||||||||||||||||||

| Other items, net | ( | ( | ||||||||||||||||||||||||

| Earnings from discontinued operations | ||||||||||||||||||||||||||

| Income tax provision | ( | ( | ( | |||||||||||||||||||||||

| Net earnings from discontinued operations, net of tax | $ | $ | $ | |||||||||||||||||||||||

| At December 31, | 2022 | 2021 | |||||||||

| Receivables, net | $ | $ | |||||||||

| Other current assets | |||||||||||

| Goodwill | |||||||||||

| Property and equipment, net | |||||||||||

| Operating lease assets | |||||||||||

| Other assets | |||||||||||

| Total Assets | $ | $ | |||||||||

| Royalties payable | $ | $ | |||||||||

| Other current liabilities | |||||||||||

| Operating lease liabilities | |||||||||||

| Other liabilities | |||||||||||

| Total Liabilities | $ | $ | |||||||||

| At December 31, | 2022 | 2021 | |||||||||

| Land | $ | $ | |||||||||

| Buildings | |||||||||||

| Equipment and other | |||||||||||

| Less accumulated depreciation | |||||||||||

| Property and equipment, net | $ | $ | |||||||||

| Year Ended December 31, | 2022 | 2021 | 2020 | ||||||||||||||

Depreciation expense (a) | $ | $ | $ | ||||||||||||||

| At December 31, | 2022 | 2021 | |||||||||

| Film Group Monetization: | |||||||||||

| Acquired program rights, including prepaid sports rights | $ | $ | |||||||||

| Internally-produced television and film programming: | |||||||||||

| Released | |||||||||||

| In process and other | |||||||||||

| Individual Monetization: | |||||||||||

| Acquired libraries | |||||||||||

| Film inventory: | |||||||||||

| Released | |||||||||||

| Completed, not yet released | |||||||||||

| In process and other | |||||||||||

| Internally-produced television programming: | |||||||||||

| Released | |||||||||||

| In process and other | |||||||||||

| Home entertainment | |||||||||||

| Total programming and other inventory | |||||||||||

| Less current portion | |||||||||||

| Total noncurrent programming and other inventory | $ | $ | |||||||||

| Year Ended December 31, | 2022 | 2021 | 2020 | ||||||||||||||

| Programming costs, acquired programming | $ | $ | $ | ||||||||||||||

| Production costs, internally-produced television and film programming: | |||||||||||||||||

| Individual monetization | $ | $ | $ | ||||||||||||||

| Film group monetization | $ | $ | $ | ||||||||||||||

| 2023 | 2024 | 2025 | |||||||||||||||

| Programming costs, acquired programming | $ | $ | $ | ||||||||||||||

| Production costs, internally-produced television and film programming: | |||||||||||||||||

| Individual monetization | $ | $ | $ | ||||||||||||||

| Film group monetization | $ | $ | $ | ||||||||||||||

| Balance at | Acquisitions / | Foreign | Balance at | ||||||||||||||||||||||||||||||||||||||

| December 31, 2021 | (Dispositions) | Currency | December 31, 2022 | ||||||||||||||||||||||||||||||||||||||

| TV Media: | |||||||||||||||||||||||||||||||||||||||||

| Goodwill | $ | $ | $ | ( | $ | ||||||||||||||||||||||||||||||||||||

| Accumulated impairment losses | ( | ( | |||||||||||||||||||||||||||||||||||||||

| Goodwill, net of impairment | ( | ||||||||||||||||||||||||||||||||||||||||

| Direct-to-Consumer | |||||||||||||||||||||||||||||||||||||||||

| Goodwill | |||||||||||||||||||||||||||||||||||||||||

| Accumulated impairment losses | |||||||||||||||||||||||||||||||||||||||||

| Goodwill, net of impairment | |||||||||||||||||||||||||||||||||||||||||

| Filmed Entertainment: | |||||||||||||||||||||||||||||||||||||||||

| Goodwill | |||||||||||||||||||||||||||||||||||||||||

| Accumulated impairment losses | |||||||||||||||||||||||||||||||||||||||||

| Goodwill, net of impairment | |||||||||||||||||||||||||||||||||||||||||

| Total: | |||||||||||||||||||||||||||||||||||||||||

| Goodwill | ( | ||||||||||||||||||||||||||||||||||||||||

| Accumulated impairment losses | ( | ( | |||||||||||||||||||||||||||||||||||||||

