UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

| | | | |

x Annual Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the Fiscal Year Ended December 31, 2019 |

or | | | | |

¨ Transition Report Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the transition period from ____________________ to _____________________ |

Commission File Number: 333-185443

_________________________________________

Aleris Corporation

(Exact name of registrant as specified in its charter)

__________________________________________

|

| | | | |

Delaware | | 27-1539594 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

25825 Science Park Drive, Suite 400

Cleveland, Ohio 44122-7392

(Address of principal executive offices) (Zip code)

(216) 910-3400

(Registrant’s telephone number, including area code)

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT: None

SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT: None

______________________________________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes x No ¨

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ¨ No x

(Note: Registrant is a voluntary filer of reports required to be filed by certain companies under Sections 13 and 15(d) of the Securities Exchange Act of 1934 and has filed all reports that would have been required during the preceding 12 months, had it been subject to such filing requirements.)

Indicate by check mark whether the registrant has submitted electronically on its corporate Web site, if any, every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or emerging growth company. See the definitions of “large accelerated filer”, “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ¨ Accelerated filer¨ Non-accelerated filer x Smaller reporting company ¨ Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The registrant is a privately held corporation. As of June 30, 2019, the last business day of the registrant’s most recently completed second fiscal quarter, there was no established public trading market for the common stock of the registrant and therefore, an aggregate market value of the registrant’s common stock is not determinable.

There were 32,527,026 shares of the registrant’s common stock, par value $0.01 per share, outstanding as of February 15, 2020.

DOCUMENTS INCORPORATED BY REFERENCE: None

|

| | |

PART I | | Page |

Item 1. | | |

Item 1A. | | |

Item 1B. | | |

Item 2. | | |

Item 3. | | |

Item 4. | | |

| | |

PART II | | |

Item 5. | | |

Item 6. | | |

Item 7. | | |

Item 7A. | | |

Item 8. | | |

Item 9. | | |

Item 9A. | | |

Item 9B. | | |

| | |

PART III | | |

Item 10. | | |

Item 11. | | |

Item 12. | | |

Item 13. | | |

Item 14. | | |

| | |

PART IV | | |

Item 15. | | |

Item 16. | | |

| | |

Signatures | | |

PART I

ITEM 1. BUSINESS.

General

Aleris Corporation is a Delaware corporation with its principal executive offices located in Cleveland, Ohio. We are a holding company and currently conduct our business and operations through our direct wholly owned subsidiary, Aleris International, Inc. and its consolidated subsidiaries. As used in this annual report on Form 10-K, unless otherwise specified or the context otherwise requires, “Aleris,” “we,” “our,” “us,” and the “Company” refer to Aleris Corporation and its consolidated subsidiaries. Aleris International, Inc. is referred to herein as “Aleris International.”

The Company is majority owned by Oaktree Capital Management, L.P. (“Oaktree”) or its respective subsidiaries. The investment funds managed by Oaktree or its respective subsidiaries that are invested in the Company are referred to collectively as the “Oaktree Funds.”

On July 26, 2018, we announced that we entered into a definitive agreement to be acquired by Novelis Inc., a subsidiary of Hindalco Industries Limited, for approximately $2,600.0 million, including the assumption of the Company’s outstanding indebtedness (the “Merger”). The Merger is subject to customary regulatory approvals and closing conditions. There can be no assurance that the Merger will be consummated. See the Company’s Current Report on Form 8-K filed on July 27, 2018 for a more detailed discussion of the definitive agreement and the transactions contemplated thereby, including the Merger. See Item 1A. – “Risk Factors – Risks Related to Our Business – The closing of the Merger is subject to customer closing conditions as well as other uncertainties, and the Merger may not be completed.”

Available Information

We make available on or through our website (www.aleris.com) our reports on Forms 10-K, 10-Q and 8-K, and amendments thereto, as soon as reasonably practicable after we electronically file (or furnish, as applicable) such material with the Securities and Exchange Commission (“SEC”). The SEC maintains an internet site that contains these reports at www.sec.gov. We use our investor website (investor.aleris.com) as a channel of distribution of Company information. The information we post through this channel may be deemed material. Accordingly, investors should monitor this channel, in addition to following our press releases, SEC filings, and public conference calls and webcasts. None of the websites referenced in this annual report on Form 10-K or the information contained therein is incorporated herein by reference.

Company Overview

We are a global leader in the manufacture and sale of aluminum rolled products, with 13 production facilities located throughout North America, Europe and China. Our product portfolio ranges from the most technically demanding heat treated plate and sheet used in mission-critical applications to sheet produced through our low-cost continuous cast process. We possess a combination of technically advanced, flexible and low-cost manufacturing operations supported by an industry-leading research and development (“R&D”) platform. Our facilities are strategically located to serve our customers globally. Our diversified customer base includes a number of industry-leading companies such as Airbus, Audi, Boeing, Bombardier, Daimler, Embraer, Ford, General Motors and Volvo. Our technological and R&D capabilities allow us to produce the most technically demanding products, many of which require close collaboration and, in some cases, joint development with our customers. For the year ended December 31, 2019, we generated revenues of $3.4 billion, of which approximately 63% were derived from North America, 27% were derived from Europe and the remaining 10% were derived from the rest of the world.

Company History

Our predecessor was formed at the end of 2004 through the merger of Commonwealth Industries, Inc. and IMCO Recycling, Inc. The predecessor’s business grew through a combination of organic growth and strategic acquisitions, the most significant of which was the 2006 acquisition of the downstream aluminum business of Corus Group plc (“Corus Aluminum”). The Corus Aluminum acquisition doubled our predecessor’s size and significantly expanded both its presence in Europe and its ability to manufacture higher value-added products, including aerospace and autobody sheet (“ABS”).

The predecessor was acquired by Texas Pacific Group (“TPG”) in December 2006 and taken private. In 2007, it sold its zinc business in order to focus on its core aluminum business. In 2009, the predecessor, along with certain of its U.S. subsidiaries, filed voluntary petitions for Chapter 11 bankruptcy protection in the United States Bankruptcy Court for the District of Delaware. The bankruptcy filings were the result of a liquidity crisis brought on by the global recession and financial crisis. The predecessor’s ability to respond to the liquidity crisis was constrained by its highly leveraged capital structure, which at filing included $2.7 billion of debt, resulting from the 2006 leveraged buyout of the predecessor by TPG. As a result of the severe economic decline, the predecessor experienced sudden and significant value reductions across each end-use industry it served and a precipitous decline in the London Metal Exchange (“LME”) price of aluminum. These factors reduced the

availability of financing under the predecessor’s revolving credit facility and required the posting of cash collateral on aluminum hedges. The predecessor sought bankruptcy protection to alleviate its liquidity constraints and restructure its operations and financial position.

The Company was formed as a Delaware corporation in 2009 to acquire the assets and operations of the predecessor upon emergence from bankruptcy, which occurred on June 1, 2010. TPG exited our business during this time and we received significant support from new equity investors, led by the Oaktree Funds, the majority owner of Aleris Corporation, as well as certain investment funds managed by affiliates of Apollo Management Holdings, L.P. (“Apollo”) and Bain Capital Credit, LP (“Bain Capital Credit” and, together with the Oaktree Funds and Apollo, the “Investors”).

Since 2010, the Company has grown through the successful combination of strategic growth initiatives involving acquisitions, such as the 2014 acquisition of Nichols Aluminum LLC (“Nichols”), and investments in our existing facilities and in China. These initiatives were targeted at broadening our product offerings and geographic presence, diversifying our end-use customer base, increasing our scale and scope, and offering a higher value-added product mix. In 2015, we sold our recycling and specification alloys and extrusions businesses in order to focus on our aluminum rolled products business.

