| (Mark One) | |||||

| QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |||||

| (State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) | |||||||

| (Address of principal executive offices) | (Zip Code) | |||||||

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered | ||||||||||||

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||||||||||||||||

☒ | Smaller reporting company | |||||||||||||||||||

| Emerging growth company | ||||||||||||||||||||

| Page | ||||||||

| Item 1. | ||||||||

| Item 2. | ||||||||

| Item 3. | ||||||||

| Item 4. | ||||||||

| Item 1. | ||||||||

| Item 1A. | ||||||||

| Item 2. | ||||||||

| Item 3. | ||||||||

| Item 4. | ||||||||

| Item 5. | ||||||||

| Item 6. | ||||||||

| $ in thousands except share amounts | March 31, 2025 | December 31, 2024 | |||||||||

| ASSETS | |||||||||||

Commercial real estate loan investments, at fair value (including pledged loans of $ | $ | $ | |||||||||

| Cash and cash equivalents | |||||||||||

| Restricted cash | |||||||||||

| Interest receivable | |||||||||||

| Derivative assets, at fair value | |||||||||||

| Other assets | |||||||||||

| Total assets | $ | $ | |||||||||

| LIABILITIES | |||||||||||

| Secured lending agreements, at fair value | $ | $ | |||||||||

| Term lending agreement, at fair value | |||||||||||

| Interest payable | |||||||||||

Dividends and distributions payable (including $ | |||||||||||

| Accounts payable, accrued expenses and other liabilities | |||||||||||

| Due to affiliates | |||||||||||

| Total liabilities | |||||||||||

Commitments and contingencies (See Note 12) | |||||||||||

Redeemable common stock - related party (see Note 9) | $ | $ | |||||||||

| STOCKHOLDERS’ EQUITY | |||||||||||

Preferred stock, $ | |||||||||||

Common stock, Class S shares, $ | |||||||||||

Common stock, Class S-1 shares, $ | |||||||||||

Common stock, Class D shares, $ | |||||||||||

Common stock, Class D-1 shares, $ | |||||||||||

Common stock, Class I shares, $ | |||||||||||

Common stock, Class E shares, $ | |||||||||||

Common stock, Class F shares, $ | |||||||||||

| Additional paid-in capital | |||||||||||

| Accumulated other comprehensive income (loss) | ( | ( | |||||||||

| Accumulated deficit | ( | ( | |||||||||

| Total stockholders’ equity | |||||||||||

| Total liabilities, redeemable common stock and stockholders’ equity | $ | $ | |||||||||

| Three Months Ended March 31, | |||||||||||

| $ in thousands except share and per share amounts | 2025 | 2024 | |||||||||

| Net Interest Income | |||||||||||

| Commercial real estate loan interest income | $ | $ | |||||||||

| Other interest income | |||||||||||

| Interest expense | ( | ( | |||||||||

| Net interest income | |||||||||||

| Other Income (Expense) | |||||||||||

Unrealized gain (loss) on loans, net (includes $ | |||||||||||

Unrealized gain (loss) on secured financing facilities, net (includes $ | ( | ( | |||||||||

| Gain (loss) on derivative instruments, net | ( | ||||||||||

| Gain (loss) on foreign currency transactions, net | |||||||||||

Commitment fee income, net of related party expense of $ | |||||||||||

| Other income | |||||||||||

| Total other income (expense), net | |||||||||||

| Expenses | |||||||||||

| Management and performance fees - related party | |||||||||||

| Debt issuance and other financing costs related to borrowings, at fair value | |||||||||||

| Organizational costs | |||||||||||

| General and administrative | |||||||||||

| Total expenses | |||||||||||

Net income (loss) | |||||||||||

| Dividends to preferred stockholders | ( | ( | |||||||||

| Issuance and redemption costs of redeemed preferred stock | ( | ||||||||||

| Net income (loss) attributable to common stockholders | $ | $ | |||||||||

| Net income (loss) | $ | $ | |||||||||

| Currency translation adjustment | |||||||||||

| Comprehensive income (loss) | |||||||||||

| Dividends to preferred stockholders | ( | ( | |||||||||

| Issuance and redemption costs of redeemed preferred stock | ( | ||||||||||

| Comprehensive income (loss) attributable to common stockholders | $ | $ | |||||||||

| Earnings (loss) per share: | |||||||||||

| Net income (loss) attributable to common stockholders | |||||||||||

| Basic | $ | $ | |||||||||

| Diluted | $ | $ | |||||||||

| Weighted average number of shares of common stock | |||||||||||

| Basic | |||||||||||

| Diluted | |||||||||||

| Series A Preferred Stock | Class S Common Stock | Class S-1 Common Stock | Class D Common Stock | Class D-1 Common Stock | Class I Common Stock | Class E Common Stock | Class F Common Stock | Additional Paid-in Capital | Accumulated Other Comprehensive Income (Loss) | Retained Earnings (Accumulated Deficit) | Total Stockholders' Equity | Redeemable Common Stock | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| $ in thousands | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Balance as of December 31, 2024 | $ | $ | $ | $ | $ | $ | $ | $ | $ | $ | ( | $ | ( | $ | $ | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net income (loss) | — | — | — | — | — | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Proceeds from issuance of common stock, net of offering costs | — | — | — | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Proceeds from issuance of redeemable common stock | — | — | — | — | — | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Common stock distribution reinvestment | — | — | — | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Common stock dividends | — | — | — | — | — | — | — | — | — | — | ( | ( | — | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Preferred stock dividends | — | — | — | — | — | — | — | — | — | — | ( | ( | — | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Amortization of equity based compensation | — | — | — | — | — | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Repurchase of common stock | — | — | — | — | — | — | — | — | ( | — | — | ( | — | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Repurchase of redeemable common stock | — | — | — | — | — | — | — | — | — | — | — | — | ( | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Redemption of preferred stock | ( | — | — | — | — | — | — | — | — | — | ( | ( | — | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Foreign currency translation adjustment | — | — | — | — | — | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Adjustment to the carrying value of redeemable common stock | — | — | — | — | — | — | — | — | ( | — | — | ( | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Balance as of March 31, 2025 | $ | $ | $ | $ | $ | $ | $ | $ | $ | $ | ( | $ | ( | $ | $ | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Series A Preferred Stock | Class S Common Stock | Class S-1 Common Stock | Class D Common Stock | Class D-1 Common Stock | Class I Common Stock | Class E Common Stock | Class F Common Stock | Additional Paid-in Capital | Accumulated Other Comprehensive Income (Loss) | Retained Earnings (Accumulated Deficit) | Total Stockholders' Equity | Redeemable Common Stock | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| $ in thousands | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Balance at December 31, 2023 | $ | $ | $ | $ | $ | $ | $ | $ | $ | $ | $ | ( | $ | $ | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net income (loss) | — | — | — | — | — | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Proceeds from issuance of common stock, net of offering costs | — | — | — | — | — | — | — | — | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Common stock distribution reinvestment | — | — | — | — | — | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Common stock dividends | — | — | — | — | — | — | — | — | — | — | ( | ( | — | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Preferred stock dividends | — | — | — | — | — | — | — | — | — | — | ( | ( | — | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Amortization of equity based compensation | — | — | — | — | — | — | — | — | — | — | — | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Balance at March 31, 2024 | $ | $ | $ | $ | $ | $ | $ | $ | $ | $ | $ | ( | $ | $ | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Three Months Ended March 31, 2025 | Three Months Ended March 31, 2024 | ||||||||||

| $ in thousands | |||||||||||

| Cash flows from operating activities: | |||||||||||

| Net income (loss) | $ | $ | |||||||||

| Adjustments to reconcile net income (loss) to net cash provided by operating activities: | |||||||||||

| Unrealized (gain) loss on loans, net | ( | ( | |||||||||

| Unrealized (gain) loss on secured financing facilities, net | |||||||||||

| (Gain) loss on derivative instruments, net | |||||||||||

| Debt issuance costs | |||||||||||

| Amortization of equity based compensation | |||||||||||

| Change in operating assets and liabilities: | |||||||||||

| Increase in operating assets | ( | ( | |||||||||

| (Increase) decrease in due from affiliates | ( | ||||||||||

| (Decrease) increase in operating liabilities | ( | ||||||||||

| (Decrease) increase in due to affiliate | ( | ||||||||||

| Net cash provided by operating activities | |||||||||||

| Cash flows from investing activities: | |||||||||||

| Originations and fundings of commercial real estate loans | ( | ( | |||||||||

| Settlement of foreign currency forward contracts, net | |||||||||||

| Net cash used in investing activities | ( | ( | |||||||||

| Cash flows from financing activities: | |||||||||||

| Proceeds from revolving credit facility | |||||||||||

| Repayment of revolving credit facility | ( | ( | |||||||||

| Proceeds from secured financing facilities | |||||||||||

| Proceeds from issuance of common stock, net of offering costs | |||||||||||

| Repurchase of common stock | ( | ||||||||||

| Repurchase of redeemable common stock | ( | ||||||||||

| Redemption of preferred stock | ( | ||||||||||

| Proceeds from subscriptions paid in advance | |||||||||||

| Cash paid for debt issuance costs | ( | ( | |||||||||

| Payments of dividends | ( | ( | |||||||||

| Net cash provided by financing activities | |||||||||||

| Effect of exchange rate changes on cash, cash equivalents and restricted cash | ( | ||||||||||

