UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

__________________

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) of the

SECURITIES EXCHANGE ACT OF 1934

__________________

November 22, 2013

Date of Report (Date of earliest event reported)

TEXAS GULF ENERGY, INCORPORATED

(Exact Name of Registrant as Specified in Charter)

| Nevada | 333-149857 | 26-0338889 |

|

(State or other Jurisdiction Of incorporation) |

(Commission File Number) | (IRS Employer Identification No.) |

| 1602 Old Underwood Road, La Porte, TX | 77571 |

| (Address of principal executive offices) | (Zip code) |

| Registrant's telephone number, including area code: | (281) 867-8400 |

| N/A |

(Former Name or Former Address, If Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| o | Pre-commencement communications pursuant to Rule 13c-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 1.01 Entry into a Material Definitive Agreement.

Please see the disclosures set forth under Item 2.01 below regarding the Agreement (as such term is defined therein) which are hereby incorporated into this Item 1.01 by reference.

Item 2.01 Completion of Acquisition or Disposition of Assets.

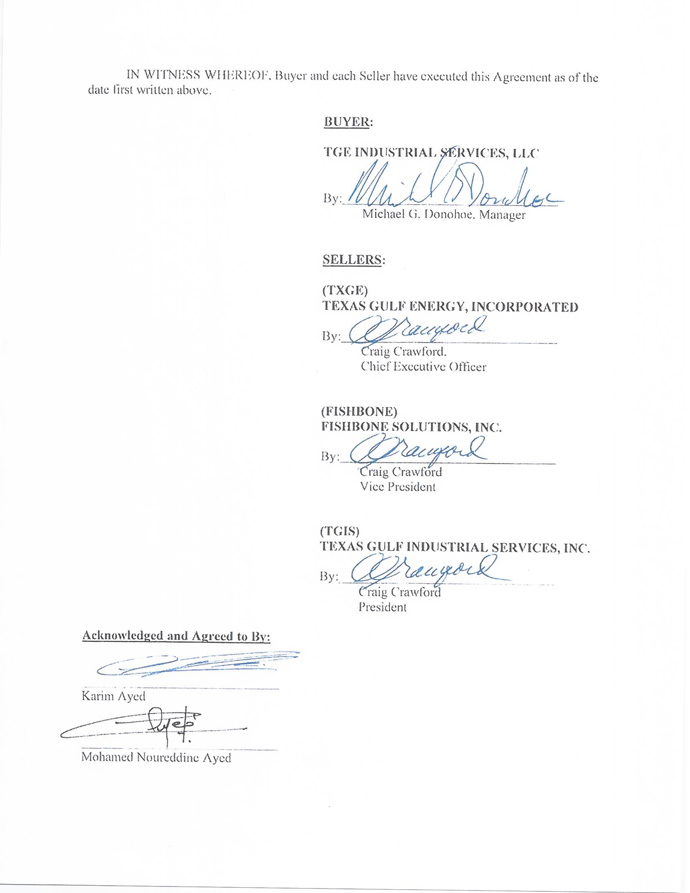