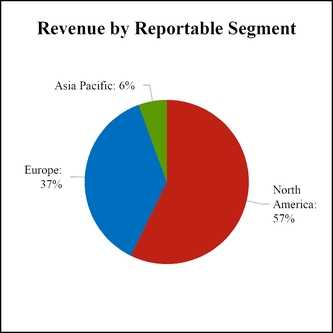

Business Segments

We report three operating segments based on the organizational structure that we use to evaluate performance, make decisions on resource allocations and perform business reviews of financial results. The Company’s operating segments (each of which is considered a reportable segment) are North America, Europe and Asia Pacific.

In addition to these reportable segments, we disclose corporate and other unallocated amounts, including start-up costs.

See Note 17, “Segment and Geographic Information,” to our audited consolidated financial statements included elsewhere in this annual report on Form 10-K for financial and geographic information about our segments.

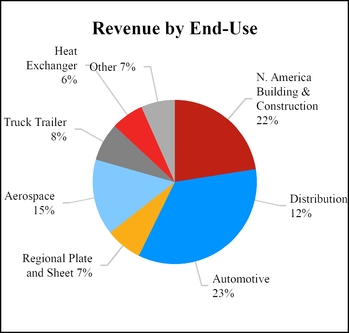

The following charts present the percentage of our consolidated revenue by reportable segment and by end-use for the year ended December 31, 2019:

North America

Our North America segment consists of nine manufacturing facilities located throughout the United States that produce rolled aluminum and coated products for the building and construction, automotive, truck trailer, consumer durables and other general industrial and distribution end-uses. Substantially all of our North America segment’s products are manufactured to specific customer requirements, using continuous cast and direct-chill technologies that provide us with significant flexibility to produce a wide range of products. Specifically, those products are integrated into, among other applications, building products, automobiles, truck trailers, appliances and recreational vehicles.

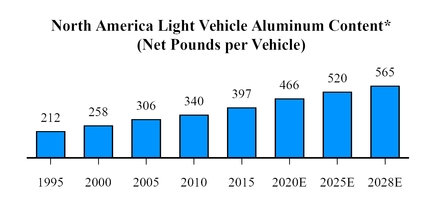

We have substantially completed our project to add autobody sheet (“ABS”) capabilities at our aluminum rolling mill in Lewisport, Kentucky (the “North America ABS Project”). We have invested approximately $425.0 million to build a new wide

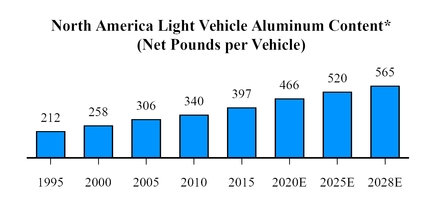

cold mill, two continuous annealing lines with pre-treatment (each, a “CALP”) and an automotive innovation center. We have also invested in upgrades to other key equipment at this facility, including upgrading our ingot scalper and pre-heating furnaces and widening the hot mill, to capture additional opportunities. We believe the investments position us to meet significant growth in demand for ABS in North America as the automotive industry pursues broader aluminum use for the production of lighter, more fuel-efficient vehicles.

In connection with the North America ABS Project, the segment has incurred costs associated with start-up activities, including the design and development of new products and processes, commissioning equipment upgrades, qualification of products, the manufacture of commissioning and qualification products, and the development of sales and marketing efforts necessary to enter this new end-use. These start-up costs were historically excluded from segment Adjusted EBITDA and segment income. The North America ABS Project substantially exited the start-up phase for the first CALP during the third quarter of 2018 and for the second CALP during the third quarter of 2019. The majority of the costs previously classified as start-up costs have been included in segment Adjusted EBITDA and segment income since the third quarter of 2018.

We have the largest footprint of continuous cast operations of any aluminum rolled products producer in North America. Our continuous cast operations have lower capital requirements and lower operating costs compared to our direct-chill cast operations.

For our continuous cast operations, scrap input typically comprises over 90% of our overall metal needs, which provides substantial benefits, including metal cost savings. For the year ended December 31, 2019, approximately 97% of our North America revenues were derived using a formula pricing model which allows us to pass through risks from the volatility of aluminum price changes by charging a market-based aluminum price plus a conversion fee.

Our North America segment produces rolled aluminum products ranging from thickness (gauge) of 0.002 to 0.249 inches in widths of up to 84 inches. The following table summarizes our North America segment’s principal products, end-uses, major customers and competitors:

|

| | |

Principal end use/product category | Major customers | Competitors |

|

• Building and construction (roofing, rainware and siding) | • American Construction Metals, First American, Gentek Building Products, Kaycan, Midwest Metals, Omnimax, Ply Gem Industries, Service Partners Gutter Supply, Rollex | • Jupiter Aluminum, JW Aluminum, Arconic, Vulcan, Oman Aluminum Rolling Company |

• Automotive | • General Motors, Ford, Tesla | • Arconic, Novelis, Constellium, Nanshan, AMAG, UACJ |

• Metal distribution | • Champagne Metals, Metals USA, Reliance, Ryerson, Wieland Metal Services, Thyssenkrupp-KenMac | • Arconic, Novelis, Constellium, Ta-Chen, Asian-American, Metal Exchange, Texarkana, Garmco, Hulamin, Alumindo Light Metal |

• Truck trailer | • Hyundai Translead, Rockwell Metals, Utility Trailer, Aluminum Line Products | • Arconic, Constellium, Novelis |

• Consumer durables, specialty coil and sheet (cookware, fuel tanks, ventilation, cooling and

lamp bases) | • ABB, Brunswick Boat Group, Ermco Distribution Transformers, Generation III, RPR Products | • Arconic, Gränges, JW Aluminum, Novelis, Skana Aluminum, Constellium |

• Converter foil, fins and tray materials | • Chart Energy & Chemicals, Handi-foil of America, Reynolds | • JW Aluminum, Gränges, Novelis, Rusal, Kibar Americas |

Key operating and financial information for the segment is presented below:

|

| | | | | | | | | | | | |

North America | | For the years ended December 31, |

(Dollars in millions, volumes in thousands of tons) | | 2019 | | 2018 | | 2017 |

Metric tons of finished product shipped | | 517.4 |

| | 517.5 |

| | 462.0 |

|

Revenues | | $ | 1,935.0 |

| | $ | 1,915.7 |

| | $ | 1,467.8 |

|

Segment income (1) | | $ | 259.8 |

| | $ | 196.0 |

| | $ | 88.0 |

|

Segment Adjusted EBITDA (1)(2) | | $ | 257.0 |

| | $ | 162.1 |

| | $ | 96.5 |

|

Total segment assets | | $ | 1,467.7 |

| | $ | 1,460.0 |

| | |

| |

(1) | Segment income and segment Adjusted EBITDA exclude start-up operating losses and expenses incurred during the start-up period. For the years ended December 31, 2019, 2018 and 2017, start-up costs were $7.8 million, $45.3 million and $66.6 million, respectively. |

| |

(2) | Segment Adjusted EBITDA is a non-GAAP financial measure. See Item 7. – “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Our Segments” for a definition and discussion of segment Adjusted EBITDA and a reconciliation to segment income. |

Europe

Our Europe segment consists of two world-class aluminum rolling mills, one in Koblenz, Germany and the other in Duffel, Belgium, and an aluminum cast house in Voerde, Germany. The segment produces aerospace plate and sheet, ABS, clad brazing sheet (clad aluminum material used for, among other applications, vehicle radiators and HVAC systems), heat-treated plate for engineered product applications and industrial coil and sheets. Substantially all of our Europe segment’s products are manufactured to specific customer requirements using direct-chill cast technologies that allow us to use and offer a variety of alloys and products for a number of technically demanding end-uses.