| Net change in cash, cash equivalents and restricted cash | ( | ( | |||||||||

| Cash, cash equivalents and restricted cash, beginning of period | |||||||||||

| Cash, cash equivalents and restricted cash, end of period | $ | $ | |||||||||

| Supplemental disclosures: | |||||||||||

| Interest paid | $ | $ | |||||||||

| Non-cash investing and financing activities: | |||||||||||

| Dividends and distributions declared not paid | $ | $ | |||||||||

| Common stock distribution reinvestment | $ | $ | |||||||||

| Issuance of redeemable common stock for payment of management and performance fees | $ | $ | |||||||||

| Deferred offering costs due to affiliate | $ | $ | |||||||||

| Offering costs due to affiliates | $ | $ | |||||||||

| Debt issuance costs due to affiliate | $ | $ | |||||||||

| Adjustment to carrying value of redeemable common stock | $ | $ | |||||||||

| $ in thousands | ||||||||||||||||||||||||||||||||

| Loan Type | Loan Amount(1) | Principal Balance Outstanding | Fair Value | Weighted Average Interest Rate(2) | Weighted Average Life (years)(3) | |||||||||||||||||||||||||||

| March 31, 2025 | ||||||||||||||||||||||||||||||||

Senior loans(4) | $ | $ | $ | % | ||||||||||||||||||||||||||||

| Mezzanine loans | % | |||||||||||||||||||||||||||||||

| Total | $ | $ | $ | % | ||||||||||||||||||||||||||||

| December 31, 2024 | ||||||||||||||||||||||||||||||||

Senior loans(4) | $ | $ | $ | % | ||||||||||||||||||||||||||||

| Mezzanine loans | % | |||||||||||||||||||||||||||||||

| Total | $ | $ | $ | % | ||||||||||||||||||||||||||||

| $ in thousands | March 31, 2025 | December 31, 2024 | ||||||||||||||||||||||||

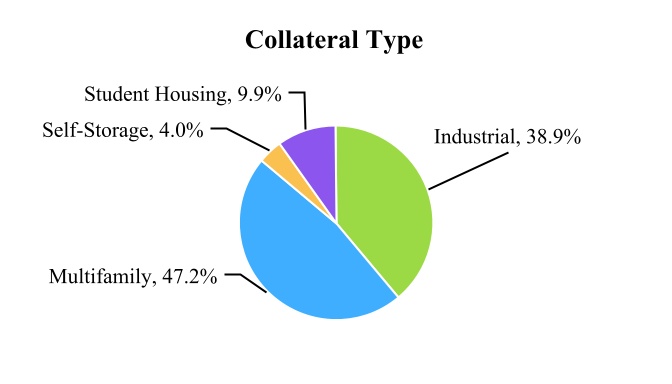

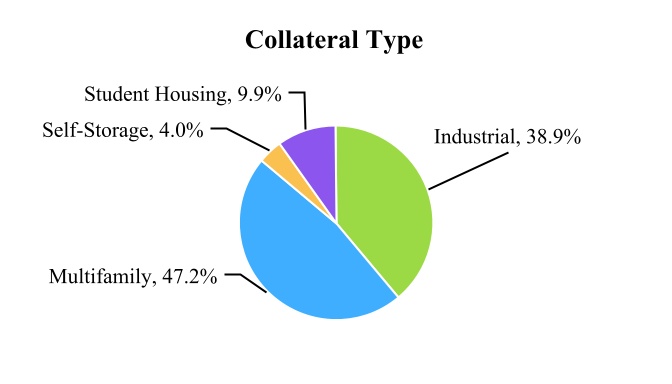

| Property Type | Fair Value | Percentage | Fair Value | Percentage | ||||||||||||||||||||||

| Multifamily | $ | % | $ | % | ||||||||||||||||||||||

| Industrial | % | % | ||||||||||||||||||||||||

| Self-storage | % | % | ||||||||||||||||||||||||

| Student housing | % | % | ||||||||||||||||||||||||

| Total | $ | % | $ | % | ||||||||||||||||||||||

| $ in thousands | March 31, 2025 | December 31, 2024 | ||||||||||||||||||||||||

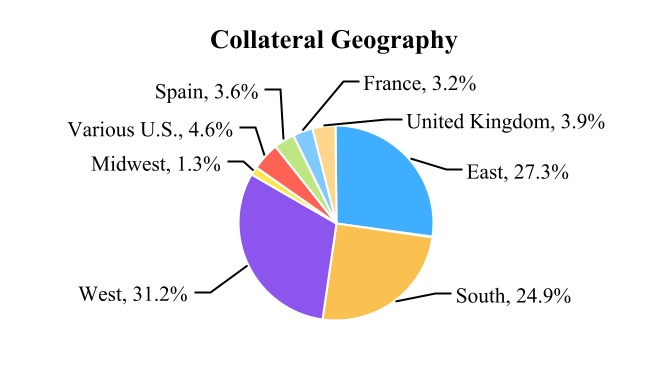

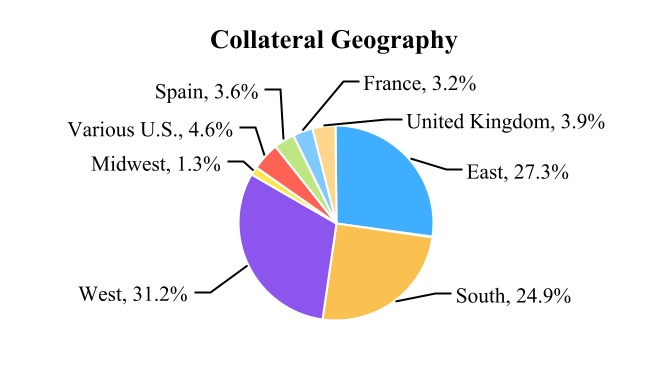

| Geographic Location | Fair Value | Percentage | Fair Value | Percentage | ||||||||||||||||||||||

| United States: | ||||||||||||||||||||||||||

| West | $ | % | $ | % | ||||||||||||||||||||||

| South | % | % | ||||||||||||||||||||||||

| East | % | % | ||||||||||||||||||||||||

| Midwest | % | % | ||||||||||||||||||||||||

Various U.S.(1) | % | % | ||||||||||||||||||||||||

| Total | $ | % | $ | % | ||||||||||||||||||||||

| Europe: | ||||||||||||||||||||||||||

France(2) | $ | % | $ | % | ||||||||||||||||||||||

Spain(2) | % | % | ||||||||||||||||||||||||

United Kingdom(3) | % | % | ||||||||||||||||||||||||

| Total | $ | % | $ | % | ||||||||||||||||||||||

| Total | $ | % | $ | % | ||||||||||||||||||||||

| March 31, 2025 | December 31, 2024 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||

| $ in thousands | Current Maturity | Extension Options(1) | Weighted Average Interest Rate(2) | Maximum Facility Size | Available Capacity | Amount Outstanding | Fair Value | Amount Outstanding | Fair Value | |||||||||||||||||||||||||||||||||||||||||||||||

| Term Lending Agreement | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| INCREF Lending II | Match-term | Match-term | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||||||||

| Secured Lending Agreements | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Term Financing | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| INCREF Lending I | Oct 2026 | Oct 2029 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Repurchase Agreements | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Morgan Stanley Bank(3) | May 2026 | May 2027 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Citibank | Sep 2026 | Sep 2028 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

Barclays(3) | Apr 2027 | Apr 2029 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Wells Fargo | May 2026 | May 2029 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

Bank of Montreal(3) | Jul 2025 | Jul 2028 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

Capital One(3) | Feb 2027 | Feb 2030 | N/A | N/A | ||||||||||||||||||||||||||||||||||||||||||||||||||||

| Total secured financing facilities | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||||||||||