| Goodwill, net of impairment | $ | $ | $ | ( | $ | ||||||||||||||||||||||||||||||||||||

| Balance at | Acquisitions / | Foreign | Balance at | ||||||||||||||||||||||||||||||||||||||

| December 31, 2020 | (Dispositions) | Currency | December 31, 2021 | ||||||||||||||||||||||||||||||||||||||

| TV Media: | |||||||||||||||||||||||||||||||||||||||||

| Goodwill | $ | $ | $ | ( | $ | ||||||||||||||||||||||||||||||||||||

| Accumulated impairment losses | ( | ( | |||||||||||||||||||||||||||||||||||||||

| Goodwill, net of impairment | ( | ||||||||||||||||||||||||||||||||||||||||

| Direct-to-Consumer: | |||||||||||||||||||||||||||||||||||||||||

| Goodwill | |||||||||||||||||||||||||||||||||||||||||

| Accumulated impairment losses | |||||||||||||||||||||||||||||||||||||||||

| Goodwill, net of impairment | |||||||||||||||||||||||||||||||||||||||||

| Filmed Entertainment: | |||||||||||||||||||||||||||||||||||||||||

| Goodwill | |||||||||||||||||||||||||||||||||||||||||

| Accumulated impairment losses | |||||||||||||||||||||||||||||||||||||||||

| Goodwill, net of impairment | |||||||||||||||||||||||||||||||||||||||||

| Total: | |||||||||||||||||||||||||||||||||||||||||

| Goodwill | ( | ||||||||||||||||||||||||||||||||||||||||

| Accumulated impairment losses | ( | ( | |||||||||||||||||||||||||||||||||||||||

| Goodwill, net of impairment | $ | $ | $ | ( | $ | ||||||||||||||||||||||||||||||||||||

| Accumulated | |||||||||||||||||

| At December 31, 2022 | Gross | Amortization | Net | ||||||||||||||

| Intangible assets subject to amortization: | |||||||||||||||||

| Trade names | $ | $ | ( | $ | |||||||||||||

| Licenses | ( | ||||||||||||||||

| Customer agreements | ( | ||||||||||||||||

| Other intangible assets | ( | ||||||||||||||||

| Total intangible assets subject to amortization | ( | ||||||||||||||||

| FCC licenses | — | ||||||||||||||||

| International broadcast licenses | — | ||||||||||||||||

| Other intangible assets | — | ||||||||||||||||

| Total intangible assets | $ | $ | ( | $ | |||||||||||||

| Accumulated | |||||||||||||||||

| At December 31, 2021 | Gross | Amortization | Net | ||||||||||||||

| Intangible assets subject to amortization: | |||||||||||||||||

| Trade names | $ | $ | ( | $ | |||||||||||||

| Licenses | ( | ||||||||||||||||

| Customer agreements | ( | ||||||||||||||||

| Other intangible assets | ( | ||||||||||||||||

| Total intangible assets subject to amortization | ( | ||||||||||||||||

| FCC licenses | — | ||||||||||||||||

| International broadcast licenses | — | ||||||||||||||||

| Other intangible assets | — | ||||||||||||||||

| Total intangible assets | $ | $ | ( | $ | |||||||||||||

| Year Ended December 31, | 2022 | 2021 | 2020 | ||||||||||||||||||||||||||||||||