For over a decade, we have been a leading supplier of automotive and aerospace aluminum rolled products in Europe. We believe the technical and quality requirements needed to participate in these end-uses provides us with a competitive advantage. In 2018 we qualified and started production of wingskin products, a product for commercial aircraft wings to be used in the aerospace industry, in Koblenz.

Our Europe segment produces rolled aluminum products ranging from thickness (gauge) of 0.00031 to 11.0 inches in widths of up to 138 inches. The following table summarizes our Europe segment’s principal products, end-uses, major customers and competitors:

|

| | |

Principal end use/product category | Major customers | Competitors |

|

• Aerospace plate and sheet | • Airbus, Boeing, Bombardier, Dassault,

Embraer | • Arconic, AMAG, Constellium, Kaiser |

• Autobody sheet (inner, outer and structural parts) | • Audi, Daimler, Renault, Volvo, VW Group | • AMAG, Constellium, Hydro, Novelis, Profilglass, Maaden, Nanshan |

• Clad brazing sheet (heat exchanger materials for automotive and general industrial) | • Mahle, Dana, Denso, Hanon, Modine, Chart | • Arconic, AMAG, Gränges, Hydro, UACJ |

• Industrial plate and sheet (tooling, molding, road & rail, shipbuilding, LNG, silos, anodizing qualities for architecture, multi-layer tubing, and general industry) | • Amari Group, Amco, Euramax, Gilette, Henco, Linde, Multivac, RemiClaeys, SAG, Thyssenkrupp | • Arconic, AMAG, Constellium, Hydro, Novelis, Elval. Aludium, Zhongwang, Nanshan |

Key operating and financial information for the segment is presented below:

|

| | | | | | | | | | | | |

Europe | | For the years ended December 31, |

(Dollars in millions, volumes in thousands of tons) | | 2019 | | 2018 | | 2017 |

Metric tons of finished product shipped | | 310.8 |

| | 330.4 |

| | 317.3 |

|

Revenues | | $ | 1,275.9 |

| | $ | 1,407.4 |

| | $ | 1,300.7 |

|

Segment income | | $ | 130.1 |

| | $ | 129.8 |

| | $ | 127.4 |

|

Segment Adjusted EBITDA (1) | | $ | 125.1 |

| | $ | 128.7 |

| | $ | 127.7 |

|

Total segment assets | | $ | 719.7 |

| | $ | 736.4 |

| | |

| |

(1) | Segment Adjusted EBITDA is a non-GAAP financial measure. See Item 7. – “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Our Segments” for a definition and discussion of segment Adjusted EBITDA and a reconciliation to segment income. |

Asia Pacific

Our Asia Pacific segment consists of a rolling mill in Zhenjiang, Peoples Republic of China (PRC) that produces technically demanding and value-added plate products for aerospace, semiconductor equipment, general engineering, distribution and other end-uses worldwide. Substantially all of our Asia Pacific segment’s products are manufactured to specific customer requirements using direct-chill cast technologies that allow us to use and offer a variety of alloys and products principally for aerospace and also for a number of other technically demanding end-uses.

The Zhenjiang rolling mill commenced operations in the first quarter of 2013 and achieved Nadcap certification, an industry standard for the production of aerospace aluminum, in 2014. Since then, the Zhenjiang rolling mill has received qualifications from several industry-leading aircraft manufacturers, including Airbus, Boeing, Bombardier and COMAC, and is one of few facilities in Asia capable of meeting the exacting standards of the global aerospace industry.

We expect demand for aluminum plate in Asia to grow, driven by the development and expansion of industries serving aerospace, semiconductor, rail and other technically demanding applications. In anticipation of this demand, we built the

Zhenjiang rolling mill with 250,000 tons of annual hot mill capacity and the capability to both expand into other high growth and high value-added products, including ABS, clad brazing sheet and other technically demanding products, as well as produce additional aerospace and heat treated plate with modest incremental investment. We recently expanded our aerospace offerings by investing in machining equipment, and are introducing advanced alloys to allow for the production of pre-machined plates for commercial aircraft wings to be used in the aerospace industry, commercial shipments of which commenced in the second half of 2019.

The following table summarizes our Asia Pacific segment’s principal products, end-uses, major customers and competitors:

|

| | |

Principal end use/product category | Major customers | Competitors |

|

• Aerospace plate | • Airbus, Bombardier, Boeing, All Metal Services, Castle Metals, AVIC, Comac, Korean Aerospace Industries, Thyssenkrupp Aeropsace | • Arconic, Constellium, Kaiser, Nanshan, Chinalco, Kumz, SWA, NELA |

• Heat treated plate | • Clinton Aluminum, Hengtai, Jusung, Thyssenkrupp, Huahang | • Arconic, AMAG, Alro, Constellium, Kaiser, Kumz, Nanshan, UACJ, Zhongwang |

• Non-heat treated plate | • Kobelco Precision Parts, Korean Non Ferrous, Tozzhin | • UACJ, Alnan, SWA, NELA, Zhongwang, Nanshan, Kobelco |

Key operating and financial information for the segment is presented below:

|

| | | | | | | | | | | | |

Asia Pacific | | For the years ended December 31, |

(Dollars in millions, volumes in thousands of tons) | | 2019 | | 2018 | | 2017 |

Metric tons of finished product shipped | | 35.1 |

| | 29.4 |

| | 26.9 |

|

Revenues | | $ | 186.6 |

| | $ | 148.8 |

| | $ | 122.3 |

|

Segment income | | $ | 44.0 |

| | $ | 23.6 |

| | $ | 15.0 |

|

Segment Adjusted EBITDA (1) | | $ | 42.7 |

| | $ | 22.2 |

| | $ | 12.6 |

|

Total segment assets | | $ | 345.7 |

| | $ | 340.2 |

| | |

| |

(1) | Segment Adjusted EBITDA is non-GAAP financial measure. See Item 7. – “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Our Segments” for a definition and discussion of segment Adjusted EBITDA and a reconciliation to segment income. |

Industry Overview

Aluminum is a widely-used, attractive industrial material. Compared to several alternative metals such as steel and copper, aluminum is lightweight, has a high strength-to-weight ratio and is resistant to corrosion. Aluminum can be recycled repeatedly without any material decline in performance or quality. The recycling of aluminum delivers energy and capital investment savings relative to both the cost of producing primary aluminum and many other competing materials. The penetration of aluminum into a wide variety of applications continues to grow. We believe several factors support fundamental long-term growth in aluminum consumption in the end-uses we serve.

The global aluminum industry consists of primary aluminum producers with bauxite mining, alumina refining and aluminum smelting capabilities; aluminum semi-fabricated products manufacturers, including aluminum casters, recyclers, extruders and flat rolled products producers; and integrated companies that are present across multiple stages of the aluminum production chain. The industry is cyclical and is affected by global economic conditions, industry competition and product development.

Primary aluminum prices are determined by worldwide forces of supply and demand and, as a result, are volatile. This volatility has a significant impact on the profitability of primary aluminum producers whose selling prices are typically based upon prevailing LME prices while their costs to manufacture are not highly correlated to LME prices. We participate in select segments of the aluminum fabricated products industry, focusing on aluminum rolled products. We do not smelt aluminum, nor do we participate in other upstream activities, including mining bauxite or refining alumina. Since the majority of our products are sold on a market-based aluminum price plus conversion fee basis, we are less exposed to aluminum price volatility.