Revolving Credit Facility(4) | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||||||||||||||||||||

| $ in thousands | Outstanding Principal | Net Counterparty Exposure | Weighted Average Life (Years)(1) | |||||||||||||||||

| March 31, 2025 | ||||||||||||||||||||

| Morgan Stanley Bank | $ | $ | ||||||||||||||||||

| Citibank | ||||||||||||||||||||

| Wells Fargo | ||||||||||||||||||||

| Capital One | ||||||||||||||||||||

| Total | $ | $ | ||||||||||||||||||

| December 31, 2024 | ||||||||||||||||||||

| Morgan Stanley Bank | $ | $ | ||||||||||||||||||

| Citibank | ||||||||||||||||||||

| Barclays | ||||||||||||||||||||

| Wells Fargo | ||||||||||||||||||||

| Total | $ | $ | ||||||||||||||||||

| $ in thousands | Secured Lending Agreements(1) | Term Lending Agreement(1) | Total | |||||||||||||||||

| Year | ||||||||||||||||||||

| 2025 (remaining) | $ | $ | $ | |||||||||||||||||

| 2026 | ||||||||||||||||||||

| 2027 | ||||||||||||||||||||

| 2028 | ||||||||||||||||||||

| 2029 | ||||||||||||||||||||

| 2030 | ||||||||||||||||||||

| Thereafter | ||||||||||||||||||||

| Total | $ | $ | $ | |||||||||||||||||

| Local Currency | |||||||||||||||||||||||||||||

| In thousands | Notional Amount as of December 31, 2024 | Additions | Settlement, Termination, Expiration or Exercise | Notional Amount as of March 31, 2025 | Notional Amount as of March 31, 2025 | ||||||||||||||||||||||||

| Buy USD / Sell EUR Forward | € | € | € | ( | € | $ | |||||||||||||||||||||||

| Buy USD / Sell GBP Forward | £ | £ | £ | ( | £ | $ | |||||||||||||||||||||||

| $ in thousands | Fair Value as of | ||||||||||

| March 31, 2025 | December 31, 2024 | ||||||||||

| Derivative Assets | $ | $ | |||||||||

| Derivative Liabilities | $ | $ | |||||||||

| $ in thousands | Three Months Ended March 31, 2025 | |||||||||||||||||||

| Derivatives not designated as hedging instruments | Realized gain (loss) on derivative instruments, net | Unrealized gain (loss), net | Gain (loss) on derivative instruments, net | |||||||||||||||||

| Currency Forward Contracts | $ | $ | ( | $ | ( | |||||||||||||||

| March 31, 2025 | |||||||||||||||||||||||

| Fair Value Measurements Using: | |||||||||||||||||||||||

| $ in thousands | Level 1 | Level 2 | Level 3 | Total at Fair Value | |||||||||||||||||||

| Assets: | |||||||||||||||||||||||

| Commercial real estate loan investments | $ | $ | $ | $ | |||||||||||||||||||

| Derivative assets | |||||||||||||||||||||||

| Total assets | $ | $ | $ | $ | |||||||||||||||||||

| Liabilities: | |||||||||||||||||||||||

| Secured lending agreements | $ | $ | $ | $ | |||||||||||||||||||

| Term lending agreement | |||||||||||||||||||||||

| Total liabilities | $ | $ | $ | $ | |||||||||||||||||||

| December 31, 2024 | |||||||||||||||||||||||

| Fair Value Measurements Using: | |||||||||||||||||||||||

| $ in thousands | Level 1 | Level 2 | Level 3 | Total at Fair Value | |||||||||||||||||||

| Assets: | |||||||||||||||||||||||

| Commercial real estate loan investments | $ | $ | $ | $ | |||||||||||||||||||

| Derivative assets | |||||||||||||||||||||||

| Total assets | $ | $ | $ | $ | |||||||||||||||||||

| Liabilities: | |||||||||||||||||||||||

| Secured lending agreements | $ | $ | $ | $ | |||||||||||||||||||

| Term lending agreements | |||||||||||||||||||||||

| Total liabilities | $ | $ | $ | $ | |||||||||||||||||||

| $ in thousands | Three Months Ended March 31, 2025 | ||||

| Beginning Balance | $ | ||||

| Loan originations and fundings | |||||

| Net unrealized gain (loss) | |||||

Foreign currency adjustments(1) | |||||

| Ending Balance | $ | ||||

| March 31, 2025 | ||||||||||||||||||||||||||||||||

| Type | Valuation Technique | Unobservable Input | Weighted Average Rate | Range | Weighted Average Life (years)(1) | |||||||||||||||||||||||||||

| Commercial loans | Discounted cash flow | Discount rate | ||||||||||||||||||||||||||||||

| December 31, 2024 | ||||||||||||||||||||||||||||||||

| Type | Valuation Technique | Unobservable Input | Weighted Average Rate | Range | Weighted Average Life (years)(1) | |||||||||||||||||||||||||||

| Commercial loans | Discounted cash flow | Discount rate | ||||||||||||||||||||||||||||||

| $ in thousands | Three Months Ended March 31, 2025 | ||||

| Beginning Balance | $ | ||||

| Proceeds from revolving credit facility | |||||

| Repayment of revolving credit facility | ( | ||||

| Net unrealized (gain) loss | |||||

| Ending Balance | $ | ||||

| Three Months Ended March 31, 2025 | |||||||||||||||||

| $ in thousands | Secured Lending Agreements | Term Lending Agreement | Total | ||||||||||||||

| Beginning Balance | $ | $ | $ | ||||||||||||||

| Proceeds from secured financing facilities | |||||||||||||||||

| Net unrealized (gain) loss | ( | ( | |||||||||||||||

| Unrealized foreign currency (gain) loss | |||||||||||||||||

| Ending Balance | $ | $ | $ | ||||||||||||||

| March 31, 2025 | ||||||||||||||||||||||||||||||||

| Type | Valuation Technique | Unobservable Input | Weighted Average Rate | Range | Weighted Average Life (years)(1) | |||||||||||||||||||||||||||

| Secured financing facilities | Discounted cash flow | Discount rate | ||||||||||||||||||||||||||||||

| December 31, 2024 | ||||||||||||||||||||||||||||||||

| Type | Valuation Technique | Unobservable Input | Weighted Average Rate | Range | Weighted Average Life (years) | |||||||||||||||||||||||||||

| Secured financing facilities | Discounted cash flow | Discount rate | ||||||||||||||||||||||||||||||

| $ in thousands | March 31, 2025 | December 31, 2024 | ||||||||||||

| Accounts payable and accrued expenses | $ | $ | ||||||||||||

Subscriptions paid in advance (1) | ||||||||||||||

| Accrued common stock repurchases | ||||||||||||||

| Other liabilities | ||||||||||||||

| Total | $ | $ | ||||||||||||

| $ in thousands | March 31, 2025 | December 31, 2024 | |||||||||

| Advanced organizational, offering and operating expenses | $ | $ | |||||||||

| Reimbursable operating expenses | |||||||||||

| Adviser commitment fee payable | |||||||||||

| Stockholder servicing fees | |||||||||||

| Management fees | |||||||||||

| Performance fees | |||||||||||

| Total | $ | $ | |||||||||

| $ in thousands | Class S Shares | Class S-1 Shares | Class D Shares | Class D-1 Shares | |||||||||||||||||||

| For the period ended March 31, 2025 | $ | $ | $ | $ | |||||||||||||||||||

| For the year ended December 31, 2024 | $ | $ | $ | $ | |||||||||||||||||||

| Class S Shares | Class S-1 Shares | Class D Shares | Class D -1 Shares | Class I Shares | Class E Shares | Class F Shares | |||||||||||||||||||||||||||||||||||

| Maximum Upfront Selling Commissions (% of Transaction Price) | up to | up to | up to | up to | |||||||||||||||||||||||||||||||||||||

| Stockholder Servicing Fee (% of NAV) | |||||||||||||||||||||||||||||||||||||||||

| March 31, 2025 | |||||||||||||||||||||||||||||||||||||||||||||||

| $ in thousands, except share amounts | Class S Shares | Class S-1 Shares | Class D Shares | Class D-1 Shares | Class I Shares | Class E Shares | Class F Shares | Total Purchase Price | |||||||||||||||||||||||||||||||||||||||

Invesco Realty, Inc.(1) | $ | ||||||||||||||||||||||||||||||||||||||||||||||

Invesco Advisers, Inc.(2) | |||||||||||||||||||||||||||||||||||||||||||||||

Members of our board of directors (3) | |||||||||||||||||||||||||||||||||||||||||||||||

| Total | $ | ||||||||||||||||||||||||||||||||||||||||||||||

| December 31, 2024 | |||||||||||||||||||||||||||||||||||||||||||||||

| $ in thousands, except share amounts | Class S Shares | Class S-1 Shares | Class D Shares | Class D-1 Shares | Class I Shares | Class E Shares | Class F Shares | Total Purchase Price | |||||||||||||||||||||||||||||||||||||||

Invesco Realty, Inc.(1) | $ | ||||||||||||||||||||||||||||||||||||||||||||||

Invesco Advisers, Inc.(2) | |||||||||||||||||||||||||||||||||||||||||||||||

Members of our board of directors (3) | |||||||||||||||||||||||||||||||||||||||||||||||

| Total | $ | ||||||||||||||||||||||||||||||||||||||||||||||

| $ in thousands | Class S Redeemable Common Stock | Class D Redeemable Common Stock | Class I Redeemable Common Stock | Class E Redeemable Common Stock | Total Redeemable Common Stock | ||||||||||||||||||||||||

| Balance as of December 31, 2024 | $ | $ | $ | $ | $ | ||||||||||||||||||||||||

| Issuance of redeemable common stock | |||||||||||||||||||||||||||||

| Repurchase of redeemable common stock | ( | ( | ( | ( | ( | ||||||||||||||||||||||||

| Adjustment to carrying value of redeemable common stock | ( | ( | ( | ||||||||||||||||||||||||||

| Balance as of March 31, 2025 | $ | $ | $ | $ | $ | ||||||||||||||||||||||||

| $ in thousands | Class S Redeemable Common Shares | Class D Redeemable Common Shares | Class I Redeemable Common Shares | Class E Redeemable Common Shares | Total Redeemable Common Stock | ||||||||||||||||||||||||

