The Company’s assessments are completed for the years up to March 31, 2019. The Company has

received demands on multiple tax issues. These claims are primarily arising out of denial of deduction under section 10A of the Income Tax Act, 1961 in respect of profit earned by the Company’s undertaking in Software Technology Park at

Bengaluru, the appeals filed against the said demand before the Appellate authorities have been allowed in favor of the Company by the second appellate authority for the years up to March 31, 2008 which either has been or may be contested by

the Income tax authorities before the Hon’ble Supreme Court of India. Other claims relate to disallowance of tax benefits on profits earned from Software Technology Park and Special Economic Zone units, capitalization of research and

development expenses, transfer pricing adjustments on intercompany / inter unit transactions and other issues.

Income tax claims against the Company

amounting to ₹ 92,476 and

₹ 94,230 are not acknowledged as debt as at March 31, 2022 and December 31, 2022, respectively. These matters are pending

before various Appellate Authorities and the management expects its position will likely be upheld on ultimate resolution and will not have a material adverse effect on the Company’s financial position and results of operations.

The contingent liability in respect of disputed demands for excise duty, custom duty, sales tax and other matters amounting to ₹ 12,092 and ₹ 12,001

as of March 31, 2022, and December 31, 2022, respectively. However, the resolution of these disputed demands is not likely to have a material and adverse effect on the results of operations or the financial position of the Company.

The Hon’ble Supreme Court of India, through a ruling in February 2019, provided interpretation on the components of Salary on which the Company and its

employees are to contribute towards Provident Fund under the Employee’s Provident Fund Act. Based on the current evaluation, the Company believes it is not probable that certain components of Salary paid by the Company will be subject to

contribution towards Provident Fund due to the Hon’ble Supreme Court order. The Company will continue to monitor and evaluate its position based on future events and developments.