Sales and Marketing

We sell our products to end-users and distributors, principally for use in the aerospace, automotive, building and construction, truck trailer, consumer durables, other general industrial and distribution industries. Backlog as of December 31, 2019 and 2018 was approximately $102.7 million and $88.1 million, respectively, for North America, $222.0 million and $251.2 million, respectively, for Europe, and $70.5 million and $86.0 million, respectively, for Asia Pacific.

Sales of products are made through each segment’s own sales force, which are strategically located to provide international coverage, and through a broad network of sales offices and agents in North America and major European countries, as well as in Asia and Australia. The majority of our customer sales agreements in our segments are for a term of one year or less.

Competition

The worldwide aluminum industry is highly competitive. Aluminum also competes with other materials such as steel, plastic, composite materials and glass for various applications.

We compete in the production and sale of rolled aluminum sheet and plate. In the sectors in which we compete, other industry leaders include Arconic, Constellium, Novelis, Kaiser, Hydro, JW Aluminum and Jupiter Aluminum. We compete with other rolled products suppliers on the basis of quality, price, timeliness of delivery and customer service.

Raw Materials and Supplies

A significant portion of the aluminum metal used by our North America segment is purchased aluminum scrap that is acquired from aluminum scrap dealers or brokers. We believe that our North America segment is one of the largest users of aluminum scrap (other than beverage can scrap) in North America. The remaining metal requirements of this segment are met with purchased primary metal and rolling slab, including metal produced in the U.S. and internationally.

Our Europe segment relies on a number of European smelters for primary aluminum and rolling slab. Due to a shortage of internal slab casting capacity, we contract with smelters and other third parties to provide slab that meets our specifications.

Our Asia Pacific segment relies primarily on domestic smelters for primary aluminum. A portion of the raw material used by this segment is imported in order to meet quality requirements.

We believe that the raw materials necessary to our business are and will continue to be available. In an effort to manage our exposure to commodity price fluctuations, we use a formula pricing model which allows us to pass through risks from the volatility of aluminum price changes by charging a market-based aluminum price plus a conversion fee for the substantial majority of our contracts, and we strive to manage the remaining key commodity risks through our hedging programs.

Energy Supplies

Our operations are fueled by natural gas and electricity, which represent a large component of our cost of sales. We purchase the majority of our natural gas and electricity on a spot-market basis. However, in an effort to acquire the most favorable energy costs, we have secured some of our natural gas and electricity at fixed price commitments. We use forward contracts and options, as well as contractual price escalators, to reduce the risks associated with our natural gas requirements.

Research and Development

Our research and development organization includes three centers in Europe, one in North America and one in Asia, with a support staff focused on new product and alloy offerings and process performance technology. Research and development expenses were $17.4 million, $18.4 million and $16.0 million for the years ended December 31, 2019, 2018 and 2017, respectively.

Patents and Other Intellectual Property

We hold patents registered in the United States and other countries relating to our business. In addition to patents, we also possess other intellectual property, including trademarks, tradenames, know-how, developed technology and trade secrets. Although we believe these intellectual property rights are important to the operations of our specific businesses, we do not consider any single patent, trademark, tradename, know-how, developed technology, trade secret or any group of patents, trademarks, tradenames, know-how, developed technology or trade secrets to be material to our business as a whole.

Seasonality

Certain of our products are seasonal. Demand in the rolled products business is generally stronger in the spring and summer seasons due to higher demand in the building and construction industry. This typically results in higher operating income in our second and third quarters, followed by our first and fourth quarters.

Employees

As of December 31, 2019, we had a total of approximately 5,600 employees, which included approximately 1,900 employees engaged in administrative and supervisory activities and approximately 3,700 employees engaged in manufacturing, production and maintenance functions. In addition, collectively, approximately 64% of our U.S. employees and substantially all

of our non-U.S. employees were covered by collective bargaining agreements. We believe our labor relations with employees have been satisfactory.

Environmental

Our operations are subject to federal, state, local and foreign environmental, health and safety laws and regulations, which govern, among other things, air emissions, wastewater discharges, the handling, storage, and disposal of hazardous substances and wastes, the investigation or remediation of contaminated sites and employee health and safety. These laws can impose joint and several liability for releases or threatened releases of hazardous substances upon statutorily defined parties, including us, regardless of fault or the lawfulness of the original activity or disposal. Given the changing nature of environmental, health and safety legal requirements, we may be required, from time to time, to incur substantial costs in order to achieve and maintain compliance with these laws and regulations. For example, we may be required to install additional pollution control equipment, make process changes, or take other environmental control measures at some of our facilities to meet future requirements.

We have been named as a potentially responsible party in certain proceedings initiated pursuant to the Comprehensive Environmental Response, Compensation, and Liability Act (“Superfund”) and similar state statutes and may be named a potentially responsible party in other similar proceedings in the future. We are performing operations and maintenance at two Superfund sites for matters arising out of past waste disposal activity associated with closed facilities. We are also under orders to perform environmental remediation by agencies in four states and one non-U.S. country at seven sites. It is not anticipated that the costs incurred in connection with the presently pending proceedings will, individually or in the aggregate, have a material adverse effect on our financial condition or results of operations. Currently, and from time to time, we are a party to notices of violation brought by governmental agencies concerning the laws governing environmental, health and safety matters, such as air emissions.

Our aggregate accrual for environmental matters was $24.5 million and $25.6 million at December 31, 2019 and 2018, respectively. Of these amounts, approximately $9.9 million and $11.9 million are indemnified at December 31, 2019 and 2018, respectively. Although the outcome of any such matters, to the extent they exceed any applicable accrual, could have a material adverse effect on our financial condition, results of operations or cash flows for the applicable period, we currently believe that any such outcome would not have a material adverse effect on our consolidated financial condition, results of operations or cash flows.

In addition, we have asset retirement obligations of $6.8 million for both of the years ended December 31, 2019 and 2018 for costs related to the future removal of asbestos and costs to remove underground storage tanks. The related asset retirement costs are capitalized as long-lived assets (asset retirement cost), and are being amortized over the remaining useful life of the related asset. See Note 2, “Summary of Significant Accounting Policies,” and Note 10, “Asset Retirement Obligations,” to our audited consolidated financial statements included elsewhere in this annual report on Form 10-K.

The processing of scrap generates solid waste in the form of salt cake and baghouse dust. This material is disposed of at off-site landfills. If salt cake was ever classified as a hazardous waste in the U.S., the costs to manage and dispose of it would increase, which could result in significant increased expenditures.

Financial Information About Geographic Areas

See Note 17, “Segment and Geographic Information,” to our audited consolidated financial statements included elsewhere in this annual report on Form 10-K.

ITEM 1A. RISK FACTORS.

Risks Related to Our Business

If we fail to implement our business strategy, our financial condition and results of operations could be adversely affected.

Our future financial performance and success depend in large part on our ability to successfully implement our business strategy. We cannot assure you that we will be able to successfully implement our business strategy or be able to continue improving our operating results. In particular, we cannot assure you that we will be able to successfully execute our significant ongoing, or any future, strategic investments, achieve all operating cost savings targeted through focused productivity improvements and capacity optimization, further enhance our business and product mix, manage key commodity exposures and opportunistically pursue strategic transactions, some of which may be material. Implementation of our business strategy may be impacted by factors outside of our control, including competition, commodity price fluctuations, industry, legal and regulatory changes or developments and general economic and political conditions. Any failure to successfully implement our business strategy could adversely affect our financial condition and results of operations. We may, in addition, decide to alter or discontinue certain aspects of our business strategy at any time.

