| SCHEDULE 14A | ||

| Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934 (Amendment No. ) | ||

Rexford Industrial Realty, Inc. (Name of Registrant as Specified in Its Charter) | ||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||

| Strongest Industrial Market Opportunity | ||||||||||

| Irreplaceable Portfolio | ||||||||||

| Superior Cash Flow Growth Through Value Creation | ||||||||||

| Low-Leverage Balance Sheet and Substantial Liquidity | ||||||||||

| ESG Purpose Drives Long-Term Value | ||||||||||

| ||||||||||||||

| ||||||||||||||

| ||||||||||||||

| 2023 PROXY STATEMENT | 3 | |||||||||||||

4 | REXFORD INDUSTRIAL | |||||||||||||

| Date and Time Monday, June 5, 2023 at 9:00 a.m. (Pacific Time) |  | Location https://web.lumiagm.com/ 218892223 |  | Who Can Vote Stockholders of record at the close of business on April 3, 2023 | ||||||||||||||||||||||||

| 1 | 2 | 3 | ||||||||||||||||||||||||

To elect eight directors, each to serve until the next annual meeting of our stockholders and until his or her successor is duly elected and qualifies | To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2023 | To vote on an advisory resolution to approve the Company’s named executive officer compensation for the fiscal year ended December 31, 2022 | ||||||||||||||||||||||||

(Page 15) Vote FOR | (Page 32) Vote FOR | (Page 35) Vote FOR | ||||||||||||||||||||||||

|  |  |  | ||||||||||||||||||||||||||||||||

| Internet | Telephone | QR Code | |||||||||||||||||||||||||||||||||

| www.voteproxy.com | 1-800-776-9437 | Mail, sign, date and mail the proxy card in the enclosed return envelope | Scan this QR code to vote with your mobile device | ||||||||||||||||||||||||||||||||

Important Notice Regarding the Internet Availability of Proxy Materials for the Stockholder Meeting to be Held on June 5, 2023. The Notice of Annual Meeting, Proxy Statement, 2022 Annual Report and other SEC filings are made available on or about April 17, 2023 at the investor relations page of our website at www.rexfordindustrial.com. | |||||||||||||||||||||||||||||||||||

| 2023 PROXY STATEMENT | 5 | |||||||||||||

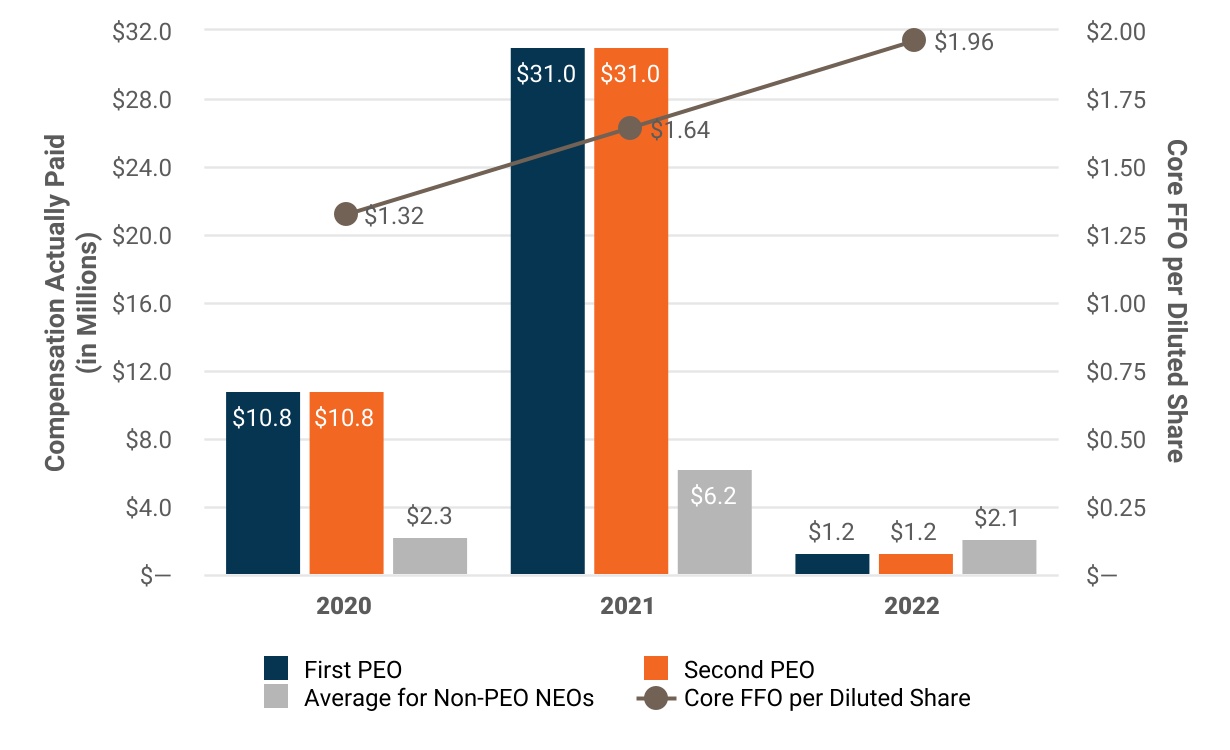

17% 5-Year Annual Average Dividend Per Share Growth | 106% 5-Year Total Shareholder Return | 22% 5-Year Net Income Per Diluted Share CAGR(1) | 15% 5-Year Core FFO Per Diluted Share CAGR(1)(2) | 32% 5-Year Consolidated NOI CAGR(1)(2) | ||||||||||

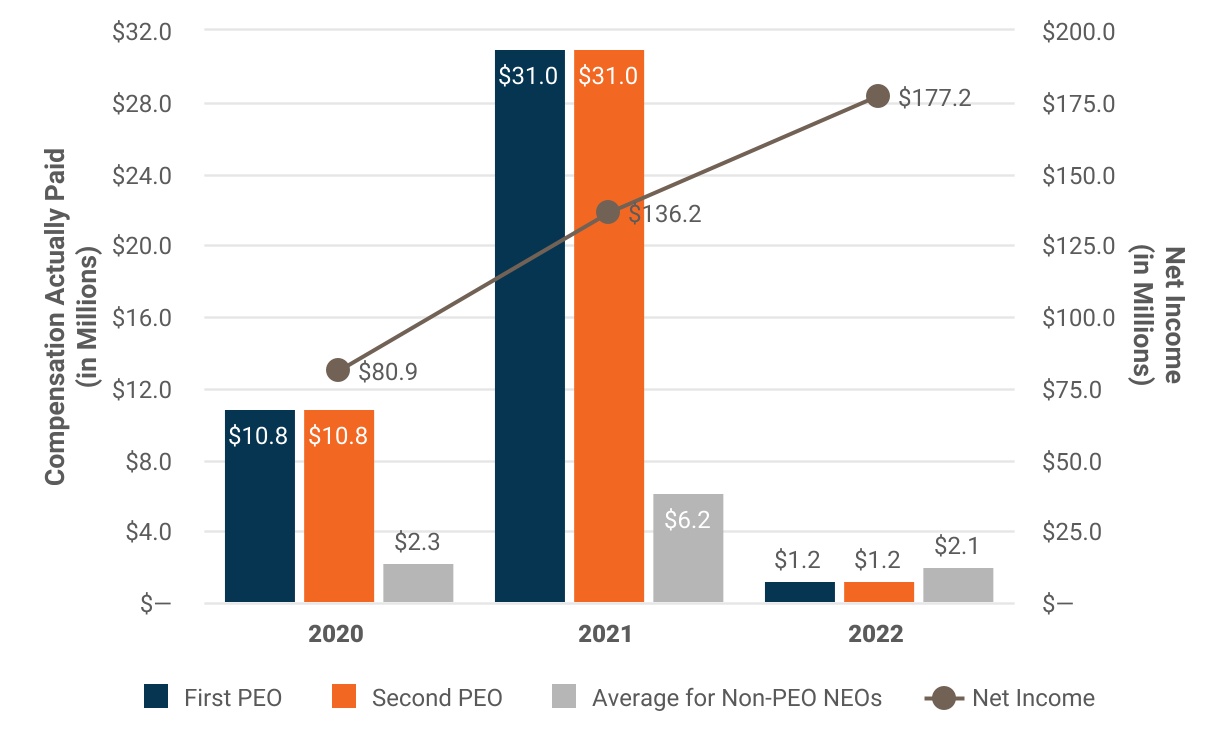

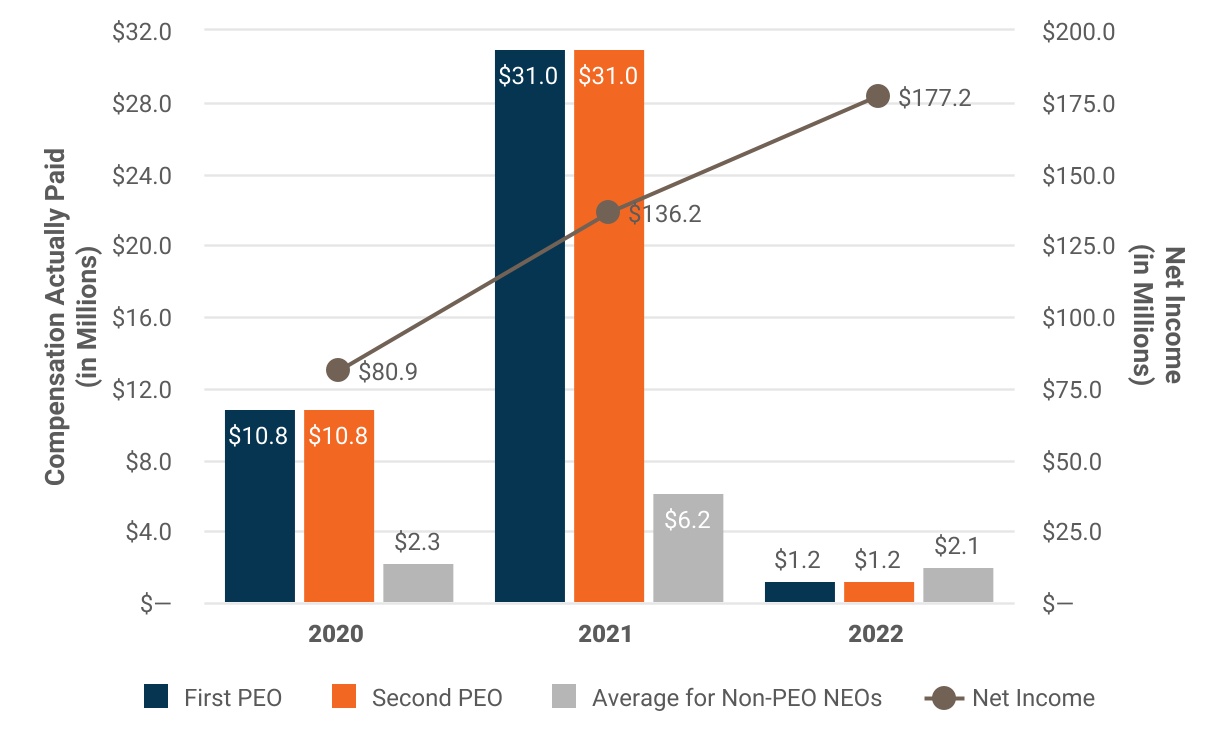

$177.2M 2022 Net Income (increase of 30% from 2021) | $365.5M 2022 FFO (increase of 44% from 2021) | $480.1M 2022 Consolidated NOI (increase of 40% from 2021) | 10.5% Same Property Portfolio Cash NOI Growth for FY 2022 | 98.7% Same Property Portfolio 2022 Weighted Average Occupancy | ||||||||||

$2.4B Aggregate purchase price of 61 properties acquired with 5.9 million square feet (SF) | 80.9% GAAP releasing spreads on over 5.1 million square feet of new and renewal leases | 8.9% Weighted average unlevered stabilized yield for 7 repositioning/redevelopment properties stabilized during 2022 | ||||||||||||

$1.0B Borrowing Capacity of unsecured revolving credit facility (upsized from $700M) | 14.9% Net Debt to Enterprise Value as of 12/31/22 | $2.5B Capital Raised to Fund Acquisitions ($1.8B Equity and $0.7B Debt) | BBB+/Baa2/BBB+ Credit ratings upgrades (S&P/Moody’s/Fitch) | ||||||||