Amortization expense (a) | $ | $ | $ | ||||||||||||||||||||||||||||||||

| 2023 | 2024 | 2025 | 2026 | 2027 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Future amortization expense | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Year Ended December 31, | 2022 | 2021 | 2020 | ||||||||||||||

Severance (a) | $ | $ | $ | ||||||||||||||

| Lease impairments and other exit costs | |||||||||||||||||

| Restructuring charges | |||||||||||||||||

| Merger-related costs | |||||||||||||||||

| Other corporate matters | |||||||||||||||||

| Restructuring and other corporate matters | $ | $ | $ | ||||||||||||||

| 2022 Activity | |||||||||||||||||||||||||||||||||||||||||

| Balance at December 31, 2021 | Charges (a) | Payments | Balance at December 31, 2022 | ||||||||||||||||||||||||||||||||||||||

| TV Media | $ | $ | $ | ( | $ | ||||||||||||||||||||||||||||||||||||

| Direct-to-Consumer | |||||||||||||||||||||||||||||||||||||||||

| Filmed Entertainment | ( | ||||||||||||||||||||||||||||||||||||||||

| Corporate | ( | ||||||||||||||||||||||||||||||||||||||||

| Total | $ | $ | $ | ( | $ | ||||||||||||||||||||||||||||||||||||

| 2021 Activity | |||||||||||||||||||||||||||||||||||||||||

| Balance at December 31, 2020 | Charges (a) | Payments | Balance at December 31, 2021 | ||||||||||||||||||||||||||||||||||||||

| TV Media | $ | $ | $ | ( | $ | ||||||||||||||||||||||||||||||||||||

| Filmed Entertainment | ( | ||||||||||||||||||||||||||||||||||||||||

| Corporate | ( | ||||||||||||||||||||||||||||||||||||||||

| Total | $ | $ | $ | ( | $ | ||||||||||||||||||||||||||||||||||||

| Year Ended December 31, | 2022 (a) | 2021 | 2020 | ||||||||||||||

| Revenues | $ | $ | $ | ||||||||||||||

| Operating expenses | $ | $ | $ | ||||||||||||||

| At December 31, | 2022 (a) | 2021 | |||||||||

| Accounts receivable | $ | $ | |||||||||

| Year Ended December 31, | 2022 | 2021 | 2020 | ||||||||||||||

| Revenues by Type: | |||||||||||||||||

| Advertising | $ | $ | $ | ||||||||||||||

| Affiliate and subscription | |||||||||||||||||

| Theatrical | |||||||||||||||||

| Licensing and other | |||||||||||||||||

| Total Revenues | $ | $ | $ | ||||||||||||||

| At December 31, | 2022 | 2021 | |||||||||

| $ | $ | ||||||||||

| Other bank borrowings | |||||||||||

Total debt (a) | |||||||||||

Less current portion of long-term debt | |||||||||||

| Total long-term debt, net of current portion | $ | $ | |||||||||

| 2028 and | ||||||||||||||||||||||||||||||||||||||||||||||||||

| 2023 | 2024 | 2025 | 2026 | 2027 | Thereafter | |||||||||||||||||||||||||||||||||||||||||||||

| Long-term debt | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||||

| 2022 | 2021 | ||||||||||

| Right-of-Use Assets | |||||||||||

| Operating lease assets | $ | $ | |||||||||

| Lease Liabilities | |||||||||||

| $ | $ | ||||||||||

| Operating lease liabilities | |||||||||||

| Total lease liabilities | $ | $ | |||||||||

| 2022 | 2021 | ||||||||||

| Weighted average remaining lease term | |||||||||||

| Weighted average discount rate | % | % | |||||||||

| Year Ended December 31, | 2022 | 2021 | 2020 | ||||||||||||||

Operating lease cost (a) (b) | $ | $ | $ | ||||||||||||||

Short-term lease cost (b) (c) | |||||||||||||||||

Variable lease cost (b) (d) | |||||||||||||||||

| Sublease income | ( | ( | ( | ||||||||||||||

| Total lease cost | $ | $ | $ | ||||||||||||||

| Year Ended December 31, | 2022 | 2021 | 2020 | ||||||||||||||

| Payments for amounts included in operating lease liabilities (operating cash flows) | $ | $ | $ | ||||||||||||||