Although we have undertaken and expect to continue to undertake productivity and manufacturing system and process transformation initiatives to improve performance, we cannot assure you that all of these initiatives will be completed or that any estimated cost savings from such activities will be fully realized. Even when we are able to generate new efficiencies in the short- to medium-term, we may not be able to continue to reduce costs and increase productivity over the long-term.

While the Merger is pending, we are subject to business uncertainties and contractual restrictions that could materially adversely affect our business or result in a loss of customers or employees.

The agreement governing the Merger includes restrictions on how we conduct our business while the Merger is pending, generally requiring us to conduct our business in the ordinary course in all material respects, as well as imposing more specific limits with respect to certain matters absent our Merger counterparty’s consent. These and other restrictions in the agreement governing the Merger may prevent us from responding effectively to business developments and opportunities. The pendency of the Merger may also divert our management’s attention and our other resources from ongoing business and operations. In addition, customers may have uncertainties about the Merger, and delay or defer business decisions or seek to terminate or change their relationships because of the Merger. Similarly, the Merger may materially adversely affect our ability to attract, retain or motivate employees. If any of these effects were to occur, it could materially and adversely impact our financial performance while the Merger is pending.

The closing of the Merger is subject to customary closing conditions as well as other uncertainties, and the Merger may not be completed.

The consummation of the Merger is subject to the satisfaction of certain closing conditions, including, but not limited to, (i) the representations and warranties of the parties being true and correct, except as permitted by the agreement governing the Merger, (ii) the parties’ performance in all material respects of their respective covenants and other obligations, and (iii) the expiration or termination of the applicable Hart-Scott-Rodino waiting period and the receipt of certain foreign regulatory approvals. The Merger is not subject to a financing condition. If these conditions to the closing of the Merger are not fulfilled, then the Merger may not be consummated. Several of the closing conditions are not within our control, and it is not known whether and when any of the required closing conditions will be satisfied or if another uncertainty may arise. In addition, the outside date in the Merger Agreement of January 21, 2020 has passed. If the closing conditions are not satisfied, or if another event occurs that delays or prevents the Merger, or if the Merger Agreement is validly terminated, our business, financial condition and results of operations may be materially and adversely affected.

We may undertake acquisitions or divestitures, or be the target of a strategic acquisition, which may not be successful, and which could adversely affect our business, financial condition and results of operations.

As part of our strategy, from time to time, we may consider acquisitions or strategic alliances, which may not be completed or, if completed, may not be ultimately beneficial to us. We also consider potential divestitures of businesses from time to time. We prudently evaluate these opportunities as potential enhancements to our existing operating platforms and continue to consider strategic alternatives on an ongoing basis, including having discussions concerning potential acquisitions, strategic alliances and divestitures that may be material.

There are numerous risks commonly encountered in business combinations, including the following:

| |

▪ | our ability to identify appropriate acquisition targets and to negotiate acceptable terms for their acquisition; |

| |

▪ | our ability to obtain all necessary regulatory approvals on the terms expected and/or to complete any acquisition in a timely manner or at all; |

| |

▪ | our ability to integrate new businesses into our operations; |

| |

▪ | the availability of capital on acceptable terms to finance acquisitions; |

| |

▪ | the ability to generate the cost savings or synergies anticipated; |

| |

▪ | the inaccurate assessment of undisclosed liabilities; |

| |

▪ | increasing demands on our operational systems; and |

| |

▪ | the amortization of acquired intangible assets. |

In addition, the process of integrating new businesses could cause the interruption of, or loss of momentum in, the activities of our existing businesses, the diversion of management’s attention or the loss of key employees, customers, suppliers or other business partners. Any delays or difficulties encountered in connection with the integration of new businesses or divestiture of existing assets or businesses could negatively impact our business, financial condition and results of operations. Furthermore, any acquisition we may make could result in significant increases in our outstanding indebtedness and debt service requirements. The terms of our indebtedness may limit the acquisitions, strategic alliances and divestitures that we can pursue.

There are numerous risks commonly encountered in divestitures, including the following:

| |

▪ | our ability to identify appropriate assets or businesses for divestiture and buyers, and to negotiate favorable terms for the divestiture of such assets or businesses; |

| |

▪ | diversion of resources and management’s attention from the operation of our business, including providing on-going services to the divested business; |

| |

▪ | loss of key employees following such a transaction; |

| |

▪ | difficulties in the separation of operations, services, products and personnel; |

| |

▪ | retention of future liabilities as a result of contractual indemnity obligations; and |

| |

▪ | loss of, or damage to our relationships with, our existing customers, suppliers or other business relationships. |

In addition, sellers typically retain certain liabilities or indemnify buyers for certain matters such as lawsuits, tax liabilities, product liability claims and environmental matters. The magnitude of any such retained liability or indemnification obligation may be difficult to quantify at the time of the transaction, may involve conditions outside our control and ultimately may be material. Also, as is typical in divestiture transactions, third parties may be unwilling to release us from guarantees or other credit support provided prior to the sale of the divested assets. As a result, after a divestiture, we may remain secondarily liable for the obligations guaranteed or supported to the extent that the buyer of the assets fails to perform these obligations.

We cannot readily predict the timing or size of any future acquisition, strategic alliance or divestiture, and there can be no assurance that we will realize any anticipated benefits from any such acquisition, strategic alliance or divestiture. If we do not realize any such anticipated benefits, our business, financial condition and results of operations could be materially adversely affected.

The cyclical nature of the metals industry, our end-uses and our customers’ industries could negatively affect our financial condition and results of operations.

The metals industry in general is cyclical in nature. It tends to reflect and be amplified by changes in general and local economic conditions. These conditions include the level of economic growth, financing availability, the availability of affordable raw materials and energy sources, employment levels, interest rates, consumer confidence and housing demand. Historically, in periods of recession or periods of minimal economic growth, metals companies have often tended to underperform other sectors. We are particularly sensitive to trends in the key end-uses we serve, such as the automotive, aerospace, heat exchanger, building and construction and truck trailer industries. During recessions or periods of low growth, these industries typically experience major cutbacks in production, resulting in decreased demand for aluminum, which can lead to significant fluctuations in demand and pricing for our products and services.

Demand for our automotive and heat exchanger products is dependent on the production of cars, light trucks and heavy duty vehicles and trailers. The automotive industry is highly cyclical, as new vehicle demand is dependent on consumer spending and is tied closely to the strength of the overall economy, including credit markets and interest rates. In addition, the automotive industry is sensitive to consumer preferences regarding vehicle ownership and usage and vehicle size, fuel prices, regulatory requirements and levels of competition. Production cuts by manufacturers may adversely affect the demand for our products. Many automotive-related manufacturers and first tier suppliers are burdened with substantial structural costs, including pension, healthcare and labor costs that have resulted in severe financial difficulty, including bankruptcy, for several of them. A worsening of these companies’ financial condition or their bankruptcy could have further serious effects on the conditions of the automotive industry, which directly affects the demand for our products. In addition, sensitivity to fuel prices and consumer preferences can influence consumer demand for vehicles that have a higher content of aluminum. The loss of business with respect to, or a lack of commercial success of, one or more particular vehicle models for which we are a significant supplier could have a materially adverse impact on our financial condition and results of operations.