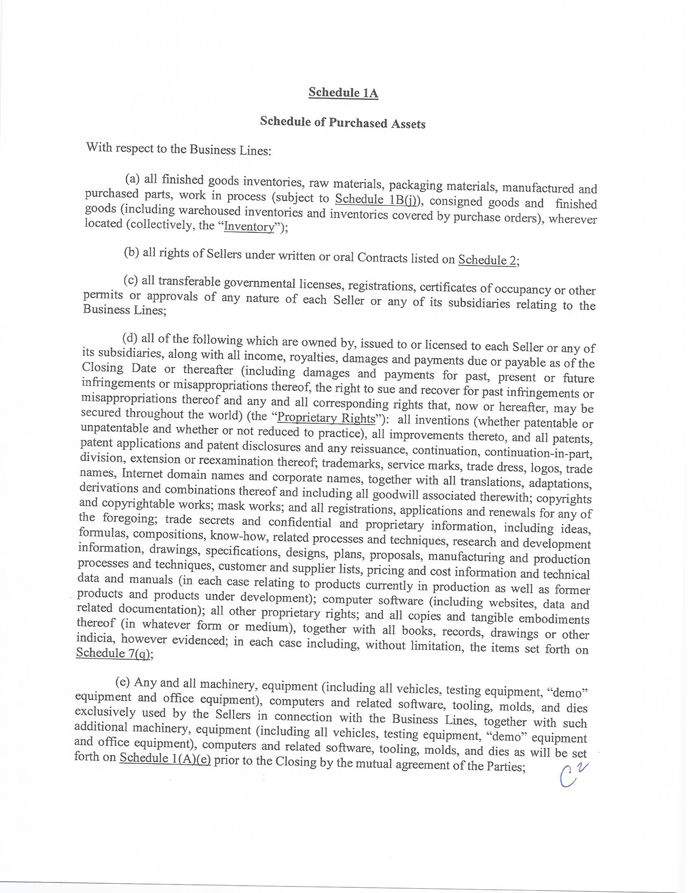

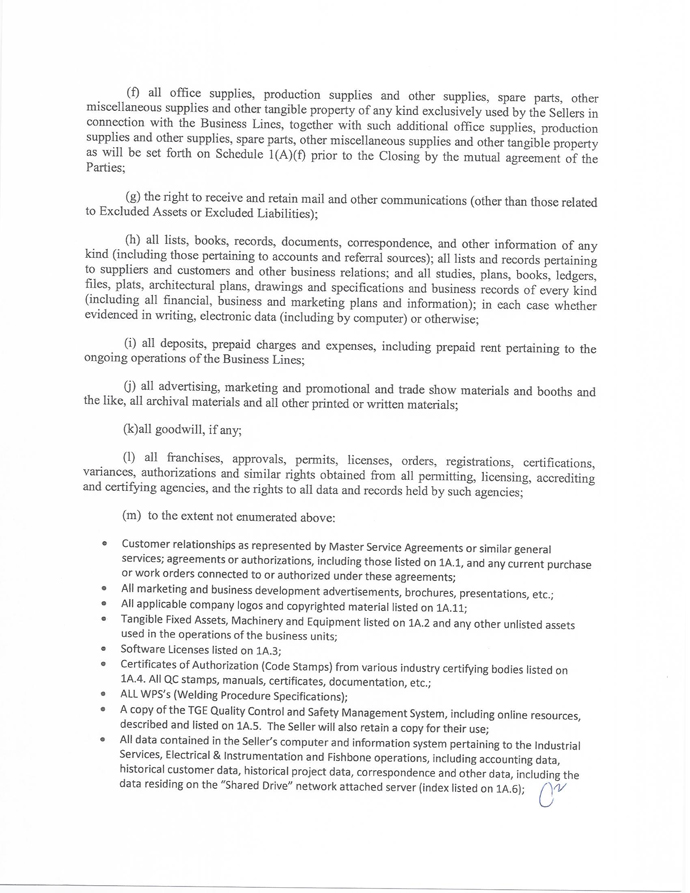

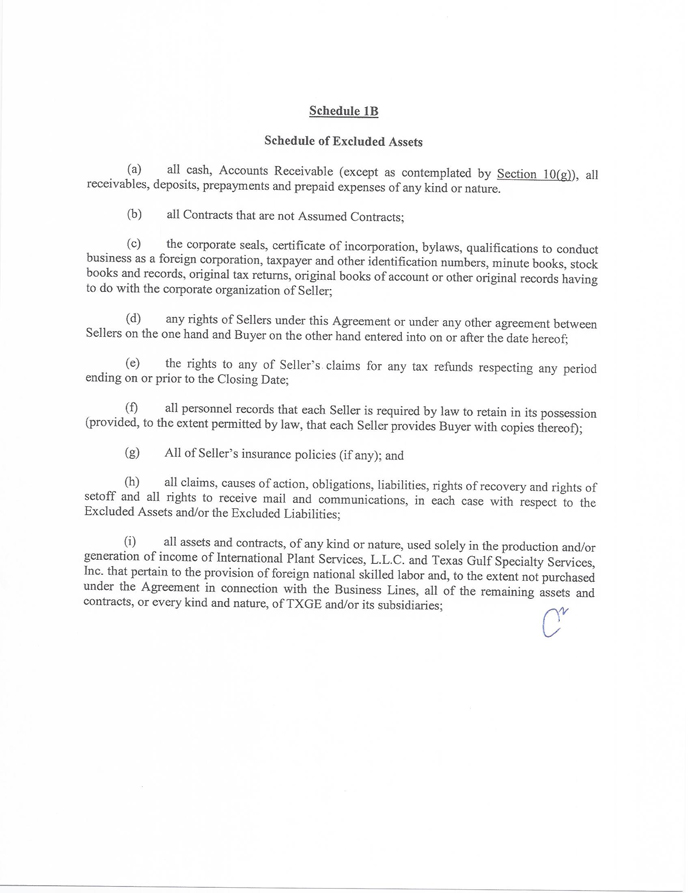

On November 22, 2013 (the “Closing Date”), Texas Gulf Energy, Incorporated, a Nevada corporation (the “Company”), closed a transaction (the “Transaction”) involving an Asset Purchase Agreement dated the Closing Date (the “Agreement”) by and among the Company and two of its subsidiaries, Fishbone Solutions, Inc., a Texas corporation (“FSI”), and Texas Gulf Industrial Services, Inc,, a Texas corporation (“TGIS”), and TGE Industrial Services, LLC, a Texas limited liability company (the “Buyer”). Pursuant to the terms of the Agreement, the Company sold substantially all of the assets of FSI, TGIS and TGE Electrical and Instrumentation (“TGEI”), an operating division of the Company, to the Buyer. As consideration for the transaction, the Buyer agreed to pay to the Company an aggregate purchase price of $4,137,335, consisting of (i) the assumption of $1,597,000 in certain promissory note obligations of the Company and FSI, including certain convertible promissory notes issued to John Sloan (“Sloan”) and a promissory note in favor of David Mathews (“Mathews”), as further described below, and (ii) cash in the amount of $2,540,335.