| Balance as of December 31, 2023 | $ | $ | $ | $ | $ | ||||||||||||||||||||||||

| Issuance of redeemable common stock | |||||||||||||||||||||||||||||

| Adjustment to carrying value of redeemable common stock | |||||||||||||||||||||||||||||

| Balance as of March 31, 2024 | $ | $ | $ | $ | $ | ||||||||||||||||||||||||

| Class S Redeemable Common Shares | Class D Redeemable Common Shares | Class I Redeemable Common Shares | Class E Redeemable Common Shares | Total Redeemable Common Stock | |||||||||||||||||||||||||

| Outstanding Shares as of December 31, 2024 | |||||||||||||||||||||||||||||

| Issuance of redeemable common stock | |||||||||||||||||||||||||||||

| Repurchase of redeemable common stock | ( | ( | ( | ( | ( | ||||||||||||||||||||||||

| Outstanding Shares as of March 31, 2025 | |||||||||||||||||||||||||||||

| Class S Redeemable Common Shares | Class D Redeemable Common Shares | Class I Redeemable Common Shares | Class E Redeemable Common Shares | Total Redeemable Common Stock | |||||||||||||||||||||||||

| Outstanding Shares as of December 31, 2023 | |||||||||||||||||||||||||||||

| Issuance of redeemable common stock | |||||||||||||||||||||||||||||

| Outstanding Shares as of March 31, 2024 | |||||||||||||||||||||||||||||

| Three Months Ended March 31, 2025 | |||||||||||||||||||||||||||||||||||||||||||||||

| Class S Shares | Class S-1 Shares | Class D Shares | Class D-1 Shares | Class I Shares | Class E Shares | Class F Shares | Total | ||||||||||||||||||||||||||||||||||||||||

| Total Outstanding Shares as of December 31, 2024 | |||||||||||||||||||||||||||||||||||||||||||||||

| Issuance of common stock to unaffiliated stockholders | |||||||||||||||||||||||||||||||||||||||||||||||

| Common stock distribution reinvestment | |||||||||||||||||||||||||||||||||||||||||||||||

Issuance of redeemable common shares(1) | |||||||||||||||||||||||||||||||||||||||||||||||

| Repurchase of common stock | ( | ( | ( | ( | ( | ||||||||||||||||||||||||||||||||||||||||||

| Repurchase of redeemable common stock | ( | ( | ( | ( | ( | ||||||||||||||||||||||||||||||||||||||||||

Total Outstanding Shares as of March 31, 2025 | |||||||||||||||||||||||||||||||||||||||||||||||

| Three Months Ended March 31, 2024 | |||||||||||||||||||||||||||||||||||||||||

| Class S Shares | Class S-1 Shares | Class D Shares | Class I Shares | Class E Shares | Class F Shares | Total | |||||||||||||||||||||||||||||||||||

| Total Outstanding Shares as of December 31, 2023 | |||||||||||||||||||||||||||||||||||||||||

| Issuance of common stock to unaffiliated stockholders | |||||||||||||||||||||||||||||||||||||||||

| Common stock distribution reinvestment | |||||||||||||||||||||||||||||||||||||||||

| Total Outstanding Shares as of March 31, 2024 | |||||||||||||||||||||||||||||||||||||||||

| Three Months Ended March 31, 2025 | ||||||||||||||||||||||||||||||||||||||||||||

| Class S Shares | Class S-1 Shares | Class D Shares | Class D-1 Shares(1) | Class I Shares | Class E Shares | Class F Shares | ||||||||||||||||||||||||||||||||||||||

| Aggregate distribution declared per share | $ | $ | $ | $ | $ | $ | $ | |||||||||||||||||||||||||||||||||||||

| Stockholder servicing fee per share | ( | ( | ||||||||||||||||||||||||||||||||||||||||||

| Net distribution declared per share | $ | $ | $ | $ | $ | $ | $ | |||||||||||||||||||||||||||||||||||||

| Three Months Ended March 31, 2024 | ||||||||||||||||||||||||||||||||||||||

| Class S Shares | Class S-1 Shares | Class D Shares | Class I Shares | Class E Shares | Class F Shares(3) | |||||||||||||||||||||||||||||||||

| Aggregate distribution declared per share | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||

| Stockholder servicing fee per share | ( | |||||||||||||||||||||||||||||||||||||

| Net distribution declared per share | $ | $ | $ | $ | $ | $ | ||||||||||||||||||||||||||||||||

| For the Three Months Ended | |||||||||||

| $ in thousands, except share and per share amounts | March 31, 2025 | March 31, 2024 | |||||||||

| Net income (loss) available to common stockholders | $ | $ | |||||||||

| Weighted average common shares outstanding | |||||||||||

| Effect of dilutive restricted stock awards | |||||||||||

| Diluted weighted average common shares outstanding | |||||||||||

| Earnings (loss) per share: | |||||||||||

| Basic | $ | $ | |||||||||

| Diluted | $ | $ | |||||||||

| $ in thousands except share amounts | Shares Issued to Third-Parties | Shares Issued to Affiliates(1)(2) | DRP Shares(3) | |||||||||||||||||

| Class S | ||||||||||||||||||||

| Class S-1 | ||||||||||||||||||||

| Class D | ||||||||||||||||||||

| Class D-1 | ||||||||||||||||||||

| Class I | ||||||||||||||||||||

| Class E | ||||||||||||||||||||

| Class F | ||||||||||||||||||||

| Total | ||||||||||||||||||||

Total net proceeds(4) | $ | $ | $ | |||||||||||||||||

| $ in thousands | March 31, 2025 | December 31, 2024 | March 31, 2024 | ||||||||||||||

| Number of investments | 56 | 46 | 14 | ||||||||||||||

| Principal balance | $ | 2,785,906 | $ | 2,390,362 | $ | 823,415 | |||||||||||

| Fair value | $ | 2,788,480 | $ | 2,391,078 | $ | 824,333 | |||||||||||

Unfunded loan commitments(1) | $ | 337,952 | $ | 298,266 | $ | 131,091 | |||||||||||

Weighted-average interest rate(2) | 7.23 | % | 7.38 | % | 8.46 | % | |||||||||||

Weighted-average maximum maturity (years)(3) | 4.1 | 4.3 | 4.6 | ||||||||||||||

Origination loan-to-value (LTV)(4) | 62 | % | 63 | % | 65 | % | |||||||||||

| Three Months Ended | Three Months Ended | ||||||||||

| $ in thousands | March 31, 2025 | March 31, 2024 | |||||||||

| Loan originations | $ | 368,733 | $ | 204,439 | |||||||

| Loan fundings | 15,973 | 5,473 | |||||||||

| Loan repayments and sales | — | — | |||||||||

| Total net fundings | $ | 384,706 | $ | 209,912 | |||||||

| $ in thousands | ||||||||||||||||||||||||||||||||||||||||||||||||||

| Metropolitan Statistical Area | Property Type | Origination Date | Weighted Average Interest Rate(1) | Loan Amount(2) | Principal Balance Outstanding | Fair Value | Current Maturity | Maximum Maturity(3) | ||||||||||||||||||||||||||||||||||||||||||

| Phoenix | Industrial | 05/17/2023 | 7.67% | $ | 136,000 | $ | 123,926 | $ | 123,926 | 6/9/2025 | 6/9/2028 | |||||||||||||||||||||||||||||||||||||||

| San Jose | Multifamily | 05/31/2023 | 7.47% | 41,700 | 41,700 | 41,700 | 6/9/2026 | 6/9/2028 | ||||||||||||||||||||||||||||||||||||||||||

New York (4) | Multifamily | 07/26/2023 | 7.42% | 73,600 | 73,600 | 73,600 | 8/9/2026 | 8/9/2028 | ||||||||||||||||||||||||||||||||||||||||||

| Los Angeles | Multifamily | 08/04/2023 | 7.42% | 85,180 | 81,037 | 81,037 | 8/9/2025 | 8/9/2028 | ||||||||||||||||||||||||||||||||||||||||||

| Miami | Industrial | 08/25/2023 | 7.67% | 42,676 | 36,700 | 36,700 | 9/9/2025 | 9/9/2028 | ||||||||||||||||||||||||||||||||||||||||||

| Richmond | Industrial | 09/25/2023 | 7.67% | 38,300 | 34,718 | 34,718 | 10/9/2025 | 10/9/2028 | ||||||||||||||||||||||||||||||||||||||||||

| Atlanta | Industrial | 11/06/2023 | 7.67% | 92,950 | 84,494 | 84,494 | 11/9/2025 | 11/9/2028 | ||||||||||||||||||||||||||||||||||||||||||

| Dallas | Multifamily | 12/07/2023 | 7.12% | 70,000 | 65,224 | 65,280 | 12/9/2026 | 12/9/2028 | ||||||||||||||||||||||||||||||||||||||||||

| Seattle | Multifamily | 12/12/2023 | 7.27% | 68,500 | 68,500 | 68,500 | 12/9/2026 | 12/9/2028 | ||||||||||||||||||||||||||||||||||||||||||