| Noncash additions to operating lease assets | $ | $ | $ | ||||||||||||||

| 2023 | $ | ||||

| 2024 | |||||

| 2025 | |||||

| 2026 | |||||

| 2027 | |||||

| 2028 and thereafter | |||||

| Total minimum payments | |||||

| Less amounts representing interest | |||||

| Present value of minimum payments | $ | ||||

| Year Ended December 31, | 2022 | 2021 | Financial Statement Account | ||||||||||||||||||||||||||

| Non-designated foreign exchange contracts | $ | $ | Other items, net | ||||||||||||||||||||||||||

| At December 31, | 2022 | 2021 | |||||||||

| Assets: | |||||||||||

| Foreign currency hedges | $ | $ | |||||||||

| Total Assets | $ | $ | |||||||||

| Liabilities: | |||||||||||

| Deferred compensation | $ | $ | |||||||||

| Foreign currency hedges | |||||||||||

| Total Liabilities | $ | $ | |||||||||

| At December 31, | 2022 | 2021 | |||||||||

| Total assets | $ | $ | |||||||||

| Total liabilities | $ | $ | |||||||||

| Year Ended December 31, | 2022 | 2021 | 2020 (a) | ||||||||||||||

| Revenues | $ | $ | $ | ||||||||||||||

Operating income (loss) | $ | ( | $ | $ | |||||||||||||

| Continuing Operations | Discontinued Operations | |||||||||||||||||||||||||||||||||||||||||||||||||

| Net Actuarial | Accumulated | |||||||||||||||||||||||||||||||||||||||||||||||||

| Cumulative | Loss and | Other | Other | |||||||||||||||||||||||||||||||||||||||||||||||

| Translation | Prior | Comprehensive | Comprehensive | |||||||||||||||||||||||||||||||||||||||||||||||

| Adjustments | Service Cost | Income (Loss) (a) | Loss | |||||||||||||||||||||||||||||||||||||||||||||||

| At December 31, 2019 | $ | ( | $ | ( | $ | ( | $ | ( | ||||||||||||||||||||||||||||||||||||||||||

| Other comprehensive income (loss) before reclassifications | ( | |||||||||||||||||||||||||||||||||||||||||||||||||

| Reclassifications to net earnings | (b) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Other comprehensive income (loss) | ( | |||||||||||||||||||||||||||||||||||||||||||||||||

| At December 31, 2020 | ( | ( | ( | ( | ||||||||||||||||||||||||||||||||||||||||||||||

| Other comprehensive income (loss) before reclassifications | ( | ( | ( | |||||||||||||||||||||||||||||||||||||||||||||||

| Reclassifications to net earnings | (b) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Other comprehensive income (loss) | ( | ( | ( | |||||||||||||||||||||||||||||||||||||||||||||||

| At December 31, 2021 | ( | ( | ( | ( | ||||||||||||||||||||||||||||||||||||||||||||||

| Other comprehensive income (loss) before reclassifications | ( | ( | ||||||||||||||||||||||||||||||||||||||||||||||||

| Reclassifications to net earnings | (b) | |||||||||||||||||||||||||||||||||||||||||||||||||

| Other comprehensive income (loss) | ( | ( | ||||||||||||||||||||||||||||||||||||||||||||||||

| At December 31, 2022 | $ | ( | $ | ( | $ | ( | $ | ( | ||||||||||||||||||||||||||||||||||||||||||

| Year Ended December 31, | 2022 | 2021 | 2020 | ||||||||||||||

| RSUs and PSUs | $ | $ | $ | ||||||||||||||

| Stock options | |||||||||||||||||

| Expense included in operating and SG&A | |||||||||||||||||

Expense included in restructuring and other corporate matters (a) | |||||||||||||||||