6 | REXFORD INDUSTRIAL | |||||||||||||

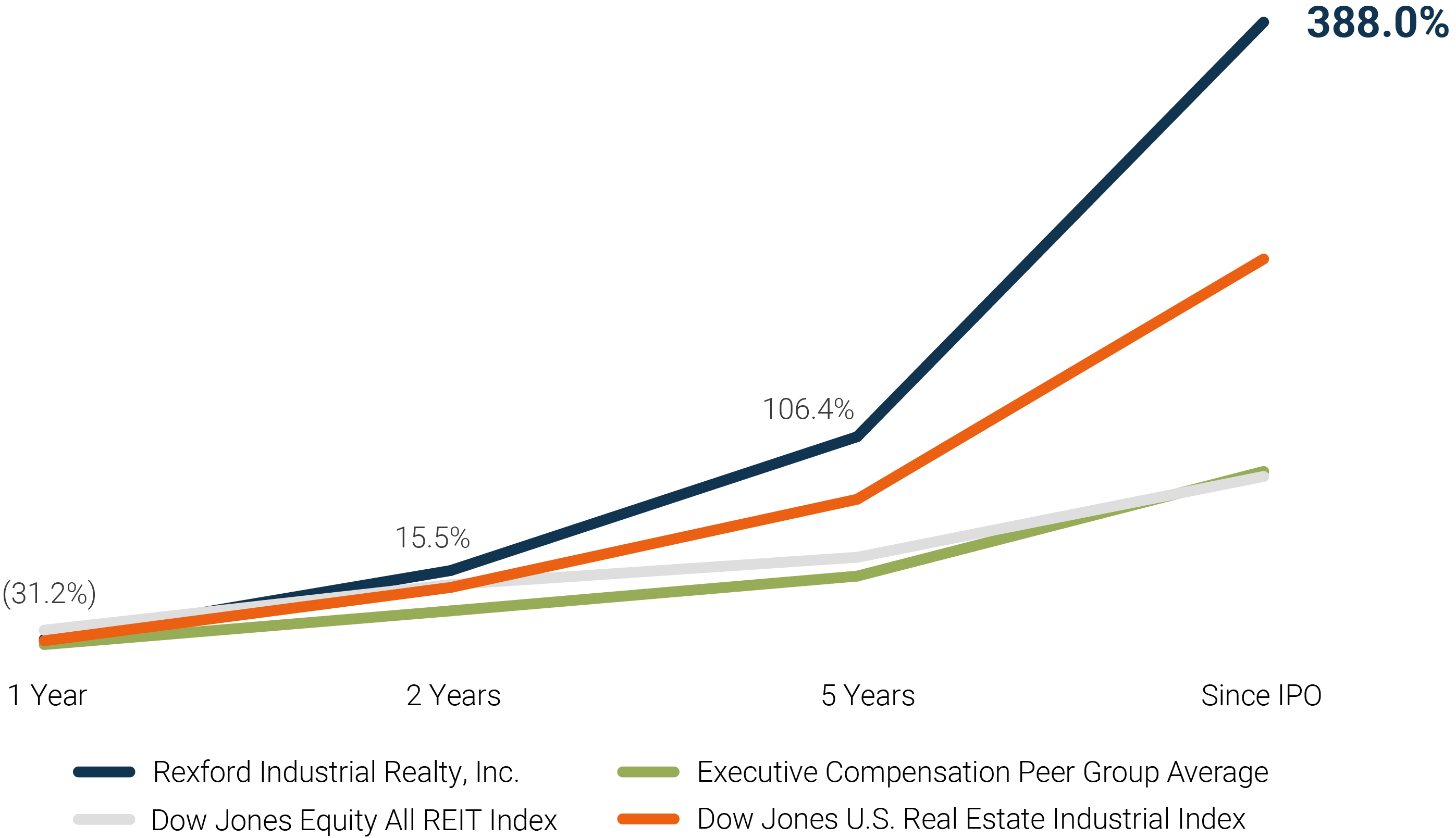

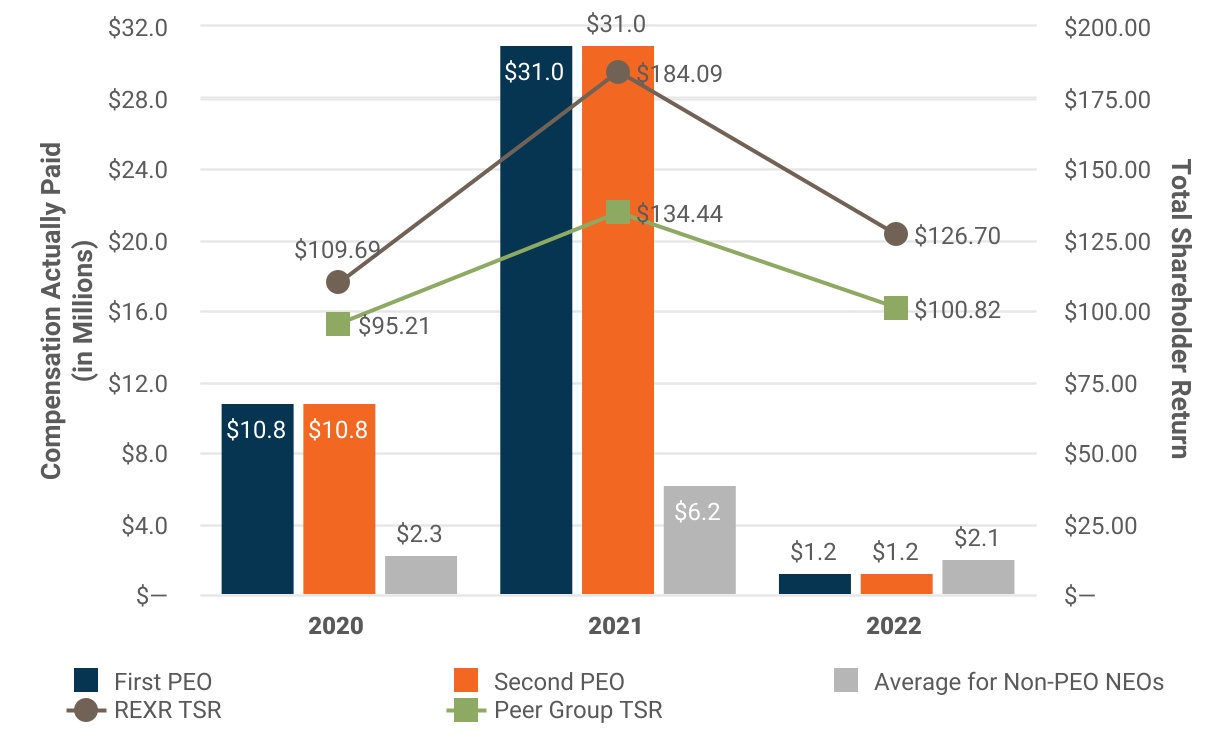

| Total Shareholder Return (% Change): | 1 Year(1) | 2 Years(1) | 5 Years(1) | Since IPO(1) | ||||||||||

| Rexford Industrial Realty, Inc. | (31.2 | %) | 15.5 | % | 106.4 | % | 388.0 | % | ||||||

Executive Compensation Peer Group Average(2) | (34.8 | %) | (11.9 | %) | 11.7 | % | 82.8 | % | ||||||

| Dow Jones Equity All REIT Index | (25.0 | %) | 5.9 | % | 24.5 | % | 79.4 | % | ||||||

| Dow Jones U.S. Real Estate Industrial Index | (32.2 | %) | 4.0 | % | 63.9 | % | 227.1 | % | ||||||

| 2023 PROXY STATEMENT | 7 | |||||||||||||

2022 ESG Goal Progress | Our 2022 ESG goals are aligned with the United Nations Sustainable Development Goals (SDGs). |  | ||||||||||||||||||

|  | ||||||||||||||||||||||

Environmental Stewardship | Culture of Respect and Excellence | ||||||||||||||||||||||

| Installed ~5 MW of solar to bring total portfolio to over 9MW |  |  | Ensured candidate slates included a minimum of 20% diverse candidates | |||||||||||||||||||

| Earned LEED Silver for all ground-up developments |  | Implemented employee resource group WIRE (Women in Real Estate) | ||||||||||||||||||||

Increased employee vacation time use and transitioned to an unlimited time off model | |||||||||||||||||||||||

| Continued development of our Science-based Targets initiative (SBTi) emissions reduction targets | ||||||||||||||||||||||

| Established a dedicated Department of Professional Excellence | ||||||||||||||||||||||

| |||||||||||||||||||||||

| Community Welfare | |||||||||||||||||||||||

Achieved an average of 20 training hours per employee | |||||||||||||||||||||||

| Exceeded 2021 Kingsley Survey score | ||||||||||||||||||||||

| Expanded board oversight over climate-related risks | ||||||||||||||||||||||

| Over 2,000 hours of employee community volunteer time | |||||||||||||||||||||||

| Submitted first CDP Climate Change Disclosure (formerly Carbon Disclosure Project) | |||||||||||||||||||||||

| |||||||||||||||||||||||

| Awarded Gold Green Lease Leader | |||||||||||||||||||||||

8 | REXFORD INDUSTRIAL | |||||||||||||

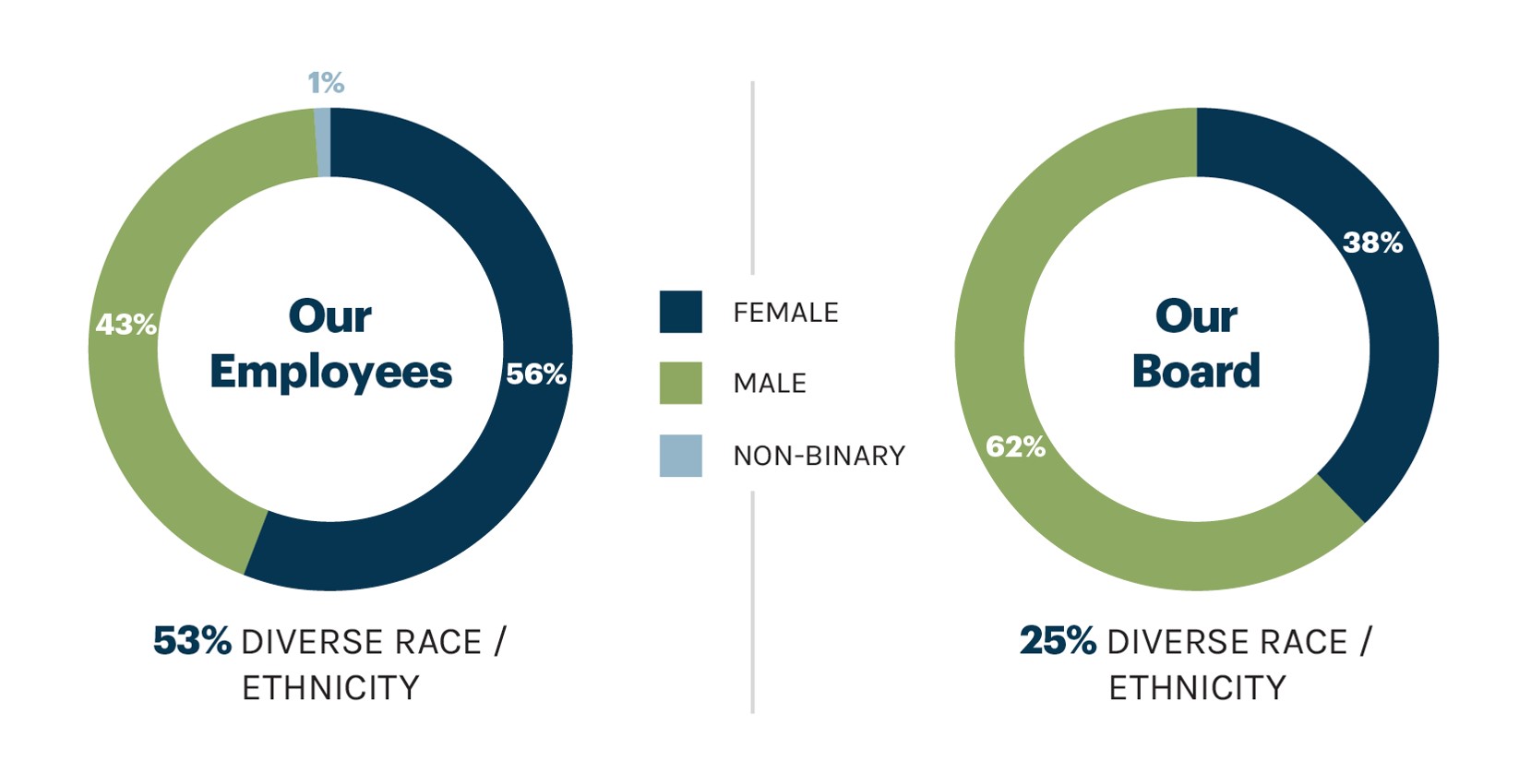

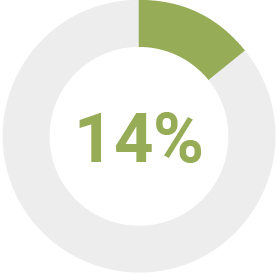

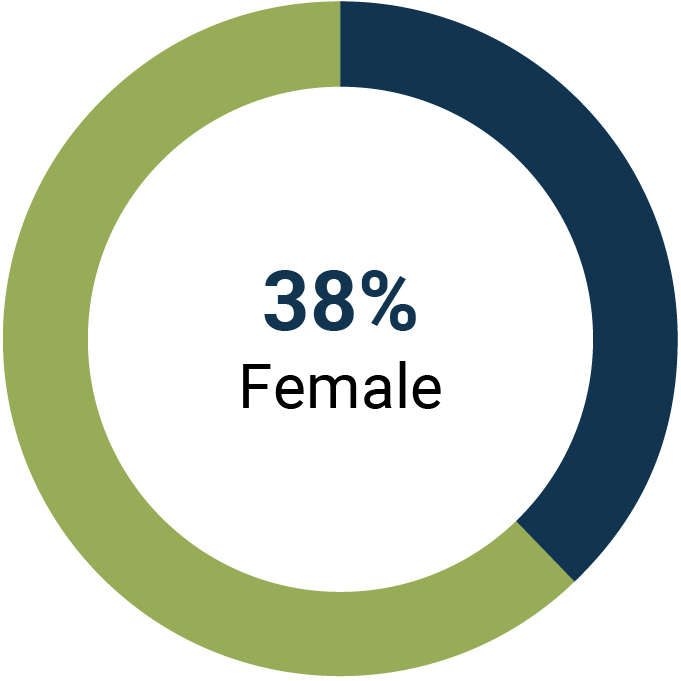

The value we create for our tenants, shareholders and communities is directly linked to our culture of inclusion. We empower employees to bring their best selves to work and to provide feedback on the direction of our business. In 2021, we increased gender diversity to over 30% on our board of directors. The Board includes three women and two members of underrepresented communities, enabling more effective governance through enhanced expertise and perspectives. |  | ||||||||||