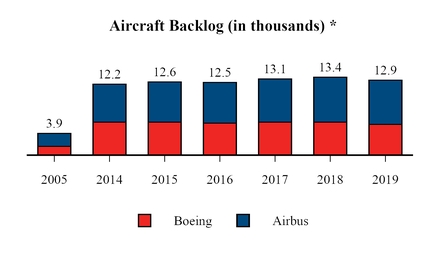

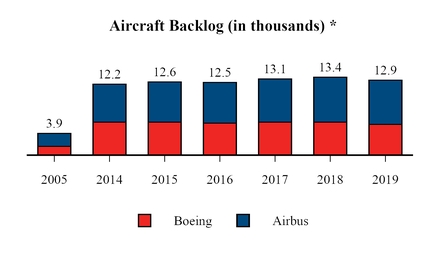

We derive a portion of our revenues from products sold to the aerospace industry, which is highly cyclical and tends to decline in response to overall declines in the general economy. The commercial aerospace industry is historically driven by demand from commercial airlines for new aircraft. Demand for commercial aircraft is influenced by airline industry profitability, trends in airline passenger traffic, the state of the U.S. and global economies and numerous other factors, including the availability of financing, regulatory requirements, the retirement of older aircraft and the effects of terrorism. A number of major airlines have consolidated, undergone bankruptcy or comparable insolvency proceedings and experienced financial strain from competitive pressures and volatile fuel prices. Despite existing backlogs, continued financial uncertainty in the industry, inadequate liquidity of certain airline companies, production issues and delays in the launch of new aircraft programs at major aircraft manufacturers, stock variations in the supply chain, terrorist acts or the increased threat of terrorism may lead to reduced demand for new aircraft that utilize our products, which could materially adversely affect our financial condition and results of operations. For example, the grounding of the Boeing 737 MAX may have a negative impact on demand.

Because we generally have high fixed costs, our near-term profitability is significantly affected by decreased processing volume. Accordingly, reduced demand and pricing pressures may significantly reduce our profitability and adversely affect our financial condition. Economic downturns in regional and global economies or a prolonged recession in our principal industry

end-uses have had a negative impact on our operations in the past and could have a negative impact on our future financial condition or results of operations. Although we continue to seek to diversify our business on a geographic and industry end-use basis, we cannot assure you that diversification will significantly mitigate the effect of cyclical downturns.

In addition, the market price of aluminum has historically been subject to significant cyclical price fluctuations. Although in recent years global economic and commodity trends have been increasingly correlated, the timing of changes in the market price of aluminum is largely unpredictable. Changes in the market price of aluminum impact the selling prices of our products and the benefit we gain from using scrap in our manufacturing process. Market prices of aluminum are dependent upon supply and demand and a variety of factors over which we have minimal or no control, including:

| |

▪ | regional, global economic and political conditions; |

| |

▪ | availability and relative pricing of metal substitutes; |

| |

▪ | governmental regulations; |

| |

▪ | seasonal factors and weather; and |

| |

▪ | tariffs, import and export levels and/or other trade restrictions. |

Furthermore, we depend upon third-party transportation providers for delivery of products to us and to our customers, and we are sensitive to cyclical and other trends that impact such providers. Transportation disruptions or other conditions in the transportation industry, including, but not limited to, increases in fuel prices, disruptions in rail service, port congestion or shortages of truck drivers, could increase our costs and disrupt our operations and our ability to service our customers on a timely basis.

We may encounter increases in the cost, or limited availability, of raw materials and energy, which could cause our cost of sales to increase thereby reducing our operating results and limiting our operating flexibility.

We require substantial amounts of raw materials and energy in our business, consisting principally of primary aluminum, aluminum scrap, alloys and other materials and energy, including natural gas. Any substantial increases in the cost of raw materials or energy could cause our operating costs to increase and negatively affect our financial condition and results of operations.

Primary aluminum, aluminum scrap, rolling slab and alloy prices are subject to significant cyclical price fluctuations. Metallics (primary aluminum and aluminum scrap) represent the largest component of our costs of sales. We purchase aluminum primarily from aluminum producers, aluminum scrap dealers and other intermediaries. We have limited control over the price or availability of these supplies.

In particular, the availability and price of aluminum scrap and rolling slab depend on a number of factors outside our control, including general economic conditions, international demand for metallics and internal recycling activities by primary aluminum producers and other consumers of aluminum. Increased regional and global demand for aluminum scrap can have the effect of increasing the prices that we pay for these raw materials thereby increasing our cost of sales. We may not be able to adjust the selling prices for our products to recover the increases in scrap prices. If scrap prices were to increase significantly without a commensurate increase in the traded value of the primary metals, our future financial condition and results of operations could be affected by higher costs and lower profitability.

After raw material and labor costs, energy costs represent the third largest component of our cost of sales. The price of natural gas, and therefore the costs, can be particularly volatile. Price and volatility can differ by global region based on supply and demand, political issues, government regulation and the imposition of further taxes on energy, among other things. As a result, our natural gas costs may fluctuate dramatically, and we may not be able to reduce the effect of higher natural gas costs on our cost of sales. If natural gas costs increase, our financial condition and results of operations may be adversely affected. Although we attempt to mitigate volatility in natural gas costs through the use of hedging and the inclusion of price escalators in certain of our long-term supply contracts, we may not be able to eliminate or reduce the effects of such cost volatility. Furthermore, in an effort to offset the effect of increasing costs, we may also limit our potential benefit from declining costs.

We may be unable to manage effectively our exposure to commodity price fluctuations, and our hedging activities may affect profitability in a changing metals price environment and subject our earnings to greater volatility from period-to-period.

Significant increases in the price of primary aluminum, aluminum scrap, alloys, hardeners, or energy would cause our cost of sales to increase significantly and, if not offset by product price increases, would negatively affect our financial condition and results of operations. We are substantial consumers of raw materials, and by far the largest input cost in producing our goods is the cost of aluminum. The cost of energy used by us is also substantial. Customers pay for our products based on the price of the aluminum contained in the products, plus a “rolling margin” or “conversion margin” fee (the “Price

Margin”), or based on a fixed price. Although we generally use this pricing mechanism to pass changes in the price of aluminum through to our customers, we may not be able to pass on the entire cost of the increases to our customers. In most end-uses and by industry convention, however, we offer our products at times on a fixed price basis as a service to the customer. This commitment to supply an aluminum-based product to a customer at a fixed price often extends months, but sometimes years, into the future. Such commitments require us to purchase raw materials in the future, exposing us to the risk that increased aluminum or energy prices will increase the cost of our products, thereby reducing or eliminating the Price Margin we receive when we deliver the product. These risks may be exacerbated by the failure of our customers to pay for products on a timely basis, or at all.

The overall price of primary aluminum consists of several components, including the underlying base metal component, which is typically based on quoted prices from the London Metal Exchange (LME) and the regional premium, which comprises the incremental price over the base LME component that is associated with the delivery of metal to a particular region as further described below. The LME price is typically driven by macroeconomic factors, global supply and demand of aluminum (including expectations for growth and contraction and the level of global inventories) and financial investors, and may be impacted by political conditions and changes in laws, regulations and policies, such as those related to international trade. Speculative trading in aluminum and the influence of hedge funds and other financial institutions participating in commodity markets have contributed to higher levels of price volatility. Furthermore, the North America and Europe segments are exposed to variability in the market price of a regional premium differential (referred to as “Midwest Premium” in the U.S. and “Rotterdam Premium” in Europe) charged by industry participants to deliver aluminum from the smelter to the manufacturing facility. This premium differential also fluctuates in relation to several conditions, including based on the supply of and demand for metal in a particular region, associated transportation costs and the extent of warehouse financing transactions, which limit the amount of physical metal flowing to consumers and increases the price differential as a result. During times of greater volatility in the premium, the variability in our earnings can also increase. In addition to impacting the price we pay for the raw materials we purchase, changing premium differentials impact our customers, who may delay purchases from us during times of uncertainty with respect to the premium differential or seek to purchase alternative materials or lower priced imported products which are not susceptible to the changes in these premium differentials. The North America and Europe segments follow a pattern of increasing or decreasing their selling prices to customers in response to changes in the Midwest Premium and the Rotterdam Premium. In addition, aluminum prices could fluctuate as a result of LME warehousing rules. Warehousing rules could also cause an increase in the supply of aluminum which may cause regional delivery premiums and LME aluminum prices to fall. A sustained weak LME aluminum pricing environment or adverse changes in LME aluminum prices or regional premiums, or the inability to pass through any fluctuation in aluminum prices or regional premiums to our customers, could have a material adverse effect on our business, financial condition, results of operations and cash flow.