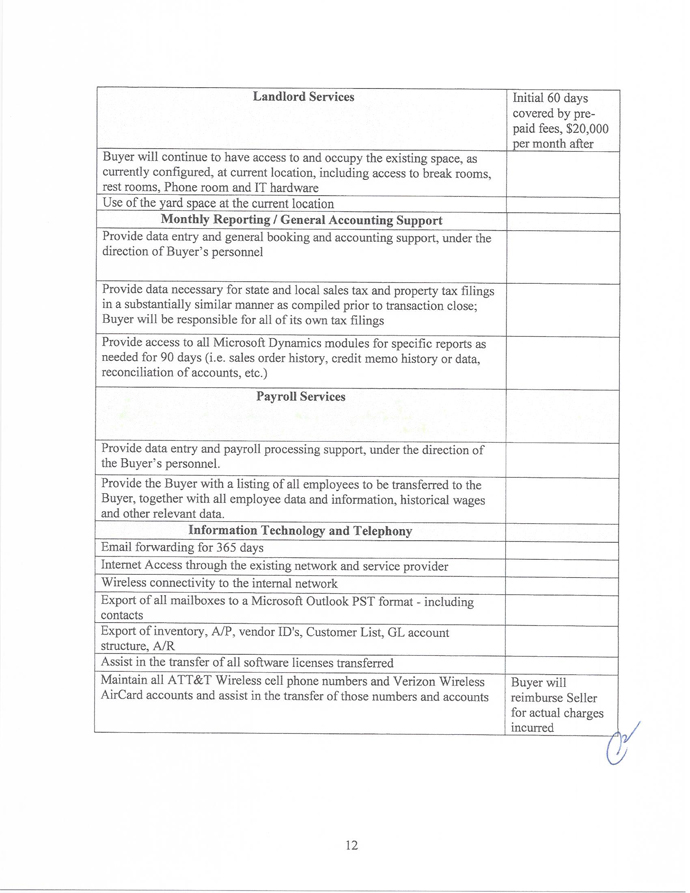

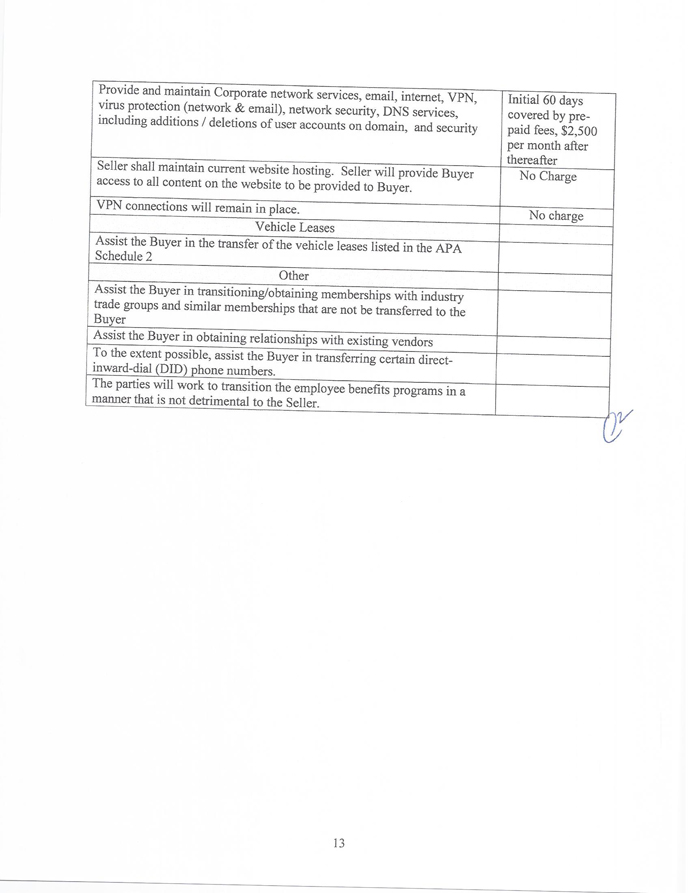

Also as of Closing Date, pursuant to the Agreement, the Company and the Buyer entered into a Transition Agreement (the “Transition Agreement”) whereby the Company agreed to provide certain services related to the continuing operation of FSI, TGIS and TGEI for a period of sixty (60) days, which by written notice of the Buyer may be extended for an additional thirty (30) days thereafter. As consideration for these services be rendered pursuant to the Transition Agreement, on the Closing Date the Buyer pre-paid the sum of $150,000 to the Company.