Our hiring practices are connected with our ability to build a strong, diverse workforce. We have formalized our policy around diverse candidate slates and enhanced engagement with underrepresented communities through various avenues including jobs postings focused on enhancing our professional diversity network. This resulted in exceeding our goal to include a minimum 20% diverse candidate slate for every open position. Additional details regarding our employee population and EEO-1 data can be found on our corporate website. | |||||||||||

| 2023 PROXY STATEMENT | 9 | |||||||||||||

Code of Business Conduct and Ethics

Code of Business Conduct and Ethics Environment and Climate Change Policy

Environment and Climate Change Policy Diversity and Inclusion Policy

Diversity and Inclusion Policy Human Rights Policy

Human Rights Policy  Shareholder Rights Policy

Shareholder Rights Policy Cybersecurity Policy

Cybersecurity Policy Supplier Code of Conduct

Supplier Code of Conduct Green Development Guidelines

Green Development Guidelines Health and Safety Policy

Health and Safety Policy Stakeholder Engagement Policy

Stakeholder Engagement Policy10 | REXFORD INDUSTRIAL | |||||||||||||

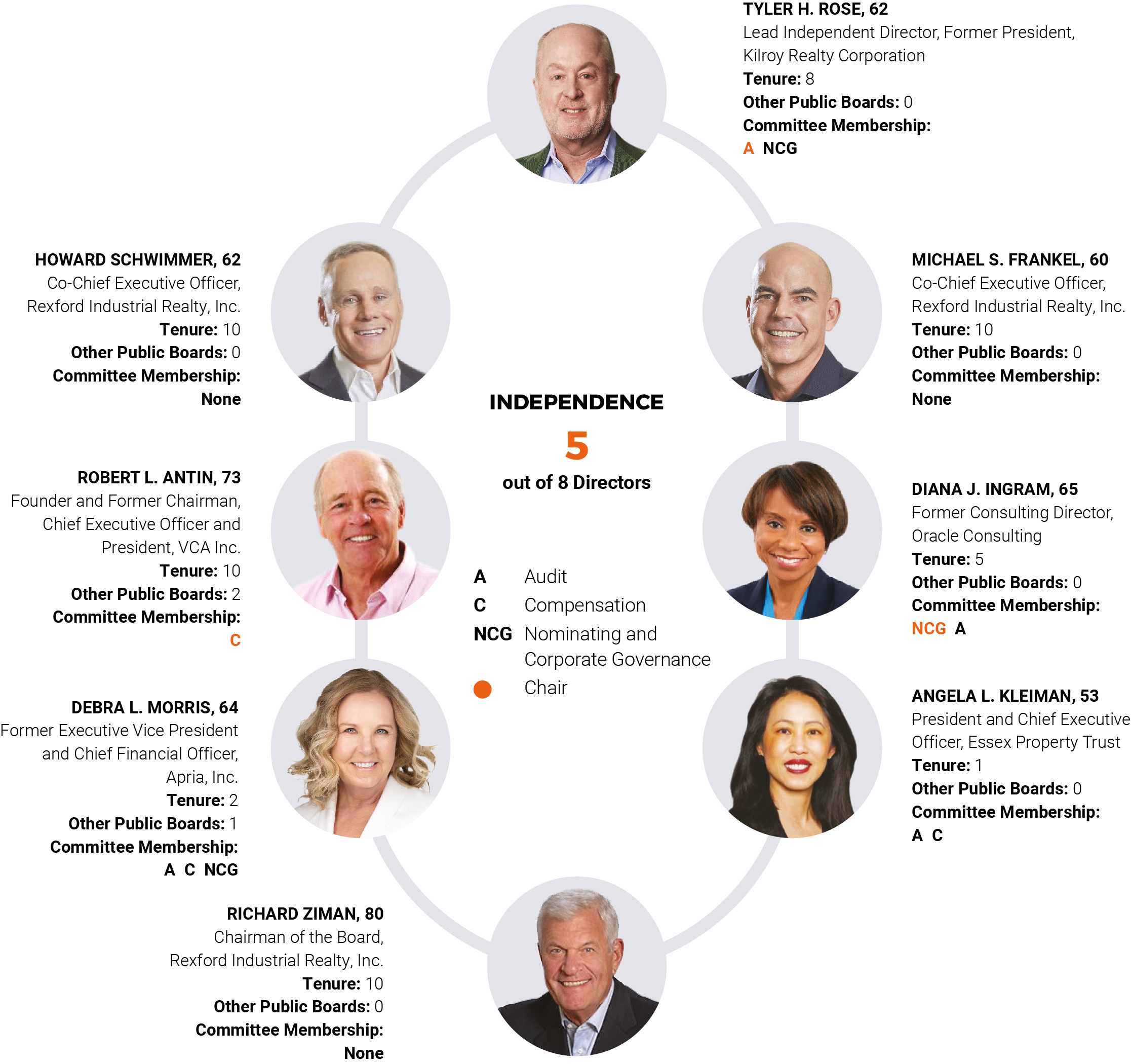

PROPOSAL NO. 1 Election of Directors |  “FOR” the eight nominees | ||||

PROPOSAL NO. 2 Ratification of Independent Registered Public Accounting Firm |  “FOR” the ratification of Ernst & Young LLP | ||||

PROPOSAL NO. 3 Advisory Vote on the Compensation of the Named Executive Officers (“Say-on-Pay Vote”) |  “FOR” the advisory approval of the compensation of the NEOs | ||||

| 2023 PROXY STATEMENT | 11 | |||||||||||||

12 | REXFORD INDUSTRIAL | |||||||||||||

| Board Structure and Independence | Shareholder Rights | Board Oversight | ||||||||||||||||||

•Separate Chairman and Co-CEOs •Strong Lead Independent Director •5 of 8 directors up for re-election are independent; Audit, Compensation and Nominating and Corporate Governance Committees each entirely comprised of independent directors •Executive sessions of independent directors held at every regular Board and committee meeting, presided over by Lead Independent Director •Diverse Board with three female directors and two racially/ethnically diverse directors •No familial relationships among Board members | •Annual election of directors •Majority voting for directors •Annual Say-on-Pay Advisory Vote •Shareholders satisfying the SEC Rule 14a-8 stock ownership levels ($2,000 to $25,000, depending on holding period) can propose amendments to our bylaws •No “poison pill” in effect | •Structured oversight of the Company’s corporate strategy and risk management •Corporate responsibility (ESG) strategy and initiatives and ethics and compliance program oversight by Nominating and Corporate Governance Committee •Climate change risk oversight by the Board •Cybersecurity oversight by Audit Committee •Annual self-assessment of Board and Board committee performance •Human capital management oversight by the Board | ||||||||||||||||||

| Accountability and Governance Practices | Executive Compensation | |||||||||||||||||||

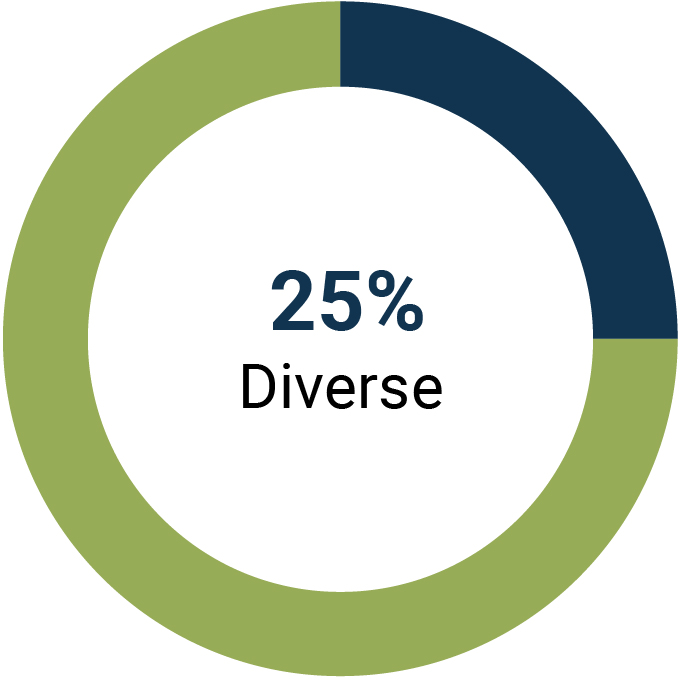

•Met or spoke with shareholders representing over 88% of our common stock in 2022 •Stock ownership policy for directors and senior management •Prohibition of hedging and pledging Company stock by officers and directors •Robust Code of Business Conduct and Ethics for directors, officers and employees | •Annual incentives for NEOs largely based on corporate financial results •Long term incentives for NEOs largely based on total shareholder return on an absolute and relative basis •Introduction of ESG compensation component in 2022 in annual incentive program for NEOs •Clawback policy for officers •No NEO “special grants” in 2022 •Double trigger vesting for new executive officers | |||||||||||||||||||

| 2023 PROXY STATEMENT | 13 | |||||||||||||

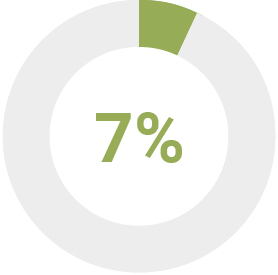

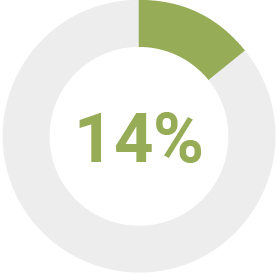

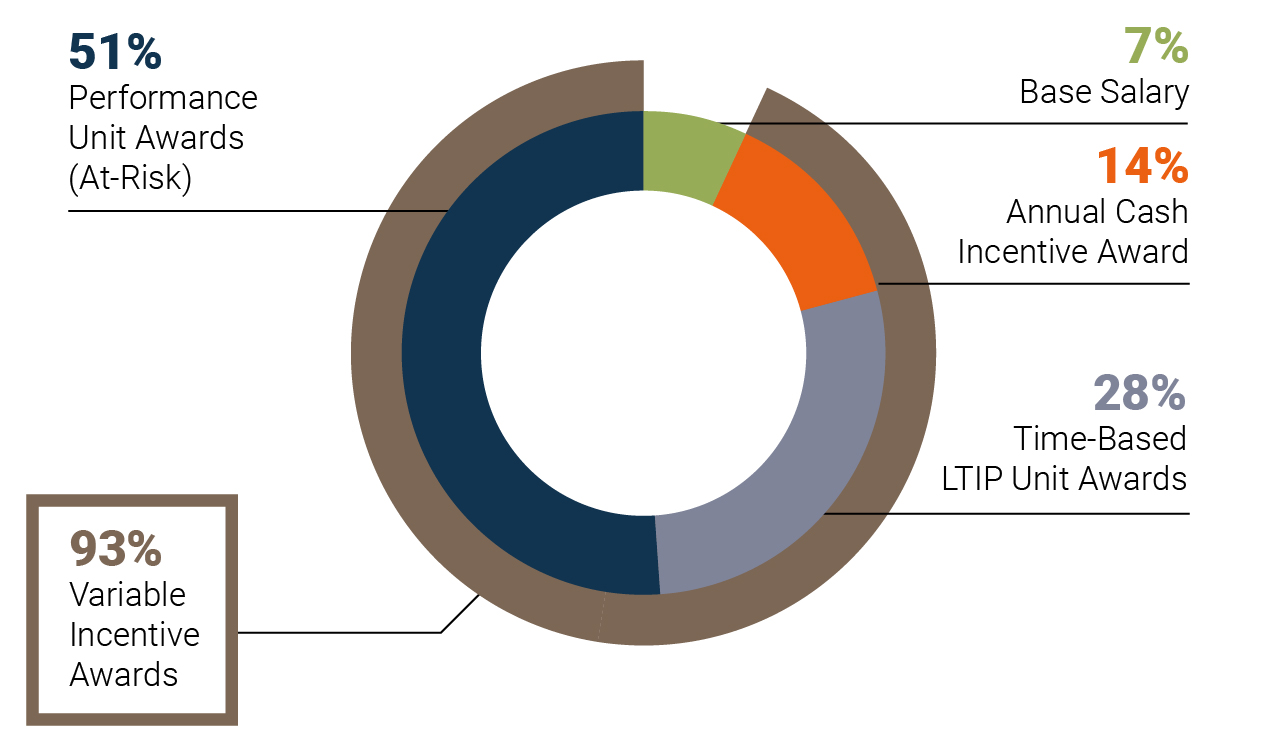

| % Allocation of Target Compensation | |||||||||||||||||||||||

| Component | CEO | Other NEOs (Average) | Features | ||||||||||||||||||||

| Fixed | Base Salary |  |  | •Set within a competitive range of base salaries paid to such comparable officers in the Executive Compensation Peer Group. | |||||||||||||||||||

Variable 93% of CEO target pay opportunity 86% of Other NEOs target pay opportunity | Annual Cash Incentive Award |  |  | •Based on attainment of Company performance goals for the year. •Pays out between 0% and 275% of base salary (100% if threshold goals met) for Co-CEOs and between 0% and 200% of base salary for the other NEOs. | |||||||||||||||||||

Time-Based LTIP Unit Awards |  |  | •Based on a detailed retrospective review of the Company’s overall annual performance and the compensation levels of the individual NEO in comparison to our Executive Compensation Peer Group. •Vest ratably over a three-year period. | ||||||||||||||||||||

Performance Unit Awards |  |  | •Based on rigorous absolute TSR hurdles, outperforming relative to our peers’ TSR and Core FFO per diluted share growth. •Pays out between 0% and 300% of target (50% of target if threshold goals met). | ||||||||||||||||||||

14 | REXFORD INDUSTRIAL | |||||||||||||

PROPOSAL NO. 1 Election of Directors At the Annual Meeting, our stockholders will elect eight directors to serve until our next annual meeting of stockholders and until their respective successors are elected and qualify. •The Board seeks directors who represent a mix of backgrounds and experiences that will enhance the quality of the Board’s deliberations and decisions. •In nominating candidates, the Board considers a diversified membership in the broadest sense, including persons diverse in experience, gender and ethnicity. •The Board does not discriminate on the basis of race, color, national origin, gender, religion, disability or sexual preference. Our director nominees were nominated by the Board based on the recommendation of the Nominating and Corporate Governance Committee. They were selected on the basis of outstanding achievement in their professional careers, broad experience, personal and professional integrity, their ability to make independent analytical inquiries, financial literacy, mature judgment, high performance standards, familiarity with our business and industry, and an ability to work collegially. We also believe that all of our director nominees have a reputation for integrity, honesty and adherence to high ethical standards. All nominees are presently directors of Rexford Industrial Realty, Inc. and each of the nominees has consented, if elected as a director, to serve until his or her term expires. | |||||||||||||||||

•Robert L. Antin* •Michael S. Frankel (Co-Chief Executive Officer) •Diana J. Ingram* •Angela L. Kleiman* | •Debra L. Morris* •Tyler H. Rose* (Lead Independent Director) •Howard Schwimmer (Co-Chief Executive Officer) •Richard Ziman (Chairman of the Board of Directors) | ||||||||||||||||