As we maintain large quantities of base inventory, significant and rapid decreases in the price of primary aluminum would reduce the realizable value of our inventory, negatively affecting our financial condition and results of operations. In addition, a decrease in aluminum prices between the date of purchase and the final settlement date on derivative contracts used to mitigate the risk of price fluctuations may require us to post additional margin, which, in turn, could place a significant demand on our liquidity.

We purchase and sell LME forwards, futures and options contracts to reduce our exposure to changes in aluminum, copper and zinc prices. While exchanges have recently begun to offer derivative financial instruments to hedge premium differentials, we are only beginning to use these markets in our risk management practices. Despite the use of LME forwards, futures and options contracts, we remain exposed to the variability in prices of aluminum scrap and premium differentials. We depend on scrap for our operations, and seek to take advantage of the lower price of scrap metals compared to primary aluminum to provide a cost-competitive product. While aluminum scrap is typically priced in relation to prevailing LME prices, it may also be priced at a discount to LME aluminum (depending upon the quality of the material supplied). This discount is referred to in the industry as the “scrap spread” and fluctuates depending upon industry conditions. At this time, financial instruments are not readily available to effectively hedge against the scrap spread, and to the extent this spread narrows, our competitive advantage may be reduced. In addition, we purchase forwards, futures or options contracts to reduce our exposure to changes in natural gas and fuel prices, currency risks and interest rate risks. To the extent our hedging contracts fix prices or exchange rates, if prices or exchange rates are below the fixed prices or rates established by such contracts, then our income and cash flows will be lower than they otherwise would have been.

The ability to realize the benefit of our hedging program is dependent upon factors beyond our control, such as counterparty risk as well as our customers making timely payment to us for products. In addition, at certain times, hedging options may be unavailable or not available on terms acceptable to us. In certain scenarios when market price movements result in a decline in value of our current derivatives position, our mark-to-market expense may exceed our credit line and counterparties may request the posting of cash collateral. We do not account for our forwards, futures, or options contracts as hedges of the underlying risks. As a result, unrealized gains and losses on our derivative financial instruments must be reported in our consolidated results of operations. The inclusion of such unrealized gains and losses in earnings may produce significant

period to period earnings volatility that is not necessarily reflective of our underlying operating performance. See Item 7A. - “Quantitative and Qualitative Disclosures about Market Risk.”

A deterioration of our financial position or a downgrade of our ratings by a credit rating agency could impair our business, financial condition and results of operations, and our business relationships could be adversely affected.

A deterioration of our financial position or a downgrade of our credit ratings could adversely affect our financing, limit our access to the capital or credit markets or our liquidity facilities, or otherwise adversely affect our ability to obtain new financing on favorable terms or at all, result in more restrictive covenants in agreements governing the terms of any future indebtedness that we incur, or otherwise impair our business, financial condition and results of operations. Moreover, it could also increase our borrowing costs, trigger the posting of cash collateral and have an adverse effect on our business relationships with customers, suppliers and hedging counterparties. As discussed above, we enter into various forms of hedging arrangements against commodity, energy, currency and interest rate risks. Financial strength and credit ratings are important to the availability and terms of these hedging and financing activities. As a result, any downgrade of our credit ratings may make it more costly for us to engage in these activities.

The profitability of our operations depends, in part, on the availability of an adequate source of supplies.

The availability and price of aluminum could impact our margins and our ability to meet customer volumes. We rely on third parties for the supply of aluminum. There can be no assurance that we will be able to maintain or renew, or obtain replacements for, any of our supply arrangements on terms that are as favorable as our existing agreements or at all. In the future, we may face an increased risk of supply to meet our demand due to issues affecting suppliers, including their rising costs of production, their ability to extend short-term credit to us and their ability to sustain their business, and we may be required to purchase aluminum from alternative sources, which may not be available in sufficient quantities or on favorable terms. Our inability to satisfy our future supply needs may impact our profitability and expose us to penalties as a result of contractual commitments with some of our customers.

In addition, the price and availability of aluminum may be influenced by factors beyond our control, such as weak or deteriorating economic conditions, changes in world politics or regulatory requirements, trade restrictions and forces of supply and demand, which may cause regional supply constraints or may cause rapid aluminum price fluctuations. In particular, we depend on scrap for our operations and acquire our scrap inventory from numerous sources. These suppliers generally are not bound by long-term contracts and have no obligation to sell scrap metal to us. In periods of low industry prices, suppliers may elect to hold scrap and wait for higher prices, which may cause periodic supply interruptions. In addition, the slowdown in industrial production and consumer consumption in the U.S. during the previous economic crisis reduced the supply of scrap metal available to us. Furthermore, exports of scrap out of North America and Europe can negatively impact scrap availability and scrap spreads. If an adequate supply of scrap metal is not available to us, we would be unable to use recycled metals in our products at desired volumes and our results of operations and financial condition would be materially and adversely affected.

Our operating segments also depend on external suppliers for rolling slab for certain products. The availability of rolling slab is dependent upon a number of factors, including general economic conditions, which can impact the supply of available rolling slab and LME pricing, where lower LME prices may cause certain rolling slab producers to curtail production. If rolling slab is less available, our margins could be impacted by higher premiums that we may not be able to pass along to our customers or we may not be able to meet the volume requirements of our customers, which may cause sales losses or result in damage claims from our customers. We maintain long-term contracts for certain volumes of our rolling slab requirements, for the remainder we depend on annual and spot purchases. If we enter into a period of persistent short supply, we could incur significant capital expenditures to internally produce 100% of our rolling slab requirements.

Our business requires substantial amounts of capital to operate; failure to maintain sufficient liquidity will have a material adverse effect on our financial condition and results of operations.

Our business requires substantial amounts of cash to operate and our liquidity and ability to access capital can be adversely affected by a number of factors, including many factors outside our control. For example, fluctuations in the LME prices for aluminum may result in increased cash costs for metal or scrap. In addition, if aluminum price movements result in a negative valuation of our current financial derivative positions, our counterparties may require posting of cash collateral. Furthermore, in an environment of falling LME prices, the borrowing base under Aleris International’s asset backed multi-currency revolving credit facility (the “ABL Facility”) may shrink, which would constrain our liquidity. The borrowing base may also fluctuate due to, in part, seasonal working capital increases. As a result of these factors, both our borrowing base and ABL Facility utilization may fluctuate on a monthly basis. We cannot assure you that we will be able to draw under the ABL Facility in an amount sufficient to fund our liquidity needs.

We may not be able to compete successfully in the industry end-uses we serve and aluminum may become less competitive with alternative materials, which could reduce our share of industry sales, sales volumes and selling prices.