| Stock-based compensation expense, before income taxes | |||||||||||||||||

| Related tax benefit | ( | ( | ( | ||||||||||||||

| Stock-based compensation expense, net of tax benefit | $ | $ | $ | ||||||||||||||

| Weighted Average | ||||||||||||||||||||

| Shares | Grant Date Fair Value | |||||||||||||||||||

| Non-vested at December 31, 2021 | $ | |||||||||||||||||||

| Granted | $ | |||||||||||||||||||

| Vested | ( | $ | ||||||||||||||||||

| Forfeited | ( | $ | ||||||||||||||||||

| Non-vested at December 31, 2022 | $ | |||||||||||||||||||

| Weighted Average | |||||||||||||||||||||||

| Stock Options | Exercise Price | ||||||||||||||||||||||

| Outstanding at December 31, 2021 | $ | ||||||||||||||||||||||

| Forfeited or expired | ( | $ | |||||||||||||||||||||

| Outstanding at December 31, 2022 | $ | ||||||||||||||||||||||

| Exercisable at December 31, 2022 | $ | ||||||||||||||||||||||

| Year Ended December 31, | 2021 | 2020 | |||||||||

| Cash received from stock option exercises | $ | $ | |||||||||

| Tax benefit of stock option exercises | $ | $ | |||||||||

| Intrinsic value of stock option exercises | $ | $ | |||||||||

| Year Ended December 31, | 2022 | 2021 | 2020 | ||||||||||||||

| United States | $ | $ | $ | ||||||||||||||

| Foreign | |||||||||||||||||

| Total | $ | $ | $ | ||||||||||||||

| Year Ended December 31, | 2022 | 2021 | 2020 | ||||||||||||||

| Current: | |||||||||||||||||

| Federal | $ | $ | $ | ||||||||||||||

| State and local | |||||||||||||||||

| Foreign | |||||||||||||||||

| Total current | |||||||||||||||||

| Deferred: | |||||||||||||||||

| Federal | ( | ||||||||||||||||

| State and local | ( | ||||||||||||||||

| Foreign | ( | ( | ( | ||||||||||||||

| Total deferred | ( | ||||||||||||||||

| Provision for income taxes | $ | $ | $ | ||||||||||||||

| Year Ended December 31, | 2022 | 2021 | 2020 | ||||||||||||||

| Taxes on income at U.S. federal statutory rate | $ | $ | $ | ||||||||||||||

| State and local taxes, net of federal tax benefit | |||||||||||||||||

| Effect of foreign operations | ( | ( | ( | ||||||||||||||

| Noncontrolling interests | ( | ( | ( | ||||||||||||||

| U.K. statutory rate change | ( | ( | |||||||||||||||

Reorganization of foreign operations (a) | ( | ( | |||||||||||||||

| Excess tax (benefit) deficiency from stock-based compensation | ( | ||||||||||||||||