New York (5) | Multifamily | 12/21/2023 | 7.32% | 22,500 | 22,500 | 22,500 | 12/9/2026 | 12/9/2028 | ||||||||||||||||||||||||||||||||||||||||||

| Houston | Multifamily | 01/24/2024 | 7.32% | 61,500 | 61,000 | 61,000 | 2/9/2027 | 2/9/2029 | ||||||||||||||||||||||||||||||||||||||||||

| New York | Multifamily | 02/08/2024 | 7.32% | 120,000 | 76,865 | 76,865 | 2/9/2027 | 2/9/2029 | ||||||||||||||||||||||||||||||||||||||||||

| Orange County | Multifamily | 03/05/2024 | 7.47% | 56,600 | 56,520 | 56,520 | 3/9/2027 | 3/9/2029 | ||||||||||||||||||||||||||||||||||||||||||

| Los Angeles | Multifamily | 03/28/2024 | 7.32% | 45,000 | 41,535 | 41,538 | 4/9/2026 | 4/9/2029 | ||||||||||||||||||||||||||||||||||||||||||

| Los Angeles | Multifamily | 04/12/2024 | 7.37% | 66,050 | 61,125 | 61,163 | 4/9/2027 | 4/9/2029 | ||||||||||||||||||||||||||||||||||||||||||

| New York | Multifamily | 05/02/2024 | 7.32% | 150,000 | 40,724 | 40,935 | 5/9/2027 | 5/9/2029 | ||||||||||||||||||||||||||||||||||||||||||

| Fort Worth | Multifamily | 05/15/2024 | 7.22% | 22,500 | 21,775 | 21,775 | 6/9/2026 | 6/9/2029 | ||||||||||||||||||||||||||||||||||||||||||

| Fort Worth | Multifamily | 05/15/2024 | 7.22% | 23,650 | 23,500 | 23,500 | 6/9/2026 | 6/9/2029 | ||||||||||||||||||||||||||||||||||||||||||

| Orange County | Industrial | 05/31/2024 | 7.17% | 47,275 | 43,472 | 43,497 | 6/9/2027 | 6/9/2029 | ||||||||||||||||||||||||||||||||||||||||||

| Dallas | Multifamily | 06/07/2024 | 7.12% | 40,740 | 36,797 | 36,873 | 6/9/2027 | 6/9/2029 | ||||||||||||||||||||||||||||||||||||||||||

| San Francisco | Multifamily | 06/17/2024 | 6.97% | 33,500 | 30,653 | 30,701 | 7/9/2027 | 7/9/2029 | ||||||||||||||||||||||||||||||||||||||||||

| Jacksonville | Multifamily | 06/28/2024 | 7.42% | 40,350 | 38,903 | 38,903 | 7/9/2027 | 7/9/2029 | ||||||||||||||||||||||||||||||||||||||||||

| Various U.S. | Self-Storage | 07/10/2024 | 7.52% | 42,448 | 41,439 | 41,469 | 8/9/2027 | 8/9/2029 | ||||||||||||||||||||||||||||||||||||||||||

| Houston | Multifamily | 07/24/2024 | 7.22% | 50,750 | 49,750 | 49,786 | 8/9/2026 | 8/9/2029 | ||||||||||||||||||||||||||||||||||||||||||

| Tampa | Multifamily | 08/01/2024 | 7.02% | 41,750 | 41,750 | 41,780 | 8/9/2027 | 8/9/2029 | ||||||||||||||||||||||||||||||||||||||||||

| Dallas | Multifamily | 08/01/2024 | 7.17% | 44,000 | 44,000 | 44,032 | 8/9/2026 | 8/9/2029 | ||||||||||||||||||||||||||||||||||||||||||

| Las Vegas | Industrial | 08/20/2024 | 7.12% | 55,515 | 53,325 | 53,373 | 9/9/2027 | 9/9/2029 | ||||||||||||||||||||||||||||||||||||||||||

| Various U.S. | Self-Storage | 08/27/2024 | 7.52% | 11,267 | 10,467 | 10,476 | 9/9/2027 | 9/9/2029 | ||||||||||||||||||||||||||||||||||||||||||

| Washington D.C. | Multifamily | 08/28/2024 | 7.07% | 101,000 | 98,611 | 98,796 | 9/9/2027 | 9/9/2029 | ||||||||||||||||||||||||||||||||||||||||||

| Various U.S. | Industrial | 08/30/2024 | 7.72% | 83,500 | 77,576 | 77,683 | 9/9/2027 | 9/9/2029 | ||||||||||||||||||||||||||||||||||||||||||

| Various U.S. | Industrial | 09/12/2024 | 7.07% | 128,010 | 122,463 | 122,463 | 10/9/2027 | 10/9/2029 | ||||||||||||||||||||||||||||||||||||||||||

| Various U.S. | Industrial | 09/13/2024 | 7.07% | 47,881 | 47,881 | 47,881 | 10/9/2027 | 10/9/2029 | ||||||||||||||||||||||||||||||||||||||||||

| Barcelona, Spain | Industrial | 09/26/2024 | 5.96% | 99,014 | 99,014 | 99,111 | 10/9/2027 | 10/9/2028 | ||||||||||||||||||||||||||||||||||||||||||

| Paris, France | Industrial | 09/26/2024 | 5.96% | 88,463 | 88,463 | 88,550 | 10/9/2027 | 10/9/2028 | ||||||||||||||||||||||||||||||||||||||||||

| Bristol, United Kingdom | Industrial | 09/26/2024 | 7.72% | 107,366 | 107,366 | 107,516 | 10/9/2027 | 10/9/2028 | ||||||||||||||||||||||||||||||||||||||||||

| Tacoma | Self-Storage | 10/08/2024 | 7.52% | 13,356 | 12,829 | 12,842 | 10/9/2027 | 10/9/2029 | ||||||||||||||||||||||||||||||||||||||||||

| Gainesville | Self-Storage | 10/08/2024 | 7.52% | 7,030 | 6,757 | 6,765 | 10/9/2027 | 10/9/2029 | ||||||||||||||||||||||||||||||||||||||||||

| Lynchburg | Self-Storage | 10/08/2024 | 7.52% | 14,225 | 13,383 | 13,397 | 10/9/2027 | 10/9/2029 | ||||||||||||||||||||||||||||||||||||||||||

| Los Angeles | Multifamily | 10/10/2024 | 7.17% | 22,545 | 20,360 | 20,382 | 10/9/2026 | 10/9/2029 | ||||||||||||||||||||||||||||||||||||||||||

| Washington D.C. | Multifamily | 10/15/2024 | 7.02% | 98,900 | 97,570 | 97,786 | 10/9/2027 | 10/9/2029 | ||||||||||||||||||||||||||||||||||||||||||

| San Jose | Industrial | 10/31/2024 | 12.08% | 30,000 | 11,475 | 11,475 | 10/31/2027 | 10/31/2029 | ||||||||||||||||||||||||||||||||||||||||||

New York (6) | Multifamily | 12/06/2024 | 7.07% | 61,897 | 61,397 | 61,421 | 12/9/2027 | 12/9/2029 | ||||||||||||||||||||||||||||||||||||||||||

| Orange County | Industrial | 12/13/2024 | 7.27% | 67,832 | 54,400 | 54,485 | 1/9/2028 | 1/9/2030 | ||||||||||||||||||||||||||||||||||||||||||

| Riverside | Industrial | 12/17/2024 | 7.52% | 58,092 | 47,187 | 47,260 | 1/9/2028 | 1/9/2030 | ||||||||||||||||||||||||||||||||||||||||||

| Ft Lauderdale | Self-Storage | 12/18/2024 | 7.52% | 14,251 | 13,096 | 13,117 | 1/9/2028 | 1/9/2030 | ||||||||||||||||||||||||||||||||||||||||||

| Chicago | Industrial | 12/20/2024 | 7.27% | 31,802 | 30,415 | 30,463 | 1/9/2028 | 1/9/2030 | ||||||||||||||||||||||||||||||||||||||||||

| Austin | Industrial | 01/16/2025 | 7.37% | 26,042 | 22,044 | 22,082 | 2/9/2028 | 2/9/2030 | ||||||||||||||||||||||||||||||||||||||||||

| Raleigh | Student Housing | 01/30/2025 | 7.02% | 43,460 | 38,500 | 38,604 | 2/9/2027 | 2/9/2030 | ||||||||||||||||||||||||||||||||||||||||||

| Baton Rouge | Student Housing | 02/06/2025 | 7.02% | 29,500 | 22,750 | 22,812 | 2/9/2027 | 2/9/2030 | ||||||||||||||||||||||||||||||||||||||||||

| Columbia | Student Housing | 02/06/2025 | 7.02% | 29,750 | 24,780 | 24,847 | 2/9/2027 | 2/9/2030 | ||||||||||||||||||||||||||||||||||||||||||

| Portland | Multifamily | 02/13/2025 | 7.02% | 60,165 | 59,483 | 59,556 | 3/9/2027 | 3/9/2030 | ||||||||||||||||||||||||||||||||||||||||||

| Austin | Student Housing | 02/19/2025 | 7.02% | 49,943 | 44,800 | 44,921 | 3/9/2027 | 3/9/2030 | ||||||||||||||||||||||||||||||||||||||||||

| Eugene | Student Housing | 02/19/2025 | 7.02% | 73,053 | 63,857 | 64,030 | 3/9/2027 | 3/9/2030 | ||||||||||||||||||||||||||||||||||||||||||

| Knoxville | Student Housing | 02/20/2025 | 7.02% | 98,290 | 80,500 | 80,644 | 3/9/2027 | 3/9/2030 | ||||||||||||||||||||||||||||||||||||||||||

| Minneapolis | Self-Storage | 03/11/2025 | 7.42% | 7,475 | 6,900 | 6,900 | 4/9/2028 | 4/9/2030 | ||||||||||||||||||||||||||||||||||||||||||

| Philadelphia | Self-Storage | 03/11/2025 | 7.42% | 6,715 | 6,050 | 6,050 | 4/9/2028 | 4/9/2030 | ||||||||||||||||||||||||||||||||||||||||||

| 7.23% | $ | 3,123,858 | $ | 2,785,906 | $ | 2,788,480 | ||||||||||||||||||||||||||||||||||||||||||||

| $ in thousands | ||||||||||||||||||||

| Counterparty | Loan Count | Fair Value | % of Loan Portfolio | |||||||||||||||||