*Independent within the meaning of the New York Stock Exchange (“NYSE”) listing standards. Your proxy holder will cast your votes for each of the Board’s nominees, unless you instruct otherwise. If a nominee is unable to serve as a director, your proxy holder will vote for any substitute nominee proposed by the Board. | |||||||||||||||||

| The Board of Directors unanimously recommends that the stockholders vote “FOR” the eight nominees listed in this Proxy Statement. | |||||||||||||

| 2023 PROXY STATEMENT | 15 | |||||||||||||

| SKILLS/ EXPERIENCE |  |  |  |  |  |  |  |  | |||||||||||||||||||||

| CEO /Executive Management experience brings leadership qualifications and skills to help our Board advise, support and oversee our management team across a range of governance, strategic, operational and financial matters. |  |  |  |  |  |  |  |  | ||||||||||||||||||||

| Business Operations experience gives directors a practical understanding of developing, implementing and assessing our operating plan and business strategy. |  |  |  |  |  |  |  |  | ||||||||||||||||||||

| ESG experience strengthens our Board’s oversight of environmental, social, governance, enterprise risk and resilience matters to achieve strategic business imperatives and long-term value creation for shareholders within a sustainable business model. |  |  |  |  |  |  |  |  | ||||||||||||||||||||

| Other Public Company Board Service & Governance experience supports our goals of strong Board and management accountability, transparency and protection of shareholder interests. |  |  |  | |||||||||||||||||||||||||

| Technology experience provides an advantage in leveraging digital technology to drive competitive strategy, innovation, revenue growth and business performance. |  |  |  | |||||||||||||||||||||||||

| Financial/Capital Allocation experience is important in evaluating our financial statements and capital structure. |  |  |  |  |  |  |  | |||||||||||||||||||||

| Financial Expertise/Literacy experience is important because it assists our directors in understanding and overseeing our financial reporting and internal controls. |  |  |  |  |  |  |  |  | ||||||||||||||||||||

| REITs / Real Estate Industry experience is beneficial in understanding our investment opportunities, business model and structure and the issues facing real estate investment trusts. |  |  |  |  |  |  | ||||||||||||||||||||||

| Human Capital Management/Compensation experience assists our Board in overseeing executive compensation, succession planning and retaining talent. |  |  |  |  |  |  |  |  | ||||||||||||||||||||

16 | REXFORD INDUSTRIAL | |||||||||||||

| Robert L. Antin INDEPENDENT Founder and Former Chairman, Chief Executive Officer and President, VCA Inc. | ||||||||||

Age: 73 Director since: IPO Board committees: Compensation (Chair) | Other public company directorships: B. Riley Financial (NASDAQ: RILY); Heska Corporation (NASDAQ: HSKA) | ||||||||||

BACKGROUND •Board member since completion of 2013 IPO. •Founder of VCA Inc. (“VCA”), formerly a publicly traded national animal healthcare company purchased in 2017 by Mars Inc., providing veterinary services, diagnostic testing and various medical technology products and related services to the veterinary market. Served as a CEO and President at VCA since its inception in 1986, and served as the Chairman of the Board from inception through September 2017. •President, Chief Executive Officer, a Director and co-founder of AlternaCare Corp., a publicly held company that owned, operated and developed freestanding out-patient surgical centers from 1983-1985. •Officer of American Medical International, Inc., an owner and operator of health care facilities from 1978-1983. EDUCATION •Bachelor’s degree from the State University of New York at Cortland. •MBA with a certification in hospital and health administration from Cornell University. SKILLS AND QUALIFICATIONS Extensive experience as an executive at a public company which enables him to make significant contributions to the deliberations of the Board, especially in relation to operations, financings and strategic planning. | |||||||||||||||||||||||

| CEO/Executive Management |  | ESG |  | Financial/Capital Allocation |  | Human Capital Management/Compensation | ||||||||||||||||

| Business Operations |  | Other Public Company Board Service & Governance |  | Financial Expertise/Literacy | ||||||||||||||||||

| Michael S. Frankel Co-Chief Executive Officer, Rexford Industrial Realty, Inc. | ||||||||||

Age: 60 Director since: IPO | Other public company directorships: None | ||||||||||

BACKGROUND •Serves as Rexford Co-Chief Executive Officer and Board member since 2013 as part of Rexford formation transactions. •Served as Chief Financial Officer of one of the management companies acquired as part of our formation transactions and as Managing Partner of Rexford Industrial LLC and Rexford Sponsor LLC. •Career includes 19 years co-managing our predecessor and current businesses, which have exclusively focused on investing in infill Southern California industrial real estate. •Prior to Rexford: ◦Served with LEK Consulting, providing strategic advisory services to several of the world’s leading investment institutions. ◦Responsible for investments at the private equity firm “C3,” a subsidiary of the Comcast Corporation (NASD: CMCSA). ◦Vice President at Melchers & Co., a European-based firm, responsible for Melchers’ U.S.-Asia operations, principally based in Beijing. •Substantial international experience working in China, Southeast Asia and France, and speaks Mandarin and French. •Licensed real estate broker in the state of California and a member of the Urban Land Institute. •Serves on the Policy Advisory Board for the Fisher Center for Real Estate and Urban Economics at the University of California, Berkeley. EDUCATION •Bachelor of Arts degree in political economy from the University of California at Berkeley. •Masters of Business Administration from the Harvard Business School. SKILLS AND QUALIFICATIONS Extensive executive management and finance experience in the real estate industry and an extensive knowledge of our Company and our operations. | |||||||||||||||||||||||

| CEO/Executive Management |  | ESG |  | Financial Expertise/Literacy |  | Human Capital Management/Compensation | ||||||||||||||||

| Business Operations |  | Financial/Capital Allocation |  | REITs/Real Estate Industry | ||||||||||||||||||

| 2023 PROXY STATEMENT | 17 | |||||||||||||

| Diana J. Ingram INDEPENDENT Former Consulting Director, Oracle Consulting | ||||||||||

Age: 65 Director since: April 2018 Board committees: Nominating and Corporate Governance (Chair); Audit | Other public company directorships: None | ||||||||||

BACKGROUND •Senior business development, sales, and marketing leader with extensive background in information technology in the U.S., Latin American and global markets. •Served as Consulting Director at Oracle Consulting from 2015-2022, focused on helping corporate clients accelerate their transition to cloud computing and enhance their IT security posture. •Ran Ingram & Associates, an independent consulting firm based in Los Angeles from 2013-2015. •Executive Vice President and Head of Operations for the U.S. start-up of networking software company IBT /Realtime from 2012 to 2013. Held several key positions at IBM from 2004 to 2012, including Director of Security and Privacy Services, U.S.; Vice President of Global Sales for Wireless E-Business Solutions; Vice President of Telecommunications – Media Sector, Latin America and Director of Enterprise Content Management Software Sales, Americas. •Senior Vice President and General Manager of Operations, West Region at Kinko's Inc., now part of FedEx from 2002 to 2003., •Serves on the boards of directors of Goodwill of Southern California (also serving as chair of the Diversity, Equity and Inclusion Committee), ECMC Group, Inc. and UCLA Foundation. Previous board service includes the International Women’s Forum, Southern California affiliate, Big Brothers Big Sisters, Los Angeles, the Los Angeles Urban League and the Coalition for Clean Air. •Holds the Certified Information Systems Security Professional (CISSP) designation from the International Information System Security Certification Consortium (ISC)². EDUCATION •Bachelor of Arts degree from Stanford University. •Master of Business Administration from the Kellogg Graduate School of Management at Northwestern University. SKILLS AND QUALIFICATIONS Significant expertise in information technology and systems, service on other private boards and professional background and experience. | ||||||||||||||||||||

| CEO/Executive Management |  | ESG |  | Financial Expertise/Literacy | |||||||||||||||

| Business Operations |  | Technology |  | Human Capital Management/Compensation | |||||||||||||||

| Angela L. Kleiman INDEPENDENT President and Chief Executive Officer, Essex Property Trust | ||||||||||

Age: 53 Director since: December 2021 Board committees: Audit; Compensation | Other public company directorships: None | ||||||||||

BACKGROUND •President and Chief Executive Officer of Essex Property Trust (NYSE: ESS) (“Essex”), a fully integrated real estate investment trust (REIT) and an S&P 500 company, since April 1, 2023, after serving as Senior Executive Vice President and Chief Operating Officer since January 2021 and as Executive Vice President and Chief Financial Officer from 2015 to 2020 and managing the Essex Private Equity platform from 2009 to 2015. •Prior to joining Essex, held roles in institutional investment management and investment banking including Senior Equity Analyst and Vice President of Investor Relations at Security Capital and Vice President within J.P. Morgan's Real Estate & Lodging Investment Banking Group. •Began her career in real estate development management in 1991. •Member of the National Association of Real Estate Investment Trusts (NAREIT) and the National Multifamily Housing Council. EDUCATION •Bachelor of Science degree from Northwestern University. •Master of Business Administration degree from the Kellogg School of Management of Northwestern University. SKILLS AND QUALIFICATIONS Extensive real estate, finance and operations expertise and significant experience as an executive at a public real estate investment trust. | |||||||||||||||||||||||

| CEO/Executive Management |  | ESG |  | Financial/Capital Allocation |  | REITs/Real Estate Industry | ||||||||||||||||

| Business Operations |  | Technology |  | Financial Expertise/Literacy |  | Human Capital Management/Compensation | ||||||||||||||||

18 | REXFORD INDUSTRIAL | |||||||||||||

| Debra L. Morris INDEPENDENT Former Executive Vice President, Chief Financial Officer, Apria, Inc. | ||||||||||

Age: 64 Director since: December 2020 Board committees: Audit; Compensation | Other public company directorships: biote Corp. (Nasdaq: BTMD) | ||||||||||

BACKGROUND •Served as Executive Vice President, Chief Financial Officer of Apria, Inc., a leading provider of integrated home healthcare equipment and related services in the United States, from March 2013 through October 2022. •Served as Chief Financial Officer—Americas for SITEL Worldwide Corporation, a global leader in business processing outsourcing, from 2010 to 2013. •Served as a Partner of Tatum LLC, a national executive services firm, from 2004 to 2010 and as a Director from 2008 to 2010 and provided interim and permanent Chief Financial Officer services for companies contracted with Tatum LLC including Life Masters Supported Selfcare and RelaDyne. •From 1999 to 2002, Chief Financial Officer of Caliber Collision Centers. •Earlier career in progressively more responsible roles with CB Richard Ellis, including as Executive Vice President—Global Marketing and Integration and Executive Vice President—Global Chief Accounting Officer. •Currently serves on the board and chairs the Audit Committee of ALC Schools, a provider of alternative student transportation for school districts nationwide. EDUCATION •Bachelor of Science in Business Administration from Colby Sawyer College in New London, New Hampshire. SKILLS AND QUALIFICATIONS Extensive finance and accounting expertise and extensive leadership experience. | |||||||||||||||||

| CEO/Executive Management |  | ESG |  | Financial Expertise/Literacy | ||||||||||||

| Business Operations |  | Technology |  | REITs/Real Estate Industry | ||||||||||||

| Other Public Company Board Service & Governance |  | Financial/Capital Allocation |  | Human Capital Management/Compensation | ||||||||||||

| Tyler H. Rose LEAD INDEPENDENT DIRECTOR Former President, Kilroy Realty Corporation | ||||||||||

Age: 62 Director since: February 2015 Board committees: Audit (Chair); Nominating and Corporate Governance | Other public company directorships: None | ||||||||||

BACKGROUND •Appointed Lead Independent Director. •Served as President of Kilroy Realty Corporation (NYSE: KRC) (“Kilroy”) from 2020 to 2023 after serving as Executive Vice President and Chief Financial Officer since 2009 and Senior Vice President and Treasurer from 1997 to 2009. •Senior Vice President, Corporate Finance of Irvine Apartment Communities, Inc. from 1995 to 1997, and appointed Treasurer in 1996. •Vice President, Corporate Finance of The Irvine Company from 1994 to 1995. •Served in Real Estate Corporate Finance Group at J.P. Morgan & Co., from 1986-1992 and Vice President of the Australia Mergers and Acquisitions Group from 1992-1994. •Early in career, served as a financial analyst for General Electric Company. •Served on the Policy Advisory Board for the Fisher Center for Real Estate and Urban Economics at the University of California, Berkeley. EDUCATION •Bachelor of Arts degree in Economics from the University of California, Berkeley. •Business Administration degree from The University of Chicago Booth School of Business. SKILLS AND QUALIFICATIONS Extensive real estate, finance and accounting expertise and extensive experience as an executive at a public real estate investment trust. | |||||||||||||||||||||||

| CEO/Executive Management |  | ESG |  | Financial Expertise/Literacy |  | Human Capital Management/Compensation | ||||||||||||||||

| Business Operations |  | Financial/Capital Allocation |  | REITs/Real Estate Industry | ||||||||||||||||||

| 2023 PROXY STATEMENT | 19 | |||||||||||||

| Howard Schwimmer Co-Chief Executive Officer, Rexford Industrial Realty, Inc. | ||||||||||

Age: 62 Director since: IPO | Other public company directorships: None | ||||||||||

BACKGROUND •Serves as our Co-Chief Executive Officer and as a Board member since 2013 as part of our formation transactions. •Served as Co-Founder and Senior Managing Partner of Rexford predecessor business since December 2001 and President of one of the management companies acquired as part of Rexford formation transactions. •Served at various times as manager, executive vice president and broker of record for DAUM Commercial Real Estate from 1983-2001. •Forty-year professional career dedicated entirely and exclusively to Southern California infill industrial real estate, including its acquisition, value-add improvement, management, sales, leasing and disposition. •Extensive experience forming private and public real estate investment companies, managing real estate brokerage offices, serving on private, public and charitable boards and acquiring, repositioning, developing, leasing, selling and adding value to over 50 million square feet of industrial properties in Southern California. •Serves on the USC Lusk Center Real Estate Leadership Council, is a former Board Chair of USC Hillel, and is the Chair of the Los Angeles Jewish Federation, Real Estate Principals Organization. •Licensed California real estate broker. EDUCATION •Bachelor’s degree from the University of Southern California majoring in business with an emphasis in real estate finance and development. SKILLS AND QUALIFICATIONS Extensive executive management experience in the real estate industry and extensive knowledge of our Company and our operations. | |||||||||||||||||||||||

| CEO/Executive Management |  | ESG |  | Financial Expertise/Literacy |  | Human Capital Management/Compensation | ||||||||||||||||

| Business Operations |  | Financial/Capital Allocation |  | REITs/Real Estate Industry | ||||||||||||||||||

| Richard Ziman Chairman of the Board, Rexford Industrial Realty, Inc. | ||||||||||

Age: 80 Director since: IPO Board committees: None | Other public company directorships: None | ||||||||||