Other, net | ( | ||||||||||||||||

| Provision for income taxes | $ | $ | $ | ||||||||||||||

| At December 31, | 2022 | 2021 | |||||||||

| Deferred income tax assets: | |||||||||||

| Reserves and other accrued liabilities | $ | $ | |||||||||

| Pension, postretirement and other employee benefits | |||||||||||

| Lease liability | |||||||||||

| Tax credit and loss carryforwards | |||||||||||

| Interest limitation carryforward | |||||||||||

| Capitalized costs | |||||||||||

| Other | |||||||||||

| Total deferred income tax assets | |||||||||||

| Valuation allowance | ( | ( | |||||||||

| Deferred income tax assets, net | |||||||||||

| Deferred income tax liabilities: | |||||||||||

| Intangible assets | ( | ( | |||||||||

| Unbilled licensing receivables | ( | ||||||||||

| Lease asset | ( | ( | |||||||||

| Property, equipment and other assets | ( | ( | |||||||||

| Financing obligations | ( | ( | |||||||||

| Other | ( | ( | |||||||||

| Total deferred income tax liabilities | ( | ( | |||||||||

| Deferred income tax assets, net | $ | $ | |||||||||

| At January 1, 2020 | $ | ||||

| Additions for current year tax positions | |||||

| Additions for prior year tax positions | |||||

| Reductions for prior year tax positions | ( | ||||

| Cash settlements | ( | ||||

| Statute of limitations lapses | ( | ||||

| Reclassification to deferred income tax liability | ( | ||||

| At December 31, 2020 | |||||

| Additions for current year tax positions | |||||

| Additions for prior year tax positions | |||||

| Reductions for prior year tax positions | ( | ||||

| Cash settlements | ( | ||||

| Statute of limitations lapses | ( | ||||

| At December 31, 2021 | |||||

| Additions for current year tax positions | |||||

| Additions for prior year tax positions | |||||

| Reductions for prior year tax positions | ( | ||||

| Cash settlements | ( | ||||

| Statute of limitations lapses | ( | ||||

| At December 31, 2022 | $ | ||||

| Pension Benefits | Postretirement Benefits | ||||||||||||||||||||||

| 2022 | 2021 | 2022 | 2021 | ||||||||||||||||||||

| Change in benefit obligation: | |||||||||||||||||||||||

| Benefit obligation, beginning of year | $ | $ | $ | $ | |||||||||||||||||||

| Service cost | |||||||||||||||||||||||

| Interest cost | |||||||||||||||||||||||

| Actuarial gain | ( | ( | ( | ( | |||||||||||||||||||

| Benefits paid | ( | ( | ( | ( | |||||||||||||||||||

| Settlements paid | ( | ||||||||||||||||||||||

| Participants’ contributions | |||||||||||||||||||||||

| Retiree Medicare drug subsidy | |||||||||||||||||||||||

| Benefit obligation, end of year | $ | $ | $ | $ | |||||||||||||||||||

| Pension Benefits | Postretirement Benefits | ||||||||||||||||||||||

| 2022 | 2021 | 2022 | 2021 | ||||||||||||||||||||

| Change in plan assets: | |||||||||||||||||||||||

| Fair value of plan assets, beginning of year | $ | $ | $ | $ | |||||||||||||||||||

| Actual (loss) return on plan assets | ( | ||||||||||||||||||||||

| Employer contributions | |||||||||||||||||||||||

| Benefits paid | ( | ( | ( | ( | |||||||||||||||||||

| Settlements paid | ( | ||||||||||||||||||||||

| Participants’ contributions | |||||||||||||||||||||||

| Retiree Medicare drug subsidy | |||||||||||||||||||||||

| Fair value of plan assets, end of year | $ | $ | $ | $ | |||||||||||||||||||

| Pension Benefits | Postretirement Benefits | ||||||||||||||||||||||

| At December 31, | 2022 | 2021 | 2022 | 2021 | |||||||||||||||||||

| Funded status at end of year | $ | ( | $ | ( | $ | ( | $ | ( | |||||||||||||||

| Amounts recognized on the Consolidated Balance Sheets: | |||||||||||||||||||||||

| Other assets | $ | $ | $ | $ | |||||||||||||||||||

| Current liabilities | ( | ( | ( | ( | |||||||||||||||||||

| Noncurrent liabilities | ( | ( | ( | ( | |||||||||||||||||||

| Net amounts recognized | $ | ( | $ | ( | $ | ( | $ | ( | |||||||||||||||

| Pension Benefits | Postretirement Benefits | ||||||||||||||||||||||

| At December 31, | 2022 | 2021 | 2022 | 2021 | |||||||||||||||||||

| Net actuarial (loss) gain | $ | ( | $ | ( | $ | $ | |||||||||||||||||

| Net prior service cost | ( | ( | |||||||||||||||||||||

| Share of equity investee | ( | ||||||||||||||||||||||

| ( | ( | ||||||||||||||||||||||

| Deferred income taxes | ( | ( | |||||||||||||||||||||

Net amount recognized in accumulated other comprehensive income (loss) | $ | ( | $ | ( | $ | $ | |||||||||||||||||