Borrower A(1) | 3 | 295,177 | 11 | % | ||||||||||||||||

Sponsor A(2) | 7 | 320,596 | 11 | % | ||||||||||||||||

Sponsor B - Facility I(3) | 6 | 251,160 | 9 | % | ||||||||||||||||

Sponsor B - Facility II(3) | 8 | 111,016 | 4 | % | ||||||||||||||||

Sponsor B - Facility III(3) | 5 | 195,214 | 7 | % | ||||||||||||||||

| $ in thousands | Current Maturity | Extension Options | Weighted Average Interest Rate | Maximum Facility Size | Amount Outstanding | Available Balance | ||||||||||||||||||||||||||||||||

| Term Lending Agreement | ||||||||||||||||||||||||||||||||||||||

| INCREF Lending II | Match-term | Match-term | 6.61% | 300,000 | 134,518 | 165,482 | ||||||||||||||||||||||||||||||||

| Secured Lending Agreements | ||||||||||||||||||||||||||||||||||||||

| Term Financing | ||||||||||||||||||||||||||||||||||||||

| INCREF Lending I | Oct 2026 | Oct 2029 | 6.33% | 837,517 | 728,711 | 108,806 | ||||||||||||||||||||||||||||||||

| Repurchase Agreements | ||||||||||||||||||||||||||||||||||||||

| Morgan Stanley Bank | May 2026 | May 2027 | 6.59% | 500,000 | 345,886 | 154,114 | ||||||||||||||||||||||||||||||||

| Citibank | Sep 2026 | Sep 2028 | 5.65% | 500,000 | 284,992 | 215,008 | ||||||||||||||||||||||||||||||||

| Barclays | Apr 2027 | Apr 2029 | 6.23% | 500,000 | 199,305 | 300,695 | ||||||||||||||||||||||||||||||||

| Wells Fargo | May 2026 | May 2029 | 6.15% | 300,000 | 268,724 | 31,276 | ||||||||||||||||||||||||||||||||

| Bank of Montreal | Jul 2025 | Jul 2028 | —% | 25,000 | — | 25,000 | ||||||||||||||||||||||||||||||||

| Capital One | Feb 2027 | Feb 2030 | 5.85% | 250,000 | 187,124 | 62,876 | ||||||||||||||||||||||||||||||||

| Total secured financing facilities | $ | 3,212,517 | $ | 2,149,260 | $ | 1,063,257 | ||||||||||||||||||||||||||||||||

| Revolving Credit Facility | 8.26% | $ | 135,000 | $ | — | $ | 135,000 | |||||||||||||||||||||||||||||||

| Three Months Ended March 31, | |||||||||||||||||

| $ in thousands except per share amount | 2025 | 2024 | $ Change | ||||||||||||||

| Net Interest Income | |||||||||||||||||

| Commercial real estate loan interest income | $ | 46,841 | $ | 15,140 | $ | 31,701 | |||||||||||

| Other interest income | 975 | 241 | 734 | ||||||||||||||

| Interest expense | (31,297) | (10,406) | (20,891) | ||||||||||||||

| Net interest income | 16,519 | 4,975 | 11,544 | ||||||||||||||

| Other Income (Expense) | |||||||||||||||||

| Unrealized gain (loss) on loans, net | 12,680 | 918 | 11,762 | ||||||||||||||

| Unrealized gain (loss) on secured financing facilities, net | (8,474) | (723) | (7,751) | ||||||||||||||

| Gain (loss) on derivative instruments, net | (2,180) | — | (2,180) | ||||||||||||||

| Gain (loss) on foreign currency transactions, net | 9 | — | 9 | ||||||||||||||

Commitment fee income, net of related party expense of $2,119 and $1,398 for the three months ended March 31, 2025 and 2024, respectively | 2,119 | 1,398 | 721 | ||||||||||||||

| Other income | 289 | 101 | 188 | ||||||||||||||

| Total other income (expense), net | 4,443 | 1,694 | 2,749 | ||||||||||||||

| Expenses | |||||||||||||||||

| Management and performance fees - related party | 1,830 | 350 | 1,480 | ||||||||||||||

| Debt issuance and other financing costs related to borrowings, at fair value | 4,916 | 469 | 4,447 | ||||||||||||||

| Organizational costs | 2 | 5 | (3) | ||||||||||||||

| General and administrative | 2,550 | 1,158 | 1,392 | ||||||||||||||

| Total expenses | 9,298 | 1,982 | 7,316 | ||||||||||||||

| Net income (loss) | $ | 11,664 | $ | 4,687 | $ | 6,977 | |||||||||||

| Dividends to preferred stockholders | (2) | (7) | 5 | ||||||||||||||

| Issuance and redemption costs of redeemed preferred stock | (27) | — | (27) | ||||||||||||||

| Net income (loss) attributable to common stockholders | $ | 11,635 | $ | 4,680 | $ | 6,955 | |||||||||||

| Earnings (loss) per share: | |||||||||||||||||

| Net income (loss) attributable to common stockholders | |||||||||||||||||

| Basic | $ | 0.43 | $ | 0.65 | $ | (0.22) | |||||||||||

| Diluted | $ | 0.43 | $ | 0.65 | $ | (0.22) | |||||||||||

| Weighted average number of shares of common stock | |||||||||||||||||

| Basic | 27,233,292 | 7,183,194 | 20,050,098 | ||||||||||||||

| Diluted | 27,233,368 | 7,183,777 | 20,049,591 | ||||||||||||||

| Three Months Ended March 31, | |||||||||||

| $ in thousands | 2025 | 2024 | |||||||||

Average earning assets(1) | $ | 2,663,955 | $ | 740,952 | |||||||

Average earning assets yield(2) | 7.03 | % | 8.17 | % | |||||||

| Three Months Ended March 31, | |||||||||||

| $ in thousands | 2025 | 2024 | |||||||||

Average borrowings(1) | $ | 2,043,460 | $ | 569,169 | |||||||

Maximum borrowings (2) | $ | 2,149,259 | $ | 627,258 | |||||||

Average cost of funds(3) | 6.13 | % | 7.31 | % | |||||||

| Three Months Ended March 31, | |||||||||||

| $ in thousands | 2025 | 2024 | |||||||||

| Secured financing facilities interest expense | $ | 31,072 | $ | 10,134 | |||||||

| Revolving credit agreement interest expense | 225 | 272 | |||||||||

| Total interest expense | $ | 31,297 | $ | 10,406 | |||||||

| $ in thousands, except share data | March 31, 2025 | December 31, 2024 | ||||||||||||

| Commercial real estate loan investments, at fair value | $ | 2,788,480 | 2,391,078 | |||||||||||

| Cash and cash equivalents | 65,675 | 80,221 | ||||||||||||

| Restricted cash | 28,572 | 19,813 | ||||||||||||

| Interest receivable | 13,316 | 12,600 | ||||||||||||

| Derivative assets, at fair value | 1,767 | 4,064 | ||||||||||||

Other assets(1) | 727 | 5,780 | ||||||||||||

Unamortized debt costs | 9,608 | 332 | ||||||||||||

| Secured lending agreements, at fair value | (2,015,125) | (1,720,350) | ||||||||||||

| Term lending agreement, at fair value | (134,518) | (134,518) | ||||||||||||

| Interest payable | (7,871) | (8,344) | ||||||||||||

| Dividends and distributions payable | (4,257) | (3,765) | ||||||||||||

| Accounts payable, accrued expenses and other liabilities | (34,294) | (23,159) | ||||||||||||

Due to affiliates(2) | (6,389) | (8,756) | ||||||||||||

| Preferred stock liquidation preference | — | (228) | ||||||||||||

| Net asset value | $ | 705,691 | $ | 614,768 | ||||||||||

Number of outstanding shares(3) | 27,808,959 | 24,252,394 | ||||||||||||

$ in thousands, except per share data | Class S Shares | Class S-1 Shares | Class D Shares | Class I Shares | Class E Shares | Class F Shares | Total | |||||||||||||||||||||||||||||||||||||

| Net asset value | $ | 30,299 | $ | 266,239 | $ | 30,307 | $ | 125,584 | $ | 37,394 | $ | 215,868 | $ | 705,691 | ||||||||||||||||||||||||||||||