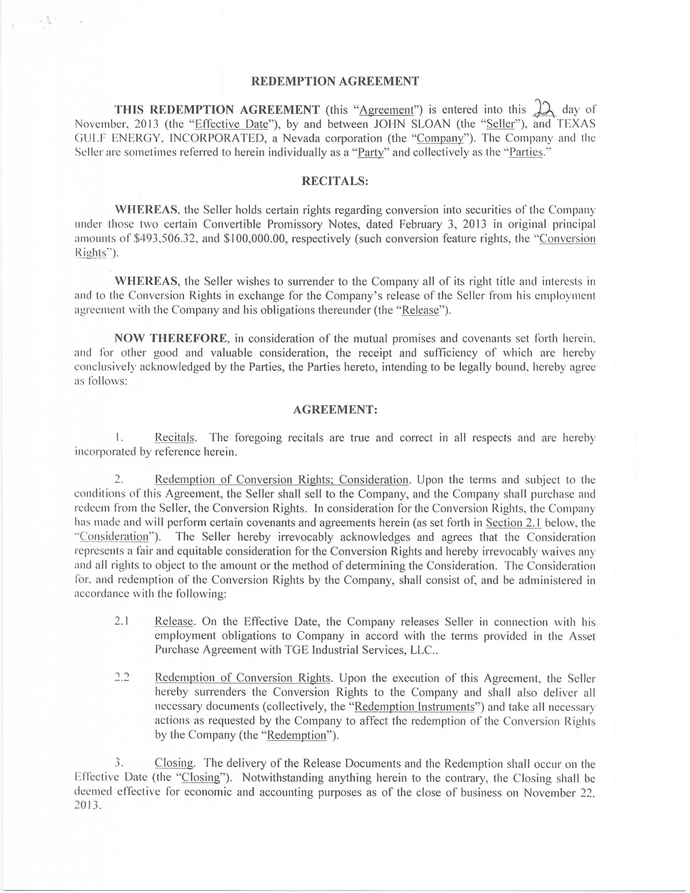

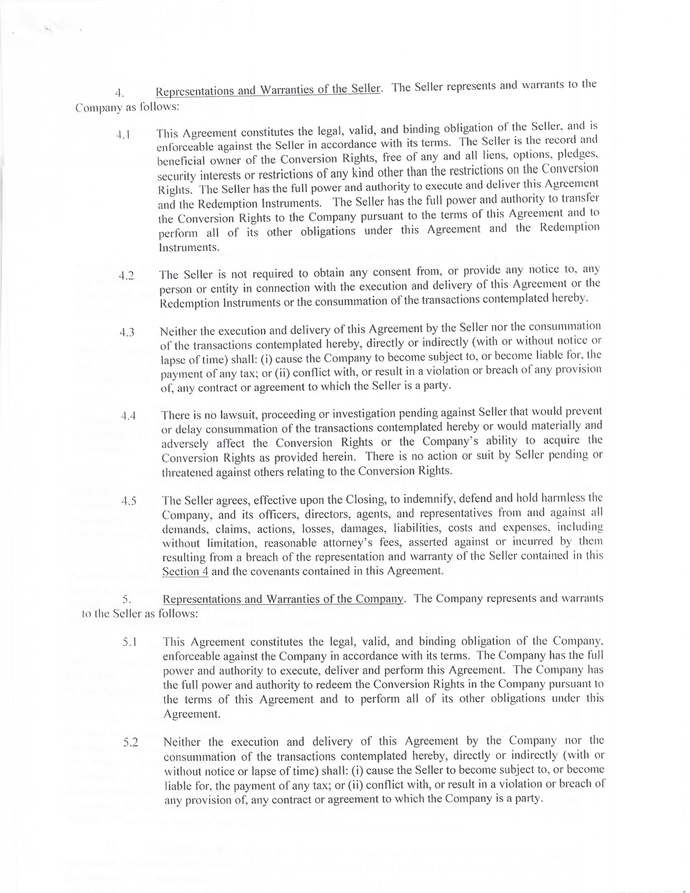

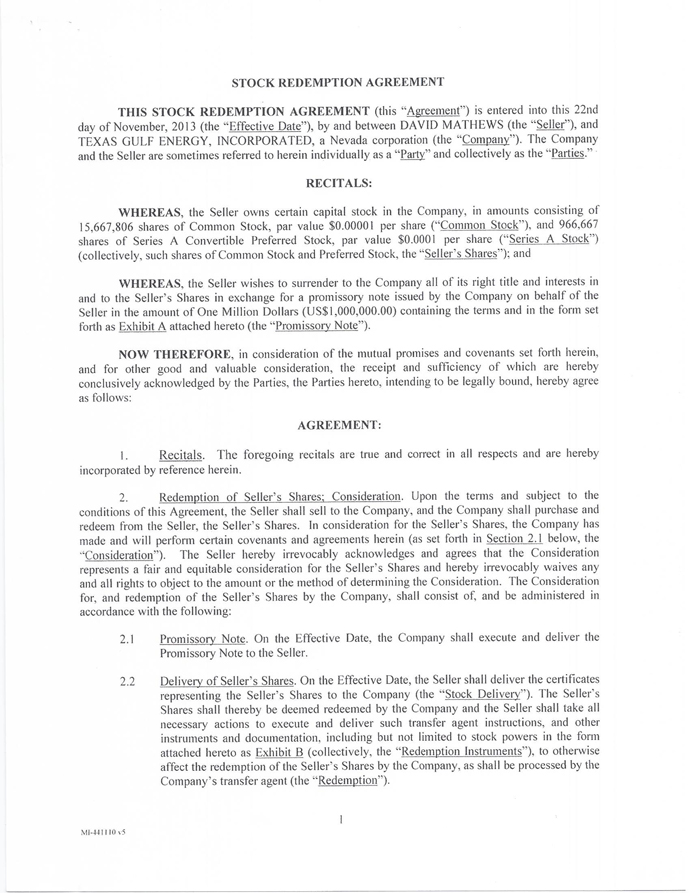

In conjunction and concurrent with the closing of the Transaction, the Company entered into and closed two other agreements, as follows: (i) a Redemption Agreement with Sloan whereby Sloan surrendered conversion rights under two Convertible Promissory Notes issued by the Company to Sloan, both dated February 3, 2013, in the original principal amounts of $493,506.32 and $100,000.00, respectively, (the “Sloan Notes”), in exchange for the Company's release of Sloan from his obligations under an employment agreement with the Company, and (ii) a Stock Redemption Agreement with Mathews, an officer of certain of the Company's subsidiaries and the Company's former Chief Executive Officer, whereby the Company redeemed certain capital stock in the Company, in amounts consisting of 15,667,806 shares of Common Stock and 966,667 shares of Series A Convertible Preferred Stock, in exchange for the Company’s issuance to Mathews of a Promissory Note in the amount of $1,000,000.00 (the “Mathews Note”). As a part of the Transaction, the Sloan Notes and the Mathews Note were assumed by the Buyer, and the Company has no further obligations under the Sloan Notes and the Mathews Note.

In connection with the Transaction, Mathews and Sloan each resigned from all employee and official or appointed positions with the Company and its subsidiaries and affiliates, including but limited to Fishbone Solutions, Inc. and Texas Gulf Industrial Services, Inc.