BACKGROUND •Serves as the Chairman of the Board since 2013 as part of the formation transactions in connection with IPO. •Served as the Co-Founder and Chairman of Rexford predecessor business from inception in 2001. •Industrial real estate experience comprises over forty years of industrial real estate investment experience overseeing his personal, family and foundation-related investments in Southern California. •Founding Chairman and CEO of Arden Realty, Inc., a real estate investment firm focused on the commercial office real estate markets in infill Southern California from 1990-2006, when it was sold to GE Real Estate. •Co-founded AVP Advisors, LLC and AVP Capital, LLC, the exclusive advisor to American Value Partners, a real estate fund of funds deploying capital on behalf of pension funds throughout the United States in 2006. •Serves on the boards of directors of The Rosalinde and Arthur Gilbert Foundation and The Gilbert Collection Trust. •Practiced law as a partner of the law firm Loeb & Loeb from 1971 to 1980, specializing in transactional and financial aspects of real estate. •Established and endowed the Richard S. Ziman Center for Real Estate at the Anderson Graduate School of Management at the University of California at Los Angeles in 2001. EDUCATION •Bachelor’s degree and Juris Doctor degree from the University of Southern California. SKILLS AND QUALIFICATIONS Extensive executive management experience in the industrial real estate industry and in public companies and extensive knowledge of our Company and our operations. | |||||||||||||||||||||||

| CEO/Executive Management |  | ESG |  | Financial/Capital Allocation |  | REITs/Real Estate Industry | ||||||||||||||||

| Business Operations |  | Other Public Company Board Service & Governance |  | Financial Expertise/Literacy |  | Human Capital Management/Compensation | ||||||||||||||||

20 | REXFORD INDUSTRIAL | |||||||||||||

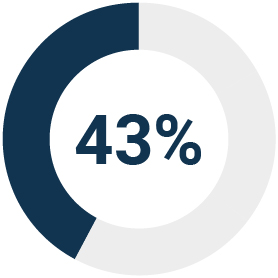

| GENDER | ETHNICITY/RACE | ||||

|  | ||||

| AGE | TENURE (YEARS) | ||||

|  | ||||

| 2023 PROXY STATEMENT | 21 | |||||||||||||

|  |  |  |  |  |  | |||||||||||||||||||||||||||||||||||||||||

| Review Desired Skills/Experience | Director Nominee Search | Evaluation of Candidates | Recommendations to Board | ||||||||||||||||||||||||||||||||||||||||||||

| The Nominating and Corporate Governance Committee will evaluate needs of the Board and Company, and consider any necessary updates to Board composition and planning. | Potential candidates are recommended by: •Directors •Senior Management •Search Firms •Shareholders | The Nominating and Corporate Governance Committee will evaluate potential qualified candidates and conduct interviews. | The Nominating and Corporate Governance Committee will analyze background, independence and other qualifications of candidates and recommend potential nominees to the Board. | ||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||

| Selection by Board | ||||||||||

| The Board will evaluate and select director nominees based on the recommendations by the Nominating and Corporate Governance Committee, including additional interviews if appropriate. | |||||||||||

22 | REXFORD INDUSTRIAL | |||||||||||||

Our Board is not classified, with each of our directors subject to re-election annually;

Our Board is not classified, with each of our directors subject to re-election annually; We have a lead independent director with a well-defined role and robust responsibilities;

We have a lead independent director with a well-defined role and robust responsibilities; Of the eight persons who currently serve on our Board, our Board has determined that five, or 62.5%, of our directors satisfy the listing standards for independence of the NYSE and Rule 10A-3 under the Exchange Act.

Of the eight persons who currently serve on our Board, our Board has determined that five, or 62.5%, of our directors satisfy the listing standards for independence of the NYSE and Rule 10A-3 under the Exchange Act. Three of our directors qualify as “audit committee financial experts” as defined by the SEC;

Three of our directors qualify as “audit committee financial experts” as defined by the SEC; We have opted out of the business combination and control share acquisition statutes in the Maryland General Corporation Law (the “MGCL”); and

We have opted out of the business combination and control share acquisition statutes in the Maryland General Corporation Law (the “MGCL”); and We do not have a stockholder rights plan.

We do not have a stockholder rights plan.| 2023 PROXY STATEMENT | 23 | |||||||||||||

Our Corporate Governance Guidelines provide that if the Chairman is not an Independent Director, the Board may annually appoint from amongst the Independent Directors a Lead Independent Director. Mr. Rose is currently our Lead Independent Director and brings to this role considerable skills and experience, as described above in his background section. The role of our Lead Independent Director is designed to further promote the independence of our Board and appropriate oversight of management and to facilitate free and open discussion and communication among the Independent Directors. The responsibilities of our Lead Independent Director are clearly delineated in our Corporate Governance Guidelines and include: •Advise on Board agenda, meeting materials and informational needs overseeing the conduct of the Company's business and evaluating whether the Company's business is being properly managed; •Advise on information flow to the Board between regular meetings, including the scope, quality, quantity and timeliness of such information; •Call and preside over executive sessions of the independent directors of the Board; •Communicate feedback from executive sessions of the independent directors of the Board to management and the Chair of the Board; and •Perform such other duties as the Board may delegate from time to time. We believe this current leadership structure with a Chairman and a Lead Independent Director enhances our Board’s ability to provide insight and direction on important strategic initiatives and, at the same time, promotes effective and independent oversight of management and our business. | ||||||||

24 | REXFORD INDUSTRIAL | |||||||||||||

The Board held four regularly scheduled meetings in 2022 to review significant developments, engage in strategic planning and act on matters requiring Board approval. Each incumbent director attended 100 percent of the Board meetings and the meetings of committees on which he or she served, during the period that he or she served in 2022. The Board also acted by unanimous written consent on three occasions. | |||||||||||

2022 Board Meetings 4 2022 Committee Meetings (Total) 9 2022 Director Attendance 100% | |||||||||||

Audit Committee Members Tyler H. Rose (Chair) Diana J. Ingram Debra L. Morris Angela Kleiman Attendance: 100% Meetings in 2022: 4 Acted by Unanimous Written Consent: 3 | We have adopted an Audit Committee charter, which details the principal functions of the Audit Committee, including oversight related to: •our accounting and financial reporting processes; •the integrity of our consolidated financial statements and financial reporting process; •our disclosure controls and procedures and internal control over financial reporting; •our compliance with financial, legal and regulatory requirements; •the evaluation of the qualifications, independence and performance of our independent registered public accounting firm; •the performance of our internal audit function; and •our overall risk profile. The Audit Committee is also responsible for engaging an independent registered public accounting firm, reviewing with the independent registered public accounting firm the plans and results of the audit engagement, approving professional services provided by the independent registered public accounting firm, including all audit and non-audit services, reviewing the independence of the independent registered public accounting firm, considering the range of audit and non-audit fees and reviewing the adequacy of our internal accounting controls. The Audit Committee is also responsible for the Audit Committee report included in this Proxy Statement. Our Board has determined that each of our Audit Committee members is “financially literate” as that term is defined by NYSE corporate governance listing standards. We have further determined that each of Mr. Rose, Ms. Kleiman and Ms. Morris qualify as an “audit committee financial expert” and Ms. Ingram qualifies as “financially literate” as those terms are defined by applicable SEC regulations and NYSE corporate governance listing standards. | |||||||

| 2023 PROXY STATEMENT | 25 | |||||||||||||

Compensation Committee Members Robert L. Antin (Chair) Debra L. Morris Angela Kleiman Attendance: 100% Meetings in 2022: 3 Acted by Unanimous Written Consent: 7 | We adopted a Compensation Committee charter, which details the principal functions of the Compensation Committee, including: •reviewing and approving, at least annually, the performance goals and objectives relevant to our Co-Chief Executive Officers’ compensation, evaluating our Co-Chief Executive Officers’ performance in light of such goals and objectives and determining and approving the remuneration of our Co-Chief Executive Officers based on such evaluation; •reviewing and approving the compensation of all of our other officers; •reviewing our executive compensation policies and plans; •implementing and administering our incentive compensation equity-based remuneration plans; •assisting management in complying with our Proxy Statement and annual report disclosure requirements; •producing a report on executive compensation to be included in our annual Proxy Statement (if required); and •reviewing, evaluating and recommending changes, if appropriate, to the remuneration for directors. The Compensation Committee may delegate its responsibilities to a subcommittee of the Compensation Committee. The Compensation Committee has the authority to retain legal and other advisors, to the extent it deems necessary or appropriate, and has retained Ferguson Partners Consulting (“Ferguson Consulting”) as its independent compensation consultant to provide the Compensation Committee with advice and guidance on the design and implementation of the Company’s executive compensation programs. Additional information concerning Ferguson Consulting and its services is set forth under “Executive Compensation-Compensation Discussion and Analysis.” | |||||||

Nominating and Corporate Governance Committee Members Diana J. Ingram (Chair) Debra L. Morris Tyler H. Rose Attendance: 100% Meetings in 2022: 2 Acted by Unanimous Written Consent: 3 | We adopted a Nominating and Corporate Governance Committee charter, which details the principal functions of the Nominating and Corporate Governance Committee, including: •identifying and recommending to the full Board qualified candidates for election as directors to fill vacancies on the Board or at any annual meeting of stockholders; •developing and recommending to the Board corporate governance guidelines and implementing and monitoring such guidelines; •reviewing and making recommendations on matters involving the general operation of the Board, including Board size and composition, and committee composition and structure; •recommending to the Board nominees for each committee of the Board of Directors; •facilitating the annual assessment of the Board’s performance as a whole and of the individual directors, as required by applicable law, regulations and NYSE corporate governance listing standards; •overseeing the Board’s evaluation of the performance of management; and •oversight of the Board’s evaluation of the ESG Committee, which oversight role was established pursuant to Board action. | |||||||

26 | REXFORD INDUSTRIAL | |||||||||||||

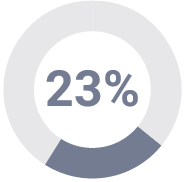

| WHO WE ENGAGED WITH |  | HOW WE ENGAGED |  | FEEDBACK | ||||||||||||||||||||||||

Stockholders representing  of our outstanding stock participated in meetings | •In-person and virtual one-on-one meetings with U.S. and international investors •Investor and industry conferences •Property tours •ESG focused meetings •Sell-side analysts meetings •Quarterly earnings conference calls | We consider and share our shareholder feedback and trends and developments about corporate governance matters and other various topics with our Board and its Committees as we seek to enhance our governance and sustainability practices and improve our public disclosures. | |||||||||||||||||||||||||||

| 2023 PROXY STATEMENT | 27 | |||||||||||||

BOARD The Board is primarily responsible for overseeing the Company’s risk management processes. A portion of this responsibility has been delegated by the Board to each of the committees of the Board with respect to the assessment of the Company’s risks and risk management in its respective areas of oversight. The focus of each of the committees with respect to risk management is highlighted below. | ||||||||||||||||||||||||||||||||

AUDIT COMMITTEE |  COMPENSATION COMMITTEE |  NOMINATING AND CORPORATE GOVERNANCE COMMITTEE | ||||||||||||||||||||||||||||||

•Has the responsibility to consider and discuss our major financial risk exposures and the steps our management has taken to monitor and control these exposures •Risk oversight includes climate related risk and cybersecurity •Monitors compliance with legal and regulatory requirements, in addition to oversight of the performance of our internal audit function •Is responsible for reviewing related party transactions as described below under “Review and Approval of Transaction with Related Persons” | •Assesses and monitors, with input from our management, whether any of our compensation policies and programs has the potential to encourage excessive risk-taking •Reviews our policies related to payment of salaries and wages, benefits, bonuses, stock-based compensation and other compensation-related practices and considers the relationship between risk management policies and practices, corporate strategy and compensation | •Oversees Board processes •Oversees governance-related risks •Monitors the effectiveness of our Corporate Governance Guidelines, including whether they are successful in preventing illegal or improper liability-creating conduct •Assesses disclosure of ESG and climate change matters •Oversees the Company’s culture, policies and strategies related to human capital management, including with respect to diversity and inclusion and pay equity | ||||||||||||||||||||||||||||||

MANAGEMENT Management identifies material risks, implements appropriate risk management strategies and integrates risk management into our Company processes and strategies. Management ensures that material risks are communicated to senior executives and the Board. | ||||||||||||||||||||||||||||||||

28 | REXFORD INDUSTRIAL | |||||||||||||

| 2023 PROXY STATEMENT | 29 | |||||||||||||

30 | REXFORD INDUSTRIAL | |||||||||||||

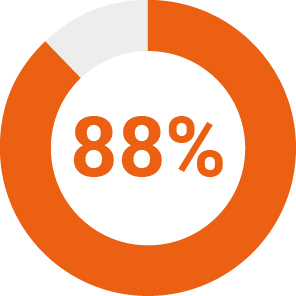

Name(1) | Fees Earned or Paid in Cash ($)(3) | Stock Awards ($)(4) | Total ($) | |||||||||||||||||

| Robert L. Antin | 100,000 | 139,998 | 239,998 | |||||||||||||||||

| Diana J. Ingram | 100,000 | 139,998 | 239,998 | |||||||||||||||||

| Angela L. Kleiman | 97,993 | 139,998 | 237,991 | |||||||||||||||||

| Debra L. Morris | 107,993 | 139,998 | 247,991 | |||||||||||||||||

| Tyler H. Rose | 122,500 | 139,998 | 262,498 | |||||||||||||||||

Peter E. Schwab(2) | 50,996 | — | 50,996 | |||||||||||||||||

| Richard Ziman | 155,000 | 139,998 | 294,998 | |||||||||||||||||

In December 2021, we adopted revised stock ownership guidelines for our non-employee directors that increased their respective stock ownership requirements. Pursuant to the revised guidelines, our non-employee directors are required to hold a number of shares of Company stock having a market value equal to or greater than five times their annual cash retainer (not including any additional committee retainers and/or lead independent director retainers), increased from the prior requirement of three times their annual cash retainer. Our current non-employee directors have until December 31, 2026 to achieve these stock ownership requirements or, in the case of a new non-employee director, five years from his or her initial election to the Board. As of April 17, 2023, all our non-employee directors satisfied the stock ownership guidelines or had time remaining under the five-year period since first becoming a director to acquire the applicable level of ownership. | |||||||||||