Number of outstanding shares(1) | 1,206,852 | 10,563,745 | 1,207,933 | 4,989,536 | 1,461,264 | 8,379,629 | 27,808,959 | |||||||||||||||||||||||||||||||||||||

NAV Per Share(2) | $ | 25.11 | $ | 25.20 | $ | 25.09 | $ | 25.17 | $ | 25.59 | $ | 25.76 | ||||||||||||||||||||||||||||||||

| $ in thousands | March 31, 2025 | December 31, 2024 | ||||||||||||

| Stockholders' equity | $ | 546,203 | 435,349 | |||||||||||

| Adjustments: | ||||||||||||||

| Redeemable common stock - related party | 124,341 | 151,367 | ||||||||||||

Advanced organizational, offering and operating expenses(1) | 13,371 | 14,128 | ||||||||||||

Accrued stockholder servicing fees not currently payable(2) | 12,168 | 8,372 | ||||||||||||

| Unamortized debt issuance costs | 9,608 | 5,780 | ||||||||||||

| Preferred stock liquidation preference | — | (228) | ||||||||||||

| NAV | $ | 705,691 | $ | 614,768 | ||||||||||

| Three Months Ended | Three Months Ended | ||||||||||||||||||||||

| March 31, 2025 | March 31, 2024 | ||||||||||||||||||||||

| $ in thousands | Amount | Percentage | Amount | Percentage | |||||||||||||||||||

| Distributions | |||||||||||||||||||||||

| Payable in cash | $ | 4,915 | 38 | % | $ | 4,779 | 76 | % | |||||||||||||||

| Reinvested in shares | 8,028 | 62 | % | 1,532 | 24 | % | |||||||||||||||||

| Total distributions | $ | 12,943 | 100 | % | $ | 6,311 | 100 | % | |||||||||||||||

| Sources of Distributions | |||||||||||||||||||||||

| Cash flows from operating activities | $ | 11,271 | 87 | % | $ | 6,311 | 100 | % | |||||||||||||||

| Offering proceeds | 1,672 | 13 | % | — | — | ||||||||||||||||||

| Total sources of distribution | $ | 12,943 | 100 | % | $ | 6,311 | 100 | % | |||||||||||||||

| Net cash provided by operating activities | $ | 11,271 | $ | 8,435 | |||||||||||||||||||

| Declaration Date | Class S Shares | Class S-1 Shares | Class D Shares | Class I Shares | Class E Shares | Class F Shares | ||||||||||||||||||||||||||||||||

| January 31, 2025 | $ | 0.1599 | $ | 0.1418 | $ | 0.1600 | $ | 0.1600 | $ | 0.1600 | $ | 0.1600 | ||||||||||||||||||||||||||

| February 28, 2025 | 0.1599 | 0.1436 | 0.1600 | 0.1600 | 0.1600 | 0.1600 | ||||||||||||||||||||||||||||||||

February 28, 2025(1) | 0.0200 | 0.0200 | 0.0200 | 0.0200 | 0.0200 | 0.0200 | ||||||||||||||||||||||||||||||||

| March 31, 2025 | 0.1599 | 0.1418 | 0.1600 | 0.1600 | 0.1600 | 0.1600 | ||||||||||||||||||||||||||||||||

Total(2) | $ | 0.4997 | $ | 0.4472 | $ | 0.5000 | $ | 0.5000 | $ | 0.5000 | $ | 0.5000 | ||||||||||||||||||||||||||

| Three Months Ended March 31, | |||||||||||

| $ in thousands | 2025 | 2024 | |||||||||

| Cash flows from operating activities | $ | 11,271 | $ | 8,435 | |||||||

| Cash flows from investing activities | (384,589) | (209,912) | |||||||||

| Cash flows from financing activities | 367,532 | 195,917 | |||||||||

| Effect of exchange rate changes on cash, cash equivalents and restricted cash | (1) | — | |||||||||

| Net change in cash, cash equivalents and restricted cash | $ | (5,787) | $ | (5,560) | |||||||

| $ in thousands | March 31, 2025 | December 31, 2024 | |||||||||

| Cash and cash equivalents | $ | 65,675 | $ | 80,221 | |||||||

| Available borrowings under revolving credit agreements | 135,000 | 135,000 | |||||||||

| Available borrowings under secured financing facilities | 1,063,257 | 1,008,228 | |||||||||

| $ | 1,263,932 | $ | 1,223,449 | ||||||||

| $ in thousands | At March 31, 2025 | |||||||||||||

Change in Interest Rates | Projected Increase (Decrease) in Net Interest Income | Percentage Change in Projected Net Interest Income | ||||||||||||

| +1.00% | $ | 6,326 | 9.80 | % | ||||||||||

| -1.00% | $ | (921) | (1.40) | % | ||||||||||

| Counterparty | Loan Count | Fair Value | % of Loan Portfolio | |||||||||||||||||

Borrower A(1) | 3 | 295,177 | 11 | % | ||||||||||||||||

| $ in thousands | At March 31, 2025 | |||||||||||||

Change in Market Spreads | Projected Increase (Decrease) in Net Portfolio Value | Percentage Change in Projected Net Portfolio Value | ||||||||||||

| +1.00% | $ | (1,509) | (0.24) | % | ||||||||||

| -1.00% | $ | 5,479 | 0.86 | % | ||||||||||

| March 31, 2025 | ||||||||||||||

| Euro | GBP | |||||||||||||

| Foreign currency assets | € | 175,602 | £ | 84,439 | ||||||||||

| Foreign currency liabilities | (140,098) | (67,323) | ||||||||||||

| Foreign currency contracts - notional, net | (38,597) | (18,911) | ||||||||||||

| Net exposure to exchange rate fluctuations | € | (3,093) | £ | (1,795) | ||||||||||

Net exposure to exchange rate fluctuations in USD(1) | $ | (3,347) | $ | (2,322) | ||||||||||

| $ in thousands, except share and per share amounts | Issuance Date | Number of Shares | Price per Share | Total Value | ||||||||||||||||||||||

| Class S-1 | January 16, 2025 | 26,237 | $ | 25.1648 | $ | 660 | ||||||||||||||||||||

| Class D | January 16, 2025 | 12 | $ | 25.0440 | $ | — | ||||||||||||||||||||

| Class I | January 16, 2025 | 10,737 | $ | 25.1302 | $ | 270 | ||||||||||||||||||||

| Class E | January 16, 2025 | 427 | $ | 25.4005 | $ | 11 | ||||||||||||||||||||

| Class F | January 16, 2025 | 51,391 | $ | 25.5864 | $ | 1,315 | ||||||||||||||||||||

| Class S-1 | February 12, 2025 | 31,892 | $ | 25.1951 | $ | 804 | ||||||||||||||||||||

| Class D | February 12, 2025 | 13 | $ | 25.0840 | $ | — | ||||||||||||||||||||

| Class I | February 12, 2025 | 11,724 | $ | 25.1623 | $ | 295 | ||||||||||||||||||||

| Class E | February 12, 2025 | 428 | $ | 25.4712 | $ | 11 | ||||||||||||||||||||

| Class F | February 12, 2025 | 51,589 | $ | 25.6480 | $ | 1,323 | ||||||||||||||||||||

| Class S-1 | March 14, 2025 | 39,966 | $ | 25.1612 | $ | 1,005 | ||||||||||||||||||||

| Class D | March 14, 2025 | 74 | $ | 25.0527 | $ | 2 | ||||||||||||||||||||

| Class I | March 14, 2025 | 14,349 | $ | 25.1292 | $ | 361 | ||||||||||||||||||||

| Class E | March 14, 2025 | 515 | $ | 25.4785 | $ | 13 | ||||||||||||||||||||

| Class F | March 14, 2025 | 58,391 | $ | 25.6517 | $ | 1,498 | ||||||||||||||||||||

| Month of: | Total Number of Shares Repurchased | Average Price Paid per Share(1) | Total Number of Shares Repurchased as Part of Publicly Announced Plans or Programs(2) | Maximum Number of Shares Pending Repurchase Pursuant to Publicly Announced Plans or Programs (3) | ||||||||||||||||||||||

| January 2025 | 14,028 | $ | 24.33 | 14,028 | — | |||||||||||||||||||||

| February 2025 | 16,705 | $ | 24.70 | 16,705 | — | |||||||||||||||||||||

March 2025(4) | 1,191,045 | $ | 25.19 | — | — | |||||||||||||||||||||

| 1,221,778 | $ | 25.17 | 30,733 | — | ||||||||||||||||||||||

| Class of Notes | Principal or Notional Amount | Percentage of the Aggregate Notional Amount of all Notes | Ratings (Moody's/Fitch) | Initial Weighted Average Life of Notes(1) | Fully Extended Weighted Average Life of Notes(1) | |||||||||||||||||||||||||||

| Class A Notes | $ 706,068,00 | 58.000% | Aaa(sf) / AAAsf | 3.37 years | 3.88 years | |||||||||||||||||||||||||||

| Class A-S Notes | $ 129,344,00 | 10.625% | NR / AAAsf | 3.96 years | 4.59 years | |||||||||||||||||||||||||||