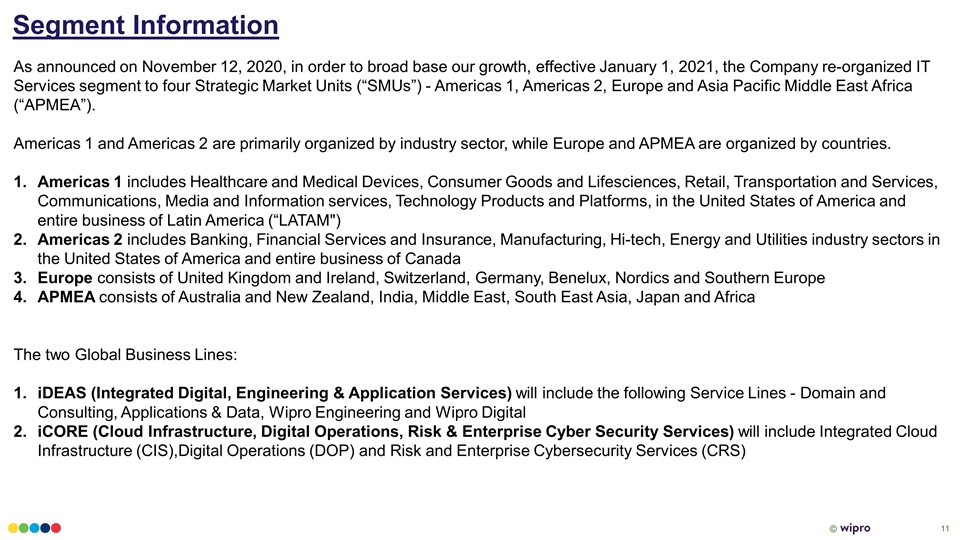

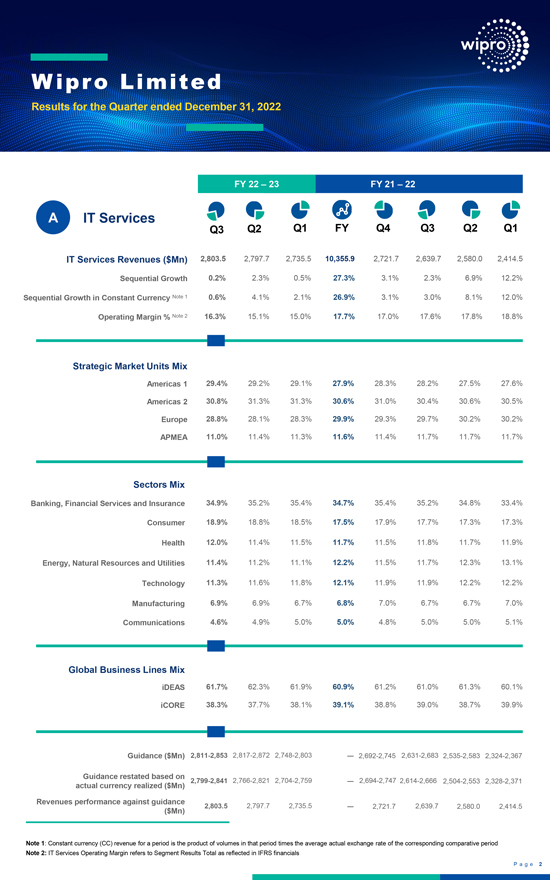

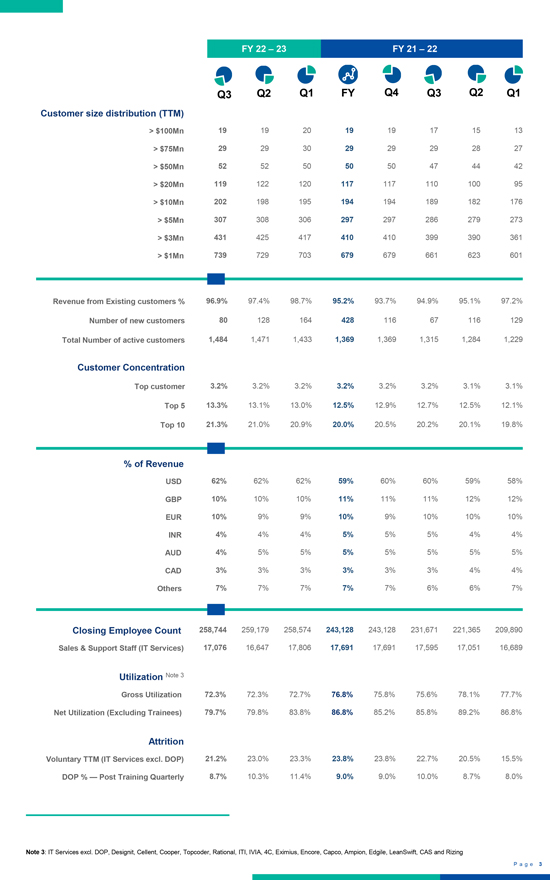

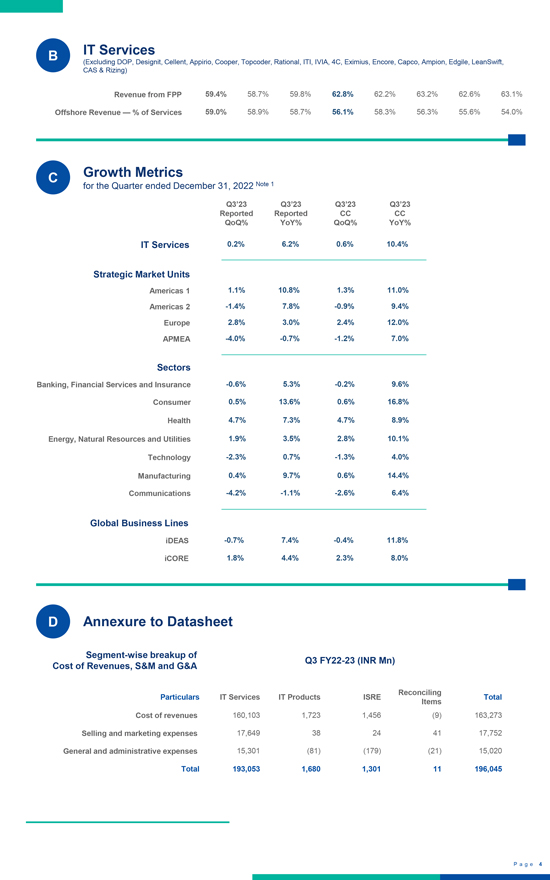

28. Segment information

The Company is organized into

the following operating segments: IT Services, IT Products and India State Run Enterprise segment (“ISRE”).

IT Services: The IT

Services segment primarily consists of IT services offerings to customers organized by four Strategic Market Units (“SMUs”) - Americas 1, Americas 2, Europe and Asia Pacific Middle East Africa (“APMEA”). Americas 1

and Americas 2 are primarily organized by industry sector, while Europe and APMEA are organized by countries.

Americas 1 includes the entire

business of Latin America (“LATAM”) and the following industry sectors in the United States of America: healthcare and medical devices, consumer goods and life sciences, retail, transportation and services, communications, media and

information services, technology products and platforms. Americas 2 includes the entire business in Canada and the following industry sectors in the United States of America: banking, financial services and insurance, manufacturing, hi-tech, energy and utilities. Europe consists of the United Kingdom and Ireland, Switzerland, Germany, Benelux, the Nordics and Southern Europe. APMEA consists of Australia and New Zealand, India,

Middle East, South East Asia, Japan and Africa.

Revenue from each customer is attributed to the respective SMUs based on the location of the

customer’s primary buying center of such services. With respect to certain strategic global customers, revenue may be generated from multiple countries based on such customer’s buying centers, but the total revenue related to these

strategic global customers are attributed to a single SMU based on the geographical location of key decision makers.

Our IT Services segment provides a

range of IT and IT enabled services which include digital strategy advisory, customer centric design, technology consulting, IT consulting, custom application design, development, re-engineering and

maintenance, systems integration, package implementation, cloud and infrastructure services, business process services, cloud, mobility and analytics services, research and development and hardware and software design.

IT Products: The Company is a value-added reseller of security, packaged and SaaS software for leading international brands. In certain total

outsourcing contracts of the IT Services segment, the Company delivers hardware, software products and other related deliverables. Revenue relating to these items is reported as revenue from the sale of IT Products.

ISRE: This segment consists of IT Services offerings to entities and/or departments owned or controlled by Government of India and/or any State

Governments.

The Chairman of the Company has been identified as the Chief Operating Decision Maker (“CODM”) as defined by IFRS 8,

“Operating Segments”. The Chairman of the Company evaluates the segments based on their revenue growth and operating income.

Assets and

liabilities used in the Company’s business are not identified to any of the operating segments, as these are used interchangeably between segments. Management believes that it is currently not practicable to provide segment disclosures relating

to total assets and liabilities since a meaningful segregation of the available data is onerous.

25