DIRECTOR STOCK OWNERSHIP GUIDELINES 5x Annual cash retainer | |||||||||||

| 2023 PROXY STATEMENT | 31 | |||||||||||||

PROPOSAL NO. 2 Ratification of Independent Registered Public Accounting Firm The Audit Committee appointed Ernst & Young LLP as our independent registered public accounting firm to audit our consolidated financial statements for the fiscal year ending December 31, 2023. Ernst & Young LLP has served as our independent registered public accounting firm since 2012, prior to our initial public offering. In order to ensure continuing auditor independence, the Audit Committee and Ernst & Young LLP rotate the lead audit engagement partner every five years. Annual Evaluation and Selection of Independent Auditors The Audit Committee reviews the performance of the independent registered public accounting firm annually. In making the determination to re-appoint Ernst & Young LLP for 2023, the Audit Committee considered, among other factors, the independence and performance of Ernst & Young LLP, the appropriateness of Ernst & Young LLP’s fees and the quality and candor of Ernst & Young’s communications with the Audit Committee and management. Benefits of Tenure The Audit Committee and the Board believe that the continued retention of Ernst & Young LLP to serve as our independent public accountant is in the best interest of the company and our stockholders. The benefits of tenure include the following: •Higher audit quality through deeper knowledge of our business, accounting policies and practices, and internal control over financial reporting. •Consistency in critical focus areas and communications to Audit Committee and Board. We expect that representatives of Ernst & Young LLP will attend the Annual Meeting and will have the opportunity to make a statement if they so desire and to respond to appropriate questions. Although stockholder ratification is not required, the appointment of Ernst & Young LLP is being submitted for ratification at the Annual Meeting with a view towards soliciting stockholders’ opinions, which the Audit Committee will take into consideration in future deliberations. If Ernst & Young LLP’s selection is not ratified at the Annual Meeting, the Audit Committee will consider the engagement of another independent registered accounting firm. The Audit Committee may terminate Ernst & Young LLP’s engagement as our independent registered public accounting firm without the approval of our stockholders whenever the Audit Committee deems termination appropriate. | ||||||||||||||

| Our Board of Directors recommends a vote “FOR” the ratification of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2023. | |||||||||||||

32 | REXFORD INDUSTRIAL | |||||||||||||

| Fiscal Year Ended December 31 | ||||||||||||||

| 2022 | 2021 | |||||||||||||

| Audit Fees | $ | 1,482,000 | $ | 1,382,000 | ||||||||||

| Audit-Related Fees | 2,000 | 2,000 | ||||||||||||

| Tax Fees | 753,000 | 661,000 | ||||||||||||

| All Other Fees | — | — | ||||||||||||

| Total Fees | $ | 2,237,000 | $ | 2,045,000 | ||||||||||

| 2023 PROXY STATEMENT | 33 | |||||||||||||

34 | REXFORD INDUSTRIAL | |||||||||||||

PROPOSAL NO. 3 Advisory Vote on the Compensation of the Named Executive Officers (“Say-on-Pay Vote”) As required by Section 14A of the Exchange Act, we are providing our stockholders with a vote at the Annual Meeting to approve, on an advisory basis, the compensation of the Company’s named executive officers as disclosed in this Proxy Statement pursuant to the compensation disclosure rules of the SEC. The stockholder vote on named executive officer compensation, commonly known as a “say-on-pay” vote, is an advisory recommendation only, and it is not binding on the Company or our Board or Compensation Committee. At our 2022 annual meeting of stockholders, the Company’s stockholders recommended, on an advisory basis, that the “say-on-pay” vote occur every year. In light of the foregoing recommendation, the Company has determined to continue to hold a “say-on-pay” advisory vote every year. Unless the Board modifies its determination on the frequency of future “say-on-pay” advisory notes, our next advisory “say-on-pay” vote (following the non-binding “say-on-pay” advisory vote at this Annual Meeting) is expected to occur at our 2024 annual meeting of stockholders. As described more fully in the “Compensation Discussion and Analysis” section of this Proxy Statement, our executive compensation program is designed to enable us to attract, motivate and retain individuals with superior ability, experience and leadership capability to deliver on our annual and long-term business objectives necessary to create long-term stockholder value. We encourage stockholders to read the “Compensation Discussion and Analysis” section of this Proxy Statement, which describes in detail how our executive compensation policies and procedures operate and are intended to operate in the future. We are asking our stockholders to indicate their support for our named executive officer compensation as described in this Proxy Statement. This proposal gives our stockholders the opportunity to express their views on our named executive officers’ compensation. This vote is not intended to address any specific item of compensation, but rather the overall compensation of our named executive officers and the philosophy, policies and practices described in this Proxy Statement. As an advisory approval, this proposal is not binding upon us or our Board. However, the Compensation Committee, which is responsible for the design and administration of our executive compensation program, values the opinions of our stockholders expressed through the vote on this proposal. The Compensation Committee will consider the outcome of this vote in making future compensation decisions for our named executive officers. Accordingly, we ask that our stockholders vote “FOR” the following resolution: | ||||||||||||||

“RESOLVED, that the stockholders of Rexford Industrial Realty, Inc. approve, on an advisory basis, the compensation of Rexford Industrial Realty’s named executive officers for the year ended December 31, 2022, as described in the Compensation Discussion & Analysis and disclosed in the Summary Compensation Table and related compensation tables and narrative disclosure set forth in Rexford Industrial Realty’s Proxy Statement.” | ||||||||||||||

| Our Board of Directors unanimously recommends that stockholders vote “FOR” the advisory resolution approving the compensation of the named executive officers for the fiscal year ended December 31, 2022, as more fully disclosed in this Proxy Statement. | |||||||||||||

| 2023 PROXY STATEMENT | 35 | |||||||||||||

| Name | Position | Age | ||||||

| Howard Schwimmer | Co-Chief Executive Officer and Director | 62 | ||||||

| Michael S. Frankel | Co-Chief Executive Officer and Director | 60 | ||||||

| Laura Clark | Chief Financial Officer | 43 | ||||||

| David Lanzer | General Counsel and Secretary | 50 | ||||||

Laura Clark Chief Financial Officer Age: 43 | BACKGROUND •Serves as our Chief Financial Officer since September 2020. •Served as Senior Vice President, Capital Markets at Regency Centers, (NASDAQ: REG) a publicly traded retail real estate investment trust and S&P 500 Index member from 2017-2020 and Vice President, Financial Services from 2012-2017, overseeing all operational analysis, budgeting and reporting for the West region portfolio. •Prior roles include institutional sales and equity research at Green Street Advisors, Vice President, Capital Markets at Iron Tree Capital and Vice President at Inland Capital Markets Group. •Holds the Chartered Financial Analyst (CFA) designation. •Brings to the Company 21 years of finance, accounting, real estate and operations experience. EDUCATION •Bachelor of Science degree in finance from DePaul University Chicago. •Master of Business Administration degree from Ball State University. | |||||||

David Lanzer General Counsel and Secretary Age: 50 | BACKGROUND •Serves as our General Counsel and Secretary since March 2016. •Served as First Vice President and Senior Counsel of Prologis, Inc. (NYSE: PLD), the world’s largest industrial real estate investment trust from 2010-2016. •Served as Vice President and Deputy General Counsel and a Market Officer at Lauth Group, Inc., a privately held, national development and construction firm that has developed in excess of $3 billion of industrial, office, retail and healthcare projects across the United States from 2002-2009. •Began legal career as an attorney with the Indianapolis law firm of Wooden & McLaughlin LLP. •Brings to the Company 25 years of real estate and legal experience. EDUCATION •Bachelor of Arts, with distinction, in Political Science at Purdue University, West Lafayette. •Doctor of Jurisprudence at Indiana University, Bloomington. | |||||||

36 | REXFORD INDUSTRIAL | |||||||||||||

|  |  |  | |||||||||||||||||

Howard Schwimmer | Michael S. Frankel | Laura Clark | David Lanzer | |||||||||||||||||

Co-Chief Executive Officer | Co-Chief Executive Officer | Chief Financial Officer | General Counsel and Secretary | |||||||||||||||||

| 2023 PROXY STATEMENT | 37 | |||||||||||||

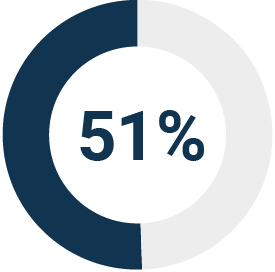

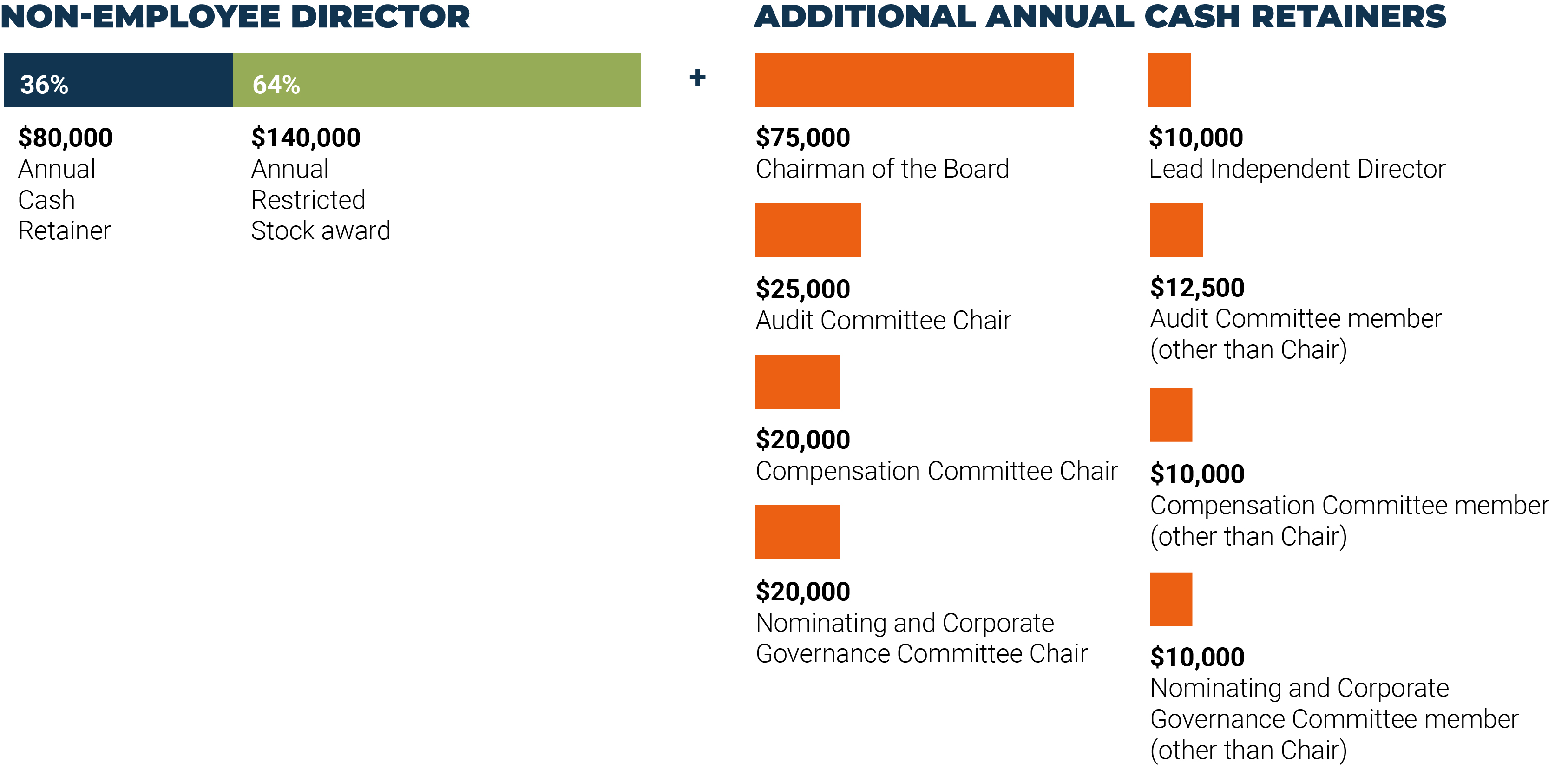

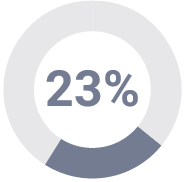

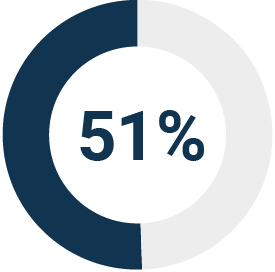

| Pay Element Allocation | Compensation Type | ||||||||||||||||||||||||||||||||||

| CEO | Average Other NEOs | Objective | Key Characteristics | ||||||||||||||||||||||||||||||||

|  |  |  | Fixed Cash | Provide base pay level that is commensurate with our NEOs’ positions and provide competitive fixed pay to attract and retain our NEOs. | Reviewed annually and adjusted when appropriate. | |||||||||||||||||||||||||||||

|  |  |  | Variable Incentive Cash and Equity | Incentivize the attainment of short-term Company objectives (that align the interests of our NEOs with those of our stockholders) and individual contributions to the achievement of those objectives for the year. | Variable compensation weighted 80% on pre-established quantitative measures: •Core FFO per diluted Share (40%) •Consolidated Portfolio NOI Growth (40%) Weighted 20% on qualitative measures. | |||||||||||||||||||||||||||||

| Service-Vesting LTIP Units | Variable Incentive Equity | Align the interests of NEOs with long-term stockholder value. Promote retention by requiring continued employment over a multi-year period as a condition to vesting. | •Grant size was determined based on a detailed retrospective review of the Company’s overall annual performance and the compensation levels of the individual NEO in comparison to our Executive Compensation Peer Group. •Vest ratably over a three-year period. | |||||||||||||||||||||||||||||||

|  | ||||||||||||||||||||||||||||||||||

| Performance-Vesting LTIP Units | Variable Incentive At-Risk Equity | Motivate and reward NEOs for performance on key long-term measures. Enhance the overall pay-for-performance structure of our executive compensation program and align the interests of NEOs with long-term stockholder value. Promote retention by requiring continued employment over a multi-year performance period. | Only provides tangible value upon the creation of meaningful long-term stockholder value and growth in Core FFO per diluted share above specified hurdles over a three-year performance period. 2022 awards are based on achievement of: •Company’s absolute TSR •Company’s TSR performance relative to a peer group (the Dow Jones Equity All REIT Index) •Company’s growth in Core FFO per diluted share •Cliff vest following the end of a three-year performance period. | ||||||||||||||||||||||||||||||||

|  | ||||||||||||||||||||||||||||||||||

38 | REXFORD INDUSTRIAL | |||||||||||||

| 2023 PROXY STATEMENT | 39 | |||||||||||||

WHAT WE DO | WHAT WE DON’T DO | |||||||

Align compensation design and practices with stockholder long-term interests and pay and performance Align compensation design and practices with stockholder long-term interests and pay and performance |  Maintain compensation programs that encourage excessive risk taking Maintain compensation programs that encourage excessive risk taking | |||||||