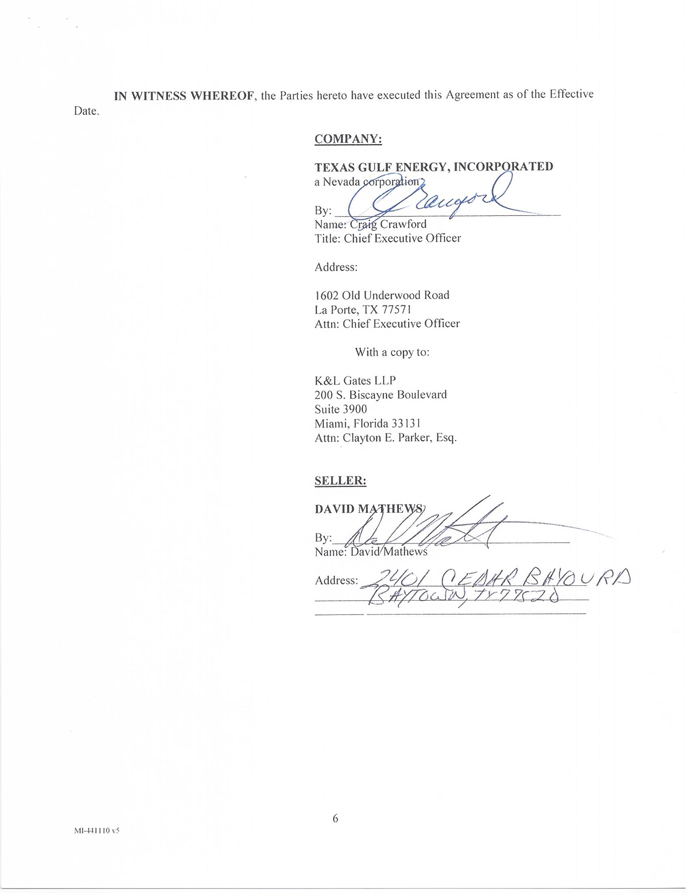

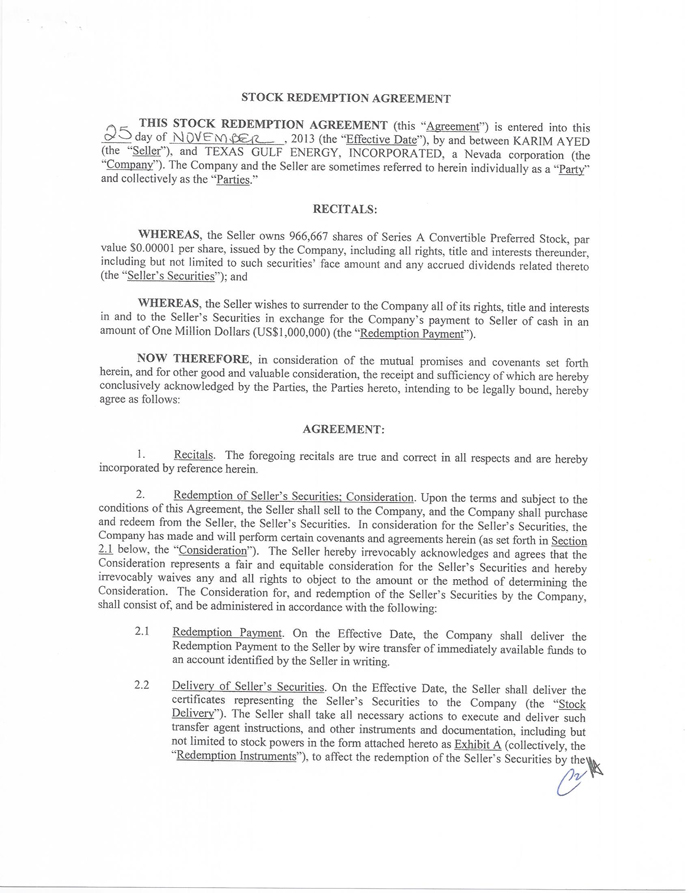

Following the closing of the Transaction, on November 25, 2013 the Company entered into and closed (i) a Stock Redemption Agreement with Karim Ayed, the Company's Chairman of the Board, whereby the Company redeemed 966,667 shares of Series A Convertible Preferred Stock in exchange for cash in the amount of $1,000,000.00 and (ii) a Stock Redemption Agreement with Mohamed Noureddine Ayed, the Company's former Chairman of the Board, whereby the Company redeemed 966,667 shares of Series A Convertible Preferred Stock in exchange for cash in the amount of $1,000,000.00. As a result of the redemptions of the Series A Convertible Preferred Stock previously owned by Mathews, Karim Ayed and Mohamed Noureddine Ayed, all previously issued and outstanding shares of the Series A Convertible Preferred Stock have been redeemed and retired.

As a result of the redemptions of shares and notes, as described hereinabove, the Company has reduced the number of outstanding shares of its Common Stock by 15,667,802 to 53,110,834 and the potential dilution of the remaining ouststanding shares of its Common Stock by approximately 39,092,656 shares.