| Class B Notes | $ 91,302,00 | 7.500% | NR / AA-sf | 4.12 years | 4.73 years | |||||||||||||||||||||||||||

| Class C Notes | $ 71,520,00 | 5.875% | NR / A-sf | 4.20 years | 4.84 years | |||||||||||||||||||||||||||

| Class D Notes | $ 42,608,00 | 3.500% | NR / BBBsf | 4.41 years | 4.87 years | |||||||||||||||||||||||||||

| Class E Notes | $ 22,825,00 | 1.875% | NR / BBB-sf | 4.45 years | 4.87 years | |||||||||||||||||||||||||||

| Class F Notes | $ 42,608,00 | 3.500% | NR / BB-sf | 4.45 years | 4.87 years | |||||||||||||||||||||||||||

| Class G Notes | $ 30,434,00 | 2.500% | NR / B-sf | 4.45 years | 4.87 years | |||||||||||||||||||||||||||

| Income Notes | $ 80,650,32 | 6.625% | NR / NR | N/A | N/A | |||||||||||||||||||||||||||

| Note Protection Test | Ratio | |||||||

| Minimum Par Value | 112.16% | |||||||

| Minimum Interest Coverage | 120.00% | |||||||

| Exhibit No. | Description | |||||||

| 3.1 | ||||||||

| 3.2 | ||||||||

| 3.3 | ||||||||

| 3.4 | ||||||||

| 3.5 | ||||||||

| 3.6 | ||||||||

| 3.7 | ||||||||

| 3.8 | ||||||||

| 3.9 | ||||||||

| 3.10 | ||||||||

| 3.11 | ||||||||

| 4.1 | ||||||||

31.1* | ||||||||

31.2* | ||||||||

32.1** | ||||||||

32.2** | ||||||||

101 | The following financial information from the Company’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2025, formatted in iXBRL (inline eXtensible Business Reporting Language): (i) Condensed Consolidated Balance Sheets; (ii) Condensed Consolidated Statements of Comprehensive Income; (iii) Condensed Consolidated Statements of Changes in Equity and Redeemable Equity Instruments; and (iv) Condensed Consolidated Statements of Cash Flows | |||||||

104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) | |||||||

* Filed herewith ** Furnished herewith | ||||||||

| INVESCO COMMERCIAL REAL ESTATE FINANCE TRUST, INC. | ||||||||

| May 12, 2025 | By: | /s/ Hubert J. Crouch | ||||||

| Hubert J. Crouch | ||||||||

| Chief Executive Officer | ||||||||

| (Principal Executive Officer) | ||||||||

| May 12, 2025 | By: | /s/ Courtney Popelka | ||||||

| Courtney Popelka | ||||||||

| Chief Financial Officer | ||||||||

| (Principal Financial Officer and Principal Accounting Officer) | ||||||||

Date: May 12, 2025 | ||||||||

/s/ Hubert J. Crouch | ||||||||

| Hubert J. Crouch | ||||||||

| Chief Executive Officer | ||||||||

| (Principal Executive Officer) | ||||||||

Date: May 12, 2025 | ||||||||

| /s/ Courtney Popelka | ||||||||

| Courtney Popelka | ||||||||

| Chief Financial Officer | ||||||||

| (Principal Financial Officer and Principal Accounting Officer) | ||||||||

/s/ Hubert J. Crouch | |||||

| Hubert J. Crouch | |||||

| Chief Executive Officer | |||||

| (Principal Executive Officer) | |||||

May 12, 2025 | |||||

| /s/ Courtney Popelka | |||||

| Courtney Popelka | |||||

| Chief Financial Officer | |||||

| (Principal Financial Officer and Principal Accounting Officer) | |||||

| May 12, 2025 | |||||

Condensed Consolidated Statements of Comprehensive Income (Unaudited) (Parenthetical) - USD ($) $ in Thousands |

3 Months Ended | |

|---|---|---|

Mar. 31, 2025 |

Mar. 31, 2024 |

|

| Unrealized foreign exchange gains | $ 10,800 | |

| Unrealized foreign exchange losses | (8,700) | |

| Related Party | ||

| Commitment and other fee expense | $ 2,119 | $ 1,398 |

Organization and Business Purpose |

3 Months Ended |

|---|---|

Mar. 31, 2025 | |

| Organization, Consolidation and Presentation of Financial Statements [Abstract] | |

| Organization and Business Purpose | Organization and Business Purpose Invesco Commercial Real Estate Finance Trust, Inc. (the “Company” or “we”) is a Maryland corporation incorporated in October 2022. Our primary investment strategy is to originate, acquire and manage a diversified portfolio of loans and debt-like preferred equity interests secured by, or unsecured but related to, commercial real estate. We commenced investing activities in May 2023. We own substantially all of our assets through Invesco Commercial Real Estate Finance Investments, L.P. (the “Operating Partnership”), a wholly-owned subsidiary. We are externally managed by Invesco Advisers, Inc. (the “Adviser”), a registered investment adviser and an indirect, wholly-owned subsidiary of Invesco Ltd. (“Invesco”), an independent global investment management firm. We qualified as a real estate investment trust (“REIT”) for U.S. federal income tax purposes beginning with the taxable year ended December 31, 2023. We have one operating segment. We operate our business in a manner that permits our exclusion from the definition of an “Investment Company” under the Investment Company Act of 1940, as amended (the “Investment Company Act”). We are structured as a perpetual-life REIT and are engaging in a continuous, unlimited private placement offering of our common stock to “accredited investors” (as defined by Rule 501 promulgated pursuant to the Securities Act) (the “Continuous Offering”) under exemptions provided by Section 4(a)(2) of the Securities Act and applicable state securities laws. The Class S, Class S-1, Class D, Class D-1, Class I, and Class E shares sold in our Continuous Offering have different upfront selling commissions, ongoing stockholder servicing fees, management fees and performance fees.

|

Summary of Significant Accounting Policies |

3 Months Ended |

|---|---|

Mar. 31, 2025 | |

| Accounting Policies [Abstract] | |

| Summary of Significant Accounting Policies | Summary of Significant Accounting Policies Basis of Presentation and Consolidation Certain disclosures included in our Annual Report on Form 10-K are not required to be included on an interim basis in our quarterly reports on Form 10-Q. We have condensed or omitted these disclosures. Therefore, this Form 10-Q should be read in conjunction with our Annual Report on Form 10-K for the year ended December 31, 2024. Our condensed consolidated financial statements have been prepared in accordance with generally accepted accounting principles in the United States of America (“U.S. GAAP”) and consolidate the financial statements of the Company and its controlled subsidiaries. All significant intercompany transactions, balances, revenues and expenses are eliminated upon consolidation. In the opinion of management, the condensed consolidated financial statements reflect all adjustments, consisting of normal recurring accruals, which are necessary for a fair statement of our financial condition and results of operations for the period presented. Use of Estimates The preparation of condensed consolidated financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the amounts reported in our condensed consolidated financial statements and accompanying notes. Examples of estimates may include, but are not limited to, estimates of the fair values of financial instruments and estimated payment periods for certain stockholder servicing fee liabilities. Actual results may differ from those estimates. Significant Accounting Policies There have been no changes to our accounting policies included in Note 2 to the consolidated financial statements of our Annual Report on Form 10-K for the year ended December 31, 2024.

|

Commercial Real Estate Loan Investments |

3 Months Ended | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Mar. 31, 2025 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Fair Value Disclosures [Abstract] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Commercial Real Estate Loan Investments | Commercial Real Estate Loan Investments The table below summarizes our investments in commercial real estate loans as of March 31, 2025 and December 31, 2024.

(1)Loan amount consists of outstanding principal balance plus unfunded loan commitments. (2)Domestic loans earn interest at the one-month Term Secured Overnight Financing Rate (“SOFR”) plus a spread. Euro denominated loans earn interest at three-month Euro Interbank Offered Rate (“Euribor”) plus a spread. Our loan denominated in British pounds sterling earns interest at three-month Sterling Overnight Index Average (“SONIA”) plus a spread. (3)Assumes all extension options are exercised by the borrower; however, loans may be repaid prior to such date. Extension options are subject to certain conditions, as defined in the respective loan agreement. (4)Senior loans include senior mortgages and similar credit quality loans, including related contiguous subordinate loans and accommodation mezzanine loans in connection with the senior mortgage financing. The tables below detail the property type and geographic location of the properties securing our commercial real estate loans as of March 31, 2025 and December 31, 2024.

(1) Various U.S. includes self-storage and industrial portfolios with multiple locations throughout the United States. (2) Our European loans that are collateralized by industrial commercial real estate in France and Spain are denominated in Euros and have a fair value of €81.8 million and €91.6 million, respectively, as of March 31, 2025. (3) Our European loan that is collateralized by industrial commercial real estate in the United Kingdom is denominated in British pounds sterling and has a fair value of £83.1 million as of March 31, 2025. The weighted average loan-to-value ratio, a metric utilized in the fair value measurement of our commercial real estate loan investments, for our loan investments at March 31, 2025 was approximately 65% based on the loan principal amount and the independent property appraisals.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Borrowings |

3 Months Ended | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Mar. 31, 2025 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||