Provide significant variable pay linked to performance Provide significant variable pay linked to performance |  Allow hedging or pledging of company stock Allow hedging or pledging of company stock | |||||||

Use an independent compensation consultant Use an independent compensation consultant |  Provide excise tax gross-ups Provide excise tax gross-ups | |||||||

Review our peer group annually Review our peer group annually |  Pay any significant or excessive perquisites Pay any significant or excessive perquisites | |||||||

Double-trigger change-in-control provisions Double-trigger change-in-control provisions | ||||||||

Minimum stock ownership guidelines Minimum stock ownership guidelines | ||||||||

Have a compensation clawback policy for NEOs Have a compensation clawback policy for NEOs | ||||||||

Regular engagement with investors Regular engagement with investors | ||||||||

Motivate, attract and retain qualified executives who drive, and who are committed to, the Company’s mission, performance and culture. | + | Create a fair, reasonable and balanced compensation program that rewards NEOs’ performance and contributions to the Company while closely aligning the interests of the NEOs with the long-term interests of the Company and its stockholders. | + | Provide total direct compensation to our NEOs that is competitive with total direct compensation paid by real estate investment trusts comparable to our Company in order to enhance the Company’s retention of key executives and to contribute towards the maintenance of a positive, team-oriented corporate culture. | ||||||||||

40 | REXFORD INDUSTRIAL | |||||||||||||

| 2023 PROXY STATEMENT | 41 | |||||||||||||

Peers removed from the Executive Compensation Peer Group | Peers added to the Executive Compensation Peer Group | |||||||||||||||||||

| - | + | |||||||||||||||||||

•Duke Realty Corporation •PS Business Parks, Inc. •VEREIT, Inc. | •AvalonBay Communities, Inc. •Medical Properties Trust, Inc. •Sun Communities, Inc. | |||||||||||||||||||

| Company | Implied Equity Market Cap ($ million)(1) | Peer Based on Size Parameter of $3B - $40B | Peer Based on Industrial Portfolio Parameter | |||||||||||||||||

| Alexandria Real Estate Equities, Inc. | 23,902.6 | ü | ||||||||||||||||||

| AvalonBay Communities, Inc. | 22,566.1 | ü | ||||||||||||||||||

| Sun Communities, Inc. | 18,063.6 | ü | ||||||||||||||||||

| Boston Properties, Inc. | 11,824.5 | ü | ||||||||||||||||||

| Rexford Industrial Realty, Inc. | 10,348.5 | |||||||||||||||||||

STORE Capital Corporation Inc.(2) | 9,049.5 | ü | ü | |||||||||||||||||

| Americold Realty Trust, Inc. | 7,626.7 | ü | ü | |||||||||||||||||

| Medical Properties Trust, Inc. | 6,661.7 | ü | ||||||||||||||||||

| First Industrial Realty Trust. Inc. | 6,524.6 | ü | ü | |||||||||||||||||

| East Group Properties Trust, Inc. | 6,451.8 | ü | ü | |||||||||||||||||

| STAG Industrial Inc. | 5,841.2 | ü | ü | |||||||||||||||||

| Kilroy Realty Corporation | 4,564.1 | ü | ||||||||||||||||||

| Terreno Realty Corporation | 4,281.3 | ü | ü | |||||||||||||||||

| Vornado Realty Trust | 4,265.8 | ü | ||||||||||||||||||

| Douglas Emmett, Inc. | 3,239.3 | ü | ||||||||||||||||||

| LXP Industrial Trust | 2,771.2 | ü | ü | |||||||||||||||||

| SL Green Realty Corp. | 2,179.1 | ü | ||||||||||||||||||

| Kennedy-Wilson Holdings, Inc. | 2,167.4 | ü | ||||||||||||||||||

| Hudson Pacific Properties, Inc. | 1,387.3 | ü | ||||||||||||||||||

42 | REXFORD INDUSTRIAL | |||||||||||||

| 2023 PROXY STATEMENT | 43 | |||||||||||||

| Named Executive Officer | 2021 Base Salaries | 2022 Base Salaries | Year-over-Year Base Salary Increase (2021-22) | ||||||||||||||

| Howard Schwimmer | $750,000 | $825,000 | 10 | % | |||||||||||||

| Michael S. Frankel | $750,000 | $825,000 | 10 | % | |||||||||||||

| Laura Clark | $500,000 | $575,000 | 15 | % | |||||||||||||

| David Lanzer | $425,000 | $475,000 | 12 | % | |||||||||||||

| Named Executive Officer | Threshold | Target | Maximum | ||||||||

| Howard Schwimmer | 100 | % | 200 | % | 275 | % | |||||

| Michael S. Frankel | 100 | % | 200 | % | 275 | % | |||||

| Laura Clark | 100 | % | 150 | % | 200 | % | |||||

| David Lanzer | 100 | % | 125 | % | 200 | % | |||||

44 | REXFORD INDUSTRIAL | |||||||||||||

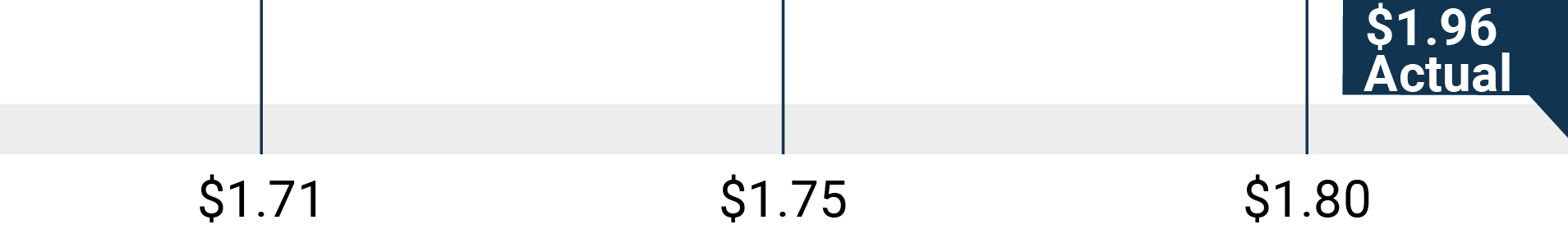

Performance Criteria(1) | Weighting | Threshold | Target | Maximum | ||||||||||

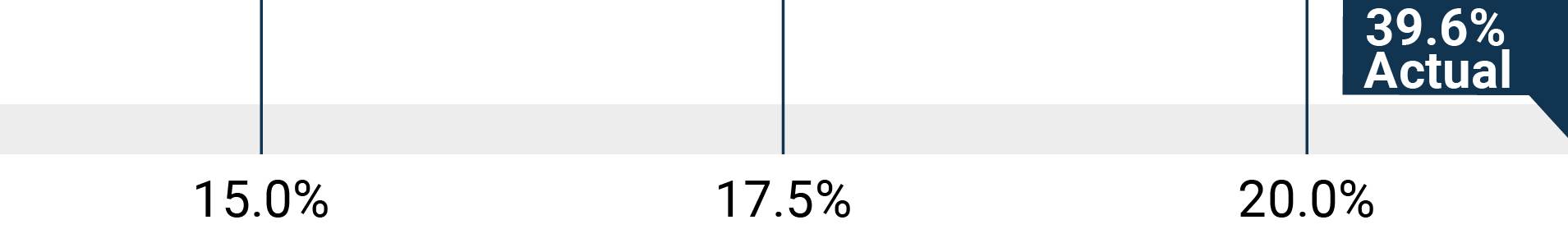

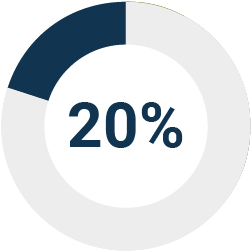

Core FFO per Diluted Share(2) |  |  | ||||||||||||

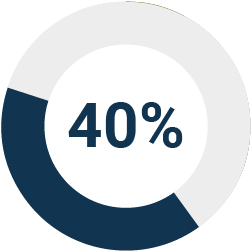

Consolidated Portfolio NOI Growth(3) |  |  | ||||||||||||

| Qualitative |  | Qualitative measurement considerations included favorable positioning of the Company for future growth, capital structure and balance sheet management, commitment to and development of ESG goals and management of the Company while emerging from the COVID-19 pandemic. | ||||||||||||

| 2023 PROXY STATEMENT | 45 | |||||||||||||

| Qualitative Performance Criteria | 2022 Achievements | |||||||

| Favorable positioning of the Company for future growth | •Completed 52 acquisitions representing 61 properties and 5.9 million RSF for an aggregate purchase price of $2.4 billion, in which 90% of transactions were executed through off-market or lightly-marketed transactions. •Stabilized seven of our repositioning and redevelopment properties with a combined 0.6 million rentable square feet at a weighted average unlevered stabilized yield of 8.9%. •Demonstrated strength in leasing activity with the execution of over 5.1 million square feet of new and renewal leases with aggregate GAAP re-leasing spreads of 80.9%. •As a result of strong leasing activity, achieved Same Property Portfolio occupancy of 98.1% as of December 31, 2022. •Enabled the Rexford team to achieve our performance objectives while emerging from the COVID-19 pandemic and navigating economic uncertainty by providing employees with the opportunity to work remotely or utilize our various offices and promoting team and cross-departmental relationships and activities to maximize engagement, collaboration and quality of work for our team reflecting our core values and ensuring a corporate culture driven by mutual respect while evolving the way we lead and manage to optimize employee performance, growth and opportunity in the post-pandemic hybrid work environment. | |||||||

| Capital structure and balance sheet management | •Received credit ratings upgrades to BBB+ from S&P and Fitch and Baa2 from Moody’s. •Raised $2.5 billion of capital, including $1.8 billion through a range of equity transactions and $0.7 billion from two new term loan facilities, allowing the Company to fund acquisitions throughout the year. •Increased the borrowing capacity of our unsecured revolving credit facility to $1.0 billion from $700.0 million. •Ended the year with low leverage equating to 14.9% net debt to enterprise value ratio. | |||||||

| Commitment to and development of ESG goals | •Installed ~5 MW of solar to bring total portfolio to over 9MW. •Earned LEED Silver for all ground-up developments. •Continued development of our SBTi emissions reduction targets. •Awarded Gold Green Lease Leader. •Ensured candidate slates included a minimum of 20% diverse candidates, resulting in an increase in the diversity of our new hires to 63%, up from 50% in the prior year. •Implemented employee resource group WIRE (Women in Real Estate). •Established a dedicated Department of Professional Excellence and achieved an average of 20 training hours per employee. •Expanded board oversight over climate-related risk. | |||||||

| Management emerging from COVID-19 pandemic | •Operated the Company with no material litigation, environmental or regulatory claims. •Despite ongoing eviction moratoriums, managed properties to achieve rent collections at pre-pandemic levels. | |||||||

46 | REXFORD INDUSTRIAL | |||||||||||||

| Named Executive Officer | 2022 Annual Cash Incentive Awards | Portion of Annual Cash Incentive Award Delivered in Cash | Portion of Annual Cash Incentive Award Delivered in LTIP Units | Total STI LTIP Units Granted | ||||||||||||||||||||||

| Howard Schwimmer | $ | 2,268,750 | $ | 1,134,375 | $ | 1,134,375 | 19,367 | |||||||||||||||||||

| Michael S. Frankel | $ | 2,268,750 | $ | 1,134,375 | $ | 1,134,375 | 19,367 | |||||||||||||||||||

| Laura Clark | $ | 1,150,000 | $ | 1,150,000 | $ | — | — | |||||||||||||||||||

| David Lanzer | $ | 950,000 | $ | 950,000 | $ | — | — | |||||||||||||||||||

| Named Executive Officer | Total Service-Vesting LTIP Units | Grant Date Value ($)(1) | |||||||||

| Howard Schwimmer | 66,740 | 3,333,641 | |||||||||

| Michael S. Frankel | 66,740 | 3,333,641 | |||||||||

| Laura Clark | 21,876 | 1,092,700 | |||||||||

| David Lanzer | 11,865 | 592,653 | |||||||||

| 2023 PROXY STATEMENT | 47 | |||||||||||||

| Named Executive Officer | Absolute TSR Base LTIP Units | Relative TSR Base LTIP Units | Core FFO Per-Share Base LTIP Units | Distribution Equivalent LTIP Units | Total Performance- Vesting LTIP Units | |||||||||||||||

| Howard Schwimmer | 81,572 | 81,572 | 81,572 | 23,948 | 268,664 | |||||||||||||||

| Michael S. Frankel | 81,572 | 81,572 | 81,572 | 23,948 | 268,664 | |||||||||||||||

| Laura Clark | 26,789 | 26,789 | 26,789 | 7,865 | 88,232 | |||||||||||||||

| David Lanzer | 14,461 | 14,461 | 14,461 | 4,245 | 47,628 | |||||||||||||||

| Named Executive Officer | Threshold Award (# Units) | Target Award (# Units) | Maximum Award (# Units)(1) | Grant Date Value ($)(2) | ||||||||||||||||||||||

| Howard Schwimmer | 40,786 | 81,572 | 244,716 | $ | 6,203,551 | |||||||||||||||||||||

| Michael S. Frankel | 40,786 | 81,572 | 244,716 | $ | 6,203,551 | |||||||||||||||||||||

| Laura Clark | 13,395 | 26,789 | 80,367 | $ | 2,037,303 | |||||||||||||||||||||

| David Lanzer | 7,231 | 14,461 | 43,383 | $ | 1,099,759 | |||||||||||||||||||||

48 | REXFORD INDUSTRIAL | |||||||||||||

| Threshold Level | Target Level | High Level | Maximum Level | |||||||||||

| Vesting Percentage | 50% of Target | 100% | 200% of Target | 300% of Target | ||||||||||

| Absolute TSR Performance |  | |||||||||||||

| Relative TSR Performance (based on the Dow Jones All Equity REIT Index) |  | |||||||||||||

| Core FFO Per-Share Growth |  | |||||||||||||

| 2023 PROXY STATEMENT | 49 | |||||||||||||

| Grant Year (Performance Period) and Metrics | Metric Weighting | 2020 | 2021 | 2022 | 2023 | 2024 | Payout as % of Target(1) | |||||||||||||||||||

| 2019 Grant (Jan 2020 - Dec 2022) | ||||||||||||||||||||||||||

| Absolute TSR | 42.5% | Absolute TSR achieved between Target and Maximum and Relative TSR and Core FFO Per-Share growth achieved at Maximum (183.7% of Target Earned) | 68.7 | % | ||||||||||||||||||||||