Item 9.01 Financial Statements and Exhibits.

| (a) | Financial statements of business acquired. Not applicable. |

| (b) | Pro forma financial information. Not applicable |

| (c) | Shell company transactions. Not applicable. |

| (d) | Exhibits. |

|

EXHIBIT |

DESCRIPTION |

LOCATION | ||

|

10.1

|

Asset Purchase Agreement, dated November 22, 2013, by and among Texas Gulf Energy, Incorporated, Fishbone Solutions, Inc., Texas Gulf Industrial Services, Inc., and TGE Industrial Services, LLC. |

Provided herewith.

| ||

|

10.2

|

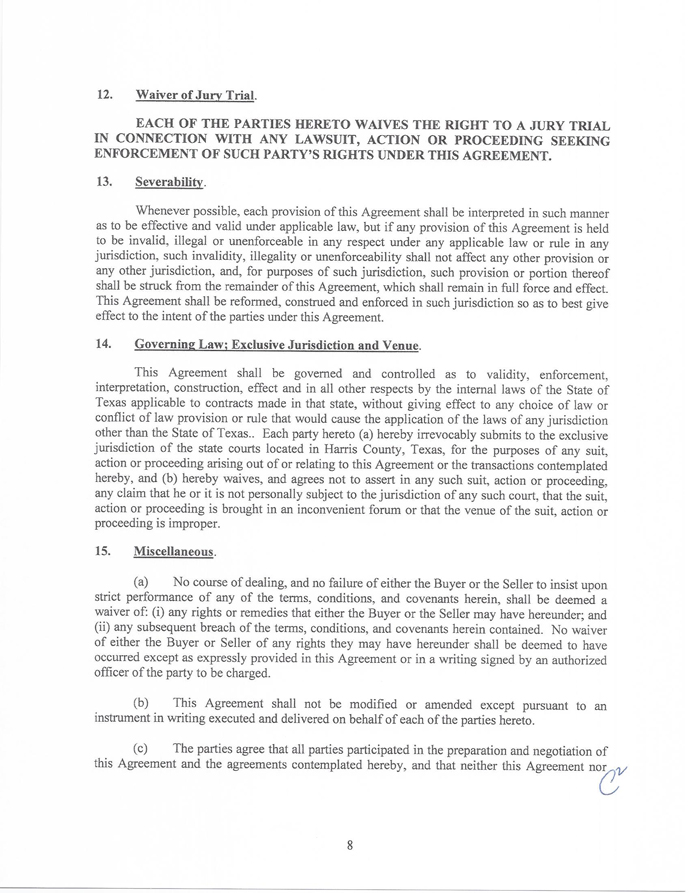

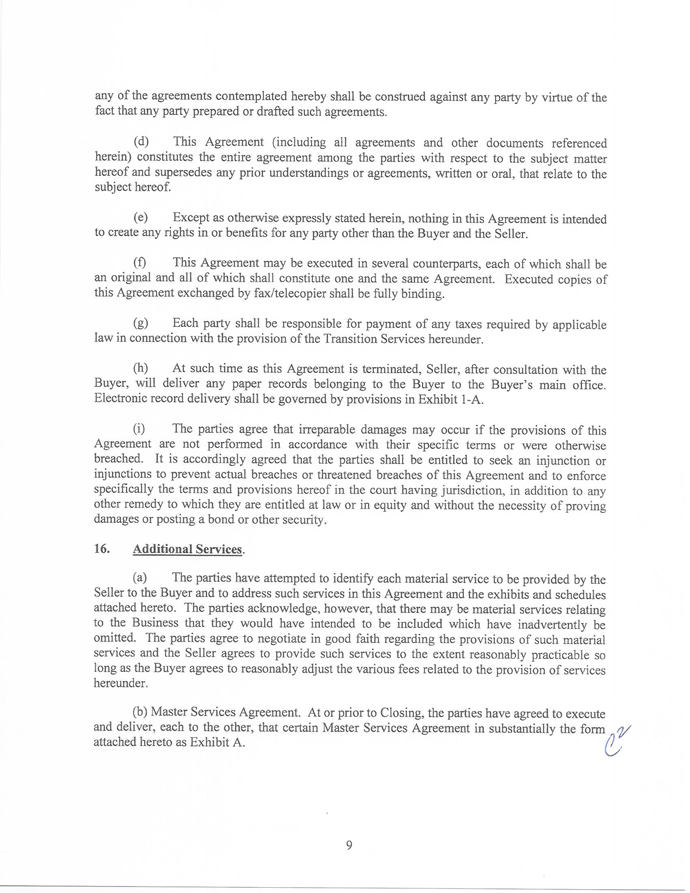

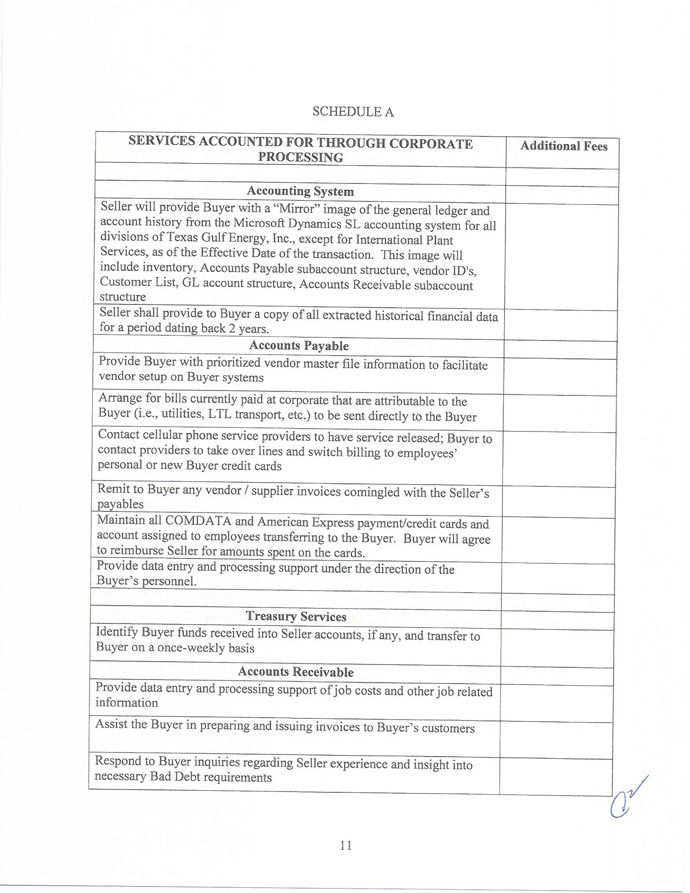

Transition Agreement, dated November 22, 2013, by and between Texas Gulf Energy, Incorporated and TGE Industrial Services, LLC. |

Provided herewith. | ||

|

10.3 |

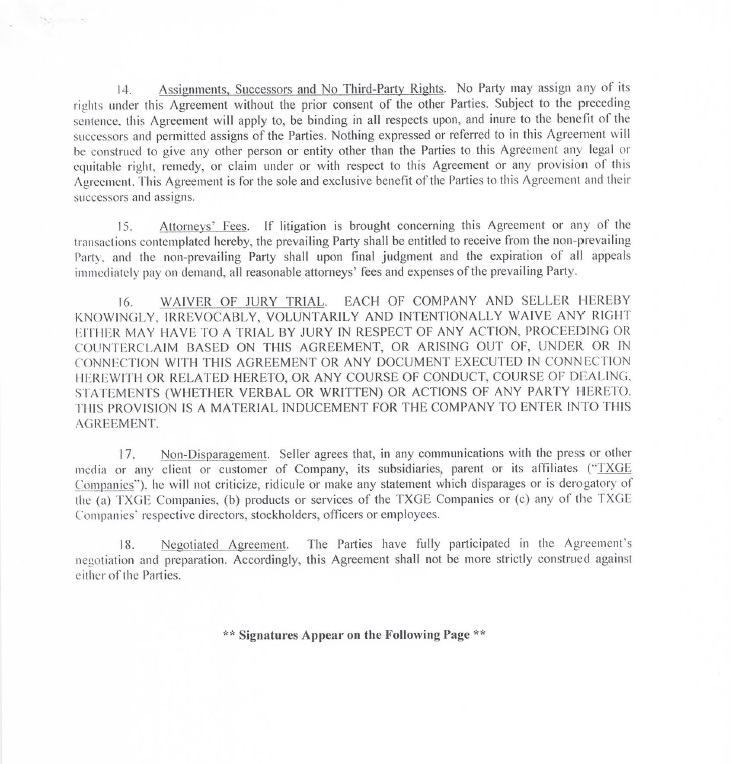

Redemption Agreement, dated November 22, 2013, by and between Texas Gulf Energy, Incorporated and John Sloan. |

Provided herewith. | ||

|

10.4 |

Stock Redemption Agreement, dated November 22, 2013, by and between Texas Gulf Energy, Incorporated and David Mathews. |

Provided herewith. | ||

|

10.5 |

Stock Redemption Agreement, dated November 25, 2013, by and between Texas Gulf Energy, Incorporated and Karim Ayed. |

Provided herewith. | ||

| 10.6 | Stock Redemption Agreement, dated November 25, 2013, by and between Texas Gulf Energy, Incorporated and Mohamed Noureddine Ayed. | Provided herewith. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this Current Report on Form 8-K to be signed on its behalf by the undersigned hereunto duly authorized.

Date: November 29, 2013

TEXAS GULF ENERGY, INCORPORATED

| By: /s/ Craig Crawford | ||

| Name: Craig Crawford | ||

| Title: Chief Executive Officer |