| At December 31, | 2022 | 2021 | |||||||||

| Projected and accumulated benefit obligation | $ | $ | |||||||||

| Fair value of plan assets | $ | $ | |||||||||

| Pension Benefits | Postretirement Benefits | ||||||||||||||||||||||||||||||||||

| Year Ended December 31, | 2022 | 2021 | 2020 | 2022 | 2021 | 2020 | |||||||||||||||||||||||||||||

| Components of net periodic cost: | |||||||||||||||||||||||||||||||||||

| Service cost | $ | $ | $ | $ | $ | $ | |||||||||||||||||||||||||||||

| Interest cost | |||||||||||||||||||||||||||||||||||

| Expected return on plan assets | ( | ( | ( | ||||||||||||||||||||||||||||||||

| Amortization of actuarial losses (gains) | ( | ( | ( | ||||||||||||||||||||||||||||||||

| Amortization of prior service cost | |||||||||||||||||||||||||||||||||||

Settlements (a) | |||||||||||||||||||||||||||||||||||

Net periodic cost (b) | $ | $ | $ | $ | ( | $ | ( | $ | ( | ||||||||||||||||||||||||||

| Pension Benefits | Postretirement Benefits | ||||||||||||||||||||||||||||||||||

| Year Ended December 31, | 2022 | 2021 | 2020 | 2022 | 2021 | 2020 | |||||||||||||||||||||||||||||

| Other comprehensive income (loss): | |||||||||||||||||||||||||||||||||||

| Actuarial (loss) gain | $ | $ | ( | $ | ( | $ | $ | $ | |||||||||||||||||||||||||||

| Share of equity investee | |||||||||||||||||||||||||||||||||||

| Curtailment gain | |||||||||||||||||||||||||||||||||||

| Settlements | |||||||||||||||||||||||||||||||||||

| Amortization of actuarial losses (gains) | ( | ( | ( | ||||||||||||||||||||||||||||||||

| Amortization of prior service cost | |||||||||||||||||||||||||||||||||||

| ( | |||||||||||||||||||||||||||||||||||

| Deferred income taxes | ( | ( | ( | ( | ( | ||||||||||||||||||||||||||||||

| Recognized in other comprehensive income (loss), net of tax | $ | $ | $ | $ | $ | $ | ( | ||||||||||||||||||||||||||||

| Pension Benefits | Postretirement Benefits | ||||||||||||||||||||||||||||||||||

| 2022 | 2021 | 2020 | 2022 | 2021 | 2020 | ||||||||||||||||||||||||||||||

| Weighted average assumptions used to determine benefit obligations at December 31: | |||||||||||||||||||||||||||||||||||

| Discount rate | % | % | % | % | % | % | |||||||||||||||||||||||||||||

| Rate of compensation increase | % | % | % | N/A | N/A | N/A | |||||||||||||||||||||||||||||

| Weighted average assumptions used to determine net periodic costs for the year ended December 31: | |||||||||||||||||||||||||||||||||||

| Discount rate | % | % | % | % | % | % | |||||||||||||||||||||||||||||

| Expected long-term return on plan assets | % | % | % | N/A | N/A | N/A | |||||||||||||||||||||||||||||

| Cash balance interest crediting rate | % | % | % | N/A | N/A | N/A | |||||||||||||||||||||||||||||

| Rate of compensation increase | % | % | % | N/A | N/A | N/A | |||||||||||||||||||||||||||||

| 2022 | 2021 | ||||||||||

| Projected health care cost trend rate (pre-65) | % | % | |||||||||

| Projected health care cost trend rate (post-65) | % | % | |||||||||

| Ultimate trend rate | % | % | |||||||||