| Relative TSR vs. Peer Group | 26.6% | 53.2 | % | |||||||||||||||||||||||

| Core FFO Per-Share growth | 30.9% | 61.8 | % | |||||||||||||||||||||||

| Total | 183.7 | % | ||||||||||||||||||||||||

2020 Grant (Dec 2020 - Dec 2023) | ||||||||||||||||||||||||||

| Absolute TSR | 33.3% | Absolute TSR tracking below Threshold, Relative TSR tracking above Target and Core FFO Per-Share growth tracking at Maximum (144% of Target Earned)(2) | — | % | ||||||||||||||||||||||

| Relative TSR vs. Peer Group | 33.3% | 44.0 | % | |||||||||||||||||||||||

| Core FFO Per-Share growth | 33.3% | 100.0 | % | |||||||||||||||||||||||

| Total | 144.0 | % | ||||||||||||||||||||||||

2021 Grant (Dec 2021 - Dec 2024) | ||||||||||||||||||||||||||

| Absolute TSR | 33.3% | Absolute TSR and Relative TSR tracking below Threshold and Core FFO Per-Share growth tracking at Maximum (100% of Target Earned)(2) | — | % | ||||||||||||||||||||||

| Relative TSR vs. Peer Group | 33.3% | — | % | |||||||||||||||||||||||

| Core FFO Per-Share growth | 33.3% | 100.0 | % | |||||||||||||||||||||||

| Total | 100.0 | % | ||||||||||||||||||||||||

50 | REXFORD INDUSTRIAL | |||||||||||||

Co-CEOs | CFO & General Counsel and Secretary | |||||||||||||||||||

6x | 3x | |||||||||||||||||||

Base Salary | Base Salary | |||||||||||||||||||

| 2023 PROXY STATEMENT | 51 | |||||||||||||

52 | REXFORD INDUSTRIAL | |||||||||||||

| 2023 PROXY STATEMENT | 53 | |||||||||||||

| Name and Principal Position | Year | Salary ($) | Stock Awards ($) | Non-Equity Incentive Plan Compensation ($)(1) | All Other Compensation ($)(2) | Total ($) | ||||||||||||||||||||||||||||||||

Howard Schwimmer Co-Chief Executive Officer | 2022 | 825,000 | 10,671,567 | (3)(4) | 1,134,375 | 17,351 | 12,648,293 | |||||||||||||||||||||||||||||||

| 2021 | 750,000 | 8,456,492 | 937,500 | 16,910 | 10,160,902 | |||||||||||||||||||||||||||||||||

| 2020 | 675,000 | 6,898,366 | 759,375 | 16,310 | 8,349,051 | |||||||||||||||||||||||||||||||||

Michael S. Frankel Co-Chief Executive Officer | 2022 | 825,000 | 10,671,567 | (3)(4) | 1,134,375 | 17,351 | 12,648,293 | |||||||||||||||||||||||||||||||

| 2021 | 750,000 | 8,456,492 | 937,500 | 16,910 | 10,160,902 | |||||||||||||||||||||||||||||||||

| 2020 | 675,000 | 6,898,366 | 759,375 | 16,310 | 8,349,051 | |||||||||||||||||||||||||||||||||

Laura Clark Chief Financial Officer | 2022 | 575,000 | 3,130,003 | (3) | 1,150,000 | 17,351 | 4,872,354 | |||||||||||||||||||||||||||||||

| 2021 | 500,000 | 2,129,763 | 875,000 | 16,910 | 3,521,673 | |||||||||||||||||||||||||||||||||

| 2020 | 121,667 | 1,521,457 | 182,500 | 12,637 | 1,838,261 | |||||||||||||||||||||||||||||||||

David Lanzer General Counsel and Secretary | 2022 | 475,000 | 1,692,412 | (3) | 950,000 | 17,351 | 3,134,763 | |||||||||||||||||||||||||||||||

| 2021 | 425,000 | 1,383,496 | 743,750 | 16,910 | 2,569,156 | |||||||||||||||||||||||||||||||||

| 2020 | 375,000 | 1,129,022 | 487,500 | 16,310 | 2,007,832 | |||||||||||||||||||||||||||||||||

54 | REXFORD INDUSTRIAL | |||||||||||||

Estimated Future Payouts Under Non-Equity Incentive Plan Awards(1) | Estimated Future Payouts Under Equity Incentive Plan Awards(2) | All Other Stock Awards; Number of Units (#) | Grant Date Fair Value of Stock Awards ($)(4) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Name | Grant Date | Threshold ($) | Target ($) | Maximum ($) | Threshold (#) | Target (#) | Maximum (#) | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Howard Schwimmer | 11/8/2022 | — | — | — | — | — | — | 66,740 | (3) | 3,333,641 | |||||||||||||||||||||||||||||||||||||||||||||||||

| 11/8/2022 | — | — | — | 40,786 | 81,572 | 244,716 | — | 6,203,551 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| — | 825,000 | 1,650,000 | 2,268,750 | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Michael S. Frankel | 11/8/2022 | — | — | — | — | — | — | 66,740 | (3) | 3,333,641 | |||||||||||||||||||||||||||||||||||||||||||||||||

| 11/8/2022 | — | — | — | 40,786 | 81,572 | 244,716 | — | 6,203,551 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| — | 825,000 | 1,650,000 | 2,268,750 | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||||

| Laura Clark | 11/8/2022 | — | — | — | — | — | — | 21,876 | (3) | 1,092,700 | |||||||||||||||||||||||||||||||||||||||||||||||||

| 11/8/2022 | — | — | — | 13,395 | 26,789 | 80,367 | — | 2,037,303 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| — | 575,000 | 862,500 | 1,150,000 | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||||

| David Lanzer | 11/8/2022 | — | — | — | — | — | — | 11,865 | (3) | 592,653 | |||||||||||||||||||||||||||||||||||||||||||||||||

| 11/8/2022 | — | — | — | 7,231 | 14,461 | 43,383 | — | 1,099,759 | |||||||||||||||||||||||||||||||||||||||||||||||||||

| — | 475,000 | 593,750 | 950,000 | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||||

| 2023 PROXY STATEMENT | 55 | |||||||||||||

56 | REXFORD INDUSTRIAL | |||||||||||||

| Name | Grant Date(1) | Number of Shares or Stock Units that Have Not Vested (#) | Market Value of Shares of Stock or Units that Have Not Vested ($)(2) | Equity Incentive Plan Awards; Number of Unearned Units That Have Not Vested (#) | Equity Incentive Plan Awards; Market or Payout Value of Unearned Units That Have Not Vested ($)(3) | |||||||||||||||||||||||||||||||||

| Howard Schwimmer | 12/22/2020 | 16,789 | (4) | 917,351 | — | — | ||||||||||||||||||||||||||||||||

| 12/22/2020 | — | — | 112,861 | (5) | 6,166,725 | |||||||||||||||||||||||||||||||||

| 12/23/2021 | 25,160 | (6) | 1,374,742 | — | — | |||||||||||||||||||||||||||||||||

| 12/23/2021 | — | — | 61,505 | (7) | 3,360,633 | |||||||||||||||||||||||||||||||||

| 11/8/2022 | 66,740 | (8) | 3,646,674 | — | — | |||||||||||||||||||||||||||||||||

| 11/8/2022 | — | — | 190,335 | (9) | 10,399,904 | |||||||||||||||||||||||||||||||||

| Michael S. Frankel | 12/22/2020 | 16,789 | (4) | 917,351 | — | — | ||||||||||||||||||||||||||||||||

| 12/22/2020 | — | — | 112,861 | (5) | 6,166,725 | |||||||||||||||||||||||||||||||||

| 12/23/2021 | 25,160 | (6) | 1,374,742 | — | — | |||||||||||||||||||||||||||||||||

| 12/23/2021 | — | — | 61,505 | (7) | 3,360,633 | |||||||||||||||||||||||||||||||||

| 11/8/2022 | 66,740 | (8) | 3,646,674 | — | — | |||||||||||||||||||||||||||||||||

| 11/8/2022 | — | — | 190,335 | (9) | 10,399,904 | |||||||||||||||||||||||||||||||||

| Laura Clark | 9/1/2020 | 1,165 | (10) | 63,656 | — | — | ||||||||||||||||||||||||||||||||

| 12/22/2020 | 3,705 | (4) | 202,441 | — | — | |||||||||||||||||||||||||||||||||

| 12/22/2020 | — | — | 24,907 | (5) | 1,360,918 | |||||||||||||||||||||||||||||||||

| 12/23/2021 | 7,096 | (6) | 387,725 | — | — | |||||||||||||||||||||||||||||||||

| 12/23/2021 | — | — | 17,463 | (7) | 954,178 | |||||||||||||||||||||||||||||||||

| 11/8/2022 | 21,876 | (8) | 1,195,305 | — | — | |||||||||||||||||||||||||||||||||

| 11/8/2022 | — | — | 62,508 | (9) | 3,415,437 | |||||||||||||||||||||||||||||||||

| David Lanzer | 12/22/2020 | 3,087 | (4) | 168,674 | — | — | ||||||||||||||||||||||||||||||||

| 12/22/2020 | — | — | 20,756 | (5) | 1,134,108 | |||||||||||||||||||||||||||||||||

| 12/23/2021 | 4,602 | (6) | 251,453 | — | — | |||||||||||||||||||||||||||||||||

| 12/23/2021 | — | — | 11,354 | (7) | 620,383 | |||||||||||||||||||||||||||||||||

| 11/8/2022 | 11,865 | (8) | 648,304 | — | — | |||||||||||||||||||||||||||||||||

| 11/8/2022 | — | — | 33,742 | (9) | 1,843,663 | |||||||||||||||||||||||||||||||||

| 2023 PROXY STATEMENT | 57 | |||||||||||||

| Stock Awards | ||||||||||||||

| Name | Number of Shares Acquired on Vesting (#) | Value Realized on Vesting ($)(1) | ||||||||||||

| Howard Schwimmer | 163,799 | 9,159,067 | ||||||||||||

| Michael S. Frankel | 163,799 | 9,159,067 | ||||||||||||

| Laura Clark | 8,420 | 465,553 | ||||||||||||

| David Lanzer | 26,425 | 1,437,933 | ||||||||||||

58 | REXFORD INDUSTRIAL | |||||||||||||

| 2023 PROXY STATEMENT | 59 | |||||||||||||

60 | REXFORD INDUSTRIAL | |||||||||||||

| Name | Benefit | Death/ Disability ($) | Qualifying Termination (no Change in Control) ($) | Change in Control (no Termination) ($)(1) | Qualifying Termination in Connection with a Change in Control ($)(1) | ||||||||||||||||||||||||||||||

| Howard Schwimmer | Cash Severance | 2,268,750 | 16,078,625 | — | 16,078,625 | ||||||||||||||||||||||||||||||

| Continued Health Benefits | — | 49,823 | — | 49,823 | |||||||||||||||||||||||||||||||

| Equity Acceleration | 27,579,595 | (2) | 27,579,595 | (2) | 12,656,132 | (3) | 12,656,132 | (4) | |||||||||||||||||||||||||||

| Total | 29,848,345 | 43,708,043 | 12,656,132 | 28,784,580 | |||||||||||||||||||||||||||||||

| Michael S. Frankel | Cash Severance | 2,268,750 | 16,078,625 | — | 16,078,625 | ||||||||||||||||||||||||||||||

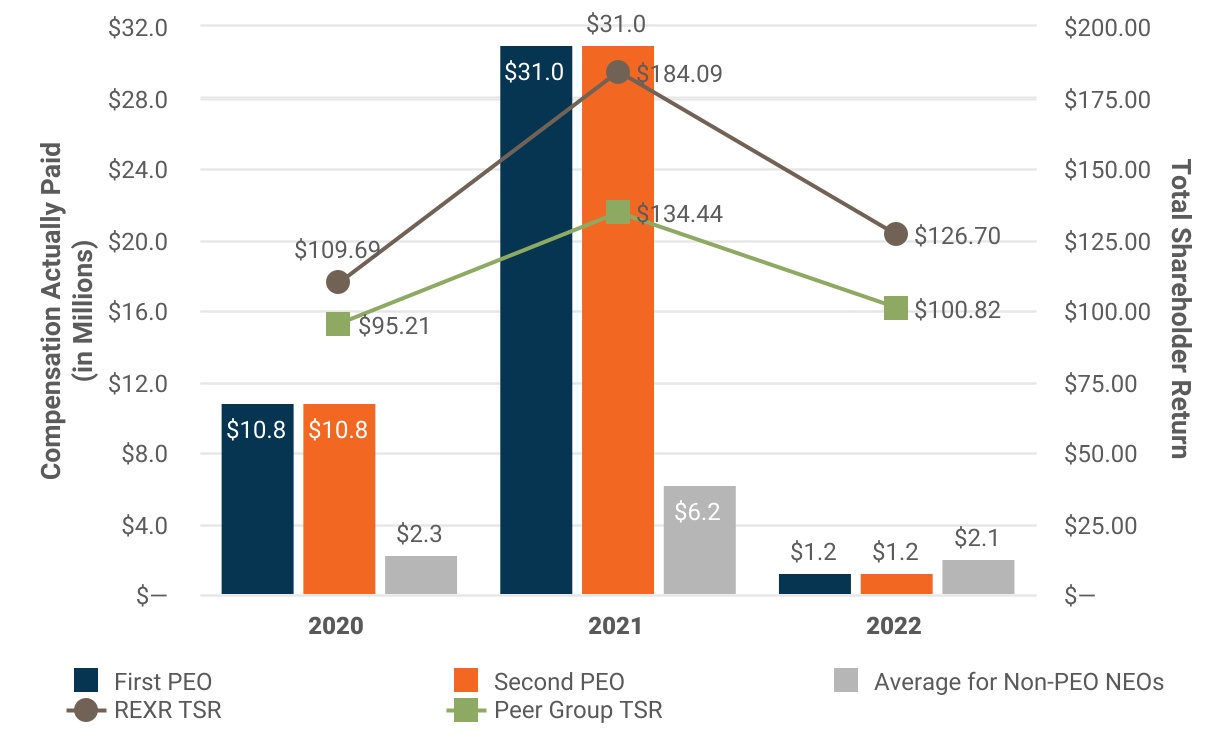

| Continued Health Benefits | — | 49,823 | — | 49,823 | |||||||||||||||||||||||||||||||