Aluminum competes with other materials such as steel, plastic, composite materials and glass for various applications. Higher aluminum prices relative to substitute materials tend to make aluminum products less competitive with these alternative materials. In addition, environmental, trade and other laws and regulations may also increase our costs, which we may seek to pass on to our customers. These regulations may make our products less competitive as compared to materials that are subject to fewer regulations. The willingness of customers to accept substitutions for aluminum could reduce demand or prices for our products, either of which could materially and adversely affect our business, financial condition, results of operations and cash flows.

Our aerospace and automotive customers use and continue to evaluate the further use of alternative materials to aluminum in order to reduce the weight and increase the efficiency of their products. Although trends in “light-weighting” have generally increased rates of using aluminum as a substitute for another material, the willingness of customers to accept substitutions for aluminum, or the ability of large customers to exert leverage in the marketplace to reduce the pricing for fabricated aluminum products, could adversely affect the demand for our products, and thus materially adversely affect our financial position, results of operations and cash flows. In addition, the automotive industry, while motivated to reduce vehicle weight through the use of aluminum, may revert to steel or other materials for certain applications.

We compete in the production and sale of rolled aluminum products with a number of other aluminum rolling mills, including large, single-purpose sheet mills, continuous casters and other multi-purpose mills, some of which are larger and have greater financial and technical resources than we do. We compete on the basis of quality, price, timeliness of delivery, technological innovation and customer service. Producers with a different cost basis may, in certain circumstances, have a competitive pricing advantage. Our competitors may be better able to withstand reductions in price or other adverse industry or economic conditions. In addition, a current or new competitor may also add or build new capacity, which could diminish our profitability by decreasing the equilibrium prices in our marketplace. Our competitive position may also be adversely affected by industry consolidation and economies of scale in purchasing, production and sales, which accrue to the benefit of some of our competitors. In addition, technological innovation is important to our customers who require us to lead or keep pace with new innovations to address their needs, and new product offerings or new technologies in the marketplace may compete with or replace our products. If we do not compete successfully, our share of industry sales, sales volumes and selling prices may be negatively impacted.

As we increase our international business, we encounter the risk that governments could take actions to enhance local production or local ownership at our expense. In addition, new competitors could emerge globally in emerging or transitioning markets with abundant natural resources, low-cost labor and energy, and lower environmental and other standards. This may pose a significant competitive threat to our business. Our competitive position may also be affected by exchange rate fluctuations that may make our products less competitive. Changes in regulation that have a disproportionately negative effect on us or our methods of production may also diminish our competitive advantage and industry position.

Additional competition could result in a reduced share of industry sales, reduced prices for our products and services, or increased expenditures, which could decrease revenues, reduce volumes or increase costs, all of which could have a negative effect on our financial condition and results of operations.

If our products fail to meet customer requirements, we could incur losses which could adversely affect our reputation, business and results of operations.

Product manufacturing in our business is a highly complex process. Our customers specify quality, performance and reliability standards that we must meet. If our products do not meet these standards or are defective, we may be required to replace or rework the products. In some cases, our products may contain undetected defects or flaws that only become evident at a later time, including after shipment. Problems may arise during manufacturing for a variety of reasons, including equipment malfunction, failure to follow specific protocols and procedures, problems with raw materials, supply chain interruptions, natural disasters, labor unrest and environmental factors. We have experienced product quality, performance or reliability problems and defects from time to time, and similar defects or failures may occur in the future. If these failures or defects occur, they could result in losses or product recalls, customer penalties, contract cancellation and product liability exposure. A significant product recall could adversely affect product demand, result in negative publicity, damage to our reputation and could lead to a loss of customer confidence in our products. Any of such consequences could have a material adverse effect on our reputation, business and results of operations.

The qualification process for our products can be lengthy and unpredictable, possibly delaying adoption of our products and causing us to incur expense possibly without recovery.

Qualification of our products by many of our customers can be lengthy and unpredictable and many of these customers have extensive sourcing and qualification processes. The qualification process requires substantial time and financial resources, with no certainty of success or recovery of our related expenses. In addition, even after an extensive qualification process, our products may fail to meet the standards sought by our customers and may not be qualified for use by such customers. Further, our continued process improvements and cost-reduction efforts may require us or our customers to re-qualify our products. Failure to qualify or re-qualify our products may result in us losing such customers or customer contracts, which could materially adversely affect our business and results of operations.

The loss of certain members of our management may have an adverse effect on our operating results.

Our success will depend, in part, on the efforts of our senior management and other key employees. These individuals possess sales, marketing, engineering, manufacturing, financial and administrative skills that are critical to the operation of our business. The continuity of key personnel and the preservation of institutional knowledge are vital to the success of our growth and business strategy. If we lose or suffer an extended interruption in the services of one or more of our senior management or other key employees or fail to develop adequate succession plans for key positions, our financial condition and results of operations may be negatively affected. Moreover, competition for the pool of qualified individuals may be high, and we may not be able to attract and retain qualified personnel to replace or succeed members of our senior management or other key employees, should the need arise.

If we were to lose order volumes from any of our largest customers, our sales volumes, revenues and cash flows could be reduced.

Our business is exposed to risks related to customer concentration. Our ten largest customers were responsible for less than 38% of our consolidated revenues for the year ended December 31, 2019. No one customer accounted for more than 11% of those revenues. A loss of order volumes from, a loss of industry share by, or a significant downturn or deterioration in the business or financial condition of, any major customer could negatively affect our financial condition and results of operations by lowering sales volumes, increasing costs and lowering profitability. If we fail to successfully maintain, renew, renegotiate or re-price our long-term agreements or related arrangements with our largest customers, or if we fail to successfully replace business lost from any such customers, our results of operations, financial condition and cash flows could be materially adversely affected.

Our strategy of having dedicated facilities and arrangements with customers subjects us to the inherent risk of increased dependence on a single or a few customers with respect to these facilities. In such cases, our failure to renew such arrangements on terms as favorable as our existing contracts, the loss of such a customer, or the reduction of that customer’s business at one or more of our facilities, could negatively affect our financial condition and results of operations, and we may be unable to timely replace, or replace at all, lost order volumes. In addition, several of our customers have become involved in bankruptcy or insolvency proceedings and have defaulted on their obligations to us in recent years. Similar incidents in the future would adversely impact our financial condition and results of operations.

Customers in our end-uses, including aerospace and automotive, may consolidate and grow in a manner that could affect their relationships with us. For example, if one of our competitors’ customers acquires any of our customers, we may lose that acquired customer’s business. Additionally, if our customers become larger and more concentrated, they could exert pricing pressure on all suppliers, including us. Accordingly, our ability to maintain or raise prices in the future may be limited, including during periods of raw material and other cost increases. If we are forced to reduce prices or to maintain prices during periods of increased costs, or if we lose customers because of consolidation, pricing or other methods of competition, our financial position, results of operations and cash flows may be adversely affected.

We do not have long-term contractual arrangements with a substantial number of our customers, and our sales volumes and revenues could be reduced if our customers switch their suppliers.

Approximately 64% of our consolidated revenues for the year ended December 31, 2019 were generated from customers who do not have long-term contractual arrangements with us. These customers purchase products and services from us on a purchase order basis and may choose not to continue to purchase our products and services. Any significant loss of these customers or a significant reduction in their purchase orders could have a material negative impact on our sales volume and business.

Our business requires substantial capital investments that we may be unable to fulfill, and we may be unable to timely complete our expected capital investments or may be unable to achieve the anticipated benefits of such investments.